UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05201

Thornburg Investment Trust

(Exact name of registrant as specified in charter)

119 East Marcy Street, Santa Fe, New Mexico 87501

(Address of principal executive offices) (Zip code)

Garrett Thornburg, 119 East Marcy Street, Santa Fe, New Mexico 87501

(Name and address of agent for service)

Registrant’s telephone number, including area code: 505-984-0200

| Date of fiscal year end: | June 30, 2004 | ||

| Date of reporting period: | June 30, 2004 | ||

Item 1. Reports to Stockholders

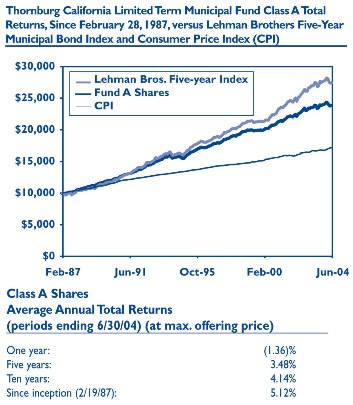

The following annual reports are attached hereto, in order:

| Thornburg Limited Term Municipal Fund | |||

| Thornburg Limited Term Municipal Fund Class I | |||

| Thornburg California Limited Term Municipal Fund | |||

| Thornburg California Limited Term Municipal Fund Class I | |||

| Thornburg New York Intermediate Municipal Fund | |||

Thornburg Limited Term Municipal Fund

Annual Report

June 30, 2004

Investment Manager

Thornburg Investment Management, Inc.

119 East Marcy Street

Santa Fe, New Mexico 87501

800.847.0200

Principal Underwriter

Thornburg Securities Corporation

119 East Marcy Street

Santa Fe, New Mexico 87501

800.847.0200

www.thornburg.com

This report is submitted for the general information of shareholders of the Fund. It is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus. Carefully consider information in the prospectus regarding the Fund’s investment objectives and policies, risks, sales charges, expenses, experience of its management, marketability of shares, and other information. Performance data quoted represent past performance and do not guarantee future results.

Thornburg Limited Term Municipal Fund

ALL DATA AS OF 06/30/2004.

FUND FACTS: Thornburg Limited Term Municipal Fund

| A Shares | C Shares | ||

|---|---|---|---|

| Annualized Distribution Rate (at NAV) | 2.83% | 2.57% | |

| SEC Yield | 2.08% | 1.84% | |

| NAV | $ 13.68 | $ 13.70 | |

| Maximum Offering Price | $ 13.89 | $ 13.70 |

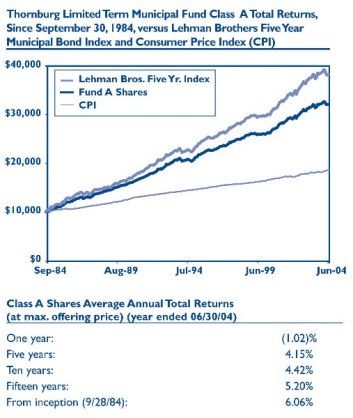

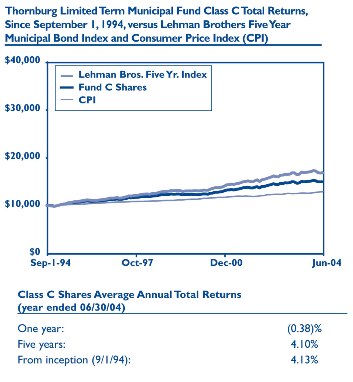

TOTAL RETURNS: (Annual Average - After Subtracting Maximum Sales Charge)

| One Year | (1.02)% | (0.38)% | |

| Three Years | 3.46% | 3.64% | |

| Five Years | 4.15% | 4.10% | |

| Ten Years | 4.42% | N/A | |

| Fifteen Years | 5.20% | N/A | |

| Since Inception | 6.06% | 4.13% | |

| Inception Date | 9/28/84 | 9/1/94 |

Total return figures for the Public Offering Price (POP) include subtraction of maximum sales charge of 1.50% for the A shares. Total return figures at the public offering price for the C shares include a 0.50% CDSC for the first year only. |

| Performance data quoted represent past performance and are no guarantee of future results. Current returns may be either lower or higher than those shown. Share prices and returns will fluctuate and investors may experience a loss upon redemption. There is no guarantee that the Fund will meet its objectives. Shares in the Fund carry risks, including possible loss of principal. |

| Carefully consider the Fund’s investment objectives, risks, sales charges, and expenses; this information is found in the prospectus, which is available from your financial advisor or from www.thornburg.com. Read it carefully before you invest or send money. For the most recent month-end performance information, visit www.thornburg.com. |

| The SEC yield is computed in accordance with SEC standards measuring the net investment income per share over a specified 30-day period expressed as a percentage of the maximum offering price of the Fund’s shares at the end of the period. |

| The distribution rate is calculated by taking the sum of the month’s total daily dividend distribution factors and dividing this sum by a 30-day period and annualizing to a 360-day year. The value is then divided by the ending NAV to arrive at the annualized distribution yield. The yield is calculated on a periodic basis and is subject to change depending on the Fund’s NAV and current distributions. |

Letter to shareholders

Thornburg Limited Term Municipal Fund July 14, 2004

Dear Fellow Shareholder:

I am pleased to present the annual report for the Thornburg Limited Term Municipal Fund. The net asset value of the A shares decreased by 33¢ to $13.68 during the year ended June 30, 2004. If you were with us for the entire period, you received dividends of 39.6per share. If you reinvested dividends, you received 40.1¢ per share. Investors who owned C shares received dividends of 35.7¢ and 36.1¢ per share, respectively.

Over the last year, interest rates on high-quality municipal bonds have risen dramatically. Most of the change happened in April and May of this year. Usually, bond market participants take their cue, at least in part, from the Federal Reserve. In April and May of 2004, the bond market jumped the gun. In anticipation of a rising Fed Funds rate, investors sold bonds, which pushed up the yield on a 5-year Treasury note from a low of 2.64% on March 16th to 3.93% on June 30th. The municipal market followed suit. The yield on a 5-year AAA-rated municipal bond rose from a low of 2.09% to 3.16% at the quarter’s end.

The rise in rates caused bond prices to move down sharply, leading to the worst quarterly total return for bonds since 1994. Our strategy of laddering short and intermediate bonds helped diffuse some, but not all, of the downward price pressures. Thornburg Limited Term Municipal Fund A shares produced a total return of 0.47% for the year ended June 30, 2004. This compares favorably to the Lehman Brothers 5-year Municipal Bond Index, which posted a 0.24% return over the same time period. Your Fund’s out-performance was mostly due to its dispersion of maturities and its shorter duration relative to the index.

Your Thornburg Limited Term Municipal Fund is a laddered portfolio of over 660 municipal obligations from 49 states. Approximately 93% of the bonds are rated A or better by one of the major rating agencies. Today, your Fund’s weighted average maturity is 3.9 years, and we normally keep it below 5 years. As you know, we “ladder” the maturity dates of the bonds in your portfolio so that some of the bonds are scheduled to mature during each of the coming years.

When interest rates rise, virtually all bonds fall in value. However, as the bonds in a laddered portfolio approach maturity, they tend to recapture lost value. Meanwhile, cash from maturing bonds can be reinvested in a higher interest rate environment, raising the portfolio’s yield. In this way, a laddered portfolio should benefit from rising interest rates over time.

We have been targeting a somewhat shorter duration than normal so far this year because we have been concerned about a rise in interest rates. Now that rates have moved up by over 1.00%, is it time to start extending duration? We have decided not to extend your Fund’s duration yet because we believe that interest rates are more likely to increase than decrease in the months ahead.

Most indicators of economic activity are strong. Personal consumption expenditures are up 4.1% and corporate cash flows have surged 24% in the last year. Almost one million new jobs have been created in the last three months. Clearly a 1.25% Fed Funds rate is inconsistent with such robust economic growth. Since bond yields rose earlier this year, our bond market has already built-in expectations of a somewhat higher Fed Funds rate. The next major question concerns what happens to economic growth and inflation after the Fed Funds rate hits 2.5%.

We believe that the economy has enough momentum to continue growing rapidly in such a scenario. Furthermore, we believe that we are only beginning to see the long-term effects on inflation of government policies over the last three years. Low interest rates, tax cuts, deficit spending, and a weak dollar have all combined to create an environment where businesses and their workers have more pricing power. We expect that this will translate to a sustained, though moderate, rise in the official inflation statistics over the next several years.

2

Letter to shareholders, Continued

Thornburg Limited Term Municipal Fund

If these events unfold as we expect, bond yields should eventually resume their upward path. We have positioned your Fund with this outlook in mind. The duration is near the short end of its typical range, and the ladder is somewhat more concentrated in shorter maturities. We are looking forward to a buyer-friendly environment in the future when we will hopefully be able to add a significant amount of additional yield while positioning your Fund to perform well for years to come.

Thanks to a strong economy and some recently implemented tax increases, state tax revenue is up a healthy 8.1% over last year. Surpluses are showing up in states that worked hard to balance this year’s budget. Where budgets were not properly balanced, deficits are becoming easier to solve. A few pockets of weakness still exist, but by and large, municipal bond credit quality is starting to improve. We have kept your Fund’s credit quality high, with average ratings of AA and broad diversification across issuers and market sectors.

As your Fund approaches its 20th birthday, we hope that you are pleased with your investment in the Thornburg Limited Term Municipal Fund. Over the years, our practice of laddering a diversified portfolio of short- and intermediate-maturity municipal bonds has allowed your Fund to perform consistently well in varying interest rate environments. Thank you for investing in Thornburg Limited Term Municipal Fund.

| % of portfolio maturing within | Cumulative % maturing by end of | |

|---|---|---|

| 1 years = 13% | year 1 = 13% | |

| 1 to 2 years = 13% | year 2 = 26% | |

| 2 to 3 years = 12% | year 3 = 38% | |

| 3 to 4 years = 13% | year 4 = 51% | |

| 4 to 5 years = 13% | year 5 = 64% | |

| 5 to 6 years = 11% | year 6 = 75% | |

| 6 to 7 years = 10% | year 7 = 85% | |

| 7 to 8 years = 6% | year 8 = 91% | |

| 8 to 9 years = 5% | year 9 = 96% | |

| over 9 years = 4% | over 9 years =100% |

Percentages can and do vary. Data as of 06/30/04.

