UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-05201

Thornburg Investment Trust

(Exact name of registrant as specified in charter)

c/o Thornburg Investment Management, Inc.

2300 North Ridgetop Road, Santa Fe, New Mexico 87506

(Address of principal executive offices) (Zip code)

Garrett Thornburg, 2300 North Ridgetop Road, Santa Fe, New Mexico 87506

(Name and address of agent for service)

Registrant’s telephone number, including area code: 505-984-0200

Date of fiscal year end: September 30

Date of reporting period: March 31, 2023

Item 1. Reports to Stockholders

The following Semi-annual reports are attached hereto, in order:

Thornburg Global Opportunities

Thornburg International Equity Fund

Thornburg Better World International Fund

Thornburg International Growth Fund

Thornburg Developing World Fund

Thornburg Small/Mid Cap Core Fund

Thornburg Small/Mid Cap Growth Fund

Thornburg Investment Income Builder Fund

Thornburg Summit Fund

Thornburg Limited Term U.S. Government Fund

Thornburg Limited Term Income Fund

Thornburg Ultra Short Income Fund

Thornburg Strategic Income Fund

Thornburg Short Duration Municipal Fund

Thornburg Limited Term Municipal Fund

Thornburg California Limited Term Municipal Fund

Thornburg New Mexico Intermediate Municipal Fund

Thornburg New York Intermediate Municipal Fund

Thornburg Intermediate Municipal Fund

Thornburg Strategic Municipal Income Fund

Thornburg Capital Management Fund

Semi-Annual Report | March 31, 2023

| EQUITY FUNDS |

| Global Equity |

| Thornburg Global Opportunities Fund |

| International Equity |

| Thornburg International Equity Fund |

| Thornburg Better World International Fund |

| Thornburg International Growth Fund |

| Thornburg Developing World Fund |

| U.S. Equity |

| Thornburg Small/Mid Cap Core Fund |

| Thornburg Small/Mid Cap Growth Fund |

| Multi Asset |

| Thornburg Investment Income Builder Fund |

| Thornburg Summit Fund |

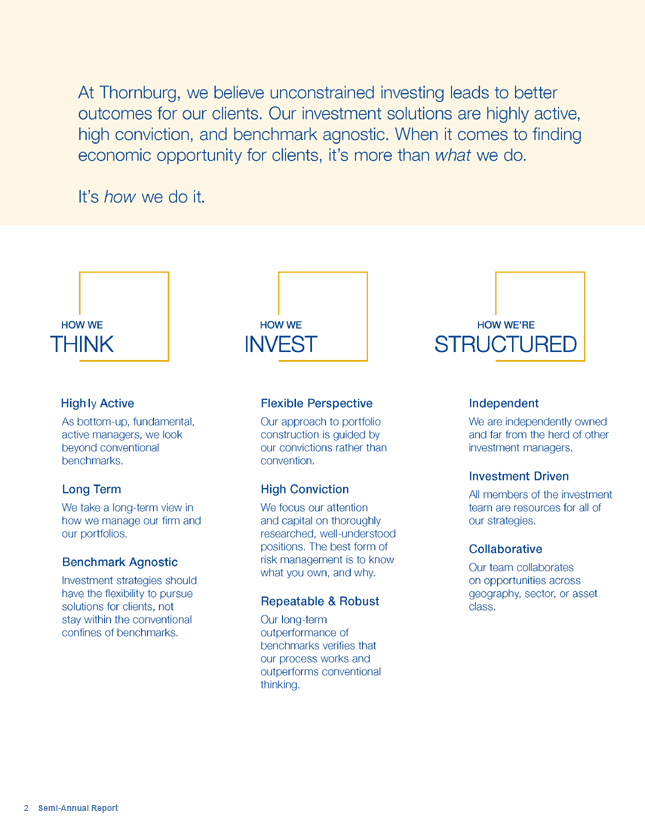

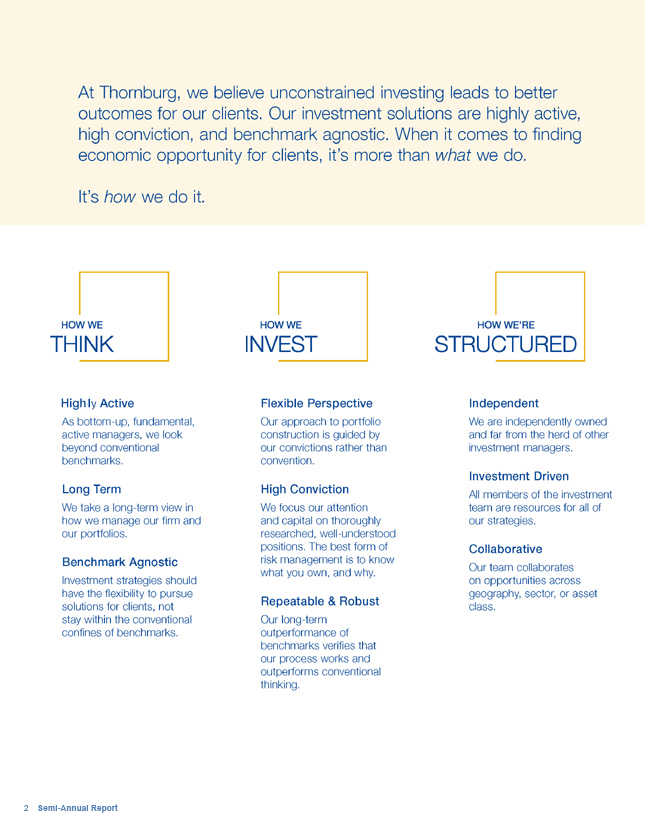

At Thornburg, we believe unconstrained investing leads to better outcomes for our clients. Our investment solutions are highly active, high conviction, and benchmark agnostic. When it comes to finding economic opportunity for clients, it’s more than what we do.

It’s how we do it. Active As bottom-up, fundamental, active managers, we look beyond conventional benchmarks. Long Term We take a long-term view in how we manage our firm and our portfolios. Benchmark Agnostic Investment strategies should have the flexibility to pursue solutions for clients, not stay within the conventional confines of benchmarks. Flexible Perspective Our approach to portfolio construction is guided by our convictions rather than convention. High Conviction We focus our attention and capital on thoroughly researched, well-understood positions. The best form of risk management is to know what you own, and why. Repeatable & Robust Our long-term outperformance of benchmarks verifies that our process works and outperforms conventional thinking. Independent We are independently owned and far from the herd of other investment managers. Investment Driven All members of the investment team are resources for all of our strategies. Collaborative Our team collaborates on opportunities across geography, sector, or asset class.2 semi-annual report

Thornburg Equity Funds

Semi-Annual Report | March 31, 2023

Table of Contents

Investments carry risks, including possible loss of principal. Additional risks may be associated with investments outside the United States, especially in emerging markets, including currency fluctuations, illiquidity, volatility, and political and economic risks. Investments in small- and mid-capitalization companies may increase the risk of greater price fluctuations. Portfolios investing in bonds have the same interest rate, inflation, and credit risks that are associated with the underlying bonds. The value of bonds will fluctuate relative to changes in interest rates, decreasing when interest rates rise. A short position will lose value as the security’s price increases. Theoretically, the loss on a short sale can be unlimited. Investments in derivatives are subject to the risks associated with the securities or other assets underlying the pool of securities, including illiquidity and difficulty in valuation. Please see the Funds’ prospectus for a discussion of the risks associated with an investment in the Funds. Investments in the Funds are not FDIC insured, nor are they deposits of or guaranteed by a bank or any other entity.

Thornburg Equity Funds Semi-Annual Report | 3

Letter to Shareholders

March 31, 2023 (Unaudited)

Dear Shareholder:

As I reflect on the current market environment, I can’t help but think of Hemingway’s novel “The Sun Also Rises,” as one of the characters is asked how they went bankrupt. The answer: “Two ways. Gradually and then suddenly.” The answer often feels appropriate in the context of changes in a market dynamic. Over the past year or so, we’ve seen the effects of the Federal Reserve’s (the “Fed”) interest rate hiking cycle work through the markets gradually, with losses on both risky and riskless assets affected by a notably higher cost of borrowing money.

Six months ago, I wrote:

”We at Thornburg believe that this dramatic interest rate hiking cycle, combined with a significant pace of quantitative tightening, will continue to drive market volatility and likely create moments of intermittent liquidity in the market similar to a dry Santa Fe spring.”

Fast forward to today, spring has returned to Santa Fe, and liquidity continues to dry up. While the weather varies, the desert climate is parched. In markets too, there are days and weeks where it feels as though data and earnings, as well as market liquidity, are fairly good. But the overall trends in the current market are troubling us both in Santa Fe and beyond. While it is possible that the Fed engineers a soft landing for the U.S. economy this year, the direction of many leading economic indicators remains lower. I am always on the lookout for how market and economic impact might be different this time because sometimes there are more secular changes in the market that are likely to continue in the same general direction for the foreseeable future than cyclical changes. Furthermore, the pandemic has created a huge set of reverberations that we are still experiencing three years later. Yet, in our view, people and psychology are the same. Our experience tells us that a higher cost of capital has fairly universal effects. While outcomes are never linear, and history never really repeats itself, it’s difficult for us to see how the market storms we’re tasked with navigating these past several years will become calmer or less frequent.

