Sovereign Bank, N.A. 4Q11 Investor Update April 2012

2 2 Disclaimer Banco Santander, S.A. (“Santander”), Santander Holdings USA, Inc. (“SHUSA”), Sovereign Bank, N.A.(“Sovereign”), and Santander Consumer USA, Inc. (“SCUSA”) caution that this presentation contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements are found in various places throughout this presentation and include, without limitation, statements concerning our future business development and economic performance. While these forward-looking statements represent our judgment and future expectations concerning the development of our business, a number of risks, uncertainties, and other important factors could cause actual developments and results to different materially from our expectations. These factors include, but are not limited to: (1) general market, macro-economic, governmental, and regulatory trends; (2) movements in local and international securities markets, currency exchange rates, and interest rates; (3) competitive pressures; (4) technological developments; and (5) changes in the financial position or credit worthiness of our customers, obligors, and counterparties. The risk factors and other key factors that we have indicated in our past and future filings and reports, including our Annual Report on Form 10-K for the year ended December 31, 2011 and other filings and reports with the Securities and Exchange Commission of the United States of America (the “SEC”), could adversely affect our business and financial performance. Other unknown and unpredictable factors could cause actual results to differ materially from those in the forward- looking statements. The information contained in this presentation is not complete. It is subject to, and must be read in conjunction with, all other publicly available information, including reports filed with or furnished to the SEC, press releases, and other relevant information. Because this information is intended only to assist investors, it does not constitute investment advice or an offer to invest or to provide management services. It is subject to correction, completion, and amendment without notice. It is not our intention to state, indicate, or imply in any manner that current or past results are indicative of future results or expectations. As with all investments, there are associated risks, and you could lose money investing. Prior to making any investment, a prospective investor should consult with its own investment, accounting, legal, and tax advisers to evaluate independently the risks, consequences, and suitability of that investment. The information in this presentation is not intended to constitute “research” as that term is defined by applicable regulations. Nothing in this presentation constitutes investment, legal, accounting, or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances, or otherwise constitutes a personal recommendation to you. Recipients of this presentation should obtain advice based on their own individual circumstances from their own tax, financial, legal, and other advisers before making an investment decision, and only make such decisions on the basis of the investor’s own objectives, experience, and resources. In making this presentation available, Santander, SHUSA, Sovereign, and SCUSA give no advice and make no recommendation to buy, sell, or otherwise deal in shares or other securities of Santander, SHUSA, Sovereign, or SCUSA, or in any other securities or investments whatsoever. No offering of Securities shall be made in the United States except pursuant to registration under the U.S. Securities Act of 1933, as amended, or an exemption there from. Nothing contained in this presentation is intended to constitute an invitation or inducement to engage in investment activity for the purposes of the prohibition on financial promotion in the U.K. Financial Services and Markets Act 2000. In this presentation, we will sometimes refer to certain non-GAAP figures or financial ratios to help illustrate certain concepts. These ratios, each of which is defined in this document, include Pre-Tax Pre-Provision Income, the Tangible Common Equity to Tangible Assets Ratio, and the Texas Ratio. This information supplements our results as reported in accordance with GAAP and should not be viewed in isolation from, or as a substitute for, our GAAP results. We believe that this additional information and the reconciliations we provide may be useful to investors, analysts, regulators and others as they evaluate the impact of these respective items on our results for the periods presented due to the extent to which the items are not indicative of our ongoing operations. Where applicable, we provide GAAP reconciliations for such additional information. Note: Nothing in this presentation should be construed as a profit forecast. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding performance. Information, opinions, and estimates contained in this presentation reflect a judgment at its original date of publication by Santander, SHUSA, Sovereign, and SCUSA and are subject to change without notice. Santander, SHUSA, Sovereign, and SCUSA have no obligation to update, modify, or amend this presentation or to otherwise notify a recipient thereof in the event that any information, opinion, or estimate set forth herein changes or subsequently becomes inaccurate. This presentation is provided for information purposes only. The numbers and financial statements included in this presentation represent the results of Sovereign Bank, N.A.– a subsidiary of Santander Holdings, USA .

3 3 Sovereign Bank, N.A. - Credit Review Sovereign Bank, N.A. - Overview Sovereign Bank, N.A. – 4Q11 Results Sovereign Bank, N.A. - Capital Agenda

