| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811-00653) |

| | |

| Exact name of registrant as specified in charter: | Putnam Income Fund |

| | |

| Address of principal executive offices: | One Post Office Square, Boston, Massachusetts 02109 |

| | |

| Name and address of agent for service: | Robert T. Burns, Vice President

One Post Office Square

Boston, Massachusetts 02109 |

| | |

| Copy to: | John W. Gerstmayr, Esq.

Ropes & Gray LLP

800 Boylston Street

Boston, Massachusetts 02199-3600 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | October 31, 2014 |

| | |

| Date of reporting period: | November 1, 2013 — April 30, 2014 |

| | |

|

Item 1. Report to Stockholders: | |

| | |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

Putnam

Income

Fund

Semiannual report

4 | 30 | 14

| | |

| Message from the Trustees | 1 | |

| |

| About the fund | 2 | |

| |

| Performance snapshot | 4 | |

| |

| Interview with your fund’s portfolio manager | 5 | |

| |

| Your fund’s performance | 10 | |

| |

| Your fund’s expenses | 12 | |

| |

| Terms and definitions | 14 | |

| |

| Other information for shareholders | 15 | |

| |

| Financial statements | 16 | |

| |

| Shareholder meeting results | 68 | |

| |

Consider these risks before investing: Funds that invest in government securities are not guaranteed. Mortgage-backed securities are subject to prepayment risk and the risk that they may increase in value less when interest rates decline and decline in value more when interest rates rise. Bond investments are subject to interest-rate risk (the risk of bond prices falling if interest rates rise) and credit risk (the risk of an issuer defaulting on interest or principal payments). Interest-rate risk is greater for longer-term bonds, and credit risk is greater for below-investment-grade bonds. Risks associated with derivatives include increased investment exposure (which may be considered leverage) and, in the case of over-the-counter instruments, the potential inability to terminate or sell derivatives positions and the potential failure of the other party to the instrument to meet its obligations. Unlike bonds, funds that invest in bonds have fees and expenses. Bond prices may fall or fail to rise over time for several reasons, including general financial market conditions and factors related to a specific issuer or industry. You can lose money by investing in the fund.

Message from the Trustees

Dear Fellow Shareholder:

Global stock markets continue to advance, albeit at a slower pace than in 2013, as the recovery in economies around the world progresses.

In the United States, recent improvements in the vital areas of employment, manufacturing, and consumer sales appear to have returned the economy to its upward trajectory. Likewise, capital spending by businesses — a key variable needed to support continued economic expansion — has risen. This strength, along with the leadership transition at the Federal Reserve, has fueled debate about future monetary policy.

In this environment, we believe Putnam’s commitment to active fundamental research and new ways of thinking can serve the best interests of investors. We are pleased to report that this commitment has played a positive role in investment performance. Barron’s has ranked Putnam second among 55 fund families based on total return across asset classes for the five years ending in December 2013.

We also believe that it is worthwhile to meet with your financial advisor periodically to discuss the range of strategies that Putnam offers. Your advisor can help you assess your individual needs, time horizon, and risk tolerance — crucial considerations as you work toward your investment goals.

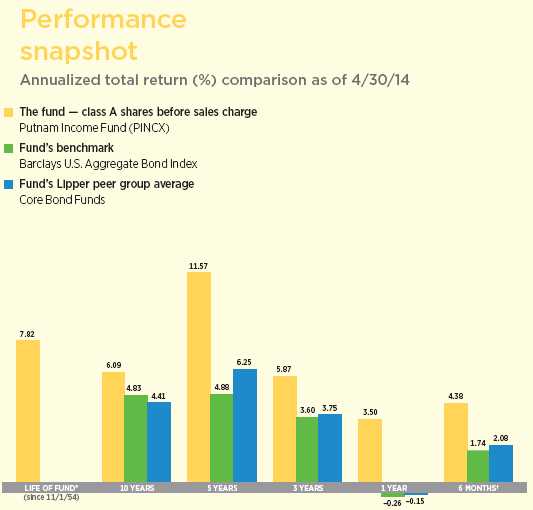

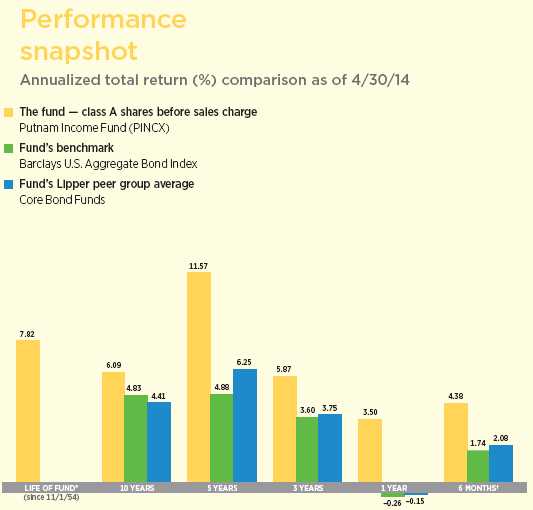

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 4.00%; had they, returns would have been lower. See pages 5 and 10–12 for additional performance information. For a portion of the periods, the fund had expense limitations, without which returns would have been lower. To obtain the most recent month-end performance, visit putnam.com.

* The fund’s benchmark, the Barclays U.S. Aggregate Bond Index, was introduced on 12/31/75, and the fund’s Lipper category was introduced on 12/31/59. Both post-date the inception of the fund’s class A shares.

† Returns for the six-month period are not annualized, but cumulative.

Interview with your fund’s portfolio manager

Mike, what was the bond market environment like during the six months ended April 30, 2014?

Overall, it was a favorable environment for taking prepayment and credit risk, but there was occasional volatility. At its December policy meeting, the Federal Reserve surprised investors by announcing the first reduction in its bond-buying program somewhat earlier than the market was anticipating. The Fed agreed to lower its $85-billion-per-month pace of purchases by $10 billion beginning in January, citing improving labor-market conditions as its rationale. Bond yields spiked on the news, with the yield on the benchmark 10-year U.S. Treasury reaching 3.04% by the end of December.

In January, with the central bank beginning the process of reducing its bond-buying, lack-luster economic data, coupled with concern about emerging-market [EM] currencies, caused investors to assume a more risk-averse posture. Asset flows shifted toward the relative safety of U.S. Treasuries, pushing the yield on the 10-year note down to 2.67%, its lowest level since mid-November. By February, however, with EM stress abating, market participants were encouraged by the resiliency of U.S. stocks as well as lower Treasury yields. The bond markets were also buoyed by investors largely dismissing weak economic data as a function of severe weather affecting some of the country’s most

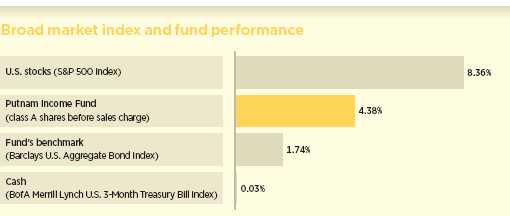

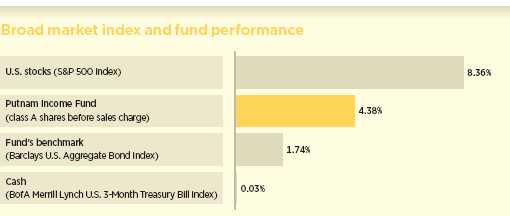

This comparison shows your fund’s performance in the context of broad market indexes for the six months ended 4/30/14. See pages 4 and 10–12 for additional fund performance information. Index descriptions can be found on page 15.

densely populated regions, and by the fact that the crisis in Ukraine remained localized.

Interest rates rose slightly in March only to decline marginally again in April, as the Fed reiterated that it is likely to keep its target for short-term interest rates close to zero for a “considerable time” after its bond purchases end.

The fund outpaced its benchmark and the average return of its Lipper peer group by sizable margins at net asset value. What factors fueled this solid showing?

Our prepayment and mortgage credit strategies were the biggest contributors to relative performance. We implemented our prepayment strategies with securities such as interest-only and inverse interest-only collateralized mortgage obligations [CMOs]. Lower policy risk coupled with mortgage rates that remained at elevated levels versus the past couple of years reduced the likelihood that the mortgages underlying our CMO holdings would be refinanced. As a result, slower prepayment speeds bolstered the securities’ values. Additionally, positioning the fund for higher mortgage rates worked well, as rates rose steadily during the final months of 2013.

Within mortgage credit, our holdings of commercial mortgage-backed securities [CMBS] were the primary contributors. Within CMBS, adroit security selection in subordinated “mezzanine” bonds rated BBB/ Baa, which offered higher yields at what

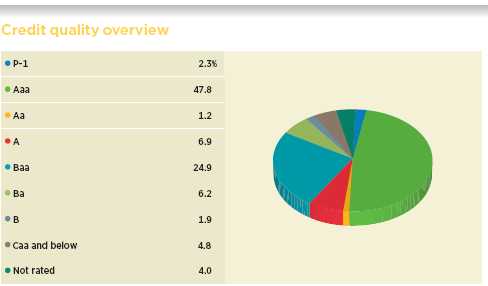

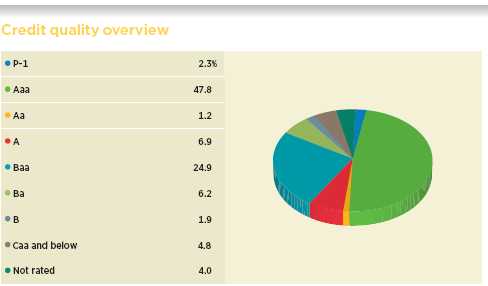

Credit qualities are shown as a percentage of the fund’s net assets as of 4/30/14. A bond rated Baa or higher (Prime-3 or higher, for short-term debt) is considered investment grade. The chart reflects Moody’s ratings; percentages may include bonds or derivatives not rated by Moody’s but rated by Standard & Poor’s (S&P) or, if unrated by S&P, by Fitch ratings, and then included in the closest equivalent Moody’s rating. To be announced (TBA) mortgage commitments, if any, are included based on their issuer ratings. Ratings and portfolio credit quality will vary over time. Derivative instruments, including forward currency contracts, are only included to the extent of any unrealized gain or loss on such instruments and are shown in the not-rated category. Cash is also shown in the not-rated category. Derivative offset values are included in the not-rated category and may result in negative weights. The fund itself has not been rated by an independent rating agency.

we believed were acceptable risks, helped the most. Mezzanine CMBS are lower in the capital structure of a package of securities backed by commercial mortgages, and provide a yield advantage over higher-rated bonds along with meaningful principal protection. Allocations to non-agency residential mortgage-backed securities [RMBS] and interest-only CMBS also modestly aided relative performance.

