2011: A Record Year.

With great success comes great responsibility. Despite the challenges faced in 2011, Citizens & Northern recorded record earnings. It was also a year to give back to the communities we serve. Throughout the year, C&N contributed more than $120,000 to over 200 charitable and non-profit organizations. The largest contribution went to the American Red Cross to help with flood relief efforts in Bradford, Sullivan and Lycoming counties following the devastating September flooding.

Our Corporate Profile Citizens & Northern Corporation is a bank holding company with assets exceeding $1.3 billion and is headquartered in Wellsboro, PA. Banking services are provided by its subsidiary, Citizens & Northern Bank, from 26 banking offices in Bradford, Cameron, Lycoming, McKean, Potter, Sullivan and Tioga Counties in Pennsylvania and Steuben County in New York. Investment products are offered through C&N Investment Services and insurance products are offered through C&N Financial Services Corp. Trust services are offered by Citizens & Northern Bank through the C&N Trust and Financial Management Group. Citizens & Northern Corporation stock trades on the NASDAQ Capital Market Securities under the symbol CZNC. Citizens & Northern Corporation officers include: Charles H. Updegraff, Jr., chairman, president and chief executive officer; Mark A. Hughes, treasurer and Jessica R. Brown, corporate secretary. Citizens & Northern Bank is the deposit market leader in the eight counties it serves.

