UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-5162 |

|

Delaware VIP Trust |

(Exact name of registrant as specified in charter) |

|

2005 Market Street Philadelphia, PA | | 19103 |

(Address of principal executive offices) | | (Zip code) |

|

David F. Connor, Esq. 2005 Market Street Philadelphia, PA 19103 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800) 523-1918 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2006 | |

| | | | | | | | |

Item 1. Reports to Stockholders

Delaware VIP Trust — Delaware VIP Balanced Series

For the 12-month period ended December 31, 2006, the Delaware VIP Balanced Series showed a positive return of 16.20% for Standard Class shares with distributions reinvested, as Service Class shares gained 15.88% with distributions reinvested. The benchmarks for the Series are the Standard & Poor's 500 Index, which gained 15.78%, and the Lehman Brothers Aggregate Bond Index, which returned +4.33% (source: Lipper).

Expecting a slowdown in the economy and a reduced rate of corporate earnings growth during the fiscal year, we believed it was prudent to position the equity portion of the Series more defensively than usual. As a result, we had more holdings in less economically sensitive sectors, such as healthcare and consumer staples, than those reflected in the benchmark indices. The Series' equity allocation was underweight relative to the S&P 500 Index in the more economically sensitive areas, such as consumer discretionary.

We regularly looked to invest in undervalued companies with good business models and prices that we believed were well below their intrinsic value. During this recent period, we focused on companies that we believed to have particularly sound balance sheets, strong dividend yields, and the potential to continue generating relatively stable earnings, even in a weaker economy. This approach led us to hold smaller positions in the energy and industrial sectors relative to the benchmark indices, both of which tend to be relatively sensitive to economic changes.

Despite being faced with rising interest rates during the first half of the year, the fixed income markets had positive total returns for the year as measured by the 4.33% advance of the broad Lehman Brothers Aggregate Bond Index for 2006. While bond market returns trailed those of equities, the Series' fixed income allocation continued to provide an important counterweight to stock holdings. Throughout the year, we continued to hold a broad array of fixed income assets, with the largest holdings at year-end falling into the categories of government agency bonds and U.S. Treasury holdings.

The views expressed are current as of the date of this report and are subject to change.

The performance data quoted below and on the next page represent past performance; past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling the number noted on the page related to this Series in the introductory section of this report.

You should consider the investment objectives, risks, charges, and expenses of the investment carefully before investing. The Delaware VIP Balanced Series prospectus contains this and other important information about the Series. To obtain a prospectus, contact the company noted on the page related to this Series in the introductory section of this report, either by phone or through the company Web site. We advise you to read the prospectus carefully before you invest.

Delaware VIP Balanced Series

Average Annual Total Returns

For the periods ending Dec. 31, 2006 | | 1 Year | | 5 Years | | 10 Years | | Lifetime | |

| Standard Class Shares* | | | +16.20 | % | | | +4.94 | % | | | +4.64 | % | | | +8.17 | % | |

| Service Class Shares** | | | +15.88 | % | | | +4.71 | % | | | NA | | | | +2.55 | % | |

* Commenced operations on July 28, 1988

** Commenced operations on May 1, 2000

Balanced Series- 1

Delaware VIP Trust — Delaware VIP Balanced Series (continued)

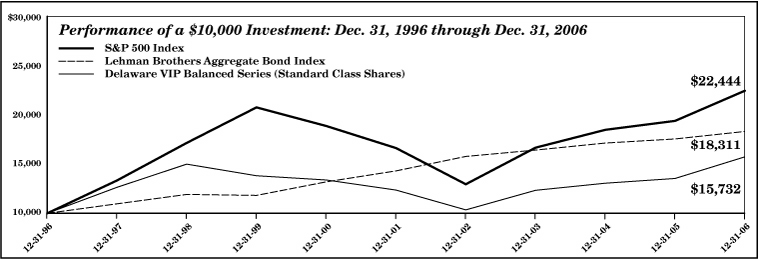

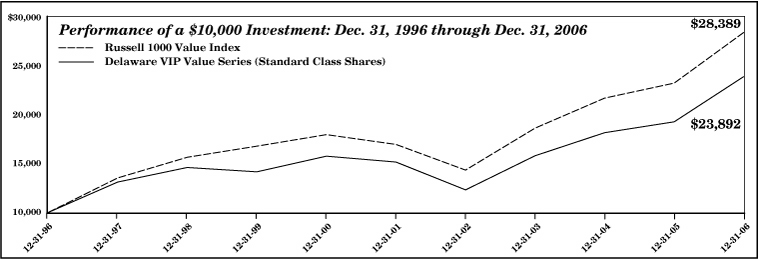

The chart shows a $10,000 investment in the Delaware VIP Balanced Series Standard Class shares for the period from Dec. 31, 1996 through Dec. 31, 2006. All distributions were reinvested. The chart also shows $10,000 invested in the Lehman Brothers Aggregate Bond Index and S&P 500 Index for the period from Dec. 31, 1996 through Dec. 31, 2006.

Lehman Brothers Aggregate Bond Index measures the performance of a large group of high quality, fixed income securities across the government, corporate, mortgage-backed, asset-backed, and commercial mortgage-backed markets. The S&P 500 Index measures the performance of mostly large-capitalization U.S. companies. An index is unmanaged and does not reflect the costs of operating a mutual fund, such as the costs of buying, selling, and holding securities. You cannot invest directly in an index.

Earnings from a variable annuity or variable life investment compound tax free until withdrawal, so no adjustments were made for income taxes.

An expense limitation was in effect for the Delaware VIP Balanced Series during the periods shown.

Performance of Service Class shares will vary due to different charges and expenses.

Performance does not reflect insurance fees related to a variable annuity or variable life investment or the deferred sales charge that would apply to certain withdrawals of investments held for fewer than eight years. Performance shown here would have been reduced if such fees were included and the expense limitation was removed. For more information about fees, consult your variable annuity or variable life prospectus.

Investments in variable products involve risk. A rise or fall in interest rates can have a significant impact on bond prices and the net asset value (NAV) of the Series. Series that invest in bonds may lose their value as interest rates rise, and an investor may lose principal. High yielding, noninvestment grade bonds involve higher risk than investment grade bonds. Adverse conditions may affect the issuer's ability to pay interest and principal on these securities. The Series may be invested in emerging markets and foreign high yield corporate bonds, which have special risks that include currency fluctuations, economic and political change, and different accounting standards. Some portfolios offer more risk than others. Please read both the contract and underlying prospectus for specific details regarding the product's risk profile.

Balanced Series- 2

Delaware VIP Trust — Delaware VIP Balanced Series

Disclosure of Series Expenses

For the Period July 1, 2006 to December 31, 2006

As a shareholder of the Series, you incur ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Series expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2006 to December 31, 2006.

Actual Expenses

The first section of the table shown, "Actual Series Return," provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second section of the table shown, "Hypothetical 5% Return," provides information about hypothetical account values and hypothetical expenses based on the Series' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Series' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Series and other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. As a shareholder of the Series, you do not incur any transaction costs, such as sales charges (loads), redemption fees or exchange fees, but shareholders of other funds may incur such costs. Also, the fees related to the variable annuity investment or the deferred sales charge that could apply have not been included. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. The Series' actual expenses shown in the table reflect fee waivers in effect. The expenses shown in the table assume reinvestment of all dividends and distributions.

Expense Analysis of an Investment of $1,000

| | | Beginning

Account

Value

7/1/06 | | Ending

Account

Value

12/31/06 | | Annualized

Expense

Ratios | | Expenses

Paid During

Period

7/1/06 to

12/31/06* | |

| Actual Series Return | |

| Standard Class | | $ | 1,000.00 | | | $ | 1,119.60 | | | | 0.82 | % | | $ | 4.38 | | |

| Service Class | | | 1,000.00 | | | | 1,118.10 | | | | 1.07 | % | | | 5.71 | | |

| Hypothetical 5% Return (5% return before expenses) | |

| Standard Class | | $ | 1,000.00 | | | $ | 1,021.07 | | | | 0.82 | % | | $ | 4.18 | | |

| Service Class | | | 1,000.00 | | | | 1,019.81 | | | | 1.07 | % | | | 5.45 | | |

*"Expenses Paid During Period" are equal to the Series' annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Balanced Series- 3

Delaware VIP Trust — Delaware VIP Balanced Series

Sector Allocation and Credit Rating Breakdown

As of December 31, 2006

Sector designations may be different than the sector designations presented in other Series materials.

