UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-05201

Thornburg Investment Trust

(Exact name of registrant as specified in charter)

c/o Thornburg Investment Management, Inc.

2300 North Ridgetop Road, Santa Fe, New Mexico 87506

(Address of principal executive offices) (Zip code)

Garrett Thornburg, 2300 North Ridgetop Road, Santa Fe, New Mexico 87506

(Name and address of agent for service)

Registrant’s telephone number, including area code: 505-984-0200

Date of fiscal year end: September 30

Date of reporting period: March 31, 2020

Item 1.Reports to Stockholders

The following Semi-annual reports are attached hereto, in order:

Thornburg Short Duration Municipal Fund

Thornburg Limited Term Municipal Fund

Thornburg Intermediate Municipal Fund

Thornburg Strategic Municipal Income Fund

Thornburg California Limited Term Municipal Fund

Thornburg New Mexico Intermediate Municipal Fund

Thornburg New York Intermediate Municipal Fund

Thornburg Limited Term U.S. Government Fund

Thornburg Limited Term Income Fund

Thornburg Low Duration Income Fund

Thornburg Strategic Income Fund

Thornburg Value Fund

Thornburg International Value Fund

Thornburg Core Growth Fund

Thornburg International Growth Fund

Thornburg Investment Income Builder Fund

Thornburg Global Opportunities Fund

Thornburg Developing World Fund

Thornburg Better World International Fund

Thornburg Capital Management Fund

Thornburg Long/Short Equity Fund

Thornburg Summit Fund

Semi-Annual Report

March 31, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund or your financial intermediary electronically by going to thornburg.com/edelivery.

You may elect to receive all future reports in paper free of charge. You can inform the Fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by calling 800.847.0200 or your financial intermediary directly. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

| THORNBURG EQUITY FUNDS |

| Multi Asset |

| Thornburg Investment Income Builder Fund |

| Thornburg Summit Fund |

| Global Equity |

| Thornburg Global Opportunities Fund |

| International Equity |

| Thornburg International Value Fund |

| Thornburg Better World International Fund |

| Thornburg International Growth Fund |

| Thornburg Developing World Fund |

| Domestic Equity |

| Thornburg Value Fund |

| Thornburg Core Growth Fund |

| Alternatives |

| Thornburg Long/Short Equity Fund |

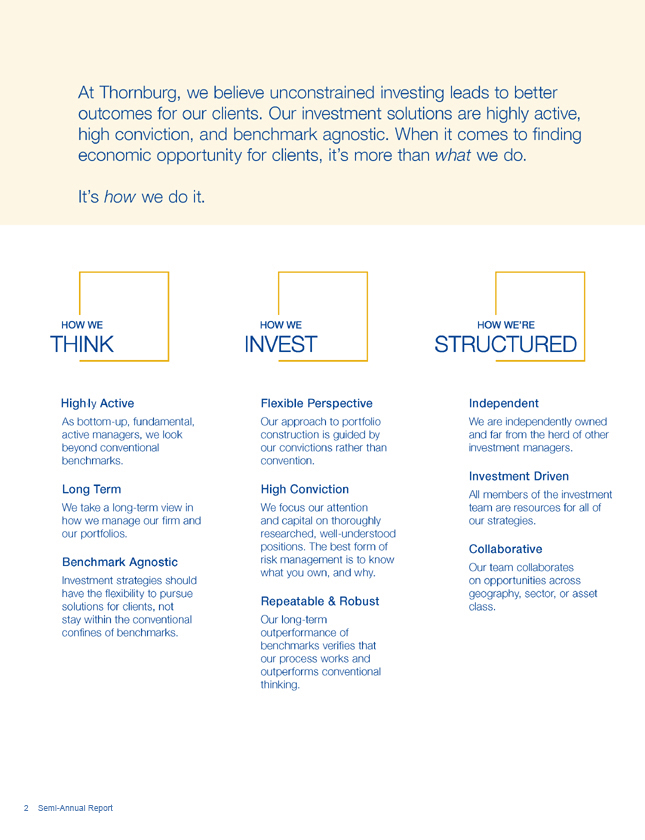

At Thornburg, we believe unconstrained investing leads to better outcomes for our clients. Our investment solutions are highly active, high conviction, and benchmark agnostic. When it comes to finding economic opportunity for clients, it’s more than what we do.

It’s how we do it. Active Asbottom-up, fundamental, active managers, we look beyond conventional benchmarks. Long Term We take a long-term view in how we manage our firm and our portfolios. Benchmark Agnostic Investment strategies should have the flexibility to pursue solutions for clients, not stay within the conventional confines of benchmarks. Flexible Perspective Our approach to portfolio construction is guided by our convictions rather than convention. High Conviction We focus our attention and capital on thoroughly researched, well-understood positions. The best form of risk management is to know what you own, and why. Repeatable & Robust Our long-term outperformance of benchmarks verifies that our process works and outperforms conventional thinking. Independent We are independently owned and far from the herd of other investment managers. Investment Driven All members of the investment team are resources for all of our strategies. Collaborative Our team collaborates on opportunities across geography, sector, or asset class.

Thornburg Equity Funds

Semi-Annual Reports | March 31, 2020

Table of Contents

Investments carry risks, including possible loss of principal. Additional risks may be associated with investments outside the United States, especially in emerging markets, including currency fluctuations, illiquidity, volatility, and political and economic risks. Investments in small- and mid-capitalization companies may increase the risk of greater price fluctuations. Portfolios investing in bonds have the same interest rate, inflation, and credit risks that are associated with the underlying bonds. The value of bonds will fluctuate relative to changes in interest rates, decreasing when interest rates rise. A short position will lose value as the security’s price increases. Theoretically, the loss on a short sale can be unlimited. Investments in derivatives are subject to the risks associated with the securities or other assets underlying the pool of securities, including illiquidity and difficulty in valuation. Please see the Funds’ prospectus for a discussion of the risks associated with an investment in the Funds. Investments in the Funds are not FDIC insured, nor are they deposits of or guaranteed by a bank or any other entity.

Thornburg Equity Funds Semi-Annual Report | 3

Letter to Shareholders

March 31, 2020 (Unaudited)

Dear Shareholder:

I hope this letter finds you safe and healthy. Amid the COVID-19 pandemic, we’re all adjusting to the challenges of working and living new ways while trying to see into a cloudy future. In these uncertain times, all of us at Thornburg Investment Management are squarely focused on providing you with the best investment outcomes that we can.

Many of our portfolios were well positioned for higher volatility. While we did not predict the cause of this downturn, it’s clear that high prices make for more vulnerable markets. Given our solid liquidity and preparation, we’ve been able to take advantage of price swings as many assets were on sale after the market’s decline. Longer term, it appears even the extraordinary fiscal and monetary support will merely cushion the blow. After all, the reason policy makers’ actions have been so extreme is in large part because they view them as necessary.

Looking forward, our nimble, collaborative investment team is well suited to deliver. The reason that we have a benchmark agnostic, flexible approach is so that we can go where we find value, within the mandate and objectives of the portfolio. While many investment firms have good products and processes, Thornburg is designed to see the world differently, and our perspective from Santa Fe, NM, is especially valuable in challenging times. While many other professionals are siloed into narrow areas of expertise, without the ability to evaluate the bigger picture, we work across sectors and asset classes to find great investments and put them into balanced portfolios. The last few months have demonstrated the strength of our approach, given its adaptability and capacity to place new information in the context of broad portfolios quickly. Being nimble is part of Thornburg’s culture, and people across the organization are finding new ways to pitch in for the sake of our clients.

No one can predict with certainty what the market has in store for us, especially in the context of the current health crisis. What does seem certain, however, is that the events of the last few months are accelerating change that was already occurring, as well as underlining the vulnerability of many of the systems that many of us take for granted. That is true in our daily lives, as well as in financial markets. We believe our understanding of and participation in the interconnectedness of these markets is our core competency: We’re built for this.

Thank you so much for your time and your business.

| |

Jason Brady,cfa

Portfolio Manager

CEO, President, and

Managing Director | |

The matters discussed in this report may constitute forward-looking statements made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995. These include any advisor or portfolio manager prediction, assessment, analysis or outlook for individual securities, industries, investment styles, market sectors and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for each fund in its current prospectus, other factors bearing on these reports include the accuracy of the advisor’s or portfolio manager’s forecasts and predictions, the appropriateness of the investment strategies designed by the advisor or portfolio manager and the ability of the advisor or portfolio manager to implement their strategies efficiently and successfully. Any one or more of these factors, as well as other risks affecting the securities markets generally, could cause the actual results of any fund to differ materially as compared to its benchmarks.

The views expressed are subject to change and do not necessarily reflect the views of Thornburg Investment Management, Inc. This information should not be relied upon as a recommendation or investment advice and is not intended to predict the performance of any investment or market.

Performance results of individual share classes will vary based on the fees and expenses associated with each share class, and may be higher or lower than other share classes within the same Fund. Please see Performance Summary for performance results of each share class.

4 | Thornburg Equity Funds Semi-Annual Report

Letter to Shareholders, Continued

March 31, 2020 (Unaudited)

Thornburg Investment Income Builder Fund

Dear Fellow Shareholder:

This letter highlights the basic results of your Fund’s investment portfolio for the six-month period ended March 31, 2020. Your Fund’s fiscal year ends on September 30. In addition, we comment on the overall investment landscape, which has been evolving rapidly amidst the extraordinary developments associated with the global spread of COVID-19.

Thornburg Investment Income Builder Fund paid an ordinary dividend of $0.52 per Class I share in the six-month period ending March 31, 2020. This was approximately 4% above the dividend of $0.50 for the comparable period of fiscal 2019. The Fund paid $1.014 per Class I share for the trailing four quarters, up 4.4% from $0.970 in the prior year comparable period. The dividend per share were higher for Class R6 shares and lower for Class A, Class C, R3, R4 and R5 shares, to account for varying class-specific expenses.

The net asset value of the Class I shares decreased by $5.27 per share ($21.88 to $16.61) during the period under review. Importantly, the net asset value decreased by $6.53 per share in the 41 days from February 19 to March 31 as the COVID-19 pandemic gained momentum globally and set off a chain reaction of selling across a range of financial assets. As of the close of business on February 19, the net asset value of the Class I shares was $23.14 per share and the total return for the then partial semiannual period was 7.69%. The ensuing global chain reaction of selling financial assets was unprecedented in speed, depth and breadth, though the selling wave was significantly reversed in the final week of March with respect to government bonds, government agency bonds and high-grade corporate bonds as a result of U.S. Federal Reserve (and other central bank) buying of these instruments with newly printed money.

