UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): November 27, 2007

REHABCARE GROUP, INC.

(Exact name of Company as specified in its charter)

| Delaware | 0-19294 | 51-0265872 | |

| (State or other jurisdiction | (Commission | (I.R.S. Employer | |

| of incorporation) | File Number) | Identification No.) |

| | | | | | | | | | | |

| 7733 Forsyth Boulevard | |

| Suite 2300 | |

| St. Louis, Missouri | 63105 | |

(Address of principal executive offices) | (Zip Code) |

| | | | | | | | |

(314) 863-7422

(Company's telephone number, including area code)

Not applicable

(Former name or former address if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Company under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01 | Regulation FD Disclosure |

Beginning on November 27, 2007, RehabCare executives will make presentations at investor conferences to analysts and in other forums using the slides as included in this Form 8-K as Exhibit 99. Presentations will be made using these slides, or modifications thereof, in connection with other presentations in the foreseeable future.

Information contained in this presentation is an overview and intended to be considered in the context of RehabCare's SEC filings and all other publicly disclosed information. We undertake no duty or obligation to update or revise this information. However, we may update the presentation periodically in a Form 8-K filing.

Forward-looking statements have been provided pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties that may cause our actual results in future periods to differ materially from forecasted results. These risks and uncertainties may include but are not limited to, our ability to consummate acquisitions and other partnering relationships at reasonable valuations; our ability to integrate acquisitions and partnering relationships within the expected timeframes and to achieve the revenue, cost savings and earnings levels from such acquisitions and relationships at or above the levels projected; our ability to comply with the terms of our borrowing agreements; changes in governmental reimbursement rates and other regulations or policies affecting reimbursement for the services provided by us to clients and/or patients; the operational, administrative and financial effect of our compliance with other governmental regulations and applicable licensing and certification requirements; our ability to attract new client relationships or to retain and grow existing client relationships through expansion of our service offerings and the development of alternative product offerings; the future financial results of any unconsolidated affiliates; our ability to attract and the additional costs of attracting and retaining administrative, operational and professional employees; shortages of qualified therapists and other healthcare personnel; significant increases in health, workers compensation and professional and general liability costs; litigation risks of our past and future business, including our ability to predict the ultimate costs and liabilities or the disruption of our operations; competitive and regulatory effects on pricing and margins; our ability to effectively respond to fluctuations in our census levels and number of patient visits; the adequacy and effectiveness of our information systems; natural disasters and other unexpected events which could severely damage or interrupt our systems and operations; changes in federal and state income tax laws and regulations, the effectiveness of our tax planning strategies and the sustainability of our tax positions; and general and economic conditions, including efforts by governmental reimbursement programs, insurers, healthcare providers and others to contain healthcare costs.

Item 9.01 | Financial Statements and Exhibits. |

| (d) | Exhibits - See exhibit index |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 27, 2007

By: /s/ Jay W. Shreiner

Name: Jay W. Shreiner

Title: Senior Vice President and

Chief Financial Officer

EXHIBIT INDEX

99 | Investor Relations Presentation in use beginning November 27, 2007. |

Exhibit 99

Investor Presentation, Third Quarter 2007

0

About Us

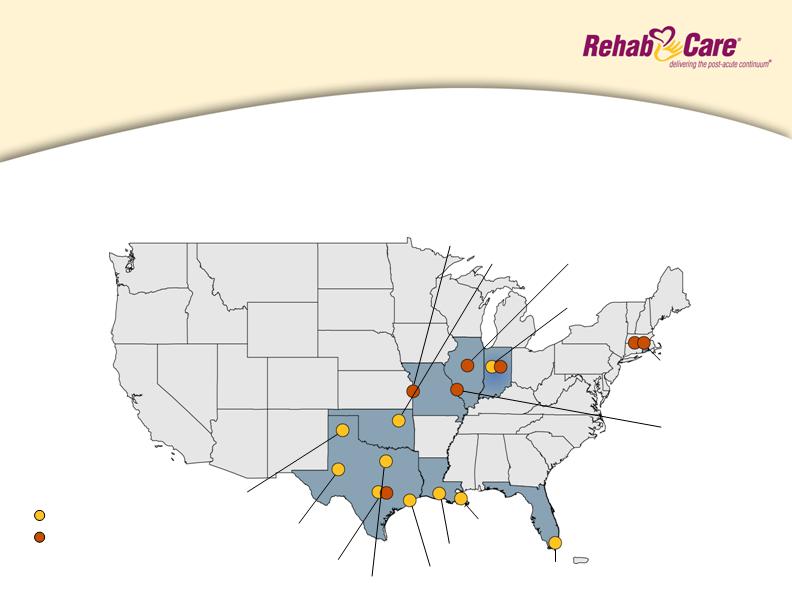

RehabCare is a leading national provider of

physical rehabilitation services in conjunction with

nearly 1,250 hospitals and skilled nursing facilities

in 43 states and the District of Columbia. We also

own and/or operate 10 freestanding rehabilitation

and long-term acute care hospitals.