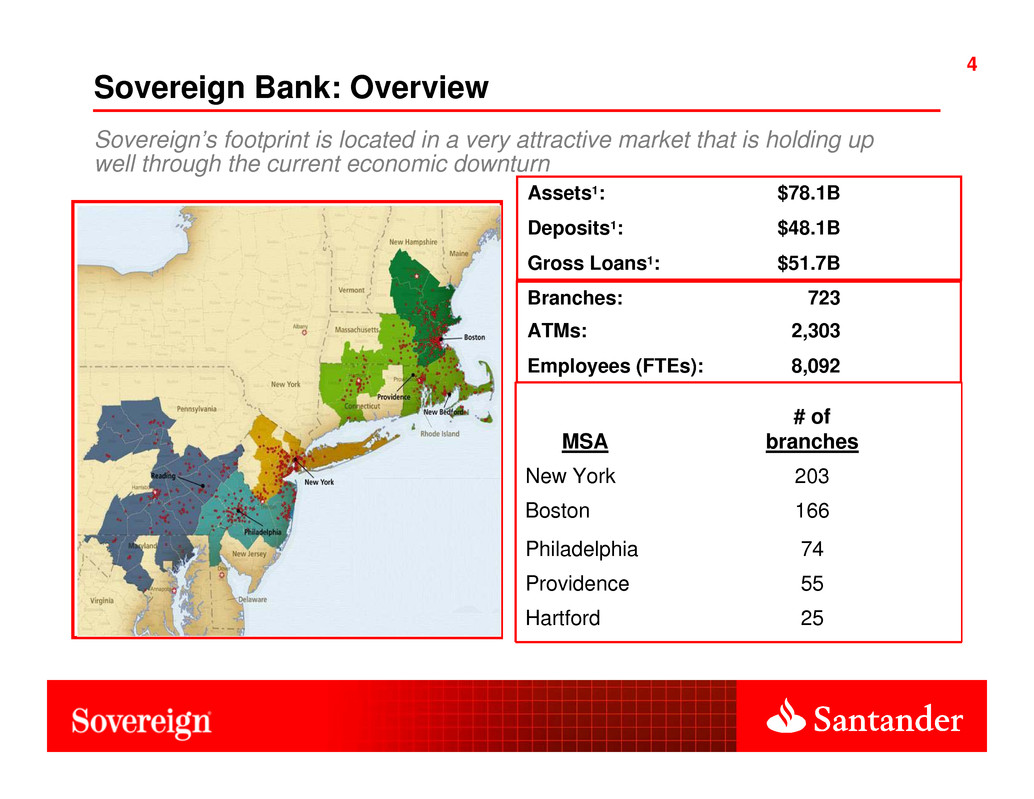

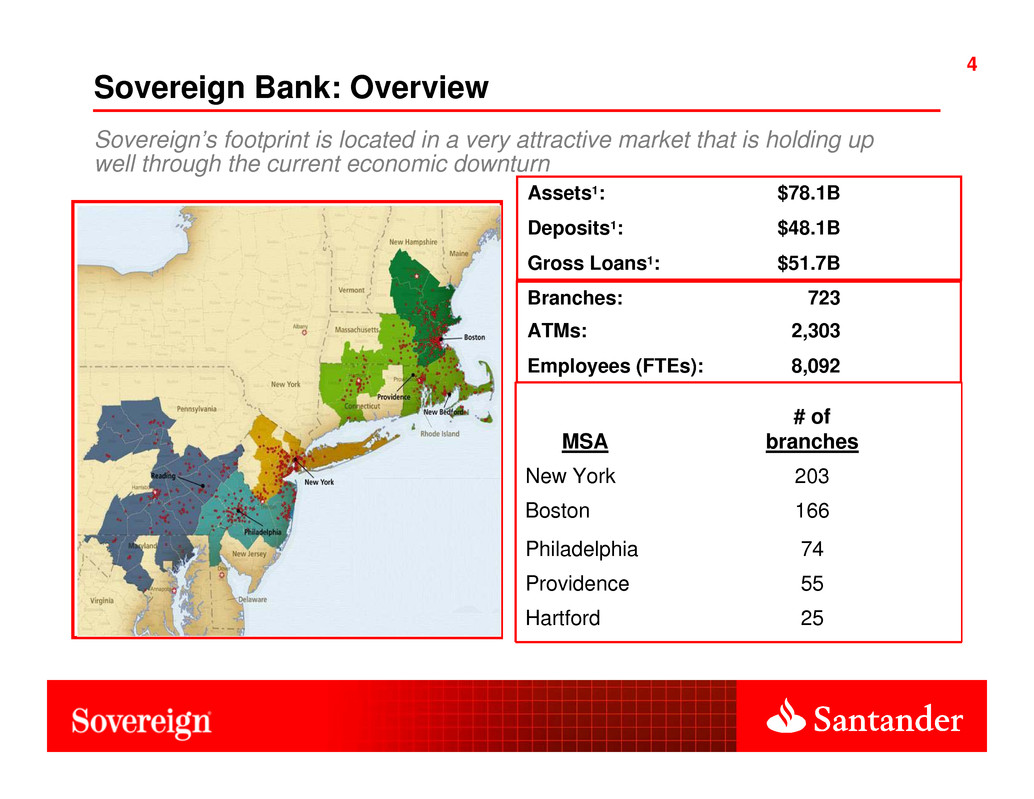

4 Sovereign Bank: Overview MSA # of branches New York 203 Boston 166 Philadelphia 74 Providence 55 Hartford 25 Branches: 723 ATMs: 2,303 Employees (FTEs): 8,092 Sovereign’s footprint is located in a very attractive market that is holding up well through the current economic downturn Assets1: $78.1B Deposits1: $48.1B Gross Loans1: $51.7B

5 Sovereign Bank: Balance Sheet $65.6B LIABILITIES $12.5B EQUITY Loan Portfolio funded almost entirely by deposits $78.1B ASSETS Equity 16% Other Liabilities 2% Other Borrowings 6% Deposits 62% FHLB 14%

