UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05201

Thornburg Investment Trust

(Exact name of registrant as specified in charter)

| 119 East Marcy Street, Santa Fe, New Mexico | 87501 | |

| (Address of principal executive offices) | (Zip code) |

Garrett Thornburg, 119 East Marcy Street, Santa Fe, New Mexico 87501

(Name and address of agent for service)

Registrant’s telephone number, including area code: 505-984-0200

Date of fiscal year end: September 30, 2006

Date of reporting period: March 31, 2006

Item 1. Reports to Stockholders

The following semiannual reports are attached hereto, in order:

Thornburg Limited Term Municipal Fund

Thornburg Limited Term Municipal Fund Class I

Thornburg California Limited Term Municipal Fund

Thornburg California Limited Term Municipal Fund Class I

Thornburg Intermediate Municipal Fund

Thornburg Intermediate Municipal Fund Class I

Thornburg New Mexico Intermediate Municipal Fund

Thornburg Florida Intermediate Municipal Fund

Thornburg New York Intermediate Municipal Fund

Thornburg Limited Term Income Funds

Thornburg Limited Term Income Funds Class I

Thornburg Value Fund

Thornburg Value Fund Class I

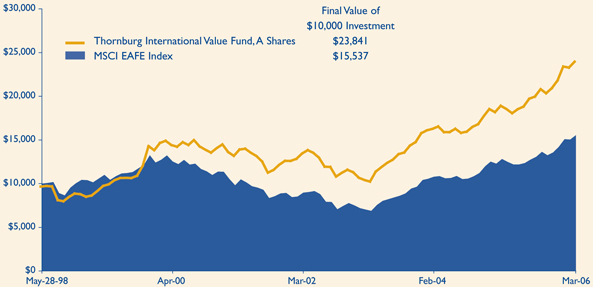

Thornburg International Value Fund

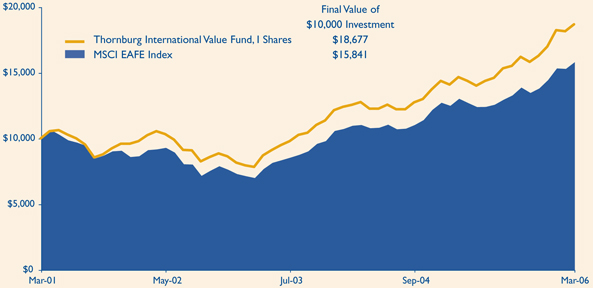

Thornburg International Value Fund Class I

Thornburg Core Growth Fund

Thornburg Core Growth Fund Class I

Thornburg Investment Income Builder Fund

Thornburg Investment Income Builder Fund Class I

Thornburg Limited Term Municipal Fund

Laddering – an All Weather Strategy

The Fund’s investment objective is to obtain as high a level of current income exempt from Federal income taxes as is consistent, in the view of the Fund’s investment advisor, with preservation of capital (may be subject to Alternative Minimum Tax).

This Fund is a laddered portfolio of municipal bonds with an average maturity of five years or less. Laddering involves building a portfolio of bonds with staggered maturities so that a portion of the portfolio matures each year; cash from maturing bonds, if not needed for other purposes, is invested in bonds with longer maturities at the far end of the ladder. The strategy is a good compromise for managing different types of risk.

Thornburg Bond Funds

| • | Thornburg Limited Term Municipal Fund |

| • | Thornburg Intermediate Municipal Fund |

| • | Thornburg California Limited Term Municipal Fund |

| • | Thornburg New Mexico Intermediate Municipal Fund |

| • | Thornburg Florida Intermediate Municipal Fund |

| • | Thornburg New York Intermediate Municipal Fund |

| • | Thornburg Limited Term U.S. Government Fund |

| • | Thornburg Limited Term Income Fund |

Thornburg invests in short- and intermediate-term investment grade bonds. We ladder the maturities of individual bonds in the portfolios to moderate risk. Laddering involves building a portfolio of bonds with staggered maturities so that a portion of the portfolio will mature each year. We apply this disciplined process in all interest rate environments.

Thornburg Equity Funds

| • | Thornburg Value Fund |

| • | Thornburg International Value Fund |

| • | Thornburg Core Growth Fund |

| • | Thornburg Investment Income Builder Fund |

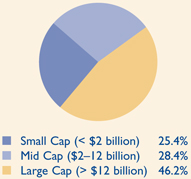

Thornburg’s equity research uses a fundamental, yet comprehensive, analytical approach. We invest when and where we perceive compelling value. Thornburg equity funds focus on a limited number of securities so that each holding can impact performance. The equity team searches for firms believed to have a promising future and seeks to buy shares of those companies at a discount to their intrinsic value.

More information at www.thornburg.com

| Reduce paper clutter. Receive your shareholder reports and prospectus online instead of through traditional mail.

Sign up at www.thornburg.com/edelivery |

2 This page is not part of the Semi-Annual Report. |

2006

Certified Semi-Annual Report

Thornburg Limited Term Municipal Fund

March 31, 2006

| 5 | ||

| 7 | ||

| 8 | ||

| 9 | ||

| 10 | ||

| 13 | ||

| 16 | ||

| 36 | ||

| 37 | ||

This report is certified under the Sarbanes-Oxley Act of 2002, which requires that public companies, including mutual funds, affirm that the information provided in their annual and semiannual shareholder reports fully and fairly represents their financial position.

| Certified Semi-Annual Report 3 |

Important Information

Performance data quoted represents past performance and does not guarantee future results. Investment return and principal value will fluctuate so that upon redemption, investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than the data quoted. For performance data current to the most recent month end, visit www.thornburg.com.

The maximum sales charge for the Fund’s A shares is 1.50%. C shares include a 0.50% contingent deferred sales charge (CDSC) for the first year only.

Performance data given at net asset value (NAV) does not take into account these sales charges. If the sales charges had been included, the performance would have been lower.

Shares in the Fund carry risks, including possible loss of principal. As with direct bond ownership, Funds that invest in bonds are subject to certain risks including interest-rate risk, credit risk, and inflation risk. The principal value of bond funds will fluctuate relative to changes in interest rates, decreasing when interest rates rise. Unlike bonds, bond funds have ongoing fees and expenses. Shares in the fund are not deposits or obligations of, or guaranteed or endorsed by, any bank, the Federal Deposit Insurance Corporation, the Federal Reserve Board or any government agency.

The information presented on the following pages was current as of March 31, 2006. The manager’s views, portfolio holdings, and sector diversification are historical and subject to change. This material should not be deemed a recommendation to buy or sell any of the securities mentioned.

The matters discussed in this report may constitute forward-looking statements made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995. These include any advisor or portfolio manager prediction, assessment, analysis or outlook for individual securities, industries, investment styles, market sectors and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for each fund in its current prospectus, other factors bearing on these reports include the accuracy of the advisor’s or portfolio manager’s forecasts and predictions, the appropriateness of the investment strategies designed by the advisor or portfolio manager and the ability of the advisor or portfolio manager to implement their strategies efficiently and successfully. Any one or more of these factors, as well as other risks affecting the securities markets generally, could cause the actual results of any fund to differ materially as compared to its benchmarks.

Glossary

The Lehman Brothers Five-Year Municipal Bond Index – A rules-based, market-value-weighted index engineered for the long-term tax-exempt bond market. To be included in the index, bonds must have a minimum credit rating of Baa. The approximate maturity of the municipal bonds in the index is five years. Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. Investors may not make direct investments into any index.

Duration – The measure of the price sensitivity of a fixed-income security to an interest rate change of 100 basis points. Calculation is based on the weighted average of the present values for all cash flows.

Weighted Average Maturity – Is a weighted average of all the effective maturities of the bonds in a portfolio. Effective maturity takes into consideration mortgage prepayments, puts, sinking funds, adjustable coupons, and other features of individual bonds and is thus a more accurate measure of interest-rate sensitivity. Longer-maturity funds are generally considered more interest-rate sensitive than their shorter counterparts.

Fed Funds Rate – Is the interest rate at which a depository institution lends immediately available funds (balances at the Federal Reserve) to another depository institution overnight.

4 Certified Semi-Annual Report |

George Strickland

Portfolio Manager

April 19, 2006

Dear Fellow Shareholder:

I am pleased to present the Semi-Annual Report for the Thornburg Limited Term Municipal Fund. The net asset value of the Class A shares decreased by 16 cents to $13.43 during the six month period ended March 31, 2006. If you were with us for the entire period, you received dividends of 21.8 cents per share. If you reinvested dividends, you received 21.9 cents per share. Investors who owned Class C shares received dividends of 20.0 and 20.1 cents per share, respectively.

Over the past six months, the municipal bond yield curve has continued to flatten. Interest rates on short and intermediate bonds have risen, while the interest rates on long-term bonds have barely budged. Since bond prices move in the opposite direction of yields, long-term bond prices have been relatively stable while short and intermediate bond prices have fallen somewhat. The Class A shares of your Fund produced a total return of 0.43% over the last six months, slightly better than the 0.32% return for the Lehman Brothers Five Year Municipal Bond Index.

The flatter yield curve has created a fairly unusual situation in the municipal bond market whereby 10-year municipal bonds currently yield 92% as much as 30-year municipal bonds. Over the last five years, that ratio has averaged closer to 84%. We believe that the higher ratio indicates that there is better relative value in 10-year municipal bonds, where we prefer to invest, than in longer term municipal bonds.

We are not surprised that short and intermediate bond yields have risen. Short-term bond yields tend to be closely tied to the Fed Funds Rate, which has increased from 1.0% to 4.75% since June 2004. Long-term bond yields are influenced by future expectations about inflation and economic growth, and by large-scale capital flows. U.S. economic growth has shown no signs of faltering or overheating – just a steady push toward full utilization. Commodity price inflation has been alarming, but broader measures of consumer prices have been better behaved. In previous environments, such conditions accompanied by a tightening Fed would have led to higher long-term interest rates. However, capital flows have kept a lid on long-term rates so far. In 2005, foreign buyers purchased 160% of Treasury bond net issuance. That volume of offshore buying has kept long-term bond yields low.

This year, the U.S. Treasury will be issuing significantly more debt than last year, both to finance a widening budget deficit and to roll over maturing notes. There are some signs that Japanese and European interest rates may rise and create more competition for U.S. bonds. Such a combination could put a significant amount of upward pressure on long-term interest rates. However, short-term interest rates, by contrast, have already risen substantially and may be close to leveling off. So we believe that long-term bonds carry much more risk than short-term bonds in the current environment.

New issue municipal bond supply is down 29% from last year’s pace. The reduced supply has helped the municipal market significantly outperform the Treasury bond market so far this year. We have been gradually shortening the duration of the Fund through the first quarter of 2006, but if interest rates continue rising, we will likely extend the duration somewhat as we find interesting buying opportunities toward the top of the Fund’s bond ladder.

| Certified Semi-Annual Report 5 |

Your Thornburg Limited Term Municipal Fund is a laddered portfolio of over 600 municipal obligations from 46 states. Today, your Fund’s weighted average maturity is 4.3 years. We ladder the maturity dates of the bonds in your portfolio so that some of the bonds are scheduled to mature during each of the coming years. Laddering intermediate bonds accomplishes two goals. First, the staggered bond maturities contained in a ladder defuse interest-rate risk and dampen the Fund’s price volatility. Second, laddering gives the Fund a steady cash flow stream from maturing bonds to reinvest toward the top of the ladder where yields are typically higher. The laddering strategy is what differentiates this Fund from most bond mutual funds. It will be particularly useful if interest rates continue rising, because it should allow the Fund to continue increasing the yield of the portfolio as bonds mature and get replaced with new ones. The chart shown here describes the percentages of your Fund’s bond portfolio maturing in each of the coming years.

% of portfolio maturing | Cumulative % maturing | |||||||||||||

1 year | = | 12.1 | % | Year 1 | = | 12.1 | % | |||||||

1 to 2 years | = | 12.3 | % | Year 2 | = | 24.4 | % | |||||||

2 to 3 years | = | 9.9 | % | Year 3 | = | 34.3 | % | |||||||

3 to 4 years | = | 12.7 | % | Year 4 | = | 47.0 | % | |||||||

4 to 5 years | = | 12.5 | % | Year 5 | = | 59.5 | % | |||||||

5 to 6 years | = | 10.0 | % | Year 6 | = | 69.5 | % | |||||||

6 to 7 years | = | 10.7 | % | Year 7 | = | 80.2 | % | |||||||

7 to 8 years | = | 8.2 | % | Year 8 | = | 88.4 | % | |||||||

8 to 9 years | = | 5.2 | % | Year 9 | = | 93.6 | % | |||||||

Over 9 years | = | 6.4 | % | Over 9 years | = | 100.0 | % | |||||||

Percentages can and do vary. Data as of 3/31/06.

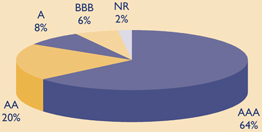

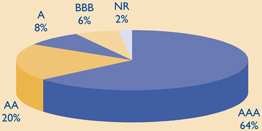

Thanks to a strong economy, state tax revenues were up 10.7% in 2005 – the fastest growth rate since 1999. The National Association of State Budget Officers recently reported that 45 states collected $17.6 billion more in tax revenues than they had budgeted for. The strong tax revenues and lack of major credit problems have helped drive down the risk premiums on lower quality municipal debt. We believe that the strong economy is cyclical in nature, so we are cautious about buying lower quality bonds in this environment. To reduce credit risk, we have kept 92% of the portfolio in bonds rated A or above by at least one rating agency and maintained broad diversification across issuers and market sectors.

Over the years, our practice of laddering a diversified portfolio of short and intermediate maturity municipal bonds has allowed your Fund to perform consistently well in varying interest rate environments. Thank you for investing in Thornburg Limited Term Municipal Fund.

Sincerely, |

|

George Strickland Portfolio Manager |

6 Certified Semi-Annual Report |

| STATEMENT OF ASSETS AND LIABILITIES | ||

| Thornburg Limited Term Municipal Fund | March 31, 2006 (Unaudited) | |

ASSETS | ||||

Investments at value (cost $1,252,226,305) | $ | 1,262,397,954 | ||

Cash | 283,199 | |||

Receivable for investments sold | 990,000 | |||

Receivable for fund shares sold | 1,752,334 | |||

Interest receivable | 16,905,974 | |||

Prepaid expenses and other assets | 37,216 | |||

Total Assets | 1,282,366,677 | |||

LIABILITIES | ||||

Payable for fund shares redeemed | 2,162,520 | |||

Payable to investment advisor and other affiliates (Note 3) | 815,408 | |||

Accounts payable and accrued expenses | 130,473 | |||

Dividends payable | 1,037,322 | |||

Total Liabilities | 4,145,723 | |||

NET ASSETS | $ | 1,278,220,954 | ||

NET ASSETS CONSIST OF: | ||||

Distribution in excess of net investment income | $ | (2,553 | ) | |

Net unrealized appreciation on investments | 10,171,649 | |||

Accumulated net realized gain (loss) | (8,482,590 | ) | ||

Net capital paid in on shares of beneficial interest | 1,276,534,448 | |||

| $ | 1,278,220,954 | |||

NET ASSET VALUE: | ||||

Class A Shares: | ||||

Net asset value and redemption price per share ($873,009,044 applicable to 65,000,646 shares of beneficial interest outstanding - Note 4) | $ | 13.43 | ||

Maximum sales charge, 1.50% of offering price | 0.20 | |||

Maximum offering price per share | $ | 13.63 | ||

Class C Shares: | ||||

Net asset value and offering price per share * ($117,188,296 applicable to 8,709,538 shares of beneficial interest outstanding - Note 4) | $ | 13.46 | ||

Class I Shares: | ||||

Net asset value, offering and redemption price per share ($288,023,614 applicable to 21,442,399 shares of beneficial interest outstanding - Note 4) | $ | 13.43 | ||

| * | Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. |

See notes to financial statements.

| Certified Semi-Annual Report 7 |

| STATEMENT OF OPERATIONS | ||

| Thornburg Limited Term Municipal Fund | Six Months Ended March 31, 2006 (Unaudited) | |

INVESTMENT INCOME: | ||||

Interest income (net of premium amortized of $6,368,661) | $ | 27,417,970 | ||

EXPENSES: | ||||

Investment advisory fees (Note 3) | 2,740,636 | |||

Administration fees (Note 3) | ||||

Class A Shares | 572,372 | |||

Class C Shares | 80,627 | |||

Class I Shares | 70,915 | |||

Distribution and service fees (Note 3) | ||||

Class A Shares | 1,144,745 | |||

Class C Shares | 642,511 | |||

Transfer agent fees | ||||

Class A Shares | 241,840 | |||

Class C Shares | 41,757 | |||

Class I Shares | 44,890 | |||

Registration and filing fees | ||||

Class A Shares | 11,155 | |||

Class C Shares | 10,377 | |||

Class I Shares | 14,348 | |||

Custodian fees (Note 3) | 206,743 | |||

Professional fees | 36,924 | |||

Accounting fees | 58,270 | |||

Trustee fees | 16,303 | |||

Other expenses | 82,918 | |||

Total Expenses | 6,017,331 | |||

Less: | ||||

Distribution and service fees waived (Note 3) | (321,255 | ) | ||

Fees paid indirectly (Note 3) | (14,423 | ) | ||

Net Expenses | 5,681,653 | |||

Net Investment Income | 21,736,317 | |||

REALIZED AND UNREALIZED GAIN (LOSS) | ||||

Net realized gain (loss) on investments sold | (2,004,085 | ) | ||

Net change in unrealized appreciation (depreciation) of investments | (13,963,804 | ) | ||

Net Realized and Unrealized Loss | (15,967,889 | ) | ||

Net Increase in Net Assets Resulting From Operations | $ | 5,768,428 | ||

See notes to financial statements.

8 Certified Semi-Annual Report |

| STATEMENTS OF CHANGES IN NET ASSETS | ||

| Thornburg Limited Term Municipal Fund | (Unaudited)* | |

| *Six Months Ended March 31, 2006 | Year Ended September 30, 2005 | |||||||

INCREASE (DECREASE) IN NET ASSETS FROM: | ||||||||

OPERATIONS: | ||||||||

Net investment income | $ | 21,736,317 | $ | 41,560,133 | ||||

Net realized loss on investments | (2,004,085 | ) | (1,895,726 | ) | ||||

Increase (Decrease) in unrealized appreciation (depreciation) of investments | (13,963,804 | ) | (23,004,183 | ) | ||||

Net Increase (Decrease) in Net Assets Resulting from Operations | 5,768,428 | 16,660,224 | ||||||

DIVIDENDS TO SHAREHOLDERS: | ||||||||

From net investment income | ||||||||

Class A Shares | (14,772,577 | ) | (29,220,801 | ) | ||||

Class C Shares | (1,902,358 | ) | (4,017,994 | ) | ||||

Class I Shares | (5,061,382 | ) | (8,321,340 | ) | ||||

FUND SHARE TRANSACTIONS (NOTE 4): | ||||||||

Class A Shares | (83,648,067 | ) | (53,647,281 | ) | ||||

Class C Shares | (21,883,370 | ) | (13,573,272 | ) | ||||

Class I Shares | 1,095,221 | 56,236,683 | ||||||

Net Decrease in Net Assets | (120,404,105 | ) | (35,883,781 | ) | ||||

NET ASSETS: | ||||||||

Beginning of period | 1,398,625,059 | 1,434,508,840 | ||||||

End of period | $ | 1,278,220,954 | $ | 1,398,625,059 | ||||

See notes to financial statements.

| Certified Semi-Annual Report 9 |

| NOTES TO FINANCIAL STATEMENTS | ||

| Thornburg Limited Term Municipal Fund | March 31, 2006 (Unaudited) | |

NOTE 1 – ORGANIZATION

Thornburg Limited Term Municipal Fund (the “Fund”) (formerly Thornburg Limited Term Municipal Fund – National Portfolio) is a diversified series of Thornburg Investment Trust (the “Trust”). The Trust is organized as a Massachusetts business trust under a Declaration of Trust dated June 3, 1987 and is registered as a diversified, open-end management investment company under the Investment Company Act of 1940, as amended. The Trust is currently issuing eleven series of shares of beneficial interest in addition to those of the Fund: Thornburg California Limited Term Municipal Fund, Thornburg Florida Intermediate Municipal Fund, Thornburg New York Intermediate Municipal Fund, Thornburg New Mexico Intermediate Municipal Fund, Thornburg Intermediate Municipal Fund, Thornburg Limited Term U.S. Government Fund, Thornburg Limited Term Income Fund, Thornburg Value Fund, Thornburg International Value Fund, Thornburg Core Growth Fund, and Thornburg Investment Income Builder Fund. Each series is considered to be a separate entity for financial reporting and tax purposes and bears expenses directly attributable to it. The Fund’s investment objective is to obtain as high a level of current income exempt from Federal income taxes as is consistent, in the view of the Fund’s investment advisor, with the preservation of capital.

The Fund currently offers three classes of shares of beneficial interest, Class A, Class C, and Institutional Class, (Class I) shares. Each class of shares of the Fund represents an interest in the same portfolio of investments, except that (i) Class A shares are sold subject to a front-end sales charge collected at the time the shares are purchased and bear a service fee, (ii) Class C shares are sold at net asset value without a sales charge at the time of purchase, but are subject to a contingent deferred sales charge upon redemption within one year, and bear both a service fee and a distribution fee, (iii) Class I shares are sold at net asset value without a sales charge at the time of purchase, and (iv) the respective classes may have different reinvestment privileges and conversion rights.

Additionally, the Fund may allocate among its classes certain expenses, to the extent applicable to specific classes, including transfer agent fees, government registration fees, certain printing and postage costs, and administrative and legal expenses. Currently, class specific expenses of the Fund are limited to service and distribution fees, administrative fees, and certain registration and transfer agent expenses.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

Significant accounting policies of the Trust are as follows:

Valuation of Investments: The Trust determines the value of investments utilizing an independent pricing service approved by the Board of Trustees. Debt investment securities have a primary market over the counter and are valued on the basis of valuations furnished by the pricing service. The pricing service values portfolio securities at quoted bid prices, normally at 4:00 p.m. EST. When quotations are not readily available, securities are valued at evaluated prices as determined by the pricing service using methods which include consideration of yields or prices of municipal obligations of comparable quality, type of issue, coupon, maturity, and rating; indications as to value from dealers and general market conditions. In any case where a price is not available from a pricing service for an investment, the Trust’s valuation and pricing committee determines a fair value for the investment using factors approved by the Trustees. The valuation procedures used by the pricing service and the portfolio valuations received by the Fund are reviewed by the officers of the Trust under the general supervision of the Board of Trustees. Short-term obligations having remaining maturities of 60 days or less are valued at amortized cost, which approximates market value.

Federal Income Taxes: It is the policy of the Trust to comply with the provisions of the Internal Revenue Code applicable to “regulated investment companies” and to distribute all taxable (if any) and tax exempt income of the Fund to the shareholders. Therefore, no provision for Federal income tax is required.

When-Issued and Delayed Delivery Transactions: The Trust may engage in when-issued or delayed delivery transactions. To the extent the Trust engages in such transactions, it will do so for the purpose of acquiring portfolio securities consistent with the Fund’s investment objectives and not for the purpose of investment leverage or to speculate on interest rate and or market changes. At the time the Trust makes a commitment to purchase a security on a when-issued basis, the Fund will record the transaction and reflect the value in determining its net asset value. When effecting such transactions, assets of an amount sufficient to make payment for the portfolio securities to be purchased will be segregated on the Fund’s records on the trade date. Securities purchased on a when-issued or delayed delivery basis do not earn interest until the settlement date.

Dividends: Net investment income of the Fund is declared daily as a dividend on shares for which the Fund has received payment. Dividends are paid monthly and are reinvested in additional shares of the Fund at net asset value per share at the close of business on the dividend payment date, or at the shareholder’s option, paid in cash. Net capital gains, to the extent available, will be distributed at least annually.

General: Securities transactions are accounted for on a trade date basis. Interest income is accrued as earned. Premiums and discounts on securities purchased are amortized to call dates or maturity dates of the respective securities. Realized gains and losses from the sale of securities are recorded on an identified cost basis. Net investment income (other than class specific expenses) and realized and unrealized gains and losses are allocated daily to each class of shares based upon the relative net asset value of outstanding shares (or the value of

10 Certified Semi-Annual Report |

| NOTES TO FINANCIAL STATEMENTS, CONTINUED | ||

| Thornburg Limited Term Municipal Fund | March 31, 2006 (Unaudited) | |

the dividend-eligible shares, as appropriate) of each class of shares at the beginning of the day (after adjusting for the current capital shares activity of the respective class). Expenses common to all funds are allocated among the funds comprising the Trust based upon their relative net asset values or other appropriate allocation methods.

Guarantees and Indemnifications: Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liability arising out of the performance of their duties to the Fund. Additionally, in the normal course of business the Trust enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown. However, based on experience, the Trust expects the risk of loss to be remote.

Use of Estimates: The preparation of financial statements, in conformity with generally accepted accounting principles, requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

NOTE 3 – INVESTMENT ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

Pursuant to an Investment Advisory Agreement, Thornburg Investment Management, Inc. (the “Advisor”) serves as the investment advisor and performs services for which the fees are payable at the end of each month. For the period ended March 31, 2006, these fees were payable at annual rates ranging from .50 of 1% to .225 of 1% per annum of the average daily net assets of the Fund. The Trust also has entered into an Administrative Services Agreement with the Advisor, whereby the Advisor will perform certain administrative services for the shareholders of each class of the Fund’s shares, and for which fees will be payable at an annual rate of up to .125 of 1% per annum of the average daily net assets attributable to each class of shares.

The Trust has an underwriting agreement with Thornburg Securities Corporation (the “Distributor”, an affiliate of the Advisor), which acts as the Distributor of Fund shares. For the period ended March 31, 2006, the Distributor has advised the Fund that it earned commissions aggregating $5,628 from the sale of Class A shares, and collected contingent deferred sales charges aggregating $8,315 from redemptions of Class C shares of the Fund.

Pursuant to a Service Plan under Rule 12b-1 of the Investment Company Act of 1940, the Fund may reimburse to the Advisor amounts not to exceed .25 of 1% per annum of the average daily net assets attributable to each class of shares of the Fund for payments made by the Advisor to securities dealers and other persons for distribution of the Fund’s shares and to obtain various shareholder related services. The Advisor may pay out of its own resources additional expenses for distribution of the Fund’s shares.

The Trust has also adopted a Distribution Plan pursuant to Rule 12b-1, applicable only to the Fund’s Class C shares under which the Fund compensates the Distributor for services in promoting the sale of Class C shares of the Fund at an annual rate of up to .75 of 1% per annum of the average daily net assets attributable to Class C shares. Total fees incurred by each class of shares of the Fund under their respective service and distribution plans and Class C distribution fees waived by the Distributor for the period ended March 31, 2006, are set forth in the Statement of Operations. Distribution fees in the amount of $321,255 were waived for Class C shares.

The Trust has an agreement with the custodian bank to indirectly pay a portion of the custodian’s fees through credits earned by the Fund’s cash on deposit with the bank. This deposit agreement is an alternative to overnight investments. Custodial fees have been adjusted to reflect amounts that would have been paid without this agreement, with a corresponding adjustment reflected as fees paid indirectly in the Statement of Operations. For the period ended March 31, 2006, fees paid indirectly were $14,423. This figure may include additional fees waived by the Custodian.

Certain officers and Trustees of the Trust are also officers and/or Directors of the Advisor and Distributor. The compensation of independent Trustees is borne by the Trust.

| Certified Semi-Annual Report 11 |

| NOTES TO FINANCIAL STATEMENTS, CONTINUED | ||

| Thornburg Limited Term Municipal Fund | March 31, 2006 (Unaudited) | |

NOTE 4 – SHARES OF BENEFICIAL INTEREST

At March 31, 2006, there were an unlimited number of shares of beneficial interest authorized. Transactions in shares of beneficial interest were as follows:

| Period Ended March 31, 2006 | Year Ended September 30, 2005 | |||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||

Class A Shares | ||||||||||||||

Shares sold | 4,187,091 | $ | 56,592,053 | 10,112,925 | $ | 138,664,895 | ||||||||

Shares issued to shareholders in reinvestment of dividends | 739,763 | 9,989,340 | 1,429,462 | 19,572,574 | ||||||||||

Shares repurchased | (11,119,963 | ) | (150,229,460 | ) | (15,463,654 | ) | (211,884,750 | ) | ||||||

Net Increase (Decrease) | (6,193,109 | ) | $ | (83,648,067 | ) | (3,921,267 | ) | $ | (53,647,281 | ) | ||||

Class C Shares | ||||||||||||||

Shares sold | 361,822 | $ | 4,898,853 | 1,853,494 | $ | 25,470,518 | ||||||||

Shares issued to shareholders in reinvestment of dividends | 95,094 | 1,286,374 | 198,591 | 2,724,023 | ||||||||||

Shares repurchased | (2,073,524 | ) | (28,068,597 | ) | (3,045,634 | ) | (41,767,813 | ) | ||||||

Net Increase (Decrease) | (1,616,608 | ) | $ | (21,883,370 | ) | (993,549 | ) | $ | (13,573,272 | ) | ||||

Class I Shares | ||||||||||||||

Shares sold | 4,168,822 | $ | 56,342,769 | 8,961,752 | $ | 122,650,992 | ||||||||

Shares issued to shareholders in reinvestment of dividends | 292,248 | 3,946,218 | 501,520 | 6,865,525 | ||||||||||

Shares repurchased | (4,379,412 | ) | (59,193,766 | ) | (5,348,315 | ) | (73,279,834 | ) | ||||||

Net Increase (Decrease) | 81,658 | $ | 1,095,221 | 4,114,957 | $ | 56,236,683 | ||||||||

NOTE 5 – SECURITIES TRANSACTIONS

For the period ended March 31, 2006, the Fund had purchase and sale transactions of investment securities (excluding short-term investments) of $169,641,521 and $272,430,777, respectively.

NOTE 6 – INCOME TAXES

At March 31, 2006, information on the tax components of capital is as follows:

Cost of investments for tax purposes | $ | 1,252,231,196 | ||

Gross unrealized appreciation on a tax basis | $ | 16,184,545 | ||

Gross unrealized depreciation on a tax basis | (6,017,787 | ) | ||

Net unrealized appreciation (depreciation) on investments (tax basis) | $ | 10,166,758 | ||

At March 31, 2006, the Fund had tax basis capital losses, which may be carried over to offset future capital gains. To the extent such carry forwards are used, capital gain distributions may be reduced to the extent provided by regulations.

Such capital loss carryovers expire as follows:

2007 | $ | 1,013,153 | |

2008 | 3,565,103 | ||

2013 | 30,614 | ||

| $ | 4,608,870 | ||

As of March 31, 2006, the Fund had deferred capital losses occurring subsequent to October 31, 2004 of $1,864,744. For tax purposes, such losses will be reflected in the year ending September 30, 2006.

12 Certified Semi-Annual Report |

| FINANCIAL HIGHLIGHTS | ||

| Thornburg Limited Term Municipal Fund | (Unaudited)* | |

*6 Mo. 2006 | Year 2005 | 3 Mo. 2004(c) | Year Ended June 30, | |||||||||||||||||||||||||

| 2004 | 2003 | 2002 | 2001 | |||||||||||||||||||||||||

Class A Shares: | ||||||||||||||||||||||||||||

PER SHARE PERFORMANCE | ||||||||||||||||||||||||||||

(for a share outstanding throughout the period) | ||||||||||||||||||||||||||||

Net asset value, beginning of period | $ | 13.59 | $ | 13.83 | $ | 13.68 | $ | 14.01 | $ | 13.65 | $ | 13.44 | $ | 13.06 | ||||||||||||||

Income from investment operations: | ||||||||||||||||||||||||||||

Net investment income | 0.22 | 0.40 | 0.09 | 0.40 | 0.45 | 0.52 | 0.58 | |||||||||||||||||||||

Net realized and unrealized gain (loss) on investments | (0.16 | ) | (0.24 | ) | 0.15 | (0.33 | ) | 0.36 | 0.21 | 0.38 | ||||||||||||||||||

Total from investment operations | 0.06 | 0.16 | 0.24 | 0.07 | 0.81 | 0.73 | 0.96 | |||||||||||||||||||||

Less dividends from: | ||||||||||||||||||||||||||||

Net investment income | (0.22 | ) | (0.40 | ) | (0.09 | ) | (0.40 | ) | (0.45 | ) | (0.52 | ) | (0.58 | ) | ||||||||||||||

Change in net asset value | (0.16 | ) | (0.24 | ) | 0.15 | (0.33 | ) | 0.36 | 0.21 | 0.38 | ||||||||||||||||||

NET ASSET VALUE, end of period | $ | 13.43 | $ | 13.59 | $ | 13.83 | $ | 13.68 | $ | 14.01 | $ | 13.65 | $ | 13.44 | ||||||||||||||

RATIOS/SUPPLEMENTAL DATA | ||||||||||||||||||||||||||||

Total return(a) | 0.43 | % | 1.16 | % | 1.78 | % | 0.47 | % | 5.99 | % | 5.54 | % | 7.49 | % | ||||||||||||||

Ratios to average net assets: | ||||||||||||||||||||||||||||

Net investment income | 3.23 | %(b) | 2.91 | % | 2.69 | %(b) | 2.85 | % | 3.20 | % | 3.83 | % | 4.36 | % | ||||||||||||||

Expenses, after expense reductions | 0.90 | %(b) | 0.90 | % | 0.89 | %(b) | 0.91 | % | 0.93 | % | 0.95 | % | 0.99 | % | ||||||||||||||

Expenses, after expense reductions and net of custody credits | 0.90 | %(b) | 0.90 | % | 0.89 | %(b) | 0.91 | % | 0.93 | % | 0.95 | % | — | |||||||||||||||

Expenses, before expense reductions | 0.90 | %(b) | 0.90 | % | 0.89 | %(b) | 0.91 | % | 0.93 | % | 0.96 | % | 0.99 | % | ||||||||||||||

Portfolio turnover rate | 13.02 | % | 27.80 | % | 4.57 | % | 21.37 | % | 15.81 | % | 19.59 | % | 25.37 | % | ||||||||||||||

Net assets at end of period (000) | $ | 873,009 | $ | 967,650 | $ | 1,039,050 | $ | 1,047,482 | $ | 998,878 | $ | 785,145 | $ | 654,157 | ||||||||||||||

| (a) | Sales loads are not reflected in computing total return, which is not annualized for periods less than one year. |

| (b) | Annualized. |

| (c) | The Fund’s fiscal year-end changed to September 30. |

| Certified Semi-Annual Report 13 |

| FINANCIAL HIGHLIGHTS, CONTINUED | ||

| Thornburg Limited Term Municipal Fund | (Unaudited)* | |

*6 Mo. 2006 | Year 2005 | 3 Mo. 2004(c) | Year Ended June 30, | |||||||||||||||||||||||||

| 2004 | 2003 | 2002 | 2001 | |||||||||||||||||||||||||

Class C Shares: | ||||||||||||||||||||||||||||

PER SHARE PERFORMANCE | ||||||||||||||||||||||||||||

(for a share outstanding throughout the period) | ||||||||||||||||||||||||||||

Net asset value, beginning of period | $ | 13.62 | $ | 13.86 | $ | 13.70 | $ | 14.04 | $ | 13.67 | $ | 13.46 | $ | 13.08 | ||||||||||||||

Income from investment operations: | ||||||||||||||||||||||||||||

Net investment income | 0.20 | 0.36 | 0.08 | 0.36 | 0.41 | 0.47 | 0.53 | |||||||||||||||||||||

Net realized and unrealized gain (loss) on investments | (0.16 | ) | (0.24 | ) | 0.16 | (0.34 | ) | 0.37 | 0.21 | 0.38 | ||||||||||||||||||

Total from investment operations | 0.04 | 0.12 | 0.24 | 0.02 | 0.78 | 0.68 | 0.91 | |||||||||||||||||||||

Less dividends from: | ||||||||||||||||||||||||||||

Net investment income | (0.20 | ) | (0.36 | ) | (0.08 | ) | (0.36 | ) | (0.41 | ) | (0.47 | ) | (0.53 | ) | ||||||||||||||

Change in net asset value | (0.16 | ) | (0.24 | ) | 0.16 | (0.34 | ) | 0.37 | 0.21 | 0.38 | ||||||||||||||||||

NET ASSET VALUE, end of period | $ | 13.46 | $ | 13.62 | $ | 13.86 | $ | 13.70 | $ | 14.04 | $ | 13.67 | $ | 13.46 | ||||||||||||||

RATIOS/SUPPLEMENTAL DATA | ||||||||||||||||||||||||||||

Total return(a) | 0.29 | % | 0.89 | % | 1.79 | % | 0.12 | % | 5.78 | % | 5.13 | % | 7.07 | % | ||||||||||||||

Ratios to average net assets: | ||||||||||||||||||||||||||||

Net investment income | 2.95 | %(b) | 2.63 | % | 2.43 | %(b) | 2.56 | % | 2.89 | % | 3.42 | % | 3.96 | % | ||||||||||||||

Expenses, after expense reductions | 1.18 | %(b) | 1.18 | % | 1.15 | %(b) | 1.19 | % | 1.18 | % | 1.33 | % | 1.38 | % | ||||||||||||||

Expenses, after expense reductions and net of custody credits | 1.18 | %(b) | 1.18 | % | 1.15 | %(b) | 1.19 | % | 1.18 | % | 1.33 | % | — | |||||||||||||||

Expenses, before expense reductions | 1.68 | %(b) | 1.68 | % | 1.65 | %(b) | 1.69 | % | 1.68 | % | 1.80 | % | 1.85 | % | ||||||||||||||

Portfolio turnover rate | 13.02 | % | 27.80 | % | 4.57 | % | 21.37 | % | 15.81 | % | 19.59 | % | 25.37 | % | ||||||||||||||

Net assets at end of period (000) | $ | 117,188 | $ | 140,606 | $ | 156,870 | $ | 155,458 | $ | 137,559 | $ | 57,258 | $ | 24,773 | ||||||||||||||

| (a) | Not annualized for periods less than one year. |

| (b) | Annualized. |

| (c) | The Fund’s fiscal year-end changed to September 30. |

14 Certified Semi-Annual Report |

| FINANCIAL HIGHLIGHTS, CONTINUED | ||

| Thornburg Limited Term Municipal Fund | (Unaudited)* | |

*6 Mo. 2006 | Year 2005 | 3 Mo. 2004(c) | Year Ended June 30, | |||||||||||||||||||||||||

| 2004 | 2003 | 2002 | 2001 | |||||||||||||||||||||||||

Class I Shares: | ||||||||||||||||||||||||||||

PER SHARE PERFORMANCE | ||||||||||||||||||||||||||||

(for a share outstanding throughout the period) | ||||||||||||||||||||||||||||

Net asset value, beginning of period | $ | 13.59 | $ | 13.83 | $ | 13.68 | $ | 14.01 | $ | 13.65 | $ | 13.44 | $ | 13.06 | ||||||||||||||

Income from investment operations: | ||||||||||||||||||||||||||||

Net investment income | 0.24 | 0.44 | 0.11 | 0.44 | 0.49 | 0.57 | 0.63 | |||||||||||||||||||||

Net realized and unrealized gain (loss) on investments | (0.16 | ) | (0.24 | ) | 0.15 | (0.33 | ) | 0.36 | 0.21 | 0.38 | ||||||||||||||||||

Total from investment operations | 0.08 | 0.20 | 0.26 | 0.11 | 0.85 | 0.78 | 1.01 | |||||||||||||||||||||

Less dividends from: | ||||||||||||||||||||||||||||

Net investment income | (0.24 | ) | (0.44 | ) | (0.11 | ) | (0.44 | ) | (0.49 | ) | (0.57 | ) | (0.63 | ) | ||||||||||||||

Change in net asset value | (0.16 | ) | (0.24 | ) | 0.15 | (0.33 | ) | 0.36 | 0.21 | 0.38 | ||||||||||||||||||

NET ASSET VALUE, end of period | $ | 13.43 | $ | 13.59 | $ | 13.83 | $ | 13.68 | $ | 14.01 | $ | 13.65 | $ | 13.44 | ||||||||||||||

RATIOS/SUPPLEMENTAL DATA | ||||||||||||||||||||||||||||

Total return(a) | 0.60 | % | 1.50 | % | 1.87 | % | 0.80 | % | 6.36 | % | 5.91 | % | 7.91 | % | ||||||||||||||

Ratios to average net assets: | ||||||||||||||||||||||||||||

Net investment income | 3.57 | %(b) | 3.25 | % | 3.02 | %(b) | 3.18 | % | 3.54 | % | 4.18 | % | 4.75 | % | ||||||||||||||

Expenses, after expense reductions | 0.56 | %(b) | 0.57 | % | 0.55 | %(b) | 0.57 | % | 0.58 | % | 0.60 | % | 0.60 | % | ||||||||||||||

Expenses, after expense reductionsand net of custody credits | 0.56 | %(b) | 0.57 | % | 0.55 | %(b) | 0.57 | % | 0.58 | % | 0.60 | % | — | |||||||||||||||

Expenses, before expense reductions | 0.56 | %(b) | 0.57 | % | 0.55 | %(b) | 0.57 | % | 0.58 | % | 0.62 | % | 0.65 | % | ||||||||||||||

Portfolio turnover rate | 13.02 | % | 27.80 | % | 4.57 | % | 21.37 | % | 15.81 | % | 19.59 | % | 25.37 | % | ||||||||||||||

Net assets at end of period (000) | $ | 288,024 | $ | 290,369 | $ | 238,589 | $ | 222,760 | $ | 197,367 | $ | 123,652 | $ | 86,160 | ||||||||||||||

| (a) | Not annualized for periods less than one year. |

| (b) | Annualized. |

| (c) | The Fund’s fiscal year-end changed to September 30. |

| Certified Semi-Annual Report 15 |

| SCHEDULE OF INVESTMENTS | ||

Thornburg Limited Term Municipal Fund | March 31, 2006 (Unaudited) | |

CUSIPS: CLASS A - 885-215-459, CLASS C - 885-215-442, CLASS I - 885-215-434

NASDAQ SYMBOLS: CLASS A - LTMFX, CLASS C - LTMCX, CLASS I - LTMIX

Issuer-Description | Credit Rating† Moody’s/S&P | Principal Amount | Value | |||||

ALABAMA — 1.66% | ||||||||

Birmingham Carraway Alabama Special, 6.25% due 8/15/2009 (Insured: Connie Lee) | NR/AAA | $ | 10,000,000 | $ | 10,389,800 | |||

Scottsboro Industrial Development Board Refunding, 5.25% due 5/1/2009 (LOC: PNC Bank) | NR/NR | 1,920,000 | 1,921,363 | |||||

Wilsonville Industrial Development Board Pollution Control Revenue Refunding, 4.20% due 6/1/2019 put 6/1/2006 (Southern Electric Gaston Project; Insured:AMBAC) | Aaa/AAA | 8,955,000 | 8,960,821 | |||||

ALASKA — 0.94% | ||||||||

Alaska Energy Authority Power Revenue Refunding Third Series, 6.00% due 7/1/2008 (Bradley Lake Project; Insured: FSA) | Aaa/AAA | 2,800,000 | 2,937,620 | |||||

Alaska Municipal Bond Bank Refunding Series One, 5.00% due 6/1/2014 (Insured: MBIA) | Aaa/AAA | 1,175,000 | 1,252,996 | |||||

Alaska Student Loan Corp. Revenue Series A, 5.25% due 1/1/2012 (Capital Project; Insured: FSA) | NR/AAA | 3,000,000 | 3,211,410 | |||||

Anchorage Ice Rink Revenue, 6.375% due 1/1/2020 pre-refunded 7/1/2010 | NR/NR | 1,000,000 | 1,096,410 | |||||

North Slope Boro Revenue Refunding Series A, 5.00% due 6/30/2015 (Insured: MBIA) | Aaa/AAA | 3,250,000 | 3,473,080 | |||||

ARIZONA — 1.05% | ||||||||

Maricopa County School District 008, 7.50% due 7/1/2008 (Insured: MBIA) | A1/AAA | 1,000,000 | 1,080,900 | |||||

Mohave County Industrial Development Authority Correctional Facilities Contract Revenue Series A, 5.00% due 4/1/2009 (Mohave Prison LLC Project; Insured: XLCA) | NR/AAA | 4,595,000 | 4,756,560 | |||||

Mohave County Industrial Development Authority Series A, 5.00% due 4/1/2014 (Mohave Prison LLC Project; Insured: XLCA) | NR/AAA | 3,135,000 | 3,312,661 | |||||

Pima County Industrial Development Authority, 5.45% due 4/1/2010 (Insured: HealthPartners, Series A) | Aaa/AAA | 2,060,000 | 2,131,070 | |||||

Pima County Industrial Development Authority Education Revenue Series C, 6.40% due 7/1/2013 (Arizona Charter Schools Project) | Baa3/NR | 1,000,000 | 1,063,850 | |||||

Pima County Industrial Development Authority Industrial Revenue Refunding Lease Obligation A, 7.25% due 7/15/2010 (Insured: FSA) | Aaa/AAA | 480,000 | 483,936 | |||||

Tucson Water Revenue Series D, 9.75% due 7/1/2008 | Aa3/A+ | 500,000 | 563,870 | |||||

ARKANSAS — 0.55% | ||||||||

Conway Electric Revenue Refunding, 5.00% due 8/1/2007 | A2/NR | 2,000,000 | 2,033,760 | |||||

Jefferson County Hospital Revenue Refunding & Improvement, 5.50% due 6/1/2010 (Regional Medical Center Project) | NR/A | 1,000,000 | 1,056,120 | |||||

Jefferson County Hospital Revenue Refunding & Improvement, 5.50% due 6/1/2011 (Regional Medical Center Project) | NR/A | 1,075,000 | 1,143,499 | |||||

Little Rock Hotel & Restaurant Gross Receipts Tax Refunding, 7.125% due 8/1/2009 | A3/NR | 2,645,000 | 2,822,374 | |||||

CALIFORNIA — 3.52% | ||||||||

Bay Area Government Associates Lease Series 2002, 4.00% due 7/1/2006 (Insured:AMBAC) | Aaa/AAA | 765,000 | 766,186 | |||||

California Health Facilities Financing Authority Revenue Series 83 C, 9.25% due 12/1/2006 (Mercy Health Care Project) (ETM) | Aaa/AAA | 1,600,000 | 1,660,176 | |||||

California Health Facilities Financing Authority Revenue Series B Refunding, 5.25% due 10/1/2013 (Kaiser Permanente Project) (ETM) | A3/AAA | 2,620,000 | 2,743,245 | |||||

California State Department of Water Resources Power Supply Series A, 5.50% due 5/1/2008 | A2/A- | 2,050,000 | 2,123,554 | |||||

California State Department of Water Resources Power Supply Series A, 5.50% due 5/1/2012 | A2/A- | 2,600,000 | 2,808,650 | |||||

California State Department of Water Resources Power Supply Series A, 6.00% due 5/1/2013 | A2/A- | 2,550,000 | 2,847,457 | |||||

California State Department of Water Series Resources Power Supply Series B-5, 3.10% due 5/1/2022 put 4/3/2006 (LOC: Bayerische Landesbank;West Deutsche Landesbank) (daily demand notes) | VMIG1/A-1+ | 2,600,000 | 2,600,000 | |||||

California State Economic Recovery Series C-2, 3.10% due 7/1/2023 put 4/3/2006 (SPA: Bank of America N.A.)(daily demand notes) | VMIG1/A-1+ | 2,700,000 | 2,700,000 | |||||

16 Certified Semi-Annual Report |

| SCHEDULE OF INVESTMENTS, CONTINUED | ||

Thornburg Limited Term Municipal Fund | March 31, 2006 (Unaudited) | |

Issuer-Description | Credit Rating† Moody’s/S&P | Principal Amount | Value | |||||

California State Economic Recovery Series C-3, 3.10% due 7/1/2023 put 4/3/2006 (Guaranty: Landesbank) (daily demand notes) | VMIG1/A-1+ | $ | 2,750,000 | $ | 2,750,000 | |||

California State School Improvement, 3.04% due 5/1/2034 put 4/3/2006 (LOC: Citibank) (daily demand notes) | VMIG1/A-1+ | 3,500,000 | 3,500,000 | |||||

California Statewide Community Development Authority Revenue Series D, 4.35% due 11/1/2036 put 3/1/2007 (Kaiser Permanente Project) | VMIG2/A-1 | 2,000,000 | 2,011,080 | |||||

Irvine Improvement Bond Act 1915 Limited Obligation Assessment District, 3.16% due 9/2/2025 put 4/3/2006 (LOC: Bank of America) (daily demand notes) | VMIG1/A-1+ | 1,700,000 | 1,700,000 | |||||

Metropolitan Water District Southern California Waterworks Revenue, 2.95% due 7/1/2036 put 4/3/2006 (SPA: Loyds TSB Bank) (daily demand notes) | VMIG1/A-1+ | 3,000,000 | 3,000,000 | |||||

Northern California Power Agency Public Power Revenue Series A, 5.00% due 7/1/2009 (Geothermal Project Number 3) | Baa2/BBB+ | 6,100,000 | 6,104,514 | |||||

Ontario Montclair California School District COP Refunding, 3.80% due 9/1/2028 put 8/31/2007 (School Facility Bridge Funding Project; Insured: FSA) | VMIG1/A-1 | 1,680,000 | 1,679,950 | |||||

San Jose Financing Authority Lease Revenue Series D, 5.00% due 6/1/2039 mandatory put 6/1/2006 (Civic Center Project; Insured: AMBAC) | Aaa/AAA | 3,400,000 | 3,408,058 | |||||

Santa Clara Valley Transportation Authority Sales Tax Revenue Measure A, 4.00% due 4/1/2036 put 10/2/2006 (Insured: AMBAC) | Aaa/AAA | 1,000,000 | 1,002,750 | |||||

South Orange County California Public Financing Authority Special Tax Revenue Series C, 8.00% due 8/15/2008 (Foothill Area Project; Insured: FGIC) | Aaa/AAA | 1,500,000 | 1,649,400 | |||||

COLORADO — 3.76% | ||||||||

Adams County Revenue Platte Valley Medical Center, 5.00% due 2/1/2012 (Insured: FHA, MBIA) | NR/AAA | 1,310,000 | 1,381,185 | |||||

Adams County Revenue Platte Valley Medical Center, 5.00% due 8/1/2012 (Insured: FHA, MBIA) | NR/AAA | 1,345,000 | 1,420,683 | |||||

Adams County Revenue Platte Valley Medical Center, 5.00% due 2/1/2013 (Insured: FHA, MBIA) | NR/AAA | 1,380,000 | 1,457,929 | |||||

Adams County Revenue Platte Valley Medical Center, 5.00% due 2/1/2015 (Insured: FHA, MBIA) | NR/AAA | 1,530,000 | 1,623,758 | |||||

Adams County Revenue Platte Valley Medical Center, 5.00% due 8/1/2015 (Insured: FHA, MBIA) | NR/AAA | 1,565,000 | 1,662,875 | |||||

Adams County School District 012 Series A, 4.375% due 12/15/2007 | Aa3/AA- | 1,000,000 | 1,012,990 | |||||

Central Platte Valley Metropolitan District Refunding Series A, 5.00% due 12/1/2031 put 12/1/2009 (LOC: US Bank) | NR/AA | 12,200,000 | 12,549,530 | |||||

Colorado Department of Transport Revenue Anticipation Notes, 6.00% due 6/15/2008 (Insured: AMBAC) | Aaa/AAA | 1,500,000 | 1,574,025 | |||||

Colorado Educational & Cultural Facilities, 4.90% due 4/1/2008 (Nashville Public Radio Project) | NR/BBB+ | 685,000 | 692,391 | |||||

Colorado Health Facilities Authority, 5.00% due 9/1/2007 (Catholic Health Initiatives Project) | Aa2/AA | 5,705,000 | 5,804,438 | |||||

Colorado Health Facilities Authority Series A, 5.375% due 12/1/2009 (Catholic Health Initiatives Project) | Aa2/AA | 515,000 | 536,687 | |||||

Denver City & County COP Series A, 5.50% due 5/1/2006 (Insured: MBIA) (ETM) | Aaa/AAA | 500,000 | 500,825 | |||||

Denver Convention Center Senior Series A, 5.00% due 12/1/2011 (Insured: XLCA) | Aaa/AAA | 3,335,000 | 3,523,728 | |||||

El Paso County School District Number 49 Series A, 6.00% due 12/1/2009 (Insured: FSA) | Aaa/AAA | 1,000,000 | 1,059,160 | |||||

Highlands Ranch Metropolitan District 2 Colorado, 6.50% due 6/15/2012 (Insured: FSA) (ETM) | Aaa/AAA | 525,000 | 601,235 | |||||

Highlands Ranch Metropolitan District 2 Colorado Unrefunded Balance, 6.50% due 6/15/2012 (Insured: FSA) | Aaa/AAA | 475,000 | 542,255 | |||||

Highlands Ranch Metropolitan District 3 Refunding Series B, 5.25% due 12/1/2008 (Insured: ACA) | NR/A | 1,760,000 | 1,810,847 | |||||

Highlands Ranch Metropolitan District 3 Series A, 5.25% due 12/1/2008 (Insured: ACA) | NR/A | 1,520,000 | 1,563,913 | |||||

Pinery West Metropolitan District 3, 4.70% due 12/1/2021 put 12/1/2007 (LOC: Compass Bank) | NR/A | 1,040,000 | 1,047,613 | |||||

Plaza Metropolitan District 1 Revenue, 7.60% due 12/1/2016 (Public Improvement Fee/Tax Increment Project) | NR/NR | 6,000,000 | 6,620,400 | |||||

Southland Metropolitan District Number 1 Unlimited GO, 6.75% due 12/1/2016 | NR/NR | 1,000,000 | 1,101,080 | |||||

DELAWARE — 0.57% | ||||||||

Delaware State Economic Development Authority Revenue, 5.50% due 7/1/2025 put 7/1/2010 (Delmarva Power & Light Project) | Baa1/BBB | 2,045,000 | 2,111,974 | |||||

Delaware State Health Facilities Authority Revenue, 6.25% due 10/1/2006 (ETM) | Aaa/AAA | 845,000 | 855,115 | |||||

| Certified Semi-Annual Report 17 |

| SCHEDULE OF INVESTMENTS, CONTINUED | ||

Thornburg Limited Term Municipal Fund | March 31, 2006 (Unaudited) | |

Issuer-Description | Credit Rating† Moody’s/S&P | Principal Amount | Value | |||||

Delaware State Health Facilities Authority Revenue Series A, 5.25% due 6/1/2011 (Beebe Medical Center Project) | Baa1/BBB+ | $ | 1,275,000 | $ | 1,337,309 | |||

Delaware State Health Facilities Authority Revenue Series A, 5.25% due 5/1/2012 (Nanticoke Memorial Hospital Project; Insured: Radian) | NR/AA | 1,370,000 | 1,449,706 | |||||

Delaware State Health Facilities Authority Revenue Series A, 5.25% due 5/1/2013 (Nanticoke Memorial Hospital Project; Insured: Radian) | NR/AA | 1,445,000 | 1,521,686 | |||||

DISTRICT OF COLUMBIA — 1.50% | ||||||||

District of Columbia COP, 5.00% due 1/1/2008 (Public Safety & Emergency Project; Insured: AMBAC) | Aaa/AAA | 1,000,000 | 1,022,290 | |||||

District of Columbia COP, 5.25% due 1/1/2013 (Insured: AMBAC) | Aaa/AAA | 5,950,000 | 6,313,485 | |||||

District of Columbia Hospital Revenue, 5.70% due 8/15/2008 (Medlantic Healthcare Project) (ETM) | Aaa/AAA | 4,430,000 | 4,551,160 | |||||

District of Columbia Hospital Revenue Refunding, 5.10% due 8/15/2008 (Medlantic Healthcare Group A Project) (ETM) | Aaa/AAA | 1,500,000 | 1,550,655 | |||||

District of Columbia Revenue, 6.00% due 1/1/2007 (American Assoc. for Advancement of Science Project; Insured: AMBAC) | Aaa/AAA | 500,000 | 508,695 | |||||

District of Columbia Tax Increment Capital Appreciation, 0% due 7/1/2009 (Mandarin Oriental Project; Insured: FSA) | Aaa/AAA | 2,000,000 | 1,761,820 | |||||

District of Columbia Tax Increment Capital Appreciation, 0% due 7/1/2011 (Mandarin Oriental Project; Insured: FSA) | Aaa/AAA | 1,990,000 | 1,604,816 | |||||

District of Columbia Tax Increment Capital Appreciation, 0% due 7/1/2012 (Mandarin Oriental Project; Insured: FSA) | Aaa/AAA | 1,480,000 | 1,136,522 | |||||

Washington DC Convention Center Authority Dedicated Tax Revenue, 5.00% due 10/1/2006 (Insured: AMBAC) | Aaa/AAA | 750,000 | 755,528 | |||||

FLORIDA — 4.62% | ||||||||

Broward County Resource Recovery Revenue Refunding, 5.375% due 12/1/2009 (Wheelabrator South Project) | A3/AA | 5,000,000 | 5,223,050 | |||||

Capital Projects Finance Authority Student Housing, 5.50% due 10/1/2012 (Capital Projects Student Housing; Insured: MBIA) | Aaa/AAA | 1,000,000 | 1,066,840 | |||||

Crossings at Fleming Island Community Development Refunding Series B, 5.45% due 5/1/2010 (Insured: MBIA) | Aaa/AAA | 2,461,000 | 2,542,853 | |||||

Dade County Solid Waste Systems Special Obligation Revenue Refunding, 6.00% due 10/1/2007 (Insured: AMBAC) | Aaa/AAA | 7,000,000 | 7,239,050 | |||||

Escambia County Health Facilities Revenue Baptist Hospital Baptist Manor, 5.125% due 10/1/2014 | Baa1/BBB+ | 2,755,000 | 2,822,029 | |||||

Flagler County School Board Certificates of Participation Series A, 5.00% due 8/1/2014 (Insured: FSA) | Aaa/AAA | 1,605,000 | 1,703,338 | |||||

Florida State Department of Children & Families COP South Florida Evaluation Treatment, 5.00% due 10/1/2015 | NR/AA+ | 925,000 | 979,501 | |||||

Florida State Refunding, 6.00% due 7/1/2006 (Department of Transportation Right of Way Project) | Aa1/AAA | 1,465,000 | 1,473,922 | |||||

Gulf Breeze Florida Revenue Local Government Series C, 4.00% due 12/1/2015 put 12/1/2007 (Insured: FGIC) | Aaa/AAA | 1,900,000 | 1,896,029 | |||||

Gulf Breeze Florida Revenue Local Government Series E, 4.00% due 12/1/2020 put 12/1/2007 (Insured: FGIC) | Aaa/AAA | 2,170,000 | 2,165,465 | |||||

Hillsborough County Industrial Development Authority, 5.10% due 10/1/2013 (Tampa Electric Co. Project) | Baa2/BBB- | 6,000,000 | 6,230,760 | |||||

Jacksonville Electric St. John’s River Park Systems Revenue Issue-2, 17th Series, 5.25% due 10/1/2012 | Aa2/AA- | 5,000,000 | 5,320,300 | |||||

Miami Dade County School Board COP Series A, 5.00% due 5/1/2006 (ETM) | Aaa/AAA | 1,910,000 | 1,912,177 | |||||

Miami Dade County School Board COP Series B, 5.50% due 5/1/2030 put 5/1/2011 (Insured: MBIA) | Aaa/AAA | 1,010,000 | 1,083,346 | |||||

Miami Dade County School Board COP Series C, 5.00% due 8/1/2007 (Insured: MBIA) | Aaa/AAA | 3,390,000 | 3,449,427 | |||||

Miami Dade County Special Housing Revenue Refunding, 5.80% due 10/1/2012 (HUD Section 8) | Baa3/NR | 3,560,000 | 3,554,304 | |||||

Orange County Health Facilities Authority, 5.80% due 11/15/2009 (Adventist Health System Project) (ETM) | A2/NR | 1,395,000 | 1,491,925 | |||||

Orange County Health Facilities Authority Revenue Unrefunded Balance Series A, 6.25% due 10/1/2007 (Orlando Regional Hospital Project; Insured: MBIA) | Aaa/AAA | 925,000 | 958,152 | |||||

18 Certified Semi-Annual Report |

| SCHEDULE OF INVESTMENTS, CONTINUED | ||

Thornburg Limited Term Municipal Fund | March 31, 2006 (Unaudited) | |

Issuer-Description | Credit Rating† Moody’s/S&P | Principal Amount | Value | |||||

Palm Beach County Industrial Development Revenue Series 1996, 6.00% due 12/1/2006 (Lourdes-Noreen McKeen Residence Project) (ETM) | NR/A | $ | 485,000 | $ | 492,348 | |||

Pasco County Housing Finance Authority Multi Family Revenue Refunding Series A, 5.35% due 6/1/2027 put 6/1/2008 (Oak Trail Apts. Project; Insured: AXA) | NR/AA- | 1,000,000 | 1,000,910 | |||||

Pelican Marsh Community Development District Refunding Series A, 5.00% due 5/1/2011 (Insured: Radian) | NR/NR | 3,025,000 | 3,086,317 | |||||

Sarasota County Public Hospital Series A, 3.17% due 7/1/2037 put 4/3/2006 (Sarosota Memorial Hospital Project; Insured: AMBAC) (daily demand notes) | VMIG1/NR | 450,000 | 450,000 | |||||

St. John’s County Florida Industrial Development Authority Series A, 5.50% due 8/1/2014 (Presbyterian Retirement Project) | NR/NR | 1,755,000 | 1,847,172 | |||||

Sunshine State Governmental Financing, 3.20% due 7/1/2016 put 4/7/2006 (Insured: AMBAC) (weekly demand note) | VMIG1/NR | 1,050,000 | 1,050,000 | |||||

GEORGIA — 0.34% | ||||||||

Georgia Municipal Association Inc. COP, 5.00% due 12/1/2006 (Atlanta City Court Project; Insured: AMBAC) | Aaa/AAA | 1,000,000 | 1,009,530 | |||||

Monroe County Development Authority Pollution Control Revenue, 6.75% due 1/1/2010 (Oglethorpe Power Project; Insured: MBIA) | Aaa/AAA | 2,000,000 | 2,204,240 | |||||

Monroe County Development Authority Pollution Control Revenue, 6.80% due 1/1/2012 (Oglethorpe Power Project; Insured: MBIA) | Aaa/AAA | 1,000,000 | 1,145,570 | |||||

HAWAII — 0.32% | ||||||||

Hawaii State Department of Budget & Finance Special Purpose Hawaiian Electric Co., 4.95% due 4/1/2012 (Insured: MBIA) | Aaa/AAA | 2,000,000 | 2,092,320 | |||||

Hawaii State Refunding Series CB, 5.75% due 1/1/2007 | Aa2/AA- | 1,000,000 | 1,016,000 | |||||

Honolulu City & County Refunding Series A, 7.35% due 7/1/2006 | Aa2/AA- | 1,000,000 | 1,009,220 | |||||

IDAHO — 0.24% | ||||||||

Twin Falls Urban Renewal Agency Refunding Series A, 4.95% due 8/1/2014 | NR/NR | 1,640,000 | 1,616,794 | |||||

Twin Falls Urban Renewal Agency Refunding Series A, 5.15% due 8/1/2017 | NR/NR | 1,455,000 | 1,431,604 | |||||

ILLINOIS — 10.01% | ||||||||

Champaign County Community School District No. 116 Series C, 0% due 1/1/2009 (ETM) | Aaa/AAA | 1,205,000 | 1,089,441 | |||||

Champaign County Community School District No. 116 Unrefunded Balance Series C, 0% due 1/1/2009 (Insured: FGIC) | Aaa/AAA | 2,140,000 | 1,927,990 | |||||

Chicago Board of Education, 6.00% due 12/1/2009 (Insured: FGIC) | Aaa/AAA | 2,000,000 | 2,152,200 | |||||

Chicago Board of Education School Reform, 6.25% due 12/1/2012 (Insured: MBIA) | Aaa/AAA | 750,000 | 848,078 | |||||

Chicago Housing Authority Capital Program Revenue, 5.00% due 7/1/2007 | Aa3/AA | 1,000,000 | 1,015,190 | |||||

Chicago Housing Authority Capital Program Revenue, 5.25% due 7/1/2010 | Aa3/AA | 2,300,000 | 2,418,542 | |||||

Chicago Metropolitan Water Reclamation, 6.90% due 1/1/2007 | Aaa/AA+ | 1,185,000 | 1,213,570 | |||||

Chicago Midway Airport Revenue Series A, 5.40% due 1/1/2009 (Insured: MBIA) | Aaa/AAA | 1,340,000 | 1,367,845 | |||||

Chicago Midway Airport Revenue Series C, 5.50% due 1/1/2013 (Insured: MBIA) | Aaa/AAA | 1,180,000 | 1,279,368 | |||||

Chicago O’Hare International Airport Revenue, 5.375% due 1/1/2007 (Insured: AMBAC) | Aaa/AAA | 1,000,000 | 1,013,480 | |||||

Chicago O’Hare International Airport Revenue, 5.00% due 1/1/2012 (Insured: MBIA) | Aaa/AAA | 1,105,000 | 1,164,095 | |||||

Chicago O’Hare International Airport Revenue 2nd Lien Series C-1, 5.00% due 1/1/2010 (Insured: MBIA) | Aaa/AAA | 1,000,000 | 1,041,160 | |||||

Chicago O’Hare International Airport Revenue Passenger Facility Series A, 5.625% due 1/1/2014 (Insured: AMBAC) | Aaa/AAA | 3,065,000 | 3,130,744 | |||||

Chicago Park District Parking Facility Revenue, 5.75% due 1/1/2010 (ETM) | Baa1/A | 1,000,000 | 1,069,290 | |||||

Chicago Refunding Series A, 5.375% due 1/1/2013 (Insured: MBIA) | Aaa/AAA | 3,000,000 | 3,189,450 | |||||

Chicago Refunding Series A-2, 6.125% due 1/1/2012 (Insured: AMBAC) | Aaa/AAA | 1,000,000 | 1,111,370 | |||||

Chicago Water Revenue, 6.50% due 11/1/2011 (Insured: FGIC) | Aaa/AAA | 1,810,000 | 2,044,667 | |||||

Cook County Capital Improvement, 5.50% due 11/15/2008 pre-refunded 11/15/2006 | Aaa/AAA | 995,000 | 1,016,960 | |||||

| Certified Semi-Annual Report 19 |

| SCHEDULE OF INVESTMENTS, CONTINUED | ||

Thornburg Limited Term Municipal Fund | March 31, 2006 (Unaudited) | |

Issuer-Description | Credit Rating† Moody’s/S&P | Principal Amount | Value | |||||

Cook County Community Capital Appreciation, 0% due 12/1/2010 (Insured: FSA) | Aaa/NR | $ | 2,000,000 | $ | 1,671,660 | |||

Cook County Community School District 97 Series B, 9.00% due 12/1/2013 (Insured: FGIC) | Aaa/NR | 2,250,000 | 2,960,640 | |||||

Cook County Refunding Series A, 6.25% due 11/15/2013 (Insured: MBIA) | Aaa/AAA | 3,995,000 | 4,562,010 | |||||

Cook County School District 99, 9.00% due 12/1/2012 (Insured: FGIC) | Aaa/NR | 1,000,000 | 1,277,500 | |||||

Du Page County Forest Preservation District, 0% due 11/1/2009 | Aaa/AAA | 5,000,000 | 4,366,900 | |||||

Glenview Multi Family Revenue Refunding, 5.20% due 12/1/2027 put 12/1/2007 (Collateralized: FNMA) | NR/AAA | 1,470,000 | 1,493,153 | |||||

Hoffman Estates Illinois Tax Increment Revenue, 0% due 5/15/2006 (Hoffman Estates Economic Development Project; Guaranty: Sears) | Ba1/NR | 3,075,000 | 3,057,872 | |||||

Hoffman Estates Illinois Tax Increment Revenue Junior Lien, 0% due 5/15/2007 | Ba1/NR | 1,500,000 | 1,424,895 | |||||

Illinois Development Finance Authority Multi Family Housing Revenue Refunding Series A, 5.55% due 7/20/2008 (Collateralized: GNMA) | NR/AAA | 900,000 | 915,210 | |||||

Illinois Development Finance Authority Pollution Control Revenue Refunding, 5.70% due 1/15/2009 (Commonwealth Edison Co. Project; Insured: MBIA) | Aaa/AAA | 3,000,000 | 3,148,230 | |||||

Illinois Development Finance Authority Pollution Series A, 7.375% due 7/1/2021 pre-refunded 7/1/2006 (Illinois Power Co. Project) | Baa2/NR | 5,000,000 | 5,144,550 | |||||

Illinois Development Finance Authority Revenue, 6.00% due 11/15/2009 (Adventist Health Project; Insured: MBIA) | Aaa/AAA | 3,635,000 | 3,873,929 | |||||

Illinois Development Finance Authority Revenue, 6.00% due 11/15/2010 (Adventist Health Project; Insured: MBIA) | Aaa/AAA | 3,860,000 | 4,164,901 | |||||

Illinois Development Finance Authority Revenue Community Rehab Providers A, 5.00% due 7/1/2006 | NR/BBB | 645,000 | 645,161 | |||||

Illinois Development Finance Authority Revenue Provena Health Series A, 5.50% due 5/15/2011 (Insured: MBIA) | Aaa/AAA | 1,000,000 | 1,040,720 | |||||

Illinois Development Finance Authority Revenue Refunding Community Rehab Providers A, 5.60% due 7/1/2006 | NR/BBB | 1,000,000 | 1,002,240 | |||||

Illinois Development Finance Authority Revenue Refunding Community Rehab Providers Series A, 6.00% due 7/1/2015 | NR/BBB | 4,500,000 | 4,608,135 | |||||

Illinois Development Finance Authority Revenue Series A, 5.75% due 5/15/2014 (Provena Health Project; Insured: MBIA) | Aaa/AAA | 6,035,000 | 6,311,162 | |||||

Illinois Educational Facilities Authority Revenues Unrefunded Balance Loyola A, 6.00% due 7/1/2009 (Insured: MBIA) | Aaa/AAA | 1,275,000 | 1,357,505 | |||||

Illinois Health Facilities Authority Revenue, 5.50% due 11/15/2007 (OSF Healthcare System Project) | A2/A | 915,000 | 936,859 | |||||

Illinois Health Facilities Authority Revenue, 6.50% due 2/15/2008 (Iowa Health System Project) | A1/NR | 1,290,000 | 1,345,651 | |||||

Illinois Health Facilities Authority Revenue, 6.50% due 2/15/2009 (Iowa Health System Project) | A1/NR | 1,375,000 | 1,459,453 | |||||

Illinois Health Facilities Authority Revenue, 6.50% due 2/15/2010 (Iowa Health System Project) (ETM) | A1/NR | 1,465,000 | 1,579,563 | |||||

Illinois Health Facilities Authority Revenue, 6.00% due 2/15/2011 (Iowa Health System Project; Insured:AMBAC) (ETM) | Aaa/AAA | 1,560,000 | 1,701,492 | |||||

Illinois Health Facilities Authority Revenue Refunding, 5.00% due 8/15/2007 (University of Chicago Hospital & Health Project; Insured: MBIA) | Aaa/AAA | 1,500,000 | 1,526,595 | |||||

Illinois Health Facilities Authority Revenue Refunding, 5.00% due 8/15/2008 (University of Chicago Hospital & Health Project; Insured: MBIA) | Aaa/AAA | 1,500,000 | 1,542,975 | |||||

Illinois Health Facilities Authority Revenue Refunding, 5.50% due 11/15/2011 (Methodist Medical Center Project; Insured: MBIA) | Aaa/AAA | 3,000,000 | 3,142,440 | |||||

Illinois Health Facilities Authority Revenue University of Chicago, 5.00% due 8/15/2009 (Hospital Systems Project; Insured: MBIA) | Aaa/AAA | 1,000,000 | 1,037,280 | |||||

Illinois Hospital District, 5.50% due 1/1/2010 (Insured: FGIC) | Aaa/AAA | 1,040,000 | 1,098,947 | |||||

Illinois State COP Central Management Department, 5.00% due 7/1/2007 (Insured: AMBAC) | Aaa/AAA | 500,000 | 508,390 | |||||

Illinois State Partners Series A, 6.00% due 7/1/2006 (Insured: AMBAC) | Aaa/AAA | 1,000,000 | 1,005,990 | |||||

Kane County School District Number 129 Aurora West Side Refunding, 5.50% due 2/1/2012 (Insured: FGIC) | Aaa/NR | 1,200,000 | 1,236,372 | |||||

Lake County Community High School District 117 Series B, 0% due 12/1/2006 (Insured: FGIC) | Aaa/NR | 2,000,000 | 1,953,880 | |||||

Lake County Community High School District 117 Series B, 0% due 12/1/2011 (Insured: FGIC) | Aaa/NR | 3,235,000 | 2,589,423 | |||||

McHenry & Kane Counties Community Consolidated School District 158, 0% due 1/1/2010 (Insured: FGIC) | Aaa/AAA | 1,000,000 | 866,750 | |||||

20 Certified Semi-Annual Report |

| SCHEDULE OF INVESTMENTS, CONTINUED | ||

Thornburg Limited Term Municipal Fund | March 31, 2006 (Unaudited) | |

Issuer-Description | Credit Rating† Moody’s/S&P | Principal Amount | Value | |||||

McHenry & Kane Counties Il, 0% due 1/1/2012 (Insured: FGIC) | Aaa/AAA | $ | 2,200,000 | $ | 1,748,010 | |||

Mclean & Woodford Counties School District GO, 7.375% due 12/1/2010 (Insured: FSA) | Aaa/NR | 1,500,000 | 1,722,885 | |||||

Metropolitan Pier & Exposition Authority Dedicated State Tax Revenue Series A-2002, 6.00% due 6/15/2007 pre-refunded 6/15/2006 (McCormick Place Exposition Project; Insured: AMBAC) | Aaa/AAA | 1,250,000 | 1,281,163 | |||||

Metropolitan Pier & Exposition Authority Dedicated State Tax Revenue Series A-2002 Unrefunded Balance, 6.00% due 6/15/2007 (McCormick Place Exposition Project; Insured: AMBAC) | Aaa/AAA | 3,750,000 | 3,842,212 | |||||

Naperville City, Du Page & Will Counties Economic Development Revenue, 6.10% due 5/1/2008 (Hospital & Health System Association Project; LOC: Bank One N.A.) | NR/AA- | 1,895,000 | 1,934,018 | |||||

Peoria Public Building Commission School District Facilities Revenue, 0% due 12/1/2007 (Insured: FGIC) | Aaa/NR | 1,100,000 | 1,034,682 | |||||

University of Illinois COP Series A, 5.00% due 8/15/2019 pre-refunded 8/15/2011 (Utility Infrastructure Project) | Aaa/AAA | 5,235,000 | 5,547,896 | |||||

University of Illinois Revenues, 0% due 10/1/2006 (Insured: MBIA) | Aaa/AAA | 6,300,000 | 6,190,758 | |||||

INDIANA — 7.20% | ||||||||

Allen County Economic Development Revenue, 5.00% due 12/30/2012 (Indiana Institute of Technology Project) | NR/NR | 1,370,000 | 1,401,387 | |||||

Allen County Economic Development Revenue First Mortgage, 5.30% due 12/30/2006 (Indiana Institute of Technology Project) | NR/NR | 690,000 | 696,776 | |||||

Allen County Economic Development Revenue First Mortgage, 5.60% due 12/30/2009 (Indiana Institute of Technology Project) | NR/NR | 1,110,000 | 1,158,229 | |||||

Allen County Jail Building Corp. First Mortgage, 5.75% due 10/1/2010 (ETM) | Aa3/NR | 1,115,000 | 1,208,961 | |||||

Allen County Jail Building Corp. GO, 5.00% due 10/1/2011 (Insured: XLCA) | Aaa/AAA | 2,390,000 | 2,511,770 | |||||

Allen County Jail Building Corp. GO, 5.00% due 10/1/2012 (Insured: XLCA) | Aaa/AAA | 1,275,000 | 1,342,498 | |||||

Allen County Jail Building Corp. GO, 5.00% due 10/1/2014 (Insured: XLCA) | Aaa/AAA | 1,000,000 | 1,056,690 | |||||

Allen County Jail Building Corp. GO, 5.00% due 10/1/2015 (Insured: XLCA) | Aaa/AAA | 1,480,000 | 1,564,834 | |||||

Allen County Jail Building Corp. GO, 5.00% due 10/1/2016 (Insured: XLCA) | Aaa/AAA | 1,520,000 | 1,603,843 | |||||

Allen County Redevelopment District Tax Series A, 5.00% due 11/15/2016 | A3/NR | 1,000,000 | 1,025,060 | |||||

Ball State University Revenues Student Fee Series K, 5.75% due 7/1/2012 (Insured: FGIC) | Aaa/AAA | 1,000,000 | 1,092,250 | |||||

Boone County Hospital Association Lease Revenue, 5.00% due 1/15/2007 (ETM) | Aaa/AAA | 1,085,000 | 1,096,968 | |||||

Boonville Junior High School Building Corp. Revenue, 0% due 7/1/2010 (State Aid Withholding) | NR/A | 850,000 | 701,191 | |||||

Boonville Junior High School Building Corp. Revenue, 0% due 1/1/2011 (State Aid Withholding) | NR/A | 850,000 | 682,635 | |||||

Boonville Junior High School Building Corp. Revenue Refunding, 0% due 7/1/2011 (State Aid Withholding) | NR/A | 950,000 | 744,772 | |||||

Brownsburg 1999 School Building, 5.00% due 2/1/2011 (Insured: FSA) | Aaa/AAA | 1,720,000 | 1,810,661 | |||||

Brownsburg 1999 School Building, 5.00% due 8/1/2011 (Insured: FSA) | Aaa/AAA | 1,835,000 | 1,938,219 | |||||

Brownsburg 1999 School Building, 5.25% due 2/1/2012 (Insured: FSA) | Aaa/AAA | 1,880,000 | 2,011,675 | |||||

Brownsburg 1999 School Building, 5.25% due 8/1/2012 (Insured: FSA) | Aaa/AAA | 1,755,000 | 1,884,186 | |||||

Carmel Indiana Redevelopment Authority Lease Capital Appreciation Performing Arts, 0% due 2/1/2015 | Aa2/AA | 1,575,000 | 1,060,132 | |||||

Center Grove 2000 Building First Mortgage, 5.00% due 7/15/2009 (Insured: AMBAC) (ETM) | Aaa/AAA | 1,175,000 | 1,222,564 | |||||

Center Grove 2000 Building First Mortgage, 5.00% due 7/15/2010 (Insured: AMBAC) (ETM) | Aaa/AAA | 1,135,000 | 1,192,964 | |||||

Dekalb County Redevelopment Authority Lease Rental Revenue Refunding, 5.00% due 1/15/2011 (Mini Mill Local Public Improvement Project; Insured: XLCA) | Aaa/AAA | 1,015,000 | 1,060,036 | |||||

Dekalb County Redevelopment Authority Lease Rental Revenue Refunding, 5.00% due 1/15/2012 (Mini Mill Local Public Improvement Project; Insured: XLCA) | Aaa/AAA | 1,000,000 | 1,047,370 | |||||

Dekalb County Redevelopment Authority Lease Rental Revenue Refunding, 5.25% due 1/15/2013 (Mini Mill Local Public Improvement Project; Insured: XLCA) | Aaa/AAA | 1,000,000 | 1,063,800 | |||||

Dekalb County Redevelopment Authority Lease Rental Revenue Refunding, 5.25% due 1/15/2014 (Mini Mill Local Public Improvement Project; Insured: XLCA) | Aaa/AAA | 1,000,000 | 1,060,070 | |||||

Eagle Union Middle School Building Corp., 5.50% due 7/15/2009 (ETM) | Aaa/AAA | 910,000 | 960,805 | |||||

Elberfeld J. H. Castle School Building Corp. Indiana First Mortgage Refunding, 0% due 7/5/2008 (Insured: MBIA) | NR/AAA | 1,860,000 | 1,709,712 | |||||

| Certified Semi-Annual Report 21 |

| SCHEDULE OF INVESTMENTS, CONTINUED | ||

Thornburg Limited Term Municipal Fund | March 31, 2006 (Unaudited) | |

Issuer-Description | Credit Rating† Moody’s/S&P | Principal Amount | Value | |||||

Evansville Vanderburgh Refunding, 5.00% due 7/15/2014 (Insured: AMBAC) | Aaa/AAA | $ | 1,000,000 | $ | 1,061,780 | |||

Evansville Vanderburgh Refunding, 5.00% due 7/15/2015 (Insured: AMBAC) | Aaa/AAA | 1,000,000 | 1,063,160 | |||||

Goshen Multi School Building Corp. First Mortgage, 5.20% due 7/15/2007 (Insured: MBIA) | Aaa/AAA | 965,000 | 984,223 | |||||

Hammond Multi-School Building Corp. First Mortgage Refunding Bond Series 1997, 6.00% due 7/15/2008 (Lake County Project; State Aid Withholding) | NR/A | 2,305,000 | 2,384,592 | |||||

Huntington Economic Development Revenue, 6.00% due 11/1/2006 (United Methodist Membership Project) | NR/NR | 200,000 | 201,830 | |||||

Huntington Economic Development Revenue, 6.15% due 11/1/2008 (United Methodist Membership Project) | NR/NR | 700,000 | 724,647 | |||||

Huntington Economic Development Revenue, 6.20% due 11/1/2010 (United Methodist Membership Project) | NR/NR | 790,000 | 817,776 | |||||

Indiana Health Facility Financing Authority Hospital Revenue Series D, 5.00% due 11/1/2026 pre-refunded 11/1/2007 | Aaa/NR | 1,600,000 | 1,631,024 | |||||

Indiana State Educational Facilities Authority Revenue, 5.75% due 10/1/2009 (University of Indianapolis Project) | NR/A- | 670,000 | 705,262 | |||||

Indiana University Revenues Refunding, 0% due 8/1/2007 (Insured: AMBAC) | Aaa/AAA | 2,500,000 | 2,381,250 | |||||

Indianapolis Airport Authority Revenue Refunding Series A, 5.35% due 7/1/2007 (Insured: FGIC) | Aaa/AAA | 1,100,000 | 1,122,176 | |||||

Indianapolis Local Public Improvement Bond Bank Transportation Revenue, 0% due 7/1/2006 (ETM) | Aa2/AA- | 1,240,000 | 1,229,460 | |||||

Indianapolis Local Public Improvement Bond Waterworks Project Series F, 5.00% due 1/1/2015 (Insured: MBIA) | Aaa/AAA | 1,000,000 | 1,064,790 | |||||

Indianapolis Local Public Improvement Bond Waterworks Project Series F, 5.00% due 7/1/2015 (Insured: MBIA) | Aaa/AAA | 1,000,000 | 1,066,260 | |||||

Indianapolis Resource Recovery Revenue Refunding, 6.75% due 12/1/2006 (Ogden Martin Systems, Inc. Project; Insured: AMBAC) | Aaa/AAA | 2,000,000 | 2,038,640 | |||||

Knox Middle School Building Corp. First Mortgage, 6.00% due 7/15/2008 (Insured: FGIC) | Aaa/AAA | 855,000 | 897,297 | |||||

Knox Middle School Building Corp. First Mortgage, 6.00% due 7/15/2009 (Insured: FGIC) | Aaa/AAA | 455,000 | 486,049 | |||||

Madison Schools Lydia Middleton Building Corp., 5.00% due 7/15/2014 (Insured: FGIC) | Aaa/AAA | 1,200,000 | 1,275,000 | |||||

Madison Schools Lydia Middleton Building Corp., 5.00% due 7/15/2015 (Insured: FGIC) | Aaa/AAA | 1,250,000 | 1,329,937 | |||||

Monroe County Community School Building Corp. Revenue Refunding, 5.00% due 1/15/2007 (Insured: AMBAC) | Aaa/AAA | 625,000 | 630,113 | |||||

Mount Vernon of Hancock County Refunding First Mortgage, 5.00% due 7/15/2013 (Insured: MBIA) | Aaa/AAA | 1,055,000 | 1,115,462 | |||||

Mount Vernon of Hancock County Refunding First Mortgage, 5.00% due 7/15/2014 (Insured: MBIA) | Aaa/AAA | 1,135,000 | 1,202,669 | |||||

Mount Vernon of Hancock County Refunding First Mortgage, 5.00% due 7/15/2015 (Insured: MBIA) | Aaa/AAA | 1,140,000 | 1,209,301 | |||||

Mount Vernon Pollution Control & Waste, 3.17% due 12/1/2014 put 4/3/2006 (General Electric Co. Project) (daily demand notes) | Aaa/AAA | 3,200,000 | 3,200,000 | |||||

Northwestern School Building Corp., 5.00% due 7/15/2011 (State Aid Withholding) | Aaa/AAA | 1,240,000 | 1,304,430 | |||||

Perry Township Multi School Building Refunding, 5.00% due 1/10/2013 (Insured: FSA) | Aaa/NR | 1,225,000 | 1,293,208 | |||||

Perry Township Multi School Building Refunding, 5.00% due 7/10/2013 (Insured: FSA) | Aaa/NR | 2,025,000 | 2,140,992 | |||||

Perry Township Multi School Building Refunding, 5.00% due 7/10/2014 (Insured: FSA) | Aaa/NR | 2,130,000 | 2,256,948 | |||||

Peru Community School Corp. Refunding First Mortgage, 0% due 7/1/2010 (State Aid Withholding) | NR/A | 835,000 | 688,817 | |||||

Plainfield Indiana Community High School Building Corp. First Mtg, 5.00% due 1/15/2015 (Insured: FGIC) | Aaa/AAA | 1,445,000 | 1,534,373 | |||||

Rockport Pollution Control Revenue Series C, 2.625% due 4/1/2025 put 10/1/2006 (Indiana Michigan Power Co. Project) | Baa2/BBB | 4,030,000 | 3,991,957 | |||||

Warren Township Vision 2005, 5.00% due 7/10/2015 (Insured: FGIC) | Aaa/AAA | 2,095,000 | 2,224,555 | |||||

Wawasee Community School Corp. First Mortgage, 5.50% due 7/15/2010 (State Aid Withholding) (ETM) | NR/AA | 995,000 | 1,060,043 | |||||

Wawasee Community School Corp. First Mortgage, 5.50% due 7/15/2011 (State Aid Withholding) (ETM) | NR/AA | 1,095,000 | 1,177,826 | |||||

West Clark 2000 School Building Corp., 5.25% due 1/15/2013 (Insured: MBIA) | Aaa/AAA | 1,235,000 | 1,326,513 | |||||

West Clark 2000 School Building Corp., 5.25% due 7/15/2013 (Insured: MBIA) | Aaa/AAA | 1,305,000 | 1,405,289 | |||||

West Clark 2000 School Building Corp., 5.25% due 1/15/2014 (Insured: MBIA) | Aaa/AAA | 1,335,000 | 1,438,983 | |||||

West Clark School Building Corp. First Mortgage, 5.75% due 7/15/2011 (Insured: FGIC) | Aaa/AAA | 2,080,000 | 2,267,138 | |||||

Westfield Elementary School Building Corp. First Mortgage Series 1997, 6.80% due 7/15/2007 (ETM) | Aaa/AAA | 1,130,000 | 1,158,792 | |||||