UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

xANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedDecember 31, 2014

OR

¨TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _________________________.

Commission file number: 0-16084

CITIZENS & NORTHERN CORPORATION

(Exact name of Registrant as specified in its charter)

| PENNSYLVANIA | 23-2451943 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

90-92 MAIN STREET, WELLSBORO, PA 16901

(Address of principal executive offices) (Zip code)

570-724-3411

(Registrant's telephone number including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Exchange Where Registered |

| Common Stock Par Value $1.00 | The NASDAQ Stock Market LLC |

Securities registered pursuant to section 12(g) of the Act:None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes¨No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes¨Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesx No¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YesxNo¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer “and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

(Check one:) Large accelerated filer¨ Accelerated filerx Non-accelerated filer¨ Smaller reporting company¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes¨ Nox

The aggregate market value of the registrant's common stock held by non-affiliates at June 30, 2014, the registrant’s most recently completed second fiscal quarter, was $236,364,605.

The number of shares of common stock outstanding at February 20, 2015 was 12,263,027

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement for the annual meeting of its shareholders to be held April 23, 2015 are incorporated by reference into Parts III and IV of this report.

PART I

ITEM 1. BUSINESS

Citizens & Northern Corporation (“Corporation”) is a holding company whose principal activity is community banking. The Corporation’s principal office is located in Wellsboro, Pennsylvania. The largest subsidiary is Citizens & Northern Bank (“C&N Bank” or the “Bank”). The Corporation’s other wholly-owned subsidiaries are Citizens & Northern Investment Corporation and Bucktail Life Insurance Company (“Bucktail”). Citizens & Northern Investment Corporation was formed in 1999 to engage in investment activities. Bucktail reinsures credit and mortgage life and accident and health insurance on behalf of C&N Bank.

C&N Bank is a Pennsylvania banking institution that was formed by the consolidation of Northern National Bank of Wellsboro and Citizens National Bank of Towanda on October 1, 1971. Subsequent mergers included: First National Bank of Ralston in May 1972; Sullivan County National Bank in October 1977; Farmers National Bank of Athens in January 1984; and First National Bank of East Smithfield in May 1990. In 2005, the Corporation acquired Canisteo Valley Corporation and its subsidiary, First State Bank, a New York State chartered commercial bank with offices in Canisteo and South Hornell, NY. In 2010, the First State Bank operations were merged into C&N Bank and Canisteo Valley Corporation was merged into the Corporation. On May 1, 2007, the Corporation acquired Citizens Bancorp, Inc. (“Citizens”), with banking offices in Coudersport, Emporium and Port Allegany, Pennsylvania. Citizens Trust Company, the banking subsidiary of Citizens, was merged with and into C&N Bank as part of the transaction. C&N Bank has held its current name since May 6, 1975, at which time C&N Bank changed its charter from a national bank to a Pennsylvania bank.

C&N Bank provides an extensive range of banking services, including deposit and loan products for personal and commercial customers. The Bank also maintains a trust division that provides a wide range of financial services, such as 401(k) plans, retirement planning, estate planning, estate settlements and asset management. In January 2000, C&N Bank formed a subsidiary, C&N Financial Services Corporation (“C&NFSC”). C&NFSC is a licensed insurance agency that provides insurance products to individuals and businesses. In 2001, C&NFSC added a broker-dealer division, which offers mutual funds, annuities, educational savings accounts and other investment products through registered agents. C&NFSC’s operations are not significant in relation to the total operations of the Corporation.

All phases of the Bank’s business are competitive. The Bank primarily competes in Tioga, Bradford, Sullivan, Lycoming, Potter, Cameron and McKean counties in Pennsylvania, and Steuben and Allegany counties in New York. The Bank competes with local commercial banks headquartered in our market area as well as other commercial banks with branches in our market area. Some of the banks that have branches in our market area are larger in overall size. With respect to lending activities and attracting deposits, the Bank also competes with savings banks, savings and loan associations, insurance companies, regulated small loan companies and credit unions. Also, the Bank competes with mutual funds for deposits. C&N Bank competes with insurance companies, investment counseling firms, mutual funds and other business firms and individuals for trust, investment management, brokerage and insurance services. The Bank is generally competitive with all financial institutions in our service area with respect to interest rates paid on time and savings deposits, service charges on deposit accounts and interest rates charged on loans. The Bank serves a diverse customer base, and is not economically dependent on any small group of customers or on any individual industry.

Major initiatives within the last 5 years included the following:

| · | in 2010, repurchased preferred stock of $26.440 million and redeemed a warrant from the TARP Capital Purchase Program; |

| · | merged the operations of First State Bank into C&N Bank and Canisteo Valley Corporation into Citizens & Northern Corporation in 2010; |

| · | in 2011, sold the banking facility at 130 Court Street, Williamsport, PA, and entered into a leasing arrangement to continue to offer banking and trust services from the facility, resulting in an estimated $122,000 (pre-tax) reduction in operating expenses in 2012; |

| · | in April 2012, re-opened the Athens, PA, facility, which was damaged by flooding in September 2011; |

| · | in 2013, worked with consultants on projects which resulted in increases in revenues from service charges on deposit accounts, starting primarily in the fourth quarter 2013, and reductions in electronic funds processing expenses and other benefits over approximately the next five years; and |

| 2 |

| · | in 2014, approved a new treasury stock repurchase program. Under the new program, the Corporation is authorized to repurchase up to 622,500 shares of the Corporation’s common stock, or approximately 5% of the Corporation’s outstanding shares at July 16, 2014. In 2014, 208,300 shares had been repurchased. |

Virtually all of the Corporation’s banking offices are located in the “Marcellus Shale,” an area extending across portions of New York State, Pennsylvania, Ohio, Maryland, West Virginia and Virginia. In recent years, most of the Pennsylvania counties in which the Corporation operates have been significantly affected by an upsurge in natural gas exploration, as technological developments have made exploration of the Marcellus Shale commercially feasible. After a surge of activity in 2009 through most of 2011, the market price of natural gas declined, causing Marcellus Shale natural gas exploration activity to slow, though some activity has continued to occur throughout the Corporation’s market area and this activity continues to have a significant impact on economic opportunities throughout the area. Over approximately the past five years, a significant portion of the Corporation’s new business opportunities in lending, Trust and other services arose either directly or indirectly from Marcellus Shale-related activity. Due to its pervasive nature, it is virtually impossible to quantify the aggregate impact of Marcellus Shale-related activity on the Corporation’s financial position at December 31, 2014 and results of operations.

At December 31, 2014, C&N Bank had total assets of $1,228,210,000, total deposits of $978,232,000, net loans outstanding of $623,209,000 and 278full-time equivalent employees.

Most activities of the Corporation and its subsidiaries are regulated by federal or state agencies. The primary regulatory relationships are described as follows:

| · | The Corporation is a bank holding company formed under the provisions of Section 3 of the Federal Reserve Act. The Corporation is under the direct supervision of the Federal Reserve and must comply with the reporting requirements of the Federal Bank Holding Company Act. |

| · | C&N Bank is a state-chartered, nonmember bank, supervised by the Federal Deposit Insurance Corporation and the Pennsylvania Department of Banking and Securities. |

| · | C&NFSC is a Pennsylvania corporation. The Pennsylvania Department of Insurance regulates C&NFSC’s insurance activities. Brokerage products are offered through third party networking agreements. |

| · | Bucktail is incorporated in the state of Arizona and supervised by the Arizona Department of Insurance. |

A copy of the Corporation’s annual report on Form 10-K, quarterly reports on Form 10-Q, current events reports on Form 8-K, and amendments to these reports, will be furnished without charge upon written request to the Corporation’s Treasurer at P.O. Box 58, Wellsboro, PA 16901. Copies of these reports will be furnished as soon as reasonably possible, after they are filed electronically with the Securities and Exchange Commission. The information is also available through the Corporation’s web site at www.cnbankpa.com.

ITEM 1A. RISK FACTORS

The Corporation is subject to the many risks and uncertainties applicable to all banking companies, as well as risks specific to the Corporation’s geographic locations. Although the Corporation seeks to effectively manage risks, and maintains a level of equity that exceeds the banking regulatory agencies’ thresholds for being considered “well capitalized” (see Note 18 to the consolidated financial statements), management cannot predict the future and cannot eliminate the possibility of credit, operational or other losses. Accordingly, actual results may differ materially from management's expectations. Some of the Corporation’s significant risks and uncertainties are discussed below.

