UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05201

Thornburg Investment Trust

(Exact name of registrant as specified in charter)

c/o Thornburg Investment Management, Inc.

2300 North Ridgetop Road, Santa Fe, New Mexico 87506

(Address of principal executive offices) (Zip code)

Garrett Thornburg, 2300 North Ridgetop Road, Santa Fe, New Mexico 87506

(Name and address of agent for service)

Registrant’s telephone number, including area code: 505-984-0200

Date of fiscal year end: September 30, 2010

Date of reporting period: September 30, 2010

Explanatory Note: The Registrant is filing this amendment to its Form N-CSR for the period ended September 30, 2010, originally filed with the Securities and Exchange Commission on November 23, 2010, to add to or revise certain information in the Letter to Shareholders in the annual report for each of Thornburg Strategic Municipal Income Fund, Thornburg Value Fund and Thornburg Investment Income Builder Fund. This amendment does not modify in any way the annual reports for any other Fund of the Registrant.

Item 1. Reports to Stockholders

The following annual reports are attached hereto, in order:

Thornburg Value Fund

Thornburg Investment Income Builder Fund

Thornburg Strategic Municipal Income Fund

Each annual report is preceded by a supplement containing the additional or revised information in that report. Such information is also incorporated into the annual reports.

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than quoted. For performance current to the most recent month end, visit thornburg.com.

The maximum sales charge for Class A shares is 4.50%. Class A shares are subject to a 1% 30-day redemption fee. The total annual fund operating expense of Class A shares is 1.34%, as disclosed in the most recent Prospectus.

TH2331

|

Important Information

The information presented on the following pages was current as of September 30, 2010. The managers’ views, portfolio holdings, and sector diversification are provided for the general information of the Fund’s shareholders; they are historical and subject to change. This material should not be deemed a recommendation to buy or sell any of the securities mentioned.

Investments in the Fund carry risks, including possible loss of principal. Special risks may be associated with investments outside the United States, especially in emerging markets, including currency fluctuations, illiquidity and volatility. Investments in small capitalization companies may increase the risk of greater price fluctuations. Please see the Fund’s Prospectus for a discussion of the risks associated with an investment in the Fund. Investments in the Fund are not FDIC insured, nor are they deposits of or guaranteed by a bank or any other entity. There is no guarantee that the Fund will meet its investment objectives. Funds invested in a limited number of holdings may expose an investor to greater volatility.

Performance data given at net asset value (NAV) does not take into account the applicable sales charges. If the sales charges had been included, the performance would have been lower.

Class I, R3, R4, and R5 shares may not be available to all investors. Minimum investments for Class I shares may be higher than those for other classes.

Share Class | NASDAQ Symbol | Cusip | ||

Class A | TVAFX | 885-215-731 | ||

Class B | TVBFX | 885-215-590 | ||

Class C | TVCFX | 885-215-715 | ||

Class I | TVIFX | 885-215-632 | ||

Class R3 | TVRFX | 885-215-533 | ||

Class R4 | TVIRX | 885-215-277 | ||

Class R5 | TVRRX | 885-215-376 |

Glossary

Standard & Poor’s 500 Stock Index (S&P 500) – The S&P 500 Index is a broad measure of the U.S. stock market.

Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. Investors may not make direct investments into any index. The performance of any index is not indicative of the performance of any particular investment.

Alpha – A measure of the difference between a fund’s actual returns and its expected performance, given its level of risk as measured by beta.

Beta – A measure of market-related risk. Less than one means the portfolio is less volatile than the index, while greater than one indicates more volatility than the index.

Forward P/E – Price to earnings ratio, using earnings estimates for the next four quarters.

Median Market Capitalization – Market capitalization (market cap) is the total value of a company’s stock, calculated by multiplying the number of outstanding common shares by the current share price. The company whose market cap is in the middle of the portfolio is the median market cap. Half the companies in the portfolio have values greater than the median and half have values that are less.

Price to Book Value (P/B) – A ratio used to compare a stock’s market value to its book value. It is calculated by dividing the current closing price of the stock by the latest quarter’s book value (book value is simply assets minus liabilities).

Price to Cash Flow Ratio – A measure of the market’s expectations of a firm’s future financial health. It is calculated by dividing the price per share by cash flow per share.

Price to Earnings Ratio (P/E) – A valuation ratio equaling a company’s market value per share divided by earnings per share.

This page is not part of the Annual Report. 3

Thornburg Value Fund

CO-PORTFOLIO MANAGERS

Left to right:

Connor Browne, CFA, and Edward Maran, CFA.

IMPORTANT

PERFORMANCE INFORMATION

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than quoted. For performance current to the most recent month end, visit thornburg.com.

The maximum sales charge for Class A shares is 4.50%. Class A shares are subject to a 1% 30-day redemption fee. The total annual fund operating expense of Class A shares is 1.34%, as disclosed in the most recent Prospectus.

Finding Promising Companies at a Discount

The Thornburg Value Fund seeks to find promising companies at a discounted valuation. It differs from many other equity funds in two key ways. First, it focuses on a limited number of stocks, and second, it takes a more comprehensive approach to value investing.

Our team is dedicated to providing value to shareholders. We accomplish this through the application of seasoned investment principles with hands-on, company-oriented research. We use a collaborative research approach in identifying and analyzing investment ideas. Our focus is on finding promising companies available at a discount to our estimate of their intrinsic value.

In managing the Thornburg Value Fund, we take a bottom-up approach to stock selection. The Fund is not predisposed to an industry or sector. We use a combination of financial analysis, collaborative research, and business evaluation in an effort to gauge the intrinsic value of a company based on its past record and future potential. The continuum of process moves from screens and idea generation, through conventional “Wall Street” research and documentation, to company contact, the last often including on-site visits. The focus of the analysis is on what’s behind the numbers, its revenue and cash-generating model. We make an effort to get to know the company’s reputation in the industry, its people and its corporate culture.

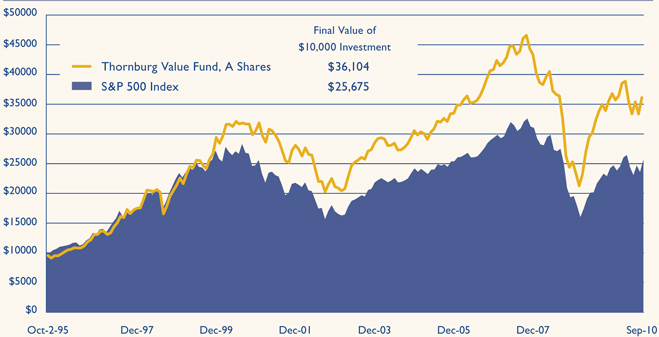

AVERAGE ANNUAL TOTAL RETURNS

FOR PERIODS ENDED 9/30/10

| 1 Yr | 3 Yrs | 5 Yrs | 10 Yrs | Since Inception | ||||||||||||||||

A Shares (Incep: 10/2/95) | ||||||||||||||||||||

Without sales charge | 3.21 | % | -7.83 | % | 2.05 | % | 1.32 | % | 9.27 | % | ||||||||||

With sales charge | -1.44 | % | -9.23 | % | 1.11 | % | 0.85 | % | 8.94 | % | ||||||||||

S&P 500 Index | ||||||||||||||||||||

(Since 10/2/95) | 10.16 | % | -7.16 | % | 0.64 | % | -0.43 | % | 6.49 | % | ||||||||||

4 This page is not part of the Annual Report.

The current posture is to maintain a portfolio of 40–55 companies diversified by sector, industry, market capitalization, and our three categories of stocks: Basic Value, Consistent Earners and Emerging Franchises. Because of the limited number of stocks in the portfolio, every holding counts. At the time of purchase, we set a 12–18 month price target for each stock. The target is reviewed as the fundamentals of the stock change during the course of ownership.

The bottom line? Engendering a wide-open, collegial environment fosters information flow and critical thinking intended to benefit portfolio decision making. We do not view our location in Santa Fe, New Mexico, as a disadvantage. While we have access to the best of Wall Street’s analysis, we are not ruled by it. Distance from the crowd serves to fortify independent and objective thinking.

STOCKS CONTRIBUTING AND DETRACTING

FOR THE YEAR ENDED 9/30/10

Top Contributors | Top Detractors | |

| Smith International Inc. | Transocean Ltd. | |

| DIRECTV Group, Inc. | Gilead Sciences, Inc. | |

| ConocoPhillips | Monsanto Co. | |

| Varian Medical Systems, Inc. | Dell, Inc. | |

| ING Groep N.V. | Alere, Inc. | |

| Source: FactSet | ||

KEY PORTFOLIO ATTRIBUTES

As of 9/30/10

Portfolio P/E Trailing 12-months* | 12.9x | |||

Portfolio Price to Cash Flow* | 5.3x | |||

Portfolio Price to Book Value* | 1.4x | |||

Median Market Cap* | $ | 10.2 B | ||

7-Year Beta (A Shares vs. S&P 500)* | 1.07 | |||

Number of Companies | 50 | |||

* Source: FactSet | ||||

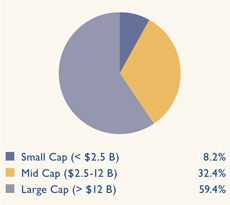

MARKET CAPITALIZATION EXPOSURE

As of 9/30/10

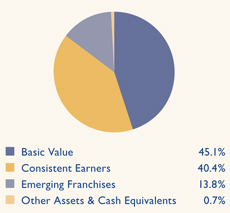

BASKET STRUCTURE

As of 9/30/10

This page is not part of the Annual Report. 5

Thornburg Value Fund

September 30, 2010

Table of Contents | ||||

| 7 | ||||

| 10 | ||||

| 14 | ||||

| 16 | ||||

| 18 | ||||

| 19 | ||||

| 28 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 36 |

This report is certified under the Sarbanes-Oxley Act of 2002, which requires that public companies, including mutual funds, affirm that the information provided in their annual and semiannual shareholder reports fully and fairly represents their financial position.

