UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

Saks Incorporated

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which the transaction applies: |

| | (2) | | Aggregate number of securities to which the transaction applies: |

| | (3) | | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of the transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

12 E. 49th Street

New York, New York 10017

May 3, 2007

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of the Shareholders to be held at 11:30 a.m. Central Time, on Wednesday, June 6, 2007, at Harrah’s, 228 Poydras Street, New Orleans, Louisiana 70130.

The Notice of Annual Meeting of Shareholders and Proxy Statement accompanying this letter describe the specific business to be acted upon. Your vote is very important. We ask that you vote over the Internet or by telephone or return your proxy card in the postage-paid envelope as soon as possible.

I hope you will be able to join us, and I look forward to seeing you.

|

| Sincerely, |

|

|

Stephen I. Sadove Chief Executive Officer |

12 E. 49th Street

New York, New York 10017

NOTICE OF ANNUAL MEETING OF THE SHAREHOLDERS

To the Shareholders of Saks Incorporated:

Notice is hereby given that the Annual Meeting of the Shareholders of Saks Incorporated (the “Company”) will be held at 11:30 a.m. Central Time, on Wednesday, June 6, 2007, at Harrah’s, 228 Poydras Street, New Orleans, Louisiana 70130.

1. To elect three Directors to hold office for the term specified or until their respective successors have been elected and qualified;

2. To approve the Saks Incorporated 2007 Senior Executive Bonus Plan;

3. To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the current fiscal year ending February 2, 2008;

4. To vote on a shareholder proposal concerning cumulative voting for the election of Directors; and

5. To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

Shareholders of record at the close of business on April 2, 2007 are entitled to notice of, and to vote at, the meeting.

Shareholders are cordially invited to attend the meeting in person.

By order of the Board of Directors,

Julia Bentley

Secretary

May 3, 2007

Whether or not you intend to be present at the meeting, you are urged to vote over the Internet, by telephone, or to mark, sign, and date the enclosed proxy card and return it promptly in the envelope provided. Please see the proxy card for procedures and instructions for Internet and telephone voting.

Table of Contents

PROXY STATEMENT

Information Concerning the Solicitation

This Proxy Statement is furnished in connection with the solicitation of proxies to be used at the Annual Meeting of the Shareholders (the “Annual Meeting”) of Saks Incorporated, a Tennessee corporation (the “Company”), to be held on June 6, 2007.

The solicitation of proxies in the enclosed form is made on behalf of the Board of Directors of the Company. Directors, officers, and employees of the Company may solicit proxies by telephone, Internet, telecopier, mail, or personal contact. In addition, the Company has retained Georgeson Inc., New York, New York, to assist with the solicitation of proxies for a fee not to exceed $11,500, plus reimbursement for out-of-pocket expenses. Arrangements will be made with brokers, nominees, and fiduciaries to send proxies and proxy materials at the Company’s expense to their principals. The proxy materials are first being mailed to shareholders on or about May 3, 2007.

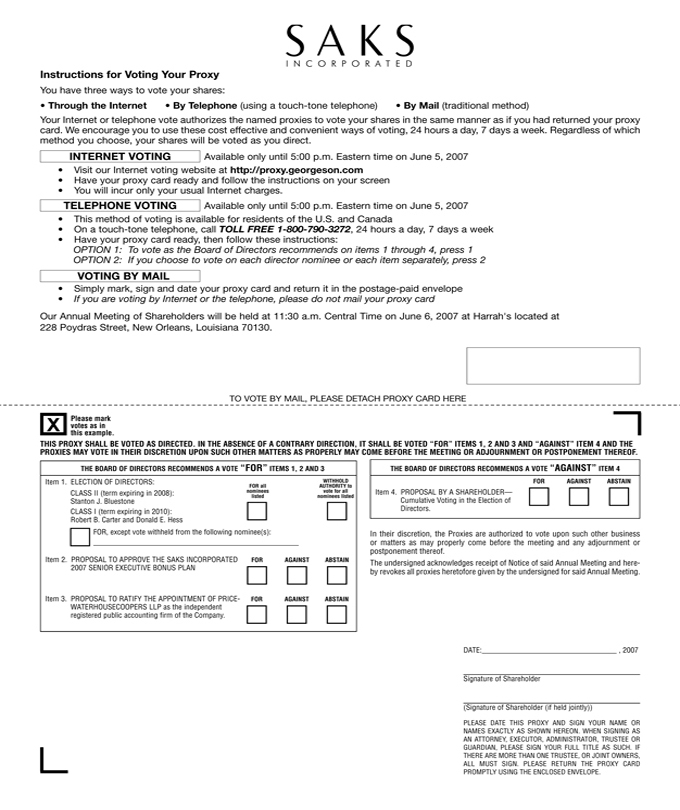

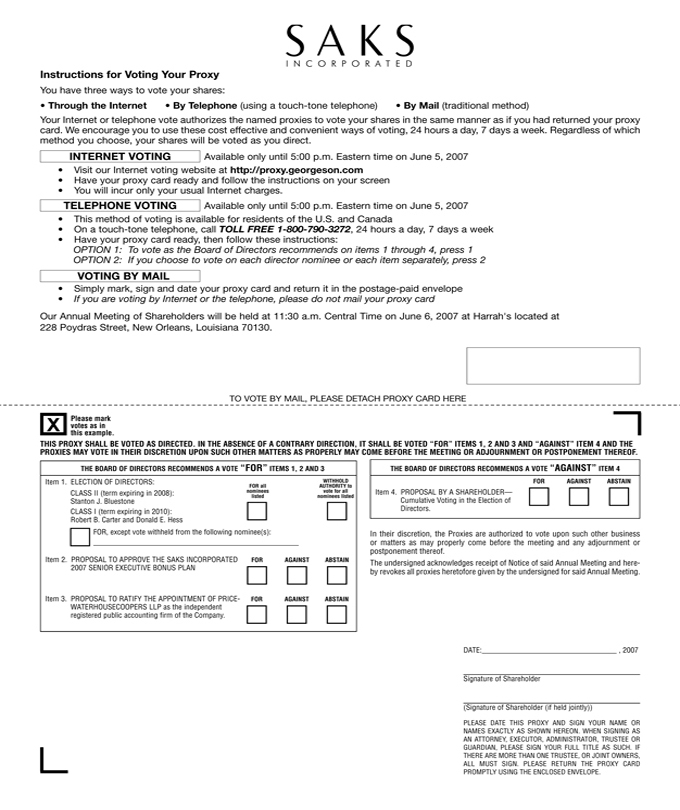

Shareholders whose shares are registered in their own name may vote over the Internet, by telephone, or by signing and returning a proxy in the enclosed form. Instructions for voting over the Internet or by telephone are set forth in the enclosed proxy card. A shareholder has the power to revoke the proxy at any time before the shares subject to it are voted by (i) returning a later-dated proxy, (ii) entering a new vote by telephone or on the Internet, (iii) delivering written notice of revocation to the Company’s Secretary, or (iv) voting in person by ballot at the Annual Meeting. If your shares are registered in the name of a bank or brokerage firm, you will receive instructions from your holder of record that must be followed in order for the record holder to vote the shares in accordance with your instructions.

If you properly complete your proxy card, your shares will be voted at the Annual Meeting in the manner that you direct. In the event you return a signed proxy card on which no directions are specified, your shares will be voted FOR the election of the three Director nominees (Item 1), FOR the approval of the Saks Incorporated 2007 Senior Executive Bonus Plan (Item 2), FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending February 2, 2008 (“2007”) (Item 3), and AGAINST the proposal regarding cumulative voting that was submitted by a shareholder (Item 4).

Votes cast by proxy or in person at the Annual Meeting will be tabulated by the election inspectors appointed for the meeting. A quorum must be present in order for the Annual Meeting to be held. In order for the quorum requirement to be satisfied, a majority of the issued and outstanding shares of Common Stock of the Company (“Common Stock”) entitled to vote at the meeting must be present in person or represented by proxy. The election inspectors will treat abstentions and “broker non-votes” as shares that are present and entitled to vote for purposes of determining the presence of a quorum. A “broker non-vote” occurs when a broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. Brokers will not have discretionary voting power with respect to the proposal submitted by the shareholder.

