| UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 |

| FORM N-CSR CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES |

Investment Company Act file number 811- 5079

| John Hancock Tax-Exempt Series (Exact name of registrant as specified in charter) |

| 601 Congress Street, Boston, Massachusetts 02210 (Address of principal executive offices) (Zip code) |

| Alfred P. Ouellette Senior Attorney and Assistant Secretary |

| 601 Congress Street Boston, Massachusetts 02210 |

| (Name and address of agent for service) Registrant's telephone number, including area code: 617-663-4324 |

| Date of fiscal year end: | August 31 |

| Date of reporting period: | February 28, 2006 |

ITEM 1. REPORT TO SHAREHOLDERS.

| Table of contents |

| Your fund at a glance |

| page 1 |

| Managers’ report |

| page 2 |

| A look at performance |

| page 6 |

| Growth of $10,000 |

| page 7 |

| Your expenses |

| page 8 |

| Fund’s investments |

| page 10 |

| Financial statements |

| page 14 |

| For more information |

| page 29 |

To Our Shareholders,

The mutual fund industry has seen enormous growth over the last several decades. A good half of all American households are now invested in at least one mutual fund and the industry has grown to more than $8 trillion invested in some 7,000–8,000 mutual funds. With this growth, investors and their financial professionals have had access to an increasing array of investment choices — and greater challenges as they try to find the best-performing funds to fit their investment objectives.

Morningstar, Inc., a major independent analyst of the mutual fund industry, has provided investors and their advisors with an important evaluation tool since 1985, when it launched its “star” rating. Based on certain measurements, the Morningstar Rating for funds reflects each fund’s risk-adjusted return compared to a peer group, designating the results with a certain number of stars, from five stars for the best down to one star. The star ranking system has become the gold standard, with 4- and 5-star funds accounting for the bulk of fund sales.

As good, and important, as this ranking measurement has been, we have long taken issue with part of the process that adjusts performance on broker-sold Class A shares for “loads” — or up-front commissions. We have argued that this often does not accurately reflect an A-share investor’s experience, since they increasingly are purchasing A shares in retirement plans and fee-based platforms that waive the up-front fee.

We are pleased to report that Morningstar has acknowledged this trend and has added a new rating for Class A shares on a no-load basis, called the “Load-Waived A Share” rating, that captures the experience of an investor who is not paying a front-end load. This new rating will better assist our plan sponsors, 401(k) plan participants and clients of financial professionals who invest via fee-based platforms or commit to invest more than a certain dollar amount, in evaluating their choice of mutual funds.

Since being implemented in early December 2005, the impact on our funds has been terrific. Under the new load-waived rating, 11 of our 43 open-end retail mutual funds now have 4- or 5-star rankings on their load-waived A shares, as of February 28, 2006.

We commend Morningstar for its move and urge our shareholders to consider this another tool at your disposal as you and your financial professional are evaluating investment choices.

Sincerely,

| Keith F. Hartstein, President and Chief Executive Officer |

| This commentary reflects the CEO’s views as of February 28, 2006. They are subject to change at any time. |

| YOUR FUND AT A GLANCE The Fund seeks a high level of current income, consistent with preservation of capital, that is exempt from fed- eral, New York State and New York City personal income taxes. In pursuing this goal, the fund normally invests at least 80% of its assets in securities of any maturity exempt from federal and New York personal income taxes. |

Over the last six months

| * | Municipal bonds posted modest gains and outpaced the broad |

| taxable bond market. | |

| * | The Fund’s performance trailed the returns of its benchmark index |

| and peer group average because of its exposure to higher-quality and | |

| shorter-term bonds. | |

| * | Top-performing sectors included economic development, health care |

| and housing bonds. | |

Total returns for the Fund are at net asset value with all distributions reinvested. These returns do not reflect the deduction of the maximum sales charge, which would reduce the performance shown above.

| Top 10 holdings | |

| 3.9% | Puerto Rico Aqueduct & Sewer Auth, 7-1-11, 8.095% |

| 3.6% | New York State Dormitory Auth, 5-15-19, 5.500% |

| 3.5% | Port Auth of New York & New Jersey, 7-15-18, 5.500% |

| 2.9% | Triborough Bridge & Tunnel Auth, 1-1-21, 6.125% |

| 2.6% | New York City Municipal Water Finance Auth, |

| 6-15-33, 5.500% | |

| 2.6% | New York, City of, 12-1-17, 5.250% |

| 2.5% | Virgin Islands Public Finance Auth, 10-1-18, 5.875% |

| 2.4% | Port Auth of New York & New Jersey, 10-1-19, 6.750% |

| 2.2% | New York Local Government Assistance Corp, 4-1-17, 5.500% |

| 2.0% | Puerto Rico Public Building Auth, 7-1-12, 6.250% |

As a percentage of net assets on February 28, 2006. | |

1

BY DIANNE SALES, CFA, AND FRANK A. LUCIBELLA, PORTFOLIO MANAGERS,

SOVEREIGN ASSET MANAGEMENT LLC

| MANAGERS’ REPORT |

| JOHN HANCOCK New York Tax-Free Income Fund |

Municipal bonds edged higher during the six months ended February 28, 2006 and outperformed taxable bonds. The Lehman Brothers Municipal Bond Index returned 0.99%, while the Lehman Brothers U.S. Aggregate Index — a broad measure of the taxable bond market — returned –0.11% ..

The bond market’s muted performance reflected the resiliency of the U.S. economy, which grew at a healthy rate despite the dampening impact of higher energy prices and the devastating 2005 hurricane season. To keep the economy on an even keel, the Federal Reserve extended its series of short-term interest rate increases, raising the federal funds rate four times during the six-month period (for a total of 14 rate hikes since June 2004). By the end of the period, the federal funds rate stood at 4.5%, its highest level in nearly five years. Short-term municipal bond yields rose along with the federal funds rate, though to a lesser degree, while longer-term municipal yields held steady as inflation remained benign.

| “Municipal bonds edged higher during the six months ended February 28, 2006 and outperformed taxable bonds.” |

Demand for yield continued to drive performance in the municipal bond market. Investors seeking the highest yields available flocked to lower-rated issues, which outperformed higher-quality bonds during the six-month period. Consequently, the yields of high-quality and lower-quality bonds converged further, nearing historically narrow levels.

Improving credit quality in New York, both at the state level and in New York City, was driven by the persistent strength of the economy, as well as strong earnings and wages in the financial services industry. Tax revenues exceeded expectations, reflecting both the strong growth and tax increases implemented in 2003. The state’s improved income and balance sheets were rewarded in

2

December 2005, when Moody’s upgraded the state’s credit rating. At the county and local government level, finances were somewhat mixed as economic conditions were uneven across the state. Revenue growth often failed to offset rising funding demands, and many county governments continue to grapple with budget challenges.

Fund performance

For the six months ended February 28, 2006, John Hancock New York Tax-Free Income Fund’s Class A, Class B and Class C shares posted total returns of 0.71%, 0.36% and 0.36%, respectively, at net asset value. This performance trailed the 0.91% average return of Morningstar’s Muni New York Long fund category1 and the 0.99% return of the Lehman Brothers Municipal Bond Index. Keep in mind that your net asset value return will be different from the Fund’s performance if you were not invested in the Fund for the entire period and did not reinvest all distributions. See pages six and seven for historical performance information.

Individual security selection remained a key contributing factor to the Fund’s performance. Our emphasis on thorough credit research helped us build a portfolio of bonds with an attractive balance of credit quality, yield and total return potential.

| “Reflecting the strong demand for yield, the portfolio’s best performers were lower-rated bonds with relatively high yields, which outperformed ...” |

Lower-quality bonds produced best returns

Reflecting the strong demand for yield, the portfolio’s best performers were lower-rated bonds with relatively high yields, which outperformed as the yield spreads between higher- and lower-quality bonds narrowed. Bonds rated BBB and BB were the stars in the period, while A-rated and non-rated bonds battled for third place. Although the tighter yield spreads were favorable for performance, they also presented reinvestment challenges in the current low-yield environment. We had to be very opportunistic in identifying undervalued investment opportunities with the necessary credit characteristics and performance potential.

3

| Sector | |

| distribution2 | |

| Revenue bonds | |

| Other | |

| revenue | 16% |

| Education | 15% |

| Water & sewer | 13% |

| Health | 10% |

| Industrial | |

| development | 8% |

| Sales tax | 7% |

| Transportation | 6% |

| Tobacco | 5% |

| Public facility | 4% |

| Pollution | 4% |

| Electric | 2% |

| Economic | |

| development | 2% |

| Housing | 1% |

| General | |

| obligation | 5% |

Looking at sector performance, economic development and redevelopment bonds served us well, reflecting overall demand growth and support for continued rebuilding in the downtown New York City area. Other leading sectors included housing and health care bonds, which benefited from the robust economy and improving credit quality. Although our land development bonds also produced positive results, the Fed’s continued series of rate hikes caused us to become more selective in this segment of the market because of concerns about rising mortgage rates and their impact on the housing market.

