UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-649

Fidelity Puritan Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

William C. Coffey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | July 31 |

| |

Date of reporting period: | July 31, 2019 |

Item 1.

Reports to Stockholders

Fidelity® Low-Priced Stock Fund

Annual Report July 31, 2019 |

|

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary, such as a financial advisor, broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a fund electronically, by contacting your financial intermediary. For Fidelity customers, visit Fidelity's web site or call Fidelity using the contact information listed below.

You may elect to receive all future reports in paper free of charge. If you wish to continue receiving paper copies of your shareholder reports, you may contact your financial intermediary or, if you are a Fidelity customer, visit Fidelity’s website, or call Fidelity at the applicable toll-free number listed below. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

| Account Type | Website | Phone Number |

| Brokerage, Mutual Fund, or Annuity Contracts: | fidelity.com/mailpreferences | 1-800-343-3548 |

| Employer Provided Retirement Accounts: | netbenefits.fidelity.com/preferences (choose 'no' under Required Disclosures to continue to print) | 1-800-343-0860 |

| Advisor Sold Accounts Serviced Through Your Financial Intermediary: | Contact Your Financial Intermediary | Your Financial Intermediary's phone number |

| Advisor Sold Accounts Serviced by Fidelity: | institutional.fidelity.com | 1-877-208-0098 |

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 if you’re an individual investing directly with Fidelity, call 1-800-835-5092 if you’re a plan sponsor or participant with Fidelity as your recordkeeper or call 1-877-208-0098 on institutional accounts or if you’re an advisor or invest through one to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2019 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended July 31, 2019 | Past 1 year | Past 5 years | Past 10 years |

