Investor Presentation, Fourth Quarter 2007

0

About Us

RehabCare is a leading national provider of

physical rehabilitation services in conjunction with

more than 1,200 hospitals and skilled nursing

facilities in 42 states. We also own and/or operate

10 freestanding rehabilitation and long-term acute

care hospitals.

1

Service Lines

$712 million consolidated

revenues(1)

Contract Therapy Division

$401 million revenue - 56% of revenue (1)

1,064 skilled nursing facility programs

39 states

7.4 million annual patient visits

Hospital Rehabilitation Services Division

$164 million revenue - 23% of revenue (1)

154 hospital-based programs

31 states

45,000 inpatient and skilled nursing unit discharges/year

1.0 million annual outpatient visits

$103 million revenue - 15% of revenue (1)

Hospital Division

6 rehabilitation hospitals, 3 LTACHs

1 rehabilitation hospital minority owned (2)

5 states (3)

462 beds (3)

Approximately 6,500 annualized patient discharges (3)

Other Healthcare Services Division

$45 million revenue - 6% of revenue (1)

Phase 2 Consulting – consulting and care management for hospitals and health systems

Polaris Group – consulting for long-term care facilities

VTA Management Services – therapy and nurse staffing for New York

(1)

For twelve months ended 12/31/07

(2)

Not included in consolidated

revenues

(3)

