The Swiss Helvetia Fund, Inc.

Invest in Switzerland

Stefan Frischknecht, CFA

Fund Manager

October 27, 2015

THE SWISS HELVETIA FUND, INC.

Agenda

n Case for Swiss equities

n Description of “The Swiss Helvetia Fund, Inc.” (SWZ US)

n The Adviser: Schroders

n Investment Philosophy and Process

n Performance

n Portfolio positioning and changes

n Outlook

n Conclusion

n Appendix

1

Source: Schroders

THE SWISS HELVETIA FUND, INC.

Why invest in The Swiss Helvetia Fund, Inc.

Isn’t this a single country equity fund which invests only in a small nation?

Switzerland = approx. 1/300 of global GDP

= approx. 1/1000 of world population

= approx. 1/1000 of world population

= approx. 1/3000 of land area of our planet

However, Switzerland is one of the top 10 global stock markets as measured by capitalization.

The size of the Swiss stock market is the result of its successful companies.

The size of the Swiss stock market is the result of its successful companies.

2

Source: Schroders, CIA World Fact Book (www.cia.gov).

The case for Swiss equities

THE SWISS HELVETIA FUND, INC.

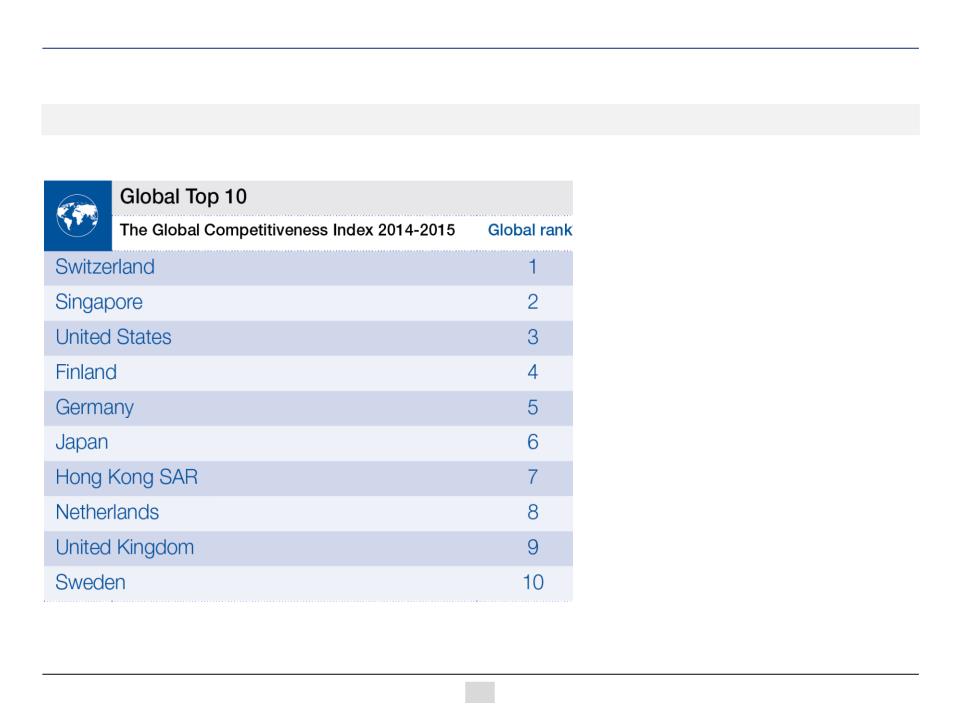

Swiss stocks also leading in global competitiveness

Very high percentage of Swiss index members are global leaders

4

1 Source: Schroder research and company own websites, Forbes 2014, EvaluateMedTech October 2014, BloombergNews July 17, 2014, Chemweek Aug 23, 2013, GlobalCement Dec

9, 2013, Leffingwell May 15, 2015, Staffingindustry Oct 16, 2013, Reuters May 19, 2015, Rigzone July 20, 2011. The views and forecasts contained herein are those of the Schroders

Swiss Equities team based on information that they believe to be reliable.

9, 2013, Leffingwell May 15, 2015, Staffingindustry Oct 16, 2013, Reuters May 19, 2015, Rigzone July 20, 2011. The views and forecasts contained herein are those of the Schroders

Swiss Equities team based on information that they believe to be reliable.

Name | Global rank within market | Market |

Nestle | 1 | Food |

Novartis | 2 | Drugs |

Roche | 1 | Diagnostics |

UBS | 1 | Wealth management |

ABB | 2 | Power transmission / distribution |

Richemont | 1 | Jewelry |

Syngenta | 1 | Crop protection |

Swiss Re | 2 | Reinsurance |

LafargeHolcim | 1 | Cement |

Givaudan | 1 | Flavours / fragrance |

Adecco | 1 | Staffing |

Swatch | 1 | Watches |

SGS | 1 | Inspection / testing |

Transocean | 1 | Ocean drilling rigs |

At points over the past several years, 70%

of large caps in the Swiss Market Index

(“SMI”) have been ranked first or second

within their markets on a global basis.1

of large caps in the Swiss Market Index

(“SMI”) have been ranked first or second

within their markets on a global basis.1

Approximately 40% of Swiss mid caps, too.