Credit Risk from Lending Activities -A significant source of risk is the possibility that losses will be sustained because borrowers, guarantors and related parties may fail to perform in accordance with the terms of their loan agreements. Most of the Corporation’s loans are secured, but some loans are unsecured. With respect to secured loans, the collateral securing the repayment of these loans may be insufficient to cover the obligations owed under such loans. Collateral values may be adversely affected by changes in economic, environmental and other conditions, including declines in the value of real estate, changes in interest rates, changes in monetary and fiscal policies of the federal government, wide-spread disease, terrorist activity, environmental contamination and other external events. In addition, collateral appraisals that are out of date or that do not meet industry recognized standards may create the impression that a loan is adequately collateralized when it is not. The Corporation has adopted underwriting and credit monitoring procedures and policies, including regular reviews of appraisals and borrower financial statements, that management believes are appropriate to mitigate the risk of loss. Also, as discussed further in the “Provision and Allowance for Loan Losses” section of Management’s Discussion and Analysis, the Corporation attempts to estimate the amount of losses that may be inherent in the portfolio through a quarterly evaluation process that includes several members of management and that addresses specifically identified problem loans, as well as other quantitative data and qualitative factors. Such risk management and accounting policies and procedures, however, may not prevent unexpected losses that could have a material adverse effect on the Corporation’s financial condition, results of operations or liquidity.

| 3 |

Interest Rate Risk - Business risk arising from changes in interest rates is an inherent factor in operating a banking organization. The Corporation’s assets are predominantly long-term, fixed-rate loans and debt securities. Funding for these assets comes principally from shorter-term deposits and borrowed funds. Accordingly, there is an inherent risk of lower future earnings or decline in fair value of the Corporation’s financial instruments when interest rates change. Significant fluctuations in interest rates could have a material adverse effect on the Corporation’s financial condition, results of operations or liquidity. For additional information regarding interest rate risk, see Part II, Item 7A, "Quantitative and Qualitative Disclosures About Market Risk."

Breach of Information Security and Technology Dependence -The Corporation relies on software, communication, and information exchange on a variety of computing platforms and networks and over the Internet. Despite numerous safeguards, the Corporation cannot be certain that all of its systems are entirely free from vulnerability to attack or other technological difficulties or failures. The Corporation relies on the services of a variety of vendors to meet its data processing and communication needs. If information security is breached or other technology difficulties or failures occur, information may be lost or misappropriated, services and operations may be interrupted and the Corporation could be exposed to claims from customers. Any of these results could have a material adverse effect on the Corporation’s financial condition, results of operations or liquidity.

Limited Geographic Diversification -The Corporation grants commercial, residential and personal loans to customers primarily in the Pennsylvania counties of Tioga, Bradford, Sullivan, Lycoming, Potter, Cameron and McKean, and in Steuben and Allegany Counties in New York State. Although the Corporation has a diversified loan portfolio, a significant portion of its debtors’ ability to honor their contracts is dependent on the local economic conditions within the region. As described in the “Business” section of Form 10-K, in recent years the Corporation’s market area has been significantly impacted by natural gas development activities associated with exploration of the Marcellus Shale. While Marcellus Shale-related development has created economic opportunities for business and individuals throughout much of our market area, natural gas exploration activity has slowed somewhat from the level in 2009 through 2011, and the possibility exists that this activity could be further reduced or cease as a result of changes in economic conditions, environmental concerns or other factors. Deterioration in economic conditions, including possible effects if Marcellus Shale-related activity were to further diminish or cease, could adversely affect the quality of the Corporation's loan portfolio and the demand for its products and services, and accordingly, could have a material adverse effect on the Corporation's financial condition, results of operations or liquidity.

Competition -All phases of the Corporation’s business are competitive. Some competitors are much larger in total assets and capitalization than the Corporation, have greater access to capital markets and can offer a broader array of financial services. There can be no assurance that the Corporation will be able to compete effectively in its markets. Furthermore, developments increasing the nature or level of competition could have a material adverse effect on the Corporation's financial condition, results of operations or liquidity.

Government Regulation and Monetary Policy -The Corporation and the banking industry are subject to extensive regulation and supervision under federal and state laws and regulations. The requirements and limitations imposed by such laws and regulations limit the manner in which the Corporation conducts its business, undertakes new investments and activities and obtains financing. These regulations are designed primarily for the protection of the deposit insurance funds and consumers and not to benefit the Corporation's shareholders. Financial institution regulation has been the subject of significant legislation in recent years and may be the subject of further significant legislation in the future, none of which is in the control of the Corporation. Significant new laws or changes in, or repeals of, existing laws could have a material adverse effect on the Corporation's financial condition, results of operations or liquidity. Further, federal monetary policy, particularly as implemented through the Federal Reserve System, significantly affects short-term interest rates and credit conditions, and any unfavorable change in these conditions could have a material adverse effect on the Corporation's financial condition, results of operations or liquidity.

| 4 |

Mortgage Banking – In September 2009, the Corporation entered into an agreement to originate and sell residential mortgage loans to the secondary market through the MPF Xtra program administered by the Federal Home Loan Banks of Pittsburgh and Chicago. The Corporation’s mortgage sales activity under this program was not significant in 2009, but has subsequently increased. In 2014, the Corporation entered into an agreement and in June 2014 began to originate and sell residential mortgage loans to the secondary market through the MPFX Original program, which is also administered by the Federal Home Loan Banks of Pittsburgh and Chicago. At December 31, 2014, total residential mortgages sold and serviced through the two programs amounted to $152,505,000. The Corporation must strictly adhere to the MPF Xtra and MPFX Original program guidelines for origination, underwriting and servicing loans, and failure to do so may result in the Corporation being forced to repurchase loans or being dropped from the program. As of December 31, 2014, the total outstanding balance of residential mortgage loans the Corporation has repurchased as a result of identified instances of noncompliance amounted to $1,802,000. If the volume of such forced repurchases of loans were to increase significantly, or if the Corporation were to be dropped from the programs, it could have a material adverse effect on the Corporation’s financial condition, results of operations or liquidity.

Equity Securities Risk - The Corporation’s equity securities portfolio consists of investments in stocks of banks and bank holding companies. Investments in bank stocks are subject to the risk factors affecting the banking industry, and that could cause a general market decline in the value of bank stocks. Also, losses could occur in individual stocks held by the Corporation because of specific circumstances related to each bank. These factors could have a material adverse effect on the Corporation’s financial condition, results of operations or liquidity. For additional information regarding equity securities risk, see Part II, Item 7A, "Quantitative and Qualitative Disclosures About Market Risk."

Debt Securities Risk– In 2009, the Corporation’s earnings were materially impaired by securities losses. Much of the Corporation’s 2009 losses from trust-preferred securities and other securities stem from the much-publicized economic problems affecting the national and international economy, which particularly hurt the banking industry. The Corporation has exposure to the possibility of future losses from investments in obligations of states and political subdivisions (also known as municipal bonds) and other debt securities. For additional information regarding debt securities, see Note 7 to the consolidated financial statements.

The Federal Home Loan Bank of Pittsburgh- Through its subsidiary (C&N Bank), the Corporation is a member of the Federal Home Loan Bank of Pittsburgh (FHLB-Pittsburgh), which is one of 12 regional Federal Home Loan Banks. The Corporation has a line of credit with the FHLB-Pittsburgh that is secured by a blanket lien on its loan portfolio. Access to this line of credit is critical if a funding need arises. However, there can be no assurance that the FHLB-Pittsburgh will be able to provide funding when needed, nor can there be assurance that the FHLB-Pittsburgh will provide funds specifically to the Corporation should its financial condition deteriorate and/or regulators prevent that access. The inability to access this source of funds could have a materially adverse effect on the Corporation’s financial flexibility if alternate financing is not available at acceptable interest rates. The failure of the FHLB-Pittsburgh or the FHLB system in general, may materially impair the Corporation’s ability to meet short- and long-term liquidity needs or to meet growth plans.

The Corporation owns common stock of the FHLB-Pittsburgh in order to qualify for membership in the FHLB system and access services from the FHLB-Pittsburgh. The FHLB-Pittsburgh faces a variety of risks in its operations including interest rate risk, counterparty credit risk, and adverse changes in its regulatory framework. In addition, the 12 Federal Home Loan Banks are jointly liable for the consolidated obligations of the FHLB system. To the extent that one FHLB cannot meet its obligations, other FHLBs can be called upon to make required payments. Such risks affecting the FHLB-Pittsburgh could adversely impact the value of the Corporation’s investment in the common stock of the FHLB-Pittsburgh and/or affect its access to credit.

Soundness of Other Financial Institutions- In addition to the FHLB-Pittsburgh, the Corporation maintains other credit facilities that provide it with additional liquidity. These facilities include secured and unsecured borrowings from the Federal Reserve Bank and third-party commercial banks. The Corporation believes that it maintains a strong liquidity position and that it is well positioned to withstand foreseeable market conditions. However, legal agreements with counterparties typically include provisions allowing them to restrict or terminate the Corporation’s access to these credit facilities with or without advance notice and at their sole discretion.