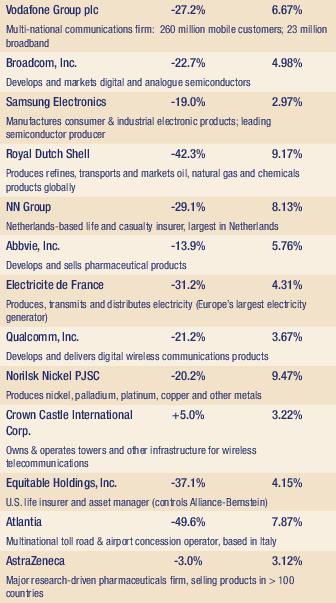

The next several paragraphs focus on the first three months of 2020. We provide brief descriptions of the largest individual equity holdings in your Fund portfolio and how these individual assets repriced during the March quarter. The final six weeks of the quarter dominated outcomes for the semiannual period under review. In general, we believe the rapid price declines for these businesses represent significant buying opportunities rather than warnings of impending competitive irrelevance or significant financial distress. Most have strong positions providing products and services that will prove to be more resilient than the overall global economy.

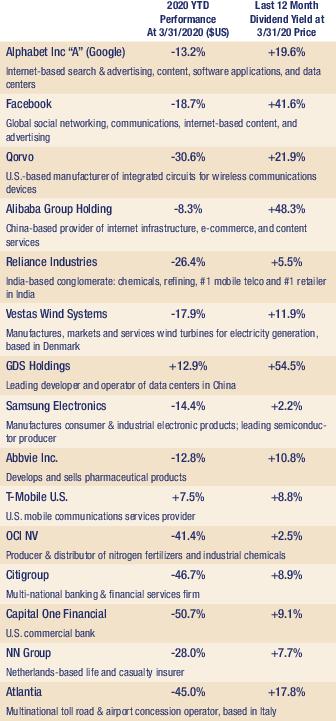

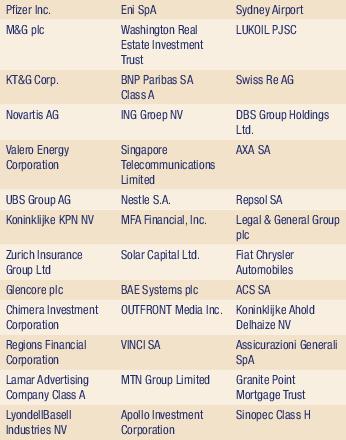

Most dividend-paying equities in the Thornburg Investment Income Builder Fund were down more than 15% in the first three months of calendar 2020. Listed below in descending order are the 25 largest equity holdings in the Fund as of March 31, 2020, along with year-to-date share price performance and trailing-year dividend yields at closing March 31, 2020, stock prices. Twenty-three of these holdings have delivered share price declines in 2020 to date. Together,

these 25 firms comprise approximately 66% of the Fund’s total assets. Interest-bearing debt comprises almost 12% of assets and 39 other equities comprise a total of approximately 22% of portfolio assets. Individual position sizes range from more than 5% (telecom operator Orange SA) to approximately 1.5% for those holdings shown near the bottom of this list.

Thornburg Investment Income Builder Fund – Top 25 Equity Holdings as of March 31, 2020

Thornburg Equity Funds Semi-Annual Report | 5

Letter to Shareholders, Continued

March 31, 2020 (Unaudited)

These are not trivial companies. Over time they generally tend to be well capitalized, and we epxect most should be good dividend payors in the years to come.

The global economy has been significantly dented by the COVID-19 outbreak, and by government actions taken to control this outbreak: travel restrictions, mandatory business closings, school closings, event cancellations, stay home orders, etc. We cannot predict how these companies’ 2020 dividends will be impacted by the COVID-19 outbreak, particularly any possible political pressures to reduce dividends. That noted, we believe these are strong businesses with important positions in their respective markets. The reader will notice a significant number of telecommunications, communications infrastructure and health care firms among these top 25 holdings, as well as other providers of various ingredients important to modern life. Aside from the fact that they have paid attractive dividends

previously, in our view, the current crisis reinforces the essential nature of the products and services they provide.

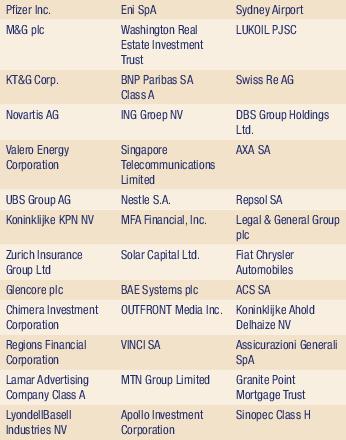

The 39 equity investments shown below comprised approximately 22% of your Fund’s total net assets as of March 31, 2020. Some of these are not cyclical businesses (pharmaceuticals firms Pfizer and Novartis, or telecommunications network operators KPN and Singapore Telecommunications). Others are cyclical businesses that have paid attractive dividends in recent years (investment managers M&G and UBS), non-bank financials (Chimera Investment, MFA Financial, Solar Capital) or industrial materials producers (Glencore and LyondellBasell). In general, share prices of the cyclical businesses in the Thornburg Investment Income Builder Fund’s portfolio declined more than the entire portfolio for the period under review. The five insurance companies among these 39 have varying degrees of cyclicality, but their stock prices declined mostly due to concerns about the market values of their bond portfolios, which have likely recovered significantly as global central banks buy bonds (Zurich Insurance Group, Swiss Reinsurance, Axa, Legal & General and Generali).

Thornburg Investment Income Builder Fund’s bond holdings overall delivered negative returns during the period under review. U.S. government bond prices increased significantly as 10-year U.S. Treasury yields dropped from 1.92% to 0.67%. Corporate bond prices were generally lower, as much of March saw heavy selling of corporate credit.

6 | Thornburg Equity Funds Semi-Annual Report

Letter to Shareholders, Continued

March 31, 2020 (Unaudited)

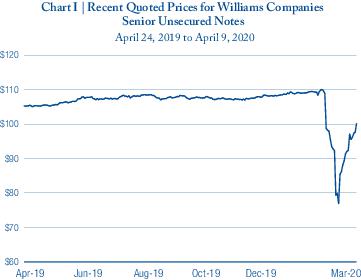

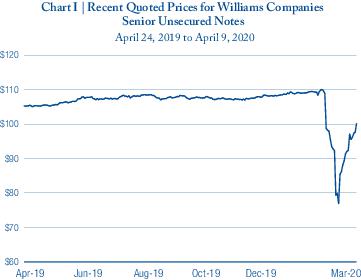

For example, the following graph shows the precipitous drop of the quoted price of a 4.55% bond due June 24, 2024, issued by U.S. energy infrastructure firm Williams Companies. This bond, issued at par in 2014, was quoted by Bloomberg at a dollar price of 110% of par to yield below 2% as recently as March 5, 2020. Over the next 18 days to March 23, the market price of this bond declined by some 33%, to yield 11.57%. We observed that bond mutual funds in the U.S. saw high redemptions over this period, so many sellers of corporate bond funds at that time were selling good assets at low prices. On the afternoon of March 23, the Federal Reserve Bank announced it would fund a bond purchase program for investment grade corporate bonds with final maturities below five years. The Williams Companies 4.55% bond qualifies for the Fed’s bond purchase program. As you can see in the accompanying graph of recent market prices for this bond, it has increased in value by more than 26% since March 23, and now yields 3.62% at a price of 103.36% of par. This bond is the second largest individual bond holding in Thornburg Investment Income Builder Fund’s portfolio. It is illustrative of the volatile ride many of the portfolio’s other bonds took during the month of March.

Thornburg Investment Income Builder Fund’s Class I share return of negative 21.96% for the semiannual period trailed its blended benchmark (75% MSCI World Net Total Return USD Index and 25% Bloomberg Barclays US Aggregate Bond Total Return Index Value USD), which returned negative 9.9% for the period. We have described many of the individual ingredients of your Fund’s six-month performance in the preceding paragraphs. The comparison benchmark benefited significantly from (i) a larger bond weighting than Investment Income Builder Fund and central bank support for the bond component of the blended index in the last week of March, and (ii) the fact that six of the seven largest holdings of the equity portion of the benchmark are technology giants whose share prices have performed relatively well, but pay low dividends or no dividends (Microsoft, Apple, Amazon, Facebook, Alphabet/Google and

Alibaba). Performance comparisons of Investment Income Builder to its blended benchmark over various periods are shown elsewhere in this report.

Although no central banks have been bidding up prices of most of the assets in your Investment Income Builder Fund portfolio, we are optimistic about the future return potential of these assets. Why? Virtually all of the businesses in your fund retain their market positions, providing important products and services that generate cash flows to pay attractive dividends. As high-quality bond yields, bank deposit yields and money market yields decline, we believe investors will direct capital into dividend-paying stocks and certain bonds, supporting prices of these.

Readers of this commentary who are long-time shareholders of Thornburg Investment Income Builder Fund will recall that the interest-bearing debt portion of the Fund’s portfolio has varied over time, ranging from less than 9% in 2015 to 45% at June 30, 2009. We tend to allocate more portfolio assets to interest-bearing debt when yields are more attractive. In the September 2019 fiscal year, more than 85% of Investment Income Builder Fund’s income was derived from stock dividends, the remainder coming from interest. In the coming quarters, this mix may likely include a higher proportion of interest income. We have already modestly increased your Fund’s weighting in interest-bearing debt. From today’s vantage point, we would expect to add assets from the more dislocated segments of the bond market that are less subject to price support from central bank buying.

The quarter ending March 31, 2020, was the 69th full calendar quarter since the inception of Thornburg Investment Income Builder Fund in December 2002. In 51 of these quarters the Fund delivered a positive total return. The Fund has delivered positive total returns in 14 of its 17 calendar years of existence.

