SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the registrantx Filed by a party other than the registrant¨

Check the appropriate box:

| ¨ | Preliminary proxy statement |

| ¨ | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive proxy statement |

| ¨ | Definitive additional materials |

| ¨ | Soliciting material pursuant to §240.14a |

Provident Bankshares Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transactions applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Provident Bankshares Corporation

114 East Lexington Street

Baltimore, Maryland 21201

(410) 277-7000

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The annual meeting of shareholders of Provident Bankshares Corporation will be held on Wednesday, May 18, 2005 at 10:00 a.m., local time, at the offices of Provident Bankshares, 114 East Lexington Street, Baltimore, Maryland, for the following purposes:

| | 1. | To elect five directors to a three-year term of office; |

| | 2. | To ratify the appointment of KPMG LLP as the independent registered public accounting firm of Provident Bankshares for the fiscal year ending December 31, 2005; and |

| | 3. | To transact any other business as may properly come before the meeting or any adjournment or postponement. |

Shareholders of record as of the close of business on April 1, 2005 are entitled to receive notice of and to vote at the meeting and any adjournment or postponement of the meeting.

Please complete and sign the enclosed form of proxy and mail it promptly in the enclosed envelope or promptly vote via the Internet or by telephone as instructed on the enclosed form of proxy. Your proxy will not be used if you attend the meeting and vote in person.

|

| By Order of the Board of Directors |

|

/s/ Gary N. Geisel

|

Gary N. Geisel |

Chairman and Chief Executive Officer |

Baltimore, Maryland

April 13, 2005

PROVIDENT BANKSHARES CORPORATION

Proxy Statement

This proxy statement is being furnished in connection with the solicitation of proxies by the board of directors of Provident Bankshares Corporation (“Provident” or the “Company”) to be used at the annual meeting of shareholders of the Company. Provident is the holding company for Provident Bank (“Provident Bank” or the “Bank”). The annual meeting will be held on Wednesday, May 18, 2005 at 10:00 a.m., local time, at Provident’s offices at 114 East Lexington Street, Baltimore, Maryland 21202. The 2004 Annual Report to Shareholders, including the consolidated financial statements of the Company for the fiscal year ended December 31, 2004, accompanies this proxy statement, which is first being mailed to shareholders on or about April 13, 2005.

Voting and Proxy Procedure

Who Can Vote at the Meeting

You are entitled to vote your Provident common stock if the records of the Company show that you held your shares as of the close of business on April 1, 2005. As of the close of business on that date, a total of 33,055,974 shares of Provident common stock were outstanding and entitled to vote. Each share of common stock has one vote.

Attending the Meeting

If you are a beneficial owner of Provident common stock held by a broker, bank or other nominee (i.e., in “street name”), you will need proof of ownership to be admitted to the meeting. A recent brokerage statement or letter from a bank or broker are examples of proof of ownership. If you want to vote your shares of Provident common stock held in street name in person at the meeting, you will have to obtain a written proxy in your name from the broker, bank or other nominee who holds your shares.

Vote Required

The annual meeting will be held only if there is a quorum present. A quorum exists if a majority of the outstanding shares of common stock entitled to vote is represented at the meeting. If you return valid proxy instructions or attend the meeting in person, your shares will be counted for purposes of determining whether there is a quorum, even if you abstain from voting. Broker non-votes also will be counted for purposes of determining the existence of a quorum. A broker non-vote occurs when a broker, bank or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner. Under Maryland corporate law and Provident’s Articles of Incorporation and Bylaws, proxies specifying an abstention as to a proposal will cause the shares to be counted toward a quorum, but not counted as voting for or against the proposal.

In voting on the election of directors, you may vote in favor of all nominees, withhold votes as to all nominees, or withhold votes as to specific nominees. There is no cumulative voting for the election of directors. Directors must be elected by a plurality of the votes cast at the annual meeting. This means that the nominees receiving the greatest number of votes will be elected. Votes that are withheld and

broker non-votes will have no effect on the outcome of the election. In voting on the ratification of the appointment of KPMG LLP as Provident’s independent registered public accounting firm, you may vote in favor of the proposal, vote against the proposal or abstain from voting. This matter will be decided by the affirmative vote of a majority of the votes cast at the annual meeting. On this matter, abstentions and broker non-votes will have no effect on the voting.

Voting by Proxy

The board of directors of Provident is sending you this proxy statement for the purpose of requesting that you allow your shares of Provident common stock to be represented at the annual meeting by the persons named in the enclosed proxy card. All shares of Provident common stock represented at the meeting by properly executed proxies will be voted in accordance with the instructions indicated on the proxy card. If you sign, date and return a proxy card without giving voting instructions, your shares will be voted as recommended by the Company’s board of directors.The board of directors recommends a vote FOR each of the nominees for director and FOR ratification of KPMG LLP as Provident’s independent registered public accounting firm.

Alternately, shareholders of record may vote their shares of Provident common stock over the Internet, or by calling a specially designated telephone number. The Internet and telephone voting procedures are designed to authenticate shareholders’ identities, and to allow shareholders to provide their voting instructions and confirm that said instructions have been properly recorded. Specific instructions for shareholders of record who wish to vote their proxies over the Internet or by telephone are set forth on the enclosed form of proxy.

Please be aware that if you vote over the Internet, you may incur costs such as telephone and Internet access charges for which you will be responsible. The Internet and telephone voting facilities for eligible shareholders of record will close at 11:59 p.m. Eastern Time on May 17, 2005.

If any matters not described in this proxy statement are properly presented at the annual meeting, the persons named in the proxy card will use their own judgment to determine how to vote your shares. This includes a motion to adjourn or postpone the meeting in order to solicit additional proxies. If the annual meeting is adjourned or postponed, your Provident common stock may be voted by the persons named in the proxy card on the new meeting date as well, unless you have revoked your proxy. The Company does not know of any other matters to be presented at the meeting.

You may revoke your proxy at any time before the vote is taken at the meeting. To revoke your proxy you must either advise the Secretary of the Company in writing before your common stock has been voted at the annual meeting, deliver a later dated proxy, or attend the meeting and vote your shares in person. Attendance at the annual meeting will not in itself revoke your proxy.

If your Provident common stock is held in “street name,” you will receive instructions from your broker, bank or other nominee that you must follow in order to have your shares voted. Your broker or bank may allow you to deliver your voting instructions via the telephone or the Internet. Please see the instruction form provided by your broker, bank or other nominee that accompanies this proxy statement.

Provident will pay the cost of solicitation of proxies on behalf of its management. In addition to the solicitation of proxies by mail, Innisfree M&A Incorporated, a proxy solicitation firm, will assist Provident in soliciting proxies for the annual meeting for a fee of $10,000, plus out-of-pocket expenses. Proxies may also be solicited personally or by telephone by directors, officers and other employees of Provident and Provident Bank, without additional compensation. Provident will also request persons, firms and corporations holding shares in their names, or in the names of their nominees, which are beneficially owned by others, to send proxy materials to, and obtain proxies from, such beneficial owners, and will reimburse such persons for their reasonable expenses in doing so.

2

Participants in Provident Bank’s 401(k) Plan

If you hold shares of Provident common stock through Provident Bank’s 401(k) plan, you will receive voting instructions under separate cover. By following these instructions, you may direct the trustee for the 401(k) plan how to vote the shares of Provident common stock allocated to your 401(k) plan account. If you do not provide voting instructions, the trustee will vote your 401(k) plan shares in the same proportion as those shares for which the trustee has received voting instructions, subject to the exercise of the trustee’s fiduciary duties. The deadline for returning your voting instructions to the trustee is May 6, 2005.

Corporate Governance

General

Provident periodically reviews its corporate governance policies and procedures to ensure that the Company meets the highest standards of ethical conduct, reports results with accuracy and transparency and maintains full compliance with the laws, rules and regulations that govern Provident’s operations. As part of this periodic corporate governance review, the board of directors reviews and adopts best corporate governance policies and practices for Provident.

