UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-05104

Capital World Bond Fund

(Exact Name of Registrant as Specified in Charter)

333 South Hope Street

Los Angeles, California 90071

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (213) 486-9200

Date of fiscal year end: December 31

Date of reporting period: December 31, 2016

Steven I. Koszalka

Capital World Bond Fund

333 South Hope Street

Los Angeles, California 90071

(Name and Address of Agent for Service)

ITEM 1 – Reports to Stockholders

Find opportunities

in global bonds

| Capital World Bond Fund® Annual report

for the period ended

December 31, 2016 |

Capital World Bond Fund seeks to provide you, over the long term, with a high level of total return consistent with prudent investment management. Total return comprises the income generated by the fund and the changes in the market value of the fund’s investments.

This fund is one of more than 40 offered by one of the nation’s largest mutual fund families, American Funds, from Capital Group. For more than 85 years, Capital has invested with a long-term focus based on thorough research and attention to risk.

Fund results shown in this report, unless otherwise indicated, are for Class A shares at net asset value. If a sales charge (maximum 3.75%) had been deducted, the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value. For current information and month-end results, visit americanfunds.com.

Here are the average annual total returns on a $1,000 investment with all distributions reinvested for periods ended December 31, 2016:

| Class A shares | 1 year | 5 years | 10 years |

| | | | |

| Reflecting 3.75% maximum sales charge | –1.58% | –0.02% | 2.76% |

For other share class results, visit americanfunds.com and americanfundsretirement.com.

The total annual fund operating expense ratio was 0.95% for Class A shares as of the prospectus dated March 1, 2017 (unaudited).

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit americanfunds.com for more information.

The fund’s 30-day yield for Class A shares as of January 31, 2017, calculated in accordance with the U.S. Securities and Exchange Commission (SEC) formula, was 1.80%. The fund’s 12-month distribution rate for Class A shares as of that date was 1.60%. Both reflect the 3.75% maximum sales charge. The SEC yield reflects the rate at which the fund is earning income on its current portfolio of securities, while the distribution rate reflects the fund’s past dividends paid to shareholders. Accordingly, the fund’s SEC yield and distribution rate may differ.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. High-yield and lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than investment-grade and higher rated bonds. Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. Investing in bonds issued outside the U.S. may be subject to additional risks. They include currency fluctuations, political and social instability, differing securities regulations and accounting standards, higher transaction costs, possible changes in taxation, illiquidity and price volatility. These risks may be heightened in connection with investments in developing countries. Refer to the fund prospectus and the Risk Factors section of this report for more information on these and other risks associated with investing in the fund.

Fellow investors:

Not long has passed since our last letter, though much has happened in recent months. So, as we write to let you know that Capital World Bond Fund’s fiscal year-end has shifted to coincide with the calendar year-end, we’re also offering an update on market developments and our latest thinking.

Over the 12-month period ended December 31, 2016, bond prices and currencies fluctuated considerably. In addition to Donald Trump’s victory in November’s U.S. presidential election, divergent central bank actions had a profound impact on markets.

Bond yields (which move inversely to prices) moved sharply higher in November and December. Many currencies weakened against the dollar, which acted as a further drag on returns in certain non-U.S. markets.

The fund recorded a 12-month total return of 2.27%. The result outpaced the unmanaged Bloomberg Barclays Global Aggregate Index, which rose 2.09%. Favorable bond selection contributed most to relative results. Decisions in regard to emphasizing certain bond sectors and countries in the portfolio also helped. Less-than-index exposure to the British pound was a significant positive, though overall currency exposure detracted from relative results.

As always, Capital World Bond Fund has maintained its disciplined diversified relative value approach to investing, designed to deliver a consistently high level of total return to fund investors over time. For longer term results see the table below. Dividends were paid in March, June, October and December, totaling 32 cents a share, including about 4 cents in return of capital. Fund investors who

Results at a glance

For periods ended December 31, 2016, with all distributions reinvested

| | | Cumulative total returns | | Average annual total returns |

| | | 6 months | | 1 year | | 5 years | | 10 years | | Lifetime1 |

| | | | | | | | | | | | | | | | | | | | | |

| Capital World Bond Fund (Class A shares) | | | –5.12 | % | | | 2.27 | % | | | 0.75 | % | | | 3.15 | % | | | 6.08 | % |

| Bloomberg Barclays Global Aggregate Index2 | | | –6.31 | | | | 2.09 | | | | 0.21 | | | | 3.29 | | | | 6.02 | % |

| Lipper Global Income Funds Average3 | | | –2.43 | | | | 3.54 | | | | 1.48 | | | | 3.61 | | | | 6.13 | % |

| 2 | Bloomberg Barclays source: Bloomberg Index Services Ltd. The Bloomberg Barclays Global Aggregate Index began on December 31, 1989. For the period August 4, 1987, to December 31, 1989, the Citigroup World Government Bond Index was used. The indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. Citigroup data: ©2017 Citigroup Index LLC. All rights reserved. |

| 3 | Source: Thomson Reuters Lipper. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. |

On the cover:

Shibuya Crossing, Tokyo

reinvested their dividends earned an income return of 1.70%, or 1.47% excluding return of capital. For those taking their dividends in cash, the figure was 1.69%, or 1.46% excluding return of capital.

The fund’s result lagged the Lipper Global Income Funds Average, a measure of comparable funds, which rose 3.54%. As a fund category, “Global Income” includes a broad spectrum of funds, such as those that fully hedge currency exposure, and others with substantial investments in emerging markets bonds or high-yield bonds (rated BB/Ba and below); lower rated corporates were one of the few areas that rallied amid the late-2016 bond selloff.

United States

The Federal Reserve held rates steady at its July and September meetings, but gave a generally upbeat verdict on the economy. By December, the Fed was ready to act and the federal funds target rate was raised by a quarter of a percentage point to a range of 0.50% to 0.75%.

However, the hawkishness of the Fed’s outlook seemed to surprise markets and yields moved even higher, reflecting stronger growth and inflation expectations for 2017.

The yield on the benchmark 10-year U.S. Treasury note ended the 12-month period at 2.45% — 0.18 percentage points higher than a year earlier, and well above the record low of 1.37% reached in July. Investment-grade (rated BBB/Baa and above) corporate bonds notched a 6.1% gain. Treasury Inflation Protected Securities (TIPS) advanced 4.7%, helped by higher actual and expected inflation. TIPS are a significant fund holding.

One important driver of higher inflation has been rising oil prices. After hitting a 13-year low of $26 per barrel in February, crude oil mostly traded in a range of $40-$55 per barrel toward the end of 2016. The recovery in oil prices helped boost the fund’s Investments in corporate bonds from the energy sector.

Excluding cash, U.S. dollar-denominated debt accounted for 50.2% of the fund’s portfolio as of December 31, 2016, before currency hedging; this amount included 16.7% in Treasury bonds and notes.

Europe

In March, ECB President Mario Draghi announced a series of policy actions that included reductions in three key lending rates, some of which were already in negative territory. The ECB also expanded its bond-buying program to €80 billion a month (from €60 billion) and pledged to buy corporate bonds in addition to government bonds.

The U.K.’s “Brexit” vote in June weakened the British pound and sent European bond yields into uncharted negative territory as investors sought safe-haven assets. By year-end, however, sub-zero yields had become less prevalent.

In December, encouraging economic data prompted a change of tack by the ECB. The central bank announced that it would extend its program into 2017, while dialing purchases back down to €60 billion each month. The yield on

| 2 | Capital World Bond Fund |

Germany’s benchmark 10-year note ended 2016 at 0.20%, while the euro shed 3.00% over the 12 months.

Euro-zone bonds accounted for 10.6% of the fund’s portfolio (before currency hedging) as of December 31. Holdings of government issues from Poland, Hungary and Germany are among the larger exposures.

Other developed markets

The Bank of Japan surprised markets twice over the fund’s fiscal year. In late January 2016, the central bank sought to kick-start growth and spark inflation by adopting negative short-term interest rates. Then, in September, it announced that it would tailor its official bond purchases in a bid to push 10-year government bond yields back up to around zero.

The fund’s exposure to Japan is much less than that of the index. That said, Japanese investments — including a sizable amount of inflation-linked issues — remain meaningful in absolute terms: 8.3%, before currency hedging.

Developing markets

Despite the sharp selloff in the final few months of 2016, developing country bonds notched a 10% gain over the 12-month period. In the near term, rebounding prices for certain commodities and stimulus measures in the euro zone, Japan and China all seem supportive, as do reform efforts in select markets.

We remain mindful that future U.S. interest rate increases may dampen investor enthusiasm. As of December 31, 2016, developing country bonds amounted to 22.5% of the portfolio (before currency hedging).

Looking ahead

The global outlook has brightened somewhat. Growth and inflation have picked up and manufacturing activity also seems to be recovering after an extended slump. While some major central banks have maintained accommodative policies, the Fed is tightening. Gradual increases in U.S. interest rates seem likely in 2017. However, the Fed’s stance may evolve as clarity on the new administration’s policy priorities around infrastructure spending, tax cuts and trade policy develops.

Still, concerns about global growth persist. The possibility of more protectionist trade policies in the U.S. and political uncertainty about Brexit and euro zone elections may be sources of volatility.

Near-term dollar strength also seems quite possible — even though valuations for some currencies appear quite low. In recent months, managers increased the portfolio’s less-than-index stance in the euro and reduced the underweight in the British pound. Yen exposure has decreased from neutral to modestly below-index.

Active management of exposure to currencies — as well as countries, interest rates and sectors — is a hallmark of this fund’s flexible research-driven approach. Research has helped us uncover attractive bonds among diverse areas — ranging from Danish mortgage-backed securities and Hungarian government issues, to Malaysian government bonds — and shaped longer term strategic thinking.

We expect broad dollar strength to relent in the next year or so. We see sustained relative value in central Europe and Scandinavia, where higher growth economies adjacent to the euro zone offer European exposure with some positive twists. We also see some great opportunities in emerging markets. For instance, we recently added to investments in Brazil — mindful that bonds there could rally further, if disappointing growth prompts the central bank to cut rates more aggressively than is widely anticipated.