These statistics include the

minority-owned rehab hospital

2

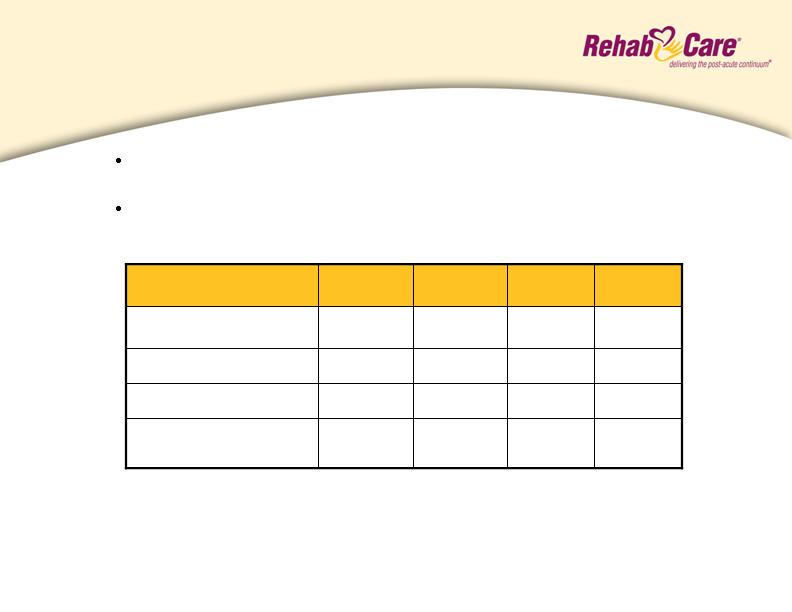

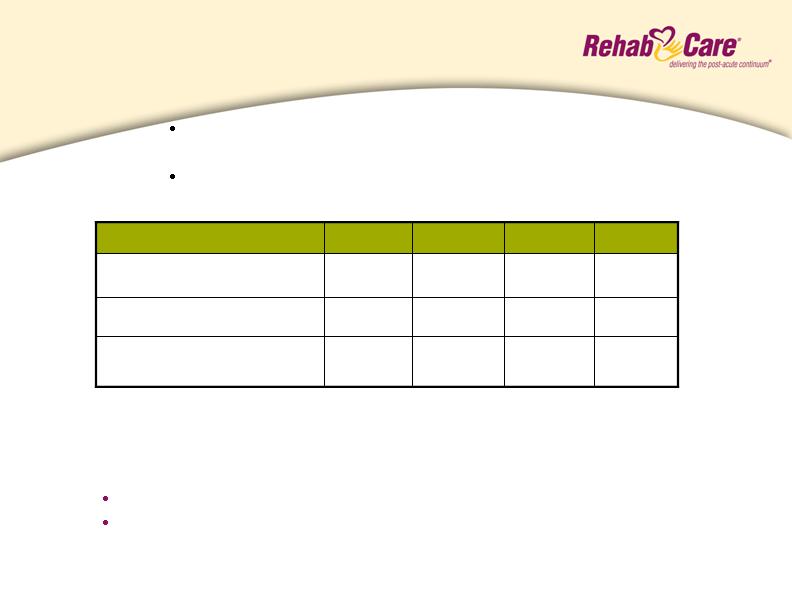

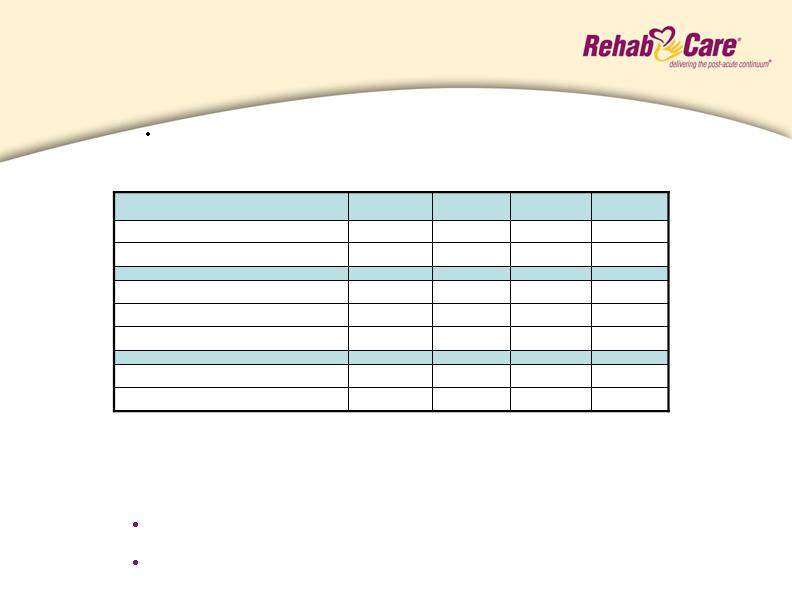

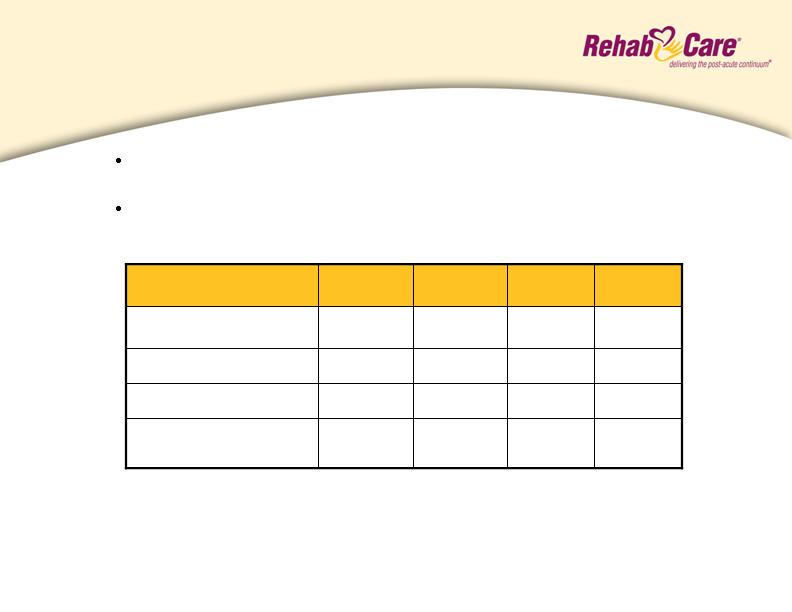

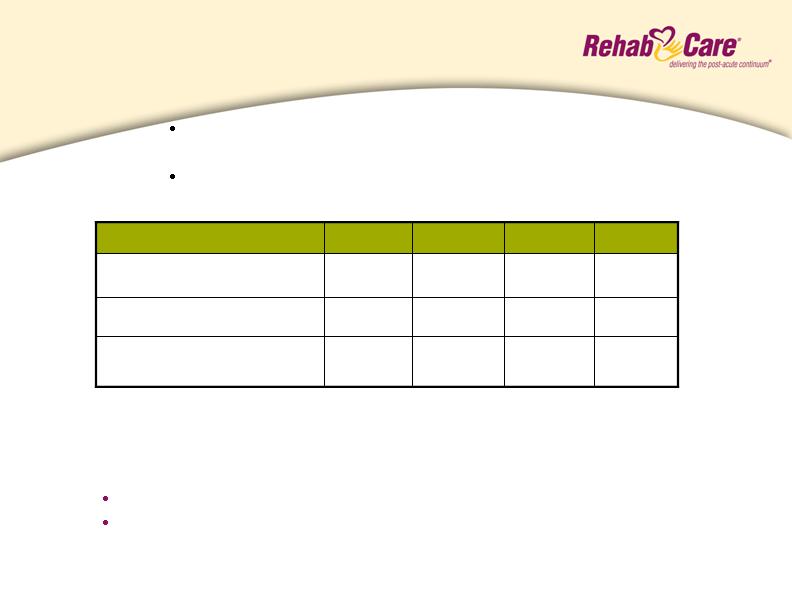

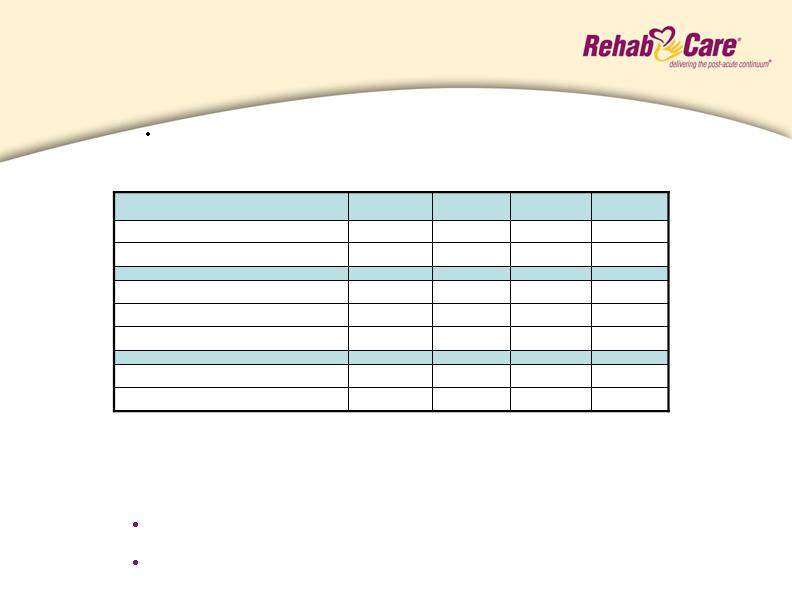

Financial Summary

$0.29(1)

5.1(1)

9.0(1)

$173.6

4Q 07

$0.12

2.0

5.5

$184.0

1Q 07

$0.09(2)

$0.22(1)

Diluted Earnings Per

Share

1.7(2)

3.9(1)

Net Earnings

4.2(2)

8.2(1)

Operating Earnings

$181.1

$172.9

Operating Revenues

2Q 07

3Q 07

(dollars in millions except per

share)

(1)

