UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-05201

Thornburg Investment Trust

(Exact name of registrant as specified in charter)

c/o Thornburg Investment Management, Inc.

2300 North Ridgetop Road, Santa Fe, New Mexico 87506

(Address of principal executive offices) (Zip code)

Garrett Thornburg, 2300 North Ridgetop Road, Santa Fe, New Mexico 87506

(Name and address of agent for service)

Registrant’s telephone number, including area code: 505-984-0200

Date of fiscal year end: September 30, 2010

Date of reporting period: March 31, 2010

| Item 1. | Reports to Stockholders |

The following annual reports are attached hereto, in order:

Thornburg Limited Term Municipal Fund

Thornburg Intermediate Municipal Fund

Thornburg Strategic Municipal Income Fund

Thornburg California Limited Term Municipal Fund

Thornburg New Mexico Intermediate Municipal Fund

Thornburg New York Intermediate Municipal Fund

Thornburg Limited Term Income Funds

Thornburg Strategic Income Fund

Thornburg Value Fund

Thornburg International Value Fund

Thornburg Core Growth Fund

Thornburg International Growth Fund

Thornburg Investment Income Builder Fund

Thornburg Global Opportunities Fund

Thornburg Developing World Fund

2 This page is not part of the Semi-Annual Report.

Important Information

The information presented on the following pages is current as of March 31, 2010. The managers’ views, portfolio holdings, and sector diversification are provided for the general information of the Fund’s shareholders; they are historical and subject to change. This material should not be deemed a recommendation to buy or sell any of the securities mentioned.

Investments in the Fund carry risks, including possible loss of principal. Bond funds have the same interest rate, inflation, and credit risks that are associated with the underlying bonds. The principal value of bonds will fluctuate relative to changes in interest rates, decreasing when interest rates rise. Unlike bonds, bond funds have ongoing fees and expenses. Please see the Fund’s Prospectus for a discussion of the risks associated with an investment in the Fund. Investments in the Fund are not FDIC insured, nor are they deposits of or guaranteed by a bank or any other entity. There is no guarantee that the Fund will meet its investment objectives. The laddering strategy does not assure or guarantee better performance and cannot eliminate the risk of investment losses.

Performance data given at net asset value (NAV) does not take into account applicable sales charges. If the sales charges had been included, the performance would have been lower.

Minimum investments for Class I shares are higher than those for other classes. Class I shares may not be available to all investors.

| | | | |

Share Class | | NASDAQ Symbol | | Cusip |

Class A | | LTMFX | | 885-215-459 |

Class C | | LTMCX | | 885-215-442 |

Class I | | LTMIX | | 885-215-434 |

Lipper’s 2008

Best Fixed-Income Fund Family

Thornburg Investment Management ranked #1 out of 41 eligible firms in Lipper, Inc.’s fixed income large firm universe for the three-year period ended 12/31/07, based on risk-adjusted returns. Past performance does not guarantee future results.

Lipper’s large firm universe is comprised of fund families with more than $28 billion in total net assets. Only fund families with at least five bond funds were eligible. Risk-adjusted returns were calculated with dividends reinvested and without sales charges. We did not win this award in 2009 or 2010.

Glossary

Barclays Capital Five-Year Municipal Bond Index – A rules-based, market-value-weighted index of the tax-exempt bond market. To be included in the index, bonds must have a minimum credit rating of Baa. The approximate maturity of the municipal bonds in the index is five years.

Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. Investors may not make direct investments into any index.

Alternative Minimum Tax (AMT) – A federal tax aimed at ensuring that high-income individuals, estates, trusts, and corporations pay a minimal level income tax. For individuals, the AMT is calculated by adding tax preference items to regular taxable income.

Annualized Distribution Yield – The distribution yield is calculated by taking the sum of the month’s total distribution factors and dividing this sum by a 30-day period and annualizing to a 360-day year. The value is then divided by the ending maximum offering price per share to arrive at the annualized distribution yield. The yield is calculated on a periodic basis and is subject to change.

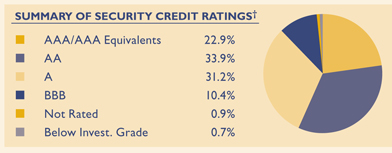

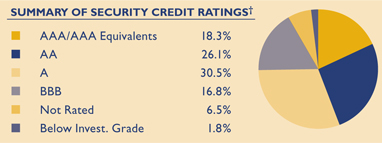

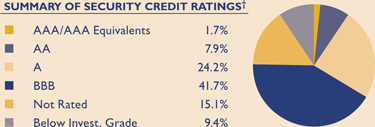

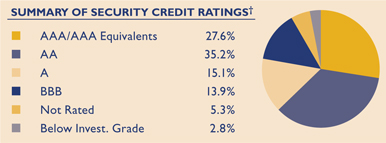

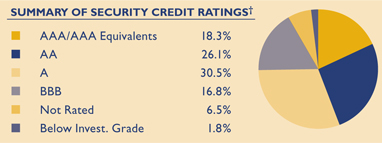

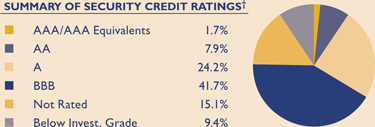

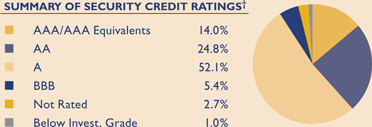

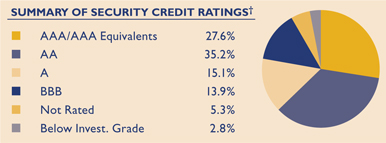

Bond Credit Ratings – A bond credit rating assesses the financial ability of a debt issuer to make timely payments of principal and interest. Ratings of AAA (the highest), AA, A, and BBB are investment-grade quality. Ratings of BB, B, CCC, CC, C, and D (the lowest) are considered below investment grade, speculative grade, or junk bonds. Unless otherwise noted, the ratings listed are from Municipal Market Data and are a combination of ratings from Standard and Poor’s, Moody’s Investors Service, and Fitch Ratings.

Duration – The weighted maturity of a bond’s cash flows. Duration measures the price sensitivity of a bond for a given change in interest rates. Bonds with longer durations experience greater price volatility than bonds with shorter durations.

Fed Funds Rate – The Fed Funds Rate is the interest rate at which a depository institution lends immediately available funds (balances at the Federal Reserve) to another depository institution overnight.

Revenue Bond – A bond on which the debt service is payable solely from the revenue generated from the operation of the project being financed or a category of facilities, or from other non-tax sources.

SEC Yield – SEC Yield is computed in accordance with SEC standards measuring the net investment income per share over a specified 30-day period expressed as a percentage of the maximum offering price of the Fund’s shares at the end of the period.

This page is not part of the Semi-Annual Report. 3

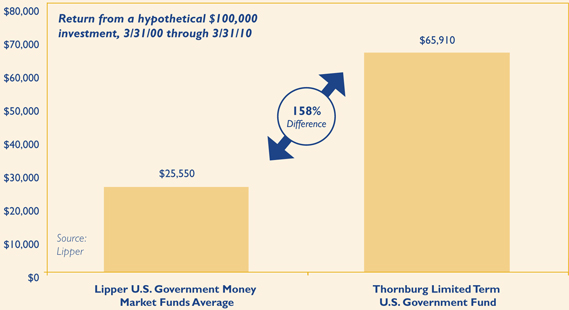

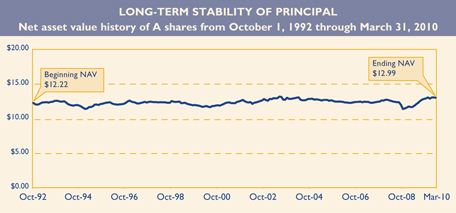

Thornburg Limited Term Municipal Fund

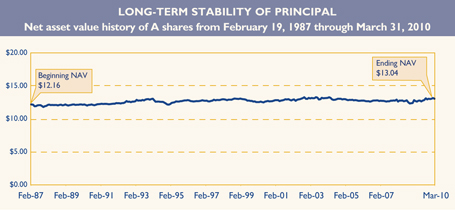

At Thornburg, our approach to management of the Fund is based on the premise that investors in the Fund seek preservation of capital along with an attractive, relatively stable yield. While aggressive bond strategies may generate stronger returns when the market is turning a blind eye towards risk, they usually fail to stack up over longer periods of time. Our patience and diligence were recognized by Lipper in 2008 with the Best Fixed-Income Fund Family Award.

We apply time-tested techniques to manage risk and provide attractive returns. These include:

| | • | | Building a laddered portfolio. Laddering has been shown over time to mitigate price and interest rate risk. |

| | • | | Investing on a cash-only basis without using leverage. While leveraged strategies may enhance returns when market conditions are favorable, they can quickly compound losses when sentiment shifts. |

| | • | | Conducting in-depth fundamental research on each issue and actively monitoring positions for subsequent credit events. |

| | • | | Diversifying among a large number of generally high-quality bonds. |

IMPORTANT PERFORMANCE INFORMATION

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than quoted. For performance current to the most recent month end, visit thornburg.com.

The maximum sales charge for the Fund’s Class A shares is 1.50%. The total annual fund operating expense of Class A shares is 0.86%, as disclosed in the most recent Prospectus.

AVERAGE ANNUAL TOTAL RETURNS

For periods ended March 31, 2010

| | | | | | | | | | | | | | | |

| | | 1 Yr | | | 3 Yrs | | | 5 Yrs | | | 10 Yrs | | | Since

Inception | |

A Shares (Incep: 9/28/84) | | | | | | | | | | | | | | | |

Without sales charge | | 7.09 | % | | 4.55 | % | | 3.86 | % | | 4.14 | % | | 5.57 | % |

With sales charge | | 5.51 | % | | 4.01 | % | | 3.54 | % | | 3.98 | % | | 5.50 | % |

30-DAY YIELDS, A SHARES

As of March 31, 2010

| | | | |

Annualized

Distribution Yield | | | SEC

Yield | |

| 2.41 | % | | 1.90 | % |

KEY PORTFOLIO ATTRIBUTES

As of March 31, 2010

| | |

Number of Bonds | | 942 |

Duration | | 3.4 Yrs |

Average Maturity | | 4.4 Yrs |

| | |

| | |

See the entire portfolio in the Schedule of Investments beginning on page 10.

