| UNITED STATES SECURITIES AND EXCHANGE COMMISSION | ||

| Washington, D.C. 20549 | ||

FORM N-CSR | ||

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES | ||

| Investment Company Act file number: | (811-02608) |

| Exact name of registrant as specified in charter: | Putnam Money Market Fund |

| Address of principal executive offices: | One Post Office Square, Boston, Massachusetts 02109 |

| Name and address of agent for service: | Robert T. Burns, Vice President One Post Office Square Boston, Massachusetts 02109 |

| Copy to: | John W. Gerstmayr, Esq. Ropes & Gray LLP 800 Boylston Street Boston, Massachusetts 02199-3600 |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| Date of fiscal year end: | September 30, 2013 |

| Date of reporting period: | October 1, 2012 — March 31, 2013 |

Item 1. Report to Stockholders: |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |||

Putnam

Money Market

Fund

Semiannual report

3 | 31 | 13

| Message from the Trustees | 1 | ||

| About the fund | 2 | ||

| Performance snapshot | 4 | ||

| Interview with your fund’s portfolio managers | 5 | ||

| Your fund’s performance | 10 | ||

| Your fund’s expenses | 12 | ||

| Terms and definitions | 14 | ||

| Other information for shareholders | 15 | ||

| Financial statements | 16 | ||

Consider these risks before investing: Money market funds are not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other governmental agency. Although the fund seeks to preserve the value of your investment at $1.00 per share, deterioration in the credit quality of issuers whose securities the fund holds or an increase in interest rates may impair the value of your investment, and it is possible to lose money by investing in this fund. The effects of inflation may erode the value of your investment over time. The values of money market investments usually rise and fall in response to changes in interest rates. Although the fund only buys high quality investments, investments backed by a letter of credit have the risk that the provider of the letter of credit will not be able to fulfill its obligations to the issuer.

Message from the Trustees

Dear Fellow Shareholder:

Many macroeconomic risks to global growth have diminished in recent months. A widespread financial collapse in Europe, an economic hard landing in China, and significant fallout from budget sequestration and the fiscal cliff in the United States have not come to pass. While these risks have not entirely dissipated, U.S. equity markets have managed to achieve record highs in the first quarter, recouping all of their losses from the 2008 financial crisis.

In the United States, corporate profits and balance sheets are strong. The Federal Reserve has pledged to keep interest rates at historic lows until the nation’s employment situation meaningfully improves. The U.S. housing market, a significant driver of GDP, has been steadily rebounding. And while the federal budget battle is not yet resolved, the markets appear to believe that Washington lawmakers will eventually reach a resolution.

At Putnam, our investment team employs a measured, balanced approach to managing risk while pursuing returns. It is also important to rely on the guidance of your financial advisor, who can help ensure that your portfolio matches your individual goals and tolerance for risk.

We would like to extend a welcome to new shareholders of the fund and to thank all of our investors for your continued confidence in Putnam.

About the fund

Seeking to offer accessibility and current income with relatively low risk

For most people, keeping part of their savings in an easily accessible place is an essential part of an investment plan. Putnam Money Market Fund can play a valuable role in many investors’ portfolios because it seeks to provide stability of principal and liquidity to meet short-term needs. In addition, the fund aims to provide investors with current income at short-term rates.

Because it invests in high-quality short-term money market instruments, the fund’s risk of losing principal may be lower than that of other funds. It typically invests in securities that are rated in the highest or second-highest category of at least one nationally recognized rating service. The fund seeks as high a rate of current income as Putnam Management believes is consistent with preservation of capital and maintenance of liquidity. Money market fund yields typically rise and fall along with short-term interest rates. Money market funds may not track rates exactly, however, as securities in these funds mature and are replaced with newer instruments earning the most current interest rates.

Whether you want to earmark money for near-term expenses or future investment opportunities, or just stow away cash for a “rainy day,” this fund can be an appropriate choice.

Types of money market securities

Money market securities are issued by governments, government agencies, financial institutions, and established non-financial companies. Securities your fund invests in include:

Commercial paper Short-term unsecured loans issued by large corporations, typically for financing accounts receivable and inventories

Bank certificates of deposit Direct obligations of the issuing commercial bank or savings and loan association

Repurchase agreements (repos) Contracts in which one party sells a security to another party and agrees to buy it back later at a specified price; acts in economic terms as a secured loan

Government securities Direct short-term obligations of governments or government agencies; for example, U.S. Treasury bills

Variable-rate demand notes (VRDNs) Floating-rate securities with a long-term maturity, usually 20 or 30 years, that carry a coupon that resets every one or seven days, making them eligible for purchase by money market mutual funds

| 2 | Money Market Fund | Money Market Fund | 3 |

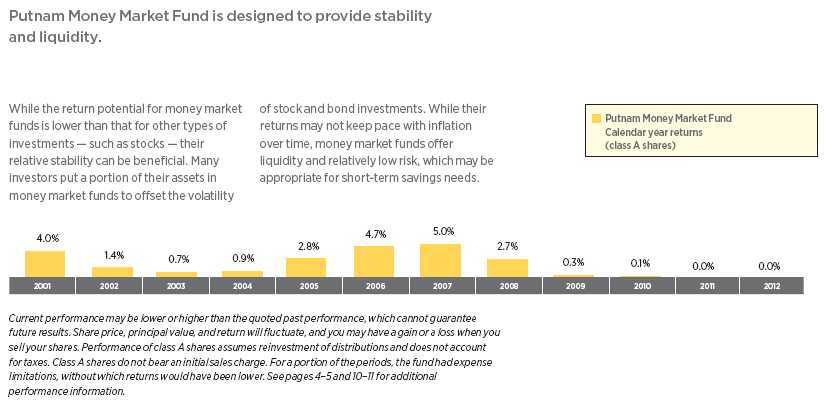

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Class A shares do not bear an initial sales charge. For a portion of the periods, the fund had expense limitations, without which returns would have been lower. Yield reflects current performance more closely than total return. Due to market volatility, current performance may be higher or lower than performance shown. See pages 2–3, 5, and 10–11 for additional performance information. To obtain the most recent month-end performance, visit putnam.com.

* Returns for the six-month period are not annualized, but cumulative.

| 4 | Money Market Fund |

Interview with your fund’s portfolio managers

How would you characterize the market environment for the six months ended March 31, 2013?

Joanne: The financial markets saw broad improvement, as fears waned over the prospect of the eurozone’s demise and economic data suggested that China’s economy was beginning to reaccelerate. U.S. economic growth, bolstered by a recovering housing market, continued to show more strength, and corporations posted healthy profits. Japan also experienced a jolt of new life this past December in the wake of national elections and the installation of new political leadership, which raised hopes that an area marked by protracted economic and market weakness would see improvement. Economic weakness in Latin America, most notably in Brazil, and the Cyprus banking crisis did cause some unease in the final months of the reporting period, but investors were decidedly in a more upbeat mood.

How did Putnam Money Market Fund perform in this environment?

Jonathan: With the Federal Reserve’s efforts to stimulate economic growth by holding the benchmark federal funds rate near zero percent, where it has remained since December 2008, there was limited volatility across the money market sectors. Thus, Putnam Money Market Fund delivered performance that was generally in line with this interest-rate environment and the average

This comparison shows your fund’s performance in the context of broad market indexes for the six months ended 3/31/13. See pages 2–4 and 10–11 for additional fund performance information. Index descriptions can be found on pages 14–15.

| Money Market Fund | 5 |

return for its Lipper peer group for the six months ended March 31, 2013. At period-end, the fund’s weighted average days to maturity stood at 43 days.

Could you bring us up to date with regard to the Securities and Exchange Commission’s [SEC’s] efforts to improve the functioning of the money markets?

Joanne: The SEC strongly believes that retail and institutional money market funds still remain a concern with regard to the stability of the financial system. Regulators feel that the amendments to Rule 2a-7 under the Investment Company Act of 1940 that were implemented three years ago did not go far enough to avoid major market disruptions, such as we saw in September 2008, when the value of the Reserve Primary Fund’s shares fell below $1.00 and precipitated a surge in money market redemptions.

Last year, the SEC laid out three proposals to further reform the money market sector. They included imposing a floating net asset value [NAV] on money market funds, meaning that funds would no longer rely upon amortized cost pricing and would convert to a mark-to-market model as used in other mutual funds. The second proposal would require money market funds to maintain a capital buffer, which would be funded either by the fund’s advisor injecting capital into a fund or the fund withholding earnings from investors to build a cushion over time. The third proposal would require funds to hold back a stated percentage of any redemption being made, which would be returned after a period of time.

