THE SWISS HELVETIA FUND, INC.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission (“SEC”), paper copies of the Fund’s shareholder reports will no longer be sent by U.S. mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website (www.swzfund.com), and you will be notified by U.S. mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications electronically by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can follow the instructions included with this disclosure, if applicable, or you can contact your financial intermediary to inform it that you wish to continue receiving paper copies of your shareholder reports. If you invest directly with the Fund, you can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by calling (800)-730-2932 or email swzintermediary@schroders.com. Your election to receive reports in paper will apply to all funds held with your financial intermediary.

THE SWISS HELVETIA FUND, INC.

Managed Distribution Policy Disclosure

In May 2018, The Swiss Helvetia Fund, Inc. (the “Fund”), acting pursuant to an SEC exemptive order and with the approval of the Fund’s Board of Directors (the “Board”), adopted a managed distribution policy. Under that policy, as resumed by the Board and announced in November 2019, the Fund will pay a quarterly distribution stated in terms of a fixed amount of $0.1404 per share of the Fund’s common stock, which equates to an annualized distribution rate of 6.00% based on the Fund’s net asset value of $9.36 as of October 31, 2019. In accordance with the policy, the Fund distributed on March 31, 2020 and June 29, 2020, $0.1404 per share to stockholders of record on March 23, 2020 and June 22, 2020.

You should not draw any conclusions about the Fund’s investment performance from the amount of the Fund’s distribution or from the terms of the Fund’s managed distribution policy. The Board may amend or terminate the managed distribution policy at any time without prior notice to Fund stockholders, which could have an adverse effect on the market price of the Fund’s shares.

With each distribution, the Fund will issue a notice to stockholders and a press release which will provide detailed information regarding the amount and composition of the distribution and other related information. The amounts and sources of distributions reported in the notice to stockholders are only estimates, are likely to change over time, and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. The Fund will send you a Form 1099- DIV for the calendar year that will tell you how to report these distributions for federal income tax purposes. Please refer to “Federal Income Tax and Investment Transactions” under Note 5 of the Notes to Financial Statements for information regarding the tax character of the Fund’s distributions. A copy of the Fund’s Section 19(a) notices is available on the Fund’s website at www.swzfund.com.

The Fund’s total return in relation to changes in net asset value is presented in the Financial Highlights.

THE SWISS HELVETIA FUND, INC.

Dear Stockholder,

We are pleased to provide the Semi-Annual Report for The Swiss Helvetia Fund, Inc. (the “Fund”) for the six-month period ended June 30, 2020.

The onset of the COVID-19 pandemic brought with it significant challenges and uncertainties, including severe adverse economic impacts. After a major crash in global equity markets in March, governmental response in the form of fiscal and monetary stimulus was followed by securities markets recovering, albeit unevenly and accompanied with great volatility. As I write this letter, both the Fund’s per share net asset value and market price have recovered a large part of their March declines. However, over the six-month period the discount to net asset value per share has widened.

I would like to remind you that at the end of 2019 the Fund announced that the Board of Directors approved the resumption of its managed distribution plan in the form of quarterly distributions at an annualized distribution rate of 6.00% of the Fund’s net asset value of $9.36 per share as of October 31, 2019.

In addition, the Board of Directors previously approved a stock repurchase program for 2020 pursuant to which the Fund may purchase up to 250,000 shares of its common stock. The principal purpose of the stock repurchase program is to enhance stockholder value by increasing the Fund’s net asset value per share.

Detailed comments regarding the Swiss economy and market environment follow in the Management Discussion and Analysis.

On behalf of the Board, I thank you for your investment in the Fund.

Sincerely yours,

Andrew Dakos

Chairman

THE SWISS HELVETIA FUND, INC.

Management Discussion and Analysis (as of June 30, 2020)

For the six-month period ended June 30, 2020, the performance of The Swiss Helvetia Fund, Inc. (the “Fund”), as measured by the change in value in the Fund’s net asset value (“NAV”), decreased -1.35% in US dollars (“USD”). For the same period, the Fund’s share price performance decreased -3.01% in USD, as the discount at which the Fund traded its shares slightly increased. This compares with a decrease of -0.98% in the Swiss Performance Index (the “Index” or “SPI”) in USD.

Economic environment during the period under review

Global economic review

The macro-economic environment in the first half of 2020 was dominated by uncertainties due to the worldwide outbreak of COVID-19. As many countries imposed lockdowns in late March, growth slumped in April.

Central banks were at the forefront of the policy response and unleashed unprecedented monetary stimuli. Vast amounts of liquidity were supplied to the financial system and into the non-bank private sector. In addition, the Federal Reserve purchased over 1 trillion USD of government bonds and the European Central Bank committed to buy up to 1.35 trillion EUR of securities.

Massive fiscal stimulus packages were administered globally. Temporary solutions, such as employee furloughs, provided financial buffers to companies that saw demand collapse. Many businesses implemented further cost saving measures. Industries expecting longer lasting downturns, such as aviation, announced deeper cuts to their workforce. Unsurprisingly, unemployment skyrocketed in many parts of the world.

While the full economic impact of the COVID-19 pandemic will depend on the timing of the disease’s spread, many nations felt its impact as early as in the first quarter (Q1). Swiss Gross Domestic Product (“GDP”) declined by -2.6% in Q1, performing slightly better than that of the European Union, which fell by -3.2%. Being the first to experience the onset of COVID-19 in 2020, China’s GDP fell by -9.8% in Q1. In contrast, the United States’ GDP contracted by only -1.3% in the same period. Second quarter (Q2) figures are expected to bear the brunt of the slowdown in the majority of economies, with the exception of China, which may already be on the path to recovery (at the time of writing, China’s Q2 GDP data had not been released).

The shape and speed of the recovery will depend on the pandemic’s evolution and the economic damage it causes. While early signs of recovery in Europe and

THE SWISS HELVETIA FUND, INC.

China are encouraging, it remains to be seen how the world economy will cope with the repercussions of COVID-19.

Market environment during the period under review

Worldwide equities rose until February, recording several new or all-time highs despite the COVID-19 outbreak in China. When the disease appeared to be contained and limited to China, with few isolated cases elsewhere, market participants seemed optimistic and appeared to regard the drop in the stock market as a temporary one that would recover shortly. In our view, this optimistic attitude changed as the disease spread to other countries in larger numbers on the weekend of February 21-22, 2020. Over that weekend, major stock indices experienced one of the steepest declines in history, losing more than one-third from top to bottom in local currency (with the exception of the Swiss Performance Index (SPI), which lost “only” -26.3%).

From an intraday low on March 23, 2020, markets then staged a record recovery in one week as massive monetary and fiscal stimuli were announced. The Dow Jones Industrial Average registered its strongest daily rise since 1933. Volatility remained elevated throughout the quarter as market sentiment was closely connected to COVID-19-related headlines. The recovery continued to the end of June, and the year-to-date performance for the benchmark SPI index stood at -0.98% as of June 30, 2020 – a rather benign outcome in light of the intra-period performance range.

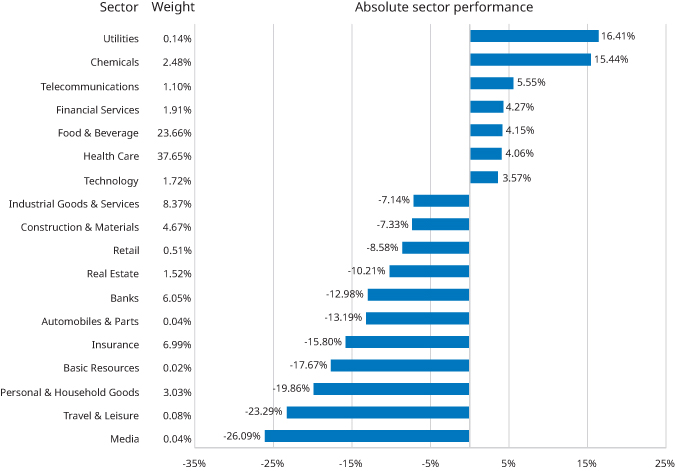

Performance dispersion was high, both from a stock and sector point of view. Generally, technology and telecommunications fared better during the period, as market participants expected the pandemic to accelerate long-term digitization trends such as home office or e-commerce. On the other hand, investors seem to expect longer lasting impacts on directly affected sectors such as air travel and retail, where recovery to 2019 levels may take several years.

On an individual level, companies with strong fundamentals typically outperformed as investors sought stocks with solid balance sheets, good margins and proven business models.

Overall, Swiss equities retreated by -0.98% (in USD) in the first half of 2020 as measured by the SPI, outperforming international peers; MSCI World’s, MSCI Europe’s and S&P 500’s total returns in USD for the first 6 months of 2020 were -5.47%, -12.35% and -3.09%, respectively. This comes after the SPI’s increase of 32.82% in 2019. Small- and mid-caps, represented by the SPI Extra Index (SPIEX), underperformed large caps, which were represented by the Swiss Market Index Total Return (SMIC), by -4.51% in USD.

THE SWISS HELVETIA FUND, INC.

Swiss Performance Index for the first half 2020

Source: Schroders, Bloomberg, as of June 30, 2020. Performance measured as total return in USD. Sectors mentioned should not be viewed as a recommendation to buy/sell. Portfolio composition is subject to change over time. Investors cannot invest directly in the Index.