Over the last six months, we have seen a recovery in risky asset prices, from equities to credit spreads. We’ve also seen fairly dramatic market movements towards lower yields as the market appears to bet on a resolution of dissolvement of recent interest rate increases from monetary policymakers. While inflation is high, it is coming down, and from our vantage point many market participants are explicitly or implicitly reasoning that the pain of recession will feel clearer and more present than the ache of inflation. I’m not so sure that the Fed will. It is highly unlikely that any policymaker wants to be seen as responsible for runaway inflation. It will mostly likely take a higher unemployment rate and an inflation print closer to 2% for the Fed to move interest rates lower. While I believe that this could happen by the end of 2023, the intervening period may not be fun. I also think that the collapse of Silicon Valley Bank says more about the tech and private capital ecosystem than the banking system writ large. The inescapable conclusion to us is that cheap money finds its way into all the

financial system cracks. When that dries out, the system can be vulnerable and brittle.

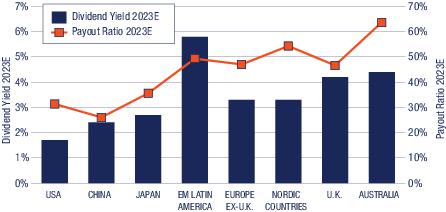

Looking forward, there may be very interesting opportunities arising from the current chaotic market conditions we are seeing. Yields on high-quality bonds have recently risen to the point of having traditional sources of value: income and portfolio ballast. International and income-producing equities presently have undemanding multiples, especially relative to the U.S. While it has been well over a decade since the best equity returns have been outside the U.S., the last time was the early 2000s, which for me, is the best analogue for the present market situation.

As in any environment, we will be focused on you, our clients, as our most important constituency. Though there is never a guarantee that we will be able to navigate the evolving marketplace as well as we may have before, I have a confidence born of experience that our unsiloed, global approach to active investment management should continue to allow us to achieve our goal of long-term investment excellence. It is always the case that challenges often come hand-in-hand with opportunities, and I have watched our portfolios perform well over the years when difficult situations arise. We continue to see that no market is an island, and the effects from actions somewhere in the world can be felt everywhere. Our process, which focuses on this interconnection through the development of a collaborative and deeply informed perspective, by design has thrived in these kind of investment conditions.

Thornburg’s 41-year history is not one of perfection but rather one of a continual focus on our craft that leads to deliberate reflection and evolution. We reinvest in our investment process and our ability to meet client needs while staying true to what makes the firm’s identity differentiated and successful. I have great respect for other investment firms and there are many good products that are available to investors. But we believe that in times like these, our firm’s broad perspective and collaborative, unsiloed approach is our sustainable competitive advantage. These qualities are what underlie the excellent long-term outcomes we have achieved for our clients: we’re built to deliver on the promise of active management.

Thank you so much for your time and your business.

| |

Jason Brady, cfa

Portfolio Manager

CEO, President, and

Managing Director | |

The matters discussed in this report may constitute forward-looking statements made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995. These include any advisor or portfolio manager prediction, assessment, analysis or outlook for individual securities, industries, investment styles, market sectors and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for each fund in its current prospectus, other factors bearing on these reports include the accuracy of the advisor’s or portfolio manager’s forecasts and predictions, the appropriateness of the investment strategies designed by the advisor or portfolio manager and the ability of the advisor or portfolio manager to implement their strategies efficiently and successfully. Any one or more of these factors, as well as other risks affecting the securities markets generally, could cause the actual results of any fund to differ materially as compared to its benchmarks.

The views expressed are subject to change and do not necessarily reflect the views of Thornburg Investment Management, Inc. This information should not be relied upon as a recommendation or investment advice and is not intended to predict the performance of any investment or market.

Performance results of individual share classes will vary based on the fees and expenses associated with each share class, and may be higher or lower than other share classes within the same Fund. Please see Performance Summary for performance results of each share class.

4 | Thornburg Equity Funds Semi-Annual Report

Letter to Shareholders, Continued

March 31, 2023 (Unaudited)

Thornburg Global Opportunities Fund |

March 31, 2023 (Unaudited)

Dear Fellow Shareholder,

This note highlights the results of the Thornburg Global Opportunities Fund investment portfolio for the 6-month period ended March 31, 2023. It is published amidst the ongoing developments associated with the Russian invasion of Ukraine, continuing high inflation in the U.S., and tremors in the banking sector caused by some banks being poorly positioned for rising interest rates. Despite these issues, a broad collection of financial assets delivered price appreciation in the period, following broad-based price declines in 2022.

The Fund paid $1.23 per share of dividends with respect to the Class I shares during the six months. Due to a combination of those dividend payments and modest overall changes in the aggregate values of the Fund’s investments, the net asset value of the Class I shares from the beginning of the period to the end of the period increased by $4.25 per share (from $27.91 to $32.16), bringing the total return for the six-month period to 19.86%. Consequently, the Fund outperformed the 17.78% return of the MSCI All Country World Net Total Return USD Index (the “Index”), the Fund’s benchmark, for the period. Dividend amounts and returns for other Fund share classes varied slightly based on class specific expenses.

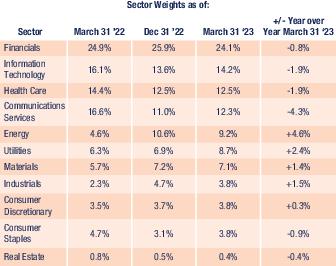

We are now in our 17th year of managing Thornburg Global Opportunities Fund. From its inception on July 28, 2006, through March 31, 2023, the Fund has outpaced the Index by an average margin of more than 3% per year, resulting in a total cumulative return since inception of 345% (Class I shares) versus 176% for the Index.

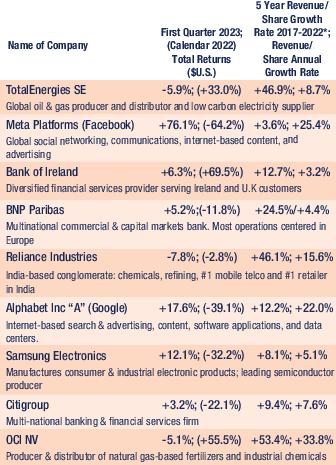

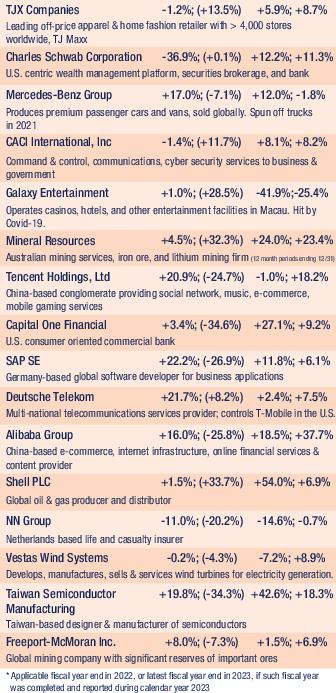

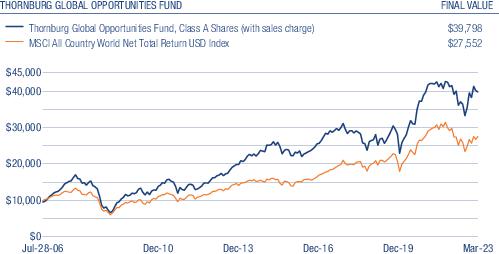

Listed below in descending order are the 25 largest equity holdings in the Fund as of March 31, 2023, along with their first quarter of 2023 and calendar year 2022 returns (the latter in parentheses). Returns are shown in U.S. dollars and assume reinvestment of dividends in shares of the firm. We also show the trailing 5-year average annual revenue growth rates for these businesses through their 2022 fiscal year ends, along with each company’s latest reported trailing 12-month revenue growth. For a rough comparison:

| • | The trailing 5-year weighted average revenue growth rate of firms included in the Index was +3.1%/year through December 31, 2022. The annualized average revenue growth rate was +6.8% through the most recently reported trailing 12-month period, which ended December 31, 2022 for most of these firms. |

| • | The trailing 5-year weighted average revenue growth rate of the equity holdings in the Fund was +10.5%/year through December 31, 2022. The weighted average revenue growth rate of these firms was +17.1% through the most recently reported trailing 12-month period, which ended December 31, 2022 for many of these firms. |

Thornburg Equity Funds Semi-Annual Report | 5

Letter to Shareholders, Continued

March 31, 2023 (Unaudited)

Together, these firms comprised approximately 82% of the Fund’s total assets as of March 31, 2023. Cash and cash equivalents comprised approximately 2% of Fund assets, and 12 other equities comprised the remaining 16%. Individual position sizes of the Fund’s top 20 positions range from 5% or more (TotalEnergies) to approximately 2.3% for those shown near the bottom of this list.

The U.S. dollar appreciation averaging approximately 8% vis-à-vis foreign currencies is responsible for some of the dollar-based share price declines of the Fund’s foreign currency denominated holdings seen in 2022. We hedged a significant portion of the foreign currency exposure with respect to these holdings. Many foreign currencies

appreciated marginally versus the U.S. dollar in the first quarter of 2023.

These are not trivial businesses. Weighted average revenue growth for the Fund exceeded global GDP growth in 2022 and the trailing 5-year period. Notably, these businesses’ average revenue growth rates compare favorably to the revenue growth of the Index, both in 2022 and over the trailing 5-year period. Most of these businesses have emerged from the 2020 economic valley with their competitive positions intact or improved and we believe they are ready to address the challenges and opportunities that lie ahead.

