0000810902baroncapitalmgmt:C000077820Member2021-09-300000810902baroncapitalmgmt:Russell3000Index3101AdditionalIndexMember2015-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-5032

BARON INVESTMENT FUNDS TRUST

f/k/a BARON ASSET FUND

(Exact Name of Registrant as Specified in Charter)

767 Fifth Avenue, 49th Floor

New York, NY 10153

(Address of Principal Executive Offices) (Zip Code)

Patrick M. Patalino, General Counsel

c/o Baron Investment Funds Trust

767 Fifth Avenue, 49th Floor

New York, NY 10153

(Name and Address of Agent for Service)

(Registrant’s Telephone Number, including Area Code): 212-583-2000

Date of fiscal year end: September 30

Date of reporting period: September 30, 2024

Item 1. Reports to Stockholders.

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about Baron Asset Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at BaronCapitalGroup.com. You can also request this information by contacting us at 1.800.99.BARON.

What were the Fund costs for the past 12 months?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Retail | $145 | 1.29% |

How did the Fund perform last year and what affected its performance?

Mid-cap stocks posted solid returns, although they lagged large caps throughout much of the period in a market dominated by the Magnificent Seven mega-cap names. The Fund, while posting double-digit gains, underperformed due to weak stock selection, particularly in Real Estate, Consumer Discretionary, and Industrials. Sector weightings did not factor much into results, with the positive impact of lack of exposure to the lagging Consumer Staples and Energy sectors along with an overweight in Real Estate, which soared on falling rates late in the period, cancelled out by the negative impact of higher exposure to the lagging Health Care sector and lack of exposure to the outperforming Utilities sector.

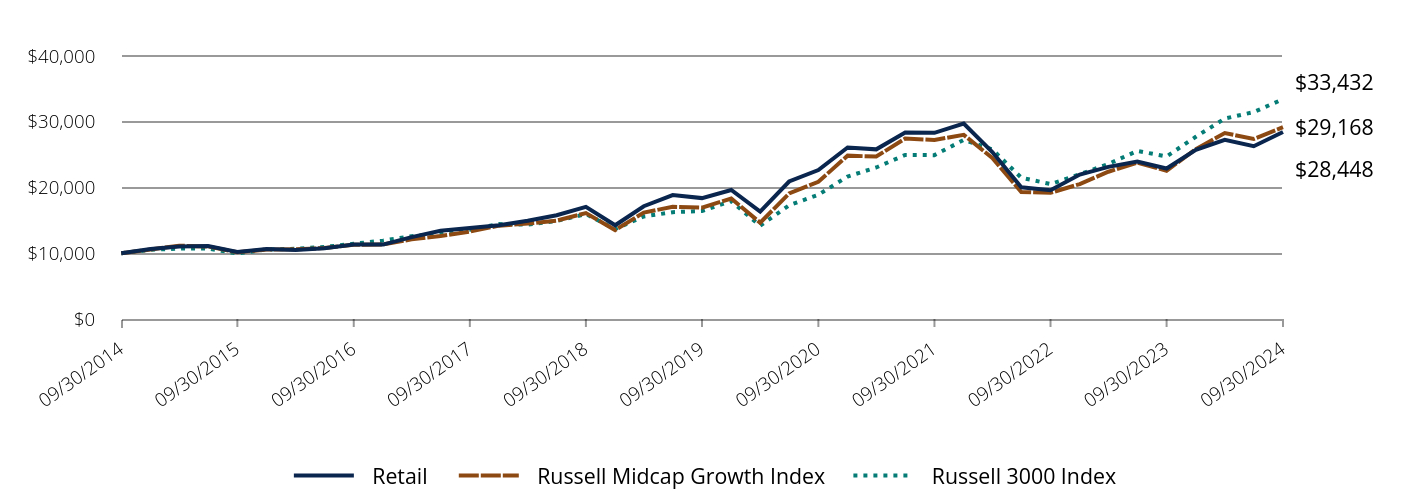

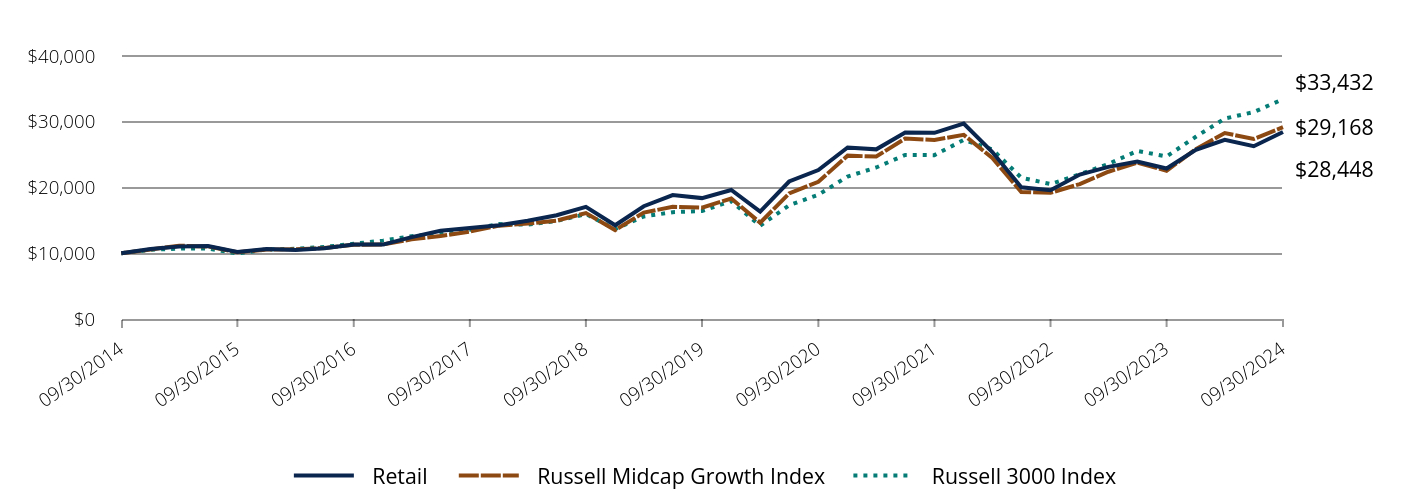

Comparison of the Change in Value of $10,000 Investment in the Fund in Relation to the Benchmarks

| Retail | Russell Midcap Growth Index | Russell 3000 Index |

|---|

| 09/30/2014 | $10,000 | $10,000 | $10,000 |

| 12/31/2014 | $10,663 | $10,584 | $10,524 |

| 03/31/2015 | $11,029 | $11,153 | $10,714 |

| 06/30/2015 | $11,106 | $11,026 | $10,728 |

| 09/30/2015 | $10,183 | $10,145 | $9,951 |

| 12/31/2015 | $10,655 | $10,563 | $10,574 |

| 03/31/2016 | $10,485 | $10,624 | $10,677 |

| 06/30/2016 | $10,772 | $10,790 | $10,958 |

| 09/30/2016 | $11,317 | $11,285 | $11,440 |

| 12/31/2016 | $11,318 | $11,337 | $11,921 |

| 03/31/2017 | $12,458 | $12,118 | $12,606 |

| 06/30/2017 | $13,410 | $12,629 | $12,986 |

| 09/30/2017 | $13,854 | $13,296 | $13,580 |

| 12/31/2017 | $14,275 | $14,201 | $14,440 |

| 03/31/2018 | $14,933 | $14,510 | $14,347 |

| 06/30/2018 | $15,783 | $14,968 | $14,905 |

| 09/30/2018 | $17,055 | $16,102 | $15,967 |

| 12/31/2018 | $14,255 | $13,527 | $13,683 |

| 03/31/2019 | $17,155 | $16,181 | $15,605 |

| 06/30/2019 | $18,844 | $17,055 | $16,244 |

| 09/30/2019 | $18,388 | $16,940 | $16,433 |

| 12/31/2019 | $19,618 | $18,324 | $17,928 |

| 03/31/2020 | $16,343 | $14,652 | $14,181 |

| 06/30/2020 | $20,912 | $19,086 | $17,304 |

| 09/30/2020 | $22,658 | $20,875 | $18,898 |

| 12/31/2020 | $26,088 | $24,846 | $21,672 |

| 03/31/2021 | $25,804 | $24,705 | $23,048 |

| 06/30/2021 | $28,373 | $27,440 | $24,947 |

| 09/30/2021 | $28,316 | $27,232 | $24,921 |

| 12/31/2021 | $29,722 | $28,008 | $27,234 |

| 03/31/2022 | $25,393 | $24,484 | $25,796 |

| 06/30/2022 | $20,023 | $19,325 | $21,488 |

| 09/30/2022 | $19,596 | $19,199 | $20,528 |

| 12/31/2022 | $21,978 | $20,524 | $22,003 |

| 03/31/2023 | $23,137 | $22,399 | $23,583 |

| 06/30/2023 | $23,962 | $23,795 | $25,561 |

| 09/30/2023 | $22,889 | $22,552 | $24,729 |

| 12/31/2023 | $25,722 | $25,833 | $27,714 |

| 03/31/2024 | $27,249 | $28,286 | $30,491 |

| 06/30/2024 | $26,276 | $27,377 | $31,471 |

| 09/30/2024 | $28,448 | $29,168 | $33,432 |

Average Annual Total Returns (%)

| Total Net Assets | $4,441,124,161 |

| # of Issuers | 52 |

| Portfolio Turnover Rate | 4% |

| Total Advisory Fees Paid | $44,072,858 |

| fund | 1 Year | 5 Years | 10 Years |

|---|

| Retail | 24.29% | 9.12% | 11.02% |

| Russell Midcap Growth Index | 29.33% | 11.48% | 11.30% |

| Russell 3000 Index | 35.19% | 15.26% | 12.83% |

Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower.

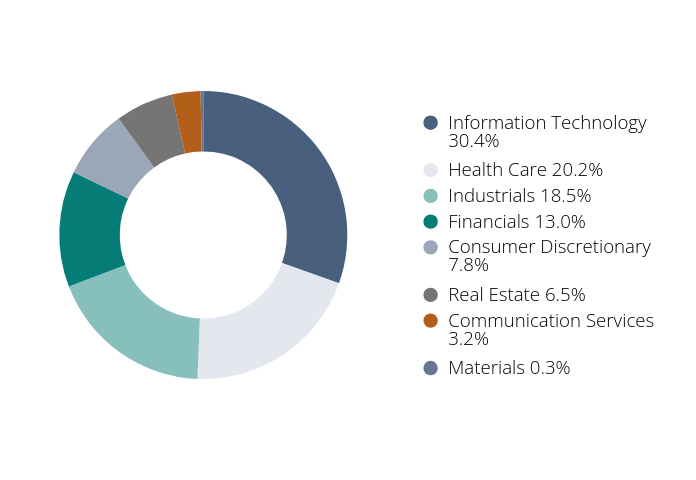

What did the Fund invest in?

| Holding | % of Total Investments (9/30/24)* |

| Gartner, Inc. | 9.7% |

| IDEXX Laboratories, Inc. | 5.9% |

| Guidewire Software, Inc. | 5.2% |

| Verisk Analytics, Inc. | 5.2% |

| Arch Capital Group Ltd. | 5.1% |

| Mettler-Toledo International, Inc. | 5.1% |

| CoStar Group, Inc. | 3.7% |

| Fair Isaac Corporation | 3.6% |

| Roper Technologies, Inc. | 2.9% |

| Space Exploration Technologies Corp. | 2.8% |

| Total | 49.2% |

* Individual weights may not sum to 100% (or displayed total) due to rounding.

Sector Breakdown

(as a % of total investments)*

| Value | Value |

|---|

| Information Technology | 30.4% |

| Health Care | 20.2% |

| Industrials | 18.5% |

| Financials | 13.0% |

| Consumer Discretionary | 7.8% |

| Real Estate | 6.5% |

| Communication Services | 3.2% |

| Materials | 0.3% |

If you wish to view additional information about the Fund; including but not limited to its financial statements, prospectus, or holdings, please visit connect.rightprospectus.com/Baron. For benchmark definitions and attribution language please visit BaronCapitalGroup.com.

Phone: 1.800.99.BARON

Email: info@BaronCapitalGroup.com

Annual Shareholder Report September 30, 2024

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about Baron Asset Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at BaronCapitalGroup.com. You can also request this information by contacting us at 1.800.99.BARON.

What were the Fund costs for the past 12 months?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $117 | 1.04% |

How did the Fund perform last year and what affected its performance?

Mid-cap stocks posted solid returns, although they lagged large caps throughout much of the period in a market dominated by the Magnificent Seven mega-cap names. The Fund, while posting double-digit gains, underperformed due to weak stock selection, particularly in Real Estate, Consumer Discretionary, and Industrials. Sector weightings did not factor much into results, with the positive impact of lack of exposure to the lagging Consumer Staples and Energy sectors along with an overweight in Real Estate, which soared on falling rates late in the period, cancelled out by the negative impact of higher exposure to the lagging Health Care sector and lack of exposure to the outperforming Utilities sector.

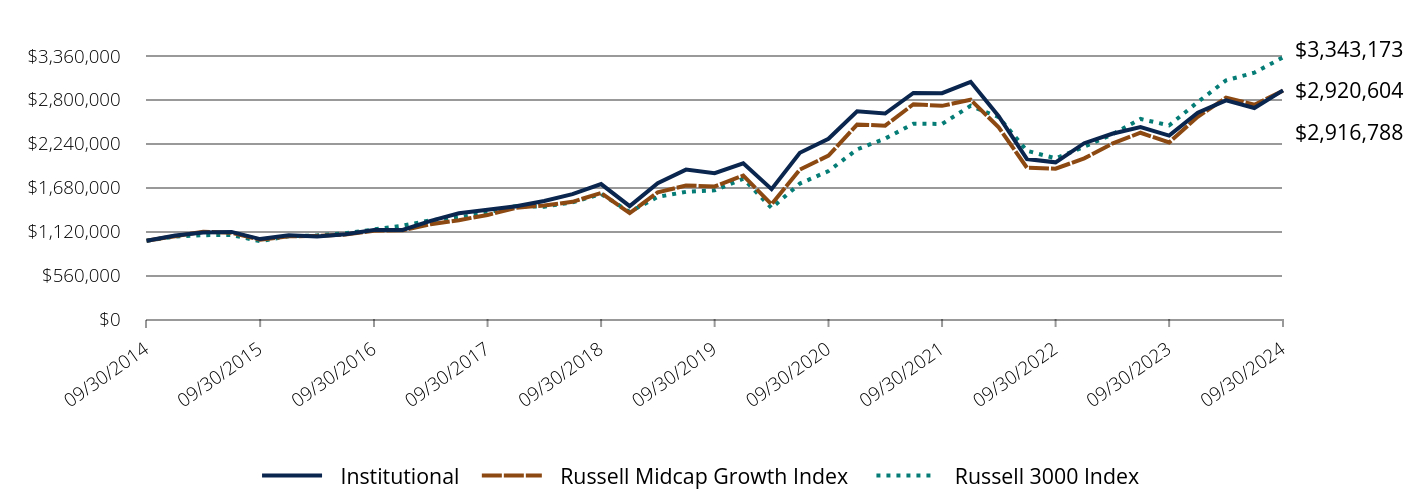

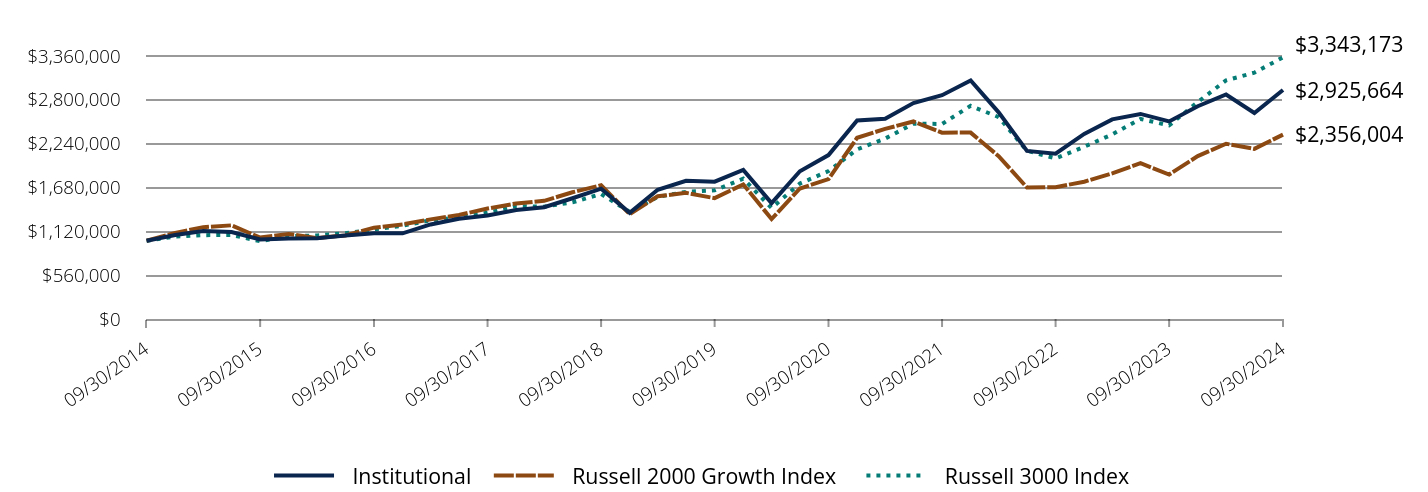

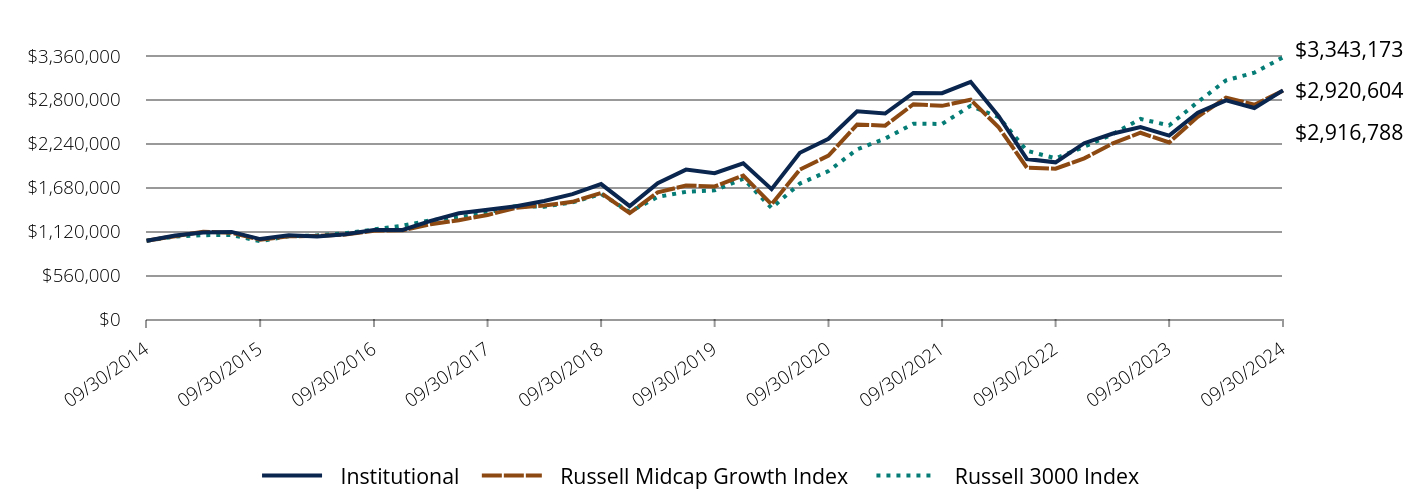

Comparison of the Change in Value of $1,000,000 Investment in the Fund in Relation to the Benchmarks

| Institutional | Russell Midcap Growth Index | Russell 3000 Index |

|---|

| 09/30/2014 | $1,000,000 | $1,000,000 | $1,000,000 |

| 12/31/2014 | $1,066,865 | $1,058,378 | $1,052,402 |

| 03/31/2015 | $1,104,463 | $1,115,298 | $1,071,348 |

| 06/30/2015 | $1,112,836 | $1,102,573 | $1,072,824 |

| 09/30/2015 | $1,021,058 | $1,014,483 | $995,053 |

| 12/31/2015 | $1,069,025 | $1,056,260 | $1,057,439 |

| 03/31/2016 | $1,052,775 | $1,062,377 | $1,067,679 |

| 06/30/2016 | $1,082,185 | $1,078,979 | $1,095,765 |

| 09/30/2016 | $1,137,892 | $1,128,525 | $1,143,953 |

| 12/31/2016 | $1,138,566 | $1,133,669 | $1,192,106 |

| 03/31/2017 | $1,254,411 | $1,211,829 | $1,260,572 |

| 06/30/2017 | $1,351,139 | $1,262,907 | $1,298,585 |

| 09/30/2017 | $1,396,827 | $1,329,627 | $1,357,947 |

| 12/31/2017 | $1,440,198 | $1,420,124 | $1,444,005 |

| 03/31/2018 | $1,507,640 | $1,451,003 | $1,434,699 |

| 06/30/2018 | $1,594,497 | $1,496,818 | $1,490,491 |

| 09/30/2018 | $1,724,068 | $1,610,195 | $1,596,672 |

| 12/31/2018 | $1,442,153 | $1,352,660 | $1,368,314 |

| 03/31/2019 | $1,736,412 | $1,618,065 | $1,560,472 |

| 06/30/2019 | $1,908,662 | $1,705,470 | $1,624,375 |

| 09/30/2019 | $1,863,798 | $1,693,983 | $1,643,258 |

| 12/31/2019 | $1,989,621 | $1,832,444 | $1,792,751 |

| 03/31/2020 | $1,658,681 | $1,465,223 | $1,418,072 |

| 06/30/2020 | $2,123,457 | $1,908,612 | $1,730,438 |

| 09/30/2020 | $2,302,422 | $2,087,518 | $1,889,769 |

| 12/31/2020 | $2,652,706 | $2,484,546 | $2,167,217 |

| 03/31/2021 | $2,625,335 | $2,470,502 | $2,304,769 |

| 06/30/2021 | $2,888,780 | $2,744,039 | $2,494,677 |

| 09/30/2021 | $2,884,675 | $2,723,186 | $2,492,140 |

| 12/31/2021 | $3,029,989 | $2,800,785 | $2,723,349 |

| 03/31/2022 | $2,590,065 | $2,448,436 | $2,579,598 |

| 06/30/2022 | $2,043,834 | $1,932,508 | $2,148,776 |

| 09/30/2022 | $2,001,597 | $1,919,889 | $2,052,841 |

| 12/31/2022 | $2,246,070 | $2,052,388 | $2,200,278 |

| 03/31/2023 | $2,366,103 | $2,239,893 | $2,358,264 |

| 06/30/2023 | $2,452,085 | $2,379,534 | $2,556,047 |

| 09/30/2023 | $2,343,811 | $2,255,228 | $2,472,878 |

| 12/31/2023 | $2,635,716 | $2,583,276 | $2,771,400 |

| 03/31/2024 | $2,793,874 | $2,828,598 | $3,049,076 |

| 06/30/2024 | $2,695,786 | $2,737,706 | $3,147,134 |

| 09/30/2024 | $2,920,604 | $2,916,788 | $3,343,173 |

Average Annual Total Returns (%)

| Total Net Assets | $4,441,124,161 |

| # of Issuers | 52 |

| Portfolio Turnover Rate | 4% |

| Total Advisory Fees Paid | $44,072,858 |

| fund | 1 Year | 5 Years | 10 Years |

|---|

| Institutional | 24.61% | 9.40% | 11.31% |

| Russell Midcap Growth Index | 29.33% | 11.48% | 11.30% |

| Russell 3000 Index | 35.19% | 15.26% | 12.83% |

Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower.