Financial institutions are interconnected as a result of trading, clearing, counterparty, and other relationships. Financial market conditions have been negatively impacted in the past and such disruptions or adverse changes in the Corporation's results of operations or financial condition could, in the future, have a negative impact on available sources of liquidity. Such a situation may arise due to circumstances that are outside the Corporation’s control, such as general market disruptions or operational problems affecting the Corporation or third parties. The Corporation’s efforts to monitor and manage liquidity risk may not be successful or sufficient to deal with dramatic or unanticipated reductions in available liquidity. In such events, the Corporation’s cost of funds may increase, thereby reducing net interest income, or the Corporation may need to sell a portion of its securities and/or loan portfolio, which, depending upon market conditions, could necessitate realizing a loss.

| 5 |

FDIC Insurance Assessments -In 2008 and 2009, higher levels of bank failures dramatically increased the resolution costs of the Federal Deposit Insurance Corporation, or the FDIC, and depleted the deposit insurance fund. In addition, the FDIC and the U.S. Congress increased federal deposit insurance coverage, placing additional stress on the deposit insurance fund. In order to maintain a strong funding position and restore reserve ratios of the deposit insurance fund, in 2009 the FDIC increased assessment rates. Although our total expenses from FDIC assessments have steadily decreased – to $600,000 in 2014 from $2,092,000 in 2009, we are generally unable to control the amount of premiums that we are required to pay for FDIC insurance. If a significant number of bank or financial institution failures occur, we may be required to pay higher FDIC premiums. Future increases in FDIC insurance premiums or additional special assessments may materially adversely affect our results of operations.

Bank Secrecy Act and Related Laws and Regulations -These laws and regulations have significant implications for all financial institutions. They increase due diligence requirements and reporting obligations for financial institutions, create new crimes and penalties, and require the federal banking agencies, in reviewing merger and other acquisition transactions, to consider the effectiveness of the parties to such transactions in combating money laundering activities. Even innocent noncompliance and inconsequential failure to follow the regulations could result in significant fines or other penalties, which could have a material adverse impact on the Corporation's financial condition, results of operations or liquidity.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 2. PROPERTIES

The Bank owns each of its properties, except for the branch facilities located at 130 Court Street, Williamsport, PA, and at 2 East Mountain Avenue, South Williamsport, PA, which are leased. All of the properties are in good condition. None of the owned properties are subject to encumbrance.

A listing of properties is as follows:

Main administrative offices:

| 90-92 Main Street | or | 10 Nichols Street | |

| Wellsboro, PA 16901 | Wellsboro, PA 16901 |

Branch offices – Citizens & Northern Bank:

| 428 S. Main Street | 514 Main Street | 2 East Mountain Avenue ** | |||

| Athens, PA 18810 | Laporte, PA 18626 | South Williamsport, PA 17702 | |||

| 10 North Main Street | 4534 Williamson Trail | 41 Main Street | |||

| Coudersport, PA 16915 | Liberty, PA 16930 | Tioga, PA 16946 | |||

| 111 W. Main Street | 1085 S. Main Street | 428 Main Street | |||

| Dushore, PA 18614 | Mansfield, PA 16933 | Towanda, PA 18848 | |||

| 563 Main Street | 612 James Monroe Avenue | 64 Elmira Street | |||

| East Smithfield, PA 18817 | Monroeton, PA 18832 | Troy, PA 16947 | |||

| 104 W. Main Street | 3461 Route 405 Highway | 90-92 Main Street | |||

| Elkland, PA 16920 | Muncy, PA 17756 | Wellsboro, PA 16901 | |||

| 135 East Fourth Street | 100 Maple Street | 1510 Dewey Avenue | |||

| Emporium, PA 15834 | Port Allegany, PA 16743 | Williamsport, PA 17701 | |||

| 230 Railroad Street | 24 Thompson Street | 130 Court Street ** | |||

| Jersey Shore, PA 17740 | Ralston, PA 17763 | Williamsport, PA 17701 | |||

| 102 E. Main Street | 1827 Elmira Street | 1467 Golden Mile Road | |||

| Knoxville, PA 16928 | Sayre, PA 18840 | Wysox, PA 18854 | |||

| 3 Main Street | 6250 County Rte 64 | ||||

| Canisteo, NY 14823 | Hornell, NY 14843 |

Facilities management office:

13 Water Street

Wellsboro, PA 16901

** designates leased branch facility

| 6 |

ITEM 3. LEGAL PROCEEDINGS

The Corporation and the Bank are involved in various legal proceedings incidental to their business. Management believes the aggregate liability, if any, resulting from such pending and threatened legal proceedings will not have a material adverse effect on the Corporation’s financial condition or results of operations.

ITEM 4. MINE SAFETY DISCLOSURE

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

QUARTERLY SHARE DATA

Trades of the Corporation’s stock are executed through various brokers who maintain a market in the Corporation’s stock. The Corporation’s stock is listed on the NASDAQ Capital Market with the trading symbol CZNC. As of December 31, 2014, there were 2,397 shareholders of record of the Corporation’s common stock.

The following table sets forth the high and low sales prices of the common stock during 2014 and 2013.

| 2014 | 2013 | ||||||

| Dividend | Dividend | ||||||

| Declared | Declared | ||||||

| per | per | ||||||

| High | Low | Quarter | High | Low | Quarter | ||

| First quarter | $20.74 | $18.19 | $0.26 | $20.00 | $18.65 | $0.25 | |

| Second quarter | 20.10 | 17.94 | 0.26 | 20.46 | 18.51 | 0.25 | |

| Third quarter | 20.10 | 18.50 | 0.26 | 21.45 | 19.08 | 0.25 | |

| Fourth quarter | 21.49 | 18.83 | 0.26 | 21.00 | 19.37 | 0.25 |

Future dividend payments will depend upon maintenance of a strong financial condition, future earnings and capital and regulatory requirements. Also, the Corporation and C&N Bank are subject to restrictions on the amount of dividends that may be paid without approval of banking regulatory authorities. These restrictions are described in Note 18 to the consolidated financial statements.

Effective July 17, 2014, the Corporation terminated its existing treasury stock repurchase programs and approved a new treasury stock repurchase program. Under the new program, the Corporation is authorized to repurchase up to 622,500 shares of the Corporation’s common stock, or approximately 5% of the Corporation’s issued and outstanding shares at July 16, 2014. As permitted by securities laws and other legal requirements and subject to market conditions and other factors, purchases under the new program may be made from time to time in the open market at prevailing prices, or through privately negotiated transactions.

Consistent with previous programs, the Board of Directors’ July 17, 2014 authorization provides that: (1) the new treasury stock repurchase program shall be effective when publicly announced and shall continue thereafter until suspended or terminated by the Board of Directors, in its sole discretion; and (2) all shares of common stock repurchased pursuant to

the new program shall be held as treasury shares and be available for use and reissuance for purposes as and when determined by the Board of Directors including, without limitation, pursuant to the Corporation’s Dividend Reinvestment and Stock Purchase Plan and its equity compensation program. Through December 31, 2014, 208,300 shares had been repurchased at a cost of $4,002,000.

| 7 |

The following table sets forth a summary of purchases by the Corporation, on the open market, of its equity securities during the fourth quarter 2014:

| Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Number of Shares that May Yet be Purchased Under the Plans or Programs |

| October 1 - 31, 2014 | 48,200 | $19.34 | 177,200 | 445,300 |

| November 1 - 30, 2014 | 10,600 | $19.46 | 187,800 | 434,700 |

| December 1 - 31, 2014 | 20,500 | $19.49 | 208,300 | 414,200 |

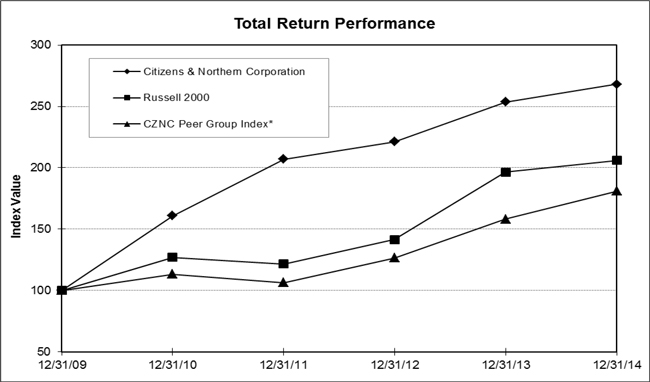

PERFORMANCE GRAPH

Set forth below is a chart comparing the Corporation’s cumulative return to stockholders against the cumulative return of the Russell 2000 and a Peer Group Index of similar banking organizations selected by the Corporation for the five-year period commencing December 31, 2009 and ended December 31, 2014. The index values are market-weighted dividend-reinvestment numbers, which measure the total return for investing $100.00 five years ago. This meets Securities & Exchange Commission requirements for showing dividend reinvestment share performance over a five-year period and measures the return to an investor for placing $100.00 into a group of bank stocks and reinvesting any and all dividends into the purchase of more of the same stock for which dividends were paid.