You may either vote “FOR” or “WITHHOLD” authority to vote for each nominee for election to the Board of Directors. The number of nominees proposed by the Board of Directors to be re-elected as Directors at the Annual Meeting is the same as the number of Directors to be elected, and no shareholder has utilized the procedures provided in the Company’s Amended and Restated Bylaws (the “Bylaws”) to nominate an additional

1

person or persons for election to the Board of Directors at the Annual Meeting (see “Shareholders’ Proposals or Nominations for 2008 Annual Meeting”). As a result, in accordance with the Tennessee Business Corporation Law each nominee proposed for re-election at the Annual Meeting who receives an affirmative vote at the Annual Meeting in person or by proxy will be elected. You may vote “FOR,” “AGAINST,” or “ABSTAIN” on the other proposals, which will be approved if the votes cast favoring the action exceed the votes cast opposing the action. As such, abstentions and broker non-votes will have no effect on the outcome of such matters.

Outstanding Voting Securities

Only shareholders of record at the close of business on April 2, 2007 are entitled to vote at the Annual Meeting. On that day, there were issued and outstanding 140,846,455 shares of Common Stock. Each share has one vote.

Listed in the following table are the number of shares owned by each Director, the executive officers named in the Summary Compensation Table under the caption “Executive Compensation” (the “Named Executive Officers”), and all Directors and executive officers of the Company as a group as of April 3, 2007. Except as otherwise noted, each of the persons named in the table below has sole voting and investment power with respect to the shares shown as beneficially owned by him or her. The table also includes the beneficial owners as of April 3, 2007 (unless otherwise noted) of more than 5% of the outstanding Common Stock who are known to the Company.

| | | | | | |

Name of Beneficial Owner (and Address if “Beneficial Ownership” Exceeds 5%) | | Total Shares

Beneficially

Owned (1) | | | Percentage of Common Stock

Ownership | |

Stanton J. Bluestone | | 119,460 | | | * | |

Robert B. Carter | | 11,000 | | | * | |

James A. Coggin | | 85,135 | | | * | |

Ronald de Waal | | 147,673 | | | * | |

Julius W. Erving | | 127,122 | | | * | |

Ronald Frasch | | 134,740 | | | * | |

Michael S. Gross | | 36,598 | | | * | |

Donald E. Hess | | 159,157 | | | * | |

Marguerite W. Kondracke | | 31,898 | | | * | |

R. Brad Martin | | 299,250 | (2) | | * | |

Nora P. McAniff | | 23,022 | | | * | |

C. Warren Neel | | 39,483 | | | * | |

Stephen I. Sadove | | 1,652,088 | (3) | | 1.16 | % |

Christopher J. Stadler | | 44,004 | | | * | |

Kevin G. Wills | | 57,672 | | | * | |

| | |

All Directors and Executive Officers as a group (26 persons) | | 3,671,276 | | | 2.57 | % |

| | |

5% Owners: | | | | | | |

AXA Financial, Inc. | | 9,626,902 | (4)(5) | | 6.83 | % |

FMR Corp. | | 14,868,317 | (4)(6) | | 10.55 | % |

Inmobiliaria Carso, S.A. de C.V. | | 11,000,000 | (4)(7) | | 7.81 | % |

Marsico Capital Management LLC | | 14,464,959 | (4)(8) | | 10.27 | % |

| * | Owns less than 1% of the total outstanding shares of Common Stock. |

2

| (1) | Includes (a) shares that the following persons have a right to acquire within sixty days after April 3, 2007 through the exercise of stock options and (b) shares of restricted stock (including performance shares) for which the restrictions have not lapsed: Mr. Bluestone (108,460; 6,000), Mr. Carter (0; 11,000), Mr. Coggin (0; 33,334), Mr. de Waal (83,673; 14,000), Mr. Erving (86,078; 8,000), Mr. Frasch (0, 97,500), Mr. Gross (25,824; 8,000), Mr. Hess (53,157; 4,000), Ms. Kondracke (11,362; 8,000), Mr. Martin (30,128; 45,000), Ms. McAniff (12,052; 5,600), Dr. Neel (3,444; 8,000), Mr. Sadove (1,068,166; 249,085), Mr. Stadler (22,380; 8,000), Mr. Wills (8,609; 10,000), and all Directors and executive officers as a group (1,748,226; 898,422). |

| (2) | Includes 2,175 shares owned by RBM Venture Company, of which Mr. Martin is sole shareholder. |

| (3) | Does not include an amount equal to 221,360 shares of Common Stock held in Mr. Sadove’s stock grant account under the Company’s Deferred Compensation Plan (“DCP”). |

| (4) | Information in the table and in notes 5 through 8 below relating to the beneficial owner of Common Stock (and any related entity or person) is as of December 31, 2006 and was obtained from Schedule 13Gs filed with the Securities and Exchange Commission (“SEC”) as follows: (a) on February 14, 2007 for AXA Financial, Inc. (“AXA”); (b) on January 10, 2007 for FMR Corp; (c) on January 23, 2007 for Inmobiliaria Carso, S.A. de C.V. (“Inmobiliaria”) by Carlos Slim Helu (which includes beneficial ownership of Carlos Slim Helu, Carlos Slim Domit, Marco Antonio Slim Domit, Patrick Slim Domit, Maria Soumaya Slim Domit, Vanessa Paola Slim Domit, Johanna Monique Slim Domit (collectively “the Slim family”)(see Note 7)); and (d) on February 9, 2007 for Marsico Capital Management, LLC (“Marsico”). |

| (5) | The majority of the shares reported in the Schedule 13G are held by unaffiliated third-party client accounts managed by AllianceBernstein, L.P., as investment advisor, which is a majority-owned subsidiary of AXA. AXA and its related entities report sole voting power over 7,806,344 shares, shared voting power over 52,025 shares, sole dispositive power over 9,572,552 shares, and shared dispositive power over 110 shares. The principal business address for AXA is 1290 Avenue of the Americas, New York, New York 10104. |

| (6) | FMR Corp. and its related entities and persons report sole voting power over 4,204,917 shares and sole dispositive power over 14,868,317 shares. The principal business address for FMR Corp. is 82 Devonshire Street, Boston, Massachusetts 02109. |

| (7) | Inmobiliaria beneficially owns directly 11,000,000 shares. The Slim family beneficially owns all of the outstanding voting equity securities of Inmobiliaria. As a result, each member of the Slim family may be deemed to have indirect beneficial ownership of the 11,000,000 shares beneficially owned directly by Inmobiliaria. The principal business address for each member of the Slim family is Paseo de las Palmas 736, Colonia Lomas de Chapultepec, 11000 Mexico D.F., Mexico. |

(8) | Marsico reports sole voting power over 14,188,561 shares and sole dispositive power over 14,464,959 shares. The principal business address for Marsico is 1200 17th Street, Suite 1600, Denver, Colorado 80202. |

The Company encourages its executive officers, other senior management, and Directors to hold a personally meaningful equity interest in the Company, and stock ownership guidelines have been established for Directors and selected executives. The Company believes Common Stock ownership aligns the interests of management, Directors, and shareholders. See “Executive Compensation—Compensation Discussion and Analysis—What Do Our Compensation Programs Reward?” for information concerning the Company’s stock ownership guidelines for the selected executives.

ELECTION OF DIRECTORS

(Item No. 1)

The Company’s Amended and Restated Charter provides that the Board of Directors shall be divided into three classes, designated as Class I, Class II, and Class III. The terms of Class I, II, and III will expire at the annual meetings of shareholders in 2007, 2008, and 2009, respectively. The Board of Directors proposes the re-election of two Class I Directors, Robert B. Carter and Donald E. Hess, and one Class II Director, Stanton J. Bluestone.

See “Corporate Governance—Corporate Governance Committee” for a discussion of the Corporate Governance Committee’s process to identify and select Director candidates.

3

Mr. Martin resigned, effective as of May 4, 2007, as Chairman of the Board of the Company and as a Director of the Company. Mr. Sadove, Chief Executive Officer of the Company, has been elected Chairman of the Board of the Company effective as of May 4, 2007. Current Class I Director Julius W. Erving is not standing for reelection and will retire from the Board of Directors on June 6, 2007.

