PROSPECTUS February 28, 2017

CENTURY SHARES TRUST Institutional Shares [CENSX]

CENTURY SMALL CAP SELECT FUND Investor Shares [CSMVX], Institutional Shares [CSMCX]

The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Intentionally Left Blank

| Century Funds | Table of Contents |

CENTURY SHARES TRUST

Investment Objective

Century Shares Trust (CST) seeks long-term capital growth.

Fees and Expenses

The following table describes the fees and expenses you may pay if you buy and hold shares of the Fund.

Shareholder Fees (Fees paid directly from your investment)

| | Institutional Shares |

| Redemption Fee (for Fund shares held less than 90 days, as a percentage of total redemption proceeds) | 1.00% |

Annual Fund Operating Expenses (Expenses that you pay each year as a percentage of the value of your investment) |

| | Institutional Shares |

| Management Fees | 0.80% |

| Distribution and Service (12b-1) Fees | None |

| Other Expenses | 0.33% |

| Total Annual Fund Operating Expenses | 1.13% |

Example

The following example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same.

| | 1 Year | 3 Years | 5 Years | 10 Years |

Although your actual costs may be higher or lower,

based on these assumptions your costs would be: | $115 | $359 | $622 | $1,373 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 44% of the average value of the portfolio.

Investments, Risks and Performance

Principal Investment Strategies

The Fund invests mainly in the common stocks of U.S. companies. Typically, the Fund’s portfolio is composed of 25-45 large and medium-sized companies, but the Fund may invest in any company without regard to market capitalization. The Fund’s portfolio is mainly invested in companies with market capitalizations in excess of $4 billion at the time of purchase. The Fund may invest in companies across all sectors of the economy, but may favor companies in particular sectors or industries at different times. The Fund may invest in foreign securities without limit, but such investments are not expected to exceed 20% of the Fund’s total assets and typically are limited to the equity securities of companies incorporated outside of the U.S. that are traded on U.S. exchanges and American Depositary Receipts (ADRs). In selecting investments for the Fund’s portfolio, the Adviser uses fundamental research to evaluate each company, focusing on the company’s revenues and earnings, return on equity, and capital structure. A stock may be sold, among other reasons, if it has reached a price target, the issuer’s fundamental outlook has changed, or a better investment opportunity is available.

Principal Risks

It is important to understand that you could lose money by investing in the Fund. The following is a summary of the principal risks of investing in the Fund:

Stock Market Risk, which is the risk that stock prices will decline. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices. Movements in the stock markets may adversely affect a stock’s price, regardless of how well a company performs.

Industry/Sector Risk, which is the risk that companies within the same industry or sector may decline in value due to issues that affect the entire industry or sector. To the extent that the Fund focuses its investments in a particular industry or sector, there is a risk that economic conditions or other developments that affect companies in that industry or sector will have a significant impact on the Fund’s performance.

Investing in Fewer Issuers Risk, which is the risk that stock price movements affecting one or a small number of companies may have a significant impact on the Fund’s net asset value because the Fund invests in a limited number of companies.

Security Selection Risk, which is the risk that poor stock selection will cause the Fund to underperform its benchmark or other funds with similar investment objectives.

Growth Securities Risk, which is the risk that the price of a “growth” security may be impacted if the company does not realize its anticipated potential or if there is a shift in the market to favor other types of securities. The stocks of growth companies can be more sensitive to company earnings and more volatile than the market in general.

Foreign Securities Risk, which is the risk that the value of foreign securities may decline in response to changes in currency exchange rates, unfavorable political developments, sanctions, embargoes or economic and financial instability in a particular country. Foreign securities markets generally have less trading volume and liquidity than U.S. markets, and prices on some foreign markets can be highly volatile. Other risks arise from different accounting, financial reporting and legal standards, as well as higher transaction costs.

Active Trading Risk, which is the risk that active trading could raise transaction costs (thus lowering return). In addition, active trading could result in increased taxable distributions to shareholders and distributions that will be taxable to shareholders at higher federal income tax rates.

An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

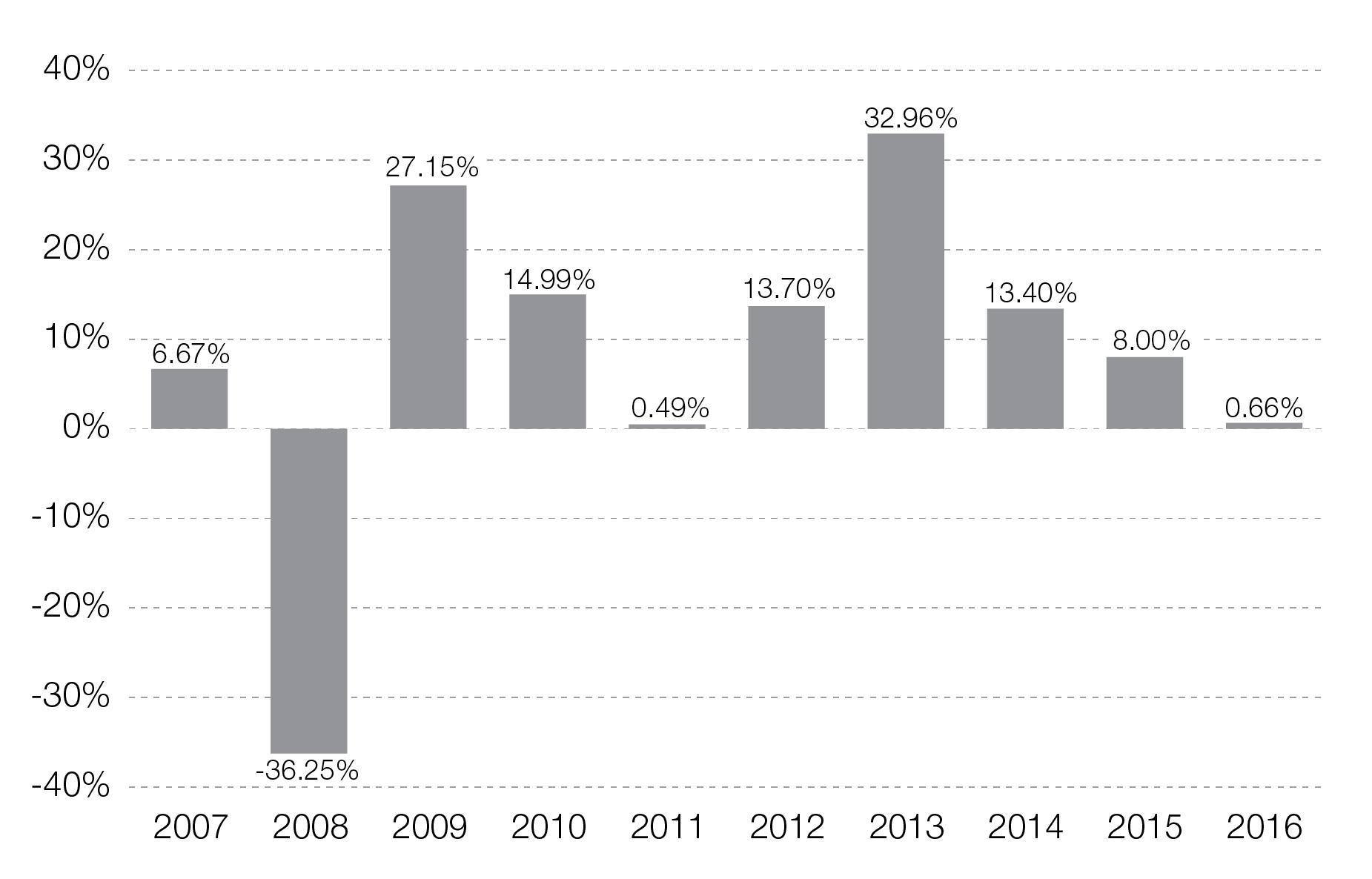

Performance

The following bar chart and table provide some indication of the risks of investing in the Fund. The bar chart shows how the performance of the Fund’s Institutional Shares has varied from one calendar year to another over the past 10 years. The table shows how the average annual returns for 1, 5 and 10 years compare with those of a broad measure of market performance. The returns shown in the bar chart and table include reinvestment of all dividends and capital gains distributions and reflect fund expenses.

