UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-649

Fidelity Puritan Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | July 31 |

| |

Date of reporting period: | July 31, 2018 |

Item 1.

Reports to Stockholders

Fidelity® Low-Priced Stock Fund

Annual Report July 31, 2018 |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2018 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Notes to Shareholders

The Board of Trustees approved a change to the fund's investment policies (effective November 7, 2017) that has expanded the definition of “low-priced stocks.” Previously, low-priced stocks were defined as those priced at or below $35 per share. This definition was expanded to include stocks with an earnings yield at or above the median for the Russell 2000® Index, as well as those priced at or below $35 per share. Earnings yield represents a stock’s earnings per share for the most recent 12 months divided by current price per share. We believe the expanded definition better reflects the portfolio managers’ investment process and provides greater flexibility while remaining faithful to the fund name. No changes to the investment process and portfolio characteristics are expected.

During the period, Joel Tillinghast assumed responsibility of the fund's consumer and financials sleeves, succeeding Kathy Buck and Justin Bennett, respectively.

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended July 31, 2018 | Past 1 year | Past 5 years | Past 10 years |

| Fidelity® Low-Priced Stock Fund | 12.07% | 9.73% | 10.46% |

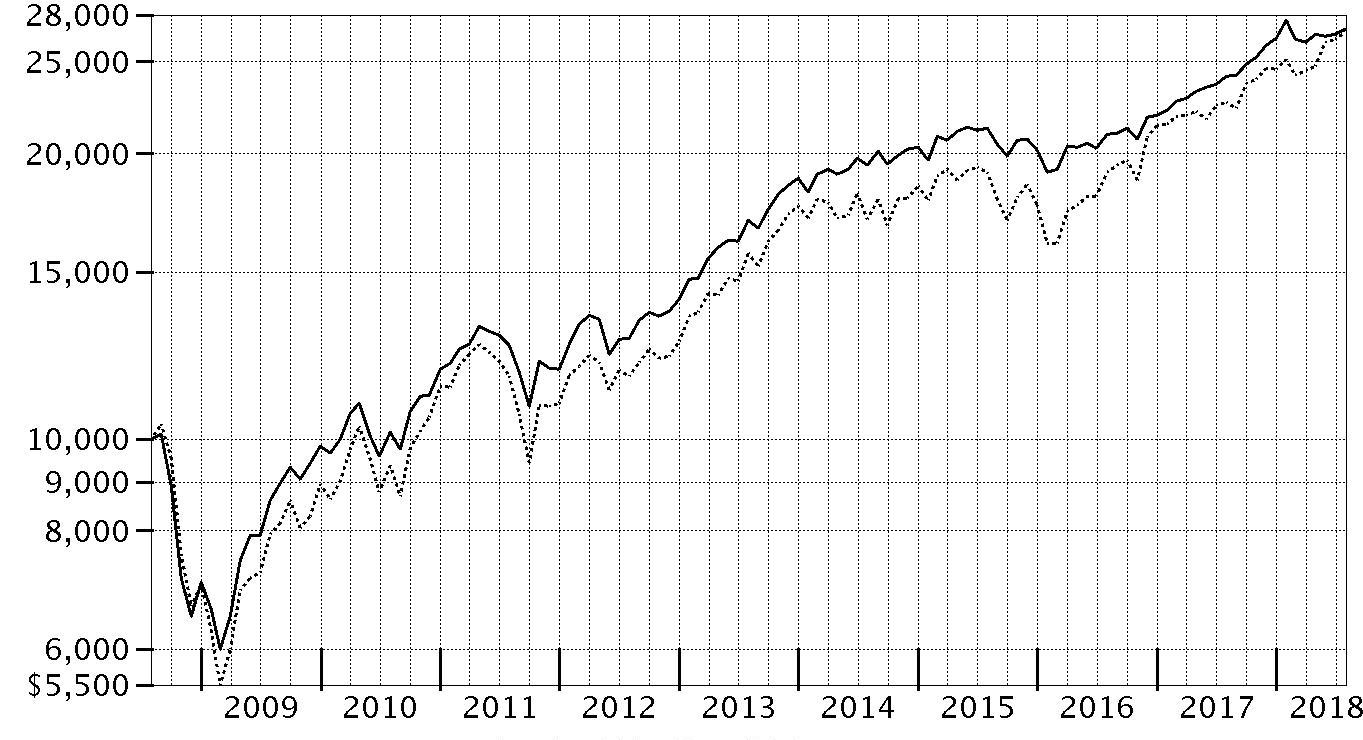

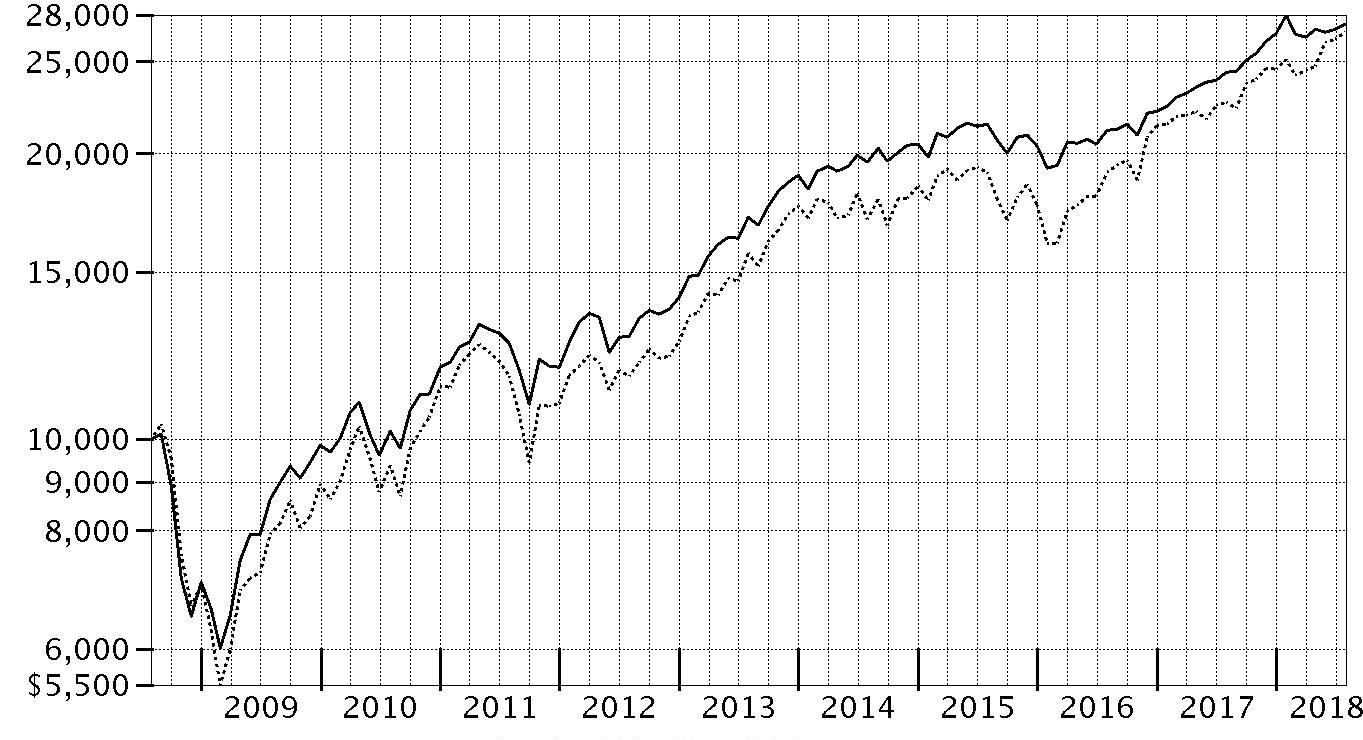

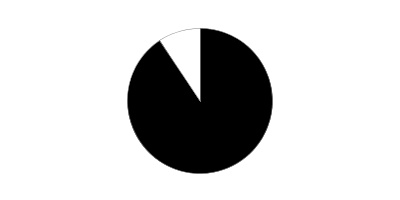

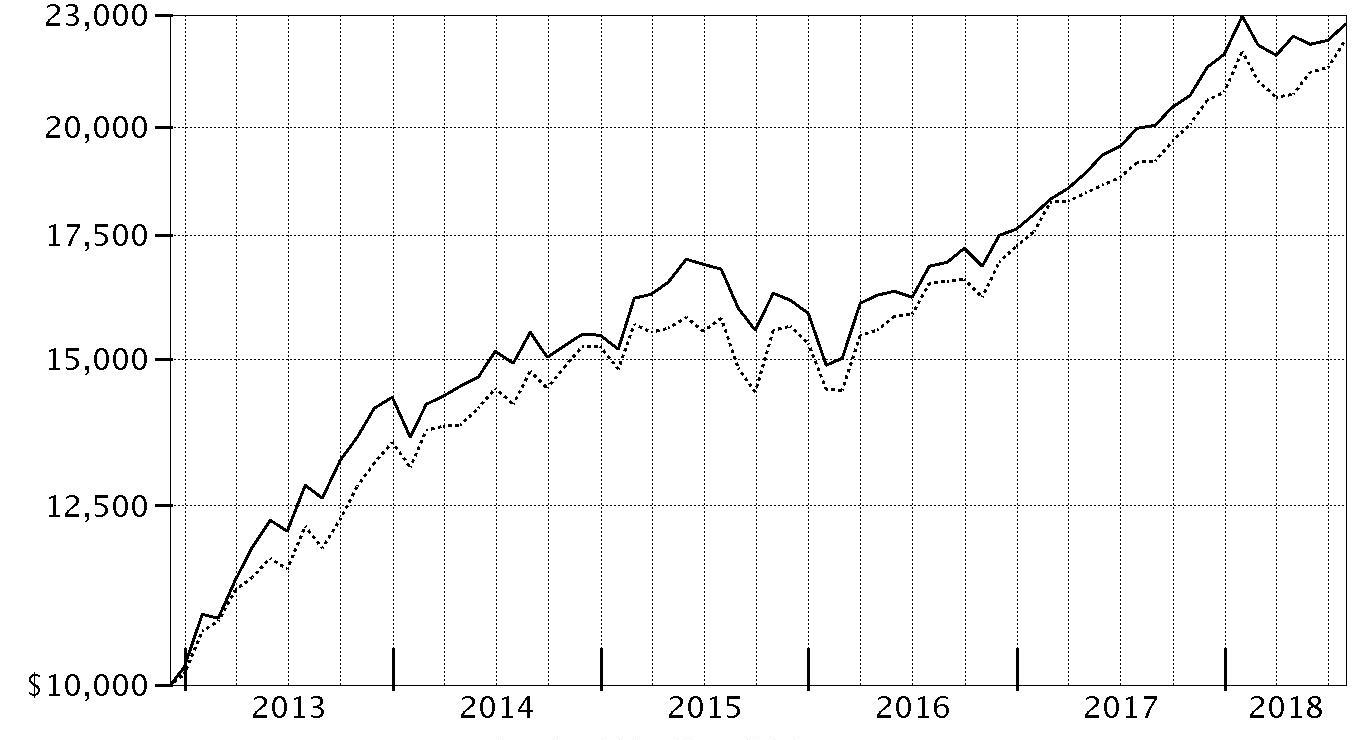

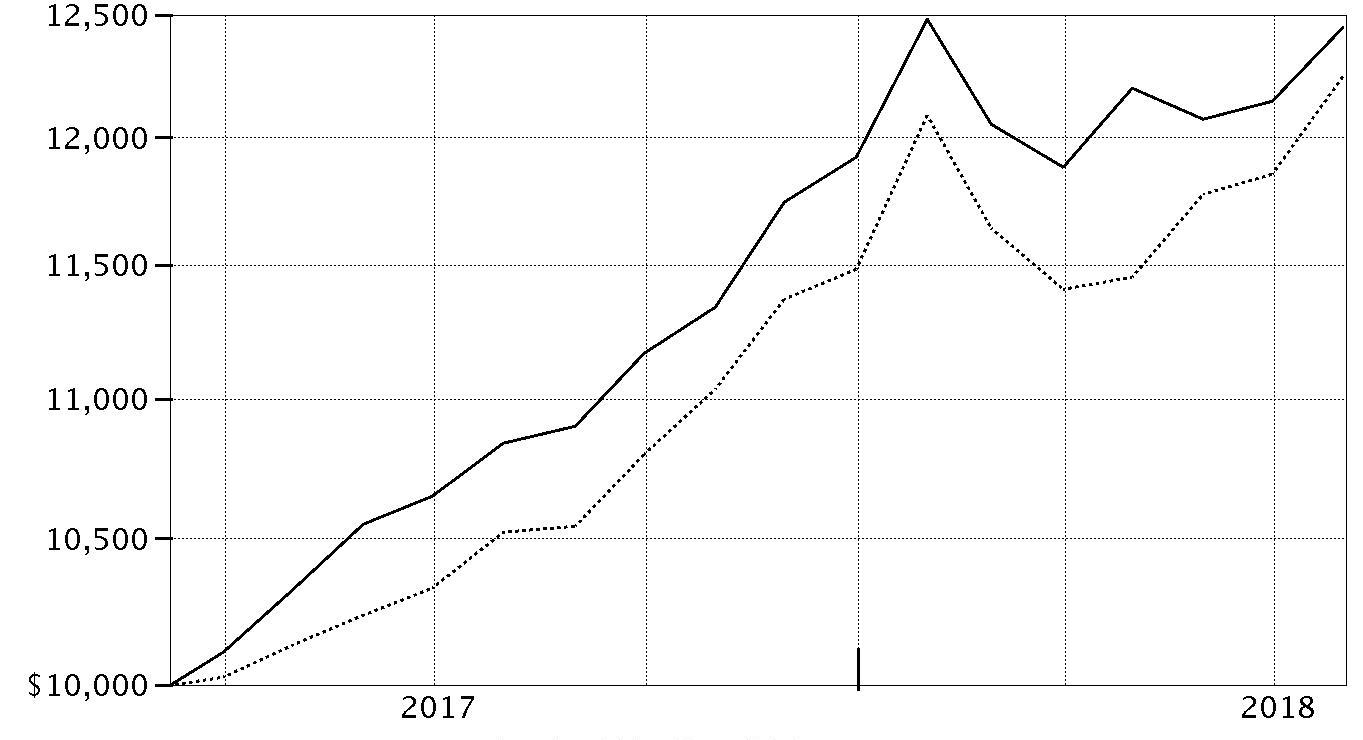

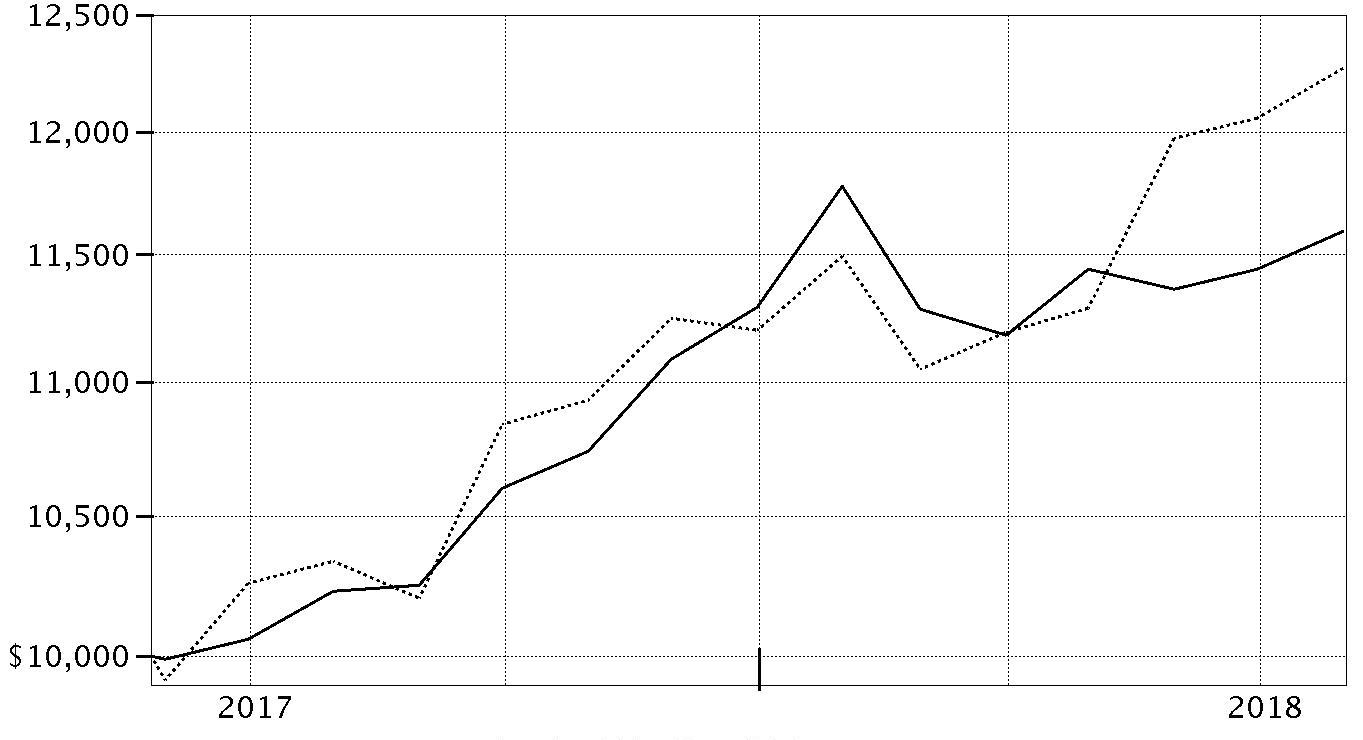

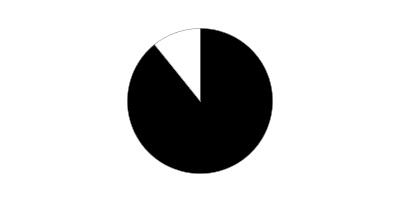

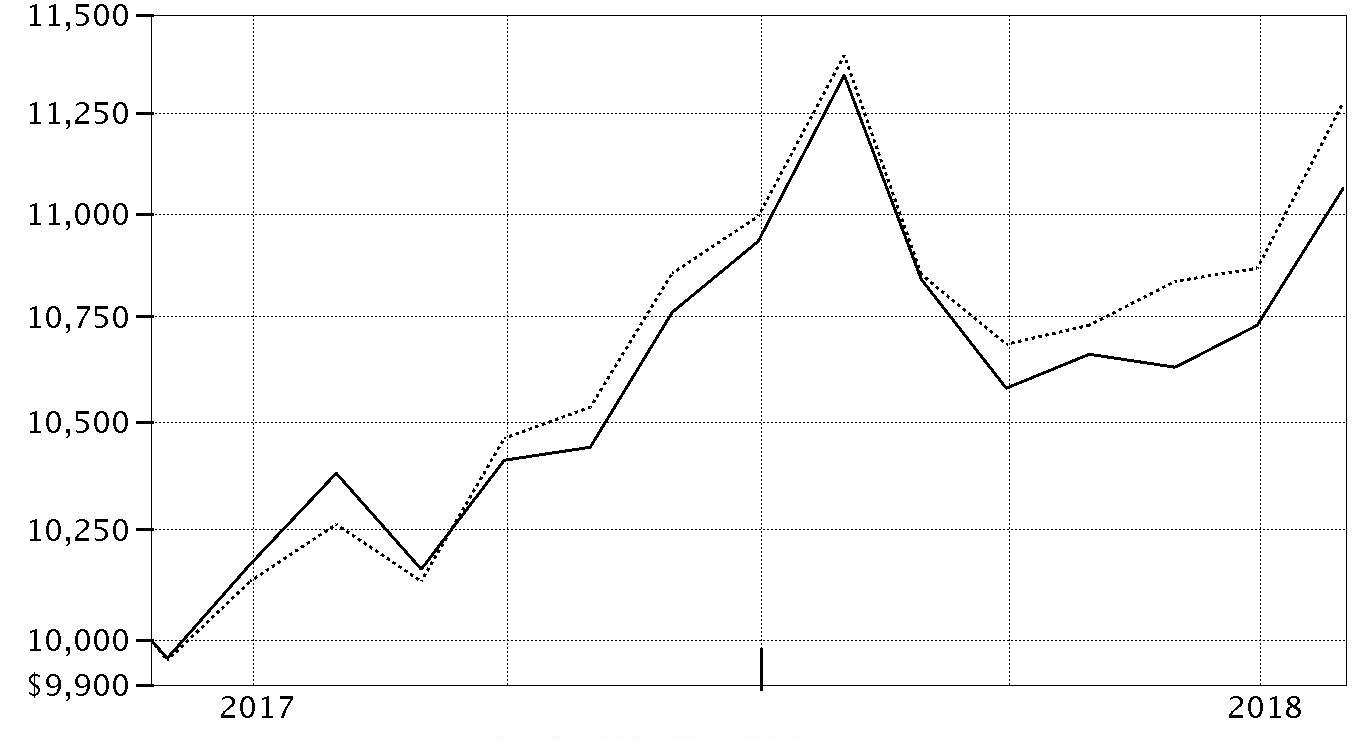

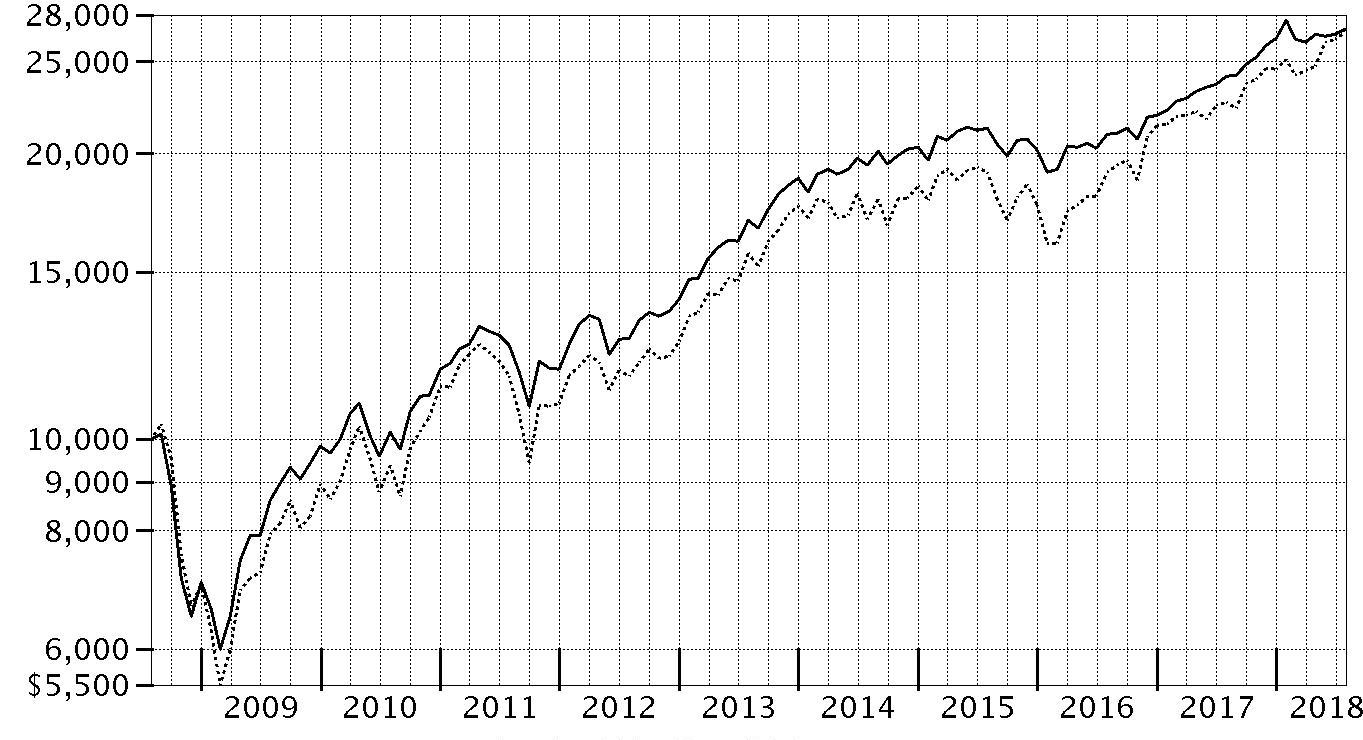

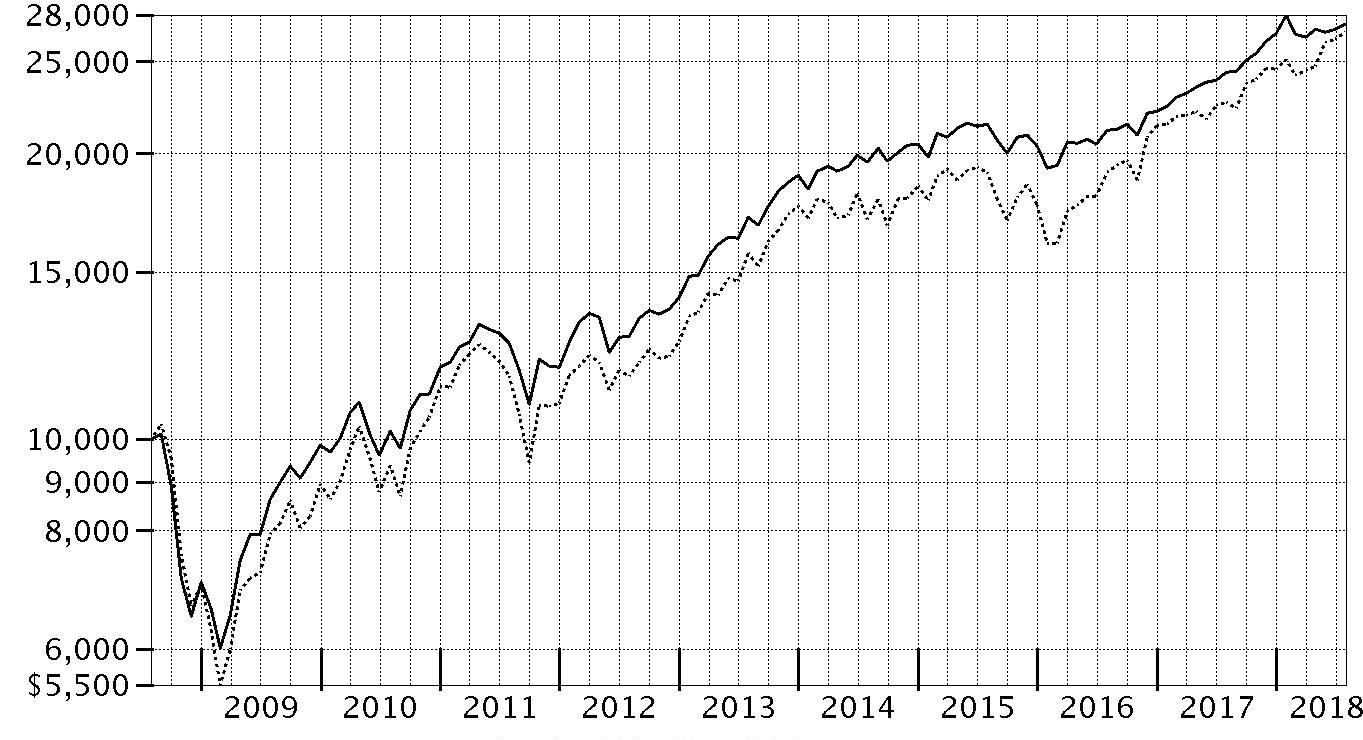

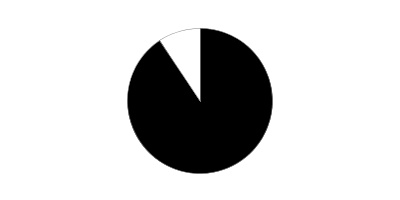

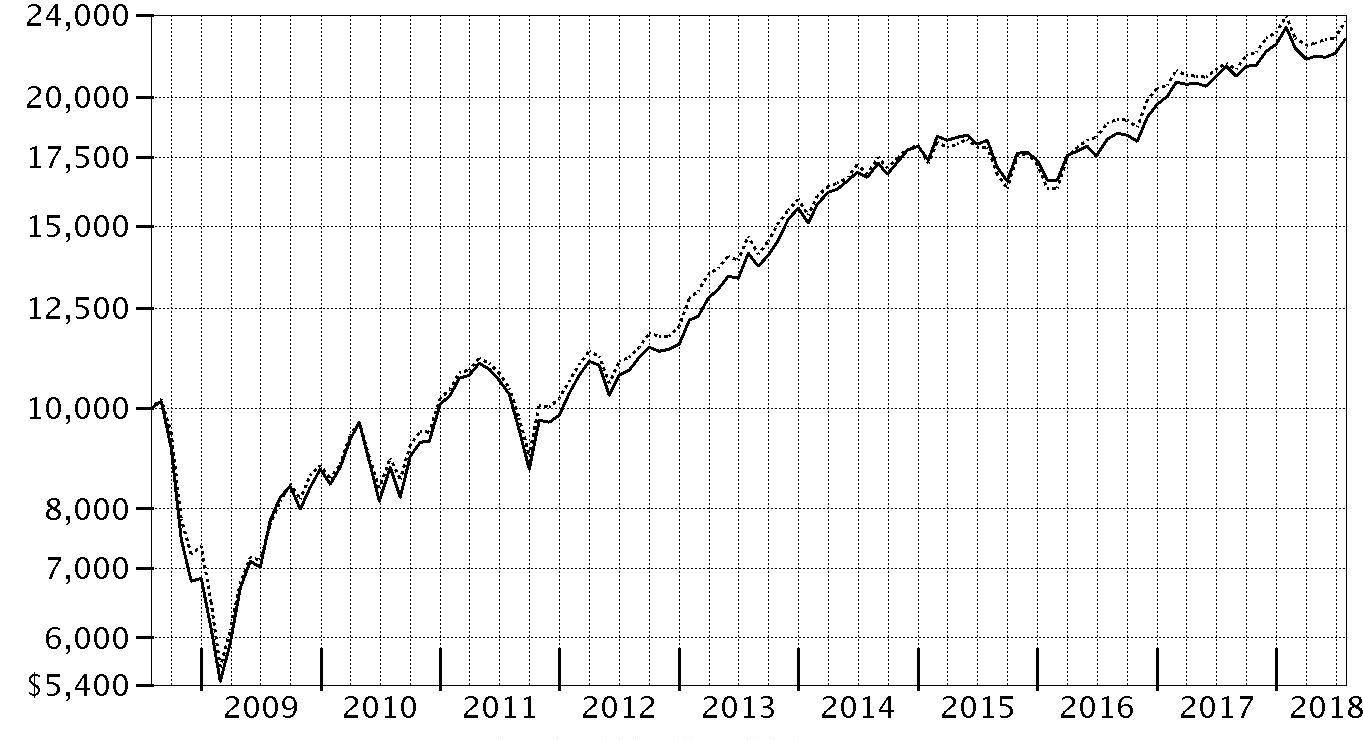

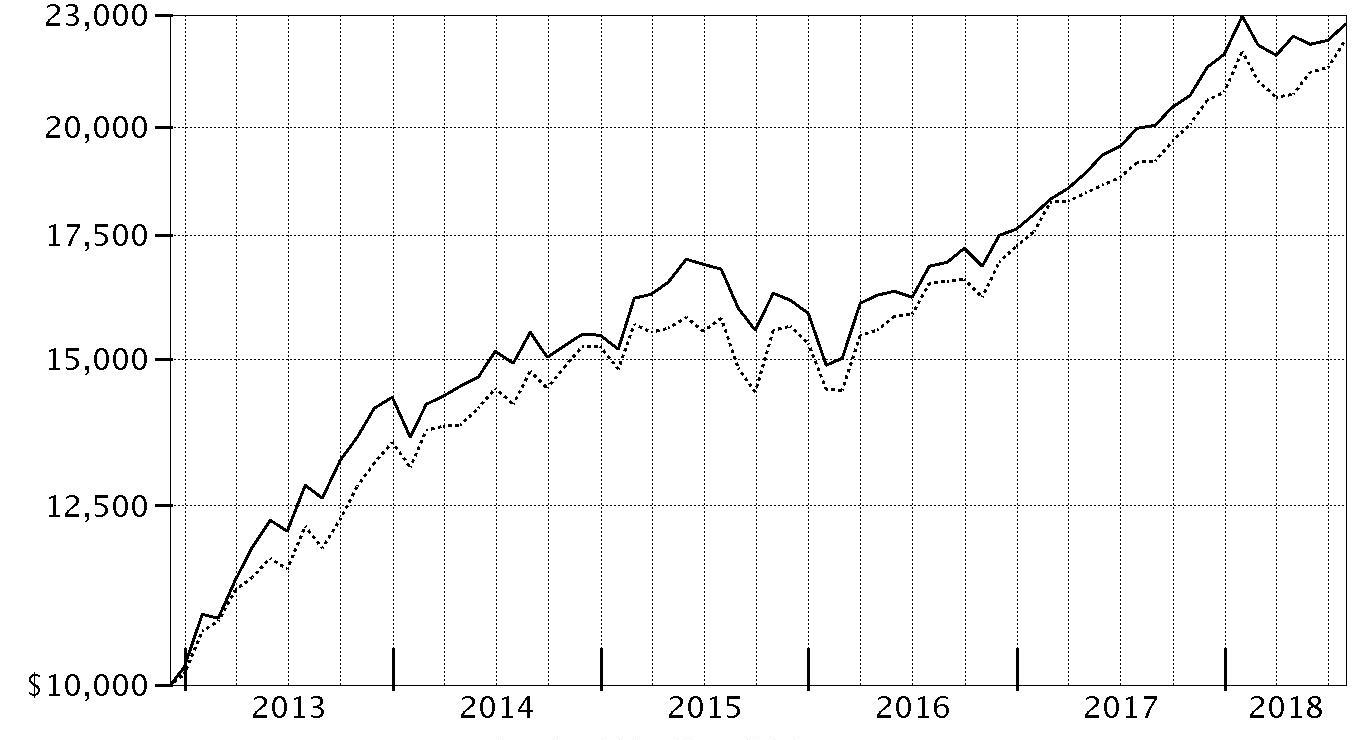

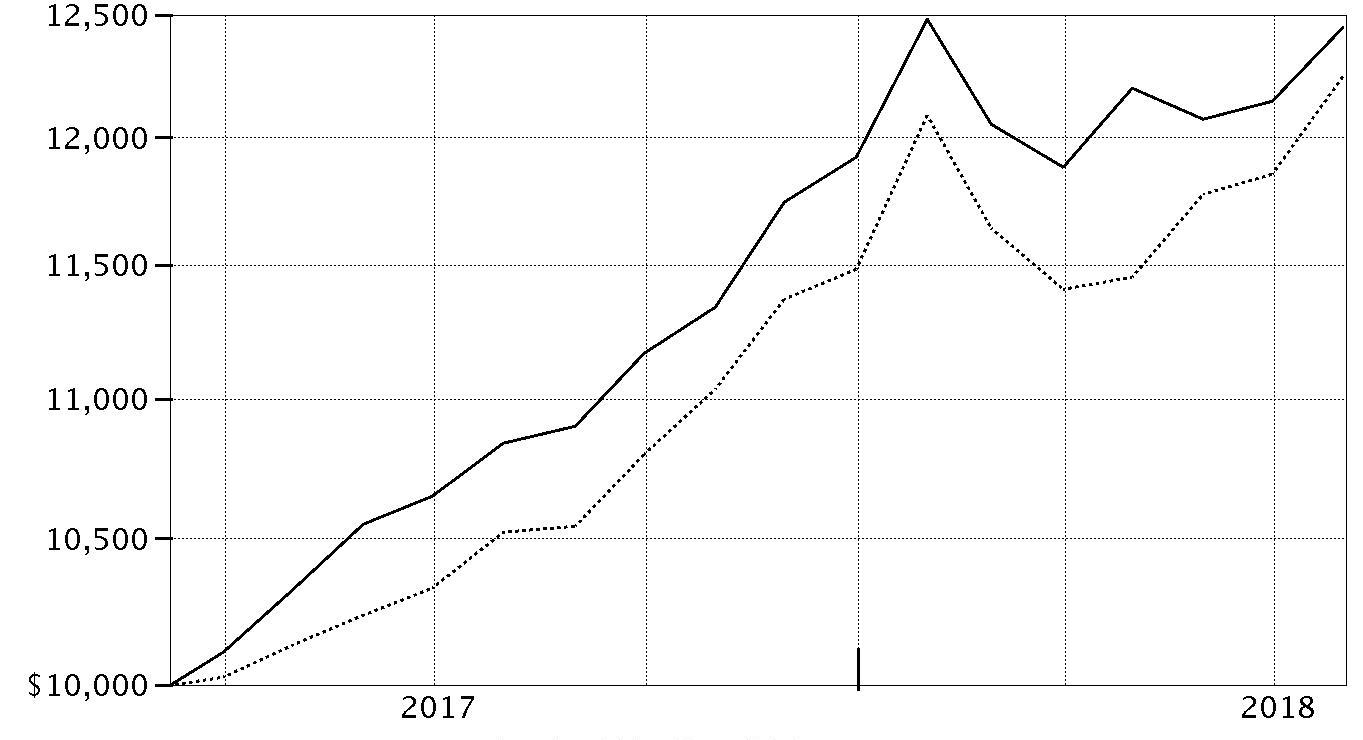

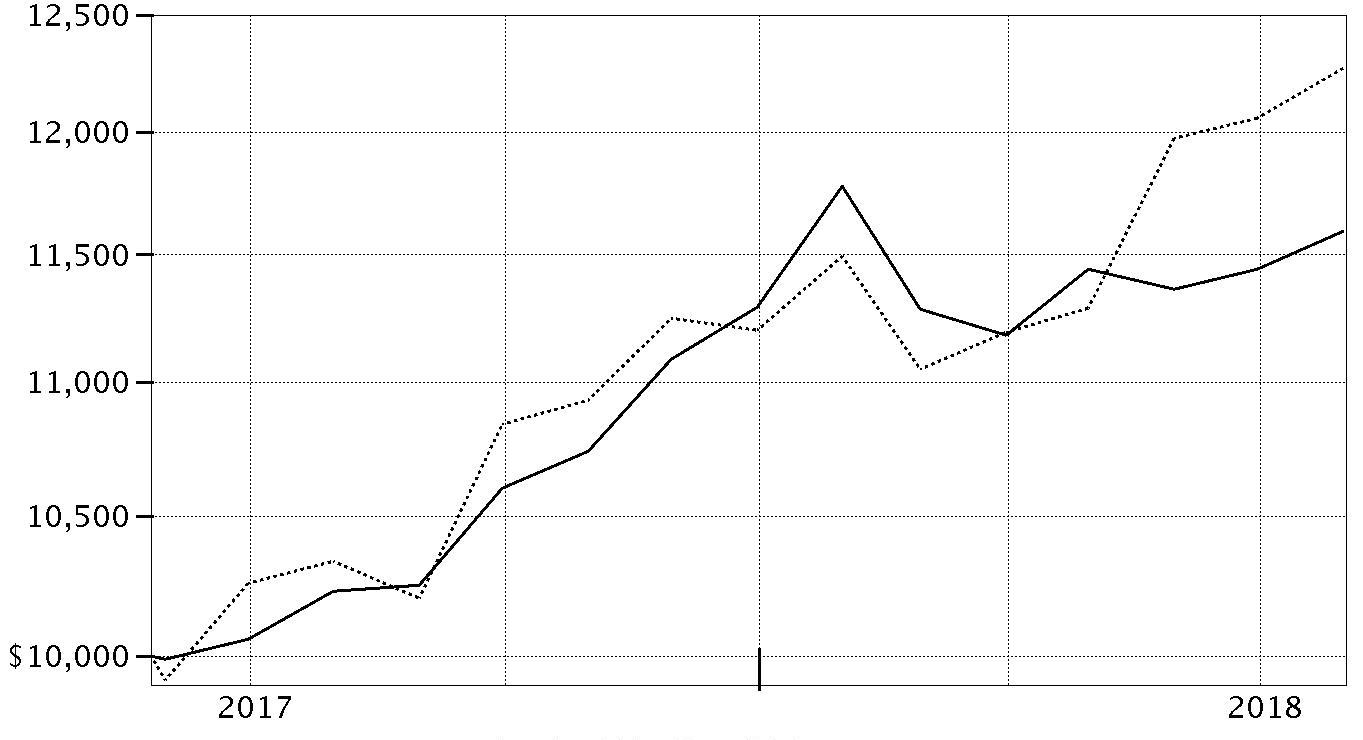

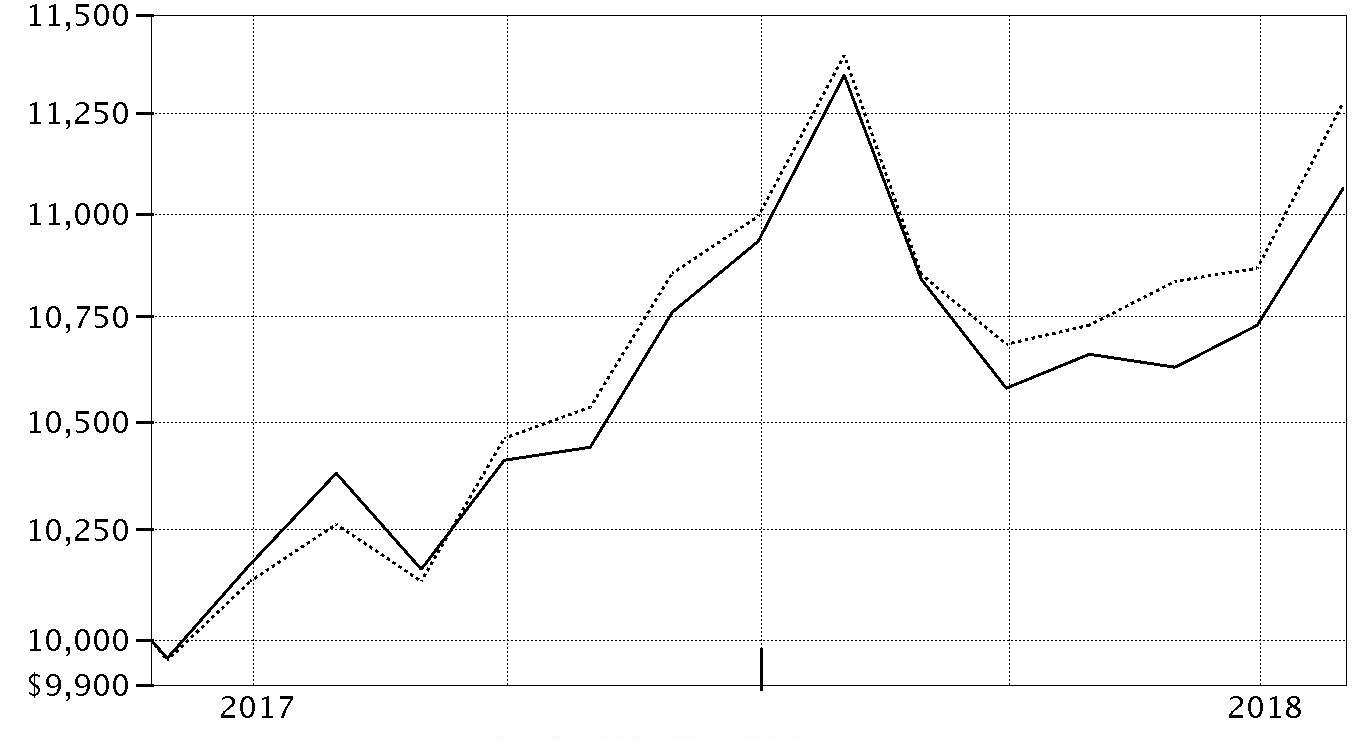

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity® Low-Priced Stock Fund, a class of the fund, on July 31, 2008.

