As filed with the Securities and Exchange Commission on October 7, 2014

1933 Act File No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

| | | | | | |

| | REGISTRATION STATEMENT | | | | |

| | UNDER | | | | |

| | THE SECURITIES ACT OF 1933 | | | | |

| | Pre-Effective Amendment No. | | ¨ | | |

| | Post-Effective Amendment No. | | x | | |

The Huntington Funds

(Exact Name of Registrant as Specified in Charter)

2960 N. Meridian Street, Suite 300

Indianapolis, IN 46208

(Address of Principal Executive Offices:)

(800) 544-8347

(Area Code and Telephone Number)

Jay S. Fitton, Esq.

The Huntington National Bank

3805 Edwards Road

Cincinnati, OH 45209

(Name and Address of Agent for Service)

Copies to:

David C. Mahaffey, Esq.

Sullivan & Worcester, LLP

1666 K Street, NW

Washington, DC 20006

202-775-1207

No filing fee is due because the Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended.

This post-effective amendment no. is being filed solely for the purpose of filing exhibits to the registration statement on Form N-14 (File No. ), filed with the Commission on October 7, 2014 (the “Registration Statement”). Parts A and B are incorporated herein by reference to the definitive proxy statement/prospectus filed pursuant to Rule 497 under the Securities Act of 1933, as amended, filed on November , 2014.

As filed with the Securities and Exchange Commission on October 7, 2014

1933 Act File No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

¨ Pre-Effective Amendment No. x Post-Effective Amendment No.

The Huntington Funds

(Exact Name of Registrant as Specified in Charter)

2960 N. Meridian Street, Suite 300

Indianapolis, IN 46208

(Address of Principal Executive Offices)

(800) 544-8347

(Area Code and Telephone Number)

Jay S. Fitton, Esq.

The Huntington National Bank

3805 Edwards Road

Cincinnati, OH 45209

(Name and address of Agent for service)

Copies to:

David C. Mahaffey, Esq.

Sullivan & Worcester, LLP

1666 K Street, NW

Washington, DC 20006

202-775-1207

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933.

Title of Securities Being Registered: Class A and Institutional Shares of beneficial interest, without par value, of the Huntington Global Select Markets Fund, a series of the Huntington Funds.

No filing fee is due because Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended. It is proposed that this filing will become effective on November 6, 2014, pursuant to Rule 488 under the Securities Act of 1933.

TABLE OF CONTENTS

1

Acquisition of Assets and Liabilities of

HUNTINGTON INTERNATIONAL EQUITY FUND

a series of

The Huntington Funds

2960 N. Meridian Street, Suite 300

Indianapolis, IN 46208

(800) 253-0412

By and in Exchange for Shares of

HUNTINGTON GLOBAL SELECT MARKETS FUND

also a series of

The Huntington Funds

PROSPECTUS/INFORMATION STATEMENT

This Prospectus/Information Statement is available online at:

http://huntingtonfunds.com/newsite/taxes/taxinformation.php.

Dated November 6, 2014

This document is a prospectus/information statement (“Prospectus/Information Statement”). This Prospectus/Information Statement is being furnished to shareholders of the Huntington International Equity Fund (“Huntington International Equity” or “Acquired Fund”), a series of the Huntington Funds (the “Trust”), in connection with the approval by the Board of Trustees of the Trust (collectively, the “Board” or the “Trustees”) of an Agreement and Plan of Reorganization relating to Huntington International Equity.

The Trust is organized as a Delaware statutory trust, and is not required to hold an annual meeting of its shareholders.

THIS PROSPECTUS/INFORMATION STATEMENT IS FOR INFORMATIONAL PURPOSES ONLY. YOU DO NOT NEED TO DO ANYTHING IN RESPONSE TO THIS PROSPECTUS/INFORMATION STATEMENT. WE ARE NOT ASKING YOU FOR A PROXY OR WRITTEN CONSENT, AND YOU ARE REQUESTED NOT TO SEND US A PROXY OR WRITTEN CONSENT.

The Board has fixed the close of business on December 19, 2014 as the record date for determination of shareholders entitled to receive this Prospectus/Information Statement (“Record Date”). As of November 1, 2014, the number of shares outstanding for Huntington International Equity was [ ] total shares, which represents [ ] Institutional Shares and [ ] Class A Shares.

1

GENERAL

The Board has approved an Agreement and Plan of Reorganization (the “Reorganization Plan” or the “Plan”), a copy of which is attached as Exhibit A to this Prospectus/Information Statement, providing for the transfer of all of the assets of Huntington International Equity to the Huntington Global Select Markets Fund (“Huntington Global Select Markets” or “Acquiring Fund”), a series of the Trust (such actions taken in accordance with the Reorganization Plan being the “Reorganization”). The transfer will involve (a) an exchange of your shares of Huntington International Equity for shares of Huntington Global Select Markets, which would be distributed pro rata by Huntington International Equity to its shareholders in complete liquidation of Huntington International Equity, and (b) the assumption by Huntington Global Select Markets of all of the liabilities of Huntington International Equity. The total value of your investment will not change as a result of the Reorganization. Immediately after the Reorganization, you will hold the number of full or fractional shares of Huntington Global Select Markets which have an aggregate net asset value equal to the aggregate net asset value of the shares of Huntington International Equity you held immediately before the Reorganization.

Huntington International Equity and Huntington Global Select Markets (each, a “Fund,” and together, the “Funds”) are each a separate, diversified series of the Trust. The primary investment objectives of the Huntington International Equity and Huntington Global Select Markets are identical, as follows:

| | |

Portfolio | | Investment Objective |

| Huntington International Equity | | To seek total return. |

| Huntington Global Select Markets | | To seek total return. |

This Prospectus/Information Statement explains concisely the information about Huntington Global Select Markets that you should know. Please read it carefully and keep it for future reference. Additional information concerning each Fund and the Reorganization is contained in the documents described below, all of which have been filed with the Securities and Exchange Commission (“SEC”):

| | |

Information about Huntington International Equity: | | How to Obtain this Information: |

Prospectus of the Trust relating to Huntington International Equity, dated April 30, 2014, as Amended September 2, 2014 Statement of Additional Information of the Trust relating to Huntington International Equity, dated April 30, 2014, as Amended September 2, 2014 Annual Report of the Trust relating to Huntington International Equity for the year ended December 31, 2013 Semi-Annual Report of the Trust relating to Huntington International Equity, for the period ended June 30, 2014 | | Copies are available upon request and without charge if you: • Visit www.huntingtonfunds.com on the internet; or • Write to The Huntington Funds P.O. Box 6110 Indianapolis, IN 46206-6110; or • Call (800) 253-0412 toll-free. |

2

| | |

Information about Huntington Global Select Markets: | | How to Obtain this Information: |

Prospectus of the Trust relating to Huntington Global Select Markets, dated April 30, 2014, as Amended September 2, 2014 Statement of Additional Information of the Trust relating to Huntington Global Select Markets, dated April 30, 2014, as Amended September 2, 2014 Annual Report of the Trust relating to Huntington Global Select Markets for the year ended December 31, 2013 Semi-Annual Report of the Trust relating to Huntington Global Select Markets, for the period ended June 30, 2014 | | Copies are available upon request and without charge if you: • Visit www.huntingtonfunds.com on the internet; or • Write to The Huntington Funds P.O. Box 6110 Indianapolis, IN 46206-6110; or • Call (800) 253-0412 toll-free. |

| | |

Information about the Reorganization: | | How to Obtain this Information: |

| Statement of Additional Information dated November 6, 2014, which relates to this Prospectus/Information Statement and the Reorganization | | Copies are available upon request and without charge if you: • Write to The Huntington Funds P.O. Box 6110 Indianapolis, IN 46206-6110; or • Call (800) 253-0412 toll-free. |

You can also obtain copies of any of these documents without charge on the EDGAR database on the SEC’s Internet site at http://www.sec.gov. Copies are available for a fee by electronic request at the following e-mail address: publicinfo@sec.gov, or from the Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, 100 F Street, N.E., Washington, D.C. 20549.