4 This page is not part of the Semi-Annual Report.

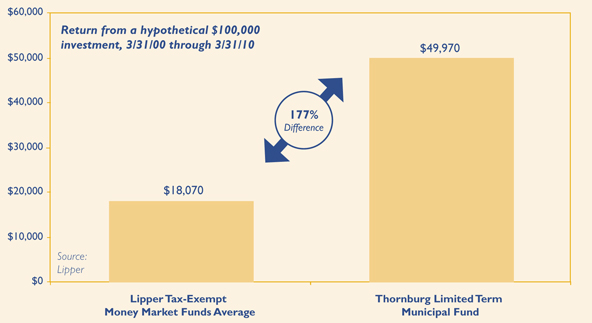

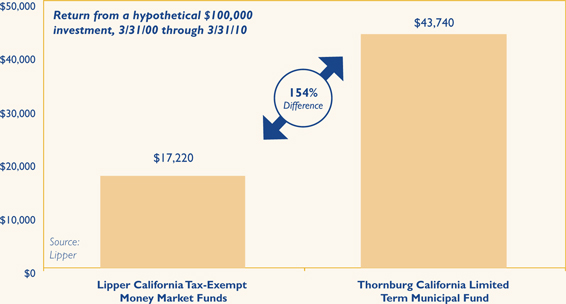

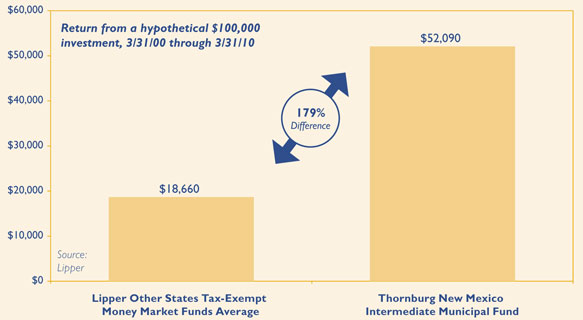

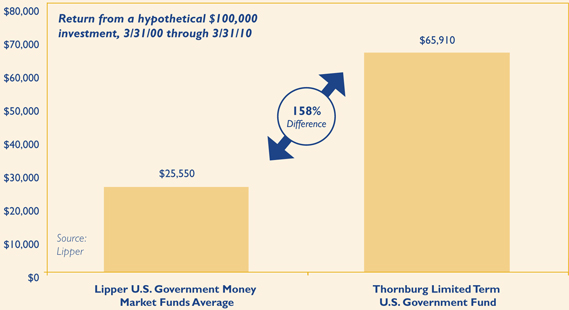

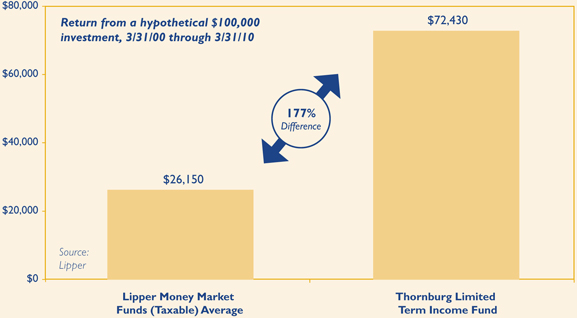

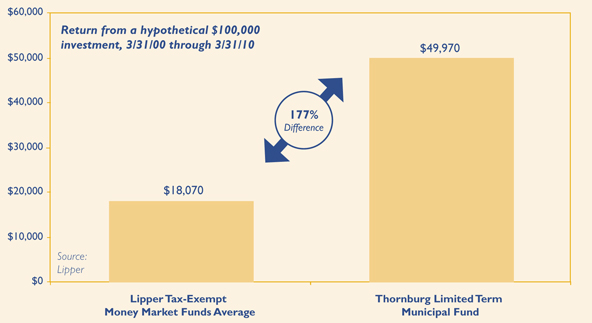

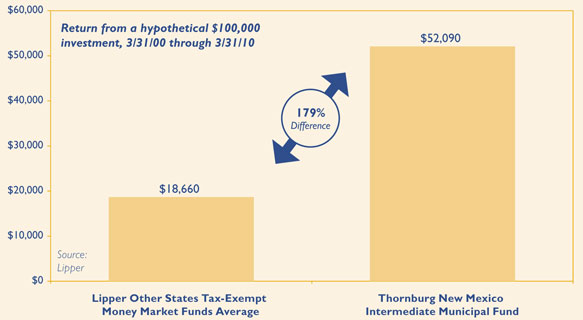

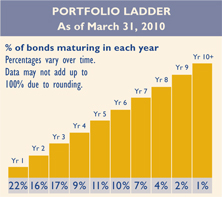

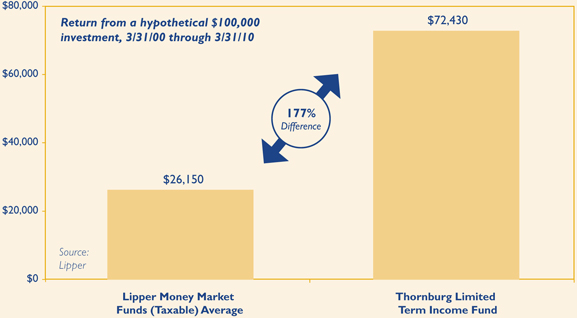

THORNBURG LIMITED TERM MUNICIPAL FUND VERSUS

LIPPER TAX-EXEMPT MONEY MARKET FUNDS AVERAGE

Class A shares as of March 31, 2010

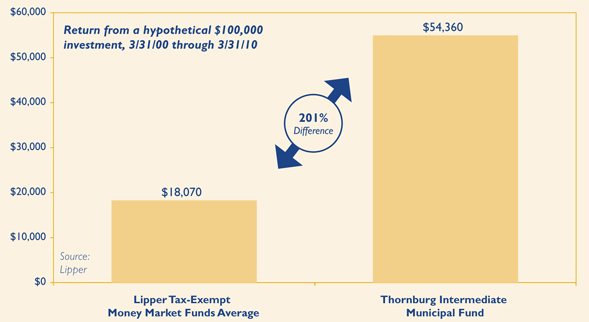

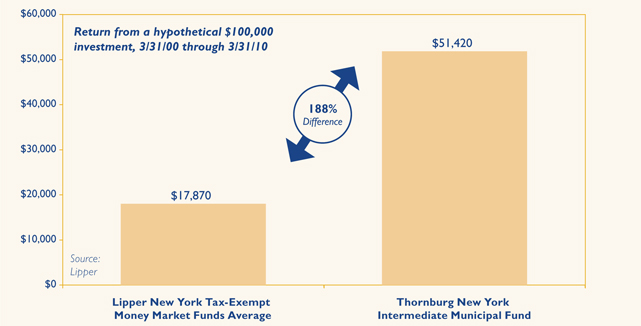

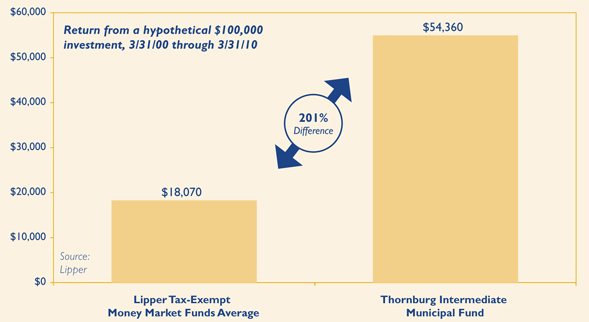

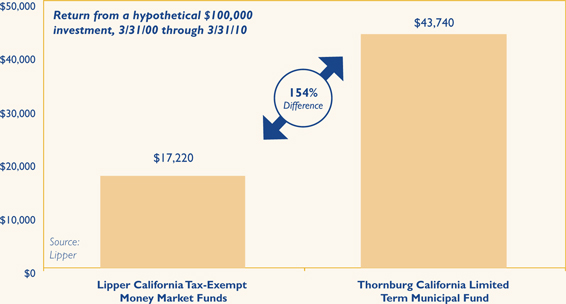

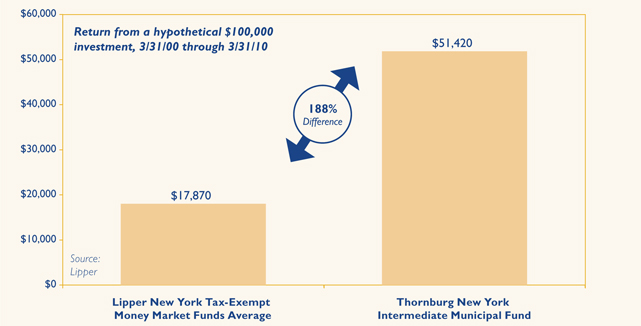

We are often asked to compare Thornburg Limited Term Municipal Fund to money market fund returns. Municipal bond funds are not an exact substitute for money market funds. These investments have certain differences, which are summarized below. Investors in the Thornburg Limited Term Municipal Fund took more risk than tax-exempt money market fund investors to earn their higher returns.

Past performance does not guarantee future results. Performance data above does not include the 1.50% sales charge for Class A shares. If the sales charge had been included, returns would have been lower. Returns shown are minus the initial investment.

Investors in municipal bond funds may experience more volatility than those in comparable money market funds. There are also differences in fees and expenses.

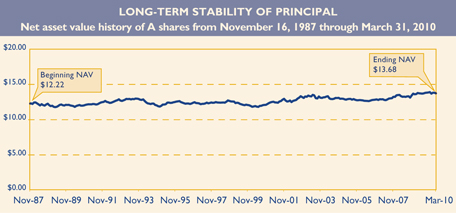

Investors in the Thornburg Limited Term Municipal Fund took more risk than money market investors to earn their higher returns, including interest rate and credit risk. Unlike money market funds, the prices of bonds fluctuate relative to changes in interest rates, with principal values decreasing when interest rates rise and increasing when interest rates fall. Generally, money market funds seek to maintain an investment portfolio with an average maturity of 90 days or less. Thornburg Limited Term Municipal Fund has an average maturity of normally less than five years. Interest dividends paid by the Fund or by tax-exempt money market funds are generally exempt from federal income tax (interest dividends may be subject to AMT). Income sourced from state of residency is generally exempt from state income tax.

Money market funds seek to preserve the value per share at $1.00, whereas the Thornburg Limited Term Municipal Fund’s net asset value changes daily. It is possible to lose money when investing in either the Thornburg Limited Term Municipal Fund or a tax-exempt money market fund. Neither are insured by the FDIC or any other government agency.

Lipper Tax-Exempt Money Market Funds Average is an arithmetic average of the total return of all tax-exempt money market mutual funds. You cannot invest in a category average.

This page is not part of the Semi-Annual Report. 5

Thornburg Limited Term Municipal Fund

March 31, 2010

Table of Contents

This report is certified under the Sarbanes-Oxley Act of 2002, which requires that public companies, including mutual funds, affirm that the information provided in their annual and semiannual shareholder reports fully and fairly represents their financial position.

6 Certified Semi-Annual Report

Letter to Shareholders

| | |

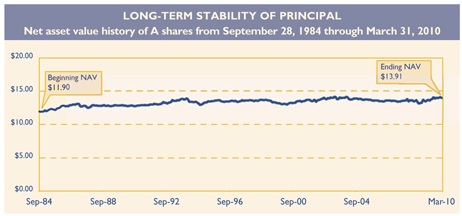

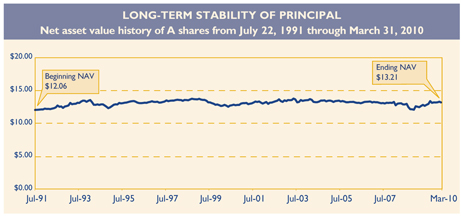

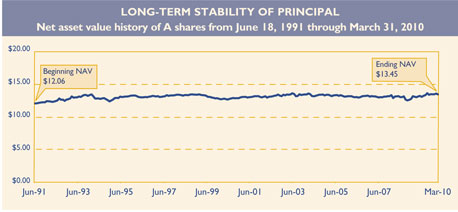

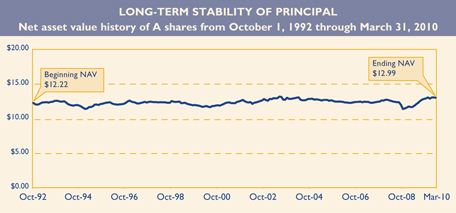

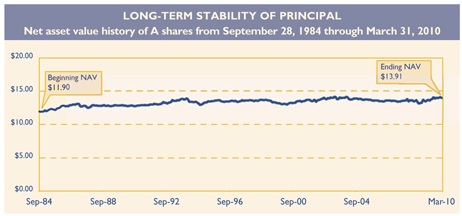

| | April 15, 2010 Dear Fellow Shareholder: We are pleased to present the semi-annual report for the Thornburg Limited Term Municipal Fund. The net asset value of the Class A shares declined by 9 cents to $13.91 during the six months ended March 31, 2010. If you were with us for the entire period, you received dividends of 19.7 cents per share. If you reinvested your dividends, you received 19.8 cents per share. Dividends per share were lower for Class C shares and higher for Class I shares to account for varying class-specific expenses. After a couple of years of unprecedented volatility, the municipal bond market has regained its status as one of the least exciting U.S. capital markets. While we embrace the new reality – slow and steady is what we strive for – we do not entirely trust it. Like other U.S. markets, the municipal market is benefiting from U.S. Treasury and Federal Reserve Bank support. By setting the Fed Funds Rate effectively at 0%, the Federal Open Market Committee (FOMC) is basically pushing hundreds of billions of dollars into bonds and bond funds. Flows into bond funds were $357 billion last year and may reach that level again this year. While we do not expect the Federal Reserve (the Fed) to hike the Fed Funds Rate soon, it is a reasonable bet that the next move will not be down. A significantly higher Fed Funds Rate, if and when it materializes, would likely not be good for bond fund flows or bond prices. The second major element of federal support has been the implementation of the Build America Bond (BAB) program. This program allows municipalities to issue taxable bonds for qualified projects and receive a subsidy of 35% of their interest cost from the federal government. The program has been very popular, with almost $100 billion issued since the first deal was sold in April 2009. BAB issues currently account for over 30% of new issue municipal bond supply, crowding out much of the supply of traditional tax-exempt bonds. The reduced supply, coupled with heavy demand for bonds has provided significant support to municipal bond prices. The BAB program is scheduled to expire at the end of this year, but will probably be extended, most likely with a reduced subsidy. Depending upon the final form of the program, we may see the balance shift back to more traditional tax-exempt issuance in 2011, which could erode some support for bond prices. Another part of the American Recovery and Reinvestment Act allocated approximately $280 billion to the states for various stimulus-related projects. The federal dollars helped the states close over $300 billion of budget gaps during the current recession, but most of that money will be spent by June 30, 2011. If tax revenues come back strongly over the next 12-24 months, the disappearing stimulus money may not be missed. However, if tax revenues are slow to bounce back, budget balancing will remain a perilous task. |

| |

| |

| |

| |

| |

Certified Semi-Annual Report 7

| | |

Letter to Shareholders, Continued | | |

Working in the opposite direction, higher tax rates should bolster demand for tax-exempt municipals, as the Bush tax cuts expire and the highest marginal tax rates climb back up to 39.6% from 35%. On top of this, the recently signed health insurance reform law applies Medicare taxes to virtually all investment income except interest from tax-exempt municipal bonds. We believe that the status of municipal bonds as perhaps the last true legal tax shelter available to investors is not fully priced into the market.

The U.S. economy apparently hit bottom last summer and has been growing the last three quarters. However, payroll employment growth just showed up last month, and so many jobs were lost in the last two years that it will take several years of robust growth just to get back down to 6% unemployment. Most banks are still very reluctant to increase lending, and core consumer price inflation has slowed to a level not seen since 1960. So, despite the large amount of additional debt (particularly from the U.S. Treasury) coming into the marketplace, we don’t expect a dramatic rise in interest rates this year.

After three quarters of positive GDP growth, state tax revenues are still falling. The 4th quarter of 2009 marks the fifth consecutive quarter of declining state tax revenues. The rate of decline has decreased to 4.2% from a peak of 16.5% in the second quarter, but state tax revenues are still down over 8% from levels two years ago. Prior to the current downturn, state tax revenues grew 5 to 5.5% on average for two decades, allowing budgets and entitlements to expand at an unsustainable pace. Most states are going through a very difficult adjustment process and dealing with shrinking tax revenues in very different ways. In general, we have favored states that set aside large reserve balances when times were better, and cut budgets and/or found new ongoing revenue streams when tax revenues declined. A few states have primarily added to debt loads, borrowed from future revenues, delayed payments and pension contributions, or used other accounting gimmicks to balance their budgets. These states seem to be making the assumption that tax revenues will bounce back strongly. There has been some recent improvement in revenues from some states in the early months of 2010, but it is still too early to count on. We will have to watch the numbers carefully to determine if the more aggressive states get bailed out by rapid revenue growth or end up confronting even worse challenges ahead.

Tax revenues have held up much better at the local level, not yet going negative and growing 4.6% in the fourth quarter of 2009. Most local governments rely heavily on property taxes, which have traditionally been quite stable, and have proven to be so even in the worst real estate downturn in decades. Real estate taxes take a while to adjust and there are some areas of the country that are starting to see significantly lower tax revenues as properties make their way through the appeal process. We are watching these trends as they develop. Revenue bonds such as municipal utility bonds, hospital bonds, and toll roads have generally held up quite well in the current recession, and we continue to find issuers we like in these sectors. Hospitals, in particular, appear to be one of the few clear winners coming out of the recent health care reform.

