QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. 3)

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Under Rule 14a-12 |

National Medical Health Card Systems, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

(1) |

|

Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials: |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

|

|

(1) |

|

Amount previously paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

NATIONAL MEDICAL HEALTH CARD SYSTEMS, INC.

26 HARBOR PARK DRIVE

PORT WASHINGTON, NEW YORK 11050

To our Stockholders:

We are writing to inform you of an important event in the development and growth of our company. On October 30, 2003, New Mountain Partners, L.P. agreed to invest approximately $80 million in National Medical Health Card Systems, Inc. The investment, which will be in the form of a new class of series A convertible preferred stock, is subject to various conditions described in the accompanying proxy statement. We intend to use approximately $50 million of the investment to complete a tender offer for up to 4,545,455 shares of our common stock at a price of $11.00 per share.

The contemplated transactions have the unanimous support of our board of directors. Our board of directors has determined that the issuance of the series A convertible preferred stock and the completion of the tender offer are advisable to, and in the best interests of, our company.

At the annual meeting you will be asked to:

- 1.

- Approve the issuance and sale of our newly created series A 7% convertible preferred stock, par value $0.10 per share (the "series A preferred stock"). This approval is required under (a) National Association of Securities Dealers, Inc. ("NASD") rule 4350(i)(1)(D)(ii), which is applicable because the shares of the series A preferred stock are convertible into shares of our common stock, par value $0.001 per share ("common stock"), at a price below the market value of our common stock and are convertible into more than 20% of our common stock and more than 20% of our voting power outstanding before the issuance of the series A preferred stock and (b) NASD rule 4350(i)(1)(B), which is applicable because the issuance and sale of the series A preferred stock will result in a change of control of us.

- 2.

- Approve an amendment to our certificate of incorporation to (a) increase the authorized number of shares of common stock from 25,000,000 to 35,000,000 shares, (b) increase the authorized number of shares of preferred stock from 10,000,000 to 15,000,000 shares and (c) take certain other actions as described in the accompanying proxy statement.

- 3.

- Elect two Class II directors to our board of directors to serve for a term of three years and until their successors are duly elected, except that if the contemplated transactions with New Mountain Partners are consummated our board of directors be reconstituted as described in the accompanying proxy statement and the term of office of our directors will change to one year.

- 4.

- Approve an amendment to our 1999 Stock Option Plan, as amended (the "Plan") to (a) increase the number of shares of common stock available for issuance pursuant to the Plan by 2,000,000 and (b) limit the number of shares of common stock with respect to which options and stock appreciation rights may be granted pursuant to the Plan to any employee during any fiscal year to 600,000.

Our board of directors recommends that all stockholders vote "FOR" the approval of the matters on which you are being asked to vote.

The accompanying proxy statement explains the contemplated transactions and other matters and provides specific information concerning the annual meeting. Please read these materials carefully.

We are extremely pleased with our new relationship with New Mountain Partners, L.P., a private equity fund managed by New Mountain Capital, LLC. The contemplated transactions address important issues facing our company today, including the need for new capital to accelerate growth.

Your vote is important. We will not complete the contemplated transactions under our purchase agreement with New Mountain Partners, L.P. unless the conditions to the closing of the contemplated transactions are satisfied or waived, including the approval of the issuance of the series A preferred stock and the amendment to our certificate of incorporation.

We believe this is a very important step forward for our company. As always, we thank you for your continuing support. We look forward to seeing you at the annual meeting of stockholders at our executive offices located at 26 Harbor Park Drive, Port Washington, New York, on March 18, 2004, at 9:30 a.m., local time.

| |

| |

|

|---|

| | | Sincerely, | | |

|

|

|

|

|

| | | James J. Bigl

President and Chief Executive Officer | | |

February 19, 2004

The accompanying proxy statement is dated February 19, 2004 and is first being mailed to stockholders on or about February 19, 2004.

NATIONAL MEDICAL HEALTH CARD SYSTEMS, INC.

26 HARBOR PARK DRIVE

PORT WASHINGTON, NEW YORK 11050

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MARCH 18, 2004

To the Stockholders of

National Medical Health Card Systems, Inc.:

NOTICE IS HEREBY GIVEN that an Annual Meeting of Stockholders ofNATIONAL MEDICAL HEALTH CARD SYSTEMS, INC., a Delaware corporation, will be held at our executive offices located at 26 Harbor Park Drive, Port Washington, New York, on March 18, 2004, at 9:30 a.m., local time, for the following purposes:

- 1.

- To consider and vote on a proposal to approve the issuance and sale of our newly created series A 7% convertible preferred stock, par value $0.10 per share (the "series A preferred stock") under (a) National Association of Securities Dealers, Inc. ("NASD") rule 4350(i)(1)(D)(ii), which is applicable because the shares of the series A preferred stock are convertible into shares of our common stock, par value $0.001 per share ("common stock"), at a price below the market value of our common stock and are convertible into more than 20% of our common stock and more than 20% of our voting power outstanding before the issuance of the series A preferred stock and (b) NASD rule 4350(i)(1)(B), which is applicable because the issuance and sale of the series A preferred stock will result in a change of control of us.

- 2.

- To consider and vote on each of the following proposals to amend our certificate of incorporation to:

- (a)

- increase the authorized number of shares of common stock from 25,000,000 to 35,000,000 shares,

- (b)

- increase the authorized number of shares of preferred stock from 10,000,000 to 15,000,000 shares,

- (c)

- eliminate the classified structure of our board of directors,

- (d)

- enable the holders of series A preferred stock to appoint a majority of the members of our board of directors in the event that we fail to pay the redemption price upon a redemption of the series A preferred stock made at the request of the holders of series A preferred stock,

- (e)

- provide that the terms of the series A preferred stock described in our certificate of incorporation (including the certificate of designations relating to such series of preferred stock) may be amended solely by a vote of a majority of the holders of the then outstanding series A preferred stock, without the vote of the holders of common stock, provided that such amendment is approved by a majority of the independent directors then in office, and

- (f)

- enable the authorized shares of our common stock to be increased or decreased by the holders of a majority of our voting power, without requiring a separate common stock class vote,

which amendments will be implemented only if the contemplated transactions with New Mountain Partners, L.P. ("New Mountain Partners") are consummated.

- 3.

- To consider and vote on a proposal to elect two Class II directors to our board of directors to serve for a term of three years and until their successors are duly elected, except that if the contemplated transactions with New Mountain Partners are consummated the term of office of our directors will change to one year. We draw your attention to the fact that our board of directors would be reconstituted in connection with the contemplated transactions, as described under "Composition of our Board of Directors" under Proposal 3 in the accompanying proxy statement.

- 4.

- To consider and vote on a proposal to approve an amendment to our 1999 Stock Option Plan, as amended (the "Plan") to (a) increase the number of shares of common stock available for issuance pursuant to the Plan by 2,000,000 and (b) limit the number of shares of common stock with respect to which options and stock appreciation rights may be granted pursuant to the Plan to any employee during any fiscal year to 600,000.

We direct your attention to the accompanying proxy statement, which more fully describes the foregoing proposals.

Our board of directors believes that the contemplated transactions involving New Mountain Partners are in our best interests and unanimously recommends that you vote "FOR" the sale of the series A preferred stock and the amendment to our certificate of incorporation. Our board of directors also unanimously recommends that you vote "FOR" the election of each of our nominees for Class II director and the approval of the amendment to the Plan.

Our board of directors has fixed the close of business on February 6, 2004 as the record date for determining stockholders entitled to notice of and to vote at the annual meeting or any adjournments or postponements of the annual meeting. A list of stockholders entitled to vote at the annual meeting will be available for examination at our headquarters, during ordinary business hours, from the date of the proxy statement until the annual meeting. Information concerning the matters to be acted upon at the meeting is set forth in the accompanying proxy statement.