The chart shows how the value of your investment would have changed, and also shows how the Russell 2000® Index performed over the same period.

| Period Ending Values |

| $27,035 | Fidelity® Low-Priced Stock Fund |

| $26,870 | Russell 2000® Index |

Management's Discussion of Fund Performance

Market Recap: The U.S. equity bellwether S&P 500

® index gained 16.24% for the 12 months ending July 31, 2018, despite a resurgence in volatility that challenged the multiyear bull market. Stocks maintained their steady growth until a sharp reversal in February, as volatility spiked amid fear that rising inflation and the potential for the economy to overheat would prompt the U.S. Federal Reserve to pick up the pace of interest rate hikes. The index posted its first negative monthly result since October 2016, and then lost further ground in March on fear of a global trade war. The market stabilized in April and turned upward through mid-June, when escalating trade tension between the U.S. and China soured investor sentiment. The resulting uncertainty lingered into July, but strong corporate earnings helped the S&P 500 rise 3.72% that month to cap the period. For the full one-year period, growth handily topped value, while small-caps bested large-caps. By sector, information technology (+28%) led the way, boosted by strong earnings growth from several major index constituents. Consumer discretionary rose roughly 24%, driven by retailers (+49%). Energy (+20%) gained alongside higher oil prices. Laggards were telecommunication services (-2%), consumer staples (0%) and utilities (+3%), defensive groups that struggled amid rising interest rates and a general preference for risk. Real estate (+5%) fared a bit better but still lagged, as did financials, industrials, health care (each up 13%) and materials (+11%).

Comments from Lead Portfolio Manager Joel Tillinghast: For the fiscal year, the fund's share classes gained roughly 12%, trailing the 18.73% advance of the benchmark Russell 2000

