| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811-00653) |

| | |

| Exact name of registrant as specified in charter: | Putnam Income Fund |

| | |

| Address of principal executive offices: | One Post Office Square, Boston, Massachusetts 02109 |

| | |

| Name and address of agent for service: | Robert T. Burns, Vice President

One Post Office Square

Boston, Massachusetts 02109 |

| | |

| Copy to: | John W. Gerstmayr, Esq.

Ropes & Gray LLP

800 Boylston Street

Boston, Massachusetts 02199-3600 |

| | |

| Registrant’s telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | October 31, 2012 |

| | |

| Date of reporting period: | November 1, 2011 — April 30, 2012 |

| | |

|

Item 1. Report to Stockholders: | |

| | |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

Putnam

Income

Fund

Semiannual report

4 | 30 | 12

| | |

| Message from the Trustees | 1 | |

| |

| About the fund | 2 | |

| |

| Performance snapshot | 4 | |

| |

| Interview with your fund’s portfolio manager | 5 | |

| |

| Your fund’s performance | 11 | |

| |

| Your fund’s expenses | 13 | |

| |

| Terms and definitions | 15 | |

| |

| Other information for shareholders | 16 | |

| |

| Financial statements | 17 | |

| |

Consider these risks before investing: Funds that invest in government securities are not guaranteed. Mortgage-backed securities are subject to prepayment risk. The use of derivatives involves additional risks, such as the potential inability to terminate or sell derivatives positions and the potential failure of the other party to the instrument to meet its obligations. Funds that invest in bonds are subject to certain risks including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Credit risk is generally greater for below-investment-grade bonds (a significant portion of the fund’s investments). Unlike bonds, bond funds have ongoing fees and expenses. The prices of bonds may fall or fail to rise over extended periods of time for a variety of reasons, including both general financial market conditions and factors related to a specific issuer or industry.

Message from the Trustees

Dear Fellow Shareholder:

Since the start of 2012, the economic picture and market performance worldwide have been mixed and volatile, punctuated by periodic worries over Europe’s unresolved sovereign-debt troubles and China’s efforts to maintain its robust economic growth. The U.S. economy has shown signs of gathering steam, but continues to face the dual headwinds of tepid jobs growth and a burgeoning federal debt.

Putnam’s portfolio managers and analysts are trained to uncover opportunities that often emerge in this type of environment, while also seeking to guard against downside risk. During these times, your financial advisor also can be a valuable resource, helping you to maintain a long-term focus and a balanced investment approach.

In other news, please join us in welcoming the return of Elizabeth T. Kennan to the Board of Trustees. Dr. Kennan, who served as a Trustee from 1992 until 2010, has rejoined the Board, effective January 1, 2012. Dr. Kennan is a Partner of Cambus-Kenneth Farm (thoroughbred horse breeding and general farming), and is also President Emeritus of Mount Holyoke College.

We would also like to take this opportunity to welcome new shareholders to the fund and to thank all of our investors for your continued confidence in Putnam.

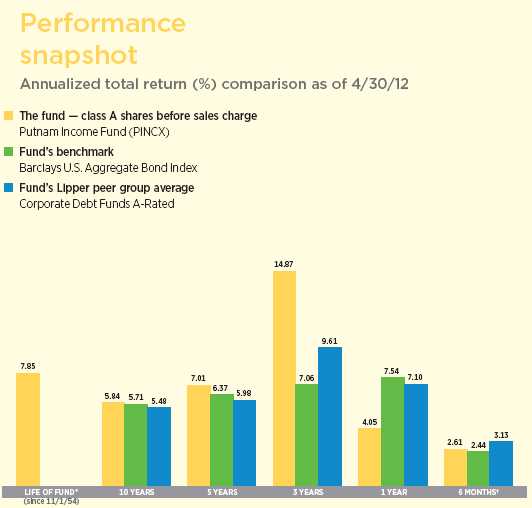

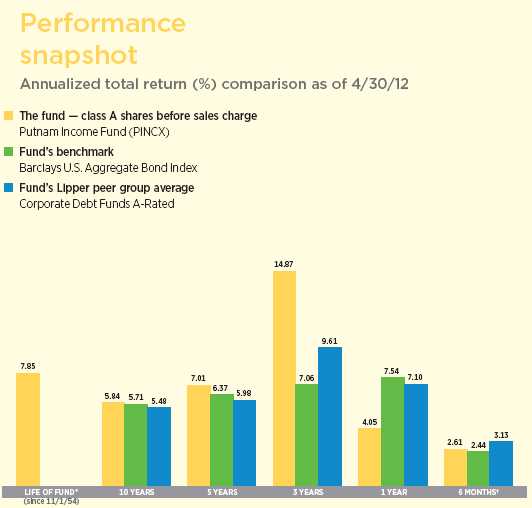

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 4.00%; had they, returns would have been lower. See pages 5 and 11–13 for additional performance information. For a portion of the periods, the fund had expense limitations, without which returns would have been lower. To obtain the most recent month-end performance, visit putnam.com.

* The fund’s benchmark, the Barclays U.S. Aggregate Bond Index, was introduced on 12/31/75, and the fund’s Lipper category was introduced on 12/31/59. Both post-date the inception date of the fund’s class A shares.

† Returns for the six-month period are not annualized, but cumulative.

4

Interview with your fund’s portfolio manager

Mike, what was the bond-market environment like during the six months ended April 30, 2012?

Investor sentiment shifted early in the period, as better U.S. economic data, coordinated central bank efforts to ease pressure on banks in Europe, and an extension of the Federal Reserve’s [the Fed] accommodative monetary policy, bolstered demand for lower-quality, more economically sensitive fixed-income assets. As a result, high-yield bonds, emerging-market debt, and non-government-agency residential mortgage-backed securities [non-agency RMBS] were among the best-performing market sectors.

Intermediate-maturity U.S. Treasury yields declined, helping the broad Barclays U.S. Aggregate Bond Index — the fund’s benchmark — achieve a modestly positive return. Within the index, higher-yielding spread sectors, including corporate and mortgage-backed securities, solidly outpaced Treasuries.

March was the first month since last summer’s eurozone sovereign debt flare-up that the Treasury market began to show signs of any meaningful stress. A string of better-than-expected readings on the domestic economy pushed Treasury prices lower and yields higher. During April, however, Treasuries rallied and yields declined amid renewed concern about Europe’s debt crisis and uncertainty about the impact of a slowing Chinese economy on global economic growth.

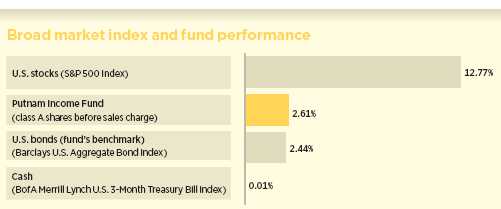

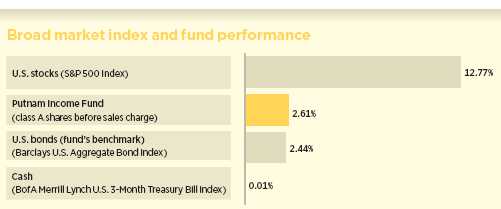

This comparison shows your fund’s performance in the context of broad market indexes for the six months ended 4/30/12. See pages 4 and 11–13 for additional fund performance information. Index descriptions can be found on pages 15–16.

5

Against this backdrop, the fund slightly outperformed its benchmark but trailed the average return of its Lipper peer group.

Which holdings helped the fund outpace its benchmark?

Our out-of-benchmark allocation to non-agency RMBS was a significant contributor for the period. Robust demand from hedge funds and other institutional investors, coupled with reduced supply concerns, drove the sector’s performance.

In 2011, concern about potential forced selling by banks caused investors to retreat from the non-agency RMBS market, prompting the Fed to suspend the auction of its “Maiden Lane” portfolio, which contained a sizable amount of the securities. The Fed resumed the auction in early 2012 and sold its entire portfolio during the first quarter. Completion of the auction helped to greatly diversify the holders of non-agency RMBS, thereby reducing the likelihood that a single seller could flood the market with excess supply.

Our holdings of investment-grade corporate bonds also aided the fund’s relative performance. Within the sector, favorable positioning among financial institutions drove

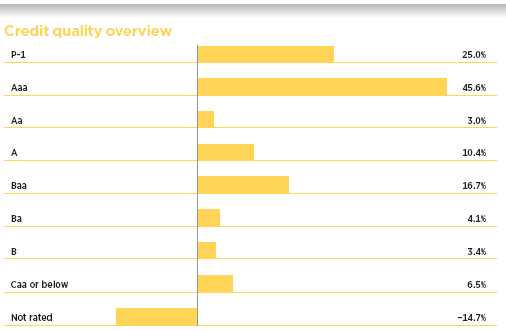

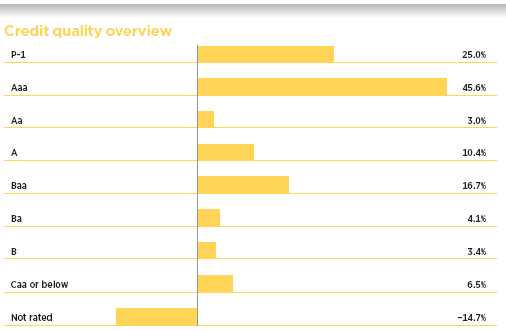

Credit qualities are shown as a percentage of net assets as of 4/30/12. A bond rated Baa or higher (Prime-3 or higher, for short-term debt) is considered investment grade. The chart reflects Moody’s ratings; percentages may include bonds or derivatives not rated by Moody’s but rated by Standard & Poor’s (S&P) or, if unrated by S&P, by Fitch, and then included in the closest equivalent Moody’s rating. Ratings will vary over time.

Credit quality includes bonds and represents only the fixed-income portion of the portfolio. Derivative instruments, including currency forwards, are only included to the extent of any unrealized gain or loss on such instruments and are shown in the not-rated category. The fund itself has not been rated by an independent rating agency.

A negative percentage reflects the effect of fund strategies that are designed to enhance performance if certain securities decline in value.

