UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05038

Clearwater Investment Trust

(Exact name of registrant as specified in charter)

2000 Wells Fargo Place, 30 East 7th Street, Saint Paul, Minnesota 55101-4930

(Address of principal executive offices) (Zip code)

Jason K. Mitchell

Fiduciary Counselling, Inc.

2000 Wells Fargo Place, 30 E. 7th Street

Saint Paul, Minnesota 55101-4930

Copy to:

John V. O’Hanlon, Esq.

Dechert LLP

One International Place, 40th Floor

100 Oliver Street

Boston, Massachusetts 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code: 651-228-0935

Date of fiscal year end: December 31

Date of reporting period: June 30, 2021

Item 1. Reports to Stockholders

| (a) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1) |

CLEARWATER INVESTMENT TRUST

Clearwater Core Equity Fund

Clearwater Select Equity Fund

Clearwater Tax-Exempt Bond Fund

Clearwater International Fund

Semi-annual Report

for the period ended

June 30, 2021

Clearwater Investment Trust

Financial Statements

For the Six Months Ended June 30, 2021 (Unaudited)

Table of Contents

Fund Expense Example

(unaudited)

As a shareholder of the Clearwater Core Equity Fund (“Core Equity Fund”), Clearwater Select Equity Fund (“Select Equity Fund”), Clearwater Tax-Exempt Bond Fund (“Tax-Exempt Bond Fund”), and Clearwater International Fund (“International Fund” and together with the Core Equity Fund, Select Equity Fund and Tax-Exempt Bond Fund, the “Funds”), you incur costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. In addition to the ongoing costs which the Funds pay directly, you as a shareholder indirectly bear the expenses of any outside exchange traded funds or mutual funds in which the Funds invest. (These are also referred to as “acquired funds” and those indirect expenses represent the Funds’ pro rata portion of the cumulative expense charged by the acquired funds.)

The example provided is based on an investment of $1,000 invested at the beginning of the period and held for the six-month period ended June 30, 2021.

Actual Expenses

The first section of the table on the following page provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During the Period January 1, 2021 through June 30, 2021” to estimate the expenses attributable to your investment during this period.

Hypothetical Example for Comparison Purposes

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. Thus, you should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures are provided to enable you to compare the ongoing costs of investing in the Funds and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the second section of the table are meant to highlight your ongoing costs only. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you compare the relative total costs of the Funds to other mutual funds that charge transaction costs and/or sales charges or redemption fees.

| Actual returns | Beginning Account

Value January 1, 2021 | Ending Account Value

June 30, 2021 | Expenses Paid During the

Period January 1, 2021 through June 30, 2021* |

| Core Equity Fund | $1,000.00 | $1,163.70 | $1.63 |

| Select Equity Fund | $1,000.00 | $1,158.30 | $4.76 |

| Tax-Exempt Bond Fund | $1,000.00 | $1,026.30 | $1.46 |

| International Fund | $1,000.00 | $1,120.50 | $3.55 |

Hypothetical 5% return

(before expenses) | | | |

| Core Equity Fund | $1,000.00 | $1,023.28 | $1.53 |

| Select Equity Fund | $1,000.00 | $1,020.38 | $4.46 |

| Tax-Exempt Bond Fund | $1,000.00 | $1,023.36 | $1.45 |

| International Fund | $1,000.00 | $1,021.45 | $3.38 |

| * | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). Expense ratios for the most recent one-half year period may differ from expense ratios based on one-year data in the Financial Highlights. |

The annualized expense ratios (reflecting voluntary fee waivers in effect during the period) are as follows:

| | |

| Core Equity Fund | 0.30% |

| Select Equity Fund | 0.89% |

| Tax-Exempt Bond Fund | 0.29% |

| International Fund | 0.67% |

Quarterly Portfolio Schedule of Investments

The Funds file a complete schedule of their portfolio holdings as of the close of the first and third quarters of their fiscal years with the Securities and Exchange Commission (the “SEC”) on Form N-PORT. Shareholders may request portfolio holdings information free of charge by calling the Transfer Agent toll free at 1- 855-684-9144 or by sending a written request to: The Northern Trust Company, P.O. Box 4766, Chicago, IL 60680-4766 Attn: Clearwater Investment Trust Funds. These filings are also available on the SEC's Internet site at http://www.sec.gov.

Voting Proxies on Fund Portfolio Securities

The Funds have established Proxy Voting Policies and Procedures (“Policies”) that the Funds use to determine how to vote proxies relating to portfolio securities. They also report, on Form N-PX, how the Funds voted any such proxies during the most recent 12-month period ended June 30. Shareholders may request copies of the Policies or Form N-PX free of charge by calling Fiduciary Counselling, Inc. toll free at 1-888-228-0935 or by sending a written request to: Fiduciary Counselling, Inc., 30 East 7th Street, Suite 2000, St. Paul, MN 55101 Attn: Clearwater Investment Trust Funds. The Policies and Form N-PX are also available from the EDGAR database on the SEC's Internet site at http://www.sec.gov.

CLEARWATER INVESTMENT TRUST

Statements of Assets and Liabilities

June 30, 2021 (unaudited)

| | | Core Equity

Fund | | Select Equity

Fund | | Tax-Exempt

Bond Fund | | International

Fund |

| Assets | | | | | | | | |

| Investments in securities, at fair value (including securities on loan of: $0, $0, $0 and $6,093,749, respectively); (identified cost: $379,189,657, $458,001,592, $654,118,014 and $675,045,881, respectively) | $ | 789,829,958 | | 549,276,639 | | 689,201,866 | | 1,049,479,346 |

| Foreign currencies, at value (cost: $0, $0, $0 and $2,925,304, respectively) | | - | | - | | - | | 2,899,743 |

| Cash | | - | | - | | - | | 52,959 |

| Receivable for securities sold | | - | | 5,660,839 | | - | | 1,292,178 |

| Receivable for shares of beneficial interest sold | | 208,000 | | - | | - | | 122,700 |

| Accrued dividend and interest receivable | | 554,386 | | 242,463 | | 5,646,356 | | 1,355,295 |

| Foreign tax reclaim receivable | | 3,396 | | - | | - | | 1,380,804 |

| Unrealized appreciation on forward foreign currency exchange contracts | | - | | - | | - | | 48,688 |

| Total assets | | 790,595,740 | | 555,179,941 | | 694,848,222 | | 1,056,631,713 |

| Liabilities | | | | | | | | |

| Payables for investment securities purchased | | - | | 6,303,302 | | 6,045,851 | | 2,817,415 |

| Payable for fund shares redeemed | | - | | 533,281 | | 657,037 | | 56,188 |

| Accrued investment advisory fee | | 537,120 | | 1,119,786 | | 461,486 | | 1,617,110 |

| Payable for dividend distribution | | - | | - | | 174,427 | | - |

| Payable upon return of securities loaned | | - | | - | | - | | 6,400,482 |

| Deferred foreign capital gains taxes payable | | - | | - | | - | | 1,131,218 |

| Total liabilities | | 537,120 | | 7,956,369 | | 7,338,801 | | 12,022,413 |

| Net assets | $ | 790,058,620 | | 547,223,572 | | 687,509,421 | | 1,044,609,300 |

| Capital | | | | | | | | |

| Capital Stock and additional paid-in capital (authorized unlimited number of shares at no par value for each Fund: 12,319,280, 23,517,270, 67,280,985 and 46,246,125 shares outstanding, respectively) | $ | 364,160,654 | | 381,472,098 | | 656,159,472 | | 605,639,584 |

| Distributable earnings | | 425,897,966 | | 165,751,474 | | 31,349,949 | | 438,969,716 |

| Net assets | $ | 790,058,620 | | 547,223,572 | | 687,509,421 | | 1,044,609,300 |

| Net asset value per share of outstanding capital stock | $ | 64.13 | | 23.27 | | 10.22 | | 22.59 |

See accompanying notes to financial statements.