Higher-grade bonds weighed on performance

The Fund’s performance was somewhat limited by its exposure to higher-quality bonds, including general obligation bonds and securities backed by revenues from essential services, such as water/sewer and education. Higher-rated bonds trailed the overall municipal market as investors’ search for incremental yield spurred demand for lower-quality securities.

An overweight in shorter-term bonds, which resulted from the multi-year effort by both the state and New York City to refinance and restructure their outstanding debt, also hindered portfolio performance. Many of these securities are pre-refunded bonds that are now exhibiting AA and AAA ratings, and they are trading to their call dates in approximately 10 years rather than their much longer maturity dates. As a result, they were unable to keep pace with the total returns generated by long-term bonds.

4

Outlook

The U.S. economy has held up well despite higher short-term interest rates, rising energy prices and catastrophic hurricanes. In fact, rebuilding in hurricane-damaged areas may provide an additional boost to economic growth in the coming months. Current expectations suggest that the Fed is likely to raise short-term interest rates at least one or two more times in the next few months. What occurs after mid-year, however, is less clear — evidence of slowing economic activity could convince the Fed to adopt a “wait-and-see” approach during the second half of the year.

| “...we have adopted a more conservative approach to credit analysis because there is little reward for taking on additional credit risk.” |

In the municipal bond market, issuance is expected to be down substantially from record levels in 2005. Overall estimates are for a 20%-30% decline in 2006, and New York should be in line with these expectations; issuance in the first two months of 2006 was down 30% from the previous year. Although reduced issuance bodes well for market performance, we expect to see pockets of oversupply that will provide opportunities for us to pick our spots. Given the tight yield spreads between higher- and lower-quality bonds, we have adopted a more conservative approach to credit analysis because there is little reward for taking on additional credit risk.

This commentary reflects the views of the portfolio managers through the end of the Fund’s period discussed in this report. The managers’ statements reflect their own opinions. As such, they are in no way guarantees of future events and are not intended to be used as investment advice or a recommendation regarding any spe-cific security. They are also subject to change at any time as market and other conditions warrant.

1 Figures from Morningstar, Inc. include reinvested dividends and do not take into account sales charges. Actual load-adjusted performance is lower.

2 As a percentage of net assets on February 28, 2006.

5

| A LOOK AT PERFORMANCE For the period ended February 28, 2006 |

| Class A | Class B | Class C | |

| Inception date | 9-13-87 | 10-3-96 | 4-1-99 |

| Average annual returns with maximum sales charge (POP) | |||

| One year | –1.01% | –2.03% | 1.95% |

| Five years | 3.87 | 3.76 | 4.10 |

| Ten years | 4.81 | — | — |

| Since inception | — | 4.81 | 4.07 |

| Cumulative total returns with maximum sales charge (POP) | |||

| Six months | –3.79 | –4.57 | –0.62 |

| One year | –1.01 | –2.03 | 1.95 |

| Five years | 20.90 | 20.28 | 22.28 |

| Ten years | 59.93 | — | — |

| Since inception | — | 55.62 | 31.76 |

| SEC 30-day yield as of February 28, 2006 | |||

| 3.79 | 3.28 | 3.28 | |

Performance figures assume all distributions are reinvested. Returns with maximum sales charge reflect a sales charge on Class A shares of 4.5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The returns for Class C shares have been adjusted to reflect the elimination of the front-end sales charge effective July 15, 2004. The Class B shares’ CDSC declines annually between years 1–6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month-end, please call 1-800-225-5291 or visit the Fund’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Please note that a portion of the Fund’s income may be subject to taxes, and some investors may be subject to the Alternative Minimum Tax (AMT). Also note that capital gains are taxable.

The Fund’s performance results reflect any applicable expense reductions, without which the expenses would increase and results would have been less favorable.

6

| GROWTH OF $10,000 |

This chart shows what happened to a hypothetical $10,000 investment in Class A shares for the period indicated. For comparison, we’ve shown the same investment in the Lehman Brothers Municipal Bond Index.

| Class B1,2 | Class C2 | |

| Period beginning | 10-3-96 | 4-1-99 |

| New York Tax-Free Income Fund | $15,562 | $13,176 |

| Index | 17,278 | 14,364 |

Assuming all distributions were reinvested for the period indicated, the table above shows the value of a $10,000 investment in the Fund’s Class B and Class C shares, respectively, as of February 28, 2006. The Class C shares investment with maximum sales charge has been adjusted to reflect the elimination of the front-end sales charge effective July 15, 2004. Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

Lehman Brothers Municipal Bond Index is an unmanaged index that includes municipal bonds and is commonly used as a measure of bond performance. It is not possible to invest directly in an index. Index figures do not reflect sales charges and would be lower if they did.

1 Index as of September 30, 1996.

2 No contingent deferred sales charge applicable.

7

| YOUR EXPENSES |

operating expenses.

Understanding fund expenses

As a shareholder of the Fund, you incur two types of costs:

| * | Transaction costs which include sales charges (loads) on |

| purchases or redemptions (varies by share class), minimum | |

| account fee charge, etc. | |

* | Ongoing operating expenses including management |

| fees, distribution and service fees (if applicable) and other | |

| fund expenses. |

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about your fund’s actual ongoing operating expenses, and is based on your fund’s actual return. It assumes an account value of $1,000.00 on August 31, 2005, with the same investment held until February 28, 2006.

| Account value | Expenses paid | |

| $1,000.00 | Ending value | during period |

| on 8-31-05 | on 2-28-06 | ended 2-28-061 |

| Class A | $1,007.10 | $5.32 |

| Class B | 1,003.60 | 8.82 |

| Class C | 1,003.60 | 8.82 |

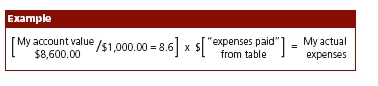

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at February 28, 2006 by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

8

Hypothetical example for comparison purposes

This table allows you to compare your fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annual return before expenses (which is not your fund’s actual return). It assumes an account value of $1,000.00 on August 31, 2005, with the same investment held until February 28, 2006. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| Account value | Expenses paid | |

| $1,000.00 | Ending value | during period |

| on 8-31-05 | on 2-28-06 | ended 2-28-061 |

| Class A | $1,019.50 | $5.35 |

| Class B | 1,016.00 | 8.87 |

| Class C | 1,016.00 | 8.87 |

Remember, these examples do not include any transaction costs, such as sales charges; therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund’s annualized expense ratio of 1.07%, 1.77% and 1.77% for Class A, Class B and Class C, respectively, multiplied by the average account value over the period, multiplied by number of days in most recent fiscal half-year/365 or 366 (to reflect the one-half year period).

9

F I N A N C I A L S TAT E M E N T S

| FUND’S INVESTMENTS Securities owned by the Fund on February 28, 2006 (unaudited) |

This schedule has two main categories: tax-exempt long-term bonds and short-term investments. Tax-exempt long-term bonds are broken down by state or territory. Under each state or territory is a list of securities owned by the Fund. Short-term investments, which represent the Fund’s cash position, are listed last.

| Interest | Maturity | Credit | Par value | ||

| State, issuer, description | rate | date | rating (A) | (000) | Value |

| Tax-exempt long-term bonds 98.10% | $61,492,443 | ||||

| (Cost $56,863,658) | |||||

| New York 85.18% | 53,393,829 | ||||

| Albany Parking Auth, | |||||

| Rev Ref Ser 2001A | 5.625% | 07-15-25 | BBB+ | $750 | 802,463 |

| Chautauqua Tobacco Asset | |||||

| Securitization Corp, | |||||

| Rev Ref Asset Backed Bond | 6.750 | 07-01-40 | BBB | 1,000 | 1,073,500 |

| Essex County Industrial | |||||

| Development Agency, | |||||

| Rev Ref Solid Waste Disp Intl Paper | |||||

| Ser 2005A | 5.200 | 12-01-23 | BBB | 800 | 808,480 |

| Herkimer County Industrial | |||||

| Development Agency, | |||||

| Rev Ref Folts Adult Home Ser 2005A | 5.500 | 03-20-40 | Aaa | 1,000 | 1,110,320 |

| Islip Community Development Agency, | |||||

| Rev Ref NY Institute of Technology | 7.500 | 03-01-26 | AAA | 1,000 | 1,020,340 |

| Liberty Development Corp, | |||||

| Rev Goldman Sachs Headquarters | 5.250 | 10-01-35 | A+ | 1,000 | 1,132,650 |

| Metropolitan Transportation Auth, | |||||

| Rev Serv Contract Commuter Facil Ser 3 | 7.375 | 07-01-08 | A1 | 550 | 576,675 |