6

results, as bonds issued by this industry group outperformed those issued by industrial and utility companies.

A significant overweighting in commercial mortgage-backed securities [CMBS] was another notable contributor. We held both AAA-rated CMBS and “seasoned mezzanine” securities. CMBS are created when an underwriter assembles a package of commercial mortgages and issues bonds of varying creditworthiness. AAA-rated CMBS occupy the top of the underwriter’s capital structure, and thus offer the greatest principal protection. Mezzanine CMBS are slightly lower in the capital structure, but still provide a meaningful amount of principal protection along with higher yields. The mezzanine bonds we selected were issued prior to 2006, when CMBS underwriting standards were stronger than they were later in the decade, and provided the fund with a reliable stream of cash flows.

Lastly, collateralized mortgage obligations [CMOs] derived from agency mortgage pass-through securities provided a modest boost versus the index. We favored CMOs created from mortgages that were issued after the cut-off date of the revised Home Affordable Refinance Program [HARP] because we believed they carried lower levels of prepayment risk.

To explain, HARP was introduced by the Obama administration in 2009 to help homeowners who owed more on their mortgages than their homes were worth. When the program was launched, the rules stipulated that mortgages originating before June 1, 2009, would be eligible for a streamlined refinancing process, while mortgages created after that date would not be eligible. Consequently, loans originating after May 31, 2009, would be more cumbersome to refinance, and the securities created from these mortgage pools would have relatively slow prepayment rates. In November 2011, HARP was revised to correct the disparity created by the May 31, 2009 cut-off date by making it easier for borrowers with lower credit ratings and mortgages with relatively high interest rates to refinance.

This chart shows how the fund’s top weightings have changed over the past six months. Weightings are shown as a percentage of net assets. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities and the exclusion of as-of trades, if any. Holdings will vary over time.

7

Seeking to capitalize on the changes to HARP, we executed a twofold strategy: invest in CMOs derived from pass-throughs issued after May 31, 2009, which were created from mortgages not eligible for HARP treatment, and underweight higher-coupon pass-throughs, where prepayment speeds were likely to be much faster. Since, at period-end, the full effect of the HARP revisions were yet to be felt throughout the market, this strategy aided performance only during the period’s second half.

Some readers may not be familiar with the critical role of prepayment risk when investing in mortgage-backed securities [MBS]. Could you provide an explanation?

Sure. All MBS are subject to prepayment risk, because mortgage holders have the right to prepay their loans without penalty. A homeowner can prepay a mortgage by selling the property, refinancing the mortgage, or otherwise paying off the loan in part or whole. Fast prepayments are generally unwelcome for holders of MBS priced above their $100 par value. That’s because prepayment would result in the loss of the security’s price premium on the prepaid balance. For example, if a security is priced at $105 and, hypothetically speaking, all the borrowers prepay, investors would get back $100 on bonds that had been valued at $105.

What factors hampered the fund’s relative results?

Given the low level of Treasury yields and expectations for modestly improving economic growth, we took a cautious approach toward interest-rate risk by generally keeping the fund’s duration — a key measure of interest-rate sensitivity — shorter than that of the benchmark. However, this positioning, which can be beneficial when rates are rising, was the primary detractor from performance, as longer-term yields declined during most of the period and the yield curve flattened.

How did you use derivatives during the period?

We used futures and interest-rate swaps —which allow two parties to exchange one stream of future interest payments for another, based on a specified principal amount — to take tactical positions at various points along the yield curve.

In addition, we employed interest-rate swaps and “swaptions” — which give us the option to enter into a swap contract — to hedge the interest-rate risk associated with our mortgage pass-through and CMO holdings.

What is your outlook for the coming months, and how are you positioning the fund?

Much of the recent data on the domestic economy has been positive and, in my view, modest GDP growth is likely to continue. Overseas, while there are no easy solutions to the fiscal problems plaguing various European economies, I don’t believe weakness in Europe will spill over and lead to recession in the United States. Similarly, I don’t think China’s economy will slow to the point where it will negatively affect U.S. growth.

That said, there is considerable uncertainty on the horizon, given the major fiscal changes that may occur in 2013, such as the possible expiration of the Bush-era tax cuts, surcharges related to health-care reform, and automatic spending cuts. Changes of this magnitude have investors concerned about their potentially detrimental effect on U.S. economic growth.

As we have seen during the past few years, macroeconomic developments can lead to periods of volatility and constrained liquidity in the credit markets. Accordingly, while we remain optimistic about the direction of the U.S. economic recovery, we are taking a cautious approach toward risk, given the potential for increased volatility.

Thanks for your time and for bringing us up to date, Mike.

8

The views expressed in this report are exclusively those of Putnam Management and are subject to change. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

Of special interest

Your fund’s dividend rate was decreased during the semiannual period ended April 30, 2012. The dividend per class A share declined from $0.020 to $0.016, effective April 2012. The reduction was due to the fund’s increased focus on higher-quality, lower-yielding segments of the bond market, and lower overall yields across the market. Similar reductions were made to other share classes.

Portfolio Manager Michael V. Salm is Co-Head of Fixed Income at Putnam. He has a B.A. from Cornell University. Michael joined Putnam in 1997 and has been in the investment industry since 1989.

In addition to Michael, your fund’s portfolio managers are Daniel S. Choquette, CFA; Brett S. Kozlowski, CFA; Kevin F. Murphy; and Raman Srivastava, CFA.

A word about derivatives

Derivatives are an increasingly common type of investment instrument, the performance of which is derived from an underlying security, index, currency, or other area of the capital markets. Derivatives employed by the fund’s managers serve one of two main purposes: to implement a strategy that may be difficult or more expensive to invest in through traditional securities, or to hedge unwanted risk associated with a particular position.

For example, the fund’s managers might use forward currency contracts to capitalize on an anticipated change in exchange rates between two currencies. This approach would require a significantly smaller outlay of capital than purchasing traditional bonds denominated in the underlying currencies. In another example, the managers may identify a bond that they believe is undervalued relative to its risk of default, but may seek to reduce the interest-rate risk of that bond by using interest-rate swaps, a derivative through which two parties “swap” payments based on the movement of certain rates.

Like any other investment, derivatives may not appreciate in value and may lose money. Derivatives may in some cases amplify traditional fixed-income risks and may be less liquid than traditional securities. And because derivatives typically represent contractual agreements between two financial institutions, derivatives entail “counterparty risk,” which is the risk that the other party is unable to meet its obligation. Putnam continuously monitors the counterparty risks we assume, and analyzes the cash flows and balance sheets of those institutions we enter into contracts with in much the same way we analyze a company’s financial health before purchasing its stock or debt. Putnam also enters into collateral agreements with counterparties in which collateral is posted on a regular basis to cover the developing gain or loss of open swaps and forward contracts in order to mitigate the level of ongoing counterparty credit risk.

See pages 64–66 for more information on the types of derivatives used.

9

IN THE NEWS

Gasoline prices have dropped in recent weeks from the year-to-date high of $3.94 reached on April 2. As of June 4, 2012, the average price of a gallon of regular gasoline fell to $3.61, the U.S. Energy Information Administration reported. Driving the price declines were waning concerns over Iran’s nuclear program as well as sluggish demand from slow-growing economies in the United States and Europe. Meanwhile, the crude oil supply situation has improved, with some refineries that were slated for closure now coming back online. The recent drop in prices at the pump has led analysts to recalibrate their price predictions for the summer driving season. Just months ago, some predicted that gas prices could shoot above $4 a gallon and reach $5 by the summer. Now those price increases appear unlikely. Because high gas prices can hinder economic growth, falling prices could help by putting more money back into consumers’ pockets.

10

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended April 30, 2012, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance information as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R and class Y shares are not available to all investors. See the Terms and Definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 4/30/12

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (11/1/54) | (3/1/93) | (7/26/99) | (12/14/94) | (1/21/03) | (6/16/94) |

|

| | Before | After | | | | | Before | After | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset |

| charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 7.85% | 7.78% | 6.87% | 6.87% | 7.04% | 7.04% | 7.41% | 7.35% | 7.58% | 7.94% |

|

| 10 years | 76.45 | 69.43 | 63.51 | 63.51 | 63.58 | 63.58 | 71.86 | 66.20 | 72.05 | 80.76 |

| Annual average | 5.84 | 5.41 | 5.04 | 5.04 | 5.04 | 5.04 | 5.56 | 5.21 | 5.58 | 6.10 |

|

| 5 years | 40.29 | 34.72 | 34.83 | 32.83 | 35.06 | 35.06 | 38.34 | 33.94 | 38.36 | 41.91 |

| Annual average | 7.01 | 6.14 | 6.16 | 5.84 | 6.20 | 6.20 | 6.71 | 6.02 | 6.71 | 7.25 |

|

| 3 years | 51.56 | 45.41 | 47.74 | 44.74 | 47.94 | 47.94 | 50.26 | 45.38 | 50.12 | 52.58 |

| Annual average | 14.87 | 13.29 | 13.89 | 13.12 | 13.94 | 13.94 | 14.54 | 13.28 | 14.50 | 15.12 |

|

| 1 year | 4.05 | –0.15 | 3.17 | –1.82 | 3.16 | 2.16 | 3.74 | 0.33 | 3.82 | 4.38 |

|

| 6 months | 2.61 | –1.56 | 2.12 | –2.88 | 2.12 | 1.12 | 2.42 | –0.97 | 2.37 | 2.82 |

|

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns for class A and M shares reflect the deduction of the maximum 4.00% and 3.25% sales charge, respectively, levied at the time of purchase. Class B share returns after contingent deferred sales charge (CDSC) reflect the applicable CDSC, which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C share returns after CDSC reflect a 1% CDSC for the first year that is eliminated thereafter. Class R and Y shares have no initial sales charge or CDSC. Performance for class B, C, M, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and the higher operating expenses for such shares, except for class Y shares, for which 12b-1 fees are not applicable.

For a portion of the periods, the fund had expense limitations, without which returns would have been lower.

Class B share performance does not reflect conversion to class A shares.

