1

The Swiss Helvetia

Fund, Inc.

Annual Meeting of Stockholders

May 22, 2008

1

2

Macro-Economic Topics and

Comments on Financial Markets

2

3

Consumer Price Indexes Comparisons (CPI)

3

4

4

5

5

6

6

7

7

8

8

9

9

10

10 Year French, Italian and Spanish Government Bond Spreads

vs. Germany

(1/1/99 – 4/30/08)

10

11

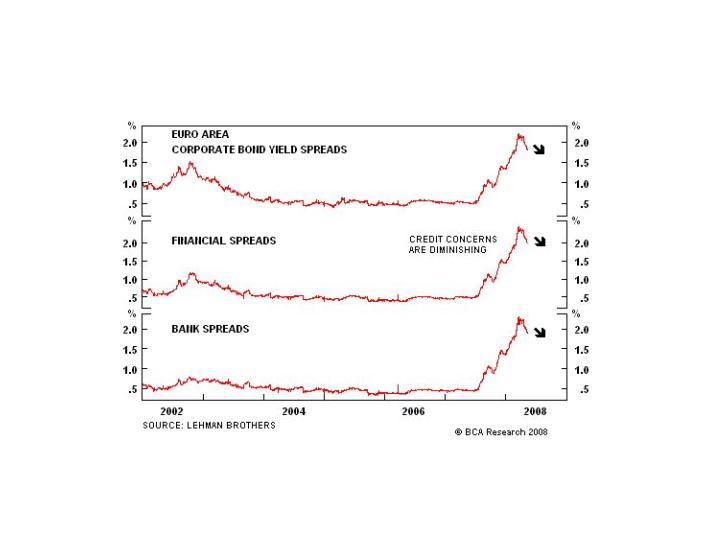

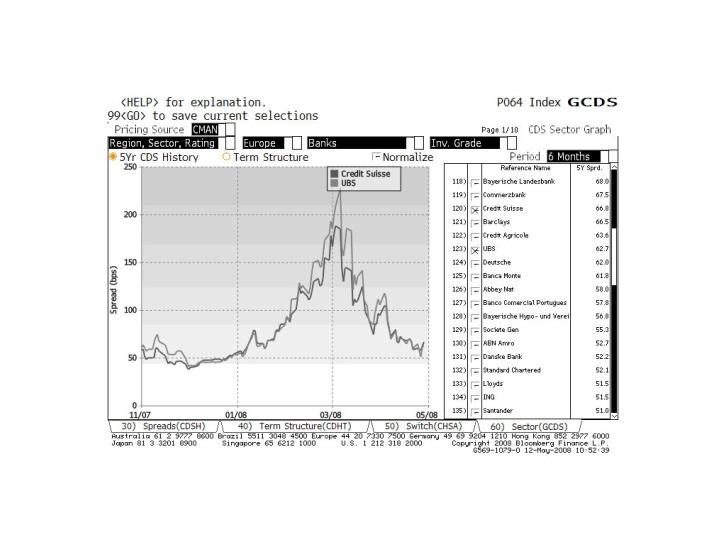

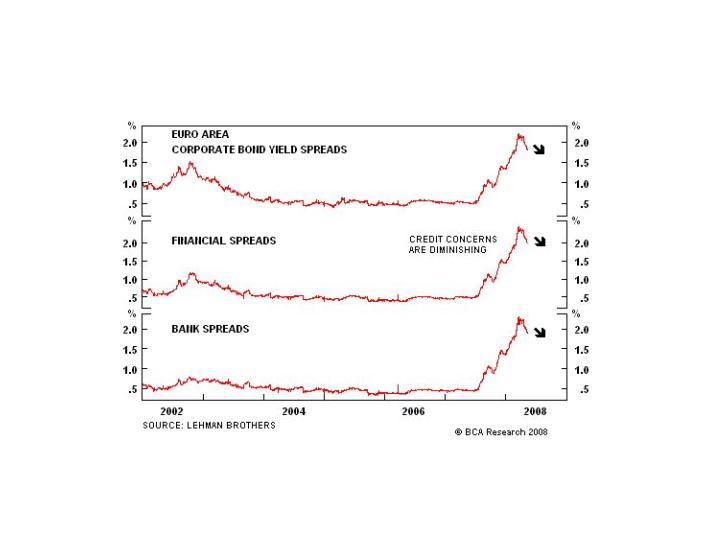

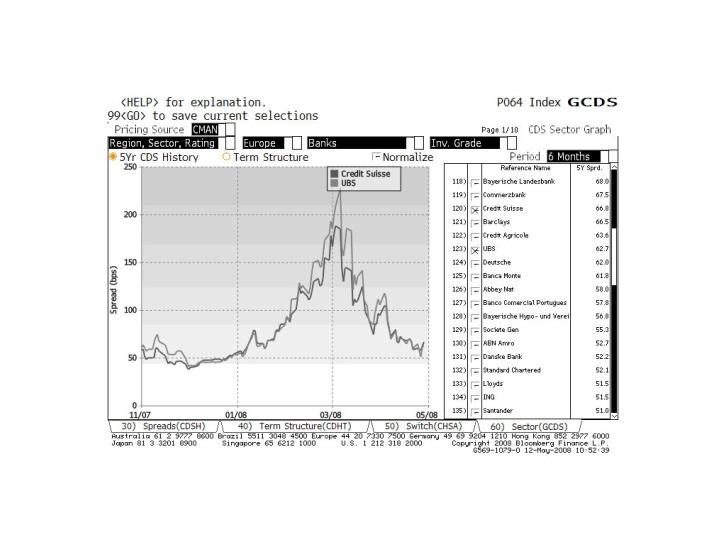

Debt Spreads of Financial Sector in Europe

11

12

Swiss Banks: cost of credit insurance

12

13

