UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-05206 |

| |

| Exact name of registrant as specified in charter: | | Prudential Jennison Natural Resources Fund, Inc. |

| |

| Address of principal executive offices: | | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs |

| | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 10/31/2016 |

| |

| Date of reporting period: | | 10/31/2016 |

Item 1 – Reports to Stockholders

PRUDENTIAL INVESTMENTS, A PGIM BUSINESS | MUTUAL FUNDS

Prudential Jennison Natural Resources Fund, Inc.

| | |

| ANNUAL REPORT | | OCTOBER 31, 2016 |

| | |

To enroll in e-delivery, go to prudentialfunds.com/edelivery | |  |

|

| Objective: Long-term growth of capital |

Highlights

PRUDENTIAL JENNISON NATURAL RESOURCES FUND, INC.

| • | | The Prudential Jennison Natural Resources Fund, Inc.’s metals & mining holdings, specifically within the gold and copper segments, were among the main drivers of performance during the reporting period. Positions within the energy equipment & services industry also helped. (For a complete list of holdings, refer to the Portfolio of Investments section of this report.) |

| • | | Conversely, holdings within the oil & gas refining & marketing segment, along with those in the oil & gas storage & transportation and oil & gas exploration & production segments, all detracted from absolute performance during the period. |

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC, member SIPC. Jennison Associates LLC is a registered investment adviser. Both are Prudential Financial companies. © 2016 Prudential Financial, Inc. and its related entities. Jennison Associates, Jennison, the Prudential logo, and the Rock symbol are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| | |

| 2 | | Visit our website at prudentialfunds.com |

Letter from the President

Dear Shareholder:

We hope you find the annual report for the Prudential Jennison Natural Resources Fund, Inc. informative and useful. The report covers performance for the 12-month period that ended October 31, 2016.

During the reporting period, the US economy experienced modest growth. Labor markets were healthy, and consumer confidence rose. The housing market brightened somewhat, as momentum continued for the new home market. The Federal Reserve kept interest rates unchanged at its September meeting, but pointed to the strong possibility of a rate hike in December. Internationally, concerns over Brexit—the term used to represent Britain’s decision to leave the European Union—remained in the spotlight.

Equity markets in the US were firmly in positive territory at the end of the reporting period, as US stocks posted strong gains. European stocks struggled earlier, but found some traction in the third quarter. Asian markets also advanced, and emerging markets rose sharply.

US fixed income markets experienced overall gains. High yield bonds posted very strong results. Corporate bonds and Treasuries also performed well. Accommodative monetary policy by central banks helped lift global bond markets.

Given the uncertainty in today’s investment environment, we believe that active professional portfolio management offers a potential advantage. Active managers often have the knowledge and flexibility to find the best investment opportunities in the most challenging markets.

Even so, it’s best if investment decisions are based on your long-term goals rather than on short-term market and economic developments. We also encourage you to work with an experienced financial advisor who can help you set goals, determine your tolerance for risk, build a diversified plan that’s right for you, and make adjustments when necessary.

By having Prudential Investments help you address your goals, you gain the advantage of asset managers that also manage money for many major corporations and pension funds around the world. That means you benefit from the same expertise, innovation, and attention to risk demanded by today’s most sophisticated investors.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

Prudential Jennison Natural Resources Fund, Inc.

December 15, 2016

| | | | |

| Prudential Jennison Natural Resources Fund, Inc. | | | 3 | |

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.prudentialfunds.com or by calling (800) 225-1852.

| | | | | | | | | | | | | | | | |

| Cumulative Total Returns (Without Sales Charges) as of 10/31/16 | |

| | | One Year (%) | | | | Five Years (%) | | | | Ten Years (%) | | | | Since Inception (%) | |

| Class A | | | 5.60 | | | | –30.67 | | | | –2.52 | | | | — | |

| Class B | | | 4.86 | | | | –33.07 | | | | –9.19 | | | | — | |

| Class C | | | 4.86 | | | | –33.06 | | | | –9.16 | | | | — | |

| Class Q | | | 6.12 | | | | –29.08 | | | | N/A | | | | –36.84 (12/27/10) | |

| Class R | | | 5.36 | | | | –31.37 | | | | –4.34 | | | | — | |

| Class Z | | | 5.90 | | | | –29.61 | | | | 0.41 | | | | — | |

| Lipper Global Natural Resources Index | | | 14.03 | | | | –9.58 | | | | 2.86 | | | | — | |

| S&P 500 Index | | | 4.49 | | | | 88.79 | | | | 91.14 | | | | — | |

| MSCI World ND Index | | | 1.18 | | | | 54.04 | | | | 46.50 | | | | — | |

| Lipper Global Natural Resources Funds Average | | | 3.24 | | | | –15.18 | | | | –9.75 | | | | — | |

| | | | | | | | | | | | | | | | |

| Average Annual Total Returns (With Sales Charges) as of 9/30/16 | |

| | | One Year (%) | | | | Five Years (%) | | | | Ten Years (%) | | | | Since Inception (%) | |

| Class A | | | 16.06 | | | | –3.71 | | | | 0.23 | | | | — | |

| Class B | | | 16.96 | | | | –3.49 | | | | 0.09 | | | | — | |

| Class C | | | 20.91 | | | | –3.30 | | | | 0.09 | | | | — | |

| Class Q | | | 23.42 | | | | –2.16 | | | | N/A | | | | –6.95 (12/27/10) | |

| Class R | | | 22.55 | | | | –2.81 | | | | 0.61 | | | | — | |

| Class Z | | | 23.18 | | | | –2.32 | | | | 1.10 | | | | — | |

| Lipper Global Natural Resources Index | | | 28.61 | | | | 1.74 | | | | 1.15 | | | | — | |

| S&P 500 Index | | | 15.41 | | | | 16.36 | | | | 7.23 | | | | — | |

| MSCI World ND Index | | | 11.36 | | | | 11.63 | | | | 4.47 | | | | — | |

| Lipper Global Natural Resources Funds Average | | | 16.17 | | | | –0.18 | | | | –0.32 | | | | — | |

| | |

| 4 | | Visit our website at prudentialfunds.com |

| | | | | | | | | | | | | | |

| Average Annual Total Returns (With Sales Charges) as of 10/31/16 | |

| | One Year (%) | | | Five Years (%) | | | | Ten Years (%) | | | | Since Inception (%) | |

| Class A | | –0.21 | | | –8.11 | | | | –0.82 | | | | — | |

| Class B | | –0.14 | | | –7.90 | | | | –0.96 | | | | — | |

| Class C | | 3.86 | | | –7.71 | | | | –0.96 | | | | — | |

| Class Q | | 6.12 | | | –6.64 | | | | N/A | | | | –7.56 (12/27/10) | |

| Class R | | 5.36 | | | –7.25 | | | | –0.44 | | | | — | |

| Class Z | | 5.90 | | | –6.78 | | | | 0.04 | | | | — | |

| | | | | | | | | | | | | | |

| Average Annual Total Returns (Without Sales Charges) as of 10/31/16 | |

| | One Year (%) | | | Five Years (%) | | | | Ten Years (%) | | | | Since Inception (%) | |

| Class A | | 5.60 | | | –7.06 | | | | –0.26 | | | | — | |

| Class B | | 4.86 | | | –7.72 | | | | –0.96 | | | | — | |

| Class C | | 4.86 | | | –7.71 | | | | –0.96 | | | | — | |

| Class Q | | 6.12 | | | –6.64 | | | | N/A | | | | –7.56 (12/27/10) | |

| Class R | | 5.36 | | | –7.25 | | | | –0.44 | | | | — | |

| Class Z | | 5.90 | | | –6.78 | | | | 0.04 | | | | — | |

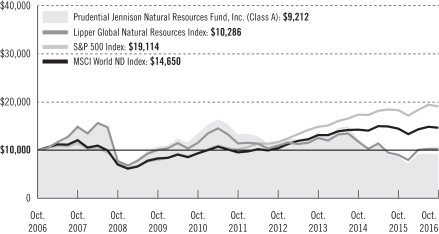

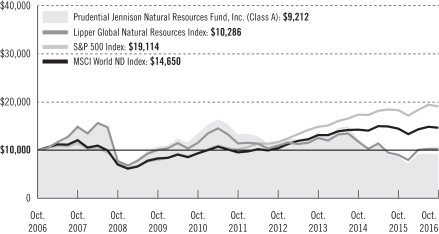

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Prudential Jennison Natural Resources Fund, Inc. (Class A shares) with a similar investment in the Lipper Global Natural

| | | | |

| Prudential Jennison Natural Resources Fund, Inc. | | | 5 | |

Your Fund’s Performance (continued)

Resources Index, Morgan Stanley Capital International World Net Dividends Index (MSCI World ND Index), and the Standard & Poor’s 500 Composite Stock Price Index (S&P 500 Index) by portraying the initial account values at the beginning of the 10-year period for Class A shares (October 31, 2006) and the account values at the end of the current fiscal year (October 31, 2016) as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) the maximum applicable front-end sales charge was deducted from the initial $10,000 investment in Class A shares; (b) all recurring fees (including management fees) were deducted; and (c) all dividends and distributions were reinvested. The line graph provides information for Class A shares only. As indicated in the tables provided earlier, performance for Class B, Class C, Class Q, Class R, and Class Z shares will vary due to the differing charges and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursement, if any, the Fund’s returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Source: Prudential Investments LLC and Lipper Inc.

