Item 1: Report to Shareholders

| | | | | SEMI-ANNUAL REPORT

JUNE 30, 2013

(unaudited) |

| | |  |

| | | | | |

| | | | | |

| | | | | |

| | | Van Eck VIP Trust Van Eck VIP Multi-Manager Alternatives Fund |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | |  |

| | | | | |

Van Eck VIP Multi-Manager Alternatives Fund

The information contained in this shareholder letter represents the personal opinions of the investment team members and may differ from those of other portfolio managers or of the firm as a whole. This information is not intended to be a forecast of future events, a guarantee of future results or investment advice. Also, unless otherwise specifically noted, any discussion of the Fund’s holdings and the Fund’s performance, and the views of the investment team members are as of June 30, 2013, and are subject to change.

VAN ECK VIP MULTI-MANAGER ALTERNATIVES FUND

Dear Shareholder:

The Initial Class shares of the Van Eck VIP Multi-Manager Alternatives Fund (the “Fund”) declined 1.56% for the six months ended June 30, 2013. The Fund underperformed its benchmark, the HFRX Global Hedge Fund Index1, which rose 3.16%. The S&P® 500 Index2 gained 13.82% for the same period.

The Fund’s semi-annual performance is attributable primarily to losses within its global macro and tactical sleeves. However, the Fund did experience underperformance in each of its four core investment strategies, which include: long/short equity, event driven, global macro and yield focused. Although temporary periods of underperformance among fundamentally driven investment strategies are common, it is very uncommon to simultaneously experience it within all of the sub-strategies.

Uninspiring performance of fundamentally driven strategies often indicates turmoil is lurking in the markets. We believe that investment acumen is a skill not easily diminished and time proven investment processes are by design-consistent. Therefore, while we are not happy with the Fund’s recent performance, we remain confident in our current and prospective sub-advisors’ ability to perform throughout the course of the market cycle.

Overview

| | n | The U.S. equity market, as measured by the S&P® 500 Index, rallied, benefiting from both the accommodative stimulus of the Federal Reserve (the “Fed”) and strengthening economic data. |

| | | |

| | n | In May 2013, following Fed Chair Bernanke’s comments, the fixed income markets began pricing in a withdrawal of accommodative support from the Fed. |

| | | |

| | n | In mid-June, Bernanke stated the Fed could begin to wind down its $85 billion monthly asset purchase program later this year and end it completely by mid-2014. |

| | | |

| | | —The yield on the 10-year U.S. Treasury note increased from 1.63% on May 1 to 2.49% on June 28. |

| | | |

| | n | The rapid increase in U.S. Treasury yields led to a sell-off in fixed income assets that resulted in returns of -1.78% and -1.55% for the Barclays U.S. Aggregate Bond Index3 in May and June, respectively, and an outflow from fixed income mutual funds. |

| | | |

| | n | The spot price of gold decreased from $1,675 per ounce on December 31, 2012 to $1,235 per ounce at the end of June. |

| | | |

| | | —Gold prices were negatively affected by the abrupt increase in yields, as investors began to weigh the opportunity cost to holding a non-yielding asset during a period of minimal U.S. inflation. |

| | | |

| | n | Historically, rising interest rates have been a positive signal for both the equity markets and for alternative strategies. |

| | | |

| | | —Equity markets are often viewed as beneficiaries of rising rates because they are typically a signal of a strengthening economy. |

| | | |

| | | —The indirect impact to alternative strategies may include rising equity markets, wider arbitrage spreads and more interest on collateral pledged against derivative instruments. |

| | | |

| | | —The correlation4 matrix below illustrates the relationship of traditional and alternative investments relative to the change in yield of the 10-year U.S. Treasury note. |

| | | |

| | | —A positive correlation with rising interest rates supports the position that alternative strategies and equities are beneficiaries of increasing yields. |

Correlation4 to Changes in Interest Rates (January 1990–May 2013)

| | | U.S. 10-Year

U.S. Treasury

Yield Change | | HFRI Fund

Weighted

Composite | | Barclays

U.S. Aggregate

Bond Index | | S&P® 500

Index TR |

| U.S. 10-Year U.S. Treasury Yield Change | | 1 | | | | | | | | | | |

| HFRI Fund Weighted Composite | | 0.20 | | | 1 | | | | | | | |

| Barclays U.S. Aggregate Bond Index | | -0.81 | | | 0.07 | | | 1 | | | | |

| S&P® 500 Index TR | | 0.16 | | | 0.74 | | | 0.12 | | | 1 | |

Source: Van Eck Research. Past performance is no guarantee of future results; current performance may be lower or higher than the performance data quoted.

VAN ECK VIP MULTI-MANAGER ALTERNATIVES FUND

Fund Review

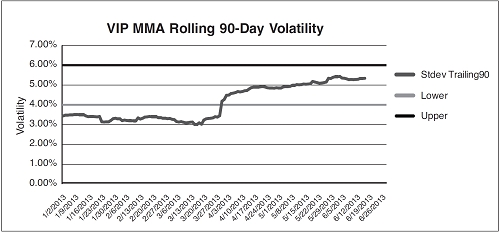

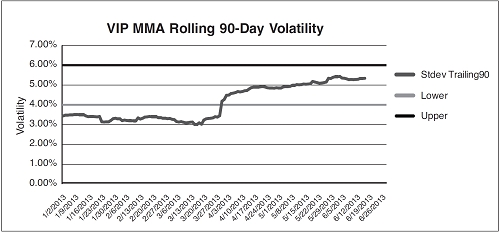

In seeking to increase investor returns over the long term, our Investment Committee set the Fund’s portfolio volatility to the upper-end of the range at the end of March 2013. Targeting volatility is accomplished through our proprietary quantitative risk allocation process and macro discretionary overlay designed to simultaneously maximize volatility and diversification within the Fund’s stated risk parameters. The increase in volatility can be seen in this chart of the Fund’s rolling 90-day volatility.

Source: Van Eck Research. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue.

Looking at the results of each of the Fund’s sub-strategies, the best performing sleeve, on an absolute basis, during the semi-annual period was its long/short equity strategies. The Fund’s allocation to long/short equity strategies‡ returned 3.19%, but underperformed the HFRX Equity Hedged Index5, which returned 4.59%. Sub-adviser Millrace Asset Group, Inc. (“Millrace”) (8.5% of Fund net assets†) returned 12.70% and was the best performer within this strategy, largely benefiting from long positions in the technology and commercial services industries. Sub-adviser RiverPark Advisors, LLC (“RiverPark”) (8.3% of Fund net assets†) was the primary detractor within this strategy, with a return of 0.22%. Most of RiverPark’s disappointing performance can be attributed to a long position in information technology giant Apple and to short positions in “broken growth” companies that rallied during the semi-annual period. While the RiverPark team is confident in the long-term demise of its short positions, in a market fueled by high beta6 equities, the slightest hint of optimism can send stock prices soaring. Industries that detracted most from RiverPark’s results were technology, retail and consumer durables.

The Fund’s allocation to global macro strategies‡ returned -3.80% compared to the HRFX Macro Index7, which returned -1.07%. During the semi-annual period, the global macro strategies allocation benefited from an investment in The Marketfield Fund (“Marketfield”) (2.6% of Fund net assets†), which is predominantly positioned long U.S. equities and short emerging market equities. The S&P 500 Index outperformed the MSCI Emerging Markets Index8 by 23.22% during the semi-annual period. The largest detractor within this strategy was the AC-Risk Parity 12 Volatility Fund (“Risk Parity Fund”) (sold by Fund by end of period), an investment through an open-end UCITS9 III structure managed by Aquila Capital, which returned -13.95%. The Risk Parity Fund is broadly diversified across equities, currencies, commodities and fixed income. However, during the latter months of the semi-annual period, when the fixed income markets rapidly declined, its diversification attributes did not maintain and the Risk Parity Fund experienced a material loss of capital. We proactively decided to remove any significant interest rate exposure from the Fund, and thus redeemed the Fund’s investment in the Risk Parity Fund by the end of the semi-annual period.

The Fund’s allocation to event-driven strategies‡ returned 2.64% in comparison to a return of 7.37% for the HRFX Event Driven Index10. The Fund’s top performing event-driven strategy was EMERALD 2X (Equity Mean Reversion Alpha Index) (5.4% of Fund net assets†), a “rules-based” volatility arbitrage strategy through a note structured by Deutsche Bank, which seeks to benefit from mean reversion in equity volatility. The Fund’s investment in EMERALD 2X returned 10.20%, as daily volatility exceeded weekly volatility, particularly in February, April and June 2013. The weakest performer within the strategy was Tiburon Capital Management (“Tiburon”) (9.5% of Fund net assets†) with a return of 0.91%. Sub-adviser Tiburon seeks

to exploit event opportunities across the capitalization structure. Tiburon benefited from profits in the financials sector, but losses within precious metals mitigated most of the gains.

The Fund’s allocation to fixed income, or yield, strategies‡ returned -0.61% relative to a return of 4.57% for the HFRX Fixed Income Credit Index11. The Fund’s allocation to Sub-adviser Horizon Management (“Horizon”) (8.1% of Fund net assets†) returned 0.46%, and its lack of meaningful performance was primarily due to high levels of cash held during the semi-annual period. Horizon is a relatively new Sub-Advisor to the Fund, who invests gradually in order to dollar cost average into positions. Toward the end of the semi-annual period, Horizon was actively purchasing closed-end bond funds at discounts to net asset value and equity positions that it believes offer either yield or total return benefits to the overall allocation. Sub-adviser SW Asset Management, LLC (“SW”) (9.9% of Fund net assets†) returned -1.21%, and most of its losses were experienced in June 2013 during the sell-off in emerging markets debt. The team at SW had been quite cautious early in 2013 due to the rapid run-up of emerging market debt issues, and its defensive posture mitigated losses during the sell-off.

The Fund’s tactical, or opportunistic, strategy‡ sleeve returned -1.15% for the semi-annual period. Most of the losses can be attributed to net long exposure to gold and gold mining equities, which returned -14.52%. The material losses in the Fund’s gold positions were a catalyst for the Fund’s Investment Committee to trigger our risk management process and move to fully hedge the positions and focus on exploiting the alpha12 between our long and short positions. On the positive side, notable performers within the Fund’s tactical allocation were a long position in Japanese equities (currency hedged) and a short Japanese yen versus U.S. dollar position, which returned 7.71% and 11.21%, respectively, during the semi-annual period.

The Fund is hedge-style mutual fund that can allocate among long/short equity, distressed debt, market neutral, global macro, managed futures and other investment strategies. Our Investment Committee—which averages more than eight years’ experience in managing a multi-manager, hedge-style mutual fund strategy—managed the Fund with a goal of consistent returns, low beta and low volatility. Throughout the semi-annual period, we continued to search for alpha-generating strategies with repeatable processes that exist within stable business models. The mutual fund structure of the Fund provides portfolio transparency, daily valuation and liquidity unlike many unregistered hedge funds.