1

Service Lines

$720 million consolidated

revenues(1)

Contract Therapy Division

$405 million revenue - 57% of revenue (1)

1,085 skilled nursing facility programs

39 states

7.5 million annual patient visits

Hospital Rehabilitation Services Division

$169 million revenue - 23% of revenue (1)

154 hospital-based programs

31 states & DC

47,000 inpatient and skilled nursing unit discharges/year

1.0 million annual outpatient visits

$101 million revenue - 14% of revenue (1)

Freestanding Hospitals Division

6 rehabilitation hospitals, 3 LTACHs

1 rehabilitation hospital minority owned (2)

5 states (3)

462 beds (3)

6,100 annualized patient discharges (3)

Other Healthcare Services Division

$45 million revenue - 6% of revenue (1)

Phase 2 Consulting – consulting and care management for hospitals and health systems

Polaris Group – consulting for long-term care facilities

VTA Management Services – therapy and nurse staffing for New York

(1)

For twelve months ended 9/30/07

(2)

Not included in consolidated

revenues

(3)

These statistics include the

minority-owned rehab hospital

2

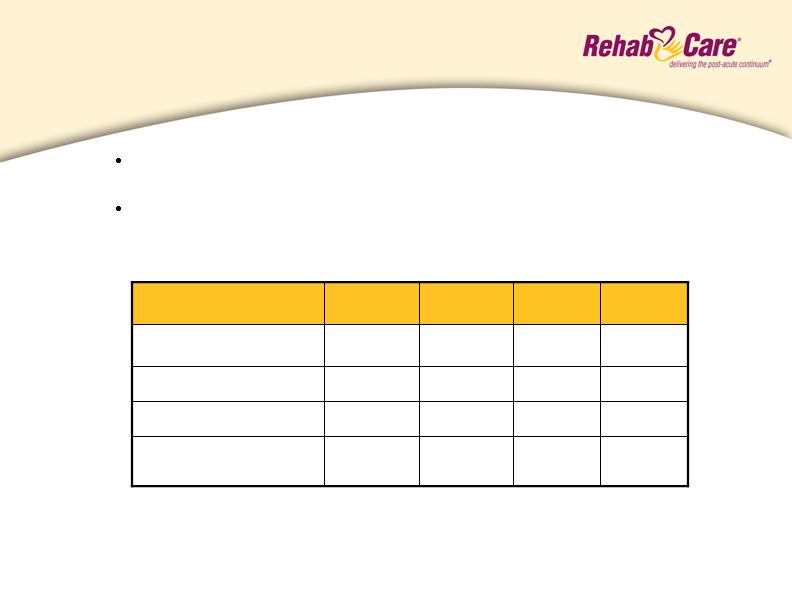

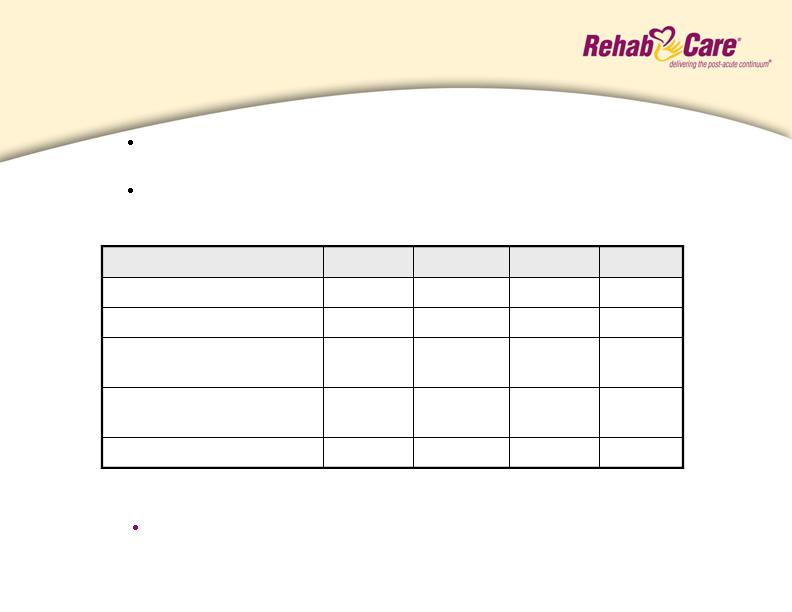

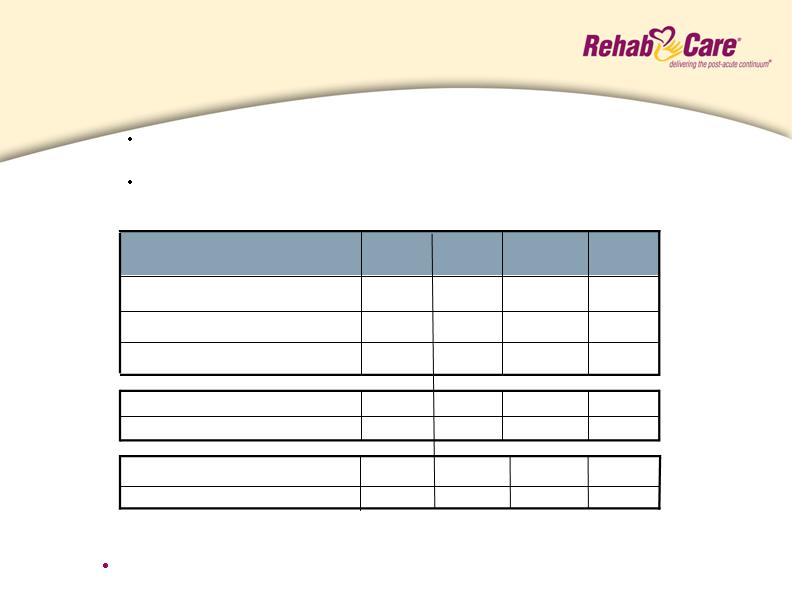