The reader will also notice a high incidence of investments in firms tied to the digital economy, producers of critical resources, and financial intermediaries that we believe should benefit from higher interest rates. Despite positive revenue production from the Fund’s portfolio of “digital” businesses in 2022, the share price performances of these investments were primarily negative due to concerns about demand/supply imbalances. Price declines of most of these firms reversed in the first quarter of 2023. Despite a pause in demand growth for the products and services of these digital economy firms, we have confidence in the fundamental backdrop for secular growth of digital communications, data collection and analysis, and the key components of devices that make both the digital economy and a greener economy possible.

As of March 31, 2023, the weighted average price-to-earnings ratio for the Fund’s equity investments was 12.1x. This compares to a weighted average multiple of 16.2x for the Index. We believe that the Fund’s strategy of owning a focused portfolio of firms with above-average revenue growth that are value priced with respect to revenue/earnings/cash flow vis-à-vis the overall market has been a key ingredient to long-term outperformance by the Fund versus the Index.

Twenty-nine equities made positive contributions to Fund performance of at least 0.1% during the 6-month period ended March 31, 2023. Leading contributors to portfolio performance for the period included global oil & gas giants TotalEnergies and Shell; U.S. technology giants Meta Platforms and Alphabet; business software developer SAP; semiconductor manufacturers Taiwan Semiconductor Manufacturing, Samsung Electronics, and Micron; financials Bank of Ireland, BNP Paribas, Citigroup, and Capital One; German multi-national telecommunications service provider Deutsche Telekom; miners Freeport McMoran, Mineral Resources, and First Quantum Minerals; Chinese digital economy platforms Tencent Holdings and Alibaba Group; fertilizer manufacturer OCI NV; and various others including TJX, Vestas Wind Systems, Mercedes Benz Group, Tesco PLC, Booking Holdings, CACI, Barratt Developments, Galaxy, Qorvo, AbbVie.

Three equities subtracted more than -0.1% from Fund performance during the 6-month period ended March 31, 2023: Charles Schwab, Roche Holding, and European insurer NN Group. We made various position size

6 | Thornburg Equity Funds Semi-Annual Report

Letter to Shareholders, Continued

March 31, 2023 (Unaudited)

adjustments of these equities during this period for portfolio diversification purposes and to better balance the downside risk versus upside capital appreciation potential of individual positions.

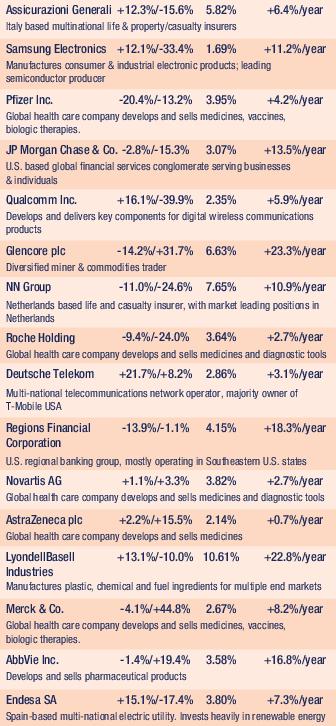

The following table summarizes major sector weightings within the Fund’s equity holdings as of March 31, 2023, versus six months prior.

Incoming economic data from around the world indicate a slowing global economy, possibly leading to a recession in some countries. As we write this letter, inflation remains near 40-year highs in most developed countries, this has impeded unit demand growth, and labor market conditions currently remain tight. However, inflation is showing clear signs of having already peaked in many economies, including the U.S. We are paying attention to the abilities of companies the Fund owns to manage cost inflation and maintain profit margins consistent with our expectations.

Our Investment Framework

Thornburg Global Opportunities Fund seeks capital appreciation from a focused portfolio of global equity investments. We believe the structure of the Fund—built on our core investment principles of flexibility, focus, and value—provides a durable framework for those seeking value-added investing.

We urge shareholders of the Fund to maintain a long-term investment perspective rather than placing too much emphasis on return figures that are available daily, weekly, monthly and quarterly. A clear example of the need to keep a longer-term investment perspective is illustrated by comparing the +65.2% trailing 33-month return of the Fund (as of December 31, 2022) with the -24.8% quarterly return at the onset of COVID-19 (as of March 31, 2020) that preceded these 33 months. In general, the businesses in the portfolio have managed well through varying economic environments across business cycles. We continue to follow our core investment principles of flexibility, focus, and value, as we have since the Fund’s inception back in 2006.

Thank you for being a shareholder of Thornburg Global Opportunities Fund. Remember that you can monitor the holdings of the Fund and other information on our website at www.thornburg.com.

Sincerely,

|

|

Brian McMahon

Portfolio Manager

Chief Investment Strategist

and Managing Director | Miguel Oleaga

Portfolio Manager

and Managing Director |

Thornburg Equity Funds Semi-Annual Report | 7

Letter to Shareholders, Continued

March 31, 2023 (Unaudited)

Thornburg Investment Income Builder Fund |

March 31, 2023 (Unaudited)

Dear Fellow Shareholder:

This letter highlights the results of the Thornburg Investment Income Builder Fund investment portfolio for the 6-month period ended March 31, 2023. It is published amidst the ongoing developments associated with the Russian invasion of Ukraine, continuing high inflation in the U.S., and tremors in the banking sector caused by some banks being poorly positioned for rising interest rates. Despite these issues, a broad collection of financial assets delivered price appreciation in the period, following broad-based price declines in 2022.

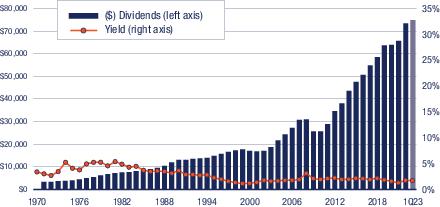

The Fund paid ordinary dividends of $0.63 per Class I share for the trailing two quarters ended March 31, 2023. This is a 4.1% increase versus the prior comparable 6-month period ended March 31, 2022, excluding the special year-end 2021 dividend paid in January 2022. The dividends per share for the period ended March 31, 2023 were lower for Class A shares and Class C shares to account for varying class specific expenses. More than 70% of the Fund’s equity holdings increased dividends in local currencies in 2022 versus 2021, contributing to the 4.1% dividend increase noted above. A stronger U.S. dollar was a mid-single digit percentage headwind to dividends received in foreign currencies in the first quarter of 2023 vis-à-vis those received in the first quarter of 2022.

The net asset value of the Fund’s Class I shares increased by $2.97 per share (from $19.36 to $22.33) during the trailing 6-month period and decreased by $1.51 per share (from $23.84 to $22.33) for the 12-month period ended March 31, 2023. The Fund’s Class I share return of 18.68% for the semi-annual period outperformed the return of the Blended Benchmark of 14.87% (the Blended Benchmark is comprised of 75% MSCI World Net Total Return USD Index and 25% Bloomberg U.S. Aggregate Bond Total Return Index Value USD (the “Blended Benchmark”). For the year ended March 31, 2023, the Fund’s Class I share return of -0.96% exceeded the Blended Benchmark return of -6.25%. Performance comparisons of the Fund to the Blended Benchmark over various periods are shown elsewhere in this report.

The quarter ended March 31, 2023, was the 81st full calendar quarter since the Fund’s inception. In 59 of these quarters, the Fund delivered a positive total return. Additionally, the Fund has delivered positive returns in 15 of its 20 calendar years. Most importantly, Thornburg Investment Income Builder Fund has provided an average annualized total return of more than 8.50% since its inception over 20 years ago, split between quarterly income distributions and share price appreciation.

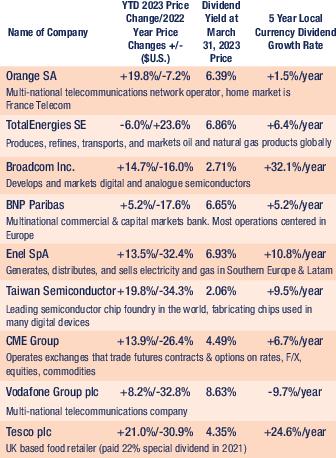

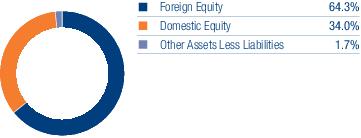

Listed below in descending order are the 25 largest equity holdings in the Fund as of March 31, 2023, along with their first quarter of 2023 and 2022 calendar year share price changes in U.S. dollars. Also noted are dividend yields, stock price changes, and the trailing 5-year growth rate of each firm’s dividend/share in local currency, all as of March 31, 2023. These 25 firms comprised approximately 62% of the Fund’s total assets. Cash and more than 250 interest-bearing debt and hybrid securities comprised around 15% of Fund assets, and 31 other common equities comprised approximately 22% of Fund assets. Individual position sizes of the 25 equities listed range from 5.1% of Fund assets (Orange SA) to about 1.4% for those shown near the bottom of the list.

Thornburg Investment Income Builder Fund – Top 25 Equity Holdings as of March 31,2023.

8 | Thornburg Equity Funds Semi-Annual Report

Letter to Shareholders, Continued

March 31, 2023 (Unaudited)

These are not trivial businesses. These firms occupy important positions in their respective markets, and they tend to be well capitalized. Most have made reasonable progress in growing their bases of paying customers and distributable cash flows to support multi-year dividend growth. Among these, only Vodafone (a special situation) paid a lower dividend in 2022 versus 2017.

U.S. dollar appreciation averaging approximately 8% vis-à-vis foreign currencies is responsible for some of the dollar-based share price declines of the Fund’s foreign

currency denominated holdings seen in 2022. During the semi-annual period, we hedged a significant percentage of the foreign currency exposure with respect to these holdings but could not hedge the headwind to dividend income paid in foreign currencies without having periodic fluctuations in the hedge values creating significant volatility for the Fund’s quarterly dividends. The reader will notice several telecommunications, financial, and health care firms among these top 25 holdings, as well as other providers of various ingredients important to modern life. We believe that their attractive current dividend yields and records of dividend growth indicate good value.