Includes favorable net self insurance costs of approximately $1.4 million and $1.2 million, or

$0.05 and $0.04 per diluted share after tax in Q4 and Q3, respectively, when compared to the

quarterly run rate for these costs in Q2.

(2)

Includes a pretax intangible asset impairment charge of $4.9 million ($2.9 million after tax), or

$0.17 per diluted share after tax.

Q4/07 EPS of $0.29 per diluted share and $0.73 for full year 2007,

74% higher than 2006

Lower operating revenues reflect elimination of programs that

don’t meet profit and credit objectives

3

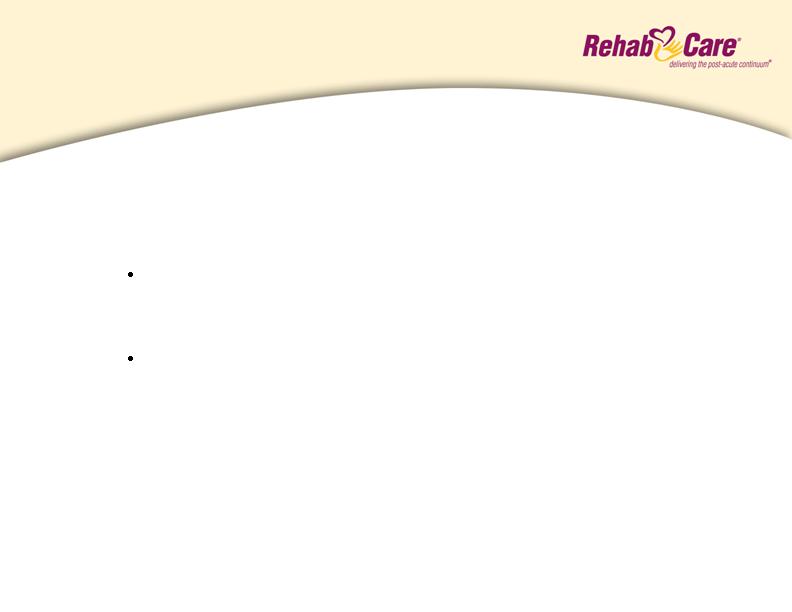

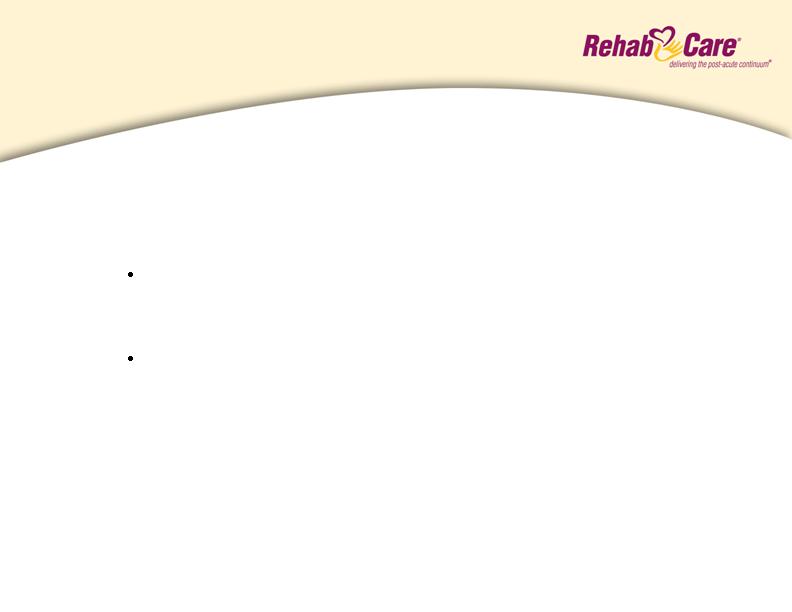

Consolidated Balance Sheet

(Dollars in thousands)

