Exhibit 99.1

2014 annual highlights C&N lit up Times Square during a year of celebration.

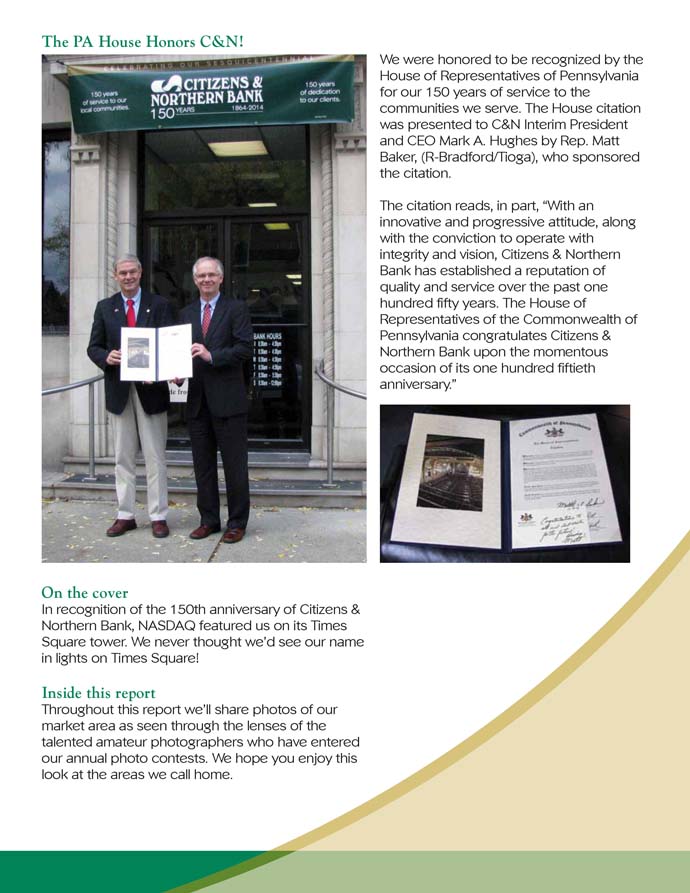

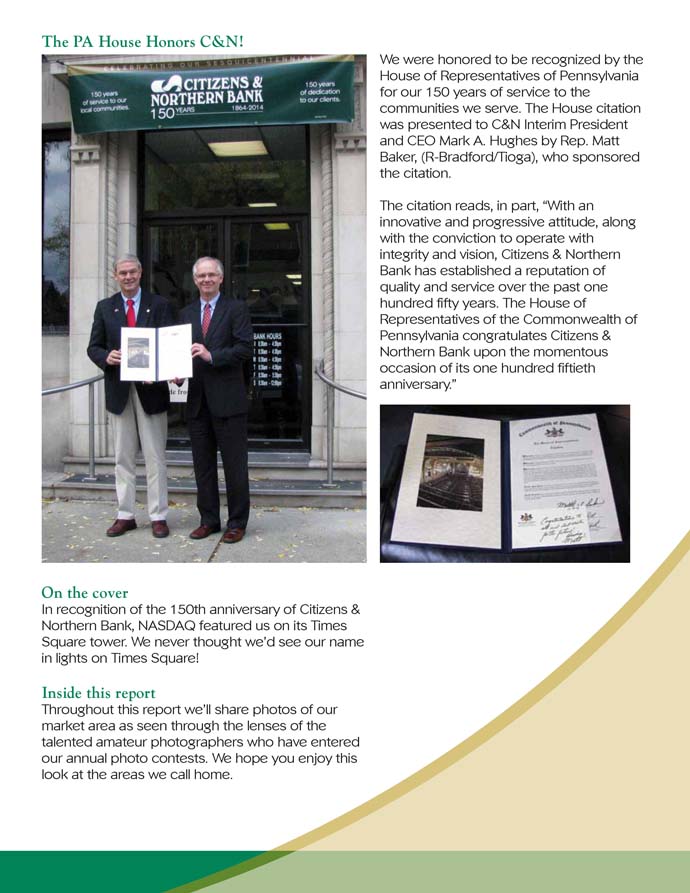

The PA House Honors C&N! We were honored to be recognized by the House of Representatives of Pennsylvania for our 150 years of service to the communities we serve. The House citation was presented to C&N Interim President and CEO Mark A. Hughes by Rep. Matt Baker, (R-Bradford/Tioga), who sponsored the citation. The citation reads, in part, “With an innovative and progressive attitude, along with the conviction to operate with integrity and vision, Citizens & Northern Bank has established a reputation of quality and service over the past one hundred fifty years. The House of Representatives of the Commonwealth of Pennsylvania congratulates Citizens & Northern Bank upon the momentous occasion of its one hundred fiftieth anniversary.” On the cover In recognition of the 150th anniversary of Citizens & Northern Bank, NASDAQ featured us on its Times Square tower. We never thought we’d see our name in lights on Times Square! Inside this report Throughout this report we’ll share photos of our market area as seen through the lenses of the talented amateur photographers who have entered our annual photo contests. We hope you enjoy this look at the areas we call home.

Our Corporate Profile Citizens & Northern Corporation is a bank holding company with assets of approximately $1.2 billion and is headquartered in Wellsboro, PA. Banking services are provided by its subsidiary, Citizens & Northern Bank, from 26 banking offices in Bradford, Cameron, Lycoming, McKean, Potter, Sullivan and Tioga Counties in Pennsylvania and Steuben County in New York. Investment products are offered through C&N Investment Services and insurance products are offered through C&N Financial Services Corp. Trust services are offered by Citizens & Northern Bank through the C&N Trust and Financial Management Group. Citizens & Northern Corporation stock trades on the NASDAQ Capital Market Securities under the symbol CZNC. Citizens & Northern Corporation officers include: Mark A. Hughes, interim president and CEO Anthony J. Peluso, treasurer Kimberly N. Battin, corporate secretary Photo by Robert Bair, Jr. of Wellsboro - taken at the Galeton fireworks celebration in Potter County.