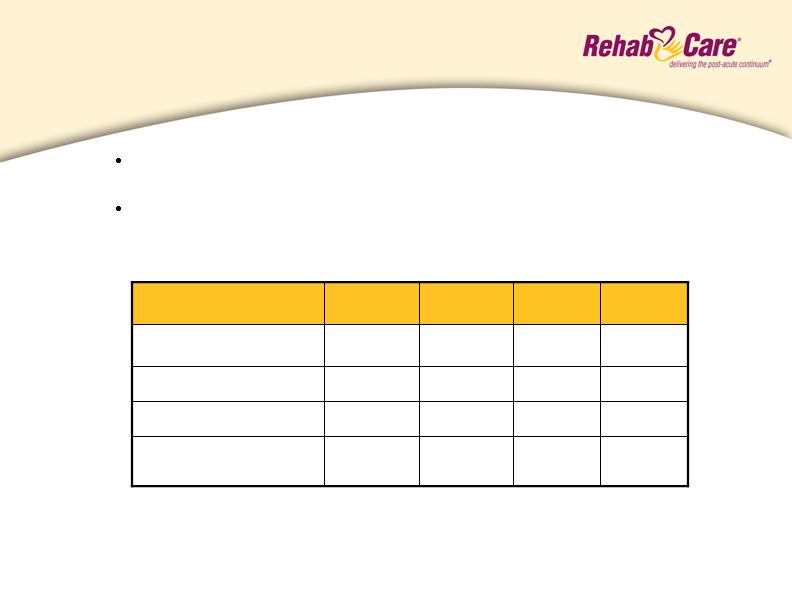

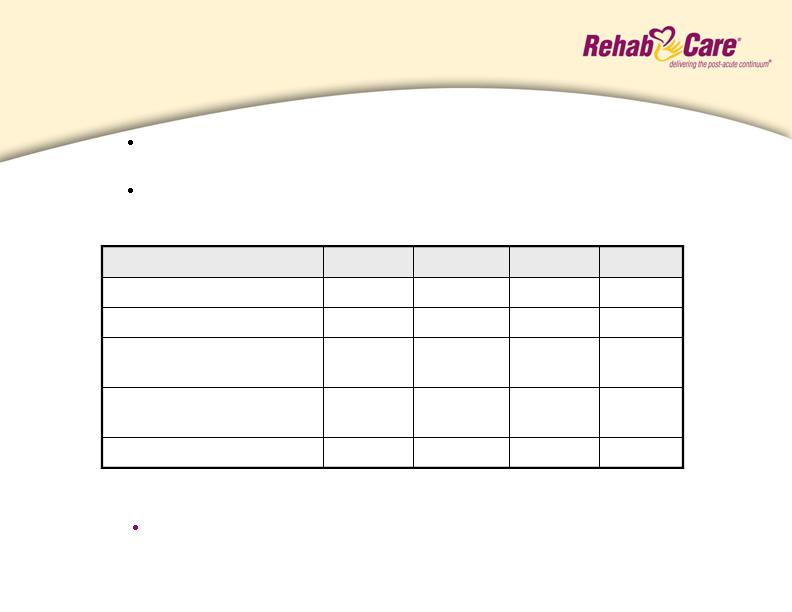

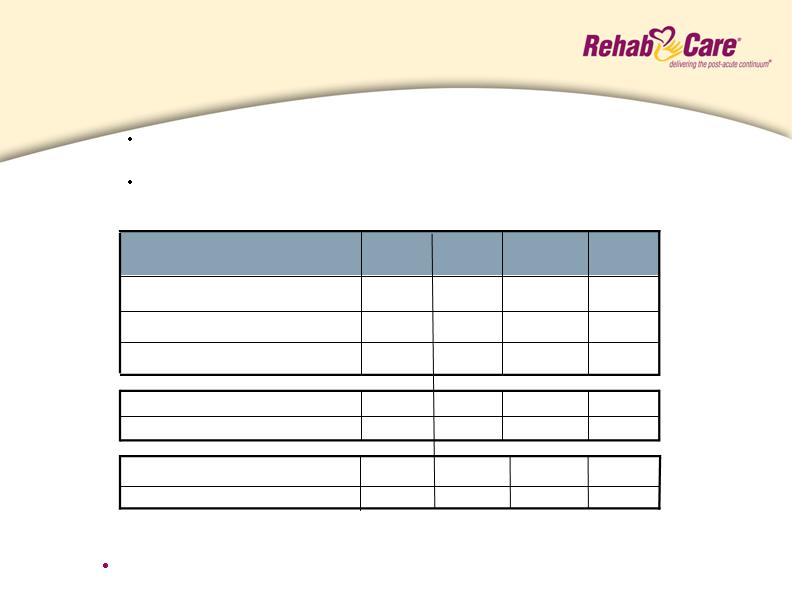

Financial Summary

$0.22

3.9

8.2

$172.9

3Q 07

$0.12(1)

2.1(1)

4.7(1)

$182.2

4Q 06

$0.12

$0.09(2)

Diluted Earnings Per

Share

2.0

1.7(2)

Net Earnings

5.5

4.2(2)

Operating Earnings

$184.0

$181.1

Operating Revenues

1Q 07

2Q 07

(dollars in millions except per

share)

(1) Includes a pretax software development impairment charge of $2.4 million, or $0.09 per diluted

share after tax

(2) Includes a pretax intangible asset impairment charge of $4.9 million ($2.9 million after tax), or $0.17

per diluted share after tax

Q3/07 operating earnings of $8.2 million and EPS of $0.22 per

diluted share, are at the highest level in the last 8 quarters

Lower operating revenues reflect elimination of programs that

don’t meet profit and credit objectives

3

Consolidated Balance Sheet

(Dollars in thousands)

Cash and Cash Equivalents

Total Assets

Total Debt

Stockholders’ Equity

Percent of Debt to Total Capital

12/31/06

9/30/07

$ 9,430

428,296

120,559

$210,779

36%

$ 14,203

425,331

100,600

$235,142

30%

Cash flow from operations totaled $30.9 million for nine