Inception returns are provided for any share class with less than 10 calendar years of returns.

| | |

| 6 | | Visit our website at prudentialfunds.com |

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | | | | | | | | | |

| | | Class A | | Class B* | | Class C | | Class Q | | Class R | | Class Z |

| Maximum initial sales charge | | 5.50% of the public offering price | | None | | None | | None | | None | | None |

| Contingent deferred sales charge (CDSC) (as a percentage of the lower of original purchase price or net asset value at redemption) | | 1% on sales of $1 million or more made within 12 months of purchase | | 5% (Yr. 1) 4% (Yr. 2) 3% (Yr. 3) 2% (Yr. 4) 1% (Yr. 5) 1% (Yr. 6) 0% (Yr. 7) | | 1% on sales made within 12 months of purchase | | None | | None | | None |

| Annual distribution and service (12b-1) fees (shown as a percentage of average daily net assets) | | .30% | | 1% | | 1% | | None | | .75% (.50% currently) | | None |

*Class B shares are closed to all purchase activity and no additional Class B shares may be purchased or acquired except by exchange from Class B shares of another Fund or through dividend or capital gains reinvestment.

Benchmark Definitions

Lipper Global Natural Resources Index—The Lipper Global Natural Resources Index (Lipper Index) is an unmanaged index which tracks the performance of the 30 largest global natural resources mutual funds. The cumulative total returns for the Lipper Index measured from the month-end closest to the inception date through 10/31/16 are –20.39% for Class Q shares and 2.23% for Class R shares. The average annual total returns for the Lipper Index measured from the month-end closest to the inception date through 9/30/16 are –3.37% for Class Q shares and 0.53% for Class R shares.

S&P 500 Index—The Standard & Poor’s 500 Composite Stock Price Index (S&P 500 Index) is an unmanaged index of over 500 stocks of large US public companies. It gives a broad look at how stock prices in the United States have performed. The cumulative total returns for the S&P 500 Index measured from the month-end closest to the inception date through 10/31/16 are 91.21% for Class Q shares and 102.45% for Class R shares. The average annual total returns for the S&P 500 Index measured from the month-end closest to the inception date through 9/30/16 are 12.29% for Class Q shares and 7.44% for Class R shares.

MSCI World Net Dividends Index—The Morgan Stanley Capital International World Net Dividends Index (MSCI World ND Index) is an unmanaged free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World ND Index consists of the

| | | | |

| Prudential Jennison Natural Resources Fund, Inc. | | | 7 | |

Your Fund’s Performance (continued)

following 23 developed market country indexes: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. The MSCI World ND Index is unmanaged and the total return includes the reinvestment of all dividends. The ND version of the MSCI World Index reflects the impact of the maximum withholding taxes on reinvested dividends. The cumulative total returns for the MSCI World ND Index measured from the month-end closest to the inception date through 10/31/16 are 49.23% for Class Q shares and 53.69% for Class R shares. The average annual total returns for the MSCI World ND Index measured from the month-end closest to the inception date through 9/30/16 are 7.58% for Class Q shares and 4.56% for Class R shares.

Lipper Global Natural Resources Funds Average—The Lipper Global Natural Resources Funds Average (Lipper Average) is based on the average return of all mutual funds in the Lipper Global Natural Resources Funds category and does not include the effect of any sales charges or taxes payable by investors. The cumulative total returns for the Lipper Average measured from the month-end closest to the inception date through 10/31/16 are –25.07% for Class Q shares and –9.79% for Class R shares. The average annual total returns for the Lipper Average measured from the month-end closest to the inception date through 9/30/16 are –5.02% for Class Q shares and

–0.92% for Class R shares.

Investors cannot invest directly in an index or average. The returns for the S&P 500 and MSCI World ND Indexes would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes that may be paid by an investor. Returns for the Lipper Index and the Lipper Average would be lower if they included the effects of sales charges or taxes. The Since Inception returns for the indexes and the Lipper Average are measured from the closest month-end to the inception date for the indicated share class.

| | | | |

Five Largest Holdings expressed as a

percentage of net assets as of 10/31/16 (%) | |

Halliburton Co., Oil & Gas Equipment & Services | | | 4.5 | |

Concho Resources, Inc., Oil & Gas Exploration & Production | | | 4.4 | |

Schlumberger Ltd., Oil & Gas Equipment & Services | | | 3.6 | |

EOG Resources, Inc., Oil & Gas Exploration & Production | | | 3.5 | |

Noble Energy, Inc., Oil & Gas Exploration & Production | | | 3.4 | |

Holdings reflect only long-term investments and are subject to change.

| | | | |

Five Largest Industries expressed as a

percentage of net assets as of 10/31/16 (%) | |

Oil & Gas Exploration & Production | | | 37.5 | |

Oil & Gas Equipment & Services | | | 15.4 | |

Gold | | | 8.8 | |

Integrated Oil & Gas | | | 6.3 | |

Copper | | | 4.8 | |

Industry weightings reflect only long-term investments and are subject to change.

| | |

| 8 | | Visit our website at prudentialfunds.com |

Strategy and Performance Overview

How did the Fund perform?

The Prudential Jennison Natural Resources Fund Inc.’s Class A shares rose 5.60% for the 12 months ended October 31, 2016. Over the same period, the Lipper Global Natural Resources Index (the Index) rose 14.03%, and the Lipper Global Natural Resources Funds Average gained 3.24%. The Fund also outperformed the 4.49% gain of the S&P 500 Index and the 1.18% gain of the MSCI World Index.

The Fund’s metals & mining holdings, specifically within the gold and copper segments, were among the main drivers of performance during the period. Positions within the energy equipment & services industry also helped. Conversely, holdings within the oil & gas refining & marketing segment, along with those in the oil & gas storage & transportation and oil & gas exploration & production segments all detracted from absolute performance during the period.

What was the market environment?

| • | | During the reporting period uncertainty over Iran and the oil market showing bearish fundamentals led to extreme volatility. Crude prices double-dipped in early 2016 after hitting multi-year lows, but recovered during the spring. In the second half of 2016, OPEC’s agreement to cut production following oil production restarts in Libya and Nigeria whipsawed oil prices. |

| • | | Numerous factors contributed to overall market volatility during the period, including decelerating economic growth in China; concerns that emerging economies might face balance sheet risks; the negative effect of lower energy prices on industrial sectors; fears of slowing economic growth in the US; uncertainty about the course of future Federal Reserve monetary tightening; Brexit, the United Kingdom’s vote to leave the European Union; and anxiety about the highly unconventional US presidential election. |

| • | | Risk aversion in this volatile global market environment affected how investors valued different securities. Low-volatility/high-dividend-paying and other “safety” stocks were significant drivers of market returns. Stocks of higher-growth companies generally underperformed. |

What worked?