Thank you for your continued commitment to long-term investing. We look forward to reporting to you again in six months.

Cordially,

Thomas H. Høgh

President

February 13, 2017

For current information about the fund, visit americanfunds.com.

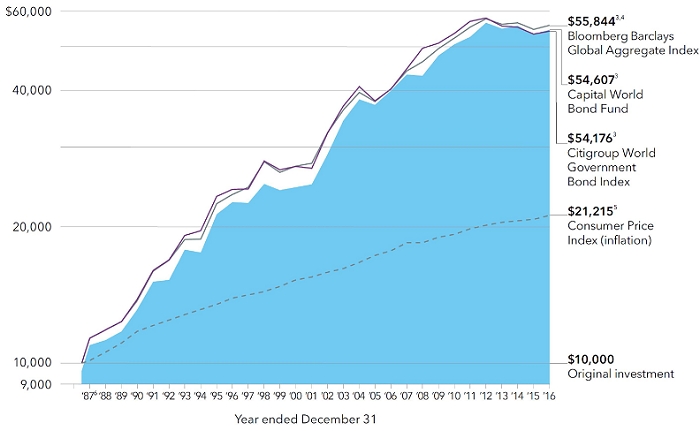

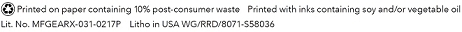

The value of a long-term perspective

Fund results shown reflect deduction of the maximum sales charge of 3.75% on the $10,000 investment.1 Thus, the net amount invested was $9,625.2

How a $10,000 investment has grown over the fund’s lifetime

| 1 | As outlined in the prospectus, the sales charge is reduced for accounts (and aggregated investments) of $100,000 or more and is eliminated for purchases of $1 million or more. There is no sales charge on dividends or capital gain distributions that are reinvested in additional shares. |

| 2 | The maximum initial sales charge was 4.75% prior to January 10, 2000. |

| 3 | With dividends and capital gains reinvested or interest compounded. Results of the Citigroup World Government Bond Index are represented by the purple line. Citigroup data: ©2017 Citigroup Index LLC. All rights reserved. |

| 4 | Bloomberg Barclays Global Aggregate Index did not exist until December 31, 1989. For the period of August 4, 1987, through December 31, 1989, the Citigroup World Government Bond Index results were used. Bloomberg Barclays source: Bloomberg Index Services Ltd. |

| 5 | Computed from data supplied by the U.S. Department of Labor, Bureau of Labor Statistics. |

| 6 | For the period of August 4, 1987, commencement of operations, through December 31, 1987. |

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

Past results are not predictive of results for future periods. The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a $1,000 investment

| For periods ended December 31, 2016* | | | |

| | | | |

| | 1 year | 5 years | 10 years |

| | | | |

| Class A shares | –1.58% | –0.02% | 2.76% |

| | | | |

| * | Assumes reinvestment of all distributions and payment of the maximum 3.75% sales charge. |

The total annual fund operating expense ratio is 0.95% for Class A shares as of the prospectus dated March 1, 2017 (unaudited).

Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers, without which results would have been lower. Visit americanfunds.com for more information.

About your fund

Capital World Bond Fund offers shareholders a selection of global bonds that is unparalleled among the other fixed income funds of the American Funds family. It may invest in virtually any bond market in the world and in bonds denominated in any currency. This broad mandate allows the fund to seek a high level of total return through capital appreciation, through a wide range of income opportunities and from changing currency relationships.

Where the fund’s assets are invested … and how those markets have done over the past year

unaudited

| | | | | | | | | Bond market total returns1 |

| | | Capital World Bond Fund | | 12 months ended |

| | | December 31, 2016 | | December 31, 2016 |

| | | Before forward | | After forward | | In local | | In U.S. |

| Currency weighting by country: | | contracts | | contracts | | currency | | dollars |

| United States2 | | | 50.2 | | | | 46.0 | | | | 2.8 | % | | | 2.8 | % |

| Euro zone3 | | | 10.6 | | | | 11.4 | | | | 3.2 | | | | 0.3 | |

| Japan | | | 8.3 | | | | 14.4 | | | | 2.7 | | | | 6.2 | |

| Hungary | | | 4.7 | | | | 4.6 | | | | 6.8 | 4 | | | 6.1 | 4 |

| Poland | | | 4.6 | | | | 4.2 | | | | 0.2 | | | | –5.0 | |

| Mexico | | | 4.4 | | | | 4.4 | | | | –1.2 | | | | –16.8 | |

| United Kingdom | | | 2.6 | | | | 3.8 | | | | 11.3 | | | | –7.1 | |

| Malaysia | | | 2.6 | | | | 2.4 | | | | 2.9 | | | | –1.1 | |

| Denmark | | | 2.3 | | | | 2.3 | | | | 5.1 | | | | 2.5 | |

| India | | | 1.8 | | | | 1.2 | | | | 15.3 | 4 | | | 12.4 | 4 |

| Brazil | | | 1.4 | | | | 1.1 | | | | 29.8 | 4 | | | 57.8 | 4 |

| Australia | | | 1.2 | | | | 0.1 | | | | 2.9 | | | | 2.4 | |

| Chile | | | 0.8 | | | | 0.0 | | | | 6.4 | | | | 12.7 | |

| Canada | | | 0.7 | | | | 0.2 | | | | 1.4 | | | | 5.1 | |

| Norway | | | 0.6 | | | | 1.1 | | | | 0.4 | | | | 3.3 | |

| Thailand | | | 0.5 | | | | 0.5 | | | | 0.9 | | | | 1.6 | |

| South Africa | | | 0.5 | | | | 0.4 | | | | 13.2 | | | | 29.7 | |

| Argentina | | | 0.4 | | | | 0.4 | | | | — | 5 | | | — | 5 |

| Colombia | | | 0.4 | | | | 0.1 | | | | 15.3 | 4 | | | 21.9 | 4 |

| Sweden | | | 0.4 | | | | 1.2 | | | | 2.7 | | | | –4.8 | |

| Israel | | | 0.4 | | | | 0.1 | | | | — | 5 | | | — | 5 |

| Turkey | | | 0.2 | | | | 0.2 | | | | 9.4 | 4 | | | –9.2 | 4 |

| Philippines | | | 0.2 | | | | 0.2 | | | | 3.7 | 4 | | | –1.9 | 4 |

| Ghana | | | 0.1 | | | | 0.1 | | | | — | 5 | | | — | 5 |

| New Zealand | | | 0.1 | | | | –0.5 | | | | 3.6 | | | | 5.5 | |

| Czech Republic | | | 0.0 | | | | 0.1 | | | | 1.6 | | | | –1.3 | |

| | |

| 1 | Bloomberg Barclays source: Bloomberg Index Services Ltd. Data source: Bloomberg Barclays Global Aggregate Index. |

| 2 | Includes U.S. dollar-denominated debt of other countries, totaling 17.3%. |

| 3 | Countries using the euro as a common currency: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia and Spain. |

| 4 | Data source: JP Morgan GBI–EM Broad Diversified Index. |

| 5 | This market is not included in the Bloomberg Barclays Global Aggregate Index or the JP Morgan GBI–EM Broad Diversified Index. |

| | |

| | | Before forward | | After forward |

| Currency weighting by region: | | contracts | | contracts |

| United States | | | 50.2 | % | | | 46.0 | % |

| Europe | | | 26.0 | | | | 28.9 | |

| Asia/Pacific Basin | | | 14.7 | | | | 18.3 | |

| Other* | | | 9.1 | | | | 6.8 | |

| | |

| * | Argentina, Brazil, Canada, Chile, Colombia, Ghana, Israel, Mexico and South Africa. |

| | |

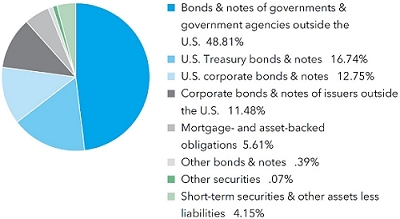

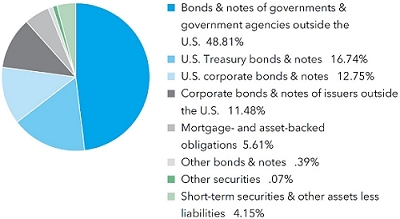

Portfolio summary December 31, 2016

| Investment mix by security type | Percent of net assets |

Bonds & notes of governments & government agencies outside the U.S.

| | | | | | Percent of net assets | |

| Euro zone*: | | | | | | | | |

| Germany | | | 1.86 | % | | | | |

| Ireland | | | 1.69 | | | | | |

| Italy | | | 1.36 | | | | | |

| Spain | | | 1.10 | | | | | |

| Belgium | | | .89 | | | | | |

| Slovenia | | | .73 | | | | | |

| France | | | .25 | | | | | |

| Other | | | .17 | | | | 8.05 | % |

| Japan | | | | | | | 8.26 | |

| Hungary | | | | | | | 5.34 | |

| Poland | | | | | | | 4.52 | |

| Mexico | | | | | | | 4.46 | |

| Malaysia | | | | | | | 2.58 | |

| United Kingdom | | | | | | | 2.13 | |

| India | | | | | | | 1.77 | |

| Brazil | | | | | | | 1.44 | |

| Argentina | | | | | | | 1.39 | |

| Australia | | | | | | | 1.23 | |

| Other | | | | | | | 7.64 | |

| | | | | | | | 48.81 | % |

| | |

| * | Countries using the euro as a common currency: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia and Spain. |

