| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811-02608) |

| | |

| Exact name of registrant as specified in charter: | Putnam Money Market Fund |

| | |

| Address of principal executive offices: | One Post Office Square, Boston, Massachusetts 02109 |

| | |

| Name and address of agent for service: | Robert T. Burns, Vice President

One Post Office Square

Boston, Massachusetts 02109 |

| | |

| Copy to: | Bryan Chegwidden, Esq.

Ropes & Gray LLP

1211 Avenue of the Americas

New York, New York 10036 |

| | |

| Registrant's telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | September 30, 2016 |

| | |

| Date of reporting period: | October 1, 2015 — March 31, 2016 |

| | |

|

Item 1. Report to Stockholders: | |

| | |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

Putnam

Money Market

Fund

Semiannual report

3 | 31 | 16

| | |

| Message from the Trustees | 1 | |

| |

| About the fund | 2 | |

| |

| Performance snapshot | 4 | |

| |

| Interview with your fund’s portfolio managers | 5 | |

| |

| Your fund’s performance | 10 | |

| |

| Your fund’s expenses | 12 | |

| |

| Terms and definitions | 14 | |

| |

| Other information for shareholders | 15 | |

| |

| Financial statements | 16 | |

| |

Consider these risks before investing: Although a money market fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The fund’s sponsor has no legal obligation to provide finan-cial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time. Money market values typically rise and fall in response to changes in interest rates. Although the fund only buys high-quality investments, investments backed by a letter of credit carry the risk of the provider failing to fulfill its obligations to the issuer.

Message from the Trustees

Dear Fellow Shareholder:

After enduring significant volatility in early 2016, markets around the world have shown fresh signs of strength as investor sentiment has improved. Many factors had fueled turbulence in the financial markets, including oil price volatility, uncertainty about U.S. monetary policy, and concerns about the ripple effects of China’s economic slowdown.

In the United States, investors were encouraged by the Federal Reserve’s decision in March to hold off on raising interest rates and dialing back its 2016 rate-hike forecast to two hikes instead of four. Recent U.S. economic data also have been positive, with improvements in employment, manufacturing, and consumer confidence. Meanwhile, policymakers in Europe, China, Japan, and many emerging markets continue their efforts to lift economic growth rates.

Putnam’s portfolio managers are positioned to maneuver in all types of markets with active investment strategies and support from teams of equity and fixed-income research analysts. The interview on the following pages provides an overview of your fund’s performance for the reporting period ended March 31, 2016, as well as an outlook for the coming months.

In today’s market environment, it may be helpful to consult your financial advisor to ensure that your investment portfolio is aligned with your goals, time horizon, and risk tolerance.

As always, thank you for investing with Putnam.