| Sector | | Percentage

of Net Assets | |

| Common Stock | | | 61.09 | % | |

| Consumer Discretionary | | | 5.26 | % | |

| Consumer Staples | | | 7.43 | % | |

| Energy | | | 3.78 | % | |

| Financials | | | 14.86 | % | |

| Health Care | | | 11.05 | % | |

| Industrials | | | 3.76 | % | |

| Information Technology | | | 7.39 | % | |

| Materials | | | 1.89 | % | |

| Telecommunications | | | 3.82 | % | |

| Utilities | | | 1.85 | % | |

| Preferred Stock | | | 0.06 | % | |

| Agency Asset-Backed Securities | | | 0.01 | % | |

| Agency Collateralized Mortgage Obligations | | | 1.75 | % | |

| Agency Mortgage-Backed Securities | | | 5.56 | % | |

| Agency Obligations | | | 0.62 | % | |

| Commercial Mortgage-Backed Securities | | | 2.26 | % | |

| Corporate Bonds | | | 11.49 | % | |

| Banking | | | 1.60 | % | |

| Basic Industry | | | 0.27 | % | |

| Brokerage | | | 0.78 | % | |

| Capital Goods | | | 0.27 | % | |

| Communications | | | 1.76 | % | |

| Consumer Cyclical | | | 0.68 | % | |

| Consumer Non-Cyclical | | | 0.53 | % | |

| Electric | | | 1.25 | % | |

| Energy | | | 0.53 | % | |

| Finance Companies | | | 0.70 | % | |

| Industrial | | | 0.01 | % | |

| Insurance | | | 1.51 | % | |

| Natural Gas | | | 0.94 | % | |

| Real Estate | | | 0.21 | % | |

| Technology & Electronics | | | 0.02 | % | |

| Transportation | | | 0.43 | % | |

| Foreign Agencies | | | 0.16 | % | |

| Municipal Bonds | | | 0.95 | % | |

| Non-Agency Asset-Backed Securities | | | 2.46 | % | |

| Non-Agency Collateralized Mortgage Obligations | | | 8.47 | % | |

| U.S. Treasury Obligations | | | 3.18 | % | |

| Repurchase Agreements | | | 5.49 | % | |

| Securities Lending Collateral | | | 6.57 | % | |

| Fixed Rate Note | | | 1.24 | % | |

| Variable Rate Notes | | | 5.33 | % | |

| Total Market Value of Securities | | | 110.12 | % | |

| Obligation to Return Securities Lending Collateral | | | (6.57 | %) | |

| Liabilities Net of Receivables and Other Assets | | | (3.55 | %) | |

| Total Net Assets | | | 100.00 | % | |

Credit Rating Breakdown

(as a % of fixed income investments) | |

| AAA | | | 66.85 | % | |

| AA | | | 4.24 | % | |

| A | | | 8.53 | % | |

| BBB | | | 18.40 | % | |

| BB | | | 0.56 | % | |

| B | | | 1.13 | % | |

| CCC | | | 0.21 | % | |

| Not Rated | | | 0.08 | % | |

| Total | | | 100.00 | % | |

Balanced Series-4

Delaware VIP Trust — Delaware VIP Balanced Series

Statement of Net Assets

December 31, 2006

| | | Number of

Shares | | Market

Value

(U.S. $) | |

| COMMON STOCK–61.09% | |

| Consumer Discretionary–5.26% | |

| Gap | | | 33,800 | | | $ | 659,100 | | |

| † Idearc | | | 860 | | | | 24,639 | | |

| Limited Brands | | | 19,900 | | | | 575,906 | | |

| Mattel | | | 27,200 | | | | 616,352 | | |

| | | | | | | | 1,875,997 | | |

| Consumer Staples–7.43% | |

| ConAgra Foods | | | 24,900 | | | | 672,300 | | |

| Heinz (H.J.) | | | 14,400 | | | | 648,144 | | |

| Kimberly-Clark | | | 9,800 | | | | 665,910 | | |

| Safeway | | | 19,100 | | | | 660,096 | | |

| | | | | | | | 2,646,450 | | |

| Energy–3.78% | |

| Chevron | | | 9,400 | | | | 691,182 | | |

| ConocoPhillips | | | 9,100 | | | | 654,745 | | |

| | | | | | | | 1,345,927 | | |

| Financials–14.86% | |

| Allstate | | | 10,100 | | | | 657,611 | | |

| * Aon | | | 18,900 | | | | 667,926 | | |

| Chubb | | | 12,000 | | | | 634,920 | | |

| Hartford Financial Services | | | 7,300 | | | | 681,163 | | |

| Huntington Bancshares | | | 26,700 | | | | 634,125 | | |

| Morgan Stanley | | | 8,100 | | | | 659,583 | | |

| Wachovia | | | 12,000 | | | | 683,399 | | |

| Washington Mutual | | | 14,900 | | | | 677,801 | | |

| | | | | | | | 5,296,528 | | |

| Health Care–11.05% | |

| Abbott Laboratories | | | 13,900 | | | | 677,069 | | |

| Baxter International | | | 14,100 | | | | 654,099 | | |

| Bristol-Myers Squibb | | | 27,100 | | | | 713,272 | | |

| Merck & Co | | | 14,200 | | | | 619,120 | | |

| Pfizer | | | 23,800 | | | | 616,420 | | |

| Wyeth | | | 12,900 | | | | 656,868 | | |

| | | | | | | | 3,936,848 | | |

| Industrials–3.76% | |

| Donnelley (R.R.) & Sons | | | 19,500 | | | | 693,030 | | |

| Waste Management | | | 17,600 | | | | 647,152 | | |

| | | | | | | | 1,340,182 | | |

| Information Technology–7.39% | |

| Hewlett-Packard | | | 16,100 | | | | 663,159 | | |

| * Intel | | | 31,000 | | | | 627,750 | | |

| International Business Machines | | | 7,000 | | | | 680,050 | | |

| † Xerox | | | 39,100 | | | | 662,745 | | |

| | | | | | | | 2,633,704 | | |

| Materials–1.89% | |

| duPont (E.I.) deNemours | | | 13,800 | | | | 672,198 | | |

| | | | | | | | 672,198 | | |

| Telecommunications–3.82% | |

| AT&T | | | 18,600 | | | | 664,950 | | |

| Verizon Communications | | | 18,700 | | | | 696,388 | | |

| | | | | | | | 1,361,338 | | |

| Utilities–1.85% | |

| * Progress Energy | | | 13,400 | | | | 657,672 | | |

| | | | | | | | 657,672 | | |

Total Common Stock

(cost $17,866,449) | | | | | | | 21,766,844 | | |

| | | Number of

Shares | | Market

Value

(U.S. $) | |

| PREFERRED STOCK–0.06% | |

| Nexen 7.35% | | | 790 | | | $ | 20,382 | | |

Total Preferred Stock

(cost $19,750) | | | | | | | 20,382 | | |

| | | Principal

Amount

(U.S. $) | | | |

AGENCY ASSET-BACKED

SECURITIES–0.01% | |

• Fannie Mae Whole Loan

Series 2002-W11 AV1 5.69% 11/25/32 | | $ | 3,677 | | | | 3,676 | | |

Total Agency Asset-Backed Securities

(cost $3,678) | | | | | | | 3,676 | | |

AGENCY COLLATERALIZED

MORTGAGE OBLIGATIONS–1.75% | |

Fannie Mae

Series 1996-46 ZA 7.50% 11/25/26 | | | 20,341 | | | | 21,010 | | |

| Series 2003-122 AJ 4.50% 2/25/28 | | | 19,709 | | | | 19,220 | | |

| Series 2005-110 MB 5.50% 9/25/35 | | | 60,000 | | | | 60,150 | | |

| Series 2006-M2 A2F 5.259% 5/25/20 | | | 80,000 | | | | 79,152 | | |

Fannie Mae Grantor Trust

Series 2001-T8 A2 9.50% 7/25/41 | | | 17,166 | | | | 18,486 | | |

Fannie Mae Whole Loan

Series 2004-W9 2A1 6.50% 2/25/44 | | | 29,511 | | | | 30,196 | | |

| Series 2004-W11 1A2 6.50% 5/25/44 | | | 31,457 | | | | 32,197 | | |

Freddie Mac

Series 1730 Z 7.00% 5/15/24 | | | 16,934 | | | | 17,651 | | |

| Series 2326 ZQ 6.50% 6/15/31 | | | 79,706 | | | | 82,521 | | |

| Series 2480 EH 6.00% 11/15/31 | | | 1,468 | | | | 1,467 | | |

| Series 2662 MA 4.50% 10/15/31 | | | 37,418 | | | | 36,648 | | |

| Series 2872 GC 5.00% 11/15/29 | | | 40,000 | | | | 39,136 | | |

| Series 2890 PC 5.00% 7/15/30 | | | 65,000 | | | | 63,550 | | |

| Series 3022 MB 5.00% 12/15/28 | | | 30,000 | | | | 29,561 | | |

| Series 3063 PC 5.00% 2/15/29 | | | 60,000 | | | | 59,071 | | |

t Freddie Mac Structured Pass Through

Securities

Series T-58 2A 6.50% 9/25/43 | | | 32,181 | | | | 32,857 | | |

Total Agency Collateralized

Mortgage Obligations (cost $633,928) | | | | | | | 622,873 | | |

AGENCY MORTGAGE-BACKED

SECURITIES–5.56% | |

| Fannie Mae 6.50% 8/1/17 | | | 22,942 | | | | 23,352 | | |

Fannie Mae Relocation 30 yr

5.00% 11/1/33 | | | 56,586 | | | | 55,136 | | |

| 5.00% 11/1/34 | | | 36,530 | | | | 35,570 | | |

Fannie Mae S.F. 15 yr TBA

6.00% 1/1/22 | | | 80,000 | | | | 81,125 | | |

Fannie Mae S.F. 30 yr

5.50% 3/1/29 | | | 71,657 | | | | 71,196 | | |

| 5.50% 4/1/29 | | | 78,647 | | | | 78,141 | | |

| 7.50% 6/1/31 | | | 27,107 | | | | 28,226 | | |

| 9.50% 6/1/19 | | | 7,363 | | | | 7,774 | | |

Balanced Series- 5

Delaware VIP Balanced Series

Statement of Net Assets (continued)

