Management’s Discussion and Analysis of Results of Operations and Financial Condition — (Continued)

income are net gains on sales of securities of $302,000, $47,000 and $64,000 in 2018, 2017 and 2016, respectively. Also included in other operating income are net gains on sales of mortgage loans of $0, $370,000 and $1,331,000 in 2018, 2017 and 2016, respectively. Service charge income, which continues to be a major source of other operating income, totaling $8,560,000 in 2018, decreased $26,000 compared to 2017. This followed an increase of $679,000 in 2017 compared to 2016. The decrease in fees, in 2018, was mainly attributable to an increase earnings credit rates that are used to offset fees collected from processing activities, this was offset somewhat by an increase in debit card fees. The increase in fees, in 2017, was mainly attributable to an increase in fees collected from processing activities and debit card fees. Lockbox revenues totaled $3,274,000, down $16,000 in 2018 following an increase of $126,000 in 2017. Other income totaled $3,764,000, down $142,000 in 2018 following an increase of $465,000 in 2017. The decrease in 2018 was primarily the result of decreases in the returns on life insurance policies offset, somewhat by increase in wealth management fees, and merchant card sales royalties. The increase in 2017 was primarily the result of increases in wealth management fees and merchant card sales royalties.

Operating Expenses

Total operating expenses were $69,693,000 in 2018, compared to $67,119,000 in 2017 and $64,757,000 in 2016.

Salaries and employee benefits expenses increased by $2,193,000 or 5.4% in 2018, after increasing by 5.2% in 2017. The increase in 2018 was mainly attributable to merit increases in salaries. The increase in 2017 was mainly attributable to merit increases in salaries and bonus, and health insurance costs.

Occupancy expense decreased by $48,000, or 0.8%, in 2018, following a decrease of $7,000, or 0.1%, in 2017. The decrease in 2018 was primarily attributable to a decrease in depreciation expense. The decrease in 2017 was primarily attributable to a decrease in rent expense.

Equipment expense increased by $240,000, or 8.3%, in 2018, following an increase of $47,000, or 1.7%, in 2017. The increase in 2018 was primarily attributable to an increase in depreciation expense. The increase in 2017 was primarily attributable to an increase in service contracts.

FDIC assessments decreased by $110,000, or 7.0%, in 2018, following a decrease of $321,000, or 16.9%, in 2017. FDIC assessments decreased in 2018 and 2017 mainly as a result of a decrease in the assessment rate.

Other operating expenses increased by $299,000 in 2018, which followed a $642,000 increase in 2017. The increase in 2018 was primarily attributable to an increase in consultants’ expense and software maintenance expense. The increase in 2017 was primarily attributable to an increase in contributions, legal expenses, and marketing expenses.

Provision for Income Taxes

Income tax expense was $1,568,000 in 2018, $10,958,000 in 2017, and $(362,000) in 2016. The effective tax rate was 4.2% in 2018, 32.9% in 2017, and (1.5%) in 2016. The decrease for 2018 was primarily as a result of a reduction in the value of its net deferred tax asset resulting in a charge of $8,448,000 to 2017 income tax expense as a result of the Tax Act as previously discussed. The increase in the effective tax rate for 2017 was primarily the result of a reduction in the value of the deferred tax asset resulting in a charge of $8,448,000 to income tax expense. On December 22, 2017, the Tax Act was enacted, which lowered the Company’s federal tax rate from 34% to 21%. As a result of the rate reduction, the Company recorded a reduction in the value of its net deferred tax asset. The federal tax rate was 21% in 2018, and 34% in 2017 and 2016.

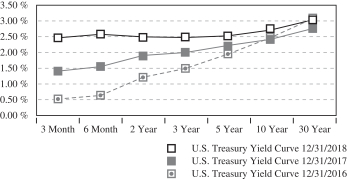

Market Risk and Asset Liability Management

Market risk is the risk of loss from adverse changes in market prices and rates. The Company’s market risk arises primarily from interest rate risk inherent in its lending and deposit-taking activities. To that end, management actively monitors and manages its interest rate risk exposure.

35