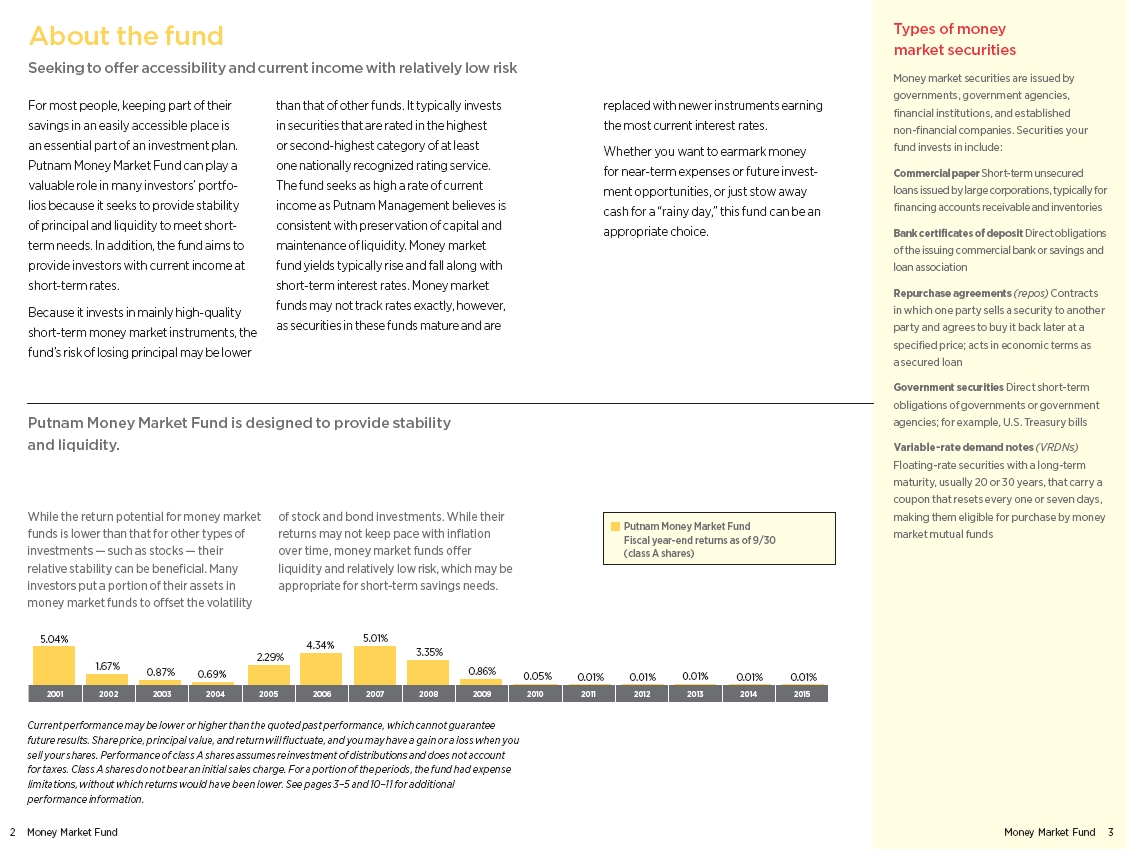

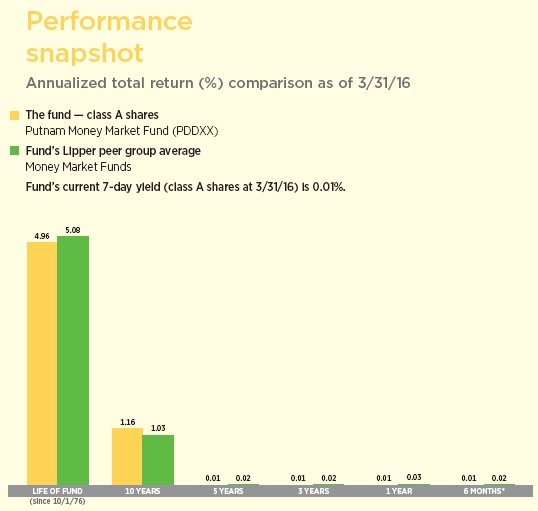

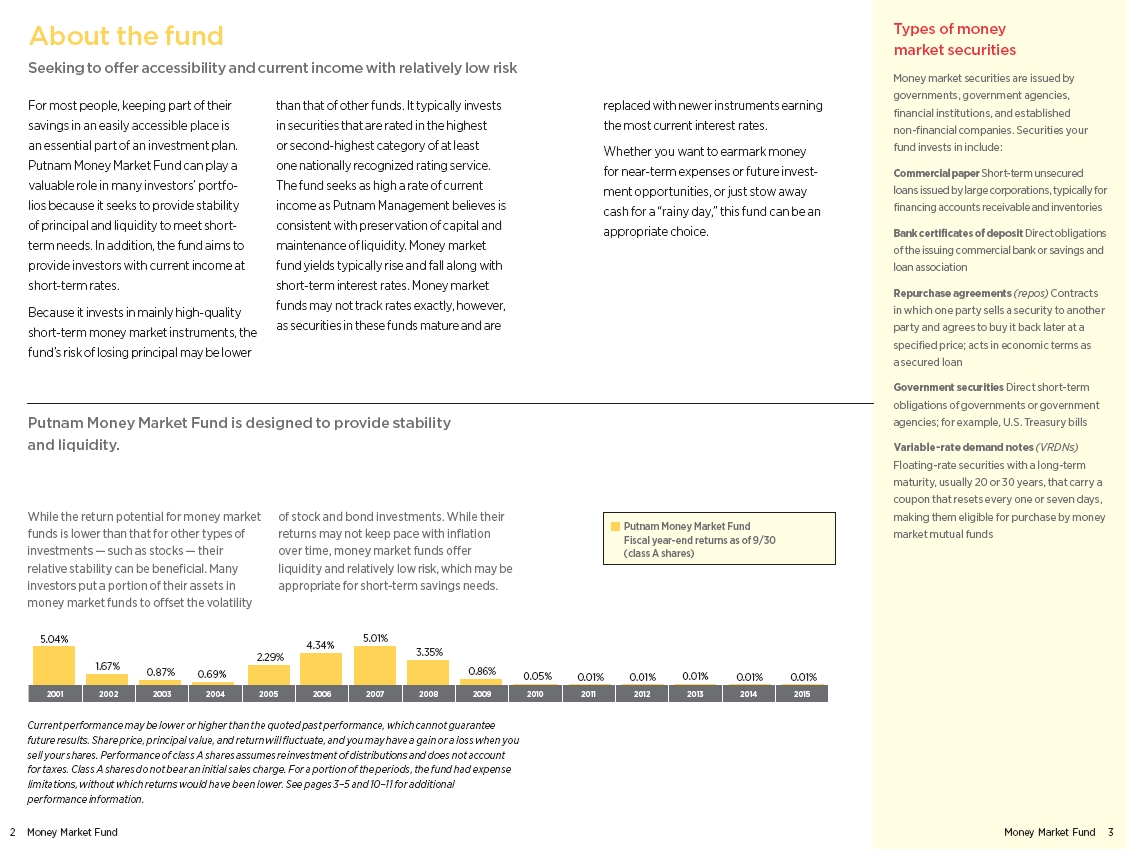

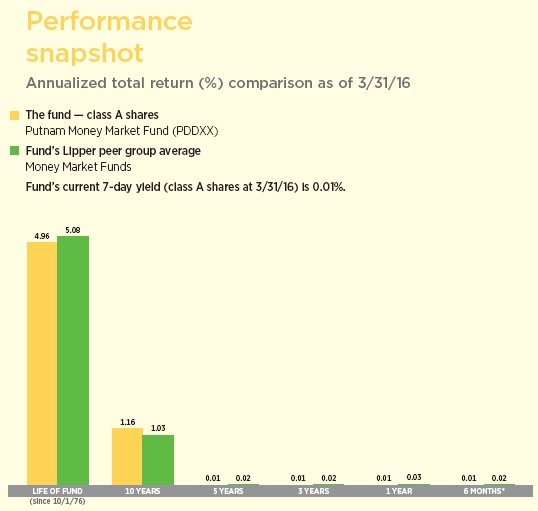

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Class A shares do not bear an initial sales charge. For a portion of the periods, the fund had expense limitations, without which returns would have been lower. Yield reflects current performance more closely than total return. See pages 2–3, 5, and 10–11 for additional performance information. To obtain the most recent month-end performance, visit putnam.com.

* Returns for the six-month period are not annualized, but cumulative.

Interview with

your fund’s

portfolio managers

What was the interest-rate environment like during the six-month reporting period ended March 31, 2016?

Joanne: With increased confidence in the U.S. economy, the Federal Reserve took the first step on the path of gradual normalization of interest rates and raised its short-term benchmark rate to a range between 0.25% and 0.50% on December 16, 2015. While investors initially welcomed the rate hike, global markets in early 2016 experienced a return of heightened volatility and a “risk-off” flight to safe havens, such as U.S. Treasuries and gold. Contributing to the change in sentiment were divergent central bank monetary policies, weakness in commodity prices, and China’s economic slowdown.

In January, global equity markets sold off sharply when oil fell to $27 a barrel, pressured by a growing oversupply. The U.S. job market continued to improve, however, adding jobs that pushed the unemployment rate to 4.9% — its lowest level since 2008. In her semiannual congressional testimony in early February, Fed Chair Janet Yellen affirmed the U.S. economy’s strengths, but added that future rate hikes would be data dependent and that macroeconomic conditions “warranted only gradual increases” in the federal funds rate. Given the recent market volatility and its potential impact on U.S. economic growth, Fed observers began to anticipate that a March rate hike

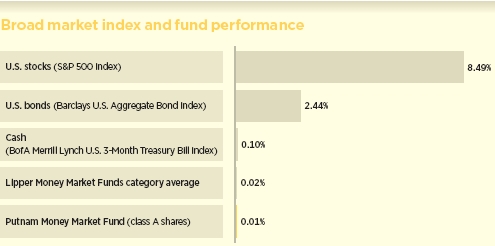

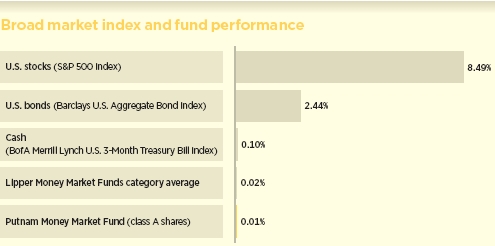

This comparison shows your fund’s performance in the context of broad market indexes for the six months ended 3/31/16. See pages 2–4 and 10–11 for additional fund performance information. Index descriptions can be found on page 14.

would be pushed out to the central bank’s June meeting.

In the weeks that followed Yellen’s comments, several upbeat U.S. corporate earnings announcements, rumblings of a cap on oil production, and a growing belief that the equity markets were deeply oversold sparked a rally off lows not seen since August 2015. By mid-March, the S&P 500 Index had bounced back from its worst-ever start of a calendar year, as positive developments in global central bank policies heightened demand for equities and oil prices approached three-month highs. At its March meeting, the Fed left interest rates unchanged. Taking a slightly dovish tone, policymakers at the central bank dialed back their forecast for interest-rate increases this year to two hikes from the four they predicted this past December. With diminished expectations of rate increases, stocks and other higher-risk assets advanced amid optimism and expectations for more gradual increases in interest rates. Just before the close of the reporting period, Yellen reaffirmed that the central bank would move cautiously, calling into question an April interest-rate hike, in our view.

During the reporting period, we continued to witness the importance of money market funds as an investment option for investors

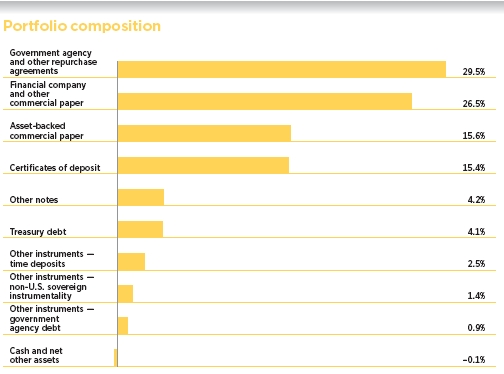

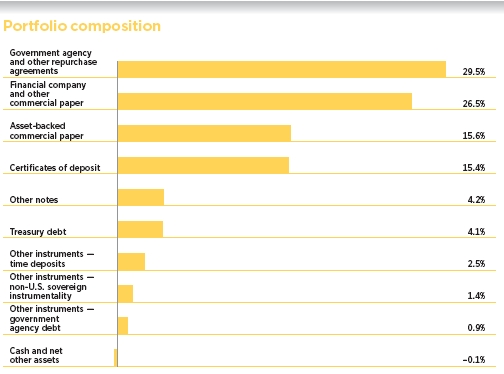

Allocations are shown as a percentage of the fund’s net assets as of 3/31/16. Cash and net other assets, if any, represent the market value weights of cash and other unclassified assets in the portfolio. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of any interest accruals, the exclusion of as-of trades, if any, and the use of different classifications of securities for presentation purposes. Holdings and allocations may vary over time.

The cash and net other assets category may show a negative market value percentage as a result of the timing of trade-date versus settlement-date transactions.

seeking refuge from extraordinary market volatility. It is difficult to gauge if investment inflows were due to a specific factor, such as concerns about Fed rate policy or the Securities and Exchange Commission’s [SEC] money market reforms slated to take effect in October 2016. However, U.S. money market fund assets were up considerably year over year to $2.77 trillion on March 31, 2016. With the Fed’s recent rate hike and market expectations of more increases to come, albeit gradual, money market fund yields have begun to inch higher — attracting renewed investor interest.

What was your investment approach in this environment?

Jonathan: During the reporting period, we kept the portfolio’s weighted average maturity [WAM] below that of the average of its Lipper peers heading into the end of 2015, focusing on shorter-dated commercial paper and floating-rate instruments. With the markets anticipating the timing of a Fed

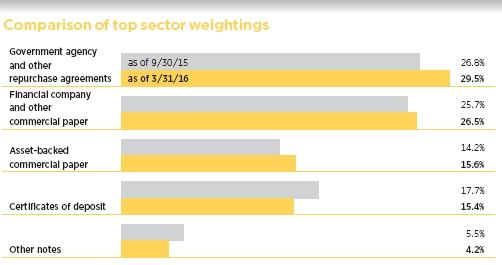

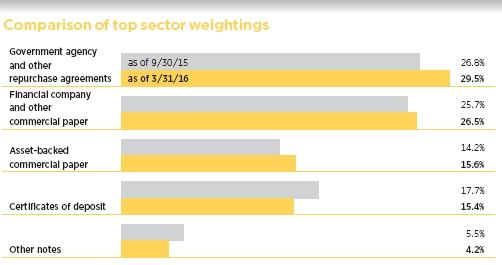

This chart shows how the fund’s top weightings have changed over the past six months. Allocations are shown as a percentage of the fund’s net assets. Current period summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of any interest accruals, the exclusion of as-of trades, if any, and the use of different classifications of securities for presentation purposes. Holdings and allocations may vary over time.

decision to raise the federal funds rate off its very accommodative near-zero level, the three-month London Interbank Offered Rate [LIBOR] widened 29 basis points, or just over a quarter of a percentage point, from September 30 to December 31. [LIBOR is a widely followed benchmark rate that the world’s largest banks use in determining rates for interbank loans.]