Whether or not you expect to attend the annual meeting, we urge you to complete, date and sign the enclosed proxy card and mail it promptly in the enclosed return envelope. Even if you have given your proxy, you may still vote in person if you attend the annual meeting. However, if your shares are held of record by a broker, bank or other nominee and you wish to vote at the annual meeting, you must obtain from the record holder a proxy issued in your name.

| |

| |

|

|---|

| | |  | | |

| | | Gerald Shapiro

Secretary | | |

Port Washington, New York

February 19, 2004

NATIONAL MEDICAL HEALTH CARD SYSTEMS, INC.

PROXY STATEMENT

TABLE OF CONTENTS

| | Page

|

|---|

| SUMMARY | | 1 |

| | Information About National Medical Health Card Systems, Inc | | 1 |

| | Information About the Annual Meeting of the Stockholders | | 1 |

| | Information About this Proxy Statement | | 1 |

| | Information About Voting | | 2 |

| | Board Recommendation | | 2 |

| | Quorum and Voting Requirements | | 2 |

| | Interests of Management and Directors in the Contemplated Transactions | | 3 |

| | Cost and Method of Soliciting Proxies | | 5 |

| | Opinion of the Financial Advisor to the Special Committee of Our Board of Directors | | 5 |

| | Regulatory Approvals | | 5 |

| | Other Matters | | 5 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | 6 |

| PROPOSAL 1—APPROVAL OF THE ISSUANCE AND SALE OF OUR SERIES A PREFERRED STOCK | | 8 |

| | Summary of the Contemplated Transactions | | 8 |

| | Background of the Contemplated Transactions | | 9 |

| | Reasons for the Contemplated Transactions; Recommendation of the Special Committee and Our Board of Directors | | 13 |

| | Impact of the Issuance and Sale of the Series A Preferred Stock on Our Existing Stockholders | | 16 |

| | Opinion of Southwest Securities, Inc. | | 17 |

| | Summary of Southwest Securities' Valuation Approach | | 19 |

| | Certain Financial Projections | | 24 |

| | Reason for Request for Approval | | 25 |

| | Interests of Management and Directors in the Contemplated Transactions | | 26 |

| | Composition of our Board of Directors Following the Contemplated Transactions | | 29 |

| | Terms of the Purchase Agreement | | 30 |

| | Terms of the Series A Preferred Stock | | 40 |

| | Corporate Governance | | 43 |

| | Terms of the Support Agreement | | 45 |

| | Terms of the Registration Rights Agreement | | 49 |

| | Other Terms of the Contemplated Transactions | | 51 |

| | No Appraisal Rights | | 52 |

| | Delaware Anti-Takeover Law and Certain Provisions of Our Certificate of Incorporation | | 52 |

| | Required Vote | | 52 |

| | Recommendation of Our Board of Directors | | 52 |

| UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL INFORMATION | | 53 |

i

| PROPOSAL 2—AMENDMENTS TO OUR CERTIFICATE OF INCORPORATION | | 58 |

| | Our Current Preferred Stock | | 58 |

| | Purpose and Effect of the Amendments | | 58 |

| | Potential Effects of the Proposed Amendments to the Certificate of Incorporation on Holders of Our Common Stock | | 59 |

| | Implementing the Proposed Amendments to Our Certificate of Incorporation | | 60 |

| | No Appraisal Rights | | 61 |

| | Required Vote | | 61 |

| | Recommendation of Our Board of Directors | | 61 |

| PROPOSAL 3—ELECTION OF CLASS II DIRECTORS | | 62 |

| | Nomination of Class II Directors | | 62 |

| | Incumbent Directors | | 63 |

| | Required Vote | | 64 |

| | Recommendation of Our Board of Directors | | 64 |

| | Executive Officers | | 64 |

| | Familial Relationships | �� | 65 |

| | Compensation of Directors | | 65 |

| | Meetings and Committees of Our Board of Directors | | 65 |

| | The Audit Committee | | 66 |

| | The Compensation Committee | | 66 |

| AUDIT COMMITTEE REPORT | | 66 |

| COMPENSATION COMMITTEE'S REPORT ON EXECUTIVE COMPENSATION | | 68 |

| SUMMARY COMPENSATION TABLE | | 70 |

| | Option Grants in Last Fiscal Year Table | | 73 |

| | Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Value Table | | 73 |

| | Employee Contracts, Termination of Employment and Change-in-Control Arrangements | | 73 |

| | Legal Proceedings | | 78 |

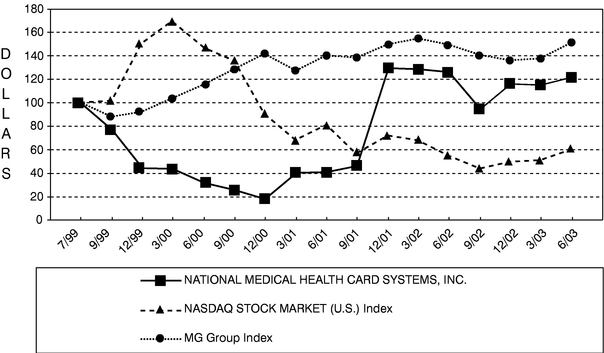

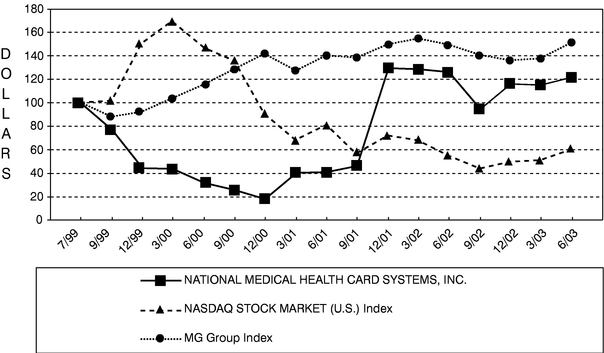

| COMPARATIVE STOCK PERFORMANCE | | 79 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | | 80 |

| PROPOSAL 4—APPROVAL OF AMENDMENT TO OUR 1999 STOCK OPTION PLAN | | 83 |

| | Summary of the Plan | | 83 |

| | Amended Plan Benefits | | 85 |

| | Equity Compensation Plan Information | | 86 |

| | United States Federal Income Tax Consequences | | 87 |

| | Required Vote | | 87 |

| | Recommendation of Our Board of Directors | | 87 |

| RELATIONSHIP WITH INDEPENDENT AUDITORS | | 88 |

| | Audit Fees | | 88 |

| | All Other Fees | | 88 |

| CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS | | 88 |

| DEADLINE FOR RECEIPT OF STOCKHOLDER PROPOSALS | | 89 |

| SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | | 89 |

| FINANCIAL STATEMENTS | | 89 |

| WHERE YOU CAN FIND MORE INFORMATION | | 90 |

| HOUSEHOLDING OF ANNUAL MEETING MATERIALS | | 90 |

| OTHER INFORMATION | | 91 |

ii

| ANNEX A—OPINION OF SOUTHWEST SECURITIES | | A-1 |

ANNEX B—AMENDED AND RESTATED PREFERRED STOCK PURCHASE

AGREEMENT | | B-1 |

| ANNEX C—FORM OF CERTIFICATE OF DESIGNATIONS | | C-1 |

| ANNEX D—FORM OF REGISTRATION RIGHTS AGREEMENT | | D-1 |

| ANNEX E—SUPPORT AGREEMENT | | E-1 |

| ANNEX F—FORM OF AMENDMENT TO CERTIFICATE OF INCORPORATION | | F-1 |

| ANNEX G—1999 STOCK OPTION PLAN | | G-1 |

iii

SUMMARY

This summary highlights selected information from this proxy statement deemed most material by us. It does not contain all of the detailed information that may be important to you. To understand the contemplated transactions fully and for a more complete description of the legal terms of the transactions, you should read carefully this entire document and the other documents to which we refer. Unless otherwise provided, references to "Health Card," "we," "us" and "our" refer to National Medical Health Card Systems, Inc. and references to "series A preferred stock" refer to our Series A 7% Convertible Preferred Stock, par value $0.10 per share, that we propose to issue to New Mountain Partners.