Our President’s Message Mark A. Hughes Interim President and CEO Our C&N Team is committed to delivering consistently excellent earnings results with the belief that, over time, such excellent results will lead to enhanced shareholder value. Although earnings per share in 2014 were lower than the amounts in each of the previous four years, I think it is important to put these results in a broader perspective by comparison to the results achieved by our banking industry peers. After all, what I think of as the “earnings opportunity” of a community banking company in any given year is heavily influenced by a variety of external and internal factors, including strength of the local economy, changes in interest rates and the need to incur expenses to keep up with new regulatory requirements or technological demands. It is also important to acknowledge weaknesses pointed out by comparisons to the peers’ data, and to formulate and execute plans to address the weaknesses. “The ‘earnings opportunity’ of a community banking company in any given year is heavily influenced by a variety of external and internal factors.” Before addressing our results in comparison to peers’, summary information concerning C&N’s financial performance in 2014 is as follows: Net income totaled $17,086,000 in 2014, or $1.38 per diluted share, down 8% from 2013 diluted earnings per share of $1.50. Our 2014 return on average assets was 1.38%, and our return on average equity was 9.21%. In 2014, we were unable to generate revenue at a level as high as in 2013, as net interest income fell $2.3 million. Over the past few years, yields earned on securities and loans have dropped by more than interest rates paid on deposits and borrowed funds. Further contributing to the reduction in net interest income, the average balance of loans outstanding was 4.3% lower in 2014 than in 2013. Also significant in 2014 was a $1.2 million decrease in gains from sales of residential mortgage loans, reflecting lower volume of refinancing and other activity in the market. On a positive note, total revenue from Trust and brokerage services increased $520,000 (10.7%) in 2014. Despite the reduction in earnings, dividends per share increased to $1.04 per share in 2014 from $1.00 in 2013. Based on the year-end closing stock price of $20.67, the annualized dividend yield for 2014 was 5.03%. In July 2014, the Board of Directors announced a common stock repurchase plan of up to 622,500 shares, or 5% of total shares outstanding at that time. Through the end of the year, 208,300 shares had been repurchased for a total cost of $4,002,000, at an average price of $19.21 per share. Our ability to increase the dividend and repurchase shares in 2014 resulted from maintenance of capital at levels well in excess of regulatory requirements. How do we compare to our peers? Consolidated financial data comparing C&N to a peer group of similar-sized bank holding companies can be found via the internet at www.ffiec.gov. The information available through that site includes data from quarterly financial reports that U.S. bank holding companies file with the Federal Reserve. C&N’s peer group includes bank holding companies with total assets between $1 billion and $3 billion. With total assets of $1.242 billion at December 31, 2014, C&N is in the smaller end of the range for its peer group. See a table of key ratios on Page 3.