Outlook

Overall, we expect U.S. interest rates to gradually trend higher as economic recovery continues and the Fed tapers its asset purchases. A near-term pullback in interest rates may occur, but, in our view, would be minimal. We believe this broad trend toward higher interest rates, along with the Fed’s actions, may well drive some financial market volatility.

We believe the equity markets as a whole will likely benefit amid heightened volatility, as the U.S. economy is anticipated to continue recovering. Long/short equity strategies, trend following commodity trading advisors and arbitrage strategies should also perform well given these conditions, in our view. However, strategies correlated to bonds, including credit-related strategies, for example, may well face headwinds.

As the Fund implements a fund-of-funds strategy, an investor in the Fund will bear the operating expenses of the “Underlying Funds” in which the Fund invests. The total expenses borne by an investor in the Fund will be higher than if the investor invested directly in the Underlying Funds, and the returns may therefore be lower. The Fund, the Sub-Advisers and the Underlying Funds may use aggressive investment strategies, including absolute return strategies, which are riskier than those used by typical mutual funds. If the Fund and Sub-Advisers are unsuccessful in applying these investment strategies, the Fund and you may lose more money than if you had invested in another fund that did not invest aggressively. The Fund is subject to risks associated with the Sub-Advisers making trading decisions independently, investing in other investment companies, using a particular style or set of styles, basing investment decisions on historical relationships and correlations, trading frequently, using leverage, making short sales, being non-diversified and investing in securities with low correlation to the market. The Fund is also subject to risks associated with investments in foreign markets, emerging market securities, small cap companies, debt securities, derivatives, commodity-linked instruments, illiquid securities, asset-backed securities and CMOs.

VAN ECK VIP MULTI-MANAGER ALTERNATIVES FUND

We appreciate your investment in the Van Eck VIP Multi-Manager Alternatives Fund, and we look forward to helping you meet your investment goals in the future.

Investment Committee:

| |  | |  | |

| |  | |  | |

| Stephen H. Scott | Jan F. van Eck | Michael F. Mazier |

| Co-Portfolio Manager | Co-Portfolio Manager | Investment Committee Member |

July 19, 2013

| † | All Fund assets referenced are Total Net Assets as of June 30, 2013. |

| | |

| All indices listed are unmanaged indices and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made. |

| |

| 1 | HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of eight strategies: convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry. |

| | |

| 2 | S&P® 500 Index consists of 500 widely held common stocks, covering industrials, utility, financial and transportation sectors. |

| | |

| 3 | Barclays U.S. Aggregate Bond Index represents securities that are SEC-registered, taxable and dollar denominated. The index covers the U.S. investment-grade fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities and asset-backed securities. |

| | |

| 4 | The correlation coefficient is a measure that determines the degree to which two variables’ movements are associated and will vary from -1.0 to 1.0. -1.0 indicates perfect negative correlation, and 1.0 indicates perfect positive correlation. Correlation describes a complementary or parallel relationship between two investments. |

| | |

| 5 | HFRX Equity Hedged Index is a hedge fund benchmark representative of the overall composition of the hedge fund universe. |

| | |

| 6 | Beta is a measure of sensitivity to market movements. A beta higher than 1 indicates that a security or portfolio will tend to exhibit higher volatility than the market. A beta lower than 1 indicates that a security or portfolio will tend to exhibit lower volatility than the market. |

| | |

| 7 | HFRX Macro Index is a hedge fund benchmark on strategies that include long/short positions in equity, fixed income, currency and futures markets based on a top-down analysis on a broader view of the world economy. |

| | |

| 8 | MSCI Emerging Markets Index (MSCI EM), a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets, is calculated with dividends reinvested. The Index covers 2,700 securities of the publicly traded equities in each industry for 21 emerging markets that are currently classified as emerging market countries. |

| | |

| 9 | UCITS stands for “Undertakings for Collective Investment in Transferable Securities.” |

| | |

| 10 | HFRX Event Driven Index is a hedge fund benchmark on strategies that trade in various corporate transactions that include mergers, restructurings, financial distress, tender offers, shareholder buybacks, debt exchanges, security issuance or other capital structure adjustments. |

| | |

| 11 | HFRX Fixed Income Credit Index is a hedge fund benchmark on strategies that utilize a broad continuum of credit sub-strategies, including corporate, sovereign, distressed, convertible, asset-backed, capital structure arbitrage and other relative value and event-driven sub-strategies to realize the spreads of various related credit instruments. |

| | |

| 12 | Alpha is a measure of an investment’s performance over and above the performance of other investments of the same risk. A stock with an alpha of 1.25 is projected to rise by an annual premium of 1.25% above its comparable benchmark index. |

| ‡ | Strategy Definitions |

| | |

| | A long/short strategy seeks to invest in securities believed to be undervalued or offer high growth opportunities while also attempting to reduce overall market risk or take advantage of an anticipated decline in the price of an overvalued company or index by using short sales or options on common stocks or indexes to hedge risk. This strategy may also use derivatives, including options, financial futures and options on futures. Long and short positions may not be invested in equal dollars and, as such, may not seek to neutralize general market risks. |

| | |

| | Event-driven strategies seek to benefit from price movements caused by anticipated corporate events, such as mergers, acquisitions, spin-offs or other special situations. |

| | |

| | Credit arbitrage may seek to take advantage of pricing inefficiencies between the credit-sensitive securities of different issuers. Instruments commonly traded include CDOs (collateralized debt obligations) and CDSs (credit default swaps). |

| | |

| | Merger arbitrage seeks to exploit price differentials in the shares of companies that are involved in announced corporate events, such as mergers and acquisitions (M&A) or leveraged buy-outs, by taking a directional position on the stocks of the companies involved in the deal. Success is dependent on the likelihood that such events will be consummated as proposed. |

| | |

| | Special situations invest in the securities of issuers based upon the expectations of the manager as to whether the price of such securities may change in the short term due to a special situation, such as a stock buy-back, spin-off, bond upgrade or a positive earnings report. |

| | |

| | Long biased fixed income strategies seek to invest in between a market-neutral fund and a long-only fund. Rather than hedging to reduce market correlation as found in a market neutral fund, or having substantial long exposure as in a long-only fund, a long-bias fund maintains a differing ratio of long positions (compared to short positions) that usually exceeds 40%. |

| | |

| | Global macro and emerging markets strategy seeks to profit from directional changes in currencies, stock markets, commodity prices and market volatility. This strategy may utilize positions held through individual securities, ETFs, derivative contracts, swaps or other financial instruments linked to major market, sector or country indices, fixed income securities, currencies and commodities. This strategy may invest in a limited number of securities, issuers, industries or countries which may result in higher volatility. |

| | |

| | Long/short fixed income strategies seek to invest in securities believed to be undervalued or offer high growth opportunities while also attempting to reduce overall market risk or take advantage of an anticipated decline in the price of an overvalued company or index by using short sales or options on fixed income assets or indexes to hedge risk. This strategy may also use derivatives, including options, financial futures and options on futures. Long and short positions may not be invested in equal dollars and, as such, may not seek to neutralize general market risks. |

| | |

| | Contrarian is an investment style that goes against prevailing market trends, seeking to profit from buying assets trending lower due to unjustifiable wide spread pessimism and selling assets that have trended upward due to widespread optimism that overstates a company’s value. |

VAN ECK VIP MULTI-MANAGER ALTERNATIVES FUND

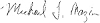

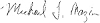

FUND ALLOCATION BY STRATEGY*

(unaudited)

As of June 30, 2013. *Percentage of net assets.

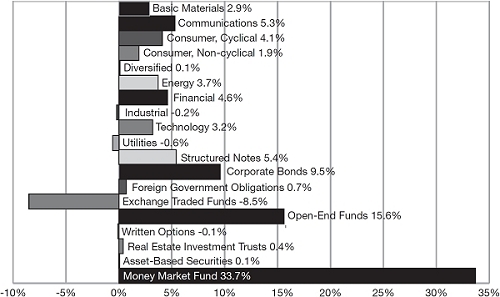

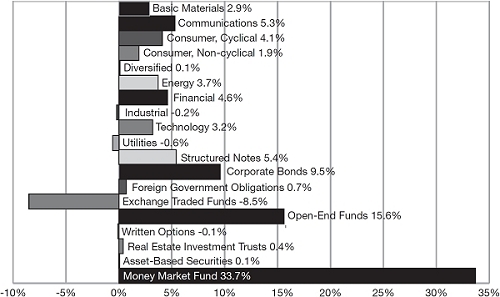

SECTOR WEIGHTING NET EXPOSURE**

(unaudited)

As of June 30, 2013. Portfolio subject to change.

**Net exposure was calculated by adding long and short positions.

VAN ECK VIP MULTI-MANAGER ALTERNATIVES FUND

EXPLANATION OF EXPENSES

(unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including program fees on purchase payments; and (2) ongoing costs, including management fees and other Fund expenses. This disclosure is intended to help you understand the ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The disclosure is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, January 1, 2013 to June 30, 2013.

Actual Expenses

The first line in the table below provides information about account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period.”