Following the Fed’s interest-rate hike in December, LIBOR was relatively stable for the balance of the reporting period — only increasing slightly more than one basis point, as mixed economic data and the Fed’s concern about global pressures threatening U.S. economic growth reduced market expectations for a near-term rate increase. As this dynamic played out during the first quarter of 2016, we increased the portfolio’s investments in fixed-rate commercial paper in the three- to six-month maturity range, bringing the fund’s WAM to 31 days by period-end, which was closer to the fund’s peer group average.

How did Putnam Money Market Fund perform during the six-month reporting period ended March 31, 2016?

Joanne: The fund’s sizable weighting in repurchase agreements was beneficial for performance, as these securities were influenced by the increase in the Fed’s benchmark rate. The fund’s allocation to commercial paper and certificates of deposit also aided results, as their rates rose in response to the steeper LIBOR curve. Accordingly, the fund’s total return performance fell in line with this rate environment.

What are your thoughts about Fed policy in the coming months?

Joanne: At the Fed’s March meeting, Yellen stated that U.S. economic growth has been “somewhat mixed,” with higher global risks offsetting solid domestic fundamentals. With the second quarter of 2016 under way, we are seeing encouraging signs about the health of the American economy. March’s 5% unemployment rate was near the Fed’s goal of longer-term full employment, some inflation markers have begun to rise, and the U.S. economy has experienced steady growth with the help of improving consumer sentiment.

We will be keeping a sharp eye on U.S. economic data for clues regarding the future path of Fed rate hikes. Meanwhile, we will continue to maintain the fund’s flexibility to best position it for any upticks in short-term interest rates.

Thank you, Joanne and Jonathan, for your time and insights today.

The views expressed in this report are exclusively those of Putnam Management and are subject to change. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

Of special interest

In connection with the SEC’s amendments to Rule 2a-7 under the Investment Company Act of 1940, as amended, which governs money market funds, the fund intends to operate as a “retail money market fund” as defined by Rule 2a-7 beginning no later than October 2016. In anticipation of its operation as a retail money market fund, the fund has adopted policies and procedures reasonably designed to limit investments in the fund to accounts beneficially owned by natural persons and may involuntarily redeem any investor who is not a natural person. The fund will provide advance notice of any involuntary redemption to affected investors. The fund has also adopted policies and procedures such that,

beginning no later than October 2016, the fund may impose liquidity fees and/or temporarily suspend redemptions in the event that the fund’s liquidity falls below required minimum levels.

Portfolio Manager Joanne M. Driscoll has an M.B.A. from the D’Amore-McKim School of Business at Northeastern University and a B.S. from Westfield State College. Joanne joined Putnam in 1995 and has been in the investment industry since 1992.

Portfolio Manager Jonathan M. Topper has a B.A. from Northeastern University. He has been in the investment industry since he joined Putnam in 1990.

IN THE NEWS

Since its introduction in January 2012, the Federal Reserve’s interest-rate path “dot plot” has become something of a must-read for Fed watchers. The dot plot’s origins date to 2011, when the Fed was seeking a way to convey publicly more information about the central bank’s outlook. Before every other Fed meeting, officials on the policy-setting Federal Open Market Committee (FOMC) submit updated forecasts for economic growth, unemployment, inflation, and interest-rate hikes. The dots, published as a graph in the quarterly “Summary of Economic Projections,” represent anonymously delivered forecasts from individual FOMC members. In recent months, the dot plot has been criticized by some for conveying an overly hawkish message, but Federal Reserve Chair Janet Yellen has defended the dot plot, saying it should be used to manage expectations about future hikes and not be viewed as a definitive rate path. Meanwhile, after its March 2016 meeting, the Fed released a dot plot more aligned with current market expectations — reducing the number of rate hikes this year to two from the four predicted in December. So, for now, the Fed and the market appear to be on the same page.

Your fund’s performance

This section shows your fund’s performance and distribution information for periods ended March 31, 2016, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R shares are not available to all investors. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 3/31/16

| | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class T |

| (inception dates) | (10/1/76) | (4/27/92) | (2/1/99) | (12/8/94) | (1/21/03) | (12/31/01) |

|

| | Net | | | | | Net | Net | Net |

| | asset | Before | After | Before | After | asset | asset | asset |

| | value | CDSC | CDSC | CDSC | CDSC | value | value | value |

|

| Annual average (life of fund) | 4.96% | 4.85% | 4.85% | 4.53% | 4.53% | 4.83% | 4.52% | 4.75% |

|

| 10 years | 12.20 | 10.46 | 10.46 | 10.46 | 10.46 | 11.65 | 10.46 | 11.30 |

| Annual average | 1.16 | 1.00 | 1.00 | 1.00 | 1.00 | 1.11 | 1.00 | 1.08 |

|

| 5 years | 0.05 | 0.05 | –1.95 | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 |

| Annual average | 0.01 | 0.01 | –0.39 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 |

|

| 3 years | 0.03 | 0.03 | –2.97 | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 |

| Annual average | 0.01 | 0.01 | –1.00 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 |

|

| 1 year | 0.01 | 0.01 | –4.99 | 0.01 | –0.99 | 0.01 | 0.01 | 0.01 |

|

| 6 months | 0.01 | 0.01 | –4.99 | 0.01 | –0.99 | 0.01 | 0.01 | 0.01 |

|

| | Net | | | | | Net | Net | Net |

| | asset | Before | After | Before | After | asset | asset | asset |

| Current rate (end of period)* | value | CDSC | CDSC | CDSC | CDSC | value | value | value |

|

| Current 7-day yield | | | | | | | | |

| (with expense limitation) | 0.01% | 0.01% | — | 0.01% | — | 0.01% | 0.01% | 0.01% |

|

| Current 7-day yield | | | | | | | | |

| (without expense limitation) | 0.01 | –0.49 | — | –0.49 | — | –0.14 | –0.49 | –0.24 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. None of the share classes carry an initial sales charge. Class B share returns reflect the applicable contingent deferred sales charge (CDSC), which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C share returns reflect a 1% CDSC for the first year that is eliminated thereafter. Class A, M, R, and T shares generally have no CDSC. Performance for class B, C, M, R, and T shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and the higher operating expenses for such shares.

* The 7-day yield is the most common gauge for measuring money market mutual fund performance. Yield reflects current performance more closely than total return.

For a portion of the periods, the fund had expense limitations, without which returns and yields would have been lower.

Class B share performance reflects conversion to class A shares after eight years.

Comparative Lipper returns For periods ended 3/31/16

| |

| | Lipper Money Market Funds |

| | category average* |

|

| Annual average (life of fund) | 5.08% |

|

| 10 years | 10.82 |

| Annual average | 1.03 |

|

| 5 years | 0.09 |

| Annual average | 0.02 |

|

| 3 years | 0.05 |

| Annual average | 0.02 |

|

| 1 year | 0.03 |

|

| 6 months | 0.02 |

|

Lipper results should be compared with fund performance at net asset value.

* Over the 6-month, 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 3/31/16, there were 163, 160, 159, 153, 127, and 8 funds, respectively, in this Lipper category.

Fund distribution information For the six-month period ended 3/31/16

| | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class R | Class T |

|

| Number | 6 | 6 | 6 | 6 | 6 | 6 |

|

| Income | $0.000050 | $0.000050 | $0.000050 | $0.000050 | $0.000050 | $0.000050 |

|

| Capital gains | — | — | — | — | — | — |

|

| Total | $0.000050 | $0.000050 | $0.000050 | $0.000050 | $0.000050 | $0.000050 |

|

The classification of distributions, if any, is an estimate. Final distribution information will appear on your year-end tax forms.

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. In the most recent six-month period, your fund’s expenses were limited; had expenses not been limited, they would have been higher. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class T |

|

| Total annual operating expenses | | | | | | |

| for the fiscal year ended 9/30/15 | 0.49% | 0.99% | 0.99% | 0.64% | 0.99% | 0.74% |

|

| Annualized expense ratio for | | | | | | |

| the six-month period ended | | | | | | |

| 3/31/16* | 0.36% | 0.36% | 0.36% | 0.36% | 0.36% | 0.36% |

|

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report.

Expenses are shown as a percentage of average net assets.

* Reflects a voluntary waiver of certain fund expenses.

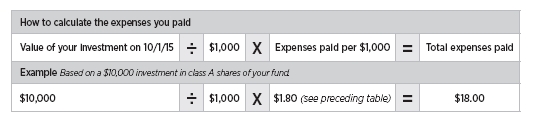

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in each class of the fund from 10/1/15 to 3/31/16. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class T |

|

| Expenses paid per $1,000*† | $1.80 | $1.80 | $1.80 | $1.80 | $1.80 | $1.80 |

|

| Ending value (after expenses) | $1,000.10 | $1,000.10 | $1,000.10 | $1,000.10 | $1,000.10 | $1,000.10 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 3/31/16. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

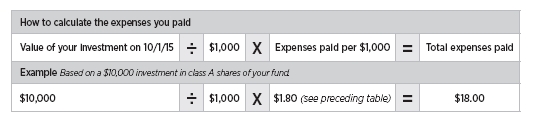

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended 3/31/16, use the following calculation method. To find the value of your investment on 10/1/15, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return . You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class T |

|

| Expenses paid per $1,000*† | $1.82 | $1.82 | $1.82 | $1.82 | $1.82 | $1.82 |

|

| Ending value (after expenses) | $1,023.20 | $1,023.20 | $1,023.20 | $1,023.20 | $1,023.20 | $1,023.20 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 3/31/16. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the six-month period; then multiplying the result by the number of days in the six-month period; and then dividing that result by the number of days in the year.