Cash and Cash Equivalents

Total Assets

Total Debt

Stockholders’ Equity

Percent of Debt to Total Capital

12/31/06

12/31/07

$ 9,430

428,296

120,559

$210,779

36%

$ 10,265

408,560

74,500

$244,022

23%

Cash flow from operations totaled $52.0 million for

twelve months ended December 31, 2007; $46.1

million debt repaid during this period

4

Contract Therapy

Market Overview

The Contract Therapy division manages skilled nursing facility rehab programs that are

designed to provide therapy intervention to both short-stay patients and long-term residents

with a wide range of conditions, including neurological, orthopedic and other conditions

common to the geriatric patient.

Market Size

17,000 Medicare certified skilled nursing facilities

Competitive Landscape

Owned

Self-Operation

Aegis (333)

Kindred - Peoplefirst (332)

Genesis (220)

Sundance (107)

Skilled Healthcare (74)

Managed

RehabCare (1,064)

Aegis (667)

Genesis (480)

Select Medical (400)

Sundance (309)

Kindred - Peoplefirst (298)

EnduraCare (270)

Skilled Healthcare (113)

Source: Information available from public filings or from company websites

5

Contract Therapy

Performance

Q1 07

Q2 07

Q3 07

Q4 07

Dollars in millions

1,064

$4.0 (1)

$99.4

1,146

$(2.2)

$102.8

1,110

1,085

Number of Locations End

of Period

$1.1

$3.2 (1)

Operating Earnings (loss)

$100.3

$98.3

Operating Revenues

Outlook (assumes Part B therapy cap exception remains in place for 2008)

4.5 - 5.5% operating earnings margins during 2008

Return to net additions in locations in 2008

Operating earnings have improved sequentially

each quarter since Q1/07

Lower operating revenues reflect elimination of programs

that don’t meet profit and credit objectives

(1)

Includes favorable net self insurance costs of approximately $0.4 million in both Q4 and Q3 when compared to the costs

incurred in Q2. Excluding the favorable adjustments for self insurance costs, operating earnings would have been $3.6 million and $2.8 million in Q4 and Q3, respectively.

incurred in Q2. Excluding the favorable adjustments for self insurance costs, operating earnings would have been $3.6

6

Contract Therapy

Legislative/Regulatory Environment

Part B Therapy Caps & Physician Fee Schedule (PFS)

The President signed into law the Medicare, Medicaid and SCHIP

Extension Act of 2007 (Extension Act) which includes:

A six-month extension of the exception process which

essentially eliminates the annual limit on therapies for Part B

Medicare beneficiaries - expires June 30, 2008

A 0.5% increase in the PFS, which serves as the charge

master for reimbursement for Part B therapy services, for the

next six-months, rather than the 10.1% scheduled reduction -

expires June 30, 2008

We are actively pursuing an 18-month extension of these

provisions

7

Hospital Rehabilitation Services

Market Overview

Acute care hospital-based inpatient rehabilitation facilities in RehabCare’s Hospital

Rehabilitation Services (HRS) division are for patients who require early, intensive therapies (at

least 3 hours/day 5 days/week) for recovery from stroke, brain injury, neurological disorders,

amputation and other disabling injuries and illnesses. Outpatient therapy programs provide

proactive, exercise-oriented therapy with hands-on treatment for individuals of all ages.

Market Size

5,000 acute care hospitals (approximately 1,000 hospital-based IRFs)

Competitive Landscape (Acute care hospital-based IRFs)

Self-Operation

RehabCare (107)

Horizon Health (Specialty Rehab Mgmt) (23)

HealthSouth (11)

Milestone(1)

TherEx (formerly National Rehab Partners)(1)

(1) Private company or a subsidiary of a public company; number of locations is not available