Information About National Medical Health Card Systems, Inc.

We provide comprehensive pharmacy benefit management services under the name NMHCRX. In addition, we operate a health information company through our wholly owned subsidiary, Integrail, Inc., a mail service pharmacy through our wholly owned subsidiary, NMHCRX Mail Order, Inc., and a specialty pharmacy through our wholly owned subsidiary, Ascend Specialty Pharmacy Services, Inc. Our mission is to improve our clients' members' health through the timely delivery of effective pharmaceutical care and health information management systems.

We were incorporated in New York in 1981 and reincorporated in Delaware in February 2002. Our executive offices are in Port Washington, New York.

Information About the Annual Meeting of the Stockholders

The annual meeting of the stockholders will be held on March 18, 2004 at 9:30 a.m., local time, at our executive offices located at 26 Harbor Park Drive, Port Washington, New York. At the annual meeting, we will ask you to vote to approve:

- •

- the issuance and sale of our series A preferred stock under (1) NASD rule 4350(i)(1)(D)(ii), which is applicable because the shares of the series A preferred stock are convertible into shares of our common stock at a price below the market value of our common stock and are convertible into more than 20% of our common stock and more than 20% of our voting power outstanding before the issuance of the series A preferred stock and (2) NASD rule 4350(i)(1)(B), which is applicable because the issuance and sale of the series A preferred stock will result in a change of control of us;

- •

- the amendment of our certificate of incorporation;

- •

- the election of two Class II members to our board of directors; and

- •

- the amendment of our 1999 Stock Option Plan, as amended (the "Plan").

You can vote at the annual meeting of stockholders if you owned our common stock at the close of business on February 6, 2004.

Information About this Proxy Statement

You are receiving this proxy statement and the enclosed proxy card because our board of directors is soliciting your proxy to vote your shares at the annual meeting. We began mailing this proxy statement on or about February 19, 2004 to all stockholders of record as of February 6, 2004. This proxy statement contains the information we are required to provide to you under the rules of the Securities and Exchange Commission (the "SEC"). It is designed to assist you in voting your shares.

1

Information About Voting

You can vote on the matters to be presented at the annual meeting in two ways:

- •

- By Proxy—you can vote by marking, dating, signing, and returning the enclosed proxy card. If you do this, the individuals named on the card (your "proxies") will vote your shares in the manner you indicate. You may specify on your proxy card whether your shares should be voted:

- (1)

- in favor of or against the issuance of the shares of series A preferred stock;

- (2)

- in favor of or against each of the amendments to our certificate of incorporation;

- (3)

- in favor of or to withhold authority to vote for, the election of either or both of the Class II nominees to our board of directors; and

- (4)

- in favor of or against the amendment to the Plan.

You may revoke your proxy at any time before it is exercised at the annual meeting by sending a written notice of revocation to our corporate secretary, Gerald Shapiro, by providing a fully executed proxy bearing a later date, or by voting in person while in attendance at the meeting.

Each share of our common stock is entitled to one vote and is entitled to vote at the annual meeting. As of February 6, 2004, there were 7,965,327 shares of common stock outstanding and entitled to vote at the annual meeting. Each outstanding share of common stock is entitled to one vote on each of the matters to be presented at the meeting. Neither our bylaws nor our certificate of incorporation provide holders of shares of our common stock cumulative voting rights.

Board Recommendation

Our board of directors formed a special committee comprised entirely of non-management, independent directors to review and negotiate the terms of the Contemplated Transactions (as defined below). The members of the special committee are Paul J. Konigsberg (chairman), Gerald Angowitz, Kenneth J. Daley and Ronald L. Fish. The special committee, after completion of its review and deliberations regarding the contemplated transactions, unanimously recommended the issuance of the series A preferred stock, the completion of the tender offer by us and the other transactions contemplated by the purchase agreement (collectively, the "Contemplated Transactions").

In accordance with the unanimous vote of the special committee, our board of directors has determined that the Contemplated Transactions, which are described in this proxy statement, are advisable and in our best interests, and recommends that all stockholders vote "FOR" all of the proposals at the annual meeting.

Quorum and Voting Requirements

To hold a valid meeting, a quorum of stockholders is necessary. If stockholders entitled to cast at least a majority of all the votes entitled to be cast at the meeting are present in person or by proxy, a quorum will exist. Abstentions and broker non-votes are counted as present for establishing a quorum. A broker non-vote occurs when a broker votes on some matters on the proxy card but not on others because the broker does not have the authority to vote on the other matters.

2

Issuance and Sale of Series A Preferred Stock. The affirmative vote of the holders of a majority of the shares in person or represented by proxy and entitled to vote at the annual meeting is required for the approval of the issuance and sale of the series A preferred stock.

Amendments to Our Certificate of Incorporation. The affirmative vote of the holders of a majority of the outstanding shares of our common stock is required to approve each amendment to our certificate of incorporation. As a result, failures to vote, abstentions and broker non-votes will have the effect of a negative vote. None of the amendments to our certificate of incorporation will be implemented unless all of the amendments receive the required vote for approval.

�� Election of Class II Directors. The nominees receiving the highest number of affirmative votes of the votes cast at the annual meeting either in person or by proxy will be elected as Class II directors. A properly executed proxy card marked "WITHHOLD AUTHORITY" and broker non-votes with respect to the election of one or more Class II directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum. Broker non-votes, if any, will not affect the outcome of voting on directors.

Amendment to the Plan. The affirmative vote of the holders of a majority of the shares in person or represented by proxy and entitled to vote at the annual meeting is required for the approval of the amendment to the Plan.

With respect to these proposals, other than the proposal relating to the election of Class II directors, a properly executed proxy marked "ABSTAIN" with respect to such proposal will have the same legal effect as a vote "against" the proposal as it represents a share present or represented at the annual meeting and entitled to vote, but is not considered an affirmative vote for the proposal.

Bert E. Brodsky, the chairman of our board of directors, and certain stockholders related to Mr. Brodsky, who in the aggregate hold 4,943,219 shares of common stock (assuming the exercise of 330,000 options and warrants held by Mr. Brodsky), or approximately 60% of our outstanding common stock, have agreed, pursuant to the support agreement described herein, to vote their shares in favor of the issuance of the series A preferred stock and the amendment to our certificate of incorporation. As long as the purchase agreement between us and New Mountain Partners remains in effect, Mr. Brodsky and the stockholders related to Mr. Brodsky are obligated to vote their shares in favor of these matters, unless our board of directors ceases to recommend approval of these proposals under circumstances permitted by the purchase agreement. Accordingly, adoption of these proposals is assured, absent the occurrence of certain events described elsewhere in this proxy statement.

Interests of Management and Directors in the Contemplated Transactions

Mr. Brodsky and certain stockholders related to Mr. Brodsky have also agreed, pursuant to the support agreement, to tender 4,448,900 shares of our common stock that they hold into the tender offer. Upon the closing of the Contemplated Transactions, options covering 100,000 shares of our common stock will accelerate and become exercisable by Mr. Brodsky at a price of $1.84 per share under his existing stock option agreement. Mr. Brodsky would also be entitled to a severance payment from us of $857,500 upon his resignation as chairman of our board of directors upon the closing of the Contemplated Transactions. However, in connection with the Contemplated Transactions, Mr. Brodsky has agreed to amend his employment agreement to reduce his severance payment to $357,500 and to defer our obligation to pay him that amount until the later of July 1, 2004 or the closing date of the Contemplated Transactions. This amendment would cease to be effective if the closing of the Contemplated Transactions does not occur by July 1, 2004. In addition, we have agreed to indemnify and hold Mr. Brodsky harmless from any "golden parachute" taxes (and any additional federal, state and local taxes incurred by Mr. Brodsky as a result of such indemnification) that he may incur as a result of any payments to Mr. Brodsky from us (including his severance payment and the accelerated vesting of his stock options).

