UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-5262

MFS SERIES TRUST VIII

(Exact name of registrant as specified in charter)

500 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Susan S. Newton

Massachusetts Financial Services Company

500 Boylston Street

Boston, Massachusetts 02116

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2008

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

MFS®

INVESTMENT MANAGEMENT

Annual report

MFS® Global Growth Fund

SIPC Contact Information:

You may obtain information about the Securities Investor Protection Corporation (“SIPC”), including the SIPC Brochure, by contacting SIPC either by telephone (202-371-8300) or by accessing SIPC’s website address (www.sipc.org).

Note to Shareholders: At the close of business on April 18, 2008, Class R shares and Class R2 shares converted into Class R3 shares. Following this conversion, Class R3, Class R4, and Class R5 shares were renamed Class R2, Class R3, and Class R4 shares, respectively.

The report is prepared for the general information of shareholders. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED Ÿ MAY LOSE VALUE Ÿ

NO BANK OR CREDIT UNION GUARANTEE Ÿ NOT A DEPOSIT Ÿ

NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY OR

NCUA/NCUSIF

10/31/08

WGF-ANN

LETTER FROM THE CEO

Dear Shareholders:

The global economy is not a very welcoming place these days. Headlines tell the story of slowing growth, accelerating inflation, and credit collapse. We have watched the rampant selling that has typified equity and credit markets since the strains in the financial system first became apparent last year.

The volatility in commodity and currency markets has further complicated investment choices. There are so many parts moving in so many directions; it has become very easy to get overwhelmed.

At MFS® we remind investors to keep their eye on the long term and not become panicked by the uncertainty of the day to day.

Remember that what goes down could very easily come back up. And that is where we as money managers like to turn our focus.

Investment opportunities may arise in declining markets. When markets experience substantial selloffs, assets often become undervalued. At MFS, we have a team of global sector analysts located in Boston, London, Mexico City, Singapore, Sydney, and Tokyo working together to do the kind of bottom-up research that will root out these investment opportunities.

In times like these, we encourage our investors to check in with their advisors to ensure they have an investment plan in place that will pay heed to the present, but that is firmly tailored to the future.

Respectfully,

Robert J. Manning

Chief Executive Officer and Chief Investment Officer

MFS Investment Management®

December 15, 2008

The opinions expressed in this letter are subject to change, may not be relied upon for investment advice, and no forecasts can be guaranteed.

1

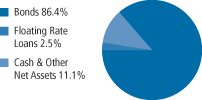

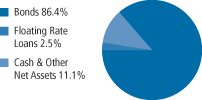

PORTFOLIO COMPOSITION

Portfolio structure

| | |

| Top ten holdings | | |

| Nestle S.A. | | 2.8% |

| Roche Holding AG | | 2.4% |

| TOTAL S.A. | | 1.9% |

| 3M Co. | | 1.7% |

| Novo Nordisk A/S, “B” | | 1.7% |

| Procter & Gamble Co. | | 1.5% |

| INPEX Holdings, Inc. | | 1.5% |

| WPP Group PLC | | 1.5% |

LVMH Moet Hennessy Louis

Vuitton S.A. | | 1.5% |

| Novartis AG | | 1.4% |

| | |

| Equity sectors | | |

| Technology | | 17.9% |

| Consumer Staples | | 13.3% |

| Health Care | | 13.3% |

| Financial Services | | 11.9% |

| Basic Materials | | 8.8% |

| Retailing | | 7.5% |

| Energy | | 6.6% |

| Special Products & Services | | 5.5% |

| Leisure | | 5.4% |

| Utilities & Communications | | 4.8% |

| Industrial Goods & Services | | 3.3% |

| Transportation | | 1.1% |

| |

| Country weightings | | |

| United States | | 34.4% |

| Switzerland | | 11.5% |

| Japan | | 9.7% |

| France | | 8.3% |

| United Kingdom | | 6.2% |

| Germany | | 6.0% |

| Spain | | 2.1% |

| Mexico | | 2.0% |

| India | | 2.0% |

| Other Countries | | 17.8% |

Percentages are based on net assets as of 10/31/08.

The portfolio is actively managed and current holdings may be different.

2

MANAGEMENT REVIEW

Summary of Results

For the twelve months ended October 31, 2008, Class A shares of the MFS Global Growth Fund provided a total return of –40.34%, at net asset value. This compares with a return of –42.80% for the fund’s benchmark, the MSCI All Country World Growth Index, and a return of –40.65% for the fund’s other benchmark, the MSCI World Growth Index.

Market Environment

The U.S. economy and financial markets experienced significant deterioration and extraordinary volatility over the reporting period. U.S. economic growth slowed significantly, despite the short-term bounce from the second quarter fiscal stimulus. Strong domestic headwinds included accelerated deterioration in the housing market, anemic corporate investment, a markedly weaker job market, and a much tighter credit environment. During the second half of the period, a seemingly continuous series of tumultuous financial events hammered markets, including: the distressed sale of failing Bear Stearns to JPMorgan, the conservatorship of Government Sponsored Enterprises (GSEs) Fannie Mae and Freddie Mac, the bankruptcy of investment bank Lehman Brothers, the Federal Reserve Bank’s complex intervention of insurance company American International Group (AIG), the nationalization of several large European banks, the failure of Washington Mutual, and the distressed sale of Wachovia. As a result of this barrage of turbulent news, global equity markets pushed significantly lower and credit markets witnessed the worst dislocation since the beginning of the credit crisis.

While reasonably resilient during the first half of the period, the global economy and financial system increasingly experienced considerable negative spillovers from the U.S. slowdown. Not only did Europe and Japan show obvious signs of economic softening, the more powerful engine of global growth – emerging markets – also began to display weakening dynamics.

During the reporting period, the U.S. Federal Reserve Board cut interest rates aggressively and introduced a multitude of new lending facilities to alleviate ever-tightening credit markets, while the U.S. federal government moved quickly to design and implement a modest fiscal stimulus package. Although several other global central banks also cut rates, the dilemma of rising energy and food prices heightened concerns among central bankers that inflationary expectations might become unhinged despite weaker growth. Only late in the reporting period did slowing global growth result in a precipitous decline in commodity prices, which began to ease inflation and inflationary expectations. As inflationary concerns diminished in the face of global deleveraging, and equity and credit markets deteriorated more sharply, a coordinated rate cut

3

Management Review – continued

marked the beginning of much more aggressive easing by the major global central banks.

Contributors to Performance

A combination of stock selection and an underweighted position in the industrial goods and services sector was the principal contributor to performance relative to the MSCI All Country World Growth Index. Industrial machinery manufacturer Bucyrus International (aa)(g) was among the fund’s top performers. Shares of Bucyrus rose as a major new contract with an Eastern European mine was signed.

Stock selection in the special products and services sector also boosted relative returns. The fund’s positioning in credit card company Visa was a top contributor in this sector. Shares of Visa rose as profits were up due to a higher volume of credit card transactions around the world.

In the health care sector, stock selection was a positive factor in relative performance. Overweighted positions in diabetes care company Novo Nordisk (Denmark), global biotechnology company Genzyme, agrochemical company Synthes (Swiss), and pharmaceutical company Roche Holding (Swiss) aided relative returns as stocks of these companies outperformed the benchmark.

Stocks in other sectors that contributed to relative performance included global food company Nestle S.A. (Switzerland), beauty and personal care company Alberto-Culver (aa), and industrial conglomerate 3M.

The fund’s cash position was also a contributor to relative performance. The fund holds cash to buy new holdings and to provide liquidity. In a period when equity markets declined, as measured by the fund’s benchmark, holding cash helped performance versus the benchmark, which has no cash position.

Detractors from Performance

An overweighted position in the financial services sector hurt relative performance. The fund’s positioning in financial services firms, UBS (Switzerland) (g), Erste Group Bank (g), Raiffeisen International Bank (Austria), and Goldman Sachs, held back relative results over the reporting period. Shares of UBS dropped as market concerns increased about additional write-downs by the investment banking unit. Holdings of banking firm Unicredito Italiano (Italy) (aa)(g) also hindered relative performance.

Stock selection in the retailing sector held back relative returns. Not holding strong-performing retail giant Wal-Mart dampened results as the stock performed well during the reporting period.

An underweighted position in the autos and housing sector was also a detractor from relative results. Not holding auto maker Volkswagen (Germany) had a negative impact on relative returns as the company’s stock rose significantly during the period.

4

Management Review – continued

Elsewhere, holdings of poor-performing oil company Inpex (Japan) and advertising and marketing firm WPP Group (U.K.) dampened relative returns. Not holding relatively strong-performing biotechnology firm Amgen (g) also hurt.

Respectfully,

| | |

| Jeffrey Constantino | | Barry Dargan |

| Portfolio Manager | | Portfolio Manager |

| (aa) | Security is not a benchmark constituent. |

| (g) | Security was not held in the portfolio at period end. |

Note to Shareholders: Effective July 2008, Jeffrey Constantino became a co-manager of the fund.

