UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05201

Thornburg Investment Trust

(Exact name of registrant as specified in charter)

c/o Thornburg Investment Management, Inc.

2300 North Ridgetop Road, Santa Fe, New Mexico 87506

(Address of principal executive offices) (Zip code)

Garrett Thornburg, 2300 North Ridgetop Road, Santa Fe, New Mexico 87506

(Name and address of agent for service)

Registrant’s telephone number, including area code: 505-984-0200

Date of fiscal year end: September 30, 2012

Date of reporting period: September 30, 2012

Item 1. Reports to Stockholders

The following annual reports are attached hereto, in order:

Thornburg Limited Term Municipal Fund

Thornburg Intermediate Municipal Fund

Thornburg Strategic Municipal Income Fund

Thornburg California Limited Term Municipal Fund

Thornburg New Mexico Intermediate Municipal Fund

Thornburg New York Intermediate Municipal Fund

Thornburg Limited Term Income Funds

Thornburg Strategic Income Fund

Thornburg Value Fund

Thornburg International Value Fund

Thornburg Core Growth Fund

Thornburg International Growth Fund

Thornburg Investment Income Builder Fund

Thornburg Global Opportunities Fund

Thornburg Developing World Fund

IMPORTANT INFORMATION

The information presented on the following pages is current as of September 30, 2012. The managers’ views, portfolio holdings, and sector diversification are provided for the general information of the Fund’s shareholders; to the extent this information is historical, it should not be considered predictive of future circumstances. This material should not be deemed a recommendation to buy or sell any of the securities mentioned.

Investments in the Fund carry risks, including possible loss of principal. Bond funds have the same interest rate, inflation, and credit risks that are associated with the underlying bonds. The principal value of bonds will fluctuate relative to changes in interest rates, decreasing when interest rates rise. Unlike bonds, bond funds have ongoing fees and expenses. Please see the Fund’s Prospectus for a discussion of the risks associated with an investment in the Fund. Investments in the Fund are not FDIC insured, nor are they deposits of or guaranteed by a bank or any other entity. There is no guarantee that the Fund will meet its investment objectives. The laddering strategy does not assure or guarantee better performance and cannot eliminate the risk of investment losses.

Performance data given at net asset value (NAV) does not take into account applicable sales charges. If the sales charges had been included, the performance would have been lower.

Minimum investments for Class I shares are higher than those for other classes. Class I shares may not be available to all investors.

Share Class | NASDAQ Symbol | CUSIP | ||

Class A | LTMFX | 885-215-459 | ||

Class C | LTMCX | 885-215-442 | ||

Class I | LTMIX | 885-215-434 |

Lipper’s 2012 Best Fixed Income Funds Manager

Thornburg Investment Management ranked #1 out of 41 eligible firms in Lipper, Inc.’s fixed income Large Company Universe for the three-year period ended 11/30/11, based on risk-adjusted returns. Lipper’s Large Company Universe is comprised of fund families with more than $40 billion in total net assets. Only fund families with at least five bond funds were eligible for the fixed income funds manager award. Asset Class Group Awards are given for the three-year period only.

Best Short-Intermediate Municipal Debt Fund

Lipper Classification Awards are granted annually to the fund in each Lipper classification that consistently delivered the strongest risk-adjusted performance (calculated with dividends reinvested). Fund Classification Awards were given for three-year, five-year, and ten-year periods ended 11/30/11. The fund did not win the award for other time periods.

Glossary

Barclays Five-Year Municipal Bond Index – A rules-based, market-value-weighted index of the tax-exempt bond market. To be included in the index, bonds must have a minimum credit rating of Baa. The approximate maturity of the municipal bonds in the index is five years.

BofA Merrill Lynch 1-10 Year U.S. Municipal Securities Index – A subset of the BofA Merrill Lynch U.S. Municipal Securities Index including all securities with a remaining term to final maturity less than 10 years.

Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. Investors may not make direct investments into any index.

Alternative Minimum Tax (AMT) – A federal tax aimed at ensuring that high-income individuals, estates, trusts, and corporations pay a minimal level income tax. For individuals, the AMT is calculated by adding tax preference items to regular taxable income.

Annualized Distribution Yield – The distribution yield reflects actual distributions made to shareholders. The annualized distribution yield is calculated by summing the last 30 days of income at a given month end and annualizing to a 360-day year. The result is divided by the ending maximum offering price.

Basis Point (bps) – A unit equal to 1/100th of 1%. 1% = 100 basis points (bps).

Bond Credit Ratings – A bond credit rating assesses the financial ability of a debt issuer to make timely payments of principal and interest. Ratings of AAA (the highest), AA, A, and BBB are investment-grade quality. Ratings of BB, B, CCC, CC, C, and D (the lowest) are considered below investment grade, speculative grade, or junk bonds. Unless otherwise noted, the ratings listed are from Municipal Market Data and are a combination of ratings from Standard and Poor’s, Moody’s Investors Service, and Fitch Ratings.

Consumer Price Index (CPI) – Index that measures prices of a fixed basket of goods bought by a typical consumer, including food,

transportation, shelter, utilities, clothing, medical care, entertainment and other items. The CPI, published by the Bureau of Labor Statistics in the Department of Labor, is based at 100 in 1982 and is released monthly. It is widely used as a cost-of-living benchmark to adjust Social Security payments and other payment schedules, union contracts and tax brackets. Also known as the cost-of-living index.

Core CPI – Consumer Price Index minus the energy and food components.

Core PCE Price Index – Personal Consumption Expenditures (PCE) prices excluding food and energy.

Duration – A bond’s sensitivity to interest rates. Bonds with longer durations experience greater price volatility than bonds with shorter durations

This page is not part of the Annual Report. 3

IMPORTANT INFORMATION, CONTINUED

Effective Duration – A bond’s sensitivity to interest rates, incorporating the embedded option features, such as call provisions. Bonds with longer durations experience greater price volatility than bonds with shorter durations.

Fed Funds Rate – The interest rate at which a depository institution lends immediately available funds (balances at the Federal Reserve) to another depository institution overnight.

General Obligation Bond – A municipal bond backed by the credit and “taxing power” of the issuing jurisdiction rather than the revenue from a given project.

Gross Domestic Product (GDP) – A country’s income minus foreign investments: the total value of all goods and services produced within a country in a year, minus net income from investments in other countries.

Quantitative Easing – The Federal Reserve’s monetary policy used to stimulate the U.S. economy following the recession that began in 2007/08.

SEC Yield – SEC yield is computed in accordance with SEC standards measuring the net investment income per share over a specified 30-day period expressed as a percentage of the maximum offering price of the Fund’s shares at the end of the period.

4 This page is not part of the Annual Report.

THORNBURG LIMITED TERM MUNICIPAL FUND

At Thornburg, our approach to management of the Fund is based on the premise that investors in the Fund seek preservation of capital along with an attractive, relatively stable yield. While aggressive bond strategies may generate stronger returns when the market is turning a blind eye towards risk, they often fail to stack up over longer periods of time.

We apply time-tested techniques to manage risk and pursue attractive returns. These include:

| • | Building a laddered portfolio. Laddering has been shown over time to mitigate reinvestment and interest rate risk. |

| • | Investing on a cash-only basis without using leverage. While leveraged strategies may enhance returns when market conditions are favorable, they can quickly compound losses when sentiment shifts. |

| • | Conducting in-depth fundamental research on each issue and actively monitoring positions for subsequent credit events. |

| • | Diversifying among a large number of generally high-quality bonds. |

Important

Performance Information

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than quoted. For performance current to the most recent month end, visit thornburg. com or call 800.847.0200.

The maximum sales charge for the Fund’s Class A shares is 1.50%. The total annual fund operating expense of Class A shares is 0.74%, as disclosed in the most recent Prospectus.

Average Annual Total Returns For Periods Ended September 30, 2012 | ||||||||||||||||||||

| 1 Yr | 3 Yrs | 5 Yrs | 10 Yrs | Since Inception | ||||||||||||||||

A Shares (Incep: 9/28/84) | ||||||||||||||||||||

Without sales charge | 4.36 | % | 4.16 | % | 4.71 | % | 3.59 | % | 5.49 | % | ||||||||||

With sales charge | 2.79 | % | 3.64 | % | 4.38 | % | 3.44 | % | 5.43 | % | ||||||||||

30-Day Yields, A Shares As of September 30, 2012 | ||

Annualized Distribution Yield | SEC Yield | |

1.87% | 0.73% | |

Key Portfolio Attributes As of September 30, 2012 | ||||

| Number of Bonds | 1,449 | |||

| Effective Duration | 3.3 Yrs | |||

| Average Maturity | 4.0 Yrs | |||

See the entire portfolio in the Schedule of Investments beginning on page 13.

This page is not part of the Annual Report. 5

Thornburg Limited Term Municipal Fund – September 30, 2012

Table of Contents | ||||

| 7 | ||||

| 13 | ||||

| 50 | ||||

| 51 | ||||

| 52 | ||||

| 53 | ||||

| 60 | ||||

| 61 | ||||

| 62 | ||||

| 63 | ||||

| 64 | ||||

| 67 |

This report is certified under the Sarbanes-Oxley Act of 2002, which requires that public companies, including mutual funds, affirm that the information provided in their annual and semiannual shareholder reports fully and fairly represents their financial position.

6 Certified Annual Report

October 13, 2012

Dear Fellow Shareholder:

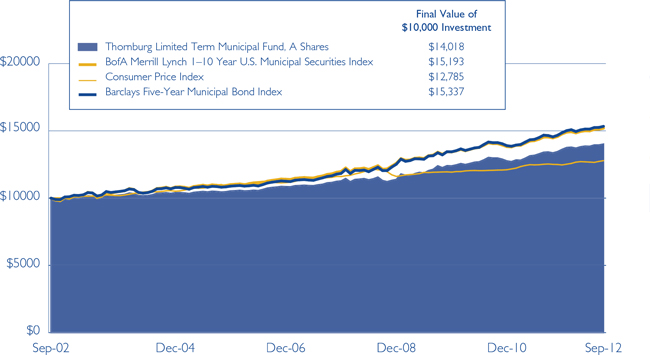

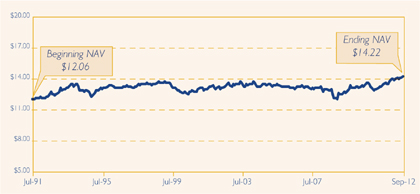

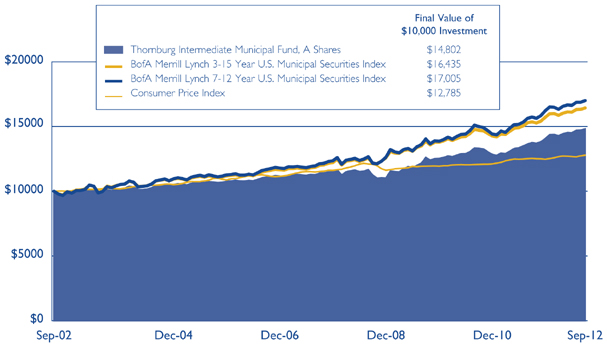

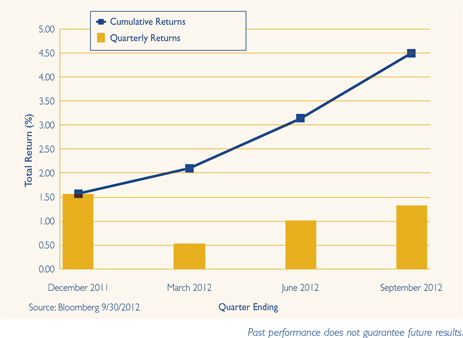

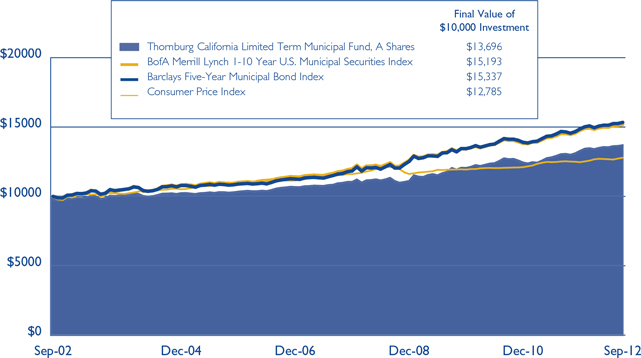

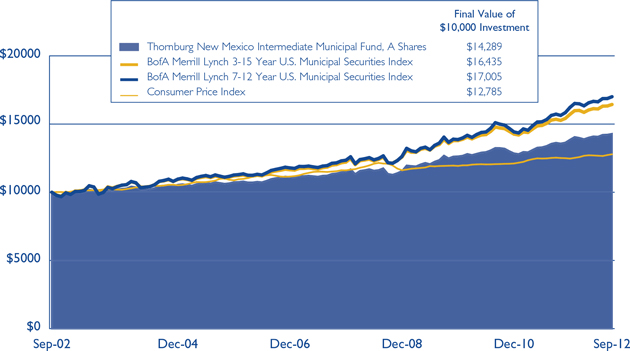

We are pleased to present the annual report for the Thornburg Limited Term Municipal Fund. The net asset value (NAV) of the Class A shares increased by 31 cents to $14.70 per share during the fiscal year ended September 30, 2012. If you were with us for the entire period, you received dividends of 31.1 cents per share. If you reinvested your dividends, you received 31.4 cents per share. Dividends per share were lower for Class C shares and higher for Class I shares to account for varying class-specific expenses. The Class A shares of your Fund slightly underperformed the index with a total return of 4.36% at NAV for the fiscal year ended

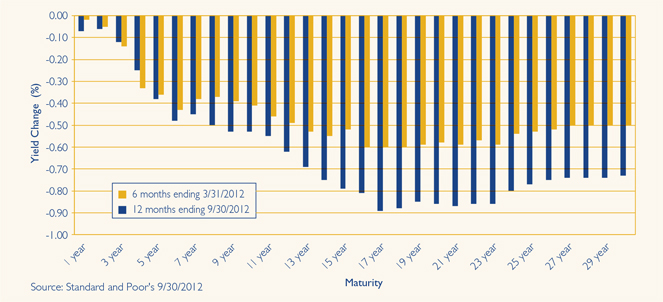

September 30, 2012, versus 4.50% for the BofA Merrill Lynch 1–10 Year U.S. Municipal Securities Index. The Fund generated 2.04% more price appreciation, but 2.18% less income.