months ended September 30, 2007; $20 million debt

repaid during this period

4

Contract Therapy

Market Overview

The Contract Therapy division manages skilled nursing facility rehab programs that are

designed to provide therapy intervention to both short-stay patients and long-term residents

with a wide range of conditions, including neurological, orthopedic and other conditions

common to the geriatric patient.

Market Size

10,000 Medicare certified skilled nursing facilities

Competitive Landscape

Owned

Self-Operation

Aegis (333)

Kindred - Peoplefirst (332)

Genesis (220)

Sundance (103)

Skilled Healthcare (74)

Managed

RehabCare (1,085)

Aegis (667)

Genesis (480)

Select Medical (400)

Sundance (309)

Kindred - Peoplefirst (286)

EnduraCare (270)

Skilled Healthcare (122)

Source: Information available from public filings or from company websites

5

Contract Therapy

Performance

Q4 06

Q1 07

Q2 07

Q3 07

Dollars in millions

1,085

3.2%

$3.2

$98.3

1,197

(1.2)%

$(1.3)

$103.4

1,146

1,110

Number of Locations End

of Period

(2.2)%

1.1%

Operating Earnings

Margin

$(2.2)

$1.1

Operating Earnings (loss)

$102.8

$100.3

Operating Revenues

Outlook (assumes no unfavorable regulatory changes)