Net assets and portfolio turnover rate

| | | Fund net assets | | Portfolio |

| Fiscal period end | | (millions) | | turnover rate |

| 12/31/2016* | | $ | 11,939 | | | | 19 | %† |

| 9/30/2016 | | | 12,621 | | | | 138 | |

| 9/30/2015 | | | 12,629 | | | | 185 | |

| 9/30/2014 | | | 13,207 | | | | 205 | |

| 9/30/2013 | | | 12,654 | | | | 199 | |

| 9/30/2012 | | | 12,629 | | | | 142 | |

| | |

| * | In 2016, the fund changed its fiscal year-end from September to December. |

| † | Not annualized. |

Expense ratios

| Capital WorldBond Fund (Class A shares) | | | .95 | %* |

| Lipper Global Income Funds Average (front-end load funds only, excluding funds of funds) | | | 1.02 | † |

| | |

| * | As of the prospectus dated March 1, 2017 (unaudited). |

| † | As of December 31, 2016. |

| | |

Summary investment portfolio December 31, 2016

| Bonds, notes & other debt instruments 95.78% | Principal amount

(000) | | | Value

(000) | |

| Euros 10.43% | | | | | | | | |

| Belgium (Kingdom of), Series 77, 1.00% 2026 | | € | 75,500 | | | $ | 82,886 | |

| Germany (Federal Republic of) 2.50% 2046 | | | 99,925 | | | | 148,104 | |

| Germany (Federal Republic of) 0.10%–4.00% 2020–20371 | | | 63,335 | | | | 74,294 | |

| Ireland (Republic of) 3.90% 2023 | | | 49,920 | | | | 65,040 | |

| Ireland (Republic of) 1.00%–5.40% 2024–2045 | | | 110,425 | | | | 136,204 | |

| Italy (Republic of) 0.95%–4.75% 2021–2025 | | | 141,025 | | | | 162,108 | |

| Spain (Kingdom of) 1.30% 2026 | | | 49,500 | | | | 51,805 | |

| Spain (Kingdom of) 0.75%–5.15% 2021–2046 | | | 64,730 | | | | 79,953 | |

| Other securities | | | | | | | 444,999 | |

| | | | | | | | 1,245,393 | |

| | | | | | | | | |

| Japanese yen 8.26% | | | | | | | | |

| Japan, Series 326, 0.70% 2022 | | ¥ | 9,825,000 | | | | 88,028 | |

| Japan, Series 18, 0.10% 20241 | | | 21,135,360 | | | | 190,512 | |

| Japan, Series 19, 0.10% 20241 | | | 13,077,480 | | | | 118,886 | |

| Japan, Series 336, 0.50% 2024 | | | 6,255,000 | | | | 55,742 | |

| Japan, Series 145, 1.70% 2033 | | | 6,955,000 | | | | 72,125 | |

| Japan, Series 42, 1.70% 2044 | | | 7,940,000 | | | | 85,150 | |

| Japan 0.10%–2.20% 2018–20451 | | | 40,249,510 | | | | 375,312 | |

| | | | | | | | 985,755 | |

| | | | | | | | | |

| Hungarian forints 4.62% | | | | | | | | |

| Hungary, Series C, 2.00% 2019 | | HUF | 29,556,570 | | | | 104,117 | |

| Hungary, Series A, 6.50% 2019 | | | 32,438,230 | | | | 125,988 | |

| Hungary, Series A, 7.50% 2020 | | | 40,559,270 | | | | 170,465 | |

| Hungary, Series B, 5.50% 2025 | | | 12,474,160 | | | | 50,905 | |

| Hungary 3.50%–7.00% 2018–2023 | | | 24,912,550 | | | | 100,215 | |

| | | | | | | | 551,690 | |

| | | | | | | | | |

| Polish zloty 4.52% | | | | | | | | |

| Poland (Republic of), Series 0420, 1.50% 2020 | | PLN | 729,525 | | | | 168,825 | |

| Poland (Republic of), Series 1020, 5.25% 2020 | | | 333,450 | | | | 87,119 | |

| Poland (Republic of), Series 0421, 2.00% 2021 | | | 443,750 | | | | 102,691 | |

| Poland (Republic of), Series 0922, 5.75% 2022 | | | 256,955 | | | | 69,730 | |

| Poland (Republic of) 2.75%–5.75% 2021–20251 | | | 436,336 | | | | 110,915 | |

| | | | | | | | 539,280 | |

| | | | | | | | | |

| Mexican pesos 4.40% | | | | | | | | |

| United Mexican States, Series M, 6.50% 2021 | | MXN | 5,449,000 | | | | 256,561 | |

| United Mexican States, Series M20, 10.00% 2024 | | | 1,093,500 | | | | 61,129 | |

| United Mexican States, Series M, 5.75% 2026 | | | 2,463,000 | | | | 105,602 | |

| United Mexican States 4.00%–10.00% 2017–20421 | | | 1,871,027 | | | | 93,738 | |

| Other securities | | | | | | | 8,475 | |

| | | | | | | | 525,505 | |

| | | | | | | | | |

| British pounds 2.58% | | | | | | | | |

| United Kingdom 1.75% 2022 | | £ | 60,850 | | | | 79,481 | |

| United Kingdom 1.00%–3.50% 2017–2045 | | | 129,075 | | | | 173,995 | |

| Other securities | | | | | | | 55,183 | |

| | | | | | | | 308,659 | |

| | | | | | | | | |

| Malaysian ringgits 2.57% | | | | | | | | |

| Malaysia (Federation of), Series 0315, 3.659% 2020 | | MYR | 498,636 | | | | 111,113 | |

| Malaysia (Federation of) 3.58%–4.79% 2018–2035 | | | 894,854 | | | | 196,130 | |

| | | | | | | | 307,243 | |

| | | | | | | | | |

| Danish kroner 2.27% | | | | | | | | |

| Nykredit Realkredit AS, Series 01E, 2.00% 20372 | | DKr | 977,559 | | | | 141,149 | |

| Nykredit Realkredit AS, Series 01E, 2.50% 20472 | | | 86,254 | | | | 12,356 | |

| Realkredit Danmark AS, Series 22S, 2.00% 20372 | | | 581,961 | | | | 83,638 | |

| Other securities | | | | | | | 33,527 | |

| | | | | | | | 270,670 | |

| Bonds, notes & other debt instruments (continued) | Principal amount

(000) | | | Value

(000) | |

| Indian rupees 1.77% | | | | | | | | |

| India (Republic of) 7.80% 2021 | | INR | 5,196,610 | | | $ | 80,097 | |

| India (Republic of) 8.83% 2023 | | | 4,774,600 | | | | 78,270 | |

| India (Republic of) 7.28%–9.20% 2019–2030 | | | 3,372,290 | | | | 53,324 | |

| | | | | | | | 211,691 | |

| | | | | | | | | |

| Brazilian reais 1.41% | | | | | | | | |

| Brazil (Federative Republic of) 0% 2020 | | BRL | 406,000 | | | | 91,019 | |

| Brazil (Federative Republic of) 0%–10.00% 2017–20271 | | | 271,824 | | | | 77,205 | |

| | | | | | | | 168,224 | |

| | | | | | | | | |

| Australian dollars 1.23% | | | | | | | | |

| Australia (Commonwealth of), Series 124, 5.75% 2021 | | A$ | 109,800 | | | | 91,021 | |

| Australia (Commonwealth of) 3.25%–5.50% 2023–2029 | | | 71,500 | | | | 55,695 | |

| | | | | | | | 146,716 | |

| | | | | | | | | |

| Chilean pesos 0.79% | | | | | | | | |

| Chile (Banco Central de) 4.50% 2021 | | CLP | 61,335,000 | | | | 94,088 | |

| | | | | | | | | |

| Canadian dollars 0.67% | | | | | | | | |

| Canada 2.25% 2025 | | C$ | 78,040 | | | | 60,957 | |

| Other securities | | | | | | | 18,999 | |

| | | | | | | | 79,956 | |

| | | | | | | | | |

| Argentine pesos 0.43% | | | | | | | | |

| Argentina (Central Bank of) 0% 2017 | | ARS | 11,400 | | | | 710 | |

| Argentine Republic 2.50%–22.75% 2018–20261 | | | 814,006 | | | | 51,063 | |

| | | | | | | | 51,773 | |

| | | | | | | | | |

| Israeli shekels 0.41% | | | | | | | | |

| Israel (State of) 5.50% 2042 | | ILS | 137,250 | | | | 49,340 | |

| | | | | | | | | |

| U.S. dollars 46.45% | | | | | | | | |

| Argentine Republic 6.63%–8.28% 2021–20462,3,4 | | $ | 109,587 | | | | 112,607 | |

| Brazil (Federative Republic of) 4.25% 2025 | | | 3,545 | | | | 3,319 | |

| Freddie Mac 4.00% 20462 | | | 46,791 | | | | 49,173 | |

| Hungary 5.38%–7.63% 2020–2041 | | | 72,848 | | | | 86,087 | |

| Slovenia (Republic of) 5.50% 2022 | | | 46,940 | | | | 51,973 | |

| U.S. Treasury 1.625% 20195 | | | 125,550 | | | | 126,507 | |

| U.S. Treasury 1.75% 2019 | | | 74,350 | | | | 75,082 | |

| U.S. Treasury 1.375% 20205 | | | 120,450 | | | | 119,697 | |

| U.S. Treasury 1.125% 2021 | | | 334,210 | | | | 325,229 | |

| U.S. Treasury 2.00% 2021 | | | 82,150 | | | | 82,484 | |

| U.S. Treasury 2.50% 2024 | | | 76,900 | | | | 78,087 | |

| U.S. Treasury 3.00% 2045 | | | 61,450 | | | | 60,443 | |

| U.S. Treasury 2.875% 2046 | | | 136,775 | | | | 131,692 | |

| U.S. Treasury 0.75%–8.00% 2017–2046 | | | 505,359 | | | | 499,197 | |

| U.S. Treasury Inflation-Protected Security 0.625% 20241 | | | 152,423 | | | | 155,306 | |

| U.S. Treasury Inflation-Protected Security 0.625% 20261 | | | 55,442 | | | | 55,973 | |

| U.S. Treasury Inflation-Protected Security 1.00% 20461 | | | 144,770 | | | | 145,692 | |

| U.S. Treasury Inflation-Protected Securities 0.13%–2.38% 2024–20451 | | | 139,852 | | | | 143,573 | |