| Monroe Newpower Corp, | |||||

| Rev Ref Pwr Facil | 5.100 | 01-01-16 | BBB | 1,000 | 1,041,090 |

| Nassau County Industrial | |||||

| Development Agency, | |||||

| Rev Ref Civic Facil North Shore Hlth | |||||

| Sys Projs Ser 2001A | 6.250 | 11-01-21 | A3 | 275 | 300,715 |

| Rev Ref Civic Facil North Shore Hlth | |||||

| Sys Projs Ser 2001B | 5.875 | 11-01-11 | A3 | 285 | 302,262 |

| New York, City of, | |||||

| Gen Oblig Unltd Preref Ser 1990B | 8.250 | 06-01-07 | A+ | 180 | 190,539 |

| Gen Oblig Unltd Unref Bal Ser 1990B | 8.250 | 06-01-07 | A+ | 20 | 21,133 |

| Gen Oblig Unltd Ser 2001B | 5.250 | 12-01-17 | A+ | 1,500 | 1,597,875 |

| Gen Oblig Unltd Ser 2004J | 5.000 | 05-15-23 | A+ | 1,000 | 1,048,650 |

| See notes to financial statements. |

10

| F I N A N C I A L S TAT E M E N T S |

| Interest | Maturity | Credit | Par value | ||

| State, issuer, description | rate | date | rating (A) | (000) | Value |

| New York (continued) | |||||

| New York City Industrial | |||||

| Development Agency, | |||||

| Rev Civic Facil Lycee Francais de NY Proj | |||||

| Ser 2002A | 5.375% | 06-01-23 | A | $1,000 | $1,046,280 |

| Rev Civic Facil Polytechnic Univ Proj | 6.125 | 11-01-30 | BB+ | 1,000 | 1,005,050 |

| Rev Liberty 7 World Trade Ctr | |||||

| Ser 2005A (G) | 6.250 | 03-01-15 | BB | 1,000 | 1,050,430 |

| Rev Ref Brooklyn Navy Yard | |||||

| Cogen Partners | 5.650 | 10-01-28 | BBB– | 1,000 | 1,000,660 |

| Rev Spec Airport Facil Airis JFK I LLC Proj | |||||

| Ser 2001A | 5.500 | 07-01-28 | BBB– | 1,000 | 1,006,120 |

| Rev Terminal One Group Assn Proj | 5.500 | 01-01-21 | BBB+ | 1,000 | 1,079,570 |

| New York City Municipal Water | |||||

| Finance Auth, | |||||

| Rev Preref Wtr & Swr Sys Ser 2000B | 6.000 | 06-15-33 | AA+ | 740 | 820,549 |

| Rev Ref Wtr & Swr Sys | 5.500 | 06-15-33 | AA+ | 1,500 | 1,633,575 |

| Rev Ref Wtr & Swr Sys Cap Apprec | |||||

| Ser 2001D | Zero | 06-15-20 | AA+ | 2,000 | 1,107,040 |

| Rev Unref Bal Wtr & Swr Sys Ser 2000B | 6.000 | 06-15-33 | AA+ | 460 | 506,580 |

| New York City Transitional Finance Auth, | |||||

| Rev Future Tax Sec Ser 2000B | 6.000 | 11-15-29 | AAA | 1,000 | 1,107,190 |

| Rev Ref Future Tax Sec Ser 2002A | |||||

| (Zero to 11-01-11 then 14.000%) (O) | Zero | 11-01-29 | AAA | 1,000 | 808,550 |

| Rev Ref Future Tax Secd Sub | |||||

| Ser 2002C4 (P) | 2.940 | 08-01-31 | AAA | 250 | 250,000 |

| New York City Trust For Cultural Resources, | |||||

| Rev Ref American Museum of Natural | |||||

| History Ser 2004A | 5.000 | 07-01-36 | AAA | 1,000 | 1,054,310 |

| New York Local Government | |||||

| Assistance Corp, | |||||

| Rev Ref Ser 1993C | 5.500 | 04-01-17 | AAA | 1,225 | 1,377,157 |

| New York Mortgage Agency, | |||||

| Rev Ref Homeowner Mtg Ser 94 | 5.900 | 10-01-30 | Aa1 | 495 | 515,508 |

| New York State Dormitory Auth, | |||||

| Rev Cap Apprec FHA Insd Mtg Ser 2000B | Zero | 08-15-40 | AAA | 3,000 | 379,860 |

| Rev Lease State Univ Dorm Facil Ser 2000A | 6.000 | 07-01-30 | AA– | 1,000 | 1,109,720 |

| Rev Miriam Osborn Mem Home Ser 2000B | 6.875 | 07-01-25 | A | 750 | 842,610 |

| Rev North Shore L I Jewish Grp | 5.375 | 05-01-23 | A3 | 1,000 | 1,066,340 |

| Rev Personal Income Tax Ser 2005F | 5.000 | 03-15-30 | AAA | 1,000 | 1,055,820 |

| Rev Ref Concord Nursing Home Inc | 6.500 | 07-01-29 | Aa1 | 500 | 543,230 |

| Rev Ref Ser 2002B | 5.250 | 11-15-23 | AA– | 1,000 | 1,073,800 |

| Rev Ref State Univ Edl Facil Ser 1993A | 5.500 | 05-15-19 | AA– | 2,000 | 2,260,540 |

| Rev Ref State Univ Edl Facil Ser 1993A | 5.250 | 05-15-15 | AAA | 1,000 | 1,102,520 |

| Ref Ref Univ of Rochester Defd Income | |||||

| Ser 2000A (Zero to 07-01-10 then | |||||

| 6.05%) (O) | Zero | 07-01-25 | AAA | 1,000 | 854,070 |

| See notes to financial statements. | |||||

11

| F I N A N C I A L S TAT E M E N T S |

| Interest | Maturity | Credit | Par value | ||

| State, issuer, description | rate | date | rating (A) | (000) | Value |

| New York (continued) | |||||

| New York State Dormitory Auth, (continued) | |||||

| Rev State Univ Edl Facil Ser 2000B | 5.375% | 05-15-23 | AA– | $1,000 | $1,082,890 |

| Rev Unref City Univ 4th Ser 2001A | 5.250 | 07-01-31 | AA– | 130 | 140,859 |

| New York State Environmental | |||||

| Facilities Corp, | |||||

| Rev Ref Poll Control (P) | 12.630 | 06-15-11 | AAA | 500 | 671,510 |

| Rev Unref Bal Poll Control Ser 1991E | 6.875 | 06-15-10 | AAA | 40 | 40,126 |

| New York State Power Auth, | |||||

| Rev Ref Gen Purpose Ser 1990W | 6.500 | 01-01-08 | AAA | 150 | 155,206 |

| Onondaga County Industrial | |||||

| Development Agency, | |||||

| Rev Sr Air Cargo | 6.125 | 01-01-32 | Baa3 | 1,000 | 1,027,120 |

| Orange County Industrial | |||||

| Development Agency, | |||||

| Rev Civic Facil Arden Hill Care Ctr | |||||

| Newburgh Ser 2001C (G) | 7.000 | 08-01-31 | BB | 500 | 530,495 |

| Port Auth of New York & New Jersey, | |||||

| Rev Cons Thirty Seventh Ser 2004 | 5.500 | 07-15-18 | AAA | 2,000 | 2,215,540 |

| Rev Ref Spec Proj KIAC Partners Ser 4 (G) | 6.750 | 10-01-19 | BBB– | 1,500 | 1,514,340 |

| Sales Tax Asset Receivables Corp, | |||||

| Rev Ser 2004A | 5.000 | 10-15-32 | AAA | 1,000 | 1,058,110 |

| Suffolk County Industrial | |||||

| Development Agency, | |||||

| Rev Civic Facil Huntington Hosp Proj | |||||

| Ser 2002B | 6.000 | 11-01-22 | BBB | 1,000 | 1,079,010 |

| Triborough Bridge & Tunnel Auth, | |||||

| Rev Ref Gen Purpose Ser 1992Y | 6.125 | 01-01-21 | AAA | 1,500 | 1,839,045 |

| TSASC, Inc., | |||||

| Rev Tobacco Settlement Asset Backed | |||||

| Bond Ser 1 | 5.500 | 07-15-24 | Aaa | 850 | 925,029 |

| Upper Mohawk Valley Regional Water | |||||

| Finance Auth, | |||||

| Rev Wtr Sys Cap Apprec | Zero | 04-01-22 | Aaa | 2,230 | 1,146,019 |

| Westchester County Healthcare Corp, | |||||

| Rev Ref Sr Lien Ser 2000A | 6.000 | 11-01-30 | B | 1,150 | 1,154,059 |

| Westchester Tobacco Asset | |||||

| Securitization Corp, | |||||

| Rev Ref Asset Backed Bond | 5.000 | 06-01-26 | BBB | 1,000 | 991,120 |

| Yonkers Industrial Development Agency, | |||||

| Rev Community Dev Pptys Yonkers Inc | |||||

| Ser 2001A | 6.625 | 02-01-26 | BBB– | 1,000 | 1,139,580 |

| See notes to financial statements. |

12

F I N A N C I A L S TAT E M E N T S

| Interest | Maturity | Credit | Par value | ||

| State, issuer, description | rate | date | rating (A) | (000) | Value |

| Puerto Rico 9.45% | $5,921,789 | ||||

| Puerto Rico Aqueduct & Sewer Auth, | |||||

| Rev Ref Inverse Floater (Gtd) (P) | 8.095% | 07-01-11 | AAA | $2,000 | 2,439,960 |