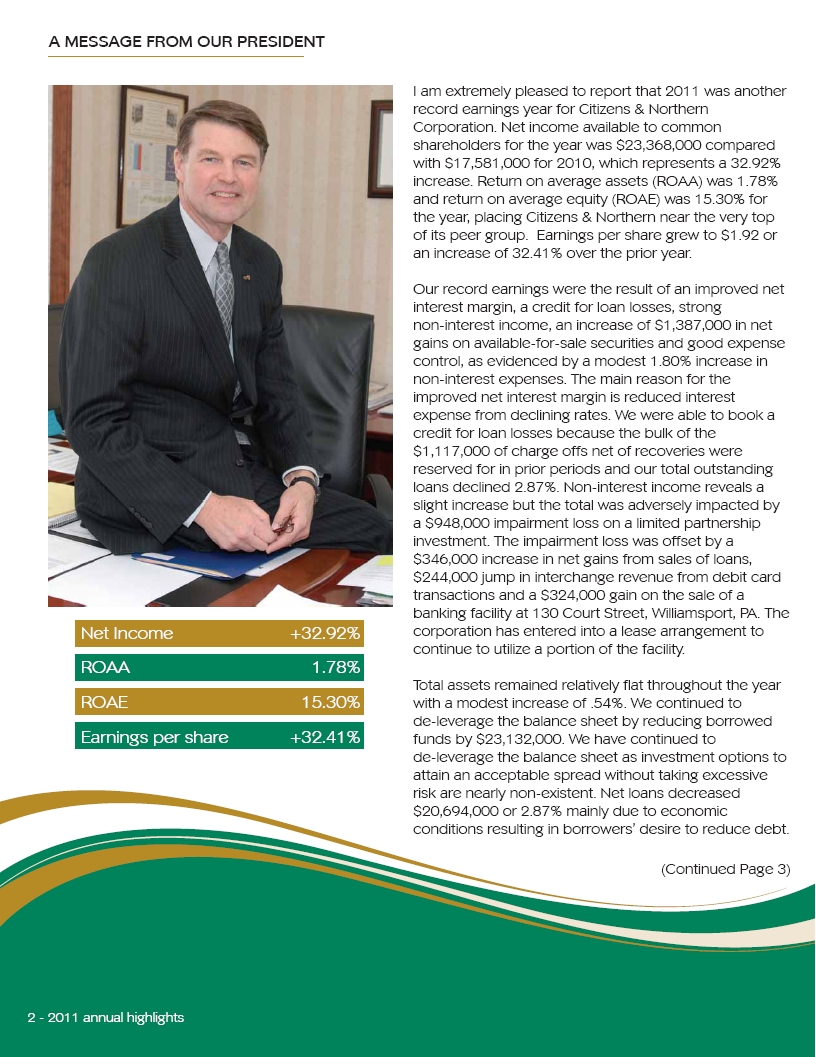

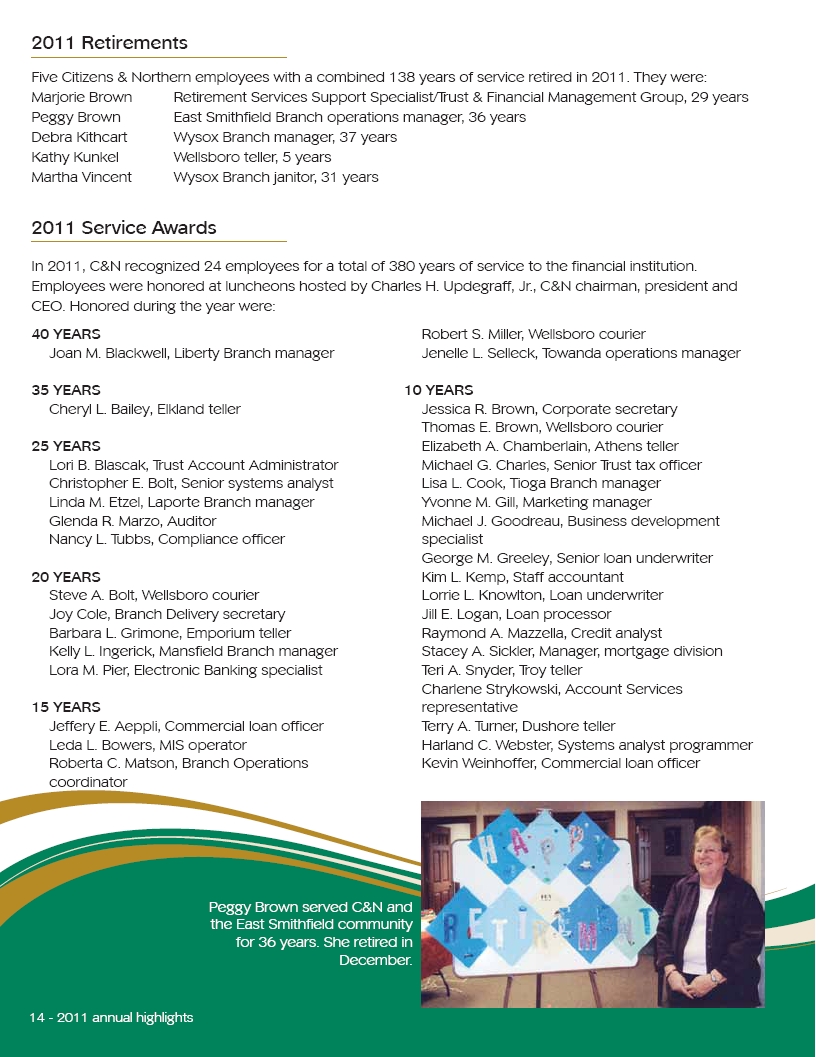

A MESSAGE FROM OUR PRESIDENT I am extremely pleased to report that 2011 was another record earnings year for Citizens & Northern Corporation. Net income available to common shareholders for the year was $23,368,000 compared with $17,581,000 for 2010, which represents a 32.92% increase. Return on average assets (ROAA) was 1.78% and return on average equity (ROAE) was 15.30% for the year, placing Citizens & Northern near the very top of its peer group. Earnings per share grew to $1.92 or an increase of 32.41% over the prior year. Our record earnings were the result of an improved net interest margin, a credit for loan losses, strong non-interest income, an increase of $1,387,000 in net gains on available-for-sale securities and good expense control, as evidenced by a modest 1.80% increase in non-interest expenses. The main reason for the improved net interest margin is reduced interest expense from declining rates. We were able to book a credit for loan losses because the bulk of the $1,117,000 of charge offs net of recoveries were reserved for in prior periods and our total outstanding loans declined 2.87%. Non-interest income reveals a slight increase but the total was adversely impacted by a $948,000 impairment loss on a limited partnership investment. The impairment loss was offset by a $346,000 increase in net gains from sales of loans, $244,000 jump in interchange revenue from debit card transactions and a $324,000 gain on the sale of a banking facility at 130 Court Street, Williamsport, PA. The corporation has entered into a lease arrangement to continue to utilize a portion of the facility. Total assets remained relatively flat throughout the year with a modest increase of .54%. We continued to de-leverage the balance sheet by reducing borrowed funds by $23,132,000. We have continued to de-leverage the balance sheet as investment options to attain an acceptable spread without taking excessive risk are nearly non-existent. Net loans decreased $20,694,000 or 2.87% mainly due to economic conditions resulting in borrowers’ desire to reduce debt. (Continued Page 3) Net Income +32.92% ROAA 1.78% ROAE 15.30% Earnings per share +32.41%

PRESIDENT’S MESSAGE (Cont.) It should be noted that while loans outstanding declined in 2011, at year-end 2011 the bank was servicing $56,638,000 in residential loans it originated and sold in the secondary market, which is a $30,922,000 increase over the prior year. Our nonperforming assets to total assets ratio declined to .73% from .92%, which is well below many of our peers. This ratio is an excellent indicator of the quality of our assets. During the past year the bank made a conscious effort to improve our net interest margin by driving down interest expense which resulted in our total deposits and repo sweep balances being relatively unchanged year over year. This decision was a significant factor in reducing our interest expense by $5,689,000 over the past year. Our capital ratios continue to substantially exceed the definition of well capitalized by regulators and as of year-end we had a total risk based capital ratio of 21.17%. Our stock continues to perform well and closed the year at $18.47 per share, a 24.29% increase over the prior year. Our strong earnings and capital position enabled the corporation to increase the cash dividend each quarter during 2011 with total per share dividend of 58 cents, an increase of 48.72% over the prior year. Our strong capital position will enable the corporation to take advantage of acquisition opportunities that may arise over time. On September 8, 2011 the community of Athens, PA was severely damaged by a flood. Our Athens banking office suffered significant damage and is currently closed. We are in the process of repairing the damage and anticipate re-opening for business by the end of March 2012. C&N was very fortunate that the Athens office was the only office significantly damaged as our offices in Wysox, Monroeton, Towanda, Dushore and Muncy were precariously close to the flood waters. Our industry continues its rapid pace of change, much of which is driven by technology. Our customers increasingly demand alternative delivery channels to transact their business as compared to coming into a bank branch office. Over 50% of all customer transactions are now handled outside of a branch. Industry experts predict that percentage will continue to grow as customers demand more convenience to meet their lifestyle needs and the explosion of smartphone ownership. C&N continues to invest in alternative delivery channels and we recently introduced e-z Mobile Deposit which allows customers to deposit checks to their account 24/7 from anywhere by simply downloading our e-z Mobile Deposit app to their iPhone or Android. We are proud to be the first to market in our branch office footprint. Customer enrollment has been brisk in the very short time since we rolled out the product. Citizens & Northern Bank covers seven counties in Pennsylvania and one county in New York all of which are located within the Marcellus Shale region. Our twenty-six branch offices are the most of any bank within the region. The Marcellus Shale gas play brings many opportunities and challenges to C&N. C&N has been able to capitalize on lending to area businesses that provide services to the large out-of-area exploration firms and the wealth creation by leasing and royalty payments has benefited our Wealth Management Group. We are acutely aware of the boom or bust nature of natural gas exploration. We actively monitor our loan portfolio to avoid concentrations and have developed a risk profile for Marcellus Shale related lending to minimize credit losses in the event exploration was to slow or stop. Regulatory pressures continue to be a concern. Many provisions of the Dodd-Frank legislation adopted in 2010 are just now beginning to be implemented. These changes will increase our cost of providing credit to our customers, have the potential to significantly reduce non-interest income and divert employee focus from servicing customers to compliance with the myriad of new regulations. Though challenging, we continue to work hard at managing the compliance process while identifying opportunities to continuously improve efficiency and effectiveness. Our superior financial performance this past year is the result of the cumulative effort by our dedicated employees, officers and Board of Directors. We solicit your support as we continue to strive to have Citizens & Northern recognized as a superior community bank. Athens office September, 2011