We have maintained the Fund’s exposure to dividend-paying firms that we believe have resilient businesses with strong capital structures. The large increase in energy sector investments was due to adding Shell and Petrobras investments during 2022 and stronger relative price performance versus other sectors. The large decrease in communications services investments was primarily due to sales of positions in Chinese telecoms to conform to new legal requirements. Here is a sector allocation comparison of the equities in the Fund’s portfolio over the trailing year:

All eleven sectors of the MSCI World Net Total Return USD Index delivered positive returns over the trailing six months ended March 31, 2023, ranging from 28.1% for the information technology sector to 6.3% for the real estate sector. The MSCI World Net Total Return USD Index comprises 75%, and the entire equity portion, of the Thornburg Investment Income Builder Fund’s global performance benchmark.

In the Fund’s portfolio, 56 equity investments contributed positive returns to overall portfolio performance during the semi-annual period. The largest equity contributors to trailing 6-month performance included telecommunications firms Orange SA and Deutsche Telekom; technology firms Taiwan Semiconductor, Broadcom, Samsung Electronics, and Qualcomm; financials Generali, BNP Paribas and CME Group; multinational electric utility Enel, UK grocer Tesco,

Thornburg Equity Funds Semi-Annual Report | 9

Letter to Shareholders, Continued

March 31, 2023 (Unaudited)

German industrial conglomerate Siemens AG, and Deutsche Post AG.

Ten of the Fund’s equity investments detracted from portfolio performance during the semi-annual period. This included pharmaceutical firms Pfizer and Roche Holding; and financials Regions Financial and NN Group.

The Fund’s bond holdings delivered positive returns during the trailing six months ended March 31, 2023. The 10-year U.S. Treasury bond yields dropped from 3.83% to 3.47% over the semi-annual period. Corporate and asset-backed bond prices also rose. The yield to worst of the Bloomberg U.S. Corporate High Yield Index declined from 9.68% to 8.52% over the past six months, though up from 6.01% on March 31, 2022. On March 31, 2023, the $62 trillion Bloomberg Global Aggregate Bond Index showed an average maturity of 8.61 years and a yield of 3.54%, the latter +1.40% over the last 12 months. As of March 31, 2023, developed world bond yields outside the U.S. lag domestic bond yields by a significant margin, a circumstance that supported the U.S. dollar for much of 2022. The U.S. dollar has weakened modestly in the last two quarters on narrowing yield differentials and expanding U.S. deficits.

Readers of this commentary who are long-time Thornburg Investment Income Builder Fund shareholders will recall that the interest-bearing debt portion of the Fund’s portfolio has varied over time, ranging from less than 9% in 2015 to a high of 45% in 2009. We tend to allocate more portfolio assets to interest-bearing debt when debt yields are more attractive. At the start of this semi-annual period, 20% of Fund assets were invested in interest-bearing debt and near cash assets. Appreciation of portfolio equities in the last 2 quarters and some significant bond maturities reduced this to 15% as of March 31, 2023.

The outlook for financial asset returns in our view remains cloudy. The “real” yield on the 10-year U.S. Treasury note (March 31 market yield on 10-year UST of 3.47% minus core consumer price index of 4.6%) remains negative at -1.13%, using the February 2023 core consumer price index. This negative real yield level differs materially from levels typically experienced over the investment lifetimes of most readers of this note. As of March 31, 2023, the trailing 30-year average “real yield” on 10-year U.S. Treasury notes was +1.50%, so the current difference versus the historical average is significant. In 2022, bond yields increased in favor of saver investors at the expense of borrowers for the first time in many years. Equity valuations have since cheapened, and inflation now appears to us to be headed lower.

In our view, incoming economic data from around the world indicate a resilient global economy that is resisting falling into

a broadly predicted recession. Prices of traded financial assets have been and may continue to be volatile, with day-to-day news capable of changing investor perceptions of near-term economic performance. We are optimistic about the future return potential of Thornburg Investment Income Builder Fund’s assets. Why?

Equity and bond prices have already delivered significant declines in anticipation of central bank policy rate increases and some degree of economic recession. At some point, in our view, investors will likely anticipate lower interest rates and a strengthening global economy. Virtually all the businesses in the Fund’s portfolio currently retain their market positions providing important products and services that generate cash flows to pay attractive dividends, and as such, we believe they are valued very attractively in relation to their own histories and relative to other assets.

The weighted average price/earnings ratio for Thornburg Investment Income Builder Fund’s equity portfolio, tabulated using Bloomberg reported results, was approximately 10.9x as of March 31, 2023, significantly below the 17.8x price/earnings ratio of the MSCI World Net Total Return USD Index and the 11.9x price/earnings ratio of the Fund one year ago. The Fund’s 5.5% weighted average equity portfolio dividend yield as of March 31, 2023 significantly exceeds the 2.3% dividend yield of the MSCI World Net Total Return USD Index. We believe the Fund’s portfolio incorporates significant intrinsic value.

Thank you for being a shareholder of Thornburg Investment Income Builder Fund. Remember that you can review additional information about the portfolio by going to our website, www.thornburg.com.

Sincerely,

|

|

Brian McMahon

Portfolio Manager

Chief Investment Strategist

and Managing Director | Jason Brady, cfa

Portfolio Manager

CEO, President, and

Managing Director |

|

|

Ben Kirby, cfa

Portfolio Manager

Head of Investments

and Managing Director | Matt Burdett

Portfolio Manager and

Managing Director |

10 | Thornburg Equity Funds Semi-Annual Report

Thornburg Global Opportunities Fund

Investment Goal and

Fund Overview

The Fund seeks long-term capital appreciation by investing in equity and debt securities of all types from issuers around the world.

A flexible mandate allows the Fund to pursue long-term performance using a broad approach to geography and market capitalization. The Fund invests primarily in a broad range of equity securities, including common stocks, preferred stocks and publicly traded real estate investment trusts, including smaller companies with market capitalizations less than $500 million. Investment decisions are based on domestic and international economic developments, outlooks for securities markets, interest rates and inflation, the supply and demand for debt and equity securities, and analysis of specific issuers.

See letter beginning on page 5 of this report for a discussion of factors affecting the Fund’s performance for the reporting period ended March 31, 2023.

Performance Summary

March 31, 2023 (Unaudited)

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

AVERAGE ANNUAL TOTAL RETURNS

| THORNBURG GLOBAL OPPORTUNITIES FUND | 1-YR | 3-YR | 5-YR | 10-YR | SINCE

INCEPTION |

| Class A Shares (Incep: 7/28/06) | | | | | |

| Without sales charge | -4.17% | 20.23% | 7.03% | 9.05% | 8.94% |

| With sales charge | -8.47% | 18.40% | 6.04% | 8.55% | 8.64% |

| Class C Shares (Incep: 7/28/06) | | | | | |

| Without sales charge | -4.93% | 19.32% | 6.22% | 8.23% | 8.10% |

| With sales charge | -5.86% | 19.32% | 6.22% | 8.23% | 8.10% |

| Class I Shares (Incep: 7/28/06) | -3.90% | 20.59% | 7.34% | 9.42% | 9.37% |

| Class R3 Shares (Incep: 2/1/08) | -4.37% | 19.98% | 6.80% | 8.86% | 6.56% |

| Class R4 Shares (Incep: 2/1/08) | -4.29% | 20.09% | 6.91% | 8.96% | 6.66% |

| Class R5 Shares (Incep: 2/1/08) | -3.90% | 20.59% | 7.34% | 9.41% | 7.11% |

| Class R6 Shares (Incep: 4/10/17) | -3.75% | 20.74% | 7.49% | - | 7.46% |

MSCI All Country World Net Total Return USD Index

(Since 7/28/06) | -7.44% | 15.36% | 6.93% | 8.06% | 6.27% |

The matters discussed in this report may constitute forward-looking statements made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995. These include any advisor or portfolio manager prediction, assessment, analysis or outlook for individual securities, industries, investment styles, market sectors and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for each fund in its current prospectus, other factors bearing on these reports include the accuracy of the advisor’s or portfolio manager’s forecasts and predictions, the appropriateness of the investment strategies designed by the advisor or portfolio manager and the ability of the advisor or portfolio manager to implement their strategies efficiently and successfully. Any one or more of these factors, as well as other risks affecting the securities markets generally, could cause the actual results of any fund to differ materially as compared to its benchmarks.

The views expressed are subject to change and do not necessarily reflect the views of Thornburg Investment Management, Inc. This information should not be relied upon as a recommendation or investment advice and is not intended to predict the performance of any investment or market.

Performance results of individual share classes will vary based on the fees and expenses associated with each share class, and may be higher or lower than other share classes within the same Fund. Please see Performance Summary for performance results of each share class.

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than quoted. For performance current to the most recent month end, visit thornburg.com or call 800-847-0200. The performance information does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of Fund shares. Returns reflect the reinvestment of dividends and capital gains. Class A shares are sold with a maximum sales charge of 4.50%. Class C shares are subject to a 1% contingent deferred sales charge (CDSC) for the first year only. There is no sales charge for Class I, R3, R4, R5 and R6 shares. As disclosed in the Fund’s most recent prospectus, the total annual fund operating expenses before fee waivers or expense reimbursements are as follows: A shares, 1.35%; C shares, 2.11%; I shares, 1.06%; R3 shares, 2.40%; R4 shares, 2.09%; R5 shares, 1.38%; R6 shares, 1.03%. Thornburg Investment Management has contractually agreed to waive fees and reimburse expenses until at least February 1, 2024, for some of the share classes, resulting in net expense ratios of the following: I shares, 0.99%; R3 shares, 1.50%; R4 shares, 1.40%; R5 shares, 0.99%; R6 shares, 0.85%. For more detailed information on fund expenses and waivers/reimbursements please see the Fund’s prospectus.

