UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-05104

Capital World Bond Fund

(Exact Name of Registrant as Specified in Charter)

333 South Hope Street

Los Angeles, California 90071

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (213) 486-9200

Date of fiscal year end: December 31

Date of reporting period: December 31, 2017

Steven I. Koszalka

Capital World Bond Fund

333 South Hope Street

Los Angeles, California 90071

(Name and Address of Agent for Service)

ITEM 1 – Reports to Stockholders

Capital World Bond Fund®

Annual report

for the year ended

December 31, 2017

Find diverse total

return opportunities

in global bonds.

Capital World Bond Fund seeks to provide you, over the long term, with a high level of total return consistent with prudent investment management. Total return comprises the income generated by the fund and the changes in the market value of the fund’s investments.

This fund is one of more than 40 offered by one of the nation’s largest mutual fund families, American Funds, from Capital Group. For more than 85 years, Capital has invested with a long-term focus based on thorough research and attention to risk.

Fund results shown in this report, unless otherwise indicated, are for Class A shares at net asset value. If a sales charge (maximum 3.75%) had been deducted, the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month-end results, visit americanfunds.com.

See page 4 for Class A share results with relevant sales charges deducted. For other share class results, visit americanfunds.com and americanfundsreitrement.com.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit americanfunds.com for more information.

The fund’s 30-day yield for Class A shares as of January 31, 2018, calculated in accordance with the U.S. Securities and Exchange Commission (SEC) formula, was 1.91%. The fund’s 12-month distribution rate for Class A shares as of that date was 1.71%. Both reflect the 3.75% maximum sales charge. The SEC yield reflects the rate at which the fund is earning income on its current portfolio of securities, while the distribution rate reflects the fund’s past dividends paid to shareholders. Accordingly, the fund’s SEC yield and distribution rate may differ.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. High-yield and lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than investment-grade and higher rated bonds. Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. Investing in bonds issued outside the U.S. may be subject to additional risks. They include currency fluctuations, political and social instability, differing securities regulations and accounting standards, higher transaction costs, possible changes in taxation, illiquidity and price volatility. These risks may be heightened in connection with investments in developing countries. Refer to the fund prospectus and the Risk Factors section of this report for more information on these and other risks associated with investing in the fund.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Contents

| 1 | Letter to investors |

| 4 | The value of a long-term perspective |

| 5 | About your fund |

| 6 | Summary investment portfolio |

| 14 | Financial statements |

| 42 | Board of trustees and other officers |

Fellow investors:

Global bonds rallied broadly in 2017. A synchronized upswing in global growth and muted inflation in the U.S., euro area and Japan provided a supportive backdrop. Bond yields (which move inversely to prices) declined, while many currencies appreciated against the U.S. dollar — acting as a tailwind to market returns.

Over the 12-month period ended December 31, 2017, Capital World Bond Fund recorded a total return of 7.26%; this result slightly lagged the unmanaged Bloomberg Barclays Global Aggregate Index, which rose 7.39%. See the table below for longer term results.

The fund’s selectivity in regard to countries, sectors and particular bonds helped results relative to the market index. Currency exposure detracted, mostly due to the fund’s less-than-index exposure to the euro (which gained versus the U.S. dollar). The portfolio’s currency positioning is managed by emphasizing bonds issued in particular currencies, and use of derivatives such as currency forward contracts.

The fund’s result outpaced the Lipper Global Income Funds Average; this peer group measure advanced 6.68%. As a category, “Global Income” includes a broad spectrum of funds, such as those with substantial investments in high yield (rated BB/Ba and below) or emerging markets bonds, for example.

In contrast to some other funds in the category, Capital World Bond Fund’s approach is relatively cautious and diversified. The fund seeks to offer investors a high level of total return over time — consistent with prudent investment management.

Results at a glance

For periods ended December 31, 2017, with all distributions reinvested

| | | | Cumulative total returns | | | Average annual total returns | |

| | | | 1 year | | | 5 years | | | 10 years | | | Lifetime1 |

| | | | | | | | | | | | | | | | | |

| Capital World Bond Fund (Class A shares) | | | 7.26 | % | | | 0.72 | % | | | 3.03 | % | | | 6.12 | % |

| Bloomberg Barclays Global Aggregate Index2 | | | 7.39 | | | | 0.79 | | | | 3.09 | | | | 6.07 | |

| Lipper Global Income Funds Average3 | | | 6.68 | | | | 1.22 | | | | 3.57 | | | | 6.33 | |

| 1 | Since August 4, 1987. |

| 2 | Bloomberg Barclays source: Bloomberg Index Services Ltd. The Bloomberg Barclays Global Aggregate Index began on December 31, 1989. For the period August 4, 1987, to December 31, 1989, the Citigroup World Government Bond Index was used. The indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. Citigroup data: ©2018 Citigroup Index LLC. All rights reserved. |

| 3 | Source: Thomson Reuters Lipper. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Lipper categories are dynamic and averages may have few funds, especially over longer periods. To see the number of funds included in the Lipper category for each fund’s lifetime, please see the Quarterly Statistical Update, available on our website. |

The fund paid a dividend of nine cents in March, June, September and December, a portion of which was a return of capital. Fund investors who reinvested their dividends earned an income return of 1.91%, or 0.76% excluding the return of capital. For those taking their dividends in cash, the figure was 1.90%, or 0.75% excluding return of capital.

United States

In the U.S., economic growth, corporate earnings and the labor market all showed improvements. With those positives in mind, the Federal Reserve persevered with interest rate hikes — even as inflation fell short of expectations.

Following 0.25 percentage point increases in March, June and December, the federal funds rate ended 2017 at a range of 1.25%–1.50%. The Fed also began a gradual reduction of its $4.5 trillion balance sheet.

The yield on the benchmark 10-year U.S. Treasury note ended the 12-month period at 2.40%, a 0.05 percentage point decrease. Investment-grade (rated BBB/ Baa and above) corporate bonds notched a 6.4% gain.

Despite unexpectedly weak inflation data for much of 2017, Treasury Inflation Protected Securities (TIPS) notched a 3.01% 12-month gain. Over the period, managers took advantage of attractive valuations to add to investments in TIPS (in our view, inflation weakness is likely to be short-lived).

Exposure to U.S. corporate bonds declined. The fund has relatively limited investments in high-yield corporates. Excluding cash, U.S. dollar-denominated debt accounted for 47.5% of the fund’s portfolio as of December 31, before currency hedging; this amount included 16.8% in Treasury bonds and notes.

Europe

Election victories for Emmanuel Macron in France and Angela Merkel in Germany helped reduce political uncertainty in the European Union. Growth accelerated through much of 2017, reaching an annualized rate of 2.6% in the third quarter. The region’s unemployment rate fell to 8.8% in October 2017, the lowest level since 2009.

The European Central Bank (ECB) decided to extend its bond-buying program into 2018 and kept short-term interest rates in negative territory. Nevertheless, the yield on Germany’s benchmark 10-year note climbed to 0.42%, a 0.21 percentage point increase. The euro strengthened 14% over the 12 months.

Investments in euro-zone government bonds accounted for 12.3% of the fund’s portfolio (before currency hedging) as of December 31. Managers added to investments in government bonds from Portugal — which regained its investment-grade rating in 2017 — and inflation-linked bonds from France and Germany.

Outside the euro zone, investments in Norwegian bonds were increased amid attractive relative value and the potential we saw for the Norwegian krone to appreciate. Conversely, holdings of Hungarian government bonds were reduced.

Other developed markets

Japan’s economic outlook brightened. Recent data showed seven consecutive quarters of positive growth — the longest streak on record. Exports remained robust, despite the yen’s 4% appreciation against the dollar in 2017.

Why your annual report has a different look

You have probably noticed that this annual report doesn’t look like the glossier reports of the past. After surveying a large, representative sample of our investors, we have decided to make a few key changes to these documents and have adjusted the look and feel of our reports (e.g., paper stock and design standards) to reflect the prevailing industry norm. These changes will reduce costs and the amount of paper we consume.

You also told us that we should be considering ways to deliver the valuable perspective of our investment professionals to you digitally. We are in the process of building our digital investor education content on our website, which will provide a platform for investment professionals to communicate with investors using the channels that you access more often.

If you have not already done so, you can elect to receive your annual reports electronically. Once you do, you will receive an email notification as soon as the documents are available. To learn more, visit americanfunds.com/gopaperless. n

Inflation was sluggish early in the year, but picked up and reached its highest level in several years. The Bank of Japan kept monetary policy unchanged — maintaining a negative policy rate, a near-zero target for 10-year yields, and ¥80 trillion of annual asset purchases.

The fund’s exposure to Japan remains much less than that of the index. That said, Japanese investments — including a sizable amount of inflation-linked issues — remain meaningful in absolute terms: 12.3%, before currency hedging.

Developing markets

Emerging markets bonds recorded double-digit gains as improving global growth and higher prices for oil and other commodities helped support investor sentiment.

Local currency bonds led the way, boosted by widespread currency appreciation. Exposure to Mexico was reduced, though it remains among the portfolio’s larger country exposures. Our analysts have highlighted near-term volatility concerns — driven by the upcoming presidential election and ongoing negotiations with the U.S. on the North American Free Trade Agreement.

Looking ahead

A synchronized global recovery is underway, with industrial activity and trade both accelerating. In the U.S., the Fed seems likely to raise interest rates gradually — especially if, as seems possible, the Tax Cuts and Jobs Act of 2017 has a modest impact on economic activity. Any adjustments to policy will probably remain closely linked to inflation, which recent data suggested was picking up.

Elsewhere, the ECB is reducing its monthly bond-buying activity in 2018, and the Bank of Japan may follow suit. Against this changing policy backdrop, we have continued to uncover diverse opportunities.

Valuations among TIPS appear attractive. These bonds seem to entail modest downside risk amid good potential for inflation to outpace recent market expectations. It’s a similar story in Europe, where we have added to investments in inflation-linked bonds.

In Asia, India remains a significant investment. Structural reforms are setting the scene for good longer term return potential. That said, expectations for higher inflation and fiscal deterioration have recently helped push Indian bond yields higher, so the fund’s portfolio managers continue to monitor the situation.