THE SWISS HELVETIA FUND, INC.

How is global leadership of Swiss stocks possible?

Switzerland offers an attractive business environment

5

Source: World Economic Forum, Global Competitiveness Report 2014-15, rank out of 144 economies.

The World Economic Forum

has been looking into drivers of

competitiveness and prosperity

in 144 economies. Amongst

others, the following help

explain the strong position of

Switzerland:

has been looking into drivers of

competitiveness and prosperity

in 144 economies. Amongst

others, the following help

explain the strong position of

Switzerland:

- innovation

- infrastructure

- education

- labor market efficiency

- macroeconomic environment

- business sophistication

- infrastructure

- education

- labor market efficiency

- macroeconomic environment

- business sophistication

THE SWISS HELVETIA FUND, INC.

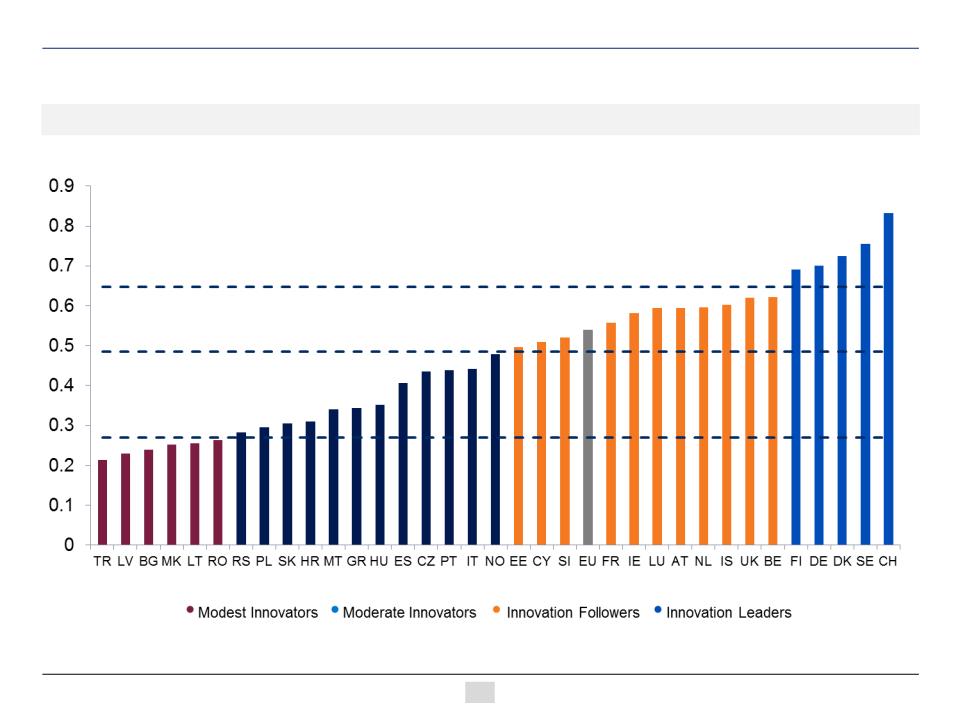

Swiss companies are innovation leaders

Per capita patent filings highest of in Europe

6

Source: Innovation Union Scoreboard 2011 (EU).

THE SWISS HELVETIA FUND, INC.

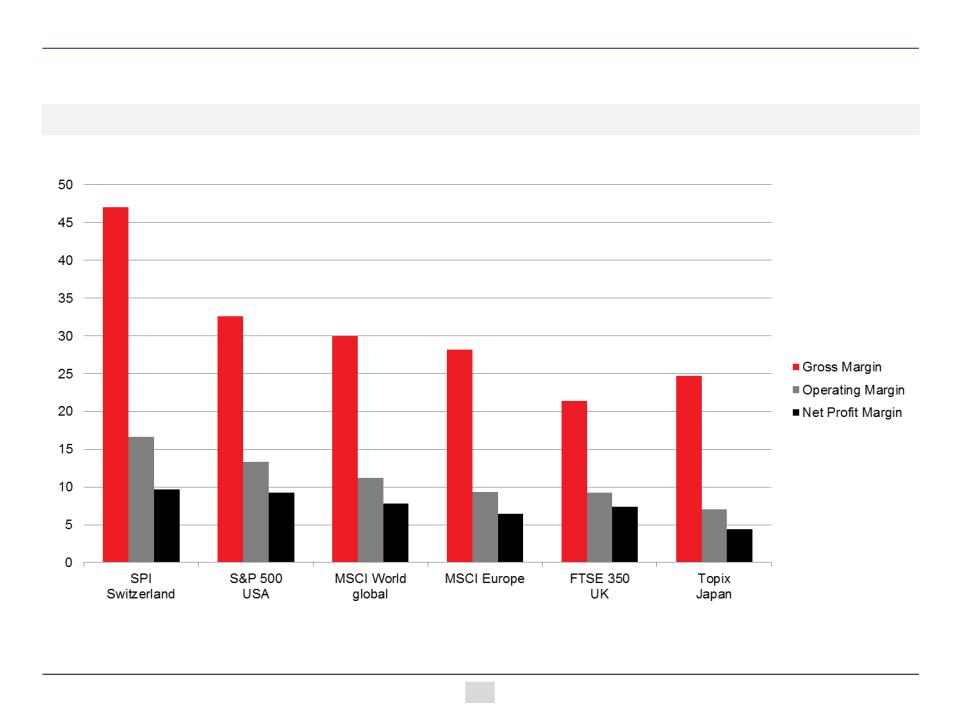

Global leadership results in high profitability

In a textbook manner, Swiss company leadership transforms into margins

7

Source: Schroders, Bloomberg as of December 31, 2014.