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as fees on purchase payments. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Van Eck VIP Multi-Manager Alternatives Fund

| | | | | Beginning

Account Value

January 1, 2013 | | Ending

Account Value

June 30, 2013 | | Expenses Paid

During the Period*

January 1, 2013 -

June 30, 2013 |

| Initial Class | | Actual | | $1,000.00 | | $984.40 | | | $11.49 |

| | | Hypothetical** | | $1,000.00 | | $1,013.21 | | | $11.66 |

| Class S | | Actual | | $1,000.00 | | $983.40 | | | $12.76 |

| | | Hypothetical** | | $1,000.00 | | $1,011.93 | | | $12.94 |

| * | Expenses are equal to the Fund’s annualized expense ratio (for the six months ended June 30, 2013), of 2.34% on Initial Class, and 2.59% on Class S Shares, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year divided by the number of days in the fiscal year (to reflect the one-half year period). |

| | |

| ** | Assumes annual return of 5% before expenses |

SCHEDULE OF INVESTMENTS

June 30, 2013 (unaudited)

Number of

Shares | | | | | Value | |

| COMMON STOCKS: 34.4% | | | | |

| | | | | | | | |

| Basic Materials: 3.1% | | | | |

| | 3,410 | | Argonaut Gold, Inc. (CAD) * | | $ | 18,449 | |

| | 7,400 | | Continental Gold Ltd. (CAD) * | | | 23,220 | |

| | 3,375 | | Eldorado Gold Corp. | | | 20,858 | |

| | 3,358 | | Eldorado Gold Corp. (CAD) | | | 20,786 | |

| | 10,200 | | Fortuna Silver Mines, Inc. (CAD) * | | | 33,945 | |

| | 1,375 | | Goldcorp, Inc. | | | 34,004 | |

| | 1,804 | | MAG Silver Corp. * | | | 10,535 | |

| | 264 | | MeadWestvaco Corp. | | | 9,005 | |

| | 225 | | Monsanto Co. | | | 22,230 | |

| | 4,690 | | New Gold, Inc. * | | | 30,110 | |

| | 366 | | Olin Corp. | | | 8,755 | |

| | 7,425 | | Osisko Mining Corp. (CAD) * | | | 24,569 | |

| | 2,700 | | Tahoe Resources, Inc. * | | | 38,205 | |

| | 18,340 | | Volta Resources, Inc. (CAD) * | | | 2,877 | |

| | | | | | | 297,548 | |

| | | | | | | | |

| Communications: 6.1% | | | | |

| | 2,765 | | Alaska Communications Systems Group, Inc. | | | 4,645 | |

| | 333 | | AOL, Inc. | | | 12,148 | |

| | 1,939 | | Brightcove, Inc. * | | | 16,986 | |

| | 1,000 | | CalAmp Corp. * | | | 14,600 | |

| | 1,784 | | Cbeyond, Inc. * | | | 13,987 | |

| | 382 | | CBS Corp. | | | 18,669 | |

| | 125 | | ChannelAdvisor Corp. * | | | 1,966 | |

| | 3,281 | | Digital Generation, Inc. * | | | 24,181 | |

| | 318 | | Discovery Communications, Inc. * | | | 22,152 | |

| | 116 | | DISH Network Corp. | | | 4,932 | |

| | 502 | | eBay, Inc. * | | | 25,963 | |

| | 236 | | EchoStar Corp. * | | | 9,230 | |

| | 1,477 | | eGain Communications Corp. * | | | 14,209 | |

| | 290 | | Equinix, Inc. * | | | 53,569 | |

| | 497 | | ExactTarget, Inc. * | | | 16,759 | |

| | 350 | | EZchip Semiconductor Ltd. * | | | 9,447 | |

| | 281 | | F5 Networks, Inc. * | | | 19,333 | |

| | 773 | | Finisar Corp. * | | | 13,102 | |

| | 46 | | Google, Inc. * | | | 40,497 | |

| | 1,092 | | ICG Group, Inc. * | | | 12,449 | |

| | 431 | | IPG Photonics Corp. | | | 26,175 | |

| | 508 | | Liberty Interactive Corp. * | | | 11,689 | |

| | 92 | | Liberty Media Corp. * | | | 11,662 | |

| | 3,303 | | Lionbridge Technologies, Inc. * | | | 9,579 | |

| | 478 | | News Corp. * | | | 7,313 | |

| | 1,161 | | Perficient, Inc. * | | | 15,488 | |

| | 198 | | Polycom, Inc. * | | | 2,087 | |

| | 36 | | Priceline.com, Inc. * | | | 29,777 | |

| | 941 | | RF Micro Devices, Inc. * | | | 5,034 | |

| | 1,112 | | ShoreTel, Inc. * | | | 4,481 | |

| | 229 | | SPS Commerce, Inc. * | | | 12,595 | |

| | 2,584 | | Support.com, Inc. * | | | 11,809 | |

| | 506 | | The Walt Disney Co. | | | 31,954 | |

| | 357 | | Twenty-First Century Fox, Inc. | | | 11,638 | |

| | 475 | | ValueClick, Inc. * | | | 11,723 | |

| | 71 | | Viacom, Inc. | | | 4,832 | |

| | 654 | | Vivendi S.A. (EUR) | | | 12,394 | |

| | 319 | | Vodafone Group Plc (ADR) | | | 9,168 | |

| | | | | | | 578,222 | |

Number of

Shares | | | | | Value | |

| Consumer, Cyclical: 5.8% | | | | |

| | 3,050 | | Accuride Corp. * | | $ | 15,433 | |

| | 411 | | Brookfield Residential Properties, Inc. * | | | 9,067 | |

| | 48 | | Burger King Worldwide, Inc. | | | 936 | |

| | 1,289 | | Coach, Inc. | | | 73,589 | |

| | 79 | | Conn’s, Inc. * | | | 4,089 | |

| | 279 | | Delphi Automotive Plc | | | 14,143 | |

| | 856 | | Diversified Restaurant Holdings, Inc. * | | | 6,814 | |

| | 725 | | Dollar Tree, Inc. * | | | 36,859 | |

| | 315 | | Dufry A.G. (CHF) * # | | | 38,158 | |

| | 1,280 | | First Cash Financial Services, Inc. * | | | 62,989 | |

| | 16,000 | | Galaxy Entertainment Group Ltd. (HKD) * # | | | 77,412 | |

| | 400 | | Hanesbrands, Inc. | | | 20,568 | |

| | 128 | | Harley-Davidson, Inc. | | | 7,017 | |

| | 401 | | hhgregg, Inc. * | | | 6,404 | |

| | 38 | | Icahn Enterprises LP | | | 2,765 | |

| | 257 | | Interface, Inc. | | | 4,361 | |

| | 289 | | Las Vegas Sands Corp. | | | 15,297 | |

| | 463 | | La-Z-Boy, Inc. | | | 9,385 | |

| | 582 | | Lennar Corp. | | | 20,975 | |

| | 340 | | Pier 1 Imports, Inc. | | | 7,987 | |

| | 71 | | Ralph Lauren Corp. | | | 12,336 | |

| | 1,699 | | Scientific Games Corp. * | | | 19,114 | |

| | 784 | | Skechers USA, Inc. * | | | 18,824 | |

| | 442 | | Sonic Corp. * | | | 6,436 | |

| | 227 | | Stage Stores, Inc. | | | 5,335 | |

| | 315 | | Starbucks Corp. | | | 20,629 | |

| | 233 | | The Childrens Place Retail Stores, Inc. * | | | 12,768 | |

| | 664 | | Wabash National Corp. * | | | 6,760 | |

| | 67 | | Watsco, Inc. | | | 5,625 | |

| | 84 | | Winnebago Industries, Inc. * | | | 1,763 | |

| | 97 | | Wynn Resorts Ltd. | | | 12,416 | |

| | | | | | | 556,254 | |

| | | | | | | | |

| Consumer, Non-cyclical: 3.4% | | | | |

| | 127 | | Alliance Data Systems Corp. * | | | 22,991 | |

| | 1,771 | | Amarin Corp. Plc (ADR) * | | | 10,272 | |

| | 164 | | Beam, Inc. | | | 10,350 | |

| | 919 | | BioScrip, Inc. * | | | 15,164 | |

| | 8 | | Crimson Wine Group Ltd. * | | | 68 | |

| | 668 | | Cynosure, Inc. * | | | 17,355 | |

| | 1,205 | | Franklin Covey Co. * | | | 16,219 | |

| | 823 | | Great Lakes Dredge & Dock Corp | | | 6,436 | |

| | 1,764 | | Guided Therapeutics, Inc. * | | | 1,207 | |

| | 1,017 | | Healthways, Inc. * | | | 17,675 | |

| | 962 | | Korn/Ferry International * | | | 18,028 | |

| | 1,000 | | MAKO Surgical Corp. * | | | 12,050 | |

| | 743 | | Masimo Corp. | | | 15,752 | |

| | 3,860 | | Merge Healthcare, Inc. * | | | 13,896 | |

| | 1,705 | | Monster Worldwide, Inc. * | | | 8,372 | |

| | 618 | | Novadaq Technologies, Inc. * | | | 8,318 | |

| | 65 | | NuVasive, Inc. * | | | 1,611 | |

| | 111 | | PAREXEL International Corp. * | | | 5,099 | |

| | 172 | | PepsiCo, Inc. | | | 14,068 | |

| | 145 | | Philip Morris International, Inc. | | | 12,560 | |

| | 325 | | Quanta Services, Inc. * | | | 8,600 | |

| | 606 | | Quidel Corp. * | | | 15,471 | |

| | 861 | | Repligen Corp. * | | | 7,095 | |

| | 3,364 | | RTI Biologics, Inc. * | | | 12,649 | |

See Notes to Financial Statements

VAN ECK VIP MULTI-MANAGER ALTERNATIVES FUND

SCHEDULE OF INVESTMENTS

(continued)