Code of Business Conduct and Ethics

Since Provident’s inception in 1987, it has had a Code of Business Conduct and Ethics. The Code of Business Conduct and Ethics is designed to ensure that Provident’s directors, executive officers and employees meet the highest standards of ethical conduct. The Code of Business Conduct and Ethics requires that Provident’s directors, executive officers and employees avoid conflicts of interest, comply with all laws and other legal requirements, conduct business in an honest and ethical manner and otherwise act with integrity and in Provident’s best interest. Under the terms of the Code of Business Conduct and Ethics, directors, executive officers and employees are required to report any conduct that they believe in good faith to be an actual or apparent violation of the Code of Business Conduct and Ethics.

As a mechanism to encourage compliance with the Code of Business Conduct and Ethics, Provident has established procedures to receive, retain and treat complaints received regarding accounting, internal accounting controls or auditing matters. These procedures ensure that individuals may submit concerns regarding questionable accounting or auditing matters in a confidential and anonymous manner. The Code of Business Conduct and Ethics also prohibits Provident from retaliating against any director, executive officer or employee who reports actual or apparent violations of the Code of Business Conduct and Ethics.

Meetings of the Board of Directors

The board of directors of Provident conducts business through meetings and the activities of the board of directors and its committees. The board of directors generally meets on a monthly basis and may have additional meetings as needed. During the fiscal year ended December 31, 2004, the board of directors held 12 meetings.

3

All of the directors of Provident attended at least 75% of the total number of meetings of the board of directors and committees on which such directors served held during the fiscal year ended December 31, 2004. The board of directors of Provident and Provident Bank maintain committees, the nature and composition of which are described below.

Committees of the Board of Directors

Audit Committee. The Audit Committee consists of Messrs. Dunn (Chair), Crowley, Cole, Joseph and Meier, each of whom is independent in accordance with the listing standards of the Nasdaq Stock Market. The committee reviews and reports to the board of directors on examinations of Provident Bank and its subsidiaries by regulatory authorities, appoints the independent registered public accounting firm for Provident and Provident Bank, reviews the scope of the work of the independent registered public accounting firm and their reports, and reviews the activities and actions of Provident Bank’s internal auditors. The Audit Committee acts under a written charter adopted by the board of directors, a copy of which is available to shareholders on Provident’s website at “www.provbank.com.” The board of directors has determined that Mr. Crowley is an “audit committee financial expert.” The Audit Committee met 13 times during 2004. The report of the Audit Committee required by the rules of the Securities and Exchange Commission is included in this proxy statement. See“Report of the Audit Committee.”

Compensation Committee. The Compensation Committee consists of Ms. Lucas (Chair), Ms. Riggs and Messrs. Bilal and Riggs. The committee reviews and determines salaries and other benefits for executive and senior management of Provident and its subsidiaries, reviews and determines employees to whom stock options are to be granted and the terms of such grants, and reviews the selection of officers who participate in incentive and other compensatory plans and arrangements. The Compensation Committee met 7 times during 2004. Each member of the Compensation Committee is independent under the listing standards of the Nasdaq Stock Market. The Compensation Committee acts under a written charter adopted by the board of directors, a copy of which is available to shareholders on Provident’s website at “www.provbank.com.” The report of the Compensation Committee required by the rules of the Securities and Exchange Commission is included in this proxy statement. See“Report of the Compensation Committee.”

Corporate Governance Committee. The Corporate Governance Committee, which consists of Dr. Wilson (Chair) and Messrs. Bozzuto, Coe and Logan, takes a leadership role in shaping governance policies and practices, including recommending to the board of directors the corporate governance policies and guidelines applicable to Provident Bank and monitoring compliance with these policies and guidelines. In addition, the Corporate Governance Committee is responsible for identifying individuals qualified to become board members and recommending to the board the director nominees for election at the next annual meeting of shareholders. This committee also recommends to the board director candidates for each committee for appointment by the board. The Corporate Governance Committee met 2 times during 2004. Each member of the Corporate Governance Committee is independent in accordance with the listing standards of the Nasdaq Stock Market. The Corporate Governance Committee acts under a written charter adopted by the board of directors, a copy of which is available to shareholders on Provident’s website at “www.provbank.com.” The procedures of the Corporate Governance Committee required to be disclosed by the rules of the Securities and Exchange Commission are included in this proxy statement. See“—Corporate Governance Committee Procedures.”

Corporate Governance Committee Procedures

General. It is the policy of the Corporate Governance Committee to consider director candidates recommended by shareholders who appear to be qualified to serve on the Provident board of

4

directors. The Corporate Governance Committee may choose not to consider an unsolicited recommendation if no vacancy exists on the board of directors and the Corporate Governance Committee does not perceive a need to increase the size of the board. In order to avoid the unnecessary use of the Corporate Governance Committee’s resources, the Corporate Governance Committee will consider only those director candidates recommended in accordance with the procedures set forth below.

Procedures to be Followed by Shareholders. To submit a recommendation of a director candidate to the Corporate Governance Committee, a shareholder should submit the following information in writing, addressed to the Chairman of the Corporate Governance Committee, care of the Corporate Secretary, at the main office of Provident:

| | 1. | The name of the person recommended as a director candidate; |

| | 2. | All information relating to such person that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended; |

| | 3. | The written consent of the person being recommended as a director candidate to being named in the proxy statement as a nominee and to serving as a director if elected; |

| | 4. | As to the shareholder making the recommendation, the name and address, as they appear on Provident’s books, of such shareholder; provided, however, that if the shareholder is not a registered holder of Provident’s common stock, the shareholder should submit his or her name and address along with a current written statement from the record holder of the shares that reflects ownership of Provident’s common stock; and |

| | 5. | A statement disclosing whether such shareholder is acting with or on behalf of any other person and, if applicable, the identity of such person. |

In order for a director candidate to be considered for nomination at Provident’s annual meeting of shareholders, the recommendation must be received by the Corporate Governance Committee at least 120 calendar days prior to the date that Provident’s proxy statement was released to shareholders in connection with the previous year’s annual meeting, advanced by one year.

Criteria for Director Nominees. The Corporate Governance Committee has adopted a set of criteria that it considers when it selects individuals to be nominated for election to the board of directors. The Corporate Governance Committee will consider the following criteria in selecting nominees: financial, regulatory and business experience; familiarity with and participation in the local community; integrity, honesty and reputation; dedication to Provident and its shareholders; independence; and any other factors the Corporate Governance Committee deems relevant, including age, diversity, size of the board of directors and regulatory disclosure obligations.

The Corporate Governance Committee may weigh the foregoing criteria differently in different situations, depending on the composition of the board of directors at the time. The committee will strive to maintain at least one director who meets the definition of “audit committee financial expert” under the Securities and Exchange Commission’s regulations.

In addition, prior to nominating an existing director for re-election to the board of directors, the Corporate Governance Committee will consider and review an existing director’s board and committee attendance and performance; length of board service; experience, skills and contributions that the existing director brings to the board; and independence.

5

Process for Identifying and Evaluating Director Nominees. Pursuant to the Corporate Governance Committee Charter as approved by the board of directors, the Corporate Governance Committee is charged with the central role in the process relating to director nominations, including identifying, interviewing and selecting individuals who may be nominated for election to the board of directors. The process that the committee follows when it identifies and evaluates individuals to be nominated for election to the board of directors is as follows:

Identification. For purposes of identifying nominees for the board of directors, the Corporate Governance Committee relies on personal contacts of the committee and other members of the board of directors as well as its knowledge of members of Provident Bank’s local communities. The Corporate Governance Committee will also consider director candidates recommended by shareholders in accordance with the policy and procedures set forth above. The Corporate Governance Committee has not previously used an independent search firm in identifying nominees.

Evaluation. In evaluating potential clients, the Corporate Governance Committee determines whether the candidate is eligible and qualified for service on the board of directors by evaluating the candidate under the selection criteria set forth above. In addition, the Corporate Governance Committee will conduct a check of the individual’s background and interview the candidate.