| Puerto Rico, Commonwealth of, | |||||

| Gen Oblig Unltd Ser 975 (P) | 6.580 | 07-01-18 | Aaa | 500 | 578,025 |

| Puerto Rico Public Building Auth, | |||||

| Rev Govt Facil Ser 1995A (Gtd) | 6.250 | 07-01-12 | AAA | 1,110 | 1,273,359 |

| Puerto Rico Public Finance Corp, | |||||

| Rev Preref Commonwealth Approp | |||||

| Ser 2002E | 5.500 | 08-01-29 | BBB– | 1,005 | 1,103,621 |

| Rev Unref Bal Commonwealth Approp | |||||

| Ser 2002E | 5.500 | 08-01-29 | BBB– | 495 | 526,824 |

| Virgin Islands 3.47% | 2,176,825 | ||||

| Virgin Islands Public Finance Auth, | |||||

| Rev Ref Gross Receipts Tax Ln Note | |||||

| Ser 1999A | 6.500 | 10-01-24 | BBB | 535 | 594,010 |

| Rev Sub Lien Fund Ln Notes | |||||

| Ser 1998E (G) | 5.875 | 10-01-18 | BBB– | 1,500 | 1,582,815 |

| Interest | Par value | ||||

| Issuer, description, maturity date | rate | (000) | Value | ||

| Short-term investments 0.05% | $35,000 | ||||

| (Cost $35,000) | |||||

| Joint Repurchase Agreement 0.05% | 35,000 | ||||

| Investment in a joint repurchase agreement transaction | |||||

| with Bank of America — Dated 02-28-06 due 03-01-06 | |||||

| (secured by U.S. Treasury Inflation Indexed Bonds 1.125% | |||||

| due 01-15-15 and 2.375% due 01-15-25, U.S. Treasury | |||||

| Inflation Indexed Note 3.875% due 04-15-29 and U.S. | |||||

| STRIPS due 11-15-21) | 4.520% | $35 | 35,000 | ||

| Total investments 98.15% | $61,527,443 | ||||

| Other assets and liabilities, net 1.85% | $1,156,597 | ||||

| Total net assets 100.00% | $62,684,040 | ||||

(A) Credit ratings are unaudited and are rated by Moody’s Investors Service or Fitch where Standard & Poor’s ratings are not available, unless indicated otherwise.

(G) Security rated internally by John Hancock Advisers, LLC.

(O) Cash interest will be paid on this obligation at the stated rate beginning on the stated date.

(P) Represents rate in effect on February 28, 2006.

The percentage shown for each investment category is the total value of that category as a percentage of the net assets of the Fund.

| See notes to financial statements. |

13

F I N A N C I A L S TAT E M E N T S

| ASSETS AND LIABILITIES February 28, 2006 (unaudited) This Statement of Assets and Liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value and the maximum offering price per share. |

| Assets | |

| Investments at value (cost $56,898,658) | $61,527,443 |

| Cash | 466 |

| Receivable for shares sold | 491,596 |

| Interest receivable | 809,649 |

| Other assets | 5,162 |

| Total assets | 62,834,316 |

| Liabilities | |

| Payable for shares repurchased | 54,020 |

| Dividends payable | 6,558 |

| Payable to affiliates | |

| Management fees | 23,831 |

| Distribution and service fees | 4,407 |

| Other | 12,018 |

| Other payables and accrued expenses | 49,442 |

| Total liabilities | 150,276 |

| Net assets | |

| Capital paid-in | 58,744,402 |

| Accumulated net realized loss on investments | (711,816) |

| Net unrealized appreciation of investments | 4,628,785 |

| Accumulated net investment income | 22,669 |

| Net assets | $62,684,040 |

| Net asset value per share | |

| Based on net asset values and shares outstanding — | |

| the Fund has an unlimited number of shares | |

| authorized with no par value | |

| Class A ($43,256,126 ÷ 3,478,288 shares) | $12.44 |

| Class B ($15,672,692 ÷ 1,260,255 shares) | $12.44 |

| Class C ($3,755,222 ÷ 301,966 shares) | $12.44 |

| Maximum offering price per share | |

| Class A1 ($12.44 ÷ 95.5%) | $13.03 |

1 On single retail sales of less than $100,000. On sales of $100,000 or more and on group sales the offering price is reduced.

| See notes to financial statements. |

14

F I N A N C I A L S TAT E M E N T S

| OPERATIONS For the period ended February 28, 2006 (unaudited)1 This Statement of Operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated. |

| Investment income | |

| Interest | $1,647,896 |

| Total investment income | 1,647,896 |

| Expenses | |

| Investment management fees | 156,868 |

| Class A distribution and service fees | 63,293 |

| Class B distribution and service fees | 81,648 |

| Class C distribution and service fees | 21,113 |

| Transfer agent fees | 28,267 |

| Custodian fees | 19,643 |

| Professional fees | 12,911 |

| Printing | 9,038 |

| Accounting and legal services fees | 7,844 |

| Registration and filing fees | 2,603 |

| Trustees’ fees | 2,298 |

| Miscellaneous | 1,868 |

| Compliance fees | 1,364 |

| Interest | 260 |

| Total expenses | 409,018 |

| Net investment income | 1,238,878 |

| Realized and unrealized gain (loss) | |

| Net realized gain on investments | 55,322 |

| Change in net unrealized appreciation | |

| (depreciation) of investments | (973,593) |

| Net realized and unrealized loss | (918,271) |

| Increase in net assets from operations | $320,607 |

1 Semiannual period from 9-1-05 through 2-28-06.

| See notes to financial statements. |

15

F I N A N C I A L S TAT E M E N T S

| CHANGES IN NET ASSETS These Statements of Changes in Net Assets show how the value of the Fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions. |

| Year | Period | |

| ended | ended | |

| 8-31-05 | 2-28-061 | |

| Increase (decrease) in net assets | ||

| From operations | ||

| Net investment income | $2,603,354 | $1,238,878 |

| Net realized gain | 294,300 | 55,322 |

| Change in net unrealized | ||

| appreciation (depreciation) | 482,944 | (973,593) |

| Increase in net assets resulting | ||

| from operations | 3,380,598 | 320,607 |

| Distributions to shareholders | ||

| From net investment income | ||

| Class A | (1,795,694) | (879,089) |

| Class B | (641,513) | (283,044) |

| Class C | (161,892) | (73,148) |

| (2,599,099) | (1,235,281) | |

| From Fund share transactions | (3,433,083) | (1,824,993) |

| Net assets | ||

| Beginning of period | 68,075,291 | 65,423,707 |

| End of period2 | $65,423,707 | $62,684,040 |

1 Semiannual period from 9-1-05 through 2-28-06. Unaudited.

2 Includes accumulated net investment income of $19,072 and $22,669, respectively.

| See notes to financial statements. |

16

F I N A N C I A L H I G H L I G H T S

| FINANCIAL HIGHLIGHTS |

CLASS A SHARES

The Financial Highlights show how the Fund’s net asset value for a

share has changed since the end of the previous period.

| Period ended | 8-31-01 | 8-31-021 | 8-31-03 | 8-31-04 | 8-31-05 | 2-28-062 |

| Per share operating performance | ||||||

| Net asset value, | ||||||

| beginning of period | $11.82 | $12.57 | $12.48 | $12.10 | $12.46 | $12.61 |

| Net investment income3 | 0.58 | 0.58 | 0.56 | 0.54 | 0.52 | 0.26 |

| Net realized and unrealized | ||||||

| gain (loss) on investments | 0.75 | (0.09) | (0.38) | 0.36 | 0.15 | (0.17) |

| Total from investment operations | 1.33 | 0.49 | 0.18 | 0.90 | 0.67 | 0.09 |

| Less distributions | ||||||

| From net investment income | (0.58) | (0.58) | (0.56) | (0.54) | (0.52) | (0.26) |

| Net asset value, end of period | $12.57 | $12.48 | $12.10 | $12.46 | $12.61 | $12.44 |