Performance

Despite strong stock picking, the Fund’s NAV return of -1.35% was behind the Index’s return of -0.98% in USD for the period under review. We believe that the first half of 2020 was a tale of three cities, and so the Fund’s relative performance should be separately assessed for the three periods discussed below.

The initial phase (December 31, 2019 through February 19, 2020) was essentially a continuation of the dynamics seen in

THE SWISS HELVETIA FUND, INC.

2019. In this momentum-driven period, our bias towards value detracted as growth continued to outperform. Our underweight in large caps also contributed adversely, as the large cap index ‘SMI Total Return Index’ (SMIC index) outperformed the small- and mid-cap index ‘SPI Extra Total Return Index’ (SPIEX index) by +2.0%. During this market phase, the largest positive contributions to relative performance came from overweight positions in BKW, VZ Holding and Cembra Money Bank. Negative contributions were attributable to underweight positions in Lonza, Alcon and Givaudan, as well as the Fund’s overweight position in Logitech.

During the severe market downturn (February 19, 2020 through March 23, 2020), the Fund outperformed the benchmark SPI by roughly +1.6% thanks to strong stock selection. It came as a surprise that value continued to trail growth in this market phase. Therefore, we believe the Fund’s focus on quality led to outperformance, as investors sought stocks with strong balance sheets and proven business models. The Fund’s underweight positions in large caps (SMIC index vs SPIEX index +4.2%) continued to drag on relative performance. The Fund’s underweight positions in Swiss Re, and cyclically exposed names such as LafargeHolcim and Adecco, were key contributors to the Fund’s solid relative performance. Logitech was also strongly positive.

The last phase of the period (March 23, 2020 through June 30, 2020) was characterized by strong market recovery. Relative performance was negative in this rebound phase. Our focus on quality was rewarded, as overweight positions in Logitech, Swiss Life, VZ Holding and Tecan had the largest positive impacts on relative performance. Negative impacts were mainly attributable to underweight positions in large caps such as Lonza, Alcon, Swiss Re and LafargeHolcim. Our overweight in value again detracted from performance.

Overall, the Fund underperformed its benchmark by -0.4% in the first half of 2020 despite what we believe to be strong stock selection. While large cap outperformance was a significant headwind (SMIC index vs SPIEX index +4.5% in USD), it is important to note that stock selection was positive during the market turmoil, as our focus on quality paid off. Strong stock picking was also able to partially compensate for the significant and surprising underperformance of value (MSCI Switzerland Small & Mid Cap Growth outperformed its value counterpart by +16.2% in H1). Sector allocation was negative, in part because of our underweight positions in healthcare (due to the Fund’s industry concentration limitations) and consumer staples (e.g., our intentional decision to hold an underweight position in Nestlé, which

THE SWISS HELVETIA FUND, INC.

accounts for approximately 20% of the benchmark, which we believe is too much exposure to a single stock). Our overweight in financials also detracted from performance.

The Fund’s private equity positions as a whole experienced some changes in valuation as Selfrag was revalued downwards by more than 70%, and Spinearts was revalued upwards by roughly 50%. Overall, private equity positions had a positive absolute and relative impact on performance. Cash holdings had a neutral impact on relative performance in the first half of 2020.

Portfolio changes

In total, there were fourteen purchases and seventeen sales of listed equities on a net basis in the first half of 2020. As of June 30, 2020, there were thirty-five listed companies held by the Fund and five direct private equity investments, including one participation in a private equity limited partnership.

THE SWISS HELVETIA FUND, INC.

New Investments by the Fund

ams

Geberit

SGS

SoftwareOne

Swiss Re

Additions to Existing Investments

ABB

Helvetia

Nestlé

Partners Group

Richemont

Schindler

SFS

Swiss Life

Zurich

Positions Entirely Disposed of

Aryzta

Bucher

Feintool

Implenia

Kuros

Sunrise

Reductions in Existing Investments

Belimo

BKW

Cembra Money Bank

Credit Suisse

Galenica

Julius Baer

Logitech

Sulzer

Tecan

UBS

VZ Holding

The Fund established new positions in ams, Geberit, SGS, SoftwareOne and Swiss Re.

ams is a semi-conductor manufacturer that supplies facial recognition technology for Apple’s iPhones. We bought a new position in May after a stark underperformance year-to-date. We believe this underperformance was in part due to the announced acquisition of Osram and the related capital increase, which led to a significant dilution. The capital increase was underwritten during the COVID-19 crisis and its success was uncertain in our view. We bought a new position only after the capital increase, as we believed downside risks were fully priced in at such a discount to fair value and saw risk tilted to the upside.

SoftwareOne is an information and communications technology company that provides consulting services on technology trends, software licensing and procurement. We started building a position in SoftwareOne after the market sold off huge quantities in March. There is almost no company not impacted by the COVID-19 crisis, but we expect SoftwareOne’s, revenues and profits to

THE SWISS HELVETIA FUND, INC.

grow – an admirable prospect in comparison to other companies that may see sales decline.

Furthermore, we opportunistically built positions in Geberit, SGS and Swiss Re as their share prices unduly corrected, each of which we believe are quality companies.

Geberit is a manufacturer and supplier of sanitary parts. We believe the company has high quality products, strong management and a solid balance sheet. We expect the construction market to be less affected by the COVID-19 outbreak, especially in key markets such as Germany. SGS is a world leader in testing and certification, with high margins and stable earnings. We decreased our underweight in Swiss Re when it fell below book value after it surprised the market once more with a reserve strengthening in its ailing corporate solutions division. While we are still skeptical of Swiss Re’s venture into first line insurance, we expect its re-insurance division to be highly profitable.

During this period of heightened volatility, we actively managed our portfolio. We increased a number of positions, such as Richmont and SFS, where we saw valuations at attractive levels due to their long-term earnings development potential.

We also took advantage of the market sell off to add to positions that we felt had over-corrected, especially in the insurance sector (Helvetia, Swiss Life, Zurich). Many insurance companies did not rebound as quickly as companies in the financial sector, but we believe that the overall implications of COVID-19 on the industry are likely overstated and that the Fund has invested in companies with solid capital positions.

We also reduced our underweight in ABB, Nestlé and Schindler.

On the other hand, we entirely sold our positions in Aryzta, Bucher, Feintool, Implenia, Kuros and Sunrise. While we were convinced that Aryzta was well underway in terms of its reorganization and debt reduction, we also believed that it was particularly vulnerable to the COVID-19 crisis, as its restaurant and hotel clients were forced to close during lockdown. As a result, we felt another capital increase could not be ruled out at this point. We sold the remaining position in Bucher, as the COVID-19 crisis’ impact on the conglomerate is difficult to predict, and Feintool due to its above average exposure to the ailing automotive sector.

We exited our positions in Implenia after its strong rebound, as well as in Kuros and Sunrise, as we see better opportunities elsewhere.

We also reduced our investment – mainly to take profits after strong relative share price developments – in a number of stocks such as Belimo, BKW, Galenica, Logitech, Tecan and VZ Holding. We reduced Sulzer before the COVID-19 crisis, as one of its non-core divisions, applicator

THE SWISS HELVETIA FUND, INC.

systems, saw growth stall. We expect this division to absorb a lot of management attention due to an important shift in client demand.

Within the finance sector, we reduced UBS and Credit Suisse. While their investment banking divisions might benefit from the higher trading activities in the short-term, we believe that a slower economy, more cautious investor behavior and an abundance of interest free liquidity might neutralize profits, especially in investment banking.

Outlook and Investment View

The United States, having been affected by COVID-19 at a later stage, still has some lockdown measures in place at the time of this writing. However, in most Asian and European countries, similar lockdown measures, which had severely reduced economic activity, have been reversed partially or almost entirely. In our view, this reversal bodes well for an expected rebound in the second half of 2020. We expect that after a very negative Q2, the remaining half of the year will see economic growth, albeit only when measured against preceding quarters, and not when compared with the same quarters 12 months prior. On this latter measure, we believe that positive outcomes may not be registered until the second quarter of 2021 in most countries. We expect the year 2020 as a whole will be one of GDP shrinkage in many parts of the world, and we anticipate that 2019 GDP levels may not be achieved again until 2022. Furthermore, we expect only fast growing or early COVID-19 affected countries to reach 2019 levels in 2021.

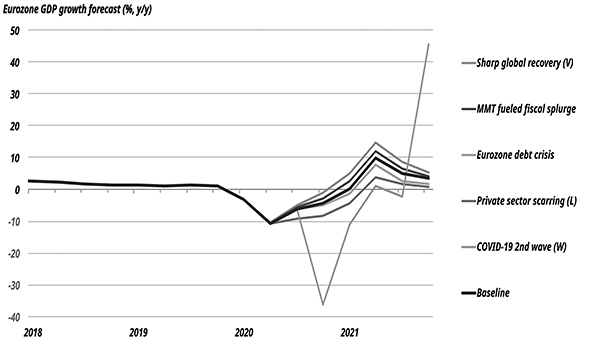

The economic outlook depends on avoiding future waves of re-infection. Most forecasts assume no new lockdowns or self-imposed isolation by consumers. Alternatively, scenarios with more rapid recoveries are possible, which would likely be reliant on a combination of even more monetary or fiscal intervention and/or mass vaccination. The charts below illustrate the stark difference in estimated GDP levels in the Eurozone, and their rate of change predicted under different scenarios. Any forecast will therefore be more prone to changes than under what are considered ‘normal conditions’.

THE SWISS HELVETIA FUND, INC.