® Index. The fund underperformed its benchmark in large part because the stocks that were largely in favor the past year – high-growth equities with elevated valuations – are not a focus of our investment approach, which seeks to own high-quality companies with stable earnings-growth prospects that we believe are mispriced. As a result, stock choices in several sectors, including financials, consumer staples, information technology and health care, detracted from our relative result. By industry, software & services and insurance hurt most, as did positioning in pharmaceuticals, biotechnology & life sciences. A non-benchmark position in electronics component manufacturer Hon Hai Precision Industry (-28%) was the fund’s biggest relative detractor. The stock was pressured by weaker-than-expected sales of Apple’s newly launched high-end smartphones, which impacted Hon Hai’s production. Shares in non-benchmark Unum Group (-19%) suffered from weakening financial trends in its long-term-care business. The fund's sizable allocation to cash – at 10% of assets, on average – amid a rising equity market also hindered our relative result. Our foreign holdings, which represented roughly a third of the fund’s assets this period, also detracted, in part due to the strength of the U.S. dollar. Conversely, a significant underweighting in the weak real estate sector boosted relative performance, as did stock selection in retailing and energy. The fund’s top relative contributors were non-benchmark positions in disk-drive maker Seagate Technology and discount retailer Ross Stores. All of the stocks mentioned were sizable fund holdings.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Investment Summary (Unaudited)

Top Ten Stocks as of July 31, 2018

| | % of fund's net assets |

| UnitedHealth Group, Inc. | 6.2 |

| Ross Stores, Inc. | 3.2 |

| Best Buy Co., Inc. | 2.8 |

| Next PLC | 2.7 |

| Seagate Technology LLC | 2.7 |

| Metro, Inc. Class A (sub. vtg.) | 2.3 |

| Aetna, Inc. | 2.2 |

| Unum Group | 1.7 |

| ANSYS, Inc. | 1.7 |

| Amgen, Inc. | 1.6 |

| | 27.1 |

Top Five Market Sectors as of July 31, 2018

| | % of fund's net assets |

| Consumer Discretionary | 22.1 |

| Information Technology | 16.5 |

| Health Care | 14.2 |

| Financials | 11.3 |

| Consumer Staples | 8.4 |

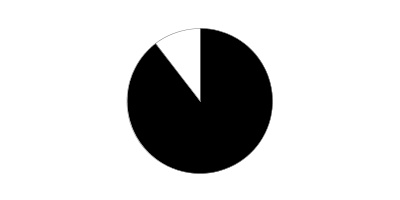

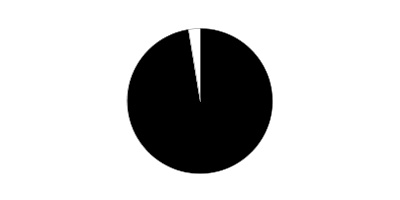

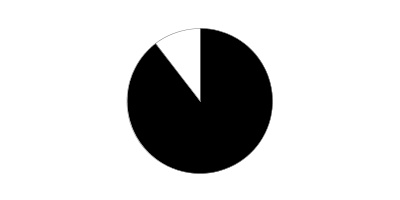

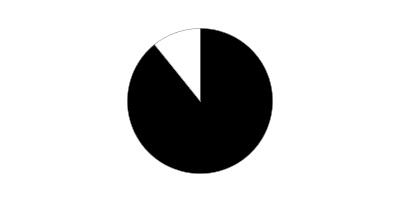

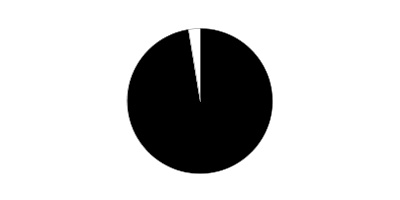

Asset Allocation (% of fund's net assets)