Despite some significant currency appreciation in 2017, many currencies appear undervalued or fairly valued according to various measures. The Polish zloty, Mexican peso, Norwegian krone and Indian rupee were among the fund’s larger exposures as of December 31.

The portfolio’s less-than-index exposure to the euro moderated over the 12 months, while the Japanese yen was a modest underweight at year-end. Although Japanese bonds aren’t that compelling, the outlook for the currency is beginning to improve.

Management of exposure to currencies —as well as countries, interest rates and sectors — is a hallmark of our flexible research-driven approach. The fund also makes use of derivatives to achieve more targeted exposures, such as when we think a bond represents attractive value, but currency weakness is a concern. In all of our investment decisions, being selective is crucial and our analysts play a critical role in this regard.

Lately, equities have experienced some volatility. Of course, it’s impossible to say when equities may take a major turn for the worse. That said, this fund’s approach is designed to try to provide investors with a potential source of resilience around times of declining stock markets.

Thank you for your continued commitment to long-term investing. We look forward to reporting to you again in six months.

Cordially,

Thomas H. Høgh

President

February 12, 2018

For current information about the fund, visit americanfunds.com.

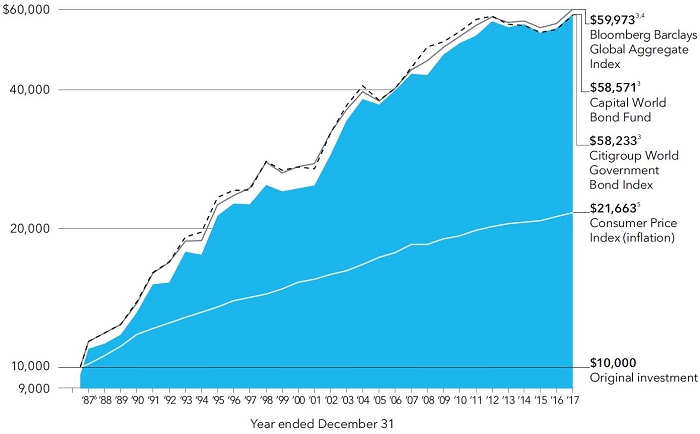

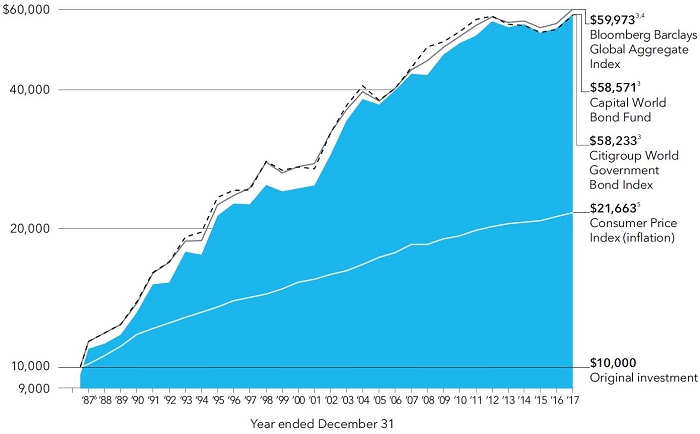

The value of a long-term perspective

Fund results shown reflect deduction of the maximum sales charge of 3.75% on the $10,000 investment.1 Thus, the net amount invested was $9,625.2

How a $10,000 investment has grown over the fund’s lifetime

| 1 | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $100,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| 2 | The maximum initial sales charge was 4.75% prior to January 10, 2000. |

| 3 | With dividends and capital gains reinvested or interest compounded. Results of the Citigroup World Government Bond Index are represented by the black line. Citigroup data: ©2018 Citigroup Index LLC. All rights reserved. |

| 4 | Bloomberg Barclays Global Aggregate Index did not exist until December 31, 1989. For the period of August 4, 1987, through December 31, 1989, the Citigroup World Government Bond Index results were used. Bloomberg Barclays source: Bloomberg Index Services Ltd. |

| 5 | Computed from data supplied by the U.S. Department of Labor, Bureau of Labor Statistics. |

| 6 | For the period of August 4, 1987, commencement of operations, through December 31, 1987. |

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

Past results are not predictive of results for future periods. The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a $1,000 investment

For periods ended December 31, 2017*

| | 1 year | 5 years | 10 years |

| | | | |

| Class A shares | 3.23% | –0.05% | 2.63% |

| | | | |

| * | Assumes reinvestment of all distributions and payment of the maximum 3.75% sales charge. |

The total annual fund operating expense ratio is 0.97% for Class A shares as of the prospectus dated March 1, 2018 (unaudited). The expense ratio is restated to reflect current fees.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit americanfunds.com for more information.

About your fund

Capital World Bond Fund offers shareholders a selection of global bonds that is unparalleled among the other fixed income funds of the American Funds family. It may invest in virtually any bond market in the world and in bonds denominated in any currency. This broad mandate allows the fund to seek a high level of total return through capital appreciation, through a wide range of income opportunities and from changing currency relationships.

Where the fund’s assets are invested … and how those markets have done over the past year

unaudited

| | | | | | | | | Bond market total returns1 |

| | | Capital World Bond Fund | | 12 months ended |

| | | December 31, 2017 | | December 31, 2017 |

| | | Before forward | | After forward | | In local | | In U.S. |

| Currency weighting by country: | | contracts | | contracts | | currency | | dollars |

| United States2 | | | 47.5 | % | | | 44.6 | % | | | 3.7 | % | | | 3.7 | % |

| EMU3 | | | 14.5 | | | | 18.6 | | | | 0.7 | | | | 14.6 | |

| Japan | | | 12.3 | | | | 17.1 | | | | 0.2 | | | | 3.7 | |

| Poland | | | 4.2 | | | | 3.3 | | | | 4.8 | | | | 26.1 | |

| Mexico | | | 3.5 | | | | 3.1 | | | | 6.0 | | | | 12.0 | |

| India | | | 2.3 | | | | 1.2 | | | | 3.0 | 4 | | | 9.6 | 4 |

| Malaysia | | | 2.2 | | | | 2.2 | | | | 5.2 | | | | 16.7 | |

| Brazil | | | 2.0 | | | | 0.3 | | | | 17.0 | 4 | | | 14.8 | 4 |

| United Kingdom | | | 1.9 | | | | 1.5 | | | | 2.8 | | | | 12.4 | |

| Norway | | | 1.7 | | | | 1.8 | | | | 2.1 | | | | 7.5 | |

| Australia | | | 1.3 | | | | 0.1 | | | | 3.8 | | | | 12.1 | |

| Thailand | | | 1.0 | | | | 1.2 | | | | 5.8 | | | | 16.3 | |

| Canada | | | 0.9 | | | | 0.3 | | | | 2.7 | | | | 9.6 | |

| Chile | | | 0.8 | | | | 0.8 | | | | 4.1 | | | | 13.4 | |

| Israel | | | 0.6 | | | | 0.2 | | | | — | 5 | | | — | 5 |

| South Africa | | | 0.6 | | | | 0.4 | | | | 7.4 | | | | 19.1 | |

| Turkey | | | 0.5 | | | | 0.4 | | | | 7.0 | 4 | | | -0.8 | 4 |

| Egypt | | | 0.4 | | | | 0.4 | | | | — | 5 | | | — | 5 |

| Nigeria | | | 0.4 | | | | 0.4 | | | | 25.9 | 4 | | | 10.2 | 4 |

| Colombia | | | 0.3 | | | | 0.3 | | | | 10.5 | 4 | | | 11.2 | 4 |

| Argentina | | | 0.3 | | | | 0.3 | | | | 19.9 | 4 | | | 0.8 | 4 |

| South Korea | | | 0.3 | | | | 0.3 | | | | -0.3 | | | | 12.5 | |

| Uruguay | | | 0.2 | | | | 0.2 | | | | — | 5 | | | — | 5 |

| Russian Federation | | | 0.1 | | | | 0.1 | | | | — | 5 | | | — | 5 |

| Hungary | | | 0.1 | | | | 0.1 | | | | 5.9 | | | | 18.4 | |

| New Zealand | | | 0.1 | | | | 0.0 | | | | 5.9 | | | | 8.0 | |

| Switzerland | | | 0.0 | | | | 0.2 | | | | 0.0 | | | | 4.3 | |

| Sweden | | | 0.0 | | | | 0.6 | | | | 0.5 | | | | 11.5 | |

| 1 | Bloomberg Barclays source: Bloomberg Index Services Ltd. Data source: Bloomberg Barclays Global Aggregate Index. |

| 2 | Includes U.S. dollar-denominated debt of other countries, totaling 15.5%. |

| 3 | Countries using the euro as a common currency: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia and Spain. |

| 4 | Data source: JP Morgan GBI–EM Broad Diversified Index. |

| 5 | This market is not included in the Bloomberg Barclays Global Aggregate Index or the JP Morgan GBI–EM Broad Diversified Index. |

| | | Before forward | | After forward |

| Currency weighting by region: | | contracts | | contracts |

| United States | | | 47.5 | % | | | 44.6 | % |

| Europe | | | 23.0 | | | | 26.6 | |

| Asia/Pacific Basin | | | 19.5 | | | | 22.1 | |

| Other* | | | 10.0 | | | | 6.7 | |

| | |

| * | Argentina, Brazil, Canada, Chile, Colombia, Ghana, Israel, Mexico and South Africa. |

Summary investment portfolio December 31, 2017

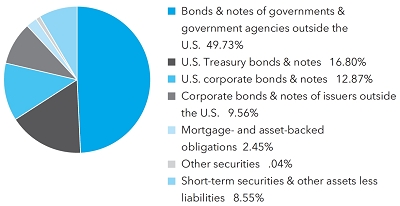

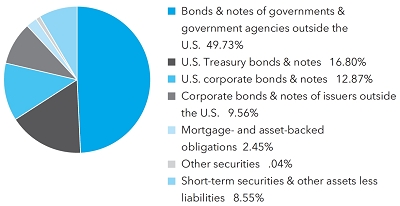

| Portfolio by type of security | Percent of net assets |

Bonds & notes of governments & government agencies outside the U.S.