Sincerely,

George Strickland

Portfolio Manager

| Past performance cannot guarantee future results. The Lehman Brothers Five-Year Municipal Bond Index is a rules-based, market-value-weighted index engineered for the long-term tax-exempt bond market. To be included in the index, bonds must have a minimum credit rating of Baa. The approximate maturity of the municipal bonds in the index is five years. Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. Investors may not make direct investments into any index. |

| The Fed Funds Rate is the interest rate at which a depository institution lends immediately available funds (balances at the Federal Reserve) to another depository institution overnight. |

| The matters discussed in this report may constitute forward-looking statements made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995. These include any advisor or portfolio manager prediction, assessment, analysis or outlook for individual securities, industries, investment styles, market sectors and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for each Fund in its current prospectus, other factors bearing on these reports include the accuracy of the advisor’s or portfolio manager’s forecasts and predictions, the appropriateness of the investment strategies designed by the advisor or portfolio manager and the ability of the advisor or portfolio manager to implement their strategies efficiently and successfully. Any one or more of these factors, as well as other risks affecting the securities markets generally, could cause the actual results of any Fund to differ materially as compared to its benchmarks. |

3

Statement of assets and liabilities

Thornburg Limited Term Municipal Fund June 30, 2004

| ASSETS | |||||

| Investments at value (cost $1,346,607,618) | $ | 1,377,591,952 | |||

| Cash | 3,214,107 | ||||

| Receivable for investments sold | 27,422,316 | ||||

| Receivable for fund shares sold | 4,039,272 | ||||

| Interest receivable | 18,570,449 | ||||

| Prepaid expenses and other assets | 47,935 | ||||

| Total Assets | 1,430,886,031 | ||||

| LIABILITIES | |||||

| Payable for fund shares redeemed | 3,047,586 | ||||

| Accounts payable and accrued expenses | 459,297 | ||||

| Payable to investment advisor (Note 3) | 601,132 | ||||

| Dividends payable | 1,078,202 | ||||

| Total Liabilities | 5,186,217 | ||||

| NET ASSETS | $ | 1,425,699,814 | |||

| NET ASSETS CONSIST OF: | |||||

| Net unrealized appreciation (depreciation) on investments | $ | 30,984,334 | |||

| Over-distributed net investment income (loss) | (1,293 | ) | |||

| Accumulated net realized gain (loss) | (4,658,982 | ) | |||

| Net capital paid in on shares of beneficial interest | 1,399,375,755 | ||||

| $ | 1,425,699,814 | ||||

| NET ASSET VALUE: | |||||

| Class A Shares: | |||||

| Net asset value and redemption price per share | |||||

| ($1,047,481,813 applicable to 76,584,691 shares of beneficial | |||||

| interest outstanding - Note 4) | $ | 13.68 | |||

| Maximum sales charge, 1.50% of offering price | 0.21 | ||||

| Maximum Offering Price Per Share | $ | 13.89 | |||

| Class C Shares: | |||||

| Net asset value and offering price per share* | |||||

| ($155,457,571 applicable to 11,345,224 shares of beneficial | |||||

| interest outstanding - Note 4) | $ | 13.70 | |||

| Class I Shares: | |||||

| Net asset value, offering and redemption price per share | |||||

| ($222,760,430 applicable to 16,284,542 shares of beneficial | |||||

| interest outstanding - Note 4) | $ | 13.68 | |||

| *Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. See notes to financial statements. |

4

Statement of operations

Thornburg Limited Term Municipal Fund Year Ended June 30, 2004

| INVESTMENT INCOME: | |||||

| Interest income (net of premium amortized of $15,358,148) | $ | 53,238,459 | |||

| EXPENSES: | |||||

| Investment advisory fees (Note 3) | 5,754,193 | ||||

| Administration fees (Note 3) | |||||

| Class A Shares | 1,311,880 | ||||

| Class C Shares | 191,093 | ||||

| Class I Shares | 107,843 | ||||

| Distribution and service fees (Note 3) | |||||

| Class A Shares | 2,622,964 | ||||

| Class C Shares | 1,538,688 | ||||

| Transfer agent fees | |||||

| Class A Shares | 377,245 | ||||

| Class C Shares | 98,715 | ||||

| Class I Shares | 60,375 | ||||

| Registration and filing fees | |||||

| Class A Shares | 75,030 | ||||

| Class C Shares | 14,731 | ||||

| Class I Shares | 15,281 | ||||

| Custodian fees (Note 3) | 534,108 | ||||

| Professional fees | 150,630 | ||||

| Accounting fees | 121,890 | ||||

| Trustee fees | 51,315 | ||||

| Other expenses | 332,331 | ||||

| Total Expenses | 13,358,312 | ||||

| Less: | |||||

| Expenses reimbursed by investment advisor (Note 3) | (4,388 | ) | |||

| Distribution and service fees waived (Note 3) | (769,344 | ) | |||

| Fees paid indirectly (Note 3) | (5,718 | ) | |||

| Net Expenses | 12,578,862 | ||||

| Net Investment Income | 40,659,597 | ||||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | |||||

| Net realized gain (loss) on investments sold | 1,795,864 | ||||

| Increase (Decrease) in unrealized appreciation of investments | (36,334,816 | ) | |||

| Net Realized and Unrealized | |||||

| Gain (Loss) on Investments | (34,538,952 | ) | |||

| Net Increase (Decrease) in Net Assets Resulting | |||||

| From Operations | $ | 6,120,645 | |||

See notes to financial statements.

5

Statements of changes in net assets

Thornburg Limited Term Municipal Fund

| Year Ended June 30, 2004 | Year Ended June 30, 2003 | |||||||

|---|---|---|---|---|---|---|---|---|

| INCREASE (DECREASE) IN NET ASSETS FROM: | ||||||||

| OPERATIONS: | ||||||||

| Net investment income | $ | 40,659,597 | $ | 36,971,587 | ||||

| Net realized gain (loss) on investments sold | 1,795,864 | 877,102 | ||||||

| Increase (Decrease) in unrealized appreciation of investments | (36,334,816 | ) | 28,100,206 | |||||

| Net Increase (Decrease) in Net Assets | ||||||||

| Resulting from Operations | 6,120,645 | 65,948,895 | ||||||

| DIVIDENDS TO SHAREHOLDERS: | ||||||||

| From net investment income | ||||||||

| Class A Shares | (29,889,249 | ) | (28,771,058 | ) | ||||

| Class C Shares | (3,916,198 | ) | (2,645,994 | ) | ||||

| Class I Shares | (6,854,150 | ) | (5,554,535 | ) | ||||

| FUND SHARE TRANSACTIONS (NOTE 4): | ||||||||

| Class A Shares | 74,238,458 | 190,903,532 | ||||||

| Class C Shares | 21,587,725 | 78,064,848 | ||||||

| Class I Shares | 30,607,967 | 69,803,156 | ||||||

| Net Increase (Decrease) in Net Assets | 91,895,198 | 367,748,844 | ||||||

| NET ASSETS: | ||||||||

| Beginning of year | 1,333,804,616 | 966,055,772 | ||||||

| End of year | $ | 1,425,699,814 | $ | 1,333,804,616 | ||||

See notes to financial statements.

6

Notes to financial statements

Thornburg Limited Term Municipal Fund June 30, 2004

NOTE 1 — ORGANIZATION

Thornburg Limited Term Municipal Fund (the “Fund”)(formerly Thornburg Limited Term Municipal Fund – National Portfolio) is a diversified series of Thornburg Investment Trust (the “Trust”). The Trust is organized as a Massachusetts business trust under a Declaration of Trust dated June 3, 1987 and is registered as a diversified, open-end management investment company under the Investment Company Act of 1940, as amended. The Trust is currently issuing eleven series of shares of beneficial interest in addition to those of the Fund: Thornburg California Limited Term Municipal Fund, Thornburg Florida Intermediate Municipal Fund, Thornburg New York Intermediate Municipal Fund, Thornburg New Mexico Intermediate Municipal Fund, Thornburg Intermediate Municipal Fund, Thornburg Limited Term U.S. Government Fund, Thornburg Limited Term Income Fund, Thornburg Value Fund, Thornburg International Value Fund, Thornburg Core Growth Fund, and Thornburg Investment Income Builder Fund. Each series is considered to be a separate entity for financial reporting and tax purposes and bears expenses directly attributable to it. The Fund’s investment objective is to obtain as high a level of current income exempt from Federal income taxes as is consistent, in the view of the Fund’s investment advisor, with the preservation of capital.

Reorganization: The Fund is the successor to Thornburg Limited Term Municipal Fund – National Portfolio (the “National Portfolio”) a series of Thornburg Limited Term Municipal Fund, Inc. On December 8, 2003, the Company’s Board of Directors approved an Agreement and Plan of Reorganization providing for the transfer of substantially all of the National Portfolio’s assets to the Fund, in exchange solely for voting shares of the Fund, and the distribution of those shares to the shareholders of the National Portfolio and the subsequent dissolution of the National Portfolio. The Fund was created by the Trust on December 8, 2003 to accomplish the reorganization, and until the reorganization was completed had only nominal assets. The reorganization was intended to simplify legal and regulatory compliance functions, and to reduce the costs of performing those functions. The Agreement and Plan of Reorganization was approved by the National Portfolio’s shareholders on May 21, 2004, and the reorganization was concluded on June 21, 2004. As a result, all of the National Portfolio’s assets were transferred to the Fund, and the shareholders of the National Portfolio became shareholders of the Fund. There was no change in investment objective or policies as a result of the reorganization, and the investment advisor did not change because of the reorganization. The National Portfolio is the accounting survivor, and the financial results of the Fund include the results of the National Portfolio prior to the reorganization.

The Fund currently offers three classes of shares of beneficial interest, Class A, Class C and Institutional Class (Class I) shares. Each class of shares of the Fund represents an interest in the same portfolio of investments, except that (i) Class A shares are sold subject to a front-end sales charge collected at the time the shares are purchased and bear a service fee, (ii) Class C shares are sold at net asset value without a sales charge at the time of purchase, but are subject to a contingent deferred sales charge upon redemption within one year, and bear both a service fee and a distribution fee, (iii) Class I shares are sold at net asset value without a sales charge at the time of purchase, and (iv) the respective classes have different reinvestment privileges. Additionally, the Fund may allocate among its classes certain expenses, to the extent applicable to specific classes, including transfer agent fees, government registration fees, certain printing and postage costs, and administrative and legal expenses. Currently, class specific expenses of the Fund are limited to service and distribution fees, administrative fees, and certain registration and transfer agent expenses.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

Significant accounting policies of the Fund are as follows:

Valuation of Investments: In determining the net asset value, the Fund utilizes an independent pricing service approved by the Board of Trustees. Debt investment securities have a primary market over the counter and are valued on the basis of valuations furnished by the pricing service. The pricing service values portfolio securities at quoted bid prices, normally at 4:00 p.m. EST or the yield equivalents when quotations are not readily available. Securities for which quotations are not readily available are valued at fair value as determined by the pricing service using methods which include consideration of yields or prices of municipal obligations of comparable quality, type of issue, coupon, maturity and rating; indications as to value from dealers and general market conditions. The valuation procedures used by the pricing service and the portfolio valuations received by the Fund are reviewed by the officers of the Trust under the general supervision of the Board of Trustees. Short-term obligations having remaining maturities of 60 days or less are valued at amortized cost, which approximates market value.

Federal Income Taxes: It is the policy of the Fund to comply with the provisions of the Internal Revenue Code applicable to “regulated investment companies” and to distribute all of its taxable (if any) and tax exempt income to its shareholders. Therefore, no provision for Federal income tax is required.