6 Certified Annual Report

Connor Browne, CFA Co-Portfolio Manager

Edward E. Maran, CFA Co-Portfolio Manager | October 18, 2010

Dear Fellow Shareholder:

It was a challenging fiscal year for the Thornburg Value Fund in terms of relative performance. While our results were positive, 3.21% for the total return of Class A shares at net asset value (NAV), we did not keep pace with the S&P 500 Index over the same period, which returned 10.16%. We think it is important to put this year’s performance in context, however. The fiscal year ended September 2009 was a terrific year for the Fund returning 7.65%, Class A shares at NAV vs. negative 6.91% for the S&P 500 Index. There are some reasons for optimism as we look ahead. Most of the investments that have been a drag on our performance this year are sound businesses with good growth prospects and attractive valuations. We are hopeful that these stocks may recover, as the underlying value of their businesses appears intact.

While we generally shy away from any macroeconomic prognostications in these pages, we do have an opinion on a current topic of interest in the press and media. It is your co-managers’ belief that any current discount in the valuation of equities that reflects the possibility of deflation is unwarranted. We believe that Ben Bernanke and the Federal Open Market Committee that he leads will fight deflation aggressively. We expect a second round of quantitative easing in the United States. We believe that this monetary stimulus will be effective and that expectations for economic growth and inflation will rise. In our opinion, the environment we anticipate should be favorable for equities in general and we believe the Thornburg Value Fund could benefit, too.

Let’s start out with what hurt performance during the year. In terms of the positioning of the portfolio, our overweight in the health care sector and our underweight in the industrials sector both weighed on performance. That said, weak stock price performance by a few of our individual holdings was a much greater driver of underperformance. Specifically, Transocean, Gilead Sciences, Actelion, Monsanto, Dell, and Alere were all weak performers during the period. All of these stocks remain in the portfolio today. In each case we remain bullish in the outlook for these companies and confident that they will contribute alpha, rather than destroy it, in future periods.

We wrote about Transocean in our semi-annual letter this year. Regarding the Deepwater Horizon oil spill in the Gulf of Mexico (Transocean owned the drilling rig), we stated, “The injuries, loss of life, and economic and environmental impacts of this incident are truly tragic.” But also that,“We currently believe the costs to Transocean associated with the Horizon disaster will be materially less than the | |

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than quoted. For performance current to the most recent month end, visit thornburg.com.

The maximum sales charge for Class A shares is 4.50%. Class A shares are subject to a 1% 30-day redemption fee. The total annual fund operating expense of Class A shares is 1.34%, as disclosed in the most recent Prospectus.

|

Certified Annual Report 7

| Letter to Shareholders, | ||

Continued | ||

decline in the market capitalization of the company since the incident.” We continue to believe this to be the case, and added to our Transocean position after the spill. We added another deepwater drilling company, Ensco, to the portfolio as well. Everyone is relieved that the environmental impact seems to be much better than worst case. Further, as the moratorium on Gulf of Mexico (GOM) drilling was recently lifted, we expect Transocean’s stock price to better reflect the true fundamentals of the business over time. Transocean was a very tough stock for us during the fiscal year, but it remains a large position and is an investment that we remain excited about.

Gilead and Actelion are both biotechnology/pharmaceutical companies. Gilead has seen a tremendous decline in the value investors are willing to ascribe to its earnings. Gilead’s forward P/E multiple has declined from over 25x two years ago to under 10x today. Why? We think it has been a combination of concerns regarding health care reform in the United States, austerity measures in the European Union, and further investor attention on their 2017/2018 patent expirations. Gilead continues to dominate the treatment of HIV/AIDS, and has grown both revenues and earnings consistently for over a decade. We don’t believe the current low valuation is justified. Actelion reported a number of new drug development setbacks during the fiscal year that were disappointing to us and investors more broadly. At time of purchase, we believed the stock was cheap, even if we attributed value only to its currently marketed products and ignored the value of its pipeline. As of this writing, Actelion’s share price has improved dramatically since the end of our fiscal year as reports of a potential takeover have surfaced.

Monsanto has faced an avalanche of bad news. When we first invested, the company derived 15%–20% of its earnings from a herbicide product called Roundup, which was facing generic competition from China. Given the low growth and declining profitability of that business line, we attributed very little value to it, but we were very enthusiastic about their genetically modified seeds business, which contributed 80% of profits and had strong growth prospects. Since that time, competition intensified and the company is now selling Roundup at a price at or near breakeven. This was disappointing news, but even worse has been weak reported yields for Monsanto’s newest corn seed, their SuperStax. While we are monitoring these developments closely, we continue to believe that limited acreage available for farming and rising consumption of meat and poultry in emerging markets will put upward pressure on grain prices and that the value added of Monsanto’s genetically modified seeds will continue to rise.

Rounding out the weak performers for the year were Dell and Alere (formerly Inverness Medical). Dell’s current valuation looks very compelling to us today. While the substitution of tablets (Apple’s iPad) for laptops may hurt Dell’s future revenue growth opportunities, we believe that the company’s strong enterprise relationships, brand, and strong position in many emerging markets are often overlooked by investors. Alere is a health care company that operates two main businesses, the development and sales of point of care testing devices, and the management of chronic diseases. We believe the testing business should be a steady growth business and justifies more than the current stock price today. To the extent that Alere is successful in chronic disease management, the company could be a very strong investment for the Fund.

On the bright side, many stocks did perform well during the period. Smith International, an oil field services company, was acquired by Schlumberger during the fiscal year. Two other energy holdings, ConocoPhillips (the large integrated energy company) and Ensco (a drilling rig operator like Transocean) also performed very well. DIRECTV (DTV), the satellite television provider, was a great holding for us during the recession. We purchased DTV in August of 2007, just as we

8 Certified Annual Report

were headed into this terrible downturn. We viewed DTV as a Consistent Earning company, rather than as an at risk consumer discretionary holding, its sector categorization. Because of this differentiated view, we held on to our shares through the downturn, and captured 73% cumulative performance in DTV through our price target sale in June of this year. In contrast, the S&P 500 Index moved 22% lower during that same time period.

Recent performance has been trying for you and for us, but through it all we have consistently remained faithful to our process and philosophy. This process and philosophy has delivered strong results to investors since inception and we remain confident that it has the potential to deliver similar results in the future. We invite you to visit our web site at www.thornburg.com where you will find useful information on the Thornburg Value Fund as well as our other funds and investment topics.

Thank you for your trust and confidence.

| Sincerely, | ||||

|  | |||

Connor Browne, CFA Co-Portfolio Manager Managing Director | Edward E. Maran, CFA Co-Portfolio Manager Managing Director |

The matters discussed in this report may constitute forward-looking statements made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995. These include any advisor or portfolio manager prediction, assessment, analysis or outlook for individual securities, industries, investment styles, market sectors and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for each fund in its current prospectus, other factors bearing on these reports include the accuracy of the advisor’s or portfolio manager’s forecasts and predictions, the appropriateness of the investment strategies designed by the advisor or portfolio manager, and the ability of the advisor or portfolio manager to implement their strategies efficiently and successfully. Any one or more of these factors, as well as other risks affecting the securities markets generally, could cause the actual results of any fund to differ materially as compared to its benchmarks.

Certified Annual Report 9

| SCHEDULE OF INVESTMENTS | ||

| Thornburg Value Fund | September 30, 2010 | |

TOP TEN HOLDINGS

As of 9/30/10

Gilead Sciences, Inc. | 4.2 | % | Google, Inc. | 3.3 | % | |||||

Transocean Ltd. | 3.9 | % | General Electric Co. | 3.2 | % | |||||

Dell, Inc. | 3.8 | % | Inpex Corp. | 3.0 | % | |||||

Fiserv, Inc. | 3.5 | % | Eli Lilly & Co. | 2.9 | % | |||||

ING Groep N.V. | 3.4 | % | Comcast Corp. | 2.8 | % |

SUMMARY OF INDUSTRY EXPOSURE

As of 9/30/10

Energy | 17.1 | % | Telecommunication Services | 4.9 | % | |||||

Software & Services | 15.5 | % | Health Care Equipment & Services | 4.3 | % | |||||

Pharmaceuticals, Biotechnology & Life Sciences | 13.2 | % | Media | 4.3 | % | |||||