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the price, or value, of one share of a mutual fund, without a sales charge. Net asset values fluctuate with market conditions, and are calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines over time from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Current rate is the annual rate of return earned from dividends or interest of an investment. Current rate is expressed as a percentage of the price of a security, fund share, or principal investment.

Share classes

Class A shares generally are fund shares purchased with an initial sales charge. In the case of your fund, which has no sales charge, the reference is to shares purchased or acquired through the exchange of class A shares from another Putnam fund. Exchange of your fund’s class A shares into another fund may involve a sales charge, however.

Class B shares are available only by exchange from another Putnam fund and are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are purchased by exchange from another Putnam fund and are redeemed during the first year.

Class M shares generally are fund shares that have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC. In the case of your fund, which has no sales charge, the reference is to shares purchased or acquired through the exchange of class M shares from another Putnam fund. Exchange of your fund’s class M shares into another fund may involve a sales charge, however.

Class R shares are not subject to an initial sales charge or CDSC and are only available to employer-sponsored retirement plans.

Class T shares are not subject to an initial sales charge or CDSC (except on certain redemptions of shares acquired by exchange of shares of another Putnam fund bought without an initial sales charge); however, they are subject to a 12b-1 fee.

Comparative indexes

Barclays U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

BofA Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

Lipper Money Market Funds category average is an arithmetic average of the total return of all money market mutual funds tracked by Lipper.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with Securities and Exchange Commission (SEC) regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2015, are available in the Individual Investors section of putnam.com, and on the SEC’s website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Form N-Q on the SEC’s website at www.sec.gov. In addition, the fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s website or the operation of the Public Reference Room.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of March 31, 2016, Putnam employees had approximately $477,000,000 and the Trustees had approximately $127,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

Financial statements

A guide to financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

The fund’s portfolio 3/31/16 (Unaudited)

| | |

| | Principal | |

| REPURCHASE AGREEMENTS (29.6%)* | amount | Value |

|

| Interest in $333,518,000 joint tri-party repurchase agreement dated | | |

| 3/31/16 with Citigroup Global Markets, Inc. due 4/1/16 — maturity | | |

| value of $123,236,130 for an effective yield of 0.330% (collateralized | | |

| by various mortgage backed securities and various U.S. Treasury notes with | | |

| coupon rates ranging from 0.750% to 4.000% and due dates ranging from | | |

| 2/28/18 to 12/1/45, valued at $340,188,360) | $123,235,000 | $123,235,000 |

|

| Interest in $125,000,000 tri-party repurchase agreement dated | | |

| 3/31/16 with Goldman, Sachs & Co. due 4/1/16 — maturity value of | | |

| $125,001,042 for an effective yield of 0.300% (collateralized by various | | |

| mortgage backed securities with coupon rates ranging from 2.465% | | |

| to 6.000% and due dates ranging from 3/1/23 to 3/1/46, valued | | |

| at $127,500,000) | 125,000,000 | 125,000,000 |

|

| Interest in $315,159,000 joint tri-party repurchase agreement dated | | |

| 3/31/16 with Merrill Lynch, Pierce, Fenner and Smith, Inc. due 4/1/16 — | | |

| maturity value of $123,230,993 for an effective yield of 0.290% (collateralized | | |

| by a mortgage backed security with a coupon rate of 4.000% and a due date | | |

| of 5/20/42, valued at $321,462,180) | 123,230,000 | 123,230,000 |

|

| Total repurchase agreements (cost $371,465,000) | | $371,465,000 |

| | | | |

| | | Maturity | Principal | |

| COMMERCIAL PAPER (26.9%)* | Yield (%) | date | amount | Value |

|

| American Honda Finance Corp. | 0.501 | 6/21/16 | $7,750,000 | $7,741,281 |

|

| Australia & New Zealand Banking Group, Ltd. | | | | |

| 144A (Australia) | 0.589 | 4/27/16 | 15,000,000 | 14,999,354 |

|

| Bank of Nova Scotia (The) 144A (Canada) | 0.854 | 9/22/16 | 5,000,000 | 4,979,458 |

|

| BMW US Capital, LLC | 0.400 | 4/1/16 | 6,250,000 | 6,250,000 |

|

| BNP Paribas SA/New York, NY (France) | 0.400 | 4/6/16 | 7,000,000 | 6,999,611 |

|

| Coca-Cola Co. (The) | 0.511 | 7/13/16 | 5,250,000 | 5,242,339 |

|

| Coca-Cola Co. (The) | 0.501 | 5/10/16 | 13,500,000 | 13,492,688 |

|

| Commonwealth Bank of Australia (Australia) | 0.818 | 9/1/16 | 12,000,000 | 11,958,435 |

|

| Commonwealth Bank of Australia 144A (Australia) | 0.854 | 9/30/16 | 6,500,000 | 6,472,068 |

|

| Cooperatieve Rabobank UA/NY (Netherlands) | 0.717 | 8/1/16 | 12,000,000 | 11,970,923 |

|

| Danske Corp. (Denmark) | 0.606 | 5/2/16 | 4,100,000 | 4,097,864 |

|

| DnB Bank ASA (Norway) | 0.621 | 5/18/16 | 10,765,000 | 10,756,286 |

|

| Export Development Canada (Canada) | 0.611 | 7/15/16 | 12,500,000 | 12,477,760 |

|

| Export Development Canada (Canada) | 0.481 | 6/9/16 | 4,500,000 | 4,495,860 |

|

| HSBC Bank PLC 144A (United Kingdom) | 0.782 | 7/21/16 | 10,500,000 | 10,500,000 |

|

| Lloyds Bank PLC (United Kingdom) | 0.621 | 4/4/16 | 11,600,000 | 11,599,401 |

|

| Lloyds Bank PLC (United Kingdom) | 0.571 | 5/2/16 | 7,500,000 | 7,496,319 |

|

| National Australia Bank, Ltd. (Australia) | 0.601 | 5/20/16 | 3,500,000 | 3,497,142 |

|

| National Australia Bank, Ltd. 144A (Australia) | 0.803 | 8/2/16 | 11,750,000 | 11,717,883 |

|

| Nestle Finance International, Ltd. (Switzerland) | 0.591 | 7/7/16 | 6,500,000 | 6,489,667 |

|

| Nestle Finance International, Ltd. (Switzerland) | 0.541 | 6/8/16 | 12,250,000 | 12,237,505 |

|

| Nordea Bank AB (Sweden) | 0.556 | 4/4/16 | 15,000,000 | 14,999,306 |

|

| Prudential PLC (United Kingdom) | 0.551 | 5/23/16 | 12,500,000 | 12,490,069 |

|

| Roche Holdings, Inc. (Switzerland) | 0.501 | 5/4/16 | 15,000,000 | 14,993,125 |

|

| Simon Property Group LP | 0.531 | 5/6/16 | 9,600,000 | 9,595,053 |

|

| Simon Property Group LP | 0.470 | 5/9/16 | 2,050,000 | 2,048,983 |

|

| | | | |

| | | Maturity | Principal | |

| COMMERCIAL PAPER (26.9%)* cont. | Yield (%) | date | amount | Value |

|

| Skandinaviska Enskilda Banken AB 144A, | | | | |

| Ser. GLOB (Sweden) | 0.727 | 7/28/16 | $6,000,000 | $5,985,742 |

|

| Skandinaviska Enskilda Banken AB 144A, | | | | |

| Ser. GLOB (Sweden) | 0.531 | 4/20/16 | 9,250,000 | 9,247,413 |

|

| Standard Chartered Bank/New York 144A | 0.601 | 5/17/16 | 11,500,000 | 11,491,183 |

|

| Svenska Handelsbanken AB 144A (Sweden) | 0.732 | 6/7/16 | 18,675,000 | 18,649,628 |

|

| Swedbank AB (Sweden) | 0.541 | 4/6/16 | 18,750,000 | 18,748,594 |

|

| Toronto-Dominion Holdings USA, Inc. 144A (Canada) | 0.520 | 4/1/16 | 1,000,000 | 1,000,000 |

|

| Toyota Motor Credit Corp. | 0.685 | 9/27/16 | 18,600,000 | 18,600,000 |

|

| Westpac Banking Corp. 144A (Australia) | 0.651 | 7/7/16 | 5,000,000 | 5,000,000 |

|

| Westpac Banking Corp./NY (Australia) | 0.874 | 8/1/16 | 9,250,000 | 9,222,728 |

|

| Total commercial paper (cost $337,543,668) | | | | $337,543,668 |

|

| |

| | | Maturity | Principal | |

| ASSET-BACKED COMMERCIAL PAPER (15.6%)* | Yield (%) | date | amount | Value |

|

| Bedford Row Funding Corp. | 0.501 | 5/12/16 | $3,600,000 | $3,597,950 |

|

| Chariot Funding, LLC | 0.501 | 5/9/16 | 2,875,000 | 2,873,483 |

|

| Chariot Funding, LLC | 0.501 | 5/3/16 | 16,250,000 | 16,242,778 |

|

| CHARTA, LLC | 0.500 | 5/23/16 | 11,400,000 | 11,391,767 |

|

| Collateralized Commercial Paper Co., LLC | 0.753 | 5/26/16 | 2,700,000 | 2,696,906 |