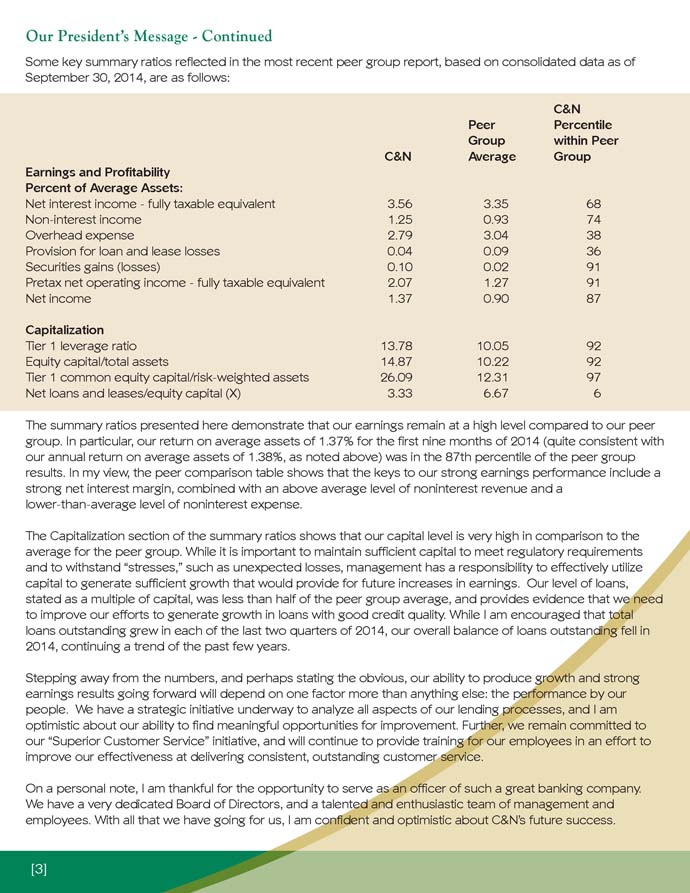

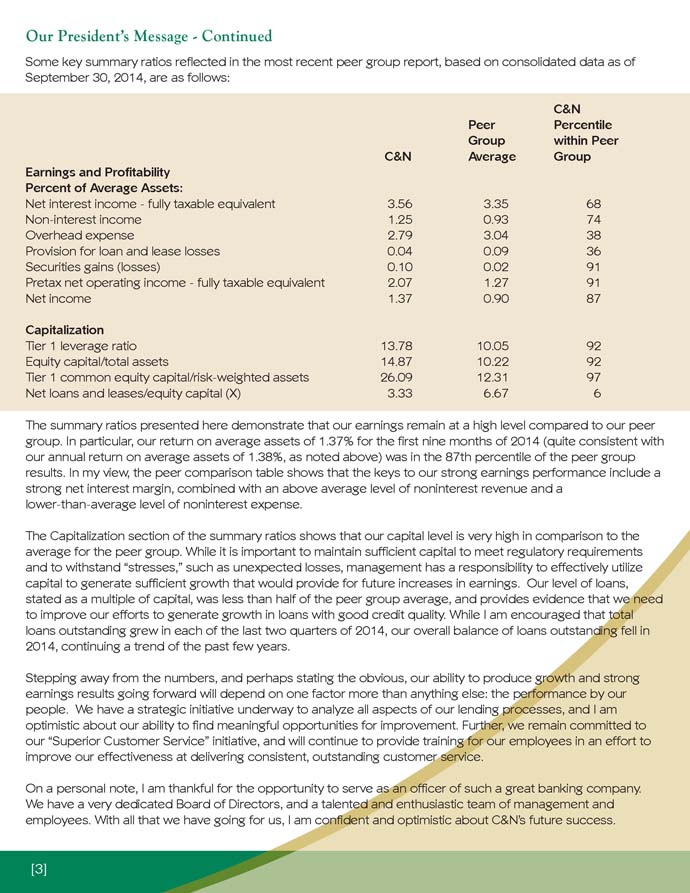

Our President’s Message - ContinuedSome key summary ratios reflected in the most recent peer group report, based on consolidated data as of September 30, 2014, are as follows: C&N Peer Percentile Group within Peer C&N Average Group Earnings and Profitability Percent of Average Assets: Net interest income - fully taxable equivalent 3.56 3.35 68 Non-interest income 1.25 0.93 74 Overhead expense 2.79 3.04 38 Provision for loan and lease losses 0.04 0.09 36 Securities gains (losses) 0.10 0.02 91 Pretax net operating income - fully taxable equivalent 2.07 1.27 91 Net income 1.37 0.90 87 Capitalization Tier 1 leverage ratio 13.78 10.05 92 Equity capital/total assets 14.87 10.22 92 Tier 1 common equity capital/risk-weighted assets 26.09 12.31 97 Net loans and leases/equity capital (X) 3.33 6.67 6 The summary ratios presented here demonstrate that our earnings remain at a high level compared to our peer group. In particular, our return on average assets of 1.37% for the first nine months of 2014 (quite consistent with our annual return on average assets of 1.38%, as noted above) was in the 87th percentile of the peer group results. In my view, the peer comparison table shows that the keys to our strong earnings performance include a strong net interest margin, combined with an above average level of noninterest revenue and a lower-than-average level of noninterest expense. The Capitalization section of the summary ratios shows that our capital level is very high in comparison to the average for the peer group. While it is important to maintain sufficient capital to meet regulatory requirements and to withstand “stresses,” such as unexpected losses, management has a responsibility to effectively utilize capital to generate sufficient growth that would provide for future increases in earnings. Our level of loans, stated as a multiple of capital, was less than half of the peer group average, and provides evidence that we need to improve our efforts to generate growth in loans with good credit quality. While I am encouraged that total loans outstanding grew in each of the last two quarters of 2014, our overall balance of loans outstanding fell in 2014, continuing a trend of the past few years. Stepping away from the numbers, and perhaps stating the obvious, our ability to produce growth and strong earnings results going forward will depend on one factor more than anything else: the performance by our people. We have a strategic initiative underway to analyze all aspects of our lending processes, and I am optimistic about our ability to find meaningful opportunities for improvement. Further, we remain committed to our “Superior Customer Service” initiative, and will continue to provide training for our employees in an effort to improve our effectiveness at delivering consistent, outstanding customer service. On a personal note, I am thankful for the opportunity to serve as an officer of such a great banking company. We have a very dedicated Board of Directors, and a talented and enthusiastic team of management and employees. With all that we have going for us, I am confident and optimistic about C&N’s future success.