The views expressed in this report are those of the portfolio managers only through the end of the period of the report as stated on the cover and do not necessarily reflect the views of MFS or any other person in the MFS organization. These views are subject to change at any time based on market or other conditions, and MFS disclaims any responsibility to update such views. These views may not be relied upon as investment advice or an indication of trading intent on behalf of any MFS portfolio. References to specific securities are not recommendations of such securities, and may not be representative of any MFS portfolio’s current or future investments.

5

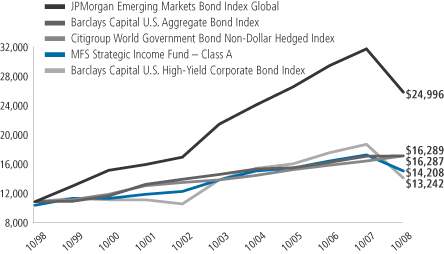

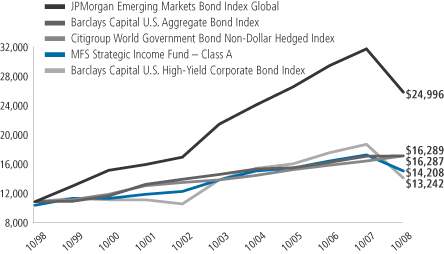

PERFORMANCE SUMMARY THROUGH 10/31/08

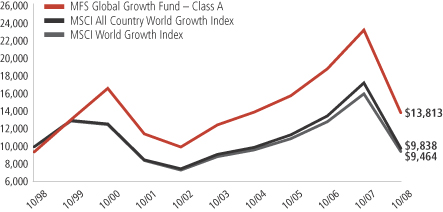

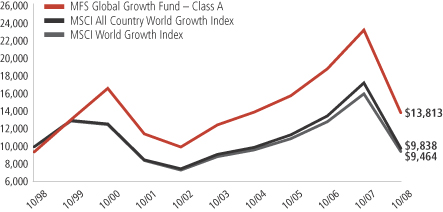

The following chart illustrates a representative class of the fund’s historical performance in comparison to its benchmarks. Performance results include the deduction of the maximum applicable sales charge and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. The performance of other share classes will be greater than or less than that of the class depicted below. Benchmark comparisons are unmanaged; do not reflect sales charges, commissions or expenses; and cannot be invested in directly. (See Notes to Performance Summary).

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value fluctuate so your shares, when sold, may be worth more or less than the original cost; current performance may be lower or higher than quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on fund distributions or the redemption of fund shares.

Growth of a Hypothetical $10,000 Investment

6

Performance Summary – continued

Total Returns through 10/31/08

Average annual without sales charge

| | | | | | | | | | | | |

| | | Share class | | Class inception date | | 1-yr | | 5-yr | | 10-yr | | |

| | | A | | 11/18/93 | | (40.34)% | | 2.08% | | 3.90% | | |

| | | B | | 11/18/93 | | (40.77)% | | 1.31% | | 3.13% | | |

| | | C | | 1/03/94 | | (40.77)% | | 1.31% | | 3.12% | | |

| | | I | | 1/02/97 | | (40.16)% | | 2.34% | | 4.16% | | |

| | | R1 | | 4/01/05 | | (40.80)% | | 1.23% | | 3.09% | | |

| | | R2

(formerly R3) | | 10/31/03 | | (40.70)% | | 1.58% | | 3.27% | | |

| | | R3

(formerly R4) | | 4/01/05 | | (40.37)% | | 2.00% | | 3.85% | | |

| | | R4

(formerly R5) | | 4/01/05 | | (40.20)% | | 2.21% | | 3.96% | | |

Comparative benchmark

| | | | | | | | | | | | |

| | | MSCI All Country World Growth Index (f) | | (42.80)% | | 1.50% | | (0.16)% | | |

| | | MSCI World Growth Index (f) | | (40.65)% | | 1.27% | | (0.55)% | | |

Average annual with sales charge

| | | | | | | | | | | | |

| | | A With Initial Sales Charge (5.75%) | | (43.77)% | | 0.88% | | 3.28% | | |

| | | B With CDSC (Declining over six years from 4% to 0%) (x) | | (43.14)% | | 0.93% | | 3.13% | | |

| | | C With CDSC (1% for 12 months) (x) | | (41.36)% | | 1.31% | | 3.12% | | |

Class I, R1, R2, R3, and R4 shares do not have a sales charge.

CDSC – Contingent Deferred Sales Charge.

| (f) | Source: FactSet Research Systems Inc. |

| (x) | Assuming redemption at the end of the applicable period. |

Benchmark Definitions

MSCI All Country World Growth Index – a market capitalization-weighted index that is designed to measure equity market performance for growth securities in the global developed and emerging markets.

MSCI World Growth Index – a market capitalization-weighted index that is designed to measure equity market performance for growth securities in the global developed markets.

It is not possible to invest directly in an index.

7

Performance Summary – continued

Notes to Performance Summary

Performance for Class R3 and Class R4 shares includes the performance of the fund’s Class A shares for periods prior to their offering. Performance for Class R1 and Class R2 shares includes the performance of the fund’s Class B shares for periods prior to their offering. This blended class performance has been adjusted to take into account differences in sales loads, if any, applicable to these share classes, but has not been adjusted to take into account differences in class specific operating expenses (such as Rule 12b-1 fees). Compared to performance these share classes would have experienced had they been offered for the entire period, the use of blended performance generally results in higher performance for share classes with higher operating expenses than the share class to which it is blended, and lower performance for share classes with lower operating expenses than the share class to which it is blended.

Performance results reflect any applicable expense subsidies and waivers in effect during the periods shown. Without such subsidies and waivers the fund’s performance results would be less favorable. Please see the prospectus and financial statements for complete details.

From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower.

8

EXPENSE TABLE

Fund expenses borne by the shareholders during the period,

May 1, 2008 through October 31, 2008

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period May 1, 2008 through October 31, 2008.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

9

Expense Table – continued

| | | | | | | | | | |

Share

Class | | | | Annualized

Expense

Ratio | | Beginning

Account Value

5/01/08 | | Ending

Account Value

10/31/08 | | Expenses

Paid During

Period (p)

5/01/08-10/31/08 |

| A | | Actual | | 1.50% | | $1,000.00 | | $647.15 | | $6.21 |

| | Hypothetical (h) | | 1.50% | | $1,000.00 | | $1,017.60 | | $7.61 |

| B | | Actual | | 2.26% | | $1,000.00 | | $644.70 | | $9.34 |

| | Hypothetical (h) | | 2.26% | | $1,000.00 | | $1,013.77 | | $11.44 |

| C | | Actual | | 2.26% | | $1,000.00 | | $644.75 | | $9.34 |

| | Hypothetical (h) | | 2.26% | | $1,000.00 | | $1,013.77 | | $11.44 |

| I | | Actual | | 1.25% | | $1,000.00 | | $648.03 | | $5.18 |

| | Hypothetical (h) | | 1.25% | | $1,000.00 | | $1,018.85 | | $6.34 |

| R1 | | Actual | | 2.26% | | $1,000.00 | | $644.58 | | $9.34 |

| | Hypothetical (h) | | 2.26% | | $1,000.00 | | $1,013.77 | | $11.44 |

| R2 (formerly R3) | | Actual | | 1.75% | | $1,000.00 | | $644.00 | | $7.23 |

| | Hypothetical (h) | | 1.75% | | $1,000.00 | | $1,016.34 | | $8.87 |

| R3 (formerly R4) | | Actual | | 1.51% | | $1,000.00 | | $646.84 | | $6.25 |

| | Hypothetical (h) | | 1.51% | | $1,000.00 | | $1,017.55 | | $7.66 |

| R4 (formerly R5) | | Actual | | 1.25% | | $1,000.00 | | $647.93 | | $5.18 |

| | Hypothetical (h) | | 1.25% | | $1,000.00 | | $1,018.85 | | $6.34 |

| (h) | 5% class return per year before expenses. |

| (p) | Expenses paid is equal to each class’ annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by the number of days in the period, divided by the number of days in the year. Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