Information contained in the Prospectuses of Huntington International Equity and Huntington Global Select Markets, each dated April 30, 2014, as Amended September 2, 2014, (SEC File No. 811-05010) are incorporated by reference in this document. (This means that such information is legally considered to be part of this Prospectus/Information Statement.) The Statement of Additional Information dated November 6, 2014, relating to this Prospectus/Information Statement and the Reorganization, which includes the Annual Reports of the Trust relating to Huntington International Equity and Huntington Global Select Markets for the year ended December 31, 2013 (SEC File No. 811-05010), the Semi-annual Reports of the Trust relating to Huntington Global Select Markets and Huntington International Equity for the six month period ended June 30, 2014 (SEC File No. 811-05010), and pro forma financial information of the Trust relating to Huntington Global Select Markets for the twelve month period ended June 30, 2014, are each incorporated by reference into this document.

THE SECURITIES AND EXCHANGE COMMISSION HAS NOT DETERMINED THAT THE INFORMATION IN THIS PROSPECTUS/INFORMATION STATEMENT IS ACCURATE OR ADEQUATE, NOR HAS IT APPROVED OR DISAPPROVED THESE SECURITIES. ANYONE WHO TELLS YOU OTHERWISE IS COMMITTING A CRIMINAL OFFENSE.

An investment in Huntington Global Select Markets:

| | • | | is not a deposit of, or guaranteed by, any bank |

| | • | | is not insured by the FDIC, the Federal Reserve Board or any other government agency |

| | • | | is not endorsed by any bank or government agency |

| | • | | involves investment risk, including possible loss of the purchase payment of your original investment |

3

SUMMARY

THIS SECTION SUMMARIZES THE PRIMARY FEATURES AND CONSEQUENCES OF THE REORGANIZATION. IT MAY NOT CONTAIN ALL OF THE INFORMATION THAT IS IMPORTANT TO YOU. TO UNDERSTAND THE REORGANIZATION, YOU SHOULD READ THIS ENTIRE PROSPECTUS/INFORMATION STATEMENT AND THE EXHIBIT.

This summary is qualified in its entirety by reference to the additional information contained elsewhere in this Prospectus/Information Statement, the Prospectuses and Statements of Information relating to the Funds and the Form of Agreement and Plan of Reorganization which is attached to this Prospectus/Information Statement.

Overview: Reasons for The Reorganization

The Reorganization will combine two series of the Trust with similar investment objectives, Huntington International Equity and Huntington Global Select Markets into one fund and is designed to achieve operating efficiencies due to the spreading of fixed costs over a larger pool of assets in the surviving Fund. The Board, consisting entirely of Independent Trustees, unanimously approved the Reorganization Plan based on information requested by the Board and provided by Huntington Asset Advisors, Inc. (the “Advisor”). Before approving the Plan, the Trustees evaluated extensive information provided by management of the Trust and reviewed various factors about the Funds and the proposed Reorganization. The Trustees considered the similarity of investment objectives and the relative performance of the Funds. Huntington Global Select Markets outperformed its benchmark for the one-year and since-inception periods ended December 31, 2013; whereas, Huntington International Equity underperformed its benchmark for the one- and five-year periods ended December 31, 2013. The Huntington International Equity outperformed its benchmark for the ten-year period ended December 31, 2013. Huntington Global Select Markets outperformed Huntington International Equity for the one-year period ended June 30, 2014; and Huntington International Equity outperformed Huntington Global Select Markets for the three-year period ended June 30, 2014. The Trustees also considered the relative asset size of Huntington International Equity, including the benefits of Huntington International Equity joining Huntington Global Select Markets. Upon completion of the Reorganization, Huntington Global Select Markets may achieve operating efficiencies because it will have a greater level of assets. As of June 30, 2014, Huntington International Equity and Huntington Global Select Markets’ total assets were approximately $189,552,152 and $17,006,696, respectively. If the Reorganization is completed, Huntington Global Select Markets is expected to have total assets of approximately $206,558,848. The Trustees also reasoned that the Reorganization would likely result in expenses at least as low as that of the Huntington International Equity shareholders due to the Advisor contractually capping expenses of the Huntington Global Select Markets’ Total Annual Fund Operating Expenses through at least April 30, 2017, prior to the Closing Date of the Reorganization.

Accordingly, in approving the Reorganization, the Board determined that the Reorganization would be in the best interests of Huntington International Equity and its shareholders, and that the interests of the shareholders of Huntington International Equity would not be diluted as a result of effecting the Reorganization.

Impact of the Reorganization on Huntington International Equity Shareholders

It is anticipated that the Reorganization will benefit you as follows, although no assurance can be given that the Reorganization will result in any such benefits:

| | • | | OPERATING EFFICIENCIES: Upon the reorganization of Huntington International Equity into Huntington Global Select Markets, operating efficiencies may be achieved by Huntington Global Select Markets because it is expected to have a greater level of assets than is currently in either of the Funds. As of June 30, 2014, Huntington International Equity had total net assets of approximately $189,552,152, while Huntington Global Select Markets had total net assets of approximately $17,006,696 as of that date. |

4

| | • | | COST CONSIDERATIONS: Following the Reorganization, total annual operating expenses of Huntington Global Select Markets are anticipated to be at least as low as that of the Huntington International Equity shareholders due to the Advisor contractually capping expenses of the Huntington Global Select Markets’ Total Annual Fund Operating Expenses through at least April 30, 2017, prior to the Closing Date of the Reorganization. A decrease in the total annual operating expenses of Huntington Global Select Markets compared to its pre-reorganization total annual operating expenses is due to the approval of an Expense Limitation Agreement between the Funds and the Advisor wherein the Huntington Global Select Markets total annual operating expenses are expected to be 0.94% lower following the Reorganization. While no assurance can be provided, following the Reorganization, the total annual operating expenses of Huntington Global Select Markets may decrease over the long-term due to the spreading of fixed costs over a larger pool of assets so that shareholders of Huntington Global Select Markets may in the future benefit from lower expenses achieved through economies of scale. |

Although Huntington International Equity and Huntington Global Select Markets have identical investment objectives and similar principal investment strategies, it is likely that some of the securities held by Huntington International Equity may need to be sold in connection with the Reorganization for the purpose of complying with the investment policies or limitations of Huntington Global Select Markets. If such sales occur, the transaction costs will be borne by the Advisor.

Summary of the Agreement and Plan of Reorganization

The Plan sets forth the key features of the Reorganization. For a complete description of the Reorganization, see Exhibit A. The Plan generally provides for the following:

| | • | | the in-kind transfer of all of the assets of Huntington International Equity to Huntington Global Select Markets in exchange for shares of Huntington Global Select Markets; |

| | • | | the assumption by Huntington Global Select Markets of all of the liabilities of Huntington International Equity; |

| | • | | the liquidation of Huntington International Equity by distribution of shares of Huntington Global Select Markets; and |

| | • | | the structuring of the Reorganization as a tax-free reorganization for federal income tax purposes. |

The Reorganization is expected to be completed on or about December 19, 2014.

COMPARISON OF THE HUNTINGTON INTERNATIONAL EQUITY AND

HUNTINGTON GLOBAL SELECT MARKETS FUNDS

Investment Objectives; Principal Investment Strategies and Risks

The investment objectives of Huntington Global Select Markets and Huntington International Equity are identical, as each Fund seeks total return. Although the principal investment strategies of the Funds are similar, there are differences between the Funds.

Specifically, Huntington Global Select Markets normally pursues its investment objective by investing primarily in equity and fixed income securities, including real estate investment trusts (“REITS”), in the United States and in developed and emerging markets throughout the world. Huntington Global Select Markets invests across different countries and regions, and under normal market conditions, will invest at least 40% of its assets in securities of issuers outside of the United States. Huntington Global Select Markets has no maturity restrictions on the fixed income securities in which it invests. Huntington Global Select Markets may invest in securities of issuers of any market capitalization and seeks to moderate volatility by employing a strategy of investing in equity and fixed income securities in developed and emerging markets.

5

In contrast, Huntington International Equity normally pursues its investment objective by investing at least 80% of its assets in equity securities, and at least 65% of its assets in companies based outside of the United States. Like Huntington Global Select Markets, Huntington International Equity invests in emerging markets; however Huntington International Equity may not invest more than 20% of its assets in companies located in emerging markets. In determining which markets are emerging markets, Huntington International Equity assesses whether the market is large and liquid enough that trading is readily available, and whether the management of the market itself has a history of meeting what the Advisor believes to be global norms of transparency.