Source: Schroders Economics Group. May 28, 2020. Please note the forecast warning at the back of the document.

Putting aside the potential for mass vaccinations, we believe that the most important factors for the stock market’s recovery are central bank and fiscal policies. Generally, corporate earnings depend on the economic environment, which in turn is heavily influenced by monetary and fiscal intervention. We therefore believe that the general environment for stocks will remain favorable in the medium to long-term, as it has become increasingly difficult for central banks and governments to roll back their stimulus. Put differently, we view their reaction to the COVID-19 outbreak as an acceleration on a path on which they had already embarked. We believe the historical performance of the Swiss Performance Index supports this conclusion, as it has continued on its five-year trend, despite the recent sharp contraction. And, although the market is lower than at the start of the year, Swiss stocks have still enjoyed positive performance over the past 12 months. This does not mean that we expect a steady continuation. To the contrary, we expect generally higher volatility levels. However, the direction of the stock market still reflects an upward trend.

THE SWISS HELVETIA FUND, INC.

Source: SIX Group; https://www.six-group.com/exchanges/indices/security_info_de.html?id=CH0009987501CHF9, as of July 6, 2020.

This trend is also underpinned by a change in sentiment towards company earnings. Whereas fundamentals were very opaque three months ago and earnings downgrades have been significant since the beginning of the COVID-19 crisis in Europe and the U.S., we believe that many companies have demonstrated good crisis management. Earnings are clearly down year-on-year for the universe in which the Fund invests as a whole, but we are optimistic that the situation will be better than many had predicted as of the beginning of the second quarter. For example, depending on end markets, revenues may be more stable than anticipated. We also anticipate better than expected margins, thanks to rigorous cost management and unprecedented government support in countries like Switzerland and Germany. Furthermore, we expect lower raw material prices to provide relief. While we believe that it is still too early to be overly optimistic, it seems very possible that worst case scenarios, in terms of company fundamentals, may be avoided.

THE SWISS HELVETIA FUND, INC.

Within Swiss equities, in the second half of 2020, we anticipate a modest rotation towards stocks that have been lagging in recovery so far. We believe that these stocks tend to be more tilted towards value than growth style. A prime example is insurance, where we have increased the Fund’s position since the onset of the COVID-19 crisis. Cyclical consumer stocks are another example, and we also believe that a number of industrial and material stocks have more room for recovery. At the same time, we will seek to reduce the Fund’s positions in stocks that we believe are unjustifiably trading above pre-COVID-19 levels.

THE SWISS HELVETIA FUND, INC.

Schedule of Investments by Industry (Unaudited)

| June 30, 2020 |

| | | | | | | | Percent | |

| No. of | | | | Fair | | | of Net | |

| Shares | | Security | | Value | | | Assets | |

| Common Stock — 91.53% | |

| | |

| Advertising — 0.94% | |

| | | | | | | | | | | | |

| | 17,914 | | DKSH Holding AG | | $ | 1,149,460 | | | | 0.94 | % |

| | | | An international | | | | | | | | |

| | | | marketing and services | | | | | | | | |

| | | | group. The company | | | | | | | | |

| | | | offers a comprehensive | | | | | | | | |

| | | | package of services that | | | | | | | | |

| | | | includes organizing and | | | | | | | | |

| | | | running the entire value | | | | | | | | |

| | | | chain for any product. | | | | | | | | |

| | | | (Cost $1,176,534) | | | | | | | | |

| | | | | | | 1,149,460 | | | | 0.94 | % |

| Banks — 3.31% | |

| | | | | | | | | | | | |

| | 10,700 | | Cembra Money Bank AG | | | 1,045,101 | | | | 0.85 | % |

| | | | Provides financial services. | | | | | | | | |

| | | | The company’s services | | | | | | | | |

| | | | include personal loans, | | | | | | | | |

| | | | vehicle financing, credit | | | | | | | | |

| | | | cards and savings and | | | | | | | | |

| | | | insurance services. | | | | | | | | |

| | | | (Cost $636,061) | | | | | | | | |

| | | | | | | | | | | | |

| | 87,000 | | Credit Suisse Group AG | | | 899,611 | | | | 0.73 | % |

| | | | A global diversified | | | | | | | | |

| | | | financial services company | | | | | | | | |

| | | | with significant activity in | | | | | | | | |

| | | | private banking, | | | | | | | | |

| | | | investment banking and | | | | | | | | |

| | | | asset management. | | | | | | | | |

| | | | (Cost $1,092,254) | | | | | | | | |

| | | | | | | | | | | | |

| | 184,000 | | UBS Group AG | | | 2,117,587 | | | | 1.73 | % |

| | | | Provides retail banking, | | | | | | | | |

| | | | corporate and institutional | | | | | | | | |

| | | | banking, wealth | | | | | | | | |

| | | | management, asset | | | | | | | | |

| | | | management and | | | | | | | | |

| | | | investment banking. | | | | | | | | |

| | | | (Cost $2,541,374) | | | | | | | | |

| | | | | | | 4,062,299 | | | | 3.31 | % |

| Building Materials — 3.14% | |

| | | | | | | | | | | | |

| | 145 | | Belimo Holding AG | |

| 1,066,593 | | | | 0.87 | % |

| | | | Market leader in damper | | | | | | | | |

| | | | and volume control | | | | | | | | |

| | | | actuators for ventilation | | | | | | | | |

| | | | and air-conditioning | | | | | | | | |

| | | | equipment. | | | | | | | | |

| | | | (Cost $344,115) | | | | | | | | |

| | | | | | | | | | | | |

| | 660 | | Forbo Holding AG | | | 955,643 | | | | 0.78 | % |

| | | | Produces floor coverings, | | | | | | | | |

| | | | adhesives and belts for | | | | | | | | |

| | | | conveying and | | | | | | | | |

| | | | power transmission. | | | | | | | | |

| | | | (Cost $1,054,700) | | | | | | | | |

| | | | | | | | | | | | |

| | 1,900 | | Geberit AG | | | 950,852 | | | | 0.77 | % |

| | | | Manufactures and supplies | | | | | | | | |

| | | | water supply pipes and | | | | | | | | |

| | | | fittings, installation, and | | | | | | | | |

| | | | drainage and flushing | | | | | | | | |

| | | | systems such as visible | | | | | | | | |

| | | | cisterns other sanitary | | | | | | | | |

| | | | systems for the commercial | | | | | | | | |

| | | | and residential | | | | | | | | |

| | | | construction markets. | | | | | | | | |

| | | | (Cost $898,622) | | | | | | | | |

| | | | | | | | | | | | |

| | 4,600 | | Sika AG | | | 885,241 | | | | 0.72 | % |

| | | | Manufactures construction | | | | | | | | |

| | | | materials, producing | | | | | | | | |

| | | | concrete and mixtures, | | | | | | | | |

| | | | mortar, sealants and | | | | | | | | |

| | | | adhesives, tooling resins, | | | | | | | | |

| | | | anti-static industrial | | | | | | | | |

| | | | flooring, and acoustic | | | | | | | | |

| | | | materials. The company | | | | | | | | |

| | | | serves customers worldwide. | | | | | | | | |

| | | | (Cost $667,979) | | | | | | | | |

| | | | | | | 3,858,329 | | | | 3.14 | |

See Notes to Financial Statements.THE SWISS HELVETIA FUND, INC.

Schedule of Investments by Industry (Unaudited)