In materials, specifically within metals & mining:

| • | | Barrick Gold is a mining company engaged in the production and sale of gold and copper, as well as mine exploration and development. The company has 14 producing gold mines, located in Canada, the United States, Peru, Argentina, Australia, the Dominican Republic, and Papua New Guinea. It also holds over a 50% equity interest in Acacia Mining plc (Acacia) that owns gold mines and exploration properties in Africa. Barrick’s shares performed well during the period as gold prices rose and the company continued to lower its unit costs while shoring up its balance sheet. Jennison likes Barrick |

| | | | |

| Prudential Jennison Natural Resources Fund, Inc. | | | 9 | |

Strategy and Performance Overview (continued)

| | as its portfolio restructuring should ultimately lead to a more focused company with structurally lower costs and an ability to grow off a smaller base. |

| • | | Randgold Resources is a gold exploration and production company that is engaged in the exploration and development of gold deposits in Sub-Saharan Africa, focusing its activities in the West and Central African regions. Jennison likes this company for its well-managed, high margin business, with good growth prospects and its leverage to the price of gold. Shares of the company performed well during the period as a surge in the price of gold in the beginning of the year, along with market volatility causing investors to find safe-haven assets, lifted its shares. Jennison also likes the company for its low-cost assets, which should allow for multi-year growth at high margins, in Jennison’s view. |

| • | | Agnico-Eagle Mines is a Canadian-based gold mining company and has nine mines located in Canada, Finland, and Mexico, with exploration and development activities in each of these regions, as well as in the US. Shares of the company rose during the period as increased organic growth and exploration, as well as solid quarterly earnings results, pushed share prices higher. Jennison likes the company for its well-managed, low political-risk profile that not only displays good growth prospects, but is also levered to the price of gold. Jennison likes this gold company for its leading growth outlook from a combination of expansions and new projects at below industry-level costs. |

What didn’t work?

Oil-price volatility dominated the energy landscape during the beginning of the period with double-digit declines in oil prices hampering the entire energy sector, causing a broad decline in energy-related stocks. In energy, specifically within oil & gas refining & marketing:

| • | | Marathon Petroleum is an independent petroleum product refiner, marketer, and transporter in the United States. Its operations consist of three business segments: Refining & Marketing, Speedway retail stations, and Pipeline Transportation. Oil-price volatility dominated the energy landscape during the beginning of the period with double-digit declines in oil prices hampering the entire energy sector, causing a broad decline in energy-related stocks. Jennison continues to see Marathon, with its network of strategically-positioned refineries near key crude supply areas with accompanying midstream businesses, as well positioned to optimize its operations toward price-advantaged crude and products. Oil-price volatility dominated the energy landscape during the beginning of the period with double-digit declines in oil prices hampering the entire energy sector, causing a broad decline in energy-related stocks. |

| • | | Western Refining is an independent crude-oil refiner and marketer of refined products. The company operates through five business segments: the refining group, the wholesale group, the retail group, Western Refining Logistics LP, and Northern Tier Energy LP. While Western’s shares have since rebounded, the oil-price volatility that dominated the energy |

| | |

| 10 | | Visit our website at prudentialfunds.com |

| | landscape at the end of 2015 into the first quarter of 2016, with double-digit price declines, hampered the entire energy sector, including refiners like it. Jennison likes the company for not only its ability to grow its midstream (refining and infrastructure) business, but also the location of its refineries in New Mexico and West Texas, which has enabled it to strengthen their margins as a result of the production growth in the Permian Basin. |

In energy, specifically within oil & gas storage & transportation:

| • | | Williams Companies is an integrated, large-scale, natural gas infrastructure company that explores, produces, transports, sells and processes natural gas and petroleum products. Williams Companies is also the parent company and General Partner (GP) of Williams Partners, which is engaged in the business of gathering, transporting, and processing natural gas and fractionating and storing natural gas liquids. While shares of the company have since rebounded, the oil-price volatility that dominated the energy landscape from the end of 2015 into the first quarter of 2016 and the failed merger with Energy Transfer Equity all weighed on Williams’ share price (similar to a share price) during the period. Jennison believes the company, along with its subsidiaries, is a gas behemoth with premier Northeast and Gulf Coast positioning, which should benefit from a rise in needed transportation projects. With its attractive footprint in fast-growing shale basins, Jennison believes Williams should be a principal beneficiary of rising demand for natural gas and natural gas liquids (NGLs). |

The percentage points shown in the tables identify each security’s positive or negative contribution to the Fund’s return, which is the sum of all contributions by individual holdings.

| | | | | | |

| Top Contributors (%) | | Top Detractors (%) |

| Barrick Gold Co. | | 2.46 | | Marathon Petroleum Corp. | | –1.02 |

| Randgold Resources Ltd. | | 1.48 | | Williams Companies, Inc. | | –0.91 |

| Agnico-Eagle Mines Ltd. | | 1.40 | | Western Refining, Inc. | | –0.90 |

| Guyana Goldfields, Inc. | | 1.17 | | Cobalt International Energy, Inc. | | –0.88 |

| Patterson-UTI Energy, LLC | | 0.88 | | Devon Energy Corp. | | –0.67 |

Current outlook

| • | | Portfolio positioning is not a direct expression of Jennison’s views on commodity prices; Jennison’s strategy is not to be dependent on a sharp upturn in crude-oil prices in order to perform; Jennison remains focused on longer-term opportunities—not tactical short-term ones. |

| • | | Regarding short-term views, US crude oil production declines are still occurring, but at a slower pace; internationally, these production declines are accelerating. The market |

| | | | |

| Prudential Jennison Natural Resources Fund, Inc. | | | 11 | |

Strategy and Performance Overview (continued)

| | rebalancing process has likely accelerated, given OPEC’s recent actions in September. Winter seasonal demand strength in combination with accelerating international declines and lack of US growth should make for a positive 2017 environment. |

| • | | Jennison’s long-term view projects that overall demand is holding up fine, but Latin America is weaker (mostly Brazil). China is decelerating but gasoline demand remains strong, although steep decline rates in existing fields and offshore/international project delays have continued to eat into excess inventory. Production declines resulting from capital flight won’t turn around quickly, in Jennison’s view. |

| • | | As a result of OPEC’s actions in September, Jennison’s investment decision hasn’t changed. In Jennison’s view, the announced productions cuts are harder in practice to implement. Overall, actions from OPEC should cause the supply issues to correct sooner than initially anticipated, and could pull forward to a full rebalancing of the market to early 2017 from mid-2017. Additionally, Jennison believes this puts a “floor” on oil prices, in turn providing Exploration & Production (E&P) companies with more comfort to raise their 2017 budgets. |

| • | | Jennison will continue to maintain “high-grade” energy E&P exposure (those companies with strong balance sheets and higher-quality resource plays). Jennison will also focus on exposure to diversified metals as tightening supply/demand dynamics will take longer to play out. |

| | |

| 12 | | Visit our website at prudentialfunds.com |

Fees and Expenses (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution, and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested on May 1, 2016, at the beginning of the period, and held through the six-month period ended October 31, 2016. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of Prudential Investments funds, including the Fund, that you own. You should consider the additional fees that were charged to your

| | | | |

| Prudential Jennison Natural Resources Fund, Inc. | | | 13 | |

Fees and Expenses (continued)

Fund account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

Prudential

Jennison Natural Resources Fund, Inc. | | Beginning Account

Value

May 1, 2016 | | | Ending Account

Value

October 31, 2016 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| Class A | | Actual | | $ | 1,000.00 | | | $ | 1,008.80 | | | | 1.22 | % | | $ | 6.16 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,019.00 | | | | 1.22 | % | | $ | 6.19 | |

| Class B | | Actual | | $ | 1,000.00 | | | $ | 1,005.40 | | | | 1.92 | % | | $ | 9.68 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,015.48 | | | | 1.92 | % | | $ | 9.73 | |

| Class C | | Actual | | $ | 1,000.00 | | | $ | 1,005.40 | | | | 1.92 | % | | $ | 9.68 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,015.48 | | | | 1.92 | % | | $ | 9.73 | |

| Class Q | | Actual | | $ | 1,000.00 | | | $ | 1,011.30 | | | | 0.76 | % | | $ | 3.84 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,021.32 | | | | 0.76 | % | | $ | 3.86 | |

| Class R | | Actual | | $ | 1,000.00 | | | $ | 1,008.00 | | | | 1.42 | % | | $ | 7.17 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,018.00 | | | | 1.42 | % | | $ | 7.20 | |

| Class Z | | Actual | | $ | 1,000.00 | | | $ | 1,010.60 | | | | 0.92 | % | | $ | 4.65 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,020.51 | | | | 0.92 | % | | $ | 4.67 | |