6 6 Sovereign Bank, N.A. - Credit Review Sovereign Bank, N.A. - Overview Sovereign Bank, N.A. – 4Q11 Results Sovereign Bank, N.A. - Capital Agenda

7 Sovereign Bank: Key highlights of 4Q2011 Results • 8th consecutive quarter of profitability Asset Quality Loan Production • Growth in C&I loans • NPL ratio and coverage continue to improve • $1.1BN Private Label MBS portfolio sold during Q4:11 Status Capital • Tier 1 Common 14.1%• $150MM dividend paid to SHUSA in Q4:11 Deposits and Liquidity • Continued growth: $0.7BN increase in non maturity deposits vs Q3:11 • Ample Liquidity with primary and secondary reserves Charter Change • Charter change to national bank effective January 26, 2012

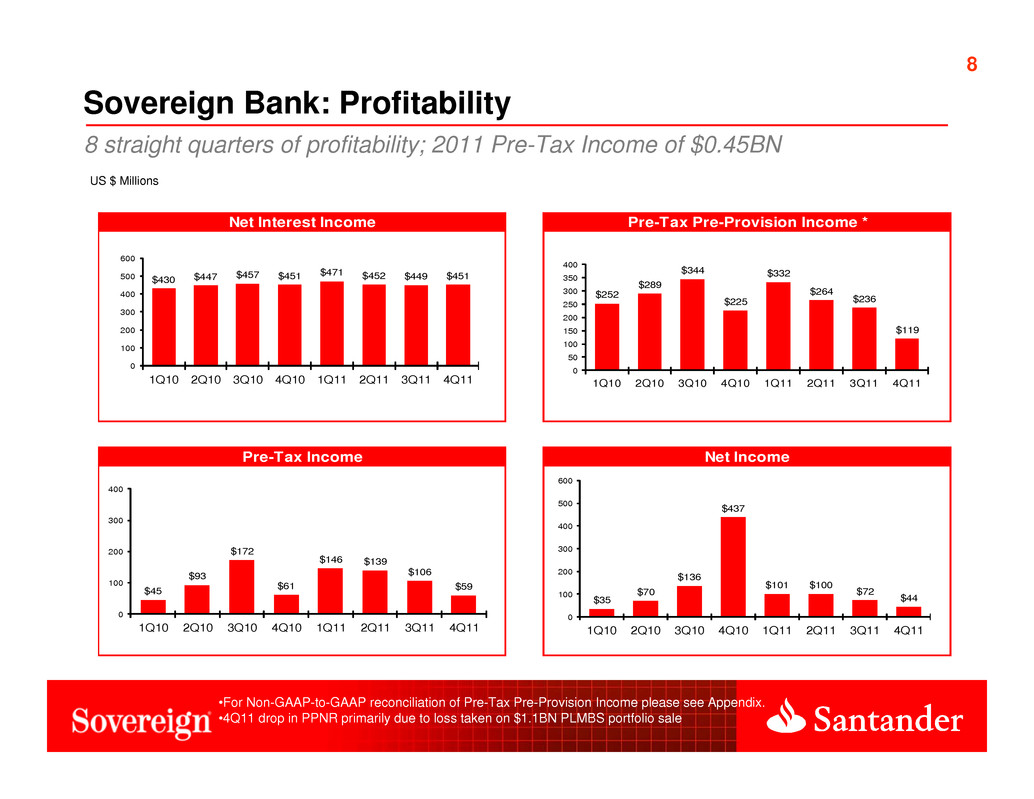

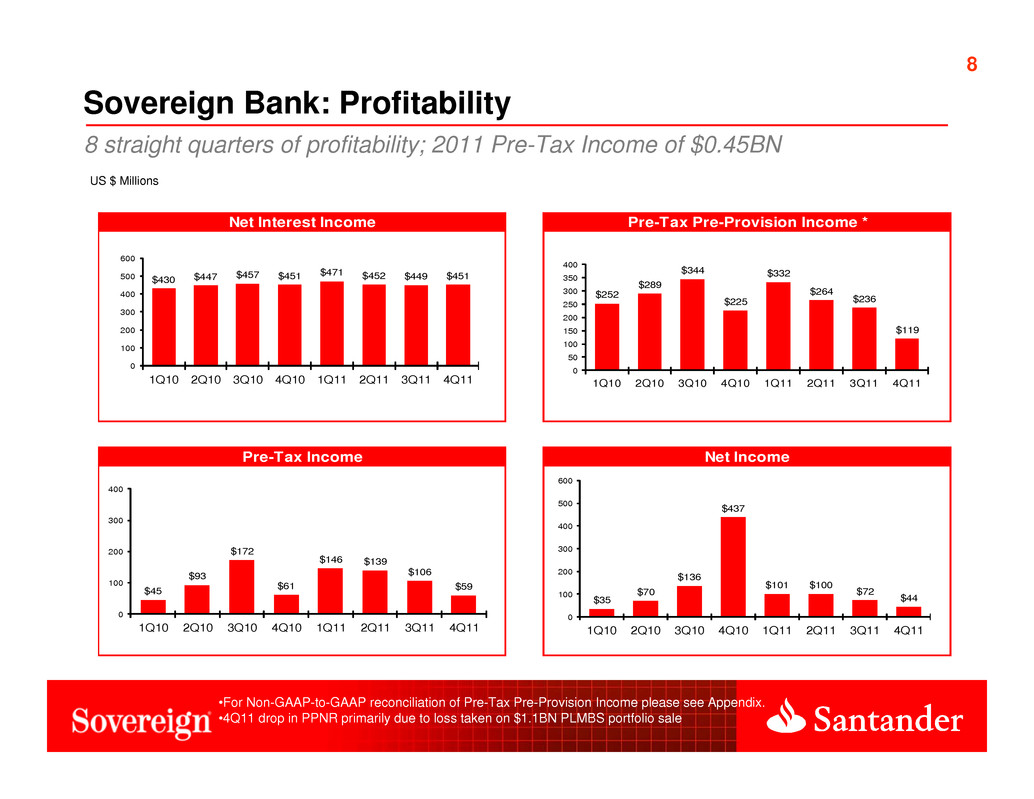

8 Sovereign Bank: Profitability 8 straight quarters of profitability; 2011 Pre-Tax Income of $0.45BN US $ Millions •For Non-GAAP-to-GAAP reconciliation of Pre-Tax Pre-Provision Income please see Appendix. •4Q11 drop in PPNR primarily due to loss taken on $1.1BN PLMBS portfolio sale Net Interest Income Pre-Tax Pre-Provision Income * Pre-Tax Income Net Income $252 $289 $344 $225 $332 $264 $236 $119 0 50 100 150 200 250 300 350 400 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 $430 $447 $457 $451 $471 $452 $449 $451 0 100 200 300 400 500 600 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 $45 $93 $172 $61 $146 $139 $106 $59 0 100 200 300 400 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 $35 $70 $136 $437 $101 $100 $72 $44 0 100 200 300 400 500 600 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11

9 9 Sovereign Bank: Average Balance Sheet Continued growth in loans and non maturity deposits (In millions) Average Yield/ Average Yield/ Average Yield/ Average Yield/ Balance Rate Balance Rate Balance Rate Balance Rate Cash and investments 15,785$ 2.48% 15,690$ 2.57% 95$ -0.09% 13,350$ 2.99% Self-originated MBS portfolio 549 3.56% 824 3.81% (275) -0.25% 1,420 4.28% Loans (non-run off portfolio) 49,084 4.26% 48,118 