Elsewhere, our positions in corporate bonds provided a further boost to the fund’s return, as the asset class gained due to solid corporate fundamentals and consistent investor demand.

How was the fund positioned with respect to interest-rate sensitivity?

The fund was defensively positioned for a rising-rate environment, as its duration was shorter than that of the benchmark, particularly in the intermediate, 5- to 10-year portion of the Treasury yield curve. Rates in this portion of the curve are currently being dampened by Fed bond buying, and we believe they will begin to rise as the central bank continues to reduce its bond purchases. This positioning slightly detracted from performance versus the benchmark, as the negative effect of declining rates in January

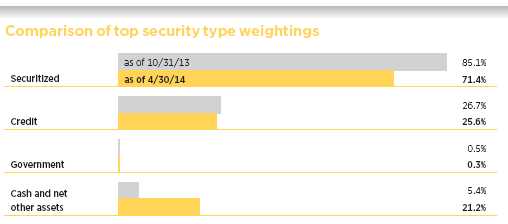

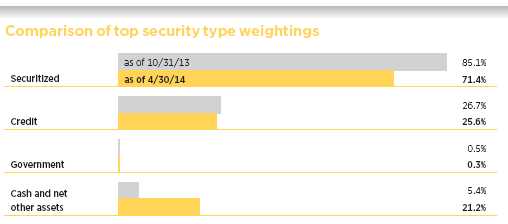

This chart shows how the fund’s top weightings have changed over the past six months. Allocations are shown as a percentage of the fund’s net assets. Cash and net other assets, if any, represent the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. Current period summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities, any interest accruals, and the use of different classifications of securities for presentation purposes. Allocations may not total 100% because the table includes the notional value of derivatives (the economic value for purposes of calculating period payment obligations), in addition to the market value of securities. Holdings and allocations may vary over time.

and April more than offset positive results in other months.

How did you use derivatives during the period?

We used bond futures and interest-rate swaps to take tactical positions at various points along the yield curve. We also employed interest-rate swaps and “swaptions” — which give us the option to enter into a swap contract — to hedge the interest-rate risk associated with our CMO holdings. Additionally, we used total return swaps as a hedging tool and to help manage the fund’s sector exposure, as well as credit default swaps to hedge the fund’s credit risk.

The fund increased its distribution rate during the period. What led to that decision?

The fund’s distribution rate per class A share was raised from $0.021 to $0.026 in December. The higher yields available on the securitized instruments we invested in enabled the fund to earn a greater amount of interest income, making this increase possible. Similar increases were made to other share classes.

What is your outlook for the coming months, and how are you positioning the fund?

In our view, Treasury yields, particularly in the intermediate part of the yield curve, are likely to move higher in 2014 as the U.S. economy continues to strengthen. However, we don’t believe rates are likely to rise so quickly that the shift will undermine economic growth.

In addition to weather, a significant inventory overhang was a factor in the weak economic readings we saw early this year, and we believe it will take some time for this surplus to work its way through the system. In 2013’s third quarter, gross domestic product [GDP] was much stronger than anticipated, and fourth-quarter 2013 GDP was firmer than originally forecast, leading manufacturers to expand their inventories. However, the weather-related slowdown in 2014’s first quarter, which contributed to an anemic 0.1% GDP, left manufacturers with excess inventory. Consequently, when growth picks up, the economy won’t immediately need production to sustain inventories, meaning it likely won’t get the cyclical boost it otherwise would if inventories were at a more normal level, in our view.

Looking at the Fed, bond investors have been willing to give the central bank leeway to pursue a fairly aggressive stimulus policy. But this leeway is heavily dependent on maintaining low inflation, particularly in the area of wages. Currently, the Fed believes the non-accelerating inflation rate of unemployment [NAIRU] — the rate to which unemployment can fall without triggering wage inflation — is between 5.2% and 5.6%. However, our research suggests that the NAIRU may be significantly higher than this, primarily because of various structural problems hampering the labor participation rate, particularly in the younger demographic. As the unemployment rate moves downward, if wage inflation develops earlier than the Fed is anticipating, the central bank may begin reducing its stimulus efforts faster than the markets are currently forecasting, which could lead to increased yield-curve volatility. In order to position the portfolio for this potential risk, we have underweight exposure relative to the benchmark on the 2- to 5-year portion of the yield curve, since that is the area of the curve that we believe would be most affected by adjustments in Fed policy. Additionally, we have continued to minimize overall interest-rate risk in the portfolio.

As for other aspects of portfolio positioning, we plan to maintain our diversified exposure to mortgage and corporate credit via allocations to mezzanine CMBS and investment-grade bonds, respectively. Concerning prepayment risk, we will continue to seek to capitalize on anticipated slower prepayment speeds through allocations to CMOs. Lastly,

liquidity risk premiums remain elevated in many parts of the non-agency RMBS market, which could provide a further boost to performance as this sector continues to normalize.

Thanks for your time and for bringing us up to date, Mike.

The views expressed in this report are exclusively those of Putnam Management and are subject to change. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

Portfolio Manager Michael V. Salm is Co-Head of Fixed Income at Putnam. He has a B.A. from Cornell University. Michael joined Putnam in 1997 and has been in the investment industry since 1989.

In addition to Michael, your fund’s portfolio managers are Brett S. Kozlowski, CFA, and Kevin F. Murphy.

ABOUT DERIVATIVES

Derivatives are an increasingly common type of investment instrument, the performance of which is derived from an underlying security, index, currency, or other area of the capital markets. Derivatives employed by the fund’s managers generally serve one of two main purposes: to implement a strategy that may be difficult or more expensive to invest in through traditional securities, or to hedge unwanted risk associated with a particular position.

For example, the fund’s managers might identify a bond that they believe is undervalued relative to its risk of default, but may seek to reduce the interest-rate risk of that bond by using interest-rate swaps, a derivative through which two parties “swap” payments based on the movement of certain rates.

Like any other investment, derivatives may not appreciate in value and may lose money. Derivatives may amplify traditional investment risks through the creation of leverage and may be less liquid than traditional securities. And because derivatives typically represent contractual agreements between two financial institutions, derivatives entail “counterparty risk,” which is the risk that the other party is unable or unwilling to pay. Putnam monitors the counterparty risks we assume. For example, Putnam often enters into collateral agreements that require the counterparties to post collateral on a regular basis to cover their obligations to the fund. Counterparty risk for exchange-traded futures and centrally cleared swaps is mitigated by the daily exchange of margin and other safeguards against default through their respective clearinghouses.

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended April 30, 2014, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance information as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R, class R5, class R6, and class Y shares are not available to all investors. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 4/30/14

| | | | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y |

| (inception dates) | (11/1/54) | (3/1/93) | (7/26/99) | (12/14/94) | (1/21/03) | (7/2/12) | (7/2/12) | (6/16/94) |

|

| | Before | After | | | | | Before | After | Net | Net | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset | asset | asset |

| | charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value | value | value |

|

| Annual average | | | | | | | | | | | | |

| (life of fund) | 7.82% | 7.74% | 7.67% | 7.67% | 7.01% | 7.01% | 7.38% | 7.32% | 7.55% | 7.91% | 7.91% | 7.91% |

|

| 10 years | 80.60 | 73.38 | 69.80 | 69.80 | 67.31 | 67.31 | 76.22 | 70.50 | 76.10 | 84.87 | 85.14 | 84.81 |

| Annual average | 6.09 | 5.66 | 5.44 | 5.44 | 5.28 | 5.28 | 5.83 | 5.48 | 5.82 | 6.34 | 6.35 | 6.33 |

|

| 5 years | 72.86 | 65.94 | 66.25 | 64.25 | 66.21 | 66.21 | 70.64 | 65.09 | 70.42 | 74.80 | 75.06 | 74.75 |

| Annual average | 11.57 | 10.66 | 10.70 | 10.43 | 10.70 | 10.70 | 11.28 | 10.55 | 11.25 | 11.82 | 11.85 | 11.81 |

|

| 3 years | 18.67 | 13.92 | 16.09 | 13.09 | 15.91 | 15.91 | 17.81 | 13.98 | 17.86 | 19.58 | 19.75 | 19.54 |

| Annual average | 5.87 | 4.44 | 5.10 | 4.19 | 5.04 | 5.04 | 5.62 | 4.46 | 5.63 | 6.14 | 6.19 | 6.13 |

|

| 1 year | 3.50 | –0.64 | 2.77 | –2.19 | 2.63 | 1.64 | 3.36 | 0.00 | 3.31 | 3.66 | 3.80 | 3.67 |

|

| 6 months | 4.38 | 0.20 | 4.03 | –0.97 | 3.89 | 2.89 | 4.21 | 0.82 | 4.16 | 4.35 | 4.49 | 4.42 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns for class A and M shares reflect the deduction of the maximum 4.00% and 3.25% sales charge, respectively, levied at the time of purchase. Class B share returns after contingent deferred sales charge (CDSC) reflect the applicable CDSC, which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C share returns after CDSC reflect a 1% CDSC for the first year that is eliminated thereafter. Class R, R5, R6, and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and the higher operating expenses for such shares, except for class Y shares, for which 12b-1 fees are not applicable. Performance for class R5 and R6 shares prior to their inception is derived from the historical performance of class Y shares and has not been adjusted for the lower investor servicing fees applicable to class R5 and R6 shares; had it, returns would have been higher.

For a portion of the periods, the fund had expense limitations, without which returns would have been lower.

Class B share performance reflects a conversion to class A shares after eight years.

Comparative index returns For periods ended 4/30/14

| | |

| | Barclays U.S. Aggregate | Lipper Core Bond Funds |

| | Bond Index | category average* |

|

| Annual average (life of fund) | —† | —† |

|

| 10 years | 60.23% | 54.61% |

| Annual average | 4.83 | 4.41 |

|

| 5 years | 26.88 | 35.69 |

| Annual average | 4.88 | 6.25 |

|

| 3 years | 11.20 | 11.70 |

| Annual average | 3.60 | 3.75 |

|

| 1 year | –0.26 | –0.15 |

|

| 6 months | 1.74 | 2.08 |

|

Index and Lipper results should be compared with fund performance before sales charge, before CDSC, or at net asset value.