| | | | | Percent of net assets | |

| Euro zone*: | | | | | | | | |

| Italy | | | 3.49 | % | | | | |

| Germany | | | 3.01 | | | | | |

| Portugal | | | 2.27 | | | | | |

| France | | | 1.26 | | | | | |

| Spain | | | .75 | | | | | |

| Ireland | | | .74 | | | | | |

| Belgium | | | .63 | | | | | |

| Greece | | | .12 | | | | 12.27 | % |

| Japan | | | | | | | 8.61 | |

| Poland | | | | | | | 4.23 | |

| Mexico | | | | | | | 3.48 | |

| India | | | | | | | 2.38 | |

| Malaysia | | | | | | | 2.23 | |

| Brazil | | | | | | | 1.99 | |

| United Kingdom | | | | | | | 1.76 | |

| Norway | | | | | | | 1.67 | |

| Australia | | | | | | | 1.33 | |

| Thailand | | | | | | | 1.04 | |

| Other | | | | | | | 8.74 | |

| | | | | | | | 49.73 | % |

| * | Countries using the euro as a common currency: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia and Spain. |

| Bonds, notes & other debt instruments 91.41% | Principal amount

(000) | | | Value

(000) | |

| Euros 13.59% | | | | | | | | |

| Belgium (Kingdom of), Series 77, 1.00% 2026 | | € | 48,300 | | | $ | 60,557 | |

| French Republic O.A.T. 1.85% 20271 | | | 37,544 | | | | 57,214 | |

| French Republic O.A.T. 0%–3.25% 2019–2048 | | | 84,625 | | | | 105,077 | |

| Germany (Federal Republic of) 0.10% 20261 | | | 137,853 | | | | 182,647 | |

| Germany (Federal Republic of) 2.50% 2046 | | | 55,000 | | | | 86,671 | |

| Germany (Federal Republic of) 0.10%–2.00% 2022–20481 | | | 74,862 | | | | 93,211 | |

| Italy (Republic of) 0.90% 2022 | | | 43,650 | | | | 52,785 | |

| Italy (Republic of) 1.45% 2022 | | | 52,700 | | | | 65,281 | |

| Italy (Republic of) 0.95% 2023 | | | 155,525 | | | | 186,977 | |

| Italy (Republic of) 1.35%–4.75% 2021–2025 | | | 107,550 | | | | 138,907 | |

| Portuguese Republic 2.875% 2025 | | | 51,800 | | | | 68,610 | |

| Portuguese Republic 2.875% 2026 | | | 58,000 | | | | 75,986 | |

| Portuguese Republic 4.125% 2027 | | | 101,250 | | | | 144,315 | |

| Other securities | | | | | | | 410,812 | |

| | | | | | | | 1,729,050 | |

| | | | | | | | | |

| Japanese yen 8.61% | | | | | | | | |

| Japan, Series 18, 0.10% 20241 | | ¥ | 21,300,480 | | | | 198,401 | |

| Japan, Series 19, 0.10% 20241 | | | 11,817,080 | | | | 110,436 | |

| Japan, Series 346, 0.10% 2027 | | | 11,630,000 | | | | 103,983 | |

| Japan, Series 145, 1.70% 2033 | | | 9,600,000 | | | | 102,863 | |

| Japan, Series 42, 1.70% 2044 | | | 8,110,000 | | | | 88,638 | |

| Japan 0.10%–2.20% 2018–20461 | | | 52,674,865 | | | | 490,306 | |

| | | | | | | | 1,094,627 | |

| | | | | | | | | |

| Polish zloty 4.16% | | | | | | | | |

| Poland (Republic of), Series 0420, 1.50% 2020 | | PLN | 258,675 | | | | 73,739 | |

| Poland (Republic of), Series 1020, 5.25% 2020 | | | 372,350 | | | | 116,499 | |

| Poland (Republic of), Series 1021, 5.75% 2021 | | | 594,520 | | | | 192,534 | |

| Poland (Republic of), Series 0922, 5.75% 2022 | | | 212,555 | | | | 69,764 | |

| Poland (Republic of) 3.25%–4.00% 2023–2025 | | | 255,730 | | | | 76,351 | |

| | | | | | | | 528,887 | |

| | | | | | | | | |

| Mexican pesos 3.56% | | | | | | | | |

| United Mexican States, Series M, 6.50% 2021 | | MXN | 3,442,500 | | | | 169,275 | |

| United Mexican States, Series M20, 10.00% 2024 | | | 1,241,000 | | | | 71,205 | |

| United Mexican States, Series M, 5.75% 2026 | | | 2,683,500 | | | | 120,778 | |

| United Mexican States 4.00%–10.00% 2019–20461 | | | 1,568,032 | | | | 82,108 | |

| Other securities | | | | | | | 9,352 | |

| | | | | | | | 452,718 | |

| | | | | | | | | |

| Indian rupees 2.32% | | | | | | | | |

| India (Republic of) 7.80% 2021 | | INR | 4,177,400 | | | | 67,046 | |

| India (Republic of) 8.83% 2023 | | | 4,874,600 | | | | 81,388 | |

| India (Republic of) 6.97% 2026 | | | 4,680,000 | | | | 71,928 | |

| India (Republic of) 7.59%–7.88% 2023–2034 | | | 3,415,560 | | | | 54,020 | |

| Other securities | | | | | | | 20,636 | |

| | | | | | | | 295,018 | |

| | | | | | | | | |

| Malaysian ringgits 2.23% | | | | | | | | |

| Malaysia (Federation of), Series 0116, 3.80% 2023 | | MYR | 227,126 | | | | 56,185 | |

| Malaysia (Federation of) 3.48%–4.79% 2018–2035 | | | 919,214 | | | | 227,735 | |

| | | | | | | | 283,920 | |

| | | | | | | | | |

| Brazilian reais 1.99% | | | | | | | | |

| Brazil (Federative Republic of) 0% 2021 | | BRL | 847,000 | | | | 186,955 | |

| Other securities | | | | | | | 65,440 | |

| | | | | | | | 252,395 | |

| | | | | | | | | |

| British pounds 1.88% | | | | | | | | |

| United Kingdom 1.25%–4.25% 2020–2065 | | £ | 138,700 | | | | 224,555 | |

| Other securities | | | | | | | 14,695 | |

| | | | | | | | 239,250 | |

| Bonds, notes & other debt instruments (continued) | Principal amount

(000) | | | Value

(000) | |

| Norwegian kroner 1.67% | | | | | | | | |

| Norway (Kingdom of) 3.75% 2021 | | NKr | 1,262,650 | | | $ | 168,445 | |

| Norway (Kingdom of) 2.00%–3.00% 2023–2024 | | | 335,700 | | | | 44,267 | |

| | | | | | | | 212,712 | |

| | | | | | | | | |

| Australian dollars 1.33% | | | | | | | | |

| Australia (Commonwealth of), Series 124, 5.75% 2021 | | A$ | 92,700 | | | | 80,672 | |

| Australia (Commonwealth of), Series 128, 5.75% 2022 | | | 64,200 | | | | 57,502 | |

| Australia (Commonwealth of) 3.25%–5.50% 2023–2029 | | | 35,300 | | | | 30,932 | |

| | | | | | | | 169,106 | |

| | | | | | | | | |

| Thai baht 1.04% | | | | | | | | |

| Thailand (Kingdom of) 1.49% 2019 | | THB | 2,129,300 | | | | 65,354 | |

| Thailand (Kingdom of) 1.88%–3.85% 2022–2026 | | | 2,158,100 | | | | 67,467 | |

| | | | | | | | 132,821 | |

| | | | | | | | | |

| Danish kroner 0.88% | | | | | | | | |

| Nykredit Realkredit AS, Series 01E, 2.00% 20372 | | DKr | 314,169 | | | | 52,773 | |

| Other securities | | | | | | | 59,161 | |

| | | | | | | | 111,934 | |

| | | | | | | | | |

| Canadian dollars 0.85% | | | | | | | | |

| Canada 2.25% 2025 | | C$ | 84,600 | | | | 68,500 | |

| Other securities | | | | | | | 39,851 | |

| | | | | | | | 108,351 | |

| | | | | | | | | |

| Chilean pesos 0.81% | | | | | | | | |

| Chile (Banco Central de) 4.50% 2021 | | CLP | 57,715,000 | | | | 96,091 | |

| Other securities | | | | | | | 7,352 | |

| | | | | | | | 103,443 | |

| | | | | | | | | |

| U.S. dollars 43.31% | | | | | | | | |

| Fannie Mae 4.00% 20482,3 | | $ | 60,250 | | | | 62,960 | |

| Poland (Republic of) 3.25% 2026 | | | 8,800 | | | | 9,004 | |

| U.S. Treasury 1.375% 2020 | | | 183,450 | | | | 180,825 | |

| U.S. Treasury 1.625% 2020 | | | 265,150 | | | | 262,833 | |

| U.S. Treasury 1.125% 20214 | | | 195,025 | | | | 189,679 | |

| U.S. Treasury 2.00% 20214 | | | 129,000 | | | | 128,585 | |

| U.S. Treasury 2.00% 2022 | | | 53,500 | | | | 53,021 | |

| U.S. Treasury 2.00% 2026 | | | 109,145 | | | | 105,709 | |

| U.S. Treasury 1.13%–3.00% 2019–2047 | | | 234,816 | | | | 231,029 | |

| U.S. Treasury Inflation-Protected Security 0.125% 20221 | | | 523,698 | | | | 520,061 | |

| U.S. Treasury Inflation-Protected Security 0.625% 20241 | | | 160,830 | | | | 163,619 | |

| U.S. Treasury Inflation-Protected Security 0.625% 20261 | | | 51,076 | | | | 51,888 | |

| U.S. Treasury Inflation-Protected Security 1.00% 20461 | | | 88,915 | | | | 94,973 | |

| U.S. Treasury Inflation-Protected Securities 0.13%–2.38% 2024–20451 | | | 147,454 | | | | 154,577 | |