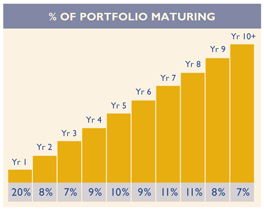

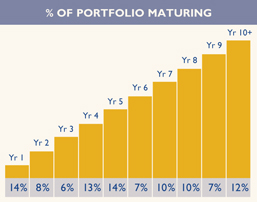

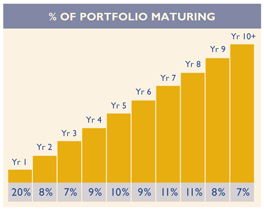

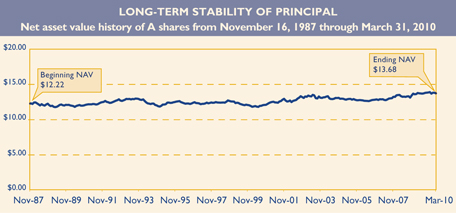

Despite much improved market liquidity, strong demand for bonds, and general economic optimism, it is clearly a time for careful diligence and diversification of investment portfolios. Your Fund is broadly diversified and 87% invested in bonds rated A or above by at least one of the major rating agencies. Your Thornburg Limited Term Municipal Fund is a laddered portfolio of over 900 municipal obligations from 47 states. We ladder the maturity dates of the bonds in

8 Certified Semi-Annual Report

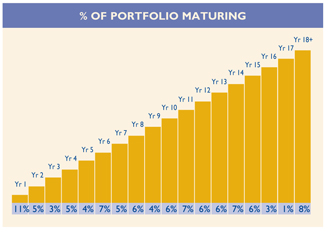

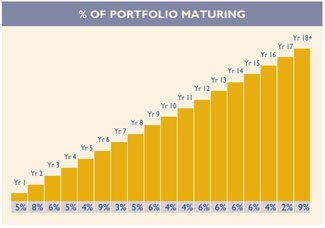

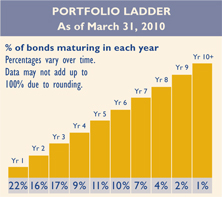

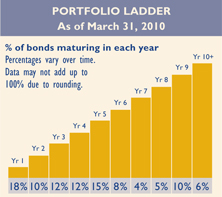

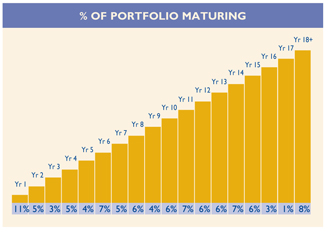

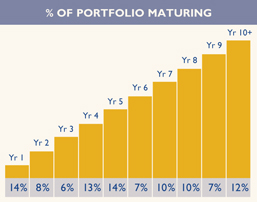

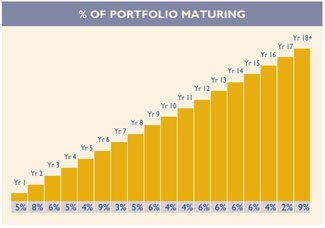

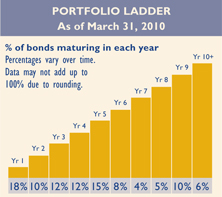

your portfolio so that some of the bonds are scheduled to mature during each of the coming years. Laddering short and intermediate bonds accomplishes two goals. First, the staggered bond maturities contained in a ladder defuse interest-rate risk and dampen the Fund’s price volatility. Second, laddering gives the Fund a steady cash flow stream from maturing bonds to reinvest toward the top of the ladder where yields are typically higher. The chart on the right describes the percentages of your Fund’s bond portfolio maturing in each of the coming years.

As of 3/31/10. Percentages vary over time.

Data may not add up to 100% due to rounding.

The Class A shares of your Fund produced a total return of 0.77% (at NAV) over the six-month period ended March 31, 2010, compared to a 1.32% return for the Barclays Capital Five-Year Municipal Bond Index. Over the last six months, 5-year bonds outperformed 1-4 year bonds and 6-10 year bonds. Since the Fund invests In a laddered portfolio of bonds from one to ten years, many of the shorter and longer bonds in the Fund underperformed the Index, leading to some underperformance by the Fund relative to the Index.

Historically, our practice of laddering a diversified portfolio of short and intermediate maturity municipal bonds has allowed your Fund to perform consistently well in varying interest rate environments. Thank you for investing in Thornburg Limited Term Municipal Fund.

Sincerely,

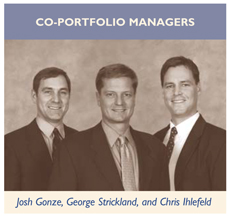

| | | | |

| |  | |  |

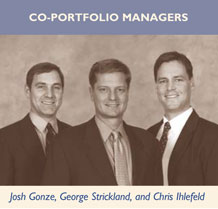

George Strickland Co-Portfolio Manager Managing Director | | Josh Gonze Co-Portfolio Manager Managing Director | | Christopher Ihlefeld Co-Portfolio Manager Managing Director |

The matters discussed in this report may constitute forward-looking statements made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995. These include any advisor or portfolio manager prediction, assessment, analysis or outlook for individual securities, industries, investment styles, market sectors and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for each fund in its current prospectus, other factors bearing on these reports include the accuracy of the advisor’s or portfolio manager’s forecasts and predictions, the appropriateness of the investment strategies designed by the advisor or portfolio manager and the ability of the advisor or portfolio manager to implement their strategies efficiently and successfully. Any one or more of these factors, as well as other risks affecting the securities markets generally, could cause the actual results of any fund to differ materially as compared to its benchmarks.

Certified Semi-Annual Report 9

| | |

| SCHEDULE OF INVESTMENTS | | |

| |

| Thornburg Limited Term Municipal Fund | | March 31, 2010 (Unaudited) |

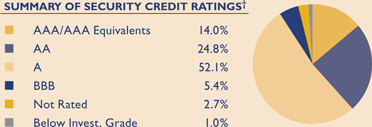

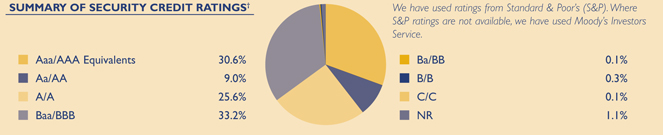

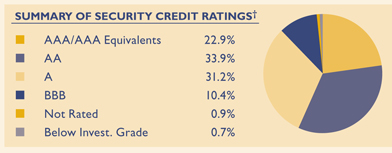

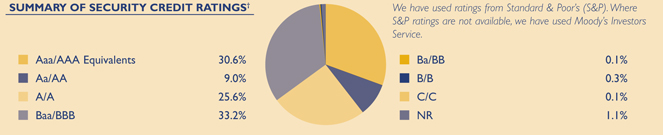

We have used ratings from Standard & Poor’s (S&P). Where S&P ratings are not available, we have used Moody’s Investors Service. Where neither rating is available, we have used ratings from Fitch Ratings. The category of investments identified as “AAA” in this graph includes investments which are pre-refunded or escrowed to maturity. Such investments are backed by an escrow or trust containing sufficient U.S. Government or U.S. Government agency securities to satisfy the timely payment of principal and interest and, therefore, are normally deemed to be equivalent to AAA-rated securities.

| | | | | | | | |

Issuer-Description | | Credit Rating†

S&P/ Moody’s | | Principal

Amount | | Value |

ALABAMA — 1.22% | | | | | | | | |

Alabama State Public School & College Authority, 5.00% due 5/1/2012 | | AA/Aa2 | | $ | 2,000,000 | | $ | 2,159,500 |

Alabama State Public School & College Authority, 5.00% due 5/1/2013 | | AA/Aa2 | | | 5,000,000 | | | 5,527,050 |

Alabama State Public School & College Authority, 5.00% due 5/1/2016 | | AA/Aa2 | | | 5,000,000 | | | 5,623,150 |

Birmingham GO, 5.00% due 10/1/2013 (Insured: Natl-Re) | | AA/Aa3 | | | 2,500,000 | | | 2,774,050 |

Huntsville GO, 5.50% due 11/1/2014 | | AAA/Aa1 | | | 3,425,000 | | | 3,804,045 |

Lake Martin Area IDA, 5.00% due 11/1/2011 | | NR/NR | | | 3,000,000 | | | 3,090,150 |

Mobile GO Warrants, 5.25% due 8/1/2012 (Insured: AGM) | | AAA/Aa3 | | | 1,025,000 | | | 1,123,082 |

Mobile GO Warrants, 4.50% due 8/15/2016 | | NR/NR | | | 2,185,000 | | | 2,316,603 |

a Mobile Industrial Development PCR, 5.00% due 6/1/2034 put 3/19/2015 (Alabama Power Co.) | | A/A2 | | | 6,000,000 | | | 6,476,820 |

University of Alabama at Birmingham Hospital Revenue, 5.25% due 9/1/2017 | | A+/A1 | | | 2,500,000 | | | 2,682,175 |

University of Alabama at Birmingham Hospital Revenue, 5.00% due 9/1/2018 | | A+/A1 | | | 1,500,000 | | | 1,569,120 |

ALASKA — 0.75% | | | | | | | | |

Alaska Energy Power Authority, 6.00% due 7/1/2011 (Bradley Lake Hydroelectric; Insured: AGM) | | AAA/Aa3 | | | 955,000 | | | 1,011,574 |

Alaska Housing Finance Corp. GO, 5.00% due 12/1/2018 (Insured: Natl-Re) | | AA/Aa2 | | | 2,000,000 | | | 2,156,700 |

Alaska Industrial Development & Export Authority GO, 5.00% due 4/1/2014 | | AA-/A1 | | | 2,000,000 | | | 2,223,840 |

Alaska Industrial Development & Export Authority GO, 5.00% due 4/1/2015 | | AA-/A1 | | | 1,900,000 | | | 2,131,078 |

Alaska Industrial Development & Export Authority GO, 5.00% due 4/1/2016 | | AA-/A1 | | | 1,000,000 | | | 1,110,990 |

Alaska Industrial Development & Export Authority GO, 5.00% due 4/1/2017 | | AA-/A1 | | | 3,000,000 | | | 3,307,200 |

Alaska Industrial Development & Export Authority GO, 5.00% due 4/1/2018 | | AA-/A1 | | | 2,455,000 | | | 2,694,387 |

Alaska Municipal Bond Bank, 5.00% due 6/1/2014 (Insured: Natl-Re; State Aid Withholding) | | A+/A1 | | | 1,175,000 | | | 1,293,640 |

Alaska Student Loan Corp., 5.25% due 1/1/2012 (Insured: AGM) | | AAA/NR | | | 3,000,000 | | | 3,157,200 |

North Slope Boro GO, 5.00% due 6/30/2015 (Insured: Natl-Re) | | AA-/A2 | | | 3,250,000 | | | 3,681,698 |

ARIZONA — 3.54% | | | | | | | | |

a Arizona Board of Regents COP, 5.00% due 7/1/2018 (Arizona State University; Insured: Natl-Re) | | AA-/A2 | | | 1,285,000 | | | 1,384,793 |

Arizona HFA, 5.00% due 7/1/2018 (Catholic Healthcare West ) | | A/A2 | | | 1,470,000 | | | 1,530,373 |

Arizona HFA, 5.00% due 7/1/2019 (Catholic Healthcare West) | | A/A2 | | | 1,365,000 | | | 1,411,383 |

a Arizona HFA, 5.00% due 7/1/2020 (Catholic Healthcare West) | | A/A2 | | | 1,290,000 | | | 1,318,664 |

Arizona Transportation Board Highway Revenue, 5.25% due 7/1/2015 | | AAA/Aa1 | | | 3,860,000 | | | 4,244,533 |

b Chandler Street & Highway User Revenue, 3.00% due 7/1/2013 | | AA/Aa3 | | | 1,905,000 | | | 1,994,040 |

b Chandler Street & Highway User Revenue, 3.00% due 7/1/2014 | | AA/Aa3 | | | 2,790,000 | | | 2,922,832 |

Glendale IDA, 5.00% due 5/15/2015 (Midwestern University) | | A-/NR | | | 1,000,000 | | | 1,075,570 |

Glendale IDA, 5.00% due 5/15/2016 (Midwestern University) | | A-/NR | | | 1,325,000 | | | 1,417,034 |

Glendale IDA, 5.00% due 5/15/2017 (Midwestern University) | | A-/NR | | | 1,440,000 | | | 1,527,494 |

Glendale Western Loop 101 Public Facilities Corp., 6.00% due 7/1/2019 | | AA/A2 | | | 2,200,000 | | | 2,339,832 |

Maricopa County IDA Health Facilities Revenue, 4.125% due 7/1/2015 (Catholic Healthcare West) | | A/A2 | | | 1,000,000 | | | 1,035,030 |

Maricopa County IDA Health Facilities Revenue, 5.00% due 7/1/2016 (Catholic Healthcare West) | | A/A2 | | | 2,355,000 | | | 2,361,076 |

Maricopa County IDA Health Facilities Revenue, 5.00% due 7/1/2038 put 7/1/2014 (Catholic Healthcare West) | | A/A2 | | | 7,500,000 | | | 8,100,225 |

10 Certified Semi-Annual Report

| | |

| SCHEDULE OF INVESTMENTS, CONTINUED | | |

| |

| Thornburg Limited Term Municipal Fund | | March 31, 2010 (Unaudited) |

| | | | | | | | |

Issuer-Description | | Credit Rating†

S&P/ Moody’s | | Principal

Amount | | Value |

Maricopa County Pollution Control Corp. PCR, 5.50% due 5/1/2029 put 5/1/2012 (Arizona Public Service Co.) | | BBB-/Baa2 | | $ | 10,000,000 | | $ | 10,409,800 |

Mohave County IDA, 5.00% due 4/1/2014 (Mohave Prison LLC; Insured: Syncora) (ETM) | | AAA/NR | | | 3,135,000 | | | 3,543,146 |