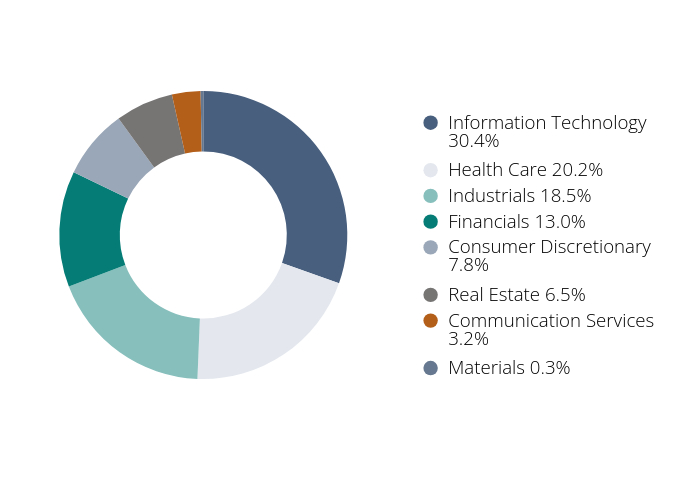

What did the Fund invest in?

| Holding | % of Total Investments (9/30/24)* |

| Gartner, Inc. | 9.7% |

| IDEXX Laboratories, Inc. | 5.9% |

| Guidewire Software, Inc. | 5.2% |

| Verisk Analytics, Inc. | 5.2% |

| Arch Capital Group Ltd. | 5.1% |

| Mettler-Toledo International, Inc. | 5.1% |

| CoStar Group, Inc. | 3.7% |

| Fair Isaac Corporation | 3.6% |

| Roper Technologies, Inc. | 2.9% |

| Space Exploration Technologies Corp. | 2.8% |

| Total | 49.2% |

* Individual weights may not sum to 100% (or displayed total) due to rounding.

Sector Breakdown

(as a % of total investments)*

| Value | Value |

|---|

| Information Technology | 30.4% |

| Health Care | 20.2% |

| Industrials | 18.5% |

| Financials | 13.0% |

| Consumer Discretionary | 7.8% |

| Real Estate | 6.5% |

| Communication Services | 3.2% |

| Materials | 0.3% |

If you wish to view additional information about the Fund; including but not limited to its financial statements, prospectus, or holdings, please visit connect.rightprospectus.com/Baron. For benchmark definitions and attribution language please visit BaronCapitalGroup.com.

Phone: 1.800.99.BARON

Email: info@BaronCapitalGroup.com

Annual Shareholder Report September 30, 2024

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about Baron Asset Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at BaronCapitalGroup.com. You can also request this information by contacting us at 1.800.99.BARON.

What were the Fund costs for the past 12 months?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| R6 | $117 | 1.04% |

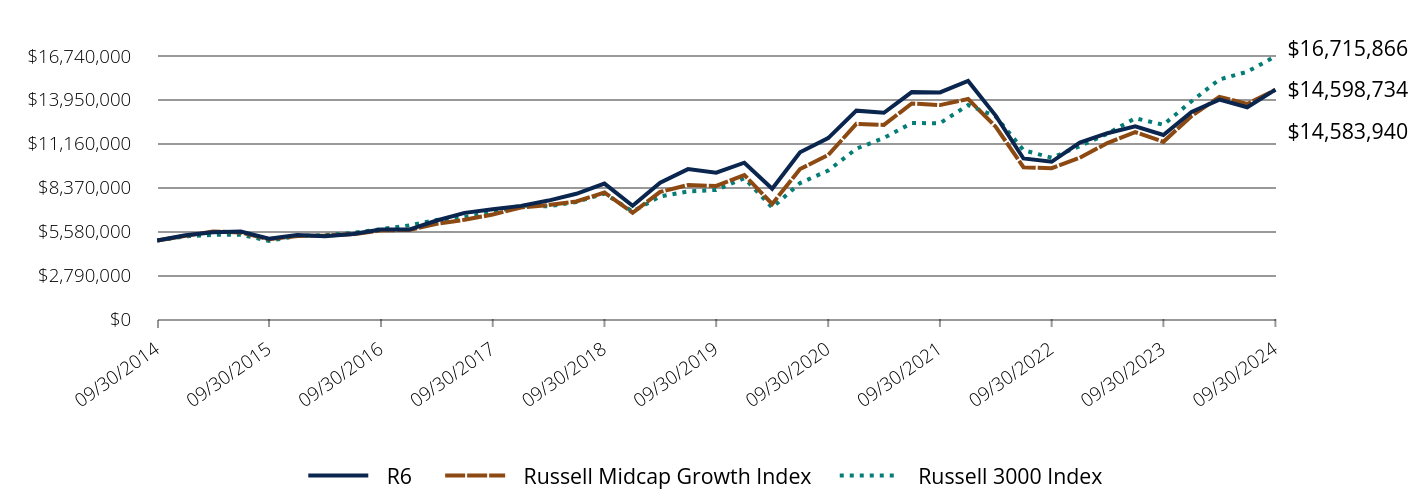

How did the Fund perform last year and what affected its performance?

Mid-cap stocks posted solid returns, although they lagged large caps throughout much of the period in a market dominated by the Magnificent Seven mega-cap names. The Fund, while posting double-digit gains, underperformed due to weak stock selection, particularly in Real Estate, Consumer Discretionary, and Industrials. Sector weightings did not factor much into results, with the positive impact of lack of exposure to the lagging Consumer Staples and Energy sectors along with an overweight in Real Estate, which soared on falling rates late in the period, cancelled out by the negative impact of higher exposure to the lagging Health Care sector and lack of exposure to the outperforming Utilities sector.

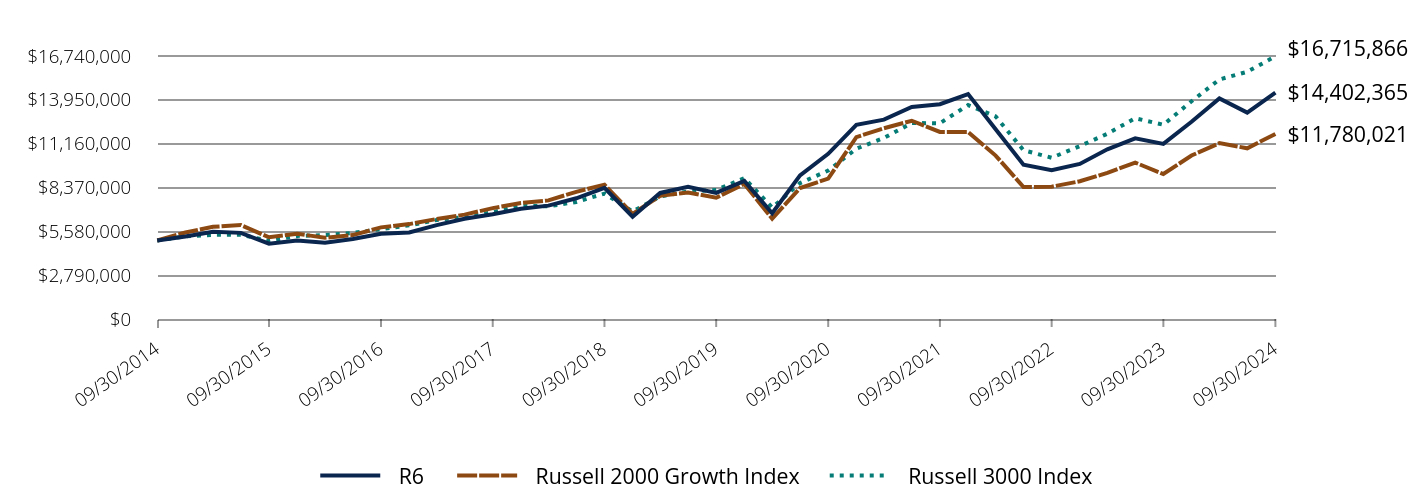

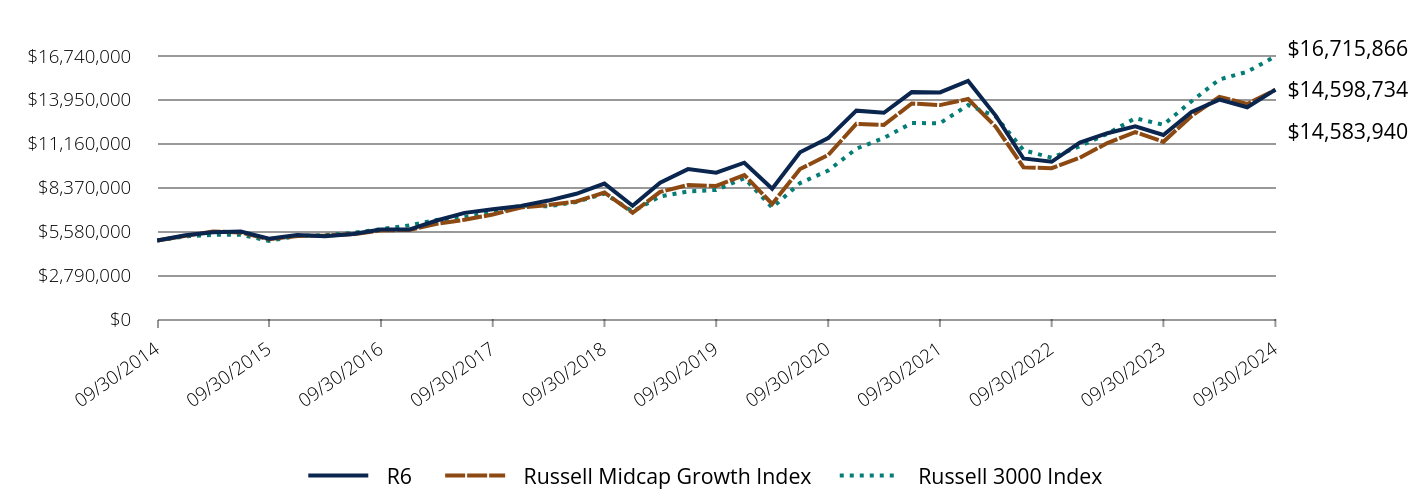

Comparison of the Change in Value of $5,000,000 Investment in the Fund in Relation to the Benchmarks

| R6 | Russell Midcap Growth Index | Russell 3000 Index |

|---|

| 09/30/2014 | $5,000,000 | $5,000,000 | $5,000,000 |

| 12/31/2014 | $5,334,325 | $5,291,890 | $5,262,007 |

| 03/31/2015 | $5,522,315 | $5,576,492 | $5,356,742 |

| 06/30/2015 | $5,564,182 | $5,512,863 | $5,364,121 |

| 09/30/2015 | $5,105,289 | $5,072,415 | $4,975,264 |

| 12/31/2015 | $5,345,126 | $5,281,301 | $5,287,195 |

| 03/31/2016 | $5,263,877 | $5,311,886 | $5,338,393 |

| 06/30/2016 | $5,411,839 | $5,394,894 | $5,478,824 |

| 09/30/2016 | $5,689,462 | $5,642,624 | $5,719,766 |

| 12/31/2016 | $5,692,832 | $5,668,344 | $5,960,531 |

| 03/31/2017 | $6,271,099 | $6,059,146 | $6,302,862 |

| 06/30/2017 | $6,754,742 | $6,314,534 | $6,492,924 |

| 09/30/2017 | $6,983,181 | $6,648,133 | $6,789,736 |

| 12/31/2017 | $7,200,031 | $7,100,621 | $7,220,024 |

| 03/31/2018 | $7,537,245 | $7,255,014 | $7,173,497 |

| 06/30/2018 | $7,971,536 | $7,484,087 | $7,452,456 |

| 09/30/2018 | $8,619,396 | $8,050,975 | $7,983,362 |

| 12/31/2018 | $7,208,716 | $6,763,297 | $6,841,571 |

| 03/31/2019 | $8,681,125 | $8,090,324 | $7,802,359 |

| 06/30/2019 | $9,541,299 | $8,527,349 | $8,121,873 |

| 09/30/2019 | $9,316,978 | $8,469,916 | $8,216,289 |

| 12/31/2019 | $9,947,210 | $9,162,219 | $8,963,755 |

| 03/31/2020 | $8,291,370 | $7,326,113 | $7,090,358 |

| 06/30/2020 | $10,616,404 | $9,543,062 | $8,652,191 |

| 09/30/2020 | $11,511,244 | $10,437,588 | $9,448,844 |

| 12/31/2020 | $13,261,600 | $12,422,730 | $10,836,087 |

| 03/31/2021 | $13,124,741 | $12,352,510 | $11,523,844 |

| 06/30/2021 | $14,440,865 | $13,720,194 | $12,473,385 |

| 09/30/2021 | $14,421,477 | $13,615,928 | $12,460,697 |

| 12/31/2021 | $15,148,157 | $14,003,922 | $13,616,746 |

| 03/31/2022 | $12,948,440 | $12,242,182 | $12,897,992 |

| 06/30/2022 | $10,217,167 | $9,662,539 | $10,743,878 |

| 09/30/2022 | $10,007,196 | $9,599,444 | $10,264,206 |

| 12/31/2022 | $11,228,392 | $10,261,942 | $11,001,387 |

| 03/31/2023 | $11,827,354 | $11,199,463 | $11,791,320 |

| 06/30/2023 | $12,258,508 | $11,897,668 | $12,780,235 |

| 09/30/2023 | $11,715,891 | $11,276,138 | $12,364,389 |

| 12/31/2023 | $13,175,488 | $12,916,382 | $13,856,999 |

| 03/31/2024 | $13,965,054 | $14,142,992 | $15,245,380 |

| 06/30/2024 | $13,475,852 | $13,688,528 | $15,735,670 |

| 09/30/2024 | $14,598,734 | $14,583,940 | $16,715,866 |

Average Annual Total Returns (%)

| Total Net Assets | $4,441,124,161 |

| # of Issuers | 52 |

| Portfolio Turnover Rate | 4% |

| Total Advisory Fees Paid | $44,072,858 |

| fund | 1 Year | 5 Years | 10 Years |

|---|

| R6 | 24.61% | 9.40% | 11.31% |

| Russell Midcap Growth Index | 29.33% | 11.48% | 11.30% |

| Russell 3000 Index | 35.19% | 15.26% | 12.83% |

Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares.

What did the Fund invest in?

| Holding | % of Total Investments (9/30/24)* |

| Gartner, Inc. | 9.7% |

| IDEXX Laboratories, Inc. | 5.9% |

Guidewire Software, Inc. | 5.2% |

| Verisk Analytics, Inc. | 5.2% |

| Arch Capital Group Ltd. | 5.1% |

| Mettler-Toledo International, Inc. | 5.1% |

| CoStar Group, Inc. | 3.7% |

| Fair Isaac Corporation | 3.6% |

| Roper Technologies, Inc. | 2.9% |

| Space Exploration Technologies Corp. | 2.8% |

| Total | 49.2% |

* Individual weights may not sum to 100% (or displayed total) due to rounding.

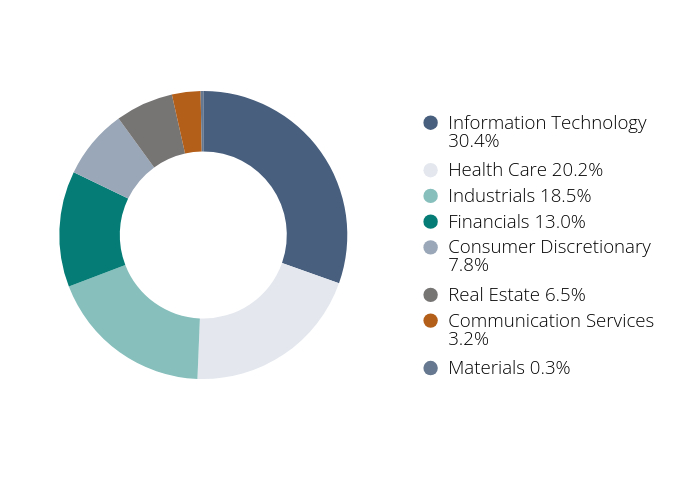

Sector Breakdown

(as a % of total investments)*

| Value | Value |

|---|

| Information Technology | 30.4% |

| Health Care | 20.2% |

| Industrials | 18.5% |

| Financials | 13.0% |

| Consumer Discretionary | 7.8% |

| Real Estate | 6.5% |

| Communication Services | 3.2% |

| Materials | 0.3% |

If you wish to view additional information about the Fund; including but not limited to its financial statements, prospectus, or holdings, please visit connect.rightprospectus.com/Baron. For benchmark definitions and attribution language please visit BaronCapitalGroup.com.

Phone: 1.800.99.BARON

Email: info@BaronCapitalGroup.com

Annual Shareholder Report September 30, 2024

Annual Shareholder Report September 30, 2024

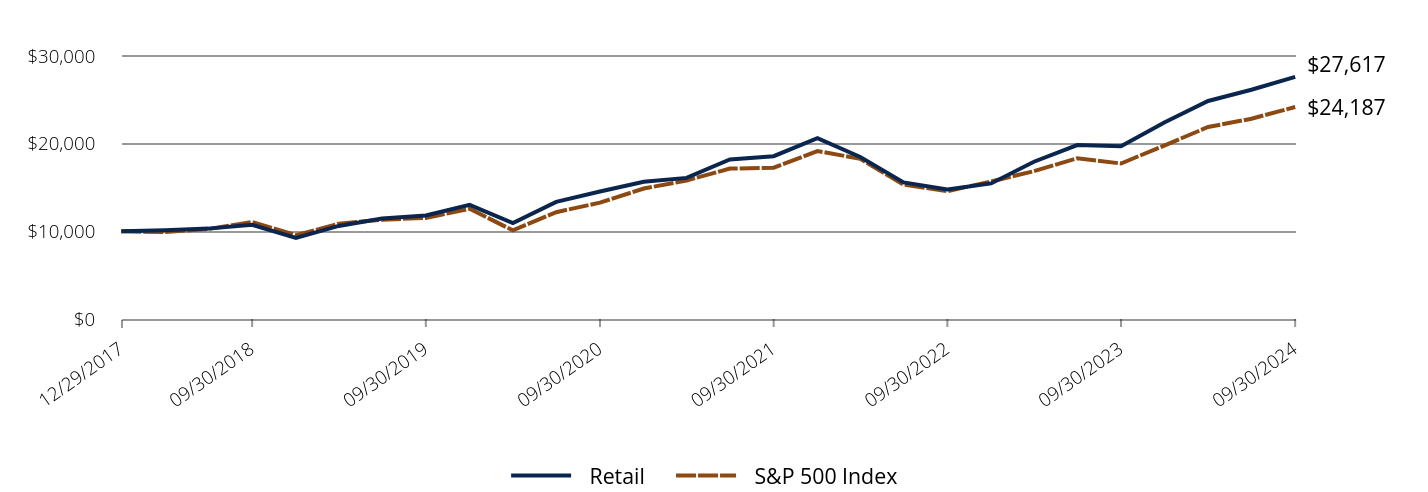

This annual shareholder report contains important information about Baron Growth Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at BaronCapitalGroup.com. You can also request this information by contacting us at 1.800.99.BARON.

What were the Fund costs for the past 12 months?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Retail | $144 | 1.34% |

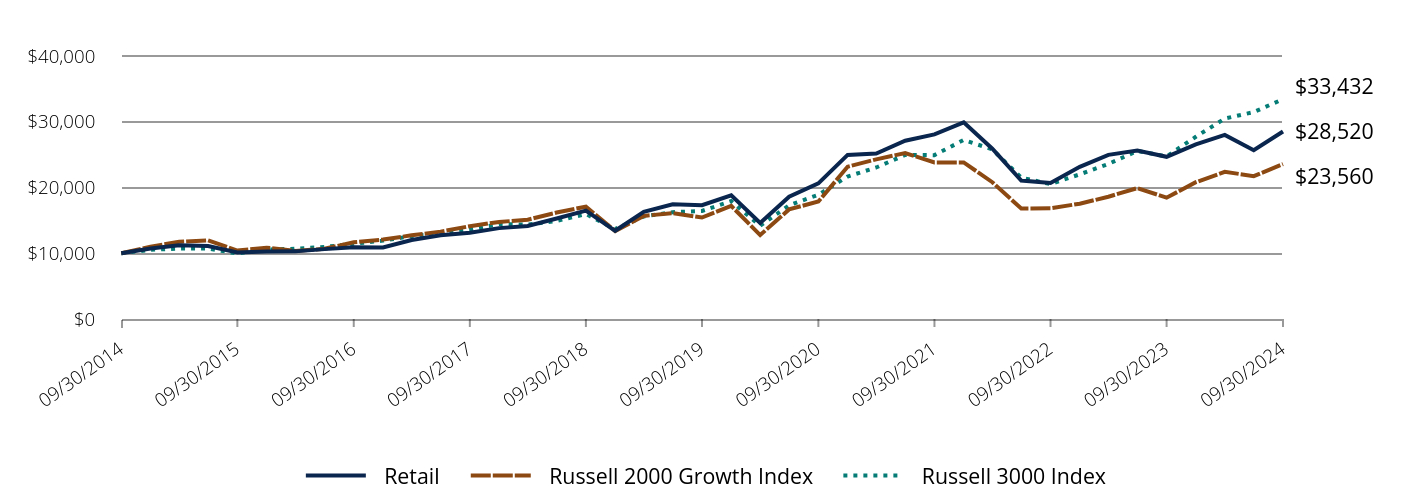

How did the Fund perform last year and what affected its performance?

For much of the year-long period, the Magnificent Seven mega-cap names dominated returns while small caps lagged their larger counterparts. This trend reversed with the U.S. Federal Reserve's September rate cut - its first in over four years - signaling the start of an easing cycle and kicking off a small-cap rally. The Fund, while posting double-digit returns, underperformed its benchmark due to weak stock section, particularly in Consumer Discretionary, Communication Services, and Real Estate. Sector weightings did not significantly impact performance despite lack of exposure to Energy, the only sector in the benchmark to post negative returns.