| June 30, 2020 |

| (continued) | |

| | | | | | | | Percent | |

| No. of | |

| | Fair |

|

| of Net | |

| Shares | | Security | | Value | | | Assets | |

| Common Stock — (continued) | | | | |

| | |

| Commercial Services — 0.83% | |

| | | | | | | | | | | | |

| | 418 | | SGS SA | | $ | 1,021,234 | | | | 0.83 | % |

| | | | Provides industrial | | | | | | | | |

| | | | inspection, analysis, | | | | | | | | |

| | | | testing, and | | | | | | | | |

| | | | verification services. | | | | | | | | |

| | | | (Cost $1,065,433) | | | | | | | | |

| | | | | | | 1,021,234 | | | | 0.83 | % |

| Computers — 4.22% | |

| | | | | | | | | | | | |

| | 66,542 | | Logitech | | | | | | | | |

| | | | International SA | | | 4,344,138 | | | | 3.53 | % |

| | | | Engages in the | | | | | | | | |

| | | | development and | | | | | | | | |

| | | | marketing of hardware | | | | | | | | |

| | | | and software products | | | | | | | | |

| | | | that enable or enhance | | | | | | | | |

| | | | digital navigation, music | | | | | | | | |

| | | | and video entertainment, | | | | | | | | |

| | | | gaming, social networking | | | | | | | | |

| | | | and audio and video | | | | | | | | |

| | | | communication. | | | | | | | | |

| | | | (Cost $902,190) | | | | | | | | |

| | | | | | | | | | | | |

| | 34,359 | | SoftwareONE | | | | | | | | |

| | | | Holding AG1 | | | 848,505 | | | | 0.69 | % |

| | | | Provides IT services. The | | | | | | | | |

| | | | Company offers cloud | | | | | | | | |

| | | | computing, portfolio | | | | | | | | |

| | | | management, | | | | | | | | |

| | | | procurement, | | | | | | | | |

| | | | communication, | | | | | | | | |

| | | | unified and other | | | | | | | | |

| | | | related solutions. | | | | | | | | |

| | | | (Cost $662,431) | | | | | | | | |

| | | | | | | 5,192,643 | | | | 4.22 | % |

| | | | | | | | | | | | |

| Diversified Financial Services — 3.10% | |

| | | | | | | | | | | | |

| | 44,000 | | Julius Baer Group Ltd. | |

| 1,841,169 | | | | 1.50 | % |

| | | | Provides private banking | | | | | | | | |

| | | | services. The company | | | | | | | | |

| | | | advises on wealth | | | | | | | | |

| | | | management, financial | | | | | | | | |

| | | | planning and investments; | | | | | | | | |

| | | | offers mortgage and other | | | | | | | | |

| | | | lending, foreign exchange, | | | | | | | | |

| | | | securities trading, custody | | | | | | | | |

| | | | and execution services. | | | | | | | | |

| | | | (Cost $2,063,888) | | | | | | | | |

| | | | | | | | | | | | |

| | 26,333 | | VZ Holding AG | | | 1,967,576 | | | | 1.60 | % |

| | | | Provides independent | | | | | | | | |

| | | | financial advice to private | | | | | | | | |

| | | | individuals and companies. | | | | | | | | |

| | | | The company consults on | | | | | | | | |

| | | | investment, tax and | | | | | | | | |

| | | | inheritance planning and | | | | | | | | |

| | | | provides advice regarding | | | | | | | | |

| | | | insurance products | | | | | | | | |

| | | | and coverage. | | | | | | | | |

| | | | (Cost $868,561) | | | | | | | | |

| | | | | | | 3,808,745 | | | | 3.10 | % |

| Electric — 1.64% | |

| | | | | | | | | | | | |

| | 22,454 | | BKW AG | | | 2,014,237 | | | | 1.64 | % |

| | | | Provides energy supply | | | | | | | | |

| | | | services. The company | | | | | | | | |

| | | | focuses on the production, | | | | | | | | |

| | | | transportation, trading and | | | | | | | | |

| | | | sale of energy. In addition | | | | | | | | |

| | | | to energy supply, the | | | | | | | | |

| | | | company also develops, | | | | | | | | |

| | | | implements and operates | | | | | | | | |

| | | | energy solutions for | | | | | | | | |

| | | | its clients. | | | | | | | | |

| | | | (Cost $1,446,175) | | | | | | | | |

| | | | | | | 2,014,237 | | | | 1.64 | % |

See Notes to Financial Statements.THE SWISS HELVETIA FUND, INC.

Schedule of Investments by Industry (Unaudited)

| June 30, 2020 |

| (continued) | |

| | | | | | | | Percent | |

| No. of | | | | Fair | | | of Net | |

| Shares | | Security | | Value | | | Assets | |

| Common Stock — (continued) | |

| | |

| Electronics — 2.15% | |

| | | | | | | | | | | | |

| | 117,603 | | ABB Ltd. | | $ | 2,647,324 | | | | 2.15 | % |

| | | | Provides power and | | | | | | | | |

| | | | automation technologies. | | | | | | | | |

| | | | The company operates | | | | | | | | |

| | | | under segments that | | | | | | | | |

| | | | include power products, | | | | | | | | |

| | | | power systems, automation | | | | | | | | |

| | | | products, process | | | | | | | | |

| | | | automation, and robotics. | | | | | | | | |

| | | | (Cost $2,789,788) | | | | | | | | |

| | | | | | | 2,647,324 | | | | 2.15 | % |

| Food — 17.30% | |

| | | | | | | | | | | | |

| | 192,300 | | Nestlé SA | | | 21,256,400 | | | | 17.30 | % |

| | | | One of the world’s | | | | | | | | |

| | | | largest food and beverage | | | | | | | | |

| | | | processing companies. | | | | | | | | |

| | | | (Cost $12,374,998) | | | | | | | | |

| | | | | | | 21,256,400 | | | | 17.30 | % |

| Hand/Machine Tools — 0.87% | |

| | | | | | | | | | | | |

| | 4,550 | | Schindler Holding AG | | | 1,070,814 | | | | 0.87 | % |

| | | | Manufactures and installs | | | | | | | | |

| | | | elevators, escalators, and | | | | | | | | |

| | | | moving walkways | | | | | | | | |

| | | | internationally. The | | | | | | | | |

| | | | company’s products are | | | | | | | | |

| | | | used in airports, subway | | | | | | | | |

| | | | stations, railroad terminals, | | | | | | | | |

| | | | shopping centers, cruise | | | | | | | | |

| | | | ships, hotels, and office | | | | | | | | |

| | | | buildings. The company | | | | | | | | |

| | | | also offers | | | | | | | | |

| | | | maintenance services. | | | | | | | | |

| | | | (Cost $977,749) | | | | | | | | |

| | | | | | | 1,070,814 | | | | 0.87 | % |

| Healthcare-Products — 4.37% | |

| | | | | | | | | | | | |

| | 125,416 | | Eyesense AG, | | | | | | | | |

| | | | Series A1,2,3 | |

| 231,627 | | | | 0.19 | % |

| | | | A spin-out from Ciba | | | | | | | | |

| | | | Vision AG. Develops novel | | | | | | | | |

| | | | ophthalmic self- diagnostic | | | | | | | | |

| | | | systems for glucose | | | | | | | | |

| | | | monitoring of | | | | | | | | |

| | | | diabetes patients. | | | | | | | | |

| | | | (Cost $3,007,048) | | | | | | | | |

| | | | | | | | | | | | |

| | 5,486 | | Sonova Holding AG | | | 1,095,116 | | | | 0.89 | % |

| | | | Designs and produces | | | | | | | | |

| | | | wireless analog and digital | | | | | | | | |

| | | | in-the-ear and behind-the- | | | | | | | | |

| | | | ear hearing aids and | | | | | | | | |

| | | | miniaturized voice | | | | | | | | |

| | | | communications systems. | | | | | | | | |

| | | | (Cost $846,271) | | | | | | | | |

| | | | | | | | | | | | |

| | 311,950 | | Spineart SA1,2,3 | | | 1,646,087 | | | | 1.34 | % |

| | | | Designs and markets an | | | | | | | | |

| | | | innovative full range of | | | | | | | | |

| | | | spine products, including | | | | | | | | |

| | | | fusion and motion | | | | | | | | |

| | | | preservation devices, | | | | | | | | |

| | | | focusing on easy to implant | | | | | | | | |

| | | | high-end products to | | | | | | | | |

| | | | simplify the surgical act. | | | | | | | | |

| | | | (Cost $2,193,373) | | | | | | | | |

| | | | | | | | | | | | |

| | 6,750 | | Tecan Group AG | | | 2,390,692 | | | | 1.95 | % |

| | | | Manufactures and | | | | | | | | |

| | | | distributes laboratory | | | | | | | | |

| | | | automation components | | | | | | | | |

| | | | and systems. The products | | | | | | | | |

| | | | are mainly used by research | | | | | | | | |

| | | | and diagnostic laboratories. | | | | | | | | |

| | | | (Cost $630,771) | | | | | | | | |

| | | | | | | 5,363,522 | | | | 4.37 | % |

See Notes to Financial Statements.THE SWISS HELVETIA FUND, INC.

Schedule of Investments by Industry (Unaudited)