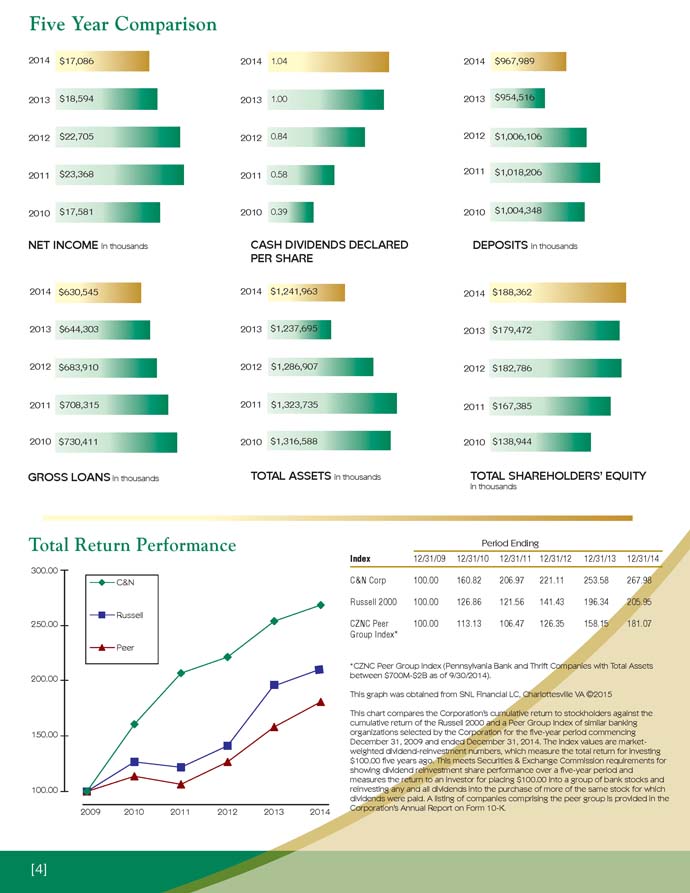

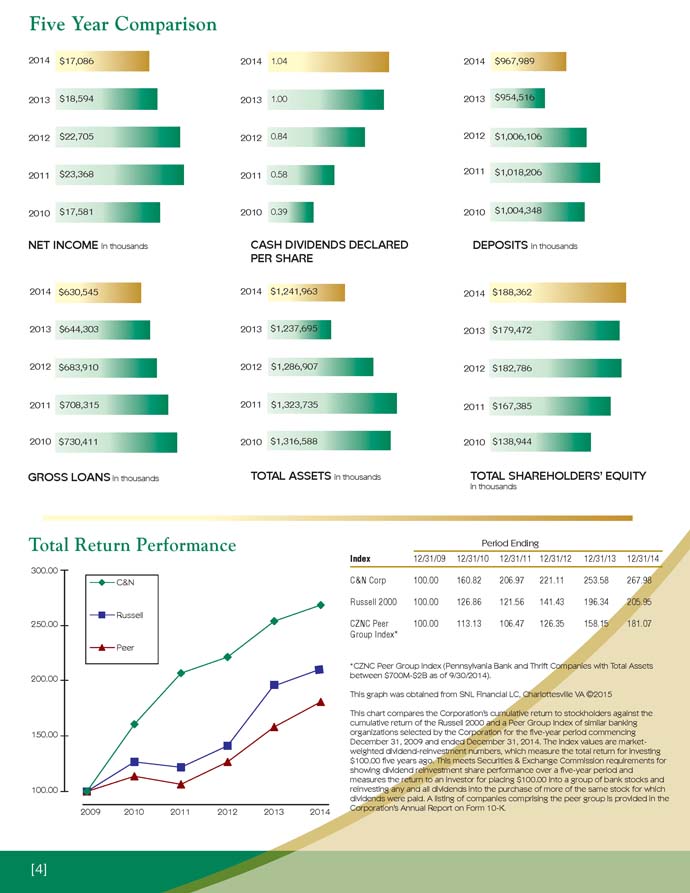

Period Ending Index 12/31/09 12/31/10 12/31/11 12/31/12 12/31/13 12/31/14 C&N Corp 100.00 160.82 206.97 221.11 253.58 267.98 Russell 2000 100.00 126.86 121.56 141.43 196.34 205.95 CZNC Peer 100.00 113.13 106.47 126.35 158.15 181.07 Group Index* *CZNC Peer Group Index (Pennsylvania Bank and Thrift Companies with Total Assets between $700M-$2B as of 9/30/2014). This graph was obtained from SNL Financial LC, Charlottesville VA ©2015 This chart compares the Corporation’s cumulative return to stockholders against the cumulative return of the Russell 2000 and a Peer Group Index of similar banking organizations selected by the Corporation for the five-year period commencing December 31, 2009 and ended December 31, 2014. The index values are market-weighted dividend-reinvestment numbers, which measure the total return for investing $100.00 five years ago. This meets Securities & Exchange Commission requirements for showing dividend reinvestment share performance over a five-year period and measures the return to an investor for placing $100.00 into a group of bank stocks and reinvesting any and all dividends into the purchase of more of the same stock for which dividends were paid. A listing of companies comprising the peer group is provided in the Corporation’s Annual Report on Form 10-K.

In Memoriam William Kroeck FrancisAll of us at Citizens & Northern were saddened at the October passing of our former President, Chairman and CEO Bill Francis. Bill died Wednesday, October 1 at his lakeside home in Dundee, NY. He was 82 years old. Bill retired in 1996 from Citizens & Northern after 38 years of service, 25 of those as CEO. During his tenure at the helm, Bill led C&N through one of its most aggressive expansion periods. It was under Bill’s guidance that Northern National Bank of Wellsboro and Citizens National Bank of Towanda consolidated to become C&N. Bill is remembered by all who knew him and worked with him as an affable man whose door was always open and who cared deeply for his coworkers, C&N and his 1932 - 2014 community. The William K. Francis Annex Building at the Wellsboro office.

Quarterly Share DataTrades of the Corporation’s stock are executed through various brokers who maintain a market in the Corporation’s stock. The Corporation’s stock is listed on NASDAQ Capital Market Securities with the trading symbol CZNC. The following tables show the approximate high and low sales price of the common stock during 2014 and 2013. 2014 High Low Dividend declared per Quarter First Quarter $20.74 $18.19 $0.26 Second Quarter $20.10 $17.94 $0.26 Third Quarter $20.10 $18.50 $0.26 Fourth Quarter $21.49 $18.83 $0.26 2013 High Low Dividend declared per Quarter First Quarter $20.00 $18.65 $0.25 Second Quarter $20.46 $18.51 $0.25 Third Quarter $21.45 $19.08 $0.25 Fourth Quarter $21.00 $19.37 $0.25 Photo by Jeff Hoodak of Dushore - taken in Sullivan County.