The market’s positive returns were primarily due to declining interest rates and narrowing credit spreads. Interest rates declined more for longer maturities; consequently longer-maturity bonds outperformed shorter-maturity bonds. As credit spreads compressed, lower-quality bonds outperformed higher-quality bonds. The Fund’s additional price appreciation is due to several factors. Our interest rate sensitivity as measured by the Fund’s duration and differing allocations along the yield curve subtracted 0.26% of relative price appreciation. Our overweight to the insured and revenue sectors subtracted 0.13%. We underweighted the general obligation and pre-refunded sectors, which added 0.79% of relative price performance. Our overweight to lower credit quality securities added 0.68% of performance relative to the benchmark. Other risk factors accounted for another 0.96%.

The Economy and the Federal Reserve

During the first quarter of the fiscal year, economic activity appeared to be picking up; the December 2011 gross domestic product (GDP) reading was a strong 4.1%. The acceleration in activity proved to be an illusion as the March and June 2012 GDP readings were 2.0% and 1.3%, respectively. Non-farm payrolls continued to grow but at rather anemic rates. The unemployment rate began the fiscal year at 9.0% and decreased to 7.8% by the end of the fiscal year. Inflation, as measured by the Consumer Price Index (CPI), is running in the 2.0% range. If one subtracts the food and energy components to arrive at core CPI, the last reading was likewise at 2.0%. But given higher readings earlier in the year, the trend shows a decline. Inflation as measured by the Personal Consumption Expenditure Index (PCE), the Federal Reserve Board’s (the Fed) favored inflation measure, is running at a core level of 1.6%. All of these economic indicators and others point to an economy on shaky footing.

In addition to these fundamental factors, many investors are concerned about the impact of the so-called “fiscal cliff”, which The Washington Post referred to as follows:

The “ fiscal cliff” is a term coined by Federal Reserve Chairman Ben S. Bernanke. It refers to a collection of changes in current law that are all set to strike in January, triggering the sharpest reduction in the federal budget deficit in more than 40 years.

Certified Annual Report 7

| LETTER TO SHAREHOLDERS, | ||

CONTINUED | ||

The Post goes on to say that taxes would also increase:

For most taxpayers, the bulk of the increase would be triggered by the expiration of tax cuts enacted in 2001 and 2003 during the George W. Bush administration. The expiration of President Obama’s payroll tax holiday, which shaved two percentage points off the 6.2 percent Social Security tax, comes in a close second. If these issues are not addressed many analysts think the United States will be pushed into another recession.

On top of all this, Europe is still a mess, but the fixed income markets seem not to be as headline sensitive to news coming out of Europe as they were last year. The Fed, at its last meeting decided to enter into its third round of quantitative easing – QE3. In this round, the Fed will concentrate its security purchases to the mortgage market in an effort to lower borrowing costs for homebuyers, which should spur the housing market. As anyone who has recently applied for a mortgage knows, it is not the interest cost of the product that stands as a borrower’s major roadblock. The fixed income markets’ initial reaction to the latest Fed move was an increase in inflation expectations and a decrease in bond prices, though this fear has subsided in recent weeks.

The Presidential Election and Tax Policy

Tax policy and the federal deficit have proven to be key election season issues. Both candidates have put forward their respective plans for deficit reduction; both could influence the municipal bond market. Table I shows a side-by-side analysis based on a recent article in The Bond Buyer, a leading publication on the municipal bond market.

Table I | ||

| Obama | Romney | |

| Extends the 2001 and 2003 tax cuts for individuals earning under $200,000 and families earning under $250,000. | Permanently extend all the 2001 and 2003 tax cuts. Eliminate taxation of investment income for individuals earning less than $200,000. | |

| Returns to the Clinton Era highest marginal tax rate of 39.6% . | Lowers marginal rates across the board by 20%, eliminates the alternative minimum tax. | |

| In a jobs bill he floated last October and his 2013 budget, Obama proposed to place a 28% cap on the value of tax-exempt interest for the wealthy. | Announced he would cap individual tax deductions at $17,000. Not clear if he would cap exclusions, like tax exemption, as well as deductions. | |

| Bruce Bartlett, former policy adviser to President Ronald Reagan and Treasury official under President George H. W. Bush, said without a doubt Obama’s tax proposals would be more beneficial to the municipal market primarily because he wants to impose higher tax rates on the wealthy, which would make tax-exempt bonds more attractive. | While Romney has not specifically mentioned capping tax exemption, in a Wall Street Journal editorial in August, Glenn Hubbard, his senior economic adviser, said the exclusion of interest on tax-exempt municipal bonds is “on the table” for the Republican candidate. | |

8 Certified Annual Report

One can see that both candidates’ potential tax policies, as known today, could influence the municipal bond market. However, as with most election rhetoric, the eventual legislation may look nothing like the campaign proposals. There are two things that people should never watch being made, sausage and legislation!

The Municipal Market

The demand picture in the municipal market improved during the fiscal year. Investors poured $56 billion into municipal bond mutual funds over the last 12 months. The total assets in municipal bond mutual funds were $562 billion, according to the Investment Company Institute, a mutual fund industry advocacy group. Assets in municipal bond mutual funds on November 30, 2010, just before the six-month period of investor exodus, were $497 billion. On the other side of the ledger, the supply picture improved. The supply of new-issue municipal bonds was $379 billion for the 12 months ended September 30, 2012. This exceeded the $329 billion for the 12 months ending September 30, 2011 by $50 billion – or a 15% increase.

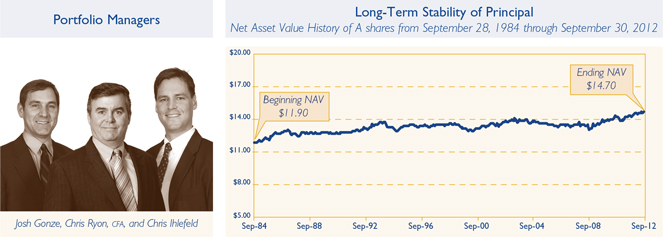

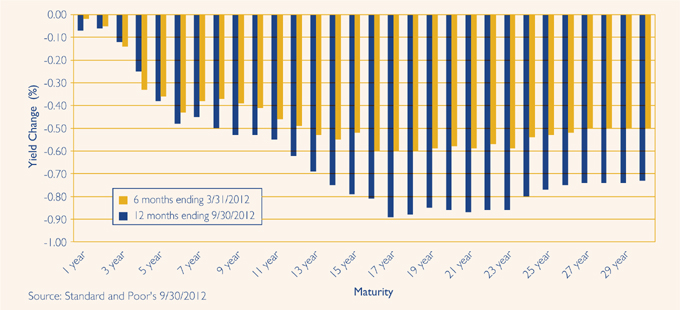

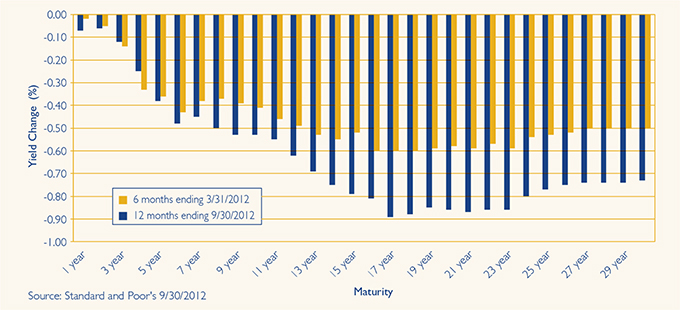

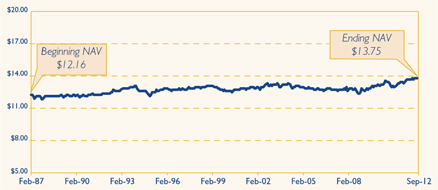

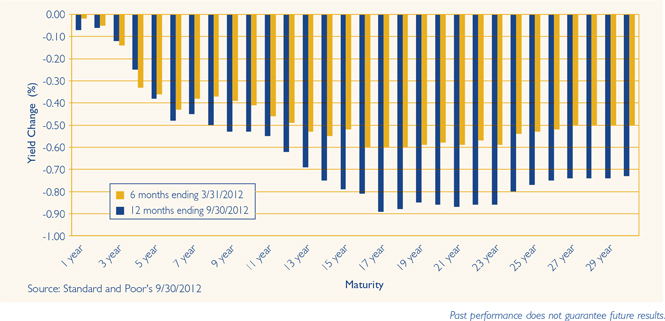

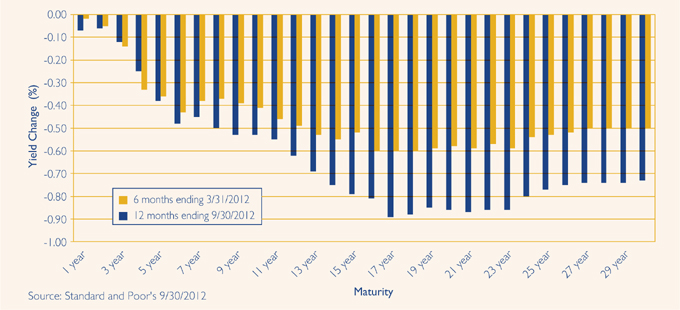

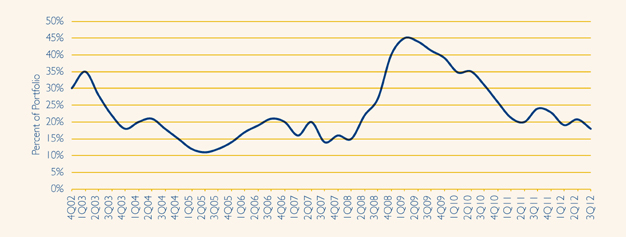

The trend towards lower interest rates continued throughout this fiscal year. With short-term yields anchored near zero, investors moved out along the yield curve in search of more income. This caused long-term maturities to decrease in yield much more than short-term maturities. The average change in yield for the Thornburg Limited Term Municipal Fund’s investment universe (1–10 years) as measured by the average change in yield of a AAA general obligation bond was 0.05% for the first half of the fiscal year. In the second half of the fiscal year, the same measure of average yield change decreased 0.29%. See Graph I.

Investors, again in a search for income, have been willing to pay much more for lower quality securities than any time since 2008. This caused quality spreads to narrow and lower-quality securities to out-perform higher-quality securities. On December 30, 2011, the incremental yield an investor gained for buying a BBB security

Graph I: AAA General Obligation Municipal Yield Changes for 9/30/2011 Through 9/30/2012

Past performance does not guarantee future results.

Certified Annual Report 9

| LETTER TO SHAREHOLDERS, | ||

CONTINUED | ||

Past performance does not guarantee future results.

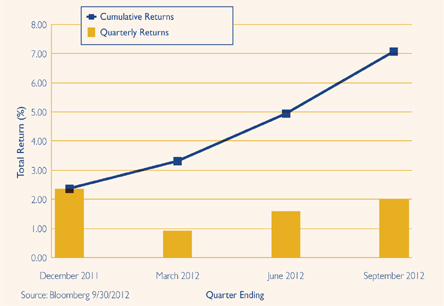

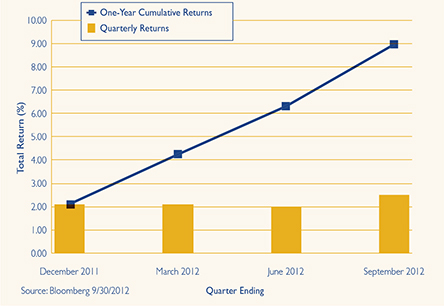

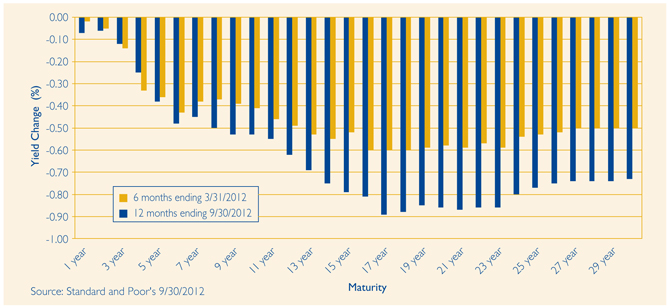

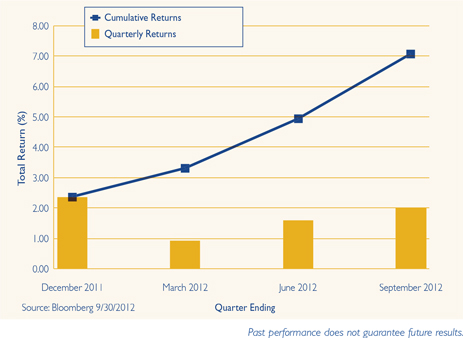

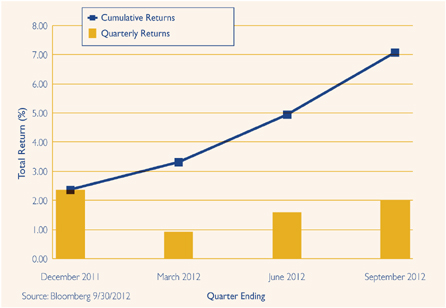

versus a AAA security with a five-year maturity was 2.48%. On September 30, 2012, that incremental yield equaled 1.63%, a 0.85% decrease. Graph II shows the quarter-by-quarter and cumulative total return performance of the BofA Merrill Lynch 1–10 Year U.S. Municipal Securities Index for the fiscal year.