| Fidelity® Low-Priced Stock Fund | (1.20)% | 6.55% | 11.99% |

| Class K | (1.10)% | 6.66% | 12.11% |

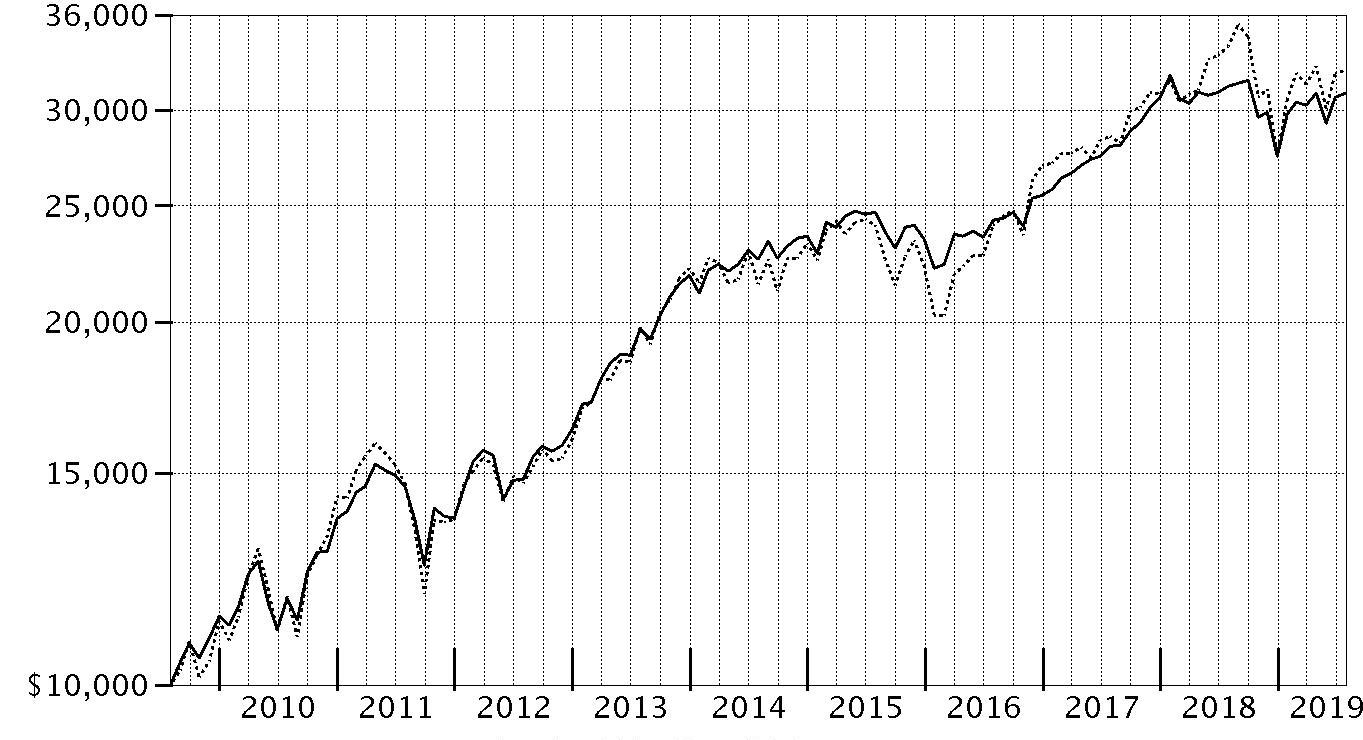

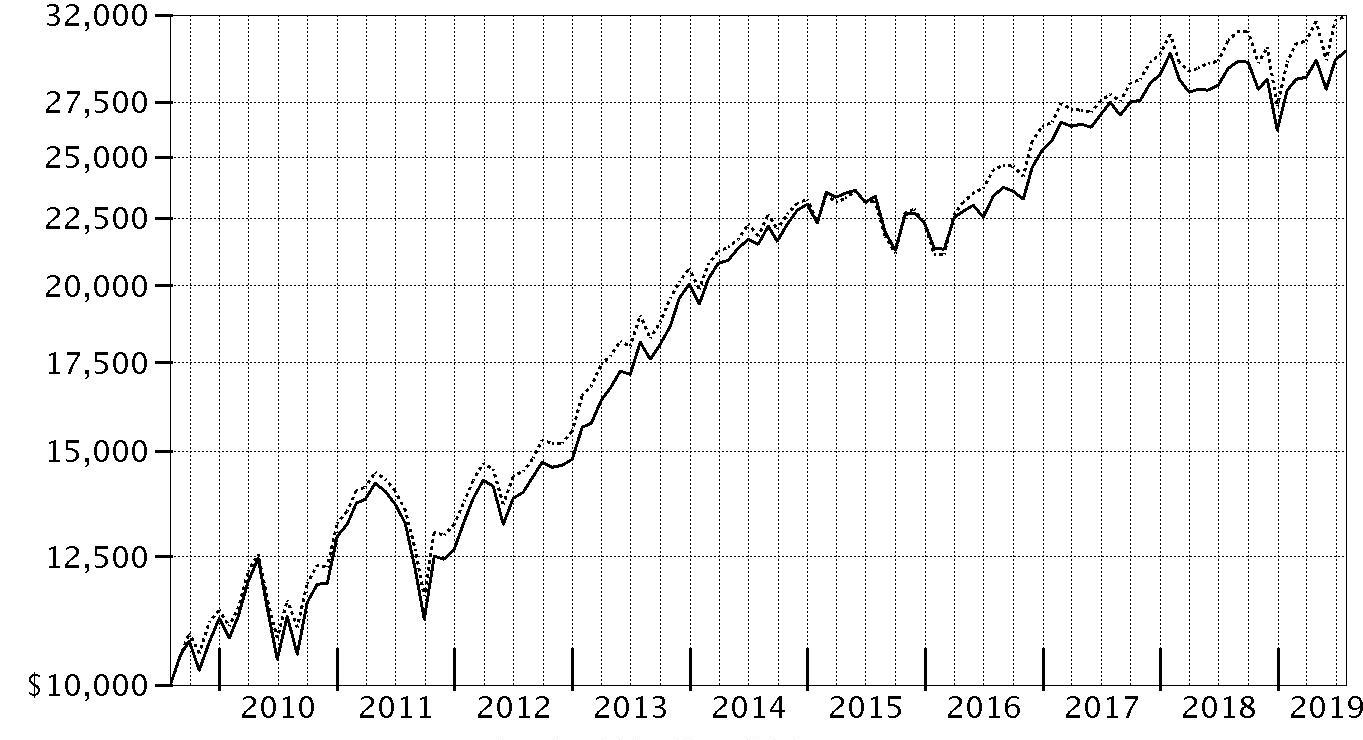

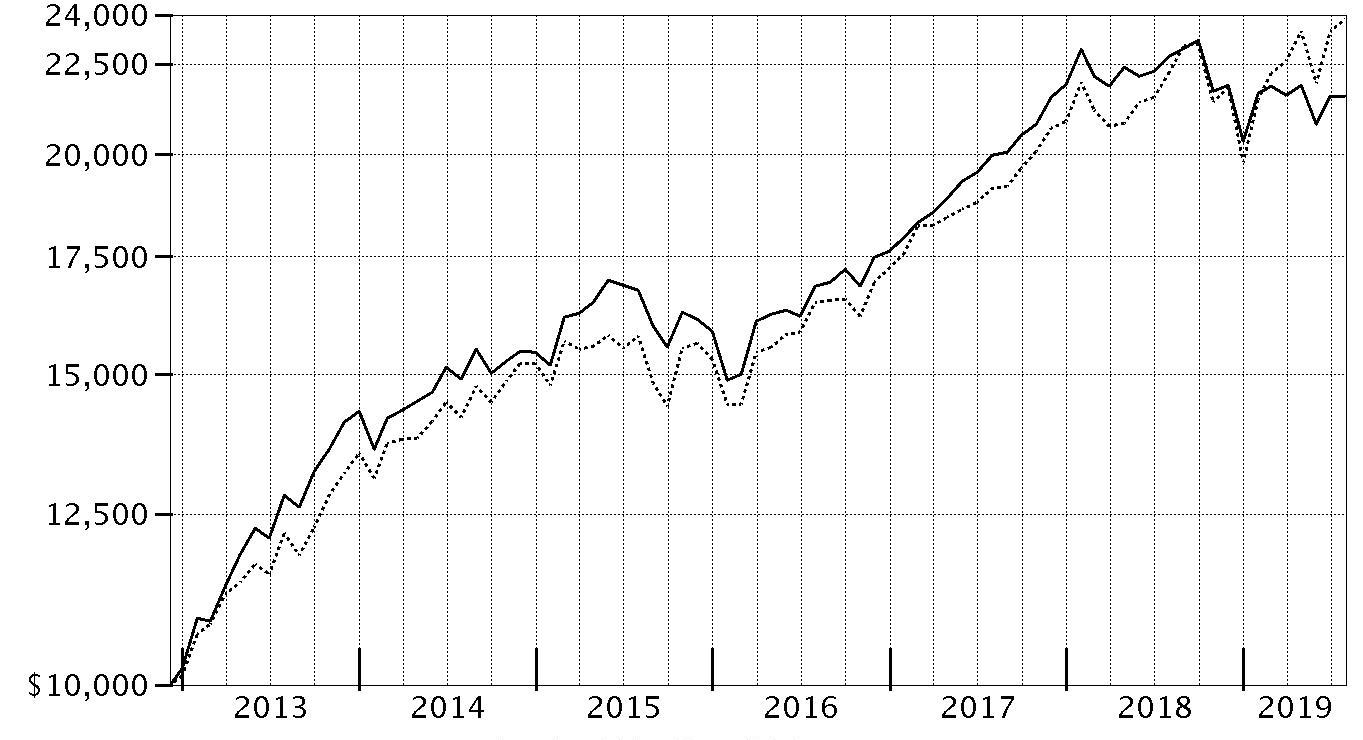

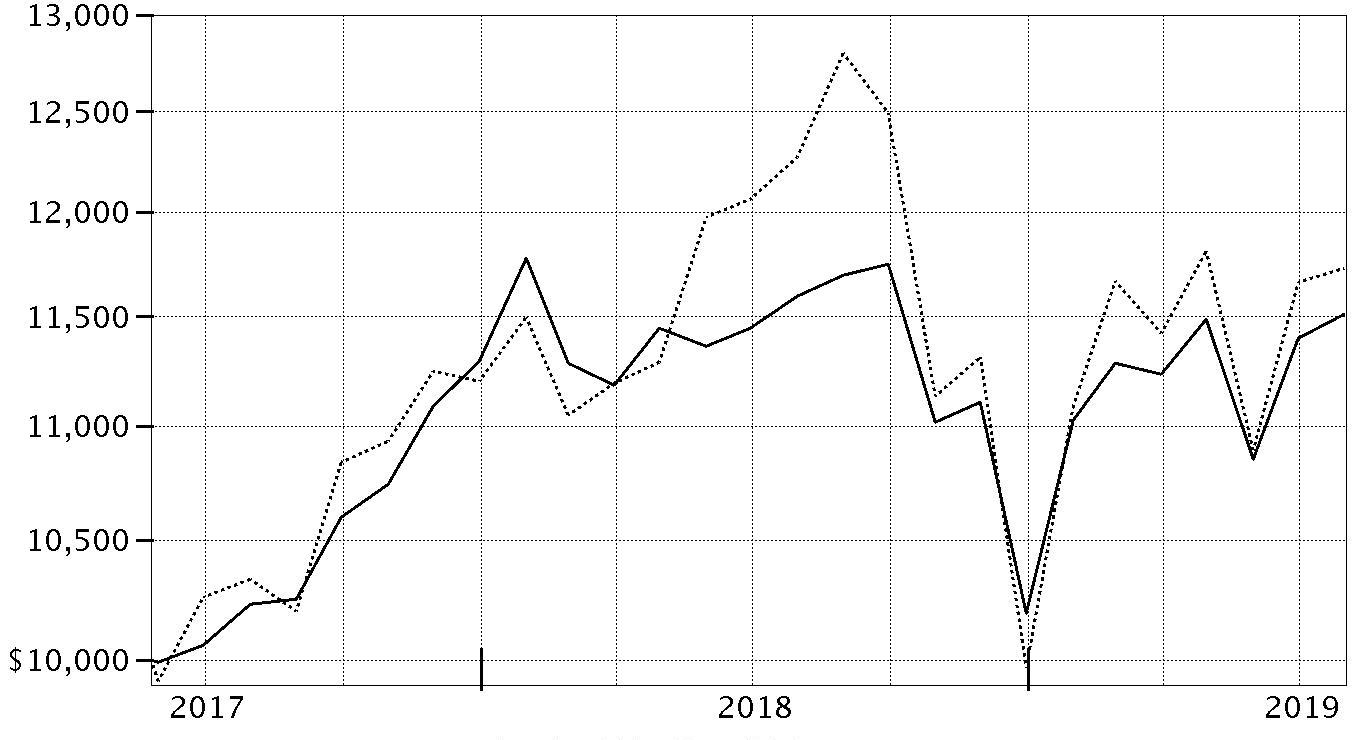

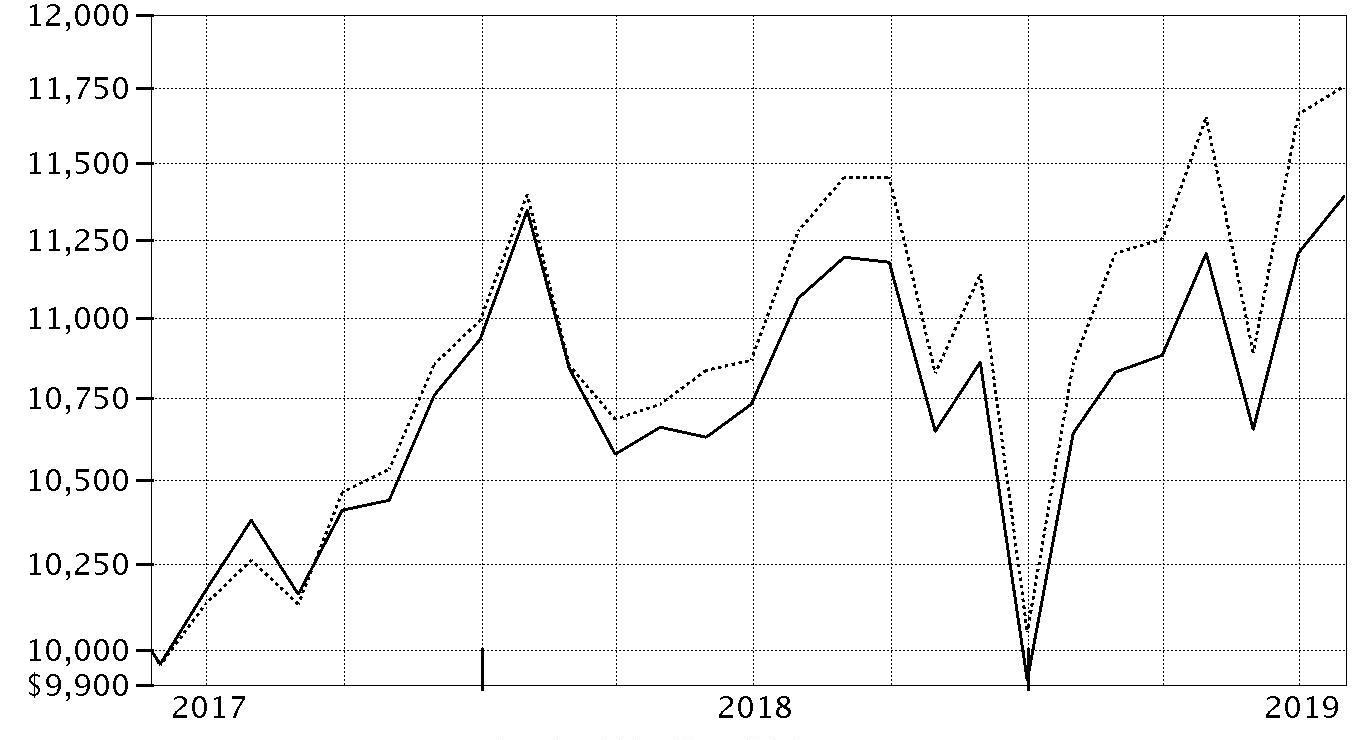

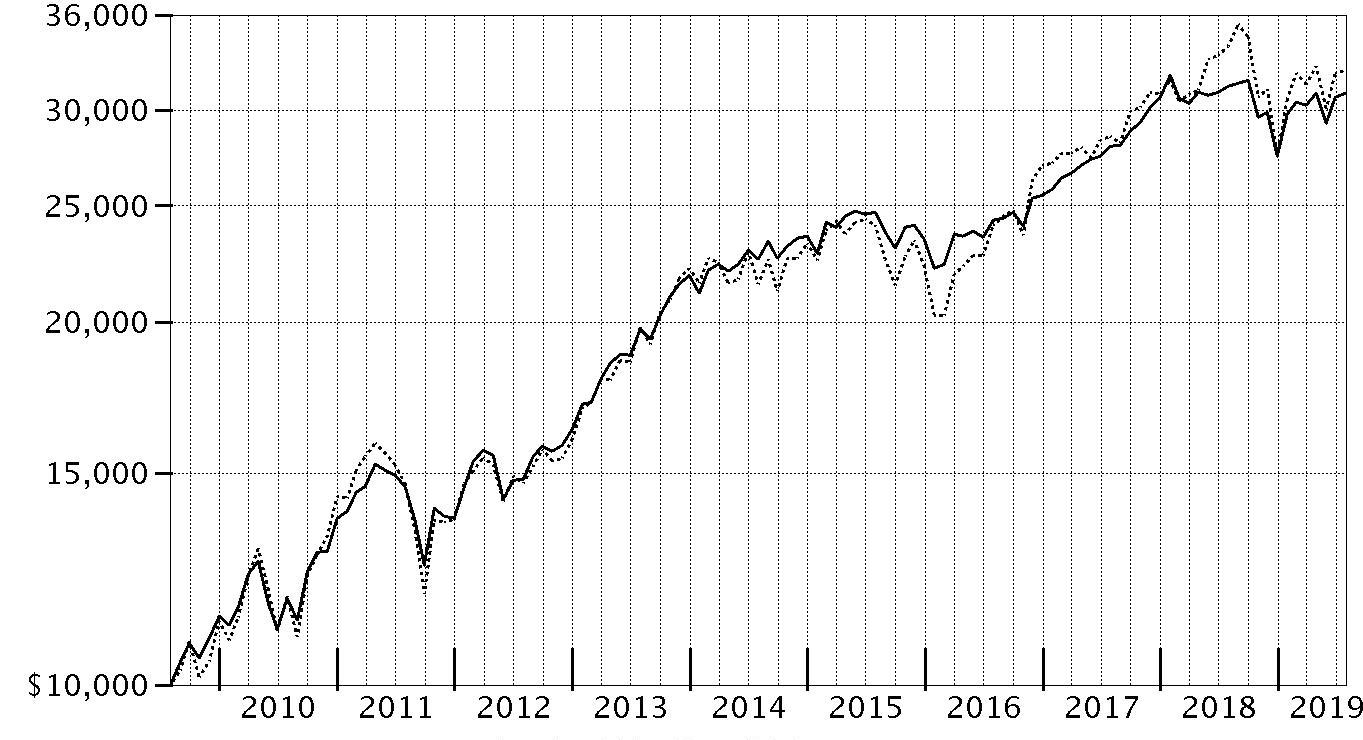

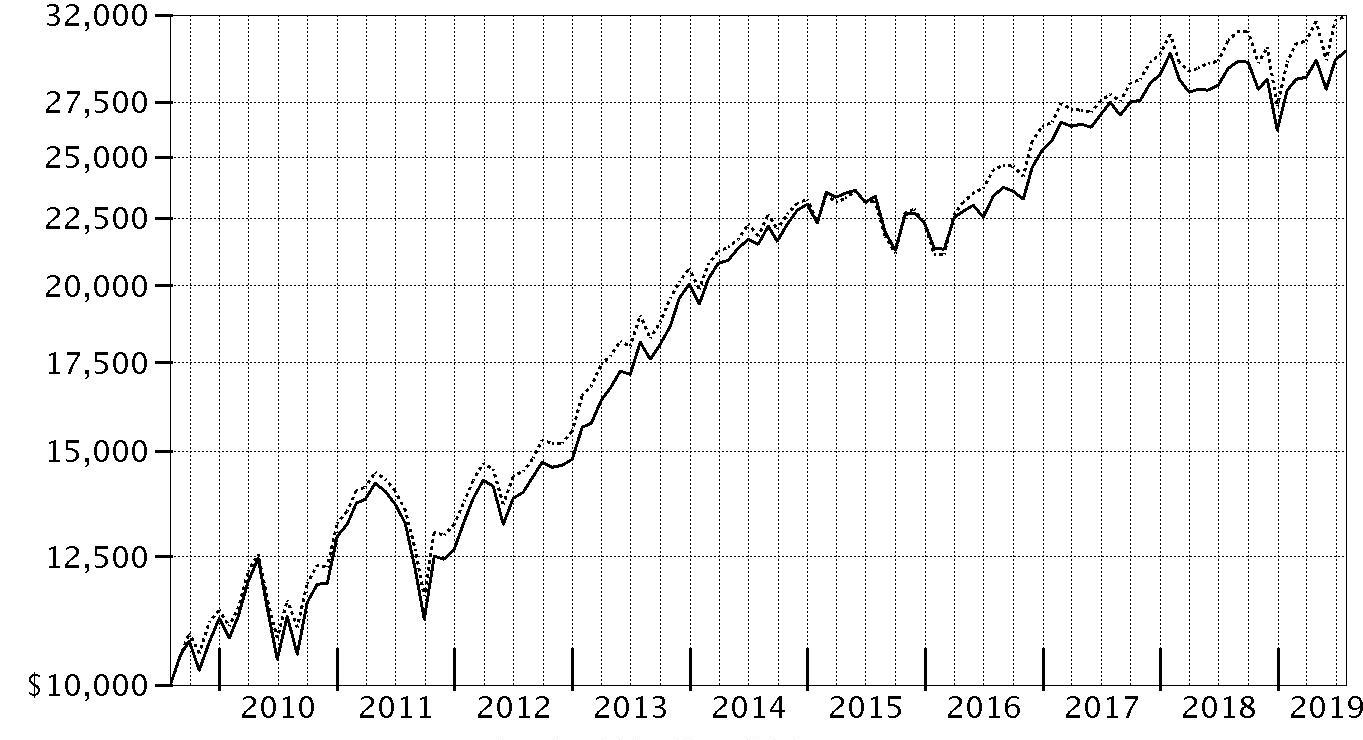

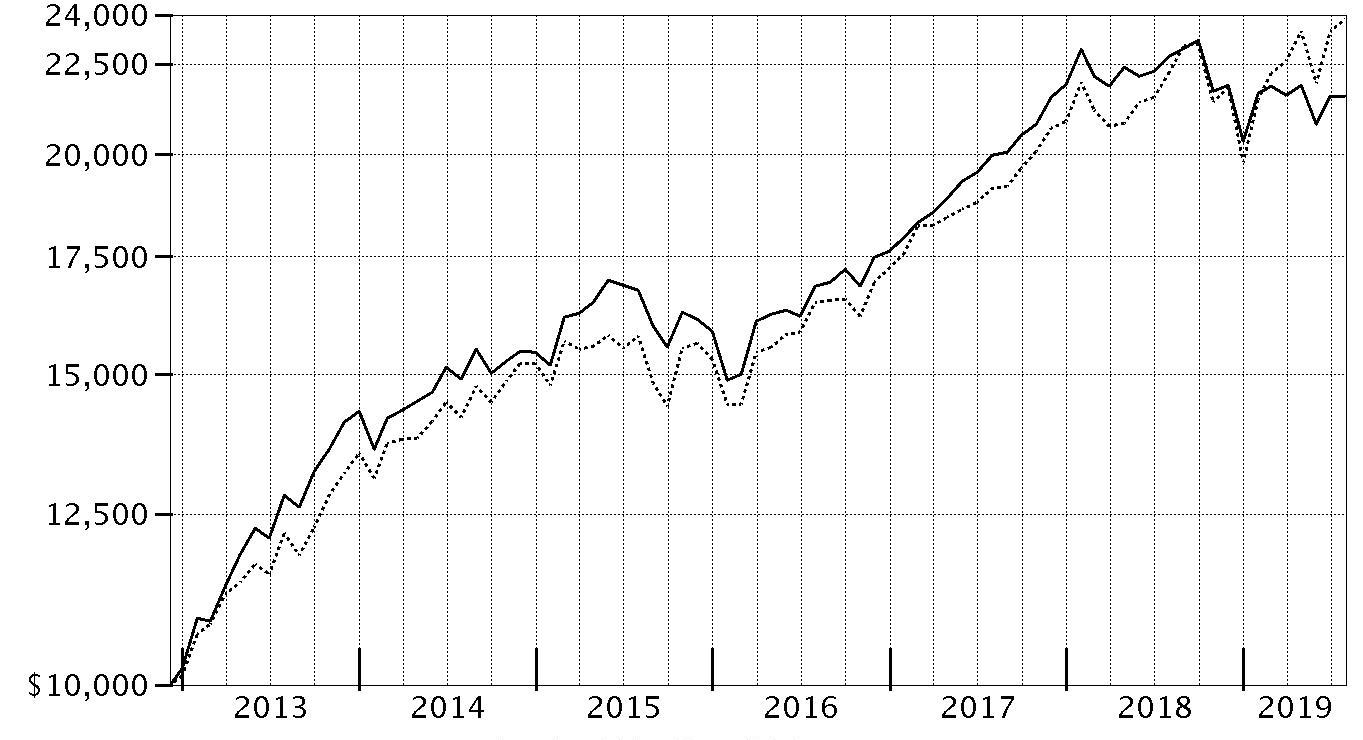

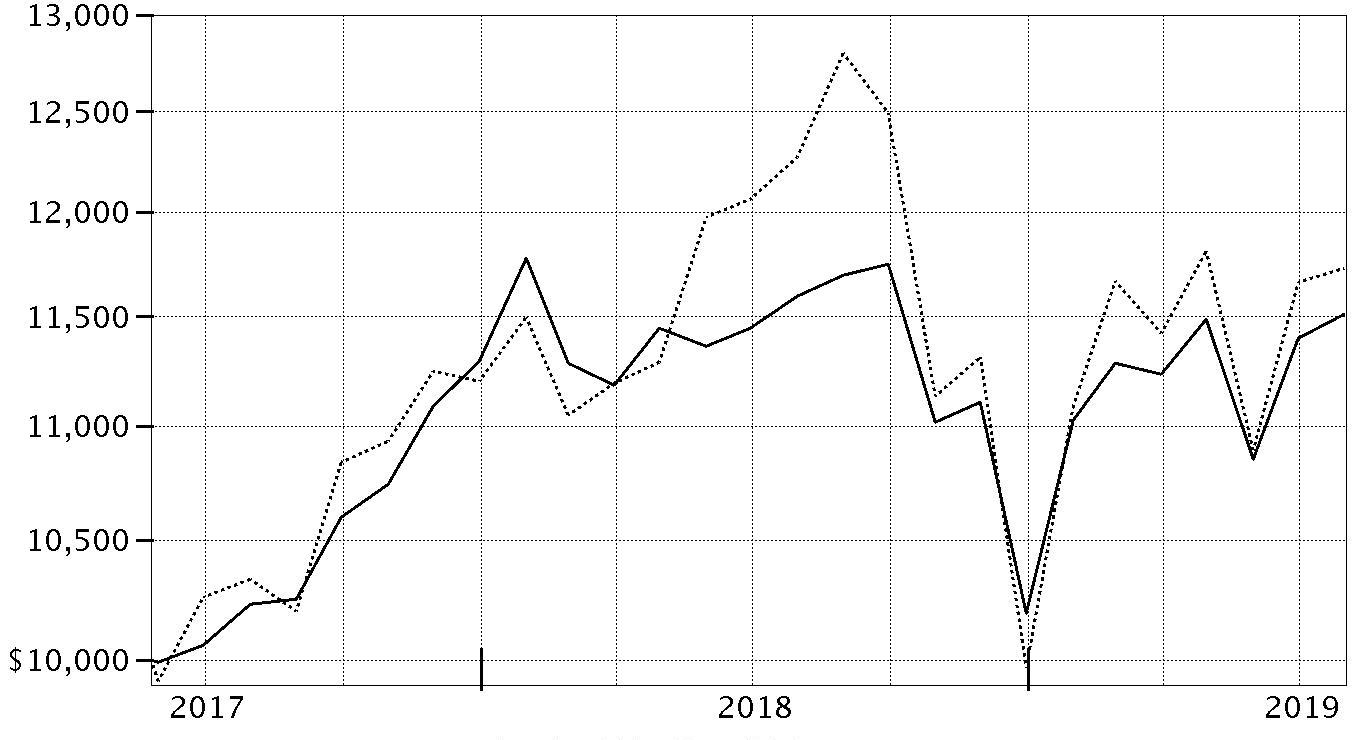

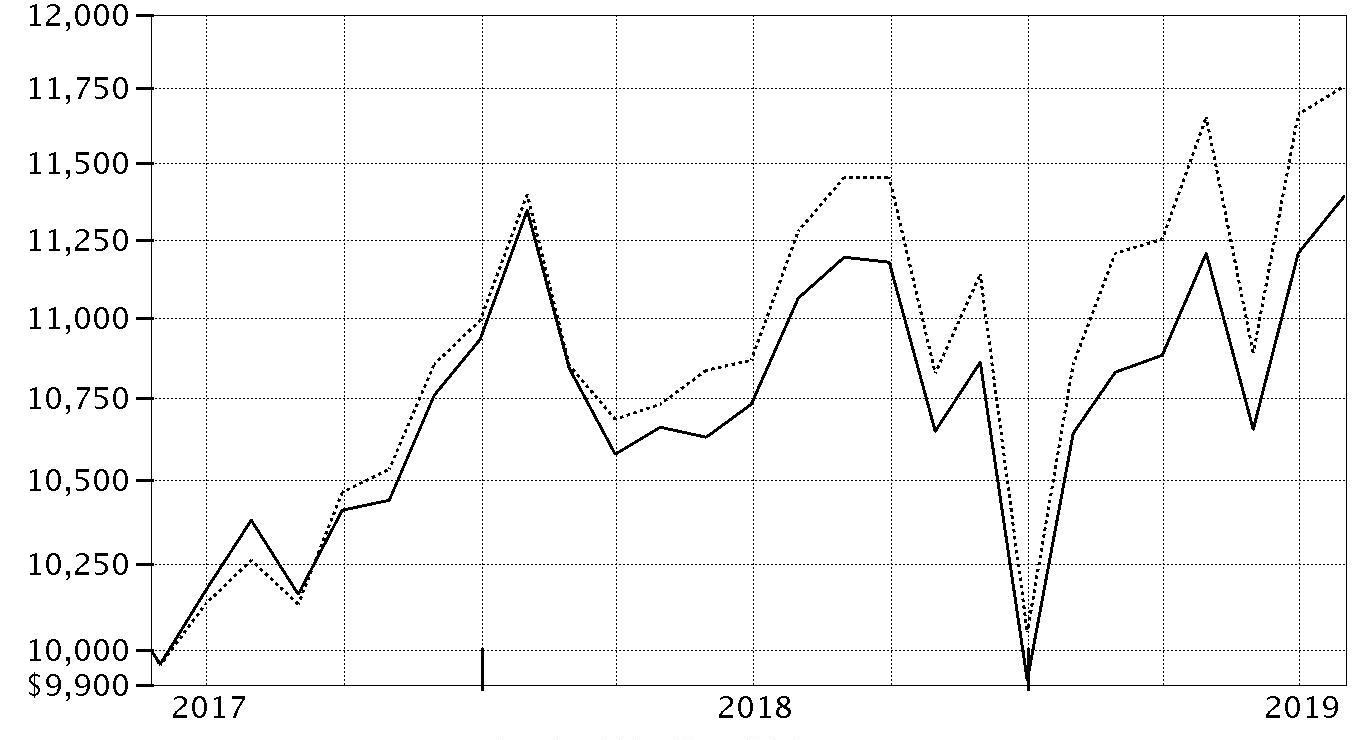

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity® Low-Priced Stock Fund, a class of the fund, on July 31, 2009.

