UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number: (811- 02608 )

Exact name of registrant as specified in charter: Putnam Money Market Fund

Address of principal executive offices: One Post Office Square, Boston, Massachusetts 02109

| Name and address of agent for service: | Beth S. Mazor, Vice President |

| | One Post Office Square |

| | Boston, Massachusetts 02109 |

| |

| Copy to: | John W. Gerstmayr, Esq. |

| | Ropes & Gray LLP |

| | One International Place |

| | Boston, Massachusetts 02110 |

| |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

Date of fiscal year end: September 30, 2006

Date of reporting period: October 1, 2005—March 31, 2006

|

Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant

to Rule 30e-1 under the Investment Company Act of 1940:

|

What makes Putnam different?

In 1830, Massachusetts Supreme Judicial Court Justice Samuel Putnam established The Prudent Man Rule, a legal foundation for responsible money management.

THE PRUDENT MAN RULE

All that can be required of a trustee to invest is that he shall conduct himself faithfully and exercise a sound discretion. He is to observe how men of prudence, discretion, and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital to be invested.

A time-honored tradition in money management

Since 1937, our values have been rooted in a profound sense of responsibility for the money entrusted to us.

A prudent approach to investing

We use a research-driven team approach to seek consistent, dependable, superior investment results over time, although there is no guarantee a fund will meet its objectives.

Funds for every investment goal

We offer a broad range of mutual funds and other financial products so investors and their financial representatives can build diversified portfolios.

A commitment to doing what’s right for investors

We have below-average expenses and stringent investor protections, and provide a wealth of information about the Putnam funds.

Industry-leading service

We help investors, along with their financial representatives, make informed investment decisions with confidence.

3| 31| 06

Semiannual Report

|

| Message from the Trustees | 2 |

| About the fund | 4 |

| Report from the fund managers | 7 |

| Performance | 13 |

| Expenses | 15 |

| Your fund’s management | 17 |

| Terms and definitions | 18 |

| Trustee approval of management contract | 20 |

| Other information for shareholders | 25 |

| Financial statements | 27 |

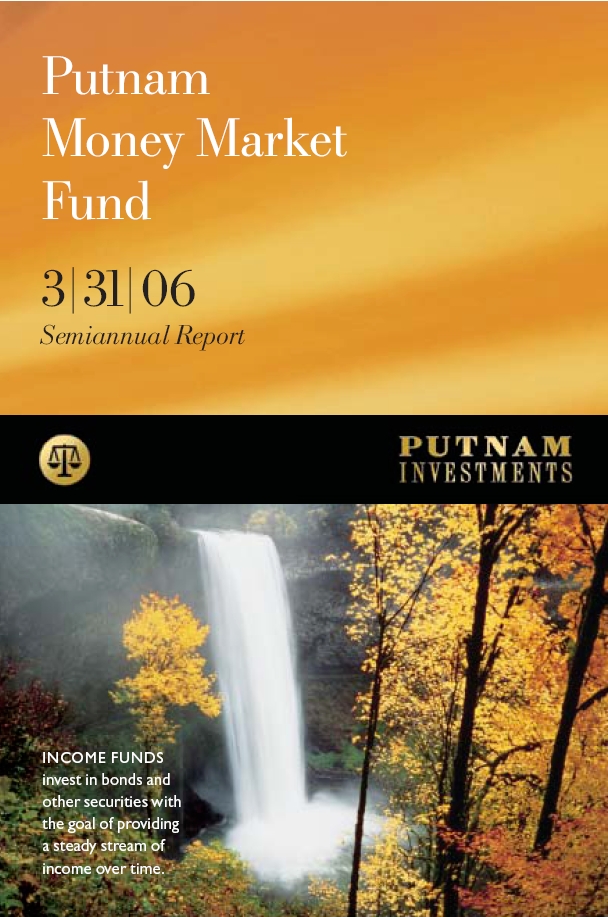

Cover photograph: © Richard H. Johnson

|

Message from the Trustees

|

Dear Fellow Shareholder

In the early months of 2006, we have seen a continuation of generally benign economic conditions in the United States. The expansion that began in late 2001 is continuing, fueled by gains in worker productivity. The stock market has advanced, driven largely by corporate profit levels that, by some measures, are near all-time highs. Inflation, which can cause problems for stock and bond markets, has remained fairly steady in recent months even as energy prices have resumed their ascent. Investors can be encouraged by these conditions, but should also be mindful of risks. Bond prices have fallen recently in response to stronger job creation. As mortgage rates have risen to higher levels, activity in the housing market has slowed. Our nation’s large trade deficit is also dampening prosperity and could cause the U.S. dollar to weaken, which might make it more difficult for U.S. stocks and bonds to attract investment from abroad.

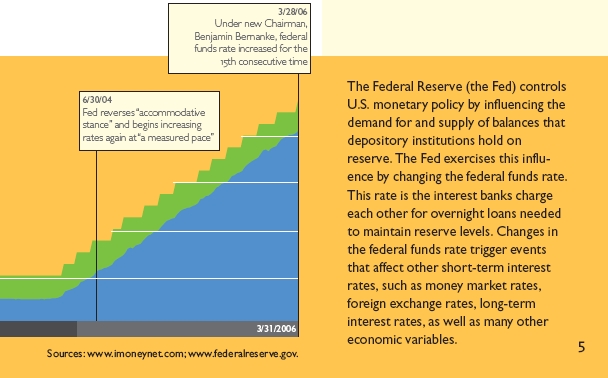

We consider it fortunate that the Federal Reserve’s (the Fed’s) new Chairman, Ben Bernanke, like his predecessor, Alan Greenspan, regards the Fed’s role in pursuing both price stability and economic growth as essential to maintaining a healthy financial system. In its first months under the leadership of Mr. Bernanke, the Fed has continued Mr. Greenspan’s program of interest-rate increases, while offering some signals that the end of the current tightening cycle might not be far away.

The economy’s significant strengths and notable weaknesses remind us once again that a well-diversified financial program under the guidance of a professional financial representative can help many investors pursue their goals. And in our view, the professional research, diversification, and active management that mutual funds provide continue to make them an intelligent choice for investors.

2

We want you to know that Putnam Investments, under the leadership of Chief Executive Officer Ed Haldeman, continues to focus on delivering consistent, dependable, superior investment performance over time. In the following pages, members of your fund’s management team discuss the fund’s performance and strategies, and their outlook for the months ahead. We thank you for your support of the Putnam funds.

Putnam Money Market Fund: seeking to offer

accessibility and current income with relatively low risk

|

For most people, keeping part of their savings in a low-risk, easily accessible place is an essential part of their overall investment strategy. Putnam Money Market Fund can play a valuable role in many investors’ portfolios because it seeks to provide stability of principal and liquidity to meet short-term needs. In addition, the fund aims to provide investors with current income at short-term rates.

By investing in high-quality short-term money market instruments for which there are deep and liquid markets, the fund’s risk of losing principal is very low. Putnam Money Market Fund invests in securities that are rated by at least one nationally recognized rating service in its highest or second-highest categories, or in unrated investments that we assess as equivalent in quality to such securities.

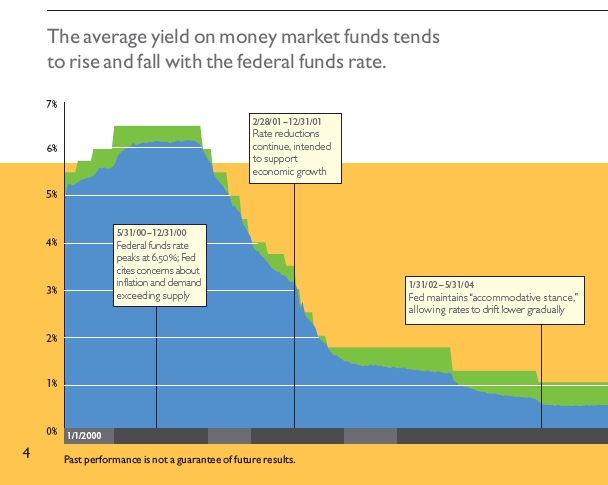

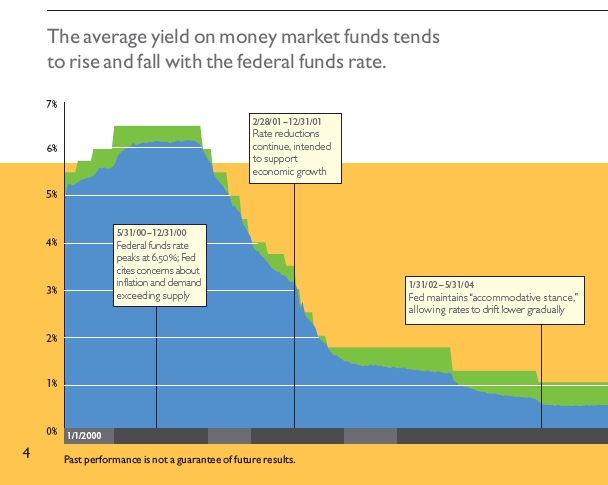

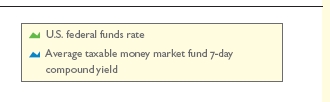

The fund seeks as high a rate of current income as Putnam believes is consistent with liquidity and preservation of principal. As illustrated below, money market fund yields typically rise and fall along with short-term interest rates. Money market funds may not

track rates exactly, however, as securities in these funds mature and are replaced with newer instruments earning the most current interest rates.

