UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05151

JPMorgan Mutual Fund Group

(Exact name of registrant as specified in charter)

245 Park Avenue

New York, NY 10167

(Address of principal executive offices) (Zip code)

Stephen M. Benham

245 Park Avenue

New York, NY 10167

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: August 31

Date of reporting period: September 1, 2006 to August 31, 2006

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

JPMorgan Emerging Markets Debt Fund

JPMorgan Enhanced Income Fund

JPMorgan Real Return Fund

JPMorgan Short Term Bond Fund

JPMorgan Short Term Bond Fund II

JPMorgan Strategic Income Fund

(formerly JPMorgan Global Strategic Income Fund)

| President’s Letter | 1 | |||||

| Fund Commentaries: | ||||||

| JPMorgan Bond Fund | 2 | |||||

| JPMorgan Emerging Markets Debt Fund | 4 | |||||

| JPMorgan Enhanced Income Fund | 6 | |||||

| JPMorgan Real Return Fund | 8 | |||||

| JPMorgan Short Term Bond Fund | 10 | |||||

| JPMorgan Short Term Bond Fund II | 12 | |||||

| JPMorgan Strategic Income Fund | 14 | |||||

| Schedules of Portfolio Investments | 16 | |||||

| Financial Statements | 84 | |||||

| Financial Highlights | 102 | |||||

| Notes to Financial Statements | 120 | |||||

| Report of Independent Registered Public Accounting Firm | 132 | |||||

| Trustees | 133 | |||||

| Officers | 135 | |||||

| Schedule of Shareholder Expenses | 137 | |||||

| Board Approval of Investment Advisory Agreement | 140 | |||||

| Tax Letter | 143 |

| • | Rate hike, energy price and inflation concerns pressed upon investors |

| • | FOMC’s tightening campaign paused in August after 17 consecutive rate increases |

| • | Bond rally underscored by better-than-expected inflation data |

| • | Cooling housing market began seeping into the broad market |

SEPTEMBER 15, 2006 (Unaudited)

“Although we do not forecast a recession, a classic economic slowdown appears to be unfolding, and this points to a potentially supportive environment for fixed income investors.”

President

JPMorgan Funds

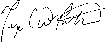

AS OF AUGUST 31, 2006 (Unaudited)

| Fund Inception | July 26, 1993 | |||||

| Fiscal Year-End | August 31 | |||||

| Net Asset as of 8/31/06 (In Thousands) | $1,740,080 | |||||

| Primary Benchmark | Lehman Brothers Aggregate Bond Index | |||||

| Average Credit Quality | AA | |||||

| Duration | 4.3 Years | |||||

Q: | HOW DID THE FUND PERFORM? |

A: | The JPMorgan Bond Fund, which seeks to provide high total return consistent with moderate risk of capital and maintenance of liquidity, returned 1.81% (Institutional Class Shares) over the 12 months ended August 31, 2006, compared to the 1.71% return for the Lehman Brothers Aggregate Bond Index over the same period.* |

Q: | WHY DID THE FUND PERFORM THIS WAY? |

A: | The Fund outperformed its benchmark for the period due primarily to emerging markets debt, which significantly outperformed the broader fixed income market. The sector experienced an impressive rally for the year, fueled by surging capital inflows, high commodity prices, improving credit quality and the announcement of debt repurchase programs by a number of countries. Asset-backed securities (ABS), commercial mortgage-backed securities (CMBS) and high-yield investments (“junk bonds”) also contributed to positive performance. The high-yield sector was well supported by solid corporate earnings, low default rates and robust technicals. |

Q: | HOW WAS THE FUND MANAGED? |

A: | Given the rising rate environment for most of the year, we managed interest rate risk from a tactical perspective, with a bias toward being short in intermediate maturities. This approach proved beneficial as interest rates rose during the Federal Reserve’s tightening cycle but came to a halt in July and August 2006 when interest rates rallied significantly. |

| Corporate Bonds | 33.8 | % | ||||

| Mortgage Pass-Through Securities | 31.4 | |||||

| Collateralized Mortgage Obligations | 18.1 | |||||

| Asset Backed Securities | 13.7 | |||||

| Short-Term Investments | 8.6 | |||||

| U.S. Government Agency Securities | 6.4 | |||||

| Commercial Mortgage Backed Securities | 5.0 | |||||

| Foreign Government Securities | 4.0 | |||||

| U.S. Treasury Obligations | 3.4 | |||||

| Other (less than 1.0%) | 2.1 |

| * | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| ** | Percentages indicated are based upon net assets as of August 31, 2006. The Fund’s composition is subject to change. |

| INCEPTION DATE OF CLASS | 1 Year | 5 Year | 10 Year | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

CLASS A SHARES | 9/10/2001 | |||||||||||||||||

| Without Sales Charge | 1.42 | % | 4.76 | % | 6.09 | % | ||||||||||||

| With Sales Charge* | (2.34 | ) | 3.97 | 5.69 | ||||||||||||||

CLASS B SHARES | 9/10/2001 | |||||||||||||||||

| Without CDSC | 0.90 | 3.87 | 5.64 | |||||||||||||||

| With CDSC** | (4.10 | ) | 3.52 | 5.64 | ||||||||||||||

CLASS C SHARES | 3/31/2003 | |||||||||||||||||

| Without CDSC | 0.97 | 3.97 | 5.69 | |||||||||||||||

| With CDSC*** | (0.03 | ) | 3.97 | 5.69 | ||||||||||||||

SELECT CLASS SHARES | 9/10/2001 | 1.55 | 4.72 | 6.07 | ||||||||||||||

INSTITUTIONAL CLASS SHARES | 7/26/1993 | 1.81 | 4.90 | 6.25 | ||||||||||||||

ULTRA SHARES | 9/10/2001 | 1.80 | 4.99 | 6.35 | ||||||||||||||

| * | Sales Charge for Class A Shares is 3.75%. |

| ** | Assumes 5% CDSC (contingent deferred sales charge) for the one year period, a 2% CDSC for the five year period and 0% CDSC thereafter. |

| *** | Assumes 1% CDSC for the one year period and 0% CDSC thereafter. |

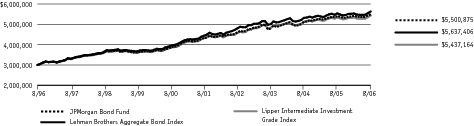

AS OF AUGUST 31, 2006 (Unaudited)

| Fund Inception | April 17, 1997 | |||||

| Fiscal Year-End | August 31 | |||||

| Net Asset as of 8/31/06 (In Thousands) | $119,917 | |||||

| Primary Benchmark | Emerging Markets Bond Index Global | |||||

| Average Credit Quality | BB+ | |||||

| Duration | 6.3 Years | |||||

Q: | HOW DID THE FUND PERFORM? |

A: | The JPMorgan Emerging Markets Debt Fund, which seeks to provide high total return from a portfolio of fixed income securities of emerging markets issuers, returned 10.99% (Select Class Shares) over the 12 months ended August 31, 2006, compared to the 9.00% return for the Emerging Markets Bond Index Global over the same period.* |

Q: | WHY DID THE FUND PERFORM THIS WAY? |

A: | The Fund outperformed its benchmark for the period due to strong economic fundamentals in emerging economies, improved credit quality and sustained inflows. The Fund benefited from an overweight in Argentina, as strong growth figures coupled with heavy investor inflows led its debt to rally. An underweight in Turkey contributed as well, as its dollar-denominated debt underperformed. Security selection played a vital role in the Fund’s outperformance, as our holdings in Venezuela, a major oil exporter, benefited from strong global demand for oil. Brazilian holdings performed well, as the government continued their plan to buy back up to $20 billion in external debt. Mexican local bonds also performed well, as local inflation continued to moderate. In addition, numerous credit upgrades from rating agencies benefited returns, as countries demonstrated a greater willingness and ability to repay debt. In March, Standard & Poor’s upgraded Argentina’s rating from B– to B, while Brazilian local debt was upgraded in late August by Moody’s from Ba3 to Ba2. On the negative side, an underweight in Peru hindered performance, as the country recovered quickly following the election of Ollanta Humala. In addition, overweights in Russia, which lagged the overall market, and the Ukraine, which was still besieged by political difficulties, hurt returns. |

Q: | HOW WAS THE FUND MANAGED? |

A: | Overall, the Fund was positioned in countries that provided strong insulation from a higher-rate environment. Economic indicators suggested that the global economy was resilient to sharply increased energy prices during 2005, which benefited commodities during the first two quarters of 2006. Market fundamentals were positive, supported by global growth and strong demand for commodity-based goods. New issuance continued to be ahead of schedule and several countries announced debt repurchasing plans. Investors’ demand has been quite strong, while new issuance has been oversubscribed. We also found that technicals favored the market’s weak supply. |

| Foreign Government Securities | 65.0 | % | ||||

| Corporate Bonds | 21.2 | |||||

| U.S. Treasury Obligations | 7.4 | |||||

| Short-Term Investments | 2.5 |

| Brazil | 16.6 | % | ||||

| Russia | 15.4 | |||||

| Venezuela | 11.5 | |||||

| United States | 9.9 | |||||

| Argentina | 7.5 | |||||

| Mexico | 6.9 | |||||

| Indonesia | 3.3 | |||||

| Peru | 3.2 | |||||

| Uruguay | 2.9 | |||||

| Turkey | 2.5 | |||||

| Ukraine | 2.5 | |||||

| Colombia | 2.5 | |||||

| Dominican Republic | 2.2 | |||||

| Luxembourg | 2.1 | |||||

| Panama | 2.1 | |||||

| Chile | 1.7 | |||||

| El Salvador | 1.7 | |||||

| Other (less than 1.0%) | 1.6 |

| * | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| ** | Percentages indicated are based upon net assets as of August 31, 2006. The Fund’s composition is subject to change. |

| INCEPTION DATE | 1 YEAR | 5 YEAR | SINCE INCEPTION | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Class A Shares | 6/30/06 | |||||||||||||||||

| Without Sales Charge | 10.95 | % | 15.22 | % | 11.20 | % | ||||||||||||

| With Sales Charge* | 6.81 | 14.33 | 10.75 | |||||||||||||||

CLASS C SHARES | 6/30/06 | |||||||||||||||||

| Without CDSC | 10.89 | 15.21 | 11.20 | |||||||||||||||

| With CDSC** | 9.89 | 15.21 | 11.20 | |||||||||||||||

R CLASS SHARES | 5/15/06 | 11.07 | 15.24 | 11.22 | ||||||||||||||

SELECT CLASS SHARES | 4/17/97 | 10.99 | 15.23 | 11.21 | ||||||||||||||

| * | Sales Charge for Class A Shares is 3.75%. |

| ** | Assumes 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

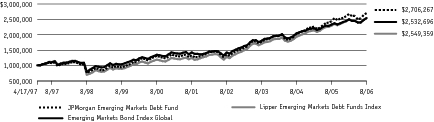

AS OF AUGUST 31, 2006 (Unaudited)

| Fund Inception | November 30, 2001 | |||||

| Fiscal Year-End | August 31 | |||||

| Net Asset as of 8/31/06 (In Thousands) | $131,238 | |||||

| Primary Benchmark* | Merrill Lynch USD LIBOR 3 Month Constant Maturity Index | |||||

| Average Credit Quality | AA– | |||||

| Duration | 0.2 Years | |||||

Q: | HOW DID THE FUND PERFORM? |

A: | The JPMorgan Enhanced Income Fund, which seeks to provide high current income consistent with principal preservation, returned 4.61% (Institutional Class Shares) over the 12 months ended August 31, 2006, compared to the 4.54% return for the Merrill Lynch USD LIBOR 3 Month Constant Maturity Index over the same period.** |

Q: | WHY DID THE FUND PERFORM THIS WAY? |

A: | The Fund outperformed its benchmark for the period due primarily to investments in investment-grade corporate bonds, asset-backed securities (ABS) and mortgage-backed securities (MBS). The investment-grade corporate sector was well supported by solid earnings, low default rates and robust fundamentals. On the negative side, select mortgage overlay trades hurt performance in fourth quarter 2005, as the sector experienced high volatility. |