Mohave County IDA, 7.25% due 5/1/2015 (Mohave Prison LLC) | | BBB+/NR | | | 12,100,000 | | | 12,845,723 |

Navajo County PCR, 5.50% due 6/1/2034 put 6/1/2014 (Arizona Public Service Co.) | | BBB-/Baa2 | | | 1,200,000 | | | 1,258,380 |

Navajo County PCR, 5.50% due 6/1/2034 put 6/1/2014 (Arizona Public Service Co.) | | BBB-/Baa2 | | | 2,600,000 | | | 2,726,490 |

Navajo County PCR, 5.75% due 6/1/2034 put 6/1/2016 (Arizona Public Service Co.) | | BBB-/Baa2 | | | 5,600,000 | | | 5,825,512 |

Northern Arizona University COP, 5.00% due 9/1/2019 (Insured: AMBAC) | | A/A3 | | | 3,500,000 | | | 3,538,115 |

Phoenix Civic Improvement Wastewater Systems, 6.00% due 7/1/2011 (Insured: FGIC) | | AA+/Aa3 | | | 4,105,000 | | | 4,204,751 |

Pima County IDA, 6.40% due 7/1/2013 (Arizona Charter Schools) | | NR/Baa3 | | | 825,000 | | | 830,099 |

Pima County IDA, 5.00% due 7/1/2016 (Metro Police Facility) | | AA/NR | | | 2,500,000 | | | 2,747,750 |

Pima County IDA, 5.00% due 7/1/2017 (Metro Police Facility) | | AA/NR | | | 3,000,000 | | | 3,280,770 |

Pima County IDA, 5.00% due 7/1/2018 (Metro Police Facility) | | AA/NR | | | 3,285,000 | | | 3,577,529 |

Pima County IDA, 5.00% due 7/1/2019 (Metro Police Facility) | | AA/Aa3 | | | 2,000,000 | | | 2,166,120 |

Salt River Agricultural Improvement & Power District, 3.00% due 1/1/2014 | | AA/Aa1 | | | 11,275,000 | | | 11,889,262 |

Salt River Agricultural Improvement & Power District, 5.00% due 1/1/2020 | | AA/Aa1 | | | 1,205,000 | | | 1,209,025 |

Show Low IDA Hospital, 5.25% due 12/1/2010 (Navapache Regional Medical Center; Insured: ACA) | | BBB/NR | | | 1,000,000 | | | 1,002,110 |

Yuma Property Corp. Utility Systems Revenue, 5.00% due 7/1/2016 (Insured: XCLA) | | A+/A3 | | | 2,000,000 | | | 2,162,920 |

Yuma Property Corp. Utility Systems Revenue, 5.00% due 7/1/2018 (Insured: XCLA) | | A+/A3 | | | 2,130,000 | | | 2,267,598 |

ARKANSAS — 0.07% | | | | | | | | |

Jefferson County Hospital Improvement, 5.50% due 6/1/2010 (Jefferson Hospital Association) | | A/NR | | | 1,000,000 | | | 1,006,930 |

Jefferson County Hospital Improvement, 5.50% due 6/1/2011 (Jefferson Hospital Association) | | A/NR | | | 1,075,000 | | | 1,123,579 |

CALIFORNIA — 10.03% | | | | | | | | |

Alameda County COP, 5.00% due 12/1/2017 (Santa Rita Jail; Insured: AMBAC) | | AA-/NR | | | 1,000,000 | | | 1,100,690 |

Anaheim Public Financing Authority, 5.25% due 10/1/2018 (Electric Systems Generation; Insured: AGM) | | AAA/Aa3 | | | 1,560,000 | | | 1,686,220 |

Calexico USD COP, 5.75% due 9/1/2013 | | BBB+/NR | | | 2,185,000 | | | 2,276,617 |

California Educational Facilities, 5.00% due 4/1/2017 (Pitzer College) | | NR/A3 | | | 1,460,000 | | | 1,556,448 |

California GO, 0.29% due 5/1/2034 put 4/1/2010 (Kindergarten; LOC: Citibank/California State Teachers Retirement) (daily demand notes) | | A+/Aaa | | | 12,700,000 | | | 12,700,000 |

California HFA, 5.00% due 7/1/2027 put 7/1/2014 (Catholic Healthcare West) | | A/A2 | | | 3,500,000 | | | 3,797,570 |

California HFA, 5.00% due 7/1/2028 (Catholic Healthcare West) | | A/A2 | | | 2,000,000 | | | 2,170,040 |

California State Department of Transportation COP, 5.25% due 3/1/2016 (Insured: Natl-Re) | | A/Baa2 | | | 1,000,000 | | | 1,003,390 |

California State Department of Water Resources, 6.00% due 5/1/2013 | | AA-/Aa3 | | | 2,550,000 | | | 2,830,092 |

California State Department of Water Resources Power Supply, 5.50% due 5/1/2012 | | AA-/Aa3 | | | 2,600,000 | | | 2,818,660 |

California State Department of Water Resources Power Supply, 0.32% due 5/1/2022 put 4/1/2010 (Insured: AGM) (daily demand notes) | | AAA/Aa3 | | | 21,700,000 | | | 21,700,000 |

California State Economic Recovery, 5.00% due 7/1/2020 | | A+/A1 | | | 4,000,000 | | | 4,335,480 |

California State Economic Recovery GO, 5.00% due 7/1/2016 | | A+/A1 | | | 12,000,000 | | | 12,424,440 |

California State Economic Recovery GO, 5.00% due 7/1/2018 | | A+/A1 | | | 4,000,000 | | | 4,408,440 |

California State GO, 5.15% due 12/1/2014 (Veterans Bonds) | | AA-/Baa1 | | | 1,000,000 | | | 1,001,990 |

California State Public Works Board, 5.00% due 9/1/2016 (Regents of University of California; Insured: FGIC) | | AA-/Aa2 | | | 3,000,000 | | | 3,336,660 |

California State Public Works Board, 5.00% due 9/1/2017 (Regents of University of California; Insured: FGIC) | | AA-/Aa2 | | | 3,000,000 | | | 3,324,060 |

California State Public Works Board, 5.00% due 11/1/2017 (California State University Trustees) | | BBB+/A1 | | | 3,000,000 | | | 3,090,510 |

California State Public Works Board, 5.00% due 11/1/2018 (California State University Trustees) | | BBB+/A1 | | | 2,700,000 | | | 2,740,554 |

California Statewide Communities Development Authority, 5.00% due 6/15/2013 | | A-/Baa1 | | | 7,000,000 | | | 7,509,670 |

California Statewide Communities Development Authority, 5.00% due 5/15/2017 (Irvine LLC-UCI East Campus) | | NR/Baa2 | | | 2,200,000 | | | 2,316,952 |

Certified Semi-Annual Report 11

| | |

| SCHEDULE OF INVESTMENTS, CONTINUED | | |

| |

| Thornburg Limited Term Municipal Fund | | March 31, 2010 (Unaudited) |

| | | | | | | | |

Issuer-Description | | Credit Rating†

S&P/ Moody’s | | Principal

Amount | | Value |

California Statewide Communities Development Authority, 5.00% due 4/1/2019 (Guaranty Agreement; Kaiser Permanente) | | A+/NR | | $ | 25,000,000 | | $ | 26,505,250 |

California Statewide Communities Development Authority, 5.00% due 7/1/2020 (Aspire Public Schools) | | NR/NR | | | 2,000,000 | | | 1,996,680 |

California Statewide Community Development Authority PCR, 4.10% due 4/1/2028 put 4/1/2013 (Southern California Edison Co.; Insured: XLCA) | | A/A1 | | | 1,000,000 | | | 1,048,330 |

Central Valley Financing Authority, 5.00% due 7/1/2017 (Carson Ice) | | A+/A1 | | | 600,000 | | | 654,150 |

Central Valley Financing Authority, 5.00% due 7/1/2019 (Carson Ice) | | A+/A1 | | | 1,500,000 | | | 1,618,545 |

Chula Vista COP, 5.25% due 3/1/2018 | | A-/NR | | | 1,170,000 | | | 1,221,679 |

Chula Vista COP, 5.25% due 3/1/2019 | | A-/NR | | | 1,235,000 | | | 1,279,139 |

Desert Sands USD COP, 5.25% due 3/1/2016 | | A+/A2 | | | 1,500,000 | | | 1,601,535 |

East Bay Water Systems Revenue, 0.28% due 6/1/2038 put 4/1/2010 (Insured: Dexia) (daily demand notes) | | AAA/Aa2 | | | 2,215,000 | | | 2,215,000 |

Golden State Tobacco Securitization Corp., 5.50% due 6/1/2043 pre-refunded 6/1/2013 | | AAA/Aaa | | | 2,000,000 | | | 2,249,780 |

Inland Valley Development Agency, 5.25% due 4/1/2013 | | A/NR | | | 2,000,000 | | | 2,105,740 |

Inland Valley Development Agency, 5.50% due 4/1/2014 | | A/NR | | | 2,000,000 | | | 2,113,280 |

Irvine Ranch Water District GO, 0.28% due 4/1/2033 put 4/1/2010 (LOC: Bank of America) (daily demand notes) | | A+/Aa3 | | | 1,800,000 | | | 1,800,000 |

Irvine Ranch Water District GO, 0.35% due 7/1/2035 put 4/1/2010 (LOC: Landesbank Baden) (daily demand notes) | | A-/Aa2 | | | 14,215,000 | | | 14,215,000 |

Irvine USD, 5.25% due 9/1/2017 (Community Facilities District 86; Insured: AGM) | | AAA/NR | | | 5,000,000 | | | 5,397,500 |

Irvine USD, 5.25% due 9/1/2018 (Community Facilities District 86; Insured: AGM) | | AAA/NR | | | 3,000,000 | | | 3,216,240 |

Irvine USD, 5.25% due 9/1/2019 (Community Facilities District 86; Insured: AGM) | | AAA/NR | | | 3,000,000 | | | 3,194,760 |

Kern Community College District COP, 4.00% due 4/1/2014 | | SP-1+/NR | | | 2,000,000 | | | 2,037,240 |

Los Angeles Convention & Exhibition Center Authority, 5.00% due 8/15/2018 | | AA-/A1 | | | 2,000,000 | | | 2,151,620 |

Los Angeles USD COP, 5.00% due 10/1/2017 (Insured: AMBAC) | | A+/A2 | | | 2,445,000 | | | 2,625,343 |

Los Angeles USD GO, 5.00% due 7/1/2018 (Insured: AGM) | | AAA/Aa3 | | | 4,000,000 | | | 4,418,800 |

Los Angeles Water & Power Revenue, 0.32% due 7/1/2034 put 4/1/2010 (SPA: Bank of America) (daily demand notes) | | AA-/Aa3 | | | 39,860,000 | | | 39,860,000 |

Modesto Irrigation District COP, 4.30% due 7/1/2010 (Insured: AMBAC) | | A+/A1 | | | 1,000,000 | | | 1,008,000 |

Monterey County COP, 5.00% due 8/1/2016 (Insured: AGM) | | AAA/Aa3 | | | 1,435,000 | | | 1,578,672 |

Monterey County COP, 5.00% due 8/1/2018 (Insured: AGM) | | AAA/Aa3 | | | 2,260,000 | | | 2,464,869 |

Newport Beach Revenue, 5.00% due 12/1/2038 put 2/7/2013 (Hoag Memorial Hospital) | | AA/Aa3 | | | 3,000,000 | | | 3,252,750 |

b Northern California Power Agency Revenue, 5.00% due 7/1/2017 | | A/A2 | | | 1,000,000 | | | 1,096,270 |

b Northern California Power Agency Revenue, 5.00% due 7/1/2019 | | A/A2 | | | 1,000,000 | | | 1,078,230 |

b Northern California Power Agency Revenue, 5.00% due 7/1/2020 | | A/A2 | | | 1,325,000 | | | 1,410,701 |

Orange County Public Financing Authority, 5.00% due 7/1/2017 (Insured: Natl-Re) | | A+/A1 | | | 1,245,000 | | | 1,352,394 |

Pittsburgh Redevelopment Agency, 5.00% due 8/1/2012 (Los Medanos Community Development; Insured: Natl-Re) | | A+/Baa1 | | | 1,255,000 | | | 1,335,144 |

Pittsburgh Redevelopment Agency, 5.00% due 8/1/2018 (Los Medanos Community Development; Insured: Natl-Re) | | A+/Baa1 | | | 5,000,000 | | | 5,094,550 |

Sacramento Cogeneration Authority, 5.00% due 7/1/2017 (Procter & Gamble) | | A+/A1 | | | 750,000 | | | 825,735 |

Sacramento Municipal Utility District, 5.00% due 7/1/2016 (Cosumnes Project; Insured: Natl-Re) | | A/Baa1 | | | 4,870,000 | | | 5,197,702 |

Sacramento Municipal Utility District, 5.00% due 7/1/2019 (Cosumnes Project; Insured: Natl-Re) | | A/Baa1 | | | 5,000,000 | | | 5,146,900 |

San Diego County Regional Transportation, 0.32% due 4/1/2038 put 4/1/2010 (SPA: Dexia) (daily demand notes) | | AAA/Aa2 | | | 14,705,000 | | | 14,705,000 |

San Joaquin County Transportation Authority, 5.00% due 4/1/2011 | | SP-1+/NR | | | 3,000,000 | | | 3,109,470 |

San Joaquin Delta Community College District GO, 0% due 8/1/2019 (Insured: AGM) | | AAA/Aa3 | | | 7,600,000 | | | 4,972,908 |

San Luis & Delta-Mendota Water Authority, 4.50% due 3/1/2014 (Water Utility Improvements) | | A+/NR | | | 3,900,000 | | | 4,136,340 |

San Mateo USD GO, 2.00% due 2/28/2011 | | NR/NR | | | 5,000,000 | | | 5,063,000 |