Whether you want to earmark money for planned near-term expenses or future investment opportunities, or just stow away cash for an unforeseen “rainy day,” Putnam Money Market Fund can be an attractive choice.

An investment in this fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund seeks to preserve your investment at $1.00 per share, it is possible to lose money by investing in the fund.

Types of money

market securities

|

Money market securities are issued by governments, government agencies, financial institutions, and established non-financial companies. Typically, such instruments have a remaining maturity of 13 months or less. Securities your fund invests in include:

Commercial paper Unsecured loans issued by large corporations, typically for financing accounts receivable and inventories

Bank certificates of deposit Direct obligations of the issuing bank

Repurchase agreements (repos) Contracts in which one party sells a security to another party and agrees to buy it back later at a specified price; acts in economic terms as a secured loan

Government securities Direct short-term obligations of governments or government agencies; for example, U.S. Treasury bills

Putnam Money Market Fund emphasizes high-quality, short-term, fixed-income securities. The fund seeks as high a level of current income as Putnam believes is consistent with preservation of capital and maintenance of liquidity. The fund may be appropriate for investors who seek stability of principal and to maintain easy access to their money.

* For the six months ended March 31, 2006, Putnam Money Market Fund’s class A shares returned 1.91% .

* The fund’s benchmark, the Merrill Lynch 91-day Treasury Bill Index, returned 1.95% .

* The average return for the fund’s Lipper category, Money Market Funds, was 1.67% .

* Additional fund performance, comparative performance, and Lipper data can be found in the performance section beginning on page 13.

Total return for class A shares for periods ended 3/31/06

Since the fund’s inception (10/1/76), average annual return is 6.28% . Current 7-day yield (at 3/31/06) is 4.28% ..

| | Average annual return | Cumulative return |

| | NAV | NAV |

|

| 10 years | 3.60% | 42.40% |

|

| 5 years | 1.88 | 9.76 |

|

| 3 year | 1.74 | 5.31 |

|

| 1 year | 3.34 | 3.34 |

|

| 6 months | — | 1.91 |

|

Data is historical. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return will fluctuate. Performance assumes reinvestment of distributions. Class A shares do not bear an initial sales charge. For the most recent month-end performance, visit www.putnam.com. The 7-day yield is one of the most common gauges for measuring money market mutual fund performance. Yield reflects current performance more closely than total return.

6

Report from the fund managers

The period in review

The Fed’s resolve to contain inflationary pressures in the U.S. economy by consistently raising short-term interest rates since June 2004 has generated some of the most attractive yields offered by money market securities in recent memory. To capture these higher yields, we used two strategies: purchasing 30-day commercial paper and increasing the fund’s allocation to floating-rate securities. By February, 2006, however, we began to anticipate that the Fed might be nearing the end of its tightening cycle. Consequently, we started to increase the fund’s exposure to longer-term fixed-rate money market securities, seeking to lock in attractive rates for a longer period of time. These strategies proved beneficial, enabling the fund’s total return at net asset value (NAV) for the six months ended March 31, 2006, to surpass the average return of the fund’s Lipper peer group. The fund’s performance was in line with that of its benchmark index, which is composed exclusively of short-maturity U.S. Treasury bills. In contrast, your fund invests in a wide range of money-market-eligible securities.

Market overview

Signs of solid economic growth, and the desire to curb the potential inflation that frequently accompanies such growth, prompted the Fed to increase short-term interest rates from 3.75% to 4.75% in four 0.25% increments during the first six months of the fund’s fiscal year. Despite a significant increase in short-term rates, long-term bond yields ended the period slightly lower. Potential forces constraining the rise of long-term rates include the strength of global demand for longer-term bonds from pension plans and other investors, as well as a widespread belief that infla-tion will remain in check as the Fed achieves its objectives through monetary policy. As shorter- and longer-term interest rates converged significantly, the yield curve — a graphical representation of yields for bonds of comparable quality plotted from the shortest to the longest maturity — flattened.

7

Given the Fed’s steady rate increases since June 2004, money market securities are currently offering some of the highest yields seen in this sector in five years. Yields on money-market-eligible certificates of deposit and commercial paper were yielding as high as 5.25% at the end of the reporting period. As a result, money market investments are drawing increased attention from investors and the financial press alike for their attractive combination of relative safety, liquidity and yield. By the end of the reporting period, assets of all money market mutual funds — taxable, institutional, and tax free — exceeded $2 trillion (compared to $1.9 trillion as of the start of the period).*

*Source: iMoneyNet Money Fund Report, September 30, 2005 and April 7, 2006.

Strategy overview

During the early months of the reporting period, when short-term interest rates were clearly on the rise, we maintained the fund’s exposure to floating-rate money market securities and commercial paper. These investments helped the portfolio capture the higher rates then coming to market, since the yields on these securities are reset in accordance with changes in short-term interest rates. As a result of this positioning, the fund’s 7-day yield rose from 3.26% at the start of the reporting period on September 30, 2005, to 3.95% by January 31, 2006.

In February, investors began to contemplate the possibility that the Fed might be approaching the end of this tightening cycle. With the yield curve still relatively

| Market sector performance | |

| These indexes provide an overview of performance in different market sectors for the | |

| six months ended 3/31/06. | |

|

| |

| Bonds | |

| Lipper Money Market Funds category average | 1.67% |

|

| Merrill Lynch 91-day Treasury Bill Index (short-maturity U.S. Treasury bills) | 1.95% |

|

| Lehman Aggregate Bond Index (broad bond market) | -0.06% |

|

| Citigroup World Government Bond Index (global government bonds) | -2.32% |

|

| Equities | |

| S&P 500 Index (broad stock market) | 6.38% |

|

| Russell 1000 Index (large-company stocks) | 6.71% |

|

| Russell 2000 Index (small-company stocks) | 15.23% |

|

8

steep, we became less inclined to add to the fund’s floating-rate securities. Accordingly, as securities matured, we reallocated the proceeds to investments in money-market-eligible fixed-rate securities from the longer end of the fund’s maturity range. The majority of these new holdings had maturities of 90 days or less, but we also selectively added six-month, nine-month, and one-year certificates of deposit. These strategies had the intended effect of pushing the portfolio’s average days to maturity to as high as 56 days on March 2, 2006. However, by the end of the semiannual period on March 31, the fund’s average days to maturity rolled down to 47 days, as we reinvested maturing holdings into shorter-term fixed-rate securities in preparation for the Fed’s widely anticipated March 28 increase in the federal funds rate.

Your fund’s holdings

Midway through the reporting period, we selectively increased the fund’s investments in fixed-rate securities with maturities of three-, six-, nine-, and twelve-months in an effort to preserve attractive yields for longer periods of time. Several of these new holdings were certificates of deposit (CDs) issued by European banks.

Societe Generale, one of the portfolio’s largest issuers, is one of the ten largest banks in Europe and the third-largest bank in France. A strong domestic and international banking franchise, Societe

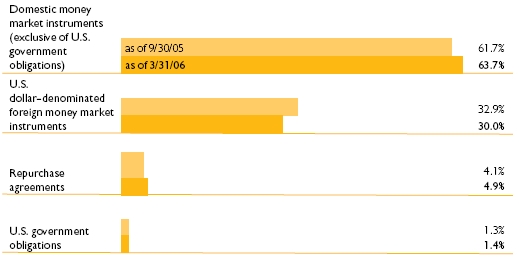

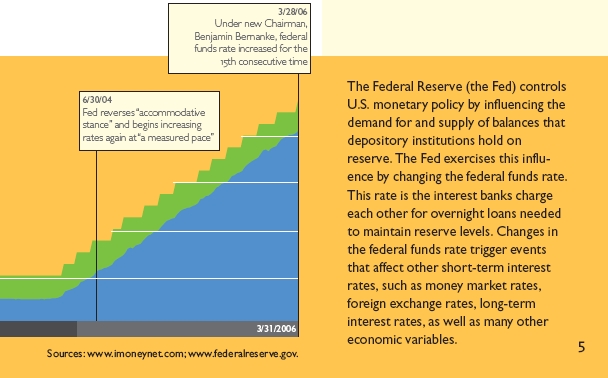

Portfolio composition comparison

This chart shows how the fund’s weightings have changed over the last six months. Weightings are shown as a percentage of portfolio value. Holdings will vary over time.