CLEARWATER INVESTMENT TRUST

Statements of Operations

for the six months ended June 30, 2021 (unaudited)

| | | Core Equity

Fund | | Select Equity

Fund | | Tax-Exempt

Bond Fund | | International

Fund |

| Investment income: | | | | | | | | |

| Income: | | | | | | | | |

| Dividends (net of foreign taxes withheld of $5,170, $2,867, $0 and $1,399,423, respectively) | $ | 5,050,815 | | 3,366,477 | | 880,046 | | 11,668,101 |

| Interest | | - | | - | | 11,480,155 | | 1,234 |

| Net income from securities loaned | | - | | 8,417 | | - | | 220,768 |

| Total income | | 5,050,815 | | 3,374,894 | | 12,360,201 | | 11,890,103 |

| Expenses: | | | | | | | | |

| Investment advisory fee | | 3,046,424 | | 3,390,867 | | 1,882,018 | | 4,632,690 |

| Other expenses | | - | | 185 | | 185 | | - |

| Total expenses | | 3,046,424 | | 3,391,052 | | 1,882,203 | | 4,632,690 |

| Less: waivers of investment advisory fee or other expense reimbursements | | (2,015,011) | | (1,156,657) | | (972,379) | | (1,506,593) |

| Net expenses | | 1,031,413 | | 2,234,395 | | 909,824 | | 3,126,097 |

| Net investment income | | 4,019,402 | | 1,140,499 | | 11,450,377 | | 8,764,006 |

| Net realized gain (loss) on: | | | | | | | | |

| Security transactions | | 26,732,201 | | 70,365,326 | | (172,878) | | 50,307,627 |

| Forward foreign currency exchange contracts | | - | | - | | - | | (185,815) |

| Foreign currency transactions | | - | | - | | - | | 19,951 |

| Net increase (decrease) in unrealized appreciation/depreciation on: | | | | | | | | |

| Security transactions (net of increase (decrease) in deferred foreign taxes of $0, $0, $0 and $(530,377), respectively) | | 71,776,226 | | (88,395) | | 5,162,435 | | 44,580,052 |

| Forward foreign currency exchange contracts | | - | | - | | - | | 245,836 |

| Translation of other assets and liabilities denominated in foreign currencies | | - | | - | | - | | (182,939) |

| Net gain (loss) on investments | | 98,508,427 | | 70,276,931 | | 4,989,557 | | 94,784,712 |

| Net increase (decrease) in net assets resulting from operations | $ | 102,527,829 | | 71,417,430 | | 16,439,934 | | 103,548,718 |

See accompanying notes to financial statements.

CLEARWATER INVESTMENT TRUST

Statements of Changes in Net Assets

for the six months ended June 30, 2021 (unaudited) and the year ended December 31, 2020

| | | Core Equity

Fund | | Select Equity

Fund |

| | | 06/30/2021 | | 12/31/2020 | | 06/30/2021 | | 12/31/2020 |

| Operations: | | | | | | | | |

| Net investment income | $ | 4,019,402 | | 7,797,355 | | 1,140,499 | | 2,445,660 |

| Net realized gain | | 26,732,201 | | 12,227,897 | | 70,365,326 | | 11,929,774 |

| Net increase (decrease) in unrealized appreciation/depreciation | | 71,776,226 | | 64,243,645 | | (88,395) | | 45,122,529 |

| Net increase in net assets resulting from operations | | 102,527,829 | | 84,268,897 | | 71,417,430 | | 59,497,963 |

| Distributions to shareholders | | - | | (10,529,448) | | - | | (9,407,511) |

| Capital share transactions: | | | | | | | | |

| Proceeds from shares sold | | 82,254,156 | | 63,017,560 | | 71,544,796 | | 50,471,692 |

| Reinvestment of distributions from net investment income and net realized gain | | - | | 10,528,034 | | - | | 9,377,725 |

| Payments for shares redeemed | | (11,707,768) | | (73,471,942) | | (51,712,965) | | (27,390,079) |

| Net increase in net assets from capital share transactions | | 70,546,388 | | 73,652 | | 19,831,831 | | 32,459,338 |

| Total increase in net assets | | 173,074,217 | | 73,813,101 | | 91,249,261 | | 82,549,790 |

| Net assets: | | | | | | | | |

| At the beginning of the period | | 616,984,403 | | 543,171,302 | | 455,974,311 | | 373,424,521 |

| At the end of the period | $ | 790,058,620 | | 616,984,403 | | 547,223,572 | | 455,974,311 |

| | | Tax-Exempt

Bond Fund | | International

Fund |

| | | 06/30/2021 | | 12/31/2020 | | 06/30/2021 | | 12/31/2020 |

| Operations: | | | | | | | | |

| Net investment income | $ | 11,450,377 | | 23,002,865 | | 8,764,006 | | 8,167,518 |

| Net realized gain (loss) | | (172,878) | | 385,724 | | 50,141,763 | | 17,480,415 |

| Net increase in unrealized appreciation/depreciation | | 5,162,435 | | 619,138 | | 44,642,949 | | 113,749,692 |

| Net increase in net assets resulting from operations | | 16,439,934 | | 24,007,727 | | 103,548,718 | | 139,397,625 |

| Distributions to shareholders | | (11,450,436) | | (24,360,229) | | - | | (16,448,467) |

| Capital share transactions: | | | | | | | | |

| Proceeds from shares sold | | 80,556,520 | | 40,880,400 | | 88,740,487 | | 42,915,665 |

| Reinvestment of distributions from net investment income and net realized gain | | 11,393,495 | | 24,589,531 | | - | | 16,448,468 |

| Payments for shares redeemed | | (26,268,960) | | (51,555,147) | | (15,464,137) | | (26,380,075) |

| Net increase in net assets from capital share transactions | | 65,681,055 | | 13,914,784 | | 73,276,350 | | 32,984,058 |

| Total increase in net assets | | 70,670,553 | | 13,562,282 | | 176,825,068 | | 155,933,216 |

| Net assets: | | | | | | | | |

| At the beginning of the period | | 616,838,868 | | 603,276,586 | | 867,784,232 | | 711,851,016 |

| At the end of the period | $ | 687,509,421 | | 616,838,868 | | 1,044,609,300 | | 867,784,232 |

See accompanying notes to financial statements.

CLEARWATER INVESTMENT TRUST

Financial Highlights

Per share data (rounded to the nearest cent) for a share of capital stock outstanding throughout the years or period ended and selected information for each year or period ended is as follows:

| | | | June 30,

2021

(Unaudited) | | Year ended December 31, |

Core Equity

Fund | | | | 2020 | | 2019 | | 2018 | | 2017 | | 2016 |

| Net asset value, beginning of period | | $ | 55.11 | | 48.14 | | 37.97 | | 43.21 | | 37.43 | | 35.57 |

| Income (loss) from investment operations: | | | | | | | | | | | | | |

| Net investment income | | | 0.33 | | 0.71 | | 0.72 | | 0.68 | | 0.64 | | 0.65 |

| Net realized and unrealized gains (losses) | | | 8.69 | | 7.22 | | 10.32 | | (3.46) | | 8.03 | | 3.27 |

| Total from investment operations | | | 9.02 | | 7.93 | | 11.04 | | (2.78) | | 8.67 | | 3.92 |

| Less distributions to shareholders from: | | | | | | | | | | | | | |

| Net investment income | | | - | | (0.71) | | (0.66) | | (0.67) | | (0.65) | | (0.49) |

| Net realized gain | | | - | | (0.25) | | (0.21) | | (1.79) | | (2.24) | | (1.57) |

| Total distributions to shareholders: | | | - | | (0.96) | | (0.87) | | (2.46) | | (2.89) | | (2.06) |

| Net asset value, end of period | | $ | 64.13 | | 55.11 | | 48.14 | | 37.97 | | 43.21 | | 37.43 |

| Total return (a) | | | 16.37 % | | 16.54 % | | 29.11 % | | (6.61)% | | 23.26 % | | 10.98 % |

| Net assets, end of period (000s omitted) | | $ | 790,059 | | 616,984 | | 543,171 | | 456,874 | | 538,392 | | 466,482 |

| Ratio of expenses, net of waivers, to average net assets (b), (c), (d), (e), (f), (g), (h), (i) | | | 0.30 % | | 0.31 % | | 0.35 % | | 0.38 % | | 0.39 % | | 0.43 % |

| Ratio of expenses, before waivers, to average net assets (b), (c), (d), (e), (f), (g), (h), (i) | | | 0.90 % | | 0.90 % | | 0.90 % | | 0.90 % | | 0.90 % | | 0.90 % |

| Ratio of net investment income (loss), net of waivers, to average net assets (c), (d), (e), (f), (g), (h), (i) | | | 1.19 % | | 1.49 % | | 1.54 % | | 1.47 % | | 1.51 % | | 1.63 % |

| Ratio of net investment income (loss), before waivers, to average net assets (c), (d), (e), (f), (g), (h), (i) | | | 0.59 % | | 0.90 % | | 0.99 % | | 0.95 % | | 1.00 % | | 1.16 % |

| Portfolio turnover rate (excluding short-term securities) | | | 12.85 % | | 37.16 % | | 33.73 % | | 34.64 % | | 31.13 % | | 44.11 % |

| | |

| (a) | Total return figures are based on the change in net asset value of a share during the period and assume reinvestment of distributions at net asset value. Total return is not annualized for periods of less than one year. |

| (b) | In addition to fees and expenses which the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any acquired funds in which it invests. Such indirect expenses are not included in the above reported expense ratios and are excluded from the voluntary waivers reflected above and described in the below footnotes. |

| (c) | Annualized for periods less than one year. |

| (d) | Effective April 1, 2021, the investment advisory fee, net of voluntary waivers, decreased to 0.30%. Also effective April 1, 2021, the Adviser increased the voluntary waiver to 0.60%. |

| (e) | Effective January 1, 2020, the investment advisory fee, net of voluntary waivers, decreased to 0.31%. Also effective January 1, 2020, the Adviser increased the voluntary waiver to 0.59%. |

| (f) | Effective December 12, 2018, the investment advisory fee, net of voluntary waivers, decreased to 0.35%. Also effective December 12, 2018, the Adviser increased the voluntary waiver to 0.55%. |

| (g) | Effective September 22, 2017, the investment advisory fee, net of voluntary waivers, increased to 0.38%. Also effective September 22, 2017, the Adviser decreased the voluntary waiver to 0.52%. |

| (h) | Effective March 16, 2017, the investment advisory fee, net of voluntary waivers, decreased to 0.37%. Also effective March 16, 2017, the Adviser increased the voluntary waiver to 0.53%. |

| (i) | Effective March 16, 2016, the investment advisory fee, net of voluntary waivers, increased to 0.44%. Also effective March 16, 2016, the Adviser decreased the voluntary waiver to 0.46%. |

See accompanying notes to financial statements.