The Board of Directors’ current policy is that no Director will be nominated by the Board to stand for re-election after reaching age 72, although the Board may determine, in special circumstances, that this policy should not apply with respect to any particular Director. Mr. Bluestone, 72, has agreed, at the request of the Board of Directors, to serve an additional one-year term as a Class II Director.

The two Class I Directors and the one Class II Director standing for re-election and the seven Directors whose terms continue after the Annual Meeting will comprise the Board of Directors. Each Director will hold office for the term specified and until the Director’s successor is elected and qualified. Unless otherwise instructed by the shareholder, the persons named in the enclosed proxy card intend to vote for the election of Messrs. Carter and Hess as Class I Directors and Mr. Bluestone as a Class II Director.

The Bylaws require that Directors who are not officers of the Company must submit to the Board a letter of resignation upon any change in the Director’s principal business or other activity in which the Director was engaged at the time of the Director’s election. The Board’s Corporate Governance Committee will review the letter of resignation and make a recommendation, based on all of the relevant facts and circumstances (including the needs of the Board), as to whether the Board should accept the Director’s resignation. Ms. McAniff and Messrs. Gross and Stadler upon request each submitted such a letter following a change in employment status. The Board of Directors, at the Corporate Governance Committee’s recommendation, did not accept these resignations, and Ms. McAniff and Messrs. Gross and Stadler continue to serve on the Board.

We have provided below information about the nominees and other Directors. The business associations shown have continued for more than five years unless otherwise noted.

| | | | |

Name, Principal Occupation, and Directorships | | Age | | Director

Since |

NOMINEES FOR DIRECTOR: | | | | |

| | |

Class II (term expiring in 2008): | | | | |

| | |

Stanton J. Bluestone | | 72 | | 1998 |

| Chairman of the Carson Pirie Scott Group of the Company from February 1998 until his retirement in January 1999. Mr. Bluestone served as Chairman and Chief Executive Officer of Carson Pirie Scott & Co. (“CPS”) between March 1996 and January 1998. Mr. Bluestone was Chief Executive Officer of CPS beginning in 1993. Prior to that, Mr. Bluestone held other executive positions with CPS. | | | | |

| | |

Class I (terms expiring in 2010): | | | | |

| | |

Robert B. Carter | | 47 | | 2004 |

| Executive Vice President of FedEx Information Services and Chief Information Officer of FedEx Corporation, an international provider of transportation, information, international trade support, and supply chain services. | | | | |

| | |

Donald E. Hess | | 58 | | 1996 |

| Chief Executive Officer of Southwood Partners, a private investment company. Mr. Hess served as Chairman Emeritus of Parisian from January 1998 until October 2006, Chairman of the Parisian group of the Company from April 1997 until his retirement in December 1997, and President and Chief Executive Officer of Parisian, Inc. from 1986 to April 1997. | | | | |

|

| THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” THE ELECTION AS DIRECTORS OF THE ABOVE-LISTED NOMINEES. |

4

| | | | |

Name, Principal Occupation, and Directorships | | Age | | Director

Since |

CONTINUING DIRECTORS: | | | | |

| | |

Class II (terms expiring in 2008): | | | | |

| | |

Michael S. Gross | | 45 | | 1994 |

| Since March 2007, Mr. Gross has served as the Chairman, Chief Executive Officer, and managing member of Solar Capital, LLC, a newly organized finance company focusing on debt and equity investments in leveraged companies. Mr. Gross has been the Chairman, Chief Executive Officer, and Secretary of Marathon Acquisition Corp. since April 2006. Since July 2006, Mr. Gross has been co-chairman of the investment committee of Magnetar Financial LLC, an investment management firm, and a senior partner in Magnetar Capital Partners LP, the holding company for Magnetar Financial LLC. Between February 2004 and February 2006, Mr. Gross was the President and Chief Executive Officer of Apollo Investment Corporation, a publicly traded business development company that he founded and on whose board of directors and investment committee he served as Chairman from February 2004 to July 2006, and was the managing partner of Apollo Investment Corporation. From 1990 to February 2006, Mr. Gross was a senior partner at Apollo Management LP, a private equity firm that he founded in 1990. In addition, from 2003 to February 2006, Mr. Gross was the managing partner of Apollo Distressed Investment Fund, an investment fund that he founded. He also serves on the Boards of Directors of Marathon Acquisition Corp. and United Rentals, Inc. | | | | |

| | |

Nora P. McAniff | | 48 | | 2002 |

| Chief Operating Officer of Time, Inc., a magazine publisher, from December 2005 until January 2007. Ms. McAniff served as Executive Vice President of Time, Inc. between September 2002 and December 2005. She served as Group President of the People Magazine Group of Time, Inc. between January 2001 and August 2002 and President of People Magazine between October 1998 and January 2001. | | | | |

| | |

Stephen I. Sadove | | 55 | | 1998 |

| Chief Executive Officer of the Company since January 2006. Mr. Sadove has been elected to the additional position of Chairman of the Board of the Company, effective May 4, 2007. Mr. Sadove joined the Company in January 2002 as Vice Chairman and served in that capacity until March 2004. He served as Vice Chairman and Chief Operating Officer of the Company from March 2004 until January 2006. Mr. Sadove served as Senior Vice President of Bristol-Myers Squibb, a beauty, nutritional, and pharmaceutical company, and President of Bristol-Myers Squibb Worldwide Beauty Care from 1996 to January 2002. Mr. Sadove serves on the Board of Directors of Ruby Tuesday, Inc. | | | | |

| | |

Class III (terms expiring in 2009): | | | | |

| | |

Ronald de Waal | | 55 | | 1985 |

| Vice Chairman of the Company’s Board of Directors. Chairman of WE International, B.V., a Netherlands corporation, which operates fashion specialty stores in Belgium, the Netherlands, Switzerland, Germany, and France. Mr. de Waal serves on the Board of Directors of Post Properties Inc. | | | | |

| | |

Marguerite W. Kondracke | | 61 | | 1996 |

| Since October 2004 President and Chief Executive Officer of America’s Promise—The Alliance for Youth, a not-for-profit children’s advocacy organization founded in 1997 by General Colin Powell. She was employed in the following positions: Staff Director, Senate Subcommittee on Children and Families between April 2003 and September 2004; President and Chief Executive Officer of The Brown Schools, the nation’s largest provider of treatment services for troubled adolescents, from September 2001 to March 2003; and President and Chief Executive Officer of Frontline Group, Inc., an employee training company, from July 1999 to August 2001. Ms. Kondracke is co-founder, former Chief Executive Officer, and currently a board member of Bright Horizons Family Solutions. | | | | |

5

| | | | |

Name, Principal Occupation, and Directorships | | Age | | Director

Since |

C. Warren Neel | | 68 | | 1987 |

| Executive Director of the Center for Corporate Governance at the University of Tennessee, Knoxville, since February 2003. Dr. Neel served as Commissioner of Finance and Administration for the State of Tennessee from July 2000 to January 2003. He served as the Dean of the College of Business Administration at the University of Tennessee, Knoxville, from 1977 until June 2000. Dr. Neel serves on the Board of Directors of Healthways, Inc. | | | | |

| | |

Christopher J. Stadler | | 42 | | 2000 |

| Managing Partner of CVC Capital Partners, an investment company, since March 2007. He served as Managing Director and Head of Corporate Investment North America of Investcorp International, Inc., an investment company, from 1996 through January 2007. | | | | |

APPROVAL OF THE SAKS INCORPORATED

2007 SENIOR EXECUTIVE BONUS PLAN

(Item No. 2)

On April 17, 2007 the Board of Directors adopted the Saks Incorporated 2007 Senior Executive Bonus Plan (the “Bonus Plan”). The Board of Directors adopted the Bonus Plan to provide to a select group of the Company’s executive officers an annual incentive opportunity that is based on the achievement of pre-established objective performance goals, to earn additional compensation to attract and retain the executive officers, and to motivate them to enhance the value of the Company’s business. The Bonus Plan is comparable in all material respects to the Saks Incorporated 2003 Senior Executive Bonus Plan (the “2003 Bonus Plan”) approved by the Company’s shareholders at the Company’s 2003 Annual Meeting of Shareholders, with two exceptions: (i) the Bonus Plan provides that the maximum bonus award payable to a participant in cash may not exceed 300% of the participant’s annual base salary, rather than 200%, as provided in the 2003 Senior Executive Bonus Plan and (ii) the Bonus Plan provides that a bonus award payable to a participant may not exceed $5 million in amount or value. The following description summarizes the Bonus Plan but is qualified by reference to the text of the Bonus Plan attached to this Proxy Statement as Attachment A.