In managing Huntington Global Select Markets Fund’s portfolio, the Advisor utilizes a “top-down” macroeconomic analysis to identify those countries believed to have the best prospects for sustainable growth and a “bottom-up” process is utilized to identify securities expected to provide what the Advisor believes will be superior risk-adjusted returns in those countries. Huntington Global Select Markets may also use various techniques, such as buying and selling futures contracts and exchange traded funds (“ETFs”), to increase or decrease the Huntington Global Select Markets’ exposure to changing security prices, interest rates or other factors that affect security values. In addition, in limited circumstances Huntington Global Select Markets may enter into derivatives contracts in which a foreign currency is an underlying asset in order to help manage the Fund’s exposure to changes in the value of the U.S. dollar relative to other currencies. In addition, the Fund may invest up to 20% of its assets in lower quality fixed income securities (also known as “junk bonds”). Similar to the Huntington Global Select Markets, the Advisor utilizes a “bottom-up” approach to stock selection and a “top-down” evaluation of industry and country exposure in managing the Huntington International Equity.

For detailed information about the principal investment strategies and risks of Huntington Global Select Markets, as well as each of its investment limitations and restrictions, see the current Prospectus and Statement of Additional Information for Huntington Global Select Markets, which is incorporated herein by reference.

The following summarizes a comparison of the Funds with respect to their principal investment strategies, as set forth in the Prospectus and Statement of Additional Information relating to each respective Fund.

| | | | |

| | | Huntington International Equity | | Huntington Global Select Markets |

Investment

Objective | | Seeks total return. | | Seeks total return. |

| | |

Principal

Investment

Strategy | | The Fund normally pursues its investment objective by investing at least 80% of its assets in equity securities, and at least 65% of its assets in companies based outside the United States. The Advisor manages the Fund based on the view that international equity markets are inefficient at pricing securities and that careful security selection generally offers the best potential for superior long-term investment returns. The Advisor uses a “bottom-up” approach to stock selection (searching for outstanding performance of individual stocks before considering the impact of economic trends) and evaluates industry and country exposure to be consistent with a “top-down” approach. The Advisor attempts to purchase | | The Fund normally pursues its investment objective by investing in equity and fixed income securities [including real estate investment trusts (“REITs”)] in the United States and in developed and emerging markets throughout the world. The proportions of the Fund’s assets invested in equity and fixed income securities vary based on the Advisor’s interpretation of economic conditions and underlying securities values. The Advisor generally allocates the Fund’s investments across different countries and regions, and under normal market conditions, the Fund invests significantly (at least 40% — unless market conditions are not deemed favorable by the Advisor, in which case the Fund invests at least 30%) in securities of issuers based outside the United States. The Fund |

6

| | | | |

| | | Huntington International Equity | | Huntington Global Select Markets |

| | |

| | securities with value characteristics consistent with an overall assessment of the economic environment in which the underlying company operates and the overall growth in the company’s economic value. The Fund will not invest more than 20% of its assets in companies located in emerging markets. In determining which markets are emerging markets, the Advisor will look at whether the market is large and liquid enough that trading is readily available, and that the management of the market itself has a history of meeting what the Advisor believes to be global norms of transparency. Because the Fund contains “equity” in its name, the Fund will normally invest at least 80% of its assets in equity securities and will notify shareholders at least 60 days in advance of any changes in this investment policy. | | may invest in equity and fixed income securities of issuers of any market capitalization. The Advisor will employ continuous “top-down” macroeconomic analysis to identify those countries believed to have the best prospects for sustainable growth. A “bottom up” process will then identify securities expected to provide what the Advisor believes will be superior risk-adjusted returns in those countries. By investing in equities and fixed income securities in developed and emerging markets, the Fund seeks to moderate volatility compared to investing solely in emerging market equities. The Fund has no maturity restrictions on the fixed income securities in which it invests. The Advisor may also use various techniques, such as buying and selling futures contracts and exchange traded funds (“ETFs”), to increase or decrease the Fund’s exposure to changing security prices, interest rates or other factors that affect security values. In addition, in limited circumstances the Advisor may, in order to help the Fund manage its exposure to changes in the value of the U.S. dollar relative to other currencies, enter into derivatives contracts in which a foreign currency is an underlying asset. In addition, the Fund may invest up to 20% of its assets in lower quality fixed income securities (also known as “junk bonds”) — for example, securities which at time of purchase are not rated in one of the four highest categories by a U.S. nationally rated statistical rating organization (or, if unrated, are not determined by the Advisor to be of a quality comparable to a security rated within the four highest rating categories). |

7

Principal Risks

An investment in each Fund is subject to certain risks. There is no assurance that the investment performance of either Fund will be positive or that either Fund will meet its investment objective. The following discussion highlights the principal risks associated with investment in each of the Funds. The risks of the Funds are similar because the Funds have identical investment objectives and similar principal investment strategies.

Huntington Global Select Markets and Huntington International Equity

Each of the Funds has the following risks:

Emerging Markets Risk. In addition to all of the risks of investing in foreign developed markets, emerging market securities involve risks attendant to less mature and stable governments and economies, such as lower trading volume, trading suspension, security price volatility, repatriation restrictions, government confiscation, inflation, deflation, currency devaluation and adverse government regulations of industries or markets. As a result of these risks, the prices of emerging market securities tend to be more volatile than the securities of issuers located in developed markets.

Equity Securities Risk. The price of equity securities in the Fund’s portfolio will fluctuate based on actual or perceived changes in a company’s financial condition and on market and economic conditions.

Foreign Custodial Services and Related Investment Costs Risk. Foreign custodial services are generally more expensive in foreign jurisdictions than in the United States. In addition, because the procedures for settling securities transactions in foreign markets differ from those in the United States, it may be more difficult for the Fund to make intended purchases and sales of securities in foreign countries.

Foreign Investment/Currency Risk. Investments in foreign securities tend to be more volatile and less liquid than investments in U.S. securities because, among other things, they involve risks relating to political, social and economic developments abroad, as well as risks resulting from differences between the regulations and reporting standards and practices to which U.S. and foreign issuers are subject. All of the risks of investing in foreign securities are typically increased by investing in emerging market countries. Securities denominated in foreign currencies may be adversely affected by changes in currency rates and by substantial currency conversion costs.

Liquidity Risk. Liquidity risk refers to the possibility that the Fund may not be able to sell a security when it wants to, which could cause the Fund to continue to hold the security and thereby incur a loss.

Market Risk. The value of securities in the Fund’s portfolio will fluctuate and, as a result, the Fund’s share price may decline suddenly or over a sustained period of time.

Huntington International Equity

Huntington International Equity has the following additional risks:

Investment Style Risk. The type of securities in which a Fund invests may underperform other assets or the overall market.

Huntington Global Select Markets

Huntington Global Select Markets has the following additional risks:

Counterparty Risk. The value of the Fund’s investments may be adversely affected if an issuer’s securities experience a credit downgrade; an issuer or guarantor of an investment held by the Fund fails to pay an

8

obligation on a timely basis, otherwise defaults or is perceived by other investors to be less creditworthy; or a counterparty to a derivatives or other transaction with the Fund files for bankruptcy, becomes insolvent, or otherwise becomes unable or unwilling to honor its obligation to the Fund.

Credit Risk. Issuers of securities in which the Fund invests may have their credit ratings downgraded or may default in the payment of principal or interest on the securities, which would cause the Fund to lose money.

Derivative Contracts and Hybrid Instruments Risk. Derivatives contracts and hybrid instruments involve risks different from, and possibly greater than, traditional investments, including valuation and tax issues, increased potential for losses and/or costs to the Fund, and interest rate, credit, currency, liquidity and leverage risks. For additional information regarding these risks, see the “Investment Risks” section in the Fund’s Statement of Additional Information.

Exchange-Traded Funds Risk. Like an open-end investment company (mutual fund), the value of an ETF can fluctuate based on the prices of the securities owned by the ETF, and ETFs are also subject to the following additional risks: (i) the ETF’s market price may be less than its net asset value; (ii) an active market for the ETF may not develop; and (iii) market trading in the ETF may be halted under certain circumstances.