* Over the 6-month, 1-year, 3-year, 5-year, and 10-year periods ended 4/30/14, there were 535, 521, 463, 397, and 283 funds, respectively, in this Lipper category.

† The fund’s benchmark, the Barclays U.S. Aggregate Bond Index, was introduced on 12/31/75, and the fund’s Lipper category was introduced on 12/31/59. Both post-date the inception of the fund’s class A shares.

Fund price and distribution information For the six-month period ended 4/30/14

| | | | | | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y |

|

| Number | 6 | 6 | 6 | 6 | 6 | 6 | 6 | 6 |

|

| Income | $0.180 | $0.153 | $0.154 | $0.172 | $0.173 | $0.192 | $0.192 | $0.187 |

|

| Capital gains | — | — | — | — | — | — | — | — |

|

| Total | $0.180 | $0.153 | $0.154 | $0.172 | $0.173 | $0.192 | $0.192 | $0.187 |

|

| | Before | After | Net | Net | Before | After | Net | Net | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value | value | value |

|

| 10/31/13 | $7.20 | $7.50 | $7.13 | $7.15 | $7.05 | $7.29 | $7.16 | $7.29 | $7.29 | $7.29 |

|

| 4/30/14 | 7.33 | 7.64 | 7.26 | 7.27 | 7.17 | 7.41 | 7.28 | 7.41 | 7.42 | 7.42 |

|

| | Before | After | Net | Net | Before | After | Net | Net | Net | Net |

| Current yield | sales | sales | asset | asset | sales | sales | asset | asset | asset | asset |

| (end of period) | charge | charge | value | value | charge | charge | value | value | value | value |

|

| Current dividend | | | | | | | | | | |

| rate 1 | 4.26% | 4.08% | 3.47% | 3.63% | 4.18% | 4.05% | 4.12% | 4.53% | 4.53% | 4.37% |

|

| Current 30-day | | | | | | | | | | |

| SEC yield 2 | N/A | 2.90 | 2.28 | 2.28 | N/A | 2.69 | 2.77 | 3.30 | 3.36 | 3.28 |

|

The classification of distributions, if any, is an estimate. Before-sales-charge share value and current dividend rate for class A and M shares, if applicable, do not take into account any sales charge levied at the time of purchase. After-sales-charge share value, current dividend rate, and current 30-day SEC yield, if applicable, are calculated assuming that the maximum sales charge (4.00% for class A shares and 3.25% for class M shares) was levied at the time of purchase. Final distribution information will appear on your year-end tax forms.

1 Most recent distribution, including any return of capital and excluding capital gains, annualized and divided by share price before or after sales charge at period-end.

2 Based only on investment income and calculated using the maximum offering price for each share class, in accordance with SEC guidelines.

Fund performance as of most recent calendar quarter

Total return for periods ended 3/31/14

| | | | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y |

| (inception dates) | (11/1/54) | (3/1/93) | (7/26/99) | (12/14/94) | (1/21/03) | (7/2/12) | (7/2/12) | (6/16/94) |

|

| | Before | After | | | | | Before | After | Net | Net | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset | asset | asset |

| | charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value | value | value |

|

| Annual average | | | | | | | | | | | | |

| (life of fund) | 7.81% | 7.74% | 7.66% | 7.66% | 7.00% | 7.00% | 7.37% | 7.31% | 7.54% | 7.90% | 7.90% | 7.90% |

|

| 10 years | 74.19 | 67.22 | 64.21 | 64.21 | 61.80 | 61.80 | 69.88 | 64.36 | 69.84 | 78.58 | 78.84 | 78.55 |

| Annual average | 5.71 | 5.28 | 5.08 | 5.08 | 4.93 | 4.93 | 5.44 | 5.09 | 5.44 | 5.97 | 5.99 | 5.97 |

|

| 5 years | 79.26 | 72.09 | 72.75 | 70.75 | 72.62 | 72.62 | 77.03 | 71.28 | 77.06 | 81.80 | 82.06 | 81.77 |

| Annual average | 12.38 | 11.47 | 11.55 | 11.29 | 11.54 | 11.54 | 12.10 | 11.36 | 12.11 | 12.70 | 12.73 | 12.69 |

|

| 3 years | 19.50 | 14.72 | 16.75 | 13.75 | 16.87 | 16.87 | 18.47 | 14.62 | 18.51 | 20.38 | 20.56 | 20.36 |

| Annual average | 6.12 | 4.68 | 5.30 | 4.39 | 5.34 | 5.34 | 5.81 | 4.65 | 5.82 | 6.38 | 6.43 | 6.37 |

|

| 1 year | 3.28 | –0.85 | 2.55 | –2.40 | 2.54 | 1.55 | 2.97 | –0.37 | 2.94 | 3.58 | 3.72 | 3.61 |

|

| 6 months | 4.91 | 0.71 | 4.58 | –0.42 | 4.56 | 3.56 | 4.75 | 1.35 | 4.69 | 5.02 | 5.16 | 5.09 |

|

See the discussion following the Fund performance table on page 10 for information about the calculation of fund performance.

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y |

|

| Total annual operating expenses for | | | | | | | | |

| the fiscal year ended 10/31/13 | 0.87% | 1.62% | 1.62% | 1.12% | 1.12% | 0.58% | 0.51% | 0.62% |

|

| Annualized expense ratio for the | | | | | | | | |

| six-month period ended 4/30/14 | 0.87% | 1.62% | 1.62% | 1.12% | 1.12% | 0.59% | 0.52% | 0.62% |

|

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report.

Expenses are shown as a percentage of average net assets.

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in the fund from November 1, 2013 to April 30, 2014. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y |

|

| Expenses paid per $1,000*† | $4.41 | $8.20 | $8.19 | $5.67 | $5.67 | $2.99 | $2.64 | $3.14 |

|

| Ending value (after expenses) | $1,043.80 | $1,040.30 | $1,038.90 | $1,042.10 | $1,041.60 | $1,043.50 | $1,044.90 | $1,044.20 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 4/30/14. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended April 30, 2014, use the following calculation method. To find the value of your investment on November 1, 2013, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class R5 | Class R6 | Class Y |

|

| Expenses paid per $1,000*† | $4.36 | $8.10 | $8.10 | $5.61 | $5.61 | $2.96 | $2.61 | $3.11 |

|

| Ending value (after expenses) | $1,020.48 | $1,016.76 | $1,016.76 | $1,019.24 | $1,019.24 | $1,021.87 | $1,022.22 | $1,021.72 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 4/30/14. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the six-month period; then multiplying the result by the number of days in the six-month period; and then dividing that result by the number of days in the year.

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Before sales charge, or net asset value, is the price, or value, of one share of a mutual fund, without a sales charge. Before-sales-charge figures fluctuate with market conditions, and are calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

After sales charge is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. After-sales-charge performance figures shown here assume the 4.00% maximum sales charge for class A shares and 3.25% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines over time from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain employer-sponsored retirement plans.

Class R5 shares and class R6 shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are only available to certain employer-sponsored retirement plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Fixed-income terms

Current rate is the annual rate of return earned from dividends or interest of an investment. Current rate is expressed as a percentage of the price of a security, fund share, or principal investment.

Mortgage-backed security (MBS), also known as a mortgage “pass-through,” is a type of asset-backed security that is secured by a mortgage or collection of mortgages. The following are types of MBSs:

• Agency “pass-through” has its principal and interest backed by a U.S. government agency, such as the Federal National Mortgage Association (Fannie Mae), Government National Mortgage Association (Ginnie Mae), and Federal Home Loan Mortgage Corporation (Freddie Mac).

• Collateralized mortgage obligation (CMO) represents claims to specific cash flows from pools of home mortgages. The streams of principal and interest payments on the mortgages are distributed to the different classes of CMO interests in “tranches.” Each tranche may have different principal balances, coupon rates, prepayment risks, and maturity dates. A CMO is highly sensitive to changes in interest rates and any resulting change in the rate at which homeowners sell their properties, refinance, or otherwise prepay loans. CMOs are subject to prepayment, market, and liquidity risks.

• Interest-only (IO) security is a type of CMO in which the underlying asset is the interest portion of mortgage, Treasury, or bond payments.

• Non-agency residential mortgage-backed security (RMBS) is an MBS not backed by Fannie Mae, Ginnie Mae, or Freddie Mac. One type of RMBS is an Alt-A mortgage-backed security.

• Commercial mortgage-backed security (CMBS) is secured by the loan on a commercial property.

Yield curve is a graph that plots the yields of bonds with equal credit quality against their differing maturity dates, ranging from shortest to longest. It is used as a benchmark for other debt, such as mortgage or bank lending rates.