| June 30, 2020 |

| (continued) | |

| | | | | | | | Percent | |

| No. of | | | | Fair | | | of Net | |

| Shares | | Security | | Value | | | Assets | |

| Common Stock — (continued) | |

| | |

| Healthcare-Services — 0.69% | |

| | | | | | | | | | | | |

| | 11,900 | | Galenica AG | | $ | 851,480 | | | | 0.69 | % |

| | | | Retails pharmaceutical | | | | | | | | |

| | | | products, and services | | | | | | | | |

| | | | customers in Switzerland. | | | | | | | | |

| | | | The Company offers health, | | | | | | | | |

| | | | beauty, and related | | | | | | | | |

| | | | products and services. | | | | | | | | |

| | | | (Cost $613,838) | | | | | | | | |

| | | | | | | 851,480 | | | | 0.69 | % |

| Insurance — 10.40% | |

| | | | | | | | | | | | |

| | 11,780 | | Baloise Holding AG | | | 1,766,596 | | | | 1.44 | % |

| | | | Offers group and | | | | | | | | |

| | | | individual life, health, | | | | | | | | |

| | | | accident, liability property, | | | | | | | | |

| | | | and transportation | | | | | | | | |

| | | | insurance to customers in | | | | | | | | |

| | | | Europe. The Company also | | | | | | | | |

| | | | offers private banking and | | | | | | | | |

| | | | asset management services. | | | | | | | | |

| | | | (Cost $1,835,913) | | | | | | | | |

| | | | | | | | | | | | |

| | 17,064 | | Helvetia Holding AG | | | 1,591,055 | | | | 1.29 | % |

| | | | Provides a broad range of | | | | | | | | |

| | | | life, casualty, liability, | | | | | | | | |

| | | | accident and transportation | | | | | | | | |

| | | | insurance in Switzerland | | | | | | | | |

| | | | and in other European | | | | | | | | |

| | | | countries. The Company | | | | | | | | |

| | | | insures individuals, | | | | | | | | |

| | | | property such as vehicles | | | | | | | | |

| | | | and buildings, and | | | | | | | | |

| | | | consumer goods and | | | | | | | | |

| | | | personal belongings | | | | | | | | |

| | | | (Cost $1,861,988) | | | | | | | | |

| | | | | | | | | | | | |

| | 9,027 | | Swiss Life Holding AG | |

| 3,343,863 | | | | 2.72 | % |

| | | | Provides life insurance | | | | | | | | |

| | | | and institutional | | | | | | | | |

| | | | investment management. | | | | | | | | |

| | | | (Cost $3,134,819) | | | | | | | | |

| | | | | | | | | | | | |

| | 15,082 | | Swiss Re AG | | | 1,162,884 | | | | 0.95 | % |

| | | | Offers reinsurance, | | | | | | | | |

| | | | insurance, and insurance | | | | | | | | |

| | | | linked financial | | | | | | | | |

| | | | market products. | | | | | | | | |

| | | | (Cost $1,232,206) | | | | | | | | |

| | | | | | | | | | | | |

| | 13,950 | | Zurich Insurance | | | | | | | | |

| | | | Group AG | | | 4,920,152 | | | | 4.00 | % |

| | | | Provides insurance-based | | | | | | | | |

| | | | financial services. The | | | | | | | | |

| | | | company offers general | | | | | | | | |

| | | | and life insurance products | | | | | | | | |

| | | | and services for individuals, | | | | | | | | |

| | | | small businesses, | | | | | | | | |

| | | | commercial enterprises, | | | | | | | | |

| | | | mid-sized and large | | | | | | | | |

| | | | corporations, and | | | | | | | | |

| | | | multinational companies. | | | | | | | | |

| | | | (Cost $4,632,059) | | | | | | | | |

| | | | | | | 12,784,550 | | | | 10.40 | % |

| Metal Fabricate/Hardware — 1.02% | |

| | | | | | | | | | | | |

| | 13,400 | | SFS Group AG | | | 1,254,372 | | | | 1.02 | % |

| | | | Provides automotive | | | | | | | | |

| | | | products, building and | | | | | | | | |

| | | | electronic components, | | | | | | | | |

| | | | flat roofing and solar | | | | | | | | |

| | | | fastening systems. The | | | | | | | | |

| | | | company operates | | | | | | | | |

| | | | production facilities in Asia, | | | | | | | | |

| | | | Europe and North America. | | | | | | | | |

| | | | (Cost $899,579) | | | | | | | | |

| | | | | | | 1,254,372 | | | | 1.02 | % |

See Notes to Financial Statements.THE SWISS HELVETIA FUND, INC.

Schedule of Investments by Industry (Unaudited)

| June 30, 2020 |

| (continued) | |

| | | | | | | | Percent | |

| No. of | | | | Fair | | | of Net | |

| Shares | | Security | | Value | | | Assets | |

| Common Stock — (continued) | |

| | |

| Miscellaneous Manufacturing — 0.66% | |

| | | | | | | | | | | | |

| | 10,200 | | Sulzer AG | | $ | 812,728 | | | | 0.66 | % |

| | | | Manufactures machinery | | | | | | | | |

| | | | and equipment, and | | | | | | | | |

| | | | operates in a surfacing | | | | | | | | |

| | | | technology business. The | | | | | | | | |

| | | | Company provides | | | | | | | | |

| | | | pumping and surface | | | | | | | | |

| | | | technology solution and | | | | | | | | |

| | | | services, services and repair | | | | | | | | |

| | | | of thermal turbo machinery, | | | | | | | | |

| | | | and service for separation | | | | | | | | |

| | | | and static mixing. | | | | | | | | |

| | | | (Cost $964,564) | | | | | | | | |

| | | | | | | 812,728 | | | | 0.66 | % |

| Packaging & Containers — 1.57% | |

| | | | | | | | | | | | |

| | 119,000 | | SIG Combibloc Group AG1 | | | 1,925,249 | | | | 1.57 | % |

| | | | The company, through its | | | | | | | | |

| | | | subsidiaries, manufactures | | | | | | | | |

| | | | and produces bottling | | | | | | | | |

| | | | machines and systems for | | | | | | | | |

| | | | the food and beverage | | | | | | | | |

| | | | industries. The company | | | | | | | | |

| | | | serves customers | | | | | | | | |

| | | | worldwide. | | | | | | | | |

| | | | (Cost $1,362,987) | | | | | | | | |

| | | | | | | 1,925,249 | | | | 1.57 | % |

Pharmaceuticals — 27.16%6 | |

| | | | | | | | | | | | |

| | 185,000 | | Novartis AG | | | 16,091,710 | | | | 13.09 | % |

| | | | One of the leading | | | | | | | | |

| | | | manufacturers of branded | | | | | | | | |

| | | | and generic pharmaceutical | | | | | | | | |

| | | | products. | | | | | | | | |

| | | | (Cost $10,468,595) | | | | | | | | |

| | | | | | | | | | | | |

| | 49,901 | | Roche Holding AG | |

| 17,291,957 | | | | 14.07 | % |

| | | | Develops and | | | | | | | | |

| | | | manufactures | | | | | | | | |

| | | | pharmaceutical and | | | | | | | | |

| | | | diagnostic products. | | | | | | | | |

| | | | Produces prescription | | | | | | | | |

| | | | drugs to treat | | | | | | | | |

| | | | cardiovascular, infectious | | | | | | | | |

| | | | and autoimmune diseases | | | | | | | | |

| | | | and for other areas | | | | | | | | |

| | | | including dermatology | | | | | | | | |

| | | | and oncology. | | | | | | | | |

| | | | (Cost $9,346,153) | | | | | | | | |

| | | | | | | 33,383,667 | | | | 27.16 | % |

| Private Equity — 1.92% | |

| | | | | | | | | | | | |

| | 2,602 | | Partners Group | | | | | | | | |

| | | | Holding AG | | | 2,359,937 | | | | 1.92 | % |

| | | | A global private markets | | | | | | | | |

| | | | investment management | | | | | | | | |

| | | | firm with investment | | | | | | | | |

| | | | programs under | | | | | | | | |

| | | | management in private | | | | | | | | |

| | | | equity, private real estate, | | | | | | | | |

| | | | private infrastructure and | | | | | | | | |

| | | | private debt. The firm | | | | | | | | |

| | | | manages a broad range of | | | | | | | | |

| | | | customized portfolios for | | | | | | | | |

| | | | an international clientele | | | | | | | | |

| | | | of institutional investors. | | | | | | | | |

| | | | Partners Group is | | | | | | | | |

| | | | headquartered in | | | | | | | | |

| | | | Zug, Switzerland. | | | | | | | | |

| | | | (Cost $1,910,370) | | | | | | | | |

| | | | | | | 2,359,937 | | | | 1.92 | % |

See Notes to Financial Statements.THE SWISS HELVETIA FUND, INC.

Schedule of Investments by Industry (Unaudited)

| June 30, 2020 |

| (continued) | |

| | |

|

|

|

| | Percent | |

| No. of | | | | Fair | | | of Net | |

| Shares | | Security | | Value | | | Assets | |

| Common Stock — (continued) | |

| | |

| Retail — 5.00% | |

| | | | | | | | | | |

| | 63,300 | | Cie Financiere | | | | | | |

| | | | Richemont SA | | $ | 4,037,626 | | | | 3.28 | % |

| | | | Manufactures and retails | | | | | | | | |

| | | | luxury goods. Produces | | | | | | | | |

| | | | jewelry, watches, leather | | | | | | | | |

| | | | goods, writing instruments | | | | | | | | |

| | | | and men’s and | | | | | | | | |

| | | | women’s wear. | | | | | | | | |

| | | | (Cost $4,873,700) | | | | | | | | |

| | | | | | | | | | | | |

| | 54,000 | | Swatch Group AG — | | | | | | | | |

| | | | Registered Shares | | | 2,112,015 | | | | 1.72 | % |

| | | | Manufactures finished | | | | | | | | |

| | | | watches, movements and | | | | | | | | |

| | | | components. Produces | | | | | | | | |

| | | | components necessary to | | | | | | | | |

| | | | its various watch brand | | | | | | | | |

| | | | companies. The company | | | | | | | | |

| | | | also operates | | | | | | | | |

| | | | retail boutiques. | | | | | | | | |

| | | | (Cost $4,777,022) | | | | | | | | |

| | | | | | | 6,149,641 | | | | 5.00 | % |

| Semiconductors — 1.24% | |

| | | | | | | | | | | | |

| | 60,741 | | AMS AG | | | 900,971 | | | | 0.73 | % |

| | | | Designs and manufactures | | | | | | | | |

| | | | advanced sensor solutions. | | | | | | | | |

| | | | The company also delivers | | | | | | | | |

| | | | a broad range of | | | | | | | | |

| | | | technology solutions for | | | | | | | | |

| | | | consumer electronics and | | | | | | | | |

| | | | communication device | | | | | | | | |

| | | | manufactures. | | | | | | | | |

| | | | (Cost $882,072) | | | | | | | | |

| | | | | | | | | | | | |

| | 13,000 | | Sensirion Holding AG1 | |

| 622,183 | | | | 0.51 | % |

| | | | The company, through its | | | | | | | | |

| | | | subsidiaries, manufactures | | | | | | | | |

| | | | gas and liquid flow sensors | | | | | | | | |

| | | | for the measurement of | | | | | | | | |

| | | | humidity and temperature, | | | | | | | | |

| | | | volatile organic compounds | | | | | | | | |

| | | | and carbon dioxide. The | | | | | | | | |

| | | | company serves | | | | | | | | |

| | | | automotive, industrial, | | | | | | | | |

| | | | medical, and consumer | | | | | | | | |

| | | | goods sectorsworldwide. | | | | | | | | |

| | | | (Cost $493,073) | | | | | | | | |

| | | | | | | 1,523,154 | | | | 1.24 | % |

| | | | Total Common Stock | | | | | | | | |

| | | | (Cost $87,529,253) | | | 112,489,785 | | | | 91.53 | % |

See Notes to Financial Statements.THE SWISS HELVETIA FUND, INC.