Government Intervention and Extreme Volatility Risk. Governments and their agencies may take legislative or regulatory actions that affect the securities in which the Fund invests, the issuers of such securities or the Fund itself, in a manner which could limit or preclude the Fund’s ability to achieve its investment objective.

Hedging Risk. When a derivative contract is used as a hedge against an opposite position that the Fund holds, any loss on an underlying security (or position) should be substantially offset by gains on the hedged investment, and vice versa. Because it may not always be possible to perfectly offset one position with another, there is no assurance that the Fund’s hedging transactions will be effective.

Interest Rate Risk. The value of the Fund’s investments in fixed income securities may decline when prevailing interest rates rise or increase when interest rates go down. The longer a security’s maturity or duration, the greater its value will change in response to changes in interest rates. The interest earned on the Fund’s investments in fixed income securities may decline when prevailing interest rates decline.

Leverage Risk. Derivatives and other transactions that give rise to leverage may cause the Fund’s performance to be more volatile than if the Fund had not been leveraged. Leveraging also may require that the Fund liquidate securities when it may not be advantageous to do so to satisfy its obligations or to meet segregation requirements.

Manager Risk. The Advisor’s selection of securities for the Fund may cause the Fund to underperform similar funds or relevant benchmarks.

Market Capitalization Risk. Investing primarily in issuers in one market capitalization category (large, medium or small) carries the risk that due to current market conditions that category may be out of favor with investors. Larger, more established companies may be unable to respond quickly to new competitive challenges or attain the high growth rate of successful smaller companies. Stocks of smaller companies may be more volatile than those of larger companies due to, among other things, narrower product lines, more limited financial resources and fewer experienced managers. In addition, there is typically less publicly available information about small capitalization companies, and their stocks may have a more limited trading market than stocks of larger companies.

Non-Investment Grade Securities Risk. Fixed income securities rated below investment grade generally entail greater interest rate, liquidity and credit risks than investment grade securities.

9

Real Estate/REIT Risk. The Fund’s investments in REITs are subject to the same risks as direct investments in real estate, including sensitivity to general economic downturns and the volatility of local real estate markets. REITs may have limited financial resources and their securities may trade infrequently and in limited volume, and thus they may be more volatile than other securities.

Fees and Expenses

The Reorganization is expected to result in annual fund operating expenses that are at least as low as those of Huntington International Equity prior to the Reorganization due to the Advisor contractually capping expenses of Huntington Global Select Markets through April 30, 2017. The investment management fee charged by the Advisor for Huntington Global Select Markets is the same as the investment management fee charged for Huntington International Equity and the fee rates to be charged by the various service providers to Huntington Global Select Markets are the same or lower than the fee rates charged to Huntington International Equity. More detailed information about the annual fund operating expenses for the each Fund is set forth in the respective Prospectus.

The following tables show the various sales charges, fees and expenses that you may pay for buying, holding and redeeming shares of each Fund.

Huntington International Equity

| | | | | | | | |

Shareholder Fees (fees paid directly from your investment) | | Institutional

Shares | | | Class A

Shares | |

Maximum Sales Charge (Load) Imposed on Purchase (as a percentage of offering price) | | | None | | | | 4.75 | % |

Maximum Deferred Sales Charge (Load) (as a percentage of net asset value) | | | None | | | | None | |

Redemption Fee (as a percentage of amount redeemed, if applicable) | | | None | | | | None | |

| | | | | | | | |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your

investment) | | Institutional

Shares | | | Class A

Shares | |

Management Fees | | | 1.00 | % | | | 1.00 | % |

Distribution (12b-1) Fees | | | None | | | | 0.25 | % |

Other Expenses (including shareholder services fee) | | | 0.55 | % | | | 0.55 | % |

Acquired Fund Fees and Expenses | | | 0.03 | % | | | 0.03 | % |

Total Annual Fund Operating Expenses | | | 1.58 | % | | | 1.83 | % |

Fee Waivers and/or Expense Reimbursements(1) | | | (0.68 | )% | | | (0.68 | )% |

| | | | | | | | |

Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements | | | 0.90 | % | | | 1.15 | % |

| | | | | | | | |

| (1) | Huntington Asset Advisors, Inc. (the “Advisor”) has contractually agreed to waive all or a portion of its management fee and/or reimburse certain operating expenses of the Fund to the extent necessary in order to limit the Fund’s total annual fund operating expenses (after the fee waivers and/or expense reimbursements, and exclusive of acquired fund fees and expenses, brokerage costs, interest, taxes and dividends, and extraordinary expenses) to not more than 0.87% and 1.12% of the Institutional Shares and Class A Shares daily net assets, respectively, through April 30, 2015. This arrangement may only be terminated prior to this date with the agreement of the Fund’s Board of Trustees. Under certain conditions, the Advisor may recapture operating expenses reimbursed under these arrangements for a period of three years following the |

10

| | fiscal year in which such reimbursement occurred. Any amounts recaptured by the Advisor may not cause the Fund’s total annual fund operating expenses to exceed the stated expense caps. |

Huntington Global Select Markets

| | | | | | | | |

Shareholder Fees (fees paid directly from your investment) | | Institutional

Shares | | | Class A

Shares | |

Maximum Sales Charge (Load) Imposed on Purchase (as a percentage of offering price) | | | None | | | | 4.75 | % |

Maximum Deferred Sales Charge (Load) (as a percentage of net asset value) | | | None | | | | None | |

Redemption Fee (as a percentage of amount redeemed, if applicable) | | | None | | | | None | |

| | | | | | | | |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your

investment) | | Institutional

Shares | | | Class A

Shares | |

Management Fees | | | 1.00 | % | | | 1.00 | % |

Distribution (12b-1) Fees | | | None | | | | 0.25 | % |

Other Expenses (including shareholder services fee) | | | 1.01 | % | | | 1.01 | % |

Acquired Fund Fees and Expenses | | | 0.09 | % | | | 0.09 | % |

Total Annual Fund Operating Expenses | | | 2.10 | % | | | 2.35 | % |

Fee Waivers and/or Expense Reimbursements(1) | | | (1.14 | )% | | | (1.14 | )% |

| | | | | | | | |

Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements | | | 0.96 | % | | | 1.21 | % |

| | | | | | | | |

| (1) | Huntington Asset Advisors, Inc. (the “Advisor”) has contractually agreed to waive all or a portion of its management fee and/or reimburse certain operating expenses of the Fund to the extent necessary in order to limit the Fund’s total annual fund operating expenses (after the fee waivers and/or expense reimbursements, and exclusive of acquired fund fees and expenses, brokerage costs, interest, taxes and dividends, and extraordinary expenses) to not more than 0.87% and 1.12% of the Institutional Shares and Class A Shares daily net assets, respectively, through April 30, 2017. This arrangement may only be terminated prior to this date with the agreement of the Fund’s Board of Trustees. Under certain conditions, the Advisor may recapture operating expenses reimbursed under these arrangements for a period of three years following the fiscal year in which such reimbursement occurred. Any amounts recaptured by the Advisor may not cause the Fund’s total annual fund operating expenses to exceed the stated expense caps. |

11

Huntington Global Select Markets (Pro Forma)

| | | | | | | | |

Shareholder Fees (fees paid directly from your investment) | | Institutional

Shares | | | Class A

Shares | |

Maximum Sales Charge (Load) Imposed on Purchase (as a percentage of offering price) | | | None | | | | 4.75 | % |

Maximum Deferred Sales Charge (Load) (as a percentage of net asset value) | | | None | | | | None | |

Redemption Fee (as a percentage of amount redeemed, if applicable) | | | None | | | | None | |

| | | | | | | | |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your

investment) | | Institutional

Shares | | | Class A

Shares | |

Management Fees | | | 1.00 | % | | | 1.00 | % |

Distribution (12b-1) Fees | | | None | | | | 0.25 | % |

Other Expenses (including shareholder services fee) | | | 0.61 | % | | | 0.61 | % |