11

Comparative index returns For periods ended 4/30/12

| | |

| | Barclays U.S. Aggregate | Lipper Corporate Debt Funds A-Rated |

| | Bond Index | category average* |

|

| Annual average (life of fund) | —† | —† |

|

| 10 years | 74.29% | 71.54% |

| Annual average | 5.71 | 5.48 |

|

| 5 years | 36.16 | 33.92 |

| Annual average | 6.37 | 5.98 |

|

| 3 years | 22.70 | 31.96 |

| Annual average | 7.06 | 9.61 |

|

| 1 year | 7.54 | 7.10 |

|

| 6 months | 2.44 | 3.13 |

|

Index and Lipper results should be compared with fund performance before sales charge, before CDSC, or at net asset value.

* Over the 6-month, 1-year, 3-year, 5-year, and 10-year periods ended 4/30/12, there were 117, 116, 98, 93, and 58 funds, respectively, in this Lipper category.

† The fund’s benchmark, the Barclays U.S. Aggregate Bond Index, was introduced on 12/31/75, and the fund’s Lipper category was introduced on 12/31/59. Both post-date the inception date of the fund’s class A shares.

Fund price and distribution information For the six-month period ended 4/30/12

| | | | | | | | |

| Distributions | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Number | 6 | 6 | 6 | 6 | 6 | 6 |

|

| Income | $0.116 | $0.092 | $0.092 | $0.110 | $0.109 | $0.122 |

|

| Capital gains | — | — | — | — | — | — |

|

| Total | $0.116 | $0.092 | $0.092 | $0.110 | $0.109 | $0.122 |

|

| | Before | After | Net | Net | Before | After | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset |

| Share value | charge | charge | value | value | charge | charge | value | value |

|

| 10/31/11 | $6.84 | $7.13 | $6.78 | $6.80 | $6.71 | $6.94 | $6.81 | $6.91 |

|

| 4/30/12 | 6.90 | 7.19 | 6.83 | 6.85 | 6.76 | 6.99 | 6.86 | 6.98 |

|

| | Before | After | Net | Net | Before | After | Net | Net |

| | sales | sales | asset | asset | sales | sales | asset | asset |

| Current yield (end of period) | charge | charge | value | value | charge | charge | value | value |

|

| Current dividend rate 1 | 2.78% | 2.67% | 2.11% | 2.10% | 2.66% | 2.58% | 2.62% | 2.92% |

|

| Current 30-day SEC yield 2 | | | | | | | | |

| (with expense limitation) | N/A | 2.56 | 1.92 | 1.93 | N/A | 2.34 | 2.42 | 2.91 |

|

The classification of distributions, if any, is an estimate. Before-sales-charge share value and current dividend rate for class A and M shares, if applicable, do not take into account any sales charge levied at the time of purchase. After-sales-charge share value, current dividend rate, and current 30-day SEC yield, if applicable, are calculated assuming that the maximum sales charge (4.00% for class A shares and 3.25% for class M shares) was levied at the time of purchase. Final distribution information will appear on your year-end tax forms.

1 Most recent distribution, excluding capital gains, annualized and divided by share price before or after sales charge at period-end.

2 Based only on investment income and calculated using the maximum offering price for each share class, in accordance with SEC guidelines.

12

Fund performance as of most recent calendar quarter

Total return for periods ended 3/31/12

| | | | | | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

| (inception dates) | (11/1/54) | (3/1/93) | (7/26/99) | (12/14/94) | (1/21/03) | (6/16/94) |

|

| | Before | After | | | | | Before | After | Net | Net |

| | sales | sales | Before | After | Before | After | sales | sales | asset | asset |

| charge | charge | CDSC | CDSC | CDSC | CDSC | charge | charge | value | value |

|

| Annual average | | | | | | | | | | |

| (life of fund) | 7.85% | 7.77% | 6.86% | 6.86% | 7.04% | 7.04% | 7.41% | 7.35% | 7.58% | 7.93% |

|

| 10 years | 78.04 | 70.85 | 65.22 | 65.22 | 65.28 | 65.28 | 73.65 | 68.10 | 73.86 | 82.39 |

| Annual average | 5.94 | 5.50 | 5.15 | 5.15 | 5.15 | 5.15 | 5.67 | 5.33 | 5.69 | 6.19 |

|

| 5 years | 39.71 | 34.15 | 34.46 | 32.46 | 34.50 | 34.50 | 37.96 | 33.57 | 37.78 | 41.34 |

| Annual average | 6.92 | 6.05 | 6.10 | 5.78 | 6.11 | 6.11 | 6.65 | 5.96 | 6.62 | 7.17 |

|

| 3 years | 57.30 | 50.95 | 53.86 | 50.86 | 53.78 | 53.78 | 56.26 | 51.26 | 56.33 | 58.61 |

| Annual average | 16.30 | 14.71 | 15.45 | 14.69 | 15.43 | 15.43 | 16.04 | 14.79 | 16.06 | 16.62 |

|

| 1 year | 4.86 | 0.72 | 3.98 | –1.03 | 4.12 | 3.12 | 4.57 | 1.24 | 4.64 | 5.03 |

|

| 6 months | 2.38 | –1.66 | 2.04 | –2.96 | 2.03 | 1.03 | 2.34 | –0.93 | 2.29 | 2.44 |

|

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Total annual operating expenses for the fiscal year | | | | | | |

| ended 10/31/11 | 0.87% | 1.62% | 1.62% | 1.12% | 1.12% | 0.62% |

|

| Annualized expense ratio for the six-month period | | | | | | |

| ended 4/30/12 | 0.87% | 1.62% | 1.62% | 1.12% | 1.12% | 0.62% |

|

Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report. Expenses are shown as a percentage of average net assets.

13

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in the fund from November 1, 2011, to April 30, 2012. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $4.38 | $8.14 | $8.14 | $5.64 | $5.64 | $3.13 |

|

| Ending value (after expenses) | $1,026.10 | $1,021.20 | $1,021.20 | $1,024.20 | $1,023.70 | $1,028.20 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 4/30/12. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended April 30, 2012, use the following calculation method. To find the value of your investment on November 1, 2011, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | |

| | Class A | Class B | Class C | Class M | Class R | Class Y |

|

| Expenses paid per $1,000*† | $4.37 | $8.12 | $8.12 | $5.62 | $5.62 | $3.12 |

|

| Ending value (after expenses) | $1,020.54 | $1,016.81 | $1,016.81 | $1,019.29 | $1,019.29 | $1,021.78 |

|

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 4/30/12. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

14

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Before sales charge, or net asset value, is the price, or value, of one share of a mutual fund, without a sales charge. Before-sales-charge figures fluctuate with market conditions, and are calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

After sales charge is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. After-sales-charge performance figures shown here assume the 4.00% maximum sales charge for class A shares and 3.25% for class M shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines over time from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Share classes

Class A shares are generally subject to an initial to sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are not subject to an initial sales charge. They may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class M shares have a lower initial sales charge and a higher 12b-1 fee than class A shares and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class R shares are not subject to an initial sales charge or CDSC and are available only to certain defined contribution plans.

Class Y shares are not subject to an initial sales charge or CDSC, and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Fixed-income terms

Current yield is the annual rate of return earned from dividends or interest of an investment. Current yield is expressed as a percentage of the price of a security, fund share, or principal investment.

Mortgage-backed security (MBS), also known as a mortgage “pass-through,” is a type of asset-backed security that is secured by a mortgage or collection of mortgages. The following are types of MBSs:

• Agency “pass-through” has its principal and interest backed by a U.S. government agency, such as the Federal National Mortgage Association (Fannie Mae), Government National Mortgage Association (Ginnie Mae), and Federal Home Loan Mortgage Corporation (Freddie Mac).

• Collateralized mortgage obligation (CMO) represents claims to specific cash flows from pools of home mortgages. The streams of principal and interest payments on the mortgages are distributed to the different classes of CMO interests in “tranches.” Each tranche may have different principal balances, coupon rates, prepayment risks, and maturity dates. A CMO is highly sensitive changes in interest rates and any resulting change in the rate at which homeowners sell their properties, refinance, or otherwise prepay loans. CMOs are subject to prepayment, market, and liquidity risks.

• Interest-only (IO) security is a type of CMO in which the underlying asset is the interest portion of mortgage, Treasury, or bond payments.

• Non-agency residential mortgage-backed security (RMBS) is an MBS not backed by Fannie Mae, Ginnie Mae, or Freddie Mac. One type of RMBS is an Alt-A mortgage-backed security.

• Commercial mortgage-backed security (CMBS) is secured by the loan on a commercial property.

Yield curve is a graph that plots the yields of bonds with equal credit quality against their

15

differing maturity dates, ranging from shortest to longest. It is used as a benchmark for other debt, such as mortgage or bank lending rates.