10

PORTFOLIO OF INVESTMENTS

10/31/08

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| | | | | |

| Common Stocks - 99.4% | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | |

| Aerospace - 1.1% | | | | | |

| United Technologies Corp. | | 40,240 | | $ | 2,211,588 |

| | |

| Alcoholic Beverages - 1.9% | | | | | |

| Companhia de Bebidas das Americas, ADR | | 44,490 | | $ | 1,890,825 |

| Pernod Ricard S.A. | | 28,816 | | | 1,877,351 |

| | | | | |

| | | | | $ | 3,768,176 |

| Apparel Manufacturers - 4.2% | | | | | |

| Compagnie Financiere Richemont S.A. | | 52,735 | | $ | 1,121,270 |

| Li & Fung Ltd. | | 636,200 | | | 1,279,237 |

| LVMH Moet Hennessy Louis Vuitton S.A. | | 42,440 | | | 2,831,598 |

| NIKE, Inc., “B” | | 34,220 | | | 1,972,099 |

| Swatch Group Ltd. | | 5,856 | | | 915,922 |

| | | | | |

| | | | | $ | 8,120,126 |

| Biotechnology - 2.1% | | | | | |

| Actelion Ltd. (a) | | 32,249 | | $ | 1,705,073 |

| Genzyme Corp. (a) | | 32,060 | | | 2,336,533 |

| | | | | |

| | | | | $ | 4,041,606 |

| Broadcasting - 4.0% | | | | | |

| Grupo Televisa S.A., ADR | | 114,580 | | $ | 2,023,483 |

| Societe Television Francaise 1 | | 70,093 | | | 898,956 |

| Walt Disney Co. | | 75,160 | | | 1,946,644 |

| WPP Group PLC (a) | | 482,320 | | | 2,910,831 |

| | | | | |

| | | | | $ | 7,779,914 |

| Brokerage & Asset Managers - 3.7% | | | | | |

| Daiwa Securities Group, Inc. | | 285,000 | | $ | 1,582,991 |

| Deutsche Boerse AG | | 26,760 | | | 2,136,769 |

| Goldman Sachs Group, Inc. | | 16,190 | | | 1,497,575 |

| Julius Baer Holding Ltd. | | 49,845 | | | 1,962,111 |

| | | | | |

| | | | | $ | 7,179,446 |

| Business Services - 4.8% | | | | | |

| Accenture Ltd., “A” | | 63,760 | | $ | 2,107,268 |

| Infosys Technologies Ltd., ADR | | 66,980 | | | 1,963,854 |

| Intertek Group PLC | | 106,160 | | | 1,256,106 |

11

Portfolio of Investments – continued

| | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | |

| Common Stocks - continued | | | | | |

| Business Services - continued | | | | | |

| MasterCard, Inc., “A” | | 9,730 | | $ | 1,438,289 |

| Visa, Inc., “A” | | 47,480 | | | 2,628,018 |

| | | | | |

| | | | | $ | 9,393,535 |

| Chemicals - 1.7% | | | | | |

| 3M Co. | | 50,450 | | $ | 3,243,935 |

| | |

| Computer Software - 2.2% | | | | | |

| Oracle Corp. (a) | | 139,640 | | $ | 2,554,016 |

| SAP AG | | 49,340 | | | 1,754,246 |

| | | | | |

| | | | | $ | 4,308,262 |

| Computer Software - Systems - 3.2% | | | | | |

| Apple, Inc. (a) | | 20,050 | | $ | 2,157,180 |

| EMC Corp. (a) | | 179,690 | | | 2,116,748 |

| International Business Machines Corp. | | 21,330 | | | 1,983,050 |

| | | | | |

| | | | | $ | 6,256,978 |

| Conglomerates - 0.7% | | | | | |

| Siemens AG | | 21,750 | | $ | 1,301,286 |

| | |

| Consumer Goods & Services - 6.3% | | | | | |

| Alberto-Culver Co. | | 70,340 | | $ | 1,809,848 |

| Colgate-Palmolive Co. | | 19,660 | | | 1,233,862 |

| Hengan International Group Co. Ltd. | | 696,000 | | | 1,962,902 |

| Procter & Gamble Co. | | 46,320 | | | 2,989,493 |

| Reckitt Benckiser Group PLC | | 57,250 | | | 2,404,731 |

| Shiseido Co. Ltd. | | 91,000 | | | 1,843,355 |

| | | | | |

| | | | | $ | 12,244,191 |

| Containers - 1.3% | | | | | |

| Brambles Ltd. | | 479,910 | | $ | 2,541,516 |

| | |

| Electrical Equipment - 2.2% | | | | | |

| Danaher Corp. | | 17,340 | | $ | 1,027,222 |

| Keyence Corp. | | 6,700 | | | 1,293,854 |

| Schneider Electric S.A. | | 33,797 | | | 2,033,023 |

| | | | | |

| | | | | $ | 4,354,099 |

| Electronics - 7.5% | | | | | |

| Canon, Inc. | | 42,300 | | $ | 1,455,608 |

| Hirose Electric Co. Ltd. | | 24,000 | | | 2,098,101 |

| Hoya Corp. | | 51,700 | | | 958,329 |

12

Portfolio of Investments – continued

| | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | |

| Common Stocks - continued | | | | | |

| Electronics - continued | | | | | |

| Intel Corp. | | 115,010 | | $ | 1,840,160 |

| Konica Minolta Holdings, Inc. | | 103,500 | | | 673,754 |

| National Semiconductor Corp. | | 120,860 | | | 1,591,726 |

| Royal Philips Electronics N.V. | | 59,240 | | | 1,093,713 |

| Samsung Electronics Co. Ltd. | | 6,370 | | | 2,661,907 |

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR | | 273,935 | | | 2,262,703 |