| Index | 12/31/09 | 12/31/10 | 12/31/11 | 12/31/12 | 12/31/13 | 12/31/14 |

| Citizens & Northern Corporation | 100.00 | 160.82 | 206.97 | 221.11 | 253.58 | 267.98 |

| Russell 2000 | 100.00 | 126.86 | 121.56 | 141.43 | 196.34 | 205.95 |

| CZNC Peer Group Index* | 100.00 | 113.13 | 106.47 | 126.35 | 158.15 | 181.07 |

| 8 |

The Corporation’s peer group consists of banks headquartered in Pennsylvania with total assets of $700 million to $2 billion as of September 30, 2014. This peer group consists of ACNB Corporation, Gettysburg; AmeriServ Financial, Inc., Johnstown; Citizens Financial Services, Inc., Mansfield; Codorus Valley Bancorp, Inc., York; ENB Financial Corp., Ephrata; ESB Financial Corporation, Ellwood; ESSA Bancorp, Inc., Stroudsburg; First Keystone Corporation, Berwick; First National Community Bancorp, Inc., Dunmore; FNB Bancorp, Inc., Newtown; Fox Chase Bancorp, Inc., Hatboro; Franklin Financial Services Corporation, Chambersburg; Harleysville Savings Financial Corporation, Harleysville; Integrity Bancshares, Inc., Camp Hill; Norwood Financial Corp., Honesdale; Orrstown Financial Services, Inc., Shippensburg; Penns Woods Bancorp, Inc., Williamsport; Peoples Financial Services Corp., Scranton; QNB Corp., Quakertown; Republic First Bancorp, Inc., Philadelphia; Royal Bancshares of Pennsylvania, Inc., Narberth; Somerset Trust Holding Company, Somerset;1st Summit Bancorp of Johnstown, Inc., Johnstown; Mid Penn Bancorp, Inc., Millersburg; Embassy Bancorp, Inc., Bethlehem.

The data for this graph was obtained from SNL Financial LC, Charlottesville, VA.

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth information concerning the Stock Incentive Plan and Independent Directors Stock Incentive Plan, both of which have been approved by the Corporation’s shareholders. The figures shown in the table below are as of December 31, 2014.

| Number of | |||

| Number of | Weighted- | Securities | |

| Securities to be | average | Remaining | |

| Issued Upon | Exercise | for Future | |

| Exercise of | Price of | Issuance Under | |

| Outstanding | Outstanding | Equity Compen- | |

| Options | Options | sation Plans | |

| Equity compensation plans | |||

| approved by shareholders | 316,157 | $19.05 | 317,161 |

| Equity compensation plans | |||

| not approved by shareholders | 0 | N/A | 0 |

More details related to the Corporation’s equity compensation plans are provided in Notes 1 and 13 to the consolidated financial statements.

| 9 |

| ITEM 6. SELECTED FINANCIAL DATA | |||||

| As of or for the Year Ended December 31, | |||||

| INCOME STATEMENT (In Thousands) | 2014 | 2013 | 2012 | 2011 | 2010 |

| Interest and fee income | $46,009 | $48,914 | $56,632 | $61,256 | $62,114 |

| Interest expense | 5,122 | 5,765 | 9,031 | 13,556 | 19,245 |

| Net interest income | 40,887 | 43,149 | 47,601 | 47,700 | 42,869 |

| Provision (credit) for loan losses | 476 | 2,047 | 288 | (285) | 1,191 |

| Net interest income after provision (credit) for loan losses | 40,411 | 41,102 | 47,313 | 47,985 | 41,678 |

| Noninterest income excluding securities gains | 15,420 | 16,451 | 16,383 | 13,897 | 13,809 |

| Net impairment losses recognized in earnings from | |||||

| available-for-sale securities | 0 | (25) | (67) | 0 | (433) |

| Net realized gains on available-for-sale securities | 1,104 | 1,743 | 2,749 | 2,216 | 1,262 |

| Loss on prepayment of debt | 0 | 1,023 | 2,333 | 0 | 0 |

| Noninterest expense excluding loss on prepayment of debt | 34,157 | 33,471 | 32,914 | 32,016 | 31,461 |

| Income before income tax provision | 22,778 | 24,777 | 31,131 | 32,082 | 24,855 |

| Income tax provision | 5,692 | 6,183 | 8,426 | 8,714 | 5,800 |

| Net income | 17,086 | 18,594 | 22,705 | 23,368 | 19,055 |

| U.S. Treasury preferred dividends | 0 | 0 | 0 | 0 | 1,474 |

| Net income available to common shareholders | $17,086 | $18,594 | $22,705 | $23,368 | $17,581 |

| PER COMMON SHARE: | |||||

| Basic earnings per share | $1.38 | $1.51 | $1.86 | $1.92 | $1.45 |

| Diluted earnings per share | $1.38 | $1.50 | $1.85 | $1.92 | $1.45 |

| Cash dividends declared per share | $1.04 | $1.00 | $0.84 | $0.58 | $0.39 |

| Book value per common share at period-end | $15.34 | $14.49 | $14.89 | $13.77 | $11.43 |

| Tangible book value per common share at period-end | $14.36 | $13.51 | $13.91 | $12.77 | $10.42 |

| Weighted average common shares outstanding - basic | 12,390,067 | 12,352,383 | 12,235,748 | 12,162,045 | 12,131,039 |

| Weighted average common shares outstanding - diluted | 12,412,050 | 12,382,790 | 12,260,208 | 12,166,768 | 12,131,039 |

| END OF PERIOD BALANCES (Dollars In Thousands) | |||||

| Available-for-sale securities | $516,807 | $482,658 | $472,577 | $481,685 | $443,956 |

| Gross loans | 630,545 | 644,303 | 683,910 | 708,315 | 730,411 |

| Allowance for loan losses | 7,336 | 8,663 | 6,857 | 7,705 | 9,107 |

| Total assets | 1,241,963 | 1,237,695 | 1,286,907 | 1,323,735 | 1,316,588 |

| Deposits | 967,989 | 954,516 | 1,006,106 | 1,018,206 | 1,004,348 |

| Borrowings | 78,597 | 96,723 | 89,379 | 130,313 | 166,908 |

| Stockholders' equity | 188,362 | 179,472 | 182,786 | 167,385 | 138,944 |

| Common shares outstanding | 12,279,980 | 12,390,063 | 12,274,035 | 12,155,529 | 12,153,598 |

| AVERAGE BALANCES (In Thousands) | |||||

| Total assets | 1,239,897 | 1,237,096 | 1,305,163 | 1,313,445 | 1,326,145 |

| Earning assets | 1,155,401 | 1,145,340 | 1,199,538 | 1,208,584 | 1,205,608 |

| Gross loans | 627,753 | 656,495 | 700,241 | 714,421 | 721,997 |

| Deposits | 965,418 | 964,031 | 1,008,469 | 1,001,125 | 965,615 |

| Stockholders' equity | 185,469 | 181,412 | 175,822 | 152,718 | 150,133 |

| 10 |

| As of or for the Year Ended December 31, | |||||

| 2014 | 2013 | 2012 | 2011 | 2010 | |

| KEY RATIOS | |||||

| Return on average assets | 1.38% | 1.50% | 1.74% | 1.78% | 1.44% |

| Return on average equity | 9.21% | 10.25% | 12.91% | 15.30% | 12.69% |

| Average equity to average assets | 14.96% | 14.66% | 13.47% | 11.63% | 11.32% |

| Net interest margin (1) | 3.80% | 4.05% | 4.26% | 4.22% | 3.81% |

| Efficiency (2) | 57.59% | 53.27% | 48.82% | 49.37% | 52.64% |

| Cash dividends as a % of diluted earnings per share | 75.36% | 66.67% | 45.41% | 30.21% | 26.90% |

| Tier 1 leverage | 13.89% | 13.78% | 12.53% | 10.93% | 9.20% |

| Tier 1 risk-based capital | 26.26% | 25.15% | 22.86% | 19.95% | 15.87% |

| Total risk-based capital | 27.60% | 26.60% | 24.01% | 21.17% | 17.17% |

| Tangible common equity/tangible assets | 14.34% | 13.66% | 13.39% | 11.84% | 9.71% |

| Nonperforming assets/total assets | 1.34% | 1.53% | 0.82% | 0.73% | 0.92% |

| Nonperforming loans/total loans | 2.45% | 2.80% | 1.41% | 1.19% | 1.58% |

| Allowance for loan losses/total loans | 1.16% | 1.34% | 1.00% | 1.09% | 1.25% |

| Net charge-offs/average loans | 0.29% | 0.04% | 0.16% | 0.16% | 0.05% |

(1) Rates of return on tax-exempt securities and loans are calculated on a fully-taxable equivalent basis.