Number of

Shares | | | | | Value | |

| Consumer, Non-cyclical: (continued) | | | | |

| | 376 | | Spectranetics Corp. * | | $ | 7,024 | |

| | 3,858 | | Synergetics USA, Inc. * | | | 15,201 | |

| | 708 | | TearLab Corp. * | | | 7,519 | |

| | 631 | | Vascular Solutions, Inc. * | | | 9,282 | |

| | 501 | | Volcano Corp. * | | | 9,083 | |

| | | | | | | 319,415 | |

| | | | | | | | |

| Diversified: 0.1% | | | | |

| | 301 | | Leucadia National Corp. | | | 7,892 | |

| | | | | | | | |

| Energy: 3.8% | | | | |

| | 25,116 | | Afren Plc (GBP) * # | | | 49,511 | |

| | 318 | | Approach Resources, Inc. * | | | 7,813 | |

| | 85 | | Atlas Energy LP | | | 4,164 | |

| | 154 | | Berry Petroleum Co. | | | 6,517 | |

| | 536 | | Bill Barrett Corp. * | | | 10,838 | |

| | 716 | | Energy XXI Bermuda Ltd. | | | 15,881 | |

| | 438 | | EPL Oil & Gas, Inc. * | | | 12,860 | |

| | 222 | | Gulfport Energy Corp. * | | | 10,450 | |

| | 32,000 | | Kunlun Energy Co. Ltd. (HKD) # | | | 56,572 | |

| | 1,685 | | Midstates Petroleum Co., Inc. * | | | 9,116 | |

| | 420 | | National Oilwell Varco, Inc. | | | 28,938 | |

| | 137 | | Noble Energy, Inc. | | | 8,225 | |

| | 914 | | Northern Oil and Gas, Inc. * | | | 12,193 | |

| | 1,900 | | Pacific Rubiales Energy Corp. | | | 33,591 | |

| | 1,080 | | Southwestern Energy Co. * | | | 39,452 | |

| | 501 | | Synergy Resources Corp. * | | | 3,667 | |

| | 114 | | Total S.A. (ADR) | | | 5,552 | |

| | 30,125 | | Volga Gas Plc (GBP) * # | | | 39,108 | |

| | 1,637 | | Willbros Group, Inc. * | | | 10,051 | |

| | | | | | | 364,499 | |

| | | | | | | | |

| Financial: 4.7% | | | | |

| | 239 | | American Express Co. | | | 17,868 | |

| | 364 | | American International Group, Inc. * | | | 16,271 | |

| | 726 | | Assured Guaranty Ltd. | | | 16,016 | |

| | 2,935 | | Blackstone Group LP | | | 61,811 | |

| | 326 | | CME Group, Inc. | | | 24,769 | |

| | 382 | | Dream Unlimited Corp. * | | | 4,031 | |

| | 382 | | Dundee Corp. * | | | 7,753 | |

| | 72 | | Ellie Mae, Inc. * | | | 1,662 | |

| | 768 | | Evoq Properties, Inc. * | | | 3,610 | |

| | 170,000 | | Franshion Properties China Ltd. (HKD) # | | | 56,758 | |

| | 8,113 | | Kasikornbank PCL (NVDR) (THB) # | | | 49,532 | |

| | 1,345 | | KKR & Co. LP | | | 26,443 | |

| | 127 | | Oaktree Capital Group LLC | | | 6,674 | |

| | 96 | | Onex Corp. | | | 4,387 | |

| | 165 | | Outerwall, Inc. * | | | 9,681 | |

| | 231 | | Partners Value Fund, Inc. * | | | 4,693 | |

| | 1,085 | | Realogy Holdings Corp. * | | | 52,123 | |

| | 1,032 | | TD Ameritrade Holding Corp. | | | 25,067 | |

| | 965 | | The Charles Schwab Corp. | | | 20,487 | |

| | 119 | | The Howard Hughes Corp. * | | | 13,339 | |

| | 151 | | Visa, Inc. | | | 27,595 | |

| | | | | | | 450,570 | |

| | | | | | | | |

| Industrial: 2.1% | | | | |

| | 5,891 | | Ainsworth Lumber Co. Ltd. (CAD) * | | | 17,925 | |

| | 3 | | Aptargroup, Inc. | | | 168 | |

| | 202 | | BE Aerospace, Inc. * | | | 12,742 | |

| | 488 | | Briggs & Stratton Corp. | | | 9,662 | |

| | 101 | | Colfax Corp. * | | | 5,263 | |

Number of

Shares | | | | | Value | |

| Industrial: (continued) | | | | |

| | 1,296 | | CPI Aerostructures, Inc. * | | $ | 14,062 | |

| | 1,704 | | CUI Global, Inc. * | | | 9,457 | |

| | 82 | | Danaher Corp. | | | 5,191 | |

| | 1,195 | | Electro Scientific Industries, Inc. | | | 12,858 | |

| | 1,921 | | Flow International Corp. * | | | 7,088 | |

| | 442 | | Greenbrier Cos, Inc. * | | | 10,772 | |

| | 233 | | Ingersoll-Rand Plc | | | 12,936 | |

| | 221 | | Lennox International, Inc. | | | 14,263 | |

| | 731 | | Methode Electronics, Inc. | | | 12,434 | |

| | 203 | | OSI Systems, Inc. * | | | 13,077 | |

| | 512 | | Roadrunner Transportation Systems, Inc. * | | | 14,254 | |

| | 182 | | Trimas Corp. * | | | 6,785 | |

| | 443 | | Trimble Navigation Ltd. * | | | 11,522 | |

| | 34 | | Vulcan Materials Co. | | | 1,646 | |

| | 267 | | Waste Connections, Inc. | | | 10,984 | |

| | | | | | | 203,089 | |

| | | | | | | | |

| Technology: 5.3% | | | | |

| | 1,189 | | Activision Blizzard, Inc. | | | 16,955 | |

| | 103 | | Apple, Inc. | | | 40,796 | |

| | 618 | | ATMI, Inc. * | | | 14,616 | |

| | 3,200 | | Callidus Software, Inc. * | | | 21,088 | |

| | 43 | | Cavium, Inc. * | | | 1,521 | |

| | 1,228 | | CDC Corp. * # | | | 1,704 | |

| | 499 | | Cognizant Technology Solutions Corp. * | | | 31,242 | |

| | 1,220 | | Cypress Semiconductor Corp. | | | 13,091 | |

| | 502 | | Entegris, Inc. * | | | 4,714 | |

| | 1,456 | | FormFactor, Inc. * | | | 9,828 | |

| | 2,641 | | inContact, Inc. * | | | 21,709 | |

| | 196 | | Inphi Corp. * | | | 2,156 | |

| | 2,571 | | Integrated Device Technology, Inc. * | | | 20,414 | |

| | 1,035 | | LivePerson, Inc. * | | | 9,268 | |

| | 1,603 | | Mercury Computer Systems, Inc. * | | | 14,780 | |

| | 429 | | Microchip Technology, Inc. | | | 15,980 | |

| | 784 | | Micron Technology, Inc. * | | | 11,235 | |

| | 171 | | MKS Instruments, Inc. | | | 4,538 | |

| | 618 | | Nova Measuring Instruments Ltd. * | | | 5,593 | |

| | 420 | | NVIDIA Corp. | | | 5,893 | |

| | 2 | | Power Integrations, Inc. | | | 81 | |

| | 605 | | Proofpoint, Inc. * | | | 14,659 | |

| | 880 | | QUALCOMM, Inc. | | | 53,750 | |

| | 372 | | Rovi Corp. * | | | 8,496 | |

| | 1,088 | | Rudolph Technologies, Inc. * | | | 12,186 | |

| | 54 | | Samsung Electronics Co. Ltd. (KRW) # | | | 63,116 | |

| | 748 | | Silicon Image, Inc. * | | | 4,376 | |

| | 1,530 | | Skyworks Solutions, Inc. * | | | 33,491 | |

| | 1,760 | | Streamline Health Solutions, Inc. * | | | 11,563 | |

| | 23,336 | | Trident Microsystems, Inc. * # | | | 1,138 | |

| | 1,423 | | TriQuint Semiconductor, Inc. * | | | 9,861 | |

| | 417 | | Virtusa Corp. * | | | 9,241 | |

| | 4,804 | | Vitesse Semiconductor Corp. * | | | 12,635 | |

| | 124 | | Western Digital Corp. | | | 7,699 | |

| | | | | | | 509,413 | |

Total Common Stocks

(Cost: $3,206,120) (a) | | | 3,286,902 | |

See Notes to Financial Statements

Number of

Shares | | | | | Value | |

| REAL ESTATE INVESTMENT TRUSTS: 0.6% | | | | |

| | | | | | | | |

| Financial: 0.6% | | | | |

| | 190 | | American Tower Corp. | | $ | 13,902 | |

| | 2,652 | | NorthStar Realty Finance Corp. | | | 24,133 | |

| | 979 | | Summit Hotel Properties, Inc. | | | 9,252 | |

| | 191 | | Weyerhaeuser Co. (Preferred Security)

6.38%,07/01/16 | | | 9,743 | |

| | | | | | | | |

Total Real Estate Investment Trusts

(Cost: $52,457) (a) | | | 57,030 | |

| | Principal Amount | | | | | |

ASSET-BACKED SECURITIES: 0.1%

(Cost: $4,982) | | | | |

| | $ 6,779 | | Countrywide Asset-Backed Certificates

5.81%,01/25/17 (c) # | | | 6,567 | |

| | | | | | | | |

| CORPORATE BONDS: 11.7% | | | | |

| | | | | | | | |

| Communications: 1.9% | | | | |

| | | | Affinion Group, Inc. | | | | |

| | 7,000 | | 11.50%,08/12/13 (c) | | | 5,425 | |

| | | | Alaska Communications Systems Group, Inc. | | | | |

| | 16,000 | | 6.25%,05/01/18 144A | | | 12,739 | |

| | | | Clear Channel Communications, Inc. | | | | |

| | 10,000 | | 5.50%,12/15/16 (c) | | | 7,750 | |

| | 20,000 | | 11.00%,08/12/13 (c) | | | 17,750 | |

| | | | FiberTower Corp. | | | | |

| | 63,343 | | 9.00%,01/01/16 (c) # ♦ | | | 6,176 | |

| | | | Maxcom Telecomunicaciones S.A.B. de C.V. | | | | |

| | 75,000 | | 11.00%,08/12/13 (c) ♦ | | | 44,363 | |

| | | | Singapore Telecommunications Ltd. | | | | |

| | 18,000 | | 7.38%,12/01/31 (c) Reg S | | | 23,916 | |

| | | | Trilogy International Partners LLC /Trilogy International Finance Inc | | | | �� |