The credit picture in the municipal market is still mixed. At the state level, revenues continue to increase. At the local level, which has a heavy reliance on real estate taxes, the continued decline of assessed values has put pressure on local finances. Pension funding levels continue to decline due to poor investment returns and cutbacks in the annual pension contributions. Several state and local pension plans, recognizing the unsustainability of this condition, have begun to reform their pension systems, calling for higher participant contributions, higher retirement ages, or both. These and other measures have caused us to forsake investments in the state of Illinois and Puerto Rico general obligation debt.

In the last semi-annual letter to shareholders, we noted the risks of rising interest rates. As bond portfolio managers, we are always worried. If bonds are doing well, the economy is probably doing poorly, and we worry. If the economy is doing well, we worry because yields are probably rising and bond prices are declining. Such is the life we have chosen!

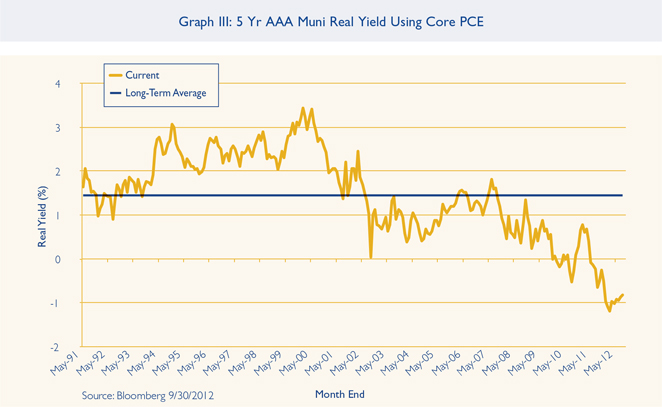

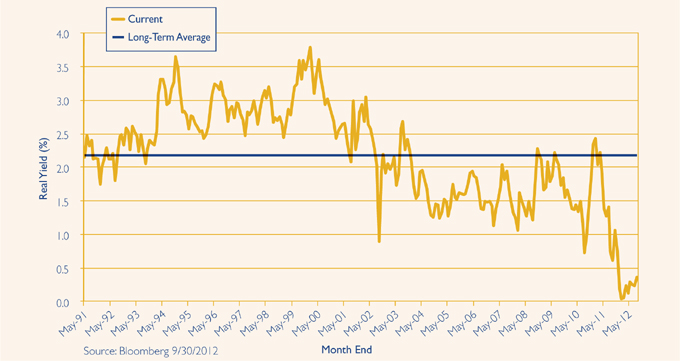

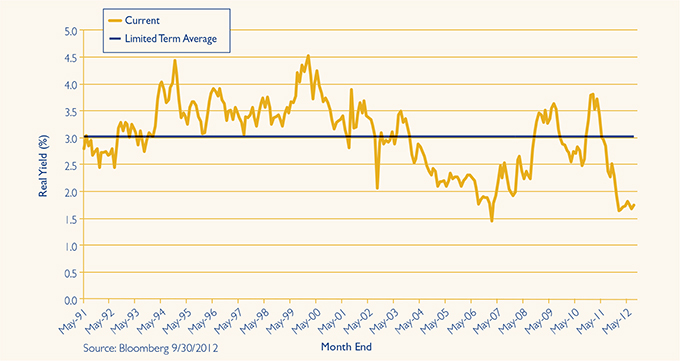

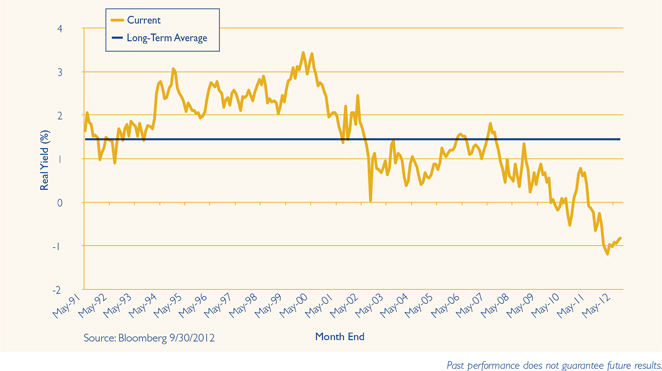

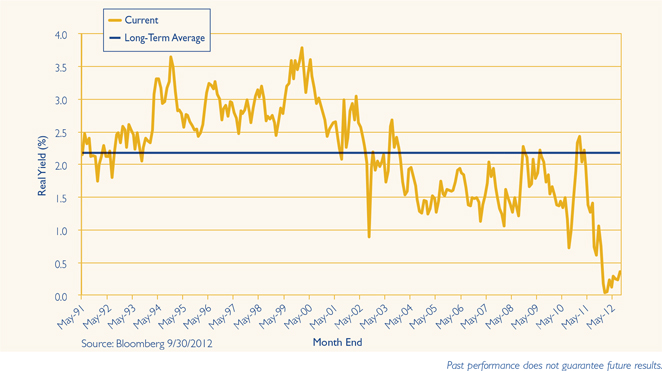

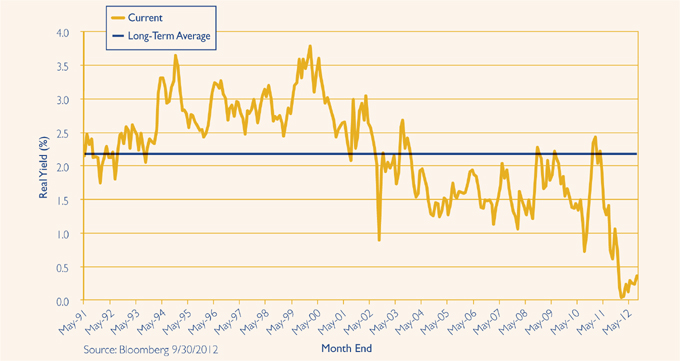

The level of real yields (yield less inflation) is a measure of value for fixed income products. Real yield levels are at record lows across all fixed income products. Relative to other fixed income products, municipal bonds appear to be attractive. Graph III illustrates this measure.

The Federal Reserve tends to favor an inflation measure known as the PCE Index, and we adopt that measure in our yield calculations here. Real yield levels for a five-year AAA general obligation municipal bond using core PCE as an inflation measure are negative and at 20-year lows, so we worry. At the same time, we are reminded of a famous quote by John Maynard Keynes, “The market can stay irrational longer than you can

10 Certified Annual Report

Past performance does not guarantee future results.

stay solvent.” Solvency is not an issue, of course, but Graph III would suggest rationality is. This state of affairs can continue for some time, but it is still a risk. The long-term average real yield for a five-year AAA municipal general obligation bond is 1.45%, meaning that since May 1991, investors have demanded 1.45% above the core PCE inflation rate to invest in five-year AAA general obligation bonds. The current yield on a five-year AAA municipal general obligation bond is 0.62%. If this relationship were return to the average long-term real yield level, one of three things would have to happen. First, five-year interest rates would need to increase about 2.50%. Second, inflation would need to decrease by about 2.50%. Neither of these two outcomes would be pleas-ant. Third, some combination of the two prior outcomes could occur, which also promises to be unpleasant. Investors should use this information to recognize the risk inherent in fixed income products at these historically low yield levels. They should take this opportunity to review their portfolios and determine whether their portfolios are properly diversified. In addition, they should ask themselves if they have an appropriate time horizon in mind for their investments. We suggest two to three years from the point that question is asked.

Certified Annual Report 11

| LETTER TO SHAREHOLDERS, | ||

CONTINUED | ||

Conclusion

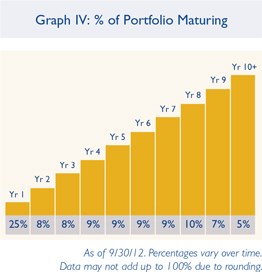

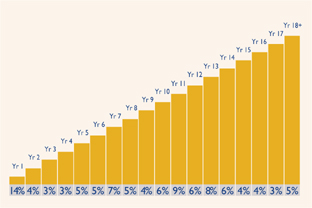

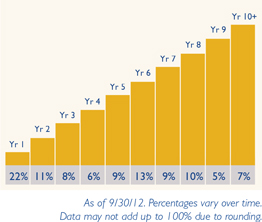

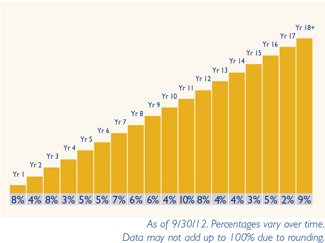

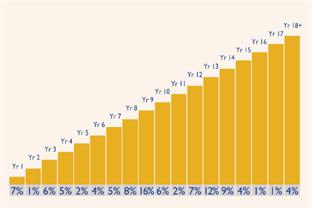

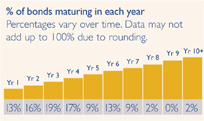

Your Thornburg Limited Term Municipal Fund currently consists of a laddered portfolio structure of over 1,440 securities. We ladder our core portfolios because we believe this structure has the potential to maximize an investor’s income. In fact, in an internal study of portfolio structures (using indices as proxies for portfolios) extending back to 1997, a hypothetical laddered portfolio structure outperformed bullet and barbell structures approximately 2/3 of the time (for a copy of the study, go to www.thornburg.com/whyladder). Past performance does not guarantee future results, of course. The laddered structure manages a portfolio’s yield curve exposure with a roughly equal weighting of each maturity, thereby mitigating a major risk factor. Graph I illustrates that yield changes are not uniform across the Limited Term Municipal Fund’s investment universe. Laddering also reduces reinvestment risk by ensuring that a portion of the portfolio matures each year, so it can be reinvested. Graph IV describes the percentages of your Fund’s bond port-folio maturing in each of the coming years. We thank you for the trust you have placed with us and will continue to keep that foremost in our minds.

Sincerely,

|

|

| ||

| Christopher Ihlefeld | Christopher Ryon, CFA | Josh Gonze | ||

| Portfolio Manager | Portfolio Manager | Portfolio Manager | ||

| Managing Director | Managing Director | Managing Director |

The matters discussed in this report may constitute forward-looking statements made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995. These include any advisor or portfolio manager prediction, assessment, analysis or outlook for individual securities, industries, investment styles, market sectors and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for each fund in its current prospectus, other factors bearing on these reports include the accuracy of the advisor’s or portfolio manager’s forecasts and predictions, the appropriateness of the investment strategies designed by the advisor or portfolio manager and the ability of the advisor or portfolio manager to implement their strategies efficiently and successfully. Any one or more of these factors, as well as other risks affecting the securities markets generally, could cause the actual results of any fund to differ materially as compared to its benchmarks.

12 Certified Annual Report

| SCHEDULE OF INVESTMENTS | ||

| Thornburg Limited Term Municipal Fund | September 30, 2012 | |

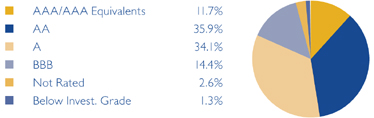

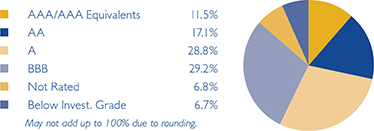

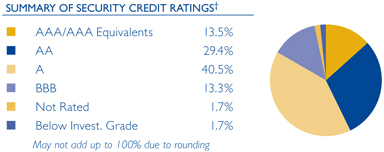

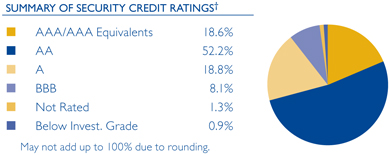

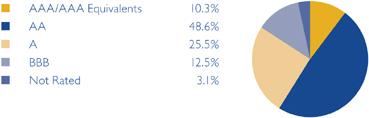

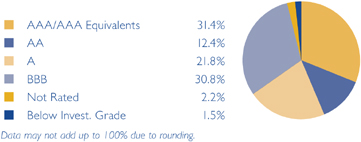

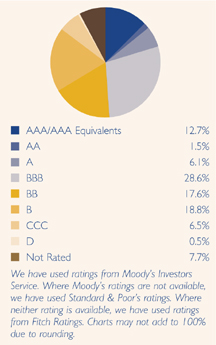

We have used ratings from Standard & Poor’s (S&P). Where S&P ratings are not available, we have used Moody’s Investors Service. Where neither rating is available, we have used ratings from Fitch Ratings. The category of investments identified as “AAA” in this graph includes investments which are pre-refunded or escrowed to maturity. Such investments are backed by an escrow or trust containing sufficient U.S. Government or U.S. Government agency securities to satisfy the timely payment of principal and interest and, therefore, are normally deemed to be equivalent to AAA-rated securities.

