UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-649

Fidelity Puritan Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | July 31 |

|

|

Date of reporting period: | July 31, 2017 |

Item 1.

Reports to Stockholders

Fidelity Flex℠ Funds Fidelity Flex℠ Intrinsic Opportunities Fund

Annual Report July 31, 2017 |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-835-5092 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2017 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Investment Summary (Unaudited)

Top Ten Stocks as of July 31, 2017

| | % of fund's net assets |

| Anthem, Inc. | 4.4 |

| Amgen, Inc. | 2.7 |

| The Western Union Co. | 2.4 |

| Best Buy Co., Inc. | 2.4 |

| UnitedHealth Group, Inc. | 2.2 |

| United Therapeutics Corp. | 2.1 |

| Itochu Corp. | 2.1 |

| Nitori Holdings Co. Ltd. | 1.8 |

| Hyundai Mobis | 1.7 |

| Aetna, Inc. | 1.7 |

| | 23.5 |

Top Five Market Sectors as of July 31, 2017

| | % of fund's net assets |

| Health Care | 22.7 |

| Consumer Discretionary | 21.3 |

| Financials | 15.3 |

| Information Technology | 11.6 |

| Industrials | 9.0 |

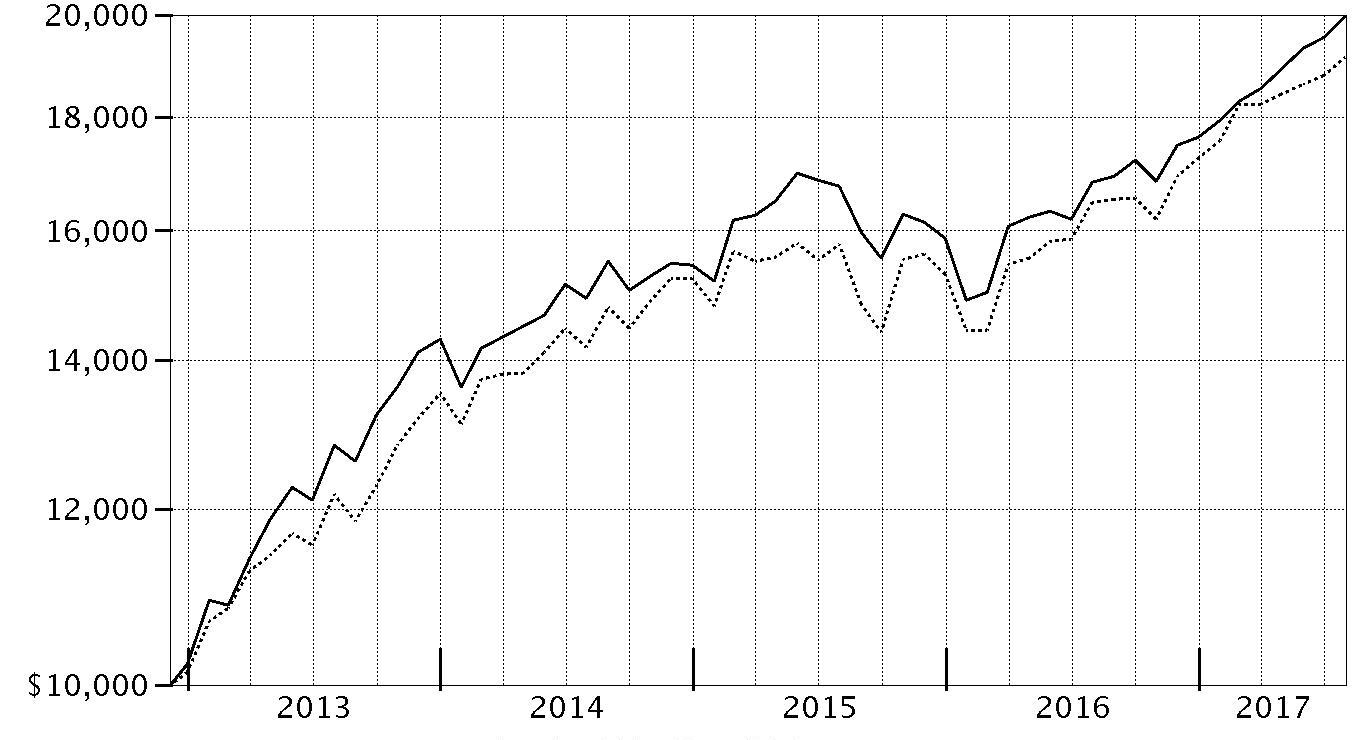

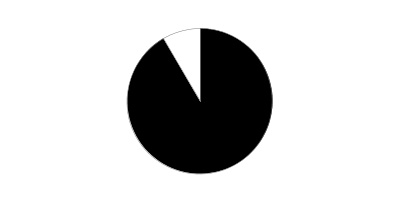

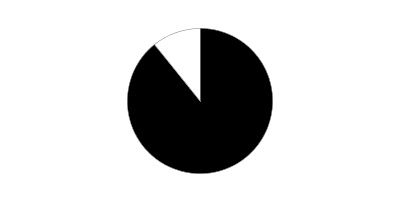

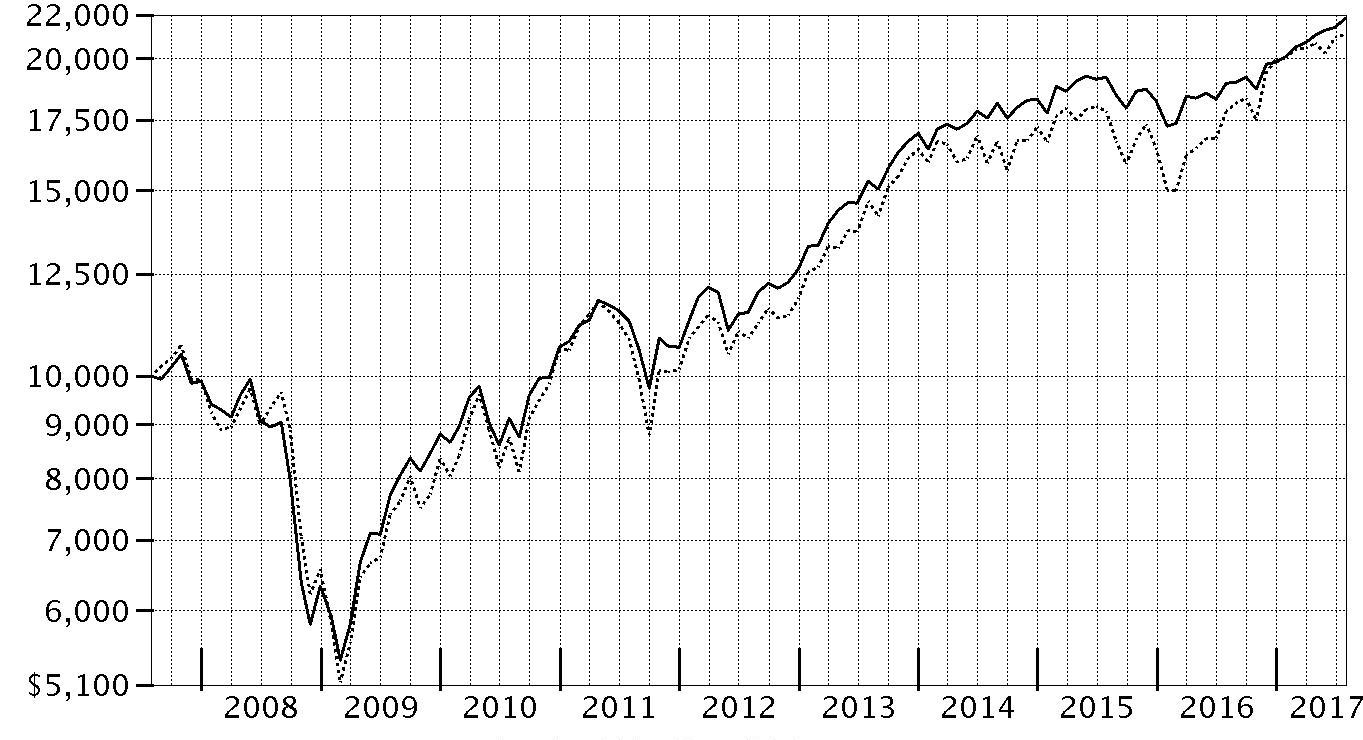

Asset Allocation (% of fund's net assets)