THE SWISS HELVETIA FUND, INC.

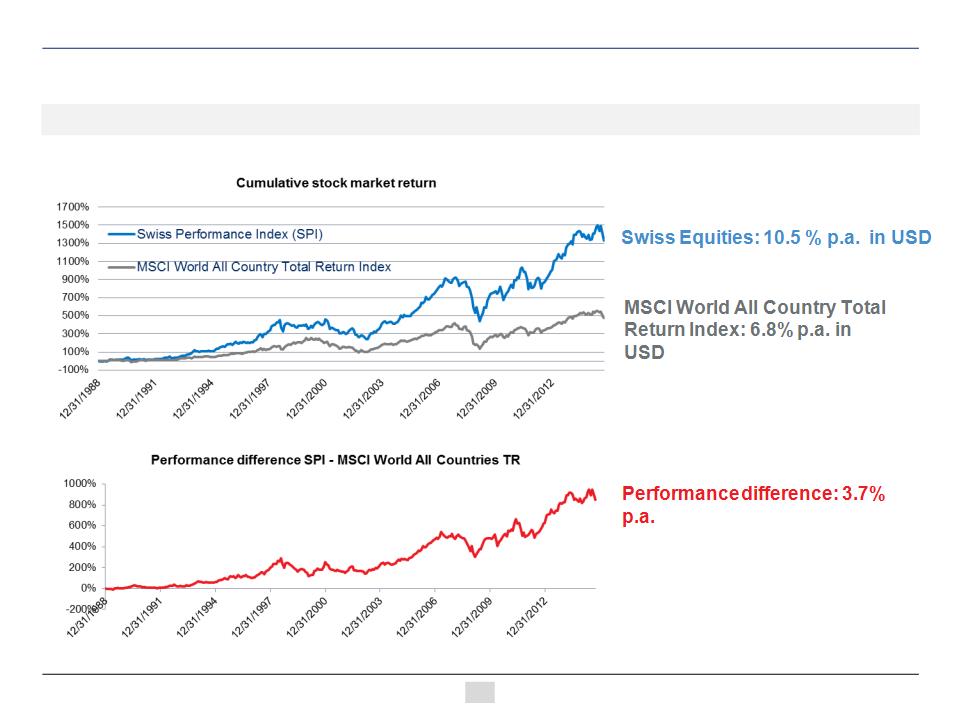

High profitability results in long-term outperformance

Swiss equities significantly outperformed global stocks for over 25 years

8

Source: Bloomberg, performance in USD as of September 30, 2015. Past performance is no guarantee of future results.

THE SWISS HELVETIA FUND, INC.

Swiss companies are geographically diversified

Swiss companies regional sales exposure

9

Source: HSBC, July 3, 2014; *UBS February 10, 2015, Data based on averages.

Europe

ex domestic

ex domestic

MEA

Unclassified

APAC

Americas

Domestic

Europe

ex domestic

ex domestic

MEA

Unclassified

APAC

Americas

Domestic

Europe

ex domestic

ex domestic

MEA

Unclassified

APAC

Americas

Domestic

Europe

Unclassified

APAC

Americas

ex US

ex US

Domestic

The Swiss Helvetia Fund, Inc.

THE SWISS HELVETIA FUND, INC.

The Swiss Helvetia Fund, Inc.

Why invest in the Fund?