9

Generale has strong market share and consistently shows healthy profitability and a strong balance sheet. We believe that this French bank will continue to profit from its diverse mix of products while limiting its risk profile. Barclays Bank, another issuer of euro CDs held by the fund, is a highly profitable bank based in the United Kingdom. The bank’s diversified mix of income sources, including its domestic and international banking operations and a large European credit card business, as well as its broad asset management expertise, make it a highly creditworthy component of the portfolio in our estimation.

The nearly one-trillion-dollar asset-backed commercial paper market continues to show growth in issuance as corporations and banks use it as a low-cost, alternative source of funding for their financing and lending operations. The diversification of the supporting assets combined with additional structural protection — such as funding and credit support from highly rated banks — makes these securities, in our opinion, attractive, high-quality investments. The fund’s holdings in this sector — both domestic and foreign —stood at approximately 40% of total net assets as of March 31, 2006.

| Performance comparisons | |

| As of 3/31/06 | |

|

| |

| | Current yield* |

|

| Regular savings account | 0.50% |

|

| Average taxable money market fund compound 7-day yield | 4.17 |

|

| 3-month certificate of deposit | 4.88 |

|

| Putnam Money Market Fund (7-day yield) | |

|

| Class A | 4.28 |

|

| Class B | 3.80 |

|

| Class C | 3.80 |

|

| Class M | 4.13 |

|

| Class R | 3.80 |

|

| Class T | 4.05 |

|

The net asset value of money market mutual funds is uninsured and designed to be fixed, while distributions vary daily. Investment returns will fluctuate.The principal value on regular savings and on bank certificates of deposit (CDs) is generally insured up to certain limits by state and federal agencies. Unlike stocks, which incur more risk, CDs offer a fixed rate of return. Unlike money market funds, bank CDs may be subject to substantial penalties for early withdrawals.

* Sources: Bank of America (regular savings account), iMoneyNet’s Money Fund Report (average taxable money market fund compound 7-day yield), and the Federal Reserve Board of Governors (3-month certificate of deposits).

10

Klio II Funding Corporation and Amstel Funding Corporation are two asset-backed commercial paper issuers that exemplify the fund’s involvement in this product market. Amstel and Klio are backed by highly diverse and highly rated financial assets. Similarly, MBNA Credit Card Master Trust (Emerald) and Citibank Credit Card Issuance Trust (Dakota) use credit card receivables to back their commercial paper issuance. The highly liquid nature of these companies’ underlying assets, coupled with the backup lending facilities earmarked for these programs, makes these holdings, in our estimation, very attractive investments.

We continue to underweight investments in the U.S. government obligations market because we believe that the corporate market currently represents a better value.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future.

Of special interest

Among the funds in its Money Market Funds category, Lipper ranked Putnam Money Market Fund’s class A shares 43rd out of 355, 46th out of 299, and 32nd out of 189 funds for the 1-, 5-, and 10-year periods ended March 31, 2006. These rankings put the fund in the 13th, 16th, and 17th percentile for the same respective periods. The lower the percentile ranking, according to Lipper, the better the fund’s performance relative to its Lipper peers.

Lipper rankings do not reflect sales charges and are based on total return of funds with similar investment styles or objectives as determined by Lipper. Past performance does not guarantee future results.

11

The outlook for your fund

|

The following commentary reflects anticipated developments that could affect your fund over the next six months, as well as your management team’s plans for responding to them.

The U.S. economy has remained strong despite steady tightening by the Fed. By mid-2005, the Fed’s program of tightening had been in place for a year, the point at which past Fed tightening cycles have begun to slow economic growth. This time, despite additional rate increases, the economy continued to strengthen. With corporate profits remaining strong, companies have defied predictions of slower earnings growth — helped by a still vibrant consumer and a revival in business spending. It certainly appears that something is making the U.S. economy impressively resilient. We believe that the main source of that resilience is advances in productivity and output.

We think the focus of the debate about the Fed’s monetary policy has shifted from a question of if the Fed will stop raising short-term rates to when it will do so We would anticipate that the Fed’s tightening cycle will be nearing an end this summer. At some point, when the Fed ceases raising rates, we think the short end of the yield curve will become less steep and that further flattening will occur. We will continue to look for opportunities to extend the portfolio and lock in attractive income by adding fixed-rate money market securities while taking advantage of pricing inefficiencies in the market.

The views expressed in this report are exclusively those of Putnam Management. They are not meant as investment advice.

Money market funds are not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other governmental agency. Although the fund seeks to maintain a constant share price of $1.00, it is possible to lose money by investing in this fund.

12

This section shows your fund’s performance for periods ended March 31, 2006, the end of the first half of its current fiscal year. Performance should always be considered in light of a fund’s investment strategy. Data represents past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return will fluctuate, and you may have a gain or a loss when you sell your shares. For the most recent month-end performance, please visit www.putnam.com or call Putnam at 1-800-225-1581.

| Fund performance | | | | | | | |

| Total return for periods ended 3/31/06 | | | | | |

|

| |

| | Class A | Class B | | Class C | | Class M | Class R | Class T |

| (inception dates) | (10/1/76) | (4/27/92) | | (2/1/99) | | (12/8/94) | (1/21/03) | (12/31/01) |

| | NAV | NAV | CDSC | NAV | CDSC | NAV | NAV | NAV |

|

| Annual average | | | | | | | | |

| (life of fund) | 6.28% | 5.76% | 5.76% | 5.76% | 5.76% | 6.12% | 5.75% | 6.02% |

|

| 10 years | 42.40 | 35.46 | 35.46 | 35.58 | 35.58 | 40.30 | 35.71 | 38.98 |

| Annual average | 3.60 | 3.08 | 3.08 | 3.09 | 3.09 | 3.44 | 3.10 | 3.35 |

|

| 5 years | 9.76 | 7.05 | 5.05 | 7.05 | 7.05 | 8.95 | 7.29 | 8.43 |

| Annual average | 1.88 | 1.37 | 0.99 | 1.37 | 1.37 | 1.73 | 1.42 | 1.63 |

|

| 3 years | 5.31 | 3.75 | 0.75 | 3.75 | 3.75 | 4.84 | 3.93 | 4.52 |

| Annual average | 1.74 | 1.23 | 0.25 | 1.23 | 1.23 | 1.59 | 1.29 | 1.48 |

|

| 1 year | 3.34 | 2.82 | –2.18 | 2.82 | 1.82 | 3.18 | 2.82 | 3.08 |

|

| 6 months | 1.91 | 1.65 | –3.35 | 1.65 | 0.65 | 1.83 | 1.65 | 1.78 |

|

| Current yield | | | | | | | | |

| (end of period)* | | | | | | | | |

| Current | | | | | | | | |

| 7-day yield | 4.28 | 3.80 | 3.80 | 4.13 | 3.80 | 4.05 |

|

| Current | | | | | | | | |

| 30-day yield | 4.20 | 3.70 | 3.70 | 4.05 | 3.70 | 3.95 |

|

Performance assumes reinvestment of distributions and does not account for taxes. None of the share classes carry an initial sales charge. Class B shares reflect the applicable contingent deferred sales charge (CDSC), which is 5% in the first year, declines to 1% in the sixth year, and is eliminated thereafter. Class C shares reflect a 1% CDSC for the first year that is eliminated thereafter. Class A, M, R, and T shares generally have no CDSC. Performance for B, C, M, R, and T shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable CDSC and higher operating expenses for such shares.

* The 7-day and 30-day yields are the two most common gauges for measuring money market mutual fund performance. Yield reflects current performance more closely than total return.

13

| Comparative index returns | | |

| For periods ended 3/31/06 | | |

|

| |

| | Merrill Lynch 91-Day | Lipper Money Market |

| | Treasury Bill Index | Funds category average* |

|

| Annual average | | |

| (life of fund) | —† | 6.27% |

|

| 10 years | 45.59% | 38.26 |

| Annual average | 3.83 | 3.29 |

|

| 5 years | 11.73 | 7.79 |

| Annual average | 2.24 | 1.51 |

|

| 3 years | 6.39 | 4.22 |

| Annual average | 2.09 | 1.39 |

|

| 1 year | 3.53 | 2.86 |

|

| 6 months | 1.95 | 1.67 |

|

Index and Lipper results should be compared to fund performance at net asset value.