|

| Collateralized Commercial Paper Co., LLC | 0.681 | 5/17/16 | 9,550,000 | 9,550,000 |

|

| CRC Funding, LLC | 0.581 | 6/21/16 | 7,000,000 | 6,990,865 |

|

| CRC Funding, LLC | 0.571 | 5/17/16 | 5,000,000 | 4,996,358 |

|

| Fairway Finance Co., LLC 144A (Canada) | 0.608 | 5/12/16 | 7,750,000 | 7,750,000 |

|

| Gotham Funding Corp. (Japan) | 0.500 | 4/11/16 | 7,025,000 | 7,024,024 |

|

| Jupiter Securitization Co., LLC | 0.854 | 7/5/16 | 5,000,000 | 4,988,785 |

|

| Jupiter Securitization Co., LLC 144A | 0.501 | 5/3/16 | 14,700,000 | 14,693,467 |

|

| Liberty Street Funding, LLC (Canada) | 0.682 | 6/21/16 | 2,000,000 | 1,996,940 |

|

| Liberty Street Funding, LLC (Canada) | 0.601 | 6/14/16 | 2,500,000 | 2,496,917 |

|

| Manhattan Asset Funding Co., LLC (Japan) | 0.621 | 4/25/16 | 18,375,000 | 18,367,405 |

|

| MetLife Short Term Funding, LLC 144A | 0.511 | 4/12/16 | 6,000,000 | 5,999,065 |

|

| MetLife Short Term Funding, LLC 144A | 0.470 | 5/17/16 | 12,250,000 | 12,242,643 |

|

| Old Line Funding, LLC 144A | 0.798 | 7/12/16 | 18,750,000 | 18,750,000 |

|

| Thunder Bay Funding, LLC 144A | 0.781 | 6/17/16 | 19,000,000 | 19,000,000 |

|

| Victory Receivables Corp. (Japan) | 0.530 | 5/5/16 | 3,500,000 | 3,498,248 |

|

| Victory Receivables Corp. (Japan) | 0.520 | 4/1/16 | 8,000,000 | 8,000,000 |

|

| Working Capital Management Co. (Japan) | 0.541 | 5/16/16 | 5,000,000 | 4,996,625 |

|

| Working Capital Management Co. (Japan) | 0.521 | 5/17/16 | 7,500,000 | 7,495,017 |

|

| Total asset-backed commercial paper (cost $195,639,243) | | | $195,639,243 |

|

| |

| | | Maturity | Principal | |

| CERTIFICATES OF DEPOSIT (15.4%)* | Yield (%) | date | amount | Value |

|

| Bank of America, NA FRN | 0.681 | 5/9/16 | $17,900,000 | $17,900,000 |

|

| Bank of Montreal/Chicago, IL FRN (Canada) | 0.768 | 10/14/16 | 10,000,000 | 10,000,000 |

|

| Bank of Nova Scotia/Houston FRN | 0.815 | 6/10/16 | 9,250,000 | 9,250,907 |

|

| BNP Paribas SA/New York, NY (France) | 0.630 | 5/25/16 | 4,200,000 | 4,200,607 |

|

| Canadian Imperial Bank of Commerce/New | | | | |

| York, NY FRN | 0.591 | 6/17/16 | 12,325,000 | 12,325,000 |

|

| | | | |

| | | Maturity | Principal | |

| CERTIFICATES OF DEPOSIT (15.4%)* cont. | Yield (%) | date | amount | Value |

|

| Citibank, NA | 0.710 | 7/25/16 | $9,000,000 | $9,000,000 |

|

| Citibank, NA | 0.580 | 6/14/16 | 10,100,000 | 10,101,238 |

|

| Credit Suisse AG/New York, NY | 0.690 | 5/6/16 | 12,000,000 | 11,999,744 |

|

| DnB Bank ASA/New York FRN (Norway) | 0.754 | 8/2/16 | 7,500,000 | 7,500,000 |

|

| HSBC Bank USA, NA/New York, NY FRN | | | | |

| (United Kingdom) | 0.621 | 4/5/16 | 8,800,000 | 8,800,000 |

|

| National Bank of Canada/New York, NY | 0.600 | 6/1/16 | 12,500,000 | 12,502,300 |

|

| Nordea Bank Finland PLC/New York FRN | 0.812 | 6/13/16 | 2,540,000 | 2,540,080 |

|

| Nordea Bank Finland PLC/New York FRN | 0.739 | 5/3/16 | 1,800,000 | 1,800,039 |

|

| Royal Bank of Canada/New York, NY (Canada) | 0.600 | 6/15/16 | 15,500,000 | 15,506,094 |

|

| Skandinaviska Enskilda Banken AB/New York, NY | 0.800 | 9/2/16 | 3,500,000 | 3,500,144 |

|

| State Street Bank & Trust Co. | 0.820 | 7/12/16 | 6,000,000 | 6,000,000 |

|

| State Street Bank & Trust Co. FRN | 0.632 | 5/20/16 | 11,500,000 | 11,500,000 |

|

| Toronto-Dominion Bank/NY (Canada) | 0.610 | 6/13/16 | 5,000,000 | 5,001,913 |

|

| Toronto-Dominion Bank/NY FRN (Canada) | 0.602 | 5/19/16 | 12,000,000 | 12,000,000 |

|

| US Bank, NA/Cincinnati OH FRN | 0.730 | 7/20/16 | 17,750,000 | 17,750,000 |

|

| Westpac Banking Corp./NY FRN (Australia) | 0.558 | 4/13/16 | 4,200,000 | 4,199,920 |

|

| Total certificates of deposit (cost $193,377,986) | | | | $193,377,986 |

|

| |

| | Interest | Maturity | Principal | |

| CORPORATE BONDS AND NOTES (4.2%)* | rate (%) | date | amount | Value |

|

| Canadian Imperial Bank of Commerce/Canada sr. | | | | |

| unsec. unsub. FRN (Canada) | 1.140 | 7/18/16 | $6,575,000 | $6,579,497 |

|

| Danske Bank A/S 144A sr. unsec. unsub. | | | | |

| notes (Denmark) | 3.875 | 4/14/16 | 8,300,000 | 8,308,747 |

|

| GE Capital International Funding Co. 144A company | | | | |

| guaranty sr. unsec. notes (Ireland) | 0.964 | 4/15/16 | 8,075,000 | 8,076,416 |

|

| General Electric Capital Corp. company guaranty sr. | | | | |

| unsec. FRN, MTN, Ser. A | 0.821 | 5/11/16 | 4,450,000 | 4,450,726 |

|

| Wells Fargo & Co. sr. unsec. unsub. FRN, Ser. MTN | 1.154 | 7/20/16 | 9,950,000 | 9,960,179 |

|

| Wells Fargo Bank, NA sr. unsec. FRN, Ser. BKNT | 0.783 | 6/2/16 | 4,150,000 | 4,150,522 |

|

| Wells Fargo Bank, NA sr. unsec. FRN, Ser. MTN | 0.754 | 2/14/17 | 11,000,000 | 11,000,000 |

|

| Total corporate bonds and notes (cost $52,526,087) | | | | $52,526,087 |

|

| |

| | | Maturity | Principal | |

| U.S. TREASURY OBLIGATIONS (4.2%)* | Yield (%) | date | amount | Value |

|

| U.S. Treasury FRN | 0.384 | 1/31/17 | $12,500,000 | $12,499,788 |

|

| U.S. Treasury FRN | 0.370 | 7/31/16 | 13,250,000 | 13,250,118 |

|

| U.S. Treasury FRN | 0.369 | 4/30/16 | 13,050,000 | 13,050,034 |

|

| U.S. Treasury FRN | 0.353 | 10/31/16 | 13,250,000 | 13,250,039 |

|

| Total U.S. treasury obligations (cost $52,049,979) | | | | $52,049,979 |

|

| |

| | | Maturity | Principal | |

| TIME DEPOSITS (2.5%)* | Yield (%) | date | amount | Value |

|

| Australia & New Zealand Banking Group, Ltd./ | | | | |

| Cayman Islands (Cayman Islands) | 0.250 | 4/1/16 | $18,750,000 | $18,750,000 |

|

| Credit Agricole Corporate and Investment Bank/ | | | | |

| Grand Cayman (Cayman Islands) | 0.270 | 4/1/16 | 12,500,000 | 12,500,000 |

|

| Total time deposits (cost $31,250,000) | | | | $31,250,000 |

| | | | |

| | | Maturity | Principal | |

| MUNICIPAL BONDS AND NOTES (1.0%)* | Yield (%) | date | amount | Value |

|

| Lehigh University Commercial Paper, Ser. A | 0.501 | 6/2/16 | $7,250,000 | $7,243,757 |

|

| University of Chicago Commercial Paper, Ser. A | 0.430 | 5/16/16 | 5,000,000 | 4,997,315 |

|

| Total municipal bonds and notes (cost $12,241,072) | | | | $12,241,072 |

| |

| |

| | | Maturity | Principal | |

| U.S. GOVERNMENT AGENCY OBLIGATIONS (0.9%)* | Yield (%) | date | amount | Value |

|

| Federal Home Loan Banks unsec. discount notes | 0.501 | 9/21/16 | $11,070,000 | $11,043,401 |

|

| Total U.S. government agency obligations (cost $11,043,401) | | | $11,043,401 |

|

| |

| TOTAL INVESTMENTS | | | | |

|

| Total investments (cost $1,257,136,436) | | | | $1,257,136,436 |

| |

| Key to holding’s abbreviations |

| BKNT | Bank Note |

| FRN | Floating Rate Notes: the rate shown is the current interest rate or yield at the close of the reporting period |

| MTN | Medium Term Notes |

Notes to the fund’s portfolio

Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from October 1, 2015 through March 31, 2016 (the reporting period). Within the following notes to the portfolio, references to “ASC 820” represent Accounting Standards Codification 820 Fair Value Measurements and Disclosures and references to “OTC”, if any, represent over-the-counter.