These proposals were tabled in August 2012 as the SEC did not have the necessary votes to pass the measures. In addition to being expensive and difficult to implement, there was some debate as to whether these

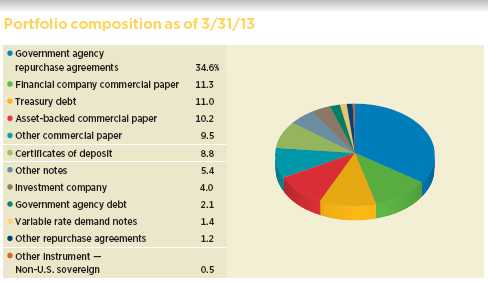

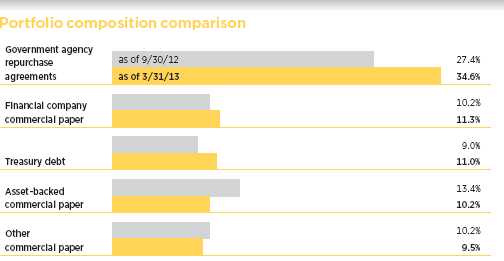

Allocations are represented as a percentage of portfolio market value. Cash and net other assets, if any, represent the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities, any interest accruals, the exclusion of as-of trades, if any, and the use of different classifications of securities for presentation purposes. Holdings and allocations may vary over time.

| 6 | Money Market Fund |

solutions would adequately reduce the propensity of institutional money market fund investors to withdraw their investments in a financial crisis. Subsequently, as a result of the Dodd-Frank Financial Reform Act, the Financial Stability Oversight Council [FSOC] was created in part to recommend financial reforms and encourage the SEC to propose and/or adopt such reforms. Another option that was recently introduced by regulators would impose redemption fees at times of market stress to limit shareholder redemptions. At some point this year, new regulations — initiated by either the SEC or FSOC — may be enacted. We’ll continue to closely monitor developments and their impact on our shareholders.

What was your strategy to capture income in such a low-rate environment?

Jonathan: The fund’s overall strategy remains focused on pursuing stability and liquidity by investing in commercial paper, repurchase agreements, and U.S. Treasury securities. We continue to feel positive about several issuers and selectively added to the fund’s credit exposure by investing in corporate notes issued by entities in Canada, Australia, Japan, and the more economically viable Nordic countries in northern Europe. In addition, we increased the fund’s exposure to repurchase agreements collateralized by U.S. government agency mortgage-backed securities. The repurchase agreements we enter into are typically executed with what we believe are high-quality counterparties and are collateralized by agency mortgage-backed

This chart shows how the fund’s top weightings have changed over the past six months. Allocations are represented as a percentage of the fund’s portfolio market value. Cash and net other assets, if any, represent the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. Current period summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities, any interest accruals, the exclusion of as-of trades, if any, and the use of different classifications of securities for presentation purposes. Holdings and allocations may vary over time.

| Money Market Fund | 7 |

securities and investment-grade corporate bonds. These agreements offered attractive yields during the period due to increased supply and the Fed’s “Operation Twist,” a large-scale fixed-income asset purchase program designed to keep downward pressure on longer-term interest rates to provide economic stimulus. While Operation Twist has ended, rates offered by repurchase agreements have remained competitive, as the supply of available collateral increased in advance of tax receipts. As always, we will be diligent in our fundamental credit research process in an effort to avoid exposure to securities that might pose a risk to the fund.

Which fund holdings exemplified your strategy during the period?

Joanne: We think that the underlying bank fundamentals continue to improve and, accordingly, have invested in what we believe are large, creditworthy banks, such as JPMorgan Chase Bank, National Australia Bank, and Toronto-Dominion Bank. We believe asset-quality measures are showing improving trends and profits are being retained to help build capital. In our opinion, these positive developments are somewhat offset by the banks’ underlying revenue weakness with soft loan demand, pressured interest margins, and ongoing regulatory pressure on fee business. Given the ongoing sovereign debt stress in Europe, we have limited the fund’s exposure to the eurozone.

We also purchased commercial paper issued by Toyota Motor Credit Corp., which operates across the consumer finance, dealer finance, commercial finance, and insurance markets. Toyota is benefiting from the continued recovery in industrywide vehicle sales across the United States as well as from favorable new product launches and the continued inventory restocking related to previous disruptions in supply chains from the tsunami-earthquake natural disaster in 2011.

We continue to find attractive opportunities in the first-tier corporate and asset-backed commercial paper [ABCP] market. The ABCP issuers that we consider safe and appropriate investments for the fund must be backed by diverse, high-quality financial assets, such as trade receivables, commercial loans, auto loans, mortgage loans, and other asset types. These issuers must maintain ample third-party structural support and have strong management and sponsorship. Thunder Bay Funding and Jupiter Securitization exemplify our strategy in this sector.

Are U.S. interest rates likely to remain “range-bound”?

Jonathan: In our opinion, it appears likely that short-term interest rates will remain in a range for the near future until we see evidence of a shift in Fed monetary policy. In September 2012, the Federal Reserve launched “QE3,” a bond-buying program authorized to purchase up to $40 billion of agency mortgage-backed securities per month. Not long after, in December, the Fed replaced the expiring “Operation Twist” with an additional unlimited round of easing, targeting up to $45 billion worth of intermediate- and longer-term Treasuries per month — with no apparent intent of stopping so long as inflation remains below 2.5% and unemployment stays above 6.5%. These kinds of explicit targets are rare coming from the Fed and, we believe, provide some welcome insight as to when the Fed is likely to begin shifting to a more neutral monetary stance. With the March 2012 unemployment rate at 7.6%, we believe a near-term change in monetary policy by the Fed is unlikely.

Given the challenges of a low-interest-rate environment, we will continue to maintain the fund’s conservative positioning with a bias toward safety and liquidity as we search for income further out on the money market yield curve.

| 8 | Money Market Fund |

Thank you, Joanne and Jonathan, for bringing us up to date.

The views expressed in this report are exclusively those of Putnam Management and are subject to change. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

Portfolio Manager Joanne M. Driscoll has an M.B.A. from the Northeastern College of Business Administration and a B.S. from Westfield State College. A CFA charterholder, Joanne joined Putnam in 1995 and has been in the investment industry since 1992.

Portfolio Manager Jonathan M. Topper has a B.A. from Northeastern University. He has been in the investment industry since he joined Putnam in 1990.

IN THE NEWS

The economic outlook for major industrialized nations is slowly improving, with the United States and Japan leading the way, according to a recent report by the Organisation for Economic Co-operation and Development (OECD). Economic expansion is also taking place in most major countries around the world, including the 17-nation eurozone, where Germany’s economy is growing and stabilization is occurring in Italy and France. Growth also is solidifying in Japan, whose new government has launched efforts to bring the country’s long-stagnant economy back to life through various stimulus efforts, and growth is picking up in China, where an economic hard landing has been avoided. The OECD sees growth weakening in India and normal, “around trend” growth taking place in Russia, Brazil, and the United Kingdom. Meanwhile, the World Trade Organization (WTO) has cut its overall 2013 forecast for global trade volume growth to 3.3% from 4.5%. Global trade grew by 2% in 2012, the second-worst figure since this economic statistic began to be tracked in 1981, according to the WTO. The worst trade figure came in 2009 during the global economic crisis.

