UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

National Medical Health Card Systems, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

NATIONAL MEDICAL HEALTH CARD SYSTEMS, INC.

26 HARBOR PARK DRIVE

PORT WASHINGTON, NEW YORK 11050

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 21, 2006

To the Stockholders of

National Medical Health Card Systems, Inc.:

NOTICE IS HEREBY GIVEN that an Annual Meeting of Stockholders ofNATIONAL MEDICAL HEALTH CARD SYSTEMS, INC., a Delaware corporation, will be held at our executive offices located at 26 Harbor Park Drive, Port Washington, New York 11050, on December 21, 2006, at 10:00 a.m., local time, for the following purposes:

| | 1. | Election of Directors. To consider and vote on a proposal to elect the ten incumbent directors to serve until the next annual meeting. |

| | 2. | Ratification of Independent Registered Public Accounting Firm. To consider and act upon a proposal to ratify the engagement of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2007. |

| | 3. | To transact such other business as may properly come before the annual meeting or any adjournment or postponement thereof. |

Our board of directors has fixed the close of business on October 25, 2006 as the record date for determining stockholders entitled to notice of and to vote at the annual meeting or any adjournments or postponements of the annual meeting. A list of stockholders entitled to vote at the annual meeting will be available for examination at our headquarters, during ordinary business hours, from the date of the proxy statement until the annual meeting. Information concerning the matters to be acted upon at the meeting is set forth in the accompanying proxy statement.

Whether or not you expect to attend the annual meeting, we urge you to complete, date and sign the enclosed proxy card and mail it promptly in the enclosed return envelope. Even if you have given your proxy, you may still vote in person if you attend the annual meeting. However, if your shares are held of record by a broker, bank or other nominee and you wish to vote at the annual meeting, you must obtain from the record holder a proxy issued in your name.

|

| By order of the Board of Directors of National Medical Health Card Systems, Inc. |

|

|

Jonathan Friedman Secretary |

Port Washington, New York

October 30, 2006

NATIONAL MEDICAL HEALTH CARD SYSTEMS, INC.

26 HARBOR PARK DRIVE

PORT WASHINGTON, NEW YORK 11050

PROXY STATEMENT

This proxy statement and accompanying form of proxy are being mailed on or about November 21, 2006 to the stockholders of record of National Medical Health Card Systems, Inc., doing business as NMHCRx, at the close of business on October 25, 2006 in connection with the solicitation of proxies by our board of directors to be voted at an Annual Meeting of Stockholders to be held on December 21, 2006 at 10:00 a.m., at our executive offices located at 26 Harbor Park Drive, Port Washington, New York 11050, and any and all adjournments or postponements thereof.

All shares represented by proxies duly executed and received will be voted on the matters presented at the annual meeting in accordance with the specifications made in such proxies. In the absence of specified instructions, proxies so received will be voted “FOR” the named nominees to our board of directors for a term of one year (Proposal No. 1) and the ratification of the independent registered public accounting firm (Proposal No. 2). Our board of directors does not know of any other matters that may be brought before the annual meeting nor does it foresee or have reason to believe that proxy holders will have to vote for substitute or alternate nominees to the board of directors. In the event that any other matter should come before the annual meeting or any nominee is not available for election, the persons named in the enclosed proxy will have discretionary authority to vote all proxies not marked to the contrary with respect to such matters in accordance with their best judgment.

A copy of our Annual Report on Form 10-K for the year ended June 30, 2006 as filed with the Securities and Exchange Commission, except for exhibits, will be furnished without charge to any stockholder upon written request to National Medical Health Card Systems, Inc., Attention: Corporate Secretary, 26 Harbor Park Drive, Port Washington, New York 11050.

Record Date and Voting Securities

The record date for determining the stockholders entitled to vote at the meeting is the close of business on October 25, 2006, at which time we had issued and outstanding 5,463,398 shares of common stock, par value $0.001 per share (the “common stock”) and 6,956,522 shares of 7% series A redeemable convertible preferred stock, par value $0.10 per share (the “series A preferred stock”). The shares of common stock and the series A preferred stock are the only outstanding securities entitled to vote at the meeting. On each matter to be voted at the meeting, the holders of the common stock have one vote for each share held and the holders of the series A preferred stock have a vote for each share held equal to 83.64% of the number of whole shares of our common stock into which all of such holder’s shares of series A preferred stock are convertible.

Quorum

The presence in person or by proxy of the holders of a majority of the issued and outstanding shares of the common stock and series A preferred stock is necessary to constitute a quorum to transact business at the annual meeting. Abstentions and broker non-votes will be counted as present for purposes of determining a quorum.

Vote Required

Proposal 1—Election of Directors.The nominees receiving the highest number of affirmative votes of the votes cast at the annual meeting either in person or by proxy will be elected as directors.

1

Proposal 2—Ratification of Independent Registered Public Accounting Firm.The ratification of our independent registered public accounting firm will require an affirmative vote of the majority of the votes cast at the annual meeting either in person or by proxy.

If you hold your shares in “street name,” and you do not instruct your broker or bank on how to vote your shares, the firm may exercise so-called “discretionary authority” to vote your shares or leave them unvoted. Depending on whether the particular matter subject to a vote is considered “routine” or “non-routine,” however, your broker or bank may not have the authority to vote your shares without your instruction. In that situation, the shares that cannot be voted by the broker or bank will be treated as “broker non-votes.” Generally speaking, brokers and banks may not vote uninstructed customer shares on matters defined as “non-routine” by the Nasdaq Stock Market, Inc. (“Nasdaq”), although they can exercise discretion to vote uninstructed customer shares on matters deemed routine. Shares held by brokers and banks that do not have discretionary authority to vote uninstructed shares on non-routine matters are not counted or deemed to be present or represented for the purpose of determining whether stockholders have approved a particular matter, but will be counted in determining whether a quorum is present at the annual meeting. Accordingly, broker non-votes will have no impact on the calculation of votes on either of the two proposals submitted, but will be viewed as present for quorum purposes.

Please note that brokers and banks may exercise discretionary authority to vote the shares owned beneficially by their customers but with respect to which they have not received instruction from such customers with respect to the election of directors (Proposal No. 1) and ratification of the independent registered public accounting firm (Proposal No. 2), both of which are considered “routine” matters. Therefore, broker non-votes will have no impact on the approval of either of the two proposals, but will be treated as present for quorum purposes.

Revocability of Proxy

Any of our stockholders giving a proxy in the form accompanying this proxy statement has the power to revoke it at any time before its exercise. You may revoke your proxy by filing with us written notice of revocation or a fully executed proxy bearing a later date. The proxy may also be revoked by voting in person while in attendance at the meeting. However, a stockholder who attends the meeting need not revoke a proxy given and vote in person unless the stockholder wishes to do so. Written revocations or amended proxies should be sent to us at National Medical Health Card Systems, Inc., 26 Harbor Park Drive, Port Washington, New York 11050, Attention: Corporate Secretary.

A list of our stockholders entitled to vote at the meeting will be available for examination by any stockholder for any purpose germane to the meeting, during ordinary business hours, from the date of the proxy statement until the annual meeting at our offices, 26 Harbor Park Drive, Port Washington, New York 11050 and also during the meeting for inspection by any stockholder who is present.

Cost and Method of Soliciting Proxies

This proxy is being solicited by our board of directors. We will bear the cost of the solicitation of proxies, including the charges and expenses of brokerage firms and other custodians, nominees and fiduciaries for forwarding proxy materials to beneficial owners of our shares. Solicitations will be made primarily by mail, but certain of our directors, officers or employees may solicit proxies in person or by telephone, telecopier or telegram without special compensation.

Additional Information about Us

National Medical Health Card Systems, Inc. provides pharmacy benefits management (PBM) services to plan clients, which include managed care organizations, local governments, unions, corporations and third party

2

health care plan administrators through its network of licensed pharmacies throughout the United States. Our PBM services include electronic point-of-sale pharmacy claims management, retail pharmacy network management, mail service pharmacy claims management, specialty pharmacy claims management, benefit design consultation, preferred drug management programs, drug review and analysis, consulting services, disease information services, data access, reporting and information analysis, and physician profiling. In addition, we operate a mail service pharmacy and a specialty pharmacy.