We believe the extreme dislocation caused by the COVID-19 pandemic will be temporary. As we write these words, more than half of the global population, from countries comprising a significant majority of global GDP, are under “shelter in place” orders that sharply reduce normal economic activity. Government bodies around the world have taken unusual steps to control the disease and mitigate the consequences of related economic disruption in order to keep the basic structure of the global economy in place to resume normal economic activity when the pandemic passes.

When the COVID-19 pandemic passes, we believe people around the world will continue to buy goods and services and trade with each other. We expect the global economy will gradually repair, albeit with some significant changes, and, in the meantime, most governments will make reasonable attempts to bridge the material dislocations we currently witness. In the United States, for example, the combination of payments from the Paycheck Protection Program, enhanced weekly unemployment benefits, and CARES Act stimulus payments to

Thornburg Equity Funds Semi-Annual Report | 7

Letter to Shareholders, Continued

March 31, 2020 (Unaudited)

qualifying households will surpass the median weekly income ($933/week as of Q4 2019) of many workers prior to the COVID-19 outbreak. More broadly, governments around the developed world have enacted fiscal stimulus programs amounting to approximately 10% of their combined GDPs, amounts approximately sufficient to offset -33% drops in GDP for a three-month period.

Thank you for being a shareholder of Thornburg Investment Income Builder Fund. Remember that you can review additional information about your portfolio by going to our website, www.thornburg.com.

Sincerely,

|

|

Brian McMahon

Portfolio Manager

Chief Investment Strategist

and Managing Director | Jason Brady,cfa

Portfolio Manager

CEO, President, and

Managing Director |

|

|

Ben Kirby,cfa

Portfolio Manager

Head of Investments

and Managing Director | Matt Burdett

Portfolio Manager and

Managing Director |

The performance data quoted represents past performance; it does not guarantee future results.

Neither the payment of, or increase in, dividends is guaranteed.

The matters discussed in this report may constitute forward-looking statements made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995. These include any advisor or portfolio manager prediction, assessment, analysis or outlook for individual securities, industries, investment styles, market sectors and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for each fund in its current prospectus, other factors bearing on these reports include the accuracy of the advisor’s or portfolio manager’s forecasts and predictions, the appropriateness of the investment strategies designed by the advisor or portfolio manager and the ability of the advisor or portfolio manager to implement their strategies efficiently and successfully. Any one or more of these factors, as well as other risks affecting the securities markets generally, could cause the actual results of any fund to differ materially as compared to its benchmarks.

The views expressed are subject to change and do not necessarily reflect the views of Thornburg Investment Management, Inc. This information should not be relied upon as a recommendation or investment advice and is not intended to predict the performance of any investment or market.

Performance results of individual share classes will vary based on the fees and expenses associated with each share class and may be higher or lower than other share classes within the same Fund. Please see Performance Summary for performance results of each share class.

8 | Thornburg Equity Funds Semi-Annual Report

Letter to Shareholders, Continued

March 31, 2020 (Unaudited)

Thornburg Global Opportunities Fund

Dear Fellow Shareholders:

This letter highlights the results of the Thornburg Global Opportunities Fund investment portfolio for the six-month period ended March 31, 2020. Your Fund’s fiscal year ends on September 30. In addition, we comment on the overall investment landscape, which has been evolving rapidly amidst the extraordinary developments associated with the global spread of COVID-19 (coronavirus).

The net asset value of the Class I shares decreased by $4.23 per share ($27.67 to $23.44) during the semiannual period under review. The net asset value decreased by $8.69 per share in the 41 days from February 19 to March 31 as the COVID-19 pandemic gained momentum globally and set off a chain reaction of selling across a range of financial assets as lockdown orders spread. As of the close of business on February 19, the net asset value of Thornburg Global Opportunities Fund’s Class I shares was $32.13 per share and the total return for the then partial semiannual period was +18.09%. The ensuing global chain reaction of selling financial assets was unprecedented in speed, depth and breadth. The selling wave was partially reversed in the final week of March with respect to government bonds, government agency bonds and high-grade corporate bonds as a result of Federal Reserve (and other central bank) buying of these instruments with newly printed money.

The next several paragraphs focus on your Fund’s largest portfolio holdings during the first three months of 2020. The final six weeks of the quarter dominated outcomes for these months and for the semiannual period under review. In general, we believe the rapid share price declines for these businesses over these weeks represent significant buying opportunities rather than warnings of impending competitive irrelevance or significant financial distress. Most have strong positions providing products and services that we believe will be resilient in the years ahead.

Most equities in the Thornburg Global Opportunities Fund were down more than 15% in the first three months of 2020 in a widespread global equity selloff. Listed below in descending order are the 20 largest equity holdings in the Fund as of March 31, 2020, along with 2020 year-to-date share price changes and trailing five-year average annual revenue growth rates for these businesses. Together, these firms comprised approximately 78% of the Fund’s total assets. Near-cash debt comprised 7% of assets, and 12 other equities comprised a total of approximately 15% of Fund assets as of March 31, 2020. Fifteen of these 20 largest equity investments delivered share price declines in 2020 through March 31, the exceptions being health care and digital communications–centric businesses. Individual position sizes varied from more than 5% (Alphabet, Facebook, Qorvo, Alibaba, Reliance Industries) to just over 2.25% for those shown near the bottom of this list.

Thornburg Global Opportunities Fund – Top 20 Equity Holdings as of March 31, 2020

Thornburg Equity Funds Semi-Annual Report | 9

Letter to Shareholders, Continued

March 31, 2020 (Unaudited)

Notice that a high incidence of these investments are in firms tied to the digital economy, and to tools that facilitate digital communications.

These are not trivial businesses. Over time they generally tend to be well capitalized. We believe most of these will emerge from the present economic valley with their competitive positions either intact or improved. Most have been growing faster than the global economy, and some of the slower growers over recent years appear to be advantaged in their industries at this time. Most of their share prices have increased significantly between March 31 and the date of this letter.

The Thornburg Global Opportunities Fund’s Class I share return of negative 13.85% for the semiannual period slightly beat its benchmark (MSCI All Country World Net Total Return USD Index "ACWI"), which returned negative 14.33% for the period. Most of your Fund’s net asset value decline occurred during the extraordinary month of March as governments around the world ordered significant portions of private economies to shut down. We expect these economies to gradually reopen in the current quarter.

In July of 2020 we will mark the 14th anniversary of the Fund’s inception. From its inception on July 28, 2006, through March 31, 2020, the Thornburg Global Opportunities Fund has outpaced the ACWI by an average margin of over 2.6% per year, resulting in a total cumulative return since inception of 154% (I shares) versus 79% for the ACWI.

The following table summarizes major sector weightings within the Global Opportunities Fund portfolio as of March 31, as well as general directional changes over the course of the semiannual period:

We believe the extreme dislocation caused by the COVID-19 pandemic will be temporary. As we write these words more than half of the global population, from countries comprising a significant majority of global GDP, are under “shelter in place” orders that sharply reduce normal economic activity. Government bodies around the world have taken unusual steps to control the disease and mitigate the consequences of related economic disruption in order to keep the basic structure of the global economy in place to resume normal economic activity when the pandemic passes.

When the COVID-19 pandemic passes, we believe people around the world will continue to buy goods and services and trade with each other. We expect the global economy will gradually repair, albeit with some significant changes, and, in the meantime, most governments will make reasonable attempts to bridge the material dislocations we currently witness. In the United States, for example, the combination of payments from the Payroll Protection Program, enhanced weekly unemployment benefits, and CARES Act stimulus payments to qualifying households will surpass the median weekly income ($933/week as of Q4 2019) of many workers prior to the COVID-19 outbreak. More broadly, governments around the developed world have enacted fiscal stimulus programs amounting to approximately 10% of their combined GDPs, amounts approximately sufficient to offset -33% drops in GDP for a three-month period.

Our Investment Framework

The Thornburg Global Opportunities Fund seeks capital appreciation from a focused portfolio of global equity investments. We believe the structure of the Fund—built on our core investment principles of flexibility, focus and value—provides a durable framework for value-added investing.

We urge shareholders of the Fund to maintain a long-term investment perspective rather than placing too much emphasis on return figures that are available daily, weekly, monthly and quarterly. We continue to follow our core investment principles of flexibility, focus and value, as we have since the Fund’s inception back in 2006.

Thank you for being a shareholder of the Thornburg Global Opportunities Fund. Remember that you can monitor portfolio

10 | Thornburg Equity Funds Semi-Annual Report

Letter to Shareholders, Continued

March 31, 2020 (Unaudited)

holdings and other Fund information on our website, www.thornburg.com.

Sincerely,

|

|

Brian McMahon

Portfolio Manager

Chief Investment Strategist

and Managing Director | Miguel Oleaga

Portfolio Manager

and Managing Director |

The performance data quoted represents past performance; it does not guarantee future results.

The matters discussed in this report may constitute forward-looking statements made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995. These include any advisor or portfolio manager prediction, assessment, analysis or outlook for individual securities, industries, investment styles, market sectors and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for each fund in its current prospectus, other factors bearing on these reports include the accuracy of the advisor’s or portfolio manager’s forecasts and predictions, the appropriateness of the investment strategies designed by the advisor or portfolio manager and the ability of the advisor or portfolio manager to implement their strategies efficiently and successfully. Any one or more of these factors, as well as other risks affecting the securities markets generally, could cause the actual results of any fund to differ materially as compared to its benchmarks.

The views expressed are subject to change and do not necessarily reflect the views of Thornburg Investment Management, Inc. This information should not be relied upon as a recommendation or investment advice and is not intended to predict the performance of any investment or market.

Performance results of individual share classes will vary based on the fees and expenses associated with each share class, and may be higher or lower than other share classes within the same Fund. Please see Performance Summary for performance results of each share class.