As with any mutual fund, the Fund’s past performance (before and after taxes) is not an indication of future performance. Updated performance information is available on the Fund’s website at www.centuryfunds.com or by calling toll-free 800-303-1928.

Annual Total Returns for Institutional Shares (for years ended December 31)

During the periods shown in the bar chart, the best return for a calendar quarter was 16.14% (Q1, 2012), and the worst return for a calendar quarter was -21.64% (Q4, 2008).

Average Annual Total Returns (for periods ended December 31, 2016)

| | 1 Year | 5 Years | 10 Years |

| CST Institutional Shares | | | |

| Return Before Taxes | 0.66% | 13.26% | 6.41% |

| Return After Taxes on Distributions | -0.14% | 10.80% | 4.64% |

| Return After Taxes on Distributions and Sales of Fund Shares | 1.05% | 10.47% | 5.09% |

Russell 1000® Growth Index (reflects no deduction for fees, expenses or taxes) | 7.08% | 14.50% | 8.33% |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

The 1-year return after taxes on distributions and sales of Fund shares was higher than the return before taxes because the calculation assumes that shareholders receive a tax benefit for capital losses incurred on the sale of their shares.

Investment Adviser: Century Capital Management, LLC

Portfolio Managers:

Alexander L. Thorndike, the Managing Partner of Century Capital Management, LLC, has been a Portfolio Manager of the Fund since 1999.

Kevin W. Callahan, a Partner of Century Capital Management, LLC, has been a Portfolio Manager of the Fund since 2001.

Other Important Information

For important information about the purchase and sale of Fund shares, tax information, and payments to financial intermediaries, please turn to the “Summary of Other Important Information about Fund Shares” section on page 10 of this prospectus.

CENTURY SMALL CAP SELECT FUND

Investment Objective

Century Small Cap Select Fund (CSCS) seeks long-term capital growth.

Fees and Expenses

The following table describes the fees and expenses you may pay if you buy and hold shares of the Fund.

Shareholder Fees (Fees paid directly from your investment)

| | Investor Shares | Institutional Shares |

| Redemption Fee (for Fund shares held less than 90 days, as a percentage of total redemption proceeds) | 1.00% | 1.00% |

Annual Fund Operating Expenses (Expenses that you pay each year as a percentage of the value of your investment) |

| | Investor Shares | Institutional Shares |

| Management Fees | 0.95% | 0.95% |

| Distribution and Service (12b-1) Fees | 0.21% | None |

| Other Expenses | 0.30% | 0.21% |

| Total Annual Fund Operating Expenses | 1.46% | 1.16% |

Example

The following example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same.

| | 1 Year | 3 Years | 5 Years | 10 Years |

| CSCS Investor Shares | | | | |

Although your actual costs may be higher or lower,

based on these assumptions your costs would be: | $149 | $462 | $797 | $1,744 |

| CSCS Institutional Shares | | | | |

Although your actual costs may be higher or lower,

based on these assumptions your costs would be: | $118 | $368 | $638 | $1,408 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 82% of the average value of the portfolio.

Investments, Risks and Performance

Principal Investment Strategies

Normally the Fund invests at least 80% of its net assets (plus borrowings, if any, for investment purposes) in the common stocks of small cap companies (generally, those companies with market capitalizations not exceeding the highest market capitalization in the Russell 2000® Index during the preceding 12 months). As of January 31, 2017, companies in the Index had market capitalizations ranging from $17.3 million to $9.4 billion. The Fund will provide shareholders with at least sixty (60) days’ notice prior to any change in its 80% policy. The Fund may invest in companies across all sectors of the economy, but may favor companies in particular sectors or industries at different times. The Fund may invest in foreign securities, including emerging markets, without limit, but such investments are not expected to exceed 20% of the Fund’s total assets and typically are limited to the equity securities of companies incorporated outside of the U.S. that are traded on U.S. exchanges and American Depositary Receipts (ADRs). In selecting investments for the Fund’s portfolio, the Adviser uses fundamental research to evaluate each company, focusing on the company’s earnings growth, return on equity, margin stability, and capital management. These and other factors are then weighed against valuation. A stock may be sold, among other reasons, if it has reached a price target, the issuer’s fundamental outlook has changed, or a better investment opportunity is available.

Principal Risks

It is important to understand that you could lose money by investing in the Fund. The following is a summary of the principal risks of investing in the Fund:

Stock Market Risk, which is the risk that stock prices will decline. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices. Movements in the stock markets may adversely affect a stock’s price, regardless of how well a company performs.

Market Capitalization Risk, which is the risk that the value of the securities of smaller, less well-known companies may perform differently from the market as a whole. Historically, small-cap stocks have been more volatile in price than the large-cap stocks that dominate the overall market. Small-cap companies may have limited product lines, financial and management resources or market and distribution channels. In addition, their shares can be less liquid than those of larger companies, especially during market declines. For purposes of the Fund’s investment policies, the market capitalization of a company is based on its market capitalization at the time the Fund purchases the company’s securities. Market capitalizations of companies change over time.

Industry/Sector Risk, which is the risk that companies within the same industry or sector may decline in value due to issues that affect the entire industry or sector. To the extent that the Fund focuses its investments in a particular industry or sector, there is a risk that economic conditions or other developments that affect companies in that industry or sector will have a significant impact on the Fund’s performance.

Growth Securities Risk, which is the risk that the price of a “growth” security may be impacted if the company does not realize its anticipated potential or if there is a shift in the market to favor other types of securities. The stocks of growth companies can be more sensitive to company earnings and more volatile than the market in general.

Foreign Securities Risk, which is the risk that the value of foreign securities may decline in response to changes in currency exchange rates, unfavorable political developments, sanctions, embargoes or economic and financial instability in a particular country. Foreign securities markets generally have less trading volume and liquidity than U.S. markets, and prices on some foreign markets can be highly volatile. Other risks arise from different accounting, financial reporting and legal standards, as well as higher transaction costs. The securities markets of emerging market countries generally are smaller, less liquid and more volatile than markets in developed countries. The risks described above apply to a greater extent to investments in emerging markets.

Security Selection Risk, which is the risk that poor stock selection will cause the Fund to underperform its benchmark or other funds with similar investment objectives.

Active Trading Risk, which is the risk that active trading could raise transaction costs (thus lowering return). In addition, active trading could result in increased taxable distributions to shareholders and distributions that will be taxable to shareholders at higher federal income tax rates.