Thornburg Equity Funds Semi-Annual Report | 11

Thornburg International Equity Fund

Investment Goal and

Fund Overview

The International Equity Fund seeks long-term capital appreciation by investing in equity and debt securities of all types. The secondary, nonfundamental goal of the Fund is to seek some current income. The Fund invests primarily in non-U.S. companies selected on a value basis using fundamental research. Under normal conditions, the Fund invests at least 80% of its assets in common stocks or depositary receipts. As described in more detail in the Fund Prospectus, the portfolio is diversified to include basic value stocks, but also includes stocks of companies with consistent earnings characteristics and those of emerging franchises, when these issues are value priced.

Performance drivers and detractors for the reporting period ended March 31, 2023

» For the 6-month period ended March 31, 2023, the Fund’s Class I shares returned 28.25% versus 22.13% for the MSCI All Country World ex USA Net Total Return USD Index (the “Index”), the Fund’s primary benchmark index, and 27.27% for the MSCI EAFE (Europe, Australasia, Far East) Net Total Return USD Index (the “EAFE Index”), the Fund’s secondary benchmark index.

» During the period, international equity markets began to recover from steep losses in the first 9 months of 2022, and numerous macro forces which had driven losses in that period – commodity prices, inflation, central bank tightening – lessened, allowing bottom-up stock selection to re-emerge as a significant contributor to performance relative to the Index.

» Emerging markets continued to trail developed markets, accounting for the differential in performance between the Index and the EAFE Index—the primary driver being a smaller weight in the Eurozone and the underperformance of India and China. During the period, the Fund held an average weight of 18% in emerging markets versus 28% for the Index, which contributed positively to performance during the period.

» The Fund’s overweighting in the Eurozone and zero exposure to India during the period were positive contributors to performance. Regarding Hong Kong, both the Fund’s overweight position and stock selection contributed positively to the Fund’s performance. Stock selection in China and Japan negatively impacted Fund performance. Currency effects on Fund returns were neutral in a period where the U.S. dollar weakened modestly.

Performance Summary

March 31, 2023 (Unaudited)

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

| THORNBURG INTERNATIONAL EQUITY FUND | FINAL VALUE |

AVERAGE ANNUAL TOTAL RETURNS

| THORNBURG INTERNATIONAL EQUITY FUND | 1-YR | 3-YR | 5-YR | 10-YR | SINCE

INCEPTION |

| Class A Shares (Incep: 5/28/98) | | | | | |

| Without sales charge | 0.54% | 13.48% | 4.39% | 5.17% | 6.99% |

| With sales charge | -3.97% | 11.76% | 3.43% | 4.69% | 6.79% |

| Class C Shares (Incep: 5/28/98) | | | | | |

| Without sales charge | -0.20% | 12.69% | 3.64% | 4.41% | 6.17% |

| With sales charge | -1.18% | 12.69% | 3.64% | 4.41% | 6.17% |

| Class I Shares (Incep: 3/30/01) | 0.82% | 13.85% | 4.71% | 5.54% | 6.83% |

| Class R3 Shares (Incep: 7/1/03) | 0.37% | 13.29% | 4.20% | 4.99% | 7.40% |

| Class R4 Shares (Incep: 2/1/07) | 0.56% | 13.51% | 4.40% | 5.19% | 3.94% |

| Class R5 Shares (Incep: 2/1/05) | 0.85% | 13.81% | 4.68% | 5.48% | 6.23% |

| Class R6 Shares (Incep: 5/1/12) | 1.06% | 14.05% | 4.89% | 5.70% | 5.89% |

MSCI All Country World ex USA Net Total Return USD

Index (Since 5/28/98) | -5.07% | 11.80% | 2.47% | 4.17% | 4.50% |

| MSCI EAFE Net Total Return USD Index (Since 5/28/98) | -1.38% | 12.99% | 3.52% | 5.00% | 4.26% |

The matters discussed in this report may constitute forward-looking statements made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995. These include any advisor or portfolio manager prediction, assessment, analysis or outlook for individual securities, industries, investment styles, market sectors and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for each fund in its current prospectus, other factors bearing on these reports include the accuracy of the advisor’s or portfolio manager’s forecasts and predictions, the appropriateness of the investment strategies designed by the advisor or portfolio manager and the ability of the advisor or portfolio manager to implement their strategies efficiently and successfully. Any one or more of these factors, as well as other risks affecting the securities markets generally, could cause the actual results of any fund to differ materially as compared to its benchmarks.

The views expressed are subject to change and do not necessarily reflect the views of Thornburg Investment Management, Inc. This information should not be relied upon as a recommendation or investment advice and is not intended to predict the performance of any investment or market.

Performance results of individual share classes will vary based on the fees and expenses associated with each share class, and may be higher or lower than other share classes within the same Fund. Please see Performance Summary for performance results of each share class.

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than quoted. For performance current to the most recent month end, visit thornburg.com or call 800-847-0200. The performance information does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of Fund shares. Returns reflect the reinvestment of dividends and capital gains. Class A shares are sold with a maximum sales charge of 4.50%. Class C shares are subject to a 1% contingent deferred sales charge (CDSC) for the first year only. There is no sales charge for Class I, R3, R4, R5 and R6 shares. As disclosed in the Fund’s most recent prospectus, the total annual fund operating expenses before fee waivers or expense reimbursements are as follows: A shares, 1.38%; C shares, 2.05%; I shares, 1.00%; R3 shares, 1.70%; R4 shares, 1.50%; R5 shares, 1.28%; R6 shares, 0.92%. Thornburg Investment Management has contractually agreed to waive fees and reimburse expenses until at least February 1, 2024, for some of the share classes, resulting in net expense ratios of the following: I shares, 0.90%; R3 shares, 1.36%; R4 shares, 1.16%; R5 shares, 0.90%; R6 shares 0.70%. For more detailed information on fund expenses and waivers/reimbursements please see the Fund’s prospectus.

12 | Thornburg Equity Funds Semi-Annual Report

Thornburg Better World International Fund

Investment Goal and

Fund Overview

The Better World International Fund seeks long-term capital appreciation. The Fund invests primarily in a broad range of foreign companies, based on fundamental research combined with analysis of those environmental, social and governance (ESG) characteristics that the investment manager identifies as significant. The Fund targets companies of any size or country of origin, and which are high-quality, attractively valued and, in our view, also demonstrate one or more significant positive ESG characteristics. The Fund portfolio is diversified to include basic value stocks, companies with consistent earnings, and emerging franchises as described in more detail in the Fund Prospectus.

Performance drivers and detractors for the reporting period ended March 31, 2023

» For the 6-month period ended March 31, 2023, the Fund’s Class I shares returned 22.38% versus 22.13% for the MSCI All Country World ex USA Net Total Return USD Index (the "Index").

» During the period, international equity markets began to recover from steep losses in the first 9 months of 2022, and numerous macro forces which had driven losses in that period – commodity prices, inflation, central bank tightening – lessened, allowing bottom-up stock selection to re-emerge as a significant contributor to performance relative to the Index.

» The biggest contributors to the Fund’s returns on a sector basis were financials and communications. Additionally, the Fund’s lack of exposure to the energy sector, which trailed over the semi-annual period, was a significant positive contributor to the Fund’s outperformance relative to the Index. The biggest sector detractors during the period were the Fund’s allocations to health care and cash.

» Additional contributors to Fund performance during the period were a zero weight in securities in India and overweight positioning and stock selection in Hong Kong. Detractors to performance included the Fund’s allocation to global companies domiciled in the U.S. and its overweight position in China. Currency effects on the Fund’s performance during the period were negative, primarily due to its country allocations to the U.S. and Hong Kong, and cash holdings, all of which were U.S. dollar-denominated or dollar-linked in a period where the U.S. dollar weakened.

Performance Summary

March 31, 2023 (Unaudited)

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

| THORNBURG BETTER WORLD INTERNATIONAL FUND | FINAL VALUE |

AVERAGE ANNUAL TOTAL RETURNS

THORNBURG BETTER WORLD

INTERNATIONAL FUND | 1-YR | 3-YR | 5-YR | 10-YR | SINCE

INCEPTION |

| Class A Shares (Incep: 10/1/15) | | | | | |

| Without sales charge | -4.76% | 18.23% | 7.47% | - | 9.00% |

| With sales charge | -9.03% | 16.42% | 6.49% | - | 8.34% |

| Class C Shares (Incep: 10/1/15) | | | | | |

| Without sales charge | -5.46% | 17.38% | 6.77% | - | 8.33% |

| With sales charge | -6.40% | 17.38% | 6.77% | - | 8.33% |

| Class I Shares (Incep: 10/1/15) | -4.23% | 18.93% | 8.15% | - | 9.75% |

MSCI All Country World ex USA Net Total Return USD

Index (Since 9/30/15) | -5.07% | 11.80% | 2.47% | - | 5.85% |

The matters discussed in this report may constitute forward-looking statements made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995. These include any advisor or portfolio manager prediction, assessment, analysis or outlook for individual securities, industries, investment styles, market sectors and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for each fund in its current prospectus, other factors bearing on these reports include the accuracy of the advisor’s or portfolio manager’s forecasts and predictions, the appropriateness of the investment strategies designed by the advisor or portfolio manager and the ability of the advisor or portfolio manager to implement their strategies efficiently and successfully. Any one or more of these factors, as well as other risks affecting the securities markets generally, could cause the actual results of any fund to differ materially as compared to its benchmarks.