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended October 31, 2016, and divided by the 366 days in the Fund’s fiscal year ended October 31, 2016 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| | |

| 14 | | Visit our website at prudentialfunds.com |

The Fund’s annual expense ratios for the 12-month period ended October 31, 2016, are as follows:

| | | | |

| Class | | Gross Operating Expenses (%) | | Net Operating Expenses (%) |

| A | | 1.25 | | 1.25 |

| B | | 1.95 | | 1.95 |

| C | | 1.95 | | 1.95 |

| Q | | 0.77 | | 0.77 |

| R | | 1.70 | | 1.45 |

| Z | | 0.95 | | 0.95 |

Net operating expenses shown above reflect any fee waivers and/or expense reimbursements. Additional information on Fund expenses and any fee waivers and/or expense reimbursements can be found in the “Financial Highlights” tables in this report and in the Notes to the Financial Statements in this report.

| | | | |

| Prudential Jennison Natural Resources Fund, Inc. | | | 15 | |

Portfolio of Investments

as of October 31, 2016

| | | | | | | | |

| Description | | Shares | | | Value (Note 1) | |

LONG-TERM INVESTMENTS 97.5% | | | | | | | | |

| | |

COMMON STOCKS | | | | | | | | |

| | |

Aluminum 0.6% | | | | | | | | |

Alcoa, Inc. | | | 4,430 | | | $ | 127,229 | |

Constellium N.V. (Netherlands) (Class A Stock)* | | | 1,978,395 | | | | 10,386,574 | |

| | | | | | | | |

| | | | | | | 10,513,803 | |

| | |

Coal & Consumable Fuels 0.8% | | | | | | | | |

CONSOL Energy, Inc.(a) | | | 868,641 | | | | 14,723,465 | |

| | |

Copper 4.8% | | | | | | | | |

First Quantum Minerals Ltd. (Canada) | | | 2,886,791 | | | | 27,419,457 | |

Freeport-McMoRan, Inc.(a) | | | 799,743 | | | | 8,941,126 | |

Lundin Mining Corp. (Canada)* | | | 7,591,605 | | | | 29,714,401 | |

Southern Copper Corp. (Peru)(a) | | | 808,484 | | | | 22,952,861 | |

| | | | | | | | |

| | | | | | | 89,027,845 | |

| | |

Diversified Chemicals 1.5% | | | | | | | | |

BASF SE (Germany) | | | 1,081 | | | | 95,429 | |

Chemours Co. (The) | | | 356,339 | | | | 5,854,650 | |

Dow Chemical Co. (The) | | | 408,027 | | | | 21,955,933 | |

E.I. du Pont de Nemours & Co. | | | 1,754 | | | | 120,657 | |

| | | | | | | | |

| | | | | | | 28,026,669 | |

| | |

Diversified Metals & Mining 4.0% | | | | | | | | |

BHP Billiton Ltd. (Australia), ADR(a) | | | 266,594 | | | | 9,336,122 | |

Glencore PLC (Switzerland)* | | | 9,018,802 | | | | 27,607,630 | |

Ivanhoe Mines Ltd. (Canada) (Class A Stock)*(a) | | | 1,239,691 | | | | 1,931,674 | |

Ivanhoe Mines Ltd. (Canada) (Class A Stock), 144A*(b) | | | 2,082,400 | | | | 3,244,775 | |

Northern Dynasty Minerals Ltd. (Canada)*(a) | | | 1,763,422 | | | | 1,475,279 | |

Rio Tinto PLC (United Kingdom) | | | 8,155 | | | | 283,594 | |

Rio Tinto PLC (United Kingdom), ADR(a) | | | 827,759 | | | | 28,847,401 | |

| | | | | | | | |

| | | | | | | 72,726,475 | |

| | |

Fertilizers & Agricultural Chemicals 1.6% | | | | | | | | |

FMC Corp.(a) | | | 337,730 | | | | 15,836,160 | |

Monsanto Co. | | | 1,324 | | | | 133,420 | |

Potash Corp. of Saskatchewan, Inc. (Canada) | | | 842,248 | | | | 13,711,797 | |

Syngenta AG (Switzerland) | | | 165 | | | | 66,027 | |

| | | | | | | | |

| | | | | | | 29,747,404 | |

See Notes to Financial Statements.

| | | | |

| Prudential Jennison Natural Resources Fund, Inc. | | | 17 | |

Portfolio of Investments (continued)

as of October 31, 2016

| | | | | | | | |

| Description | | Shares | | | Value (Note 1) | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Gold 8.8% | | | | | | | | |

Agnico Eagle Mines Ltd. (Canada) | | | 725,073 | | | $ | 36,833,708 | |

Alacer Gold Corp.* | | | 5,256,503 | | | | 10,620,385 | |

Algold Resources Ltd. (Canada), 144A*(b) | | | 43,790 | | | | 11,427 | |

Axmin, Inc. (Canada)* | | | 666,158 | | | | 22,349 | |

Barrick Gold Corp. (Canada)(a) | | | 1,429,907 | | | | 25,152,064 | |

Eldorado Gold Corp. (Canada) | | | 4,503,577 | | | | 14,202,737 | |

Guyana Goldfields, Inc. (Canada)* | | | 572,345 | | | | 3,366,735 | |

Guyana Goldfields, Inc. (Canada), 144A*(b) | | | 2,654,213 | | | | 15,613,018 | |

Newmont Mining Corp. | | | 3,618 | | | | 134,011 | |

Randgold Resources Ltd. (United Kingdom), ADR(a) | | | 423,348 | | | | 37,563,668 | |

Tahoe Resources, Inc. | | | 1,066,675 | | | | 12,787,694 | |

Tahoe Resources, Inc., 144A(b) | | | 506,600 | | | | 6,073,308 | |

| | | | | | | | |

| | | | | | | 162,381,104 | |

| | |

Industrial Gases 0.9% | | | | | | | | |

Air Products & Chemicals, Inc. | | | 126,930 | | | | 16,935,001 | |

| | |

Integrated Oil & Gas 6.3% | | | | | | | | |

Chevron Corp. | | | 1,552 | | | | 162,572 | |

Occidental Petroleum Corp. | | | 657,970 | | | | 47,972,593 | |

Royal Dutch Shell PLC (Netherlands) (Class A Stock) | | | 954,571 | | | | 23,775,633 | |

Suncor Energy, Inc. (Canada) | | | 1,484,987 | | | | 44,579,310 | |

| | | | | | | | |

| | | | | | | 116,490,108 | |

| | |

Oil & Gas Drilling 2.5% | | | | | | | | |

Helmerich & Payne, Inc. | | | 776 | | | | 48,973 | |

Independence Contract Drilling, Inc.*(a) | | | 1,722,043 | | | | 6,853,731 | |

Patterson-UTI Energy, Inc.(a) | | | 1,759,987 | | | | 39,564,508 | |

| | | | | | | | |

| | | | | | | 46,467,212 | |

| | |

Oil & Gas Equipment & Services 15.4% | | | | | | | | |

Baker Hughes, Inc. | | | 228,019 | | | | 12,632,253 | |

Core Laboratories N.V.(a) | | | 198,347 | | | | 19,233,709 | |

Dril-Quip, Inc.* | | | 345,263 | | | | 16,399,992 | |

FMC Technologies, Inc.* | | | 1,111,214 | | | | 35,858,876 | |

Halliburton Co. | | | 1,810,983 | | | | 83,305,218 | |

RPC, Inc.*(a) | | | 1,209,688 | | | | 20,891,312 | |

Schlumberger Ltd. | | | 854,867 | | | | 66,876,245 | |

Superior Energy Services, Inc.(a) | | | 874,763 | | | | 12,386,644 | |

U.S. Silica Holdings, Inc.(a) | | | 336,006 | | | | 15,520,117 | |

| | | | | | | | |

| | | | | | | 283,104,366 | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value (Note 1) | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Oil & Gas Exploration & Production 37.5% | | | | | | | | |