| | | Principal

Amount

(U.S. $) | | Market

Value

(U.S. $) | |

AGENCY MORTGAGE-BACKED

SECURITIES (continued) | |

Fannie Mae S.F. 30 yr TBA

5.00% 1/1/37 | | $ | 330,000 | | | $ | 318,656 | | |

| 5.50% 1/1/37 | | | 970,000 | | | | 958,785 | | |

| 6.00% 1/25/37 | | | 40,000 | | | | 40,275 | | |

| 6.50% 1/1/37 | | | 25,000 | | | | 25,477 | | |

| • Freddie Mac ARM 4.673% 4/1/34 | | | 21,293 | | | | 21,588 | | |

Freddie Mac Relocation 30 yr

5.00% 9/1/33 | | | 96,530 | | | | 94,225 | | |

| Freddie Mac S.F. 15 yr 4.00% 2/1/14 | | | 58,171 | | | | 56,243 | | |

| Freddie Mac S.F. 30 yr 7.00% 11/1/33 | | | 14,648 | | | | 15,067 | | |

| Freddie Mac S.F. 30 yr TBA 6.00% 1/1/37 | | | 65,000 | | | | 65,488 | | |

| GNMA S.F. 30 yr 7.50% 1/15/32 | | | 6,303 | | | | 6,578 | | |

Total Agency Mortgage-Backed

Securities (cost $1,994,572) | | | | | | | 1,982,902 | | |

| AGENCY OBLIGATIONS–0.62% | |

| ^ Fannie Mae 5.377% 10/9/19 | | | 230,000 | | | | 113,867 | | |

^ Resolution Funding Interest Strip

5.24% 10/15/25 | | | 275,000 | | | | 106,671 | | |

Total Agency Obligations

(cost $220,938) | | | | | | | 220,538 | | |

COMMERCIAL MORTGAGE-BACKED

SECURITIES–2.26% | |

Bank of America Commercial Mortgage

Securities | |

| • Series 2006-3 A4 5.889% 7/10/44 | | | 50,000 | | | | 51,976 | | |

| Series 2006-4 A4 5.634% 7/10/46 | | | 25,000 | | | | 25,520 | | |

# Bear Stearns Commercial Mortgage

Securities Series 2004-ESA E 144A

5.064% 5/14/16 | | | 40,000 | | | | 39,845 | | |

t Commercial Mortgage Pass Through

Certificates | | | | | | | | | |

# Series 2001-J1A A2 144A

6.457% 2/14/34 | | | 28,520 | | | | 29,518 | | |

| Series 2006-C7 A2 5.69% 6/10/46 | | | 25,000 | | | | 25,429 | | |

• Credit Suisse Mortgage Capital

Certificates Series 2006-C1 AAB

5.556% 2/15/39 | | | 15,000 | | | | 15,192 | | |

# Crown Castle Towers

Series 2005-1A C 144A

5.074% 6/15/35 | | | 25,000 | | | | 24,676 | | |

Deutsche Mortgage and Asset Receiving

Series 1998-C1 A2 6.538% 6/15/31 | | | 30,785 | | | | 30,988 | | |

First Union-Lehman Brothers-Bank of

America Series 1998-C2 A2

6.56% 11/18/35 | | | 26,637 | | | | 26,914 | | |

General Electric Capital Commercial

Mortgage Series 2002-1A A3

6.269% 12/10/35 | | | 75,000 | | | | 78,359 | | |

GS Mortgage Securities II

Series 2006-GG8 A4 5.56% 11/10/39 | | | 80,000 | | | | 81,254 | | |

| | | Principal

Amount

(U.S. $) | | Market

Value

(U.S. $) | |

COMMERCIAL MORTGAGE-BACKED

SECURITIES (continued) | |

JPMorgan Chase Commercial Mortgage

Securities

Series 2002-C1 A3 5.376% 7/12/37 | | $ | 35,000 | | | $ | 35,213 | | |

| Series 2003-C1 A2 4.985% 1/12/37 | | | 68,000 | | | | 66,980 | | |

•# Series 2006-RR1A A1 144A

5.456% 10/18/52 | | | 25,000 | | | | 25,180 | | |

Lehman Brothers-UBS Commercial

Mortgage Trust Series 2002-C1 A4

6.462% 3/15/31 | | | 55,000 | | | | 57,929 | | |

• Merrill Lynch Mortgage Trust

Series 2006-C1 ASB 5.66% 5/12/39 | | | 35,000 | | | | 35,819 | | |

# SBA Commercial Mortgage Securities

Trust Series 2006-1A B 144A

5.451% 11/15/36 | | | 60,000 | | | | 60,153 | | |

# Tower 144A

Series 2004-2A A 4.232% 12/15/14 | | | 45,000 | | | | 43,801 | | |

| Series 2006-1 B 5.588% 2/15/36 | | | 25,000 | | | | 25,140 | | |

| Series 2006-1 C 5.707% 2/15/36 | | | 25,000 | | | | 25,158 | | |

Total Commercial Mortgage-Backed

Securities (cost $815,102) | | | | | | | 805,044 | | |

| CORPORATE BONDS–11.49% | |

| Banking–1.60% | |

| •# Barclays Bank 144A 7.375% 6/29/49 | | | 20,000 | | | | 21,622 | | |

| Citigroup 5.875% 2/22/33 | | | 20,000 | | | | 20,132 | | |

JP Morgan Chase Capital XX

6.55% 9/29/36 | | | 25,000 | | | | 25,901 | | |

| • MUFG Capital Finance 1 6.346% 7/29/49 | | | 100,000 | | | | 101,669 | | |

Popular North America

4.25% 4/1/08 | | | 55,000 | | | | 54,205 | | |

| • 5.77% 4/6/09 | | | 25,000 | | | | 25,084 | | |

Popular North America Capital Trust I

6.564% 9/15/34 | | | 15,000 | | | | 15,006 | | |

•# Rabobank Capital Funding II 144A

5.26% 12/29/49 | | | 35,000 | | | | 34,277 | | |

| • RBS Capital Trust I 4.709% 12/29/49 | | | 60,000 | | | | 57,115 | | |

•# Resona Preferred Global Securities

Cayman 144A 7.191% 12/29/49 | | | 70,000 | | | | 73,156 | | |

* Sovereign Capital Trust VI

7.908% 6/13/36 | | | 30,000 | | | | 33,801 | | |

| SunTrust Capital II 7.90% 6/15/27 | | | 35,000 | | | | 36,503 | | |

# Wachovia Capital Trust I 144A

7.64% 1/15/27 | | | 40,000 | | | | 41,558 | | |

• Wachovia Capital Trust III

5.80% 3/15/42 | | | 30,000 | | | | 30,276 | | |

| | | | | | | | 570,305 | | |

| Basic Industry–0.27% | |

| * Abitibi-Consolidated 7.875% 8/1/09 | | | 5,000 | | | | 4,900 | | |

| Bowater 9.50% 10/15/12 | | | 5,000 | | | | 5,200 | | |

| Lubrizol 4.625% 10/1/09 | | | 30,000 | | | | 29,447 | | |

| * Norske Skog Canada 8.625% 6/15/11 | | | 2,000 | | | | 2,035 | | |

| Potlatch 13.00% 12/1/09 | | | 5,000 | | | | 5,790 | | |

| * Vale Overseas 6.25% 1/23/17 | | | 25,000 | | | | 25,239 | | |

| Weyerhaeuser 7.125% 7/15/23 | | | 25,000 | | | | 25,053 | | |

| | | | | | | | 97,664 | | |

Balanced Series- 6

Delaware VIP Balanced Series

Statement of Net Assets (continued)

| | | Principal

Amount

(U.S. $) | | Market

Value

(U.S. $) | |

| CORPORATE BONDS (continued) | |

| Brokerage–0.78% | |

| • Ameriprise Financial 7.518% 6/1/66 | | $ | 80,000 | | | $ | 88,004 | | |

| Amvescap 4.50% 12/15/09 | | | 55,000 | | | | 53,656 | | |

| Goldman Sachs Group 6.345% 2/15/34 | | | 25,000 | | | | 25,388 | | |

| LaBranche & Co. 11.00% 5/15/12 | | | 5,000 | | | | 5,413 | | |

| Merrill Lynch 6.05% 5/16/16 | | | 100,000 | | | | 103,688 | | |

| | | | | | | | 276,149 | | |

| Capital Goods–0.27% | |

| Casella Waste Systems 9.75% 2/1/13 | | | 5,000 | | | | 5,263 | | |

| Caterpillar 6.05% 8/15/36 | | | 15,000 | | | | 15,494 | | |

| General Electric 5.00% 2/1/13 | | | 40,000 | | | | 39,607 | | |

| * Geo Sub 11.00% 5/15/12 | | | 5,000 | | | | 4,850 | | |

| * Graham Packaging 9.875% 10/15/14 | | | 5,000 | | | | 5,075 | | |

| Interface 10.375% 2/1/10 | | | 5,000 | | | | 5,550 | | |

| Intertape Polymer 8.50% 8/1/14 | | | 5,000 | | | | 4,538 | | |

| United Technologies 6.05% 6/1/36 | | | 15,000 | | | | 15,856 | | |

| | | | | | | | 96,233 | | |

| Communications–1.76% | |

| n Adelphia Communications 8.125% 4/1/07 | | | 5,000 | | | | 4,613 | | |

| * American Tower 7.125% 10/15/12 | | | 5,000 | | | | 5,163 | | |

AT&T

7.30% 11/15/11 | | | 40,000 | | | | 43,351 | | |

| 8.00% 11/15/31 | | | 15,000 | | | | 18,666 | | |

| BellSouth 4.20% 9/15/09 | | | 25,000 | | | | 24,319 | | |

British Telecommunications

9.125% 12/15/30 | | | 15,000 | | | | 20,577 | | |

| n Century Communications 9.50% 4/1/07 | | | 5,000 | | | | 6,075 | | |

| Charter Communications 13.50% 1/15/11 | | | 5,000 | | | | 4,975 | | |

| Comcast | |

| • 5.674% 7/14/09 | | | 15,000 | | | | 15,044 | | |

| 6.45% 3/15/37 | | | 15,000 | | | | 15,058 | | |

| 6.50% 11/15/35 | | | 15,000 | | | | 15,155 | | |

| Cox Communications 4.625% 1/15/10 | | | 25,000 | | | | 24,488 | | |

| Embarq 6.738% 6/1/13 | | | 20,000 | | | | 20,497 | | |

| o Inmarsat Finance 10.375% 11/15/12 | | | 5,000 | | | | 4,631 | | |

| Insight Communications 12.25% 2/15/11 | | | 5,000 | | | | 5,250 | | |

| Insight Midwest 9.75% 10/1/09 | | | 4,000 | | | | 4,075 | | |

| * Mediacom Capital 9.50% 1/15/13 | | | 7,000 | | | | 7,245 | | |

| News America Holdings 7.75% 12/1/45 | | | 20,000 | | | | 22,928 | | |

| * Rural Cellular 9.875% 2/1/10 | | | 5,000 | | | | 5,344 | | |

Sprint Capital

6.875% 11/15/28 | | | 10,000 | | | | 10,038 | | |

| 7.625% 1/30/11 | | | 35,000 | | | | 37,507 | | |

| 8.75% 3/15/32 | | | 15,000 | | | | 18,105 | | |

| Telecom Italia Capital | |

| *• 5.984% 7/18/11 | | | 40,000 | | | | 39,988 | | |

| 7.20% 7/18/36 | | | 45,000 | | | | 47,160 | | |

| Telefonica Emisones 5.984% 6/20/11 | | | 75,000 | | | | 76,418 | | |

| * Telefonos de Mexico 4.50% 11/19/08 | | | 65,000 | | | | 64,152 | | |

| Thomson 5.75% 2/1/08 | | | 30,000 | | | | 30,098 | | |

| Time Warner 5.50% 11/15/11 | | | 20,000 | | | | 19,970 | | |

Time Warner Entertainment

8.375% 3/15/23 | | | 10,000 | | | | 11,759 | | |

| • US LEC 13.87% 10/1/09 | | | 5,000 | | | | 5,325 | | |

| | | | | | | | 627,974 | | |

| | | Principal

Amount

(U.S. $) | | Market

Value

(U.S. $) | |

| CORPORATE BONDS (continued) | |

| Consumer Cyclical–0.68% | |

| Caesars Entertainment 9.375% 2/15/07 | | $ | 5,000 | | | $ | 5,019 | | |

| • DaimlerChrysler Holdings 5.82% 8/3/09 | | | 50,000 | | | | 50,116 | | |

General Motors Acceptance Corporation

6.875% 9/15/11 | | | 35,000 | | | | 35,935 | | |

| Harrah's Operating 6.50% 6/1/16 | | | 5,000 | | | | 4,484 | | |

Home Depot

5.40% 3/1/16 | | | 10,000 | | | | 9,798 | | |

| 5.875% 12/16/36 | | | 50,000 | | | | 49,237 | | |

| * Mandalay Resort Group 9.375% 2/15/10 | | | 5,000 | | | | 5,375 | | |

Penney (JC)