Quarterly sequential improvement in operating earnings

4.5 - 5.5% operating earnings margins during 2008

Return to net additions in locations in 2008

Operating earnings have improved sequentially

each quarter since Q1/07 with a cumulative

improvement of $5.4 million over that time period

Lower operating revenues reflect elimination of programs

that don’t meet profit and credit objectives

6

Contract Therapy

Legislative/Regulatory Environment

Part B Therapy Caps

Places annual limit on physical and speech therapy services as well as

occupational therapy services provided in non-hospital settings; exceptions

process scheduled to expire December 31, 2007

Legislative Update: House Medicare language extends exceptions process

through 2009 and requires HHS to conduct a study on a refined payment plan;

legislation currently under consideration by the Senate Finance Committee

Physician Fee Schedule (PFS)

Scheduled 9.9% reduction beginning January 2008; impacts Medicare

reimbursement for Part B services. PFS serves as the charge master for Part

B therapy

Legislative Update: House Medicare language allows 0.5% increase in

reimbursement versus a 9.9% scheduled reduction; legislation currently under

consideration by the Senate Finance Committee

For conditions most frequently treated and reimbursed under Medicare Part B, we developed a

care mapping process that ties treatment plans to cost of care. This mapping process, scheduled

for completion in December, will enable clinicians to match treatment and cost to therapy cap dollars

assisting patients to better manage their limited annual benefits.

7

Hospital Rehabilitation Services

Market Overview

Acute care hospital-based inpatient rehabilitation facilities in RehabCare’s Hospital

Rehabilitation Services (HRS) division are for patients who require early, intensive therapies (at

least 3 hours/day 5 days/week) for recovery from stroke, brain injury, neurological disorders,

amputation and other disabling injuries and illnesses. Outpatient therapy programs provide

proactive, exercise-oriented therapy with hands-on treatment for individuals of all ages.

Market Size

5,000 acute care hospitals (approximately 1,000 hospital-based IRFs)

Competitive Landscape (Acute care hospital-based IRFs)

Self-Operation

RehabCare (108)

Horizon Health (Specialty Rehab Mgmt) (23)

HealthSouth (11)

Milestone(1)

TherEx (formerly National Rehab Partners)(1)

(1) Private company or a subsidiary of a public company; number of locations is not available