Schedule of Investments by Industry (Unaudited)

| June 30, 2020 |

| (continued) | |

| | | | | | | | Percent | |

| No. of | | | | Fair | | | of Net | |

| Shares | | Security | | Value | | | Assets | |

| Preferred Stock — 0.03% | |

| | |

| Biotechnology — 0.01% | |

| | | | | | | | | | | | |

| | 8,400 | | Ixodes AG, Series B1,2,3,4 | | $ | 7,624 | | | | 0.01 | % |

| | | | Develops and produces a | | | | | | | | |

| | | | topical product for the | | | | | | | | |

| | | | treatment of borreliosis | | | | | | | | |

| | | | infection and the | | | | | | | | |

| | | | prevention of Lyme | | | | | | | | |

| | | | disease from a tick bite. | | | | | | | | |

| | | | (Cost $2,252,142) | | | | | | | | |

| | | | | | | 7,624 | | | | 0.01 | % |

| Industrial Goods & Services — 0.02% | |

| | | | | | | | | | | | |

| | 500,863 | | SelFrag AG Class A1,2,3 | | | 26,429 | | | | 0.02 | % |

| | | | Designs, manufactures and | | | | | | | | |

| | | | sells industrial machines | | | | | | | | |

| | | | and processes using | | | | | | | | |

| | | | selective fragmentation | | | | | | | | |

| | | | technology. | | | | | | | | |

| | | | (Cost $1,932,198) | | | | | | | | |

| | | | | | | 26,429 | | | | 0.02 | % |

| | | | Total Preferred Stock | | | | | | | | |

| | | | (Cost $4,184,340) | | | 34,053 | | | | 0.03 | % |

| | | | | | | | | | | | |

| Limited Partnership — 0.84% | |

| | |

| Biotechnology — 0.84% | |

| | | | | | | | | | | | |

| | 3,294,705 | | Aravis Biotech II, | | | | | | | | |

| | | | Limited Partnership1,3,4 | |

| 1,038,220 | | | | 0.84 | % |

| | | | Makes early stage venture | | | | | | | | |

| | | | investments in the | | | | | | | | |

| | | | biotechnology & | | | | | | | | |

| | | | pharmaceuticals industry. | | | | | | | | |

| | | | (Cost $1,810,184) | | | | | | | | |

| | | | | | | 1,038,220 | | | | 0.84 | % |

| | | | Total Limited Partnership | | | | | | | | |

| | | | (Cost $1,810,184) | | | 1,038,220 | | | | 0.84 | % |

| | | | | | | | | | | | |

| Short-Term Investment — 1.59% | |

| | | | | | | | | | | | |

| | 1,959,124 | | U.S. Bank Money Market | | | | | | | | |

| | | | Deposit Account, 0.40%5 | | | 1,959,124 | | | | 1.59 | % |

| | | | (Cost $1,959,124) | | | | | | | | |

| | | | | | | 1,959,124 | | | | 1.59 | % |

| | | | Total Short-Term | | | | | | | | |

| | | | Investment | | | | | | | | |

| | | | (Cost $1,959,124) | | | 1,959,124 | | | | 1.59 | % |

| | | | | | | | | | | | |

| | | | Total Investments | | | | | | | | |

| | | | (Cost $95,482,901) | | | 115,521,182 | | �� | | 93.99 | % |

| | | | | | | | | | | | |

| | | | Other Assets | | | | | | | | |

| | | | Less Liabilities | | | 7,383,516 | | | | 6.01 | % |

| | | | Net Assets | | $ | 122,904,698 | | | | 100.00 | % |

| | | | | | | | | | | | |

| | | | Net Asset Value Per Share: | | | | | | | | |

| | | | ($122,904,698 ÷13,262,011 | | | | | | | | |

| | | | shares outstanding, | | | | | | | | |

| | | | $0.001 par value: 50 million | | | | | | | | |

| | | | shares authorized) | | | | | | $ | 9.27 | |

See Notes to Financial Statements.THE SWISS HELVETIA FUND, INC.

Schedule of Investments by Industry (Unaudited)

| June 30, 2020 |

| (continued) | |

1 | Non-income producing security. |

2 | Value determined using significant unobservable inputs. |

3 | Illiquid. There is not a public market for these securities in the United States or in any foreign jurisdiction, including Switzerland. Securities are priced at Fair Value in accordance with the Fund’s valuation policy and procedures. At the end of the period, the aggregate Fair Value of these securities amounted to $2,949,987 or 2.40% of the Fund’s net assets. Additional information on these securities is as follows: |

Security | Acquisition Date | | Cost | |

Aravis Biotech II, Limited Partnership | July 31, 2007 – May 29, 2018 | | $ | 1,810,184 | |

Eyesense AG – Common Shares | July 22, 2010 – October 3, 2011 | | | 3,007,048 | |

Ixodes AG – Preferred Shares B | April 7, 2011 – June 1, 2012 | | | 2,252,142 | |

SelFrag AG – Class A – Preferred Shares | December 15, 2011 – January 28, 2014 | | | 1,932,198 | |

Spineart SA – Common Shares | December 22, 2010 – May 27, 2020 | | | 2,193,373 | |

| | | | $ | 11,194,945 | |

4 | Affiliated Company. An affiliated company is a company in which the Fund has ownership of at least 5% of the company’s outstanding voting securities or an equivalent interest in the company. Details related to affiliated company holdings are as follows: |

| | | Fair Value | | | | | | | | | | | | Change in | | | | | | Fair Value | |

| | | as of | | | Gross | | | Gross | | | Realized | | | Unrealized | | | Interest | | | as of | |

Name of Issuer | | 12/31/19 | | | Additions | | | Reductions | | | Gain/(Loss) | | | Gain/(Loss) | | | Income | | | 6/30/20 | |

Aravis Biotech II, | | | | | | | | | | | | | | | | | | | | | |

Limited Partnership | | $ | 1,059,436 | | | $ | — | | | $ | — | | | $ | — | | | $ | (21,216 | ) | | $ | — | | | $ | 1,038,220 | |

Ixodes AG – Preferred | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Shares B | | | 7,460 | | | | — | | | | — | | | | — | | | | 164 | | | | — | | | | 7,624 | |

| | | $ | 1,066,896 | | | $ | — | | | $ | — | | | $ | — | | | $ | (21,052 | ) | | $ | — | | | $ | 1,045,844 | |

5 | Rate shown is the seven day annualized yield as of June 30, 2020. |

6 | The Fund has a fundamental investment policy that prohibits it from investing 25% or more of its total assets in a particular industry. As of June 30, 2020, the Fund had more than 25% of its total assets invested in the pharmaceuticals industry as a result of the appreciation of the value of its existing investments. The Fund will not invest in any additional companies in the industry until such time that the percentage of the Fund’s total assets invested in that industry is below 25%. |

See Notes to Financial Statements.THE SWISS HELVETIA FUND, INC.

Schedule of Investments by Industry (Unaudited)

| June 30, 2020 |

| (continued) | |

| PORTFOLIO HOLDINGS | | | |

| % of Net Assets as of June 30, 2020 | | | |

Industry: | | | |

Pharmaceuticals | | | 27.16 | % |

Food | | | 17.30 | % |

Insurance | | | 10.40 | % |

Retail | | | 5.00 | % |

Healthcare-Products | | | 4.37 | % |

Computers | | | 4.22 | % |

Banks | | | 3.31 | % |

Building Materials | | | 3.14 | % |

Diversified Financial Services | | | 3.10 | % |

Electronics | | | 2.15 | % |

Private Equity | | | 1.92 | % |

Electric | | | 1.64 | % |

Short-Term Investment | | | 1.59 | % |

Packaging & Containers | | | 1.57 | % |

Semiconductors | | | 1.24 | % |

Metal Fabricate/Hardware | | | 1.02 | % |

Advertising | | | 0.94 | % |

Hand/Machine Tools | | | 0.87 | % |

Biotechnology | | | 0.85 | % |

Commercial Services | | | 0.83 | % |

Healthcare-Services | | | 0.69 | % |

Miscellaneous Manufacturing | | | 0.66 | % |

Industrial Goods & Services | | | 0.02 | % |

Other Assets Less Liabilities | | | 6.01 | % |

| | | | 100.00 | % |

| | | | | |

| TOP 10 PORTFOLIO HOLDINGS | | | | |

| % of Net Assets as of June 30, 2020 | | | | |

Nestlé SA | | | 17.30 | % |

Roche Holding AG | | | 14.07 | % |

Novartis AG | | | 13.09 | % |

Zurich Insurance Group AG | | | 4.00 | % |

Logitech International SA | | | 3.53 | % |

Cie Financiere Richemont SA | | | 3.28 | % |

Swiss Life Holding AG | | | 2.72 | % |

ABB Ltd. | | | 2.15 | % |

Tecan Group AG | | | 1.95 | % |

Partners Group Holding AG | | 1.92 | % |

See Notes to Financial Statements.THE SWISS HELVETIA FUND, INC.