Diversified Financials | 9.1 | % | Insurance | 3.9 | % | |||||

Materials | 6.9 | % | Semiconductors & Semiconductor Equipment | 2.6 | % | |||||

Technology Hardware & Equipment | 5.6 | % | Consumer Services | 1.7 | % | |||||

Banks | 5.0 | % | Food & Staples Retailing | 0.2 | % | |||||

Capital Goods | 5.0 | % | Other Assets & Cash Equivalents | 0.7 | % |

| Shares/ Principal Amount | Value | |||||||

COMMON STOCK — 96.41% | ||||||||

BANKS — 4.31% | ||||||||

COMMERCIAL BANKS — 4.31% | ||||||||

Mitsubishi UFJ Financial Group, Inc. | 16,426,201 | $ | 76,542,791 | |||||

a,b Sterling Financial Corp. | 12,000,000 | 2,400,000 | ||||||

U.S. Bancorp | 4,421,058 | 95,583,274 | ||||||

| 174,526,065 | ||||||||

CAPITAL GOODS — 4.97% | ||||||||

AEROSPACE & DEFENSE — 1.76% | ||||||||

Lockheed Martin Corp. | 1,001,983 | 71,421,348 | ||||||

INDUSTRIAL CONGLOMERATES — 3.21% | ||||||||

General Electric Co. | 8,014,900 | 130,242,125 | ||||||

| 201,663,473 | ||||||||

CONSUMER SERVICES — 1.70% | ||||||||

HOTELS, RESTAURANTS & LEISURE — 1.70% | ||||||||

b Life Time Fitness, Inc. | 1,746,636 | 68,939,723 | ||||||

| 68,939,723 | ||||||||

DIVERSIFIED FINANCIALS — 9.06% | ||||||||

CAPITAL MARKETS — 0.51% | ||||||||

AllianceBernstein Holding LP | 787,430 | 20,796,026 | ||||||

10 Certified Annual Report

| SCHEDULE OF INVESTMENTS, CONTINUED | ||

| Thornburg Value Fund | September 30, 2010 | |

| Shares/ Principal Amount | Value | |||||||

DIVERSIFIED FINANCIAL SERVICES — 8.55% | ||||||||

Bank of America Corp. | 7,672,000 | $ | 100,579,920 | |||||

b ING Groep N.V. | 13,269,200 | 137,659,125 | ||||||

JPMorgan Chase & Co. | 2,844,125 | 108,275,839 | ||||||

| 367,310,910 | ||||||||

ENERGY — 17.06% | ||||||||

ENERGY EQUIPMENT & SERVICES — 6.46% | ||||||||

Ensco plc ADR | 2,320,000 | 103,773,600 | ||||||

b Transocean Ltd. | 2,457,200 | 157,973,388 | ||||||

OIL, GAS & CONSUMABLE FUELS — 10.60% | ||||||||

ConocoPhillips | 1,512,475 | 86,861,439 | ||||||

Inpex Corp. | 25,960 | 122,212,267 | ||||||

Marathon Oil Corp. | 2,643,300 | 87,493,230 | ||||||

OAO Gazprom ADR | 3,869,420 | 81,064,349 | ||||||

b Sandridge Energy, Inc. | 9,215,065 | 52,341,569 | ||||||

| 691,719,842 | ||||||||

FOOD & STAPLES RETAILING — 0.20% | ||||||||

FOOD & STAPLES RETAILING — 0.20% | ||||||||

b Rite Aid Corp. | 8,717,107 | 8,220,232 | ||||||

| 8,220,232 | ||||||||

HEALTH CARE EQUIPMENT & SERVICES — 4.28% | ||||||||

HEALTH CARE EQUIPMENT & SUPPLIES — 3.74% | ||||||||

b Alere, Inc. | 2,029,900 | 62,784,807 | ||||||

b Varian Medical Services, Inc. | 1,468,090 | 88,819,445 | ||||||

HEALTH CARE PROVIDERS & SERVICES — 0.54% | ||||||||

b Community Health Systems, Inc. | 706,024 | 21,865,563 | ||||||

| 173,469,815 | ||||||||

INSURANCE — 3.93% | ||||||||

INSURANCE — 3.93% | ||||||||

Hartford Financial Services Group, Inc. | 2,700,540 | 61,977,393 | ||||||

Transatlantic Holdings, Inc. | 1,914,600 | 97,299,972 | ||||||

| 159,277,365 | ||||||||

MATERIALS — 6.21% | ||||||||

CHEMICALS — 2.28% | ||||||||

Monsanto Co. | 1,923,600 | 92,198,148 | ||||||

METALS & MINING — 3.93% | ||||||||

Tokyo Steel Mfg. | 7,435,600 | 87,734,379 | ||||||

United States Steel Corp. | 1,636,100 | 71,726,624 | ||||||

| 251,659,151 | ||||||||

MEDIA — 4.26% | ||||||||

MEDIA — 4.26% | ||||||||

Comcast Corp. | 6,792,675 | 115,543,402 | ||||||

Dish Network Corp. | 2,983,838 | 57,170,336 | ||||||

| 172,713,738 | ||||||||

Certified Annual Report 11

| SCHEDULE OF INVESTMENTS, CONTINUED | ||

| Thornburg Value Fund | September 30, 2010 | |

| Shares/ Principal Amount | Value | |||||||

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES — 13.21% | ||||||||

BIOTECHNOLOGY — 6.36% | ||||||||

b Actelion Ltd. | 1,080,600 | $ | 43,294,380 | |||||

b Gilead Sciences, Inc. | 4,797,905 | 170,853,397 | ||||||

b Talecris Biotherapeutics Holdings Corp. | 1,920,400 | 43,938,752 | ||||||

LIFE SCIENCES TOOLS & SERVICES — 2.07% | ||||||||

b Thermo Fisher Scientific, Inc. | 1,754,365 | 83,998,996 | ||||||

PHARMACEUTICALS — 4.78% | ||||||||

Eli Lilly & Co. | 3,167,730 | 115,717,177 | ||||||

Roche Holdings AG | 570,800 | 77,953,859 | ||||||

| 535,756,561 | ||||||||

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT — 2.64% | ||||||||

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT — 2.64% | ||||||||

b MEMC Electronic Materials, Inc. | 6,469,851 | 77,120,624 | ||||||

b ON Semiconductor Corp. | 4,126,527 | 29,752,260 | ||||||

| 106,872,884 | ||||||||

SOFTWARE & SERVICES — 15.49% | ||||||||

INFORMATION TECHNOLOGY SERVICES — 7.92% | ||||||||

b Amdocs Ltd. | 3,023,348 | 86,649,154 | ||||||

Computer Sciences Corp. | 1,981,218 | 91,136,028 | ||||||

b Fiserv, Inc. | 2,663,570 | 143,353,337 | ||||||

INTERNET SOFTWARE & SERVICES — 3.31% | ||||||||

b Google, Inc. | 255,554 | 134,367,738 | ||||||

SOFTWARE — 4.26% | ||||||||

b Adobe Systems, Inc. | 2,447,400 | 63,999,510 | ||||||

b ANSYS, Inc. | 993,025 | 41,955,306 | ||||||

Microsoft Corp. | 2,722,100 | 66,664,229 | ||||||

| 628,125,302 | ||||||||

TECHNOLOGY HARDWARE & EQUIPMENT — 5.65% | ||||||||

COMPUTERS & PERIPHERALS — 4.91% | ||||||||

b Dell, Inc. | 11,801,700 | 152,950,032 | ||||||

b NCR Corp. | 3,368,100 | 45,907,203 | ||||||

ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS — 0.74% | ||||||||

Corning, Inc. | 1,650,735 | 30,175,436 | ||||||

| 229,032,671 | ||||||||

TELECOMMUNICATION SERVICES — 3.44% | ||||||||

DIVERSIFIED TELECOMMUNICATION SERVICES — 0.92% | ||||||||

b Level 3 Communications, Inc. | 39,653,356 | 37,167,091 | ||||||

WIRELESS TELECOMMUNICATION SERVICES — 2.52% | ||||||||

China Mobile Ltd. | 8,188,500 | 83,902,350 | ||||||

b Leap Wireless International, Inc. | 1,498,818 | 18,510,402 | ||||||

| 139,579,843 | ||||||||

TOTAL COMMON STOCK (Cost $4,029,042,909) | 3,908,867,575 | |||||||

12 Certified Annual Report

| SCHEDULE OF INVESTMENTS, CONTINUED | ||

| Thornburg Value Fund | September 30, 2010 | |

| Shares/ Principal Amount | Value | |||||||

PREFERRED STOCK — 0.68% | ||||||||

BANKS — 0.68% | ||||||||

COMMERCIAL BANKS — 0.68% | ||||||||

a,b Sterling Financial Corp. Pfd, 0.00% | 300,000 | $ | 27,600,000 | |||||

TOTAL PREFERRED STOCK (Cost $27,600,000) | 27,600,000 | |||||||

CORPORATE BONDS — 1.19% | ||||||||

TELECOMMUNICATION SERVICES — 1.19% | ||||||||

DIVERSIFIED TELECOMMUNICATION SERVICES — 1.19% | ||||||||

Level 3 Financing, Inc., 9.25%, 11/1/2014 | $ | 51,489,000 | 48,399,660 | |||||

TOTAL CORPORATE BONDS (Cost $44,632,016) | 48,399,660 | |||||||

CONVERTIBLE BONDS — 1.04% | ||||||||

MATERIALS — 0.73% | ||||||||

METALS & MINING — 0.73% | ||||||||

c Anglogold Holdings Ltd., 3.50%, 5/22/2014 | 25,000,000 | 29,618,750 | ||||||

| 29,618,750 | ||||||||

TELECOMMUNICATION SERVICES — 0.31% | ||||||||

DIVERSIFIED TELECOMMUNICATION SERVICES — 0.31% | ||||||||

Level 3 Communications, Inc., 6.50%, 10/1/2016 | 12,049,000 | 12,320,102 | ||||||

TOTAL CONVERTIBLE BONDS (Cost $37,044,212) | 41,938,852 | |||||||

SHORT TERM INVESTMENTS — 1.16% | ||||||||

Atmos Energy Corp., 0.29%, 10/1/2010 | 47,000,000 | 47,000,000 | ||||||

TOTAL SHORT TERM INVESTMENTS (Cost $47,000,000) | 47,000,000 | |||||||

TOTAL INVESTMENTS — 100.48% (Cost $4,185,319,137) | $ | 4,073,806,087 | ||||||

LIABILITIES NET OF OTHER ASSETS — (0.48)% | (19,444,232 | ) | ||||||

NET ASSETS — 100.00% | $ | 4,054,361,855 | ||||||

Footnote Legend

| a | Security currently fair valued by the valuation and pricing committee using procedures approved by the Trustees. |

| b | Non-income producing. |

| c | Securities exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities may only be resold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. As of September 30, 2010, the aggregate value of these securities in the Fund’s portfolio was $29,618,750, representing 0.73% of the Fund’s net assets. |

Portfolio Abbreviations

To simplify the listings of securities, abbreviations are used per the table below:

| ADR | American Depository Receipt | |

| Pfd | Preferred Stock |

See notes to financial statements.