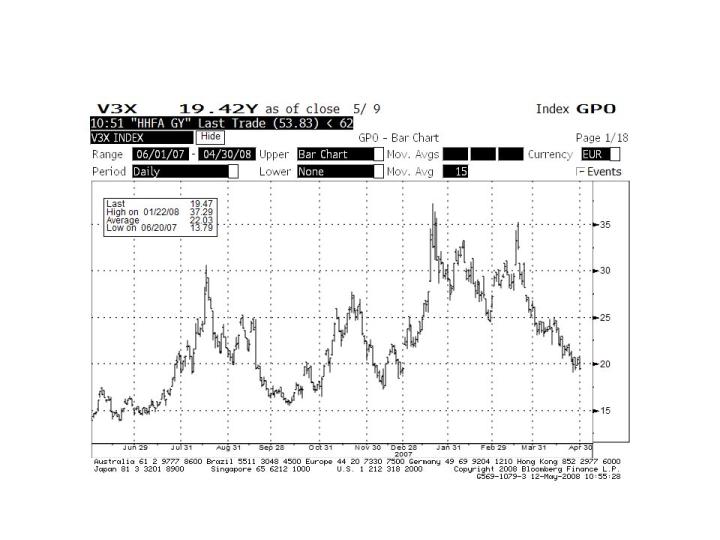

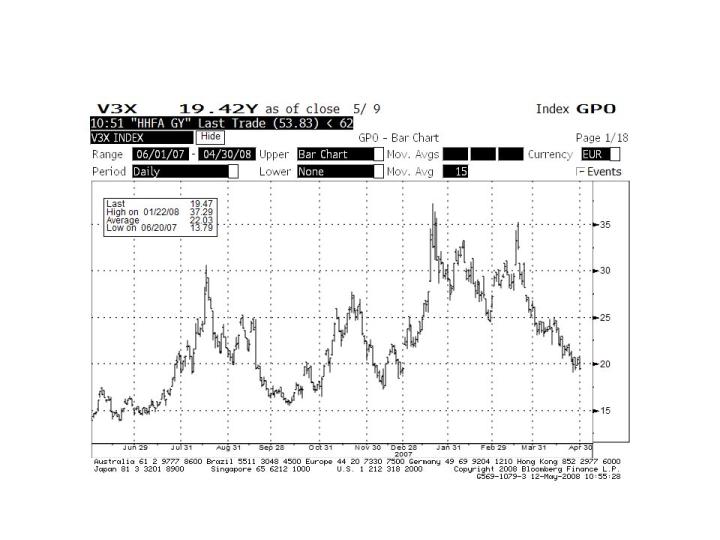

Swiss Market Implied Volatility: cost of hedging

13

14

Swiss Helvetia Fund and Swiss

Market Performance Analysis

14

15

Swiss Performance Index (SPI) Industry Groups

Performance in Swiss Francs YTD as of 04/30/08

*includes real estate companies

- 9.11%

ENTIRE SPI

- 8.70%

Basic Resources

- 5.29%

Utilities

- 15.29%

Retail

- 20.09%

Technology

- 11.32%

Financial Services*

- 12.66%

Construction

+ 3.96%

Chemicals

- 18.99%

Personal & Household Goods

5.01%

Insurances

2.35%

Industrial Goods & Services

22.01%