| Money Market Fund | 9 |

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended March 31, 2013, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R shares are not available to all investors. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 3/31/13

| Class A | Class B | Class C | Class M | Class R | Class T | |||

| (inception dates) | (10/1/76) | (4/27/92) | (2/1/99) | (12/8/94) | (1/21/03) | (12/31/01) | ||

| Net | Net | Net | Net | |||||

| asset | Before | After | Before | After | asset | asset | asset | |

| value | CDSC | CDSC | CDSC | CDSC | value | value | value | |

| Annual average | ||||||||

| (life of fund) | 5.38% | 4.91% | 4.91% | 4.91% | 4.91% | 5.24% | 4.90% | 5.14% |

| 10 years | 18.13 | 14.57 | 14.57 | 14.57 | 14.57 | 17.02 | 14.77 | 16.30 |

| Annual average | 1.68 | 1.37 | 1.37 | 1.37 | 1.37 | 1.58 | 1.39 | 1.52 |

| 5 years | 2.13 | 1.56 | –0.44 | 1.56 | 1.56 | 1.94 | 1.56 | 1.82 |

| Annual average | 0.42 | 0.31 | –0.09 | 0.31 | 0.31 | 0.38 | 0.31 | 0.36 |

| 3 years | 0.06 | 0.06 | –2.94 | 0.06 | 0.06 | 0.06 | 0.06 | 0.06 |

| Annual average | 0.02 | 0.02 | –0.99 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 |

| 1 year | 0.01 | 0.01 | –4.99 | 0.01 | –0.99 | 0.01 | 0.01 | 0.01 |

| 6 months | 0.00 | 0.00 | –5.00 | 0.00 | –1.00 | 0.00 | 0.00 | 0.00 |

| Net | Net | Net | Net | |||||

| Current yield | asset | Before | After | Before | After | asset | asset | asset |

| (end of period)* | value | CDSC | CDSC | CDSC | CDSC | value | value | value |

| Current 7-day yield | ||||||||

| (with expense limitation) | 0.01% | 0.01% | — | 0.01% | — | 0.01% | 0.01% | 0.01% |

| Current 7-day yield | ||||||||

| (without expense limitation) | –0.34 | –0.84 | — | –0.83 | — | –0.48 | –0.83 | –0.58 |

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. None of the share classes carry an initial sales charge. Class B share returns reflect the applicable contingent deferred sales charge (CDSC), which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C share returns reflect a 1% CDSC for the first year that is eliminated thereafter. Class A, M, R, and T shares generally have no CDSC. Performance for class B, C, M, R, and T shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and the higher operating expenses for such shares.

* The 7-day yield is the most common gauge for measuring money market mutual fund performance. Yield reflects current performance more closely than total return.

For a portion of the periods, the fund had expense limitations, without which returns and yields would have been lower.

Class B share performance does not reflect conversion to class A shares.

| 10 | Money Market Fund |

Comparative Lipper returns For periods ended 3/31/13

| Lipper Money Market Funds | |

| category average* | |

| Annual average (life of fund) | 5.43% |

| 10 years | 15.29 |

| Annual average | 1.43 |

| 5 years | 1.58 |

| Annual average | 0.31 |

| 3 years | 0.06 |

| Annual average | 0.02 |

| 1 year | 0.02 |

| 6 months | 0.01 |

Lipper results should be compared to fund performance at net asset value.

* Over the 6-month, 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 3/31/13, there were 238, 236, 221, 214, 180 and 13 funds, respectively, in this Lipper category.

Fund distribution information For the six-month period ended 3/31/13

| Distributions | Class A | Class B | Class C | Class M | Class R | Class T |

| Number | 6 | 6 | 6 | 6 | 6 | 6 |

| Income | $0.000050 | $0.000050 | $0.000050 | $0.000050 | $0.000050 | $0.000050 |

| Capital gains | — | — | — | — | — | — |

| Total | $0.000050 | $0.000050 | $0.000050 | $0.000050 | $0.000050 | $0.000050 |

The classification of distributions, if any, is an estimate. Final distribution information will appear on your year-end tax forms.

| Money Market Fund | 11 |

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. In the most recent six-month period, your fund’s expenses were limited; had expenses not been limited, they would have been higher. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| Class A | Class B | Class C | Class M | Class R | Class T | |

| Total annual operating expenses | ||||||

| for the fiscal year ended 9/30/12 | 0.52% | 1.02% | 1.02% | 0.67% | 1.02% | 0.77% |

| Annualized expense ratio for | ||||||

| the six-month period ended | ||||||

| 3/31/13* | 0.22% | 0.22% | 0.22% | 0.22% | 0.22% | 0.22% |

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report. Expenses are shown as a percentage of average net assets.

* Reflects a voluntary waiver of certain fund expenses.

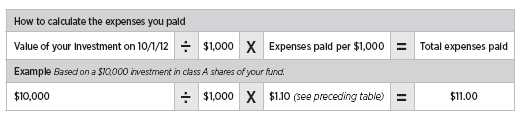

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in the fund from October 1, 2012, to March 31, 2013. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| Class A | Class B | Class C | Class M | Class R | Class T | |

| Expenses paid per $1,000*† | $1.10 | $1.10 | $1.10 | $1.10 | $1.10 | $1.10 |

| Ending value (after expenses) | $1,000.05 | $1,000.05 | $1,000.05 | $1,000.05 | $1,000.05 | $1,000.05 |

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 3/31/13. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

| 12 | Money Market Fund |

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended March 31, 2013, use the following calculation method. To find the value of your investment on October 1, 2012, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| Class A | Class B | Class C | Class M | Class R | Class T | |

| Expenses paid per $1,000*† | $1.11 | $1.11 | $1.11 | $1.11 | $1.11 | $1.11 |

| Ending value (after expenses) | $1,023.83 | $1,023.83 | $1,023.83 | $1,023.83 | $1,023.83 | $1,023.83 |

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 3/31/13. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

| Money Market Fund | 13 |

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the price, or value, of one share of a mutual fund, without a sales charge. Net asset values fluctuate with market conditions, and are calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines over time from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Current yield is the annual rate of return earned from dividends or interest of an investment. Current yield is expressed as a percentage of the price of a security, fund share, or principal investment.

Share classes

Class A shares generally are fund shares purchased with an initial sales charge. In the case of your fund, which has no sales charge, the reference is to shares purchased or acquired through the exchange of class A shares from another Putnam fund. Exchange of your fund’s class A shares into another fund may involve a sales charge, however.

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares generally are fund shares that have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC. In the case of your fund, which has no sales charge, the reference is to shares purchased or acquired through the exchange of class M shares from another Putnam fund. Exchange of your fund’s class M shares into another fund may involve a sales charge, however.

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class T shares are not subject to an initial sales charge or CDSC (except on certain redemptions of shares acquired by exchange of shares of another Putnam fund bought without an initial sales charge); however, they are subject to a 12b-1 fee.

Comparative indexes

Barclays U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

BofA (Bank of America) Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

Lipper Money Market Funds category average is an arithmetic average of the total return of all money market mutual funds tracked by Lipper.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

| 14 | Money Market Fund |

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with Securities and Exchange Commission (SEC) regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2012, are available in the Individual Investors section of putnam.com, and on the SEC’s website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s website at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s website or the operation of the Public Reference Room.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of March 31, 2013, Putnam employees had approximately $377,000,000 and the Trustees had approximately $90,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

| Money Market Fund | 15 |

Financial statements

A guide to financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

| 16 | Money Market Fund |

The fund’s portfolio 3/31/13 (Unaudited)

| Principal | ||

| REPURCHASE AGREEMENTS (35.9%)* | amount | Value |

| Interest in $336,500,000 joint tri-party repurchase agreement dated | ||

| 3/28/13 with Citigroup Global Markets, Inc. due 4/1/13 — maturity value | ||

| of $92,042,148 for an effective yield of 0.21% (collateralized by various | ||

| mortgage backed securities with coupon rates ranging from 1.745% to 6.00% | ||

| and due dates ranging from 1/1/18 to 3/1/43, valued at $343,230,000) | $92,040,000 | $92,040,000 |

| Interest in $315,000,000 joint tri-party term repurchase agreement dated | ||

| 3/27/13 with Citigroup Global Markets, Inc. due 4/3/13 — maturity value | ||

| of $29,000,564 for an effective yield of 0.10% (collateralized by various | ||

| mortgage backed securities with coupon rates ranging from 2.779% to 4.50% | ||

| and due dates ranging from 12/1/20 to 2/1/43, valued at $321,612,966) | 29,000,000 | 29,000,000 |

| Interest in $77,700,000 joint tri-party repurchase agreement dated | ||

| 3/28/13 with Credit Suisse Securities (USA), LLC due 4/1/13 — maturity | ||

| value of $17,925,518 for an effective yield of 0.26% (collateralized by various | ||

| mortgage backed securities, foreign government bonds and notes and | ||

| corporate bonds and notes with coupon rates ranging from 0.631% | ||

| to 11.375% and due dates ranging from 3/7/14 to 12/15/47, valued | ||

| at $81,261,284) | 17,925,000 | 17,925,000 |

| Interest in $110,000,000 joint tri-party repurchase agreement dated | ||

| 3/28/13 with Deutsche Bank Securities, Inc. due 4/1/13 — maturity value of | ||