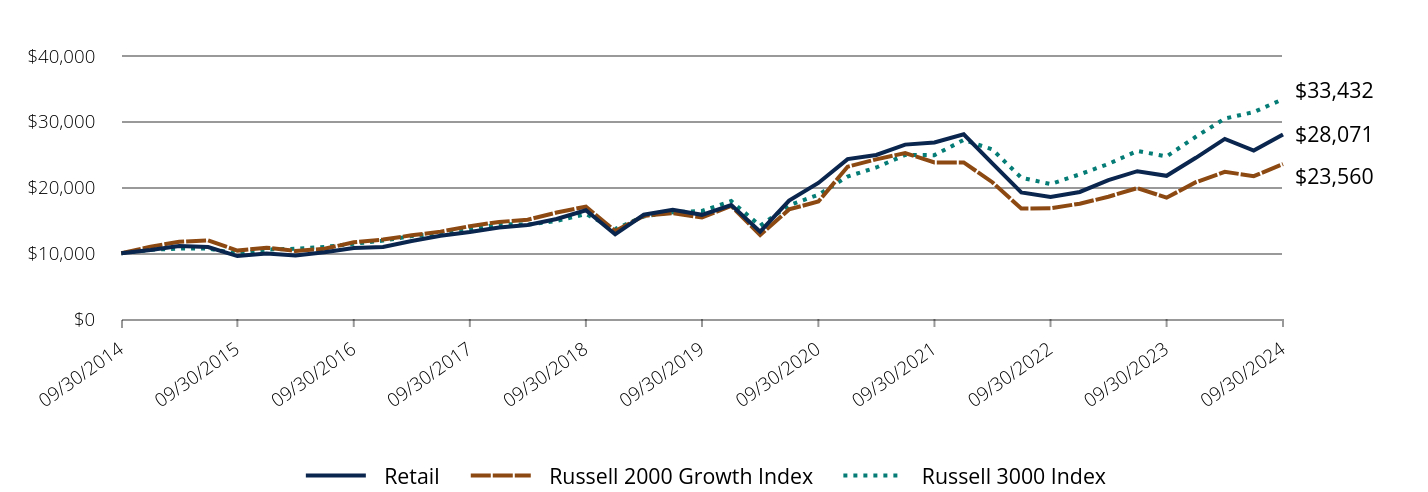

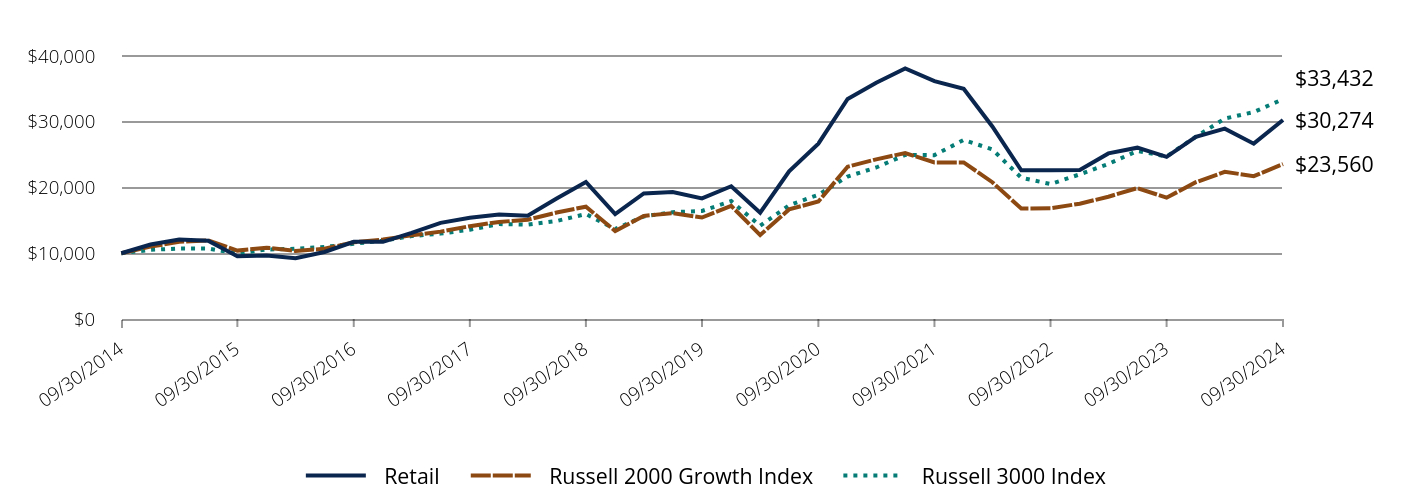

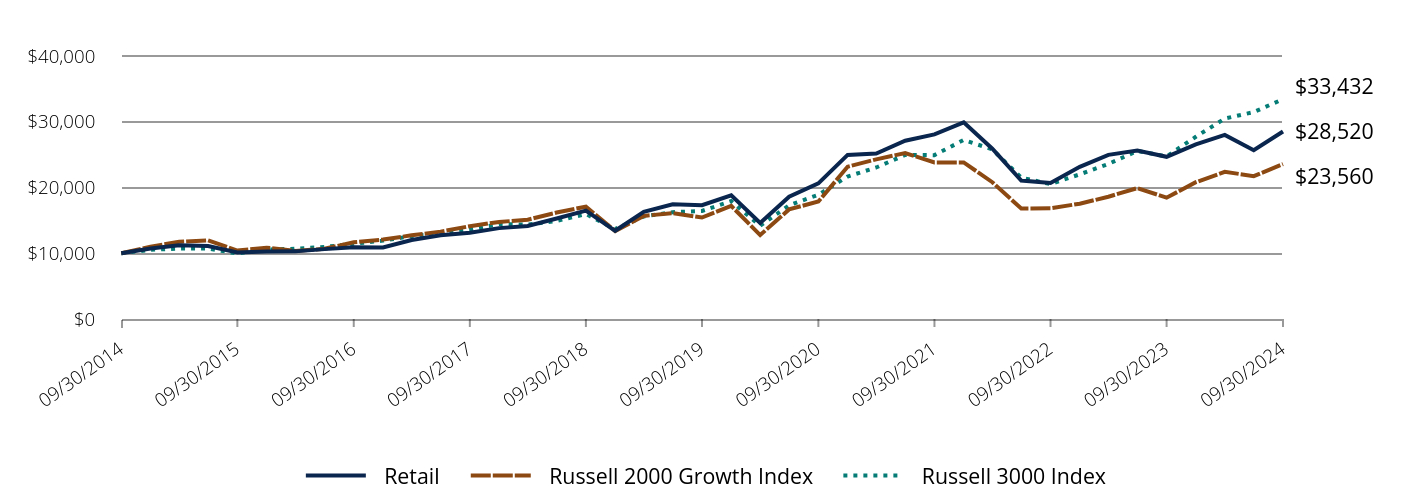

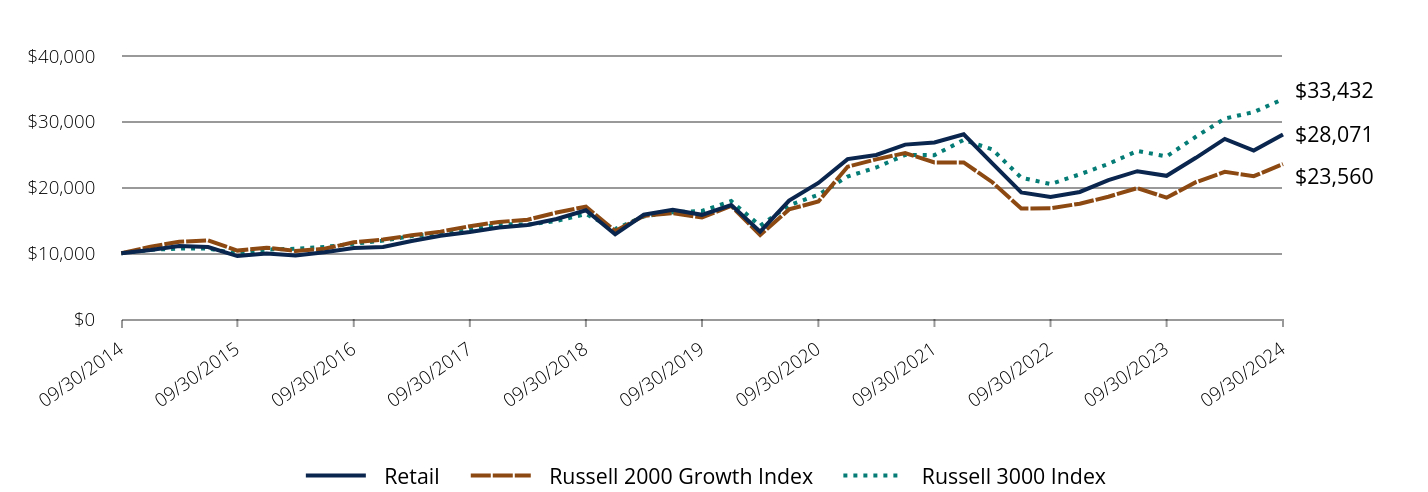

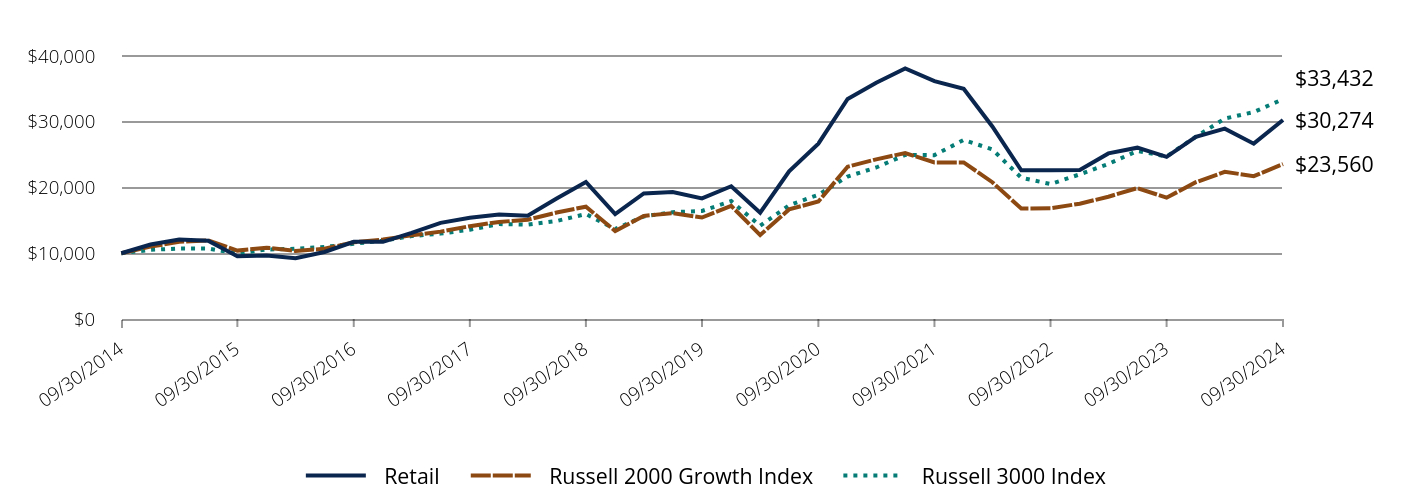

Comparison of the Change in Value of $10,000 Investment in the Fund in Relation to the Benchmarks

| Retail | Russell 2000 Growth Index | Russell 3000 Index |

|---|

| 09/30/2014 | $10,000 | $10,000 | $10,000 |

| 12/31/2014 | $10,723 | $11,006 | $10,524 |

| 03/31/2015 | $11,225 | $11,736 | $10,714 |

| 06/30/2015 | $11,093 | $11,968 | $10,728 |

| 09/30/2015 | $10,127 | $10,404 | $9,951 |

| 12/31/2015 | $10,261 | $10,854 | $10,574 |

| 03/31/2016 | $10,287 | $10,346 | $10,677 |

| 06/30/2016 | $10,628 | $10,681 | $10,958 |

| 09/30/2016 | $10,896 | $11,666 | $11,440 |

| 12/31/2016 | $10,881 | $12,082 | $11,921 |

| 03/31/2017 | $12,006 | $12,729 | $12,606 |

| 06/30/2017 | $12,724 | $13,287 | $12,986 |

| 09/30/2017 | $13,127 | $14,113 | $13,580 |

| 12/31/2017 | $13,822 | $14,761 | $14,440 |

| 03/31/2018 | $14,155 | $15,100 | $14,347 |

| 06/30/2018 | $15,279 | $16,192 | $14,905 |

| 09/30/2018 | $16,480 | $17,086 | $15,967 |

| 12/31/2018 | $13,419 | $13,387 | $13,683 |

| 03/31/2019 | $16,316 | $15,682 | $15,605 |

| 06/30/2019 | $17,451 | $16,113 | $16,244 |

| 09/30/2019 | $17,319 | $15,440 | $16,433 |

| 12/31/2019 | $18,805 | $17,200 | $17,928 |

| 03/31/2020 | $14,601 | $12,768 | $14,181 |

| 06/30/2020 | $18,601 | $16,673 | $17,304 |

| 09/30/2020 | $20,623 | $17,867 | $18,898 |

| 12/31/2020 | $24,958 | $23,156 | $21,672 |

| 03/31/2021 | $25,175 | $24,285 | $23,048 |

| 06/30/2021 | $27,121 | $25,236 | $24,947 |

| 09/30/2021 | $28,087 | $23,810 | $24,921 |

| 12/31/2021 | $29,910 | $23,813 | $27,234 |

| 03/31/2022 | $25,906 | $20,806 | $25,796 |

| 06/30/2022 | $21,049 | $16,800 | $21,488 |

| 09/30/2022 | $20,699 | $16,840 | $20,528 |

| 12/31/2022 | $23,151 | $17,536 | $22,003 |

| 03/31/2023 | $24,962 | $18,601 | $23,583 |

| 06/30/2023 | $25,622 | $19,913 | $25,561 |

| 09/30/2023 | $24,667 | $18,456 | $24,729 |

| 12/31/2023 | $26,549 | $20,808 | $27,714 |

| 03/31/2024 | $27,998 | $22,386 | $30,491 |

| 06/30/2024 | $25,678 | $21,732 | $31,471 |

| 09/30/2024 | $28,520 | $23,560 | $33,432 |

Average Annual Total Returns (%)

| Total Net Assets | $7,586,737,355 |

| # of Issuers | 33 |

| Portfolio Turnover Rate | 0%Footnote Reference† |

| Total Advisory Fees Paid | $75,000,891 |

| fund | 1 Year | 5 Years | 10 Years |

|---|

| Retail | 15.62% | 10.49% | 11.05% |

| Russell 2000 Growth Index | 27.66% | 8.82% | 8.95% |

| Russell 3000 Index | 35.19% | 15.26% | 12.83% |

Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower.

| Footnote | Description |

Footnote† | Less than 0.5%. |

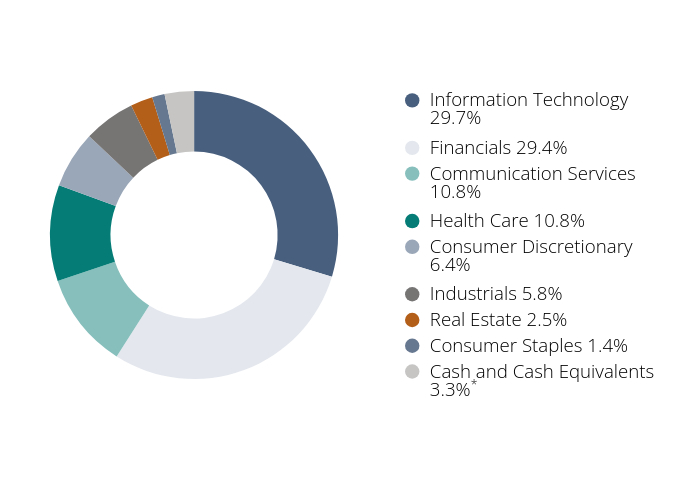

What did the Fund invest in?

| Holding | % of Total Investments (9/30/24)* |

| Arch Capital Group Ltd. | 13.2% |

| MSCI Inc. | 10.7% |

| Gartner, Inc. | 9.5% |

| FactSet Research Systems Inc. | 6.8% |

| Kinsale Capital Group, Inc. | 5.7% |

| Choice Hotels International, Inc. | 5.1% |

| CoStar Group, Inc. | 5.0% |

| Primerica, Inc. | 4.7% |

| Vail Resorts, Inc. | 4.6% |

| Morningstar, Inc. | 3.9% |

| Total | 69.1% |

* Individual weights may not sum to 100% (or displayed total) due to rounding.

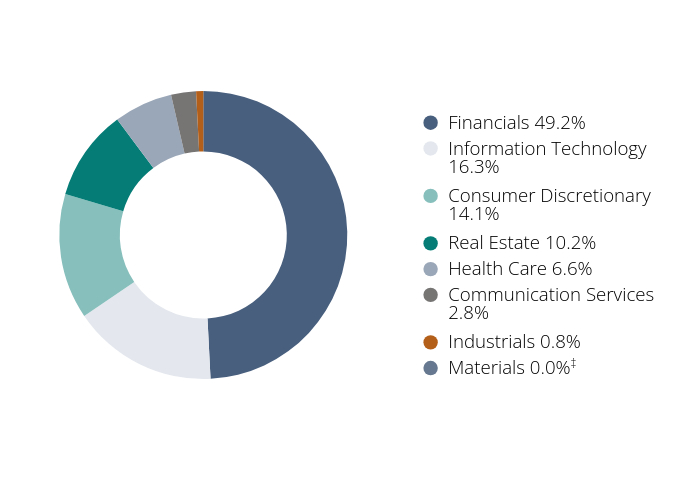

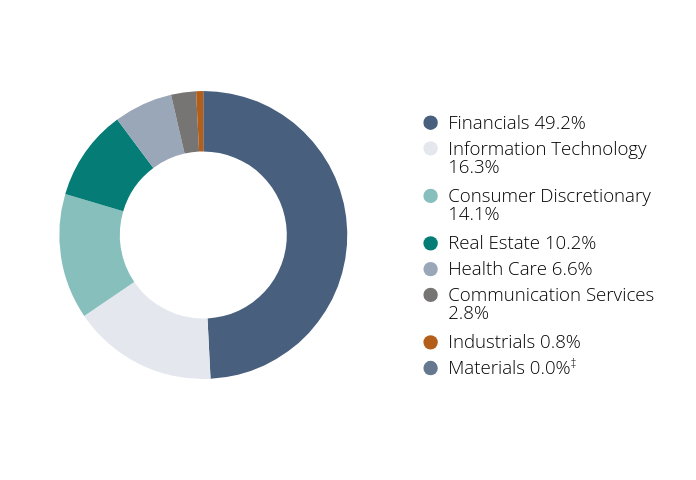

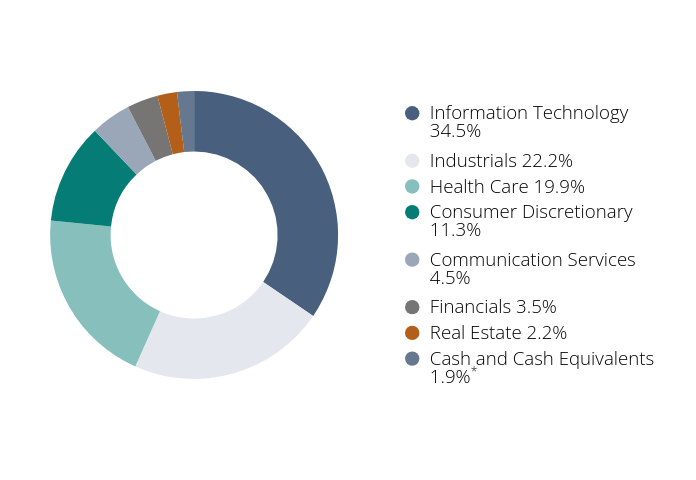

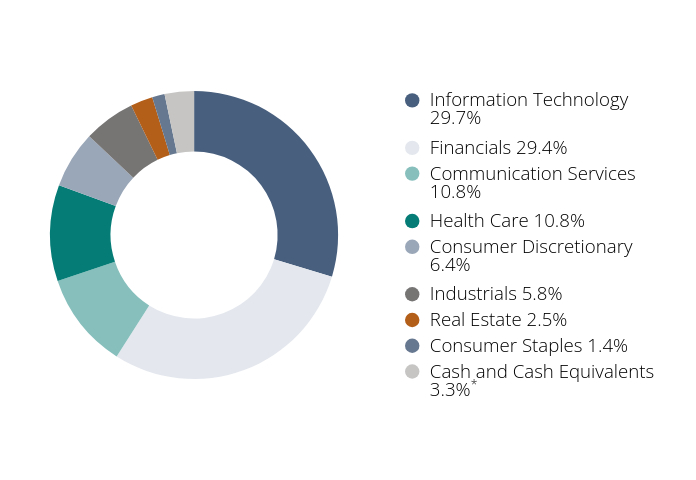

Sector Breakdown

(as a % of total investments)*

| Value | Value |

|---|

| Financials | 49.2% |

| Information Technology | 16.3% |

| Consumer Discretionary | 14.1% |

| Real Estate | 10.2% |

| Health Care | 6.6% |

| Communication Services | 2.8% |

| Industrials | 0.8% |

| Materials | 0.0%Footnote Reference‡ |

| Footnote | Description |

Footnote‡ | Rounds to less than 0.1%. |

If you wish to view additional information about the Fund; including but not limited to its financial statements, prospectus, or holdings, please visit connect.rightprospectus.com/Baron. For benchmark definitions and attribution language please visit BaronCapitalGroup.com.

Phone: 1.800.99.BARON

Email: info@BaronCapitalGroup.com

Annual Shareholder Report September 30, 2024

Annual Shareholder Report September 30, 2024

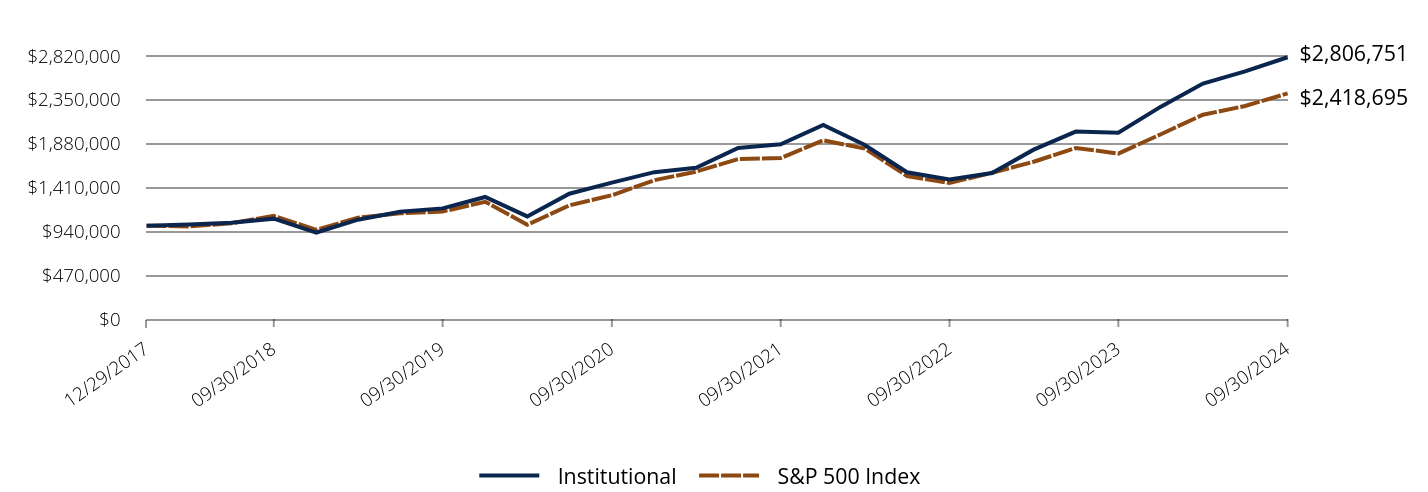

This annual shareholder report contains important information about Baron Growth Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at BaronCapitalGroup.com. You can also request this information by contacting us at 1.800.99.BARON.

What were the Fund costs for the past 12 months?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $117 | 1.08% |

How did the Fund perform last year and what affected its performance?

For much of the year-long period, the Magnificent Seven mega-cap names dominated returns while small caps lagged their larger counterparts. This trend reversed with the U.S. Federal Reserve's September rate cut - its first in over four years - signaling the start of an easing cycle and kicking off a small-cap rally. The Fund, while posting double-digit returns, underperformed its benchmark due to weak stock section, particularly in Consumer Discretionary, Communication Services, and Real Estate. Sector weightings did not significantly impact performance despite lack of exposure to Energy, the only sector in the benchmark to post negative returns.