Santa Clara County Financing Authority Lease Revenue, 4.00% due 5/15/2011 (Multiple Facilities) | | AA/Aa3 | | | 2,000,000 | | | 2,073,960 |

Santa Clara County Financing Authority Lease Revenue, 4.00% due 5/15/2014 (Multiple Facilities) | | AA/Aa3 | | | 4,245,000 | | | 4,581,713 |

Santa Clara County Financing Authority Lease Revenue, 4.00% due 5/15/2017 (Multiple Facilities) | | AA/Aa3 | | | 1,000,000 | | | 1,054,610 |

12 Certified Semi-Annual Report

| | |

| SCHEDULE OF INVESTMENTS, CONTINUED | | |

| |

| Thornburg Limited Term Municipal Fund | | March 31, 2010 (Unaudited) |

| | | | | | | | |

Issuer-Description | | Credit Rating†

S&P/ Moody’s | | Principal

Amount | | Value |

Solano County COP, 5.00% due 11/15/2017 | | AA-/A2 | | $ | 1,580,000 | | $ | 1,646,360 |

Southeast Resource Recovery Facilities Authority, 5.25% due 12/1/2017 (Insured: AMBAC) | | A+/A2 | | | 2,000,000 | | | 2,086,240 |

Tuolumne Wind Project Authority, 5.00% due 1/1/2018 (Tuolumne Co.) | | A+/A1 | | | 2,000,000 | | | 2,165,280 |

Tuolumne Wind Project Authority, 5.00% due 1/1/2019 (Tuolumne Co.) | | A+/A1 | | | 2,000,000 | | | 2,144,780 |

Twin Rivers USD GO, 0% due 4/1/2014 | | A+/NR | | | 3,490,000 | | | 3,064,744 |

Ventura County COP, 5.00% due 8/15/2016 | | AA/A1 | | | 1,520,000 | | | 1,635,930 |

Ventura County COP, 5.25% due 8/15/2017 | | AA/A1 | | | 1,635,000 | | | 1,770,149 |

COLORADO — 2.28% | | | | | | | | |

Adams County Platte Valley Medical Center, 5.00% due 2/1/2015 (Brighton Community Hospital Association; Insured: FHA, Natl-Re) | | A/NR | | | 1,530,000 | | | 1,649,080 |

Adams County Platte Valley Medical Center, 5.00% due 8/1/2015 (Brighton Community Hospital Association; Insured: FHA, Natl-Re) | | A/NR | | | 1,565,000 | | | 1,690,810 |

Beacon Point Metropolitan District, 4.375% due 12/1/2015 (LOC: Compass Bank) | | A+/NR | | | 1,905,000 | | | 1,873,796 |

Colorado COP, 3.00% due 3/1/2013 (Colorado Penitentiary) | | AA-/Aa3 | | | 1,205,000 | | | 1,256,104 |

Colorado COP, 4.00% due 3/1/2014 (Colorado Penitentiary) | | AA-/Aa3 | | | 1,285,000 | | | 1,380,527 |

Colorado COP, 5.00% due 3/1/2016 (Colorado Penitentiary) | | AA-/Aa3 | | | 2,000,000 | | | 2,225,080 |

Colorado COP, 5.00% due 3/1/2017 (Colorado Penitentiary) | | AA-/Aa3 | | | 2,000,000 | | | 2,214,140 |

Colorado COP, 5.00% due 3/1/2018 (Colorado Penitentiary) | | AA-/Aa3 | | | 1,500,000 | | | 1,652,400 |

Colorado Educational & Cultural Facilities, 6.00% due 6/1/2011 | | A/A3 | | | 710,000 | | | 720,742 |

Colorado HFA, 5.00% due 11/15/2013 | | AA-/A1 | | | 2,365,000 | | | 2,580,735 |

Colorado HFA, 5.00% due 11/15/2015 | | AA-/A1 | | | 2,365,000 | | | 2,587,215 |

Colorado HFA, 5.25% due 5/15/2017 (Northern Colorado Medical Center; Insured: AGM) | | AAA/NR | | | 1,185,000 | | | 1,275,427 |

Colorado HFA, 5.25% due 5/15/2019 (Northern Colorado Medical Center; Insured: AGM) | | AAA/NR | | | 2,225,000 | | | 2,375,210 |

Colorado HFA, 5.50% due 10/1/2038 put 11/12/2015 (Catholic Health Initiatives) | | AA/Aa2 | | | 1,000,000 | | | 1,124,230 |

Colorado HFA, 5.00% due 7/1/2039 put 11/8/2012 (Catholic Health) | | AA/Aa2 | | | 3,500,000 | | | 3,776,885 |

Colorado HFA, 5.00% due 7/1/2039 put 11/12/2013 (Catholic Health) | | AA/Aa2 | | | 5,000,000 | | | 5,486,400 |

Colorado HFA, 5.00% due 7/1/2039 put 11/11/2014 (Catholic Health) | | AA/Aa2 | | | 3,000,000 | | | 3,317,760 |

Denver City & County Airport System, 5.00% due 11/15/2016 (Insured: Natl-Re) | | A+/A1 | | | 1,515,000 | | | 1,676,423 |

Denver City & County Airport System, 5.00% due 11/15/2017 (Insured: Natl-Re) | | A+/A1 | | | 1,000,000 | | | 1,099,130 |

Denver City & County COP, 5.00% due 5/1/2013 (Insured: Natl-Re) | | AA+/Aa2 | | | 3,890,000 | | | 4,261,806 |

Denver City & County COP, 5.00% due 5/1/2014 (Insured: Natl-Re) | | AA+/Aa2 | | | 4,000,000 | | | 4,463,880 |

Denver Convention Center Hotel, 5.25% due 12/1/2014 (Insured: Syncora) | | BBB-/Baa3 | | | 3,450,000 | | | 3,651,308 |

E-470 Public Highway Authority Capital Appreciation, 0% due 9/1/2014 (Insured: Natl-Re) | | A/Baa1 | | | 1,910,000 | | | 1,569,390 |

Park Creek Metropolitan District, 5.00% due 12/1/2015 (Insured: AGM) | | AAA/NR | | | 1,000,000 | | | 1,121,520 |

Park Creek Metropolitan District, 5.00% due 12/1/2016 (Insured: AGM) | | AAA/NR | | | 1,035,000 | | | 1,148,757 |

Park Creek Metropolitan District, 5.00% due 12/1/2017 (Insured: AGM) | | AAA/NR | | | 1,525,000 | | | 1,686,986 |

Park Creek Metropolitan District, 5.50% due 12/1/2018 (Insured: AGM) | | AAA/NR | | | 1,200,000 | | | 1,366,188 |

Park Creek Metropolitan District, 5.50% due 12/1/2019 (Insured: AGM) | | AAA/NR | | | 1,000,000 | | | 1,139,270 |

Plaza Metropolitan District, 7.125% due 12/1/2010 (Public Improvement Fee/Tax Increment) | | NR/NR | | | 2,270,000 | | | 2,272,679 |

Plaza Metropolitan District, 7.60% due 12/1/2016 (Public Improvement Fee/Tax Increment) | | NR/NR | | | 6,000,000 | | | 5,916,240 |

Southlands Metropolitan District GO, 6.75% due 12/1/2016 pre-refunded 12/1/2014 | | AAA/NR | | | 930,000 | | | 1,083,617 |

CONNECTICUT — 0.07% | | | | | | | | |

Connecticut Development Authority PCR, 5.75% due 6/1/2026 put 2/1/2012 | | NR/Baa2 | | | 1,000,000 | | | 1,049,000 |

Connecticut Health & Educational Facilities, 3.50% due 11/15/2029 put 2/1/2012 (Ascension Health) | | AA/Aa1 | | | 965,000 | | | 989,665 |

DELAWARE — 0.15% | | | | | | | | |

Delaware EDA, 5.50% due 7/1/2025 put 7/1/2010 (Delmarva Power & Light) | | BBB/Baa2 | | | 2,045,000 | | | 2,065,941 |

Delaware EDA, 6.375% due 5/1/2027 (Peninsula United Methodist Homes) | | NR/NR | | | 1,000,000 | | | 1,114,800 |

Delaware HFA, 5.25% due 6/1/2011 (Beebe Medical Center) | | BBB+/Baa1 | | | 1,275,000 | | | 1,317,802 |

Certified Semi-Annual Report 13

| | |

| SCHEDULE OF INVESTMENTS, CONTINUED | | |

| |

| Thornburg Limited Term Municipal Fund | | March 31, 2010 (Unaudited) |

| | | | | | | | |

Issuer-Description | | Credit Rating†

S&P/ Moody’s | | Principal

Amount | | Value |

DISTRICT OF COLUMBIA — 1.47% | | | | | | | | |

District of Columbia Convention Center Authority, 5.00% due 10/1/2013 (Washington Convention Center; Insured: AMBAC) | | A/A2 | | $ | 3,000,000 | | $ | 3,255,300 |

District of Columbia COP, 5.25% due 1/1/2013 (Insured: AMBAC) | | A/NR | | | 5,950,000 | | | 6,275,167 |

District of Columbia COP, 5.25% due 1/1/2015 (Insured: FGIC) | | A/A2 | | | 2,875,000 | | | 3,157,929 |

District of Columbia COP, 5.25% due 1/1/2016 (Insured: FGIC) | | A/A2 | | | 4,625,000 | | | 5,053,044 |

District of Columbia COP, 5.00% due 1/1/2019 (Insured: Natl-Re) | | A/A2 | | | 5,000,000 | | | 5,259,500 |

District of Columbia GO, 6.00% due 6/1/2018 (Insured: Natl-Re) | | A+/A1 | | | 5,000,000 | | | 5,851,550 |

b District of Columbia Revenue, 3.00% due 4/1/2014 (National Public Radio) | | NR/Aa3 | | | 1,020,000 | | | 1,057,832 |

b District of Columbia Revenue, 4.00% due 4/1/2015 (National Public Radio) | | NR/Aa3 | | | 1,000,000 | | | 1,076,720 |

b District of Columbia Revenue, 5.00% due 4/1/2016 (National Public Radio) | | NR/Aa3 | | | 500,000 | | | 558,990 |

b District of Columbia Revenue, 4.00% due 4/1/2017 (National Public Radio) | | NR/Aa3 | | | 1,630,000 | | | 1,716,749 |

b District of Columbia Revenue, 5.00% due 4/1/2018 (National Public Radio) | | NR/Aa3 | | | 1,195,000 | | | 1,322,913 |

b District of Columbia Revenue, 5.00% due 4/1/2019 (National Public Radio) | | NR/Aa3 | | | 805,000 | | | 892,294 |

b District of Columbia Revenue, 5.00% due 4/1/2020 (National Public Radio) | | NR/Aa3 | | | 1,250,000 | | | 1,377,112 |

District of Columbia Tax Increment, 0% due 7/1/2011 (Mandarin Oriental; Insured: AGM) | | AAA/Aa3 | | | 1,990,000 | | | 1,949,782 |

District of Columbia Tax Increment, 0% due 7/1/2012 (Mandarin Oriental; Insured: AGM) | | AAA/Aa3 | | | 1,580,000 | | | 1,508,458 |

Metropolitan Washington Airports Authority, 0% due 10/1/2014 (Dulles Toll Road; Insured: AGM) | | AAA/Aa3 | | | 2,000,000 | | | 1,709,000 |

Metropolitan Washington Airports Authority, 0% due 10/1/2016 (Dulles Toll Road; Insured: AGM) | | AAA/Aa3 | | | 4,000,000 | | | 3,027,240 |

FLORIDA — 9.09% | | | | | | | | |

Broward County Airport Systems, 5.00% due 10/1/2014 (Insured: AMBAC) | | A+/A1 | | | 4,000,000 | | | 4,412,360 |

Broward County Educational Facilities Authority, 6.25% due 4/1/2013 (Nova Southeastern; Insured: Radian) | | BBB/Baa2 | | | 1,705,000 | | | 1,743,857 |

Broward County Port Facilities, 5.00% due 9/1/2013 | | A-/A2 | | | 2,000,000 | | | 2,167,500 |

Broward County Port Facilities, 5.00% due 9/1/2017 | | A-/A2 | | | 2,820,000 | | | 3,001,213 |

Broward County Port Facilities, 5.50% due 9/1/2018 | | A-/A2 | | | 3,500,000 | | | 3,821,475 |

Broward County Port Facilities, 5.50% due 9/1/2019 | | A-/A2 | | | 2,800,000 | | | 3,044,944 |

Broward County School Board COP, 5.00% due 7/1/2010 (Insured: AMBAC) | | NR/A1 | | | 2,000,000 | | | 2,006,780 |

Broward County School Board COP, 5.25% due 7/1/2016 (Insured: AGM) | | AAA/Aa3 | | | 7,630,000 | | | 8,461,441 |

Broward County School Board COP, 5.00% due 7/1/2017 (Insured: FGIC) | | A+/A1 | | | 1,000,000 | | | 1,082,940 |

Capital Projects Finance Authority, 5.50% due 10/1/2012 (Insured: Natl-Re) | | A/Baa1 | | | 1,820,000 | | | 1,897,041 |

Capital Projects Finance Authority, 5.50% due 10/1/2015 (Insured: Natl-Re) | | A/Baa1 | | | 3,260,000 | | | 3,350,498 |

Capital Trust Agency Multi Family Housing, 5.15% due 11/1/2030 put 11/1/2010 (Shadow Run; Collateralized: FNMA) | | NR/Aaa | | | 3,190,000 | | | 3,255,523 |

Crossings at Fleming Island Community Development, 5.45% due 5/1/2010 (Insured: Natl-Re) | | A/Baa1 | | | 825,000 | | | 826,559 |

Escambia County HFA, 5.25% due 11/15/2014 (Ascension Health Credit) | | AA/Aa1 | | | 1,000,000 | | | 1,128,160 |

Escambia County HFA, 5.00% due 11/1/2028 pre-refunded 11/1/2010 (Charity Obligated Group) | | NR/Aaa | | | 2,540,000 | | | 2,562,657 |

a FAU Financing Corp. Capital Improvements Revenue, 5.00% due 7/1/2014 (Innovation Village) | | NR/A2 | | | 1,950,000 | | | 2,124,778 |

