ITEM 1. REPORT TO SHAREHOLDERS

| | | | | SEMI-ANNUAL REPORT

JUNE 30, 2014

(unaudited) |

| | |  |

| | | | | |

| | | | | |

| | | Van Eck VIP Trust Van Eck VIP Global Hard Assets Fund |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | |  |

| | | | | |

Van Eck VIP Global Hard Assets Fund

The information contained in this shareholder letter represents the personal opinions of the investment team members and may differ from those of other portfolio managers or of the firm as a whole. This information is not intended to be a forecast of future events, a guarantee of future results or investment advice. Also, unless otherwise specifically noted, any discussion of the Fund’s holdings and the Fund’s performance, and the views of the investment team members are as of June 30, 2014 and are subject to change.

VAN ECK VIP GLOBAL HARD ASSETS FUND

(unaudited)

Dear Shareholder:

The Initial Class shares of the Van Eck VIP Global Hard Assets Fund (the “Fund”) gained 13.58% for the six months ended June 30, 2014. To compare, the Standard and Poor’s (S&P®) North American Natural Resources Sector Index1 rose 16.43% for the same period. Two key aspects of the Fund that detracted from performance relative to its primary benchmark were an overweight position in oil and gas refining and marketing, which suffered from a weak spread between WTI and Brent, and an underweight position, and poor stock selection, in oil and gas storage and transportation.

It is important to note that, as the Fund continues to employ a diversified natural resource strategy, it has, historically, been underweight energy relative to the S&P® North American Natural Resources Sector Index (the “Index”), the Fund’s benchmark index. For example, the benchmark was approximately 86% energy as of June 30, whereas the Fund was approximately 70% energy. It is, however, also important to note that the S&P® Global Natural Resources Index2 gained only 6.88% for the six-month period. As of June 30, this index was a little more than 33% energy. This divergence in performances amongst indices, over the six months ended June 30, 2014, highlights the effect that energy allocation had on performance during the period.

The Fund remained underweight relative to the benchmark in the energy sector overall at the end of the six-month period, but continued, with its focus on the U.S. unconventional shale story, to maintain an energy allocation close to its historical highs. At the end of the first half of 2014, within energy, the Fund was significantly underweight integrated oil and gas, having no allocation to the sub-sector at period end. The next largest underweight was in the oil and gas storage and transportation sub-sector. As of June 30, 2014, the Fund was overweight relative to the Index in the oil and gas equipment and services and oil and gas drilling sub-sectors, and slightly overweight in the oil and gas exploration and production sub-sector. As of the same date, the Fund was also overweight in the oil and gas refining and marketing sub-sector and the coal and consumable fuels sub-sector. The Fund’s largest overweights relative to the Index were in the diversified metals and mining sub-sector, and in the gold sub-sector.

Overview

Several important factors influenced the markets in which the Fund invested during the first six month of 2014. On the demand side, there was, on the one hand, the continuing clear deceleration of growth in China, particularly during the first quarter of the year, but, as a result of the government stimulus program, less so during the second quarter. On the other hand, not only was there solid demand for commodities on a global basis, which included China, but also, in the developed markets, there were continuing indications of inflections in GDP growth.

On the supply side, markets were affected by a number of significant disruptions. While the situation in Ukraine, and the possibility of further sanctions on Russia, remained a concern during the period under review, there was also the continuing disruption caused by Indonesia’s decision in January to implement a total ban on the export of unprocessed nickel and copper ore. The platinum miners’ strike in South Africa lasted throughout most of the first six months of the year, with the dispute only eventually being settled in the last week in June. And, finally, as June drew to a close, there was the accelerating deterioration of the situation in Iraq.

During the period, too, the risk of inflation, not only in the U.S., but also in Europe and Asia, increasingly became both a topic of conversation and a factor for consideration in future investment decisions.

Fund Review

Our underweight in integrated oil and gas and paper products led them to be two of the Fund’s strongest positive-contributing sub-sectors relative to the primary benchmark. In the case of integrated oil and gas, a sub-sector currently experiencing a decline in capital expenditure, we were significantly underweight. In the case of paper products, the absence of any exposure to the sub-sector enabled the Fund to avoid the benchmark’s negative performance. In gold, not only was the Fund overweight, but it also had reasonable stock selection. Gold companies are currently benefitting, among other things, from an increase in the price of gold, successful cost-cutting and an increase in merger and acquisition activity.

The three weakest-contributing sub-sectors to the Fund’s performance relative to the primary benchmark were oil and gas refining and marketing, vulnerable to a narrowing spread between WTI and Brent, oil and gas storage and transportation, in which a weak tanker selection by the Fund detracted from performance, and steel, a sub-sector facing not only over capacity, but also only modest demand. There was no allocation to steel in the benchmark index during the period.

The Fund’s three strongest contributors were energy-related companies. The strongest contributor was oil services giant Halliburton (4.2% of Fund’s net assets†) which continued to enjoy strong revenue growth from its directional drilling,

VAN ECK VIP GLOBAL HARD ASSETS FUND

(unaudited)

pressure pumping and fracking activities, especially in North America. The second and third strongest contributors were Cimarex Energy (4.0% of Fund’s net assets†) and Concho Resources (4.1% of Fund’s net assets†), both oil and gas exploration companies and both continuing beneficiaries of their unconventional shale oil activities, especially in the Permian Basin and, in particular, in the Delaware Sub-Basin.

The Fund’s three weakest contributing companies were Louisiana Pacific (1.2% of Fund’s net assets†), a forest products company, currently affected by concerns about the sustainability of the housing recovery in the U.S.; Marathon Petroleum (1.8% of Fund’s net assets†), an oil and gas refining and marketing company, vulnerable to a narrowing of the spread between WTI and Brent; and, Ophir Energy (0.6% of Fund’s net assets†), an oil and gas exploration and production company, which recently reported some poor drilling results.

Significant purchases by the Fund were made in the diversified metals and mining, oil and gas drilling and gold sub-sectors, with a new position in Freeport-McMoRan (2.1% of Fund’s net assets†) and the addition of shares in Nabors Industries (2.6% of Fund’s net assets†) and Goldcorp (2.3% of Fund’s net assets†) respectively.

The Fund’s largest sales during the period were the integrated oil and gas company Occidental Petroleum, the gold company Newmont Mining, and the oil and gas exploration and production company Whiting Petroleum (all eliminated by the Fund at period end).

During the six-month period, the Fund’s positions in both the gold and diversified metals and mining sub-sectors increased not least because of both its new position in Freeport-McMoRan and the addition of shares in Goldcorp. The Fund’s allocation to the energy sector also trended higher in all sub-sectors except oil and gas refining and marketing and integrated oil and gas which both declined. By period end the Fund had no allocation to the integrated oil and gas sub-sector. The Fund’s allocation to steel had also declined.

Outlook

Our outlook for demand is that we continue to see a gradual improvement in global GDP, driven by a combination of both the developed and emerging markets. Very importantly, we believe that, as some of the most obvious products of both global geopolitics and social unrest, in the immediate term, supply issues and disruptions will continue to have the most impact on the markets in which we invest. In the longer term, however, persistent concerns over resource scarcity and political issues, such as resource nationalization, will continue to affect these markets, as will the current downtrend in capital expenditure.

Within the themes of resource scarcity and the need for supply security, we have recently added liquid natural gas (LNG) as an area of interest and have, consequently, taken a very small position therein.

Finally, in our extensive travels over the last six months, in addition to the increasing concern we have encountered about the risk of inflation, not just here in the U.S., but also in both Asia and Europe, we have also been informed by a number of natural resource fund managers, particularly in Europe, that they think the unconventional shale story in North America is passé. We would beg strongly to differ. Based on results alone, we believe the unconventional esource story continues to be the most prominent individual natural resource investment theme and will probably be around for quite some time.

The Fund is subject to risks associated with concentrating its investments in hard assets and the hard assets sector, including real estate, precious metals and natural resources, and can be significantly affected by events relating to these industries, including international political and economic developments, inflation, and other factors. The Fund’s portfolio securities may experience substantial price fluctuations as a result of these factors, and may move independently of the trends of industrialized companies. The Fund’s investments in foreign securities involve risks related to adverse political and economic developments unique to a country or a region, currency fluctuations or controls, and the possibility of arbitrary action by foreign governments, including the takeover of property without adequate compensation or imposition of prohibitive taxation. The Fund is subject to risks associated with investments in debt securities, derivative, commodity-linked instruments, illiquid securities, asset-backed securities and CMOs. The Fund is also subject to inflation risk, short sales risk, market risk, non-diversification risk and leverage risk. An investment in the Fund should be considered part of an overall investment program, rather than a complete investment program.