| $96,232,673 for an effective yield of 0.25% (collateralized by a U.S. Treasury | ||

| Bond with a coupon rate of 4.50% and a due date of 5/15/38, valued | ||

| at $112,200,100) | 96,230,000 | 96,230,000 |

| Interest in $33,000,000 joint tri-party term repurchase agreement dated | ||

| 3/26/13 with Deutsche Bank Securities, Inc. due 4/2/13 — maturity value | ||

| of $29,000,733 for an effective yield of 0.13% (collateralized by various | ||

| mortgage backed securities with coupon rates ranging from 2.11% to 6.50% | ||

| and due dates ranging from 3/1/20 to 9/1/42, valued at $33,660,000) | 29,000,000 | 29,000,000 |

| Interest in $175,000,000 joint tri-party repurchase agreement dated | ||

| 3/28/13 with Goldman Sach & Co. due 4/1/13 — maturity value of | ||

| $92,042,148 for an effective yield of 0.21% (collateralized by various | ||

| mortgage backed securities with coupon rates ranging from 2.263% to 7.00% | ||

| and due dates ranging from 6/1/19 to 4/1/43, valued at $178,500,000) | 92,040,000 | 92,040,000 |

| Interest in $461,568,000 joint tri-party repurchase agreement dated | ||

| 3/28/13 with RBC Capital Markets, LLC due 4/1/13 — maturity value | ||

| of $92,043,250 for an effective yield of 0.22% (collateralized by various | ||

| mortgage backed securities with coupon rates ranging from 3.50% to 4.00% | ||

| and due dates ranging from 1/1/42 to 5/1/42, valued at $470,802,237) | 92,041,000 | 92,041,000 |

| Interest in $100,000,000 joint tri-party term repurchase agreement dated | ||

| 3/28/13 with JPMorgan Securities, Inc. due 4/4/13 — maturity value | ||

| of $29,000,733 for an effective yield of 0.13% (collateralized by various | ||

| mortgage backed securities with coupon rates ranging from 3.00% to 4.00% | ||

| and due dates ranging from 2/1/27 to 1/1/43, valued at $102,000,786) | 29,000,000 | 29,000,000 |

| Interest in $47,845,000 joint tri-party term repurchase agreement dated | ||

| 3/7/13 with Merrill Lynch & Co., Inc. due 6/5/13 — maturity value of | ||

| $14,406,840 for an effective yield of 0.19% (collateralized by various | ||

| U.S. Treasury Notes with a coupon rate of 0.25% and due dates ranging from | ||

| 12/15/14 to 2/15/15, valued at $48,802,795) | 14,400,000 | 14,400,000 |

| Interest in $29,000,000 tri-party term repurchase agreement dated | ||

| 3/27/12 with Barclays Capital, Inc. due 4/3/13 — maturity value of | ||

| $29,000,508 for an effective yield of 0.09% (collateralized by various | ||

| mortgage backed securities with coupon rates ranging from 2.50% to 5.50% | ||

| and due dates ranging from 2/1/21 to 12/1/42, valued at $29,580,000) | 29,000,000 | 29,000,000 |

| Total repurchase agreements (cost $520,676,000) | $520,676,000 | |

| Money Market Fund | 17 |

| Maturity | Principal | |||

| COMMERCIAL PAPER (18.2%)* | Yield (%) | date | amount | Value |

| Australia & New Zealand Banking Group, | ||||

| Ltd. (Australia) | 0.210 | 4/15/13 | $12,000,000 | $11,999,020 |

| Bank of Nova Scotia (Canada) | 0.230 | 9/9/13 | 16,000,000 | 15,983,542 |

| Barclays Bank PLC 144A, Ser. 10-1 (United Kingdom) | 0.170 | 4/18/13 | 7,500,000 | 7,499,398 |

| Canada (Government of) (Canada) | 0.170 | 10/9/13 | 7,350,000 | 7,343,371 |

| COFCO Capital Corp. (Rabobank Nederland, | ||||

| NY Branch (LOC)) | 0.320 | 4/5/13 | 14,500,000 | 14,499,484 |

| Commonwealth Bank of Australia 144A (Australia) | 0.260 | 6/17/13 | 12,550,000 | 12,543,021 |

| DnB Bank ASA (Norway) | 0.285 | 7/8/13 | 13,100,000 | 13,089,837 |

| DnB Bank ASA 144A (Norway) | 0.270 | 8/7/13 | 9,000,000 | 8,991,360 |

| Export Development Canada (Canada) | 0.200 | 4/23/13 | 6,700,000 | 6,699,181 |

| General Electric Capital Corp. | 0.230 | 7/22/13 | 17,300,000 | 17,287,621 |

| HSBC USA, Inc. (United Kingdom) | 0.601 | 4/4/13 | 4,700,000 | 4,699,883 |

| HSBC USA, Inc. (United Kingdom) | 0.371 | 8/16/13 | 9,175,000 | 9,162,081 |

| HSBC USA, Inc. (United Kingdom) | 0.290 | 7/10/13 | 5,155,000 | 5,150,847 |

| ICICI Bank, Ltd./Hong Kong (Hong Kong) | 0.321 | 7/23/13 | 14,725,000 | 14,710,210 |

| Nordea North America Inc./DE (Sweden) | 0.250 | 6/10/13 | 2,200,000 | 2,198,931 |

| Roche Holdings, Inc. (Switzerland) | 0.125 | 5/15/13 | 14,600,000 | 14,597,769 |

| Roche Holdings, Inc. (Switzerland) | 0.120 | 5/13/13 | 7,500,000 | 7,498,950 |

| Royal Bank of Scotland Holdings (USA), Inc. | 0.130 | 4/10/13 | 7,300,000 | 7,299,763 |

| Standard Chartered Bank/New York | 0.260 | 7/1/13 | 5,350,000 | 5,346,484 |

| Standard Chartered Bank/New York 144A | 0.290 | 4/9/13 | 9,250,000 | 9,249,404 |

| State Street Corp. | 0.200 | 8/8/13 | 14,000,000 | 13,989,967 |

| Sumitomo Mitsui Banking Corp. (Japan) | 0.260 | 4/9/13 | 2,250,000 | 2,249,870 |

| Sumitomo Mitsui Banking Corp. (Japan) | 0.240 | 4/11/13 | 6,900,000 | 6,899,540 |

| Toyota Credit Canada, Inc. (Canada) | 0.220 | 5/14/13 | 6,925,000 | 6,923,180 |

| Toyota Motor Credit Corp. | 0.230 | 5/29/13 | 7,000,000 | 6,997,406 |

| Toyota Motor Credit Corp. | 0.210 | 5/16/13 | 8,175,000 | 8,172,854 |

| Wal-Mart Stores, Inc. | 0.110 | 4/29/13 | 10,500,000 | 10,499,102 |

| Westpac Banking Corp. 144A (Australia) | 0.591 | 8/12/13 | 12,400,000 | 12,386,486 |

| Total commercial paper (cost $263,968,562) | $263,968,562 | |||

| Maturity | Principal | |||

| U.S. TREASURY OBLIGATIONS (11.0%)* | Yield (%) | date | amount | Value |

| U.S. Treasury Bills | 0.147 | 1/9/14 | $18,100,000 | $18,078,657 |

| U.S. Treasury Bills | 0.147 | 5/2/13 | 15,000,000 | 14,998,024 |

| U.S. Treasury Bills | 0.139 | 4/4/13 | 35,000,000 | 34,999,592 |

| U.S. Treasury Bills | 0.129 | 8/22/13 | 7,300,000 | 7,296,230 |

| U.S. Treasury Bills | 0.119 | 7/25/13 | 15,650,000 | 15,644,001 |

| U.S. Treasury Bills | 0.109 | 7/5/13 | 18,100,000 | 18,094,746 |

| U.S. Treasury Notes k | 3.500 | 5/31/13 | 16,000,000 | 16,087,277 |

| U.S. Treasury Notes k | 0.625 | 4/30/13 | 34,250,000 | 34,262,640 |

| Total U.S. treasury obligations (cost $159,461,167) | $159,461,167 | |||

| 18 | Money Market Fund |

| Maturity | Principal | |||

| ASSET-BACKED COMMERCIAL PAPER (10.2%)* | Yield (%) | date | amount | Value |

| Alpine Securitization Corp. (Switzerland) | 0.160 | 4/17/13 | $7,250,000 | $7,249,484 |