FAU Financing Corp. Capital Improvements Revenue, 5.00% due 7/1/2015 (Innovation Village) | | NR/A2 | | | 2,395,000 | | | 2,611,508 |

FAU Financing Corp. Capital Improvements Revenue, 5.00% due 7/1/2016 (Innovation Village) | | NR/A2 | | | 2,275,000 | | | 2,447,104 |

Flagler County School Board COP, 5.00% due 8/1/2014 (Insured: AGM) | | AAA/Aa3 | | | 1,605,000 | | | 1,758,871 |

Flagler County School Board COP, 5.00% due 8/1/2015 (Insured: AGM) | | AAA/Aa3 | | | 1,500,000 | | | 1,645,380 |

Florida Department of Management Services, 5.25% due 9/1/2016 (Insured: AGM) | | AAA/Aa2 | | | 3,500,000 | | | 3,954,930 |

Florida Hurricane Catastrophe, 5.00% due 7/1/2014 | | AA-/Aa3 | | | 11,000,000 | | | 12,073,930 |

Florida State Correctional Privatization Commission COP, 5.00% due 8/1/2015 (Insured: AMBAC) | | AA+/Aa2 | | | 2,000,000 | | | 2,181,040 |

Florida State Department of Children & Families COP, 5.00% due 10/1/2012 | | AA+/NR | | | 770,000 | | | 828,012 |

Florida State Department of Children & Families COP, 5.00% due 10/1/2014 | | AA+/NR | | | 905,000 | | | 996,676 |

Florida State Department of Children & Families COP, 5.00% due 10/1/2015 | | AA+/NR | | | 925,000 | | | 1,022,106 |

Florida State Department of Transportation GO, 5.375% due 7/1/2017 | | AAA/Aa1 | | | 4,675,000 | | | 5,119,405 |

Florida State Department of Transportation GO, 5.00% due 7/1/2018 | | AAA/Aa1 | | | 3,000,000 | | | 3,376,860 |

14 Certified Semi-Annual Report

| | |

| SCHEDULE OF INVESTMENTS, CONTINUED | | |

| |

| Thornburg Limited Term Municipal Fund | | March 31, 2010 (Unaudited) |

| | | | | | | | |

Issuer-Description | | Credit Rating†

S&P/ Moody’s | | Principal

Amount | | Value |

Florida State Division of Bond Finance, 5.375% due 7/1/2011 (Preservation 2000; Insured: Natl-Re/FGIC) | | AA-/A1 | | $ | 2,515,000 | | $ | 2,539,119 |

Gainesville Utilities Systems Revenue, 0.42% due 10/1/2026 put 4/1/2010 (SPA: Suntrust Bank) (daily demand notes) | | AA/Aa2 | | | 28,205,000 | | | 28,205,000 |

Highlands County HFA, 5.00% due 11/15/2015 (Adventist Health) | | AA-/A1 | | | 1,000,000 | | | 1,103,710 |

Highlands County HFA, 5.00% due 11/15/2016 (Adventist/Sunbelt) | | AA-/A1 | | | 1,000,000 | | | 1,089,360 |

Highlands County HFA, 5.00% due 11/15/2017 (Adventist/Sunbelt) | | AA-/A1 | | | 3,200,000 | | | 3,449,728 |

Highlands County HFA, 5.00% due 11/15/2017 (Adventist Health) | | AA-/A1 | | | 1,000,000 | | | 1,059,670 |

Highlands County HFA, 5.00% due 11/15/2019 (Adventist/Sunbelt) | | AA-/A1 | | | 3,000,000 | | | 3,140,070 |

Highlands County HFA, 3.95% due 11/15/2032 (Adventist/Sunbelt) | | AA-/A1 | | | 2,500,000 | | | 2,607,975 |

Hillsborough County Assessment, 5.00% due 3/1/2015 (Insured: FGIC) | | A+/A3 | | | 5,000,000 | | | 5,353,650 |

Hillsborough County IDA PCR, 5.10% due 10/1/2013 (Tampa Electric Co.) | | BBB/Baa1 | | | 6,410,000 | | | 6,813,061 |

Hillsborough County IDA PCR, 5.00% due 12/1/2034 put 3/15/2012 (Tampa Electric Co.; Insured: AMBAC) | | BBB/Baa1 | | | 3,250,000 | | | 3,407,007 |

Hollywood Community Redevelopment Agency, 5.00% due 3/1/2016 (Insured: Syncora) | | NR/Baa1 | | | 2,000,000 | | | 2,023,280 |

Hollywood Community Redevelopment Agency, 5.00% due 3/1/2017 (Insured: Syncora) | | NR/Baa1 | | | 2,000,000 | | | 1,998,180 |

JEA, 5.25% due 10/1/2012 (St. John’s River Park Systems) | | AA-/Aa2 | | | 5,000,000 | | | 5,303,250 |

JEA, 5.00% due 10/1/2014 (Electric Systems) | | A+/Aa3 | | | 7,165,000 | | | 7,880,067 |

JEA Water & Sewer Systems Revenue, 3.50% due 10/1/2013 | | NR/Aa3 | | | 5,565,000 | | | 5,906,914 |

JEA Water & Sewer Systems Revenue, 5.00% due 10/1/2018 | | AA-/Aa3 | | | 1,500,000 | | | 1,658,970 |

Marion County Hospital District, 5.00% due 10/1/2015 (Munroe Regional Health Systems) | | NR/A3 | | | 1,000,000 | | | 1,061,350 |

Miami Dade County Educational Facilities Authority, 5.00% due 4/1/2016 (University of Miami; Insured: AMBAC; GO of University) | | A-/A2 | | | 3,000,000 | | | 3,242,160 |

Miami Dade County GO, 5.25% due 7/1/2018 (Building Better Communities) | | AA-/Aa3 | | | 4,540,000 | | | 5,123,889 |

Miami Dade County Professional Sports Franchise Facilities Tax, 0% due 10/1/2015 (Insured: AGM) | | AAA/Aa3 | | | 3,845,000 | | | 3,117,526 |

Miami Dade County Professional Sports Franchise Facilities Tax, 0% due 10/1/2016 (Insured: AGM) | | AAA/Aa3 | | | 3,535,000 | | | 2,683,878 |

a Miami Dade County Professional Sports Franchise Facilities Tax, 0% due 10/1/2017 (Insured: AGM) | | AAA/Aa3 | | | 2,435,000 | | | 1,729,751 |

Miami Dade County Professional Sports Franchise Facilities Tax, 0% due 10/1/2018 (Insured: AGM) | | AAA/Aa3 | | | 5,385,000 | | | 3,562,554 |

Miami Dade County Professional Sports Franchise Facilities Tax, 0% due 10/1/2019 (Insured: AGM) | | AAA/Aa3 | | | 2,170,000 | | | 1,342,753 |

Miami Dade County School Board COP, 5.00% due 5/1/2014 (Insured: Natl-Re) | | A/A3 | | | 1,000,000 | | | 1,071,690 |

Miami Dade County School Board COP, 5.00% due 10/1/2015 (Insured: AMBAC) | | A/A3 | | | 1,000,000 | | | 1,076,270 |

Miami Dade County School Board COP, 5.00% due 5/1/2016 (Insured: Natl-Re) | | A/A3 | | | 4,015,000 | | | 4,259,594 |

Miami Dade County School Board COP, 5.00% due 10/1/2016 (Insured: AMBAC) | | A/A3 | | | 1,000,000 | | | 1,061,150 |

Miami Dade County School Board COP, 5.50% due 5/1/2030 put 5/1/2011 (Insured: Natl-Re) | | A/A3 | | | 1,010,000 | | | 1,049,228 |

Miami Dade County School District GO, 5.375% due 8/1/2015 (Insured: AGM) | | AAA/Aa3 | | | 5,000,000 | | | 5,669,850 |

Miami Dade County Special Housing, 5.80% due 10/1/2012 (HUD Section 8) | | NR/Baa3 | | | 1,735,000 | | | 1,807,870 |

Miami GO, 5.00% due 1/1/2017 (Homeland Defense/Neighborhood Capital Improvements) | | A/A3 | | | 1,245,000 | | | 1,338,512 |

Miami GO, 5.00% due 1/1/2018 (Homeland Defense/Neighborhood Capital Improvements) | | A/A3 | | | 2,040,000 | | | 2,183,086 |

Miami GO, 5.00% due 1/1/2019 (Homeland Defense/Neighborhood Capital Improvements) | | A/A3 | | | 1,870,000 | | | 1,988,334 |

Miami Special Obligation, 5.00% due 1/1/2018 (Insured: Natl-Re) | | A/A3 | | | 1,970,000 | | | 2,156,362 |

Orange County HFA, 5.00% due 10/1/2014 (Orlando Health) | | A/A2 | | | 2,790,000 | | | 3,020,203 |

Orange County HFA, 5.00% due 10/1/2017 (Orlando Health) | | A/A2 | | | 1,980,000 | | | 2,077,119 |

Orange County HFA, 5.25% due 10/1/2019 (Orlando Health) | | A/A2 | | | 3,000,000 | | | 3,097,860 |

Orlando & Orange County Expressway Authority, 6.50% due 7/1/2011 (Insured: Natl-Re/FGIC) | | A/A1 | | | 3,550,000 | | | 3,783,625 |

Orlando & Orange County Expressway Authority, 5.00% due 7/1/2013 (Insured: AMBAC) | | A/A1 | | | 5,695,000 | | | 6,251,515 |

Palm Beach County Public Improvement, 5.00% due 11/1/2030 put 11/1/2011 (Convention Center; Insured: FGIC) | | AA+/Aa1 | | | 3,000,000 | | | 3,158,310 |

Palm Beach County School Board COP, 5.375% due 8/1/2017 (Insured: AMBAC) | | AA-/A1 | | | 7,000,000 | | | 7,387,380 |

Palm Beach County School Board COP, 5.00% due 8/1/2025 (Insured: FGIC) | | AA-/A1 | | | 1,500,000 | | | 1,556,550 |

Pelican Marsh Community Development District, 5.00% due 5/1/2011 (Insured: Radian) | | AA/NR | | | 570,000 | | | 565,839 |

Polk County Transportation Improvement Revenue, 5.00% due 12/1/2025 (Insured: AGM) | | NR/Aa3 | | | 1,550,000 | | | 1,586,611 |

Port Everglades Authority, 5.00% due 9/1/2016 (Insured: AGM) | | AAA/Aa3 | | | 9,990,000 | | | 10,074,316 |

Putnam County Development Authority PCR, 5.35% due 3/15/2042 put 5/1/2018 (Seminole Project; Insured: AMBAC) | | A-/Baa1 | | | 10,000,000 | | | 10,609,900 |

Certified Semi-Annual Report 15

| | |

| SCHEDULE OF INVESTMENTS, CONTINUED | | |

| |

| Thornburg Limited Term Municipal Fund | | March 31, 2010 (Unaudited) |

| | | | | | | | |

Issuer-Description | | Credit Rating†

S&P/ Moody’s | | Principal

Amount | | Value |

South Miami HFA, 5.00% due 8/15/2016 (Baptist Health) | | AA-/Aa3 | | $ | 1,560,000 | | $ | 1,697,202 |

South Miami HFA, 5.00% due 8/15/2017 (Baptist Health) | | AA-/Aa3 | | | 4,610,000 | | | 4,984,148 |

St. John’s County IDA, 5.50% due 8/1/2014 (Presbyterian Retirement) | | NR/NR | | | 2,755,000 | | | 2,892,034 |

Tampa Sports Authority Revenue, 5.75% due 10/1/2015 (Tampa Bay Arena; Insured: Natl-Re) | | A/Baa1 | | | 1,500,000 | | | 1,584,210 |

University of Central Florida Athletics Association Inc. COP, 5.00% due 10/1/2016 (Insured: FGIC) | | A/NR | | | 1,640,000 | | | 1,719,015 |

GEORGIA — 2.62% | | | | | | | | |

Atlanta Tax Allocation, 5.25% due 12/1/2016 (Atlantic Station; Insured: AGM) | | AAA/Aa3 | | | 3,850,000 | | | 4,233,422 |

Atlanta Water & Wastewater Revenue, 5.50% due 11/1/2014 (Insured: Natl-Re/FGIC) | | A/Baa1 | | | 3,000,000 | | | 3,244,410 |

Atlanta Water & Wastewater Revenue, 5.00% due 11/1/2016 (Insured: AGM) | | AAA/Aa3 | | | 3,215,000 | | | 3,538,943 |

Atlanta Water & Wastewater Revenue, 5.50% due 11/1/2016 (Insured: Natl-Re/FGIC) | | A/Baa1 | | | 8,215,000 | | | 8,825,867 |

Atlanta Water & Wastewater Revenue, 5.00% due 11/1/2017 (Insured: AGM) | | AAA/Aa3 | | | 4,745,000 | | | 5,161,943 |

Atlanta Water & Wastewater Revenue, 6.00% due 11/1/2019 | | A/Baa1 | | | 5,650,000 | | | 6,252,629 |

Burke County PCR, 4.75% due 1/1/2039 put 4/1/2011 (Oglethorpe Power; Insured: Natl-Re) | | A/A3 | | | 10,000,000 | | | 10,371,700 |

a Fulton County Facilities COP, 5.90% due 11/1/2019 pre-refunded 11/1/2010 (Insured: AGM/ AMBAC) | | AAA/Aa3 | | | 16,865,000 | | | 17,571,138 |

Gainesville Water & Sewer Revenue, 6.00% due 11/15/2012 (Insured: Natl-Re/FGIC) | | AA-/A2 | | | 1,200,000 | | | 1,286,352 |

Lagrange Troup County Hospital Authority, 5.00% due 7/1/2018 | | A+/A1 | | | 2,500,000 | | | 2,699,325 |