CLEARWATER INVESTMENT TRUST

Financial Highlights

Per share data (rounded to the nearest cent) for a share of capital stock outstanding throughout the years or period ended and selected information for each year or period ended is as follows:

| | | | June 30,

2021

(Unaudited) | | Year ended December 31, |

Select Equity

Fund | | | | 2020 | | 2019 | | 2018 | | 2017 | | 2016 |

| Net asset value, beginning of period | | $ | 20.09 | | 18.45 | | 14.90 | | 18.92 | | 19.79 | | 17.18 |

| Income (loss) from investment operations: | | | | | | | | | | | | | |

| Net investment income | | | 0.05 | | 0.11 | | 0.14 | | 0.07 | | 0.02 | | 0.07 |

| Net realized and unrealized gains (losses) | | | 3.13 | | 1.95 | | 3.79 | | (2.37) | | 2.58 | | 3.30 |

| Total from investment operations | | | 3.18 | | 2.06 | | 3.93 | | (2.30) | | 2.60 | | 3.37 |

| Less distributions to shareholders from: | | | | | | | | | | | | | |

| Net investment income | | | - | | (0.11) | | (0.11) | | (0.07) | | (0.03) | | (0.05) |

| Net realized gain | | | - | | (0.31) | | (0.27) | | (1.65) | | (3.44) | | (0.71) |

| Total distributions to shareholders: | | | - | | (0.42) | | (0.38) | | (1.72) | | (3.47) | | (0.76) |

| Net asset value, end of period | | $ | 23.27 | | 20.09 | | 18.45 | | 14.90 | | 18.92 | | 19.79 |

| Total return (a) | | | 15.83 % | | 11.25 % | | 26.40 % | | (12.49)% | | 13.46 % | | 19.67 % |

| Net assets, end of period (000s omitted) | | $ | 547,224 | | 455,974 | | 373,425 | | 305,921 | | 369,720 | | 343,393 |

| Ratio of expenses, net of waivers, to average net assets (b), (c), (d), (e), (f), (g), (h), (i), (j) | | | 0.89 % | | 0.94 % | | 0.98 % | | 1.03 % | | 0.99 % | | 1.02 % |

| Ratio of expenses, before waivers, to average net assets (b), (c), (d), (e), (f), (g), (h), (i), (j) | | | 1.35 % | | 1.35 % | | 1.35 % | | 1.35 % | | 1.35 % | | 1.35 % |

| Ratio of net investment income (loss), net of waivers, to average net assets (c), (d), (e), (f), (g), (h), (i), (j) | | | 0.45 % | | 0.70 % | | 0.64 % | | 0.33 % | | 0.11 % | | 0.28 % |

| Ratio of net investment income (loss), before waivers, to average net assets (c), (d), (e), (f), (g), (h), (i), (j) | | | (0.01)% | | 0.29 % | | 0.27 % | | 0.01 % | | (0.25)% | | (0.05)% |

| Portfolio turnover rate (excluding short-term securities) | | | 54.54 % | | 102.30 % | | 64.32 % | | 63.08 % | | 113.85 % | | 78.82 % |

| | |

| (a) | Total return figures are based on the change in net asset value of a share during the period and assume reinvestment of distributions at net asset value. Total return is not annualized for periods of less than one year. |

| (b) | In addition to fees and expenses which the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any acquired funds in which it invests. Such indirect expenses are not included in the above reported expense ratios and are excluded from the voluntary waivers reflected above and described in the below footnotes. |

| (c) | Annualized for periods less than one year. |

| (d) | Effective April 1, 2021, the investment advisory fee, net of voluntary waivers, decreased to 0.87%. Also effective April 1, 2021, the Adviser increased the voluntary waiver to 0.48%. |

| (e) | Effective October 1, 2020, the investment advisory fee, net of voluntary waivers, decreased to 0.91%. Also effective October 1, 2020, the Adviser increased the voluntary waiver to 0.44%. |

| (f) | Effective January 1, 2020, the investment advisory fee, net of voluntary waivers, decreased to 0.95%. Also effective January 1, 2020, the Adviser increased the voluntary waiver to 0.40%. |

| (g) | Effective December 12, 2018, the investment advisory fee, net of voluntary waivers, decreased to 0.98%. Also effective December 12, 2018, the Adviser increased the voluntary waiver to 0.37%. |

| (h) | Effective September 22, 2017, the investment advisory fee, net of voluntary waivers, increased to 1.03%. Also effective September 22, 2017, the Adviser decreased the voluntary waiver to 0.32%. |

| (i) | Effective March 16, 2017, the investment advisory fee, net of voluntary waivers, decreased to 0.96%. Also effective March 16, 2017, the Adviser increased the voluntary waiver to 0.39%. |

| (j) | Effective March 16, 2016, the investment advisory fee, net of voluntary waivers, increased to 1.03%. Also effective March 16, 2016, the Adviser decreased the voluntary waiver to 0.32%. |

See accompanying notes to financial statements.

CLEARWATER INVESTMENT TRUST

Financial Highlights

Per share data (rounded to the nearest cent) for a share of capital stock outstanding throughout the years or period ended and selected information for each year or period ended is as follows:

| | | | June 30,

2021

(Unaudited) | | Year ended December 31, |

Tax-Exempt

Bond Fund | | | | 2020 | | 2019 | | 2018 | | 2017 | | 2016 |

| Net asset value, beginning of period | | $ | 10.14 | | 10.13 | | 9.82 | | 10.21 | | 9.93 | | 10.16 |

| Income (loss) from investment operations: | | | | | | | | | | | | | |

| Net investment income | | | 0.18 | | 0.39 | | 0.40 | | 0.42 | | 0.45 | | 0.46 |

| Net realized and unrealized gains (losses) | | | 0.08 | | 0.03 | | 0.34 | | (0.26) | | 0.38 | | (0.23) |

| Total from investment operations | | | 0.26 | | 0.42 | | 0.74 | | 0.16 | | 0.83 | | 0.23 |

| Less distributions to shareholders from: | | | | | | | | | | | | | |

| Net investment income | | | (0.18) | | (0.41) | | (0.43) | | (0.45) | | (0.49) | | (0.44) |

| Net realized gain | | | - | | - | | - | | (0.10) | | (0.06) | | (0.02) |

| Total distributions to shareholders: | | | (0.18) | | (0.41) | | (0.43) | | (0.55) | | (0.55) | | (0.46) |

| Net asset value, end of period | | $ | 10.22 | | 10.14 | | 10.13 | | 9.82 | | 10.21 | | 9.93 |

| Total return (a) | | | 2.63 % | | 4.26 % | | 7.69 % | | 1.59 % | | 8.54 % | | 2.28 % |

| Net assets, end of period (000s omitted) | | $ | 687,509 | | 616,839 | | 603,277 | | 529,485 | | 525,156 | | 484,856 |

| Ratio of expenses, net of waivers, to average net assets (b), (c), (d), (e) | | | 0.29 % | | 0.29 % | | 0.32 % | | 0.34 % | | 0.34 % | | 0.34 % |

| Ratio of expenses, before waivers, to average net assets (b), (c), (d), (e) | | | 0.60 % | | 0.60 % | | 0.60 % | | 0.60 % | | 0.60 % | | 0.60 % |

| Ratio of net investment income (loss), net of waivers, to average net assets (c), (d), (e) | | | 3.65 % | | 3.85 % | | 4.05 % | | 4.22 % | | 4.35 % | | 4.54 % |

| Ratio of net investment income (loss), before waivers, to average net assets (c), (d), (e) | | | 3.34 % | | 3.54 % | | 3.77 % | | 3.96 % | | 4.09 % | | 4.28 % |

| Portfolio turnover rate (excluding short-term securities) | | | 5.82 % | | 17.21 % | | 12.53 % | | 11.36 % | | 13.28 % | | 13.48 % |

| | |

| (a) | Total return figures are based on the change in net asset value of a share during the period and assume reinvestment of distributions at net asset value. Total return is not annualized for periods of less than one year. |

| (b) | In addition to fees and expenses which the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any acquired funds in which it invests. Such indirect expenses are not included in the above reported expense ratios and are excluded from the voluntary waivers reflected above and described in the below footnotes. |

| (c) | Annualized for periods less than one year. |

| (d) | Effective January 1, 2020, the investment advisory fee, net of voluntary waivers, decreased to 0.29%. Also effective January 1, 2020, the Adviser increased the voluntary waiver to 0.31%. |

| (e) | Effective December 12, 2018, the investment advisory fee, net of voluntary waivers, decreased to 0.32%. Also effective December 12, 2018, the Adviser increased the voluntary waiver to 0.28%. |

See accompanying notes to financial statements.