Comparative indexes

Barclays U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

BofA (Bank of America) Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with Securities and Exchange Commission (SEC) regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2013, are available in the Individual Investors section of putnam.com, and on the SEC’s website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s website at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s website or the operation of the Public Reference Room.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of April 30, 2014, Putnam employees had approximately $458,000,000 and the Trustees had approximately $110,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

Financial statements

A guide to financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

The fund’s portfolio 4/30/14 (Unaudited)

| | |

| MORTGAGE-BACKED SECURITIES (44.0%)* | Principal amount | Value |

|

| Agency collateralized mortgage obligations (19.5%) | | |

| Federal Home Loan Mortgage Corp. | | |

| IFB Ser. 3182, Class SP, 27.991s, 2032 | $142,834 | $215,010 |

| IFB Ser. 3408, Class EK, 25.181s, 2037 | 1,577,306 | 2,291,970 |

| IFB Ser. 2976, Class LC, 23.862s, 2035 | 186,923 | 273,556 |

| IFB Ser. 2979, Class AS, 23.715s, 2034 | 69,677 | 89,186 |

| IFB Ser. 3072, Class SB, 23.092s, 2035 | 624,944 | 886,989 |

| IFB Ser. 3249, Class PS, 21.773s, 2036 | 509,504 | 695,582 |

| IFB Ser. 3065, Class DC, 19.403s, 2035 | 850,351 | 1,208,256 |

| IFB Ser. 2990, Class LB, 16.557s, 2034 | 922,101 | 1,207,518 |

| IFB Ser. 4105, Class HS, IO, 6.448s, 2042 | 5,021,099 | 1,257,585 |

| IFB Ser. 3861, Class PS, IO, 6.448s, 2037 | 4,117,283 | 594,289 |

| IFB Ser. 4105, Class LS, IO, 5.998s, 2041 | 5,196,084 | 941,478 |

| IFB Ser. 4245, Class AS, IO, 5.848s, 2043 | 13,428,141 | 3,021,359 |

| IFB Ser. 271, Class S5, IO, 5.848s, 2042 | 12,363,320 | 2,706,578 |

| IFB Ser. 3852, Class NT, 5.848s, 2041 | 3,256,829 | 3,234,845 |

| IFB Ser. 14-326, Class S2, IO, 5.798s, 2044 | 27,181,593 | 6,407,501 |

| IFB Ser. 310, Class S4, IO, 5.798s, 2043 | 3,773,758 | 947,138 |

| IFB Ser. 311, Class S1, IO, 5.798s, 2043 | 21,267,945 | 4,536,942 |

| IFB Ser. 14-327, Class S8, IO, 5.768s, 2044 | 14,420,964 | 3,163,960 |

| IFB Ser. 314, Class AS, IO, 5.738s, 2043 | 8,891,109 | 1,952,248 |

| Ser. 3632, Class CI, IO, 5s, 2038 | 151,816 | 14,236 |

| Ser. 3626, Class DI, IO, 5s, 2037 | 35,604 | 579 |

| Ser. 4132, Class IP, IO, 4 1/2s, 2042 | 15,623,701 | 2,815,639 |

| Ser. 4122, Class TI, IO, 4 1/2s, 2042 | 5,703,812 | 1,258,261 |

| Ser. 4018, Class DI, IO, 4 1/2s, 2041 | 6,546,189 | 1,233,433 |

| Ser. 3707, Class PI, IO, 4 1/2s, 2025 | 4,053,880 | 388,483 |

| Ser. 4116, Class MI, IO, 4s, 2042 | 12,943,361 | 2,602,775 |

| Ser. 13-303, Class C19, IO, 3 1/2s, 2043 | 8,381,678 | 1,980,101 |

| Ser. 304, Class C22, IO, 3 1/2s, 2042 | 9,460,329 | 2,211,352 |

| Ser. 4122, Class AI, IO, 3 1/2s, 2042 | 10,865,068 | 1,724,797 |

| Ser. 4141, Class PI, IO, 3s, 2042 | 11,277,398 | 1,556,732 |

| Ser. 4158, Class TI, IO, 3s, 2042 | 28,797,774 | 3,976,685 |

| Ser. 4165, Class TI, IO, 3s, 2042 | 32,860,960 | 4,495,379 |

| Ser. 4176, Class DI, IO, 3s, 2042 | 30,946,097 | 4,216,406 |

| Ser. 4171, Class NI, IO, 3s, 2042 | 17,878,607 | 2,424,339 |

| Ser. 4183, Class MI, IO, 3s, 2042 | 10,226,082 | 1,396,883 |

| Ser. 13-4206, Class IP, IO, 3s, 2041 | 12,924,346 | 1,803,980 |

| Ser. 13-4176, Class IA, IO, 2 1/2s, 2028 | 19,043,223 | 2,192,065 |

| Ser. T-56, Class A, IO, 0.524s, 2043 | 11,178,595 | 190,822 |

| Ser. T-56, Class 1, IO, zero %, 2043 | 13,257,573 | 1,036 |

| Ser. T-56, Class 2, IO, zero %, 2043 | 4,885,837 | 15,268 |

| Ser. T-56, Class 3, IO, zero %, 2043 | 3,978,272 | 311 |

| Ser. 3835, Class FO, PO, zero %, 2041 | 11,246,419 | 9,392,335 |

| Ser. 3369, Class BO, PO, zero %, 2037 | 27,463 | 24,222 |

| Ser. 3391, PO, zero %, 2037 | 271,019 | 226,485 |

| Ser. 3300, PO, zero %, 2037 | 426,020 | 378,159 |

| | |

| MORTGAGE-BACKED SECURITIES (44.0%)* cont. | Principal amount | Value |

|

| Agency collateralized mortgage obligations cont. | | |

| Federal Home Loan Mortgage Corp. | | |

| Ser. 3206, Class EO, PO, zero %, 2036 | $21,544 | $18,957 |

| Ser. 3175, Class MO, PO, zero %, 2036 | 72,370 | 62,733 |

| Ser. 3210, PO, zero %, 2036 | 81,022 | 73,268 |

| FRB Ser. 3117, Class AF, zero %, 2036 | 18,953 | 16,465 |

| FRB Ser. 3326, Class WF, zero %, 2035 | 18,817 | 16,088 |

| FRB Ser. 3036, Class AS, zero %, 2035 | 6,600 | 6,536 |

|

| Federal National Mortgage Association | | |

| IFB Ser. 06-62, Class PS, 38.986s, 2036 | 895,791 | 1,679,271 |

| IFB Ser. 06-8, Class HP, 24.008s, 2036 | 724,579 | 1,113,482 |

| IFB Ser. 05-45, Class DA, 23.862s, 2035 | 1,418,602 | 2,116,091 |

| IFB Ser. 05-122, Class SE, 22.567s, 2035 | 1,465,078 | 2,101,637 |

| IFB Ser. 05-75, Class GS, 19.793s, 2035 | 445,010 | 592,969 |

| IFB Ser. 05-106, Class JC, 19.652s, 2035 | 785,230 | 1,147,606 |

| IFB Ser. 05-83, Class QP, 16.998s, 2034 | 162,960 | 210,048 |

| IFB Ser. 11-4, Class CS, 12.595s, 2040 | 1,771,766 | 2,087,319 |

| IFB Ser. 13-19, Class DS, IO, 6.048s, 2041 | 8,880,477 | 1,611,321 |

| Ser. 06-10, Class GC, 6s, 2034 | 4,777,081 | 4,920,393 |

| Ser. 12-134, Class SA, IO, 5.998s, 2042 | 6,261,822 | 1,460,162 |

| IFB Ser. 13-59, Class SC, IO, 5.998s, 2043 | 12,633,922 | 2,846,581 |

| IFB Ser. 13-13, Class SA, IO, 5.998s, 2043 | 13,888,208 | 3,488,023 |

| IFB Ser. 12-128, Class ST, IO, 5.998s, 2042 | 6,669,753 | 1,512,433 |

| IFB Ser. 13-128, Class SA, IO, 5.848s, 2043 | 10,891,540 | 2,426,308 |

| Ser. 13-98, Class SA, IO, 5.798s, 2043 | 8,278,332 | 1,787,292 |

| IFB Ser. 13-101, Class AS, IO, 5.798s, 2043 | 21,948,401 | 5,015,649 |

| IFB Ser. 13-103, Class SK, IO, 5.768s, 2043 | 5,018,897 | 1,160,850 |

| Ser. 13-101, Class SE, IO, 5.748s, 2043 | 11,819,595 | 2,971,564 |

| IFB Ser. 13-136, Class SB, IO, 5.748s, 2044 | 29,053,918 | 5,925,837 |

| IFB Ser. 13-102, Class SH, IO, 5.748s, 2043 | 12,185,383 | 2,655,195 |

| Ser. 418, Class C24, IO, 4s, 2043 | 8,524,383 | 2,004,562 |

| Ser. 12-124, Class UI, IO, 4s, 2042 | 24,724,233 | 4,734,691 |

| Ser. 12-40, Class MI, IO, 4s, 2041 | 12,711,469 | 2,197,360 |

| Ser. 12-22, Class CI, IO, 4s, 2041 | 14,143,129 | 2,558,942 |

| Ser. 418, Class C15, IO, 3 1/2s, 2043 | 17,684,986 | 4,049,586 |

| Ser. 13-55, Class IK, IO, 3s, 2043 | 8,946,205 | 1,281,812 |

| Ser. 12-144, Class KI, IO, 3s, 2042 | 21,214,882 | 3,023,757 |

| Ser. 13-35, Class IP, IO, 3s, 2042 | 10,275,354 | 1,169,624 |

| Ser. 13-55, Class PI, IO, 3s, 2042 | 17,283,455 | 2,189,295 |

| Ser. 13-67, Class IP, IO, 3s, 2042 | 21,428,841 | 2,661,033 |

| Ser. 13-30, Class IP, IO, 3s, 2041 | 9,018,136 | 926,613 |

| Ser. 13-23, Class LI, IO, 3s, 2041 | 10,540,123 | 1,134,539 |

| Ser. 03-W10, Class 1, IO, 1.092s, 2043 | 7,904,501 | 230,033 |

| Ser. 01-50, Class B1, IO, 0.419s, 2041 | 774,425 | 10,406 |

| Ser. 2002-W6, Class 1AIO, 0.154s, 2042 | 978,609 | 2,141 |

| Ser. 2005-W4, Class 1AIO, 0.092s, 2035 | 225,601 | 635 |

| Ser. 03-34, Class P1, PO, zero %, 2043 | 219,011 | 190,539 |

| Ser. 07-64, Class LO, PO, zero %, 2037 | 107,215 | 94,250 |

| Ser. 07-14, Class KO, PO, zero %, 2037 | 314,476 | 271,153 |