7.625% 3/1/97 | | | 25,000 | | | | 25,600 | | |

| 8.00% 3/1/10 | | | 15,000 | | | | 15,982 | | |

| * Playtex Products 9.375% 6/1/11 | | | 5,000 | | | | 5,238 | | |

| Viacom 5.75% 4/30/11 | | | 25,000 | | | | 25,036 | | |

| * WMG Acquisition 7.375% 4/15/14 | | | 5,000 | | | | 4,975 | | |

Wheeling Island Gaming

10.125% 12/15/09 | | | 5,000 | | | | 5,119 | | |

| | | | | | | | 241,914 | | |

| Consumer Non-Cyclical–0.53% | |

| Boston Scientific 6.40% 6/15/16 | | | 25,000 | | | | 25,343 | | |

| Cott Beverages 8.00% 12/15/11 | | | 5,000 | | | | 5,125 | | |

| CRC Health 10.75% 2/1/16 | | | 5,000 | | | | 5,400 | | |

| Gold Kist 10.25% 3/15/14 | | | 3,000 | | | | 3,457 | | |

| Kraft Foods 4.125% 11/12/09 | | | 15,000 | | | | 14,559 | | |

| Kroger 6.375% 3/1/08 | | | 30,000 | | | | 30,227 | | |

| Medco Health Solutions 7.25% 8/15/13 | | | 10,000 | | | | 10,748 | | |

| Medtronic 4.375% 9/15/10 | | | 5,000 | | | | 4,855 | | |

| Merck & Co. 5.75% 11/15/36 | | | 35,000 | | | | 34,747 | | |

| UST 6.625% 7/15/12 | | | 10,000 | | | | 10,552 | | |

| o Vanguard Health 11.25% 10/1/15 | | | 5,000 | | | | 3,875 | | |

| Warner Chilcott 8.75% 2/1/15 | | | 5,000 | | | | 5,150 | | |

| Wyeth 5.50% 2/1/14 | | | 35,000 | | | | 35,232 | | |

| | | | | | | | 189,270 | | |

| Electric–1.25% | |

• Alabama Power Capital Trust IV

4.75% 10/1/42 | | | 55,000 | | | | 54,720 | | |

| # Calpine 144A 8.496% 7/15/07 | | | 196 | | | | 216 | | |

| Commonweallth Edison 5.95% 8/15/16 | | | 45,000 | | | | 45,578 | | |

| Dominion Resources 5.687% 5/15/08 | | | 20,000 | | | | 20,035 | | |

| Duke Capital 5.668% 8/15/14 | | | 35,000 | | | | 34,959 | | |

FPL Group Capital

5.625% 9/1/11 | | | 25,000 | | | | 25,300 | | |

| • 6.35% 10/1/66 | | | 35,000 | | | | 35,547 | | |

| Midamerican Energy 6.125% 4/1/36 | | | 20,000 | | | | 20,230 | | |

| * Midwest Generation 8.75% 5/1/34 | | | 5,000 | | | | 5,450 | | |

| • Nisource Finance 5.94% 11/23/09 | | | 20,000 | | | | 20,022 | | |

| Oncor Electric Delivery 7.00% 9/1/22 | | | 35,000 | | | | 37,739 | | |

| Orion Power 12.00% 5/1/10 | | | 5,000 | | | | 5,700 | | |

Pepco

5.50% 8/15/07 | | | 40,000 | | | | 39,974 | | |

| • 5.994% 6/1/10 | | | 30,000 | | | | 30,068 | | |

# Power Contract Financing 144A

6.256% 2/1/10 | | | 16,628 | | | | 16,724 | | |

Balanced Series- 7

Delaware VIP Balanced Series

Statement of Net Assets (continued)

| | | Principal

Amount

(U.S. $) | | Market

Value

(U.S. $) | |

| CORPORATE BONDS (continued) | |

| Electric (continued) | |

| Puget Sound Energy 5.483% 6/1/35 | | $ | 15,000 | | | $ | 13,719 | | |

Southwestern Public Service

6.00% 10/1/36 | | | 30,000 | | | | 29,791 | | |

| Xcel Energy 6.50% 7/1/36 | | | 10,000 | | | | 10,601 | | |

| | | | | | | | 446,373 | | |

| Energy–0.53% | |

| Anadarko Petroleum 5.95% 9/15/16 | | | 15,000 | | | | 15,059 | | |

| * Bluewater Finance 10.25% 2/15/12 | | | 5,000 | | | | 5,263 | | |

| # Canadian Oil Sands 144A 4.80% 8/10/09 | | | 35,000 | | | | 34,357 | | |

| Kerr-McGee 7.125% 10/15/27 | | | 15,000 | | | | 16,121 | | |

| Nexen 5.875% 3/10/35 | | | 5,000 | | | | 4,696 | | |

# Ras Laffan Liquiefied Natural Gas III

144A 5.832% 9/30/16 | | | 25,000 | | | | 25,120 | | |

| • Secunda International 13.374% 9/1/12 | | | 5,000 | | | | 5,181 | | |

| Valero Energy 6.125% 4/15/07 | | | 45,000 | | | | 45,059 | | |

Weatherford International

4.95% 10/15/13 | | | 35,000 | | | | 33,574 | | |

| Whiting Petroleum 7.25% 5/1/13 | | | 5,000 | | | | 5,038 | | |

| | | | | | | | 189,468 | | |

| Finance Companies–0.70% | |

| *• American Express 6.80% 9/1/66 | | | 20,000 | | | | 21,365 | | |

American General Finance

4.875% 7/15/12 | | | 30,000 | | | | 29,304 | | |

| FTI Consulting 7.625% 6/15/13 | | | 5,000 | | | | 5,188 | | |

| Residential Capital | |

| • 5.85% 6/9/08 | | | 25,000 | | | | 24,958 | | |

| 6.00% 2/22/11 | | | 20,000 | | | | 19,980 | | |

| 6.125% 11/21/08 | | | 30,000 | | | | 30,162 | | |

| 6.375% 6/30/10 | | | 25,000 | | | | 25,311 | | |

| 6.50% 4/17/13 | | | 50,000 | | | | 50,736 | | |

| 6.875% 6/30/15 | | | 40,000 | | | | 41,533 | | |

| | | | | | | | 248,537 | | |

| Industrial–0.01% | |

| # Mobile Services Group 144A 9.75% 8/1/14 | | | 5,000 | | | | 5,250 | | |

| | | | | | | | 5,250 | | |

| Insurance–1.51% | |

# Farmers Insurance Exchange 144A

6.00% 8/1/14 | | | 10,000 | | | | 9,901 | | |

| 8.625% 5/1/24 | | | 70,000 | | | | 84,165 | | |

•# Great West Life & Annuity Insurance

144A 7.153% 5/16/46 | | | 20,000 | | | | 21,230 | | |

| # Liberty Mutual 144A 6.70% 8/15/16 | | | 15,000 | | | | 15,853 | | |

Marsh & McLennan

5.15% 9/15/10 | | | 35,000 | | | | 34,415 | | |

| * 5.375% 3/15/07 | | | 40,000 | | | | 39,989 | | |

MetLife

5.00% 6/15/15 | | | 10,000 | | | | 9,715 | | |

| • 6.40% 12/15/36 | | | 30,000 | | | | 30,239 | | |

| Montpelier Re Holdings 6.125% 8/15/13 | | | 45,000 | | | | 43,899 | | |

# Nationwide Mutual Insurance 144A

7.875% 4/1/33 | | | 45,000 | | | | 53,541 | | |

*# Nippon Life Insurance 144A

4.875% 8/9/10 | | | 35,000 | | | | 34,261 | | |

| | | Principal

Amount

(U.S. $) | | Market

Value

(U.S. $) | |

| CORPORATE BONDS (continued) | |

| Insurance (continued) | |

| PMI Group 5.568% 11/15/08 | | $ | 30,000 | | | $ | 29,984 | | |

| SAFECO Capital Trust I 8.072% 7/15/37 | | | 45,000 | | | | 47,104 | | |

WellPoint

4.25% 12/15/09 | | | 25,000 | | | | 24,318 | | |

| 5.85% 1/15/36 | | | 35,000 | | | | 34,117 | | |

Willis Group

5.125% 7/15/10 | | | 15,000 | | | | 14,636 | | |

| 5.625% 7/15/15 | | | 10,000 | | | | 9,588 | | |

| | | | | | | | 536,955 | | |

| Natural Gas–0.94% | |

| Boardwalk Pipelines 5.875% 11/15/16 | | | 25,000 | | | | 24,796 | | |

| El Paso Natural Gas 7.625% 8/1/10 | | | 5,000 | | | | 5,250 | | |

| El Paso Production 7.75% 6/1/13 | | | 5,000 | | | | 5,256 | | |

Enterprise Products Operating

4.00% 10/15/07 | | | 50,000 | | | | 49,398 | | |

| 4.625% 10/15/09 | | | 40,000 | | | | 39,189 | | |

| Inergy Finance 6.875% 12/15/14 | | | 5,000 | | | | 4,938 | | |

| ONEOK 5.51% 2/16/08 | | | 25,000 | | | | 24,989 | | |

| • Sempra Energy 5.845% 5/21/08 | | | 50,000 | | | | 50,022 | | |

| Southern Union 6.15% 8/16/08 | | | 50,000 | | | | 50,224 | | |

| Valero Logistics Operations 6.05% 3/15/13 | | | 80,000 | | | | 80,692 | | |

| | | | | | | | 334,754 | | |

| Real Estate–0.21% | |

| BF Saul REIT 7.50% 3/1/14 | | | 5,000 | | | | 5,106 | | |

* Developers Diversified Realty

4.625% 8/1/10 | | | 50,000 | | | | 48,718 | | |

| HRPT Properties Trust 5.75% 2/15/14 | | | 20,000 | | | | 20,042 | | |

| | | | | | | | 73,866 | | |

| Technology & Electronics–0.02% | |

* MagnaChip Semiconductor

8.00% 12/15/14 | | | 5,000 | | | | 3,375 | | |

| # UGS Capital II PIK 144A 10.348% 6/1/11 | | | 5,000 | | | | 5,038 | | |

| | | | | | | | 8,413 | | |

| Transportation–0.43% | |

| American Airlines 3.857% 7/9/10 | | | 40,429 | | | | 39,236 | | |

| Continental Airlines 6.503% 6/15/11 | | | 50,000 | | | | 51,500 | | |

| # Erac USA Finance 144A 7.35% 6/15/08 | | | 40,000 | | | | 41,015 | | |

| # Hertz 144A 8.875% 1/1/14 | | | 10,000 | | | | 10,525 | | |

| o H-Lines Finance Holdings 11.00% 4/1/13 | | | 5,000 | | | | 4,675 | | |

Kansas City Southern de Mexico

12.50% 6/15/12 | | | 5,000 | | | | 5,425 | | |

Kansas City Southern Railway

9.50% 10/1/08 | | | 1,000 | | | | 1,050 | | |

| | | | | | | | 153,426 | | |

Total Corporate Bonds

(cost $4,020,442) | | | | | | | 4,096,551 | | |

| FOREIGN AGENCIES–0.16% | |

Pemex Project Funding Master Trust

6.125% 8/15/08 | | | 35,000 | | | | 35,368 | | |

| 6.625% 6/15/35 | | | 20,000 | | | | 20,485 | | |

Total Foreign Agencies

(cost $52,817) | | | | | | | 55,853 | | |

Balanced Series- 8

Delaware VIP Balanced Series

Statement of Net Assets (continued)