Comparative indexes

Barclays U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

BofA (Bank of America) Merrill Lynch U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with Securities and Exchange Commission (SEC) regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2011, are available in the Individual Investors section of putnam.com, and on the SEC’s website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s website at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s website or the operation of the Public Reference Room.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of April 30, 2012, Putnam employees had approximately $350,000,000 and the Trustees had approximately $80,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

16

Financial statements

A guide to financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

17

The fund’s portfolio 4/30/12 (Unaudited)

| | |

| U.S. GOVERNMENT AGENCY MORTGAGE OBLIGATIONS (37.5%)* | Principal amount | Value |

|

| Federal National Mortgage Association | | |

| Pass-Through Certificates | | |

| 7s, January 1, 2017 | $7,596 | $8,001 |

| 4 1/2s, TBA, May 1, 2042 | 9,000,000 | 9,636,328 |

| 4s, TBA, May 1, 2042 | 73,000,000 | 77,220,313 |

| 3 1/2s, TBA, June 1, 2042 | 135,000,000 | 139,809,375 |

| 3 1/2s, TBA, May 1, 2042 | 278,000,000 | 288,685,625 |

|

| Total U.S. government agency mortgage obligations (cost $510,145,501) | $515,359,642 |

|

| |

| MORTGAGE-BACKED SECURITIES (30.1%)* | Principal amount | Value |

|

| Adjustable Rate Mortgage Trust FRB Ser. 05-7, Class 7A21, | | |

| 0.489s, 2035 | $6,581,528 | $5,001,961 |

|

| Banc of America Commercial Mortgage, Inc. | | |

| Ser. 04-4, Class D, 5.073s, 2042 | 1,667,000 | 1,575,315 |

| Ser. 07-1, Class XW, IO, 0.466s, 2049 | 11,438,675 | 113,220 |

|

| Banc of America Commercial Mortgage, Inc. 144A | | |

| Ser. 04-4, Class XC, IO, 1.04s, 2042 | 20,004,590 | 261,760 |

| Ser. 04-5, Class XC, IO, 0.879s, 2041 | 33,624,136 | 446,865 |

| Ser. 02-PB2, Class XC, IO, 0.731s, 2035 | 12,281,447 | 10,734 |

| Ser. 07-5, Class XW, IO, 0.58s, 2051 | 21,744,635 | 329,431 |

| Ser. 05-1, Class XW, IO, 0.075s, 2042 | 314,446,690 | 139,300 |

|

| Bear Stearns Asset Backed Securities Trust FRB Ser. 04-AC6, | | |

| Class A2, 0.639s, 2034 | 4,781,641 | 3,251,516 |

|

| Bear Stearns Commercial Mortgage Securities, Inc. | | |

| Ser. 04-PWR3, Class D, 4.889s, 2041 F | 1,989,000 | 1,944,982 |

| Ser. 04-PR3I, Class X1, IO, 1.158s, 2041 | 8,275,208 | 136,036 |

|

| Bear Stearns Commercial Mortgage Securities, Inc. 144A | | |

| Ser. 06-PW14, Class X1, IO, 0.232s, 2038 F | 17,538,219 | 298,239 |

|

| CFCRE Commercial Mortgage Trust 144A Ser. 11-C1, Class XA, | | |

| IO, 1.674s, 2044 F | 29,151,309 | 2,064,789 |

|

| Citigroup Commercial Mortgage Trust FRB Ser. 05-C3, | | |

| Class AJ, 4.96s, 2043 | 2,050,000 | 1,920,112 |

|

| Citigroup Commercial Mortgage Trust 144A Ser. 06-C5, | | |

| Class XC, IO, 0.154s, 2049 | 79,085,783 | 1,104,038 |

|

| Citigroup/Deutsche Bank Commercial Mortgage Trust | | |

| Ser. 07-CD4, Class A2B, 5.205s, 2049 | 534,224 | 539,728 |

|

| Citigroup/Deutsche Bank Commercial Mortgage Trust 144A | | |

| Ser. 07-CD4, Class XW, IO, 0.573s, 2049 | 50,406,175 | 742,987 |

| Ser. 07-CD4, Class XC, IO, 0.224s, 2049 | 159,839,641 | 1,406,589 |

|

| Commercial Mortgage Acceptance Corp. 144A Ser. 98-C1, | | |

| Class F, 6.23s, 2031 | 351,300 | 358,820 |

|

| Commercial Mortgage Pass-Through Certificates | | |

| Ser. 05-C6, Class AJ, 5.209s, 2044 | 4,547,000 | 4,471,656 |

| Ser. 05-LP5, Class B, 5.105s, 2043 F | 1,755,000 | 1,650,123 |

|

| Commercial Mortgage Pass-Through Certificates 144A | | |

| Ser. 05-LP5, Class XC, IO, 0.23s, 2043 | 26,484,479 | 271,439 |

| Ser. 06-C8, Class XS, IO, 0.207s, 2046 | 59,337,966 | 745,961 |

| Ser. 05-C6, Class XC, IO, 0.112s, 2044 F | 51,670,817 | 277,505 |

|

18

| | |

| MORTGAGE-BACKED SECURITIES (30.1%)* cont. | Principal amount | Value |

|

| Credit Suisse Mortgage Capital Certificates | | |

| FRB Ser. 07-C4, Class A2, 5.967s, 2039 | $4,477,997 | $4,471,979 |

| Ser. 06-C5, Class AX, IO, 0.234s, 2039 | 30,497,166 | 411,601 |

|

| Credit Suisse Mortgage Capital Certificates 144A | | |

| Ser. 07-C2, Class AX, IO, 0.258s, 2049 | 93,105,884 | 558,930 |

|

| CS First Boston Mortgage Securities Corp. | | |

| FRB Ser. 04-C2, Class D, 5.575s, 2036 | 1,733,000 | 1,733,000 |

| Ser. 05-C6, Class AJ, 5.23s, 2040 ∆ F | 1,825,000 | 1,802,459 |

| Ser. 05-C5, Class AJ, 5.1s, 2038 F | 3,941,000 | 3,999,320 |

| FRB Ser. 04-C5, Class B, 4.929s, 2037 | 1,590,000 | 1,594,770 |

| Ser. 03-CPN1, Class E, 4.891s, 2035 | 1,528,000 | 1,515,700 |

|

| CS First Boston Mortgage Securities Corp. 144A | | |

| Ser. 98-C1, Class F, 6s, 2040 | 2,625,429 | 2,825,633 |

| FRB Ser. 03-CK2, Class G, 5.744s, 2036 | 2,984,000 | 2,974,038 |

| Ser. 03-C3, Class AX, IO, 1.937s, 2038 | 63,502,846 | 695,991 |

| Ser. 02-CP3, Class AX, IO, 1.452s, 2035 | 15,802,570 | 8,533 |

| Ser. 04-C4, Class AX, IO, 1.189s, 2039 | 6,152,761 | 94,488 |

|

| Deutsche Mortgage Securities, Inc. Ser. 2009-RS2, | | |

| Class 4A2, 0.372s, 2037 | 8,894,363 | 3,557,745 |

|

| DLJ Commercial Mortgage Corp. 144A FRB Ser. 98-CG1, | | |

| Class B4, 7.444s, 2031 | 3,188,000 | 3,332,456 |

|

| Federal Home Loan Mortgage Corp. | | |

| IFB Ser. 3408, Class EK, 24.826s, 2037 | 1,846,966 | 2,958,982 |

| IFB Ser. 2976, Class LC, 23.539s, 2035 | 260,840 | 414,736 |

| IFB Ser. 2979, Class AS, 23.392s, 2034 | 192,361 | 264,568 |

| IFB Ser. 3072, Class SB, 22.769s, 2035 | 1,005,932 | 1,547,133 |

| IFB Ser. 3249, Class PS, 21.482s, 2036 | 959,881 | 1,415,947 |

| IFB Ser. 3065, Class DC, 19.139s, 2035 | 1,083,876 | 1,662,394 |

| IFB Ser. 2990, Class LB, 16.332s, 2034 | 1,332,734 | 1,832,815 |

| IFB Ser. 3835, Class SN, 15.524s, 2041 | 9,573,624 | 13,320,261 |

| IFB Ser. 3835, Class SC, IO, 6.41s, 2038 | 8,861,160 | 1,629,833 |

| IFB Ser. 3803, Class SP, IO, 6.36s, 2038 | 11,150,148 | 1,448,538 |

| IFB Ser. 3861, Class PS, IO, 6.36s, 2037 | 5,801,568 | 969,558 |

| IFB Ser. 3907, Class KS, IO, 6.31s, 2040 | 6,605,155 | 1,217,030 |

| IFB Ser. 3708, Class SA, IO, 6.21s, 2040 | 20,657,643 | 3,026,758 |

| IFB Ser. 3852, Class NT, 5.76s, 2041 | 3,998,836 | 4,182,022 |

| IFB Ser. 3852, Class TB, 5.76s, 2041 | 3,221,516 | 3,372,766 |

| IFB Ser. 3752, Class PS, IO, 5.76s, 2040 | 9,161,019 | 1,563,878 |

| Ser. 3632, Class CI, IO, 5s, 2038 | 419,098 | 34,048 |

| Ser. 3626, Class DI, IO, 5s, 2037 | 274,947 | 12,909 |

| Ser. 4018, Class DI, IO, 4 1/2s, 2041 | 10,728,345 | 1,544,345 |

| Ser. 3747, Class HI, IO, 4 1/2s, 2037 | 2,563,976 | 302,039 |

| Ser. 3707, Class PI, IO, 4 1/2s, 2025 | 11,158,827 | 887,573 |

| Ser. 3768, Class MI, IO, 4s, 2035 | 58,780,514 | 5,676,975 |