Main Street Natural Gas Inc., 5.00% due 3/15/2013 (Georgia Gas) | | A/A2 | | | 1,500,000 | | | 1,580,130 |

Main Street Natural Gas Inc., 5.00% due 3/15/2014 (Georgia Gas) | | A+/Aa3 | | | 3,000,000 | | | 3,224,280 |

Main Street Natural Gas Inc., 5.00% due 3/15/2014 (Georgia Gas) | | A/A2 | | | 3,590,000 | | | 3,803,318 |

Main Street Natural Gas Inc., 5.00% due 3/15/2015 (Georgia Gas) | | A/A2 | | | 2,000,000 | | | 2,120,980 |

a Monroe County Development Authority PCR, 6.80% due 1/1/2012 (Oglethorpe Power; Insured: Natl-Re) | | A/A3 | | | 1,000,000 | | | 1,088,590 |

Monroe County Development Authority PCR, 4.50% due 7/1/2025 put 4/1/2011 (Georgia Power Co.) | | A/A2 | | | 5,000,000 | | | 5,166,850 |

GUAM — 0.43% | | | | | | | | |

Guam Educational Financing Foundation COP, 5.00% due 10/1/2010 (Guam Public Schools) | | A-/NR | | | 1,000,000 | | | 1,007,540 |

Guam Government Limited Obligation Revenue, 5.25% due 12/1/2016 | | BBB-/NR | | | 5,610,000 | | | 5,869,070 |

Guam Government Limited Obligation Revenue, 5.25% due 12/1/2017 | | BBB-/NR | | | 2,000,000 | | | 2,082,400 |

Guam Government Limited Obligation Revenue, 5.50% due 12/1/2018 | | BBB-/NR | | | 3,000,000 | | | 3,170,790 |

Guam Government Limited Obligation Revenue, 5.50% due 12/1/2019 | | BBB-/NR | | | 1,000,000 | | | 1,045,220 |

HAWAII — 0.24% | | | | | | | | |

Hawaii Department of Budget & Finance, 6.40% due 7/1/2013 (Kapiolani Health Care; Insured: Natl-Re) | | A/Baa1 | | | 1,150,000 | | | 1,191,768 |

Hawaii Department of Budget & Finance, 4.95% due 4/1/2012 (Hawaiian Electric Company; Insured: Natl-Re) | | A/Baa1 | | | 5,850,000 | | | 6,140,219 |

IDAHO — 0.30% | | | | | | | | |

Twin Falls Urban Renewal Agency, 4.95% due 8/1/2014 | | NR/NR | | | 1,640,000 | | | 1,595,802 |

Twin Falls Urban Renewal Agency, 5.15% due 8/1/2017 | | NR/NR | | | 1,455,000 | | | 1,348,610 |

b University of Idaho, 1.00% due 4/1/2041 | | A+/A1 | | | 6,250,000 | | | 6,349,875 |

ILLINOIS — 7.45% | | | | | | | | |

Bolingbrook GO, 0% due 1/1/2016 (Insured: Natl-Re) | | NR/A2 | | | 1,500,000 | | | 1,212,045 |

Bolingbrook GO, 0% due 1/1/2017 (Insured: Natl-Re) | | NR/A2 | | | 2,000,000 | | | 1,512,380 |

Broadview Tax Increment Revenue, 5.375% due 7/1/2015 | | NR/NR | | | 3,400,000 | | | 3,315,578 |

Chicago Board of Education GO, 5.25% due 12/1/2017 (Chicago School Reform Board; Insured: Natl-Re/FGIC) | | AA-/A1 | | | 4,100,000 | | | 4,631,237 |

Chicago Board of Education GO, 5.00% due 12/1/2018 (Insured: Natl-Re) | | AA-/A1 | | | 1,000,000 | | | 1,103,310 |

16 Certified Semi-Annual Report

| | |

| SCHEDULE OF INVESTMENTS, CONTINUED | | |

| |

| Thornburg Limited Term Municipal Fund | | March 31, 2010 (Unaudited) |

| | | | | | | | |

Issuer-Description | | Credit Rating†

S&P/ Moody’s | | Principal

Amount | | Value |

Chicago Gas Supply, 4.75% due 3/1/2030 put 6/30/2014 (Peoples Gas Light & Coke) | | A-/A2 | | $ | 1,500,000 | | $ | 1,525,290 |

Chicago GO, 6.125% due 1/1/2012 (Insured: AMBAC) | | NR/Aa3 | | | 775,000 | | | 845,564 |

Chicago GO, 6.125% due 1/1/2012 (Insured: AMBAC) | | NR/Aa3 | | | 225,000 | | | 243,882 |

Chicago GO, 5.375% due 1/1/2013 (Insured: Natl-Re) | | AA-/Aa3 | | | 2,435,000 | | | 2,593,689 |

Chicago GO, 0% due 1/1/2016 (City Colleges; Insured: FGIC) | | AA-/Aa3 | | | 2,670,000 | | | 2,183,393 |

Chicago GO, 5.40% due 1/1/2018 (Insured: AGM) | | AAA/Aa3 | | | 3,000,000 | | | 3,009,930 |

Chicago GO, 0.32% due 1/1/2040 put 4/8/2010 (Insured: AGM/SPA-Dexia ) (weekly demand notes) | | AAA/Aa3 | | | 27,900,000 | | | 27,900,000 |

Chicago Housing Authority Capital Program, 5.25% due 7/1/2010 (ETM) | | NR/Aaa | | | 2,300,000 | | | 2,328,589 |

Chicago Housing Authority Capital Program, 5.00% due 7/1/2015 (Insured: AGM) | | AAA/Aa3 | | | 8,460,000 | | | 9,393,476 |

Chicago Housing Authority Capital Program, 5.00% due 7/1/2016 (Insured: AGM) | | AAA/Aa3 | | | 2,000,000 | | | 2,204,160 |

Chicago Metropolitan Water Reclamation District, 7.00% due 1/1/2011 (ETM) | | NR/Aaa | | | 380,000 | | | 396,750 |

Chicago Midway Airport, 5.50% due 1/1/2013 (Insured: Natl-Re) | | A/A2 | | | 1,180,000 | | | 1,283,639 |

Cicero Illinois GO, 5.25% due 1/1/2019 (Insured: XLCA) | | NR/NR | | | 6,140,000 | | | 6,000,683 |

Cook County Community Consolidated School District GO, 0% due 12/1/2010 (Insured: AGM) | | NR/Aa3 | | | 2,000,000 | | | 1,993,760 |

Cook County Community Consolidated School District GO, 9.00% due 12/1/2016 (Tinley Park; Insured: FGIC) | | NR/A1 | | | 2,500,000 | | | 3,347,875 |

Cook County Community High School District, 5.00% due 12/15/2012 (Insured: Assured Guaranty) | | AAA/NR | | | 3,180,000 | | | 3,493,357 |

Cook County Community High School District, 5.00% due 12/15/2013 (Insured: Assured Guaranty) | | AAA/NR | | | 6,875,000 | | | 7,693,331 |

Cook County Community School District GO, 9.00% due 12/1/2013 (Oak Park; Insured: FGIC) | | NR/Aa3 | | | 2,250,000 | | | 2,810,768 |

Cook County GO, 3.25% due 11/15/2011 | | AA/Aa3 | | | 1,250,000 | | | 1,296,263 |

Cook County GO, 5.00% due 11/15/2012 | | AA/Aa3 | | | 6,000,000 | | | 6,557,880 |

Cook County GO, 6.25% due 11/15/2013 (Insured: Natl-Re) | | AA/Aa3 | | | 3,995,000 | | | 4,494,495 |

Illinois DFA, 6.00% due 11/15/2010 (Adventist Health; Insured: Natl-Re) | | AA/Baa1 | | | 3,860,000 | | | 3,956,461 |

Illinois DFA, 6.00% due 11/15/2011 (Adventist Health; Insured: Natl-Re) | | AA/Baa1 | | | 1,000,000 | | | 1,032,170 |

Illinois Educational Facilities, 4.75% due 3/1/2030 put 3/1/2017 (Art Institute of Chicago) | | A+/A1 | | | 2,625,000 | | | 2,786,989 |

Illinois Educational Facilities, 5.00% due 3/1/2030 put 3/1/2017 (Art Institute of Chicago) | | NR/NR | | | 3,000,000 | | | 3,161,250 |

Illinois Educational Facilities, 5.25% due 3/1/2034 put 3/1/2018 (Art Institute of Chicago) | | NR/NR | | | 3,500,000 | | | 3,723,895 |

a Illinois Educational Facilities, 4.15% due 11/1/2036 put 11/1/2012 (Field Museum) | | A/A2 | | | 5,250,000 | | | 5,460,788 |

Illinois Educational Facilities, 4.30% due 11/1/2036 put 11/1/2013 (Field Museum) | | A/A2 | | | 3,000,000 | | | 3,155,820 |

Illinois Finance Authority, 5.00% due 11/1/2014 (Cent Dupage Health) | | AA/NR | | | 5,000,000 | | | 5,501,600 |

Illinois Finance Authority, 4.00% due 4/1/2015 (Advocate Health) | | AA/Aa2 | | | 2,800,000 | | | 2,930,424 |

Illinois Finance Authority, 5.00% due 11/1/2015 (Cent Dupage Health) | | AA/NR | | | 5,000,000 | | | 5,469,000 |

Illinois Finance Authority, 5.00% due 4/1/2016 (Advocate Health) | | AA/Aa2 | | | 1,250,000 | | | 1,352,788 |

Illinois Finance Authority, 5.00% due 11/1/2017 (Rush University Medical Center; Insured: Natl-Re) | | A/A3 | | | 1,000,000 | | | 1,048,020 |

Illinois Finance Authority, 5.50% due 11/1/2018 (Advocate Health) | | AA/Aa2 | | | 1,000,000 | | | 1,099,640 |

Illinois Finance Authority, 5.00% due 4/1/2020 (Advocate Health) | | AA/Aa2 | | | 1,000,000 | | | 1,044,200 |

Illinois Finance Authority, 3.875% due 11/1/2030 put 5/1/2012 (Advocate Health) | | AA/Aa2 | | | 2,000,000 | | | 2,046,860 |

Illinois Finance Authority Student Housing, 5.00% due 5/1/2014 | | NR/Baa3 | | | 3,895,000 | | | 3,874,980 |

Illinois HFA, 5.50% due 11/15/2011 (Methodist Medical Center; Insured: Natl-Re) | | A/A2 | | | 3,000,000 | | | 3,007,890 |

Illinois HFA, 5.00% due 11/15/2013 (Northwestern Medical Facility; Insured: Natl-Re) | | NR/A2 | | | 2,470,000 | | | 2,476,101 |

Illinois HFA, 6.00% due 7/1/2017 (Lake Forest Hospital) | | AA+/Aa2 | | | 1,500,000 | | | 1,568,775 |

Illinois HFA, 6.125% due 11/15/2022 (Advocate Network Health Care) | | AAA/Aa2 | | | 1,000,000 | | | 1,035,600 |

Illinois HFA, 0.31% due 7/1/2032 put 4/1/2010 (Northwest Community Hospital) (daily demand notes) | | AA-/Aa3 | | | 6,000,000 | | | 6,000,000 |

Illinois Sales Tax, 5.00% due 6/15/2011 | | AAA/A2 | | | 6,050,000 | | | 6,320,737 |

Illinois Sales Tax, 3.50% due 6/15/2012 | | AAA/A2 | | | 6,055,000 | | | 6,302,286 |

Illinois Sales Tax, 3.50% due 6/15/2013 | | AAA/A2 | | | 6,455,000 | | | 6,771,101 |

Illinois Sales Tax, 3.50% due 6/15/2014 | | AAA/A2 | | | 6,455,000 | | | 6,747,024 |

Illinois Sales Tax, 5.50% due 6/15/2016 | | AAA/A2 | | | 3,000,000 | | | 3,147,930 |

Illinois Sales Tax, 5.50% due 6/15/2016 | | AAA/A2 | | | 4,000,000 | | | 4,197,240 |

Kane County Forest Preservation District GO, 5.00% due 12/15/2015 (Insured: FGIC) | | AA/NR | | | 2,780,000 | | | 3,171,452 |

Certified Semi-Annual Report 17

| | |

| SCHEDULE OF INVESTMENTS, CONTINUED | | |

| |

| Thornburg Limited Term Municipal Fund | | March 31, 2010 (Unaudited) |

| | | | | | | | |

Issuer-Description | | Credit Rating†

S&P/ Moody’s | | Principal

Amount | | Value |

Kane County Waubonsee Community College District GO, 0% due 12/15/2013 (Insured: FGIC) | | AA-/Aa3 | | $ | 3,000,000 | | $ | 2,591,490 |

Lake County Community High School District GO, 0% due 12/1/2011 (Insured: FGIC) | | NR/NR | | | 3,235,000 | | | 3,109,903 |

McLean & Woodford Counties United School District GO, 6.25% due 12/1/2014 (Insured: AGM) | | NR/Aa3 | | | 1,005,000 | | | 1,090,807 |

McHenry & Kane Counties Community Consolidated School District GO, 0% due 1/1/2012 (Insured: FGIC) | | A/NR | | | 2,200,000 | | | 2,100,934 |

Melrose Park Water Revenue, 5.20% due 7/1/2018 (Insured: Natl-Re) | | A/Baa1 | | | 1,190,000 | | | 1,200,924 |

Metropolitan Pier & Exposition Authority Dedicated State Tax, 0% due 6/15/2013 (McCormick Place; Insured: Natl-Re) | | AAA/A3 | | | 1,045,000 | | | 963,145 |

Metropolitan Pier & Exposition Authority Dedicated State Tax, 0% due 6/15/2016 (McCormick Place; Insured: FGIC) | | A/A3 | | | 11,295,000 | | | 8,915,934 |

Quincy Illinois, 5.00% due 11/15/2014 (Blessing Hospital) | | A-/A3 | | | 1,000,000 | | | 1,049,440 |