We appreciate your continued investment in the Van Eck VIP Global Hard Assets Fund, and we look forward to helping you meet your investment goals in the future.

|  | |

| | | |

| Charles T. Cameron | Shawn Reynolds | |

| Co-Portfolio Manager | Co-Portfolio Manager | |

The performance quoted represents past performance. Past performance is no guarantee of future results; current performance may be lower or higher than the performance data quoted. Performance information reflects temporary waivers of expenses and/or fees and does not include insurance/annuity fees and expenses. Investment returns would have been reduced had these fees/expenses been included. Investment return and the value of the shares of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Index returns assume that dividends of the Index constituents in the Index have been reinvested. Performance information current to the most recent month end is available by calling 1.800.826.2333.

The Fund is only available to life insurance and annuity companies to fund their variable annuity and variable life insurance products. These contracts offer life insurance and tax benefits to the beneficial owners of the Fund. Your insurance or annuity company charges, fees and expenses for these benefits are not reflected in this report or in the Fund’s performance, since they are not direct expenses of the Fund. Had these fees been included, returns would have been lower. For insurance products, performance figures do not reflect the cost for insurance and if they did, the performance shown would be significantly lower. A review of your particular life and/or annuity contract will provide you with much greater detail regarding these costs and benefits.

| † | All Fund assets referenced are Total Net Assets as of June 30, 2014. |

| | |

| All indices are unmanaged and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in the Fund. An index’s performance is not illustrative of the Fund’s performance. Indices are not securities in which investments can be made. Results reflect past performance and do not guarantee future results. |

| | |

| 1 | S&P® North American Natural Resources Sector (SPGINRTR) Index includes mining, energy, paper and forest products, and plantation-owning companies. |

| | |

| 2 | S&P® Global Natural Resources Index (SPGNRUP) includes 90 of the largest publicly traded companies in natural resources and commodities businesses that meet specific investability requirements, offering investors diversified and investable equity exposure across three primary commodity-related sectors: agribusiness, energy and metals and mining. |

VAN ECK VIP GLOBAL HARD ASSETS FUND

TOP TEN EQUITY HOLDINGS*

June 30, 2014 (unaudited)

Glencore Xstrata Plc

(Switzerland, 4.6%)

Glencore Xstrata is a diversified natural resources company. The company operates in three groups: metals and minerals, energy products, and agricultural products. Glencore Xstrata offers its products and services around the world.

Schlumberger Ltd.

(U.S., 4.3%)

Schlumberger is an oil services company. The company, through its subsidiaries, provides a wide range of services, including technology, project management and information solutions to the international petroleum industry as well as advanced acquisition and data processing surveys.

Halliburton Co.

(U.S., 4.2%)

Halliburton provides energy services and engineering and construction services, as well as manufactures products for the energy industry. The company offers services and products and integrated solutions to customers in the exploration, development, and production of oil and natural gas.

Concho Resources, Inc.

(U.S, 4.1%)

Concho acquires, develops and explores for oil and natural gas properties in the Permian Basin area of Southeast New Mexico and West Texas.

Cimarex Energy Co.

(U.S., 3.9%)

Cimarex Energy explores for and produces crude oil and natural gas in the United States. The company conducts activities primarily in New Mexico, Texas and Oklahoma.

Consol Energy, Inc.

(U.S., 3.9%)

Consol is a diversified fuel producer in the Eastern U.S. The company owns and operates mining complexes in several states that contain coal reserves. Consol also explores, develops and produces natural gas, including methane and shale beds.

Pioneer Natural Resources Co.

(U.S., 3.9%)

Pioneer Natural Resources is an independent oil and gas exploration and production company, headquartered in Dallas, Texas, with operations primarily in the United States.

Anadarko Petroleum Corp.

(U.S., 3.6%)

Anadarko Petroleum is an oil and gas exploration and production company, with major areas of operation located onshore in the United States, the Gulf of Mexico, Algeria, East and West Africa, and has production in China. The company markets natural gas, oil and natural gas liquids (NGLs), and owns and operates gas gathering and processing systems.

First Quantum Minerals Ltd.

(Canada, 3.1%)

First Quantum explores for, mines, and produces copper cathode, copper in concentrate, and gold. The company also produces sulfuric acid.

EOG Resources, Inc.

(U.S., 3.1%)

EOG explores for, develops, produces and markets natural gas and crude oil. The company operates in major producing basins in the United States, Canada, Trinidad, the United Kingdom North Sea, China and, from time to time, select other international areas

| * | Percentage of net assets. Portfolio is subject to change. |

| | Company descriptions courtesy of Bloomberg.com. |

EXPLANATION OF EXPENSES

(unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including program fees on purchase payments; and (2) ongoing costs, including management fees and other Fund expenses. This disclosure is intended to help you understand the ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The disclosure is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, January 1, 2014 to June 30, 2014.

Actual Expenses

The first line in the table below provides information about account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period.”

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as fees on purchase payments. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Van Eck VIP Global Hard Assets Fund

| | | | | Expenses Paid |

| | | Beginning | Ending | During the Period* |

| | | Account Value | Account Value | January 1, 2014 – |

| | | January 1, 2014 | June 30, 2014 | June 30, 2014 |

| Initial Class | Actual | $ 1,000.00 | $ 1,135.80 | $ 5.67 |

| | Hypothetical** | $ 1,000.00 | $ 1,019.49 | $ 5.36 |

| Class S | Actual | $ 1,000.00 | $ 1,134.20 | $ 7.04 |

| | Hypothetical** | $ 1,000.00 | $ 1,018.20 | $ 6.66 |

| * | Expenses are equal to the Fund’s annualized expense ratio (for the six months ended June 30, 2014), of 1.07% on Initial Class, and 1.33% on Class S Shares, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half divided by the number of days in the fiscal year (to reflect the one-half year period). |

| | |

| ** | Assumes annual return of 5% before expenses |

VAN ECK VIP GLOBAL HARD ASSETS FUND

SCHEDULE OF INVESTMENTS

June 30, 2014 (unaudited)