| As of July 31, 2017 * |

| | Stocks | 93.7% |

| | Short-Term Investments and Net Other Assets (Liabilities) | 6.3% |

* Foreign investments - 39.7%

Investments July 31, 2017

Showing Percentage of Net Assets

| Common Stocks - 93.6% | | | |

| | | Shares | Value |

| CONSUMER DISCRETIONARY - 21.3% | | | |

| Auto Components - 3.4% | | | |

| Adient PLC | | 93 | $6,089 |

| Cooper Tire & Rubber Co. | | 312 | 11,404 |

| Dongah Tire & Rubber Co. Ltd. | | 69 | 1,694 |

| Eagle Industry Co. Ltd. | | 195 | 3,400 |

| ElringKlinger AG | | 17 | 297 |

| Fukoku Co. Ltd. | | 100 | 948 |

| G-Tekt Corp. | | 1,800 | 34,924 |

| Gentex Corp. | | 136 | 2,315 |

| Hi-Lex Corp. | | 163 | 4,261 |

| Hyundai Mobis | | 623 | 136,845 |

| IJT Technology Holdings Co. Ltd. | | 800 | 4,535 |

| INFAC Corp. | | 71 | 380 |

| Piolax, Inc. | | 600 | 16,599 |

| Seoyon Co. Ltd. | | 214 | 1,882 |

| Seoyon E-Hwa Co., Ltd. | | 467 | 5,609 |

| TBK Co. Ltd. | | 400 | 1,803 |

| TPR Co. Ltd. | | 600 | 18,994 |

| Yorozu Corp. | | 1,300 | 21,968 |

| | | | 273,947 |

| Automobiles - 0.8% | | | |

| Audi AG | | 17 | 14,288 |

| Fiat Chrysler Automobiles NV | | 96 | 1,161 |

| Fiat Chrysler Automobiles NV | | 876 | 10,577 |

| General Motors Co. | | 969 | 34,865 |

| Harley-Davidson, Inc. | | 3 | 146 |

| | | | 61,037 |

| Distributors - 0.4% | | | |

| Chori Co. Ltd. | | 1,000 | 18,550 |

| Doshisha Co. Ltd. | | 300 | 6,047 |

| Harima-Kyowa Co. Ltd. | | 100 | 1,742 |

| Nakayamafuku Co. Ltd. | | 100 | 714 |

| Yagi & Co. Ltd. | | 300 | 4,817 |

| | | | 31,870 |

| Diversified Consumer Services - 0.6% | | | |

| Heian Ceremony Service Co. Ltd. | | 300 | 2,615 |

| Kukbo Design Co. Ltd. | | 14 | 250 |

| MegaStudy Co. Ltd. | | 247 | 6,661 |

| MegaStudyEdu Co. Ltd. | | 143 | 4,501 |

| Multicampus Co. Ltd. | | 35 | 1,175 |

| Tsukada Global Holdings, Inc. | | 700 | 3,810 |

| Weight Watchers International, Inc. (a) | | 784 | 28,083 |

| | | | 47,095 |

| Hotels, Restaurants & Leisure - 0.9% | | | |

| Brinker International, Inc. | | 52 | 1,844 |

| Dunkin' Brands Group, Inc. | | 208 | 11,030 |

| Flight Centre Travel Group Ltd. | | 85 | 2,958 |

| Hiday Hidaka Corp. | | 200 | 5,344 |

| Koshidaka Holdings Co. Ltd. | | 200 | 5,432 |

| Kura Corp. Ltd. | | 100 | 5,034 |

| Ohsho Food Service Corp. | | 100 | 3,891 |

| Retail Food Group Ltd. | | 1,315 | 5,102 |

| St. Marc Holdings Co. Ltd. | | 200 | 6,259 |

| The Restaurant Group PLC | | 4,803 | 21,191 |

| Whitbread PLC | | 1 | 51 |

| Wyndham Worldwide Corp. | | 3 | 313 |

| | | | 68,449 |

| Household Durables - 0.8% | | | |

| Ace Bed Co. Ltd. | | 28 | 4,343 |

| Emak SpA | | 409 | 765 |

| FJ Next Co. Ltd. | | 700 | 5,638 |

| Helen of Troy Ltd. (a) | | 418 | 42,114 |

| NACCO Industries, Inc. Class A | | 52 | 3,411 |

| Q.E.P. Co., Inc. (a) | | 24 | 634 |

| Sanyo Housing Nagoya Co. Ltd. | | 500 | 5,107 |

| Tupperware Brands Corp. | | 93 | 5,646 |

| | | | 67,658 |

| Internet & Direct Marketing Retail - 0.0% | | | |

| Hyundai Home Shopping Network Corp. | | 7 | 863 |

| NS Shopping Co. Ltd. | | 30 | 447 |

| Trade Maine Group Ltd. | | 34 | 140 |

| Webjet Ltd. | | 68 | 627 |

| | | | 2,077 |

| Leisure Products - 0.1% | | | |

| Mars Engineering Corp. | | 400 | 7,924 |

| Media - 2.4% | | | |

| AMC Networks, Inc. Class A (a) | | 87 | 5,564 |

| Comcast Corp. Class A | | 1,353 | 54,729 |

| Corus Entertainment, Inc. Class B (non-vtg.) | | 273 | 3,031 |

| Discovery Communications, Inc. Class A (a) | | 1,592 | 39,163 |

| DMS, Inc. | | 100 | 1,107 |

| Gendai Agency, Inc. | | 600 | 3,075 |

| Hyundai HCN | | 1,363 | 5,087 |

| Ipsos SA | | 7 | 242 |

| Liberty Global PLC LiLAC Class A (a) | | 5 | 129 |

| Multiplus SA | | 400 | 5,104 |

| Nippon BS Broadcasting Corp. | | 100 | 1,176 |

| Nippon Television Network Corp. | | 147 | 2,515 |

| Pico Far East Holdings Ltd. | | 6,000 | 2,474 |

| Proto Corp. | | 100 | 1,564 |

| Scripps Networks Interactive, Inc. Class A | | 69 | 6,031 |

| SMG PLC | | 7 | 36 |

| Television Broadcasts Ltd. | | 1,400 | 5,126 |

| The Walt Disney Co. | | 65 | 7,145 |

| Time Warner, Inc. | | 113 | 11,573 |

| Viacom, Inc.: | | | |

| Class A | | 554 | 22,437 |

| Class B (non-vtg.) | | 415 | 14,492 |

| WOWOW INC. | | 100 | 2,907 |

| | | | 194,707 |

| Multiline Retail - 0.4% | | | |

| Grazziotin SA (a) | | 200 | 1,534 |

| Hanwha Galleria Timeworld Co. Ltd.(a) | | 41 | 1,045 |

| Lifestyle China Group Ltd. (a) | | 8,500 | 3,482 |

| Lifestyle International Holdings Ltd. | | 8,500 | 11,622 |

| Macy's, Inc. | | 225 | 5,344 |

| Treasure Factory Co. Ltd. | | 600 | 4,512 |

| | | | 27,539 |

| Specialty Retail - 10.1% | | | |

| Arc Land Sakamoto Co. Ltd. | | 300 | 4,112 |

| AT-Group Co. Ltd. | | 237 | 6,019 |

| AutoNation, Inc. (a) | | 242 | 10,256 |

| Beacon Lighting Group Ltd. | | 17 | 19 |

| Best Buy Co., Inc. | | 3,277 | 191,180 |

| Dunelm Group PLC | | 136 | 1,080 |

| Ff Group (a) | | 589 | 14,119 |

| Fuji Corp. | | 99 | 1,829 |

| GameStop Corp. Class A | | 447 | 9,695 |

| GNC Holdings, Inc. Class A | | 4,112 | 39,105 |

| Goldlion Holdings Ltd. | | 5,000 | 2,183 |

| Guess?, Inc. | | 4,018 | 52,475 |

| Handsman Co. Ltd. | | 500 | 7,116 |

| Hibbett Sports, Inc. (a) | | 208 | 3,245 |

| JB Hi-Fi Ltd. | | 589 | 12,256 |

| John David Group PLC | | 23,333 | 110,182 |

| K's Holdings Corp. | | 1,700 | 34,171 |

| Ku Holdings Co. Ltd. | | 400 | 3,632 |

| Lookers PLC | | 750 | 1,089 |

| Mandarake, Inc. | | 100 | 550 |

| Nafco Co. Ltd. | | 200 | 3,173 |

| Nitori Holdings Co. Ltd. | | 1,000 | 141,140 |

| Oriental Watch Holdings Ltd. | | 4,000 | 845 |

| Padini Holdings Bhd | | 1,800 | 1,572 |

| Sacs Bar Holdings, Inc. | | 300 | 3,301 |

| Sally Beauty Holdings, Inc. (a) | | 3,220 | 65,141 |

| Samse SA | | 24 | 4,210 |

| Silvano Fashion Group A/S | | 7 | 21 |

| Sports Direct International PLC (a) | | 68 | 340 |

| Staples, Inc. | | 3,946 | 40,052 |

| The Buckle, Inc. | | 415 | 7,097 |

| Tokatsu Holdings Co. Ltd. | | 100 | 393 |

| Truworths International Ltd. | | 228 | 1,308 |

| Urban Outfitters, Inc. (a) | | 831 | 16,279 |

| Vita Group Ltd. | | 17 | 18 |

| Vitamin Shoppe, Inc. (a) | | 104 | 1,144 |

| Williams-Sonoma, Inc. | | 485 | 22,519 |

| | | | 812,866 |

| Textiles, Apparel & Luxury Goods - 1.4% | | | |

| Best Pacific International Holdings Ltd. | | 2,000 | 1,093 |

| Embry Holdings Ltd. | | 1,000 | 320 |

| Fossil Group, Inc. (a) | | 562 | 6,323 |

| Geox SpA | | 3,749 | 14,876 |

| Gerry Weber International AG (Bearer) | | 426 | 5,441 |