| United Mexican States 3.63%–5.13% 2020–2044 | | | 18,100 | | | | 16,921 | |

| Other securities | | | | | | | 3,226,282 | |

| | | | | | | | 5,545,324 | |

| | | | | | | | | |

| Other 2.97% | | | | | | | | |

| Other securities | | | | | | | 354,337 | |

| | | | | | | | | |

| Total bonds, notes & other debt instruments (cost: $11,954,146,000) | | | | | | | 11,435,644 | |

| | | | | | | | | |

| Convertible stocks 0.03% | | Shares | | | Value

(000) | |

| U.S. dollars 0.01% | | | | | | |

| Other securities | | | | | | $ | 537 | |

| | | | | | | | | |

| Miscellaneous 0.02% | | | | | | | | |

| Other convertible stocks in initial period of acquisition | | | | | | | 2,640 | |

| | | | | | | | | |

| Total convertible stocks (cost: $5,056,000) | | | | | | | 3,177 | |

| | | | | | | | | |

| Common stocks 0.04% | | | | | | | | |

| U.S. dollars 0.04% | | | | | | | | |

| Other securities | | | | | | | 4,642 | |

| | | | | | | | | |

| Total common stocks (cost: $9,903,000) | | | | | | | 4,642 | |

| | | | | | | | | |

| Short-term securities 4.26% | Principal amount

(000) | | | | | |

| Bank of Nova Scotia 1.03% due 1/17/20173 | | $ | 52,100 | | | | 52,085 | |

| Bank of Tokyo-Mitsubishi UFJ, Ltd. 0.65%–0.72% due 1/4/2017–2/1/2017 | | | 72,600 | | | | 72,583 | |

| JPMorgan Chase & Co. 1.03% due 3/13/2017 | | | 50,000 | | | | 50,017 | |

| Liberty Street Funding Corp. 0.97% due 3/8/20173 | | | 40,000 | | | | 39,938 | |

| Mizuho Bank, Ltd. 0.70%–0.89% due 1/30/2017–2/21/20173 | | | 80,000 | | | | 79,926 | |

| Toronto-Dominion Holdings USA Inc. 0.60%–0.69% due 1/10/2017–1/31/20173 | | | 75,000 | | | | 74,979 | |

| U.S. Treasury Bills 0.44% due 2/16/2017 | | | 5,000 | | | | 4,997 | |

| Victory Receivables Corp. 1.10% due 3/10/20173 | | | 50,000 | | | | 49,918 | |

| Other securities | | | | | | | 84,256 | |

| | | | | | | | | |

| Total short-term securities (cost: $508,635,000) | | | | | | | 508,699 | |

| Total investment securities 100.11% (cost: $12,477,740,000) | | | | | | | 11,952,162 | |

| Other assets less liabilities (0.11)% | | | | | | | (13,122 | ) |

| | | | | | | | | |

| Net assets 100.00% | | | | | | $ | 11,939,040 | |

This summary investment portfolio is designed to streamline the report and help investors better focus on the fund’s principal holdings. See the inside back cover for details on how to obtain a complete schedule of portfolio holdings.

As permitted by U.S. Securities and Exchange Commission regulations, “Miscellaneous” securities include holdings in their first year of acquisition that have not previously been publicly disclosed.

“Other securities” includes all issues that are not disclosed separately in the summary investment portfolio. “Miscellaneous” and “Other securities” includes securities which were valued under fair value procedures adopted by authority of the board of trustees. The total value of securities which were valued under fair value procedures was $7,672,000, which represented .06% of the net assets of the fund. “Other securities” also includes loan participations and assignments, which may be subject to legal or contractual restrictions on resale. The total value of all such loans was $24,208,000, which represented .20% of the net assets of the fund. Some securities in “Other securities” (with aggregate value of $669,000, an aggregate cost of $3,135,000, and which represented .01% of the net assets of the fund) were acquired from 3/10/2010 to 8/27/2013 through private placement transactions exempt from registration under the Securities Act of 1933, which may subject them to legal or contractual restrictions on resale.

Forward currency contracts

The fund has entered into forward currency contracts as shown in the following table. The average month-end notional amount of open forward currency contracts while held was $2,468,225,000.

| | | | | | | | | | | Unrealized | |

| | | | | | | | | (depreciation) | |

| | | | | | | Contract amount | | appreciation | |

| | | | | | | Receive | | Deliver | | at 12/31/2016 | |

| | | Settlement date | | Counterparty | | (000) | | (000) | | (000) | |

| Purchases: | | | | | | | | | | | | | |

| Euros | | 1/6/2017 | | UBS AG | | €74,700 | | $81,619 | | | $ | (2,945 | ) |

| Euros | | 1/9/2017 | | Citibank | | €45,000 | | $48,623 | | | | (1,222 | ) |

| Euros | | 1/10/2017 | | HSBC Bank | | €50,979 | | $55,043 | | | | (1,341 | ) |

| Euros | | 1/12/2017 | | Barclays Bank PLC | | €32,924 | | $35,078 | | | | (391 | ) |

| Euros | | 1/19/2017 | | Bank of America, N.A. | | €47,856 | | $51,451 | | | | (1,017 | ) |

| Japanese yen | | 1/6/2017 | | JPMorgan Chase | | ¥15,248,338 | | $137,500 | | | | (6,953 | ) |

| Japanese yen | | 1/11/2017 | | HSBC Bank | | ¥11,675,659 | | $103,150 | | | | (3,165 | ) |

| Japanese yen | | 1/12/2017 | | JPMorgan Chase | | ¥1,246,991 | | $12,050 | | | | (1,371 | ) |

| | | | | | | | | | | | | | |

Forward currency contracts (continued)

| | | | | | | | | | | Unrealized | |

| | | | | | | | | (depreciation) | |

| | | | | | | Contract amount | | appreciation | |

| | | | | | | Receive | | Deliver | | at 12/31/2016 | |

| | | Settlement date | | Counterparty | | (000) | | (000) | | (000) | |

| Japanese yen | | 1/19/2017 | | JPMorgan Chase | | ¥17,090,369 | | $150,708 | | | $ | (4,293 | ) |

| Japanese yen | | 1/20/2017 | | JPMorgan Chase | | ¥6,522,912 | | $56,800 | | | | (915 | ) |

| Japanese yen | | 1/20/2017 | | JPMorgan Chase | | ¥4,075,718 | | $35,836 | | | | (918 | ) |

| Japanese yen | | 1/26/2017 | | Bank of America, N.A. | | ¥10,852,733 | | $94,550 | | | | (1,540 | ) |

| Japanese yen | | 2/16/2017 | | HSBC Bank | | ¥12,195,000 | | $106,108 | | | | (1,508 | ) |

| Japanese yen | | 2/24/2017 | | HSBC Bank | | ¥4,334,444 | | $36,867 | | | | 322 | |

| Norwegian kroner | | 1/13/2017 | | Bank of America, N.A. | | NKr213,338 | | $25,269 | | | | (560 | ) |

| Norwegian kroner | | 1/24/2017 | | Barclays Bank PLC | | NKr207,685 | | $23,985 | | | | 72 | |

| South African rand | | 1/26/2017 | | Bank of America, N.A. | | ZAR26,104 | | $1,842 | | | | 48 | |

| Swedish kronor | | 1/24/2017 | | Barclays Bank PLC | | SKr197,119 | | $21,046 | | | | 628 | |

| Swedish kronor | | 2/16/2017 | | Barclays Bank PLC | | SKr154,107 | | $16,879 | | | | 87 | |

| | | | | | | | | | | | $ | (26,982 | ) |

| | | | | | | | | | | | | | |

| Sales: | | | | | | | | | | | | | |

| Australian dollars | | 1/9/2017 | | JPMorgan Chase | | $16,829 | | A$22,500 | | | | 597 | |

| Australian dollars | | 1/11/2017 | | Bank of America, N.A. | | $31,412 | | A$42,550 | | | | 716 | |

| Australian dollars | | 1/19/2017 | | JPMorgan Chase | | $2,434 | | A$3,200 | | | | 126 | |

| Australian dollars | | 1/20/2017 | | JPMorgan Chase | | $11,163 | | A$15,000 | | | | 345 | |

| Australian dollars | | 1/20/2017 | | JPMorgan Chase | | $4,480 | | A$6,000 | | | | 152 | |

| Australian dollars | | 1/25/2017 | | UBS AG | | $69,411 | | A$95,300 | | | | 687 | |

| Australian dollars | | 1/25/2017 | | JPMorgan Chase | | €7,025 | | A$10,000 | | | | 194 | |

| Brazilian reais | | 4/3/2017 | | Citibank | | $12 | | BRL41 | | | | — | 6 |

| Brazilian reais | | 4/3/2017 | | Citibank | | $1,024 | | BRL3,600 | | | | (54 | ) |

| Brazilian reais | | 4/3/2017 | | Citibank | | $34,605 | | BRL121,400 | | | | (1,749 | ) |

| British pounds | | 1/9/2017 | | Bank of America, N.A. | | $5,483 | | £4,300 | | | | 181 | |

| British pounds | | 1/10/2017 | | HSBC Bank | | €20,181 | | £17,100 | | | | 177 | |

| British pounds | | 1/24/2017 | | Bank of New York Mellon | | $8,349 | | £6,700 | | | | 86 | |

| British pounds | | 1/26/2017 | | Bank of America, N.A. | | $4,446 | | £3,500 | | | | 129 | |

| British pounds | | 2/17/2017 | | Bank of New York Mellon | | $18,451 | | £14,800 | | | | 189 | |

| Canadian dollars | | 1/10/2017 | | JPMorgan Chase | | $3,775 | | C$5,000 | | | | 51 | |

| Canadian dollars | | 1/20/2017 | | Barclays Bank PLC | | $8,286 | | C$11,000 | | | | 91 | |

| Canadian dollars | | 1/23/2017 | | JPMorgan Chase | | €11,489 | | C$16,000 | | | | 190 | |