| Total return4 (%) | 11.545 | 4.045 | 1.435 | 7.545 | 5.50 | 0.716 |

| Ratios and supplemental data | ||||||

| Net assets, end of period | ||||||

| (in millions) | $48 | $49 | $46 | $44 | $44 | $43 |

| Ratio of expenses | ||||||

| to average net assets (%) | 0.97 | 1.05 | 1.00 | 1.01 | 1.06 | 1.077 |

| Ratio of adjusted expenses | ||||||

| to average net assets8 (%) | 1.12 | 1.06 | 1.02 | 1.02 | — | — |

| Ratio of net investment income | ||||||

| to average net assets (%) | 4.77 | 4.71 | 4.55 | 4.35 | 4.18 | 4.187 |

| Portfolio turnover (%) | 54 | 36 | 17 | 43 | 25 | 12 |

| See notes to financial statements. |

17

F I N A N C I A L H I G H L I G H T S

CLASS B SHARES

| Period ended | 8-31-01 | 8-31-021 | 8-31-03 | 8-31-04 | 8-31-05 | 2-28-062 |

| Per share operating performance | ||||||

| Net asset value, | ||||||

| beginning of period | $11.82 | $12.57 | $12.48 | $12.10 | $12.46 | $12.61 |

| Net investment income3 | 0.49 | 0.49 | 0.47 | 0.45 | 0.43 | 0.21 |

| Net realized and unrealized | ||||||

| gain (loss) on investments | 0.75 | (0.09) | (0.38) | 0.36 | 0.15 | (0.17) |

| Total from investment operations | 1.24 | 0.40 | 0.09 | 0.81 | 0.58 | 0.04 |

| Less distributions | ||||||

| From net investment income | (0.49) | (0.49) | (0.47) | (0.45) | (0.43) | (0.21) |

| Net asset value, end of period | $12.57 | $12.48 | $12.10 | $12.46 | $12.61 | $12.44 |

| Total return4 (%) | 10.765 | 3.315 | 0.725 | 6.805 | 4.77 | 0.366 |

| Ratios and supplemental data | ||||||

| Net assets, end of period | ||||||

| (in millions) | $17 | $23 | $22 | $20 | $17 | $16 |

| Ratio of expenses | ||||||

| to average net assets (%) | 1.67 | 1.75 | 1.70 | 1.71 | 1.76 | 1.777 |

| Ratio of adjusted expenses | ||||||

| to average net assets8 (%) | 1.82 | 1.76 | 1.72 | 1.72 | — | — |

| Ratio of net investment income | ||||||

| to average net assets (%) | 4.07 | 4.01 | 3.85 | 3.65 | 3.48 | 3.487 |

| Portfolio turnover (%) | 54 | 36 | 17 | 43 | 25 | 12 |

| See notes to financial statements. |

18

F I N A N C I A L H I G H L I G H T S

CLASS C SHARES

| Period ended | 8-31-01 | 8-31-021 | 8-31-03 | 8-31-04 | 8-31-05 | 2-28-062 |

| Per share operating performance | ||||||

| Net asset value, | ||||||

| beginning of period | $11.82 | $12.57 | $12.48 | $12.10 | $12.46 | $12.61 |

| Net investment income3 | 0.50 | 0.49 | 0.47 | 0.45 | 0.43 | 0.21 |

| Net realized and unrealized | ||||||

| gain (loss) on investments | 0.75 | (0.09) | (0.38) | 0.36 | 0.15 | (0.17) |

| Total from investment operations | 1.25 | 0.40 | 0.09 | 0.81 | 0.58 | 0.04 |

| Less distributions | ||||||

| From net investment income | (0.50) | (0.49) | (0.47) | (0.45) | (0.43) | (0.21) |

| Net asset value, end of period | $12.57 | $12.48 | $12.10 | $12.46 | $12.61 | $12.44 |

| Total return4 (%) | 10.775 | 3.315 | 0.725 | 6.805 | 4.77 | 0.366 |

| Ratios and supplemental data | ||||||

| Net assets, end of period | ||||||

| (in millions) | $1 | $3 | $5 | $5 | $5 | $4 |

| Ratio of expenses | ||||||

| to average net assets (%) | 1.67 | 1.75 | 1.70 | 1.71 | 1.76 | 1.777 |

| Ratio of adjusted expenses | ||||||

| to average net assets8 (%) | 1.82 | 1.76 | 1.72 | 1.72 | — | — |

| Ratio of net investment income | ||||||

| to average net assets (%) | 4.07 | 4.01 | 3.81 | 3.65 | 3.48 | 3.477 |

| Portfolio turnover (%) | 54 | 36 | 17 | 43 | 25 | 12 |

1 As required, effective 9-1-01 the Fund adopted the provisions of the AICPA Audit and Accounting Guide for Investment Companies, as revised, relating to the amortization of premiums and accretion of discounts on debt securities. This change had no effect on per share amounts for the year ended 8-31-02 and, had the Fund not made these changes to amortization and accretion, the ratio of net investment income to average net assets would have been 4.69%, 3.99% and 3.99%, for Class A, Class B and Class C shares, respectively. Per share ratios and supplemental data for periods prior to 9-1-01, have not been restated to reflect this change in presentation.

2 Semiannual period from 9-1-05 through 2-28-06. Unaudited.

3 Based on the average of the shares outstanding.

4 Assumes dividend reinvestment and does not reflect the effect of sales charges.

5 Total returns would have been lower had certain expenses not been reduced during the periods shown.

6 Not annualized.

7 Annualized.

8 Does not take into consideration expense reductions during the periods shown.

| See notes to financial statements. |

19

| NOTES TO STATEMENTS Unaudited |

Accounting policies

John Hancock New York Tax-Free Income Fund (the “Fund”) is a non-diversified series of John Hancock Tax-Exempt Series Fund, an open-end management investment company registered under the Investment Company Act of 1940. The Fund seeks a high level of current income, consistent with the preservation of capital, that is exempt from federal, New York State and New York City personal income taxes. Since the Fund invests primarily in New York state issuers, the Fund may be affected by political, economic or regulatory developments in the state of New York.

The Trustees have authorized the issuance of multiple classes of shares of the Fund, designated as Class A, Class B and Class C shares. The shares of each class represent an interest in the same portfolio of investments of the Fund and have equal rights as to voting, redemptions, dividends and liquidation, except that certain expenses, subject to the approval of the Trustees, may be applied differently to each class of shares in accordance with current regulations of the Securities and Exchange Commission and the Internal Revenue Service. Shareholders of a class that bears distribution and service expenses under the terms of a distribution plan have exclusive voting rights to that distribution plan.

Significant accounting policies

of the Fund are as follows:

Valuation of investments

Securities in the Fund’s portfolio are valued on the basis of market quotations, valuations provided by independent pricing services or at fair value as determined in good faith in accordance with procedures approved by the Trustees. Short-term debt investments which have a remaining maturity of 60 days or less may be valued at amortized cost, which approximates market value.

Joint repurchase agreement

Pursuant to an exemptive order issued by the Securities and Exchange Commission, the Fund, along with other registered investment companies having a management contract with John Hancock Advisers, LLC (the “Adviser”), a wholly owned subsidiary of John Hancock Financial Services, Inc., a subsidiary of Manulife Financial Corporation (“MFC”), may participate in a joint repurchase agreement transaction. Aggregate cash balances are invested in one or more large repurchase agreements, whose underlying securities are obligations of the U.S. government and/or its agencies. The Fund’s custodian bank receives delivery of the underlying securities for the joint account on the Fund’s behalf. The Adviser is responsible for ensuring that the agreement is fully collateralized at all times.

20

Investment transactions

Investment transactions are recorded as of the date of purchase, sale or maturity. Net realized gains and losses on sales of investments are determined on the identified cost basis.

Discount and premium on securities

The Fund accretes discount and amortizes premium from par value on securities from either the date of issue or the date of purchase over the life of the security.

Class allocations

Income, common expenses and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the appropriate net asset value of the respective classes. Distribution and service fees, if any, are calculated daily at the class level based on the appropriate net asset value of each class and the specific expense rate(s) applicable to each class.

Expenses

The majority of expenses are directly identifiable to an individual fund. Expenses that are not readily identifi-able to a specific fund are allocated in such a manner as deemed equitable, taking into consideration, among other things, the nature and type of expense and the relative size of the funds.

Bank borrowings

The Fund is permitted to have bank borrowings for temporary or emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. The Fund has entered into a syndicated line of credit agreement with various banks. This agreement enables the Fund to participate with other funds managed by the Adviser, in an unsecured line of credit with banks, which permits borrowings of up to $250 million, collectively. Interest is charged to each fund based on its borrowing. In addition, a commitment fee is charged to each fund based on the average daily unused portion of the line of credit, and is allocated among the participating funds. The Fund had no borrowing activity under the line of credit during the period ended February 28, 2006.

Federal income taxes

The Fund qualifies as a “regulated investment company” by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required. For federal income tax purposes, the Fund has $717,524 of a capital loss carryforward available, to the extent provided by regulations, to offset future net realized capital gains. To the extent that such carryforward is used by the Fund, no capital gain distributions will be made. The loss carryforward expires as follows: August 31, 2008 — $119,641, August 31, 2010 —$181,898, August 31, 2011 — $414,533 and August 31, 2012 — $1,452.