| Chariot Funding, LLC | 0.180 | 6/20/13 | 14,250,000 | 14,244,300 |

| Chariot Funding, LLC | 0.180 | 5/6/13 | 7,610,000 | 7,608,668 |

| Fairway Finance, LLC (Canada) | 0.200 | 4/10/13 | 6,800,000 | 6,799,660 |

| Fairway Finance, LLC 144A (Canada) | 0.000 | 4/9/13 | 6,300,000 | 6,300,000 |

| Gotham Funding Corp. (Japan) | 0.200 | 6/14/13 | 7,550,000 | 7,546,896 |

| Gotham Funding Corp. (Japan) | 0.200 | 4/15/13 | 14,100,000 | 14,098,903 |

| Jupiter Securitization Co., LLC | 0.180 | 6/6/13 | 4,750,000 | 4,748,433 |

| Jupiter Securitization Co., LLC | 0.180 | 5/28/13 | 17,000,000 | 16,995,155 |

| Manhattan Asset Funding Co., LLC (Japan) | 0.200 | 5/16/13 | 5,400,000 | 5,398,650 |

| Old Line Funding, LLC | 0.190 | 4/9/13 | 2,400,000 | 2,399,899 |

| Old Line Funding, LLC | 0.180 | 4/22/13 | 4,300,000 | 4,299,549 |

| Straight-A Funding, LLC 144A, Ser. 1 | 0.190 | 4/17/13 | 16,250,000 | 16,248,628 |

| Straight-A Funding, LLC 144A, Ser. 1 | 0.190 | 4/9/13 | 4,600,000 | 4,599,806 |

| Thunder Bay Funding, LLC | 0.200 | 4/18/13 | 1,370,000 | 1,369,871 |

| Thunder Bay Funding, LLC | 0.190 | 4/23/13 | 5,600,000 | 5,599,350 |

| Thunder Bay Funding, LLC | 0.150 | 4/25/13 | 7,500,000 | 7,499,250 |

| Thunder Bay Funding, LLC 144A | 0.190 | 4/19/13 | 7,500,000 | 7,499,288 |

| Working Capital Management Co. (Japan) | 0.210 | 4/16/13 | 7,444,000 | 7,443,349 |

| Total asset-backed commercial paper (cost $147,949,139) | $147,949,139 | |||

| Interest | Maturity | Principal | ||

| CERTIFICATES OF DEPOSIT (8.8%)* | rate (%) | date | amount | Value |

| Bank of America, NA, Ser. GLOB | 0.200 | 4/22/13 | $7,500,000 | $7,500,000 |

| Bank of Montreal/Chicago, IL FRN (Canada) | 0.424 | 6/21/13 | 9,250,000 | 9,250,000 |

| Bank of Nova Scotia/Houston FRN | 0.630 | 9/17/13 | 5,500,000 | 5,508,182 |

| Canadian Imperial Bank of Commerce/New York, | ||||

| NY FRN (Canada) | 0.321 | 4/26/13 | 15,000,000 | 15,000,000 |

| Citibank, NA | 0.180 | 4/9/13 | 7,350,000 | 7,350,000 |

| JPMorgan Chase Bank | 0.250 | 9/18/13 | 6,360,000 | 6,360,000 |

| National Australia Bank, Ltd. (Australia) | 0.258 | 5/20/13 | 14,200,000 | 14,200,000 |

| National Australia Bank, Ltd./New York | ||||

| FRN (Australia) | 0.382 | 4/24/13 | 8,350,000 | 8,350,000 |

| Nordea Bank Finland PLC/New York | 0.250 | 9/12/13 | 19,525,000 | 19,525,000 |

| Svenska Handelsbanken/New York, NY (Sweden) | 0.255 | 7/15/13 | 14,750,000 | 14,751,502 |

| Toronto-Dominion Bank/NY (Canada) | 0.305 | 7/19/13 | 8,000,000 | 8,001,813 |

| Toronto-Dominion Bank/NY FRN (Canada) | 0.302 | 10/21/13 | 12,500,000 | 12,500,000 |

| Total certificates of deposit (cost $128,296,497) | $128,296,497 | |||

| Interest | Maturity | Principal | ||

| CORPORATE BONDS AND NOTES (5.4%)* | rate (%) | date | amount | Value |

| Australia & New Zealand Banking Group, Ltd. 144A sr. | ||||

| unsec. notes FRN (Australia) | 0.343 | 4/12/13 | $10,520,000 | $10,520,916 |

| HSBC Bank PLC 144A sr. unsec. notes | ||||

| (United Kingdom) | 1.625 | 8/12/13 | 3,490,000 | 3,506,458 |

| JPMorgan Chase & Co. sr. unsec. notes | 4.750 | 5/1/13 | 15,800,000 | 15,858,508 |

| Royal Bank of Canada 144A sr. unsec. notes | ||||

| FRN (Canada) M | 0.683 | 5/15/14 | 29,425,000 | 29,425,100 |

| Money Market Fund | 19 |

| Interest | Maturity | Principal | ||

| CORPORATE BONDS AND NOTES (5.4%)* cont. | rate (%) | date | amount | Value |

| Toronto-Dominion Bank (The) sr. unsec. notes FRN | ||||

| Ser. MTN (Canada) | 0.481 | 7/26/13 | $1,700,000 | $1,701,250 |

| Wachovia Corp. sr. unsec. notes MTN, Ser. G | 5.700 | 8/1/13 | 3,803,000 | 3,870,998 |

| Wachovia Corp. sr. unsec. notes MTN, Ser. G | 5.500 | 5/1/13 | 3,700,000 | 3,715,831 |

| Westpac Banking Corp. 144A sr. unsec. notes | ||||

| FRN (Australia) | 0.701 | 6/14/13 | 10,000,000 | 10,006,884 |

| Total corporate bonds and notes (cost $78,605,945) | $78,605,945 | |||

| Maturity | Principal | |||

| MUNICIPAL BONDS AND NOTES (4.4%)* | Yield (%) | date | amount | Value |

| American University Commercial | ||||

| Paper, Ser. A | 0.170 | 6/10/13 | $8,000,000 | $7,997,356 |

| Catholic Health Initiatives Commercial | ||||

| Paper, Ser. A | 0.160 | 5/21/13 | 4,000,000 | 3,999,111 |

| Duke University Commercial | ||||

| Paper, Ser. B-98 | 0.170 | 6/13/13 | 12,675,000 | 12,670,631 |

| Harris County, Health Facilities | ||||

| Development Authority VRDN (Texas | ||||

| Childrens Hospital), Ser. B-1 M | 0.120 | 10/1/29 | 3,665,000 | 3,665,000 |

| Johns Hopkins University Commercial | ||||

| Paper, Ser. C | 0.170 | 6/25/13 | 5,000,000 | 5,000,000 |

| Johns Hopkins University Commercial | ||||

| Paper, Ser. C | 0.170 | 6/19/13 | 5,290,000 | 5,290,000 |

| Kentucky State Economic Development | ||||

| Finance Authority VRDN (Catholic Health | ||||

| Initiatives), Ser. C M | 0.110 | 5/1/34 | 11,000,000 | 11,000,000 |

| Trinity Health Corporation | ||||

| Commercial Paper | 0.160 | 4/2/13 | 9,100,000 | 9,099,960 |

| Wake County, VRDN, Ser. B M | 0.130 | 3/1/24 | 1,500,000 | 1,500,000 |

| Wisconsin State Health & Educational | ||||

| Facilities Authority VRDN (Wheaton | ||||

| Franciscan Services), Ser. B (U.S. Bank, | ||||

| NA (LOC)) M | 0.110 | 8/15/33 | 4,100,000 | 4,100,000 |

| Total municipal bonds and notes (cost $64,322,058) | $64,322,058 | |||

| SHORT-TERM INVESTMENT FUND (4.0%)* | Shares | Value |

| Putnam Money Market Liquidity Fund 0.12% L | 58,000,000 | $58,000,000 |

| Total short-term investment fund (cost $58,000,000) | $58,000,000 | |

| Interest | Maturity | Principal | ||

| U.S. GOVERNMENT AGENCY OBLIGATIONS (2.1%)* | rate (%) | date | amount | Value |

| Federal Home Loan Bank sr. unsec. notes | 0.170 | 9/20/13 | $14,900,000 | $14,899,649 |

| Federal Home Loan Bank unsec. notes | 0.400 | 7/9/13 | 7,000,000 | 7,004,733 |

| Federal National Mortgage Association unsec. notes | 0.500 | 8/9/13 | 9,000,000 | 9,010,994 |

| Total U.S. government agency obligations (cost $30,915,376) | $30,915,376 | |||

| TOTAL INVESTMENTS | ||||

| Total investments (cost $1,452,194,744) | $1,452,194,744 | |||

| 20 | Money Market Fund |

Key to holding’s abbreviations

FRN Floating Rate Notes: the rate shown is the current interest rate at the close of the reporting period

LOC Letter of Credit

MTN Medium Term Notes

VRDN Variable Rate Demand Notes, which are floating-rate securities with long-term maturities, that carry coupons that reset every one or seven days. The rate shown is the current interest rate at the close of the reporting period.