Certified Annual Report 13

| STATEMENT OF ASSETS AND LIABILITIES | ||

| Thornburg Value Fund | September 30, 2010 | |

ASSETS | ||||

Investments at value (cost $4,185,319,137) (Note 2) | $ | 4,073,806,087 | ||

Cash | 724,816 | |||

Receivable for fund shares sold | 9,329,094 | |||

Dividends receivable | 5,967,596 | |||

Dividend and interest reclaim receivable | 636,965 | |||

Interest receivable | 2,321,944 | |||

Prepaid expenses and other assets | 65,023 | |||

Total Assets | 4,092,851,525 | |||

LIABILITIES | ||||

Payable for securities purchased | 935,124 | |||

Payable for fund shares redeemed | 17,075,569 | |||

Unrealized depreciation on forward currency contracts (Note 7) | 15,756,867 | |||

Payable to investment advisor and other affiliates (Note 3) | 3,087,374 | |||

Accounts payable and accrued expenses | 1,616,474 | |||

Dividends payable | 18,262 | |||

Total Liabilities | 38,489,670 | |||

NET ASSETS | $ | 4,054,361,855 | ||

NET ASSETS CONSIST OF: | ||||

Undistributed net investment income | $ | 1,815,153 | ||

Net unrealized depreciation on investments | (127,194,751 | ) | ||

Accumulated net realized gain (loss) | (775,813,245 | ) | ||

Net capital paid in on shares of beneficial interest | 4,955,554,698 | |||

| $ | 4,054,361,855 | |||

14 Certified Annual Report

| STATEMENT OF ASSETS AND LIABILITIES, CONTINUED | ||

| Thornburg Value Fund | September 30, 2010 | |

NET ASSET VALUE: | ||||

Class A Shares: | ||||

Net asset value and redemption price per share ($1,131,593,792 applicable to 37,176,030 shares of beneficial interest outstanding - - Note 4) | $ | 30.44 | ||

Maximum sales charge, 4.50% of offering price | 1.43 | |||

Maximum offering price per share | $ | 31.87 | ||

Class B Shares: | ||||

Net asset value and offering price per share * ($22,036,462 applicable to 764,827 shares of beneficial interest outstanding - Note 4) | $ | 28.81 | ||

Class C Shares: | ||||

Net asset value and offering price per share * ($329,760,484 applicable to 11,301,772 shares of beneficial interest outstanding - Note 4) | $ | 29.18 | ||

Class I Shares: | ||||

Net asset value, offering and redemption price per share ($2,087,380,037 applicable to 67,449,169 shares of beneficial interest outstanding - Note 4) | $ | 30.95 | ||

Class R3 Shares: | ||||

Net asset value, offering and redemption price per share ($200,362,111 applicable to 6,624,857 shares of beneficial interest outstanding - Note 4) | $ | 30.24 | ||

Class R4 Shares: | ||||

Net asset value, offering and redemption price per share ($54,460,797 applicable to 1,791,881 shares of beneficial interest outstanding - Note 4) | $ | 30.39 | ||

Class R5 Shares: | ||||

Net asset value, offering and redemption price per share ($228,768,172 applicable to 7,399,016 shares of beneficial interest outstanding - Note 4) | $ | 30.92 | ||

| * | Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. |

See notes to financial statements.

Certified Annual Report 15

| STATEMENT OF OPERATIONS | ||

| Thornburg Value Fund | Year Ended September 30, 2010 | |

INVESTMENT INCOME: | ||||

Dividend income (net of foreign taxes withheld of $1,135,337) | $ | 61,950,591 | ||

Interest income (net of premium amortized of $20,037) | 14,601,399 | |||

Total Income | 76,551,990 | |||

EXPENSES: | ||||

Investment advisory fees (Note 3) | 29,279,476 | |||

Administration fees (Note 3) | ||||

Class A Shares | 1,547,184 | |||

Class B Shares | 36,605 | |||

Class C Shares | 447,041 | |||

Class I Shares | 940,989 | |||

Class R3 Shares | 235,693 | |||

Class R4 Shares | 73,248 | |||

Class R5 Shares | 106,767 | |||

Distribution and service fees (Note 3) | ||||

Class A Shares | 3,088,219 | |||

Class B Shares | 292,332 | |||

Class C Shares | 3,576,325 | |||

Class R3 Shares | 942,508 | |||

Class R4 Shares | 146,393 | |||

Transfer agent fees | ||||

Class A Shares | 2,011,115 | |||

Class B Shares | 66,475 | |||

Class C Shares | 561,408 | |||

Class I Shares | 2,038,020 | |||

Class R3 Shares | 467,713 | |||

Class R4 Shares | 177,728 | |||

Class R5 Shares | 619,266 | |||

Registration and filing fees | ||||

Class A Shares | 47,820 | |||

Class B Shares | 16,977 | |||

Class C Shares | 21,689 | |||

Class I Shares | 140,496 | |||

Class R3 Shares | 20,263 | |||

Class R4 Shares | 21,274 | |||

Class R5 Shares | 19,927 | |||

Custodian fees (Note 3) | 550,475 | |||

Professional fees | 132,155 | |||

Accounting fees | 167,260 | |||

Trustee fees | 98,255 | |||

Other expenses | 395,667 | |||

Total Expenses | 48,286,763 | |||

Less: | ||||

Expenses reimbursed by investment advisor (Note 3) | (1,003,299 | ) | ||

Net Expenses | 47,283,464 | |||

Net Investment Income | $ | 29,268,526 | ||

16 Certified Annual Report

| STATEMENT OF OPERATIONS, CONTINUED | ||

| Thornburg Value Fund | Year Ended September 30, 2010 | |

REALIZED AND UNREALIZED GAIN (LOSS) | ||||

Net realized gain (loss) from: | ||||

Investments | $ | 399,144,302 | ||

Forward currency contracts (Note 7) | (4,208,059 | ) | ||

Foreign currency transactions | (863,395 | ) | ||

| 394,072,848 | ||||

Net change in unrealized appreciation (depreciation) on: | ||||

Investments | (303,173,201 | ) | ||

Forward currency contracts (Note 7) | (15,756,867 | ) | ||

Foreign currency translations | 53,064 | |||

| (318,877,004 | ) | |||

Net Realized and Unrealized Gain | 75,195,844 | |||

Net Increase in Net Assets Resulting from Operations | $ | 104,464,370 | ||

See notes to financial statements.

Certified Annual Report 17

STATEMENTS OF CHANGES IN NET ASSETS

Thornburg Value Fund

| Year Ended September 30, 2010 | Year Ended September 30, 2009 | |||||||

INCREASE (DECREASE) IN NET ASSETS FROM | ||||||||

OPERATIONS: | ||||||||

Net investment income | $ | 29,268,526 | $ | 45,726,331 | ||||

Net realized gain (loss) on investments, forward currency contracts and foreign currency transactions | 394,072,848 | (886,084,841 | ) | |||||

Increase (Decrease) in unrealized appreciation (depreciation) on investments, forward currency contracts and foreign currency translations | (318,877,004 | ) | 899,659,702 | |||||

Net Increase (Decrease) in Net Assets Resulting from Operations | 104,464,370 | 59,301,192 | ||||||

DIVIDENDS TO SHAREHOLDERS: | ||||||||

From net investment income | ||||||||

Class A Shares | (7,120,379 | ) | (16,118,746 | ) | ||||

Class B Shares | (57,103 | ) | (326,779 | ) | ||||

Class C Shares | (815,194 | ) | (2,935,911 | ) | ||||

Class I Shares | (17,633,649 | ) | (24,133,460 | ) | ||||

Class R3 Shares | (1,025,249 | ) | (2,185,830 | ) | ||||

Class R4 Shares | (339,423 | ) | (535,872 | ) | ||||

Class R5 Shares | (1,893,225 | ) | (2,440,948 | ) | ||||

FUND SHARE TRANSACTIONS (NOTE 4): | ||||||||

Class A Shares | (100,540,665 | ) | 64,047,983 | |||||

Class B Shares | (17,635,969 | ) | (22,207,742 | ) | ||||

Class C Shares | (40,055,751 | ) | (43,229,232 | ) | ||||

Class I Shares | 479,233,524 | (326,092,244 | ) | |||||

Class R3 Shares | 34,129,445 | (5,811,678 | ) | |||||

Class R4 Shares | 10,529,029 | 11,324,512 | ||||||

Class R5 Shares | 60,623,632 | 21,262,560 | ||||||

Net Increase (Decrease) in Net Assets | 501,863,393 | (290,082,195 | ) | |||||

NET ASSETS: | ||||||||

Beginning of Year | 3,552,498,462 | 3,842,580,657 | ||||||

End of Year | $ | 4,054,361,855 | $ | 3,552,498,462 | ||||

Undistributed net investment income | $ | 1,815,153 | $ | 1,871,097 | ||||

See notes to financial statements.

18 Certified Annual Report

| NOTES TO FINANCIAL STATEMENTS | ||

| Thornburg Value Fund | September 30, 2010 | |

NOTE 1 – ORGANIZATION

Thornburg Value Fund, hereinafter referred to as the “Fund,” is a diversified series of Thornburg Investment Trust (the “Trust”). The Trust is organized as a Massachusetts business trust under a Declaration of Trust dated June 3, 1987 and is registered as a diversified, open-end management investment company under the Investment Company Act of 1940, as amended. The Fund is currently one of sixteen separate series of the Trust. Each series is considered to be a separate entity for financial reporting and tax purposes and bears expenses directly attributable to it. The Fund seeks long-term capital appreciation by investing in equity and debt securities of all types. As a secondary objective, the Fund also seeks some current income.