Interest and distributions

Interest income on investment securities is recorded on the accrual basis.

The Fund records distributions to shareholders from net investment income and net realized gains, if any, on the ex-dividend date. The Fund’s net investment income is declared daily as dividends to shareholders of record as of the close of business on the preceding day, and distributed monthly. During the year ended August 31, 2005, the tax character of distributions paid was as follows: ordinary income $2,692 and exempt income $2,596,407. Distributions paid by the Fund with respect to each class of shares are calculated in the same manner, at the same time and are in the same amount, except for the effect of expenses that may be applied differently to each class.

Such distributions, on a tax basis, are determined in conformity with income tax regulations, which may differ

21

from accounting principles generally accepted in the United States of America. Distributions in excess of tax basis earnings and profits, if any, are reported in the Fund’s financial statements as a return of capital.

Use of estimates

The preparation of these financial statements, in accordance with accounting principles generally accepted in the United States of America, incorporates estimates made by management in determining the reported amount of assets, liabilities, revenues and expenses of the Fund. Actual results could differ from these estimates.

Note B

Management fee and

transactions with

affiliates and others

The Fund has an investment management contract with the Adviser. Under the investment management contract, the Fund pays a monthly management fee to the Adviser equivalent, on an annual basis, to the sum of: (a) 0.50% of the first $250,000,000 of the Fund’s average daily net asset value, (b) 0.45% of the next $250,000,000, (c) 0.425% of the next $500,000,000, (d) 0.40% of the next $250,000,000 and (e) 0.30% of the Fund’s average daily net asset value in excess of $1,250,000,000.

Effective December 31, 2005, the investment management teams of the Adviser were reorganized into Sovereign Asset Management LLC (“Sovereign”), a wholly owned indirect subsidiary of John Hancock Life Insurance Company (“JHLICo”), a subsidiary of MFC. The Adviser remains the principal advisor on the Fund and Sovereign acts as subadviser under the supervision of the Adviser. The restructuring did not have an impact on the Fund, which continues to be managed using the same investment philosophy and process. The Fund is not responsible for payment of the subadvisory fees.

The Fund has Distribution Plans with John Hancock Funds, LLC (“JH Funds”), a wholly owned subsidiary of the Adviser. The Fund has adopted Distribution Plans with respect to Class A, Class B and Class C, pursuant to Rule 12b-1 under the Investment Company Act of 1940, to reimburse JH Funds for the services it provides as distributor of shares of the Fund. Accordingly, the Fund makes monthly payments to JH Funds at an annual rate not to exceed 0.30% of Class A average daily net asset value and 1.00% of Class B and Class C average daily net asset values. A maximum of 0.25% of such payments may be service fees, as defined by the Conduct Rules of the National Association of Securities Dealers. Under the Conduct Rules, curtailment of a portion of the Fund’s 12b-1 payments could occur under certain circumstances.

Class A shares are assessed up-front sales charges. During the period ended February 28, 2006, JH Funds received net up-front sales charges of $12,075 with regard to sales of Class A shares. Of this amount, $1,436 was retained and used for printing prospectuses, advertising, sales literature and other purposes, $8,005 was paid as sales commissions to unrelated broker-dealers and $2,634 was paid as sales commissions to sales personnel of Signator Investors, Inc. (“Signator Investors”), a related broker-dealer. The Adviser’s indirect parent JHLICo, is the indirect sole shareholder of Signator Investors.

Class B shares that are redeemed within six years of purchase are subject to a contingent deferred sales charge (“CDSC”) at declining rates, beginning at 5.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Class C shares that are redeemed within one year of purchase are subject to a CDSC at a rate of 1.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed.

22

Proceeds from the CDSCs are paid to JH Funds and are used, in whole or in part, to defray its expenses for providing distribution-related services to the Fund in connection with the sale of Class B and Class C shares. During the period ended February 28, 2006, CDSCs received by JH Funds amounted to $8,576 for Class B shares and $23 for Class C shares.

The Fund has a transfer agent agreement with John Hancock Signature Services, Inc. (“Signature Services”), an indirect subsidiary of JHLICo. The Fund pays a monthly transfer agent fee at an annual rate of 0.01% of each class’s average daily net asset values, plus a fee based on the number of shareholder accounts and reimbursement for certain out-of-pocket expenses, aggregated and allocated to each class on the basis of its relative net asset value. Signature Services agreed to voluntarily reduce the Fund’s asset-based portion of the transfer agent fee if the total transfer agent fee exceeds the Lipper, Inc. median transfer agency fee for comparable mutual funds by greater than 0.05% . There were no transfer agent fee reductions during the period ended February 28, 2006. Signature Services reserves the right to terminate this limitation at any time.

The Fund has an agreement with the Adviser to perform necessary tax, accounting and legal services for the Fund. The compensation for the period amounted to $7,844. The Fund also paid the Adviser the amount of $211 for certain publishing services, included in the printing fees. The Fund also reimbursed JHLICo for certain compliance costs, included in the Fund’s Statement of Operations.

Mr. James R. Boyle is Chairman of the Adviser, as well as affiliated Trustee of the Fund, and is compensated by the Adviser and/or its affiliates. The compensation of unaffiliated Trustees is borne by the Fund. The unaffiliated Trustees may elect to defer, for tax purposes, their receipt of this compensation under the John Hancock Group of Funds Deferred Compensation Plan. The Fund makes investments into other John Hancock funds, as applicable, to cover its liability for the deferred compensation. Investments to cover the Fund’s deferred compensation liability are recorded on the Fund’s books as an other asset. The deferred compensation liability and the related other asset are always equal and are marked to market on a periodic basis to reflect any income earned by the investments, as well as any unrealized gains or losses. The Deferred Compensation Plan investments had no impact on the operations of the Fund.

23

Note C

Fund share transactions

This listing illustrates the number of Fund shares sold, reinvested and repurchased during the last two periods, along with the corresponding dollar value.

| Year ended 8-31-05 | Period ended 2-28-061 | |||

| Shares | Amount | Shares | Amount | |

| Class A shares | ||||

| Sold | 275,656 | $3,450,163 | 155,543 | $1,927,104 |

| Distributions reinvested | 99,529 | 1,245,508 | 48,858 | 604,980 |

| Repurchased | (411,025) | (5,140,957) | (189,689) | (2,346,754) |

| Net increase (decrease) | (35,840) | ($445,286) | 14,712 | $185,330 |

| Class B shares | ||||

| Sold | 76,183 | $951,422 | 21,546 | $266,881 |

| Distributions reinvested | 29,637 | 370,864 | 14,183 | 175,621 |

| Repurchased | (322,709) | (4,037,119) | (142,064) | (1,757,360) |

| Net decrease | (216,889) | ($2,714,833) | (106,335) | ($1,314,858) |

| Class C shares | ||||

| Sold | 29,713 | $371,933 | 930 | $11,497 |

| Distributions reinvested | 8,575 | 107,317 | 3,998 | 49,508 |

| Repurchased | (60,071) | (752,214) | (61,118) | (756,470) |

| Net decrease | (21,783) | ($272,964) | (56,190) | ($695,465) |

| Net decrease | (274,512) | ($3,433,083) | (147,813) | ($1,824,993) |

1 Semiannual period from 9-1-05 through 2-28-06. Unaudited.

Note D

Investment

transactions

Purchases and proceeds from sales or maturities of securities, other than short-term securities and obligations of the U.S. government, during the period ended February 28, 2006, aggregated $7,661,980 and $9,940,585, respectively.

The cost of investments owned on February 28, 2006 including short-term investments, for federal income tax purposes, was $56,867,214. Gross unrealized appreciation and depreciation of investments aggregated $4,660,229 and none, respectively, resulting in net unrealized appreciation of $4,660,229. The difference between book basis and tax basis net unrealized appreciation of investments is attributable primarily to the accretion of discounts on debt securities.

24

Board Consideration

of Sovereign Asset

Management LLC

as Subadviser to

John Hancock

New York Tax-

Free Income Fund

At a meeting held on December 6, 2005, the Board reviewed a Subadvisory Agreement among the Fund, the Adviser and Sovereign Asset Management LLC, an affiliate of the Adviser (the “Subadviser”). At that meeting, the Adviser proposed, and the Board accepted, a reorganization of the Adviser’s operations and the transfer to the Subadviser of all of the Adviser’s investment personnel. As a result of this restructuring, the Adviser remains the principal adviser to the Fund, and the Subadviser acts as subadviser under the supervision of the Adviser. In evaluating the Subadviser Agreement, the Board relied upon the review that it conducted at its May and June 2005 meetings, its familiarity with the operations and personnel transferred to Sovereign and representations by the Adviser that the reorganization would not result in a change in the quality of services provided under the Subadvisory Agreement or the personnel responsible for the day-today management of the Fund. The Board also reviewed an analysis of the fee paid by the Adviser to the Subadviser under the Subadvisory Agreement relative to subadvisory fees paid by the Adviser and its affiliates to third party subadvisers and fees paid by a peer group of unaffiliated investment companies. After considering the above-described factors and based on its deliberations and its evaluation of the information described above, the Board concluded that approval of the Subadvisory Agreement was in the best interest of the Fund and its shareholders. Accordingly, the Board unanimously approved the Subadvisory Agreement, which became effective on December 31, 2005.