4.30% 966 -0.04% 45,203 4.40% Loans (run off portfolio) 2,242 6.17% 2,526 5.87% (284) 0.30% 3,739 5.97% Allowance for loan losses (1,114) --- (1,271) --- 157 --- (1,357) --- Other assets 9,428 --- 9,452 --- (24) --- 9,241 --- TOTAL ASSETS 75,974$ 3.48% 75,339$ 3.52% 635$ -0.04% 71,596$ 3.72% Non Maturity Deposits 34,333 0.31% 33,660 0.34% 673 -0.03% 30,540 0 Term and govt deposits and cust repos 11,832 1.08% 12,044 1.13% (212) -0.05% 11,377 0.93% Wholesale deposits 1,633 0.42% 2,059 0.45% (426) -0.03% 760 0 Borrowed funds 13,610 3.97% 13,059 4.26% 551 -0.29% 15,027 4.01% Other liabilities 1,912 --- 1,987 --- (75) --- 2,031 --- Equity 12,654 --- 12,530 --- 124 --- 11,861 --- TOTAL LIABILITIES & SE 75,974$ 1.03% 75,339$ 1.08% 635$ -0.05% 71,596$ 1.14% NET INTEREST MARGIN 2.79% 2.78% 0.01% 2.96% 4Q11 4Q103Q11 Change

10 10 Historical Non Maturity Deposit Balances2 Sovereign Bank: Continued Deposit Growth Year-over-year Growth rate Retail & Commercial Non Maturity Deposits 1 CAGR, or Compound Annual Growth Rate, represents the annualized rate assuming growth was at a steady rate. 2 Represents average quarterly balance Positive Deposit Growth Rate Trends1 Significant improvement in core deposit balances

11 11 Sovereign Bank, N.A. - Credit Review Sovereign Bank, N.A. - Overview Sovereign Bank, N.A. – 4Q11 Results Sovereign Bank, N.A. - Capital Agenda

12 12 Non-Performing Loan RatioNon-Performing Loans Sovereign Bank: Credit Asset Quality Trend Consistent reduction in NPLs; comparable to large bank average Source: SNL Bank level data Large Bank = Bank of America, Capital One, Citibank, KeyBank, BMO Harris Bank, HSBC USA, PNC Bank, RBS Citizens, JPMorgan, Union Bank, TD Bank, US Bank, Wells Fargo $2,147 $1,942 $1,825 $1,496 $1,364 4Q10 1Q11 2Q11 3Q11 4Q11 US $ Millions NPL = Nonaccruing loans plus accruing loans past due 90+ days, except loans partially or wholly guaranteed by the US Government 3.80% 3.59% 2.93% 2.64% 4.35% 3.46% 3.31% 2.98% 2.77% 2.60% 4Q10 1Q11 2Q11 3Q11 4Q11 Sovereign Large Bank -36%