| | 60,000 | | 10.25%,08/15/13 (c) 144A | | | 57,900 | |

| | | | WebMD Health Corp. | | | | |

| | 5,000 | | 2.50%,01/31/18 | | | 4,650 | |

| | | | | | | 180,669 | |

| | | | | | | | |

| Consumer, Cyclical: 2.1% | | | | |

| | | | Chukchansi Economic Development Authority | | | | |

| | 6,958 | | 9.75%,05/30/16 (c) Reg S ♦ | | | 3,444 | |

| | 72,566 | | 9.75%,05/30/16 (c) 144A ♦ | | | 35,920 | |

| | | | Claire’s Stores, Inc. | | | | |

| | 8,000 | | 8.88%,03/15/15 (c) | | | 8,440 | |

| | | | Continental Airlines 1997-4 Class A Pass Through Trust | | | | |

| | 17,972 | | 6.90%,01/02/18 (c) # | | | 18,871 | |

| | | | Inn of the Mountain Gods Resort & Casino | | | | |

| | 30,050 | | 1.25%,08/12/13 (c) 144A | | | 27,947 | |

| | | | JC Penney Corp., Inc. | | | | |

| | 9,000 | | 6.88%,10/15/15 | | | 9,023 | |

| | 9,000 | | 7.95%,04/01/17 | | | 8,708 | |

| | | | Kellwood Co. | | | | |

| | 11,275 | | 12.88%,12/31/14 | | | 11,078 | |

| | | | Neebo, Inc. | | | | |

| | 16,000 | | 15.00%,08/12/13 (c) 144A | | | 16,240 | |

| | Principal

Amount | | | | | Value | |

| Consumer, Cyclical: (continued) | | | | |

| | $ 1,600 | | 15.00%,08/12/13 (c) | | $ | 1,624 | |

| | | | New Albertsons, Inc. | | | | |

| | 7,000 | | 7.45%,08/01/29 (c) | | | 5,530 | |

| | 13,000 | | 7.75%,06/15/26 | | | 10,319 | |

| | | | Shingle Springs Tribal Gaming Authority | | | | |

| | 18,000 | | 9.38%,08/12/13 (c) 144A | | | 17,865 | |

| | 9,000 | | 9.38%,08/21/13 (c) Reg S | | | 8,933 | |

| | | | The Bon-Ton Department Stores, Inc. | | | | |

| | 18,000 | | 10.63%,08/12/13 (c) | | | 18,090 | |

| | | | The River Rock Entertainment Authority | | | | |

| | 432 | | 9.75%,11/01/11 * ♦ | | | 356 | |

| | | | | | | 202,388 | |

| | | | | | | | |

| Consumer, Non-cyclical: 1.1% | | | | |

| | | | Fresenius Medical Care US Finance, Inc. | | | | |

| | 50,000 | | 6.50%,09/15/18 (c) 144A | | | 54,625 | |

| | | | Kinetic Concepts, Inc. | | | | |

| | 13,000 | | 12.50%,11/01/15 (c) | | | 13,520 | |

| | | | Teva Pharmaceutical Finance Co. B.V. | | | | |

| | 21,000 | | 2.40%,11/10/16 (c) | | | 21,637 | |

| | | | Teva Pharmaceutical Finance IV LLC | | | | |

| | 20,000 | | 2.25%,03/18/20 (c) | | | 19,161 | |

| | | | | | | 108,943 | |

| | | | | | | | |

| Energy: 2.3% | | | | |

| | | | Drill Rigs Holdings, Inc. | | | | |

| | 16,000 | | 6.50%,10/01/15 (c) 144A | | | 16,040 | |

| | | | Enercoal Resources Pte Ltd. | | | | |

| | 100,000 | | 9.25%,08/05/14 (p) | | | 74,500 | |

| | | | EPL Oil & Gas, Inc. | | | | |

| | 14,000 | | 8.25%,02/15/15 (c) | | | 14,490 | |

| | | | Green Field Energy Services, Inc. | | | | |

| | 2,000 | | 13.25%,11/15/14 (c) § 144A | | | 2,090 | |

| | | | Pengrowth Energy Corp. | | | | |

| | CAD 5,000 | | 6.25%,03/31/17 | | | 4,826 | |

| | | | Petrobras International Finance Co. | | | | |

| | $25,000 | | 2.88%,02/06/15 (c) | | | 25,288 | |

| | | | SunCoke Energy, Inc. | | | | |

| | 7,000 | | 7.63%,08/01/14 (c) | | | 7,298 | |

| | | | Tristan Oil Ltd. | | | | |

| | 150,000 | | 23.78%,08/09/13 (c) ^ Reg S ♦ * | | | 78,750 | |

| | | | | | | 223,282 | |

| | | | | | | | |

| Financial: 1.9% | | | | |

| | | | Banco Cruzeiro do Sul S.A. | | | | |

| | 150,000 | | 8.50%,02/20/15 Reg S ♦ * | | | 47,250 | |

| | | | Bancolombia S.A. | | | | |

| | 40,000 | | 5.13%,09/11/22 | | | 38,300 | |

| | | | Emigrant Bancorp, Inc. | | | | |

| | 19,000 | | 6.25%,06/15/14 144A | | | 18,763 | |

| | | | Jefferies Group, Inc. | | | | |

| | 9,000 | | 3.88%,11/01/17 (c) (p) | | | 9,624 | |

| | | | MF Global Holdings Ltd. | | | | |

| | 15,000 | | 6.25%,08/08/16 (c) ♦ * | | | 7,331 | |

| | | | Nuveen Investments, Inc. | | | | |

| | 12,000 | | 5.50%,09/15/15 (c) | | | 11,760 | |

| | | | Standard Bank Plc | | | | |

| | 50,000 | | 12.9%,01/27/14 ^ 144A | | | 46,428 | |

| | | | | | | 179,456 | |

See Notes to Financial Statements

VAN ECK VIP MULTI-MANAGER ALTERNATIVES FUND

SCHEDULE OF INVESTMENTS

(continued)

| | Principal

Amount | | | | | Value | |

| Industrial: 2.0% | | | | |

| | | | Grupo Senda Autotransporte S.A. de C.V. | | | | |

| | $ 55,000 | | 10.50%,08/09/13 (c) Reg S | | $ | 57,062 | |

| | | | Inversiones Alsacia S.A. | | | | |

| | 130,862 | | 8.00%,02/18/15 (c) Reg S | | | 111,887 | |

| | | | Tervita Corp. | | | | |

| | 18,000 | | 9.75%,11/01/15 (c) Reg S | | | 16,830 | |

| | | | | | | 185,779 | |

| | | | | | | | |

| Utilities: 0.4% | | | | |

| | | | Empresa Distribuidora Y

Comercializadora Norte | | | | |

| | 75,000 | | 9.75%,10/25/18 (c) Reg S | | | 37,313 | |

| | | | | | | | |

Total Corporate Bonds

(Cost: $1,168,594) (a) | | | 1,117,830 | |

| | | | | | | | |

| FOREIGN GOVERNMENT OBLIGATIONS: 0.7% | | | | |

| | | | African Development Bank | | | | |

| | GHS 50,000 | | 14.00%,08/25/15 | | | 22,382 | |

| | | | Argentine Republic Government

International Bond | | | | |

| | ARS 374,000 | | 12/15/35 | | | 5,498 | |

| | | | Provincia de Buenos Aires, Argentina | | | | |

| | $100,000 | | 4.00%,05/15/35 Reg S | | | 40,000 | |

| | | | | | | | |

Total Foreign Government Obligations

(Cost: $68,466) | | | 67,880 | |

| | | | | | | | |

| STRUCTURED NOTES: 5.4% | | | | |

| | | | | | | | |

| Financial: 5.4% | | | | |

| | | | Deutsche Bank A.G. London Branch,

Alpha Overlay Securities | | | | |

| | 20,000 | | 07/03/13 § (b) | | | 20,932 | |

| | 500,000 | | 06/23/16 § (b) | | | 495,150 | |

| | | | | | | | |

Total Structured Notes

(Cost: $520,000) | | | 516,082 | |

Number of

Shares | | | | | |

| CLOSED-END FUNDS: 2.0% | | | | |

| | 2,937 | | American Select Portfolio | | | 29,957 | |

| | 1,513 | | Federated Enhanced Treasury Income Fund | | | 19,684 | |

| | 270 | | First Trust Strategic High Income Fund II | | | 4,253 | |

| | 530 | | Helios High Income Fund, Inc. | | | 4,320 | |

| | 740 | | Helios Multi-Sector High Income Fund, Inc. | | | 4,233 | |

| | 620 | | JZ Capital Partners Ltd. (GBP) | | | 4,503 | |

| | 260 | | Montgomery Street Income Securities, Inc. | | | 4,202 | |

| | 1,267 | | Morgan Stanley Income Securities, Inc. | | | 21,577 | |

| | 450 | | Nuveen Credit Strategies Income Fund | | | 4,496 | |

| | 4,400 | | Nuveen Diversified Currency Opportunities Fund | | | 49,324 | |

| | 580 | | PIMCO Dynamic Credit Income Fund | | | 13,288 | |

| | 450 | | PIMCO Dynamic Income Fund | | | 13,163 | |

| | 80 | | PIMCO Income Opportunity Fund | | | 2,288 | |

| | 70 | | PIMCO Income Strategy Fund II | | | 736 | |

| | 708 | | Western Asset High Income Opportunity Fund, Inc. | | | 4,208 | |

Number of

Shares | | | | | Value | |

| CLOSED-END FUNDS: (continued) | | | | |

| | 310 | | Western Asset Mortgage Defined

Opportunity Fund, Inc. | | $ | 7,167 | |

| | | | | | | | |

Total Closed-End Funds

(Cost: $190,947) (a) | | | 187,399 | |

| | | | | | | | |

| EXCHANGE TRADED FUNDS: 0.3% | | | | |

| | 76 | | iShares Silver Trust * | | | 1,442 | |

| | 275 | | SPDR Gold Trust * | | | 32,766 | |

| | | | | | | | |

Total Exchange Traded Funds

(Cost: $43,776) (a) | | | 34,208 | |

| | | | | | | | |

| OPEN-END FUNDS: 15.6% | | | | |

| | 75,577 | | AQR Managed Futures Strategy Fund | | | 758,791 | |

| | 14,656 | | Marketfield Fund | | | 249,740 | |

| | 31,114 | | TFS Market Neutral Fund * | | | 482,578 | |

| | | | | | | | |

Total Open-End Funds

(Cost: $1,407,044) | | | 1,491,109 | |

| | | | | |

| OPTIONS PURCHASED: 0.0% | | | | |

| | 2,200 | | Alaska Communications Systems Group, Inc. Call

($3, expiring 10/19/13) | | | 220 | |

| | 2,300 | | Amarin Corp. Plc Call

($16, expiring 09/21/13) | | | 276 | |

| | 100 | | Equinix, Inc. Call

($200, expiring 09/21/13) | | | 690 | |

| | 300 | | iShares Russell 2000 ETF Call

($97, expiring 07/20/13) | | | 420 | |

| | 1,000 | | SPDR S&P 500 ETF Trust Put

($161, expiring 07/20/13) | | | 2,660 | |

| | 3,200 | | Windstream Corp. Call

($9, expiring 08/17/13) | | | 224 | |

| | | | | | | | |

| | | | | | | | |

Total Options Purchased

(Cost: $4,771) | | | 4,490 | |

| | | | | | | | |

MONEY MARKET FUND: 33.7%

(Cost: $3,217,577) | | | | |

| | 3,217,577 | | AIM Treasury Portfolio - Institutional Class | | | 3,217,577 | |