| | | | | |

| | | | | $ | 14,636,001 |

| Energy - Independent - 1.5% | | | | | |

| INPEX Holdings, Inc. | | 513 | | $ | 2,983,162 |

| | |

| Energy - Integrated - 3.8% | | | | | |

| OAO Gazprom, ADR | | 110,210 | | $ | 2,224,037 |

| Petroleo Brasileiro S.A., ADR | | 54,760 | | | 1,472,496 |

| TOTAL S.A. | | 66,790 | | | 3,668,426 |

| | | | | |

| | | | | $ | 7,364,959 |

| Food & Beverages - 5.1% | | | | | |

| Groupe Danone | | 33,671 | | $ | 1,864,244 |

| Nestle S.A. | | 140,282 | | | 5,468,117 |

| PepsiCo, Inc. | | 44,570 | | | 2,540,936 |

| | | | | |

| | | | | $ | 9,873,297 |

| Food & Drug Stores - 2.0% | | | | | |

| CVS Caremark Corp. | | 71,500 | | $ | 2,191,475 |

| Tesco PLC | | 320,479 | | | 1,750,499 |

| | | | | |

| | | | | $ | 3,941,974 |

| Gaming & Lodging - 0.4% | | | | | |

| International Game Technology | | 59,800 | | $ | 837,200 |

| | |

| Internet - 1.2% | | | | | |

| Google, Inc., “A” (a) | | 6,570 | | $ | 2,360,995 |

| | |

| Major Banks - 5.7% | | | | | |

| Bank of New York Mellon Corp. | | 48,320 | | $ | 1,575,232 |

| Credit Suisse Group AG | | 48,940 | | | 1,867,871 |

| Erste Bank der oesterreichischen Sparkassen AG | | 51,560 | | | 1,395,603 |

| HSBC Holdings PLC | | 163,536 | | | 1,973,960 |

| Raiffeisen International Bank Holding AG | | 22,070 | | | 698,655 |

| Standard Chartered PLC | | 109,223 | | | 1,813,370 |

| State Street Corp. | | 38,500 | | | 1,668,975 |

| | | | | |

| | | | | $ | 10,993,666 |

13

Portfolio of Investments – continued

| | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | |

| Common Stocks - continued | | | | | |

| Medical Equipment - 3.7% | | | | | |

| Essilor International S.A. | | 26,080 | | $ | 1,170,973 |

| Medtronic, Inc. | | 48,580 | | | 1,959,231 |

| Synthes, Inc. | | 15,180 | | | 1,959,975 |

| Zimmer Holdings, Inc. (a) | | 46,900 | | | 2,177,567 |

| | | | | |

| | | | | $ | 7,267,746 |

| Network & Telecom - 3.8% | | | | | |

| Cisco Systems, Inc. (a) | | 137,080 | | $ | 2,435,912 |

| NICE Systems Ltd., ADR (a) | | 46,080 | | | 1,030,349 |

| Nokia Oyj | | 139,280 | | | 2,124,444 |

| Research in Motion Ltd. (a) | | 33,760 | | | 1,702,517 |

| | | | | |

| | | | | $ | 7,293,222 |

| Oil Services - 1.3% | | | | | |

| Halliburton Co. | | 47,050 | | $ | 931,120 |

| Schlumberger Ltd. | | 31,590 | | | 1,631,624 |

| Vallourec S.A. | | 40 | | | 4,498 |

| | | | | |

| | | | | $ | 2,567,242 |

| Other Banks & Diversified Financials - 2.5% | | | | | |

| Aeon Credit Service Co. Ltd. (a) | | 148,900 | | $ | 1,617,646 |

| American Express Co. | | 48,690 | | | 1,338,975 |

| Housing Development Finance Corp. Ltd. | | 53,259 | | | 1,954,239 |

| | | | | |

| | | | | $ | 4,910,860 |

| Pharmaceuticals - 7.5% | | | | | |

| Allergan, Inc. | | 57,420 | | $ | 2,277,851 |

| Bayer AG | | 30,700 | | | 1,688,794 |

| Novartis AG | | 54,360 | | | 2,749,999 |

| Novo Nordisk A/S, “B” | | 60,175 | | | 3,221,200 |

| Roche Holding AG | | 30,070 | | | 4,602,688 |

| | | | | |

| | | | | $ | 14,540,532 |

| Railroad & Shipping - 1.1% | | | | | |

| East Japan Railway Co. | | 297 | | $ | 2,110,504 |

| | |

| Restaurants - 1.0% | | | | | |

| YUM! Brands, Inc. | | 68,260 | | $ | 1,980,223 |

| | |

| Specialty Chemicals - 5.8% | | | | | |

| Akzo Nobel N.V. | | 50,320 | | $ | 2,093,849 |

| L’Air Liquide S.A. | | 21,552 | | | 1,857,588 |

| Linde AG | | 23,750 | | | 1,966,438 |

14

Portfolio of Investments – continued

| | | | | | | |

| Issuer | | Shares/Par | | Value ($) | |

| | | | | | | |

| Common Stocks - continued | | | | | | | |

| Specialty Chemicals - continued | | | | | | | |

| Praxair, Inc. | | | 30,000 | | $ | 1,954,500 | |

| Shin-Etsu Chemical Co. Ltd. | | | 44,900 | | | 2,349,735 | |

| Symrise AG | | | 88,757 | | | 1,098,168 | |

| | | | | | | |

| | | | | | $ | 11,320,278 | |

| Specialty Stores - 1.3% | | | | | | | |

| Industria de Diseno Textile S.A. | | | 41,000 | | $ | 1,385,113 | |

| Staples, Inc. | | | 53,780 | | | 1,044,945 | |

| | | | | | | |

| | | | | | $ | 2,430,058 | |

| Telecommunications - Wireless - 2.5% | | | | | | | |

| America Movil S.A.B. de C.V., “L”, ADR | | | 62,960 | | $ | 1,947,982 | |

| MTN Group Ltd. | | | 133,450 | | | 1,505,995 | |

| Rogers Communications, Inc., “B” | | | 48,220 | | | 1,399,832 | |

| | | | | | | |

| | | | | | $ | 4,853,809 | |

| Telephone Services - 1.4% | | | | | | | |

| Telefonica S.A. | | | 146,850 | | $ | 2,716,312 | |

| | |

| Utilities - Electric Power - 0.9% | | | | | | | |

| E.ON AG | | | 45,663 | | $ | 1,742,806 | |

| Total Common Stocks (Identified Cost, $267,371,596) | | | | | $ | 193,469,504 | |

| | |

| Money Market Funds (v) - 1.3% | | | | | | | |

MFS Institutional Money Market Portfolio, 0.93%,

at Cost and Net Asset Value | | $ | 2,572,621 | | $ | 2,572,621 | |

| Total Investments (Identified Cost, $269,944,217) (k) | | | | | $ | 196,042,125 | |

| | |

| Other Assets, Less Liabilities - (0.7)% | | | | | | (1,378,863 | ) |

| Net Assets - 100.0% | | | | | $ | 194,663,262 | |

| (a) | Non-income producing security. |

| (k) | As of October 31, 2008 the fund had 50 securities that were fair valued, aggregating $96,488,840 and 49.22% of market value, in accordance with the policies adopted by the Board of Trustees. |

| (v) | Underlying fund that is available only to investment companies managed by MFS. The rate quoted is the annualized seven-day yield of the fund at period end. |

The following abbreviations are used in this report and are defined:

| ADR | | American Depository Receipt |

See Notes to Financial Statements

15

Financial Statements

STATEMENT OF ASSETS AND LIABILITIES

At 10/31/08

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| | | | | |

| Assets | | | | | |

Investments- | | | | | |

Non-affiliated issuers, at value (identified cost, $267,371,596) | | $193,469,504 | | | |

Underlying funds, at cost and value | | 2,572,621 | | | |

Total investments, at value (identified cost, $269,944,217) | | | | | $196,042,125 |

Foreign currency, at value (identified cost, $2,914) | | 2,914 | | | |

Receivable for investments sold | | 2,697,423 | | | |

Receivable for fund shares sold | | 36,637 | | | |

Interest and dividends receivable | | 380,283 | | | |

Total assets | | | | | $199,159,382 |

| Liabilities | | | | | |

Payable to custodian | | $58,226 | | | |

Payable for investments purchased | | 2,412,878 | | | |

Payable for fund shares reacquired | | 1,767,886 | | | |

Payable to affiliates | | | | | |

Management fee | | 9,279 | | | |

Shareholder servicing costs | | 83,258 | | | |

Distribution and service fees | | 3,801 | | | |

Administrative services fee | | 222 | | | |

Payable for independent trustees’ compensation | | 42,107 | | | |

Accrued expenses and other liabilities | | 118,463 | | | |

Total liabilities | | | | | $4,496,120 |

Net assets | | | | | $194,663,262 |

| Net assets consist of | | | | | |

Paid-in capital | | $274,491,312 | | | |

Unrealized appreciation (depreciation) on investments and translation of assets and liabilities in foreign currencies | | (73,903,850 | ) | | |

Accumulated net realized gain (loss) on investments and foreign currency transactions | | (5,898,348 | ) | | |

Accumulated distributions in excess of net investment income | | (25,852 | ) | | |

Net assets | | | | | $194,663,262 |

Shares of beneficial interest outstanding | | | | | 11,348,853 |

16

Statement of Assets and Liabilities – continued

| | | | |

Class A shares | | | | |

Net assets | | $153,184,207 | | |

Shares outstanding | | 8,829,256 | | |

Net asset value per share | | | | $17.35 |

Offering price per share (100/94.25 × net asset value per share) | | | | $18.41 |

Class B shares | | | | |

Net assets | | $19,582,321 | | |

Shares outstanding | | 1,205,907 | | |

Net asset value and offering price per share | | | | $16.24 |

Class C shares | | | | |

Net assets | | $10,325,615 | | |

Shares outstanding | | 642,279 | | |

Net asset value and offering price per share | | | | $16.08 |

Class I shares | | | | |

Net assets | | $4,306,003 | | |

Shares outstanding | | 242,929 | | |

Net asset value, offering price, and redemption price per share | | | | $17.73 |

Class R1 shares | | | | |

Net assets | | $631,735 | | |

Shares outstanding | | 39,353 | | |

Net asset value, offering price, and redemption price per share | | | | $16.05 |

Class R2 shares (formerly Class R3 shares) | | | | |

Net assets | | $4,808,426 | | |

Shares outstanding | | 283,624 | | |

Net asset value, offering price, and redemption price per share | | | | $16.95 |

Class R3 shares (formerly Class R4 shares) | | | | |

Net assets | | $1,778,528 | | |

Shares outstanding | | 102,838 | | |

Net asset value, offering price, and redemption price per share | | | | $17.29 |

Class R4 shares (formerly Class R5 shares) | | | | |

Net assets | | $46,427 | | |

Shares outstanding | | 2,667 | | |

Net asset value, offering price, and redemption price per share | | | | $17.41 |

On sales of $50,000 or more, the offering price of Class A shares is reduced. A contingent deferred sales charge may be imposed on redemptions of Class A, Class B, and Class C shares.

Shares outstanding are rounded for presentation purposes.

See Notes to Financial Statements

17

Financial Statements

STATEMENT OF OPERATIONS

Year ended 10/31/08

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| | | | | | |

| Net investment income | | | | | | |

Income | | | | | | |

Dividends | | $5,865,774 | | | | |

Interest | | 121,562 | | | | |

Dividends from underlying funds | | 90,456 | | | | |

Foreign taxes withheld | | (378,466 | ) | | | |

Total investment income | | | | | $5,699,326 | |

Expenses | | | | | | |

Management fee | | $2,826,530 | | | | |

Distribution and service fees | | 1,457,316 | | | | |

Shareholder servicing costs | | 638,046 | | | | |

Administrative services fee | | 52,301 | | | | |

Retirement plan administration and services fees | | 4,107 | | | | |

Independent trustees’ compensation | | 5,424 | | | | |

Custodian fee | | 208,262 | | | | |

Shareholder communications | | 26,978 | | | | |

Auditing fees | | 73,928 | | | | |

Legal fees | | 6,921 | | | | |

Miscellaneous | | 142,512 | | | | |

Total expenses | | | | | $5,442,325 | |

Fees paid indirectly | | (766 | ) | | | |

Reduction of expenses by investment adviser and distributor | | (239,987 | ) | | | |

Net expenses | | | | | $5,201,572 | |

Net investment income | | | | | $497,754 | |

Realized and unrealized gain (loss) on investments

and foreign currency transactions | | | | | | |

Realized gain (loss) (identified cost basis) | | | | | | |

Investment transactions | | $3,899,229 | | | | |

Foreign currency transactions | | (180,452 | ) | | | |

Net realized gain (loss) on investments

and foreign currency transactions | | | | | $3,718,777 | |

Change in unrealized appreciation (depreciation) | | | | | | |

Investments (net of $81,167 decrease in deferred country tax) | | $(148,469,051 | ) | | | |