| Grendene SA | | 100 | 848 |

| Handsome Co. Ltd. | | 17 | 548 |

| Magni-Tech Industries Bhd | | 900 | 1,598 |

| Michael Kors Holdings Ltd. (a) | | 1,419 | 51,708 |

| Portico International Holdings (a) | | 8,000 | 2,694 |

| Sitoy Group Holdings Ltd. | | 6,000 | 1,314 |

| Texwinca Holdings Ltd. | | 2,000 | 1,214 |

| Van de Velde | | 65 | 3,501 |

| Vera Bradley, Inc. (a) | | 658 | 6,633 |

| Youngone Holdings Co. Ltd. | | 176 | 8,455 |

| Yue Yuen Industrial (Holdings) Ltd. | | 1,500 | 6,193 |

| | | | 112,759 |

|

| TOTAL CONSUMER DISCRETIONARY | | | 1,707,928 |

|

| CONSUMER STAPLES - 6.0% | | | |

| Beverages - 0.9% | | | |

| A.G. Barr PLC | | 273 | 2,161 |

| Britvic PLC | | 4,741 | 44,663 |

| C&C Group PLC | | 300 | 1,087 |

| Jinro Distillers Co. Ltd. | | 295 | 8,771 |

| Lucas Bols BV | | 82 | 1,922 |

| Olvi PLC (A Shares) | | 68 | 2,393 |

| Spritzer Bhd | | 200 | 111 |

| Willamette Valley Vineyards, Inc. (a) | | 3 | 24 |

| Yantai Changyu Pioneer Wine Co. Ltd. (B Shares) | | 4,200 | 10,679 |

| | | | 71,811 |

| Food & Staples Retailing - 3.1% | | | |

| Ain Holdings, Inc. | | 200 | 14,422 |

| Amsterdam Commodities NV | | 409 | 12,153 |

| CVS Health Corp. | | 692 | 55,312 |

| Dong Suh Companies, Inc. | | 468 | 12,348 |

| Genky Stores, Inc. | | 300 | 11,198 |

| J Sainsbury PLC | | 136 | 439 |

| Kroger Co. | | 1,246 | 30,552 |

| Majestic Wine PLC | | 334 | 1,409 |

| MARR SpA | | 545 | 13,949 |

| OM2 Network Co. Ltd. | | 100 | 1,167 |

| Retail Partners Co. Ltd. | | 400 | 4,223 |

| Satsudora Holdings Co. Ltd. | | 300 | 5,440 |

| Tesco PLC (a) | | 7,498 | 17,233 |

| United Natural Foods, Inc. (a) | | 285 | 10,981 |

| Valor Holdings Co. Ltd. | | 500 | 11,311 |

| Wal-Mart Stores, Inc. | | 354 | 28,316 |

| Walgreens Boots Alliance, Inc. | | 276 | 22,265 |

| | | | 252,718 |

| Food Products - 1.1% | | | |

| Ajinomoto Malaysia Bhd | | 1,200 | 7,259 |

| B&G Foods, Inc. Class A | | 227 | 8,229 |

| Bakkafrost | | 104 | 4,086 |

| Bell AG | | 9 | 4,142 |

| Binggrea Co. Ltd. | | 10 | 598 |

| Changshouhua Food Co. Ltd. | | 1,000 | 499 |

| Cranswick PLC | | 343 | 13,133 |

| Dean Foods Co. | | 34 | 510 |

| Kawan Food Bhd | | 100 | 114 |

| Lamb Weston Holdings, Inc. | | 17 | 748 |

| Lassonde Industries, Inc. Class A (sub. vtg.) | | 34 | 6,540 |

| London Biscuits Bhd (a) | | 2,700 | 470 |

| Pickles Corp. | | 100 | 1,472 |

| President Rice Products PCL | | 100 | 179 |

| Prima Meat Packers Ltd. | | 142 | 907 |

| S Foods, Inc. | | 200 | 7,456 |

| Select Harvests Ltd. | | 975 | 3,822 |

| Thai Wah PCL | | 300 | 87 |

| The Hain Celestial Group, Inc. (a) | | 467 | 20,880 |

| The J.M. Smucker Co. | | 23 | 2,804 |

| Toyo Sugar Refining Co. Ltd. | | 1,000 | 1,088 |

| Valsoia SpA | | 42 | 833 |

| Want Want China Holdings Ltd. | | 2,000 | 1,352 |

| | | | 87,208 |

| Personal Products - 0.6% | | | |

| Asaleo Care Ltd. | | 682 | 726 |

| Hengan International Group Co. Ltd. | | 1,633 | 12,461 |

| USANA Health Sciences, Inc. (a) | | 640 | 36,544 |

| | | | 49,731 |

| Tobacco - 0.3% | | | |

| KT&G Corp. | | 218 | 22,191 |

|

| TOTAL CONSUMER STAPLES | | | 483,659 |

|

| ENERGY - 3.0% | | | |

| Energy Equipment & Services - 0.5% | | | |

| AKITA Drilling Ltd. Class A (non-vtg.) | | 170 | 987 |

| Atwood Oceanics, Inc. (a) | | 1,070 | 8,410 |

| Baker Hughes, a GE Co. | | 110 | 4,058 |

| Carbo Ceramics, Inc. (a) | | 1,579 | 11,164 |

| Geospace Technologies Corp. (a) | | 401 | 6,171 |

| Gulfmark Offshore, Inc. Class A (a) | | 1,714 | 266 |

| National Oilwell Varco, Inc. | | 136 | 4,449 |

| Oceaneering International, Inc. | | 46 | 1,180 |

| Prosafe ASA (a) | | 68 | 264 |

| Tecnicas Reunidas SA | | 121 | 4,292 |

| | | | 41,241 |

| Oil, Gas & Consumable Fuels - 2.5% | | | |

| Alvopetro Energy Ltd. (a) | | 1,900 | 320 |

| Baytex Energy Corp. (a) | | 409 | 1,148 |

| Bonavista Energy Corp. | | 34 | 85 |

| Chevron Corp. | | 296 | 32,320 |

| China Petroleum & Chemical Corp. (H Shares) | | 28,667 | 21,732 |

| ConocoPhillips Co. | | 953 | 43,238 |

| Contango Oil & Gas Co. (a) | | 170 | 1,020 |

| Enagas SA | | 2,077 | 58,727 |

| Fuji Kosan Co. Ltd. | | 100 | 533 |

| Husky Energy, Inc. (a) | | 277 | 3,206 |

| Imperial Oil Ltd. | | 38 | 1,091 |

| International Seaways, Inc. (a) | | 7 | 160 |

| Motor Oil (HELLAS) Corinth Refineries SA | | 205 | 4,623 |

| Murphy Oil Corp. | | 682 | 18,128 |

| San-Ai Oil Co. Ltd. | | 100 | 1,017 |

| Ship Finance International Ltd. (NY Shares) | | 7 | 95 |

| Thai Oil PCL (For. Reg.) | | 400 | 1,031 |

| Total SA sponsored ADR | | 69 | 3,496 |

| Tsakos Energy Navigation Ltd. | | 307 | 1,514 |

| World Fuel Services Corp. | | 239 | 7,729 |

| | | | 201,213 |

|

| TOTAL ENERGY | | | 242,454 |

|

| FINANCIALS - 15.3% | | | |

| Banks - 5.1% | | | |

| Cambridge Bancorp | | 3 | 196 |

| Central Valley Community Bancorp | | 17 | 374 |

| Citizens Financial Services, Inc. | | 8 | 432 |

| Erste Group Bank AG | | 3 | 125 |

| F & M Bank Corp. | | 91 | 2,753 |

| Gunma Bank Ltd. | | 3,515 | 20,629 |

| Hiroshima Bank Ltd. | | 1,633 | 6,991 |

| JPMorgan Chase & Co. | | 944 | 86,659 |

| Mitsubishi UFJ Financial Group, Inc. | | 11,783 | 74,753 |

| Nordea Bank AB | | 69 | 871 |

| OFG Bancorp | | 1,220 | 12,261 |

| Skandiabanken ASA | | 346 | 3,894 |

| Sparebank 1 Oestlandet | | 692 | 7,371 |

| Sumitomo Mitsui Financial Group, Inc. | | 2,767 | 106,767 |

| The Keiyo Bank Ltd. | | 317 | 1,343 |

| The Mie Bank Ltd. | | 132 | 2,957 |

| The San-In Godo Bank Ltd. | | 1,075 | 8,747 |

| Unicaja Banco SA | | 4,154 | 6,044 |

| Van Lanschot NV (Bearer) | | 55 | 1,632 |

| Wells Fargo & Co. | | 823 | 44,393 |

| Yamaguchi Financial Group, Inc. | | 1,538 | 18,122 |

| | | | 407,314 |

| Capital Markets - 1.5% | | | |

| ABG Sundal Collier ASA | | 1,023 | 709 |

| Apollo Global Management LLC Class A | | 274 | 7,699 |

| Ares Capital Corp. | | 279 | 4,573 |

| Edify SA (a) | | 7 | 443 |

| Franklin Resources, Inc. | | 102 | 4,568 |

| Goldman Sachs Group, Inc. | | 67 | 15,097 |

| MLP AG | | 1,595 | 11,688 |

| Morgan Stanley | | 465 | 21,809 |

| T. Rowe Price Group, Inc. | | 17 | 1,406 |

| The Blackstone Group LP | | 1,493 | 49,941 |

| TPG Specialty Lending, Inc. | | 77 | 1,599 |

| | | | 119,532 |

| Consumer Finance - 0.9% | | | |

| Credit Corp. Group Ltd. | | 36 | 488 |

| Discover Financial Services | | 554 | 33,761 |

| Synchrony Financial | | 1,246 | 37,779 |

| | | | 72,028 |

| Diversified Financial Services - 1.4% | | | |

| Fuyo General Lease Co. Ltd. | | 400 | 23,475 |