| Other securities | | | | | | | 3,299,426 | |

| | | | | | | | 5,508,189 | |

| | | | | | | | | |

| Other 3.18% | | | | | | | | |

| Other securities | | | | | | | 403,614 | |

| | | | | | | | | |

| Total bonds, notes & other debt instruments (cost: $11,495,157,000) | | | | | | | 11,626,035 | |

| | | | | | | | | |

| Convertible stocks 0.03% | | | Shares | | | | | |

| U.S. dollars 0.03% | | | | | | | | |

| Other securities | | | | | | | 4,176 | |

| | | | | | | | | |

| Total convertible stocks (cost: $5,056,000) | | | | | | | 4,176 | |

| | | | | | | | | |

| Common stocks 0.01% | | | | | | | | |

| U.S. dollars 0.01% | | | | | | | | |

| Other securities | | | | | | | 1,985 | |

| | | | | | | | | |

| Total common stocks (cost: $5,987,000) | | | | | | | 1,985 | |

| Short-term securities 8.42% | Principal amount

(000) | | | Value

(000) | |

| Bank of Montreal 1.48%–1.72% due 2/14/2018–3/29/2018 | | $ | 94,700 | | | $ | 94,397 | |

| Fairway Finance Corp. 1.58% due 3/7/20185 | | | 75,000 | | | | 74,761 | |

| Japanese Treasury Discount Bills (0.16%)–(0.13%) due 5/21/2018–8/20/2018 | | ¥ | 53,510,000 | | | | 475,188 | |

| Oversea-Chinese Banking Corp. Ltd. 1.42% due 1/5/20185 | | $ | 83,100 | | | | 83,077 | |

| Sumitomo Mitsui Banking Corp. 1.42% due 2/12/20185 | | | 66,300 | | | | 66,168 | |

| U.S. Treasury Bills 1.50%–1.55% due 6/28/2018–11/8/2018 | | | 70,900 | | | | 70,024 | |

| Other securities | | | | | | | 207,028 | |

| | | | | | | | | |

| Total short-term securities (cost: $1,068,133,000) | | | | | | | 1,070,643 | |

| Total investment securities 99.87% (cost: $12,574,333,000) | | | | | | | 12,702,839 | |

| Other assets less liabilities 0.13% | | | | | | | 16,189 | |

| | | | | | | | | |

| Net assets 100.00% | | | | | | $ | 12,719,028 | |

This summary investment portfolio is designed to streamline the report and help investors better focus on the fund’s principal holdings. See the inside back cover for details on how to obtain a complete schedule of portfolio holdings.

“Other securities” includes all issues that are not disclosed separately in the summary investment portfolio. “Other securities” includes securities which were valued under fair value procedures adopted by authority of the board of trustees. The total value of securities which were valued under fair value procedures was $11,316,000, which represented .09% of the net assets of the fund. “Other securities” also includes loan participations and assignments, which may be subject to legal or contractual restrictions on resale. The total value of all such loans was $15,210,000, which represented .12% of the net assets of the fund. Some securities in “Other securities” (with an aggregate value of $14,524,000, an aggregate cost of $15,551,000, and which represented .11% of the net assets of the fund) were acquired from 3/10/2010-3/6/2017 through private placement transactions exempt from registration under the Securities Act of 1933, which may subject them to legal or contractual restrictions on resale.

Futures contracts

| | | | | | | | | | | | | | | Unrealized | |

| | | | | | | | | | | | | | | (depreciation) | |

| | | | | | | | | Notional | | | Value at | | | appreciation | |

| | | | | Number of | | | | amount6 | | | 12/31/20177 | | | at 12/31/2017 | |

| Contracts | | Type | | contracts | | Expiration | | (000) | | | (000) | | | (000) | |

| 10 Year Euro-Bund Futures | | Long | | 32 | | March 2018 | | $ | 3,200 | | | $ | 6,208 | | | | $ | (46 | ) |

| 10 Year Ultra U.S. Treasury Note Futures | | Long | | 814 | | March 2018 | | | 81,400 | | | | 108,720 | | | | | (626 | ) |

| 10 Year U.S. Treasury Note Futures | | Long | | 655 | | March 2018 | | | 65,500 | | | | 81,251 | | | | | (411 | ) |

| 30 Year Ultra U.S. Treasury Bond Futures | | Long | | 225 | | March 2018 | | | 22,500 | | | | 37,722 | | | | | 326 | |

| 5 Year U.S. Treasury Note Futures | | Long | | 6,699 | | April 2018 | | | 669,900 | | | | 778,183 | | | | | (1,882 | ) |

| 90 Day Euro Dollar Futures | | Short | | 1,417 | | September 2018 | | | (354,250 | ) | | | (347,023 | ) | | | | 658 | |

| | | | | | | | | | | | | | | | | | $ | (1,981 | ) |

Forward currency contracts

| | | | | | | | | Unrealized | |

| Contract amount | | | | | | appreciation

(depreciation) | |

| Purchases | | Sales | | | | | | at 12/31/2017 | |

| (000) | | (000) | | Counterparty | | Settlement date | | (000) | |

| USD36,896 | | MXN669,000 | | JPMorgan Chase | | 1/4/2018 | | | $ | 2,910 | |

| USD1,020 | | INR66,000 | | Citibank | | 1/5/2018 | | | | (13 | ) |

| JPY1,643,290 | | USD14,650 | | Bank of America, N.A. | | 1/5/2018 | | | | (61 | ) |

| USD2,982 | | TRY11,975 | | Bank of America, N.A. | | 1/5/2018 | | | | (171 | ) |

| USD11,762 | | CAD15,000 | | Bank of America, N.A. | | 1/5/2018 | | | | (173 | ) |

| USD17,672 | | INR1,144,000 | | Citibank | | 1/5/2018 | | | | (236 | ) |

| USD37,647 | | AUD48,800 | | UBS AG | | 1/5/2018 | | | | (429 | ) |

| USD61,029 | | INR3,946,950 | | JPMorgan Chase | | 1/5/2018 | | | | (755 | ) |

| USD18,746 | | ZAR264,925 | | UBS AG | | 1/5/2018 | | | | (2,643 | ) |

| EUR29,747 | | USD34,802 | | HSBC Bank | | 1/8/2018 | | | | 911 | |

| EUR25,842 | | USD30,248 | | Goldman Sachs | | 1/8/2018 | | | | 778 | |

| THB428,157 | | USD13,130 | | JPMorgan Chase | | 1/8/2018 | | | | 12 | |

| USD2,104 | | IDR28,589,600 | | JPMorgan Chase | | 1/8/2018 | | | | (1 | ) |

| USD11,280 | | INR730,800 | | Barclays Bank PLC | | 1/8/2018 | | | | (156 | ) |

| USD21,309 | | ILS74,600 | | Bank of America, N.A. | | 1/9/2018 | | | | (139 | ) |

| USD36,029 | | EUR30,450 | | HSBC Bank | | 1/9/2018 | | | | (531 | ) |

| EUR44,866 | | USD53,600 | | Bank of America, N.A. | | 1/10/2018 | | | | 272 | |

Forward currency contracts (continued)

| | | | | | | | | Unrealized | |

| Contract amount | | | | | | appreciation

(depreciation) | |

| Purchases | | Sales | | | | | | at 12/31/2017 | |

| (000) | | (000) | | Counterparty | | Settlement date | | (000) | |

| EUR8,035 | | USD9,500 | | JPMorgan Chase | | 1/10/2018 | | | $ | 147 | |

| EUR12,055 | | USD14,332 | | Citibank | | 1/10/2018 | | | | 142 | |

| USD325 | | EUR275 | | JPMorgan Chase | | 1/10/2018 | | | | (5 | ) |

| USD3,483 | | GBP2,600 | | Bank of America, N.A. | | 1/10/2018 | | | | (29 | ) |

| USD2,075 | | NZD3,000 | | JPMorgan Chase | | 1/10/2018 | | | | (51 | ) |

| JPY1,426,776 | | USD12,855 | | Goldman Sachs | | 1/10/2018 | | | | (184 | ) |

| JPY5,495,683 | | USD49,081 | | JPMorgan Chase | | 1/10/2018 | | | | (277 | ) |

| USD12,610 | | CAD16,200 | | Bank of America, N.A. | | 1/10/2018 | | | | (281 | ) |

| USD20,049 | | PLN70,985 | | JPMorgan Chase | | 1/10/2018 | | | | (343 | ) |

| USD15,964 | | AUD21,000 | | JPMorgan Chase | | 1/10/2018 | | | | (421 | ) |

| USD17,332 | | AUD22,800 | | Goldman Sachs | | 1/10/2018 | | | | (457 | ) |

| JPY9,682,061 | | USD86,480 | | Bank of America, N.A. | | 1/10/2018 | | | | (499 | ) |

| JPY5,249,283 | | USD47,268 | | Barclays Bank PLC | | 1/10/2018 | | | �� | (652 | ) |

| USD26,084 | | AUD34,300 | | Bank of America, N.A. | | 1/10/2018 | | | | (678 | ) |

| USD37,736 | | CAD48,330 | | Goldman Sachs | | 1/10/2018 | | | | (722 | ) |

| JPY15,841,887 | | USD142,793 | | JPMorgan Chase | | 1/10/2018 | | | | (2,110 | ) |

| EUR10,754 | | USD12,688 | | Bank of America, N.A. | | 1/11/2018 | | | | 225 | |

| JPY5,005,864 | | USD44,379 | | Bank of America, N.A. | | 1/11/2018 | | | | 78 | |

| JPY8,889,867 | | USD80,148 | | UBS AG | | 1/11/2018 | | | | (1,198 | ) |

| EUR74,700 | | USD86,934 | | UBS AG | | 1/12/2018 | | | | 2,773 | |

| SEK39,107 | | USD4,632 | | UBS AG | | 1/12/2018 | | | | 140 | |

| JPY2,601,220 | | USD23,126 | | UBS AG | | 1/12/2018 | | | | (24 | ) |

| USD3,421 | | NZD5,000 | | JPMorgan Chase | | 1/12/2018 | | | | (122 | ) |

| USD50,282 | | AUD66,830 | | Citibank | | 1/12/2018 | | | | (1,862 | ) |

| USD1,683 | | INR108,700 | | Citibank | | 1/16/2018 | | | | (16 | ) |

| USD17,497 | | INR1,134,000 | | Bank of America, N.A. | | 1/16/2018 | | | | (231 | ) |

