UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-5262

MFS SERIES TRUST VIII

(Exact name of registrant as specified in charter)

500 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Susan S. Newton

Massachusetts Financial Services Company

500 Boylston Street

Boston, Massachusetts 02116

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: October 31

Date of reporting period: April 30, 2010

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

MFS® Global Growth Fund

The report is prepared for the general information of shareholders. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED Ÿ MAY LOSE VALUE Ÿ

NO BANK GUARANTEE

4/30/10

WGF-SEM

LETTER FROM THE CEO

Dear Shareholders:

After having suffered their biggest declines since the Great Depression, most global markets experienced an impressive resurgence during the latter months of 2009 and the first quarter of 2010. The global economy was able to reap the benefits of two major trends. The first of these was the massive efforts of governments and central banks to increase liquidity in the financial system as they sought to prevent the credit crisis from further affecting the banking system. The second was the move by companies around the world to cut costs and operations to prepare for rapidly changing market conditions. We believe that these moves not only shortened the length of the downturn but also set the stage for recovery.

Even with the significant market gains of 2009 and the early part of 2010, the recovery is unrolling at a moderate pace, with rebounds in the manufacturing sector and corporate America leading the way. Central bankers are proceeding with caution and have held benchmark interest rates unchanged as they debate the best way to withdraw stimulus measures without disrupting the fragile growth process.

While hurdles remain, we believe that the global economy is on the road to recovery. As always, we continue to be mindful of the many challenges faced at the individual, national, and international levels. It is at times such as these that we want to remind investors of the merits of maintaining a long-term view, adhering to basic investing principles such as asset allocation and diversification, and working closely with advisors to identify and research investment opportunities. At MFS®, we take particular pride in how well mutual funds can help investors by providing the diversification that is important in any type of market climate.

Respectfully,

Robert J. Manning

Chief Executive Officer and Chief Investment Officer

MFS Investment Management®

June 15, 2010

The opinions expressed in this letter are subject to change, may not be relied upon for investment advice, and no forecasts can be guaranteed.

1

PORTFOLIO COMPOSITION

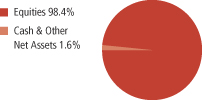

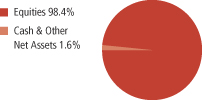

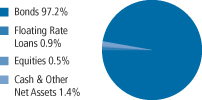

Portfolio structure

| | |

| Top ten holdings | | |

| Cisco Systems, Inc. | | 2.6% |

| Oracle Corp. | | 2.5% |

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR | | 2.0% |

| MasterCard, Inc., “A” | | 2.0% |

| Schlumberger Ltd. | | 2.0% |

| Nestle S.A. | | 1.9% |

| Google, Inc., “A” | | 1.8% |

| Accenture Ltd., “A” | | 1.8% |

| Johnson & Johnson | | 1.7% |

| Danaher Corp. | | 1.6% |

| | |

| Equity sectors | | |

| Technology | | 16.7% |

| Financial Services | | 15.1% |

| Health Care | | 15.0% |

| Consumer Staples | | 13.1% |

| Special Products & Services | | 8.5% |

| Retailing | | 7.9% |

| Basic Materials | | 7.8% |

| Energy | | 7.7% |

| Industrial Goods & Services | | 4.3% |

| Leisure | | 1.5% |

| Utilities & Communications | | 0.8% |

| |

| Issuer country weightings | | |

| United States | | 48.3% |

| United Kingdom | | 9.5% |

| Switzerland | | 9.2% |

| Japan | | 6.8% |

| France | | 5.1% |

| Germany | | 4.6% |

| Taiwan | | 3.3% |

| Netherlands | | 2.3% |

| Hong Kong | | 2.0% |

| Other Countries | | 8.9% |

Percentages are based on net assets as of 4/30/10.

The portfolio is actively managed and current holdings may be different.

2

MARKET ENVIRONMENT

After having suffered through one of the largest and most concentrated downturns since the 1930s, most asset markets staged a remarkable rebound during 2009 and early 2010. This recovery in global activity, which covers this reporting period, has been led importantly by emerging Asian economies, but broadening to include most of the global economy to varying degrees. Primary drivers of the recovery included an unwinding of the inventory destocking that took place earlier, the production of manufacturing and capital goods, as well as massive fiscal and monetary stimulus.

During the worst of the credit crisis, policy makers globally loosened monetary and fiscal policy on a massive scale. Having reached their lower bound on policy rates prior to the beginning of the reporting period, several central banks were implementing quantitative easing as a means to further loosen monetary policy to offset the continuing fall in global economic activity. However, by the beginning of the period, there were ever-broadening signs that the global macroeconomic deterioration had passed, which caused the subsequent rise in asset valuations. As most asset prices rebounded during the period and the demand for liquidity waned, the debate concerning the existence of asset bubbles and the need for monetary exit strategies had begun, creating added uncertainty regarding the forward path of policy rates. Nonetheless, risky-asset valuation generally hit secular highs by the end of the period.