| IBJ Leasing Co. Ltd. | | 163 | 3,881 |

| Kyushu Railway Co. | | 200 | 6,594 |

| NICE Holdings Co. Ltd. | | 156 | 2,305 |

| Ricoh Leasing Co. Ltd. | | 700 | 24,477 |

| Scandinavian Tobacco Group A/S | | 273 | 4,406 |

| Tokyo Century Corp. | | 1,000 | 42,632 |

| Varex Imaging Corp. (a) | | 69 | 2,129 |

| | | | 109,899 |

| Insurance - 6.2% | | | |

| AFLAC, Inc. | | 1,385 | 110,454 |

| ASR Nederland NV | | 692 | 26,173 |

| Assurant, Inc. | | 136 | 14,317 |

| Chubb Ltd. | | 345 | 50,529 |

| Dongbu Insurance Co. Ltd. | | 865 | 61,867 |

| Genworth Financial, Inc. Class A (a) | | 4,363 | 14,965 |

| Hannover Reuck SE | | 28 | 3,537 |

| Hyundai Fire & Marine Insurance Co. Ltd. | | 260 | 10,540 |

| Kansas City Life Insurance Co. | | 1 | 50 |

| MetLife, Inc. | | 2,311 | 127,105 |

| National Western Life Group, Inc. | | 7 | 2,356 |

| NN Group NV | | 1,108 | 44,976 |

| Prudential Financial, Inc. | | 154 | 17,437 |

| Sony Financial Holdings, Inc. | | 700 | 12,134 |

| | | | 496,440 |

| Mortgage Real Estate Investment Trusts - 0.0% | | | |

| Two Harbors Investment Corp. | | 103 | 1,019 |

| Thrifts & Mortgage Finance - 0.2% | | | |

| ASAX Co. Ltd. | | 200 | 3,062 |

| Genworth MI Canada, Inc. | | 312 | 9,102 |

| Genworth Mortgage Insurance Ltd. | | 2,216 | 5,336 |

| Hingham Institution for Savings | | 7 | 1,238 |

| | | | 18,738 |

|

| TOTAL FINANCIALS | | | 1,224,970 |

|

| HEALTH CARE - 22.7% | | | |

| Biotechnology - 8.2% | | | |

| AbbVie, Inc. | | 903 | 63,129 |

| Amgen, Inc. | | 1,229 | 214,473 |

| Biogen, Inc. (a) | | 346 | 100,198 |

| Bioverativ, Inc. | | 136 | 8,428 |

| Cell Biotech Co. Ltd. | | 104 | 3,301 |

| Essex Bio-Technology Ltd. | | 1,000 | 544 |

| Gilead Sciences, Inc. | | 1,258 | 95,721 |

| United Therapeutics Corp. (a) | | 1,316 | 168,974 |

| | | | 654,768 |

| Health Care Equipment & Supplies - 0.5% | | | |

| Ansell Ltd. | | 341 | 5,993 |

| Fukuda Denshi Co. Ltd. | | 300 | 22,314 |

| Nakanishi, Inc. | | 200 | 8,390 |

| Paramount Bed Holdings Co. Ltd. | | 100 | 4,563 |

| Value Added Technologies Co. Ltd. | | 52 | 1,439 |

| | | | 42,699 |

| Health Care Providers & Services - 11.1% | | | |

| Aetna, Inc. | | 865 | 133,478 |

| Almost Family, Inc. (a) | | 134 | 6,626 |

| Amedisys, Inc. (a) | | 1,003 | 47,502 |

| Anthem, Inc. | | 1,912 | 356,024 |

| Chemed Corp. | | 251 | 49,573 |

| Humana, Inc. | | 351 | 81,151 |

| Laboratory Corp. of America Holdings (a) | | 7 | 1,112 |

| Lifco AB | | 68 | 2,266 |

| MEDNAX, Inc. (a) | | 52 | 2,443 |

| Quest Diagnostics, Inc. | | 228 | 24,695 |

| Saint-Care Holding Corp. | | 100 | 1,582 |

| Sigma Healthcare Ltd. | | 4,500 | 3,456 |

| Tokai Corp. | | 100 | 4,422 |

| Uchiyama Holdings Co. Ltd. | | 500 | 2,109 |

| UnitedHealth Group, Inc. | | 900 | 172,629 |

| Universal Health Services, Inc. Class B | | 17 | 1,884 |

| | | | 890,952 |

| Health Care Technology - 0.1% | | | |

| Pharmagest Interactive | | 187 | 9,264 |

| Life Sciences Tools & Services - 0.2% | | | |

| ICON PLC (a) | | 104 | 10,915 |

| Pharmaceuticals - 2.6% | | | |

| Apex Healthcare Bhd | | 500 | 551 |

| AstraZeneca PLC sponsored ADR | | 682 | 20,583 |

| Biofermin Pharmaceutical Co. Ltd. | | 100 | 2,776 |

| Bristol-Myers Squibb Co. | | 148 | 8,421 |

| Dawnrays Pharmaceutical Holdings Ltd. | | 1,267 | 762 |

| DongKook Pharmaceutical Co. Ltd. | | 57 | 3,064 |

| Genomma Lab Internacional SA de CV (a) | | 3,300 | 4,243 |

| GlaxoSmithKline PLC | | 57 | 1,135 |

| Indivior PLC | | 1,772 | 8,978 |

| Johnson & Johnson | | 596 | 79,101 |

| Korea United Pharm, Inc. | | 90 | 1,619 |

| Lee's Pharmaceutical Holdings Ltd. | | 2,000 | 1,585 |

| Luye Pharma Group Ltd. | | 1,500 | 851 |

| Novo Nordisk A/S Series B sponsored ADR | | 173 | 7,335 |

| PT Tempo Scan Pacific Tbk | | 300 | 44 |

| Sanofi SA sponsored ADR | | 136 | 6,441 |

| SciClone Pharmaceuticals, Inc. (a) | | 3 | 33 |

| Stallergenes Greer PLC (a) | | 72 | 3,060 |

| Taro Pharmaceutical Industries Ltd. (a) | | 242 | 27,668 |

| Teva Pharmaceutical Industries Ltd. sponsored ADR | | 194 | 6,241 |

| Towa Pharmaceutical Co. Ltd. | | 100 | 4,835 |

| Tsumura & Co. | | 500 | 19,479 |

| Vetoquinol SA | | 7 | 435 |

| | | | 209,240 |

|

| TOTAL HEALTH CARE | | | 1,817,838 |

|

| INDUSTRIALS - 9.0% | | | |

| Aerospace & Defense - 0.0% | | | |

| Austal Ltd. | | 205 | 296 |

| Kongsberg Gruppen ASA | | 7 | 119 |

| Orbital ATK, Inc. | | 3 | 307 |

| SIFCO Industries, Inc. (a) | | 25 | 168 |

| The Lisi Group | | 3 | 145 |

| | | | 1,035 |

| Air Freight & Logistics - 0.5% | | | |

| C.H. Robinson Worldwide, Inc. | | 32 | 2,099 |

| CTI Logistics Ltd. | | 282 | 210 |

| Onelogix Group Ltd. | | 2,727 | 538 |

| SBS Co. Ltd. | | 100 | 764 |

| United Parcel Service, Inc. Class B | | 312 | 34,410 |

| | | | 38,021 |

| Building Products - 0.2% | | | |

| InnoTec TSS AG | | 33 | 692 |

| Nihon Dengi Co. Ltd. | | 200 | 5,227 |

| Noda Corp. | | 200 | 1,863 |

| Sekisui Jushi Corp. | | 400 | 7,278 |

| | | | 15,060 |

| Commercial Services & Supplies - 0.6% | | | |

| Aeon Delight Co. Ltd. | | 100 | 3,343 |

| Asia File Corp. Bhd | | 2,400 | 1,850 |

| Calian Technologies Ltd. | | 211 | 4,735 |

| Civeo Corp. (a) | | 2,007 | 3,874 |

| KAR Auction Services, Inc. | | 312 | 13,116 |

| Matsuda Sangyo Co. Ltd. | | 100 | 1,358 |

| Mitie Group PLC | | 1,636 | 5,746 |

| Riverstone Holdings Ltd. | | 100 | 78 |

| VSE Corp. | | 221 | 11,459 |

| | | | 45,559 |

| Construction & Engineering - 0.4% | | | |

| Arcadis NV | | 346 | 7,080 |

| Astaldi SpA | | 208 | 1,386 |

| Boustead Projs. Pte Ltd. | | 1,700 | 1,173 |

| Geumhwa PSC Co. Ltd. | | 1 | 34 |

| Meisei Industrial Co. Ltd. | | 400 | 2,594 |

| Monadelphous Group Ltd. | | 7 | 85 |

| Nippon Rietec Co. Ltd. | | 700 | 8,261 |

| Shinnihon Corp. | | 100 | 815 |

| Sumitomo Densetsu Co. Ltd. | | 155 | 2,470 |

| Toshiba Plant Systems & Services Corp. | | 390 | 6,353 |

| | | | 30,251 |

| Electrical Equipment - 0.5% | | | |

| Aichi Electric Co. Ltd. | | 100 | 2,767 |

| Aros Quality Group AB | | 582 | 16,688 |

| Canare Electric Co. Ltd. | | 30 | 676 |

| Eaton Corp. PLC | | 222 | 17,372 |

| Hammond Power Solutions, Inc. Class A | | 307 | 1,807 |

| Holding Co. ADMIE IPTO SA (a) | | 17 | 41 |

| Somfy SA | | 35 | 3,313 |

| | | | 42,664 |

| Industrial Conglomerates - 0.1% | | | |

| Carr's Group PLC | | 2,007 | 3,780 |

| Mytilineos Holdings SA (a) | | 205 | 2,039 |

| Nolato AB Series B | | 24 | 1,054 |

| Reunert Ltd. | | 205 | 1,119 |

| | | | 7,992 |