* Percentages indicated are based on net assets of $1,253,993,420.

Debt obligations are considered secured unless otherwise indicated.

144A after the name of an issuer represents securities exempt from registration under Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

The dates shown on debt obligations are the original maturity dates.

|

| DIVERSIFICATION BY COUNTRY |

|

Distribution of investments by country of risk at the close of the reporting period, excluding collateral received, if any (as a percentage of Portfolio Value):

| | | | |

| United States | 64.5% | | Cayman Islands | 2.5% |

| |

|

| Canada | 6.7 | | Norway | 1.5 |

| |

|

| Sweden | 5.4 | | Denmark | 1.0 |

| |

|

| Australia | 5.3 | | Netherlands | 1.0 |

| |

|

| United Kingdom | 4.0 | | France | 0.9 |

| |

|

| Japan | 3.9 | | Ireland | 0.6 |

| |

|

| Switzerland | 2.7 | | Total | 100.0% |

| |

|

ASC 820 establishes a three-level hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of the fund’s investments. The three levels are defined as follows:

Level 1: Valuations based on quoted prices for identical securities in active markets.

Level 2: Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

Level 3: Valuations based on inputs that are unobservable and significant to the fair value measurement.

The following is a summary of the inputs used to value the fund’s net assets as of the close of the reporting period:

| | | |

| | | Valuation inputs | |

|

| Investments in securities: | Level 1 | Level 2 | Level 3 |

|

| Asset-backed commercial paper | $— | $195,639,243 | $— |

|

| Certificates of deposit | — | 193,377,986 | — |

|

| Commercial paper | — | 337,543,668 | — |

|

| Corporate bonds and notes | — | 52,526,087 | — |

|

| Municipal bonds and notes | — | 12,241,072 | — |

|

| Repurchase agreements | — | 371,465,000 | — |

|

| Time deposits | — | 31,250,000 | — |

|

| U.S. government agency obligations | — | 11,043,401 | — |

|

| U.S. treasury obligations | — | 52,049,979 | — |

|

| Totals by level | $— | $1,257,136,436 | $— |

During the reporting period, transfers within the fair value hierarchy, if any, did not represent, in the aggregate, more than 1% of the fund’s net assets measured as of the end of the period. Transfers are accounted for using the end of period pricing valuation method.

The accompanying notes are an integral part of these financial statements.

Statement of assets and liabilities 3/31/16 (Unaudited)

| |

| ASSETS | |

|

| Investment in securities, at value (Note 1): | |

| Unaffiliated issuers (at amortized cost) | $885,671,436 |

|

| Repurchase agreements (identified cost $371,465,000) | 371,465,000 |

|

| Cash | 807 |

|

| Interest and other receivables | 761,852 |

|

| Receivable for shares of the fund sold | 8,610,852 |

|

| Prepaid assets | 68,331 |

|

| Total assets | 1,266,578,278 |

| |

| LIABILITIES | |

|

| Payable for shares of the fund repurchased | 11,230,469 |

|

| Payable for compensation of Manager (Note 2) | 290,156 |

|

| Payable for custodian fees (Note 2) | 11,712 |

|

| Payable for investor servicing fees (Note 2) | 369,057 |

|

| Payable for Trustee compensation and expenses (Note 2) | 484,236 |

|

| Payable for administrative services (Note 2) | 4,317 |

|

| Distributions payable to shareholders | 116 |

|

| Other accrued expenses | 194,795 |

|

| Total liabilities | 12,584,858 |

| | |

| Net assets | $1,253,993,420 |

|

| |

| REPRESENTED BY | |

|

| Paid-in capital (Unlimited shares authorized) (Notes 1, 4 and 5) | $1,253,995,625 |

|

| Undistributed net investment income (Note 1) | 150 |

|

| Accumulated net realized loss on investments (Note 1) | (2,355) |

|

| Total — Representing net assets applicable to capital shares outstanding | $1,253,993,420 |

| |

| COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE | |

|

| Net asset value, offering price and redemption price per class A share | |

| ($1,110,934,479 divided by 1,110,936,336 shares) | $1.00 |

|

| Net asset value and offering price per class B share ($8,365,425 divided by 8,365,439 shares)* | $1.00 |

|

| Net asset value and offering price per class C share ($30,489,111 divided by 30,489,156 shares)* | $1.00 |

|

| Net asset value, offering price and redemption price per class M share | |

| ($27,428,770 divided by 27,428,831 shares) | $1.00 |

|

| Net asset value, offering price and redemption price per class R share | |

| ($15,814,937 divided by 15,815,108 shares) | $1.00 |

|

| Net asset value, offering price and redemption price per class T share | |

| ($60,960,698 divided by 60,960,753 shares) | $1.00 |

|

* Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

The accompanying notes are an integral part of these financial statements.

Statement of operations Six months ended 3/31/16 (Unaudited)

| |

| INVESTMENT INCOME | |

|

| Interest (including interest income of $39,820 from investments in affiliated issuers) (Note 5) | $2,408,032 |

| |

| EXPENSES | |

|

| Compensation of Manager (Note 2) | 1,863,781 |

|

| Investor servicing fees (Note 2) | 1,110,325 |

|

| Custodian fees (Note 2) | 14,556 |

|

| Trustee compensation and expenses (Note 2) | 52,399 |

|

| Distribution fees (Note 2) | 225,215 |

|

| Administrative services (Note 2) | 21,278 |

|

| Other | 267,366 |

|

| Fees waived and reimbursed by Manager (Note 2) | (1,202,961) |

|

| Total expenses | 2,351,959 |

| | |

| Expense reduction (Note 2) | (9,653) |

|

| Net expenses | 2,342,306 |

| | |

| Net investment income | 65,726 |

|

| |

| Net realized loss on investments (Notes 1 and 3) | (1,288) |

|

| Net loss on investments | (1,288) |

| | |

| Net increase in net assets resulting from operations | $64,438 |

|

The accompanying notes are an integral part of these financial statements.

Statement of changes in net assets

| | |

| DECREASE IN NET ASSETS | Six months ended 3/31/16* | Year ended 9/30/15 |

|

| Operations: | | |

| Net investment income | $65,726 | $125,934 |

|

| Net realized loss on investments | (1,288) | (1,067) |

|

| Net increase in net assets resulting from operations | 64,438 | 124,867 |

|

| Distributions to shareholders (Note 1): | | |

| From ordinary income | | |

| Net investment income | | |

|

| Class A | (58,815) | (114,294) |

|

| Class B | (434) | (877) |

|

| Class C | (1,735) | (2,612) |

|

| Class M | (1,633) | (2,926) |

|

| Class R | (766) | (2,884) |

|

| Class T | (2,193) | (2,341) |

|

| Increase in capital from settlement payments (Note 5) | — | 2,981,728 |

|

| Decrease from capital share transactions (Note 4) | (13,387,033) | (60,975,552) |

|

| Total decrease in net assets | (13,388,171) | (57,994,891) |

|

| NET ASSETS | | |

|

| Beginning of period | 1,267,381,591 | 1,325,376,482 |

|

| End of period (including undistributed net investment | | |

| income of $150 and $—, respectively) | $1,253,993,420 | $1,267,381,591 |

|

* Unaudited.