The Fund currently offers seven classes of shares of beneficial interest: Class A, Class B, Class C, Institutional Class (Class I), and Retirement Classes (Class R3, Class R4, and Class R5). Each class of shares of the Fund represents an interest in the same portfolio of investments, except that (i) Class A shares are sold subject to a front-end sales charge collected at the time the shares are purchased and bear a service fee, (ii) Class B shares are sold at net asset value without a sales charge at the time of purchase, but are subject to a contingent deferred sales charge upon redemption and bear both a service fee and distribution fee, (iii) Class C shares are sold at net asset value without a sales charge at the time of purchase, but are subject to a contingent deferred sales charge upon redemption within one year of purchase, and bear both a service fee and a distribution fee, (iv) Class I shares are sold at net asset value without a sales charge at the time of purchase, (v) Class R3 shares are sold at net asset value without a sales charge at the time of purchase, but bear both a service fee and distribution fee, (vi) Class R4 shares are sold at net asset value without a sales charge at the time of purchase, but bear a service fee, (vii) Class R5 shares are sold at net asset value without a sales charge at the time of purchase, and (viii) the respective classes may have different reinvestment privileges and conversion rights. Additionally, the Fund may allocate among its classes certain expenses, to the extent allowable to specific classes, including transfer agent fees, government registration fees, certain printing and postage costs, and administrative and legal expenses. Currently, class specific expenses of the Fund are limited to service and distribution fees, administration fees, and certain registration and transfer agent expenses. Class B shares of the Fund outstanding for eight years will convert to Class A shares of the Fund.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

Significant accounting policies of the Trust are as follows:

Valuation of Investments: Portfolio securities listed or traded on a national securities exchange are valued on the valuation date at the last reported sale price on the exchange that is the primary market for the security. Portfolio securities traded on an exchange for which there has been no sale that day and other equity securities traded in the over-the-counter market are valued at the mean between the last reported bid and asked prices. Portfolio securities reported by NASDAQ are valued at the NASDAQ official closing price. Any foreign security traded on exchanges outside the United States is valued at the price of the security on the exchange that is normally the security’s primary market, as of the close of that exchange preceding the time of the Fund’s valuation.

Debt obligations held by the Fund have a primary market over the counter and are valued by an independent pricing service approved by the Trustees of the Trust. The pricing service ordinarily values debt obligations at quoted bid prices. When quotations are not available, debt obligations held by the Fund are valued at evaluated prices determined by the pricing service using methods which include consideration of yields or prices of debt obligations of comparable quality, type of issue, coupon, maturity and rating, and indications as to value from dealers and general market conditions. Short-term obligations having remaining maturities of 60 days or less are valued at amortized cost, which approximates market value.

Quotations in foreign currencies for foreign portfolio investments are converted to U.S. dollar equivalents using the foreign exchange quotation in effect at the time of valuation.

In any case where the market value of an equity security held by the Fund is not readily available, the Trust’s valuation and pricing committee determines a fair value for the security using procedures approved by the Trustees, which may include the use of a price obtained from an independent pricing service. The pricing service ordinarily values equity securities in these instances using multi-factor models to adjust market prices based upon various inputs, including exchange data, depository receipt prices, futures and index data and other data. A security’s market value is deemed not readily available whenever the exchange or market on which the security is primarily traded is closed for the entire scheduled day of trading. Additionally, a security’s market value may be deemed not readily available under other circumstances identified by the Trustees, including when developments occurring after the most recent close of

Certified Annual Report 19

| NOTES TO FINANCIAL STATEMENTS, CONTINUED | ||

| Thornburg Value Fund | September 30, 2010 | |

the security’s primary exchange or market, but before the most recent close of trading in Fund shares, create a serious question about the reliability of the security’s market value.

In any case where a pricing service fails to provide a price for a debt obligation held by the Fund, the valuation and pricing committee determines a fair value for the debt obligation using procedures approved by the Trustees. Additionally, in any case where management believes that a price provided by a pricing service for a debt obligation held by the Fund may be unreliable, the valuation and pricing committee decides whether or not to use the pricing service’s valuation or to determine a fair value for the debt obligation.

In determining fair value for any portfolio security or other investment, the valuation and pricing committee seeks to determine the amount that an owner of the investment might reasonably expect to receive upon a sale of the investment. However, because fair value prices are estimated prices, the valuation and pricing committee’s determination of fair value for an investment may differ from the value that would be realized by the Fund upon a sale of the investment, and that difference could be material to the Fund’s financial statements. The valuation and pricing committee’s determination of fair value for an investment may also differ from the prices obtained by other persons (including other mutual funds) for the investment.

Valuation Measurements: Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three levels listed below.

Level 1: Quoted prices in active markets for identical investments.

Level 2: Other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment rates, credit risk, etc.).

Level 3: Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments).

The following table displays a summary of the inputs used to value the Fund’s net assets as of September 30, 2010. In any instance when valuation inputs from more than one level are used to determine the fair value of a specific investment, the investment is placed in the level of the table based upon the lowest level input that is significant in determining the fair value of the investment:

| Fair Value Measurements at September 30, 2010 | ||||||||||||||||

| Total | Level 1 | Level 2 | Level 3 | |||||||||||||

Assets | ||||||||||||||||

Investments in Securities* | ||||||||||||||||

Common Stock(a) | $ | 3,908,867,575 | $ | 3,906,467,575 | $ | — | $ | 2,400,000 | ||||||||

Preferred Stock(a) | 27,600,000 | — | — | 27,600,000 | ||||||||||||

Corporate Bonds | 48,399,660 | — | 48,399,660 | — | ||||||||||||

Convertible Bonds | 41,938,852 | — | 41,938,852 | — | ||||||||||||

Short Term Investments | 47,000,000 | — | 47,000,000 | — | ||||||||||||

Total Investments in Securities | $ | 4,073,806,087 | $ | 3,906,467,575 | $ | 137,338,512 | $ | 30,000,000 | ||||||||

Liabilities | ||||||||||||||||

Other Financial Instruments** | ||||||||||||||||

Forward Currency Contracts | $ | (15,756,867 | ) | $ | — | $ | (15,756,867 | ) | $ | — | ||||||

| (a) | Industry classifications for Level 3 valuations consisted of $2,400,000 in Common Stock and $27,600,000 in Preferred Stock, both in Banks at September 30, 2010. |

| * | See Schedule of Investments for a summary of the industry exposure as grouped according to the Global Industry Classification Standard (GICS), which is an industry taxonomy developed by MSCI Barra and Standard & Poor’s (S&P). |

| ** | Other Financial Instruments include investments not reflected in the Schedule of Investments, such as futures, forwards and swap contracts, which are valued at the unrealized appreciation (depreciation) on the investment. |

20 Certified Annual Report

| NOTES TO FINANCIAL STATEMENTS, CONTINUED | ||

| Thornburg Value Fund | September 30, 2010 | |

A rollforward of fair value measurements using significant unobservable inputs (Level 3) for the year ended September 30, 2010, was as follows:

| Beginning Balance 9/30/2009 | Gross Purchases(b) | Gross Sales | Net Realized Gain/(Loss) | Net Unrealized Appreciation/ (Depreciation) | Net Transfers in/(out) of Level 3 | Ending Balance 9/30/2010 | ||||||||||||||||||||||

Investments in Securities(a) | $ | — | $ | 30,000,000 | $ | — | $ | — | $ | — | $ | — | $ | 30,000,000 | ||||||||||||||

| (a) | Level 3 Securities represent 0.74% of Total Net Assets at the year ended September 30, 2010. |

| (b) | Assets valued using Level 3 inputs comprised of purchases of unregistered stock during the year ended September 30, 2010. |

Other Notes: It is the policy of the Fund to recognize significant transfers between Levels 1 and 2 and to disclose those transfers at the last date of the reporting period. The Fund recognized no significant transfers into and out of Levels 1 and 2 during the year ended September 30, 2010.

Foreign Currency Translation: Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against the U.S. dollar on the date of valuation. Purchases and sales of securities and income items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the translation date. When the Fund purchases or sells foreign securities, it will customarily enter into a foreign exchange contract to minimize foreign exchange risk from the trade date to the settlement date of such transactions.

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments.

Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books, and the U.S. dollar equivalent of the amounts actually received or paid.

Net unrealized foreign exchange gains and losses arise from changes in the fair value of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates.

Federal Income Taxes: It is the policy of the Trust to comply with the provisions of the Internal Revenue Code applicable to “regulated investment companies” and to distribute to shareholders substantially all taxable income, including any net realized gain on investments of the Fund. Therefore, no provision for federal income taxes is required.

Management reviews each tax position believed to be material to the preparation of the Fund’s financial statements, to assess if it is more likely than not that the position would be sustained upon examination, based upon the technical merits of the position. As of September 30, 2010, management has not identified any such position for which a liability must be reflected in the Statement of Assets and Liabilities. The Fund’s tax returns remain subject to examination for three years after filing.

When-Issued and Delayed Delivery Transactions: The Fund may engage in when-issued or delayed delivery transactions. To the extent the Fund engages in such transactions, it will do so for the purpose of acquiring portfolio securities consistent with the Fund’s investment objectives and not for the purpose of investment leverage or to speculate on interest rate and/or market changes. At the time the Fund makes a commitment to purchase a security on a when-issued or delayed delivery basis, the Fund will record the transaction and reflect the value in determining its net asset value. When effecting such transactions, assets of an amount sufficient to make payment for the portfolio securities to be purchased will be segregated on the Fund’s records on the trade date. Securities purchased on a when-issued or delayed delivery basis do not earn interest until the settlement date.