| Canadian dollars | | 1/23/2017 | | Bank of America, N.A. | | €11,488 | | C$16,000 | | | | 189 | |

| Canadian dollars | | 1/23/2017 | | Bank of America, N.A. | | $23,337 | | C$31,150 | | | | 129 | |

| Chilean pesos | | 1/20/2017 | | Citibank | | $94,295 | | CLP62,796,000 | | | | 691 | |

| Colombian pesos | | 1/11/2017 | | JPMorgan Chase | | $14,836 | | COP45,946,200 | | | | (433 | ) |

| Colombian pesos | | 1/11/2017 | | Citibank | | $20,591 | | COP63,665,807 | | | | (567 | ) |

| Colombian pesos | | 1/13/2017 | | Bank of America, N.A. | | $375 | | COP1,158,000 | | | | (10 | ) |

| Euros | | 1/6/2017 | | JPMorgan Chase | | $45,149 | | €42,700 | | | | 178 | |

| Euros | | 1/9/2017 | | Citibank | | SKr227,831 | | €23,200 | | | | 590 | |

| Euros | | 1/9/2017 | | UBS AG | | $8,292 | | €7,680 | | | | 203 | |

| Euros | | 1/11/2017 | | Citibank | | NKr90,454 | | €10,000 | | | | (58 | ) |

| Euros | | 1/12/2017 | | HSBC Bank | | ¥4,109,404 | | €33,800 | | | | (416 | ) |

| Euros | | 1/13/2017 | | HSBC Bank | | NKr38,866 | | €4,325 | | | | (55 | ) |

| Euros | | 1/19/2017 | | Bank of America, N.A. | | $8,843 | | €8,250 | | | | 148 | |

| Euros | | 1/19/2017 | | UBS AG | | $3,057 | | €2,830 | | | | 75 | |

| Euros | | 1/19/2017 | | Bank of America, N.A. | | $100,865 | | €97,025 | | | | (1,387 | ) |

| Euros | | 1/20/2017 | | Citibank | | SKr117,089 | | €12,000 | | | | 224 | |

| Euros | | 1/20/2017 | | Citibank | | £80,649 | | €96,000 | | | | (1,722 | ) |

| Euros | | 1/23/2017 | | JPMorgan Chase | | £52,915 | | €62,850 | | | | (990 | ) |

| Euros | | 1/24/2017 | | Bank of America, N.A. | | CZK269,450 | | €10,000 | | | | (31 | ) |

| Euros | | 1/26/2017 | | Citibank | | SKr181,406 | | €18,550 | | | | 393 | |

| Euros | | 2/3/2017 | | Citibank | | $10,526 | | €9,500 | | | | 507 | |

| Euros | | 2/7/2017 | | HSBC Bank | | $5,018 | | €4,500 | | | | 272 | |

| Euros | | 2/17/2017 | | Citibank | | $11,355 | | €10,730 | | | | 32 | |

| Euros | | 2/24/2017 | | Citibank | | $2,672 | | €2,500 | | | | 33 | |

| Euros | | 2/24/2017 | | Bank of America, N.A. | | $25,098 | | €24,000 | | | | (235 | ) |

| Euros | | 3/15/2017 | | Citibank | | $18,954 | | €17,775 | | | | 172 | |

| Hungarian forints | | 1/10/2017 | | HSBC Bank | | €14,316 | | HUF4,500,000 | | | | (243 | ) |

| Indian rupees | | 1/11/2017 | | UBS AG | | $31,951 | | INR2,200,000 | | | | (426 | ) |

| Indian rupees | | 1/11/2017 | | JPMorgan Chase | | $38,134 | | INR2,625,500 | | | | (506 | ) |

| Indonesian rupiah | | 1/13/2017 | | JPMorgan Chase | | $2,141 | | IDR28,589,600 | | | | 23 | |

| Israeli shekels | | 1/9/2017 | | Bank of America, N.A. | | $2,393 | | ILS9,100 | | | | 31 | |

| | | | | | | | | | | | | | |

| 10 | Capital World Bond Fund |

| | | | | | | | | | | Unrealized | |

| | | | | | | | | (depreciation) | |

| | | | | | | Contract amount | | appreciation | |

| | | | | | | Receive | | Deliver | | at 12/31/2016 | |

| | | Settlement date | | Counterparty | | (000) | | (000) | | (000) | |

| Israeli shekels | | 1/23/2017 | | Citibank | | $32,103 | | ILS123,500 | | | $ | 23 | |

| Israeli shekels | | 1/26/2017 | | HSBC Bank | | $3,645 | | ILS14,100 | | | | (18 | ) |

| Japanese yen | | 1/10/2017 | | Citibank | | $11,791 | | ¥1,335,000 | | | | 359 | |

| Japanese yen | | 1/10/2017 | | Bank of America, N.A. | | $46 | | ¥5,204 | | | | 1 | |

| Malaysian ringgits | | 1/13/2017 | | UBS AG | | $25,206 | | MYR111,600 | | | | 342 | |

| Malaysian ringgits | | 1/13/2017 | | Citibank | | $5,657 | | MYR25,000 | | | | 88 | |

| Mexican pesos | | 1/12/2017 | | HSBC Bank | | $4,601 | | MXN95,800 | | | | (11 | ) |

| New Zealand dollars | | 1/13/2017 | | Citibank | | £26,853 | | NZ$48,050 | | | | (254 | ) |

| New Zealand dollars | | 1/19/2017 | | JPMorgan Chase | | $2,133 | | NZ$3,000 | | | | 51 | |

| New Zealand dollars | | 1/20/2017 | | JPMorgan Chase | | $2,142 | | NZ$3,000 | | | | 60 | |

| New Zealand dollars | | 1/24/2017 | | JPMorgan Chase | | $23,889 | | NZ$34,000 | | | | 291 | |

| New Zealand dollars | | 1/26/2017 | | JPMorgan Chase | | €10,112 | | NZ$15,000 | | | | 250 | |

| Polish zloty | | 1/10/2017 | | JPMorgan Chase | | $35,762 | | PLN149,385 | | | | 72 | |

| Polish zloty | | 1/26/2017 | | Citibank | | €6,768 | | PLN30,000 | | | | (30 | ) |

| South African rand | | 1/10/2017 | | JPMorgan Chase | | $615 | | ZAR8,500 | | | | (3 | ) |

| South African rand | | 1/12/2017 | | JPMorgan Chase | | $9,351 | | ZAR133,200 | | | | (324 | ) |

| Turkish lira | | 1/19/2017 | | Barclays Bank PLC | | $2,921 | | TRY10,275 | | | | 20 | |

| | | | | | | | | | | | $ | (164 | ) |

| Forward currency contracts — net | | | | $ | (27,146 | ) |

Interest rate swaps

The fund has entered into interest rate swaps as shown in the following table. The average month-end notional amount of interest rate swaps while held was $964,270,000.

| | | | | | | | | | | | | Unrealized | |

| | | | | | | | | | | | | (depreciation) | |

| | | | | | | | | | | | | appreciation | |

| Pay/receive | | | | | | Fixed | | Expiration | | Notional | | at 12/31/2016 | |

| fixed rate | | Clearinghouse | | Floating rate index | | rate | | date | | (000) | | (000) | |

| Receive | | LCH | | 3-month USD-LIBOR | | 1.384 | % | 12/15/2018 | | $270,000 | | | $ | (327 | ) |

| Receive | | LCH | | 6-month NOK-NIBOR | | 1.345 | | 12/16/2019 | | NKr350,000 | | | | — | |

| Pay | | LCH | | 6-month EURIBOR | | (0.1003 | ) | 12/16/2019 | | €32,000 | | | | (109 | ) |

| Receive | | LCH | | 6-month NOK-NIBOR | | 1.36 | | 12/19/2019 | | NKr500,000 | | | | 21 | |

| Receive | | LCH | | 3-month SEK-STIBOR | | 0.5725 | | 7/24/2020 | | SKr43,250 | | | | 104 | |

| Receive | | LCH | | 3-month USD-LIBOR | | 1.572 | | 9/16/2020 | | $60,000 | | | | (501 | ) |

| Receive | | LCH | | 3-month SEK-STIBOR | | 0.4825 | | 9/22/2020 | | SKr300,000 | | | | 607 | |

| Receive | | LCH | | 3-month Canada BA | | 1.0625 | | 11/5/2020 | | C$80,000 | | | | (633 | ) |

| Receive | | LCH | | 6-month AUD-BBSW Benchmark Rate | | 2.22 | | 11/7/2020 | | A$80,000 | | | | (612 | ) |

| Pay | | LCH | | 3-month USD-LIBOR | | 1.358 | | 11/8/2020 | | $60,000 | | | | 980 | |

| Pay | | LCH | | 3-month USD-LIBOR | | 1.365 | | 11/8/2020 | | 60,000 | | | | 972 | |

| Pay | | LCH | | 3-month USD-LIBOR | | 1.67 | | 11/14/2020 | | 55,000 | | | | 575 | |

| Receive | | LCH | | 3-month NZD-BBR-FRA | | 2.86 | | 11/14/2020 | | NZ$80,000 | | | | (476 | ) |

| Receive | | LCH | | 3-month USD-LIBOR | | 1.2185 | | 2/8/2021 | | $70,000 | | | | (1,784 | ) |

| Receive | | LCH | | 3-month USD-LIBOR | | 1.8855 | | 12/15/2021 | | 108,000 | | | | (406 | ) |

| Receive | | LCH | | 3-month USD-LIBOR | | 1.885 | | 12/15/2021 | | 542,000 | | | | (2,054 | ) |

| Pay | | LCH | | 3-month USD-LIBOR | | 2.1955 | | 5/6/2025 | | 60,000 | | | | 235 | |

| Pay | | LCH | | 3-month USD-LIBOR | | 1.5075 | | 9/22/2026 | | 9,600 | | | | 696 | |

| Pay | | LCH | | 3-month USD-LIBOR | | 1.9815 | | 11/14/2026 | | 20,000 | | | | 625 | |