Anadarko Petroleum Corp. | | | 1,006,092 | | | $ | 59,802,109 | |

Cimarex Energy Co. | | | 360,284 | | | | 46,523,473 | |

Concho Resources, Inc.* | | | 634,401 | | | | 80,530,863 | |

Continental Resources, Inc.*(a) | | | 504,122 | | | | 24,656,607 | |

Crew Energy, Inc. (Canada)* | | | 1,546,831 | | | | 7,599,803 | |

Devon Energy Corp. | | | 828,268 | | | | 31,383,075 | |

EOG Resources, Inc. | | | 723,004 | | | | 65,374,022 | |

Extraction Oil & Gas, Inc.* | | | 162,476 | | | | 3,470,487 | |

Gulfport Energy Corp.* | | | 559,810 | | | | 13,497,019 | |

Hess Corp. | | | 729,819 | | | | 35,009,417 | |

Kosmos Energy Ltd.*(a) | | | 1,135,010 | | | | 5,913,402 | |

Laredo Petroleum, Inc.* | | | 1,457,075 | | | | 17,368,334 | |

Lekoil Ltd. (Nigeria)* | | | 4,166,462 | | | | 1,044,566 | |

Lekoil Ltd. (Nigeria), 144A*(b) | | | 5,248,879 | | | | 1,315,936 | |

Lekoil Ltd. (Nigeria) Reg D* | | | 14,524,211 | | | | 3,641,337 | |

Marathon Oil Corp. | | | 1,523,045 | | | | 20,073,733 | |

MEG Energy Corp. (Canada)*(a) | | | 612,347 | | | | 2,497,233 | |

MEG Energy Corp. (Canada), 144A*(b) | | | 752,400 | | | | 3,068,387 | |

Newfield Exploration Co.* | | | 876,307 | | | | 35,569,301 | |

Noble Energy, Inc. | | | 1,827,929 | | | | 63,008,713 | |

Oil Search Ltd. (Australia) | | | 2,240,000 | | | | 11,228,257 | |

PDC Energy, Inc.*(a) | | | 441,318 | | | | 27,066,033 | |

Pioneer Natural Resources Co.(a) | | | 243,092 | | | | 43,518,330 | |

Range Resources Corp.(a) | | | 735,397 | | | | 24,849,065 | |

Rice Energy, Inc.* | | | 994,674 | | | | 21,972,349 | |

Seven Generations Energy Ltd. (Canada) (Class A Stock)*(a) | | | 264,594 | | | | 5,641,831 | |

Seven Generations Energy Ltd. (Canada) (Class A Stock), 144A*(a)(b) | | | 662,575 | | | | 14,127,820 | |

Sintana Energy, Inc. (Canada)* | | | 637,992 | | | | 21,404 | |

Sintana Energy, Inc. (Canada), Reg D* | | | 1,304,999 | | | | 43,782 | |

WPX Energy, Inc.* | | | 2,064,833 | | | | 22,424,086 | |

| | | | | | | | |

| | | | | | | 692,240,774 | |

| | |

Oil & Gas Refining & Marketing 3.6% | | | | | | | | |

Marathon Petroleum Corp. | | | 645,600 | | | | 28,141,704 | |

Phillips 66 | | | 247,833 | | | | 20,111,648 | |

Tesoro Corp. | | | 1,405 | | | | 119,383 | |

Valero Energy Corp. | | | 301,979 | | | | 17,889,236 | |

| | | | | | | | |

| | | | | | | 66,261,971 | |

See Notes to Financial Statements.

| | | | |

| Prudential Jennison Natural Resources Fund, Inc. | | | 19 | |

Portfolio of Investments (continued)

as of October 31, 2016

| | | | | | | | |

| Description | | Shares | | | Value (Note 1) | |

COMMON STOCKS (Continued) | | | | | | | | |

| | |

Oil & Gas Storage & Transportation 2.0% | | | | | | | | |

Cheniere Energy, Inc.*(a) | | | 422,439 | | | $ | 15,925,950 | |

Kinder Morgan, Inc. | | | 7,078 | | | | 144,604 | |

Plains GP Holdings LP (Class A Stock) | | | 857,009 | | | | 10,764,033 | |

Targa Resources Corp. | | | 244,041 | | | | 10,713,400 | |

| | | | | | | | |

| | | | | | | 37,547,987 | |

| | |

Packaged Foods & Meats 0.8% | | | | | | | | |

Adecoagro S.A. (Luxembourg)* | | | 1,391,927 | | | | 15,311,197 | |

| | |

Precious Metals & Minerals | | | | | | | | |

Sedibelo Platinum Mines Ltd. (South Africa) Private Placement

(original cost $4,469,143; purchased 11/27/07)*^(b)(c) | | | 523,100 | | | | — | |

| | |

Renewable Electricity 0.7% | | | | | | | | |

NextEra Energy Partners LP | | | 496,780 | | | | 13,586,933 | |

| | |

Semiconductor Equipment 0.1% | | | | | | | | |

Versum Materials, Inc.* | | | 63,465 | | | | 1,440,656 | |

| | |

Silver 0.9% | | | | | | | | |

Silver Wheaton Corp. (Canada)(a) | | | 685,903 | | | | 16,537,121 | |

| | |

Specialty Chemicals 1.8% | | | | | | | | |

Albemarle Corp.(a) | | | 161,201 | | | | 13,468,344 | |

Celanese Corp. Series A | | | 148,802 | | | | 10,850,642 | |

Ecolab, Inc. | | | 1,014 | | | | 115,768 | |

PPG Industries, Inc. | | | 1,549 | | | | 144,258 | |

WR Grace & Co. | | | 129,436 | | | | 8,667,035 | |

| | | | | | | | |

| | | | | | | 33,246,047 | |

| | |

Steel 2.1% | | | | | | | | |

ArcelorMittal (Luxembourg), ADR* | | | 24,541 | | | | 165,161 | |

Nucor Corp. | | | 3,015 | | | | 147,283 | |

Reliance Steel & Aluminum Co. | | | 275,820 | | | | 18,970,899 | |

Steel Dynamics, Inc. | | | 684,376 | | | | 18,792,965 | |

| | | | | | | | |

| | | | | | | 38,076,308 | |

| | |

Trading Companies & Distributors 0.8% | | | | | | | | |

Univar, Inc.* | | | 636,529 | | | | 14,162,770 | |

| | | | | | | | |

TOTAL LONG-TERM INVESTMENTS

(cost $1,576,548,256) | | | | | | | 1,798,555,216 | |

| | | | | | | | |

See Notes to Financial Statements.

| | | | | | | | |

| Description | | Shares | | | Value (Note 1) | |

SHORT-TERM INVESTMENTS 18.2% | | | | | | | | |

| | |

AFFILIATED MUTUAL FUNDS | | | | | | | | |

Prudential Investment Portfolios 2 -

Prudential Core Ultra Short Bond Fund(d) | | | 49,316,408 | | | $ | 49,316,408 | |

Prudential Investment Portfolios 2 -

Prudential Institutional Money Market Fund

(cost $286,673,897; includes $286,527,924 of cash collateral for securities on loan)(d)(e) | | | 286,670,979 | | | | 286,728,313 | |

| | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(cost $335,990,305)(Note 3) | | | | | | | 336,044,721 | |

| | | | | | | | |

TOTAL INVESTMENTS 115.7%

(cost $1,912,538,561)(Note 5) | | | | | | | 2,134,599,937 | |

Liabilities in excess of other assets (15.7)% | | | | | | | (290,307,214 | ) |

| | | | | | | | |

NET ASSETS 100.0% | | | | | | $ | 1,844,292,723 | |

| | | | | | | | |

The following abbreviations are used in the annual report:

144A—Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and may not be resold subject to that rule except to qualified institutional buyers. Unless otherwise noted, 144A securities are deemed to be liquid.

ADR—American Depositary Receipt

LIBOR—London Interbank Offered Rate

Reg D—Security was purchased pursuant to Regulation D under the Securities Act of 1933, providing exemption from the registration requirements. Unless otherwise noted, Regulation D securities are deemed to be liquid.

| ^ | Indicates a Level 3 security. The aggregate value of Level 3 securities is $0 and 0.0% of net assets. |

| * | Non-income producing security. |

| (a) | All or a portion of security is on loan. The aggregate market value of such securities, including those sold and pending settlement, is $279,396,614; cash collateral of $286,527,924 (included in liabilities) was received with which the Fund purchased highly liquid short-term investments. Securities on loan are subject to contractual netting arrangements. |

| (b) | Indicates a security or securities that have been deemed illiquid. (unaudited) |

| (c) | Indicates a restricted security; the aggregate cost of the restricted securities is $4,469,143. The aggregate value of $0, is approximately 0.0% of net assets. |

| (d) | Prudential Investments LLC, the manager of the Fund, also serves as manager of the Prudential Investment Portfolios 2 - Prudential Core Ultra Short Bond Fund and the Prudential Investment Portfolios 2 - Prudential Institutional Money Market Fund. |

| (e) | Represents security purchased with cash collateral received for securities on loan and includes dividend reinvestment. |

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

Level 1—quoted prices generally in active markets for identical securities.