Dividends: Dividends, if any, to shareholders are generally paid quarterly and are reinvested in additional shares of the Fund at net asset value per share at the close of business on the dividend payment date or, at the shareholder’s option, paid in cash. Net realized capital gains, to the extent available, will be distributed at least annually. Distributions to shareholders are based on income tax regulations and therefore, their characteristics may differ for financial statement and tax purposes.

Certified Annual Report 21

| NOTES TO FINANCIAL STATEMENTS, CONTINUED | ||

| Thornburg Value Fund | September 30, 2010 | |

General: Securities transactions are accounted for on a trade date basis. Interest income is accrued as earned and dividend income is recorded on the ex-dividend date. Certain income from foreign securities is recognized as soon as information is available to the Fund. Realized gains and losses from the sale of securities are recorded on an identified cost basis. Net investment income (other than class specific expenses) and realized and unrealized gains and losses are allocated daily to each class of shares based upon the relative net asset value of outstanding shares of each class of shares at the beginning of the day (after adjusting for the current share activity of the respective class). Expenses common to all Funds are allocated among the Funds comprising the Trust based upon their relative net asset values or other appropriate allocation methods.

Guarantees and Indemnifications: Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business the Trust enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown. However, based on experience, the Trust expects the risk of loss to be remote.

Use of Estimates: The preparation of financial statements, in conformity with generally accepted accounting principles, requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

NOTE 3 – INVESTMENT ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

Pursuant to an investment advisory agreement, Thornburg Investment Management, Inc. (the “Advisor”) serves as the investment advisor and performs services to the Fund for which the fees are payable at the end of each month. For the year ended September 30, 2010, these fees were payable at annual rates ranging from .875 of 1% to .675 of 1% per annum of the average daily net assets of the Fund depending on the Fund’s asset size. The Trust also has entered into administrative services agreements with the Advisor, whereby the Advisor will perform certain administrative services for the shareholders of each class of the Fund’s shares, and for which fees will be payable at an annual rate of up to .125 of 1% per annum of the average daily net assets attributable to each class of shares. For the year ended September 30, 2010, the Advisor contractually reimbursed certain class specific expenses, administrative fees, and distribution fees of $576,336 for Class R3 shares, $138,710 for Class R4 Shares, and $288,253 for Class R5 shares.

The Trust has an underwriting agreement with Thornburg Securities Corporation (the “Distributor,” an affiliate of the Advisor), which acts as the distributor of the Fund’s shares. For the year ended September 30, 2010, the Distributor has advised the Fund that it earned net commissions aggregating $78,214 from the sale of Class A shares, and collected contingent deferred sales charges aggregating $26,809 from redemptions of Class C shares of the Fund.

Pursuant to a service plan under Rule 12b-1 of the Investment Company Act of 1940, the Fund may reimburse to the Advisor an amount not to exceed .25 of 1% per annum of the average daily net assets attributable to each class of shares of the Fund for payments made by the Advisor to securities dealers and other financial institutions to obtain various shareholder and distribution related services. For the year ended September 30, 2010, there were no 12b-1 service plan fees charged for Class I and Class R5 shares. The Advisor may pay out of its own resources additional expenses for distribution of the Fund’s shares.

The Trust has also adopted distribution plans pursuant to Rule 12b-1, applicable only to the Fund’s Class B, Class C, and Class R3 shares, under which the Fund compensates the Distributor for services in promoting the sale of Class B, Class C, and Class R3 shares of the Fund at an annual rate of up to .75 of 1% per annum of the average daily net assets attributable to Class B, Class C, and Class R3 shares. Total fees incurred by the Distributor for each class of shares of the Fund under their respective Service and Distribution Plans for the year ended September 30, 2010, are set forth in the Statement of Operations.

The Trust has an agreement with the custodian bank to indirectly pay a portion of the custodian’s fees through credits earned by the Fund’s cash on deposit with the bank. This deposit agreement is an alternative to overnight investments. Custodial fees have been adjusted to reflect amounts that would have been paid without this agreement, with a corresponding adjustment reflected as fees paid indirectly in the Statement of Operations. For the year ended September 30, 2010, there were no fees paid indirectly.

Certain officers and Trustees of the Trust are also officers and/or directors of the Advisor and Distributor. The compensation of independent Trustees is borne by the Trust.

22 Certified Annual Report

| NOTES TO FINANCIAL STATEMENTS, CONTINUED | ||

| Thornburg Value Fund | September 30, 2010 | |

NOTE 4 – SHARES OF BENEFICIAL INTEREST

At September 30, 2010, there were an unlimited number of shares of beneficial interest authorized. Transactions in shares of beneficial interest were as follows:

| Year Ended September 30, 2010 | Year Ended September 30, 2009 | |||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||

Class A Shares | ||||||||||||||||

Shares sold | 8,919,655 | $ | 275,295,386 | 21,996,783 | $ | 495,137,300 | ||||||||||

Shares issued to shareholders in reinvestment of dividends | 185,067 | 5,782,360 | 526,363 | 12,590,999 | ||||||||||||

Shares repurchased | (12,535,727 | ) | (381,632,085 | ) | (20,767,504 | ) | (443,715,236 | ) | ||||||||

Redemption fees received* | — | 13,674 | — | 34,920 | ||||||||||||

Net Increase (Decrease) | (3,431,005 | ) | $ | (100,540,665 | ) | 1,755,642 | $ | 64,047,983 | ||||||||

Class B Shares | ||||||||||||||||

Shares sold | 33,963 | $ | 1,007,852 | 123,500 | $ | 2,607,505 | ||||||||||

Shares issued to shareholders in reinvestment of dividends | 1,560 | 46,442 | 12,305 | 270,413 | ||||||||||||

Shares repurchased | (640,143 | ) | (18,690,579 | ) | (1,177,554 | ) | (25,087,288 | ) | ||||||||

Redemption fees received* | — | 316 | — | 1,628 | ||||||||||||

Net Increase (Decrease) | (604,620 | ) | $ | (17,635,969 | ) | (1,041,749 | ) | $ | (22,207,742 | ) | ||||||

Class C Shares | ||||||||||||||||

Shares sold | 1,160,118 | $ | 34,417,962 | 1,876,368 | $ | 41,683,603 | ||||||||||

Shares issued to shareholders in reinvestment of dividends | 23,192 | 698,534 | 110,865 | 2,523,300 | ||||||||||||

Shares repurchased | (2,561,879 | ) | (75,176,179 | ) | (4,196,286 | ) | (87,447,481 | ) | ||||||||

Redemption fees received* | — | 3,932 | — | 11,346 | ||||||||||||

Net Increase (Decrease) | (1,378,569 | ) | $ | (40,055,751 | ) | (2,209,053 | ) | $ | (43,229,232 | ) | ||||||

Class I Shares | ||||||||||||||||

Shares sold | 33,481,948 | $ | 1,049,288,699 | 22,175,103 | $ | 544,582,100 | ||||||||||

Shares issued to shareholders in reinvestment of dividends | 436,183 | 13,744,602 | 780,762 | 18,926,149 | ||||||||||||

Shares repurchased | (18,718,597 | ) | (583,820,763 | ) | (39,596,078 | ) | (889,646,618 | ) | ||||||||

Redemption fees received* | — | 20,986 | — | 46,125 | ||||||||||||

Net Increase (Decrease) | 15,199,534 | $ | 479,233,524 | (16,640,213 | ) | $ | (326,092,244 | ) | ||||||||

Class R3 Shares | ||||||||||||||||

Shares sold | 3,017,720 | $ | 92,556,011 | 1,686,345 | $ | 39,658,963 | ||||||||||

Shares issued to shareholders in reinvestment of dividends | 31,966 | 989,285 | 89,721 | 2,114,046 | ||||||||||||

Shares repurchased | (1,927,763 | ) | (59,417,965 | ) | (2,071,335 | ) | (47,589,434 | ) | ||||||||

Redemption fees received* | — | 2,114 | — | 4,747 | ||||||||||||

Net Increase (Decrease) | 1,121,923 | $ | 34,129,445 | (295,269 | ) | $ | (5,811,678 | ) | ||||||||

Certified Annual Report 23

| NOTES TO FINANCIAL STATEMENTS, CONTINUED | ||

| Thornburg Value Fund | September 30, 2010 | |

| Year Ended September 30, 2010 | Year Ended September 30, 2009 | |||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||

Class R4 Shares | ||||||||||||||||

Shares sold | 1,194,182 | $ | 37,191,449 | 808,447 | $ | 20,006,549 | ||||||||||

Shares issued to shareholders in reinvestment of dividends | 9,282 | 288,552 | 18,317 | 442,047 | ||||||||||||

Shares repurchased | (898,513 | ) | (26,951,640 | ) | (392,575 | ) | (9,125,077 | ) | ||||||||

Redemption fees received* | — | 668 | — | 993 | ||||||||||||

Net Increase (Decrease) | 304,951 | $ | 10,529,029 | 434,189 | $ | 11,324,512 | ||||||||||

Class R5 Shares | ||||||||||||||||

Shares sold | 3,281,252 | $ | 103,225,130 | 2,235,661 | $ | 55,055,512 | ||||||||||

Shares issued to shareholders in reinvestment of dividends | 59,336 | 1,869,704 | 99,135 | 2,411,510 | ||||||||||||

Shares repurchased | (1,440,353 | ) | (44,473,586 | ) | (1,587,441 | ) | (36,208,743 | ) | ||||||||

Redemption fees received* | — | 2,384 | — | 4,281 | ||||||||||||

Net Increase (Decrease) | 1,900,235 | $ | 60,623,632 | 747,355 | $ | 21,262,560 | ||||||||||

| * | The Fund charges a redemption fee of 1% of the Class A and Class I shares redeemed or exchanged within 30 days of purchase. Redemption fees charged to any class are allocated to all classes upon receipt of payment based on relative net asset values of each class or other appropriate allocation methods. |

NOTE 5 – SECURITIES TRANSACTIONS

For the year ended September 30, 2010, the Fund had purchase and sale transactions of investment securities (excluding short-term investments) of $3,297,887,462 and $2,762,149,653, respectively.