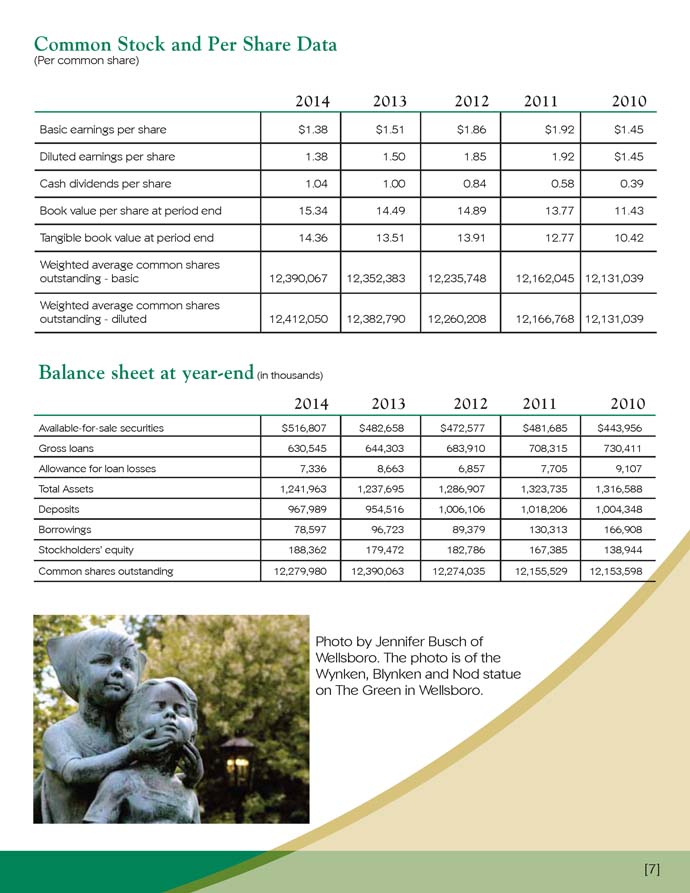

Common Stock and Per Share Data (Per common share) 2014 2013 2012 2011 2010 Basic earnings per share $1.38 $1.51 $1.86 $1.92 $1.45 Diluted earnings per share 1.38 1.50 1.85 1.92 $1.45 Cash dividends per share 1.04 1.00 0.84 0.58 0.39 Book value per share at period end 15.34 14.49 14.89 13.77 11.43 Tangible book value at period end 14.36 13.51 13.91 12.77 10.42 Weighted average common shares outstanding - basic 12,390,067 12,352,383 12,235,748 12,162,045 12,131,039 Weighted average common shares outstanding - diluted 12,412,050 12,382,790 12,260,208 12,166,768 12,131,039 Balance sheet at year-end (in thousands) 2014 2013 2012 2011 2010 Available-for-sale securities $516,807 $482,658 $472,577 $481,685 $443,956 Gross loans 630,545 644,303 683,910 708,315 730,411 Allowance for loan losses 7,336 8,663 6,857 7,705 9,107 Total Assets 1,241,963 1,237,695 1,286,907 1,323,735 1,316,588 Deposits 967,989 954,516 1,006,106 1,018,206 1,004,348 Borrowings 78,597 96,723 89,379 130,313 166,908 Stockholders’ equity 188,362 179,472 182,786 167,385 138,944 Common shares outstanding 12,279,980 12,390,063 12,274,035 12,155,529 12,153,598 Photo by Jennifer Busch of Wellsboro. The photo is of the Wynken, Blynken and Nod statue on The Green in Wellsboro.

Five-year summary of operations Income statement (in thousands) 2014 2013 2012 2011 2010 Interest and fee income $46,009 $48,914 $56,632 $61,256 $62,114 Interest expense 5,122 5,765 9,031 13,556 19,245 Net interest income 40,887 43,149 47,601 47,700 42,869 Provision (credit) for loan losses 476 2,047 288 (285) 1,191 Net interest income after provision (credit) for loan losses 40,411 41,102 47,313 47,985 41,678 Noninterest income excluding securities gains 15,420 16,451 16,383 13,897 13,809 Net impairment losses recognized in earnings from available-for-sale securities 0 (25) (67) 0 (433) Net realized gains on available-for-sale securities 1,104 1,743 2,749 2,216 1,262 Loss on prepayment of debt 0 1,023 2,333 0 0 Noninterest expense excluding loss on prepayment of debt 34,157 33,471 32,914 32,016 31,461 Income before income tax provision 22,778 24,777 31,131 32,082 24,855 Income tax provision 5,692 6,183 8,426 8,714 5,800 Net income 17,086 18,594 22,705 23,368 19,055 U.S. Treasury preferred dividends 0 0 0 0 1,474 Net income available to common shareholders $17,086 $18,594 $22,705 $23,368 $17,581 Photo by James Welch of Jersey Shore. The photo is of the falls in Tiadaughton State Park, Lycoming County.

Five-year summary of operations Average balance sheet (in thousands) 2014 2013 2012 2011 2010 Total assets $1,239,897 $1,237,096 $1,305,163 $1,313,445 $1,326,145 Earning assets 1,155,401 1,145,340 1,199,538 1,208,584 1,205,608 Gross loans 627,753 656,495 700,241 714,421 721,997 Deposits 965,418 964,031 1,008,469 1,001,125 965,615 Stockholders’ equity 185,469 181,412 175,822 152,718 150,133 Key Ratios Return on average assets 1.38% 1.50% 1.74% 1.78% 1.44% Return on average equity 9.21% 10.25% 12.91% 15.30% 12.69% Average equity to average assets 14.96% 14.66% 13.47% 11.63% 11.32% Net interest margin(1) 3.80% 4.05% 4.26% 4.22% 3.81% Efficiency(2) 57.59% 53.27% 48.82% 49.37% 52.64% Cash dividends as a percentage of diluted earnings per share 75.36% 66.67% 45.41% 30.21% 26.90% Tier 1 leverage 13.89% 13.78% 12.53% 10.93% 9.20% Tier 1 risk-based capital 26.26% 25.15% 22.86% 19.95% 15.87% Total risk-based capital 27.60% 26.60% 24.01% 21.17% 17.17% Tangible common equity/tangible assets 14.34% 13.66% 13.39% 11.84% 9.71% Nonperforming assets/total assets 1.34% 1.53% 0.82% 0.73% 0.92% Nonperforming loans/total loans 2.45% 2.80% 1.41% 1.19% 1.58% Allowance for loan losses/total loans 1.16% 1.34% 1.00% 1.09% 1.25% Net charge-offs/average loans 0.29% 0.04% 0.16% 0.16% 0.05% (1) Rates of return on tax-exempt securities and loans are calculated on a fully-taxable equivalent basis. (2) The efficiency ratio is calculated by dividing: (a) total noninterest expense excluding losses from prepayment of debt, by (b) the sum of net interest income (including income from tax-exempt securities and loans on a fully-taxable equivalent basis) and noninterest income excluding securities gains or losses.