| Pay | | LCH | | 3-month USD-LIBOR | | 2.468 | | 12/19/2026 | | 40,000 | | | | (493 | ) |

| Pay | | LCH | | 6-month EURIBOR | | 0.7962 | | 9/22/2036 | | €14,700 | | | | 1,049 | |

| Receive | | LCH | | 6-month EURIBOR | | 1.6073 | | 7/9/2045 | | 6,000 | | | | 610 | |

| Pay | | LCH | | 3-month USD-LIBOR | | 2.562 | | 11/4/2045 | | $20,000 | | | | 84 | |

| Pay | | LCH | | 3-month USD-LIBOR | | 2.52611 | | 11/24/2045 | | 67,000 | | | | 799 | |

| Pay | | LCH | | 3-month USD-LIBOR | | 2.535 | | 11/24/2045 | | 8,000 | | | | 80 | |

| Pay | | LCH | | 3-month USD-LIBOR | | 2.556 | | 11/27/2045 | | 47,000 | | | | 258 | |

| Pay | | LCH | | 3-month USD-LIBOR | | 2.354 | | 1/29/2046 | | 30,000 | | | | 1,466 | |

| Pay | | LCH | | 3-month USD-LIBOR | | 2.116 | | 4/15/2046 | | 25,000 | | | | 2,522 | |

| | | | | | | | | | | | | | | | |

| Capital World Bond Fund | 11 |

Interest rate swaps (continued)

| | | | | | | | | | | | | Unrealized | |

| | | | | | | | | | | | | (depreciation) | |

| | | | | | | | | | | | | appreciation | |

| Pay/receive | | | | | | Fixed | | Expiration | | Notional | | at 12/31/2016 | |

| fixed rate | | Clearinghouse | | Floating rate index | | rate | | date | | (000) | | (000) | |

| Pay | | LCH | | 3-month USD-LIBOR | | 1.794 | % | 8/3/2046 | | $50,000 | | | $ | 8,594 | |

| Pay | | LCH | | 3-month USD-LIBOR | | 1.9095 | | 10/11/2046 | | 30,000 | | | | 4,421 | |

| | | | | | | | | | | | | | $ | 17,303 | |

Futures contracts

The fund has entered into futures contracts as shown in the following table. The average month-end notional amount of open futures contracts while held was $16,880,000.

| | | | | | | | | | | | | Unrealized | |

| | | | | | | | | | | | | appreciation | |

| | | | | | | | | | | Notional | | (depreciation) | |

| | | | | | | Number of | | | | amount | | at 12/31/2016 | |

| Contracts | | Clearinghouse | | Type | | contracts | | Expiration | | (000) | | (000) | |

| 10 Year Euro-Bund Futures | | Eurex | | Long | | 37 | | March 2017 | | $6,345 | | | $ | 48 | |

| 10 Year U.S. Treasury Note Futures | | CME | | Long | | 48 | | March 2017 | | 5,997 | | | | (31 | ) |

| 30 Year Ultra U.S. Treasury Bond Futures | | CME | | Long | | 35 | | March 2017 | | 5,677 | | | | (68 | ) |

| | | | | | | | | | | | | | $ | (51 | ) |

The following footnotes apply to either the individual securities noted or one or more of the securities aggregated and listed as a single line item.

| 1 | Index-linked bond whose principal amount moves with a government price index. |

| 2 | Principal payments may be made periodically. Therefore, the effective maturity date may be earlier than the stated maturity date. |

| 3 | Acquired in a transaction exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933. May be resold in the U.S. in transactions exempt from registration, normally to qualified institutional buyers. The total value of all such securities, including those in “Other securities,” was $1,387,965,000, which represented 11.63% of the net assets of the fund. |

| 4 | Payment in kind; the issuer has the option of paying additional securities in lieu of cash. |

| 5 | A portion of this security was pledged as collateral. The total value of pledged collateral was $70,420,000, which represented .59% of the net assets of the fund. |

| 6 | Amount less than one thousand. |

Key to abbreviations and symbols

AUD/A$ = Australian dollars

ARS = Argentine pesos

BA = Banker’s acceptances

BBR = Bank base rate

BBSW = Bank Bill Swap

BRL = Brazilian reais

C$ = Canadian dollars

CLP = Chilean pesos

CME = CME Group

COP = Colombian pesos

CZK = Czech korunas

DKr = Danish kroner

EUREX = Eurex Exchange

€ = Euros

EURIBOR = Euro Interbank Offered Rate

FRA = Forward rate agreement

£ = British pounds

HUF = Hungarian forints

IDR = Indonesian rupiah

ILS = Israeli shekels

INR = Indian rupees

¥ = Japanese yen

LCH = LCH.Clearnet

LIBOR = London Interbank Offered Rate

MXN = Mexican pesos

MYR = Malaysian ringgits

NIBOR = Norway Interbank Offered Rate

NOK/NKr = Norwegian kroner

NZD/NZ$ = New Zealand dollars

PLN = Polish zloty

SEK/SKr = Swedish kronor

STIBOR = Stockholm Interbank Offered Rate

TRY = Turkish lira

ZAR = South African rand

See Notes to Financial Statements

| 12 | Capital World Bond Fund |

Financial statements

Statement of assets and liabilities

at December 31, 2016 | | (dollars in thousands) |

| | | | | | | |

| Assets: | | | | | | |

| Investment securities, at value (cost: $12,477,740) | | | | | | $ | 11,952,162 | |

| Cash | | | | | | | 167 | |

| Cash denominated in currencies other than U.S. dollars (cost: $12,789) | | | | | | | 12,819 | |

| Unrealized appreciation on open forward currency contracts | | | | | | | 10,515 | |

| Receivables for: | | | | | | | | |

| Sales of investments | | $ | 38,123 | | | | | |

| Sales of fund’s shares | | | 26,732 | | | | | |

| Closed forward currency contracts | | | 1,279 | | | | | |

| Variation margin | | | 1,058 | | | | | |

| Interest | | | 109,692 | | | | | |

| Other | | | 415 | | | | 177,299 | |

| | | | | | | | 12,152,962 | |

| Liabilities: | | | | | | | | |

| Unrealized depreciation on open forward currency contracts | | | | | | | 37,661 | |

| Payables for: | | | | | | | | |

| Purchases of investments | | | 131,892 | | | | | |

| Repurchases of fund’s shares | | | 24,889 | | | | | |

| Closed forward currency contracts | | | 6,217 | | | | | |

| Investment advisory services | | | 4,476 | | | | | |

| Services provided by related parties | | | 2,494 | | | | | |

| Trustees’ deferred compensation | | | 212 | | | | | |

| Variation margin | | | 2,644 | | | | | |

| Other | | | 3,437 | | | | 176,261 | |

| Net assets at December 31, 2016 | | | | | | $ | 11,939,040 | |

| | | | | | | | | |

| Net assets consist of: | | | | | | | | |

| Capital paid in on shares of beneficial interest | | | | | | $ | 12,652,008 | |

| Distributions in excess of net investment income | | | | | | | (21,724 | ) |

| Accumulated net realized loss | | | | | | | (153,140 | ) |

| Net unrealized depreciation | | | | | | | (538,104 | ) |

| Net assets at December 31, 2016 | | | | | | $ | 11,939,040 | |

(dollars and shares in thousands, except per-share amounts)

Shares of beneficial interest issued and outstanding (no stated par value) —

unlimited shares authorized (630,318 total shares outstanding)

| | | Net assets | | | Shares

outstanding | | | Net asset value

per share | |

| Class A | | $ | 5,824,352 | | | | 307,183 | | | $ | 18.96 | |

| Class B | | | 4,171 | | | | 221 | | | | 18.88 | |

| Class C | | | 336,480 | | | | 18,048 | | | | 18.64 | |

| Class F-1 | | | 322,229 | | | | 17,035 | | | | 18.92 | |

| Class F-2 | | | 1,933,044 | | | | 102,134 | | | | 18.93 | |

| Class 529-A | | | 288,499 | | | | 15,174 | | | | 19.01 | |

| Class 529-B | | | 400 | | | | 21 | | | | 18.94 | |

| Class 529-C | | | 109,110 | | | | 5,812 | | | | 18.77 | |

| Class 529-E | | | 15,440 | | | | 817 | | | | 18.89 | |

| Class 529-F-1 | | | 34,618 | | | | 1,832 | | | | 18.90 | |

| Class R-1 | | | 10,806 | | | | 576 | | | | 18.77 | |

| Class R-2 | | | 133,335 | | | | 7,106 | | | | 18.76 | |

| Class R-2E | | | 1,995 | | | | 105 | | | | 18.93 | |

| Class R-3 | | | 139,893 | | | | 7,388 | | | | 18.93 | |

| Class R-4 | | | 106,619 | | | | 5,627 | | | | 18.95 | |

| Class R-5E | | | 10 | | | | 1 | | | | 18.94 | |

| Class R-5 | | | 76,106 | | | | 4,012 | | | | 18.97 | |

| Class R-6 | | | 2,601,933 | | | | 137,226 | | | | 18.96 | |

See Notes to Financial Statements

| Capital World Bond Fund | 13 |

| Statements of operations | |

| | (dollars in thousands) |

| | | Three months ended

December 31, 20161 | | | Year ended

September 30, 2016 | |

| Investment income: | | | | | | | | | | | | | | | | |

| Income: | | | | | | | | | | | | | | | | |

| Interest (net of non-U.S. taxes of $666) | | | | | | $ | 92,307 | | | | | | | $ | 361,773 | |

| Fees and expenses2: | | | | | | | | | | | | | | | | |

| Investment advisory services | | $ | 13,574 | | | | | | | $ | 55,307 | | | | | |

| Distribution services | | | 5,972 | | | | | | | | 26,674 | | | | | |

| Transfer agent services | | | 4,427 | | | | | | | | 20,491 | | | | | |

| Administrative services | | | 918 | | | | | | | | 3,721 | | | | | |

| Reports to shareholders | | | 329 | | | | | | | | 1,246 | | | | | |

| Registration statement and prospectus | | | 238 | | | | | | | | 818 | | | | | |

