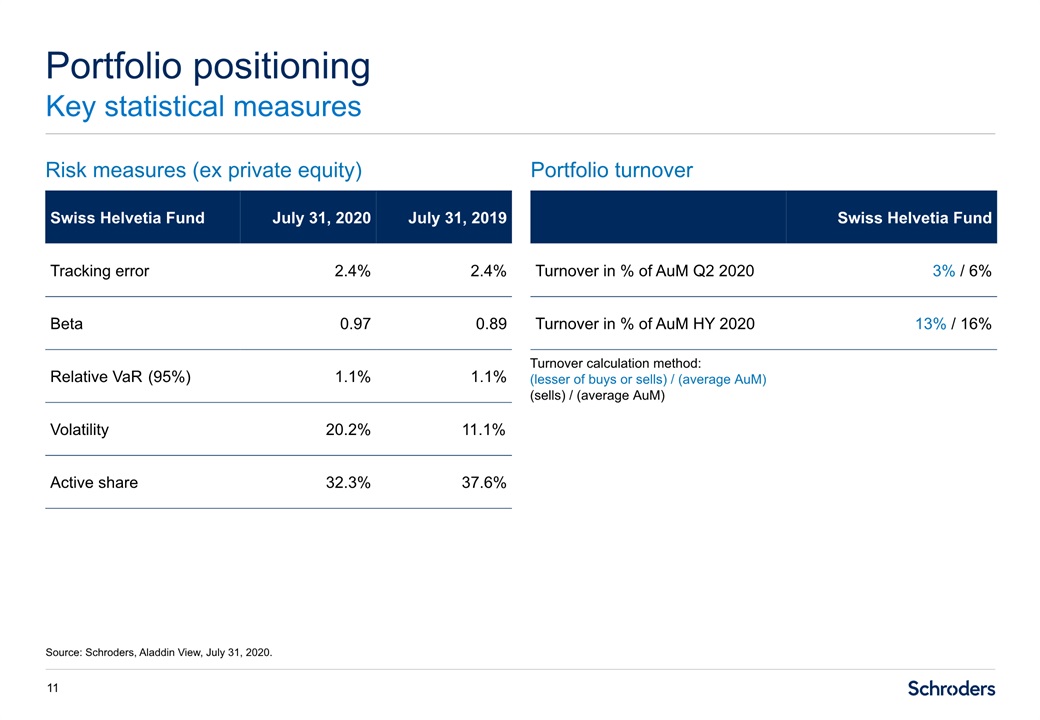

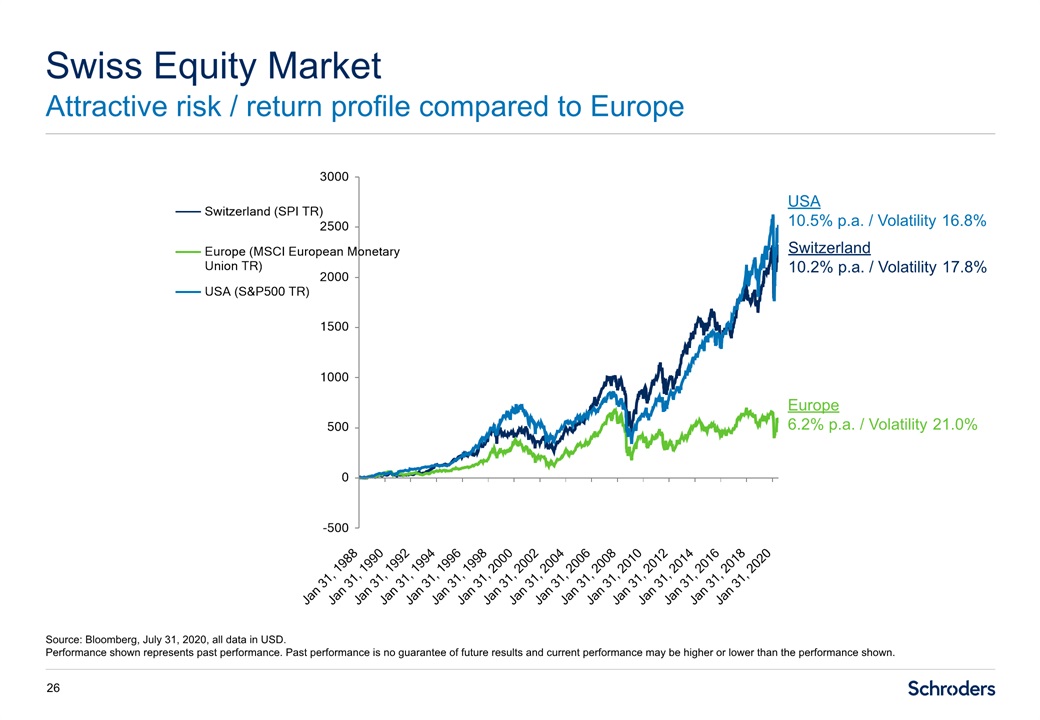

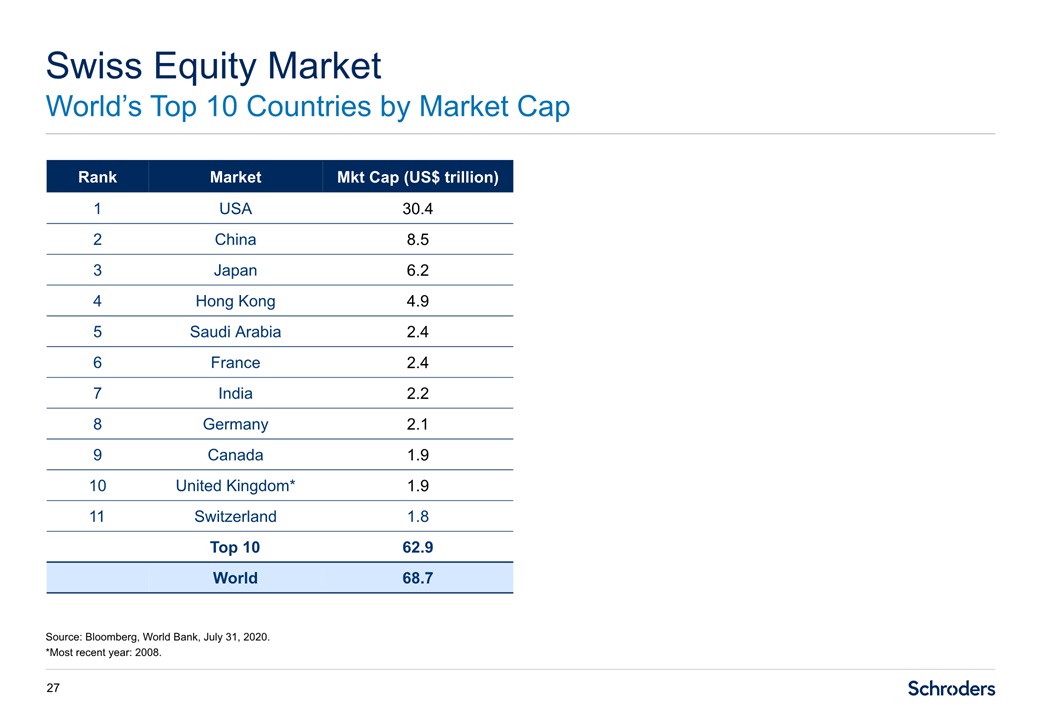

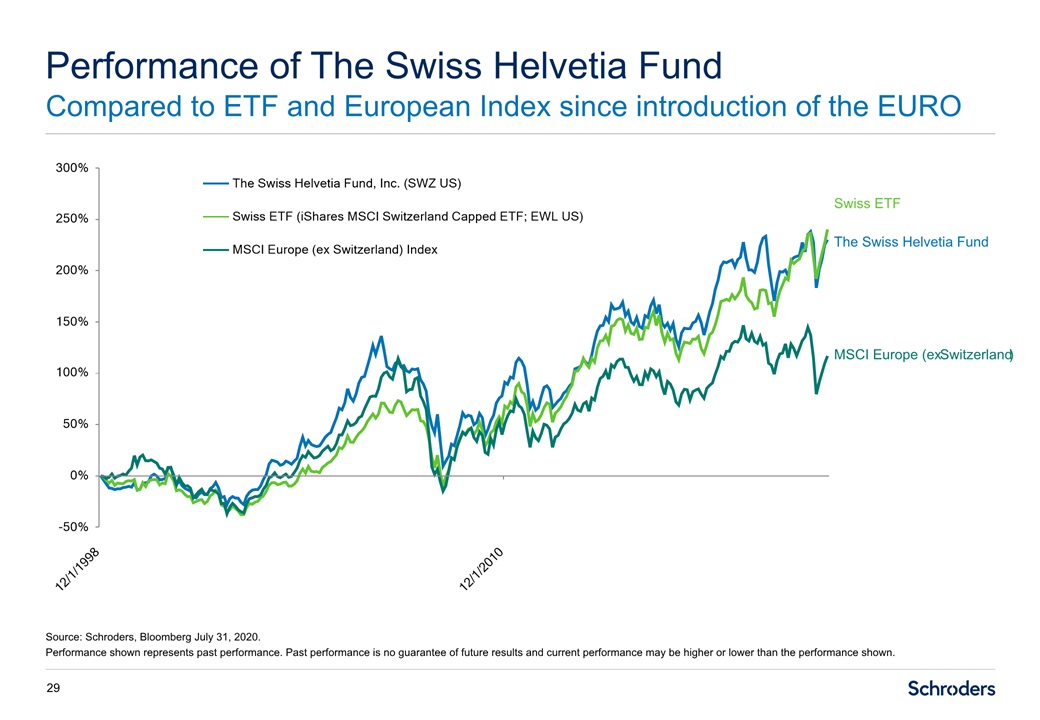

Important information 30 The Fund is a closed-end investment product. Common stock of the Fund is only available for purchase/sale on the NYSE at the then current market price. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.This presentation is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of the Fund’s shares or any other financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management North America Inc. does not warrant its completeness or accuracy.The returns presented represent past performance and are not necessarily representative of future returns, which may vary. The value of investments can fall as well as rise as a result of market or currency movements.All investments, domestic and foreign, involve risks, including the risk of possible loss of principal. The market value of a fund’s portfolio may decline as