3

We also agreed, pursuant to a side letter agreement dated October 30, 2003, with Mr. Brodsky, that the non-competition covenant contained in the support agreement would be effective in lieu of the non-competition covenant contained in Mr. Brodsky's existing employment agreement with us.

James J. Bigl, a director, our president and chief executive officer, David Gershen, our executive vice president of financial services and treasurer, Tery Baskin, our chief marketing officer, and Agnes Hall, our chief information officer, are each entitled to a transaction bonus upon the closing of the Contemplated Transactions. In connection with the Contemplated Transactions, Messrs. Bigl, Gershen and Baskin and Ms. Hall have agreed to use a portion of their bonuses to purchase additional shares of our common stock after the closing of the Contemplated Transactions. Please see the section "Interests of Management and Directors in the Contemplated Transactions" in Proposal 1 for a more detailed description of the transaction bonuses payable to our executive officers.

In addition, as part of the Contemplated Transactions, Mr. Bigl's employment agreement has been amended to provide that upon a termination of his employment with us for any reason prior to the eighteen-month anniversary of the closing date of the Contemplated Transactions, in addition to any other severance payments that he is otherwise entitled to, Mr. Bigl will become entitled to a lump-sum payment equal to $624,000; provided, however, that if such termination is either by us without cause or by Mr. Bigl for good reason, the lump sum payment will be increased to $874,000.

Upon the closing of the Contemplated Transactions, options granted to Mr. Bigl covering 473,665 shares of common stock will accelerate and become fully vested. Mr. Bigl however, has agreed that with respect to these and other vested options covering 527,330 shares of common stock, he will not exercise (1) options covering more than 93,330 shares before April 30, 2004, (2) options covering more than an additional 34,000 shares before June 12, 2004, (3) options covering more than an additional 133,334 shares before on June 12, 2005, and (4) options covering more than an additional 133,333 shares before June 12, 2006. After June 12, 2006, options covering all of the 527,330 shares will be fully exercisable; provided that, all of these options will become fully exercisable upon either (x) a change in control of us following the closing of the Contemplated Transactions or (y) a termination of Mr. Bigl's employment with us for any reason following the closing of the Contemplated Transactions.

Furthermore, we have agreed to hold Mr. Bigl harmless from any "golden parachute" taxes (and any additional federal, state and local taxes incurred by Mr. Bigl as a result of such indemnification) that he may incur as a result of any payments to Mr. Bigl from us (including his transaction bonus and the accelerated vesting of his stock options).

Upon the closing of the Contemplated Transactions, options granted to Messrs. Gershen and Baskin and Ms. Hall covering 19,985, 58,331, and 47,330 shares of common stock, respectively, will accelerate and become fully vested and immediately exercisable. Also, upon the closing of the Contemplated Transactions, options granted to Patrick McLaughlin, the president of our pharmacy benefit management division, covering 15,000 shares of common stock will accelerate and become fully vested and immediately exercisable.

Upon the closing of the Contemplated Transactions, Kenneth J. Daley, Ronald L. Fish and Gerald Shapiro will resign from our board of directors so that our board may be reconstituted as required under the purchase agreement. When Messrs. Daley and Fish resign upon the closing of the Contemplated Transactions, we will fully vest the 22,000 unvested options to purchase common stock held by each of them so that they become immediately exercisable upon their resignation. To the extent such vesting occurs, we will recognize a one-time charge to our statement of income in the fiscal quarter in which such vesting occurs equal to the difference between the fair market value of our common stock on the date such vesting occurs less the exercise price multiplied by the number of options whose vesting was accelerated. Using an estimated fair market value of $28.43, which represents the closing price of our common stock on February 18, 2004, this will result in a charge

4

against net income of approximately $257,000. See the section titled "Unaudited Pro Forma Condensed Consolidated Financial Information" beginning on page 53 of this proxy statement.

We have entered into indemnification agreements with each of our directors. The agreements provide that we will indemnify each director against any judgments, penalties, fines, amounts paid in settlement and expenses incurred in connection with any actual or threatened proceeding against us or our affiliates. In addition, we agreed to pay in advance certain expenses, including attorneys' fees, incurred by any director prior to the final disposition of such proceedings, except that the director must repay such amounts if it is ultimately determined that the director is not entitled to be indemnified by us.

Cost and Method of Soliciting Proxies

This proxy is being solicited by our board of directors. We will bear the entire cost of the solicitation of proxies, including the charges and expenses of brokerage firms and other custodians, nominees and fiduciaries for forwarding proxy materials to beneficial owners of our shares of common stock. Solicitations will be made primarily by mail, but some of our directors, officers or employees may solicit proxies in person or by telephone, for which such persons will receive no additional compensation.

Opinion of the Financial Advisor to the Special Committee of Our Board of Directors

In deciding to approve the issuance of the series A preferred stock and the amendment to our certificate of incorporation, our board of directors considered a number of factors, including the opinion of the financial advisor to the special committee of our board of directors, Southwest Securities, Inc. On October 29, 2003, Southwest Securities, Inc. delivered its oral opinion to the special committee and our board of directors, which opinion was subsequently confirmed by a written opinion to the special committee dated October 30, 2003, to the effect that, as of that date, the issuance of the series A preferred stock and use of the proceeds from the issuance of the series A preferred stock to effect the tender offer was fair from a financial point of view to non-affiliated holders of our common stock.

The full text of the written opinion of Southwest Securities, Inc., dated October 30, 2003, is attached to this proxy statement as Annex A. We urge you to read this opinion carefully for a description of the assumptions made, matters considered and limitations on the review undertaken in connection with the opinion. The written opinion of Southwest Securities, Inc. is directed to the special committee of our board of directors and does not constitute a recommendation to any stockholder with respect to any matter relating to the Transactions (as defined therein). The written opinion of Southwest Securities, Inc. speaks only as of the date issued.

Regulatory Approvals

In order to complete the Contemplated Transactions, we and the persons ultimately controlling New Mountain Partners (for purposes of the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended), if any, are required under the Hart-Scott-Rodino Act, to make filings with the United States Department of Justice and the Federal Trade Commission and wait for the expiration or early termination of the required waiting period. These filings were made on December 31, 2003.

Other Matters

Our board of directors does not know of any other matter that will be presented at the annual meeting other than the proposals discussed in this proxy statement. Generally, no business other than the items discussed in this proxy statement may be transacted at the meeting.

5

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND

MANAGEMENT

The following table sets forth certain information, as of February 6, 2004, concerning the persons or entities known to us to be the beneficial owner of more than 5% of the shares of our common stock as well as the number of shares of common stock that our directors and certain executive officers beneficially own, and that our directors and executive officers own as a group. Except as otherwise indicated below, each of the entities or persons named in the table has sole voting and investment power with respect to all shares of common stock beneficially owned. Unless otherwise indicated, the business address of each stockholder listed below is c/o National Medical Health Card Systems, Inc., 26 Harbor Park Drive, Port Washington, New York 11050.