| | | | | | | | |

Total Investments: 104.5%

(Cost: $9,884,734) | | | 9,987,074 | |

| Liabilities in excess of other assets: (4.5)% | | | (434,476 | ) |

| NET ASSETS: 100.0% | | $ | 9,552,598 | |

| | | | | | | | |

| SECURITIES SOLD SHORT: (20.6)% | | | | |

| | | | | | | | |

| COMMON STOCKS: (9.4)% | | | | |

| | | | | | | | |

| Basic Materials: (0.2)% | | | | |

| | (62 | ) | Ecolab, Inc. | | | (5,282 | ) |

| | (137 | ) | HB Fuller Co. | | | (5,180 | ) |

| | (231 | ) | PolyOne Corp. | | | (5,724 | ) |

| | | | | | | (16,186 | ) |

| | | | | | | | |

| Communications: (0.8)% | | | | |

| | (24 | ) | Amazon.com, Inc. * | | | (6,665 | ) |

| | (812 | ) | Corning, Inc. | | | (11,555 | ) |

| | (50 | ) | Factset Research Systems, Inc. | | | (5,097 | ) |

| | (191 | ) | Gannett Co., Inc. | | | (4,672 | ) |

| | (20 | ) | Netflix, Inc. * | | | (4,222 | ) |

| | (345 | ) | Nielsen Holdings N.V. | | | (11,589 | ) |

| | (2,504 | ) | Nokia OYJ (ADR) * | | | (9,365 | ) |

See Notes to Financial Statements

Number of

Shares | | | | | Value | |

| Communications: (continued) | | | | |

| | (141 | ) | Splunk, Inc. * | | $ | (6,537 | ) |

| | (367 | ) | Starz - Liberty Capital * | | | (8,111 | ) |

| | (117 | ) | Viasat, Inc. * | | | (8,361 | ) |

| | | | | | | (76,174 | ) |

| | | | | | | | |

| Consumer, Cyclical: (1.7)% | | | | |

| | (70 | ) | Autoliv, Inc. | | | (5,417 | ) |

| | (554 | ) | Best Buy Co., Inc. | | | (15,141 | ) |

| | (40 | ) | Buffalo Wild Wings, Inc. * | | | (3,926 | ) |

| | (625 | ) | Burger King Worldwide, Inc. | | | (12,194 | ) |

| | (113 | ) | Cabela’s, Inc. * | | | (7,318 | ) |

| | (193 | ) | Darden Restaurants, Inc. | | | (9,743 | ) |

| | (214 | ) | Genesco, Inc. * | | | (14,336 | ) |

| | (100 | ) | GNC Holdings, Inc. | | | (4,421 | ) |

| | (212 | ) | Guess?, Inc. | | | (6,578 | ) |

| | (282 | ) | hhgregg, Inc. * | | | (4,504 | ) |

| | (138 | ) | Macy’s, Inc. | | | (6,624 | ) |

| | (246 | ) | Mobile Mini, Inc. * | | | (8,155 | ) |

| | (392 | ) | National CineMedia, Inc. | | | (6,621 | ) |

| | (693 | ) | Newell Rubbermaid, Inc. | | | (18,191 | ) |

| | (643 | ) | Sony Corp. (ADR) | | | (13,625 | ) |

| | (599 | ) | Staples, Inc. | | | (9,500 | ) |

| | (1,018 | ) | The Wendy’s Co. | | | (5,935 | ) |

| | (40 | ) | Tractor Supply Co. | | | (4,704 | ) |

| | | | | | | (156,933 | ) |

| | | | | | | | |

| Consumer, Non-cyclical: (1.5)% | | | | |

| | (201 | ) | Alere, Inc. * | | | (4,925 | ) |

| | (556 | ) | DeVry, Inc. | | | (17,247 | ) |

| | (221 | ) | Fairway Group Holdings Corp. * | | | (5,342 | ) |

| | (558 | ) | Green Dot Corp. * | | | (11,132 | ) |

| | (110 | ) | Green Mountain Coffee Roasters, Inc. * | | | (8,257 | ) |

| | (350 | ) | Iron Mountain, Inc. | | | (9,314 | ) |

| | (203 | ) | Lancaster Colony Corp. | | | (15,832 | ) |

| | (123 | ) | Neogen Corp. * | | | (6,834 | ) |

| | (154 | ) | PAREXEL International Corp. * | | | (7,075 | ) |

| | (289 | ) | Rollins, Inc. | | | (7,485 | ) |

| | (171 | ) | Safeway, Inc. | | | (4,046 | ) |

| | (91 | ) | Strayer Education, Inc. | | | (4,444 | ) |

| | (183 | ) | The ADT Corp. | | | (7,293 | ) |

| | (268 | ) | The Brink’s Co. | | | (6,837 | ) |

| | (95 | ) | The Hain Celestial Group, Inc. * | | | (6,172 | ) |

| | (232 | ) | The Kroger Co. | | | (8,013 | ) |

| | (475 | ) | The Western Union Co. | | | (8,127 | ) |

| | (170 | ) | Weight Watchers International, Inc. | | | (7,820 | ) |

| | | | | | | (146,195 | ) |

| | | | | | | | |

| Energy: (0.1)% | | | | |

| | (100 | ) | Cabot Oil & Gas Corp. | | | (7,102 | ) |

| | (346 | ) | Trican Well Service Ltd. | | | (4,615 | ) |

| | | | | | | (11,717 | ) |

| | | | | | | | |

| Financial: (0.1)% | | | | |

| | (281 | ) | Legg Mason, Inc. | | | (8,714 | ) |

| | (190 | ) | The Progressive Corp. | | | (4,830 | ) |

| | | | | | | (13,544 | ) |

| | | | | | | | |

| Industrial: (2.3)% | | | | |

| | (114 | ) | Actuant Corp. | | | (3,759 | ) |

| | (301 | ) | Advanced Energy Industries, Inc. * | | | (5,240 | ) |

| | (241 | ) | Apogee Enterprises, Inc. | | | (5,784 | ) |

| | (162 | ) | Applied Industrial Technologies, Inc. | | | (7,829 | ) |

Number of

Shares | | | | | Value | |

| Industrial: (continued) | | | | |

| | (3 | ) | Aptargroup, Inc. | | $ | (168 | ) |

| | (299 | ) | Boise Cascade Co. * | | | (7,598 | ) |

| | (166 | ) | Chicago Bridge & Iron Co. N.V. | | | (9,904 | ) |

| | (524 | ) | FARO Technologies, Inc. * | | | (17,722 | ) |

| | (1,043 | ) | Flextronics International Ltd. * | | | (8,073 | ) |

| | (263 | ) | Garmin Ltd. | | | (9,510 | ) |

| | (80 | ) | General Dynamics Corp. | | | (6,266 | ) |

| | (238 | ) | Hub Group, Inc. * | | | (8,668 | ) |

| | (72 | ) | Huntington Ingalls Industries, Inc. | | | (4,067 | ) |

| | (291 | ) | IDEX Corp. | | | (15,659 | ) |

| | (507 | ) | Itron, Inc. * | | | (21,512 | ) |

| | (205 | ) | Jabil Circuit, Inc. | | | (4,178 | ) |

| | (74 | ) | Jacobs Engineering Group, Inc. * | | | (4,080 | ) |

| | (45 | ) | Kansas City Southern | | | (4,768 | ) |

| | (141 | ) | Lincoln Electric Holdings, Inc. | | | (8,075 | ) |

| | (63 | ) | Lockheed Martin Corp. | | | (6,833 | ) |

| | (770 | ) | National Instruments Corp. | | | (21,514 | ) |

| | (94 | ) | Northrop Grumman Corp. | | | (7,783 | ) |

| | (112 | ) | Snap-on, Inc. | | | (10,011 | ) |

| | (74 | ) | Trex Co., Inc. * | | | (3,514 | ) |

| | (220 | ) | Trimble Navigation Ltd. * | | | (5,722 | ) |

| | (252 | ) | Werner Enterprises, Inc. | | | (6,091 | ) |

| | | | | | | (214,328 | ) |

| | | | | | | | |

| Technology: (2.1)% | | | | |

| | (899 | ) | Activision Blizzard, Inc. | | | (12,820 | ) |

| | (90 | ) | Akamai Technologies, Inc. * | | | (3,821 | ) |

| | (80 | ) | ANSYS, Inc. * | | | (5,848 | ) |

| | (96 | ) | Bottomline Technologies, Inc. * | | | (2,428 | ) |

| | (245 | ) | Cabot Microelectronics Corp. * | | | (8,087 | ) |

| | (83 | ) | Cerner Corp. * | | | (7,975 | ) |

| | (644 | ) | Electronic Arts, Inc. * | | | (14,793 | ) |

| | (207 | ) | First Solar, Inc. * | | | (9,259 | ) |

| | (584 | ) | Hewlett-Packard Co. | | | (14,483 | ) |

| | (321 | ) | Hittite Microwave Corp. * | | | (18,618 | ) |

| | (148 | ) | Infosys Ltd. (ADR) | | | (6,096 | ) |

| | (369 | ) | Intel Corp. | | | (8,937 | ) |

| | (137 | ) | Jack Henry & Associates, Inc. | | | (6,457 | ) |

| | (256 | ) | Lexmark International, Inc. | | | (7,826 | ) |

| | (140 | ) | Linear Technology Corp. | | | (5,158 | ) |

| | (86 | ) | Manhattan Associates, Inc. * | | | (6,636 | ) |

| | (100 | ) | MICROS Systems, Inc. * | | | (4,315 | ) |

| | (392 | ) | Microsoft Corp. | | | (13,536 | ) |

| | (106 | ) | NetApp, Inc. | | | (4,005 | ) |

| | (282 | ) | Pitney Bowes, Inc. | | | (4,140 | ) |

| | (372 | ) | Research In Motion Ltd. * | | | (3,895 | ) |

| | (54 | ) | SAP A.G. (ADR) | | | (3,933 | ) |

| | (171 | ) | ServiceNow, Inc. * | | | (6,907 | ) |

| | (521 | ) | Silicon Image, Inc. * | | | (3,048 | ) |

| | (236 | ) | Synaptics, Inc. * | | | (9,100 | ) |

| | (70 | ) | Ultimate Software Group, Inc. * | | | (8,210 | ) |

| | (56 | ) | Vmware, Inc. * | | | (3,751 | ) |

| | | | | | | (204,082 | ) |

| | | | | | | | |

| Utilities: (0.6)% | | | | |

| | (27,000 | ) | Centrais Eletricas Brasileiras S.A. (ADR) | | | (57,240 | ) |

| | | | | | | | |

| | | | | | | | |

Total Common Stocks

(Proceeds: $(853,513)) | | | (896,399 | ) |

See Notes to Financial Statements

VAN ECK VIP MULTI-MANAGER ALTERNATIVES FUND

SCHEDULE OF INVESTMENTS

(continued)

Number of

Shares | | | | | Value | |

| REAL ESTATE INVESTMENT TRUSTS: (0.2)% | | | | |

| | | | | | | | |

| Financial: (0.2)% | | | | |

| | (57 | ) | Coresite Realty Corp. | | $ | (1,813 | ) |

| | (23 | ) | Digital Realty Trust, Inc. | | | (1,403 | ) |

| | (1,169 | ) | Hersha Hospitality Trust | | | (6,593 | ) |

| | (221 | ) | Weyerhaeuser Co. | | | (6,296 | ) |

| | | | | | | | |

Total Real Estate Investment Trusts

(Proceeds: $(16,507)) | | | (16,105 | ) |

| | Principal

Amount | | | | | | |

| CORPORATE BONDS: (2.2)% | | | | |

| | | | | | | | |

| Basic Materials: (1.5)% | | | | |

| | | | AngloGold Ashanti Holdings Plc | | | | |

| $ | (100,000 | ) | 5.38%,04/15/20 | | | (93,620 | ) |

| | | | Vale Overseas Ltd. | | | | |

| | (50,000 | ) | 4.38%,01/11/22 | | | (47,742 | ) |

| | | | | | | (141,362 | ) |

| | | | | | | | |

| Financial: (0.7)% | | | | |

| | | | BBVA Banco Continental S.A. | | | | |

| | (75,000 | ) | 5.00%,08/26/22 Reg S | | | (73,313 | ) |

| | | | | | | | |

Total Corporate Bonds

(Proceeds: $(226,015)) | | | (214,675 | ) |

Number of

Shares | | | | | | |

| EXCHANGE TRADED FUNDS: (8.8)% | | | | |

| | (1,560 | ) | CurrencyShares Japanese Yen Trust * | | | (153,863 | ) |

| | (4,305 | ) | Direxion Daily Emerging Markets Bull 3X Shares | | | (100,694 | ) |