| As of July 31, 2018* |

| | Stocks | 90.7% |

| | Short-Term Investments and Net Other Assets (Liabilities) | 9.3% |

* Foreign investments - 40.9%

Schedule of Investments July 31, 2018

Showing Percentage of Net Assets

| Common Stocks - 90.6% | | | |

| | | Shares | Value (000s) |

| CONSUMER DISCRETIONARY - 22.1% | | | |

| Auto Components - 1.2% | | | |

| Adient PLC | | 499,082 | $23,771 |

| ASTI Corp. (a)(b) | | 181,200 | 3,940 |

| Autoliv, Inc. (a) | | 17,500 | 1,793 |

| Cooper Tire & Rubber Co. | | 1,297,832 | 37,053 |

| ElringKlinger AG (a) | | 698,718 | 8,865 |

| G-Tekt Corp. | | 73,100 | 1,266 |

| Gentex Corp. | | 2,537,679 | 58,874 |

| GUD Holdings Ltd. | | 295,435 | 3,117 |

| Hi-Lex Corp. | | 1,367,200 | 33,968 |

| INFAC Corp. | | 325,139 | 1,314 |

| INZI Controls Co. Ltd. (b) | | 1,516,000 | 7,407 |

| Lear Corp. | | 19,173 | 3,454 |

| Motonic Corp. (b) | | 3,250,000 | 26,269 |

| Murakami Corp. (b) | | 782,700 | 21,350 |

| Nippon Seiki Co. Ltd. | | 2,639,800 | 55,197 |

| Piolax, Inc. (b) | | 2,486,100 | 60,277 |

| S&T Holdings Co. Ltd. (b) | | 885,108 | 10,056 |

| Samsung Climate Control Co. Ltd. (b) | | 499,950 | 4,804 |

| Sewon Precision Industries Co. Ltd. (b) | | 500,000 | 4,625 |

| SJM Co. Ltd. (b) | | 1,282,000 | 4,312 |

| SJM Holdings Co. Ltd. (b) | | 1,291,382 | 4,506 |

| Strattec Security Corp. (b) | | 343,035 | 11,320 |

| Sungwoo Hitech Co. Ltd. | | 2,518,110 | 10,312 |

| TBK Co. Ltd. | | 925,900 | 4,240 |

| Yachiyo Industry Co. Ltd. | | 896,600 | 10,280 |

| Yutaka Giken Co. Ltd. (b) | | 1,228,100 | 29,952 |

| | | | 442,322 |

| Distributors - 0.2% | | | |

| Central Automotive Products Ltd. | | 75,400 | 1,227 |

| Chori Co. Ltd. | | 430,500 | 7,989 |

| Nakayamafuku Co. Ltd. | | 748,500 | 4,793 |

| PALTAC Corp. | | 121,100 | 6,390 |

| SPK Corp. | | 253,600 | 6,128 |

| Uni-Select, Inc. | | 1,647,187 | 27,427 |

| | | | 53,954 |

| Diversified Consumer Services - 0.3% | | | |

| Clip Corp. (b) | | 272,000 | 2,255 |

| Cross-Harbour Holdings Ltd. | | 2,321,000 | 3,903 |

| Estacio Participacoes SA | | 407,600 | 2,818 |

| ServiceMaster Global Holdings, Inc. (c) | | 184,559 | 10,518 |

| Shingakukai Holdings Co. Ltd. | | 99,900 | 532 |

| Step Co. Ltd. (b) | | 1,077,300 | 15,560 |

| Weight Watchers International, Inc. (c) | | 1,000,774 | 89,599 |

| | | | 125,185 |

| Hotels, Restaurants & Leisure - 0.3% | | | |

| Ark Restaurants Corp. | | 157,407 | 3,542 |

| Bluegreen Vacations Corp. | | 218,433 | 5,616 |

| Brinker International, Inc. | | 22,714 | 1,071 |

| Flanigans Enterprises, Inc. | | 89,612 | 2,626 |

| Greggs PLC | | 499,482 | 6,910 |

| Hiday Hidaka Corp. (b) | | 1,845,300 | 39,244 |

| Ibersol SGPS SA | | 912,355 | 10,669 |

| Koshidaka Holdings Co. Ltd. | | 294,120 | 3,383 |

| Kura Corp. Ltd. | | 10,000 | 603 |

| Sportscene Group, Inc. Class A (b) | | 331,600 | 2,039 |

| St. Marc Holdings Co. Ltd. | | 400,300 | 9,734 |

| Texas Roadhouse, Inc. Class A | | 93,513 | 5,876 |

| The Monogatari Corp. | | 79,900 | 7,360 |

| The Restaurant Group PLC | | 6,498,637 | 22,604 |

| TORIDOLL Holdings Corp. | | 74,900 | 1,662 |

| Wyndham Destinations, Inc. | | 25,009 | 1,153 |

| Wyndham Hotels & Resorts, Inc. | | 25,009 | 1,451 |

| | | | 125,543 |

| Household Durables - 3.3% | | | |

| Abbey PLC (b) | | 1,775,890 | 31,773 |

| Barratt Developments PLC (b) | | 72,241,313 | 506,341 |

| Bellway PLC | | 3,914,975 | 149,893 |

| D.R. Horton, Inc. | | 2,866,806 | 125,279 |

| Dorel Industries, Inc. Class B (sub. vtg.) | | 2,585,365 | 47,401 |

| Emak SpA | | 4,388,097 | 6,199 |

| First Juken Co. Ltd. (b) | | 1,400,500 | 17,548 |

| Flexsteel Industries, Inc. | | 27,826 | 997 |

| Hamilton Beach Brands Holding Co.: | | | |

| Class A | | 176,552 | 4,484 |

| Class B | | 183,780 | 4,668 |

| Helen of Troy Ltd. (b)(c) | | 1,680,238 | 192,471 |

| Henry Boot PLC | | 2,949,666 | 10,144 |

| Iida Group Holdings Co. Ltd. | | 186,300 | 3,647 |

| M/I Homes, Inc. (c) | | 25,382 | 656 |

| Meritage Homes Corp. (c) | | 20,965 | 905 |

| P&F Industries, Inc. Class A (b) | | 322,495 | 2,683 |

| PulteGroup, Inc. | | 101,806 | 2,900 |

| Q.E.P. Co., Inc. | | 30,058 | 956 |

| Sanei Architecture Planning Co. Ltd. (b) | | 1,210,700 | 21,406 |

| Stanley Furniture Co., Inc. (c) | | 150,671 | 98 |

| Taylor Morrison Home Corp. (c) | | 210,457 | 4,110 |

| Token Corp. | | 623,700 | 47,970 |

| Toll Brothers, Inc. | | 94,819 | 3,343 |

| Tupperware Brands Corp. | | 29,354 | 1,078 |

| | | | 1,186,950 |

| Internet & Direct Marketing Retail - 0.3% | | | |

| Belluna Co. Ltd. (b) | | 6,985,900 | 81,345 |

| Liberty Interactive Corp. QVC Group Series A (c) | | 854,888 | 18,201 |

| | | | 99,546 |

| Leisure Products - 0.2% | | | |

| Accell Group NV (b) | | 1,757,314 | 36,577 |

| Amer Group PLC (A Shares) | | 118,243 | 3,795 |

| Brunswick Corp. | | 119,700 | 7,697 |

| Fenix Outdoor AB Class B (c)(d) | | 32,298 | 0 |

| Kabe Husvagnar AB (B Shares) | | 277,074 | 5,184 |

| Mars Engineering Corp. | | 500,000 | 10,835 |

| Miroku Corp. | | 140,500 | 2,586 |

| | | | 66,674 |

| Media - 1.1% | | | |

| Comcast Corp. Class A | | 2,644,653 | 94,626 |

| Corus Entertainment, Inc. Class B (non-vtg.) (a) | | 585,765 | 1,828 |

| Discovery Communications, Inc.: | | | |

| Class A (a)(c) | | 2,645,227 | 70,310 |

| Class C (non-vtg.) (c) | | 499,061 | 12,252 |

| DISH Network Corp. Class A (c) | | 109,980 | 3,471 |

| Entercom Communications Corp. Class A | | 50,107 | 378 |

| Gannett Co., Inc. | | 1,076,384 | 11,377 |

| Harte-Hanks, Inc. (c) | | 74,105 | 750 |

| Hyundai HCN | | 2,723,979 | 10,153 |

| Informa PLC | | 451,363 | 4,677 |

| Intage Holdings, Inc. (b) | | 3,306,600 | 34,244 |

| Ipsos SA | | 8,810 | 295 |

| KK Culture Holdings Ltd. (c) | | 8,087,000 | 1,690 |

| MSG Network, Inc. Class A (c) | | 288,809 | 6,801 |

| Multiplus SA | | 536,800 | 3,962 |

| Pico Far East Holdings Ltd. | | 18,538,000 | 7,676 |

| Proto Corp. | | 235,200 | 2,890 |

| RKB Mainichi Broadcasting Corp. | | 42,400 | 2,378 |

| Saga Communications, Inc. Class A | | 397,449 | 15,043 |

| Sky Network Television Ltd. | | 5,847,362 | 10,801 |

| STW Group Ltd. | | 4,100,892 | 2,803 |

| Tegna, Inc. | | 1,174,466 | 12,954 |

| Television Broadcasts Ltd. | | 1,962,100 | 6,087 |

| TOW Co. Ltd. (b) | | 1,831,300 | 13,217 |

| TVA Group, Inc. Class B (non-vtg.) (c) | | 3,091,099 | 7,105 |

| Twenty-First Century Fox, Inc. Class A | | 418,527 | 18,834 |

| Viacom, Inc. Class B (non-vtg.) | | 1,216,553 | 35,341 |

| WOWOW INC. | | 184,400 | 5,582 |

| | | | 397,525 |

| Multiline Retail - 2.9% | | | |

| Big Lots, Inc. (a) | | 140,068 | 6,083 |

| Lifestyle China Group Ltd. (c) | | 24,958,500 | 10,144 |

| Lifestyle International Holdings Ltd. | | 25,000,000 | 49,688 |

| Next PLC (b) | | 12,702,310 | 989,675 |

| Nordstrom, Inc. | | 79,448 | 4,164 |

| Watts Co. Ltd. | | 648,800 | 6,342 |

| | | | 1,066,096 |

| Specialty Retail - 10.9% | | | |

| Aaron's, Inc. Class A | | 65,395 | 2,832 |

| Abercrombie & Fitch Co. Class A | | 2,750,080 | 65,149 |

| AT-Group Co. Ltd. | | 1,095,100 | 27,795 |

| AutoCanada, Inc. | | 199,959 | 2,223 |

| AutoNation, Inc. (c) | | 78,859 | 3,827 |

| AutoZone, Inc. (c) | | 730,209 | 515,184 |

| Bed Bath & Beyond, Inc. | | 2,068,796 | 38,749 |

| Best Buy Co., Inc. | | 13,484,839 | 1,011,767 |

| BMTC Group, Inc. (b) | | 3,634,497 | 42,943 |

| Bonia Corp. Bhd | | 2,503,000 | 268 |

| Buffalo Co. Ltd. | | 93,200 | 791 |

| Burlington Stores, Inc. (c) | | 37,468 | 5,725 |

| Cars.com, Inc. (c) | | 434,702 | 12,332 |

| Cash Converters International Ltd. (c) | | 22,077,204 | 5,495 |

| Chico's FAS, Inc. | | 634,386 | 5,519 |

| Delek Automotive Systems Ltd. | | 737,100 | 3,894 |

| DSW, Inc. Class A | | 203,875 | 5,594 |

| Dunelm Group PLC | | 650,011 | 4,475 |

| Ff Group (b)(c)(d) | | 4,363,428 | 24,491 |

| Formosa Optical Technology Co. Ltd. | | 1,362,000 | 2,761 |

| Fourlis Holdings SA | | 200,431 | 1,352 |

| Francesca's Holdings Corp. (c) | | 299,858 | 2,441 |

| GameStop Corp. Class A (a) | | 3,030,465 | 43,669 |

| Genesco, Inc. (c) | | 599,091 | 24,383 |

| GNC Holdings, Inc. Class A (c) | | 949,973 | 3,021 |

| Goldlion Holdings Ltd. | | 21,953,000 | 9,090 |

| Guess?, Inc. (b) | | 4,938,084 | 111,897 |

| Hour Glass Ltd. | | 8,339,600 | 3,951 |

| IA Group Corp. (b) | | 117,640 | 3,987 |

| JB Hi-Fi Ltd. (a) | | 106,044 | 1,879 |

| John David Group PLC | | 7,906,780 | 48,559 |

| Jumbo SA (b) | | 10,027,525 | 160,642 |

| K's Holdings Corp. | | 4,790,300 | 53,852 |

| Ku Holdings Co. Ltd. | | 850,600 | 7,143 |

| Le Chateau, Inc. Class B (sub. vtg.) (c) | | 620,700 | 143 |

| Leon's Furniture Ltd. | | 186,348 | 2,620 |

| Lewis Group Ltd. | | 1,077,376 | 2,446 |

| Mr. Bricolage SA (b) | | 860,713 | 13,235 |

| Murphy U.S.A., Inc. (c) | | 46,567 | 3,690 |

| Nafco Co. Ltd. (b) | | 1,938,400 | 31,794 |

| Ross Stores, Inc. | | 13,400,498 | 1,171,606 |

| Sacs Bar Holdings, Inc. | | 199,900 | 1,734 |

| Sally Beauty Holdings, Inc. (c) | | 2,431,153 | 40,090 |

| Second Chance Properties Ltd. warrants 1/23/20 (c) | | 1,941,600 | 6 |

| Sonic Automotive, Inc. Class A (sub. vtg.) | | 1,098,619 | 22,357 |

| The Buckle, Inc. (a)(b) | | 4,502,441 | 108,284 |

| The Children's Place Retail Stores, Inc. | | 30,939 | 3,802 |

| Urban Outfitters, Inc. (c) | | 2,350,151 | 104,347 |

| USS Co. Ltd. | | 5,147,400 | 97,410 |

| Vitamin Shoppe, Inc. (c) | | 873,939 | 7,297 |

| Williams-Sonoma, Inc. (a) | | 354,771 | 20,751 |

| Workman Co. Ltd. | | 2,022,700 | 90,629 |

| | | | 3,979,921 |

| Textiles, Apparel & Luxury Goods - 1.4% | | | |

| Best Pacific International Holdings Ltd. | | 4,818,000 | 1,780 |

| Deckers Outdoor Corp. (c) | | 33,000 | 3,723 |

| Embry Holdings Ltd. | | 2,161,000 | 727 |

| Emerald Expositions Events, Inc. | | 128,392 | 2,478 |

| Fossil Group, Inc. (b)(c) | | 4,138,034 | 108,416 |

| Gildan Activewear, Inc. | | 6,895,942 | 177,640 |

| Handsome Co. Ltd. (b) | | 2,000,000 | 67,806 |

| JLM Couture, Inc. (b)(c) | | 160,355 | 1,267 |

| Makalot Industrial Co. Ltd. | | 906,000 | 4,029 |

| McRae Industries, Inc. | | 24,161 | 725 |

| Michael Kors Holdings Ltd. (c) | | 76,284 | 5,090 |

| Oxford Industries, Inc. | | 24,123 | 2,222 |

| Portico International Holdings (c) | | 10,198,500 | 5,314 |

| Steven Madden Ltd. | | 155,407 | 8,400 |

| Sun Hing Vision Group Holdings Ltd. (b) | | 19,833,000 | 6,974 |

| Texwinca Holdings Ltd. | | 48,936,000 | 21,572 |

| Victory City International Holdings Ltd. (c) | | 90,567,225 | 1,454 |

| Wolverine World Wide, Inc. | | 120,185 | 4,252 |

| Youngone Corp. | | 500,000 | 13,561 |

| Youngone Holdings Co. Ltd. (b) | | 889,600 | 42,903 |

| Yue Yuen Industrial (Holdings) Ltd. | | 5,095,500 | 13,698 |

| | | | 494,031 |

|

| TOTAL CONSUMER DISCRETIONARY | | | 8,037,747 |

|

| CONSUMER STAPLES - 8.4% | | | |

| Beverages - 1.6% | | | |

| A.G. Barr PLC | | 3,076,444 | 27,337 |

| Baron de Ley SA (c) | | 129,900 | 16,861 |

| Britvic PLC | | 6,452,327 | 68,091 |

| C&C Group PLC | | 1,890,226 | 7,604 |

| Jinro Distillers Co. Ltd. | | 47,081 | 1,294 |

| Monster Beverage Corp. (c) | | 6,712,002 | 402,854 |

| Muhak Co. Ltd. (b) | | 2,799,256 | 38,087 |

| Olvi PLC (A Shares) | | 99,277 | 3,738 |

| Spritzer Bhd | | 5,120,400 | 3,023 |

| Yantai Changyu Pioneer Wine Co. Ltd. (B Shares) | | 2,799,936 | 7,473 |

| | | | 576,362 |

| Food & Staples Retailing - 5.0% | | | |

| Amsterdam Commodities NV | | 139,172 | 3,263 |

| Aoki Super Co. Ltd. | | 225,000 | 2,652 |

| Australasian Foods Holdco Pty Ltd. (c)(d) | | 3,481,102 | 2,328 |

| Belc Co. Ltd. (b) | | 1,650,600 | 79,124 |

| Casey's General Stores, Inc. | | 18,000 | 1,969 |

| Cosmos Pharmaceutical Corp. | | 999,900 | 219,895 |

| Create SD Holdings Co. Ltd. (b) | | 5,347,100 | 132,942 |

| Daikokutenbussan Co. Ltd. | | 548,800 | 24,295 |

| Dong Suh Companies, Inc. | | 1,100,000 | 25,192 |

| Genky DrugStores Co. Ltd. | | 733,600 | 25,358 |

| Halows Co. Ltd. (b) | | 1,292,700 | 29,828 |

| Kirindo Holdings Co. Ltd. | | 151,200 | 3,067 |

| Kroger Co. | | 1,840,934 | 53,387 |

| Kusuri No Aoki Holdings Co. Ltd. | | 745,800 | 54,694 |

| Majestic Wine PLC | | 1,796,432 | 10,563 |

| McColl's Retail Group PLC | | 1,446,367 | 2,848 |

| Medical System Network Co. Ltd. | | 69,500 | 283 |

| Metro, Inc. Class A (sub. vtg.) (b) | | 24,662,015 | 831,515 |

| North West Co., Inc. | | 111,752 | 2,553 |

| Performance Food Group Co. (c) | | 196,165 | 7,033 |

| Qol Co. Ltd. | | 1,852,300 | 30,415 |

| Retail Partners Co. Ltd. | | 440,200 | 6,016 |

| Sligro Food Group NV (a) | | 350,919 | 14,526 |

| Sundrug Co. Ltd. | | 3,048,000 | 121,849 |

| Tesco PLC | | 3,001,515 | 10,250 |

| Thai President Foods PCL | | 512,288 | 2,387 |