* Over the 6-month and 1-, 3-, 5-, and 10-year periods ended 3/31/06, there were 359, 355, 336, 299, and 189 funds, respectively, in this Lipper category.

† Inception date of index was 12/31/77, after the fund’s inception.

Fund distribution information

For the six-month period ended 3/31/06

|

| Distributions* | Class A | Class B | Class C | Class M | Class R | Class T |

|

| Number | 6 | 6 | 6 | 6 | 6 | 6 |

|

| Income | $0.018906 | $0.016412 | $0.016414 | $0.018163 | $0.016406 | $0.017657 |

|

| Total | $0.018906 | $0.016412 | $0.016414 | $0.018163 | $0.016406 | $0.017657 |

|

* Dividend sources are estimated and may vary based on final tax calculations after the fund’s fiscal year-end.

14

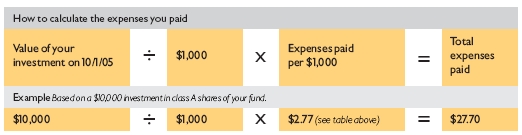

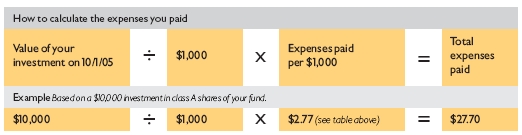

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. In the most recent six-month period, your fund limited these expenses; had it not done so, expenses would have been higher. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial advisor.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Putnam Money Market Fund from October 1, 2005, to March 31, 2006. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | Class A | Class B | Class C | Class M | Class R | Class T |

|

| Expenses paid per $1,000* | $ 2.77 | $ 5.28 | $ 5.28 | $ 3.52 | $ 5.28 | $ 4.02 |

|

| Ending value (after expenses) | $1,019.10 | $1,016.50 | $1,016.50 | $1,018.30 | $1,016.50 | $1,017.80 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of net assets for the six months ended 3/31/06. The expense ratio may differ for each share class (see the table at the bottom of the next page). Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year. Does not reflect the effect of a non-recurring reimbursement by Putnam. If this amount had been reflected in the table above, the fund's expenses would have been lower.

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended March 31, 2006, use the calculation method below. To find the value of your investment on October 1, 2005, go to www.putnam.com and log on to your account. Click on the “Transaction History” tab in your Daily Statement and enter 10/01/2005 in both the “from” and “to” fields. Alternatively, call Putnam at 1-800-225-1581.

15

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | Class A | Class B | Class C | Class M | Class R | Class T |

|

| Expenses paid per $1,000* | $ 2.77 | $ 5.29 | $ 5.29 | $ 3.53 | $ 5.29 | $ 4.03 |

|

| Ending value (after expenses) | $1,022.19 | $1,019.70 | $1,019.70 | $1,021.44 | $1,019.70 | $1,020.94 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of net assets for the six months ended 3/31/06. The expense ratio may differ for each share class (see the table at the bottom of this page). Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year. Does not reflect the effect of a non-recurring reimbursement by Putnam. If this amount had been reflected in the table above, the fund’s expenses would have been lower.

Compare expenses using industry averages

You can also compare your fund’s expenses with the average of its peer group, as defined by Lipper, an independent fund-rating agency that ranks funds relative to others that Lipper considers to have similar investment styles or objectives. The expense ratio for each share class shown below indicates how much of your fund’s net assets have been used to pay ongoing expenses during the period. Does not reflect the effect of a non-recurring reimbursement by Putnam. If this amount had been reflected in the table above, the fund's expenses would have been lower.

| | Class A | Class B | Class C | Class M | Class R | Class T |

|

| Your fund's annualized | | | | | | |

| expense ratio* | 0.55% | 1.05% | 1.05% | 0.70% | 1.05% | 0.80% |

|

| Average annualized expense | | | | | | |

| ratio for Lipper peer group** | 0.61% | 1.11% | 1.11% | 0.76% | 1.11% | 0.86% |

|

* Does not reflect the effect of a non-recurring reimbursement by Putnam. If this amount had been reflected in the table above, the fund's expense ratio would have been lower.

** Simple average of the expenses of all funds in the fund’s Lipper peer group, calculated in accordance with Lipper’s standard method for comparing fund expenses (excluding 12b-1 fees and without giving effect to any expense offset and brokerage service arrangements that may reduce fund expenses). This average reflects each fund’s expenses for its most recent fiscal year available to Lipper as of 3/31/06. To facilitate comparison, Putnam has adjusted this average to reflect the 12b-1 fees carried by each class of shares, other than class A shares, which do not incur 12b-1 fees. The peer group may include funds that are significantly smaller or larger than the fund, which may limit the comparability of the fund’s expenses to the simple average, which typically is higher than the asset-weighted average.

16

Your fund is managed by the members of the Putnam Fixed-Income Money Market Team. Joanne Driscoll is the Portfolio Leader and Jonathan Topper is a Portfolio Member of the fund. The Portfolio Leader and Portfolio Member coordinate the team’s management of the fund.

For a complete listing of the members of the Putnam Fixed-Income Money Market Team, including those who are not Portfolio Leaders or Portfolio Members of your fund, visit Putnam’s Individual Investor Web site at www.putnam.com.

Fund manager compensation

|

The total 2005 fund manager compensation that is attributable to your fund is approximately $650,000. This amount includes a portion of 2005 compensation paid by Putnam Management to the fund managers listed in this section for their portfolio management responsibilities, calculated based on the fund assets they manage taken as a percentage of the total assets they manage. The compensation amount also includes a portion of the 2005 compensation paid to the Chief Investment Officer of the team and the Group Chief Investment Officer of the fund’s broader investment category for their oversight responsibilities, calculated based on the fund assets they oversee taken as a percentage of the total assets they oversee. This amount does not include compensation of other personnel involved in research, trading, administration, systems, compliance, or fund operations; nor does it include non-compensation costs. These percentages are determined as of the fund’s fiscal period-end. For personnel who joined Putnam Management during or after 2005, the calculation reflects annualized 2005 compensation or an estimate of 2006 compensation, as applicable.

Other Putnam funds managed by the Portfolio Leader and Portfolio Member

Joanne Driscoll is also a Portfolio Leader of Putnam Prime Money Market Fund and Putnam Tax Exempt Money Market Fund.

Jonathan Topper is also a Portfolio Member of Putnam Prime Money Market Fund and Putnam Tax Exempt Money Market Fund.

Joanne Driscoll and Jonathan Topper may also manage other accounts and variable trust funds advised by Putnam Management or an affiliate.

Changes in your fund’s Portfolio Leader and Portfolio Member

Your fund’s Portfolio Leader and Portfolio Member did not change during the year ended March 31, 2006.

17

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the price, or value, of one share of a mutual fund, without a sales charge. NAVs fluctuate with market conditions. NAV is calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

Contingent deferred sales charge (CDSC) is a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Class A shares generally are fund shares purchased with an initial sales charge. In the case of your fund, which has no sales charge, the reference is to shares purchased or acquired through the exchange of class A shares from another Putnam fund. Exchange of your fund’s class A shares into another fund may involve a sales charge, however.

Class B shares may be subject to a sales charge upon redemption.

Class C shares are not subject to an initial sales charge and are subject to a contingent deferred sales charge only if the shares are redeemed during the first year.

Class M shares generally have a lower initial sales charge and a higher 12b-1 fee than class A shares and no sales charge on redemption. In the case of your fund, which has no sales charge, the reference is to shares purchased or acquired through the exchange of class M shares from another Putnam fund. Exchange of your fund’s class M shares into another fund may involve a sales charge, however.

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class T shares are not subject to an initial sales charge or sales charge on redemption (except on certain redemptions of shares bought without an initial sales charge); however, they are subject to a 12b-1 fee.

18

Citigroup World Government Bond Index is an unmanaged index of global investment-grade fixed-income securities.

Lehman Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

Lipper Money Market Funds category average is an arithmetic average of the total return of all Lipper Money Market funds.

Merrill Lynch 91-day Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

Russell 1000 Index is an unmanaged index of the 1,000 largest companies in the Russell 3000 Index.

Russell 2000 Index is an unmanaged index of the 2,000 smallest companies in the Russell 3000 Index.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

19

Trustee approval of

management contract

|

The Board of Trustees of the Putnam funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract with Putnam Management. In this regard, the Board of Trustees, with the assistance of its Contract Committee consisting solely of Trustees who are not “interested persons” (as such term is defined in the Investment Company Act of 1940, as amended) of the Putnam funds (the “Independent Trustees”), requests and evaluates all information it deems reasonably necessary under the circumstances. Over the course of several months beginning in March and ending in June 2005, the Contract Committee met five times to consider the information provided by Putnam Management and other information developed with the assistance of the Board’s independent counsel and independent staff. The Contract Committee reviewed and discussed key aspects of this information with all of the Independent Trustees. Upon completion of this review, the Contract Committee recommended and the Independent Trustees approved the continuance of your fund’s management contract, effective July 1, 2005.