| | | Principal

Amount

(U.S. $) | | Market

Value

(U.S. $) | |

| MUNICIPAL BONDS–0.95% | |

Augusta, Georgia Water & Sewer Revenue

5.25% 10/1/39 (FSA) | | $ | 55,000 | | | $ | 59,371 | | |

| California State 5.00% 2/1/33 | | | 20,000 | | | | 20,836 | | |

California State University Systemwide

Revenue 5.00% 11/1/30 (AMBAC) | | | 20,000 | | | | 21,252 | | |

Colorado Department of Transportation

Revenue 5.00% 12/15/12 (FGIC) | | | 70,000 | | | | 75,000 | | |

Illinois State Taxable Pension

5.10% 6/1/33 | | | 30,000 | | | | 28,776 | | |

New Jersey Economic Development

Authority Revenue Cigarette Tax

5.75% 6/15/29 | | | 40,000 | | | | 43,318 | | |

New York State Urban Development

Series A-1 5.25% 3/15/34 (FGIC) | | | 35,000 | | | | 37,629 | | |

Oregon State Taxable Pension

5.892% 6/1/27 | | | 35,000 | | | | 36,713 | | |

West Virginia Economic Development

Authority 5.37% 7/1/20 (MBIA) | | | 15,000 | | | | 14,959 | | |

Total Municipal Bonds

(cost $329,637) | | | | | | | 337,854 | | |

NON-AGENCY ASSET-BACKED

SECURITIES–2.46% | |

Countrywide Asset-Backed Certificates

Series 2004-S1 A2 3.872% 3/25/20 | | | 15,841 | | | | 15,608 | | |

| • Series 2006-3 2A2 5.53% 6/25/36 | | | 105,000 | | | | 105,172 | | |

| Series 2006-S3 A2 6.085% 6/25/21 | | | 40,000 | | | | 40,359 | | |

| • Series 2006-S6 A2 5.519% 3/25/34 | | | 40,000 | | | | 39,881 | | |

| • Series 2006-S7 A3 5.712% 11/25/35 | | | 75,000 | | | | 74,821 | | |

| • Series 2006-S9 A3 5.728% 8/25/36 | | | 35,000 | | | | 34,786 | | |

• GMAC Mortgage Corporation Loan

Trust Series 2006-HE3 A2

5.75% 10/25/36 | | | 25,000 | | | | 24,993 | | |

GSAMP Series 2006-S3 A1

6.085% 5/25/36 | | | 15,162 | | | | 15,129 | | |

•# MASTR Specialized Loan Trust

Series 2005-2 A2 144A 5.006% 7/25/35 | | | 26,141 | | | | 25,651 | | |

• Merrill Lynch Mortgage Investors

Series 2005-NCB A1A 5.451% 7/25/36 | | | 6,343 | | | | 6,317 | | |

| Series 2006-AR1 A2C 5.51% 3/25/37 | | | 75,000 | | | | 75,026 | | |

Mid-State Trust

Series 11 A1 4.864% 7/15/38 | | | 18,944 | | | | 18,222 | | |

| Series 2004-1 A 6.005% 8/15/37 | | | 10,241 | | | | 10,400 | | |

| # Series 2006-1 A 144A 5.787% 10/15/40 | | | 24,247 | | | | 24,254 | | |

• Option One Mortgage Loan Trust

Series 2005-4 A3 5.61% 11/25/35 | | | 100,000 | | | | 100,252 | | |

Renaissance Home Equity Loan Trust

Series 2004-4 AF2 3.856% 2/25/35 | | | 37 | | | | 37 | | |

| Series 2005-4 A2 5.399% 2/25/36 | | | 35,000 | | | | 34,833 | | |

• Residential Asset Securities

Series 2006-KS3 AI3 5.52% 4/25/36 | | | 105,000 | | | | 105,168 | | |

Structured Asset Securities

Series 2001-SB1 A2 3.375% 8/25/31 | | | 32,618 | | | | 29,305 | | |

| Series 2004-16XS A2 4.91% 8/25/34 | | | 26,053 | | | | 25,930 | | |

| | | Principal

Amount

(U.S. $) | | Market

Value

(U.S. $) | |

NON-AGENCY ASSET-BACKED

SECURITIES (continued) | |

Triad Auto Receivables Owner Trust

Series 2006-C A4 5.31% 5/13/13 | | $ | 40,000 | | | $ | 40,144 | | |

UPFC Auto Receivables Trust

Series 2006-B A3 5.01% 8/15/12 | | | 30,000 | | | | 29,933 | | |

Total Non-Agency Asset-Backed Securities

(cost $878,565) | | | | | | | 876,221 | | |

NON-AGENCY COLLATERALIZED

MORTGAGE OBLIGATIONS–8.47% | |

American Home Mortgage Investment Trust

Series 2005-2 5A1 5.064% 9/25/35 | | | 35,000 | | | | 34,009 | | |

Bank of America Alternative Loan Trust

Series 2003-10 2A1 6.00% 12/25/33 | | | 66,478 | | | | 66,624 | | |

| Series 2004-2 1A1 6.00% 3/25/34 | | | 36,810 | | | | 36,891 | | |

| Series 2005-3 2A1 5.50% 4/25/20 | | | 38,414 | | | | 38,246 | | |

| Series 2005-5 2CB1 6.00% 6/25/35 | | | 41,111 | | | | 41,188 | �� | |

| Series 2005-9 5A1 5.50% 10/25/20 | | | 25,449 | | | | 25,306 | | |

• Bank of America Funding Securities

Series 2006-F 1A2 5.172% 7/20/36 | | | 46,822 | | | | 46,477 | | |

| Bank of America Mortgage Securities | |

| • Series 2003-D 1A2 6.114% 5/25/33 | | | 1,041 | | | | 1,049 | | |

| Series 2005-9 2A1 4.75% 10/25/20 | | | 44,530 | | | | 43,574 | | |

• Bear Stearns Alternative A Trust

Series 2006-3 33A1 6.189% 5/25/36 | | | 50,092 | | | | 50,669 | | |

| Series 2006-3 34A1 6.186% 5/25/36 | | | 51,109 | | | | 51,697 | | |

| Series 2006-4 23A5 6.242% 8/25/36 | | | 40,335 | | | | 40,889 | | |

Chase Mortgage Finance

Series 2003-S8 A2 5.00% 9/25/18 | | | 79,516 | | | | 78,274 | | |

Countrywide Alternative Loan Trust

Series 2004-28CB 6A1 6.00% 1/25/35 | | | 18,047 | | | | 18,075 | | |

| • Series 2004-J7 1A2 4.673% 8/25/34 | | | 19,493 | | | | 19,337 | | |

| • Series 2005-63 3A1 5.895% 11/25/35 | | | 50,151 | | | | 50,164 | | |

| Series 2006-2CB A3 5.50% 3/25/36 | | | 38,811 | | | | 38,878 | | |

| Series 2006-33CB M 6.00% 11/25/36 | | | 24,965 | | | | 24,682 | | |

t Countrywide Home Loan

Mortgage Pass Through Trust | | | | | | | | | |

| • Series 2004-12 1M 4.564% 8/25/34 | | | 34,484 | | | | 34,188 | | |

| Series 2005-23 A1 5.50% 11/25/35 | | | 70,752 | | | | 69,271 | | |

| Series 2006-1 A2 6.00% 3/25/36 | | | 39,933 | | | | 39,937 | | |

| • Series 2006-HYB3 3A1A 6.113% 5/20/36 | | | 50,067 | | | | 50,564 | | |

| • Series 2006-HYB4 1A2 5.711% 6/20/36 | | | 38,131 | | | | 38,298 | | |

Credit Suisse First Boston Mortgage Securities

Series 2003-29 5A1 7.00% 12/25/33 | | | 15,131 | | | | 15,415 | | |

| Series 2004-1 3A1 7.00% 2/25/34 | | | 10,269 | | | | 10,461 | | |

First Horizon Asset Securities

Series 2003-5 1A17 8.00% 7/25/33 | | | 17,451 | | | | 18,453 | | |

| • Series 2004-AR5 4A1 5.682% 10/25/34 | | | 33,194 | | | | 33,017 | | |

• GMAC Mortgage Loan Trust

Series 2005-AR2 4A 5.188% 5/25/35 | | | 40,812 | | | | 40,037 | | |

# GSMPS Mortgage Loan Trust 144A

Series 1998-3 A 7.75% 9/19/27 | | | 31,719 | | | | 33,254 | | |

| Series 2005-RP1 1A3 8.00% 1/25/35 | | | 24,516 | | | | 25,946 | | |

| Series 2005-RP1 1A4 8.50% 1/25/35 | | | 14,230 | | | | 15,195 | | |

Balanced Series- 9

Delaware VIP Balanced Series

Statement of Net Assets (continued)