Summary of the Bonus Plan

The Bonus Plan is intended to provide an annual incentive compensation opportunity that is not subject to the limitation on deductions for federal income tax purposes in Section 162(m) of the Internal Revenue Code of 1986 (the “Code”) and is to be construed as providing for “qualified performance-based compensation” within the meaning of Section 162(m).

Bonus Plan participants include those executive officers selected by the Human Resources and Compensation Committee of the Board of Directors (the “Committee”) within 90 days following the beginning of each annual performance period commencing with the Company’s fiscal year beginning February 3, 2008 (“2008”) and ending with the Company’s 2012 fiscal year. Participation in the Bonus Plan will cease upon death, permanent and total disability, or termination of employment.

The Committee will establish written performance goals for each participant for each annual performance period, the outcome of which at the time of establishment must be substantially uncertain, and bonus potential amounts. Each performance goal will consist of, and achievement will be measured against, one or more of the following business criteria: revenue; net or gross sales; comparable store sales; gross margin; operating profit; earnings before all or any of interest, taxes, depreciation or amortization, or a percentage to revenue; cash flow; working capital; return on equity, assets, capital or investment; market share; earnings or book value per share; earnings from continuing operations; net worth; turnover in inventory; expense control within budgets; appreciation in the price of the Company’s common stock; total shareholder return; new unit growth; and

6

implementation of critical projects or processes. The performance goals may be expressed in terms of attaining a specified level or may be applied relative to a market index, a group of other companies, or a combination, as determined by the Committee. All performance goals will be determined in accordance with generally accepted accounting principles. Financial performance will be determined by excluding all items of gain, loss, and expense for the fiscal year determined to be extraordinary or unusual in nature or infrequent in occurrence or related to the disposal of a segment of a business or related to a change in accounting principle. Different annual performance periods may have different performance goals, and different participants may have different performance goals.

Bonus awards are payable in cash or stock. Stock awards would be payable under the Company’s 2004 Long-Term Incentive Plan. Bonus payments will be determined as follows: no bonus payment will be made if achievement is below the established minimum; a maximum bonus payment will be made if achievement equals or is greater than the established maximum; and a prorated bonus payment will be made if achievement is between the minimum and maximum levels of performance. The Committee may, in its discretion, reduce or eliminate a bonus amount payable upon the attainment of a performance goal.

Subject to the next sentence, a cash bonus award may not exceed 300% of a participant’s salary, and a stock bonus for the Company’s Chief Executive Officer may not exceed 50,000 shares of Common Stock, and for other participants may not exceed 25,000 shares, in each case subject to adjustment in the case of stock splits or stock dividends. No cash or stock bonus for any participant may exceed $5 million annually in amount or value. To receive a bonus payment, a participant must be employed by the Company on the last day of the Company’s fiscal year. Upon the request of a participant, the Company will defer payment of the participant’s bonus in accordance with the Company’s Deferred Compensation Plan and all successor plans in effect from time to time and Section 409A of the Code. Deferred bonus payments, together with earnings based on a reasonable rate of return or rate of return on specified investments, will be distributed to participants when they request except as limited by the Committee. The Company’s obligation to pay deferred bonus payments will be unfunded and unsecured. The Bonus Plan is intended to be unfunded for purposes of the Employee Retirement Income Security Act of 1974 and the Code. A participant may not assign, pledge, or encumber a deferred bonus payment, but the participant may designate beneficiaries to receive deferred bonus payments upon the participant’s death.

The Committee will administer the Bonus Plan and is authorized to take all actions necessary or desirable to effect the purposes of the Bonus Plan, in its sole discretion, including but not limited to the following: providing rules for the management, operation, and administration of the Bonus Plan; interpreting the Bonus Plan in its sole discretion to the fullest extent permitted by law; and correcting any defect or omission or reconciling any inconsistency in the Bonus Plan in the manner and to extent the Committee deems appropriate in its sole discretion. The decisions of the Committee will be final and conclusive for all purposes.

The Company has reserved the right, exercisable by the Committee, to amend the Bonus Plan at any time and in any respect and to discontinue and terminate the Bonus Plan in whole or in part at any time.

The Bonus Plan will be interpreted in accordance with Tennessee law. If the Company’s shareholders approve the Bonus Plan, it will become effective upon that approval.

Participants in the Bonus Plan

At this time the Committee expects that approximately 20 senior executives and officers of the Company will be eligible to participate in the Bonus Plan for 2008. The amount of benefits to be received pursuant to the Bonus Plan by participants cannot be determined at this time. See “Executive Compensation—Summary Compensation Table—2006” for cash bonuses paid pursuant to the 2003 Bonus Plan to the Named Executive Officers with respect to 2006. The aggregate annual cash bonuses earned in 2006 under the 2003 Bonus Plan by the Company’s executive officers as a group was $5,606,618.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” THE APPROVAL OF THE SAKS INCORPORATED 2007 SENIOR EXECUTIVE BONUS PLAN (ITEM NO. 2).

7

RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

(Item No. 3)

The Audit Committee of the Company’s Board of Directors has appointed PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm to audit the financial statements of the Company for 2007. The Company is asking the shareholders to ratify the Audit Committee’s appointment. If the shareholders fail to ratify the appointment, the Audit Committee will reconsider the appointment.

PricewaterhouseCoopers LLP (or their predecessor firm Coopers & Lybrand) has audited the financial statements of the Company since 1991. Representatives of PricewaterhouseCoopers LLP will be present at the Annual Meeting and will have an opportunity to make a statement, if they so desire, and will be available to respond to appropriate questions.

THE AUDIT COMMITTEE AND THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMEND THAT THE SHAREHOLDERS VOTE “FOR” SUCH RATIFICATION (ITEM NO. 3).

PricewaterhouseCoopers LLP Fees and Services in 2006 and 2005

Aggregate fees for professional services rendered to the Company by PricewaterhouseCoopers LLP for the Company’s fiscal year ended February 3, 2007 (“2006”) and the Company’s fiscal year ended January 28, 2006 (“2005”) were:

| | | | | | |

| | | 2006 | | 2005 |

| Audit—Professional services for audits of the consolidated financial statements and internal controls of the Company, for the review of the financial statements included in the Company’s Quarterly Reports on Form 10-Q, and for the issuance of comfort letters and consents for financing transactions. | | $ | 1,316,656 | | $ | 4,890,000 |

| | |

| Audit-Related—Assurance and related services including benefit plan audits and audits related to business divestitures. | | | 138,950 | | | 839,396 |

| | |

| Tax—Tax return preparation and tax services for employee benefit plans. | | | — | | | — |

| | |

| All Other—All other services includes a license fee for a technical research application. | | | 1,500 | | | 1,500 |

| | | | | | |

| Total | | $ | 1,457,106 | | $ | 5,730,896 |

The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by the independent auditors. These services may include audit services, audit-related services, tax services, and other services. Pre-approval is generally provided for up to one year, and any pre-approval is detailed as to the particular service or category of services and is subject to a specific budget. The independent auditors and management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent auditors in accordance with this pre-approval, and the fees for the services performed to date. The Audit Committee may also pre-approve particular services on a case-by-case basis.

8

Audit Committee Report

The primary function of the Audit Committee is to assist the Board of Directors in its oversight and monitoring of the Company’s financial reporting and audit processes, the Company’s system of internal control, and the Company’s process for monitoring compliance with laws, regulations, and policies. The Board of Directors of the Company has adopted an Audit Committee Charter that describes the responsibilities of the Audit Committee.