Quarterly financial data The following table presents summarized financial data for 2014 and 2013 (unaudited, in thousands, except per share) 2014 quarter ended March 31 June 30 Sept. 30 Dec. 31 Interest income $11,406 $11,563 $11,572 $11,468 Interest expense 1,288 1,290 1,287 1,257 Net interest income 10,118 10,273 10,285 10,211 (Credit) Provision for loan losses (311) 446 218 123 Net interest income after (credit) provision for loan losses 10,429 9,827 10,067 10,088 Other income 3,751 3,980 3,887 3,802 Net gains on available-for-sale securities 31 103 760 210 Other expenses 8,524 8,347 9,036 8,250 Income before income tax provision 5,687 5,563 5,678 5,850 Income tax provision 1,399 1,400 1,411 1,482 Net income available to common shareholders $ 4,288 $ 4,163 $ 4,267 $ 4,368 Net income per share - basic $ 0.35 $ 0.33 $ 0.34 $ 0.36 Net income per share - diluted $ 0.34 $ 0.33 $ 0.34 $ 0.35 2013 quarter ended March 31 June 30 Sept. 30 Dec. 31 Interest income $12,647 $12,355 $12,027 $11,885 Interest expense 1,600 1,415 1,396 1,354 Net interest income 11,047 10,940 10,631 10,531 Provision for loan losses 183 66 239 1,559 Net interest income after provision for loan losses 10,864 10,874 10,392 8,972 Other income 3,843 4,191 4,293 4,124 Net gains on available-for-sale securities 1,159 100 193 266 Loss on prepayment of debt 1,023 0 0 0 Other expenses 8,553 8,520 8,610 7,788 Income before income tax provision 6,290 6,645 6,268 5,574 Income tax provision 1,584 1,671 1,579 1,349 Net income available to common shareholders $ 4,706 $ 4,974 $ 4,689 $ 4,225 Net income per share - basic $ 0.38 $ 0.40 $ 0.38 $ 0.34 Net income per share - diluted $ 0.38 $ 0.40 $ 0.38 $ 0.34 Photo by Darla Karchella of Jersey Shore. The photo of Tundra swans in flight was taken near her home in Lycoming County.