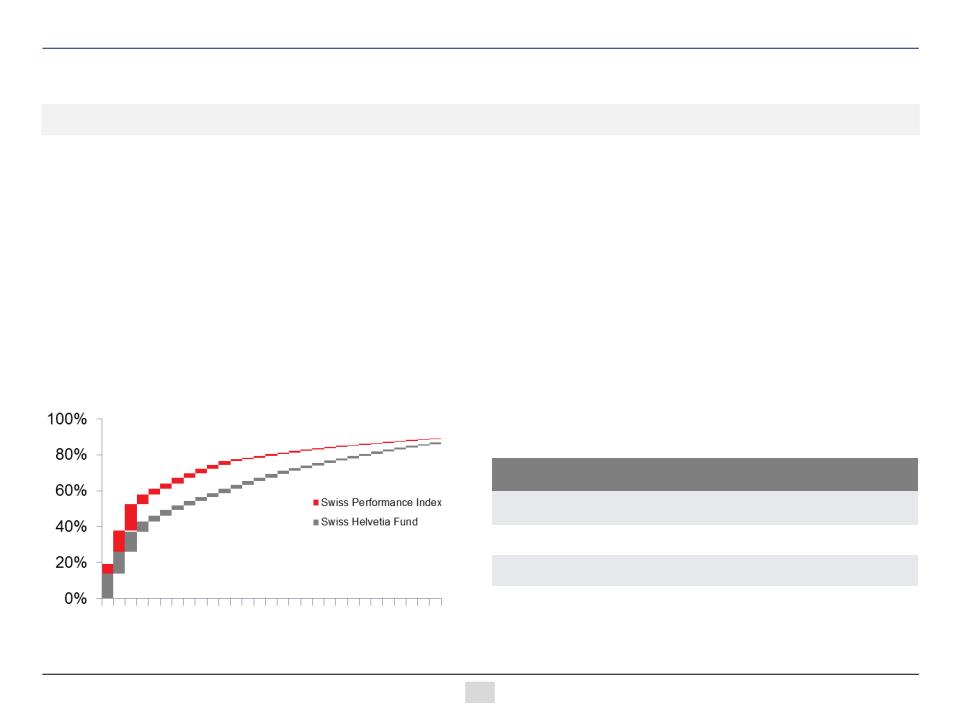

n Allows US investors to participate in the performance of the entire Swiss equity universe

n The Fund is actively managed by an experienced team out of Zurich, Switzerland

n Track record of team Swiss equities started on January 1, 1999

n Fundamental stock picking (bottom-up)

n Robust portfolio construction and risk management (top-down)

n Style focus on value, quality and size

n The Fund has a better diversification compared to the Swiss Performance Index (SPI)

11

Source: Schroders, Bloomberg.

Portfolio weight | SWZ | SPI |

Top 3 positions | 37% | 53% |

Top 5 positions | 46% | 61% |

Top 10 positions | 59% | 74% |

The investment adviser:

Schroders

Schroders

THE SWISS HELVETIA FUND, INC.

Schroders

Focus

n Asset management is our main business

Experience and independence

n Over 200 years of financial services

experience

experience

n Founding Schroder family controls 48%1 of

voting equity

voting equity

Resources

n Well established teams in all key investment

regions

regions

n Over 420 portfolio managers and

analysts worldwide

analysts worldwide

n Over 3,600 personnel in 27 countries

Financial strength

n US $487.4 billion in AUM globally

n Over US $1.5 billion surplus capital

available for building the business

available for building the business

1As of December 31, 2014.

Source: Schroders. Statistics are as of June 30, 2015.

Source: Schroders. Statistics are as of June 30, 2015.

Schroders offices

Key

A Alternatives (Property/EMD/Commodities) E Equities FI Fixed Income

MA Multi-Asset *Wealth management

Investment centers where Schroders has investment capabilities

Numbers represent personnel count

Argentina 2 (E)

Bermuda

Brazil 3 (E/FI/MA)

Cayman Islands*

Americas

UK and

Channel Islands

Channel Islands

UK 216 (A/E/FI/MA)*

Channel Islands 4 (A/MA)*

Denmark

France 3 (A)

Germany 5 (A)*

Gibraltar*

Italy 1 (MA)*

Europe and Middle East

Luxembourg

Netherlands

Spain*

Sweden

Switzerland 27 (A/E/FI/MA)*

UAE 3 (E)

Asia

Australia 26 (E/FI/MA)

China 4 (E) BoComm JV

Hong Kong 23 (E/FI/MA)*

India Axis JV

Indonesia 7 (E/FI/MA)

Japan 16 (E/FI/MA)

Singapore 19 (E/FI/MA)*

South Korea 8 (E/MA)

Taiwan 7 (E/MA)

Chile

Mexico

USA 52

(A/E/FI/MA)

A worldwide team dedicated to asset management

13

THE SWISS HELVETIA FUND, INC.

Schroders has had an established investment management presence since 1923 in

the US

the US

About Schroders

Schroder Investment Management North America

n A registered Investment Adviser with the SEC

n SIMNA Inc. manages $88.5 billion for clients across a range of asset classes

n AUM of $3.4 billion across 17 open-end mutual funds and $21.1 billion across 18 sub-

advisory portfolios

advisory portfolios

n Resources and infrastructure dedicated to managing, servicing and marketing 40-Act

registered portfolios

registered portfolios

n Dedicated U.S.-based compliance and legal teams to oversee regulatory requirements

n Existing structure in place for compliance & client service specialists to coordinate with

regional investment offices

regional investment offices

14

Source: Schroders, Schroder Investment Management North America assets include both SIMNA Inc. and SIMNA, Ltd SEC registered entities as of June 30, 2015,

mutual fund/sub-advisory AUM as of August 31, 2015.

mutual fund/sub-advisory AUM as of August 31, 2015.

THE SWISS HELVETIA FUND, INC.

n Track record of Swiss equity team started on January 1, 1999

n Proven and easy to understand process

n Fundamental stock picking (bottom-up)

n Robust portfolio construction and risk management (top-down)

n Style focus on value, quality and size

Schroders was selected by the independent directors of the Fund in 2014

for its track record, investment philosophy & process, its team and experience1

for its track record, investment philosophy & process, its team and experience1

About the portfolio management team

The Fund is managed by a Zurich based, experienced Swiss equity team

15

Source: Schroders; 1 The Swiss Helvetia Fund, Inc. press release, April 18, 2014 (www.swzfund.com).

Investment philosophy

and process

and process

THE SWISS HELVETIA FUND, INC.