This approval was based on the following conclusions:

* That the fee schedule currently in effect for your fund, subject to certain changes noted below, represents reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds and the costs incurred by Putnam Management in providing such services, and

* That such fee schedule represents an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the fee arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that certain aspects of such arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of these same arrangements in prior years.

Model fee schedules and categories; total expenses

The Trustees’ review of the management fees and total expenses of the Putnam funds focused on three major themes:

* Consistency. The Trustees, working in cooperation with Putnam Management, have developed and implemented a series of model fee schedules for the Putnam funds designed to ensure that

20

each fund’s management fee is consistent with the fees for similar funds in the Putnam family of funds and compares favorably with fees paid by competitive funds sponsored by other investment advisors. Under this approach, each Putnam fund is assigned to one of several fee categories based on a combination of factors, including competitive fees and perceived difficulty of management, and a common fee schedule is implemented for all funds in a given fee category. The Trustees reviewed the model fee schedule then in effect for your fund, including fee levels and breakpoints, and the assignment of the fund to a particular fee category under this structure. (“Breakpoints” refer to reductions in fee rates that apply to additional assets once specified asset levels are reached.) During the course of their review, the Trustees observed that the fee schedule for your fund should be conformed to the model fee schedule in effect for other Putnam money market funds. As a result, the Trustees approved the adoption of a new fee schedule that conforms more closely with the model fee schedule. Under the new fee schedule, the fund pays a quarterly fee to Putnam Management at the following rates:

0.50% of the first $100 million of the fund’s average net assets;

0.40% of the next $100 million;

0.35% of the next $300 million;

0.325% of the next $500 million;

0.30% of the next $500 million;

0.275% of the next $2.5 billion;

0.25% of the next $2.5 billion;

0.225% of the next $5 billion;

0.205% of the next $5 billion;

0.19% of the next $5 billion; and

0.18% thereafter.

|

The new fee schedule for your fund results in lower management fees paid by fund shareholders. The Trustees approved the new fee schedule for your fund effective as of January 1, 2006, in order to provide Putnam Management an opportunity to accommodate the impact on revenues in its budget process for the coming year.

* Competitiveness. The Trustees also reviewed comparative fee and expense information for competitive funds, which indicated that, in a custom peer group of competitive funds selected by Lipper Inc., your fund ranked in the 31st percentile in management fees and in the 34th percentile in total expenses (less any applicable 12b-1 fees) as of December 31, 2004 (the first percentile being the least expensive funds and the 100th percentile being the most expensive funds). (Because the fund’s custom peer group is smaller than the fund’s broad Lipper Inc. peer group, this expense comparison may differ from the Lipper peer expense information found elsewhere in this report.) The Trustees noted that expense ratios for a number of Putnam funds, which show the percentage of fund assets used to pay for management and administrative services, distribution (12b-1) fees and other expenses, had been increasing recently as a result of declining net assets and the natural operation of fee breakpoints. They

21

noted that such expense ratio increases were currently being controlled by expense limitations implemented in January 2004 and which Putnam Management, in consultation with the Contract Committee, has committed to maintain at least through 2006. The Trustees expressed their intention to monitor this information closely to ensure that fees and expenses of the Putnam funds continue to meet evolving competitive standards.

* Economies of scale. The Trustees concluded that the fee schedule currently in effect for your fund, subject to the changes noted above, represents an appropriate sharing of economies of scale at current asset levels. Your fund currently has the benefit of breakpoints in its management fee that provide shareholders with significant economies of scale, which means that the effective management fee rate of a fund (as a percentage of fund assets) declines as a fund grows in size and crosses specified asset thresholds. The Trustees examined the existing breakpoint structure of the Putnam funds’ management fees in light of competitive industry practices. The Trustees considered various possible modifications to the Putnam funds’ current breakpoint structure, but ultimately concluded that the current breakpoint structure continues to serve the interests of fund shareholders. Accordingly, the Trustees continue to believe that the fee schedules currently in effect for the funds, subject to the changes noted above, represent an appropriate sharing of economies of scale at current asset levels. The Trustees noted that significant redemptions in many Putnam funds, together with significant changes in the cost structure of Putnam Management, have altered the economics of Putnam Management’s business in significant ways. In view of these changes, the Trustees intend to consider whether a greater sharing of the economies of scale by fund shareholders would be appropriate if and when aggregate assets in the Putnam funds begin to experience meaningful growth.

In connection with their review of the management fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of the services to be provided and profits to be realized by Putnam Management and its affiliates from the relationship with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability with respect to the funds’ management contracts, allocated on a fund-by-fund basis.

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the funds’ investment process and performance by the work of the Investment Oversight Committees of the Trustees, which meet on a regular monthly basis with the funds’ portfolio teams throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process — as measured by the experience and skills of the individuals assigned to the

22

management of fund portfolios, the resources made available to such personnel, and in general the ability of Putnam Management to attract and retain high-quality personnel — but also recognize that this does not guarantee favorable investment results for every fund in every time period. The Trustees considered the investment performance of each fund over multiple time periods and considered information comparing the fund’s performance with various benchmarks and with the performance of competitive funds. The Trustees noted the satisfactory investment performance of many Putnam funds. They also noted the disappointing investment performance of certain funds in recent years and continued to discuss with senior management of Putnam Management the factors contributing to such underperformance and actions being taken to improve performance. The Trustees recognized that, in recent years, Putnam Management has made significant changes in its investment personnel and processes and in the fund product line to address areas of underperformance. The Trustees indicated their intention to continue to monitor performance trends to assess the effectiveness of these changes and to evaluate whether additional remedial changes are warranted.

In the case of your fund, the Trustees considered that your fund’s class A share cumulative total return performance at net asset value was in the following percentiles of its Lipper Inc. peer group (Lipper Money Market Funds) for the one-, three- and five-year periods ended December 31, 2004 (the first percentile being the best-performing funds and the 100th percentile being the worst-performing funds):

| One-year period | Three-year period | Five-year period |

|

| 17th | 17th | 14th |

(Because of the passage of time, these performance results may differ from the performance results for more recent periods shown elsewhere in this report. Over the one-, three-, and five-year periods ended December 31, 2004, there were 394, 351, and 304 funds, respectively, in your fund’s Lipper peer group.* Past performance is no guarantee of future performance.)

As a general matter, the Trustees believe that cooperative efforts between the Trustees and Putnam Management represent the most effective way to address investment performance problems. The Trustees believe that investors in the Putnam funds have, in effect, placed their trust in the Putnam organization, under the oversight of the funds’ Trustees, to make appropriate decisions regarding the management of the funds. Based on the responsiveness of Putnam Management in the recent past to Trustee concerns about investment performance, the Trustees believe that it is preferable to seek change within Putnam Management to address performance shortcomings. In the Trustees’ view, the alternative of terminating a management contract and engaging a new investment advisor for an underperforming fund would entail significant disruptions and would not provide any greater assurance of improved investment performance.

* The percentile rankings for your fund’s class A share annualized total return performance in the Lipper Money Market Funds category for the one-, five-, and ten-year periods ended March 31, 2006, were 13%, 15%, and 17%, respectively. Over the one-, five-, and ten-year periods ended March 31, 2006, the fund ranked 43rd out of 355, 44th out of 299, and 31st out of 189 funds, respectively. Note that this more recent information was not available when the Trustees approved the continuance of your fund’s management contract.

23

Brokerage and soft-dollar allocations; other benefits

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include principally benefits related to brokerage and soft-dollar allocations, whereby a portion of the commissions paid by a fund for brokerage is earmarked to pay for research services that may be utilized by a fund’s investment advisor, subject to the obligation to seek best execution. The Trustees believe that soft-dollar credits and other potential benefits associated with the allocation of fund brokerage, which pertains mainly to funds investing in equity securities, represent assets of the funds that should be used for the benefit of fund shareholders. This area has been marked by significant change in recent years. In July 2003, acting upon the Contract Committee’s recommendation, the Trustees directed that allocations of brokerage to reward firms that sell fund shares be discontinued no later than December 31, 2003. In addition, commencing in 2004, the allocation of brokerage commissions by Putnam Management to acquire research services from third-party service providers has been significantly reduced, and continues at a modest level only to acquire research that is customarily not available for cash. The Trustees will continue to monitor the allocation of the funds’ brokerage to ensure that the principle of “best price and execution” remains paramount in the portfolio trading process.