Level 2—quoted prices for similar securities, interest rates and yield curves, prepayment speeds, foreign currency exchange rates and other observable inputs.

See Notes to Financial Statements.

| | | | |

| Prudential Jennison Natural Resources Fund, Inc. | | | 21 | |

Portfolio of Investments (continued)

as of October 31, 2016

Level 3—unobservable inputs for securities valued in accordance with Board approved fair valuation procedures.

The following is a summary of the inputs used as of October 31, 2016 in valuing such portfolio securities:

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Investments in Securities | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | |

Aluminum | | $ | 10,513,803 | | | $ | — | | | $ | — | |

Coal & Consumable Fuels | | | 14,723,465 | | | | — | | | | — | |

Copper | | | 89,027,845 | | | | — | | | | — | |

Diversified Chemicals | | | 27,931,240 | | | | 95,429 | | | | — | |

Diversified Metals & Mining | | | 41,590,476 | | | | 31,135,999 | | | | — | |

Fertilizers & Agricultural Chemicals | | | 29,681,377 | | | | 66,027 | | | | — | |

Gold | | | 140,694,778 | | | | 21,686,326 | | | | — | |

Industrial Gases | | | 16,935,001 | | | | — | | | | — | |

Integrated Oil & Gas | | | 92,714,475 | | | | 23,775,633 | | | | — | |

Oil & Gas Drilling | | | 46,467,212 | | | | — | | | | — | |

Oil & Gas Equipment & Services | | | 283,104,366 | | | | — | | | | — | |

Oil & Gas Exploration & Production | | | 657,814,471 | | | | 34,426,303 | | | | — | |

Oil & Gas Refining & Marketing | | | 66,261,971 | | | | — | | | | — | |

Oil & Gas Storage & Transportation | | | 37,547,987 | | | | — | | | | — | |

Packaged Foods & Meats | | | 15,311,197 | | | | — | | | | — | |

Precious Metals & Minerals | | | — | | | | — | | | | — | |

Renewable Electricity | | | 13,586,933 | | | | — | | | | — | |

Semiconductor Equipment | | | 1,440,656 | | | | — | | | | — | |

Silver | | | 16,537,121 | | | | — | | | | — | |

Specialty Chemicals | | | 33,246,047 | | | | — | | | | — | |

Steel | | | 38,076,308 | | | | — | | | | — | |

Trading Companies & Distributors | | | 14,162,770 | | | | — | | | | — | |

Affiliated Mutual Funds | | | 336,044,721 | | | | — | | | | — | |

| | | | | | | | | | | | |

Total | | $ | 2,023,414,220 | | | $ | 111,185,717 | | | $ | — | |

| | | | | | | | | | | | |

During the period, there were no transfers between Level 1 and Level 2 to report.

The country allocation of portfolio holdings and liabilities in excess of other assets shown as a percentage of net assets as of October 31, 2016 were as follows (unaudited):

| | | | |

United States (including 15.5% of collateral for securities on loan) | | | 90.7 | % |

Canada | | | 14.5 | |

United Kingdom | | | 3.6 | |

Netherlands | | | 1.9 | |

Switzerland | | | 1.5 | |

Peru | | | 1.2 | |

Australia | | | 1.1 | |

Luxembourg | | | 0.8 | |

Nigeria | | | 0.4 | |

| | | | |

| | | 115.7 | |

Liabilities in excess of other assets | | | (15.7 | ) |

| | | | |

| | | 100.0 | % |

| | | | |

See Notes to Financial Statements.

This Page Intentionally Left Blank

Statement of Assets & Liabilities

as of October 31, 2016

| | | | |

Assets | | | | |

Investments at value, including securities on loan of $279,396,614: | | | | |

Unaffiliated investments (cost $1,576,548,256) | | $ | 1,798,555,216 | |

Affiliated investments (cost $335,990,305) | | | 336,044,721 | |

Receivable for Fund shares sold | | | 2,609,414 | |

Receivable for investments sold | | | 1,696,363 | |

Dividends and interest receivable | | | 829,550 | |

Tax reclaim receivable | | | 110,091 | |

Prepaid expenses | | | 20,977 | |

| | | | |

Total Assets | | | 2,139,866,332 | |

| | | | |

| |

Liabilities | | | | |

Payable to broker for collateral for securities on loan | | | 286,527,924 | |

Payable for Fund shares reacquired | | | 6,611,293 | |

Management fee payable | | | 1,183,430 | |

Accrued expenses and other liabilities | | | 732,248 | |

Distribution fee payable | | | 417,007 | |

Affiliated transfer agent fee payable | | | 71,575 | |

Payable for investments purchased | | | 30,132 | |

| | | | |

Total Liabilities | | | 295,573,609 | |

| | | | |

| |

Net Assets | | $ | 1,844,292,723 | |

| | | | |

| | | | | |

Net assets were comprised of: | | | | |

Common stock, at par | | $ | 546,272 | |

Paid-in capital in excess of par | | | 2,616,247,368 | |

| | | | |

| | | 2,616,793,640 | |

Distributions in excess of net investment income | | | (2,964,490 | ) |

Accumulated net realized loss on investment and foreign currency transactions | | | (991,597,443 | ) |

Net unrealized appreciation on investments and foreign currencies | | | 222,061,016 | |

| | | | |

Net assets, October 31, 2016 | | $ | 1,844,292,723 | |

| | | | |

See Notes to Financial Statements.

| | | | |

Class A | |

Net asset value and redemption price per share | | | | |

($606,461,485 ÷ 17,732,323 shares of common stock issued and outstanding) | | $ | 34.20 | |

Maximum sales charge (5.50% of offering price) | | | 1.99 | |

| | | | |

Maximum offering price to public | | $ | 36.19 | |

| | | | |

| |

Class B | | | | |

Net asset value, offering price and redemption price per share | | | | |

($23,687,170 ÷ 852,230 shares of common stock issued and outstanding) | | $ | 27.79 | |

| | | | |

| |

Class C | | | | |

Net asset value, offering price and redemption price per share | | | | |

($234,821,411 ÷ 8,446,150 shares of common stock issued and outstanding) | | $ | 27.80 | |

| | | | |

| |

Class Q | | | | |

Net asset value, offering price and redemption price per share | | | | |

($109,741,930 ÷ 3,063,220 shares of common stock issued and outstanding) | | $ | 35.83 | |

| | | | |

| |

Class R | | | | |

Net asset value, offering price and redemption price per share | | | | |

($59,728,570 ÷ 1,770,980 shares of common stock issued and outstanding) | | $ | 33.73 | |

| | | | |

| |

Class Z | | | | |

Net asset value, offering price and redemption price per share | | | | |

($809,852,157 ÷ 22,762,306 shares of common stock issued and outstanding) | | $ | 35.58 | |

| | | | |

See Notes to Financial Statements.

| | | | |

| Prudential Jennison Natural Resources Fund, Inc. | | | 25 | |

Statement of Operations

Year Ended October 31, 2016

| | | | |

Net Investment Income (Loss) | | | | |

Income | | | | |

Unaffiliated dividend income (net of foreign withholding taxes of $862,818) | | $ | 25,028,972 | |

Income from securities lending, net (including affiliated $970,194) | | | 1,116,918 | |

Affiliated dividend income | | | 340,234 | |

| | | | |

Total income | | | 26,486,124 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 14,426,241 | |

Distribution fee—Class A | | | 2,123,365 | |

Distribution fee—Class B | | | 278,096 | |

Distribution fee—Class C | | | 2,364,407 | |

Distribution fee—Class R | | | 424,680 | |

Transfer agent’s fees and expenses (including affiliated expense of $709,600) | | | 3,593,000 | |

Shareholders’ reports | | | 350,000 | |

Custodian and accounting fees (net of $16,900 fee credit) | | | 230,000 | |

Registration fees | | | 156,000 | |

Legal fees and expenses | | | 41,000 | |

Directors’ fees | | | 39,000 | |

Insurance expenses | | | 32,000 | |

Audit fee | | | 24,000 | |

Miscellaneous | | | 27,322 | |

| | | | |

Total expenses | | | 24,109,111 | |

Less: Distribution fee waiver—Class R | | | (141,552 | ) |

| | | | |

Net expenses | | | 23,967,559 | |

| | | | |

Net investment income (loss) | | | 2,518,565 | |

| | | | |

| |

Realized And Unrealized Gain (Loss) On Investments And Foreign Currency Transactions | | | | |

Net realized gain (loss) on: | | | | |

Investment transactions (including affiliated of $6,897) | | | (330,845,073 | ) |

Foreign currency transactions | | | (226,869 | ) |

| | | | |

| | | (331,071,942 | ) |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments (including affiliated of $54,416) | | | 415,355,846 | |

Foreign currencies | | | 703 | |

| | | | |

| | | 415,356,549 | |

| | | | |

Net gain (loss) on investment and foreign currency transactions | | | 84,284,607 | |

| | | | |

Net Increase (Decrease) In Net Assets Resulting From Operations | | $ | 86,803,172 | |

| | | | |

See Notes to Financial Statements.