Name of Beneficial Owner

| | Number of Shares

Beneficially Owned(1)

| | Percentage

Owned

| |

|---|

| Bert E. Brodsky | | 3,365,374 | (2) | 41.1 | % |

| Gerald Shapiro | | 294,534 | | 3.7 | % |

| James J. Bigl | | 159,335 | (3) | 2.0 | % |

| Tery Baskin | | 121,286 | (4) | 1.5 | % |

| David Gershen | | 60,015 | (5) | * | |

| Agnes Hall | | 24,670 | (6) | * | |

| Patrick McLaughlin | | 41,666 | (7) | * | |

| Kenneth J. Daley | | 24,667 | (8) | * | |

| Ronald L. Fish | | 24,667 | (8) | * | |

| Gerald Angowitz | | 24,667 | (8) | * | |

| Paul Konigsberg | | 14,667 | (8) | * | |

| Stuart F. Fleischer | | — | (9) | * | |

| All executive officers and directors as a group (12 persons) | | 4,155,548 | (10) | 49.3 | % |

- *

- Less than 1%

- (1)

- The number of shares beneficially owned includes outstanding shares of our common stock held by that person and shares of our common stock issuable upon exercise of stock options and warrants exercisable within 60 days of February 6, 2004.

- (2)

- Based on a Schedule 13D filed with the SEC on November 10, 2003. Includes (i) 200,000 shares issuable pursuant to exercisable options, (ii) 30,000 warrants to purchase common stock that are exercisable, (iii) 1,725 shares of common stock beneficially owned by P.W. Capital Corp., of which Mr. Brodsky is President, (iv) 100,000 shares of common stock beneficially owned by the Bert E. Brodsky Revocable Trust, (v) 10,144 shares held by the Irrevocable Trust of Lee Jared Brodsky, (vi) 10,145 shares held by the Irrevocable Trust of David Craig Brodsky, (vii) 10,145 shares held by the Irrevocable Trust of Jeffrey Holden Brodsky, and (viii) 10,145 shares held by the Irrevocable Trust of Jessica Brodsky Miller. Muriel Brodsky, Mr. Brodsky's wife, is the trustee for the trusts described in clauses (iv) through (viii). Does not include (a) 1,477,845 shares beneficially owned by Mr. Brodsky's children as reported in the Schedule 13D filed with the SEC on November 10, 2003 or (b) an aggregate of 100,000 shares of common stock subject to unexercisable options, but such options will become exercisable upon the closing of the Contemplated Transactions. The Schedule 13D provides that the filers may be deemed to constitute a "group" under Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, with respect to the support agreement. The filers disclaim that they are a "group" for any other purpose.

- (3)

- Includes 32,139 shares of common stock issuable pursuant to exercisable options. Does not include an aggregate of 473,665 shares of common stock subject to unexercisable options. Upon the closing of the Contemplated Transactions, all of these unexercisable options will accelerate and become

6

fully vested and immediately exercisable. Mr. Bigl has agreed that, with respect to those and other options covering 505,804 shares of common stock, he will not exercise (1) options covering more than 93,330 shares before April 30, 2004, (2) options covering more than an additional 34,000 shares before June 12, 2004, (3) options covering more than an additional 133,334 shares before June 12, 2005 and (4) options covering more than an additional 133,333 shares before June 12, 2006. After June 12, 2006, options covering all of the 505,804 shares will be fully exercisable; provided, that, all of these options will become fully exercisable upon either (x) a change in control of us following the closing of the Contemplated Transactions or (y) a termination of Mr. Bigl's employment with us for any reason following the closing of the Contemplated Transactions.

- (4)

- Does not include an aggregate of 58,331 shares of common stock subject to unexercisable options. All of the unexercisable options will become exercisable upon the closing of the Contemplated Transactions.

- (5)

- Includes 48,680 shares of common stock issuable pursuant to exercisable options. Does not include an aggregate of 19,985 shares of common stock subject to unexercisable options. All of the unexercisable options will become exercisable upon the closing of the Contemplated Transactions.

- (6)

- 23,335 of these shares are issuable pursuant to exercisable options. Does not include an aggregate of 47,330 shares of common stock subject to unexercisable options. All of the unexercisable options will become exercisable upon the closing of the Contemplated Transactions.

- (7)

- All of these shares are issuable pursuant to exercisable options. Does not include an aggregate of 98,334 shares of common stock subject to unexercisable options, which includes unexercisable options to purchase 31,250 shares, the exercisability of which is subject to the satisfaction of certain performance targets relating to our Centrus business. As of the current date, it appears, subject to final adjustments, that these performance targets will be achieved. Unexercisable options for 15,000 shares of common stock will become exercisable upon the closing of the Contemplated Transactions.

- (8)

- All of these shares are issuable pursuant to exercisable options. Does not include for each of them 7,333 shares of common stock subject to unexercisable options.

- (9)

- Does not include 80,000 shares of common stock subject to unexercisable options.

- (10)

- Includes all of the shares that are included in the table above.

7

PROPOSAL 1—APPROVAL OF THE ISSUANCE AND SALE OF OUR SERIES A

PREFERRED STOCK

We are seeking stockholder approval for the issuance and sale of the series A preferred stock (the "Series A Preferred Stock Proposal") under (1) NASD rule 4350(i)(1)(D)(ii), which is applicable because the shares of the series A preferred stock are convertible into shares of our common stock at a price below the market value of the common stock and are convertible into more than 20% of our common stock and more than 20% of our voting power outstanding before the issuance of the series A preferred stock and (2) NASD rule 4350(i)(1)(B), which is applicable because the issuance and sale of the series A preferred stock will result in a change of control of us.

The following is a summary of the provisions of: (1) the amended and restated preferred stock purchase agreement, dated as of November 26, 2003, between us and New Mountain Partners, L.P. (the "purchase agreement"); (2) the form of certificate of designations governing the series A preferred stock; (3) the form of registration rights agreement between us and New Mountain Partners, L.P.; and (4) the support agreement, dated as of October 30, 2003, between us, New Mountain Partners, L.P., and Bert E. Brodsky and certain stockholders related to Mr. Brodsky (the "support agreement"). New Mountain Partners, L.P. has assigned a portion of its rights and obligations under the purchase agreement and support agreement to New Mountain Affiliated Investors, L.P., a partnership related to New Mountain Partners, L.P. (together with New Mountain Partners, L.P., "New Mountain Partners"). Because this section is a summary, it does not describe every term of the documents. This summary is qualified in its entirety by reference to, and should be read in conjunction with, those documents.

We have attached hereto copies of the purchase agreement, the form of certificate of designations, the form of registration rights agreement, and the support agreement as Annexes B, C, D and E, respectively. We urge all of our stockholders to read these documents carefully.

Summary of the Contemplated Transactions

Pursuant to the purchase agreement, we agreed, subject to various conditions, to issue to New Mountain Partners, and New Mountain Partners agreed to purchase from us, a total of 6,956,522 shares of series A preferred stock at a purchase price of $11.50 per share, for aggregate proceeds of $80,000,003. Once certain conditions described in more detail below have been met or waived, including receipt of certain stockholder approvals sought by this proxy statement, we are obligated to complete the sale of the series A preferred stock to New Mountain Partners and to use approximately $50 million of the proceeds of the sale of the series A preferred stock to fund the purchase price for a tender offer for up to 4,545,455 shares of our outstanding common stock at $11.00 per share. Mr. Brodsky, the chairman of our board, and certain stockholders related to him (assuming the exercise of 330,000 options and warrants held by Mr. Brodsky), currently hold, in the aggregate, approximately 60% of our outstanding common stock and have agreed to tender 4,448,900 shares, or approximately 54% of our outstanding common stock, held by them into the tender offer. If the tender offer is oversubscribed by our stockholders, we will repurchase the shares of common stock on apro rata basis. If the tender offer is fully subscribed by our stockholders and assuming the exercise of 330,000 options and warrants held by Mr. Brodsky, after the tender offer is completed, New Mountain Partners will own securities that are initially convertible into approximately 65% of our issued and outstanding common stock and prior to conversion of the series A preferred stock will be entitled to cast that number of votes that is equal to approximately 61% of our aggregate voting power. Following the closing of the Contemplated Transactions, New Mountain Partners will initially be entitled to nominate and elect 60% of the members of our board of directors. On October 29, 2003, our board of directors approved the terms of the Contemplated Transactions. The Series A Preferred Stock Proposal is subject to the approval of our stockholders as required by the NASD 20% Rule and NASD Control Rule (each as defined below in "Reason for Request for Approval"), as well as the satisfaction or waiver of certain other conditions described below. On October 30, 2003, the last full trading day before the public

8

announcement of the execution of the purchase agreement, the last reported sale price of our common stock, as reported on The Nasdaq National Market (the "Nasdaq Market"), was $13.75 per share. On February 18, 2004, the last reported sale price of our common stock, as reported on the Nasdaq Market, was $28.43 per share.