Issuer-Description | Credit Rating† S&P/ Moody’s | Principal Amount | Value | |||||||||

ALABAMA — 1.55% | ||||||||||||

Alabama Public School and College Authority, 5.00% due 5/1/2013 (Education System Capital Improvements) | AA/Aa1 | $ | 5,000,000 | $ | 5,139,800 | |||||||

Alabama Public School and College Authority, 5.00% due 5/1/2015 (Education System Capital Improvements) | NR/Aa1 | 8,530,000 | 9,514,789 | |||||||||

Alabama Public School and College Authority, 5.00% due 5/1/2016 (Education System Capital Improvements) | AA/Aa1 | 5,000,000 | 5,783,100 | |||||||||

Alabama State Board of Education, 3.00% due 5/1/2017 (Calhoun Community College) | NR/A1 | 2,070,000 | 2,213,969 | |||||||||

Alabama State Board of Education, 3.00% due 5/1/2018 (Calhoun Community College) | NR/A1 | 2,130,000 | 2,275,969 | |||||||||

Alabama State Board of Education, 4.00% due 5/1/2019 (Calhoun Community College) | NR/A1 | 2,195,000 | 2,459,607 | |||||||||

Alabama State Board of Education, 4.00% due 5/1/2020 (Calhoun Community College) | NR/A1 | 1,000,000 | 1,117,550 | |||||||||

Alabama State Board of Education, 4.00% due 5/1/2021 (Calhoun Community College) | NR/A1 | 1,000,000 | 1,105,300 | |||||||||

Alabama State Board of Education, 4.00% due 5/1/2022 (Calhoun Community College) | NR/A1 | 1,230,000 | 1,355,595 | |||||||||

City of Birmingham GO, 5.00% due 10/1/2013 (Government Services; Insured: MBIA) | AA/Aa2 | 2,500,000 | 2,611,125 | |||||||||

City of Birmingham GO, 5.00% due 2/1/2015 (Government Services) | AA/Aa2 | 4,240,000 | 4,643,436 | |||||||||

City of Birmingham GO, 4.00% due 8/1/2015 (Government Services) | AA/Aa2 | 3,005,000 | 3,264,422 | |||||||||

City of Birmingham GO, 5.00% due 2/1/2016 (Government Services) | AA/Aa2 | 3,775,000 | 4,274,659 | |||||||||

City of Birmingham GO, 4.00% due 8/1/2016 (Government Services) | AA/Aa2 | 3,645,000 | 4,056,812 | |||||||||

City of Birmingham GO, 5.00% due 2/1/2017 (Government Services) | AA/Aa2 | 2,045,000 | 2,382,180 | |||||||||

City of Birmingham GO, 4.00% due 8/1/2017 (Government Services) | AA/Aa2 | 2,760,000 | 3,127,991 | |||||||||

City of Birmingham GO, 5.00% due 2/1/2018 (Government Services) | AA/Aa2 | 2,000,000 | 2,379,480 | |||||||||

City of Mobile Industrial Development Board PCR, 1.65% due 6/1/2034 put 3/20/2017 (Alabama Power Company Barry Plant Project) | A/A2 | 6,000,000 | 6,129,900 | |||||||||

City of Mobile Industrial Development Board Pollution Control, 5.00% due 6/1/2034 put 3/19/2015 (Alabama Power Company Barry Plant Project) | A/A2 | 6,000,000 | 6,585,720 | |||||||||

City of Mobile Private Placement Warrants GO, 4.50% due 8/15/2016 (Senior Center) | NR/NR | 1,420,000 | 1,480,236 | |||||||||

City of Mobile Warrants GO, 5.00% due 2/15/2019 (City Capital Improvements) | AA-/Aa2 | 2,000,000 | 2,365,360 | |||||||||

East Alabama Health Care Authority GO, 5.00% due 9/1/2021 | A/NR | 1,245,000 | 1,455,305 | |||||||||

East Alabama Health Care Authority GO, 5.00% due 9/1/2022 | A/NR | 800,000 | 927,872 | |||||||||

Montgomery Waterworks and Sanitation, 5.00% due 9/1/2016 | AAA/Aa1 | 2,080,000 | 2,424,760 | |||||||||

Montgomery Waterworks and Sanitation, 5.00% due 9/1/2019 | AAA/Aa1 | 3,375,000 | 4,060,631 | |||||||||

Town of Courtland Industrial Development Board, 4.75% due 5/1/2017 (Solid Waste Disposal-International Paper Company Project) | BBB/NR | 5,000,000 | 5,251,300 | |||||||||

University of Alabama at Birmingham Hospital, 5.25% due 9/1/2017 | A+/A1 | 2,500,000 | 2,869,950 | |||||||||

University of Alabama at Birmingham Hospital, 5.00% due 9/1/2018 | A+/A1 | 1,500,000 | 1,729,980 | |||||||||

ALASKA — 0.66% | ||||||||||||

Alaska Energy Power Authority, 6.00% due 7/1/2013 (Bradley Lake Hydroelectric; Insured: AGM) | AA-/Aa2 | 1,600,000 | 1,660,944 | |||||||||

Alaska Housing Finance Corp. GO, 5.00% due 12/1/2018 (Insured: Natl-Re) | AA+/Aa2 | 2,000,000 | 2,357,060 | |||||||||

Alaska Industrial Development & Export Authority GO, 5.00% due 4/1/2014 | AA+/Aa3 | 2,000,000 | 2,136,480 | |||||||||

Certified Annual Report 13

| SCHEDULE OF INVESTMENTS, CONTINUED | ||

| Thornburg Limited Term Municipal Fund | September 30, 2012 | |

Issuer-Description | Credit Rating† S&P/ Moody’s | Principal Amount | Value | |||||||||

Alaska Industrial Development & Export Authority GO, 5.00% due 4/1/2015 | AA+/Aa3 | $ | 1,900,000 | $ | 2,110,596 | |||||||

Alaska Industrial Development & Export Authority GO, 5.00% due 4/1/2016 | AA+/Aa3 | 1,000,000 | 1,144,460 | |||||||||

Alaska Industrial Development & Export Authority GO, 5.00% due 4/1/2017 | AA+/Aa3 | 3,000,000 | 3,532,110 | |||||||||

Alaska Industrial Development & Export Authority GO, 5.00% due 4/1/2018 | AA+/Aa3 | 2,455,000 | 2,953,758 | |||||||||

Alaska Municipal Bond Bank, 5.00% due 6/1/2014 (Insured: Natl-Re) (State Aid Withholding) | AA/Aa2 | 1,175,000 | 1,264,418 | |||||||||

North Slope Boro GO, 5.00% due 6/30/2015 (Insured: Natl-Re) | AA-/Aa3 | 3,250,000 | 3,642,112 | |||||||||

North Slope Boro GO, 5.00% due 6/30/2017 (Insured: Natl-Re) | AA-/Aa3 | 8,800,000 | 10,491,976 | |||||||||

Valdez Alaska Marine Terminal, 5.00% due 1/1/2021 (BP Pipelines, Inc.) | A/A2 | 7,000,000 | 8,367,450 | |||||||||

ARIZONA — 3.30% | ||||||||||||

Arizona Board of Regents COP, 5.00% due 7/1/2018 (Arizona State University; Insured: Natl-Re) | AA-/A1 | 1,285,000 | 1,471,698 | |||||||||

Arizona Board of Regents COP, 5.00% due 7/1/2019 (Arizona State University; Insured: Natl-Re) | AA-/A1 | 3,735,000 | 4,263,017 | |||||||||

Arizona Board of Regents COP, 5.00% due 6/1/2022 (University of Arizona) | AA-/Aa3 | 6,080,000 | 7,368,778 | |||||||||

Arizona HFA, 5.25% due 1/1/2018 (Banner Health) | AA-/NR | 3,500,000 | 4,163,110 | |||||||||

Arizona HFA, 5.00% due 7/1/2018 (Catholic Health Care West) | A/A2 | 1,470,000 | 1,700,055 | |||||||||

Arizona HFA, 5.00% due 7/1/2019 (Catholic Health Care West) | A/A2 | 1,365,000 | 1,582,854 | |||||||||

Arizona HFA, 5.00% due 7/1/2020 (Catholic Health Care West) | A/A2 | 1,290,000 | 1,488,492 | |||||||||

Arizona Lottery, 5.00% due 7/1/2018 (Insured: AGM) | AA-/Aa3 | 8,370,000 | 10,067,352 | |||||||||

Arizona Lottery, 5.00% due 7/1/2020 (Insured: AGM) | AA-/Aa3 | 8,000,000 | 9,803,680 | |||||||||

Arizona School Facilities Board, 5.00% due 7/1/2016 (Insured: AMBAC) | NR/NR | 5,775,000 | 6,391,366 | |||||||||

Arizona Transportation Board, 5.00% due 7/1/2019 | AA+/Aa2 | 3,500,000 | 4,332,755 | |||||||||

Arizona Transportation Board, 5.00% due 7/1/2021 | AA+/Aa2 | 7,465,000 | 9,409,782 | |||||||||

Arizona Transportation Board, 5.00% due 7/1/2022 | AA+/Aa2 | 5,000,000 | 6,215,450 | |||||||||

City of Chandler, 3.00% due 7/1/2013 | AA/Aa3 | 1,905,000 | 1,942,890 | |||||||||

City of Chandler, 3.00% due 7/1/2014 | AA/Aa3 | 2,790,000 | 2,911,449 | |||||||||

City of Phoenix Civic Improvement Corp., 3.00% due 7/1/2013 | A+/A1 | 1,000,000 | 1,019,400 | |||||||||

Glendale IDA, 5.00% due 5/15/2015 (Midwestern University) | A-/NR | 1,000,000 | 1,083,870 | |||||||||

Glendale IDA, 5.00% due 5/15/2016 (Midwestern University) | A-/NR | 1,325,000 | 1,472,367 | |||||||||

Glendale IDA, 5.00% due 5/15/2017 (Midwestern University) | A-/NR | 1,440,000 | 1,630,224 | |||||||||

Glendale Western Loop 101 Public Facilities Corp., 6.00% due 7/1/2019 | AA/A3 | 2,200,000 | 2,344,650 | |||||||||

Maricopa County IDA Health Facilities, 4.125% due 7/1/2015 (Catholic Health Care West) | A/A2 | 1,000,000 | 1,081,380 | |||||||||

Maricopa County IDA Health Facilities, 5.00% due 7/1/2038 put 7/1/2014 (Catholic Health | ||||||||||||

Care West) | A/A2 | 7,500,000 | 7,969,875 | |||||||||

Mesa Highway GO, 3.25% due 7/1/2016 | AA+/Aa3 | 10,000,000 | 10,464,600 | |||||||||

Mohave County IDA, 5.00% due 4/1/2014 (Mohave Prison LLC; Insured: Syncora) (ETM) | AA+/NR | 3,135,000 | 3,353,635 | |||||||||

Mohave County IDA, 7.25% due 5/1/2015 (Mohave Prison LLC) | BBB+/NR | 12,100,000 | 13,434,993 | |||||||||

Navajo County PCR, 5.50% due 6/1/2034 put 6/1/2014 (Arizona Public Service Co.) | BBB/Baa1 | 1,600,000 | 1,708,976 | |||||||||

Navajo County PCR, 5.50% due 6/1/2034 put 6/1/2014 (Arizona Public Service Co.) | BBB/Baa1 | 2,600,000 | 2,767,674 | |||||||||

Navajo County PCR, 5.75% due 6/1/2034 put 6/1/2016 (Arizona Public Service Co.) | BBB/Baa1 | 9,700,000 | 10,942,570 | |||||||||

Northern Arizona University COP, 5.00% due 9/1/2019 (Insured: AMBAC) | A/A2 | 3,500,000 | 3,665,865 | |||||||||

Pima County IDA, 6.40% due 7/1/2013 (Arizona Charter Schools) | NR/Baa3 | 190,000 | 190,828 | |||||||||

Pima County IDA, 5.00% due 7/1/2016 (Metro Police Facility) | AA/Aa3 | 2,500,000 | 2,798,600 | |||||||||

a Pima County IDA, 5.00% due 7/1/2017 (Metro Police Facility) | AA/Aa3 | 3,000,000 | 3,424,830 | |||||||||

Pima County IDA, 5.00% due 7/1/2018 (Metro Police Facility) | AA/Aa3 | 3,285,000 | 3,798,150 | |||||||||

Pima County IDA, 5.00% due 7/1/2019 (Metro Police Facility) | AA/Aa3 | 2,000,000 | 2,332,780 | |||||||||

Pima County Sewer, 4.00% due 7/1/2014 | A+/NR | 1,500,000 | 1,586,205 | |||||||||

Pima County Sewer, 5.00% due 7/1/2015 | A+/NR | 1,250,000 | 1,390,750 | |||||||||

Pima County Sewer, 5.00% due 7/1/2016 | A+/NR | 2,000,000 | 2,295,940 | |||||||||

Pima County Sewer, 4.50% due 7/1/2017 (Insured: AGM) | AA-/Aa3 | 5,000,000 | 5,831,500 | |||||||||

Pima County Sewer, 5.00% due 7/1/2017 | A+/NR | 2,750,000 | 3,240,270 | |||||||||

Pima County Sewer, 5.00% due 7/1/2018 | A+/NR | 2,000,000 | 2,403,120 | |||||||||

Pima County Sewer, 5.00% due 7/1/2018 (Insured: AGM) | AA-/Aa3 | 5,000,000 | 6,046,350 | |||||||||

Salt River Agricultural Improvement & Power District, 3.00% due 1/1/2014 | AA/Aa1 | 11,275,000 | 11,652,712 | |||||||||

Scottsdale IDA, 5.00% due 9/1/2019 (Scottsdale Healthcare) | A-/A3 | 6,885,000 | 7,693,230 | |||||||||

14 Certified Annual Report

| SCHEDULE OF INVESTMENTS, CONTINUED | ||

| Thornburg Limited Term Municipal Fund | September 30, 2012 | |

Issuer-Description | Credit Rating† S&P/ Moody’s | Principal Amount | Value | |||||||||

Town of Gilbert Public Facilities Municipal Property Corporation, 3.00% due 7/1/2015 | AA/Aa2 | $ | 1,080,000 | $ | 1,142,856 | |||||||