The chart shows how the value of your investment would have changed, and also shows how the Russell 2000® Index performed over the same period.

| Period Ending Values |

| $31,023 | Fidelity® Low-Priced Stock Fund |

| $32,396 | Russell 2000® Index |

Management's Discussion of Fund Performance

Market Recap: The U.S. equity bellwether S&P 500

® index gained 7.99% for the 12 months ending July 31, 2019, beginning the new year on a high note after enduring a historically volatile final quarter of 2018. Upbeat company earnings/outlooks and signs the Federal Reserve may pause on rates boosted stocks to an all-time high on April 30. In May, however, volatility spiked and stocks returned -6.35% for the month amid the Fed’s decision to hold interest rates steady and signal that it had little appetite to adjust them any time soon, as well as retaliatory tariffs imposed on the U.S. by China. The downtrend was similar to late 2018, when many investors fled from risk assets on elevated concerns about future economic growth, global trade and tighter monetary policy. The bull market roared back in June, with the S&P 500

® rising 7.05%, and recorded a series of all-time highs in a productive July (+1.44%). For the full 12 months, growth stocks outpaced value, while large-caps handily bested small-caps. By sector, information technology (+19%) led the way, boosted by continued strength in software & services (+26%), the market’s largest industry segment. Three defensive groups also stood out – real estate (+18%), utilities (+17%) and consumer staples (+15%) – followed by consumer discretionary (+10%) and communication services (+8%). In contrast, energy (-16%) was by far the weakest sector. Other notable laggards included materials (0%), financials (+3%), industrials (+4%) and health care (+4%).

Comments from Lead Portfolio Manager Joel Tillinghast: For the fiscal year, the fund's share classes returned roughly -1%, ahead of the -4.42% result of the benchmark Russell 2000

® Index. Versus the benchmark, favorable stock selection was the primary contributor the past 12 months, whereas industry positioning detracted. Our picks in the consumer discretionary, health care and financials sectors contributed most. The fund’s cash position – about 7%, on average – also added value in a declining small-cap equity market. Conversely, choices in information technology and positioning in utilities detracted. In addition, the fund's foreign holdings detracted overall, hampered in part by foreign exchange. The top-3 contributors the past year were non-benchmark stakes in auto-parts retailer AutoZone (+59%), discount apparel retailer Ross Stores (+23%) and Montreal-based supermarket retailer Metro (+18%). All three stocks were among the fund’s biggest holdings. Conversely, an overweighting in oil & gas exploration & production company Southwestern Energy was the largest detractor. Our holdings returned about -58% due to the company’s operational challenges. Not owning index constituent Array BioPharma was the fund’s second-largest relative detractor, as shares of the company gained 212% but we missed out. Lastly, the fund's foreign holdings detracted overall, hampered in part by foreign exchange.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Investment Summary (Unaudited)

Top Ten Stocks as of July 31, 2019

| | % of fund's net assets |

| UnitedHealth Group, Inc. | 6.0 |

| Ross Stores, Inc. | 3.6 |

| Metro, Inc. Class A (sub. vtg.) | 3.2 |

| Best Buy Co., Inc. | 3.1 |

| Next PLC | 3.0 |

| Seagate Technology LLC | 2.8 |

| AutoZone, Inc. | 2.6 |

| MetLife, Inc. | 2.2 |

| Barratt Developments PLC | 1.9 |

| ANSYS, Inc. | 1.9 |

| | 30.3 |

Top Five Market Sectors as of July 31, 2019

| | % of fund's net assets |

| Consumer Discretionary | 23.7 |

| Information Technology | 15.0 |

| Financials | 13.1 |

| Health Care | 12.6 |

| Consumer Staples | 10.0 |

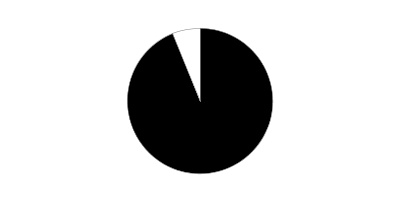

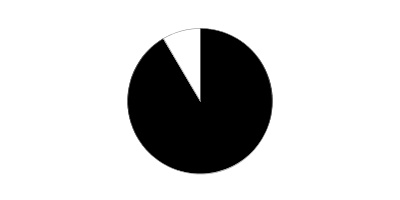

Asset Allocation (% of fund's net assets)