| Total Produce PLC | | 8,923,590 | 23,165 |

| United Natural Foods, Inc. (c) | | 1,247,519 | 40,170 |

| Valor Holdings Co. Ltd. | | 488,000 | 10,466 |

| Walgreens Boots Alliance, Inc. | | 27,852 | 1,883 |

| Walmart, Inc. | | 33,935 | 3,028 |

| Yaoko Co. Ltd. | | 948,100 | 49,010 |

| | | | 1,825,954 |

| Food Products - 1.6% | | | |

| Aryzta AG (a) | | 850,479 | 12,029 |

| Carr's Group PLC | | 2,230,900 | 4,334 |

| Cranswick PLC | | 450,611 | 19,364 |

| Dean Foods Co. | | 196,383 | 1,928 |

| Devro PLC | | 1,450,246 | 3,746 |

| Food Empire Holdings Ltd. (b) | | 39,079,200 | 17,941 |

| Fresh Del Monte Produce, Inc. (b) | | 4,812,249 | 174,685 |

| Hilton Food Group PLC | | 666,255 | 8,360 |

| Inghams Group Ltd. (a) | | 1,677,688 | 4,574 |

| Ingredion, Inc. | | 22,634 | 2,293 |

| Japan Meat Co. Ltd. | | 167,800 | 3,165 |

| Kaveri Seed Co. Ltd. | | 82,484 | 736 |

| Mitsui Sugar Co. Ltd. | | 351,300 | 10,651 |

| Nam Yang Dairy Products | | 10,500 | 6,045 |

| Natori Co. Ltd. | | 49,900 | 826 |

| Origin Enterprises PLC (b) | | 9,199,309 | 64,974 |

| Pacific Andes International Holdings Ltd. (c)(d) | | 106,378,500 | 989 |

| Pacific Andes Resources Development Ltd. (c)(d) | | 207,240,893 | 1,675 |

| Pickles Corp. | | 99,600 | 1,980 |

| Rocky Mountain Chocolate Factory, Inc. (b) | | 436,321 | 4,481 |

| S Foods, Inc. | | 402,100 | 15,769 |

| Seaboard Corp. | | 39,475 | 143,610 |

| Select Harvests Ltd. (a) | | 3,909,740 | 17,428 |

| Sunjin Co. Ltd. (b)(c) | | 2,376,955 | 29,566 |

| The Hain Celestial Group, Inc. (c) | | 300,527 | 8,547 |

| Want Want China Holdings Ltd. | | 13,499,000 | 11,162 |

| | | | 570,858 |

| Household Products - 0.0% | | | |

| Central Garden & Pet Co. Class A (non-vtg.) (c) | | 87,630 | 3,516 |

| Personal Products - 0.1% | | | |

| Grape King Bio Ltd. | | 1,748,000 | 13,433 |

| Natural Alternatives International, Inc. (c) | | 131,621 | 1,336 |

| Sarantis SA (b) | | 4,005,208 | 32,784 |

| | | | 47,553 |

| Tobacco - 0.1% | | | |

| Karelia Tobacco Co., Inc. | | 1,610 | 520 |

| Scandinavian Tobacco Group A/S (e) | | 1,775,731 | 28,896 |

| | | | 29,416 |

|

| TOTAL CONSUMER STAPLES | | | 3,053,659 |

|

| ENERGY - 5.0% | | | |

| Energy Equipment & Services - 1.6% | | | |

| AKITA Drilling Ltd. Class A (non-vtg.) | | 1,472,682 | 5,513 |

| Bristow Group, Inc. (b)(c) | | 2,147,436 | 30,021 |

| Carbo Ceramics, Inc. (c) | | 970,992 | 9,059 |

| Cathedral Energy Services Ltd. (c) | | 1,326,950 | 1,193 |

| Diamond Offshore Drilling, Inc. (a)(c) | | 4,250,530 | 81,610 |

| Divestco, Inc. (c) | | 2,899,000 | 178 |

| Dril-Quip, Inc. (c) | | 195,745 | 10,091 |

| Ensco PLC Class A | | 11,026,797 | 81,929 |

| Fugro NV (Certificaten Van Aandelen) (a)(c) | | 1,321,088 | 19,055 |

| Geospace Technologies Corp. (b)(c) | | 1,148,900 | 16,165 |

| Gulf Island Fabrication, Inc. | | 59,879 | 542 |

| GulfMark Offshore, Inc. warrants 11/14/24 (c) | | 76,904 | 192 |

| John Wood Group PLC | | 683,959 | 5,833 |

| Liberty Oilfield Services, Inc. Class A (a) | | 1,500,783 | 29,415 |

| National Oilwell Varco, Inc. | | 249,728 | 12,142 |

| Oceaneering International, Inc. | | 399,941 | 10,942 |

| Oil States International, Inc. (c) | | 2,315,809 | 80,822 |

| PHX Energy Services Corp. (c) | | 1,369,526 | 2,148 |

| RigNet, Inc. (c) | | 65,049 | 800 |

| Shinko Plantech Co. Ltd. | | 1,174,900 | 11,085 |

| Smart Sand, Inc. (c) | | 125,008 | 725 |

| Solstad Offshore ASA (a)(c) | | 2,067,803 | 1,557 |

| Total Energy Services, Inc. | | 2,054,043 | 17,369 |

| Transocean Ltd. (United States) (a)(c) | | 2,885,654 | 37,138 |

| Unit Corp. (b)(c) | | 5,387,244 | 134,142 |

| | | | 599,666 |

| Oil, Gas & Consumable Fuels - 3.4% | | | |

| Adams Resources & Energy, Inc. | | 136,169 | 5,447 |

| Andeavor | | 1,123,672 | 168,618 |

| Beach Energy Ltd. | | 15,782,560 | 22,396 |

| Bonavista Energy Corp. | | 278,447 | 334 |

| Chevron Corp. | | 199,965 | 25,250 |

| CNX Resources Corp. (c) | | 293,265 | 4,774 |

| ConocoPhillips Co. | | 873,295 | 63,026 |

| CONSOL Energy, Inc. (c) | | 48,446 | 2,017 |

| Contango Oil & Gas Co. (b)(c) | | 2,599,689 | 14,584 |

| Denbury Resources, Inc. (c) | | 5,743,600 | 25,904 |

| Eni SpA | | 7,285,345 | 140,232 |

| Fuji Kosan Co. Ltd. (b) | | 637,500 | 3,729 |

| Great Eastern Shipping Co. Ltd. | | 5,100,000 | 22,494 |

| Hankook Shell Oil Co. Ltd. | | 49,000 | 15,468 |

| International Seaways, Inc. (c) | | 23,313 | 508 |

| KyungDong City Gas Co. Ltd. | | 208,063 | 8,241 |

| Kyungdong Invest Co. Ltd. | | 84,315 | 3,673 |

| Marathon Oil Corp. | | 3,736,234 | 78,909 |

| Marathon Petroleum Corp. | | 136,564 | 11,038 |

| Michang Oil Industrial Co. Ltd. (b) | | 173,900 | 12,557 |

| Murphy Oil Corp. (b) | | 10,909,025 | 362,834 |

| NACCO Industries, Inc. Class A | | 176,552 | 5,826 |

| Newfield Exploration Co. (c) | | 378,210 | 10,862 |

| QEP Resources, Inc. (c) | | 1,697,069 | 17,633 |

| Reliance Industries Ltd. | | 162,800 | 2,820 |

| Southwestern Energy Co. (c) | | 12,800,316 | 65,794 |

| Star Petroleum Refining PCL | | 7,445,700 | 3,267 |

| Thai Oil PCL (For. Reg.) | | 371,400 | 896 |

| Whitecap Resources, Inc. | | 456,136 | 3,012 |

| Whiting Petroleum Corp. (c) | | 1,398,961 | 69,458 |

| World Fuel Services Corp. | | 1,864,425 | 51,887 |

| WPX Energy, Inc. (c) | | 1,036,018 | 19,446 |

| | | | 1,242,934 |

|

| TOTAL ENERGY | | | 1,842,600 |

|

| FINANCIALS - 11.3% | | | |

| Banks - 1.1% | | | |

| ACNB Corp. | | 94,455 | 3,240 |

| Associated Banc-Corp. | | 175,888 | 4,749 |

| BancFirst Corp. | | 65,670 | 4,078 |

| Bank Ireland Group PLC | | 11,458,526 | 98,349 |

| Bank of America Corp. | | 125,951 | 3,889 |

| Boston Private Financial Holdings, Inc. | | 192,787 | 2,776 |

| Camden National Corp. | | 55,435 | 2,556 |

| Cathay General Bancorp | | 625,752 | 26,025 |

| Central Pacific Financial Corp. | | 147,641 | 4,069 |

| Codorus Valley Bancorp, Inc. (b) | | 624,297 | 19,497 |

| Cullen/Frost Bankers, Inc. | | 79,615 | 8,797 |

| Dah Sing Banking Group Ltd. | | 1,713,200 | 3,636 |

| Dimeco, Inc. | | 36,256 | 1,504 |

| East West Bancorp, Inc. | | 26,000 | 1,683 |

| First Bancorp, Puerto Rico (c) | | 4,650,140 | 38,224 |

| First Citizen Bancshares, Inc. | | 8,884 | 3,614 |

| First Hawaiian, Inc. | | 452,374 | 12,784 |

| Hanmi Financial Corp. | | 49,905 | 1,250 |

| Hope Bancorp, Inc. | | 798,410 | 13,397 |

| Huntington Bancshares, Inc. | | 263,871 | 4,074 |

| KeyCorp | | 148,277 | 3,095 |

| LCNB Corp. | | 141,217 | 2,627 |

| Meridian Bank/Malvern, PA (c) | | 148,930 | 2,593 |

| Northrim Bancorp, Inc. | | 114,636 | 4,620 |

| OFG Bancorp | | 435,546 | 7,252 |

| Peoples Bancorp, Inc. | | 52,121 | 1,888 |

| PNC Financial Services Group, Inc. | | 27,404 | 3,969 |

| Popular, Inc. | | 34,800 | 1,727 |

| Regions Financial Corp. | | 203,911 | 3,795 |

| SpareBank 1 SR-Bank ASA (primary capital certificate) | | 1,233,555 | 13,702 |

| Sparebanken More (primary capital certificate) | | 208,532 | 6,954 |

| Sparebanken Nord-Norge | | 2,315,482 | 17,600 |

| Umpqua Holdings Corp. | | 125,800 | 2,680 |

| Van Lanschot NV (Bearer) | | 1,062,198 | 29,313 |

| Wells Fargo & Co. | | 841,197 | 48,192 |

| | | | 408,198 |

| Capital Markets - 0.5% | | | |

| AllianceBernstein Holding LP | | 700,127 | 21,144 |

| Ameriprise Financial, Inc. | | 13,730 | 2,000 |

| Ares Capital Corp. | | 200,000 | 3,370 |

| Banca Generali SpA | | 129,514 | 3,495 |

| Close Brothers Group PLC | | 138,145 | 2,879 |

| Cowen Group, Inc. Class A (a)(c) | | 408,471 | 6,413 |

| Franklin Resources, Inc. | | 1,082,698 | 37,158 |

| GAMCO Investors, Inc. Class A | | 107,994 | 2,645 |

| Hamilton Lane, Inc. Class A | | 91,919 | 4,501 |

| Invesco Ltd. | | 108,593 | 2,931 |

| Lazard Ltd. Class A | | 352,724 | 19,153 |

| OM Asset Management Ltd. | | 204,456 | 2,913 |

| State Street Corp. | | 172,431 | 15,227 |

| Tullett Prebon PLC | | 709,958 | 2,609 |

| Waddell & Reed Financial, Inc. Class A | | 2,470,604 | 51,166 |

| | | | 177,604 |

| Consumer Finance - 1.3% | | | |

| Aeon Credit Service (Asia) Co. Ltd. | | 12,750,000 | 10,802 |

| American Express Co. | | 37,528 | 3,735 |

| Discover Financial Services | | 563,749 | 40,257 |

| H&T Group PLC | | 538,783 | 2,235 |

| Navient Corp. | | 1,126,615 | 14,883 |

| Nicholas Financial, Inc. (c) | | 359,572 | 3,308 |

| OneMain Holdings, Inc. (c) | | 685,356 | 22,788 |

| Santander Consumer U.S.A. Holdings, Inc. | | 9,040,082 | 173,931 |

| Synchrony Financial | | 6,694,447 | 193,737 |

| | | | 465,676 |

| Diversified Financial Services - 0.2% | | | |

| AXA Equitable Holdings, Inc. | | 2,195,561 | 48,280 |

| Far East Horizon Ltd. | | 2,513,000 | 2,420 |

| Newship Ltd. (c)(d) | | 2,500 | 906 |

| Ricoh Leasing Co. Ltd. | | 765,600 | 24,992 |

| | | | 76,598 |

| Insurance - 7.3% | | | |

| AEGON NV | | 45,707,932 | 301,557 |

| AFLAC, Inc. | | 654,832 | 30,476 |

| Allstate Corp. | | 40,170 | 3,821 |

| April | | 2,187,623 | 34,790 |

| ASR Nederland NV | | 556,991 | 24,945 |

| Assurant, Inc. | | 2,400,088 | 264,730 |

| Aub Group Ltd. | | 246,187 | 2,398 |

| Axis Capital Holdings Ltd. | | 1,600,497 | 90,524 |

| CNO Financial Group, Inc. | | 186,864 | 3,803 |

| Employers Holdings, Inc. | | 92,040 | 4,275 |

| FBD Holdings PLC | | 145,047 | 1,755 |

| First American Financial Corp. | | 109,261 | 6,119 |

| Great-West Lifeco, Inc. | | 46,294 | 1,144 |

| Hartford Financial Services Group, Inc. | | 1,896,469 | 99,944 |

| Hiscox Ltd. | | 240,081 | 5,036 |

| Hyundai Fire & Marine Insurance Co. Ltd. | | 114,734 | 3,776 |

| Investors Title Co. | | 7,423 | 1,421 |

| Lincoln National Corp. | | 4,474,622 | 304,722 |

| MetLife, Inc. | | 10,559,047 | 482,971 |

| National Western Life Group, Inc. | | 132,121 | 42,807 |

| NN Group NV | | 1,151,464 | 50,923 |

| Primerica, Inc. | | 123,713 | 14,202 |

| Principal Financial Group, Inc. | | 53,703 | 3,119 |

| RenaissanceRe Holdings Ltd. | | 1,686,076 | 222,309 |

| Sony Financial Holdings, Inc. | | 2,445,000 | 46,984 |

| The Travelers Companies, Inc. | | 28,419 | 3,698 |

| Torchmark Corp. | | 89,244 | 7,860 |

| Universal Insurance Holdings, Inc. | | 45,491 | 2,020 |

| Unum Group (b) | | 15,095,575 | 599,747 |

| WMI Holdings Corp. (c) | | 385,255 | 524 |

| | | | 2,662,400 |

| Mortgage Real Estate Investment Trusts - 0.5% | | | |

| Annaly Capital Management, Inc. | | 14,680,820 | 157,378 |

| MFA Financial, Inc. | | 277,769 | 2,236 |

| New Residential Investment Corp. | | 24,468 | 438 |

| Redwood Trust, Inc. | | 481,349 | 8,091 |

| | | | 168,143 |

| Thrifts & Mortgage Finance - 0.4% | | | |

| ASAX Co. Ltd. | | 333,800 | 1,914 |

| Genworth MI Canada, Inc. | | 4,000,817 | 140,829 |

| Genworth Mortgage Insurance Ltd. | | 6,179,851 | 12,351 |

| Meridian Bancorp, Inc. Maryland | | 211,193 | 3,865 |

| | | | 158,959 |

|

| TOTAL FINANCIALS | | | 4,117,578 |

|

| HEALTH CARE - 14.2% | | | |

| Biotechnology - 1.6% | | | |

| Amgen, Inc. | | 2,860,423 | 562,216 |

| Celgene Corp. (c) | | 9,789 | 882 |

| Gilead Sciences, Inc. | | 193,052 | 15,025 |

| United Therapeutics Corp. (c) | | 37,343 | 4,590 |

| | | | 582,713 |

| Health Care Equipment & Supplies - 0.8% | | | |

| Apex Biotechnology Corp. | | 1,200,000 | 1,099 |

| Arts Optical International Holdings Ltd. (b) | | 22,612,000 | 5,935 |

| Boston Scientific Corp. (c) | | 252,681 | 8,493 |

| Hoshiiryou Sanki Co. Ltd. (b) | | 298,464 | 10,891 |

| Huvitz Co. Ltd. | | 25,000 | 272 |

| LivaNova PLC (c) | | 64,834 | 7,140 |

| Microlife Corp. | | 3,683,500 | 10,323 |

| Nakanishi, Inc. | | 974,700 | 20,354 |

| Pacific Hospital Supply Co. Ltd. | | 1,454,000 | 3,148 |

| Prim SA (b) | | 1,437,100 | 22,014 |

| ResMed, Inc. | | 76,907 | 8,135 |

| Shandong Weigao Medical Polymer Co. Ltd. (H Shares) | | 928,000 | 709 |

| St.Shine Optical Co. Ltd. | | 2,000,000 | 44,014 |

| Supermax Corp. Bhd | | 10,000,000 | 10,750 |

| Techno Medica Co. Ltd. | | 38,800 | 734 |

| Utah Medical Products, Inc. (b) | | 283,123 | 27,463 |

| Zimmer Biomet Holdings, Inc. | | 800,062 | 100,424 |

| | | | 281,898 |

| Health Care Providers & Services - 10.6% | | | |

| Aetna, Inc. | | 4,166,607 | 784,947 |

| Anthem, Inc. | | 1,872,031 | 473,624 |

| CVS Health Corp. | | 555,122 | 36,005 |

| DVx, Inc. (b) | | 698,000 | 8,927 |

| Hanger, Inc. (b)(c) | | 2,494,350 | 43,651 |

| Hi-Clearance, Inc. | | 1,489,000 | 4,864 |

| Humana, Inc. | | 9,482 | 2,979 |

| Laboratory Corp. of America Holdings (c) | | 9,938 | 1,743 |

| Medica Sur SA de CV | | 333,308 | 679 |

| MEDNAX, Inc. (c) | | 490,950 | 21,008 |

| Patterson Companies, Inc. | | 249,574 | 6,120 |

| Premier, Inc. (c) | | 143,733 | 5,376 |

| Quest Diagnostics, Inc. | | 28,948 | 3,118 |

| Ship Healthcare Holdings, Inc. | | 131,400 | 5,094 |

| Tokai Corp. | | 342,500 | 7,495 |