Q: | HOW WAS THE FUND MANAGED? |

A: | We tactically traded duration with a bias toward being short versus the benchmark. This approach proved beneficial as interest rates rose during the Federal Reserve’s tightening cycle but came to a halt in July and August 2006 when interest rates rallied significantly. |

| Corporate Bonds | 37.8 | % | ||||

| Asset Backed Securities | 25.5 | |||||

| Collateralized Mortgage Obligations | 22.7 | |||||

| Short-Term Investments | 16.6 | |||||

| Mortgage Pass Through Securities | 3.1 | |||||

| Commercial Mortgage Backed Securities | 3.0 | |||||

| Other (less than 1.0%) | 0.6 |

| * | The Fund’s benchmark changed to the Merrill Lynch USD LIBOR 3 Month Constant Maturity Index effective December 31, 2005. |

| ** | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based upon net assets as of August 31, 2006. The Fund’s composition is subject to change. |

| INCEPTION DATE | 1 YEAR | 3 YEAR | SINCE INCEPTION | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

INSTITUTIONAL CLASS SHARES | 11/30/01 | 4.61 | % | 2.85 | % | 2.37 | % | |||||||||||

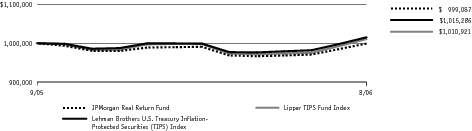

AS OF AUGUST 31, 2006 (Unaudited)

| Fund Inception | September 1, 2005 | |||||

| Fiscal Year-End | August 31 | |||||

| Net Asset as of 8/31/06 (In Thousands) | $60,434 | |||||

| Primary Benchmark | Lehman Brothers U.S. Treasury Inflation-Protected Securities (TIPS) Index | |||||

| Average Credit Quality | AAA | |||||

| Duration | 7.7 Years | |||||

Q: | HOW DID THE FUND PERFORM? |

A: | The JPMorgan Real Return Fund, which seeks to maximize inflation protected return, returned –0.09% (Select Class Shares) for the since-inception period ended August 31, 2006, compared to the 1.53% return for the Lehman Brothers U.S. Treasury Inflation-Protected Securities (TIPS) Index over the same period.* |

Q: | WHY DID THE FUND PERFORM THIS WAY? |

A: | The Fund underperformed its benchmark for the period due to its interest-rate and yield curve strategies, particularly in the latter half of the year when interest rates rallied on fears that U.S. economic growth would fall below trend. Short-duration exposures in foreign markets, such as the U.K. and Japan, hindered performance as bond markets rallied despite fundamentally positive economic growth. |

Q: | HOW WAS THE FUND MANAGED? |

A: | Major gains in wholesale energy markets led to an overweight in short-term TIPS due to anticipated high rates of headline inflation in the second and third quarters of 2006. |

| U.S. Treasury Obligations | 80.8 | % | ||||

| Mortgage Pass-Through Securities | 11.3 | |||||

| Collateralized Mortgage Obligations | 7.8 | |||||

| Short-Term Investments | 4.9 | |||||

| Asset Backed Securities | 4.2 | |||||

| Corporate Bonds | 1.6 | |||||

| Other (less than 1.0%) | 2.1 |

| * | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| ** | Percentages indicated are based upon net assets as of August 31, 2006. The Fund’s composition is subject to change. |

| INCEPTION DATE OF CLASS | Since Inception | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

CLASS A SHARES | �� | 9/1/05 | ||||||||

| Without Sales Charge | (0.43 | )% | ||||||||

| With Sales Charge* | (4.17 | ) | ||||||||

CLASS C SHARES | 9/1/05 | |||||||||

| Without CDSC | (0.91 | ) | ||||||||

| With CDSC** | (1.91 | ) | ||||||||

SELECT CLASS SHARES | 9/1/05 | (0.09 | ) | |||||||

INSTITUTIONAL CLASS SHARES | 9/1/05 | 0.12 | ||||||||

| * | Sales Charge for Class A Shares is 3.75%. |

| ** | Assumes 1% CDSC for the one year period and 0% CDSC thereafter. |

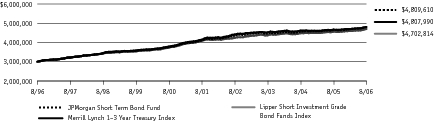

AS OF AUGUST 31, 2006 (Unaudited)

| Fund Inception | September 13, 1993 | |||||

| Fiscal Year-End | August 31 | |||||

| Net Asset as of 8/31/06 (In Thousands) | $1,026,269 | |||||

| Primary Benchmark | Merrill Lynch 1–3 Year Treasury Index | |||||

| Average Credit Quality | AA | |||||

| Duration | 1.6 Years | |||||

Q: | HOW DID THE FUND PERFORM? |

A: | The JPMorgan Short Term Bond Fund, which seeks to provide high total return, consistent with low volatility of principal, returned 3.47% (Institutional Class Shares) over the 12 months ended August 31, 2006, compared to the 2.95% return for the Merrill Lynch 1–3 Year Treasury Index over the same period.* |

Q: | WHY DID THE FUND PERFORM THIS WAY? |

A: | The Fund outperformed its benchmark for the period due to investments in corporate bonds, high yield securities (“junk bonds”), structured products, and duration and curve positioning. The investment-grade corporate sector was supported by solid earnings, low default rates and robust fundamentals. Within corporate, we held a bias toward financials, as valuations remained attractive. Additionally, we continued to favor short-term BBB-rated securities, relative to more defensive higher-rated names, given the tight level of spreads. The high-yield sector posted strong performance on account of low default rates, favorable earnings and strong technicals. Our holdings in the high-yield sector were highly diversified across different industries. |

Q: | HOW WAS THE FUND MANAGED? |

A: | We tactically traded duration with a bias toward being short versus the benchmark. Our short duration bias proved beneficial, as interest rates rose over the year. The Fund’s allocation to collateralized mortgage obligations (CMOs) was increased, swapping out of lower-yielding corporates and agencies. We selectively added names in the investment-grade corporate sector that offered attractive relative value and diversification opportunities. We also added more asset-backed securities, such as home equity loans, which remain well supported by strong CDO (collateralized debt obligation) and real money demand. |

| Short-Term Investments | 29.3 | % | ||||

| Corporate Bonds | 28.2 | |||||

| Asset Backed Securities | 17.3 | |||||

| Collateralized Mortgage Obligations | 14.8 | |||||

| Mortgage Pass-Through Securities | 11.1 | |||||

| Commercial Mortgage Backed Securities | 9.4 | |||||

| Foreign Government Securities | 1.9 | |||||

| Preferred Stock | 1.3 | |||||

| Other (less than 1.0%) | 0.4 |

| * | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| ** | Percentages indicated are based upon net assets as of August 31, 2006. The Fund’s composition is subject to change. |

| INCEPTION DATE OF CLASS | 1 YEAR | 5 YEAR | 10 YEAR | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

CLASS A SHARES | 9/10/01 | |||||||||||||||||

| Without Sales Charge | 3.04 | % | 2.75 | % | 4.47 | % | ||||||||||||

| With Sales Charge* | 0.74 | 2.28 | 4.23 | |||||||||||||||

SELECT CLASS SHARES | 9/10/01 | 3.22 | 2.94 | 4.56 | ||||||||||||||

INSTITUTIONAL CLASS SHARES | 9/13/93 | 3.47 | 3.22 | 4.83 | ||||||||||||||

| * | Sales Charge for Class A Shares is 2.25%. |

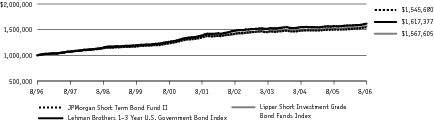

AS OF AUGUST 31, 2006 (Unaudited)

| Fund Inception | November 30, 1990 | |||||

| Fiscal Year-End | August 31 | |||||

| Net Asset as of 8/31/06 (In Thousands) | $616,938 | |||||

| Primary Benchmark | Lehman Brothers 1–3 Year U.S. Government Bond Index | |||||

| Average Credit Quality | AA | |||||

| Duration | 1.6 Years | |||||

Q: | HOW DID THE FUND PERFORM? |

A: | The JPMorgan Short Term Bond Fund II, which seeks a high level of income, consistent with preservation of capital, returned 2.91% (Select Class Shares) over the 12 months ended August 31, 2006, compared to the 3.02% return for the Lehman Brothers 1–3 Year U.S. Government Bond Index over the same period.* |

Q: | WHY DID THE FUND PERFORM THIS WAY? |

A: | The Fund underperformed its benchmark for the period due to select agency holdings and duration trades. Even though agencies received a boost from persistently strong demand from the hedge fund community and Asian investors, holding an underweight in the sector prevented the Fund from benefiting and adversely impacted results. Duration trades also detracted from performance when rates rallied significantly in July and August. On the positive side, the Fund’s allocation in corporate bonds, structured products and collateralized mortgage obligations (CMOs) contributed to performance. We also took profit on our duration and curve positioning. |

Q: | HOW WAS THE FUND MANAGED? |

A: | We tactically traded duration with a bias toward being short versus the benchmark. Our short duration bias proved beneficial, as interest rates rose over the year. The Fund’s allocation to CMOs was increased as we swapped out of lower-yielding corporates and agencies. We also added more asset-backed securities, such as home equity loans, which remained well supported by strong CDO (collateralized debt obligation) and real money demand. |

| Corporate Bonds | 29.5 | % | ||||

| Asset Backed Securities | 21.0 | |||||

| Collateralized Mortgage Obligations | 19.8 | |||||

| Commercial Mortgage Backed Securities | 13.7 | |||||

| Short-Term Investments | 13.1 | |||||

| Mortgage Pass-Through Securities | 12.6 | |||||

| Foreign Government Securities | 2.8 | |||||

| Other (less than 1%) | 0.5 |

| * | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| ** | Percentages indicated are based upon net assets as of August 31, 2006. The Fund’s composition is subject to change. |

| INCEPTION DATE OF CLASS | 1 Year | 5 Year | 10 Year | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

CLASS A SHARES | 5/6/96 | |||||||||||||||||

| Without Sales Charge | 2.66 | % | 2.58 | % | 4.15 | % | ||||||||||||

| With Sales Charge* | 0.36 | 2.12 | 3.91 | |||||||||||||||

CLASS M SHARES | 7/1/99 | |||||||||||||||||

| Without Sales Charge | 2.40 | 2.32 | 3.96 | |||||||||||||||

| With Sales Charge** | 0.89 | 2.00 | 3.81 | |||||||||||||||

SELECT CLASS SHARES | 11/30/90 | 2.91 | 2.82 | 4.45 | ||||||||||||||

| * | Sales Charge for Class A Shares is 2.25%. |

| ** | Sales Charge for Class M Shares is 1.50%. |

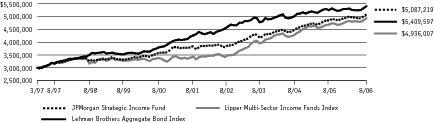

(formerly JPMorgan Global Strategic Income Fund)

AS OF AUGUST 31, 2006 (Unaudited)

| Fund Inception | March 17, 1997 | |||||

| Fiscal Year-End | August 31 | |||||

| Net Asset as of 8/31/06 (In Thousands) | $25,048 | |||||

| Primary Benchmark | Lehman Brothers Aggregate Bond Index | |||||

| Average Credit Quality | A+ | |||||

| Duration | 4.1 Years | |||||

Q: | HOW DID THE FUND PERFORM? |

A: | The JPMorgan Strategic Income Fund, which seeks to provide high total return primarily from a portfolio of fixed income investments of foreign and domestic issuers and counterparties, returned 3.81% (Institutional Class Shares) over the 12 months ended August 31, 2006, compared to the 1.71% return for the Lehman Brothers Aggregate Bond Index over the same period.** |

Q: | WHY DID THE FUND PERFORM THIS WAY? |

A: | The Fund outperformed its benchmark for the period due to significant exposure to and security selection in emerging market and high-yield debt (“junk bonds”), which outperformed the broader fixed income market. Despite some volatility in the sector, emerging market debt continued to prosper due to strong capital inflows, rising energy prices and improving credit quality. The sector’s returns were fueled by the underlying strength in commodity prices, firm fundamentals and the continued support of debt buy-backs by emerging market countries. High-yield debt outperformed as well on the back of strong corporate earnings, low default rates and new issuance that was well received in the primary market. The Fund’s investment in mortgages also contributed positively. On the negative side, an underweight in corporates detracted from performance. Returns for the international sector were flat for the period. |

Q: | HOW WAS THE FUND MANAGED? |

A. | As spreads in the emerging market debt and high-yield markets narrowed, we reduced our exposure, taking some profit. This approach proved beneficial, as these sectors experienced volatility toward the end of the second quarter. |

| Corporate Bonds | 33.0 | % | ||||

| Mortgage Pass-Through Securities | 32.9 | |||||

| Short-Term Investments | 20.5 | |||||

| Foreign Government Securities | 12.9 | |||||

| Non-Call Mortgages | 7.3 | |||||

| Asset Backed Securities | 5.1 | |||||

| U.S. Treasury Obligations | 2.7 | |||||

| Collateralized Mortgage Obligations | 2.1 | |||||

| Commercial Mortgage Backed Securities | 1.6 |

| United States | 103.2 | % | ||||

| Venezuela | 1.7 | |||||

| Argentina | 1.4 | |||||

| Dominican Republic | 1.1 | |||||

| Ukraine | 1.0 | |||||

| Mexico | 1.0 | |||||

| Other (less than 1.0%) | 8.7 |

| * | The Fund’s name was changed from JPMorgan Global Strategic Income Fund to JPMorgan Strategic Income Fund on June 16, 2006. Its investment objective and strategies also changed on the same date. |

| ** | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | Percentages indicated are based upon net assets as of August 31, 2006. The Fund’s composition is subject to change. |

| INCEPTION DATE OF CLASS | 1 Year | 5 Year | Since Inception | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

CLASS A SHARES | 9/10/01 | |||||||||||||||||

| Without Sales Charge | 3.24 | % | 5.08 | % | 5.25 | % | ||||||||||||

| With Sales Charge* | (0.59 | ) | 4.28 | 4.82 | ||||||||||||||

CLASS B SHARES | 2/19/05 | |||||||||||||||||

| Without CDSC | 2.80 | 4.91 | 5.16 | |||||||||||||||

| With CDSC** | (2.20 | ) | 4.58 | 5.16 | ||||||||||||||

CLASS C SHARES | 2/19/05 | |||||||||||||||||

| Without CDSC | 2.71 | 4.92 | 5.16 | |||||||||||||||

| With CDSC *** | 1.71 | 4.92 | 5.16 | |||||||||||||||

CLASS M SHARES | 2/19/05 | |||||||||||||||||

| Without Sales Charge | 2.99 | 5.00 | 5.20 | |||||||||||||||

| With Sales Charge**** | (0.11 | ) | 4.35 | 4.86 | ||||||||||||||

SELECT CLASS SHARES | 9/10/01 | 3.58 | 5.39 | 5.41 | ||||||||||||||

INSTITUTIONAL CLASS SHARES | 3/17/97 | 3.81 | 5.72 | 5.74 | ||||||||||||||

| * | Sales Charge for Class A Shares is 3.75%. |

| ** | Assumes 5% CDSC (contingent deferred sales charge) for the one year period, a 2% CDSC for the five year period and 0% CDSC thereafter. |

| *** | Assumes 1% CDSC for the one year period and 0% CDSC thereafter. |

| **** | Sales Charge for Class M Shares is 3.00%. |

AS OF AUGUST 31, 2006

| PRINCIPAL AMOUNT($) | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — 117.0% | |||||||||||

Asset Backed Securities — 13.7% | |||||||||||

| 5,000 | Accredited Mortgage Loan Trust, Series 2006-1, Class A3, FRN, 5.50%, 04/25/36 (m) | 5,007 | |||||||||

| 2,022 | American Express Credit Account Master Trust, Series 2004-C, Class C, FRN, 5.83%, 02/15/12 (e) (m) | 2,027 | |||||||||

| AmeriCredit Automobile Receivables Trust, | |||||||||||

| 2,058 | Series 2003-DM, Class A4A, 2.84%, 08/06/10 (m) | 2,027 | |||||||||

| 747 | Series 2004-DF, Class A3, 2.98%, 07/06/09 (m) | 739 | |||||||||

| 5,000 | Asset Backed Securities Corp Home Equity, Series 2006-HE5, Class M2, FRN, 5.62%, 07/25/36 (m) | 5,000 | |||||||||

| 6,000 | Bank of America Credit Card Trust, Series 2006-C4, Class C4, FRN, 5.56%, 11/15/11 (m) | 5,998 | |||||||||

| Capital Auto Receivables Asset Trust, | |||||||||||

| 2,093 | Series 2003-2, Class A4A, 1.96%, 01/15/09 (m) | 2,090 | |||||||||

| 6,320 | Series 2006-1 A2A, 5.03%, 09/15/08 (m) | 6,307 | |||||||||

| Capital One Auto Finance Trust, | |||||||||||

| 1,107 | Series 2003-B, Class A4, 3.18%, 09/15/10 (m) | 1,091 | |||||||||

| 3,250 | Series 2004-A, Class A4, FRN, 5.43%, 03/15/11 (m) | 3,251 | |||||||||

| 6,480 | Capital One Master Trust, Series 2001-8A, Class A, 4.60%, 08/17/09 (m) | 6,473 | |||||||||

| Capital One Multi-Asset Execution Trust, | |||||||||||

| 7,580 | Series 2003-A, IF, 6.58%, 12/15/10 (e) (i) (m) | 7,702 | |||||||||

| 6,233 | Series 2003-A4, Class A4, 3.65%, 07/15/11 (m) | 6,057 | |||||||||

| 1,500 | Capital One Prime Auto Receivables Trust, Series 2005-1, Class A4, FRN, 5.35%, 04/15/11 (m) | 1,500 | |||||||||

| Carmax Auto Owner Trust, | |||||||||||

| 818 | Series 2003-2, Class A4, 3.07%, 10/15/10 (m) | 807 | |||||||||

| 5,000 | Series 2006-1, Class A4, 5.41%, 06/15/11 (m) | 5,039 | |||||||||

| CARSS Finance LP (Cayman Islands), | |||||||||||

| 273 | Series 2004-A, Class B1, FRN, 5.61%, 01/15/11 (e) (m) | 273 | |||||||||

| 182 | Series 2004-A, Class B2, FRN, 6.28%, 01/15/11 (e) (m) | 182 | |||||||||

| 94 | Centex Home Equity, Series 2004-A, Class AV2, FRN, 5.57%, 06/25/34 (m) | 94 | |||||||||

| Citibank Credit Card Issuance Trust, | |||||||||||

| 1,555 | Series 2004-A8, Class A8, 4.90%, 12/12/16 (m) | 1,514 | |||||||||

| 1,145 | Series 2005-A9, Class A9, 5.10%, 11/20/17 (m) | 1,126 | |||||||||

| Citigroup Mortgage Loan Trust, Inc., | |||||||||||

| 1,867 | Series 2003-HE3, Class A, FRN, 5.70%, 12/25/33 (m) | 1,875 | |||||||||

| 1,563 | Series 2005-OPT1, Class A1B, FRN, 5.53%, 02/25/35 (m) | 1,564 | |||||||||

| 1,995 | CNH Equipment Trust, Series 2005-B, Class A3, 4.27%, 01/15/10 (m) | 1,967 | |||||||||

| Countrywide Asset-Backed Certificates, | |||||||||||

| 4,775 | Series 2003-5, Class MF1, 5.41%, 01/25/34 (m) | 4,728 | |||||||||

| 439 | Series 2004-1, Class 3A, FRN, 5.60%, 04/25/34 (m) | 439 | |||||||||

| 1,320 | Series 2004-1, Class M1, FRN, 5.82%, 03/25/34 (m) | 1,327 | |||||||||

| 1,080 | Series 2004-1, Class M2, FRN, 5.87%, 03/25/34 (m) | 1,086 | |||||||||

| 157 | Series 2004-BC, Class 1A, FRN, 5.55%, 04/25/34 (m) | 157 | |||||||||

| 1,835 | Series 2005-3, Class AF3, VAR, 4.82%, 08/25/35 (m) | 1,819 | |||||||||

| 1,290 | Series 2005-11, Class 3AV1, FRN, 5.48%, 02/25/36 (m) | 1,290 | |||||||||

| 940 | Series 2005-11, Class AF3, VAR, 4.78%, 02/25/36 (m) | 925 | |||||||||

| 553 | Countrywide Home Equity Loan Trust, Series 2004-I, Class A, FRN, 5.62%, 05/15/29 (m) | 555 | |||||||||

| 784 | Series 2004-K, Class 2A, FRN, 5.63%, 11/15/29 (m) | 786 | |||||||||

| 981 | Credit-Based Asset Servicing and Securitization, Series 2006-CB1, Class AF1, SUB, 5.46%, 01/25/36 (m) | 976 | |||||||||

| 5,000 | Daimler Chrysler Auto Trust, Series 2006-B, Class A2, 5.30%, 10/08/08 (m) | 4,998 | |||||||||

| First Franklin Mortgage Loan Asset Backed Certificates, | |||||||||||

| 2,600 | Series 2005-FF2, Class A2B, FRN, 5.50%, 03/25/35 (m) | 2,602 | |||||||||

| 6,000 | Series 2006-FF10, Class M1, FRN, 5.60%, 07/25/36 (m) | 6,002 | |||||||||

| Ford Credit Auto Owner Trust, | |||||||||||

| 3,070 | Series 2004-A, Class A4, 3.54%, 11/15/08 (m) | 3,017 | |||||||||

| 6,000 | Series 2006-B, Class A2A, 5.42%, 07/15/09 (m) | 6,006 | |||||||||

| 2,800 | GE Equipment Small Ticket LLC, Series 2005-1A, Class A3, 4.38%, 07/22/09 (e) (m) | 2,773 | |||||||||

| 1,000 | GMAC Mortgage Corp. Loan Trust, Series 2004-HE1, Class A2, FRN, 5.42%, 06/25/34 (m) | 1,000 | |||||||||

| 1,325 | Gracechurch Card Funding plc (United Kingdom), Series 2005-7, Class A, FRN, 5.35%, 11/16/09 (m) | 1,325 | |||||||||

| 1,750 | GS Auto Loan Trust, Series 2004-1, Class A4, 2.65%, 05/15/11 (m) | 1,720 | |||||||||

| GSAMP Trust, | |||||||||||

| 784 | Series 2004-OPT, Class A1, FRN, 5.66%, 11/25/34 (m) | 786 | |||||||||

| PRINCIPAL AMOUNT($) | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — Continued | |||||||||||

Asset Backed Securities — Continued | |||||||||||

| 2,000 | Series 2005-WMC2, Class A2B, FRN, 5.58%, 11/25/35 (m) | 2,004 | |||||||||

| 6,000 | Series 2006-NC1, Class A2, FRN, 5.50%, 02/25/36 (m) | 6,009 | |||||||||

| Home Equity Asset Trust, | |||||||||||

| 1,465 | Series 2005-8, Class M2, FRN, 5.77%, 02/25/36 (m) | 1,473 | |||||||||

| 7,000 | Series 2006-3, Class2A3, FRN, 5.50%, 07/25/36 (m) | 7,011 | |||||||||

| 662 | Honda Auto Receivables Owner Trust, Series 2003-3, Class A4, 2.77%, 11/21/08 (m) | 651 | |||||||||

| Household Automotive Trust, | |||||||||||

| 3,905 | Series 2003-2, Class A4, 3.02%, 12/17/10 (m) | 3,836 | |||||||||

| 2,000 | Series 2006-1 A2, 5.40%, 06/17/09 (m) | 2,000 | |||||||||

| 6,650 | Series 2006-2 A2, 5.61%, 06/17/09 (m) | 6,664 | |||||||||

| 330 | Household Mortgage Loan Trust, Series 2004-HC1, Class A, FRN, 5.68%, 02/20/34 (m) | 331 | |||||||||

| 5,000 | HSI Asset Securitization Corp. Trust, Series 2006-OPT2, Class 2A3, FRN, 5.51%, 01/25/36 (m) | 5,010 | |||||||||

| Long Beach Mortgage Loan Trust, | |||||||||||

| 2,000 | Series 2003-4, Class M1, FRN, 6.00%, 08/25/33 (m) | 2,007 | |||||||||

| 2,030 | Series 2004-1, Class M1, FRN, 5.82%, 02/25/34 (m) | 2,035 | |||||||||

| 1,360 | Series 2004-1, Class M2, FRN, 5.87%, 02/25/34 (m) | 1,364 | |||||||||

| 81 | Series 2004-3, Class A3, FRN, 5.58%, 07/25/34 (m) | 81 | |||||||||

| 1,500 | Series 2004-3, Class M1, FRN, 5.89%, 07/25/34 (m) | 1,512 | |||||||||

| 1,510 | M&I Auto Loan Trust, Series 2003-1, Class A4, 2.97%, 04/20/09 (m) | 1,486 | |||||||||

| MASTR Asset Backed Securities Trust, | |||||||||||

| 1,194 | Series 2005-NC1, Class A4, FRN, 5.55%, 12/25/34 (m) | 1,194 | |||||||||

| 10,560 | Series 2006-AB1 A1, FRN, 5.46%, 02/25/36 (m) | 10,562 | |||||||||

| 5,000 | Series 2006-NC1, Class A3, FRN, 5.51%, 01/25/36 (m) | 5,010 | |||||||||

| MBNA Credit Card Master Note Trust, | |||||||||||

| 3,000 | Series 2001-C2, Class C2, FRN, 6.48%, 12/15/10 (e) (m) | 3,054 | |||||||||

| 4,875 | Series 2003-A1, Class A1, 3.30%, 07/15/10 (m) | 4,747 | |||||||||

| 5,000 | Merrill Lynch Mortgage Investors, Inc., Series 2006-WMC1 A2C, FRN, 5.52%, 01/25/37 (m) | 5,001 | |||||||||

| New Century Home Equity Loan Trust, | |||||||||||

| 1,215 | Series 2005-1, Class A2B, FRN, 5.54%, 03/25/35 (m) | 1,216 | |||||||||

| 1,350 | Series 2005-1, Class M1, FRN, 5.77%, 03/25/35 (m) | 1,356 | |||||||||

| 1,565 | Series 2005-2, Class A2B, FRN, 5.50%, 06/25/35 (m) | 1,566 | |||||||||

| 1,000 | Series 2005-B, Class A2B, FRN, 5.50%, 10/25/35 (m) | 1,000 | |||||||||

| 4,000 | Newcastle Mortgage Securities Trust, Series 2006-1, Class A2, FRN, 5.44%, 03/25/36 (m) | 4,001 | |||||||||

| 1,500 | Nissan Auto Receivables Owner Trust, Series 2006-A, Class A2, 4.80%, 06/16/08 (m) | 1,495 | |||||||||

| 686 | Onyx Acceptance Grantor Trust, Series 2003-D, Series A4, 3.20%, 03/15/10 (m) | 677 | |||||||||

| Option One Mortgage Loan Trust, | |||||||||||

| 529 | Series 2003-1, Class A2, FRN, 5.74%, 02/25/33 (m) | 530 | |||||||||

| 311 | Series 2003-5, Class A2, FRN, 5.64%, 08/25/33 (m) | 312 | |||||||||

| 2,000 | Peco Energy Transition Trust, Series 2000-A, Class A3, 7.63%, 03/01/10 (m) | 2,112 | |||||||||

| 5,998 | PP&L Transition Bond Co. LLC, Series 1999-1, Class A8, 7.15%, 06/25/09 (m) | 6,188 | |||||||||

| 2,650 | PSE&G Transition Funding LLC, Series 2001-1, Class A6, 6.61%, 06/15/15 (m) | 2,832 | |||||||||

| 2,000 | Residential Asset Mortgage Products, Inc., Series 2006-RS1, Class AI2, FRN, 5.55%, 01/25/36 (m) | 2,003 | |||||||||

| Residential Asset Securities Corp., | |||||||||||

| 643 | Series 2002-KS4, Class AIIB, FRN, 5.57%, 07/25/32 (m) | 644 | |||||||||

| 1,200 | Series 2003-KS5, Class AIIB, FRN, 5.61%, 07/25/33 (m) | 1,201 | |||||||||

| 875 | Series 2005-AHL2, Class M2, FRN, 5.76%, 10/25/35 (m) | 879 | |||||||||

| 1,301 | Series 2005-KS2, Class AI2, FRN, 5.52%, 05/25/34 (m) | 1,302 | |||||||||

| 2,000 | Specialty Underwriting & Residential Finance, Series 2005- BC3, Class A2B, FRN, 5.57%, 06/25/36 (m) | 2,004 | |||||||||

| 6,365 | Structured Asset Securities Corp, Series 2006-WF2, Class M2, FRN, 5.61%, 07/25/36 (m) | 6,368 | |||||||||

| 4,722 | Triad Auto Receivables Owner Trust, Series 2003-B, Class A4, 3.20%, 12/13/10 (m) | 4,635 | |||||||||

| 1,755 | Volkswagen Auto Loan Enhanced Trust, Series 2003-2, Class A4, 2.94%, 03/22/10 (m) | 1,726 | |||||||||

| Wachovia Asset Securitization, Inc., | |||||||||||

| 1,800 | Series 2002-HE2, Class A, FRN, 5.76%, 12/25/32 (m) | 1,802 | |||||||||

| 1,112 | Series 2003-HE3, Class A, FRN, 5.57%, 11/25/33 (m) | 1,114 | |||||||||

AS OF AUGUST 31, 2006 (continued)

| PRINCIPAL AMOUNT($) | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — Continued | |||||||||||

Asset Backed Securities — Continued | |||||||||||

| WFS Financial Owner Trust, | |||||||||||

| 1,397 | Series 2003-3, Class A4, 3.25%, 05/20/11 (m) | 1,376 | |||||||||

| 3,252 | Series 2003-4, Class A4, 3.15%, 05/20/11 (m) | 3,202 | |||||||||

| Total Asset Backed Securities (Cost $239,957) | 238,610 | ||||||||||

Collateralized Mortgage Obligations — 18.1% | |||||||||||

Agency CMO — 5.4% | |||||||||||

| Federal Home Loan Mortgage Corp., | |||||||||||

| 9,843 | Series 237, Class S22, IF, IO, 1.82%, 05/15/36 (m) | 794 | |||||||||

| 17,718 | Series 237, Class S23, IF, IO, 1.77%, 05/15/36 (m) | 1,390 | |||||||||

| 49,874 | Series 239, Class 30, IF, IO, 2.37%, 08/15/36 (m) | 4,177 | |||||||||

| 57,854 | Series 239, Class S29, IF, IO, 2.42%, 08/15/36 (m) | 4,972 | |||||||||

| 41,869 | Series 240, Class S22, IF, IO, 1.82%, 07/15/36 (m) | 3,369 | |||||||||

| 839 | Series 2508, Class PE, 5.50%, 05/15/28 (m) | 838 | |||||||||

| 10,395 | Series 2564, Class LS, IF, IO, 2.32%, 01/15/17 (m) | 617 | |||||||||

| 4,488 | Series 2643, Class PI, IO, 5.00%, 03/15/28 (m) | 508 | |||||||||

| 13,912 | Series 2701, Class ST, IF, IO, 1.67%, 08/15/21 (m) | 743 | |||||||||

| 5,041 | Series 2751, Class AI, IO, 5.00%, 04/15/22 (m) | 255 | |||||||||

| 2,195 | Series 2760, Class GI, IO, 4.50%, 02/15/11 (m) | 42 | |||||||||

| 5,820 | Series 2772, Class GI, IO, 5.00%, 11/15/22 (m) | 351 | |||||||||

| 8,443 | Series 2779, Class SM, IF, IO,1.82%, 10/15/18 (m) | 501 | |||||||||

| 4,280 | Series 2781, Class PI, IO, 5.00%, 10/15/23 (m) | 252 | |||||||||

| 30,641 | Series 2791, Class SI, IF, IO, 1.82%, 12/15/31 (m) | 1,609 | |||||||||

| 24,356 | Series 2813, Class SB, IF, IO, 1.72%, 02/15/34 (m) | 1,378 | |||||||||

| 3,317 | Series 2857, Class NI, IO, 5.00%, 04/15/17 (m) | 74 | |||||||||

| 23,416 | Series 2861, Class GS, IF, IO, 1.87%, 01/15/21 (m) | 842 | |||||||||

| 5,588 | Series 2891, Class LI, IO, 5.00%, 06/15/24 (m) | 404 | |||||||||

| 8,975 | Series 2894, Class S, IF, IO, 1.87%, 03/15/31 (m) | 516 | |||||||||

| 3,774 | Series 2897, Class SI, IF, 4.77%, 10/15/31 (m) | 3,511 | |||||||||

| 1,379 | Series 2921, Class SC, IF, 7.28%, 10/15/32 (m) | 1,342 | |||||||||

| 6,625 | Series 2931, Class GA, 5.00%, 11/15/28 (m) | 6,569 | |||||||||

| 6,408 | Series 2971, Class Pl, IO, 5.50%, 03/15/26 (m) | 637 | |||||||||

| 901 | Series 2980, Class QB, 6.50%, 05/15/35 (m) | 926 | |||||||||

| 9,267 | Series 3029, Class S, IF, IO, 1.87%, 08/15/35 (m) | 834 | |||||||||

| 48,499 | Series 3117, Class ES, IF, IO, 1.82%, 02/15/36 (m) | 3,872 | |||||||||

| 19,691 | Series 3174, Class SA, IF, IO, 2.37%, 04/15/36 (m) | 1,674 | |||||||||

| Federal National Mortgage Association, | |||||||||||

| 8,110 | Series 2004-61, Class TS, IF, IO, 1.78%, 10/25/31 (m) | 324 | |||||||||

| 6,622 | Series 2004-87, Class JI, IO, 5.00%, 11/25/30 (m) | 746 | |||||||||

| 3,584 | Series 2006-3, Class SY, IF, 7.05%, 03/25/36 (m) | 3,549 | |||||||||

| 5,736 | Series 2006-43, Class GS, IF, 6.75%, 06/25/36 (m) | 5,662 | |||||||||

| 2,432 | Series 2006-59, Class DA, 6.50%, 12/25/33 (m) | 2,488 | |||||||||

| 10,364 | Series 2006-63, Class AB, 6.50%, 10/25/33 (m) | 10,601 | |||||||||

| 24,754 | Series 2006-78, Class BC, 6.50%, 01/25/34 (m) | 25,287 | |||||||||

| Federal National Mortgage Association Whole Loan, | |||||||||||

| 195 | Series 2003-W3, Class 2A5, 5.36%, 06/25/42 (m) | 192 | |||||||||

| 2,550 | Series 2003-W6, Class 1A41, 5.40%, 10/25/42 (m) | 2,512 | |||||||||

| Government National Mortgage Association, | |||||||||||

| 2,627 | Series 2004-39, Class IM, IO, 5.50%, 01/20/27 (m) | 108 | |||||||||

| 4,924 | Series 2004-44, Class PK, IO, 5.50%, 10/20/27 (m) | 321 | |||||||||

| 1,421 | Series 2004-46, Class IH, IO, 5.50%, 04/20/25 (m) | 39 | |||||||||

| 94,826 | |||||||||||

Non-Agency CMO — 12.7% | |||||||||||

| Adjustable Rate Mortgage Trust, | |||||||||||

| 775 | Series 2005-4, Class 7A2, FRN, 5.55%, 08/25/35 (m) | 778 | |||||||||

| 2,823 | Series 2005-6, Class 6A21, FRN, 5.55%, 09/25/35 (m) | 2,824 | |||||||||

| 605 | Series 2005-6A Class 2A1, FRN, 5.63%, 11/25/35 (m) | 607 | |||||||||

| 14,906 | American Home Mortgage Assets, Series 2006-2 Class 2A1, FRN, 5.51%, 09/25/46 (m) | 14,902 | |||||||||

| 2,846 | Citicorp Mortgage Securities, Inc., Series 2003-11, Class 2A1, 5.50%, 12/25/33 (m) | 2,802 | |||||||||

| 2,222 | Citigroup Mortgage Loan Trust, Inc., Series 2006-WF2, Class A2A, SUB, 5.91%, 05/25/36 (m) | 2,216 | |||||||||

| Countrywide Alternative Loan Trust, | |||||||||||

| 11,130 | Series 2006-OA10, Class 3A1, FRN, 5.51%, 08/25/46 (m) | 11,124 | |||||||||

| PRINCIPAL AMOUNT($) | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — Continued | |||||||||||

Non-Agency CMO — Continued | |||||||||||

| 4,231 | Series 2006-OA9, Class 1A1, FRN, 5.52%, 07/20/46 (m) | 4,231 | |||||||||

| 3,949 | Series 2006-OT9, Class 2A1B, FRN, 5.52%, 07/20/46 (m) | 3,949 | |||||||||

| 12,989 | Series 2006-OA1, Class 2A1, FRN, 5.54%, 03/20/46 (m) | 13,002 | |||||||||

| 6,213 | Series 2006-OA2, Class A1, FRN, 5.54%, 05/20/46 (m) | 6,225 | |||||||||

| 5,986 | Series 2006-OA12, Class A2, FRN, 5.54%, 09/20/46 (m) | 5,985 | |||||||||

| 6,409 | Series 2005-51 Class 1A1, FRN, 5.65%, 11/20/35 (m) | 6,438 | |||||||||

| 6,144 | Series 2004-28CB, Class 3A1, 6.00%, 01/25/35 (m) | 6,108 | |||||||||

| 11,570 | Countrywide Home Loan Mortgage Pass Through Trust, Series 2002-22, Class A20, 6.25%, 10/25/32 (m) | 11,517 | |||||||||

| CS First Boston Mortgage Securities Corp., | |||||||||||

| 583 | Series 2003-29, Class 7A1, 6.50%, 12/25/33 (m) | 586 | |||||||||

| 990 | Series 2004-4, Class 1A1, 6.00%, 08/25/34 (m) | 987 | |||||||||

| 3,327 | Series 2004-5, Class 1A8, 6.00%, 09/25/34 (m) | 3,327 | |||||||||

| 6,000 | Deutsche ALT — A Securities Inc Alternate Loan Trust, Series 2006-AR1, Class 3A2, VAR, 5.57%, 02/25/36 (m) | 6,003 | |||||||||

| 2,634 | Downey Savings & Loan Association Mortgage Loan Trust, Series 2005-AR6, Class 2A1A, FRN, 5.61%, 10/19/45 (m) | 2,644 | |||||||||

| 3,000 | Granite Master Issuer plc, Series 2006-2 Class A4, FRN, 5.54%, 12/20/54 (m) | 3,020 | |||||||||

| 1,439 | Granite Mortgages plc (United Kingdom), Series 2004-3, Class 1A3, FRN, 5.51%, 09/20/44 (m) | 1,439 | |||||||||

| 1,642 | Greenpoint Mortgage Funding Trust, Series 2005-AR4, Class 4A1A, FRN, 5.63%, 10/25/45 (m) | 1,649 | |||||||||

| 5,665 | GSMPS Mortgage Loan Trust, Series 2005-RP1, Class 1AF, FRN, 5.67%, 01/25/35 (e) (m) | 5,687 | |||||||||

| Harborview Mortgage Loan Trust, | |||||||||||

| 7,215 | Series 2005-3, Class 2A1A, FRN, 5.57%, 06/19/35 (m) | 7,232 | |||||||||

| 1,727 | Series 2005-8, Class 1A2A, FRN, 5.66%, 09/19/35 (m) | 1,733 | |||||||||

| Indymac Index Mortgage Loan Trust, | |||||||||||

| 3,095 | Series 2004-AR7, Class A1, FRN, 5.76%, 09/25/34 (m) | 3,123 | |||||||||

| 1,174 | Series 2005-AR14, Class 2A1A, FRN, 5.62%, 08/25/35 (m) | 1,180 | |||||||||

| 14,733 | Series 2006-AR2, Class 1A1A, FRN, 5.54%, 04/25/46 (m) | 14,745 | |||||||||

| 4,100 | Lehman Mortgage Trust, Series 2005-3, Class 2A3, 5.50%, 01/25/36 (m) | 4,080 | |||||||||

| 1,866 | Lehman XS Trust, Series 2005-7N, Class 1A1A, FRN, 5.59%, 11/25/35 (m) | 1,875 | |||||||||

| 1,395 | Medallion Trust (Australia), Series 2004-1G, Class A1, FRN, 5.53%, 05/25/35 (m) | 1,398 | |||||||||

| Permanent Financing plc (United Kingdom), | |||||||||||

| 2,500 | Series 4, Class 2A, FRN, 5.37%, 03/10/09 (m) | 2,500 | |||||||||

| 5,000 | Series 9A, Class 2A, FRN, 5.34%, 03/10/15 (e) (m) | 5,000 | |||||||||

| RESI Finance LP (Cayman Islands), | |||||||||||

| 3,777 | Series 2003-B, Class B3, FRN, 6.92%, 07/10/35 (e) (m) | 3,849 | |||||||||

| 6,502 | Series 2003-C, Class B3, FRN, 6.77%, 09/10/35 (e) (m) | 6,616 | |||||||||

| 1,245 | Series 2003-C, Class B4, FRN, 6.97%, 09/10/35 (e) (m) | 1,287 | |||||||||

| 1,388 | Series 2003-D, Class B3, FRN, 6.67%, 12/10/35 (e) (m) | 1,392 | |||||||||

| 2,008 | Series 2003-D, Class B4, FRN, 6.87%, 12/10/35 (e) (m) | 2,014 | |||||||||

| 2,356 | Series 2005-A, Class B3, FRN, 5.95%, 03/10/37 (e) (m) | 2,360 | |||||||||

| 789 | Series 2005-A, Class B4, FRN, 6.05%, 03/10/37 (e) (m) | 795 | |||||||||

| Residential Accredit Loans, Inc., | |||||||||||

| 1,357 | Series 2005-Q04, Class 2A1, FRN, 5.60%, 12/25/45 (m) | 1,362 | |||||||||

| 10,000 | Series 2006-QS11, Class 1A1, 6.50%, 08/25/36 (m) | 10,078 | |||||||||

| 4,149 | Residential Asset Securitization Trust, Series 2006-A2, Class A3, 6.00%, 05/25/36 (m) | 4,133 | |||||||||

| 362 | SACO I, Inc., Series 1997-2, Class 1A5, 7.00%, 08/25/36 (e) (i) (m) | 358 | |||||||||

| Structured Asset Mortgage Investments, Inc., | |||||||||||

| 1,937 | Series 2005-AR2, Class 2A1, FRN, 5.55%, 05/25/45 (m) | 1,942 | |||||||||

| 9,612 | Series 2006-AR1, Class 3A1, FRN, 5.55%, 02/25/36 (m) | 9,621 | |||||||||

| 1,332 | Washington Mutual, Inc., Series 2005-AR17, Class A1A1, FRN, 5.59%, 12/25/45 (m) | 1,336 | |||||||||

| Washington Mutual Mortgage Securities Corp., | |||||||||||

| 1,532 | Series 2005-AR2, Class 2A21, FRN, 5.65%, 01/25/45 (m) | 1,536 | |||||||||

| 2,528 | Series 2005-AR9, Class A1A, FRN, 5.64%, 07/25/45 (m) | 2,533 | |||||||||

| 2,279 | Series 2005-AR15, Class A1A1, FRN, 5.58%, 11/25/45 (m) | 2,286 | |||||||||

AS OF AUGUST 31, 2006 (continued)

| PRINCIPAL AMOUNT($) | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — Continued | |||||||||||

Non-Agency CMO — Continued | |||||||||||

| Wells Fargo Mortgage Backed Securities Trust, | |||||||||||

| 2,666 | Series 2003-2, Class A6, 5.25%, 03/25/18 (m) | 2,638 | |||||||||

| 4,084 | Series 2006-AR3, Class A1, FRN, 5.72%, 03/25/36 (m) | 4,074 | |||||||||

| 221,126 | |||||||||||

| Total Collateralized Mortgage Obligations (Cost $318,493) | 315,952 | ||||||||||

Commercial Mortgage Backed Securities — 5.0% | |||||||||||

| Bear Stearns Commercial Mortgage Securities, | |||||||||||

| 4,655 | Series 2005-PWR9, Class A4A, 4.87%, 09/11/42 (m) | 4,464 | |||||||||

| 4,155 | Series 2005-T18, Class A4, VAR, 4.93%, 02/13/42 (m) | 4,009 | |||||||||

| 2,515 | Series 2005-T20, Class A4A, VAR, 5.30%, 10/12/42 (m) | 2,474 | |||||||||

| 5,000 | Series 2006-PW12, Class A4, VAR, 5.90%, 09/11/38 (m) | 5,124 | |||||||||

| 5,790 | Citigroup Commercial Mortgage Trust, Series 2006-C4, Class A3, VAR, 5.91%, 03/15/49 (m) | 5,930 | |||||||||

| 10,000 | Commercial Mortgage Pass Through Certificates, Series 2006-C7, Class A4, VAR, 5.96%, 06/10/46 (m) | 10,266 | |||||||||

| 8,610 | Credit Suisse Mortgage Capital Certificates, Series 2006-C3, Class A3, VAR, 6.02%, 06/15/38 (m) | 8,870 | |||||||||

| Greenwich Capital Commercial Funding Corp., | |||||||||||

| 5,405 | Series 2005-GG3, Class A4, VAR, 4.80%, 08/10/42 (m) | 5,170 | |||||||||

| 5,405 | Series 2005-GG3, Class AJ, VAR, 4.86%, 08/10/42 (m) | 5,171 | |||||||||

| LB-UBS Commercial Mortgage Trust, | |||||||||||

| 1,200 | Series 2003-C1, Class A2, 3.32%, 03/15/27 (m) | 1,166 | |||||||||

| 2,170 | Series 2006-C1, Class A4, 5.16%, 02/15/31 (m) | 2,122 | |||||||||

| 4,060 | Series 2006-C4, Class A4, VAR, 6.10%, 06/15/38 (m) | 4,212 | |||||||||

| 6,500 | Lehman Brothers Floating Rate Commercial Mortgage Trust, Series 2006-FFLA, Class A2, FRN, 5.45%, 09/15/21 (e) (m) | 6,500 | |||||||||

| 7,610 | Merrill Lynch Mortgage Trust, Series 2006-C1, Class A4, VAR, 5.84%, 05/12/39 (m) | 7,757 | |||||||||

| 5,000 | Morgan Stanley Capital I, Series 2006-IQ11, Class A4, VAR, 5.95%, 10/15/42 (m) | 5,121 | |||||||||

| 1,755 | Morgan Stanley Dean Witter Capital I, Series 2003-HQ2, Class A2, 4.92%, 03/12/35 (m) | 1,710 | |||||||||

| Wachovia Bank Commercial Mortgage Trust, | |||||||||||

| 370 | Series 2005-C17, Class A4, VAR, 5.08%, 03/15/42 (m) | 360 | |||||||||

| 5,605 | Series 2006-C26, Class A3, VAR, 6.01%, 06/15/45 (m) | 5,819 | |||||||||

| Total Commercial Mortgage Backed Securities (Cost $85,982) | 86,245 | ||||||||||

Corporate Bonds — 33.8% | |||||||||||

Aerospace & Defense — 0.3% | |||||||||||

| 900 | L-3 Communications Corp., 5.88%, 01/15/15 (m) | 851 | |||||||||

| 3,500 | United Technologies Corp., FRN, 5.47%, 06/01/09 (m) | 3,501 | |||||||||

| 4,352 | |||||||||||

Auto Components — 0.0% (g) | |||||||||||

| 549 | TRW Automotive, Inc., 9.38%, 02/15/13 (m) | 586 | |||||||||

Automobiles — 0.9% | |||||||||||

| DaimlerChrysler NA Holding Corp., | |||||||||||

| 10,280 | 5.88%, 03/15/11 (m) | 10,322 | |||||||||

| 3,425 | FRN, 5.74%, 03/13/09 (m) | 3,429 | |||||||||

| 2,000 | FRN, 6.02%, 10/31/08 (m) | 2,008 | |||||||||

| 15,759 | |||||||||||

Beverages — 0.2% | |||||||||||

| 450 | Diageo Capital plc (United Kingdom), 3.38%, 03/20/08 (m) | 437 | |||||||||

| 3,875 | Diageo Finance BV (United Kingdom), 3.00%, 12/15/06 (m) | 3,849 | |||||||||

| 4,286 | |||||||||||

Capital Markets — 4.3% | |||||||||||

| 1,395 | Arch Western Finance LLC, 6.75%, 07/01/13 (m) | 1,346 | |||||||||

| 1,020 | Banque Paribas, 6.88%, 03/01/09 (m) | 1,057 | |||||||||

| Bear Stearns Cos., Inc. (The), | |||||||||||

| 520 | 4.00%, 01/31/08 (m) | 511 | |||||||||

| 1,640 | FRN, 5.64%, 04/29/08 (m) | 1,644 | |||||||||

| 2,190 | Credit Suisse First Boston USA, Inc., FRN, 5.50%, 06/02/08 (m) | 2,193 | |||||||||

| Credit Suisse USA, Inc., | |||||||||||

| 3,000 | FRN, 5.41%, 12/09/08 (m) | 3,005 | |||||||||

| 2,000 | FRN, 5.47%, 06/05/09 (m) | 2,000 | |||||||||

| Goldman Sachs Group, Inc., | |||||||||||

| 1,550 | 4.13%, 01/15/08 (m) | 1,528 | |||||||||

| 5,565 | 6.45%, 05/01/36 (m) | 5,633 | |||||||||

| 7,000 | FRN, 5.53%, 12/22/08 (m) | 7,006 | |||||||||

| 4,275 | FRN, 5.54%, 06/23/09 (m) | 4,275 | |||||||||

| 2,235 | Kaupthing Bank (Iceland), 7.13%, 05/19/16 (e) (m) | 2,294 | |||||||||

| PRINCIPAL AMOUNT($) | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — Continued | |||||||||||

Capital Markets — Continued | |||||||||||

| Lehman Brothers Holdings, Inc., | |||||||||||

| 12,000 | FRN, 5.43%, 05/29/08 (m) | 12,004 | |||||||||

| 7,000 | FRN, 5.49%, 08/21/09 (m) | 6,998 | |||||||||

| 3,100 | Links Finance LLC, FRN, 5.58%, 09/15/06 (e) (i) (m) | 3,103 | |||||||||

| Merrill Lynch & Co., Inc., | |||||||||||

| 2,000 | FRN, 5.58%, 10/27/08 (m) | 2,003 | |||||||||

| 1,900 | FRN, 5.73%, 02/06/09 (m) | 1,909 | |||||||||

| Morgan Stanley, | |||||||||||

| 8,835 | 5.38%, 10/15/15 (m) | 8,644 | |||||||||

| 7,000 | FRN, 5.55%, 02/09/09 (m) | 7,012 | |||||||||

| 1,000 | FRN, 5.56%, 11/09/07 (m) | 1,002 | |||||||||

| 75,167 | |||||||||||

Chemicals — 0.2% | |||||||||||

| 1,025 | Huntsman LLC, 11.50%, 07/15/12 (m) | 1,163 | |||||||||

| 835 | Nalco Co., 7.75%, 11/15/11 (m) | 850 | |||||||||

| 705 | PolyOne Corp., 10.63%, 05/15/10 (m) | 756 | |||||||||

| 2,769 | |||||||||||

Commercial Banks — 4.9% | |||||||||||

| Bank of America Corp., | |||||||||||

| 2,100 | 3.25%, 08/15/08 (m) | 2,023 | |||||||||

| 2,415 | 4.25%, 10/01/10 (m) | 2,331 | |||||||||

| 2,695 | 4.38%, 12/01/10 (m) | 2,606 | |||||||||

| 1,230 | 5.88%, 02/15/09 (m) | 1,249 | |||||||||

| 2,495 | Bank of New York Co., Inc. (The), 5.20%, 07/01/07 (m) | 2,490 | |||||||||

| 1,595 | Barclays Bank plc (United Kingdom), 7.40%, 12/15/09 (m) | 1,696 | |||||||||

| 1,670 | Bayerische Landesbank/New York, 2.60%, 10/16/06 (m) | 1,664 | |||||||||

| 620 | BB&T Capital Trust I, 5.85%, 08/18/35 (m) | 586 | |||||||||

| 4,995 | Commonwealth Bank of Australia (Australia), VAR, 6.02%, 12/31/49 (e) (m) | 4,957 | |||||||||

| 4,750 | Deutsche Bank Capital Funding Trust VII, VAR, 5.63%, 12/31/49 (e) (m) | 4,592 | |||||||||

| 2,660 | Export-Import Bank of Korea (South Korea), 4.63%, 03/16/10 (m) | 2,589 | |||||||||

| 1,500 | Glitnir Banki HF (Iceland), FRN, 5.67%, 10/15/08 (e) (m) | 1,490 | |||||||||

| 5,000 | HBOS plc (United Kingdom), VAR, 5.92%, 12/31/49 (e) (m) | 4,804 | |||||||||

| 1,720 | Industrial Bank of Korea (South Korea), VAR, 4.00%, 05/19/14 (e) (m) | 1,646 | |||||||||

| 1,000 | KEY Bank NA, 7.55%, 09/15/06 (m) | 1,001 | |||||||||

| 2,100 | KeyCorp, FRN, 5.71%, 07/23/07 (m) | 2,105 | |||||||||

| 1,795 | KFW International Finance, 4.75%, 01/24/07 (m) | 1,789 | |||||||||

| 4,250 | Landesbanki Islands HF (Iceland), 6.10%, 08/25/11 (e) (m) | 4,258 | |||||||||

| 2,930 | Popular North America, Inc., Series E, 6.13%, 10/15/06 (m) | 2,932 | |||||||||

| 305 | Royal Bank of Scotland Group plc (United Kingdom), VAR, 7.65%, 12/31/49 (m) | 346 | |||||||||

| 12,390 | Sberbank of Russia (Russia), FRN, 7.24%, 10/24/06 | 12,445 | |||||||||

| 3,845 | Shinsei Finance II (Cayman Islands), VAR, 7.16%, 12/31/49 (e) (m) | 3,802 | |||||||||

| 1,545 | Standard Chartered First Bank Korea Ltd. (South Korea), VAR, 7.27%, 03/03/34 (e) (m) | 1,644 | |||||||||

| 2,920 | Suntrust Bank, 2.50%, 11/01/06 (m) | 2,906 | |||||||||

| 2,005 | United Overseas Bank Ltd. (Singapore), VAR, 5.38%, 09/03/19 (e) (m) | 1,952 | |||||||||

| 6,955 | Vneshtorgbank (Luxembourg), FRN, 6.17%, 09/21/07 (e) (m) | 6,973 | |||||||||

| 1,500 | Wachovia Bank NA/Charlotte, 5.80%, 12/01/08 (m) | 1,520 | |||||||||

| 2,140 | Wachovia Corp., FRN, 5.59%, 07/20/07 (m) | 2,142 | |||||||||

| Wells Fargo & Co., | |||||||||||

| 185 | 4.20%, 01/15/10 (m) | 179 | |||||||||

| 140 | 5.13%, 09/01/12 (m) | 139 | |||||||||

| 2,070 | Wells Fargo Bank, 6.45%, 02/01/11 (m) | 2,165 | |||||||||

| 2,335 | Woori Bank (South Korea), VAR, 5.75%, 03/13/14 (e) (m) | 2,329 | |||||||||

| 85,350 | |||||||||||

Commercial Services & Supplies — 0.1% | |||||||||||

| 725 | ACCO Brands Corp., 7.63%, 08/15/15 (m) | 687 | |||||||||

| 415 | Corrections Corp. of America, 6.25%, 03/15/13 (m) | 401 | |||||||||

| Iron Mountain, Inc., | |||||||||||

| 945 | 6.63%, 01/01/16 (m) | 879 | |||||||||

| 480 | 7.75%, 01/15/15 (m) | 475 | |||||||||

| 2,442 | |||||||||||

Communications Equipment — 1.1% | |||||||||||

| Cisco Systems, Inc., | |||||||||||

| 15,205 | 5.25%, 02/22/11 (m) | 15,205 | |||||||||

| 4,000 | FRN, 5.48%, 02/20/09 (m) | 4,006 | |||||||||

| 19,211 | |||||||||||

Computers & Peripherals — 0.2% | |||||||||||

| 3,500 | Hewlett-Packard Co., FRN, 5.52%, 05/22/09 (m) | 3,503 | |||||||||

| 695 | International Business Machines Corp., 5.38%, 02/01/09 (m) | 699 | |||||||||

| 4,202 | |||||||||||

AS OF AUGUST 31, 2006 (continued)

| PRINCIPAL AMOUNT($) | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — Continued | |||||||||||

Consumer Finance — 2.1% | |||||||||||

| 2,500 | AIG SunAmerica Global Financing VII, 5.85%, 08/01/08 (e) (m) | 2,525 | |||||||||

| 4,722 | American General Finance Corp., Series H, 4.50%, 11/15/07 (m) | 4,677 | |||||||||

| 2,910 | Capital One Financial Corp., 8.75%, 02/01/07 (m) | 2,946 | |||||||||

| Ford Motor Credit Co., | |||||||||||

| 900 | 7.25%, 10/25/11 (m) | 860 | |||||||||

| 1,100 | FRN, 6.37%, 03/21/07 (m) | 1,098 | |||||||||

| 195 | FRN, 7.08%, 01/15/10 (m) | 184 | |||||||||

| 1,290 | General Motors Acceptance Corp., 6.88%, 08/28/12 (m) | 1,259 | |||||||||

| HSBC Finance Corp., | |||||||||||

| 6,460 | 5.00%, 06/30/15 (m) | 6,202 | |||||||||

| 1,885 | 7.88%, 03/01/07 (m) | 1,907 | |||||||||

| 2,000 | FRN, 5.46%, 09/15/08 (m) | 2,005 | |||||||||

| 3,110 | FRN, 5.58%, 05/09/08 (m) | 3,117 | |||||||||

| International Lease Finance Corp., | |||||||||||

| 1,330 | 4.88%, 09/01/10 (m) | 1,310 | |||||||||

| 3,500 | FRN, 5.62%, 05/24/10 (m) | 3,504 | |||||||||

| 900 | John Deere Capital Corp., 3.90%, 01/15/08 (m) | 883 | |||||||||

| SLM Corp., | |||||||||||

| 1,655 | 3.63%, 03/17/08 (m) | 1,614 | |||||||||

| 1,900 | Series A, FRN, 5.56%, 01/25/08 (m) | 1,903 | |||||||||

| 35,994 | |||||||||||

Containers & Packaging — 0.1% | |||||||||||

| 1,210 | Owens-Brockway Glass Container, Inc., 8.25%, 05/15/13 (m) | 1,225 | |||||||||

Diversified Consumer Services — 0.1% | |||||||||||

| Service Corp. International, | |||||||||||

| 680 | 6.75%, 04/01/16 (m) | 646 | |||||||||

| 250 | 7.70%, 04/15/09 (m) | 256 | |||||||||

| 902 | |||||||||||

Diversified Financial Services — 4.1% | |||||||||||

| Caterpillar Financial Services Corp., | |||||||||||

| 3,250 | FRN, 5.45%, 08/11/09 (m) | 3,248 | |||||||||

| 3,255 | FRN, 5.47%, 02/26/07 (m) | 3,258 | |||||||||

| 4,250 | FRN, 5.47%, 05/18/09 (m) | 4,252 | |||||||||

| 3,100 | CIT Group Holdings, Inc., FRN, 5.64%, 01/30/09 (m) | 3,106 | |||||||||

| CIT Group, Inc., | |||||||||||

| 1,300 | 4.00%, 05/08/08 (m) | 1,273 | |||||||||

| 1,795 | 5.50%, 11/30/07 (m) | 1,795 | |||||||||

| 4,000 | FRN, 5.38%, 06/08/09 (m) | 4,003 | |||||||||

| General Electric Capital Corp., | |||||||||||

| 3,360 | 4.25%, 01/15/08 (m) | 3,316 | |||||||||

| 1,000 | FRN, 5.44%, 05/19/08 (m) | 1,001 | |||||||||

| 865 | ILFC E-Capital Trust I, VAR, 5.90%, 12/21/65 (e) (m) | 865 | |||||||||

| 9,000 | K2 Corp., 5.43%, 11/15/06 (e) (i) (m) | 9,000 | |||||||||

| 4,770 | Mizuho Capital Investment 1 Ltd. (Cayman Islands), VAR, 6.69%, 12/31/49 (e) (m) | 4,778 | |||||||||

| 1,815 | Mizuho JGB Investment LLC, VAR, 9.87%, 12/30/06 (e) (m) | 1,947 | |||||||||

| 7,073 | Mizuho Preferred Capital Co. LLC, VAR, 8.79%, 12/31/49 (e) (m) | 7,457 | |||||||||

| 4,810 | MUFG Capital Finance 1 Ltd. (Cayman Islands), VAR, 6.35%, 12/31/49 (m) | 4,815 | |||||||||

| 6,425 | Pemex Finance Ltd. (Cayman Islands), 7.31%, 10/15/09 (m) | 6,634 | |||||||||

| 4,225 | Pricoa Global Funding I, FRN, 5.62%, 12/22/06 (e) (m) | 4,228 | |||||||||

| 2,610 | Resona Preferred Global Securities Cayman Ltd., VAR 7.19%, 12/31/49 (e) (m) | 2,685 | |||||||||

| 1,250 | TIAA Global Markets, Inc., FRN, 5.60%, 01/12/11 (e) (m) | 1,251 | |||||||||

| 1,100 | TRAINS HY-1-2006, 7.55%, 05/01/16 (e) (m) | 1,091 | |||||||||

| 1,045 | Visant Corp., 7.63%, 10/01/12 (m) | 1,024 | |||||||||

| 71,027 | |||||||||||

Diversified Telecommunication Services — 3.3% | |||||||||||

| AT&T, Inc., | |||||||||||

| 5,750 | FRN, 5.50%, 05/15/08 (m) | 5,750 | |||||||||

| 3,250 | 6.80%, 05/15/36 (m) | 3,360 | |||||||||

| 4,700 | BellSouth Corp., FRN, 5.58%, 08/15/08 (m) | 4,700 | |||||||||

| 750 | Consolidated Communications Holdings, Inc., 9.75%, 04/01/12 (m) | 786 | |||||||||

| Embarq Corp., | |||||||||||

| 4,350 | 6.74%, 06/01/13 (m) | 4,438 | |||||||||

| 2,845 | 7.08%, 06/01/16 (m) | 2,903 | |||||||||

| 655 | 8.00%, 06/01/36 (m) | 685 | |||||||||

| 280 | Qwest Communications International, Inc., FRN, 8.90%, 02/15/09 (m) | 284 | |||||||||

| 590 | Qwest Corp., 8.88%, 03/15/12 (m) | 639 | |||||||||

| Sprint Capital Corp., | |||||||||||

| 2,190 | 6.00%, 01/15/07 (m) | 2,193 | |||||||||

| 835 | 6.90%, 05/01/19 (m) | 867 | |||||||||

| 1,975 | 7.63%, 01/30/11 (m) | 2,119 | |||||||||

| 1,660 | 8.38%, 03/15/12 (m) | 1,855 | |||||||||

| 490 | 8.75%, 03/15/32 (m) | 594 | |||||||||

| 2,995 | Telecom Italia Capital S.A. (Luxembourg), 7.20%, 07/18/36 (m) | 3,128 | |||||||||

| 10,000 | Telefonica Emisones SAU (Spain), FRN, 5.71%, 06/19/09 (m) | 10,011 | |||||||||

| PRINCIPAL AMOUNT($) | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — Continued | |||||||||||

Diversified Telecommunication Services — Continued | |||||||||||

| Verizon Communications, Inc., | |||||||||||

| 975 | 5.35%, 02/15/11 (m) | 971 | |||||||||

| 7,000 | FRN, 5.54%, 08/15/07 (m) | 7,005 | |||||||||

| Verizon Global Funding Corp., | |||||||||||

| 1,915 | 4.90%, 09/15/15 (m) | 1,793 | |||||||||

| 2,125 | 5.85%, 09/15/35 (m) | 1,956 | |||||||||

| 1,340 | 7.38%, 09/01/12 (m) | 1,458 | |||||||||

| 55 | 7.75%, 12/01/30 (m) | 62 | |||||||||

| 57,557 | |||||||||||

Electric Utilities — 1.1% | |||||||||||

| 5,160 | Alabama Power Co., Series Y, 2.80%, 12/01/06 (m) | 5,128 | |||||||||

| Appalachian Power Co. | |||||||||||

| 1,445 | 6.38%, 04/01/36 (m) | 1,448 | |||||||||

| 925 | Series L, 5.80%, 10/01/35 (m) | 860 | |||||||||

| 80 | Florida Power & Light Co., 5.63%, 04/01/34 (m) | 78 | |||||||||

| 735 | FPL Group Capital, Inc., 7.63%, 09/15/06 (m) | 735 | |||||||||

| 3,975 | Midamerican Energy Holdings Co., 6.13%, 04/01/36 (e) (m) | 3,925 | |||||||||

| NiSource Finance Corp., | |||||||||||

| 2,935 | 5.25%, 09/15/17 (m) | 2,704 | |||||||||

| 1,730 | 5.45%, 09/15/20 (m) | 1,588 | |||||||||

| 1,890 | Public Service Enterprise Group, Inc., FRN, 5.80%, 09/21/08 (m) | 1,893 | |||||||||

| 110 | San Diego Gas & Electric Co., 5.35%, 05/15/35 (m) | 103 | |||||||||

| 18,462 | |||||||||||

Food Products — 0.1% | |||||||||||

| 1,425 | General Mills, Inc., 5.13%, 02/15/07 (m) | 1,423 | |||||||||

Gas Utilities — 0.1% | |||||||||||

| 2,005 | Duke Capital LLC, 6.75%, 02/15/32 (m) | 2,063 | |||||||||

Health Care Equipment & Supplies — 0.0% (g) | |||||||||||

| 615 | Fresenius Medical Care Capital Trust II, 7.88%, 02/01/08 (m) | 629 | |||||||||

Health Care Providers & Services — 0.3% | |||||||||||

| HCA, Inc., | |||||||||||

| 1,555 | 6.50%, 02/15/16 (m) | 1,224 | |||||||||

| 345 | 6.95%, 05/01/12 (m) | 302 | |||||||||

| 2,970 | WellPoint, Inc., 5.00%, 01/15/11 (m) | 2,920 | |||||||||

| 4,446 | |||||||||||

Hotels, Restaurants & Leisure — 0.1% | |||||||||||

| 620 | ITT Corp., 7.38%, 11/15/15 (m) | 660 | |||||||||

| 1,190 | MGM Mirage, Inc., 5.88%, 02/27/14 (m) | 1,086 | |||||||||

| 585 | Vail Resorts, Inc., 6.75%, 02/15/14 (m) | 567 | |||||||||

| 2,313 | |||||||||||

Household Durables — 0.2% | |||||||||||

| Beazer Homes USA, Inc. | |||||||||||

| 1,025 | 6.50%, 11/15/13 (m) | 915 | |||||||||

| 200 | 6.88%, 07/15/15 (m) | 178 | |||||||||

| 730 | DR Horton, Inc., 5.63%, 09/15/14 (m) | 684 | |||||||||

| 500 | Jarden Corp., 9.75%, 05/01/12 (m) | 518 | |||||||||

| 780 | Sealy Mattress Co., 8.25%, 06/15/14 (m) | 788 | |||||||||

| 3,083 | |||||||||||

Household Products — 0.1% | |||||||||||

| Spectrum Brands, Inc., | |||||||||||

| 1,917 | 7.38%, 02/01/15 (m) | 1,485 | |||||||||

| 250 | 8.50%, 10/01/13 (m) | 208 | |||||||||

| 1,693 | |||||||||||

Industrial Conglomerates — 0.3% | |||||||||||

| 4,485 | Hutchison Whampoa International Ltd. (Cayman Islands), 7.45%, 11/24/33 (e) (m) | 5,020 | |||||||||

Insurance — 1.4% | |||||||||||

| 1,765 | American International Group, Inc., 6.25%, 05/01/36 (m) | 1,812 | |||||||||

| 1,000 | GE Global Insurance Holding Corp., 7.75%, 06/15/30 (m) | 1,176 | |||||||||

| 240 | Hartford Financial Services Group, Inc., 4.70%, 09/01/07 (m) | 238 | |||||||||

| 3,440 | Lincoln National Corp., VAR, 7.00%, 05/17/66 (m) | 3,564 | |||||||||

| 1,570 | Monumental Global Funding II, 3.85%, 03/03/08 (e) (m) | 1,535 | |||||||||

| 3,085 | Mony Group, Inc., 8.35%, 03/15/10 (m) | 3,370 | |||||||||

| Protective Life Secured Trust, | |||||||||||

| 4,505 | 3.70%, 11/24/08 (m) | 4,359 | |||||||||

| 3,390 | 4.00%, 10/07/09 (m) | 3,270 | |||||||||

| 1,250 | FRN, 5.58%, 01/14/08 (m) | 1,252 | |||||||||

| 3,630 | Stingray Pass-Through (Cayman Islands), 5.90%, 01/12/15 (e) (m) | 3,231 | |||||||||

| 1,205 | Swiss RE Capital I LP, VAR, 6.85%, 12/31/49 (e) (m) | 1,231 | |||||||||

| 25,038 | |||||||||||

IT Services — 0.1% | |||||||||||

| 900 | SunGard Data Systems, Inc., 10.25%, 08/15/15 (m) | 919 | |||||||||

Media — 2.3% | |||||||||||

| 500 | CCO Holdings LLC/CCO Holdings Capital Corp., 8.75%, 11/15/13 (m) | 500 | |||||||||

| 455 | Charter Communications Operating LLC/Charter Communications Operating Capital, 8.00%, 04/30/12 (e) (m) | 456 | |||||||||

AS OF AUGUST 31, 2006 (continued)

| PRINCIPAL AMOUNT($) | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — Continued | |||||||||||

Media — Continued | |||||||||||

| Comcast Corp., | |||||||||||

| 615 | 4.95%, 06/15/16 (m) | 567 | |||||||||

| 1,730 | 5.90%, 03/15/16 (m) | 1,715 | |||||||||

| 2,690 | 6.50%, 01/15/17 (m) | 2,780 | |||||||||

| 7,775 | FRN, 5.80%, 07/14/09 (m) | 7,787 | |||||||||

| 1,900 | Dex Media, Inc., SUB, 0.00%, 11/15/13 (m) | 1,582 | |||||||||

| 685 | DirecTV Holdings LLC, 6.38%, 06/15/15 (m) | 640 | |||||||||

| 1,560 | Echostar DBS Corp., 7.13%, 02/01/16 (e) (m) | 1,519 | |||||||||

| 245 | News America Holdings, Inc., 7.75%, 01/20/24 (m) | 267 | |||||||||

| TCI Communications, Inc., | |||||||||||

| 200 | 7.13%, 02/15/28 (m) | 207 | |||||||||

| 1,285 | 8.75%, 08/01/15 (m) | 1,505 | |||||||||

| Viacom, Inc., | |||||||||||

| 2,625 | 5.75%, 04/30/11 (e) (m) | 2,603 | |||||||||

| 6,900 | 6.25%, 04/30/16 (e) (m) | 6,811 | |||||||||

| 10,000 | FRN, 5.69%, 06/16/09 (e) (m) | 10,003 | |||||||||

| 380 | WMG Holdings Corp., 0.00%, SUB, 12/15/14 (m) | 274 | |||||||||

| 39,216 | |||||||||||

Metals & Mining — 0.0% | |||||||||||

| 840 | Newmont Mining Corp., 5.88%, 04/01/35 (m) | 779 | |||||||||

Multi-Utilities — 0.7% | |||||||||||

| Dominion Resources, Inc., | |||||||||||

| 1,220 | 5.00%, 03/15/13 (m) | 1,170 | |||||||||

| 225 | 6.30%, 03/15/33 (m) | 223 | |||||||||

| 2,290 | Series A, 8.13%, 06/15/10 (m) | 2,487 | |||||||||

| 6,135 | Series C, 5.15%, 07/15/15 (m) | 5,833 | |||||||||

| 1,600 | Series D, FRN, 5.79%, 09/28/07 (m) | 1,601 | |||||||||

| 1,090 | Series E, 7.20%, 09/15/14 (m) | 1,179 | |||||||||

| 12,493 | |||||||||||

Oil, Gas & Consumable Fuels — 1.5% | |||||||||||

| 255 | Atlantic Richfield Co., 5.90%, 04/15/09 (m) | 260 | |||||||||

| 4,785 | BP Canada Finance Co. (Canada), 3.38%, 10/31/07 (m) | 4,680 | |||||||||

| 960 | Chesapeake Energy Corp., 6.50%, 08/15/17 (m) | 890 | |||||||||

| 4,700 | ChevronTexaco Capital Co. (Canada), 3.50%, 09/17/07 (m) | 4,614 | |||||||||

| Enterprise Products Operating LP, | |||||||||||

| 4,000 | Series B, 5.00%, 03/01/15 (m) | 3,734 | |||||||||

| 1,155 | Series B, 6.65%, 10/15/34 (m) | 1,148 | |||||||||

| 3,050 | Gazprom International S.A. (Luxembourg), 7.20%, 02/01/20 (m) | 3,195 | |||||||||

| 5,469 | Gazstream S.A. (Germany), 5.63%, 07/22/13 (e) | 5,414 | |||||||||

| 2,925 | OAO Gazprom (Russia), 9.13%, 04/25/07 (m) | 2,986 | |||||||||

| 40 | Suncor Energy, Inc. (Canada), 7.15%, 02/01/32 (m) | 46 | |||||||||

| 26,967 | |||||||||||

Paper & Forest Products — 0.1% | |||||||||||

| 1,200 | Georgia Pacific Corp., 7.70%, 06/15/15 (m) | 1,189 | |||||||||

Personal Products — 0.0% | |||||||||||

| 500 | DEL Laboratories, Inc., 8.00%, 02/01/12 (m) | 425 | |||||||||

Pharmaceuticals — 0.2% | |||||||||||

| 3,305 | Teva Pharmaceutical Finance LLC, 6.15%, 02/01/36 (m) | 3,122 | |||||||||

Road & Rail — 0.1% | |||||||||||

| 1,705 | BNSF Funding Trust I, VAR, 6.61%, 12/15/55 (m) | 1,693 | |||||||||

Software — 0.2% | |||||||||||

| 2,405 | Oracle Corp and Ozark Holding Inc., FRN, 5.73%, 01/13/09 (m) | 2,408 | |||||||||

| 635 | UGS Corp., 10.00%, 06/01/12 (m) | 682 | |||||||||

| 3,090 | |||||||||||

Thrifts & Mortgage Finance — 2.7% | |||||||||||

| 5,800 | Bancaja US Debt S.A., FRN, 5.66%, 07/10/09 (e) (m) | 5,801 | |||||||||

| 4,500 | Countrywide Financial Corp., FRN, 5.68%, 03/24/09 (m) | 4,504 | |||||||||

| 570 | Countrywide Home Loans, Inc., 5.63%, 07/15/09 (m) | 574 | |||||||||

| Residential Capital Corp., | |||||||||||

| 7,865 | 6.13%, 11/21/08 (m) | 7,882 | |||||||||

| 2,885 | 6.38%, 06/30/10 (m) | 2,910 | |||||||||

| 1,000 | 6.88%, 06/30/15 (m) | 1,035 | |||||||||

| 2,400 | FRN, 6.61%, 04/17/09 (m) | 2,410 | |||||||||

| 2,100 | FRN, 6.69%, 11/21/08 (m) | 2,122 | |||||||||

| 14,825 | FRN, 7.34%, 04/17/09 (e) (m) | 14,891 | |||||||||

| 1,250 | Sovereign Bancorp, Inc., FRN, 5.68%, 03/01/09 (e) (m) | 1,252 | |||||||||

| 4,000 | Washington Mutual Bank, FRN, 5.58%, 05/01/09 (m) | 4,003 | |||||||||

| 47,384 | |||||||||||

Wireless Telecommunication Services — 0.3% | |||||||||||

| 1,000 | iPCS, Inc., 11.50%, 05/01/12 (m) | 1,125 | |||||||||

| New Cingular Wireless Services, Inc., | |||||||||||

| 610 | 7.88%, 03/01/11 (m) | 665 | |||||||||

| 1,110 | 8.13%, 05/01/12 (m) | 1,243 | |||||||||

| 390 | 8.75%, 03/01/31 (m) | 493 | |||||||||

| PRINCIPAL AMOUNT($) | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — Continued | |||||||||||

Wireless Telecommunication Services — Continued | |||||||||||

| 860 | Rogers Wireless, Inc. (Canada), 6.38%, 03/01/14 (m) | 843 | |||||||||

| 1,170 | Vodafone Group plc (United Kingdom), 7.75%, 02/15/10 (m) | 1,251 | |||||||||

| 5,620 | |||||||||||

| Total Corporate Bonds (Cost $590,665) | 587,896 | ||||||||||

Foreign Government Securities — 4.0% | |||||||||||

| 4,220 | Federal Republic of Brazil, 12.25%, 03/06/30 (m) | 6,752 | |||||||||

| Bundesrepublik Deutschland (Germany), | |||||||||||

| EUR 780 | 4.00%, 01/04/37 (m) | 996 | |||||||||

| EUR 4,215 | 4.75%, 07/04/34 (m) | 6,043 | |||||||||

| $1,875 | Arab Republic of Egypt (Egypt), 4.45%, 09/15/15 (m) | 1,797 | |||||||||

| 10,610 | Government of Argentina (Argentina), FRN, 5.59%, 08/03/12 (m) | 7,427 | |||||||||

| 6,640 | Government of Peru (Peru), FRN, 6.23%, 03/07/27 (m) | 6,374 | |||||||||

| 6,660 | Mexico Government International Bond (Mexico), 8.00%, 09/24/22 (m) | 8,009 | |||||||||

| 2,000 | National Agricultural Cooperative Federation (South Korea), VAR, 5.75%, 06/18/14 (m) | 2,008 | |||||||||

| 4,875 | Russia Government International Bond (Russia), 12.75%, 06/24/28 (m) | 8,702 | |||||||||

| 8,550 | United Mexican States (Mexico), FRN, 6.20%, 01/13/09 (m) | 8,631 | |||||||||

| Government of Venezuela (Venezuela), | |||||||||||

| 4,048 | 5.75%, 02/26/16 (m) | 3,764 | |||||||||

| 415 | 7.00%, 12/01/18 (m) | 420 | |||||||||

| 5,265 | 9.38%, 01/13/34 (m) | 6,613 | |||||||||

| 833 | 13.63%, 08/15/18 (m) | 1,258 | |||||||||

| Total Foreign Government Securities (Cost $66,959) | 68,794 | ||||||||||

Mortgage Pass-Through Securities — 31.4% | |||||||||||

| Federal Home Loan Mortgage Corp. Various Pools, | |||||||||||

| 720 | 6.00%, 02/01/11–10/15/36 (m) | 723 | |||||||||

| 78 | 7.00%, 12/01/25–02/01/26 (m) | 80 | |||||||||

| 165 | 7.50%, 10/01/26–02/01/27 (m) | 172 | |||||||||

| 138 | 8.00%, 04/01/26–07/01/26 (m) | 144 | |||||||||

| 2 | 9.75%, 11/01/08 | 2 | |||||||||

| 28,200 | TBA, 5.50%, 10/15/36 | 27,693 | |||||||||

| 97,010 | TBA, 6.00%, 09/01/36–10/15/36 | 97,171 | |||||||||

| 75,000 | TBA, 6.50%, 09/15/36 | 76,189 | |||||||||

| Federal National Mortgage Association Various Pools, | |||||||||||

| 222 | 7.00%, 09/01/36 (m) | 227 | |||||||||

| 28,000 | TBA, 4.50%, 09/25/21 | 26,933 | |||||||||

| 1,149 | 4.96%, 11/01/08 (m) | 1,137 | |||||||||

| 12,095 | 5.00%, 09/25/21–10/25/21 | 11,848 | |||||||||

| 3,216 | TBA, 5.50%, 09/25/21–10/25/21 | 3,203 | |||||||||

| 8,561 | 6.00%, 10/01/23–03/01/35 | 8,588 | |||||||||

| 2,830 | 6.50%, 04/01/29–03/01/35 | 2,874 | |||||||||

| 81,903 | 7.00%, 04/01/34–09/25/36 (m) | 84,099 | |||||||||

| 1,215 | 7.50%, 03/01/35–01/01/36 (m) | 1,255 | |||||||||

| 1,398 | 8.00%, 08/01/22–01/01/36 (m) | 1,475 | |||||||||

| —(h) | 8.50%, 10/01/25 (m) | — | (h) | ||||||||

| 26,000 | TBA, 6.00%, 09/25/21 | 26,301 | |||||||||

| 106,200 | TBA, 6.50%, 09/25/36–11/01/36 | 107,801 | |||||||||

| Government National Mortgage Association Pool, | |||||||||||

| 1,352 | 7.00%, 09/15/31 (m) | 1,395 | |||||||||

| 18 | 9.00%, 02/15/10 (m) | 19 | |||||||||

| 18 | 9.00%, 04/15/11 (m) | 19 | |||||||||

| 16,500 | TBA, 5.50%, 09/15/36 | 16,360 | |||||||||

| 35,000 | TBA, 6.00%, 09/15/36 | 35,350 | |||||||||

| 14,000 | TBA, 6.50%, 09/15/36 | 14,326 | |||||||||

| Total Mortgage Pass-Through Securities (Cost $542,291) | 545,384 | ||||||||||

Private Placements — 0.9% | |||||||||||

| 10,474 | 200 East 57th St., 200 East Tenants Corporation, Secured by First Mortgage and Agreement on Co-op Apartment Building in New York City, 6.50%, 01/01/14 (f) (i) (m) | 10,982 | |||||||||

| 725 | 200 East 57th St., 200 East Tenants Corporation, Secured by Second Mortgage and Agreement on Co-op Apartment Building in New York City, 6.72%, 01/01/13 (f) (i) (m) | 752 | |||||||||

| 2,974 | 81 Irving Place, Irving Tenants Corporation, Secured by First Mortgage and Agreement on Co-op Apartment Building in New York City, 6.95%, 01/01/29 (f) (i) (m) | 3,226 | |||||||||

| Total Private Placements (Cost $14,173) | 14,960 | ||||||||||

Supranational — 0.3% | |||||||||||

| 5,000 | European Investment Bank, 4.88%, 02/16/16 (m) (Cost $4,994) | 4,912 | |||||||||

U.S. Government Agency Securities — 6.4% | |||||||||||

| Federal Home Loan Mortgage Corp., | |||||||||||

| 8,670 | 4.00%, 06/12/13 (m) | 8,134 | |||||||||

| 4,040 | 4.88%, 11/15/13 (m) | 3,988 | |||||||||

| 11,950 | 5.75%, 01/15/12 (m) | 12,336 | |||||||||

| 4,640 | 6.25%, 07/15/32 (m) | 5,290 | |||||||||

AS OF AUGUST 31, 2006 (continued)

| PRINCIPAL AMOUNT($) | | SECURITY DESCRIPTION | | VALUE($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Long-Term Investments — Continued | |||||||||||

U.S. Government Agency Securities — Continued | |||||||||||

| 2,315 | 6.75%, 03/15/31 (m) | 2,782 | |||||||||

| 6,680 | 7.00%, 03/15/10 (m) | 7,099 | |||||||||

| Federal National Mortgage Association, | |||||||||||

| 2,025 | 2.38%, 02/15/07 (m) | 1,998 | |||||||||

| 14,745 | 3.25%, 08/15/08 (m) | 14,240 | |||||||||

| 39,000 | 3.88%, 02/15/10 (m) | 37,599 | |||||||||

| 13,415 | 5.00%, 03/15/16 (m) | 13,304 | |||||||||

| 2,600 | 5.25%, 08/01/12 (m) | 2,599 | |||||||||

| 830 | 6.13%, 03/15/12 (m) | 873 | |||||||||

| 15 | 7.13%, 01/15/30 (m) | 19 | |||||||||

| 1,600 | Tennessee Valley Authority, 6.79%, 05/23/12 (m) | 1,736 | |||||||||