| As of July 31, 2019 * |

| | Stocks | 93.9% |

| | Short-Term Investments and Net Other Assets (Liabilities) | 6.1% |

* Foreign investments - 42.7%

Schedule of Investments July 31, 2019

Showing Percentage of Net Assets

| Common Stocks - 93.8% | | | |

| | | Shares | Value (000s) |

| COMMUNICATION SERVICES - 1.8% | | | |

| Diversified Telecommunication Services - 0.0% | | | |

| AT&T, Inc. | | 37,601 | $1,280 |

| Iridium Communications, Inc. (a) | | 298,540 | 7,595 |

| | | | 8,875 |

| Entertainment - 0.2% | | | |

| Cinemark Holdings, Inc. | | 123,141 | 4,916 |

| Viacom, Inc. Class B (non-vtg.) | | 1,283,629 | 38,958 |

| | | | 43,874 |

| Interactive Media & Services - 0.5% | | | |

| Cars.com, Inc. (a) | | 497,605 | 9,454 |

| Yahoo! Japan Corp. | | 50,224,041 | 147,103 |

| | | | 156,557 |

| Media - 1.1% | | | |

| Comcast Corp. Class A | | 2,590,577 | 111,835 |

| Corus Entertainment, Inc. Class B (non-vtg.) | | 580,384 | 2,230 |

| Discovery Communications, Inc.: | | | |

| Class A (a)(b) | | 2,288,095 | 69,352 |

| Class C (non-vtg.) (a)(b) | | 494,477 | 13,964 |

| Gannett Co., Inc. | | 503,779 | 5,164 |

| Hyundai HCN | | 2,723,979 | 8,190 |

| Intage Holdings, Inc. (c) | | 3,276,300 | 27,857 |

| MSG Network, Inc. Class A (a) | | 286,156 | 5,434 |

| Nexstar Broadcasting Group, Inc. Class A | | 85,969 | 8,749 |

| Pico Far East Holdings Ltd. | | 18,368,000 | 5,622 |

| Proto Corp. | | 396,100 | 4,147 |

| RKB Mainichi Broadcasting Corp. | | 42,100 | 2,322 |

| Saga Communications, Inc. Class A | | 393,816 | 12,295 |

| Sky Network Television Ltd. | | 5,793,662 | 4,822 |

| STW Group Ltd. | | 4,063,392 | 1,798 |

| Tegna, Inc. | | 1,044,390 | 15,864 |

| The New York Times Co. Class A | | 239,250 | 8,536 |

| TOW Co. Ltd. (c) | | 1,814,500 | 13,043 |

| TVA Group, Inc. Class B (non-vtg.) (a) | | 3,062,707 | 4,177 |

| WOWOW INC. | | 182,800 | 4,419 |

| | | | 329,820 |

|

| TOTAL COMMUNICATION SERVICES | | | 539,126 |

|

| CONSUMER DISCRETIONARY - 23.7% | | | |

| Auto Components - 1.4% | | | |

| Adient PLC | | 149,449 | 3,549 |

| ASTI Corp. (b)(c) | | 179,600 | 2,944 |

| DaikyoNishikawa Corp. | | 252,600 | 2,094 |

| ElringKlinger AG (a)(b) | | 692,300 | 3,947 |

| G-Tekt Corp. | | 173,400 | 2,542 |

| Gentex Corp. | | 2,621,912 | 71,893 |

| GUD Holdings Ltd. | | 341,605 | 2,213 |

| Hi-Lex Corp. | | 1,354,700 | 22,028 |

| INFAC Corp. | | 325,139 | 1,018 |

| INZI Controls Co. Ltd. | | 550,000 | 2,529 |

| Lear Corp. | | 763,353 | 96,778 |

| Linamar Corp. | | 198,514 | 6,723 |

| Motonic Corp. (c) | | 2,850,000 | 22,792 |

| Murakami Corp. (c) | | 818,100 | 17,807 |

| Nippon Seiki Co. Ltd. | | 2,615,600 | 45,970 |

| Piolax, Inc. (c) | | 2,463,300 | 44,402 |

| S&T Holdings Co. Ltd. (c) | | 885,108 | 11,296 |

| Samsung Climate Control Co. Ltd. (c) | | 499,950 | 4,098 |

| Sewon Precision Industries Co. Ltd. (c)(d) | | 500,000 | 3,405 |

| SJM Co. Ltd. (c) | | 1,282,000 | 3,338 |

| SJM Holdings Co. Ltd. (c) | | 895,656 | 2,363 |

| Strattec Security Corp. (c) | | 364,655 | 7,581 |

| Sungwoo Hitech Co. Ltd. | | 2,518,110 | 8,006 |

| TBK Co. Ltd. | | 917,400 | 3,365 |

| Yachiyo Industry Co. Ltd. | | 888,400 | 5,194 |

| Yutaka Giken Co. Ltd. (c) | | 1,216,700 | 19,348 |

| | | | 417,223 |

| Automobiles - 0.0% | | | |

| Isuzu Motors Ltd. | | 169,600 | 1,877 |

| Kabe Husvagnar AB (B Shares) | | 274,530 | 4,532 |

| Thor Industries, Inc. | | 4,982 | 297 |

| | | | 6,706 |

| Distributors - 0.1% | | | |

| Arata Corp. | | 93,200 | 3,028 |

| Central Automotive Products Ltd. | | 74,700 | 1,369 |

| Nakayamafuku Co. Ltd. | | 609,100 | 2,962 |

| PALTAC Corp. | | 40,500 | 1,995 |

| SPK Corp. | | 251,300 | 6,041 |

| Uni-Select, Inc. | | 1,290,421 | 11,733 |

| | | | 27,128 |

| Diversified Consumer Services - 0.1% | | | |

| Clip Corp. (c) | | 266,800 | 1,903 |

| Collectors Universe, Inc. | | 82,613 | 1,959 |

| Cross-Harbour Holdings Ltd. | | 2,400,000 | 3,430 |

| Estacio Participacoes SA | | 365,200 | 3,282 |

| Shingakukai Holdings Co. Ltd. | | 34,900 | 184 |

| Step Co. Ltd. (c) | | 1,067,400 | 15,022 |

| | | | 25,780 |

| Hotels, Restaurants & Leisure - 0.3% | | | |

| Ark Restaurants Corp. | | 100,008 | 1,927 |

| Flanigans Enterprises, Inc. | | 89,202 | 2,010 |

| Hiday Hidaka Corp. | | 1,583,140 | 30,763 |

| Ibersol SGPS SA | | 903,976 | 8,186 |

| Koshidaka Holdings Co. Ltd. | | 291,520 | 4,159 |

| Kura Sushi, Inc. | | 10,000 | 412 |

| Sportscene Group, Inc. Class A(c) | | 657,100 | 2,738 |

| Texas Roadhouse, Inc. Class A | | 112,308 | 6,203 |

| The Monogatari Corp. | | 49,600 | 4,231 |

| The Restaurant Group PLC | | 15,756,106 | 29,201 |

| Wyndham Destinations, Inc. | | 106,000 | 4,988 |

| | | | 94,818 |

| Household Durables - 4.0% | | | |

| Abbey PLC (c) | | 1,757,984 | 27,245 |

| Barratt Developments PLC (c) | | 71,000,784 | 557,092 |

| Bellway PLC | | 3,879,016 | 140,103 |

| D.R. Horton, Inc. | | 2,759,009 | 126,721 |

| Dorel Industries, Inc. Class B (sub. vtg.) | | 1,889,477 | 13,357 |

| Emak SpA | | 4,347,792 | 4,741 |

| First Juken Co. Ltd. (c) | | 1,387,600 | 16,033 |

| Flexsteel Industries, Inc. | | 27,586 | 507 |

| Gree Electric Appliances, Inc. of Zhuhai (A Shares) | | 1,200,000 | 9,544 |

| Hamilton Beach Brands Holding Co.: | | | |

| Class A | | 176,509 | 2,897 |

| Class B (a) | | 183,780 | 3,016 |

| Helen of Troy Ltd. (a) | | 1,125,232 | 166,849 |

| Henry Boot PLC | | 2,922,575 | 8,779 |

| Iida Group Holdings Co. Ltd. | | 95,200 | 1,570 |

| Lennar Corp. Class A | | 59,793 | 2,844 |

| M.D.C. Holdings, Inc. | | 99,547 | 3,598 |

| M/I Homes, Inc. (a) | | 308,269 | 10,903 |

| Meritage Homes Corp. (a) | | 498,338 | 31,301 |

| Mohawk Industries, Inc. (a) | | 9,994 | 1,246 |

| PulteGroup, Inc. | | 88,233 | 2,780 |

| Q.E.P. Co., Inc. (a) | | 29,602 | 696 |

| Sanei Architecture Planning Co. Ltd. (c) | | 1,199,700 | 16,795 |

| Taylor Morrison Home Corp. (a) | | 216,905 | 4,885 |

| Token Corp. | | 618,000 | 35,561 |

| Toll Brothers, Inc. | | 104,096 | 3,744 |

| | | | 1,192,807 |

| Internet & Direct Marketing Retail - 0.2% | | | |

| Aucnet, Inc. | | 195,600 | 2,229 |

| Belluna Co. Ltd. (c) | | 6,551,100 | 42,634 |

| Moneysupermarket.com Group PLC | | 371,237 | 1,665 |

| | | | 46,528 |

| Leisure Products - 0.1% | | | |

| Brunswick Corp. | | 99,439 | 4,888 |

| Fenix Outdoor AB Class B (a)(d) | | 32,298 | 0 |

| Mars Group Holdings Corp. | | 460,600 | 8,637 |

| Miroku Corp. | | 139,200 | 2,289 |

| | | | 15,814 |

| Multiline Retail - 3.2% | | | |

| Big Lots, Inc. | | 1,445,017 | 36,992 |

| Lifestyle China Group Ltd. (a) | | 18,858,500 | 6,008 |

| Lifestyle International Holdings Ltd. | | 21,797,500 | 29,785 |

| Next PLC (c) | | 12,034,437 | 887,471 |

| Watts Co. Ltd. | | 155,700 | 1,006 |

| | | | 961,262 |

| Specialty Retail - 12.7% | | | |

| Aaron's, Inc. Class A | | 43,571 | 2,747 |

| AT-Group Co. Ltd. | | 1,085,000 | 19,249 |

| AutoNation, Inc. (a) | | 199,317 | 9,703 |

| AutoZone, Inc. (a) | | 692,927 | 778,185 |

| Bed Bath & Beyond, Inc. (b)(c) | | 11,442,583 | 111,107 |

| Best Buy Co., Inc. | | 12,217,552 | 935,009 |

| BMTC Group, Inc. (c) | | 3,527,981 | 28,923 |

| Bonia Corp. Bhd (a) | | 2,503,000 | 175 |

| Buffalo Co. Ltd. | | 92,300 | 1,177 |

| Burlington Stores, Inc. (a) | | 32,357 | 5,849 |

| Cash Converters International Ltd. (a) | | 23,925,404 | 2,114 |

| Delek Automotive Systems Ltd. | | 730,200 | 3,113 |

| Dick's Sporting Goods, Inc. | | 81,716 | 3,037 |

| Dunelm Group PLC | | 23,133 | 260 |

| Formosa Optical Technology Co. Ltd. | | 1,362,000 | 2,893 |

| GameStop Corp. Class A (b) | | 3,002,790 | 12,071 |

| Genesco, Inc. (a) | | 234,824 | 9,247 |

| GNC Holdings, Inc. Class A (a) | | 887,325 | 1,846 |

| Goldlion Holdings Ltd. | | 21,752,000 | 8,264 |

| Guess?, Inc. (c) | | 4,313,694 | 72,686 |

| Hour Glass Ltd. | | 8,775,500 | 5,364 |

| IA Group Corp. (c) | | 116,640 | 3,881 |

| JB Hi-Fi Ltd. (b) | | 248,144 | 5,090 |

| John David Group PLC | | 7,834,156 | 61,907 |

| Jumbo SA (c) | | 9,935,423 | 194,124 |

| K's Holdings Corp. | | 4,746,200 | 43,453 |

| Ku Holdings Co. Ltd. | | 892,300 | 7,136 |

| Leon's Furniture Ltd. | | 210,420 | 2,455 |

| Mr. Bricolage SA (c) | | 852,808 | 3,257 |

| Murphy U.S.A., Inc. (a) | | 83,711 | 7,397 |

| Nafco Co. Ltd. (c) | | 1,920,600 | 24,981 |

| Ross Stores, Inc. | | 10,059,355 | 1,066,593 |

| Sally Beauty Holdings, Inc. (a) | | 3,167,781 | 43,525 |

| Second Chance Properties Ltd. warrants 1/23/20 (a)(d) | | 1,941,600 | 1 |

| The Buckle, Inc. (b)(c) | | 4,481,891 | 91,206 |

| The Children's Place Retail Stores, Inc. | | 36,518 | 3,567 |

| Urban Outfitters, Inc. (a) | | 3,299,681 | 78,565 |

| USS Co. Ltd. | | 4,882,000 | 97,245 |

| Vitamin Shoppe, Inc. (a)(b) | | 865,912 | 3,827 |

| Williams-Sonoma, Inc. | | 732,083 | 48,815 |

| | | | 3,800,044 |

| Textiles, Apparel & Luxury Goods - 1.6% | | | |

| Best Pacific International Holdings Ltd. | | 5,770,000 | 1,934 |

| Capri Holdings Ltd. (a) | | 99,257 | 3,533 |

| CRG, Inc. BHD (d) | | 2,503,000 | 55 |

| Deckers Outdoor Corp. (a) | | 38,169 | 5,965 |

| Embry Holdings Ltd. | | 2,141,000 | 519 |

| Ff Group (a)(c)(d) | | 4,323,350 | 5,743 |

| Fossil Group, Inc. (a)(c) | | 4,100,028 | 45,264 |

| Gildan Activewear, Inc. | | 6,712,435 | 264,368 |

| Handsome Co. Ltd. (c) | | 1,950,000 | 60,853 |

| JLM Couture, Inc. (a)(c)(d) | | 158,882 | 1,144 |

| Kontoor Brands, Inc. | | 49,817 | 1,461 |

| McRae Industries, Inc. | | 23,954 | 631 |

| Steven Madden Ltd. | | 211,628 | 7,303 |

| Sun Hing Vision Group Holdings Ltd. (c) | | 19,651,000 | 7,237 |

| Tapestry, Inc. | | 273,991 | 8,475 |

| Ted Baker PLC | | 98,078 | 1,085 |

| Texwinca Holdings Ltd. | | 48,488,000 | 14,339 |

| Victory City International Holdings Ltd. | | 14,603,108 | 912 |

| Youngone Corp. | | 400,000 | 11,293 |

| Youngone Holdings Co. Ltd. (c) | | 889,600 | 39,347 |

| Yue Yuen Industrial (Holdings) Ltd. | | 2,488,500 | 6,973 |

| | | | 488,434 |

|

| TOTAL CONSUMER DISCRETIONARY | | | 7,076,544 |

|

| CONSUMER STAPLES - 10.0% | | | |

| Beverages - 1.9% | | | |

| A.G. Barr PLC | | 2,650,794 | 22,114 |

| Baron de Ley SA (a) | | 109,400 | 12,777 |

| Britvic PLC | | 6,227,515 | 69,447 |

| C&C Group PLC | | 500,166 | 2,259 |

| Jinro Distillers Co. Ltd. | | 47,081 | 1,166 |

| Monster Beverage Corp. (a) | | 6,650,353 | 428,748 |

| Muhak Co. Ltd. (c) | | 2,799,256 | 24,675 |

| Olvi PLC (A Shares) | | 108,305 | 4,214 |

| Spritzer Bhd | | 5,120,400 | 2,775 |

| Yantai Changyu Pioneer Wine Co. Ltd. (B Shares) | | 2,799,936 | 5,939 |

| | | | 574,114 |

| Food & Staples Retailing - 6.1% | | | |

| Amsterdam Commodities NV | | 148,911 | 3,155 |

| Aoki Super Co. Ltd. | | 111,500 | 2,696 |

| Australasian Foods Holdco Pty Ltd. (a)(d) | | 3,481,102 | 0 |

| Belc Co. Ltd. (c) | | 1,635,500 | 76,070 |

| Casey's General Stores, Inc. | | 23,486 | 3,803 |

| Cosmos Pharmaceutical Corp. | | 951,100 | 176,337 |

| Create SD Holdings Co. Ltd. (c) | | 5,298,000 | 119,508 |

| Daikokutenbussan Co. Ltd. | | 460,700 | 13,869 |

| Dong Suh Companies, Inc. | | 1,050,000 | 15,726 |

| Genky DrugStores Co. Ltd. | | 726,900 | 14,199 |

| Halows Co. Ltd. (c) | | 1,313,700 | 27,291 |

| Kirindo Holdings Co. Ltd. | | 149,800 | 2,452 |

| Kroger Co. | | 50,561 | 1,070 |

| Kusuri No Aoki Holdings Co. Ltd. | | 496,300 | 33,075 |

| Majestic Wine PLC (b) | | 911,977 | 2,839 |

| McColl's Retail Group PLC | | 1,550,685 | 1,296 |

| Metro, Inc. Class A (sub. vtg.) (c) | | 24,435,497 | 955,721 |

| North West Co., Inc. | | 110,747 | 2,535 |

| Performance Food Group Co. (a) | | 170,137 | 7,461 |

| Qol Holdings Co. Ltd. | | 1,835,300 | 27,734 |

| Sundrug Co. Ltd. | | 3,002,000 | 83,473 |

| Thai President Foods PCL | | 507,588 | 3,018 |

| Total Produce PLC | | 8,841,628 | 13,703 |

| United Natural Foods, Inc. (a) | | 594,477 | 5,862 |

| Valor Holdings Co. Ltd. | | 247,600 | 5,139 |

| Walgreens Boots Alliance, Inc. | | 3,488,943 | 190,113 |

| Walmart, Inc. | | 33,643 | 3,714 |

| Yaoko Co. Ltd. | | 842,200 | 38,785 |

| | | | 1,830,644 |

| Food Products - 1.7% | | | |

| Carr's Group PLC | | 2,210,410 | 4,019 |

| Cranswick PLC | | 446,471 | 14,453 |

| Dean Foods Co. (b) | | 194,691 | 282 |

| Devro PLC | | 900,680 | 2,245 |

| Food Empire Holdings Ltd. (c) | | 38,617,000 | 14,526 |

| Fresh Del Monte Produce, Inc. (c) | | 4,768,049 | 144,615 |

| Hilton Food Group PLC | | 622,843 | 7,090 |

| Inghams Group Ltd. | | 1,079,172 | 2,990 |

| Ingredion, Inc. | | 450,556 | 34,823 |

| Japan Meat Co. Ltd. | | 116,100 | 1,931 |