Shareholder Communications

Provident encourages shareholder communications to the board of directors and/or individual directors. Written communications may be made to the board of directors or to specific members of the board by delivering them to the intended addressee, care of the Corporate Secretary, Provident Bankshares Corporation, 114 East Lexington Street, Baltimore, Maryland, 21202.

Attendance at Annual Meetings

In addition, the board of directors encourages directors to attend the annual meeting of shareholders. All directors attended the annual meeting of shareholders held on April 21, 2004.

Directors’ Compensation

Each outside director of Provident and Provident Bank receives an annual retainer of $25,000 for service as a director. Fifteen thousand dollars of this retainer is paid in the form of restricted shares of Provident common stock. The restriction applicable to these shares is that they may not be sold or otherwise divested until six months after the recipient has left the board of directors. The remaining $10,000 of the annual retainer is paid in cash. Each outside director also receives a fee of $1,250 for attendance at regular or special board of director meetings, except that a single fee is paid if the Provident and Provident Bank board of director meetings are held on the same day. Finally, outside directors who are members of board committees receive a fee of $1,250 for attendance at committee meetings, while the chairpersons of such committees receive a fee of $1,875 for attendance at committee meetings.

Provident and Provident Bank have a deferred compensation plan for non-employee directors. Each year, a director may elect to defer payment of all or part of the director’s fees for that year until the individual ceases to be a director. Interest is accrued on the deferred amount at the prime rate. Payment of the deferred amount may be made to the director or to his or her beneficiary. In addition, non-employee directors are eligible to receive options under Provident’s Amended and Restated Stock Option Plan (the “Stock Option Plan”) and the 2004 Equity Compensation Plan. The Non-Employee Directors’

6

Severance Plan provides that if a director’s service is terminated following a “change in control” (as defined in the plan) of Provident or Provident Bank, the director will be entitled to receive a payment equal to five times the director’s annual retainer.

Award Grants. Mr. Fry received non-statutory stock options to acquire 10,000 shares of common stock at an exercise price of $32.22 per share, the fair market value of the common stock on the date of grant. The options became exercisable in three approximately equal annual installments commencing on February 18, 2005. Mr. Logan received non-statutory stock options to acquire 5,000 shares of common stock at an exercise price of $31.025 per share, the fair market value of the common stock on the date of grant. The options became exercisable in two equal annual installments commencing on January 21, 2004. Mr. Logan also received non-statutory stock options to acquire 2,000 shares of common stock at an exercise price of $31.025 per share, the fair market value of the common stock on the date of grant. The options became exercisable on January 21, 2005.

Independent Directors

Provident’s board of directors is comprised of 17 directors. The board of directors has determined that the following directors are independent directors under the corporate listing standards of the Nasdaq Stock Market: Messrs. Bilal, Bozzuto, Coe, Cole, Crowley, Dunn, Joseph, Meier, Riggs, Wilson and Logan and Ms. Lucas and Ms. Riggs.

Stock Ownership

The following table provides information as of April 1, 2005, with respect to persons known to Provident to be the beneficial owners of more than 5% of Provident’s outstanding common stock. A person may be considered to beneficially own any shares of common stock over which he or she has, directly or indirectly, sole or shared voting or investing power.

| | | | | | |

Name and Address

| | Number of Shares Owned

| | | Percent of Common Stock Outstanding

| |

Barclays Global Investors, NA. Barclays Global Fund Advisors Barclays Capital Investments 45 Fremont St., 17th Floor San Francisco, California 94105 | | 2,923,915 | (1) | | 8.8 | % |

| (1) | Based on information filed in Schedule 13G with the U.S. Securities and Exchange Commission on February 14, 2005, and includes shares held by each of Barclays Global Investors, N.A., Barclays Global Fund Advisors and Barclays Capital Inc. The shares reported are reported to be held by the company in trust accounts for the economic benefit of the beneficiaries of those accounts. Barclays Global Investors, NA., Barclays Global Fund Advisors and Barclays Capital Inc. filed a joint Schedule 13G to report such beneficial holdings together with the following entities, each of which reported that it did not individually beneficially own any shares of Provident common stock: Barclays Global Investors, Ltd, Barclays Life Assurance Company Limited, Barclays Bank PLC, Barclays Capital Securities Limited, Barclays Private Bank Limited, Bronco (Barclays Cayman) Limited, Palomino Limited, HYMF Limited, Barclays Private Bank & Trust (Isle of Man) Limited, Barclays Private Bank and Trust (Jersey) Limited, Barclays Bank Trust Company Limited, Barclays Bank (Sussie) SA and Barclays Trust and Banking Company (Japan) Limited. |

7

The following table provides information as of April 1, 2005 about the shares of common stock of Provident that may be considered to be beneficially owned by each director of Provident, by those executive officers of Provident whose salary and bonus during the 2004 fiscal year exceeded $100,000, and by all directors and executive officers of Provident as a group. Unless otherwise indicated, each of the named individuals has sole voting power and sole investment power with respect to the shares shown.

| | | | | | | | |

Name

| | Number of Shares Owned (excluding options)

| | | Number of Shares That May Be Acquired Within 60 Days by Exercising Options

| | Percent of Common Stock Outstanding(1)

| |

Directors | | | | | | | | |

Melvin A. Bilal | | 958 | | | 12,213 | | * | |

Thomas S. Bozzuto | | 6,450 | | | 11,455 | | * | |

Kevin G. Byrnes | | 4,318 | (2) | | 26,000 | | * | |

Ward B. Coe, III | | 4,562 | (3) | | 16,593 | | * | |

Charles W. Cole, Jr. | | 19,781 | | | — | | * | |

William J. Crowley, Jr. | | 6,518 | (4) | | 6,333 | | * | |

Pierce B. Dunn | | 48,739 | (5) | | 20,389 | | * | |

Enos K. Fry | | 11,062 | (6) | | 71,292 | | * | |

Gary N. Geisel | | 23,012 | (7) | | 158,217 | | * | |

Mark K. Joseph | | 15,348 | | | 20,389 | | * | |

Bryan J. Logan | | 818 | | | 5,666 | | * | |

Barbara B. Lucas | | 3,602 | | | 19,873 | | * | |

Peter M. Martin | | 103,820 | | | 37,000 | | * | |

Frederick W. Meier, Jr. | | 11,522 | | | — | | * | |

Francis G. Riggs | | 87,239 | (8) | | 4,863 | | * | |

Sheila K. Riggs | | 55,162 | (9) | | 17,575 | | * | |

Donald E. Wilson | | 618 | | | 5,000 | | * | |

Named Executive Officers who are not also Directors | | | | | | | | |

Richard J. Oppitz | | 7,325 | (10) | | 85,717 | | * | |

Dennis A. Starliper | | 22,673 | (11) | | 60,294 | | * | |

All directors and executive officers as a group (19 persons) | | 450,782 | | | 578,869 | | 3.1 | % |

| * | Indicates ownership of less than 1.0%. |

| (1) | Percentages with respect to each person or group of persons have been calculated on the basis of 33,055,974 shares of Provident’s common stock outstanding as of April 1, 2005, plus the number of shares of Provident’s common stock which such person or group of persons has the right to acquire within 60 days after April 1, 2005 by the exercise of stock options. |

| (2) | Includes 1,318 shares held in 401(k) plan. |

| (3) | Includes 700 shares held as trustee for mother’s trust. |

| (4) | Includes 5,500 shares held by spouse. |

| (5) | Includes 135 shares held by spouse; 1,999 shares held as custodian; and 29,002 shares held as trustee. |

| (6) | Includes 8,124 shares held in 401(k) plan, 35 shares held by IRA and 1,411 shares held by spouse. |

| (7) | Includes 6,279 shares held in 401(k) plan. |

| (8) | Includes 13,269 shares held as custodian. |

| (9) | Includes 2,424 shares held as custodian. |

| (10) | Includes 6,024 shares held in 401(k) plan. |

| (11) | Includes 20,253 shares held in 401(k) plan. |

8

Proposal 1 - Election of Directors

Provident’s board of directors consists of 17 directors, of which 13 are independent directors. The board of directors is divided into three classes with three-year staggered terms, with approximately one-third of the directors elected each year. The board of directors’ nominees for election this year, to serve for a three-year term, or until their respective successors have been elected and qualified, are Thomas S. Bozzuto, Charles W. Cole, Jr., Barbara B. Lucas, Francis G. Riggs and Enos K. Fry.