7

Notes to financial statements, Continued

Thornburg Limited Term Municipal Fund June 30, 2004

When-Issued and Delayed Delivery Transactions: The Fund may engage in when-issued or delayed delivery transactions. To the extent the Fund engages in such transactions, it will do so for the purpose of acquiring portfolio securities consistent with the investment objectives of the Fund and not for the purpose of investment leverage or to speculate on interest rate changes. At the time the Fund makes a commitment to purchase a security on a when-issued basis, the Fund will record the transaction and reflect the value in determining its net asset value. When effecting such transactions, assets of the Fund of an amount sufficient to make payment for the portfolio securities to be purchased will be segregated on the Fund’s records on the trade date. Securities purchased on a when-issued or delayed delivery basis do not earn interest until the settlement date.

Dividends: Net investment income of the Fund is declared daily as a dividend on shares for which the Fund has received payment. Dividends are paid monthly and are reinvested in additional shares of the Fund at net asset value per share at the close of business on the dividend payment date, or at the shareholder’s option, paid in cash. Net capital gains, to the extent available, will be distributed at least annually.

General: Securities transactions are accounted for on a trade date basis. Interest income is accrued as earned. Premiums and discounts on securities purchased are amortized to call dates or maturity dates of the respective securities. Realized gains and losses from the sale of securities are recorded on an identified cost basis. Net investment income, other than class specific expenses, and realized and unrealized gains and losses, are allocated daily to each class of shares based upon the relative net asset value of outstanding shares (or the value of the dividend-eligible shares, as appropriate) of each class of shares at the beginning of the day (after adjusting for the current capital shares activity of the respective class). Expenses common to all funds are allocated among the funds comprising the Trust based upon their relative net asset values or other appropriate allocation methods.

Use of Estimates: The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Guarantees and Indemnifications: Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liability arising out of the performance of their duties to the Fund. Additionally, in the normal course of business the Trust enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown. However, based on experience, the Trust expects the risk of loss to be remote.

NOTE 3 – INVESTMENT ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

Pursuant to an Investment Advisory Agreement, Thornburg Investment Management, Inc. (the “Advisor”) serves as the investment advisor and performs services for which the fees are payable at the end of each month. For the year ended June 30, 2004, these fees were payable at annual rates ranging from .50 of 1% to .225 of 1% of the average daily net assets of the Fund. The Fund also has an Administrative Services Agreement with the Advisor, whereby the Advisor will perform certain administrative services for the shareholders of each class of the Fund’s shares, and for which fees will be payable at an annual rate of up to .125 of 1% of the average daily net assets attributable to each class of shares. For the year ended June 30, 2004, the Advisor voluntarily reimbursed certain class specific expenses and administrative fees of $4,388 for Class C shares.

The Fund has a Distribution Agreement with Thornburg Securities Corporation (the “Distributor”), which acts as the Distributor of Fund shares. For the year ended June 30, 2004, the Distributor has advised the Fund that it earned commissions aggregating $16,530 from the sale of Class A shares, and collected contingent deferred sales charges aggregating $71,750 from redemptions of Class C shares of the Fund.

Pursuant to a Service Plan under Rule 12b-1 of the Investment Company Act of 1940, the Fund may reimburse to the Advisor amounts not to exceed .25 of 1% per annum of the average daily net assets attributable to each class of shares of the Fund for payments made by the Advisor to securities dealers and other persons for distribution of the Fund’s shares and to obtain various shareholder related services. The Advisor may pay out of its own resources additional expenses for distribution of the Fund’s shares.

8

Notes to financial statements, Continued

Thornburg Limited Term Municipal Fund June 30, 2004

The Fund has also adopted a Distribution Plan pursuant to Rule 12b-1, applicable only to the Fund’s Class C shares under which the Fund compensates the Distributor for services in promoting the sale of Class C shares of the Fund at an annual rate of up to .75 of 1% per annum of the average daily net assets attributable to Class C shares. Total fees incurred by each class of shares of the Fund under their respective Service and Distribution plans and Class C distribution fees waived by the Distributor for the year ended June 30, 2004, are set forth in the statement of operations.

The Fund has an agreement with the custodian bank to indirectly pay a portion of the custodian’s fees through credits earned by the Fund’s cash on deposit with the bank. This deposit agreement is an alternative to overnight investments. Custodial fees have been adjusted to reflect amounts that would have been paid without this agreement, with a corresponding adjustment reflected as fees paid indirectly in the statement of operations. For the year ended June 30, 2004 fees paid indirectly were $5,718.

Certain officers and Trustees of the Trust are also officers and/or directors of the Advisor and Distributor. The compensation of independent Trustees is borne by the Trust.

NOTE 4 - SHARES OF BENEFICIAL INTEREST

At June 30, 2004, there were an unlimited number of shares of beneficial interest authorized. Transactions in shares of beneficial interest were as follows:

| Year Ended June 30, 2004 | Year Ended June 30, 2003 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Shares | Amount | Shares | Amount | |||||||||||

| Class A Shares | ||||||||||||||

| Shares sold | 22,343,137 | $ | 310,234,300 | 24,734,784 | $ | 343,160,230 | ||||||||

| Shares issued to shareholders in | ||||||||||||||

| reinvestment of dividends | 1,399,170 | 19,393,497 | 1,359,442 | 18,874,006 | ||||||||||

| Shares repurchased | (18,441,220 | ) | (255,389,339 | ) | (12,329,726 | ) | (171,130,704 | ) | ||||||

| Net Increase (Decrease) | 5,301,087 | $ | 74,238,458 | 13,764,500 | $ | 190,903,532 | ||||||||

| Class C Shares | ||||||||||||||

| Shares sold | 4,814,111 | $ | 66,984,540 | 7,145,702 | $ | 99,350,605 | ||||||||

| Shares issued to shareholders in | ||||||||||||||

| reinvestment of dividends | 194,692 | 2,704,058 | 135,892 | 1,892,308 | ||||||||||

| Shares repurchased | (3,462,370 | ) | (48,100,873 | ) | (1,670,144 | ) | (23,178,065 | ) | ||||||

| Net Increase (Decrease) | 1,546,433 | $ | 21,587,725 | 5,611,450 | $ | 78,064,848 | ||||||||

| Class I Shares | ||||||||||||||

| Shares sold | 8,616,079 | $ | 119,652,434 | 7,667,976 | $ | 106,488,989 | ||||||||

| Shares issued to shareholders in | ||||||||||||||

| reinvestment of dividends | 394,435 | 5,468,468 | 309,747 | 4,303,264 | ||||||||||

| Shares repurchased | (6,808,603 | ) | (94,512,935 | ) | (2,952,400 | ) | (40,989,097 | ) | ||||||

| Net Increase (Decrease) | 2,201,911 | $ | 30,607,967 | 5,025,323 | $ | 69,803,156 | ||||||||

9

Notes to financial statements, Continued

Thornburg Limited Term Municipal Fund June 30, 2004

NOTE 5 – SECURITIES TRANSACTIONS

For the year ended June 30, 2004, the Fund had purchase and sale transactions (excluding short-term securities) of $465,353,933 and $289,684,557, respectively.

NOTE 6 – INCOME TAXES

At June 30, 2004, information on the tax components of capital is as follows:

| Cost of investments for tax purposes | $ | 1,346,613,399 | |||

| Gross unrealized appreciation on a tax basis | $ | 35,385,004 | |||

| Gross unrealized depreciation on a tax basis | (4,406,451 | ) | |||

| Net unrealized appreciation (depreciation) on investments (tax basis) | $ | 30,978,553 | |||

At June 30, 2004, the Fund did not have any undistributed tax-exempt/ordinary net income or undistributed capital gains.

At June 30, 2004, the Fund had tax basis capital losses, which may be carried over to offset future capital gains. Such capital loss carryovers expire as follows:

| 2008 | $ | 1,088,098 | |||

| 2009 | 3,565,103 | ||||

| $ | 4,653,201 | ||||

The Fund utilized $1,796,480 of its capital loss carry forward during the year ended June 30, 2004. Unutilized tax basis capital losses may be carried forward to offset realized gains in future years. To the extent such carry forwards are used, capital gain distributions may be reduced to the extent provided by regulations.

During the year ended June 30, 2004, $873,288 of capital loss carry forwards from prior years expired.

In order to account for permanent book/tax differences, the Fund decreased over-distributed net investment income by $1,293, increased accumulated net realized gain (loss) by $734,388, and decreased net capital paid in on shares of beneficial interest by $733,095. This reclassification has no impact on the net asset value of the Fund. Reclassifications result primarily from an expired capital loss carry forward and the difference in the tax treatment of market discounts.

All dividends paid by the Fund for the years ended June 30, 2004 and June 30, 2003, represent exempt interest dividends, which are excludable by shareholders from gross income for Federal income tax purposes.

10

Financial highlights

Thornburg Limited Term Municipal Fund

| Yr End June 30, | |||||

|---|---|---|---|---|---|

| 2004 | 2003 | 2002 | 2001 | 2000 | |

| Class A Shares: | |||||

| Per Share Performance | |||||

| (for a share outstanding throughout the year) | |||||

| Net asset value, beginning of year | $ 14.01 | $ 13.65 | $ 13.44 | $ 13.06 | $ 13.26 |

| Income from investment operations: | |||||

| Net investment income | 0.40 | 0.45 | 0.52 | 0.58 | 0.59 |

| Net realized and unrealized | |||||

| gain (loss) on investments | (0.33) | 0.36 | 0.21 | 0.38 | (0.20) |

| Total from investment operations | 0.07 | 0.81 | 0.73 | 0.96 | 0.39 |

| Less dividends from: | |||||

| Net investment income | (0.40) | (0.45) | (0.52) | (0.58) | (0.59) |

| Change in net asset value | (0.33) | 0.36 | 0.21 | 0.38 | (0.20) |

| Net asset value, end of year | $ 13.68 | $ 14.01 | $ 13.65 | $ 13.44 | $ 13.06 |

| Total return (a) | 0.47% | 5.99% | 5.54% | 7.49% | 3.00% |

| Ratios/Supplemental Data | |||||

| Ratios to average net assets: | |||||

| Net investment income | 2.85% | 3.20% | 3.83% | 4.36% | 4.48% |

| Expenses, after expense reductions | 0.91% | 0.93% | 0.95% | 0.99% | 0.96% |

| Expenses, after expense reductions | |||||

| and net of custody credits | 0.91% | 0.93% | 0.95% | -- | -- |

| Expenses, before expense reductions | 0.91% | 0.93% | 0.96% | 0.99% | 0.96% |

| Portfolio turnover rate | 21.37% | 15.81% | 19.59% | 25.37% | 33.65% |

| Net assets at end of year (000) | $ 1,047,482 | $ 998,878 | $ 785,145 | $ 654,157 | $ 672,775 |

(a) Sales loads are not reflected in computing total return.