Quincy Illinois, 5.00% due 11/15/2016 (Blessing Hospital) | | A-/A3 | | | 1,000,000 | | | 1,021,590 |

Southwestern Illinois Development Authority, 5.125% due 8/15/2016 (Anderson Hospital) | | BBB/

Baa2 | | | 1,935,000 | | | 1,968,843 |

Springfield Electric Revenue, 5.50% due 3/1/2013 (Insured: Natl-Re) | | AA-/NR | | | 2,000,000 | | | 2,112,160 |

INDIANA — 4.29% | | | | | | | | |

Allen County Economic Development, 5.00% due 12/30/2012 (Indiana Institute of Technology) | | NR/NR | | | 1,370,000 | | | 1,380,042 |

Allen County Jail Building Corp. First Mortgage, 5.75% due 10/1/2010 (ETM) | | NR/NR | | | 565,000 | | | 571,571 |

Allen County Jail Building Corp. First Mortgage, 5.00% due 10/1/2014 (Insured: Syncora) | | NR/Aa3 | | | 1,000,000 | | | 1,119,800 |

Allen County Jail Building Corp. First Mortgage, 5.00% due 10/1/2015 (Insured: Syncora) | | NR/Aa3 | | | 1,480,000 | | | 1,661,344 |

Allen County Jail Building Corp. First Mortgage, 5.00% due 10/1/2016 (Insured: Syncora) | | NR/Aa3 | | | 1,520,000 | | | 1,680,254 |

Allen County Redevelopment District, 5.00% due 11/15/2016 | | NR/A3 | | | 1,000,000 | | | 1,083,610 |

Avon Community School Building Corp., 5.00% due 7/15/2017 (Insured: AMBAC; State Aid Withholding) | | A/NR | | | 2,500,000 | | | 2,731,050 |

Ball State University Student Fee, 5.75% due 7/1/2012 (Insured: FGIC) | | A+/A1 | | | 1,000,000 | | | 1,074,830 |

Boonville Junior High School Building Corp., 0% due 7/1/2010 (State Aid Withholding) | | A/NR | | | 850,000 | | | 845,351 |

Boonville Junior High School Building Corp., 0% due 1/1/2011 (State Aid Withholding) | | A/NR | | | 850,000 | | | 834,743 |

a Boonville Junior High School Building Corp., 0% due 7/1/2011 (State Aid Withholding) | | A/NR | | | 950,000 | | | 920,379 |

Brownsburg 1999 School Building Corp., 5.00% due 7/15/2013 (Insured: AGM; State Aid Withholding) | | AAA/Aa3 | | | 1,000,000 | | | 1,102,530 |

Brownsburg 1999 School Building Corp., 5.00% due 8/1/2018 (Insured: AGM; State Aid Withholding) | | AAA/Aa3 | | | 1,250,000 | | | 1,337,488 |

Carmel Redevelopment Authority, 0% due 2/1/2015 (Performing Arts Center) | | AA+/Aa2 | | | 1,575,000 | | | 1,358,233 |

Center Grove Building Corp., 5.00% due 7/15/2010 (Insured: AMBAC) (ETM) | | AA+/NR | | | 575,000 | | | 582,849 |

Central High School Building Corp., 5.00% due 2/1/2011 (First Mortgage; Insured: AMBAC; State Aid Withholding) | | AA+/NR | | | 1,970,000 | | | 2,043,658 |

Clay Multiple School Building Corp., 4.00% due 7/15/2015 | | AA+/NR | | | 1,000,000 | | | 1,059,440 |

Clay Multiple School Building Corp., 5.00% due 7/15/2016 | | AA+/NR | | | 1,295,000 | | | 1,437,515 |

Clay Multiple School Building Corp., 5.00% due 1/15/2017 | | AA+/NR | | | 1,000,000 | | | 1,106,700 |

Evansville Vanderburgh, 5.00% due 7/15/2014 (Insured: AMBAC) | | A+/NR | | | 1,000,000 | | | 1,095,240 |

Evansville Vanderburgh, 5.00% due 7/15/2015 (Insured: AMBAC) | | A+/NR | | | 1,000,000 | | | 1,096,690 |

b Fort Wayne Sewer Works Improvement, 4.25% due 8/1/2013 | | NR/A2 | | | 1,715,000 | | | 1,819,546 |

b Fort Wayne Sewer Works Improvement, 4.25% due 8/1/2014 | | NR/A2 | | | 1,745,000 | | | 1,852,317 |

b Fort Wayne Sewer Works Improvement, 4.25% due 8/1/2015 | | NR/A2 | | | 1,780,000 | | | 1,876,031 |

Indiana Bond Bank, 4.80% due 2/1/2014 | | AAA/NR | | | 4,060,000 | | | 4,070,353 |

a Indiana Bond Bank, 5.25% due 10/15/2016 (Special Gas Program) | | NR/Aa3 | | | 1,545,000 | | | 1,658,156 |

Indiana Bond Bank, 5.00% due 10/15/2017 | | NR/Aa3 | | | 5,000,000 | | | 5,153,100 |

Indiana Finance Authority, 5.00% due 5/1/2015 (Parkview Health Systems) | | A+/A1 | | | 1,500,000 | | | 1,621,830 |

Indiana Finance Authority, 5.00% due 5/1/2016 (Parkview Health Systems) | | A+/A1 | | | 3,090,000 | | | 3,281,673 |

Indiana Finance Authority, 5.00% due 5/1/2017 (Parkview Health Systems) | | A+/A1 | | | 1,000,000 | | | 1,045,420 |

Indiana Health Facilities, 5.00% due 11/1/2014 (Sisters of St. Francis) | | NR/Aa3 | | | 1,000,000 | | | 1,098,960 |

Indiana Health Facilities, 5.50% due 11/15/2016 | | AA/Aa1 | | | 1,385,000 | | | 1,518,916 |

a Indiana Health Facilities, 5.00% due 11/1/2018 (Sisters of St. Francis) | | NR/Aa3 | | | 1,250,000 | | | 1,326,025 |

Indiana Health Facilities, 5.75% due 11/1/2021 pre-refunded 11/1/11 (Sisters of St. Francis) | | NR/Aa3 | | | 3,545,000 | | | 3,852,564 |

18 Certified Semi-Annual Report

| | |

| SCHEDULE OF INVESTMENTS, CONTINUED | | |

| |

| Thornburg Limited Term Municipal Fund | | March 31, 2010 (Unaudited) |

| | | | | | | | |

Issuer-Description | | Credit Rating†

S&P/ Moody’s | | Principal

Amount | | Value |

Indiana Health Facilities, 3.625% due 11/15/2036 put 8/1/2011 (Ascension Health) | | NR/Aa1 | | $ | 3,955,000 | | $ | 4,085,159 |

Indiana Multi School Building Corp. First Mortgage, 5.00% due 7/15/2016 (Insured: Natl-Re) | | AA/Baa1 | | | 5,000,000 | | | 5,572,350 |

Indiana State Finance Authority Revenue, 5.00% due 7/1/2011 (Wabash Correctional Facilities) | | AA+/Aa2 | | | 1,390,000 | | | 1,458,360 |

Indiana State Finance Authority Revenue, 4.90% due 1/1/2016 (Indianapolis Power & Light Co.) | | BBB/A3 | | | 11,650,000 | | | 12,183,104 |

Indiana State Finance Authority Revenue, 5.00% due 7/1/2016 (Forensic & Health Science; Insured: Natl-Re) | | AA+/Aa2 | | | 1,030,000 | | | 1,140,066 |

Indiana State Finance Authority Revenue, 5.25% due 7/1/2018 (Wabash Correctional Facilities) | | AA+/Aa2 | | | 1,000,000 | | | 1,116,430 |

Indiana State Finance Authority Revenue, 5.25% due 7/1/2018 (Rockville Correctional Facilities) | | AA+/Aa2 | | | 2,150,000 | | | 2,400,324 |

Indiana State Finance Authority Revenue, 5.00% due 11/1/2018 | | AA+/Aa3 | | | 2,750,000 | | | 3,023,075 |

Indianapolis Local Public Improvement Bond Bank, 6.75% due 2/1/2014 | | AA/NR | | | 1,270,000 | | | 1,394,752 |

Indianapolis Local Public Improvement Bond Bank, 5.00% due 1/1/2015 (Waterworks; Insured: Natl-Re) | | AA-/A3 | | | 1,000,000 | | | 1,107,490 |

Indianapolis Local Public Improvement Bond Bank, 5.00% due 7/1/2015 (Waterworks; Insured: Natl-Re) | | AA-/A3 | | | 1,000,000 | | | 1,112,410 |

Indianapolis Local Public Improvement Bond Bank, 5.00% due 7/1/2016 (Insured: FGIC) | | AA+/Aa2 | | | 1,030,000 | | | 1,142,528 |

Indianapolis Multi-School Building Corp., 5.50% due 7/15/2015 (First Mortgage; Insured: Natl-Re) | | AA/Baa1 | | | 1,690,000 | | | 1,932,346 |

Ivy Tech Community College, 4.00% due 7/1/2013 | | AA-/NR | | | 1,000,000 | | | 1,073,420 |

Ivy Tech Community College, 4.00% due 7/1/2014 | | AA-/NR | | | 1,500,000 | | | 1,618,185 |

Knox Middle School Building Corp. First Mortgage, 0% due 1/15/2020 (Insured: FGIC; State Aid Withholding) | | A/NR | | | 1,295,000 | | | 770,732 |

Madison Schools Lydia Middleton Building Corp., 5.00% due 7/15/2014 (Insured: Natl-Re/ FGIC; State Aid Withholding) | | AA+/NR | | | 1,200,000 | | | 1,358,100 |

Madison Schools Lydia Middleton Building Corp., 5.00% due 7/15/2015 (Insured: Natl-Re/ FGIC; State Aid Withholding) | | AA+/NR | | | 1,250,000 | | | 1,421,062 |

Mount Vernon of Hancock County First Mortgage, 5.00% due 7/15/2013 (Insured: Natl-Re; State Aid Withholding) | | A+/Baa1 | | | 1,055,000 | | | 1,165,131 |

Mount Vernon of Hancock County First Mortgage, 5.00% due 7/15/2014 (Insured: Natl-Re; State Aid Withholding) | | A+/Baa1 | | | 1,135,000 | | | 1,266,524 |

Mount Vernon of Hancock County First Mortgage, 5.00% due 7/15/2015 (Insured: Natl-Re; State Aid Withholding) | | A+/Baa1 | | | 1,140,000 | | | 1,277,450 |

Noblesville Redevelopment Authority, 5.00% due 8/1/2016 (146th Street Extension A) | | AA-/NR | | | 1,660,000 | | | 1,821,518 |

Perry Township Multi School Building Corp., 5.00% due 7/10/2014 (Insured: AGM; State Aid Withholding) | | NR/Aa3 | | | 2,130,000 | | | 2,383,172 |

Peru Community School Corp. First Mortgage, 0% due 7/1/2010 (State Aid Withholding) | | A/NR | | | 835,000 | | | 830,433 |

Plainfield Community High School Building Corp. First Mortgage, 5.00% due 1/15/2015 (Insured: Natl-Re/FGIC) | | A/NR | | | 1,445,000 | | | 1,611,319 |

Rockport PCR, 6.25% due 6/1/2025 put 6/2/2014 (Indiana Michigan Power Co.) | | BBB/Baa2 | | | 4,100,000 | | | 4,542,185 |

Rockport PCR, 6.25% due 6/1/2025 put 6/2/2014 (Indiana Michigan Power Co.) | | BBB/Baa2 | | | 1,000,000 | | | 1,107,850 |

South Bend Community School Building Corp., 5.00% due 7/15/2016 (Insured: Natl-Re/FGIC; State Aid Withholding) | | AA+/NR | | | 1,785,000 | | | 2,013,105 |

Vincennes University, 3.00% due 6/1/2014 | | NR/A1 | | | 1,000,000 | | | 1,026,880 |

Vincennes University, 3.00% due 6/1/2015 | | NR/A1 | | | 1,000,000 | | | 1,013,050 |

Vincennes University, 4.00% due 6/1/2018 | | NR/A1 | | | 1,000,000 | | | 1,020,580 |

Vincennes University, 5.00% due 6/1/2020 | | NR/A1 | | | 1,000,000 | | | 1,079,600 |

Warren Township Vision 2005, 5.00% due 7/10/2015 (Insured: Natl-Re/FGIC; State Aid Withholding) | | AA+/NR | | | 2,895,000 | | | 3,251,056 |

Wawasee Community School Corp. First Mortgage, 5.50% due 7/15/2010 (State Aid Withholding) (ETM) | | AA+/NR | | | 510,000 | | | 517,196 |

Wawasee Community School Corp. First Mortgage, 5.50% due 7/15/2011 (State Aid Withholding) (ETM) | | AA+/NR | | | 1,095,000 | | | 1,148,337 |

West Clark School Building Corp., 5.25% due 1/15/2014 (Insured: Natl-Re) | | AA+/Baa1 | | | 1,335,000 | | | 1,506,160 |

West Clark School Building Corp. First Mortgage, 5.75% due 7/15/2011 (Insured: Natl-Re/ FGIC; State Aid Withholding) | | AA+/NR | | | 2,080,000 | | | 2,214,826 |

Certified Semi-Annual Report 19

| | |

| SCHEDULE OF INVESTMENTS, CONTINUED | | |

| |

| Thornburg Limited Term Municipal Fund | | March 31, 2010 (Unaudited) |

| | | | | | | | |

Issuer-Description | | Credit Rating†

S&P/ Moody’s | | Principal

Amount | | Value |

IOWA — 0.80% | | | | | | | | |

Ankeny Community School District Sales & Services Tax, 5.00% due 7/1/2010 | | AA-/NR | | $ | 2,900,000 | | $ | 2,931,204 |

Des Moines Limited Obligation, 4.40% due 12/1/2015 put 12/1/2011 (Des Moines Parking Associates; LOC: Wells Fargo Bank) | | NR/NR | | | 2,270,000 | | | 2,273,746 |