We were incorporated in New York in 1981 and reincorporated in Delaware in February 2002. Our executive offices are located in Port Washington, New York.

We entered into an amended and restated preferred stock purchase agreement (the “purchase agreement”), dated as of November 26, 2003, with New Mountain Partners, L.P. (“New Mountain Partners”). Pursuant to the purchase agreement, we agreed, subject to various conditions, to issue to New Mountain Partners a total of 6,956,522 shares of the series A preferred stock at a purchase price of $11.50 per share, for aggregate proceeds of approximately $80 million. On March 19, 2004, we completed the sale of the series A preferred stock to New Mountain Partners and used approximately $49 million of the proceeds of the sale of the series A preferred stock to fund the purchase price pursuant to a tender offer of 4,448,900 shares of its outstanding common stock at $11.00 per share (collectively, the “New Mountain Transaction”). Prior to the closing of the New Mountain Transaction, Bert E. Brodsky, the then chairman of the board of directors, and certain stockholders related to him, held (assuming the exercise of 330,000 options and warrants held by Mr. Brodsky), in the aggregate, approximately 59% of our outstanding common stock and had agreed to and did tender 4,448,900 shares, or approximately 53% of our outstanding common stock, held by them, into the tender offer. No other stockholders tendered shares in the offer.

Following the completion of the tender offer, and assuming the exercise of 330,000 options and warrants held by Mr. Brodsky, New Mountain Partners owned securities at March 19, 2004 that were initially convertible into approximately 64% of our issued and outstanding common stock and prior to conversion of the series A preferred stock were entitled to cast that number of votes that is equal to approximately 60% of our aggregate voting power. Immediately following the closing of the New Mountain Transaction, New Mountain Partners was entitled to and did nominate and elect 60% of the members of our board of directors.

The series A preferred stock provides for an initial annual cash dividend equal to 7% of the investment amount, which decreases to 3.5% after the fifth anniversary of issuance (March 19, 2009). The series A preferred stock is convertible into common stock at a price of $11.50 per share of common stock, or an aggregate of 6,956,522 shares of our common stock.

The series A preferred stock may be redeemed at our option subsequent to the fourth anniversary of its issuance, subject to certain conditions. After the tenth anniversary of the issuance of the series A preferred stock, each holder of shares of the series A preferred stock may require us to redeem all or a part of that holder’s shares of the series A preferred stock.

As part of the New Mountain Transaction, and upon Mr. Brodsky’s sale of stock in the tender offer, Mr. Brodsky stepped down as Chairman of our board of directors, but remained as a director until May 2005. Mr. Steven B. Klinsky, the Managing Member of the general partner of New Mountain Partners and the Managing Member and Chief Executive Officer of New Mountain Capital, LLC, the investment manager of New Mountain Partners, assumed the Chairmanship from Mr. Brodsky. On June 14, 2004, Mr. James Bigl, Chief Executive Officer and President, was appointed Chairman of our board of directors with Mr. Klinsky assuming the newly created role of Lead Non-Executive Director. On August 30, 2004, Mr. Bigl resigned as our Chief Executive Officer and President. On August 30, 2004, we appointed Mr. James F. Smith, as our Chief Executive Officer and President and on December 7, 2005, Mr. Smith was elected as a director to our board. On March 13, 2006, Mr. Bigl resigned as Chairman of our board of directors with Mr. Harry Durity assuming the role of Chairman of our board.

3

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth certain information with respect to the compensation paid, earned, or awarded by us to our chief executive officer and other executive officers whose salary and bonus exceeded $100,000 in all capacities during the fiscal years ended June 30, 2006, 2005 and 2004. We refer to these five executive officers as our “named executive officers.”

| | | | | | | | | | | | | | | | | | | | |

| | | | | Annual Compensation | | | Long-term Compensation | | | |

Name and Principal Position | | Fiscal

Year | | Salary | | Bonus | | Other Annual

Compensation | | | Restricted

Stock

Awards | | Securities

Underlying

Options

Granted | | All Other

Compensation | |

James F. Smith Chief Executive Officer & President (1) | | 2006

2005 | | $

| 355,230

62,500 | | $

| 45,000

200,000 | |

| —

— |

| | 6,670

— | | 24,270

126,552 | | $

| 3,085

4,480 | (4)

(5) |

Stuart Diamond Chief Financial Officer (2) | | 2006 | | | 122,692 | | | 55,000 | | | — | | | 2,670 | | 86,134 | | | 2,115 | (4) |

Bill Masters Chief Information Officer (3) | | 2006

2005 | |

| 216,946

149,423 | |

| 34,178

69,300 | |

| —

— |

| | 1,970

— | | 7,160

56,862 | |

| 180

— | (4)

|

Mark Adkison Chief Specialty Officer | | 2006

2005

2004 | |

| 206,846

207,692

142,307 | |

| 42,000

70,000

49,875 | |

| —

—

— |

| | 1,400

—

— | | 5,100

8,170

50,000 | |

| 5,201

5,192

1,731 | (4)

(5)

(6) |

Tery Baskin Chief Marketing Officer | | 2006

2005

2004 | |

| 230,884

208,461

188,327 | |

| 16,675

69,000

78,125 | |

$ | —

—

32,184 |

(7) | | 2,050

—

— | | 9,920

32,761

15,000 | |

| 5,492

5,211

194,707 | (4)

(5)

(6)(8) |

| (1) | On August 30, 2004, we appointed Mr. James Smith as our Chief Executive Officer and President. His salary for fiscal year 2005 reflects the proportionate share earned of his annual salary of $325,000. |

| (2) | On January 20, 2006, we appointed Stuart Diamond as our Chief Financial Officer. His salary for fiscal year 2006 reflects the proportionate share earned of his annual salary of $275,000. |

| (3) | On October 4, 2004, we appointed Mr. Masters as our Chief Information Officer. His salary for fiscal year 2005 reflects the proportionate share earned of his annual salary of $210,000. |

| (4) | Represents the aggregate amount contributed by us under our 401(k) Plan as of June 30, 2006, some of which amount was funded subsequent to June 30, 2006 and amounts contributed by us pursuant to a group term life insurance policy. |

| (5) | Represents the aggregate amount contributed by us under our 401(k) Plan as of June 30, 2005, some of which amount was funded subsequent to June 30, 2005. |

| (6) | Represents the aggregate amount contributed by us under our 401(k) Plan as of June 30, 2004, some of which amount was funded subsequent to June 30, 2004. |

| (7) | Represents payments on behalf of Mr. Baskin for life insurance premiums and our payments under an automobile loan for the use of an automobile by Mr. Baskin. |

| (8) | Mr. Baskin received in the fiscal year ended June 30, 2004, a $190,000 transaction bonus in connection with the New Mountain Transaction, of which $95,000 was paid subsequent to June 30, 2004. |

4

Option Grants in Last Fiscal Year Table

The following table sets forth certain information concerning individual grants of stock options to the named executive officers during the fiscal year ended June 30, 2006:

| | | | | | | | | | | | | | |

| | | Individual Grants | | Potential Realizable Value at Assumed Annual Rates of Share Price Appreciation for Option Term |

Name | | Number of Securities Underlying Options Granted | | | % of Total Options

Granted to Employees in Fiscal 2006 | | | Exercise or Base Price ($/Share) | | Expiration Date | | 5% ($) | | 10% ($) |

James F. Smith | | 24,270 | (1) | | 3.3 | % | | 27.50 | | 12/2/2012 | | 272,167 | | 634,438 |

Stuart Diamond | | 75,000

11,134 | (2)

(3) | | 10.2

1.5 | %

% | | 31.00

30.16 | | 1/27/2016

1/20/2016 | | 1,464,028

211,451 | | 3,711,202

536,012 |

Bill Masters | | 7,160 | (4) | | 0.1 | % | | 27.50 | | 12/2/2012 | | 80,293 | | 187,168 |

Mark Adkison | | 5,100 | (5) | | 0.1 | % | | 27.50 | | 12/2/2012 | | 57,192 | | 133,318 |