The accompanying notes are an integral part of these financial statements.

|

| This page left blank intentionally. |

Financial highlights (For a common share outstanding throughout the period)

| | | | | | | | | | | | |

| INVESTMENT OPERATIONS: | | | | | LESS DISTRIBUTIONS: | | | | | RATIOS AND SUPPLEMENTAL DATA: | |

|

| | | | | | | | | | | | | Ratio of net |

| | | | | | | | | | | | | investment |

| | | | | | | | | | | | | income |

| | Net asset | | | | | | | | | | Ratio | (loss) |

| | value, | | Net realized | Total from | From | | | | Total return | Net assets, | of expenses | to average |

| | beginning | Net investment | gain (loss) | investment | net investment | Total | Non-recurring | Net asset value, | at net asset | end of period | to average | net assets |

| Period ended | of period | income (loss) | on investments | operations | income | distributions | payments | end of period | value (%) a | (in thousands) | net assets (%) b, c | (%) c |

|

| Class A | | | | | | | | | | | | |

| March 31, 2016** | $1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | — | $1.00 | .01* | $1,110,934 | .18* | —* f |

| September 30, 2015 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | .0023 e | 1.00 | .01 | 1,141,026 | .16 | .01 |

| September 30, 2014 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | — | 1.00 | .01 | 1,202,778 | .13 | .01 |

| September 30, 2013 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | — | 1.00 | .01 | 1,306,628 | .18 | .01 |

| September 30, 2012 | 1.00 | .0001 | .0001 | .0002 | (.0001) | (.0001) | — | 1.00 | .01 | 1,398,514 | .23 | .01 |

| September 30, 2011 | 1.00 | .0001 | .0001 | .0002 | (.0001) | (.0001) | — | 1.00 | .01 | 1,739,458 | .22 | .01 |

|

| Class B | | | | | | | | | | | | |

| March 31, 2016** | $1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | — | $1.00 | .01* | $8,365 | .18* | .01* |

| September 30, 2015 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | .0020 e | 1.00 | .01 | 8,597 | .16 | .01 |

| September 30, 2014 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | — | 1.00 | .01 | 10,136 | .13 | .01 |

| September 30, 2013 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | — | 1.00 | .01 | 13,952 | .18 | .01 |

| September 30, 2012 | 1.00 | .0001 | .0001 | .0002 | (.0001) | (.0001) | — | 1.00 | .01 | 18,000 | .23 | .01 |

| September 30, 2011 | 1.00 | .0001 | .0001 | .0002 | (.0001) | (.0001) | — | 1.00 | .01 | 27,668 | .22 | .01 |

|

| Class C | | | | | | | | | | | | |

| March 31, 2016** | $1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | — | $1.00 | .01* | $30,489 | .18* | .01* |

| September 30, 2015 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | .0020 e | 1.00 | .01 | 39,085 | .16 | .01 |

| September 30, 2014 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | — | 1.00 | .01 | 29,443 | .13 | .01 |

| September 30, 2013 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | — | 1.00 | .01 | 26,082 | .18 | — f |

| September 30, 2012 | 1.00 | .0001 | .0001 | .0002 | (.0001) | (.0001) | — | 1.00 | .01 | 23,037 | .23 | .01 |

| September 30, 2011 | 1.00 | .0001 | .0001 | .0002 | (.0001) | (.0001) | — | 1.00 | .01 | 31,073 | .22 | .01 |

|

| Class M | | | | | | | | | | | | |

| March 31, 2016** | $1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | — | $1.00 | .01* | $27,429 | .18* | .01* |

| September 30, 2015 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | .0021 e | 1.00 | .01 | 33,919 | .16 | .01 |

| September 30, 2014 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | — | 1.00 | .01 | 29,845 | .13 | .01 |

| September 30, 2013 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | — | 1.00 | .01 | 29,196 | .18 | .01 |

| September 30, 2012 | 1.00 | .0001 | .0001 | .0002 | (.0001) | (.0001) | — | 1.00 | .01 | 28,559 | .23 | .01 |

| September 30, 2011 | 1.00 | .0001 | .0001 | .0002 | (.0001) | (.0001) | — | 1.00 | .01 | 31,296 | .22 | .01 |

|

| Class R | | | | | | | | | | | | |

| March 31, 2016** | $1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | — | $1.00 | .01* | $15,815 | .18* | .01* |

| September 30, 2015 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | .0020 e | 1.00 | .01 | 15,692 | .16 | .01 |

| September 30, 2014 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | — | 1.00 | .01 | 31,934 | .13 | .01 |

| September 30, 2013 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | — | 1.00 | .01 | 35,167 | .18 | — f |

| September 30, 2012 | 1.00 | .0001 | .0001 | .0002 | (.0001) | (.0001) | — | 1.00 | .01 | 19,425 | .23 | .01 |

| September 30, 2011 | 1.00 | .0001 | .0001 | .0002 | (.0001) | (.0001) | — | 1.00 | .01 | 18,508 | .22 | .01 |

|

| Class T | | | | | | | | | | | | |

| March 31, 2016** | $1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | — | $1.00 | .01* | $60,961 | .18* | .02* |

| September 30, 2015 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | .0021e | 1.00 | .01 | 29,063 | .16 | .01 |

| September 30, 2014 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | — | 1.00 | .01 | 21,240 | .13 | .01 |

| September 30, 2013 | 1.00 | .0001 | — d | .0001 | (.0001) | (.0001) | — | 1.00 | .01 | 20,969 | .18 | .01 |

| September 30, 2012 | 1.00 | .0001 | .0001 | .0002 | (.0001) | (.0001) | — | 1.00 | .01 | 25,430 | .23 | .01 |

| September 30, 2011 | 1.00 | .0001 | .0001 | .0002 | (.0001) | (.0001) | — | 1.00 | .01 | 33,941 | .22 | .01 |

|

See notes to financial highlights at the end of this section.

The accompanying notes are an integral part of these financial statements.

| |

| 26 Money Market Fund | Money Market Fund 27 |

Financial highlights (Continued)

* Not annualized.

** Unaudited.

a Total return assumes dividend reinvestment and does not reflect the effect of sales charges.

b Includes amounts paid through expense offset and/or brokerage/service arrangements, if any (Note 2). Also excludes acquired fund fees and expenses, if any.

c Reflects a voluntary waiver of certain fund expenses in effect during the period relating to the enhancement of certain annualized net yields of the fund. As a result of such waivers, the expenses of each class reflect a reduction of the following amounts as a percentage of average net assets (Note 2):

| | | | | | |

| | 3/31/16 | 9/30/15 | 9/30/14 | 9/30/13 | 9/30/12 | 9/30/11 |

|

| Class A | 0.08% | 0.32% | 0.36% | 0.32% | 0.29% | 0.28% |

|

| Class B | 0.33 | 0.82 | 0.86 | 0.82 | 0.79 | 0.78 |

|

| Class C | 0.33 | 0.82 | 0.86 | 0.82 | 0.79 | 0.78 |

|

| Class M | 0.15 | 0.47 | 0.51 | 0.47 | 0.44 | 0.43 |

|

| Class R | 0.33 | 0.82 | 0.86 | 0.82 | 0.79 | 0.78 |

|

| Class T | 0.20 | 0.57 | 0.61 | 0.57 | 0.54 | 0.53 |

|

d Amount represents less than $0.0001 per share.

e Reflects a voluntary non-recurring payment from Putnam Investments (Note 5).

f Amount represents less than 0.01% of average net assets.

The accompanying notes are an integral part of these financial statements.

Notes to financial statements 3/31/16 (Unaudited)

Within the following Notes to financial statements, references to “State Street” represent State Street Bank and Trust Company, references to “the SEC” represent the Securities and Exchange Commission, references to “Putnam Management” represent Putnam Investment Management, LLC, the fund’s manager, an indirect wholly-owned subsidiary of Putnam Investments, LLC and references to “OTC”, if any, represent over-the-counter. Unless otherwise noted, the “reporting period” represents the period from October 1, 2015 through March 31, 2016.

Putnam Money Market Fund (the fund) is a Massachusetts business trust, which is registered under the Investment Company Act of 1940, as amended, as a diversified open-end management investment company. The goal of the fund is to seek as high a rate of current income as Putnam Management believes is consistent with preservation of capital and maintenance of liquidity. The fund invests mainly in money market instruments that are high quality and have short-term maturities. The fund invests significantly in certificates of deposit, commercial paper (including asset-backed commercial paper), U.S. government debt, repurchase agreements, corporate obligations and bankers acceptances. The fund may also invest in U.S. dollar denominated foreign securities of these types. Putnam Management may consider, among other factors, credit and interest rate risks, as well as general market conditions, when deciding whether to buy or sell investments.

The fund offers class A, class B, class C, class M, class R and class T shares. Each class of shares is sold without a front-end sales charge. Class A, class R and class T shares also are generally not subject to a contingent deferred sales charge, and effective November 1, 2015, class M shares are not subject to a contingent deferred sales charge. In addition to the standard offering of class A shares, they are also sold to certain college savings plans and other Putnam funds. Class B shares convert to class A shares after approximately eight years and are subject to a contingent deferred sales charge on certain redemptions. Class C shares have a one-year 1.00% contingent deferred sales charge on certain redemptions and do not convert to class A shares. Class R shares are not available to all investors. The expenses for class A, class B, class C, class M, class R and class T shares may differ based on each class’ distribution fee, which is identified in Note 2.

In the normal course of business, the fund enters into contracts that may include agreements to indemnify another party under given circumstances. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be, but have not yet been, made against the fund. However, the fund’s management team expects the risk of material loss to be remote.

Note 1: Significant accounting policies

The following is a summary of significant accounting policies consistently followed by the fund in the preparation of its financial statements. The preparation of financial statements is in conformity with accounting principles generally accepted in the United States of America and requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and the reported amounts of increases and decreases in net assets from operations. Actual results could differ from those estimates. Subsequent events after the Statement of assets and liabilities date through the date that the financial statements were issued have been evaluated in the preparation of the financial statements.