If any nominee is unable to serve or declines to serve for any reason, it is intended that proxies will be voted for the election of the balance of those nominees named and for such other persons as may be designated by the present board of directors. The board of directors has no reason to believe that any of the persons named will be unable or unwilling to serve.No person being nominated as a director is being proposed for election pursuant to any agreement or understanding between any such person and Provident.

The board of directors recommends a vote “FOR” the election of Ms. Lucas and Messrs. Bozzuto, Cole, Riggs and Fry.

Information with Respect to Nominees, Continuing Directors and

Certain Executive Officers

Information regarding the nominees for election at the annual meeting, as well as information regarding the continuing directors whose terms expire in 2006 and 2007, is provided below. Unless otherwise stated, each nominee has held his or her current occupation for the last five years. The age indicated in each nominee’s biography is as of December 31, 2004. The indicated period for service as a director includes service as a director of Provident Bank.

Nominees for Election of Directors

Thomas S. Bozzuto is Chief Executive Officer of The Bozzuto Group, a full-service residential development company located in Greenbelt, Maryland. Age 58. Director since 1998.

Charles W. Cole, Jr.is Chairman of the Board of Legg Mason Trust F.S.B. and was previously Vice Chairman of the Board and Managing Director of Brown Investment Advisory and Trust Co. Prior to that position, Mr. Cole was the President and Chief Executive Officer of First Maryland Bancorp and the First National Bank of Maryland. Age 69. Director since 1995.

Barbara B. Lucasis Senior Vice President and Corporate Secretary of The Black & Decker Corporation. Ms. Lucas serves as Chair of the Compensation Committee. Age 59. Director since 1996.

Francis G. Riggs is Executive Vice President and a director of Riggs, Counselman, Michaels & Downes, Inc., an insurance brokerage company. Age 67. Director since 1972.

Enos K. Fry has been Group Manager, Washington Metro Area, of Provident Bank since 1997. Prior to joining Provident Bank, he served in various executive capacities with Citizens Savings Bank, F.S.B., including President, director and Vice Chairman of the Board, until Citizens Savings was acquired by Provident Bank in 1997. Age 61. Director since 1997.

9

Directors Continuing in Office

The following directors have terms ending in 2006:

Pierce B. Dunn is Chairman of the Board of MIRCON, Inc., an environmental and engineering company. Mr. Dunn serves as Chair of the Audit Committee. Age 54. Director since 1987.

Mark K. Josephis Chairman of the Board of Municipal Mortgage and Equity, LLC (Muni Mae) (NYSE, MMN), a real estate finance company. Mr. Joseph is also the Founding Chairman of The Shelter Group, a real estate development and property management company. Age 66. Director since 1993.

Peter M. Martin served as Chairman of the Board and Chief Executive Officer of Provident and Provident Bank from 1998 until his retirement in April 2003. Mr. Martin also served as President of Provident and Provident Bank from 1990 until January 2001. Age 67. Director since 1990.

Sheila K. Riggs is the Chairperson of the Maryland Health and Higher Educational Facilities Authority, which issues bonds to finance health care and higher education facilities. Age 61. Director since 1982.

Kevin G. Byrneshas been President and Chief Operating Officer of Provident and Provident Bank since April 2003. Before becoming President and Chief Operating Officer, Mr. Byrnes served as Senior Executive Vice President of Provident since 2002. Previously, Mr. Byrnes was Regional Executive in charge of the upstate operations of Chase Manhattan Bank in Rochester, New York. Age 57. Director since 2002.

Donald E. Wilson is Vice President for Medical Affairs of the University of Maryland and Dean of the School of Medicine. Dr. Wilson serves as the Chair of the Corporate Governance Committee. Age 69. Director since 2002.

The following directors have terms ending in 2007:

Melvin A. Bilalis an attorney engaged in the private practice of law. Formerly, he served as President of Bilal Consulting. Previously, Mr. Bilal was the owner and Managing Executive of the Bilal Group, Inc., a provider of long and short term staffing needs. Prior to holding this position, Mr. Bilal was President and founder of Security America Services, Inc., a security consulting firm. Age 62. Director since 1992.

Ward B. Coe, III is a partner in the law firm of Whiteford, Taylor & Preston, LLP. Age 59. Director since 1997.

Frederick W. Meier, Jr. is President of Lord Baltimore Capital Corp., formerly ATAPCO Capital Management Group. Prior to being elected to this position in 1996, Mr. Meier was an Executive Vice President of First Maryland Bancorp and First National Bank of Maryland. Age 61. Director since 1997.

Gary N. Geisel has been Chairman of the Board and Chief Executive Officer of Provident and Provident Bank since April 2003. Before becoming Chairman and Chief Executive Officer, Mr. Geisel was President and Chief Operating Officer of Provident and Provident Bank from January 2001 until April 2003, was a member of Provident Bank’s Office of the Chairman from 1999 until January 2001, and was Group Manager, Community Banking, of Provident Bank from 1997 until 1999. Prior to joining Provident Bank, Mr. Geisel was an executive officer with Citizens Bank of Maryland. Age 56. Director since 2001.

10

William J. Crowley, Jr. was managing partner of the Baltimore office of Arthur Andersen LLP from 1995 to 2002 and general partner from 1980 to 1995. Mr. Crowley serves on the Boards of Directors of Foundation Coal Holdings, Inc. and BioVeris Corporation and is the Chair of the Audit Committee for each company. Mr. Crowley has been designated as an audit committee financial expert. Age 59. Director since 2003.

Bryan J. Logan is Chairman and Chief Executive Officer of EarthData Group, which consists of EarthData Holdings, EarthData International of Maryland, EarthData International of North Carolina, EarthData International of Florida, EarthData Aviation, EarthData Technologies and EarthData International, Inc. The EarthData group of companies specializes in the acquisition, development, analysis and application of spatial data and GIS services for engineering, environmental and land management clients worldwide. Age 56. Director since January 2004.

Named Executive Officers Who Are Not Also Directors

Richard J. Oppitz is an Executive Vice President of Provident Bank. Previously, Mr. Oppitz served as a member of Provident Bank’s Office of the Chairman, Group Manager, Commercial Banking and Managing Director, Credit Administration Division. Age 58.

Dennis A. Starliper is Executive Vice President and Chief Financial Officer of Provident and Provident Bank. Previously, Mr. Starliper served as a Group Manager, Treasurer and Managing Director, Treasury Division, of Provident Bank. Age 58.

Proposal 2 - Ratification of Appointment of the Independent Registered Public Accounting Firm

Provident’s independent registered public accounting firm for the fiscal year ended December 31, 2004 was KPMG LLP. Provident’s board of directors reappointed KPMG LLP to continue as the independent registered public accounting firm for Provident for the fiscal year ending December 31, 2005, subject to ratification of such appointment by shareholders. If shareholders do not ratify the appointment of KPMG LLP as the independent registered public accounting firm, the board of directors may consider another independent registered public accounting firm.

Representatives of KPMG LLP will be present at the annual meeting. They will be given the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions from shareholders present at the annual meeting.

The board of directors recommends that you vote “FOR” ratification of the appointment of KPMG LLP as the independent registered public accounting firm of Provident.