Tery Baskin | | 7,450 | (6) | | 1.0 | % | | 27.50 | | 12/2/2012 | | 83,545 | | 194,749 |

| (1) | Exercisable over a four year period to the extent of 6,068 shares of common stock in December 2006, 2007, 2008 and 2009. |

| (2) | Exercisable over a four year period to the extent of 18,750 shares of common stock in January 2007, 2008, 2009 and 2010. |

| (3) | Exercisable over a four year period to the extent of 2,781 shares of common stock in January 2007, 2008, 2009 and 2010. |

| (4) | Exercisable over a four year period to the extent of 1,790 shares of common stock in December 2006, 2007, 2008 and 2009. |

| (5) | Exercisable over a four year period to the extent of 1,275 shares of common stock in December 2006, 2007, 2008 and 2009. |

| (6) | Exercisable over a four year period to the extent of 1,863 shares of common stock in December 2006, 2007, 2008 and 2009. |

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Value Table

The following table sets forth certain information concerning each stock option exercised during the fiscal year ended June 30, 2006 by each of the named executive officers and the value of unexercised options held by such officers at the end of the fiscal year ended June 30, 2006:

| | | | | | | | |

Name | | Shares Acquired

on Exercise | | Value Realized ($) | | Number of Securities Underlying Unexercised Options at June 30, 2006 (#) Exercisable/Unexercisable | | Value of Unexercised In-the-Money Options at June 30, 2006 (1) ($) Exercisable/Unexercisable |

James F. Smith | | 0 | | 0 | | 20,000/130,822 | | 0/0 |

Stuart Diamond | | 0 | | 0 | | 0/86,134 | | 0/0 |

Bill Masters | | 0 | | 0 | | 12,500/51,522 | | 0/0 |

Mark Adkison | | 0 | | 0 | | 33,333/29,937 | | 7,000/3,500 |

Tery Baskin | | 0 | | 0 | | 48,101/45,211 | | 142,375/0 |

| (1) | Value of an unexercised in-the-money option is determined by subtracting the exercise price per share from the fair market value per share for the underlying shares as of June 30, 2006, multiplied by the number of such underlying shares. The fair market value of our common stock is based upon the last reported sale price as reported on the Nasdaq National Market on June 30, 2006 ($13.80 per share). |

5

Employee Contracts and Termination of Employment and Change-in-Control Arrangements

Employment Agreement with James F. Smith. On August 30, 2004, we entered into an employment agreement with James F. Smith to serve as President and Chief Executive Officer for a term of two years at an annual salary of $325,000 and an annual bonus in accordance with our executive management bonus plan. The employment agreement automatically renews for an additional one-year term unless terminated by either party upon 30 days prior written notice. The employment agreement also contains a confidentiality provision and noncompetition and noninterference provisions, all effective during the employment term and for a period of two years following his employment or his severance period. The agreement also provides for a car allowance of $600 per month and certain termination benefits, which, depending on the reason for termination, can equal up to two years salary and benefits. An excise tax gross up provision in the event of a change of control or ownership was added to Mr. Smith’s employment agreement on August 15, 2006.

We have granted the following options to Mr. Smith since he joined us:

| | | | | | | | | |

Date of Grant | | Amount of Options | | Exercise Price per Share | | Vesting | | Expiring |

8/30/2004 | | 100,000 | | $ | 24.51 | | Annually over 4 years | | 8/30/2014 |

12/2/2005 | | 24,270 | | $ | 27.50 | | Annually over 4 years | | 12/2/2012 |

9/7/2006 | | 43,110 | | $ | 15.20 | | Annually over 4 years | | 9/7/2013 |

We have also granted Mr. Smith restricted stock as follows:

| | | | | | | |

Date of Grant | | Number of Shares | | Vesting | | Stock Price per Share on Day of Grant |

12/20/2004 | | 26,522 | | Cliff vest 100% on 12/20/2008 | | $ | 22.45 |

11/9/2005 | | 6,670 | | Cliff vest 100% on 11/9/2009 | | $ | 26.49 |

9/7/2006 | | 11,950 | | Cliff vest 100% on 9/7/2010 | | $ | 15.20 |

Employment Agreement with Stuart Diamond. Effective January 20, 2006, we entered into an employment agreement with Stuart Diamond to serve as Chief Financial Officer on an at-will basis at an annual base salary of $275,000 and the ability to participate in our executive management bonus plan. Mr. Diamond also has entered into an agreement containing confidentiality provisions and noncompetition and noninterference provisions, all effective during the employment term and for a period of one year following employment or severance period. Mr. Diamond’s agreement also provides for certain termination benefits, which, depending on the reason for termination, can equal up to one year of salary and benefits. An excise tax gross up provision in the event of a change of control or ownership was added to Mr. Diamond’s employment agreement on August 15, 2006.

We have granted the following options to Mr. Diamond since he joined us:

| | | | | | | | | |

Date of Grant | | Amount of Options | | Exercise Price per Share | | Vesting | | Expiring |

1/20/2006 | | 11,134 | | $ | 30.16 | | Annually over 4 years | | 1/20/2016 |

1/27/2006 | | 75,000 | | $ | 31.00 | | Annually over 4 years | | 1/27/2016 |

9/7/2006 | | 21,560 | | $ | 15.20 | | Annually over 4 years | | 9/7/2013 |

We have also granted Mr. Diamond restricted stock as follows:

| | | | | | | |

Date of Grant | | Number of Shares | | Vesting | | Stock Price per Share on Day of Grant |

2/3/2006 | | 2,670 | | Cliff vest 100% on 11/9/2009 | | $ | 32.22 |

9/7/2006 | | 5,930 | | Cliff vest 100% on 9/7/2010 | | $ | 15.20 |

Employment Agreement with Bill Masters. On October 4, 2004, we entered into an employment agreement with Bill Masters to serve as Chief Information Officer for a term of two years at an annual salary of $210,000 and an annual bonus in accordance with our executive management bonus plan. On December 1, 2005, Mr. Masters’ annual salary was increased to $220,500. The employment agreement also contains a confidentiality provision and a noncompete provision, effective during the employment term and for a period of

6

two years following his employment or severance period. It also contains a noninterference provision effective during the employment term and for a period of three years following his employment or severance period. The agreement also provides for certain termination benefits, which, depending on the reason for termination can equal up to one year of salary and benefits. An excise tax gross up provision in the event of a change of control or ownership was added to Mr. Masters’ employment agreement on August 15, 2006.

We have granted the following options to Mr. Masters since he joined us:

| | | | | | | | | |

Date of Grant | | Amount of Options | | Exercise Price per Share | | Vesting | | Expiring |

10/4/2004 | | 50,000 | | $ | 19.80 | | Annually over 4 years | | 10/4/2014 |

12/2/2005 | | 7,160 | | $ | 27.50 | | Annually over 4 years | | 12/2/2016 |

9/7/2006 | | 9,790 | | $ | 15.20 | | Annually over 4 years | | 9/7/2013 |

We have also granted Mr. Masters restricted stock as follows:

| | | | | | | |

Date of Grant | | Number of Shares | | Vesting | | Stock Price per Share

on Day of Grant |

12/20/2004 | | 6,862 | | Cliff vest 100% on 12/20/2008 | | $ | 22.45 |

11/9/2005 | | 1,970 | | Cliff vest 100% on 11/9/2009 | | $ | 26.49 |

9/7/2006 | | 2,690 | | Cliff vest 100% on 9/7/2010 | | $ | 15.20 |

Employment Agreement with Mark Adkison.We entered into an employment agreement with Mark Adkison effective October 20, 2003, as amended to date, for an initial two year term and automatic one year renewals unless terminated by either party upon 30 days prior written notice. The employment agreement provides that Mr. Adkison will serve as President of our Specialty Pharmacy Subsidiary at an annual base salary of $200,000, a one time $30,000 sign on bonus and the ability for annual bonuses, in accordance and payable with our executive management bonus plan. On December 1, 2005, Mr. Adkison’s annual salary was increased to $210,000. The agreement contains confidentiality provisions and noncompetition and noninterference provisions, all effective during the employment term and for a period of two years following employment or severance period. The agreement also provides for certain termination benefits, which, depending on the reason for termination, can equal up to one year of salary and benefits. In addition, an excise tax gross up provision in the case of a change of control or ownership was added to Mr. Adkison’s employment agreement on August 15, 2006.