25

| OUR FAMILY OF FUNDS |

| Equity | Balanced Fund |

| Classic Value Fund | |

| Core Equity Fund | |

| Focused Equity Fund | |

| Growth Trends Fund | |

| Large Cap Equity Fund | |

| Large Cap Select Fund | |

| Mid Cap Equity Fund | |

| Mid Cap Growth Fund | |

| Multi Cap Growth Fund | |

| Small Cap Fund | |

| Small Cap Equity Fund | |

| Small Cap Intrinsic Value Fund | |

| Sovereign Investors Fund | |

| U.S. Global Leaders Growth Fund | |

| Asset Allocation and | Allocation Growth + Value Portfolio |

| Lifestyle Portfolios | Allocation Core Portfolio |

| Lifestyle Aggressive Portfolio | |

| Lifestyle Growth Portfolio | |

| Lifestyle Balanced Portfolio | |

| Lifestyle Moderate Portfolio | |

| Lifestyle Conservative Portfolio | |

| Sector | Financial Industries Fund |

| Health Sciences Fund | |

| Real Estate Fund | |

| Regional Bank Fund | |

| Technology Fund | |

| Technology Leaders Fund | |

| International | Greater China Opportunities Fund |

| International Fund | |

| International Classic Value Fund | |

| Income | Bond Fund |

| Government Income Fund | |

| High Yield Fund | |

| Investment Grade Bond Fund | |

| Strategic Income Fund | |

| Tax-Free Income | California Tax-Free Income Fund |

| High Yield Municipal Bond Fund | |

| Massachusetts Tax-Free Income Fund | |

| New York Tax-Free Income Fund | |

| Tax-Free Bond Fund | |

| Money Market | Money Market Fund |

| U.S. Government Cash Reserve | |

For more complete information on any John Hancock Fund and a prospectus, which includes charges and expenses, call your financial professional, or John Hancock Funds at 1-800-225-5291. Please read the prospectus carefully before investing or sending money.

26

| ELECTRONIC DELIVERY Now available from John Hancock Funds |

Instead of sending annual and semiannual reports

and prospectuses through the U.S. mail, we’ll notify

you by e-mail when these documents are available

for online viewing.

How does electronic delivery benefit you?

| * | No more waiting for the mail to arrive; you’ll receive an |

| e-mail notification as soon as the document is ready for | |

| online viewing. | |

| * | Reduces the amount of paper mail you receive from |

| John Hancock Funds. | |

| * | Reduces costs associated with printing and mailing. |

| Sign up for electronic delivery today at www.jhfunds.com/edelivery |

27

| A wealth of information — | |

| OUR WEB SITE | www.jhfunds.com |

| View the latest information for your account. | |

| Transfer money from one account to another. | |

| Get current quotes for major market indexes. | |

| Use our online calculators to help you with your | |

| financial goals. | |

| Get up-to-date commentary from John Hancock | |

| Funds investment experts. | |

| Access forms, applications and tax information. |

28

For more information

The Fund’s proxy voting policies, procedures and records are available without charge, upon request:

| By phone | On the Fund’s Web site | On the SEC’s Web site |

| 1-800-225-5291 | www.jhfunds.com/proxy | www.sec.gov |

| Trustees | Francis V. Knox, Jr. | Custodian |

| Ronald R. Dion, Chairman | Vice President and | The Bank of New York |

| James R. Boyle† | Chief Compliance Officer | One Wall Street |

| James F. Carlin | John G. Vrysen | New York, NY 10286 |

| Richard P. Chapman, Jr.* | Executive Vice President and | |

| William H. Cunningham | Chief Financial Officer | Transfer agent |

| Charles L. Ladner* | John Hancock Signature | |

| Dr. John A. Moore* | Investment adviser | Services, Inc. |

| Patti McGill Peterson* | John Hancock Advisers, LLC | 1 John Hancock Way, |

| Steven R. Pruchansky | 601 Congress Street | Suite 1000 |

| Boston, MA 02210-2805 | Boston, MA 02217-1000 | |

| *Members of the Audit Committee | ||

| †Non-Independent Trustee | Subadviser | Legal counsel |

| Sovereign Asset | Wilmer Cutler Pickering | |

| Officers | Management LLC | Hale and Dorr LLP |

| 101 Huntington Avenue | 60 State Street | |

| Keith F. Hartstein | Boston, MA 02199 | Boston, MA 02109-1803 |

| President and | ||

| Chief Executive Officer | Principal distributor | |

| William H. King | John Hancock Funds, LLC | |

| Vice President and Treasurer | 601 Congress Street | |

| Boston, MA 02210-2805 | ||

The Fund’s investment objective, risks, charges and expenses are included in the prospectus and should be considered carefully before investing. For a prospectus, call your financial professional, call John Hancock Funds at 1-800-225-5291, or visit the Fund’s Web site at www.jhfunds.com. Please read the prospectus carefully before investing or sending money.

| How to contact us | ||

| Internet | www.jhfunds.com | |

| Regular mail: | Express mail: | |

| John Hancock | John Hancock | |

| Signature Services, Inc. | Signature Services, Inc. | |

| 1 John Hancock Way, Suite 1000 | Mutual Fund Image Operations | |

| Boston, MA 02217-1000 | 380 Stuart Street | |

| Boston, MA 02116 | ||

| Phone | Customer service representatives | 1-800-225-5291 |

| 24-hour automated information | 1-800-338-8080 | |

| TDD line | 1-800-554-6713 | |

A listing of month-end portfolio holdings is available on our Web site, www.jhfunds.com. A more detailed portfolio holdings summary is available on a quarterly basis 60 days after the fiscal quarter on our Web site or upon request by calling 1-800-225-5291, or on the Securities and Exchange Commission’s Web site, www.sec.gov.

29

1-800-225-5291

1-800-554-6713 (TDD)

1-800-338-8080 EASI-Line

www.jhfunds. com

Now available: electronic delivery

www.jhfunds. com/edelivery

This report is for the information of

the shareholders of John Hancock

New York Tax-Free Income Fund.

760SA 2/06

4/06

| Table of contents |

| Your fund at a glance |

| page 1 |

| Managers’ report |

| page 2 |

| A look at performance |

| page 6 |

| Growth of $10,000 |

| page 7 |

| Your expenses |

| page 8 |

| Fund’s investments |

| page 10 |

| Financial statements |

| page 14 |

| For more information |

| page 29 |

To Our Shareholders,

The mutual fund industry has seen enormous growth over the last several decades. A good half of all American households are now invested in at least one mutual fund and the industry has grown to more than $8 trillion invested in some 7,000–8,000 mutual funds. With this growth, investors and their financial professionals have had access to an increasing array of investment choices — and greater challenges as they try to find the best-performing funds to fit their investment objectives.

Morningstar, Inc., a major independent analyst of the mutual fund industry, has provided investors and their advisors with an important evaluation tool since 1985, when it launched its “star” rating. Based on certain measurements, the Morningstar Rating for funds reflects each fund’s risk-adjusted return compared to a peer group, designating the results with a certain number of stars, from five stars for the best down to one star. The star ranking system has become the gold standard, with 4- and 5-star funds accounting for the bulk of fund sales.

As good, and important, as this ranking measurement has been, we have long taken issue with part of the process that adjusts performance on broker-sold Class A shares for “loads” — or up-front commissions. We have argued that this often does not accurately reflect an A-share investor’s experience, since they increasingly are purchasing A shares in retirement plans and fee-based platforms that waive the up-front fee.

We are pleased to report that Morningstar has acknowledged this trend and has added a new rating for Class A shares on a no-load basis, called the “Load-Waived A Share” rating, that captures the experience of an investor who is not paying a front-end load. This new rating will better assist our plan sponsors, 401(k) plan participants and clients of financial professionals who invest via fee-based platforms or commit to invest more than a certain dollar amount, in evaluating their choice of mutual funds.

Since being implemented in early December 2005, the impact on our funds has been terrific. Under the new load-waived rating, 11 of our 43 open-end retail mutual funds now have 4- or 5-star rankings on their load-waived A shares, as of February 28, 2006.

We commend Morningstar for its move and urge our shareholders to consider this another tool at your disposal as you and your financial professional are evaluating investment choices.