Source: Information available from public filings or from company websites

8

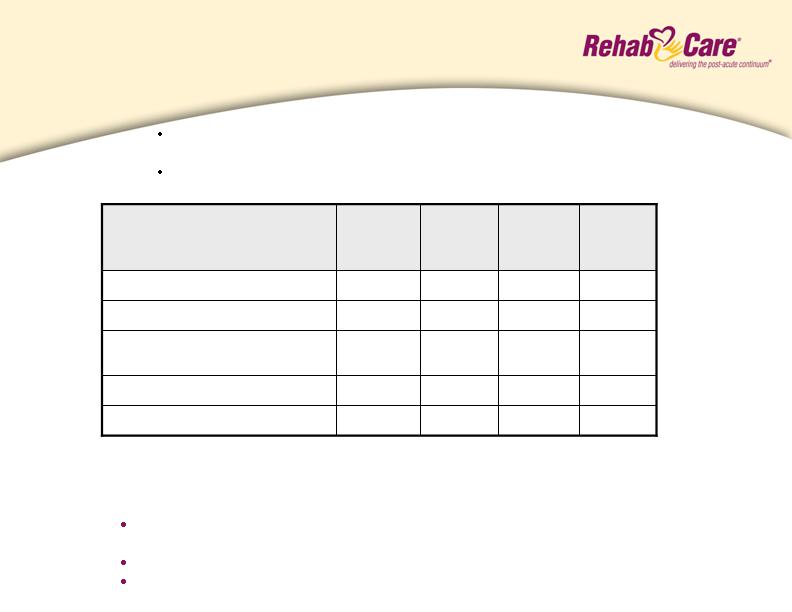

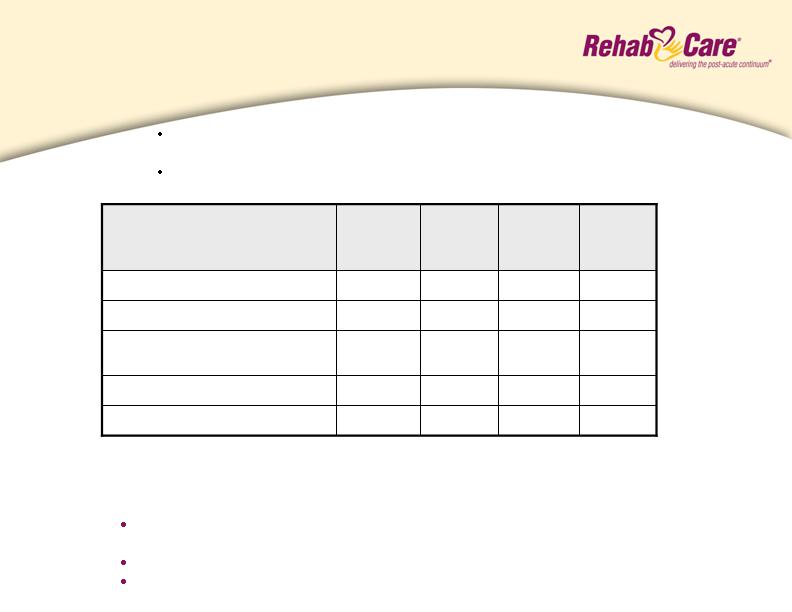

Hospital Rehab Services

Performance

63.0%

63.7%

64.9%

67.8%

75% Compliance Level (Avg)

Q1 07

Q2 07

Q3 07

Q4 07

Dollars in millions

10,190

154

$6.0 (1)

$38.8

11,093

10,786

10,173

IRF Discharges

164

$5.2

$43.3

161

154

Number of Locations End of

Period

$5.4

$6.3 (1)

Operating Earnings

$41.8

$40.3

Operating Revenues

Outlook

Modest increase in IRF units during 2008 (have already opened 3 IRFs in

2008 compared to 7 openings for the entire year of 2007)

Resumption of 3 – 5% growth in same store discharges during 2008

Continued 12 - 15% operating margins

Continued strong operating earnings performance through

focus on controlling costs

Lower operating revenues reflect impact of the 75% Rule and

reduction in units that don’t meet profit and credit objectives

(1)

Includes favorable net self insurance costs of approximately $0.6 million and $0.5 million in Q4 and Q3, respectively, when compared

to the costs incurred in Q2. Excluding the favorable adjustments for self insurance costs, operating earnings would have

been approximately $5.4 million and $5.8 million in Q4 and Q3, respectively.

9

Hospital Rehab Services

Legislative/Regulatory Environment

IRF 75% Rule

The Extension Act:

Permanently freezes the compliance threshold at 60%

for cost reporting periods starting July 1, 2006

Continues the use of comorbid conditions to qualify

patients and averts a planned cut in reimbursement rates

for lower extremity joint procedures

Requires HHS to conduct a study on patient access and

eligibility for rehabilitation services

Eliminates market basket updates through 2009

We believe the impact of the market basket elimination will be

mitigated through higher patient volumes resulting from the freeze

at 60%.