We have granted the following options to Mr. Adkison since he joined us:

| | | | | | | | | |

Date of Grant | | Amount of Options | | Exercise Price per Share | | Vesting | | Expiring |

10/27/2003 | | 50,000 | | $ | 13.59 | | Annually over 3 years | | 10/27/2013 |

12/2/2005 | | 5,100 | | $ | 27.50 | | Annually over 4 years | | 12/2/2012 |

We have also granted Mr. Adkison restricted stock as follows:

| | | | | | | |

Date of Grant | | Number of Shares | | Vesting | | Stock Price per Share on

Day of Grant |

12/20/2004 | | 8,170 | | Cliff vest 100% on 12/20/2008 | | $ | 22.45 |

11/9/2005 | | 1,400 | | Cliff vest 100% on 11/9/2009 | | $ | 20.49 |

Employment Agreement with Tery Baskin. We entered into an employment agreement with Tery Baskin effective June 4, 2001, as amended to date, for an initial one-year term and extends until terminated by either party upon 30 days prior written notice, which superseded his prior employment agreement with us. The employment agreement provides that Mr. Baskin will serve as our Chief Operating Officer at an annual base salary of $150,000, in addition to the ability to participate in the bonus pool for senior executives. Effective

7

April 2003, Mr. Baskin’s title was changed to Chief Marketing Officer and on August 1, 2003, Mr. Baskin’s annual base salary was increased to $190,000 and in January 2005, his salary was increased to $230,000. Furthermore, the agreement provides that we will provide Mr. Baskin with an automobile allowance. In the event of a change of control, Mr. Baskin is entitled to receive a transaction bonus of up to 100% of his current base salary. In connection with the New Mountain Transaction, Mr. Baskin was entitled to receive and did receive a total transaction bonus in the amount of $190,000 under his employment agreement payable in two installments, the first upon the closing of the New Mountain Transaction and the second on the earlier of (x) the six month anniversary of the closing of the New Mountain Transaction and (y) the effective date of the termination of his employment with us for a reason other than cause (as such term is defined in his employment agreement). The employment agreement also contains a perpetual confidentiality provision, noncompetition and noninterference provisions effective during the term of his employment and for a period of eighteen months after the severance period, and a nonsolicitation provision effective during the term of his employment and for a period of three years after the severance period. In addition, the agreement provides for certain termination benefits, which, depending upon the reason for termination, can equal up to six months salary. An excise tax gross up provision in the event of a change of control or ownership was added to Mr. Baskin’s employment agreement on August 15, 2006.

We have granted the following options to Mr. Baskin since he joined us:

| | | | | | | | | |

Date of Grant | | Amount of Options | | Exercise Price per Share | | Vesting | | Expiring |

7/20/2000 | | 40,000 | | $ | 4.00 | | Annually over 4 years | | 7/20/2006 |

6/4/2001 | | 15,000 | | $ | 4.00 | | Annually over 3 years | | 6/4/2006 |

8/10/01 | | 2,000 | | $ | 3.50 | | Annually over 3 years | | 8/10/2006 |

8/1/2002 | | 20,000 | | $ | 8.60 | | Annually over 3 years | | 8/1/2007 |

9/19/2002 | | 5,000 | | $ | 8.15 | | Annually over 3 years | | 9/19/2007 |

8/1/2003 | | 20,000 | | $ | 11.50 | | Annually over 3 years | | 9/1/2008 |

9/17/2004 | | 15,000 | | $ | 25.10 | | Annually over 4 years | | 9/17/2014 |

1/3/2005 | | 25,000 | | $ | 22.22 | | Annually over 4 years | | 1/3/2015 |

12/2/2005 | | 7,450 | | $ | 27.50 | | Annually over 4 years | | 12/2/12 |

9/7/2006 | | 9,920 | | $ | 15.20 | | Annually over 4 years | | 9/7/2013 |

Upon the closing of the New Mountain Transaction, options granted to Mr. Baskin prior to March 19, 2004, covering 58,331 shares of common stock, became fully vested and immediately exercisable.

We have also granted Mr. Baskin restricted stock as follows:

| | | | | | | |

Date of Grant | | Number of Shares | | Vesting | | Stock Price per Share on Day of Grant |

12/20/2004 | | 7,761 | | Cliff vest 100% on 12/20/2008 | | $ | 22.45 |

11/9/2005 | | 2,050 | | Cliff vest 100% on 11/9/2009 | | $ | 26.49 |

9/7/2006 | | 2,730 | | Cliff vest 100% on 9/7/2010 | | $ | 15.20 |

8

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information, as of October 25, 2006, concerning the persons or entities known to us to be the beneficial owner of more than 5% of the shares of our common stock as well as the number of shares of common stock that our directors, director nominee and certain executive officers beneficially own, and that our directors and executive officers own as a group. Except as otherwise indicated below, each of the entities or persons named in the table has sole voting and investment power with respect to all shares of common stock beneficially owned. Unless otherwise indicated, the business address of each stockholder listed below is c/o National Medical Health Card Systems, Inc., 26 Harbor Park Drive, Port Washington, New York 11050.

| | | | | | | | |

Name and Address of Beneficial Owner | | Title of Class | | Number of Shares Beneficially

Owned(1) | | | Percentage Owned | |

Principal Stockholders: | | | | | | | | |

| | | |

New Mountain Partners, L.P. 787 Seventh Avenue, 49th Floor New York, NY 10019 | | series A preferred

stock | | 6,790,797 | (2) | | 54.7 | %** |

| | | |

New Mountain Affiliated Investors, L.P. 787 Seventh Avenue, 49th Floor New York, NY 10019 | | series A preferred

stock | | 165,725 | (2) | | 1.3 | %** |

| | | |

Name of Beneficial Owner | | | | | | | | |

| | | |

Directors and Executive Officers: | | | | | | | | |

| | | |

Steven B. Klinsky(3) | | series A preferred

stock | | 6,956,522 | (2) | | 56.0 | %** |

Michael B. Ajouz(14) | | — | | — | | | — | |

Michael T. Flaherman(15) | | — | | — | | | — | |

Robert R. Grusky(16) | | — | | — | | | — | |

Daniel B. Hébert | | common stock | | 1,250 | (4) | | — | |

David E. Shaw | | — | | — | | | — | |

G. Harry Durity | | common stock | | 13,987 | (5) | | * | |

Gerald Angowitz | | common stock | | 27,003 | (6) | | * | |

Paul Konigsberg | | common stock | | 22,903 | (7) | | * | |

James F. Smith | | common stock | | 46,068 | (8) | | * | |

Tery Baskin | | common stock | | 135,944 | (9) | | 2.5 | % |

Stuart Diamond | | common stock | | 0 | (10) | | * | |

Bill Masters | | common stock | | 26,790 | (11) | | * | |

Mark Adkison | | common stock | | 42,861 | (12) | | | |

All executive officers and directors as a group (14 persons) | | common stock | | 7,273,328 | (13) | | 58.5 | %** |

| ** | Assuming the conversion into common stock of (a) in the case of New Mountain Partners, L.P. and New Mountain Affiliated Investors, L.P., only the shares of series A preferred stock held by such person, and (b) in the case of Mr. Klinsky and all executive officers and directors as a group , the shares of series A preferred stock held by New Mountain Partners, L.P. and New Mountain Affiliated Investors, L.P. Common stock issuable upon conversion of the series A preferred stock is included in the number of outstanding common shares (denominator) calculation only for these persons. |

| (1) | The number of shares beneficially owned includes outstanding shares of our common stock held by that person and shares of our common stock issuable upon exercise of stock options exercisable within 60 days of October 25, 2006. |

| (2) | Assuming the conversion into common stock of (a) in the case of New Mountain Partners, L.P. and New Mountain Affiliated Investors, L.P., the shares of series A preferred stock held by such person. and (b) in the case of Mr. Klinsky and all executive officers and directors as a group, the shares of series A preferred stock held by New Mountain Partners, L.P. and New Mountain Affiliated Investors, L.P. |