CLEARWATER INVESTMENT TRUST

Financial Highlights

Per share data (rounded to the nearest cent) for a share of capital stock outstanding throughout the years or period ended and selected information for each year or period ended is as follows:

| | | | June 30,

2021

(Unaudited) | | Year ended December 31, |

International

Fund | | | | 2020 | | 2019 | | 2018 | | 2017 | | 2016 |

| Net asset value, beginning of period | | $ | 20.16 | | 17.28 | | 14.08 | | 17.23 | | 14.04 | | 14.02 |

| Income (loss) from investment operations: | | | | | | | | | | | | | |

| Net investment income | | | 0.19 | | 0.20 | | 0.29 | | 0.30 | | 0.27 | | 0.27 |

| Net realized and unrealized gains (losses) | | | 2.24 | | 3.07 | | 3.43 | | (2.70) | | 3.44 | | 0.02 |

| Total from investment operations | | | 2.43 | | 3.27 | | 3.72 | | (2.40) | | 3.71 | | 0.29 |

| Less distributions to shareholders from: | | | | | | | | | | | | | |

| Net investment income | | | - | | (0.17) | | (0.30) | | (0.29) | | (0.30) | | (0.27) |

| Net realized gain | | | - | | (0.22) | | (0.22) | | (0.46) | | (0.22) | | - (a) |

| Total distributions to shareholders: | | | - | | (0.39) | | (0.52) | | (0.75) | | (0.52) | | (0.27) |

| Net asset value, end of period | | $ | 22.59 | | 20.16 | | 17.28 | | 14.08 | | 17.23 | | 14.04 |

| Total return (b) | | | 12.05 % | | 19.02 % | | 26.47 % | | (14.01)% | | 26.54 % | | 2.09 % |

| Net assets, end of period (000s omitted) | | $ | 1,044,609 | | 867,784 | | 711,851 | | 524,708 | | 624,642 | | 508,999 |

| Ratio of expenses, net of waivers, to average net assets (c), (d), (e), (f), (g), (h), (i), (j) | | | 0.67 % | | 0.66 % | | 0.68 % | | 0.68 % | | 0.67 % | | 0.70 % |

| Ratio of expenses, before waivers, to average net assets (c), (d), (e), (f), (g), (h), (i), (j) | | | 1.00 % | | 1.00 % | | 1.00 % | | 1.00 % | | 1.00 % | | 1.00 % |

| Ratio of net investment income (loss), net of waivers, to average net assets (d), (e), (f), (g), (h), (i), (j) | | | 1.90 % | | 1.17 % | | 1.88 % | | 1.79 % | | 1.67 % | | 1.90 % |

| Ratio of net investment income (loss), before waivers, to average net assets (d), (e), (f), (g), (h), (i), (j) | | | 1.57 % | | 0.83 % | | 1.56 % | | 1.47 % | | 1.34 % | | 1.60 % |

| Portfolio turnover rate (excluding short-term securities) | | | 19.52 % | | 39.61 % | | 49.69 % | | 19.57 % | | 36.17 % | | 37.21 % |

| | |

| (a) | Per share amounts from distributions paid from net realized gain were less than $0.01 per share. |

| (b) | Total return figures are based on the change in net asset value of a share during the period and assume reinvestment of distributions at net asset value. Total return is not annualized for periods of less than one year. |

| (c) | In addition to fees and expenses which the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any acquired funds in which it invests. Such indirect expenses are not included in the above reported expense ratios and are excluded from the voluntary waivers reflected above and described in the below footnotes. |

| (d) | Annualized for periods less than one year. |

| (e) | Effective April 1, 2021, the investment advisory fee, net of voluntary waivers, decreased to 0.67%. Also effective April 1, 2021, the Adviser increased the voluntary waiver to 0.33%. |

| (f) | Effective October 1, 2020, the investment advisory fee, net of voluntary waivers, increased to 0.68%. Also effective October 1, 2020, the Adviser decreased the voluntary waiver to 0.32%. |

| (g) | Effective January 1, 2020, the investment advisory fee, net of voluntary waivers, decreased to 0.65%. Also effective January 1, 2020, the Adviser increased the voluntary waiver to 0.35%. |

| (h) | Effective September 22, 2017, the investment advisory fee, net of voluntary waivers, increased to 0.68%. Also effective September 22, 2017, the Adviser decreased the voluntary waiver to 0.32%. |

| (i) | Effective March 16, 2017, the investment advisory fee, net of voluntary waivers, decreased to 0.65%. Also effective March 16, 2017, the Adviser increased the voluntary waiver to 0.35%. |

| (j) | Effective March 16, 2016, the investment advisory fee, net of voluntary waivers, increased to 0.70%. Also effective March 16, 2016, the Adviser decreased the voluntary waiver to 0.30%. |

See accompanying notes to financial statements.

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements (unaudited)

June 30, 2021

(1) Organization

Clearwater Investment Trust (the “Trust”) was established on January 12, 1987 as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a diversified open end management investment company and presently includes four series: Clearwater Core Equity Fund (“Core Equity Fund”), Clearwater Select Equity Fund ("Select Equity Fund"), Clearwater Tax-Exempt Bond Fund (“Tax-Exempt Bond Fund”), and Clearwater International Fund (“International Fund” and together with the Core Equity Fund, Select Equity Fund and Tax-Exempt Bond Fund, the “Funds”). Clearwater Management Co., Inc. (the “Adviser”) serves as the investment adviser for each of the Funds and is responsible for the oversight of each of the Fund’s subadvisers. The Trust’s declaration of trust permits the Board of Trustees to create additional funds in the future. The investment objective of the Core Equity, Select Equity, and International Funds is long-term capital growth. The investment objective of the Tax-Exempt Bond Fund is high current income that is exempt from United States (“U.S.”) federal income tax, consistent with preservation of capital.

Fiduciary Counselling, Inc. (“FCI”) acts as subadviser to each of the Funds. FCI does not provide day-to-day management, but provides the Funds with various investment-related services, including investment strategy advice, manager recommendations and related duties as requested by the Adviser. FCI also provides certain services related to due diligence, performance reporting, compliance, and other administrative functions, which support the investment management services and subadviser oversight services provided to the Funds by the Adviser.

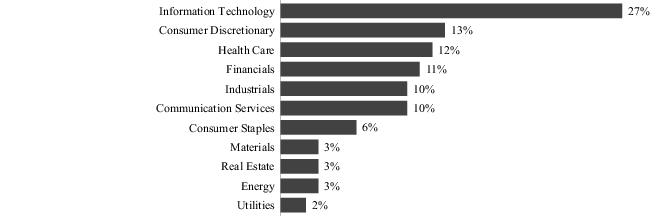

The Northern Trust Company serves as the custodian, administrator, accounting services agent and transfer agent for the Trust.

Under normal market conditions, the Core Equity Fund pursues its investment objective by investing at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in equity securities of U.S. companies. The equity securities in which the Fund primarily invests are common and preferred stocks. The Fund employs a multi-style (growth and value) and multi-manager approach whereby portions of the Fund are allocated to different subadvisers who employ distinct investment styles. The Fund’s Adviser allocates portions of the Fund’s assets among subadvisers. The Fund currently allocates assets among the following subadvisers who provide day-to-day management for the Fund: Parametric Portfolio Associates LLC (“Parametric”), AQR Capital Management, LLC (“AQR”), and O’Shaughnessy Asset Management, LLC (“OSAM”). The allocation among subadvisers will vary over time, but the current intent of the Fund’s Adviser is that under normal market conditions approximately 40% to 60% of the Fund’s total assets will be allocated to Parametric; the remaining assets will be allocated to one or more of the Fund’s two other subadvisers that provide day-to-day management. Parametric manages its portion of the Fund’s assets using a passive management strategy to seek investment results that track, before fees and expenses, the investment results of the Russell 1000® Index as closely as possible without requiring the Fund to realize taxable gains. In addition, as noted above, FCI also acts as a subadviser to the Fund but does not provide day-to-day management.