10

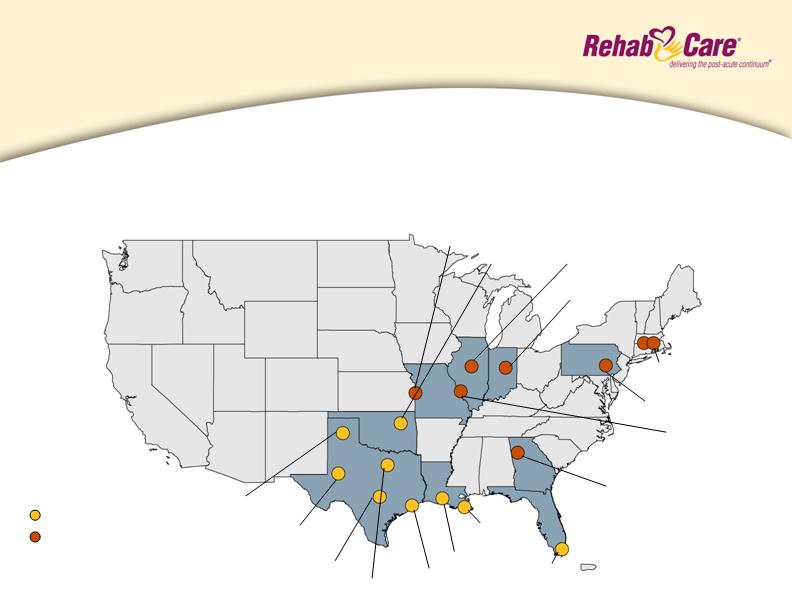

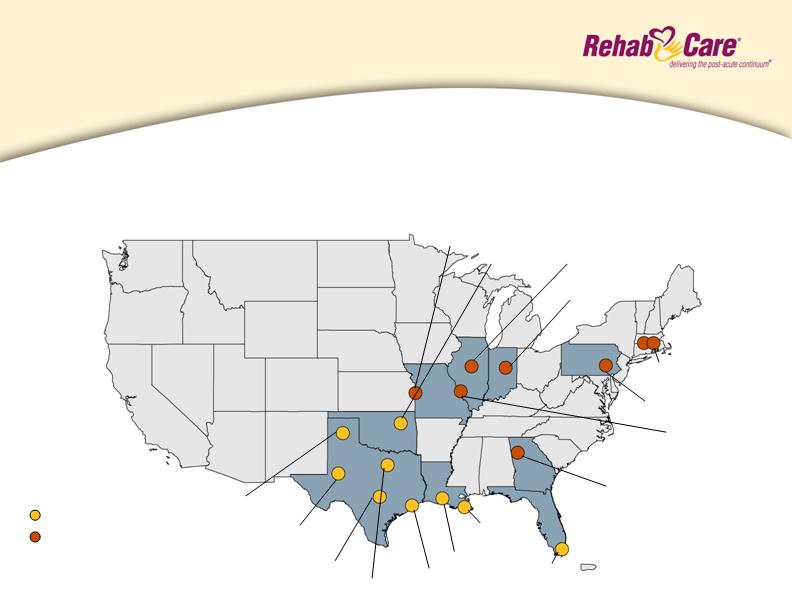

Inpatient rehabilitation facilities (IRFs) are equipped to treat patients with a wide range of

debilitating injuries and illnesses, offering inpatient and outpatient services in a home-like

environment. Long-term acute carehospitals(LTACHs) are specialty care hospitals

designed for extended stay patients with complex and chronic conditions.

Hospital Division

Description and Locations

Arlington, TX

Providence, RI

St. Louis, MO

N. Kansas City, MO

Reading, PA

Tulsa, OK

Miami, FL

Houston, TX

New Orleans, LA

Amarillo, TX

Midland, TX

Austin, TX

Rome, GA

Lafayette, LA

Peoria, IL

9 current locations

8 future locations

Kokomo, IN

11

Hospital Division

Market Overview

Competitive Landscape

HealthSouth (94)

RehabCare (7)

Ernest Health (5)

Select Medical (4)

Vibra Healthcare (4)

Centerre (2)

Market Size:

240+ IRFs

Competitive Landscape

Select Medical (87)

Kindred (84)

Regency Hospital (23)

Triumph Healthcare (22)

LifeCare (20)

Vibra Healthcare (9)

Cornerstone Healthcare (9)

HealthSouth (6)

Ernest Health (6)

RehabCare (3)

Market Size:

460+ LTACHs

Freestanding IRFs

LTACHs

Source: Information available from public filings or from company websites

12

Hospital Division

Performance

3

3

3

3

Number of LTACHs End of Period

403

380

386

407

LTACH Patient Discharges

5

5

6

6

Number of IRFs End of Period

972

1,006

1,060

1,104

IRF Patient Discharges

59.0%

59.0%

63.7%

63.6%

75% Compliance Level (Avg)

Q1 07

Q2 07

Q3 07

Q4 07

Dollars in millions

$(0.8) (2)

$25.7

$1.9

$26.0

$(3.1) (1)

$(1.6) (2)

Operating Earnings (loss)

$27.0

$24.4

Operating Revenues

Outlook

13-15% EBITDA margins before corporate overhead in 2008 for group of

8 hospitals in operation more than one year

$4.5 - $5.5 million of net EBITDA drag in 2008 for group of 5 hospitals in

operation less than one year

Q4/07 operating results impacted by $800,000 start-up and $300,000

ramp-up costs at Central Texas Rehabilitation Hospital and investment

in additional infrastructure support

(1)

Includes a pretax impairment charge on a Louisiana Specialty Hospital intangible asset of $4.9 million, partially offset by net

favorable cost report/contractual adjustments of $0.9 million.