(2) The efficiency ratio is calculated by dividing: (a) total noninterest expense excluding losses from prepayment of debt, by (b) the sum of net interest income (including income from tax-exempt securities and loans on a fully-taxable equivalent basis) and noninterest income excluding securities gains or losses.

| 11 |

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Certain statements in this section and elsewhere in this Annual Report on Form 10-K are forward-looking statements. Citizens & Northern Corporation and its wholly-owned subsidiaries (collectively, the Corporation) intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Reform Act of 1995. Forward-looking statements, which are not historical facts, are based on certain assumptions and describe future plans, business objectives and expectations, and are generally identifiable by the use of words such as, "should", “likely”, "expect", “plan”, "anticipate", “target”, “forecast”, and “goal”. These forward-looking statements are subject to risks and uncertainties that are difficult to predict, may be beyond management’s control and could cause results to differ materially from those expressed or implied by such forward-looking statements. Factors which could have a material, adverse impact on the operations and future prospects of the Corporation include, but are not limited to, the following:

| · | changes in monetary and fiscal policies of the Federal Reserve Board and the U.S. Government, particularly related to changes in interest rates |

| · | changes in general economic conditions |

| · | legislative or regulatory changes |

| · | downturn in demand for loan, deposit and other financial services in the Corporation’s market area |

| · | increased competition from other banks and non-bank providers of financial services |

| · | technological changes and increased technology-related costs |

| · | changes in accounting principles, or the application of generally accepted accounting principles. |

These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements.

EARNINGS OVERVIEW

In 2014, net income totaled $17,086,000, or $1.38 per common share - basic and diluted, as compared to $1.51 per share – basic and $1.50 per share – diluted in 2013 and $1.86 per share basic and $1.85 per share – diluted in 2012. The results for 2014 represented a return on average assets of 1.38% and a return on average equity of 9.21%.

2014 vs. 2013

Net income per share – diluted for 2014 was 8.0% lower than in 2013. Some of the more significant highlights related to annual earnings in 2014 as compared to 2013 are as follows:

| · | Net interest income totaled $40,887,000 in 2014, down $2,262,000 (5.2%) from 2013. In 2014, yields earned on securities and loans fell by more than the corresponding drop in interest rates paid on deposits and borrowings. Also, average total loans outstanding were 4.3% lower in 2014 as compared to 2013. The net interest margin was 3.80% in 2014, down from 4.05% in 2013. |

| · | The provision for loan losses was $476,000 in 2014, down from $2,047,000 in 2013. The higher levels of expense in 2013 included a charge of $1,552,000 from loans to one commercial customer. |

| · | In 2014, noninterest revenue, excluding net realized gains on available-for-sale securities, totaled $15,420,000, which was lower than the 2013 amount by $1,031,000 (6.3%). Gains from sales of residential mortgage loans totaled $768,000 in 2014, down from $1,969,000 in 2013, reflecting lower volume from refinancing activity. Service charges on deposit accounts fell $221,000 in 2014 as compared to 2013, a decline of 4.2%, primarily as a result of lower net overdraft fees. Total Trust and brokerage revenue of $5,391,000 in 2014 was $520,000 (10.7%) higher than in 2013. |

| · | Realized gains from available-for-sale securities totaled $1,104,000 in 2014, while in 2013 realized gains from securities totaled $1,718,000 and losses from prepayment of borrowings totaled $1,023,000. |

| 12 |

| · | In 2014, noninterest expenses totaled $34,157,000, which was $686,000 (2.0%) higher than total 2013 noninterest expenses, excluding the loss on prepayment of borrowings. Salaries and wages expense increased $915,000 in 2014 as compared to 2013, mainly as a result of severance benefits, and pensions and other employee benefit expenses increased $619,000, mainly due to higher health care costs and the fourth quarter charge related to a distribution from a defined benefit pension plan. Professional fees expense was $835,000 lower in 2014 as compared to 2013, as the total in 2013 included fees associated with projects designed to identify sources of noninterest revenue and reductions in debit card and ATM processing expense. |

2013 vs. 2012

In 2013, net income per share – diluted of $1.50 was down 18.4% from 2012. Some of the more significant earnings-related variances in 2013 as compared to 2012 are as follows:

| · | Net interest income of $43,149,000 in 2013 was down $4,452,000 (9.4%) from 2012. The fully taxable equivalent net interest margin of 4.05% in 2013 was down 0.21% from 2012, and the interest rate spread (excess of the yield on earning assets over the average rate incurred on interest-bearing liabilities) shrunk by 0.16%. Average earning assets declined in 2013 by $54.2 million, reflecting a reduction in average loans outstanding of $43.7 million, and average deposits decreased $44.4 million. Also, net interest income in 2012 was enhanced by the recovery of a security that had been written down in prior years, resulting in income (accretion) of $855,000. |

| · | The provision for loan losses was $2,047,000 in 2013, as compared to $288,000 in 2012. The increase in the provision in 2013 included the effects of establishing an allowance of $1,552,000 on loans to one commercial borrower. |

| · | In 2013, noninterest revenue, excluding net realized gains on available-for-sale securities, totaled $16,451,000, which exceeded the total 2012 amount by $68,000. Total Trust and brokerage revenue of $4,871,000 in 2013 was $223,000 (4.8%) higher than the total for 2012. In 2013, the fair value of servicing rights increased $67,000, while the fair value of servicing rights decreased $188,000 in 2012. In 2013, the net loss from disposals of premises and equipment totaled ($16,000) as compared to net gains of $270,000 in 2012, mainly from an insurance recovery in 2012 associated with a flood-related claim. |

| · | In 2013 and 2012, the Corporation generated gains from sales of securities and also incurred losses from prepayment of borrowings. Realized gains from securities totaled $1,718,000 in the year ended December 31, 2013 as compared to $2,682,000 in 2012, while losses from prepayment of borrowings amounted to $1,023,000 in 2013 as compared to $2,333,000 in 2012. |

| · | Noninterest expenses, excluding losses from prepayment of borrowings, totaled $33,471,000 in 2013, an increase of $557,000 (1.7%) over the corresponding total for 2012. In 2013, the Corporation incurred professional fees expense of $724,000 related to a consulting engagement in which the consulting firm identified recommendations for potential increases in revenues, mainly related to service charges on deposit accounts. Also, in 2013, the Corporation incurred professional fees expense of $315,000 from a consulting project related to debit card operations and electronic funds processing, for which reductions in electronic funds processing expenses and other benefits are expected to be realized over approximately the next five years. Mainly as a result of the consulting engagements described above, professional fees expense was $1,048,000 higher in 2013 as compared to 2012. Pensions and other employee benefit costs were $347,000 lower in 2013 than in 2012, including a reduction of $171,000 in health insurance expense associated with the Corporation’s partially self-insured plan due to a lower amount of claims. |

More detailed information concerning fluctuations in the Corporation’s earnings results are provided in other sections of Management’s Discussion and Analysis.

CRITICAL ACCOUNTING POLICIES

The presentation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect many of the reported amounts and disclosures. Actual results could differ from these estimates

| 13 |

A material estimate that is particularly susceptible to significant change is the determination of the allowance for loan losses. The Corporation maintains an allowance for loan losses that represents management’s estimate of the losses inherent in the loan portfolio as of the balance sheet date and recorded as a reduction of the investment in loans. Management believes the allowance for loan losses is adequate and reasonable. Notes 1 and 8 to the consolidated financial statements provide an overview of the process management uses for evaluating and determining the allowance for loan losses, and additional discussion of the allowance for loan losses is provided in a separate section later in Management’s Discussion and Analysis. Given the very subjective nature of identifying and valuing loan losses, it is likely that well-informed individuals could make materially different assumptions, and could, therefore calculate a materially different allowance value. While management uses available information to recognize losses on loans, changes in economic conditions may necessitate revisions in future years. In addition, various regulatory agencies, as an integral part of their examination process, periodically review the Corporation’s allowance for loan losses. Such agencies may require the Corporation to recognize adjustments to the allowance based on their judgments of information available to them at the time of their examination.

Another material estimate is the calculation of fair values of the Corporation’s debt securities. For most of the Corporation’s debt securities, the Corporation receives estimated fair values of debt securities from an independent valuation service, or from brokers. In developing fair values, the valuation service and the brokers use estimates of cash flows, based on historical performance of similar instruments in similar interest rate environments. Based on experience, management is aware that estimated fair values of debt securities tend to vary among brokers and other valuation services.

As described in Note 7 to the consolidated financial statements, management evaluates securities for other-than-temporary impairment (“OTTI”). In making that evaluation, consideration is given to (1) the length of time and the extent to which the fair value has been less than cost, (2) the financial condition and near-term prospects of the issuer, and (3) whether the Corporation intends to sell the security or more likely than not will be required to sell the security before its anticipated recovery. Management’s assessments of the likelihood and potential for recovery in value of securities are subjective and based on sensitive assumptions.