| Number of | | | | | | |

| Shares | | | | | Value | |

| | | | | | | | | |

| COMMON STOCKS: 95.6% |

| |

| Bermuda: 3.0% |

| | 33,600 | | | Golar LNG Ltd. (USD) | | $ | 2,019,360 | |

| | 462,500 | | | Nabors Industries Ltd. (USD) | | | 13,583,625 | |

| | | | | | | | 15,602,985 | |

| Brazil: 0.0% | | | | |

| | 1,614,800 | | | Brazilian Resources, Inc. (CAD) *#§ | | | 0 | |

| Canada: 10.4% | | | | |

| | 26,623 | | | Agnico-Eagle Mines Ltd. | | | 1,019,444 | |

| | 68,700 | | | Agrium, Inc. (USD) | | | 6,294,981 | |

| | 792,300 | | | Eldorado Gold Corp. (USD) | | | 6,053,172 | |

| | 763,600 | | | First Quantum Minerals Ltd. | | | 16,330,399 | |

| | 442,300 | | | Goldcorp, Inc. (USD) | | | 12,344,593 | |

| | 454,519 | | | Kinross Gold Corp. (USD) * | | | 1,881,708 | |

| | 806,100 | | | New Gold, Inc. (USD) * | | | 5,134,857 | |

| | 36,650 | | | Osisko Gold Royalties Ltd. * | | | 551,270 | |

| | 97,016 | | | Yamana Gold, Inc. | | | 798,278 | |

| | 531,200 | | | Yamana Gold, Inc. (USD) | | | 4,366,464 | |

| | | | | | | | 54,775,166 | |

| Kuwait: 2.2% | | | | |

| | 3,890,609 | | | Kuwait Energy Plc *#§ø | | | 11,382,507 | |

| Monaco: 0.3% | | | | |

| | 166,000 | | | Scorpio Tankers, Inc. (USD) | | | 1,688,220 | |

| Norway: 0.7% | | | | |

| | 100,400 | | | SeaDrill Ltd. # | | | 3,978,911 | |

| Switzerland: 5.5% | | | | |

| | 4,392,465 | | | Glencore Xstrata Plc (GBP) # | | | 24,477,955 | |

| | 127,900 | | | Noble Corp Plc (USD) | | | 4,292,324 | |

| | | | | | | | 28,770,279 | |

| United Kingdom: 4.2% | | | | |

| | 3,102,200 | | | Afren Plc *# | | | 7,685,125 | |

| | 15,000 | | | African Minerals Ltd. *#ø | | | 17,770 | |

| | 285,500 | | | African Minerals Ltd. *# | | | 338,218 | |

| | 143,800 | | | Genel Energy Plc *# | | | 2,495,107 | |

| | 848,820 | | | Ophir Energy Plc *# | | | 3,192,929 | |

| | 97,600 | | | Randgold Resources Ltd. (ADR) | | | 8,256,960 | |

| | | | | | | | 21,986,109 | |

| United States: 69.3% | | | | |

| | 100,905 | | | Alpha Natural Resources, Inc. * | | | 374,357 | |

| | 172,400 | | | Anadarko Petroleum Corp. | | | 18,872,628 | |

| | 71,200 | | | Archer-Daniels-Midland Co. | | | 3,140,632 | |

| | 153,600 | | | Atwood Oceanics, Inc. * | | | 8,060,928 | |

| | 153,000 | | | Cameron International Corp. * | | | 10,359,630 | |

| | 37,500 | | | CARBO Ceramics, Inc. | | | 5,779,500 | |

| | 144,400 | | | Cimarex Energy Co. | | | 20,715,624 | |

| | 120,500 | | | Cloud Peak Energy, Inc. * | | | 2,219,610 | |

| | 150,150 | | | Concho Resources, Inc. * | | | 21,696,675 | |

| | 448,300 | | | Consol Energy, Inc. | | | 20,653,181 | |

| | 50,100 | | | Cummins, Inc. | | | 7,729,929 | |

| | 112,300 | | | Delek US Holdings, Inc. | | | 3,170,229 | |

| | 66,500 | | | Diamond Offshore Drilling, Inc. | | | 3,300,395 | |

| | 102,700 | | | Diamondback Energy, Inc. * | | | 9,119,760 | |

| | 82,000 | | | Dril-Quip, Inc. * | | | 8,957,680 | |

| | 138,000 | | | EOG Resources, Inc. | | | 16,126,680 | |

| | 306,700 | | | Freeport-McMoRan Copper & Gold, Inc. | | | 11,194,550 | |

| Number of | | | | | | |

| Shares | | | | | Value | |

| | | | | | | | | |

| United States: (continued) | | | | |

| | 97,500 | | | Gulfport Energy Corp. * | | $ | 6,123,000 | |

| | 309,100 | | | Halliburton Co. | | | 21,949,191 | |

| | 210,700 | | | HollyFrontier Corp. | | | 9,205,483 | |

| | 18,700 | | | Jacobs Engineering Group, Inc. * | | | 996,336 | |

| | 91,400 | | | Laredo Petroleum, Inc. * | | | 2,831,572 | |

| | 414,300 | | | Louisiana-Pacific Corp. * | | | 6,222,786 | |

| | 339,700 | | | Marathon Oil Corp. | | | 13,560,824 | |

| | 118,900 | | | Marathon Petroleum Corp. | | | 9,282,523 | |

| | 147,500 | | | National Oilwell Varco, Inc. | | | 12,146,625 | |

| | 87,350 | | | Newfield Exploration Co. * | | | 3,860,870 | |

| | 36,875 | | | NOW, Inc. * | | | 1,335,244 | |

| | 281,900 | | | Peabody Energy Corp. | | | 4,609,065 | |

| | 121,500 | | | Phillips 66 | | | 9,772,245 | |

| | 89,600 | | | Pioneer Natural Resources Co. | | | 20,590,976 | |

| | 73,800 | | | Royal Gold, Inc. | | | 5,617,656 | |

| | 192,200 | | | Schlumberger Ltd. | | | 22,669,990 | |

| | 186,600 | | | SM Energy Co. | | | 15,693,060 | |

| | 194,900 | | | Steel Dynamics, Inc. | | | 3,498,455 | |

| | 266,700 | | | Superior Energy Services, Inc. | | | 9,638,538 | |

| | 169,400 | | | Tesoro Corp. | | | 9,938,698 | |

| | 157,000 | | | United States Steel Corp. | | | 4,088,280 | |

| | | | | | | | 365,103,405 | |

Total Common Stocks

(Cost: $377,423,408) | | | 503,287,582 | |

WARRANTS: 0.0%

(Cost: $29,072) | | | | |

| | | | | |

| Canada: 0.0% | | | | |

| | 24,704 | | | Kinross Gold Corp. Warrants

(CAD 21.30, expiring 09/17/14) * | | | 579 | |

| United States: 0.0% | | | | |

| | 419,074 | | | Far East Energy Corp. Warrants

(USD 1.25, expiring 12/28/14) *#§ | | | 0 | |

| MONEY MARKET FUND: 3.4% | | | | |

| (Cost: $18,160,862) | | | | |

| | 18,160,862 | | | AIM Treasury Portfolio – Institutional Class | | | 18,160,862 | |

| Total Investments: 99.0% | | | | |

| (Cost: $395,613,342) | | | 521,449,023 | |

| Other assets less liabilities: 1.0% | | | 5,279,553 | |

| NET ASSETS: 100.0% | | $ | 526,728,576 | |

| ADR | — | American Depositary Receipt |

| CAD | — | Canadian Dollar |

| GBP | — | British Pound |

| USD | — | United States Dollar |

| * | Non-income producing |

| # | Indicates a fair valued security which has not been valued utilizing an independent quote, but has been valued pursuant to guidelines established by the Board of Trustees. The aggregate value of fair valued securities is $53,568,522 which represents 10.2% of net assets. |

| § | Illiquid Security - the aggregate value of illiquid securities is $11,382,507 which represents 2.2% of net assets. |

| ø | Restricted Security - the aggregate value of restricted securities is $11,400,277, or 2.2% of net assets. |

See Notes to Financial Statements

Restricted securities held by the Fund as of June 30, 2014 are as follows:

| | | Acquisition | | | Number of | | Acquisition | | | | | | % of |

| Security | | Date | | | Shares | | Cost | | | Value | | | Net Assets |

| African Minerals Ltd. | | 07/02/2009 | | | 15,000 | | $ | 61,440 | | | $ | 17,770 | | | | 0.0 | % |

| Kuwait Energy Plc | | 08/06/2008 | | | 3,890,609 | | | 11,764,893 | | | | 11,382,507 | | | | 2.2 | |

| | | | | | | | $ | 11,826,333 | | | $ | 11,400,277 | | | | 2.2 | % |

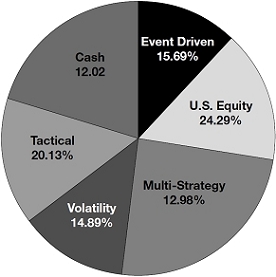

| Summary of Investments | | % of | | | |

| by Sector (unaudited) | | Investments | | Value | |

| Consumer Staples | | | 0.6 | % | | $ | 3,140,632 | |

| Energy | | | 71.3 | | | | 371,597,645 | |

| Industrials | | | 1.9 | | | | 10,061,509 | |

| Materials | | | 22.7 | | | | 118,488,375 | |

| Money Market Fund | | | 3.5 | | | | 18,160,862 | |

| | | | 100.0 | % | | $ | 521,449,023 | |

The summary of inputs used to value the Fund’s investments as of June 30, 2014 is as follows:

| | | | | | Level 2 | | | Level 3 | | | |

| | | Level 1 | | | Significant | | | Significant | | | |

| | | Quoted | | | Observable | | | Unobservable | | | |

| | | Prices | | | Inputs | | | Inputs | | Value | |

| Common Stocks | | | | | | | | | | | | | | | | | |

| Bermuda | | $ | 15,602,985 | | | $ | — | | | | $ | — | | | $ | 15,602,985 | |

| Brazil | | | — | | | | — | | | | | — | | | | — | |

| Canada | | | 54,775,166 | | | | — | | | | | — | | | | 54,775,166 | |

| Kuwait | | | — | | | | — | | | | | 11,382,507 | | | | 11,382,507 | |

| Monaco | | | 1,688,220 | | | | — | | | | | — | | | | 1,688,220 | |

| Norway | | | — | | | | 3,978,911 | | | | | — | | | | 3,978,911 | |

| Switzerland | | | 4,292,324 | | | | 24,477,955 | | | | | — | | | | 28,770,279 | |

| United Kingdom | | | 8,256,960 | | | | 13,729,149 | | | | | — | | | | 21,986,109 | |

| United States | | | 365,103,405 | | | | — | | | | | — | | | | 365,103,405 | |

| Warrants | | | | | | | | | | | | | | | | | |

| Canada | | | 579 | | | | — | | | | | — | | | | 579 | |

| United States | | | — | | | | — | | | | | — | | | | — | |

| Money Market Fund | | | 18,160,862 | | | | — | | | | | — | | | | 18,160,862 | |

| Total | | $ | 467,880,501 | | | $ | 42,186,015 | | | | $ | 11,382,507 | | | $ | 521,449,023 | |