(2) Includes favorable net self insurance costs of approximately $0.2 million in both Q4 and Q3 when compared to the costs incurred in

Q2. In addition, Q3 contains unfavorable contractual allowance adjustments of approximately $1.4 million. Excluding the favorable

self insurance adjustments in Q4 and Q3 and the unfavorable contractual allowance adjustments in Q3, operating losses would

have been $1.0 million and $0.4 million in Q4 and Q3, respectively.

13

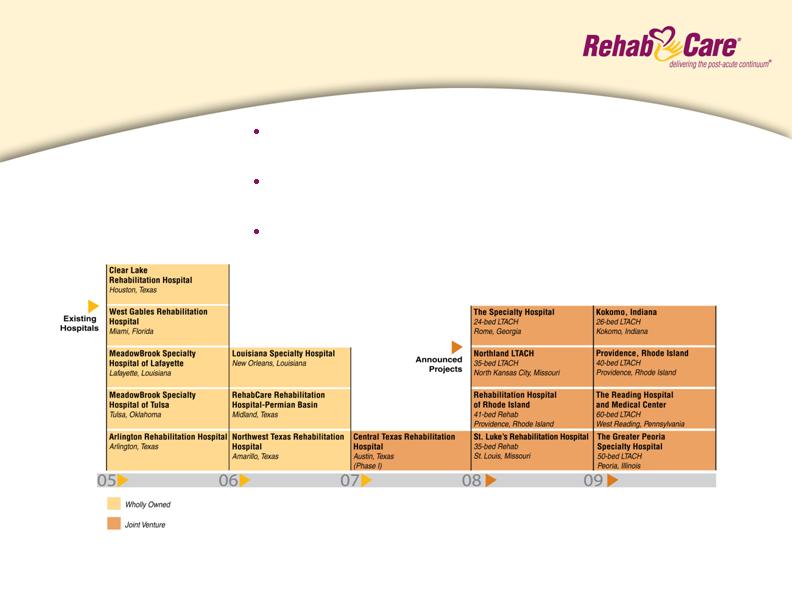

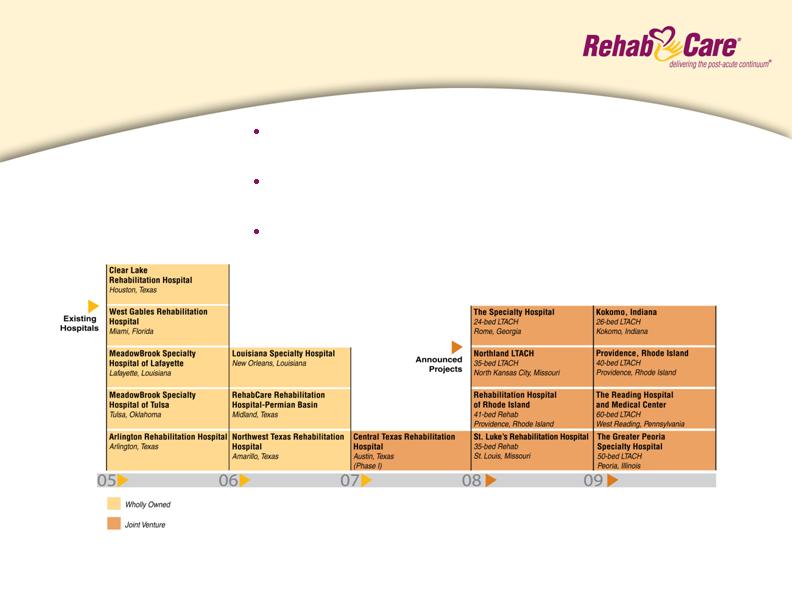

Hospital Division

Development Timeline

Division established in 2005 with the acquisition of

MeadowBrook Healthcare

9 existing hospitals, 6 in development, 2 awaiting State

Attorney General approval

Anticipated 4-6 new projects/year

14

Hospital Division

Legislative/Regulatory Environment

LTACH 25% Rule

The Extension Act:

Eliminates application of the 25% Rule for freestanding LTACHs and

grandfathered LTACHs for next three years

Eliminates the recent payment reductions for very short stay outlier cases for

a three-year period

Imposes a three-year moratorium on new LTACHs and new LTACH beds

with some exceptions – we believe all of our announced LTACH JVs will not

be subject to this moratorium

Requires a study by HHS to establish facility and patient criteria.

IRF 75% Rule

Freestanding Hospitals are subject to the same 75% Rule provisions as

previously discussed. The division managed its rehab hospitals to an

average compliance level of 63.6% during the fourth quarter.