11

Financial highlights, Continued

Thornburg Limited Term Municipal Fund

| Yr End June 30, | |||||

|---|---|---|---|---|---|

| 2004 | 2003 | 2002 | 2001 | 2000 | |

| Class C Shares: | |||||

| Per Share Performance | |||||

| (for a share outstanding throughout the year) | |||||

| Net asset value, beginning of year | $ 14.04 | $ 13.67 | $ 13.46 | $ 13.08 | $ 13.28 |

| Income from investment operations: | |||||

| Net investment income | 0.36 | 0.41 | 0.47 | 0.53 | 0.53 |

| Net realized and unrealized | |||||

| gain (loss) on investments | (0.34) | 0.37 | 0.21 | 0.38 | (0.20) |

| Total from investment operations | 0.02 | 0.78 | 0.68 | 0.91 | 0.33 |

| Less dividends from: | |||||

| Net investment income | (0.36) | (0.41) | (0.47) | (0.53) | (0.53) |

| Change in net asset value | (0.34) | 0.37 | 0.21 | 0.38 | (0.20) |

| Net asset value, end of year | $ 13.70 | $ 14.04 | $ 13.67 | $ 13.46 | $ 13.08 |

| Total return | 0.12% | 5.78% | 5.13% | 7.07% | 2.57% |

| Ratios/Supplemental Data | |||||

| Ratios to average net assets: | |||||

| Net investment income | 2.56% | 2.89% | 3.42% | 3.96% | 4.06% |

| Expenses, after expense reductions | 1.19% | 1.18% | 1.33% | 1.38% | 1.38% |

| Expenses, after expense reductions | |||||

| and net of custody credits | 1.19% | 1.18% | 1.33% | -- | -- |

| Expenses, before expense reductions | 1.69% | 1.68% | 1.80% | 1.85% | 1.82% |

| Portfolio turnover rate | 21.37% | 15.81% | 19.59% | 25.37% | 33.65% |

| Net assets at end of year (000) | $ 155,458 | $ 137,559 | $ 57,258 | $ 24,773 | $ 21,322 |

12

Financial highlights, Continued

Thornburg Limited Term Municipal Fund

| Yr End June 30, | |||||

|---|---|---|---|---|---|

| 2004 | 2003 | 2002 | 2001 | 2000 | |

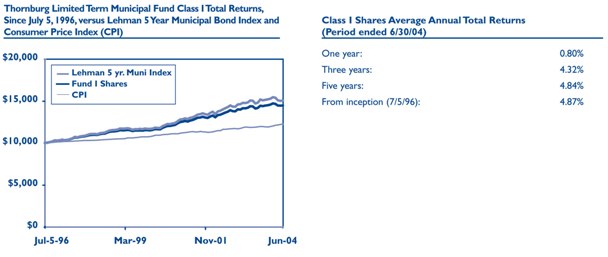

| Class I Shares: | |||||

| Per Share Performance | |||||

| (for a share outstanding throughout the year) | |||||

| Net asset value, beginning of year | $ 14.01 | $ 13.65 | $ 13.44 | $ 13.06 | $ 13.26 |

| Income from investment operations: | |||||

| Net investment income | 0.44 | 0.49 | 0.57 | 0.63 | 0.63 |

| Net realized and unrealized | |||||

| gain (loss) on investments | (0.33) | 0.36 | 0.21 | 0.38 | (0.20) |

| Total from investment operations | 0.11 | 0.85 | 0.78 | 1.01 | 0.43 |

| Less dividends from: | |||||

| Net investment income | (0.44) | (0.49) | (0.57) | (0.63) | (0.63) |

| Change in net asset value | (0.33) | 0.36 | 0.21 | 0.38 | (0.20) |

| Net asset value, end of year | $ 13.68 | $ 14.01 | $ 13.65 | $ 13.44 | $ 13.06 |

| Total return | 0.80% | 6.36% | 5.91% | 7.91% | 3.37% |

| Ratios/Supplemental Data | |||||

| Ratios to average net assets: | |||||

| Net investment income | 3.18% | 3.54% | 4.18% | 4.75% | 4.84% |

| Expenses, after expense reductions | 0.57% | 0.58% | 0.60% | 0.60% | 0.60% |

| Expenses, after expense reductions | |||||

| and net of custody credits | 0.57% | 0.58% | 0.60% | -- | -- |

| Expenses, before expense reductions | 0.57% | 0.58% | 0.62% | 0.65% | 0.62% |

| Portfolio turnover rate | 21.37% | 15.81% | 19.59% | 25.37% | 33.65% |

| Net assets at end of year (000) | $ 222,760 | $ 197,367 | $ 123,652 | $ 86,160 | $ 76,470 |

13

Schedule of Investments

Thornburg Limited Term Municipal Fund June 30, 2004

| Issuer-Desription | Credit Rating† Moody's/S&P | Principal Amount | Value | ||||

|---|---|---|---|---|---|---|---|

| Alabama | (2.00%) | ||||||

| Alabama State Public School & College Authority, 4.375% due 8/1/2004 | Aa3/AA | $ 2,000,000 | $ 2,005,200 | ||||

| Birmingham Carraway Alabama Special, 6.25% due 8/15/2009 (Insured: Connie Lee) | NR/AAA | 10,000,000 | 10,882,600 | ||||

| Birmingham General Obligation, 7.25% due 7/1/2004 (ETM)* | NR/NR | 980,000 | 980,157 | ||||

| Huntsville Health Care Authority Facilities Revenue Series B, 4.65% due 6/1/2024 | |||||||

| (Insured: MBIA) | Aaa/AAA | 1,245,000 | 1,275,154 | ||||

| Huntsville Health Care Series A, 4.65% due 6/1/2024 put 6/1/2005 (Insured: MBIA) | Aaa/AAA | 5,330,000 | 5,459,092 | ||||

| Scottsboro Industrial Development Board Refunding, 5.25% due 5/1/2009 (LOC: PNC | |||||||

| Bank) | NR/NR | 1,920,000 | 1,959,245 | ||||

| Shelby County Series A, 7.20% due 8/1/2005 (Insured: MBIA) (ETM)* | Aaa/AAA | 500,000 | 502,210 | ||||

| Wilsonville Industrial Development Board Pollution Control Revenue Refunding, 4.20% | |||||||

| due 6/1/2019 put 6/1/2006 (Southern Electric Gaston Project; Insured: AMBAC) | Aaa/AAA | 5,000,000 | 5,168,250 | ||||

| Alaska | (0.10%) | ||||||

| North Slope Borough Alaska, 0% due 6/30/2006 (Insured: MBIA) | Aaa/AAA | 2,070,000 | 1,973,579 | ||||

| Arizona | (0.90%) | ||||||

| Arizona State Transportation Board Grant Anticipation Notes Series A, 5.00% due | |||||||

| 7/1/2009 | Aa3/AA- | 2,500,000 | 2,706,500 | ||||

| Maricopa County Arizona School District 97, 5.50% due 7/1/2008 (Insured: FGIC) | Aaa/NR | 650,000 | 712,660 | ||||

| Maricopa County School District 008, 7.50% due 7/1/2008 (Insured: MBIA) | Aaa/AAA | 1,000,000 | 1,167,100 | ||||

| Maricopa County Unified School District Number 41 Gilbert Refunding, 0% due | |||||||

| 1/1/2006 (Insured: FGIC) | Aaa/AAA | 1,000,000 | 968,370 | ||||

| Mohave County Industrial Development Authority Correctional Facilities Contract | |||||||

| Revenue Series A, 5.00% due 4/1/2009 (Mohave Prison LLC Project; Insured: XLCA) | Aaa/AAA | 4,595,000 | 4,923,267 | ||||

| Pima County Industrial Development Authority Education Revenue Series C, 6.40% due | |||||||

| 7/1/2013 (Arizona Charter Schools Project) | Baa3/NR | 1,000,000 | 1,035,870 | ||||

| Pima County Industrial Development Authority Industrial Revenue Refunding Lease | |||||||

| Obligation A, 7.25% due 7/15/2010 (Insured: FSA) | Aaa/AAA | 680,000 | 715,972 | ||||

| Tucson Water Revenue Series D, 9.75% due 7/1/2008 | Aa3/A+ | 500,000 | 624,475 | ||||

| Arkansas | (0.90%) | ||||||

| Conway Electric Revenue Refunding, 5.00% due 8/1/2007 | A2/NR | 2,000,000 | 2,123,260 | ||||

| Jefferson County Hospital Revenue Refunding & Improvement, 5.50% due 6/1/2010 | |||||||

| (Regional Medical Center Project) | NR/A | 1,000,000 | 1,088,830 | ||||

| Jefferson County Hospital Revenue Refunding & Improvement, 5.50% due 6/1/2011 | |||||||

| (Regional Medical Center Project) | NR/A | 1,075,000 | 1,169,966 | ||||

| Little Rock Arkansas Capital Improvement, 4.00% due 4/1/2005 (Insured: FSA) | Aaa/AAA | 1,000,000 | 1,018,170 | ||||

| Little Rock Hotel & Restaurant Gross Receipts Tax Refunding, 7.125% due 8/1/2009 | A3/NR | 2,645,000 | 3,000,726 | ||||

| Rogers Sales & Use Tax Revenue, 6.00% due 11/1/2007 | A1/AA- | 1,735,000 | 1,761,736 | ||||

| Rogers Sales & Use Tax Revenue Refunding & Improvement Series A, 4.25% due 9/1/2006 | |||||||

| (Insured: FGIC) | Aaa/AAA | 1,545,000 | 1,611,466 | ||||

| �� California | (2.40%) | ||||||

| Bay Area Government Association Rapid Transit, 4.875% due 6/15/2009 (Insured: | |||||||

| AMBAC) | Aaa/AAA | 2,385,000 | 2,391,129 | ||||

| California Health Facilities Financing Authority Revenue Series B Refunding, 5.25% | |||||||

| due 10/1/2013 (Kaiser Permanente Project) (ETM)* | A3/A | 2,620,000 | 2,836,884 | ||||

| California State Department of Water Resources Power Supply Series A, 5.50% due | |||||||

| 5/1/2008 | A3/BBB+ | 2,050,000 | 2,219,084 | ||||

| California State Department of Water Resources Power Supply Series A, 5.50% due | |||||||

| 5/1/2012 | A3/BBB+ | 2,600,000 | 2,856,308 | ||||

| California State Department of Water Resources Power Supply Series A, 6.00% due | |||||||

| 5/1/2013 | A3/BBB+ | 2,550,000 | 2,874,411 | ||||

| Central Valley Financing Authority Revenue, 6.00% due 7/1/2009 (Carson Ice Project) | NR/BBB | 3,660,000 | 3,783,708 | ||||

| Fairfield Water Revenue Refunding, 5.25% due 4/1/2012 (Insured: AMBAC) | Aaa/AAA | 3,700,000 | 3,865,353 | ||||

| Irvine Improvement Bond Act 1915 Limited Obligation Assessment District, 1.06% due | |||||||

| 9/2/2025 put 7/1/2004 (daily demand notes) | VMIG1/A1+ | 100,000 | 100,000 | ||||