| Trustees’ compensation | | | 23 | | | | | | | | 118 | | | | | |

| Auditing and legal | | | 11 | | | | | | | | 170 | | | | | |

| Custodian | | | 714 | | | | | | | | 2,341 | | | | | |

| Other | | | 132 | | | | | | | | 525 | | | | | |

| Total fees and expenses before reimbursements | | | 26,338 | | | | | | | | 111,411 | | | | | |

| Less transfer agent services reimbursements | | | — | 3 | | | | | | | — | | | | | |

| Total fees and expenses after reimbursements | | | | | | | 26,338 | | | | | | | | 111,411 | |

| Net investment income | | | | | | | 65,969 | | | | | | | | 250,362 | |

| | | | | | | | | | | | | | | | | |

| Net realized (loss) gain and unrealized (depreciation) appreciation: | | | | | | | | | | | | | | | | |

| Net realized (loss) gain on: | | | | | | | | | | | | | | | | |

| Investments (net of non-U.S. taxes of $305 and $544, respectively) | | | (61,149 | ) | | | | | | | (75,290 | ) | | | | |

| Forward currency contracts | | | (94,887 | ) | | | | | | | 104,146 | | | | | |

| Interest rate swaps | | | (591 | ) | | | | | | | (16,431 | ) | | | | |

| Futures contracts | | | (934 | ) | | | | | | | — | | | | | |

| Currency transactions | | | (4,000 | ) | | | (161,561 | ) | | | (10,659 | ) | | | 1,766 | |

| Net unrealized (depreciation) appreciation on: | | | | | | | | | | | | | | | | |

| Investments (net of non-U.S. taxes of $936 and $1,068, respectively) | | | (746,526 | ) | | | | | | | 767,278 | | | | | |

| Forward currency contracts | | | (22,078 | ) | | | | | | | (13,892 | ) | | | | |

| Interest rate swaps | | | 46,655 | | | | | | | | (35,558 | ) | | | | |

| Futures contracts | | | (89 | ) | | | | | | | 38 | | | | | |

| Currency translations | | | (2,203 | ) | | | (724,241 | ) | | | 2,133 | | | | 719,999 | |

| Net realized (loss) gain and unrealized (depreciation) appreciation | | | | | | | (885,802 | ) | | | | | | | 721,765 | |

| | | | | | | | | | | | | | | | | |

| Net (decrease) increase in net assets resulting from operations | | | | | | $ | (819,833 | ) | | | | | | $ | 972,127 | |

| 1 | In 2016, the fund changed its fiscal year-end from September to December. |

| 2 | Additional information related to class-specific fees and expenses is included in the Notes to Financial Statements. |

| 3 | Amount less than one thousand. |

See Notes to Financial Statements

| 14 | Capital World Bond Fund |

Statements of changes in net assets

(dollars in thousands)

| | | | Three months ended | | | | | | | |

| | | | December 31, | | | Year ended September 30 | |

| | | | 2016* | | | | 2016 | | | | 2015 | |

| Operations: | | | | | | | | | | | | | |

| Net investment income | | | $ | 65,969 | | | $ | 250,362 | | | $ | 263,682 | |

| Net realized (loss) gain | | | | (161,561 | ) | | | 1,766 | | | | (233,968 | ) |

| Net unrealized (depreciation) appreciation | | | | (724,241 | ) | | | 719,999 | | | | (566,527 | ) |

| Net (decrease) increase in net assets resulting from operations | | | | (819,833 | ) | | | 972,127 | | | | (536,813 | ) |

| | | | | | | | | | | | | | |

| Dividends and distributions paid to shareholders: | | | | | | | | | | | | | |

| Dividends from net investment income | | | | (76,502 | ) | | | (152,624 | ) | | | (124,011 | ) |

| Distributions from net realized gain on investments | | | | (42,817 | ) | | | — | | | | (182,169 | ) |

| Return of capital | | | | (28,799 | ) | | | — | | | | — | |

| Total dividends and distributions paid to shareholders | | | | (148,118 | ) | | | (152,624 | ) | | | (306,180 | ) |

| | | | | | | | | | | | | | |

| Net capital share transactions | | | | 285,846 | | | | (827,841 | ) | | | 265,916 | |

| | | | | | | | | | | | | | |

| Total decrease in net assets | | | | (682,105 | ) | | | (8,338 | ) | | | (577,077 | ) |

| | | | | | | | | | | | | | |

| Net assets: | | | | | | | | | | | | | |

| Beginning of period | | | | 12,621,145 | | | | 12,629,483 | | | | 13,206,560 | |

| End of period (including distributions in excess of net investment income and undistributed net investment income: $(21,724), $(7,752) and $30,277, respectively) | | | $ | 11,939,040 | | | $ | 12,621,145 | | | $ | 12,629,483 | |

| * | In 2016, the fund changed its fiscal year-end from September to December. |

See Notes to Financial Statements

| Capital World Bond Fund | 15 |

Notes to financial statements

1. Organization

Capital World Bond Fund (the “fund”) is registered under the Investment Company Act of 1940 as an open-end, nondiversified management investment company. The fund seeks to provide, over the long term, a high level of total return consistent with prudent investment management. Total return comprises the income generated by the fund and the changes in the market value of the fund’s investments.

On January 27, 2016, the fund’s board of trustees changed the fund’s next fiscal year-end from September 30 to December 31.

The fund has 18 share classes consisting of five retail share classes (Classes A, B and C, as well as two F share classes, F-1 and F-2), five 529 college savings plan share classes (Classes 529-A, 529-B, 529-C, 529-E and 529-F-1) and eight retirement plan share classes (Classes R-1, R-2, R-2E, R-3, R-4, R-5E, R-5 and R-6). The 529 college savings plan share classes can be used to save for college education. The retirement plan share classes are generally offered only through eligible employer-sponsored retirement plans. The fund’s share classes are described further in the following table:

| Share class | | Initial sales charge | | Contingent deferred sales

charge upon redemption | | Conversion feature |

| Classes A and 529-A | | Up to 3.75% | | None (except 1% for certain redemptions within one year of purchase without an initial sales charge) | | None |

| Classes B and 529-B* | | None | | Declines from 5% to 0% for redemptions within six years of purchase | | Classes B and 529-B convert to Classes A and 529-A, respectively, after eight years |

| Class C | | None | | 1% for redemptions within one year of purchase | | Class C converts to Class F-1 after 10 years |

| Class 529-C | | None | | 1% for redemptions within one year of purchase | | None |

| Class 529-E | | None | | None | | None |

| Classes F-1, F-2 and 529-F-1 | | None | | None | | None |

| Classes R-1, R-2, R-2E, R-3, R-4, R-5E, R-5 and R-6 | | None | | None | | None |

* Class B and 529-B shares of the fund are not available for purchase.

Holders of all share classes have equal pro rata rights to the assets, dividends and liquidation proceeds of the fund. Each share class has identical voting rights, except for the exclusive right to vote on matters affecting only its class. Share classes have different fees and expenses (“class-specific fees and expenses”), primarily due to different arrangements for distribution, transfer agent and administrative services. Differences in class-specific fees and expenses will result in differences in net investment income and, therefore, the payment of different per-share dividends by each share class.

2. Significant accounting policies

The fund is an investment company that applies the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board. The fund’s financial statements have been prepared to comply with U.S. generally accepted accounting principles (“U.S. GAAP”). These principles require the fund’s investment adviser to make estimates and assumptions that affect reported amounts and disclosures. Actual results could differ from those estimates. Subsequent events, if any, have been evaluated through the date of issuance in the preparation of the financial statements. The fund follows the significant accounting policies described in this section, as well as the valuation policies described in the next section on valuation.

Security transactions and related investment income — Security transactions are recorded by the fund as of the date the trades are executed with brokers. Realized gains and losses from security transactions are determined based on the specific identified cost of the securities. In the event a security is purchased with a delayed payment date, the fund will segregate liquid assets sufficient to meet its payment obligations. Interest income is recognized on an accrual basis. Market discounts, premiums and original issue discounts on fixed-income securities are amortized daily over the expected life of the security.

| 16 | Capital World Bond Fund |

Class allocations — Income, fees and expenses (other than class-specific fees and expenses) and realized and unrealized gains and losses are allocated daily among the various share classes based on their relative net assets. Class-specific fees and expenses, such as distribution, transfer agent and administrative services, are charged directly to the respective share class.

Dividends and distributions to shareholders — Dividends and distributions to shareholders are recorded on the ex-dividend date.

Currency translation — Assets and liabilities, including investment securities, denominated in currencies other than U.S. dollars are translated into U.S. dollars at the exchange rates supplied by one or more pricing vendors on the valuation date. Purchases and sales of investment securities and income and expenses are translated into U.S. dollars at the exchange rates on the dates of such transactions. The effects of changes in exchange rates on investment securities are included with the net realized gain or loss and net unrealized appreciation or depreciation on investments in the fund’s statement of operations. The realized gain or loss and unrealized appreciation or depreciation resulting from all other transactions denominated in currencies other than U.S. dollars are disclosed separately.

3. Valuation

Capital Research and Management Company (“CRMC”), the fund’s investment adviser, values the fund’s investments at fair value as defined by U.S. GAAP. The net asset value of each share class of the fund is generally determined as of approximately 4:00 p.m. New York time each day the New York Stock Exchange is open.

Methods and inputs — The fund’s investment adviser uses the following methods and inputs to establish the fair value of the fund’s assets and liabilities. Use of particular methods and inputs may vary over time based on availability and relevance as market and economic conditions evolve.

Equity securities are generally valued at the official closing price of, or the last reported sale price on, the exchange or market on which such securities are traded, as of the close of business on the day the securities are being valued or, lacking any sales, at the last available bid price. Prices for each security are taken from the principal exchange or market on which the security trades.