Translation of assets and liabilities in foreign currencies | | (19,128 | ) | | | |

Net unrealized gain (loss) on investments

and foreign currency translation | | | | | $(148,488,179 | ) |

Net realized and unrealized gain (loss) on investments

and foreign currency | | | | | $(144,769,402 | ) |

Change in net assets from operations | | | | | $(144,271,648 | ) |

See Notes to Financial Statements

18

Financial Statements

STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| | | | | | |

| | | Year ended 10/31 | |

| | | 2008 | | | 2007 | |

| Change in net assets | | | | | | |

| From operations | | | | | | |

Net investment income | | $497,754 | | | $3,167,148 | |

Net realized gain (loss) on investments and

foreign currency transactions | | 3,718,777 | | | 61,903,461 | |

Net unrealized gain (loss) on investments and

foreign currency translation | | (148,488,179 | ) | | 17,282,988 | |

Change in net assets from operations | | $(144,271,648 | ) | | $82,353,597 | |

| Distributions declared to shareholders | | | | | | |

From net investment income | | | | | | |

Class A | | $(1,726,947 | ) | | $(2,861,070 | ) |

Class B | | — | | | (164,047 | ) |

Class C | | (2,099 | ) | | (60,897 | ) |

Class I | | (59,758 | ) | | (88,085 | ) |

Class R (b) | | — | | | (27,079 | ) |

Class R1 | | (7,483 | ) | | (526 | ) |

Former Class R2 (b) | | (2,230 | ) | | (1,478 | ) |

Class R2 (formerly Class R3) | | (32,323 | ) | | (3,363 | ) |

Class R3 (formerly Class R4) | | (19,553 | ) | | (17,370 | ) |

Class R4 (formerly Class R5) | | (555 | ) | | (727 | ) |

Total distributions declared to shareholders | | $(1,850,948 | ) | | $(3,224,642 | ) |

Change in net assets from fund share transactions | | $(61,887,349 | ) | | $(77,431,825 | ) |

Total change in net assets | | $(208,009,945 | ) | | $1,697,130 | |

| Net assets | | | | | | |

At beginning of period | | 402,673,207 | | | 400,976,077 | |

At end of period (including accumulated distributions in excess of net investment income of $25,852 and undistributed net investment income of $1,778,279, respectively) | | $194,663,262 | | | $402,673,207 | |

| (b) | At the close of business on April 18, 2008, Class R and Class R2 shares converted into Class R3 shares. Following the conversion, Class R3 shares were renamed Class R2 shares. |

See Notes to Financial Statements

19

Financial Statements

FINANCIAL HIGHLIGHTS

The financial highlights table is intended to help you understand the fund’s financial performance for the past 5 years (or life of a particular share class, if shorter). Certain information reflects financial results for a single fund share. The total returns in the table represent the rate by which an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| | | | | | | | | | | | | |

| Class A | | Years ended 10/31 | |

| | | 2008 | | | 2007 | | | 2006 | | 2005 | | 2004 | |

Net asset value, beginning of period | | $29.26 | | | $23.97 | | | $20.10 | | $17.76 | | $15.91 | |

| Income (loss) from investment operations | | | | | | | | | | | | | |

Net investment income (loss) (d) | | $0.08 | | | $0.25 | | | $0.11 | | $0.01 | | $(0.01 | ) |

Net realized and unrealized gain (loss)

on investments and foreign currency | | (11.82 | ) | | 5.28 | | | 3.76 | | 2.33 | | 1.86 | |

Total from investment operations | | $(11.74 | ) | | $5.53 | | | $3.87 | | $2.34 | | $1.85 | |

Less distributions declared to

shareholders | | | | | | | | | | | | | |

From net investment income | | $(0.17 | ) | | $(0.24 | ) | | $— | | $— | | $— | |

Net asset value, end of period | | $17.35 | | | $29.26 | | | $23.97 | | $20.10 | | $17.76 | |

Total return (%) (r)(s)(t) | | (40.34 | ) | | 23.24 | | | 19.25 | | 13.18 | | 11.70 | (b)(q) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 1.62 | | | 1.58 | | | 1.61 | | 1.69 | | 1.70 | |

Expenses after expense reductions (f) | | 1.52 | | | 1.48 | | | 1.51 | | 1.59 | | 1.60 | |

Net investment income (loss) | | 0.30 | | | 0.97 | | | 0.49 | | 0.07 | | (0.04 | ) |

Portfolio turnover | | 88 | | | 68 | | | 96 | | 92 | | 163 | |

Net assets at end of period (000 Omitted) | | $153,184 | | | $297,956 | | | $290,952 | | $290,256 | | $304,348 | |

See Notes to Financial Statements

20

Financial Highlights – continued

| | | | | | | | | | | | | | | |

| Class B | | Years ended 10/31 | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

Net asset value, beginning of period | | $27.42 | | | $22.46 | | | $18.98 | | | $16.90 | | | $15.25 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | $(0.11 | ) | | $0.06 | | | $(0.05 | ) | | $(0.13 | ) | | $(0.13 | ) |

Net realized and unrealized gain (loss)

on investments and foreign currency | | (11.07 | ) | | 4.95 | | | 3.53 | | | 2.21 | | | 1.78 | |

Total from investment operations | | $(11.18 | ) | | $5.01 | | | $3.48 | | | $2.08 | | | $1.65 | |

Less distributions declared to

shareholders | | | | | | | | | | | | | | | |

From net investment income | | $— | | | $(0.05 | ) | | $— | | | $— | | | $— | |

Net asset value, end of period | | $16.24 | | | $27.42 | | | $22.46 | | | $18.98 | | | $16.90 | |

Total return (%) (r)(s)(t) | | (40.77 | ) | | 22.35 | | | 18.34 | | | 12.31 | | | 10.82 | (b)(q) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 2.27 | | | 2.23 | | | 2.26 | | | 2.34 | | | 2.35 | |

Expenses after expense reductions (f) | | 2.27 | | | 2.23 | | | 2.26 | | | 2.34 | | | 2.35 | |

Net investment income (loss) | | (0.47 | ) | | 0.25 | | | (0.26 | ) | | (0.70 | ) | | (0.81 | ) |

Portfolio turnover | | 88 | | | 68 | | | 96 | | | 92 | | | 163 | |

Net assets at end of period (000 Omitted) | | $19,582 | | | $64,416 | | | $75,573 | | | $87,769 | | | $108,750 | |

| | | | | | | | | | | | | | | |

| Class C | | Years ended 10/31 | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

Net asset value, beginning of period | | $27.15 | | | $22.26 | | | $18.80 | | | $16.74 | | | $15.11 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | $(0.11 | ) | | $0.05 | | | $(0.06 | ) | | $(0.13 | ) | | $(0.13 | ) |

Net realized and unrealized gain (loss)

on investments and foreign currency | | (10.96 | ) | | 4.91 | | | 3.52 | | | 2.19 | | | 1.76 | |

Total from investment operations | | $(11.07 | ) | | $4.96 | | | $3.46 | | | $2.06 | | | $1.63 | |

Less distributions declared to

shareholders | | | | | | | | | | | | | | | |

From net investment income | | $(0.00 | )(w) | | $(0.07 | ) | | $— | | | $— | | | $— | |

Net asset value, end of period | | $16.08 | | | $27.15 | | | $22.26 | | | $18.80 | | | $16.74 | |

Total return (%) (r)(s)(t) | | (40.77 | ) | | 22.33 | | | 18.40 | | | 12.31 | | | 10.79 | (b)(q) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 2.27 | | | 2.23 | | | 2.26 | | | 2.34 | | | 2.35 | |

Expenses after expense reductions (f) | | 2.27 | | | 2.23 | | | 2.26 | | | 2.34 | | | 2.35 | |

Net investment income (loss) | | (0.45 | ) | | 0.21 | | | (0.27 | ) | | (0.69 | ) | | (0.81 | ) |

Portfolio turnover | | 88 | | | 68 | | | 96 | | | 92 | | | 163 | |

Net assets at end of period (000 Omitted) | | $10,326 | | | $20,249 | | | $20,450 | | | $20,924 | | | $21,945 | |

See Notes to Financial Statements

21

Financial Highlights – continued

| | | | | | | | | | | | | |

| Class I | | Years ended 10/31 | |

| | | 2008 | | | 2007 | | | 2006 | | 2005 | | 2004 | |

Net asset value, beginning of period | | $29.87 | | | $24.46 | | | $20.46 | | $18.04 | | $16.11 | |

| Income (loss) from investment operations | | | | | | | | | | | | | |

Net investment income (d) | | $0.14 | | | $0.32 | | | $0.17 | | $0.06 | | $0.04 | |