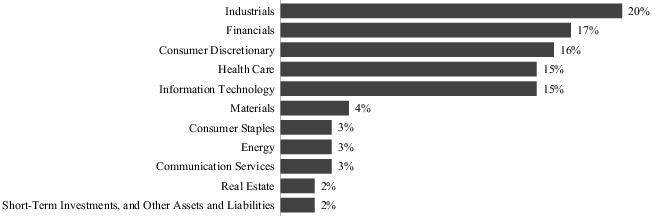

Under normal market conditions, the Select Equity Fund invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in equity securities. Equity securities in which the Fund invests consist primarily of exchange-traded common and preferred stocks. The Fund may also invest in a type of equity security called a convertible security to reduce volatility or correlation risk in the portfolio. A convertible security generally entitles the holder to receive interest paid or accrued on debt securities or the dividend paid on preferred stock until the convertible security matures or is redeemed, converted or exchanged. While the Fund is permitted to invest in

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements (unaudited)

June 30, 2021

securities of any market capitalization, the Fund invests primarily in securities of micro-, small- and medium-sized companies. The Fund may obtain exposure to equity securities through investment in exchange-traded funds and other investment companies. The Fund uses a “multi-style, multi-manager” approach. The Fund’s Adviser allocates portions of the Fund’s assets among subadvisers who employ distinct investment styles. The Fund currently allocates assets among the following subadvisers who provide day-to-day management for the Fund: Cooke & Bieler, L.P. (“Cooke & Bieler”), Jackson Square Partners, LLC (“Jackson Square”), Parametric and Pzena Investment Management LLC (“Pzena”). The allocation among subadvisers will vary over time, but the current intent of the Fund’s adviser is that under normal market conditions approximately 25% of the Fund’s assets will be allocated to Parametric and the remaining assets will be allocated to one or more of the Fund’s three other subadvisers that provide day-to-day management of the Fund. The percentage of the Fund’s assets allocated to Parametric will change from time to time in the discretion of CMC and could be higher or lower in the future. Parametric manages its portion of the Fund’s assets using a passive management strategy to seek investment results that track, before fees and expenses, the investment results of the S&P SmallCap 600® Index as closely as possible without requiring the Fund to realize taxable gains. FCI also acts as a subadviser to the Fund but does not provide day-to-day management. Effective June 11, 2021, the Trust terminated the subadvisory agreement with Kennedy Capital Management, Inc., one of the subadvisers to the Select Equity Fund.

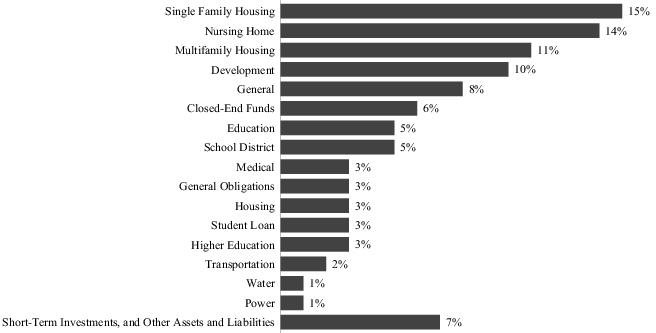

Under normal market conditions, the Tax-Exempt Bond Fund invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in tax-exempt bonds, which are debt obligations issued by or for the U.S. states, territories and possessions and the District of Columbia. The interest on these bonds is generally exempt from both U.S. regular federal income tax and U.S. federal alternative minimum tax. However, the Fund may invest up to 20% of its net assets in bonds that generate interest income subject to federal alternative minimum tax for individuals. The Fund invests in both revenue bonds, which are backed by and payable only from the revenues derived from a specific facility or specific revenue source, and in general obligation bonds, which are secured by the full faith, credit and taxation power of the issuing municipality. The Fund currently has one subadviser that provides day-to-day management for the Fund, Sit Fixed Income Advisors II, LLC (“Sit”). FCI also acts as a subadviser to the Fund but does not provide day-to-day management.

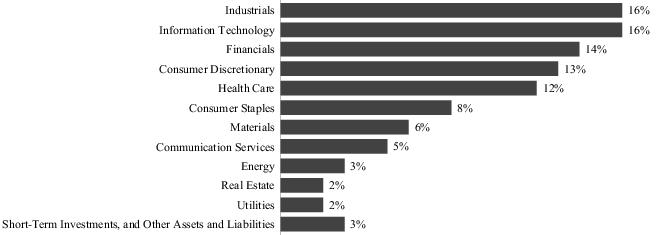

Under normal market conditions, the International Fund intends to invest at least 80% of the value of its net assets, plus the amount of any borrowings for investment purposes, in equity securities of companies organized or located outside the United States and doing a substantial amount of business outside the United States. Equity securities in which the Fund invests include common and preferred stock, sponsored and unsponsored American Depositary Receipts, European Depositary Receipts, Global Depositary Receipts, exchange-traded funds, and other investment companies. The Fund diversifies its investments among a number of different countries throughout the world, and may invest in companies of any size. The Fund does not intend to invest more than 20% of its net assets in the equity securities of developing or emerging market issuers (including frontier market issuers). In order to hedge against adverse movements in currency exchange rates, the Fund may enter into foreign currency exchange contracts. The Fund may use options, futures contracts, and options on futures contracts to attempt to manage market or business risks. The Fund does not intend to invest in foreign currency exchange contracts, options, futures contracts, or options on futures contracts for speculative purposes. The Fund uses a “multi-style, multi-manager” approach. The Fund’s assets are allocated to different subadvisers who employ distinct investment styles. The Fund currently allocates assets among the following subadvisers who provide day-to-day management for the Fund: Parametric, Artisan Partners Limited Partnership (“Artisan Partners”), WCM Investment Management, LLC (“WCM”) and LSV Asset Management (“LSV”). The allocation among subadvisers will vary over time, but the current intent of the Fund’s Adviser is that under normal market conditions approximately 30% of the Fund’s assets will be allocated to Parametric, and the remaining assets will be allocated to one or more of the Fund’s

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements (unaudited)

June 30, 2021

three other subadvisers that provide day-to-day management of the Fund. Parametric manages its portion of the Fund’s assets using a passive management strategy to seek investment results that track, before fees and expenses, the investment results of the MSCI World Ex U.S.A. Index - Net Dividends as closely as possible without requiring the Fund to realize taxable gains. FCI also acts as a subadviser to the Fund but does not provide day-to-day management.

(2) Summary of Significant Accounting Policies

The Funds are investment companies and follow accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies.”

The significant accounting policies followed by the Funds are as follows:

(a) Investments in Securities

Investments in U.S. and foreign equity securities are valued at the last sales price or the regular trading session closing price on the principal exchange or market where they are traded. Foreign security values are stated in U.S. dollars. Equity securities which have not traded on the date of valuation or securities for which sales prices are not generally reported are valued at the mean between the last bid and asked prices. Debt securities are valued on the basis of evaluated prices provided by independent pricing services when such prices are believed to reflect the fair value of such securities or broker provided prices. Such prices may be determined by taking into account other similar securities’ prices, yields, maturities, call features, ratings, prepayment speeds, credit risks, cash flows, institutional size trading in similar groups of securities and developments related to specific securities. Shares of open end investment companies are valued at their daily net asset value (“NAV”). Shares of closed-end funds and exchange traded funds are valued at the last sales price or the regular trading session closing price on the principal exchange or market where they are traded.

Securities for which no market quotations are readily available (including those for which trading has been suspended), or when the Adviser becomes aware that a significant event impacting the value of a security or group of securities has occurred after the closing of the exchange on which the security or securities principally trade, but before the calculation of the NAV, are valued at fair value as determined in good faith using procedures established by the Board of Trustees. This may occur particularly with respect to certain foreign securities held by the International Fund, whereby the Board of Trustees may use adjustment factors obtained from an independent evaluation service that are intended to reflect more accurately the fair value of these foreign securities as of the time the Fund’s NAV is calculated. The procedures consider, among others, the following factors to determine a security’s fair value: the nature and pricing history (if any) of the security; whether any dealer quotations for the security are available; and possible valuation methodologies that could be used to determine the fair value of the security. These procedures are used by the Valuation Committee, in accordance with the procedures established by the Board of Trustees, to determine the fair value of the security or securities. Such determinations are then submitted for review and ratification by the Board of Trustees. The use of fair valuation involves the risk that the values used by the Funds to price their investments may be higher or lower than the values used by other unaffiliated investment companies and investors to price the same investments.

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements (unaudited)

June 30, 2021

Security transactions are accounted for on the trade date, which is the date the securities are purchased or sold. Realized gains and losses are calculated on an identified cost basis. Dividend income is recognized on the ex-dividend date or, for foreign securities, as soon as the information is available. Interest income, is recognized on an accrual basis and includes amortization of premiums and accretion of discounts using the effective yield method.

(b) Foreign Currency Translation

The International Fund invests in securities which are purchased and sold in foreign currencies as a principal investment strategy. The costs of purchases, proceeds from sales of investments, interest and dividend income are translated into U.S. dollars using the spot market rate of exchange prevailing on the respective dates of such transactions. The value of the International Fund’s net assets, as measured in U.S. dollars, may be affected favorably or unfavorably by changes in foreign currency exchange rates and exchange control regulations. The gains or losses, if any, on investments resulting from changes in foreign exchange rates are recorded within net realized gain (loss) on security transactions and within net increase (decrease) in unrealized appreciation/depreciation on security transactions on the Statements of Operations. The realized gains or losses, if any, on translation of other assets and liabilities denominated in foreign currencies are recorded within net realized gain (loss) on foreign currency transactions on the Statements of Operations. The International Fund also will incur costs in converting U.S. dollars to local currencies, and vice versa. Risks may arise upon investing in foreign securities including, but not limited to, political, social or economic instability in the country of the issuer, the difficulty of predicting international trade patterns, the possibility of the imposition of exchange controls, expropriation, limits on removal of currency or other assets, nationalization of assets, foreign withholding and income tax and possible delays in the settlement of foreign stock exchange transactions. The principal markets on which these securities trade may have less volume and liquidity, and may be more volatile, than securities markets in the U.S.