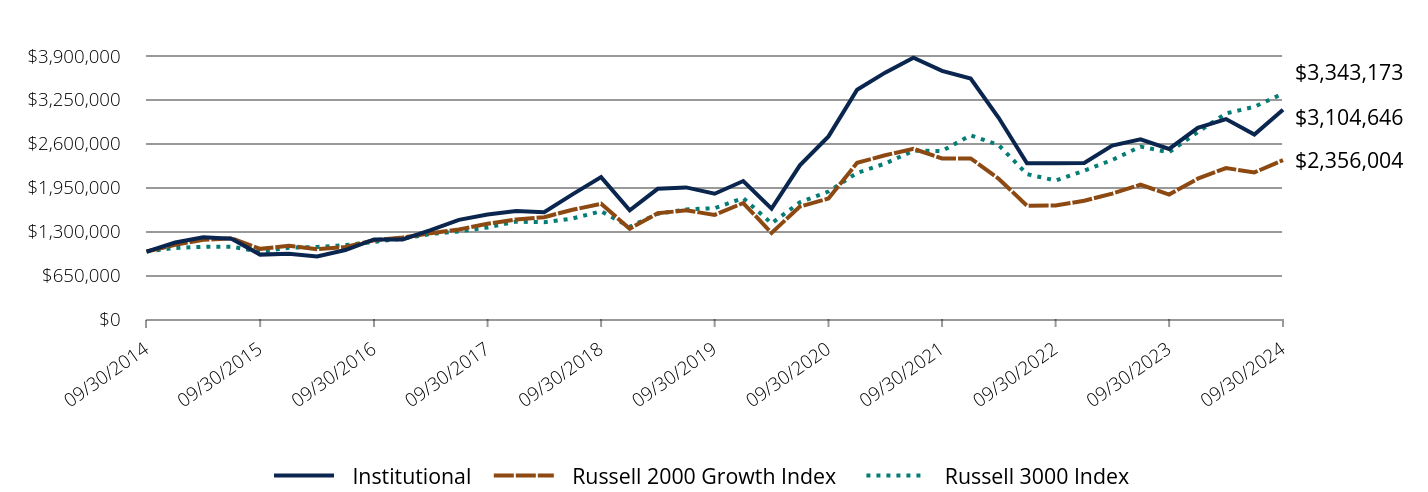

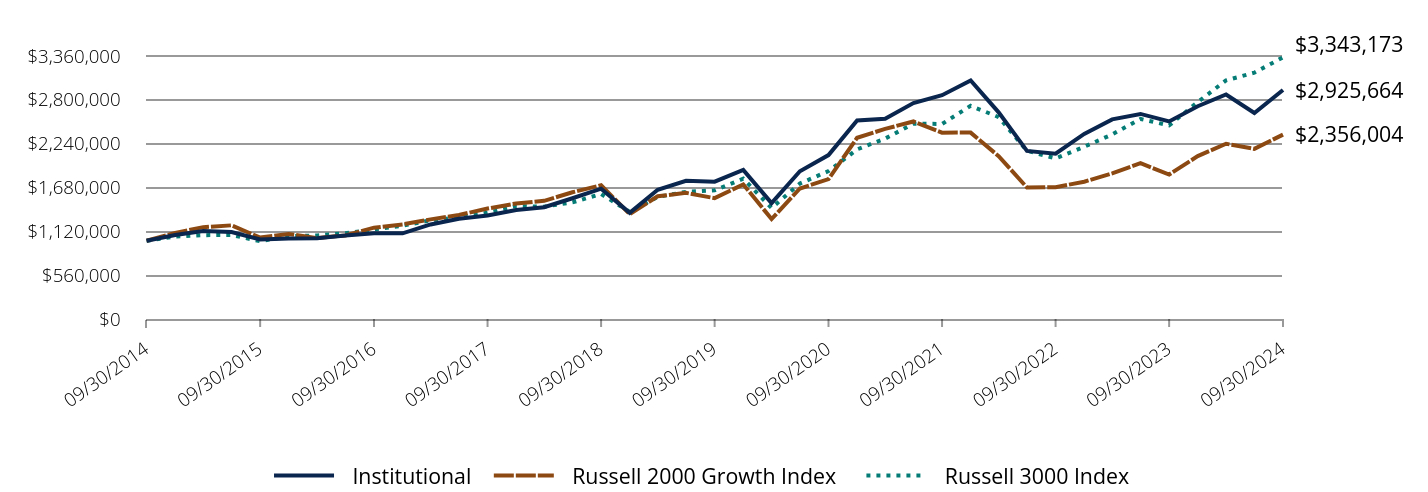

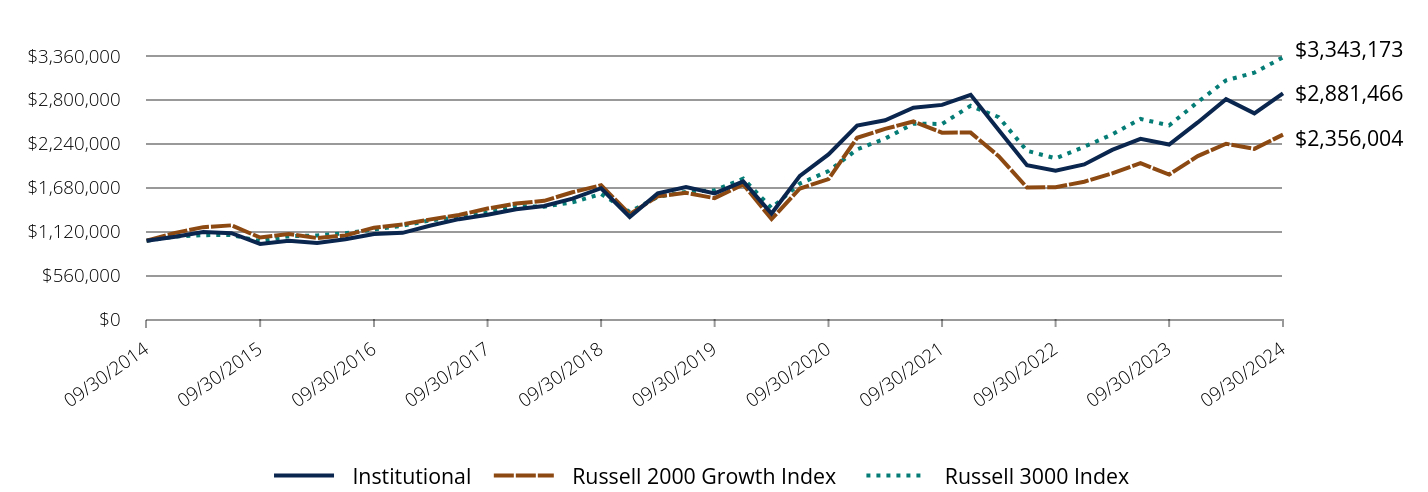

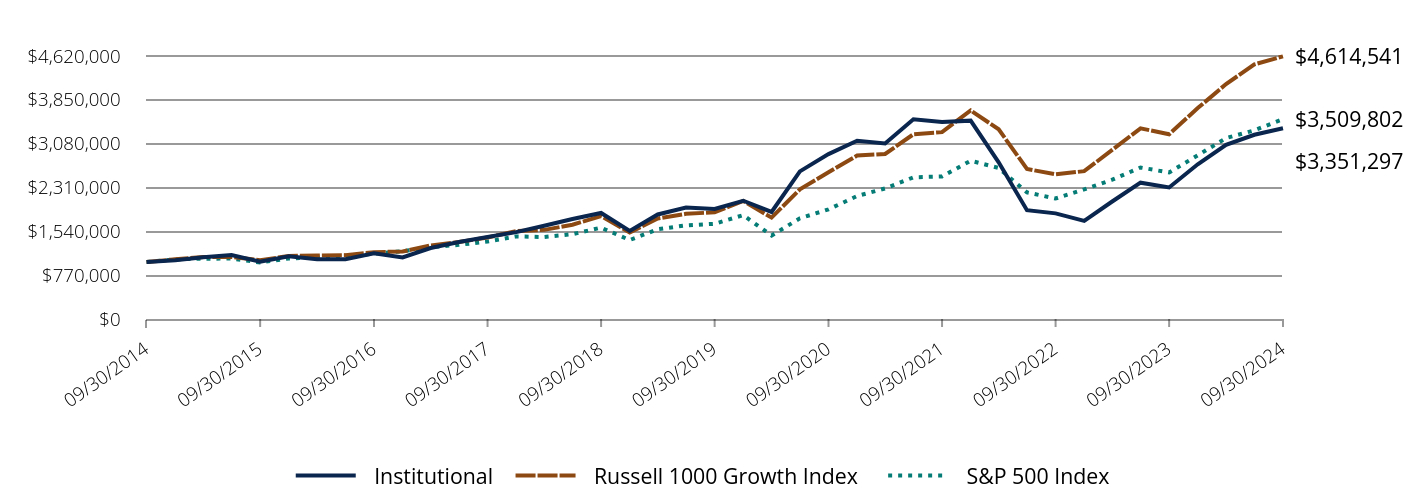

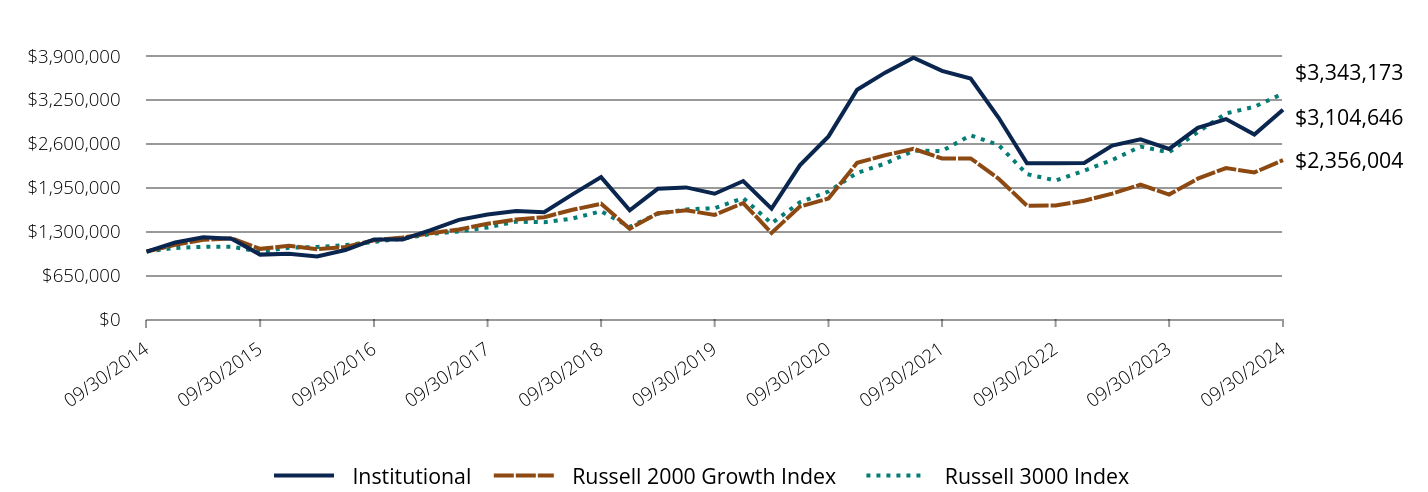

Comparison of the Change in Value of $1,000,000 Investment in the Fund in Relation to the Benchmarks

| Institutional | Russell 2000 Growth Index | Russell 3000 Index |

|---|

| 09/30/2014 | $1,000,000 | $1,000,000 | $1,000,000 |

| 12/31/2014 | $1,072,851 | $1,100,587 | $1,052,402 |

| 03/31/2015 | $1,123,828 | $1,173,556 | $1,071,348 |

| 06/30/2015 | $1,111,403 | $1,196,754 | $1,072,824 |

| 09/30/2015 | $1,015,135 | $1,040,438 | $995,053 |

| 12/31/2015 | $1,029,313 | $1,085,382 | $1,057,439 |

| 03/31/2016 | $1,032,514 | $1,034,554 | $1,067,679 |

| 06/30/2016 | $1,067,406 | $1,068,082 | $1,095,765 |

| 09/30/2016 | $1,095,096 | $1,166,579 | $1,143,953 |

| 12/31/2016 | $1,094,269 | $1,208,225 | $1,192,106 |

| 03/31/2017 | $1,208,158 | $1,272,853 | $1,260,572 |

| 06/30/2017 | $1,281,385 | $1,328,714 | $1,298,585 |

| 09/30/2017 | $1,322,766 | $1,411,337 | $1,357,947 |

| 12/31/2017 | $1,393,589 | $1,476,051 | $1,444,005 |

| 03/31/2018 | $1,428,053 | $1,509,990 | $1,434,699 |

| 06/30/2018 | $1,542,465 | $1,619,201 | $1,490,491 |

| 09/30/2018 | $1,664,893 | $1,708,632 | $1,596,672 |

| 12/31/2018 | $1,356,401 | $1,338,660 | $1,368,314 |

| 03/31/2019 | $1,650,356 | $1,568,170 | $1,560,472 |

| 06/30/2019 | $1,766,306 | $1,611,263 | $1,624,375 |

| 09/30/2019 | $1,754,066 | $1,544,026 | $1,643,258 |

| 12/31/2019 | $1,905,799 | $1,719,957 | $1,792,751 |

| 03/31/2020 | $1,480,781 | $1,276,810 | $1,418,072 |

| 06/30/2020 | $1,887,340 | $1,667,312 | $1,730,438 |

| 09/30/2020 | $2,093,955 | $1,786,658 | $1,889,769 |

| 12/31/2020 | $2,535,751 | $2,315,616 | $2,167,217 |

| 03/31/2021 | $2,559,513 | $2,428,508 | $2,304,769 |

| 06/30/2021 | $2,759,158 | $2,523,644 | $2,494,677 |

| 09/30/2021 | $2,859,285 | $2,380,994 | $2,492,140 |

| 12/31/2021 | $3,046,752 | $2,381,259 | $2,723,349 |

| 03/31/2022 | $2,640,518 | $2,080,568 | $2,579,598 |

| 06/30/2022 | $2,146,877 | $1,679,969 | $2,148,776 |

| 09/30/2022 | $2,112,314 | $1,684,032 | $2,052,841 |

| 12/31/2022 | $2,364,369 | $1,753,619 | $2,200,278 |

| 03/31/2023 | $2,550,634 | $1,860,111 | $2,358,264 |

| 06/30/2023 | $2,619,855 | $1,991,296 | $2,556,047 |

| 09/30/2023 | $2,523,865 | $1,845,561 | $2,472,878 |

| 12/31/2023 | $2,718,320 | $2,080,817 | $2,771,400 |

| 03/31/2024 | $2,868,382 | $2,238,582 | $3,049,076 |

| 06/30/2024 | $2,632,264 | $2,173,234 | $3,147,134 |

| 09/30/2024 | $2,925,664 | $2,356,004 | $3,343,173 |

Average Annual Total Returns (%)

| Total Net Assets | $7,586,737,355 |

| # of Issuers | 33 |

| Portfolio Turnover Rate | 0%Footnote Reference† |

| Total Advisory Fees Paid | $75,000,891 |

| fund | 1 Year | 5 Years | 10 Years |

|---|

| Institutional | 15.92% | 10.77% | 11.33% |

| Russell 2000 Growth Index | 27.66% | 8.82% | 8.95% |

| Russell 3000 Index | 35.19% | 15.26% | 12.83% |

Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower.

| Footnote | Description |

Footnote† | Less than 0.5%. |

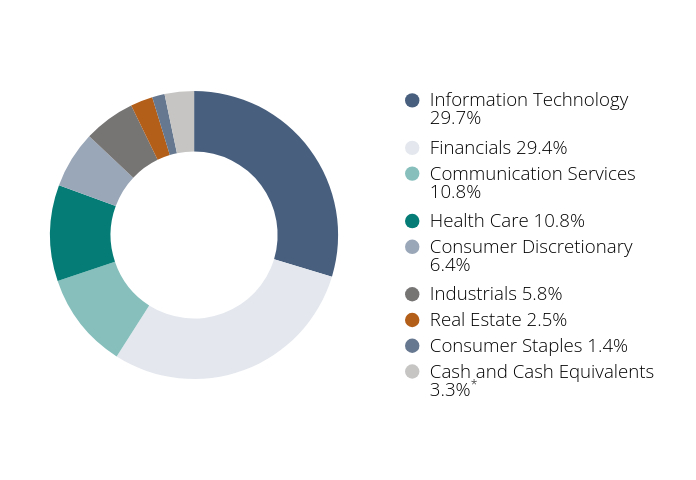

What did the Fund invest in?

| Holding | % of Total Investments (9/30/24)* |

| Arch Capital Group Ltd. | 13.2% |

| MSCI Inc. | 10.7% |

| Gartner, Inc. | 9.5% |

| FactSet Research Systems Inc. | 6.8% |

| Kinsale Capital Group, Inc. | 5.7% |

| Choice Hotels International, Inc. | 5.1% |

| CoStar Group, Inc. | 5.0% |

| Primerica, Inc. | 4.7% |

| Vail Resorts, Inc. | 4.6% |

| Morningstar, Inc. | 3.9% |

| Total | 69.1% |

* Individual weights may not sum to 100% (or displayed total) due to rounding.

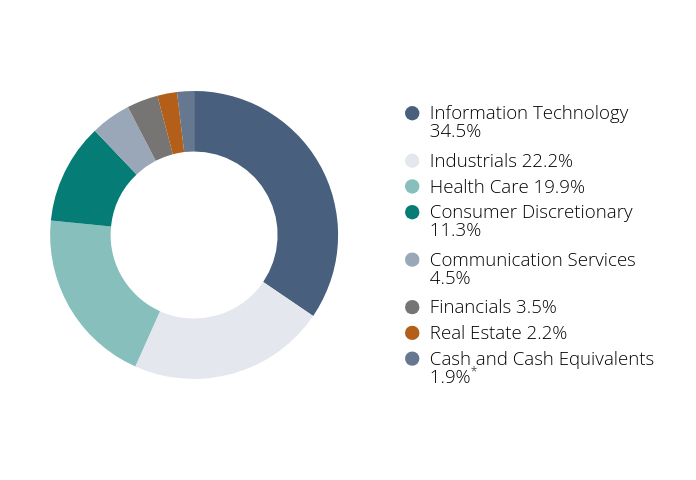

Sector Breakdown

(as a % of total investments)*

| Value | Value |

|---|

| Financials | 49.2% |

| Information Technology | 16.3% |

| Consumer Discretionary | 14.1% |

| Real Estate | 10.2% |

| Health Care | 6.6% |

| Communication Services | 2.8% |

| Industrials | 0.8% |

| Materials | 0.0%Footnote Reference‡ |

| Footnote | Description |

Footnote‡ | Rounds to less than 0.1%. |

If you wish to view additional information about the Fund; including but not limited to its financial statements, prospectus, or holdings, please visit connect.rightprospectus.com/Baron. For benchmark definitions and attribution language please visit BaronCapitalGroup.com.

Phone: 1.800.99.BARON

Email: info@BaronCapitalGroup.com

Annual Shareholder Report September 30, 2024

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about Baron Growth Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at BaronCapitalGroup.com. You can also request this information by contacting us at 1.800.99.BARON.

What were the Fund costs for the past 12 months?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| R6 | $118 | 1.09% |

How did the Fund perform last year and what affected its performance?

For much of the year-long period, the Magnificent Seven mega-cap names dominated returns while small caps lagged their larger counterparts. This trend reversed with the U.S. Federal Reserve's September rate cut - its first in over four years - signaling the start of an easing cycle and kicking off a small-cap rally. The Fund, while posting double-digit returns, underperformed its benchmark due to weak stock section, particularly in Consumer Discretionary, Communication Services, and Real Estate. Sector weightings did not significantly impact performance despite lack of exposure to Energy, the only sector in the benchmark to post negative returns.