Thornburg Equity Funds Semi-Annual Report | 11

Performance Summary

March 31, 2020 (Unaudited)

AVERAGE ANNUAL TOTAL RETURNS

| THORNBURG INVESTMENT INCOME BUILDER FUND | 1-YR | 3-YR | 5-YR | 10-YR | SINCE

INCEPTION |

| Class A Shares(Incep: 12/24/02) | | | | | |

| Without sales charge | -18.64% | -2.76% | -0.91% | 3.90% | 7.27% |

| With sales charge | -22.30% | -4.25% | -1.82% | 3.42% | 6.98% |

| Class C Shares(Incep: 12/24/02) | | | | | |

| Without sales charge | -19.29% | -3.49% | -1.64% | 3.16% | 6.59% |

| With sales charge | -20.07% | -3.49% | -1.64% | 3.16% | 6.59% |

| Class I Shares(Incep: 11/3/03) | -18.46% | -2.48% | -0.62% | 4.23% | 6.60% |

| Class R3 Shares(Incep: 2/1/05) | -18.93% | -3.07% | -1.23% | 3.58% | 5.01% |

| Class R4 Shares(Incep: 2/1/08) | -18.86% | -3.01% | -1.16% | 3.69% | 2.91% |

| Class R5 Shares(Incep: 2/1/07) | -18.51% | -2.60% | -0.74% | 4.10% | 3.81% |

| Class R6 Shares(Incep: 4/10/17) | -18.37% | - | - | - | -2.33% |

| MSCI World Net Total Return USD Index(Since 12/24/02) | -10.39% | 1.92% | 3.25% | 6.57% | 7.10% |

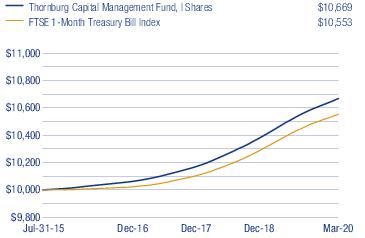

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

| THORNBURG INVESTMENT INCOME BUILDER FUND | FINAL VALUE |

AVERAGE ANNUAL TOTAL RETURNS

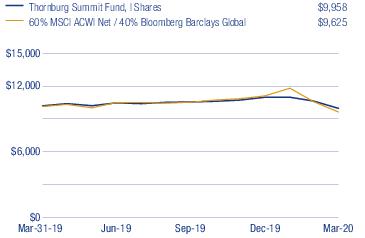

| THORNBURG SUMMIT FUND | 1-YR | 3-YR | 5-YR | 10-YR | SINCE

INCEPTION |

| Class I Shares(Incep: 3/1/19) | -2.28% | - | - | - | -0.39% |

| 60% MSCI ACWI Net / 40% Bloomberg Barclays Global(Since 3/1/19) | -4.94% | - | - | - | -3.62% |

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

| THORNBURG SUMMIT FUND | FINAL VALUE |

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than quoted. For performance current to the Funds’ most recent month end, visit thornburg.com or call 800-847-0200. The performance information does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of Fund shares. Returns reflect the reinvestment of dividends and capital gains. Thornburg Investment Income Builder Fund; Class A shares are sold with a maximum sales charge of 4.50%. Class C shares are subject to a 1% CDSC for the first year only. There is no sales charge for Class I, R3, R4, R5 and R6 shares. Thornburg Summit Fund; Class A shares are sold with a maximum sales charge of 4.50%. There is no sales charge for Class I shares. As disclosed in the Funds’ most recent prospectus, the total annual fund operating expenses before fee waivers or expense reimbursements are as follows: Thornburg Investment Income Builder Fund; A shares, 1.27%; C shares, 2.01%; I shares, 1.02%; R3 shares, 1.72%; R4 shares, 1.64%; R5 shares, 1.22%; R6 shares, 0.96%. Thornburg Summit Fund;A shares, 2.72%; I shares, 2.47%. Thornburg Investment Management has contractually agreed to waive fees and reimburse expenses until at least February 1, 2021, for some of the share classes, resulting in net expense ratios of the following: Thornburg Investment Income Builder Fund;R3 shares, 1.64%; R4 shares, 1.54%; R5 shares, 1.13%; R6 shares, 0.94%. Thornburg Summit Fund; A shares, 2.00%; I shares, 1.75%. For more detailed information on fund expenses and waivers/reimbursements please see the Funds’ prospectus.

30-day SEC Yield as of 3/31/20 for Thornburg Investment Income Builder Fund (A Shares) : 4.21%

12 | Thornburg Equity Funds Semi-Annual Report

Performance Summary, Continued

March 31, 2020 (Unaudited)

AVERAGE ANNUAL TOTAL RETURNS

| THORNBURG GLOBAL OPPORTUNITIES FUND | 1-YR | 3-YR | 5-YR | 10-YR | SINCE

INCEPTION |

| Class A Shares(Incep: 7/28/06) | | | | | |

| Without sales charge | -14.10% | -4.66% | -1.82% | 5.76% | 6.60% |

| With sales charge | -17.97% | -6.11% | -2.72% | 5.28% | 6.25% |

| Class C Shares(Incep: 7/28/06) | | | | | |

| Without sales charge | -14.75% | -5.39% | -2.55% | 4.96% | 5.79% |

| With sales charge | -15.59% | -5.39% | -2.55% | 4.96% | 5.79% |

| Class I Shares(Incep: 7/28/06) | -13.88% | -4.37% | -1.50% | 6.18% | 7.06% |

| Class R3 Shares(Incep: 2/1/08) | -14.33% | -4.86% | -2.00% | 5.64% | 3.49% |

| Class R4 Shares(Incep: 2/1/08) | -14.23% | -4.77% | -1.91% | 5.74% | 3.58% |

| Class R5 Shares(Incep: 2/1/08) | -13.91% | -4.39% | -1.51% | 6.17% | 4.02% |

| Class R6 Shares(Incep: 4/10/17) | -13.76% | - | - | - | -4.46% |

| MSCI AC World Net Total Return USD Index(Since 7/28/06) | -11.26% | 1.50% | 2.85% | 5.88% | 4.37% |

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

| THORNBURG GLOBAL OPPORTUNITIES FUND | FINAL VALUE |

AVERAGE ANNUAL TOTAL RETURNS

| THORNBURG INTERNATIONAL VALUE FUND | 1-YR | 3-YR | 5-YR | 10-YR | SINCE

INCEPTION |

| Class A Shares(Incep: 5/28/98) | | | | | |

| Without sales charge | -10.39% | -1.07% | -0.10% | 2.63% | 6.13% |

| With sales charge | -14.42% | -2.58% | -1.02% | 2.16% | 5.91% |

| Class C Shares(Incep: 5/28/98) | | | | | |

| Without sales charge | -11.03% | -1.81% | -0.83% | 1.87% | 5.31% |

| With sales charge | -11.87% | -1.81% | -0.83% | 1.87% | 5.31% |

| Class I Shares(Incep: 3/30/01) | -10.13% | -0.75% | 0.25% | 3.01% | 5.76% |

| Class R3 Shares(Incep: 7/1/03) | -10.60% | -1.26% | -0.27% | 2.45% | 6.38% |

| Class R4 Shares(Incep: 2/1/07) | -10.42% | -1.05% | -0.08% | 2.65% | 1.87% |

| Class R5 Shares(Incep: 2/1/05) | -10.19% | -0.80% | 0.19% | 2.93% | 4.79% |

| Class R6 Shares(Incep: 5/1/12) | -10.04% | -0.62% | 0.40% | - | 2.95% |

| MSCI EAFE Net Total Return USD Index(Since 5/28/98) | -14.38% | -1.82% | -0.62% | 2.72% | 3.11% |

| MSCI AC World ex USA Net Total Return USD Index(Since 5/28/98) | -15.57% | -1.96% | -0.64% | 2.05% | 3.53% |

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

| THORNBURG INTERNATIONAL VALUE FUND | FINAL VALUE |

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than quoted. For performance current to the most recent month end, visit thornburg.com or call 800-847-0200. The performance information does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of Fund shares. Returns reflect the reinvestment of dividends and capital gains. Thornburg Global Opportunities Fund; Class A shares are sold with a maximum sales charge of 4.50%. Class C shares are subject to a 1% CDSC for the first year only. There is no sales charge for Class I, R3, R4, R5 and R6 shares. Thornburg International Value Fund; Class A shares are sold with a maximum sales charge of 4.50%. Class C shares are subject to a 1% CDSC for the first year only. There is no sales charge for Class I, R3, R4, R5 and R6 shares. As disclosed in the Funds’ most recent prospectus, the total annual fund operating expenses before fee waivers or expense reimbursements are as follows: Thornburg Global Opportunities Fund;A shares, 1.33%; C shares, 2.09%; I shares, 1.06%; R3 shares, 2.20%; R4 shares, 1.86%; R5 shares, 1.27%; R6 shares, 1.00%. Thornburg International Value Fund; A shares, 1.26%; C shares, 2.09%; I shares, 0.97%; R3 shares, 1.65%; R4 shares, 1.44%; R5 shares, 1.12%; R6 shares, 0.88%. Thornburg Investment Management has contractually agreed to waive fees and reimburse expenses until at least February 1, 2021, for some of the share classes, resulting in net expense ratios of the following: Thornburg Global Opportunities Fund; R3 shares, 1.50%; R4 shares, 1.40%; R5 shares, 0.99%; R6 shares, 0.85%. Thornburg International Value Fund;R3 shares, 1.45%; R4 shares, 1.25%; R5 shares, 0.99%. For more detailed information on fund expenses and waivers/reimbursements please see the Funds’ prospectus.