11

Audit and Non-Audit Fees

The following table sets forth the fees billed to Provident for the fiscal years ending December 31, 2004 and 2003 by KPMG LLP:

| | | | | | |

| | | 2004

| | 2003

|

Audit Fees | | $ | 1,489,950 | | $ | 280,100 |

Audit Related Fees (1) | | | 64,900 | | | 18,800 |

Tax Fees (2) | | | 35,649 | | | 17,350 |

All Other Fees | | | — | | | — |

| (1) | Includes assurance and related services that are reasonably related to the performance of the audit or review of the financial statements and are not reported as “Audit Fees.” |

| (2) | Consists of tax filing and tax related compliance and other advisory services. |

Approval of Services by the Independent Registered Public Accounting Firm

The Audit Committee has adopted a policy for approval of audit and permitted non-audit services by the Company’s independent registered public accounting firm. The Audit Committee will consider annually and approve the provision of audit services by its independent registered public accounting firm and consider and, if appropriate, approve the provision of certain defined audit and non-audit services. The Audit Committee will also consider specific engagements on a case-by-case basis and approve them, if appropriate.

Any proposed specific engagement may be presented to the Audit Committee for consideration at its next regular meeting or, if earlier consideration is required, to the Audit Committee or one or more of its members. The member or members to whom such authority is delegated shall report any specific approval of services at its next regular meeting. The Audit Committee will regularly review summary reports detailing all services being provided to the Company by its independent registered public accounting firm.

During the year ended December 31, 2004, 100% of the Audit Related Fees, Tax Fees and All Other Fees set forth above were approved by the Audit Committee.

The Report of the Audit Committee, the Report of the Compensation Committee, and the stock performance graph shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that Provident specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

Report of the Audit Committee

The Audit Committee of Provident Bankshares’ board of directors is composed of five non-employee directors and operates under a written charter adopted by the board of directors. The board of directors has determined that each Audit Committee member is independent in accordance with the currently effective listing standards of the Nasdaq Stock Market. In addition, the board of directors has determined that William J. Crowley, as defined by SEC rules, is both independent and an audit committee financial expert.

12

Provident Bankshares’ management is responsible for Provident Bankshares’ internal controls and financial reporting process. The independent registered public accounting firm is responsible for performing an integrated audit of Provident Bankshares’ consolidated financial statements and management’s assessment that Provident Bankshares maintained effective internal control over financial reporting and for issuing opinions on the conformity of those financial statements with U.S. generally accepted accounting principles and on management’s assessment of, and the effective operation of, internal control over financial reporting. The Audit Committee oversees Provident Bankshares’ internal controls and financial reporting process on behalf of the board of directors.

In this context, the Audit Committee has met and held discussions with management and the independent registered public accounting firm. Management represented to the Audit Committee that Provident Bankshares’ consolidated financial statements were prepared in accordance with U.S. generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent registered public accounting firm. The Audit Committee discussed with the independent registered public accounting firm matters required to be discussed by Statement on Auditing Standards No. 61 (Communication With Audit Committees), including the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of the disclosures in the financial statements.

In addition, the Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm required by relevant professional and regulatory standards and has discussed with the independent registered public accounting firm the firm’s independence from Provident Bankshares and its management. In concluding that the firm is independent, the Audit Committee considered, among other factors, whether the non-audit services provided by the firm were compatible with its independence.

The Audit Committee discussed with Provident Bankshares’ independent registered public accounting firm the overall scope and plans for their audit. The Audit Committee meets with the independent registered public accounting firm, with and without management present, to discuss the results of their examination, their evaluation of Provident Bankshares’ internal controls, and the overall quality of Provident Bankshares’ financial reporting.

In performing all of these functions, the Audit Committee acts only in an oversight capacity. In its oversight role, the Audit Committee relies on the work and assurances of Provident Bankshares’ management, which has the primary responsibility for financial statements and reports, and of the independent registered public accounting firm who, in their report, express an opinion on the conformity of Provident Bankshares’ financial statements to U.S. generally accepted accounting principles and on management’s assessment of, and the effective operation of, internal control over financial reporting. The Audit Committee’s oversight does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions with management and the independent registered public accounting firm do not assure that Provident Bankshares’ financial statements are presented in accordance with U.S. generally accepted accounting principles, that the audit of Provident Bankshares’ financial statements has been carried out in accordance with the standards of the Public Company Accounting Oversight Board (United States) or that Provident Bankshares’ independent registered public accounting firm is in fact “independent.”

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the board of directors, and the board has approved, that the audited consolidated financial statements be included in Provident Bankshares’ Annual Report on Form 10-K for the year ended December 31, 2004

13

for filing with the SEC. The Audit Committee and the board of directors also have approved, subject to shareholder ratification, the selection of Provident Bankshares’ independent registered public accounting firm.

The Audit Committee of the Board of Directors of Provident

Pierce B. Dunn (Chair)

Charles W. Cole, Jr.

William J. Crowley, Jr.

Mark K. Joseph

Frederick W. Meier, Jr.

Executive Compensation

Summary Compensation Table

The following information is furnished for the Chief Executive Officer and all other executive officers of Provident and Provident Bank employed during the fiscal year by Provident and Provident Bank who received salary and bonus in excess of $100,000 during fiscal 2004. These persons are sometimes referred to in this proxy statement as the “named executive officers.”

| | | | | | | | | | | | | | | | |

| | | | | Annual Compensation

| | | | |

Name and Principal Positions

| | Fiscal Year

| | Salary ($)

| | Bonus ($)

| | Other Annual Compensation ($)

| | Securities Underlying Options (#)

| | All Other Compensation ($)(1)

|

Gary N. Geisel

Chairman and Chief Executive Officer of

Provident and Provident Bank | | 2004

2003

2002 | | $

| 450,000

375,000

328,600 | | $

| 112,500

112,500

164,300 | | $

| —

—

— | | 40,000

15,000

50,000 | | $

| 9,750

9,000

8,250 |

Kevin G. Byrnes

President and Chief Operating Officer of

Provident and Provident Bank | | 2004

2003

2002 | | $

| 340,000

320,000

— | | $

| 85,000

96,000

— | | $

| —

—

— | | 30,000

50,000

— | | $

| 9,750

7,239

— |

Richard J. Oppitz

Executive Vice President, Provident Bank | | 2004

2003

2002 | | $

| 268,400

264,434

256,732 | | $

| 35,000

53,000

77,020 | | $

| —

—

— | | 10,000

10,000

15,000 | | $

| 9,750

9,000

8,250 |

Dennis A. Starliper

Chief Financial Officer and Executive Vice

President of Provident and Provident Bank | | 2004

2003

2002 | | $

| 264,000

260,178

238,695 | | $

| 47,000

85,000

95,475 | | $

| —

—

— | | 15,000

15,000

20,000 | | $

| 8,357

7,214

7,071 |

| (1) | The amounts shown for Messrs. Geisel, Byrnes, Oppitz and Starliper were employer-provided contributions under the Bank’s 401(k) plan. |

Change in Control Agreements. Provident and Provident Bank have entered into change in control agreements with Messrs. Geisel, Byrnes, Oppitz and Starliper. Each agreement is extended on a daily basis unless written notice of non-renewal is given by the board of directors. The agreements provide that if involuntary termination or, under certain circumstances, voluntary termination, follows a change in control of Provident or Provident Bank, the executive officer is entitled to receive a severance payment equal to three times his average annual compensation for the five most recent taxable years

14

preceding termination. Provident or Provident Bank also would continue to pay for life, health and disability coverage for 36 months following termination. Payments to the executive officer under the agreements are paid by Provident to the extent that payments (or other benefits) are not paid by Provident Bank. Notwithstanding that both Provident and Provident Bank change in control agreements provide for a severance payment in the event of a change in control, no duplicate payments would be made under the agreements.

Stock Option Grants

The following table lists all grants of options under the Stock Option Plan to the named executive officers for fiscal year 2004 and contains certain information about the potential value of those options based upon certain assumptions as to the appreciation of Provident’s stock over the life of the option.