| Kaveri Seed Co. Ltd. | | 74,873 | 484 |

| Lassonde Industries, Inc. Class A (sub. vtg.) | | 16,327 | 2,289 |

| Mitsui Sugar Co. Ltd. | | 348,200 | 7,451 |

| Nam Yang Dairy Products | | 10,500 | 4,734 |

| Origin Enterprises PLC (c) | | 9,114,910 | 49,896 |

| Pacific Andes International Holdings Ltd. (a)(d) | | 106,294,500 | 991 |

| Pacific Andes Resources Development Ltd. (a)(d) | | 207,240,893 | 1,659 |

| Pickles Corp. | | 98,600 | 2,108 |

| Rocky Mountain Chocolate Factory, Inc. (c) | | 442,200 | 3,980 |

| S Foods, Inc. | | 398,400 | 12,305 |

| Seaboard Corp. | | 37,100 | 151,429 |

| Select Harvests Ltd. | | 1,250,001 | 6,356 |

| Sunjin Co. Ltd. (c) | | 2,376,955 | 20,333 |

| | | | 490,989 |

| Personal Products - 0.2% | | | |

| Grape King Bio Ltd. | | 1,500,000 | 9,282 |

| Hengan International Group Co. Ltd. | | 496,000 | 3,752 |

| Natural Alternatives International, Inc. (a) | | 130,487 | 1,317 |

| Sarantis SA (c) | | 3,968,421 | 38,088 |

| | | | 52,439 |

| Tobacco - 0.1% | | | |

| Karelia Tobacco Co., Inc. | | 1,595 | 480 |

| Scandinavian Tobacco Group A/S (e) | | 1,715,631 | 18,083 |

| Universal Corp. | | 29,300 | 1,743 |

| | | | 20,306 |

|

| TOTAL CONSUMER STAPLES | | | 2,968,492 |

|

| ENERGY - 4.7% | | | |

| Energy Equipment & Services - 0.7% | | | |

| AKITA Drilling Ltd. Class A (non-vtg.) | | 1,459,156 | 2,742 |

| Carbo Ceramics, Inc. (a) | | 962,073 | 1,231 |

| Cathedral Energy Services Ltd. (a) | | 1,314,761 | 364 |

| Diamond Offshore Drilling, Inc. (a)(b) | | 4,855,519 | 43,894 |

| Dril-Quip, Inc. (a) | | 150,947 | 7,943 |

| Ensco PLC Class A (b) | | 3,090,532 | 25,311 |

| Fugro NV (Certificaten Van Aandelen) (a)(b) | | 150,043 | 1,229 |

| Geospace Technologies Corp. (a)(c) | | 846,929 | 13,221 |

| Gulf Island Fabrication, Inc. (a) | | 59,328 | 425 |

| John Wood Group PLC | | 789,773 | 5,100 |

| KLX Energy Services Holdings, Inc. (a) | | 28,228 | 444 |

| Liberty Oilfield Services, Inc. Class A | | 1,734,703 | 24,546 |

| Oceaneering International, Inc. (a) | | 396,269 | 6,122 |

| Oil States International, Inc. (a) | | 2,286,592 | 34,116 |

| PHX Energy Services Corp. (a) | | 1,356,948 | 2,611 |

| Raiznext Corp. | | 1,164,100 | 12,455 |

| Tidewater, Inc. warrants 11/14/24 (a) | | 76,844 | 78 |

| Total Energy Services, Inc. | | 2,020,859 | 10,657 |

| Transocean Ltd. (United States) (a) | | 3,555,997 | 21,620 |

| | | | 214,109 |

| Oil, Gas & Consumable Fuels - 4.0% | | | |

| Adams Resources & Energy, Inc. | | 134,676 | 4,394 |

| Beach Energy Ltd. | | 15,637,660 | 22,542 |

| Berry Petroleum Corp. | | 794,083 | 7,782 |

| Bonanza Creek Energy, Inc. (a) | | 50,000 | 1,090 |

| China Petroleum & Chemical Corp.: | | | |

| (H Shares) | | 2,484,000 | 1,595 |

| sponsored ADR (H Shares) | | 99,239 | 6,368 |

| CNX Resources Corp. (a) | | 500,571 | 4,115 |

| ConocoPhillips Co. | | 912,408 | 53,905 |

| CONSOL Energy, Inc. (a) | | 143,055 | 3,074 |

| Contango Oil & Gas Co. (a)(c) | | 2,575,811 | 3,426 |

| Delek U.S. Holdings, Inc. | | 58,273 | 2,510 |

| Denbury Resources, Inc. (a)(b) | | 6,346,334 | 7,171 |

| Encana Corp. | | 1,286,928 | 5,881 |

| Eni SpA | | 7,218,430 | 112,761 |

| Fuji Kosan Co. Ltd. (b)(c) | | 631,700 | 5,162 |

| Great Eastern Shipping Co. Ltd. | | 4,800,000 | 16,402 |

| Hankook Shell Oil Co. Ltd. | | 47,500 | 12,698 |

| KyungDong City Gas Co. Ltd. | | 208,063 | 5,142 |

| Kyungdong Invest Co. Ltd. | | 84,315 | 2,496 |

| Marathon Oil Corp. | | 2,739,964 | 38,551 |

| Marathon Petroleum Corp. | | 1,989,895 | 112,210 |

| Michang Oil Industrial Co. Ltd. (c) | | 173,900 | 11,337 |

| Murphy Oil Corp. (c) | | 10,651,543 | 256,063 |

| NACCO Industries, Inc. Class A | | 198,895 | 10,571 |

| Oil & Natural Gas Corp. Ltd. | | 35,710,893 | 71,759 |

| QEP Resources, Inc. (a) | | 1,783,537 | 8,829 |

| Reliance Industries Ltd. | | 143,500 | 2,416 |

| Southwestern Energy Co. (a)(b)(c) | | 50,048,627 | 110,107 |

| Star Petroleum Refining PCL | | 9,093,900 | 2,900 |

| Thai Oil PCL (For. Reg.) | | 495,800 | 1,106 |

| Total SA sponsored ADR | | 1,837,205 | 95,057 |

| Unit Corp. (a)(c) | | 5,337,763 | 34,695 |

| Whitecap Resources, Inc. | | 452,032 | 1,452 |

| Whiting Petroleum Corp. (a)(b)(c) | | 4,583,162 | 81,030 |

| World Fuel Services Corp. | | 1,419,578 | 55,420 |

| WPX Energy, Inc. (a) | | 986,514 | 10,299 |

| | | | 1,182,316 |

|

| TOTAL ENERGY | | | 1,396,425 |

|

| FINANCIALS - 13.1% | | | |

| Banks - 1.0% | | | |

| ACNB Corp. | | 106,392 | 3,968 |

| Associated Banc-Corp. | | 169,507 | 3,673 |

| BancFirst Corp. | | 65,080 | 3,797 |

| Bank Ireland Group PLC | | 11,353,281 | 50,272 |

| Bank of America Corp. | | 124,866 | 3,831 |

| Camden National Corp. | | 106,226 | 4,749 |

| Cathay General Bancorp | | 650,005 | 24,193 |

| Central Pacific Financial Corp. | | 89,528 | 2,638 |

| Codorus Valley Bancorp, Inc. (c) | | 656,967 | 15,373 |

| Cullen/Frost Bankers, Inc. | | 42,645 | 4,049 |

| Dah Sing Banking Group Ltd. | | 1,697,600 | 2,952 |

| Dimeco, Inc. | | 35,924 | 1,563 |

| East West Bancorp, Inc. | | 625,926 | 30,051 |

| First Bancorp, Puerto Rico | | 1,774,458 | 19,093 |

| First Citizens Bancshares, Inc. | | 8,456 | 3,949 |

| First Hawaiian, Inc. | | 542,601 | 14,520 |

| Hanmi Financial Corp. | | 500,996 | 10,766 |

| Hope Bancorp, Inc. | | 1,243,092 | 18,336 |

| Huntington Bancshares, Inc. | | 82,382 | 1,174 |

| KeyCorp | | 89,689 | 1,648 |

| LCNB Corp. | | 50,305 | 906 |

| Meridian Bank/Malvern, PA (a) | | 147,562 | 2,516 |

| NIBC Holding NV (e) | | 247,703 | 2,205 |

| OFG Bancorp | | 431,547 | 9,766 |

| Peoples Bancorp, Inc. | | 47,447 | 1,538 |

| PNC Financial Services Group, Inc. | | 27,167 | 3,882 |

| Popular, Inc. | | 34,302 | 1,974 |

| Signature Bank | | 13,384 | 1,706 |

| SpareBank 1 SR-Bank ASA (primary capital certificate) | | 1,222,225 | 13,186 |

| Sparebanken More (primary capital certificate) | | 206,617 | 7,325 |

| Sparebanken Nord-Norge | | 2,294,214 | 16,863 |

| Umpqua Holdings Corp. | | 84,068 | 1,468 |

| United Community Bank, Inc. | | 106,514 | 3,057 |

| Van Lanschot NV (Bearer) | | 1,052,468 | 21,624 |

| Wells Fargo & Co. | | 47,408 | 2,295 |

| | | | 310,906 |

| Capital Markets - 1.0% | | | |

| AllianceBernstein Holding LP | | 695,565 | 20,985 |

| Ameriprise Financial, Inc. | | 11,638 | 1,693 |

| Ares Capital Corp. | | 204,722 | 3,802 |

| Banca Generali SpA | | 135,339 | 3,949 |

| GAMCO Investors, Inc. Class A | | 123,952 | 2,516 |

| Hamilton Lane, Inc. Class A | | 67,619 | 3,969 |

| Lazard Ltd. Class A | | 2,125,512 | 82,279 |

| State Street Corp. | | 2,524,410 | 146,643 |

| Tullett Prebon PLC | | 716,638 | 2,734 |

| Waddell & Reed Financial, Inc. Class A (b) | | 2,448,032 | 42,841 |

| | | | 311,411 |

| Consumer Finance - 2.8% | | | |

| Aeon Credit Service (Asia) Co. Ltd. | | 12,634,000 | 10,867 |

| American Express Co. | | 23,500 | 2,923 |

| Discover Financial Services | | 1,309,904 | 117,551 |

| H&T Group PLC | | 533,835 | 2,107 |

| Navient Corp. | | 1,376,630 | 19,479 |

| Nicholas Financial, Inc. (a) | | 356,301 | 2,986 |

| Santander Consumer U.S.A. Holdings, Inc. | | 10,044,107 | 270,287 |

| Synchrony Financial | | 10,941,826 | 392,593 |

| | | | 818,793 |

| Diversified Financial Services - 0.4% | | | |

| AXA Equitable Holdings, Inc. | | 3,568,952 | 80,230 |

| Far East Horizon Ltd. | | 1,889,000 | 1,757 |

| Ricoh Leasing Co. Ltd. | | 758,600 | 23,395 |

| | | | 105,382 |

| Insurance - 6.9% | | | |

| AEGON NV | | 45,288,108 | 223,176 |

| AFLAC, Inc. | | 543,842 | 28,628 |

| Allstate Corp. | | 39,824 | 4,277 |

| Amerisafe, Inc. | | 34,091 | 2,218 |

| ASR Nederland NV | | 551,875 | 20,790 |

| Aub Group Ltd. | | 208,851 | 1,697 |

| FBD Holdings PLC | | 143,714 | 1,518 |

| First American Financial Corp. | | 126,818 | 7,333 |

| FNF Group | | 36,872 | 1,581 |

| Great-West Lifeco, Inc. | | 99,467 | 2,184 |

| Hartford Financial Services Group, Inc. | | 61,719 | 3,557 |

| Hiscox Ltd. | | 111,895 | 2,313 |

| Hyundai Fire & Marine Insurance Co. Ltd. | | 120,804 | 2,837 |

| Lincoln National Corp. | | 4,350,988 | 284,294 |

| MetLife, Inc. | | 13,535,083 | 668,904 |

| National Western Life Group, Inc. | | 129,379 | 34,803 |

| NN Group NV | | 1,140,888 | 42,979 |

| Old Republic International Corp. | | 55,000 | 1,255 |

| Primerica, Inc. | | 64,593 | 7,925 |

| Principal Financial Group, Inc. | | 63,448 | 3,683 |

| RenaissanceRe Holdings Ltd. | | 1,275,920 | 231,133 |

| The Travelers Companies, Inc. | | 28,174 | 4,131 |

| Torchmark Corp. | | 63,870 | 5,833 |

| Universal Insurance Holdings, Inc. | | 39,654 | 984 |

| Unum Group (c) | | 14,887,847 | 475,667 |

| | | | 2,063,700 |

| Mortgage Real Estate Investment Trusts - 0.5% | | | |

| Annaly Capital Management, Inc. | | 14,545,979 | 138,914 |

| Redwood Trust, Inc. | | 399,215 | 6,755 |

| | | | 145,669 |

| Thrifts & Mortgage Finance - 0.5% | | | |

| ASAX Co. Ltd. | | 397,100 | 2,146 |

| Genworth MI Canada, Inc. | | 3,905,030 | 144,123 |

| Genworth Mortgage Insurance Ltd. | | 6,123,251 | 14,163 |

| | | | 160,432 |

|

| TOTAL FINANCIALS | | | 3,916,293 |

|

| HEALTH CARE - 12.6% | | | |

| Biotechnology - 2.5% | | | |

| Amgen, Inc. | | 2,849,185 | 531,601 |

| Biogen, Inc. (a) | | 174,413 | 41,479 |

| Celgene Corp. (a) | | 1,502,788 | 138,046 |

| Cell Biotech Co. Ltd. | | 50,000 | 742 |

| Essex Bio-Technology Ltd. | | 1,199,000 | 944 |

| Gilead Sciences, Inc. | | 191,290 | 12,533 |

| | | | 725,345 |

| Health Care Equipment & Supplies - 0.4% | | | |

| Apex Biotechnology Corp. | | 959,000 | 918 |

| Arts Optical International Holdings Ltd. (c) | | 20,074,000 | 4,468 |

| Boston Scientific Corp. (a) | | 209,633 | 8,901 |

| Hoshiiryou Sanki Co. Ltd. (c) | | 280,764 | 9,794 |

| Nakanishi, Inc. | | 495,400 | 9,089 |

| Prim SA (c) | | 1,424,000 | 17,498 |

| ResMed, Inc. | | 74,887 | 9,638 |

| Shandong Weigao Medical Polymer Co. Ltd. (H Shares) | | 924,000 | 881 |

| St.Shine Optical Co. Ltd. | | 2,100,000 | 34,985 |

| Techno Medica Co. Ltd. | | 38,500 | 774 |

| Utah Medical Products, Inc. (c) | | 261,719 | 23,814 |

| Vieworks Co. Ltd. | | 5,000 | 114 |

| | | | 120,874 |

| Health Care Providers & Services - 8.9% | | | |

| Anthem, Inc. | | 1,841,790 | 542,610 |

| CVS Health Corp. | | 14,782 | 826 |

| DVx, Inc. (c) | | 691,600 | 5,048 |

| Hi-Clearance, Inc. | | 1,442,000 | 4,719 |

| Humana, Inc. | | 9,400 | 2,789 |

| Laboratory Corp. of America Holdings (a) | | 267,464 | 44,806 |

| Medica Sur SA de CV | | 329,628 | 368 |

| MEDNAX, Inc. (a) | | 634,047 | 15,579 |

| Patterson Companies, Inc. | | 82,500 | 1,634 |

| Premier, Inc. (a) | | 142,440 | 5,520 |

| Quest Diagnostics, Inc. | | 78,566 | 8,020 |

| Ship Healthcare Holdings, Inc. | | 60,500 | 2,736 |

| Tokai Corp. | | 339,400 | 6,704 |

| Triple-S Management Corp. (c) | | 1,707,170 | 40,938 |

| United Drug PLC (United Kingdom) | | 1,952,439 | 18,995 |

| UnitedHealth Group, Inc. | | 7,219,502 | 1,797,734 |

| Universal Health Services, Inc. Class B | | 874,441 | 131,918 |

| WIN-Partners Co. Ltd. (c) | | 2,505,500 | 27,729 |

| | | | 2,658,673 |

| Pharmaceuticals - 0.8% | | | |

| Apex Healthcare Bhd | | 190,400 | 97 |

| Bliss Gvs Pharma Ltd. (a) | | 3,700,000 | 7,909 |

| Corteva, Inc. | | 31,016 | 915 |

| Daewon Pharmaceutical Co. Ltd. (c) | | 1,923,725 | 23,694 |

| Daewoong Co. Ltd. | | 350,000 | 4,547 |

| Daito Pharmaceutical Co. Ltd. | | 108,700 | 3,042 |

| Dawnrays Pharmaceutical Holdings Ltd. | | 35,669,000 | 6,721 |

| DongKook Pharmaceutical Co. Ltd. (c) | | 623,700 | 34,908 |

| FDC Ltd. (a) | | 2,816,443 | 6,310 |

| Fuji Pharma Co. Ltd. | | 642,900 | 8,646 |

| Genomma Lab Internacional SA de CV (a) | | 5,357,400 | 4,887 |

| Jazz Pharmaceuticals PLC (a) | | 20,000 | 2,788 |

| Korea United Pharm, Inc. | | 239,629 | 4,078 |

| Kwang Dong Pharmaceutical Co. Ltd. (c) | | 3,100,000 | 17,632 |

| Kyung Dong Pharmaceutical Co. Ltd. | | 960,000 | 6,790 |

| Lee's Pharmaceutical Holdings Ltd. | | 7,940,000 | 5,017 |

| Recordati SpA | | 1,588,768 | 71,283 |

| Taro Pharmaceutical Industries Ltd. | | 58,000 | 4,685 |

| Vivimed Labs Ltd. (a) | | 600,000 | 129 |

| Whanin Pharmaceutical Co. Ltd. (c) | | 1,750,000 | 24,055 |

| | | | 238,133 |

|

| TOTAL HEALTH CARE | | | 3,743,025 |

|

| INDUSTRIALS - 7.1% | | | |

| Aerospace & Defense - 0.0% | | | |

| Ultra Electronics Holdings PLC | | 97,748 | 2,333 |

| Vectrus, Inc. (a) | | 82,711 | 3,345 |

| | | | 5,678 |

| Air Freight & Logistics - 0.0% | | | |

| Air T Funding warrants 6/7/20 (a) | | 181,708 | 11 |