| Machinery - 0.8% | | | |

| Castings PLC | | 51 | 311 |

| Conrad Industries, Inc. | | 1 | 18 |

| Daihatsu Diesel Manufacturing Co. Ltd. | | 900 | 5,829 |

| Daiwa Industries Ltd. | | 700 | 7,994 |

| Fujimak Corp. | | 300 | 5,875 |

| Fukushima Industries Corp. | | 100 | 4,154 |

| Global Brass & Copper Holdings, Inc. | | 167 | 5,352 |

| Haitian International Holdings Ltd. | | 3,000 | 8,603 |

| Hy-Lok Corp. | | 68 | 1,400 |

| Ihara Science Corp. | | 63 | 1,237 |

| Luxfer Holdings PLC sponsored ADR | | 3 | 38 |

| Momentum Group AB Class B (a) | | 358 | 3,691 |

| Sansei Co. Ltd. | | 1,000 | 2,204 |

| Semperit AG Holding | | 234 | 7,152 |

| Teikoku Sen-I Co. Ltd. | | 500 | 9,107 |

| | | | 62,965 |

| Marine - 0.1% | | | |

| Japan Transcity Corp. | | 1,443 | 5,589 |

| Professional Services - 1.9% | | | |

| ABIST Co. Ltd. | | 32 | 1,287 |

| Akka Technologies SA | | 623 | 34,029 |

| Bertrandt AG | | 145 | 13,826 |

| Career Design Center Co. Ltd. | | 100 | 1,245 |

| CBIZ, Inc. (a) | | 1,471 | 21,844 |

| Dun & Bradstreet Corp. | | 606 | 67,121 |

| Harvey Nash Group PLC | | 205 | 263 |

| Robert Half International, Inc. | | 268 | 12,127 |

| WDB Holdings Co. Ltd. | | 100 | 2,094 |

| | | | 153,836 |

| Road & Rail - 0.6% | | | |

| Autohellas SA | | 450 | 10,947 |

| Daqin Railway Co. Ltd. (A Shares) | | 24,900 | 32,390 |

| Higashi Twenty One Co. Ltd. | | 100 | 346 |

| Nikkon Holdings Co. Ltd. | | 32 | 758 |

| SENKO Co. Ltd. | | 200 | 1,362 |

| STEF-TFE Group | | 7 | 778 |

| Tohbu Network Co. Ltd. | | 100 | 1,030 |

| Utoc Corp. | | 1,000 | 4,046 |

| | | | 51,657 |

| Trading Companies & Distributors - 3.3% | | | |

| AerCap Holdings NV (a) | | 467 | 22,930 |

| Bergman & Beving AB (B Shares) | | 358 | 4,434 |

| Canox Corp. | | 300 | 2,672 |

| Green Cross Co. Ltd. | | 200 | 3,498 |

| HERIGE | | 41 | 1,874 |

| Houston Wire & Cable Co. | | 934 | 5,371 |

| Howden Joinery Group PLC | | 102 | 572 |

| iMarketKorea, Inc. | | 7 | 80 |

| Itochu Corp. | | 10,754 | 168,804 |

| Kamei Corp. | | 1,207 | 17,266 |

| Meiwa Corp. | | 900 | 3,576 |

| Mitani Shoji Co. Ltd. | | 500 | 19,706 |

| Rasa Corp. | | 100 | 825 |

| Shinsho Corp. | | 32 | 847 |

| Yuasa Trading Co. Ltd. | | 400 | 12,826 |

| | | | 265,281 |

| Transportation Infrastructure - 0.0% | | | |

| Isewan Terminal Service Co. Ltd. | | 200 | 1,170 |

| Qingdao Port International Co. Ltd. | | 3,583 | 2,028 |

| | | | 3,198 |

|

| TOTAL INDUSTRIALS | | | 723,108 |

|

| INFORMATION TECHNOLOGY - 11.6% | | | |

| Communications Equipment - 1.5% | | | |

| Cisco Systems, Inc. | | 3,903 | 122,749 |

| EVS Broadcast Equipment SA | | 3 | 122 |

| HF Co. | | 153 | 1,686 |

| | | | 124,557 |

| Electronic Equipment & Components - 0.8% | | | |

| AAC Technology Holdings, Inc. | | 500 | 6,728 |

| Dell Technologies, Inc. (a) | | 128 | 8,227 |

| Elematec Corp. | | 300 | 5,440 |

| Intelligent Digital Integrated Security Co. Ltd. | | 88 | 636 |

| Lacroix SA | | 163 | 4,438 |

| Macnica Fuji Electronics Holdings, Inc. | | 1,300 | 20,718 |

| Makus, Inc. | | 205 | 678 |

| PAX Global Technology Ltd. | | 2,000 | 1,326 |

| Riken Kieki Co. Ltd. | | 400 | 7,572 |

| TE Connectivity Ltd. | | 134 | 10,772 |

| | | | 66,535 |

| Internet Software & Services - 1.0% | | | |

| Akamai Technologies, Inc. (a) | | 69 | 3,253 |

| Alphabet, Inc. Class A (a) | | 21 | 19,856 |

| AuFeminin.com SA (a) | | 85 | 2,627 |

| F@N Communications, Inc. | | 300 | 2,748 |

| Kakaku.com, Inc. | | 211 | 2,980 |

| Yahoo! Japan Corp. | | 3,500 | 15,874 |

| YY, Inc. ADR (a) | | 450 | 32,175 |

| Zappallas, Inc. | | 700 | 3,226 |

| | | | 82,739 |

| IT Services - 4.3% | | | |

| Amdocs Ltd. | | 870 | 58,438 |

| Cielo SA | | 400 | 3,348 |

| Computer Services, Inc. | | 3 | 147 |

| Data#3 Ltd. | | 341 | 486 |

| E-Credible Co. Ltd. | | 104 | 1,240 |

| Estore Corp. | | 300 | 2,155 |

| Future Corp. | | 300 | 2,427 |

| Korea Information & Communication Co. Ltd. (a) | | 225 | 2,300 |

| Leidos Holdings, Inc. | | 20 | 1,069 |

| Neurones | | 7 | 239 |

| Shinsegae Information & Communication Co. Ltd. | | 19 | 1,398 |

| Sopra Steria Group | | 381 | 65,873 |

| Tessi SA | | 50 | 9,151 |

| The Western Union Co. | | 9,811 | 193,767 |

| | | | 342,038 |

| Semiconductors & Semiconductor Equipment - 0.6% | | | |

| e-LITECOM Co. Ltd. | | 34 | 283 |

| KLA-Tencor Corp. | | 14 | 1,297 |

| Miraial Co. Ltd. | | 400 | 3,846 |

| Qualcomm, Inc. | | 562 | 29,893 |

| Taiwan Semiconductor Manufacturing Co. Ltd. sponsored ADR | | 260 | 9,350 |

| | | | 44,669 |

| Software - 0.5% | | | |

| Ebix, Inc. | | 217 | 12,532 |

| GAMEVIL, Inc. (a) | | 7 | 344 |

| InfoVine Co. Ltd. | | 43 | 1,044 |

| Jastec Co. Ltd. | | 100 | 1,188 |

| Justplanning, Inc. | | 100 | 677 |

| KSK Co., Ltd. | | 100 | 1,321 |

| Microsoft Corp. | | 277 | 20,138 |

| Uchida Esco Co. Ltd. | | 96 | 1,104 |

| | | | 38,348 |

| Technology Hardware, Storage & Peripherals - 2.9% | | | |

| Apple, Inc. | | 104 | 15,468 |

| Hewlett Packard Enterprise Co. | | 4,639 | 81,229 |

| HP, Inc. | | 4,916 | 93,896 |

| Seagate Technology LLC | | 1,170 | 38,563 |

| TPV Technology Ltd. | | 16,000 | 3,749 |

| | | | 232,905 |

|

| TOTAL INFORMATION TECHNOLOGY | | | 931,791 |

|

| MATERIALS - 1.9% | | | |

| Chemicals - 1.3% | | | |

| Bloomage BioTechnology Corp. Ltd. | | 2,500 | 4,679 |

| C. Uyemura & Co. Ltd. | | 100 | 5,742 |

| CF Industries Holdings, Inc. | | 184 | 5,400 |

| Chokwang Paint Ltd. | | 34 | 352 |

| Chugoku Marine Paints Ltd. | | 500 | 3,900 |

| Fuso Chemical Co. Ltd. | | 300 | 10,000 |

| K&S AG | | 569 | 14,815 |

| KPX Green Chemical Co. Ltd. | | 34 | 137 |

| Kuriyama Holdings Corp. | | 100 | 1,957 |

| LyondellBasell Industries NV Class A | | 103 | 9,279 |

| Nippon Soda Co. Ltd. | | 253 | 1,427 |

| Potash Corp. of Saskatchewan, Inc. | | 204 | 3,649 |

| Scientex Bhd | | 2,700 | 5,461 |

| Soda Aromatic Co. Ltd. | | 100 | 1,030 |

| T&K Toka Co. Ltd. | | 200 | 2,199 |

| Tae Kyung Industrial Co. Ltd. | | 614 | 2,741 |

| Toho Acetylene Co. Ltd. | | 200 | 3,204 |

| Yara International ASA | | 640 | 25,501 |

| Yip's Chemical Holdings Ltd. | | 2,000 | 832 |

| | | | 102,305 |

| Construction Materials - 0.1% | | | |

| Ibstock PLC | | 334 | 1,124 |

| Mitani Sekisan Co. Ltd. | | 200 | 4,708 |

| RHI AG | | 7 | 265 |

| | | | 6,097 |

| Containers & Packaging - 0.1% | | | |

| Mayr-Melnhof Karton AG | | 69 | 9,108 |

| Metals & Mining - 0.4% | | | |

| Ausdrill Ltd. | | 7,408 | 11,527 |

| Chubu Steel Plate Co. Ltd. | | 300 | 1,995 |