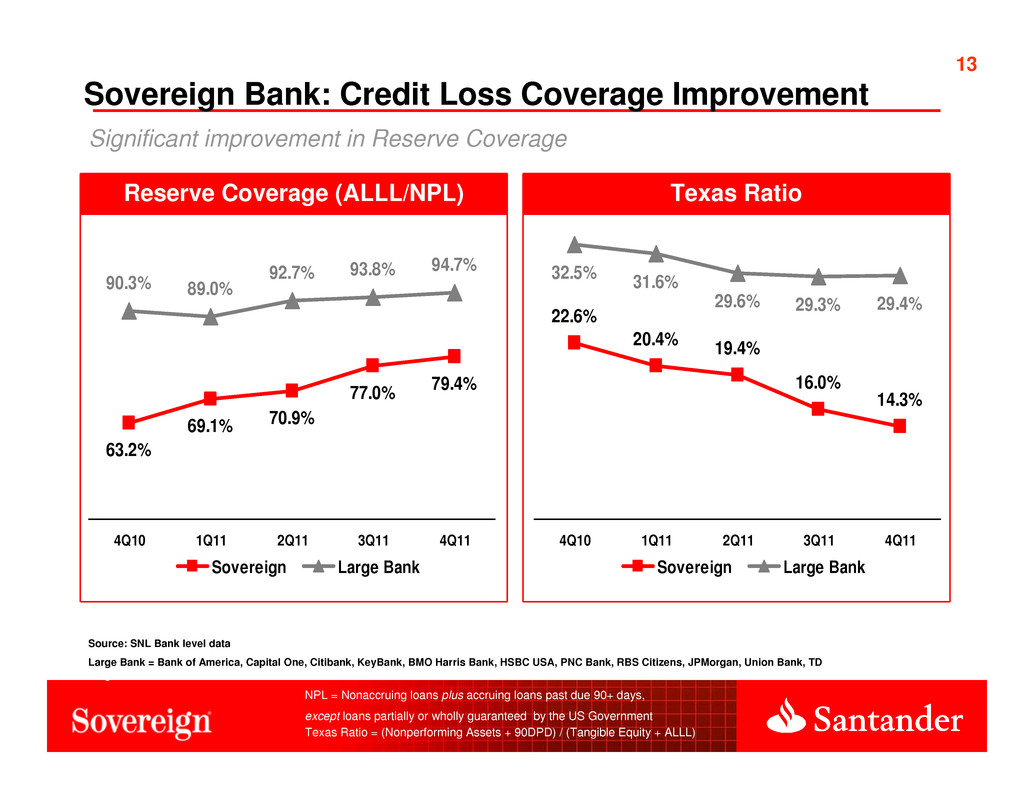

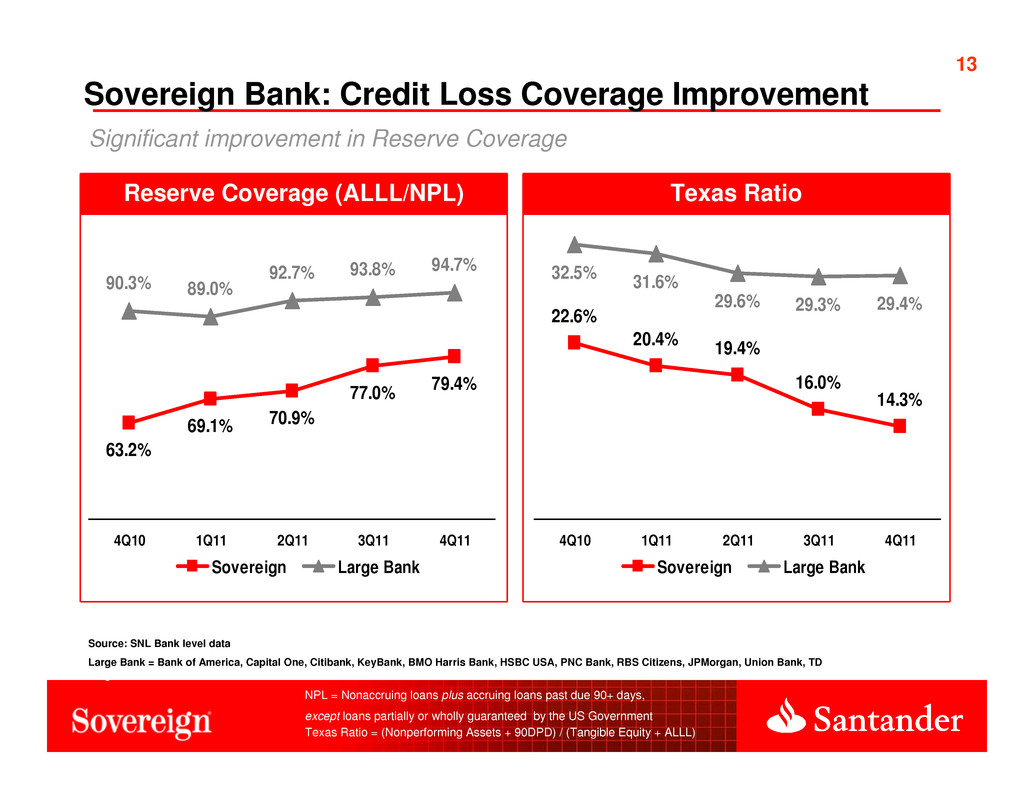

13 13 Significant improvement in Reserve Coverage Reserve Coverage (ALLL/NPL) Sovereign Bank: Credit Loss Coverage Improvement Texas Ratio Source: SNL Bank level data Large Bank = Bank of America, Capital One, Citibank, KeyBank, BMO Harris Bank, HSBC USA, PNC Bank, RBS Citizens, JPMorgan, Union Bank, TD Bank, US Bank, Wells Fargo 69.1% 70.9% 77.0% 79.4% 63.2% 90.3% 89.0% 92.7% 93.8% 94.7% 4Q10 1Q11 2Q11 3Q11 4Q11 Sovereign Large Bank 20.4% 19.4% 16.0% 14.3% 22.6% 32.5% 31.6% 29.6% 29.3% 29.4% 4Q10 1Q11 2Q11 3Q11 4Q11 Sovereign Large Bank NPL = Nonaccruing loans plus accruing loans past due 90+ days, except loans partially or wholly guaranteed by the US Government Texas Ratio = (Nonperforming Assets + 90DPD) / (Tangible Equity + ALLL)

14 14 NPL ratios stable in Real Estate and improving in C&I and CRE US $ Billions Mortgage and Home Equity Commercial Real Estate Other Consumer C&I Outstandings NPL to Total Loans Net Charge-Offs Sovereign Bank: Credit NPL Ratio Trend by Asset Class NPL = Nonaccruing loans plus accruing loans past due 90+ days, except loans partially or wholly guaranteed by the US Government $15.7 $15.6 $15.5 $15.3 $15.4 5.2% 4.5% 4.3% 3.6% 3.6% 2.0% 2.0% 2.1% 1.8% 1.8% 4Q10 1Q11 2Q11 3Q11 4Q11 $13.2 $13.3 $13.6 $13.8 $14.5 4.4% 4.0% 3.4% 2.7% 1.7% 2.0% 1.7% 1.3% 1.2% 1.5% 4Q10 1Q11 2Q11 3Q11 4Q11 $2.6 $4.0 $3.7 $3.9 $3.6 2.8% 1.7% 1.8% 1.6% 1.7% 3.2% 1.9% 2.2% 2.3% 2.6% 4Q10 1Q11 2Q11 3Q11 4Q11 $17.7 $18.1 $18.1 $18.0 $18.1 3.8% 3.6% 3.5% 2.8% 2.8% 0.60% 0.57% 0.56% 1.14% 1.21% 4Q10 1Q11 2Q11 3Q11 4Q11