Options Grants in Last Fiscal Year

| | | | | | | | | | | | | | | |

Name

| | Number of Securities Underlying Options Granted

| | % of Total Options Granted to Employees in Fiscal Year

| | Exercise or Base Price Per Share

| | Expiration Date

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Options(1)

|

| | | | | | 5%

| | 10%

|

Gary N. Geisel | | 40,000 | | 9.0 | | $ | 32.22 | | 2/18/2014 | | $ | 811,944 | | $ | 2,049,192 |

Kevin G. Byrnes | | 30,000 | | 6.8 | | $ | 32.22 | | 2/18/2014 | | | 608,958 | | | 1,536,894 |

Richard J. Oppitz | | 10,000 | | 2.3 | | $ | 32.22 | | 2/18/2014 | | | 202,986 | | | 512,298 |

Dennis A. Starliper | | 15,000 | | 3.4 | | $ | 32.22 | | 2/18/2014 | | | 304,479 | | | 768,447 |

| (1) | The dollar gains under these columns result from calculations required by the Securities and Exchange Commission’s rules and are not intended to forecast future price appreciation of the common stock. It is important to note that options have value only if the stock price increases above the exercise price shown in the table during the effective option period. In order for the executive to realize the potential values set forth in the 5% and 10% columns in the table, the price per share of Provident’s common stock as of the expiration date of the options for Messrs. Byrnes, Geisel, Oppitz and Starliper would be approximately $52.52 per share and $83.45 per share, respectively. |

Aggregated Option Exercises in Last Fiscal Year and Option Value at Fiscal Year End

The following table provides for the named executive officers information regarding the exercise of options during the year ended December 31, 2004 and unexercised stock options as of December 31, 2004.

| | | | | | | | | | | | | | | |

| | | | | | | Number of Securities Underlying Unexercised Options at Fiscal Year End (#)

| | Value of Unexercised In-the-Money Options at Fiscal Year End ($)(1)

|

Name

| | Shares Acquired on Exercise(#)

| | Value Realized($)

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Gary N. Geisel | | 21,319 | | $ | 392,053 | | 158,217 | | 35,001 | | $ | 2,233,484 | | $ | 214,801 |

Richard J. Oppitz | | 1,340 | | | 32,267 | | 85,717 | | 10,004 | | | 1,241,885 | | | 70,543 |

Dennis A. Starliper | | 8,069 | | | 186,636 | | 60,294 | | 15,000 | | | 780,787 | | | 105,800 |

| (1) | The closing price of the common stock on December 31, 2004 was $36.37. |

15

Pension Plans

The following table sets forth the estimated annual pension benefits payable to a participant at normal retirement age (age 65) under the Provident Bank of Maryland Pension Plan, based on both the remuneration that is covered under this plan and years of service with Provident and its subsidiaries.

| | | | | | | | | | | | | | | | |

| | | Years of Service

|

Remuneration

| | 15

| | 20

| | 25

| | 30

| | 35

|

| $ | 125,000 | | $ | 26,250 | | $ | 35,000 | | $ | 43,750 | | $ | 43,750 | | $ | 43,750 |

| | 150,000 | | | 31,500 | | | 42,000 | | | 52,500 | | | 52,500 | | | 52,500 |

| | 175,000 | | | 36,750 | | | 49,000 | | | 61,250 | | | 61,250 | | | 61,250 |

| | 200,000 | | | 42,000 | | | 56,000 | | | 70,000 | | | 70,000 | | | 70,000 |

| | 225,000 | | | 47,250 | | | 63,000 | | | 78,750 | | | 78,750 | | | 78,750 |

| | 250,000 | | | 52,500 | | | 70,000 | | | 87,500 | | | 87,500 | | | 87,500 |

| | 275,000 | | | 57,750 | | | 77,000 | | | 96,250 | | | 96,250 | | | 96,250 |

| | 300,000 | | | 63,000 | | | 84,000 | | | 105,000 | | | 105,000 | | | 105,000 |

| | 325,000 | | | 68,250 | | | 91,000 | | | 113,750 | | | 113,750 | | | 113,750 |

| | 350,000 | | | 73,500 | | | 98,000 | | | 122,500 | | | 122,500 | | | 122,500 |

| | 375,000 | | | 78,750 | | | 105,000 | | | 131,250 | | | 131,250 | | | 131,250 |

| | 400,000 | | | 84,000 | | | 112,000 | | | 140,000 | | | 140,000 | | | 140,000 |

| | 425,000 | | | 89,250 | | | 119,000 | | | 148,750 | | | 148,750 | | | 148,750 |

| | 450,000 | | | 94,500 | | | 126,000 | | | 157,500 | | | 157,500 | | | 157,500 |

This table reflects the annual benefits payable at the executive officer’s 65th birthday in the form of an annuity for the executive officer’s life with a 15-year guarantee in favor of the executive officer’s spouse. Under this form, should the executive officer die within 15 years after the benefits start, the executive’s surviving spouse, if any, will continue to receive the same pension benefits until the end of that 15-year period. The table also reflects the maximum benefits payable under the Provident Bank of Maryland Pension Plan, a tax-qualified, funded plan and certain supplemental retirement income agreements providing 50% of the excess (unfunded benefits). The benefits reflected in the table are offset or reduced by 100% of the executive officer’s estimated primary Social Security benefit.

The following table sets forth the respective years of service credited for Pension Plan purposes as of December 31, 2004, and the estimated years of service at the respective normal retirement dates for the named executive officers.

| | | | |

Name

| | Years of Service at 12/31/04

| | Years of Service at Normal Retirement

|

Gary N. Geisel | | 7.2 | | 17.6 |

Kevin G. Byrnes | | 2.1 | | 10.1 |

Richard J. Oppitz | | 11.8 | | 19.8 |

Dennis A. Starliper | | 19.5 | | 27.5 |

Provident also has supplemental retirement income agreements with Messrs. Geisel, Byrnes and Starliper. Mr. Geisel’s agreement will pay 70% of his final pay, reduced by Social Security, the age-65 benefit accrued under the Bank’s Pension Plan, and then proportionately reduced for each year his retirement precedes age 60. Mr. Byrnes’ agreement will pay 50% of his final pay until he has completed 5 years of service with the Bank, at which time the benefit increases to 70% of his final pay, reduced by Social Security, the age-65 benefit accrued under the Bank’s Pension Plan, and then proportionately reduced for each year his retirement precedes age 65. Mr. Starliper’s agreement will pay 60% of his final pay, reduced by Social Security, the age-65 benefit accrued under the Bank’s Pension Plan, and then proportionately reduced for each year his retirement precedes age 65.

16

Report of the Compensation Committee

Committee Report on Executive Compensation. Recommendations regarding all of the components of the compensation of Provident’s Chairman and Chief Executive Officer are made by the board of directors’ four-member Compensation Committee to, and are approved by, the board of directors. The board of directors did not reject or modify in any material way any of the recommendations of the Compensation Committee during fiscal year 2004. Each member of the Compensation Committee is a non-employee director and independent under the corporate governance listing standards of the Nasdaq Stock Market. The following report has been prepared by the Compensation Committee and addresses the compensation policies of Provident for 2004 as they affected Provident’s named executive officers.

Executive Officer Compensation Policies and Objectives. The policies and objectives of the Compensation Committee are designed to assist Provident and its subsidiaries in attracting and retaining qualified executives, to recognize individual contributions toward the achievement of short and long-term performance goals and to align closely the financial interests of the senior managers of Provident and its subsidiaries with those of Provident’s shareholders. In furtherance of these objectives, Provident maintains a compensation program for executive officers that consists of both cash and equity-based compensation. The Compensation Committee retains independent compensation consultants to work with it on executive compensation matters. The Compensation Committee also uses and relies upon competitive data regarding executive compensation levels and practices.

Salary levels for all employees, including executive officers, are set so as to reflect the duties and levels of responsibilities inherent in the specific position and to reflect competitive conditions in the banking business in Provident’s market area. Comparative salaries paid by other financial institutions are considered in establishing the salary for a given position. Salary ranges for all employees, including the executive officers, are reviewed annually by the Compensation Committee, taking into account the competitive level of pay as reflected in the surveys consulted.

Executive Compensation Programs and Relationship to Performance. The annual cash compensation of Provident’s named executive officers consists of a base salary and an annual incentive bonus. In the case of Messrs. Geisel and Byrnes, this annual incentive bonus is determined under the terms of the Executive Incentive Plan (“EIP”) and, in the case of Messrs. Starliper and Oppitz, the Executive Vice Presidents Incentive Plan (“EVIP”). The Compensation Committee establishes, on an annual basis, the base salary of the Chief Executive Officer, generally based upon a review of the performance of the Chief Executive Officer during the prior year and competitive data for that position. The Chief Executive Officer recommends to the Compensation Committee a salary level for the other named executive officers based upon a performance review of each executive officer.