a result of a number of factors, including adverse economic and market conditions, prospects of stocks in the portfolio, changing interest rates, and real or perceived adverse competitive industry conditions. Investing overseas involves special risks including among others risks related to political or economic instability, foreign currency (such as exchange, valuation, and fluctuation) risk, market entry or exit restrictions, illiquidity, and taxation. The Swiss securities markets have substantially less trading volume than the U.S. securities markets. Additionally, the capitalization of the Swiss securities markets is highly concentrated. Securities of some companies located in Switzerland will be less liquid and more volatile than securities of comparable U.S. companies. This combination of lower volume and greater concentration in the Swiss securities markets may create a risk of greater price volatility than in the U.S. securities markets. The views and forecasts contained herein are those of the Schroders Swiss Equities team and are subject to change. The information and opinions contained in this document have been obtained from sources we consider to be reliable. No responsibility can be accepted for errors of facts obtained from third parties. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.Definitions: Active share represents the proportion of stock holdings in the Fund that is different from the properties found in the benchmark. Beta measures the sensitivity of the Fund to the movements of its benchmark. Volatility is measured by Standard deviation, which is the risk or volatility of an investment’s return over a particular time period; the greater the number, the greater the risk or volatility. Tracking error is the difference between the price behavior of a position or a portfolio and the price behavior of a benchmark. VaR is Value at Risk, a widely used risk measure of the risk of loss on a specific portfolio of financial exposures.For more information, visit www.swzfund.com