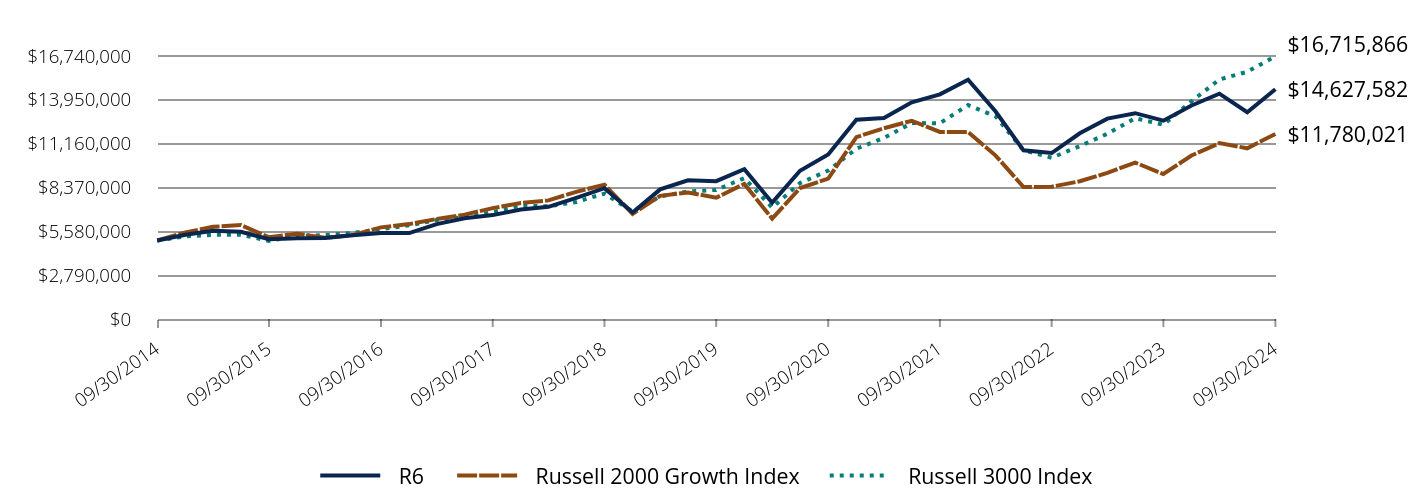

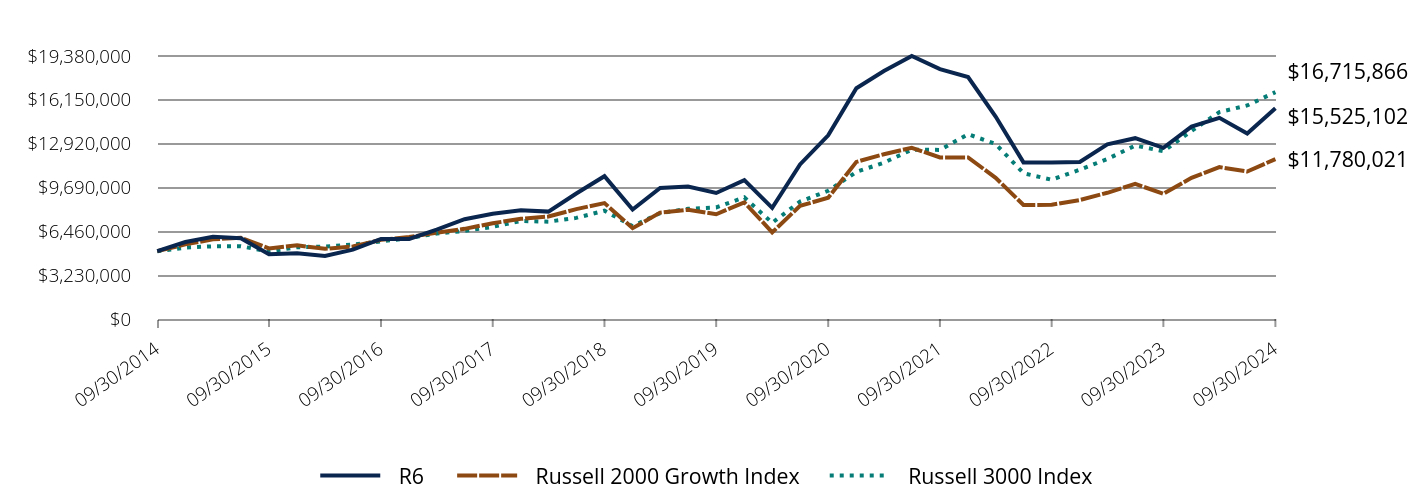

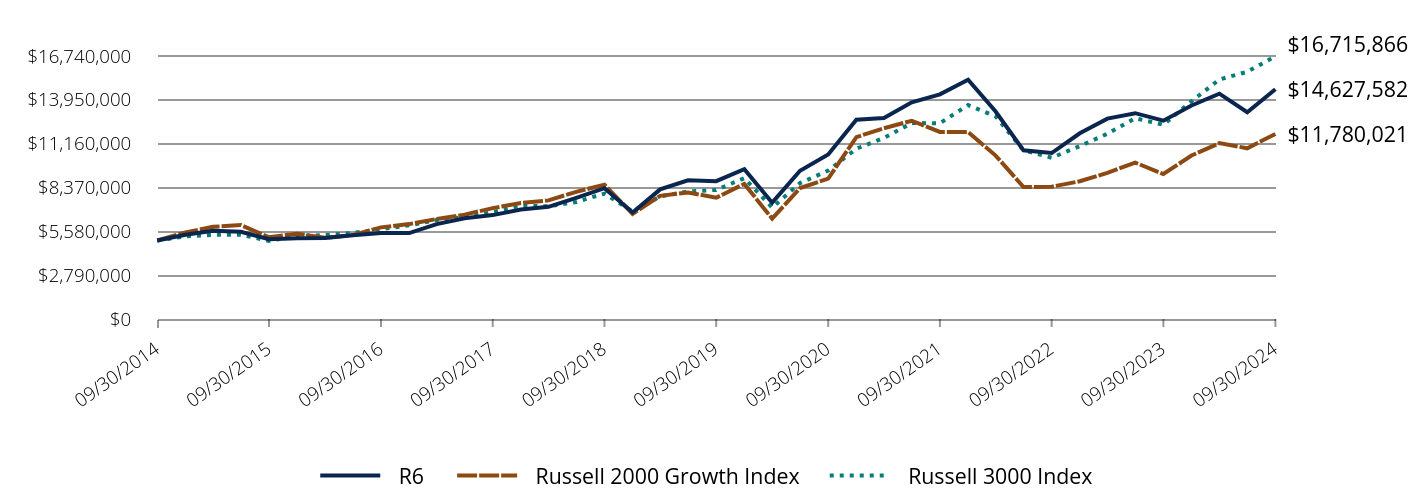

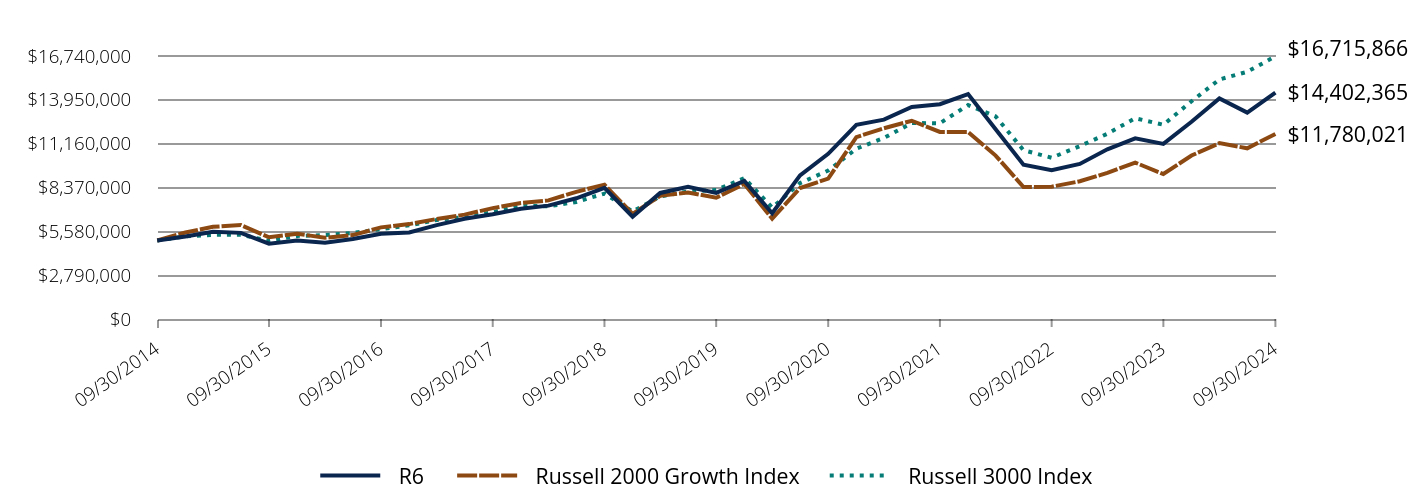

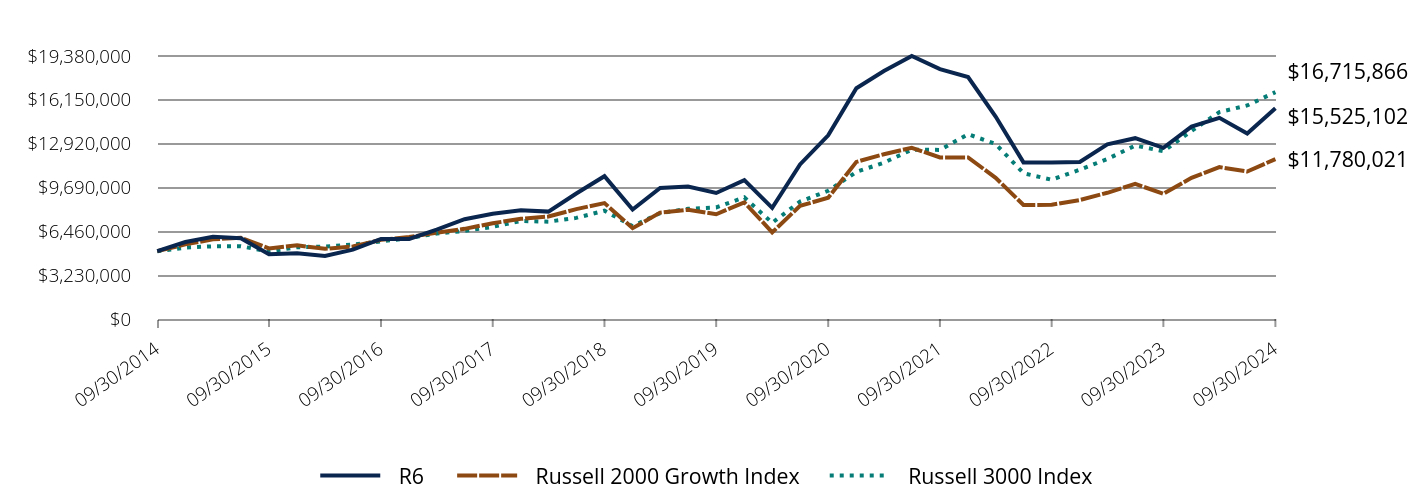

Comparison of the Change in Value of $5,000,000 Investment in the Fund in Relation to the Benchmarks

| R6 | Russell 2000 Growth Index | Russell 3000 Index |

|---|

| 09/30/2014 | $5,000,000 | $5,000,000 | $5,000,000 |

| 12/31/2014 | $5,364,256 | $5,502,937 | $5,262,007 |

| 03/31/2015 | $5,619,138 | $5,867,780 | $5,356,742 |

| 06/30/2015 | $5,557,016 | $5,983,770 | $5,364,121 |

| 09/30/2015 | $5,075,676 | $5,202,192 | $4,975,264 |

| 12/31/2015 | $5,146,565 | $5,426,909 | $5,287,195 |

| 03/31/2016 | $5,163,371 | $5,172,770 | $5,338,393 |

| 06/30/2016 | $5,337,831 | $5,340,408 | $5,478,824 |

| 09/30/2016 | $5,475,478 | $5,832,893 | $5,719,766 |

| 12/31/2016 | $5,472,243 | $6,041,127 | $5,960,531 |

| 03/31/2017 | $6,040,788 | $6,364,263 | $6,302,862 |

| 06/30/2017 | $6,407,823 | $6,643,572 | $6,492,924 |

| 09/30/2017 | $6,613,831 | $7,056,686 | $6,789,736 |

| 12/31/2017 | $6,968,843 | $7,380,255 | $7,220,024 |

| 03/31/2018 | $7,141,160 | $7,549,948 | $7,173,497 |

| 06/30/2018 | $7,713,214 | $8,096,002 | $7,452,456 |

| 09/30/2018 | $8,325,343 | $8,543,160 | $7,983,362 |

| 12/31/2018 | $6,782,914 | $6,693,298 | $6,841,571 |

| 03/31/2019 | $8,252,652 | $7,840,852 | $7,802,359 |

| 06/30/2019 | $8,832,388 | $8,056,317 | $8,121,873 |

| 09/30/2019 | $8,771,194 | $7,720,130 | $8,216,289 |

| 12/31/2019 | $9,529,840 | $8,599,783 | $8,963,755 |

| 03/31/2020 | $7,404,808 | $6,384,051 | $7,090,358 |

| 06/30/2020 | $9,438,656 | $8,336,561 | $8,652,191 |

| 09/30/2020 | $10,470,592 | $8,933,290 | $9,448,844 |

| 12/31/2020 | $12,680,616 | $11,578,080 | $10,836,087 |

| 03/31/2021 | $12,799,421 | $12,142,540 | $11,523,844 |

| 06/30/2021 | $13,796,445 | $12,618,220 | $12,473,385 |

| 09/30/2021 | $14,298,225 | $11,904,969 | $12,460,697 |

| 12/31/2021 | $15,234,359 | $11,906,297 | $13,616,746 |

| 03/31/2022 | $13,203,278 | $10,402,840 | $12,897,992 |

| 06/30/2022 | $10,735,176 | $8,399,843 | $10,743,878 |

| 09/30/2022 | $10,562,372 | $8,420,159 | $10,264,206 |

| 12/31/2022 | $11,822,594 | $8,768,096 | $11,001,387 |

| 03/31/2023 | $12,753,871 | $9,300,556 | $11,791,320 |

| 06/30/2023 | $13,099,963 | $9,956,480 | $12,780,235 |

| 09/30/2023 | $12,620,037 | $9,227,803 | $12,364,389 |

| 12/31/2023 | $13,592,263 | $10,404,087 | $13,856,999 |

| 03/31/2024 | $14,342,533 | $11,192,908 | $15,245,380 |

| 06/30/2024 | $13,160,655 | $10,866,168 | $15,735,670 |

| 09/30/2024 | $14,627,582 | $11,780,021 | $16,715,866 |

Average Annual Total Returns (%)

| Total Net Assets | $7,586,737,355 |

| # of Issuers | 33 |

| Portfolio Turnover Rate | 0%Footnote Reference† |

| Total Advisory Fees Paid | $75,000,891 |

| fund | 1 Year | 5 Years | 10 Years |

|---|

| R6 | 15.91% | 10.77% | 11.33% |

| Russell 2000 Growth Index | 27.66% | 8.82% | 8.95% |

| Russell 3000 Index | 35.19% | 15.26% | 12.83% |

Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares.

| Footnote | Description |

Footnote† | Less than 0.5%. |

What did the Fund invest in?

| Holding | % of Total Investments (9/30/24)* |

| Arch Capital Group Ltd. | 13.2% |

| MSCI Inc. | 10.7% |

| Gartner, Inc. | 9.5% |

| FactSet Research Systems Inc. | 6.8% |

| Kinsale Capital Group, Inc. | 5.7% |

| Choice Hotels International, Inc. | 5.1% |

| CoStar Group, Inc. | 5.0% |

| Primerica, Inc. | 4.7% |

| Vail Resorts, Inc. | 4.6% |

| Morningstar, Inc. | 3.9% |

| Total | 69.1% |

* Individual weights may not sum to 100% (or displayed total) due to rounding.

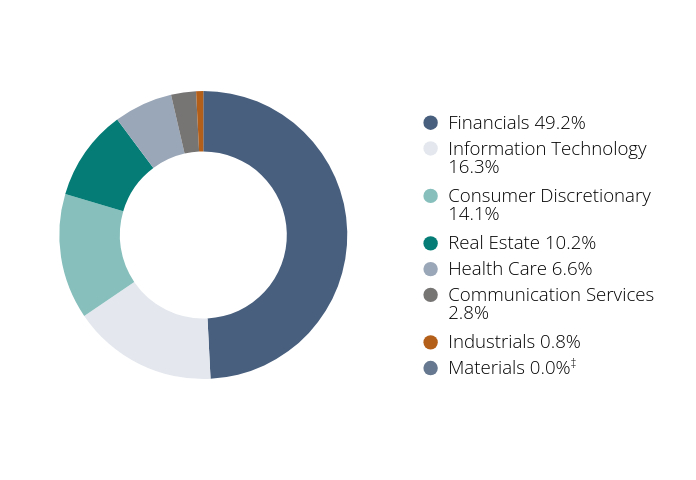

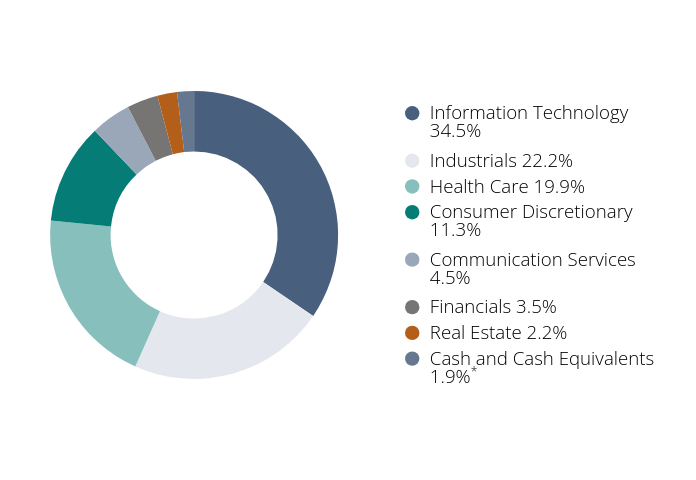

Sector Breakdown

(as a % of total investments)*

| Value | Value |

|---|

| Financials | 49.2% |

| Information Technology | 16.3% |

| Consumer Discretionary | 14.1% |

| Real Estate | 10.2% |

| Health Care | 6.6% |

| Communication Services | 2.8% |

| Industrials | 0.8% |

| Materials | 0.0%Footnote Reference‡ |

| Footnote | Description |

Footnote‡ | Rounds to less than 0.1%. |

If you wish to view additional information about the Fund; including but not limited to its financial statements, prospectus, or holdings, please visit connect.rightprospectus.com/Baron. For benchmark definitions and attribution language please visit BaronCapitalGroup.com.

Phone: 1.800.99.BARON

Email: info@BaronCapitalGroup.com

Annual Shareholder Report September 30, 2024

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about Baron Small Cap Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at BaronCapitalGroup.com. You can also request this information by contacting us at 1.800.99.BARON.

What were the Fund costs for the past 12 months?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Retail | $149 | 1.30% |

How did the Fund perform last year and what affected its performance?

For much of the year-long period, the Magnificent Seven mega-cap names dominated returns while small caps lagged their larger counterparts. This trend reversed with the U.S. Federal Reserve's September rate cut - its first in over four years - signaling the start of an easing cycle and kicking off a small-cap rally. Outperformance was driven by stock selection, with strength in Industrials and Consumer Discretionary investments more than offsetting weakness in Health Care and Information Technology holdings. Sector weightings were a modest drag on performance despite lack of exposure to Energy, the only sector in the benchmark to post negative returns.

Comparison of the Change in Value of $10,000 Investment in the Fund in Relation to the Benchmarks

| Retail | Russell 2000 Growth Index | Russell 3000 Index |

|---|

| 09/30/2014 | $10,000 | $10,000 | $10,000 |

| 12/31/2014 | $10,504 | $11,006 | $10,524 |

| 03/31/2015 | $11,097 | $11,736 | $10,714 |

| 06/30/2015 | $10,943 | $11,968 | $10,728 |

| 09/30/2015 | $9,568 | $10,404 | $9,951 |

| 12/31/2015 | $9,953 | $10,854 | $10,574 |

| 03/31/2016 | $9,671 | $10,346 | $10,677 |

| 06/30/2016 | $10,148 | $10,681 | $10,958 |

| 09/30/2016 | $10,801 | $11,666 | $11,440 |

| 12/31/2016 | $10,942 | $12,082 | $11,921 |

| 03/31/2017 | $11,870 | $12,729 | $12,606 |

| 06/30/2017 | $12,665 | $13,287 | $12,986 |

| 09/30/2017 | $13,226 | $14,113 | $13,580 |

| 12/31/2017 | $13,912 | $14,761 | $14,440 |

| 03/31/2018 | $14,304 | $15,100 | $14,347 |

| 06/30/2018 | $15,217 | $16,192 | $14,905 |

| 09/30/2018 | $16,533 | $17,086 | $15,967 |

| 12/31/2018 | $12,884 | $13,387 | $13,683 |

| 03/31/2019 | $15,855 | $15,682 | $15,605 |

| 06/30/2019 | $16,630 | $16,113 | $16,244 |

| 09/30/2019 | $15,844 | $15,440 | $16,433 |

| 12/31/2019 | $17,328 | $17,200 | $17,928 |

| 03/31/2020 | $13,280 | $12,768 | $14,181 |

| 06/30/2020 | $18,013 | $16,673 | $17,304 |

| 09/30/2020 | $20,693 | $17,867 | $18,898 |

| 12/31/2020 | $24,317 | $23,156 | $21,672 |

| 03/31/2021 | $24,951 | $24,285 | $23,048 |

| 06/30/2021 | $26,523 | $25,236 | $24,947 |

| 09/30/2021 | $26,853 | $23,810 | $24,921 |

| 12/31/2021 | $28,094 | $23,813 | $27,234 |

| 03/31/2022 | $23,676 | $20,806 | $25,796 |

| 06/30/2022 | $19,259 | $16,800 | $21,488 |

| 09/30/2022 | $18,546 | $16,840 | $20,528 |

| 12/31/2022 | $19,322 | $17,536 | $22,003 |

| 03/31/2023 | $21,134 | $18,601 | $23,583 |

| 06/30/2023 | $22,483 | $19,913 | $25,561 |

| 09/30/2023 | $21,777 | $18,456 | $24,729 |

| 12/31/2023 | $24,515 | $20,808 | $27,714 |

| 03/31/2024 | $27,391 | $22,386 | $30,491 |

| 06/30/2024 | $25,609 | $21,732 | $31,471 |

| 09/30/2024 | $28,071 | $23,560 | $33,432 |

Average Annual Total Returns (%)

| Total Net Assets | $4,515,574,556 |

| # of Issuers | 57 |

| Portfolio Turnover Rate | 10% |

| Total Advisory Fees Paid | $45,139,330 |

| fund | 1 Year | 5 Years | 10 Years |

|---|

| Retail | 28.90% | 12.12% | 10.87% |

| Russell 2000 Growth Index | 27.66% | 8.82% | 8.95% |

| Russell 3000 Index | 35.19% | 15.26% | 12.83% |

Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower.

What did the Fund invest in?

| Holding | % of Total Net Assets (9/30/24)* |

| Vertiv Holdings Co | 7.8% |

| Gartner, Inc. | 5.6% |

| Guidewire Software, Inc. | 4.8% |

| Kinsale Capital Group, Inc. | 4.6% |

| ICON Plc | 4.4% |

| Red Rock Resorts, Inc. | 3.6% |

| The Baldwin Insurance Group, Inc. | 3.3% |

| TransDigm Group Incorporated | 3.2% |

| ASGN Incorporated | 3.1% |

| SiteOne Landscape Supply, Inc. | 2.9% |

| Total | 43.3% |

* Individual weights may not sum to 100% (or displayed total) due to rounding.

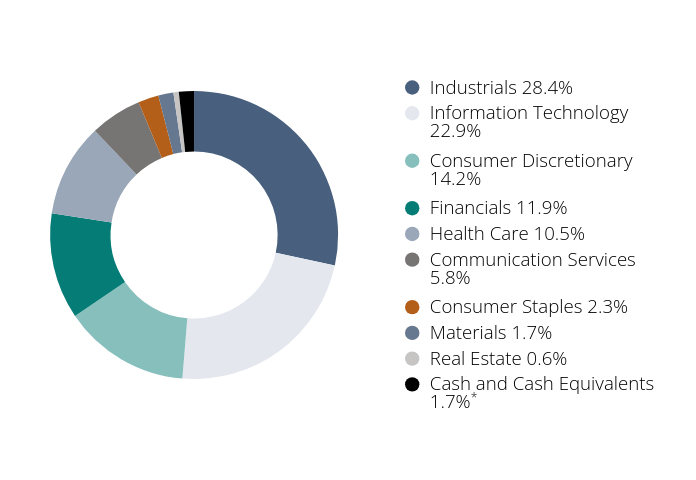

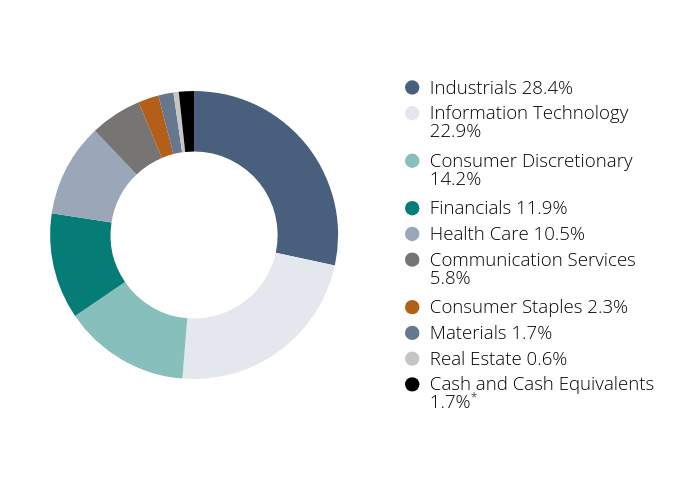

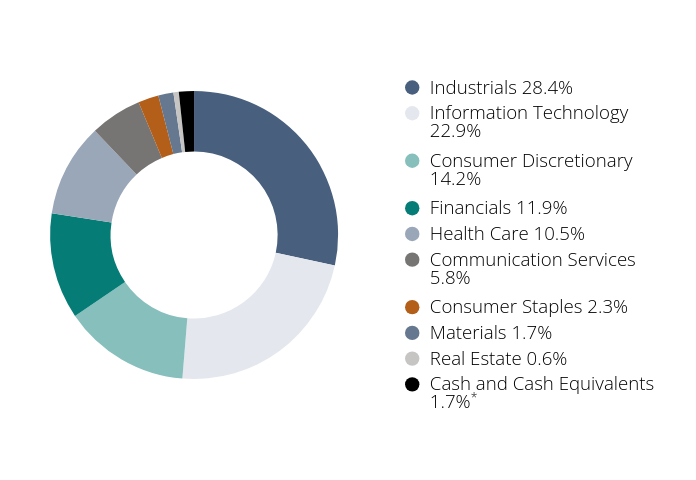

Sector Breakdown

(as a % of net assets)*

| Value | Value |

|---|

| Industrials | 28.4% |

| Information Technology | 22.9% |

| Consumer Discretionary | 14.2% |

| Financials | 11.9% |

| Health Care | 10.5% |

| Communication Services | 5.8% |

| Consumer Staples | 2.3% |

| Materials | 1.7% |

| Real Estate | 0.6% |

| Cash and Cash Equivalents | 1.7%Footnote Reference* |

| Footnote | Description |

Footnote* | Includes short-term investments, other assets and liabilities-net. |

If you wish to view additional information about the Fund; including but not limited to its financial statements, prospectus, or holdings, please visit connect.rightprospectus.com/Baron. For benchmark definitions and attribution language please visit BaronCapitalGroup.com.

Phone: 1.800.99.BARON

Email: info@BaronCapitalGroup.com

Annual Shareholder Report September 30, 2024

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about Baron Small Cap Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at BaronCapitalGroup.com. You can also request this information by contacting us at 1.800.99.BARON.

What were the Fund costs for the past 12 months?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $120 | 1.05% |

How did the Fund perform last year and what affected its performance?

For much of the year-long period, the Magnificent Seven mega-cap names dominated returns while small caps lagged their larger counterparts. This trend reversed with the U.S. Federal Reserve's September rate cut - its first in over four years - signaling the start of an easing cycle and kicking off a small-cap rally. Outperformance was driven by stock selection, with strength in Industrials and Consumer Discretionary investments more than offsetting weakness in Health Care and Information Technology holdings. Sector weightings were a modest drag on performance despite lack of exposure to Energy, the only sector in the benchmark to post negative returns.