| | |

| MORTGAGE-BACKED SECURITIES (44.0%)* cont. | Principal amount | Value |

|

| Agency collateralized mortgage obligations cont. | | |

| Federal National Mortgage Association | | |

| Ser. 06-125, Class OX, PO, zero %, 2037 | $40,310 | $36,195 |

| Ser. 06-84, Class OT, PO, zero %, 2036 | 33,105 | 29,246 |

| Ser. 06-46, Class OC, PO, zero %, 2036 | 29,554 | 25,732 |

|

| Government National Mortgage Association | | |

| IFB Ser. 11-72, Class SE, 7.208s, 2041 | 9,422,000 | 9,139,547 |

| IFB Ser. 12-26, Class SP, IO, 6.498s, 2042 | 9,461,221 | 2,234,173 |

| IFB Ser. 11-56, Class SI, IO, 6.498s, 2041 | 34,066,490 | 6,115,999 |

| IFB Ser. 10-56, Class SC, IO, 6.348s, 2040 | 3,556,065 | 671,527 |

| IFB Ser. 11-56, Class MI, IO, 6.298s, 2041 | 5,274,291 | 1,202,486 |

| IFB Ser. 13-113, Class SL, IO, 6.078s, 2042 | 4,956,316 | 862,902 |

| IFB Ser. 13-124, Class SC, IO, 6.048s, 2041 | 5,732,745 | 938,737 |

| IFB Ser. 13-129, Class SN, IO, 5.998s, 2043 | 6,541,014 | 1,116,813 |

| IFB Ser. 13-152, Class SG, IO, 5.998s, 2043 | 12,514,624 | 2,158,600 |

| IFB Ser. 10-20, Class SC, IO, 5.998s, 2040 | 7,126,792 | 1,293,156 |

| Ser. 13-149, Class MS, IO, 5.948s, 2039 | 10,713,349 | 1,707,386 |

| IFB Ser. 14-32, Class CS, IO, 5.948s, 2044 | 6,173,454 | 1,342,726 |

| IFB Ser. 11-146, Class AS, IO, 5.948s, 2041 | 7,271,006 | 1,484,876 |

| IFB Ser. 11-128, Class TS, IO, 5.898s, 2041 | 23,951,396 | 4,804,650 |

| IFB Ser. 10-151, Class SA, IO, 5.898s, 2040 | 4,267,802 | 770,552 |

| IFB Ser. 11-70, Class SM, IO, 5.738s, 2041 | 5,789,000 | 1,392,833 |

| Ser. 14-25, Class QI, IO, 5s, 2044 | 12,708,173 | 2,999,256 |

| Ser. 13-3, Class IT, IO, 5s, 2043 | 8,195,453 | 1,748,899 |

| Ser. 11-116, Class IB, IO, 5s, 2040 | 8,772,874 | 762,136 |

| Ser. 13-16, Class IB, IO, 5s, 2040 | 15,799,159 | 1,620,624 |

| Ser. 10-35, Class UI, IO, 5s, 2040 | 9,596,634 | 2,239,280 |

| Ser. 10-9, Class UI, IO, 5s, 2040 | 64,305,144 | 14,790,546 |

| Ser. 09-121, Class UI, IO, 5s, 2039 | 18,796,416 | 4,439,902 |

| Ser. 12-129, Class IO, IO, 4 1/2s, 2042 | 8,165,390 | 1,934,054 |

| Ser. 10-35, Class QI, IO, 4 1/2s, 2040 | 8,689,239 | 1,750,924 |

| Ser. 10-9, Class QI, IO, 4 1/2s, 2040 | 8,127,934 | 1,865,281 |

| Ser. 11-116, Class IA, IO, 4 1/2s, 2039 | 7,603,476 | 1,157,477 |

| Ser. 14-2, Class IL, IO, 4s, 2044 | 14,056,151 | 3,235,111 |

| Ser. 12-56, Class IB, IO, 4s, 2042 | 16,462,955 | 3,811,281 |

| Ser. 14-4, Class IK, IO, 4s, 2039 | 14,522,812 | 2,489,646 |

| Ser. 13-100, Class MI, IO, 3 1/2s, 2043 | 10,752,262 | 1,536,713 |

| Ser. 13-37, Class JI, IO, 3 1/2s, 2043 | 9,362,835 | 1,509,195 |

| Ser. 13-27, Class PI, IO, 3 1/2s, 2042 | 11,259,035 | 1,962,900 |

| Ser. 12-136, Class IO, IO, 3 1/2s, 2042 | 27,337,687 | 6,718,783 |

| Ser. 12-71, Class AI, IO, 3 1/2s, 2042 | 20,839,522 | 2,685,798 |

| Ser. 14-46, Class JI, IO, 3 1/2s, 2041 | 10,929,352 | 1,720,717 |

| Ser. 13-18, Class GI, IO, 3 1/2s, 2041 | 10,123,403 | 1,551,918 |

| Ser. 12-48, Class KI, IO, 3 1/2s, 2039 | 8,410,262 | 1,491,055 |

| Ser. 13-53, Class PI, IO, 3s, 2041 | 15,042,935 | 2,089,915 |

| Ser. 13-23, Class IK, IO, 3s, 2037 | 3,850,552 | 687,169 |

| Ser. 14-46, Class KI, IO, 3s, 2036 | 9,840,221 | 1,516,575 |

| Ser. 14-44, Class IC, IO, 3s, 2028 | 24,538,032 | 2,981,739 |

| IFB Ser. 11-70, Class YI, IO, 0.15s, 2040 | 15,722,313 | 86,630 |

| | |

| MORTGAGE-BACKED SECURITIES (44.0%)* cont. | Principal amount | Value |

|

| Agency collateralized mortgage obligations cont. | | |

| Government National Mortgage Association | | |

| Ser. 10-151, Class KO, PO, zero %, 2037 | $694,161 | $594,605 |

| Ser. 06-36, Class OD, PO, zero %, 2036 | 40,069 | 35,124 |

|

| Structured Asset Securities Corp. 144A Ser. 98-RF3, Class A, | | |

| IO, 6.1s, 2028 | 352,313 | 45,801 |

|

| 269,294,992 |

| Commercial mortgage-backed securities (18.5%) | | |

| Banc of America Commercial Mortgage Trust | | |

| Ser. 06-6, Class AJ, 5.421s, 2045 | 6,654,000 | 6,778,243 |

| FRB Ser. 05-5, Class B, 5.393s, 2045 | 6,500,000 | 6,786,000 |

| FRB Ser. 05-1, Class A4, 5.347s, 2042 | 1,070,760 | 1,080,815 |

| Ser. 04-4, Class D, 5.073s, 2042 | 994,000 | 1,030,033 |

| Ser. 07-1, Class XW, IO, 0.494s, 2049 | 7,726,894 | 63,569 |

|

| Banc of America Commercial Mortgage Trust 144A Ser. 07-5, | | |

| Class XW, IO, 0.531s, 2051 | 16,382,657 | 164,056 |

|

| Banc of America Merrill Lynch Commercial Mortgage, Inc. 144A | | |

| FRB Ser. 04-5, Class F, 5.655s, 2041 | 1,612,000 | 1,638,195 |

| Ser. 04-4, Class XC, IO, 0.932s, 2042 | 8,846,049 | 20,850 |

| Ser. 04-5, Class XC, IO, 0.865s, 2041 | 29,308,919 | 74,767 |

| Ser. 02-PB2, Class XC, IO, 0.416s, 2035 | 5,286,476 | 2,664 |

| Ser. 05-1, Class XW, IO, 0.037s, 2042 | 218,705,126 | 16,403 |

|

| Bear Stearns Commercial Mortgage Securities Trust | | |

| FRB Ser. 05-T18, Class D, 5.134s, 2042 | 2,192,000 | 2,260,500 |

| Ser. 04-PR3I, Class X1, IO, 0.81s, 2041 | 1,357,581 | 3,902 |

|

| Bear Stearns Commercial Mortgage Securities Trust 144A | | |

| FRB Ser. 06-PW11, Class B, 5.607s, 2039 | 1,881,000 | 1,911,096 |

| Ser. 06-PW14, Class X1, IO, 0.832s, 2038 | 15,832,388 | 243,502 |

|

| CFCRE Commercial Mortgage Trust 144A | | |

| FRB Ser. 11-C2, Class D, 5.744s, 2047 | 1,108,000 | 1,204,285 |

| FRB Ser. 11-C2, Class E, 5.744s, 2047 | 1,535,000 | 1,551,593 |

|

| Citigroup Commercial Mortgage Trust 144A | | |

| FRB Ser. 12-GC8, Class D, 5.04s, 2045 | 7,098,000 | 6,986,561 |

| Ser. 06-C5, Class XC, IO, 0.735s, 2049 | 111,362,733 | 1,447,716 |

|

| Citigroup/Deutsche Bank Commercial Mortgage Trust 144A | | |

| Ser. 07-CD4, Class XC, IO, 0.56s, 2049 | 142,921,879 | 1,071,914 |

| Ser. 07-CD4, Class XW, IO, 0.56s, 2049 | 45,071,080 | 383,104 |

|

| COMM Mortgage Trust | | |

| Ser. 07-C9, Class AJ, 5.65s, 2049 | 3,377,000 | 3,564,086 |

| FRB Ser. 13-CR11, Class AM, 4.715s, 2046 | 1,308,000 | 1,399,560 |

| Ser. 12-CR1, Class XA, IO, 2.398s, 2045 | 25,971,597 | 3,046,858 |

| Ser. 12-CR3, Class XA, IO, 2.349s, 2045 | 53,578,676 | 6,553,637 |

| Ser. 14-UBS2, Class XA, IO, 1.609s, 2047 | 24,438,001 | 2,324,028 |

|

| COMM Mortgage Trust 144A | | |

| FRB Ser. 12-CR3, Class E, 4.927s, 2045 | 2,781,285 | 2,653,680 |

| FRB Ser. 13-CR8, Class AM, 3.965s, 2046 | 2,166,000 | 2,200,288 |

| FRB Ser. 07-C9, Class AJFL, 0.84s, 2049 | 1,343,000 | 1,212,998 |

| Ser. 06-C8, Class XS, IO, 0.706s, 2046 | 49,955,672 | 611,238 |

|

| | |

| MORTGAGE-BACKED SECURITIES (44.0%)* cont. | Principal amount | Value |

|

| Commercial mortgage-backed securities cont. | | |

| Credit Suisse Commercial Mortgage Trust 144A Ser. 07-C2, | | |

| Class AX, IO, 0.226s, 2049 | $83,890,422 | $429,282 |

|

| Credit Suisse First Boston Mortgage Securities Corp. | | |

| Ser. 05-C5, Class C, 5.1s, 2038 | 1,487,000 | 1,525,403 |

| Ser. 03-CPN1, Class E, 4.891s, 2035 | 1,528,000 | 1,528,000 |

|

| Credit Suisse First Boston Mortgage Securities Corp. 144A | | |

| Ser. 98-C1, Class F, 6s, 2040 | 1,676,677 | 1,844,344 |

| Ser. 03-C3, Class AX, IO, 1.74s, 2038 | 2,373,445 | 100 |

| Ser. 02-CP3, Class AX, IO, 1.471s, 2035 | 1,522,417 | 20,079 |

|

| DBRR Trust 144A FRB Ser. 13-EZ3, Class A, 1.636s, 2049 | 9,249,833 | 9,278,739 |