We will primarily use the remaining proceeds from the issuance and sale of the series A preferred stock of approximately $22 million, excluding expenses related to the closing of the Contemplated Transactions, for acquisitions and working capital purposes. However, except under certain circumstances, we will be prohibited from using such proceeds to pay any outstanding amounts due under our outstanding credit facility for six months following the closing of the Contemplated Transactions. We regularly review potential acquisitions and engage in discussions with third parties regarding acquisitions, but there can be no assurance that our efforts will result in completed acquisitions. At the time of this proxy statement, we have not entered into any acquisition agreements with any potential acquisition candidate.

Background of the Contemplated Transactions

In April 2002, we entered into an engagement letter with an investment banking firm to act as our financial and capital markets advisor in connection with potential financial and strategic transactions. We engaged the financial advisor following a determination by our board of directors and management that continued growth through acquisitions was critical to support our long-term outlook given our relatively small size compared to our industry peers.

In September 2002, we received an unsolicited non-binding indication of interest from a third party ("Party 1") to acquire us at a price of $11.00 per share for all of our outstanding equity. On November 11, 2002, Party 1 revised its non-binding indication of interest in writing to $13.00 per share for all of our outstanding equity. On November 13, 2002, at a meeting of our board of directors, our board of directors considered the revised unsolicited indication of interest from Party 1. Our board of directors recommended and approved our continued discussions with Party 1 and instructed management to continue to apprise our board of directors of the status of those discussions. We then entered into a confidentiality agreement with Party 1, who then commenced financial and legal diligence. On November 25, 2002, Party 1 verbally increased its non-binding indication of interest to $13.50 per share for all of our outstanding equity.

In early December 2002, Party 1 continued to communicate through our financial advisor that it was still interested in acquiring us for approximately $13.00 to $13.50 per share for all of our outstanding equity. Our board of directors then met with its financial and legal advisors to review the financial and legal aspects of the proposal. Our board of directors authorized management to continue its negotiations with Party 1 and to pursue other potential acquisition partners if negotiations with Party 1 did not progress within a short period of time.

In the first week of January 2003, we instructed our financial advisor to solicit additional indications of interest to acquire us through a targeted auction process. Over the course of the following two weeks, we received several other preliminary non-binding indications of interest from other parties interested in acquiring us for between $11.00 and $15.00 per share for all of our outstanding equity. All of these indications of interest were subject to various conditions, including satisfactory completion of due diligence investigations of us. Three of those parties ultimately commenced due diligence investigations of us.

On January 30, 2003, we received a written non-binding offer from Party 1 informing us it had completed its due diligence and proposed to acquire us for $10.00 per share for all of our outstanding equity. As a result, our discussions with Party 1 slowed. Subsequently, in February 2003, another party ("Party 2") sent us a written offer to acquire us for $12.00 per share, but in March 2003 it informed our financial advisor that its proposal was withdrawn. Following Party 2's withdrawal, Party 1's proposal

9

was the only proposal remaining from the auction process that began in January 2003, and we therefore recommenced active negotiations with Party 1. Our management team and our representatives continued to negotiate a definitive merger agreement with Party 1 through March 2003. As a result of our negotiations with Party 1, on March 10, 2003, Party 1 subsequently increased its non-binding offer to $11.75 per share for all of our outstanding equity. At the beginning of April 2003, however, Party 1 notified us that it was no longer interested in pursuing a transaction with us.

At a meeting of our board of directors on April 18, 2003, Mr. Brodsky, the chairman of our board of directors, advised our board of directors that a private equity firm had submitted a non-binding proposal to acquire us for a purchase price of $10.50 per share in a going-private transaction in which Mr. Brodsky would retain an interest in the acquired company. At the conclusion of the meeting, our board of directors established a special committee comprised entirely of non-management, independent directors (Paul J. Konigsberg (chairman), Gerald Angowitz, Kenneth J. Daley and Ronald L. Fish) for the purpose of evaluating a possible transaction with the private equity firm. The special committee also retained Fulbright & Jaworski L.L.P. to act as its legal advisor and started to consider several investment banks to act as its financial adviser. Following several weeks of discussions with the private equity firm, however, the private equity firm decided to discontinue their discussions with us without providing us any specific reasons for its decision.

In the course of discussions with several other investment banking firms regarding our options to increase our stockholder value, in late July 2003 we were approached by Southwest Securities, Inc. ("Southwest Securities") about a possible equity investment in us by a private equity fund, New Mountain Partners, coupled with a tender offer for shares of our common stock. On July 24, 2003, we entered into a confidentiality agreement with New Mountain Partners to facilitate discussions. We then proceeded to have preliminary discussions with New Mountain Partners with respect to the structure of a proposed investment in us. On August 26, 2003, New Mountain Partners submitted a preliminary non-binding term sheet proposing an investment in us, with a substantial portion of the proceeds to be used to repurchase shares of our common stock held by Mr. Brodsky and certain stockholders related to Mr. Brodsky. On August 27, 2003, we entered into an exclusivity agreement with New Mountain Partners.

We engaged Southwest Securities on July 22, 2003 to serve as our financial advisor for the proposed transaction with New Mountain Partners. In August 2003 our board of directors determined that the special committee would have the authority to negotiate and approve a transaction with New Mountain Partners, and the special committee interviewed several financial advisor candidates, including Southwest Securities. Following the interview process, the special committee, which was composed of the same individuals as the special committee formed on April 18, 2003, formally engaged Southwest Securities as of August 29, 2003 to serve as its financial advisor for the transaction and the engagement agreement, dated July 22, 2003, between us and Southwest Securities was terminated. Our board of directors determined that it did not require a separate financial advisor in light of the special committee's mandate, and our engagement letter with Southwest Securities was terminated concurrently with Southwest Securities' retention by the special committee. Prior to the engagement, Southwest Securities advised the special committee that it had no previous relationship or agreements with New Mountain Partners, was not acting as an advisor to New Mountain Partners with respect to the proposed transactions and had not acted as an advisor to New Mountain Partners with respect to any other transaction and did not receive any, and did not anticipate receiving any, compensation from New Mountain Partners or its affiliates with respect to the proposed transactions.

Our board of directors and special committee also retained Fulbright & Jaworkski L.L.P. to act as their legal advisor in connection with the proposed transaction. Following its engagement, Southwest Securities communicated to New Mountain Partners the special committee's instructions that any use of the proceeds of an investment in us to repurchase outstanding common stock would have to be made to all of our stockholders on apro rata basis.

10

From late August 2003 through the end of October 2003, New Mountain Partners and Deloitte & Touche LLP, its accounting advisor, and Fried, Frank, Harris, Shriver & Jacobson LLP, its legal advisor, conducted an accounting, financial and legal due diligence investigation of us.

On September 11, 2003, New Mountain Partners' legal advisor provided us with an initial draft of a preferred stock purchase agreement providing for an aggregate preferred stock investment of $70 million. On September 17, 2003, New Mountain Partners' legal advisor provided us with an initial draft of the certificate of designations for an 8% participating convertible preferred stock, with a conversion price of $11.00 per share.