Management has the primary responsibility for establishing and maintaining adequate internal financial controls, for preparing the financial statements, and for the public reporting process. PricewaterhouseCoopers LLP, the Company’s independent registered public accounting firm, is responsible for expressing opinions on the conformity of the Company’s audited financial statements with generally accepted accounting principles and on management’s assessment of the effectiveness of the Company’s internal control over financial reporting.

The Audit Committee has reviewed and discussed with management and PricewaterhouseCoopers LLP the Company’s audited consolidated financial statements for 2006, management’s assessment of the effectiveness of the Company’s internal control over financial reporting, and PricewaterhouseCoopers LLP’s evaluation of the Company’s internal control over financial reporting. The Audit Committee also has discussed with PricewaterhouseCoopers LLP the matters required to be discussed by Statement on Auditing Standards No. 61 (Codification of Statements on Auditing Standards AU (S) 380).

The Audit Committee also received the written disclosures and the letter from PricewaterhouseCoopers LLP that are required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and has discussed with PricewaterhouseCoopers LLP their independence. The Audit Committee also concluded that PricewaterhouseCoopers LLP’s provision of audit and non-audit services to the Company and its affiliates is compatible with PricewaterhouseCoopers LLP’s independence.

Based upon its review of the Company’s audited financial statements and the discussions noted above, the Audit Committee recommended that the Board of Directors include the Company’s audited consolidated financial statements for 2006 in the Company’s Annual Report on Form 10-K for 2006 for filing with the Securities and Exchange Commission.

Audit Committee

C. Warren Neel, Committee Chair

Stanton J. Bluestone

Michael S. Gross

Marguerite W. Kondracke

PROPOSAL BY A SHAREHOLDER CONCERNING CUMULATIVE VOTING

(Item No. 4)

The following proposal was submitted by a shareholder. We have included the proposal and supporting statement exactly as submitted by the proponent for the proposal. To make sure readers can easily distinguish between material provided by the proponent and material provided by the Company, we have placed a box around material provided by the proponent.

9

Ms. Evelyn Y. Davis, 2600 Virginia Avenue, NW, Suite 215, Washington, D.C. 20037, owner of 600 shares of the Company’s Common Stock, submitted the following proposal, which isOPPOSEDby the Board of Directors:

RESOLVED: “That the stockholders of SAKS INC., assembled in Annual Meeting in person and by proxy, hereby request the Board of Directors to take the necessary steps to provide for cumulative voting in the election of directors, which means each stockholder shall be entitled to as many votes as shall equal the number of shares he or she owns multiplied by the number of directors to be elected, and he or she may cast all of such votes for a single candidate, or any two or more of them as he or she may see fit.”

REASONS: “Many states have mandatory cumulative voting, so do National Banks.”

“In addition, many corporations have adopted cumulative voting.”

“Last year the owners of 32,350,181 shares, representing approximately 39% of shares voting, voted FOR this proposal.”

“If you AGREE, please mark your proxy FOR this resolution.”

Statement Against Shareholder Proposal

The Board of Directors unanimously recommends a vote AGAINST this proposal for the following reasons:

This same proposal has been submitted at each Annual Meeting of Shareholders since 2002 and was rejected by shareholders at each meeting.

The Board of Directors believes that the present system of voting for Directors is more likely to assure that the Board will act in the interests of all of the Company’s shareholders.

Cumulative voting could make it possible for an individual shareholder or group of shareholders with special interests to elect one or more directors to the Company’s Board of Directors. Such a shareholder or group could have goals that were inconsistent, and could conflict, with the interests and goals of the majority of the Company’s shareholders. Any director elected by such a narrow constituency could disrupt and impair the efficient functioning of the Board of Directors, which may undermine its ability to work effectively as a governing body on behalf of the common interests of all shareholders. Moreover, directors elected by cumulative voting may feel an obligation to represent the special interest groups that elected them rather than all shareholders generally. By contrast, the present system of voting utilized by the Company and by most major publicly traded corporations promotes the election of a more effective Board of Directors in which each Director represents the shareholders as a whole.

ACCORDINGLY, THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE “AGAINST” THIS PROPOSAL (ITEM NO. 4).

Corporate Governance

Board Practices

The Board met seven times during 2006. At each regular Board meeting, the non-employee Directors also meet separately with Messrs. Martin and Sadove and then without them. Until February 28, 2007 Ronald de Waal presided over the non-employee Director sessions in his capacity as a Vice Chairman of the Board of Directors. On February 28, 2007 the Board of Directors elected Donald E. Hess as Lead Director and in that capacity he will preside over non-employee Director sessions.

10

The Company’s Board of Directors has adopted Corporate Governance Guidelines. The Company’s Board of Directors has also adopted a Code of Business Conduct and Ethics (the “Code”) in compliance with New York Stock Exchange (“NYSE”) and Securities and Exchange Commission (“SEC”) standards. The Chief Executive Officer, the Principal Financial Officer, other employees of the Company, and members of the Board must comply with the Code. The Code and the Corporate Governance Guidelines are posted on the Company’s web site atwww.saksincorporated.com and are available in print to any person who sends a written request to the Company’s General Counsel at 12 E. 49th Street, New York, New York 10017. Waivers and amendments to the policies and procedures set forth in the Code will be disclosed by means of an appropriate statement onwww.saksincorporated.com.

The Board reviews its own performance annually and routinely reviews and plans for succession of the Company’s executive team.

Director Independence

Under the Company’s Corporate Governance Guidelines, a significant majority of the Board should be composed of Independent Directors as those terms are defined in the NYSE rules. The Board of Directors has adopted categorical independence standards that supplement the NYSE listing standards. Under these standards, which are available atwww.sakincorporated.com, (i) no director will qualify as “independent” unless the Board of Directors affirmatively determines that the director does not have a material relationship with the Company (either directly or as a partner, shareholder, or officer of an organization that has a relationship with the Company), and (ii) no director will be independent if the director has any of the following relationships:

| | • | | The director is an employee of the Company or has been an employee of the Company at any time within the preceding three years. |

| | • | | A member of the director’s immediate family is an executive officer of the Company or has been an executive officer of the Company at any time within the preceding three years. |

| | • | | The director or an immediate family member of the director received during any 12 month period within the last three years more than $100,000 in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided that such compensation is not contingent in any way on continued service). |

| | • | | The director is a current partner or employee of the Company’s internal or external audit firm, or the director was within the past three years (but is no longer) a partner or employee of such a firm and personally worked on the Company’s audit within that time. |

| | • | | A member of the director’s immediate family (A) is a current partner of a firm that is the Company’s internal or external auditor, (B) is a current employee of such a firm and participates in the firm’s audit, assurance or tax compliance (but not tax planning) practice or (C) was within the past three years (but is no longer) a partner or employee of such a firm and personally worked on the Company’s audit within that time. |

| | • | | The director is, or within the preceding three years has been, employed as an executive officer of another company where any of the Company’s present executive officers at the same time serves or served on the other company’s compensation committee. |

| | • | | A member of the director’s immediate family is, or within the preceding three years has been, employed as an executive officer of another company where any of the Company’s present executive officers serves or served on the other company’s compensation committee. |

| | • | | The director is an employee of another company that has made payments to, or received payments from, the Company for property or services in an amount which, in any one of the three most recent fiscal years, exceeded the greater of $1 million, or 2% of the other company’s consolidated gross revenues. |

11

| | • | | A member of the director’s immediate family is an executive officer of another company that has made payments to, or received payments from, the Company for property or services in an amount which, in any one of the three most recent fiscal years, exceeded the greater of $1 million, or 2% of the other company’s consolidated gross revenues. |

| | • | | The director or an immediate family member is, or has been within the last three years, a director or executive officer of another company that is indebted to the Company, or to which the Company is indebted, if the total amount of either company’s indebtedness for borrowed money to the other is or was 2% or more of the other company’s total consolidated assets. |

| | • | | The director or an immediate family member is, or has been within the last three years, an officer, director or trustee of a charitable organization if the annual charitable contributions to the organization by the Company or any executive officer of the Company exceeds or exceeded the greater of $1 million, or 2% of such charitable organization’s gross revenue. |