| Metropolitan Water District South California Variable Series B-3, 1.06% due | |||||||

| 7/1/2035 put 7/1/2004 (daily demand notes) | VMIG1/A1+ | 1,400,000 | 1,400,000 | ||||

| Orange County Refunding Recovery, 6.50% due 6/1/2005 (Insured: MBIA) | Aaa/AAA | 5,200,000 | 5,434,312 | ||||

| San Jose Financing Authority Lease Revenue Series D, 5.00% due 6/1/2039 mandatory | |||||||

| put 6/1/2006 (Civic Center Project; Insured: AMBAC) | Aaa/AAA | 3,000,000 | 3,152,640 | ||||

| Torrance Hospital Revenue Series A, 7.10% due 12/1/2015 pre-refunded 12/1/2005 | |||||||

| (Little Co. of Mary Hospital Project) | NR/AAA | 1,380,000 | 1,467,423 | ||||

| Colorado | (3.50%) | ||||||

| Adams County Communication Center Series A, 4.75% due 12/1/2006 | Baa1/NR | 1,500,000 | 1,545,060 | ||||

| Adams County School District 012 Series A, 4.375% due 12/15/2007 | Aa3/AA- | 1,000,000 | 1,051,970 | ||||

| Central Platte Valley Metropolitan District Refunding Series A, 5.00% due 12/1/2031 | |||||||

| put 12/1/2009 (LOC: US Bank) | NR/A1+ | 7,210,000 | 7,542,237 | ||||

| Colorado Department Transport Revenue Anticipation Notes, 6.00% due 6/15/2008 | |||||||

| (Insured: AMBAC) | Aaa/AAA | 1,500,000 | 1,669,365 | ||||

| Colorado Educational & Cultural Facilities, 4.90% due 4/1/2008 (Nashville Public | |||||||

| Radio Project) | NR/BBB+ | 1,000,000 | 1,043,410 | ||||

| Colorado Health Facilities Authority, 5.00% due 9/1/2007 (Catholic Health | |||||||

| Initiatives Project) | Aa2/A1+ | 5,705,000 | 6,050,666 | ||||

| Colorado Health Facilities Authority Series A, 5.375% due 12/1/2009 (Catholic | |||||||

| Health Initiatives Project) | Aa2/A1+ | 515,000 | 552,327 | ||||

| Colorado Housing Finance Authority, 5.25% due 10/1/2007 | A1/AA+ | 220,000 | 221,553 | ||||

| Colorado Springs Utilities Revenue Systems Subordinated Lien Refunding & | |||||||

| Improvement Series A, 5.00% due 11/15/2005 | Aa2/AA | 2,230,000 | 2,326,314 | ||||

| Cucharas Sanitation & Water District Refunding & Improvement, 7.25% due 1/1/2015 | |||||||

| pre-refunded 1/1/2005 | NR/NR | 500,000 | 518,945 | ||||

| Denver City & County Certificates of Participation Series A, 5.50% due 5/1/2006 | |||||||

| (Insured: MBIA) | Aaa/AAA | 500,000 | 529,330 | ||||

| Denver Convention Center Senior Series A, 5.00% due 12/1/2011 (Insured: XLCA) | Aaa/AAA | 3,335,000 | 3,591,095 | ||||

| Dove Valley Metropolitan District Arapahoe County, Series B, 3.30% due 11/1/2025 | |||||||

| put 11/1/2005 @100 (LOC: BNP Paribas) | NR/A1+ | 1,820,000 | 1,851,486 | ||||

| El Paso County School District General Obligation 20 Series B, 8.25% due 12/15/2004 | |||||||

| (State Aid Withholding) | Aa3/NR | 500,000 | 515,450 | ||||

| Highlands Ranch Metropolitan District 2 General Obligation, 6.50% due 6/15/2012 | |||||||

| (Insured: FSA) | Aaa/AAA | 1,000,000 | 1,180,520 | ||||

| Highlands Ranch Metropolitan District Number 3 Refunding Series B, 5.25% due | |||||||

| 12/1/2008 (Insured: ACA) | NR/A | 1,760,000 | 1,855,251 | ||||

| Highlands Ranch Metropolitan District Number 3 Series A, 5.25% due 12/1/2008 | |||||||

| (Insured: ACA) | NR/A | 1,520,000 | 1,602,262 | ||||

| Lakewood Certificates of Participation, 4.40% due 12/1/2008 (Insured: MBIA) | Aaa/AAA | 1,000,000 | 1,050,460 | ||||

| Pinery West Metropolitan District Number 3 Co., 4.70% due 12/1/2021 put 12/1/2007 | |||||||

| (LOC: Compass Bank) | NR/A- | 1,000,000 | 1,035,160 | ||||

| Plaza Metropolitan District 1 Revenue, 7.60% due 12/1/2016 (Public Improvement | |||||||

| Fee/Tax Increment Project) | NR/NR | 6,000,000 | 6,110,760 | ||||

| Regional Transportation District of Colorado Series A, 5.00% due 6/1/2009 (Transit | |||||||

| Vehicles Project; Insured: AMBAC) | Aaa/AAA | 1,000,000 | 1,078,000 | ||||

| Section 14 Metropolitan District Jefferson Refunding Series A, 6.20% due 12/1/2013 | |||||||

| (LOC: US Bank Trust) | NR/AA- | 1,000,000 | 1,018,710 | ||||

| Superior Metropolitan District 1 Variable Refunding & Improvement Series A, 5.45% | |||||||

| due 12/1/2020 put 12/1/2004 (LOC: BNP) | NR/AA- | 1,150,000 | 1,165,732 | ||||

| Westminister Multi Family Housing Revenue Series 1995, 5.95% due 9/1/2015 put | |||||||

| 9/1/2006 (Semper Village Apartments Project; Insured: AXA) | NR/AA | 2,725,000 | 2,738,407 | ||||

| Connecticut | (0.80%) | ||||||

| Bridgeport General Obligation, 6.00% due 3/1/2006 (Insured: AMBAC) | Aaa/AAA | 1,325,000 | 1,406,461 | ||||

| Bridgeport Series A Pre-refunded, 6.00% due 3/1/2005 (Insured: AMBAC) (ETM)* | Aaa/AAA | 800,000 | 823,896 | ||||

| Bridgeport Series A Unrefunded Balance, 6.00% due 3/1/2005 (Insured: AMBAC) | Aaa/AAA | 885,000 | 911,311 | ||||

| Capitol Region Education Council, 6.375% due 10/15/2005 | NR/BBB | 690,000 | 720,767 | ||||

| Connecticut State Health & Educational Facilities Authority Revenue, 5.85% due | |||||||

| 7/1/2007 (Newington Children’s Hospital Project; Insured: MBIA) | Aaa/AAA | 1,000,000 | 1,020,120 | ||||

| Connecticut State Health & Educational Facilities Authority Revenue, 7.50% due | |||||||

| 11/1/2016 (Nursing Home/Highland Project; Insured: AMBAC) | Aaa/AAA | 4,200,000 | 4,365,396 | ||||

| New Haven Connecticut, 3.00% due 11/1/2004 (Insured: FGIC) | Aaa/AAA | 2,010,000 | 2,020,975 | ||||

| Delaware | (0.40%) | ||||||

| Delaware State Health Facilities Authority Revenue, 6.25% due 10/1/2006 (Insured: | |||||||

| MBIA) (ETM)* | Aaa/AAA | 2,000,000 | 2,062,960 | ||||

| Delaware State Health Facilities Authority Revenue Series A, 5.25% due 5/1/2012 | |||||||

| (Nanticoke Memorial Hospital Project; Insured: Radian) | NR/AA | 1,370,000 | 1,466,078 | ||||

| Delaware State Health Facilities Authority Revenue Series A, 5.25% due 5/1/2013 | |||||||

| (Nanticoke Memorial Hospital Project; Insured: Radian) | NR/AA | 1,445,000 | 1,529,793 | ||||

| District of Columbia | (2.60%) | ||||||

| District of Columbia, 5.50% due 6/1/2008 (Insured: AMBAC) | Aaa/AAA | 1,915,000 | 2,087,560 | ||||

| District of Columbia Certificates of Participation, 5.00% due 1/1/2008 (Public | |||||||

| Safety & Emergency Project) | Aaa/AAA | 1,000,000 | 1,066,030 | ||||

| District of Columbia Certificates of Participation, 5.25% due 1/1/2013 (Insured: | |||||||

| AMBAC) | Aaa/AAA | 5,950,000 | 6,370,903 | ||||

| District of Columbia Hospital Revenue, 5.70% due 8/15/2008 (Medlantic Healthcare | |||||||

| Project; Insured: MBIA) (ETM)* | Aaa/AAA | 4,430,000 | 4,819,087 | ||||

| District of Columbia Hospital Revenue Refunding, 5.10% due 8/15/2008 (Medlantic | |||||||

| Healthcare Group A Project; Insured: MBIA) (ETM)* | Aaa/AAA | 1,500,000 | 1,605,660 | ||||

| District of Columbia Revenue, 6.00% due 8/15/2005 (Medlantic Healthcare Project; | |||||||

| Insured: MBIA) (ETM)* | Aaa/AAA | 1,330,000 | 1,392,071 | ||||

| District of Columbia Revenue, 5.50% due 10/1/2005 | Aaa/AAA | 500,000 | 522,735 | ||||

| District of Columbia Revenue, 6.00% due 1/1/2007 (American Assoc. for Advancement | |||||||

| of Science Project; Insured: AMBAC) | Aaa/AAA | 500,000 | 539,675 | ||||

| District of Columbia Revenue, 6.00% due 1/1/2009 (American Assoc. for Advancement | |||||||

| of Science Project; Insured: AMBAC) | Aaa/AAA | 1,000,000 | 1,111,670 | ||||

| District of Columbia Series A, 5.50% due 6/1/2009 (Insured: MBIA) | Aaa/AAA | 4,700,000 | 5,165,864 | ||||

| District of Columbia Tax Capital Appreciation, 0% due 7/1/2009 (Mandarin Oriental | |||||||

| Project; Insured: FSA) | Aaa/AAA | 2,000,000 | 1,664,860 | ||||

| District of Columbia Tax Capital Appreciation, 0% due 7/1/2012 (Mandarin Oriental | |||||||

| Project; Insured: FSA) | Aaa/AAA | 1,480,000 | 1,050,045 | ||||

| District of Columbia Tax Revenue Capital Appreciation, 0% due 7/1/2011 (Mandarin | |||||||

| Oriental Project; Insured: FSA) | Aaa/AAA | 1,990,000 | 1,492,361 | ||||

| Washington DC Convention Center Authority Dedicated Tax Revenue, 5.00% due | |||||||

| 10/1/2006 (Insured: AMBAC) | Aaa/AAA | 750,000 | 793,335 | ||||

| Washington DC Convention Center Senior Lien, 5.00% due 10/1/2007 | Aaa/AAA | 6,110,000 | 6,522,914 | ||||