NOTE 6 – INCOME TAXES

At September 30, 2010, information on the tax components of capital is as follows:

Cost of investments for tax purposes | $ | 4,205,776,427 | ||

Gross unrealized appreciation on a tax basis | $ | 273,579,001 | ||

Gross unrealized depreciation on a tax basis | (405,549,341 | ) | ||

Net unrealized appreciation (depreciation) on investments (tax basis) | $ | (131,970,340 | ) | |

Distributable earnings – ordinary income (tax basis) | $ | 1,182,245 |

At September 30, 2010, the Fund had deferred tax basis currency losses occurring subsequent to October 31, 2009 of $840,449. For tax purposes, such losses will be reflected in the year ending September 30, 2011.

24 Certified Annual Report

| NOTES TO FINANCIAL STATEMENTS, CONTINUED | ||

| Thornburg Value Fund | September 30, 2010 | |

At September 30, 2010 the Fund had tax basis capital losses, which may be carried forward to offset future capital gains. To the extent such carryforwards are used, capital gain distributions may be reduced to the extent provided by regulations.

Such capital loss carryforwards expire as follows:

2017 | $ | 527,267,206 | ||

2018 | 242,353,997 | |||

| $ | 769,621,203 | |||

In order to account for permanent book/tax differences, the Fund decreased undistributed net investment income by $17,101 and decreased net realized investment loss by $17,101. This reclassification has no impact on the net asset value of the Fund. Reclassifications result primarily from currency losses and the disposition of a partnership investment.

The tax character of distributions paid during the year ended September 30, 2010, and September 30, 2009, was as follows:

| 2010 | 2009 | |||||||

Distributions from: | ||||||||

Ordinary income | $ | 28,884,222 | $ | 48,677,546 | ||||

Capital gains | — | — | ||||||

Total Distributions | $ | 28,884,222 | $ | 48,677,546 | ||||

NOTE 7 – DERIVATIVE FINANCIAL INSTRUMENTS WITH OFF-BALANCE SHEET RISK AND FOREIGN INVESTMENT RISK

The Fund may use a variety of derivative financial instruments to hedge or adjust the risks affecting its investment portfolio or to enhance investment returns. Provisions of FASB Accounting Standards Codification ASC 815-10-50, (“ASC 815”) require certain disclosures. This requirement amends and expands disclosures related to derivative instruments to provide users of financial statements with an enhanced understanding of the use of derivative instruments by the Fund and how these derivatives affect the financial position, financial performance and cash flows of the Fund. The Fund does not designate any derivative instruments as hedging instruments under ASC 815. During the year ended September 30, 2010, the Fund’s principal exposure to derivative financial instruments of the type addressed by ASC 815 was investment in foreign exchange contracts. A foreign exchange contract is an agreement between two parties to exchange different currencies at a specified rate of exchange at an agreed upon future date. Foreign exchange contracts involve risks to the Fund, including the risk that a contract counterparty will not meet its obligations to the Fund, the risk that a change in a contract’s value may not correlate perfectly with the currency the contract was intended to track, and the risk that the Fund’s advisor is unable to correctly implement its strategy in using a contract. In any such instance, the Fund may not achieve the intended benefit of entering into a contract, and may experience a loss.

The Fund entered into forward currency contracts during the year ended September 30, 2010 in the normal course of pursuing its investment objectives, in anticipation of purchasing foreign investments or with the intent of reducing the risk to the value of the Fund’s foreign investments from adverse changes in the relationship between the U.S. dollar and foreign currencies. In each case these contracts have been initiated in conjunction with foreign investment transactions.

These contracts are accounted for by the Fund under ASC 815. Unrealized gains and unrealized losses on outstanding contracts are reported in the Fund’s Statement of Assets and Liabilities at the Fund’s net equity, as measured by the difference between the forward exchange rates at the reporting date and the forward exchange rates at each contract’s inception date. Net realized gain (loss) on contracts closed during the period, and changes in net unrealized appreciation (depreciation) on outstanding contracts are recognized in the Fund’s Statement of Operations. Values of open currency contracts are indicative of the activity for the year ended September 30, 2010.

Certified Annual Report 25

| NOTES TO FINANCIAL STATEMENTS, CONTINUED | ||

| Thornburg Value Fund | September 30, 2010 | |

The following table displays the outstanding forward currency contracts at September 30, 2010:

Outstanding Forward Currency Contracts

to Buy or Sell at September 30, 2010

Contract Description | Buy/Sell | Contract Amount | Contract Value Date | Value USD | Unrealized Appreciation | Unrealized Depreciation | ||||||||||||||||||

Japanese Yen | Sell | 18,875,000,000 | 11/24/2010 | 226,208,672 | $ | — | $ | (15,312,460 | ) | |||||||||||||||

Japanese Yen | Sell | 3,585,000,000 | 03/02/2011 | 43,026,155 | — | (444,407 | ) | |||||||||||||||||

Total | $ | $ | (15,756,867 | ) | ||||||||||||||||||||

The unrealized appreciation (depreciation) of the outstanding forward currency contracts recognized in the Fund’s Statement of Assets and Liabilities at September 30, 2010 is disclosed in the following table:

Fair Values of Derivative Financial Instruments

at September 30, 2010

Liability Derivatives | Balance Sheet Location | Fair Value | ||||

Foreign exchange contracts | Liabilities - Unrealized depreciation on forward currency contracts | $ | (15,756,867 | ) | ||

The realized gains (losses) from forward currency contracts, and the change in unrealized appreciation (depreciation) of outstanding forward currency contracts recognized in the Fund’s Statement of Operations for the year ended September 30, 2010 are disclosed in the following tables:

Amount of Realized Gain (Loss) on Derivative Financial Instruments

Recognized in Income for the Year Ended September 30, 2010

| Total | Forward Currency Contracts | |||||||

Foreign exchange contracts | $ | (4,208,059 | ) | $ | (4,208,059 | ) | ||

Change in Unrealized Appreciation (Depreciation) of Derivative Financial Instruments

Recognized in Income for the Year Ended September 30, 2010

| Total | Forward Currency Contracts | |||||||

Foreign exchange contracts | $ | (15,756,867 | ) | $ | (15,756,867 | ) | ||

OTHER NOTES

Management has evaluated the impact on the Fund of all subsequent events occurring through the date the financial statements were issued. Effective October 1, 2010, the distribution plan applicable to Class R3 shares of the Fund has been amended by action of the Trustees to reduce the compensation payable under the plan to an annual rate of .25% of 1%.

26 Certified Annual Report

This page intentionally left blank.

Certified Annual Report 27

| FINANCIAL HIGHLIGHTS | ||

| Thornburg Value Fund | ||

| PER SHARE PERFORMANCE (for a share outstanding throughout the period)+ | RATIOS TO AVERAGE NET ASSETS | SUPPLEMENTAL DATA | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unless Otherwise Noted, Periods are Fiscal Years Ended Sept. 30, | Net Asset Value Beginning of Period | Net Investment Income (Loss) | Net Realized & Unrealized Gain (Loss) on Investments | Total from Investment Operations | Dividends from Net Investment Income | Dividends from Net Realized Gains | Total Dividends | Net Asset Value End of Period | Net Investment Income (Loss) (%) | Expenses, After Expense Reductions (%) | Expenses, After Expense Reductions and Net of Custody Credits (%) | Expenses, Before Expense Reductions (%) | Total Return (%)(a) | Portfolio Turnover Rate (%) | Net Assets at End of Period (Thousands) | |||||||||||||||||||||||||||||||||||||||||||||

Class A Shares |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2010(b) | $ | 29.66 | 0.20 | 0.76 | 0.96 | (0.18 | ) | — | (0.18 | ) | $ | 30.44 | 0.65 | 1.31 | 1.31 | 1.31 | 3.21 | 72.75 | $ | 1,131,594 | ||||||||||||||||||||||||||||||||||||||||

2009(b) | $ | 28.02 | 0.37 | 1.67 | 2.04 | (0.40 | ) | — | (0.40 | ) | $ | 29.66 | 1.58 | 1.34 | 1.34 | 1.34 | 7.65 | 83.00 | $ | 1,204,450 | ||||||||||||||||||||||||||||||||||||||||

2008(b) | $ | 44.17 | 0.18 | (12.26 | ) | (12.08 | ) | (0.14 | ) | (3.93 | ) | (4.07 | ) | $ | 28.02 | 0.52 | 1.27 | 1.27 | 1.27 | (29.52 | ) | 70.65 | $ | 1,088,766 | ||||||||||||||||||||||||||||||||||||

2007(b) | $ | 37.59 | 0.29 | 7.86 | 8.15 | (0.27 | ) | (1.30 | ) | (1.57 | ) | $ | 44.17 | 0.70 | 1.27 | 1.27 | 1.27 | 22.23 | 79.29 | $ | 1,599,976 | |||||||||||||||||||||||||||||||||||||||

2006(b) | $ | 32.79 | 0.35 | 4.76 | 5.11 | (0.31 | ) | — | (0.31 | ) | $ | 37.59 | 1.02 | 1.35 | 1.34 | 1.35 | 15.63 | 51.36 | $ | 1,121,720 | ||||||||||||||||||||||||||||||||||||||||