The following table reconciles the valuation of the Fund’s Level 3 investment securities and related transactions during the period ended June 30, 2014:

| | | Common Stocks | |

| | | Brazil | | | Kuwait | |

| Balance as of December 31, 2013 | | $ | 174,535 | | | $ | 10,996,311 | |

| Realized gain (loss) | | | — | | | | — | |

| Net change in unrealized appreciation (depreciation) | | | (174,535 | ) | | | 386,196 | |

| Purchases | | | — | | | | — | |

| Sales | | | — | | | | — | |

| Transfers in and/or out of level 3 | | | — | | | | — | |

| Balance as of June 30, 2014 | | $ | 0 | | | $ | 11,382,507 | |

See Notes to Financial Statements

VAN ECK VIP GLOBAL HARD ASSETS FUND

SCHEDULE OF INVESTMENTS

June 30, 2014 (unaudited) (continued)

The following table presents additional information about valuation methodologies and inputs used for investments that are measured at fair value and categorized within Level 3 as of June 30, 2014:

| | | | | | | | | | | Impact to |

| | | Value as of | | | | | | | | Valuation from |

| | | June 30, | | | | Unobservable Input | | Unobservable | | an Increase in |

| | | 2014 | | Valuation Technique | | Description (1) | | Input | | Input (2) |

Common Stocks

Kuwait | | $11,382,507 | | Market comparable companies | | Production multiple | | 45.0x | | Increase |

| | | | | | | | Reserve multiple | | 11.0x | | Increase |

| (1) | In determining certain of these inputs, management evaluates a variety of factors including economic condition, industry and market developments, market valuations of comparable companies and company specific developments. |

| (2) | This column represents the directional change in the fair value of the Level 3 investments that would result from an increase to the corresponding unobservable input. A decrease to the unobservable input would have the opposite effect. Significant increases or decreases in these inputs in isolation could result in significantly higher or lower fair value measurements. |

See Notes to Financial Statements

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2014 (unaudited)

| Assets: | | | | |

| Investments, at value (Cost $395,613,342) | | $ | 521,449,023 | |

| Receivables: | | | | |

| Investments sold | | | 6,446,691 | |

| Shares of beneficial interest sold | | | 481,315 | |

| Dividends | | | 191,080 | |

| Total assets | | | 528,568,109 | |

| | | | | |

| Liabilities: | | | | |

| Payables: | | | | |

| Shares of beneficial interest redeemed | | | 692,362 | |

| Due to Adviser | | | 417,660 | |

| Due to Distributor | | | 31,158 | |

| Deferred Trustee fees | | | 127,853 | |

| Accrued expenses | | | 570,500 | |

| Total liabilities | | | 1,839,533 | |

| NET ASSETS | | $ | 526,728,576 | |

| | | | | |

| Initial Class Shares: | | | | |

| Net Assets | | $ | 367,889,561 | |

| Shares of beneficial interest outstanding | | | 10,328,117 | |

| Net asset value, redemption and offering price per share | | | $35.62 | |

| | | | | |

| Class S Shares: | | | | |

| Net Assets | | $ | 158,839,015 | |

| Shares of beneficial interest outstanding | | | 4,584,160 | |

| Net asset value, redemption and offering price per share | | | $34.65 | |

| | | | | |

| Net Assets consist of: | | | | |

| Aggregate paid in capital | | $ | 407,121,255 | |

| Net unrealized appreciation | | | 125,835,680 | |

| Undistributed net investment income | | | 53,414 | |

| Accumulated net realized loss | | | (6,281,773 | ) |

| | | $ | 526,728,576 | |

See Notes to Financial Statements

VAN ECK VIP GLOBAL HARD ASSETS FUND

STATEMENT OF OPERATIONS

For the Six Months Ended June 30, 2014 (unaudited)

| Income: | | | | | | |

| Dividends (net of foreign taxes withheld of $49,229) | | | | | | $ | 3,140,099 | |

| | | | | | | | | |

| Expenses: | | | | | | | | |

| Management fees | | $ | 2,330,571 | | | | | |

| Distribution fees — Class S Shares | | | 165,820 | | | | | |

| Transfer agent fees — Initial Class Shares | | | 30,118 | | | | | |

| Transfer agent fees — Class S Shares | | | 13,773 | | | | | |

| Custodian fees | | | 23,943 | | | | | |

| Professional fees | | | 28,025 | | | | | |

| Reports to shareholders | | | 77,246 | | | | | |

| Trustees’ fees and expenses | | | 3,581 | | | | | |

| Other | | | 2,275 | | | | | |

| Total expenses | | | 2,675,352 | | | | | |

| Net investment income | | | | | | | 464,747 | |

| | | | | | | | | |

| Net realized loss on: | | | | | | | | |

| Investments | | | | | | | (4,281,477 | ) |

| Foreign currency transactions and foreign denominated assets and liabilities | | | | | | | (6,843 | ) |

| Net realized loss | | | | | | | (4,288,320 | ) |

| | | | | | | | | |

| Net change in unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments | | | | | | | 65,383,223 | |

| Net Increase in Net Assets Resulting from Operations | | | | | | $ | 61,559,650 | |

See Notes to Financial Statements

STATEMENT OF CHANGES IN NET ASSETS

| | | Six Months Ended | | Year Ended | |

| | | June 30, | | December 31, | |

| | | 2014 | | 2013 | |

| | | (unaudited) | | | | |

| Operations: | | | | | | | | | | |

| Net investment income | | | $ | 464,747 | | | | $ | 944,077 | |

| Net realized gain (loss) | | | | (4,288,320 | ) | | | | 5,530,768 | |

| Net change in unrealized appreciation (depreciation) | | | | 65,383,223 | | | | | 37,352,321 | |

| Net increase in net assets resulting from operations | | | | 61,559,650 | | | | | 43,827,166 | |

| | | | | | | | | | | |

| Dividends and Distributions to shareholders from: | | | | | | | | | | |

| Net investment income | | | | | | | | | | |

| Initial Class Shares | | | | (298,583 | ) | | | | (2,370,818 | ) |

| Class S Shares | | | | — | | | | | (468,880 | ) |

| | | | | (298,583 | ) | | | | (2,839,698 | ) |

| Net realized gains | | | | | | | | | | |

| Initial Class Shares | | | | — | | | | | (6,777,188 | ) |

| Class S Shares | | | | — | | | | | (1,817,712 | ) |

| | | | | — | | | | | (8,594,900 | ) |

| Total dividends and distributions | | | | (298,583 | ) | | | | (11,434,598 | ) |

| | | | | | | | | | | |

| Share transactions*: | | | | | | | | | | |

| Proceeds from sale of shares | | | | | | | | | | |

| Initial Class Shares | | | | 35,216,288 | | | | | 53,276,344 | |

| Class S Shares | | | | 28,212,264 | | | | | 67,429,463 | |

| | | | | 63,428,552 | | | | | 120,705,807 | |

| Reinvestment of dividends and distributions | | | | | | | | | | |

| Initial Class Shares | | | | 298,583 | | | | | 9,148,007 | |

| Class S Shares | | | | — | | | | | 2,286,591 | |

| | | | | 298,583 | | | | | 11,434,598 | |

| Cost of shares redeemed | | | | | | | | | | |

| Initial Class Shares | | | | (47,565,686 | ) | | | | (104,572,301 | ) |

| Class S Shares | | | | (9,863,658 | ) | | | | (41,518,622 | ) |

| | | | | (57,429,344 | ) | | | | (146,090,923 | ) |

| Net increase (decrease) in net assets resulting from share transactions | | | | 6,297,791 | | | | | (13,950,518 | ) |