| | (85 | ) | Direxion Daily Small Cap Bull 3X Shares * | | | (3,995 | ) |

| | (93 | ) | Energy Select Sector SPDR Fund | | | (7,287 | ) |

| | (39 | ) | Industrial Select Sector SPDR Fund | | | (1,660 | ) |

| | (736 | ) | iShares Barclays 20+ Year Treasury Bond Fund | | | (81,284 | ) |

| | (37 | ) | iShares PHLX Semiconductor ETF | | | (2,350 | ) |

| | (300 | ) | iShares Russell 2000 ETF | | | (29,148 | ) |

| | (221 | ) | iShares Russell 2000 Growth ETF | | | (24,644 | ) |

| | (125 | ) | iShares Russell 2000 Value ETF | | | (10,738 | ) |

| | (302 | ) | iShares Silver Trust * | | | (5,729 | ) |

| | (10,660 | ) | Market Vectors Gold Miners ETF ‡ | | | (260,211 | ) |

Number of

Shares | | | | | Value | |

| EXCHANGE TRADED FUNDS: (continued) | | | | |

| | (771 | ) | Market Vectors Semiconductor ETF ‡ | | $ | (29,059 | ) |

| | (117 | ) | SPDR S&P Homebuilders ETF | | | (3,442 | ) |

| | (963 | ) | Technology Select Sector SPDR Fund | | | (29,458 | ) |

| | (5,000 | ) | WisdomTree Emerging Currency Fund * | | | (100,250 | ) |

| | | | | | | | |

Total Exchange Traded Funds

(Proceeds: $(987,258)) | | | (843,812 | ) |

| | | | | | | | |

Total Securities Sold Short

(Proceeds: $(2,083,293)) | | $ | (1,970,991 | ) |

| | | | | | | | |

| WRITTEN OPTIONS: (0.1)% | | | | |

| | (600 | ) | Amarin Corp. Plc Put

($7, expiring 09/21/13) | | $ | (963 | ) |

| | (900 | ) | AOL, Inc. Put ($38, expiring 07/20/13) | | | (1,530 | ) |

| | (700 | ) | AOL, Inc. Call ($43, expiring 07/20/13) | | | (53 | ) |

| | (100 | ) | Apollo Global Management LLC Put

($20, expiring 09/21/13) | | | (63 | ) |

| | (200 | ) | Ashland, Inc. Put

($85, expiring 07/20/13) | | | (540 | ) |

| | (100 | ) | Ashland, Inc. Put

($80, expiring 07/20/13) | | | (80 | ) |

| | (100 | ) | Blackstone Group LP Call

($20, expiring 01/18/14) | | | (251 | ) |

| | (300 | ) | Digital Generation, Inc. Call

($8, expiring 08/17/13) | | | (165 | ) |

| | (100 | ) | Equinix, Inc. Put

($160, expiring 09/21/13) | | | (400 | ) |

| | (400 | ) | JC Penney Co., Inc. Put

($13, expiring 01/18/14) | | | (1,012 | ) |

| | (200 | ) | Live Nation Entertainment, Inc. Put

($10, expiring 01/18/14) | | | (60 | ) |

| | (500 | ) | SPDR S&P 500 ETF Trust Put

($151, expiring 08/17/13) | | | (630 | ) |

| | (500 | ) | SPDR S&P 500 ETF Trust Put

($155, expiring 08/17/13) | | | (1,015 | ) |

| | (500 | ) | SPDR S&P 500 ETF Trust Put

($159, expiring 07/20/13) | | | (940 | ) |

| | (1,000 | ) | SPDR S&P 500 ETF Trust Put

($155, expiring 07/20/13) | | | (890 | ) |

| | (500 | ) | SPDR S&P 500 ETF Trust Put

($156, expiring 07/20/13) | | | (535 | ) |

| | | | | | | | |

| | | | | | | | |

Total Written Options

(Premiums received: $(10,125)) | | | $(9,127 | ) |

| ADR | — American Depositary Receipt |

| ARS | — Argentine Peso |

| CAD | — Canadian Dollar |

| CHF | — Swiss Franc |

| EUR | — Euro |

| GBP | — British Pound |

| GHS | — Ghanaian Cedis |

| HKD | — Hong Kong Dollar |

| KRW | — Korean Won |

| NVDR | — Non-Voting Depositary Receipt |

| THB | — Thai Baht |

See Notes to Financial Statements

| (a) | All or a portion of these securities are segregated for securities sold short and written options. Total value of the securities segregated, including cash on deposit with broker, is $4,921,834. |

| (b) | Issued with zero coupon at par. The security is linked to the performance of the Deutsche Bank ProVol Hedge Index, the Deutsche Bank Equity Mean Reversion Alpha Index, the Deutsche Bank Equity Mean Reversion Alpha Index Emerging Markets and the Deutsche Bank Fed Funds Effective Rate Total Return Index. |

| (c) | Callable Security – the redemption date shown is when the security may be redeemed by the issuer |

| (p) | Puttable Security – the redemption date shown is when the security may be redeemed by the investor |

| ^ | Zero Coupon Bond – the rate shown is the effective yield at purchase date |

| ‡ | Affiliated issuer – as defined under the Investment Company Act of 1940. |

| * | Non-income producing |

| # | Indicates a fair valued security which has not been valued utilizing an independent quote, but has been valued pursuant to guidelines established by the Board of Trustees. The aggregate value of fair valued securities is $464,623 which represents 4.9% of net assets. |

| § | Illiquid Security – the aggregate value of illiquid securities is $518,172 which represents 5.8% of net assets. |

| Reg S | Security was purchased pursuant to Regulation S under the Securities Act of 1933, which exempts from registration securities offered and sold outside of the United States. Such a security cannot be sold in the United States without either an effective registration statement filed pursuant to the Securities Act of 1933, or pursuant to an exemption from registration. |

| 144A | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended, or otherwise restricted. These securities may be resold in transactions exempt from registration, unless otherwise noted, and the value amounted to $306,557, or 3.2% of net assets. |

| ♦ | Security in default |

As of June 30, 2013, the Fund had an outstanding swap contract with the following terms:

Credit default swap contract on credit index — Buy Protection:

| Counterparty | | Referenced

Obligation | | Notional

Amount | | Termination

Date | | Payments Made

By The Fund | | Value | | Upfront

Payments Paid | | Unrealized

Appreciation |

| | | Markit iTraxx Corp | | | | | | | | | | | | | | | | | |

| Credit Suisse | | CEEMEA Index | | $100,000 | | 06/20/18 | | 1.00% | | | $ | 7,578 | | | $ | (5,855 | ) | | | $ | 1,723 | |

As of June 30, 2013, the Fund held the following open forward foreign currency contracts:

| Counterparty | | Contracts

to deliver | | In Exchange For | | Settlement Date | | Unrealized

Appreciation |

| State Street Bank and Trust Company | | COP 96,300,000 | | USD 50,000 | | 12/6/2013 | | | $ | 647 | |

| COP | — Colombian Peso |

| USD | — United States Dollar |

Restricted securities held by the Fund as of June 30, 2013 are as follows:

| Security | | Acquisition

Date | | Number

of Shares | | Acquisition Cost | | Value | | % of

Net Assets |

| Green Field Energy Services, Inc. | | 10/02/2012 | | 2,000 | | | $ | 2,329 | | | | $ | 2,090 | | | | 0.0% | |

A summary of the Fund’s transactions in securities of affiliates for the period ended June 30, 2013 is set forth below:

| Affiliates | | Value as of

December 31, 2012 | | Purchases | | Sales

Proceeds | | Realized

Gain (Loss) | | Dividend

Income | | Value as of

June 30, 2013 |

| Market Vectors Emerging Markets High Yield Bond ETF | | | $ | 111,656 | | | | $ | — | | | | $ | 112,435 | | | | $ | 3,326 | | | | $ | 551 | | | | $ | — | |

| Market Vectors Emerging Markets Local Currency Bond ETF | | | | 146,583 | | | | | — | | | | | 146,684 | | | | | 11,576 | | | | | 738 | | | | | — | |

| Market Vectors Gold Miners ETF(1) | | | | (141,953 | ) | | | | — | | | | | 201,766 | | | | | — | | | | | — | | | | | (260,211 | ) |

| Market Vectors International High Yield Bond ETF | | | | 115,333 | | | | | — | | | | | 117,491 | | | | | 6,209 | | | | | 557 | | | | | — | |

| Market Vectors Junior Gold Miners ETF | | | | (1,643 | ) | | | | 1,055 | | | | | — | | | | | 930 | | | | | — | | | | | — | |

| Market Vectors Oil Services ETF | | | | (2,708 | ) | | | | 3,016 | | | | | 191 | | | | | (308 | ) | | | | — | | | | | — | |

| Market Vectors Semiconductor ETF(1) | | | | (4,544 | ) | | | | 29,991 | | | | | 51,445 | | | | | (2,355 | ) | | | | — | | | | | (29,059 | ) |

| | | | $ | 222,724 | | | | $ | 34,062 | | | | $ | 630,012 | | | | $ | 19,378 | | | | $ | 1,846 | | | | $ | (289,270 | ) |

(1) Represents short position at June 30, 2013.