Investment income, realized gains and losses and expenses of the fund are borne pro-rata based on the relative net assets of each class to the total net assets of the fund, except that each class bears expenses unique to that class (including the distribution fees applicable to such classes). Each class votes as a class only with respect to its own distribution plan or other matters on which a class vote is required by law or determined by the Trustees. Shares of each class would receive their pro-rata share of the net assets of the fund, if the fund were liquidated. In addition, the Trustees declare separate dividends on each class of shares.

Security valuation Portfolio securities and other investments are valued using policies and procedures adopted by the Board of Trustees. The Trustees have formed a Pricing Committee to oversee the implementation of these procedures and have delegated responsibility for valuing the fund’s assets in accordance with these procedures to Putnam Management. Putnam Management has established an internal Valuation Committee that is responsible for making fair value determinations, evaluating the effectiveness of the pricing policies of the fund and reporting to the Pricing Committee.

The valuation of the fund’s portfolio instruments is determined by means of the amortized cost method (which approximates fair value) as set forth in Rule 2a–7 under the Investment Company Act of 1940. The amortized cost of an instrument is determined by valuing it at its original cost and thereafter amortizing any discount or premium from its face value at a constant rate until maturity and is generally categorized as a Level 2 security.

Investments in open-end investment companies (excluding exchange-traded funds), if any, which can be classified as Level 1 or Level 2 securities, are valued based on their net asset value. The net asset value of such investment companies equals the total value of their assets less their liabilities and divided by the number of their outstanding shares.

Joint trading account Pursuant to an exemptive order from the SEC, the fund may transfer uninvested cash balances into a joint trading account along with the cash of other registered investment companies and certain other accounts managed by Putnam Management. These balances may be invested in issues of short-term investments having maturities of up to 90 days.

Repurchase agreements The fund, or any joint trading account, through its custodian, receives delivery of the underlying securities, the fair value of which at the time of purchase is required to be in an amount at least equal to the resale price, including accrued interest. Collateral for certain tri-party repurchase agreements is held at the counterparty’s custodian in a segregated account for the benefit of the fund and the counterparty. Putnam Management is responsible for determining that the value of these underlying securities is at all times at least equal to the resale price, including accrued interest. In the event of default or bankruptcy by the other party to the agreement, retention of the collateral may be subject to legal proceedings.

Security transactions and related investment income Security transactions are recorded on the trade date (the date the order to buy or sell is executed). Interest income is recorded on the accrual basis. Premiums and discounts from purchases of short-term investments are amortized/accreted at a constant rate until maturity. Gains or losses on securities sold are determined on the identified cost basis.

Interfund lending The fund, along with other Putnam funds, may participate in an interfund lending program pursuant to an exemptive order issued by the SEC. This program allows the fund to lend to other Putnam funds that permit such transactions. Interfund lending transactions are subject to each fund’s investment policies and borrowing and lending limits. Interest earned or paid on the interfund lending transaction will be based on the average of certain current market rates. During the reporting period, the fund did not utilize the program.

Lines of credit The fund participates, along with other Putnam funds, in a $392.5 million syndicated unsecured committed line of credit provided by State Street ($292.5 million) and Northern Trust Company ($100 million) and a $235.5 million unsecured uncommitted line of credit provided by State Street. Borrowings may be made for temporary or emergency purposes, including the funding of shareholder redemption requests and trade settlements. Interest is charged to the fund based on the fund’s borrowing at a rate equal to the higher of (1) the Federal Funds rate and (2) the overnight LIBOR plus 1.25% for the committed line of credit and the Federal Funds rate plus 1.30% for the uncommitted line of credit. A closing fee equal to 0.04% of the committed line of credit and 0.04% of the uncommitted line of credit has been paid by the participating funds. In addition, a commitment fee of 0.16% per annum on any unutilized portion of the committed line of credit is allocated to the participating funds based on their relative net assets and paid quarterly. During the reporting period, the fund had no borrowings against these arrangements.

Federal taxes It is the policy of the fund to distribute all of its taxable income within the prescribed time period and otherwise comply with the provisions of the Internal Revenue Code of 1986, as amended (the Code), applicable to regulated investment companies. It is also the intention of the fund to distribute an amount sufficient to avoid imposition of any excise tax under Section 4982 of the Code.

The fund is subject to the provisions of Accounting Standards Codification 740 Income Taxes (ASC 740). ASC 740 sets forth a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return. The fund did not have a liability to record for any unrecognized tax benefits in the accompanying financial statements. No provision has been made for federal taxes on income, capital gains or unrealized appreciation on securities held nor for excise tax on income and capital gains. Each of the fund’s federal tax returns for the prior three fiscal years remains subject to examination by the Internal Revenue Service.

At September 30, 2015, the fund had a capital loss carryover of $1,067 available to the extent allowed by the Code to offset future net capital gain, if any. The amounts of the carryovers and the expiration dates are:

| | | |

| | Loss carryover | |

|

| Short-term | Long-term | Total | Expiration |

|

| $1,067 | N/A | $1,067 | September 30, 2019 |

|

Under the Regulated Investment Company Modernization Act of 2010, the fund will be permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. However, any losses incurred will be required to be utilized prior to the losses incurred in pre-enactment tax years. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

The aggregate identified cost on a financial reporting and tax basis is the same.

Distributions to shareholders Income dividends are recorded daily by the fund and are paid monthly. Distributions from capital gains, if any, are paid at least annually. The amount and character of income and gains to be distributed are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year. Reclassifications are made to the fund’s capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations.

Note 2: Management fee, administrative services and other transactions

The fund pays Putnam Management a management fee (based on the fund’s average net assets and computed and paid monthly) at annual rates that may vary based on the average of the aggregate net assets of most open-end funds, as defined in the fund’s management contract, sponsored by Putnam Management. Such annual rates may vary as follows:

| | | | |

| 0.440% | of the first $5 billion, | | 0.240% | of the next $50 billion, |

| |

|

| 0.390% | of the next $5 billion, | | 0.220% | of the next $50 billion, |

| |

|

| 0.340% | of the next $10 billion, | | 0.210% | of the next $100 billion and |

| |

|

| 0.290% | of the next $10 billion, | | 0.205% | of any excess thereafter. |

| |

|

Putnam Management has contractually agreed, through January 30, 2017, to waive fees or reimburse the fund’s expenses to the extent necessary to limit the cumulative expenses of the fund, exclusive of brokerage, interest, taxes, investment-related expenses, extraordinary expenses, acquired fund fees and expenses and payments under the fund’s investor servicing contract, investment management contract and distribution plans, on a fiscal year-to-date basis to an annual rate of 0.20% of the fund’s average net assets over such fiscal year-to-date period. During the reporting period, the fund’s expenses were not reduced as a result of this limit.

Putnam Management may from time to time voluntarily undertake to waive fees and/or reimburse certain fund expenses in order to enhance the annualized net yield for the fund. Any such waiver or reimbursement would be voluntary and may be modified or discontinued by Putnam Management at any time without notice. During the reporting period, the fund’s expenses were reduced by $1,202,961 as a result of this limit, and the net yield at the close of the reporting period was 0.01%. This includes the following amounts per class of class specific distribution fees from the fund:

| | |

| | | Distribution fee waived |

|

| Class A | | $— |

|

| Class B | | 21,644 |

|

| Class C | | 86,440 |

|

| Class M | | 24,427 |

|

| Class R | | 38,294 |

|

| Class T | | 54,410 |

|

| Total | | $225,215 |

|

Putnam Investments Limited (PIL), an affiliate of Putnam Management, is authorized by the Trustees to manage a separate portion of the assets of the fund as determined by Putnam Management from time to time. Putnam Management will pay a quarterly sub-management fee to PIL for its services at an annual rate of 0.25% of the average net assets of the portion of the fund managed by PIL.

The fund reimburses Putnam Management an allocated amount for the compensation and related expenses of certain officers of the fund and their staff who provide administrative services to the fund. The aggregate amount of all such reimbursements is determined annually by the Trustees.

Custodial functions for the fund’s assets are provided by State Street. Custody fees are based on the fund’s asset level, the number of its security holdings and transaction volumes.

Putnam Investor Services, Inc., an affiliate of Putnam Management, provides investor servicing agent functions to the fund. Putnam Investor Services, Inc. received fees for investor servicing that included (1) a per account fee for each direct and underlying non-defined contribution account (“retail account”) of the fund and each of the other funds in its specified category, which was totaled and then allocated to each fund in the category based on its average daily net assets; (2) a specified rate of the fund’s assets attributable to defined contribution plan accounts; and (3) a specified rate based on the average net assets in retail accounts. Putnam Investor Services has agreed that the aggregate investor servicing fees for each fund’s retail and defined contribution accounts will not exceed an annual rate of 0.320% of the fund’s average assets attributable to such accounts. During the reporting period, the expenses for each class of shares related to investor servicing fees were as follows:

| | | | |

| Class A | $993,490 | | Class R | 13,171 |

| |

|

| Class B | 7,497 | | Class T | 38,283 |

| |

|

| Class C | 29,966 | | Total | $1,110,325 |

| |

|

| Class M | 27,918 | | | |

| | |