The views expressed are subject to change and do not necessarily reflect the views of Thornburg Investment Management, Inc. This information should not be relied upon as a recommendation or investment advice and is not intended to predict the performance of any investment or market.

Performance results of individual share classes will vary based on the fees and expenses associated with each share class, and may be higher or lower than other share classes within the same Fund. Please see Performance Summary for performance results of each share class.

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than quoted. For performance current to the most recent month end, visit thornburg.com or call 800-847-0200. The performance information does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of Fund shares. Returns reflect the reinvestment of dividends and capital gains. Class A shares are sold with a maximum sales charge of 4.50%. Class C shares are subject to a 1% contingent deferred sales charge (CDSC) for the first year only. There is no sales charge for Class I shares. As disclosed in the Fund’s most recent prospectus, the total annual fund operating expenses before fee waivers or expense reimbursements are as follows: A shares, 1.58%; C shares, 2.50%; I shares, 1.25%. Thornburg Investment Management has contractually agreed to waive fees and reimburse expenses until at least February 1, 2024, for some of the share classes, resulting in net expense ratios of the following: C shares, 2.19%; I shares, 0.90%. For more detailed information on fund expenses and waivers/reimbursements please see the Fund’s prospectus.

Thornburg Equity Funds Semi-Annual Report | 13

Thornburg International Growth Fund

Investment Goal and

Fund Overview

The International Growth Fund seeks long-term growth of capital by investing in equity securities from around the world selected for their growth potential based on management’s belief that the companies will have growing revenues and earnings. The Fund can invest in companies of any size, from large, well-established firms to small, emerging growth franchises. Management uses traditional fundamental research to evaluate securities and make buy/sell decisions.

Performance drivers and detractors for the reporting period ended March 31, 2023

» For the 6-month period ended March 31, 2023, the Fund’s Class I shares returned 26.45% versus a return of 22.59% for the MSCI All Country World ex USA Growth Net Total Return USD Index (the "Index").

» During the period, international equity markets began to recover from steep losses in the first 9 months of 2022, and numerous macro forces which had driven losses in that period – commodity prices, inflation, central bank tightening – lessened, allowing bottom-up stock selection to re-emerge as a significant contributor to performance relative to the Index.

» Numerous markets performed well in the period from October 2022 through January 2023, notably the Eurozone and China/Hong Kong, with the Fund’s exposure to those countries contributing positively to its performance relative to the Index.

» Over the 6-month period, the Fund benefited from growth securities modestly outperforming value securities, mostly due to increased investor fears of a slowing economy in the wake of global bank weakness in March 2023.

» Consistent with the Fund’s active investment style, its outperformance was mostly driven by bottom-up stock selection during the period as the domination of macro factors in the volatile first 9 months of 2022 subsided.

» From a sector standpoint, consumer discretionary, financials, and health care were the biggest contributors to Fund performance, led by stock selection, with industrials, communication services, and information technology the biggest detractors.

» Regionally, an overweighting of the Fund in the Eurozone combined with an underweight in India boosted performance during the period. Additionally, our stock selection in India and Brazil were positive contributors while stock selection in Japan and Germany were the biggest detractors.

» Currency effects were modestly negative as the Fund’s allocations to global companies domiciled in the U.S. and cash position negatively impacted performance as the U.S. dollar weakened during the period.

Performance Summary

March 31, 2023 (Unaudited)

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

| THORNBURG INTERNATIONAL GROWTH FUND | FINAL VALUE |

AVERAGE ANNUAL TOTAL RETURNS

| THORNBURG INTERNATIONAL GROWTH FUND | 1-YR | 3-YR | 5-YR | 10-YR | SINCE

INCEPTION |

| Class A Shares (Incep: 2/1/07) | | | | | |

| Without sales charge | -3.31% | 7.32% | 1.57% | 4.88% | 5.99% |

| With sales charge | -7.65% | 5.68% | 0.64% | 4.40% | 5.69% |

| Class C Shares (Incep: 2/1/07) | | | | | |

| Without sales charge | -4.16% | 6.43% | 0.75% | 4.06% | 5.21% |

| With sales charge | -5.12% | 6.43% | 0.75% | 4.06% | 5.21% |

| Class I Shares (Incep: 2/1/07) | -2.92% | 7.67% | 1.89% | 5.26% | 6.46% |

| Class R3 Shares (Incep: 2/1/08) | -3.44% | 7.12% | 1.38% | 4.72% | 5.08% |

| Class R4 Shares (Incep: 2/1/08) | -3.33% | 7.24% | 1.48% | 4.83% | 5.18% |

| Class R5 Shares (Incep: 2/1/08) | -2.93% | 7.67% | 1.90% | 5.25% | 5.61% |

| Class R6 Shares (Incep: 2/1/13) | -2.85% | 7.78% | 1.99% | 5.36% | 5.82% |

| MSCI All Country World ex USA Growth Net Total Return USD Index (Since 2/1/07) | -6.35% | 9.49% | 3.36% | 5.08% | 3.57% |

The matters discussed in this report may constitute forward-looking statements made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995. These include any advisor or portfolio manager prediction, assessment, analysis or outlook for individual securities, industries, investment styles, market sectors and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for each fund in its current prospectus, other factors bearing on these reports include the accuracy of the advisor’s or portfolio manager’s forecasts and predictions, the appropriateness of the investment strategies designed by the advisor or portfolio manager and the ability of the advisor or portfolio manager to implement their strategies efficiently and successfully. Any one or more of these factors, as well as other risks affecting the securities markets generally, could cause the actual results of any fund to differ materially as compared to its benchmarks.

The views expressed are subject to change and do not necessarily reflect the views of Thornburg Investment Management, Inc. This information should not be relied upon as a recommendation or investment advice and is not intended to predict the performance of any investment or market.

Performance results of individual share classes will vary based on the fees and expenses associated with each share class, and may be higher or lower than other share classes within the same Fund. Please see Performance Summary for performance results of each share class.

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than quoted. For performance current to the most recent month end, visit thornburg.com or call 800-847-0200. The performance information does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of Fund shares. Returns reflect the reinvestment of dividends and capital gains. Class A shares are sold with a maximum sales charge of 4.50%. Class C shares are subject to a 1% contingent deferred sales charge (CDSC) for the first year only. There is no sales charge for Class I, R3, R4, R5 and R6 shares. As disclosed in the Fund’s most recent prospectus, the total annual fund operating expenses before fee waivers or expense reimbursements are as follows: A shares, 1.36%; C shares, 2.23%; I shares, 1.06%; R3 shares, 2.29%; R4 shares, 2.00%; R5 shares, 1.45%; R6 shares, 1.01%. Thornburg Investment Management has contractually agreed to waive fees and reimburse expenses until at least February 1, 2024, for some of the share classes, resulting in net expense ratios of the following: I shares, 0.99%; R3 shares, 1.50%; R4 shares, 1.40%; R5 shares, 0.99%; R6 shares, 0.89%. For more detailed information on fund expenses and waivers/reimbursements please see the Fund’s prospectus.

14 | Thornburg Equity Funds Semi-Annual Report

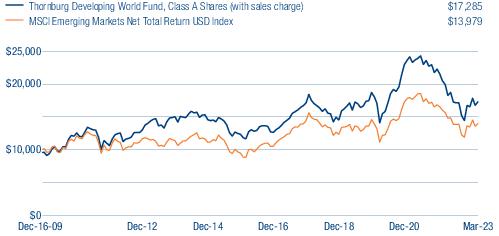

Thornburg Developing World Fund

Investment Goal and

Fund Overview

The Developing World Fund’s primary investment goal is long-term capital appreciation. The Fund invests at least 80% of its assets in equity securities of developing country issuers. A developing country issuer is a company or sovereign entity that is domiciled or otherwise tied economically to one or more developing countries. The Fund portfolio is diversified to include basic value stocks, companies with consistent earnings, and emerging franchises as described in more detail in the Fund Prospectus.

Performance drivers and detractors for the reporting period ended March 31, 2023

» For the 6-month period ended March 31, 2023, the Fund’s Class I shares returned 13.98%, slightly underperforming the 14.04% of the MSCI Emerging Markets Net Total Return USD Index (the "Index").

» Concerns around U.S. rates and regional banks have driven recent market volatility. While emerging markets (EM) have little-to-no exposure to U.S. banks, EM countries have slightly underperformed the U.S. on a year-to-date basis. A positive tailwind for EM equities is that since many EM central banks have been ahead of the curve in fighting post-COVID-19 inflation last year, real interest rates are positive across many EM economies.

» The Fund’s strong absolute performance was primarily driven by stock selection with its currency allocation decisions also contributing positively to performance. The Fund’s sector allocations detracted from the overall performance during the period.

» On a sector basis, consumer discretionary and industrials contributed positively to the Fund’s performance relative to the Index. However, financials and information technology detracted from the Fund’s performance relative to the Index during the period. In each sector, stock selection was the primary driver of absolute Fund performance.

» On a geographic basis, stock selection and an overweight allocation to the United Arab Emirates contributed positively to, while stock selection within Brazil and China detracted from, the Fund’s performance relative to the Index.