| Ser. 3736, Class QI, IO, 4s, 2034 | 13,221,748 | 628,033 |

| Ser. 3740, Class KI, IO, 4s, 2033 | 17,634,355 | 725,830 |

| Ser. T-56, Class A, IO, 0.524s, 2043 | 13,985,642 | 209,785 |

| Ser. T-56, Class 3, IO, 0.477s, 2043 | 4,947,164 | 64,932 |

| Ser. T-56, Class 1, IO, 0.295s, 2043 | 16,941,617 | 127,062 |

| Ser. T-56, Class 2, IO, 0 1/8s, 2043 | 5,964,862 | 18,640 |

| Ser. 3369, Class BO, PO, zero %, 2037 | 69,532 | 63,707 |

19

| | |

| MORTGAGE-BACKED SECURITIES (30.1%)* cont. | Principal amount | Value |

|

| Federal Home Loan Mortgage Corp. | | |

| Ser. 3391, PO, zero %, 2037 | $184,231 | $162,821 |

| Ser. 3300, PO, zero %, 2037 | 1,148,884 | 1,065,857 |

| Ser. 3206, Class EO, PO, zero %, 2036 | 45,716 | 41,694 |

| Ser. 3175, Class MO, PO, zero %, 2036 | 148,704 | 135,887 |

| Ser. 3210, PO, zero %, 2036 | 37,679 | 34,972 |

| FRB Ser. 3326, Class YF, zero %, 2037 | 33,992 | 33,354 |

| FRB Ser. 3117, Class AF, zero %, 2036 | 47,887 | 39,046 |

| FRB Ser. 3326, Class WF, zero %, 2035 | 116,773 | 102,875 |

| FRB Ser. 3036, Class AS, zero %, 2035 | 67,537 | 55,925 |

|

| Federal National Mortgage Association | | |

| IFB Ser. 06-62, Class PS, 38.468s, 2036 | 1,978,645 | 3,554,050 |

| IFB Ser. 06-8, Class HP, 23.691s, 2036 | 1,027,137 | 1,702,119 |

| IFB Ser. 05-45, Class DA, 23.545s, 2035 | 2,050,473 | 3,296,888 |

| IFB Ser. 05-122, Class SE, 22.264s, 2035 | 1,886,396 | 2,794,784 |

| IFB Ser. 05-75, Class GS, 19.534s, 2035 | 866,241 | 1,239,859 |

| IFB Ser. 05-106, Class JC, 19.384s, 2035 | 1,020,259 | 1,601,051 |

| IFB Ser. 05-83, Class QP, 16.773s, 2034 | 240,133 | 326,581 |

| IFB Ser. 11-4, Class CS, 12.423s, 2040 | 2,467,352 | 2,862,129 |

| IFB Ser. 10-129, Class PS, IO, 6.461s, 2038 | 27,608,976 | 4,762,548 |

| IFB Ser. 12-4, Class SN, IO, 6.361s, 2040 | 7,941,341 | 1,497,657 |

| IFB Ser. 12-3, Class CS, IO, 6.311s, 2040 | 10,751,257 | 2,059,081 |

| IFB Ser. 12-3, Class SD, IO, 6.271s, 2042 | 4,059,642 | 768,774 |

| IFB Ser. 11-67, Class BS, IO, 6.261s, 2041 | 21,630,602 | 3,471,712 |

| IFB Ser. 11-27, Class AS, IO, 6.241s, 2041 | 15,810,076 | 2,331,038 |

| IFB Ser. 12-30, Class HS, IO, 6.211s, 2042 | 32,450,398 | 6,603,007 |

| IFB Ser. 10-35, Class SG, IO, 6.161s, 2040 | 35,252,886 | 5,697,571 |

| IFB Ser. 12-4, Class SY, IO, 5.711s, 2042 | 6,779,277 | 1,125,224 |

| Ser. 03-W10, Class 1, IO, 1.431s, 2043 | 11,848,837 | 559,117 |

| Ser. 01-50, Class B1, IO, 0.408s, 2041 | 1,078,434 | 12,132 |

| Ser. 2002-W6, Class 1AIO, 0.272s, 2042 | 1,275,922 | 12,759 |

| Ser. 2005-W4, Class 1AIO, 0.123s, 2035 | 306,038 | 2,678 |

| Ser. 03-34, Class P1, PO, zero %, 2043 | 280,849 | 224,679 |

| Ser. 07-64, Class LO, PO, zero %, 2037 | 306,113 | 281,299 |

| Ser. 07-14, Class KO, PO, zero %, 2037 | 660,825 | 600,002 |

| Ser. 06-125, Class OX, PO, zero %, 2037 | 118,812 | 111,923 |

| Ser. 06-84, Class OT, PO, zero %, 2036 | 86,407 | 80,357 |

| Ser. 06-46, Class OC, PO, zero %, 2036 | 83,339 | 75,634 |

| Ser. 04-61, Class CO, PO, zero %, 2031 | 81,595 | 81,081 |

| FRB Ser. 06-104, Class EK, zero %, 2036 | 7,310 | 7,091 |

| IFB Ser. 06-48, Class FG, zero %, 2036 | 27,985 | 27,960 |

|

| First Union National Bank-Bank of America Commercial | | |

| Mortgage 144A Ser. 01-C1, Class 3, IO, 1.52s, 2033 | 3,631,488 | 36 |

|

| GE Capital Commercial Mortgage Corp. 144A | | |

| Ser. 05-C2, Class XC, IO, 0.157s, 2043 | 45,071,071 | 332,625 |

| Ser. 07-C1, Class XC, IO, 0.15s, 2049 | 123,413,886 | 748,505 |

| Ser. 05-C3, Class XC, IO, 0.132s, 2045 | 310,956,322 | 1,305,395 |

|

| GMAC Commercial Mortgage Securities, Inc. | | |

| Ser. 97-C1, Class X, IO, 1.336s, 2029 | 3,677,057 | 104,491 |

| Ser. 05-C1, Class X1, IO, 0.308s, 2043 | 34,860,609 | 466,330 |

|

20

| | |

| MORTGAGE-BACKED SECURITIES (30.1%)* cont. | Principal amount | Value |

|

| GMAC Commercial Mortgage Securities, Inc. 144A Ser. 99-C3, | | |

| Class G, 6.974s, 2036 | $6,757 | $6,117 |

|

| Government National Mortgage Association | | |

| IFB Ser. 11-56, Class SA, 23.504s, 2041 | 14,858,416 | 22,891,321 |

| IFB Ser. 10-158, Class SD, 14.281s, 2040 | 2,780,250 | 3,898,272 |

| IFB Ser. 11-70, Class WS, 9.221s, 2040 | 11,858,000 | 13,396,338 |

| IFB Ser. 11-72, Class SE, 7.084s, 2041 | 9,422,000 | 9,654,007 |

| IFB Ser. 11-56, Class MS, 6.831s, 2041 | 6,550,492 | 7,152,286 |

| IFB Ser. 11-56, Class SG, 6.831s, 2041 | 3,742,439 | 4,108,823 |

| IFB Ser. 11-37, Class SB, IO, 6.46s, 2038 | 2,568,074 | 354,132 |

| IFB Ser. 11-61, Class CS, IO, 6.44s, 2035 | 26,557,320 | 4,019,742 |

| IFB Ser. 11-37, Class SD, IO, 6.41s, 2038 | 3,304,672 | 451,696 |

| IFB Ser. 10-42, Class SP, IO, 6.31s, 2039 | 6,518,633 | 1,009,997 |

| IFB Ser. 11-70, Class SM, IO, 5.65s, 2041 | 5,789,000 | 1,700,461 |

| Ser. 11-116, Class IA, IO, 4 1/2s, 2039 | 12,432,384 | 1,587,118 |

| Ser. 12-8, Class PI, IO, 4s, 2041 | 17,219,163 | 3,035,739 |

| Ser. 11-116, Class BI, IO, 4s, 2026 | 10,634,102 | 1,200,696 |

| IFB Ser. 11-70, Class YI, IO, 0.15s, 2040 | 15,722,313 | 83,014 |

| Ser. 11-70, PO, zero %, 2041 | 40,170,678 | 31,525,546 |

| Ser. 10-151, Class KO, PO, zero %, 2037 | 1,384,958 | 1,259,523 |

| Ser. 06-36, Class OD, PO, zero %, 2036 | 83,378 | 76,930 |

| Ser. 99-31, Class MP, PO, zero %, 2029 | 36,853 | 34,229 |

|

| Greenpoint Mortgage Funding Trust FRB Ser. 05-AR2, | | |

| Class A1, 0.469s, 2045 | 4,842,603 | 2,881,349 |

|

| Greenwich Capital Commercial Funding Corp. 144A | | |

| Ser. 03-C1, Class G, 4.773s, 2035 | 1,618,000 | 1,578,796 |

| Ser. 05-GG3, Class XC, IO, 0.917s, 2042 | 75,956,097 | 1,067,563 |

|

| GS Mortgage Securities Corp. II Ser. 06-GG6, Class A2, | | |

| 5.506s, 2038 | 426,032 | 437,415 |

|

| GS Mortgage Securities Corp. II 144A | | |

| Ser. 98-C1, Class F, 6s, 2030 F | 572,611 | 584,066 |

| Ser. 06-GG6, Class XC, IO, 0.151s, 2038 | 108,286,702 | 191,992 |

|

| JPMorgan Chase Commercial Mortgage | | |

| Securities Corp. | | |

| FRB Ser. 07-LD12, Class A3, 6.181s, 2051 | 19,773,000 | 21,150,130 |

| FRB Ser. 04-CB9, Class B, 5.853s, 2041 F | 2,650,000 | 2,531,755 |

| FRB Ser. 02-C2, Class E, 5.518s, 2034 | 1,540,000 | 1,537,505 |

| Ser. 02-C3, Class D, 5.314s, 2035 | 1,521,000 | 1,537,534 |

| Ser. 06-LDP8, Class X, IO, 0.735s, 2045 | 61,222,467 | 1,162,247 |

| Ser. 07-LDPX, Class X, IO, 0.494s, 2049 | 41,405,725 | 452,399 |

|

| JPMorgan Chase Commercial Mortgage | | |

| Securities Corp. 144A | | |

| FRB Ser. 01-C1, Class H, 5.626s, 2035 F | 1,599,000 | 1,613,732 |

| Ser. 05-CB12, Class X1, IO, 0.152s, 2037 | 29,874,828 | 274,221 |

| Ser. 06-LDP6, Class X1, IO, 0.093s, 2043 | 56,850,714 | 193,975 |

|

| LB Commercial Conduit Mortgage Trust 144A | | |

| Ser. 99-C1, Class F, 6.41s, 2031 F | 556,463 | 545,347 |

| Ser. 99-C1, Class G, 6.41s, 2031 F | 601,777 | 607,851 |

| Ser. 98-C4, Class G, 5.6s, 2035 | 456,247 | 472,033 |