Thornburg Equity Funds Semi-Annual Report | 13

Performance Summary, Continued

March 31, 2020 (Unaudited)

AVERAGE ANNUAL TOTAL RETURNS

THORNBURG BETTER WORLD

INTERNATIONAL FUND | 1-YR | 3-YR | SINCE

INCEPTION |

| Class A Shares(Incep: 10/1/15) | | | |

| Without sales charge | -9.50% | -0.36% | 3.26% |

| With sales charge | -13.59% | -1.88% | 2.21% |

| Class C Shares(Incep: 10/1/15) | | | |

| Without sales charge | -10.01% | -0.91% | 2.69% |

| With sales charge | -10.91% | -0.91% | 2.69% |

| Class I Shares(Incep: 10/1/15) | -8.86% | 0.37% | 4.03% |

| MSCI AC World ex USA Net Total Return USD Index(Since 10/1/15) | -15.57% | -1.96% | 2.07% |

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

| THORNBURG BETTER WORLD INTERNATIONAL FUND | FINAL VALUE |

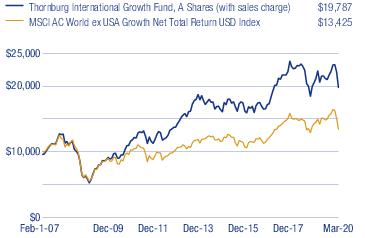

AVERAGE ANNUAL TOTAL RETURNS

| THORNBURG INTERNATIONAL GROWTH FUND | 1-YR | 3-YR | 5-YR | 10-YR | SINCE

INCEPTION |

| Class A Shares(Incep: 2/1/07) | | | | | |

| Without sales charge | -6.63% | 2.62% | 2.89% | 7.41% | 5.69% |

| With sales charge | -10.83% | 1.05% | 1.94% | 6.92% | 5.32% |

| Class C Shares(Incep: 2/1/07) | | | | | |

| Without sales charge | -7.34% | 1.84% | 2.10% | 6.59% | 4.94% |

| With sales charge | -8.26% | 1.84% | 2.10% | 6.59% | 4.94% |

| Class I Shares(Incep: 2/1/07) | -6.35% | 2.97% | 3.27% | 7.86% | 6.19% |

| Class R3 Shares(Incep: 2/1/08) | -6.80% | 2.45% | 2.75% | 7.31% | 4.58% |

| Class R4 Shares(Incep: 2/1/08) | -6.72% | 2.55% | 2.84% | 7.42% | 4.68% |

| Class R5 Shares(Incep: 2/1/08) | -6.33% | 2.97% | 3.27% | 7.85% | 5.10% |

| Class R6 Shares(Incep: 2/1/13) | -6.23% | 3.07% | 3.38% | - | 5.01% |

| MSCI AC World ex USA Growth Net Total Return USD Index(Since 2/1/07) | -7.31% | 2.53% | 2.10% | 3.91% | 2.26% |

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

| THORNBURG INTERNATIONAL GROWTH FUND | FINAL VALUE |

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than quoted. For performance current to the most recent month end, visit thornburg.com or call 800-847-0200. The performance information does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of Fund shares. Returns reflect the reinvestment of dividends and capital gains. Thornburg Better World International Fund; Class A shares are sold with a maximum sales charge of 4.50%. Class C shares are subject to a 1% CDSC for the first year only. There is no sales charge for Class I shares. Thornburg International Growth Fund; Class A shares are sold with a maximum sales charge of 4.50%. Class C shares are subject to a 1% CDSC for the first year only. There is no sales charge for Class I, R3, R4, R5 and R6 shares. As disclosed in the Funds’ most recent prospectus, the total annual fund operating expenses before fee waivers or expense reimbursements are as follows: Thornburg Better World International Fund;A shares, 2.10%; C shares, 3.48%; I shares, 1.44%. Thornburg International Growth Fund; A shares, 1.32%; C shares, 2.08%; I shares, 1.03%; R3 shares, 2.02%; R4 shares, 1.91%; R5 shares, 1.29%; R6 shares, 0.99%. Thornburg Investment Management has contractually agreed to waive fees and reimburse expenses until at least February 1, 2021, for some of the share classes, resulting in net expense ratios of the following: Thornburg Better World International Fund; A shares, 1.83%; C shares, 2.38%; I shares, 1.09%. Thornburg International Growth Fund;R3 shares, 1.50%; R4 shares, 1.40%; R5 shares, 0.99%; R6 shares, 0.89%. For more detailed information on fund expenses and waivers/reimbursements please see the Funds’ prospectus.

14 | Thornburg Equity Funds Semi-Annual Report

Performance Summary, Continued

March 31, 2020 (Unaudited)

AVERAGE ANNUAL TOTAL RETURNS

| THORNBURG DEVELOPING WORLD FUND | 1-YR | 3-YR | 5-YR | 10-YR | SINCE

INCEPTION |

| Class A Shares(Incep: 12/16/09) | | | | | |

| Without sales charge | -15.30% | 0.92% | -0.24% | 3.36% | 3.84% |

| With sales charge | -19.11% | -0.61% | -0.16% | 2.89% | 3.38% |

| Class C Shares(Incep: 12/16/09) | | | | | |

| Without sales charge | -15.90% | 0.17% | -1.00% | 2.61% | 3.09% |

| With sales charge | -16.74% | 0.17% | -1.00% | 2.61% | 3.09% |

| Class I Shares(Incep: 12/16/09) | -14.96% | 1.32% | 0.17% | 3.84% | 4.34% |

| Class R5 Shares(Incep: 2/1/13) | -15.00% | 1.32% | 0.18% | - | 0.65% |

| Class R6 Shares(Incep: 2/1/13) | -14.92% | 1.41% | 0.27% | - | 0.75% |

| MSCI Emerging Markets Net Total Return USD Index(Since 12/16/09) | -17.69% | -1.62% | -0.37% | 0.68% | 1.06% |

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

| THORNBURG DEVELOPING WORLD FUND | FINAL VALUE |

AVERAGE ANNUAL TOTAL RETURNS

| THORNBURG VALUE FUND | 1-YR | 3-YR | 5-YR | 10-YR | SINCE

INCEPTION |

| Class A Shares(Incep: 10/2/95) | | | | | |

| Without sales charge | -16.62% | -0.62% | 2.42% | 6.11% | 8.45% |

| With sales charge | -20.38% | -2.14% | 1.48% | 5.62% | 8.25% |

| Class C Shares(Incep: 10/2/95) | | | | | |

| Without sales charge | -17.27% | -1.43% | 1.62% | 5.29% | 7.62% |

| With sales charge | -18.10% | -1.43% | 1.62% | 5.29% | 7.62% |

| Class I Shares(Incep: 11/2/98) | -16.35% | -0.28% | 2.80% | 6.51% | 6.43% |

| Class R3 Shares(Incep: 7/1/03) | -16.64% | -0.64% | 2.43% | 6.11% | 6.22% |

| Class R4 Shares(Incep: 2/1/07) | -16.57% | -0.54% | 2.53% | 6.22% | 3.90% |

| Class R5 Shares(Incep: 2/1/05) | -16.36% | -0.28% | 2.80% | 6.49% | 6.10% |

S&P 500 Total Return Index

(Since 10/2/95) | -6.98% | 5.10% | 6.73% | 10.53% | 8.32% |

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

| THORNBURG VALUE FUND | FINAL VALUE |

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than quoted. For performance current to the most recent month end, visit thornburg.com or call 800-847-0200. The performance information does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of Fund shares. Returns reflect the reinvestment of dividends and capital gains. Thornburg Developing World Fund; Class A shares are sold with a maximum sales charge of 4.50%. Class C shares are subject to a 1% CDSC for the first year only. There is no sales charge for Class I, R5 and R6 shares. Thornburg Value Fund; Class A shares are sold with a maximum sales charge of 4.50%. Class C shares are subject to a 1% CDSC for the first year only. There is no sales charge for Class I, R3, R4 and R5 shares. As disclosed in the Funds’ most recent prospectus, the total annual fund operating expenses before fee waivers or expense reimbursements are as follows: Thornburg Developing World Fund; A shares, 1.50%; C shares, 2.26%; I shares, 1.19%; R5 shares, 2.07%; R6 shares, 1.14%. Thornburg Value Fund; A shares, 1.33%; C shares, 2.19%; I shares, 1.07%; R3 shares, 1.79%; R4 shares, 1.75%; R5 shares, 1.43%. Thornburg Investment Management has contractually agreed to waive fees and reimburse expenses until at least February 1, 2021, for some of the share classes, resulting in net expense ratios of the following: Thornburg Developing World Fund; I shares, 1.09%; R5 shares, 1.09%; R6 shares, 0.99%. Thornburg Value Fund; I shares, 0.99%; R3 shares, 1.35%; R4 shares, 1.25%; R5 shares, 0.99%. For more detailed information on fund expenses and waivers/reimbursements please see the Funds’ prospectus.

Thornburg Equity Funds Semi-Annual Report | 15

Performance Summary, Continued

March 31, 2020 (Unaudited)

AVERAGE ANNUAL TOTAL RETURNS

THORNBURG CORE

GROWTH FUND | 1-YR | 3-YR | 5-YR | 10-YR | SINCE

INCEPTION |

| Class A Shares(Incep: 12/27/00) | | | | | |

| Without sales charge | -4.71% | 7.54% | 5.63% | 9.97% | 6.18% |

| With sales charge | -8.99% | 5.91% | 4.66% | 9.46% | 5.93% |

| Class C Shares(Incep: 12/27/00) | | | | | |

| Without sales charge | -5.45% | 6.67% | 4.79% | 9.13% | 5.34% |

| With sales charge | -6.29% | 6.67% | 4.79% | 9.13% | 5.34% |

| Class I Shares(Incep: 11/3/03) | -4.38% | 7.93% | 6.03% | 10.43% | 8.40% |

| Class R3 Shares(Incep: 7/1/03) | -4.85% | 7.39% | 5.49% | 9.87% | 8.49% |

| Class R4 Shares(Incep: 2/1/07) | -4.75% | 7.51% | 5.60% | 9.98% | 5.32% |

| Class R5 Shares(Incep: 10/3/05) | -4.38% | 7.93% | 6.03% | 10.43% | 7.43% |

| Russell 3000 Total Return Growth Index(Since 12/27/00) | -0.44% | 10.54% | 9.74% | 12.68% | 5.85% |

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

| THORNBURG CORE GROWTH FUND | FINAL VALUE |

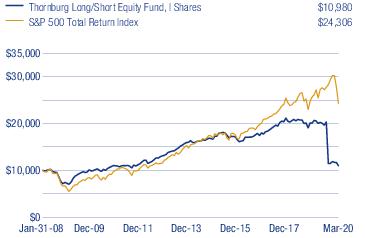

AVERAGE ANNUAL TOTAL RETURNS

| THORNBURG LONG/SHORT EQUITY FUND* | 1-YR | 3-YR | 5-YR | 10-YR | SINCE

INCEPTION |

| Class I Shares(Incep: 12/30/16) | -7.40% | 1.63% | 2.06% | 6.57% | 5.48% |

| S&P 500 Total Return Index | -6.98% | 5.10% | 6.73% | 7.57% | 7.57% |

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

| THORNBURG LONG/SHORT EQUITY FUND | FINAL VALUE |

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than quoted. For performance current to the most recent month end, visit thornburg.com or call 800-847-0200. The performance information does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of Fund shares. Returns reflect the reinvestment of dividends and capital gains. Thornburg Core Growth Fund; Class A shares are sold with a maximum sales charge of 4.50%. Class C shares are subject to a 1% CDSC for the first year only. There is no sales charge for Class I, R3, R4 and R5 shares. Thornburg Long/Short Equity Fund; there is no sales charge for Class I shares. As disclosed in the Funds’ most recent prospectus, the total annual fund operating expenses before fee waivers or expense reimbursements are as follows: Thornburg Core Growth Fund; A shares, 1.35%; C shares, 2.18%; I shares, 1.05%; R3 shares, 1.80%; R4 shares, 1.91%; R5 shares, 1.39%. Thornburg Long/Short Equity Fund; I shares, 3.47%. Thornburg Investment Management has contractually agreed to waive fees and reimburse expenses until at least February 1, 2021, for some of the share classes, resulting in net expense ratios of the following: Thornburg Core Growth Fund; I shares, 0.99%; R3 shares, 1.50%; R4 shares, 1.40%; R5 shares, 0.99%. For more detailed information on fund expenses and waivers/reimbursements please see the Funds’ prospectus.