Acquired Fund Fees and Expenses | | | 0.03 | % | | | 0.03 | % |

Total Annual Fund Operating Expenses | | | 1.64 | % | | | 1.89 | % |

Fee Waivers and/or Expense Reimbursements(1) | | | (0.74 | )% | | | (0.74 | )% |

| | | | | | | | |

Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements | | | 0.90 | % | | | 1.15 | % |

| | | | | | | | |

| (1) | Huntington Asset Advisors, Inc. (the “Advisor”) has contractually agreed to waive all or a portion of its management fee and/or reimburse certain operating expenses of the Fund to the extent necessary in order to limit the Fund’s total annual fund operating expenses (after the fee waivers and/or expense reimbursements, and exclusive of acquired fund fees and expenses, brokerage costs, interest, taxes and dividends, and extraordinary expenses) to not more than 0.87% and 1.12% of the Institutional Shares and Class A Shares daily net assets, respectively, through April 30, 2017. This arrangement may only be terminated prior to this date with the agreement of the Fund’s Board of Trustees. Under certain conditions, the Advisor may recapture operating expenses reimbursed under these arrangements for a period of three years following the fiscal year in which such reimbursement occurred. |

12

The tables below show examples that are intended to help you compare the cost of investing in the Funds and Huntington Global Select Markets Pro Forma, assuming the Reorganization takes place. The examples assume that you invest $10,000 in the Funds for the one-, three-, five- and ten-year periods as indicated. They show your costs if you sold your shares at the end of the period or continued to hold them. The examples also assume that your investment has a 5% return each year and that each Fund’s operating expenses remain the same, and the expenses were capped for two years in each period for the Huntington Global Select Markets Pro Forma. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

Examples of Fund Expenses

| | | | | | | | |

| | | One Year | | Three

Years | | Five

Years | | Ten

Years |

Huntington International Equity | | | | | | | | |

Institutional Shares | | $92 | | $432 | | $796 | | $1,821 |

Class A Shares | | $587 | | $960 | | $1,358 | | $2,468 |

Huntington Global Select Markets | | | | | | | | |

Institutional Shares | | $98 | | $358 | | $843 | | $2,182 |

Class A Shares | | $592 | | $890 | | $1,402 | | $2,804 |

Huntington Global Select Markets (Pro Forma) | | | | | | | | |

Institutional Shares | | $92 | | $339 | | $719 | | $1,789 |

Class A Shares | | $587 | | $872 | | $1,286 | | $2,439 |

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Funds’ portfolio turnover rates were 62% and 156% of the average value of the portfolios of Huntington International Equity and Huntington Global Select Markets, respectively.

13

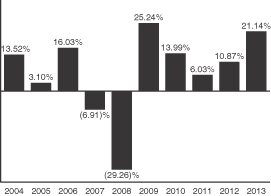

Performance Records

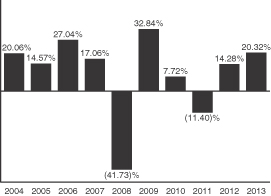

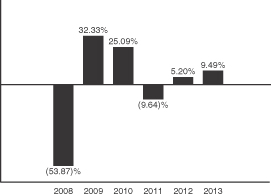

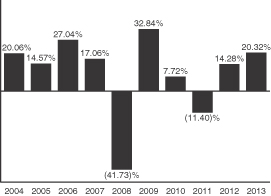

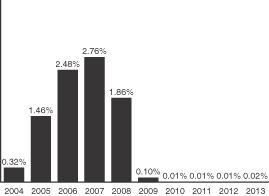

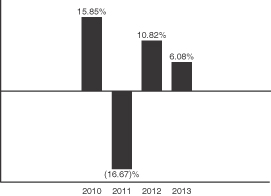

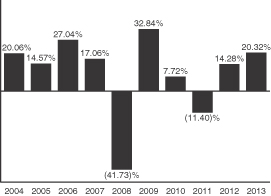

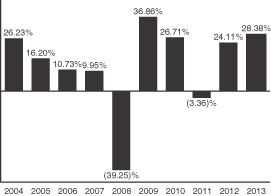

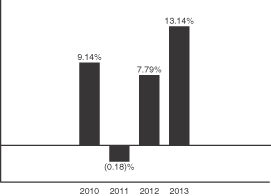

The following charts show the past performance record of each Fund. Past performance is not an indication of future results. The Funds may also experience short-term performance swings as indicated in the high and low quarter information at the bottom of each chart.

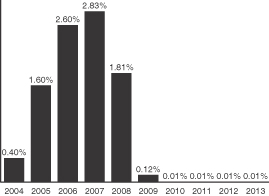

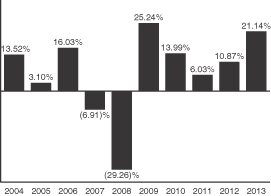

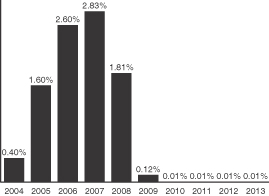

Huntington International Equity

The performance information shown below will help you analyze the Fund’s investment risks in light of its historical returns. The bar chart shows the variability of the Fund’s Institutional Shares total returns on a calendar year-by-year basis. The Average Annual Total Return Table shows returns averaged over the stated periods, and includes comparative performance information. The Fund’s performance will fluctuate, and past performance (before and after taxes) is not necessarily an indication of future results.

The annual returns in the bar chart which follows are for the Institutional Shares without reflecting payment of any sales charge; if they did reflect such payment of sales charges, annual returns would be lower.

Updated performance information will be available at www.huntingtonfunds.com, or by calling 800-253-0412.

Performance Bar Chart and Table

| | | | | | | | | | |

Risk/Return Bar Chart

| | Best Quarter Worst Quarter | |

| Q2 2009

Q4 2008 |

| |

| 22.90

(23.11 | %

)% |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

14

| | |

| | Average Annual Total Return Table (for the periods ended December 31, 2013) |

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

| International Equity Fund — Institutional Shares | | | | | | | | | | | | |

| Returns before taxes | | | 20.32% | | | | 11.76% | | | | 7.59% | |

| Returns after taxes on distributions(1) | | | 19.72% | | | | 11.61% | | | | 7.16% | |

Returns after taxes on distributions and sales of

Institutional Shares(1) | | | 12.26% | | | | 9.60% | | | | 6.47% | |

International Equity Fund — Class A Shares

(with 4.75% sales charge) | | | | | | | | | | | | |

| Returns before taxes | | | 14.32% | | | | 10.39% | | | | 6.80% | |

Morgan Stanley Capital International Europe, Australasia and Far East Index (MSCI-EAFE) (reflects no deduction for fees, expenses or taxes)(2) | | | 22.78% | | | | 12.44% | | | | 6.91% | |

| (1) | After tax returns are calculated using a standard set of assumptions. The stated returns assume the highest historical federal income and capital gains tax rates. Returns after taxes on distributions assumes a continued investment in the Fund and show the effect of taxes on Fund distributions. Returns after taxes on distributions and sales of Fund Shares assumes all Shares were redeemed at the end of each measurement period, and shows the effect of any taxable gain (or offsetting loss) on redemption, as well as the effects of taxes on Fund distributions. These after tax returns do not reflect the effect of any applicable state and local taxes. After tax returns are not relevant to investors holding Shares through tax-deferred programs, such as IRA or 401(k) plans. |

| (2) | The MSCI-EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. The MSCI-EAFE Index consists of the following 22 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an Index. |