Statement of Changes in Net Assets

| | | | | | | | |

| | | Year Ended October 31, | |

| | | 2016 | | | 2015 | |

Increase (Decrease) in Net Assets | | | | | | | | |

Operations | | | | | | | | |

Net investment income (loss) | | $ | 2,518,565 | | | $ | 10,917,366 | |

Net realized gain (loss) on investment and foreign currency transactions | | | (331,071,942 | ) | | | (162,474,293 | ) |

Net change in unrealized appreciation (depreciation) on investments and foreign currencies | | | 415,356,549 | | | | (957,061,145 | ) |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 86,803,172 | | | | (1,108,618,072 | ) |

| | | | | | | | |

| | |

Dividends from net investment income (Note 1) | | | | | | | | |

Class A | | | (2,656,951 | ) | | | — | |

Class B | | | (17,777 | ) | | | — | |

Class C | | | (163,936 | ) | | | — | |

Class Q | | | (1,241,226 | ) | | | — | |

Class R | | | (84,502 | ) | | | — | |

Class Z | | | (5,518,054 | ) | | | — | |

| | | | | | | | |

| | | (9,682,446 | ) | | | — | |

| | | | | | | | |

| | |

Fund share transactions (Net of share conversions) (Note 6) | | | | | | | | |

Net proceeds from shares sold | | | 531,196,473 | | | | 1,303,331,437 | |

Net asset value of shares issued in reinvestment of dividends and distributions | | | 8,752,022 | | | | — | |

Cost of shares reacquired | | | (1,199,884,672 | ) | | | (1,611,054,407 | ) |

| | | | | | | | |

Net increase (decrease) in net assets from Fund share transactions | | | (659,936,177 | ) | | | (307,722,970 | ) |

| | | | | | | | |

Total increase (decrease) | | | (582,815,451 | ) | | | (1,416,341,042 | ) |

| | |

Net Assets: | | | | | | | | |

Beginning of year | | | 2,427,108,174 | | | | 3,843,449,216 | |

| | | | | | | | |

End of year | | $ | 1,844,292,723 | | | $ | 2,427,108,174 | |

| | | | | | | | |

See Notes to Financial Statements.

| | | | |

| Prudential Jennison Natural Resources Fund, Inc. | | | 27 | |

Notes to Financial Statements

Prudential Jennison Natural Resources Fund, Inc. (the “Fund”) is a non-diversified open-end management investment company, registered under the Investment Company Act of 1940, as amended (“1940 Act”).

The Fund’s investment objective is long-term growth of capital.

Note 1. Accounting Policies

The Fund follows investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 Financial Services—Investment Companies. The following accounting policies conform to U.S. generally accepted accounting principles. The Fund consistently follows such policies in the preparation of its financial statements.

Securities Valuation: The Fund holds securities and other assets that are fair valued at the close of each day (generally, 4:00 PM Eastern time) the New York Stock Exchange (“NYSE”) is open for trading. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The Board of Directors (the “Board”) has adopted Valuation Procedures for security valuation under which fair valuation responsibilities have been delegated to Prudential Investments LLC (“PI” or “Manager”). Under the current Valuation Procedures, the established Valuation Committee is responsible for supervising the valuation of portfolio securities and other assets. The Valuation Procedures permit the Fund to utilize independent pricing vendor services, quotations from market makers, and alternative valuation methods when market quotations are either not readily available or not deemed representative of fair value. A record of the Valuation Committee’s actions is subject to the Board’s review, approval, and ratification at its next regularly-scheduled quarterly meeting.

Various inputs determine how the Fund’s investments are valued, all of which are categorized according to the three broad levels (Level 1, 2, or 3) detailed in the table following the Portfolio of Investments.

Common and preferred stocks, exchange-traded funds, and derivative instruments such as futures or options that are traded on a national securities exchange are valued at the last sale price as of the close of trading on the applicable exchange where the security principally trades. Securities traded via NASDAQ are valued at the NASDAQ official closing price. To the extent these securities are valued at the last sale price or NASDAQ official closing price, they are classified as Level 1 in the fair value hierarchy.

In the event that no sale or official closing price on valuation date exists, these securities are generally valued at the mean between the last reported bid and ask prices, or at the last bid price in the absence of an ask price. These securities are classified as Level 2 in the fair value hierarchy.

Common and preferred stocks traded on foreign securities exchanges are valued using pricing vendor services that provide model prices derived using adjustment factors based on information such as local closing price, relevant general and sector indices, currency fluctuations, depositary receipts, and futures, as applicable. Securities valued using such model prices are classified as Level 2 in the fair value hierarchy. The models generate an evaluated adjustment factor for each security, which is applied to the local closing price to adjust it for post closing market movements. Utilizing that evaluated adjustment factor, the vendor provides an evaluated price for each security. If the vendor does not provide an evaluated price, securities are valued in accordance with exchange-traded common and preferred stocks discussed above.

Participatory notes (“P-notes”) are generally valued based upon the value of a related underlying security that trades actively in the market and are classified as Level 2 in the fair value hierarchy.

Investments in open-end, non-exchange-traded mutual funds are valued at their net asset values as of the close of the NYSE on the date of valuation. These securities are classified as Level 1 in the fair value hierarchy since they may be purchased or sold at their net asset values on the date of valuation. Securities and other assets that cannot be priced according to the methods described above are valued based on pricing methodologies approved by the Board. In the event that unobservable inputs are used when determining such valuations, the securities will be classified as Level 3 in the fair value hierarchy.

When determining the fair value of securities, some of the factors influencing the valuation include: the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and the capitalization of the issuer; the prices of any recent transactions or bids/offers for such securities or any comparable securities; any available analyst media or other reports or information deemed reliable by the investment adviser regarding the issuer or the markets or industry in which it operates. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other mutual funds to calculate their net asset values.

Restricted and Illiquid Securities: The Fund may hold up to 15% of its net assets in illiquid securities, including those which are restricted as to disposition under securities law (“restricted securities”). Restricted securities are valued pursuant to the valuation procedures noted above. Illiquid securities are those that, because of the absence of a readily available market or due to legal or contractual restrictions on resale, cannot be sold within seven days in the ordinary course of business at approximately the amount at which

| | | | |

| Prudential Jennison Natural Resources Fund, Inc. | | | 29 | |

Notes to Financial Statements (continued)

the Fund has valued the investment. Therefore, the Fund may find it difficult to sell illiquid securities at the time considered most advantageous by its Subadviser and may incur expenses that would not be incurred in the sale of securities that were freely marketable. Certain securities that would otherwise be considered illiquid because of legal restrictions on resale to the general public may be traded among qualified institutional buyers under Rule 144A of the Securities Act of 1933. These Rule 144A securities, as well as commercial paper that is sold in private placements under Section 4(2) of the Securities Act, may be deemed liquid by the Fund’s Subadviser under the guidelines adopted by the Directors of the Fund. However, the liquidity of the Fund’s investments in Rule 144A securities could be impaired if trading does not develop or declines.

Foreign Currency Translation: The books and records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars on the following basis:

(i) market value of investment securities, other assets and liabilities-at the current rates of exchange;

(ii) purchases and sales of investment securities, income and expenses-at the rates of exchange prevailing on the respective dates of such transactions.

Although the net assets of the Fund are presented at the foreign exchange rates and market values at the close of the period, the Fund does not generally isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of long-term portfolio securities held at the end of the period. Similarly, the Fund does not isolate the effect of changes in foreign exchange rates from the fluctuations arising from changes in the market prices of long-term portfolio securities sold during the period. Accordingly, holding period realized foreign currency gains (losses) are included in the reported net realized gains (losses) on investment transactions. Notwithstanding the above, the Fund does isolate the effect of fluctuations in foreign currency exchange rates when determining the gain (loss) upon the sale or maturity of foreign currency denominated debt obligations; such amounts are included in net realized gains (losses) on foreign currency transactions.