On September 18, 2003, the members of the special committee held a telephonic meeting with its legal and financial advisors and representatives of our auditors to discuss the proposed terms and the anticipated impact of the proposed transactions on our reported financial results.

On September 25, 2003, the members of the special committee met in person with representatives of New Mountain Partners and its legal advisor, as well as the special committee's legal and financial advisors, to negotiate the principal terms of the proposed investment in us. Following discussion of the key terms, the parties agreed, among other things, that the investment amount would be increased from $70 million to $80 million; the conversion price for the series A preferred stock would be increased from $11.00 to $11.50 per share; the dividend on the series A preferred stock would be lowered from 8% to 7% for the first five years and thereafter to 3.5%; and the offer price in the tender offer would be $11.00 per share. The parties also discussed whether all or a portion of the dividends would be payable in-kind rather than in cash.

From the middle of September 2003 to the end of October 2003, our management, representatives of New Mountain Partners and each of their respective advisors spoke on numerous occasions regarding our business and financial condition. During this period, representatives of the special committee, New Mountain Partners and their respective advisors spoke on numerous occassions regarding the terms of the transaction, including the amount of the investment by New Mountain Partners, the closing amount payable to New Mountain Partners, the required tender offer amount, the dividend rate on the series A preferred stock, the special voting rights of the holders of series A preferred stock, the no solicitation covenant, our ability to terminate the transaction to accept a financially superior transaction, the termination fee trigger events, the amount of New Mountain Partners' expenses that we would be required to reimburse, the definition of material adverse effect, and other related provisions and documents. During this period, members of the special committee, Southwest Securities and our auditors discussed the impact of the proposed transactions on our reported financial results. During this period, Mr. Brodsky engaged separate legal counsel and Mr. Brodsky and his legal advisors participated in negotiations with the special committee and New Mountain Partners with respect to the terms of the proposed transactions, including the terms of the support agreement that New Mountain Partners stated was a condition to its participation in any transaction with us.

On October 8, 2003, members of our management and the special committee's legal and financial advisors met with representatives of New Mountain Partners and its legal advisors to discuss the key provisions of the purchase agreement and certificate of designations, focusing on the corporate governance provisions and the obligation to reimburse New Mountain Partners for its out-of-pocket expenses.

On October 9, 2003, the special committee held a meeting with members of management and its legal and financial advisors to discuss the status of the negotiations with New Mountain Partners. The special committee's financial advisor gave an overview of the financial terms of the proposed transactions, including our related expenses and the anticipated impact of the proposed transactions on our reported financial results. A detailed description of the estimated related expenses and the anticipated impact of the proposed transactions on our reported financial results are discussed under

11

the section "Unaudited Pro Forma Condensed Consolidated Financial Information" on page 53 and are summarized below:

- •

- a non-cash charge of $80,000,003 to net income resulting from a beneficial conversion feature (calculated using an estimated fair market value of $28.43, which was the closing price of our common stock on February 18, 2004 and capped at $80,000,003, the face value of the New Mountain Partners' investment in us);

- •

- change of control severance payments and bonuses due under certain of our employment agreements of approximately $1,565,000, as well as our indemnities to Mr. Brodsky and Mr. Bigl for any "golden parachute" taxes and any taxes due by Mr. Brodsky in connection with the non-competition covenant in his employment agreement;

- •

- a non-cash compensation charge of approximately $257,000 resulting from certain stock options granted to two directors that will vest upon their anticipated resignation from our board of directors (calculated using an estimated fair market value of $28.43, which represented the closing price of our common stock on February 18, 2004);

- •

- the accretion of the preferred stock from its initial carrying value, after deductions for estimated offering expenses of $4,617,000, to the redemption value over the 10 year life of the series A preferred stock until the series A preferred stock is redeemable at the option of the holder; and

- •

- the accrual of the dividends on the series A preferred stock at the rate of 7% per annum for the first five years and 3.5% per annum thereafter.

The special committee's legal advisor then gave an overview of the transaction documents and the remaining open issues. A lengthy discussion followed the presentations. The special committee authorized its advisors to continue to negotiate the terms of the transaction documents, including a limit on the amount of New Mountain Partners' out-of-pocket expenses that we would be required to pay upon the closing of the proposed transactions and if the transactions were not completed.

During the next two weeks, members of the special committee, our management, the special committee's legal and financial advisors and representatives of New Mountain Partners and its legal advisors continued to negotiate the terms of the key agreements relating to the proposed transactions.

The special committee held a meeting on October 23, 2003 to review with our management and the special committee's legal and financial advisors the status of the negotiations and the proposed terms and conditions of the proposed transactions with New Mountain Partners. During this meeting, the special committee's legal advisor updated the committee on changes to the material terms and conditions of the purchase agreement previously discussed and reviewed the legal duties and responsibilities of our special committee and board of directors in connection with the proposed transactions. Southwest Securities presented a comprehensive analysis of the proposed series A preferred stock financing and tender offer, including a review of the valuation methods it used, and expressed its view that, subject to a review of the final agreements, Southwest Securities should be able to deliver a written opinion that the preferred stock investment and tender offer were fair to our non-affiliated stockholders from a financial point of view. The special committee carefully considered the presentations made and the terms of the proposed transactions. The special committee also negotiated (1) a reduction in the transaction fee payable to its financial advisor, Southwest Securities, from $2.8 million to $2.5 million and (2) a reduction in the severance payments owed Mr. Brodsky in light of the substantial benefits that Mr. Brodsky would realize as a result of the closing of the proposed transactions. Following a thorough discussion, the special committee approved the proposed transactions, subject to the satisfactory negotiation of the final terms of the purchase agreement, support agreement and other related documents.

12

On October 24, 2003, the special committee's legal counsel discussed the remaining issues with Mr. Brodsky's legal counsel, which focused on the no solicitation and termination provisions contained in the purchase agreement and the support agreement. Mr. Konigsberg and the special committee's legal advisor then met with representatives of New Mountain Partners and its legal advisor to discuss those remaining issues.

Negotiation of the transaction agreements continued and the purchase agreement and the other documents contemplated by the purchase agreement were substantially finalized in the late evening of October 28, 2003.

At a meeting of the special committee held on October 29, 2003, the committee members considered the terms of the proposed financing that had been negotiated with New Mountain Partners. The other members of our board of directors joined the meeting as observers and Southwest Securities presented an updated, comprehensive analysis of the proposed series A preferred stock financing and tender offer, including a review of the valuation methods it used, and orally advised the special committee and our board of directors that the transaction was fair to our non-affiliated stockholders from a financial point of view. The oral opinion was subsequently confirmed in writing on October 30, 2003. Our legal advisor reviewed with the special committee and our board of directors the principal terms of the proposed series A preferred stock financing and the tender offer, as well as a discussion of the fiduciary duties of the directors with respect to the proposed transactions. Following thorough discussions, the directors who were not members of the special committee left the meeting and the committee unanimously agreed to approve the proposed transactions and to recommend to the full board that it also approve the proposed transactions. Shortly thereafter, our board of directors approved the proposed transactions.

Late in the evening of October 30, 2003, the purchase agreement and certain other agreements were executed by our appropriate officers, New Mountain Partners and the stockholders executing the support agreement, and the Contemplated Transactions were publicly announced the morning of October 31, 2003.

During the first week of November 2003, we were contacted by representatives of The Nasdaq Stock Market, Inc. ("Nasdaq"), who requested that we modify the manner in which voting rights of holders of the series A preferred stock are calculated in certain circumstances. Following discussion between our and New Mountain Partners' legal advisors, our board of directors met on November 19, 2003 and approved the modification to the terms of the series A preferred stock. The amended and restated purchase agreement reflecting the modification was executed on November 26, 2003.