15

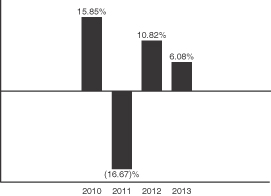

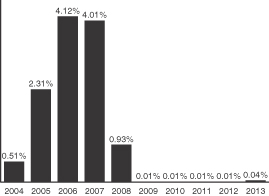

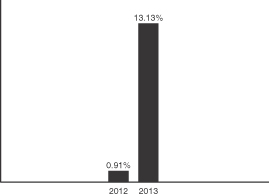

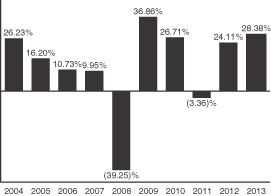

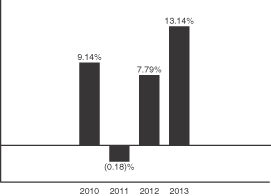

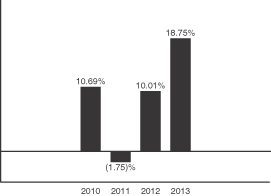

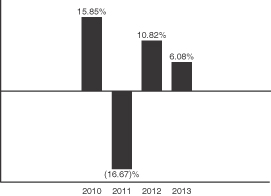

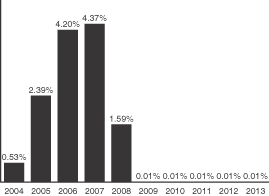

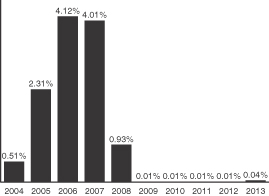

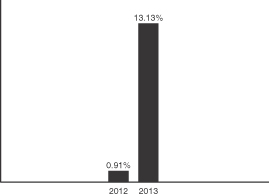

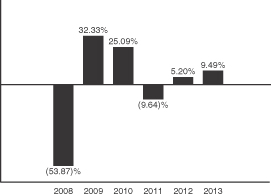

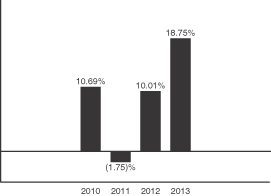

Huntington Global Select Markets

The performance information shown below will help you analyze the Fund’s investment risks in light of its historical returns. The bar chart shows the variability of the Fund’s Institutional Shares total returns on a calendar year-by-year basis. The Average Annual Total Return Table shows returns averaged over the stated periods, and includes comparative performance information. The Fund’s performance will fluctuate, and past performance (before and after taxes) is not necessarily an indication of future results.

The annual returns in the bar chart which follows are for the Institutional Shares without reflecting payment of any sales charge; if they did reflect such payment of sales charges, annual returns would be lower.

Updated performance information will be available at www.huntingtonfunds.com, or by calling 800-253-0412.

Performance Bar Chart and Table

| | | | | | | | | | |

Risk/Return Bar Chart

| | Best Quarter Worst Quarter | |

| Q3 2010

Q3 2011 |

| |

| 16.86

(21.81 | %

)% |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | |

| | Average Annual Total Return Table (for the periods ended December 31, 2013) |

| | | | | | | | | | |

| | | 1 Year | | | Since Class

Inception* | | | |

| Global Select Markets Fund — Institutional Shares | | | | | | | | | | |

| Returns before taxes | | | 6.08% | | | | 3.21% | | | |

| Returns after taxes on distributions(1) | | | 5.54% | | | | 2.97% | | | |

Returns after taxes on distributions and sales of

Institutional Shares(1) | | | 3.80% | | | | 2.55% | | | |

Global Select Markets Fund — Class A Shares (with 4.75% sales charge) | | | | | | | | | | |

| Returns before taxes | | | 0.88% | | | | 1.67% | | | |

Morgan Stanley Capital International Emerging Markets Index (MSCI-EM) (reflects no deduction for fees, expenses or taxes)(2) | | | (2.60)% | | | | 3.03% | | | |

16

| (1) | After tax returns are calculated using a standard set of assumptions. The stated returns assume the highest historical federal income and capital gains tax rates. Returns after taxes on distributions assumes a continued investment in the Fund and show the effect of taxes on Fund distributions. Returns after taxes on distributions and sales of Fund Shares assumes all Shares were redeemed at the end of each measurement period, and shows the effect of any taxable gain (or offsetting loss) on redemption, as well as the effects of taxes on Fund distributions. These after tax returns do not reflect the effect of any applicable state and local taxes. After tax returns are not relevant to investors holding Shares through tax-deferred programs, such as IRA or 401(k) plans. |

| (2) | The MSCI-EM is a market capitalization-weighted equity index comprising 21 of the 48 countries in the MSCI universe. Each MSCI country index is created separately, then aggregated, without change, into MSCI indices. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an Index. |

| * | Since December 30, 2009. |

For a detailed discussion of the manner of calculating total return, please see the Statement of Additional Information for Huntington Global Select Markets. Generally, the calculations of total return assume the reinvestment of all dividends and capital gain distributions on the reinvestment date and the deduction of all recurring expenses that were charged to shareholders’ accounts.

Important information about Huntington Global Select Markets is also contained in management’s discussion of Huntington Global Select Markets’ performance which appears in the most recent Annual Report of the Trust relating to Huntington Global Select Markets.

Management of the Funds

Investment Advisor

The Trustees of the Trust are responsible for generally overseeing the conduct of each Fund’s business. The Advisor, whose address is Huntington Center, 41 South High Street, Columbus, Ohio 43215, serves as investment advisor to the Funds pursuant to investment advisory agreements with the Trust.

Subject to the supervision of the Trustees, the Advisor provides a continuous investment program for the Funds, including investment research and management with respect to all securities, instruments, cash and cash equivalents in the Funds.

The Advisor, a separate, wholly owned subsidiary of Huntington National Bank (“Huntington Bank”), is the investment advisor to the Huntington Funds. As of December 31, 2013, the Advisor had assets under management of $3.8 billion. The Advisor (and its predecessor) has served as investment advisor to the Funds since 1987.

Huntington Bank, 41 South High Street, Columbus, Ohio 43215, is a direct, wholly-owned subsidiary of Huntington Bancshares Incorporated, a Maryland corporation with executive offices located at Huntington Center, 41 South High Street, Columbus, Ohio 43215. As of June 30, 2014, Huntington Bank had assets of over $64 billion.

As compensation for its investment advisory services, each Fund pays the Advisor management fees as a percentage of average daily net assets on the following tiered schedule:

| | | | | | |

Global Select Markets Fund | | Up to $500 million | | | 1.00 | % |

| | On the next $500 million to $1 billion | | | 0.95 | % |

| | On excess of $1 billion | | | 0.90 | % |

| | |

International Equity Fund | | Up to $500 million | | | 1.00 | % |

| | On the next $500 million to $1 billion | | | 0.95 | % |

| | On excess of $1 billion | | | 0.90 | % |

17

Portfolio Managers

Paul Attwood, CFA, and Martina Cheung, CFA, CMT, are responsible for the day-to-day management of the Global Select Markets Fund and International Equity Fund.

Paul W. Attwood is responsible for the day-to-day management of the Global Select Markets Fund and International Equity Fund. Mr. Attwood has served as the Portfolio Manager of the Global Select Markets Fund since the Fund’s inception and has served as the Portfolio Manager of the International Equity Fund since 2012. He joined Huntington in 2002 and is a Senior Vice President of the Advisor. Prior to joining the Advisor, Mr. Attwood was a Senior Research Analyst and Portfolio Manager with Haberer Investment Advisor, a division of Huntington Private Financial Group. He has over 15 years of experience in the financial services industry. Mr. Attwood holds a Chartered Financial Analyst designation. He received his Bachelor’s degree from the University of Cincinnati.

Martina Cheung is responsible for the day-to-day management of the Global Select Markets Fund and International Equity Fund. Ms. Cheung has served as the Portfolio Manager of the Global Select Markets Fund and International Equity Fund since 2014. Ms. Cheung joined The Huntington National Bank in 1995 as a securities analyst and is currently a Senior Vice President and portfolio manager. Ms. Cheung holds a Chartered Financial Analyst designation and a Chartered Market Technician designation. She received her Bachelor’s degree in Finance and Management Information Systems from The Ohio State University and received her M.B.A. from Capital University.

For more detailed information about the portfolio managers, including each portfolio manager’s principal occupation for the past five years, compensation information and other accounts managed, see the Prospectus and Statement of Additional Information for each Fund.

INFORMATION ABOUT THE REORGANIZATION

Reasons for the Reorganization

At an in-person meeting held on September 22, 2014, the Board, consisting entirely of Independent Trustees, unanimously approved the Reorganization Plan based on information requested by the Board and provided by the Advisor. In approving the Reorganization, the Board determined that the Reorganization would be in the best interests of Huntington International Equity and its shareholders, and that the interests of the shareholders of Huntington International Equity would not be diluted as a result of effecting the Reorganization.

Before approving the Plan, the Trustees evaluated extensive information provided by management of the Trust and reviewed various factors about the Funds and the proposed Reorganization. The Trustees considered the relative asset sizes of Huntington International Equity and Huntington Global Select Markets, including the benefits of Huntington International Equity joining Huntington Global Select Markets.