Net realized gains (losses) on foreign currency transactions represent net foreign exchange gains (losses) from holdings of foreign currencies, forward currency contracts, disposition of foreign currencies, currency gains (losses) realized between the trade and settlement dates on securities transactions, and the difference between the amounts of interest, dividends and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amounts actually received or paid. Net unrealized currency gains (losses) from valuing foreign currency denominated assets and liabilities (other than investments) at period end exchange rates are reflected as a component of net unrealized appreciation (depreciation) on foreign currency transactions.

Concentration of Risk: Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of domestic origin as a result of, among other factors, the possibility of political and economic instability or the level of governmental supervision and regulation of foreign securities markets.

Master Netting Arrangements: The Fund is subject to various Master Agreements, or netting arrangements, with select counterparties. These are agreements which a subadviser may have negotiated and entered into on behalf of the Fund. A master netting arrangement between the Fund and the counterparty permits the Fund to offset amounts payable by the Fund to the same counterparty against amounts to be received; and by the receipt of collateral from the counterparty by the Fund to cover the Fund’s exposure to the counterparty. However, there is no assurance that such mitigating factors are easily enforceable. In addition to master netting arrangements, the right to set-off exists when all the conditions are met such that each of the parties owes the other determinable amounts, the reporting party has the right to set-off the amount owed with the amount owed by the other party, the reporting party intends to set-off and the right of set-off is enforceable by law. During the reporting period, there was no intention to settle on a net basis and all amounts are presented on a gross basis on the Statement of Assets and Liabilities.

Securities Lending: The Fund may lend its portfolio securities to banks and broker-dealers. The loans are secured by collateral at least equal to the market value of the securities loaned. Collateral pledged by each borrower is invested in a money market fund and is marked to market daily, based on the previous day’s market value, such that the value of the collateral exceeds the value of the loaned securities. For the period March 31, 2016 through July 18, 2016 the collateral was invested in an ultra-short bond fund. Loans are subject to termination at the option of the borrower or the Fund. Upon termination of the loan, the borrower will return to the Fund securities identical to the loaned securities. Should the borrower of the securities fail financially, the Fund has the right to repurchase the securities in the open market using the collateral. The Fund recognizes income, net of any rebate and securities lending agent fees, for lending its securities in the form of fees or interest on the investment of any cash received as collateral. The borrower receives all interest and dividends from the securities loaned and such payments are passed back to the lender in amounts equivalent thereto. The Fund also continues to recognize any unrealized gain (loss) in the market price of the securities loaned and on the change in the value of the collateral invested that may occur during the term of the loan. In addition, realized gain (loss) is recognized on changes in the value of the collateral invested that may occur during the term of the loan.

Securities Transactions and Net Investment Income: Securities transactions are recorded on the trade date. Realized gains (losses) from investment and currency transactions are calculated on the identified cost basis. Dividend income is recorded on the ex-date. Interest

| | | | |

| Prudential Jennison Natural Resources Fund, Inc. | | | 31 | |

Notes to Financial Statements (continued)

income, including amortization of premium and accretion of discount on debt securities, as required, is recorded on the accrual basis.

Expenses are recorded on an accrual basis, which may require the use of certain estimates by management that may differ from actual.

Net investment income or loss (other than distribution fees which are charged directly to the respective class and transfer agency fees specific to Class Q shares are charged to that share class) and unrealized and realized gains (losses) are allocated daily to each class of shares based upon the relative proportion of adjusted net assets of each class at the beginning of the day.

Dividends and Distributions: The Fund expects to pay dividends from net investment income and distributions from net realized capital and currency gains, if any, annually. Dividends and distributions to shareholders, which are determined in accordance with federal income tax regulations and which may differ from generally accepted accounting principles, are recorded on the ex-date. Permanent book/tax differences relating to income and gain (loss) are reclassified amongst undistributed net investment income, accumulated net realized gain (loss) and paid-in capital in excess of par, as appropriate.

Taxes: For federal income tax purposes, the Fund is treated as a separate taxpaying entity. It is the Fund’s policy to continue to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable net investment income and capital gains, if any, to its shareholders. Therefore, no federal income tax provision is required. Withholding taxes on foreign dividends are recorded, net of reclaimable amounts, at the time the related income is earned.

Estimates: The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Note 2. Agreements

The Fund has a management agreement with PI. Pursuant to a subadvisory agreement between PI and Jennison Associates LLC (“Jennison”), Jennison furnishes investment advisory services in connection with the management of the Fund. Under the subadvisory agreement, Jennison, subject to the supervision of PI, is responsible for managing the assets of the Fund in accordance with its investment objective and policies. PI pays for the services of Jennison, the cost of compensation of officers of the Fund, occupancy and certain clerical and bookkeeping costs of the Fund. The Fund bears all other costs and expenses.

Pursuant to the management agreement between the Fund and PI, the management fee paid to PI is accrued daily and payable monthly at an annual rate of .75% of the Fund’s average daily net assets up to $1 billion and .70% of the average daily net assets in excess of $1 billion. The effective management fee rate was .73% of the Fund’s average daily net assets for the year ended October 31, 2016.

The Fund has a distribution agreement with Prudential Investment Management Services LLC (“PIMS”), which acts as the distributor of the Class A, Class B, Class C, Class Q, Class R and Class Z shares of the Fund. The Fund compensates PIMS for distributing and servicing the Fund’s Class A, Class B, Class C and Class R shares, pursuant to plans of distribution (the “Distribution Plans”), regardless of expenses actually incurred by PIMS. The distribution fees are accrued daily and payable monthly. No distribution or service fees are paid to PIMS as distributor of the Class Q and Class Z shares of the Fund.

Pursuant to the Distribution Plans, the Fund compensates PIMS for distribution-related activities at an annual rate of up to .30%, 1%, 1% and .75% of the average daily net assets of the Class A, B, C and Class R shares, respectively. PIMS has contractually agreed to limit such fees to .50% of the average daily net assets of the Class R shares through February 28, 2018.

PIMS has advised the Fund that it received $756,104 in front-end sales charges resulting from sales of Class A shares, during the year ended October 31, 2016. From these fees, PIMS paid such sales charges to affiliated broker/dealers, which in turn paid commissions to salespersons and incurred other distribution costs.

PIMS has advised the Fund that for the year ended October 31, 2016 it received $3,596, $34,502 and $31,517 in contingent deferred sales charges imposed upon redemptions by certain Class A, Class B and Class C shareholders, respectively.

PI, PIMS and Jennison are indirect, wholly-owned subsidiaries of Prudential Financial, Inc. (“Prudential”).

Note 3. Other Transactions with Affiliates

Prudential Mutual Fund Services LLC (“PMFS”), an affiliate of PI, and an indirect, wholly-owned subsidiary of Prudential, serves as the Fund’s transfer agent. Transfer agent’s fees and expenses in the Statement of Operations include certain out-of-pocket expenses paid to non-affiliates, where applicable.

Effective July 7, 2016, the Board replaced PGIM, Inc., an indirect, wholly-owned subsidiary of Prudential, as securities lending agent with a third party agent. Prior to July 7, 2016, PGIM, Inc. was the Fund’s securities lending agent. Net earnings from securities lending are disclosed on the Statement of Operations as “Income from securities lending, net”. For the period November 1, 2015 through February 4, 2016, PGIM, Inc. has been compensated $79,326 for these services. At the June 2016 meeting of the Board, the Board approved compensation to PGIM, Inc. related to securities lending activities. The

| | | | |

| Prudential Jennison Natural Resources Fund, Inc. | | | 33 | |

Notes to Financial Statements (continued)

payment was for services provided from February 5, 2016 through July 5, 2016 and totaled $62,941. Additionally, PGIM, Inc. reimbursed the Fund $35,623 related to securities lending income adjustments. Prior to January 4, 2016, PGIM, Inc. was known as Prudential Investment Management, Inc. (“PIM”).

The Fund may enter into certain securities purchase or sale transactions under Board approved Rule 17a-7 procedures. Rule 17a-7 is an exemptive rule under the 1940 Act, that permits purchase and sale transactions among affiliated investment companies, or between an investment company and a person that is affiliated solely by reason of having a common (or affiliated) investment adviser, common directors, and/or common officers. Such transactions are subject to ratification by the Board.