|

| DLJ Commercial Mortgage Corp. 144A FRB Ser. 98-CG1, | | |

| Class B4, 7.397s, 2031 | 47,698 | 47,648 |

|

| First Union National Bank-Bank of America Commercial | | |

| Mortgage Trust 144A Ser. 01-C1, Class 3, IO, 1.956s, 2033 | 974,910 | 8,376 |

|

| GE Business Loan Trust 144A Ser. 04-2, Class D, 2.902s, 2032 F | 174,544 | 122,142 |

|

| GE Capital Commercial Mortgage Corp. FRB Ser. 05-C1, Class B, | | |

| 4.846s, 2048 | 3,997,000 | 4,091,409 |

|

| GE Capital Commercial Mortgage Corp. 144A | | |

| Ser. 05-C3, Class XC, IO, 0.283s, 2045 | 243,901,953 | 458,284 |

| Ser. 07-C1, Class XC, IO, 0.16s, 2049 | 121,750,721 | 784,075 |

|

| GMAC Commercial Mortgage Securities, Inc. Trust | | |

| Ser. 97-C1, Class X, IO, 1.451s, 2029 | 2,138,302 | 50,338 |

| Ser. 05-C1, Class X1, IO, 0.766s, 2043 | 28,987,858 | 132,764 |

|

| Greenwich Capital Commercial Funding Corp. FRB Ser. 05-GG3, | | |

| Class B, 4.894s, 2042 | 1,894,000 | 1,930,554 |

|

| GS Mortgage Securities Trust | | |

| FRB Ser. 04-GG2, Class D, 5.946s, 2038 | 1,628,000 | 1,639,193 |

| Ser. 06-GG6, Class A2, 5.506s, 2038 | 36,668 | 36,737 |

| Ser. 05-GG4, Class B, 4.841s, 2039 | 3,246,000 | 3,271,319 |

| Ser. 13-GC10, Class XA, IO, 1.902s, 2046 | 58,273,773 | 6,151,962 |

|

| GS Mortgage Securities Trust 144A | | |

| Ser. 98-C1, Class F, 6s, 2030 | 72,622 | 72,622 |

| FRB Ser. 11-GC3, Class E, 5s, 2044 | 1,692,000 | 1,563,778 |

| FRB Ser. GC10, Class D, 4.562s, 2046 | 3,433,000 | 3,123,687 |

| Ser. 06-GG6, Class XC, IO, 0.16s, 2038 | 76,814,934 | 60,991 |

|

| JPMorgan Chase Commercial Mortgage Securities Trust | | |

| FRB Ser. 07-CB20, Class AJ, 6.282s, 2051 | 3,663,000 | 3,889,740 |

| FRB Ser. 07-LD12, Class A3, 6.135s, 2051 | 10,579,320 | 10,610,846 |

| FRB Ser. 06-LDP7, Class B, 6.025s, 2045 | 3,516,000 | 3,145,672 |

| FRB Ser. 07-LD11, Class A2, 5.974s, 2049 | 760,237 | 763,323 |

| FRB Ser. 04-CB9, Class B, 5.964s, 2041 | 2,411,000 | 2,447,647 |

| FRB Ser. 06-LDP6, Class B, 5.688s, 2043 | 2,815,000 | 2,815,000 |

| Ser. 06-LDP8, Class B, 5.52s, 2045 | 1,306,000 | 1,330,161 |

| Ser. 04-LN2, Class A2, 5.115s, 2041 | 1,362,610 | 1,372,352 |

| FRB Ser. 04-CBX, Class B, 5.021s, 2037 | 1,143,000 | 1,153,725 |

| FRB Ser. 13-C10, Class D, 4.299s, 2047 | 1,702,000 | 1,544,790 |

| Ser. 13-C16, Class XA, IO, 1.545s, 2046 | 24,291,036 | 1,797,537 |

| Ser. 06-LDP8, Class X, IO, 0.727s, 2045 | 48,618,384 | 546,957 |

| Ser. 07-LDPX, Class X, IO, 0.494s, 2049 | 60,506,987 | 537,302 |

|

| | |

| MORTGAGE-BACKED SECURITIES (44.0%)* cont. | Principal amount | Value |

|

| Commercial mortgage-backed securities cont. | | |

| JPMorgan Chase Commercial Mortgage Securities Trust 144A | | |

| FRB Ser. 10-C1, Class D, 6.522s, 2043 | $3,439,000 | $3,882,074 |

| FRB Ser. 07-CB20, Class C, 6.382s, 2051 | 1,556,000 | 1,460,041 |

| FRB Ser. 11-C3, Class E, 5.728s, 2046 | 1,416,000 | 1,497,946 |

| FRB Ser. 11-C3, Class F, 5.728s, 2046 | 1,441,000 | 1,440,781 |

| FRB Ser. 01-C1, Class H, 5.626s, 2035 | 1,296,973 | 1,315,390 |

| FRB Ser. 12-C8, Class D, 4.823s, 2045 | 8,379,000 | 8,407,654 |

| FRB Ser. 12-C8, Class E, 4.823s, 2045 | 1,452,000 | 1,405,726 |

| FRB Ser. 12-LC9, Class E, 4.574s, 2047 | 272,000 | 256,786 |

| FRB Ser. 12_LC9, Class D, 4.574s, 2047 | 3,277,000 | 3,216,797 |

| FRB Ser. 13-C10, Class E, 3 1/2s, 2047 | 3,043,000 | 2,252,733 |

| FRB Ser. 13-LC11, Class E, 3 1/4s, 2046 | 2,038,000 | 1,461,654 |

| Ser. 05-CB12, Class X1, IO, 0.493s, 2037 | 25,348,967 | 88,113 |

| Ser. 06-LDP6, Class X1, IO, 0.249s, 2043 | 47,697,653 | 117,336 |

|

| LB Commercial Conduit Mortgage Trust 144A | | |

| Ser. 99-C1, Class F, 6.41s, 2031 | 75,406 | 75,594 |

| Ser. 99-C1, Class G, 6.41s, 2031 | 851,777 | 881,456 |

| Ser. 98-C4, Class G, 5.6s, 2035 | 56,990 | 57,594 |

| Ser. 98-C4, Class H, 5.6s, 2035 | 808,000 | 846,891 |

|

| LB-UBS Commercial Mortgage Trust | | |

| FRB Ser. 06-C6, Class C, 5.482s, 2039 | 1,808,000 | 1,767,320 |

| FRB Ser. 06-C6, Class AJ, 5.452s, 2039 | 3,913,000 | 4,195,350 |

| Ser. 06-C7, Class A2, 5.3s, 2038 | 2,170,479 | 2,243,710 |

| Ser. 07-C2, Class XW, IO, 0.738s, 2040 | 5,847,654 | 88,721 |

|

| LB-UBS Commercial Mortgage Trust 144A | | |

| FRB Ser. 04-C1, Class G, 5.077s, 2036 | 7,400,000 | 7,118,304 |

| FRB Ser. 04-C7, Class G, 5.032s, 2036 | 2,082,000 | 2,126,763 |

| Ser. 06-C7, Class XCL, IO, 0.85s, 2038 | 61,606,777 | 903,771 |

| Ser. 06-C7, Class XW, IO, 0.85s, 2038 | 36,868,205 | 547,124 |

| Ser. 05-C5, Class XCL, IO, 0.604s, 2040 | 70,048,574 | 481,584 |

| Ser. 05-C2, Class XCL, IO, 0.494s, 2040 | 136,590,754 | 284,655 |

| Ser. 05-C7, Class XCL, IO, 0.369s, 2040 | 114,628,687 | 325,202 |

| Ser. 07-C2, Class XCL, IO, 0.172s, 2040 | 129,527,916 | 1,971,544 |

|

| Merrill Lynch Mortgage Investors Trust Ser. 96-C2, Class JS, IO, | | |

| 2.37s, 2028 | 24,376 | 2 |

|

| Merrill Lynch Mortgage Trust | | |

| FRB Ser. 08-C1, Class AJ, 6.47s, 2051 | 1,828,000 | 1,996,907 |

| FRB Ser. 07-C1, Class A3, 6.032s, 2050 | 726,141 | 745,109 |

| FRB Ser. 05-CKI1, Class B, 5.457s, 2037 | 10,872,000 | 11,263,392 |

|

| Merrill Lynch Mortgage Trust 144A | | |

| Ser. 04-KEY2, Class XC, IO, 1.11s, 2039 | 10,380,795 | 16,807 |

| Ser. 05-MCP1, Class XC, IO, 0.764s, 2043 | 33,827,591 | 164,098 |

|

| Mezz Cap Commercial Mortgage Trust 144A | | |

| Ser. 04-C1, Class X, IO, 8.914s, 2037 | 256,861 | 9,247 |

| Ser. 05-C3, Class X, IO, 6.524s, 2044 | 1,564,110 | 95,098 |

| Ser. 06-C4, Class X, IO, 6.48s, 2045 | 4,712,980 | 403,902 |

|

| | |

| MORTGAGE-BACKED SECURITIES (44.0%)* cont. | Principal amount | Value |

|

| Commercial mortgage-backed securities cont. | | |

| ML-CFC Commercial Mortgage Trust | | |

| Ser. 06-4, Class AJ, 5.239s, 2049 | $958,000 | $968,778 |

| FRB Ser. 06-4, Class A2FL, 0.273s, 2049 | 477,514 | 476,320 |

|

| Morgan Stanley Bank of America Merrill Lynch Trust 144A | | |

| Ser. 13-C10, Class D, 4.218s, 2046 | 1,359,000 | 1,173,211 |

|

| Morgan Stanley Capital I Trust | | |

| FRB Ser. 07-HQ12, Class A2, 5.777s, 2049 F | 745,249 | 746,102 |

| FRB Ser. 07-HQ12, Class A2FX, 5.777s, 2049 | 3,390,186 | 3,441,378 |

| Ser. 07-IQ14, Class A2, 5.61s, 2049 | 592,591 | 599,393 |

|

| Morgan Stanley Capital I Trust 144A FRB Ser. 11-C3, Class E, | | |

| 5.356s, 2049 | 1,339,000 | 1,348,895 |

|

| Morgan Stanley ReREMIC Trust 144A FRB Ser. 10-C30A, | | |

| Class A3B, 5.246s, 2043 | 411,660 | 411,681 |

|

| TIAA Real Estate CDO, Ltd. Ser. 03-1A, Class E, 8s, 2038 | 1,614,940 | 403,735 |