| Triple-S Management Corp. (b)(c) | | 1,665,016 | 59,125 |

| Tsukui Corp. | | 375,300 | 3,393 |

| United Drug PLC (United Kingdom) | | 2,506,632 | 27,637 |

| UnitedHealth Group, Inc. | | 8,971,989 | 2,271,890 |

| Universal Health Services, Inc. Class B | | 612,771 | 74,819 |

| WIN-Partners Co. Ltd. (b) | | 2,528,500 | 37,651 |

| | | | 3,880,145 |

| Health Care Technology - 0.1% | | | |

| Addlife AB | | 299,732 | 7,193 |

| Computer Programs & Systems, Inc. (a) | | 139,215 | 4,344 |

| ND Software Co. Ltd. (b) | | 1,204,400 | 12,926 |

| | | | 24,463 |

| Pharmaceuticals - 1.1% | | | |

| Akorn, Inc. (c) | | 91,905 | 1,702 |

| Apex Healthcare Bhd | | 47,600 | 83 |

| Bliss Gvs Pharma Ltd. (c) | | 4,600,000 | 11,547 |

| Bristol-Myers Squibb Co. | | 45,818 | 2,692 |

| Daewon Pharmaceutical Co. Ltd. (b) | | 1,871,384 | 32,353 |

| Daewoong Co. Ltd. | | 350,000 | 4,621 |

| Dawnrays Pharmaceutical Holdings Ltd. | | 11,111,000 | 6,342 |

| DongKook Pharmaceutical Co. Ltd. (b) | | 623,700 | 35,177 |

| FDC Ltd. (c) | | 3,141,164 | 11,049 |

| Fuji Pharma Co. Ltd. | | 648,700 | 11,267 |

| Genomma Lab Internacional SA de CV (c) | | 5,507,300 | 4,394 |

| Indivior PLC (c) | | 16,590,396 | 66,590 |

| Jazz Pharmaceuticals PLC (c) | | 24,335 | 4,212 |

| Korea United Pharm, Inc. | | 239,629 | 5,144 |

| Kwang Dong Pharmaceutical Co. Ltd. (b) | | 3,100,000 | 20,881 |

| Kyung Dong Pharmaceutical Co. Ltd. | | 960,000 | 10,432 |

| Lee's Pharmaceutical Holdings Ltd. | | 5,959,000 | 6,385 |

| Novo Nordisk A/S Series B sponsored ADR | | 1,076,594 | 53,582 |

| Phibro Animal Health Corp. Class A | | 142,459 | 6,824 |

| Recordati SpA | | 1,541,484 | 57,645 |

| Taro Pharmaceutical Industries Ltd. (c) | | 45,405 | 5,097 |

| Tsumura & Co. | | 349,700 | 11,337 |

| Vivimed Labs Ltd. (c) | | 600,000 | 496 |

| Whanin Pharmaceutical Co. Ltd. (b) | | 1,750,000 | 33,084 |

| | | | 402,936 |

|

| TOTAL HEALTH CARE | | | 5,172,155 |

|

| INDUSTRIALS - 7.0% | | | |

| Aerospace & Defense - 0.2% | | | |

| Astronics Corp. (c) | | 75,489 | 3,096 |

| Austal Ltd. | | 1,411,147 | 1,793 |

| Engility Holdings, Inc. (c) | | 1,268,833 | 43,902 |

| United Technologies Corp. | | 72,961 | 9,904 |

| | | | 58,695 |

| Air Freight & Logistics - 0.0% | | | |

| Air T, Inc. (b)(c) | | 184,505 | 6,043 |

| Airlines - 0.1% | | | |

| Air New Zealand Ltd. | | 1,189,535 | 2,631 |

| American Airlines Group, Inc. | | 256,054 | 10,124 |

| JetBlue Airways Corp. (c) | | 359,150 | 6,465 |

| | | | 19,220 |

| Building Products - 0.1% | | | |

| Builders FirstSource, Inc. (c) | | 129,752 | 2,326 |

| Continental Building Products, Inc. (c) | | 336,645 | 10,739 |

| COVIA Corp. (a)(c) | | 402,013 | 7,248 |

| Gibraltar Industries, Inc. (c) | | 106,527 | 4,629 |

| Kondotec, Inc. (b) | | 1,566,200 | 14,329 |

| | | | 39,271 |

| Commercial Services & Supplies - 0.7% | | | |

| ABM Industries, Inc. | | 223,185 | 6,963 |

| Aeon Delight Co. Ltd. | | 114,700 | 4,190 |

| AJIS Co. Ltd. (b) | | 892,800 | 27,747 |

| Asia File Corp. Bhd | | 4,480,000 | 3,031 |

| Calian Technologies Ltd. (b) | | 625,174 | 15,163 |

| Civeo Corp. (b)(c) | | 11,929,673 | 45,452 |

| Essendant, Inc. | | 1,650,608 | 27,450 |

| Fursys, Inc. (b) | | 950,000 | 25,681 |

| Interface, Inc. | | 265,304 | 5,943 |

| KAR Auction Services, Inc. | | 37,054 | 2,203 |

| Lion Rock Group Ltd. | | 19,227,640 | 3,332 |

| Mears Group PLC | | 837,111 | 3,571 |

| Mitie Group PLC | | 13,439,459 | 27,130 |

| Nac Co. Ltd. | | 349,700 | 3,068 |

| NICE Total Cash Management Co., Ltd. | | 1,025,000 | 12,059 |

| VICOM Ltd. | | 2,653,500 | 11,948 |

| VSE Corp. (b) | | 839,329 | 36,175 |

| | | | 261,106 |

| Construction & Engineering - 1.1% | | | |

| AECOM (c) | | 6,933,069 | 232,674 |

| Arcadis NV | | 2,139,787 | 39,134 |

| Astaldi SpA (c) | | 2,589,900 | 5,857 |

| Boustead Projs. Pte Ltd. | | 1,033,287 | 687 |

| Boustead Singapore Ltd. | | 4,044,700 | 2,451 |

| C-Cube Corp. | | 322,700 | 2,658 |

| Daiichi Kensetsu Corp. (b) | | 1,728,700 | 27,504 |

| EMCOR Group, Inc. | | 151,109 | 11,628 |

| Geumhwa PSC Co. Ltd. (b) | | 360,000 | 10,669 |

| Kyeryong Construction Industrial Co. Ltd. (b)(c) | | 675,000 | 13,397 |

| Meisei Industrial Co. Ltd. | | 1,104,500 | 8,920 |

| Mirait Holdings Corp. | | 400,300 | 6,143 |

| Nippon Rietec Co. Ltd. | | 1,168,900 | 16,538 |

| Severfield PLC | | 2,762,161 | 3,009 |

| Shinnihon Corp. | | 1,574,500 | 19,897 |

| Toshiba Plant Systems & Services Corp. | | 164,500 | 3,635 |

| United Integrated Services Co. | | 5,143,500 | 9,822 |

| | | | 414,623 |

| Electrical Equipment - 0.5% | | | |

| Aichi Electric Co. Ltd. | | 311,100 | 9,251 |

| Aros Quality Group AB | | 725,232 | 13,444 |

| AZZ, Inc. | | 1,015,476 | 55,039 |

| Bharat Heavy Electricals Ltd. | | 30,750,000 | 33,261 |

| Chiyoda Integre Co. Ltd. | | 329,500 | 7,285 |

| Eaton Corp. PLC | | 48,307 | 4,018 |

| Generac Holdings, Inc. (c) | | 91,005 | 4,892 |

| Hammond Power Solutions, Inc. Class A | | 452,561 | 2,498 |

| I-Sheng Electric Wire & Cable Co. Ltd. (b) | | 12,500,000 | 17,495 |

| Korea Electric Terminal Co. Ltd. (b) | | 700,000 | 28,981 |

| Regal Beloit Corp. | | 46,710 | 4,015 |

| Servotronics, Inc. | | 114,683 | 1,104 |

| TKH Group NV (depositary receipt) | | 240,518 | 15,061 |

| | | | 196,344 |

| Industrial Conglomerates - 1.0% | | | |

| DCC PLC (United Kingdom) | | 3,221,853 | 298,133 |

| ITT, Inc. | | 84,533 | 4,790 |

| Lifco AB | | 500,191 | 22,441 |

| Mytilineos Holdings SA | | 890,419 | 8,954 |

| Reunert Ltd. | | 1,699,842 | 10,534 |

| | | | 344,852 |

| Machinery - 1.5% | | | |

| Aalberts Industries NV (b) | | 6,646,561 | 301,560 |

| Allison Transmission Holdings, Inc. | | 419,467 | 19,715 |

| ASL Marine Holdings Ltd. (b)(c) | | 45,187,913 | 3,319 |

| Cummins, Inc. | | 24,953 | 3,564 |

| Douglas Dynamics, Inc. | | 31,800 | 1,561 |

| Foremost Income Fund (c) | | 2,141,103 | 8,814 |

| Global Brass & Copper Holdings, Inc. | | 47,206 | 1,555 |

| Haitian International Holdings Ltd. | | 6,946,000 | 16,372 |

| Hurco Companies, Inc. | | 54,895 | 2,432 |

| Hwacheon Machine Tool Co. Ltd. (b) | | 219,900 | 10,270 |

| Hyster-Yale Materials Handling: | | | |

| Class A (b) | | 232,017 | 15,257 |

| Class B (b) | | 310,000 | 20,386 |

| Ihara Science Corp. (b) | | 983,500 | 19,975 |

| Jaya Holdings Ltd. (b)(c)(d) | | 3,239,440 | 69 |

| Kyowakogyosyo Co. Ltd. | | 45,000 | 2,612 |

| Luxfer Holdings PLC sponsored | | 306,766 | 5,675 |

| Maruzen Co. Ltd. (b) | | 1,589,000 | 31,406 |

| Miller Industries, Inc. | | 93,896 | 2,446 |

| Mincon Group PLC | | 2,158,692 | 3,786 |

| Nadex Co. Ltd. (b) | | 795,500 | 7,449 |

| Nakano Refrigerators Co. Ltd. | | 25,700 | 1,368 |

| Nitchitsu Co. Ltd. | | 55,800 | 915 |

| Rexnord Corp. (c) | | 227,335 | 6,875 |

| Semperit AG Holding (c) | | 439,700 | 8,741 |

| SIMPAC, Inc. | | 583,000 | 1,526 |

| Takamatsu Machinery Co. Ltd. | | 323,200 | 3,399 |

| Techno Smart Corp. (a) | | 529,900 | 5,649 |

| Tocalo Co. Ltd. | | 3,065,000 | 34,977 |

| Trinity Industrial Corp. | | 721,900 | 4,584 |

| WABCO Holdings, Inc. (c) | | 79,375 | 9,976 |

| | | | 556,233 |

| Marine - 0.0% | | | |

| SITC International Holdings Co. Ltd. | | 4,512,000 | 4,380 |

| Tokyo Kisen Co. Ltd. (b) | | 829,500 | 5,987 |

| | | | 10,367 |

| Professional Services - 0.3% | | | |

| Akka Technologies SA | | 225,557 | 16,617 |

| Asiakastieto Group Oyj (e) | | 82,580 | 2,965 |

| Boardroom Ltd. | | 2,574,042 | 1,475 |

| Clarius Group Ltd. (c) | | 1,956,883 | 77 |

| ICF International, Inc. | | 64,876 | 4,778 |

| Kelly Services, Inc. Class A (non-vtg.) | | 112,368 | 2,729 |

| McMillan Shakespeare Ltd. | | 1,800,353 | 21,736 |

| Nielsen Holdings PLC | | 511,628 | 12,054 |

| Robert Half International, Inc. | | 52,600 | 3,985 |

| SHL-JAPAN Ltd. | | 101,800 | 1,788 |

| Sporton International, Inc. | | 309,088 | 1,455 |

| Stantec, Inc. | | 750,247 | 19,592 |

| Synergie SA | | 127,600 | 5,961 |

| TrueBlue, Inc. (c) | | 283,809 | 7,677 |

| | | | 102,889 |

| Road & Rail - 0.7% | | | |

| Alps Logistics Co. Ltd. (b) | | 2,856,400 | 21,765 |

| Chilled & Frozen Logistics Holdings Co. Ltd. | | 1,098,500 | 13,194 |

| CSX Corp. | | 126,724 | 8,957 |

| Daqin Railway Co. Ltd. (A Shares) | | 26,000,000 | 34,157 |

| Hamakyorex Co. Ltd. (b) | | 1,253,500 | 43,329 |

| Higashi Twenty One Co. Ltd. | | 250,200 | 1,423 |

| Knight-Swift Transportation Holdings, Inc. Class A | | 147,000 | 4,785 |

| Norfolk Southern Corp. | | 39,845 | 6,734 |

| Roadrunner Transportation Systems, Inc. (b)(c) | | 3,155,561 | 6,911 |

| Sakai Moving Service Co. Ltd. (b) | | 1,081,600 | 57,168 |

| Trancom Co. Ltd. (b) | | 855,500 | 62,738 |

| | | | 261,161 |

| Trading Companies & Distributors - 0.7% | | | |

| AddTech AB (B Shares) | | 1,131,928 | 25,643 |

| AerCap Holdings NV (c) | | 232,124 | 13,029 |

| Alconix Corp. (b) | | 2,120,300 | 32,597 |

| Goodfellow, Inc. (b)(c) | | 723,079 | 4,058 |

| HD Supply Holdings, Inc. (c) | | 479,818 | 21,102 |

| HERIGE | | 60,993 | 2,511 |

| Houston Wire & Cable Co. (c) | | 76,246 | 610 |

| Kaman Corp. | | 42,219 | 2,796 |

| KS Energy Services Ltd. (c) | | 13,173,500 | 310 |

| Lumax International Corp. Ltd. | | 3,123,900 | 6,221 |

| Meiwa Corp. | | 1,717,700 | 7,451 |

| Mitani Shoji Co. Ltd. | | 735,300 | 34,195 |

| MRC Global, Inc. (c) | | 460,407 | 10,428 |

| Otec Corp. | | 124,300 | 2,289 |

| Parker Corp. (b) | | 2,220,000 | 10,960 |

| Richelieu Hardware Ltd. | | 700,992 | 15,169 |

| Senshu Electric Co. Ltd. (b) | | 894,900 | 26,771 |

| Strongco Corp. (b)(c) | | 849,615 | 1,437 |

| Tanaka Co. Ltd. | | 36,800 | 230 |

| TECHNO ASSOCIE Co. Ltd. | | 255,100 | 3,080 |

| Titan Machinery, Inc. (c) | | 729,535 | 11,045 |

| Totech Corp. (b) | | 926,400 | 21,516 |

| WESCO International, Inc. (c) | | 51,801 | 3,160 |

| | | | 256,608 |

| Transportation Infrastructure - 0.1% | | | |

| Isewan Terminal Service Co. Ltd. | | 1,292,700 | 8,509 |

| James Fisher and Sons PLC | | 127,253 | 3,010 |

| Meiko Transportation Co. Ltd. | | 829,400 | 9,064 |

| Qingdao Port International Co. Ltd. (e) | | 4,711,000 | 3,433 |

| Sinwa Ltd. (b) | | 20,399,000 | 3,446 |

| | | | 27,462 |

|

| TOTAL INDUSTRIALS | | | 2,554,874 |

|

| INFORMATION TECHNOLOGY - 16.5% | | | |

| Communications Equipment - 0.1% | | | |

| F5 Networks, Inc. (c) | | 22,931 | 3,930 |

| InterDigital, Inc. | | 150,998 | 12,450 |

| Juniper Networks, Inc. | | 176,774 | 4,656 |

| | | | 21,036 |

| Electronic Equipment & Components - 4.9% | | | |

| A&D Co. Ltd. | | 683,100 | 6,390 |

| AVX Corp. | | 150,000 | 3,117 |

| Bel Fuse, Inc. Class A | | 84,717 | 1,660 |

| Casa Systems, Inc. (c) | | 97,021 | 1,478 |

| CDW Corp. | | 174,276 | 14,655 |

| CTS Corp. | | 314,181 | 10,965 |

| Daido Signal Co. Ltd. | | 99,400 | 524 |

| Dynapack International Technology Corp. | | 3,200,000 | 4,076 |

| Elec & Eltek International Co. Ltd. | | 1,491,300 | 2,177 |

| Elematec Corp. (b) | | 1,180,800 | 27,752 |

| ePlus, Inc. (c) | | 99,513 | 9,817 |

| Excel Co. Ltd. (b) | | 745,800 | 16,942 |

| Fabrinet | | 112,812 | 4,413 |

| Hi-P International Ltd. | | 11,932,100 | 11,044 |

| Hon Hai Precision Industry Co. Ltd. (Foxconn) | | 182,476,140 | 500,033 |

| IDIS Holdings Co. Ltd. (b) | | 800,000 | 10,166 |

| Image Sensing Systems, Inc. (c) | | 64,468 | 271 |

| Insight Enterprises, Inc. (c) | | 299,412 | 15,051 |

| Intelligent Digital Integrated Security Co. Ltd. (b) | | 900,010 | 7,137 |

| INTOPS Co. Ltd. (b) | | 1,719,800 | 14,024 |

| Isra Vision AG (b) | | 1,250,390 | 76,909 |

| Keysight Technologies, Inc. (c) | | 2,635,824 | 152,878 |

| Kingboard Chemical Holdings Ltd. (b) | | 76,053,500 | 265,008 |

| Kingboard Laminates Holdings Ltd. | | 3,725,000 | 4,452 |

| Mesa Laboratories, Inc. | | 135,046 | 27,310 |

| Muramoto Electronic Thailand PCL (For. Reg.) (b) | | 1,228,600 | 7,016 |

| Nippo Ltd. (b) | | 736,700 | 2,971 |

| PAX Global Technology Ltd. | | 4,075,000 | 1,957 |

| Philips Lighting NV (e) | | 110,968 | 3,078 |

| Pinnacle Technology Holdings Ltd. | | 7,337,376 | 10,420 |

| Plexus Corp. (c) | | 148,139 | 8,802 |

| Redington India Ltd. | | 14,700,000 | 23,190 |

| Sanmina Corp. (c) | | 24,468 | 712 |

| ScanSource, Inc. (b)(c) | | 2,258,403 | 93,159 |

| Shibaura Electronics Co. Ltd. (b) | | 626,300 | 26,494 |

| Sigmatron International, Inc. (c) | | 170,707 | 1,193 |

| Simplo Technology Co. Ltd. | | 6,300,000 | 36,567 |

| SYNNEX Corp. (b) | | 2,700,847 | 260,551 |

| Tomen Devices Corp. (b) | | 538,200 | 13,785 |

| Tripod Technology Corp. | | 1,465,000 | 4,043 |

| TTM Technologies, Inc. (c) | | 934,794 | 16,228 |

| UKC Holdings Corp. (b) | | 1,272,500 | 25,947 |

| VST Holdings Ltd. (b) | | 118,976,800 | 64,422 |