The Board has reviewed all relevant relationships between the Company and each of Stanton J. Bluestone, Robert B. Carter, Ronald de Waal, Julius W. Erving, Michael S. Gross, Donald E. Hess, Marguerite W. Kondracke, Nora P. McAniff, C. Warren Neel, and Christopher J. Stadler, comprising all of the non-employee directors. The Company has affirmatively determined that none of the non-employee directors has a material relationship with the Company directly or as a partner, shareholder, or officer of an organization that has a relationship with the Company. In determining that Mr. Carter is an independent director, the Board considered Mr. Carter’s employment as Executive Vice President of FedEx Information Services and Chief Information Officer of FedEx Corporation. During 2006 the Company obtained overnight package delivery and related services from FedEx Corporation for which the Company paid fees that it believes were not greater than the fees the Company would have paid to comparable firms to obtain similar services. In determining that Ms. McAniff is an independent director, the Board considered Ms. McAniff’s employment until January 2007 as Chief Operating Officer of Time, Inc., a subsidiary of Time Warner Inc. During 2006 the Company placed advertising in publications owned by subsidiaries of Time Warner Inc. for which the Company paid advertising rates that it believes were not greater than the advertising rates the Company would have paid to comparable firms to obtain similar services. The Board has also concluded that none of the non-employee directors has any of the disqualifying relationships identified above. Consequently, the Board has determined that all of the non-employee directors are independent within the meaning of the NYSE rules and the Board’s categorical standards.

Board Committees

The Board of Directors has established Audit, Human Resources and Compensation, Corporate Governance, and Finance Committees. The Board has determined that all members of the Audit, Human Resources and Compensation, and Corporate Governance Committees are independent within the meaning of the NYSE rules and the Board’s categorical standards. All members of the Audit Committee satisfy the standard for audit committee independence provided in the SEC rules.

The Board of Directors has adopted written charters for the Audit, Human Resources and Compensation, and Corporate Governance Committees that meet the requirements of the NYSE rules. Each charter is available atwww.saksincorporated.com and in print to any person who sends a written request to the Company’s General Counsel, at 12 E. 49th Street, New York, New York 10017. Each committee conducts an annual performance evaluation of itself.

The Board and each of its Committees has access, at the Company’s expense, to outside accounting, legal, corporate governance, and other advisors as and when Board or Committee members determine advisor retention is advisable.

Audit Committee

The Audit Committee includes C. Warren Neel (Chair), Stanton J. Bluestone, Michael S. Gross, and Marguerite W. Kondracke. The Committee met nine times during 2006. The purpose of the Committee is to

12

(i) assist the Board in its oversight of (a) the integrity of the Company’s financial statements, (b) the Company’s compliance with legal and regulatory requirements, (c) the qualifications and independence of the Company’s independent registered public accounting firm, and (d) the performance of the Company’s internal auditors and the independent registered public accounting firm; and (ii) prepare the report of the Committee required to be included in the Company’s annual proxy statement.

No member of the Audit Committee may serve on more than two other audit committees of public companies.

The Board of Directors has determined that C. Warren Neel and Michael S. Gross each is an “audit committee financial expert” as that term is defined in rules of the SEC implementing requirements of the Sarbanes-Oxley Act of 2002. In reaching this determination, the Board of Directors considered, among other things, their relevant experience as described under “Election of Directors.”

Human Resources and Compensation Committee

The Human Resources and Compensation Committee includes Christopher J. Stadler (Chair), Robert B. Carter, Julius W. Erving, Donald E. Hess, and Nora P. McAniff. The Committee met eight times during 2006. The primary purpose of the Committee is to (i) discharge the Board’s responsibilities relating to compensation of the Company’s directors and executive officers; (ii) review and recommend to the Board human resource plans, policies, and programs, as well as approve individual executive officer compensation intended to attract, motivate, retain, and appropriately reward associates in order to motivate their performance in the achievement of the Company’s business objectives and align their interests with the long-term interests of the Company’s shareholders; and (iii) provide oversight of the Company’s leadership development and succession processes and to assist the Board in developing and evaluating potential candidates for executive positions, including the Chief Executive Officer.

The Committee has retained Frederic W. Cook & Co., Inc. (“Cook”) as the Committee’s compensation consultant. Cook works exclusively for the Committee and does not provide advice or services to management. The Committee, the Company, and Cook are parties to an advisory services agreement dated September 26, 2006. The following is a summary of the salient features of the agreement:

| | • | | Cook’s sole responsibility will be to the Committee and the Committee’s Chairman, and only the Committee will have the authority to terminate Cook’s relationship with the Committee. |

| | • | | Cook will perform the services contemplated by the agreement in a professional manner in accordance with industry standards and bring expertise, experience, independence, and objectivity to the Committee’s deliberations with regard to issues presented to the Committee. |

| | • | | Cook will work directly with members of the Company’s management only on matters under the Committee’s oversight and with the knowledge and permission of the Committee Chair. |

| | • | | Cook will deliver all advice to the Committee in writing unless directed otherwise by the Committee. |

| | • | | The Company will (i) indemnify and hold harmless Cook against any losses, claims, damages or liabilities to which Cook may be subject arising out of Cook’s engagement to provide the services and (ii) reimburse Cook for all reasonable fees and expenses incurred by Cook in connection with the investigation of any pending or threatened claims, litigation or other legal or administrative proceedings arising from the provision of the services, including, but not limited to, attorneys’ fees and reasonable out-of-pocket expenses. |

| | • | | The Company will have no obligation to indemnify and hold harmless Cook with respect to losses, claims, damages, and liabilities arising out of or due to, directly or indirectly, (i) Cook’s breach of the agreement, (ii) Cook’s false or materially inaccurate written statement, (iii) Cook’s intentional misconduct or negligence, or (iv) Cook’s violation of law or regulation. |

13

The Committee has regularly scheduled meetings throughout the year and additional meetings are held as required. Prior to each meeting, the Committee receives materials concerning matters that will be discussed, seeks consultation with Cook, and otherwise seeks to fully inform itself.

For additional information regarding the Human Resources and Compensation Committee and the role of the Chief Executive Officer in making recommendations regarding individual compensation actions, see “Executive Compensation—Compensation Discussion and Analysis.”

Corporate Governance Committee

The Corporate Governance Committee includes Ronald de Waal (Chair), Robert B. Carter, Nora P. McAniff, C. Warren Neel, and Christopher J. Stadler. The Committee met four times during 2006. The primary purpose of the Committee is to (i) identify, evaluate, and recommend to the Board individuals qualified to be directors of the Company for either appointment to the Board or to stand for election at a meeting of the shareholders, and (ii) develop and recommend to the Board corporate governance guidelines for the Company. The Committee also makes recommendations with respect to shareholder proposals.

The Corporate Governance Committee does not have any single method for identifying Director candidates, but will consider candidates suggested by a wide range of sources. In 2007 the Committee retained an independent director search firm, Spencer Stuart, to make recommendations to the Committee for new Director candidates. Candidates must possess personal and business integrity, accountability, informed judgment, business literacy, and high performance standards and be able to contribute knowledge, experience, and skills in at least one of the following competencies: accounting and finance, management, marketing, industry knowledge, leadership, or strategy.

The Committee also considers any nominees for Director recommended by shareholders. The Committee will apply the same standards in considering Director candidates recommended by shareholders as it applies to other candidates. Shareholders wishing to recommend to the Committee a nominee should write to the Committee c/o the Secretary at 115 N. Calderwood Street (express mail) or P.O. Box 658 (regular mail), Alcoa, Tennessee 37701. Any recommendation submitted by a shareholder must include the same information concerning the candidate and the shareholder as would be required under the Bylaws if the shareholder were nominating that candidate directly, which information requirements are described in this Proxy Statement under the caption “Shareholders’ Proposals or Nominations for 2008 Annual Meeting.”

Finance Committee

The Finance Committee includes Donald E. Hess (Chair), Ronald de Waal, Michael S. Gross, and Christopher J. Stadler. The Committee met four times during 2006. The Committee: (i) ensures the capital structure of the Company is consistent with its long-term value-creating strategy, (ii) advises management on specific elements of its capital structure strategy, and (iii) approves, based on authority delegated from the Board of Directors, or recommends to the Board of Directors for approval, specific terms and parameters of certain financing transactions.