| Ser. 98-C4, Class H, 5.6s, 2035 | 808,000 | 879,999 |

|

21

| | |

| MORTGAGE-BACKED SECURITIES (30.1%)* cont. | Principal amount | Value |

|

| LB-UBS Commercial Mortgage Trust | | |

| Ser. 06-C7, Class A2, 5.3s, 2038 | $1,896,408 | $1,896,408 |

| Ser. 03-C5, Class F, 4.843s, 2037 | 2,504,000 | 2,367,532 |

| Ser. 07-C2, Class XW, IO, 0.712s, 2040 | 8,567,218 | 139,252 |

|

| LB-UBS Commercial Mortgage Trust 144A | | |

| Ser. 06-C7, Class XW, IO, 0.843s, 2038 | 41,495,803 | 1,005,277 |

| Ser. 06-C7, Class XCL, IO, 0.335s, 2038 | 69,339,492 | 971,030 |

| Ser. 05-C2, Class XCL, IO, 0.305s, 2040 | 144,795,259 | 1,171,538 |

| Ser. 05-C5, Class XCL, IO, 0.237s, 2040 | 94,361,994 | 1,376,175 |

| Ser. 07-C2, Class XCL, IO, 0.193s, 2040 | 189,767,377 | 1,969,026 |

| Ser. 05-C7, Class XCL, IO, 0.159s, 2040 | 124,064,174 | 720,689 |

|

| Merrill Lynch Mortgage Investors, Inc. Ser. 96-C2, | | |

| Class JS, IO, 2.518s, 2028 F | 188,377 | 4,521 |

|

| Merrill Lynch Mortgage Trust | | |

| FRB Ser. 07-C1, Class A3, 6.032s, 2050 | 475,000 | 493,365 |

| Ser. 03-KEY1, Class C, 5.373s, 2035 | 3,163,000 | 3,164,360 |

| Ser. 05-MCP1, Class XC, IO, 0.257s, 2043 | 39,803,681 | 410,018 |

|

| Merrill Lynch Mortgage Trust 144A Ser. 04-KEY2, Class XC, | | |

| IO, 1.053s, 2039 | 15,836,353 | 241,045 |

|

| Merrill Lynch/Countrywide Commercial Mortgage Trust | | |

| FRB Ser. 06-3, Class AM, 5.456s, 2046 F | 1,347,000 | 1,446,914 |

| FRB Ser. 06-4, Class A2FL, 0.36s, 2049 | 1,453,021 | 1,438,490 |

|

| Mezz Cap Commercial Mortgage Trust 144A | | |

| Ser. 04-C1, Class X, IO, 8.751s, 2037 | 2,788,348 | 209,126 |

| Ser. 06-C4, Class X, IO, 6.274s, 2045 | 6,176,797 | 463,260 |

| Ser. 05-C3, Class X, IO, 6.054s, 2044 | 1,896,501 | 142,238 |

|

| Morgan Stanley Capital I | | |

| FRB Ser. 06-T23, Class A2, 5.918s, 2041 | 1,029,434 | 1,038,174 |

| FRB Ser. 07-HQ12, Class A2, 5.782s, 2049 F | 1,378,720 | 1,404,812 |

| Ser. 07-IQ14, Class A2, 5.61s, 2049 | 2,538,454 | 2,604,756 |

|

| Morgan Stanley Capital I 144A Ser. 03-IQ6, Class C, | | |

| 5.237s, 2041 F | 2,350,000 | 2,363,371 |

|

| Morgan Stanley Dean Witter Capital I Ser. 03-HQ2, Class C, | | |

| 5.15s, 2035 | 2,146,000 | 2,122,330 |

|

| Morgan Stanley ReREMIC Trust 144A FRB Ser. 10-C30A, | | |

| Class A3B, 5.854s, 2043 F | 430,286 | 445,190 |

|

| Nomura Asset Securities Corp. 144A Ser. 98-D6, Class B1, | | |

| 6s, 2030 | 2,002,000 | 2,093,397 |

|

| Opteum Mortgage Acceptance Corp. FRB Ser. 05-3, Class A2, | | |

| 0.579s, 2035 | 6,061,282 | 4,576,268 |

|

| Structured Asset Mortgage Investments, Inc. Ser. 07-AR4, | | |

| Class X2, IO, 0 1/2s, 2047 | 146,083,408 | 3,140,793 |

|

| Structured Asset Securities Corp. IFB Ser. 07-4, Class 1A3, | | |

| IO, 6.009s, 2045 | 32,281,970 | 5,165,115 |

|

| TIAA Seasoned Commercial Mortgage Trust FRB Ser. 07-C4, | | |

| Class AJ, 5.656s, 2039 F | 4,471,000 | 4,718,009 |

|

| Wachovia Bank Commercial Mortgage Trust | | |

| Ser. 06-C29, IO, 0.55s, 2048 | 197,535,177 | 3,237,602 |

| Ser. 07-C34, IO, 0.543s, 2046 | 18,392,778 | 268,535 |

|

22

| | |

| MORTGAGE-BACKED SECURITIES (30.1%)* cont. | Principal amount | Value |

|

| Wachovia Bank Commercial Mortgage Trust 144A | | |

| Ser. 05-C18, Class XC, IO, 0.211s, 2042 | $24,413,078 | $226,797 |

| Ser. 06-C26, Class XC, IO, 0.093s, 2045 | 11,417,344 | 32,425 |

| Ser. 06-C23, Class XC, IO, 0.081s, 2045 | 155,091,764 | 713,422 |

|

| WAMU Commercial Mortgage Securities Trust 144A | | |

| Ser. 05-C1A, Class G, 5.72s, 2036 F | 129,000 | 112,244 |

| Ser. 05-C1A, Class C, 4.9s, 2036 F | 529,000 | 532,889 |

|

| WAMU Mortgage Pass-Through Certificates | | |

| FRB Ser. 05-AR11, Class A1C3, 0.749s, 2045 | 5,818,644 | 3,374,814 |

| FRB Ser. 05-AR19, Class A1C3, 0.739s, 2045 | 14,488,508 | 8,113,565 |

| FRB Ser. 05-AR11, Class A1B2, 0.689s, 2045 | 6,081,992 | 4,470,264 |

| FRB Ser. 05-AR8, Class 2AB2, 0.659s, 2045 | 11,513,430 | 8,750,207 |

| FRB Ser. 2005-AR17, Class A1B2, 0.649s, 2045 | 8,053,120 | 5,315,059 |

| FRB Ser. 05-AR11, Class A1B3, 0.639s, 2045 | 8,120,369 | 5,927,869 |

| FRB Ser. 05-AR2, Class 2A23, 0.619s, 2045 | 12,760,722 | 9,761,953 |

| FRB Ser. 2005-AR17, Class A1B3, 0.589s, 2045 | 2,396,060 | 1,532,101 |

| FRB Ser. 05-AR2, Class 2A21, 0.569s, 2045 | 3,008,361 | 2,358,525 |

| FRB Ser. 05-AR17, Class A1A2, 0.529s, 2045 | 243,552 | 180,229 |

|

| Total mortgage-backed securities (cost $374,103,407) | | $413,520,319 |

|

| |

| CORPORATE BONDS AND NOTES (27.8%)* | Principal amount | Value |

|

| Basic materials (2.2%) | | |

| Allegheny Technologies, Inc. sr. unsec. | | |

| unsub. notes 9 3/8s, 2019 | $835,000 | $1,055,303 |

|

| ArcelorMittal sr. unsec. unsub. 9.85s, 2019 (France) | 935,000 | 1,130,111 |

|

| ArcelorMittal sr. unsec. unsub. notes 7s, 2039 (France) | 1,575,000 | 1,535,786 |

|

| Celanese US Holdings, LLC sr. notes 5 7/8s, 2021 (Germany) | 835,000 | 895,538 |

|

| CF Industries, Inc. company guaranty sr. unsec. | | |

| unsub. notes 6 7/8s, 2018 | 1,210,000 | 1,406,625 |

|

| Dow Chemical Co. (The) sr. unsec. notes 5 1/4s, 2041 | 1,565,000 | 1,625,538 |

|

| Georgia-Pacific, LLC sr. unsec. unsub. notes 7 3/4s, 2029 | 470,000 | 590,513 |

|

| Georgia-Pacific, LLC 144A company guaranty sr. notes | | |

| 5.4s, 2020 | 2,120,000 | 2,416,281 |

|

| International Paper Co. sr. unsec. notes 9 3/8s, 2019 | 958,000 | 1,281,012 |

|

| International Paper Co. sr. unsec. notes 8.7s, 2038 | 510,000 | 694,766 |

|

| International Paper Co. sr. unsec. notes 7.95s, 2018 | 1,400,000 | 1,753,345 |

|

| International Paper Co. sr. unsec. unsub. notes 7.3s, 2039 | 900,000 | 1,113,619 |

|

| LyondellBasell Industries NV 144A company | | |

| guaranty sr. notes 6s, 2021 (Netherlands) | 875,000 | 945,000 |

|

| Mosaic Co. (The) sr. unsec. notes 3 3/4s, 2021 | 640,000 | 663,093 |

|

| PPG Industries, Inc. sr. unsec. unsub. debs. 7.4s, 2019 | 1,130,000 | 1,393,495 |

|

| Rio Tinto Finance USA, Ltd. company guaranty sr. unsec. | | |

| notes 5.2s, 2040 (Australia) | 2,475,000 | 2,756,375 |

|

| Rock-Tenn Co. 144A sr. unsec. notes 4.9s, 2022 | 407,000 | 412,195 |

|

| Rock-Tenn Co. 144A sr. unsec. notes 4.45s, 2019 | 393,000 | 400,156 |

|

| Rohm & Haas Co. sr. unsec. unsub. notes 7.85s, 2029 | 1,815,000 | 2,367,286 |

|

| Sealed Air Corp. sr. notes 7 7/8s, 2017 | 725,000 | 784,575 |

|

| Sealed Air Corp. 144A notes 5 5/8s, 2013 | 678,000 | 698,855 |

|

| Teck Resources Limited sr. notes 10 3/4s, 2019 (Canada) | 82,000 | 101,475 |

|

23

| | |

| CORPORATE BONDS AND NOTES (27.8%)* cont. | Principal amount | Value |

|

| Basic materials cont. | | |

| Teck Resources Limited sr. notes 10 1/4s, 2016 (Canada) | $245,000 | $280,862 |

|

| Temple-Inland, Inc. sr. unsec. unsub. notes 6 5/8s, 2018 | 1,080,000 | 1,255,931 |