Redemption Risk, which is the risk that the Fund could experience losses as a result of one or more shareholder redemptions. If the Fund is forced to sell assets at inopportune times to meet redemption requests, assets could be sold at a loss or depressed value. In that event, the value of your investment would go down.

An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Performance

The following bar chart and table provide some indication of the risks of investing in the Fund. The bar chart shows how the performance of the Fund’s Institutional Shares has varied from one calendar year to another over the past 10 years. The table shows how the average annual returns for 1, 5 and 10 years for each share class compare with those of a broad measure of market performance. The returns shown in the bar chart and table include reinvestment of all dividends and capital gains distributions and reflect fund expenses.

As with any mutual fund, the Fund’s past performance (before and after taxes) is not an indication of future performance. Updated performance information is available on the Fund’s website at www.centuryfunds.com or by calling toll-free 800-303-1928.

Annual Total Returns for Institutional Shares (for years ended December 31)

During the periods shown in the bar chart, the best return for a calendar quarter was 19.15% (Q2, 2009), and the worst return for a calendar quarter was -26.62% (Q4, 2008).

Average Annual Total Returns (for periods ended December 31, 2016)

| | 1 Year | 5 Years | 10 Years |

| CSCS Institutional Shares | | | |

| Return Before Taxes | 3.02% | 9.64% | 5.54% |

| Return After Taxes on Distributions | 3.02% | 7.44% | 4.32% |

| Return After Taxes on Distributions and Sales of Fund Shares | 1.71% | 7.56% | 4.40% |

| CSCS Investor Shares | | | |

| Return Before Taxes | 2.67% | 9.29% | 5.18% |

Russell 2000® Growth Index (reflects no deduction for fees, expenses or taxes) | 11.32% | 13.74% | 7.76% |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. Please note that after-tax returns are shown for the Institutional Shares only; after-tax returns for the Investor Shares will vary.

Investment Adviser: Century Capital Management, LLC

Portfolio Managers:

Alexander L. Thorndike, the Managing Partner of Century Capital Management, LLC, has been a Portfolio Manager of the Fund since 1999.

Other Important Information

For important information about the purchase and sale of Fund shares, tax information, and payments to financial intermediaries, please turn to the “Summary of Other Important Information about Fund Shares” section on page 10 of this prospectus.

SUMMARY OF OTHER IMPORTANT INFORMATION ABOUT FUND SHARES

Purchase and Sale of Fund Shares

You purchase and redeem shares of each Fund at the Fund’s next-determined net asset value (NAV) after your request is received in good order. NAVs are determined only on days when the New York Stock Exchange (NYSE) opens for regular trading.

The minimum initial investment for each Fund’s Institutional Shares is $100,000. There is no minimum subsequent investment for Institutional Shares.

The minimum initial investment for Century Small Cap Select Fund’s Investor Shares is $2,500 ($1,000 for Individual Retirement Accounts, UGMA accounts, and accounts established with an Automatic Investment Plan), and the minimum subsequent investment is $50.

To redeem shares of a Fund, contact your broker-dealer or send a written request to Century Funds, P.O. Box 588, Portland, ME 04112. In addition, you may redeem shares by calling 800-303-1928 if you accepted the telephone redemption privilege when you opened your account or completed a telephone redemption authorization form. Redemption proceeds normally are paid by check.

Tax Information

Each Fund intends to make distributions that may be taxed as ordinary income, qualified dividend income or capital gains unless you hold the shares through a tax-advantaged arrangement, in which case special tax rules apply.

Payments to Financial Intermediaries

If you purchase a Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

FUND DETAILS

This section contains greater detail on the investment objectives of each Fund and information about non-principal investments and related risks. This section also provides information regarding disclosure of the Funds’ portfolio holdings.

Investment Objectives

The investment objective of Century Shares Trust is long-term capital growth. This investment objective may be changed by the Board of Trustees without shareholder approval and without notice.

The investment objective of Century Small Cap Select Fund is long-term capital growth. This investment objective may be changed by the Board of Trustees without shareholder approval and without notice. The Fund will provide its shareholders with at least 60 days prior written notice of any change in the policy to invest at least 80% of its assets in small cap companies; however, other non-fundamental policies may be changed without notice.

Except as otherwise stated, each Fund’s investment strategy and policies may be changed without shareholder approval.

Note Regarding Percentage Limitations

All percentage limitations on investments in this Prospectus will apply at the time of investment and will not be considered violated unless an excess or deficiency occurs or exists immediately after and as a result of the investment. (As a result, the actual investments making up a Fund’s portfolio may not at a particular time comport with any such limitation due to increases or decreases in the values of securities or market capitalizations of the issuers of securities held by the Fund.) If at any time the Adviser determines that the value of illiquid securities held by a Fund exceeds 15% of its NAV, the Adviser will take such steps as it considers appropriate to reduce the percentage as soon as reasonably practicable; the Funds may, however, hold any such investments for a substantial period of time.

Non-Principal Investments and Risks

Each Fund may invest in various types of securities that are not described in this Prospectus. The Statement of Additional Information includes information about these and other types of securities that each Fund may invest in, investment techniques that each Fund may use, and related risks.

Each Fund may, from time to time, temporarily depart from its principal investment strategies in response to adverse market, economic, political or other conditions. For temporary defensive purposes, a Fund may invest in cash or cash equivalents, or other short-term obligations, without limit. To the extent that the assets of a Fund are invested in temporary defensive positions, the Fund may succeed in avoiding losses, but may fail to achieve its investment objective.

Cyber Security Risk. With the increased use of technologies such as the Internet and the dependence on computer systems to perform business and operational functions, investment companies (such as the Funds) and their service providers (including the Adviser) may be prone to operational and information security risks resulting from cyber-attacks and/or technological malfunctions. In general, cyber-attacks are deliberate, but unintentional events may have similar effects. Cyber-attacks include, among others, stealing or corrupting data maintained online or digitally, preventing legitimate users from accessing information or services on a website, releasing confidential information without authorization, and causing operational disruption. Successful cyber-attacks against, or security breakdowns of, a Fund, the Adviser, or a custodian, transfer agent, or other service provider may adversely affect a Fund or its shareholders. For instance, cyber-attacks may interfere with the processing of shareholder transactions, affect a Fund’s ability to calculate its NAV, cause the release of private shareholder information or confidential Fund information, impede trading, cause reputational damage, and subject a Fund to regulatory fines, penalties or financial losses, reimbursement or other compensation costs, and additional compliance costs. Cyber-attacks may render records of Fund assets and transactions, shareholder ownership of Fund shares, and other data integral to the functioning of the Fund inaccessible or inaccurate or incomplete. A Fund may also incur substantial costs for cyber security risk management in order to prevent cyber incidents in the future. A Fund and its shareholders could be negatively impacted as a result. While the Adviser has established business continuity plans and systems designed to reduce the risk of cyber-attacks through the use of technology, processes and controls, there are inherent limitations in such plans and systems, including the possibility that certain risks have not been identified given the evolving nature of this threat. A Fund relies on third-party service providers for many of its day-to-day operations, and will be subject to the risk that the protections and protocols implemented by those service providers will be ineffective to protect the Fund from cyber-attack. Similar types of cyber security risks also are present for issuers of securities in which the Funds invest, which could result in material adverse consequences for such issuers, and may cause a Fund’s investment in such securities to lose value.