Fixed-income securities, including short-term securities, are generally valued at prices obtained from one or more pricing vendors. Vendors value such securities based on one or more of the inputs described in the following table. The table provides examples of inputs that are commonly relevant for valuing particular classes of fixed-income securities in which the fund is authorized to invest. However, these classifications are not exclusive, and any of the inputs may be used to value any other class of fixed-income security.

| Fixed-income class | | Examples of standard inputs |

| All | | Benchmark yields, transactions, bids, offers, quotations from dealers and trading systems, new issues, spreads and other relationships observed in the markets among comparable securities; and proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and other reference data (collectively referred to as “standard inputs”) |

| Corporate bonds & notes; convertible securities | | Standard inputs and underlying equity of the issuer |

| Bonds & notes of governments & government agencies | | Standard inputs and interest rate volatilities |

| Mortgage-backed; asset-backed obligations | | Standard inputs and cash flows, prepayment information, default rates, delinquency and loss assumptions, collateral characteristics, credit enhancements and specific deal information |

| Municipal securities | | Standard inputs and, for certain distressed securities, cash flows or liquidation values using a net present value calculation based on inputs that include, but are not limited to, financial statements and debt contracts |

When the fund’s investment adviser deems it appropriate to do so (such as when vendor prices are unavailable or deemed to be not representative), fixed-income securities will be valued in good faith at the mean quoted bid and ask prices that are reasonably and timely available (or bid prices, if ask prices are not available) or at prices for securities of comparable maturity, quality and type.

Securities with both fixed-income and equity characteristics, or equity securities traded principally among fixed-income dealers, are generally valued in the manner described for either equity or fixed-income securities, depending on which method is deemed most appropriate by the fund’s investment adviser. Forward currency contracts are valued at the mean of representative quoted bid and ask prices, generally based on prices supplied by one or more pricing vendors. Interest rate swaps are generally valued by pricing vendors based on market inputs that include the index and term of index, reset frequency, payer/receiver, currency and pay frequency.

| Capital World Bond Fund | 17 |

Exchange-traded futures are generally valued at the official settlement price of, or the last reported sale price on, the exchange or market on which such instruments are traded, as of the close of business on the day the futures are being valued or, lacking any sales, at the last available bid price. Prices for each future are taken from the exchange or market on which the security trades.

Securities and other assets for which representative market quotations are not readily available or are considered unreliable by the fund’s investment adviser are fair valued as determined in good faith under fair valuation guidelines adopted by authority of the fund’s board of trustees as further described. The investment adviser follows fair valuation guidelines, consistent with U.S. Securities and Exchange Commission rules and guidance, to consider relevant principles and factors when making fair value determinations. The investment adviser considers relevant indications of value that are reasonably and timely available to it in determining the fair value to be assigned to a particular security, such as the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; actively traded similar or related securities; conversion or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security; and changes in overall market conditions. In addition, the closing prices of equity securities that trade in markets outside U.S. time zones may be adjusted to reflect significant events that occur after the close of local trading but before the net asset value of each share class of the fund is determined. Fair valuations and valuations of investments that are not actively trading involve judgment and may differ materially from valuations that would have been used had greater market activity occurred.

Processes and structure — The fund’s board of trustees has delegated authority to the fund’s investment adviser to make fair value determinations, subject to board oversight. The investment adviser has established a Joint Fair Valuation Committee (the “Fair Valuation Committee”) to administer, implement and oversee the fair valuation process, and to make fair value decisions. The Fair Valuation Committee regularly reviews its own fair value decisions, as well as decisions made under its standing instructions to the investment adviser’s valuation teams. The Fair Valuation Committee reviews changes in fair value measurements from period to period and may, as deemed appropriate, update the fair valuation guidelines to better reflect the results of back testing and address new or evolving issues. The Fair Valuation Committee reports any changes to the fair valuation guidelines to the board of trustees with supplemental information to support the changes. The fund’s board and audit committee also regularly review reports that describe fair value determinations and methods.

The fund’s investment adviser has also established a Fixed-Income Pricing Review Group to administer and oversee the fixed-income valuation process, including the use of fixed-income pricing vendors. This group regularly reviews pricing vendor information and market data. Pricing decisions, processes and controls over security valuation are also subject to additional internal reviews, including an annual control self-evaluation program facilitated by the investment adviser’s compliance group.

| 18 | Capital World Bond Fund |

Classifications — The fund’s investment adviser classifies the fund’s assets and liabilities into three levels based on the inputs used to value the assets or liabilities. Level 1 values are based on quoted prices in active markets for identical securities. Level 2 values are based on significant observable market inputs, such as quoted prices for similar securities and quoted prices in inactive markets. Certain securities trading outside the U.S. may transfer between Level 1 and Level 2 due to valuation adjustments resulting from significant market movements following the close of local trading. Level 3 values are based on significant unobservable inputs that reflect the investment adviser’s determination of assumptions that market participants might reasonably use in valuing the securities. The valuation levels are not necessarily an indication of the risk or liquidity associated with the underlying investment. For example, U.S. government securities are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market. The following tables present the fund’s valuation levels as of December 31, 2016 (dollars in thousands):

| | | Investment securities |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets: | | | | | | | | | | | | | | | | |

| Bonds, notes & other debt instruments: | | | | | | | | | | | | | | | | |

| Euros | | $ | — | | | $ | 1,245,393 | | | $ | — | | | $ | 1,245,393 | |

| Japanese yen | | | — | | | | 985,755 | | | | — | | | | 985,755 | |

| Hungarian forints | | | — | | | | 551,690 | | | | — | | | | 551,690 | |

| Polish zloty | | | — | | | | 539,280 | | | | — | | | | 539,280 | |

| Mexican pesos | | | — | | | | 525,505 | | | | — | | | | 525,505 | |

| British pounds | | | — | | | | 308,659 | | | | — | | | | 308,659 | |

| Malaysian ringgits | | | — | | | | 307,243 | | | | — | | | | 307,243 | |

| Danish kroner | | | — | | | | 270,670 | | | | — | | | | 270,670 | |

| Indian rupees | | | — | | | | 211,691 | | | | — | | | | 211,691 | |

| Brazilian reais | | | — | | | | 168,224 | | | | — | | | | 168,224 | |

| Australian dollars | | | — | | | | 146,716 | | | | — | | | | 146,716 | |

| Chilean pesos | | | — | | | | 94,088 | | | | — | | | | 94,088 | |

| Canadian dollars | | | — | | | | 79,956 | | | | — | | | | 79,956 | |

| Argentine pesos | | | — | | | | 51,773 | | | | — | | | | 51,773 | |

| Israeli shekels | | | — | | | | 49,340 | | | | — | | | | 49,340 | |

| U.S. dollars | | | — | | | | 5,544,675 | | | | 649 | | | | 5,545,324 | |

| Other | | | — | | | | 354,337 | | | | — | | | | 354,337 | |

| Convertible stocks | | | — | | | | 537 | | | | 2,640 | | | | 3,177 | |

| Common stocks | | | 796 | | | | 2,804 | | | | 1,042 | | | | 4,642 | |

| Short-term securities | | | — | | | | 508,699 | | | | — | | | | 508,699 | |

| Total | | $ | 796 | | | $ | 11,947,035 | | | $ | 4,331 | | | $ | 11,952,162 | |

| | | Other investments* |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

|

| Assets: | | | | | | | | | | | | | | | | |

| Unrealized appreciation on open forward currency contracts | | $ | — | | | $ | 10,515 | | | $ | — | | | $ | 10,515 | |

| Unrealized appreciation on interest rate swaps | | | — | | | | 24,698 | | | | — | | | | 24,698 | |

| Unrealized appreciation on futures contracts | | | 48 | | | | — | | | | — | | | | 48 | |

| Liabilities: | | | | | | | | | | | | | | | | |

| Unrealized depreciation on open forward currency contracts | | | — | | | | (37,661 | ) | | | — | | | | (37,661 | ) |

| Unrealized depreciation on interest rate swaps | | | — | | | | (7,395 | ) | | | — | | | | (7,395 | ) |

| Unrealized depreciation on futures contracts | | | (99 | ) | | | — | | | | — | | | | (99 | ) |

| Total | | $ | (51 | ) | | $ | (9,843 | ) | | $ | — | | | $ | (9,894 | ) |

* Forward currency contracts, interest rate swaps, and futures contracts are not included in the investment portfolio.

4. Risk factors

Investing in the fund may involve certain risks including, but not limited to, those described below.

Market conditions — The prices of, and the income generated by, the securities held by the fund may decline — sometimes rapidly or unpredictably — due to various factors, including events or conditions affecting the general economy or particular industries; overall market changes; local, regional or global political, social or economic instability; governmental or governmental agency responses to economic conditions; and currency exchange rate, interest rate and commodity price fluctuations.

| Capital World Bond Fund | 19 |

Issuer risks — The prices of, and the income generated by, securities held by the fund may decline in response to various factors directly related to the issuers of such securities, including reduced demand for an issuer’s goods or services, poor management performance and strategic initiatives such as mergers, acquisitions or dispositions and the market response to any such initiatives.

Investing in debt instruments — The prices of, and the income generated by, bonds and other debt securities held by the fund may be affected by changing interest rates and by changes in the effective maturities and credit ratings of these securities.

Rising interest rates will generally cause the prices of bonds and other debt securities to fall. Falling interest rates may cause an issuer to redeem, call or refinance a debt security before its stated maturity, which may result in the fund having to reinvest the proceeds in lower yielding securities. Longer maturity debt securities generally have greater sensitivity to changes in interest rates and may be subject to greater price fluctuations than shorter maturity debt securities.

Bonds and other debt securities are also subject to credit risk, which is the possibility that the credit strength of an issuer will weaken and/or an issuer of a debt security will fail to make timely payments of principal or interest and the security will go into default. Lower quality debt securities generally have higher rates of interest and may be subject to greater price fluctuations than higher quality debt securities. Credit risk is gauged, in part, by the credit ratings of the debt securities in which the fund invests. However, ratings are only the opinions of the rating agencies issuing them and are not guarantees as to credit quality or an evaluation of market risk. The fund’s investment adviser relies on its own credit analysts to research issuers and issues in seeking to mitigate various credit and default risks.