|

| Union Carbide Corp. sr. unsec. unsub. bonds 7 3/4s, 2096 | 135,000 | 148,164 |

|

| Xstrata Finance Canada, Ltd. 144A company | | |

| guaranty sr. unsec. notes 6s, 2041 (Canada) | 1,000,000 | 1,041,437 |

|

| Xstrata Finance Canada, Ltd. 144A company | | |

| guaranty sr. unsec. unsub. bonds 5.8s, 2016 (Canada) | 610,000 | 691,257 |

|

| | | 29,438,593 |

| Capital goods (0.5%) | | |

| Allied Waste North America, Inc. company | | |

| guaranty sr. unsec. notes 6 7/8s, 2017 | 850,000 | 882,938 |

|

| BE Aerospace, Inc. sr. unsec. unsub. notes 5 1/4s, 2022 | 1,085,000 | 1,101,275 |

|

| Legrand SA unsec. unsub. debs. 8 1/2s, 2025 (France) | 1,393,000 | 1,808,180 |

|

| Parker Hannifin Corp. sr. unsec. unsub. notes Ser. MTN, | | |

| 6 1/4s, 2038 | 435,000 | 557,466 |

|

| Republic Services, Inc. company guaranty sr. unsec. | | |

| notes 5.7s, 2041 | 595,000 | 700,570 |

|

| Republic Services, Inc. company guaranty sr. unsec. | | |

| notes 3.8s, 2018 | 720,000 | 781,404 |

|

| Republic Services, Inc. company guaranty sr. unsec. | | |

| unsub. notes 5 1/2s, 2019 | 660,000 | 776,653 |

|

| United Technologies Corp. sr. unsec. notes 5.7s, 2040 | 100,000 | 120,462 |

|

| | | 6,728,948 |

| Communication services (2.9%) | | |

| America Movil SAB de CV company guaranty sr. unsec. | | |

| unsub. notes 6 1/8s, 2040 (Mexico) | 880,000 | 1,056,837 |

|

| America Movil SAB de CV company guaranty unsec. | | |

| unsub. notes 2 3/8s, 2016 (Mexico) | 670,000 | 684,168 |

|

| American Tower Corp. sr. unsec. notes 7s, 2017 R | 1,210,000 | 1,414,457 |

|

| American Tower REIT, Inc. sr. unsec. notes 7 1/4s, 2019 R | 1,560,000 | 1,835,182 |

|

| AT&T, Inc. sr. unsec. unsub. bonds 5 1/2s, 2018 | 1,160,000 | 1,368,143 |

|

| AT&T, Inc. sr. unsec. unsub. notes 6.3s, 2038 | 1,535,000 | 1,839,664 |

|

| Bellsouth Capital Funding unsec. notes 7 7/8s, 2030 | 1,570,000 | 2,055,695 |

|

| CenturyLink, Inc. sr. unsec. debs. Ser. G, 6 7/8s, 2028 | 2,025,000 | 1,934,339 |

|

| CenturyLink, Inc. sr. unsec. unsub. notes Ser. P, 7.6s, 2039 | 855,000 | 811,782 |

|

| Comcast Cable Communications company | | |

| guaranty sr. unsub. notes 8 7/8s, 2017 | 785,000 | 1,021,129 |

|

| Comcast Corp. company guaranty sr. unsec. | | |

| unsub. notes 6.95s, 2037 | 700,000 | 889,961 |

|

| Corning, Inc. sr. unsec. unsub. notes 5 3/4s, 2040 | 265,000 | 301,964 |

|

| Cox Communications, Inc. 144A bonds 8 3/8s, 2039 | 470,000 | 674,916 |

|

| Cox Communications, Inc. 144A notes 5 7/8s, 2016 | 390,000 | 455,064 |

|

| Crown Castle Towers, LLC 144A company | | |

| guaranty sr. notes 4.883s, 2020 | 1,915,000 | 2,031,267 |

|

| France Telecom sr. unsec. unsub. notes 5 3/8s, 2019 (France) | 880,000 | 997,956 |

|

| France Telecom sr. unsec. unsub. notes 4 1/8s, 2021 (France) | 886,000 | 911,646 |

|

| Frontier Communications Corp. sr. unsec. notes 8 1/2s, 2020 | 800,000 | 832,000 |

|

| Frontier Communications Corp. sr. unsec. notes 7 7/8s, 2015 | 215,000 | 233,275 |

|

| NBCUniversal Media, LLC sr. unsec. unsub. notes 6.4s, 2040 | 845,000 | 1,025,281 |

|

24

| | |

| CORPORATE BONDS AND NOTES (27.8%)* cont. | Principal amount | Value |

|

| Communication services cont. | | |

| Qwest Corp. notes 6 3/4s, 2021 | $1,767,000 | $1,981,957 |

|

| Rogers Communications, Inc. company guaranty notes 6.8s, | | |

| 2018 (Canada) | 610,000 | 760,051 |

|

| SBA Tower Trust 144A company guaranty sr. notes 5.101s, 2017 | 2,425,000 | 2,613,211 |

|

| TCI Communications, Inc. company guaranty sr. unsec. | | |

| unsub. debs. 7 7/8s, 2026 | 2,435,000 | 3,222,876 |

|

| Telecom Italia Capital SA company guaranty sr. unsec. | | |

| unsub. notes 6.175s, 2014 (Italy) | 955,000 | 985,847 |

|

| Telefonica Emisiones SAU company guaranty sr. unsec. | | |

| notes 5.462s, 2021 (Spain) | 1,500,000 | 1,409,753 |

|

| Telefonica Emisiones SAU company guaranty sr. unsec. | | |

| unsub. notes 6.221s, 2017 (Spain) | 345,000 | 351,972 |

|

| Time Warner Cable, Inc. company guaranty sr. notes 7.3s, 2038 | 1,165,000 | 1,473,496 |

|

| Time Warner Cable, Inc. company guaranty sr. unsec. 6 3/4s, 2018 | 355,000 | 433,855 |

|

| Time Warner Cable, Inc. company guaranty sr. unsec. | | |

| unsub. notes 6 3/4s, 2039 | 350,000 | 422,028 |

|

| Time Warner Cable, Inc. company guaranty sr. unsec. | | |

| unsub. notes 5 1/2s, 2041 | 85,000 | 89,100 |

|

| Verizon Communications, Inc. sr. unsec. notes 7.35s, 2039 | 424,000 | 581,623 |

|

| Verizon Communications, Inc. sr. unsec. | | |

| unsub. notes 8 3/4s, 2018 | 856,000 | 1,170,632 |

|

| Verizon New Jersey, Inc. debs. 8s, 2022 | 640,000 | 838,435 |

|

| Verizon Pennsylvania, Inc. debs. 8.35s, 2030 | 795,000 | 1,014,376 |

|

| Verizon Virginia, Inc. debs. Ser. A, 4 5/8s, 2013 | 219,000 | 226,258 |

|

| | | 39,950,196 |

| Consumer cyclicals (2.7%) | | |

| Advance Auto Parts, Inc. company guaranty sr. unsec. | | |

| notes 5 3/4s, 2020 | 1,095,000 | 1,243,852 |

|

| Autonation, Inc. company guaranty sr. unsec. notes 6 3/4s, 2018 | 645,000 | 699,825 |

|

| Choice Hotels International, Inc. company | | |

| guaranty sr. unsec. unsub. notes 5.7s, 2020 | 1,195,000 | 1,294,766 |

|

| DIRECTV Holdings, LLC/DIRECTV Financing Co., Inc. company | | |

| guaranty sr. unsec. notes 6.35s, 2040 | 805,000 | 894,623 |

|

| DIRECTV Holdings, LLC/DIRECTV Financing Co., Inc. company | | |

| guaranty sr. unsec. unsub. notes 5 7/8s, 2019 | 1,670,000 | 1,921,596 |

|

| DISH DBS Corp. company guaranty sr. unsec. notes 6 3/4s, 2021 | 1,635,000 | 1,790,325 |

|

| Expedia, Inc. company guaranty sr. unsec. | | |

| unsub. notes 5.95s, 2020 | 950,000 | 993,145 |

|

| Ford Motor Credit Co., LLC sr. unsec. notes 5s, 2018 | 950,000 | 1,026,598 |

|

| Ford Motor Credit Co., LLC sr. unsec. unsub. notes 5 3/4s, 2021 | 740,000 | 832,619 |

|

| FUEL Trust 144A company guaranty asset backed notes | | |

| 4.207s, 2016 | 2,760,000 | 2,882,031 |

|

| Lender Processing Services, Inc. company | | |

| guaranty sr. unsec. unsub. notes 8 1/8s, 2016 | 1,769,000 | 1,846,394 |

|

| Limited Brands, Inc. company guaranty sr. unsec. | | |

| notes 6 5/8s, 2021 | 840,000 | 909,300 |

|

| Limited Brands, Inc. sr. notes 5 5/8s, 2022 | 820,000 | 825,125 |

|

| Macy’s Retail Holdings, Inc. company guaranty sr. unsec. | | |

| notes 5 1/8s, 2042 | 240,000 | 242,443 |

|

25

| | |

| CORPORATE BONDS AND NOTES (27.8%)* cont. | Principal amount | Value |

|

| Consumer cyclicals cont. | | |

| Macy’s Retail Holdings, Inc. company guaranty sr. unsec. | | |

| notes 3 7/8s, 2022 | $360,000 | $369,947 |

|

| Marriott International, Inc. sr. unsec. unsub notes 3s, 2019 | 780,000 | 776,852 |

|

| Masco Corp. sr. unsec. bonds 7 1/8s, 2020 | 470,000 | 508,384 |

|

| News America Holdings, Inc. company guaranty sr. unsec. | | |

| debs. 7 3/4s, 2024 | 870,000 | 1,019,569 |

|

| News America Holdings, Inc. debs. 7 3/4s, 2045 | 790,000 | 940,366 |

|

| Omnicom Group, Inc. sr. unsec. unsub. notes 4.45s, 2020 | 1,060,000 | 1,148,834 |

|

| Owens Corning company guaranty sr. unsec. notes 9s, 2019 | 672,000 | 831,600 |

|

| QVC, Inc. 144A sr. notes 7 1/8s, 2017 | 535,000 | 572,450 |

|

| Time Warner Entertainment Co., LP debs. 8 3/8s, 2023 | 1,450,000 | 1,962,324 |

|

| Time Warner, Inc. company guaranty sr. unsec. bonds 7.7s, 2032 | 1,850,000 | 2,423,783 |