| Air T, Inc. | | 65,298 | 1,147 |

| Echo Global Logistics, Inc. (a) | | 106,017 | 2,233 |

| United Parcel Service, Inc. Class B | | 61,850 | 7,389 |

| | | | 10,780 |

| Airlines - 0.1% | | | |

| Air New Zealand Ltd. | | 1,123,835 | 2,001 |

| American Airlines Group, Inc. | | 240,315 | 7,332 |

| JetBlue Airways Corp. (a) | | 337,928 | 6,498 |

| | | | 15,831 |

| Building Products - 0.1% | | | |

| Apogee Enterprises, Inc. | | 18,713 | 759 |

| Builders FirstSource, Inc. (a) | | 423,282 | 7,272 |

| Continental Building Products, Inc. (a) | | 152,694 | 3,753 |

| Gibraltar Industries, Inc. (a) | | 81,056 | 3,359 |

| Jeld-Wen Holding, Inc. (a) | | 528,026 | 11,569 |

| Kondotec, Inc. (c) | | 1,633,400 | 13,903 |

| Owens Corning | | 39,784 | 2,307 |

| | | | 42,922 |

| Commercial Services & Supplies - 0.6% | | | |

| Aeon Delight Co. Ltd. | | 97,700 | 2,923 |

| AJIS Co. Ltd. (c) | | 884,600 | 28,053 |

| Asia File Corp. Bhd | | 4,480,000 | 2,631 |

| Calian Technologies Ltd. (c) | | 619,431 | 15,779 |

| Civeo Corp. (a)(c) | | 11,708,441 | 19,319 |

| Fursys, Inc. (c) | | 950,000 | 24,260 |

| Lion Rock Group Ltd. | | 19,047,640 | 3,328 |

| Mears Group PLC | | 829,577 | 2,754 |

| Mitie Group PLC | | 13,000,115 | 26,086 |

| NICE Total Cash Management Co., Ltd. | | 1,025,000 | 7,021 |

| VICOM Ltd. | | 1,750,600 | 9,092 |

| VSE Corp. (c) | | 860,008 | 25,766 |

| | | | 167,012 |

| Construction & Engineering - 1.2% | | | |

| AECOM (a) | | 5,218,026 | 187,588 |

| Arcadis NV (b) | | 2,007,052 | 40,992 |

| Boustead Projs. Pte Ltd. | | 1,981,887 | 1,419 |

| Boustead Singapore Ltd. | | 3,986,900 | 2,231 |

| Daiichi Kensetsu Corp. (c) | | 1,712,700 | 27,897 |

| EMCOR Group, Inc. | | 147,336 | 12,434 |

| Geumhwa PSC Co. Ltd. (c) | | 360,000 | 9,558 |

| Jacobs Engineering Group, Inc. | | 72,651 | 5,994 |

| Kyeryong Construction Industrial Co. Ltd. (c) | | 675,000 | 14,437 |

| Meisei Industrial Co. Ltd. | | 1,094,300 | 7,604 |

| Mirait Holdings Corp. | | 396,600 | 5,895 |

| Nippon Rietec Co. Ltd. | | 1,158,200 | 14,404 |

| Severfield PLC | | 2,736,791 | 2,230 |

| Shinnihon Corp. | | 1,560,100 | 12,318 |

| Toshiba Plant Systems & Services Corp. | | 155,000 | 2,606 |

| United Integrated Services Co. | | 4,114,800 | 20,793 |

| | | | 368,400 |

| Electrical Equipment - 0.5% | | | |

| Aichi Electric Co. Ltd. | | 322,300 | 8,147 |

| Aros Quality Group AB | | 718,570 | 14,251 |

| AZZ, Inc. | | 559,361 | 26,055 |

| Bharat Heavy Electricals Ltd. | | 2,400,290 | 2,045 |

| Chiyoda Integre Co. Ltd. | | 326,400 | 6,259 |

| Eaton Corp. PLC | | 47,892 | 3,936 |

| Generac Holdings, Inc. (a) | | 89,258 | 6,453 |

| Hammond Power Solutions, Inc. Class A | | 448,405 | 3,085 |

| I-Sheng Electric Wire & Cable Co. Ltd. (c) | | 12,500,000 | 16,575 |

| Korea Electric Terminal Co. Ltd. (c) | | 709,401 | 39,666 |

| Regal Beloit Corp. | | 46,308 | 3,687 |

| Sensata Technologies, Inc. PLC (a) | | 166,048 | 7,876 |

| Servotronics, Inc. | | 113,630 | 1,178 |

| TKH Group NV (depositary receipt) | | 198,676 | 11,832 |

| | | | 151,045 |

| Industrial Conglomerates - 0.8% | | | |

| DCC PLC (United Kingdom) | | 2,150,022 | 182,031 |

| General Electric Co. | | 1,546,860 | 16,165 |

| ITT, Inc. | | 88,628 | 5,532 |

| Lifco AB | | 446,888 | 22,924 |

| Mytilineos Holdings SA | | 831,733 | 10,146 |

| Reunert Ltd. | | 1,684,230 | 7,617 |

| | | | 244,415 |

| Machinery - 1.6% | | | |

| Aalberts Industries NV (c) | | 6,585,513 | 265,799 |

| Allison Transmission Holdings, Inc. | | 197,382 | 9,070 |

| ASL Marine Holdings Ltd. (a)(c) | | 44,772,913 | 1,522 |

| Cummins, Inc. | | 34,794 | 5,706 |

| Daiwa Industries Ltd. | | 193,100 | 1,921 |

| Foremost Income Fund (a) | | 2,141,103 | 8,833 |

| Haitian International Holdings Ltd. | | 9,403,000 | 18,996 |

| Hurco Companies, Inc. | | 56,000 | 1,915 |

| Hwacheon Machine Tool Co. Ltd. (c) | | 219,900 | 7,900 |

| Hyster-Yale Materials Handling: | | | |

| Class A (c) | | 225,455 | 13,942 |

| Class B (a)(c) | | 310,000 | 19,170 |

| Ihara Science Corp. (c) | | 974,500 | 11,403 |

| Kyowakogyosyo Co. Ltd. | | 42,700 | 1,584 |

| Luxfer Holdings PLC sponsored | | 183,650 | 3,640 |

| Maruzen Co. Ltd. (c) | | 1,574,500 | 30,393 |

| Miller Industries, Inc. | | 56,698 | 1,770 |

| Mincon Group PLC | | 2,139,292 | 2,771 |

| Nadex Co. Ltd. (c) | | 788,200 | 6,340 |

| Nitchitsu Co. Ltd. | | 55,300 | 839 |

| Rexnord Corp. (a) | | 110,552 | 3,238 |

| Semperit AG Holding (a) | | 377,814 | 5,287 |

| SIMPAC, Inc. | | 1,483,000 | 3,296 |

| Takamatsu Machinery Co. Ltd. | | 320,100 | 2,510 |

| The Weir Group PLC | | 105,641 | 1,923 |

| Tocalo Co. Ltd. | | 3,037,000 | 22,891 |

| Trinity Industrial Corp. | | 839,000 | 5,522 |

| Welbilt, Inc. (a) | | 210,191 | 3,451 |

| | | | 461,632 |

| Marine - 0.0% | | | |

| SITC International Holdings Co. Ltd. | | 4,744,000 | 5,229 |

| Tokyo Kisen Co. Ltd. (c) | | 821,900 | 5,462 |

| | | | 10,691 |

| Professional Services - 0.2% | | | |

| Asiakastieto Group Oyj (e) | | 81,837 | 2,555 |

| Kelly Services, Inc. Class A (non-vtg.) | | 74,948 | 2,086 |

| McMillan Shakespeare Ltd. | | 1,684,753 | 15,952 |

| Nielsen Holdings PLC | | 820,649 | 19,006 |

| Persol Holdings Co., Ltd. | | 123,600 | 3,019 |

| SHL-JAPAN Ltd. | | 100,800 | 1,797 |

| Sporton International, Inc. | | 509,088 | 3,384 |

| Synergie SA | | 126,428 | 4,038 |

| TrueBlue, Inc. (a) | | 103,811 | 2,052 |

| | | | 53,889 |

| Road & Rail - 0.8% | | | |

| Alps Logistics Co. Ltd. (c) | | 2,830,300 | 19,486 |

| Chilled & Frozen Logistics Holdings Co. Ltd. | | 1,088,400 | 13,286 |

| Daqin Railway Co. Ltd. (A Shares) | | 32,250,000 | 36,904 |

| Hamakyorex Co. Ltd. (c) | | 1,242,100 | 44,528 |

| Higashi Twenty One Co. Ltd. | | 247,900 | 1,048 |

| Knight-Swift Transportation Holdings, Inc. Class A | | 207,782 | 7,447 |

| Norfolk Southern Corp. | | 51,976 | 9,934 |

| Sakai Moving Service Co. Ltd. (c) | | 1,071,700 | 64,032 |

| Trancom Co. Ltd. (c) | | 847,600 | 49,084 |

| | | | 245,749 |

| Trading Companies & Distributors - 1.1% | | | |

| AddTech AB (B Shares) | | 1,049,899 | 27,494 |

| AerCap Holdings NV (a) | | 229,992 | 12,541 |

| Alconix Corp. (c) | | 2,100,800 | 25,239 |

| Chori Co. Ltd. | | 426,600 | 6,686 |

| Goodfellow, Inc. (c) | | 716,438 | 2,877 |

| HD Supply Holdings, Inc. (a) | | 565,493 | 22,908 |

| HERIGE | | 60,432 | 1,739 |

| Houston Wire & Cable Co. (a) | | 100,045 | 465 |

| Itochu Corp. | | 4,119,700 | 78,442 |

| KS Energy Services Ltd. (a) | | 13,052,500 | 161 |

| Lumax International Corp. Ltd. | | 3,123,900 | 8,767 |

| Meiwa Corp. | | 1,702,000 | 5,929 |

| Mitani Shoji Co. Ltd. | | 728,500 | 36,027 |

| MRC Global, Inc. (a) | | 610,326 | 9,545 |

| Otec Corp. | | 123,300 | 2,779 |

| Parker Corp. (c) | | 2,199,600 | 10,008 |

| Richelieu Hardware Ltd. | | 784,626 | 15,493 |

| Senshu Electric Co. Ltd. (c) | | 886,700 | 22,080 |

| Strongco Corp. (a)(c) | | 841,812 | 989 |

| Tanaka Co. Ltd. | | 36,500 | 210 |

| TECHNO ASSOCIE Co. Ltd. (b) | | 252,700 | 2,971 |

| Totech Corp. (c) | | 893,300 | 19,551 |

| | | | 312,901 |

| Transportation Infrastructure - 0.1% | | | |

| Anhui Expressway Co. Ltd. (H Shares) | | 8,954,000 | 5,440 |

| Isewan Terminal Service Co. Ltd. | | 1,280,700 | 9,253 |

| Meiko Transportation Co. Ltd. | | 821,800 | 9,314 |

| Qingdao Port International Co. Ltd. (H Shares) (e) | | 11,605,000 | 8,271 |

| Winas Ltd. (c) | | 20,211,600 | 602 |

| | | | 32,880 |

|

| TOTAL INDUSTRIALS | | | 2,123,825 |

|

| INFORMATION TECHNOLOGY - 15.0% | | | |

| Communications Equipment - 0.1% | | | |

| F5 Networks, Inc. (a) | | 58,435 | 8,574 |

| InterDigital, Inc. | | 140,185 | 9,032 |

| | | | 17,606 |

| Electronic Equipment & Components - 4.3% | | | |

| A&D Co. Ltd. | | 595,500 | 4,341 |

| Amphenol Corp. Class A | | 63,468 | 5,923 |

| AVX Corp. | | 156,500 | 2,383 |

| Cardtronics PLC (a) | | 55,348 | 1,576 |

| CDW Corp. | | 173,327 | 20,480 |

| CTS Corp. | | 214,669 | 6,766 |

| Daido Signal Co. Ltd. | | 98,400 | 453 |

| Dynapack International Technology Corp. | | 3,200,000 | 4,903 |

| Elec & Eltek International Co. Ltd. | | 1,477,600 | 2,110 |

| Elematec Corp. (c) | | 2,339,800 | 22,045 |

| ePlus, Inc. (a) | | 88,544 | 6,720 |

| Excel Co. Ltd. (c) | | 738,900 | 10,324 |

| Fabrinet (a) | | 84,706 | 4,547 |

| Hi-P International Ltd. | | 11,822,500 | 11,797 |

| Hon Hai Precision Industry Co. Ltd. (Foxconn) | | 145,980,912 | 365,500 |

| IDIS Holdings Co. Ltd. (c) | | 800,000 | 7,730 |

| Image Sensing Systems, Inc. (a) | | 63,877 | 319 |

| Insight Enterprises, Inc. (a) | | 248,113 | 13,651 |

| INTOPS Co. Ltd. (c) | | 1,700,000 | 21,209 |

| Jabil, Inc. | | 113,184 | 3,495 |

| Keysight Technologies, Inc. (a) | | 555,943 | 49,768 |

| Kingboard Chemical Holdings Ltd. (c) | | 75,354,500 | 185,508 |

| Kingboard Laminates Holdings Ltd. | | 3,690,500 | 3,043 |

| Muramoto Electronic Thailand PCL (For. Reg.) (c) | | 1,217,100 | 7,007 |

| Nippo Ltd. (a)(c) | | 729,800 | 3,334 |

| PAX Global Technology Ltd. | | 4,038,000 | 1,619 |

| Philips Lighting NV (b)(e) | | 63,790 | 1,734 |

| Pinnacle Technology Holdings Ltd. (c) | | 7,269,983 | 8,195 |

| Redington India Ltd. | | 13,947,410 | 21,688 |

| ScanSource, Inc. (a)(c) | | 1,392,485 | 47,275 |

| Shibaura Electronics Co. Ltd. (c) | | 620,600 | 16,857 |

| Sigmatron International, Inc. (a) | | 169,138 | 715 |

| Simplo Technology Co. Ltd. | | 6,300,000 | 48,898 |

| SYNNEX Corp. (c) | | 2,715,024 | 267,538 |

| Tomen Devices Corp. (c) | | 533,300 | 11,363 |

| Tripod Technology Corp. | | 1,465,000 | 4,864 |

| TTM Technologies, Inc. (a) | | 692,416 | 7,243 |

| UKC Holdings Corp. | | 969,600 | 14,688 |

| VST Holdings Ltd. (c) | | 117,262,200 | 64,133 |

| Wayside Technology Group, Inc. (c) | | 335,557 | 3,785 |

| Wireless Telecom Group, Inc. (a) | | 247,661 | 381 |

| | | | 1,285,908 |

| IT Services - 4.1% | | | |

| ALTEN | | 583,365 | 72,393 |

| Amdocs Ltd. | | 5,729,478 | 366,629 |

| Argo Graphics, Inc. | | 780,000 | 17,824 |

| CACI International, Inc. Class A (a) | | 55,972 | 12,042 |

| Computer Services, Inc. | | 511,963 | 20,494 |

| CSE Global Ltd. (c) | | 40,304,200 | 13,482 |

| Data#3 Ltd. | | 2,778,797 | 4,811 |

| Dimerco Data System Corp. | | 510,000 | 625 |

| E-Credible Co. Ltd. | | 129,349 | 1,935 |

| eClerx Services Ltd. | | 1,609,270 | 13,856 |

| EOH Holdings Ltd. (a) | | 6,333,361 | 7,811 |

| Estore Corp. | | 169,800 | 1,358 |

| ExlService Holdings, Inc. (a) | | 79,267 | 5,453 |

| Fiserv, Inc. (a) | | 77,494 | 8,170 |

| Gabia, Inc. (c) | | 975,000 | 6,838 |

| Indra Sistemas SA (a)(c) | | 12,354,500 | 106,266 |

| Know IT AB (c) | | 1,379,326 | 27,240 |

| Leidos Holdings, Inc. | | 573,284 | 47,067 |

| Maximus, Inc. | | 176,547 | 12,978 |

| Net 1 UEPS Technologies, Inc. (a) | | 456,366 | 1,848 |

| NIC, Inc. | | 298,499 | 5,415 |

| Nice Information & Telecom, Inc. | | 125,020 | 3,272 |

| Presidio, Inc. | | 307,693 | 4,308 |

| Science Applications International Corp. | | 303,086 | 25,874 |

| Societe Pour L'Informatique Industrielle SA (c) | | 1,642,018 | 50,896 |

| Softcreate Co. Ltd. | | 596,500 | 9,650 |

| The Western Union Co. | | 17,230,535 | 361,841 |

| Total System Services, Inc. | | 96,173 | 13,053 |

| TravelSky Technology Ltd. (H Shares) | | 995,000 | 1,948 |

| WNS Holdings Ltd. sponsored ADR (a) | | 72,692 | 4,581 |

| | | | 1,229,958 |

| Semiconductors & Semiconductor Equipment - 0.7% | | | |

| Amkor Technology, Inc. (a) | | 198,627 | 1,833 |

| Axell Corp. (a) | | 239,200 | 1,449 |

| Boe Varitronix Ltd. | | 4,988,000 | 1,623 |

| Brooks Automation, Inc. | | 167,226 | 6,488 |

| Cabot Microelectronics Corp. | | 54,117 | 6,583 |

| Entegris, Inc. | | 275,775 | 11,999 |

| Leeno Industrial, Inc. | | 575,000 | 26,701 |

| Melexis NV (b) | | 999,300 | 68,697 |

| Miraial Co. Ltd. | | 148,600 | 1,925 |

| Nanometrics, Inc. (a) | | 156,608 | 4,914 |

| ON Semiconductor Corp. (a) | | 260,539 | 5,604 |

| Phison Electronics Corp. | | 1,900,000 | 18,580 |

| Powertech Technology, Inc. | | 10,000,000 | 27,271 |

| Renesas Electronics Corp. (a) | | 490,000 | 2,923 |

| Semtech Corp. (a) | | 49,056 | 2,594 |

| Trio-Tech International (a)(c) | | 222,545 | 743 |

| United Microelectronics Corp. | | 4,331,000 | 1,921 |

| | | | 191,848 |

| Software - 2.3% | | | |

| AdaptIT Holdings Ltd. | | 2,491,339 | 1,002 |

| ANSYS, Inc. (a) | | 2,699,724 | 548,368 |

| Aspen Technology, Inc. (a) | | 78,093 | 10,298 |

| Ebix, Inc. (b) | | 1,436,882 | 66,140 |