Notes to the fund’s portfolio

Unless noted otherwise, the notes to the fund’s portfolio are for the close of the fund’s reporting period, which ran from October 1, 2012 through March 31, 2013 (the reporting period). Within the following notes to the portfolio, references to “ASC 820” represent Accounting Standards Codification ASC 820 Fair Value Measurements and Disclosures and references to “OTC”, if any, represent over-the-counter.

* Percentages indicated are based on net assets of $1,450,185,774.

k The rates shown are the current interest rates at the close of the reporting period.

L Affiliated company (Note 5). The rate quoted in the security description is the annualized 7-day yield of the fund at the close of the reporting period.

M The security’s effective maturity date is less than one year.

Debt obligations are considered secured unless otherwise indicated.

144A after the name of an issuer represents securities exempt from registration under Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

The dates shown on debt obligations are the original maturity dates.

| DIVERSIFICATION BY COUNTRY |

Distribution of investments by country of risk at the close of the reporting period, excluding collateral received, if any (as a percentage of Portfolio Value):

| United States | 75.0% | Switzerland | 2.0% | |

| Canada | 8.7 | Norway | 1.5 | |

| Australia | 5.5 | Sweden | 1.2 | |

| Japan | 3.0 | Hong Kong | 1.0 | |

| United Kingdom | 2.1 | Total | 100.0% | |

| Money Market Fund | 21 |

ASC 820 establishes a three-level hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of the fund’s investments. The three levels are defined as follows:

Level 1: Valuations based on quoted prices for identical securities in active markets.

Level 2: Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

Level 3: Valuations based on inputs that are unobservable and significant to the fair value measurement.

The following is a summary of the inputs used to value the fund’s net assets as of the close of the reporting period:

| Valuation inputs | ||||

| Investments in securities: | Level 1 | Level 2 | Level 3 | |

| Asset-backed commercial paper | $— | $147,949,139 | $— | |

| Certificates of deposit | — | 128,296,497 | — | |

| Commercial paper | — | 263,968,562 | — | |

| Corporate bonds and notes | — | 78,605,945 | — | |

| Municipal bonds and notes | — | 64,322,058 | — | |

| Repurchase agreements | — | 520,676,000 | — | |

| Short-term investment fund | 58,000,000 | — | — | |

| U.S. government agency obligations | — | 30,915,376 | — | |

| U.S. treasury obligations | — | 159,461,167 | — | |

| Totals by level | $58,000,000 | $1,394,194,744 | $— | |

The accompanying notes are an integral part of these financial statements.

| 22 | Money Market Fund |

Statement of assets and liabilities 3/31/13 (Unaudited)

| ASSETS | |

| Investment in securities, at value (Note 1): | |

| Unaffiliated issuers (at amortized cost) | $873,518,744 |

| Affiliated issuers (identified cost $58,000,000) (Note 5) | 58,000,000 |

| Repurchase agreements (identified cost $520,676,000) | 520,676,000 |

| Cash | 362 |

| Interest and other receivables | 1,032,542 |

| Receivable for shares of the fund sold | 3,578,003 |

| Total assets | 1,456,805,651 |

| LIABILITIES | |

| Distributions payable to shareholders | 4,528 |

| Payable for shares of the fund repurchased | 5,534,466 |

| Payable for compensation of Manager (Note 2) | 13,803 |

| Payable for investor servicing fees (Note 2) | 404,864 |

| Payable for custodian fees (Note 2) | 6,363 |

| Payable for Trustee compensation and expenses (Note 2) | 461,459 |

| Payable for administrative services (Note 2) | 5,351 |

| Other accrued expenses | 189,043 |

| Total liabilities | 6,619,877 |

| Net assets | $1,450,185,774 |

| REPRESENTED BY | |

| Paid-in capital (Unlimited shares authorized) (Notes 1 and 4) | $1,451,430,329 |

| Undistributed net investment income (Note 1) | 123 |

| Accumulated net realized loss on investments (Note 1) | (1,244,678) |

| Total — Representing net assets applicable to capital shares outstanding | $1,450,185,774 |

| COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE | |

| Net asset value, offering price and redemption price per class A share | |

| ($1,339,278,995 divided by 1,342,075,781 shares) | $1.00 |

| Net asset value and offering price per class B share ($15,234,871 divided by 15,267,253 shares)* | $1.00 |

| Net asset value and offering price per class C share ($21,250,288 divided by 21,293,754 shares)* | $1.00 |

| Net asset value, offering price and redemption price per class M share | |

| ($27,051,994 divided by 27,106,421 shares) | $1.00 |

| Net asset value, offering price and redemption price per class R share | |

| ($26,388,419 divided by 26,441,508 shares) | $1.00 |

| Net asset value, offering price and redemption price per class T share | |

| ($20,981,207 divided by 21,024,942 shares) | $1.00 |

* Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

The accompanying notes are an integral part of these financial statements.

| Money Market Fund | 23 |

Statement of operations Six months ended 3/31/13 (Unaudited)

| INVESTMENT INCOME | |

| Interest (including interest income of $953 from investments in affiliated issuers) (Note 5) | $1,688,158 |

| EXPENSES | |

| Compensation of Manager (Note 2) | 2,180,377 |

| Investor servicing fees (Note 2) | 1,223,594 |

| Custodian fees (Note 2) | 11,956 |

| Trustee compensation and expenses (Note 2) | 81,464 |

| Distribution fees (Note 2) | 200,889 |

| Administrative services (Note 2) | 25,277 |

| Other | 308,803 |

| Fees waived and reimbursed by Manager (Note 2) | (2,413,113) |

| Total expenses | 1,619,247 |

| Expense reduction (Note 2) | (5,727) |

| Net expenses | 1,613,520 |

| Net investment income | 74,638 |

| Net realized gain on investments (Notes 1 and 3) | 21,000 |

| Net gain on investments | 21,000 |

| Net increase in net assets resulting from operations | $95,638 |

The accompanying notes are an integral part of these financial statements.

| 24 | Money Market Fund |

Statement of changes in net assets

| DECREASE IN NET ASSETS | Six months ended 3/31/13* | Year ended 9/30/12 |

| Operations: | ||

| Net investment income | $74,638 | $170,971 |

| Net realized gain on investments | 21,000 | 115,951 |

| Net increase in net assets resulting from operations | 95,638 | 286,922 |

| Distributions to shareholders (Note 1): | ||

| From ordinary income | ||

| Net investment income | ||

| Class A | (68,911) | (156,652) |

| Class B | (840) | (2,153) |

| Class C | (1,114) | (2,759) |

| Class M | (1,397) | (2,888) |

| Class R | (1,080) | (1,955) |

| Class T | (1,165) | (2,963) |

| Decrease from capital share transactions (Note 4) | (62,801,012) | (369,097,072) |

| Total decrease in net assets | (62,779,881) | (368,979,520) |

| NET ASSETS | ||

| Beginning of period | 1,512,965,655 | 1,881,945,175 |

| End of period (including undistributed net investment | ||

| income of $123 and distributions in excess of net investment | ||

| income of $8, respectively) | $1,450,185,774 | $1,512,965,655 |

* Unaudited

The accompanying notes are an integral part of these financial statements.