Source: Information available from public filings or from company websites

8

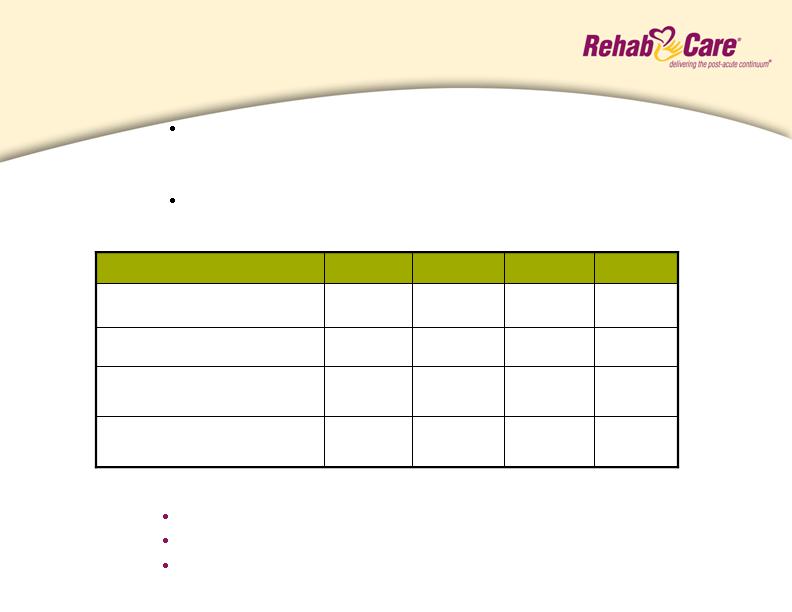

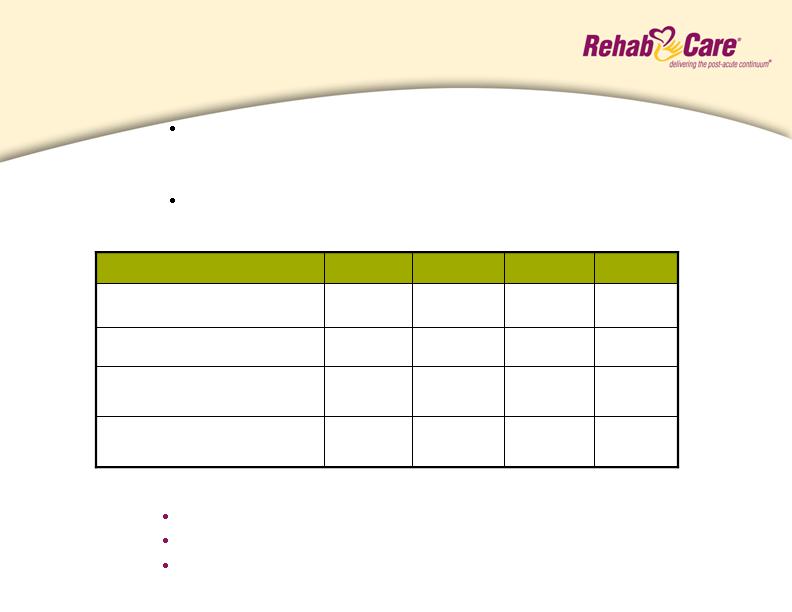

Hospital Rehab Services

Performance

Q4 06

Q1 07

Q2 07

Q3 07

Dollars in millions

10,173

154

15.7%

$6.3

$40.3

11,337

11,093

10,786

IRF Discharges

172

16.7%

$7.3

$43.8

164

161

Number of Locations End

of Period

12.0%

12.9%

Operating Earnings

Margin

$5.2

$5.4

Operating Earnings

$43.3

$41.8

Operating Revenues

Outlook

Continued modest declines in IRFs in Q4 and relatively flat same

store discharges until implementation of 75% Rule is clarified

legislatively

Continued strong operating earnings performance through

focus on controlling costs

Lower operating revenues reflect impact of the 75% Rule and

reduction in units that don’t meet profit and credit objectives

9

Hospital Rehab Services

Legislative/Regulatory Environment

Medicare Fiscal Intermediaries (FI) and Recovery Audit Contractor

Reviews (RAC)

Medical necessity reviews are growing in frequency; RHB has 90.5% overturn rate of

HRS denied claims

The Tax Relief and Healthcare Act of 2006 requires the RAC program be in place

nationwide by 2010. A demonstration project was established in 2006 for California,

Florida and New York. CMS intends to expand the program in 2008, but recently

established October 1, 2007 as earliest reach-back review date.

According to the September 2007 Moran report, IRF same store discharges for four quarters

ending Q2/07 versus four quarters ending Q2/04 declined 24.8%. On the same basis,

RehabCare discharges declined 9.7%.

For the nine months ended 3Q/07, non-Medicare discharges increased 13.1% over the same

period last year

IRF 75% Rule

Requires inpatient rehabilitation programs to maintain a minimum of 75% of their

Medicare admissions from 13 diagnostic categories. Transitioned from 60% to 65%

on July 1, 2007 with final phase-in to 75% scheduled for July 1, 2008. The comorbidity

provision (4% of RHB discharges) scheduled to expire on July 1, 2008. Division

operating at average 65% compliance.

Legislative Update: House Medicare language permanently freezes

threshold at 60% and extends the use of comorbidities; legislation

currently under consideration by the Senate Finance Committee

10

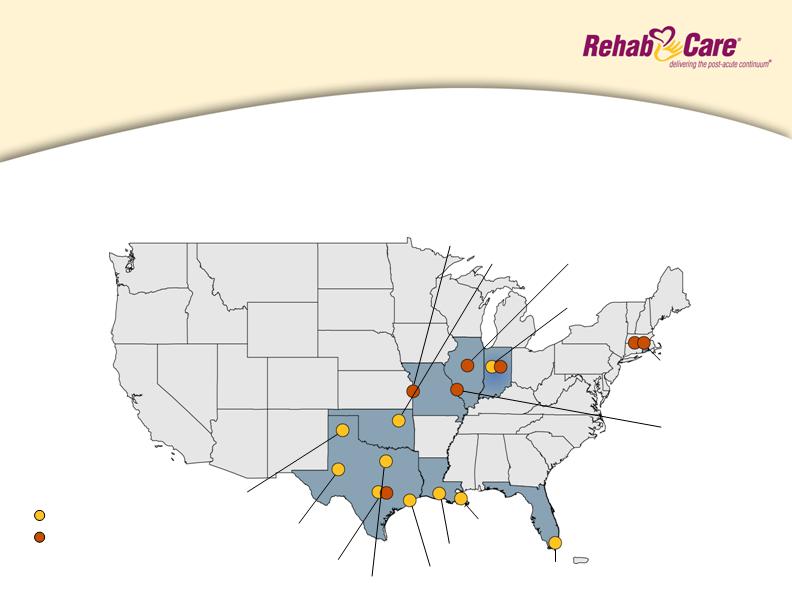

Inpatient rehabilitation facilities (IRFs) are equipped to treat patients with a wide range of

debilitating injuries and illnesses, offering inpatient and outpatient services in a home-like

environment. Long-term acute care hospitals (LTACHs) are specialty care hospitals

designed for extended stay patients with complex and chronic conditions.