(c) Forward Foreign Currency Exchange Contracts

The International Fund enters into forward foreign currency exchange contracts for the purchase or sale of a specific foreign currency at a fixed price on a future date as a hedge against adverse movements in foreign currency exchange rates, specific transactions or the portfolio position. The objective of the International Fund’s foreign currency hedging transactions is to reduce the risk that the U.S. dollar value of the International Fund’s foreign currency denominated securities will decline in value due to changes in foreign currency exchange rates. Forward foreign currency exchange contracts are marked-to-market daily at the applicable exchange rates. Any resulting unrealized gains or losses are recorded on forward foreign currency exchange contracts within net increase (decrease) in unrealized appreciation/depreciation on the Statements of Operations. The International Fund records any realized gains or losses at the time the forward foreign currency exchange contract is offset by entering into a closing transaction with the same counterparty or is extinguished by delivery of the currency. Realized gains or losses, if any, are recorded within Net realized gain (loss) on forward foreign currency exchange contracts on the Statements of Operations. Risks may arise upon entering into forward foreign currency exchange contracts from the potential of the counterparty to default on its obligations under the contract and from unanticipated movements in the value of a foreign currency relative to the U.S. dollar. The contractual amounts of forward foreign currency exchange contracts do not necessarily represent the amounts potentially subject to risk. The measurement of risks associated with these instruments is meaningful only when all related and offsetting transactions are considered. The International Fund bears the market risk from changes in foreign currency exchange rates and the credit risk if the issuer fails to perform. Additional information on derivative instruments and how these positions may impact the financial statements is found in Note 8, Derivative Instruments.

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements (unaudited)

June 30, 2021

(d) Spot Contracts

The International Fund routinely enters into spot contracts in order to buy or sell a certain amount of foreign currency at the current market rate. The International Fund may enter into spot contracts in order to make payments, or to receive payments, based on investment trading activity in a foreign currency. A spot contract allows the International Fund to buy or sell foreign currency on the day it chooses to deal. From time to time, the Core Equity Fund may also enter into spot contracts in order to make or receive payments due to investment trading activity in a foreign currency on a non-U.S. exchange. Spot contracts are marked-to-market daily at the applicable exchange rates. Any resulting unrealized gains or losses are recorded in translation of other assets and liabilities denominated in foreign currencies within net increase (decrease) in unrealized appreciation/depreciation on the Statements of Operations. Unrealized gains or losses on outstanding spot contracts are recorded in payables for investment securities purchased or receivable for securities sold, respectively, on the Statements of Assets and Liabilities. The Funds record any realized gains or losses at the time the spot contract settles. Realized gains or losses, if any, are included within Net realized gain (loss) on foreign currency transactions on the Statements of Operations. Risks may arise upon entering into spot contracts from unanticipated movements in the value of a foreign currency relative to the U.S. dollar in a short period of time. The Funds bear the market risk from changes in foreign currency exchange rates.

(e) Master Limited Partnerships

The International Fund invests in Master Limited Partnerships (“MLPs”). The benefits derived from the Fund's investments in MLPs are largely dependent on the MLPs being treated as partnerships for federal income tax purposes. If any of the MLPs held by the Fund were treated as corporations for U.S. federal income tax purposes, the after-tax return to the Fund with respect to its investments in such MLPs would be materially reduced, causing a decline in the value of the common stock. The Fund must include its allocable share of an MLP’s taxable income in its reportable taxable income, whether or not it receives a distribution in cash from the MLP. In such case, the Fund may have to liquidate securities to make required distributions to shareholders.

(f) Delayed Delivery Transactions and When-Issued Securities

Certain Funds may engage in securities transactions on a when-issued or delayed-delivery basis. In these transactions, the securities’ prices and yields are fixed on the date of the commitment, with payment and delivery scheduled for a future date. During this period, the securities are subject to market fluctuations. When delayed-delivery purchases are outstanding, a Fund will segregate liquid assets on its records in amounts sufficient to meet the purchase price. A Fund may dispose of or renegotiate a delayed-delivery transaction, which may result in a capital gain or loss.

(g) Short-Term Investments

The Core Equity, Select Equity, Tax-Exempt Bond, and International Funds currently invest in Institutional Shares of the U.S. Government Select Portfolio, a money market portfolio of Northern Institutional Funds, an investment company advised by Northern Trust Investments, Inc. The U.S. Government Select Portfolio primarily invests in securities issued by the U.S. government, government agencies, and government-sponsored enterprises.

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements (unaudited)

June 30, 2021

(h) Recoverable Taxes

The balances disclosed as foreign tax reclaim receivable, if any, represent net amounts withheld by foreign governments on dividend income earned in the respective countries subject to reclaims. All reclaims are paid directly to the applicable Funds.

(i) Federal Taxes

The Trust’s policy is to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies. On a calendar-year basis, the Funds intend to distribute substantially all of their net investment income and net realized gains, if any, to avoid the payment of federal income and excise taxes. Therefore, no income tax provision is required. Each Fund is treated as a separate entity for federal income tax purposes.

The Funds may be subject to taxes imposed by countries in which they invest. Such taxes are generally based on income and/or capital gains earned. Taxes are accrued based on net investment income, net realized gains and net unrealized appreciation as such income and/or gains are recorded. Taxes accrued on unrealized gains are reflected as a liability on the Statements of Assets and Liabilities under the caption deferred foreign capital gains taxes payable and as a reduction in net increase (decrease) in unrealized appreciation/depreciation on security transactions on the Statements of Operations. When assets subject to capital gains tax are sold, accrued taxes are relieved, and the actual amount of the taxes paid is reflected on the Statements of Operations as a reduction in net realized gain (loss) on security transactions.

Management has analyzed the Funds’ tax positions taken on federal tax returns for all open tax years and has concluded that as of December 31, 2020, no provision for income tax is required in the Funds’ financial statements. The Funds’ federal and state income and federal excise tax returns for the 2017, 2018, 2019 and 2020 tax years for which the applicable statutes of limitations have not expired remain subject to examination by the Internal Revenue Service and state departments of revenue. Net investment income and net realized gain (loss) for the Funds may differ for financial statement and tax purposes. The character of distributions made during the year from net investment income or net realized gains, if any, may differ from their ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the year that the income or realized gain was recorded by the Funds. The Trust has analyzed the Funds’ tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions. Further, the Trust is not aware of any tax positions for which it is reasonably possible that

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements (unaudited)

June 30, 2021

the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The tax character of distributions by the Funds during the years ended December 31, 2020 and 2019 was as follows:

| | | | |

| | Tax-Exempt | | Ordinary Income* |

| | 2020 | | 2019 | | 2020 | | 2019 |

| Core Equity Fund | $ — | | $ — | | $ 7,801,407 | | $ 7,398,837 |

| Select Equity Fund | — | | — | | 2,530,143 | | 2,265,820 |

| Tax-Exempt Bond Fund | 24,459,185 | | 23,538,099 | | 131,738 | | 426,352 |

| International Fund | — | | — | | 8,365,704 | | 12,139,749 |

| | | | | | | | |

| | |

| | Long-Term Capital Gains** |

| | 2020 | | 2019 |

| Core Equity Fund | $ 2,728,041 | | $ 2,349,736 |

| Select Equity Fund | 6,877,368 | | 5,292,066 |

| Tax-Exempt Bond Fund | — | | — |

| International Fund | 8,082,763 | | 8,846,708 |

| | | | |

| * | In addition to the ordinary income distributions, during 2020 the following Funds utilized equalization accounting for tax purposes whereby a portion of redemption payments were treated as distributions of ordinary income in the following amounts: |

| | |

| Core Equity Fund | $ 57,748 |

| Select Equity Fund | $ 90,250 |

| International Fund | $ 52,163 |

| | |

| | |

| ** | In addition to the long-term capital gain distributions, during 2020 the following Funds utilized equalization accounting for tax purposes whereby a portion of redemption payments were treated as distributions of long-term capital gains in the following amounts: |

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements (unaudited)