9

| (3) | New Mountain Investments, L.P. (“NMI”) is the general partner of New Mountain Partners, L.P. New Mountain GP, LLC (“NM”) is the general partner of each of New Mountain Partners, L.P, and New Mountain Affiliated Investors, L.P. Mr. Klinsky is the sole member of NM; his address is 787 Seventh Avenue, 49th Floor, New York, NY 10019. Each of Mr. Klinsky and NM disclaims beneficial ownership of the shares that may be owned by New Mountain Partners, L.P., New Mountain Affiliated Investors, L.P. and NMI, except to the extent of his and its pecuniary interest therein. |

| (4) | Includes 1,250 shares issuable pursuant to exercisable options. |

| (5) | Includes 13,987 shares issuable pursuant to exercisable options. |

| (6) | Includes 22,903 shares issuable pursuant to exercisable options. |

| (7) | Includes 22,903 shares issuable pursuant to exercisable options. |

| (8) | Includes 46,068 shares issuable pursuant to exercisable options. |

| (9) | Includes 55,443 shares issuable pursuant to exercisable options. |

| (10) | No options have vested as of October 25, 2006. |

| (11) | Includes 26,790 shares issuable pursuant to exercisable options. |

| (12) | Includes 42,861 shares issuable pursuant to exercisable options. |

| (13) | Includes all of the shares that are included in the table above. |

| (14) | Mr. Ajouz is a passive limited partner in NMI which is the general partner of New Mountain Partners, L.P. Mr. Ajouz disclaims beneficial ownership of the shares owned by New Mountain Partners, except to his pecuniary interest therein. |

| (15) | Mr. Flaherman is a passive limited partner in NMI which is the general partner of New Mountain Partners, L.P. Mr. Flaherman disclaims beneficial ownership of the shares owned by New Mountain Partners, except to his pecuniary interest therein. |

| (16) | Mr. Grusky is a passive limited partner in NMI which is the general partner of New Mountain Partners, L.P. Mr. Grusky disclaims beneficial ownership of the shares owned by New Mountain Partners, except to his pecuniary interest therein. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Consultancy Relationship with Our Chairman of the Board of Directors

Our former Chairman of the board of directors and former President and Chief Executive Officer, James J. Bigl, served as our nonexclusive, independent consultant from August 30, 2004 until August 31, 2006. Mr. Bigl received an annual consulting fee of $125,000 and served as a senior level consultant to the board of directors with regard to both transition matters and other strategic matters. Mr. Bigl was entitled to a $125,000 lump sum payment if terminated by us or if he terminated for cause prior to the end of his two year engagement. During the fiscal year ended June 30, 2006, we paid Mr. Bigl $125,004 for his consultancy services.

Real Estate

We rent two houses from Living In Style, LLC, an entity owned partially by Tery Baskin, an executive officer, and James Bigl, a former Chairman and Chief Executive Officer, which is used for out-of-town employees when they are visiting our Port Washington, New York headquarters. During the fiscal year ended June 30, 2005, we evaluated the cost of local hotels for these individuals and determined it was more cost efficient to rent the houses. Pursuant to leases dated May 1, 2002 and expiring April 30, 2007, we paid an aggregate of $140,973 in rent for these two facilities during the fiscal year ended June 30, 2006. The annual rent for each of the facilities increases by 5% per year.

We believe each of the related transactions described above in this section “Certain Relationships and Related Transactions” was negotiated on terms as favorable in the aggregate as could have been obtained from unrelated third parties.

Indebtedness of Management

For fiscal year ended June 30, 2006, our officers, directors and affiliates have no indebtedness to us.

10

PROPOSAL 1—ELECTION OF DIRECTORS

Recently adopted National Association of Securities Dealers, Inc. (“NASD”) rules require most companies whose stock is quoted on the Nasdaq, following their first annual stockholders meeting after January 15, 2004, to have a board of directors composed of a majority of independent directors, as determined and defined under NASD Rule 4350(c), and to comply with certain other requirements for committees and independent directors. Companies that are controlled by a single stockholder or a group of stockholders acting together are eligible to utilize an exemption from certain of the requirements under NASD Rule 4350(c)(5), including the requirement that a majority of directors be independent. We are a “controlled company,” as defined in Nasdaq’s new rules, because New Mountain Partners owns more than 50% of our voting power. Accordingly, we have availed ourselves of the exemption from the rule requiring a majority of the directors be independent.

Our board of directors currently consists of a ten (10) member board, all of whom are standing for re-election at this year’s annual meeting. Our current certificate of incorporation provides that each member of the board of directors shall be elected for a one-year term at each annual meeting of stockholders. All of the current directors’ terms will expire at this annual meeting. As a result of the New Mountain Transaction, New Mountain Partners, as a holder of series A preferred stock, is entitled to elect 60% of the members of our board of directors and the common stockholders are entitled to elect the remaining 40% of the members of our board of directors. All ten (10) members of the board which the common stockholders and series A preferred stockholders are entitled to elect are to be elected at the annual meeting.

The persons named in the enclosed proxy will vote to elect as directors the nominees named below, all of whom are presently serving as directors. All of the nominees have indicated their willingness to serve, if elected, but if any should be unable or unwilling to serve, proxies may be voted for a substitute nominee designated by our board of directors. Each director will be elected to hold office until the next annual meeting of stockholders subject to the election and qualification of his successor and to his earlier death, resignation or removal.

The following text presents information as of the date of this proxy statement concerning persons nominated for election as common stock directors and persons nominated for election as series A preferred stock directors, including in each case his name, his age as of October 25, 2006, his current membership of committees of the board of directors, his principal occupations or affiliations during the last five years and certain other directorships held by him.

Nominees for Common Stock Directors

The following are the three (3) incumbent nominees for common stock directors:

James F. Smith. Mr. Smith, 57, became our Chief Executive Officer and President on August 31, 2004 and has been serving as a director since May 2005. From April 2000 to July 2004, Mr. Smith served as senior vice president of healthcare services and government relations at CVS Corporation. From 1999 to 2000, he served as senior vice president of e-commerce at Eckerd Corporation, and from 1997 to 1999, he served as senior vice president of managed care operations at Eckerd Services. Mr. Smith has also served as vice president of managed care operations at TDI Managed Care from 1994 to 1997. His other positions include vice president of Express Pharmacy Service operations from 1992 to 1994, and vice president of loss prevention and operational audit at Thrift Drug from 1986 to 1992. He was a member of the board of directors of Pharmaceutical Care Management Association (PCMA) and in 1999 served as its chairman.

Gerald Angowitz. Mr. Angowitz, 57, has served as a director for us since June 26, 1998. Mr. Angowitz presently works as a management consultant through the Angowitz Company, which provides consulting services. Mr. Angowitz had served as Senior Vice President of Human Resources and Administration for RJR Nabisco, Inc. (“RJR”), a consumer products manufacturer, from March 1995 until December 1999. Mr. Angowitz previously served as Vice President of Human Resources for RJR from February 1994 to March 1995 and Vice President of employee benefits at RJR from January 1992 to February 1994. Mr. Angowitz also

11

serves as the Chairman of our compensation committee and a member of our audit committee and nominating and corporate governance committee.

Paul J. Konigsberg. Mr. Konigsberg, 69, has served as a director for us since November 2000. Mr. Konigsberg is a certified public accountant and has been a senior partner in the accounting firm of Konigsberg Wolf & Co., P.C. since 1970. Mr. Konigsberg also serves as the Chairman of our audit committee and a member of our compensation committee and nominating and corporate governance committee. He is a member of the Board of Directors of Gramercy Capital Corporation. From January 1998 until October of 2002, Mr. Konigsberg also served on the board of directors of Sandata.

Nominees for Series A Preferred Directors

The following are the seven (7) incumbent nominees for series A preferred directors:

Steven B. Klinsky. Mr. Klinsky, 50, served as our Chairman of the board of directors from March 19, 2004 until June 14, 2004 and currently serves as a director for us. Mr. Klinsky is the founder and has been the managing member and chief executive officer of New Mountain Capital, LLC since January 2000. From 1986 to June 1999, Mr. Klinsky was a general partner of Forstmann Little & Co., a private equity firm. He was formerly a director of Strayer Education, Inc., where he served as non-executive Chairman from March 2001 until February 2003 and of of Surgis, Inc. Mr. Klinsky also serves on the board of directors Overland Solutions, Inc., Apptis Holdings, Inc., MailSouth Inc., Deltek Systems Inc. and Connextions, Inc. In addition, Mr. Klinsky serves as the Chairman of our nominating and corporate governance committee and a member of our compensation committee.