Net realized and unrealized gain (loss)

on investments and foreign currency | | (12.05 | ) | | 5.39 | | | 3.83 | | 2.36 | | 1.89 | |

Total from investment operations | | $(11.91 | ) | | $5.71 | | | $4.00 | | $2.42 | | $1.93 | |

Less distributions declared to

shareholders | | | | | | | | | | | | | |

From net investment income | | $(0.23 | ) | | $(0.30 | ) | | $— | | $— | | $— | |

Net asset value, end of period | | $17.73 | | | $29.87 | | | $24.46 | | $20.46 | | $18.04 | |

Total return (%) (r)(s) | | (40.16 | ) | | 23.57 | | | 19.55 | | 13.41 | | 11.98 | (b)(q) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 1.27 | | | 1.23 | | | 1.26 | | 1.34 | | 1.34 | |

Expenses after expense reductions (f) | | 1.27 | | | 1.23 | | | 1.26 | | 1.34 | | 1.34 | |

Net investment income | | 0.54 | | | 1.22 | | | 0.74 | | 0.31 | | 0.21 | |

Portfolio turnover | | 88 | | | 68 | | | 96 | | 92 | | 163 | |

Net assets at end of period (000 Omitted) | | $4,306 | | | $7,739 | | | $7,368 | | $7,233 | | $7,011 | |

| | | | | | | | | | | | |

| Class R1 | | Years ended 10/31 | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 (i) | |

Net asset value, beginning of period | | $27.29 | | | $22.42 | | | $18.96 | | | $18.12 | |

| Income (loss) from investment operations | | | | | | | | | | | | |

Net investment loss (d) | | $(0.12 | ) | | $(0.10 | ) | | $(0.07 | ) | | $(0.08 | ) |

Net realized and unrealized gain (loss)

on investments and foreign currency | | (10.95 | ) | | 5.06 | | | 3.53 | | | 0.92 | (g) |

Total from investment operations | | $(11.07 | ) | | $4.96 | | | $3.46 | | | $0.84 | |

| Less distributions declared to shareholders | | | | | | | | | | | | |

From net investment income | | $(0.17 | ) | | $(0.09 | ) | | $— | | | $— | |

Net asset value, end of period | | $16.05 | | | $27.29 | | | $22.42 | | | $18.96 | |

Total return (%) (r)(s) | | (40.80 | ) | | 22.17 | | | 18.25 | | | 4.64 | (n) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 2.31 | | | 2.35 | | | 2.45 | | | 2.54 | (a) |

Expenses after expense reductions (f) | | 2.31 | | | 2.33 | | | 2.35 | | | 2.52 | (a) |

Net investment loss | | (0.53 | ) | | (0.43 | ) | | (0.35 | ) | | (0.77 | )(a) |

Portfolio turnover | | 88 | | | 68 | | | 96 | | | 92 | |

Net assets at end of period (000 Omitted) | | $632 | | | $1,009 | | | $127 | | | $104 | |

See Notes to Financial Statements

22

Financial Highlights – continued

| | | | | | | | | | | | | | |

| Class R2 (formerly Class R3) | | Years ended 10/31 | |

| | | 2008 | | | 2007 | | | 2006 | | 2005 | | | 2004 | |

Net asset value, beginning of period | | $28.77 | | | $23.58 | | | $19.85 | | $17.63 | | | $15.87 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | $0.02 | | | $0.04 | | | $0.03 | | $(0.06 | ) | | $(0.07 | ) |

Net realized and unrealized gain (loss)

on investments and foreign currency | | (11.66 | ) | | 5.29 | | | 3.70 | | 2.28 | | | 1.83 | |

Total from investment operations | | $(11.64 | ) | | $5.33 | | | $3.73 | | $2.22 | | | $1.76 | |

Less distributions declared to

shareholders | | | | | | | | | | | | | | |

From net investment income | | $(0.18 | ) | | $(0.14 | ) | | $— | | $— | | | $— | |

Net asset value, end of period | | $16.95 | | | $28.77 | | | $23.58 | | $19.85 | | | $17.63 | |

Total return (%) (r)(s) | | (40.70 | ) | | 22.73 | | | 18.79 | | 12.59 | | | 11.09 | (b)(q) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 1.79 | | | 1.90 | | | 2.00 | | 2.10 | | | 2.08 | |

Expenses after expense reductions (f) | | 1.79 | | | 1.88 | | | 1.90 | | 2.09 | | | 2.08 | |

Net investment income (loss) | | 0.06 | | | 0.16 | | | 0.15 | | (0.29 | ) | | (0.45 | ) |

Portfolio turnover | | 88 | | | 68 | | | 96 | | 92 | | | 163 | |

Net assets at end of period (000 Omitted) | | $4,808 | | | $4,168 | | | $619 | | $466 | | | $239 | |

| | | | | | | | | | | |

| Class R3 (formerly Class R4) | | Years ended 10/31 | |

| | | 2008 | �� | | 2007 | | | 2006 | | 2005 (i) | |

Net asset value, beginning of period | | $29.16 | | | $23.91 | | | $20.08 | | $19.10 | |

| Income (loss) from investment operations | | | | | | | | | | | |

Net investment income (d) | | $0.07 | | | $0.15 | | | $0.11 | | $0.02 | |

Net realized and unrealized gain (loss)

on investments and foreign currency | | (11.78 | ) | | 5.33 | | | 3.72 | | 0.96 | (g) |

Total from investment operations | | $(11.71 | ) | | $5.48 | | | $3.83 | | $0.98 | |

| Less distributions declared to shareholders | | | | | | | | | | | |

From net investment income | | $(0.16 | ) | | $(0.23 | ) | | $— | | $— | |

Net asset value, end of period | | $17.29 | | | $29.16 | | | $23.91 | | $20.08 | |

Total return (%) (r)(s) | | (40.37 | ) | | 23.10 | | | 19.07 | | 5.13 | (n) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | |

Expenses before expense reductions (f) | | 1.55 | | | 1.62 | | | 1.64 | | 1.75 | (a) |

Expenses after expense reductions (f) | | 1.55 | | | 1.62 | | | 1.64 | | 1.75 | (a) |

Net investment income | | 0.28 | | | 0.58 | | | 0.48 | | 0.20 | (a) |

Portfolio turnover | | 88 | | | 68 | | | 96 | | 92 | |

Net assets at end of period (000 Omitted) | | $1,779 | | | $3,563 | | | $1,857 | | $53 | |

See Notes to Financial Statements

23

Financial Highlights – continued

| | | | | | | | | | | |

| Class R4 (formerly Class R5) | | Years ended 10/31 | |

| | | 2008 | | | 2007 | | | 2006 | | 2005 (i) | |

Net asset value, beginning of period | | $29.33 | | | $24.02 | | | $20.11 | | $19.10 | |

| Income (loss) from investment operations | | | | | | | | | | | |

Net investment income (d) | | $0.14 | | | $0.28 | | | $0.14 | | $0.06 | |

Net realized and unrealized gain (loss)

on investments and foreign currency | | (11.85 | ) | | 5.31 | | | 3.77 | | 0.95 | (g) |

Total from investment operations | | $(11.71 | ) | | $5.59 | | | $3.91 | | $1.01 | |

| Less distributions declared to shareholders | | | | | | | | | | | |

From net investment income | | $(0.21 | ) | | $(0.28 | ) | | $— | | $— | |

Net asset value, end of period | | $17.41 | | | $29.33 | | | $24.02 | | $20.11 | |

Total return (%) (r)(s) | | (40.20 | ) | | 23.47 | | | 19.44 | | 5.29 | (n) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | |

Expenses before expense reductions (f) | | 1.29 | | | 1.33 | | | 1.35 | | 1.45 | (a) |

Expenses after expense reductions (f) | | 1.29 | | | 1.33 | | | 1.35 | | 1.45 | (a) |

Net investment income | | 0.54 | | | 1.07 | | | 0.65 | | 0.50 | (a) |

Portfolio turnover | | 88 | | | 68 | | | 96 | | 92 | |

Net assets at end of period (000 Omitted) | | $46 | | | $78 | | | $63 | | $53 | |

Any redemption fees charged by the fund during the 2004 and 2005 fiscal years resulted in a per share impact of less than $0.01.

| (b) | The fund’s net asset value and total return calculation include a non-recurring accrual recorded as a result of an administrative proceeding regarding disclosure of brokerage allocation practices in connection with fund sales. The non-recurring accrual did not have a material impact on the net asset value per share based on the shares outstanding on the day the proceeds were recorded. |

| (d) | Per share data are based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly, if applicable. |

| (g) | The per share amount is not in accordance with the net realized and unrealized gain/loss for the period because of the timing of sales of fund shares and the per share amount of realized and unrealized gains and losses at such time. |

| (i) | For the period from the class’ inception, April 1, 2005 (Classes R1, R3, and R4) through the stated period end. |

| (q) | The fund’s net asset value and total return calculation include proceeds received on March 19, 2004 for the remaining payment of a non-recurring litigation settlement from Cendant Corporation, recorded as a realized gain on investment transactions. The proceeds resulted in an increase in the net asset value of $0.01 per share based on shares outstanding on the day the proceeds were received. Excluding the effect of this payment from the ending net asset value per shared, total return for the year ended October 31, 2004 for Class A, Class B, Class C, Class I, Class R and Class R2 (formerly Class R3) would have been 0.05%, 0.05%, 0.06%, 0.05%, 0.06%, and 0.05% lower, respectively. |