Disclosure of Portfolio Holdings

Each Fund provides a complete schedule of its portfolio securities, for each calendar quarter, by posting the information on the Funds’ website (www.centuryfunds.com) approximately 10 days after the last day of each quarter (or the first business day thereafter). The information remains accessible on the website until the next quarter’s schedule is posted. A description of each Fund’s policies and procedures with respect to the disclosure of portfolio securities is available in the Statement of Additional Information.

MANAGEMENT OF THE FUNDS

The Investment Adviser

Century Capital Management, LLC (“Century Capital” or the “Adviser”) is the Funds’ Investment Adviser. Century Capital has provided investment management services to individuals and institutions through mutual funds and separate accounts since 1992, and had approximately $795.7 million in assets under management as of January 2, 2017. Century Capital is located at 100 Federal Street, 29th Floor, Boston, Massachusetts, 02110.

Century Capital is responsible for managing the investment portfolio of each Fund, subject to the supervision of the Funds’ Board of Trustees. Century Shares Trust pays Century Capital a management fee which is payable monthly at the annual rate of 0.80% of the average net assets of the Fund. Century Small Cap Select Fund pays Century Capital a management fee which is payable monthly at the annual rate of 0.95% of the average net assets of the Fund. A discussion of the basis for the Board’s approval of the investment advisory agreements for each Fund appears in the annual report to shareholders for the fiscal period ended October 31, 2015.

Additional Information

The Trustees of the Trust oversee generally the operations of each Fund and the Trust. The Trust enters into contractual arrangements with various parties, including among others each Fund’s investment adviser, custodian, transfer agent, and accountants, who provide services to the Fund. Shareholders are not parties to any such contractual arrangements or intended beneficiaries of those contractual arrangements, and those contractual arrangements are not intended to create in any shareholder any right to enforce them directly against the service providers or to seek any remedy under them directly against the service providers.

This Prospectus provides information concerning the Trust and the Funds that you should consider in determining whether to purchase shares of a Fund. Neither this Prospectus, nor the related Statement of Additional Information, is intended, or should be read, to be or to give rise to an agreement or contract between the Trust or a Fund and any investor, or to give rise to any rights in any shareholder or other person other than any rights under federal or state law that may not be waived.

The Portfolio Managers

Alexander L. Thorndike and Kevin W. Callahan are primarily responsible for the day-to-day management of Century Shares Trust. Mr. Thorndike has been a portfolio manager for the Fund since joining the firm in 1999, and has more than 25 years of equity research and portfolio management experience. Mr. Callahan has been a portfolio manager for the Fund since joining Century Capital in 2001, and has more than 26 years of equity research and portfolio management experience.

Alexander L. Thorndike is primarily responsible for the day-to-day management of Century Small Cap Select Fund. Mr. Thorndike has been a portfolio manager for the Fund since joining the firm in 1999, and has more than 25 years of equity research and portfolio management experience.

The Statement of Additional Information provides additional information about the portfolio managers’ compensation, other accounts which they manage, and their ownership of securities in each Fund.

SHAREHOLDER INFORMATION

Pricing of Fund Shares

The price of each class of a Fund’s shares is based on its net asset value. The net asset value of each class of shares is determined once each day as of, except as noted below, the close of regular trading on the New York Stock Exchange (the “NYSE”) (normally 4:00 p.m., New York time) on each day that the NYSE opens for regular trading. Net asset value per share is computed by dividing the net assets allocated to each share class by the number of fund shares outstanding for that class. On holidays or other days (such as Good Friday) when the NYSE is closed, net asset value is not calculated, and the Fund does not transact purchase, exchange or redemption orders. The time as of which shares are priced and the time until which purchase and redemption orders are accepted for processing at the NAV calculated that day may be changed by a Fund in its discretion as permitted by applicable law or the U.S. Securities and Exchange Commission (the “SEC”).

To determine net asset value, each Fund typically values its securities at the last reported sale price or official closing price on the primary exchange or market on which they are traded, as reported by an independent pricing service. Certain short-term instruments are valued at amortized cost, unless particular circumstances dictate otherwise (for example, if the issuer’s creditworthiness has become impaired). If no sale price or official closing price is reported or the price does not accurately reflect fair value for a security, or if a security’s value has been materially affected by a significant event occurring after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), that security may be valued by another method approved by the Board of Trustees that is intended to reflect fair value. In such a case, the Fund’s value for a security is likely to be different from the last quoted market price. In addition, due to the subjective and variable nature of fair value pricing, it is possible that the value determined for a particular security may be materially different from the value realized upon the sale of the security.

To the extent a Fund has investments in securities that are primarily listed on foreign exchanges that trade on weekends or other days when the Fund does not price its shares, the net asset value of the Fund’s shares may change on days when you will not be able to purchase, exchange or redeem shares of the Fund.

Description of Share Classes

Century Shares Trust offers one class of shares: Institutional Shares.

Century Small Cap Select Fund offers two classes of shares: Investor Shares and Institutional Shares. The different classes represent investments in the same portfolio of securities, but the classes are subject to different expenses. Investor Shares have annual distribution or service (12b-1) fees up to a maximum of 0.25% of the Fund’s net assets attributable to Investor Shares. Institutional Shares do not have annual distribution and service fees. The share classes also have different minimum investment amounts, which are described below. Be sure to specify which class of shares you are purchasing on the application form.

Purchasing Fund Shares

Each Fund reserves the right to reduce or waive the minimum amount required to open or maintain an account or to add to an existing account.

Account Minimums for Investor Shares

| • | To open and maintain an account: $2,500. |

| • | To open and maintain an IRA or UGMA account: $1,000 with an automatic investment plan. |

| • | To add to an existing account: $50. |

Account Minimums for Institutional Shares

| • | To open and maintain an account: $100,000. |

| • | There is no minimum amount for subsequent investments. |

For investors purchasing Institutional Shares through financial intermediaries, institutions, or through an omnibus account, shareholder purchases may be aggregated to meet the minimum initial investment amount. The minimum initial investment amount may be reduced for certain financial intermediaries that aggregate purchases on behalf of clients. It does not apply to accounts of the Adviser, its affiliates and related persons, or any of their employees, or Trustees of the Funds.

How to Purchase Shares

To purchase shares directly from a Fund, you must complete and sign an application to purchase shares and deliver it with your payment as follows:

Regular Mail: Century Funds P.O. Box 588 Portland, ME 04112 | Overnight Mail or Hand Delivery: Century Funds c/o Atlantic Shareholder Services, LLC 3 Canal Plaza, Ground Floor Portland, ME 04101 |

The application can be downloaded from the Fund’s website (www.centuryfunds.com) or obtained by calling Atlantic Shareholder Services, LLC (the “Transfer Agent”) toll-free at 800-303-1928.

How to Pay for a Purchase

By Check. You should make your check payable to the appropriate Fund for the requested purchase amount. The Funds do not accept cash or cash equivalents, third party checks, checks drawn on banks outside the U.S., or other checks deemed to be high risk. If your purchase order for shares of a Fund is cancelled because your check does not clear, you will be responsible for any loss incurred by the Fund; existing shareholders may have shares redeemed from their account to reimburse any loss.