Michael B. Ajouz. Mr. Ajouz, 32, has served as a director for us since March 19, 2004. Mr. Ajouz is a managing director of New Mountain Capital, LLC, joined New Mountain Capital as a principal in September 2000. From July 1998 to September 2000, Mr. Ajouz was an executive in the New York office of Kohlberg Kravis Roberts & Co., where he worked on transactions in a variety of industries. From August 1996 to July 1998, Mr. Ajouz was an investment banking professional in the Mergers and Acquisitions Department of Goldman, Sachs & Co., where he evaluated and executed numerous strategic transactions. From August 1995 to May 1996, he was a professional at the economic consulting firm Cornerstone Research. Mr. Ajouz also serves on the board of directors of Surgis, Inc. and Apptis Holdings, Inc.

G. Harry Durity. Mr. Durity, 58, has served as a director for us since March 19, 2004 and Chairman of the board of directors since March 2006. Mr. Durity has been a senior advisor to New Mountain Capital, LLC since May 2005. Previously, Mr. Durity was a corporate vice president of worldwide business development for Automatic Data Processing, Inc., or ADP, which he joined in August 1994. Mr. Durity headed ADP’s mergers and acquisitions group and was a member of ADP’s executive committee. From February 1993 to August 1994, Mr. Durity worked for Revlon Consumer Products Company as a senior vice president of corporate development and also served on Revlon’s executive committee. From January 1990 to January 1993, Mr. Durity was president of the Highlands Group, a boutique merger and acquisition advisory firm. From October 1980 to December 1989, Mr. Durity served as a vice president of corporate development for RJR Nabisco, Inc. Mr. Durity also serves as a member of the board of directors of Website Pros.

Michael T. Flaherman. Mr. Flaherman, 41, has served as a director for us since March 19, 2004. Mr. Flaherman is a managing director of New Mountain Capital, LLC, joined New Mountain Capital as a senior advisor in January 2003. From January 1995 to January 2003, Mr. Flaherman served as a member of the Board of Administration of the California Public Employees’ Retirement System, or CalPERS, the largest pension system in the United States. In his capacity as chairman of the investment committee of the CalPERS’ board from March 2000 to January 2003, Mr. Flaherman led board decision-making on all aspects of CalPERS’ investment strategy, including asset allocation, as well as CalPERS’ investment program in domestic and international equity and fixed income, real estate and private equity. Mr. Flaherman also participated in decision-making about

12

CalPERS’ health benefits program, including pharmacy benefits. From August 1993 to March 2000, Mr. Flaherman worked as an economist for the San Francisco Bay Area Rapid Transit District.

Robert R. Grusky. Mr. Grusky, 49, has served as a director for us since March 19, 2004. Mr. Grusky is the managing member of Hope Capital Management, LLC, the investment manager of Hope Capital Partners, L.P., an investment partnership, since its inception in 2000. Mr. Grusky was a co-founder and principal of New Mountain Capital, LLC from January 2000 to December 2004. In January 2005 he became a senior advisor to New Mountain Capital, LLC. From April 1997 to December 1999, Mr. Grusky served in a number of roles at RSL Management, including president of RSL Investments Corporation. From July 1985 to April 1997, with the exception of 1990-1991 when he was on a leave of absence to serve as a White House Fellow and Assistant for Special Projects to the Secretary of Defense, Mr. Grusky served in a variety of capacities at Goldman, Sachs & Co., first in its Mergers & Acquisitions Department and then in its Principal Investment Area. Mr. Grusky is also a member of the board of directors of AutoNation, Inc. and Strayer Education, Inc.

David E. Shaw.Mr. Shaw, 55, has served as a director for us since December 8, 2004. Mr. Shaw has been a senior advisor to New Mountain Capital, LLC since February 2004. Mr. Shaw is the managing partner of Black Point Partners LLC, a private investment company which he founded in 1997 and he currently serves as a consultant and limited partner to Venrock Associates. He is also the founder and, from 1984 to 2002, served as the Chairman and Chief Executive Officer of IDEXX Laboratories, Inc., a publicly-held biotechnology, medical device and software company and has been a founding investor and/or director of several high technology companies including Cytyc and Microbia. Mr. Shaw has also been a director of Magen and Ikaria. Since 2002, he has served on the advisory board of the Harvard University John F. Kennedy School of Government and from 2002-2003, he served on the faculty of Harvard’s Center for Public Leadership. Since 1989, he has been on the Board of Governing Trustees and served as the Chair of The Jackson Laboratory, a leading genetics research institute from 1997 to 2001. He also served as a member of the Council on Foreign Relations, a member of the Executive Committee of the US-Israel Science and Technology Commission from 1994 to 1997, and from 1989 to 1997 he was a Trustee of Maine Medical Center.

Daniel B. Hébert. Dan Hébert, 50, has served as a director for us since December 7, 2005. Mr. Hébert is a managing director and partner of Tri-Artisan Partners, a privately held merchant bank, since March 2005. Prior to joining Tri-Artisan Partners, he spent approximately five years as head of Merger & Acquisitions at Rabobank International, a large Dutch bank specializing in the food and beverage industry. From September 1991 through March 1999, Mr. Hébert was a managing director in the corporate finance department of BT Alex Brown. Prior to joining BT Alex Brown, Mr. Hébert formed Dakota Capital in February 1991 to acquire a leading Canadian wine distributor and from 1985 to 1991, he worked as a director in the corporate finance department of Salomon Brothers.

Required Vote

The nominees receiving the highest number of affirmative votes of the votes cast at the annual meeting either in person or by proxy will be elected as directors. A properly executed proxy card marked “ABSTAIN” and broker non-votes with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum. Broker non-votes, if any, will not affect the outcome of voting on directors.

13

Recommendation of Our Board of Directors

Our board of directors recommends a vote “FOR” the election of the nominees named above.

Executive Officers

Our executive officers, and their ages and positions as of October 25, 2006 are:

| | | | |

Name | | Age | | Office and Position Held |

James F. Smith | | 57 | | Chief Executive Officer and President |

Stuart Diamond | | 46 | | Chief Financial Officer |

Bill Masters | | 56 | | Chief Information Officer |

Mark Adkison | | 43 | | Chief Specialty Officer |

Tery Baskin | | 52 | | Chief Marketing Officer |

James F. Smith. Mr. Smith, 57, has served as our President and Chief Executive Officer since August 2004. Information about Mr. Smith’s tenure with us and his business experience is presented above under “Directors.”

Stuart Diamond. Mr. Diamond, 46, has served as our Chief Financial Officer since January 2006. Mr. Diamond has also been a director of Medicis Pharmaceutical since November 2002, a publicly-traded pharmaceutical company. He served as worldwide Chief Financial Officer for Ogilvy Healthworld (formerly Healthworld Corporation), a division of Ogilvy & Mather, a division of WPP Group Plc, a London Stock Exchange-listed company, from January 2005 until January 2006, and he served as Chief Financial Officer of Healthworld Communications Group, a division of WPP Group Plc, a London Stock Exchange-listed company, from August 2003 until January 2005. He served as Chief Financial Officer of the Americas Region of the Bates Group and of Healthworld Corporation, divisions of Cordiant Communications, a London Stock Exchange-listed company, from October 2002 to August 2003. He served as Chief Financial Officer of Healthworld Corporation, a division of Cordiant Communications Group plc from March 2000 to October 2002. He served as Executive Vice President, Chief Financial Officer, Secretary and Treasurer of Healthworld Corporation, a publicly-owned pharmaceutical advertising agency, from August 1997 to March 2000. Mr. Diamond was the Vice President-Controller of the Licensing Division of Calvin Klein, Inc., an apparel company, from April 1996 to August 1997. Mr. Diamond served as Chief Financial Officer of Medicis from 1990 until 1995.

Bill Masters. Mr. Masters, 56, has served as our Chief Information Officer since October 4, 2004. From May 1999 to July 2004, Mr. Masters was Vice President of healthcare business solutions at CVS Pharmacy. During his 10-year tenure at CVS, Mr. Masters also held the position of vice president, business development and support. From June 1980 to July 1993, Mr. Masters also held senior-level information systems positions at Reliable Drug Stores, Inc., Rite Aid Corporation and Begley Company, Inc.