| JPY9,928,693 | | USD88,053 | | JPMorgan Chase | | 1/17/2018 | | | | 150 | |

| USD4,242 | | GBP3,150 | | Bank of America, N.A. | | 1/17/2018 | | | | (13 | ) |

| USD1,678 | | ILS5,900 | | Bank of America, N.A. | | 1/17/2018 | | | | (19 | ) |

| USD7,071 | | GBP5,250 | | Goldman Sachs | | 1/17/2018 | | | | (22 | ) |

| USD5,443 | | GBP4,050 | | Bank of New York Mellon | | 1/17/2018 | | | | (29 | ) |

| USD3,792 | | EUR3,200 | | Citibank | | 1/17/2018 | | | | (52 | ) |

| USD9,515 | | EUR8,000 | | Bank of America, N.A. | | 1/17/2018 | | | | (95 | ) |

| JPY7,356,342 | | USD65,491 | | Citibank | | 1/17/2018 | | | | (140 | ) |

| JPY14,186,572 | | USD126,719 | | HSBC Bank | | 1/17/2018 | | | | (691 | ) |

| EUR82,982 | | USD97,963 | | Goldman Sachs | | 1/18/2018 | | | | 1,728 | |

| USD17,137 | | MXN330,450 | | Bank of America, N.A. | | 1/18/2018 | | | | 399 | |

| CHF22,712 | | USD23,067 | | Goldman Sachs | | 1/18/2018 | | | | 275 | |

| JPY1,937,908 | | USD17,188 | | Goldman Sachs | | 1/18/2018 | | | | 29 | |

| USD4,717 | | CAD6,000 | | Barclays Bank PLC | | 1/18/2018 | | | | (58 | ) |

| JPY499,132 | | EUR3,750 | | Goldman Sachs | | 1/18/2018 | | | | (71 | ) |

| NOK131,600 | | USD15,711 | | Bank of America, N.A. | | 1/19/2018 | | | | 327 | |

| EUR6,800 | | GBP6,000 | | HSBC Bank | | 1/19/2018 | | | | 62 | |

| USD15,422 | | EUR13,000 | | JPMorgan Chase | | 1/19/2018 | | | | (197 | ) |

| USD15,282 | | PLN54,400 | | Bank of America, N.A. | | 1/19/2018 | | | | (346 | ) |

| USD29,652 | | EUR25,150 | | Bank of America, N.A. | | 1/19/2018 | | | | (564 | ) |

| EUR83,098 | | USD98,394 | | Barclays Bank PLC | | 1/22/2018 | | | | 1,462 | |

| EUR47,856 | | USD56,408 | | Bank of America, N.A. | | 1/22/2018 | | | | 1,099 | |

| EUR27,469 | | USD32,514 | | UBS AG | | 1/22/2018 | | | | 495 | |

| JPY829,484 | | USD7,350 | | Barclays Bank PLC | | 1/22/2018 | | | | 21 | |

| USD134 | | GBP100 | | Bank of New York Mellon | | 1/22/2018 | | | | (1 | ) |

| USD3,338 | | EUR2,830 | | UBS AG | | 1/22/2018 | | | | (63 | ) |

| USD9,093 | | EUR7,680 | | UBS AG | | 1/22/2018 | | | | (136 | ) |

| USD9,468 | | EUR8,000 | | Goldman Sachs | | 1/22/2018 | | | | (145 | ) |

| JPY3,867,429 | | USD34,568 | | Barclays Bank PLC | | 1/22/2018 | | | | (203 | ) |

| JPY6,000,000 | | USD53,519 | | JPMorgan Chase | | 1/22/2018 | | | | (204 | ) |

| EUR76,027 | | USD90,038 | | Citibank | | 1/23/2018 | | | | 1,327 | |

| SEK198,192 | | USD23,617 | | Citibank | | 1/23/2018 | | | | 582 | |

| SEK69,559 | | EUR7,000 | | Citibank | | 1/23/2018 | | | | 81 | |

| USD2,516 | | AUD3,200 | | JPMorgan Chase | | 1/23/2018 | | | | 19 | |

| USD1,154 | | EUR975 | | JPMorgan Chase | | 1/23/2018 | | | | (17 | ) |

| JPY1,330,157 | | USD11,887 | | JPMorgan Chase | | 1/23/2018 | | | | (67 | ) |

| 10 | Capital World Bond Fund |

| | | | | | | | | Unrealized | |

| Contract amount | | | | | | appreciation

(depreciation) | |

| Purchases | | Sales | | | | | | at 12/31/2017 | |

| (000) | | (000) | | Counterparty | | Settlement date | | (000) | |

| EUR7,087 | | PLN30,000 | | Citibank | | 1/23/2018 | | | $ | (102 | ) |

| USD15,390 | | EUR12,995 | | Citibank | | 1/23/2018 | | | | (227 | ) |

| USD11,880 | | GBP9,000 | | Bank of America, N.A. | | 1/23/2018 | | | | (282 | ) |

| USD35,789 | | ILS125,800 | | JPMorgan Chase | | 1/23/2018 | | | | (400 | ) |

| USD23,902 | | PLN85,450 | | Citibank | | 1/23/2018 | | | | (646 | ) |

| SEK197,119 | | USD23,260 | | Barclays Bank PLC | | 1/24/2018 | | | | 810 | |

| JPY3,984,529 | | USD35,219 | | Goldman Sachs | | 1/24/2018 | | | | 191 | |

| JPY1,813,392 | | USD16,000 | | Citibank | | 1/24/2018 | | | | 115 | |

| USD6,737 | | EUR5,697 | | Citibank | | 1/24/2018 | | | | (110 | ) |

| USD1,321 | | TRY5,100 | | JPMorgan Chase | | 1/25/2018 | | | | (13 | ) |

| USD2,087 | | NZD3,000 | | JPMorgan Chase | | 1/25/2018 | | | | (38 | ) |

| USD3,631 | | ZAR46,500 | | JPMorgan Chase | | 1/29/2018 | | | | (108 | ) |

| USD4,859 | | MXN95,700 | | JPMorgan Chase | | 1/31/2018 | | | | 24 | |

| EUR60,176 | | USD72,250 | | Citibank | | 2/5/2018 | | | | 120 | |

| USD4,741 | | GBP3,500 | | Bank of America, N.A. | | 2/5/2018 | | | | 10 | |

| USD35,682 | | PLN127,000 | | Bank of America, N.A. | | 2/7/2018 | | | | (804 | ) |

| JPY12,195,000 | | USD108,309 | | HSBC Bank | | 2/15/2018 | | | | 175 | |

| SEK154,107 | | USD18,397 | | Barclays Bank PLC | | 2/22/2018 | | | | 452 | |

| JPY2,694,444 | | USD23,882 | | HSBC Bank | | 2/23/2018 | | | | 96 | |

| USD29,842 | | EUR25,000 | | Bank of America, N.A. | | 2/23/2018 | | | | (253 | ) |

| USD32,749 | | INR2,174,200 | | Citibank | | 3/26/2018 | | | | (950 | ) |

| USD7,500 | | BRL24,304 | | Citibank | | 4/20/2018 | | | | 262 | |

| USD40,733 | | BRL132,300 | | Citibank | | 4/23/2018 | | | | 1,346 | |

| USD363,513 | | JPY40,150,000 | | Citibank | | 5/21/2018 | | | | 4,315 | |

| USD115,890 | | JPY12,800,000 | | Citibank | | 5/21/2018 | | | | 1,376 | |

| USD5,150 | | JPY560,000 | | JPMorgan Chase | | 8/20/2018 | | | | 111 | |

| USD20,796 | | BRL70,000 | | Citibank | | 11/29/2018 | | | | 456 | |

| USD155,200 | | BRL529,000 | | JPMorgan Chase | | 12/4/2018 | | | | 1,567 | |

| USD1,434 | | EUR1,185 | | Bank of America, N.A. | | 12/13/2018 | | | | (22 | ) |

| USD1,816 | | EUR1,510 | | Bank of America, N.A. | | 12/13/2018 | | | | (39 | ) |

| USD3,843 | | EUR3,185 | | Bank of America, N.A. | | 12/13/2018 | | | | (70 | ) |

| | | | | | | | | | $ | 5,203 | |

| Capital World Bond Fund | 11 |

Swap contracts

Interest rate swaps

| | | | | | | | | | | | | | Unrealized | |

| | | | | | | | | | | Upfront | | | (depreciation) | |

| | | | | | | | | Value at | | payments/ | | | appreciation | |

| | | | | Expiration | | Notional | | 12/31/2017 | | receipts | | | at 12/31/2017 | |

| Receive | | Pay | | date | | (000) | | (000) | | (000) | | | (000) | |

| 7.46% | | 28-day MXN-TIIE | | 11/6/2018 | | MXN5,644,000 | | $(1,393) | | | $ | — | | | | $ | (1,393 | ) |

| 7.455% | | 28-day MXN-TIIE | | 11/7/2018 | | 4,601,000 | | (1,149) | | | — | | | | | (1,149 | ) |

| 7.44% | | 28-day MXN-TIIE | | 11/7/2018 | | 12,755,000 | | (3,265) | | | — | | | | | (3,265 | ) |

| 1.6505% | | 3-month USD-LIBOR | | 3/21/2019 | | $250,000 | | (853) | | | — | | | | | (853 | ) |

| 3-month USD-LIBOR | | 1.598% | | 8/11/2019 | | 62,500 | | 393 | | | — | | | | | 393 | |

| 3-month USD-LIBOR | | 2.0335% | | 12/19/2019 | | 140,000 | | 74 | | | — | | | | | 74 | |

| 3-month USD-LIBOR | | 1.6332% | | 5/23/2020 | | 18,000 | | 197 | | | — | | | | | 197 | |