NET INTEREST INCOME

The Corporation’s primary source of operating income is net interest income, which is equal to the difference between the amounts of interest income and interest expense. Tables I, II and III include information regarding the Corporation’s net interest income in 2014, 2013, and 2012. In each of these tables, the amounts of interest income earned on tax-exempt securities and loans have been adjusted to a fully taxable-equivalent basis. Accordingly, the net interest income amounts reflected in these tables exceed the amounts presented in the consolidated financial statements. The discussion that follows is based on amounts in the tables.

2014 vs. 2013

Fully taxable equivalent net interest income was $43,893,000 in 2014, which was $2,491,000 (5.3%) lower than in 2013. As shown in Table III, in 2014 compared to 2013, interest rate changes had the effect of decreasing net interest income $1,622000, and net changes in volume had the effect of decreasing net interest income $869,000. The most significant component of the rate-related change in net interest income in 2014 was a decrease in interest income of $1,718,000 attributable to lower rates earned on loans receivable. The most significant components of the volume-related decrease in net interest income in 2014 were a decrease in interest income of $1,602,000 attributable to a decline in the balance of loans receivable, partially offset by a volume-related increase in interest income on available-for-securities of $499,000, a decrease in interest expense of $161,000 attributable to a reduction in the balance of interest-bearing deposits (primarily certificates of deposit) and a decrease in interest expense of $109,000 attributable to a reduction in the balance of borrowed funds. As presented in Table II, the “Interest Rate Spread” (excess of average rate of return on earning assets over average cost of funds on interest-bearing liabilities) was 3.63% in 2014 as compared to 3.88% in 2013.

INTEREST INCOME AND EARNING ASSETS

Interest income totaled $49,015,000 in 2014, a decrease of 6.0% from 2013. Interest and fees on loans receivable decreased $3,320,000, or 8.8%. As indicated in Table II, average available-for-sale securities (at amortized cost) totaled $494,934,000 in 2014, an increase of $33,370,000 (7.2%) from 2013. Net increase in the Corporation’s available-for-sale securities portfolio was primarily made up of U.S. Government agency mortgage-backed securities and collateralized mortgage obligations. This increase was partially offset by decreases in the balances of U.S. Government agency bonds. The Corporation’s yield on securities was lower in 2014 than in 2013, primarily because of low market interest rates. The average rate of return on available-for-sale securities was 2.95% for 2014 and 3.12% in 2013.

The average balance of gross loans receivable decreased 4.3% to $627,753,000 in 2014 from $656,495,000 in 2013. The Corporation experienced contraction in the balance of loans receivable due to borrowers prepaying or refinancing existing loans combined with modest demand for new loans. The decline in the balance of the residential mortgage portfolio was also affected by management’s decision to sell a significant portion of newly originated residential mortgages on the secondary market. The Corporation’s average rate of return on loans receivable declined to 5.46% in 2014 from 5.73% in 2013.

| 14 |

The average balance of interest-bearing due from banks increased to $32,510,000 in 2014 from $26,159,000 in 2013. This has consisted primarily of balances held by the Federal Reserve and also includes other overnight deposits and FDIC-insured certificates of deposit issued by other financial institutions.

INTEREST EXPENSE AND INTEREST-BEARING LIABILITIES

Interest expense fell $643,000, or 11.1%, to $5,122,000 in 2014 from $5,765,000 in 2013. Table II shows that the overall cost of funds on interest-bearing liabilities fell to 0.61% in 2014 from 0.67% in 2013.

Total average deposits (interest-bearing and noninterest-bearing) increased 0.1%, to $965,418,000 in 2014 from $964,031,000 in 2013. Decreases in the average balances of certificates of deposit, Individual Retirement Accounts, and money market accounts were partially offset by increases in average balances of interest checking, savings accounts and non-interest bearing demand deposits. Consistent with continuing low short-term market interest rates, the average rates incurred on certificates of deposit and Individual Retirement Accounts have continued to decrease in 2014 as compared to 2013.

Total average borrowed funds decreased $2,388,000 to $79,940,000 in 2014 from $82,328,000 in 2013. The average rate on borrowed funds was 3.70% in 2014, compared to 3.72% in 2013.

2013 vs. 2012

Fully taxable equivalent net interest income was $46,384,000 in 2013, $4,657,000 (9.1%) lower than in 2012. As shown in Table III, in 2013 compared to 2012, interest rate changes had the effect of decreasing net interest income $3,743,000, and net changes in volume had the effect of decreasing net interest income $914,000. The most significant components of the rate change in net interest income in 2013 were a decrease in interest income of $2,615,000 attributable to lower rates earned on loans receivable and a decrease in interest income of $2,554,000 attributable to lower rates earned on available-for-sale securities, partially offset by a decrease in interest expense of $1,413,000 due to lower rates paid on interest-bearing deposits. The most significant components of the volume change in net interest income in 2013 were a decrease in interest income of $2,588,000 attributable to a decline in the balance of loans receivable, a decrease in interest expense of $1,180,000 attributable to a reduction in the balance of borrowed funds, and a decrease in interest expense of $691,000 attributable to a reduction in the balance of interest-bearing deposits (primarily certificates of deposit). As presented in Table II, the “Interest Rate Spread” (excess of average rate of return on earning assets over average cost of funds on interest-bearing liabilities) was 3.88% in 2013, as compared to 4.04% in 2012.

INTEREST INCOME AND EARNING ASSETS

Interest income totaled $52,149,000 in 2013, a decrease of 13.2% from 2012. Interest and fees on loans receivable decreased $5,203,000, or 12.2%. As indicated in Table II, average available-for-sale securities (at amortized cost) totaled $461,564,000 in 2013, a decrease of $2,785,000 (0.6%) from 2012. Net contraction in the Corporation’s available-for-sale securities portfolio was primarily made up of U.S. Government agency mortgage-backed securities and trust preferred securities. This contraction was partially offset by increases in the balances of U.S. Government agency bonds, municipal securities, and U.S. Government agency collateralized mortgage obligations. The Corporation’s yield on securities fell in 2012 and 2013 because of low market interest rates, which had the effect of increasing the volume of calls on municipal bonds and trust preferred securities, and prepayments on mortgage-backed securities and collateralized mortgage obligations, with new purchases made at lower yields than the yields on the securities being replaced. Also, the yield on available-for-sale securities was enhanced in 2012 by accretion income of $855,000 from a security for which principal was fully paid in 2012 after OTTI write-downs had been recorded in prior periods. The average rate of return on available-for-sale securities was 3.12% for 2013 and 3.67% in 2012.

The average balance of gross loans receivable decreased 6.2% to $656,495,000 in 2013 from $700,241,000 in 2012. The Corporation experienced contraction in the balance of loans receivable due to borrowers prepaying or refinancing existing loans combined with modest demand for new loans. The decline in the balance of the residential mortgage portfolio was also affected by management’s decision to sell a significant portion of newly originated residential mortgages on the secondary market. The Corporation’s average rate of return on loans receivable declined to 5.73% in 2013 from 6.11% in 2012.

The average balance of interest-bearing due from banks decreased to $26,159,000 in 2013 from $32,337,000 in 2012. This has consisted primarily of balances held by the Federal Reserve and also includes other overnight deposits and FDIC-insured certificates of deposit issued by other financial institutions.

| 15 |

INTEREST EXPENSE AND INTEREST-BEARING LIABILITIES

Interest expense fell $3,266,000, or 36.2%, to $5,765,000 in 2013 from $9,031,000 in 2012. Table II shows that the overall cost of funds on interest-bearing liabilities fell to 0.67% in 2013 from 0.97% in 2012.

Total average deposits (interest-bearing and noninterest-bearing) decreased 4.4%, to $964,031,000 in 2013 from $1,008,469,000 in 2012. Decreases in the average balances of certificates of deposit, Individual Retirement Accounts, and money market accounts were partially offset by increases in average balances of interest checking and savings accounts. Consistent with continuing low short-term market interest rates, the average rates incurred on certificates of deposit and Individual Retirement Accounts have decreased significantly in 2013 as compared to 2012.