15 15 Sovereign Bank, N.A. - Credit Review Sovereign Bank, N.A. - Overview Sovereign Bank, N.A. – 4Q11 Results Sovereign Bank, N.A. - Capital Agenda

16 16 Sovereign Bank: Capital Ratios* Sovereign Bank well above Large Bank average * Basel 1 Calculation ** Common Tier 1 = Tier 1 less hybrid capital Sovereign Bank Common Tier 1 equals total Tier 1 (no hybrid capital) For Non-GAAP to GAAP reconciliation, please see Appendix Source: SNL Bank level data Large Bank = Bank of America, Capital One, Citibank, KeyBank, BMO Harris Bank, HSBC USA, PNC Bank, RBS Citizens, JPMorgan, Union Bank, TD Bank, US Bank, Wells Fargo Tier 1 Common Risk Based** Tier 1 Leverage Tier 1 Risk Based Total Risk Based 13.9% 13.3% 13.5% 13.9% 14.3% 11.3% 11.5% 12.0% 11.9% 11.9% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 3Q10 4Q10 1Q11 2Q11 3Q11 Bank Large Banks 11.3% 11.4% 11.0% 11.2% 11.6% 8.5% 8.5% 8.8% 8.9% 9.0% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 3Q10 4Q10 1Q11 2Q11 3Q11 Bank Large Banks 14.0% 13.5% 13.6% 14.1% 14.4% 11.7% 11.9% 12.3% 12.3% 12.1% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 3Q10 4Q10 1Q11 2Q11 3Q11 Bank Large Banks 17.0% 15.9% 15.9% 16.4% 16.7% 14.8% 14.8% 15.3% 15.1% 14.9% 14% 14% 15% 15% 16% 16% 17% 17% 18% 3Q10 4Q10 1Q11 2Q11 3Q11 Bank Large Banks 13.3% .5 13.9% 14.3 .1 .5 12.0% 1 9 .7 4 1 1 2 3 4 .4 11.0% .2 11.6% 11.2% 8.8 .9 9 0 4 1 1 2 3 4 13.5% .6 14.1% 14.4 .2 .9 12.3% .1 .0 4 1 1 2 3 4 15.9% 15.9% 16.4% 16.7% 16.5% 14.8% 15.3% 15.1% 14.9% 14.8% 9 10 11% 12% 13% 14% 15% 16% 17 4 1 1 2 3 41 For Non-GAAP to GAAP reconciliation, please see Appendix