| 3-month NZD-BBR-FRA | | 2.67% | | 12/9/2020 | | NZ$170,000 | | 83 | | | — | | | | | 83 | |

| 2.2425% | | 3-month AUD-BBSW | | 12/9/2020 | | A$155,000 | | (386) | | | — | | | | | (386 | ) |

| 2.322% | | 3-month AUD-BBSW | | 12/15/2020 | | 205,000 | | (393) | | | — | | | | | (393 | ) |

| 3-month NZD-BBR-FRA | | 2.707% | | 12/18/2020 | | NZ$225,000 | | 66 | | | — | | | | | 66 | |

| 9.145% | | DI-OVER-EXTRA Grupo | | 1/4/2021 | | BRL438,000 | | 989 | | | — | | | | | 989 | |

| 9.44% | | DI-OVER-EXTRA Grupo | | 1/4/2021 | | 32,000 | | 141 | | | — | | | | | 141 | |

| 1.2185% | | 3-month USD-LIBOR | | 2/8/2021 | | $70,000 | | (1,984) | | | — | | | | | (1,984 | ) |

| 1.9575% | | 3-month Canada BA | | 7/5/2021 | | C$80,000 | | (488) | | | — | | | | | (488 | ) |

| 3-month USD-LIBOR | | 2.15875% | | 7/8/2021 | | $60,000 | | 210 | | | — | | | | | 210 | |

| 6.775% | | 28-day MXN-TIIE | | 6/20/2022 | | MXN1,100,000 | | (2,317) | | | — | | | | | (2,317 | ) |

| 3-month SEK-STIBOR | | 0.425% | | 8/4/2022 | | SKr600,000 | | (68) | | | — | | | | | (68 | ) |

| 3-month USD-LIBOR | | 1.5075% | | 9/22/2026 | | $9,600 | | 653 | | | — | | | | | 653 | |

| 0.8153% | | 6-month EURIBOR | | 4/28/2027 | | €10,000 | | 4 | | | — | | | | | 4 | |

| 3-month SEK-STIBOR | | 1.125% | | 4/28/2027 | | SKr100,000 | | (12) | | | — | | | | | (12 | ) |

| 6-month EURIBOR | | 0.7952% | | 5/23/2027 | | €12,500 | | 32 | | | — | | | | | 32 | |

| 3-month SEK-STIBOR | | 1.222% | | 8/8/2027 | | SKr50,000 | | (43) | | | — | | | | | (43 | ) |

| 3-month USD-LIBOR | | 2.4275% | | 10/31/2027 | | $27,350 | | (105) | | | — | | | | | (105 | ) |

| 3-month USD-LIBOR | | 2.562% | | 11/4/2045 | | 20,000 | | (104) | | | — | | | | | (104 | ) |

| 3-month USD-LIBOR | | 2.556% | | 11/27/2045 | | 47,000 | | (190) | | | — | | | | | (190 | ) |

| 3-month USD-LIBOR | | 1.794% | | 8/3/2046 | | 50,000 | | 7,898 | | | — | | | | | 7,898 | |

| 3-month USD-LIBOR | | 1.9095% | | 10/11/2046 | | 20,000 | | 2,683 | | | — | | | | | 2,683 | |

| 3-month USD-LIBOR | | 2.659% | | 2/8/2047 | | 15,000 | | (398) | | | — | | | | | (398 | ) |

| 1.4898% | | 6-month EURIBOR | | 8/28/2047 | | €4,000 | | (4) | | | — | | | | | (4 | ) |

| 1.4898% | | 6-month EURIBOR | | 11/24/2047 | | 8,250 | | (11) | | | — | | | | | (11 | ) |

| 1.4508% | | 6-month EURIBOR | | 12/15/2047 | | 15,000 | | (198) | | | | — | | | | | (198 | ) |

| | | | | | | | | | | | $ | — | | | | $ | 62 | |

The following footnotes apply to either the individual securities noted or one or more of the securities aggregated and listed as a single line item.

| | 1 | Index-linked bond whose principal amount moves with a government price index. |

| | 2 | Principal payments may be made periodically. Therefore, the effective maturity date may be earlier than the stated maturity date. |

| | 3 | Purchased on a TBA basis. |

| | 4 | A portion of this security was pledged as collateral. The total value of pledged collateral was $45,566,000, which represented .36% of the net assets of the fund. |

| | 5 | Acquired in a transaction exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933. May be resold in the U.S. in transactions exempt from registration, normally to qualified institutional buyers. The total value of all such securities, including those in “Other securities,” was $1,380,671,000, which represented 10.86% of the net assets of the fund. |

| | 6 | Notional amount is calculated based on the number of contracts and notional contract size. |

| | 7 | Value is calculated based on the notional amount and current market price. |

| 12 | Capital World Bond Fund |

Key to abbreviations and symbols

AUD/A$ = Australian dollars

BA = Banker’s acceptances

BBR = Bank base rate

BBSW= Bank Bill Swap

BRL = Brazilian reais

CAD/C$ = Canadian dollars

CHF = Swiss francs

CLP = Chilean pesos

DI-OVER-EXTRA Grupo = Overnight Brazilian Interbank Deposit Rate

DKr = Danish kroner

EUR/€ = Euros

EURIBOR = Euro Interbank Offered Rate

FRA = Forward rate agreement

GBP/£ = British pounds

IDR = Indonesian rupiah

ILS = Israeli shekels

INR = Indian rupees

JPY/¥ = Japanese yen

LIBOR = London Interbank Offered Rate

MXN = Mexican pesos

MYR = Malaysian ringgits

NOK/NKr = Norwegian kroner

NZD/NZ$ = New Zealand dollars

PLN = Polish zloty

SEK/SKr = Swedish kronor

STIBOR = Stockholm Interbank Offered Rate

TBA = To-be-announced

THB = Thai baht

TIIE = Equilibrium Interbank Interest Rate

TRY = Turkish lira

USD/$ = U.S. dollars

ZAR = South African rand

See Notes to Financial Statements

| Capital World Bond Fund | 13 |

Financial statements

Statement of assets and liabilities

at December 31, 2017 | | (dollars in thousands) |

| | | |

| Assets: | | | | | | | | |

| Investment securities in unaffiliated issuers, at value (cost: $12,574,333) | | | | | | $ | 12,702,839 | |

| Cash denominated in currencies other than U.S. dollars (cost: $13,813) | | | | | | | 14,012 | |

| Unrealized appreciation on open forward currency contracts | | | | | | | 27,870 | |

| Receivables for: | | | | | | | | |

| Sales of investments | | $ | 124,409 | | | | | |

| Sales of fund’s shares | | | 52,197 | | | | | |

| Closed forward currency contracts | | | 2,994 | | | | | |

| Variation margin on futures contracts | | | 1,089 | | | | | |

| Variation margin on swap contracts | | | 1,246 | | | | | |

| Interest | | | 98,686 | | | | | |

| Other | | | 1,428 | | | | 282,049 | |

| | | | | | | | 13,026,770 | |

| Liabilities: | | | | | | | | |

| Unrealized depreciation on open forward currency contracts | | | | | | | 22,667 | |

| Payables for: | | | | | | | | |

| Purchases of investments | | | 255,506 | | | | | |

| Repurchases of fund’s shares | | | 16,277 | | | | | |

| Closed forward currency contracts | | | 2,336 | | | | | |

| Investment advisory services | | | 4,708 | | | | | |

| Services provided by related parties | | | 2,888 | | | | | |

| Trustees’ deferred compensation | | | 228 | | | | | |

| Variation margin on futures contracts | | | 39 | | | | | |

| Variation margin on swap contracts | | | 1,430 | | | | | |

| Other | | | 1,663 | | | | 285,075 | |

| Net assets at December 31, 2017 | | | | | | $ | 12,719,028 | |

| | | | | | | | | |

| Net assets consist of: | | | | | | | | |

| Capital paid in on shares of beneficial interest | | | | | | $ | 12,659,691 | |

| Distributions in excess of net investment income | | | | | | | (1,105 | ) |

| Accumulated net realized loss | | | | | | | (71,713 | ) |

| Net unrealized appreciation | | | | | | | 132,155 | |

| Net assets at December 31, 2017 | | | | | | $ | 12,719,028 | |

See Notes to Financial Statements

| 14 | Capital World Bond Fund |

(dollars and shares in thousands, except per-share amounts)

Shares of beneficial interest issued and outstanding (no stated par value) —

unlimited shares authorized (637,527 total shares outstanding)