By Wire and Electronic Transfers. You may purchase shares by wire transfer. For wire transfer instructions, please call 800-303-1928.

By Systematic Investment Program. You may purchase additional shares of a Fund by having the investment amount automatically withdrawn from your bank account on a periodic basis. For more information and to receive the documentation required for this program, please call 800-303-1928.

Customer Identification and Verification

To help the government fight the funding of terrorism and money laundering activities, federal law requires each Fund to obtain, verify and record information that identifies each person who opens a Fund account. When you open an account, the Transfer Agent or your investment dealer will ask you for your name, address, date of birth and other identifying information. You also may be asked to produce a copy of your driver’s license and other identifying documents.

If you fail to provide the information requested, your application to open a new account will be rejected. Moreover, if the Transfer Agent or the investment dealer is unable to verify your identity based on information provided by you, they may take additional steps including, but not limited to, requesting additional information from you, closing your account, or reporting the matter to the appropriate federal authorities. If your account is closed for this reason, your shares may be automatically redeemed. If the Fund’s net asset value has decreased since your purchase, you will lose money as a result of this redemption.

Trade Date

Your purchase request will be completed and your shares will be purchased at the net asset value (NAV) per share next calculated after the Fund receives your application and investment in proper form. NAVs are calculated only on days that the NYSE opens for regular trading. If your purchase request is received on a business day after the Fund has determined its NAV for that day or on a nonbusiness day, the trade date for the purchase will be the next business day.

The Fund does not consider the U.S. Postal Service or other independent delivery services to be its agents. Therefore, deposits in the mail or with such services or receipt at the Fund’s post office box, for purchase orders or redemption requests, do not constitute receipt by the Fund or Transfer Agent. Because the price at which you purchase and redeem shares of a Fund is the next-determined NAV after your request is received in good order by the Fund (or its designated agent), any delivery or other delays that affect the time that the Fund receives your request in good order could cause your transaction to be processed using the Fund’s NAV on a day other than the day you expect.

Other Policies

Purchases through intermediaries. You may purchase shares of a Fund through authorized intermediaries, such as broker-dealers, fund supermarkets, financial advisors, or retirement plans. An intermediary may charge you a fee for its services, and it may have procedures or conditions for purchasing shares that differ from those described in this Prospectus. If you purchase shares through an intermediary, the intermediary is solely responsible for promptly transmitting purchase orders to the Fund.

If the intermediary is a designated agent of a Fund, your order will be priced at the NAV per share next determined after the intermediary accepts it. A purchase made through an intermediary that is not a designated agent of a Fund is made at the NAV per share next determined after the order is actually received by the Fund in proper form. To determine if an intermediary is an agent of the Fund, you must ask the intermediary.

Confirmations. If you purchase shares directly from a Fund, you will receive a confirmation of each transaction and quarterly account statements detailing all transactions completed during the prior quarter. Transactions made under certain periodic investment and withdrawal programs (including reinvestment plans) may be confirmed only on quarterly account statements. You should verify the accuracy of all transactions in your account as soon as you receive your confirmations and quarterly statements.

Rejected orders. The Funds reserve the right to reject all or part of any order to purchase Fund shares. In particular, a Fund may reject orders from investors whose trading practices are not considered to be consistent with the long-term investment objectives of the Fund.

Cancelled orders. If your order to purchase shares is accepted and processed, you may not cancel or revoke the purchase, but you may redeem the shares purchased.

Closed funds. A Fund may be closed to new investors, temporarily or permanently, without advance notice to investors.

Redeeming Fund Shares

By mail. You may redeem shares of a Fund by sending a written request for redemption to:

Regular Mail: Century Funds P.O. Box 588 Portland, ME 04112 | Overnight Mail or Hand Delivery: Century Funds c/o Atlantic Shareholder Services, LLC 3 Canal Plaza, Ground Floor Portland, ME 04101 |

In your written request, you must (1) indicate the number of shares or dollar amount to be redeemed, (2) provide your shareholder account number, and (3) have each record owner sign the request exactly as the shares are registered (e.g., a trustee or custodian must sign as such).

The Funds do not accept redemption requests sent via fax or email.

By telephone. You may redeem your shares by telephone if you have completed a telephone redemption authorization form or if you opened your account on or after February 28, 2011 and did not decline the telephone redemption privilege on the application. Shares may be redeemed by telephone in amounts up to $100,000. To redeem your shares by telephone, call 800-303-1928.

Signature guarantee requirement. In order to protect you and the Funds from fraud, you must submit a written redemption request with an original Medallion signature guarantee if:

| • | redemption proceeds exceed $100,000; |

| • | proceeds are not being paid to the owner of record; or |

| • | proceeds are being sent to an address other than the address of record or to an address of record that has been changed within the past 30 days. |

The signature guarantee must apply to the signature of each record owner of the account. The Funds will accept a signature guarantee from a U.S. bank, broker dealer, credit union (if authorized under state law), securities exchange or association, clearing agency, or savings association. A notary public cannot provide a signature guarantee.

Market Timing Policies and Procedures

Short-term and excessive trading of Fund shares may present risks to a Fund’s long-term shareholders, including potential dilution in the value of Fund shares, interference with the efficient management of the Fund’s portfolio, taxable gains to remaining shareholders and increased brokerage and administrative costs. These risks may be more pronounced for a Fund investing in securities that pose special valuation challenges (e.g., foreign securities), as certain investors may seek to make short-term trades as part of a strategy aimed at exploiting the use of “stale” or otherwise inaccurate prices for Fund portfolio holdings (e.g., “time zone arbitrage”).

The Funds discourage short-term and excessive trading and do not accommodate frequent purchases and redemptions of Fund shares by shareholders. The Funds’ Board of Trustees has adopted the following policies and procedures to address the risks associated with such practices: (i) the Funds may impose a redemption fee of 1.00% on Fund shares redeemed within 90 days after purchase (subject to certain exceptions, as described below under “Redemption Fee”); and (ii) the Funds reserve the right to reject purchase orders from investors whose trading practices are not considered to be consistent with the long-term investment objectives of the Fund. In addition, the Funds have adopted certain fair valuation practices intended to protect the Funds from efforts to exploit “stale” or otherwise inaccurate prices for portfolio holdings.

There are certain limitations on the Funds’ ability to detect and prevent short-term trading. In particular, the Funds may not have timely access to transaction information for investors who trade through financial intermediaries such as broker dealers and financial advisors or through retirement plans. Transactions for clients of financial intermediaries and transactions of retirement plan participants typically are aggregated and placed on an omnibus basis, and Fund shares are held in omnibus accounts. The Funds will use reasonable diligence to monitor the trading activity in such accounts and take appropriate corrective action if a pattern of short-term trading is detected; however, the Funds may be unable to compel financial intermediaries to apply the Funds’ short-term trading policy described above. The Funds reserve the right, in their sole discretion, to allow financial intermediaries to apply alternative short-term trading policies. You should review the disclosure provided by your financial intermediary or retirement plan administrator to determine whether any alternative short-term trading policies apply to your account.