Statement of Assets and Liabilities (Unaudited)

| June 30, 2020 |

| (continued) | |

| Assets: | | | |

| Investments in unaffiliated issuers, at value (cost $91,420,575) | | $ | 114,475,338 | |

| Investments in affiliated issuers, at value (cost $4,062,326) | | | 1,045,844 | |

| Total Investments, at value (cost $95,482,901) | | | 115,521,182 | |

| Foreign currency (cost $4,978,718) | | | 5,051,802 | |

| Tax reclaims receivable | | | 2,513,387 | |

| Receivable for investments sold | | | 418,998 | |

| Interest receivable | | | 208 | |

| Prepaid expenses | | | 95,111 | |

| Total assets | | | 123,600,688 | |

| | | | | |

| Liabilities: | | | | |

| Investments purchased | | | 299,689 | |

| Accrued advisory fees | | | 70,835 | |

| Accrued audit fees | | | 27,583 | |

| Accrued legal fees | | | 205,718 | |

| Accrued custody fees | | | 31,965 | |

| Accrued directors’ fees and expenses | | | 1,801 | |

| Accrued other expenses | | | 58,399 | |

| Total liabilities | | | 695,990 | |

| Net assets | | $ | 122,904,698 | |

| | | | | |

| Composition of Net Assets: | | | | |

| Paid-in capital | | $ | 108,357,010 | |

| Total distributable earnings | | | 14,547,688 | |

| Net assets | | $ | 122,904,698 | |

| | | | | |

| Net Asset Value Per Share: | | | | |

| ($122,904,698 ÷ 13,262,011 shares outstanding, | | | | |

| $0.001 par value: 50 million shares authorized) | | $ | 9.27 | |

See Notes to Financial Statements.THE SWISS HELVETIA FUND, INC.

Statement of Operations (Unaudited)

| For the Six Months Ended June 30, 2020

|

| |

| Investment Income: | | | |

| Dividend (less of foreign tax withheld of $425,752) | | $ | 2,554,592 | |

| Interest income | | | 32,165 | |

| Total income | | | 2,586,757 | |

| Expenses: | | | | |

| Investment advisory fees (Note 2) | | | 422,346 | |

| Legal fees (Note 3) | | | 230,080 | |

| Directors’ fees and expenses | | | 155,717 | |

| Officer Fees | | | 65,793 | |

| Administration fees (Note 3) | | | 58,533 | |

| Printing and shareholder reports | | | 51,160 | |

| Insurance fees | | | 48,847 | |

| Delaware franchise tax fees | | | 40,000 | |

| Custody fees (Note 3) | | | 32,233 | |

| Audit fees (Note 3) | | | 27,575 | |

| Transfer agency fees (Note 3) | | | 14,283 | |

| Miscellaneous expenses | | | 60,613 | |

| Total expenses | | | 1,207,180 | |

| Net investment income | | | 1,379,577 | |

| Realized and Unrealized Gains (Loss) on Investments and Foreign Currency: | | | | |

| Net realized gain (loss) from: | | | | |

| Investments in unaffiliated issuers | | | (4,045,974 | ) |

| Investments in affiliated issuers | | | — | |

| Foreign currency transactions | | | 342 | |

| Total net realized loss from unaffiliated and | | | | |

| affiliated issuers and foreign currency transactions | | | (4,045,632 | ) |

| Net change in unrealized appreciation (depreciation) from: | | | | |

| Investments in unaffiliated issuers | | | 359,956 | |

| Investments in affiliated issuers | | | (21,052 | ) |

| Foreign currency and foreign currency translations | | | 133,177 | |

| Total net change in unrealized appreciation from unaffiliated and | | | | |

| affiliated issuers, foreign currency and foreign currency translations | | | 472,081 | |

| Net Realized and Unrealized Loss on Investments and Foreign Currency | | | (3,573,551 | ) |

| Net Decrease in Net Assets from Operations | | $ | (2,193,974 | ) |

See Notes to Financial Statements.THE SWISS HELVETIA FUND, INC.

Statement of Changes in Net Assets

| | | For the | | | | |

| | | Six Months Ended | | | For the | |

| | | June 30, 2020 | | | Year Ended | |

| | | (Unaudited) | | | December 31, 2019 | |

| Increase (Decrease) in Net Assets: | | | | | | |

| Operations: | | | | | | |

| Net investment income | | $ | 1,379,577 | | | $ | 122,416 | |

| Total net realized gain (loss) from unaffiliated and | | | | | | | | |

| affiliated issuers and foreign currency transactions | | | (4,045,632 | ) | | | 2,278,006 | |

| Total net change in unrealized appreciation from | | | | | | | | |

| unaffiliated and affiliated issuers, foreign currency | | | | | | | | |

| and foreign currency translations | | | 472,081 | | | | 22,749,226 | |

| Net increase (decrease) in net assets from operations | | | (2,193,974 | ) | | | 25,149,648 | |

| Distributions to Stockholders | | | (3,724,689 | ) | | | (1,862,703 | ) |

| Capital Stock Transactions: | | | | | | | | |

| Value of shares repurchased through | | | | | | | | |

| stock repurchase program (Note 6) | | | (40,472 | ) | | | — | |

| Total decrease from capital share transactions | | | (40,472 | ) | | | — | |

| Total increase (decrease) in net assets | | | (5,959,135 | ) | | | 23,286,945 | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 128,863,833 | | | | 105,576,888 | |

| End of period | | $ | 122,904,698 | | | $ | 128,863,833 | |

See Notes to Financial Statements.THE SWISS HELVETIA FUND, INC.

Financial Highlights

| | | For the Six | | | | | | | | | | | | | | | | |

| | | Months Ended | | | | | | | | | | | | | | | | |

| | | June 30, 2020 | | | For the Years Ended December 31, | |

| | | (Unaudited) | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| Per Share Operating Performance: | | | | | | | | | | | | | | | | | | |

| Net asset value at the beginning of period | | $ | 9.71 | | | $ | 7.96 | | | $ | 14.10 | | | $ | 11.66 | | | $ | 12.30 | | | $ | 12.78 | |

| Income from Investment Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income1 | | | 0.10 | | | | 0.01 | | | | 0.14 | | | | 0.13 | | | | 0.15 | | | | 0.11 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | | | | | |

gain (loss) on investments2 | | | (0.26 | ) | | | 1.88 | | | | (1.35 | ) | | | 2.41 | | | | (0.45 | ) | | | 0.12 | |

| Total from investment activities | | | (0.16 | ) | | | 1.89 | | | | (1.21 | ) | | | 2.54 | | | | (0.30 | ) | | | 0.23 | |

| Gain from capital shares repurchases | | | — | | | | — | | | | — | | | | — | | | | 0.02 | | | | — | |

| Gain from tender offer | | | — | | | | — | | | | 0.30 | | | | 0.03 | | | | — | | | | — | |

| Capital change resulting from the issuance | | | | | | | | | | | | | | | | | | | | | | | | |

| of fund shares | | | — | | | | — | | | | (0.12 | ) | | | — | | | | (0.03 | ) | | | — | |

| Less Distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from investment income and | | | | | | | | | | | | | | | | | | | | | | | | |

| net realized gains from foreign currency | | | | | | | | | | | | | | | | | | | | | | | | |

| transactions | | | (0.28 | ) | | | (0.12 | ) | | | (0.10 | ) | | | (0.13 | ) | | | (0.12 | ) | | | (0.03 | ) |

| Distributions from net realized capital gains | | | — | | | | (0.02 | ) | | | (5.01 | ) | | | — | | | | (0.21 | ) | | | (0.68 | ) |

| Total distributions | | | (0.28 | ) | | | (0.14 | ) | | | (5.11 | ) | | | (0.13 | ) | | | (0.33 | ) | | | (0.71 | ) |

| Net asset value at end of period | | $ | 9.27 | | | $ | 9.71 | | | $ | 7.96 | | | $ | 14.10 | | | $ | 11.66 | | | $ | 12.30 | 3 |

| Market value per share at the end of period | | $ | 7.84 | | | $ | 8.41 | | | $ | 6.90 | | | $ | 12.76 | | | $ | 10.21 | | | $ | 10.56 | |

Total Investment Returns:4,5 | | | | | | | | | | | | | | | | | | | | | | | | |

| Based on market value per share | | | -3.01 | % | | | 24.00 | % | | | -10.90 | % | | | 26.26 | % | | | -0.24 | % | | | 1.41 | % |

| Based on net asset value per share | | | -1.35 | % | | | 23.80 | % | | | -6.98 | % | | | 22.17 | % | | | -2.19 | % | | | 2.96 | %3 |

Ratios to Average Net Assets:6 | | | | | | | | | | | | | | | | | | | | | | | | |

| Net expenses | | | 2.00 | % | | | 2.13 | % | | | 1.44 | % | | | 1.40 | % | | | 1.19 | % | | | 1.15 | % |

| Gross expenses | | | 2.00 | % | | | 2.13 | % | | | 1.44 | % | | | 1.40 | % | | | 1.19 | % | | | 1.15 | % |

| Net investment income | | | 2.28 | % | | | 0.10 | % | | | 1.12 | % | | | 0.98 | % | | | 1.26 | % | | | 0.81 | % |

| Supplemental Data and Ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets at end of period (000’s) | | $ | 122,905 | | | $ | 128,864 | | | $ | 105,577 | | | $ | 356,832 | | | $ | 327,861 | | | $ | 344,132 | |

| Average net assets during the period (000’s) | | $ | 121,333 | | | $ | 118,960 | | | $ | 305,270 | | | $ | 350,487 | | | $ | 331,874 | | | $ | 368,969 | |

| Portfolio turnover rate | | | 9 | % | | | 18 | % | | | 21 | % | | | 9 | % | | | 19 | % | | | 23 | % |

1 | Calculated using the average shares method. |

2 | Includes net realized and unrealized currency gain and losses. |

3 | The net assets value per share (“NAV”) for financial reporting purposes, $12.30, differs from the NAV reported on December 31, 2015, $12.33 due to adjustments made in accordance with accounting principles generally accepted in the United States of America. |

4 | Total investment return based on market value differs from total investments return based on net assets value due to changes in the relationship between the market value of the Fund’s shares and its NAV per share. |

5 | Not annualized for periods less than one year. |

6 | Annualized for periods less than one year. |

See Notes to Financial Statements.THE SWISS HELVETIA FUND, INC.