| | | | | | Shares | | | Net asset value | |

| | | Net assets | | | outstanding | | | per share | |

| | | | | | | | | | | | | |

| Class A | | $ | 5,866,530 | | | | 293,823 | | | $ | 19.97 | |

| Class C | | | 279,846 | | | | 14,257 | | | | 19.63 | |

| Class T | | | 10 | | | | — | * | | | 19.97 | |

| Class F-1 | | | 284,947 | | | | 14,306 | | | | 19.92 | |

| Class F-2 | | | 1,026,855 | | | | 51,504 | | | | 19.94 | |

| Class F-3 | | | 1,770,097 | | | | 88,717 | | | | 19.95 | |

| Class 529-A | | | 312,141 | | | | 15,590 | | | | 20.02 | |

| Class 529-C | | | 84,350 | | | | 4,265 | | | | 19.78 | |

| Class 529-E | | | 15,417 | | | | 775 | | | | 19.90 | |

| Class 529-T | | | 10 | | | | 1 | | | | 19.97 | |

| Class 529-F-1 | | | 37,581 | | | | 1,889 | | | | 19.90 | |

| Class R-1 | | | 8,436 | | | | 427 | | | | 19.77 | |

| Class R-2 | | | 126,370 | | | | 6,397 | | | | 19.75 | |

| Class R-2E | | | 3,744 | | | | 188 | | | | 19.93 | |

| Class R-3 | | | 141,010 | | | | 7,073 | | | | 19.94 | |

| Class R-4 | | | 115,006 | | | | 5,764 | | | | 19.95 | |

| Class R-5E | | | 17 | | | | 1 | | | | 19.94 | |

| Class R-5 | | | 84,256 | | | | 4,217 | | | | 19.98 | |

| Class R-6 | | | 2,562,405 | | | | 128,333 | | | | 19.97 | |

| | * | Amount less than one thousand. |

See Notes to Financial Statements

| Capital World Bond Fund | 15 |

Statement of operations

for the year ended December 31, 2017 | (dollars in thousands) |

| Investment income: | | | | | | | | |

| Income: | | | | | | | | |

| Interest (net of non-U.S. taxes of $1,588) | | $ | 378,456 | | | | | |

| Dividends | | | 272 | | | $ | 378,728 | |

| Fees and expenses*: | | | | | | | | |

| Investment advisory services | | | 54,104 | | | | | |

| Distribution services | | | 22,172 | | | | | |

| Transfer agent services | | | 17,464 | | | | | |

| Administrative services | | | 3,790 | | | | | |

| Reports to shareholders | | | 1,348 | | | | | |

| Registration statement and prospectus | | | 1,057 | | | | | |

| Trustees’ compensation | | | 116 | | | | | |

| Auditing and legal | | | 293 | | | | | |

| Custodian | | | 2,400 | | | | | |

| Other | | | 499 | | | | | |

| Total fees and expenses before reimbursement | | | 103,243 | | | | | |

| Less transfer agent services reimbursement | | | 1 | | | | | |

| Total fees and expenses after reimbursement | | | | | | | 103,242 | |

| Net investment income | | | | | | | 275,486 | |

| | | | | | | | | |

| Net realized loss and unrealized appreciation: | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | |

| Investments in unaffiliated issuers (net of non-U.S. taxes of $2,865) | | | 18,384 | | | | | |

| Futures contracts | | | 3,839 | | | | | |

| Forward currency contracts | | | (70,093 | ) | | | | |

| Swap contracts | | | (16,799 | ) | | | | |

| Currency transactions | | | (14,266 | ) | | | (78,935 | ) |

| Net unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments in unaffiliated issuers (net of non-U.S. taxes of $936) | | | 654,084 | | | | | |

| Futures contracts | | | (1,930 | ) | | | | |

| Forward currency contracts | | | 32,349 | | | | | |

| Swap contracts | | | (17,242 | ) | | | | |

| Currency translations | | | 2,998 | | | | 670,259 | |

| Net realized loss and unrealized appreciation | | | | | | | 591,324 | |

| Net increase in net assets resulting from operations | | | | | | $ | 866,810 | |

| | * | Additional information related to class-specific fees and expenses is included in the Notes to Financial Statements. |

See Notes to Financial Statements

| 16 | Capital World Bond Fund |

Statements of changes in net assets

(dollars in thousands)

| | | Year ended | | | Three months ended | | | Year ended | |

| | | December 31, | | | December 31, | | | September 30, | |

| | | 2017 | | | 2016* | | | 2016 | |

| | | | | | | | | | |

| Operations: | | | | | | | | | | | | |

| Net investment income | | $ | 275,486 | | | $ | 65,969 | | | $ | 250,362 | |

| Net realized (loss) gain | | | (78,935 | ) | | | (161,561 | ) | | | 1,766 | |

| Net unrealized appreciation (depreciation) | | | 670,259 | | | | (724,241 | ) | | | 719,999 | |

| Net increase (decrease) in net assets resulting from operations | | | 866,810 | | | | (819,833 | ) | | | 972,127 | |

| Dividends, distributions and return of capital paid to shareholders: | | | | | | | | | | | | |

| Dividends from net investment income | | | (94,497 | ) | | | (76,502 | ) | | | (152,624 | ) |

| Distributions from net realized gain on investments | | | — | | | | (42,817 | ) | | | — | |

| Return of capital | | | (143,803 | ) | | | (28,799 | ) | | | — | |

| Total dividends, distributions and return of capital paid to shareholders | | | (238,300 | ) | | | (148,118 | ) | | | (152,624 | ) |

| Net capital share transactions | | | 151,478 | | | | 285,846 | | | | (827,841 | ) |

| Total increase (decrease) in net assets | | | 779,988 | | | | (682,105 | ) | | | (8,338 | ) |

| Net assets: | | | | | | | | | | | | |

| Beginning of period | | | 11,939,040 | | | | 12,621,145 | | | | 12,629,483 | |

| End of period (including distributions in excess of net investment income: $(1,105), $(21,724) and $(7,752), respectively) | | $ | 12,719,028 | | | $ | 11,939,040 | | | $ | 12,621,145 | |

| | * | In 2016, the fund changed its fiscal year-end from September to December. |

See Notes to Financial Statements

| Capital World Bond Fund | 17 |

Notes to financial statements

1. Organization

Capital World Bond Fund (the “fund”) is registered under the Investment Company Act of 1940 as an open-end, nondiversified management investment company. The fund seeks to provide, over the long term, a high level of total return consistent with prudent investment management. Total return comprises the income generated by the fund and the changes in the market value of the fund’s investments.

The fund has 19 share classes consisting of six retail share classes (Classes A, C, T, F-1, F-2 and F-3), five 529 college savings plan share classes (Classes 529-A, 529-C, 529-E, 529-T and 529-F-1) and eight retirement plan share classes (Classes R-1, R-2, R-2E, R-3, R-4, R-5E, R-5 and R-6). The 529 college savings plan share classes can be used to save for college education. The retirement plan share classes are generally offered only through eligible employer-sponsored retirement plans. The fund’s share classes are described further in the following table:

| Share class | | Initial sales

charge | | Contingent deferred sales

charge upon redemption | | Conversion feature |

| Classes A and 529-A | | Up to 3.75% | | None (except 1% for certain redemptions within one year of purchase without an initial sales charge1) | | None |

| Class C | | None | | 1% for redemptions within one year of purchase | | Class C converts to Class F-1 after 10 years |

| Class 529-C | | None | | 1% for redemptions within one year of purchase | | Class 529-C converts to Class 529-A after 10 years2 |

| Class 529-E | | None | | None | | None |

| Classes T and 529-T3 | | Up to 2.50% | | None | | None |

| Classes F-1, F-2, F-3 and 529-F-1 | | None | | None | | None |

| Classes R-1, R-2, R-2E, R-3, R-4,R-5E, R-5 and R-6 | | None | | None | | None |

| 1 | 18 months for shares purchased on or after August 14, 2017. |

| 2 | Effective December 1, 2017. |

| 3 | Class T and 529-T shares are not available for purchase. |

Holders of all share classes have equal pro rata rights to the assets, dividends and liquidation proceeds of the fund. Each share class has identical voting rights, except for the exclusive right to vote on matters affecting only its class. Share classes have different fees and expenses (“class-specific fees and expenses”), primarily due to different arrangements for distribution, transfer agent and administrative services. Differences in class-specific fees and expenses will result in differences in net investment income and, therefore, the payment of different per-share dividends by each share class.

2. Significant accounting policies

The fund is an investment company that applies the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board. The fund’s financial statements have been prepared to comply with U.S. generally accepted accounting principles (“U.S. GAAP”). These principles require the fund’s investment adviser to make estimates and assumptions that affect reported amounts and disclosures. Actual results could differ from those estimates. Subsequent events, if any, have been evaluated through the date of issuance in the preparation of the financial statements. The fund follows the significant accounting policies described in this section, as well as the valuation policies described in the next section on valuation.

Security transactions and related investment income — Security transactions are recorded by the fund as of the date the trades are executed with brokers. Realized gains and losses from security transactions are determined based on the specific identified cost of the securities. In the event a security is purchased with a delayed payment date, the fund will segregate liquid assets sufficient to meet its payment obligations. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis. Market discounts, premiums and original issue discounts on fixed-income securities are amortized daily over the expected life of the security.

Class allocations — Income, fees and expenses (other than class-specific fees and expenses) and realized and unrealized gains and losses are allocated daily among the various share classes based on their relative net assets. Class-specific fees and expenses, such as distribution, transfer agent and administrative services, are charged directly to the respective share class.

| 18 | Capital World Bond Fund |

Dividends and distributions to shareholders — Dividends and distributions to shareholders are recorded on the ex-dividend date.

Currency translation — Assets and liabilities, including investment securities, denominated in currencies other than U.S. dollars are translated into U.S. dollars at the exchange rates supplied by one or more pricing vendors on the valuation date. Purchases and sales of investment securities and income and expenses are translated into U.S. dollars at the exchange rates on the dates of such transactions. The effects of changes in exchange rates on investment securities are included with the net realized gain or loss and net unrealized appreciation or depreciation on investments in the fund’s statement of operations. The realized gain or loss and unrealized appreciation or depreciation resulting from all other transactions denominated in currencies other than U.S. dollars are disclosed separately.

3. Valuation

Capital Research and Management Company (“CRMC”), the fund’s investment adviser, values the fund’s investments at fair value as defined by U.S. GAAP. The net asset value of each share class of the fund is generally determined as of approximately 4:00 p.m. New York time each day the New York Stock Exchange is open.

Methods and inputs — The fund’s investment adviser uses the following methods and inputs to establish the fair value of the fund’s assets and liabilities. Use of particular methods and inputs may vary over time based on availability and relevance as market and economic conditions evolve.

Equity securities are generally valued at the official closing price of, or the last reported sale price on, the exchange or market on which such securities are traded, as of the close of business on the day the securities are being valued or, lacking any sales, at the last available bid price. Prices for each security are taken from the principal exchange or market on which the security trades.