Total average borrowed funds decreased $29,723,000 to $82,328,000 in 2013 from $112,051,000 in 2012. During 2012 and 2013, the Corporation has paid off long-term borrowings as they matured using the cash flow received from loans and investment securities. In 2012, the Corporation prepaid principal totaling $17,000,000 on long-term borrowings (repurchase agreements); the Corporation incurred losses from the prepayments totaling $2,333,000. In March 2013, the Corporation prepaid principal of $7,000,000 on a long-term borrowing (repurchase agreement) with a rate of 3.60%; the Corporation incurred a loss from the prepayment totaling $1,023,000, which is reported in Other Expenses in the Consolidated Statements of Income. Management expects that the prepayments will have a favorable effect on the net interest margin in the future. After the effect of the prepayments, the remaining balance of long-term borrowings under repurchase agreements was $61,000,000 at December 31, 2013. The average rate on borrowed funds was 3.72% in 2013, compared to 3.77% in 2012.

| 16 |

| TABLE I - ANALYSIS OF INTEREST INCOME AND EXPENSE | |||||

| Years Ended December 31, | Increase/(Decrease) | ||||

| (In Thousands) | 2014 | 2013 | 2012 | 2014/2013 | 2013/2012 |

| INTEREST INCOME | |||||

| Available-for-sale securities: | |||||

| Taxable | $8,028 | $7,105 | $9,334 | $923 | ($2,229) |

| Tax-exempt | 6,577 | 7,296 | 7,725 | (719) | (429) |

| Total available-for-sale securities | 14,605 | 14,401 | 17,059 | 204 | (2,658) |

| Interest-bearing due from banks | 125 | 105 | 114 | 20 | (9) |

| Loans held for sale | 16 | 54 | 107 | (38) | (53) |

| Loans receivable: | |||||

| Taxable | 32,127 | 35,484 | 40,453 | (3,357) | (4,969) |

| Tax-exempt | 2,142 | 2,105 | 2,339 | 37 | (234) |

| Total loans receivable | 34,269 | 37,589 | 42,792 | (3,320) | (5,203) |

| Total Interest Income | 49,015 | 52,149 | 60,072 | (3,134) | (7,923) |

| INTEREST EXPENSE | |||||

| Interest-bearing deposits: | |||||

| Interest checking | 216 | 211 | 206 | 5 | 5 |

| Money market | 286 | 290 | 354 | (4) | (64) |

| Savings | 121 | 117 | 108 | 4 | 9 |

| Certificates of deposit | 1,069 | 1,522 | 3,002 | (453) | (1,480) |

| Individual Retirement Accounts | 470 | 562 | 1,136 | (92) | (574) |

| Other time deposits | 1 | 1 | 1 | 0 | 0 |

| Total interest-bearing deposits | 2,163 | 2,703 | 4,807 | (540) | (2,104) |

| Borrowed funds: | |||||

| Short-term | 9 | 9 | 10 | 0 | (1) |

| Long-term | 2,950 | 3,053 | 4,214 | (103) | (1,161) |

| Total borrowed funds | 2,959 | 3,062 | 4,224 | (103) | (1,162) |

| Total Interest Expense | 5,122 | 5,765 | 9,031 | (643) | (3,266) |

| Net Interest Income | $43,893 | $46,384 | $51,041 | ($2,491) | ($4,657) |

| (1) | Interest income from tax-exempt securities and loans has been adjusted to a fully taxable-equivalent basis, using the Corporation’s marginal federal income tax rate of 35%. |

(2) Fees on loans are included with interest on loans and amounted to $1,013,000 in 2014, $1,338,000 in 2013 and $1,427,000 in 2012.

| 17 |

| TABLE II - ANALYSIS OF AVERAGE DAILY BALANCES AND RATES | ||||||

| (Dollars in Thousands) | ||||||

| Year | Year | Year | ||||

| Ended | Rate of | Ended | Rate of | Ended | Rate of | |

| 12/31/2014 | Return/ | 12/31/2013 | Return/ | 12/31/2012 | Return/ | |

| Average | Cost of | Average | Cost of | Average | Cost of | |

| Balance | Funds % | Balance | Funds % | Balance | Funds % | |

| EARNING ASSETS | ||||||

| Available-for-sale securities, | ||||||

| at amortized cost: | ||||||

| Taxable | $371,125 | 2.16% | $330,980 | 2.15% | $332,911 | 2.80% |

| Tax-exempt | 123,809 | 5.31% | 130,584 | 5.59% | 131,438 | 5.88% |

| Total available-for-sale securities | 494,934 | 2.95% | 461,564 | 3.12% | 464,349 | 3.67% |

| Interest-bearing due from banks | 32,510 | 0.39% | 26,159 | 0.40% | 32,337 | 0.35% |

| Federal funds sold | 0 | 0.00% | 4 | 0.00% | 0 | 0.00% |

| Loans held for sale | 204 | 7.84% | 1,118 | 4.83% | 2,611 | 4.10% |

| Loans receivable: | ||||||

| Taxable | 589,120 | 5.45% | 620,412 | 5.72% | 662,751 | 6.10% |

| Tax-exempt | 38,633 | 5.54% | 36,083 | 5.83% | 37,490 | 6.24% |

| Total loans receivable | 627,753 | 5.46% | 656,495 | 5.73% | 700,241 | 6.11% |

| Total Earning Assets | 1,155,401 | 4.24% | 1,145,340 | 4.55% | 1,199,538 | 5.01% |

| Cash | 16,865 | 16,854 | 17,408 | |||

| Unrealized gain/loss on securities | 6,350 | 8,875 | 18,444 | |||

| Allowance for loan losses | (7,992) | (7,204) | (7,688) | |||

| Bank premises and equipment | 16,789 | 18,154 | 18,956 | |||

| Intangible Asset - Core Deposit Intangible | 70 | 113 | 176 | |||

| Intangible Asset – Goodwill | 11,942 | 11,942 | 11,942 | |||

| Other assets | 40,472 | 43,022 | 46,387 | |||

| Total Assets | $1,239,897 | $1,237,096 | $1,305,163 | |||

| INTEREST-BEARING LIABILITIES | ||||||

| Interest-bearing deposits: | ||||||

| Interest checking | $183,874 | 0.12% | $174,790 | 0.12% | $163,840 | 0.13% |

| Money market | 198,990 | 0.14% | 203,023 | 0.14% | 208,814 | 0.17% |

| Savings | 121,685 | 0.10% | 117,055 | 0.10% | 108,218 | 0.10% |

| Certificates of deposit | 134,732 | 0.79% | 148,598 | 1.02% | 194,175 | 1.55% |

| Individual Retirement Accounts | 120,016 | 0.39% | 129,255 | 0.43% | 142,315 | 0.80% |

| Other time deposits | 1,039 | 0.10% | 1,062 | 0.09% | 1,191 | 0.08% |

| Total interest-bearing deposits | 760,336 | 0.28% | 773,783 | 0.35% | 818,553 | 0.59% |

| Borrowed funds: | ||||||

| Short-term | 6,744 | 0.13% | 6,422 | 0.14% | 6,831 | 0.15% |

| Long-term | 73,196 | 4.03% | 75,906 | 4.02% | 105,220 | 4.00% |

| Total borrowed funds | 79,940 | 3.70% | 82,328 | 3.72% | 112,051 | 3.77% |

| Total Interest-bearing Liabilities | 840,276 | 0.61% | 856,111 | 0.67% | 930,604 | 0.97% |

| Demand deposits | 205,082 | 190,248 | 189,916 | |||

| Other liabilities | 9,070 | 9,325 | 8,821 | |||

| Total Liabilities | 1,054,428 | 1,055,684 | 1,129,341 | |||

| Stockholders' equity, excluding | ||||||

| other comprehensive income/loss | 181,271 | 175,893 | 164,316 | |||

| Other comprehensive income/loss | 4,198 | 5,519 | 11,506 | |||

| Total Stockholders' Equity | 185,469 | 181,412 | 175,822 | |||

| Total Liabilities and Stockholders' Equity | $1,239,897 | $1,237,096 | $1,305,163 | |||

| Interest Rate Spread | 3.63% | 3.88% | 4.04% | |||

| Net Interest Income/Earning Assets | 3.80% | 4.05% | 4.26% | |||

| Total Deposits (Interest-bearing | ||||||

| and Demand) | $965,418 | $964,031 | $1,008,469 | |||

| (1) | Rates of return on tax-exempt securities and loans are presented on a fully taxable-equivalent basis, using the Corporation’s marginal federal income tax rate of 35%. |

| (2) | Nonaccrual loans have been included with loans for the purpose of analyzing net interest earnings. |

| 18 |

| TABLE III - ANALYSIS OF VOLUME AND RATE CHANGES | ||||||

| (In Thousands) | Year Ended 12/31/14 vs. 12/31/13 | Year Ended 12/31/13 vs. 12/31/12 | ||||

| Change in | Change in | Total | Change in | Change in | Total | |

| Volume | Rate | Change | Volume | Rate | Change | |

| EARNING ASSETS | ||||||

| Available-for-sale securities: | ||||||

| Taxable | $868 | $55 | $923 | ($54) | ($2,175) | ($2,229) |

| Tax-exempt | (369) | (350) | (719) | (50) | (379) | (429) |

| Total available-for-sale securities | 499 | (295) | 204 | (104) | (2,554) | (2,658) |

| Interest-bearing due from banks | 24 | (4) | 20 | (24) | 15 | (9) |

| Loans held for sale | (60) | 22 | (38) | (69) | 16 | (53) |

| Loans receivable: | ||||||

| Taxable | (1,746) | (1,611) | (3,357) | (2,502) | (2,467) | (4,969) |

| Tax-exempt | 144 | (107) | 37 | (86) | (148) | (234) |

| Total loans receivable | (1,602) | (1,718) | (3,320) | (2,588) | (2,615) | (5,203) |