|

| UBS-Barclays Commercial Mortgage Trust 144A | | |

| FRB Ser. 12-C3, Class D, 5.123s, 2049 | 3,091,000 | 2,978,951 |

| Ser. 12-C4, Class XA, IO, 2.021s, 2045 | 23,720,315 | 2,636,394 |

|

| Wachovia Bank Commercial Mortgage Trust | | |

| Ser. 06-C24, Class AJ, 5.658s, 2045 | 2,499,000 | 2,502,749 |

| Ser. 05-C17, Class D, 5.396s, 2042 | 6,740,000 | 6,908,500 |

| Ser. 06-C29, IO, 0.53s, 2048 | 172,498,577 | 1,642,186 |

| Ser. 07-C34, IO, 0.494s, 2046 | 16,124,721 | 195,109 |

|

| Wachovia Bank Commercial Mortgage Trust 144A | | |

| FRB Ser. 05-C17, Class E, 5.592s, 2042 | 1,154,000 | 1,179,965 |

| FRB Ser. 05-C21, Class E, 5.414s, 2044 | 3,212,000 | 3,234,805 |

| Ser. 05-C18, Class XC, IO, 0.483s, 2042 | 21,742,889 | 55,879 |

| Ser. 06-C26, Class XC, IO, 0.189s, 2045 | 10,886,993 | 18,072 |

|

| WF-RBS Commercial Mortgage Trust Ser. 13-C14, Class XA, IO, | | |

| 1.062s, 2046 | 63,885,241 | 3,722,593 |

|

| WF-RBS Commercial Mortgage Trust 144A | | |

| FRB Ser. 11-C2, Class D, 5.647s, 2044 | 4,834,438 | 5,019,114 |

| FRB Ser. 11-C4, Class E, 5.415s, 2044 | 3,212,768 | 3,258,003 |

| FRB Ser. 13-C17, Class D, 5.298s, 2046 | 1,665,000 | 1,566,141 |

| FRB Ser. 12-C7, Class D, 5.002s, 2045 | 4,482,000 | 4,594,677 |

| FRB Ser. 12-C7, Class E, 5.002s, 2045 | 1,985,533 | 1,932,792 |

| FRB Ser. 12-C10, Class D, 4.608s, 2045 | 1,804,000 | 1,672,802 |

| Ser. 14-C19, Class D, 4.234s, 2047 | 1,781,000 | 1,560,787 |

| Ser. 13-C12, Class XA, IO, 1.653s, 2048 | 58,583,907 | 5,167,804 |

| Ser. 13-C11, Class XA, IO, 1.647s, 2045 | 25,775,669 | 2,083,576 |

|

| 255,326,587 |

| Residential mortgage-backed securities (non-agency) (6.0%) | | |

|

| BCAP, LLC Trust 144A FRB Ser. 10-RR1, Class 3A3, 5.21s, 2035 | 2,013,000 | 1,996,695 |

|

| Bear Stearns Alt-A Trust FRB Ser. 04-6, Class M1, 0.977s, 2034 | 6,225,650 | 5,305,499 |

|

| Citigroup Mortgage Loan Trust, Inc. Ser. 2005-WF2, Class AF4, | | |

| 4.964s, 2035 | 584,444 | 587,366 |

|

| Citigroup Mortgage Loan Trust, Inc. 144a Ser. 10-8, Class 1A2, | | |

| 5 1/2s, 2036 | 1,300,000 | 1,297,010 |

|

| Countrywide Asset Backed Certificates FRB Ser. 05-AB1, | | |

| Class A3, 0.752s, 2035 | 3,411,563 | 3,269,983 |

|

| | |

| MORTGAGE-BACKED SECURITIES (44.0%)* cont. | Principal amount | Value |

|

| Residential mortgage-backed securities (non-agency) cont. | | |

| First Plus Home Loan Trust Ser. 97-3, Class B1, 7.79s, 2023 | | |

| (In default) † | $134,710 | $13 |

|

| JPMorgan Resecuritization Trust 144A Ser. 14-1, Class 9A3, | | |

| 0.444s, 2035 | 2,911,774 | 2,810,444 |

|

| MortgageIT Trust FRB Ser. 05-1, Class 1M2, 0.742s, 2035 | 3,638,097 | 3,283,525 |

|

| WAMU Mortgage Pass-Through Certificates | | |

| FRB Ser. 05-AR11, Class A1C3, 0.662s, 2045 | 4,488,946 | 3,939,050 |

| FRB Ser. 05-AR19, Class A1C3, 0.652s, 2045 | 11,579,273 | 9,958,175 |

| FRB Ser. 2004-AR13, Class A1B2, 0.642s, 2034 | 11,262,225 | 10,473,870 |

| FRB Ser. 05-AR11, Class A1B2, 0.602s, 2045 | 4,692,113 | 4,105,599 |

| FRB Ser. 05-AR13, Class A1C4, 0.582s, 2045 | 19,086,420 | 16,271,173 |

| FRB Ser. 05-AR17, Class A1B2, 0.562s, 2045 | 6,360,301 | 5,597,065 |

| FRB Ser. 05-AR11, Class A1B3, 0.552s, 2045 | 8,357,888 | 7,313,152 |

| FRB Ser. 05-AR8, Class 2AC3, 0.542s, 2045 | 4,927,119 | 4,335,864 |

| FRB Ser. 2005-AR17, Class A1B3, 0.502s, 2045 | 1,892,392 | 1,662,940 |

|

| | | 82,207,423 |

| | | |

| | | $606,829,002 |

| Total mortgage-backed securities (cost $556,580,244) | | |

|

| |

| CORPORATE BONDS AND NOTES (25.9%)* | Principal amount | Value |

|

| Basic materials (1.4%) | | |

| Ashland, Inc. company guaranty sr. unsec. unsub. notes | | |

| 4 3/4s, 2022 | $571,000 | $565,290 |

|

| Celanese US Holdings, LLC sr. notes 5 7/8s, 2021 (Germany) | 835,000 | 914,325 |

|

| CF Industries, Inc. company guaranty sr. unsec. notes | | |

| 5 3/8s, 2044 | 1,728,000 | 1,813,356 |

|

| CF Industries, Inc. company guaranty sr. unsec. notes | | |

| 5.15s, 2034 | 1,170,000 | 1,224,685 |

|

| CF Industries, Inc. company guaranty sr. unsec. unsub. notes | | |

| 7 1/8s, 2020 | 112,000 | 134,968 |

|

| Cytec Industries, Inc. sr. unsec. unsub. notes 3 1/2s, 2023 | 355,000 | 341,345 |

|

| Eastman Chemical Co. sr. unsec. notes 3.6s, 2022 | 1,245,000 | 1,254,704 |

|

| Eastman Chemical Co. sr. unsec. unsub. notes 6.3s, 2018 | 300,000 | 347,530 |

|

| Georgia-Pacific, LLC sr. unsec. unsub. notes 7 3/4s, 2029 | 470,000 | 626,873 |

|

| Glencore Funding, LLC 144A company guaranty sr. unsec. | | |

| unsub. notes 4 5/8s, 2024 | 610,000 | 611,315 |

|

| International Paper Co. sr. unsec. notes 8.7s, 2038 | 510,000 | 752,667 |

|

| International Paper Co. sr. unsec. notes 7.95s, 2018 | 1,400,000 | 1,719,012 |

|

| Mosaic Co. (The) sr. unsec. notes 3 3/4s, 2021 | 640,000 | 654,859 |

|

| Mosaic Co. (The) sr. unsec. unsub. notes 5 5/8s, 2043 | 110,000 | 120,147 |

|

| Mosaic Co. (The) sr. unsec. unsub. notes 5.45s, 2033 | 45,000 | 48,965 |

|

| Packaging Corp. of America sr. unsec. unsub. notes 4 1/2s, 2023 | 215,000 | 226,409 |

|

| Packaging Corp. of America sr. unsec. unsub. notes 3.9s, 2022 | 945,000 | 957,295 |

|

| PPG Industries, Inc. sr. unsec. unsub. debs. 7.4s, 2019 | 1,130,000 | 1,381,414 |

|

| Rock-Tenn Co. company guaranty sr. unsec. unsub. notes | | |

| 4.45s, 2019 | 393,000 | 425,127 |

|

| Temple-Inland, Inc. sr. unsec. unsub. notes 6 5/8s, 2018 | 1,080,000 | 1,256,964 |

|

| Union Carbide Corp. sr. unsec. unsub. bonds 7 3/4s, 2096 | 135,000 | 158,382 |

|

| | |

| CORPORATE BONDS AND NOTES (25.9%)* cont. | Principal amount | Value |

|

| Basic materials cont. | | |

| Westvaco Corp. company guaranty sr. unsec. unsub. notes | | |

| 7.95s, 2031 | $1,470,000 | $1,833,108 |

|

| Weyerhaeuser Co. sr. unsec. unsub. notes 7 3/8s, 2032 R | 1,385,000 | 1,811,263 |

|

| Xstrata Finance Canada, Ltd. 144A company guaranty sr. unsec. | | |

| notes 6s, 2041 (Canada) | 590,000 | 623,576 |

|

| 19,803,579 |

| Capital goods (0.6%) | | |

| B/E Aerospace, Inc. sr. unsec. unsub. notes 5 1/4s, 2022 | 1,085,000 | 1,122,975 |

|

| Crown Americas, LLC/Crown Americas Capital Corp. | | |

| IV company guaranty sr. unsec. notes 4 1/2s, 2023 | 450,000 | 429,750 |

|

| Legrand France SA sr. unsec. unsub. debs 8 1/2s, 2025 (France) | 1,393,000 | 1,880,612 |