*Performance prior to 12/30/2016 is from the predecessor fund, which was managed in a materially equivalent manner to the Thornburg Long/Short Equity Fund. The predecessor fund was not a registered mutual fund and was not subject to the same investment restrictions as the Long/Short Equity Fund. If the predecessor fund had been registered under the 1940 Act, the performance may have been different.

16 | Thornburg Equity Funds Semi-Annual Report

Glossary

March 31, 2020 (Unaudited)

The Bloomberg Barclays US Aggregate Bond Total Return Index Value USD is composed of approximately 8,000 publicly traded bonds including U.S. government, mortgage-backed, corporate and Yankee bonds. The index is weighted by the market value of the bonds included in the index.

The Bloomberg Barclays Global Aggregate Bond Index provides a broad-based measure of the global investment-grade fixed-rate debt markets. It is comprised of the U.S. Aggregate, Pan European Aggregate, and the Asian-Pacific Aggregate indices. It also includes a wide range of standard and customized sub-indices by liquidity constraint, sector, quality, and maturity.

Thornburg Investment Income Builder Fund’s Blended Index is composed of 25% Bloomberg Barclays US Aggregate Bond Total Return Index Value USD and 75% MSCI World Net Total Return USD Index, rebalanced monthly.

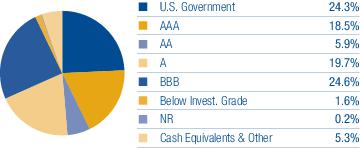

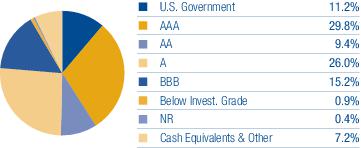

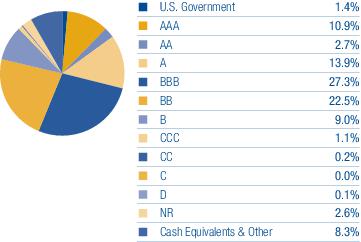

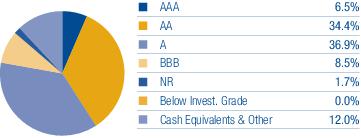

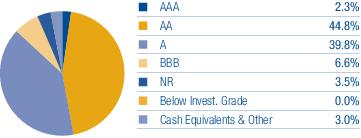

Bond Credit Ratings (Credit Quality) – A bond credit rating assesses the financial ability of a debt issuer to make timely payments of principal and interest. Ratings of AAA (the highest), AA, A, and BBB are investment-grade quality. Ratings of BB, B, CCC, CC, C and D (the lowest) are considered below investment grade, speculative grade, or junk bonds.

The MSCI World Net Total Return USD Index is an unmanaged market-weighted index that consists of securities traded in 23 of the world’s most developed countries. Securities are listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand, and the Far East. The index is calculated with net dividends reinvested in U.S. dollars.

The MSCI All Country (AC) World Net Total Return USD Index is a market capitalization weighted index that is representative of the market structure of 47 developed and emerging market countries in North and South America, Europe, Africa, the Middle East, and the Pacific Rim. The index is calculated with net dividends reinvested in U.S. dollars.

The MSCI All Country (AC) World ex USA Net Total Return USD Index is a market capitalization weighted index representative of the market structure of 45 developed and emerging market countries in North and South America, Europe, Africa, and the Pacific Rim, excluding securities of United States issuers. Beginning in January 2001, the index is calculated with net dividends reinvested in U.S. dollars. Prior data is calculated with gross dividends.

The MSCI EAFE (Europe, Australasia, Far East) Net Total Return USD Index is an unmanaged index. It is a generally accepted benchmark for major overseas markets. Index weightings represent the relative capitalizations of the major overseas developed markets on a U.S. dollar adjusted basis. The index is calculated with net dividends reinvested in U.S. dollars.

The MSCI All Country (AC) World ex USA Growth Net Total Return USD Index is a market capitalization weighted index that includes growth companies in developed and emerging markets throughout the world, excluding the United States.

The MSCI Emerging Markets Net Total Return USD Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The MSCI Emerging Markets Index consists of the following 23 emerging market country indexes: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates.

The S&P 500 Total Return Index is an unmanaged broad measure of the U.S. stock market.

The Russell 3000 Total Return Growth Index is an unmanaged index comprised of those Russell 3000 companies with higher price-to-book ratios and higher forecasted growth values. The stocks in this index are also members of either the Russell 1000 Growth or the Russell 2000 Growth indices. Source: Frank Russell Company.

P/E - Price/Earnings ratio (P/E ratio) is a valuation ratio of a company’s current share price compared to its per-share earnings. P/E equals a company’s market value per share divided by earnings per share. Forecasted P/E is not intended to be a forecast of the Fund’s future performance.

Price/Book ratio (P/B ratio) – A ratio used to compare a stock’s market value to its book value. It is calculated by dividing the current closing price of the stock by the latest quarter’s book value per share.

Yield to Worst (YTW) – The lowest potential yield that can be received on a bond without the issuer actually defaulting.

The performance of any index is not indicative of the performance of any particular investment. Unless otherwise noted, index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. Investors may not make direct investments into any index.

Any securities, sectors, or countries mentioned are for illustration purposes only. Holdings are subject to change. Under no circumstances does the information contained within represent a recommendation to buy or sell any security.

The information given should not be considered tax advice. Please consult your tax advisor for personal tax questions and concerns.

Thornburg Equity Funds Semi-Annual Report | 17

The Dividend Landscape

Thornburg Investment Income Builder Fund | March 31, 2020 (Unaudited)

To appreciate the investment environment in which Thornburg Investment Income Builder Fund operates, you may wish to review these highlights of the “dividend landscape.”

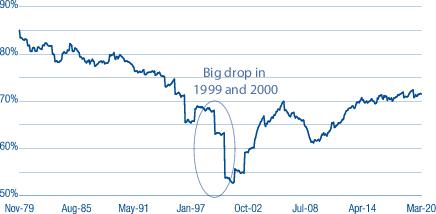

The S&P 500 Index Payout Ratio — A Historical Perspective

The dividend payout ratio is a fraction that expresses dividend payments as a percentage of per-share earnings. As the economy slowed in the wake of the financial crisis, earnings-per-share on average declined, causing the payout ratio to spike, even as dividends paid by the S&P 500 portfolio declined. Earnings have since materially improved, bringing the payout ratio back in line with the overall trend in recent times.

Corporate Willingness to Pay Dividends is Key to the Fund’s Investment Process

The Russell 1000 Index includes approximately 1,000 public companies that are supposed to be generally representative of corporate America. Between 1980 and 1993, at least 75% of these firms paid some dividend. Between 1994 and 2001, the percentage of Russell 1000 companies paying dividends sank to just over 50%, indicating a preference towards reinvesting retained earnings in growth initiatives. Dividends returned to fashion between 2002 and 2008. A reduction in the number of Russell 1000 firms paying dividends followed the 2008 recession. However, from early 2010, the number steadily climbed back to around 70%.

Rising Dividend Payments Despite Decreasing Dividend Yields

Over time, the dollar dividend per unit of the S&P 500 Index has generally increased. Because the price of the index itself has increased even more, the yield on the S&P 500 Index, as a percentage of the current index price, has generally decreased in recent decades. You should note, however, that the dollar yield on an original investment made at a fixed point in time (say, 1970 or 1989) has increased, even without reinvestment of dividends.

S&P 500 Index Payout Ratio

Source: Bloomberg, beginning in 1999 (uses operating earnings); “Irrational Exuberance”

by Robert J. Shiller, through 1998 (uses reported earnings).

Source: CSFB Quantitative and Equity Derivatives Strategy, Baseline, and FactSet.

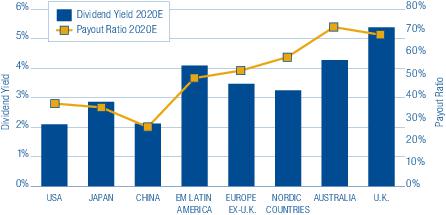

Source: Bloomberg and FactSet as of 12/31/19

Past performance does not guarantee future results.

18 | Thornburg Equity Funds Semi-Annual Report

The Dividend Landscape, Continued

Thornburg Investment Income Builder Fund | March 31, 2020 (Unaudited)

The Top 100 Dividend Yields

| | RUSSELL 1000

INDEX | RUSSELL 2000

INDEX |

| Real Estate | 27% | 31% |

| Financials | 21% | 27% |

| Consumer Discretionary | 19% | 10% |

| Energy | 18% | 15% |

| Industrials | 4% | 6% |

| Materials | 4% | 2% |

| Consumer Staples | 2% | 1% |

| Information Technology | 2% | 1% |

| Communication Services | 2% | 6% |

| Utilities | 1% | 1% |

| Health Care | 0% | 0% |

A Truly Diversified Dividend-Paying Portfolio Must Look Beyond the Obvious High-Yield Stocks!

In the (large cap) Russell 1000 Index, 49% of the top 100 dividend payers are in the real estate and financials sectors. In the (small cap) Russell 2000 Index, 60% of the top 100 dividend-yielding stocks are real estate or financials companies. To construct a diversified portfolio of attractive yielding stocks, one must look beyond these sectors. We certainly do.