Banks

2.85%

Food and Beverages

11.28%

Healthcare

YTD

Industry Group

15

16

SWZ 10 Largest Holdings

as of 04/30/08

0.16%

2.79%

TEMENOS GROUP AG

not part of SPI

2.83%

ATEL HOLDING AG

0.57%

2.85%

ACTELION LTD

6.93%

3.25%

ABB LTD

0.17%

3.28%

BKW FMB ENERGIE AG

6.60%

5.30%

UBS AG

12.98%

6.50%

NOVARTIS AG

2.93%

8.51%

SYNGENTA AG

11.40%

9.91%

ROCHE HOLDING AG

18.35%

15.66%

NESTLE SA

% of SPI

% of SWZ

16

17

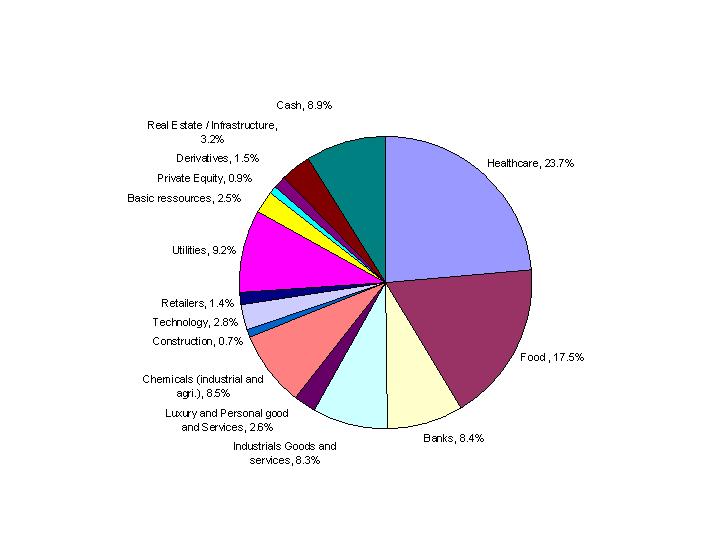

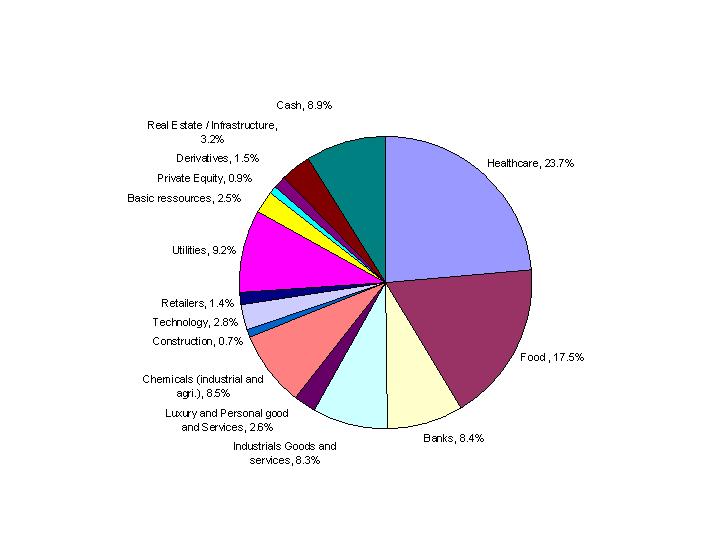

SWZ Sector Allocation 04/30/08

17

18

SWZ Sector Active Weight vs. SPI (04/30/08)