Appendix

18 Sovereign Bank: Trended Statement of Operations 1 For Non-GAAP to GAAP reconciliation, please see Appendix Description (in millions) 4Q10 1Q11 2Q11 3Q11 4Q11 Net interest income 451$ 471$ 452$ 449$ 451$ Fees & other income 151 150 150 125 108 Other non-interest income - 62 20 42 (49) Net revenue 602 683 622 616 510 General & administrative expenses (311) (310) (315) (329) (353) Other expenses (66) (41) (43) (51) (38) Provisions for credit losses (164) (186) (125) (130) (60) Income before taxes 61 146 139 106 59 Income tax expense 376 (45) (39) (34) (14) Net income 437$ 101$ 100$ 72$ 45$ 4Q10 1Q11 2Q11 3Q11 4Q11 Net interest margin 2.96% 2.99% 2.80% 2.78% 2.79% Efficiency ratio1 62.6% 51.4% 57.6% 61.7% 76.7% GAAP effective tax rate N/A 30.8% 28.1% 32.1% 23.7% ($49MM) Other Non-Interest Income in 4Q11 primarily due to loss taken on Non Agency MBS sale

19 19 Moody’s (4/11/2011) Upgraded to A2/P1 from A3/P2 S&P (2/13/2012)* Downgraded from A+ to A Fitch (2/13/2012) * Downgraded from A+ to A- Sovereign Bank: Credit ratings (as of February 13, 2012) Moody's S&P Fitch Long-term Sr Debt A2 A A- Subordinated Debt A3 A- A Short-term Deposits P-1 A-1 F1 Long-term Deposits A2 A A Outlook Stable Negative Negative SOVEREIGN *S&P and Fitch downgrades in February 2012 in conjunction with their downgrades of Spain and in turn Banco Santander

20 20 Sovereign Bank: Non-GAAP to GAAP Reconciliations $ Millions 4Q10 1Q11 2Q11 3Q11 4Q11 Sovereign Bank Texas Ratio Total Equity 12,139$ 12,242$ 12,393$ 12,554$ 12,494$ Less: Goodwill and CDI, net of Deferrred Tax Liability (3,266) (3,252) (3,246) (3,233) (3,220) Tangible Common Equity 8,873$ 8,990$ 9,147$ 9,321$ 9,274$ Nonperforming Assets 2,308$ 2,105$ 2,028$ 1,673$ 1,478$ . . . Allowance for loan losses 1,357$ 1,343$ 1,293$ 1,152$ 1,083$ 90+ DPD accruing -$ -$ -$ 4$ 5$ Texas Ratio 22.57% 20.37% 19.43% 16.01% 14.32% Efficiency Ratio G&A Expenses 311$ 310$ 315$ 329$ 353$ Other Expenses 66 41 43 51 38 377 351 358 380 391 Net interest income 451 471 452 449 451 Fees & other income 151 150 150 125 108 Other non-interest expenses - 62 20 42 (49) 602$ 683$ 622$ 616$ 510$ Ratio 62.6% 51.4% 57.6% 61.7% 76.7%

21 21 Sovereign Bank: Non-GAAP to GAAP Reconciliations (cont’d) $ Millions 4Q10 1Q11 2Q11 3Q11 4Q11 Tier 1 Common to Risk Weighted Assets Tier 1 Common Capital 7,587$ 7,660$ 7,911$ 8,150$ 8,066$ Risk Weighted Assets 57,084 56,727 56,753 57,097 57,311 Ratio 13.3% 13.5% 13.9% 14.3% 14.1% Tier 1 Leverage Tier 1 Capital 7,736$ 7,809$ 8,060$ 8,300$ 8,216$ Adjusted Total Assets 67,687 71,098 72,089 71,694 73,692 Ratio 11.4% 11.0% 11.2% 11.6% 11.2% Tier 1 Risk Based Tier 1 Capital 7,736$ 7,809$ 8,060$ 8,300$ 8,216$ Low Level Recourse Deduction (56) (69) (75) (72) (57) 7,680 7,740 7,985 8,228 8,159 Risk Weighted Assets 57,084 56,727 56,753 57,097 57,311 Ratio 13.5% 13.6% 14.1% 14.4% 14.2% Total Risk Based Risk Based Capital 9,093$ 9,048$ 9,293$ 9,540$ 9,430$ Risk Weighted Assets 57,084 56,727 56,753 57,097 57,311 Ratio 15.9% 15.9% 16.4% 16.7% 16.5%