Dividend yield is a ratio that shows how much a company pays out in dividends each year relative to its share price.

Global Diversification Can Improve the Portfolio Yield

Since firms outside the U.S. tend to pay higher dividends than U.S. firms, particularly outside the financial and utility sectors, we maintain the ability to diversify the Thornburg Investment Income Builder Fund into foreign dividend-paying stocks to try to take advantage of these opportunities.

Diversification does not assure or guarantee better performance and cannot eliminate the risk of investment losses.

Dividends are not guaranteed.

Thornburg Equity Funds Semi-Annual Report | 19

Fund Summary

Thornburg Investment Income Builder Fund | March 31, 2020 (Unaudited)

OBJECTIVES AND STRATEGIES

The Fund seeks to provide a level of current income which exceeds the average yield on U.S. stocks generally, and which will generally grow, subject to periodic fluctuations, over the years on a per share basis. The Fund’s secondary investment objective is long-term capital appreciation.

The Fund may invest in any domestic or foreign equity or debt security which Thornburg Investment Management believes may assist the Fund in pursuing its investment goals, although the Fund expects that equity securities in its portfolio will normally be weighted in favor of companies that pay dividends or other current income.

PORTFOLIO COMPOSITION

| TOP TEN EQUITY HOLDINGS |

| Orange SA | 5.4% |

| China Mobile Ltd. | 4.3% |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 3.9% |

| Roche Holding AG | 3.4% |

| Deutsche Telekom AG | 3.3% |

| CME Group, Inc. | 2.9% |

| TOTAL S.A. | 2.8% |

| Merck & Co., Inc. | 2.8% |

| Walgreens Boots Alliance, Inc. | 2.7% |

| JPMorgan Chase & Co. | 2.7% |

SECTOR EXPOSURE

(percent of equity holdings) |

| Financials | 20.7% |

| Communication Services | 20.0% |

| Health Care | 14.1% |

| Information Technology | 11.7% |

| Energy | 8.6% |

| Consumer Staples | 5.2% |

| Utilities | 5.2% |

| Real Estate | 4.1% |

| Materials | 4.0% |

| Industrials | 3.2% |

| Consumer Discretionary | 3.2% |

COUNTRY EXPOSURE *

(percent of Fund) |

| United States | 38.1% |

| France | 11.5% |

| Switzerland | 8.7% |

| Netherlands | 6.0% |

| United Kingdom | 5.9% |

| Italy | 5.0% |

| China | 4.4% |

| Taiwan | 3.9% |

| Germany | 3.7% |

| South Korea | 3.5% |

| Russian Federation | 2.2% |

| Spain | 1.4% |

| Singapore | 0.9% |

| Australia | 0.7% |

| South Africa | 0.4% |

| Ireland | 0.3% |

| Jamaica | 0.3% |

| Colombia | 0.3% |

| Canada | 0.2% |

| Brazil | 0.1% |

| Cayman Islands | 0.1% |

| Japan | 0.1% |

| Belgium | 0.1% |

| Mexico | 0.0%** |

| Saint Lucia | 0.0%** |

| Other Assets Less Liabilities | 2.2% |

| * | Holdings are classified by country of risk as determined by MSCI and Bloomberg. |

| ** | Country percentage was less than 0.1%. |

20 | Thornburg Equity Funds Semi-Annual Report

Fund Summary, Continued

Thornburg Investment Income Builder Fund | March 31, 2020 (Unaudited)

| QUARTERLY DIVIDEND HISTORY, CLASS A |

| YEAR | Q1 | Q2 | Q3 | Q4 | TOTAL |

| 2003 | 9.2¢ | 11.2¢ | 12.4¢ | 17.5¢ | 50.3¢ |

| 2004 | 10.2¢ | 12.5¢ | 15.0¢ | 21.8¢ | 59.5¢ |

| 2005 | 11.0¢ | 13.6¢ | 17.4¢ | 29.0¢ | 71.0¢ |

| 2006 | 12.5¢ | 16.0¢ | 19.2¢ | 33.0¢ | 80.7¢ |

| 2007 | 14.2¢ | 18.5¢ | 21.5¢ | 36.8¢ | 91.0¢ |

| 2008 | 17.9¢ | 21.8¢ | 26.0¢ | 36.8¢ | 102.5¢ |

| 2009 | 18.0¢ | 24.2¢ | 28.0¢ | 34.5¢ | 104.7¢ |

| 2010 | 19.8¢ | 25.0¢ | 32.0¢ | 36.0¢ | 112.8¢ |

| 2011 | 21.0¢ | 26.0¢ | 32.0¢ | 37.5¢ | 116.5¢ |

| 2012 | 21.5¢ | 26.0¢ | 28.5¢ | 36.0¢ | 112.0¢ |

| 2013 | 21.5¢ | 25.3¢ | 25.0¢ | 24.5¢ | 96.3¢ |

| 2014 | 22.5¢ | 24.0¢ | 27.0¢ | 26.0¢ | 99.5¢ |

| 2015 | 16.5¢ | 20.0¢ | 20.0¢ | 25.3¢ | 81.8¢ |

| 2016 | 17.0¢ | 18.5¢ | 19.5¢ | 21.5¢ | 76.5¢ |

| 2017 | 17.0¢ | 20.0¢ | 26.0¢ | 29.5¢ | 92.5¢ |

| 2018 | 18.0¢ | 20.0¢ | 24.0¢ | 28.0¢ | 90.0¢ |

| 2019 | 19.0¢ | 21.5¢ | 25.0¢ | 30.0¢ | 95.5¢ |

| 2020 | 19.0¢ | | | | |

We do not expect each sequential quarter’s dividend to increase over that of the prior quarter, since dividend payments outside the United States tend to be seasonal. Rather, the Fund aspires to increase the dividend paid on an annual basis.

Thornburg Equity Funds Semi-Annual Report | 21

Fund Summary, Continued

Thornburg Investment Income Builder Fund | March 31, 2020 (Unaudited)

EVOLUTION OF INDUSTRY GROUP EXPOSURE

Top 10 industry groups quarter by quarter (percent of equity holdings)

| As of 3/31/2020 | |

| Telecommunication Services | 20.0% |

| Pharmaceuticals, Biotechnology & Life Sciences | 14.1% |

| Diversified Financials | 10.3% |

| Semiconductors & Semiconductor Equipment | 9.2% |

| Energy | 8.6% |

| Banks | 5.6% |

| Utilities | 5.2% |

| Insurance | 4.6% |

| Real Estate | 4.1% |

| Materials | 4.0% |

| As of 12/31/2019 | |

| Telecommunication Services | 15.5% |

| Diversified Financials | 13.6% |

| Energy | 12.9% |

| Pharmaceuticals, Biotechnology & Life Sciences | 9.6% |

| Semiconductors & Semiconductor Equipment | 9.5% |

| Banks | 6.0% |

| Materials | 5.4% |

| Utilities | 4.7% |

| Real Estate | 3.9% |

| Insurance | 3.0% |

| As of 9/30/2019 | |

| Telecommunication Services | 15.8% |

| Diversified Financials | 15.7% |

| Energy | 12.7% |

| Pharmaceuticals, Biotechnology & Life Sciences | 9.1% |

| Semiconductors & Semiconductor Equipment | 8.5% |

| Banks | 5.5% |

| Materials | 5.3% |

| Utilities | 4.7% |

| Real Estate | 4.1% |

| Insurance | 3.0% |

| As of 6/30/2019 | |

| Telecommunication Services | 17.3% |

| Diversified Financials | 15.1% |

| Energy | 13.1% |

| Pharmaceuticals, Biotechnology & Life Sciences | 7.9% |

| Semiconductors & Semiconductor Equipment | 7.8% |

| Banks | 5.9% |

| Materials | 5.1% |

| Utilities | 4.7% |

| Real Estate | 3.9% |

| Transportation | 3.9% |

THORNBURG INVESTMENT INCOME

BUILDER FUND | NASDAQ SYMBOLS | CUSIPS |

| Class A | TIBAX | 885-215-558 |

| Class C | TIBCX | 885-215-541 |

| Class I | TIBIX | 885-215-467 |

| Class R3 | TIBRX | 885-215-384 |

| Class R4 | TIBGX | 885-215-186 |

| Class R5 | TIBMX | 885-215-236 |

| Class R6 | TIBOX | 885-216-663 |

Class I, R3, R4, R5, and R6 shares may not be available to all investors. Minimum investments for Class I shares may be higher than those for other classes.

There is no guarantee that the Fund will meet its investment objectives.

All data is subject to change. Charts may not add up to 100% due to rounding.

22 | Thornburg Equity Funds Semi-Annual Report

Fund Summary

Thornburg Summit Fund | March 31, 2020 (Unaudited)

OBJECTIVES AND STRATEGIES

The Fund seeks to grow real wealth over time. “Real wealth” for this purpose is a mix of capital appreciation and current income that is intended to exceed the rate of inflation. While the Fund seeks to achieve its goal over a variety of different market environments by selecting investments from a range of asset classes, the value of an investment in the Fund will fluctuate and the Fund may not achieve its goal in every environment or in all environments. Under normal conditions the Fund’s investments are expected to emphasize long positions in equity securities and fixed income obligations, though the Fund may also invest a significant amount of its assets in short positions in equity securities and fixed income obligations, in commodities-related investments, in derivative instruments, in currencies, and in cash or cash equivalents. There are no specific percentage limitations on the amount of the Fund’s portfolio that may be invested in a particular asset class, and the proportions of the Fund’s assets that are invested in the respective asset classes are expected to vary over time and from time to time depending upon Thornburg’s perceptions of which types of investments represent better values and opportunities to achieve the Fund’s investment goal.

With respect to its equity investments, the Fund may invest in any stock or equity security, including common stocks, preferred stocks, convertible securities, warrants, depositary receipts, partnership interests, publicly traded real estate investment trusts, and shares in exchange traded funds. The Fund may invest in companies of any size. The Fund’s portfolio may include investments in United States issuers and the securities of issuers domiciled outside the

United States, including developing countries. The relative proportions of the Fund’s U.S. and foreign investments will vary over time depending upon Thornburg’s view of specific investment opportunities and macroeconomic factors.