| Total increase in net assets | | | | 67,558,858 | | | | | 18,442,050 | |

| | | | | | | | | | | |

| Net Assets: | | | | | | | | | | |

| Beginning of period | | | | 459,169,718 | | | | | 440,727,668 | |

| End of period (including undistributed (accumulated) net investment income (loss) of $53,414 and ($112,750), respectively) | | | $ | 526,728,576 | | | | $ | 459,169,718 | |

| | | | | | | | | | | |

* Shares of beneficial interest issued, reinvested and redeemed

(unlimited number of $.001 par value shares authorized): | | | | | | | | | | |

| | | | | | | | | | | |

| Initial Class Shares: | | | | | | | | | | |

| Shares sold | | | | 1,083,437 | | | | | 1,806,442 | |

| Shares reinvested | | | | 10,006 | | | | | 308,429 | |

| Shares redeemed | | | | (1,492,386 | ) | | | | (3,557,223 | ) |

| Net decrease | | | | (398,943 | ) | | | | (1,442,352 | ) |

| | | | | | | | | | | |

| Class S Shares: | | | | | | | | | | |

| Shares sold | | | | 888,909 | | | | | 2,335,791 | |

| Shares reinvested | | | | — | | | | | 79,039 | |

| Shares redeemed | | | | (311,793 | ) | | | | (1,446,168 | ) |

| Net increase | | | | 577,116 | | | | | 968,662 | |

See Notes to Financial Statements

VAN ECK VIP GLOBAL HARD ASSETS FUND

FINANCIAL HIGHLIGHTS

For a share outstanding throughout each period:

| | | Initial Class Shares | |

| | | For the Six | | | | | | | | | | | | | | | |

| | | Months Ended | | | | | | | | | | | | | | | |

| | | June 30, | | Year Ended December 31, | |

| | | 2014 | | | 2013 | | | | 2012 | | | | 2011 | | | | 2010 | | | | 2009 | |

| | | (unaudited) | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | | $31.39 | | | | $29.13 | | | | $30.75 | | | | $37.67 | | | | $29.26 | | | | $18.75 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | | 0.04 | | | | 0.08 | (b) | | | 0.15 | (b) | | | 0.04 | (b) | | | (0.01 | ) | | | (0.03 | ) |

| Net realized and unrealized gain (loss) on investments | | | | 4.22 | | | | 2.95 | | | | 1.00 | | | | (6.09 | ) | | | 8.52 | | | | 10.72 | |

| Total from investment operations | | | | 4.26 | | | | 3.03 | | | | 1.15 | | | | (6.05 | ) | | | 8.51 | | | | 10.69 | |

| Less dividends and distributions from: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | | (0.03 | ) | | | (0.20 | ) | | | (0.18 | ) | | | (0.42 | ) | | | (0.11 | ) | | | (0.06 | ) |

| Net realized gains | | | | — | | | | (0.57 | ) | | | (2.59 | ) | | | (0.45 | ) | | | — | | | | (0.12 | ) |

| Total dividends and distributions | | | | (0.03 | ) | | | (0.77 | ) | | | (2.77 | ) | | | (0.87 | ) | | | (0.11 | ) | | | (0.18 | ) |

| Settlement payments from unaffiliated third parties | | | | — | | | | — | | | | — | | | | — | | | | 0.01 | (c) | | | — | |

| Redemption fees | | | | — | | | | — | | | | — | (d) | | | — | (d) | | | — | (d) | | | — | (d) |

| Net asset value, end of period | | | | $35.62 | | | | $31.39 | | | | $29.13 | | | | $30.75 | | | | $37.67 | | | | $29.26 | |

| Total return (a) | | | | 13.58 | %(e) | | | 10.53 | % | | | 3.39 | % | | | (16.45 | )% | | | 29.23 | %(c) | | | 57.54 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Assets, end of period (000’s) | $367,890 | | $336,763 | | $354,487 | | $926,630 | | $1,162,125 | | $897,073 | |

| Ratio of gross expenses to average net assets | | | | 1.07 | %(f) | | | 1.09 | % | | | 1.03 | % | | | 0.92 | % | | | 0.97 | % | | | 1.10 | % |

| Ratio of net expenses to average net assets | | | | 1.07 | %(f) | | | 1.09 | % | | | 1.03 | % | | | 0.92 | % | | | 0.97 | % | | | 1.10 | % |

| Ratio of net expenses, excluding interest expense, to average net assets | | | | 1.07 | %(f) | | | 1.09 | % | | | 1.03 | % | | | 0.92 | % | | | 0.97 | % | | | 1.09 | % |

| Ratio of net investment income (loss) to average net assets | | | | 0.26 | %(f) | | | 0.27 | % | | | 0.50 | % | | | 0.11 | % | | | (0.05 | )% | | | (0.15 | )% |

| Portfolio turnover rate | | | | 13 | %(e) | | | 31 | % | | | 29 | % | | | 38 | % | | | 70 | % | | | 105 | % |

| | | Class S Shares | |

| | | For the Six | | | | | | | | | | | | | | | |

| | | Months Ended | | | | | | | | | | | | | | | |

| | | June 30, | | Year Ended December 31, | |

| | | 2014 | | | 2013 | | | | 2012 | | | | 2011 | | | | 2010 | | | | 2009 | |

| | | (unaudited) | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | | $30.55 | | | | $28.38 | | | | $30.10 | | | | $36.95 | | | | $28.80 | | | | $18.53 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | | 0.01 | | | | 0.01 | (b) | | | 0.13 | (b) | | | (0.06 | )(b) | | | 0.05 | | | | (0.06 | ) |

| Net realized and unrealized gain (loss) on investments | | | | 4.09 | | | | 2.88 | | | | 0.92 | | | | (5.96 | ) | | | 8.17 | | | | 10.51 | |

| Total from investment operations | | | | 4.10 | | | | 2.89 | | | | 1.05 | | | | (6.02 | ) | | | 8.22 | | | | 10.45 | |

| Less dividends and distributions from: | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | | — | | | | (0.15 | ) | | | (0.18 | ) | | | (0.38 | ) | | | (0.08 | ) | | | (0.06 | ) |

| Net realized gains | | | | — | | | | (0.57 | ) | | | (2.59 | ) | | | (0.45 | ) | | | — | | | | (0.12 | ) |

| Total dividends and distributions | | | | — | | | | (0.72 | ) | | | (2.77 | ) | | | (0.83 | ) | | | (0.08 | ) | | | (0.18 | ) |

| Settlement payments from unaffiliated third parties | | | | — | | | | — | | | | — | | | | — | | | | 0.01 | (c) | | | — | |

| Redemption fees | | | | — | | | | — | | | | — | (d) | | | — | (d) | | | — | (d) | | | — | (d) |

| Net asset value, end of period | | | | $34.65 | | | | $30.55 | | | | $28.38 | | | | $30.10 | | | | $36.95 | | | | $28.80 | |

| Total return (a) | | | | 13.42 | %(e) | | | 10.30 | % | | | 3.11 | % | | | (16.69 | )% | | | 28.67 | %(c) | | | 56.92 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Assets, end of period (000’s) | | $158,839 | | $122,407 | | $86,241 | | $47,818 | | $25,061 | | $3,899 | |

| Ratio of gross expenses to average net assets | | | | 1.33 | %(f) | | | 1.34 | % | | | 1.34 | % | | | 1.26 | % | | | 1.36 | % | | | 2.24 | % |

| Ratio of net expenses to average net assets | | | | 1.33 | %(f) | | | 1.34 | % | | | 1.34 | % | | | 1.26 | % | | | 1.36 | % | | | 1.44 | % |

| Ratio of net expenses, excluding interest expense, to average net assets | | | | 1.33 | %(f) | | | 1.34 | % | | | 1.34 | % | | | 1.26 | % | | | 1.36 | % | | | 1.44 | % |

| Ratio of net investment income (loss) to average net assets | | | | 0.03 | %(f) | | | 0.03 | % | | | 0.47 | % | | | (0.18 | )% | | | (0.39 | )% | | | (0.73 | )% |

| Portfolio turnover rate | | | | 13 | %(e) | | | 31 | % | | | 29 | % | | | 38 | % | | | 70 | % | | | 105 | % |

| (a) | Total return is calculated assuming an initial investment made at the net asset value at the beginning of period, reinvestment of any dividends and distributions at net asset value on the dividend/distributions payment date and a redemption at the net asset value on the last day of the period. The return does not reflect the deduction of taxes that a shareholder would pay on Fund dividends/distributions or the redemption of Fund shares. |

| (b) | Calculated based upon average shares outstanding |

| (c) | For the year ended December 31, 2010, the Fund received settlement payments from unaffiliated third parties which represented 0.04% of the Initial Class Shares and Class S Shares total return. |

| (d) | Amount represents less than $0.005 per share |

| (e) | Not annualized |

| (f) | Annualized |

See Notes to Financial Statements

NOTES TO FINANCIAL STATEMENTS

June 30, 2014 (unaudited)

Note 1—Fund Organization—Van Eck VIP Trust (the “Trust”) is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The Trust was organized as a Massachusetts business trust on January 7, 1987. The Van Eck VIP Global Hard Assets Fund (the “Fund”) is a non-diversified series of the Trust and seeks long-term capital appreciation by investing primarily in hard asset securities. The Fund offers two classes of shares: Initial Class Shares and Class S Shares. The two classes are identical except Class S Shares are subject to a distribution fee.