15

Continuous Improvement

Initiatives

Intermediate

Long-Term

Open 4-6 joint ventures

annually

Standardize care

management processes

across Hospitals and

ARUs

Implement IT roadmap for

improved clinical,

revenue cycle, and data

warehouse systems

Standardize and integrate

back office processes and

information systems

Implement centralized

support infrastructure

for Hospitals division

Build out continuum of

care delivery model

around key market

relationships

Implement electronic

medical record system

Continue to address

therapist supply issue

through innovative

programs like Allied

Health Research Institute

and partnerships with

the Universities of

Kansas and Missouri

2008 Initiatives

CT operating earnings

margins to 4.5% - 5.5%

HRS modest increase in

IRF units and resumption of

3-5% growth in same store

discharges

HRS product development

to better match long-term

client needs

Hospitals EBITDA margin to

13-15% target for group of

mature hospitals

Roll out PatientPlus

compensation program in

CT division

16

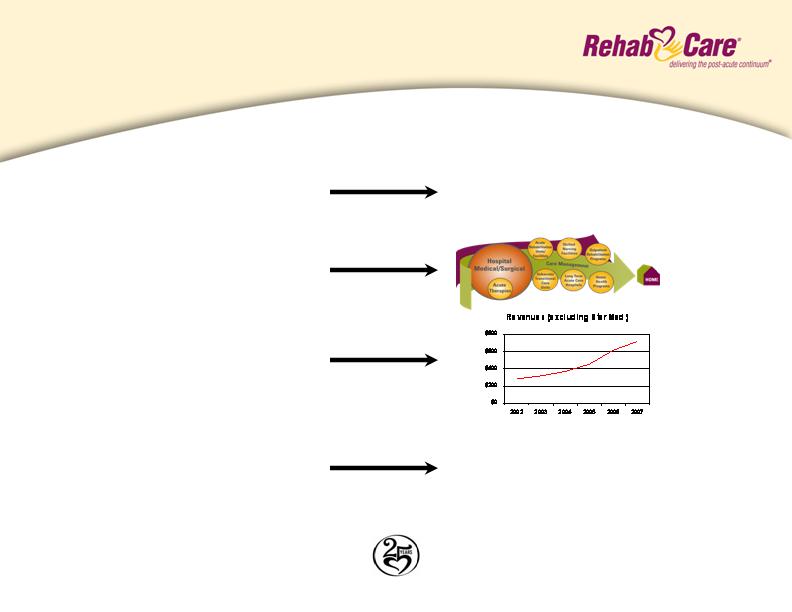

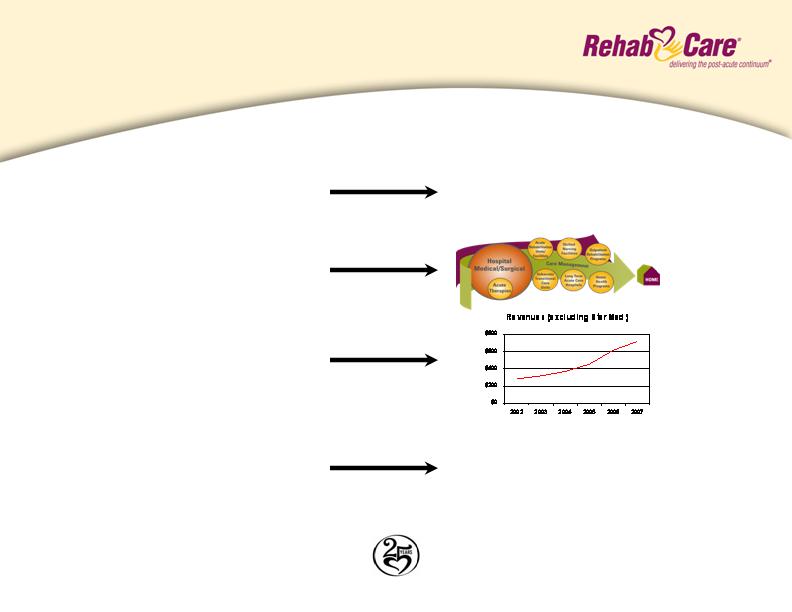

Investment Considerations

Why RehabCare?

Increasing market demand

Unique continuum of care model

Demonstrated ability to grow revenue

organically and through acquisitions

Proven ability to adapt to market

and regulatory changes

Expenditures for post-acute services:

Increase of 239% since 1998

Projected increase of 150% by 2016

Represents 12% of Medicare spending

75% rule, Part B therapy caps, LTACH

25% rule, physician fee schedule

(Annualized)

Celebrating 25 years as one of the longest tenured post-acute providers

of service in the industry

17

Safe Harbor

Forward-looking statements have been provided pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. Such statements are based on the Company’s current

expectations and could be affected by numerous factors, risks and uncertainties discussed in the

Company’s filings with the Securities and Exchange Commission, including the Company’s most recent

annual report on Form 10-K, subsequent quarterly reports on Form 10-Q and current reports on Form

8-K. Do not rely on forward looking statements as the Company cannot predict or control many of the

factors that ultimately may affect the Company’s ability to achieve the results estimated. The Company

makes no promise to update any forward looking statements whether as a result of changes in

underlying factors, new information, future events or otherwise.

18