PORTFOLIO COMPOSITION

SECTOR EXPOSURE

(percent of equity holdings) |

| Information Technology | 26.2% |

| Consumer Discretionary | 19.4% |

| Financials | 17.2% |

| Communication Services | 10.9% |

| Health Care | 7.6% |

| Energy | 6.7% |

| Consumer Staples | 5.4% |

| Industrials | 2.8% |

| Utilities | 2.4% |

| Materials | 1.4% |

Thornburg Equity Funds Semi-Annual Report | 23

Fund Summary, Continued

Thornburg Summit Fund | March 31, 2020 (Unaudited)

COUNTRY EXPOSURE *

(percent of Fund) |

| United States | 64.2% |

| Netherlands | 4.6% |

| France | 3.3% |

| Japan | 3.0% |

| India | 2.4% |

| China | 2.4% |

| Taiwan | 2.1% |

| Switzerland | 1.6% |

| Germany | 1.5% |

| Hong Kong | 1.2% |

| United Kingdom | 1.2% |

| Australia | 1.0% |

| Argentina | 1.0% |

| United Arab Emirates | 0.6% |

| Canada | 0.5% |

| Ireland | 0.5% |

| Brazil | 0.5% |

| Mexico | 0.1% |

| Other Assets Less Liabilities | 8.3% |

| * | Holdings are classified by country of risk as determined by MSCI and Bloomberg. |

| TOP TEN LONG HOLDINGS |

| Visa, Inc. Class A | 3.1% |

| Microsoft Corp. | 3.1% |

| JPMorgan Chase & Co. | 2.5% |

| CME Group, Inc. | 2.4% |

| Facebook, Inc. Class A | 2.1% |

| Amazon.com, Inc. | 2.0% |

| Royal Dutch Shell plc Class A | 1.9% |

| HDFC Bank Ltd. ADR | 1.8% |

| Estee Lauder Cos, Inc. | 1.8% |

| Alphabet, Inc. Class A | 1.7% |

| THORNBURG SUMMIT FUND | NASDAQ SYMBOLS | CUSIPS |

| Class I | TSUMX | 885-216-580 |

Class I shares may not be available to all investors. Minimum investments for Class I shares may be higher than those for other classes. Class A shares are not currently available for purchase.

There is no guarantee that the Fund will meet its investment objectives.

All data is subject to change. Charts may not add up to 100% due to rounding.

24 | Thornburg Equity Funds Semi-Annual Report

Fund Summary

Thornburg Global Opportunities Fund | March 31, 2020 (Unaudited)

OBJECTIVES AND STRATEGIES

The Fund seeks long-term capital appreciation by investing in equity and debt securities of all types from issuers around the world.

The Fund pursues its investment goals by investing primarily in a broad range of equity securities, including common stocks, preferred stocks, real estate investment trusts, other equity trusts, and partnership interests. The Fund may invest in any stock or other equity security which the investment advisor believes may assist the Fund in pursuing its goals, including smaller companies with market capitalizations of less than $500 million. The Fund may also invest in debt obligations of any kind.

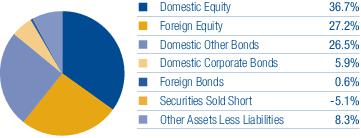

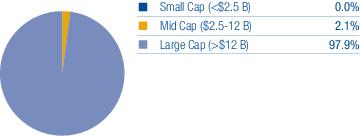

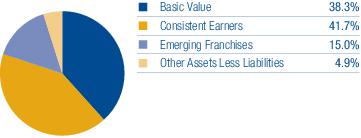

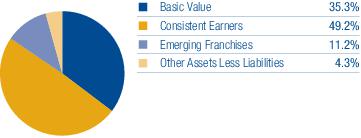

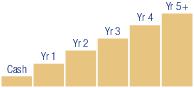

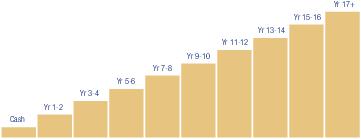

ASSET STRUCTURE

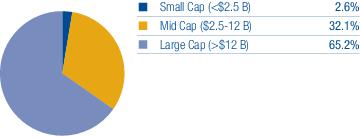

MARKET CAPITALIZATION EXPOSURE

| TOP TEN EQUITY HOLDINGS |

| Alphabet, Inc. Class A | 5.6% |

| Facebook, Inc. Class A | 5.4% |

| Qorvo, Inc. | 5.2% |

| Alibaba Group Holding Ltd. | 5.1% |

| Reliance Industries Ltd. | 5.0% |

| Vestas Wind Systems A/S | 4.7% |

| GDS Holdings Ltd. ADR | 4.6% |

| Samsung Electronics Co. Ltd. | 4.2% |

| OCI N.V. | 4.0% |

| AbbVie, Inc. | 3.9% |

| SECTOR EXPOSURE |

| Communication Services | 20.1% |

| Information Technology | 15.8% |

| Financials | 13.0% |

| Industrials | 12.4% |

| Health Care | 9.2% |

| Materials | 8.6% |

| Consumer Discretionary | 7.1% |

| Energy | 5.0% |

| Consumer Staples | 2.5% |

| Utilities | 0.1% |

| Other Assets Less Liabilities | 6.2% |

Thornburg Equity Funds Semi-Annual Report | 25

Fund Summary, Continued

Thornburg Global Opportunities Fund | March 31, 2020 (Unaudited)

| TOP TEN INDUSTRY GROUPS |

| Media & Entertainment | 13.3% |

| Materials | 8.6% |

| Semiconductors & Semiconductor Equipment | 6.9% |

| Pharmaceuticals, Biotechnology & Life Sciences | 6.8% |

| Telecommunication Services | 6.8% |

| Transportation | 6.8% |

| Capital Goods | 5.6% |

| Diversified Financials | 5.7% |

| Retailing | 5.1% |

| Energy | 5.0% |

COUNTRY EXPOSURE *

(percent of equity holdings) |

| United States | 42.4% |

| China | 13.5% |

| Netherlands | 8.0% |

| India | 5.3% |

| Denmark | 5.0% |

| South Korea | 4.5% |

| Taiwan | 4.2% |

| United Kingdom | 4.2% |

| Italy | 3.7% |

| Switzerland | 2.9% |

| Australia | 2.6% |

| Ireland | 2.1% |

| Macao | 1.5% |

| France | 0.1% |

| * | Holdings are classified by country of risk as determined by MSCI and Bloomberg. |

| THORNBURG GLOBAL OPPORTUNITIES FUND | NASDAQ SYMBOLS | CUSIPS |

| Class A | THOAX | 885-215-343 |

| Class C | THOCX | 885-215-335 |

| Class I | THOIX | 885-215-327 |

| Class R3 | THORX | 885-215-145 |

| Class R4 | THOVX | 885-215-137 |

| Class R5 | THOFX | 885-215-129 |

| Class R6 | THOGX | 885-216-655 |

Class I, R3, R4, R5, and R6 shares may not be available to all investors. Minimum investments for Class I shares may be higher than those for other classes.

There is no guarantee that the Fund will meet its investment objectives.

All data is subject to change. Charts may not add up to 100% due to rounding.

26 | Thornburg Equity Funds Semi-Annual Report

Fund Summary

Thornburg International Value Fund | March 31, 2020 (Unaudited)

OBJECTIVES AND STRATEGIES

The Fund seeks long-term capital appreciation by investing in equity and debt securities of all types. As a secondary goal, the Fund also seeks some current income.

The Fund invests primarily in foreign securities or depositary receipts of foreign securities. The Fund may invest in developing countries.

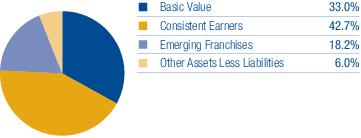

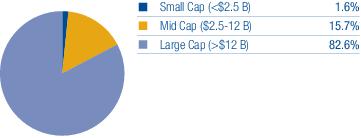

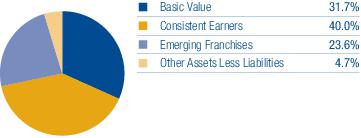

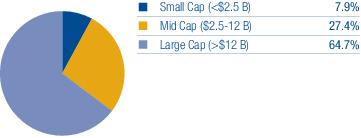

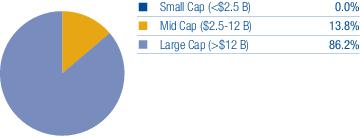

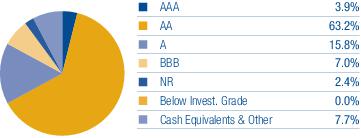

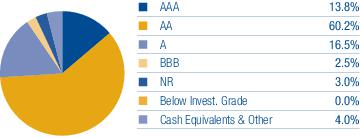

MARKET CAPITALIZATION EXPOSURE

BASKET STRUCTURE

| TOP TEN EQUITY HOLDINGS |

| Telefonaktiebolaget LM Ericsson Class B | 3.2% |

| Alibaba Group Holding Ltd. | 3.0% |

| Lonza Group AG | 2.9% |

| Tencent Holdings Ltd. | 2.8% |

| Ferrovial S.A. | 2.8% |

| Nintendo Co. Ltd. | 2.7% |

| Vinci S.A. | 2.7% |

| BAE Systems plc | 2.7% |

| adidas AG | 2.7% |

| Meituan Dianping Class B | 2.6% |

| SECTOR EXPOSURE |

| Industrials | 19.5% |

| Information Technology | 12.5% |

| Consumer Staples | 12.1% |

| Communication Services | 12.0% |

| Financials | 11.2% |

| Consumer Discretionary | 9.3% |

| Utilities | 6.1% |

| Health Care | 5.0% |

| Materials | 3.4% |

| Energy | 2.8% |

| Other Assets Less Liabilities | 6.1% |

Thornburg Equity Funds Semi-Annual Report | 27

Fund Summary, Continued

Thornburg International Value Fund | March 31, 2020 (Unaudited)

| TOP TEN INDUSTRY GROUPS |

| Capital Goods | 14.5% |

| Food, Beverage & Tobacco | 8.7% |

| Media & Entertainment | 8.1% |

| Utilities | 6.1% |

| Retailing | 5.6% |

| Banks | 5.0% |

| Semiconductors & Semiconductor Equipment | 4.5% |

| Technology Hardware & Equipment | 4.4% |

| Insurance | 4.0% |