Executive Incentive Plan and Executive Vice Presidents Incentive Plan.Under the EIP and EVIP, an annual incentive bonus may be paid to eligible executives in part based upon the financial performance of Provident and in part based upon the performance of the individual eligible to be awarded a bonus under the EIP and EVIP. The corporate performance-based goals are dependent upon the achievement of earnings per share (EPS) and return on equity (ROE) targets established by the Compensation Committee, each of which represents 50% of the available corporate performance-based award. For the corporate performance-based portion of an annual incentive bonus award, after-tax EPS and ROE targets for the upcoming year are established: threshold, budget and maximum. The Compensation Committee sets or approves a percentage of base salary eligible to be received as annual

17

incentive compensation at each of the threshold, budget and maximum targets. The percentage of base salary eligible to be received by an individual under the EIP or EVIP ranges from 30% to 90% of the individual’s salary at the end of the fiscal year for which the annual incentive compensation is to be paid. If EPS and ROE reach the threshold, budget or maximum targets, participants will automatically receive 75% of the designated percentage of base salary as corporate performance-based annual incentive compensation. In the event that EPS and ROE are less than the threshold, no corporate performance-based annual incentive compensation is payable. If only after-tax EPS or after-tax ROE reaches its respective threshold, budget or maximum target, then participants will automatically receive 37.5% of the designated percentage of base salary as corporate performance-based annual incentive compensation. The remaining 25% of the annual incentive bonus award is discretionary based on individual performance as compared to established goals, namely: management of Provident with emphasis on development and retention of key personnel; implementation of new initiatives; financial progress in addition to net earnings; and risk management. The Compensation Committee reviews the terms of the EIP and EVIP each year to assure that, in operation, they are furthering the Committee’s compensation policy objectives. Payment of all or any part of the annual incentive compensation earned under the EIP and the EVIP may be deferred.

Stock Option Plan. Long-term incentives for the named executive officers have been provided through the Stock Option Plan. Provident’s ability to grant additional awards under the Stock Option Plan terminated when shareholders approved the 2004 Equity Compensation Plan. However, awards outstanding under the Stock Option Plan continue in effect in accordance with their terms.

2004 Equity Compensation Plan.The purposes of the 2004 Equity Compensation Plan are to provide incentives and rewards to those employees and directors largely responsible for the success and growth of Provident and its affiliates, and to assist in attracting and retaining directors, executives and other key employees with relevant experience and ability. The Compensation Committee of the board of directors administers the 2004 Equity Compensation Plan. The board of directors or the Compensation Committee may also delegate some or all of its authority with respect to the 2004 Equity Compensation Plan to certain officers of Provident to provide them with limited authority to grant awards to employees, provided that no officer may designate himself or herself as an award recipient. (The appropriate acting body, be it the board, the Committee or an officer, is herein referred to as the “Administrator”). The Administrator has broad authority under the 2004 Equity Compensation Plan with respect to awards granted under the 2004 Equity Compensation Plan, including, without limitation, the authority to:

| | • | | select the individuals to receive awards under the 2004 Equity Compensation Plan; |

| | • | | determine the type, number, vesting requirements and other features and conditions of individual awards; and |

| | • | | interpret the 2004 Equity Compensation Plan and award agreements issued with respect to individual awards. |

Each award granted under the 2004 Equity Compensation Plan is evidenced by a written award agreement that sets forth the terms and conditions of the award and may include additional provisions and restrictions as determined by the Administrator. Persons eligible to receive awards under the 2004 Equity Compensation Plan include directors, officers and employees of Provident and its affiliates. All of Provident’s directors, officers and employees (including all of the named executive officers of Provident) are presently considered eligible for awards under the 2004 Equity Compensation Plan.

Other Compensation Plans. The named executive officers participate in Provident’s health and welfare and qualified retirement plans on the same terms as non-executive employees who meet the applicable eligibility criteria, subject to any legal limitations on the amounts that may be contributed or the benefits that may be payable under these plans.

18

In addition to the qualified retirement plans, Provident also has supplemental retirement income agreements with Messrs. Geisel, Byrnes and Starliper. These supplemental retirement agreements are unfunded, so that amounts payable represent unsecured liabilities of the Bank, subject to the claims of secured creditors. The Bank has purchased one corporate-owned life insurance policy on the life of Mr. Geisel.

Chief Executive Officer Compensation. The Compensation Committee set Mr. Geisel’s annual base compensation for fiscal year 2004 at $450,000, such base compensation being set in a manner consistent with the base salary guidelines applied to executive officers of Provident as described above. For Mr. Geisel’s 2004 bonus, the Compensation Committee recognized, among other accomplishments, the Bank’s net income, earnings per share, return on assets, return on equity and the successful acquisition and integration of Southern Financial Bank. The threshold target set under the EIP for 2004 was met, resulting in a formula and performance-driven pay out of $112,500 to Mr. Geisel. See “Executive Compensation Programs and Relationship to Performance”and“Executive Incentive Plan and Executive Vice Presidents Incentive Plan.”

Compensation of Other Named Executive Officers. Decisions regarding the base salaries of the other named executive officers are communicated to the Compensation Committee by the Chief Executive Officer. These decisions are based upon a review of their individual performance during the prior year by the Chief Executive Officer. The Compensation Committee did not reject or modify in any material way any of the decisions of the Chief Executive Officer concerning the base salaries of the other named executive officers for 2004.

The Compensation Committee of the Board of Directors of Provident

Barbara B. Lucas (Chair)

Melvin A. Bilal

Sheila K. Riggs

Francis G. Riggs

Compensation Committee Interlocks and Insider Participation

No executive officer of Provident or Provident Bank serves or has served as a member of the compensation committee of another entity, which has one of its executive officers on the Compensation Committee of Provident or Provident Bank. No executive officer of Provident or Provident Bank serves or has served as a director of another entity, which has one of its executive officers on the Compensation Committee of Provident or Provident Bank.

19

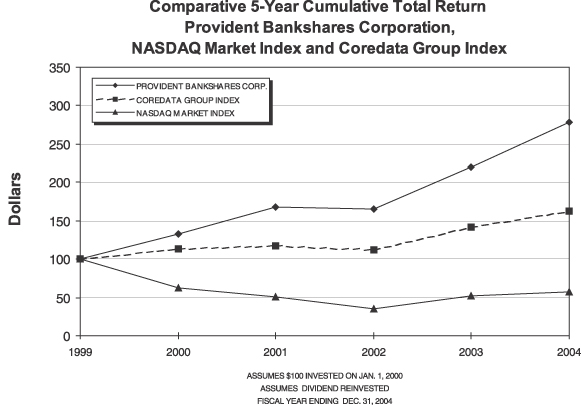

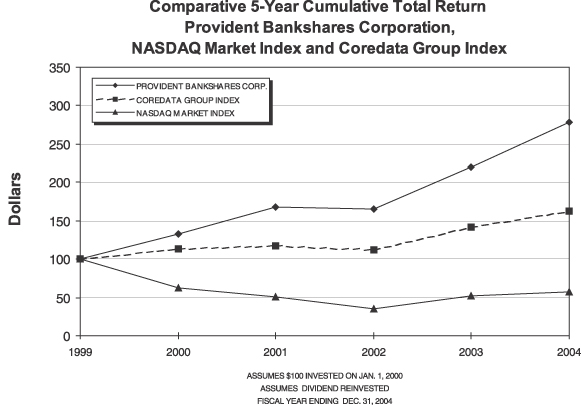

Performance Graph

The SEC requires that Provident include in this proxy statement a line-graph comparing cumulative shareholder returns as of December 31 for each of the last five years among the common stock, a broad market index and either a nationally-recognized industry standard or an index of peer companies selected by Provident, assuming in each case both an initial $100 investment and reinvestment of dividends. Consistent with past practice, the board of directors has selected the Nasdaq Market Index as the relevant broad market index because prices for the common stock are quoted on the Nasdaq National Market. Additionally, the board of directors has selected the Coredata Group Index, formerly known as the MG Index for the Mid-Atlantic Region, as the relevant industry standard because such index consists of financial institutions which are headquartered in the mid-Atlantic region and the board of directors believes that such institutions generally possess assets, liabilities and operations more similar to those of Provident and its subsidiaries than other publicly-available indices.