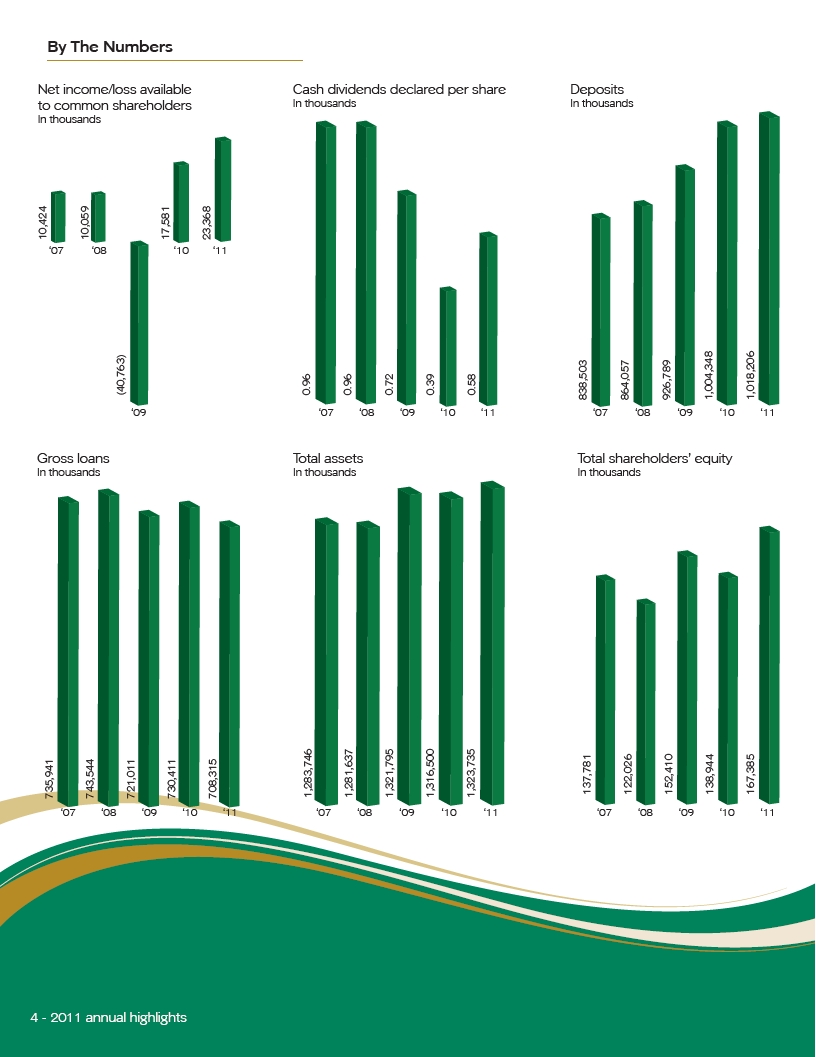

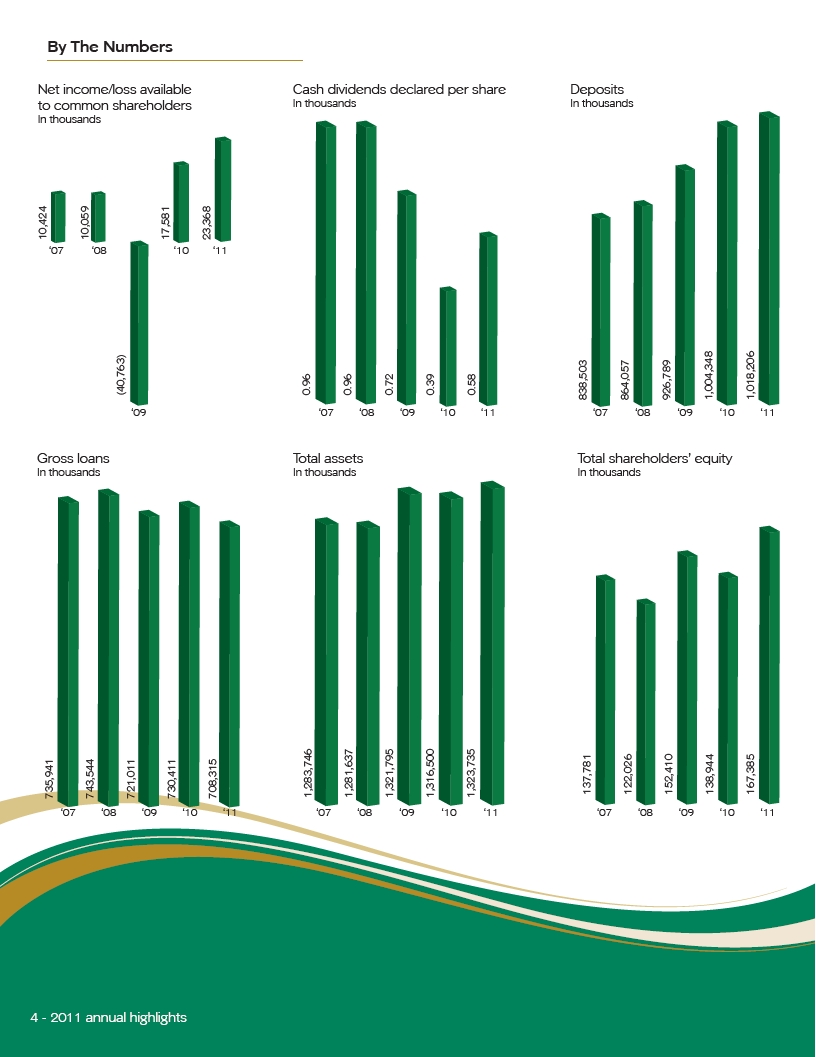

Net income/loss available to common shareholders In thousands ‘07 ‘08 ‘09 ‘10 ‘11 10,424 10,059 (40,763) 17,581 23,368 Total shareholders’ equity In thousands ‘07 ‘08 ‘09 ‘10 ‘11 137,781 122,026 152,410 138,944 167,385 Cash dividends declared per share In thousands ‘07 ‘08 ‘09 ‘10 ‘11 0.96 0.96 0.72 0.39 0.58 Total assets In thousands ‘07 ‘08 ‘09 ‘10 ‘11 1,283,746 1,281,637 1,321,795 1,316,500 1,323,735 Deposits In thousands ‘07 ‘08 ‘09 ‘10 ‘11 838,503 864,057 926,789 1,004,348 1,018,206 Gross loans In thousands ‘07 ‘08 ‘09 ‘10 ‘11 735,941 743,544 721,011 730,411 708,315

New in 2011 Technology is moving at breakneck speed and your financial institution is committed to providing our customers with the most up-to-date products and services available. In 2011, we introduced: BUSINESS BILL PAY Business Bill Pay offers small businesses a better way to pay bills and invoices by allowing them to make payments more quickly and easily and gain greater control over their cash flow. Business Bill Pay customers are able to delegate tasks and set permission controls and establish customized reporting, all from their home or office computer. MOBILE BANKING - THERE’S AN APP FOR THAT! Our new e-banking app enables our Mobile Banking customers to access their online accounts faster. Customers can download the app from their iPhone or Android App Stores or online within their C&N Internet Banking application. Our e-banking app takes customers directly to Internet Banking and loads quickly. e-z MOBILE DEPOSIT Citizens & Northern Bank’s e-z Mobile Deposit application allows our customers to deposit checks into their account without visiting a C&N branch office or ATM. This app enables customers to deposit checks into their account using their Android or iPhone and its camera. Now customers can deposit checks from anywhere 24 hours a day, 7 days a week. It’s fast, safe and secure! WELCOME to the official Facebook® page for Citizens & Northern Bank! “Like” our page and keep up with the latest news and information from your hometown bank. Member FDIC Click the “Like” button above! 1,400 PEOPLE “LIKE” US ON FACEBOOK! C&N launched its Facebook page in June as a means to further communicate with our customers. The page proved particularly valuable during the September flooding when a number of our offices were impacted by the storms. Our Facebook page allows us to communicate quickly and effectively with customers and keeps them engaged with their hometown bank.