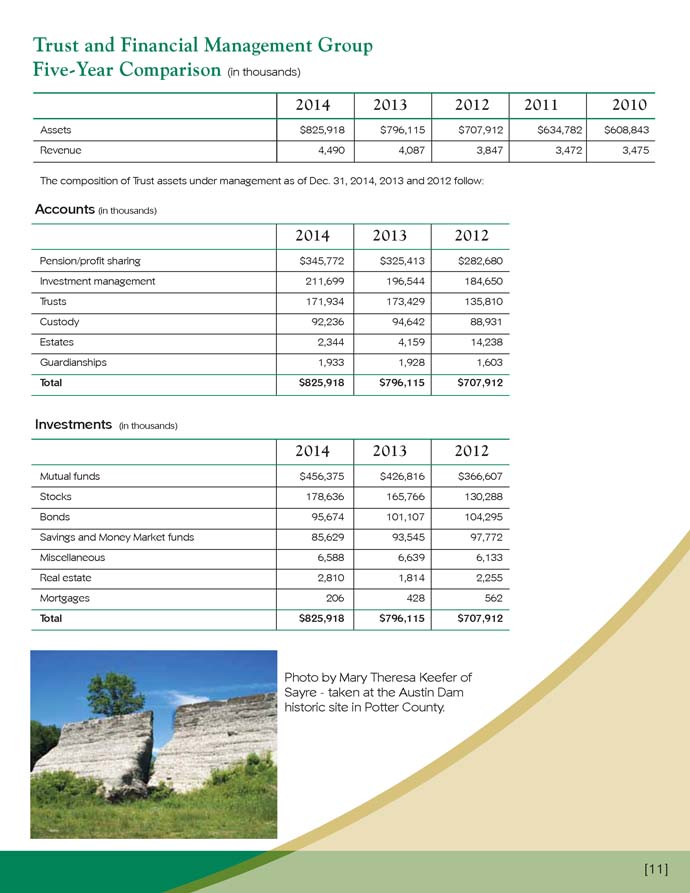

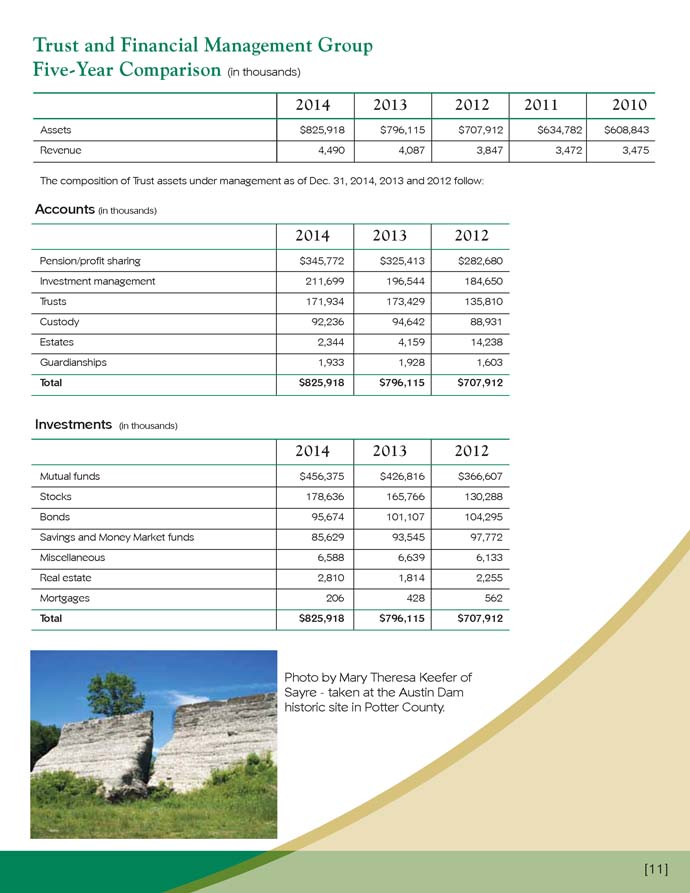

Trust and Financial Management Group Five-Year Comparison (in thousands) 2014 2013 2012 2011 2010 Assets $825,918 $796,115 $707,912 $634,782 $608,843 Revenue 4,490 4,087 3,847 3,472 3,475 The composition of Trust assets under management as of Dec. 31, 2014, 2013 and 2012 follow: Accounts (in thousands) 2014 2013 2012 Pension/profit sharing $345,772 $325,413 $282,680 Investment management 211,699 196,544 184,650 Trusts 171,934 173,429 135,810 Custody 92,236 94,642 88,931 Estates 2,344 4,159 14,238 Guardianships 1,933 1,928 1,603 Total $825,918 $796,115 $707,912 Investments (in thousands) 2014 2013 2012 Mutual funds $456,375 $426,816 $366,607 Stocks 178,636 165,766 130,288 Bonds 95,674 101,107 104,295 Savings and Money Market funds 85,629 93,545 97,772 Miscellaneous 6,588 6,639 6,133 Real estate 2,810 1,814 2,255 Mortgages 206 428 562 Total $825,918 $796,115 $707,912 Photo by Mary Theresa Keefer of Sayre - taken at the Austin Dam historic site in Potter County.

2014 Board of Directors Citizens & Northern Corporation Citizens & Northern Bank Leo F. Lambert, Chairman President/GM, Fitzpatrick & Lambert, Inc. Dennis F. Beardslee Owner, Terrace Lanes Bowling Center Jan E. Fisher Executive Vice President/COO Susquehanna Health System R. Bruce Haner Retired auto buyer for new car dealers Susan E. Hartley Attorney At Law Mark A. Hughes Interim President and CEO Raymond R. Mattie President, M&S Conversion Co., Inc. Edward H. Owlett, III President and CEO, Putnam Company Leonard Simpson Attorney At Law and Sullivan County District Attorney James E. Towner Retired General Manager, The Scranton Times Ann M. Tyler CPA, Ann M. Tyler CPA 2014 Executive Team Dawn A. Besse EVP and Chief Credit Officer Shelley L. D’Haene EVP and Director of Alternate Delivery Channels Harold F. Hoose, III EVP and Director of Lending Mark A. Hughes Interim President and CEO Anthony Peluso Interim Chief Financial Officer George M. Raup EVP and Chief Information Officer John M. Reber EVP and Director of Risk Management Thomas L. Rudy, Jr. EVP and Director of Branch Delivery Deborah E. Scott EVP and Trust Division Director 2015 Leadership Changes Due to several retirements, there have been changes to the Executive Team in 2015: Stan Dunsmore EVP and Chief Credit Officer Shelley D’Haene EVP and Senior Operations Officer Dawn A. Besse and George M. Raup retired Dec. 31, 2014 and Jan. 2, 2015, respectively.

2014 Advisory BoardsWe thank our Advisory Board members who give us valuable insight into the communities we serve. Athens/Sayre/East Smithfield Warren J. Croft, Max P. Gannon, Jr., L. Joseph Tomasso, Jr. Canisteo/Hornell William Hatch, Brian Schu. Coudersport/Emporium/Port Allegany Edwin H. Corey, Peter Fragale, Patrice D. Lavavasseur, Edwin M. Schott, Robert C. Smith, Edwin W. Tompkins III. Dushore/Laporte Ronald A. Gutosky, William B. Saxe. Elkland/Knoxville/Tioga Brian Bicksler, Mark R. Howe, John C. Kenyon, Leisa L. LaVancher, Mary C. Owlett, William W. Roosa. Mansfield/Wellsboro Donald R. Abplanalp, Craig Eccher, Scott Lewis, Lawrence B. Mansfield. Ralston/Liberty Lawrence J. Connolly, Stephen L. Davis, Ronald W. Roan, James H. Route, Jr., Ray E. Wheeland. Jersey Shore/Muncy/Old Lycoming/South Williamsport/Williamsport Thomas F. Charles, John M. Confer, Thomas D. Hess, Roger D. Jarrett, Daniel K. Mathers, Frank G. Pellegrino, David Schall, Louis Terry Waldman. Towanda/Monroeton/Wysox/Troy Gary Baker, James A. Bowen, Robert L. Fulmer, James E. Parks, Mark W. Smith, Evan S. Williams III. Photo by Jen Bailey of Nelson - taken in Roaring Branch in Tioga County.