Freestanding Hospitals

Description and Locations

Tulsa, OK

Miami, FL

Arlington, TX

Houston, TX

New Orleans, LA

Amarillo, TX

Midland, TX

Austin, TX

Kokomo, IN

Lafayette, LA

Providence, RI

Peoria, IL

St. Louis, MO

N. Kansas City, MO

10 current locations

7 future locations

11

Freestanding Hospitals

Market Overview

Competitive Landscape

HealthSouth (94)

RehabCare (7)

Ernest Health (5)

Select Medical (4)

Vibra Healthcare (4)

Centerre (2)

Market Size:

240+ IRFs

Competitive Landscape

Select Medical (87)

Kindred (83)

Regency Hospital (23)

Triumph Healthcare (22)

LifeCare (20)

Vibra Healthcare (9)

HealthSouth (6)

Ernest Health (6)

RehabCare (3)

Market Size:

460+ LTACHs

Freestanding IRFs

LTACHs

Source: Information available from public filings or from company websites

12

Freestanding Hospitals

Performance

Q4 06

Q1 07

Q2 07

Q3 07

Dollars in millions

386

3

1,060

6(2)

(6.7)%

$(1.6)

$24.4

398

403

380

LTACH Patient Discharges

3

3

3

Number of LTACHs End of Period

857

972

1,006

IRF Patient Discharges

5

0.1%

$0.0

$23.7

5

5

Number of IRFs End of Period

7.3%

(11.6)%

Operating Earnings Margin (loss)

$1.9

$(3.1)(1)

Operating Earnings (loss)

$26.0

$27.0

Operating Revenues

(1)

Includes a pretax impairment charge on Louisiana Specialty Hospital intangible asset of $4.9 million

(2)

Includes Central Texas Rehabilitation Hospital, which is in its Medicare demonstration period