| Florida | (4.70%) | ||||||

| Broward County Resource Recovery Revenue Refunding, 5.375% due 12/1/2009 | A3/AA- | 5,000,000 | 5,390,700 | ||||

| Capital Projects Finance Authority Student Housing, 5.50% due 10/1/2012 (Capital | |||||||

| Projects Student Housing; Insured: MBIA) | Aaa/AAA | 1,000,000 | 1,080,750 | ||||

| Crossings at Fleming Island Community Development Refunding Series B, 5.45% due | |||||||

| 5/1/2010 (Insured: MBIA) | Aaa/AAA | 2,996,000 | 3,312,498 | ||||

| Dade County Solid Waste Systems Special Obligation Revenue Refunding, 6.00% due | |||||||

| 10/1/2007 (Insured: AMBAC) | Aaa/AAA | 7,000,000 | 7,698,320 | ||||

| Florida State Refunding, 6.00% due 7/1/2006 (Department of Transportation Right of | |||||||

| Way Project) | Aa2/AA+ | 1,465,000 | 1,574,992 | ||||

| Hillsborough County Capital Improvement Program Revenue Refunding Junior Lien, | |||||||

| 5.00% due 8/1/2008 (Criminal Justice Project; Insured: FGIC) | Aaa/AAA | 1,000,000 | 1,075,670 | ||||

| Hillsborough County Industrial Development Authority Pollution Control Revenue | |||||||

| Refunding, 4.00% due 9/1/2025 put 8/1/2007 (Tampa Electric Co. Project) | Baa2/BBB- | 2,400,000 | 2,405,952 | ||||

| Jacksonville Electric St. John’s River Park Systems Revenue Refunding Issue-2 17th | |||||||

| Series, 5.25% due 10/1/2012 | Aa2/AA- | 5,000,000 | 5,414,350 | ||||

| Miami Dade County School Board Certificates of Participation Series A, 5.00% due | |||||||

| 5/1/2006 (Insured: MBIA) | Aaa/AAA | 1,910,000 | 2,005,557 | ||||

| Miami Dade County School Board Certificates of Participation Series B, 5.50% due | |||||||

| 5/1/2031 put 5/1/2011 (Insured: MBIA) | Aaa/AAA | 1,000,000 | 1,096,840 | ||||

| Miami Dade County School Board Certificates of Participation Series C, 5.00% due | |||||||

| 8/1/2007 (Insured: MBIA) | Aaa/AAA | 3,390,000 | 3,626,893 | ||||

| Miami Dade County Special Housing Revenue Refunding, 5.80% due 10/1/2012 (HUD | |||||||

| Section 8) | Baa3/NR | 3,700,000 | 3,612,088 | ||||

| Orange County Health Facilities Authority, 5.80% due 11/15/2009 (Adventist Health | |||||||

| System Project) | A3/A | 1,395,000 | 1,526,800 | ||||

| Orange County Health Facilities Authority Revenue Refunding, 6.25% due 11/15/2008 | |||||||

| (Adventist Health Systems Project; Insured: AMBAC) | Aaa/AAA | 3,120,000 | 3,351,566 | ||||

| Orange County Health Facilities Authority Revenue Unrefunded Balance Series A, | |||||||

| 6.25% due 10/1/2007 (Orlando Regional Hospital Project; Insured: MBIA) | Aaa/AAA | 925,000 | 1,021,690 | ||||

| Orange County School Board Certificates Series A, 5.00% due 8/1/2006 | Aaa/NR | 5,000,000 | 5,282,350 | ||||

| Orange County School District Series B, 1.06% due 8/1/2025 put 7/1/2004 (Insured: | |||||||

| AMBAC) (daily demand notes) | Aaa/NR | 1,500,000 | 1,500,000 | ||||

| Palm Beach County Industrial Development Revenue Series 1996, 6.00% due 12/1/2006 | |||||||

| (Lourdes-Noreen McKeen Residence Project; LOC: Allied Irish Bank) (ETM)* | NR/A | 940,000 | 1,016,591 | ||||

| Palm Beach County Solid Waste Authority Revenue Refunding Series A, 5.00% due | |||||||

| 10/1/2005 | Aa3/AA- | 2,420,000 | 2,509,008 | ||||

| Pasco County Housing Finance Authority Multi Family Revenue Refunding Series A, | |||||||

| 5.35% due 6/1/2027 put 6/1/2008 (Oak Trail Apts Project; Insured: AXA) | NR/AA- | 1,000,000 | 1,046,310 | ||||

| Pelican Marsh Community Development District Refunding Series A, 5.00% due 5/1/2011 | |||||||

| (Insured: Radian) | NR/NR | 3,445,000 | 3,582,628 | ||||

| Tampa Florida Guaranteed Entitlement Revenue Refunding, 6.00% due 10/1/2007 | |||||||

| (Insured: AMBAC) | Aaa/AAA | 2,040,000 | 2,247,529 | ||||

| University Athletic Association Inc. Florida Athletic Program Revenue Refunding, | |||||||

| 2.20% due 10/1/2031 put 10/1/2005 (LOC: Suntrust Bank) | VMIG1/NR | 3,000,000 | 3,015,030 | ||||

| Georgia | (1.10%) | ||||||

| Cobb County School District, 4.75% due 2/1/2005 | Aa1/AA+ | 1,000,000 | 1,012,730 | ||||

| Georgia Municipal Association Inc. Certificates of Participation City Court Atlanta | |||||||

| Project, 5.00% due 12/1/2006 (Insured: AMBAC) | Aaa/AAA | 1,000,000 | 1,061,230 | ||||

| Georgia Municipal Electric Power Authority Revenue, 7.00% due 1/1/2008 (Insured: | |||||||

| MBIA) | Aaa/AAA | 1,550,000 | 1,754,150 | ||||

| Georgia Municipal Electric Power Authority Revenue Series Y, 6.30% due 1/1/2006 | A2/A+ | 730,000 | 772,333 | ||||

| Georgia Municipal Gas Authority, 6.30% due 7/1/2009 (Southern Storage Gas Project) | NR/A | 1,000,000 | 1,031,390 | ||||

| Monroe County Development Authority Pollution Control, 6.75% due 1/1/2010 | |||||||

| (Oglethorpe Power Scherer A Refunding; Insured: MBIA) | Aaa/AAA | 2,000,000 | 2,324,960 | ||||

| Monroe County Development Authority Pollution Control Revenue Oglethorpe Power | |||||||

| Scherer A, 6.80% due 1/1/2012 (Insured: MBIA) | Aaa/AAA | 1,000,000 | 1,194,110 | ||||

| Municipal Electric Authority Georgia Subordinated Series B, 5.00% due 1/1/2026 put | |||||||

| 1/1/2009 (Project One; Insured: AMBAC) | Aaa/AAA | 5,000,000 | 5,352,950 | ||||

| Municipal Electric Authority Georgia Unrefunded Balance Subordinated A, 6.00% due | |||||||

| 1/1/2006 (Project One; Insured: AMBAC) | Aaa/AAA | 910,000 | 961,533 | ||||

| Hawaii | (0.40%) | ||||||

| Hawaii State Department of Budget & Finance Special Purpose Hawaiian Electric Co., | |||||||

| 4.95% due 4/1/2012 (Insured: MBIA) | Aaa/AAA | 2,000,000 | 2,132,320 | ||||

| Hawaii State Refunding Series Cb, 5.75% due 1/1/2007 | Aa3/AA- | 1,000,000 | 1,076,350 | ||||

| Hawaii State Series CN, 6.25% due 3/1/2006 (Insured: FGIC) | Aaa/AAA | 1,565,000 | 1,669,182 | ||||

| Honolulu City & County Refunding Series A, 7.35% due 7/1/2006 | Aa2/AA- | 1,000,000 | 1,097,880 | ||||

| Illinois | (10.50%) | ||||||

| Champaign County Community Unit Series C, 0% due 1/1/2009 (Insured: FGIC) | Aaa/AAA | 3,345,000 | 2,847,297 | ||||

| Chicago Board of Education, 6.00% due 12/1/2009 (Insured: FGIC) | Aaa/AAA | 2,000,000 | 2,254,900 | ||||

| Chicago Board of Education School Reform, 6.25% due 12/1/2012 (Insured: MBIA) | Aaa/AAA | 750,000 | 875,310 | ||||

| Chicago Housing Authority Capital Program Revenue, 5.25% due 7/1/2010 | Aa3/AA | 2,300,000 | 2,480,067 | ||||

| Chicago Metropolitan Water Reclamation District, 6.90% due 1/1/2007 | Aaa/AA+ | 2,300,000 | 2,536,026 | ||||

| Chicago Midway Airport Revenue Series A, 5.40% due 1/1/2009 (Insured: MBIA) | Aaa/AAA | 1,340,000 | 1,427,408 | ||||

| Chicago Midway Airport Revenue Series C, 5.50% due 1/1/2013 (Insured: MBIA) | Aaa/AAA | 1,180,000 | 1,297,587 | ||||

| Chicago O’Hare International Airport Refunding General Airport Series A, 6.375% due | |||||||

| 1/1/2012 (Insured: MBIA) | Aaa/AAA | 3,420,000 | 3,562,990 | ||||

| Chicago O’Hare International Airport Revenue, 5.375% due 1/1/2007 (Insured: AMBAC) | Aaa/AAA | 1,000,000 | 1,059,720 | ||||

| Chicago O’Hare International Airport Revenue, 5.00% due 1/1/2012 (Insured: MBIA) | Aaa/AAA | 1,105,000 | 1,185,632 | ||||

| Chicago O’Hare International Airport Revenue 2nd Lien Series C-1, 5.00% due | |||||||

| 1/1/2010 (Insured: MBIA) | Aaa/AAA | 1,000,000 | 1,076,040 | ||||

| Chicago O’Hare International Airport Revenue Passenger Facility Change Series A, | |||||||

| 6.00% due 1/1/2006 (Insured: AMBAC) | Aaa/AAA | 3,000,000 | 3,168,990 | ||||

| Chicago O’Hare International Airport Revenue Refunding, 4.80% due 1/1/2005 | |||||||

| (Insured: AMBAC) | Aaa/AAA | 690,000 | 701,571 | ||||

| Chicago O’Hare International Airport Revenue Refunding Series A, 4.90% due 1/1/2006 | |||||||

| (Insured: MBIA) | Aaa/AAA | 675,000 | 690,100 | ||||

| Chicago O’Hare International Airport Revenue Series C-1, 5.00% due 1/1/2008 | |||||||

| (Insured: MBIA) | Aaa/AAA | 6,000,000 | 6,398,220 | ||||

| Chicago Park District, 6.60% due 11/15/2014 partially pre-refunded 5/15/2005 | Aa3/AA | 1,700,000 | 1,803,343 | ||||

| Chicago Park District Parking Facility Revenue, 5.75% due 1/1/2010 (ETM)* | Baa1/A | 1,000,000 | 1,117,040 | ||||