| | | Principal

Amount

(U.S. $) | | Market

Value

(U.S. $) | |

NON-AGENCY COLLATERALIZED

MORTGAGE OBLIGATIONS (continued) | |

• Indymac Index Mortgage Loan Trust

Series 2005-AR25 1A21 5.877% 12/25/35 | | $ | 42,268 | | | $ | 42,300 | | |

| Series 2006-AR2 1A1A 5.57% 4/25/46 | | | 61,093 | | | | 61,141 | | |

• JPMorgan Mortgage Trust

Series 2005-A4 1A1 5.406% 7/25/35 | | | 49,282 | | | | 48,651 | | |

| Series 2005-A6 1A2 5.152% 9/25/35 | | | 60,000 | | | | 60,106 | | |

Lehman Mortgage Trust

Series 2005-2 2A3 5.50% 12/25/35 | | | 40,758 | | | | 40,729 | | |

| Series 2006-1 3A3 5.50% 2/25/36 | | | 40,000 | | | | 40,065 | | |

• MASTR Adjustable Rate Mortgages Trust

Series 2003-6 1A2 5.883% 12/25/33 | | | 26,502 | | | | 26,830 | | |

| Series 2005-1 B1 5.346% 3/25/35 | | | 39,682 | | | | 39,292 | | |

| Series 2005-6 7A1 5.375% 6/25/35 | | | 29,730 | | | | 29,313 | | |

MASTR Alternative Loans Trust

Series 2003-6 3A1 8.00% 9/25/33 | | | 7,345 | | | | 7,523 | | |

| Series 2005-3 7A1 6.00% 4/25/35 | | | 45,228 | | | | 45,245 | | |

# MASTR Reperforming Loan Trust 144A

Series 2005-1 1A5 8.00% 8/25/34 | | | 38,128 | | | | 40,253 | | |

| Series 2005-2 1A4 8.00% 5/25/35 | | | 17,153 | | | | 18,081 | | |

Morgan Stanley Mortgage Loan Trust

Series 2006-2 6A 6.50% 2/25/36 | | | 23,039 | | | | 23,370 | | |

Nomura Asset Acceptance

Series 2005-WF1 2A2 4.786% 3/25/35 | | | 65,000 | | | | 63,994 | | |

| • Series 2006-AF1 1A2 6.159% 5/25/36 | | | 60,000 | | | | 60,579 | | |

Prime Mortgage Trust

Series 2004-CL1 1A1 6.00% 2/25/34 | | | 18,820 | | | | 18,943 | | |

Residential Accredit Loans

Series 2005-QS9 A6 5.50% 6/25/35 | | | 25,000 | | | | 24,219 | | |

Residential Asset Mortgage Products

Series 2004-SL1 A3 7.00% 11/25/31 | | | 16,729 | | | | 16,986 | | |

| Series 2004-SL4 A3 6.50% 7/25/32 | | | 28,572 | | | | 29,043 | | |

| Series 2005-SL1 A2 6.00% 5/25/32 | | | 31,928 | | | | 32,629 | | |

• Residential Funding Mortgage Security I

Series 2006-SA3 3A1 6.067% 9/25/36 | | | 46,483 | | | | 46,816 | | |

• Structured Adjustable Rate

Mortgage Loan Trust

Series 2004-18 5A 5.50% 12/25/34 | | | 37,607 | | | | 37,208 | | |

| Series 2005-3XS A2 5.60% 1/25/35 | | | 33,926 | | | | 33,954 | | |

| Series 2006-5 5A4 5.582% 6/25/36 | | | 28,749 | | | | 28,390 | | |

| Structured Asset Securities | |

| • Series 2002-22H 1A 6.96% 11/25/32 | | | 11,350 | | | | 11,544 | | |

| Series 2004-12H 1A 6.00% 5/25/34 | | | 39,720 | | | | 39,795 | | |

Washington Mutual

Series 2004-CB3 4A 6.00% 10/25/19 | | | 64,073 | | | | 64,695 | | |

| • Series 2006-AR7 1A 5.807% 7/25/46 | | | 26,607 | | | | 26,612 | | |

| • Series 2006-AR8 2A3 6.16% 8/25/36 | | | 22,243 | | | | 22,468 | | |

| • Series 2006-AR10 1A1 5.97% 9/25/36 | | | 45,732 | | | | 46,126 | | |

| • Series 2006-AR14 1A4 5.666% 11/25/36 | | | 33,459 | | | | 33,515 | | |

| | | Principal

Amount

(U.S. $) | | Market

Value

(U.S. $) | |

NON-AGENCY COLLATERALIZED

MORTGAGE OBLIGATIONS (continued) | |

Washington Mutual Alternative

Mortgage Pass Through Certificates

Series 2005-6 3CB 5.50% 8/25/35 | | $ | 45,336 | | | $ | 44,415 | | |

| Series 2005-9 3CB 5.50% 10/25/20 | | | 52,890 | | | | 52,665 | | |

| Series 2006-2 2CB 6.50% 3/25/36 | | | 34,272 | | | | 34,711 | | |

| Series 2006-5 2CB3 6.00% 7/25/36 | | | 47,105 | | | | 47,599 | | |

| Series 2006-5 LB1 6.00% 7/25/36 | | | 24,882 | | | | 24,688 | | |

| • Series 2006-AR5 3A 5.767% 7/25/46 | | | 29,013 | | | | 29,086 | | |

Wells Fargo Mortgage Backed

Securities Trust | |

| • Series 2004-T A1 4.382% 9/25/34 | | | 29,262 | | | | 29,284 | | |

| Series 2005-14 2A1 5.50% 12/25/35 | | | 66,087 | | | | 64,703 | | |

| Series 2005-17 1A1 5.50% 1/25/36 | | | 52,406 | | | | 51,309 | | |

| Series 2006-2 3A1 5.75% 3/25/36 | | | 52,965 | | | | 52,436 | | |

| Series 2006-7 2A1 6.00% 6/25/36 | | | 84,740 | | | | 84,371 | | |

| • Series 2006-AR4 1A1 5.865% 4/25/36 | | | 70,254 | | | | 70,187 | | |

| • Series 2006-AR4 2A1 5.787% 4/25/36 | | | 102,969 | | | | 102,457 | | |

| • Series 2006-AR10 5A1 5.605% 7/25/36 | | | 41,845 | | | | 41,885 | | |

Total Non-Agency Collateralized

Mortgage Obligations

(cost $3,027,856) | | | | | | | 3,020,276 | | |

| U.S. TREASURY OBLIGATIONS–3.18% | |

| * U.S. Treasury Bonds 4.50% 2/15/36 | | | 205,000 | | | | 195,006 | | |

U.S. Treasury Inflation Index Notes

2.00% 1/15/26 | | | 45,761 | | | | 43,052 | | |

| 2.375% 4/15/11 | | | 86,434 | | | | 86,117 | | |

| 2.50% 7/15/16 | | | 304,823 | | | | 307,229 | | |

| m* 3.00% 7/15/12 | | | 101,030 | | | | 104,002 | | |

* U.S. Treasury Notes

4.50% 11/30/11 | | | 30,000 | | | | 29,742 | | |

| 4.625% 11/15/09 | | | 35,000 | | | | 34,902 | | |

| 4.625% 10/31/11 | | | 220,000 | | | | 219,270 | | |

| 4.875% 10/31/08 | | | 30,000 | | | | 30,023 | | |

| *^ U.S. Treasury Strip 4.293% 11/15/13 | | | 115,000 | | | | 83,681 | | |

Total U.S. Treasury Obligations

(cost $1,136,937) | | | | | | | 1,133,024 | | |

| REPURCHASE AGREEMENTS–5.49% | |

With BNP Paribas 4.80% 1/2/07

(dated 12/29/06, to be repurchased

at $743,396, collateralized by

$777,000 U.S. Treasury Bills

due 6/28/07, market value $758,787) | | | 743,000 | | | | 743,000 | | |

With Cantor Fitzgerald 4.82% 1/2/07

(dated 12/29/06, to be repurchased

at $893,478, collateralized by

$77,000 U.S. Treasury Notes 4.00%

due 6/15/09, market value $75,915,

$478,000 U.S. Treasury Notes 6.125%

due 8/15/07, market value $492,636

and $319,000 U.S. Treasury Notes 6.50%

due 2/15/10, market value $343,030) | | | 893,000 | | | | 893,000 | | |

Balanced Series- 10

Delaware VIP Balanced Series

Statement of Net Assets (continued)

| | | Principal

Amount

(U.S. $) | | Market

Value

(U.S. $) | |

| REPURCHASE AGREEMENTS (continued) | |

With UBS Warburg 4.75% 1/2/07

(dated 12/29/06, to be repurchased

at $319,168, collateralized by

$329,000 U.S. Treasury Bills

due 3/29/07, market value $325,559) | | $ | 319,000 | | | $ | 319,000 | | |

Total Repurchase Agreements

(cost $1,955,000) | | | | | | | 1,955,000 | | |

Total Market Value of Securities

Before Securities Lending

Collateral–103.55%

(cost $32,955,671) | | | | | | | 36,897,038 | | |

| SECURITY LENDING COLLATERAL**–6.57% | |

| Short-Term Investments–6.57% | |

| Fixed Rate Note–1.24% | |

Citigroup Global Markets

5.32% 1/2/07 | | | 443,300 | | | | 443,300 | | |

| | | | | | | | 443,300 | | |

| • Variable Rate Notes–5.33% | | | | | | | | | |

American Honda Finance

5.32% 2/21/07 | | | 57,326 | | | | 57,326 | | |

| ANZ National 5.35% 1/29/08 | | | 12,739 | | | | 12,739 | | |

| Australia New Zealand 5.35% 1/29/08 | | | 63,696 | | | | 63,696 | | |

| Bank of America 5.32% 2/23/07 | | | 82,805 | | | | 82,805 | | |

| Bank of New York 5.34% 1/29/08 | | | 50,957 | | | | 50,957 | | |

| Barclays New York 5.31% 5/18/07 | | | 82,805 | | | | 82,805 | | |

| | | Principal

Amount

(U.S. $) | | Market

Value

(U.S. $) | |

| SECURITY LENDING COLLATERAL (continued) | |

| Short-Term Investments (continued) | |

| • Variable Rate Notes (continued) | | | | | | | | | |

| Bayerische Landesbank 5.40% 1/29/08 | | $ | 63,696 | | | $ | 63,696 | | |

| Bear Stearns 5.41% 6/29/07 | | | 76,435 | | | | 76,435 | | |

| BNP Paribas 5.35% 1/29/08 | | | 63,696 | | | | 63,696 | | |

| Canadian Imperial Bank 5.33% 1/29/09 | | | 44,587 | | | | 44,587 | | |

| CDC Financial 5.36% 1/29/07 | | | 82,805 | | | | 82,805 | | |

| Citigroup Global Markets 5.38% 1/5/07 | | | 82,805 | | | | 82,805 | | |

| Commonwealth Bank 5.35% 1/29/08 | | | 63,696 | | | | 63,696 | | |

| Deutsche Bank 5.34% 2/23/07 | | | 76,435 | | | | 76,435 | | |

| Dexia Bank 5.33% 9/28/07 | | | 89,174 | | | | 89,161 | | |

| Goldman Sachs 5.45% 12/28/07 | | | 82,805 | | | | 82,805 | | |

| Marshall & Ilsley Bank 5.33% 1/29/08 | | | 70,065 | | | | 70,065 | | |

Merrill Lynch Mortgage Capital

5.41% 1/8/07 | | | 82,805 | | | | 82,805 | | |

| Morgan Stanley 5.49% 1/29/08 | | | 82,805 | | | | 82,805 | | |

| National Australia Bank 5.32% 3/7/07 | | | 78,983 | | | | 78,983 | | |

| National City Bank 5.32% 3/2/07 | | | 76,437 | | | | 76,439 | | |

| National Rural Utilities 5.34% 1/29/08 | | | 100,639 | | | | 100,639 | | |

| Nordea Bank New York 5.31% 5/16/07 | | | 31,848 | | | | 31,847 | | |

| Nordea Bank Norge 5.36% 1/29/08 | | | 63,696 | | | | 63,696 | | |

| Royal Bank of Scotland 5.34% 1/29/08 | | | 63,696 | | | | 63,696 | | |

| Societe Generale 5.32% 1/29/08 | | | 31,848 | | | | 31,848 | | |

| Toronto Dominion 5.32% 5/29/07 | | | 76,435 | | | | 76,435 | | |

| Wells Fargo 5.36% 1/29/08 | | | 63,696 | | | | 63,696 | | |

| | | | | | | | 1,899,403 | | |

Total Securities Lending Collateral

(cost $2,342,703) | | | | | | | 2,342,703 | | |

Balanced Series- 11

Delaware VIP Balanced Series

Statement of Net Assets (continued)

| TOTAL MARKET VALUE OF SECURITIES–110.12% (cost $35,298,374) | | $ | 39,239,741 | v | |

| OBLIGATION TO RETURN SECURITIES LENDING COLLATERAL**–(6.57%) | | | (2,342,703 | ) | |

| LIABILITIES NET OF RECEIVABLES AND OTHER ASSETS–(3.55%) | | | (1,264,585 | ) | |

| NET ASSETS APPLICABLE TO 2,335,350 SHARES OUTSTANDING–100.00% | | $ | 35,632,453 | | |

| NET ASSET VALUE-DELAWARE VIP BALANCED SERIES STANDARD CLASS ($35,626,540 / 2,334,962 Shares) | | $ | 15.26 | | |

| NET ASSET VALUE-DELAWARE VIP BALANCED SERIES SERVICE CLASS ($5,913 / 388 Shares) | | $ | 15.24 | | |

| COMPONENTS OF NET ASSETS AT DECEMBER 31, 2006: | |

| Shares of beneficial interest (unlimited authorization–no par) | | $ | 50,468,348 | | |

| Undistributed net investment income | | | 1,093,355 | | |

| Accumulated net realized loss on investments | | | (19,871,505 | ) | |

| Net unrealized appreciation of investments | | | 3,942,255 | | |

| Total net assets | | $ | 35,632,453 | | |

* Fully or partially on loan.