Sincerely,

| Keith F. Hartstein, President and Chief Executive Officer |

| This commentary reflects the CEO’s views as of February 28, 2006. They are subject to change at any time. |

| YOUR FUND AT A GLANCE The Fund seeks a high level of current income, consistent with preservation of capital, that is exempt from federal and Massachusetts personal income taxes. In pursuing this goal, the fund normally invests at least 80% of its assets in securities of any maturity exempt from federal and Massachusetts personal income taxes. |

Over the last six months

| * | Municipal bonds posted modest gains and outpaced the broad |

| taxable bond market. | |

| * | The Fund’s performance surpassed the return of its peer group average. |

| * | Top-performing sectors included health care, resource recovery and |

| electric utility bonds. | |

Total returns for the Fund are at net asset value with all distributions reinvested. These returns do not reflect the deduction of the maximum sales charge, which would reduce the performance shown above.

| Top 10 holdings | |

| 4.3% | Massachusetts Turnpike Auth, 1-1-23, 5.125% |

| 3.4% | Holyoke Gas and Electric Department, 12-1-31, 5.000% |

| 3.2% | Route 3 North Transit Improvement Assoc, 6-15-29, 5.375% |

| 3.1% | Massachusetts Development Finance Agency, |

| 12-15-24, 5.000% | |

| 2.7% | Massachusetts Industrial Finance Agency, 12-1-20, 6.750% |

| 2.7% | Massachusetts Water Pollution Abatement Trust, |

| 8-1-18, 5.250% | |

| 2.4% | Puerto Rico Aqueduct & Sewer Auth, 7-1-11, 8.095% |

| 2.3% | Massachusetts Health & Educational Facilities Auth, |

| 12-15-31, 9.200% | |

| 2.3% | Massachusetts, Commonwealth of, 12-1-24, 5.500% |

| 2.3% | Massachusetts Housing Finance Agency, 12-1-16, 4.700% |

| As a percentage of net assets on February 28, 2006. | |

1

BY DIANNE SALES, CFA, AND FRANK A. LUCIBELLA, PORTFOLIO MANAGERS, SOVEREIGN ASSET MANAGEMENT LLC

| MANAGERS’ REPORT |

| JOHN HANCOCK Massachusetts Tax-Free Income Fund |

Municipal bonds edged higher during the six months ended February 28, 2006, and outperformed taxable bonds. The Lehman Brothers Municipal Bond Index returned 0.99%, while the Lehman Brothers U.S. Aggregate Index — a broad measure of the taxable bond market — returned –0.11% ..

The bond market’s muted performance reflected the resiliency of the U.S. economy, which grew at a healthy rate despite the dampening impact of higher energy prices and the devastating 2005 hurricane season. To keep the economy on an even keel, the Federal Reserve extended its series of short-term interest rate increases, raising the federal funds rate four times during the six-month period (for a total of 14 rate hikes since June 2004). By the end of the period, the federal funds rate stood at 4.5%, its highest level in nearly five years. Short-term municipal bond yields rose along with the federal funds rate, though to a lesser degree, while longer-term municipal yields held steady as inflation remained benign.

| “Municipal bonds edged higher during the six months ended February 28, 2006, and outperformed taxable bonds.” |

Demand for yield continued to drive performance in the municipal bond market. Investors seeking the highest yields available flocked to lower-rated issues, which outperformed higher-quality bonds during the six-month period. Consequently, the yields of high-quality and lower-quality bonds converged further, nearing historically narrow levels.

Massachusetts municipalities continued to benefit from the persistent strength of the economy. The state’s economy was hit harder than most in the recent economic downturn, and recovery has been more moderate. On the positive side, continued growth allowed tax revenues to remain healthy, enabling the state and many local governments to top off their “rainy day” reserve funds,

2

which are intended to cover expenditures during emergencies and periods of lean revenues.

Fund performance

For the six months ended February 28, 2006, John Hancock Massachusetts Tax-Free Income Fund’s Class A, Class B and Class C shares posted total returns of 0.83%, 0.48% and 0.48%, respectively, at net asset value. This performance compared with the 0.65% average return of Morningstar’s Muni Massachusetts fund category1 but trailed the 0.99% return of the Lehman Brothers Municipal Bond Index. Keep in mind that your net asset value return will be different from the Fund’s performance if you were not invested in the Fund for the entire period and did not reinvest all distributions. See pages six and seven for historical performance information.

Individual security selection remained a key contributing factor to the Fund’s performance. Our emphasis on thorough credit research helped us build a portfolio of bonds with an attractive balance of credit quality, yield and total return potential.

| “Reflecting the strong demand for yield, the portfolio’s best performers were lower-rated revenue bonds with relatively high yields...” |

Lower-quality bonds produced best returns

Reflecting the strong demand for yield, the portfolio’s best performers were lower-rated revenue bonds with relatively high yields, which outperformed as the yield spreads between higher- and lower-quality bonds narrowed. Bonds rated BBB were the stars during the period, followed closely by non-rated revenue bonds, while A-rated bonds came in third place. Although the tighter yield spreads were favorable for performance, they also presented challenges in the current investment environment; we had to be very opportunistic in identifying undervalued investment opportunities with the necessary credit characteristics and performance potential.

Looking at sector performance, health care bonds, which make up a substantial portion of the lower-quality bonds in the Massachusetts municipal market, posted the best results. Other leading sectors included resource recovery, electric revenue and

3

| Sector | |

| distribution2 | |

| Revenue bonds | |

| Transportation | 19% |

| Other | 19% |

| Education | 13% |

| Health | 12% |

| Electric | 4% |

| Industrial | |

| development | 4% |

| Pollution | 4% |

| Water & sewer | 3% |

| Sales tax | 2% |

| Resource | |

| recovery | 1% |

| Economic | |

| development | 1% |

| Correctional | |

| facility | 1% |

| Public facility | 1% |

| Housing | 1% |

| General | |

| obligation | 14% |

industrial development bonds, all of which benefited from the robust economy.

GOs, essential services lagged

Higher-quality bonds — such as general obligation bonds and securities backed by revenues from essential services like water and sewer — trailed the broader municipal bond market, though returns were generally positive. The only exceptions to this were bonds that were refunded as part of the state’s continued balance-sheet restructuring. These included bonds issued by the Massachusetts Bay Transit Authority that were formerly backed by state GO bonds. In general, though, GO bonds posted muted returns following several years of solid gains.

Outlook

The U.S. economy has held up well despite higher short-term interest rates, rising energy prices and catastrophic hurricanes. In fact, rebuilding in hurricane-damaged areas may provide an additional boost to economic growth in the coming months. Current expectations suggest that the Fed is likely to raise short-term interest rates

at least one or two more times in the next few months. What occurs after mid-year, however, is less clear — evidence of slowing economic activity could convince the Fed to adopt a “wait-and-see” approach during the second half of the year.

In the municipal bond market, issuance is expected to be down substantially from record levels in 2005. Overall estimates are for a 20%-30% decline in 2006, and Massachusetts should be in line

4

| “In the municipal bond market, issuance is expected to be down substantially from record levels in 2005.” |

with these expectations; issuance in the first two months of 2006 was down 40% from the previous year. Although reduced issuance bodes well for market performance, we expect to see pockets of oversupply that will provide opportunities for us to pick our spots. Given the tight yield spreads between higher- and lower-quality bonds, we have adopted a more conservative approach to credit analysis because there is little reward for taking on additional credit risk.

This commentary reflects the views of the portfolio managers through the end of the Fund’s period discussed in this report. The managers’ statements reflect their own opinions. As such, they are in no way guarantees of future events and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

1 Figures from Morningstar, Inc. include reinvested dividends and do not take into account sales charges. Actual load-adjusted performance is lower.

2 As a percentage of net assets on February 28, 2006.

5

| A LOOK AT PERFORMANCE For the period ended February 28, 2006 |

| Class A | Class B | Class C | |

| Inception date | 9-3-87 | 10-3-96 | 4-1-99 |

| Average annual returns with maximum sales charge (POP) | |||

| One year | –1.06% | –2.11% | 1.87% |

| Five years | 4.54 | 4.44 | 4.77 |

| Ten years | 5.15 | — | — |

| Since inception | — | 5.15 | 4.33 |

| Cumulative total returns with maximum sales charge (POP) | |||

| Six months | –3.73 | –4.46 | –0.51 |

| One year | –1.06 | –2.11 | 1.87 |

| Five years | 24.86 | 24.24 | 26.24 |

| Ten years | 65.24 | — | — |

| Since inception | — | 60.37 | 34.06 |

| SEC 30-day yield as of February 28, 2006 | |||

| 3.81 | 3.30 | 3.30 | |

Performance figures assume all distributions are reinvested. Returns with maximum sales charge reflect a sales charge on Class A shares of 4.5%, and the applicable contingent deferred sales charge (CDSC) on Class B and Class C shares. The returns for Class C shares have been adjusted to reflect the elimination of the front-end sales charge effective July 15, 2004. The Class B shares’ CDSC declines annually between years 1–6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month-end, please call 1-800-225-5291 or visit the Fund’s Web site at www.jhfunds.com.