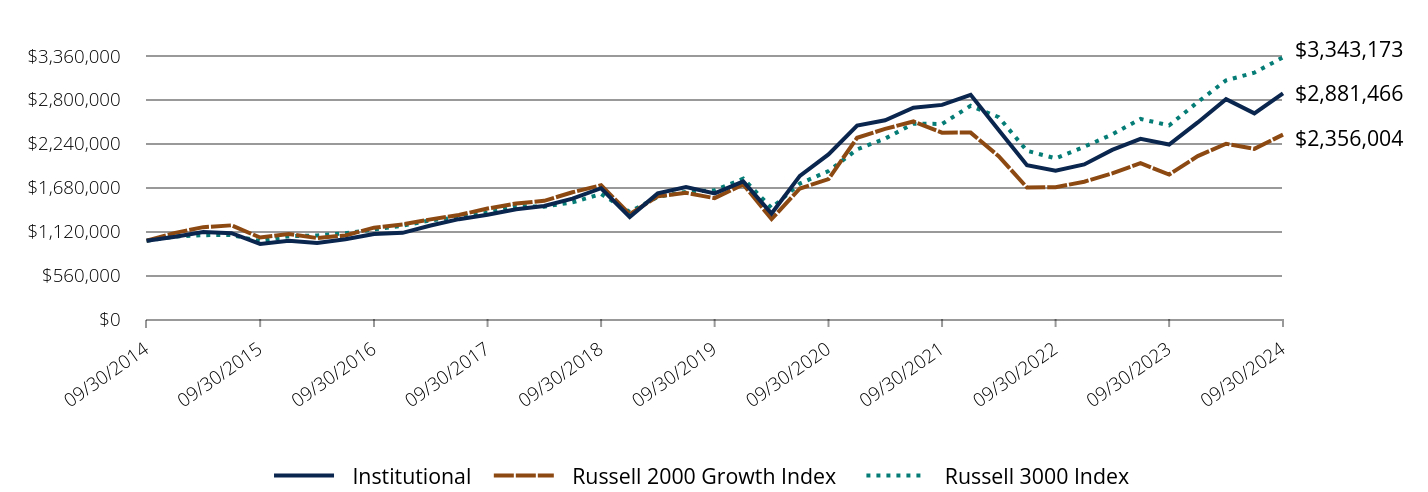

Comparison of the Change in Value of $1,000,000 Investment in the Fund in Relation to the Benchmarks

| Institutional | Russell 2000 Growth Index | Russell 3000 Index |

|---|

| 09/30/2014 | $1,000,000 | $1,000,000 | $1,000,000 |

| 12/31/2014 | $1,051,177 | $1,100,587 | $1,052,402 |

| 03/31/2015 | $1,111,129 | $1,173,556 | $1,071,348 |

| 06/30/2015 | $1,096,529 | $1,196,754 | $1,072,824 |

| 09/30/2015 | $959,230 | $1,040,438 | $995,053 |

| 12/31/2015 | $998,464 | $1,085,382 | $1,057,439 |

| 03/31/2016 | $971,047 | $1,034,554 | $1,067,679 |

| 06/30/2016 | $1,019,634 | $1,068,082 | $1,095,765 |

| 09/30/2016 | $1,085,921 | $1,166,579 | $1,143,953 |

| 12/31/2016 | $1,100,923 | $1,208,225 | $1,192,106 |

| 03/31/2017 | $1,195,058 | $1,272,853 | $1,260,572 |

| 06/30/2017 | $1,275,686 | $1,328,714 | $1,298,585 |

| 09/30/2017 | $1,333,096 | $1,411,337 | $1,357,947 |

| 12/31/2017 | $1,403,102 | $1,476,051 | $1,444,005 |

| 03/31/2018 | $1,443,259 | $1,509,990 | $1,434,699 |

| 06/30/2018 | $1,536,958 | $1,619,201 | $1,490,491 |

| 09/30/2018 | $1,670,815 | $1,708,632 | $1,596,672 |

| 12/31/2018 | $1,303,042 | $1,338,660 | $1,368,314 |

| 03/31/2019 | $1,604,909 | $1,568,170 | $1,560,472 |

| 06/30/2019 | $1,684,292 | $1,611,263 | $1,624,375 |

| 09/30/2019 | $1,605,431 | $1,544,026 | $1,643,258 |

| 12/31/2019 | $1,757,376 | $1,719,957 | $1,792,751 |

| 03/31/2020 | $1,347,265 | $1,276,810 | $1,418,072 |

| 06/30/2020 | $1,829,246 | $1,667,312 | $1,730,438 |

| 09/30/2020 | $2,102,463 | $1,786,658 | $1,889,769 |

| 12/31/2020 | $2,472,204 | $2,315,616 | $2,167,217 |

| 03/31/2021 | $2,538,180 | $2,428,508 | $2,304,769 |

| 06/30/2021 | $2,699,949 | $2,523,644 | $2,494,677 |

| 09/30/2021 | $2,735,474 | $2,380,994 | $2,492,140 |

| 12/31/2021 | $2,863,697 | $2,381,259 | $2,723,349 |

| 03/31/2022 | $2,414,629 | $2,080,568 | $2,579,598 |

| 06/30/2022 | $1,965,560 | $1,679,969 | $2,148,776 |

| 09/30/2022 | $1,894,021 | $1,684,032 | $2,052,841 |

| 12/31/2022 | $1,974,392 | $1,753,619 | $2,200,278 |

| 03/31/2023 | $2,160,796 | $1,860,111 | $2,358,264 |

| 06/30/2023 | $2,300,972 | $1,991,296 | $2,556,047 |

| 09/30/2023 | $2,229,393 | $1,845,561 | $2,472,878 |

| 12/31/2023 | $2,511,200 | $2,080,817 | $2,771,400 |

| 03/31/2024 | $2,807,720 | $2,238,582 | $3,049,076 |

| 06/30/2024 | $2,627,196 | $2,173,234 | $3,147,134 |

| 09/30/2024 | $2,881,466 | $2,356,004 | $3,343,173 |

Average Annual Total Returns (%)

| Total Net Assets | $4,515,574,556 |

| # of Issuers | 57 |

| Portfolio Turnover Rate | 10% |

| Total Advisory Fees Paid | $45,139,330 |

| fund | 1 Year | 5 Years | 10 Years |

|---|

| Institutional | 29.25% | 12.41% | 11.16% |

| Russell 2000 Growth Index | 27.66% | 8.82% | 8.95% |

| Russell 3000 Index | 35.19% | 15.26% | 12.83% |

Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower.

What did the Fund invest in?

| Holding | % of Total Net Assets (9/30/24)* |

| Vertiv Holdings Co | 7.8% |

| Gartner, Inc. | 5.6% |

| Guidewire Software, Inc. | 4.8% |

| Kinsale Capital Group, Inc. | 4.6% |

| ICON Plc | 4.4% |

| Red Rock Resorts, Inc. | 3.6% |

| The Baldwin Insurance Group, Inc. | 3.3% |

| TransDigm Group Incorporated | 3.2% |

| ASGN Incorporated | 3.1% |

| SiteOne Landscape Supply, Inc. | 2.9% |

| Total | 43.3% |

* Individual weights may not sum to 100% (or displayed total) due to rounding.

Sector Breakdown

(as a % of net assets)*

| Value | Value |

|---|

| Industrials | 28.4% |

| Information Technology | 22.9% |

| Consumer Discretionary | 14.2% |

| Financials | 11.9% |

| Health Care | 10.5% |

| Communication Services | 5.8% |

| Consumer Staples | 2.3% |

| Materials | 1.7% |

| Real Estate | 0.6% |

| Cash and Cash Equivalents | 1.7%Footnote Reference* |

| Footnote | Description |

Footnote* | Includes short-term investments, other assets and liabilities-net. |

If you wish to view additional information about the Fund; including but not limited to its financial statements, prospectus, or holdings, please visit connect.rightprospectus.com/Baron. For benchmark definitions and attribution language please visit BaronCapitalGroup.com.

Phone: 1.800.99.BARON

Email: info@BaronCapitalGroup.com

Annual Shareholder Report September 30, 2024

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about Baron Small Cap Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at BaronCapitalGroup.com. You can also request this information by contacting us at 1.800.99.BARON.

What were the Fund costs for the past 12 months?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| R6 | $120 | 1.05% |

How did the Fund perform last year and what affected its performance?

For much of the year-long period, the Magnificent Seven mega-cap names dominated returns while small caps lagged their larger counterparts. This trend reversed with the U.S. Federal Reserve's September rate cut - its first in over four years - signaling the start of an easing cycle and kicking off a small-cap rally. Outperformance was driven by stock selection, with strength in Industrials and Consumer Discretionary investments more than offsetting weakness in Health Care and Information Technology holdings. Sector weightings were a modest drag on performance despite lack of exposure to Energy, the only sector in the benchmark to post negative returns.

Comparison of the Change in Value of $5,000,000 Investment in the Fund in Relation to the Benchmarks

| R6 | Russell 2000 Growth Index | Russell 3000 Index |

|---|

| 09/30/2014 | $5,000,000 | $5,000,000 | $5,000,000 |

| 12/31/2014 | $5,255,886 | $5,502,937 | $5,262,007 |

| 03/31/2015 | $5,555,646 | $5,867,780 | $5,356,742 |

| 06/30/2015 | $5,482,647 | $5,983,770 | $5,364,121 |

| 09/30/2015 | $4,796,151 | $5,202,192 | $4,975,264 |

| 12/31/2015 | $4,992,321 | $5,426,909 | $5,287,195 |

| 03/31/2016 | $4,855,236 | $5,172,770 | $5,338,393 |

| 06/30/2016 | $5,098,172 | $5,340,408 | $5,478,824 |

| 09/30/2016 | $5,429,605 | $5,832,893 | $5,719,766 |

| 12/31/2016 | $5,504,612 | $6,041,127 | $5,960,531 |

| 03/31/2017 | $5,975,291 | $6,364,263 | $6,302,862 |

| 06/30/2017 | $6,376,317 | $6,643,572 | $6,492,924 |

| 09/30/2017 | $6,663,367 | $7,056,686 | $6,789,736 |

| 12/31/2017 | $7,013,402 | $7,380,255 | $7,220,024 |

| 03/31/2018 | $7,216,585 | $7,549,948 | $7,173,497 |

| 06/30/2018 | $7,682,711 | $8,096,002 | $7,452,456 |

| 09/30/2018 | $8,352,020 | $8,543,160 | $7,983,362 |

| 12/31/2018 | $6,513,055 | $6,693,298 | $6,841,571 |

| 03/31/2019 | $8,022,496 | $7,840,852 | $7,802,359 |

| 06/30/2019 | $8,419,442 | $8,056,317 | $8,121,873 |

| 09/30/2019 | $8,025,107 | $7,720,130 | $8,216,289 |

| 12/31/2019 | $8,784,889 | $8,599,783 | $8,963,755 |

| 03/31/2020 | $6,734,131 | $6,384,051 | $7,090,358 |

| 06/30/2020 | $9,144,271 | $8,336,561 | $8,652,191 |

| 09/30/2020 | $10,510,493 | $8,933,290 | $9,448,844 |

| 12/31/2020 | $12,359,397 | $11,578,080 | $10,836,087 |

| 03/31/2021 | $12,689,319 | $12,142,540 | $11,523,844 |

| 06/30/2021 | $13,495,091 | $12,618,220 | $12,473,385 |

| 09/30/2021 | $13,672,741 | $11,904,969 | $12,460,697 |

| 12/31/2021 | $14,313,565 | $11,906,297 | $13,616,746 |

| 03/31/2022 | $12,071,425 | $10,402,840 | $12,897,992 |

| 06/30/2022 | $9,825,743 | $8,399,843 | $10,743,878 |

| 09/30/2022 | $9,467,993 | $8,420,159 | $10,264,206 |

| 12/31/2022 | $9,869,902 | $8,768,096 | $11,001,387 |

| 03/31/2023 | $10,802,081 | $9,300,556 | $11,791,320 |

| 06/30/2023 | $11,503,078 | $9,956,480 | $12,780,235 |

| 09/30/2023 | $11,145,122 | $9,227,803 | $12,364,389 |

| 12/31/2023 | $12,554,529 | $10,404,087 | $13,856,999 |

| 03/31/2024 | $14,037,408 | $11,192,908 | $15,245,380 |

| 06/30/2024 | $13,134,619 | $10,866,168 | $15,735,670 |

| 09/30/2024 | $14,402,365 | $11,780,021 | $16,715,866 |

Average Annual Total Returns (%)

| Total Net Assets | $4,515,574,556 |

| # of Issuers | 57 |

| Portfolio Turnover Rate | 10% |

| Total Advisory Fees Paid | $45,139,330 |

| fund | 1 Year | 5 Years | 10 Years |

|---|

| R6 | 29.23% | 12.41% | 11.16% |

| Russell 2000 Growth Index | 27.66% | 8.82% | 8.95% |

| Russell 3000 Index | 35.19% | 15.26% | 12.83% |

Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. Performance for the R6 Shares prior to January 29, 2016 is based on the performance of the Institutional Shares.

What did the Fund invest in?

| Holding | % of Total Net Assets (9/30/24)* |

| Vertiv Holdings Co | 7.8% |

| Gartner, Inc. | 5.6% |

| Guidewire Software, Inc. | 4.8% |

| Kinsale Capital Group, Inc. | 4.6% |

| ICON Plc | 4.4% |

| Red Rock Resorts, Inc. | 3.6% |

| The Baldwin Insurance Group, Inc. | 3.3% |

| TransDigm Group Incorporated | 3.2% |

| ASGN Incorporated | 3.1% |

| SiteOne Landscape Supply, Inc. | 2.9% |

| Total | 43.3% |

* Individual weights may not sum to 100% (or displayed total) due to rounding.

Sector Breakdown

(as a % of net assets)*

| Value | Value |

|---|

| Industrials | 28.4% |

| Information Technology | 22.9% |

| Consumer Discretionary | 14.2% |

| Financials | 11.9% |

| Health Care | 10.5% |

| Communication Services | 5.8% |

| Consumer Staples | 2.3% |

| Materials | 1.7% |

| Real Estate | 0.6% |

| Cash and Cash Equivalents | 1.7%Footnote Reference* |

| Footnote | Description |

Footnote* | Includes short-term investments, other assets and liabilities-net. |

If you wish to view additional information about the Fund; including but not limited to its financial statements, prospectus, or holdings, please visit connect.rightprospectus.com/Baron. For benchmark definitions and attribution language please visit BaronCapitalGroup.com.

Phone: 1.800.99.BARON

Email: info@BaronCapitalGroup.com

Annual Shareholder Report September 30, 2024

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about Baron Opportunity Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at BaronCapitalGroup.com. You can also request this information by contacting us at 1.800.99.BARON.

What were the Fund costs for the past 12 months?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Retail | $160 | 1.31% |

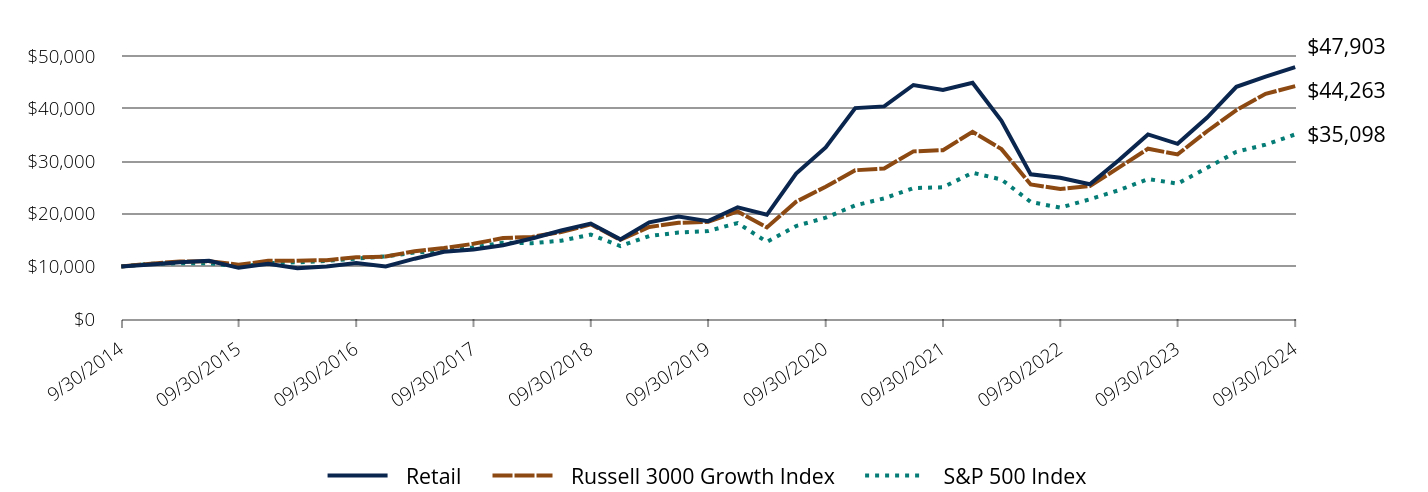

How did the Fund perform last year and what affected its performance?

Large-cap growth stocks soared during the year-long period, dominated by the Magnificent Seven technology companies, which continued to climb on enthusiasm around AI. We see significant long-term opportunities for AI beneficiaries, as we consider AI to be the most important technological advancement since the advent of the internet 30 years ago. Our stake in AI market leaders paid off during the period, as the four top contributors were all Magnificent Seven names. Sector/sub-industry weightings were also a positive, with an overweight in Information Technology and lack of exposure to Consumer Staples more than offsetting weakness in electric vehicles and autonomous driving.

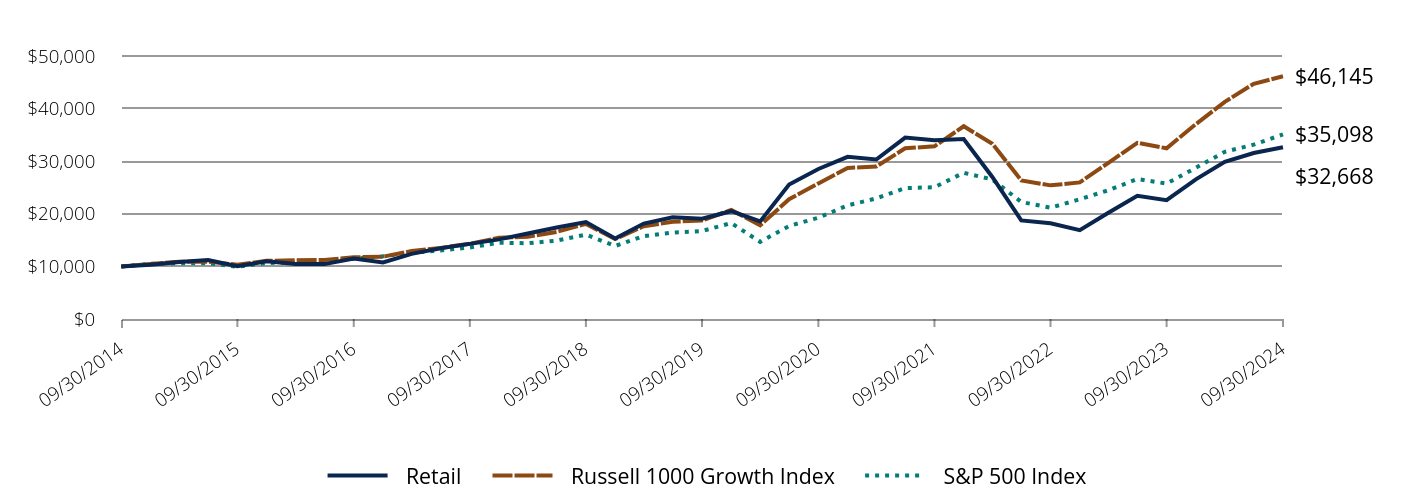

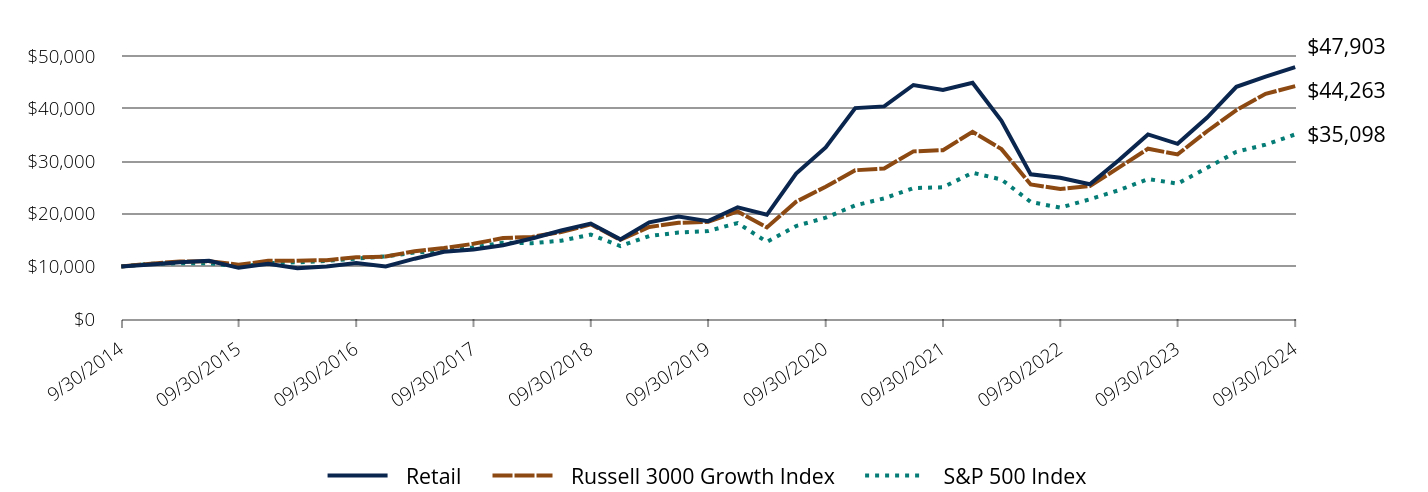

Comparison of the Change in Value of $10,000 Investment in the Fund in Relation to the Benchmarks

| Retail | Russell 3000 Growth Index | S&P 500 Index |

|---|

| 9/30/2014 | $10,000 | $10,000 | $10,000 |

| 12/31/2014 | $10,356 | $10,517 | $10,493 |

| 3/31/2015 | $10,776 | $10,943 | $10,593 |

| 6/30/2015 | $11,077 | $10,972 | $10,623 |

| 9/30/2015 | $9,730 | $10,321 | $9,939 |

| 12/31/2015 | $10,480 | $11,053 | $10,639 |

| 3/31/2016 | $9,661 | $11,090 | $10,782 |

| 6/30/2016 | $9,982 | $11,179 | $11,047 |

| 9/30/2016 | $10,625 | $11,729 | $11,472 |

| 12/31/2016 | $9,972 | $11,870 | $11,911 |

| 3/31/2017 | $11,469 | $12,895 | $12,633 |

| 6/30/2017 | $12,781 | $13,495 | $13,024 |

| 9/30/2017 | $13,209 | $14,295 | $13,607 |

| 12/31/2017 | $14,012 | $15,382 | $14,511 |

| 3/31/2018 | $15,298 | $15,610 | $14,401 |

| 6/30/2018 | $16,831 | $16,527 | $14,896 |

| 9/30/2018 | $18,150 | $17,995 | $16,044 |

| 12/31/2018 | $15,141 | $15,056 | $13,875 |

| 3/31/2019 | $18,373 | $17,492 | $15,769 |

| 6/30/2019 | $19,496 | $18,279 | $16,447 |

| 9/30/2019 | $18,606 | $18,481 | $16,727 |

| 12/31/2019 | $21,240 | $20,453 | $18,244 |

| 3/31/2020 | $19,810 | $17,415 | $14,668 |

| 6/30/2020 | $27,667 | $22,291 | $17,682 |

| 9/30/2020 | $32,608 | $25,157 | $19,261 |

| 12/31/2020 | $40,091 | $28,279 | $21,600 |

| 3/31/2021 | $40,422 | $28,616 | $22,934 |

| 6/30/2021 | $44,488 | $31,872 | $24,895 |

| 9/30/2021 | $43,557 | $32,094 | $25,040 |

| 12/31/2021 | $44,906 | $35,588 | $27,801 |

| 3/31/2022 | $37,686 | $32,296 | $26,522 |

| 6/30/2022 | $27,502 | $25,569 | $22,252 |

| 9/30/2022 | $26,839 | $24,708 | $21,165 |

| 12/31/2022 | $25,612 | $25,280 | $22,766 |

| 3/31/2023 | $30,183 | $28,781 | $24,473 |

| 6/30/2023 | $35,091 | $32,371 | $26,612 |

| 9/30/2023 | $33,299 | $31,289 | $25,741 |

| 12/31/2023 | $38,305 | $35,698 | $28,750 |

| 3/31/2024 | $44,146 | $39,705 | $31,785 |

| 6/30/2024 | $46,068 | $42,800 | $33,147 |

| 9/30/2024 | $47,903 | $44,263 | $35,098 |

Average Annual Total Returns (%)

| Total Net Assets | $1,356,177,986 |

| # of Issuers | 43 |

| Portfolio Turnover Rate | 33% |

| Total Advisory Fees Paid | $12,112,115 |

| fund | 1 Year | 5 Years | 10 Years |

|---|

| Retail | 43.85% | 20.82% | 16.96% |

| Russell 3000 Growth Index | 41.47% | 19.09% | 16.04% |

| S&P 500 Index | 36.35% | 15.98% | 13.38% |

Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser may waive or reimburse certain Fund expenses pursuant to a contract expiring on August 29, 2035, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower.