18

19

SWZ: Private Equity Portfolio (04/30/08)

Total invested : 1% in Limited Partnerships

a) Buyout: 0.85%

b) Venture: 0.15%

Total invested plus commitments :

a) Buyout : 2.5%

b) Venture : 0.8%

19

20

The Swiss Helvetia Fund: portfolio statistics

4/30/08

SWZ BETA

0.73

SWZ PORTFOLIO VOLATILITY

(100 days annualized)

21%

BENCHMARK VOLATILITY

(100 days annualized)

25%

20

21

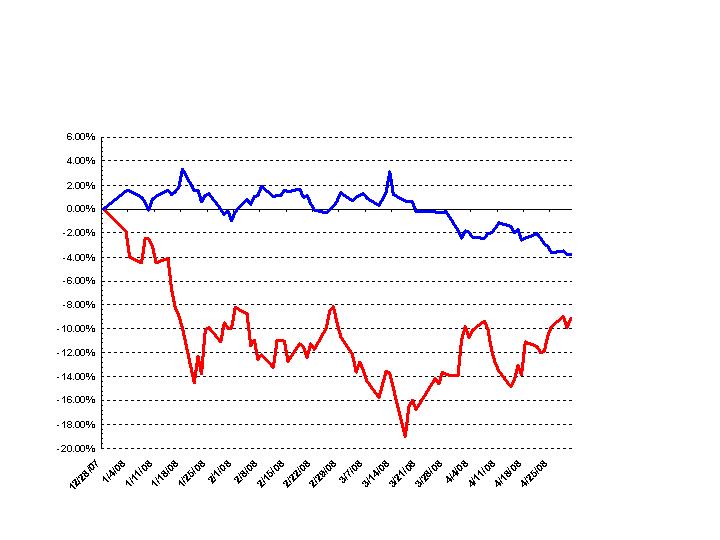

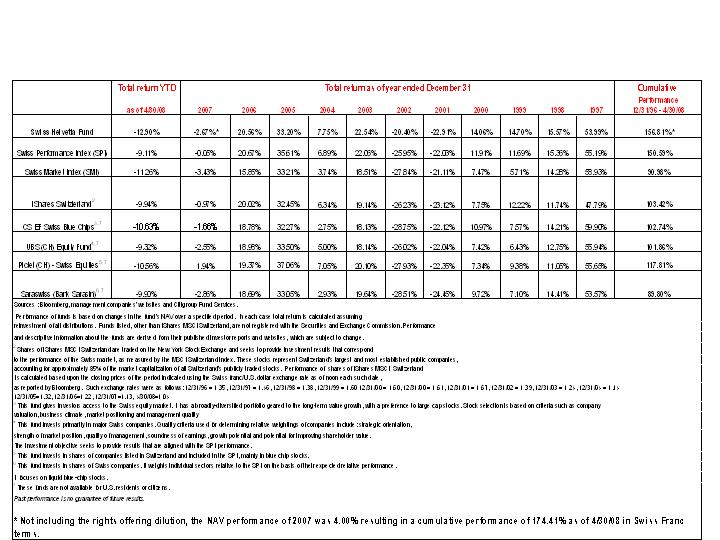

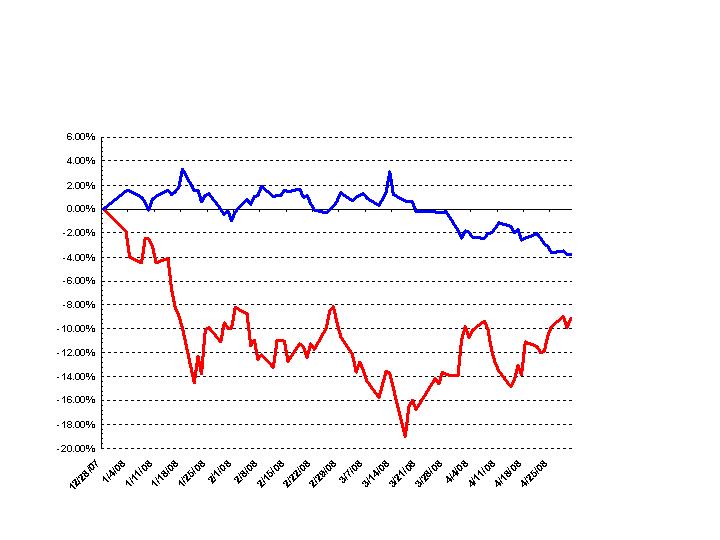

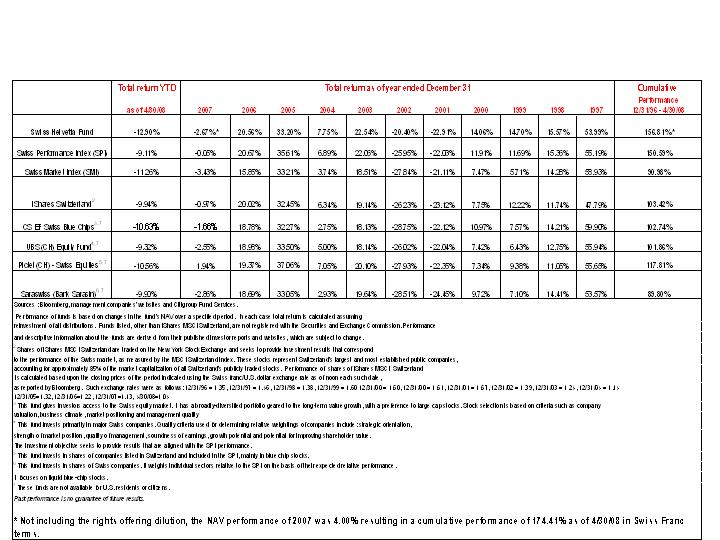

The Swiss Helvetia Fund, Inc. Total Return

Comparative Summary

YTD 4/30/08

21

Year to Date

4/30/08

Performance in Swiss Francs

SWZ (NAV)

-12.90%

Swiss Performance Index (SPI)

-9.11%

Performance in U.S. Dollars

SWZ (NAV)

-5.33%

SWZ share price

-1.88%

S&P 500 Index

-5.03%

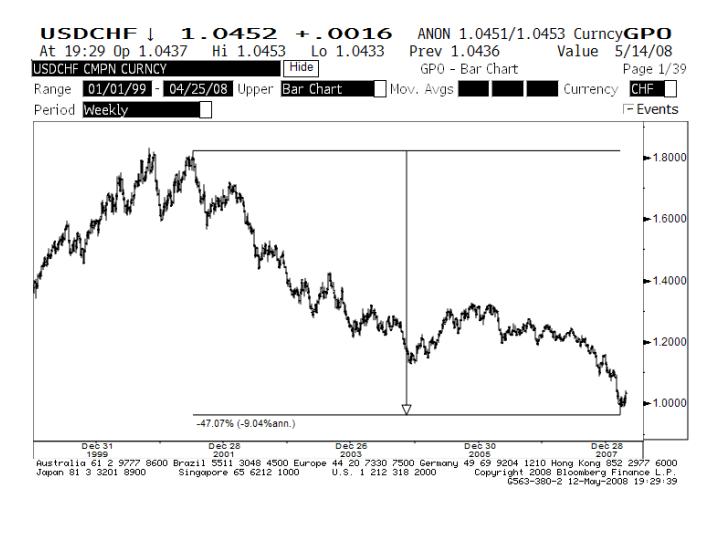

Change in U.S. Dollar vs Swiss Franc

8.00%

22

Best and Worst Performers on the Swiss Market

(large caps) in Swiss Francs during the most recent rebound in

the market from 3/17/08 to 04/30/08

22

23

The Swiss Helvetia Fund Total Return Comparative Summary

YTD 4/30/08

SWZ minus SPI

-3.8%

SPI Perf. YTD

23

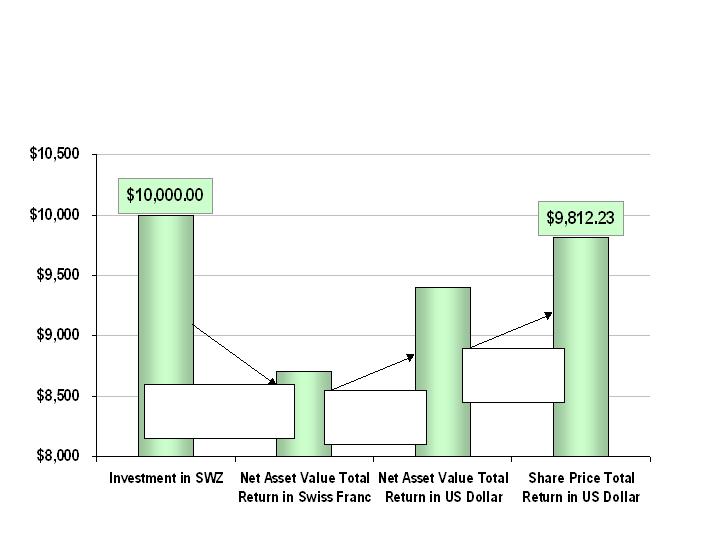

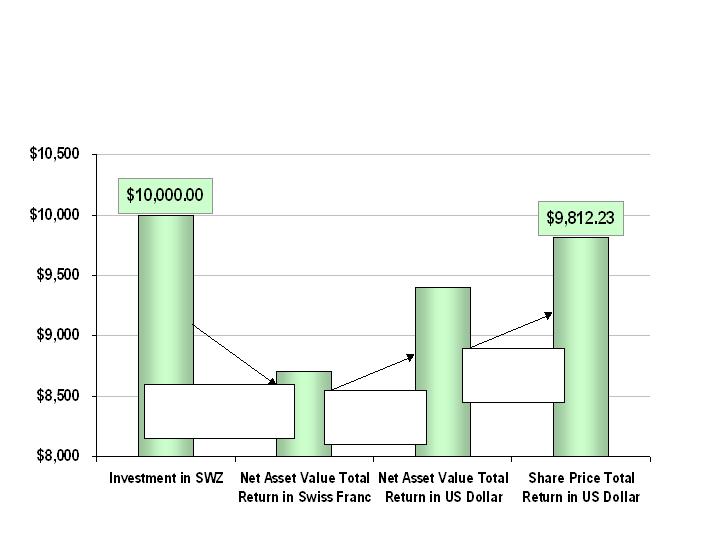

24

SWZ: Performance Analysis

ytd 12/31/07 - 4/30/08 (USD)

S&P 500 total return : - 5.03 %

Share price total return in USD: - 1.88 %

Performance of Fund

In local currency :

-12.90%

Swiss Francs

vs. USD:

+8.00%

Discount

Impact:

+4.31%

24

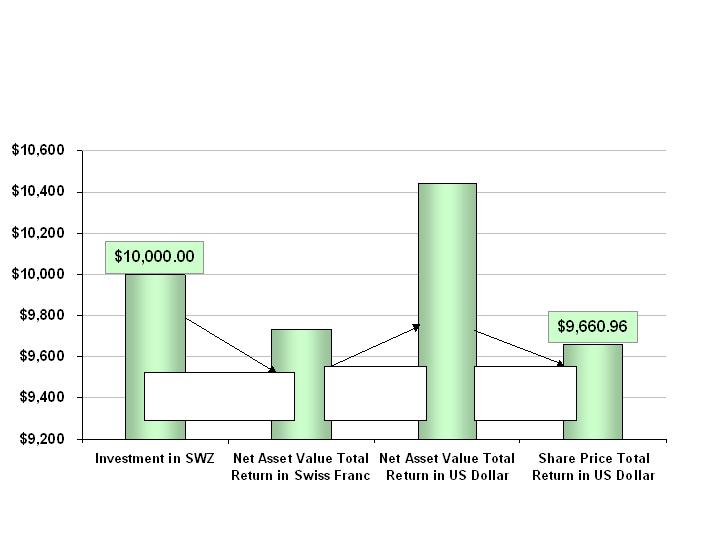

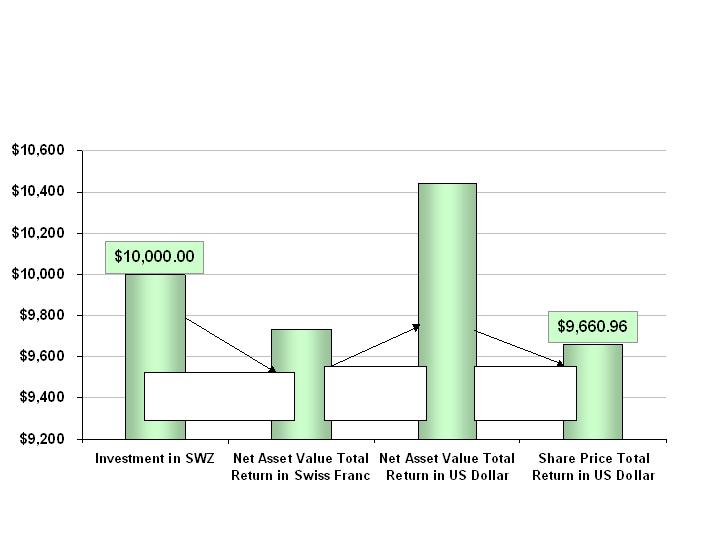

25

SWZ: Performance Analysis

calendar year 12/31/06 - 12/31/07 (USD)

Share price total return in USD: - 3.39 %

S&P 500 total return : + 5.49 %

Performance of Fund

In local currency:

-2.67%

Swiss Francs

vs. USD:

+7.25%

Discount

Impact:

-7.45%

25

26

SWZ: Cumulative Performance Analysis

5 calendar years 12/31/02 - 12/31/07 (USD)

S&P 500 total return : + 27.25%

Share price total return in USD: + 164.48%

Performance of Fund

In local currency :

+107.01%

Swiss Francs

vs. USD:

+18.12%

Discount

Impact:

+8.16%

26

27

Peer Group Performance Comparison in Swiss Francs as of

4/30/081

27

28

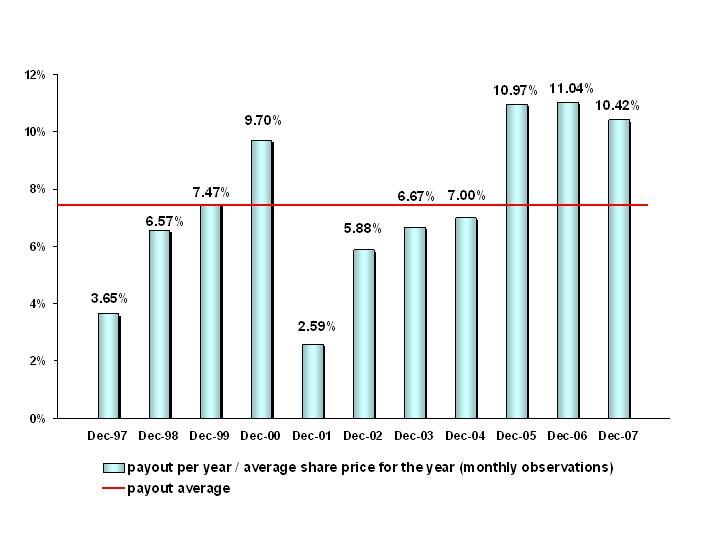

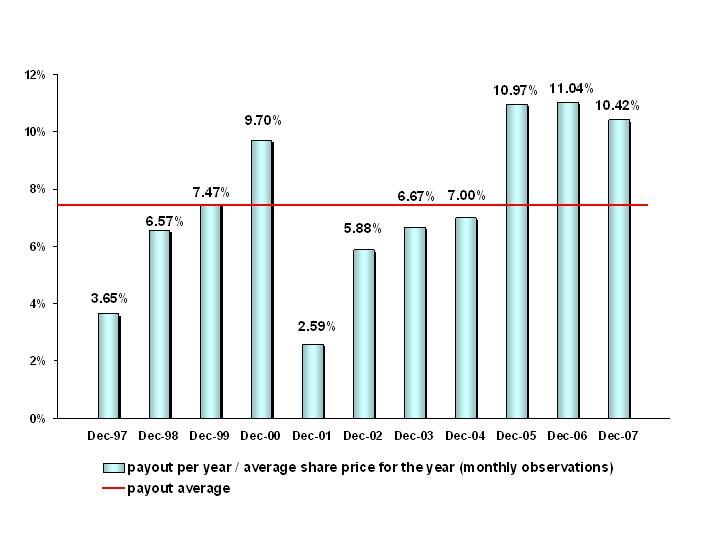

SWZ Distribution Yield

1/1/97 - 12/31/07

7.45%

28

29

SWZ: investment strategy

1.

Private Equity : exploiting synergies between private and public equity in

venture and buyout, developing a portfolio mix to diversify investment types

and time to exit (cash flow management)

2.

Derivatives: purchase options on indices (SMI, SMI mid Cap)

for cash equitization (pre-investing) and hedge.

Purchase options on individual stocks for hedging or manage capital more

effectively in specific instances.

In times where there we believe there is downside risk to volatility and

potential for sideways markets (time decay impact), derivatives will not be

actively used.

3.

Listed Equity : find market inefficiencies and liquidity premiums

29

30

Swiss Market Outlook

Industrial companies : inflation vs growth, valuation multiple no longer expanding,

limitation due to capacity utilization, questions on order intake perspective

mixed

Financials : low valuation in terms of price to asset under management, balance

sheet crisis most likely over but earnings power diminished outlook improving

Healthcare : very low valuation but corporate initiative needed (m&a, restructuring

programs and R&D partnership) outlook improving

Food producers : pricing power a necessity to combat cost inflation, growth still

present. Market share, branding to sustain margin outlook stable

Luxury goods : some cost inflation, but Asian consumer a big positive

Outlook stable to improving

Private equity: credit market dislocations affect very large deals but reduce the

valuation target companies, financing readily available for mid size and small size

deal more opportunities now to realized higher future returns

30

Marketing

31

Marketing Efforts Since May 2007

On July 28, 2007 the Fund participated in the annual Swiss National Day Celebration in