Quarterly Share Data Trades of the Corporation’s stock are executed through various brokers who maintain a market in the Corporation’s stock. The Corporation’s stock is listed on NASDAQ Capital Market Securities with the trading symbol CZNC. The following tables show the approximate high and low sales price of the common stock during 2011 and 2010. 2011 High Low Dividend Declared Per Quarter First Quarter............................$16.96 ................ $14.37..............$0.13 Second Quarter.....................$17.66 ................. $13.10..............$0.14 Third Quarter..........................$17.40 ................ $14.06..............$0.15 Fourth Quarter .......................$19.16 ................ $14.00..............$0.16 2010 High Low Dividend Declared Per Quarter First Quarter............................$12.95 ................ $8.76 ................$0.08 Second Quarter.....................$13.86 ................. $10.70..............$0.09 Third Quarter..........................$13.30 ................ $10.15..............$0.10 Fourth Quarter .......................$15.84 ................ $12.45..............$0.12 Citizens & Northern Bank Coudersport office staff members Nola Gross, left, and Georgia Cary, fourth from left, present a $600 check to representatives of The Christmas House, from left, Jane Metzger, Judy Mottershead, Leona Ruter and Barb Heimel. Employees and customers collected donations in December.

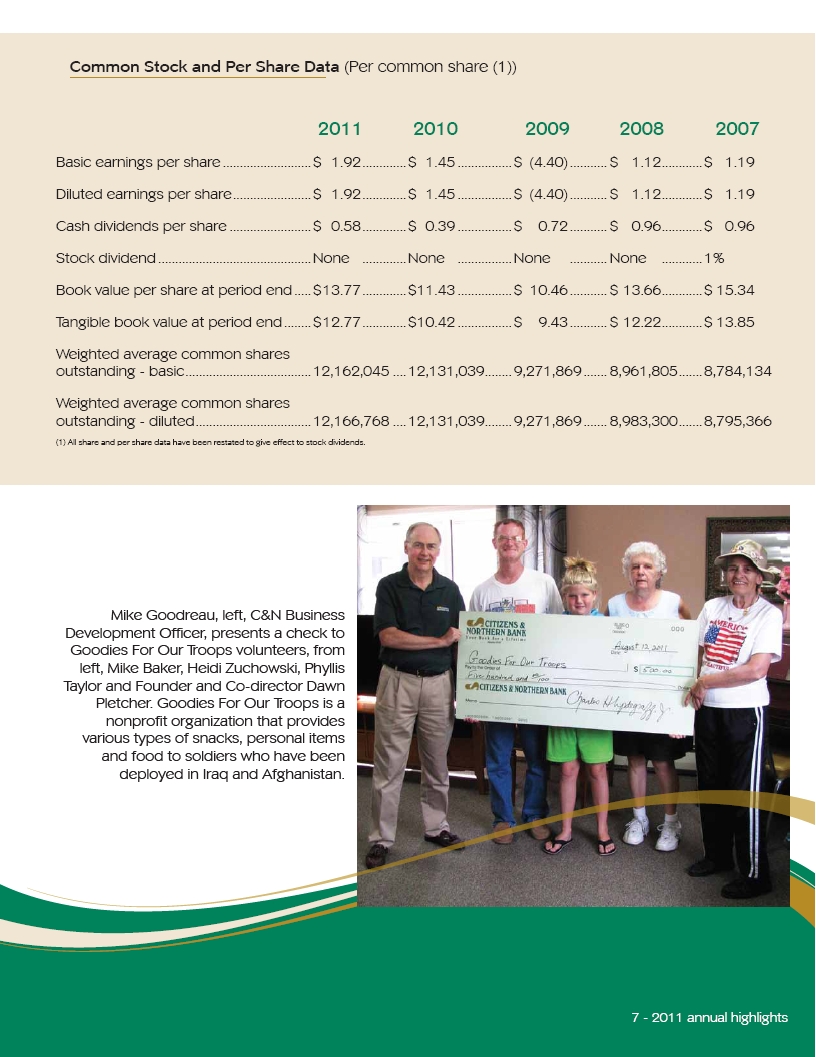

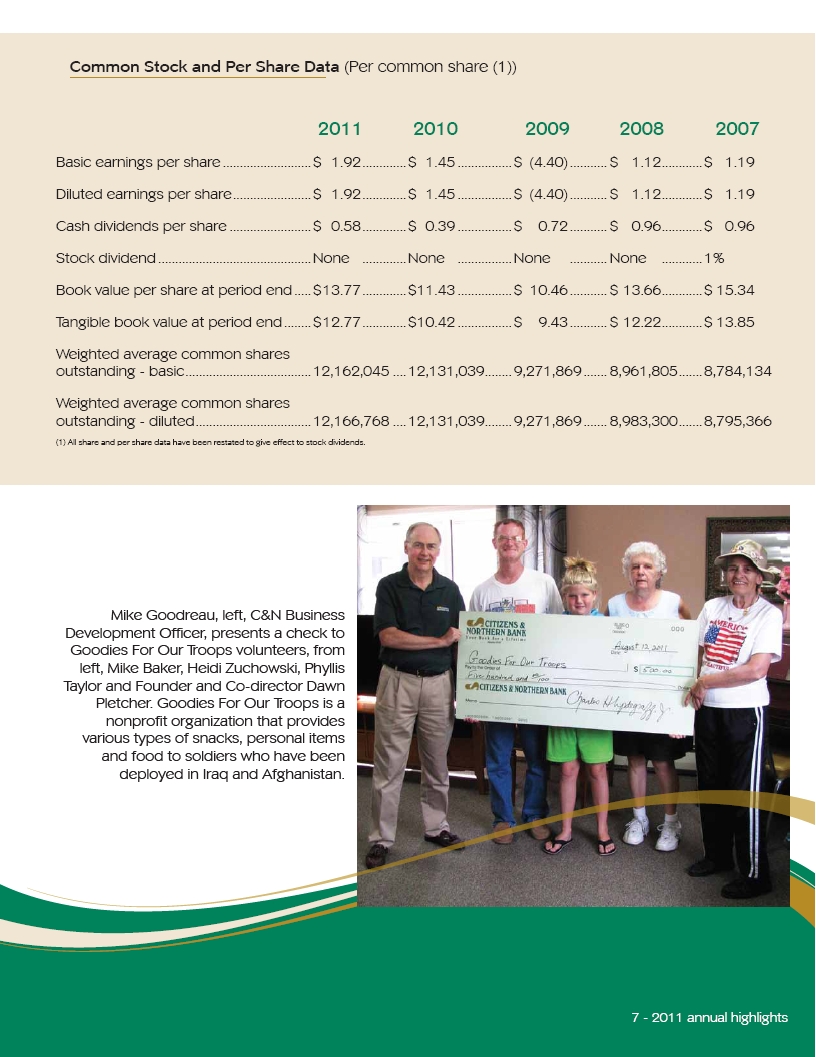

2011 2010 2009 2008 2007 Basic earnings per share .......................... $ 1.92.............$ 1.45 ................ $ (4.40) ........... $ 1.12............$ 1.19 Diluted earnings per share....................... $ 1.92.............$ 1.45 ................ $ (4.40) ........... $ 1.12............$ 1.19 Cash dividends per share ........................ $ 0.58.............$ 0.39 ................ $ 0.72 ........... $ 0.96............$ 0.96 Stock dividend .............................................None ..............None ................None ........... None ............1% Book value per share at period end ..... $ 13.77.............$ 11.43 ................ $ 10.46 ........... $ 13.66............$ 15.34 Tangible book value at period end ........ $ 12.77.............$ 10.42 ................ $ 9.43 ........... $ 12.22............$ 13.85 Weighted average common shares outstanding - basic.....................................12,162,045 .....12,131,039........9,271,869....... 8,961,805.......8,784,134 Weighted average common shares outstanding - diluted..................................12,166,768 .....12,131,039........9,271,869....... 8,983,300.......8,795,366 (1) All share and per share data have been restated to give effect to stock dividends. Common Stock and Per Share Data (Per common share (1)) Mike Goodreau, left, C&N Business Development Officer, presents a check to Goodies For Our Troops volunteers, from left, Mike Baker, Heidi Zuchowski, Phyllis Taylor and Founder and Co-director Dawn Pletcher. Goodies For Our Troops is a nonprofit organization that provides various types of snacks, personal items and food to soldiers who have been deployed in Iraq and Afghanistan.