June 30, 2021

| | |

| Select Equity Fund | $ 6,194 |

| International Fund | $ 114,539 |

| | |

| | |

As of December 31, 2020, the components of distributable earnings on a tax basis were as follows:

| | Core

Equity Fund | | Select Equity Fund | | Tax-Exempt

Bond Fund | | International

Fund |

| Undistributed ordinary income | $ 32,283 | | $ 4,795,617 | | $ — | | $ 3,645,841 |

| Undistributed tax-exempt income | — | | — | | 262,478 | | — |

| Undistributed capital gain | — | | 329,131 | | — | | 8,005,605 |

| Accumulated capital losses and other | (14,476,359) | | — | | (3,697,492) | | — |

| Unrealized appreciation/depreciation | 337,814,213 | | 89,209,296 | | 29,795,465 | | 323,769,552 |

| Total | $ 323,370,137 | | $ 94,334,044 | | $ 26,360,451 | | $ 335,420,998 |

Distributions to shareholders are determined in accordance with federal income tax regulations, which may differ from such amounts recorded in accordance with U.S. generally accepted accounting principles ("U.S. GAAP") for financial reporting purposes. Accordingly, the Funds may make reclassifications among certain of their capital accounts in order to reflect the tax treatment for certain permanent differences that exist between federal income tax regulations and U.S. GAAP. These reclassifications are reported in order to reflect the tax treatment for certain permanent differences that exist between income tax regulations and U.S. GAAP. The primary reasons for permanent differences are the Funds use of equalization accounting whereby a portion of redemption payments were treated as distributions and realized gains on in-kind redemptions that are not recognized for tax purposes. These reclassifications have no impact on the total net assets or the NAV per share of the Funds. At December 31, 2020, reclassifications have been recorded among the following capital accounts on the Statements of Assets and Liabilities:

| | Core

Equity Fund | | Select Equity Fund | | Tax-Exempt

Bond Fund | | International

Fund |

| Distributable earnings | $ (27,521,488) | | $ (2,857,696) | | $ 56,579 | | $ (166,702) |

| Additional paid-in capital | 27,521,488 | | 2,857,696 | | (56,579) | | 166,702 |

(j) Distributions to Shareholders

Distributions to shareholders from net investment income, if any, are declared annually for the Core Equity, Select Equity, and International Funds and declared daily, payable monthly, for the Tax-Exempt Bond Fund. Distributions to shareholders from net realized gains, if any, are declared annually for all Funds. Distributions are paid in cash or reinvested in additional shares at the direction of the shareholders. During the year ended December 31, 2020, the Core Equity, Select Equity and International Funds utilized equalization accounting with respect to distributions to shareholders, in order to keep remaining shareholders’ interest in undistributed income from being affected.

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements (unaudited)

June 30, 2021

(k) Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increase and decrease in net assets from operations during the period. Actual results could differ from those estimates.

(l) Indemnification

Under each Fund’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to each Fund. In addition, certain of each Fund’s contracts with its service providers contain general indemnification clauses. Each Fund’s maximum exposure under these arrangements is unknown since the amount of any future claims that may be made against each Fund cannot be determined and each Fund has no historical basis for predicting the likelihood of any such claims. The Funds believe that the likelihood of any such claims is remote.

(3) Fair Value Measurements

Fair value is an estimate of the price the Funds would receive upon selling a security in a timely transaction to an independent buyer in the principal or most advantageous market for the security. This guidance establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Various inputs are used in determining the value of the Funds’ investments, as described in Note 2(a). These inputs are summarized in the three broad levels listed below.

| • | Level 1 – Unadjusted quoted market prices in active markets for identical securities on the measurement date. |

| • | Level 2 – Other significant observable inputs including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc. or quoted prices for identical or similar assets in markets that are not active. Inputs that are derived principally from or corroborated by observable market data are also considered Level 2 measurement. An adjustment to any observable input that is significant to the fair value may render the measurement a Level 3 measurement. |

| • | Level 3 – Valuations based on unobservable inputs, which may include the Adviser’s own assumptions in determining the fair value of an investment. |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities and other financial instruments, if any. The following is a summary of the inputs used in valuing each Fund’s investments and other financial instruments, if any, which are carried at fair value, as of June 30, 2021.

| | Core Equity Fund (a) |

| | Level 1 | Level 2 | Level 3 | Total |

| Common Stocks | $ 786,637,678 | $ — | $ — | $ 786,637,678 |

| Preferred Stocks | 38,428 | — | — | 38,428 |

| Short-Term Investments | 3,153,852 | — | — | 3,153,852 |

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements (unaudited)

June 30, 2021

| | Core Equity Fund (a) |

| | Level 1 | Level 2 | Level 3 | Total |

| Total | $ 789,829,958 | $ — | $ — | $ 789,829,958 |

(a) For the Core Equity Fund, the investment value is comprised of equity securities and short-term investments. See the Fund’s Schedule of Investments for industry classification. Investments in equity and short-term securities generally are valued at the last sales price or the regular trading session closing price on the principal exchange or market where they are traded. Investments in rights generally are determined by taking into account the terms of the rights as well as the value of the underlying equity securities, which are determined by the valuation methodology described above.

| | Select Equity Fund (b) |

| | Level 1 | Level 2 | Level 3 | Total |

| Common Stocks | $ 538,830,386 | $ — | $ — | $ 538,830,386 |

| Convertible Preferred Stocks | 365,824 | — | — | 365,824 |

| Master Limited Partnerships | 306,313 | — | — | 306,313 |

| Rights | — | — | —* | —* |

| Warrants | — | — | —* | —* |

| Short-Term Investments | 9,774,116 | — | — | 9,774,116 |

| Total | $ 549,276,639 | $ — | $ —* | $ 549,276,639 |

| * Security has been deemed worthless and is a Level 3 investment. |

(b) For the Select Equity Fund, the investment value is comprised of equity securities, convertible bonds, master limited partnerships, rights, warrants and short-term investments. See the Fund’s Schedule of Investments for industry classification. Investments in equity and short-term securities generally are valued at the last sales price or the regular trading session closing price on the principal exchange or market where they are traded.

There were no significant Level 3 valuations at June 30, 2021.

| | Tax-Exempt Bond Fund (c) |

| | Level 1 | Level 2 | Level 3 | Total |

| Closed-End Funds | $ 42,064,834 | $ — | $ — | $ 42,064,834 |

| Municipal Bonds | | | | |

| Alabama | — | 1,563,017 | — | 1,563,017 |

| Alaska | — | 14,438 | — | 14,438 |

| Arizona | — | 17,470,521 | — | 17,470,521 |

| Arkansas | — | 1,584,119 | — | 1,584,119 |

| California | — | 46,685,397 | — | 46,685,397 |

| Colorado | — | 37,422,960 | — | 37,422,960 |

| Connecticut | — | 9,353,011 | — | 9,353,011 |

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements (unaudited)

June 30, 2021

| | Tax-Exempt Bond Fund (c) |

| | Level 1 | Level 2 | Level 3 | Total |

| District of Columbia | $ — | $ 5,724,308 | $ — | $ 5,724,308 |

| Florida | — | 84,941,433 | — | 84,941,433 |

| Georgia | — | 17,651,993 | — | 17,651,993 |

| Idaho | — | 2,011,314 | — | 2,011,314 |

| Illinois | — | 33,219,461 | — | 33,219,461 |

| Indiana | — | 10,410,910 | — | 10,410,910 |

| Iowa | — | 2,289,549 | — | 2,289,549 |

| Kansas | — | 2,128,547 | — | 2,128,547 |

| Kentucky | — | 461,993 | — | 461,993 |

| Louisiana | — | 11,512,722 | — | 11,512,722 |

| Maine | — | 2,742,223 | — | 2,742,223 |

| Maryland | — | 5,275,379 | — | 5,275,379 |

| Massachusetts | — | 20,478,328 | — | 20,478,328 |

| Michigan | — | 20,027,023 | — | 20,027,023 |

| Minnesota | — | 4,309,236 | — | 4,309,236 |

| Mississippi | — | 1,130,780 | — | 1,130,780 |

| Missouri | — | 7,481,621 | — | 7,481,621 |

| Montana | — | 3,653,255 | — | 3,653,255 |

| Nebraska | — | 620,767 | — | 620,767 |

| Nevada | — | 4,028,244 | — | 4,028,244 |

| New Hampshire | — | 4,208,800 | — | 4,208,800 |

| New Jersey | — | 13,593,264 | — | 13,593,264 |

| New Mexico | — | 7,575,461 | — | 7,575,461 |

| New York | — | 44,269,278 | — | 44,269,278 |

| North Carolina | — | 5,872,507 | — | 5,872,507 |

| North Dakota | — | 4,159,470 | — | 4,159,470 |

| Ohio | — | 14,732,651 | — | 14,732,651 |

| Oklahoma | — | 3,341,493 | — | 3,341,493 |

| Oregon | — | 12,587,323 | — | 12,587,323 |

| Pennsylvania | — | 16,743,428 | — | 16,743,428 |

| Puerto Rico | — | 1,548,287 | — | 1,548,287 |

| Rhode Island | — | 2,076,955 | — | 2,076,955 |

| South Carolina | — | 8,071,644 | — | 8,071,644 |

| South Dakota | — | 501,615 | — | 501,615 |

| Tennessee | — | 10,022,761 | — | 10,022,761 |

| Texas | — | 43,748,536 | — | 43,748,536 |

| Utah | — | 1,842,171 | — | 1,842,171 |

| Vermont | — | 946,948 | — | 946,948 |

| Virginia | — | 2,754,617 | — | 2,754,617 |

| Washington | — | 18,488,271 | — | 18,488,271 |

| West Virginia | — | 3,609,601 | — | 3,609,601 |

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements (unaudited)