| Wayside Technology Group, Inc. (b) | | 275,041 | 3,713 |

| Wireless Telecom Group, Inc. (c) | | 295,018 | 620 |

| | | | 1,793,117 |

| Internet Software & Services - 0.2% | | | |

| Alphabet, Inc.: | | | |

| Class A (c) | | 1,497 | 1,837 |

| Class C (c) | | 9,507 | 11,572 |

| Aucnet, Inc. | | 197,300 | 2,947 |

| Carbonite, Inc. (c) | | 218,985 | 7,511 |

| eBay, Inc. (c) | | 45,613 | 1,526 |

| Gabia, Inc. (b) | | 975,000 | 8,126 |

| j2 Global, Inc. | | 199,818 | 16,953 |

| Moneysupermarket.com Group PLC | | 744,253 | 3,068 |

| NetGem SA | | 849,884 | 2,345 |

| Softbank Technology Corp. (a) | | 256,800 | 4,568 |

| Yahoo! Japan Corp. (a) | | 1,957,300 | 7,447 |

| | | | 67,900 |

| IT Services - 3.7% | | | |

| ALTEN | | 610,716 | 60,666 |

| Amdocs Ltd. | | 6,376,612 | 430,931 |

| Argo Graphics, Inc. | | 393,600 | 15,365 |

| CACI International, Inc. Class A (c) | | 64,279 | 11,262 |

| Computer Services, Inc. | | 258,354 | 13,370 |

| CSE Global Ltd. (b) | | 40,677,900 | 13,446 |

| Data#3 Ltd. | | 2,804,497 | 3,177 |

| Dimerco Data System Corp. | | 510,000 | 615 |

| DXC Technology Co. | | 75,473 | 6,396 |

| E-Credible Co. Ltd. | | 129,349 | 1,748 |

| eClerx Services Ltd. | | 1,684,608 | 31,807 |

| EOH Holdings Ltd. | | 6,392,071 | 20,146 |

| Estore Corp. | | 283,800 | 2,452 |

| EVERTEC, Inc. | | 1,460,509 | 34,030 |

| ExlService Holdings, Inc. (c) | | 179,079 | 10,680 |

| Indra Sistemas SA (b)(c) | | 12,849,300 | 156,113 |

| Know IT AB (b) | | 1,392,111 | 27,548 |

| Leidos Holdings, Inc. | | 640,839 | 43,846 |

| Maximus, Inc. | | 312,392 | 20,246 |

| Net 1 UEPS Technologies, Inc. (c) | | 460,597 | 4,302 |

| Nice Information & Telecom, Inc. | | 53,000 | 1,159 |

| Rolta India Ltd. (c) | | 2,699,942 | 1,625 |

| Science Applications International Corp. | | 162,081 | 13,675 |

| Societe Pour L'Informatique Industrielle SA (b) | | 1,657,239 | 48,447 |

| Softcreate Co. Ltd. | | 602,100 | 9,391 |

| Sword Group | | 12,289 | 503 |

| Syntel, Inc. (c) | | 64,178 | 2,605 |

| The Western Union Co. | | 17,925,734 | 361,383 |

| TravelSky Technology Ltd. (H Shares) | | 1,005,000 | 2,849 |

| WNS Holdings Ltd. sponsored ADR (c) | | 73,352 | 3,569 |

| | | | 1,353,352 |

| Semiconductors & Semiconductor Equipment - 0.7% | | | |

| Amkor Technology, Inc. (c) | | 24,468 | 212 |

| Axell Corp. (b) | | 762,700 | 5,341 |

| Boe Varitronix Ltd. | | 5,034,000 | 1,988 |

| Cirrus Logic, Inc. (c) | | 73,110 | 3,163 |

| Diodes, Inc. (c) | | 268,979 | 9,995 |

| Entegris, Inc. | | 311,564 | 10,951 |

| Integrated Device Technology, Inc. (c) | | 463,127 | 15,945 |

| KLA-Tencor Corp. | | 23,456 | 2,754 |

| Leeno Industrial, Inc. | | 575,000 | 34,547 |

| Melexis NV | | 1,148,100 | 106,798 |

| Miraial Co. Ltd. | | 150,000 | 1,528 |

| Nanometrics, Inc. (c) | | 243,795 | 9,181 |

| ON Semiconductor Corp. (c) | | 205,718 | 4,536 |

| Phison Electronics Corp. | | 1,900,000 | 15,781 |

| Powertech Technology, Inc. | | 9,000,000 | 25,457 |

| Trio-Tech International (b)(c) | | 224,608 | 1,038 |

| United Microelectronics Corp. | | 4,331,000 | 2,483 |

| | | | 251,698 |

| Software - 3.4% | | | |

| Activision Blizzard, Inc. | | 148,513 | 10,904 |

| AdaptIT Holdings Ltd. | | 2,514,434 | 1,575 |

| ANSYS, Inc. (c) | | 3,525,193 | 595,335 |

| Aspen Technology, Inc. (c) | | 118,525 | 11,354 |

| Ebix, Inc. | | 1,500,202 | 119,041 |

| ICT Automatisering NV (b) | | 491,679 | 8,682 |

| InfoVine Co. Ltd. (b) | | 175,000 | 3,709 |

| Jorudan Co. Ltd. (b) | | 422,500 | 4,066 |

| KPIT Cummins Infosystems Ltd. | | 5,800,000 | 25,179 |

| KSK Co., Ltd. (b) | | 531,500 | 8,551 |

| Micro Focus International PLC | | 215,068 | 3,509 |

| Nucleus Software Exports Ltd. | | 601,191 | 3,034 |

| Oracle Corp. | | 8,039,806 | 383,338 |

| Pegasystems, Inc. | | 149,658 | 8,321 |

| Pro-Ship, Inc. | | 252,500 | 5,578 |

| RealPage, Inc. (c) | | 203,287 | 11,201 |

| Vitec Software Group AB | | 699,586 | 6,460 |

| Zensar Technologies Ltd. | | 800,000 | 14,441 |

| | | | 1,224,278 |

| Technology Hardware, Storage & Peripherals - 3.5% | | | |

| Compal Electronics, Inc. | | 67,500,000 | 41,938 |

| Hewlett Packard Enterprise Co. | | 2,064,640 | 31,878 |

| HP, Inc. | | 6,460,356 | 149,105 |

| Seagate Technology LLC (b) | | 18,610,388 | 979,279 |

| Super Micro Computer, Inc. (c) | | 632,618 | 13,981 |

| TPV Technology Ltd. | | 69,600,000 | 7,183 |

| Western Digital Corp. | | 41,758 | 2,929 |

| Xerox Corp. | | 2,446,803 | 63,543 |

| | | | 1,289,836 |

|

| TOTAL INFORMATION TECHNOLOGY | | | 6,001,217 |

|

| MATERIALS - 3.6% | | | |

| Chemicals - 2.4% | | | |

| Axalta Coating Systems Ltd. (c) | | 492,665 | 14,903 |

| C. Uyemura & Co. Ltd. | | 383,800 | 28,833 |

| Cabot Corp. | | 15,344 | 1,014 |

| Chase Corp. (b) | | 679,101 | 83,869 |

| Core Molding Technologies, Inc. | | 381,326 | 5,129 |

| Deepak Fertilisers and Petrochemicals Corp. Ltd. | | 1,800,000 | 7,267 |

| Deepak Nitrite Ltd. (c) | | 41,557 | 147 |

| DowDuPont, Inc. | | 49,070 | 3,375 |

| Eastman Chemical Co. | | 28,944 | 2,999 |

| EcoGreen International Group Ltd. (b) | | 50,122,080 | 10,664 |

| FMC Corp. | | 1,193,224 | 107,247 |

| Fujikura Kasei Co., Ltd. (b) | | 2,711,200 | 15,712 |

| Fuso Chemical Co. Ltd. | | 598,800 | 15,289 |

| Gujarat Narmada Valley Fertilizers Co. | | 5,000,000 | 30,485 |

| Gujarat State Fertilizers & Chemicals Ltd. (b) | | 28,500,000 | 48,562 |

| Honshu Chemical Industry Co. Ltd. (b) | | 762,700 | 7,715 |

| Huntsman Corp. | | 291,429 | 9,772 |

| Innospec, Inc. | | 799,627 | 64,730 |

| JSR Corp. | | 262,200 | 5,021 |

| KPC Holdings Corp. | | 43,478 | 2,452 |

| KPX Chemical Co. Ltd. | | 163,083 | 9,652 |

| KPX Green Chemical Co. Ltd. | | 225,000 | 875 |

| Miwon Chemicals Co. Ltd. | | 55,095 | 2,311 |

| Miwon Commercial Co. Ltd. | | 13,819 | 3,109 |

| Muto Seiko Co. Ltd. | | 238,200 | 1,638 |

| Nihon Parkerizing Co. Ltd. | | 307,700 | 4,554 |

| Nippon Soda Co. Ltd. | | 1,575,000 | 9,226 |

| SK Kaken Co. Ltd. | | 275,000 | 25,578 |

| Soken Chemical & Engineer Co. Ltd. (b) | | 667,000 | 12,151 |

| T&K Toka Co. Ltd. (b) | | 1,345,700 | 15,501 |

| Thai Carbon Black PCL (For. Reg.) (c) | | 11,472,900 | 18,104 |

| Thai Rayon PCL: | | | |

| (For. Reg.) | | 2,719,500 | 3,842 |

| NVDR | | 85,600 | 121 |

| The Chemours Co. LLC | | 259,548 | 11,890 |

| The Mosaic Co. | | 3,298,433 | 99,316 |

| UPL Ltd. | | 875,000 | 8,232 |

| Westlake Chemical Corp. | | 101,311 | 10,863 |

| Yara International ASA | | 3,498,135 | 154,350 |

| Yip's Chemical Holdings Ltd. | | 25,692,000 | 9,001 |

| | | | 865,499 |

| Construction Materials - 0.1% | | | |

| Brampton Brick Ltd. Class A (sub. vtg.) (c) | | 672,772 | 4,189 |

| Mitani Sekisan Co. Ltd. (b) | | 1,490,300 | 36,133 |

| RHI Magnesita NV | | 43,869 | 2,770 |

| | | | 43,092 |

| Containers & Packaging - 0.3% | | | |

| AMVIG Holdings Ltd. | | 3,472,000 | 854 |

| Berry Global Group, Inc. (c) | | 83,586 | 4,083 |

| Chuoh Pack Industry Co. Ltd. (b) | | 421,800 | 5,281 |

| Kohsoku Corp. (b) | | 1,737,600 | 21,243 |

| Pact Group Holdings Ltd. (e) | | 689,421 | 2,771 |

| Samhwa Crown & Closure Co. Ltd. | | 50,000 | 2,120 |

| Silgan Holdings, Inc. | | 190,711 | 5,246 |

| The Pack Corp. (b) | | 1,560,900 | 49,627 |

| | | | 91,225 |

| Metals & Mining - 0.7% | | | |

| Alcoa Corp. (c) | | 34,934 | 1,512 |

| Ausdrill Ltd. | | 2,095,496 | 2,841 |

| Chubu Steel Plate Co. Ltd. | | 414,300 | 2,542 |

| Cleveland-Cliffs, Inc. (a)(c) | | 12,750,121 | 137,574 |

| Compania de Minas Buenaventura SA sponsored ADR | | 2,256,390 | 31,003 |

| Freeport-McMoRan, Inc. | | 258,702 | 4,269 |

| Granges AB | | 262,218 | 3,283 |

| Hill & Smith Holdings PLC | | 799,599 | 15,816 |

| Newmont Mining Corp. | | 79,236 | 2,906 |

| Nucor Corp. | | 24,700 | 1,653 |

| Orosur Mining, Inc. (c) | | 2,974,432 | 137 |

| Orvana Minerals Corp. (c) | | 764,857 | 106 |

| Pacific Metals Co. Ltd. (c) | | 348,000 | 10,031 |

| Steel Dynamics, Inc. | | 73,859 | 3,478 |

| Tohoku Steel Co. Ltd. (b) | | 625,700 | 8,562 |

| Tokyo Tekko Co. Ltd. (b) | | 762,100 | 11,941 |

| Universal Stainless & Alloy Products, Inc. (c) | | 73,632 | 2,202 |

| Warrior Metropolitan Coal, Inc. (a) | | 1,036,929 | 26,825 |

| Webco Industries, Inc. (c) | | 7,595 | 851 |

| Worthington Industries, Inc. | | 78,970 | 3,697 |

| | | | 271,229 |

| Paper & Forest Products - 0.1% | | | |

| Louisiana-Pacific Corp. | | 105,226 | 2,833 |

| Stella-Jones, Inc. | | 596,610 | 19,928 |

| Western Forest Products, Inc. | | 1,949,247 | 3,626 |

| | | | 26,387 |

|

| TOTAL MATERIALS | | | 1,297,432 |

|

| REAL ESTATE - 0.7% | | | |

| Equity Real Estate Investment Trusts (REITs) - 0.3% | | | |

| Colony NorthStar, Inc. | | 1,910,980 | 11,772 |

| Corporate Office Properties Trust (SBI) | | 93,052 | 2,767 |

| Corrections Corp. of America | | 1,359,201 | 34,850 |

| Four Corners Property Trust, Inc. | | 220,706 | 5,496 |

| National Health Investors, Inc. | | 28,419 | 2,127 |

| NSI NV | | 8,335 | 325 |

| NSI NV rights 8/9/18 (c) | | 8,335 | 10 |

| Public Storage | | 12,800 | 2,788 |

| Spirit MTA REIT (c) | | 9,530 | 95 |

| Spirit Realty Capital, Inc. | | 531,805 | 4,451 |

| Store Capital Corp. | | 200,862 | 5,514 |

| Ventas, Inc. | | 55,322 | 3,119 |

| VEREIT, Inc. | | 3,614,188 | 27,576 |

| Washington Prime Group, Inc. | | 92,996 | 747 |

| | | | 101,637 |

| Real Estate Management & Development - 0.4% | | | |

| Anabuki Kosan, Inc. | | 42,950 | 1,198 |

| CBRE Group, Inc. (c) | | 65,075 | 3,241 |

| Century21 Real Estate Japan Ltd. | | 97,300 | 1,081 |

| Devine Ltd. (c) | | 1,760,889 | 412 |

| IMMOFINANZ Immobilien Anlagen AG | | 102,412 | 2,694 |

| Leopalace21 Corp. | | 1,496,900 | 8,220 |

| LSL Property Services PLC | | 1,400,272 | 4,779 |

| Relo Group, Inc. | | 3,800,400 | 102,815 |

| Selvaag Bolig ASA | | 944,200 | 5,145 |

| Servcorp Ltd. | | 759,770 | 2,461 |

| Sino Land Ltd. | | 2,776,000 | 4,768 |

| Tejon Ranch Co. (c) | | 432,058 | 10,110 |

| Wing Tai Holdings Ltd. | | 1,723,800 | 2,621 |

| | | | 149,545 |

|

| TOTAL REAL ESTATE | | | 251,182 |

|

| TELECOMMUNICATION SERVICES - 0.0% | | | |

| Diversified Telecommunication Services - 0.0% | | | |

| AT&T, Inc. | | 19,715 | 630 |

| UTILITIES - 1.8% | | | |

| Electric Utilities - 1.6% | | | |

| Exelon Corp. | | 3,264,039 | 138,722 |

| PG&E Corp. | | 3,243,471 | 139,729 |

| PPL Corp. | | 10,079,627 | 289,991 |

| | | | 568,442 |

| Gas Utilities - 0.1% | | | |

| Busan City Gas Co. Ltd. | | 13,931 | 456 |

| China Resource Gas Group Ltd. | | 758,000 | 3,592 |

| Hokuriku Gas Co. | | 152,700 | 4,199 |

| K&O Energy Group, Inc. | | 537,200 | 9,018 |

| Keiyo Gas Co. Ltd. | | 118,900 | 3,095 |

| Star Gas Partners LP | | 198,111 | 1,904 |

| | | | 22,264 |

| Independent Power and Renewable Electricity Producers - 0.1% | | | |

| Mega First Corp. Bhd (b) | | 32,700,045 | 28,477 |

| Mega First Corp. Bhd warrants 4/8/20 (c) | | 3,800,000 | 1,570 |

| The AES Corp. | | 225,550 | 3,013 |

| | | | 33,060 |

| Multi-Utilities - 0.0% | | | |

| CMS Energy Corp. | | 321,690 | 15,550 |

| Water Utilities - 0.0% | | | |

| Manila Water Co., Inc. | | 5,619,100 | 2,809 |

|

| TOTAL UTILITIES | | | 642,125 |

|

| TOTAL COMMON STOCKS | | | |

| (Cost $15,203,651) | | | 32,971,199 |

|

| Nonconvertible Preferred Stocks - 0.1% | | | |

| CONSUMER STAPLES - 0.0% | | | |

| Food Products - 0.0% | | | |

| Nam Yang Dairy Products | | 4,917 | 910 |

| ENERGY - 0.0% | | | |

| Oil, Gas & Consumable Fuels - 0.0% | | | |

| Centrus Energy Corp. 7.50% (c)(d)(e) | | 6,395 | 224 |

| INDUSTRIALS - 0.0% | | | |

| Industrial Conglomerates - 0.0% | | | |

| Steel Partners Holdings LP Series A, 6.00% | | 163,209 | 3,721 |

| MATERIALS - 0.1% | | | |

| Construction Materials - 0.1% | | | |

| Buzzi Unicem SpA (Risparmio Shares) | | 1,531,895 | 19,060 |

| TOTAL NONCONVERTIBLE PREFERRED STOCKS | | | |

| (Cost $20,295) | | | 23,915 |

| | | Principal Amount (000s) | Value (000s) |

|

| Nonconvertible Bonds - 0.0% | | | |

| ENERGY - 0.0% | | | |

| Oil, Gas & Consumable Fuels - 0.0% | | | |

| Centrus Energy Corp. 8.25% 2/28/27 (e) | | | |

| (Cost $10,585) | | 4,603 | 3,683 |

| | | Shares | Value (000s) |

|

| Money Market Funds - 10.0% | | | |

| Fidelity Cash Central Fund, 1.96% (f) | | 3,328,477,024 | 3,329,143 |

| Fidelity Securities Lending Cash Central Fund 1.97% (f)(g) | | 319,049,263 | 319,081 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $3,647,672) | | | 3,648,224 |

| TOTAL INVESTMENT IN SECURITIES - 100.7% | | | |

| (Cost $18,882,203) | | | 36,647,021 |

| NET OTHER ASSETS (LIABILITIES) - (0.7)% | | | (236,869) |

| NET ASSETS - 100% | | | $36,410,152 |

Values shown as $0 in the Schedule of Investments may reflect amounts less than $500.