Five-year summary of operations Income statement (in thousands) 2011 2010 2009 2008 2007 Interest and fee income.......................$ 61,256..........$ 62,114 ......... $ 67,976.......... $ 74,237..........$ 70,221 Interest expense..................................... 13,556.......... 19,245......... 24,456.......... 31,049.......... 33,909 Net interest income............................... 47,700.......... 42,869 ......... 43,520.......... 43,188.......... 36,312 (Credit) Provision for loan losses ...... (285) .......... 1,191 ......... 680.......... 909.......... 529 Net interest income after (credit) provision for loan losses....... 47,985.......... 41,678 ......... 42,840.......... 42,279.......... 35,783 Noninterest income excluding securities /gains (losses)...................... 13,938.......... 13,917 ......... 13,021.......... 13,140.......... 10,440 Net impairment losses recognized in earnings from available-for-sale securities................................................... 0.......... (433) ......... (85,363).......... (10,088).......... 0 Net realized gains on availablefor- sale securities................................... 2,216.......... 1,262......... 1,523.......... 750.......... 127 Noninterest expense ............................ 32,057.......... 31,569......... 34,011.......... 33,703.......... 33,283 Income (loss) before income tax provision (credit)..................................... 32,082.......... 24,855......... (61,990).......... 12,378.......... 13,067 Income tax provision (credit).............. 8,714 ........... 5,800 ......... (22,655).......... 2,319.......... 2,643 Net income (loss) ................................... 23,368.......... 19,055 ......... (39,335).......... 10,059.......... 10,424 U.S. Treasury preferred dividends .... 0.......... 1,474 ......... 1,428.......... 0.......... 0 Net income (loss) available to common shareholders.........................$ 23,368..........$ 17,581 ..........$ (40,763)..........$ 10,059..........$ 10,424 Balance sheet at year-end (in thousands) Available-for-sale securities .................$ 481,685..........$ 443,956 ......... $ 396,288.......... $ 419,688..........$ 432,755 Gross loans .............................................. 708,315.......... 730,411 ......... 721,011.......... 743,544.......... 735,941 Allowance for loan losses.................... 7,705 .......... 9,107 ......... 8,265.......... 7,857.......... 8,859 Assets ........................................................ 1,323,735 .......... 1,316,588 ......... 1,321,795.......... 1,281,637.......... 1,283,746 Deposits .................................................... 1,018,206 .......... 1,004,348 ......... 926,789.......... 864,057.......... 838,503 Borrowings ............................................... 130,313.......... 166,908 ......... 235,471.......... 285,473.......... 300,132 Stockholders’ equity............................. 167,385.......... 138,944 ......... 152,410.......... 122,026.......... 137,781 Common stockholders’ equity, (excluding preferred stock) ................ 167,385.......... 138,944 ......... 126,661.......... 122,026.......... 137,781

Five-year summary of operations Average balance sheet (in thousands) 2011 2010 2009 2008 2007 Total assets...............................................$ 1,313,445.........$ 1,326,145 ....... $ 1,296,086 ........ $ 1,280,924........$ 1,178,904 Earning assets ......................................... 1,208,584......... 1,205,608 ....... 1,208,280 ........ 1,202,872........ 1,090,035 Gross loans .............................................. 715,321......... 723,318 ....... 728,748 ........ 743,741........ 729,269 Deposits .................................................... 1,001,125......... 965,615 ....... 886,703 ........ 847,714........ 812,255 Stockholders’ equity............................. 152,718......... 150,133 ....... 141,787 ........ 130,790........ 138,669 Key Ratios Return on average assets ................... 1.78%......... 1.44%....... -3.03% ........ 0.79%........ 0.88% Return on average equity.................... 15.30%......... 12.69%....... -27.74% ......... 7.69%........ 7.52% Average equity to average assets .... 11.63%......... 11.32%....... 10.94% ........ 10.21%........ 11.76% Net interest margin (1) ........................... 4.22%......... 3.81%....... 3.84%........ 3.77%........ 3.51% Efficiency (2).............................................. 49.40%......... 52.73%....... 57.22%........ 57.59%........ 68.39% Cash dividends as a % of diluted earnings per share .................. 30.21%......... 26.90%....... NM........ 85.71%........ 80.67% Tier 1 leverage......................................... 10.93%......... 9.20%....... 9.86% ........ 10.12%........ 10.91% Tier 1 risk-based capital....................... 19.95%......... 15.87%....... 16.70% ........ 13.99%........ 15.46% Total risk-based capital......................... 21.17%......... 17.17%....... 17.89% ........ 14.84%........ 16.52% Tangible common equity/ tangible assets ........................................ 11.84%......... 9.71%....... 8.72% ........ 8.61%........ 9.79% NM = Not a meaningful ratio (1) Rates of return on tax exempt securities and loans are calculated on a fully-taxable equivalent basis. (2) The efficiency ratio is calculated by dividing total noninterest expense by the sum of net interest income (including income from tax exempt securities and loans on a fully-taxable equivalent basis) and noninterest income excluding securities (losses)/gains and gains from sale of credit card loans. Todd Coolidge, left, C&N Wellsboro branch manager, congratulates Wellsboro High School Economics and Government Teacher Benjamin Miller and his team for winning the state championship in the Stock Market Game competition. Team members, sponsored by C&N, are, from left, Samuel Mitchell, Christopher Hume and Colby Davis. Also congratulating the team is Mike Pietropola, right, high school assistant principal.

Quarterly financial data The following table presents summarized financial data for 2011 and 2010 (unaudited, in thousands, except per share) 2011 quarter ended March 31 June 30 Sept. 30 Dec. 31 Interest income...................................................... $ 15,298.................... $ 15,443..................... $ 15,317 ....................$ 15,198 Interest expense.................................................... 4,016.................... 3,628..................... 3,108 .................... 2,804 Net interest income.............................................. 11,282.................... 11,815..................... 12,209 .................... 12,394 (Credit) provision for loan losses ..................... (192).................... 31..................... (37) .................... (87) Net interest income after (credit) provision for loan losses ..................................... 11,474.................... 11,784..................... 12,246 .................... 12,481 Other income ......................................................... 2,555.................... 3,673..................... 3,999 .................... 3,711 Net gains on available-for-sale securities...... 1,839.................... 163..................... 26 .................... 188 Other expenses..................................................... 8,263.................... 7,794..................... 8,052 .................... 7,948 Income before income tax provision ............. 7,605.................... 7,826..................... 8,219 .................... 8,432 Income tax provision............................................ 2,064.................... 2,129..................... 2,230 .................... 2,291 Net income.............................................................. 5,541.................... 5,697..................... 5,989 .................... 6,141 U.S. Treasury preferred dividends ................... 0.................... 0..................... 0 .................... 0 Net income available to common shareholders........................................ $ 5,541.................... $ 5,697..................... $ 5,989 ....................$ 6,141 Net income per share - basic ........................... $ 0.46.................... $ 0.47..................... $ 0.49 ....................$ 0.51 Net income per share - diluted ........................ $ 0.45.................... $ 0.47..................... $ 0.49 ....................$ 0.51 2010 quarter ended March 31 June 30 Sept. 30 Dec. 31 Interest income...................................................... $ 15,733.................... $ 15,386..................... $ 15,495 ....................$ 15,500 Interest expense.................................................... 5,260.................... 5,036..................... 4,639 .................... 4,310 Net interest income.............................................. 10,473.................... 10,350..................... 10,856 .................... 11,190 Provision for loan losses ..................................... 207.................... 76..................... 189 .................... 719 Net interest income after provision for loan losses ...................................... 10,266.................... 10,274..................... 10,667 .................... 10,471 Other income ......................................................... 3,548.................... 3,314..................... 3,575 ..................... 3,480 Net gains on available-for-sale securities...... 58.................... 319..................... 388 ..................... 64 Other expenses..................................................... 7,997.................... 7,757..................... 8,095 .................... 7,720 Income before income tax provision ............. 5,875.................... 6,150..................... 6,535 .................... 6,295 Income tax provision............................................ 1,437.................... 1,281..................... 1,671 .................... 1,411 Net income.............................................................. 4,438.................... 4,869..................... 4,864 .................... 4,884 U.S. Treasury preferred dividends ................... 373.................... 372..................... 729 .................... 0 Net income available to common shareholders........................................ $ 4,065.................... $ 4,497..................... $ 4,135 ....................$ 4,884 Net income per share - basic ........................... $ 0.34.................... $ 0.37..................... $ 0.34 ....................$ 0.40 Net income per share - diluted ........................ $ 0.34.................... $ 0.37..................... $ 0.34 ....................$ 0.40

Trust and Financial Management Group Five-Year Comparison (in thousands) 2011 2010 2009 2008 2007 Assets $ 634,782 $ 608,843 $ 605,062 $ 550,496 $ 659,193 Revenue $ 3,472 $ 3,475 $ 3,262 $ 3,443 $ 3,440 The composition of Trust assets under management as of December 31, 2011, 2010 and 2009 follow: Accounts (in thousands) 2011 2010 2009 Pension/profit sharing $ 269,442 $ 239,310 $ 216,478 Investment management 162,183 172,373 190,611 Trusts 123,428 127,614 115,831 Custody 72,564 64,668 77,997 Estates 5,752 3,563 3,025 Guardianships 1,413 1,315 1,120 Total $ 634,782 $ 608,843 $ 605,062 Investments (in thousands) Mutual funds $ 330,906 $ 289,827 $ 270,235 Stocks 115,577 130,669 99,650 Bonds 105,471 115,474 134,604 Savings and money market funds 73,389 68,051 94,446 Miscellaneous 6,224 2,840 3,996 Real estate 2,177 1,007 1,600 Mortgages 1,038 975 531 Total $ 634,782 $ 608,843 $ 605,062 Trust Officers Larry Alderson and Darci Baird present the Trust and Financial Management Group’s donation to Marilyn Bok, Community Foundation of the Twin Tiers CEO.