Outlook

17-19% EBITDA margins before corporate overhead in 2008 for hospitals in

operation more than one year

Q3/07 operating revenues and operating loss impacted by $1.4 million

additional contractual reserve adjustment

Q3/07 operating results also impacted by $700,000 start-up costs

at Central Texas Rehabilitation Hospital

13

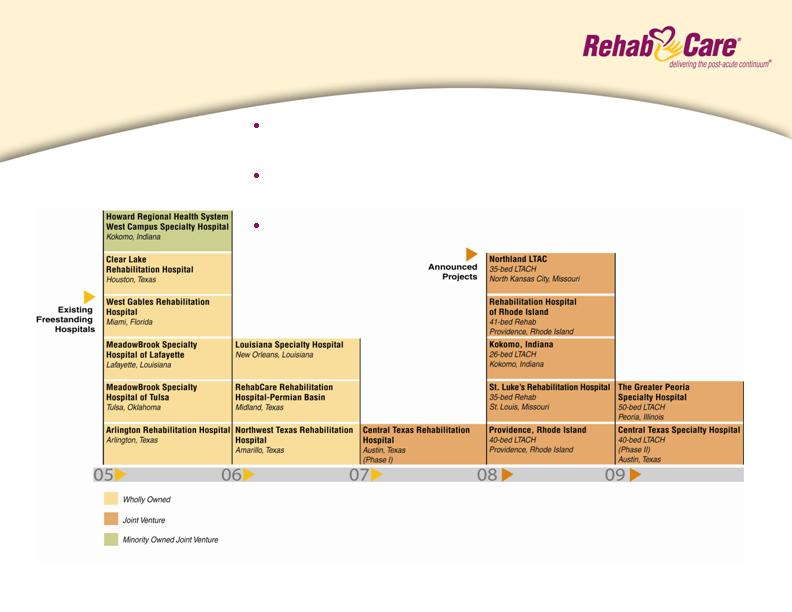

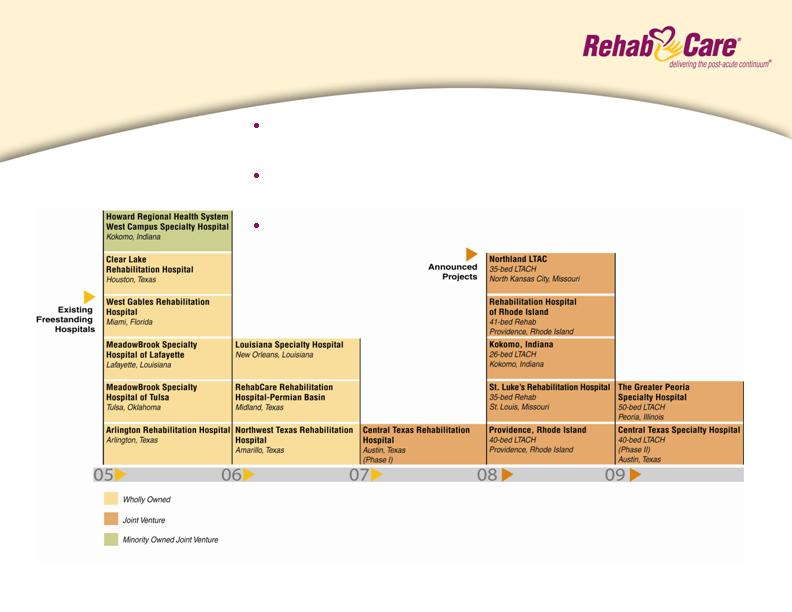

Freestanding Hospitals

Development Timeline

Division established in 2005 with the acquisition of

MeadowBrook Healthcare

10 existing hospitals, 5 in development, 1 awaiting State

Attorney General approval, 1 pending CON approval

Anticipated 4-6 new projects/year

14

Freestanding Hospitals

Legislative/Regulatory Environment

LTACH 25% Rule

3-year phase-in of rule that limits hospital-in-hospital LTACHs from receiving

no more than 25% of their admissions from a single provider; impacts

Louisiana Specialty Hospital. Mitigation strategy is currently under

development.

Legislative Update: House Medicare language prevents 25% Rule from impacting

grandfathered LTACHs, such as Louisiana Specialty, and creates specific patient

and facility admission criteria, four-year moratorium on new facilities; legislation

currently under consideration by the Senate Finance Committee

IRF 75% Rule

Freestanding Hospitals are subject to the same 75% Rule provisions as

previously discussed. Division operating at average 64% compliance.

15

Continuous Improvement

Initiatives

Intermediate

Long-Term

Open 4-6 joint ventures

annually

Standardize care

management processes

across FSH and ARUs

Implement IT roadmap for

improved clinical,

revenue cycle, and data

warehouse systems

Standardize and integrate

back office processes and

information systems

Implement centralized

support infrastructure

for FSH division

Build out continuum of

care delivery model

around key market

relationships

Implement electronic

medical record system

Continue to address

therapist supply issue

through innovation

programs like Allied

Health Research Institute

and partnerships with

the Universities of

Kansas and Missouri

2008 Initiatives

CT operating earnings

margins to 4.5% - 5.5%

HRS product development

to better match long-term

client needs

FSH EBITDA margin to

17-19% target for mature

hospitals

“Move The Mountain”

recruiting program

Roll out Patient Plus

compensation program in

CT division

16

Investment Considerations

Why RehabCare?

Increasing market demand

Unique continuum of care model

Demonstrated ability to grow revenue

organically and through acquisitions

Proven ability to adapt to market

and regulatory changes

Expenditures for post-acute services:

Increase of 239% since 1998

Projected increase of 150% by 2016

Represents 12% of Medicare spending

75% rule, Part B therapy caps, LTACH

25% rule, physician fee schedule

(Annualized)

Celebrating 25 years as one of the longest tenured post-acute providers

of service in the industry

17

Safe Harbor

Forward-looking statements have been provided pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties that may cause our actual results in future periods to differ materially from forecasted results. These risks and uncertainties may include but are not limited to, our ability to consummate acquisitions and other partnering relationships at reasonable valuations; our ability to integrate acquisitions and partnering relationships within the expected timeframes and to achieve the revenue, cost savings and earnings levels from such acquisitions and relationships at or above the levels projected; our ability to comply with the terms of our borrowing agreements; changes in governmental reimbursement rates and other regulations or policies affecting reimbursement for the services provided by us to clients and/or patients; the operational, administrative and financial effect of our compliance with other governmental regulations and applicable licensing and certification requirements; our ability to attract new client relationships or to retain and grow existing client relationships through expansion of our service offerings and the development of alternative product offerings; the future financial results of any unconsolidated affiliates; our ability to attract and the additional costs of attracting and retaining administrative, operational and professional employees; shortages of qualified therapists and other healthcare personnel; significant increases in health, workers compensation and professional and general liability costs; litigation risks of our past and future business, including our ability to predict the ultimate costs and liabilities or the disruption of our operations; competitive and regulatory effects on pricing and margins; our ability to effectively respond to fluctuations in our census levels and number of patient visits; the adequacy and effectiveness of our information systems; natural disasters and other unexpected events which could severely damage or interrupt our systems and operations; changes in federal and state income tax laws and regulations, the effectiveness of our tax planning strategies and the sustainability of our tax positions; and general and economic conditions, including efforts by governmental reimbursement programs, insurers, healthcare providers and others to contain healthcare costs.

18