Mark Adkison.Mr. Adkison, 43, has served as our Chief Specialty Officer since November 2005 and prior to that as our President of Specialty Pharmacy from October 2003 to November 2005. From December 2002 to September 2003, Mr. Adkison was the General Manager for Option Care. Mr. Adksion served as the Vice President/General Manager for MIM Corporation where he managed the Mail Service and Specialty Pharmacy Operation from January 2001 to March 2002.

Tery Baskin. Mr. Baskin, 52, has served as our Chief Marketing Officer since April 2003. He served as our chief operating officer from June 2001 to April 2003 and as our senior vice president of strategic planning from July 2000 to May 2001. He has been a licensed pharmacist since 1978. From 1993 to July 2000 he served as the President and a director of Pharmacy Associates, Inc. From July 2000 to June 2001, Mr. Baskin was the Senior Vice President of Pharmacy Associates, Inc., which in July 2000 became our wholly owned subsidiary. He has served as a director of the American Pharmaceutical Association Foundation since 1998 and as Treasurer since March 2002.

Each of the executive officers serves, subject to his or her employment agreement, until the meeting of the board of directors immediately following the annual meeting of stockholders.

14

Familial Relationships

There are no familial relationships among any of our executive officers, directors or nominees for director.

Compensation of Directors

Our bylaws provide that our directors may, by resolution of our board of directors, be paid a fixed fee and expenses for attendance at each regular or annual meeting of our board of directors and committee meetings. Directors who are our employees and directors who are New Mountain Capital professionals are not entitled to additional compensation. Directors who are neither our employees nor current New Mountain Capital professionals (the “non-employee directors”) are entitled to receive the cash and equity compensation described below.

Non-employee directors receive $25,000 per year for four quarterly board of directors meetings attended, $1,000 per session for any additional meetings attended in person and no additional compensation is paid for any additional meetings attended telephonically. Each member of the audit committee is paid an additional $5,000 for its service on the committee. An additional $5,000 is paid to the chairperson of the audit committee and the chairperson of the compensation committee. In December 2005, the per session compensation for any additional meetings attended in person was increased from $1,000 to $1,250 and non-employee directors were also eligible to receive the same $1,250 per session compensation for any additional meetings attended telephonically. Upon being appointed as a board of director, a non-employee director will be granted an option to purchase up to 20,000 shares of our common stock. The options will have an exercise price equal to the price at the close of business on the date of the grant of the options, vest over a four year period and expire after seven years. Immediately following each annual meeting, all non-employee directors will be granted options. The options will have a seven year term and will terminate 90 days after the date the non-employee director ceases to be a director or consultant or 12 months if termination is due to death or disability. Each option will vest over four years at a rate of 25% of the total shares on the anniversary of the date of grant, so long as the non-employee director remains a director or consultant. We paid an aggregate of $151,500 in directors’ fees during the fiscal year ended June 30, 2006. We reimburse directors for out-of-pocket expenses incurred in connection with attending board of directors and committee meetings.

In December 2005, following our annual meeting, we granted each of our non-employee directors, Messrs, Angowitz, Konigsberg and Hébert, a grant of options to purchase 5,000 shares of common stock with an exercise price of $27.90 per share (the closing price on the date of the grant). Such options vest over a four-year period commencing December 2006 and expire in December 2012.

Meetings and Committees of Our Board of Directors

Our board of directors held eight meetings during the fiscal year ended June 30, 2006 and at least a majority of our directors attended each meeting. Our board of directors also acted four times during the last fiscal year by unanimous written consent in lieu of a meeting.

Our board of directors has a standing audit committee, nominating and corporate governance committee and a compensation committee, the responsibilities of which are summarized below. In addition, on March 24, 2004, our board of directors approved the creation of two series A dividend committees and on October 28, 2005 our board of directors approved a change in the name and responsibilities of the nominating committee to the nominating and corporate governance committee. We are a controlled company under NASD Rule 4350(c)(5) and are exempt from NASD Rule 4350(c)(4) relating to independent director oversight of director nominations because New Mountain Partners L.P. and its affiliates own more than 50% of the voting power of our stock (specifically, 56.0% as of October 25, 2006).

Each of our directors attended at least 75% of the meetings of our board of directors or committee meetings thereof during the fiscal year ended June 30, 2006. Our policy is that all directors are invited and encouraged to attend our annual meeting of stockholders. At our 2005 annual meeting held on December 8, 2005, one director attended the annual meeting in person.

15

Communications by Stockholders and Others with the Board of Directors

We currently have a formal process for security holders to send communications to our board of directors. Stockholders and other parties interested in communicating directly with the board of directors or with non-management directors as a group may do so by sending written communications addressed to the Corporate Secretary of National Medical Health Card Systems, Inc., Attention: Board of Directors, 26 Harbor Park Drive, Port Washington, NY 11050. Our corporate secretary will review the communications and report them to the board of directors or the individual directors to whom they are addressed, unless they are deemed frivolous, inappropriate, solicitations of services or solicitations of our funds, otherwise inappropriate for the board of director’s consideration. Examples include spam, junk mail and mass mailings, product inquiries and complaints, resumes and other forms of job inquiries, and business solicitations. In such cases, that correspondence may be forwarded elsewhere within for our review and possible response. Communications that are unduly hostile, threatening, illegal or similarly unsuitable likewise will not be forwarded to the board of directors or any member thereof, although such communications may be available to any director or the full board of directors upon request.

Audit Committee

The audit committee assists the board of directors in its oversight of our compliance with all applicable laws and regulations, which includes oversight of the quality and integrity of our financial reporting, internal controls and audit functions, and is directly and solely responsible for the appointment, retention, compensation and monitoring of the performance of our independent registered public accounting firm, including the services and scope of their audit. The audit committee is currently composed of Paul J. Konigsberg (chairman of the committee), Gerald Angowitz, and Daniel Hébert. The board of directors has determined that Messrs. Konigsberg, Angowitz and Hébert are independent directors, and that each of them will be independent for the purposes of the Nasdaq’s amended governance listing standards (specifically, Rule 4200(a)(15) of the listing standards of the National Association of Securities Dealers (the “Listing Standards”)), and the requirements of the Securities and Exchange Commission (“SEC”) and the Nasdaq.

The remaining members of the board of directors do not satisfy the SEC and the Nasdaq “independence” definitions. This is permissible under applicable Nasdaq listing standards because New Mountain Partners, L.P., and its affiliates own more than 50% of the voting power of our stock. As a “controlled company” within the meaning of relevant Nasdaq listing standards (Rule 4350(c)), we are not required to comply with certain provisions that would require us to have a majority of “independent” directors serving on our board of directors, or standing nominating and compensation committees, all of whose members must be “independent” under Nasdaq standards. In creating this exception, the Nasdaq has recognized that majority shareholders, including parent companies, have the right to select directors and control certain key decisions, such as executive officer compensation, by virtue of their stock ownership rights. To summarize, because we are a controlled company, we are exempt from the requirements of the Nasdaq listing standards relating to having:

(1) a majority of independent directors on the board; as noted, the board of directors has determined that only three of the 10 directors will be “independent” under applicable Nasdaq and SEC requirements because the remaining directors are either our executive officers or are affiliated with our controlling stockholder, New Mountain Partners, L.P.;

(2) a standing board nominating committee composed entirely of “independent” directors; and

(3) a standing compensation committee composed entirely of “independent” directors as defined by the Nasdaq listing standards. Our compensation committee, which makes decisions on annual salary and cash bonus awards to our executive officers, has a member that is not independent.

In addition, as required by the rules of the SEC and the Nasdaq, our board of directors has determined that Mr. Konigsberg, the chairman of the audit committee, qualifies as an “audit committee financial expert” as defined in Item 401(h) of Regulation S-K promulgated by the SEC under the Securities Exchange Act of 1934, as amended. Stockholders should understand that this designation is an SEC disclosure requirement relating to

16

Mr. Konigsberg’s experience and understanding of certain accounting and auditing matters, which the SEC has stated does not impose on the director so designated any additional duty, obligation or liability than otherwise is imposed generally by virtue of serving on the audit committee and/or the board of directors. The audit committee met on eight occasions during the fiscal year ended June 30, 2006.