Fixed-income securities, including short-term securities, are generally valued at prices obtained from one or more pricing vendors. Vendors value such securities based on one or more of the inputs described in the following table. The table provides examples of inputs that are commonly relevant for valuing particular classes of fixed-income securities in which the fund is authorized to invest. However, these classifications are not exclusive, and any of the inputs may be used to value any other class of fixed-income security.

| Fixed-income class | Examples of standard inputs |

| All | Benchmark yields, transactions, bids, offers, quotations from dealers and trading systems, new issues, spreads and other relationships observed in the markets among comparable securities; and proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and other reference data (collectively referred to as “standard inputs”) |

| Corporate bonds & notes; convertible securities | Standard inputs and underlying equity of the issuer |

| Bonds & notes of governments & government agencies | Standard inputs and interest rate volatilities |

| Mortgage-backed; asset-backed obligations | Standard inputs and cash flows, prepayment information, default rates, delinquency and loss assumptions, collateral characteristics, credit enhancements and specific deal information |

| Municipal securities | Standard inputs and, for certain distressed securities, cash flows or liquidation values using a net present value calculation based on inputs that include, but are not limited to, financial statements and debt contracts |

When the fund’s investment adviser deems it appropriate to do so (such as when vendor prices are unavailable or deemed to be not representative), fixed-income securities will be valued in good faith at the mean quoted bid and ask prices that are reasonably and timely available (or bid prices, if ask prices are not available) or at prices for securities of comparable maturity, quality and type.

Securities with both fixed-income and equity characteristics, or equity securities traded principally among fixed-income dealers, are generally valued in the manner described for either equity or fixed-income securities, depending on which method is deemed most appropriate by the fund’s investment adviser. Exchange-traded futures are generally valued at the official settlement price of, or the last reported sale price on, the exchange or market on which such instruments are traded, as of the close of business on the day the futures are being valued or, lacking any sales, at the last available bid price. Prices for each future are taken from the exchange or market on which the security trades. Forward currency contracts are valued at the mean of representative quoted bid and ask prices, generally based on prices supplied by one or more pricing vendors. Interest rate swaps are generally valued by pricing vendors based on market inputs that include the index and term of index, reset frequency, payer/receiver, currency and pay frequency.

| Capital World Bond Fund | 19 |

Securities and other assets for which representative market quotations are not readily available or are considered unreliable by the fund’s investment adviser are fair valued as determined in good faith under fair valuation guidelines adopted by authority of the fund’s board of trustees as further described. The investment adviser follows fair valuation guidelines, consistent with U.S. Securities and Exchange Commission rules and guidance, to consider relevant principles and factors when making fair value determinations. The investment adviser considers relevant indications of value that are reasonably and timely available to it in determining the fair value to be assigned to a particular security, such as the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; actively traded similar or related securities; conversion or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security; and changes in overall market conditions. In addition, the closing prices of equity securities that trade in markets outside U.S. time zones may be adjusted to reflect significant events that occur after the close of local trading but before the net asset value of each share class of the fund is determined. Fair valuations and valuations of investments that are not actively trading involve judgment and may differ materially from valuations that would have been used had greater market activity occurred.

Processes and structure — The fund’s board of trustees has delegated authority to the fund’s investment adviser to make fair value determinations, subject to board oversight. The investment adviser has established a Joint Fair Valuation Committee (the “Fair Valuation Committee”) to administer, implement and oversee the fair valuation process, and to make fair value decisions. The Fair Valuation Committee regularly reviews its own fair value decisions, as well as decisions made under its standing instructions to the investment adviser’s valuation teams. The Fair Valuation Committee reviews changes in fair value measurements from period to period and may, as deemed appropriate, update the fair valuation guidelines to better reflect the results of back testing and address new or evolving issues. The Fair Valuation Committee reports any changes to the fair valuation guidelines to the board of trustees with supplemental information to support the changes. The fund’s board and audit committee also regularly review reports that describe fair value determinations and methods.

The fund’s investment adviser has also established a Fixed-Income Pricing Review Group to administer and oversee the fixed-income valuation process, including the use of fixed-income pricing vendors. This group regularly reviews pricing vendor information and market data. Pricing decisions, processes and controls over security valuation are also subject to additional internal reviews, including an annual control self-evaluation program facilitated by the investment adviser’s compliance group.

Classifications — The fund’s investment adviser classifies the fund’s assets and liabilities into three levels based on the inputs used to value the assets or liabilities. Level 1 values are based on quoted prices in active markets for identical securities. Level 2 values are based on significant observable market inputs, such as quoted prices for similar securities and quoted prices in inactive markets. Certain securities trading outside the U.S. may transfer between Level 1 and Level 2 due to valuation adjustments resulting from significant market movements following the close of local trading. Level 3 values are based on significant unobservable inputs that reflect the investment adviser’s determination of assumptions that market participants might reasonably use in valuing the securities. The valuation levels are not necessarily an indication of the risk or liquidity associated with the underlying investment. For example, U.S. government securities are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market. The following tables present the fund’s valuation levels as of December 31, 2017 (dollars in thousands):

| | | Investment securities | |

| | | | Level 1 | | | | Level 2 | | | | Level 3 | | | | Total | |

| Assets: | | | | | | | | | | | | | | | | |

| Bonds, notes & other debt instruments: | | | | | | | | | | | | | | | | |

| Euros | | $ | — | | | $ | 1,729,050 | | | $ | — | | | $ | 1,729,050 | |

| Japanese yen | | | — | | | | 1,094,627 | | | | — | | | | 1,094,627 | |

| Polish zloty | | | — | | | | 528,887 | | | | — | | | | 528,887 | |

| Mexican pesos | | | — | | | | 452,718 | | | | — | | | | 452,718 | |

| Indian rupees | | | — | | | | 295,018 | | | | — | | | | 295,018 | |

| Malaysian ringgits | | | — | | | | 283,920 | | | | — | | | | 283,920 | |

| Brazilian reais | | | — | | | | 252,395 | | | | — | | | | 252,395 | |

| British pounds | | | — | | | | 239,250 | | | | — | | | | 239,250 | |

| U.S. dollars | | | — | | | | 5,502,924 | | | | 5,265 | | | | 5,508,189 | |

| Other | | | — | | | | 1,241,981 | | | | — | | | | 1,241,981 | |

| Convertible stocks | | | — | | | | 1,027 | | | | 3,149 | | | | 4,176 | |

| Common stocks | | | 110 | | | | 253 | | | | 1,622 | | | | 1,985 | |

| Short-term securities | | | — | | | | 1,070,643 | | | | — | | | | 1,070,643 | |

| Total | | $ | 110 | | | $ | 12,692,693 | | | $ | 10,036 | | | $ | 12,702,839 | |

| 20 | Capital World Bond Fund |

| | | Other investments* | |

| | | | Level 1 | | | | Level 2 | | | | Level 3 | | | | Total | |

| Assets: | | | | | | | | | | | | | | | | |

| Unrealized appreciation on futures contracts | | $ | 984 | | | $ | — | | | $ | — | | | $ | 984 | |

| Unrealized appreciation on open forward currency contracts | | | — | | | | 27,870 | | | | — | | | | 27,870 | |

| Unrealized appreciation on interest rate swaps | | | — | | | | 13,423 | | | | — | | | | 13,423 | |

| Liabilities: | | | | | | | | | | | | | | | | |

| Unrealized depreciation on futures contracts | | | (2,965 | ) | | | — | | | | — | | | | (2,965 | ) |

| Unrealized depreciation on open forward currency contracts | | | — | | | | (22,667 | ) | | | — | | | | (22,667 | ) |

| Unrealized depreciation on interest rate swaps | | | — | | | | (13,361 | ) | | | — | | | | (13,361 | ) |

| Total | | $ | (1,981 | ) | | $ | 5,265 | | | $ | — | | | $ | 3,284 | |

| * | Futures contracts, forward currency contracts and interest rate swaps are not included in the investment portfolio. |

4. Risk factors

Investing in the fund may involve certain risks including, but not limited to, those described below.

Market conditions — The prices of, and the income generated by, the securities held by the fund may decline — sometimes rapidly or unpredictably — due to various factors, including events or conditions affecting the general economy or particular industries; overall market changes; local, regional or global political, social or economic instability; governmental or governmental agency responses to economic conditions; and currency exchange rate, interest rate and commodity price fluctuations.

Issuer risks — The prices of, and the income generated by, securities held by the fund may decline in response to various factors directly related to the issuers of such securities, including reduced demand for an issuer’s goods or services, poor management performance and strategic initiatives such as mergers, acquisitions or dispositions and the market response to any such initiatives.

Investing in debt instruments — The prices of, and the income generated by, bonds and other debt securities held by the fund may be affected by changing interest rates and by changes in the effective maturities and credit ratings of these securities.

Rising interest rates will generally cause the prices of bonds and other debt securities to fall. Falling interest rates may cause an issuer to redeem, call or refinance a debt security before its stated maturity, which may result in the fund having to reinvest the proceeds in lower yielding securities. Longer maturity debt securities generally have greater sensitivity to changes in interest rates and may be subject to greater price fluctuations than shorter maturity debt securities.

Bonds and other debt securities are also subject to credit risk, which is the possibility that the credit strength of an issuer will weaken and/or an issuer of a debt security will fail to make timely payments of principal or interest and the security will go into default. Lower quality debt securities generally have higher rates of interest and may be subject to greater price fluctuations than higher quality debt securities. Credit risk is gauged, in part, by the credit ratings of the debt securities in which the fund invests. However, ratings are only the opinions of the rating agencies issuing them and are not guarantees as to credit quality or an evaluation of market risk. The fund’s investment adviser relies on its own credit analysts to research issuers and issues in seeking to mitigate various credit and default risks.

Liquidity risk — Certain fund holdings may be deemed to be less liquid or illiquid because they cannot be readily sold without significantly impacting the value of the holdings. Liquidity risk may result from the lack of an active market for a holding, legal or contractual restrictions on resale, or the reduced number and capacity of market participants to make a market in such holding. Market prices for less liquid or illiquid holdings may be volatile, and reduced liquidity may have an adverse impact on the market price of such holdings. Additionally, the sale of less liquid or illiquid holdings may involve substantial delays (including delays in settlement) and additional costs and the fund may be unable to sell such holdings when necessary to meet its liquidity needs.

Investing in lower rated debt instruments — Lower rated bonds and other lower rated debt securities generally have higher rates of interest and involve greater risk of default or price declines due to changes in the issuer’s creditworthiness than those of higher quality debt securities. The market prices of these securities may fluctuate more than the prices of higher quality debt securities and may decline significantly in periods of general economic difficulty. These risks may be increased with respect to investments in junk bonds.

| Capital World Bond Fund | 21 |