Reasons for the Contemplated Transactions; Recommendation of the Special Committee and Our Board of Directors

In determining that the Contemplated Transactions are advisable, fair and in our best interests and our stockholders' best interests, the special committee and our board of directors consulted with our management and our board of directors' and the special committee's financial advisor and legal counsel, and considered numerous factors discussed below that supported their recommendations.

In deciding to approve the Contemplated Transactions, our board of directors considered the following factors which were generally viewed as advantages of the Contemplated Transactions:

- •

- the recommendation of the special committee to our board of directors;

- •

- our business, financial condition, results of operations, current business strategy and future prospects, as well as the risks involved in achieving those prospects and objectives in the current industry and market conditions; the nature of the markets in which we operate, our position in such markets; our historical inability to access the capital markets to obtain growth capital; the historical and current market prices for shares of our common stock; the limited number of

13

institutional holders of shares of our common stock; the lack of coverage by equity research analysts of our common stock; the low daily trading volume in the shares of our common stock and the lack of liquidity as a result thereof; and the desire on the part of Mr. Brodsky, our largest stockholder, to sell a significant amount of shares of his common stock and the possible negative effect on our common stock resulting from such sales;

- •

- the information provided to our board of directors by our management and Southwest Securities with respect to the financial and other aspects of the Contemplated Transactions, the positive attributes of the Contemplated Transactions from our point of view and that of our stockholders such as the infusion of growth capital, the replacement of a large stockholder who wants to sell his shares, the addition of a well-regarded institutional stockholder and the avoidance of the risks associated with raising capital in the open market, among other things, and our growth prospects if the Contemplated Transactions were not consummated;

- •

- the proposed structure of the preferred stock financing and thepro rata cash tender offer, which would enable our stockholders to immediately obtain cash for their shares;

- •

- the analyses performed by Southwest Securities in connection with rendering its fairness opinion, including Southwest Securities' comparable public company, comparable merger and acquisition transaction and discounted cash flow analyses, as well as Southwest Securities' written opinion, a copy of which is attached to this proxy statement as Annex A, to the effect that the issuance of the series A preferred stock and the tender offer is fair to our non-affiliated stockholders from a financial point of view;

- •

- the material terms and conditions of the Contemplated Transactions as reflected in the purchase agreement, including (a) the consideration to be paid for the series A preferred stock in connection with the Series A Preferred Stock Proposal; (b) the cash consideration to be paid in the tender offer; (c) approximately $22 million of net proceeds from the Series A Preferred Stock Proposal being available for acquisitions and working capital purposes; (d) the provisions in the purchase agreement permitting us to furnish nonpublic information to, and to respond to and participate in, negotiations with, any third-party that submits an unsolicited acquisition proposal concerning a merger or similar transaction with us that our board of directors determines in good faith after consultation with its legal and financial advisors is reasonably likely to be or result in a superior proposal, if our board of directors determines that such action is required to satisfy its fiduciary obligations under applicable law and the purchase agreement permits our board of directors to terminate the purchase agreement in certain circumstances in the exercise of such fiduciary duties; (e) our board of directors' belief that the termination fee and expense reimbursement payable if the purchase agreement were terminated would not deter a superior proposal; (f) the conditions precedent to the consummation of the tender offer, including regulatory approval (including from Nasdaq); and (g) and the estimated length of time to consummate the Contemplated Transactions;

- •

- the consideration offered to our stockholders relative to the historical stock price for shares of our common stock;

- •

- the experience and reputation of New Mountain Partners and the potential benefits New Mountain Partners could bring to us, including a potentially higher profile among institutional investors and equity research analysts; and

- •

- the process engaged in by our management, the special committee of our board of directors and our financial advisor, which included a number of meetings, negotiations and discussions with New Mountain Partners and consideration of alternatives to the Contemplated Transactions, including the fact that since 2002 we retained an investment banking firm and held negotiations

14

Our board of directors also considered the following factors which were viewed generally as disadvantages of the Contemplated Transactions:

- •

- we would be required to pay New Mountain Partners a closing fee of $1,450,000, and pay New Mountain Partners a $2,000,000 termination fee (less any amounts paid by Bert E. Brodsky and certain stockholders related to Mr. Brodsky under the support agreement under certain circumstances) and reimburse it for up to $1,500,000 of its reasonable documented out-of-pocket expenses if the purchase agreement were terminated under certain circumstances, including if we were to terminate the purchase agreement to accept a superior proposal;

- •

- the estimated offering expenses of $4,617,000 with respect to the Contemplated Transactions;

- •

- the non-cash charge to our net income resulting from a beneficial conversion feature related to the series A preferred stock, which is convertible into our common stock at $11.50 per share. The beneficial conversion feature will be measured based on the difference between the fair market value of our common stock on the date of the closing of the Contemplated Transactions and the effective conversion price of $11.29 per share (after deducting the closing payment of $1,450,000 payable to New Mountain Partners) multiplied by the number of shares of common stock (6,956,522) into which the series A preferred stock is convertible. The maximum amount of such charge is capped at $80,000,003 which is the amount that New Mountain Partners is investing in us. The capped amount will be charged if the fair market value of our common stock on the date of the closing of the Contemplated Transactions is equal to or greater than $22.79 per share. Assuming a fair market value of $28.43, which represents the closing price of our common stock on February 18, 2004, the beneficial conversion feature would result in a charge, recorded in the same manner as a dividend on the series A preferred stock, against net income available to holders of our common stock of $80,000,003. The charge will decrease by approximately $6,957,000 for each $1.00 decrease in the price of our common stock below $22.79;

- •

- the change of control severance payments and the bonuses due under certain of our employment agreements of approximately $1,565,000 as well as our indemnities to Mr. Brodsky and Mr. Bigl for any "golden parachute" taxes and any taxes due by Mr. Brodsky in connection with the non-competition covenant in his employment agreement; and

- •

- a non-cash compensation charge resulting from certain stock options granted to two directors, which will vest upon their anticipated resignation from our board of directors (This non-cash compensation charge will be measured based on the options' intrinsic value, which would be the difference between the fair market value of our common stock on the date of vesting and the exercise price of $8.61 per share multiplied by the number of unvested options (22,000). Using an estimated fair market value of $28.43, which represents the closing price of our common stock on February 18, 2004, this will result in a charge against net income of approximately $257,000). The charge to net income will increase or decrease by approximately $13,000 for each $1.00 increase or decrease in the price of our common stock.

Our board of directors concluded, however, that the potential disadvantages associated with the Contemplated Transactions were outweighed by the advantages of the Contemplated Transactions.

Our board of directors also considered the potential benefits to certain directors, officers and employees discussed in the section below entitled "Interests of Management and Directors in the Contemplated Transactions." Our board of directors did not believe that these interests should affect its decision to approve the Contemplated Transactions since these interests are primarily based on contractual arrangements that were in place before the negotiation of the purchase agreement and our

15

board of directors' view that the judgment and performance of the directors and executive officers would not be impaired by these interests. In considering the Contemplated Transactions, our board of directors considered the impact of these factors and the other factors described below on our stockholders.

The foregoing discussion describes the material factors considered by the special committee of our board of directors and our board of directors in their consideration of the Contemplated Transactions. In view of the wide variety of factors considered by the special committee and our board of directors, the special committee and our board of directors did not find it practicable to, and did not, quantify or otherwise attempt to assign relative weights to the specific factors considered. The special committee and our board of directors viewed their positions and recommendations as being based on the totality of the information presented to, and considered by, them. In addition, individual members of the special committee and our board of directors may have given different weights to different factors. After taking into consideration all the factors set forth above, the special committee and our board of directors determined that the potential benefits of the Contemplated Transactions outweighed the potential disadvantages associated with the Contemplated Transactions.

Impact of the Issuance and Sale of the Series A Preferred Stock on Our Existing Stockholders