Performance Summary

March 31, 2023 (Unaudited)

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

| THORNBURG DEVELOPING WORLD FUND | FINAL VALUE |

AVERAGE ANNUAL TOTAL RETURNS

| THORNBURG DEVELOPING WORLD FUND | 1-YR | 3-YR | 5-YR | 10-YR | SINCE

INCEPTION |

| Class A Shares (Incep: 12/16/09) | | | | | |

| Without sales charge | -13.30% | 7.08% | 0.33% | 1.88% | 4.56% |

| With sales charge | -17.20% | 5.44% | -0.59% | 1.42% | 4.20% |

| Class C Shares (Incep: 12/16/09) | | | | | |

| Without sales charge | -14.01% | 6.23% | -0.45% | 1.10% | 3.79% |

| With sales charge | -14.86% | 6.23% | -0.45% | 1.10% | 3.79% |

| Class I Shares (Incep: 12/16/09) | -13.00% | 7.45% | 0.70% | 2.28% | 5.03% |

| Class R5 Shares (Incep: 2/1/13) | -13.00% | 7.46% | 0.70% | 2.28% | 2.61% |

| Class R6 Shares (Incep: 2/1/13) | -12.88% | 7.58% | 0.80% | 2.38% | 2.72% |

| MSCI Emerging Markets Net Total Return USD Index (Since 12/16/09) | -10.70% | 7.83% | -0.91% | 2.00% | 2.55% |

The matters discussed in this report may constitute forward-looking statements made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995. These include any advisor or portfolio manager prediction, assessment, analysis or outlook for individual securities, industries, investment styles, market sectors and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for each fund in its current prospectus, other factors bearing on these reports include the accuracy of the advisor’s or portfolio manager’s forecasts and predictions, the appropriateness of the investment strategies designed by the advisor or portfolio manager and the ability of the advisor or portfolio manager to implement their strategies efficiently and successfully. Any one or more of these factors, as well as other risks affecting the securities markets generally, could cause the actual results of any fund to differ materially as compared to its benchmarks.

The views expressed are subject to change and do not necessarily reflect the views of Thornburg Investment Management, Inc. This information should not be relied upon as a recommendation or investment advice and is not intended to predict the performance of any investment or market.

Performance results of individual share classes will vary based on the fees and expenses associated with each share class, and may be higher or lower than other share classes within the same Fund. Please see Performance Summary for performance results of each share class.

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than quoted. For performance current to the most recent month end, visit thornburg.com or call 800-847-0200. The performance information does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of Fund shares. Returns reflect the reinvestment of dividends and capital gains. Class A shares are sold with a maximum sales charge of 4.50%. Class C shares are subject to a 1% contingent deferred sales charge (CDSC) for the first year only. There is no sales charge for Class I, R5 and R6 shares. As disclosed in the Fund’s most recent prospectus, the total annual fund operating expenses before fee waivers or expense reimbursements are as follows: A shares, 1.54%; C shares, 2.36%; I shares, 1.23%; R5 shares, 2.15%; R6 shares, 1.20%. Thornburg Investment Management has contractually agreed to waive fees and reimburse expenses until at least February 1, 2024, for some of the share classes, resulting in net expense ratios of the following: C shares, 2.33%; I shares, 1.04%; R5 shares, 1.04%; R6 shares, 0.94%. For more detailed information on fund expenses and waivers/reimbursements please see the Fund’s prospectus.

Thornburg Equity Funds Semi-Annual Report | 15

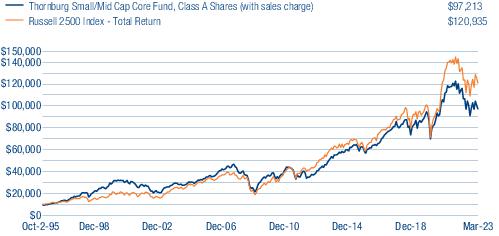

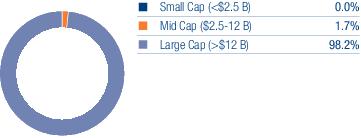

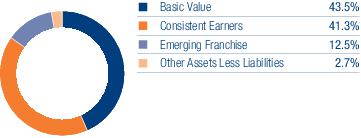

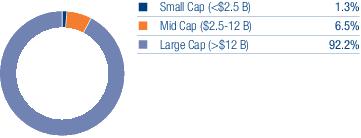

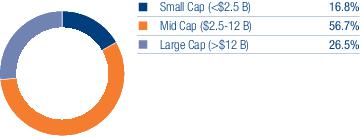

Thornburg Small/Mid Cap Core Fund

Investment Goal and

Fund Overview

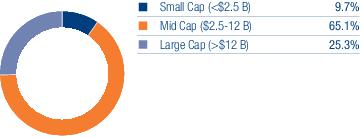

The Fund seeks long-term capital appreciation by investing in equity and debt securities of all types. The secondary, non-fundamental goal of the Fund is to seek some current income. Under normal conditions, the Fund invests at least 80% of its net assets in small- and mid-capitalization companies.

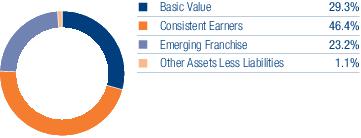

With its core approach to stock selection, the Fund seeks to invest in a broadly diversified portfolio of companies the Fund categorizes as basic values, consistent earners, and emerging franchises, as described in more detail in the Fund Prospectus. The relative proportions of securities invested in each of those categories will vary over time.

Performance drivers and detractors for the reporting period ended March 31, 2023

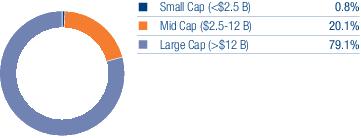

» For the 6-month period ended March 31, 2023, the Fund’s Class I shares returned 7.15% versus a return of 11.07% for the Russell 2500 Index - Total Return (the "Index").

» The Fund’s underperformance relative to the Index was primarily due to stock selection and market cap allocations.

» Stock selection in the financial sector accounted for most of the Fund’s underperformance relative to the Index. However, stock selection in the health care sector was a major positive contributor to absolute and relative Fund performance versus the Index.

» Sector allocation added a small amount of value as the Fund was underweight in financials and overweight in consumer staples and materials relative to the Index during the period.

» Parsing Fund performance by market caps versus the Index shows stock selection contributing positively to Fund equity holdings with market caps greater than $12 billion and less than $2.5 billion. The market cap range of Fund equity holdings between $2.5 billion and $12 billion accounted for the majority of underperformance relative to the Index during the period.

Performance Summary

March 31, 2023 (Unaudited)

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

| THORNBURG SMALL/MID CAP CORE FUND | FINAL VALUE |

AVERAGE ANNUAL TOTAL RETURNS

| THORNBURG SMALL/MID CAP CORE FUND | 1-YR | 3-YR | 5-YR | 10-YR | SINCE

INCEPTION |

| Class A Shares (Incep: 10/2/95) | | | | | |

| Without sales charge | -16.24% | 11.70% | 4.01% | 8.58% | 8.80% |

| With sales charge | -20.01% | 10.00% | 3.06% | 8.08% | 8.62% |

| Class C Shares (Incep: 10/2/95) | | | | | |

| Without sales charge | -17.05% | 10.73% | 3.12% | 7.71% | 7.95% |

| With sales charge | -17.88% | 10.73% | 3.12% | 7.71% | 7.95% |

| Class I Shares (Incep: 11/2/98) | -15.88% | 12.12% | 4.38% | 8.99% | 7.12% |

| Class R3 Shares (Incep: 7/1/03) | -16.18% | 11.72% | 4.01% | 8.60% | 7.04% |

| Class R4 Shares (Incep: 2/1/07) | -16.10% | 11.83% | 4.11% | 8.70% | 5.33% |

| Class R5 Shares (Incep: 2/1/05) | -15.87% | 12.13% | 4.38% | 8.99% | 7.07% |

Russell 2500 Index - Total Return

(Since 10/2/95) | -10.39% | 19.42% | 6.65% | 9.07% | 9.49% |

The matters discussed in this report may constitute forward-looking statements made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995. These include any advisor or portfolio manager prediction, assessment, analysis or outlook for individual securities, industries, investment styles, market sectors and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for each fund in its current prospectus, other factors bearing on these reports include the accuracy of the advisor’s or portfolio manager’s forecasts and predictions, the appropriateness of the investment strategies designed by the advisor or portfolio manager and the ability of the advisor or portfolio manager to implement their strategies efficiently and successfully. Any one or more of these factors, as well as other risks affecting the securities markets generally, could cause the actual results of any fund to differ materially as compared to its benchmarks.

The views expressed are subject to change and do not necessarily reflect the views of Thornburg Investment Management, Inc. This information should not be relied upon as a recommendation or investment advice and is not intended to predict the performance of any investment or market.

Performance results of individual share classes will vary based on the fees and expenses associated with each share class, and may be higher or lower than other share classes within the same Fund. Please see Performance Summary for performance results of each share class.

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than quoted. For performance current to the most recent month end, visit thornburg.com or call 800-847-0200. The performance information does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of Fund shares. Returns reflect the reinvestment of dividends and capital gains. Class A shares are sold with a maximum sales charge of 4.50%. Class C shares are subject to a 1% contingent deferred sales charge (CDSC) for the first year only. There is no sales charge for Class I, R3, R4 and R5 shares. As disclosed in the Fund’s most recent prospectus, the total annual fund operating expenses before fee waivers or expense reimbursements are as follows: A shares, 1.37%; C shares, 2.34%; I shares, 1.09%; R3 shares, 1.87%; R4 shares, 2.04%; R5 shares, 1.64%. Thornburg Investment Management has contractually agreed to waive fees and reimburse expenses until at least February 1, 2024, for some of the share classes, resulting in net expense ratios of the following: I shares, 0.95%; R3 shares, 1.31%; R4 shares, 1.21%; R5 shares, 0.95%. For more detailed information on fund expenses and waivers/reimbursements please see the Fund’s prospectus.