| Money Market Fund | 25 |

Financial highlights (For a common share outstanding throughout the period)

| INVESTMENT OPERATIONS: | LESS DISTRIBUTIONS: | RATIOS AND SUPPLEMENTAL DATA: | ||||||||||

| Ratio of net | ||||||||||||

| investment | ||||||||||||

| income | ||||||||||||

| Net asset | Ratio | (loss) | ||||||||||

| value, | Net realized | Total from | From | Total return | Net assets, | of expenses | to average | |||||

| beginning | Net investment | gain (loss) | investment | net investment | From | Total | Net asset value, | at net asset | end of period | to average | net assets | |

| Period ended | of period | income (loss) | on investments | operations | income | return of capital | distributions | end of period | value (%) a | (in thousands) | net assets (%) b | (%) |

| Class A | ||||||||||||

| March 31, 2013** | $1.00 | — c | — c | — c | — c | — | — c | $1.00 | —*d | $1,339,279 | .11*e | —*e,f |

| September 30, 2012 | 1.00 | .0001 | .0001 | .0002 | (.0001) | — | (.0001) | 1.00 | .01 | 1,398,514 | .23 e | .01 e |

| September 30, 2011 | 1.00 | .0001 | .0001 | .0002 | (.0001) | — | (.0001) | 1.00 | .01 | 1,739,458 | .22 e | .01 e |

| September 30, 2010 | 1.00 | .0001 | (.0003) | (.0002) | (.0005) | — | (.0005) | 1.00 | .06 | 2,131,331 | .32 e | — e,f |

| September 30, 2009 | 1.00 | .0091 | (.0001) | .0090 | (.0086) | — | (.0086) | 1.00 | .86 | 2,482,270 | .56 e,g | .98 e,g |

| September 30, 2008 | 1.00 | .0327 | (.0002) | .0325 | (.0325) | (.0004) | (.0329) | 1.00 | 3.35 | 3,212,674 | .56 g | 3.28 g |

| Class B | ||||||||||||

| March 31, 2013** | $1.00 | — c | — c | — c | — c | — | — c | $1.00 | —*d | $15,235 | .11*e | —*e,f |

| September 30, 2012 | 1.00 | .0001 | .0001 | .0002 | (.0001) | — | (.0001) | 1.00 | .01 | 18,000 | .23 e | .01 e |

| September 30, 2011 | 1.00 | .0001 | .0001 | .0002 | (.0001) | — | (.0001) | 1.00 | .01 | 27,668 | .22 e | .01 e |

| September 30, 2010 | 1.00 | .0001 | (.0003) | (.0002) | (.0005) | — | (.0005) | 1.00 | .06 | 37,121 | .32 e | .01 e |

| September 30, 2009 | 1.00 | .0060 | (.0001) | .0059 | (.0054) | — | (.0054) | 1.00 | .54 | 66,020 | .91 e,g | .68 e,g |

| September 30, 2008 | 1.00 | .0277 | (.0002) | .0275 | (.0276) | (.0003) | (.0279) | 1.00 | 2.83 | 99,244 | 1.06 g | 2.83 g |

| Class C | ||||||||||||

| March 31, 2013** | $1.00 | — c | — c | — c | — c | — | — c | $1.00 | —*d | $21,250 | .11*e | —*e,f |

| September 30, 2012 | 1.00 | .0001 | .0001 | .0002 | (.0001) | — | (.0001) | 1.00 | .01 | 23,037 | .23 e | .01 e |

| September 30, 2011 | 1.00 | .0001 | .0001 | .0002 | (.0001) | — | (.0001) | 1.00 | .01 | 31,073 | .22 e | .01 e |

| September 30, 2010 | 1.00 | .0001 | (.0003) | (.0002) | (.0005) | — | (.0005) | 1.00 | .06 | 21,991 | .32 e | — e,f |

| September 30, 2009 | 1.00 | .0060 | (.0001) | .0059 | (.0054) | — | (.0054) | 1.00 | .54 | 27,757 | .89 e,g | .62 e,g |

| September 30, 2008 | 1.00 | .0277 | (.0002) | .0275 | (.0276) | (.0003) | (.0279) | 1.00 | 2.83 | 30,609 | 1.06 g | 2.66 g |

| Class M | ||||||||||||

| March 31, 2013** | $1.00 | — c | — c | — c | — c | — | — c | $1.00 | —*d | $27,052 | .11*e | —*e,f |

| September 30, 2012 | 1.00 | .0001 | .0001 | .0002 | (.0001) | — | (.0001) | 1.00 | .01 | 28,559 | .23 e | .01 e |

| September 30, 2011 | 1.00 | .0001 | .0001 | .0002 | (.0001) | — | (.0001) | 1.00 | .01 | 31,296 | .22 e | .01 e |

| September 30, 2010 | 1.00 | .0001 | (.0003) | (.0002) | (.0005) | — | (.0005) | 1.00 | .06 | 35,999 | .32 e | — e,f |

| September 30, 2009 | 1.00 | .0080 | (.0001) | .0079 | (.0074) | — | (.0074) | 1.00 | .74 | 46,293 | .68 e,g | .83 e,g |

| September 30, 2008 | 1.00 | .0312 | (.0002) | .0310 | (.0310) | (.0004) | (.0314) | 1.00 | 3.19 | 53,452 | .71 g | 3.07 g |

| Class R | ||||||||||||

| March 31, 2013** | $1.00 | — c | — c | — c | — c | — | — c | $1.00 | —*d | $26,388 | .11*e | —*e,f |

| September 30, 2012 | 1.00 | .0001 | .0001 | .0002 | (.0001) | — | (.0001) | 1.00 | .01 | 19,425 | .23 e | .01 e |

| September 30, 2011 | 1.00 | .0001 | .0001 | .0002 | (.0001) | — | (.0001) | 1.00 | .01 | 18,508 | .22 e | .01 e |

| September 30, 2010 | 1.00 | .0001 | (.0003) | (.0002) | (.0005) | — | (.0005) | 1.00 | .06 | 16,283 | .32 e | — e,f |

| September 30, 2009 | 1.00 | .0060 | (.0001) | .0059 | (.0054) | — | (.0054) | 1.00 | .54 | 12,589 | .84 e,g | .43 e,g |

| September 30, 2008 | 1.00 | .0277 | (.0002) | .0275 | (.0276) | (.0003) | (.0279) | 1.00 | 2.83 | 5,564 | 1.06 g | 2.54 g |

| Class T | ||||||||||||

| March 31, 2013** | $1.00 | — c | — c | — c | — c | — | — c | $1.00 | —*d | $20,981 | .11*e | .01*e |

| September 30, 2012 | 1.00 | .0001 | .0001 | .0002 | (.0001) | — | (.0001) | 1.00 | .01 | 25,430 | .23 e | .01 e |

| September 30, 2011 | 1.00 | .0001 | .0001 | .0002 | (.0001) | — | (.0001) | 1.00 | .01 | 33,941 | .22 e | .01 e |

| September 30, 2010 | 1.00 | .0001 | (.0003) | (.0002) | (.0005) | — | (.0005) | 1.00 | .06 | 31,034 | .32 e | — e,f |

| September 30, 2009 | 1.00 | .0073 | (.0001) | .0072 | (.0067) | — | (.0067) | 1.00 | .67 | 39,088 | .74 e,g | .64 e,g |

| September 30, 2008 | 1.00 | .0302 | (.0002) | .0300 | (.0300) | (.0004) | (.0304) | 1.00 | 3.08 | 20,037 | .81 g | 2.93 g |

See notes to financial highlights at the end of this section.

The accompanying notes are an integral part of these financial statements.

| 26 | Money Market Fund | Money Market Fund | 27 |

Financial highlights (Continued)

* Not annualized.