Although the board of directors received no stockholder nominations in fiscal year ended June 30, 2006, the board of directors will consider director candidates recommended by stockholders if properly submitted in accordance with the applicable procedures set forth in our bylaws.

The information contained in this proxy statement with respect to the audit committee charter and the independence of the members of the audit committee shall not be deemed to be “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except to the extent that we specifically incorporate it by reference in such filing.

Nominating and Corporate Governance Committee

On October 18, 2005, our board of directors renamed and broadened the role of the nominating and corporate governance committee. The nominating and corporate governance committee is currently composed of Steven B. Klinsky (chairman of the committee), Gerald Angowitz and Paul J. Konigsberg. The nominating committee met one time during the fiscal year ended June 2006. The board of directors has determined that Messrs. Angowitz and Konigsberg are independent directors and independent (as defined by applicable laws, rules and regulations of the SEC and Nasdaq) of management and us.

The nominating and corporate governance committee is responsible for the identification and selection of the non-New Mountain independent director nominees to stand for election as directors at any meeting of stockholders and to fill any such independent director vacancy, however created, in the board of directors. The nominating and corporate governance committee has nominated Messrs. Angowitz and Konigsberg for re-election at the annual meeting. See “Proposal 1—Election of Directors.”

The nominating and corporate governance committee will consider candidates for nomination as a director recommended by stockholders, current directors, officers, third-party search firms and other sources. The nominating and corporate governance committee considers stockholder recommendations for candidates in the same manner as those received from others. In order for the nominating and corporate governance committee to consider a stockholder nominee, the stockholder must submit nominee information to the nominating and corporate governance committee in accordance with the procedures for submitting stockholder proposals described below.

In evaluating candidates, the nominating and corporate governance committee shall consider that the objective of the board of directors is to maintain a balance of business experience and interpersonal skills, thereby maximizing the effectiveness of the board of directors and each of its committees. The nominating and corporate governance committee shall review and assess outside director remuneration for sufficiency to attract and retain members of the board of directors of a quality needed for the successful accomplishment of the goals of the board of directors and recommend changes, if any, in the composition of the board of directors.

In addition, the nominating and corporate governance committee will develop and recommend to the board of directors a set of corporate governance principles applicable to us, adopt appropriate processes to ensure management succession and development plans for our principal officers, and otherwise take a leadership role in shaping our corporate governance.

Availability of Charters

A copy of the charters for the audit committee and the nominating and corporate governance committee are available on our website at www.nmhc.com.

17

The Compensation Committee

The compensation committee of our board of directors is responsible for making recommendations to our board of directors regarding compensation arrangements for our executive officers and consulting with our management regarding compensation policies and practices. The compensation committee also makes recommendations concerning annual bonus compensation, the adoption of any compensation plans in which management is eligible to participate and the granting of stock options or other benefits under such plans. The compensation committee currently consists of Gerald Angowitz (chairman of the committee), Paul J. Konigsberg and Steven B. Klinsky. Attached asAppendix A is a copy of the Compensation Committee Charter. The compensation committee held four meetings during the fiscal year ended June 30, 2006.

AUDIT COMMITTEE REPORT

The following Report of the audit committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other filing by us under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent we specifically incorporate this Report by reference therein.

The audit committee of our board of directors is comprised of all independent directors and acts under a written charter approved and adopted by our board of directors and is reviewed and reassessed annually by the audit committee. The members of the committee are Messrs. Konigsberg, Angowitz and Hébert, each of whom is independent, as determined under Rule 4200(a)(15) of the NASD’s listing standards and Rule 10A-3(b)(1) of the Securities Exchange Act of 1934, as amended. The audit committee held eight meetings during the fiscal year ended June 30, 2006.

Management has primary responsibility for our internal controls and financial reporting process. The independent auditors are responsible for performing an independent audit of our consolidated financial statements in accordance with auditing standards generally accepted in the U.S., and to issue a report thereon. The audit committee oversees our financial reporting process on behalf of our board of directors.

In fulfilling its oversight responsibilities, the audit committee has met and held discussions with management and the independent auditors. Management represented to the audit committee that our consolidated financial statements were prepared in accordance with generally accepted accounting principles in the United States. The audit committee has reviewed and discussed the consolidated financial statements set forth in our Form 10-K for the fiscal year ended June 30, 2006, with management and the independent auditors. The audit committee also discussed with Ernst & Young LLP, our registered public accounting firm (who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles), the matters required to be discussed by the Statement on Auditing Standards No. 61, “Communication with Audit Committees,” as amended. In addition, the audit committee also received and reviewed the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and discussed with the independent auditors their independence.

In reliance on the review and discussions referred to above, the audit committee recommended to our board of directors, and our board of directors has approved, that the audited consolidated financial statements be included in our Annual Report on Form 10-K for the fiscal year ended June 30, 2006, filed with the SEC.

This report was approved by the current members of the audit committee on September 12, 2006.

The Audit Committee

Paul J. Konigsberg, Chairman

Gerald Angowitz

Daniel Hébert

18

COMPENSATION COMMITTEE’S REPORT ON EXECUTIVE COMPENSATION

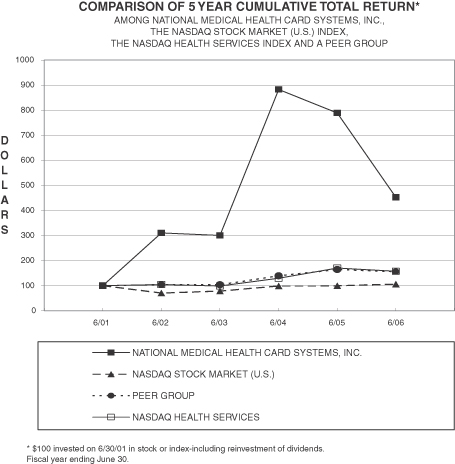

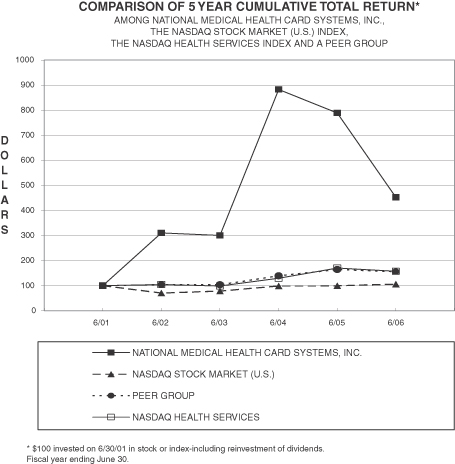

The following Report of the compensation committee of our board of directors and the performance graph included elsewhere in this proxy statement do not constitute soliciting material and should not be deemed filed or incorporated by reference into any other filings by us under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent we specifically incorporate this Report or the performance graph by reference therein.

The following is a summary of the compensation practice and philosophy that was in effect for us for the fiscal year ended June 30, 2006. Modifications to such philosophy have been and may continue to be made.

Compensation Philosophy

Our executive compensation program is designed to attract, motivate and retain management with incentives linked to financial performance and enhanced stockholder value. The compensation committee seeks to adjust compensation levels (through competitive base salaries, bonus payments and stock option grants) based on individual and our financial performance.

Compensation Program Components

Our compensation program currently consists of a number of components, including a cash salary, an executive bonus pool and stock option and restricted stock grants. The compensation committee has retained outside compensation consultants to assist in its evaluation of executive officer compensation arrangements.

Salary and bonus levels reflect job responsibility, seniority, compensation committee judgments of individual effort and performance, and our financial and market performance (in light of the competitive environment in which we operate). In considering our financial and market performance, the compensation committee reviews, among other things, net income, cash flow, working capital and revenues, and share price performance relative to comparable companies and historical performance. Annual cash compensation is also influenced by compensation practices of competitive companies of comparable size in similar industries, as well as that of companies not in our industry which do business in locations where we have operations. Based in part on this information, the compensation committee generally targets salaries at levels comparable to the median of the range of salaries paid by competitors of a comparable size.