16 | Thornburg Equity Funds Semi-Annual Report

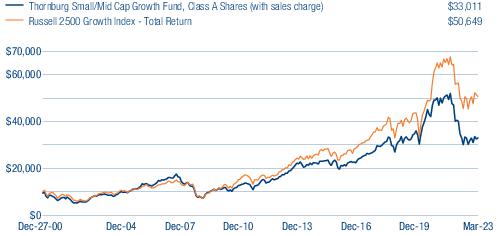

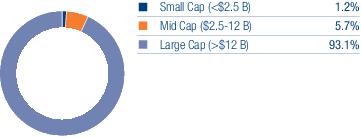

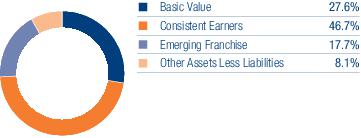

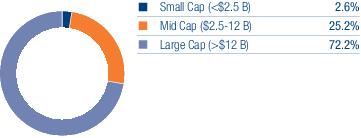

Thornburg Small/Mid Cap Growth Fund

Investment Goal and

Fund Overview

The Fund seeks long-term growth of capital by investing in equity securities selected for their growth potential. Under normal conditions, the Fund invests at least 80% of its net assets in small- and mid-capitalization companies.

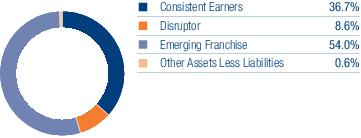

The Fund seeks to invest in a diversified portfolio of companies the Fund categorizes as consistent earners, disruptors, and emerging franchises, as described in more detail in the Fund Prospectus. The relative proportions of securities invested in each of those categories will vary over time.

Performance drivers and detractors for the reporting period ended March 31, 2023

» For the 6-month period ended March 31, 2023, the Fund’s Class I shares returned 9.53% versus a return of 11.57% for the Russell 2500 Growth Index - Total Return (the "Index").

» The Fund’s underperformance relative to the Index during the period was primarily due to stock selection and market cap allocations.

» The Fund’s stock selection was weakest in the information technology, industrial, and materials sectors and strongest in health care, consumer discretionary and energy sectors.

» Sector allocation was a small detractor to the Fund’s performance relative to the Index due to its slight underweight in energy.

» Dissecting Fund performance by market caps versus the Index shows stock selection contributing positively to Fund equity holdings with market caps greater than $12 billion and less than $2.5 billion. Fund equity holdings in the market cap range between $2.5 billion and $12 billion accounted for the majority of Fund underperformance relative to the Index.

Performance Summary

March 31, 2023 (Unaudited)

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

| THORNBURG SMALL/MID CAP GROWTH FUND | FINAL VALUE |

AVERAGE ANNUAL TOTAL RETURNS

THORNBURG SMALL/MID CAP

GROWTH FUND | 1-YR | 3-YR | 5-YR | 10-YR | SINCE

INCEPTION |

| Class A Shares (Incep: 12/27/00) | | | | | |

| Without sales charge | -17.68% | 2.89% | 2.40% | 6.66% | 5.73% |

| With sales charge | -21.37% | 1.32% | 1.46% | 6.17% | 5.51% |

| Class C Shares (Incep: 12/27/00) | | | | | |

| Without sales charge | -18.40% | 2.04% | 1.56% | 5.81% | 4.89% |

| With sales charge | -19.21% | 2.04% | 1.56% | 5.81% | 4.89% |

| Class I Shares (Incep: 11/3/03) | -17.26% | 3.30% | 2.78% | 7.07% | 7.59% |

| Class R3 Shares (Incep: 7/1/03) | -17.68% | 2.78% | 2.27% | 6.53% | 7.60% |

| Class R4 Shares (Incep: 2/1/07) | -17.60% | 2.87% | 2.37% | 6.64% | 4.86% |

| Class R5 Shares (Incep: 10/3/05) | -17.28% | 3.29% | 2.79% | 7.07% | 6.71% |

Russell 2500 Growth Index - Total Return

(Since 12/27/00) | -10.35% | 14.75% | 6.82% | 10.05% | 7.56% |

The matters discussed in this report may constitute forward-looking statements made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995. These include any advisor or portfolio manager prediction, assessment, analysis or outlook for individual securities, industries, investment styles, market sectors and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for each fund in its current prospectus, other factors bearing on these reports include the accuracy of the advisor’s or portfolio manager’s forecasts and predictions, the appropriateness of the investment strategies designed by the advisor or portfolio manager and the ability of the advisor or portfolio manager to implement their strategies efficiently and successfully. Any one or more of these factors, as well as other risks affecting the securities markets generally, could cause the actual results of any fund to differ materially as compared to its benchmarks.

The views expressed are subject to change and do not necessarily reflect the views of Thornburg Investment Management, Inc. This information should not be relied upon as a recommendation or investment advice and is not intended to predict the performance of any investment or market.

Performance results of individual share classes will vary based on the fees and expenses associated with each share class, and may be higher or lower than other share classes within the same Fund. Please see Performance Summary for performance results of each share class.

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than quoted. For performance current to the most recent month end, visit thornburg.com or call 800-847-0200. The performance information does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of Fund shares. Returns reflect the reinvestment of dividends and capital gains. Class A shares are sold with a maximum sales charge of 4.50%. Class C shares are subject to a 1% contingent deferred sales charge (CDSC) for the first year only. There is no sales charge for Class I, R3, R4 and R5 shares. As disclosed in the Fund’s most recent prospectus, the total annual fund operating expenses before fee waivers or expense reimbursements are as follows: A shares, 1.40%; C shares, 2.40%; I shares, 1.10%; R3 shares, 1.92%; R4 shares, 2.97%; R5 shares, 1.52%. Thornburg Investment Management has contractually agreed to waive fees and reimburse expenses until at least February 1, 2024, for some of the share classes, resulting in net expense ratios of the following: C shares, 2.34%; I shares, 0.95%; R3 shares, 1.46%; R4 shares, 1.36%; R5 shares, 0.95%. For more detailed information on fund expenses and waivers/reimbursements please see the Fund’s prospectus.

Thornburg Equity Funds Semi-Annual Report | 17

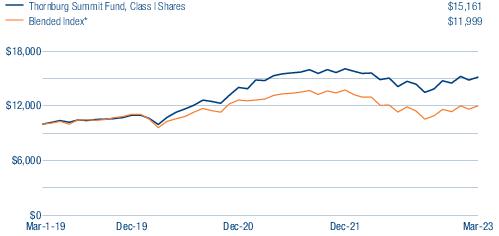

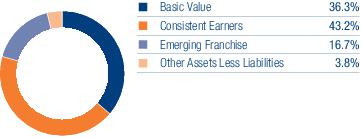

Thornburg Investment Income Builder Fund

Investment Goal and

Fund Overview

The Investment Income Builder Fund’s primary investment goal is to provide a level of current income which exceeds the average yield on U.S. stocks generally, and which will generally grow, subject to periodic fluctuations, over the years on a per share basis. The Fund’s secondary investment goal is long-term capital appreciation.

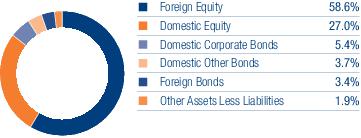

The Fund pursues its investment goals by investing in a broad range of income producing securities, primarily stocks and bonds. Equity investments normally will be weighted in favor of companies which pay dividends. The Fund may invest in securities of issuers domiciled in or economically tied to countries outside the United States, including developing countries. Investment decisions are based on domestic and international economic developments, outlooks for securities markets, interest rates and inflation, the supply and demand for debt and equity securities, and analysis of specific issuers.

See letter beginning on page 8 of this report for a discussion of factors affecting the Fund’s performance for the reporting period ended March 31, 2023.

Performance Summary

March 31, 2023 (Unaudited)

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

| THORNBURG INVESTMENT INCOME BUILDER FUND | FINAL VALUE |

AVERAGE ANNUAL TOTAL RETURNS

| THORNBURG INVESTMENT INCOME BUILDER FUND | 1-YR | 3-YR | 5-YR | 10-YR | SINCE

INCEPTION |

| Class A Shares (Incep: 12/24/02) | | | | | |

| Without sales charge | -1.21% | 15.95% | 5.82% | 5.68% | 8.51% |

| With sales charge | -5.64% | 14.18% | 4.85% | 5.19% | 8.26% |

| Class C Shares (Incep: 12/24/02) | | | | | |

| Without sales charge | -1.96% | 15.09% | 5.03% | 4.90% | 7.81% |

| With sales charge | -2.90% | 15.09% | 5.03% | 4.90% | 7.81% |

| Class I Shares (Incep: 11/3/03) | -0.96% | 16.23% | 6.09% | 5.98% | 8.04% |

| Class R3 Shares (Incep: 2/1/05) | -1.58% | 15.51% | 5.44% | 5.32% | 6.68% |

| Class R4 Shares (Incep: 2/1/08) | -1.51% | 15.64% | 5.54% | 5.42% | 5.32% |

| Class R5 Shares (Incep: 2/1/07) | -1.07% | 16.11% | 5.97% | 5.86% | 5.99% |

| Class R6 Shares (Incep: 4/10/17) | -0.86% | 16.34% | 6.18% | - | 6.64% |

MSCI World Net Total Return USD Index

(Since 12/24/02) | -7.02% | 16.40% | 8.01% | 8.85% | 8.43% |