The Trustees reviewed the historical performance record of each Fund and also noted that the Huntington Global Select Markets outperformed the Huntington International Equity for the one-year period ended June 30, 2014; and Huntington International Equity outperformed Huntington Global Select Markets for the three-year period ended June 30, 2014. Huntington Global Select Markets outperformed its benchmark for the one-year and since-inception periods ended December 31, 2013; whereas, Huntington International Equity underperformed its benchmark for the one- and five-year periods ended December 31, 2013. Huntington International Equity outperformed its benchmark for the ten-year period ended December 31, 2013. Upon completion of the Reorganization, Huntington Global Select Markets may achieve operating efficiencies because it will have a greater level of assets. As of June 30, 2014, Huntington International Equity had total net assets of approximately $189,552,152, while Huntington Global Select Markets had total net assets of approximately $17,006,696 as of that date. If the Reorganization is completed, Huntington Global Select Markets is expected to have total assets

18

of approximately $206,558,848. The Trustees considered the identical investment objectives, similar investment strategies and relative performance of the Funds. The Trustees also reasoned that the Reorganization would likely result in expenses at least as low as that of the Huntington International Equity shareholders due to the Advisor contractually capping expenses of the Huntington Global Select Markets’ Total Annual Fund Operating Expenses through at least April 30, 2017, prior to the Closing Date of the Reorganization.

In addition, the Trustees considered, among other things:

| | • | | the fact that the Funds have identical investment objectives and similar principal investment strategies and restrictions, and Huntington Global Select Markets will be managed by the same Advisor managing Huntington International Equity immediately prior to the Reorganization; |

| | • | | the terms and conditions of the Reorganization; |

| | • | | the fact that the Reorganization would not result in the dilution of shareholders’ interests; |

| | • | | the expense ratios, fees and expenses of Huntington International Equity and the fact that the anticipated expense ratios, fees and expenses of Huntington Global Select Markets will be at least as low as that of Huntington International Equity; |

| | • | | the investment objective and policies of each Fund; |

| | • | | the composition of each Fund’s portfolio; |

| | • | | the differences in the risks of each Fund; |

| | • | | the fact that Huntington Global Select Markets has better performance than Huntington International Equity over the one-year period ended June 30, 2014; |

| | • | | the potential benefits to shareholders, including operating efficiencies that may be achieved from the Reorganization; |

| | • | | the fact that Huntington Global Select Markets will assume all of the liabilities of Huntington International Equity; |

| | • | | the fact that the Advisor is paying the costs of the Reorganization; |

| | • | | the fact that the Reorganization is expected to be a tax-free transaction for federal income tax purposes; and |

| | • | | alternatives available to shareholders of Huntington International Equity, including the ability to redeem their shares. |

During their consideration of the Reorganization, the Independent Trustees of the Trust discussed with counsel to the Independent Trustees the legal issues involved.

After consideration of the factors noted above, together with other factors and information considered to be relevant, and recognizing that there can be no assurance that any operating efficiencies or other benefits will in fact be realized, the Trustees of the Trust concluded that the proposed Reorganization would be in the best interests of Huntington International Equity and its shareholders. Consequently, they approved the Plan on behalf of the shareholders of Huntington International Equity.

The Trustees of the Trust have also approved the Plan on behalf of Huntington Global Select Markets.

Agreement and Plan of Reorganization

Below is a summary of the important terms of the Reorganization Plan. This summary is qualified in its entirety by reference to the Reorganization Plan itself, a form of which is set forth in Exhibit A to this Prospectus/Information Statement, and which we encourage you to read in its entirety.

19

The Reorganization is expected to take effect on or before December 19, 2014 (the “Closing Date”), although that date may be adjusted in accordance with the Reorganization Plan.

General Information

The Reorganization Plan provides that all of the assets of Huntington International Equity will be acquired by Huntington Global Select Markets in exchange for shares of Huntington Global Select Markets and the assumption by Huntington Global Select Markets of all of the liabilities of Huntington International Equity on or about December 19, 2014 or such other date as may be agreed upon by the parties (the “Closing Date”).

On or prior to the Closing Date, Huntington International Equity will declare a dividend or dividends and distribution or distributions which, together with all previous dividends and distributions, shall have the effect of distributing to the Fund’s shareholders all of the Fund’s investment company taxable income for the taxable period ending on the Closing Date (computed without regard to any deduction for dividends paid) and all of the Fund’s net capital gains realized in all taxable periods ending on the Closing Date (after reductions for any capital loss carryforward).

The number of full and fractional shares of each class of Huntington Global Select Markets to be received by shareholders of Huntington International Equity will be determined by multiplying the number of outstanding full and fractional shares of each class of Huntington International Equity by a factor which shall be computed by dividing the net asset value (“NAV”) per share of Huntington International Equity by the NAV per share of the corresponding class of shares of Huntington Global Select Markets. These computations will take place as of the Valuation Time. The NAV per share of Huntington Global Select Markets and Huntington International Equity will be determined by dividing assets, less liabilities, by the total number of outstanding shares.

Immediately thereafter, Huntington International Equity will liquidate and distribute the shares received from Huntington Global Select Markets to its shareholders. This will be accomplished by opening an account on the books of Huntington Global Select Markets in the name of each shareholder of record of Huntington International Equity and transferring Huntington Global Select Markets shares to each such account in complete liquidation of Huntington International Equity. Each account will represent the pro rata number of full and fractional shares of Huntington Global Select Markets due to the respective Huntington International Equity shareholders. All issued and outstanding shares of Huntington International Equity will be canceled. The shares of Huntington Global Select Markets to be issued will have no preemptive or conversion rights and no share certificates will be issued. After these distributions and the winding up of its affairs, Huntington International Equity will be terminated.

Until the Closing Date, shareholders of Huntington International Equity will continue to be able to redeem their shares at the NAV per share next determined after receipt by Huntington International Equity’s transfer agent of a redemption request in proper form. After the Reorganization, all of the issued and outstanding shares of Huntington International Equity will be canceled on the books of Huntington International Equity, and the share transfer books of Huntington International Equity will be permanently closed. If the Reorganization is consummated, shareholders will be free to redeem the shares of Huntington Global Select Markets that they receive in the transaction at their then-current NAV. Shareholders of Huntington International Equity may wish to consult their tax advisors as to any different consequences of redeeming their shares prior to the Reorganization or exchanging such shares for shares of Huntington Global Select Markets following the Reorganization.

Other Provisions

The Reorganization is subject to a number of conditions set forth in the Reorganization Plan. Certain of these conditions may be waived by the Board of Trustees. The significant conditions include receipt by the Board and the Trust of an opinion of counsel as to certain federal income tax aspects of the Reorganization. The

20

Reorganization Plan may be terminated and the Reorganization abandoned at any time prior to the Closing Date by the Board of Trustees.

In the proposed Reorganization, shareholders of Huntington International Equity will receive shares of Huntington Global Select Markets and will be able to purchase, redeem and exchange shares and receive distributions the same way as they currently do with respect to their shares of Huntington International Equity.

Prior to or at the completion of the Reorganization, Huntington International Equity and Huntington Global Select Markets will have each received an opinion from the law firm of Sullivan & Worcester LLP that, while not entirely free from doubt, the reorganization will qualify as a tax-free reorganization within the meaning of section 368(a) of the United States Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, it is believed that no gain or loss generally will be recognized by Huntington International Equity or Huntington Global Select Markets or their respective shareholders. See “Federal Income Tax Consequences” for more information on the federal tax consequences of the Reorganization.

At a meeting held on September 22, 2014, the Board approved the Reorganization Plan, finding that the Reorganization is in the best interests of Huntington International Equity and its shareholders.

Comparison of Share Classes, Sales Charges and Rule 12b-1 Fees

Share Classes

Each Fund offers two share classes, Institutional Shares and Class A Shares. The different classes of shares represent investments in the same portfolio of securities, but the classes are subject to different sales charges and expenses that are likely to result in different share prices. Class A shares of the Acquiring Fund will be issued for Class A shares of the Acquired Fund. Institutional shares of the Acquiring Fund will be issued for Institutional shares of the Acquired Fund.