Note 2—Significant Accounting Policies—The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

The Fund is an investment company and is following accounting and reporting requirements of Accounting Standard Codification (“ASC”) 946 Financial Services - Investment Companies.

The following is a summary of significant accounting policies followed by the Fund.

| A. | Security Valuation—The Fund values its investments in securities and other assets and liabilities carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. Securities traded on national exchanges or traded on the NASDAQ National Market System are valued at the last sales price reported at the close of each business day. Securities traded on the NASDAQ Stock Market are valued at the NASDAQ official closing price. Over-the-counter securities not included in the NASDAQ National Market System and listed securities for which no sale was reported are valued at the mean of the bid and ask prices. To the extent these securities are actively traded they are categorized as Level 1 in the fair value hierarchy (as described below). Certain foreign securities, whose values may be affected by market direction or events occurring before the Fund’s pricing time (4:00 p.m. Eastern Standard Time) but after the last close of the securities’ primary market, are fair valued using a pricing service and are categorized as Level 2 in the fair value hierarchy. The pricing service considers the correlation of the trading patterns of the foreign security to intraday trading in the U.S. market, based on indices of domestic securities and other appropriate indicators such as prices of relevant ADR’s and futures contracts. The Fund may also fair value securities in other situations, such as, when a particular foreign market is closed but the Fund is open. Short-term obligations with more than sixty days remaining to maturity are valued at market value. Short-term obligations with sixty days or less to maturity are valued at amortized cost, which with accrued interest approximates fair value. Money market fund investments are valued at net asset value and are classified as Level 1 in the fair value hierarchy. Forward foreign currency contracts are valued at the spot currency rate plus an amount (“points”), which reflects the differences in interest rates between the U.S. and foreign markets. Securities for which quotations are not available are stated at fair value as determined by the Pricing Committee of Van Eck Associates Corporation (the “Adviser”) appointed by the Board of Trustees. The Pricing Committee provides oversight of the Fund’s valuation policies and procedures, which are approved by the Fund’s Board of Trustees. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities dealers, and other market sources to determine fair value. The Pricing Committee convenes regularly to review the fair value of financial instruments for which market prices are not readily available. The Pricing Committee employs various methods for calibrating the valuation approaches utilized to determine fair value, including a regular review of key inputs and assumptions, transactional back-testing and disposition analysis. |

Certain factors such as economic conditions, political events, market trends, the nature of and duration of any restrictions on disposition, trading in similar securities of the issuer or comparable issuers and other security specific information are used to determine the fair value for these securities. Depending on the relative significance of valuation inputs, these securities may be classified either as Level 2 or Level 3 in the fair value hierarchy. The price which the Fund may realize upon sale of an investment may differ materially from the value presented in the Schedule of Investments.

The Fund utilizes various methods to measure the fair value of its investments on a recurring basis which includes a hierarchy that prioritizes inputs to valuation methods used to measure fair value. The fair value hierarchy gives highest priority to unadjusted quoted prices in active markets for identical assets and liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The transfers between levels of the fair value hierarchy assume the financial instruments were transferred at the beginning of the reporting period. The three levels of the fair value hierarchy are described below:

| | Level 1 – | Quoted prices in active markets for identical securities. |

| | | |

| | Level 2 – | Significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). |

| | | |

| | Level 3 – | Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). |

VAN ECK VIP GLOBAL HARD ASSETS FUND

NOTES TO FINANCIAL STATEMENTS

(unaudited) (continued)

| | A summary of the inputs, the levels used to value the Fund’s investments, and transfers between levels are located in the Schedule of Investments. Additionally, tables that reconcile the valuation of the Fund’s Level 3 investments and that present additional information about valuation methodologies and unobservable inputs, if applicable, are located in the Schedule of Investments. |

| | | |

| B. | Federal Income Taxes—It is the Fund’s policy to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income to its shareholders. Therefore, no federal income tax provision is required. |

| | | |

| C. | Currency Translation—Assets and liabilities denominated in foreign currencies and commitments under foreign currency contracts are translated into U.S. dollars at the closing prices of such currencies each business day. Purchases and sales of investments are translated at the exchange rates prevailing when such investments are acquired or sold. Income and expenses are translated at the exchange rates prevailing when accrued. The portion of realized and unrealized gains and losses on investments that result from fluctuations in foreign currency exchange rates is not separately disclosed. Recognized gains or losses attributable to foreign currency fluctuations on foreign currency denominated assets, other than investments, and liabilities are recorded as net realized gain (loss) on foreign currency transactions and foreign denominated assets and liabilities in the Statement of Operations. |

| | | |

| D. | Dividends and Distributions to Shareholders—Dividends to shareholders from net investment income and distributions from net realized capital gains, if any, are declared and paid annually. Income dividends and capital gain distributions are determined in accordance with U.S. income tax regulations, which may differ from such amounts determined in accordance with GAAP. |

| | | |

| E. | Restricted Securities—The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund’s Schedule of Investments. |

| | | |

| F. | Warrants—The Fund may invest in warrants whose values are linked to indices or underlying instruments. The Fund may use these warrants to gain exposure to markets that might be difficult to invest in through conventional securities. Warrants may be more volatile than their linked indices or underlying instruments. Potential losses are limited to the amount of the original investment. Warrants held at June 30, 2014 are reflected in the Fund’s Schedule of Investments. |

| | | |

| G. | Use of Derivative Instruments—The Fund may make investments in derivative instruments, including, but not limited to, options, futures, swaps and other derivatives relating to foreign currency transactions. A derivative is an instrument whose value is derived from underlying assets, indices, reference rates or a combination of these factors. Derivative instruments may be privately negotiated contracts (often referred to as over-the-counter (“OTC”) derivatives) or they may be listed and traded on an exchange. Derivative contracts may involve future commitments to purchase or sell financial instruments or commodities at specified terms on a specified date, or to exchange interest payment streams or currencies based on a notional or contractual amount. Derivative instruments may involve a high degree of financial risk. The use of derivative instruments also involves the risk of loss if the investment adviser is incorrect in its expectation of the timing or level of fluctuations in securities prices, interest rates or currency prices. Investments in derivative instruments also include the risk of default by the counterparty, the risk that the investment may not be liquid and the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument. GAAP requires enhanced disclosures about the Fund’s derivatives instruments and hedging activities. The Fund held no derivative instruments during the period ended June 30, 2014. |

| | | |

| | Forward Foreign Currency Contracts—The Fund is subject to foreign currency risk in the normal course of pursuing its investment objectives. The Fund may buy and sell forward foreign currency contracts to settle purchases and sales of foreign denominated securities, gain currency exposure or to hedge foreign denominated assets. Realized gains and losses from forward foreign currency contracts, if any, are included in realized gain (loss) on foreign currency transactions and foreign denominated assets and liabilities in the Statement of Operations. The Fund may incur additional risk from investments in forward foreign currency contracts if the counterparty is unable to fulfill its obligation or there are unanticipated movements of the foreign currency relative to the U.S. dollar. The Fund held no forward foreign currency contract during the period ended June 30, 2014. |

| | H. | Other—Security transactions are accounted for on trade date. Dividend income is recorded on the ex-dividend date except that certain dividends from foreign securities are recognized upon notification of the ex-dividend date. Realized gains and losses are calculated on the specific identified cost basis. Interest income, including amortization of premiums and discounts, is accrued as earned. Estimated foreign taxes that are expected to be withheld from proceeds at the sale of certain foreign investments are accrued by the Fund and decrease the unrealized gain on investments. The Fund received regulatory settlement payments during 2010 from unaffiliated third parties which is included in the Financial Highlights. The Fund received redemption fees from Class R1 Shares prior to its closing on April 30, 2012 and are reflected in the Financial Highlights. |

| | | |

| | | Income, expenses (excluding class-specific expenses), realized, and unrealized gains/losses are allocated proportionately to each class of shares based upon the relative net asset value of outstanding shares of each class at the beginning of the day (after adjusting for current capital share activity of the respective classes). Class-specific expenses are charged directly to the applicable class of shares. |

| | | |

| | | In the normal course of business, the Fund enters into contracts that contain a variety of general indemnifications. The Fund’s maximum exposure under these agreements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Adviser believes the risk of loss under these arrangements to be remote. |