University Arizona Medical Center Corp. GO, 5.00% due 7/1/2014 | BBB+/Baa1 | 1,000,000 | 1,059,410 | |||||||||

Yuma Property Corp. Utility Systems, 5.00% due 7/1/2016 (Insured: Syncora) | A+/A1 | 2,000,000 | 2,259,540 | |||||||||

Yuma Property Corp. Utility Systems, 5.00% due 7/1/2018 (Insured: Syncora) | A+/A1 | 2,130,000 | 2,433,205 | |||||||||

ARKANSAS — 0.28% | ||||||||||||

Fort Smith Water & Sewer, 2.00% due 10/1/2013 (Insured: AGM) | AA-/NR | 1,000,000 | 1,013,800 | |||||||||

Fort Smith Water & Sewer, 3.00% due 10/1/2014 (Insured: AGM) | AA-/NR | 1,000,000 | 1,048,040 | |||||||||

Fort Smith Water & Sewer, 3.50% due 10/1/2016 (Insured: AGM) | AA-/NR | 1,370,000 | 1,516,193 | |||||||||

Fort Smith Water & Sewer, 3.50% due 10/1/2017 (Insured: AGM) | AA-/NR | 1,930,000 | 2,167,139 | |||||||||

Fort Smith Water & Sewer, 4.00% due 10/1/2018 (Insured: AGM) | AA-/NR | 1,000,000 | 1,156,350 | |||||||||

Fort Smith Water & Sewer, 4.00% due 10/1/2019 (Insured: AGM) | AA-/NR | 1,670,000 | 1,941,325 | |||||||||

Jefferson County Hospital, 4.00% due 6/1/2015 (Jefferson Regional Medical Center; Insured: AGM) | AA-/NR | 1,205,000 | 1,289,470 | |||||||||

Jefferson County Hospital, 4.00% due 6/1/2016 (Jefferson Regional Medical Center; Insured: | ||||||||||||

AGM) | AA-/NR | 1,395,000 | 1,501,745 | |||||||||

Jefferson County Hospital, 4.00% due 6/1/2017 (Jefferson Regional Medical Center; Insured: AGM) | AA-/NR | 1,375,000 | 1,486,691 | |||||||||

Jefferson County Hospital, 4.50% due 6/1/2018 (Jefferson Regional Medical Center; Insured: AGM) | AA-/NR | 1,495,000 | 1,667,045 | |||||||||

Jefferson County Hospital, 4.50% due 6/1/2019 (Jefferson Regional Medical Center; Insured: AGM) | AA-/NR | 1,580,000 | 1,760,689 | |||||||||

CALIFORNIA — 9.83% | ||||||||||||

Alameda County COP, 5.00% due 12/1/2017 (Santa Rita Jail; Insured: AMBAC) | AA/NR | 1,000,000 | 1,180,730 | |||||||||

Anaheim Public Financing Authority, 5.25% due 10/1/2018 (Electric Systems Generation; Insured: AGM) | AA-/Aa3 | 1,560,000 | 1,566,115 | |||||||||

Anaheim Public Financing Authority, 0% due 9/1/2022 (Public Facility Improvements; Insured: AGM) | AA-/Aa3 | 3,250,000 | 2,225,925 | |||||||||

Brentwood Infrastructure, 2.00% due 11/1/2015 (Insured: AGM) | AA-/NR | 520,000 | 527,134 | |||||||||

Brentwood Infrastructure, 4.00% due 11/1/2016 (Insured: AGM) | AA-/NR | 325,000 | 351,917 | |||||||||

Brentwood Infrastructure, 5.00% due 11/1/2017 (Insured: AGM) | AA-/NR | 965,000 | 1,097,765 | |||||||||

Brentwood Infrastructure, 5.25% due 11/1/2018 (Insured: AGM) | AA-/NR | 1,020,000 | 1,185,260 | |||||||||

Brentwood Infrastructure, 5.25% due 11/1/2019 (Insured: AGM) | AA-/NR | 725,000 | 851,143 | |||||||||

Cabrillo USD GO, 0% due 8/1/2015 (Educational Facilities Projects; Insured: AMBAC) | NR/NR | 1,000,000 | 963,420 | |||||||||

Calexico USD COP, 5.75% due 9/1/2013 | A-/NR | 590,000 | 607,446 | |||||||||

California Educational Facilities Authority, 5.00% due 4/1/2017 (Pitzer College) | NR/A3 | 1,460,000 | 1,667,072 | |||||||||

California Educational Facilities Authority, 5.00% due 4/1/2021 (Chapman University) | NR/A2 | 4,870,000 | 5,825,884 | |||||||||

California HFFA, 5.50% due 2/1/2017 (Community Developmental Disabilities Program; Insured: California Mtg Insurance) | A-/NR | 2,575,000 | 2,902,926 | |||||||||

California HFFA, 5.50% due 2/1/2019 (Community Developmental Disabilities Program; Insured: California Mtg Insurance) | A-/NR | 2,865,000 | 3,328,643 | |||||||||

California HFFA, 5.75% due 2/1/2020 (Community Developmental Disabilities Program; Insured: California Mtg Insurance) | A-/NR | 1,975,000 | 2,343,515 | |||||||||

California HFFA, 5.00% due 3/1/2020 (Catholic Healthcare West Health Facilities) | A/A2 | 4,400,000 | 5,214,308 | |||||||||

California HFFA, 5.75% due 2/1/2021 (Community Developmental Disabilities Program; Insured: California Mtg Insurance) | A-/NR | 1,695,000 | 2,005,863 | |||||||||

California HFFA, 5.00% due 3/1/2021 (Catholic Healthcare West Health Facilities) | A/A2 | 3,450,000 | 4,064,755 | |||||||||

California HFFA, 5.25% due 3/1/2022 (Catholic Healthcare West Health Facilities) | A/A2 | 7,020,000 | 8,333,863 | |||||||||

California HFFA, 5.00% due 7/1/2027 put 7/1/2014 (Catholic Healthcare West Health Facilities) | A/A2 | 3,500,000 | 3,727,500 | |||||||||

California HFFA, 5.00% due 7/1/2028 put 7/1/2014 (Catholic Healthcare West Health Facilities) | A/A2 | 2,000,000 | 2,130,000 | |||||||||

California Infrastructure & Economic Development Bank, 0.16% due 9/1/2037 put 10/1/2012 (Los Angeles County Museum of Natural History Foundation; LOC: Wells Fargo Bank) (daily demand notes) | AA-/Aa1 | 21,265,000 | 21,265,000 | |||||||||

Certified Annual Report 15

| SCHEDULE OF INVESTMENTS, CONTINUED | ||

| Thornburg Limited Term Municipal Fund | September 30, 2012 | |

Issuer-Description | Credit Rating† S&P/ Moody’s | Principal Amount | Value | |||||||||

California PCR Financing Authority, 0.20% due 11/1/2026 put 10/1/2012 (Pacific Gas & Electric; LOC: JPMorgan Chase Bank) (daily demand notes) | AA+/NR | $ | 6,300,000 | $ | 6,300,000 | |||||||

California State Department of Transportation COP, 5.25% due 3/1/2016 (Insured: Natl-Re) | BBB/A2 | 895,000 | 898,661 | |||||||||

California State Department of Water Resources, 5.00% due 5/1/2015 | AA-/Aa3 | 5,000,000 | 5,582,750 | |||||||||

California State Department of Water Resources, 5.00% due 5/1/2016 | AA-/Aa3 | 5,000,000 | 5,796,050 | |||||||||

California State Economic Recovery GO, 5.00% due 7/1/2018 | A+/Aa3 | 4,000,000 | 4,898,160 | |||||||||

California State Economic Recovery GO, 5.00% due 7/1/2020 | A+/Aa3 | 4,200,000 | 5,148,948 | |||||||||

California State GO, 4.75% due 4/1/2018 (Various Purposes) | A-/A1 | 1,250,000 | 1,482,937 | |||||||||

California State GO, 5.00% due 9/1/2020 (Tax-Exempt Various Purposes) | A-/A1 | 10,000,000 | 12,265,000 | |||||||||

California State GO, 5.00% due 9/1/2021 (Tax-Exempt Various Purposes) | A-/A1 | 5,000,000 | 6,163,700 | |||||||||

California State GO, 0.16% due 5/1/2034 put 10/1/2012 (Kindergarten University Public Education Facilities; LOC: State Street B&T Co.) (daily demand notes) | AA-/Aa2 | 1,500,000 | 1,500,000 | |||||||||

California State Housing Finance Agency, 2.50% due 12/1/2017 (One Santa Fe Apartments- MFH; Collateralized: GNMA) | NR/Aaa | 1,725,000 | 1,773,438 | |||||||||

California State Public Works Board, 5.00% due 9/1/2016 (Regents of University of California; Insured: Natl-Re/FGIC) | AA-/Aa2 | 3,000,000 | 3,499,800 | |||||||||

California State Public Works Board, 5.00% due 9/1/2017 (Regents of University of California; Insured: Natl-Re/FGIC) | AA-/Aa2 | 3,000,000 | 3,573,660 | |||||||||

California State Public Works Board, 5.00% due 11/1/2017 (California State University) | BBB+/Aa3 | 3,000,000 | 3,520,050 | |||||||||

California State Public Works Board, 5.00% due 11/1/2018 (California State University) | BBB+/Aa3 | 2,700,000 | 3,219,480 | |||||||||

California State Public Works Board, 5.00% due 10/1/2020 (California State University) | BBB+/A2 | 1,000,000 | 1,215,610 | |||||||||

California State Public Works Board, 5.00% due 10/1/2021 (Various Department Projects) | BBB+/A2 | 1,000,000 | 1,211,980 | |||||||||

California State School Cash Reserve Program Authority, 2.00% due 10/31/2012 | SP-1+/NR | 1,000,000 | 1,001,520 | |||||||||

California State School Cash Reserve Program Authority, 2.00% due 12/31/2012 | SP-1+/NR | 8,000,000 | 8,033,360 | |||||||||

California State School Cash Reserve Program Authority, 2.00% due 12/31/2012 | SP-1+/NR | 5,500,000 | 5,522,935 | |||||||||

California Statewide Community Development Authority, 5.00% due 6/15/2013 | A-/A1 | 9,500,000 | 9,818,725 | |||||||||

California Statewide Community Development Authority, 5.00% due 4/1/2019 (Kaiser Credit Group) | A+/NR | 27,000,000 | 32,256,630 | |||||||||

California Statewide Community Development Authority, 5.00% due 7/1/2020 (Aspire Public Schools; Insured: College for Certain LLC) | NR/NR | 2,100,000 | 2,112,159 | |||||||||

California Statewide Community Development Authority PCR, 4.10% due 4/1/2028 put 4/1/2013 (Southern California Edison County; Insured: Syncora) | A/A1 | 1,000,000 | 1,018,250 | |||||||||

Castaic USD GO, 0% due 5/1/2018 (Insured: Natl-Re/FGIC) | A+/NR | 7,000,000 | 5,618,060 | |||||||||

Centinela Valley USD GO, 4.00% due 12/1/2013 | SP-1+/NR | 5,665,000 | 5,885,142 | |||||||||

Central Valley Financing Authority, 5.00% due 7/1/2017 (Carson Ice) | A+/A1 | 600,000 | 694,596 | |||||||||

Central Valley Financing Authority, 5.00% due 7/1/2019 (Carson Ice) | A+/A1 | 1,750,000 | 2,086,437 | |||||||||

Chula Vista COP, 5.25% due 3/1/2018 | A-/NR | 1,170,000 | 1,338,468 | |||||||||

Chula Vista COP, 5.25% due 3/1/2019 | A-/NR | 1,235,000 | 1,427,648 | |||||||||

Clovis USD GO, 0% due 8/1/2019 (Insured: Natl-Re/FGIC) | AA/NR | 2,685,000 | 2,236,175 | |||||||||

Escondido Union High School District GO, 0% due 11/1/2020 | BBB/Baa2 | 2,655,000 | 1,961,169 | |||||||||

Golden State Tobacco Securitization Corp., 5.50% due 6/1/2043 pre-refunded 6/1/2013 | AA+/Aaa | 2,000,000 | 2,071,180 | |||||||||

Inland Valley Development Agency, 5.25% due 4/1/2013 (ETM) | NR/NR | 2,000,000 | 2,050,460 | |||||||||

Inland Valley Development Agency, 5.50% due 4/1/2014 (ETM) | NR/NR | 2,000,000 | 2,153,240 | |||||||||

Irvine USD, 5.25% due 9/1/2017 (Community Facilities District 86; Insured: AGM) | AA-/NR | 5,000,000 | 5,803,450 | |||||||||

Irvine USD, 5.25% due 9/1/2018 (Community Facilities District 86; Insured: AGM) | AA-/NR | 3,000,000 | 3,534,210 | |||||||||

Irvine USD, 5.25% due 9/1/2019 (Community Facilities District 86; Insured: AGM) | AA-/NR | 3,000,000 | 3,572,640 | |||||||||

Kern Community College District COP, 4.00% due 4/1/2014 | SP-1+/NR | 12,000,000 | 12,537,600 | |||||||||

Los Angeles Convention and Exhibition Center Authority, 5.00% due 8/15/2018 | A+/A2 | 2,095,000 | 2,408,810 | |||||||||

Los Angeles County Public Works Authority, 5.00% due 8/1/2019 (Multiple Capital Projects) | A+/A1 | 17,935,000 | 21,306,601 | |||||||||

Los Angeles County Public Works Financing Authority, 5.00% due 8/1/2018 (Multiple Capital Projects) | A+/A1 | 4,000,000 | 4,716,400 | |||||||||