Redemption Fee

If you redeem shares of a Fund within 90 days after purchase, the Fund may deduct a redemption fee from the proceeds payable to you. The redemption fee is 1.00% of the net asset value of the shares redeemed. This fee is retained by the Fund for the shareholders’ benefit in order to offset the brokerage commissions and other transaction costs associated with redemptions. If you purchased shares on different days, unless you instruct the Fund otherwise in writing, in determining whether a redemption fee is payable when shares are redeemed, the Fund will first redeem shares that are not subject to the fee and then will redeem other shares in the order in which you purchased them beginning with the shares you have held the longest. A Fund may, in the exercise of its sole discretion, waive its redemption fee in any case.

The redemption fee is not applicable to certain transactions, including the following: (i) shares redeemed for the sole purpose of using the redemption proceeds to purchase shares of another Fund; (ii) shares acquired as a result of reinvesting dividends or other distributions; (iii) shares held in an account of certain qualified retirement plans; or (iv) shares held in certain wrap fee accounts.

Payment for Redeemed Shares

Your redemption proceeds normally will be paid by check sent to you within seven days after your redemption request is received in good order. As an alternative, a Fund may, in the exercise of its sole discretion, make payment by wire transfer.

Each Fund will pay redemption proceeds in cash if, within any 90-day period, your redemptions do not exceed $250,000 or more than 1% of the Fund’s net asset value (whichever is less). However, each Fund reserves the right to make a “redemption-in-kind” payment in portfolio securities rather than cash if your redemptions exceed that amount. If the Fund makes an in-kind distribution, you could incur brokerage and transaction charges when converting the securities to cash, and the securities may increase or decrease in value until you sell them.

Trade Date

Redemption requests are processed at the net asset value (NAV) per share of a Fund next determined after the Fund (or, if applicable, a designated agent of the Fund) receives your request in good order, less any applicable redemption fee.

Other Policies

Shares purchased through intermediaries. If you purchased your shares through a financial intermediary, consult with your intermediary about redeeming your shares. Your intermediary may charge a fee for its services and have its own procedures for redeeming shares.

Documentation for certain accounts. Shares owned by corporations, trusts, partnerships, estates or other entities are subject to special rules regarding documentation required for redemption. Please call 800-303-1928 for specific instructions.

Share certificates. The Funds no longer issue share certificates; however, if you currently have shares in certificated form, you must include the share certificates properly endorsed or accompanied by a duly executed stock power when redeeming shares.

Possible redemption delays. As with all mutual funds, each Fund may suspend redemptions and defer payment for more than seven days during times when the NYSE is closed (other than on weekends or holidays), when trading on the NYSE is restricted, during any emergency making it impractical for the Fund to dispose of its securities or to fairly determine its net asset value, or during any other period permitted by the Securities and Exchange Commission for the protection of investors. Also, if you recently purchased shares by check and you wish to redeem those shares, the Fund may delay payment of the redemption proceeds until the check has cleared, which may take up to 15 days from the purchase date.

Cost basis reporting. If you purchased shares directly from a Fund, upon the redemption or exchange of your shares, the Fund generally will be required to provide you and the IRS with cost basis and certain other related tax information about the Fund shares you redeemed or exchanged. This cost basis reporting requirement is effective for shares purchased, including through dividend reinvestment, on or after January 1, 2012. Please contact a shareholder services representative, toll-free, at 800-303-1928 between 8:00 a.m. and 6:00 p.m. (Eastern time), Monday through Friday, for more information regarding available methods for cost basis reporting and how to select or change a particular method. Please consult your tax advisor to determine which available cost basis method is best for you.

Responsibility for fraud. The Funds and their agents will not be responsible for any losses resulting from unauthorized transactions provided that reasonable procedures to prevent fraudulent transactions have been followed. Procedures to reasonably assure that instructions are genuine include requesting verification of various pieces of personal and account information, recording telephone transactions, confirming transactions in writing, and restricting transmittal of redemption proceeds to preauthorized destinations.

Shareholder Accounts

Account service fees. The Funds bear the costs of maintaining their shareholders’ accounts; however, the Funds may charge you a fee to cover their additional costs if you request a duplicate confirmation statement of a transaction or a historical transcript of your account. The Funds reserve the right on 60 days’ prior written notice to impose charges to cover other administrative costs.

Low balances. If the value of your account falls below $500 for any reason, including market fluctuation, the Fund may ask you to increase your balance. If the account balance remains below $500, the Fund may close the account and send you the proceeds.

Lost shareholders. If correspondence sent to your address of record is returned as undeliverable on more than two occasions, the Transfer Agent will consider your account lost, unless the Transfer Agent determines your new address. When an account is lost, all distributions on the account will be reinvested in additional Fund shares. In addition, the amount of any outstanding checks (unpaid for six months or more) or checks that have been returned to the transfer agent will be reinvested at the then-current net asset value and the checks will be cancelled. Checks will not be reinvested into accounts with a zero balance.

Address changes. You may change the address on your account online by visiting www.centuryfunds.com, by calling 800-303-1928, or by sending a written notice to Century Funds, P.O. Box 588, Portland, ME 04112.

Dividends and Distributions

Each Fund intends to distribute all or substantially all of its net investment income and net realized capital gain (both net short-term and net long-term capital gains) annually, normally in December.

Capital gain distributions may be reduced if capital loss carryforwards are available. A Fund’s net asset value per share is reduced by the amount of any income dividends or capital gain distributions.

Your income dividends and capital gain distributions will be reinvested in additional shares of the relevant Fund unless you instruct otherwise.

Tax Consequences

The following discussion is a summary of some important U.S. federal tax considerations generally applicable to investments in the Funds by U.S. persons. Foreign persons should consult the Statement of Additional Information for information about U.S. federal income tax consequences to them. Your investment in a Fund might have other tax implications. Please consult your tax advisor about foreign, federal, state, local or other tax laws applicable to you.

The Funds have elected to be treated and intend to qualify each year as regulated investment companies. A regulated investment company is not subject to tax at the corporate level on income and gains from investments that are distributed to shareholders. A Fund’s failure to qualify as a regulated investment company would result in corporate level taxation, and consequently, a reduction in income available for distribution to shareholders.

For U.S. federal income tax purposes, distributions of net investment income are generally taxable to you as ordinary income. The tax rate on distributions of capital gains will be based on how long a Fund owned (or is deemed to have owned) the investments that generated them, rather than how long you have owned your shares in that Fund. In general, a Fund will recognize long-term capital gain or loss on investments it has owned (or is deemed to have owned) for more than one year, and short-term capital gain or loss on investments it has owned (or is deemed to have owned) for one year or less. Therefore, distributions of net capital gains (that is, the excess of net long-term capital gains over net short-term capital losses) that are properly reported by the Fund as capital gain dividends generally will be taxable to you as long-term capital gains includible in net capital gain and taxed to individuals at reduced rates.

Distributions of the excess of net short-term capital gains over net long-term capital losses generally will be taxable to you as ordinary income. Distributions of net investment income properly reported by a Fund as derived from “qualified dividend income” will be taxable to shareholders taxed as individuals at the reduced rates applicable to net capital gains provided holding period and other requirements are met at both the shareholder and Fund level.

A 3.8% Medicare contribution tax is imposed on the “net investment income” of individuals, estates and trusts to the extent their income exceeds certain threshold amounts. Net investment income generally includes for this purpose dividends paid by a Fund, including any capital gain dividends, and net gains recognized on the redemption or exchange of shares of a Fund. Shareholders are advised to consult their tax advisors regarding the possible implications of this additional tax on their investment in a Fund.

Distributions are taxable to you even if they are paid from income or gains earned by a Fund before your investment in the Fund (and thus were included in the price you paid for the Fund shares). A Fund may recognize capital gains that it, in turn, must distribute to you, even if it does not have net investment income to distribute and performance has been poor. Distributions are taxable whether you received them in cash or reinvest them in additional Fund shares. Any gains resulting from the sale or exchange of Fund shares generally will be taxable to you as long-term or short-term capital gains, depending on how long you have held the shares.

Distributions by a Fund to qualified retirement plans generally will not be taxable. However, if shares are held by a plan that ceases to qualify for tax-exempt treatment or by an individual who has received shares as a distribution from a retirement plan, the distributions generally will be taxable to the plan or individual. If you are considering purchasing shares with qualified retirement plan assets, you should consult your tax advisor for a more complete explanation of federal, state, local and (if applicable) foreign tax consequences of making such an investment.

When you redeem shares in a Fund, that Fund may elect to pay the redemption price, over a certain threshold amount, in kind. If the Fund elects to pay this portion of the redemption price by a distribution in kind of securities held by the Fund, you will be taxed on the difference between the fair market value of the assets you receive on redemption and your basis in the redeemed shares of the Fund.

The Form 1099 that is mailed to eligible taxpayers early every calendar year details your dividends and their federal tax category. Even though the Fund provides you with this information, you are responsible for verifying your tax liability with your tax advisor.

A Fund is required by federal law to withhold tax on any taxable distributions and sale proceeds paid to individual shareholders (including amounts paid to you in securities and amounts deemed to be paid to you upon an exchange of shares) if: you have not provided a correct taxpayer identification number (TIN) or have not certified to the Fund that withholding does not apply; the IRS has notified the Fund that the TIN listed on your account is incorrect according to its records; or the IRS informs the Fund that you are otherwise subject to backup withholding.

Income and gains derived from a Fund’s investments in or dispositions of foreign securities may be subject to foreign withholding or other taxes. Such taxes will reduce a Fund’s yield on those securities. The Funds do not expect to be eligible to elect to “pass through” such foreign taxes to shareholders.

Distribution Arrangements

Distribution and Service Fees

Century Small Cap Select Fund has adopted a Distribution and Service Plan (the “Plan”) pursuant to Rule 12b-1 under the Investment Company Act of 1940, as amended, with respect to its Investor Shares. Under the Plan, the Fund pays distribution and other fees in connection with the sale and distribution of its Investor Shares and for services provided to shareholders. Under the Plan, the Fund is authorized to expend up to 0.25% per annum of the Fund’s average daily net assets attributable to the Investor Shares. Because these fees are paid out of the Fund’s assets on an ongoing basis, over time, these fees will increase the cost of an investment in Investor Shares and may ultimately cost you more than other types of sales charges. The net income attributable to the Investor Shares will be reduced by the amount of the distribution and services fees attributable to that class of shares.

Payments to Third Parties by the Adviser

The Adviser may, out of its own resources and without additional cost to the Funds or their shareholders, provide compensation to certain financial intermediaries, such as broker-dealers and financial advisors, in connection with the sale of shares of a Fund or the provision of services to Fund shareholders. For example, such compensation may be paid to an intermediary for providing access to a third party platform, such as a mutual fund supermarket, or for providing services to shareholders who invest via such a platform. This compensation is in addition to any distribution and service fees paid by the Fund pursuant to a Rule 12b-1 Plan and any sub-transfer agency fees paid by the Fund.

FINANCIAL HIGHLIGHTS

The following financial highlights tables are intended to help you understand each Fund’s financial performance for the past five years. Certain information reflects financial results for a single Fund share. The total returns in the tables represent the rate that an investor would have earned (or lost) on an investment in the Fund (assuming reinvestment of all dividends and distributions). This information has been audited by Deloitte & Touche, LLP, an independent registered public accounting firm, whose report, along with each Fund’s financial statements and financial highlights are incorporated herein by reference and included in the Trust’s annual report, which is available upon request.

| CENTURY SHARES TRUST | Financial Highlights |

INSTITUTIONAL SHARES

For a share outstanding throughout the periods presented

| | | For the Year Ended October 31, |

| | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 |

NET ASSET VALUE, BEGINNING

OF PERIOD | | $ | 21.14 | | | $ | 24.78 | | | $ | 22.41 | | | $ | 19.81 | | | $ | 20.66 |

| | | | | | | | | | | | | | | | | | | | |

| INCOME/(LOSS) FROM OPERATIONS: | | | | | | | | | | | | | | | | | | | |

Net investment income/(loss)(a) | | | 0.03 | | | | 0.02 | | | | (0.02) | | | | 0.03 | | | | 0.05 |

| Net realized and unrealized gain/(loss) on investments | | | (0.50) | | | | 2.39 | | | | 3.72 | | | | 5.09 | | | | 1.28 |

Total income/(loss) from

investment operations | | | (0.47) | | | | 2.41 | | | | 3.70 | | | | 5.12 | | | | 1.33 |

| LESS DISTRIBUTIONS FROM: | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.04) | | | | – | | | | – | | | | (0.05) | | | | (0.06) |

Net realized gain on

investment transactions | | | (0.70) | | | | (6.05) | | | | (1.33) | | | | (2.47) | | | | (2.12) |

| Total distributions | | | (0.74) | | | | (6.05) | | | | (1.33) | | | | (2.52) | | | | (2.18) |

| REDEMPTION FEES | | | 0.00(b) | | | | 0.00(b) | | | | 0.00(b) | | | | 0.00(b) | | | | 0.00(b) |

| NET ASSET VALUE, END OF PERIOD | | $ | 19.93 | | | $ | 21.14 | | | $ | 24.78 | | | $ | 22.41 | | | $ | 19.81 |

| | | | | | | | | | | | | | | | | | | | |

| Total Return | | | (2.24%) | | | | 11.76% | | | | 17.29% | | | | 28.85% | | | | 7.63% |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000's) | | $ | 205,634 | | | $ | 225,360 | | | $ | 222,551 | | | $ | 201,271 | | | $ | 174,534 |

Ratio of expenses to average

net assets | | | 1.13% | | | | 1.11% | | | | 1.09% | | | | 1.11% | | | | 1.12% |

| Ratio of net investment income/(loss) to average net assets | | | 0.13% | | | | 0.12% | | | | (0.06%) | | | | 0.16% | | | | 0.24% |

| | | | | | | | | | | | | | | | | | | | |

| Portfolio Turnover Rate | | | 44% | | | | 46% | | | | 126% | | | | 39% | | | | 79% |

| a) | Per share numbers have been calculated using the average shares method. |

(b) | Less than $0.005 per share. |

| CENTURY SMALL CAP SELECT FUND | Financial Highlights |

INSTITUTIONAL SHARES

For a share outstanding throughout the periods presented

| | | For the Year Ended October 31, |

| | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 |

NET ASSET VALUE, BEGINNING

OF PERIOD | | $ | 30.00 | | | $ | 34.46 | | | $ | 33.94 | | | $ | 26.27 | | | $ | 23.91 |

| | | | | | | | | | | | | | | | | | | | |

| INCOME/(LOSS) FROM OPERATIONS: | | | | | | | | | | | | | | | | | | | |

Net investment loss(a) | | | (0.11) | | | | (0.17) | | | | (0.24) | | | | (0.04) | | | | (0.12) |

| Net realized and unrealized gain/(loss) on investments | | | (1.58) | | | | 0.87 | | | | 2.48 | | | | 7.71 | | | | 2.48 |