| CI Resources Ltd. | | 16 | 20 |

| Compania de Minas Buenaventura SA sponsored ADR | | 239 | 2,925 |

| Handy & Harman Ltd. (a) | | 68 | 2,251 |

| Mount Gibson Iron Ltd. (a) | | 6,817 | 2,427 |

| Orvana Minerals Corp. (a) | | 34 | 8 |

| Pacific Metals Co. Ltd. (a) | | 5,000 | 13,425 |

| Teck Resources Ltd. Class B (sub. vtg.) | | 7 | 152 |

| | | | 34,730 |

|

| TOTAL MATERIALS | | | 152,240 |

|

| REAL ESTATE - 0.6% | | | |

| Equity Real Estate Investment Trusts (REITs) - 0.5% | | | |

| Crown Castle International Corp. | | 121 | 12,170 |

| Duke Realty Corp. | | 138 | 3,945 |

| First Potomac Realty Trust | | 303 | 3,372 |

| Piedmont Office Realty Trust, Inc. Class A | | 286 | 6,009 |

| Public Storage | | 42 | 8,634 |

| Sabra Health Care REIT, Inc. | | 70 | 1,624 |

| Ventas, Inc. | | 46 | 3,098 |

| | | | 38,852 |

| Real Estate Management & Development - 0.1% | | | |

| HFF, Inc. | | 7 | 257 |

| Leopalace21 Corp. | | 300 | 2,142 |

| Nisshin Fudosan Co. Ltd. | | 1,800 | 10,041 |

| | | | 12,440 |

|

| TOTAL REAL ESTATE | | | 51,292 |

|

| TELECOMMUNICATION SERVICES - 1.1% | | | |

| Diversified Telecommunication Services - 1.0% | | | |

| AT&T, Inc. | | 843 | 32,877 |

| Verizon Communications, Inc. | | 1,054 | 51,014 |

| | | | 83,891 |

| Wireless Telecommunication Services - 0.1% | | | |

| Okinawa Cellular Telephone Co. | | 200 | 7,030 |

|

| TOTAL TELECOMMUNICATION SERVICES | | | 90,921 |

|

| UTILITIES - 1.1% | | | |

| Electric Utilities - 0.8% | | | |

| EVN AG | | 7 | 107 |

| Exelon Corp. | | 1,340 | 51,376 |

| Public Power Corp. of Greece (a) | | 17 | 45 |

| Southern Co. | | 244 | 11,695 |

| | | | 63,223 |

| Gas Utilities - 0.2% | | | |

| Busan City Gas Co. Ltd. | | 67 | 2,288 |

| K&O Energy Group, Inc. | | 100 | 1,529 |

| Rubis | | 14 | 891 |

| Seoul City Gas Co. Ltd. | | 67 | 5,217 |

| YESCO Co. Ltd. | | 160 | 5,472 |

| | | | 15,397 |

| Independent Power and Renewable Electricity Producers - 0.0% | | | |

| The AES Corp. | | 97 | 1,084 |

| Multi-Utilities - 0.1% | | | |

| Public Service Enterprise Group, Inc. | | 173 | 7,780 |

| Water Utilities - 0.0% | | | |

| Manila Water Co., Inc. | | 300 | 190 |

|

| TOTAL UTILITIES | | | 87,674 |

|

| TOTAL COMMON STOCKS | | | |

| (Cost $7,114,508) | | | 7,513,875 |

|

| Nonconvertible Preferred Stocks - 0.1% | | | |

| INDUSTRIALS - 0.0% | | | |

| Machinery - 0.0% | | | |

| Danieli & C. Officine Meccaniche SpA | | 7 | 131 |

| MATERIALS - 0.1% | | | |

| Construction Materials - 0.1% | | | |

| Buzzi Unicem SpA (Risparmio Shares) | | 375 | 5,358 |

| TOTAL NONCONVERTIBLE PREFERRED STOCKS | | | |

| (Cost $5,330) | | | 5,489 |

|

| Money Market Funds - 6.3% | | | |

| Fidelity Cash Central Fund, 1.11% (b) | | | |

| (Cost $502,634) | | 502,534 | 502,634 |

| TOTAL INVESTMENT PORTFOLIO - 100.0% | | | |

| (Cost $7,622,472) | | | 8,021,998 |

| NET OTHER ASSETS (LIABILITIES) - 0.0% | | | 3,116 |

| NET ASSETS - 100% | | | $8,025,114 |

Legend

(a) Non-income producing

(b) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $2,601 |

| Total | $2,601 |

Investment Valuation

The following is a summary of the inputs used, as of July 31, 2017, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | |

| Equities: | | | | |

| Consumer Discretionary | $1,707,928 | $1,707,294 | $634 | $-- |

| Consumer Staples | 483,659 | 483,659 | -- | -- |

| Energy | 242,454 | 220,722 | 21,732 | -- |

| Financials | 1,224,970 | 1,043,450 | 181,520 | -- |

| Health Care | 1,817,838 | 1,816,703 | 1,135 | -- |

| Industrials | 723,239 | 723,239 | -- | -- |

| Information Technology | 931,791 | 931,791 | -- | -- |

| Materials | 157,598 | 157,598 | -- | -- |

| Real Estate | 51,292 | 51,292 | -- | -- |

| Telecommunication Services | 90,921 | 90,921 | -- | -- |

| Utilities | 87,674 | 87,674 | -- | -- |

| Money Market Funds | 502,634 | 502,634 | -- | -- |

| Total Investments in Securities: | $8,021,998 | $7,816,977 | $205,021 | $-- |

Other Information

Distribution of investments by country or territory of incorporation, as a percentage of Total Net Assets, is as follows (Unaudited):

| United States of America | 60.3% |

| Japan | 16.6% |

| Korea (South) | 4.0% |

| United Kingdom | 3.3% |

| France | 1.8% |

| Netherlands | 1.6% |

| Cayman Islands | 1.0% |

| Ireland | 1.0% |

| Others (Individually Less Than 1%) | 10.4% |

| | 100.0% |

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| | | July 31, 2017 |

| Assets | | |

Investment in securities, at value — See accompanying schedule:

Unaffiliated issuers (cost $7,119,838) | $7,519,364 | |

| Fidelity Central Funds (cost $502,634) | 502,634 | |

| Total Investments (cost $7,622,472) | | $8,021,998 |

| Foreign currency held at value (cost $1,241) | | 1,245 |

| Receivable for fund shares sold | | 218 |

| Dividends receivable | | 3,130 |

| Distributions receivable from Fidelity Central Funds | | 653 |

| Other receivables | | 68 |

| Total assets | | 8,027,312 |

| Liabilities | | |

| Payable for investments purchased | $2,198 | |

| Total liabilities | | 2,198 |

| Net Assets | | $8,025,114 |

| Net Assets consist of: | | |

| Paid in capital | | $7,572,198 |

| Undistributed net investment income | | 43,586 |

| Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | 9,783 |

| Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 399,547 |

| Net Assets, for 739,987 shares outstanding | | $8,025,114 |

| Net Asset Value, offering price and redemption price per share ($8,025,114 ÷ 739,987 shares) | | $10.84 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | For the period

March 8, 2017 (commencement of operations) to

July 31, 2017 |

| Investment Income | | |

| Dividends | | $41,006 |

| Income from Fidelity Central Funds | | 2,601 |

| Total income | | 43,607 |

| Expenses | | |

| Independent trustees' fees and expenses | $7 | |

| Miscellaneous | 5 | |

| Total expenses | | 12 |

| Net investment income (loss) | | 43,595 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 8,066 | |

| Foreign currency transactions | 1,708 | |

| Total net realized gain (loss) | | 9,774 |

| Change in net unrealized appreciation (depreciation) on: | | |

| Investment securities | 399,526 | |

| Assets and liabilities in foreign currencies | 21 | |

| Total change in net unrealized appreciation (depreciation) | | 399,547 |

| Net gain (loss) | | 409,321 |

| Net increase (decrease) in net assets resulting from operations | | $452,916 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| | For the period