Los Angeles Department of Water & Power, 0.18% due 7/1/2034 put 10/1/2012 (SPA: Wells Fargo Bank N.A.) (daily demand notes) | AA-/Aa3 | 2,100,000 | 2,100,027 | |||||||||

Los Angeles USD COP, 5.00% due 10/1/2017 (Information Technology; Insured: AMBAC) | A+/A1 | 2,445,000 | 2,844,513 | |||||||||

16 Certified Annual Report

| SCHEDULE OF INVESTMENTS, CONTINUED | ||

| Thornburg Limited Term Municipal Fund | September 30, 2012 | |

Issuer-Description | Credit Rating† S&P/ Moody’s | Principal Amount | Value | |||||||||

Los Angeles USD COP, 5.50% due 12/1/2018 (Educational Facilities Improvements) | A+/A1 | $ | 4,600,000 | $ | 5,548,520 | |||||||

Los Angeles USD COP, 5.50% due 12/1/2019 (Educational Facilities Improvements) | A+/A1 | 7,040,000 | 8,563,034 | |||||||||

Los Angeles USD GO, 5.00% due 7/1/2018 (Educational Facilities Improvements; Insured: AGM) | AA/Aa2 | 4,000,000 | 4,770,440 | |||||||||

Monterey County COP, 5.00% due 8/1/2016 (Insured: AGM) | AA/Aa3 | 1,435,000 | 1,629,127 | |||||||||

Monterey County COP, 5.00% due 8/1/2018 (Insured: AGM) | AA/Aa3 | 2,260,000 | 2,657,331 | |||||||||

Mount San Antonio Community College GO, 0% due 8/1/2017 | AA/Aa2 | 5,000,000 | 4,562,550 | |||||||||

Newport Beach, 5.00% due 12/1/2038 put 2/7/2013 (Hoag Memorial Hospital) | AA/Aa3 | 3,000,000 | 3,049,350 | |||||||||

Northern California Power Agency, 5.00% due 7/1/2017 (Hydroelectric Project) | A+/A2 | 1,000,000 | 1,186,450 | |||||||||

Northern California Power Agency, 5.00% due 6/1/2018 (Lodi Energy Center) | A-/A3 | 4,480,000 | 5,354,182 | |||||||||

Northern California Power Agency, 5.00% due 7/1/2019 (Hydroelectric Project) | A+/A2 | 1,000,000 | 1,223,430 | |||||||||

Northern California Power Agency, 5.00% due 7/1/2020 (Hydroelectric Project) | A+/A2 | 1,325,000 | 1,587,588 | |||||||||

Orange County Public Financing Authority, 5.00% due 7/1/2017 | A+/Aa3 | 1,245,000 | 1,470,768 | |||||||||

Palo Alto USD GO, 0% due 8/1/2019 | AAA/Aa1 | 1,000,000 | 858,550 | |||||||||

Palomar Community College District GO, 0% due 8/1/2021 Pittsburgh Redevelopment Agency, 5.00% due 8/1/2018 (Los Medanos Community | AA-/Aa2 | 2,560,000 | 1,882,317 | |||||||||

Development; Insured: Natl-Re) | BBB+/Baa2 | 5,150,000 | 5,238,168 | |||||||||

Redding Electrical Systems COP, 5.00% due 6/1/2020 (Insured: AGM) | NR/Aa3 | 3,955,000 | 4,640,797 | |||||||||

Sacramento City USD GO, 4.00% due 7/1/2019 (Educational Facilities Improvements) | A+/A1 | 5,455,000 | 6,189,407 | |||||||||

Sacramento City USD GO, 5.00% due 7/1/2021 (Educational Facilities Improvements) | A+/A1 | 3,265,000 | 3,947,711 | |||||||||

Sacramento Cogeneration Authority, 5.00% due 7/1/2017 (Procter & Gamble) | A+/A1 | 750,000 | 881,813 | |||||||||

Sacramento Cogeneration Authority, 5.00% due 7/1/2017 (Insured: AMBAC) | BBB/NR | 8,290,000 | 8,890,445 | |||||||||

Sacramento County Sanitation Districts Financing Authority, 0.21% due 12/1/2039 put 10/1/2012 (LOC: Morgan Stanley) (daily demand notes) | AAA/Aa3 | 12,425,000 | 12,425,000 | |||||||||

Sacramento Municipal Utility District, 5.00% due 7/1/2016 (Cosumnes Project; Insured: Natl-Re) | BBB/A3 | 4,870,000 | 5,373,996 | |||||||||

Sacramento Municipal Utility District, 5.00% due 7/1/2019 (Cosumnes Project; Insured: Natl-Re) | BBB/A3 | 5,000,000 | 5,507,000 | |||||||||

Sacramento Municipal Utility District, 5.00% due 7/1/2020 (Cosumnes Project; Insured: Natl-Re) | BBB/A3 | 8,675,000 | 9,482,295 | |||||||||

San Diego Convention Center Expansion Financing Authority, 5.00% due 4/15/2020 | A+/NR | 4,000,000 | 4,739,040 | |||||||||

San Diego Convention Center Expansion Financing Authority, 5.00% due 4/15/2021 | A+/NR | 3,000,000 | 3,556,170 | |||||||||

San Diego Convention Center Expansion Financing Authority, 5.00% due 4/15/2022 | A+/NR | 8,000,000 | 9,448,640 | |||||||||

San Diego Redevelopment Agency, 4.50% due 9/1/2019 (Centre City Redevelopment; Insured: AMBAC) | NR/Ba1 | 1,240,000 | 1,305,695 | |||||||||

San Diego USD GO, 5.50% due 7/1/2020 (Insured: Natl-Re) | AA-/Aa2 | 10,000,000 | 12,788,500 | |||||||||

San Joaquin Delta Community College District GO, 0% due 8/1/2019 (Insured: AGM) | AA-/Aa2 | 7,600,000 | 6,064,876 | |||||||||

San Jose Redevelopment Agency, 6.00% due 8/1/2015 (Insured: Natl-Re) | BBB/Baa2 | 2,780,000 | 3,022,194 | |||||||||

San Luis & Delta-Mendota Water Authority, 4.50% due 3/1/2014 (DHCCP Development Project) | A+/NR | 3,900,000 | 4,092,660 | |||||||||

Santa Ana Financing Authority, 6.25% due 7/1/2018 (Police Administration & Holding Facility; Insured: Natl-Re) | BBB/Baa2 | 4,035,000 | 4,709,612 | |||||||||

Santa Ana USD GO, 0% due 8/1/2019 (Insured: Natl-Re/FGIC) | BBB/NR | 3,425,000 | 2,829,461 | |||||||||

Santa Clara County Financing Authority, 4.00% due 5/15/2014 (Multiple Facilities) | AA/A1 | 4,245,000 | 4,470,834 | |||||||||

Solano County COP, 5.00% due 11/15/2017 | AA-/A1 | 1,580,000 | 1,842,628 | |||||||||

Southeast Resource Recovery Facilities Authority, 5.25% due 12/1/2017 (Insured: AMBAC) | A+/A1 | 2,000,000 | 2,089,920 | |||||||||

State of California, 2.50% due 6/20/2013 (General Fund Cash Management) | SP-1+/Mig1 | 64,700,000 | 65,739,729 | |||||||||

State of California GO, 0.17% due 5/1/2034 put 10/1/2012 (Kindergarten University Facilities; LOC: Citibank N.A.) (daily demand notes) | AAA/Aa2 | 40,200,000 | 40,200,000 | |||||||||

State of California GO, 0.20% due 5/1/2034 put 10/1/2012 (Kindergarten University Facilities; LOC: Citibank N.A./California State Teachers’ Retirement System) (daily demand notes) | A/Aa3 | 2,500,000 | 2,500,000 | |||||||||

Tuolumne Wind Project Authority, 5.00% due 1/1/2018 (Tuolumne Co.) | A+/A2 | 2,000,000 | 2,376,020 | |||||||||

Tuolumne Wind Project Authority, 5.00% due 1/1/2019 (Tuolumne Co.) | A+/A2 | 2,000,000 | 2,412,640 | |||||||||

Tustin Community Redevelopment Agency, 4.00% due 9/1/2017 (Tustin Redevelopment) | A/NR | 935,000 | 998,094 | |||||||||

Tustin Community Redevelopment Agency, 4.00% due 9/1/2019 (Tustin Redevelopment) | A/NR | 1,010,000 | 1,075,529 | |||||||||

Tustin Community Redevelopment Agency, 4.00% due 9/1/2020 (Tustin Redevelopment) | A/NR | 1,050,000 | 1,110,869 | |||||||||

Twin Rivers USD GO, 0% due 4/1/2014 (Educational Facilities Improvements) | SP-1/NR | 3,490,000 | 3,418,350 | |||||||||

Ventura County COP, 5.00% due 8/15/2016 | AA/Aa3 | 1,520,000 | 1,741,616 | |||||||||

Certified Annual Report 17

| SCHEDULE OF INVESTMENTS, CONTINUED | ||

| Thornburg Limited Term Municipal Fund | September 30, 2012 | |

Issuer-Description | Credit Rating† S&P/ Moody’s | Principal Amount | Value | |||||||||

Ventura County COP, 5.25% due 8/15/2017 | AA/Aa3 | $ | 1,635,000 | $ | 1,933,093 | |||||||

West Contra Costa USD GO, 0% due 8/1/2022 (Educational Facilities Projects; Insured: AGM) | AA-/Aa3 | 4,000,000 | 2,766,320 | |||||||||

West Covina Redevelopment Agency, 6.00% due 9/1/2022 (Fashion Plaza) | AA+/NR | 6,085,000 | 7,221,191 | |||||||||

COLORADO — 3.42% | ||||||||||||

Adams County Platte Valley Medical Center, 5.00% due 2/1/2015 (Brighton Community | ||||||||||||

Hospital Association; Insured: Natl-Re/FHA) | BBB/NR | 1,530,000 | 1,654,909 | |||||||||

Adams County Platte Valley Medical Center, 5.00% due 8/1/2015 (Brighton Community Hospital Association; Insured: Natl-Re/FHA) | BBB/NR | 1,565,000 | 1,716,523 | |||||||||

Beacon Point Metropolitan District, 4.375% due 12/1/2015 (LOC: Compass Bank) | BBB/NR | 970,000 | 972,454 | |||||||||

City & County of Denver Airport System, 5.00% due 11/15/2016 (Insured: Natl-Re) | A+/A1 | 1,725,000 | 2,023,960 | |||||||||

City & County of Denver Airport System, 5.00% due 11/15/2017 (Insured: Natl-Re) | A+/A1 | 1,000,000 | 1,203,170 | |||||||||

City & County of Denver COP, 5.00% due 5/1/2013 (Human Services Center Properties; Insured: MBIA) | AA+/Aa1 | 3,890,000 | 3,994,836 | |||||||||

City & County of Denver COP, 5.00% due 5/1/2014 (Human Services Center Properties; Insured: MBIA) | AA+/Aa1 | 4,000,000 | 4,268,480 | |||||||||

City & County of Denver COP, 5.00% due 12/1/2016 (Buell Theatre/Jail Dormitory; Insured: Natl-Re) | AA+/Aa1 | 3,025,000 | 3,189,560 | |||||||||

City & County of Denver COP, 0.20 % due 12/1/2029 put 10/1/2012 (Wellington E. Webb Municipal Office Building; SPA: JPMorgan Chase Bank) (daily demand notes) | AA+/Aa1 | 44,905,000 | 44,905,000 | |||||||||

City & County of Denver COP, 0.20 % due 12/1/2031 put 10/1/2012 (Wellington E. Webb Municipal Office Building; SPA: JPMorgan Chase Bank) (daily demand notes) | AA+/Aa1 | 25,710,000 | 25,710,000 | |||||||||

City of Longmont, 6.00% due 5/15/2019 | AA+/NR | 3,215,000 | 4,071,058 | |||||||||

Colorado Educational & Cultural Facilities, 4.00% due 6/1/2014 (NCSL) | A/A3 | 1,300,000 | 1,357,434 | |||||||||

Colorado Educational & Cultural Facilities, 5.00% due 6/1/2016 (NCSL) | A/A3 | 1,475,000 | 1,643,386 | |||||||||

Colorado Educational & Cultural Facilities, 5.00% due 6/1/2018 (NCSL) | A/A3 | 1,625,000 | 1,883,781 | |||||||||

Colorado Educational & Cultural Facilities, 5.00% due 6/1/2020 (NCSL) | A/A3 | 1,805,000 | 2,140,225 | |||||||||

Colorado Educational & Cultural Facilities, 5.00% due 6/1/2021 (NCSL) | A/A3 | 1,000,000 | 1,180,190 | |||||||||

Colorado Educational & Cultural Facilities, 0.20% due 5/1/2037 put 10/1/2012 (National Jewish Federation; LOC: JPMorgan Chase Bank) (daily demand notes) | NR/Aa3 | 650,000 | 650,000 | |||||||||

Colorado Educational & Cultural Facilities, 0.20% due 9/1/2038 put 10/1/2012 (National Jewish Federation; LOC: JPMorgan Chase Bank) (daily demand notes) | NR/Aa3 | 950,000 | 950,000 | |||||||||

Colorado HFA, 5.00% due 11/15/2013 (Adventist Health/Sunbelt Group) | AA-/Aa3 | 2,840,000 | 2,989,952 | |||||||||

Colorado HFA, 5.00% due 11/15/2015 (Adventist Health/Sunbelt Group) | AA-/Aa3 | 2,365,000 | 2,686,049 | |||||||||

Colorado HFA, 5.25% due 5/15/2017 (Northern Colorado Medical Center; Insured: AGM) | AA-/NR | 1,185,000 | 1,387,078 | |||||||||