Legend

(a) Security or a portion of the security is on loan at period end.

(b) Affiliated company

(c) Non-income producing

(d) Level 3 security

(e) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $45,050,000 or 0.1% of net assets.

(f) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

(g) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| | (Amounts in thousands) |

| Fidelity Cash Central Fund | $52,293 |

| Fidelity Securities Lending Cash Central Fund | 7,783 |

| Total | $60,076 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations if applicable.

Other Affiliated Issuers

An affiliated company is a company in which the Fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are as follows:

| Affiliate | Value, beginning of period | Purchases | Sales Proceeds(a) | Dividend Income | Realized Gain (loss) | Change in Unrealized appreciation (depreciation) | Value, end of period |

| Aalberts Industries NV | $357,923 | $-- | $77,681 | $4,784 | $52,119 | $(30,801) | $301,560 |

| Abbey PLC | 30,976 | -- | 1,526 | 372 | 1,261 | 1,062 | 31,773 |

| Abercrombie & Fitch Co. Class A | 51,336 | -- | 61,625 | 3,691 | (15,171) | 90,609 | -- |

| Accell Group NV | 57,199 | -- | 3,104 | 910 | 657 | (18,175) | 36,577 |

| Air T, Inc. | 3,276 | -- | 493 | -- | 334 | 2,926 | 6,043 |

| AJIS Co. Ltd. | 18,967 | -- | 1,161 | 414 | 820 | 9,121 | 27,747 |

| Alconix Corp. | 22,007 | -- | 2,016 | 572 | 1,396 | 11,210 | 32,597 |

| Alps Logistics Co. Ltd. | 21,604 | -- | 1,169 | 433 | 642 | 688 | 21,765 |

| Ark Restaurants Corp. | 4,524 | -- | 998 | 176 | 431 | (415) | -- |

| Arts Optical International Holdings Ltd. | 8,599 | -- | 414 | 62 | (119) | (2,131) | 5,935 |

| ASL Marine Holdings Ltd. | 4,442 | -- | 168 | -- | (15) | (940) | 3,319 |

| Assurant, Inc. | 322,168 | -- | 65,530 | 6,180 | 48,908 | (40,816) | -- |

| ASTI Corp. | 5,592 | -- | 895 | 91 | 640 | (1,397) | 3,940 |

| Atwood Oceanics, Inc. | 57,677 | -- | 67,863 | -- | (126,131) | 136,317 | -- |

| Axell Corp. | 5,428 | -- | 308 | 32 | (582) | 803 | 5,341 |

| Barratt Developments PLC | 615,294 | -- | 28,428 | 43,026 | 21,622 | (102,147) | 506,341 |

| Bed Bath & Beyond, Inc. | 274,957 | 30,030 | 160,399 | 5,908 | (93,805) | (12,034) | -- |

| Belc Co. Ltd. | 80,741 | -- | 7,138 | 977 | 5,989 | (468) | 79,124 |

| Belluna Co. Ltd. | 87,499 | -- | 6,957 | 743 | 4,100 | (3,297) | 81,345 |

| Best Buy Co., Inc. | 1,088,006 | 2,576 | 362,793 | 25,768 | 224,048 | 59,930 | -- |

| Black Box Corp. | 12,338 | -- | 2,847 | -- | (38,169) | 28,678 | -- |

| BMTC Group, Inc. | 39,153 | -- | 5,793 | 960 | 5,569 | 4,014 | 42,943 |

| Bristow Group, Inc. | 3,659 | 22,570 | 358 | -- | 92 | 4,058 | 30,021 |

| Calian Technologies Ltd. | 15,187 | -- | 1,273 | 497 | 702 | 547 | 15,163 |

| Chase Corp. | 78,401 | 2,051 | 7,606 | 575 | 5,538 | 5,485 | 83,869 |

| Chilled & Frozen Logistics Holdings Co. Ltd. | 15,688 | -- | 2,866 | 205 | 1,673 | (1,301) | -- |

| Chuoh Pack Industry Co. Ltd. | 5,111 | -- | 274 | 142 | 153 | 291 | 5,281 |

| Civeo Corp. | 24,148 | -- | 1,847 | -- | 720 | 22,431 | 45,452 |

| Clip Corp. | 2,382 | -- | 120 | 92 | 50 | (57) | 2,255 |

| Codorus Valley Bancorp, Inc. | 18,561 | 222 | 2,336 | 381 | 1,129 | 1,921 | 19,497 |

| Contango Oil & Gas Co. | 12,450 | 2,763 | 672 | -- | (408) | 451 | 14,584 |

| Core Molding Technologies, Inc. | 13,648 | -- | 6,519 | 102 | 2,301 | (4,301) | -- |

| Cosmos Pharmaceutical Corp. | 262,818 | -- | 47,647 | 834 | 43,190 | (38,466) | -- |

| Create SD Holdings Co. Ltd. | 146,994 | -- | 12,250 | 1,557 | 9,121 | (10,923) | 132,942 |

| CSE Global Ltd. | 13,065 | -- | 565 | 852 | 79 | 867 | 13,446 |

| Daewon Pharmaceutical Co. Ltd. | 29,918 | -- | -- | 360 | -- | 2,435 | 32,353 |

| Daiichi Kensetsu Corp. | 22,034 | -- | 1,285 | 439 | 765 | 5,990 | 27,504 |

| DCC PLC (United Kingdom) | 464,436 | -- | 196,034 | 6,362 | 176,252 | (146,521) | -- |

| Deepak Fertilisers and Petrochemicals Corp. Ltd. | 33,595 | -- | 23,589 | 454 | 13,841 | (16,580) | -- |

| DongKook Pharmaceutical Co. Ltd. | 33,526 | -- | -- | 251 | -- | 1,651 | 35,177 |

| DVx, Inc. | 8,368 | -- | 406 | 136 | 290 | 675 | 8,927 |

| Ebix, Inc. | 158,009 | -- | 96,463 | 741 | 75,105 | (17,610) | -- |

| EcoGreen International Group Ltd. | 10,836 | -- | 474 | 312 | 121 | 181 | 10,664 |

| Elematec Corp. | 22,459 | -- | 1,364 | 646 | 873 | 5,784 | 27,752 |

| Essendant, Inc. | 27,007 | 173 | 6,981 | 1,144 | (1,660) | 8,911 | -- |

| Excel Co. Ltd. | 10,314 | -- | 1,106 | 477 | 623 | 7,111 | 16,942 |

| Ff Group | 109,703 | -- | 4,363 | -- | 2,143 | (82,992) | 24,491 |

| First Juken Co. Ltd. | 21,090 | -- | 1,061 | 498 | 770 | (3,251) | 17,548 |

| Food Empire Holdings Ltd. | 20,674 | -- | 1,657 | 181 | 616 | (1,692) | 17,941 |

| Fossil Group, Inc. | 22,766 | 18,570 | 2,633 | -- | 1,727 | 67,986 | 108,416 |

| Fresh Del Monte Produce, Inc. | 262,477 | -- | 13,440 | 2,980 | 7,209 | (81,561) | 174,685 |

| Fuji Kosan Co. Ltd. | 3,565 | -- | 170 | 86 | (11) | 345 | 3,729 |

| Fujikura Kasei Co., Ltd. | 16,713 | -- | 832 | 365 | 238 | (407) | 15,712 |

| Fursys, Inc. | 28,374 | -- | -- | 590 | -- | (2,693) | 25,681 |

| Gabia, Inc. | 5,328 | -- | -- | 23 | -- | 2,798 | 8,126 |

| GameStop Corp. Class A | 216,839 | -- | 101,453 | 14,883 | (86,627) | 14,910 | -- |

| Genky Stores, Inc. | 28,711 | -- | 443 | 76 | 373 | (23,251) | -- |

| Geospace Technologies Corp. | 18,545 | -- | 704 | -- | (378) | (1,298) | 16,165 |

| Geumhwa PSC Co. Ltd. | 12,086 | -- | -- | 251 | -- | (1,417) | 10,669 |

| Goodfellow, Inc. | 4,738 | -- | 218 | -- | 130 | (592) | 4,058 |

| Guess?, Inc. | 68,134 | -- | 4,995 | 4,567 | (1,855) | 50,613 | 111,897 |

| Gujarat State Fertilizers & Chemicals Ltd. | 65,224 | -- | 3,971 | 1,037 | 737 | (13,428) | 48,562 |

| GulfMark Offshore, Inc. Class A | 413 | -- | 10,214 | -- | (4) | 9,805 | -- |

| Halows Co. Ltd. | 29,437 | -- | 1,627 | 268 | 1,109 | 909 | 29,828 |

| Hamakyorex Co. Ltd. | 34,778 | -- | 1,834 | 475 | 1,038 | 9,347 | 43,329 |

| Handsome Co. Ltd. | 68,497 | -- | 4,222 | 576 | 3,260 | 271 | 67,806 |

| Hanger, Inc. | 30,525 | -- | 2,098 | -- | (916) | 16,140 | 43,651 |

| Helen of Troy Ltd. | 196,442 | -- | 25,213 | -- | 23,984 | (2,742) | 192,471 |

| Hiday Hidaka Corp. | 60,332 | -- | 21,838 | 636 | 16,679 | (15,929) | 39,244 |

| Honshu Chemical Industry Co. Ltd. | 7,501 | -- | 769 | 181 | 360 | 623 | 7,715 |

| Hoshiiryou Sanki Co. Ltd. | 11,966 | -- | 552 | 101 | 276 | (799) | 10,891 |

| Hurco Companies, Inc. | 16,735 | 63 | 17,861 | 56 | 11,707 | (8,212) | -- |

| Hwacheon Machine Tool Co. Ltd. | 11,663 | -- | -- | 213 | -- | (1,393) | 10,270 |

| Hyster-Yale Materials Handling Class A | 15,417 | 1,786 | 831 | 267 | 709 | (1,824) | 15,257 |

| Hyster-Yale Materials Handling Class B | 21,967 | -- | -- | 377 | -- | (1,581) | 20,386 |

| I-Sheng Electric Wire & Cable Co. Ltd. | 17,852 | -- | -- | 1,044 | -- | (357) | 17,495 |

| IA Group Corp. | 3,759 | -- | 192 | 119 | 32 | 388 | 3,987 |

| ICT Automatisering NV | 9,019 | -- | 1,872 | 175 | 474 | 1,061 | 8,682 |

| IDIS Holdings Co. Ltd. | 9,322 | -- | -- | 93 | -- | 844 | 10,166 |

| Ihara Science Corp. | 20,475 | -- | 1,311 | 375 | 975 | (164) | 19,975 |

| Indra Sistemas SA | 212,977 | -- | 12,135 | -- | (4,348) | (40,381) | 156,113 |

| InfoVine Co. Ltd. | 4,250 | -- | -- | 147 | -- | (541) | 3,709 |

| Intage Holdings, Inc. | 35,728 | -- | 2,241 | 564 | 1,507 | (750) | 34,244 |

| Intelligent Digital Integrated Security Co. Ltd. | 6,509 | -- | -- | 140 | -- | 628 | 7,137 |

| INTOPS Co. Ltd. | 18,044 | -- | -- | 263 | -- | (4,020) | 14,024 |

| INZI Controls Co. Ltd. | 6,917 | -- | -- | 176 | -- | 490 | 7,407 |

| Isra Vision AG | 65,170 | -- | 27,568 | 195 | 24,859 | 14,448 | 76,909 |

| Jaya Holdings Ltd. | 206 | -- | -- | -- | (24) | (113) | 69 |

| JLM Couture, Inc. | 511 | -- | 31 | -- | (11) | 798 | 1,267 |

| Jorudan Co. Ltd. | 4,478 | -- | 331 | 47 | 82 | (163) | 4,066 |

| Jumbo SA | 176,166 | -- | 8,644 | 3,722 | 6,737 | (13,617) | 160,642 |

| Kingboard Chemical Holdings Ltd. | 370,346 | -- | 32,877 | 15,860 | 24,580 | (97,041) | 265,008 |

| Know IT AB | 24,210 | -- | 2,074 | 651 | 1,079 | 4,333 | 27,548 |

| Kohsoku Corp. | 18,103 | -- | 997 | 410 | 558 | 3,579 | 21,243 |

| Kondotec, Inc. | 14,958 | -- | 720 | 316 | 588 | (497) | 14,329 |

| Korea Electric Terminal Co. Ltd. | 44,065 | -- | -- | 375 | -- | (15,084) | 28,981 |

| KSK Co., Ltd. | 7,360 | -- | 420 | 211 | 286 | 1,325 | 8,551 |

| Kwang Dong Pharmaceutical Co. Ltd. | 23,334 | -- | -- | 192 | -- | (2,453) | 20,881 |

| Kyeryong Construction Industrial Co. Ltd. | 11,076 | -- | 280 | -- | (20) | 2,621 | 13,397 |

| Maruzen Co. Ltd. | 27,369 | -- | 1,699 | 355 | 1,386 | 4,350 | 31,406 |

| Mega First Corp. Bhd | 29,328 | -- | -- | 318 | -- | (851) | 28,477 |

| Mega First Corp. Bhd warrants 4/8/20 | 1,794 | -- | 43 | -- | 43 | (224) | -- |

| Mesa Laboratories, Inc. | 34,239 | -- | 19,351 | 145 | 17,943 | (5,521) | -- |

| Metro, Inc. Class A (sub. vtg.) | 876,121 | -- | 38,601 | 11,655 | 36,447 | (42,452) | 831,515 |

| Michang Oil Industrial Co. Ltd. | 13,913 | -- | -- | 230 | -- | (1,356) | 12,557 |

| Mitani Sekisan Co. Ltd. | 36,788 | -- | 1,729 | 294 | 1,391 | (317) | 36,133 |

| Motonic Corp. | 28,729 | -- | -- | 883 | -- | (2,460) | 26,269 |

| Mr. Bricolage SA | 16,992 | -- | 768 | 509 | 258 | (3,247) | 13,235 |

| Muhak Co. Ltd. | 56,738 | -- | -- | 760 | -- | (18,651) | 38,087 |

| Murakami Corp. | 17,692 | -- | 1,131 | 237 | 956 | 3,833 | 21,350 |

| Muramoto Electronic Thailand PCL (For. Reg.) | 9,120 | -- | 717 | 298 | 74 | (1,461) | 7,016 |

| Murphy Oil Corp. | 209,012 | 91,767 | 11,932 | 8,707 | 5,119 | 68,868 | 362,834 |

| Nac Co. Ltd. | 8,739 | -- | 5,396 | 96 | (5,141) | 4,866 | -- |

| Nadex Co. Ltd. | 6,782 | -- | 462 | 316 | 316 | 813 | 7,449 |

| Nafco Co. Ltd. | 32,256 | -- | 1,611 | 620 | 668 | 481 | 31,794 |

| Nakayamafuku Co. Ltd. | 7,504 | -- | 2,087 | 187 | (384) | (240) | -- |

| ND Software Co. Ltd. | 13,121 | -- | 648 | 202 | 321 | 132 | 12,926 |

| Next PLC | 720,096 | -- | 75,390 | 43,815 | 48,769 | 296,200 | 989,675 |

| NICE Total Cash Management Co., Ltd. | 12,891 | -- | 4,227 | 117 | 3,271 | 124 | -- |

| Nippo Ltd. | 2,397 | -- | 178 | 25 | 66 | 686 | 2,971 |

| Nucleus Software Exports Ltd. | 9,766 | -- | 9,099 | 90 | 5,213 | (2,846) | -- |

| Nutraceutical International Corp. | 41,542 | -- | 41,542 | -- | 27,850 | (27,850) | -- |

| Origin Enterprises PLC | 75,152 | -- | 3,245 | 2,387 | 665 | (7,598) | 64,974 |

| P&F Industries, Inc. Class A | 1,986 | 62 | 119 | 65 | 29 | 725 | 2,683 |

| Parker Corp. | 12,168 | -- | 678 | 187 | 505 | (1,035) | 10,960 |

| Piolax, Inc. | 72,133 | -- | 3,355 | 938 | 3,114 | (11,615) | 60,277 |

| Prim SA | 19,681 | -- | 914 | 829 | 297 | 2,950 | 22,014 |

| Qol Co. Ltd. | 31,384 | -- | 1,761 | 437 | 1,242 | (450) | -- |

| RenaissanceRe Holdings Ltd. | 326,272 | -- | 73,384 | 2,308 | 62,131 | (92,710) | -- |