March 8, 2017 (commencement of operations) to

July 31, 2017 |

| Increase (Decrease) in Net Assets | |

| Operations | |

| Net investment income (loss) | $43,595 |

| Net realized gain (loss) | 9,774 |

| Change in net unrealized appreciation (depreciation) | 399,547 |

| Net increase (decrease) in net assets resulting from operations | 452,916 |

| Share transactions | |

| Proceeds from sales of shares | 7,638,459 |

| Cost of shares redeemed | (66,261) |

| Net increase (decrease) in net assets resulting from share transactions | 7,572,198 |

| Total increase (decrease) in net assets | 8,025,114 |

| Net Assets | |

| Beginning of period | – |

| End of period | $8,025,114 |

| Other Information | |

| Undistributed net investment income end of period | $43,586 |

| Shares | |

| Sold | 746,147 |

| Redeemed | (6,160) |

| Net increase (decrease) | 739,987 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity Flex Intrinsic Opportunities Fund

| Years ended July 31, | 2017 A |

| Selected Per–Share Data | |

| Net asset value, beginning of period | $10.00 |

| Income from Investment Operations | |

| Net investment income (loss)B | .08 |

| Net realized and unrealized gain (loss) | .76 |

| Total from investment operations | .84 |

| Net asset value, end of period | $10.84 |

| Total ReturnC,D | 8.40% |

| Ratios to Average Net AssetsE,F | |

| Expenses before reductions | - %G,H |

| Expenses net of fee waivers, if any | - %G,H |

| Expenses net of all reductions | - %G,H |

| Net investment income (loss) | 1.97%G |

| Supplemental Data | |

| Net assets, end of period (000 omitted) | $8,025 |

| Portfolio turnover rateI | 9%J |

A For the period March 8, 2017 (commencement of operations) to July 31, 2017.

B Calculated based on average shares outstanding during the period.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

G Annualized

H Amount represents less than .005%.

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

J Amount not annualized.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements

For the period ended July 31, 2017

1. Organization.

Fidelity Flex Intrinsic Opportunities Fund (the Fund) is a fund of Fidelity Puritan Trust (the Trust) and is authorized to issue an unlimited number of shares. Share transactions on the Statement of Changes in Net Assets may contain exchanges between affiliated funds. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund is available only to certain fee-based accounts offered by Fidelity.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .005%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investments Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Investments in the open-end mutual funds, including Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of July 31, 2017 is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of July 31, 2017, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, passive foreign investment companies and partnerships.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

| Gross unrealized appreciation | $523,096 |

| Gross unrealized depreciation | (130,457) |

| Net unrealized appreciation (depreciation) on securities | $392,639 |

| Tax Cost | $7,629,359 |

The tax-based components of distributable earnings as of period end were as follows:

| Undistributed ordinary income | $60,256 |

| Net unrealized appreciation (depreciation) on securities and other investments | $392,660 |

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $7,601,908 and $490,039, respectively.

5. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company (the investment adviser) and its affiliates provide the Fund with investment management related services and the Fund does not pay any fees for these services. Under the management contract, the investment adviser or an affiliate pays all other expenses of the Fund, excluding fees and expenses of the independent Trustees, and certain miscellaneous expenses such as proxy and shareholder meeting expenses.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were $360 for the period.

Interfund Trades. The Fund may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note.

6. Committed Line of Credit.

The Fund participates with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $5 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, the Fund did not borrow on this line of credit.

7. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

At the end of the period, the investment adviser or its affiliates were the owners of record of 68% of the total outstanding shares of the Fund.

Report of Independent Registered Public Accounting Firm

To the Trustees of Fidelity Puritan Trust and Shareholders of Fidelity Flex Intrinsic Opportunities Fund:

We have audited the accompanying statement of assets and liabilities of Fidelity Flex Intrinsic Opportunities Fund (the Fund), a fund of Fidelity Puritan Trust, including the schedule of investments, as of July 31, 2017, and the related statement of operations, the statement of changes in net assets and the financial highlights for the period from March 8, 2017 (commencement of operations) to July 31, 2017. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of July 31, 2017, by correspondence with the custodians and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, such financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Fidelity Flex Intrinsic Opportunities Fund as of July 31, 2017, and the results of its operations, the changes in its net assets and the financial highlights for the period from March 8, 2017 (commencement of operations) to July 31, 2017, in conformity with accounting principles generally accepted in the United States of America.

DELOITTE & TOUCHE LLP

Boston, Massachusetts

September 19, 2017

Trustees and Officers

The Trustees, Members of the Advisory Board (if any), and officers of the trust and fund, as applicable, are listed below. The Board of Trustees governs the fund and is responsible for protecting the interests of shareholders. The Trustees are experienced executives who meet periodically throughout the year to oversee the fund's activities, review contractual arrangements with companies that provide services to the fund, oversee management of the risks associated with such activities and contractual arrangements, and review the fund's performance. Except for Jonathan Chiel, each of the Trustees oversees 190 funds. Mr. Chiel oversees 142 funds.

The Trustees hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at least two-thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instrument signed by a majority of the other Trustees; and (d) any Trustee may be removed at any special meeting of shareholders by a two-thirds vote of the outstanding voting securities of the trust. Each Trustee who is not an interested person (as defined in the 1940 Act) of the trust and the fund is referred to herein as an Independent Trustee. Each Independent Trustee shall retire not later than the last day of the calendar year in which his or her 75th birthday occurs. The Independent Trustees may waive this mandatory retirement age policy with respect to individual Trustees. Officers and Advisory Board Members hold office without limit in time, except that any officer or Advisory Board Member may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Except as indicated, each individual has held the office shown or other offices in the same company for the past five years.

The fund’s Statement of Additional Information (SAI) includes more information about the Trustees. To request a free copy, call Fidelity at 1-800-835-5092.

Experience, Skills, Attributes, and Qualifications of the Trustees. The Governance and Nominating Committee has adopted a statement of policy that describes the experience, qualifications, attributes, and skills that are necessary and desirable for potential Independent Trustee candidates (Statement of Policy). The Board believes that each Trustee satisfied at the time he or she was initially elected or appointed a Trustee, and continues to satisfy, the standards contemplated by the Statement of Policy. The Governance and Nominating Committee also engages professional search firms to help identify potential Independent Trustee candidates who have the experience, qualifications, attributes, and skills consistent with the Statement of Policy. From time to time, additional criteria based on the composition and skills of the current Independent Trustees, as well as experience or skills that may be appropriate in light of future changes to board composition, business conditions, and regulatory or other developments, have also been considered by the professional search firms and the Governance and Nominating Committee. In addition, the Board takes into account the Trustees' commitment and participation in Board and committee meetings, as well as their leadership of standing and ad hoc committees throughout their tenure.

In determining that a particular Trustee was and continues to be qualified to serve as a Trustee, the Board has considered a variety of criteria, none of which, in isolation, was controlling. The Board believes that, collectively, the Trustees have balanced and diverse experience, qualifications, attributes, and skills, which allow the Board to operate effectively in governing the fund and protecting the interests of shareholders. Information about the specific experience, skills, attributes, and qualifications of each Trustee, which in each case led to the Board's conclusion that the Trustee should serve (or continue to serve) as a trustee of the fund, is provided below.

Board Structure and Oversight Function. James C. Curvey is an interested person and currently serves as Chairman. The Trustees have determined that an interested Chairman is appropriate and benefits shareholders because an interested Chairman has a personal and professional stake in the quality and continuity of services provided to the fund. Independent Trustees exercise their informed business judgment to appoint an individual of their choosing to serve as Chairman, regardless of whether the Trustee happens to be independent or a member of management. The Independent Trustees have determined that they can act independently and effectively without having an Independent Trustee serve as Chairman and that a key structural component for assuring that they are in a position to do so is for the Independent Trustees to constitute a substantial majority for the Board. The Independent Trustees also regularly meet in executive session. Ned C. Lautenbach serves as Chairman of the Independent Trustees and as such (i) acts as a liaison between the Independent Trustees and management with respect to matters important to the Independent Trustees and (ii) with management prepares agendas for Board meetings.

Fidelity® funds are overseen by different Boards of Trustees. The fund's Board oversees Fidelity's high income and certain equity funds, and other Boards oversee Fidelity's investment-grade bond, money market, asset allocation, and sector funds. The asset allocation funds may invest in Fidelity® funds overseen by the fund's Board. The use of separate Boards, each with its own committee structure, allows the Trustees of each group of Fidelity® funds to focus on the unique issues of the funds they oversee, including common research, investment, and operational issues. On occasion, the separate Boards establish joint committees to address issues of overlapping consequences for the Fidelity® funds overseen by each Board.