Colorado HFA, 5.25% due 5/15/2019 (Northern Colorado Medical Center; Insured: AGM) | AA-/NR | 2,225,000 | 2,692,206 | |||||||||

Colorado HFA, 5.50% due 10/1/2038 put 11/12/2015 (Catholic Health Initiatives) | AA/Aa2 | 1,000,000 | 1,146,260 | |||||||||

Colorado HFA, 5.00% due 7/1/2039 put 11/8/2012 (Catholic Health Initiatives) | AA/Aa2 | 3,500,000 | 3,517,885 | |||||||||

Colorado HFA, 5.00% due 7/1/2039 put 11/12/2013 (Catholic Health Initiatives) | AA/Aa2 | 7,255,000 | 7,623,336 | |||||||||

Colorado HFA, 5.00% due 7/1/2039 put 11/11/2014 (Catholic Health Initiatives) | AA/Aa2 | 3,000,000 | 3,278,460 | |||||||||

Colorado Higher Education COP, 5.00% due 11/1/2013 | AA-/Aa2 | 1,025,000 | 1,074,128 | |||||||||

Denver City & County COP, 0.20% due 12/1/2029 put 10/1/2012 (Wellington E. Webb Municipal Office Building; SPA: JPMorgan Chase Bank) (daily demand notes) | AA+/Aa2 | 23,310,000 | 23,310,000 | |||||||||

Denver Convention Center Hotel Authority, 5.25% due 12/1/2014 (Insured: Syncora) | BBB-/Baa3 | 3,450,000 | 3,651,756 | |||||||||

Denver Convention Center Hotel Authority, 5.00% due 12/1/2019 pre-refunded 12/1/2013 (Insured: Syncora) | NR/NR | 5,000,000 | 5,271,150 | |||||||||

Denver Convention Center Hotel Authority, 5.25% due 12/1/2021 (Insured: Syncora) | BBB-/Baa3 | 3,700,000 | 3,901,391 | |||||||||

Denver Convention Center Hotel Authority, 5.00% due 12/1/2022 pre-refunded 12/1/2013 (Insured: Syncora) | NR/NR | 2,000,000 | 2,108,460 | |||||||||

Denver Convention Center Hotel Authority, 5.25% due 12/1/2022 (Insured: Syncora) | BBB-/Baa3 | 1,000,000 | 1,046,330 | |||||||||

Denver West Metropolitan District GO, 5.00% due 12/1/2021 (Insured: AGM) | AA-/NR | 2,175,000 | 2,626,334 | |||||||||

E-470 Public Highway Authority, 0% due 9/1/2014 (Insured: Natl-Re) | BBB/Baa2 | 1,910,000 | 1,826,820 | |||||||||

Park Creek Metropolitan District, 5.00% due 12/1/2015 (Insured: AGM) | AA-/NR | 1,000,000 | 1,119,620 | |||||||||

Park Creek Metropolitan District, 5.00% due 12/1/2016 (Insured: AGM) | AA-/NR | 1,035,000 | 1,189,049 | |||||||||

18 Certified Annual Report

| SCHEDULE OF INVESTMENTS, CONTINUED | ||

| Thornburg Limited Term Municipal Fund | September 30, 2012 | |

Issuer-Description | Credit Rating† S&P/ Moody’s | Principal Amount | Value | |||||||||

Park Creek Metropolitan District, 5.00% due 12/1/2017 (Insured: AGM) | AA-/NR | $ | 1,525,000 | $ | 1,782,527 | |||||||

Park Creek Metropolitan District, 5.50% due 12/1/2018 (Insured: AGM) | AA-/NR | 1,200,000 | 1,461,408 | |||||||||

Park Creek Metropolitan District, 5.50% due 12/1/2019 (Insured: AGM) | AA-/NR | 1,000,000 | 1,237,220 | |||||||||

Regional Transportation District COP, 5.00% due 6/1/2018 | A-/Aa3 | 1,750,000 | 2,056,390 | |||||||||

Regional Transportation District COP, 5.00% due 6/1/2019 | A-/Aa3 | 4,730,000 | 5,634,754 | |||||||||

Regional Transportation District COP, 5.00% due 6/1/2020 | A-/Aa3 | 3,655,000 | 4,372,805 | |||||||||

Regional Transportation District COP, 5.50% due 6/1/2021 | A-/Aa3 | 2,370,000 | 2,881,375 | |||||||||

Southlands Metropolitan District GO, 6.75% due 12/1/2016 pre-refunded 12/1/2014 | AA+/NR | 745,000 | 818,494 | |||||||||

State of Colorado COP, 3.00% due 3/1/2013 (Colorado Penitentiary II Project) | AA-/Aa2 | 1,205,000 | 1,214,411 | |||||||||

State of Colorado COP, 4.00% due 3/1/2014 (Colorado Penitentiary II Project) | AA-/Aa2 | 1,285,000 | 1,334,383 | |||||||||

State of Colorado COP, 5.00% due 3/1/2016 (Colorado Penitentiary II Project) | AA-/Aa2 | 2,000,000 | 2,270,860 | |||||||||

State of Colorado COP, 5.00% due 3/1/2017 (Colorado Penitentiary II Project) | AA-/Aa2 | 2,000,000 | 2,338,700 | |||||||||

State of Colorado COP, 5.00% due 3/1/2018 (Colorado Penitentiary II Project) | AA-/Aa2 | 1,500,000 | 1,790,715 | |||||||||

CONNECTICUT — 0.79% | ||||||||||||

Connecticut Health & Educational Facilities Authority, 0.16% due 7/1/2036 put 10/1/2012 (Yale University) (daily demand notes) | AAA/Aaa | 11,400,000 | 11,400,000 | |||||||||

Connecticut Health & Educational Facilities Authority, 0.17% due 7/1/2036 put 10/1/2012 (Yale University) (daily demand notes) | AAA/Aaa | 26,030,000 | 26,030,000 | |||||||||

b State of Connecticut GO Floating Rate Note, 0.867% due 9/15/2024 (Public Improvements) | AA/Aa3 | 10,000,000 | 10,002,900 | |||||||||

DISTRICT OF COLUMBIA — 0.87% | ||||||||||||

District of Columbia, 4.00% due 4/1/2015 (National Public Radio) | AA-/Aa3 | 1,000,000 | 1,076,330 | |||||||||

District of Columbia, 5.00% due 4/1/2016 (National Public Radio) | AA-/Aa3 | 500,000 | 568,875 | |||||||||

District of Columbia, 4.00% due 4/1/2017 (National Public Radio) | AA-/Aa3 | 1,830,000 | 2,059,390 | |||||||||

District of Columbia, 5.00% due 4/1/2018 (National Public Radio) | AA-/Aa3 | 1,195,000 | 1,426,519 | |||||||||

District of Columbia, 5.00% due 4/1/2019 (National Public Radio) | AA-/Aa3 | 805,000 | 974,936 | |||||||||

District of Columbia, 5.00% due 4/1/2020 (National Public Radio) | AA-/Aa3 | 1,250,000 | 1,523,625 | |||||||||

District of Columbia Convention Center Authority, 5.00% due 10/1/2013 (Washington Convention Center; Insured: AMBAC) | A/A1 | 3,000,000 | 3,122,640 | |||||||||

District of Columbia COP, 5.25% due 1/1/2013 (Insured: AMBAC) | A/NR | 2,085,000 | 2,109,415 | |||||||||

District of Columbia COP, 5.25% due 1/1/2015 (Insured: Natl-Re/FGIC) | A/Aa3 | 2,875,000 | 3,139,672 | |||||||||

District of Columbia COP, 5.25% due 1/1/2016 (Insured: Natl-Re/FGIC) | A/Aa3 | 4,625,000 | 5,194,846 | |||||||||

District of Columbia COP, 5.00% due 1/1/2018 | A/Aa3 | 5,000,000 | 5,586,550 | |||||||||

District of Columbia COP, 5.00% due 1/1/2019 (Insured: Natl-Re) | A/Aa3 | 5,000,000 | 5,545,900 | |||||||||

District of Columbia COP, 4.50% due 1/1/2021 (Insured: Natl-Re/FGIC) | A/Aa3 | 1,100,000 | 1,196,833 | |||||||||

District of Columbia GO, 6.00% due 6/1/2018 (Insured: Natl-Re) | A+/Aa2 | 5,000,000 | 6,270,950 | |||||||||

District of Columbia GO, 5.25% due 6/1/2020 (Insured: Syncora) | A+/Aa2 | 3,005,000 | 3,759,045 | |||||||||

District of Columbia Housing Finance Agency, 5.00% due 7/1/2014 (Insured: AGM-HUD Loan) | AA-/Aa3 | 1,195,000 | 1,271,815 | |||||||||

District of Columbia Housing Finance Agency, 5.00% due 7/1/2015 (Insured: AGM-HUD Loan) | AA-/Aa3 | 1,480,000 | 1,621,962 | |||||||||

Metropolitan Washington Airports Authority, 0% due 10/1/2014 (Dulles Toll Road; Insured: AGM) | AA-/Aa3 | 2,000,000 | 1,936,220 | |||||||||

Metropolitan Washington Airports Authority, 0% due 10/1/2016 (Dulles Toll Road; Insured: AGM) | AA-/Aa3 | 4,000,000 | 3,628,360 | |||||||||

FLORIDA — 7.83% | ||||||||||||

Broward County, 5.00% due 9/1/2013 (Port Facilities) | A-/A2 | 2,000,000 | 2,072,900 | |||||||||

Broward County, 5.00% due 10/1/2014 (Airport, Marina & Port Improvements; Insured: AMBAC) (ETM) | NR/A1 | 1,625,000 | 1,774,370 | |||||||||

Broward County, 5.00% due 10/1/2014 (Airport, Marina & Port Improvements; Insured: AMBAC) | A+/A1 | 2,375,000 | 2,589,059 | |||||||||

Broward County, 5.00% due 9/1/2017 (Port Facilities) | A-/A2 | 2,820,000 | 3,239,108 | |||||||||

Broward County, 4.00% due 10/1/2017 (Airport, Marina & Port Improvements) | A+/A1 | 250,000 | 284,188 | |||||||||

Broward County, 5.00% due 10/1/2017 (Airport, Marina & Port Improvements) | A+/A1 | 1,000,000 | 1,185,240 | |||||||||

Certified Annual Report 19

| SCHEDULE OF INVESTMENTS, CONTINUED | ||

| Thornburg Limited Term Municipal Fund | September 30, 2012 | |

Issuer-Description | Credit Rating† S&P/ Moody’s | Principal Amount | Value | |||||||||

Broward County, 5.50% due 9/1/2018 (Port Facilities) | A-/A2 | $ | 3,500,000 | $ | 4,176,130 | |||||||

Broward County, 4.00% due 10/1/2018 (Airport, Marina & Port Improvements) | A+/A1 | 425,000 | 485,567 | |||||||||

Broward County, 5.00% due 10/1/2018 (Airport, Marina & Port Improvements) | A+/A1 | 500,000 | 600,190 | |||||||||

Broward County, 5.50% due 9/1/2019 (Port Facilities) | A-/A2 | 2,800,000 | 3,385,760 | |||||||||

Broward County, 5.00% due 10/1/2019 (Airport, Marina & Port Improvements) | A+/A1 | 1,000,000 | 1,207,980 | |||||||||

Broward County, 4.00% due 10/1/2020 (Airport, Marina & Port Improvements) | A+/A1 | 1,660,000 | 1,885,129 | |||||||||

Broward County, 5.00% due 10/1/2020 (Airport, Marina & Port Improvements) | A+/A1 | 2,000,000 | 2,419,320 | |||||||||

Broward County School Board COP, 5.25% due 7/1/2015 (Insured: AGM) | AA-/Aa3 | 3,035,000 | 3,378,896 | |||||||||

Broward County School Board COP, 5.00% due 7/1/2016 (Insured: AGM) | AA-/Aa3 | 1,495,000 | 1,697,827 | |||||||||

Broward County School Board COP, 5.25% due 7/1/2016 (Insured: AGM) | AA-/Aa3 | 7,630,000 | 8,734,900 | |||||||||

Broward County School Board COP, 5.25% due 7/1/2016 (Insured: AGM) | AA-/Aa3 | 3,715,000 | 4,252,969 | |||||||||

Broward County School Board COP, 5.00% due 7/1/2017 | A/Aa3 | 1,000,000 | 1,147,510 | |||||||||

Broward County School Board COP, 5.00% due 7/1/2021 | A/Aa3 | 4,000,000 | 4,737,280 | |||||||||

Broward County School Board COP, 5.00% due 7/1/2022 | A/Aa3 | 4,580,000 | 5,422,170 | |||||||||

Capital Projects Finance Authority, 5.50% due 10/1/2012 (Insured: Natl-Re) | BBB/Baa2 | 1,820,000 | 1,820,091 | |||||||||

Capital Projects Finance Authority, 5.50% due 10/1/2015 (Insured: Natl-Re) | BBB/Baa2 | 2,660,000 | 2,672,156 | |||||||||

City of Fort Myers, 5.00% due 12/1/2018 (Insured: Natl-Re) | A+/Aa3 | 2,195,000 | 2,511,234 | |||||||||

City of Gainesville, 6.50% due 10/1/2013 (Utilities Systems) | AA/Aa2 | 4,800,000 | 5,076,096 | |||||||||

City of Gainesville, 0.21% due 10/1/2026 put 10/1/2012 (Utilities Systems; SPA: SunTrust Bank) (daily demand notes) | AA/Aa2 | 5,775,000 | 5,775,000 | |||||||||