** Unaudited.

a Total return assumes dividend reinvestment and does not reflect the effect of sales charges.

b Includes amounts paid through expense offset arrangements (Note 2).

c Amount represents less than $0.0001 per share.

d Amount represents less than 0.01%.

e Reflects a voluntary waiver of certain fund expenses in effect during the period relating to the enhancement of certain annualized net yields of the fund. As a result of such waivers, the expenses of each class reflect a reduction of the following amounts as a percentage of average net assets (Note 2):

| 3/31/13 | 9/30/12 | 9/30/11 | 9/30/10 | 9/30/09 | |

| Class A | 0.15% | 0.29% | 0.28% | 0.20% | 0.02% |

| Class B | 0.40 | 0.79 | 0.78 | 0.70 | 0.17 |

| Class C | 0.40 | 0.79 | 0.78 | 0.70 | 0.19 |

| Class M | 0.22 | 0.44 | 0.43 | 0.35 | 0.05 |

| Class R | 0.40 | 0.79 | 0.78 | 0.70 | 0.24 |

| Class T | 0.27 | 0.54 | 0.53 | 0.45 | 0.09 |

f Amount represents less than 0.01% of average net assets.

g Reflects an involuntary contractual expense limitation in effect during the period. For periods prior to September 30, 2009, certain fund expenses were waived in connection with the fund’s investment in Putnam Prime Money Market Fund. As a result of such limitation and/or waivers, the expenses of each class reflect a reduction of the following amounts:

| Percentage of | |

| average net assets | |

| September 30, 2009 | 0.03% |

| September 30, 2008 | <0.01 |

The accompanying notes are an integral part of these financial statements.

| 28 | Money Market Fund |

Notes to financial statements 3/31/13 (Unaudited)

Within the following Notes to financial statements, references to “State Street” represent State Street Bank and Trust Company, references to “the SEC” represent the Securities and Exchange Commission, references to “Putnam Management” represent Putnam Investment Management, LLC, the fund’s manager, an indirect wholly-owned subsidiary of Putnam Investments, LLC and references to “OTC”, if any, represent over-the-counter. Unless otherwise noted, the “reporting period” represents the period from October 1, 2012 through March 31, 2013.

Putnam Money Market Fund (the fund) is a Massachusetts business trust, which is registered under the Investment Company Act of 1940, as amended, as a diversified open-end management investment company. The investment objective of the fund is to seek as high a rate of current income as Putnam Management believes is consistent with preservation of capital and maintenance of liquidity. The fund invests mainly in money market instruments that are high quality and have short-term maturities. The fund invests significantly in certificates of deposit, commercial paper (including asset-backed commercial paper), U.S. government debt and repurchase agreements, corporate obligations and bankers acceptances. The fund may also invest in U.S. dollar denominated foreign securities of these types. Putnam Management may consider, among other factors, credit and interest rate risks, as well as general market conditions, when deciding whether to buy or sell investments.

The fund offers class A, class B, class C, class M, class R and class T shares. Each class of shares is sold without a front-end sales charge. Class A, class M, class R and class T shares also are generally not subject to a contingent deferred sales charge. In addition to the standard offering of class A shares, they are also sold to certain college savings plans and other Putnam funds. Class B shares convert to class A shares after approximately eight years and are subject to a contingent deferred sales charge on certain redemptions. Class C shares have a one-year 1.00% contingent deferred sales charge on certain redemptions and do not convert to class A shares. Class R shares are not available to all investors. The expenses for class A, class B, class C, class M, class R and class T shares may differ based on each class’ distribution fee, which is identified in Note 2.

In the normal course of business, the fund enters into contracts that may include agreements to indemnify another party under given circumstances. The fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be, but have not yet been, made against the fund. However, the fund’s management team expects the risk of material loss to be remote.

Note 1: Significant accounting policies

The following is a summary of significant accounting policies consistently followed by the fund in the preparation of its financial statements. The preparation of financial statements is in conformity with accounting principles generally accepted in the United States of America and requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements and the reported amounts of increases and decreases in net assets from operations. Actual results could differ from those estimates. Subsequent events after the Statement of assets and liabilities date through the date that the financial statements were issued have been evaluated in the preparation of the financial statements.

Investment income, realized gains and losses and expenses of the fund are borne pro-rata based on the relative net assets of each class to the total net assets of the fund, except that each class bears expenses unique to that class (including the distribution fees applicable to such classes). Each class votes as a class only with respect to its own distribution plan or other matters on which a class vote is required by law or determined by the Trustees. Shares of each class would receive their pro-rata share of the net assets of the fund, if the fund were liquidated. In addition, the Trustees declare separate dividends on each class of shares.

Security valuation The valuation of the fund’s portfolio instruments is determined by means of the amortized cost method (which approximates market value) as set forth in Rule 2a–7 under the Investment Company Act of 1940. The amortized cost of an instrument is determined by valuing it at its original cost and thereafter amortizing any discount or premium from its face value at a constant rate until maturity and is generally categorized as a Level 2 security.

Investments in open-end investment companies (excluding exchange traded funds), if any, which can be classified as Level 1 or Level 2 securities, are based on their net asset value. The net asset value of such investment companies equals the total value of their assets less their liabilities and divided by the number of their outstanding shares.

Joint trading account Pursuant to an exemptive order from the SEC, the fund may transfer uninvested cash balances into a joint trading account along with the cash of other registered investment companies and certain

| Money Market Fund | 29 |

other accounts managed by Putnam Management. These balances may be invested in issues of short-term investments having maturities of up to 90 days.

Repurchase agreements The fund, or any joint trading account, through its custodian, receives delivery of the underlying securities, the market value of which at the time of purchase is required to be in an amount at least equal to the resale price, including accrued interest. Collateral for certain tri-party repurchase agreements is held at the counterparty’s custodian in a segregated account for the benefit of the fund and the counterparty. Putnam Management is responsible for determining that the value of these underlying securities is at all times at least equal to the resale price, including accrued interest. In the event of default or bankruptcy by the other party to the agreement, retention of the collateral may be subject to legal proceedings.

Security transactions and related investment income Security transactions are recorded on the trade date (the date the order to buy or sell is executed). Interest income is recorded on the accrual basis. Premiums and discounts from purchases of short-term investments are amortized/accreted at a constant rate until maturity. Gains or losses on securities sold are determined on the identified cost basis.

Interfund lending The fund, along with other Putnam funds, may participate in an interfund lending program pursuant to an exemptive order issued by the SEC. This program allows the fund to lend to other Putnam funds that permit such transactions. Interfund lending transactions are subject to each fund’s investment policies and borrowing and lending limits. Interest earned or paid on the interfund lending transaction will be based on the average of certain current market rates. During the reporting period, the fund did not utilize the program.

Line of credit The fund participates, along with other Putnam funds, in a $315 million unsecured committed line of credit and a $185 million unsecured uncommitted line of credit, both provided by State Street. Borrowings may be made for temporary or emergency purposes, including the funding of shareholder redemption requests and trade settlements. Interest is charged to the fund based on the fund’s borrowing at a rate equal to the Federal Funds rate plus 1.25% for the committed line of credit and the Federal Funds rate plus 1.30% for the uncommitted line of credit. A closing fee equal to 0.02% of the committed line of credit and $50,000 for the uncommitted line of credit has been paid by the participating funds. In addition, a commitment fee of 0.11% per annum on any unutilized portion of the committed line of credit is allocated to the participating funds based on their relative net assets and paid quarterly. During the reporting period, the fund had no borrowings against these arrangements.

Federal taxes It is the policy of the fund to distribute all of its taxable income within the prescribed time period and otherwise comply with the provisions of the Internal Revenue Code of 1986, as amended (the Code), applicable to regulated investment companies. It is also the intention of the fund to distribute an amount sufficient to avoid imposition of any excise tax under Section 4982 of the Code.

The fund is subject to the provisions of Accounting Standards Codification ASC 740 Income Taxes (ASC 740). ASC 740 sets forth a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return. The fund did not have a liability to record for any unrecognized tax benefits in the accompanying financial statements. No provision has been made for federal taxes on income, capital gains or unrealized appreciation on securities held nor for excise tax on income and capital gains. Each of the fund’s federal tax returns for the prior three fiscal years remains subject to examination by the Internal Revenue Service.

At September 30, 2012, the fund had a capital loss carryover of $1,265,679 available to the extent allowed by the Code to offset future net capital gain, if any. The amounts of the carryovers and the expiration dates are:

| Loss carryover | ||||

| Short-term | Long-term | Total | Expiration | |

| $744,258 | N/A | $744,258 | September 30, 2017 | |

| 521,421 | N/A | 521,421 | September 30, 2019 | |

Under the Regulated Investment Company Modernization Act of 2010, the fund will be permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. However, any losses incurred will be required to be utilized prior to the losses incurred in pre-enactment tax years. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

The aggregate identified cost on a financial reporting and tax basis is the same.

| 30 | Money Market Fund |

Distributions to shareholders Income dividends are recorded daily by the fund and are paid monthly. Distributions from capital gains, if any, are paid at least annually. The amount and character of income and gains to be distributed are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year. Reclassifications are made to the fund’s capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations.

Note 2: Management fee, administrative services and other transactions