|

| Parker Hannifin Corp. sr. unsec. unsub. notes Ser. MTN, | | |

| 6 1/4s, 2038 | 435,000 | 546,040 |

|

| Republic Services, Inc. company guaranty sr. unsec. | | |

| notes 5.7s, 2041 | 595,000 | 693,371 |

|

| Republic Services, Inc. company guaranty sr. unsec. | | |

| notes 3.8s, 2018 | 720,000 | 770,469 |

|

| Republic Services, Inc. company guaranty sr. unsec. unsub. | | |

| notes 5 1/2s, 2019 | 660,000 | 755,515 |

|

| United Technologies Corp. sr. unsec. notes 5.7s, 2040 | 100,000 | 122,075 |

|

| United Technologies Corp. sr. unsec. unsub. notes 3.1s, 2022 | 560,000 | 565,677 |

|

| Waste Management, Inc. company guaranty sr. unsec. notes | | |

| 7 3/4s, 2032 | 995,000 | 1,391,319 |

|

| 8,277,803 |

| Communication services (3.2%) | | |

| America Movil SAB de CV company guaranty sr. unsec. unsub. | | |

| notes 6 1/8s, 2040 (Mexico) | 880,000 | 1,007,343 |

|

| America Movil SAB de CV company guaranty sr. unsec. unsub. | | |

| notes 2 3/8s, 2016 (Mexico) | 670,000 | 688,244 |

|

| American Tower Corp. sr. unsec. notes 7s, 2017 R | 1,210,000 | 1,408,036 |

|

| American Tower Corp. sr. unsec. unsub. notes 3.4s, 2019 R | 135,000 | 139,202 |

|

| CC Holdings GS V, LLC/Crown Castle GS III Corp. company | | |

| guaranty sr. notes 3.849s, 2023 | 1,415,000 | 1,388,839 |

|

| CenturyLink, Inc. sr. unsec. unsub. notes Ser. G, 6 7/8s, 2028 | 2,025,000 | 2,025,000 |

|

| Comcast Corp. company guaranty sr. unsec. unsub. notes | | |

| 6 1/2s, 2035 | 700,000 | 880,425 |

|

| Crown Castle Towers, LLC 144A company guaranty sr. notes | | |

| 4.883s, 2020 | 1,915,000 | 2,123,341 |

|

| Frontier Communications Corp. sr. unsec. notes 8 1/2s, 2020 | 800,000 | 931,500 |

|

| NBCUniversal Media, LLC sr. unsec. unsub. notes 6.4s, 2040 | 845,000 | 1,060,620 |

|

| Orange SA sr. unsec. unsub. notes 5 3/8s, 2019 (France) | 880,000 | 997,008 |

|

| Orange SA sr. unsec. unsub. notes 4 1/8s, 2021 (France) | 886,000 | 932,330 |

|

| Qwest Corp. sr. unsec. notes 6 3/4s, 2021 | 1,394,000 | 1,581,111 |

|

| Rogers Communications, Inc. company guaranty notes 6.8s, | | |

| 2018 (Canada) | 610,000 | 726,943 |

|

| Rogers Communications, Inc. company guaranty sr. unsec. | | |

| unsub. notes 4 1/2s, 2043 (Canada) | 425,000 | 405,024 |

|

| SBA Tower Trust 144A company guaranty sr. notes 5.101s, 2017 | 2,425,000 | 2,601,710 |

|

| SES SA 144A company guaranty sr. unsec. notes 5.3s, | | |

| 2043 (France) | 920,000 | 951,982 |

|

| TCI Communications, Inc. sr. unsec. unsub. notes 7 7/8s, 2026 | 2,435,000 | 3,241,275 |

|

| | |

| CORPORATE BONDS AND NOTES (25.9%)* cont. | Principal amount | Value |

|

| Communication services cont. | | |

| Telecom Italia Capital SA company guaranty sr. unsec. unsub. | | |

| notes 6.175s, 2014 (Italy) | $621,000 | $624,726 |

|

| Telefonica Emisiones SAU company guaranty sr. unsec. notes | | |

| 5.462s, 2021 (Spain) | 1,845,000 | 2,077,394 |

|

| Telefonica Emisiones SAU company guaranty sr. unsec. notes | | |

| 4.57s, 2023 (Spain) | 192,000 | 200,809 |

|

| Telefonica Emisiones SAU company guaranty sr. unsec. unsub. | | |

| notes 3.192s, 2018 (Spain) | 850,000 | 880,937 |

|

| Time Warner Cable, Inc. company guaranty sr. notes 7.3s, 2038 | 1,593,000 | 2,116,812 |

|

| Time Warner Cable, Inc. company guaranty sr. unsec. notes | | |

| 6 3/4s, 2018 | 355,000 | 421,741 |

|

| Time Warner Cable, Inc. company guaranty sr. unsec. unsub. | | |

| notes 8 3/4s, 2019 | 800,000 | 1,024,487 |

|

| Time Warner Cable, Inc. company guaranty sr. unsec. unsub. | | |

| notes 6 3/4s, 2039 | 350,000 | 443,490 |

|

| Time Warner Cable, Inc. company guaranty sr. unsec. unsub. | | |

| notes 5 1/2s, 2041 | 85,000 | 93,690 |

|

| Time Warner Entertainment Co. LP company guaranty sr. unsec. | | |

| bonds 8 3/8s, 2033 | 449,000 | 648,761 |

|

| Time Warner Entertainment Co. LP company guaranty sr. unsec. | | |

| bonds 8 3/8s, 2023 | 1,119,000 | 1,502,259 |

|

| Verizon Communications, Inc. sr. unsec. unsub. notes 6.4s, 2033 | 985,000 | 1,188,880 |

|

| Verizon Communications, Inc. sr. unsec. unsub. notes 5.9s, 2054 | 127,000 | 3,180,173 |

|

| Verizon Communications, Inc. sr. unsec. unsub. notes | | |

| 5.05s, 2034 | 4,675,000 | 4,883,087 |

|

| Verizon New Jersey, Inc. company guaranty sr. unsec. unsub. | | |

| bonds 8s, 2022 | 640,000 | 795,203 |

|

| Verizon Pennsylvania, Inc. company guaranty sr. unsec. bonds | | |

| 8.35s, 2030 | 795,000 | 1,024,194 |

|

| 44,196,576 |

| Consumer cyclicals (2.7%) | | |

| 21st Century Fox America, Inc. company guaranty sr. unsec. | | |

| debs. 7 3/4s, 2024 | 870,000 | 1,095,999 |

|

| 21st Century Fox America, Inc. company guaranty sr. unsec. | | |

| notes 7.85s, 2039 | 1,065,000 | 1,465,064 |

|

| 21st Century Fox America, Inc. company guaranty sr. unsec. | | |

| unsub. debs. 7 3/4s, 2045 | 790,000 | 1,108,587 |

|

| 21st Century Fox America, Inc. company guaranty sr. unsec. | | |

| unsub. notes 6.2s, 2034 | 675,000 | 801,651 |

|

| Autonation, Inc. company guaranty sr. unsec. notes | | |

| 6 3/4s, 2018 | 645,000 | 741,750 |

|

| CBS Corp. company guaranty sr. unsec. debs. 7 7/8s, 2030 | 2,400,000 | 3,208,877 |

|

| Choice Hotels International, Inc. company guaranty sr. unsec. | | |

| unsub. notes 5.7s, 2020 | 1,195,000 | 1,272,675 |

|

| Dollar General Corp. sr. unsec. notes 3 1/4s, 2023 | 1,820,000 | 1,718,477 |

|

| Expedia, Inc. company guaranty sr. unsec. unsub. notes | | |

| 5.95s, 2020 | 950,000 | 1,053,513 |

|

| Ford Motor Co. sr. unsec. unsub. notes 7.45s, 2031 | 2,591,000 | 3,381,001 |

|

| Ford Motor Co. sr. unsec. unsub. notes 7.4s, 2046 | 350,000 | 465,309 |

|

| Ford Motor Credit Co., LLC sr. unsec. notes 4.207s, 2016 | 2,760,000 | 2,926,254 |

|

| | |

| CORPORATE BONDS AND NOTES (25.9%)* cont. | Principal amount | Value |

|

| Consumer cyclicals cont. | | |

| General Motors Financial Co., Inc. company guaranty sr. unsec. | | |

| notes 3 1/4s, 2018 | $661,000 | $667,610 |

|

| General Motors Financial Co., Inc. company guaranty sr. unsec. | | |

| notes 2 3/4s, 2016 | 944,000 | 958,160 |

|

| GLP Capital LP/GLP Financing II, Inc. 144A company guaranty | | |

| sr. unsec. notes 4 3/8s, 2018 | 130,000 | 134,550 |

|

| Grupo Televisa, S.A.B. sr. unsec. unsub. notes 6 5/8s, | | |

| 2025 (Mexico) | 510,000 | 606,794 |

|

| Historic TW, Inc. company guaranty sr. unsec. unsub. bonds | | |

| 9.15s, 2023 | 675,000 | 927,509 |

|

| Host Hotels & Resorts LP sr. unsec. unsub. notes 6s, 2021 R | 266,000 | 304,378 |

|

| Host Hotels & Resorts LP sr. unsec. unsub. notes 5 1/4s, 2022 R | 124,000 | 136,236 |

|

| Hyatt Hotels Corp. sr. unsec. unsub. notes 3 3/8s, 2023 | 660,000 | 634,023 |

|

| L Brands, Inc. company guaranty sr. unsec. notes 6 5/8s, 2021 | 840,000 | 939,750 |

|

| L Brands, Inc. sr. unsec. notes 5 5/8s, 2022 | 820,000 | 863,050 |

|

| Macy’s Retail Holdings, Inc. company guaranty sr. unsec. | | |

| notes 6.9s, 2029 | 1,945,000 | 2,381,433 |

|

| Macy’s Retail Holdings, Inc. company guaranty sr. unsec. notes | | |

| 6.65s, 2024 | 405,000 | 491,533 |

|

| Macy’s Retail Holdings, Inc. company guaranty sr. unsec. notes | | |

| 5 1/8s, 2042 | 240,000 | 251,776 |

|

| Marriott International, Inc. sr. unsec. unsub. notes 3s, 2019 | 780,000 | 802,948 |

|

| NVR, Inc. sr. unsec. unsub. notes 3.95s, 2022 | 740,000 | 737,482 |

|

| O’Reilly Automotive, Inc. company guaranty sr. unsec. unsub. | | |

| notes 3.85s, 2023 | 640,000 | 640,091 |

|