What did the Fund invest in?

| Holding | % of Total Net Assets (9/30/24)* |

| Microsoft Corporation | 12.2% |

| NVIDIA Corporation | 11.5% |

| Amazon.com, Inc. | 6.7% |

| Meta Platforms, Inc. | 5.2% |

| Apple Inc. | 4.7% |

| Broadcom Inc. | 4.6% |

| Tesla, Inc. | 4.5% |

| Space Exploration Technologies Corp. | 2.7% |

| Gartner, Inc. | 2.6% |

| argenx SE | 2.6% |

| Total | 57.2% |

* Individual weights may not sum to 100% (or displayed total) due to rounding.

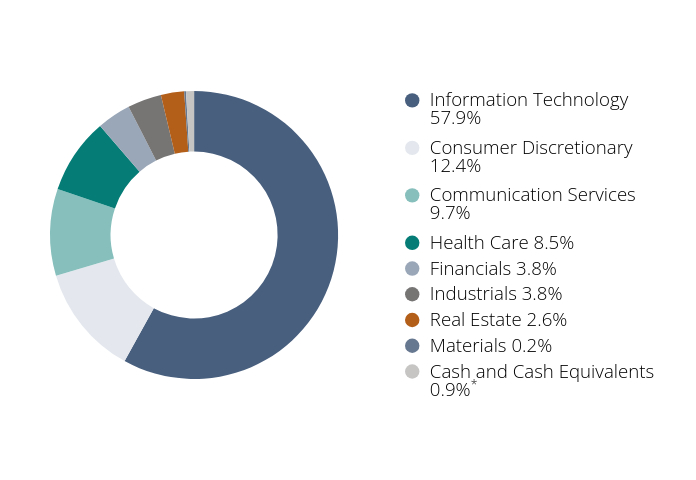

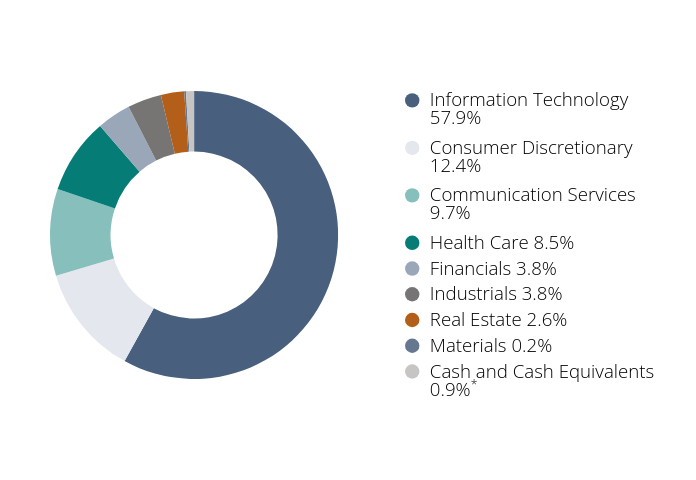

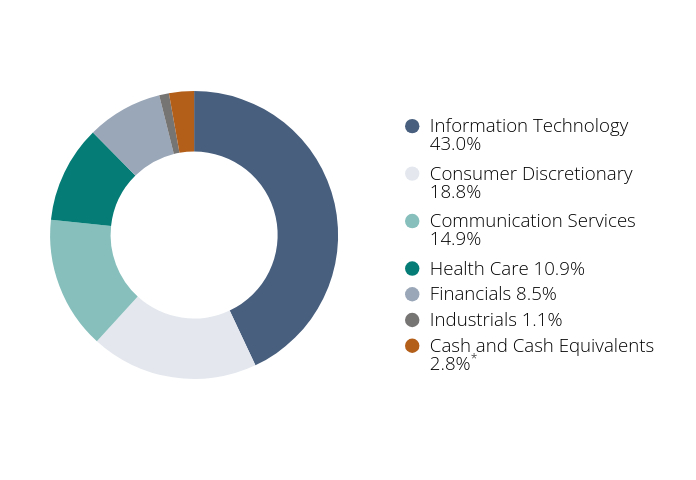

Sector Breakdown

(as a % of net assets)*

| Value | Value |

|---|

| Information Technology | 57.9% |

| Consumer Discretionary | 12.4% |

| Communication Services | 9.7% |

| Health Care | 8.5% |

| Financials | 3.8% |

| Industrials | 3.8% |

| Real Estate | 2.6% |

| Materials | 0.2% |

| Cash and Cash Equivalents | 0.9%Footnote Reference* |

| Footnote | Description |

Footnote* | Includes short-term investments, other assets and liabilities-net. |

If you wish to view additional information about the Fund; including but not limited to its financial statements, prospectus, or holdings, please visit connect.rightprospectus.com/Baron. For benchmark definitions and attribution language please visit BaronCapitalGroup.com.

Phone: 1.800.99.BARON

Email: info@BaronCapitalGroup.com

Annual Shareholder Report September 30, 2024

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about Baron Opportunity Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at BaronCapitalGroup.com. You can also request this information by contacting us at 1.800.99.BARON.

What were the Fund costs for the past 12 months?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional | $128 | 1.05% |

How did the Fund perform last year and what affected its performance?

Large-cap growth stocks soared during the year-long period, dominated by the Magnificent Seven technology companies, which continued to climb on enthusiasm around AI. We see significant long-term opportunities for AI beneficiaries, as we consider AI to be the most important technological advancement since the advent of the internet 30 years ago. Our stake in AI market leaders paid off during the period, as the four top contributors were all Magnificent Seven names. Sector/sub-industry weightings were also a positive, with an overweight in Information Technology and lack of exposure to Consumer Staples more than offsetting weakness in electric vehicles and autonomous driving.

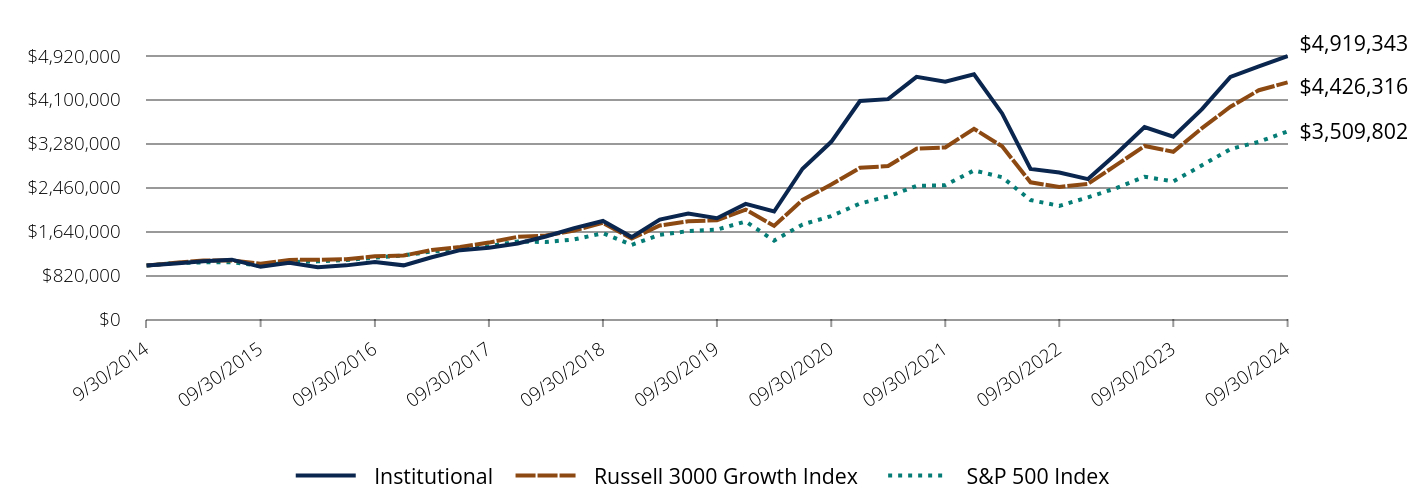

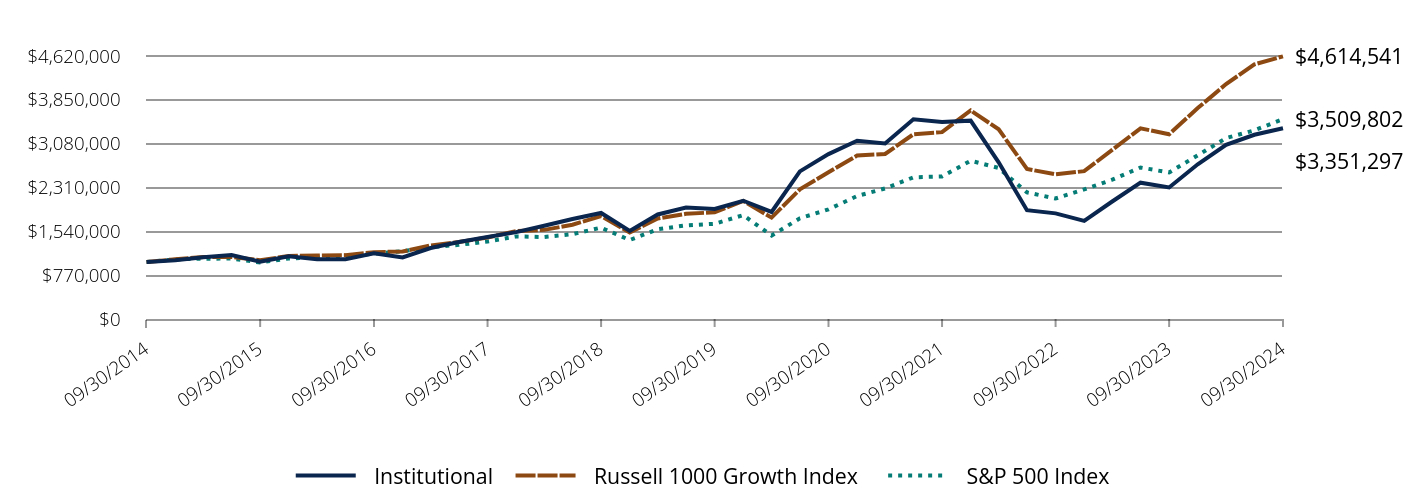

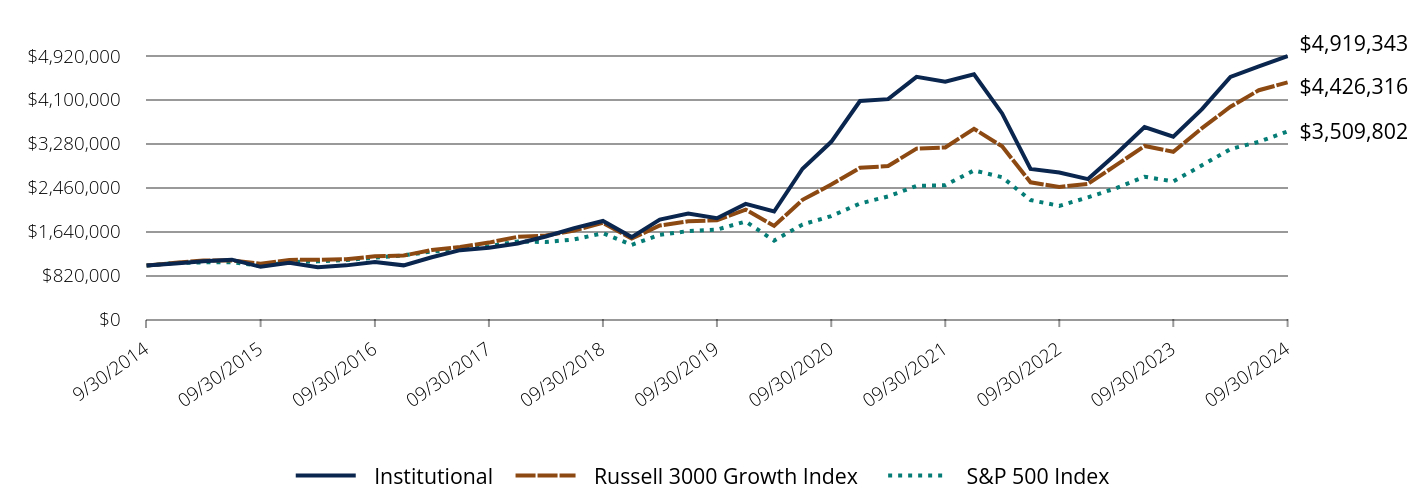

Comparison of the Change in Value of $1,000,000 Investment in the Fund in Relation to the Benchmarks

| Institutional | Russell 3000 Growth Index | S&P 500 Index |

|---|

| 9/30/2014 | $1,000,000 | $1,000,000 | $1,000,000 |

| 12/31/2014 | $1,036,662 | $1,051,705 | $1,049,327 |

| 3/31/2015 | $1,079,181 | $1,094,288 | $1,059,301 |

| 6/30/2015 | $1,110,510 | $1,097,208 | $1,062,247 |

| 9/30/2015 | $976,242 | $1,032,109 | $993,855 |

| 12/31/2015 | $1,051,654 | $1,105,268 | $1,063,848 |

| 3/31/2016 | $969,996 | $1,108,993 | $1,078,187 |

| 6/30/2016 | $1,003,401 | $1,117,863 | $1,104,659 |

| 9/30/2016 | $1,068,356 | $1,172,900 | $1,147,210 |

| 12/31/2016 | $1,003,669 | $1,186,989 | $1,191,082 |

| 3/31/2017 | $1,155,127 | $1,289,467 | $1,263,335 |

| 6/30/2017 | $1,287,739 | $1,349,468 | $1,302,350 |

| 9/30/2017 | $1,331,711 | $1,429,451 | $1,360,700 |

| 12/31/2017 | $1,413,956 | $1,538,185 | $1,451,114 |

| 3/31/2018 | $1,544,104 | $1,560,999 | $1,440,099 |

| 6/30/2018 | $1,700,764 | $1,652,675 | $1,489,550 |

| 9/30/2018 | $1,834,126 | $1,799,483 | $1,604,406 |

| 12/31/2018 | $1,532,036 | $1,505,590 | $1,387,494 |

| 3/31/2019 | $1,859,969 | $1,749,185 | $1,576,858 |

| 6/30/2019 | $1,975,166 | $1,827,934 | $1,644,723 |

| 9/30/2019 | $1,885,194 | $1,848,110 | $1,672,656 |

| 12/31/2019 | $2,154,112 | $2,045,289 | $1,824,365 |

| 3/31/2020 | $2,010,865 | $1,741,529 | $1,466,826 |

| 6/30/2020 | $2,810,886 | $2,229,046 | $1,768,160 |

| 9/30/2020 | $3,314,504 | $2,515,683 | $1,926,047 |

| 12/31/2020 | $4,077,400 | $2,827,858 | $2,160,026 |

| 3/31/2021 | $4,113,218 | $2,861,577 | $2,293,407 |

| 6/30/2021 | $4,530,445 | $3,187,218 | $2,489,467 |

| 9/30/2021 | $4,438,481 | $3,209,356 | $2,503,957 |

| 12/31/2021 | $4,578,709 | $3,558,827 | $2,780,071 |

| 3/31/2022 | $3,845,196 | $3,229,550 | $2,652,229 |

| 6/30/2022 | $2,808,665 | $2,556,940 | $2,225,190 |

| 9/30/2022 | $2,741,792 | $2,470,791 | $2,116,543 |

| 12/31/2022 | $2,617,450 | $2,527,979 | $2,276,576 |

| 3/31/2023 | $3,087,650 | $2,878,134 | $2,447,253 |

| 6/30/2023 | $3,591,287 | $3,237,118 | $2,661,195 |

| 9/30/2023 | $3,410,521 | $3,128,850 | $2,574,083 |

| 12/31/2023 | $3,925,652 | $3,569,747 | $2,875,034 |

| 3/31/2024 | $4,527,509 | $3,970,490 | $3,178,520 |

| 6/30/2024 | $4,728,128 | $4,280,012 | $3,314,681 |

| 9/30/2024 | $4,919,343 | $4,426,316 | $3,509,802 |

Average Annual Total Returns (%)

| Total Net Assets | $1,356,177,986 |

| # of Issuers | 43 |

| Portfolio Turnover Rate | 33% |

| Total Advisory Fees Paid | $12,112,115 |

| fund | 1 Year | 5 Years | 10 Years |

|---|

| Institutional | 44.24% | 21.15% | 17.27% |

| Russell 3000 Growth Index | 41.47% | 19.09% | 16.04% |

| S&P 500 Index | 36.35% | 15.98% | 13.38% |

Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser may waive or reimburse certain Fund expenses pursuant to a contract expiring on August 29, 2035, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower.

What did the Fund invest in?

| Holding | % of Total Net Assets (9/30/24)* |

| Microsoft Corporation | 12.2% |

| NVIDIA Corporation | 11.5% |

| Amazon.com, Inc. | 6.7% |

| Meta Platforms, Inc. | 5.2% |

| Apple Inc. | 4.7% |

| Broadcom Inc. | 4.6% |

| Tesla, Inc. | 4.5% |

| Space Exploration Technologies Corp. | 2.7% |

| Gartner, Inc. | 2.6% |

| argenx SE | 2.6% |

| Total | 57.2% |

* Individual weights may not sum to 100% (or displayed total) due to rounding.

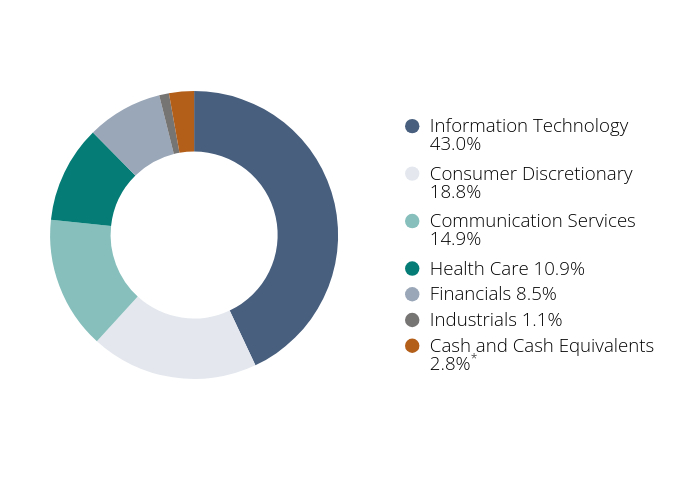

Sector Breakdown

(as a % of net assets)*

| Value | Value |

|---|

| Information Technology | 57.9% |

| Consumer Discretionary | 12.4% |

| Communication Services | 9.7% |

| Health Care | 8.5% |

| Financials | 3.8% |

| Industrials | 3.8% |

| Real Estate | 2.6% |

| Materials | 0.2% |

| Cash and Cash Equivalents | 0.9%Footnote Reference* |

| Footnote | Description |

Footnote* | Includes short-term investments, other assets and liabilities-net. |

If you wish to view additional information about the Fund; including but not limited to its financial statements, prospectus, or holdings, please visit connect.rightprospectus.com/Baron. For benchmark definitions and attribution language please visit BaronCapitalGroup.com.

Phone: 1.800.99.BARON

Email: info@BaronCapitalGroup.com

Annual Shareholder Report September 30, 2024

Annual Shareholder Report September 30, 2024

This annual shareholder report contains important information about Baron Opportunity Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at BaronCapitalGroup.com. You can also request this information by contacting us at 1.800.99.BARON.

What were the Fund costs for the past 12 months?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| R6 | $128 | 1.05% |

How did the Fund perform last year and what affected its performance?

Large-cap growth stocks soared during the year-long period, dominated by the Magnificent Seven technology companies, which continued to climb on enthusiasm around AI. We see significant long-term opportunities for AI beneficiaries, as we consider AI to be the most important technological advancement since the advent of the internet 30 years ago. Our stake in AI market leaders paid off during the period, as the four top contributors were all Magnificent Seven names. Sector/sub-industry weightings were also a positive, with an overweight in Information Technology and lack of exposure to Consumer Staples more than offsetting weakness in electric vehicles and autonomous driving.

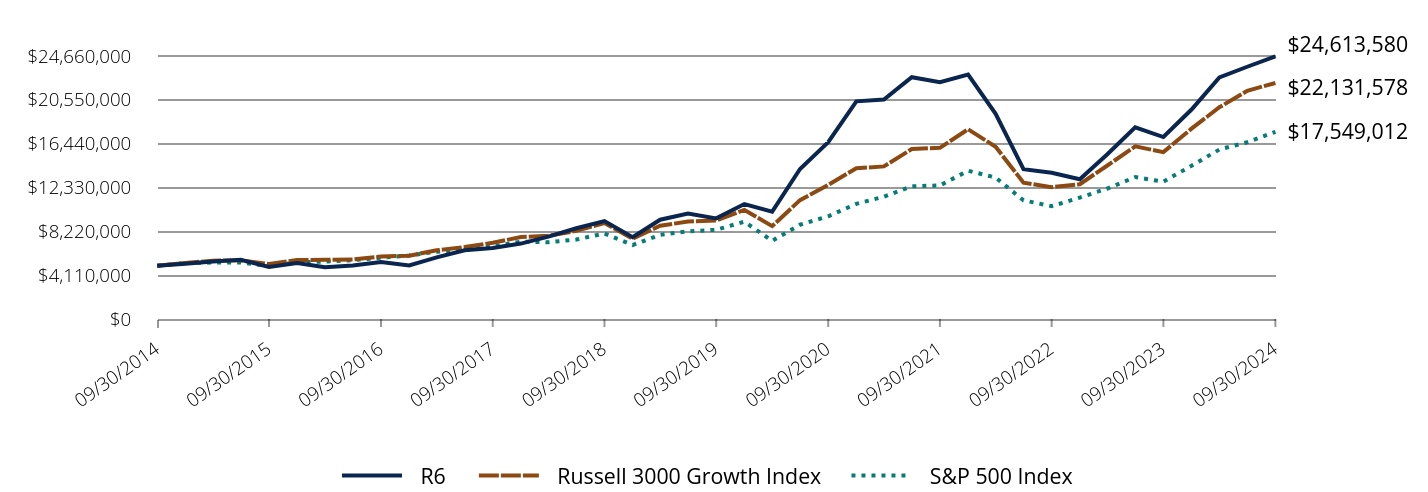

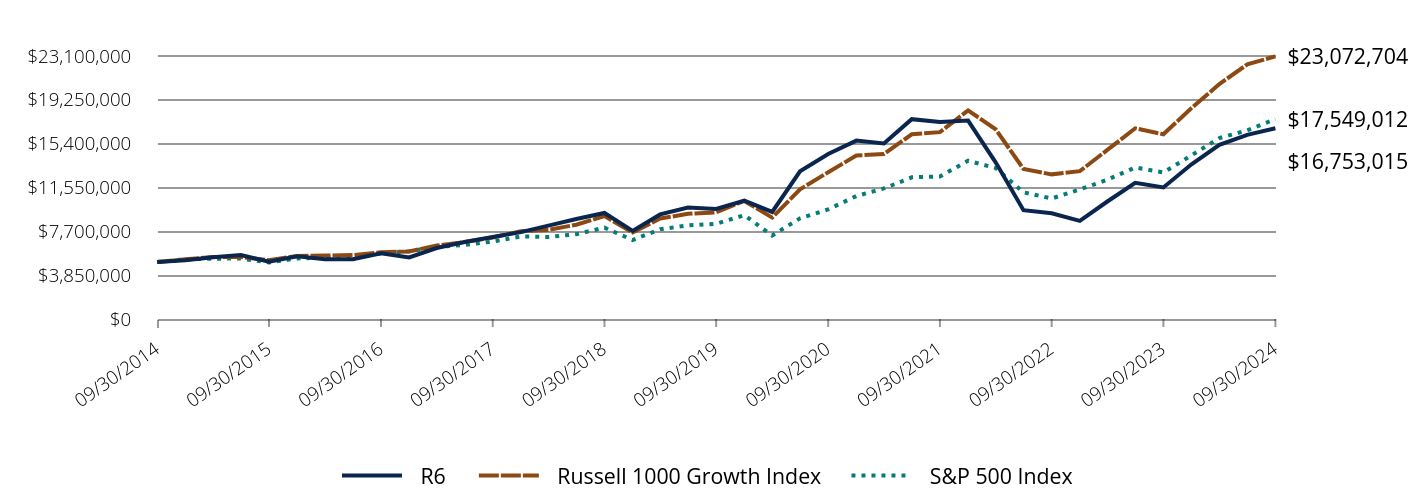

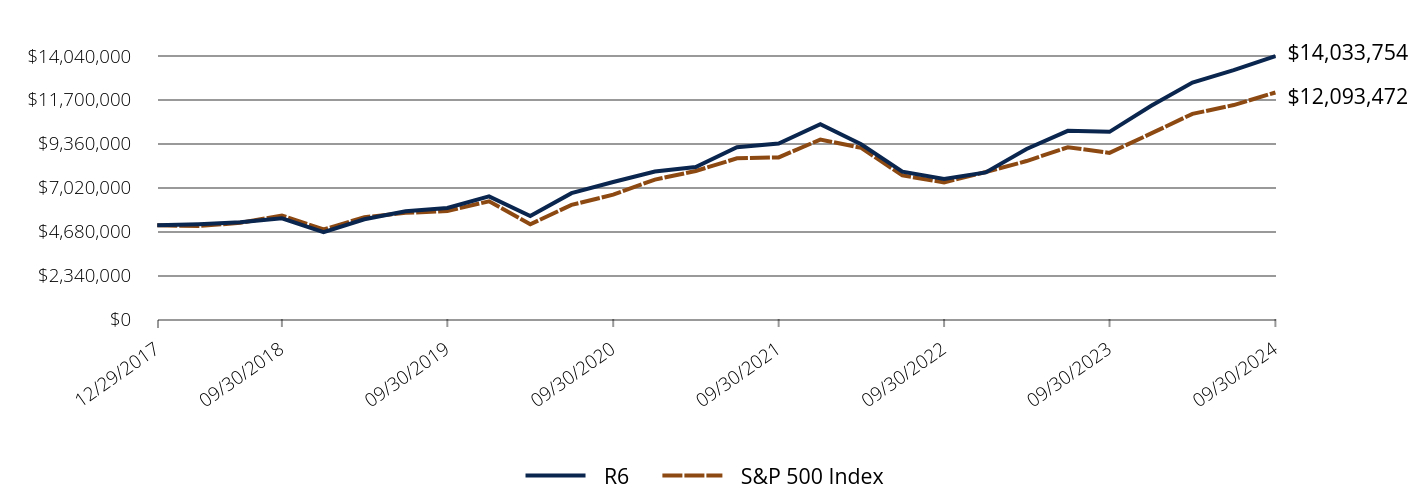

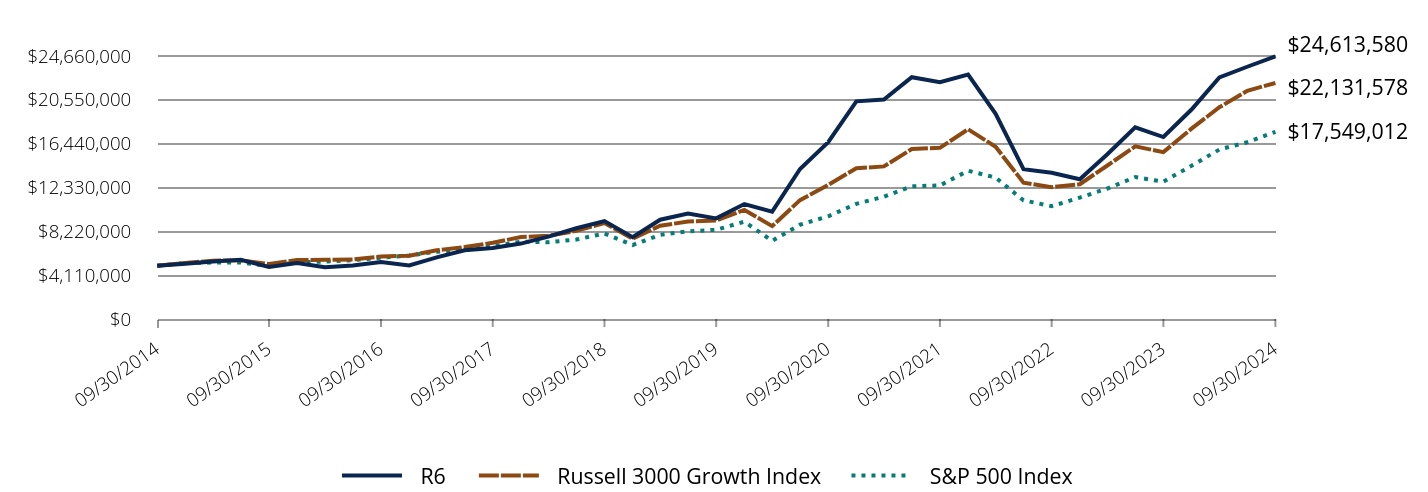

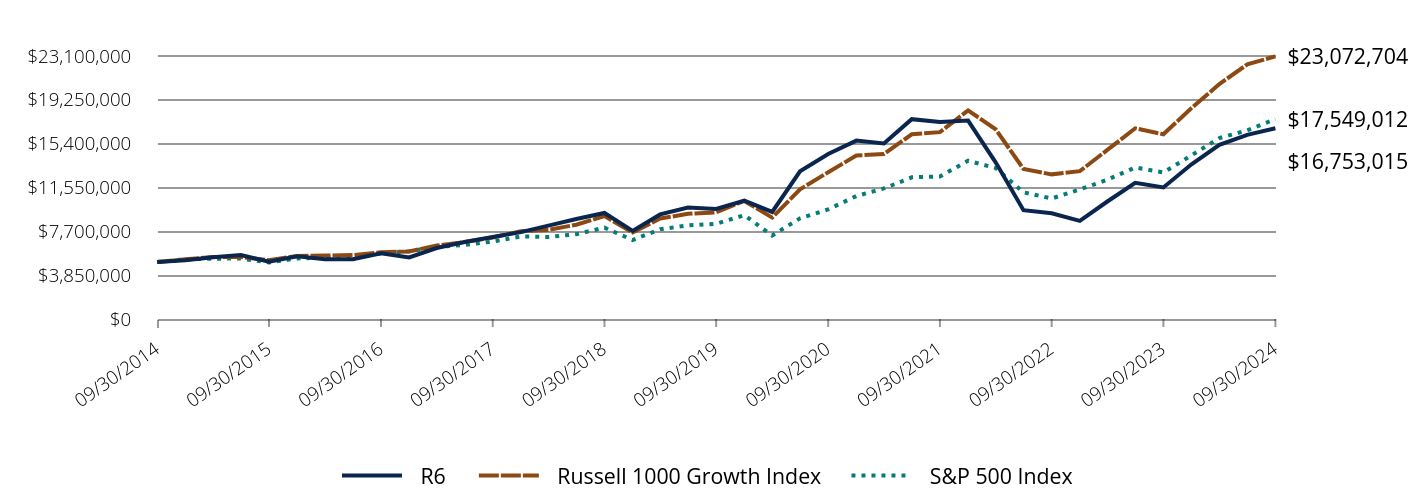

Comparison of the Change in Value of $5,000,000 Investment in the Fund in Relation to the Benchmarks

| R6 | Russell 3000 Growth Index | S&P 500 Index |

|---|

| 09/30/2014 | $5,000,000 | $5,000,000 | $5,000,000 |

| 12/31/2014 | $5,183,312 | $5,258,527 | $5,246,634 |

| 03/31/2015 | $5,395,903 | $5,471,440 | $5,296,507 |

| 06/30/2015 | $5,552,550 | $5,486,039 | $5,311,236 |

| 09/30/2015 | $4,881,209 | $5,160,543 | $4,969,274 |

| 12/31/2015 | $5,258,268 | $5,526,340 | $5,319,239 |

| 03/31/2016 | $4,849,979 | $5,544,967 | $5,390,934 |

| 06/30/2016 | $5,017,006 | $5,589,316 | $5,523,294 |

| 09/30/2016 | $5,344,875 | $5,864,500 | $5,736,049 |

| 12/31/2016 | $5,018,345 | $5,934,947 | $5,955,411 |

| 03/31/2017 | $5,779,123 | $6,447,336 | $6,316,675 |

| 06/30/2017 | $6,442,187 | $6,747,341 | $6,511,748 |

| 09/30/2017 | $6,662,045 | $7,147,256 | $6,803,501 |

| 12/31/2017 | $7,073,269 | $7,690,925 | $7,255,572 |

| 03/31/2018 | $7,727,978 | $7,804,995 | $7,200,495 |

| 06/30/2018 | $8,511,219 | $8,263,375 | $7,447,750 |

| 09/30/2018 | $9,177,978 | $8,997,412 | $8,022,029 |

| 12/31/2018 | $7,663,466 | $7,527,951 | $6,937,470 |

| 03/31/2019 | $9,307,139 | $8,745,927 | $7,884,287 |

| 06/30/2019 | $9,883,055 | $9,139,669 | $8,223,616 |

| 09/30/2019 | $9,437,456 | $9,240,548 | $8,363,278 |

| 12/31/2019 | $10,777,362 | $10,226,445 | $9,121,826 |

| 03/31/2020 | $10,065,777 | $8,707,647 | $7,334,132 |

| 06/30/2020 | $14,065,065 | $11,145,228 | $8,840,802 |

| 09/30/2020 | $16,582,635 | $12,578,416 | $9,630,235 |

| 12/31/2020 | $20,405,512 | $14,139,292 | $10,800,131 |

| 03/31/2021 | $20,584,550 | $14,307,883 | $11,467,036 |

| 06/30/2021 | $22,670,102 | $15,936,091 | $12,447,334 |

| 09/30/2021 | $22,210,410 | $16,046,780 | $12,519,783 |

| 12/31/2021 | $22,911,049 | $17,794,136 | $13,900,354 |

| 03/31/2022 | $19,244,863 | $16,147,748 | $13,261,144 |

| 06/30/2022 | $14,053,712 | $12,784,700 | $11,125,951 |

| 09/30/2022 | $13,719,473 | $12,353,956 | $10,582,716 |

| 12/31/2022 | $13,097,997 | $12,639,892 | $11,382,879 |

| 03/31/2023 | $15,448,116 | $14,390,670 | $12,236,264 |

| 06/30/2023 | $17,970,577 | $16,185,592 | $13,305,974 |

| 09/30/2023 | $17,061,864 | $15,644,248 | $12,870,415 |

| 12/31/2023 | $19,641,772 | $17,848,733 | $14,375,168 |

| 03/31/2024 | $22,649,925 | $19,852,452 | $15,892,600 |

| 06/30/2024 | $23,652,642 | $21,400,058 | $16,573,406 |

| 09/30/2024 | $24,613,580 | $22,131,578 | $17,549,012 |

Average Annual Total Returns (%)

| Total Net Assets | $1,356,177,986 |

| # of Issuers | 43 |

| Portfolio Turnover Rate | 33% |

| Total Advisory Fees Paid | $12,112,115 |

| fund | 1 Year | 5 Years | 10 Years |

|---|

| R6 | 44.26% | 21.13% | 17.28% |

| Russell 3000 Growth Index | 41.47% | 19.09% | 16.04% |

| S&P 500 Index | 36.35% | 15.98% | 13.38% |

Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser may waive or reimburse certain Fund expenses pursuant to a contract expiring on August 29, 2035, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. Performance for the R6 Shares prior to August 31, 2016 is based on the performance of the Institutional Shares.

What did the Fund invest in?

| Holding | % of Total Net Assets (9/30/24)* |

| Microsoft Corporation | 12.2% |

| NVIDIA Corporation | 11.5% |

| Amazon.com, Inc. | 6.7% |

| Meta Platforms, Inc. | 5.2% |

| Apple Inc. | 4.7% |

| Broadcom Inc. | 4.6% |

| Tesla, Inc. | 4.5% |

| Space Exploration Technologies Corp. | 2.7% |

| Gartner, Inc. | 2.6% |

| argenx SE | 2.6% |

| Total | 57.2% |

* Individual weights may not sum to 100% (or displayed total) due to rounding.

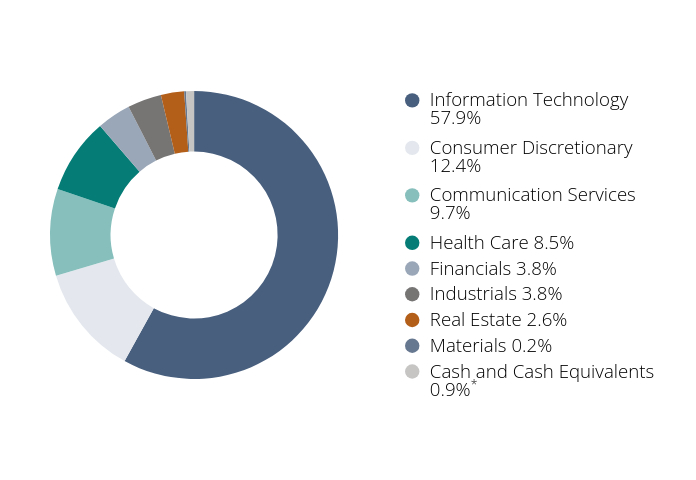

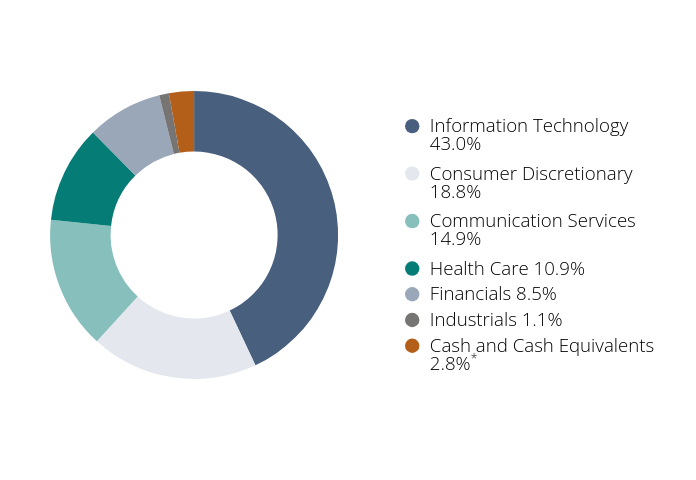

Sector Breakdown

(as a % of net assets)*

| Value | Value |

|---|

| Information Technology | 57.9% |

| Consumer Discretionary | 12.4% |

| Communication Services | 9.7% |

| Health Care | 8.5% |

| Financials | 3.8% |

| Industrials | 3.8% |

| Real Estate | 2.6% |

| Materials | 0.2% |

| Cash and Cash Equivalents | 0.9%Footnote Reference* |

| Footnote | Description |

Footnote* | Includes short-term investments, other assets and liabilities-net. |

If you wish to view additional information about the Fund; including but not limited to its financial statements, prospectus, or holdings, please visit connect.rightprospectus.com/Baron. For benchmark definitions and attribution language please visit BaronCapitalGroup.com.

Phone: 1.800.99.BARON

Email: info@BaronCapitalGroup.com

Annual Shareholder Report September 30, 2024

Annual Shareholder Report September 30, 2024

Baron Fifth Avenue Growth Fund

This annual shareholder report contains important information about Baron Fifth Avenue Growth Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the Fund at BaronCapitalGroup.com. You can also request this information by contacting us at 1.800.99.BARON.

What were the Fund costs for the past 12 months?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Retail | $122 | 1.00% |

How did the Fund perform last year and what affected its performance?

Large-cap growth stocks soared during the year-long period, dominated by the Magnificent Seven technology companies, which continued to climb on investor enthusiasm around AI. The Fund's investments in these secular growth market leaders paid off, as the three top contributors were all Magnificent Seven names. Sector/sub-industry weightings did not factor much into results, with the positive impact of the Fund's overweight in Information Technology and underexposure to Industrials and Consumer Staples cancelled out by weakness elsewhere -- in particular, electric vehicles and autonomous driving.

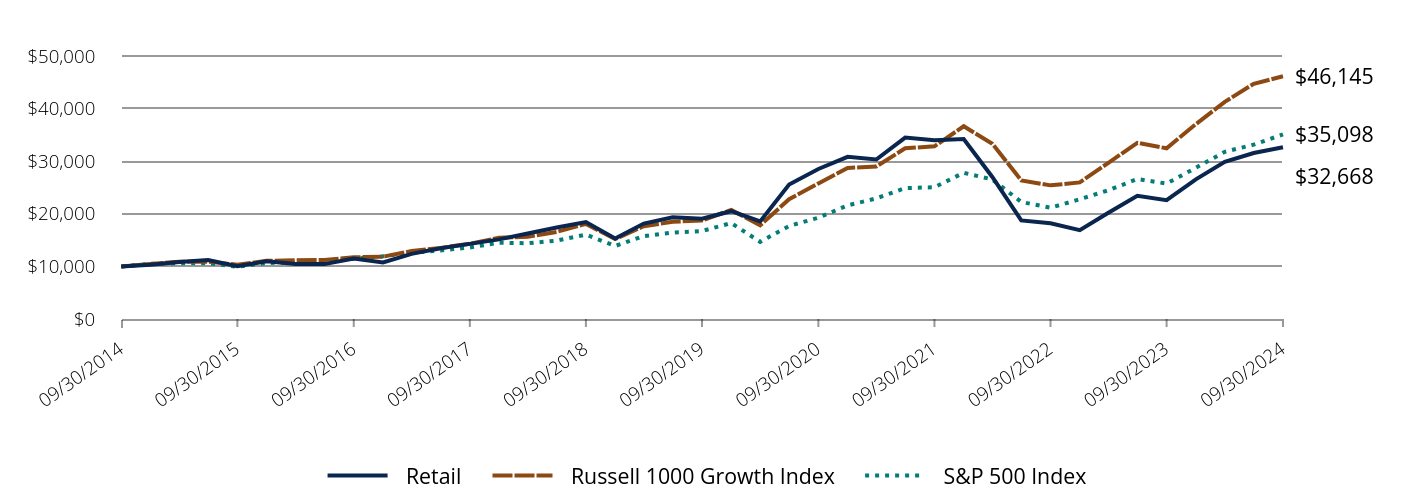

Comparison of the Change in Value of $10,000 Investment in the Fund in Relation to the Benchmarks

| Retail | Russell 1000 Growth Index | S&P 500 Index |

|---|

| 09/30/2014 | $10,000 | $10,000 | $10,000 |

| 12/31/2014 | $10,333 | $10,478 | $10,493 |

| 03/31/2015 | $10,844 | $10,881 | $10,593 |

| 06/30/2015 | $11,224 | $10,894 | $10,623 |

| 09/30/2015 | $10,048 | $10,317 | $9,939 |

| 12/31/2015 | $10,986 | $11,072 | $10,639 |

| 03/31/2016 | $10,440 | $11,154 | $10,782 |

| 06/30/2016 | $10,440 | $11,223 | $11,047 |

| 09/30/2016 | $11,497 | $11,737 | $11,472 |

| 12/31/2016 | $10,761 | $11,856 | $11,911 |

| 03/31/2017 | $12,389 | $12,912 | $12,633 |

| 06/30/2017 | $13,440 | $13,515 | $13,024 |

| 09/30/2017 | $14,284 | $14,312 | $13,607 |

| 12/31/2017 | $15,134 | $15,438 | $14,511 |

| 03/31/2018 | $16,245 | $15,656 | $14,401 |

| 06/30/2018 | $17,398 | $16,558 | $14,896 |

| 09/30/2018 | $18,431 | $18,076 | $16,044 |

| 12/31/2018 | $15,300 | $15,204 | $13,875 |

| 03/31/2019 | $18,152 | $17,652 | $15,769 |

| 06/30/2019 | $19,340 | $18,471 | $16,447 |

| 09/30/2019 | $19,073 | $18,746 | $16,727 |

| 12/31/2019 | $20,497 | $20,737 | $18,244 |

| 03/31/2020 | $18,539 | $17,813 | $14,668 |

| 06/30/2020 | $25,551 | $22,772 | $17,682 |

| 09/30/2020 | $28,525 | $25,782 | $19,261 |

| 12/31/2020 | $30,832 | $28,719 | $21,600 |

| 03/31/2021 | $30,329 | $28,990 | $22,934 |

| 06/30/2021 | $34,493 | $32,449 | $24,895 |

| 09/30/2021 | $33,983 | $32,825 | $25,040 |

| 12/31/2021 | $34,200 | $36,644 | $27,801 |

| 03/31/2022 | $26,997 | $33,331 | $26,522 |

| 06/30/2022 | $18,736 | $26,357 | $22,252 |

| 09/30/2022 | $18,186 | $25,410 | $21,165 |

| 12/31/2022 | $16,888 | $25,967 | $22,766 |

| 03/31/2023 | $20,199 | $29,698 | $24,473 |

| 06/30/2023 | $23,414 | $33,502 | $26,612 |

| 09/30/2023 | $22,585 | $32,453 | $25,741 |

| 12/31/2023 | $26,547 | $37,050 | $28,750 |

| 03/31/2024 | $29,877 | $41,279 | $31,785 |

| 06/30/2024 | $31,561 | $44,719 | $33,147 |

| 09/30/2024 | $32,668 | $46,145 | $35,098 |

Average Annual Total Returns (%)

| Total Net Assets | $636,410,481 |

| # of Issuers | 31 |

| Portfolio Turnover Rate | 26% |

| Total Advisory Fees Paid | $3,919,830 |

| fund | 1 Year | 5 Years | 10 Years |

|---|

| Retail | 44.65% | 11.36% | 12.57% |