Note 3—Investment Management and Other Agreements—The Adviser is the investment adviser to the Fund. The Adviser receives a management fee, calculated daily and payable monthly based on an annual rate of 1.00% of the first $500 million of average daily net assets, 0.90% of the next $250 million of average daily net assets and 0.70% of the average daily net assets in excess of $750 million. The Adviser has agreed to, at least until May 1, 2015, waive management fees and/or assume expenses (excluding acquired fund fees and expenses, interest expense, trading expenses, dividends and interest payments on securities sold short, taxes, and extraordinary expenses) from exceeding 1.20% for the Initial Class Shares and 1.45% for the Class S Shares. For the period ended June 30, 2014, no management fees were waived nor were any expenses assumed by the Adviser. Certain of the officers and trustees of the Trust are officers, directors or stockholders of the Adviser and Van Eck Securities Corporation, (the “Distributor”).

Note 4—12b-1 Plans of Distribution—The Fund and the Distributor are parties to a distribution agreement dated May 1, 2006. The Fund has adopted a Distribution Plan (the “Plan”) for Class S Shares in accordance with Rule 12b-1 under the 1940 Act. Pursuant to the Plan, the Fund is authorized to incur distribution expenses for its Class S Shares which will principally be payments to securities dealers who have sold shares and serviced shareholder accounts and payments to the Distributor, for reimbursement of other actual promotion and distribution expenses incurred by the Distributor on behalf of the Fund. The amount paid in any one year is 0.25% of average daily net assets for Class S Shares.

Note 5—Investments—For the period ended June 30, 2014, the cost of purchases and proceeds from sales of investments, excluding U.S. government securities and short-term obligations, aggregated $66,146,822 and $59,177,152, respectively.

Note 6—Income Taxes—For Federal income tax purposes, the identified cost of investments owned at June 30, 2014 was $397,589,288 and net unrealized appreciation aggregated $123,859,735 of which $145,330,021 related to appreciated securities and $21,470,286 related to depreciated securities.

The tax character of dividends and distributions paid to shareholders during the year ended December 31, 2013 were as follows:

| | | Year Ended |

| | | December 31, 2013 |

| Ordinary income | | | $ | 2,855,232 | |

| Long-term capital gains | | | | 8,579,366 | |

| Total | | | $ | 11,434,598 | |

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more-likely-than-not” to be sustained assuming examination by applicable tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on return filings for open tax years (tax years ended December 31, 2010-2013), or expected to be taken in the Fund’s current tax year. The Fund does not have exposure for additional years that might still be open in certain foreign jurisdictions. Therefore, no provision for income tax is required in the Fund’s financial statements.

The Fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period ended June 30, 2014, the Fund did not incur any interest or penalties.

VAN ECK VIP GLOBAL HARD ASSETS FUND

NOTES TO FINANCIAL STATEMENTS

(unaudited) (continued)

Note 7—Concentration of Risk—The Fund may purchase securities on foreign exchanges. Securities of foreign issuers involve special risks and considerations not typically associated with investing in U.S. issuers. These risks include devaluation of currencies, less reliable information about issuers, different securities transaction clearance and settlement practices, and future adverse political and economic developments. These risks are heightened for investments in emerging market countries. Moreover, securities of many foreign issuers and their markets may be less liquid and their prices more volatile than those of comparable U.S. issuers.

The Fund may concentrate its investments in companies which are significantly engaged in the exploration, development, production and distribution of gold and other natural resources such as strategic and other metals, minerals, forest products, oil, natural gas and coal and by investing in gold bullion and coins. Since the Fund may so concentrate, it may be subject to greater risks and market fluctuations than other more diversified portfolios. The production and marketing of gold and other natural resources may be affected by actions and changes in governments. In addition, gold and natural resources may be cyclical in nature.

At June 30, 2014, the aggregate shareholder accounts of three insurance companies own approximately 53%, 22%, and 5% of the Initial Class Shares and four insurance companies own approximately 50%, 30% and 7%, and 6% of the Class S Shares.

Note 8—Trustee Deferred Compensation Plan—The Trust has a Deferred Compensation Plan (the “Deferred Plan”) for Trustees under which the Trustees can elect to defer receipt of their trustee fees until retirement, disability or termination from the Board of Trustees. The fees otherwise payable to the participating Trustees are deemed invested in shares of eligible Funds of the Trust and the Van Eck Funds (another registered investment company managed by the Adviser) as directed by the Trustees.

The expense for the Deferred Plan is included in “Trustees’ fees and expenses” in the Statement of Operations. The liability for the Deferred Plan is shown as “Deferred Trustee fees” in the Statement of Assets and Liabilities.

Note 9—Bank Line of Credit—The Trust may participate with Van Eck Funds (collectively the “VE/VIP Funds”) in a $30 million committed credit facility (the “Facility”) to be utilized for temporary financing until the settlement of sales or purchases of portfolio securities, the repurchase or redemption of shares of the Fund and other temporary or emergency purposes. The VE/VIP Funds have agreed to pay commitment fees, pro rata, based on the unused but available balance. Interest is charged to the VE/VIP Funds at rates based on prevailing market rates in effect at the time of borrowings. During the period ended June 30, 2014, the Fund had no borrowings under the Facility.

Note 10—Securities Lending—To generate additional income, the Fund may lend its securities pursuant to a securities lending agreement with State Street Bank & Trust Co., the securities lending agent and also the Fund’s custodian. During the period ended June 30, 2014, the Fund had no securities lending activity.

Note 11—Subsequent Event Review—The Fund has evaluated subsequent events and transactions for potential recognition or disclosure through the date the financial statements were issued.

VAN ECK VIP GLOBAL HARD ASSETS FUND

APPROVAL OF ADVISORY AGREEMENT

June 30, 2014 (unaudited)

The Investment Company Act of 1940, as amended (the “1940 Act”), provides, in substance, that an investment advisory agreement between a fund and its investment adviser may be entered into only if it is approved, and may continue in effect from year to year after an initial two-year period only if its continuance is approved, at least annually by the fund’s board of trustees, including by a vote of a majority of the trustees who are not “interested persons” of the fund as defined in the 1940 Act (the “Independent Trustees”), cast in person at a meeting called for the purpose of considering such approval. On June 25, 2014, the Board of Trustees (the “Board”) of Van Eck VIP Trust (the “Trust”), which is comprised exclusively of Independent Trustees, voted to approve the continuation of the existing advisory agreement (the “Advisory Agreement”) between the Van Eck VIP Global Hard Assets Fund (the “Fund”) and its investment adviser, Van Eck Associates Corporation (together with its affiliated companies, the “Adviser”). Information regarding the material factors considered and related conclusions reached by the Board in approving the continuation of the Advisory Agreement is set forth below.