Investment philosophy

3 main alpha sources

1. Value

n Definition: Classical Value Multiple Analysis (P/E, P/B, P/CF etc.) and Proprietary DCF Model

n Evidence: Kenneth R. French Database for Switzerland

2. Quality

n Definition: Quality of Balance Sheet, Management, Product/Service and shareholder value creation

n Evidence: Own empirical analysis re: debt/equity

3. Size (Small and Mid Cap)

n Definition: Stocks outside the large cap “Swiss Market Index” (SMI)

n Evidence: Performance of sub-indices within the all cap “Swiss Performance Index” (SPI)

17

Source: Schroders

THE SWISS HELVETIA FUND, INC.

Investment philosophy

Avoid high debt

18

Source: Bloomberg, Schroders, April 30, 2015. All returns in CHF.

THE SWISS HELVETIA FUND, INC.

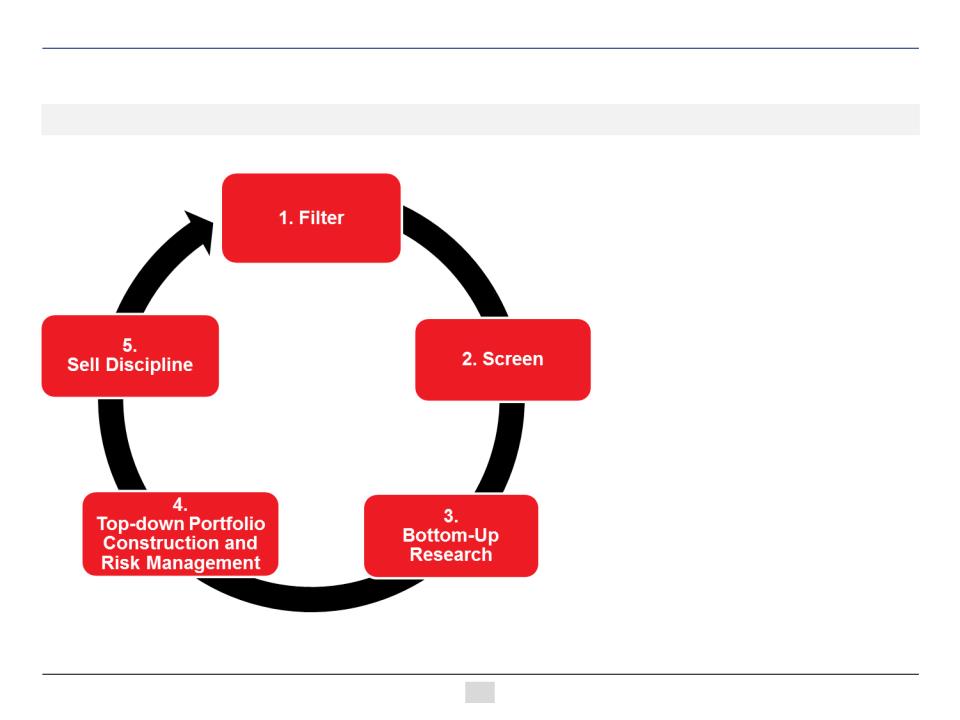

Investment process

5 recurring steps

19

Source: Schroders

1. Filter universe (209 stocks)

into investable stocks

(~125)

into investable stocks

(~125)

2. Screen for best ideas:

focus list of 60-80 names;

rest goes on watch list

focus list of 60-80 names;

rest goes on watch list

3. Detailed fundamental

research to come-up with

stock recommendations

research to come-up with

stock recommendations

4. Construct portfolio with 30-

40 names and monitor risks

40 names and monitor risks

5. Sell discipline a inherent part

of investment process

of investment process

209 stocks

60-80

30-40

125

THE SWISS HELVETIA FUND, INC.

Investment process II

Stock example: Implenia

Valuation

n Fair value: CHF 66 (upside 35%)

n Multiples: Est. P/E (2016) 10.9, Div yield 3.7%

20

Source: Schroders, Bloomberg, June 30, 2014. Data in CHF. For illustration only. Not a recommendation to buy or sell stocks mentioned.

Book value per share plus cumulative

dividends

dividends

1.

2.

3. bottom-up

Research

Research

4.

5.

Quality (Summary)

n Competitive Analysis +/- Leading construction services company in CH

n Shareholder Value Creation + 9% p.a. book value per share increase over 8y

n Management Quality + Seasoned and strongly committed management

n Balance Sheet Quality + Solid balance sheet, net cash; 27% goodwill/equity

THE SWISS HELVETIA FUND, INC.

Investment process

Sell discipline

Having a clear selling discipline is important for seeking to achieve consistent performance.

A stock is sold when:

A stock is sold when:

n Price target is reached

n Negative change of investment case (environment, positioning of firm, management)

n We find a better investment opportunity

21

Source: Schroders

1.

4.

5. Sell

discipline

discipline

2.

3.

Performance

THE SWISS HELVETIA FUND, INC.

Performance in USD % | H1 2015 | Q3 2015 | YTD (Sept 2015) |

NAV | 6.24 | -6.17 | -0.32 |

Swiss Performance Index, SPI | 6.50 | -6.64 | -0.57 |

Difference NAV | -0.26 | +0.47 | +0.25 |

Performance 2015

NAV and price performance in USD, as of September 30, 2015

23

Source: Schroders, Citi for fund performance and Bloomberg for Index performance; year-to-date performance as at September 30, 2015, reflecting end-of-day NAV

information available as of the date of publication; subject to subsequent change. Please consult quarterly, semi-annual and annual reports for NAV updates post

date of filing. Past performance is no guarantee of future results. Other periods would have achieved different results. Current performance may be higher or lower

than shown. Visit www.swzfund.com for the Fund’s most current performance.

information available as of the date of publication; subject to subsequent change. Please consult quarterly, semi-annual and annual reports for NAV updates post

date of filing. Past performance is no guarantee of future results. Other periods would have achieved different results. Current performance may be higher or lower

than shown. Visit www.swzfund.com for the Fund’s most current performance.

Net Asset Value

Performance in USD % | H1 2015 | Q3 2015 | YTD (Sept 2015) |

Share price SWZ | 5.03 | -5.03 | -0.26 |

Swiss Performance Index, SPI | 6.50 | -6.64 | -0.57 |

Difference | -1.47 | +1.61 | +0.31 |

Share price

This is after a negative performance

impact of approx. -1% from write-

downs on legacy private equity

positions. Significant positive

contribution to relative performance

from listed stocks.

impact of approx. -1% from write-

downs on legacy private equity

positions. Significant positive

contribution to relative performance

from listed stocks.

Portfolio positioning

THE SWISS HELVETIA FUND, INC.

Top Ten holdings

Top/bottom relative weights

Portfolio positioning

As of September 30, 2015

25

Source: Schroders. Portfolio composition is subject to change over time.

Name | Absolute weight |

Novartis | 13.9% |

Nestlé | 12.0% |

Roche | 11.4% |

Lindt & Sprüngli (Reg.) | 5.5% |

Syngenta | 3.4% |

Richemont | 3.1% |

Swatch (Registered) | 2.5% |

Tecan | 2.4% |

Burckhardt Compression | 2.3% |

Swiss Life | 2.3% |

58.8% |

Name | Relative weight |

Lindt & Sprüngli (Reg.) | +4.9% |

Tecan | +2.3% |

Burckhardt Compression | +2.2% |

Swatch (Registered) | +2.1% |

Logitech | +2.1% |

ABB | -3.1% |

Roche | -3.4% |

UBS | -4.0% |

Novartis | -4.7% |

Nestlé | -7.1% |

THE SWISS HELVETIA FUND, INC.

Portfolio positioning

ICB classification

26

Source: Schroders Citi, Bloomberg, September 30, 2015.

SWZ | SPI | Rel. % |

25.3% | 33.5% | -8.2% |

18.1% | 20.8% | -2.7% |

3.7% | 10.0% | -6.3% |

8.8% | 8.2% | 0.6% |

3.5% | 6.6% | -3.1% |

5.6% | 4.5% | 1.1% |

3.7% | 4.0% | -0.3% |

3.7% | 3.7% | 0.0% |

4.7% | 1.8% | 2.9% |

1.3% | 1.2% | 0.1% |

2.1% | 1.1% | 1.0% |

0.0% | 1.0% | -1.0% |

3.6% | 0.9% | 2.7% |

1.1% | 0.8% | 0.3% |

4.5% | 0.7% | 3.8% |

0.0% | 0.4% | -0.4% |

0.0% | 0.3% | -0.3% |

1.2% | 0.2% | 1.0% |

0.0% | 0.1% | -0.1% |

0.0% | 0.1% | -0.1% |

0.0% | 0.1% | -0.1% |

0.0% | 0.0% | 0.0% |

0.0% | 0.0% | 0.0% |

4.8% | 0.0% | 4.8% |

4.3% | 0.0% | 4.3% |

THE SWISS HELVETIA FUND, INC.

Portfolio positioning

Changes in positioning YTD 2015

27

Source: Schroders, Year-to-date through September 30, 2015.

New Positions |

Aryzta |

Airopack |

SFS |

Adecco |

gategroup |

ams |

Sunrise Communication |

Increased Positions |

Syngenta |

Richemont |

Swatch (Reg.) |

Dufry |

Nestlé |

Swiss Life |

Credit Suisse |

GAM |

Feintool |

Implenia |

OC Oerlikon |

DKSH |

Logitech |

Decreased Positions |

Clariant |

BCV |

UBS |

VZ |

Actelion |

Basilea |

Evolva |

Tecan |

Burckhardt Compression |

Bucher Industries |

Sold Positions |

Sika |

EFG International |

Leonteq |

THE SWISS HELVETIA FUND, INC.

Risk measures September 30, 2015

Portfolio positioning

Key statistical measures

28

Source: Schroders, Charles River, Prism, September 30, 2015. Please refer to the back of this presentation for definitions.

Swiss Helvetia Fund | Q3 2015 | Q4 2014 |

Tracking error | 2.9% | 2.8% |

Beta | 0.89* | 0.92 |

Relative VaR (95%) | 1.4% | 1.3% |

Volatility | 10.5% | 9.2% |

Active share | 43.8% | 42.8% |

Portfolio turnover

Swiss Helvetia Fund | |

Turnover in % of AuM Q3 2015 | 11% |

Turnover in % of AuM YTD 2015 | 27% |

Turnover calculation method: (Buys + Sells) / (average AuM)

*low beta due to cash position and underweight in financials

Outlook

THE SWISS HELVETIA FUND, INC.