The Trustees’ annual review of your fund’s management contract also included the review of its distributor’s contract and distribution plan with Putnam Retail Management Limited Partnership and the custodian agreement and investor servicing agreement with Putnam Fiduciary Trust Company, all of which provide benefits to affiliates of Putnam Management.

Comparison of retail and institutional fee schedules

The information examined by the Trustees as part of their annual contract review has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, etc. This information included comparison of such fees with fees charged to the funds, as well as a detailed assessment of the differences in the services provided to these two types of clients. The Trustees observed, in this regard, that the differences in fee rates between institutional clients and the mutual funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients reflect to a substantial degree historical competitive forces operating in separate market places. The Trustees considered the fact that fee rates across all asset sectors are higher on average for mutual funds than for institutional clients, as well as the differences between the services that Putnam Management provides to the Putnam funds and those that it provides to institutional clients of the firm, but have not relied on such comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

24

Other information

for shareholders

|

Important notice regarding delivery of shareholder documents

In accordance with SEC regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2005, are available on the Putnam Individual Investor Web site, www.putnam.com/individual, and on the SEC’s Web site, www.sec.gov. If you have questions about finding forms on the SEC’s Web site, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s Web site at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s Web site or the operation of the Public Reference Room.

25

Putnam’s policy on confidentiality

|

In order to conduct business with our shareholders, we must obtain certain personal information such as account holders’ addresses, telephone numbers, Social Security numbers, and the names of their financial advisors. We use this information to assign an account number and to help us maintain accurate records of transactions and account balances. It is our policy to protect the confidentiality of your information, whether or not you currently own shares of our funds, and in particular, not to sell information about you or your accounts to outside marketing firms. We have safeguards in place designed to prevent unauthorized access to our computer systems and procedures to protect personal information from unauthorized use. Under certain circumstances, we share this information with outside vendors who provide services to us, such as mailing and proxy solicitation. In those cases, the service providers enter into confidentiality agreements with us, and we provide only the information necessary to process transactions and perform other services related to your account. We may also share this information with our Putnam affiliates to service your account or provide you with information about other Putnam products or services. It is also our policy to share account information with your financial advisor, if you’ve listed one on your Putnam account. If you would like clarification about our confidentiality policies or have any questions or concerns, please don’t hesitate to contact us at 1-800-225-1581, Monday through Friday, 8:30 a.m. to 7:00 p.m., or Saturdays from 9:00 a.m. to 5:00 p.m. Eastern Time.

26

A guide to financial statements

|

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and noninvestment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlight table also includes the current reporting period.

27

| The fund’s portfolio 3/31/06 (Unaudited) | | | | |

|

| |

| |

| |

| COMMERCIAL PAPER (60.4%)* | | | | | | |

|

| | Yield(%) | Maturity date | Principal amount | | Value |

|

| Domestic (52.1%) | | | | | | |

| Amstel Funding Corp. | 4.834 | 8/2/06 | $ | 18,200,000 | $ | 17,906,495 |

| Amstel Funding Corp. | 4.797 | 5/31/06 | | 8,889,000 | | 8,818,777 |

| Amstel Funding Corp. | 4.750 | 5/23/06 | | 14,608,000 | | 14,508,933 |

| Amstel Funding Corp. | 4.652 | 6/20/06 | | 56,000,000 | | 55,435,110 |

| Amstel Funding Corp. | 4.618 | 4/6/06 | | 40,000,000 | | 39,974,444 |

| Atlantic Asset Securitization, LLC | 4.833 | 4/3/06 | | 11,705,000 | | 11,701,859 |

| Atlantic Asset Securitization, LLC | 4.624 | 4/11/06 | | 47,000,000 | | 46,940,075 |

| Bank of America Corp. | 4.899 | 6/21/06 | | 27,000,000 | | 26,705,970 |

| Bank of America Corp. | 4.869 | 6/14/06 | | 20,000,000 | | 19,802,256 |

| Bank of America Corp. | 4.799 | 8/3/06 | | 33,000,000 | | 32,467,472 |

| Bear Stearns Cos. | 4.807 | 5/11/06 | | 22,000,000 | | 21,883,156 |

| Bear Stearns Cos. | 4.780 | 5/8/06 | | 20,000,000 | | 19,902,361 |

| Bryant Park Funding, LLC | 4.804 | 5/4/06 | | 26,000,000 | | 25,886,077 |

| Bryant Park Funding, LLC | 4.798 | 5/31/06 | | 32,000,000 | | 31,747,200 |

| Bryant Park Funding, LLC | 4.644 | 4/20/06 | | 25,094,000 | | 25,032,945 |

| Bryant Park Funding, LLC | 4.643 | 4/12/06 | | 15,000,000 | | 14,978,871 |

| CAFCO, LLC. | 4.950 | 8/28/06 | | 30,000,000 | | 29,400,275 |

| CAFCO, LLC. | 4.705 | 5/17/06 | | 30,000,000 | | 29,821,750 |

| CHARTA, LLC | 4.707 | 4/13/06 | | 27,000,000 | | 26,957,790 |

| CHARTA, LLC | 4.704 | 5/15/06 | | 30,000,000 | | 29,829,500 |

| CHARTA, LLC | 4.691 | 5/3/06 | | 20,000,000 | | 19,917,333 |

| CHARTA, LLC | 4.643 | 4/26/06 | | 33,000,000 | | 32,894,583 |

| CHARTA, LLC | 4.634 | 4/25/06 | | 30,000,000 | | 29,908,200 |

| CIT Group, Inc. | 4.715 | 5/24/06 | | 22,000,000 | | 21,849,392 |

| Citibank Credit Card Issuance Trust | | | | | | |

| (Dakota) | 4.818 | 5/11/06 | | 21,500,000 | | 21,385,572 |

| Citibank Credit Card Issuance Trust | | | | | | |

| (Dakota) | 4.760 | 5/3/06 | | 13,000,000 | | 12,945,342 |

| Citibank Credit Card Issuance Trust | | | | | | |

| (Dakota) | 4.635 | 4/13/06 | | 20,000,000 | | 19,969,333 |

| Citibank Credit Card Issuance Trust | | | | | | |

| (Dakota) | 4.624 | 4/6/06 | | 20,000,000 | | 19,987,222 |

| Citibank Credit Card Issuance Trust | | | | | | |

| (Dakota) | 4.622 | 4/5/06 | | 30,000,000 | | 29,984,667 |

| Citibank Credit Card Issuance Trust | | | | | | |

| (Dakota) | 4.621 | 4/4/06 | | 30,000,000 | | 29,988,500 |

| Countrywide Financial Corp. | 4.850 | 4/3/06 | | 20,719,000 | | 20,713,417 |

| Countrywide Financial Corp. | 4.810 | 4/24/06 | | 30,000,000 | | 29,908,192 |

| Countrywide Financial Corp. | 4.807 | 4/20/06 | | 36,000,000 | | 35,908,990 |

| CRC Funding, LLC | 4.892 | 6/2/06 | | 35,826,000 | | 35,526,753 |

| CRC Funding, LLC | 4.887 | 6/1/06 | | 23,000,000 | | 22,811,180 |

| CRC Funding, LLC | 4.825 | 5/18/06 | | 33,000,000 | | 32,793,631 |

| CRC Funding, LLC | 4.615 | 4/10/06 | | 34,000,000 | | 33,961,070 |

| Curzon Funding, LLC | 4.807 | 5/9/06 | | 20,000,000 | | 19,899,089 |

| Curzon Funding, LLC | 4.594 | 4/7/06 | | 24,000,000 | | 23,981,760 |

| Curzon Funding, LLC | 4.556 | 4/18/06 | | 20,000,000 | | 19,957,453 |

28

| COMMERCIAL PAPER (60.4%)* continued | | | | | | |

|

| | Yield(%) | Maturity date | Principal amount | | Value |

|

| Domestic continued | | | | | | |

| Curzon Funding, LLC 144A FRN | 4.052 | 4/28/06 | $ | 20,000,000 | $ | 19,999,702 |

| Falcon Asset Securitization Corp. | 4.717 | 4/13/06 | | 18,000,000 | | 17,971,800 |

| Goldman Sachs Group, Inc. (The) | 4.837 | 10/24/06 | | 25,000,000 | | 24,331,931 |

| Goldman Sachs Group, Inc. (The) | 4.552 | 5/23/06 | | 29,000,000 | | 28,813,594 |