In considering the continuation of the Advisory Agreement, the Board reviewed and considered information that had been provided by the Adviser throughout the year at regular and special meetings of the Board and its committees, including information requested by the Board and furnished by the Adviser for meetings of the Board held on June 5, 2014 and June 24 and 25, 2014 specifically for the purpose of considering the continuation of the Advisory Agreement. The written and oral reports provided to the Board included, among other things, the following:

| | ■ | Information about the overall organization of the Adviser and the Adviser’s short-term and long-term business plans with respect to its mutual fund operations and other lines of business; |

| | | |

| | ■ | The consolidated financial statements of the Adviser for the past three fiscal years; |

| | | |

| | ■ | A copy of the Advisory Agreement and descriptions of the services provided by the Adviser thereunder; |

| | | |

| | ■ | Information regarding the qualifications, education and experience of the investment professionals responsible for portfolio management, investment research and trading activities for the Fund, the structure of their compensation and the resources available to support these activities; |

| | | |

| | ■ | A report prepared by an independent consultant comparing the Fund’s investment performance (including, where relevant, total returns, standard deviations, Sharpe ratios, information ratios, beta and alpha) with respect to a representative class of shares of the Fund for the one-, three-, five- and ten-year periods ended March 31, 2014 with those of (i) a universe of mutual funds selected by the independent consultant with similar portfolio holding characteristics, share class attributes and other operational characteristics as the Fund (the “Category”), (ii) a sub-group of funds selected from the Category by the independent consultant further limited to approximate more closely the Fund’s investment style, expense structure and asset size (the “Peer Group”), (iii) an appropriate benchmark index, and (iv) an additional benchmark index that includes relevant exposures not otherwise reflected in the benchmark index (the “Additional Index”); |

| | | |

| | ■ | A report prepared by an independent consultant comparing the advisory fees and other expenses of a representative class of shares of the Fund during its fiscal year ended December 31, 2013 with a similar share class of each fund in the (i) Category and (ii) Peer Group; |

| | | |

| | ■ | An analysis of the profitability of the Adviser with respect to its services for the Fund and the Van Eck complex of mutual funds as a whole (the “Van Eck Complex”); |

| | | |

| | ■ | Information regarding other investment products and services offered by the Adviser involving investment objectives and strategies similar to the Fund (“Comparable Products”), including the fees charged by the Adviser for managing the Comparable Products, a description of material differences and similarities in the services provided by the Adviser for the Fund and the Comparable Products, the size of the Comparable Products, the performance of the Comparable Products and identity of the individuals responsible for managing the Comparable Products; |

| | | |

| | ■ | Information concerning the Adviser’s compliance program, the resources devoted to compliance efforts undertaken by the Adviser on behalf of the Fund, and reports regarding a variety of compliance-related issues; |

| | | |

| | ■ | Information with respect to the Adviser’s brokerage practices, including the Adviser’s processes for monitoring best execution of portfolio transactions and the benefits received by the Adviser from research acquired with soft dollars; |

| | | |

| | ■ | Information regarding the procedures used by the Adviser in monitoring the valuation of portfolio securities, including the methodologies used in making fair value determinations; |

| | | |

| | ■ | Information regarding the Adviser’s policies and practices with respect to personal investing by the Adviser and its employees, including reports regarding the administration of the Adviser’s code of ethics and the Adviser’s policy with respect to investments in the Fund by the Adviser’s investment personnel; |

VAN ECK VIP GLOBAL HARD ASSETS FUND

APPROVAL OF ADVISORY AGREEMENT

(unaudited) (continued)

| | ■ | Descriptions of other administrative and other non-investment management services provided by the Adviser for the Fund, including the Adviser’s activities in managing relationships with the Fund’s custodian, transfer agent and other service providers; and |

| | | |

| | ■ | Other information provided by the Adviser in its response to a comprehensive questionnaire prepared by independent legal counsel on behalf of the Independent Trustees. |

In determining whether to approve the continuation of the Advisory Agreement, the Board considered, among other things, the following: (1) the nature, quality, extent and cost of the investment management, administrative and other non-investment management services provided by the Adviser; (2) the nature, quality and extent of the services performed by the Adviser in interfacing with, and monitoring the services performed by, third parties, such as the Fund’s custodian, transfer agent, sub-accounting agent and independent auditors, and the Adviser’s commitment and efforts to review the quality and pricing of third party service providers to the Fund with a view to reducing non-management expenses of the Fund; (3) the terms of the Advisory Agreement and the services performed thereunder; (4) the willingness of the Adviser to reduce the overall expenses of the Fund from time to time, if necessary or appropriate, by means of waiving a portion of its fees or paying expenses of the Fund; (5) the quality of the services, procedures and processes used to determine the value of the Fund’s assets and the actions taken to monitor and test the effectiveness of such services, procedures and processes; (6) the ongoing efforts of, and resources devoted by, the Adviser with respect to the development and implementation of a comprehensive compliance program; (7) the responsiveness of the Adviser to inquiries from, and examinations by, regulatory authorities, including the Securities and Exchange Commission; (8) the resources committed by the Adviser in recent periods to information technology; and (9) the ability of the Adviser to attract and retain quality professional personnel to perform investment advisory and administrative services for the Fund.

The Board considered the fact that the Adviser is managing other investment products, including exchange-traded funds, hedge funds, separate accounts and UCITs, one or more of which may invest in the same financial markets and may be managed by the same investment professionals according to a similar investment objective and/or strategy as the Fund. The Board concluded that the management of these products contributes to the Adviser’s financial stability and is helpful to the Adviser in attracting and retaining quality portfolio management personnel for the Fund. In addition, the Board concluded that the Adviser has established appropriate procedures to monitor conflicts of interest involving the management of the Fund and the other products and for resolving any such conflicts of interest in a fair and equitable manner.

The performance data and the advisory fee and expense ratio data described below for the Fund is based on data for a representative class of shares of the Fund. The performance data is for periods on an annualized basis ended March 31, 2014, and the advisory fee and expense ratio data is as of the Fund’s fiscal year end of December 31, 2013.

Performance. The Board noted, based on a review of comparative annualized total returns, that the Fund had outperformed its Peer Group median over the one-year period and its Category and Peer Group medians for the ten-year period, but had underperformed its Category median for the one-year period and its Category and Peer Group medians over the three- and five-year periods. The Board also noted that the Fund had outperformed its benchmark index for the ten-year period, but had underperformed its benchmark index for the one-, three- and five-year periods. The Board further noted that the Fund had outperformed its Additional Index for the one-, three-, five- and ten-year periods. On the basis of the foregoing and other relevant information provided in response to inquiries by the Board regarding material factors that contributed to the Fund’s underperformance in recent periods, the Board concluded that the performance of the Fund was satisfactory.

Fees and Expenses. The Board noted that the fees payable for advisory services were higher than the median advisory fees of its Category and Peer Group, but that the Fund’s total expense ratio, net of waivers or reimbursements, was equal to the median expense ratio of its Category and higher than the median expense ratio of its Peer Group. The Board also noted that the Adviser has agreed to waive fees or pay expenses of the Fund through April 2015 to the extent necessary to prevent the expense ratio of the Fund from exceeding a specified maximum amount. On the basis of the foregoing, and in light of the nature, extent and quality of the services provided by the Adviser, the Board concluded that the advisory fee charged to the Fund is reasonable.

Profitability and Economies of Scale. The Board considered the profits, if any, realized by the Adviser from managing the Fund and other mutual funds in the Van Eck Complex and the methodology used to determine such profits, including the results of an analysis of the methodology performed by an independent consultant in 2013 on behalf of the Board and its independent counsel. The Board noted that the levels of profitability reported on a fund-by-fund basis varied widely depending on such factors as the size, type of fund and operating history The Board further noted that, in evaluating the reasonableness of the Adviser’s profits from managing any particular Fund, it would be appropriate to consider the size of

the Adviser relative to other firms in the investment management industry and the impact on the Adviser’s profits of the volatility of the markets in which the Funds invest and the volatility of cash flows into and out of the Funds through various market cycles. Based on its review of the foregoing information, and in light of the nature, extent and quality of the services provided by the Adviser, the Board concluded that the profits realized by the Adviser, if any, are not excessive. In this regard, the Board also considered the extent to which the Adviser may realize economies of scale as the Fund grows and whether the Fund’s fee schedule, which includes breakpoints, reflects these economies of scale for the benefit of shareholders. The Board concluded that, with respect to the Fund, the economies of scale being realized, if any, are currently being shared by the Adviser and the Fund, and that adding or modifying existing breakpoints would not be warranted at this time for the Fund.

Conclusion. In determining the material factors to be considered in evaluating the Advisory Agreement and the weight to be given to such factors, the members of the Board relied upon the advice of independent legal counsel and their own business judgment. The Board did not consider any single factor as controlling in determining whether to approve the continuation of the Advisory Agreement and each member of the Board may have placed varying emphasis on particular factors considered in reaching a conclusion. Moreover, this summary description does not necessarily identify all of the factors considered or conclusions reached by the Board. Based on its consideration of the foregoing factors and conclusions, and such other factors and conclusions as it deemed relevant, the Board (comprised exclusively of Independent Trustees) concluded that the continuation of the Advisory Agreement is in the interests of shareholders and, accordingly, the Board approved the continuation of the Advisory Agreement for an additional one-year period.

[This page intentionally left blank.]