|

| Time Warner, Inc. company guaranty sr. unsec. notes 4.7s, 2021 | 365,000 | 404,360 |

|

| Time Warner, Inc. debs. 9.15s, 2023 | 675,000 | 929,858 |

|

| Toyota Motor Credit Corp. sr. unsec. unsub. notes 3.3s, 2022 | 2,075,000 | 2,150,768 |

|

| Viacom, Inc. company guaranty sr. unsec. notes 7 7/8s, 2030 | 2,400,000 | 3,164,261 |

|

| Walt Disney Co. (The) sr. unsec. notes 2 3/4s, 2021 | 1,305,000 | 1,317,209 |

|

| Walt Disney Co. (The) sr. unsec. unsub. notes 4 3/8s, 2041 | 520,000 | 546,242 |

|

| | | 36,469,449 |

| Consumer staples (2.1%) | | |

| Altria Group, Inc. company guaranty sr. unsec. notes 9.7s, 2018 | 910,000 | 1,235,632 |

|

| Altria Group, Inc. company guaranty sr. unsec. | | |

| notes 9 1/4s, 2019 | 1,735,000 | 2,367,409 |

|

| Anheuser-Busch InBev Worldwide, Inc. company | | |

| guaranty sr. unsec. unsub. notes 8.2s, 2039 | 1,313,000 | 2,075,088 |

|

| Bacardi, Ltd. 144A unsec. notes 4 1/2s, 2021 (Bermuda) | 1,430,000 | 1,568,421 |

|

| Campbell Soup Co. debs. 8 7/8s, 2021 | 715,000 | 1,039,408 |

|

| Corrections Corporation of America company | | |

| guaranty sr. notes 7 3/4s, 2017 | 466,000 | 506,193 |

|

| CVS Caremark Corp. sr. unsec. unsub. notes 6.6s, 2019 | 1,310,000 | 1,631,417 |

|

| CVS Pass-Through Trust 144A company | | |

| guaranty sr. notes 7.507s, 2032 | 2,219,863 | 2,751,187 |

|

| Darden Restaurants, Inc. sr. unsec. unsub. notes 6.8s, 2037 | 2,270,000 | 2,627,162 |

|

| Diageo Investment Corp. company guaranty sr. unsec. | | |

| debs. 8s, 2022 (Canada) | 675,000 | 934,646 |

|

| General Mills, Inc. sr. unsec. notes 5.65s, 2019 | 190,000 | 229,552 |

|

| Kraft Foods, Inc. sr. unsec. notes 5 3/8s, 2020 | 590,000 | 688,868 |

|

| Kraft Foods, Inc. sr. unsec. unsub. notes 6 1/2s, 2040 | 3,905,000 | 4,897,462 |

|

| Kroger Co. company guaranty sr. unsec. unsub. notes 6.4s, 2017 | 605,000 | 732,373 |

|

| Kroger Co. sr. notes 6.15s, 2020 | 200,000 | 244,318 |

|

| McDonald’s Corp. sr. unsec. Ser. MTN, 6.3s, 2038 | 680,000 | 915,868 |

|

| McDonald’s Corp. sr. unsec. bond 6.3s, 2037 | 530,000 | 713,355 |

|

| McDonald’s Corp. sr. unsec. notes 5.7s, 2039 | 775,000 | 976,855 |

|

| SABMiller Holdings, Inc. 144A company guaranty sr. unsec. | | |

| notes 4.95s, 2042 | 630,000 | 669,826 |

|

| Tyson Foods, Inc. sr. unsec. unsub. notes 10 1/2s, 2014 | 675,000 | 777,938 |

|

| WPP Finance UK company guaranty sr. unsec. notes 8s, 2014 | | |

| (United Kingdom) | 1,370,000 | 1,573,068 |

|

| | | 29,156,046 |

26

| | |

| CORPORATE BONDS AND NOTES (27.8%)* cont. | Principal amount | Value |

|

| Energy (1.9%) | | |

| Anadarko Finance Co. company guaranty sr. unsec. | | |

| unsub. notes Ser. B, 7 1/2s, 2031 | $2,880,000 | $3,625,209 |

|

| BG Energy Capital PLC 144A company guaranty sr. unsec. | | |

| notes 4s, 2021 (United Kingdom) | 200,000 | 213,883 |

|

| BP Capital Markets PLC company guaranty sr. unsec. | | |

| unsub. notes 4.742s, 2021 (United Kingdom) | 1,860,000 | 2,114,150 |

|

| BP Capital Markets PLC company guaranty sr. unsec. | | |

| unsub. notes 4 1/2s, 2020 (United Kingdom) | 620,000 | 688,911 |

|

| Chesapeake Energy Corp. sr. unsec. notes 7 5/8s, 2013 | 835,000 | 868,400 |

|

| Chesapeake Midstream Partners LP/CHKM Finance Corp. company | | |

| guaranty sr. unsec notes 5 7/8s, 2021 | 602,000 | 571,900 |

|

| DCP Midstream, LLC 144A sr. unsec. notes 5.35s, 2020 | 775,000 | 858,458 |

|

| EOG Resources, Inc. sr. unsec. notes 5 5/8s, 2019 | 340,000 | 407,428 |

|

| Kerr-McGee Corp. company guaranty sr. unsec. | | |

| unsub. notes 7 7/8s, 2031 | 885,000 | 1,144,864 |

|

| Marathon Petroleum Corp. sr. unsec. unsub. notes 6 1/2s, 2041 | 525,000 | 576,621 |

|

| Motiva Enterprises, LLC 144A sr. unsec. notes 6.85s, 2040 | 895,000 | 1,119,814 |

|

| Motiva Enterprises, LLC 144A sr. unsec. unsub. notes 5.2s, 2012 | 195,000 | 197,663 |

|

| Newfield Exploration Co. sr. sub. notes 6 5/8s, 2016 | 550,000 | 561,000 |

|

| Noble Holding International, Ltd. company | | |

| guaranty sr. unsec. notes 6.05s, 2041 | 1,095,000 | 1,214,182 |

|

| Petrohawk Energy Corp. company guaranty sr. unsec. | | |

| notes 7 1/4s, 2018 | 2,910,000 | 3,317,400 |

|

| Petronas Capital, Ltd. 144A company guaranty unsec. | | |

| unsub. notes 5 1/4s, 2019 (Malaysia) | 975,000 | 1,108,166 |

|

| Pride International, Inc. sr. unsec. notes 7 7/8s, 2040 | 2,160,000 | 3,027,633 |

|

| Ras Laffan Liquefied Natural Gas Co., Ltd. 144A company | | |

| guaranty sr. notes 5 1/2s, 2014 (Qatar) | 1,015,000 | 1,094,982 |

|

| Statoil ASA company guaranty sr. unsec. notes 5.1s, 2040 | | |

| (Norway) | 1,900,000 | 2,171,417 |

|

| Weatherford Bermuda company guaranty sr. unsec. | | |

| notes 9 5/8s, 2019 | 584,000 | 772,561 |

|

| Weatherford International, Inc. company guaranty sr. unsec. | | |

| unsub. notes 6.8s, 2037 | 205,000 | 232,245 |

|

| Weatherford International, Inc. company guaranty sr. unsec. | | |

| unsub. notes 6.35s, 2017 | 240,000 | 278,964 |

|

| Weatherford International, Ltd. company guaranty 6 1/2s, | | |

| 2036 (Switzerland) | 470,000 | 508,686 |

|

| | | 26,674,537 |

| Financials (10.4%) | | |

| ABN Amro Bank NV 144A sr. unsec. notes 4 1/4s, 2017 | | |

| (Netherlands) | 4,460,000 | 4,512,137 |

|

| Aflac, Inc. sr. unsec. notes 6.9s, 2039 | 1,395,000 | 1,668,606 |

|

| Aflac, Inc. sr. unsec. notes 6.45s, 2040 | 990,000 | 1,138,317 |

|

| American Express Bank FSB notes Ser. BKN1, 5.55s, 2012 | 995,000 | 1,017,280 |

|

| American Express Bank FSB sr. unsec. FRN Ser. BKNT, 0.54s, 2017 | 1,035,000 | 975,761 |

|

| American Express Co. sr. unsec. notes 8 1/8s, 2019 | 1,450,000 | 1,920,480 |

|

| American International Group, Inc. jr. sub. bonds FRB | | |

| 8.175s, 2068 | 210,000 | 224,438 |

|

27

| | |

| CORPORATE BONDS AND NOTES (27.8%)* cont. | Principal amount | Value |

|

| Financials cont. | | |

| American International Group, Inc. sr. unsec. Ser. MTN, | | |

| 5.85s, 2018 | $2,440,000 | $2,685,094 |

|

| Aon PLC jr. unsec. sub. notes 8.205s, 2027 | 3,255,000 | 3,802,908 |

|

| Associates Corp. of North America sr. unsec. notes 6.95s, 2018 | 2,745,000 | 3,106,742 |

|

| Assurant, Inc. sr. unsec. notes 6 3/4s, 2034 | 1,485,000 | 1,598,830 |

|

| AXA SA 144A jr. unsec. sub. notes FRN 6.463s, 2018 (France) | 1,630,000 | 1,324,375 |

|

| Banco do Brasil SA 144A unsec. sub. notes 5 7/8s, 2022 (Brazil) | 2,665,000 | 2,757,017 |

|

| Bank of America Corp. sr. unsec. unsub notes 5 7/8s, 2042 | 840,000 | 829,119 |

|

| Bank of America Corp. sub. notes 7 3/4s, 2015 | 1,465,000 | 1,612,057 |

|

| Bank of America NA sub. notes Ser. BKNT, 5.3s, 2017 | 905,000 | 943,867 |

|

| Barclays Bank PLC 144A sub. notes 10.179s, 2021 | | |

| (United Kingdom) | 3,331,000 | 3,875,019 |

|