| Govco, Inc. | 4.723 | 5/18/06 | | 28,000,000 | | 27,829,286 |

| Govco, Inc. | 4.647 | 6/23/06 | | 45,000,000 | | 44,528,514 |

| Grampian Funding, LLC | 5.081 | 9/26/06 | | 22,750,000 | | 22,192,631 |

| Grampian Funding, LLC | 4.853 | 4/4/06 | | 20,000,000 | | 19,991,917 |

| Jupiter Securitization Corp. | 4.740 | 5/4/06 | | 25,542,000 | | 25,431,722 |

| Klio II Funding Corp. | 4.889 | 6/13/06 | | 19,725,000 | | 19,531,810 |

| Klio II Funding Corp. | 4.795 | 5/26/06 | | 54,000,000 | | 53,608,683 |

| Klio II Funding Corp. | 4.789 | 4/21/06 | | 18,499,000 | | 18,449,978 |

| Klio II Funding Corp. | 4.718 | 5/12/06 | | 25,943,000 | | 25,805,167 |

| Klio II Funding Corp. | 4.643 | 4/27/06 | | 22,000,000 | | 21,927,070 |

| MBNA Credit Card Master Note Trust | | | | | | |

| (Emerald) | 4.862 | 5/16/06 | | 26,000,000 | | 25,843,025 |

| MBNA Credit Card Master Note Trust | | | | | | |

| (Emerald) | 4.707 | 4/10/06 | | 36,700,000 | | 36,656,969 |

| MBNA Credit Card Master Note Trust | | | | | | |

| (Emerald) | 4.667 | 4/25/06 | | 31,000,000 | | 30,904,313 |

| MBNA Credit Card Master Note Trust | | | | | | |

| (Emerald) | 4.635 | 4/19/06 | | 40,000,000 | | 39,908,200 |

| NATC California, LLC | | | | | | |

| (SunTrust Bank (Letter of credit (LOC))) | 4.551 | 4/13/06 | | 20,000,000 | | 19,970,000 |

| Park Avenue Receivables Corp. | 4.698 | 4/12/06 | | 26,201,000 | | 26,163,533 |

| Park Granada, LLC | 4.714 | 4/27/06 | | 27,000,000 | | 26,908,740 |

| Park Granada, LLC | 4.686 | 4/28/06 | | 25,000,000 | | 24,912,813 |

| Preferred Receivables Funding Corp. | 4.660 | 4/11/06 | | 30,000,000 | | 29,961,333 |

| Thunder Bay Funding, Inc. | 4.560 | 4/17/06 | | 57,000,000 | | 56,885,747 |

| | | | | | | 1,732,521,473 |

|

| |

| Foreign (8.3%) | | | | | | |

| Atlantis One Funding Corp. (Netherlands) | 4.755 | 5/23/06 | | 20,000,000 | | 19,864,222 |

| Atlantis One Funding Corp. (Netherlands) | 4.521 | 4/12/06 | | 30,000,000 | | 29,959,025 |

| Danske Corp. (Denmark) | 4.796 | 10/30/06 | | 24,000,000 | | 23,346,333 |

| Danske Corp. (Denmark) | 4.621 | 4/10/06 | | 26,500,000 | | 26,469,525 |

| Spintab AB (Sweden) | 4.653 | 4/19/06 | | 18,000,000 | | 17,958,420 |

| Toyota Motor Credit Corp. (Japan) | 4.611 | 4/7/06 | | 22,000,000 | | 21,983,170 |

| Tulip Funding Corp. (Netherlands) | 4.887 | 6/1/06 | | 24,150,000 | | 23,951,943 |

| Tulip Funding Corp. (Netherlands) | 4.593 | 4/24/06 | | 37,000,000 | | 36,892,679 |

| Westpac Banking Corp. (Australia) | 4.753 | 5/15/06 | | 25,000,000 | | 24,856,083 |

| Westpac Banking Corp. (Australia) | 4.673 | 5/9/06 | | 30,000,000 | | 29,853,700 |

| Westpac Banking Corp. (Australia) | 4.673 | 5/8/06 | | 23,000,000 | | 22,890,788 |

| | | | | | | 278,025,888 |

|

| |

| Total commercial paper (cost $2,010,547,361) | | | | $2,010,547,361 |

29

| CERTIFICATES OF DEPOSIT (19.5%)* | | | | | | |

|

| | Yield(%) | Maturity date | Principal amount | | Value |

|

| Domestic (3.3%) | | | | | | |

| Citibank, N.A. Ser. CD | 4.700 | 5/16/06 | $ | 24,000,000 | $ | 24,000,000 |

| SunTrust Bank FRN, Ser. CD | 4.763 | 9/26/06 | | 36,000,000 | | 35,998,581 |

| SunTrust Bank FRN, Ser. CD | 4.691 | 5/12/06 | | 31,000,000 | | 31,000,000 |

| SunTrust Bank FRN, Ser. CD | 4.641 | 2/9/07 | | 18,000,000 | | 17,998,478 |

| | | | | | | 108,997,059 |

|

| |

| Foreign (16.2%) | | | | | | |

| Barclays Bank PLC FRN, Ser. YCD | | | | | | |

| (United Kingdom) | 4.774 | 4/4/07 | | 23,000,000 | | 22,995,460 |

| Barclays Bank PLC FRN, Ser. YCD | | | | | | |

| (United Kingdom) | 4.575 | 6/1/06 | | 15,000,000 | | 14,999,750 |

| BNP Paribas FRN, Ser. YCD (France) | 4.690 | 6/19/06 | | 30,000,000 | | 29,993,244 |

| Canadian Imperial Bank of Commerce | | | | | | |

| FRN, Ser. YCD (Canada) | 4.980 | 9/15/06 | | 30,000,000 | | 30,009,666 |

| Canadian Imperial Bank of Commerce | | | | | | |

| FRN, Ser. YCD1(Canada) | 4.780 | 4/23/07 | | 31,000,000 | | 31,000,000 |

| Credit Suisse New York FRN, Ser. YCD | | | | | | |

| (Switzerland) | 4.796 | 7/18/06 | | 25,000,000 | | 25,003,449 |

| Deutsche Bank AG Ser. ECD (Germany) | 4.900 | 2/5/07 | | 29,000,000 | | 28,985,928 |

| Deutsche Bank AG Ser. ECD (Germany) | 4.900 | 2/5/07 | | 16,500,000 | | 16,485,918 |

| Deutsche Bank AG Ser. ECD (Germany) | 4.860 | 1/31/07 | | 28,000,000 | | 27,993,219 |

| Deutsche Bank AG Ser. ECD (Germany) | 4.760 | 11/8/06 | | 25,000,000 | | 24,995,450 |

| Dexia Credit Local FRN, Ser. YCD | | | | | | |

| (Belgium) | 4.580 | 10/3/06 | | 32,000,000 | | 31,996,772 |

| Fortis Bank NY Ser. YCD (Belgium) | 3.950 | 4/21/06 | | 24,000,000 | | 24,000,000 |

| Societe Generale Ser. ECD (France) | 4.800 | 12/6/06 | | 9,000,000 | | 8,994,207 |

| Societe Generale Ser. ECD (France) | 4.760 | 5/2/06 | | 24,000,000 | | 24,000,000 |

| Societe Generale Ser. ECD (France) | 4.750 | 8/30/06 | | 29,000,000 | | 29,000,000 |

| Societe Generale Ser. ECD (France) | 3.900 | 4/18/06 | | 63,000,000 | | 62,999,771 |

| Svenska Handelsbanken FRN (Sweden) | 4.716 | 9/20/06 | | 36,000,000 | | 35,996,631 |

| Svenska Handelsbanken FRN, Ser. YCD1 | | | | | | |

| (Sweden) | 4.560 | 4/3/06 | | 45,000,000 | | 44,986,455 |

| Svenska Handelsbanken Ser. YCD | | | | | | |

| (Sweden) | 4.783 | 12/5/06 | | 24,000,000 | | 23,979,339 |

| | | | | | | 538,415,259 |

|

| |

| Total certificates of deposit (cost $647,412,318) | | | | | $647,412,318 |

|

| |

| |

| CORPORATE BONDS AND NOTES (13.3%)* | | | | | |

|

| | Yield(%) | Maturity date | Principal amount | | Value |

|

| Domestic (8.7%) | | | | | | |

| Bank of New York Co., Inc. (The) | | | | | | |

| 144A sr. notes FRN, Ser. XMTN | 4.688 | 5/10/07 | $ | 20,000,000 | $ | 20,000,000 |

| Citigroup, Inc. notes | 5.750 | 5/10/06 | | 38,964,000 | | 39,013,930 |

| Lehman Brothers Holdings, Inc. FRN, Ser. G | 4.590 | 6/2/06 | | 73,400,000 | | 73,411,799 |

| Merrill Lynch & Co., Inc. FRN, Ser. C | 4.729 | 4/16/07 | | 14,500,000 | | 14,500,000 |

| Morgan Stanley Dean Witter & Co. FRN | 4.930 | 11/24/06 | | 36,000,000 | | 36,039,003 |