| Chicago Public Commerce Building Revenue, 5.00% due 3/1/2005 (Insured: AMBAC) | Aaa/AAA | 750,000 | 767,378 | ||||

| Chicago Public Commerce Building Revenue Series C, 5.50% due 2/1/2006 (Insured: | |||||||

| FGIC) | Aaa/AAA | 2,000,000 | 2,103,760 | ||||

| Chicago Refunding Series A, 5.375% due 1/1/2013 (Insured: MBIA) | Aaa/AAA | 2,000,000 | 2,177,060 | ||||

| Chicago Refunding Series A-2, 6.125% due 1/1/2012 (Insured: AMBAC) | Aaa/AAA | 1,000,000 | 1,151,250 | ||||

| Chicago Tax Increment Allocation Central Series A, 0% due 12/1/2005 (Insured: | |||||||

| AMBAC) | Aaa/AAA | 5,000,000 | 4,866,800 | ||||

| Cicero Refunding Tax Increment Series A, 4.25% due 1/1/2007 (Insured: FGIC) | Aaa/AAA | 1,000,000 | 1,038,740 | ||||

| Collinsville Leased Facilities Revenue Refunding, 5.15% due 11/1/2004 (Insured: | |||||||

| MBIA) | Aaa/AAA | 1,000,000 | 1,012,220 | ||||

| Cook & Will Counties Township High School District 206 Series C, 0% due 12/1/2005 | |||||||

| (Insured: FSA) | Aaa/AAA | 2,545,000 | 2,477,201 | ||||

| Cook County Capital Improvement, 5.50% due 11/15/2008 pre-refunded 11/15/2006 | Aaa/AAA | 995,000 | 1,078,083 | ||||

| Cook County Community School District 97 Series B, 9.00% due 12/1/2013 (Insured: | |||||||

| FGIC) | Aaa/NR | 2,250,000 | 3,109,950 | ||||

| Cook County Series C Refunding, 5.80% due 11/15/2004 (Insured: FGIC) | Aaa/AAA | 2,650,000 | 2,693,539 | ||||

| Du Page County Forest Preservation District, 0% due 11/1/2009 | Aaa/AAA | 5,000,000 | 4,111,550 | ||||

| Glenview Multi Family Revenue Refunding, 5.20% due 12/1/2027 put 12/1/2007 | |||||||

| (Collateralized: FNMA) | NR/AAA | 1,500,000 | 1,560,165 | ||||

| Hoffman Estates Illinois Tax Increment Revenue, 0% due 5/15/2005 (Hoffman Estates | |||||||

| Economic Dev. Project; Guaranty: Sears) | Baa1/NR | 1,015,000 | 986,357 | ||||

| Hoffman Estates Illinois Tax Increment Revenue, 0% due 5/15/2006 (Hoffman Estates | |||||||

| Economic Dev. Project; Guaranty: Sears) | Baa1/NR | 3,075,000 | 2,874,756 | ||||

| Hoffman Estates Illinois Tax Increment Revenue Refunding, 5.25% due 11/15/2009 | |||||||

| (Economic Development Project; Insured: AMBAC) | Aaa/AAA | 5,000,000 | 5,065,450 | ||||

| Illinois Department Central Management Services Certificates of Participation, | |||||||

| 5.85% due 7/1/2009 (Insured: MBIA) | Aaa/AAA | 1,000,000 | 1,061,120 | ||||

| Illinois Development Finance Authority Pollution Control Revenue Refunding, 5.70% | |||||||

| due 1/15/2009 (Commonwealth Edison Company Project; Insured: MBIA) | Aaa/AAA | 3,000,000 | 3,290,970 | ||||

| Illinois Development Finance Authority Revenue, 4.00% due 11/15/2005 (Insured: | |||||||

| XLCA) | Aaa/AAA | 860,000 | 884,218 | ||||

| Illinois Development Finance Authority Revenue, 4.00% due 11/15/2006 (Insured: | |||||||

| XLCA) | Aaa/AAA | 915,000 | 947,528 | ||||

| Illinois Development Finance Authority Revenue, 6.00% due 11/15/2009 (Adventist | |||||||

| Health Project; Insured: MBIA) | Aaa/AAA | 3,635,000 | 4,030,561 | ||||

| Illinois Development Finance Authority Revenue, 6.35% due 7/1/2010 pre-refunded | |||||||

| 7/1/2005 (Elderly Housing 8 Mattoon Tower A Project) | A3/NR | 1,005,000 | 1,048,798 | ||||

| Illinois Development Finance Authority Revenue, 6.00% due 11/15/2010 (Adventist | |||||||

| Health Project; Insured: MBIA) | Aaa/AAA | 3,860,000 | 4,312,276 | ||||

| Illinois Development Finance Authority Revenue, 5.25% due 2/15/2011 (Insured: | |||||||

| AMBAC) | NR/AAA | 785,000 | 816,431 | ||||

| Illinois Development Finance Authority Revenue Refunding Community Rehab Providers | |||||||

| A, 5.60% due 7/1/2004 | NR/BBB | 400,000 | 400,032 | ||||

| Illinois Development Finance Authority Revenue Refunding Community Rehab Providers | |||||||

| A, 5.60% due 7/1/2005 | NR/BBB | 1,000,000 | 1,022,110 | ||||

| Illinois Development Finance Authority Revenue Refunding Community Rehab Providers | |||||||

| A, 5.60% due 7/1/2006 | NR/BBB | 1,000,000 | 1,033,420 | ||||

| Illinois Development Finance Authority Revenue Refunding Community Rehab Providers | |||||||

| Series A, 6.00% due 7/1/2015 | NR/BBB | 4,500,000 | 4,615,425 | ||||

| Illinois Health Facilities Authority Revenue, 5.50% due 11/15/2007 (OSF Healthcare | |||||||

| System Project) | A2/A | 915,000 | 975,893 | ||||

| Illinois Health Facilities Authority Revenue, 6.50% due 2/15/2008 (Iowa Health | |||||||

| System Project) | A1/NR | 1,290,000 | 1,418,536 | ||||

| Illinois Health Facilities Authority Revenue, 6.50% due 2/15/2009 (Iowa Health | |||||||

| System Project) | A1/NR | 1,375,000 | 1,531,337 | ||||

| Illinois Health Facilities Authority Revenue, 6.50% due 2/15/2010 (Iowa Health | |||||||

| System Project) | A1/NR | 1,465,000 | 1,643,701 | ||||

| Illinois Health Facilities Authority Revenue, 6.00% due 2/15/2011 (Iowa Health | |||||||

| System Project; Insured: AMBAC) | Aaa/AAA | 1,560,000 | 1,742,785 | ||||

| Illinois Health Facilities Authority Revenue Refunding, 4.00% due 8/15/2005 | |||||||

| (University of Chicago Hospital & Health Project) | Aaa/AAA | 1,000,000 | 1,024,620 | ||||

| Illinois Health Facilities Authority Revenue Refunding, 5.00% due 8/15/2006 | |||||||

| (University of Chicago Hospital & Health Project) | Aaa/AAA | 1,000,000 | 1,054,290 | ||||

| Illinois Health Facilities Authority Revenue Refunding, 5.00% due 8/15/2007 | |||||||

| (University of Chicago Hospital & Health Project) | Aaa/AAA | 1,500,000 | 1,598,085 | ||||

| Illinois Health Facilities Authority Revenue Refunding, 5.00% due 8/15/2008 | |||||||

| (University of Chicago Hospital & Health Project) | Aaa/AAA | 1,500,000 | 1,606,260 | ||||

| Illinois Health Facilities Authority Revenue Refunding, 5.50% due 11/15/2011 | |||||||

| (Methodist Medical Center Project; Insured: MBIA) | Aaa/AAA | 3,000,000 | 3,252,540 | ||||

| Illinois Health Facilities Authority Revenue Series 1993-A, 7.875% due 8/15/2005 | |||||||

| (Community Provider Pooled Loan Program Project) | NR/NR | 104,000 | 104,626 | ||||

| Illinois Health Facilities Authority Revenue University of Chicago, 5.00% due | |||||||

| 8/15/2009 (Hospital Systems Project; Insured: MBIA) | Aaa/AAA | 1,000,000 | 1,071,770 | ||||

| Illinois Hospital District, 5.50% due 1/1/2010 (Insured: FGIC) | Aaa/AAA | 1,040,000 | 1,138,935 | ||||

| Illinois State COPS Central Management Department, 5.00% due 7/1/2007 (Insured: | |||||||

| AMBAC) | Aaa/AAA | 500,000 | 532,955 | ||||

| Illinois State Partners Series A, 6.00% due 7/1/2006 (Insured: AMBAC) | Aaa/AAA | 1,000,000 | 1,072,630 | ||||

| Illinois State Refunding, 5.125% due 12/1/2006 (Insured: FGIC) | Aaa/AAA | 2,250,000 | 2,379,173 | ||||

| Kankakee Series A, 5.25% due 1/1/2012 pre-refunded 1/1/2006 @100 | Aaa/AAA | 920,000 | 963,912 | ||||

| Kankakee Unrefunded Balance Series A, 5.25% due 1/1/2012 (Insured: FSA) | Aaa/AAA | 80,000 | 83,358 | ||||

| Lake County Community Consolidated School District 73, 9.00% due 1/1/2006 (Insured: | |||||||

| FSA) | Aaa/NR | 1,000,000 | 1,098,720 | ||||

| Lake County Community High School District 117 Series B, 0% due 12/1/2006 (Insured: | |||||||

| FGIC) | Aaa/NR | 2,000,000 | 1,877,300 | ||||

| Lake County Community High School District 117 Series B, 0% due 12/1/2011 (Insured: | |||||||

| FGIC) | Aaa/NR | 3,235,000 | 2,387,430 | ||||

| Lake County Consolidated High School Refunding, 3.00% due 12/1/2004 | NR/AA- | 2,370,000 | 2,384,457 | ||||

| Lake County Consolidated High School Refunding, 3.25% due 12/1/2005 | NR/AA- | 2,990,000 | 3,045,225 | ||||

| McHenry & Kane Counties Community Consolidated School District 158, 0% due 1/1/2010 | |||||||

| (Insured: FGIC) | Aaa/AAA | 1,000,000 | 808,090 | ||||

| Metropolitan Pier & Exposition Authority Dedicated State Tax Revenue Refunding | |||||||

| Series A-2002, 6.00% due 6/15/2007 (McCormick Place Exposition Project; Insured: | |||||||

| AMBAC) | Aaa/AAA | 1,250,000 | 1,365,175 | ||||

| Metropolitan Pier & Exposition Authority Dedicated State Tax Revenue Refunding | |||||||

| Series A-2002, 6.00% due 6/15/2007 pre-refunded 6/15/2006 @102 (McCormick Place | |||||||

| Exposition Project; Insured: AMBAC) | Aaa/AAA | 3,750,000 | 4,057,050 | ||||

| Naperville City, Du Page & Will Counties Economic Development Revenue, 6.10% due | |||||||

| 5/1/2008 (Hospital & Health System Association Project; LOC: American National | |||||||