** See Note 10 in "Notes to Financial Statements."

v Includes $2,389,755 of securities loaned.

† Non-income producing security for the year ended December 31, 2006.

• Variable rate security. The interest rate shown is the rate as of December 31, 2006.

t Pass Through Agreement. Security represents the contractual right to receive a proportionate amount of underlying payments due to the counterparty pursuant to various agreements related to the rescheduling of obligations and the exchange of certain notes.

^ Zero coupon security. The interest rate shown is the yield at the time of purchase.

‡ Non-income producing security. Security is currently in default.

n Security is currently in default. The issue has missed the maturity date. Bankruptcy proceedings are in process to determine distribution of assets. The date listed is the estimate of when proceedings will be finalized.

o Step coupon bond. Indicates security that has a zero coupon that remains in effect until a predetermined date at which time the stated interest rate becomes effective.

m Fully or partially pledged as collateral for financial futures contracts.

# Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. At December 31, 2006, the aggregate amount of Rule 144A securities equaled $983,914, which represented 2.76% of the Series' net assets. See Note 11 in "Notes to Financial Statements."

Summary of Abbreviations:

AMBAC – Insured by the AMBAC Assurance Corporation

ARM – Adjustable Rate Mortgage

FGIC – Insured by the Financial Guaranty Insurance Company

FSA – Insured by Financial Security Assurance

GNMA – Government National Mortgage Association

GSMPS – Goldman Sachs Reperforming Mortgage Securities

MBIA – Insured by the Municipal Bond Insurance Association

PIK – Pay-in-kind

REIT – Real Estate Investment Trust

S.F. – Single Family

TBA – To be announced

yr – Year

The following financial futures contracts and swap contracts were outstanding at December 31, 2006:

Futures Contracts1

Contracts

to Buy | | Notional

Cost | | Notional

Value | | Expiration Date | | Unrealized

Depreciation | |

| | 3 | | | U.S. Treasury 5 year Notes | | $ | 317,923 | | | $ | 315,188 | | | 3/31/07 | | $ | (2,735 | ) | |

| | 1 | | | U.S. Treasury Long Bond | | | 113,607 | | | | 111,438 | | | 3/31/07 | | | (2,169 | ) | |

| | | $ | (4,904 | ) | |

Swap Contracts2

| Notional Amount | | Expiration Date | | Description | | Unrealized

Appreciation | |

| $ | 405,000 | | | | 2/1/07 | | | Agreement with Goldman Sachs to receive the notional amount multiplied by the return on the Lehman Brothers Commercial MBS Index AAA and to pay the notional amount multiplied by the 1 month BBA LIBOR adjusted by a spread of plus 0.05%. | | $ | 5,792 | | |

|

The use of financial futures contracts and swap contracts involves elements of market risk and risks in excess of the amount recognized in the financial statements. The notional amounts presented above represent the Series' total exposure in such contracts, whereas only the net unrealized appreciation (depreciation) is reflected in the Series' net assets.

1See Note 8 in "Notes to Financial Statements."

2See Note 9 in "Notes to Financial Statements."

See accompanying notes

Balanced Series- 12

Delaware VIP Trust — Delaware VIP Balanced Series

Statement of Operations

Year Ended December 31, 2006

Delaware VIP Trust — Delaware VIP Balanced Series

Statements of Changes in Net Assets

| INVESTMENT INCOME: | |

| Interest | | $ | 725,314 | | |

| Dividends | | | 609,208 | | |

| Securities lending income | | | 4,538 | | |

| | | | 1,339,060 | | |

| EXPENSES: | |

| Management fees | | | 235,990 | | |

| Accounting and administration expenses | | | 14,523 | | |

| Audit and tax | | | 12,124 | | |

| Pricing fees | | | 10,828 | | |

| Reports and statements to shareholders | | | 8,893 | | |

| Custodian fees | | | 8,343 | | |

| Trustees' fees and benefits | | | 6,404 | | |

| Dividend disbursing and transfer agent fees and expenses | | | 3,631 | | |

| Legal fees | | | 3,230 | | |

| Dues and services | | | 1,164 | | |

| Insurance fees | | | 1,082 | | |

| Consulting fees | | | 480 | | |

| Taxes (other than taxes on income) | | | 239 | | |

| Trustees' expenses | | | 185 | | |

| Registration fees | | | 52 | | |

| Distribution expenses – Service Class | | | 16 | | |

| Other | | | 22 | | |

| | | | 307,206 | | |

| Less expenses absorbed or waived | | | (11,104 | ) | |

| Less waiver of distribution expenses – Service Class | | | (3 | ) | |

| Less expense paid indirectly | | | (2,113 | ) | |

| Total operating expenses | | | 293,986 | | |

| NET INVESTMENT INCOME | | | 1,045,074 | | |

NET REALIZED AND UNREALIZED GAIN (LOSS)

ON INVESTMENTS: | |

| Net realized gain (loss) on: | |

| Investments | | | 1,181,617 | | |

| Futures contracts | | | 13,452 | | |

| Swap contracts | | | (8,985 | ) | |

| Net realized gain | | | 1,186,084 | | |

Net change in unrealized appreciation/depreciation

of investments | | | 3,149,987 | | |

NET REALIZED AND UNREALIZED GAIN ON

INVESTMENTS | | | 4,336,071 | | |

NET INCREASE IN NET ASSETS RESULTING

FROM OPERATIONS | | $ | 5,381,145 | | |

See accompanying notes

| | | Year Ended | |

| | | 12/31/06 | | 12/31/05 | |

INCREASE (DECREASE) IN NET

ASSETS FROM OPERATIONS: | |

| Net investment income | | $ | 1,045,074 | | | $ | 1,063,172 | | |

| Net realized gain on investments | | | 1,186,084 | | | | 3,661,335 | | |

Net change in unrealized appreciation/

depreciation of investments | | | 3,149,987 | | | | (3,243,861 | ) | |

Net increase in net assets

resulting from operations | | | 5,381,145 | | | | 1,480,646 | | |

DIVIDENDS AND DISTRIBUTIONS

TO SHAREHOLDERS FROM: | |

| Net investment income: | |

| Standard Class | | | (1,122,023 | ) | | | (993,690 | ) | |

| Service Class | | | (144 | ) | | | (102 | ) | |

| | | | (1,122,167 | ) | | | (993,792 | ) | |

| CAPITAL SHARE TRANSACTIONS: | |

| Proceeds from shares sold: | |

| Standard Class | | | 35,103,629 | | | | 672,726 | | |

Net asset value of shares issued upon

reinvestment of dividends and distributions: | |

| Standard Class | | | 1,122,023 | | | | 993,690 | | |

| Service Class | | | 144 | | | | 102 | | |

| | | | 36,225,796 | | | | 1,666,518 | | |

| Cost of shares repurchased: | |

| Standard Class | | | (43,084,571 | ) | | | (9,333,352 | ) | |

Decrease in net assets derived from

capital share transactions | | | (6,858,775 | ) | | | (7,666,834 | ) | |

| NET DECREASE IN NET ASSETS | | | (2,599,797 | ) | | | (7,179,980 | ) | |

| NET ASSETS: | |

| Beginning of year | | | 38,232,250 | | | | 45,412,230 | | |

End of year (including undistributed

net investment income of $1,093,355 and

$1,113,970, respectively) | | $ | 35,632,453 | | | $ | 38,232,250 | | |

See accompanying notes

Balanced Series-13

Delaware VIP Trust — Delaware VIP Balanced Series

Financial Highlights

Selected data for each share of the Series outstanding throughout each period were as follows:

| | | Delaware VIP Balanced Series Standard Class | |

| | | Year Ended | |

| | | 12/31/06 | | 12/31/05 | | 12/31/04 | | 12/31/03 | | 12/31/02 | |

| Net asset value, beginning of period | | $ | 13.530 | | | $ | 13.360 | | | $ | 12.890 | | | $ | 11.170 | | | $ | 13.730 | | |

| Income (loss) from investment operations: | |

| Net investment income1 | | | 0.405 | | | | 0.341 | | | | 0.245 | | | | 0.211 | | | | 0.258 | | |

Net realized and unrealized gain (loss) on investments

and foreign currencies | | | 1.739 | | | | 0.135 | | | | 0.493 | | | | 1.872 | | | | (2.430 | ) | |

| Total from investment operations | | | 2.144 | | | | 0.476 | | | | 0.738 | | | | 2.083 | | | | (2.172 | ) | |

| Less dividends and distributions from: | |

| Net investment income | | | (0.414 | ) | | | (0.306 | ) | | | (0.268 | ) | | | (0.363 | ) | | | (0.388 | ) | |

| Total dividends and distributions | | | (0.414 | ) | | | (0.306 | ) | | | (0.268 | ) | | | (0.363 | ) | | | (0.388 | ) | |

| Net asset value, end of period | | $ | 15.260 | | | $ | 13.530 | | | $ | 13.360 | | | $ | 12.890 | | | $ | 11.170 | | |

| Total return2 | | | 16.20 | % | | | 3.68 | % | | | 5.84 | % | | | 19.21 | % | | | (16.27 | %) | |

| Ratios and supplemental data: | |

| Net assets, end of period (000 omitted) | | $ | 35,626 | | | $ | 38,227 | | | $ | 45,407 | | | $ | 53,233 | | | $ | 54,789 | | |

| Ratio of expenses to average net assets | | | 0.81 | % | | | 0.80 | % | | | 0.77 | % | | | 0.77 | % | | | 0.75 | % | |

Ratio of expenses to average net assets prior to expense

limitation and expenses paid indirectly | | | 0.84 | % | | | 0.85 | % | | | 0.77 | % | | | 0.77 | % | | | 0.76 | % | |

| Ratio of net investment income to average net assets | | | 2.88 | % | | | 2.57 | % | | | 1.91 | % | | | 1.80 | % | | | 2.10 | % | |

Ratio of net investment income to average net assets prior

to expense limitation and expenses paid indirectly | | | 2.85 | % | | | 2.52 | % | | | 1.91 | % | | | 1.80 | % | | | 2.09 | % | |

| Portfolio turnover | | | 131 | % | | | 200 | % | | | 247 | % | | | 231 | % | | | 303 | % | |

1The average shares outstanding method has been applied for per share information.

2Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total investment return reflects waivers and payment of fees by the manager, as applicable. Performance would have been lower had the expense limitation not been in effect.