30

| CORPORATE BONDS AND NOTES (13.3%)* continued | | | | | |

|

| | Yield(%) | Maturity date | | Principal amount | | Value |

|

| Domestic continued | | | | | | |

| National City Bank FRN, Ser. BKNT | 4.818 | 7/26/06 | | $ 72,000,000 | $ | 72,008,697 |

| National City Bank FRN, Ser. BKNT | 4.783 | 6/2/06 | | 35,000,000 | | 34,996,500 |

| | | | | | | 289,969,929 |

|

| |

| Foreign (4.6%) | | | | | | |

| Bank of Ireland 144A unsec. notes | | | | | | |

| FRN, Ser. XMTN (Ireland) | 4.746 | 4/20/07 | | 23,000,000 | | 23,000,000 |

| HBOS Treasury Services PLC | | | | | | |

| 144A FRN, Ser. MTN (United Kingdom) | 4.661 | 5/9/07 | | 25,000,000 | | 25,000,000 |

| HSBC USA, Inc. sr. notes FRN, Ser. EXT | | | | | | |

| (United Kingdom) | 4.729 | 4/16/07 | | 36,000,000 | | 36,000,000 |

| National Australia Bank 144A FRB | | | | | | |

| (Australia) | 4.640 | 4/6/07 | | 11,000,000 | | 11,000,000 |

| Nordea Bank AB 144A FRN (Sweden) | 4.700 | 5/11/07 | | 20,000,000 | | 20,000,000 |

| Societe Generale 144A unsec. notes | | | | | | |

| FRN, Ser. MTN (France) | 4.603 | 5/2/07 | | 15,000,000 | | 15,000,000 |

| Westpac Banking Corp. 144A FRN | | | | | | |

| (Australia) | 4.721 | 4/16/07 | | 24,000,000 | | 24,000,000 |

| | | | | | | 154,000,000 |

|

| |

| Total corporate bonds and notes (cost $443,969,929) | | | | $ | 443,969,929 |

|

| |

| |

| U.S. GOVERNMENT AGENCY OBLIGATIONS (1.4%)* | | | | | |

|

| | Yield(%) | Maturity date | | Principal amount | | Value |

|

| Fannie Mae FRN | 4.550 | 9/7/06 | | $ 23,000,000 | $ | 22,979,631 |

| Federal Farm Credit Bank FRB | 4.686 | 7/20/06 | | 25,000,000 | | 24,990,600 |

|

| Total U.S. government agency obligations (cost $47,970,231) | | | $ | 47,970,231 |

|

| |

| |

| ASSET BACKED SECURITIES (1.0%)* (cost $34,694,526) | | | | |

|

| | Yield(%) | Maturity date | | Principal amount | | Value |

|

| TIAA Real Estate CDO, Ltd. 144A FRN, | | | | | | |

| Ser. 03-1A, Class A1MM (Cayman Islands) | 4.851 | 12/28/18 | | $ 34,694,526 | $ | 34,694,526 |

|

| |

| |

| SHORT-TERM INVESTMENTS (4.9%)* (cost $163,090,000) | | | | |

|

| | | | | Principal amount | | Value |

|

| Interest in $582,000,000 joint tri-party repurchase agreement | | | | |

| dated March 31, 2006 with UBS Securities, LLC due April 3, 2006 | | | | |

| with respect to various U.S. Government obligations — maturity | | | | |

| value of $163,155,644 for an effective yield of 4.83% (collateralized | | | | |

| by Fannie Mae and Freddie Mac securities with yields ranging from | | | | |

| 3.50% to 12.00% and due dates ranging from July 1, 2006 to | | | | |

| April 1, 2036, valued at $593,642,766) | | | $ | 163,090,000 | $ | 163,090,000 |

|

| Total investments (cost $3,347,684,365) | | | | | $ | 3,347,684,365 |

31

* Percentages indicated are based on net assets of $3,327,947,807.

144A after the name of an issuer represents securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

The rates shown on Floating Rate Bonds (FRB) and Floating Rate Notes (FRN) are the current interest rates at March 31, 2006.

DIVERSIFICATION BY COUNTRY

Distribution of investments by country of issue at March 31, 2006 (as a percentage of Portfolio Value):

| Australia | 3.4% |

| Belgium | 1.7 |

| Canada | 1.8 |

| Cayman Islands | 1.0 |

| Denmark | 1.5 |

| France | 5.1 |

| Germany | 2.9 |

| Ireland | 0.7 |

| Japan | 0.6 |

| Netherlands | 3.3 |

| Sweden | 4.3 |

| Switzerland | 0.7 |

| United Kingdom | 3.0 |

| United States | 70.0 |

|

|

| Total | 100.0% |

The accompanying notes are an integral part of these financial statements.

32

| Statement of assets and liabilities 3/31/06 (Unaudited) | |

|

| |

| ASSETS | |

| Investments in securities, at value (Note 1): | |

| Unaffiliated issuers (at amortized cost) | $3,347,684,365 |

|

| Cash | 5,869 |

|

| Interest and other receivables | 8,169,509 |

|

| Receivable for shares of the fund sold | 13,765,367 |

|

| Total assets | 3,369,625,110 |

|

| |

| LIABILITIES | |

| Distributions payable to shareholders | 1,333,787 |

|

| Payable for securities purchased | 22,995,460 |

|

| Payable for shares of the fund repurchased | 13,520,126 |

|

| Payable for compensation of Manager (Notes 2 and 5) | 2,598,997 |

|

| Payable for investor servicing and custodian fees (Note 2) | 519,176 |

|

| Payable for Trustee compensation and expenses (Note 2) | 258,385 |

|

| Payable for administrative services (Note 2) | 4,300 |

|

| Payable for distribution fees (Note 2) | 213,654 |

|

| Other accrued expenses | 233,418 |

|

| Total liabilities | 41,677,303 |

|

| Net assets | $3,327,947,807 |

|

| |

| REPRESENTED BY | |

| Paid-in capital (Unlimited shares authorized) (Notes 1 and 4) | $3,327,947,807 |

|

| Total — Representing net assets applicable to capital shares outstanding | $3,327,947,807 |

|

| |

| COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE | |

| Net asset value, offering price and redemption price per class A share | |

| ($2,892,340,534 divided by 2,892,332,745 shares)* | $1.00 |

|

| Net asset value and offering price per class B share | |

| ($201,961,766 divided by 201,959,773 shares)** | $1.00 |

|

| Net asset value and offering price per class C share | |

| ($12,514,186 divided by 12,514,239 shares)** | $1.00 |

|

| Net asset value, offering price and redemption price per class M share | |

| ($41,101,737 divided by 41,103,549 shares)* | $1.00 |

|

| Net asset value, offering price and redemption price per class R share | |

| ($2,041,533 divided by 2,041,541 shares)* | $1.00 |

|

| Net asset value, offering price and redemption price per class T share | |

| ($177,988,051 divided by 177,995,960 shares)* | $1.00 |

* Offered at net asset value.

** Class B and class C shares are available only by exchange of class B and class C shares from other Putnam funds and to certain systematic investment plan investors. Redemption price per share is equal to net asset value less an applicable contingent deferred sales charge.

The accompanying notes are an integral part of these financial statements.

33

| Statement of operations Six months ended 3/31/06 (Unaudited) | |

|

| |

| INVESTMENT INCOME | |

| Interest (including interest income of $70,929 | |

| from investments in affiliated issuers) (Note 5) | $75,439,338 |

|

| |

| EXPENSES | |

| Compensation of Manager (Note 2) | 5,433,719 |

|

| Investor servicing fees (Note 2) | 3,661,157 |

|

| Custodian fees (Note 2) | 14,378 |

|

| Trustee compensation and expenses (Note 2) | 60,161 |

|

| Administrative services (Note 2) | 37,899 |

|

| Distribution fees — Class B (Note 2) | 613,904 |

|

| Distribution fees — Class C (Note 2) | 49,029 |

|

| Distribution fees — Class M (Note 2) | 31,440 |

|

| Distribution fees — Class R (Note 2) | 4,681 |

|

| Distribution fees — Class T (Note 2) | 224,314 |

|

| Other | 455,903 |

|

| Non-recurring costs (Notes 2 and 6) | 16,945 |

|

| Costs assumed by Manager (Notes 2 and 6) | (16,945) |

|

| Fees waived and reimbursed by Manager or affiliate (Notes 5 and 6) | (1,400,478) |

|

| Total expenses | 9,186,107 |

|

| Expense reduction (Note 2) | (604,788) |

|

| Net expenses | 8,581,319 |

|