Meeting Attendance

The Board expects that all Directors will devote sufficient time to the full performance of their Board duties and responsibilities, including attending all Board meetings and all meetings of committees on which the Director serves. Any Director who attends less than 75% of board and committee meetings in a fiscal year is required to provide a written explanation to the Board’s Corporate Governance Committee immediately following the fiscal year end. If the Committee finds the explanation inadequate, the Director will submit a letter of resignation to the Committee, which will determine, based on all relevant facts and circumstances (including the needs of the Board), whether to recommend to the Board that it should accept the Director’s resignation.

14

Each Director attended 75% or more of the aggregate number of meetings of the Board of Directors and the committee(s) on which such Director served during 2006. The overall average percentage for Directors’ meeting attendance was 91%.

Directors are encouraged, but not required, to attend annual meetings of shareholders. Eleven of the twelve Directors attended the Company’s June 2006 Annual Meeting. Ms. McAniff did not attend due to a business conflict.

Policy and Process Regarding Communications with the Board

The Board of Directors has adopted a policy and process for shareholders and other interested parties to communicate with the Board or an individual Director, including Lead Director Mr. Hess, who presides over the non-employee Director sessions, or with the non-employee Directors as a group. Shareholders and other interested parties may communicate with the Board collectively, or with any of its individual members, by writing to them c/o the Secretary at 115 N. Calderwood Street (express mail) or P.O. Box 658 (regular mail), Alcoa, TN 37701. The Secretary, with the advice of the Company’s General Counsel, will have discretion to determine whether shareholder communications are proper for submission to the intended recipient. Examples of shareholder communications that would be considered presumptively inappropriate for submission include communications regarding the Company’s pricing of products or services, personal grievances, solicitations, communications that do not relate, directly or indirectly, to the Company, and communications that are duplicative of previously submitted communications or are frivolous in nature. Additional information concerning the Company’s process regarding communications with the Board may be found atwww.saksincorporated.com.

Executive Compensation

Compensation Discussion and Analysis

This section provides information regarding the compensation programs and practices as they relate to the total pay for the Company’s Principal Executive Officer, Principal Financial Officer, and the three most highly compensated executive officers other than the Principal Executive Officer and Principal Financial Officer (the “Named Executive Officers”) for 2006. All references in this section to “executive officers” include the Named Executive Officers. This section includes information regarding, among other things, the overall objectives of the Company’s compensation programs and practices, the rationale for the level and mix of rewards provided, and a discussion of the manner in which the various elements of executive pay support the Company’s business objectives.

The responsibilities of the Human Resources and Compensation Committee of the Board of Directors (the “Committee”) include approving the Company’s compensation programs and individual awards to the Named Executive Officers under such programs. A detailed description of the Committee’s specific responsibilities is contained in the Committee’s Charter, which can be viewed atwww.saksincorporated.com.

The Committee seeks to ensure that a substantial portion of total compensation paid to the Named Executive Officers and other executive officers is performance-based, consisting of annual cash bonuses and, within the limits established by the Company’s 2004 Long-Term Incentive Plan (the “2004 Plan”) approved by the Company’s shareholders at the 2004 Annual Meeting of Shareholders, performance-share awards, and stock options. Performance-based compensation is directly linked to the achievement of growth in Company stock price, clearly defined financial measures, and in some cases, corporate objectives and/or personal goals. The Committee believes that the Company’s achievement of the established financial measures and the Named Executive Officers’ achievement of their personal goals and key corporate objectives will in large part directly reward the Company’s shareholders. If the Company does not meet the established financial measures or corporate goals or if a Named Executive Officer does not meet established personal goals, performance-based

15

compensation tied to these performance measures would be appropriately reduced or entirely forfeited depending on the extent to which the performance measures are not achieved. For example, in early 2006 the Committee determined that none of the Named Executive Officers or the Company’s other executive officers earned any performance shares under the Company’s 2004-2005 Long-Term Incentive Program because the Company did not meet the performance goals established for these awards.

What are the Objectives of our Compensation Policies?

The objectives of the Company’s compensation policies applicable to the executive officers are to (i) provide a compelling incentive to the Company’s executive officers to achieve the Company’s business objectives and financial performance goals, (ii) align the economic interests of the Company’s executive officers with the economic interests of the Company’s shareholders, and (iii) enable the Company to attract, retain, and reward talented executive officers who will contribute to the Company’s long-term success.

What do our Compensation Programs Reward?

The Company’s compensation programs are designed to reward the accomplishment of both financial and non-financial performance objectives. Specifically, base salary is the foundation of the compensation program and recognizes the level of job scope and complexity, the accomplishment of managerial responsibilities including identifying and developing associate talent, participation in the development of the Company’s business strategies, and personal leadership in modeling and encouraging the development of the desired Company culture. The performance measures for the 2006 annual bonus and the 2006 performance share awards include performance against pre-established division operating profit objectives and, in some cases, the accomplishment of key corporate objectives.

In addition to rewarding performance and maintaining competitiveness in the market for top talent, the Company’s compensation programs provide the opportunity for executive officers to establish and maintain meaningful levels of share ownership, which is intended to align the economic interests of the Company’s shareholders, the Named Executive Officers, and the Company’s other executive officers. To that end, the Board of Directors during 2006 approved the following revised share ownership guidelines, which are expressed as a multiple of annual base salary:

| | |

| Chairman of the Board | | 5x or 500% of salary |

| Chief Executive Officer | | 5x or 500% of salary |

Other specified executive officers and other senior executives as determined by the Chief Executive Officer | | 1x or 100% of salary |

In determining compliance with these guidelines, share ownership includes shares owned outright by the executive (or by immediate family members) and unvested restricted stock as well as shares (or equivalent interests) held in the Company’s 401(k) Retirement Plan (the “401(k) Plan”), Employee Stock Purchase Program, and the DCP. The Company currently does not have a policy that prohibits its executive officers from hedging the economic risks of share ownership under the Company’s equity compensation programs but has begun a process to implement such a policy.

There is no set time frame for achieving the targeted level of share ownership. However, until the ownership guidelines are satisfied, the executives are required to hold 75% of the net shares (after satisfying withholding for taxes and the exercise price for stock option exercises) from the Company’s equity-based compensation programs. To ensure that each executive builds an ever-increasing ownership position over the executive’s career, once the executive has achieved the guideline level of ownership the executive will be required to hold 25% of the net shares subsequently acquired from equity compensation programs. To monitor compliance with these guidelines the Board will review, on an annual basis, the executive’s share ownership.

16

What are the Elements of our Compensation Program? Why Do We Choose to Pay Each Element?

The Company uses a mix of compensation programs that recognize the scope and complexity of job responsibility, reinforce performance, reward achievement of annual goals and objectives, encourage the creation of shareholder value, reward achievement of long-term performance goals, and reinforce leadership behavior consistent with the values of integrity, mutual respect, and support of the desired culture of teamwork and personal accountability. The Company attempts to maintain a competitive level of total compensation as warranted by Company performance. The specific elements of the compensation package and the corresponding performance measures, however, are specifically tailored to meet the Company’s strategic objectives and culture.

Outlined below is the rationale for providing each element of the compensation package provided to executive officers:

Base salary: designed to recognize the level of job scope and complexity, level of current performance, and sustained performance during tenure in role.

Annual bonus: designed to reward the achievement of operating profitability and accomplishment of key corporate objectives and/or personal goals.

Long-term incentives: comprised of (i) performance shares to reward accomplishment of operating profitability and in some cases achievement of key corporate objectives; (ii) stock options to align the interests of executive officers and shareholders and to provide an opportunity to establish a meaningful ownership position; and (iii) time-vested restricted stock to attract and retain top talent and to further reinforce share ownership.