2011 Board of Directors Citizens & Northern Corporation Citizens & Northern Bank Dennis F. Beardslee ..................................Owner, Terrace Lanes Bowling Center R. Robert DeCamp (Emeritus)...............President, Patterson Lumber Co., Inc. Jan E. Fisher................................................EVP/COO, Laurel Health Systems and President & CEO of Soldiers & Sailors Memorial Hospital R. Bruce Haner...........................................Retired auto buyer for new car dealers Susan E. Hartley.........................................Attorney at law Leo F. Lambert............................................President/GM, Fitzpatrick & Lambert, Inc. Edward L. Learn .........................................Former owner, Learn Hardware and Building Supply Raymond R. Mattie ...................................President, M&S Conversion Co., Inc. Edward H. Owlett, III .................................President and CEO, Putnam Company Leonard Simpson......................................Attorney at law and Sullivan County District Attorney James E. Towner........................................General Manager, The Scranton Times Ann M. Tyler.................................................Retired CPA, Ann M. Tyler CPA, PC Charles H. Updegraff, Jr. .........................C&N chairman, president and CEO 2011 Executive Team Dawn A. Besse...........................................EVP and chief credit officer Harold F. Hoose, III ....................................EVP and director of lending Mark A. Hughes .........................................EVP and chief financial officer George M. Raup .........................................EVP and chief information officer John M. Reber............................................EVP and director of risk management Thomas L. Rudy, Jr....................................EVP and director of branch delivery Deborah E. Scott .......................................EVP and Trust Division director Charles H. Updegraff, Jr. .........................Chairman, president and CEO Sammy Saver and Knoxville staff employees participated in the annual Knoxville Day parade. Riding with Sammy in back are Amy Haskins and Lyndie Hughes. In front are Marlene King and Laura Losinger.

2011 Advisory Boards Our Advisory Board members are the eyes and ears of the communities we serve. We depend on them to better help us serve those who depend on us. Thomas Hendershot, commercial lender, and Mark Elsbree, Sayre Branch manager, were among the Sayre and Athens employees ringing the bell for the Salvation Army during the holiday season. Athens and Sayre Warren J. Croft Max P. Gannon, Jr. R. Bruce Haner Susan E. Hartley Dr. Edward Jones David Rosenbloom L. Joseph Tomasso, Jr. Canisteo and Hornell William Hatch Brian Schu Coudersport, Emporium, Port Allegany P. Gregory Buchanan Edwin H. Corey Madelyn Farber Peter Fragale Patrice D. Lavavasseur Edwin M. Schott Robert C. Smith Edwin W. Tompkins, III Dushore and Laporte Ronald A. Gutosky Leo F. Lambert Kerry A. Meehan William B. Saxe Leonard Simpson East Smithfield Thomas G. Furman James G. Wilcox Elkland Mary C. Heitzenrater Mark R. Howe John C. Kenyon Edward L. Learn Knoxville Brian Bicksler L. Grant Gehman William W. Roosa Liberty Lyle R. Brion Lawrence J. Connolly James H. Route, Jr. Ray E. Wheeland Mansfield David Kurzejewski Larry Mansfield Joseph R. Maresco Ralston William W. Brooks, III Stephen L. Davis Ronald Roan Jersey Shore, Muncy, Old Lycoming, South Williamsport, Williamsport Thomas F. Charles John Confer James R. Fetter, Jr. Thomas D. Hess Roger D. Jarrett Daniel Mathers Raymond Mattie Melanie McLane Frank G. Pellegrino David A. Schall Ann M. Tyler Louis “Terry” Waldman Tioga C. Frederick LaVancher Leisa L. LaVancher Dirk D’Haene Towanda and Monroeton Gary Baker James A. Bowen W. John Greenland James E. Parks Jeffrey A. Smith Mark W. Smith Troy Dennis F. Beardslee Roy W. Cummings, Jr. J. Robert Garrison Evan S. Williams, Jr. Wellsboro Donald R. Abplanalp Robert F. Cox, Jr. R. Robert DeCamp Craig Eccher Jan E. Fisher Scott Lewis Edward H. Owlett, III Wysox Robert L. Fulmer Gary Hennip James E. Towner Walter E. Warburton, Jr.