Sales Charges

Class A shares of each of the Funds are offered at their public offering price, which is its NAV plus the applicable sales charge. The sales charge varies, depending on how much you invest. There are some instances where investors can purchase Class A shares without a sales charge. More detailed information about sales charges can be found in the respective Fund prospectuses.

Institutional shares of each of the Funds are offered at their public offering price, which is its NAV. There are no sales charges on Institutional shares. Institutional shares are available for purchase only to fiduciary, advisory and agency accounts of Huntington Bank correspondent banks and the Huntington Asset Allocation Funds, as well as participants in special programs that may be offered from time to time through financial intermediaries.

No sales charges will be imposed on existing shareholders in connection with the Reorganization.

Distribution and Service (Rule 12b-1) Fee Comparison

The Trust has adopted a Distribution and Shareholder Servicing Plan pursuant to Rule 12b-1 under the 1940 Act for Huntington Global Select Markets and Huntington International Equity which allows the Funds to pay fees to financial intermediaries for the sale and distribution of shares. There will be no change in the fee rates paid by shareholders pursuant to the Plan following the Reorganization.

21

Purchases and Redemptions

Each Fund has the same purchase and redemption procedures. You may purchase shares on any business day when the New York Stock Exchange (“NYSE”) is open. You may redeem shares on any business day when both the NYSE and Federal Reserve Bank are open.

Exchanges

Each Fund has the same exchange privileges. On any business day when the NYSE is open, you may exchange shares of each Fund for the same class of shares of any other Huntington Fund offering such shares.

For more information, see the sections “Purchasing Shares” and “Redeeming Shares” in the respective Fund prospectus.

Dividends and Distributions

The Funds have the same dividend distribution policy. Each Fund declares and pays dividends on investment income, if any, annually. Each Fund distributes its capital gains at least annually. All dividends and distributions payable to a holder of Shares will be automatically reinvested in additional Shares of the same class of the Fund, unless the shareholder makes an alternative election. Shareholders may choose to receive all distributions in cash or may choose to reinvest capital gains distributions, but receive all other distributions in cash. See the respective Funds’ prospectuses for further information concerning dividends and distributions.

Fiscal Year

Huntington International Equity and Huntington Global Select Markets currently operate on a fiscal year ending December 31. Following the Reorganization Huntington Global Select Markets will continue to operate on a fiscal year ending December 31 of each year.

Expenses of the Reorganization

The expenses associated with the transactions contemplated by the Reorganization Plan shall be borne by the Advisor.

Federal Income Tax Consequences

The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization within the meaning of Section 368(a) of the Code. No gain or loss will be recognized as a consequence of the Reorganization by Huntington International Equity (except to the extent that such assets consist of contracts described in Section 1256 of the Code), nor will a gain or loss be recognized by the shareholders of Huntington International Equity as a result of Huntington Global Select Markets’ distribution of its corresponding Fund shares to such shareholders in exchange for such shareholder’s Huntington International Equity Fund shares. In addition, a shareholder’s tax basis for shares held in Huntington International Equity will carry over to the shares of Huntington Global Select Markets acquired in the Reorganization, and the holding period for shares held as a capital asset also will carry over to Huntington Global Select Markets shares received in the Reorganization. As a condition to the closing of the proposed Reorganization, each of the Trust and the Acquiring Fund shall have received a legal opinion from Sullivan & Worcester LLP to the effect that, while the matter is not entirely free from doubt, the Reorganization will qualify as a tax-free reorganization with the foregoing tax consequences. That opinion will be based upon certain assumptions and conditions and on the representations set forth in the Reorganization Plan (and, if such counsel requests, in separate letters from the Trust and the Acquiring Fund) being true and complete at the time of the Closing Date and the Reorganization’s being consummated in

22

accordance with the Reorganization Plan (without the waiver or modification of any terms or conditions thereof and without taking into account any amendment thereof that counsel has not approved).

Opinions of counsel are not binding upon the Internal Revenue Service (“IRS”) or the courts. If a Reorganization is consummated but does not qualify as a tax-free reorganization under the Code, Huntington International Equity would recognize gain or loss on the transfer of its assets to Huntington Global Select Markets and each shareholder of Huntington International Equity would recognize a taxable gain or loss equal to the difference between its tax basis in the shares of Huntington International Equity and the fair market value of the shares of Huntington Global Select Markets it receives.

Immediately prior to the Closing Date, Huntington International Equity shall have declared and paid a distribution or distributions that, together with all previous distributions, shall have the effect of distributing to its shareholders: (i) all of its investment company taxable income and all of its net realized capital gains, if any, for the period from the close of its last fiscal year to 4:00 p.m. Eastern Time on the Closing Date, and (ii) any undistributed investment company taxable income and net realized capital gains from any period to the extent not otherwise already distributed.

You should consult your tax adviser regarding the effect, if any, of the proposed Reorganization in light of your individual circumstances. Since the foregoing discussion relates only to the federal income tax consequences of the Reorganization, you should also consult your tax adviser as to state and local tax consequences, if any, of the Reorganization.

Pro Forma Capitalization

The following table sets forth the capitalization of the Funds as of June 30, 2014, and the capitalization of Huntington Global Select Markets on a pro forma basis as of that date, giving effect to the proposed acquisition of assets at net asset value. The pro forma data reflects an exchange ratio of approximately 1.14 and 1.15 shares of Class A Shares and Institutional Shares, respectively, of Huntington Global Select Markets for each share of Class A Shares and Institutional Shares of Huntington International Equity, respectively.

Capitalization of Huntington International Equity, Huntington Global Select Markets and

Huntington Global Select Markets (Pro Forma)

| | | | | | | | | | | | | | | | |

| | | Huntington

International

Equity | | | Huntington

Global Select

Markets | | | Adjustments | | | Huntington

Global Select

Markets Pro

Forma (After

Reorganization) | |

Net Assets | | | | | | | | | | | | | | | | |

Institutional Class | | $ | 180,395,387 | | | $ | 16,018,622 | | | | | | | $ | 196,414,009 | |

Class A | | $ | 9,156,765 | | | $ | 988,074 | | | | | | | $ | 10,144,839 | |

Total Net Assets | | $ | 189,552,152 | | | $ | 17,006,696 | | | | | | | $ | 206,558,848 | |

Net Asset Value Per Share | | | | | | | | | | | | | | | | |

Institutional Class | | $ | 13.07 | | | $ | 11.35 | | | | | | | $ | 11.35 | |

Class A | | $ | 12.95 | | | $ | 11.33 | | | | | | | $ | 11.33 | |

Shares Outstanding | | | | | | | | | | | | | | | | |

Institutional Class | | | 13,805,774 | | | | 1,411,662 | | | | 2,087,763 | | | | 17,305,199 | |

Class A | | | 706,895 | | | | 87,227 | | | | 101,274 | | | | 895,396 | |

Total Shares Outstanding | | | 14,512,669 | | | | 1,498,889 | | | | 2,189,037 | | | | 18,200,595 | |

The table set forth above should not be relied upon to calculate the number of shares to be received in the Reorganization; the actual number of shares to be received will depend upon the net asset value and number of shares outstanding of each Fund at the time of the Reorganization.

23

COMPARATIVE INFORMATION ON SHAREHOLDERS’ RIGHTS

Form of Organization

Huntington International Equity and Huntington Global Select Markets are series of the Trust, an open-end management investment company registered with the SEC under the 1940 Act. The Trust was reorganized as a Delaware statutory trust in June 2006, and is governed by its Declaration of Trust and By-Laws, as amended, its Board of Trustees, and applicable Delaware and federal law. The Trust is organized as a “series company” as that term is used in Rule 18f-2 under the 1940 Act. The series of the Trust currently consist of Huntington International Equity and Huntington Global Select Markets and 16 other mutual funds of various asset classes.

Capitalization

The beneficial interests in the Trust are represented by an unlimited number of transferable shares of beneficial interest, no par value, of one or more series. The Declaration of Trust of the Trust permits the Trustees to allocate shares into one or more series, and classes thereof, with rights determined by the Trustees, all without shareholder approval. Fractional shares may be issued by each Fund.

Shareholders of each Fund are entitled to receive dividends and other amounts as determined by the Trustees. Shareholders of each Fund vote separately, by Fund, as to matters, such as changes in fundamental investment restrictions, that affect only their particular Fund.

Shareholder Liability