| Bank) | NR/A-1 | 2,445,000 | 2,541,675 | ||||

| Peoria Public Building Commission School District Facilities Revenue, 0% due | |||||||

| 12/1/2007 (Insured: FGIC) | Aaa/NR | 1,100,000 | 989,175 | ||||

| University of Illinois Revenue, 0% due 10/1/2006 (Insured: MBIA) | Aaa/AAA | 6,300,000 | 5,954,445 | ||||

| Indiana | (4.30%) | ||||||

| Allen County Economic Development Revenue, 5.00% due 12/30/2012 (Indiana Institute | |||||||

| of Technology Project) | NR/NR | 1,370,000 | 1,409,168 | ||||

| Allen County Economic Development Revenue First Mortgage, 5.20% due 12/30/2005 | |||||||

| (Indiana Institute of Technology Project) | NR/NR | 965,000 | 1,003,426 | ||||

| Allen County Economic Development Revenue First Mortgage, 5.30% due 12/30/2006 | |||||||

| (Indiana Institute of Technology Project) | NR/NR | 690,000 | 727,626 | ||||

| Allen County Economic Development Revenue First Mortgage, 5.60% due 12/30/2009 | |||||||

| (Indiana Institute of Technology Project) | NR/NR | 1,110,000 | 1,188,688 | ||||

| Allen County Jail Building Corp. First Mortgage, 5.75% due 10/1/2010 | Aa3/NR | 1,115,000 | 1,249,079 | ||||

| Ball State University Revenues Student Fee Series K, 5.75% due 7/1/2012 (Insured: | |||||||

| FGIC) | Aaa/AAA | 1,000,000 | 1,121,410 | ||||

| Boone County Hospital Association Lease Revenue, 5.00% due 1/15/2007 (Insured: | |||||||

| FGIC) (ETM)* | Aaa/AAA | 1,085,000 | 1,149,015 | ||||

| Boonville Junior High School Building Corp. Revenue, 0% due 7/1/2010 (State Aid) | NR/A | 850,000 | 652,264 | ||||

| Boonville Junior High School Building Corp. Revenue, 0% due 1/1/2011 (State Aid) | NR/A | 850,000 | 630,377 | ||||

| Boonville Junior High School Building Corp. Revenue Refunding, 0% due 7/1/2011 | |||||||

| (State Aid) | NR/A | 950,000 | 687,591 | ||||

| Center Grove 2000 Building First Mortgage, 5.00% due 7/15/2009 (Insured: AMBAC) | Aaa/AAA | 1,175,000 | 1,266,438 | ||||

| Center Grove 2000 Building First Mortgage, 5.00% due 7/15/2010 (Insured: AMBAC) | Aaa/AAA | 1,135,000 | 1,225,369 | ||||

| Eagle Union Middle School Building Corp., 5.50% due 7/15/2009 (Insured: AMBAC) | |||||||

| (ETM)* | Aaa/AAA | 910,000 | 1,007,261 | ||||

| Elberfeld J. H. Castle School Building Corp. Indiana First Mortgage (State Aid), 0% | |||||||

| due 1/15/2006 | NR/A | 1,860,000 | 1,779,443 | ||||

| Elberfeld J. H. Castle School Building Corp. Indiana First Mortgage Refunding, 0% | |||||||

| due 7/5/2008 (Insured: MBIA) | Aaa/AAA | 1,860,000 | 1,624,580 | ||||

| Evansville Vanderburgh School Building Corp. First Mortgage, 5.00% due 1/15/2008 | |||||||

| (Insured: FSA) | Aaa/AAA | 965,000 | 1,028,777 | ||||

| Goshen Multi School Building Corp. First Mortgage, 5.20% due 7/15/2007 (Insured: | |||||||

| MBIA) | Aaa/AAA | 965,000 | 1,034,634 | ||||

| Hammond Multi-School Building Corp. First Mortgage Refunding Bond Series 1997, | |||||||

| 6.00% due 7/15/2008 (Lake County Project) | NR/A | 2,305,000 | 2,491,843 | ||||

| Huntington Economic Development Revenue, 6.00% due 11/1/2006 (United Methodist | |||||||

| Membership Project) | NR/NR | 390,000 | 412,503 | ||||

| Huntington Economic Development Revenue, 6.15% due 11/1/2008 (United Methodist | |||||||

| Membership Project) | NR/NR | 700,000 | 755,048 | ||||

| Huntington Economic Development Revenue, 6.20% due 11/1/2010 (United Methodist | |||||||

| Membership Project) | NR/NR | 790,000 | 837,037 | ||||

| Indiana Health Facility Financing Authority Hospital Revenue, 5.75% due 11/1/2005 | |||||||

| (Daughters of Charity Project) (ETM)* | Aaa/NR | 180,000 | 185,200 | ||||

| Indiana Health Facility Financing Authority Hospital Revenue Series D, 5.00% due | |||||||

| 11/1/2026 pre-refunded 11/1/2007 | Aaa/NR | 1,265,000 | 1,331,084 | ||||

| Indiana State Educational Facilities Authority Revenue, 5.75% due 10/1/2009 | |||||||

| (University of Indianapolis Project) | NR/A- | 670,000 | 731,975 | ||||

| Indiana University Revenues Refunding, 0% due 8/1/2007 (Insured: AMBAC) | Aaa/AAA | 2,500,000 | 2,280,700 | ||||

| Indianapolis Airport Authority Revenue Refunding Series A, 5.75% due 7/1/2005 | |||||||

| (Insured: FGIC) | Aaa/AAA | 1,000,000 | 1,040,100 | ||||

| Indianapolis Airport Authority Revenue Refunding Series A, 5.35% due 7/1/2007 | |||||||

| (Insured: FGIC) | Aaa/AAA | 1,100,000 | 1,176,417 | ||||

| Indianapolis Local Public Improvement Bond Bank Transportation Revenue, 0% due | |||||||

| 7/1/2005 (ETM)* | Aa2/NR | 1,220,000 | 1,199,589 | ||||

| Indianapolis Local Public Improvement Bond Bank Transportation Revenue, 0% due | |||||||

| 7/1/2006 (ETM)* | Aa2/NR | 1,240,000 | 1,184,250 | ||||

| Indianapolis Resource Recovery Revenue Refunding, 6.75% due 12/1/2004 (Ogden Martin | |||||||

| Systems, Inc. Project; Insured: AMBAC) | Aaa/AAA | 2,200,000 | 2,245,518 | ||||

| Indianapolis Resource Recovery Revenue Refunding, 6.75% due 12/1/2006 (Ogden Martin | |||||||

| Systems, Inc. Project; Insured: AMBAC) | Aaa/AAA | 2,000,000 | 2,183,020 | ||||

| Knox Middle School Building Corp. First Mortgage, 6.00% due 7/15/2008 (Insured: | |||||||

| FGIC) | Aaa/AAA | 855,000 | 948,802 | ||||

| Knox Middle School Building Corp. First Mortgage, 6.00% due 7/15/2009 (Insured: | |||||||

| FGIC) | Aaa/AAA | 455,000 | 510,478 | ||||

| Merrillville Multi School Building Corp. Refunding First Mortgage, 6.55% due | |||||||

| 7/1/2005 (Insured: MBIA) | Aaa/AAA | 890,000 | 932,462 | ||||

| Monroe County Community School Building Corp. Revenue Refunding, 5.00% due | |||||||

| 1/15/2007 (Insured: AMBAC) | Aaa/AAA | 625,000 | 661,244 | ||||

| North Adams Community Schools, 3.50% due 7/15/2004 (Insured: FSA) | Aaa/AAA | 405,000 | 405,336 | ||||

| North Adams Community Schools, 4.00% due 7/15/2005 (Insured: FSA) | Aaa/AAA | 940,000 | 962,175 | ||||

| North Central Campus School Building Corp. Indiana, 4.50% due 7/10/2005 (Insured: | |||||||

| AMBAC) | Aaa/AAA | 1,070,000 | 1,100,506 | ||||

| Northwest Allen Building Corp. First Mortgage, 5.30% due 12/1/2005 (Insured: MBIA) | Aaa/AAA | 684,000 | 706,846 | ||||

| Peru Community School Corp. Refunding First Mortgage, 0% due 7/1/2010 | NR/A | 835,000 | 640,754 | ||||

| Plymouth Multi School Building Corp. Refunding, 5.50% due 7/1/2005 (Plymouth | |||||||

| Community School Project; Insured: MBIA) | Aaa/AAA | 1,655,000 | 1,688,481 | ||||

| Rockport Pollution Control Revenue Series C, 2.625% due 4/1/2025 put 10/1/2006 | |||||||

| (Indiana Michigan Power Co. Project) | Baa2/BBB | 4,000,000 | 3,955,760 | ||||

| Vigo County Elementary School Building Corp. Refunding & Improvement First | |||||||

| Mortgage, 4.00% due 1/10/2006 (Insured: FSA) | Aaa/AAA | 1,540,000 | 1,582,180 | ||||

| Vigo County Elementary School Building Corp. Refunding & Improvement First | |||||||

| Mortgage, 4.00% due 1/10/2008 (Insured: FSA) | Aaa/AAA | 1,635,000 | 1,690,165 | ||||

| Wawasee Community School Corp. First Mortgage, 5.50% due 7/15/2010 (State Aid) | NR/AA- | 995,000 | 1,095,395 | ||||

| Wawasee Community School Corp. First Mortgage, 5.50% due 7/15/2011 (State Aid) | NR/AA- | 1,095,000 | 1,207,336 | ||||

| West Clark School Building Corp. First Mortgage, 5.75% due 7/15/2011 (Insured: | |||||||

| FGIC) | Aaa/AAA | 2,080,000 | 2,340,249 | ||||

| Westfield Elem. School Building Corp. First Mortgage Series 1997, 6.80% due | |||||||

| 7/15/2007 (Insured: AMBAC) (ETM)* | Aaa/AAA | 1,820,000 | 2,032,285 | ||||

| Iowa | (2.10%) | ||||||

| Ankeny Community School District Sales & Services Tax Revenue, 5.00% due 7/1/2010 | NR/A+ | 2,900,000 | 3,083,628 | ||||

| Des Moines Limited Obligation Revenue, 6.25% due 12/1/2015 put 12/1/2005 (Des | |||||||

| Moines Parking Associates Project; LOC: Wells Fargo Bank) | NR/NR | 3,515,000 | 3,520,519 | ||||

| Iowa Finance Authority Commercial Development Revenue Refunding, 5.75% due 4/1/2014 | |||||||

| put 4/1/2010 (Governor Square Project; Insured: AXA) | NR/AA | 6,650,000 | 6,992,142 | ||||

| Iowa Finance Authority Hospital Facility Revenue, 6.50% due 2/15/2007 (Iowa Health | |||||||

| Services Project) | A1/NR | 435,000 | 470,618 | ||||

| Iowa Finance Authority Hospital Facility Revenue, 6.50% due 2/15/2009 (Iowa Health | |||||||