See accompanying notes

Balanced Series- 14

Delaware VIP Balanced Series

Financial Highlights (continued)

Selected data for each share of the Series outstanding throughout each period were as follows:

| | | Delaware VIP Balanced Series Service Class | |

| | | Year Ended | |

| | | 12/31/06 | | 12/31/05 | | 12/31/04 | | 12/31/03 | | 12/31/02 | |

| Net asset value, beginning of period | | $ | 13.520 | | | $ | 13.340 | | | $ | 12.880 | | | $ | 11.170 | | | $ | 13.720 | | |

| Income (loss) from investment operations: | |

| Net investment income1 | | | 0.371 | | | | 0.310 | | | | 0.214 | | | | 0.186 | | | | 0.238 | | |

Net realized and unrealized gain (loss) on investments

and foreign currencies | | | 1.732 | | | | 0.145 | | | | 0.488 | | | | 1.867 | | | | (2.421 | ) | |

| Total from investment operations | | | 2.103 | | | | 0.455 | | | | 0.702 | | | | 2.053 | | | | (2.183 | ) | |

| Less dividends and distributions from: | |

| Net investment income | | | (0.383 | ) | | | (0.275 | ) | | | (0.242 | ) | | | (0.343 | ) | | | (0.367 | ) | |

| Total dividends and distributions | | | (0.383 | ) | | | (0.275 | ) | | | (0.242 | ) | | | (0.343 | ) | | | (0.367 | ) | |

| Net asset value, end of period | | $ | 15.240 | | | $ | 13.520 | | | $ | 13.340 | | | $ | 12.880 | | | $ | 11.170 | | |

| Total return2 | | | 15.88 | % | | | 3.51 | % | | | 5.55 | % | | | 18.90 | % | | | (16.40 | %) | |

| Ratios and supplemental data: | |

| Net assets, end of period (000 omitted) | | $ | 6 | | | $ | 5 | | | $ | 5 | | | $ | 5 | | | $ | 4 | | |

| Ratio of expenses to average net assets | | | 1.06 | % | | | 1.05 | % | | | 1.02 | % | | | 0.99 | % | | | 0.90 | % | |

Ratio of expenses to average net assets prior to expense

limitation and expenses paid indirectly | | | 1.14 | % | | | 1.15 | % | | | 1.07 | % | | | 1.02 | % | | | 0.91 | % | |

| Ratio of net investment income to average net assets | | | 2.63 | % | | | 2.32 | % | | | 1.66 | % | | | 1.58 | % | | | 1.95 | % | |

Ratio of net investment income to average net assets prior

to expense limitation and expenses paid indirectly | | | 2.55 | % | | | 2.22 | % | | | 1.61 | % | | | 1.55 | % | | | 1.94 | % | |

| Portfolio turnover | | | 131 | % | | | 200 | % | | | 247 | % | | | 231 | % | | | 303 | % | |

1The average shares outstanding method has been applied for per share information.

2Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total investment return reflects waivers and payment of fees by the manager and distributor, as applicable. Performance would have been lower had the expense limitation not been in effect.

See accompanying notes

Balanced Series- 15

Delaware VIP Trust — Delaware VIP Balanced Series

Notes to Financial Statements

December 31, 2006

Delaware VIP Trust (the "Trust") is organized as a Delaware statutory trust and offers 15 series: Delaware VIP Balanced Series, Delaware VIP Capital Reserves Series, Delaware VIP Cash Reserve Series, Delaware VIP Diversified Income Series, Delaware VIP Emerging Markets Series, Delaware VIP Global Bond Series, Delaware VIP Growth Opportunities Series, Delaware VIP High Yield Series, Delaware VIP International Value Equity Series, Delaware VIP REIT Series, Delaware VIP Select Growth Series, Delaware VIP Small Cap Value Series, Delaware VIP Trend Series, Delaware VIP U.S. Growth Series and Delaware VIP Value Series. These financial statements and the related notes pertain to Delaware VIP Balanced Series (the "Series"). The Trust is an open-end investment company. The Series is considered diversified under the Investment Company Act of 1940, as amended, and offers Standard Class and Service Class shares. The Standard Class shares do not carry a 12b-1 fee and the Service Class shares carry a 12b-1 fee. The shares of the Series are sold only to separate accounts of life insurance companies.

The investment objective of the Series is to seek a balance of capital appreciation, income and preservation of capital.

1. Significant Accounting Policies

The following accounting policies are in accordance with U.S. generally accepted accounting principles and are consistently followed by the Series.

Security Valuation—Equity securities, except those traded on the Nasdaq Stock Market, Inc. (Nasdaq), are valued at the last quoted sales price as of the time of the regular close of the New York Stock Exchange (NYSE) on the valuation date. Securities traded on the Nasdaq are valued in accordance with the Nasdaq Official Closing Price, which may not be the last sales price. If on a particular day an equity security does not trade, then the mean between the bid and asked prices will be used. U.S. government and agency securities are valued at the mean between the bid and asked prices. Other long-term debt securities are valued by an independent pricing service and such prices are believed to reflect the fair value of such securities. Short-term debt securities having less than 60 days to maturity are valued at amortized cost, which approximates market value. Se curities lending collateral is valued at amortized cost, which approximates market value. Futures contracts and options on futures contracts are valued at the daily quoted settlement prices. Exchange-traded options are valued at the last reported sale price or, if no sales are reported, at the mean between the last reported bid and asked prices. Swap contracts and other securities and assets for which market quotations are not readily available are valued at fair value as determined in good faith under the direction of the Series' Board of Trustees. In determining whether market quotations are readily available or fair valuation will be used, various factors will be taken into consideration, such as market closures, or with respect to foreign securities, aftermarket trading, or significant events after local market trading (e.g., government actions or pronouncements, trading volume or volatility on markets, exchanges among dealers, or news events).

In September 2006, the Financial Accounting Standards Board (FASB) issued FASB Statement No. 157 "Fair Value Measurements" (Statement 157). Statement 157 establishes a framework for measuring fair value in generally accepted accounting principles, clarifies the definition of fair value within that framework, and expands disclosures about the use of fair value measurements. Statement 157 is intended to increase consistency and comparability among fair value estimates used in financial reporting. Statement 157 is effective for fiscal years beginning after November 15, 2007. Management does not expect the adoption of Statement 157 to have an impact on the amounts reported in the financial statements.

Federal Income Taxes—The Series intends to continue to qualify for federal income tax purposes as a regulated investment company and make the requisite distributions to shareholders. Accordingly, no provision for federal income taxes has been made in the financial statements.

On July 13, 2006, FASB released FASB Interpretation No. 48 "Accounting for Uncertainty in Income Taxes" (FIN 48). FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. FIN 48 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Series' tax returns to determine whether the tax positions are "more-likely-than-not" of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax benefit or expense in the current year. Adoption of FIN 48 is required for fiscal years beginning after December 15, 2006 and is to be applied to all open tax years as of the effective date. Recent SEC guidance allows implementing FIN 48 in Series net asset value calculations as late as the Series' last net asset value calculation in the first required fi nancial statement reporting period. As a result, the Series will incorporate FIN 48 in its semiannual report on June 30, 2007. Although the Series' tax positions are currently being evaluated, management does not expect the adoption of FIN 48 to have a material impact on the Series' financial statements.

Class Accounting—Investment income, common expenses and realized and unrealized gain (loss) on investments are allocated to the classes of the Series on the basis of daily net assets of each class. Distribution expenses relating to a specific class are charged directly to that class.

Repurchase Agreements—The Series may invest in a pooled cash account along with other members of the Delaware Investments® Family of Funds pursuant to an exemptive order issued by the Securities and Exchange Commission. The aggregate daily balance of the pooled cash account is invested in repurchase agreements secured by obligations of the U.S. government. The respective collateral is held by the Series' custodian bank until the maturity of the respective repurchase agreements. Each repurchase agreement is at least 102% collateralized. However, in the event of default or bankruptcy by the counterparty to the agreement, realization of the collateral may be subject to legal proceedings.

Use of Estimates—The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Other—Expenses directly attributable to the Series are charged directly to the Series. Other expenses common to various funds within the Delaware Investments® Family of Funds are generally allocated amongst such funds on the basis of average net assets. Management fees and some other expenses are paid monthly. Security transactions are recorded on the date the securities are purchased or sold (trade date) for financial reporting purposes. Costs used in calculating realized gains and losses on the sale of investment securities are those of the specific securities sold. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. Discounts and premiums are amortized to interest income over the lives of the respective securities. Realized gains (losses) on paydowns of mortgage- and asset-backed securiti es are classified as interest income.

Balanced Series- 16

Delaware VIP Balanced Series

Notes to Financial Statements (continued)

1. Significant Accounting Policies (continued)

The Series declares and pays dividends from net investment income and distributions from net realized gain on investments, if any, following the close of the fiscal year.

Subject to seeking best execution, the Series may direct certain security trades to brokers who have agreed to rebate a portion of the related brokerage commission to the Series in cash. There were no commission rebates during the year ended December 31, 2006. In general, best execution refers to many factors, including the price paid or received for a security, the commission charged, the promptness and reliability of execution, the confidentiality and placement accorded the order, and other factors affecting the overall benefit obtained by the Series on the transaction.

The Series receives earnings credits from its custodian when positive cash balances are maintained, which are used to offset custody fees. The expense paid under this arrangement is included in custodian fees on the Statement of Operations with the corresponding expense offset shown as "expense paid indirectly."

2. Investment Management, Administration Agreements and Other Transactions with Affiliates

In accordance with the terms of its investment management agreement, the Series pays Delaware Management Company (DMC), a series of Delaware Management Business Trust and the investment manager, an annual fee which is calculated daily at the rate of 0.65% on the first $500 million of average daily net assets of the Series, 0.60% on the next $500 million, 0.55% on the next $1.5 billion, and 0.50% on average daily net assets in excess of $2.5 billion.

DMC has contractually agreed to waive that portion, if any, of its management fee and reimburse the Series to the extent necessary to ensure that annual operating expenses, exclusive of taxes, interest, brokerage commissions, distribution fees, certain insurance costs and extraordinary expenses, do not exceed 0.80% of average daily net assets of the Series through April 30, 2007.

Delaware Service Company, Inc. (DSC), an affiliate of DMC, provides accounting, administration, dividend disbursing and transfer agent services. The Series pays DSC a monthly fee computed at the annual rate of 0.04% of the Series' average daily net assets for accounting and administrative services. The Series pays DSC a monthly fee based on average net assets for dividend disbursing and transfer agent services.

Pursuant to a distribution agreement and distribution plan, the Series pays Delaware Distributors, L.P. (DDLP), the distributor and an affiliate of DMC, an annual distribution and service fee not to exceed 0.30% of the average daily net assets of the Service Class shares. DDLP has contracted to waive distribution and service fees through April 30, 2007 in order to prevent distribution and service fees of the Service Class shares from exceeding 0.25% of average daily net assets. Standard Class shares pay no distribution and service expenses.

At December 31, 2006, the Series had liabilities payable to affiliates as follows: