UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05201

Thornburg Investment Trust

(Exact name of registrant as specified in charter)

119 East Marcy Street, Santa Fe, New Mexico 87501

(Address of principal executive offices) (Zip code)

Garrett Thornburg, 119 East Marcy Street, Santa Fe, New Mexico 87501

(Name and address of agent for service)

Registrant’s telephone number, including area code: 505-984-0200

Date of fiscal year end: September 30, 2007

Date of reporting period: September 30, 2007

| Item 1. | Reports to Stockholders |

The following annual reports are attached hereto, in order:

Thornburg Limited Term Municipal Fund

Thornburg Limited Term Municipal Fund Class I

Thornburg California Limited Term Municipal Fund

Thornburg California Limited Term Municipal Fund Class I

Thornburg Intermediate Municipal Fund

Thornburg Intermediate Municipal Fund Class I

Thornburg New Mexico Intermediate Municipal Fund

Thornburg New Mexico Intermediate Municipal Fund Class I

Thornburg New York Intermediate Municipal Fund

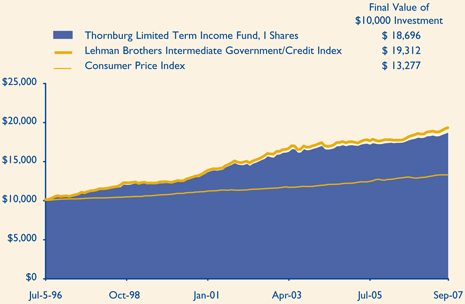

Thornburg Limited Term Income Funds

Thornburg Limited Term Income Funds Class I

Thornburg Value Fund

Thornburg Value Fund Class I

Thornburg International Value Fund

Thornburg International Value Fund Class I

Thornburg Core Growth Fund

Thornburg Core Growth Fund Class I

Thornburg Investment Income Builder Fund

Thornburg Investment Income Builder Fund Class I

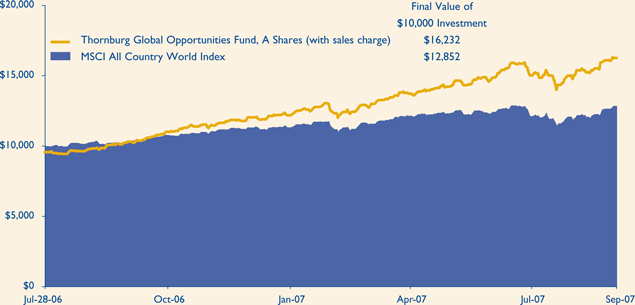

Thornburg Global Opportunities Fund

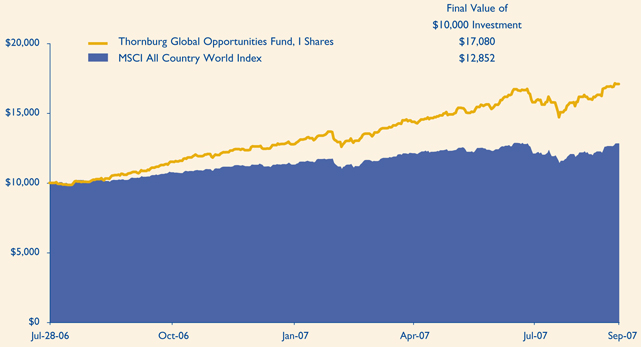

Thornburg Global Opportunities Fund Class I

Thornburg International Growth Fund

Thornburg International Growth Fund Class I

Thornburg Limited Term Municipal Fund

Laddering – an All Weather Strategy

The Fund’s primary investment objective is to obtain as high a level of current income exempt from federal individual income taxes as is consistent, in the view of the Fund’s investment advisor, with preservation of capital (may be subject to Alternative Minimum Tax). The secondary goal of the Fund is to reduce expected changes in its share price compared to longer intermediate and long-term bond portfolios.

This Fund is a laddered portfolio of municipal bonds with an average maturity of normally less than five years. Laddering involves building a portfolio of bonds with staggered maturities so that a portion of the portfolio matures each year; cash from maturing bonds, if not needed for other purposes, is invested in bonds with longer maturities at the far end of the ladder. We regard the strategy as a good compromise for managing different types of risk.

Thornburg Bond Funds

| • | Thornburg Limited Term Municipal Fund |

| • | Thornburg Intermediate Municipal Fund |

| • | Thornburg California Limited Term Municipal Fund |

| • | Thornburg New Mexico Intermediate Municipal Fund |

| • | Thornburg New York Intermediate Municipal Fund |

| • | Thornburg Limited Term U.S. Government Fund |

| • | Thornburg Limited Term Income Fund |

Thornburg invests in short- and intermediate-term investment grade bonds. We ladder the maturities of individual bonds in the portfolios to moderate risk. Laddering involves building a portfolio of bonds with staggered maturities so that a portion of the portfolio will mature each year. We apply this disciplined process in all interest rate environments.

Thornburg Equity Funds

| • | Thornburg Value Fund |

| • | Thornburg International Value Fund |

| • | Thornburg Core Growth Fund |

| • | Thornburg Investment Income Builder Fund |

| • | Thornburg Global Opportunities Fund |

| • | Thornburg International Growth Fund |

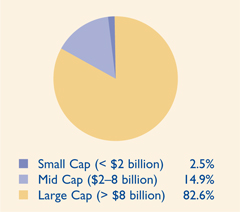

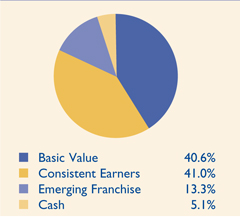

Thornburg’s equity research uses a fundamental and comprehensive analytical approach. Thornburg equity funds focus on a limited number of securities so that each holding can impact performance. The equity team searches for firms believed to have a promising future and seeks to buy shares of those companies at a discount to their intrinsic value.

More information at www.thornburg.com

| Reduce paper clutter. Receive your shareholder reports and prospectus online instead of through traditional mail.

Sign up at www.thornburg.com/edelivery |

| 2 | This page is not part of the Annual Report. |

Thornburg Limited Term Municipal Fund

September 30, 2007

| 6 | ||

| 8 | ||

| 9 | ||

| 10 | ||

| 11 | ||

| 15 | ||

| 18 | ||

| 32 | ||

| 33 | ||

| 34 | ||

| 35 | ||

| 38 |

This report is certified under the Sarbanes-Oxley Act of 2002, which requires that public companies, including mutual funds, affirm that the information provided in their annual and semiannual shareholder reports fully and fairly represents their financial position.

| Certified Annual Report | 3 |

Important Information

Performance data quoted represents past performance and does not guarantee future results. Investment return and principal value will fluctuate so that upon redemption, investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than the data quoted. For performance data current to the most recent month end, visit www.thornburg.com.

The maximum sales charge for the Fund’s Class A shares is 1.50%. Class C shares include a 0.50% contingent deferred sales charge (CDSC) for the first year only.

Performance data given at net asset value (NAV) does not take into account these sales charges. If the sales charges had been included, the performance would have been lower.

Investments in the Fund carry risks, including possible loss of principal. As with direct bond ownership, funds that invest in bonds are subject to certain risks including interest-rate risk, credit risk, and inflation risk. The principal value of bond funds will fluctuate relative to changes in interest rates, decreasing when interest rates rise. Unlike bonds, bond funds have ongoing fees and expenses. Please see the Fund’s Prospectus for a discussion of the risks associated with an investment in the Fund. Investments in the Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank, the Federal Deposit Insurance Corporation, the Federal Reserve Board or any government agency. There is no guarantee that the Fund will meet its investment objectives. The laddering strategy does not assure or guarantee better performance and cannot eliminate the risk of investment losses.

The information presented on the following pages was current as of September 30, 2007. The managers’ views, portfolio holdings, and sector diversification are historical and subject to change. This material should not be deemed a recommendation to buy or sell any of the securities mentioned.

The matters discussed in this report may constitute forward-looking statements made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995. These include any advisor or portfolio manager prediction, assessment, analysis or outlook for individual securities, industries, investment styles, market sectors and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for each fund in its current prospectus, other factors bearing on these reports include the accuracy of the advisor’s or portfolio manager’s forecasts and predictions, the appropriateness of the investment strategies designed by the advisor or portfolio manager and the ability of the advisor or portfolio manager to implement their strategies efficiently and successfully. Any one or more of these factors, as well as other risks affecting the securities markets generally, could cause the actual results of any fund to differ materially as compared to its benchmarks.

| 4 | This page is not part of the Annual Report. |

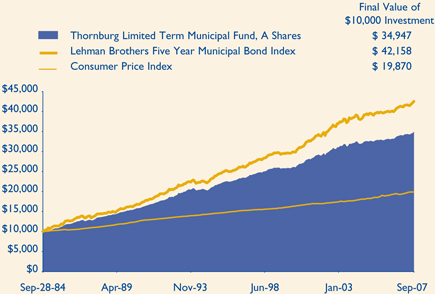

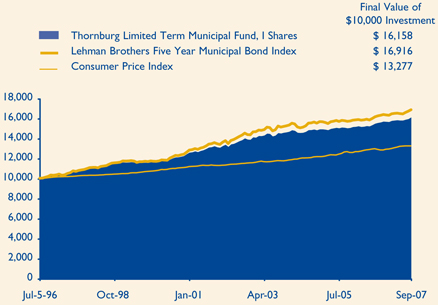

Glossary

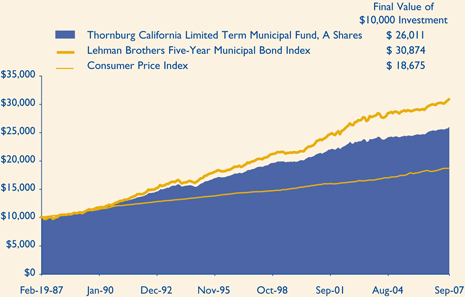

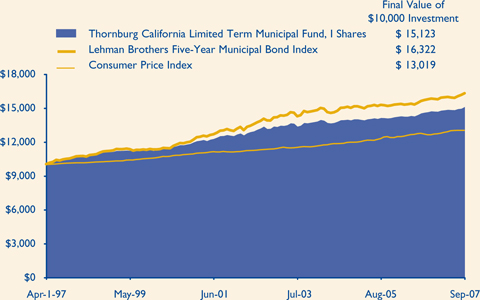

The Lehman Brothers Five-Year Municipal Bond Index – A rules-based, market-value-weighted index engineered for the long-term tax-exempt bond market. To be included in the index, bonds must have a minimum credit rating of Baa. The approximate maturity of the municipal bonds in the index is five years.

Consumer Price Index – The Consumer Price Index (“CPI”) measures prices of a fixed basket of goods bought by a typical consumer, including food, transportation, shelter, utilities, clothing, medical care, entertainment and other items. The CPI, published by the Bureau of Labor Statistics in the Department of Labor, is based at 100 in 1982 and is released monthly. It is widely used as a cost-of-living benchmark to adjust Social Security payments and other payment schedules, union contracts and tax brackets. Also known as the cost-of-living index.

Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. Investors may not make direct investments into any index.

Duration – The measure of the price sensitivity of a fixed-income security to an interest rate change of 100 basis points. Calculation is based on the weighted average of the present values for all cash flows.

Weighted Average Maturity – A weighted average of all the effective maturities of the bonds in a portfolio. Effective maturity takes into consideration mortgage prepayments, puts, sinking funds, adjustable coupons, and other features of individual bonds and is thus a more accurate measure of interest-rate sensitivity. Longer-maturity funds are generally considered more interest-rate sensitive than their shorter counterparts.

Fed Funds Rate – The interest rate at which a depository institution lends immediately available funds (balances at the Federal Reserve) to another depository institution overnight.

U.S. Treasury Securities – U.S. Treasury securities, such as bills, notes and bonds, are negotiable debt obligations of the U.S. government. These debt obligations are backed by the “full faith and credit” of the government and issued at various schedules and maturities. Income from Treasury securities is exempt from state and local, but not federal, taxes.

| Certified Annual Report | 5 |

George Strickland Co-Portfolio Manager

Josh Gonze Co-Portfolio Manager

Christopher Ihlefeld Co-Portfolio Manager | October 18, 2007

Dear Fellow Shareholder:

We are pleased to present the Annual Report for the Thornburg Limited Term Municipal Fund. The

The past year has been one of the more interesting in recent memory. Municipal bonds traded

Meanwhile, quality spreads (the difference in yield between the highest quality bonds and lower

Since the end of August, the bond market has been gradually regaining its composure. A calmer,

The Class A shares of your Fund produced a total return of 3.18% over the twelve-month period

Your Thornburg Limited Term Municipal Fund is a laddered portfolio of over 470 municipal |

| 6 | Certified Annual Report |

mediate bonds accomplishes two goals. First, the staggered bond maturities contained in a ladder defuse interest-rate risk and dampen the Fund’s price volatility. Second, laddering gives the Fund a steady cash flow stream from maturing bonds to reinvest toward the top of the ladder where yields are typically higher. The chart on the right describes the percentages of your Fund’s bond portfolio maturing in each of the coming years.

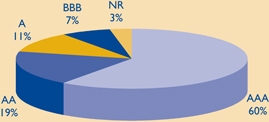

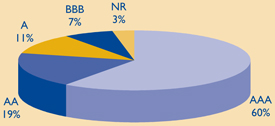

We were able to take advantage of the late summer market weakness to restructure the Fund somewhat. Early in 2007, the Fund’s ladder was a bit overweighted in the early years, which led to an average maturity of 4.3 years and duration of 3.4 years. As interest rates rose, we invested primarily in the later years of the Fund’s ladder so that it is now more evenly distributed. Consequently, at fiscal year end (September 30, 2007), the Fund had an average maturity of 4.75 and duration of 3.77 years. We also added incrementally to lower rated investment grade bonds, although we continue to maintain a AA average quality.

% of portfolio | Cumulative % | |

1 years = 10.9% | Year 1 = 10.9% | |

1 to 2 years = 8.4% | Year 2 = 19.3% | |

2 to 3 years = 11.1% | Year 3 = 30.4% | |

3 to 4 years = 12.3% | Year 4 = 42.7% | |

4 to 5 years = 8.8% | Year 5 = 51.5% | |

5 to 6 years = 10.2% | Year 6 = 61.7% | |

6 to 7 years = 9.5% | Year 7 = 71.2% | |

7 to 8 years = 9.2% | Year 8 = 80.4% | |

8 to 9 years = 10.1% | Year 9 = 90.5% | |

Over 9 years = 9.5% | Over 9 years = 100.0% |

Percentages can and do vary. Data as of 9/30/07.

Looking forward, we do expect U.S. economic growth to slow from the second quarter’s healthy 3.8% rate. However, consumer spending seems to be holding up well, and exports are surging. These factors, along with new job growth of about 100,000 per month, should keep the U.S. economy out of recession territory. However, the dismal housing sector and the dislocation in financial markets will probably cap future growth at a relatively low rate. This should allow the Fed to continue easing monetary conditions, but with a close eye on what happens to inflation. Market unease about the depreciating dollar and the long-term inflation outlook should keep long-term interest rates from dropping precipitously, which, in turn, should lead to a steeper yield curve going forward. We believe that a steepening yield curve would be advantageous for the laddering style employed by this Fund.

State tax revenues have slowed from the double digit growth rates that prevailed in 2005 and early 2006, but are still increasing a solid 6.1% through June of 2007. Other sectors of the municipal bond market are also generally performing well, with credit rating upgrades continuing to greatly outnumber downgrades. While the current trend is positive, we expect the depressed housing market and slower economic growth to create a tougher environment for municipal bonds to show further credit improvement. We did add marginally to the Fund’s exposure to lower investment grade bonds recently, but we do believe it is prudent to keep overall credit quality high in the current environment. Your Fund is broadly diversified and 90% invested in bonds rated A or above by at least one of the major rating agencies.

Over the years, our practice of laddering a diversified portfolio of short and intermediate maturity municipal bonds has allowed your Fund to perform consistently well in varying interest rate environments. Thank you for investing in Thornburg Limited Term Municipal Fund.

Sincerely,

|  |  | ||

George Strickland | Josh Gonze | Christopher Ihlefeld | ||

Co-Portfolio Manager | Co-Portfolio Manager | Co-Portfolio Manager | ||

| Certified Annual Report | 7 |

| STATEMENT OF ASSETS AND LIABILITIES | ||

Thornburg Limited Term Municipal Fund | September 30, 2007 | |

ASSETS | ||||

Investments at value (cost $1,053,413,389) (Note 2) | $ | 1,070,576,863 | ||

Cash | 207,318 | |||

Receivable for investments sold | 7,988,440 | |||

Receivable for fund shares sold | 2,460,233 | |||

Interest receivable | 13,795,600 | |||

Prepaid expenses and other assets | 22,408 | |||

Total Assets | 1,095,050,862 | |||

LIABILITIES | ||||

Payable for securities purchased | 2,865,591 | |||

Payable for fund shares redeemed | 3,468,998 | |||

Payable to investment advisor and other affiliates (Note 3) | 664,027 | |||

Accounts payable and accrued expenses | 166,291 | |||

Dividends payable | 889,285 | |||

Total Liabilities | 8,054,192 | |||

NET ASSETS | $ | 1,086,996,670 | ||

NET ASSETS CONSIST OF: | ||||

Distribution in excess of net investment income | $ | (3,894 | ) | |

Net unrealized appreciation on investments | 17,162,817 | |||

Accumulated net realized gain (loss) | (9,637,355 | ) | ||

Net capital paid in on shares of beneficial interest | 1,079,475,102 | |||

| $ | 1,086,996,670 | |||

NET ASSET VALUE: | ||||

Class A Shares: | ||||

Net asset value and redemption price per share ($696,716,791 applicable to 51,652,175 shares of beneficial interest outstanding - Note 4) | $ | 13.49 | ||

Maximum sales charge, 1.50% of offering price | 0.21 | |||

Maximum offering price per share | $ | 13.70 | ||

Class C Shares: | ||||

Net asset value and offering price per share * ($86,563,998 applicable to 6,405,928 shares of beneficial interest outstanding - Note 4) | $ | 13.51 | ||

Class I Shares: | ||||

Net asset value, offering and redemption price per share ($303,715,881 applicable to 22,513,725 shares of beneficial interest outstanding - Note 4) | $ | 13.49 | ||

| * | Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. |

See notes to financial statements.

| 8 | Certified Annual Report |

| STATEMENT OF OPERATIONS | ||

Thornburg Limited Term Municipal Fund | Year Ended September 30, 2007 | |

INVESTMENT INCOME: | ||||

Interest income (net of premium amortized of $8,593,349) | $ | 49,796,503 | ||

EXPENSES: | ||||

Investment advisory fees (Note 3) | 4,943,763 | |||

Administration fees (Note 3) | ||||

Class A Shares | 949,124 | |||

Class C Shares | 117,076 | |||

Class I Shares | 147,481 | |||

Distribution and service fees (Note 3) | ||||

Class A Shares | 1,898,247 | |||

Class C Shares | 934,928 | |||

Transfer agent fees | ||||

Class A Shares | 393,230 | |||

Class C Shares | 61,273 | |||

Class I Shares | 102,185 | |||

Registration and filing fees | ||||

Class A Shares | 33,898 | |||

Class C Shares | 20,890 | |||

Class I Shares | 25,191 | |||

Custodian fees (Note 3) | 264,045 | |||

Professional fees | 57,847 | |||

Accounting fees | 31,803 | |||

Trustee fees | 17,608 | |||

Other expenses | 120,879 | |||

Total Expenses | 10,119,468 | |||

Less: | ||||

Distribution fees waived (Note 3) | (467,464 | ) | ||

Fees paid indirectly (Note 3) | (14,720 | ) | ||

Net Expenses | 9,637,284 | |||

Net Investment Income | $ | 40,159,219 | ||

REALIZED AND UNREALIZED GAIN (LOSS) | ||||

Net realized gain (loss) on investments | (1,146,124 | ) | ||

Net change in unrealized appreciation (depreciation) of investments | (3,013,630 | ) | ||

Net Realized and Unrealized Loss on Investments | (4,159,754 | ) | ||

Net Increase in Net Assets Resulting From Operations | $ | 35,999,465 | ||

See notes to financial statements.

| Certified Annual Report | 9 |

| STATEMENTS OF CHANGES IN NET ASSETS | ||

Thornburg Limited Term Municipal Fund | ||

| Year Ended September 30, 2007 | Year Ended September 30, 2006 | |||||||

INCREASE (DECREASE) IN NET ASSETS FROM: | ||||||||

OPERATIONS: | ||||||||

Net investment income | $ | 40,159,219 | $ | 42,819,933 | ||||

Net realized loss on investments | (1,146,124 | ) | (3,027,220 | ) | ||||

Increase (Decrease) in unrealized appreciation (depreciation) of investments | (3,013,630 | ) | (3,959,006 | ) | ||||

Net Increase (Decrease) in Net Assets Resulting from Operations | 35,999,465 | 35,833,707 | ||||||

DIVIDENDS TO SHAREHOLDERS: | ||||||||

From net investment income | ||||||||

Class A Shares | (26,069,081 | ) | (28,968,791 | ) | ||||

Class C Shares | (2,952,660 | ) | (3,602,082 | ) | ||||

Class I Shares | (11,137,478 | ) | (10,249,060 | ) | ||||

FUND SHARE TRANSACTIONS (NOTE 4): | ||||||||

Class A Shares | (133,561,208 | ) | (129,601,272 | ) | ||||

Class C Shares | (18,529,049 | ) | (34,410,880 | ) | ||||

Class I Shares | 18,744,294 | (3,124,294 | ) | |||||

Net Decrease in Net Assets | (137,505,717 | ) | (174,122,672 | ) | ||||

NET ASSETS: | ||||||||

Beginning of year | 1,224,502,387 | 1,398,625,059 | ||||||

End of year | $ | 1,086,996,670 | $ | 1,224,502,387 | ||||

See notes to financial statements.

| 10 | Certified Annual Report |

| NOTES TO FINANCIAL STATEMENTS | ||

Thornburg Limited Term Municipal Fund | September 30, 2007 | |

NOTE 1 – ORGANIZATION

Thornburg Limited Term Municipal Fund (the “Fund”) (formerly Thornburg Limited Term Municipal Fund – National Portfolio) is a diversified series of Thornburg Investment Trust (the “Trust”). The Trust is organized as a Massachusetts business trust under a Declaration of Trust dated June 3, 1987 and is registered as a diversified, open-end management investment company under the Investment Company Act of 1940, as amended. The Trust is currently issuing twelve series of shares of beneficial interest in addition to those of the Fund: Thornburg California Limited Term Municipal Fund, Thornburg New York Intermediate Municipal Fund, Thornburg New Mexico Intermediate Municipal Fund, Thornburg Intermediate Municipal Fund, Thornburg Limited Term U.S. Government Fund, Thornburg Limited Term Income Fund, Thornburg Value Fund, Thornburg International Value Fund, Thornburg Core Growth Fund, Thornburg Investment Income Builder Fund, Thornburg Global Opportunities Fund, and Thornburg International Growth Fund. Each series is considered to be a separate entity for financial reporting and tax purposes and bears expenses directly attributable to it. The Fund’s primary investment objective is to obtain as high a level of current income exempt from federal individual income taxes as is consistent, in the view of the Fund’s investment advisor, with the preservation of capital. The Fund’s secondary goal is to seek to reduce changes in its share price compared to longer intermediate and long-term bond portfolios.

The Fund currently offers three classes of shares of beneficial interest, Class A, Class C, and Institutional Class (Class I) shares. Each class of shares of the Fund represents an interest in the same portfolio of investments, except that (i) Class A shares are sold subject to a front-end sales charge collected at the time the shares are purchased and bear a service fee, (ii) Class C shares are sold at net asset value without a sales charge at the time of purchase, but are subject to a contingent deferred sales charge upon redemption within one year, and bear both a service fee and a distribution fee, (iii) Class I shares are sold at net asset value without a sales charge at the time of purchase, and (iv) the respective classes may have different reinvestment privileges and conversion rights. Additionally, the Fund may allocate among its classes certain expenses, to the extent applicable to specific classes, including transfer agent fees, government registration fees, certain printing and postage costs, and administrative and legal expenses. Currently, class specific expenses of the Fund are limited to service and distribution fees, administrative fees, and certain registration and transfer agent expenses.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

Significant accounting policies of the Trust are as follows:

Valuation of Securities: Debt securities have a primary market over the counter and are valued by an independent pricing service approved by the Trustees of the Trust. The pricing service ordinarily values debt securities at quoted bid prices. When quotations are not available, debt securities are valued at evaluated prices determined by the pricing service using methods which include consideration of yields or prices of debt securities of comparable quality, type of issue, coupon, maturity, and rating, indications as to value from dealers and general market conditions. Short-term obligations having remaining maturities of 60 days or less are valued at amortized cost, which approximates market value.

In any case where a pricing service fails to provide a price for a debt security held by the Fund, the valuation and pricing committee determines a fair value for the security using factors approved by the Trustees. Additionally, in any case where management believes that a price provided by a pricing service for a debt security may be unreliable, the valuation and pricing committee decides whether or not to use the pricing service’s valuation or to determine a fair value for the security.

Federal Income Taxes: It is the policy of the Trust to comply with the provisions of the Internal Revenue Code applicable to “regulated investment companies” and to distribute all taxable (if any) and tax exempt income of the Fund to the shareholders. Therefore, no provision for federal income tax is required.

When-Issued and Delayed Delivery Transactions: The Trust may engage in when-issued or delayed delivery transactions. To the extent the Trust engages in such transactions, it will do so for the purpose of acquiring portfolio securities consistent with the Fund’s investment objectives and not for the purpose of investment leverage or to speculate on interest rate and/or market changes. At the time the Trust makes a commitment to purchase a security on a when-issued basis, the Fund will record the transaction and reflect the value in determining its net asset value. When effecting such transactions, assets of an amount sufficient to make payment for the portfolio securities to be purchased will be segregated on the Fund’s records on the trade date. Securities purchased on a when-issued or delayed delivery basis do not earn interest until the settlement date.

Dividends: Net investment income of the Fund is declared daily as a dividend on shares for which the Fund has received payment. Dividends are paid monthly and are reinvested in additional shares of the Fund at net asset value per share at the close of business on the dividend payment date, or at the shareholder’s option, paid in cash. Net realized capital gains, to the extent available, will be distributed at least annually.

General: Securities transactions are accounted for on a trade date basis. Interest income is accrued as earned. Premiums and discounts on securities purchased are amortized to call dates or maturity dates of the respective securities. Realized gains and losses from the sale of securities are recorded on an identified cost basis. Net investment income (other than

| Certified Annual Report | 11 |

| NOTES TO FINANCIAL STATEMENTS, CONTINUED | ||

Thornburg Limited Term Municipal Fund | September 30, 2007 | |

class specific expenses) and realized and unrealized gains and losses are allocated daily to each class of shares based upon the relative net asset value of outstanding shares (or the value of the dividend-eligible shares, as appropriate) of each class of shares at the beginning of the day (after adjusting for the current capital shares activity of the respective class). Expenses common to all funds are allocated among the funds comprising the Trust based upon their relative net asset values or other appropriate allocation methods.

Guarantees and Indemnifications: Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business the Trust enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown. However, based on experience, the Trust expects the risk of loss to be remote.

Use of Estimates: The preparation of financial statements, in conformity with generally accepted accounting principles, requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

NOTE 3 – INVESTMENT ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

Pursuant to an Investment Advisory Agreement, Thornburg Investment Management, Inc. (the “Advisor”) serves as the investment advisor and performs services to the Fund for which the fees are payable at the end of each month. For the year ended September 30, 2007, these fees were payable at annual rates ranging from .50 of 1% to .225 of 1% per annum of the average daily net assets of the Fund depending on the Fund’s asset size. The Trust also has entered into administrative services agreements with the Advisor, whereby the Advisor will perform certain administrative services for the shareholders of each class of the Fund’s shares, and for which fees will be payable at an annual rate of up to .125 of 1% per annum of the average daily net assets attributable to each class of shares.

The Trust has an underwriting agreement with Thornburg Securities Corporation (the “Distributor,” an affiliate of the Advisor), which acts as the distributor of the Fund’s shares.

For the year ended September 30, 2007, the Distributor has advised the Fund that it earned commissions aggregating $2,288 from the sale of Class A shares, and collected contingent deferred sales charges aggregating $2,603 from redemptions of Class C shares of the Fund.

Pursuant to a service plan under Rule 12b-1 of the Investment Company Act of 1940, the Fund may reimburse to the Advisor an amount not to exceed .25 of 1% per annum of the average daily net assets attributable to each class of shares of the Fund for payments made by the Advisor to securities dealers and other financial institutions to obtain various shareholder and distribution related services. The Advisor may pay out of its own resources additional expenses for distribution of the Fund’s shares.

The Trust has also adopted distribution plans pursuant to Rule 12b-1, applicable only to the Fund’s Class C shares under which the Fund compensates the Distributor for services in promoting the sale of Class C shares of the Fund at an annual rate of up to .75 of 1% per annum of the average daily net assets attributable to Class C shares. Total fees incurred by the Distributor for each class of shares of the Fund under their respective Service and Distribution Plans and Class C distribution fees waived by the Distributor for the year ended September 30, 2007, are set forth in the Statement of Operations. Distribution fees in the amount of $467,464 were waived for Class C shares.

The Trust has an agreement with the custodian bank to indirectly pay a portion of the custodian’s fees through credits earned by the Fund’s cash on deposit with the bank. This deposit agreement is an alternative to overnight investments. Custodial fees have been adjusted to reflect amounts that would have been paid without this agreement, with a corresponding adjustment reflected as fees paid indirectly in the Statement of Operations. For the year ended September 30, 2007, fees paid indirectly were $14,720. This figure may include additional fees waived by the custodian.

Certain officers and Trustees of the Trust are also officers and/ or directors of the Advisor and Distributor. The compensation of independent Trustees is borne by the Trust.

| 12 | Certified Annual Report |

| NOTES TO FINANCIAL STATEMENTS, CONTINUED | ||

Thornburg Limited Term Municipal Fund | September 30, 2007 | |

NOTE 4 – SHARES OF BENEFICIAL INTEREST

At September 30, 2007, there were an unlimited number of shares of beneficial interest authorized. Transactions in shares of beneficial interest were as follows:

Year Ended September 30, 2007 | Year Ended September 30, 2006 | |||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||

Class A Shares | ||||||||||||||

Shares sold | 4,907,768 | $ | 66,014,807 | 7,002,507 | $ | 94,383,822 | ||||||||

Shares issued to shareholders in reinvestment of dividends | 1,327,844 | 17,870,751 | 1,451,447 | 19,553,941 | ||||||||||

Shares repurchased | (16,162,702 | ) | (217,446,766 | ) | (18,068,444 | ) | (243,539,035 | ) | ||||||

Net Increase (Decrease) | (9,927,090 | ) | $ | (133,561,208 | ) | (9,614,490 | ) | $ | (129,601,272 | ) | ||||

Class C Shares | ||||||||||||||

Shares sold | 638,787 | $ | 8,601,275 | 720,729 | $ | 9,723,762 | ||||||||

Shares issued to shareholders in reinvestment of dividends | 146,274 | 1,972,339 | 179,128 | 2,417,463 | ||||||||||

Shares repurchased | (2,157,502 | ) | (29,102,663 | ) | (3,447,634 | ) | (46,552,105 | ) | ||||||

Net Increase (Decrease) | (1,372,441 | ) | $ | (18,529,049 | ) | (2,547,777 | ) | $ | (34,410,880 | ) | ||||

Class I Shares | ||||||||||||||

Shares sold | 7,495,756 | $ | 100,902,857 | 6,913,539 | $ | 93,207,821 | ||||||||

Shares issued to shareholders in reinvestment of dividends | 632,992 | 8,518,497 | 583,980 | 7,867,045 | ||||||||||

Shares repurchased | (6,741,062 | ) | (90,677,060 | ) | (7,732,221 | ) | (104,199,160 | ) | ||||||

Net Increase (Decrease) | 1,387,686 | $ | 18,744,294 | (234,702 | ) | $ | (3,124,294 | ) | ||||||

NOTE 5 – SECURITIES TRANSACTIONS

For the year ended September 30, 2007, the Fund had purchase and sale transactions of investment securities (excluding short-term investments) of $240,103,810 and $383,959,545, respectively.

NOTE 6 – INCOME TAXES

At September 30, 2007, information on the tax components of capital is as follows:

Cost of investments for tax purposes | $ | 1,053,418,196 | ||

Gross unrealized appreciation on a tax basis | $ | 18,463,308 | ||

Gross unrealized depreciation on a tax basis | (1,304,641 | ) | ||

Net unrealized appreciation (depreciation) on investments (tax basis) | $ | 17,158,667 | ||

At September 30, 2007, the Fund did not have any undistributed tax-exempt/ordinary net income or undistributed capital gains.

At September 30, 2007, the Fund had tax basis capital losses, which may be carried over to offset future capital gains. To the extent such carry forwards are used, capital gain distributions may be reduced to the extent provided by regulations.

Such capital loss carryovers expire as follows:

2008 | $ | 3,565,103 | |

2013 | 30,614 | ||

2014 | 2,276,013 | ||

2015 | 2,811,143 | ||

| $ | 8,682,873 | ||

During the year ending September 30, 2007, $1,013,153 of capital loss carry forwards expired.

As of September 30, 2007, the Fund had deferred capital losses occurring subsequent to October 31, 2006 of $949,675. For tax purposes, such losses will be reflected in the year ending September 30, 2008.

| Certified Annual Report | 13 |

| NOTES TO FINANCIAL STATEMENTS, CONTINUED | ||

Thornburg Limited Term Municipal Fund | September 30, 2007 | |

In order to account for permanent book/tax differences, the Fund decreased net capital paid in on shares of beneficial interest by $1,013,153, increased over-distributed investment income by $1,890 and decreased accumulated net realized investment loss by $1,015,043. This reclassification has no impact on the net asset value of the Fund. Reclassifications result primarily from expired capital loss carry forwards and market discount.

All dividends paid by the Fund for the year ended September 30, 2007 and September 30, 2006, represent exempt interest dividends, which are excludable by shareholders from gross income for federal income tax purposes.

OTHER NOTES:

FASB Interpretation No. 48:

On July 13, 2006, the Financial Accounting Standards Board issued Interpretation No. 48, “Accounting for Uncertainty in Income Taxes - an Interpretation of FASB Statement No. 109” (the “Interpretation”). The Interpretation prescribes a model for how a company, including the Fund, should recognize, measure, present and disclose in its financial statements uncertain tax positions that the company has taken or expects to take on income tax returns, and also revises certain disclosure requirements. The Interpretation is effective for fiscal years beginning after December 15, 2006, and, upon implementation, is applicable to all open tax years. On December 22, 2006, the Securities and Exchange Commission extended the first required financial statement reporting period for its fiscal year beginning after December 15, 2006, which for the Fund is March 31, 2008. As of the date of this report, management of the Fund has not identified any material effect on the Fund’s financial statements resulting from the implementation of FIN 48.

Statement of Accounting Standards No. 157:

On September 15, 2006, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 157, “Fair Value Measurements” (the “Statement”). The Statement defines fair value, provides guidelines for measuring fair value in accordance with generally accepted accounting principles, and addresses disclosures about fair value measurements. The Statement establishes a fair value hierarchy that distinguishes between (i) market participant assumptions developed based upon market data obtained from sources independent of the reporting entity (observable inputs) and (ii) the entity’s own assumptions about market participant assumptions developed based upon the best information available under the circumstances (unobservable inputs). The Statement is effective for financial statements issued for fiscal years beginning after November 15, 2007, and is to be applied prospectively as of the beginning of the first fiscal year for which the Statement is applied. Management is evaluating the Statement, and is not in a position at this time to estimate the significance of its impact, if any, on the Fund’s financial statements.

| 14 | Certified Annual Report |

Thornburg Limited Term Municipal Fund

Year Ended Sept. 30, | 3 Months Ended Sept. 30, | Year Ended June 30, | ||||||||||||||||||||||

Class A Shares: | 2007 | 2006 | 2005 | 2004(c) | 2004 | 2003 | ||||||||||||||||||

PER SHARE PERFORMANCE | ||||||||||||||||||||||||

(for a share outstanding throughout the period) | ||||||||||||||||||||||||

Net asset value, beginning of period | $ | 13.53 | $ | 13.59 | $ | 13.83 | $ | 13.68 | $ | 14.01 | $ | 13.65 | ||||||||||||

Income from investment operations: | ||||||||||||||||||||||||

Net investment income | 0.46 | 0.44 | 0.40 | 0.09 | 0.40 | 0.45 | ||||||||||||||||||

Net realized and unrealized gain (loss) on investments | (0.04 | ) | (0.06 | ) | (0.24 | ) | 0.15 | (0.33 | ) | 0.36 | ||||||||||||||

Total from investment operations | 0.42 | 0.38 | 0.16 | 0.24 | 0.07 | 0.81 | ||||||||||||||||||

Less dividends from: | ||||||||||||||||||||||||

Net investment income | (0.46 | ) | (0.44 | ) | (0.40 | ) | (0.09 | ) | (0.40 | ) | (0.45 | ) | ||||||||||||

Change in net asset value | (0.04 | ) | (0.06 | ) | (0.24 | ) | 0.15 | (0.33 | ) | 0.36 | ||||||||||||||

NET ASSET VALUE, end of period | $ | 13.49 | $ | 13.53 | $ | 13.59 | $ | 13.83 | $ | 13.68 | $ | 14.01 | ||||||||||||

RATIOS/SUPPLEMENTAL DATA | ||||||||||||||||||||||||

Total return(a) | 3.18 | % | 2.87 | % | 1.16 | % | 1.78 | % | 0.47 | % | 5.99 | % | ||||||||||||

Ratios to average net assets: | ||||||||||||||||||||||||

Net investment income | 3.43 | % | 3.28 | % | 2.91 | % | 2.69 | %(b) | 2.85 | % | 3.20 | % | ||||||||||||

Expenses, after expense reductions | 0.90 | % | 0.91 | % | 0.90 | % | 0.89 | %(b) | 0.91 | % | 0.93 | % | ||||||||||||

Expenses, after expense reductions and net of custody credits | 0.90 | % | 0.90 | % | 0.90 | % | 0.89 | %(b) | 0.91 | % | 0.93 | % | ||||||||||||

Expenses, before expense reductions | 0.90 | % | 0.91 | % | 0.90 | % | 0.89 | %(b) | 0.91 | % | 0.93 | % | ||||||||||||

Portfolio turnover rate | 21.35 | % | 23.02 | % | 27.80 | % | 4.57 | % | 21.37 | % | 15.81 | % | ||||||||||||

Net assets at end of period (000) | $ | 696,717 | $ | 833,189 | $ | 967,650 | $ | 1,039,050 | $ | 1,047,482 | $ | 998,878 | ||||||||||||

| (a) | Sales loads are not reflected in computing total return, which is not annualized for periods less than one year. |

| (b) | Annualized. |

| (c) | The Fund’s fiscal year-end changed to September 30. |

See notes to financial statements.

| Certified Annual Report | 15 |

| FINANCIAL HIGHLIGHTS, CONTINUED | ||

Thornburg Limited Term Municipal Fund | ||

Year Ended Sept. 30, | 3 Months Ended Sept. 30, | Year Ended June 30, | ||||||||||||||||||||||

Class C Shares: | 2007 | 2006 | 2005 | 2004(c) | 2004 | 2003 | ||||||||||||||||||

PER SHARE PERFORMANCE | ||||||||||||||||||||||||

(for a share outstanding throughout the period) | ||||||||||||||||||||||||

Net asset value, beginning of period | $ | 13.55 | $ | 13.62 | $ | 13.86 | $ | 13.70 | $ | 14.04 | $ | 13.67 | ||||||||||||

Income from investment operations: | ||||||||||||||||||||||||

Net investment income | 0.43 | 0.41 | 0.36 | 0.08 | 0.36 | 0.41 | ||||||||||||||||||

Net realized and unrealized gain (loss) on investments | (0.04 | ) | (0.07 | ) | (0.24 | ) | 0.16 | (0.34 | ) | 0.37 | ||||||||||||||

Total from investment operations | 0.39 | 0.34 | 0.12 | 0.24 | 0.02 | 0.78 | ||||||||||||||||||

Less dividends from: | ||||||||||||||||||||||||

Net investment income | (0.43 | ) | (0.41 | ) | (0.36 | ) | (0.08 | ) | (0.36 | ) | (0.41 | ) | ||||||||||||

Change in net asset value | (0.04 | ) | (0.07 | ) | (0.24 | ) | 0.16 | (0.34 | ) | 0.37 | ||||||||||||||

NET ASSET VALUE, end of period | $ | 13.51 | $ | 13.55 | $ | 13.62 | $ | 13.86 | $ | 13.70 | $ | 14.04 | ||||||||||||

RATIOS/SUPPLEMENTAL DATA | ||||||||||||||||||||||||

Total return(a) | 2.90 | % | 2.52 | % | 0.89 | % | 1.79 | % | 0.12 | % | 5.78 | % | ||||||||||||

Ratios to average net assets: | ||||||||||||||||||||||||

Net investment income | 3.15 | % | 3.00 | % | 2.63 | % | 2.43 | %(b) | 2.56 | % | 2.89 | % | ||||||||||||

Expenses, after expense reductions | 1.19 | % | 1.18 | % | 1.18 | % | 1.15 | %(b) | 1.19 | % | 1.18 | % | ||||||||||||

Expenses, after expense reductions and net of custody credits | 1.18 | % | 1.18 | % | 1.18 | % | 1.15 | %(b) | 1.19 | % | 1.18 | % | ||||||||||||

Expenses, before expense reductions | 1.68 | % | 1.68 | % | 1.68 | % | 1.65 | %(b) | 1.69 | % | 1.68 | % | ||||||||||||

Portfolio turnover rate | 21.35 | % | 23.02 | % | 27.80 | % | 4.57 | % | 21.37 | % | 15.81 | % | ||||||||||||

Net assets at end of period (000) | $ | 86,564 | $ | 105,436 | $ | 140,606 | $ | 156,870 | $ | 155,458 | $ | 137,559 | ||||||||||||

| (a) | Not annualized for periods less than one year. |

| (b) | Annualized. |

| (c) | The Fund’s fiscal year-end changed to September 30. |

See notes to the financial statements.

| 16 | Certified Annual Report |

| FINANCIAL HIGHLIGHTS, CONTINUED | ||

Thornburg Limited Term Municipal Fund | ||

Year Ended Sept. 30, | 3 Months Ended Sept. 30, | Year Ended June 30, | ||||||||||||||||||||||

Class I Shares: | 2007 | 2006 | 2005 | 2004(c) | 2004 | 2003 | ||||||||||||||||||

PER SHARE PERFORMANCE | ||||||||||||||||||||||||

(for a share outstanding throughout the period) | ||||||||||||||||||||||||

Net asset value, beginning of period | $ | 13.53 | $ | 13.59 | $ | 13.83 | $ | 13.68 | $ | 14.01 | $ | 13.65 | ||||||||||||

Income from investment operations: | ||||||||||||||||||||||||

Net investment income | 0.51 | 0.49 | 0.44 | 0.11 | 0.44 | 0.49 | ||||||||||||||||||

Net realized and unrealized gain (loss) on investments | (0.04 | ) | (0.06 | ) | (0.24 | ) | 0.15 | (0.33 | ) | 0.36 | ||||||||||||||

Total from investment operations | 0.47 | 0.43 | 0.20 | 0.26 | 0.11 | 0.85 | ||||||||||||||||||

Less dividends from: | ||||||||||||||||||||||||

Net investment income | (0.51 | ) | (0.49 | ) | (0.44 | ) | (0.11 | ) | (0.44 | ) | (0.49 | ) | ||||||||||||

Change in net asset value | (0.04 | ) | (0.06 | ) | (0.24 | ) | 0.15 | (0.33 | ) | 0.36 | ||||||||||||||

NET ASSET VALUE, end of period | $ | 13.49 | $ | 13.53 | $ | 13.59 | $ | 13.83 | $ | 13.68 | $ | 14.01 | ||||||||||||

RATIOS/SUPPLEMENTAL DATA | ||||||||||||||||||||||||

Total return(a) | 3.53 | % | 3.22 | % | 1.50 | % | 1.87 | % | 0.80 | % | 6.36 | % | ||||||||||||

Ratios to average net assets: | ||||||||||||||||||||||||

Net investment income | 3.78 | % | 3.62 | % | 3.25 | % | 3.02 | %(b) | 3.18 | % | 3.54 | % | ||||||||||||

Expenses, after expense reductions | 0.57 | % | 0.57 | % | 0.57 | % | 0.55 | %(b) | 0.57 | % | 0.58 | % | ||||||||||||

Expenses, after expense reductions and net of custody credits | 0.57 | % | 0.57 | % | 0.57 | % | 0.55 | %(b) | 0.57 | % | 0.58 | % | ||||||||||||

Expenses, before expense reductions | 0.57 | % | 0.57 | % | 0.57 | % | 0.55 | %(b) | 0.57 | % | 0.58 | % | ||||||||||||

Portfolio turnover rate | 21.35 | % | 23.02 | % | 27.80 | % | 4.57 | % | 21.37 | % | 15.81 | % | ||||||||||||

Net assets at end of period (000) | $ | 303,716 | $ | 285,878 | $ | 290,369 | $ | 238,589 | $ | 222,760 | $ | 197,367 | ||||||||||||

| (a) | Not annualized for periods less than one year. |

| (b) | Annualized. |

| (c) | The Fund’s fiscal year-end changed to September 30. |

See notes to the financial statements.

| Certified Annual Report | 17 |

| SCHEDULE OF INVESTMENTS | ||

Thornburg Limited Term Municipal Fund | September 30, 2007 | |

CUSIPS: CLASS A - 885-215-459, CLASS C - 885-215-442, CLASS I - 885-215-434

NASDAQ SYMBOLS: CLASS A - LTMFX, CLASS C - LTMCX, CLASS I - LTMIX

Issuer-Description | Credit Rating† | Principal Amount | Value | |||||

ALABAMA — 0.27% | ||||||||

Mobile GO Warrants, 4.50% due 8/15/2016 | NR/NR | $ | 2,875,000 | $ | 2,887,535 | |||

ALASKA — 0.83% | ||||||||

Alaska Energy Authority Power, 6.00% due 7/1/2011 (Bradley Lake Hydroelectric; Insured: FSA) | Aaa/AAA | 955,000 | 1,032,737 | |||||

Alaska Municipal Bond Bank, 5.00% due 6/1/2014 (Insured: MBIA) | Aaa/AAA | 1,175,000 | 1,265,416 | |||||

Alaska Student Loan Corp., 5.25% due 1/1/2012 (Insured: FSA) | NR/AAA | 3,000,000 | 3,196,080 | |||||

North Slope Boro, 5.00% due 6/30/2015 (Insured: MBIA) | Aaa/AAA | 3,250,000 | 3,516,468 | |||||

ARIZONA — 1.25% | ||||||||

Agricultural Impact & Power Distribution, 5.00% due 1/1/2020 (Salt River) | Aa1/AA | 1,205,000 | 1,220,267 | |||||

Glendale IDA, 5.00% due 5/15/2015 (Midwestern University) | NR/A- | 1,000,000 | 1,050,590 | |||||

Glendale IDA, 5.00% due 5/15/2016 (Midwestern University) | NR/A- | 1,325,000 | 1,392,482 | |||||

Glendale IDA, 5.00% due 5/15/2017 (Midwestern University) | NR/A- | 1,440,000 | 1,512,936 | |||||

Mohave County IDA, 5.00% due 4/1/2014 (Mohave Prison LLC; Insured: XLCA) | NR/AAA | 3,135,000 | 3,344,512 | |||||

Pima County IDA, 5.45% due 4/1/2010 (Insured: MBIA) | Aaa/AAA | 2,060,000 | 2,103,754 | |||||

Pima County IDA, 6.40% due 7/1/2013 (Arizona Charter Schools) | Baa3/NR | 990,000 | 1,047,559 | |||||

Pima County IDA Lease Obligation, 7.25% due 7/15/2010 (Insured: FSA) | Aaa/AAA | 390,000 | 400,897 | |||||

Show Low IDA Hospital, 5.25% due 12/1/2010 (Navapache Regional Medical Center; Insured: ACA) | NR/A | 1,000,000 | 1,018,210 | |||||

Tucson Water, 9.75% due 7/1/2008 | Aa3/A+ | 500,000 | 523,000 | |||||

ARKANSAS — 0.37% | ||||||||

Jefferson County Hospital Improvement, 5.50% due 6/1/2010 (Jefferson Hospital Association) | NR/A | 1,000,000 | 1,039,950 | |||||

Jefferson County Hospital Improvement, 5.50% due 6/1/2011 (Jefferson Hospital Association) | NR/A | 1,075,000 | 1,130,782 | |||||

Little Rock Hotel & Restaurant GRT, 7.125% due 8/1/2009 | A3/NR | 1,820,000 | 1,890,561 | |||||

CALIFORNIA — 2.74% | ||||||||

California State Public Works Board, 5.00% due 9/1/2016 (Regents University of California; Insured: FGIC) | Aaa/AAA | 3,000,000 | 3,273,330 | |||||

California HFA, 5.25% due 10/1/2013 (Kaiser Permanente) (ETM) | NR/AAA | 2,620,000 | 2,690,845 | |||||

California State Department of Transportation COP, 5.25% due 3/1/2016 (Insured: MBIA) | Aaa/AAA | 1,000,000 | 1,021,240 | |||||

California State Department of Water Resources Power Supply, 5.50% due 5/1/2012 | A1/A- | 2,600,000 | 2,801,552 | |||||

California State Department of Water Resources Power Supply, 6.00% due 5/1/2013 | A1/A- | 2,550,000 | 2,815,888 | |||||

California State Public Works Board, 5.00% due 9/1/2017 (Regents University of California; Insured: FGIC) | Aaa/AAA | 3,000,000 | 3,257,250 | |||||

Escondido USD, 5.60% due 11/1/2009 (Insured: MBIA) (ETM) | Aaa/AAA | 1,250,000 | 1,264,775 | |||||

Northern California Public Power Agency, 5.00% due 7/1/2009 (Geothermal Number 3) | A2/BBB+ | 11,100,000 | 11,109,657 | |||||

South Orange County Public Financing Authority Special Tax, 8.00% due 8/15/2008 (Foothill Area; Insured: FGIC) | Aaa/AAA | 1,500,000 | 1,558,065 | |||||

COLORADO — 4.47% | ||||||||

Adams County Platte Valley Medical Center, 5.00% due 2/1/2015 (Brighton Community Hospital Association; Insured: FHA, MBIA) | NR/AAA | 1,530,000 | 1,637,284 | |||||

Adams County Platte Valley Medical Center, 5.00% due 8/1/2015 (Brighton Community Hospital Association; Insured: FHA, MBIA) | NR/AAA | 1,565,000 | 1,680,043 | |||||

Central Platte Valley Metropolitan District, 5.00% due 12/1/2031 put 12/1/2009 (LOC: US Bank) | NR/AA | 12,365,000 | 12,607,354 | |||||

Colorado Department of Transportation Anticipation Notes, 6.00% due 6/15/2008 (Insured: AMBAC) | Aaa/AAA | 1,500,000 | 1,526,655 | |||||

| 18 | Certified Annual Report |

| SCHEDULE OF INVESTMENTS, CONTINUED | ||

Thornburg Limited Term Municipal Fund | September 30, 2007 | |

Issuer-Description | Credit Rating† | Principal Amount | Value | |||||

Colorado Educational & Cultural Facilities, 4.90% due 4/1/2008 (Nashville Public Radio) (ETM) | NR/BBB+ | $ | 345,000 | $ | 346,787 | |||

Colorado HFA, 5.25% due 10/1/2026 pre-refunded 10/1/2008 (Children’s Hospital; Insured: MBIA) | Aaa/AAA | 2,295,000 | 2,309,642 | |||||

Denver City and County Airport System, 5.00% due 11/15/2016 (Insured: MBIA) | Aaa/AAA | 1,515,000 | 1,636,245 | |||||

Denver City and County Airport System, 5.00% due 11/15/2017 (Insured: MBIA) | Aaa/AAA | 1,000,000 | 1,080,240 | |||||

Denver Convention Center Hotel, 5.25% due 12/1/2014 (Insured: XLCA) | Aaa/AAA | 3,000,000 | 3,255,480 | |||||

Denver Convention Center Hotel, 5.25% due 12/1/2015 (Insured: XLCA) | Aaa/AAA | 5,000,000 | 5,447,150 | |||||

Denver Convention Center Hotel Authority, 5.00% due 12/1/2011 (Insured: XLCA) (ETM) | Aaa/AAA | 3,335,000 | 3,518,292 | |||||

E 470 Public Highway Authority Capital Appreciation, 0% due 9/1/2014 (Insured: MBIA) | Aaa/AAA | 2,110,000 | 1,609,318 | |||||

Highlands Ranch Metropolitan GO District 3, 5.25% due 12/1/2008 (Insured: ACA) | NR/A | 1,520,000 | 1,537,146 | |||||

Highlands Ranch Metropolitan GO District 3, 5.25% due 12/1/2008 (Insured: ACA) | NR/A | 1,760,000 | 1,769,926 | |||||

Pinery West Metropolitan District 3, 4.70% due 12/1/2021 pre-refunded 12/1/2007 (LOC: Compass Bank) | NR/A+ | 1,000,000 | 1,000,650 | |||||

Plaza Metropolitan District 1, 7.60% due 12/1/2016 (Public Improvement Fee/Tax Increment) | NR/NR | 6,000,000 | 6,465,360 | |||||

Southlands Metropolitan GO District 1, 6.75% due 12/1/2016 | NR/NR | 1,000,000 | 1,145,290 | |||||

DELAWARE — 0.58% | ||||||||

Delaware EDA, 5.50% due 7/1/2025 put 7/1/2010 (Delmarva Power & Light) | Baa2/BBB- | 2,045,000 | 2,116,104 | |||||

Delaware HFA, 5.25% due 6/1/2011 (Beebe Medical Center) | Baa1/BBB+ | 1,275,000 | 1,318,006 | |||||

Delaware HFA, 5.25% due 5/1/2012 (Nanticoke Memorial Hospital; Insured: Radian) | NR/AA | 1,370,000 | 1,424,978 | |||||

Delaware HFA, 5.25% due 5/1/2013 (Nanticoke Memorial Hospital; Insured: Radian) | NR/AA | 1,445,000 | 1,499,939 | |||||

DISTRICT OF COLUMBIA — 2.17% | ||||||||

District of Columbia Capital Appreciation, 0% due 4/1/2040 pre-refunded 4/1/2011 (Georgetown University) | Aaa/AAA | 6,685,000 | 1,049,411 | |||||

District of Columbia COP, 5.25% due 1/1/2013 (Insured: AMBAC) | Aaa/AAA | 5,950,000 | 6,286,115 | |||||

District of Columbia COP, 5.25% due 1/1/2015 (Insured: FGIC) | Aaa/AAA | 2,875,000 | 3,123,803 | |||||

District of Columbia COP, 5.25% due 1/1/2016 (Insured: FGIC) | Aaa/AAA | 4,125,000 | 4,499,509 | |||||

District of Columbia Hospital, 5.10% due 8/15/2008 (Medlantic Healthcare) (ETM) | Aaa/AAA | 1,500,000 | 1,520,055 | |||||

District of Columbia Hospital, 5.70% due 8/15/2008 (Medlantic Healthcare) (ETM) | Aaa/AAA | 2,280,000 | 2,306,539 | |||||

District of Columbia Tax Increment, 0% due 7/1/2009 (Mandarin Oriental; Insured: FSA) | Aaa/AAA | 2,000,000 | 1,870,620 | |||||

District of Columbia Tax Increment, 0% due 7/1/2011 (Mandarin Oriental; Insured: FSA) | Aaa/AAA | 1,990,000 | 1,720,474 | |||||

District of Columbia Tax Increment, 0% due 7/1/2012 (Mandarin Oriental; Insured: FSA) | Aaa/AAA | 1,480,000 | 1,226,358 | |||||

FLORIDA — 7.64% | ||||||||

Broward County Airport Systems, 5.00% due 10/1/2014 (Insured: AMBAC) | Aaa/AAA | 4,000,000 | 4,289,080 | |||||

Broward County Resource Recovery, 5.375% due 12/1/2009 (Wheelabrator South) | A3/AA | 5,000,000 | 5,152,400 | |||||

Broward County School Board COP, 5.25% due 7/1/2016 (Insured: FSA) | Aaa/AAA | 7,630,000 | 8,340,200 | |||||

Broward County School Board COP, 5.00% due 7/1/2017 (Insured: FGIC) | Aaa/AAA | 1,000,000 | 1,077,560 | |||||

Capital Projects Finance Authority, 5.50% due 10/1/2012 (Insured: MBIA) | Aaa/AAA | 1,820,000 | 1,944,488 | |||||

Capital Projects Finance Authority, 5.50% due 10/1/2015 (Insured: MBIA) | Aaa/AAA | 3,260,000 | 3,467,303 | |||||

Capital Trust Agency Multi Family Housing, 5.15% due 11/1/2030 put 11/1/2010 (Shadow Run; Collateralized: FNMA) | Aaa/NR | 2,190,000 | 2,265,380 | |||||

Crossings at Fleming Island Community Development, 5.45% due 5/1/2010 (Insured: MBIA) | Aaa/AAA | 2,340,000 | 2,396,839 | |||||

Escambia County HFA, 5.125% due 10/1/2014 (Baptist Hospital/Baptist Manor) | Baa1/BBB+ | 2,755,000 | 2,798,529 | |||||

Escambia County HFA, 5.00% due 11/1/2028 pre-refunded 11/1/2010 (Charity Obligation Group) | Aaa/NR | 2,500,000 | 2,562,725 | |||||

Flagler County School Board COP, 5.00% due 8/1/2014 (Insured: FSA) | Aaa/AAA | 1,605,000 | 1,716,804 | |||||

Flagler County School Board COP, 5.00% due 8/1/2015 (Insured: FSA) | Aaa/AAA | 1,500,000 | 1,608,180 | |||||

Florida State Correctional Privatization Commission COP, 5.00% due 8/1/2015 (Insured: AMBAC) | Aaa/AAA | 2,000,000 | 2,130,640 | |||||

Florida State Department of Children & Families COP South Florida Evaluation Treatment, 5.00% due 10/1/2015 | NR/AA+ | 925,000 | 990,139 | |||||

Hillsborough County Assessment, 5.00% due 3/1/2015 (Insured: FGIC) | Aaa/AAA | 5,000,000 | 5,337,200 | |||||

Hillsborough County IDA PCR, 5.10% due 10/1/2013 (Tampa Electric Co.) | Baa2/BBB- | 6,410,000 | 6,570,314 | |||||

| Certified Annual Report | 19 |

| SCHEDULE OF INVESTMENTS, CONTINUED | ||

Thornburg Limited Term Municipal Fund | September 30, 2007 | |

Issuer-Description | Credit Rating† | Principal Amount | Value | |||||

Hollywood Community Redevelopment Agency, 5.00% due 3/1/2016 (Insured: XLCA) | Aaa/AAA | $ | 2,000,000 | $ | 2,135,460 | |||

Hollywood Community Redevelopment Agency, 5.00% due 3/1/2017 (Insured: XLCA) | Aaa/AAA | 2,000,000 | 2,135,780 | |||||

Jacksonville Electric St. John’s River Park Systems, 5.25% due 10/1/2012 | Aa2/AA- | 5,000,000 | 5,295,800 | |||||

Marion County Hospital District, 5.00% due 10/1/2015 (Munroe Regional Health Systems) | A2/NR | 1,000,000 | 1,045,960 | |||||

Miami Dade County Educational Facilities Authority, 5.00% due 4/1/2016 (University of Miami; Insured: AMBAC) | Aaa/AAA | 3,000,000 | 3,231,360 | |||||

Miami Dade County School Board COP, 5.50% due 5/1/2030 put 5/1/2011 (Insured: MBIA) | Aaa/AAA | 1,010,000 | 1,070,933 | |||||

Miami Dade County Special Housing, 5.80% due 10/1/2012 (HUD Section 8) | Baa3/NR | 2,485,000 | 2,559,277 | |||||

Orange County HFA, 6.25% due 10/1/2007 (Orlando Regional Hospital; Insured: MBIA) | Aaa/AAA | 925,000 | 925,204 | |||||

Orange County HFA, 5.80% due 11/15/2009 (Adventist Health System) (ETM) | A1/NR | 1,395,000 | 1,458,793 | |||||

Palm Beach County Public Improvement, 5.00% due 11/1/2030 (Convention Center; Insured: FGIC) | Aaa/AAA | 3,000,000 | 3,139,770 | |||||

Pelican Marsh Community Development District, 5.00% due 5/1/2011 (Insured: Radian) | NR/NR | 2,115,000 | 2,105,461 | |||||

South Miami HFA Hospital, 5.00% due 8/15/2016 (Baptist Health) | Aa3/AA- | 1,560,000 | 1,645,488 | |||||

St. John’s County IDA, 5.50% due 8/1/2014 (Presbyterian Retirement) | NR/NR | 1,755,000 | 1,850,700 | |||||

University of Central Florida Athletics Association Inc. COP, 5.00% due 10/1/2016 (Insured: FGIC) | Aaa/AAA | 1,640,000 | 1,749,700 | |||||

GEORGIA — 0.78% | ||||||||

Atlanta Tax Allocation, 5.25% due 12/1/2016 (Atlantic Station; Insured: Assured Guaranty) | Aaa/AAA | 3,850,000 | 4,213,863 | |||||

Atlanta Water & Wastewater, 5.00% due 11/1/2038 pre-refunded 5/1/2009 (Insured: FGIC) | Aaa/AAA | 1,015,000 | 1,048,536 | |||||

Monroe County Development Authority PCR, 6.75% due 1/1/2010 (Oglethorpe Power; Insured: MBIA) | Aaa/AAA | 2,000,000 | 2,133,080 | |||||

Monroe County Development Authority PCR, 6.80% due 1/1/2012 (Oglethorpe Power; Insured: MBIA) | Aaa/AAA | 1,000,000 | 1,120,440 | |||||

GUAM — 0.09% | ||||||||

Guam Educational Financing Foundation COP, 5.00% due 10/1/2010 (Guam Public Schools) | NR/A- | 1,000,000 | 1,029,510 | |||||

HAWAII — 0.19% | ||||||||

Hawaii State Department of Budget & Finance Special Purpose, 4.95% due 4/1/2012 (Hawaiian Electric Company; Insured: MBIA) | Aaa/AAA | 2,000,000 | 2,097,000 | |||||

IDAHO — 0.28% | ||||||||

Twin Falls Urban Renewal Agency, 4.95% due 8/1/2014 | NR/NR | 1,640,000 | 1,600,689 | |||||

Twin Falls Urban Renewal Agency, 5.15% due 8/1/2017 | NR/NR | 1,455,000 | 1,417,228 | |||||

ILLINOIS — 9.55% | ||||||||

Bolingbrook, 0% due 1/1/2016 (Insured: MBIA) | Aaa/NR | 1,500,000 | 1,058,475 | |||||

Bolingbrook, 0% due 1/1/2017 (Insured: MBIA) | Aaa/NR | 2,000,000 | 1,333,560 | |||||

Champaign County Community School District 116, 0% due 1/1/2009 (ETM) | Aaa/AAA | 1,205,000 | 1,150,245 | |||||

Champaign County Community School District 116, 0% due 1/1/2009 (Insured: FGIC) | Aaa/AAA | 2,140,000 | 2,042,266 | |||||

Chicago, 6.125% due 1/1/2012 (Insured: AMBAC) | Aaa/AAA | 1,000,000 | 1,098,380 | |||||

Chicago, 5.375% due 1/1/2013 (Insured: MBIA) | Aaa/AAA | 3,000,000 | 3,159,960 | |||||

Chicago Board of Education GO, 6.00% due 12/1/2009 (Insured: FGIC) | Aaa/AAA | 2,000,000 | 2,104,580 | |||||

Chicago Capital Appreciation, 0% due 1/1/2016 (City Colleges; Insured: FGIC) | Aaa/AAA | 2,670,000 | 1,901,921 | |||||

Chicago Gas Supply, 4.75% due 3/1/2030 (Peoples Gas Light & Coke) | A1/A- | 1,500,000 | 1,531,455 | |||||

Chicago Housing Authority Capital Program, 5.25% due 7/1/2010 (ETM) | Aaa/NR | 2,300,000 | 2,402,373 | |||||

Chicago Housing Authority Capital Program, 5.00% due 7/1/2015 (Insured: FSA) | Aaa/AAA | 8,460,000 | 9,083,164 | |||||

Chicago Housing Authority Capital Program, 5.00% due 7/1/2016 (Insured: FSA) | Aaa/AAA | 2,000,000 | 2,151,020 | |||||

Chicago Metropolitan Water Reclamation District, 7.00% due 1/1/2011 (ETM) | Aaa/AAA | 1,070,000 | 1,142,781 | |||||

Chicago Midway Airport, 5.40% due 1/1/2009 (Insured: MBIA) | Aaa/AAA | 1,340,000 | 1,355,035 | |||||

Chicago Midway Airport, 5.50% due 1/1/2013 (Insured: MBIA) | Aaa/AAA | 1,180,000 | 1,279,993 | |||||

Chicago O’Hare International Airport, 5.625% due 1/1/2014 (Insured: AMBAC) | Aaa/AAA | 3,065,000 | 3,079,620 | |||||

| 20 | Certified Annual Report |

| SCHEDULE OF INVESTMENTS, CONTINUED | ||

Thornburg Limited Term Municipal Fund | September 30, 2007 | |

Issuer-Description | Credit Rating† Moody’s/S&P | Principal Amount | Value | |||||

Chicago Park District Parking Facility, 5.75% due 1/1/2010 (ETM) | Baa1/A | $ | 1,000,000 | $ | 1,047,060 | |||

Cook County, 6.25% due 11/15/2013 (Insured: MBIA) | Aaa/AAA | 3,995,000 | 4,556,737 | |||||

Cook County Community Consolidated School District GO, 0% due 12/1/2010 (Insured: FSA) | Aaa/NR | 2,000,000 | 1,776,900 | |||||

Cook County Community Consolidated School District GO, 9.00% due 12/1/2016 (Tinley Park; Insured: FGIC) | Aaa/NR | 2,500,000 | 3,408,375 | |||||

Cook County Community School District GO, 9.00% due 12/1/2013 (Insured: FGIC) | Aaa/NR | 2,250,000 | 2,904,458 | |||||

Du Page County Forest Preservation District, 0% due 11/1/2009 (Partial ETM) | Aaa/AAA | 5,000,000 | 4,629,000 | |||||

Illinois DFA, 6.00% due 11/15/2009 (Adventist Health; Insured: MBIA) | Aaa/AAA | 3,635,000 | 3,817,550 | |||||

Illinois DFA, 6.00% due 11/15/2010 (Adventist Health; Insured: MBIA) | Aaa/AAA | 3,860,000 | 4,131,783 | |||||

Illinois DFA Community Rehab Providers, 6.00% due 7/1/2015 | NR/BBB | 1,450,000 | 1,469,082 | |||||

Illinois DFA Multi Family Housing, 5.55% due 7/20/2008 (Collateralized: GNMA) | NR/AAA | 375,000 | 378,094 | |||||

Illinois DFA PCR, 5.70% due 1/15/2009 (Commonwealth Edison Co.; Insured: MBIA) | NR/AAA | 3,000,000 | 3,082,050 | |||||

Illinois Financing Authority Student Housing, 5.00% due 5/1/2014 | Baa3/NR | 3,895,000 | 3,995,919 | |||||

Illinois HFA, 5.50% due 11/15/2007 (OSF Healthcare System) | A2/A | 915,000 | 916,857 | |||||

Illinois HFA, 6.50% due 2/15/2008 (Iowa Health System) | A1/NR | 1,290,000 | 1,302,384 | |||||

Illinois HFA, 6.50% due 2/15/2009 (Iowa Health System) | A1/NR | 1,375,000 | 1,421,214 | |||||

Illinois HFA, 6.50% due 2/15/2010 (Iowa Health System) (ETM) | A1/NR | 1,465,000 | 1,544,227 | |||||

Illinois HFA, 6.00% due 2/15/2011 (Iowa Health System; Insured: AMBAC) (ETM) | Aaa/AAA | 1,560,000 | 1,661,150 | |||||

Illinois HFA, 5.50% due 11/15/2011 (Methodist Medical Center; Insured: MBIA) | Aaa/AAA | 3,000,000 | 3,084,870 | |||||

Illinois HFA, 6.00% due 7/1/2017 (Lake Forest Hospital) | A3/A- | 1,500,000 | 1,603,905 | |||||

Illinois Hospital District, 5.50% due 1/1/2010 (Insured: FGIC) | Aaa/AAA | 1,040,000 | 1,083,118 | |||||

Illinois State GO, 5.00% due 10/1/2017 | Aa3/AA | 2,000,000 | 2,123,420 | |||||

Kane County Forest Preservation District, 5.00% due 12/15/2015 (Insured: FGIC) | NR/AAA | 2,780,000 | 3,013,520 | |||||

Lake County Community High School District, 0% due 12/1/2011 (Insured: FGIC) | Aaa/NR | 3,235,000 | 2,765,666 | |||||

McHenry & Kane Counties Community Consolidated School District, 0% due 1/1/2010 (Insured: FGIC) | Aaa/AAA | 1,000,000 | 919,320 | |||||

McHenry & Kane Counties Community Consolidated School District, 0% due 1/1/2012 (Insured: FGIC) | Aaa/AAA | 2,200,000 | 1,871,804 | |||||

Metropolitan Pier & Exposition Authority Dedicated State Tax, 0% due 6/15/2013 (McCormick; Insured: MBIA) | Aaa/AAA | 1,045,000 | 840,452 | |||||

Naperville City, Du Page & Will Counties Economic Development, 6.10% due 5/1/2008 (Hospital & Health System Association; LOC: Bank One N.A.) | NR/AA | 675,000 | 676,181 | |||||

Peoria Public Building Commission School District Facilities, 0% due 12/1/2007 (Insured: FGIC) | Aaa/NR | 1,100,000 | 1,093,059 | |||||

Quincy Hospital, 5.00% due 11/15/2014 | A3/A- | 1,000,000 | 1,042,110 | |||||

Quincy Hospital, 5.00% due 11/15/2016 | A3/A- | 1,000,000 | 1,043,370 | |||||

Southwestern Illinois Development Authority, 5.125% due 8/15/2016 (Anderson Hospital) | Baa2/BBB | 2,375,000 | 2,445,395 | |||||

State of Illinois Waubonsee Community College District GO, 0% due 12/15/2013 (Insured: FGIC) | Aaa/AAA | 3,000,000 | 2,310,420 | |||||

INDIANA — 5.17% | ||||||||

Allen County Economic Development, 5.60% due 12/30/2009 (Indiana Institute of Technology) | NR/NR | 1,110,000 | 1,126,728 | |||||

Allen County Economic Development, 5.00% due 12/30/2012 (Indiana Institute of Technology) | NR/NR | 1,370,000 | 1,407,456 | |||||

Allen County Jail Building Corp. First Mortgage, 5.75% due 10/1/2010 (ETM) | Aa3/NR | 1,115,000 | 1,184,732 | |||||

Allen County Jail Building Corp. First Mortgage, 5.00% due 10/1/2014 (Insured: XLCA) | Aaa/NR | 1,000,000 | 1,072,270 | |||||

Allen County Jail Building Corp. First Mortgage, 5.00% due 10/1/2015 (Insured: XLCA) | Aaa/NR | 1,480,000 | 1,591,577 | |||||

Allen County Jail Building Corp. First Mortgage, 5.00% due 10/1/2016 (Insured: XLCA) | Aaa/NR | 1,520,000 | 1,631,538 | |||||

Allen County Redevelopment District, 5.00% due 11/15/2016 | A3/NR | 1,000,000 | 1,040,850 | |||||

Ball State University Student Fee, 5.75% due 7/1/2012 (Insured: FGIC) | Aaa/AAA | 1,000,000 | 1,082,890 | |||||

Boonville Junior High School Building Corp., 0% due 7/1/2010 (State Aid Withholding) | NR/A | 850,000 | 755,879 | |||||

Boonville Junior High School Building Corp., 0% due 1/1/2011 (State Aid Withholding) | NR/A | 850,000 | 737,613 | |||||

Boonville Junior High School Building Corp., 0% due 7/1/2011 (State Aid Withholding) | NR/A | 950,000 | 806,645 | |||||

Carmel Redevelopment Authority Lease Performing Arts, 0% due 2/1/2015 | Aa2/AA | 1,575,000 | 1,162,381 | |||||

Center Grove 2000 Building First Mortgage, 5.00% due 7/15/2010 (Insured: AMBAC) (ETM) | Aaa/AAA | 1,135,000 | 1,178,709 | |||||

Dekalb County Redevelopment Authority Lease Rental, 5.25% due 1/15/2014 (Mini Mill Local Public Improvement; Insured: XLCA) | Aaa/AAA | 1,000,000 | 1,068,680 | |||||

| Certified Annual Report | 21 |

| SCHEDULE OF INVESTMENTS, CONTINUED | ||

Thornburg Limited Term Municipal Fund | September 30, 2007 | |

Issuer-Description | Credit Rating† Moody’s/S&P | Principal Amount | Value | ||||

Eagle Union Middle School Building Corp., 5.50% due 7/15/2009 (ETM) | Aaa/AAA | $ | 910,000 $ | 941,704 | |||

Elberfeld J. H. Castle School Building Corp. First Mortgage, 0% due 7/5/2008 (Insured: MBIA) | NR/AAA | 1,860,000 | 1,809,352 | ||||

Evansville Vanderburgh, 5.00% due 7/15/2014 (Insured: AMBAC) | NR/AAA | 1,000,000 | 1,075,510 | ||||

Evansville Vanderburgh, 5.00% due 7/15/2015 (Insured: AMBAC) | NR/AAA | 1,000,000 | 1,079,500 | ||||

Huntington Economic Development, 6.15% due 11/1/2008 (United Methodist Membership) | NR/NR | 535,000 | 543,421 | ||||

Huntington Economic Development, 6.20% due 11/1/2010 (United Methodist Membership) | NR/NR | 790,000 | 809,932 | ||||

Indiana Bond Bank, 5.25% due 10/15/2016 (Special Gas Program) | Aa2/NR | 1,500,000 | 1,583,280 | ||||

Indiana Multi School Building Corp. First Mortgage, 5.00% due 7/15/2016 (Insured: MBIA) | Aaa/AAA | 5,000,000 | 5,405,600 | ||||

Indiana State Educational Facilities Authority, 5.75% due 10/1/2009 (University of Indianapolis) | NR/A- | 670,000 | 695,031 | ||||

Indiana State Finance Authority Facilities, Forensic & Health Science, 5.00% due 7/1/2016 (Insured: MBIA) | Aaa/AAA | 1,030,000 | 1,114,903 | ||||

Indianapolis Local Public Improvement Bond, 5.00% due 1/1/2015 (Waterworks; Insured: MBIA) | Aaa/AAA | 1,000,000 | 1,075,440 | ||||

Indianapolis Local Public Improvement Bond, 5.00% due 7/1/2015 (Waterworks; Insured: MBIA) | Aaa/AAA | 1,000,000 | 1,079,220 | ||||

Indianapolis Local Public Improvement Bond, 5.00% due 7/1/2016 (Insured: FGIC) | Aaa/AAA | 1,030,000 | 1,105,159 | ||||

Knox Middle School Building Corp. First Mortgage, 6.00% due 7/15/2008 (Insured: FGIC) | Aaa/AAA | 855,000 | 871,741 | ||||

Knox Middle School Building Corp. First Mortgage, 6.00% due 7/15/2009 (Insured: FGIC) | Aaa/AAA | 455,000 | 474,620 | ||||

Madison Schools Lydia Middleton Building Corp., 5.00% due 7/15/2014 (Insured: FGIC) | Aaa/AAA | 1,200,000 | 1,290,612 | ||||

Madison Schools Lydia Middleton Building Corp., 5.00% due 7/15/2015 (Insured: FGIC) | Aaa/AAA | 1,250,000 | 1,349,375 | ||||

Mount Vernon of Hancock County First Mortgage, 5.00% due 7/15/2013 (Insured: MBIA) | Aaa/AAA | 1,055,000 | 1,128,702 | ||||

Mount Vernon of Hancock County First Mortgage, 5.00% due 7/15/2014 (Insured: MBIA) | Aaa/AAA | 1,135,000 | 1,220,704 | ||||

Mount Vernon of Hancock County First Mortgage, 5.00% due 7/15/2015 (Insured: MBIA) | Aaa/AAA | 1,140,000 | 1,230,630 | ||||

Noblesville Redevelopment Authority, 5.00% due 8/1/2016 (146th Street Extension A) | NR/A+ | 1,660,000 | 1,750,868 | ||||

Perry Township Multi School Building, 5.00% due 7/10/2014 (Insured: FSA) | Aaa/NR | 2,130,000 | 2,289,367 | ||||

Peru Community School Corp. First Mortgage, 0% due 7/1/2010 (State Aid Withholding) | NR/A | 835,000 | 742,540 | ||||

Plainfield Community High School Building Corp. First Mortgage, 5.00% due 1/15/2015 (Insured: FGIC) | Aaa/AAA | 1,445,000 | 1,554,430 | ||||

Warren Township Vision 2005, 5.00% due 7/10/2015 (Insured: FGIC) | Aaa/AAA | 2,095,000 | 2,252,146 | ||||

Wawasee Community School Corp. First Mortgage, 5.50% due 7/15/2010 (State Aid Withholding) (ETM) | NR/AA | 995,000 | 1,046,451 | ||||

Wawasee Community School Corp. First Mortgage, 5.50% due 7/15/2011 (State Aid Withholding) (ETM) | NR/AA | 1,095,000 | 1,169,767 | ||||

West Clark 2000 School Building Corp., 5.25% due 1/15/2014 (Insured: MBIA) | Aaa/AAA | 1,335,000 | 1,448,582 | ||||

West Clark School Building Corp. First Mortgage, 5.75% due 7/15/2011 (State Aid Withholding) | Aaa/AAA | 2,080,000 | 2,237,269 | ||||

IOWA — 2.07% | |||||||

Ankeny Community School District Sales & Services Tax, 5.00% due 7/1/2010 | NR/AA- | 2,900,000 | 3,012,491 | ||||

Des Moines Limited Obligation, 4.40% due 12/1/2015 put 12/1/2011 (Des Moines Parking Associates; LOC: Wells Fargo Bank) | NR/NR | 2,985,000 | 2,984,880 | ||||

Dubuque Community School District, 5.00% due 1/1/2013 (1) | NR/NR | 1,600,000 | 1,620,432 | ||||

Dubuque Community School District, 5.00% due 7/1/2013 | NR/NR | 1,640,000 | 1,660,943 | ||||

Iowa Finance Authority, 6.50% due 2/15/2009 (Iowa Health Services) | Aa3/NR | 1,825,000 | 1,892,069 | ||||

Iowa Finance Authority, 6.50% due 2/15/2010 (Iowa Health Services) | Aa3/NR | 2,955,000 | 3,131,354 | ||||

Iowa Finance Authority, 6.00% due 2/15/2011 pre-refunded 2/15/2010 (Iowa Health Services; Insured: AMBAC) | Aaa/AAA | 3,145,000 | 3,347,444 | ||||

Iowa Finance Authority Trinity Health, 5.75% due 12/1/2007 | Aa2/AA- | 1,430,000 | 1,434,905 | ||||

Iowa Finance Authority Trinity Health, 5.75% due 12/1/2010 | Aa2/AA- | 3,295,000 | 3,430,128 | ||||

KENTUCKY — 1.46% | |||||||

Kentucky Economic DFA, 5.35% due 10/1/2009 (Norton Healthcare; Insured: MBIA) (ETM) | Aaa/AAA | 2,835,000 | 2,934,735 | ||||

Kentucky Economic DFA, 5.35% due 10/1/2009 (Norton Healthcare; Insured: MBIA) | Aaa/AAA | 4,565,000 | 4,728,290 | ||||

Kentucky Economic DFA, 5.40% due 10/1/2010 (Norton Healthcare; Insured: MBIA) (ETM) | Aaa/AAA | 3,775,000 | 3,971,489 | ||||

Kentucky Economic DFA, 5.40% due 10/1/2010 (Norton Healthcare; Insured MBIA) | Aaa/AAA | 4,055,000 | 4,266,063 | ||||

| 22 | Certified Annual Report |

| SCHEDULE OF INVESTMENTS, CONTINUED | ||

Thornburg Limited Term Municipal Fund | September 30, 2007 | |

Issuer-Description | Credit Rating† Moody’s/S&P | Principal Amount | Value | |||||

LOUISIANA — 3.25% | ||||||||

East Baton Rouge Sewer Commission, 5.00% due 2/1/2018 (Insured: FSA) | Aaa/AAA | $ | 3,000,000 | $ | 3,193,110 | |||

Jefferson Sales Tax District Special Sales Tax, 5.25% due 12/1/2007 (Insured: AMBAC) | Aaa/AAA | 1,515,000 | 1,519,515 | |||||

Louisiana Environmental Facilities & Community Development Authority Multi Family, 5.00% due 9/1/2012 (Bellemont Apartments) | Baa3/NR | 1,000,000 | 984,980 | |||||

Louisiana Public Facilities Authority, 5.75% due 10/1/2008 (Loyola University) | A1/A+ | 1,000,000 | 1,019,310 | |||||

Louisiana Public Facilities Authority, 5.375% due 12/1/2008 (Wynhoven Health Care Center; Guaranty: Archdiocese of New Orleans) | NR/NR | 975,000 | 974,532 | |||||

Louisiana Public Facilities Authority Hospital, 5.50% due 7/1/2010 (Franciscan Missionaries; Insured: FSA) | Aaa/AAA | 1,000,000 | 1,048,600 | |||||

Louisiana Public Facilities Authority Revenue, 5.00% due 5/15/2014 (Ochsner Clinic Foundation) | A3/NR | 1,000,000 | 1,037,220 | |||||

Louisiana Public Facilities Authority Revenue, 5.00% due 5/15/2015 (Ochsner Clinic Foundation) | A3/NR | 1,825,000 | 1,894,387 | |||||

Louisiana Public Facilities Authority Revenue, 5.00% due 5/15/2016 (Ochsner Clinic Foundation) | A3/NR | 1,000,000 | 1,037,770 | |||||

Louisiana Public Facilities Authority Revenue, 5.00% due 5/15/2017 (Ochsner Clinic Foundation) | A3/NR | 1,035,000 | 1,072,001 | |||||

Louisiana Public Facilities Authority Revenue, 5.00% due 5/15/2018 (Ochsner Clinic Foundation) | A3/NR | 1,000,000 | 1,027,650 | |||||

Louisiana State, 5.50% due 11/15/2008 (Insured: FGIC) | Aaa/AAA | 1,980,000 | 2,024,312 | |||||

Louisiana State Citizens Property Insurance Corp., 5.00% due 6/1/2015 (Insured: AMBAC) | Aaa/AAA | 5,000,000 | 5,365,650 | |||||

Louisiana State Correctional Facilities Corp. Lease, 5.00% due 12/15/2007 (Insured: Radian) | NR/AA | 3,760,000 | 3,767,106 | |||||

Louisiana State Offshore Terminal Authority, 4.25% due 10/1/2037 put 10/1/2010 (Deepwater Port Loop LLC) | A3/A | 4,200,000 | 4,223,562 | |||||

Monroe Sales Tax Increment Garrett Road Economic Development Area, 5.00% due 3/1/2017 (Insured: Radian) | Aa3/AA | 1,505,000 | 1,532,963 | |||||

Morehouse Parish PCR, 5.25% due 11/15/2013 (International Paper Co.) | Baa3/BBB | 2,400,000 | 2,505,816 | |||||

New Orleans Parish School Board, 0% due 2/1/2008 (ETM) | NR/AAA | 1,115,000 | 1,097,495 | |||||

MASSACHUSETTS — 3.70% | ||||||||

Massachusetts DFA Resource Recovery, 5.50% due 1/1/2011 (Seamass Partnership; Insured: MBIA) | Aaa/AAA | 3,470,000 | 3,663,140 | |||||

Massachusetts GO, 6.00% due 11/1/2008 | Aa2/AA | 1,000,000 | 1,027,490 | |||||

Massachusetts GO Construction Loan, 5.00% due 9/1/2015 | Aa2/AA | 10,000,000 | 10,869,200 | |||||

Massachusetts Health & Educational Facilities Authority, 5.00% due 10/1/2011 (Berkshire Health Systems; Insured: Assured Guaranty) | NR/AAA | 2,345,000 | 2,462,953 | |||||

Massachusetts Health & Educational Facilities Authority, 5.375% due 5/15/2012 (New England Medical Center Hospital; Insured: FGIC) | Aaa/AAA | 3,415,000 | 3,659,685 | |||||

Massachusetts Health & Educational Facilities Authority, 5.00% due 10/1/2012 (Berkshire Health Systems; Insured: Assured Guaranty) | NR/AAA | 2,330,000 | 2,463,486 | |||||

Massachusetts Health & Educational Facilities Authority, 5.00% due 10/1/2013 (Berkshire Health Systems; Insured: Assured Guaranty) | NR/AAA | 3,215,000 | 3,418,735 | |||||

Massachusetts Industrial Finance Agency Biomedical, 0% due 8/1/2008 | Aa2/AA- | �� | 1,000,000 | 969,350 | ||||

Massachusetts Industrial Finance Agency Biomedical, 0% due 8/1/2010 | Aa2/AA- | 13,000,000 | 11,668,150 | |||||

MICHIGAN — 3.44% | ||||||||

Detroit Convention Facility, 5.25% due 9/30/2007 (Cobo Hall Expansion) | NR/A | 1,000,000 | 1,000,080 | |||||

Dickinson County Economic Development Corp. Environmental Impact, 5.75% due 6/1/2016 (International Paper Co.) | Baa3/BBB | 3,715,000 | 3,884,664 | |||||

Dickinson County Healthcare Systems, 5.50% due 11/1/2013 (Insured: ACA) | NR/A | 2,500,000 | 2,572,700 | |||||

Gull Lake Community School District GO, 0% due 5/1/2013 (Insured: FGIC) | Aaa/AAA | 3,000,000 | 2,240,340 | |||||

Michigan HFA, 5.375% due 7/1/2012 (Port Huron Hospital; Insured: FSA) | Aaa/AAA | 1,710,000 | 1,712,138 | |||||

Michigan State Building Authority, 5.00% due 10/15/2015 (Insured: AMBAC) | Aaa/AAA | 6,000,000 | 6,496,800 | |||||

Michigan State COP, 5.00% due 9/1/2031 put 9/1/2011 (Insured: MBIA) | Aaa/AAA | 6,000,000 | 6,271,200 | |||||

Michigan State HFA, 5.00% due 11/15/2017 (Sparrow Memorial Hospital) | A1/A+ | 1,000,000 | 1,051,320 | |||||

Michigan State HFA, 5.375% due 11/15/2033 put 11/15/2007 (Ascension Health Credit) | Aa2/AA | 10,000,000 | 10,014,900 | |||||

Michigan State Strategic Fund Detroit Educational, 4.85% due 9/1/2030 put 9/1/2011 (Detroit Edison Co.; Insured: AMBAC) | Aaa/NR | 2,075,000 | 2,151,401 | |||||

| Certified Annual Report | 23 |

| SCHEDULE OF INVESTMENTS, CONTINUED | ||

Thornburg Limited Term Municipal Fund | September 30, 2007 | |

Issuer-Description | Credit Rating† Moody’s/S&P | Principal Amount | Value | |||||

MINNESOTA — 1.13% | ||||||||

Dakota County Community Development Agency Multi Family Housing, 5.00% due 11/1/2017 (Commons on Marice) | NR/NR | $ | 1,150,000 | $ | 1,118,870 | |||

Minneapolis & St. Paul Metropolitan Airports, 5.00% due 1/1/2017 (Insured: AMBAC) | NR/AAA | 8,005,000 | 8,618,823 | |||||

Minneapolis St. Paul Health Care Systems, 5.25% due 12/1/2012 (Healthpartners Obligated Group) | Baa1/BBB | 1,000,000 | 1,037,580 | |||||

Minneapolis St. Paul Health Care Systems, 5.25% due 12/1/2013 (Healthpartners Obligated Group) | Baa1/BBB | 1,500,000 | 1,561,035 | |||||

MISSISSIPPI — 0.54% | ||||||||

Gautier Utility District Systems, 5.50% due 3/1/2012 (Insured: FGIC) | Aaa/NR | 1,020,000 | 1,094,276 | |||||

Mississippi Development Bank Public Improvement GO, 4.75% due 7/1/2017 | NR/NR | 1,565,000 | 1,545,657 | |||||

Mississippi State GO, 6.20% due 2/1/2008 (ETM) | Aaa/AAA | 3,175,000 | 3,197,447 | |||||

MISSOURI — 0.22% | ||||||||

Missouri Development Finance Board Healthcare Facilities, 4.80% due 11/1/2012 (Lutheran Home Aged; LOC: Commerce Bank) | Aa2/NR | 1,275,000 | 1,304,070 | |||||

Missouri State Health & Educational Facilities Authority, 5.00% due 6/1/2011 (SSM Healthcare Corp.) | NR/AA- | 1,000,000 | 1,041,440 | |||||

MONTANA — 1.68% | ||||||||