New York City. This celebration included various traditional Swiss attractions including

music, crafts and food. The event attracted approximately 2,500 attendees. The Fund

had a booth where information on the Fund was distributed along with key chains with

the Fund’s new logo.

Ease of movement between topics

Graphics that are quick to upload

Faster updating of information

On September 20, 2007 the Fund attended the 6th Annual Alumni Garden Party at the

Embassy of Switzerland in Washington, D.C. This event was hosted by Ambassador and

Mrs. Urs Ziswiler.

On August 3, 2007 the Fund launched its new user-friendly website. This website

includes the new Swiss Helvetia logo which was established through the Swiss Roots

program. Focus on this website is:

On August 1, 2007 the Fund co-sponsored the Swiss National Day in New York. The

festivities included live bands and a light show. The fund distributed flashlight key

chains to the approximate 1000 revelers.

32

Marketing Efforts Since May 2007 cont’d

Highlight in the Swiss Roots quarterly newsletter which included the launch of the new

www.swz.com website, the 20th anniversary celebration of the Swiss Helvetia Fund, and

the closing bell ceremony at the New York Stock Exchange. This article included a link

to the webcast of the closing bell ceremony.

Participation in the virtual forum for the Closed End Fund Association on December 4,

2007.

Monthly advertisement in The New Swiss Journal.

Ongoing efforts in keeping www.swz.com up to date with current news and statistics.

Mailing of quarterly reports to all Swiss Consulates in the U.S.

33

Stock Repurchase Program

Basic Data

34

Stock Repurchase Program 2008 (as of 4/30/08)

¹ Issue of 8,148,552 shares through rights offering.

² Dividend distribution of 1,204,020 shares issued 1/29/08.

$277,875

Net gain for the Fund

12.76%

Average discount

$15.53

Average purchase price

121,870

Shares repurchased

33,238,757²

Outstanding shares as of 4/30/08

32,547,207¹

Outstanding shares as of 6/28/07

24,397,655

Outstanding shares as of 12/31/06

35