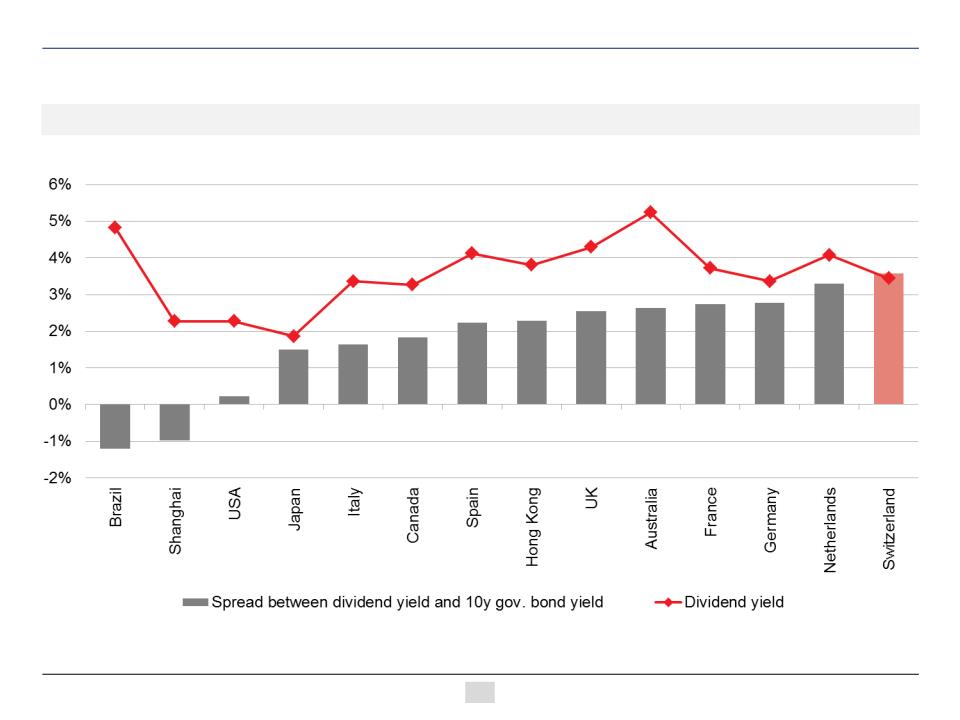

Investment outlook

n Global stock market valuations have become more expensive almost year after year since 2010

n But equity markets likely to benefit further from attractive / increasing dividends

n Swiss spread of dividend yield vs. 10 year government bond yield highest among major stock markets

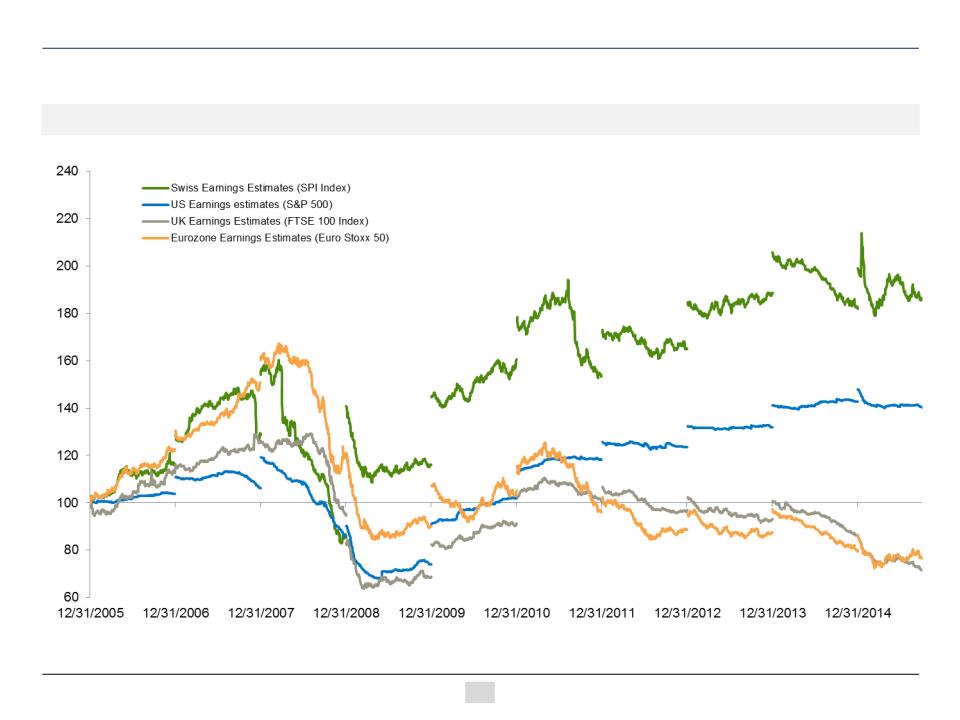

n We believe that Swiss equities will be among the best performing equity markets long-term

- thanks to its global leaders of industry

- which has over past 10 years led to superior earnings growth (which is likely to persist)

- in spite of strong Swiss franc (despite making news headlines in 2015, it is rather “business as

usual”)

- thanks to its global leaders of industry

- which has over past 10 years led to superior earnings growth (which is likely to persist)

- in spite of strong Swiss franc (despite making news headlines in 2015, it is rather “business as

usual”)

n Simultaneously, investors need to be aware of shorter-term risks/volatility

(due to geopolitics, central banks, economic data, contagion from other asset classes, etc.)