June 30, 2021

| | Tax-Exempt Bond Fund (c) |

| | Level 1 | Level 2 | Level 3 | Total |

| Wisconsin | $ — | $ 23,273,727 | $ — | $ 23,273,727 |

| Wyoming | — | 2,002,496 | — | 2,002,496 |

| Short-Term Investments | 46,973,179 | — | — | 46,973,179 |

| Total | $ 89,038,013 | $ 600,163,853 | $ — | $ 689,201,866 |

(c) For the Tax-Exempt Bond Fund, the investment value is comprised of closed-end funds, municipal bonds, and short-term investments. Investments in closed-end funds and short-term securities generally are valued at the last sales price or the regular trading session closing price on the principal exchange or market where they are traded. Investments in municipal bonds generally are based on valuations using adjusted evaluated prices provided by the primary pricing provider. The Board of Trustees has delegated to the Valuation Committee the responsibility to determine in good faith the fair value of securities for which no price quotation is available from an approved pricing service or broker-dealer at the time the Tax-Exempt Bond Fund’s NAV is calculated, including securities for which the prices do not represent fair value or for which a significant event occurs that materially affects the value of the security after the close of the market on which the security principally trades and before the time the Tax-Exempt Bond Fund’s NAV is calculated.

| | International Fund (d) |

| | Level 1 | Level 2 | Level 3 | Total |

| Common Stocks | | | | |

| Australia | $ 40,127,748 | $ — | $ —* | $ 40,127,748 |

| France | 69,848,817 | — | 667,227 | 70,516,044 |

| Thailand | — | 493,831 | — | 493,831 |

| All other countries | 888,720,723 | — | — | 888,720,723 |

| Convertible Bonds | — | 86,413 | — | 86,413 |

| Preferred Stocks | 9,476,833 | — | — | 9,476,833 |

| Warrants | 2,221,501 | — | — | 2,221,501 |

| Short-Term Investments | 37,836,253 | — | — | 37,836,253 |

| Total | $1,048,231,875 | $ 580,244 | $ 667,227 | $1,049,479,346 |

| * Security has been deemed worthless and is a Level 3 investment. |

(d) For the International Fund, the investment value is comprised of equity securities, warrants, convertible bonds and short-term investments. See the Fund’s Schedule of Investments for additional information on industry sector and currency concentration information. Investments in equity and short-term securities generally are valued at the last sales price or the regular trading session closing price on the principal exchange or market where they are traded.

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements (unaudited)

June 30, 2021

There were no significant Level 3 valuations for which significant unobservable inputs were used at June 30, 2021.

International Fund

Other Financial Instruments | | Level 1 | Level 2 | Level 3 | Total |

| Assets | | | | | |

| Forward foreign currency exchange contracts | | $ — | $ 48,688 | $ — | $ 48,688 |

The forward foreign currency exchange contracts outstanding at June 30, 2021 are considered Level 2 investments due to the contracts being marked-to-market daily at the applicable exchange rates that have been adjusted from the initial quoted rate. Forward foreign currency exchange contracts are shown on a gross basis in the above table and on the Statements of Assets and Liabilities.

(4) Investment Security Transactions

The cost of purchases and proceeds from sales of securities (excluding short-term securities) for the period ended June 30, 2021, were as follows:

| | Purchases | | Sales |

| Core Equity Fund | $ 162,404,765 | | $ 86,713,270 |

| Select Equity Fund | 290,411,341 | | 265,397,912 |

| Tax-Exempt Bond Fund | 76,350,132 | | 35,333,345 |

| International Fund | 253,714,798 | | 174,053,172 |

| | | | |

| | | | |

The difference between book basis and tax basis net unrealized appreciation (depreciation) is attributable primarily to the tax deferral of losses on wash sales, deferral of post-October currency and capital losses for tax purposes, and the recharacterization of income recognition on investments in passive foreign investment companies.

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements (unaudited)

June 30, 2021

At June 30, 2021, for federal income tax purposes, gross unrealized appreciation, gross unrealized depreciation, net unrealized appreciation (depreciation) on investments (including the effects of foreign currency translation and derivative instruments, if any) and the cost basis of investments (including derivative instruments, if any) were as follows:

| Funds | | Unrealized

Appreciation | | Unrealized

Depreciation | | Net

Appreciation

(Depreciation) | | Cost Basis of

Investments |

| Core Equity Fund | | $ 410,563,958 | | $ (942,833) | | $ 409,621,125 | | $ 380,208,833 |

| Select Equity Fund | | 96,428,211 | | (6,600,719) | | 89,827,492 | | 459,449,147 |

| Tax-Exempt Bond Fund | | 46,056,717 | | (11,098,817) | | 34,957,900 | | 654,243,966 |

| International Fund | | 382,761,250 | | (12,832,862) | | 369,928,388 | | 679,599,646 |

| | | | | | | | | |

| | | | | | | | | |

(5) Capital Share Transactions

Transactions in capital shares for the six months ended June 30, 2021 and the fiscal year ended December 31, 2020 were as follows:

| | Core Equity Fund | | Select Equity Fund |

| | 2021 | | 2020 | | 2021 | | 2020 |

| Sold | 1,317,923 | | 1,356,005 | | 3,097,131 | | 3,565,994 |

| Issued for reinvestment of distributions | — | | 196,822 | | — | | 482,393 |

| Redeemed | (193,647) | | (1,641,622) | | (2,279,227) | | (1,589,669) |

| Net Increase (decrease) | 1,124,276 | | (88,795) | | 817,904 | | 2,458,718 |

| | Tax-Exempt Bond Fund | | International Fund |

| | 2021 | | 2020 | | 2021 | | 2020 |

| Sold | 7,906,514 | | 4,046,480 | | 3,933,515 | | 2,607,637 |

| Issued for reinvestment of distributions | 1,123,253 | | 2,463,261 | | — | | 848,734 |

| Redeemed | (2,598,900) | | (5,188,108) | | (722,882) | | (1,622,611) |

| Net Increase (decrease) | 6,430,867 | | 1,321,633 | | 3,210,633 | | 1,833,760 |

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements (unaudited)

June 30, 2021

(6) Capital Loss Carryforward

At December 31, 2020, the Funds had the following short term capital loss carry-forwards and long term capital loss carry forwards available to offset future net capital gains which do not expire. Future utilization of the capital loss carry-forward may be limited.

| | Short-Term | Long-Term | Late-year

Gain/Loss | Total |

| Core Equity Fund | $ 14,476,359 | $ — | $ — | $ 14,476,359 |

| Tax-Exempt Bond Fund | 2,245,374 | 1,334,632 | — | 3,580,006 |

(7) Expenses and Related-Party Transactions

The Trust has a contract for investment advisory services with the Adviser. Under terms of separate agreements, Core Equity Fund, Select Equity Fund, Tax-Exempt Bond Fund and International Fund each pay an investment advisory fee equal to an annual rate of 0.90%, 1.35%, 0.60% and 1.00%, respectively, of each Fund’s average daily net assets. Management fees are calculated and accrued daily, and are paid quarterly. The Adviser is responsible for the payment or reimbursement of all the Funds’ expenses, except brokerage, taxes, interest, and extraordinary expenses. The Adviser has periodically modified its management fee for each of the Funds through voluntary waivers. For the period ending June 30, 2021, voluntary waivers on management fees were as follows:

| | Management Fees Voluntary Waivers |

| | Voluntary Waivers %

Prior to

April 1, 2021 | | Voluntary Waivers %

Effective

April 1, 2021 |

| Core Equity Fund | (0.59) | | (0.60) |

| Select Equity Fund | (0.44) | | (0.48) |

| Tax-Exempt Bond Fund | (0.31) | | (0.31) |

| International Fund | (0.32) | | (0.33) |

The Adviser has periodically modified its management fee for each of the Funds through voluntary waivers. Effective January 1, 2020, the net management fee actually paid for the Tax-Exempt Bond Fund due to the Adviser’s modification of the voluntary waivers for the Fund was 0.29%. Effective April 1, 2021, the net management fees actually paid for the Core Equity Fund, Select Equity Fund and International Fund due to the Adviser’s modification of the voluntary waivers for those Funds were 0.30%, 0.87% and 0.67%, respectively.

The Adviser currently intends to continue these voluntary waivers indefinitely. However, the Adviser may terminate these voluntary arrangements at any time.

In addition to fees and expenses which the Funds bear directly, the Funds indirectly bear a pro rata share of the fees and expenses of any acquired funds in which they invest, such as short-term investments in mutual funds or other investment companies and investments in closed-end funds. Such indirect expenses are not included in any of the reported expense ratios and are excluded from the voluntary waivers described above.

CLEARWATER INVESTMENT TRUST

Notes to Financial Statements (unaudited)

June 30, 2021

The Adviser has entered into subadvisory contracts with independent investment advisory firms for each Fund to provide daily investment management services. The subadvisory fees are based on each subadviser’s proportional net assets it currently manages within each Fund and are paid directly by the Adviser.