Total income/(loss) from

investment operations | | | (1.69) | | | | 0.70 | | | | 2.24 | | | | 7.67 | | | | 2.36 |

| LESS DISTRIBUTIONS FROM: | | | | | | | | | | | | | | | | | | | |

Net realized gain on

investment transactions | | | (6.35) | | | | (5.16) | | | | (1.72) | | | | – | | | | – |

| Total distributions | | | (6.35) | | | | (5.16) | | | | (1.72) | | | | – | | | | – |

| REDEMPTION FEES | | | 0.00(b) | | | | 0.00(b) | | | | 0.00(b) | | | | 0.00(b) | | | | 0.00(b) |

| NET ASSET VALUE, END OF PERIOD | | $ | 21.96 | | | $ | 30.00 | | | $ | 34.46 | | | $ | 33.94 | | | $ | 26.27 |

| | | | | | | | | | | | | | | | | | | | |

| Total Return | | | (6.53%) | | | | 2.48% | | | | 6.79% | | | | 29.20% | | | | 9.87% |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000's) | | $ | 88,182 | | | $ | 164,141 | | | $ | 266,045 | | | $ | 300,833 | | | $ | 281,480 |

Ratio of expenses to average

net assets | | | 1.16% | | | | 1.13% | | | | 1.11% | | | | 1.12% | | | | 1.10% |

| Ratio of net investment loss to average net assets | | | (0.47%) | | | | (0.52%) | | | | (0.71%) | | | | (0.14%) | | | | (0.48%) |

| | | | | | | | | | | | | | | | | | | | |

| Portfolio Turnover Rate | | | 82% | | | | 69% | | | | 97% | | | | 91% | | | | 53% |

| (a) | Per share numbers have been calculated using the average shares method. |

(b) | Less than $0.005 per share |

CENTURY SMALL CAP SELECT FUND

| INVESTOR SHARES | Financial Highlights |

For a share outstanding throughout the periods presented

| | | For the Year Ended October 31, |

| | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 |

NET ASSET VALUE, BEGINNING

OF PERIOD | | $ | 28.53 | | | $ | 33.12 | | | $ | 32.78 | | | $ | 25.45 | | | $ | 23.25 |

| | | | | | | | | | | | | | | | | | | | |

| INCOME/(LOSS) FROM OPERATIONS: | | | | | | | | | | | | | | | | | | | |

Net investment loss(a) | | | (0.17) | | | | (0.26) | | | | (0.33) | | | | (0.13) | | | | (0.21) |

| Net realized and unrealized gain/(loss) on investments | | | (1.48) | | | | 0.83 | | | | 2.39 | | | | 7.46 | | | | 2.41 |

Total income/(loss) from

investment operations | | | (1.65) | | | | 0.57 | | | | 2.06 | | | | 7.33 | | | | 2.20 |

| LESS DISTRIBUTIONS FROM: | | | | | | | | | | | | | | | | | | | |

Net realized gain on

investment transactions | | | (6.35) | | | | (5.16) | | | | (1.72) | | | | – | | | | – |

| Total distributions | | | (6.35) | | | | (5.16) | | | | (1.72) | | | | – | | | | – |

| REDEMPTION FEES | | | 0.00(b) | | | | 0.00(b) | | | | 0.00(b) | | | | 0.00(b) | | | | 0.00(b) |

| NET ASSET VALUE, END OF PERIOD | | $ | 20.53 | | | $ | 28.53 | | | $ | 33.12 | | | $ | 32.78 | | | $ | 25.45 |

| | | | | | | | | | | | | | | | | | | | |

| Total Return | | | (6.77%) | | | | 2.14% | | | | 6.47R | | | | 28.80R | | | | 9.46% |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000's) | | $ | 66,102 | | | $ | 100,720 | | | $ | 118,181 | | | $ | 128,029 | | | $ | 111,965 |

Ratio of expenses to average

net assets | | | 1.46% | | | | 1.42% | | | | 1.40R | | | | 1.41R | | | | 1.47% |

| Ratio of net investment loss to average net assets | | | (0.78%) | | | | (0.85%) | | | | (1.00%) | | | | (0.44%) | | | | (0.84%) |

| | | | | | | | | | | | | | | | | | | | |

| Portfolio Turnover Rate | | | 82% | | | | 69% | | | | 97% | | | | 91% | | | | 53% |

| (a) | Per share numbers have been calculated using the average shares method. |

(b) | Less than $0.005 per share. |

Intentionally Left Blank

PRIVACY POLICY

Century Capital Management and the Century Funds are committed to maintaining the confidentiality, integrity and security of your personal information and financial data. We consider this information to be private and held in confidence between you and Century. This is to inform you of our policies to protect the privacy of your non-public personal information.

Information We Collect

When you invest in the Century Funds, we collect certain non-public personal information about you, which we use to open and service your account and respond to your requests. This information includes your name, address, tax identification number, birth date, investment selection, beneficiary information and possibly personal bank account information. It also includes information about your transactions and account history, as well as information that we may receive from third parties, such as financial advisers, consumer reporting agencies, and consultants.

Disclosure Policy

We do not disclose non-public personal information about current or former shareholders or customers to any third parties except as necessary to process a transaction, service an account, or as otherwise permitted by law. For example, the Century Funds use a third party transfer agent who uses your information only to process or analyze transactions that you have requested. Our contracts with such parties contain provisions restricting their use of your non-public personal information to those purposes for which they were hired. We do not sell non-public personal information to anyone.

Confidentiality and Security

We restrict access to non-public personal information about you to those employees and service providers involved in administering or servicing your account or helping us meet our regulatory obligations. We maintain physical, electronic and procedural safeguards that comply with federal standards to protect your non-public personal information.

This Privacy Policy applies to Century Shares Trust and Century Small Cap Select Fund.

[This page is not part of the prospectus.]

HOW TO OBTAIN MORE INFORMATION

A Statement of Additional Information (“SAI”) for the Trust includes additional information about the Funds. The SAI is incorporated by reference into this Prospectus (which means it is legally part of this Prospectus). Additional information about the Funds’ investments is also available in the Funds’ annual and semi-annual reports to shareholders. The Funds’ most recent annual report provides a discussion of the market conditions and investment strategies that significantly affected the Funds’ performance during their last fiscal year.

The SAI and shareholder reports are available, without charge, upon request. To request copies of these documents or other information about the Funds, please direct inquiries to:

Century Funds

P.O. Box 588

Portland, ME 04112

800-303-1928

The SAI and shareholder reports are also available, without charge, on the Funds’ website: www.centuryfunds.com.

Shareholders can review and copy the Prospectus, SAI, reports and other information about the Funds at the Securities and Exchange Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling the Commission at 1-202-551-8090. Reports and other information about the Funds are available on the EDGAR Database on the Commission’s website at www.sec.gov. Copies of this information may be obtained, after paying a copying fee, by emailing a request to: publicinfo@sec.gov, or by writing the Commission’s Public Reference Section, Washington, D.C. 20549-1520.

Investment Company Act File Number 811-09561

Table of Contents - Prospectus