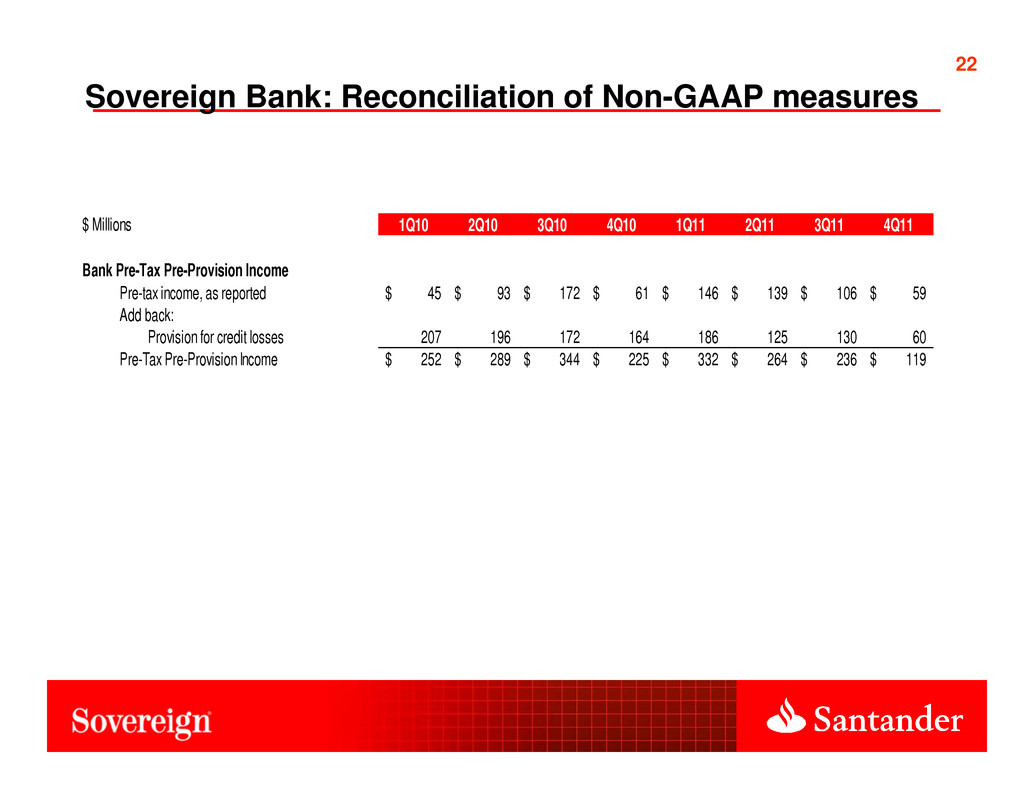

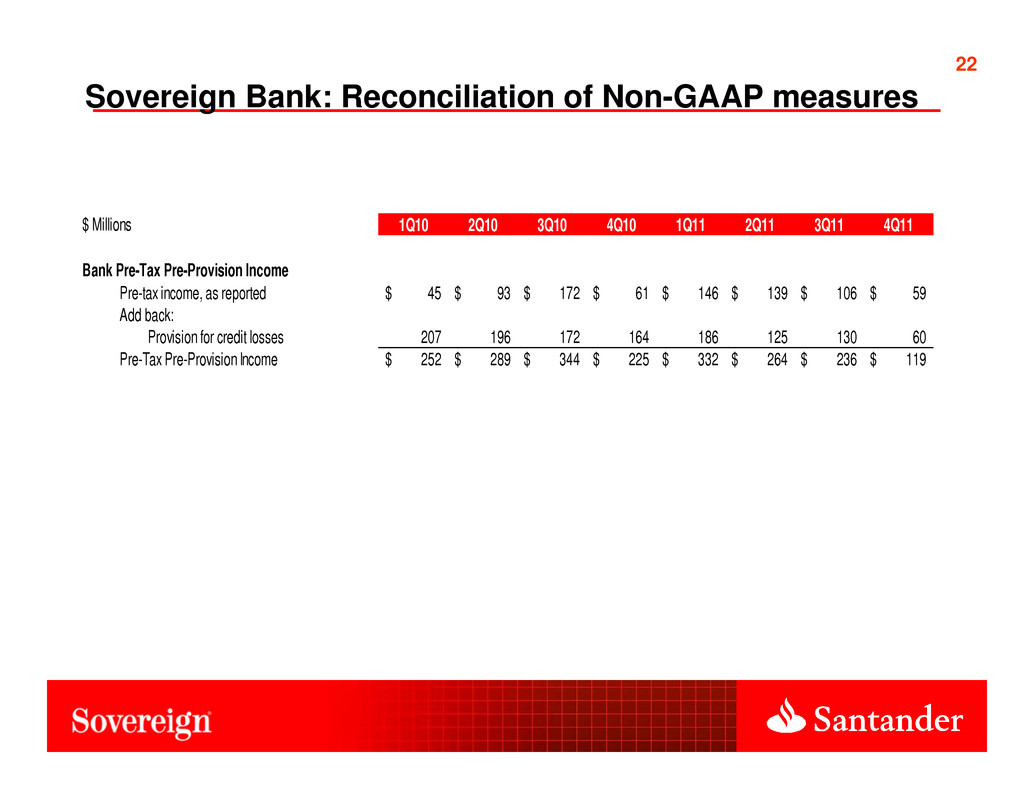

22 22 Sovereign Bank: Reconciliation of Non-GAAP measures $ Millions 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 Bank Pre-Tax Pre-Provision Income Pre-tax income, as reported 45$ 93$ 172$ 61$ 146$ 139$ 106$ 59$ Add back: Provision for credit losses 207 196 172 164 186 125 130 60 Pre-Tax Pre-Provision Income 252$ 289$ 344$ 225$ 332$ 264$ 236$ 119$