Class B Shares |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2010 | $ | 28.21 | (0.04 | ) | 0.69 | 0.65 | (0.05 | ) | — | (0.05 | ) | $ | 28.81 | (0.13 | ) | 2.18 | 2.18 | 2.18 | 2.29 | 72.75 | $ | 22,036 | ||||||||||||||||||||||||||||||||||||||

2009 | $ | 26.66 | 0.16 | 1.58 | 1.74 | (0.19 | ) | — | (0.19 | ) | $ | 28.21 | 0.74 | 2.22 | 2.22 | 2.22 | 6.72 | 83.00 | $ | 38,630 | ||||||||||||||||||||||||||||||||||||||||

2008 | $ | 42.36 | (0.09 | ) | (11.68 | ) | (11.77 | ) | — | (c) | (3.93 | ) | (3.93 | ) | $ | 26.66 | (0.28 | ) | 2.05 | 2.05 | 2.05 | (30.05 | ) | 70.65 | $ | 64,287 | ||||||||||||||||||||||||||||||||||

2007 | $ | 36.17 | (0.04 | ) | 7.55 | 7.51 | (0.02 | ) | (1.30 | ) | (1.32 | ) | $ | 42.36 | (0.09 | ) | 2.07 | 2.07 | 2.07 | 21.26 | 79.29 | $ | 113,299 | |||||||||||||||||||||||||||||||||||||

2006 | $ | 31.60 | 0.07 | 4.58 | 4.65 | (0.08 | ) | — | (0.08 | ) | $ | 36.17 | 0.21 | 2.15 | 2.14 | 2.15 | 14.71 | 51.36 | $ | 96,587 | ||||||||||||||||||||||||||||||||||||||||

Class C Shares |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2010 | $ | 28.55 | (0.03 | ) | 0.73 | 0.70 | (0.07 | ) | — | (0.07 | ) | $ | 29.18 | (0.09 | ) | 2.06 | 2.06 | 2.06 | 2.43 | 72.75 | $ | 329,761 | ||||||||||||||||||||||||||||||||||||||

2009 | $ | 26.99 | 0.18 | 1.61 | 1.79 | (0.23 | ) | — | (0.23 | ) | $ | 28.55 | 0.81 | 2.12 | 2.12 | 2.12 | 6.83 | 83.00 | $ | 361,966 | ||||||||||||||||||||||||||||||||||||||||

2008 | $ | 42.82 | (0.08 | ) | (11.81 | ) | (11.89 | ) | (0.01 | ) | (3.93 | ) | (3.94 | ) | $ | 26.99 | (0.23 | ) | 2.02 | 2.01 | 2.02 | (30.03 | ) | 70.65 | $ | 401,880 | ||||||||||||||||||||||||||||||||||

2007 | $ | 36.55 | (0.02 | ) | 7.62 | 7.60 | (0.03 | ) | (1.30 | ) | (1.33 | ) | $ | 42.82 | (0.05 | ) | 2.03 | 2.03 | 2.03 | 21.29 | 79.29 | $ | 621,687 | |||||||||||||||||||||||||||||||||||||

2006 | $ | 31.92 | 0.09 | 4.62 | 4.71 | (0.08 | ) | — | (0.08 | ) | $ | 36.55 | 0.27 | 2.09 | 2.09 | 2.09 | 14.77 | 51.36 | $ | 490,399 | ||||||||||||||||||||||||||||||||||||||||

Class I Shares |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2010 | $ | 30.15 | 0.30 | 0.80 | 1.10 | (0.30 | ) | — | (0.30 | ) | $ | 30.95 | 0.97 | 0.94 | 0.94 | 0.94 | 3.62 | 72.75 | $ | 2,087,380 | ||||||||||||||||||||||||||||||||||||||||

2009 | $ | 28.47 | 0.46 | 1.70 | 2.16 | (0.48 | ) | — | (0.48 | ) | $ | 30.15 | 1.94 | 0.98 | 0.97 | 1.00 | 8.04 | 83.00 | $ | 1,575,522 | ||||||||||||||||||||||||||||||||||||||||

2008 | $ | 44.80 | 0.32 | (12.45 | ) | (12.13 | ) | (0.27 | ) | (3.93 | ) | (4.20 | ) | $ | 28.47 | 0.92 | 0.91 | 0.90 | 0.91 | (29.24 | ) | 70.65 | $ | 1,961,495 | ||||||||||||||||||||||||||||||||||||

2007 | $ | 38.11 | 0.44 | 7.96 | 8.40 | (0.41 | ) | (1.30 | ) | (1.71 | ) | $ | 44.80 | 1.05 | 0.93 | 0.92 | 0.93 | 22.62 | 79.29 | $ | 2,401,473 | |||||||||||||||||||||||||||||||||||||||

2006 | $ | 33.23 | 0.50 | 4.82 | 5.32 | (0.44 | ) | — | (0.44 | ) | $ | 38.11 | 1.41 | 0.98 | 0.97 | 0.98 | 16.10 | 51.36 | $ | 1,074,492 | ||||||||||||||||||||||||||||||||||||||||

Class R3 Shares |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2010 | $ | 29.48 | 0.17 | 0.76 | 0.93 | (0.17 | ) | — | (0.17 | ) | $ | 30.24 | 0.57 | 1.35 | 1.35 | 1.66 | 3.14 | 72.75 | $ | 200,362 | ||||||||||||||||||||||||||||||||||||||||

2009 | $ | 27.86 | 0.36 | 1.66 | 2.02 | (0.40 | ) | — | (0.40 | ) | $ | 29.48 | 1.57 | 1.35 | 1.35 | 1.72 | 7.62 | 83.00 | $ | 162,231 | ||||||||||||||||||||||||||||||||||||||||

2008 | $ | 43.94 | 0.17 | (12.19 | ) | (12.02 | ) | (0.13 | ) | (3.93 | ) | (4.06 | ) | $ | 27.86 | 0.50 | 1.35 | 1.35 | 1.66 | (29.54 | ) | 70.65 | $ | 161,517 | ||||||||||||||||||||||||||||||||||||

2007 | $ | 37.43 | 0.26 | 7.81 | 8.07 | (0.26 | ) | (1.30 | ) | (1.56 | ) | $ | 43.94 | 0.63 | 1.35 | 1.35 | 1.63 | 22.11 | 79.29 | $ | 151,260 | |||||||||||||||||||||||||||||||||||||||

2006 | $ | 32.68 | 0.37 | 4.71 | 5.08 | (0.33 | ) | — | (0.33 | ) | $ | 37.43 | 1.05 | 1.36 | 1.35 | 1.69 | 15.60 | 51.36 | $ | 48,627 | ||||||||||||||||||||||||||||||||||||||||

Class R4 Shares |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2010 | $ | 29.62 | 0.19 | 0.78 | 0.97 | (0.20 | ) | — | (0.20 | ) | $ | 30.39 | 0.63 | 1.25 | 1.25 | 1.49 | 3.25 | 72.75 | $ | 54,461 | ||||||||||||||||||||||||||||||||||||||||

2009 | $ | 27.99 | 0.39 | 1.67 | 2.06 | (0.43 | ) | — | (0.43 | ) | $ | 29.62 | 1.65 | 1.25 | 1.25 | 1.54 | 7.74 | 83.00 | $ | 44,037 | ||||||||||||||||||||||||||||||||||||||||

2008 | $ | 44.14 | 0.19 | (12.23 | ) | (12.04 | ) | (0.18 | ) | (3.93 | ) | (4.11 | ) | $ | 27.99 | 0.58 | 1.24 | 1.24 | 1.48 | (29.47 | ) | 70.65 | $ | 29,462 | ||||||||||||||||||||||||||||||||||||

2007(d) | $ | 41.00 | 0.20 | 3.12 | 3.32 | (0.18 | ) | — | (0.18 | ) | $ | 44.14 | 0.70 | (e) | 1.25 | (e) | 1.25 | (e) | 2.34 | (e) | 8.09 | 79.29 | $ | 7,038 | ||||||||||||||||||||||||||||||||||||

Class R5 Shares |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2010 | $ | 30.13 | 0.28 | 0.79 | 1.07 | (0.28 | ) | — | (0.28 | ) | $ | 30.92 | 0.91 | 0.99 | 0.99 | 1.12 | 3.54 | 72.75 | $ | 228,768 | ||||||||||||||||||||||||||||||||||||||||

2009 | $ | 28.45 | 0.46 | 1.71 | 2.17 | (0.49 | ) | — | (0.49 | ) | $ | 30.13 | 1.93 | 0.98 | 0.98 | 1.18 | 8.05 | 83.00 | $ | 165,663 | ||||||||||||||||||||||||||||||||||||||||

2008 | $ | 44.78 | 0.32 | (12.47 | ) | (12.15 | ) | (0.25 | ) | (3.93 | ) | (4.18 | ) | $ | 28.45 | 0.92 | 0.98 | 0.98 | 1.03 | (29.30 | ) | 70.65 | $ | 135,173 | ||||||||||||||||||||||||||||||||||||

2007 | $ | 38.09 | 0.49 | 7.91 | 8.40 | (0.41 | ) | (1.30 | ) | (1.71 | ) | $ | 44.78 | 1.14 | 0.91 | 0.91 | 0.93 | 22.63 | 79.29 | $ | 106,906 | |||||||||||||||||||||||||||||||||||||||

2006 | $ | 33.22 | 0.24 | 5.07 | 5.31 | (0.44 | ) | — | (0.44 | ) | $ | 38.09 | 0.64 | 1.00 | 0.98 | 3.24 | 16.07 | 51.36 | $ | 10,483 | ||||||||||||||||||||||||||||||||||||||||