| | | | | | | | | | | | | | | | | | |

| | | 1999

| | 2000

| | 2001

| | 2002

| | 2003

| | 2004

|

Provident Bankshares Corporation | | $ | 100.00 | | $ | 132.55 | | $ | 167.73 | | $ | 165.43 | | $ | 219.35 | | $ | 278.69 |

Coredata Group Index | | $ | 100.00 | | $ | 113.17 | | $ | 116.70 | | $ | 111.60 | | $ | 142.25 | | $ | 162.23 |

NASDAQ Market Index | | $ | 100.00 | | $ | 62.85 | | $ | 50.10 | | $ | 34.95 | | $ | 52.55 | | $ | 56.97 |

20

Other Information Relating to Directors and Executive Officers

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities and Exchange Act of 1934 requires Provident’s executive officers and directors, and persons who own more than 10% of any registered class of Provident’s equity securities, to file reports of ownership and changes in ownership with the SEC. Executive officers, directors and greater than 10% shareholders are required by regulation to furnish Provident with copies of all Section 16(a) reports they file.

Based solely on its review of the copies of the reports it has received and written representations provided to Provident from the individuals required to file the reports, Provident believes that each of Provident’s executive officers and directors has complied with applicable reporting requirements for transactions in Provident’s common stock during the fiscal year ended December 31, 2004, except that: Mr. Logan filed one late report, representing one transaction; Mr. Meier filed one late report, representing one transaction; Mr. Oppitz filed two late reports, representing three transactions; Mr. Starliper filed two late reports, representing two transactions; Mr. Byrnes filed one late report, representing one transaction; Mr. Fry filed one late report, representing one transaction; Mr. Geisel filed one late report, representing one transaction; Mr. Joseph filed one late report, representing one transaction; Mr. Bilal filed one late report, representing one transaction; and Mr. Dunn filed one late report, representing one transaction.

Transactions With Management

Loans to Officers and Directors. Periodically, Provident Bank may engage in lending transactions with its officers and directors, as well as entities associated with such persons. Such transactions are made in the ordinary course of business and on substantially the same terms, including interest rate and collateral, as those prevailing at the time for comparable transactions with other persons. Loans to such persons do not involve more than the normal risk of collectibility or present other unfavorable features.

Other Transactions. Mr. Coe is a partner in the law firm of Whiteford, Taylor & Preston, LLP, which provided legal services to Provident and Provident Bank during the fiscal year ended December 31, 2004.

Submission of Future Shareholder Proposals and Nominations

Provident must receive proposals that shareholders seek to include in the proxy statement for Provident’s next annual meeting no later than December 14, 2005. If next year’s annual meeting is held on a date more than 30 calendar days from May 18, 2005, a shareholder proposal must be received by a reasonable time before Provident begins to print and mail its proxy solicitation for such annual meeting. Any shareholder proposals will be subject to the requirements of the proxy rules adopted by the SEC.

Provident’s Bylaws provide that in order for a shareholder to make nominations for the election of directors or proposals for business to be brought before the annual meeting, a shareholder must deliver notice of such nominations and/or proposals to the Corporate Secretary not less than 90 days before the date of the annual meeting; provided that if less than 100 days’ notice or prior public disclosure of the date of the annual meeting is given to shareholders, such notice must be delivered not later than the close of the tenth day following the day on which notice of the date of the annual meeting was mailed to shareholders or prior public disclosure of the meeting date was made. A copy of the full text of the Bylaw provisions discussed above may be obtained by writing to the Corporate Secretary at 114 East Lexington Street, Baltimore, Maryland 21202.

21

Miscellaneous

Provident’s Annual Report to Shareholders and Annual Report on Form 10-K accompany this proxy statement and have been mailed to persons who were shareholders as of the close of business on April 1, 2005. Any shareholder who has not received a copy of the Annual Report or Annual Report on Form 10-K may obtain a copy by writing to the Corporate Secretary of Provident. The Annual Report and Annual Report on Form 10-K are not to be treated as part of the proxy solicitation material or as having been incorporated in this proxy statement by reference.

If you and others who share your address own your shares in “street name,” your broker or other holder of record may be sending only one annual report and proxy statement to your address. This practice, known as “householding,” is designed to reduce printing and postage costs. However, if a shareholder residing at such an address wishes to receive a separate annual report or proxy statement in the future, he or she should contact the broker or other holder of record. If you own your shares in “street name” and are receiving multiple copies of the annual report and proxy statement, you can request householding by contacting your broker or other holder of record.

Whether or not you plan to attend the annual meeting, please vote by marking, signing, dating and promptly returning the enclosed proxy card in the enclosed envelope or by promptly voting either via the Internet or by telephone.

|

| By Order of the Board of Directors |

|

/s/ Gary N. Geisel

|

GARY N. GEISEL |

Chairman of the Board and |

Chief Executive Officer |

Baltimore, Maryland

April 13, 2005

22

PROXY

PROVIDENT BANKSHARES CORPORATION

ANNUAL MEETING OF SHAREHOLDERS

May 18, 2005

10:00 a.m. Local Time

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints Dennis A. Starliper and Robert L. Davis, each with full power of substitution, to act as proxy for the undersigned, and to vote all shares of common stock of Provident Bankshares Corporation (the “Company”) owned of record by the undersigned at the Annual Meeting of Shareholders, to be held on May 18, 2005, at 10:00 a.m, local time, at 114 East Lexington Street, Baltimore, Maryland, and at any and all adjournments thereof, as designated below with respect to the matters set forth below and described in the accompanying proxy statement and, in their discretion, for the election of a person to the board of directors if any nominee named herein becomes unable to serve or for good cause will not serve and with respect to any other business that may properly come before the Annual Meeting. Any prior proxy or voting instructions are hereby revoked.

This proxy will be voted as directed, but if no instructions are specified, this proxy will be voted “FOR” each of the proposals listed. If any other business is presented at the annual meeting, including whether or not to adjourn the meeting, this proxy will be voted by the proxies in their best judgment. At the present time, the board of directors knows of no other business to be presented at the Annual Meeting.

| | | | |

SEE REVERSE SIDE | | CONTINUED AND TO BE SIGNED ON REVERSE SIDE | | SEE REVERSE SIDE |

| | | | |

Vote-by-Internet Log on to the Internet and go to http://www.eproxyvote.com/pbks | | OR | | Vote-by-Telephone Call toll-free 1-877-PRX-VOTE (1-877-779-8683) |

If you vote over the Internet or by telephone, please do not mail your card.

Please mark

example.

YOUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSALS 1 AND 2.

| 1. | The election as directors of all nominees listed (except as marked to the contrary below). |

| | |

| Nominees: | | (01) Thomas S. Bozzuto, (02) Charles W. Cole, Jr., (03) Barbara B. Lucas (04) Francis G. Riggs, and (05) Enos K. Fry |

| | | | |

FOR ALL NOMINEES

| | WITHELD FROM ALL NOMINEES

| | FOR ALL EXCEPT

|

| ¨ | | ¨ | | ¨ |

INSTRUCTION: To withhold your vote for any individual nominee, mark “FOR ALL EXCEPT” and write that nominee’s name in the space provided above.

| 2. | The ratification of the appointment of KPMG LLP as the independent registered public accounting firm for the fiscal year ending December 31, 2005. |

PLEASE COMPLETE, DATE, SIGN AND PROMPTLY MAIL THIS PROXY IN THE ENCLOSED

POSTAGE-PAID ENVELOPE.