| Total Interest Income | (1,139) | (1,995) | (3,134) | (2,785) | (5,138) | (7,923) |

| INTEREST-BEARING LIABILITIES | ||||||

| Interest-bearing deposits: | ||||||

| Interest checking | 11 | (6) | 5 | 13 | (8) | 5 |

| Money market | (6) | 2 | (4) | (10) | (54) | (64) |

| Savings | 5 | (1) | 4 | 9 | 0 | 9 |

| Certificates of deposit | (133) | (320) | (453) | (607) | (873) | (1,480) |

| Individual Retirement Accounts | (38) | (54) | (92) | (96) | (478) | (574) |

| Other time deposits | 0 | 0 | 0 | 0 | 0 | 0 |

| Total interest-bearing deposits | (161) | (379) | (540) | (691) | (1,413) | (2,104) |

| Borrowed funds: | ||||||

| Short-term | 0 | 0 | 0 | (1) | 0 | (1) |

| Long-term | (109) | 6 | (103) | (1,179) | 18 | (1,161) |

| Total borrowed funds | (109) | 6 | (103) | (1,180) | 18 | (1,162) |

| Total Interest Expense | (270) | (373) | (643) | (1,871) | (1,395) | (3,266) |

| Net Interest Income | ($869) | ($1,622) | ($2,491) | ($914) | ($3,743) | ($4,657) |

| (1) | Changes in income on tax-exempt securities and loans are presented on a fully taxable-equivalent basis, using the Corporation’s marginal federal income tax rate of 35%. |

| (2) | The change in interest due to both volume and rates has been allocated to volume and rate changes in proportion to the relationship of the absolute dollar amounts of the change in each. |

| 19 |

NONINTEREST INCOME

Years Ended December 31, 2014, 2013 and 2012

The table below presents a comparison of noninterest income and excludes realized gains on available-for-sale securities, which are discussed in the “Earnings Overview” section of Management’s Discussion and Analysis.

| TABLE IV - COMPARISON OF NONINTEREST INCOME | ||||

| (In Thousands) | ||||

| Years Ended | ||||

| December 31, | $ | % | ||

| 2014 | 2013 | Change | Change | |

| Service charges on deposit accounts | $5,025 | $5,246 | ($221) | (4.2) |

| Service charges and fees | 538 | 597 | (59) | (9.9) |

| Trust and financial management revenue | 4,490 | 4,087 | 403 | 9.9 |

| Brokerage revenue | 901 | 784 | 117 | 14.9 |

| Insurance commissions, fees and premiums | 118 | 170 | (52) | (30.6) |

| Interchange revenue from debit card transactions | 1,959 | 1,941 | 18 | 0.9 |

| Net gains from sales of loans | 768 | 1,969 | (1,201) | (61.0) |

| (Decrease) increase in fair value of servicing rights | (27) | 67 | (94) | (140.3) |

| Increase in cash surrender value of life insurance | 376 | 399 | (23) | (5.8) |

| Net gain (loss) from premises and equipment | 8 | (16) | 24 | (150.0) |

| Other operating income | 1,264 | 1,207 | 57 | 4.7 |

| Total other operating income before realized gains | ||||

| on available-for-sale securities, net | $15,420 | $16,451 | ($1,031) | (6.3) |

| Years Ended | ||||

| December 31, | $ | % | ||

| 2013 | 2012 | Change | Change | |

| Service charges on deposit accounts | $5,246 | $5,322 | ($76) | (1.4) |

| Service charges and fees | 597 | 643 | (46) | (7.2) |

| Trust and financial management revenue | 4,087 | 3,847 | 240 | 6.2 |

| Brokerage revenue | 784 | 801 | (17) | (2.1) |

| Insurance commissions, fees and premiums | 170 | 221 | (51) | (23.1) |

| Interchange revenue from debit card transactions | 1,941 | 1,938 | 3 | 0.2 |

| Net gains from sales of loans | 1,969 | 2,016 | (47) | (2.3) |

| Increase (decrease) in fair value of servicing rights | 67 | (188) | 255 | (135.6) |

| Increase in cash surrender value of life insurance | 399 | 455 | (56) | (12.3) |

| Net (loss) gain from premises and equipment | (16) | 270 | (286) | (105.9) |

| Other operating income | 1,207 | 1,058 | 149 | 14.1 |

| Total other operating income before realized gains | ||||

| on available-for-sale securities, net | $16,451 | $16,383 | $68 | 0.4 |

Total noninterest income, excluding realized gains on available-for-sale securities, decreased $1,031,000 or 6.3% in 2014 compared to 2013. In 2013, total noninterest income increased $68,000 (0.4%) from 2012. Changes of significance are discussed in the narrative that follows.

2014 vs. 2013

Net gains from sales of loans decreased $1,201,000 in 2014. Since December 2009, the Corporation has sold a significant amount of residential mortgage loans into the secondary market through the MPF Xtra and Original programs administered by the Federal Home Loan Banks of Pittsburgh and Chicago. Volume remained brisk throughout most of 2013, slowing somewhat in the fourth quarter 2013 with a continued slowdown throughout 2014 reflecting a decrease in refinancing activity.

| 20 |

Service charges on deposit accounts were $221,000 lower in 2014 than 2013. Consumer and business overdraft fees decreased $543,000 in 2014 as compared to 2013. Changes made as a result of recommendations made by a consulting firm in 2013 resulted in service charges on deposit accounts of $611,000 in 2014 as compared to $229,000 in 2013, as most of the recommendations were implemented in the fourth quarter 2013.

In 2014, Trust and financial management revenue increased $403,000, or 9.9%. The increase in trust revenue in 2014 reflects the impact of new business obtained as well as higher valuations of U.S. equity securities throughout most of the period. Assets under management by the Corporation’s Trust and financial management group totaled $825,918,000 at December 31, 2014, an increase of 3.7% over the total one year earlier.

As a result of increased annuity sales, brokerage revenue increased $117,000 or 14.9% in 2014 over 2013.

2013 vs. 2012

The fair value of servicing rights increased $67,000 in 2013 as compared to a decrease of $188,000 in 2012. Management’s estimated prepayment speeds on mortgage loans sold and serviced were lower at December 31, 2013 than at December 31, 2012, which had the effect of increasing the estimated fair value of the related servicing rights. Conversely, estimated prepayment speeds at December 31, 2012 were higher than the corresponding speeds at the end of 2011, causing the fair value of servicing rights to decline in 2012.

In 2013, Trust and financial management revenue increased $240,000, or 6.2%. Trust revenue from employee benefit and retirement services was $121,000 higher in 2013 as compared to 2012. The increase in trust revenue in 2013 reflects the impact of new business obtained as well as higher valuations of U.S. equities and fixed income securities throughout most of the period. Assets under management by the Corporation’s Trust and financial management group totaled $796,115,000 at December 31, 2013, an increase of 12.5% over the total one year earlier.

Other operating income increased $149,000, or 14.1%, in 2013 as compared to 2012, as mortgage servicing revenue increased $127,000 due to a higher volume of mortgage loans sold and serviced.

The net gain from premises and equipment of $270,000 in 2012 included a gain of $272,000 from the excess of insurance proceeds received over the historical book value of assets replaced or reconstructed at the Athens, PA branch, which was damaged by a flood in September 2011 and remained closed until it was re-opened in April 2012. The loss of $16,000 in 2013 included charges related to the abandonment of certain communications equipment

NONINTEREST EXPENSE

Years Ended December 31, 2014, 2013 and 2012

As shown in Table V below, total noninterest expense, excluding losses from prepayment of debt, increased $686,000 in 2014 as compared to 2013. Excluding losses from prepayment of debt, total noninterest expense was $557,000 (16.9%) higher in 2013 as compared to 2012. In 2013, the Corporation incurred losses totaling $1,023,000 and, in 2012, losses totaling $2,333,000 from prepayment of borrowings (repurchase agreements). There were no losses from prepayment of borrowings incurred in 2014. Changes of significance (other than the previously discussed loss on prepayment of debt) are discussed in the narrative that follows.

| TABLE V - COMPARISON OF NONINTEREST EXPENSE | ||||

| (In Thousands) | ||||

| $ | % | |||

| 2014 | 2013 | Change | Change | |

| Salaries and wages | $15,121 | $14,206 | $915 | 6.4 |

| Pensions and other employee benefits | 4,769 | 4,150 | 619 | 14.9 |

| Occupancy expense, net | 2,628 | 2,473 | 155 | 6.3 |

| Furniture and equipment expense | 1,859 | 1,948 | (89) | (4.6) |

| FDIC Assessments | 600 | 604 | (4) | (0.7) |

| Pennsylvania shares tax | 1,350 | 1,402 | (52) | (3.7) |

| Professional fees | 699 | 1,534 | (835) | (54.4) |

| Automated teller machine and interchange expense | 924 | 1,020 | (96) | (9.4) |

| Software subscriptions | 784 | 836 | (52) | (6.2) |