| ICT Automatisering NV (c) | | 485,785 | 7,529 |

| InfoVine Co. Ltd. (c) | | 175,000 | 3,003 |

| KSK Co., Ltd. (c) | | 526,700 | 9,160 |

| LivePerson, Inc. (a) | | 226,218 | 7,508 |

| Micro Focus International PLC | | 110,187 | 2,321 |

| NetGem SA | | 842,077 | 983 |

| Nucleus Software Exports Ltd. | | 600,000 | 2,547 |

| Pegasystems, Inc. | | 83,921 | 6,344 |

| Pro-Ship, Inc. | | 500,400 | 5,754 |

| RealPage, Inc. (a) | | 130,727 | 8,168 |

| Vitec Software Group AB | | 545,867 | 7,345 |

| Zensar Technologies Ltd. | | 3,500,000 | 10,664 |

| | | | 697,134 |

| Technology Hardware, Storage & Peripherals - 3.5% | | | |

| Compal Electronics, Inc. | | 66,000,000 | 40,275 |

| HP, Inc. | | 6,103,607 | 128,420 |

| Seagate Technology LLC (c) | | 17,941,438 | 830,868 |

| Super Micro Computer, Inc. (a) | | 1,193,568 | 21,854 |

| TPV Technology Ltd. | | 68,962,000 | 21,602 |

| | | | 1,043,019 |

|

| TOTAL INFORMATION TECHNOLOGY | | | 4,465,473 |

|

| MATERIALS - 3.8% | | | |

| Chemicals - 2.4% | | | |

| Axalta Coating Systems Ltd. (a) | | 469,875 | 13,922 |

| C. Uyemura & Co. Ltd. | | 380,300 | 20,835 |

| Chase Corp. (c) | | 590,462 | 61,160 |

| Core Molding Technologies, Inc. (a)(c) | | 697,490 | 4,638 |

| Deepak Fertilisers and Petrochemicals Corp. Ltd. | | 1,150,000 | 1,434 |

| Dow, Inc. (a) | | 31,016 | 1,502 |

| DowDuPont, Inc. | | 31,016 | 2,238 |

| EcoGreen International Group Ltd. (c) | | 49,660,080 | 9,478 |

| FMC Corp. | | 1,182,264 | 102,171 |

| Fujikura Kasei Co., Ltd. (c) | | 2,686,300 | 14,692 |

| Fuso Chemical Co. Ltd. | | 570,400 | 12,022 |

| Gujarat Narmada Valley Fertilizers Co. | | 4,800,000 | 14,632 |

| Gujarat State Fertilizers & Chemicals Ltd. (c) | | 28,500,000 | 33,181 |

| Honshu Chemical Industry Co. Ltd. (c) | | 755,800 | 8,219 |

| Huntsman Corp. | | 287,239 | 5,903 |

| Innospec, Inc. | | 776,714 | 72,530 |

| JSR Corp. | | 259,700 | 4,318 |

| KPC Holdings Corp. | | 55,171 | 2,601 |

| KPX Chemical Co. Ltd. | | 163,083 | 7,749 |

| Miwon Chemicals Co. Ltd. | | 55,095 | 1,814 |

| Miwon Commercial Co. Ltd. (d) | | 89,782 | 3,431 |

| Muto Seiko Co. Ltd. | | 236,100 | 1,018 |

| Nihon Parkerizing Co. Ltd. | | 305,000 | 3,418 |

| Nippon Soda Co. Ltd. | | 312,100 | 7,895 |

| SK Kaken Co. Ltd. | | 54,500 | 24,798 |

| Soken Chemical & Engineer Co. Ltd. (c) | | 660,800 | 9,895 |

| T&K Toka Co. Ltd. (c) | | 1,333,200 | 11,924 |

| Thai Carbon Black PCL (For. Reg.) | | 11,367,500 | 17,549 |

| Thai Rayon PCL: | | | |

| (For. Reg.) | | 2,694,500 | 3,257 |

| NVDR | | 84,700 | 102 |

| The Chemours Co. LLC | | 249,854 | 4,765 |

| The Mosaic Co. | | 3,203,419 | 80,694 |

| Westlake Chemical Corp. | | 104,025 | 7,029 |

| Yara International ASA | | 3,282,208 | 154,386 |

| Yip's Chemical Holdings Ltd. | | 25,454,000 | 7,756 |

| | | | 732,956 |

| Construction Materials - 0.1% | | | |

| Brampton Brick Ltd. Class A (sub. vtg.) (a) | | 665,800 | 3,254 |

| Mitani Sekisan Co. Ltd. (c) | | 1,476,600 | 40,529 |

| RHI Magnesita NV | | 43,474 | 2,406 |

| | | | 46,189 |

| Containers & Packaging - 0.3% | | | |

| AMVIG Holdings Ltd. | | 5,451,000 | 1,262 |

| Chuoh Pack Industry Co. Ltd. (c) | | 418,000 | 4,611 |

| Kohsoku Corp. (c) | | 1,721,600 | 19,797 |

| Mayr-Melnhof Karton AG | | 17,152 | 2,165 |

| Packaging Corp. of America | | 4,982 | 503 |

| Samhwa Crown & Closure Co. Ltd. | | 50,000 | 1,959 |

| Silgan Holdings, Inc. | | 244,873 | 7,361 |

| The Pack Corp. (c) | | 1,546,500 | 46,911 |

| | | | 84,569 |

| Metals & Mining - 0.9% | | | |

| Ausdrill Ltd. | | 10,804,097 | 14,477 |

| Chubu Steel Plate Co. Ltd. | | 410,500 | 2,411 |

| Cleveland-Cliffs, Inc. (b) | | 12,678,754 | 135,156 |

| Compania de Minas Buenaventura SA sponsored ADR | | 2,235,665 | 34,072 |

| Granges AB | | 259,859 | 2,596 |

| Hill & Smith Holdings PLC | | 792,255 | 10,877 |

| Livent Corp. | | 1,105,772 | 7,121 |

| Nucor Corp. | | 28,056 | 1,526 |

| Orvana Minerals Corp. (a) | | 700,832 | 199 |

| Pacific Metals Co. Ltd. | | 344,900 | 6,539 |

| Steel Dynamics, Inc. | | 53,813 | 1,696 |

| Tohoku Steel Co. Ltd. (c) | | 620,000 | 8,241 |

| Tokyo Tekko Co. Ltd. (c) | | 755,200 | 9,670 |

| Universal Stainless & Alloy Products, Inc. (a) | | 72,955 | 1,180 |

| Warrior Metropolitan Coal, Inc. | | 1,057,330 | 26,158 |

| Webco Industries, Inc. (a) | | 7,526 | 963 |

| | | | 262,882 |

| Paper & Forest Products - 0.1% | | | |

| Stella-Jones, Inc. | | 511,131 | 15,944 |

| Western Forest Products, Inc. | | 1,931,704 | 2,078 |

| | | | 18,022 |

|

| TOTAL MATERIALS | | | 1,144,618 |

|

| REAL ESTATE - 0.4% | | | |

| Equity Real Estate Investment Trusts (REITs) - 0.2% | | | |

| Colony Capital, Inc. | | 1,893,429 | 10,698 |

| Corrections Corp. of America | | 1,372,670 | 23,294 |

| Four Corners Property Trust, Inc. | | 156,415 | 4,214 |

| National Health Investors, Inc. | | 28,174 | 2,236 |

| NSI NV | | 8,385 | 357 |

| NSI NV rights (a)(f) | | 8,385 | 10 |

| Public Storage | | 6,976 | 1,693 |

| Store Capital Corp. | | 155,900 | 5,333 |

| Ventas, Inc. | | 54,845 | 3,691 |

| VEREIT, Inc. | | 323,294 | 2,948 |

| | | | 54,474 |

| Real Estate Management & Development - 0.2% | | | |

| Anabuki Kosan, Inc. | | 42,650 | 1,119 |

| Century21 Real Estate Japan Ltd. | | 124,000 | 1,377 |

| IMMOFINANZ Immobilien Anlagen AG | | 101,491 | 2,717 |

| Jones Lang LaSalle, Inc. | | 21,648 | 3,154 |

| LSL Property Services PLC | | 1,407,797 | 3,493 |

| Relo Group, Inc. | | 1,315,700 | 35,085 |

| Selvaag Bolig ASA | | 935,600 | 4,912 |

| Servcorp Ltd. | | 835,256 | 2,299 |

| Sino Land Ltd. | | 1,755,954 | 2,844 |

| Tejon Ranch Co. (a) | | 428,090 | 7,933 |

| Wing Tai Holdings Ltd. | | 1,708,300 | 2,619 |

| | | | 67,552 |

|

| TOTAL REAL ESTATE | | | 122,026 |

|

| UTILITIES - 1.6% | | | |

| Electric Utilities - 1.3% | | | |

| Exelon Corp. | | 329,883 | 14,865 |

| PG&E Corp. (a) | | 4,475,120 | 81,134 |

| PPL Corp. | | 9,952,095 | 294,881 |

| Vistra Energy Corp. | | 55,500 | 1,191 |

| | | | 392,071 |

| Gas Utilities - 0.1% | | | |

| Busan City Gas Co. Ltd. | | 50,971 | 1,565 |

| China Resource Gas Group Ltd. | | 676,000 | 3,422 |

| Hokuriku Gas Co. | | 151,300 | 4,214 |

| K&O Energy Group, Inc. | | 321,900 | 4,361 |

| Keiyo Gas Co. Ltd. | | 117,900 | 3,267 |

| Star Gas Partners LP | | 196,904 | 1,894 |

| | | | 18,723 |

| Independent Power and Renewable Electricity Producers - 0.1% | | | |

| Mega First Corp. Bhd (c) | | 32,000,045 | 29,374 |

| Mega First Corp. Bhd warrants 4/8/20 (a) | | 3,800,000 | 1,483 |

| | | | 30,857 |

| Multi-Utilities - 0.1% | | | |

| CMS Energy Corp. | | 262,969 | 15,310 |

| Water Utilities - 0.0% | | | |

| Manila Water Co., Inc. | | 5,567,500 | 2,564 |

|

| TOTAL UTILITIES | | | 459,525 |

|

| TOTAL COMMON STOCKS | | | |

| (Cost $14,731,577) | | | 27,955,372 |

|

| Nonconvertible Preferred Stocks - 0.1% | | | |

| CONSUMER STAPLES - 0.0% | | | |

| Food Products - 0.0% | | | |

| Nam Yang Dairy Products | | 4,917 | 815 |

| INDUSTRIALS - 0.0% | | | |

| Air Freight & Logistics - 0.0% | | | |

| Air T Funding 8.00% (a) | | 34,484 | 82 |

| Industrial Conglomerates - 0.0% | | | |

| Steel Partners Holdings LP Series A, 6.00% | | 162,154 | 3,543 |

|

| TOTAL INDUSTRIALS | | | 3,625 |

|

| MATERIALS - 0.1% | | | |

| Construction Materials - 0.1% | | | |

| Buzzi Unicem SpA (Risparmio Shares) | | 1,517,823 | 21,473 |

| TOTAL NONCONVERTIBLE PREFERRED STOCKS | | | |

| (Cost $15,686) | | | 25,913 |

| | | Principal Amount (000s) | Value (000s) |

|

| Nonconvertible Bonds - 0.0% | | | |

| ENERGY - 0.0% | | | |

| Energy Equipment & Services - 0.0% | | | |

| Bristow Group, Inc. 6.25% 10/15/22 (g) | | 9,944 | 1,889 |

| Oil, Gas & Consumable Fuels - 0.0% | | | |

| Centrus Energy Corp. 8.25% 2/28/27 (e) | | 4,561 | 3,523 |

| TOTAL NONCONVERTIBLE BONDS | | | |

| (Cost $12,726) | | | 5,412 |

| | | Shares | Value (000s) |

|

| Money Market Funds - 7.6% | | | |

| Fidelity Cash Central Fund 2.43% (h) | | 1,765,843,455 | 1,766,197 |

| Fidelity Securities Lending Cash Central Fund 2.43% (h)(i) | | 507,292,888 | 507,344 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $2,273,210) | | | 2,273,541 |

| TOTAL INVESTMENT IN SECURITIES - 101.5% | | | |

| (Cost $17,033,199) | | | 30,260,238 |

| NET OTHER ASSETS (LIABILITIES) - (1.5)% | | | (437,937) |

| NET ASSETS - 100% | | | $29,822,301 |

Values shown as $0 in the Schedule of Investments may reflect amounts less than $500.

Legend

(a) Non-income producing

(b) Security or a portion of the security is on loan at period end.

(c) Affiliated company

(d) Level 3 security

(e) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $36,371,000 or 0.1% of net assets.

(f) Security or a portion of the security purchased on a delayed delivery or when-issued basis.

(g) Non-income producing - Security is in default.

(h) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

(i) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| | (Amounts in thousands) |

| Fidelity Cash Central Fund | $51,413 |

| Fidelity Securities Lending Cash Central Fund | 4,723 |

| Total | $56,136 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Other Affiliated Issuers

An affiliated company is a company in which the Fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are as follows:

| Affiliate (Amounts in thousands) | Value, beginning of period | Purchases | Sales Proceeds(a) | Dividend Income | Realized Gain (loss) | Change in Unrealized appreciation (depreciation) | Value, end of period |

| Aalberts Industries NV | $301,560 | $-- | $2,240 | $4,730 | $1,637 | $(35,158) | $265,799 |

| Abbey PLC | 31,773 | -- | 288 | 2,400 | 231 | (4,471) | 27,245 |

| Accell Group NV | 36,577 | -- | 37,155 | -- | 92 | 486 | -- |

| Air T, Inc. | 6,043 | -- | 4,795 | -- | 3,189 | (3,272) | -- |

| AJIS Co. Ltd. | 27,747 | -- | 236 | 471 | 172 | 370 | 28,053 |

| Alconix Corp. | 32,597 | -- | 231 | 665 | 111 | (7,238) | 25,239 |

| Alps Logistics Co. Ltd. | 21,765 | -- | 192 | 414 | 93 | (2,180) | 19,486 |

| Arts Optical International Holdings Ltd. | 5,935 | -- | 598 | 143 | (520) | (349) | 4,468 |

| ASL Marine Holdings Ltd. | 3,319 | -- | 18 | -- | (17) | (1,762) | 1,522 |

| ASTI Corp. | 3,940 | -- | 27 | 103 | 12 | (981) | 2,944 |

| Axell Corp. | 5,341 | -- | 2,993 | -- | (13,946) | 13,047 | -- |

| Barratt Developments PLC | 506,341 | -- | 9,306 | 42,660 | 4,666 | 55,391 | 557,092 |

| Bed Bath & Beyond, Inc. | 38,749 | 121,213 | 1,253 | 5,916 | 41 | (47,643) | 111,107 |

| Belc Co. Ltd. | 79,124 | -- | 732 | 934 | 607 | (2,929) | 76,070 |

| Belluna Co. Ltd. | 81,345 | -- | 4,330 | 806 | 1,857 | (36,238) | 42,634 |

| BMTC Group, Inc. | 42,943 | -- | 1,109 | 640 | 1,063 | (13,974) | 28,923 |

| Bristow Group, Inc. | 30,021 | 6,739 | 2,808 | -- | (35,738) | 1,786 | -- |

| Calian Technologies Ltd. | 15,163 | -- | 138 | 449 | 97 | 657 | 15,779 |

| Chase Corp. | 83,869 | -- | 10,143 | 497 | 9,077 | (21,643) | 61,160 |

| Chuoh Pack Industry Co. Ltd. | 5,281 | -- | 41 | 136 | 19 | (648) | 4,611 |

| Civeo Corp. | 45,452 | -- | 433 | -- | (2,463) | (23,237) | 19,319 |

| Clip Corp. | 2,255 | -- | 37 | 88 | (4) | (311) | 1,903 |

| Codorus Valley Bancorp, Inc. | 19,497 | 214 | 137 | 414 | 111 | (4,312) | 15,373 |

| Contango Oil & Gas Co. | 14,584 | -- | 67 | -- | (8) | (11,083) | 3,426 |

| Core Molding Technologies, Inc. | 5,129 | 2,856 | 48 | -- | 33 | (3,332) | 4,638 |

| Create SD Holdings Co. Ltd. | 132,942 | -- | 1,192 | 1,548 | 900 | (13,142) | 119,508 |

| CSE Global Ltd. | 13,446 | -- | 128 | 817 | 31 | 133 | 13,482 |

| Daewon Pharmaceutical Co. Ltd. | 32,353 | -- | 57 | 362 | 26 | (8,628) | 23,694 |

| Daiichi Kensetsu Corp. | 27,504 | -- | 240 | 477 | 142 | 491 | 27,897 |

| DongKook Pharmaceutical Co. Ltd. | 35,177 | -- | -- | 242 | -- | (269) | 34,908 |

| DVx, Inc. | 8,927 | -- | 55 | 136 | 33 | (3,857) | 5,048 |

| EcoGreen International Group Ltd. | 10,664 | -- | 93 | 358 | 21 | (1,114) | 9,478 |

| Elematec Corp. | 27,752 | -- | 197 | 627 | 101 | (5,611) | 22,045 |

| Estore Corp. | 2,452 | -- | 871 | 40 | 249 | (472) | -- |

| Excel Co. Ltd. | 16,942 | -- | 116 | 156 | 45 | (6,547) | 10,324 |

| Ff Group | 24,491 | -- | 127 | -- | (292) | (18,329) | 5,743 |

| First Juken Co. Ltd. | 17,548 | -- | 141 | 481 | 84 | (1,458) | 16,033 |

| Food Empire Holdings Ltd. | 17,941 | -- | 184 | 194 | 67 | (3,298) | 14,526 |

| Fossil Group, Inc. | 108,416 | -- | 549 | -- | 461 | (63,064) | 45,264 |

| Fresh Del Monte Produce, Inc. | 174,685 | -- | 1,259 | 1,444 | 318 | (29,129) | 144,615 |