City of Gainesville, 0.23% due 10/1/2026 put 10/1/2012 (Utilities Systems; SPA: Suntrust Bank) (daily demand notes) | AA/Aa2 | 18,260,000 | 18,260,000 | |||||||||

City of Lakeland, 3.00% due 11/15/2013 (Lakeland Regional Health Systems) | NR/A2 | 1,000,000 | 1,025,420 | |||||||||

City of Lakeland, 4.00% due 11/15/2014 (Lakeland Regional Health Systems) | NR/A2 | 1,000,000 | 1,054,700 | |||||||||

City of Lakeland, 5.00% due 10/1/2016 (Energy System; Insured: AGM) | AA/Aa3 | 9,780,000 | 11,315,362 | |||||||||

City of Lakeland, 5.00% due 10/1/2017 (Energy System; Insured: AGM) | AA/Aa3 | 7,105,000 | 8,424,967 | |||||||||

City of Lakeland, 5.00% due 10/1/2019 (Energy System; Insured: AGM) | AA/Aa3 | 5,000,000 | 6,113,500 | |||||||||

City of Lakeland, 5.00% due 11/15/2019 (Lakeland Regional Health Systems) | NR/A2 | 5,640,000 | 6,586,618 | |||||||||

City of Lakeland, 5.00% due 10/1/2020 (Energy System; Insured: AGM) | AA/Aa3 | 1,695,000 | 2,082,562 | |||||||||

City of Miami, 5.00% due 1/1/2018 (Street & Sidewalk Improvement Program; Insured: Natl-Re) | A-/A2 | 1,970,000 | 2,299,955 | |||||||||

City of North Miami, 5.00% due 4/1/2013 (Johnston & Wales University; Insured: Syncora) | NR/NR | 1,530,000 | 1,555,077 | |||||||||

Collier County, 4.00% due 10/1/2014 | AA/Aa2 | 1,410,000 | 1,509,814 | |||||||||

Escambia County HFA, 5.25% due 11/15/2014 (Ascension Health Credit) | AA+/Aa1 | 1,835,000 | 2,018,243 | |||||||||

Flagler County School Board COP, 5.00% due 8/1/2014 (Insured: AGM) | AA-/Aa3 | 1,605,000 | 1,725,054 | |||||||||

Flagler County School Board COP, 5.00% due 8/1/2015 (Insured: AGM) | AA-/Aa3 | 1,500,000 | 1,667,895 | |||||||||

Florida Atlantic University Financing Corp., 5.00% due 7/1/2014 (Innovation Village Capital Improvements) | A/A1 | 1,950,000 | 2,103,251 | |||||||||

Florida Atlantic University Financing Corp., 5.00% due 7/1/2015 (Innovation Village Capital Improvements) | A/A1 | 2,395,000 | 2,658,450 | |||||||||

Florida Atlantic University Financing Corp., 5.00% due 7/1/2016 (Innovation Village Capital Improvements) | A/A1 | 2,275,000 | 2,591,725 | |||||||||

Florida Department of Management Services, 5.25% due 9/1/2016 (Insured: AGM) | AA+/Aa2 | 3,500,000 | 4,078,445 | |||||||||

Florida Higher Educational Facilities Financing Authority, 4.00% due 4/1/2013 (Nova Southeastern University) | BBB/Baa2 | 1,100,000 | 1,116,830 | |||||||||

Florida Higher Educational Facilities Financing Authority, 5.00% due 4/1/2014 (Nova Southeastern University) | BBB/Baa2 | 2,365,000 | 2,486,892 | |||||||||

Florida Higher Educational Facilities Financing Authority, 5.00% due 4/1/2015 (Nova Southeastern University) | BBB/Baa2 | 2,350,000 | 2,539,645 | |||||||||

Florida Higher Educational Facilities Financing Authority, 5.00% due 4/1/2016 (Nova Southeastern University) | BBB/Baa2 | 2,345,000 | 2,590,170 | |||||||||

Florida Higher Educational Facilities Financing Authority, 5.25% due 4/1/2017 (Nova Southeastern University) | BBB/Baa2 | 1,325,000 | 1,504,246 | |||||||||

Florida Higher Educational Facilities Financing Authority, 5.25% due 4/1/2018 (Nova Southeastern University) | BBB/Baa2 | 2,630,000 | 2,991,309 | |||||||||

20 Certified Annual Report

| SCHEDULE OF INVESTMENTS, CONTINUED | ||

| Thornburg Limited Term Municipal Fund | September 30, 2012 | |

Issuer-Description | Credit Rating† S&P/ Moody’s | Principal Amount | Value | |||||||||

Florida Higher Educational Facilities Financing Authority, 5.00% due 4/1/2019 (University of Tampa) | BBB+/NR | $ | 1,225,000 | $ | 1,400,212 | |||||||

Florida Higher Educational Facilities Financing Authority, 5.00% due 4/1/2019 (Nova Southeastern University) | BBB/Baa2 | 1,035,000 | 1,183,036 | |||||||||

Florida Higher Educational Facilities Financing Authority, 5.50% due 4/1/2019 (Nova Southeastern University) | BBB/Baa2 | 1,705,000 | 1,972,770 | |||||||||

Florida Higher Educational Facilities Financing Authority, 5.00% due 4/1/2020 (Nova Southeastern University) | BBB/Baa2 | 1,030,000 | 1,180,802 | |||||||||

Florida Higher Educational Facilities Financing Authority, 5.00% due 4/1/2022 (University of Tampa) | BBB+/NR | 620,000 | 714,724 | |||||||||

Florida Hurricane Catastrophe Fund Finance Corp., 5.00% due 7/1/2014 | AA-/Aa3 | 11,000,000 | 11,850,300 | |||||||||

Florida State Board of Governors, 4.00% due 7/1/2020 (University System Capital Improvements) | AA/Aa2 | 4,055,000 | 4,608,548 | |||||||||

Florida State Board of Governors, 4.00% due 7/1/2021 (University System Capital Improvements) | AA/Aa2 | 4,215,000 | 4,778,672 | |||||||||

Florida State Board of Governors, 4.00% due 7/1/2022 (University System Capital Improvements) | AA/Aa2 | 4,385,000 | 4,973,730 | |||||||||

Florida State Correctional Privatization Commission COP, 5.00% due 8/1/2015 (Insured: AMBAC) | AA+/Aa2 | 2,000,000 | 2,155,900 | |||||||||

Florida State Department of Children & Families COP, 5.00% due 10/1/2012 | AA+/NR | 770,000 | 770,254 | |||||||||

Florida State Department of Children & Families COP, 5.00% due 10/1/2014 | AA+/NR | 905,000 | 969,481 | |||||||||

Florida State Department of Children & Families COP, 5.00% due 10/1/2015 | AA+/NR | 925,000 | 1,020,164 | |||||||||

Florida State Department of Transportation GO, 5.00% due 7/1/2018 | AAA/Aa1 | 3,000,000 | 3,586,440 | |||||||||

Florida State Housing Finance Corp., 1.625% due 1/1/2015 (Captiva Cove Apartments-Multi- Family Mtg; Insured: FNMA) | NR/Aaa | 1,600,000 | 1,602,480 | |||||||||

Florida Turnpike Authority, 5.00% due 7/1/2013 (Department of Transportation) | AA-/Aa3 | 4,875,000 | 5,047,282 | |||||||||

Highlands County HFA, 5.00% due 11/15/2015 (Adventist Health System/Sunbelt Group) | AA-/Aa3 | 1,000,000 | 1,129,260 | |||||||||

Highlands County HFA, 5.00% due 11/15/2016 (Adventist Health System Orange County Health Facilities) | AA-/Aa3 | 1,000,000 | 1,160,240 | |||||||||

Highlands County HFA, 5.00% due 11/15/2017 (Adventist Health System Orange County Health Facilities) | AA-/Aa3 | 3,200,000 | 3,807,872 | |||||||||

Highlands County HFA, 5.00% due 11/15/2017 (Adventist Health System/Sunbelt Group) | AA-/Aa3 | 1,000,000 | 1,127,800 | |||||||||

Highlands County HFA, 5.00% due 11/15/2019 (Adventist Health System Orange County Health Facilities) | AA-/Aa3 | 3,000,000 | 3,603,540 | |||||||||

Hillsborough County, 5.00% due 3/1/2015 (Water and Wastewater System Capital Improvements; Insured: Natl-Re/FGIC) | A+/A1 | 5,000,000 | 5,458,250 | |||||||||

Hillsborough County Community Investment, 5.00% due 11/1/2016 (Transportation Related Capital Improvements; Insured: AMBAC) | AA/A1 | 1,000,000 | 1,157,780 | |||||||||

Hillsborough County Community Investment, 5.00% due 11/1/2018 (Court Facilities) | AA/A1 | 4,210,000 | 5,026,740 | |||||||||

Hillsborough County Community Investment, 5.00% due 11/1/2019 (Court Facilities) | AA/A1 | 4,420,000 | 5,313,017 | |||||||||

Hillsborough County Community Investment, 5.00% due 11/1/2020 (Court Facilities) | AA/A1 | 4,645,000 | 5,623,841 | |||||||||

Hillsborough County Community Investment, 5.00% due 11/1/2021 (Court Facilities) | AA/A1 | 4,880,000 | 5,933,592 | |||||||||

Hillsborough County Community Investment, 5.00% due 11/1/2021 (Jail and Storm Water Projects) | AA/A1 | 2,300,000 | 2,796,570 | |||||||||

Hillsborough County Community Investment, 5.00% due 11/1/2022 (Jail and Storm Water Projects) | AA/A1 | 3,005,000 | 3,678,811 | |||||||||

Hillsborough County School Board COP, 5.25% due 7/1/2017 | AA-/Aa2 | 1,000,000 | 1,172,600 | |||||||||

Hollywood Community Redevelopment Agency, 5.00% due 3/1/2016 (Insured: Syncora) | NR/A3 | 2,000,000 | 2,193,820 | |||||||||

Hollywood Community Redevelopment Agency, 5.00% due 3/1/2017 (Insured: Syncora) | NR/A3 | 2,000,000 | 2,227,920 | |||||||||

Hollywood Water & Sewer, 5.00% due 10/1/2014 (Insured: AGM) | NR/Aa2 | 1,300,000 | 1,357,148 | |||||||||

Jacksonville Economic Development Commission, 6.00% due 9/1/2017 (Florida Proton Therapy Institute) | NR/NR | 4,500,000 | 5,122,530 | |||||||||

JEA Electric System, 5.00% due 10/1/2014 | A+/Aa3 | 7,165,000 | 7,662,967 | |||||||||

JEA Electric System, 4.00% due 10/1/2016 | A+/Aa3 | 3,540,000 | 3,986,713 | |||||||||

Certified Annual Report 21

| SCHEDULE OF INVESTMENTS, CONTINUED | ||

| Thornburg Limited Term Municipal Fund | September 30, 2012 | |

Issuer-Description | Credit Rating† S&P/ Moody’s | Principal Amount | Value | |||||||||

JEA Water & Sewer Systems, 3.50% due 10/1/2013 | AA/Aa2 | $ | 5,565,000 | $ | 5,743,303 | |||||||

JEA Water & Sewer Systems, 5.00% due 10/1/2018 | AA/Aa2 | 1,500,000 | 1,842,900 | |||||||||

Kissimmee Utilities Authority, 5.25% due 10/1/2016 (Electrical Systems; Insured: AGM) | NR/Aa3 | 1,700,000 | 1,978,443 | |||||||||

Lake County School Board COP, 5.25% due 6/1/2017 (Insured: AMBAC) | A/NR | 2,000,000 | 2,313,620 | |||||||||

Lake County School Board COP, 5.25% due 6/1/2018 (Insured: AMBAC) | A/NR | 1,475,000 | 1,735,279 | |||||||||

Marion County Hospital District, 5.00% due 10/1/2015 (Munroe Regional Health Systems) | NR/A3 | 1,000,000 | 1,092,680 | |||||||||

Miami Beach GO, 4.00% due 9/1/2019 | AA-/Aa2 | 2,745,000 | 3,182,333 | |||||||||

Miami Beach GO, 5.00% due 9/1/2020 | AA-/Aa2 | 3,720,000 | 4,587,169 | |||||||||

Miami Beach GO, 4.00% due 9/1/2021 | AA-/Aa2 | 1,015,000 | 1,175,959 | |||||||||

Miami Beach GO, 5.00% due 9/1/2022 | AA-/Aa2 | 1,000,000 | 1,229,390 | |||||||||

Miami Dade County, 5.80% due 10/1/2012 (Special Housing-HUD Section 8) | NR/Baa3 | 625,000 | 625,163 | |||||||||

Miami Dade County, 0% due 10/1/2015 (Professional Sports Franchise Facilities; Insured: AGM) | AA-/Aa3 | 3,845,000 | 3,597,920 | |||||||||

Miami Dade County, 0% due 10/1/2016 (Professional Sports Franchise Facilities; Insured: AGM) | AA-/Aa3 | 3,535,000 | 3,216,744 | |||||||||

Miami Dade County, 0% due 10/1/2017 (Professional Sports Franchise Facilities; Insured: AGM) | AA-/Aa3 | 2,435,000 | 2,133,157 | |||||||||

Miami Dade County, 0% due 10/1/2018 (Professional Sports Franchise Facilities; Insured: AGM) | AA-/Aa3 | 5,385,000 | 4,541,655 | |||||||||

Miami Dade County, 0% due 10/1/2019 (Professional Sports Franchise Facilities; Insured: AGM) | AA-/Aa3 | 2,170,000 | 1,732,940 | |||||||||

Miami Dade County Educational Facilities Authority GO, 5.00% due 4/1/2016 (University of Miami; Insured: AMBAC) | A-/A3 | 3,000,000 | 3,326,040 | |||||||||