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (s) | From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower. |

| (t) | Total returns do not include any applicable sales charges. |

| (w) | Per share amount was less than $0.01. |

See Notes to Financial Statements

24

NOTES TO FINANCIAL STATEMENTS

| (1) | | Business and Organization |

MFS Global Growth Fund (the fund) is a series of MFS Series Trust VIII (the trust). The trust is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company.

| (2) | | Significant Accounting Policies |

General – The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. The fund can invest in foreign securities, including securities of emerging market issuers. Investments in foreign securities are vulnerable to the effects of changes in the relative values of the local currency and the U.S. dollar and to the effects of changes in each country’s legal, political, and economic environment. The markets of emerging markets countries are generally more volatile than the markets of developed countries with more mature economies. All of the risks of investing in foreign securities previously described are heightened when investing in emerging markets countries.

FASB Statement No. 161, Disclosures about Derivative Instruments and Hedging Activities, effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008, and FASB Staff Position (FSP) 133-1, effective for fiscal years and interim periods ending after November 15, 2008 (the “Standards”) were recently issued. These Standards provide enhanced disclosures about the fund’s use of and accounting for derivative instruments and the effect of derivative instruments on the fund’s results of operations and financial position. Management is evaluating the application of the Standards to the fund, and has not at this time determined the impact, resulting from the adoption of these Standards on the fund’s financial statements.

Investment Valuations – Equity securities, including restricted equity securities, are generally valued at the last sale or official closing price as reported by a third party pricing service on the market or exchange on which they are primarily traded. For securities for which there were no sales reported that day, equity securities are generally valued at the last quoted daily bid quotation as reported by a third party pricing service on the market or exchange on which they are primarily traded. For securities held short for which there were no sales reported for the day, the position is generally valued

25

Notes to Financial Statements – continued

at the last quoted daily ask quotation as reported by a third party pricing service on the market or exchange on which such securities are primarily traded. Short-term instruments with a maturity at issuance of 60 days or less may be valued at amortized cost, which approximates market value. Open-end investment companies are generally valued at net asset value per share. Securities and other assets generally valued on the basis of information from a third party pricing service may also be valued at a broker-dealer bid quotation. Values obtained from pricing services can utilize both dealer-supplied valuations and electronic data processing techniques, which take into account factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics, and other market data. The values of foreign securities and other assets and liabilities expressed in foreign currencies are converted to U.S. dollars using the mean of bid and asked prices for rates reported by a third party pricing service.

The Board of Trustees has delegated primary responsibility for determining or causing to be determined the value of the fund’s investments (including any fair valuation) to the adviser pursuant to valuation policies and procedures approved by the Board. If the adviser determines that reliable market quotations are not readily available, investments are valued at fair value as determined in good faith by the adviser in accordance with such procedures under the oversight of the Board of Trustees. Under the fund’s valuation policies and procedures, market quotations are not considered to be readily available for most types of debt instruments and floating rate loans and many types of derivatives. These investments are generally valued at fair value based on information from independent pricing services. In addition, investments may be valued at fair value if the adviser determines that an investment’s value has been materially affected by events occurring after the close of the exchange or market on which the investment is principally traded (such as foreign exchange or market) and prior to the determination of the fund’s net asset value, or after the halting of trading of a specific security where trading does not resume prior to the close of the exchange or market on which the security is principally traded. Events that occur on a frequent basis after foreign markets close (such as developments in foreign markets and significant movements in the U.S. markets) and prior to the determination of the fund’s net asset value may be deemed to have a material affect on the value of securities traded in foreign markets. Accordingly, the fund’s foreign equity securities may often be valued at fair value. The adviser may rely on third party pricing services or other information (such as the correlation with price movements of similar securities in the same or other markets; the type, cost and investment characteristics of the security; the business and financial condition of the issuer; and trading and other market data) to assist in determining whether to fair value and at what value to fair value an

26

Notes to Financial Statements – continued

investment. The value of an investment for purposes of calculating the fund’s net asset value can differ depending on the source and method used to determine value. When fair valuation is used, the value of investments used to determine the fund’s net asset value may differ from quoted or published prices for the same investments.

In September 2006, FASB Statement No. 157, Fair Value Measurements (the “Statement”) was issued, and is effective for fiscal years beginning after November 15, 2007 and for all interim periods within those fiscal years. This Statement provides a single definition of fair value, a hierarchy for measuring fair value and expanded disclosures about fair value measurements. Management is evaluating the application of the Statement to the fund, and believes the impact will be limited to expanded disclosures resulting from the adoption of this Statement in the fund’s financial statements.

Repurchase Agreements – The fund may enter into repurchase agreements with approved counterparties. Each repurchase agreement is recorded at cost. The fund requires that the securities collateral in a repurchase transaction be transferred to a custodian. The fund monitors, on a daily basis, the value of the collateral to ensure that its value, including accrued interest, is greater than amounts owed to the fund under each such repurchase agreement.

Foreign Currency Translation – Purchases and sales of foreign investments, income, and expenses are converted into U.S. dollars based upon currency exchange rates prevailing on the respective dates of such transactions or on the reporting date for foreign denominated receivables and payables. Gains and losses attributable to foreign currency exchange rates on sales of securities are recorded for financial statement purposes as net realized gains and losses on investments. Gains and losses attributable to foreign exchange rate movements on receivables, payables, income and expenses are recorded for financial statement purposes as foreign currency transaction gains and losses. That portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed.

Security Loans – JPMorgan Chase and Co. (“Chase”), as lending agent, may loan the securities of the fund to certain qualified institutions (the “Borrowers”) approved by the fund. The loans are collateralized at all times by cash and/or U.S. Treasury and federal agency obligations in an amount at least equal to the market value of the securities loaned. Security lending activity through Chase is further collateralized by an irrevocable standby letter of credit. Chase provides the fund with indemnification against Borrower default. The fund bears the risk of loss with respect to the investment of cash collateral. On loans collateralized by cash, the cash collateral is invested in short-term securities. A portion of the income generated upon investment of the collateral is remitted to the Borrowers, and the remainder is allocated between the fund

27

Notes to Financial Statements – continued

and the lending agent. On loans collateralized by U.S. Treasury and/or federal agency obligations, a fee is received from the Borrower, and is allocated between the fund and the lending agent. Income from securities lending is included in interest income on the Statement of Operations. The dividend and interest income earned on the securities loaned is accounted for in the same manner as other dividend and interest income. At October 31, 2008, there were no securities on loan.

Indemnifications – Under the fund’s organizational documents, its officers and trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the fund. Additionally, in the normal course of business, the fund enters into agreements with service providers that may contain indemnification clauses. The fund’s maximum exposure under these agreements is unknown as this would involve future claims that may be made against the fund that have not yet occurred.

Investment Transactions and Income – Investment transactions are recorded on the trade date. Interest income is recorded on the accrual basis. All premium and discount is amortized or accreted for financial statement purposes in accordance with U.S. generally accepted accounting principles. Dividends received in cash are recorded on the ex-dividend date. Certain dividends from foreign securities will be recorded when the fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date. Dividend and interest payments received in additional securities are recorded on the ex-dividend or ex-interest date in an amount equal to the value of the security on such date. The fund may receive proceeds from litigation settlements. Any proceeds received from litigation involving portfolio holdings are reflected in the Statement of Operations in realized gain/loss if the security has been disposed of by the fund or in unrealized gain/loss if the security is still held by the fund. Any other proceeds from litigation not related to portfolio holdings are reflected as other income in the Statement of Operations.

Fees Paid Indirectly – The fund’s custody fee may be reduced according to an arrangement that measures the value of cash deposited with the custodian by the fund. This amount, for the year ended October 31, 2008, is shown as a reduction of total expenses on the Statement of Operations.

Tax Matters and Distributions – The fund intends to qualify as a regulated investment company, as defined under Subchapter M of the Internal Revenue Code, and to distribute all of its taxable income, including realized capital gains. As a result, no provision for federal income tax is required. The fund adopted the provisions of FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes (“the Interpretation”) on the first day of the fund’s fiscal year. The Interpretation prescribes a minimum threshold for financial statement recognition of the benefit of a tax position taken or

28

Notes to Financial Statements – continued

expected to be taken in a tax return. There was no impact resulting from the adoption of this Interpretation on the fund’s financial statements. Each of the fund’s federal tax returns for the prior three fiscal years remains subject to examination by the Internal Revenue Service. Foreign taxes, if any, have been accrued by the fund in the accompanying financial statements.