The Trustees operate using a system of committees to facilitate the timely and efficient consideration of all matters of importance to the Trustees, the fund, and fund shareholders and to facilitate compliance with legal and regulatory requirements and oversight of the fund's activities and associated risks. The Board, acting through its committees, has charged FMR and its affiliates with (i) identifying events or circumstances the occurrence of which could have demonstrably adverse effects on the fund's business and/or reputation; (ii) implementing processes and controls to lessen the possibility that such events or circumstances occur or to mitigate the effects of such events or circumstances if they do occur; and (iii) creating and maintaining a system designed to evaluate continuously business and market conditions in order to facilitate the identification and implementation processes described in (i) and (ii) above. Because the day-to-day operations and activities of the fund are carried out by or through FMR, its affiliates, and other service providers, the fund's exposure to risks is mitigated but not eliminated by the processes overseen by the Trustees. While each of the Board's committees has responsibility for overseeing different aspects of the fund's activities, oversight is exercised primarily through the Operations, Audit, and Compliance Committees. In addition, the Independent Trustees have worked with FMR to enhance the Board's oversight of investment and financial risks, legal and regulatory risks, technology risks, and operational risks, including the development of additional risk reporting to the Board. For example, a working group comprised of Independent Trustees and FMR has worked and continues to work to review the Fidelity® funds' valuation-related activities, reporting and risk management. Appropriate personnel, including but not limited to the fund's Chief Compliance Officer (CCO), FMR's internal auditor, the independent accountants, the fund's Treasurer and portfolio management personnel, make periodic reports to the Board's committees, as appropriate, including an annual review of Fidelity's risk management program for the Fidelity® funds. The responsibilities of each standing committee, including their oversight responsibilities, are described further under "Standing Committees of the Trustees."

Interested Trustees*:

Correspondence intended for a Trustee who is an interested person may be sent to Fidelity Investments, 245 Summer Street, Boston, Massachusetts 02210.

Name, Year of Birth; Principal Occupations and Other Relevant Experience+

Jonathan Chiel (1957)

Year of Election or Appointment: 2016

Trustee

Mr. Chiel also serves as Trustee of other Fidelity funds. Mr. Chiel is Executive Vice President and General Counsel for FMR LLC (diversified financial services company, 2012-present). Previously, Mr. Chiel served as general counsel (2004-2012) and senior vice president and deputy general counsel (2000-2004) for John Hancock Financial Services; a partner with Choate, Hall & Stewart (1996-2000) (law firm); and an Assistant United States Attorney for the United States Attorney’s Office of the District of Massachusetts (1986-95), including Chief of the Criminal Division (1993-1995). Mr. Chiel is a director on the boards of the Boston Bar Foundation and the Maimonides School.

James C. Curvey (1935)

Year of Election or Appointment: 2007

Trustee

Chairman of the Board of Trustees

Mr. Curvey also serves as Trustee of other Fidelity® funds. Mr. Curvey is a Director of Fidelity Research & Analysis Co. (investment adviser firm, 2009-present), and Vice Chairman (2007-present) and Director of FMR LLC (diversified financial services company). In addition, Mr. Curvey serves as an Overseer for the Boston Symphony Orchestra and a member of the board of Artis-Naples, Naples, Florida, and as a Trustee for Brewster Academy, Wolfeboro, New Hampshire. Previously, Mr. Curvey served as a Director of Fidelity Investments Money Management, Inc. (investment adviser firm, 2009-2014) and a Director of FMR and FMR Co., Inc. (investment adviser firms, 2007-2014).

Charles S. Morrison (1960)

Year of Election or Appointment: 2014

Trustee

Mr. Morrison also serves as Trustee of other funds. He serves as President of Fidelity Management & Research Company (FMR) (investment adviser firm, 2016-present), a Director of Fidelity Investments Money Management, Inc. (FIMM) (investment adviser firm, 2014-present), Director of Fidelity SelectCo, LLC (investment adviser firm, 2014-present), President, Asset Management (2014-present), and is an employee of Fidelity Investments. Previously, Mr. Morrison served as Vice President of Fidelity's Fixed Income and Asset Allocation Funds (2012-2014), President, Fixed Income (2011-2014), Vice President of Fidelity's Money Market Funds (2005-2009), President, Money Market Group Leader of FMR (investment adviser firm, 2009), and Senior Vice President, Money Market Group of FMR (2004-2009). Mr. Morrison also served as Vice President of Fidelity's Bond Funds (2002-2005), certain Balanced Funds (2002-2005), and certain Asset Allocation Funds (2002-2007), and as Senior Vice President (2002-2005) of Fidelity's Bond Division.

* Determined to be an “Interested Trustee” by virtue of, among other things, his or her affiliation with the trust or various entities under common control with FMR.

+ The information includes the Trustee's principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to the Trustee's qualifications to serve as a Trustee, which led to the conclusion that the Trustee should serve as a Trustee for the fund.

Independent Trustees:

Correspondence intended for an Independent Trustee may be sent to Fidelity Investments, P.O. Box 55235, Boston, Massachusetts 02205-5235.

Name, Year of Birth; Principal Occupations and Other Relevant Experience+

Dennis J. Dirks (1948)

Year of Election or Appointment: 2005

Trustee

Mr. Dirks also serves as Trustee of other Fidelity® funds. Prior to his retirement in May 2003, Mr. Dirks was Chief Operating Officer and a member of the Board of The Depository Trust & Clearing Corporation (DTCC). He also served as President, Chief Operating Officer, and Board member of The Depository Trust Company (DTC) and President and Board member of the National Securities Clearing Corporation (NSCC). In addition, Mr. Dirks served as Chief Executive Officer and Board member of the Government Securities Clearing Corporation, Chief Executive Officer and Board member of the Mortgage-Backed Securities Clearing Corporation, as a Trustee and a member of the Finance Committee of Manhattan College (2005-2008), as a Trustee and a member of the Finance Committee of AHRC of Nassau County (2006-2008), as a member of the Independent Directors Council (IDC) Governing Council (2010-2015), and as a member of the Board of Directors for The Brookville Center for Children’s Services, Inc. (2009-2017). Mr. Dirks is a member of the Finance Committee (2016-present) and Board of Directors (2017-present) of the Asolo Repertory Theatre.

Alan J. Lacy (1953)

Year of Election or Appointment: 2008

Trustee

Mr. Lacy also serves as Trustee of other Fidelity® funds. Mr. Lacy serves as a Director of Bristol-Myers Squibb Company (global pharmaceuticals, 2008-present). He is a Trustee of the California Chapter of The Nature Conservancy (2015-present) and a Director of the Center for Advanced Study in the Behavioral Sciences at Stanford University (2015-present). In addition, Mr. Lacy served as Senior Adviser (2007-2014) of Oak Hill Capital Partners, L.P. (private equity) and also served as Chief Executive Officer (2005) and Vice Chairman (2005-2006) of Sears Holdings Corporation (retail) and Chief Executive Officer and Chairman of the Board of Sears, Roebuck and Co. (retail, 2000-2005). Previously, Mr. Lacy served as Chairman (2014-2017) and a member (2010-2017) of the Board of Directors of Dave & Buster’s Entertainment, Inc. (restaurant and entertainment complexes), as Chairman (2008-2011) and a member (2006-2015) of the Board of Trustees of the National Parks Conservation Association, and as a member of the Board of Directors for The Hillman Companies, Inc. (hardware wholesalers, 2010-2014), Earth Fare, Inc. (retail grocery, 2010-2014), and The Western Union Company (global money transfer, 2006-2011).

Ned C. Lautenbach (1944)

Year of Election or Appointment: 2000

Trustee

Chairman of the Independent Trustees

Mr. Lautenbach also serves as Trustee of other Fidelity® funds. Mr. Lautenbach currently serves as the Lead Director of the Eaton Corporation Board of Directors (diversified industrial, 1997-present). Mr. Lautenbach is Chairman of the Board of Directors of Artis-Naples in Naples, Florida (2012-present), a member of the Council on Foreign Relations (1994-present), and currently Vice Chair of the Board of Governors, State University System of Florida (2013-present). Previously, Mr. Lautenbach was a Partner and Advisory Partner at Clayton, Dubilier & Rice, LLC (private equity investment, 1998-2010), as well as a Director of Sony Corporation (2006-2007). Mr. Lautenbach also had a 30-year career with IBM (technology company) during which time he served as Senior Vice President and a member of the Corporate Executive Committee (1968-1998).

Joseph Mauriello (1944)

Year of Election or Appointment: 2008

Trustee

Mr. Mauriello also serves as Trustee of other Fidelity® funds. Prior to his retirement in January 2006, Mr. Mauriello served in numerous senior management positions including Deputy Chairman and Chief Operating Officer (2004-2005), and Vice Chairman of Financial Services (2002-2004) of KPMG LLP US (professional services, 1965-2005). Mr. Mauriello currently serves as a member of the Board of Directors of XL Group plc. (global insurance and re-insurance, 2006-present) and the Independent Directors Council (IDC) Governing Council (2015-present). Previously, Mr. Mauriello served as a Director of the Hamilton Funds of the Bank of New York (2006-2007) and of Arcadia Resources Inc. (health care services and products, 2007-2012).

Cornelia M. Small (1944)

Year of Election or Appointment: 2005

Trustee

Ms. Small also serves as Trustee of other Fidelity® funds. Ms. Small is a member of the Board of Directors (2009-present) and Chair of the Investment Committee (2010-present) of the Teagle Foundation. Ms. Small also serves on the Investment Committee of the Berkshire Taconic Community Foundation (2008-present). Previously, Ms. Small served as Chairperson (2002-2008) and a member of the Investment Committee and Chairperson (2008-2012) and a member of the Board of Trustees of Smith College. In addition, Ms. Small served as Chief Investment Officer, Director of Global Equity Investments, and a member of the Board of Directors of Scudder, Stevens & Clark and Scudder Kemper Investments.

William S. Stavropoulos (1939)

Year of Election or Appointment: 2001

Trustee

Vice Chairman of the Independent Trustees