(due to geopolitics, central banks, economic data, contagion from other asset classes, etc.)

30

Views expressed reflect those of the portfolio management team and do not necessarily reflect the views of Schroders. These views are subject to change.

THE SWISS HELVETIA FUND, INC.

Investment outlook

Global comparison of dividend yield versus government bond yield

31

Source: Bloomberg, as of September 30, 2015. Yields fluctuate.

THE SWISS HELVETIA FUND, INC.

Investment outlook

Global comparison of earnings expectations

32

Source: Bloomberg: as of September 30, 2015, all earnings converted into US dollars.

Conclusion

THE SWISS HELVETIA FUND, INC.

Conclusion

n Swiss equities have a history of outperformance and are highly attractive from a long-term

total return perspective

total return perspective

n The Swiss Helvetia Fund is currently a way to invest in Swiss stocks at a discount

n Schroders has a proven philosophy, process and track record for Swiss equities

34

Views expressed reflect those of the portfolio management team and do not necessarily reflect the views of Schroders. These views are subject to change.

THE SWISS HELVETIA FUND, INC.

The Fund is a closed-end investment product. Common shares of the Fund are only available for purchase/sale on the NYSE at the current market price.

An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other

government agency.

An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other

government agency.

This presentation is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer

or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax

advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management North America Inc. does not warrant its

completeness or accuracy.

or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax

advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management North America Inc. does not warrant its

completeness or accuracy.

The returns presented represent past performance and are not necessarily representative of future returns, which may vary. The value of investments can fall as well

as rise as a result of market or currency movements.

as rise as a result of market or currency movements.

All investments, domestic and foreign, involve risks, including the risk of possible loss of principal. The market value of a fund’s portfolio may decline as a result of a

number of factors, including adverse economic and market conditions, prospects of stocks in the portfolio, changing interest rates, and real or perceived adverse

competitive industry conditions. Investing overseas involves special risks including among others risks related to political or economic instability, foreign currency

(such as exchange, valuation, and fluctuation) risk, market entry or exit restrictions, illiquidity, and taxation. The Swiss securities markets have substantially less

trading volume than the U.S. securities markets. Additionally, the capitalization of the Swiss securities markets is highly concentrated. Securities of some companies

located in Switzerland will be less liquid and more volatile than securities of comparable U.S. companies. This combination of lower volume and greater

concentration in the Swiss securities markets may create a risk of greater price volatility than in the U.S. securities markets.

number of factors, including adverse economic and market conditions, prospects of stocks in the portfolio, changing interest rates, and real or perceived adverse

competitive industry conditions. Investing overseas involves special risks including among others risks related to political or economic instability, foreign currency

(such as exchange, valuation, and fluctuation) risk, market entry or exit restrictions, illiquidity, and taxation. The Swiss securities markets have substantially less

trading volume than the U.S. securities markets. Additionally, the capitalization of the Swiss securities markets is highly concentrated. Securities of some companies

located in Switzerland will be less liquid and more volatile than securities of comparable U.S. companies. This combination of lower volume and greater

concentration in the Swiss securities markets may create a risk of greater price volatility than in the U.S. securities markets.

The views and forecasts contained herein are those of the Schroders Swiss Equities team and are subject to change. The information and opinions contained in this

document have been obtained from sources we consider to be reliable. No responsibility can be accepted for errors of facts obtained from third parties. Reliance

should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

document have been obtained from sources we consider to be reliable. No responsibility can be accepted for errors of facts obtained from third parties. Reliance

should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Definitions: Active share represents the proportion of stock holdings in the fund that is different from the composition found in the benchmark. Beta measures the

sensitivity of the fund to the movements of its benchmark. Volatility is measured by Standard deviation, which is the risk or volatility of an investment’s return over a

particular time period; the greater the number, the greater the risk. Tracking error is the difference between the price behavior of a position or a portfolio and the price

behavior of a benchmark. VaR is Value at Risk, a widely used risk measure of the risk of loss on a specific portfolio of financial exposures.

sensitivity of the fund to the movements of its benchmark. Volatility is measured by Standard deviation, which is the risk or volatility of an investment’s return over a

particular time period; the greater the number, the greater the risk. Tracking error is the difference between the price behavior of a position or a portfolio and the price

behavior of a benchmark. VaR is Value at Risk, a widely used risk measure of the risk of loss on a specific portfolio of financial exposures.

Each of the indices shown are for illustrative purposes and are intended only to reflect a comparative investment proxy for their respective asset class. Each is an

unmanaged basket of securities, and investors cannot invest directly in any index.

unmanaged basket of securities, and investors cannot invest directly in any index.

www.schroders.com/us

Important information

35