See Notes to Financial Statements

VAN ECK VIP MULTI-MANAGER ALTERNATIVES FUND

SCHEDULE OF INVESTMENTS

(continued)

The summary of inputs used to value the Fund’s investments as of June 30, 2013 is as follows:

| Long positions | | Level 1

Quoted

Prices | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | Value | |

| Common Stocks | | | | | | | | | | | | | | | | | | |

| Basic Materials | | $ | 297,548 | | | $ | — | | | | $ | — | | | | $ | 297,548 | |

| Communications | | | 578,222 | | | | — | | | | | — | | | | | 578,222 | |

| Consumer, Cyclical | | | 440,684 | | | | 115,570 | | | | | — | | | | | 556,254 | |

| Consumer, Non-cyclical | | | 319,415 | | | | — | | | | | — | | | | | 319,415 | |

| Diversified | | | 7,892 | | | | — | | | | | — | | | | | 7,892 | |

| Energy | | | 219,308 | | | | 145,191 | | | | | — | | | | | 364,499 | |

| Financial | | | 344,280 | | | | 106,290 | | | | | — | | | | | 450,570 | |

| Industrial | | | 203,089 | | | | — | | | | | — | | | | | 203,089 | |

| Technology | | | 443,455 | | | | 63,116 | | | | | 2,842 | | | | | 509,413 | |

| Real Estate Investment Trusts* | | | 57,030 | | | | — | | | | | — | | | | | 57,030 | |

| Asset-Backed Securities | | | — | | | | 6,567 | | | | | — | | | | | 6,567 | |

| Corporate Bonds | | | | | | | | | | | | | | | | | | |

| Communications | | | — | | | | 174,493 | | | | | 6,176 | | | | | 180,669 | |

| Consumer, Cyclical | | | — | | | | 202,388 | | | | | — | | | | | 202,388 | |

| Consumer, Non-cyclical | | | — | | | | 108,943 | | | | | — | | | | | 108,943 | |

| Energy | | | — | | | | 223,282 | | | | | — | | | | | 223,282 | |

| Financial | | | — | | | | 179,456 | | | | | — | | | | | 179,456 | |

| Industrial | | | — | | | | 185,779 | | | | | — | | | | | 185,779 | |

| Utilities | | | — | | | | 37,313 | | | | | — | | | | | 37,313 | |

| Foreign Government Obligations* | | | — | | | | 67,880 | | | | | — | | | | | 67,880 | |

| Structured Notes* | | | — | | | | 516,082 | | | | | — | | | | | 516,082 | |

| Closed-End Funds | | | 187,399 | | | | — | | | | | — | | | | | 187,399 | |

| Exchange Traded Funds | | | 34,208 | | | | — | | | | | — | | | | | 34,208 | |

| Open-End Funds | | | 1,491,109 | | | | — | | | | | — | | | | | 1,491,109 | |

| Options Purchased | | | 4,490 | | | | — | | | | | — | | | | | 4,490 | |

| Money Market Fund | | | 3,217,577 | | | | — | | | | | — | | | | | 3,217,577 | |

| Total | | $ | 7,845,706 | | | $ | 2,132,350 | | | | $ | 9,018 | | | | $ | 9,987,074 | |

| Short positions | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | Value | |

| Common Stocks* | | $ | (896,399 | ) | | $ | — | | | | $ | — | | | | $ | (896,399 | ) |

| Real Estate Investment Trusts* | | | (16,105 | ) | | | — | | | | | — | | | | | (16,105 | ) |

| Corporate Bonds* | | | — | | | | (214,675 | ) | | | | — | | | | | (214,675 | ) |

| Exchange Traded Funds | | | (843,812 | ) | | | — | | | | | — | | | | | (843,812 | ) |

| Total | | $ | (1,756,316 | ) | | $ | (214,675 | ) | | | $ | — | | | | $ | (1,970,991 | ) |

| | | | | | | | | | | | | | | | | | | |

| Other Financial Instruments | | | | | | | | | | | | | | | | | | |

| Swap Contract | | $ | — | | | $ | 7,578 | | | | $ | — | | | | $ | 7,578 | |

| Forward Foreign Currency Contracts | | | — | | | | 647 | | | | | — | | | | | 647 | |

| Written Options | | | (9,127 | ) | | | — | | | | | — | | | | | (9,127 | ) |

| Total | | $ | (9,127 | ) | | $ | 8,225 | | | | $ | — | | | | $ | (902 | ) |

* See Schedule of Investments for security type and industry sector breakouts.

The following table reconciles the valuation of the Fund’s Level 3 investment securities and related transactions during the period June 30, 2013:

| | | Common Stocks | | Corporate Bonds |

| | | Long position | | Long position |

| | | Technology | | Communications |

| Balance as of December 31, 2012 | | | $ | 3,789 | | | | $ | — | |

| Realized gain (loss) | | | | — | | | | | — | |

| Net change in unrealized appreciation (depreciation) | | | | (947 | ) | | | | — | |

| Purchases | | | | — | | | | | — | |

| Sales | | | | — | | | | | — | |

| Transfers in and/or out of level 3 | | | | — | | | | | 6,176 | |

| Balance as of June 30, 2013 | | | $ | 2,842 | | | | $ | 6,176 | |

During the period ended June 30, 2013, transfers of securities from Level 2 to Level 3 were $6,176. These transfers from Level 2 to Level 3 resulted primarily from limited trading activity.

See Notes to Financial Statements

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2013 (unaudited)

| Assets: | | | | |

| Investments, at value (cost $9,884,734) | | $ | 9,987,074 | |

| Credit default swap contracts, at value (premiums paid $6,709) | | | 7,578 | |

| Unrealized appreciation on forward foreign currency contracts | | | 647 | |

| Cash | | | 10,126 | |

| Deposits with broker for securities sold short and written options | | | 1,880,078 | |

| Cash denominated in foreign currency, at value (cost $659) | | | 678 | |

| Receivables: | | | | |

| Investments sold | | | 88,002 | |

| Dividends and interest | | | 38,500 | |

| Prepaid expenses | | | 82 | |

| Total assets | | $ | 12,012,765 | |

| | | | | |

| Liabilities: | | | | |

| Securities sold short: | | | | |

| Unaffiliated issuers (proceeds $1,692,559) | | | 1,681,721 | |

| Affiliated issuers (proceeds $390,734) | | | 289,270 | |

| Written options, at value (premiums received $10,125) | | | 9,127 | |

| Payables: | | | | |

| Dividends on securities sold short | | | 1,396 | |

| Investments purchased | | | 284,431 | |

| Shares of beneficial interest redeemed | | | 87,139 | |

| Due to Adviser | | | 8,658 | |

| Deferred Trustee fees | | | 1,737 | |

| Accrued expenses | | | 96,688 | |

| Total liabilities | | | 2,460,167 | |

| NET ASSETS | | $ | 9,552,598 | |

| | | | | |

| Initial Class Shares: | | | | |

| Net Assets | | $ | 9,528,257 | |

| Shares of beneficial interest outstanding | | | 984,087 | |

| Net asset value, redemption and offering price per share | | | $9.68 | |

| | | | | |

| Class S Shares: | | | | |

| Net Assets | | $ | 24,341 | |

| Shares of beneficial interest outstanding | | | 2,521 | |

| Net asset value, redemption and offering price per share | | | $9.66 | |

| | | | | |

| Net Assets consist of: | | | | |

| Aggregate paid in capital | | $ | 9,560,187 | |

| Net unrealized appreciation | | | 207,687 | |

| Accumulated net investment loss | | | (184,249 | ) |

| Accumulated net realized loss | | | (31,027 | ) |

| | | $ | 9,552,598 | |

See Notes to Financial Statements

VAN ECK VIP MULTI-MANAGER ALTERNATIVES FUND

STATEMENT OF OPERATIONS

For the Six Months Ended June 30, 2013 (unaudited)

| Income: | | | | | | |

| Dividends – unaffiliated issuers (net of foreign taxes withheld of $565) | | | | $ | 27,042 | |

| Dividends – affiliated issuers | | | | | 1,846 | |

| Interest | | | | | 40,832 | |

| Total income | | | | | 69,720 | |

| | | | | | | |

| Expenses: | | | | | | |

| Management fees | | $ 87,614 | | | | |

| Dividends on securities sold short | | 11,709 | | | | |

| Interest on securities sold short | | 666 | | | | |

| Distribution fees – Class S Shares | | 31 | | | | |

| Transfer agent fees – Initial Class | | 10,117 | | | | |

| Transfer agent fees – Class S Shares | | 7,106 | | | | |

| Custodian fees | | 63,191 | | | | |

| Professional fees | | 16,631 | | | | |

| Reports to shareholders | | 22,724 | | | | |

| Insurance | | 142 | | | | |

| Trustees’ fees and expenses | | 735 | | | | |

| Interest | | 29 | | | | |

| Other | | 590 | | | | |

| Total expenses | | 221,285 | | | | |

| Waiver of management fees | | (87,614) | | | | |

| Expenses assumed by the Adviser | | (23,621) | | | | |

| Net expenses | | | | | 110,050 | |

| Net investment loss | | | | | (40,330 | ) |

| | | | | | | |

| Net realized gain (loss) on: | | | | | | |

| Investments – unaffiliated issuers (net of foreign taxes of $876) | | | | | 91,391 | |

| Investments – affiliated issuers | | | | | 21,111 | |

| Securities sold short – unaffiliated issuers | | | | | (21,455 | ) |

| Securities sold short – affiliated issuers | | | | | (1,733 | ) |

| Forward foreign currency contracts, foreign currency transactions and foreign denominated assets and liabilities | | | | | (8,482 | ) |

| Swap contracts | | | | | (981 | ) |

| Options purchased | | | | | (19,090 | ) |

| Written options | | | | | 14,509 | |

| Net realized gain | | | | | 75,270 | |

| | | | | | | |

| Net change in unrealized appreciation (depreciation) on: | | | | | | |

| Investments, options purchased and written options (net of foreign taxes of $709) | | | | | (235,823 | ) |

| Securities sold short – unaffiliated issuers | | | | | 63,104 | |

| Securities sold short – affiliated issuers | | | | | (19,228 | ) |

| Swap contracts | | | | | 2,185 | |

| Forward foreign currency contracts, foreign currency transactions and foreign denominated assets and liabilities | | | | | 2,487 | |

| Net change in unrealized appreciation (depreciation) | | | | | (187,275 | ) |

| Net Decrease in Net Assets Resulting from Operations | | | | $ | (152,335 | ) |

See Notes to Financial Statements

STATEMENT OF CHANGES IN NET ASSETS

| | | Six Months Ended

June 30,

2013 | | Year Ended

December 31,

2012 |

| | | (unaudited) | | | | | |

| Operations: | | | | | | | | | | |

| Net investment loss | | | $ | (40,330 | ) | | | $ | (133,599 | ) |

| Net realized gain | | | | 75,270 | | | | | 57,921 | |

| Net change in unrealized appreciation (depreciation) | | | | (187,275 | ) | | | | 180,962 | |

| Net increase (decrease) in net assets resulting from operations | | | | (152,335 | ) | | | | 105,284 | |

| | | | | | | | | | | |

| Distributions to shareholders from: | | | | | | | | | | |

| Net realized gains | | | | | | | | | | |

| Initial Class Shares | | | | (52,025 | ) | | | | — | |

| Class S Shares | | | | (143 | ) | | | | — | |

| Total distributions | | | | (52,168 | ) | | | | — | |

| | | | | | | | | | | |

| Share transactions*: | | | | | | | | | | |

| Proceeds from sale of shares | | | | | | | | | | |

| Initial Class Shares | | | | 1,962,553 | | | | | 2,344,688 | |

| Class S Shares† | | | | — | | | | | 25,025 | |

| | | | | 1,962,553 | | | | | 2,369,713 | |

| Reinvestment of distributions | | | | | | | | | | |

| Initial Class Shares | | | | 52,025 | | | | | — | |

| Class S Shares† | | | | 143 | | | | | — | |

| | | | | 52,168 | | | | | — | |

| Cost of shares redeemed | | | | | | | | | | |

| Initial Class Shares | | | | (1,252,580 | ) | | | | (2,459,025 | ) |