Distributions to shareholders are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles. Certain capital accounts in the financial statements are periodically adjusted for permanent differences in order to reflect their tax character. These adjustments have no impact on net assets or net asset value per share. Temporary differences which arise from recognizing certain items of income, expense, gain or loss in different periods for financial statement and tax purposes will reverse at some time in the future. Distributions in excess of net investment income or net realized gains are temporary overdistributions for financial statement purposes resulting from differences in the recognition or classification of income or distributions for financial statement and tax purposes.

Book/tax differences primarily relate to wash sale loss deferrals, foreign currency transactions, and foreign taxes.

The tax character of distributions declared to shareholders for the last two fiscal years is as follows:

| | | | |

| | | 10/31/08 | | 10/31/07 |

| Ordinary income (including any short-term capital gains) | | $1,850,948 | | $3,224,642 |

The federal tax cost and the tax basis components of distributable earnings were as follows:

| | | |

| As of 10/31/08 | | | |

| Cost of investments | | $270,889,890 | |

| Gross appreciation | | 1,691,043 | |

| Gross depreciation | | (76,538,808 | ) |

| Net unrealized appreciation (depreciation) | | $(74,847,765 | ) |

| Undistributed ordinary income | | 23,641 | |

| Capital loss carryforwards | | (4,551,465 | ) |

| Other temporary differences | | (452,461 | ) |

As of October 31, 2008, the fund had capital loss carryforwards available to offset future realized gains. Such losses expire as follows:

29

Notes to Financial Statements – continued

Multiple Classes of Shares of Beneficial Interest – The fund offers multiple classes of shares, which differ in their respective distribution, service, and retirement plan administration and services fees. The fund’s income, realized and unrealized gain (loss), and common expenses are allocated to shareholders based on the daily net assets of each class. Dividends are declared separately for each class. Differences in per share dividend rates are generally due to differences in separate class expenses. Class B shares will convert to Class A shares approximately eight years after purchase. At the close of business on April 18, 2008, Class R and Class R2 shares converted into Class R3 shares. Following this conversion, Class R3, Class R4, and Class R5 shares were renamed Class R2, Class R3, and Class R4 shares, respectively.

| (3) | | Transactions with Affiliates |

Investment Adviser – The fund has an investment advisory agreement with Massachusetts Financial Services Company (MFS) to provide overall investment management and related administrative services and facilities to the fund. The management fee is computed daily and paid monthly at the following annual rates:

| | | |

| First $1 billion of average daily net assets | | 0.90 | % |

| Next $1 billion of average daily net assets | | 0.75 | % |

| Average daily net assets in excess of $2 billion | | 0.65 | % |

The management fee incurred for the year ended October 31, 2008 was equivalent to an annual effective rate of 0.90% of the fund’s average daily net assets.

Distributor – MFS Fund Distributors, Inc. (MFD), a wholly-owned subsidiary of MFS, as distributor, received $12,799 for the year ended October 31, 2008, as its portion of the initial sales charge on sales of Class A shares of the fund.

The Board of Trustees has adopted a distribution plan for certain class shares pursuant to Rule 12b-1 of the Investment Company Act of 1940.

The fund’s distribution plan provides that the fund will pay MFD for services provided by MFD and financial intermediaries in connection with the distribution and servicing of certain share classes. One component of the plan is a distribution fee paid to MFD and another component of the plan is a service fee paid to MFD. MFD may subsequently pay all, or a portion, of the distribution and/or service fees to financial intermediaries.

30

Notes to Financial Statements – continued

Distribution Plan Fee Table:

| | | | | | | | | | |

| | | Distribution

Fee Rate | | Service

Fee Rate | | Total

Distribution

Plan (d) | | Annual

Effective

Rate (e) | | Distribution

and Service

Fee |

| Class A | | 0.10% | | 0.25% | | 0.35% | | 0.25% | | $834,111 |

| Class B | | 0.75% | | 0.25% | | 1.00% | | 1.00% | | 396,137 |

| Class C | | 0.75% | | 0.25% | | 1.00% | | 1.00% | | 164,124 |

| Class R (b) | | 0.25% | | 0.25% | | 0.50% | | 0.50% | | 2,518 |

| Class R1 | | 0.75% | | 0.25% | | 1.00% | | 0.91% | | 8,953 |

| Former Class R2 (b) | | 0.25% | | 0.25% | | 0.50% | | 0.50% | | 2,187 |

| Class R2 (formerly Class R3) | | 0.25% | | 0.25% | | 0.50% | | 0.50% | | 41,501 |

| Class R3 (formerly Class R4) | | — | | 0.25% | | 0.25% | | 0.25% | | 7,785 |

| Total Distribution and Service Fees | | | | | | $1,457,316 |

| (b) | At the close of business on April 18, 2008, Class R and Class R2 shares converted into Class R3 shares. Following the conversion, Class R3 shares were renamed Class R2 shares. |

| (d) | In accordance with the distribution plan for certain classes, the fund pays distribution and/or service fees up to these annual percentage rates of each class’ average daily net assets. |

| (e) | The annual effective rates represent actual fees incurred under the distribution plan for the year ended October 31, 2008 based on each class’ average daily net assets. 0.10% of the Class A distribution fee is currently being waived under a written waiver arrangement through February 29, 2009. For the year ended October 31, 2008, this waiver amounted to $238,315 and is reflected as a reduction of total expenses in the Statement of Operations. Effective March 1, 2008, the distribution fee rate for Class R1 shares increased from 0.50% to 0.75%. |

Certain Class A shares purchased prior to September 1, 2008 are subject to a contingent deferred sales charge (CDSC) in the event of a shareholder redemption within 12 months of purchase. Certain Class A shares purchased on or subsequent to September 1, 2008 are subject to a CDSC in the event of a shareholder redemption within 24 months of purchase. Class C shares are subject to a CDSC in the event of a shareholder redemption within 12 months of purchase. Class B shares are subject to a CDSC in the event of a shareholder redemption within six years of purchase. All contingent deferred sales charges are paid to MFD and during the year ended October 31, 2008, were as follows:

| | |

| | | Amount |

| Class A | | $2,310 |

| Class B | | 32,159 |

| Class C | | 762 |

Shareholder Servicing Agent – MFS Service Center, Inc. (MFSC), a wholly-owned subsidiary of MFS, receives a fee from the fund for its services as shareholder servicing agent calculated as a percentage of the average daily net assets of the fund as determined periodically under the supervision of the fund’s Board of Trustees. For the year ended October 31, 2008, the fee was $264,485, which equated to 0.0843% annually of the fund’s average daily net assets. MFSC also receives payment from the fund for out-of-pocket expenses, sub-accounting and other shareholder servicing costs which may be paid to

31

Notes to Financial Statements – continued

affiliated and unaffiliated service providers. For the year ended October 31, 2008, these out-of-pocket expenses, sub-accounting and other shareholder servicing costs amounted to $373,561.

Administrator – MFS provides certain financial, legal, shareholder communications, compliance, and other administrative services to the fund. Under an administrative services agreement, the fund partially reimburses MFS the costs incurred to provide these services. The fund is charged a fixed amount plus a fee based on average daily net assets. The fund’s annual fixed amount is $17,500.

The administrative services fee incurred for the year ended October 31, 2008 was equivalent to an annual effective rate of 0.0167% of the fund’s average daily net assets.

In addition to the administrative services provided by MFS to the fund as described above, prior to March 1, 2008, MFS was responsible for providing certain retirement plan administration and services with respect to certain shares. These services included various administrative, recordkeeping, and communication/educational services with respect to the retirement plans which invest in these shares, and may have been provided directly by MFS or by a third party. MFS generally paid all, or a portion, of the retirement plan administration and services fee to affiliated or unaffiliated third parties. For the year ended October 31, 2008, the fund paid MFS an annual retirement plan administration and services fee up to the following annual percentage rates of each class’ average daily net assets:

| | | | | | | | | | |

| | | Beginning

of period

through

12/31/07 | | Effective

1/01/08 | | Effective

3/01/08 | | Annual

Effective

Rate (g) | | Total

Amount |

Class R1 | | 0.35% | | 0.35% | | — | | 0.13% | | $1,330 |

Former Class R2 (b) | | 0.25% | | — | | — | | 0.08% | | 354 |

Class R2 (formerly Class R3) | | 0.15% | | — | | — | | 0.02% | | 1,544 |

Class R3 (formerly Class R4) | | 0.15% | | — | | — | | 0.03% | | 867 |

Class R4 (formerly Class R5) | | 0.10% | | — | | — | | 0.02% | | 12 |

| Total Retirement Plan Administration and Services Fees | | $4,107 |

| (b) | At the close of business on April 18, 2008, Class R and Class R2 shares converted into Class R3 shares. Following the conversion, Class R3 shares were renamed Class R2 shares. |