| Fuji Kosan Co. Ltd. | 3,729 | -- | 42 | 83 | 8 | 1,467 | 5,162 |

| Fujikura Kasei Co., Ltd. | 15,712 | -- | 134 | 349 | 20 | (906) | 14,692 |

| Fursys, Inc. | 25,681 | -- | -- | 707 | -- | (1,421) | 24,260 |

| Gabia, Inc. | 8,126 | -- | -- | 22 | -- | (1,288) | 6,838 |

| Geospace Technologies Corp. | 16,165 | -- | 4,366 | -- | (4,030) | 5,452 | 13,221 |

| Geumhwa PSC Co. Ltd. | 10,669 | -- | -- | 347 | -- | (1,111) | 9,558 |

| Goodfellow, Inc. | 4,058 | -- | 28 | 47 | 10 | (1,163) | 2,877 |

| Guess?, Inc. | 111,897 | -- | 10,941 | 3,767 | (6,778) | (21,492) | 72,686 |

| Gujarat State Fertilizers & Chemicals Ltd. | 48,562 | -- | -- | 863 | -- | (15,381) | 33,181 |

| Halows Co. Ltd. | 29,828 | 772 | 250 | 276 | 175 | (3,234) | 27,291 |

| Hamakyorex Co. Ltd. | 43,329 | -- | 412 | 656 | 258 | 1,353 | 44,528 |

| Handsome Co. Ltd. | 67,806 | -- | 1,878 | 596 | 1,497 | (6,572) | 60,853 |

| Hanger, Inc. | 43,651 | -- | 48,459 | -- | (7,242) | 12,050 | -- |

| Helen of Troy Ltd. | 192,471 | -- | 71,123 | -- | 68,583 | (23,081) | -- |

| Hiday Hidaka Corp. | 39,244 | -- | 8,020 | 459 | 5,834 | (6,295) | -- |

| Honshu Chemical Industry Co. Ltd. | 7,715 | -- | 75 | 172 | 46 | 533 | 8,219 |

| Hoshiiryou Sanki Co. Ltd. | 10,891 | -- | 631 | 143 | 121 | (587) | 9,794 |

| Hwacheon Machine Tool Co. Ltd. | 10,270 | -- | -- | 205 | -- | (2,370) | 7,900 |

| Hyster-Yale Materials Handling Class A | 15,257 | 1,200 | 1,794 | 288 | (192) | (529) | 13,942 |

| Hyster-Yale Materials Handling Class B | 20,386 | -- | -- | 387 | -- | (1,216) | 19,170 |

| I-Sheng Electric Wire & Cable Co. Ltd. | 17,495 | -- | -- | 997 | -- | (920) | 16,575 |

| IA Group Corp. | 3,987 | -- | 32 | 152 | 4 | (78) | 3,881 |

| ICT Automatisering NV | 8,682 | 202 | 320 | 201 | 90 | (1,125) | 7,529 |

| IDIS Holdings Co. Ltd. | 10,166 | -- | -- | 119 | -- | (2,436) | 7,730 |

| Ihara Science Corp. | 19,975 | -- | 123 | 359 | 79 | (8,528) | 11,403 |

| Indra Sistemas SA | 156,113 | -- | 4,952 | -- | (5,863) | (39,032) | 106,266 |

| InfoVine Co. Ltd. | 3,709 | -- | -- | 124 | -- | (706) | 3,003 |

| Intage Holdings, Inc. | 34,244 | -- | 256 | 590 | 156 | (6,287) | 27,857 |

| Intelligent Digital Integrated Security Co. Ltd. | 7,137 | -- | 19,559 | -- | 12,178 | 244 | -- |

| INTOPS Co. Ltd. | 14,024 | -- | 334 | 254 | 160 | 7,359 | 21,209 |

| INZI Controls Co. Ltd. | 7,407 | -- | 6,961 | 113 | 3,908 | (1,824) | -- |

| Isra Vision AG | 76,909 | -- | 66,836 | -- | 60,402 | (70,475) | -- |

| Jaya Holdings Ltd. | 69 | -- | -- | -- | (59,063) | 59,045 | -- |

| JLM Couture, Inc. | 1,267 | -- | 13 | -- | 5 | (115) | 1,144 |

| Jorudan Co. Ltd. | 4,066 | -- | 5,893 | 42 | 3,101 | (1,274) | -- |

| Jumbo SA | 160,642 | -- | 1,568 | 4,009 | 1,200 | 33,850 | 194,124 |

| Kingboard Chemical Holdings Ltd. | 265,008 | -- | 2,042 | 17,418 | 1,687 | (79,145) | 185,508 |

| Know IT AB | 27,548 | -- | 266 | 717 | 165 | (207) | 27,240 |

| Kohsoku Corp. | 21,243 | -- | 163 | 405 | 80 | (1,363) | 19,797 |

| Kondotec, Inc. | 14,329 | 751 | 132 | 340 | 106 | (1,151) | 13,903 |

| Korea Electric Terminal Co. Ltd. | 28,981 | 320 | -- | 366 | -- | 10,365 | 39,666 |

| KSK Co., Ltd. | 8,551 | -- | 76 | 405 | 51 | 634 | 9,160 |

| Kwang Dong Pharmaceutical Co. Ltd. | 20,881 | -- | -- | 185 | -- | (3,249) | 17,632 |

| Kyeryong Construction Industrial Co. Ltd. | 13,397 | -- | -- | 251 | -- | 1,040 | 14,437 |

| Maruzen Co. Ltd. | 31,406 | -- | 293 | 360 | 235 | (955) | 30,393 |

| Mega First Corp. Bhd | 28,477 | -- | 576 | 309 | 149 | 1,324 | 29,374 |

| Metro, Inc. Class A (sub. vtg.) | 831,515 | -- | 8,218 | 12,005 | 7,811 | 124,613 | 955,721 |

| Michang Oil Industrial Co. Ltd. | 12,557 | -- | -- | 208 | -- | (1,220) | 11,337 |

| Mitani Sekisan Co. Ltd. | 36,133 | -- | 345 | 361 | 279 | 4,462 | 40,529 |

| Motonic Corp. | 26,269 | -- | 4,690 | 727 | 1,348 | (135) | 22,792 |

| Mr. Bricolage SA | 13,235 | -- | 52 | -- | (44) | (9,882) | 3,257 |

| Muhak Co. Ltd. | 38,087 | -- | -- | 730 | -- | (13,412) | 24,675 |

| Murakami Corp. | 21,350 | 1,044 | 169 | 290 | 133 | (4,551) | 17,807 |

| Muramoto Electronic Thailand PCL (For. Reg.) | 7,016 | -- | 68 | 458 | 18 | 41 | 7,007 |

| Murphy Oil Corp. | 362,834 | 4,908 | 13,252 | 10,783 | 1,786 | (100,213) | 256,063 |

| Nadex Co. Ltd. | 7,449 | -- | 60 | 230 | 32 | (1,081) | 6,340 |

| Nafco Co. Ltd. | 31,794 | -- | 253 | 593 | 76 | (6,636) | 24,981 |

| ND Software Co. Ltd. | 12,926 | -- | 84 | 72 | 9,624 | (3,684) | -- |

| Next PLC | 989,675 | -- | 45,183 | 25,683 | 25,210 | (82,231) | 887,471 |

| Nippo Ltd. | 2,971 | -- | 28 | -- | 6 | 385 | 3,334 |

| Origin Enterprises PLC | 64,974 | -- | 523 | 2,194 | 36 | (14,591) | 49,896 |

| P&F Industries, Inc. Class A | 2,683 | -- | 2,457 | 32 | (68) | (158) | -- |

| Parker Corp. | 10,960 | -- | 91 | 223 | 58 | (919) | 10,008 |

| Pinnacle Technology Holdings Ltd. | 10,420 | -- | 81 | 117 | 27 | (2,171) | 8,195 |

| Piolax, Inc. | 60,277 | -- | 454 | 900 | 408 | (15,829) | 44,402 |

| Prim SA | 22,014 | -- | 170 | 752 | 55 | (4,401) | 17,498 |

| Roadrunner Transportation Systems, Inc. | 6,911 | -- | 4,101 | -- | (22,024) | 19,214 | -- |

| Rocky Mountain Chocolate Factory, Inc. | 4,481 | 82 | 34 | 209 | (2) | (547) | 3,980 |

| S&T Holdings Co. Ltd. | 10,056 | -- | -- | 263 | -- | 1,240 | 11,296 |

| Sakai Moving Service Co. Ltd. | 57,168 | -- | 574 | 480 | 485 | 6,953 | 64,032 |

| Samsung Climate Control Co. Ltd. | 4,804 | -- | -- | 30 | -- | (706) | 4,098 |

| Sanei Architecture Planning Co. Ltd. | 21,406 | -- | 152 | 704 | 79 | (4,538) | 16,795 |

| Sarantis SA | 32,784 | -- | 327 | 592 | 234 | 5,397 | 38,088 |

| ScanSource, Inc. | 93,159 | -- | 33,319 | -- | 7,835 | (20,400) | 47,275 |

| Seagate Technology LLC | 979,279 | -- | 31,997 | 45,743 | 23,216 | (139,630) | 830,868 |

| Senshu Electric Co. Ltd. | 26,771 | -- | 200 | 466 | 118 | (4,609) | 22,080 |

| Sewon Precision Industries Co. Ltd. | 4,625 | -- | -- | 36 | -- | (1,220) | 3,405 |

| Shibaura Electronics Co. Ltd. | 26,494 | -- | 180 | 381 | 143 | (9,600) | 16,857 |

| SJM Co. Ltd. | 4,312 | -- | -- | 95 | -- | (974) | 3,338 |

| SJM Holdings Co. Ltd. | 4,506 | -- | 1,224 | 124 | (340) | (579) | 2,363 |

| Societe Pour L'Informatique Industrielle SA | 48,447 | -- | 382 | 248 | 304 | 2,527 | 50,896 |

| Soken Chemical & Engineer Co. Ltd. | 12,151 | -- | 92 | 297 | 24 | (2,188) | 9,895 |

| Southwestern Energy Co. | 65,794 | 191,675 | 4,792 | -- | (782) | (141,788) | 110,107 |

| Sportscene Group, Inc. Class A | 2,039 | -- | 24 | -- | 20 | 703 | 2,738 |

| Step Co. Ltd. | 15,560 | -- | 129 | 312 | 88 | (497) | 15,022 |

| Strattec Security Corp. | 11,320 | 916 | 93 | 206 | 14 | (4,576) | 7,581 |

| Strongco Corp. | 1,437 | -- | 10 | -- | (14) | (424) | 989 |

| Sun Hing Vision Group Holdings Ltd. | 6,974 | -- | 64 | 455 | 1 | 326 | 7,237 |

| Sunjin Co. Ltd. | 29,566 | -- | -- | 89 | -- | (9,233) | 20,333 |

| SYNNEX Corp. | 260,551 | 3,516 | 2,309 | 4,001 | 1,900 | 3,880 | 267,538 |

| T&K Toka Co. Ltd. | 15,501 | -- | 115 | 368 | 62 | (3,524) | 11,924 |

| The Buckle, Inc. | 108,284 | 386 | 757 | 8,980 | (180) | (16,527) | 91,206 |

| The Pack Corp. | 49,627 | -- | 426 | 642 | 217 | (2,507) | 46,911 |

| Tohoku Steel Co. Ltd. | 8,562 | -- | 70 | 121 | 39 | (290) | 8,241 |

| Tokyo Kisen Co. Ltd. | 5,987 | -- | 51 | 168 | 31 | (505) | 5,462 |

| Tokyo Tekko Co. Ltd. | 11,941 | -- | 77 | 123 | (30) | (2,164) | 9,670 |

| Tomen Devices Corp. | 13,785 | -- | 104 | 393 | (12) | (2,306) | 11,363 |

| Totech Corp. | 21,516 | -- | 646 | 492 | 340 | (1,659) | 19,551 |

| TOW Co. Ltd. | 13,217 | -- | 118 | 437 | 72 | (128) | 13,043 |

| Trancom Co. Ltd. | 62,738 | -- | 447 | 633 | 437 | (13,644) | 49,084 |

| Trio-Tech International | 1,038 | -- | 7 | -- | (4) | (284) | 743 |

| Triple-S Management Corp. | 59,125 | -- | 826 | -- | 132 | (17,493) | 40,938 |

| UKC Holdings Corp. | 25,947 | -- | 5,586 | 922 | 1,555 | (7,228) | -- |

| Unit Corp. | 134,142 | -- | 674 | -- | (221) | (98,552) | 34,695 |

| Unum Group | 599,747 | -- | 7,223 | 15,982 | 3,005 | (119,862) | 475,667 |

| Utah Medical Products, Inc. | 27,463 | -- | 1,976 | 289 | 1,801 | (3,474) | 23,814 |

| VSE Corp. | 36,175 | 871 | 332 | 277 | 41 | (10,989) | 25,766 |

| VST Holdings Ltd. | 64,422 | -- | 930 | 2,280 | 581 | 60 | 64,133 |

| Wayside Technology Group, Inc. | 3,713 | 770 | 35 | 219 | -- | (663) | 3,785 |

| Whanin Pharmaceutical Co. Ltd. | 33,084 | -- | -- | 391 | -- | (9,029) | 24,055 |

| Whiting Petroleum Corp. | 69,458 | 87,107 | 798 | -- | 14 | (74,751) | 81,030 |

| WIN-Partners Co. Ltd. | 37,651 | -- | 236 | 656 | 170 | (9,856) | 27,729 |

| Winas Ltd. | 3,446 | -- | 30 | 4,578 | 10 | (2,824) | 602 |

| Youngone Holdings Co. Ltd. | 42,903 | -- | -- | 529 | -- | (3,556) | 39,347 |

| Yutaka Giken Co. Ltd. | 29,952 | -- | 191 | 711 | 99 | (10,512) | 19,348 |

| | $9,583,908 | $425,542 | $520,948 | $255,711 | $115,991 | $(1,319,267) | $8,047,590 |

(a) Includes the value of securities delivered through in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of July 31, 2019, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| (Amounts in thousands) | | | | |

| Investments in Securities: | | | | |

| Equities: | | | | |

| Communication Services | $539,126 | $371,591 | $167,535 | $-- |

| Consumer Discretionary | 7,076,544 | 6,790,592 | 275,604 | 10,348 |

| Consumer Staples | 2,969,307 | 2,850,086 | 116,571 | 2,650 |

| Energy | 1,396,425 | 1,133,271 | 263,154 | -- |

| Financials | 3,916,293 | 3,658,844 | 257,449 | -- |

| Health Care | 3,743,025 | 3,553,367 | 189,658 | -- |

| Industrials | 2,127,450 | 1,761,077 | 366,373 | -- |

| Information Technology | 4,465,473 | 3,495,181 | 970,292 | -- |

| Materials | 1,166,091 | 1,038,870 | 123,790 | 3,431 |

| Real Estate | 122,026 | 114,264 | 7,762 | -- |

| Utilities | 459,525 | 421,117 | 38,408 | -- |

| Corporate Bonds | 5,412 | -- | 5,412 | -- |

| Money Market Funds | 2,273,541 | 2,273,541 | -- | -- |

| Total Investments in Securities: | $30,260,238 | $27,461,801 | $2,782,008 | $16,429 |

Other Information

Distribution of investments by country or territory of incorporation, as a percentage of Total Net Assets, is as follows (Unaudited):

| United States of America | 57.3% |

| Japan | 9.1% |

| United Kingdom | 6.5% |

| Canada | 5.3% |

| Ireland | 4.0% |

| Netherlands | 2.4% |

| Taiwan | 2.1% |

| Bermuda | 2.0% |

| Korea (South) | 1.9% |