With the adoption of Financial Accounting Standards Board Statement of Financial Accounting Standard No. 123 (revised in 2004), Share-Based Payment (“FAS 123(R)”), the Company suspended the granting of stock options for executive officers and utilized only performance shares and restricted stock as the Company’s long-term incentives and to promote retention. This change was made in anticipation of the diminished competitive prevalence of stock options and to allow the Company to analyze evolving retail-industry practices. Based upon a recent survey by Hay Group (a compensation consultant retained by the Company) of retail-industry practices, the Company has determined that a competitive mix of long-term incentives and retention features should include stock options and has reintroduced stock options as a key component of the long-term incentive and retention package. Stock options are granted in combination with performance shares and restricted stock to provide a competitive mix and level of total compensation.

The Committee’s general, but not invariable, practice has been to grant long-term incentive and retention awards to executive officers during the Company’s first fiscal quarter. On November 28, 2006 the Board of Directors adopted a “Policy and Procedures for the Granting of Equity Awards,” which provides that:

| | • | | All awards will be made in accordance with the 2004 Plan; |

| | • | | All awards will be granted by the Committee except for awards to be granted by the Chief Executive Officer pursuant to delegated authority, which may not exceed 120,000 shares per fiscal quarter, of which the total number of restricted stock awards, performance share awards, restricted stock unit awards, performance share unit awards, unrestricted stock awards, and performance unit awards will not exceed 40,000 shares. |

| | • | | Awards will be made at Committee meetings, and awards will not be made by unanimous written consent. |

| | • | | Committee meetings for the purpose of making stock option awards will be scheduled to occur during the Company’s regularly scheduled “permitted trading” periods. |

| | • | | If at the time proposed for the grant of a stock option award the Company possesses material non-public information, the Company’s General Counsel will be consulted before the award is granted. The Board of Directors expects that, absent compelling circumstances, (i) the award will not be granted if the award grantor reasonably anticipates that promptly following the grant the Company will release material non-public information that the grantor reasonably believes would result in an increase in the |

17

| | Company’s Common Stock price or (ii) the grant of the award will not be delayed if the award grantor reasonably anticipates that the delay would result in the granting of the award promptly after the release by the Company of material non-public information that the grantor reasonably believes would result in a decrease in the Company’s Common Stock price. |

| | • | | The grant date for awards made by the Committee will be the date of the meeting. |

| | • | | The grant date for awards made by the Chief Executive Officer will be (i) in the case of new hires, the first day of employment, (ii) in the case of promoted associates, the effective date of the promotion, and (iii) in all other cases, the date the Chief Executive Officer grants the award. |

| | • | | The exercise price for stock option awards will be the NYSE closing price of the Common Stock on the grant date. |

Medical, disability and life insurance coverage: executive officers participate in benefits coverage to help manage the financial impact of ill health, disability, and death. Executive officers participate in the same benefits offered to all eligible employees, but executive officers pay an executive surcharge equal to 150% of the regular premium. Mr. Martin’s December 8, 2004 Employment Agreement provides for a supplemental long-term disability benefit and annual physical examination. In addition, Mr. Coggin has an additional life insurance benefit provided by the Company.

Retirement benefits: the Company sponsors the 401(k) Plan in which the majority of full-time employees are eligible to participate. The purpose of this plan is to provide an incentive for employees to save for their retirement income needs and to provide additional attraction and retention of employees. Executive officers participate in the 401(k) Plan on the same basis as other eligible employees. The amount of annual savings that may be contributed to the 401(k) Plan is capped by the compensation and annual addition limitations imposed on qualified savings plans by the Code (currently $15,500 per year). The Company also maintains a deferred compensation program in which executive officers may voluntarily participate. For additional information regarding the deferred compensation program see “Executive Compensation—Nonqualified Deferred Compensation—2006.”

Perquisites: Messrs. Martin and Coggin receive reimbursement for club dues, and Mr. Martin receives reimbursement for home security. Messrs. Sadove, Coggin, and Wills are eligible for reimbursement for financial and tax planning and preparation. Mr. Sadove is provided with a car and driver. While the primary purpose of this benefit is business-related, Mr. Sadove has access to the car and driver for commuting. Subject to approval of the Chief Executive Officer, the other Named Executive Officers may use Company-provided aircraft for personal use. The rationale for providing perquisites to executive officers is to enhance the attractiveness of the overall compensation program and, in the case of Company-provided transportation, to provide greater security and convenience. For additional information regarding perquisites see “Executive Compensation—Summary Compensation Table—2006.”

How Does the Company Determine the Amount of Each Element of Pay?

The Company reviews competitive data provided by the Hay Group to benchmark the total level of compensation paid by the Company’s competitors. For additional information see “Executive Compensation—Compensation Discussion and Analysis—Competitive Position of Pay.” Once the total market pay for each position is determined, the Company targets the mix and level of base salary, annual incentive, and long-term incentives such that total pay approximates the median of competitive practices. The Company provides a mix of rewards that represents a balance of cash and equity-based payouts to provide attractive incentives and facilitate share ownership.

In determining the compensation of the executive officers reporting to the Chief Executive Officer, the Committee seeks the Chief Executive Officer’s assessment of the performance and contributions of these executive officers and the Chief Executive Officer’s recommendations regarding individual compensation actions. The Committee consults with Cook regarding competitive pay practices and appropriate compensation for the Chief Executive Officer.

18

Outlined below is a discussion of each specific element of total compensation provided to the executive officers.

Base Salary

Base salary reflects the scope of job responsibility and the day-to-day performance of the executive officer relative to duties and responsibilities. The performance and contributions of each executive officer are reviewed annually and, based upon this review, the executive officer may be eligible to receive a “merit increase.” The Company’s annual merit increase guideline for executive officers is based on competitive practices and overall Company performance. These increases reflect the Company’s operating results and individual contributions to overall performance and are consistent with competitive merit increases at the executive-officer level. The Committee’s current practice is to review the performance of the senior management team annually for a salary increase effective May 1. The Named Executive Officers will not receive annual merit increases on May 1, 2007 because 2007 compensation will include a larger percentage of performance-based compensation. Effective May 4, 2007 Mr. Wills will receive a salary increase as a result of his appointment as Executive Vice President and Chief Financial Officer. See “Executive Compensation—Employment Agreements” for a description of Mr. Wills’s April 17, 2007 Employment Agreement.

Annual Cash Bonuses

At the start of a fiscal year the Committee establishes performance measures for the Company’s annual bonus plan for executive officers. Following the close of the fiscal year and based on the Company’s consolidated results of operations for the fiscal year, the Committee assesses the Company’s actual performance against the established performance objectives and determines the amount, if any, of the payout to the executive officers.

The Committee established the following performance measures for the 2006 annual cash bonuses: (1) for Mr. Sadove, a specified level of Saks Fifth Avenue (“SFA”) operating profit (75% weight) and the accomplishment of key corporate objectives (25% weight); (2) for Mr. Coggin, the same level of SFA operating profit (50% weight) and the achievement of the same key corporate objectives (50% weight); and (3) for Mr. Frasch, the same level of SFA operating profit (75% weight) and the achievement of personal objectives (25% weight). The SFA operating-profit performance measure established by the Committee for the 2006 annual cash bonus plan was higher than the comparable performance measure established by the Committee for the 2005 annual cash bonus plan and was based on the achievement of a significant comparable store sales increase, significant gross margin rate improvement, and expense leverage. The Committee believed that the successful execution of these objectives likely would result in a significant year-over-year improvement in SFA operating profit, which the Committee expected would lead to enhanced shareholder value. When the Committee established the 2006 SFA operating-profit performance measure, the Company’s management believed that (1) the performance measure would not be achieved unless management were to fully execute in a timely manner its plans designed to achieve the performance measure, and (2) based on the Company’s past performance and other factors, there were significant obstacles to achievement of the performance measure. Based on the Company’s 2006 results of operations, the Committee determined that 2006 SFA operating-profit performance resulted in a payout of 105% of target-level performance on this portion of the 2006 annual cash bonus program. The key corporate objectives for Messrs. Sadove and Coggin were the execution of transition services agreements relating to divested businesses, successful outcome of the strategic alternatives process for the Company’s Parisian specialty department store business, and the restructuring of the Company’s corporate functions. The Committee determined that achievement of the key corporate objectives resulted in a payout of 141.7% of target-level performance on this portion of the 2006 annual cash bonus program.