2014 RetirementsWe said goodbye to three C&N employees who retired in 2014 and in January of 2015. Together they had 90 years of service to Citizens & Northern. Dawn Besse - EVP/ Chief Credit Officer, Wellsboro -14 years George Raup EVP/ Chief Information Officer, Wellsboro-36 years Charles H. Updegraff, Jr.-- President, Chairman and CEO --40 years 2014 Service Awards Last year 32 Citizens & Northern employees were recognized for a total of 490 years of service to the financial institution. Employees were honored at luncheons hosted by the President and CEO. 35 Years 10 Years George Raup, EVP and Chief Information Officer, Brandy Allen, Deposit Operations Coordinator, Wellsboro Wellsboro Joan Grenell, Staff Accountant, Towanda Robert Baker, Customer Service Representative, Monroeton 30 Years Darci Baird, Senior Financial Consultant, Sayre Stan Dunsmore, EVP and Chief Credit Officer Claudia Brown, Customer Service Specialist, Carla Packard, Loan Processing Escrow Tioga Specialist, Troy Sandra Christ, Marketing Assistant, Wellsboro Diane Egly, Community Office Manager, Muncy Carol Ellenberger, Customer Service 25 Years Representative, Canisteo William Holmes, Business Development Sales Leslie Fassett, Community Office Manager, Officer, Troy Monroeton Karen Hall, Customer Service Representative, 20 Years East Smithfield Barbara Clinger, Customer Service Sara Heatley, Staff Auditor, Wellsboro Representative, Emporium Marcy Hughes, Loan Operations Team Leader, Linda Koeppel, Customer Service Representative, Wellsboro Wellsboro Sheila Kingsley, Customer Service Representative, Athens 15 Years Jessica Loper, Customer Service Representative, Hornell Larry Alderson, Regional Manager of Financial Kenna Marshall, Resource Recovery Services Delivery and Trust Officer Administrative Assistant, Muncy James Butters, Director of Financial Services Brenda Mitchell, Community Office Manager, Support, Wellsboro South Williamsport Shelley D’Haene, EVP and Senior Operations Anna Phelps, Customer Service Representative, Officer, Wellsboro Liberty Nancy Hardes, Customer Service Representative, Melissa Peters, Customer Service Representative, Port Allegany Towanda Erath Zelewicz, Customer Transaction Specialist, John Reber, EVP and Director of Risk Dushore Management, Wellsboro Bruce Smithgall, Regional Team Leader - Lending, Williamsport Kathryn Wesneski, Customer Service Representative, Liberty

Contact Information Client Contact Center 1-877-838-2517 Internet Banking 1-877-838-2517 Telephone Banking 1-877-622-5526 C&N Financial Services Wellsboro 1-866-ASK-CNFS Coudersport 814-274-1929 Trust and Financial Management Group Wellsboro 1-800-487-8784 Sayre 1-888-760-8192 Towanda 1-888-987-8784 Williamsport 1-866-732-7213 Canisteo 607-698-4295 Coudersport 814-274-1929 On the Web www.cnbankpa.com Facebook www.facebook.com/citizensandnorthernbank Stockholder Inquiries A copy of the Corporation’s annual Report Form 10-K for the year ended December 31, 2014, as required to be filed with the Securities and Exchange Commission, will be furnished to any stockholder without charge upon written request to the Corporation’s treasurer at our principal office at P.O. Box 58, Wellsboro, PA 16901. The information is also available through the Citizens & Northern Bank website at www.cnbankpa.com and the website of the Securities and Exchange Commission at www.sec.gov. This statement has not been reviewed or confirmed for accuracy or relevance by the Federal Deposit Insurance Corporation. Investor Information The annual Meeting of Shareholders will be held at the Deane Center, 104 Main Street in Wellsboro, PA at 2:00 p.m. Thursday, April 23, 2015. General shareholder inquiries should be sent to Citizens & Northern Corporation, 90-92 Main Street, P.O. Box 58, Wellsboro, PA 16901. Our Stock Transfer Agent is American Stock Transfer & Trust Company, 59 Maiden Lane, Plaza Level, New York, NY 10038. Telephone: 800-278-4353. Our independent auditors are Baker Tilley Virchow Krause, LLP, 400 Market Street, Williamsport, PA 17701. Photo by Donna Sherwood of Dushore - taken in Forksville, Sullivan County.

Our Offices Athens 428 South Main Street Canisteo 3 Main Street Coudersport 10 North Main Street Dushore 111 West Main Street East Smithfield 563 Main Street Elkland 104 West Main Street Emporium 135 East Fourth Street Hornell 6250 County Route 64 Jersey Shore 230 Railroad Street Knoxville 102 East Main Street Laporte 514 Main Street Liberty 4534 Williamson Trail Mansfield 1085 South Main Street Monroeton 612 James Monroe Avenue Muncy 3461 Route 405 Highway Old Lycoming 1510 Dewey Avenue Port Allegany 100 Maple Street Ralston 24 Thompson Street Sayre 1827 Elmira Street South Williamsport 2 East Mountain Avenue Tioga 41 North Main Street Towanda 428 Main Street Troy 64 Elmira Street Wellsboro 90-92 Main Street Williamsport 130 Court Street Wysox 1467 Golden Mile Road Toll-free: 1-877-838-2517 Our Client Contact Center is available to help you Monday-Thursday 8:00 a.m.-5:00 p.m.; Friday 8:00 a.m. - 6:00 p.m. and Saturday 8:00 a.m.-noon. Photo by Michael Blackwell of Williamsport - taken in Lycoming County.

More views from our back yardPhoto by Don Biresch of Ottsville - taken near Photo by Ann Kamzelski of Wellsboro - taken in Sabinsville in Tioga County. Tioga County Photo by Molly Kinsey of Dushore - taken in Sullivan Photo by Dr. Ralph Winston of Towanda - taken in County. Bradford County. Photo by Bernadette Chiaramonte-Brown of Photo by Deb Davis of Muncy Valley - taken in Wellsboro - taken at the Pennsylvania Grand Canyon Lairdsville, Lycoming County. in Tioga County.

2014 annual highlightsDEDICATED to our clients to our local businesses to our local communities to our shareholders to our employees For more than 150 years