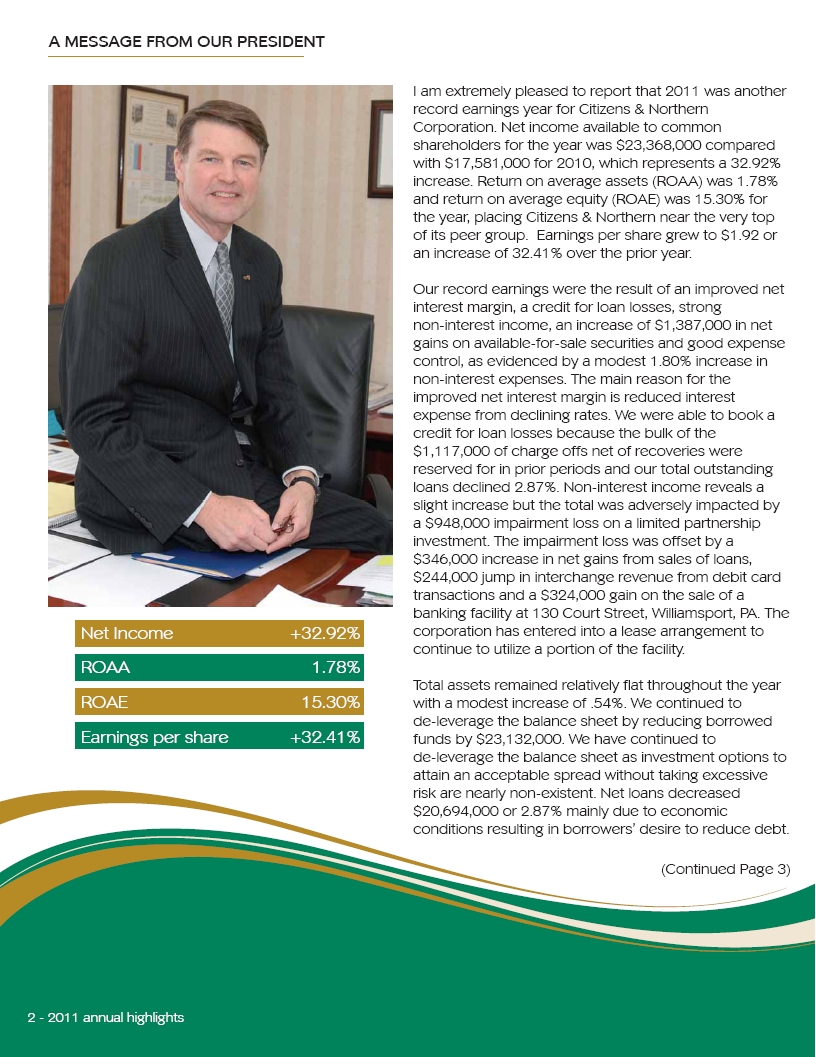

2011 Retirements Five Citizens & Northern employees with a combined 138 years of service retired in 2011. They were: Marjorie Brown Retirement Services Support Specialist/Trust & Financial Management Group, 29 years Peggy Brown East Smithfield Branch operations manager, 36 years Debra Kithcart Wysox Branch manager, 37 years Kathy Kunkel Wellsboro teller, 5 years Martha Vincent Wysox Branch janitor, 31 years 2011 Service Awards In 2011, C&N recognized 24 employees for a total of 380 years of service to the financial institution. Employees were honored at luncheons hosted by Charles H. Updegraff, Jr., C&N chairman, president and CEO. Honored during the year were: 40 YEARS Joan M. Blackwell, Liberty Branch manager 35 YEARS Cheryl L. Bailey, Elkland teller 25 YEARS Lori B. Blascak, Trust Account Administrator Christopher E. Bolt, Senior systems analyst Linda M. Etzel, Laporte Branch manager Glenda R. Marzo, Auditor Nancy L. Tubbs, Compliance officer 20 YEARS Steve A. Bolt, Wellsboro courier Joy Cole, Branch Delivery secretary Barbara L. Grimone, Emporium teller Kelly L. Ingerick, Mansfield Branch manager Lora M. Pier, Electronic Banking specialist 15 YEARS Jeffery E. Aeppli, Commercial loan officer Leda L. Bowers, MIS operator Roberta C. Matson, Branch Operations coordinator Robert S. Miller, Wellsboro courier Jenelle L. Selleck, Towanda operations manager 10 YEARS Jessica R. Brown, Corporate secretary Thomas E. Brown, Wellsboro courier Elizabeth A. Chamberlain, Athens teller Michael G. Charles, Senior Trust tax officer Lisa L. Cook, Tioga Branch manager Yvonne M. Gill, Marketing manager Michael J. Goodreau, Business development specialist George M. Greeley, Senior loan underwriter Kim L. Kemp, Staff accountant Lorrie L. Knowlton, Loan underwriter Jill E. Logan, Loan processor Raymond A. Mazzella, Credit analyst Stacey A. Sickler, Manager, mortgage division Teri A. Snyder, Troy teller Charlene Strykowski, Account Services representative Terry A. Turner, Dushore teller Harland C. Webster, Systems analyst programmer Kevin Weinhoffer, Commercial loan officer Peggy Brown served C&N and the East Smithfield community for 36 years. She retired in December.

Contact Information Client Contact Center.....................................................1-877-838-2517 Internet Banking ...............................................................1-877-838-2517 Telephone Banking ..........................................................1-877-622-5526 C&N Financial Services Wellsboro.....................................................................1-866-ASK-CNFS Coudersport...............................................................814-274-1929 Trust and Financial Management Group Wellsboro.....................................................................1-800-487-8784 Sayre.............................................................................1-888-760-8192 Towanda.......................................................................1-888-987-8784 Williamsport ................................................................1-866-732-7213 Canisteo.......................................................................607-698-4295 Coudersport...............................................................814-274-1929 On the Web........................................................................www.cnbankpa.com Facebook............................................................................www.facebook.com/citizensandnothernbank Stockholder Inquiries A copy of the Corporation’s Annual Report Form 10-K for the year ended December 31, 2011, as required to be filed with the Securities and Exchange Commission, will be furnished to any stockholder without charge upon written request to the Corporation’s treasurer at our principal office at P.O. Box 58, Wellsboro, PA 16901. The information is also available through the Citizens & Northern Bank website at www.cnbankpa.com and the website of the Securities and Exchange Commission at www.sec.gov. This statement has not been reviewed or confirmed for accuracy or relevance by the Federal Deposit Insurance Corporation. Investor Information The Annual Meeting of Shareholders will be held at the Arcadia Theatre, 50 Main Street in Wellsboro, PA at 2:00 p.m. Tuesday, April 17, 2012. General shareholder inquiries should be sent to Citizens & Northern Corporation, 90-92 Main Street, P.O. Box 58, Wellsboro, PA 16901. Our Stock Transfer Agent is American Stock Transfer & Trust Company, 59 Maiden Lane, Plaza Level, New York, NY 10038. Telephone: 800-278-4353. Our independent auditors are ParenteBeard, LLC, 400 Market Street, Williamsport, PA 17701. A large crowd attended the Canisteo Valley Idol competition, part of Canisteo’s Crazee Days and sponsored by C&N.

Our offices Athens..............................................428 South Main Street Canisteo ..........................................3 Main Street Coudersport ..................................10 North Main Street Dushore...........................................111 West Main Street East Smithfield...............................563 Main Street Elkland..............................................104 Main Street Emporium .......................................135 East Fourth Street Hornell..............................................6250 County Route 64 Jersey Shore..................................230 Railroad Street Knoxville ..........................................102 East Main Street Laporte ............................................514 Main Street Liberty..............................................4534 Williamson Trail Mansfield.........................................1085 Main Street Monroeton......................................612 James Avenue Muncy..............................................3461 Route 405 Highway Old Lycoming.................................1510 Dewey Avenue Port Allegany..................................100 Maple Street Ralston.............................................24 Thompson Street Sayre ................................................1827 Elmira Street South Williamsport.......................2 East Mountain Avenue Tioga.................................................41 North Main Street Towanda..........................................428 Main Street Troy....................................................64 Elmira Street Wellsboro ........................................90-92 Main Street Williamsport....................................130 Court Street Wysox ..............................................1467 Golden Mile Road Toll-free: 1-877-838-2517 Our Client Contact Center is available to help you Monday-Friday 8:00 a.m.-5:00 p.m. and Saturday 8:30 a.m.-noon. Dushore Branch staff members visited a classroom to help children learn to distinguish between “wants” and “needs” as part of the Teach Children To Save campaign.

Community involvement Citizens & Northern is committed to the communities it serves and takes pride in its civic responsibility, not only on a corporate level, but on a branch level as well. Father Paul Siebert of the Cameron County Ministerium accepts a check from Kimberlea Whiting, Emporium branch manager. Funds raised were donated to the Emporium Food Bank. Jon Cleveland of the C&N Trust and Financial Management Group and Canisteo teller Mikel Quinlan deliver gifts to the Steuben County Rural Ministry. Our Monroeton, Wysox and Towanda offices sponsor an annual Easter egg hunt.