Notes to Financial Statements (Unaudited)

Note 1—Organization and Significant Accounting Policies

A. Organization

The Swiss Helvetia Fund, Inc. (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as a non-diversified, closed-end management investment company. The Fund is organized as a corporation under the laws of the State of Delaware.

The investment objective of the Fund is to seek long-term growth of capital through investment in equity and equity-linked securities of Swiss companies. The Fund may also acquire and hold equity and equity-linked securities of non-Swiss companies in limited instances.

B. Securities Valuation

The Fund values its investments at fair value in accordance with accounting principles generally accepted in the United States (“GAAP”).

When valuing listed equity securities, the Fund uses the last sale price on the securities exchange or national securities market on which such securities primarily are traded (the “Primary Market”) prior to the calculation of the Fund’s net asset value (“NAV”). When valuing equity securities that are not listed (except privately-held companies and private equity limited partnerships) or that are listed but have not traded on a day on which the Fund calculates its NAV, the Fund uses the mean between the bid and asked prices for that day. If there are no asked quotations for such a security, the value of such security will be the most recent bid quotation on the Primary Market on that day. On any day when a security’s Primary Market is closed because of a local holiday or other scheduled closure, but the New York Stock Exchange is open, the Fund may use the prior day’s closing prices to value such security regardless of the length of the scheduled closing.

When valuing fixed-income securities, if any, the Fund uses the last bid price prior to the calculation of the Fund’s NAV. If there is no current bid price for a fixed-income security, the value of such security will be the mean between the last quoted bid and asked prices on that day. Overnight and certain other short-term fixed-income securities with maturities of less than 60 days will be valued by the amortized cost method, unless it is determined that the amortized cost method would not represent the fair value of such security.

It is the responsibility of the Fund’s Board of Directors (the “Board”) to establish procedures to provide for the valuation of the Fund’s portfolio holdings. When valuing securities for which market quotations are not readily available, or for which the market quotations that are available are considered unreliable, the Fund determines a fair value in good faith in accordance with these procedures (a “Fair Value”). The Fund may use these procedures to establish the Fair Value of securities when, for example, a significant event occurs between the time the market closes and the time the Fund values its investments. After consideration of various factors, the Fund may value the securities at their last reported price or at some other value.

Swiss exchange-listed options, if any, including Eurex-listed options, are valued at their most recent sale price (latest bid for long options and the latest ask for short options) on the Primary Market, or

THE SWISS HELVETIA FUND, INC.

Notes to Financial Statements (Unaudited) (continued)

if there are no such sales, at the average of the most recent bid and asked quotations on such Primary Market, or if such quotations are not available, at the last bid quotation (in the case of purchased options) or the last asked quotation (in the case of written options). If, however, there are no such quotations, such options will be valued using the implied volatilities observed for similar options or from aggregated data as an input to a model. Options traded in the over-the-counter market, if any, are valued at the price communicated by the counterparty to the option, which typically is the price at which the counterparty would close out the transaction. Option contracts, if any, that are neither exchange-listed nor traded in the over-the-counter market, and where no broker can provide a quote or approved pricing vendor a price, may be valued using the implied volatilities observed for similar instruments or from aggregated market data received from services (e.g., Bloomberg) as an input to a widely accepted model.

The Fund is permitted to invest in investments that do not have readily available market quotations. For such investments, the Act requires the Board to determine their Fair Value. The aggregate value of these investments amounted to $2,949,987, or 2.40% of the Fund’s net assets at June 30, 2020 and are listed in Note 3 to the Schedule of Investments.

Various inputs are used to determine the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| Level 1— | unadjusted quoted prices in active markets for identical assets and liabilities |

| | |

| Level 2— | other significant observable inputs (including quoted prices of similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| | |

| Level 3— | significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s investments as of June 30, 2020:

| | | | | | Level 2 | | | Level 3 | | | Investments | | | | |

| | | Level 1 | | | Other Significant | | | Significant | | | Valued at | | | | |

| | | Quoted Prices | | | Observable Inputs | | | Unobservable Inputs | | | NAV** | | | Total | |

| Investments in Securities* | | | | | | | | | | | | | | | |

| Common Stock | | $ | 110,612,071 | | | $ | — | | | $ | 1,877,714 | | | $ | — | | | $ | 112,489,785 | |

| Preferred Stock | | | — | | | | — | | | | 34,053 | | | | — | | | | 34,053 | |

| Limited Partnership | | | — | | | | — | | | | — | | | | 1,038,220 | | | | 1,038,220 | |

| Money Market Deposit Account | | | — | | | | 1,959,124 | | | | — | | | | — | | | | 1,959,124 | |

Total Investments in Securities | | $ | 110,612,071 | | | $ | 1,959,124 | | | $ | 1,911,767 | | | $ | 1,038,220 | | | $ | 115,521,182 | |

| * | Please see the Schedule of Investments for industry classifications. |

| | |

| ** | As of June 30, 2020, certain of the Fund’s investments were valued using net asset value (“NAV”) per share (or its equivalent) as a practical expedient for fair value and have been excluded from the fair value hierarchy in accordance with ASU 2015-07. The fair value amount presented in this table is intended to permit reconciliation of the amounts presented in the fair value hierarchy to the amounts presented in the statement of assets and liabilities. |

THE SWISS HELVETIA FUND, INC.

Notes to Financial Statements (Unaudited) (continued)

The Fund values its investment in a private equity limited partnership in accordance with Accounting Standards Codification 820-10-35, “Investments in Certain Entities that Calculate Net Asset Value Per Share (Or its Equivalent)” (“ASC 820-10-35”). ASC 820-10-35 permits a reporting entity to measure the fair value of an investment that does not have a readily determinable fair value, based on the NAV of the investment as a practical expedient, without further adjustment, unless it is probable that the investment will be sold at a value significantly different than the NAV. If the NAV of the investment is not as of the Fund’s measurement date, then the NAV should be adjusted to reflect any significant events that may change the valuation. Inputs and valuation techniques for these adjustments may include fair valuations of the partnership and its portfolio holdings provided by the partnership’s general partner or manager, other available information about the partnership’s portfolio holdings, values obtained on redemption from other limited partners, discussions with the partnership’s general partner or manager and/or other limited partners and comparisons of previously-obtained estimates to the partnership’s audited financial statements. In using the unadjusted NAV as a practical expedient, certain attributes of the investment that may impact its fair value are not considered. Attributes of those investments include the investment strategies of the privately held companies and may also include, but are not limited to, restrictions on the investor’s ability to redeem its investments at the measurement date and any unfunded commitments.

Inputs and valuation techniques used by the Fund to value its Level 3 investments in privately-held companies may include the following: acquisition cost; fundamental analytical data; discounted cash flow analysis; nature and duration of restrictions on disposition of the investment; public trading of similar securities of similar issuers; economic outlook and condition of the industry in which the issuer participates; financial condition of the issuer; and the issuer’s prospects, including any recent or potential management or capital structure changes. Although these valuation inputs may be observable in the marketplace as is characteristic of Level 2 investments, the privately-held companies, categorized as Level 3 investments, generally are highly illiquid in terms of resale.

When valuing Level 3 investments, management also may consider potential events that could have a material impact on the operations of a privately-held company. Not all of these factors may be considered or available, and other relevant factors may be considered on an investment-by-investment basis. The table below summarizes the techniques and unobservable inputs for the valuation of Level 3 investments.

THE SWISS HELVETIA FUND, INC.

Notes to Financial Statements (Unaudited) (continued)

Quantitative Information about certain Level 3 Fair Value Measurements

| | | Fair Value at | | | | | | |

| | | June 30, 2020 | | Valuation Technique | Unobservable Inputs | | Range1 | |

| | | | | | | | |

| Biotechnology | | | | | | | | |

| Ixodes AG, Series B—Preferred Shares | | $ | 7,624 | | Asset based | Operational | | | 0-20 | % |

| | | | | | approach | cash expenditure | | | | |

| | | | | | | | | | |

| Healthcare-Products | | | | | | | | | | |

| EyeSense AG, Series A—Common Shares | | | 231,627 | | Market approach | Latest round of financing | | | N/A | |

| | | | | | | with an additional discount | | | | |

| | | | | | | to account for failure risk | | | | |

| Spineart SA—Common Shares | | | 1,646,087 | | Market approach | Secondary share purchase | | | 15-25 | % |

| | | | | | | with an additional discount | | | | |