3

EXPENSE TABLE

Fund expenses borne by the shareholders during the period, November 1, 2009 through April 30, 2010

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period November 1, 2009 through April 30, 2010.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

4

Expense Table – continued

| | | | | | | | | | |

Share

Class | | | | Annualized

Expense

Ratio | | Beginning

Account Value

11/01/09 | | Ending

Account Value

4/30/10 | | Expenses

Paid During

Period (p)

11/01/09-4/30/10 |

| A | | Actual | | 1.56% | | $1,000.00 | | $1,095.20 | | $8.10 |

| | Hypothetical (h) | | 1.56% | | $1,000.00 | | $1,017.06 | | $7.80 |

| B | | Actual | | 2.31% | | $1,000.00 | | $1,091.80 | | $11.98 |

| | Hypothetical (h) | | 2.31% | | $1,000.00 | | $1,013.34 | | $11.53 |

| C | | Actual | | 2.31% | | $1,000.00 | | $1,091.72 | | $11.98 |

| | Hypothetical (h) | | 2.31% | | $1,000.00 | | $1,013.34 | | $11.53 |

| I | | Actual | | 1.31% | | $1,000.00 | | $1,096.84 | | $6.81 |

| | Hypothetical (h) | | 1.31% | | $1,000.00 | | $1,018.30 | | $6.56 |

| R1 | | Actual | | 2.31% | | $1,000.00 | | $1,091.36 | | $11.98 |

| | Hypothetical (h) | | 2.31% | | $1,000.00 | | $1,013.34 | | $11.53 |

| R2 | | Actual | | 1.81% | | $1,000.00 | | $1,094.40 | | $9.40 |

| | Hypothetical (h) | | 1.81% | | $1,000.00 | | $1,015.82 | | $9.05 |

| R3 | | Actual | | 1.56% | | $1,000.00 | | $1,095.64 | | $8.11 |

| | Hypothetical (h) | | 1.56% | | $1,000.00 | | $1,017.06 | | $7.80 |

| R4 | | Actual | | 1.31% | | $1,000.00 | | $1,096.74 | | $6.81 |

| | Hypothetical (h) | | 1.31% | | $1,000.00 | | $1,018.30 | | $6.56 |

| (h) | 5% class return per year before expenses. |

| (p) | Expenses paid is equal to each class’ annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by the number of days in the period, divided by the number of days in the year. Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

5

PORTFOLIO OF INVESTMENTS

4/30/10 (unaudited)

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| | | | | |

| Common Stocks - 98.4% | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | |

| Aerospace - 1.0% | | | | | |

| United Technologies Corp. | | 32,100 | | $ | 2,405,895 |

| | |

| Alcoholic Beverages - 3.4% | | | | | |

| Companhia de Bebidas das Americas, ADR | | 25,570 | | $ | 2,500,746 |

| Diageo PLC | | 193,120 | | | 3,294,638 |

| Heineken N.V. (l) | | 45,100 | | | 2,093,465 |

| | | | | |

| | | | | $ | 7,888,849 |

| Apparel Manufacturers - 4.3% | | | | | |

| Compagnie Financiere Richemont S.A. | | 59,651 | | $ | 2,205,148 |

| Li & Fung Ltd. | | 406,200 | | | 1,973,827 |

| LVMH Moet Hennessy Louis Vuitton S.A. | | 19,330 | | | 2,209,793 |

| NIKE, Inc., “B” | | 45,920 | | | 3,485,787 |

| | | | | |

| | | | | $ | 9,874,555 |

| Broadcasting - 1.0% | | | | | |

| Walt Disney Co. | | 29,400 | | $ | 1,083,096 |

| WPP Group PLC | | 117,389 | | | 1,248,043 |

| | | | | |

| | | | | $ | 2,331,139 |

| Brokerage & Asset Managers - 5.8% | | | | | |

| Charles Schwab Corp. | | 144,130 | | $ | 2,780,268 |

| CME Group, Inc. | | 5,340 | | | 1,753,709 |

| Deutsche Boerse AG | | 35,000 | | | 2,728,008 |

| Franklin Resources, Inc. | | 20,620 | | | 2,384,497 |

| ICAP PLC | | 379,330 | | | 2,183,528 |

| Nomura Holdings, Inc. | | 222,900 | | | 1,537,604 |

| | | | | |

| | | | | $ | 13,367,614 |

| Business Services - 8.5% | | | | | |

| Accenture Ltd., “A” | | 94,770 | | $ | 4,135,763 |

| Dun & Bradstreet Corp. | | 38,690 | | | 2,977,969 |

| Infosys Technologies Ltd., ADR | | 21,660 | | | 1,297,001 |

| Intertek Group PLC | | 133,730 | | | 3,046,696 |

| MasterCard, Inc., “A” | | 18,620 | | | 4,618,505 |

| Verisk Analytics, Inc., “A” (a) | | 60,480 | | | 1,694,650 |

| Visa, Inc., “A” | | 20,570 | | | 1,856,031 |

| | | | | |

| | | | | $ | 19,626,615 |

6

Portfolio of Investments (unaudited) – continued

| | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | |

| Common Stocks - continued | | | | | |

| Chemicals - 0.7% | | | | | |

| Monsanto Co. | | 26,660 | | $ | 1,681,180 |

| | |

| Computer Software - 2.5% | | | | | |

| Oracle Corp. | | 220,950 | | $ | 5,709,348 |

| | |

| Computer Software - Systems - 4.4% | | | | | |

| Acer, Inc. | | 1,079,330 | | $ | 2,926,073 |

| Apple, Inc. (a) | | 12,600 | | | 3,290,112 |

| EMC Corp. (a) | | 63,340 | | | 1,204,093 |

| Konica Minolta Holdings, Inc. | | 226,000 | | | 2,844,956 |

| | | | | |

| | | | | $ | 10,265,234 |

| Consumer Products - 4.6% | | | | | |

| Beiersdorf AG (l) | | 18,790 | | $ | 1,058,141 |

| Church & Dwight Co., Inc. | | 36,680 | | | 2,540,090 |

| Colgate-Palmolive Co. | | 23,660 | | | 1,989,806 |

| Procter & Gamble Co. | | 49,080 | | | 3,050,813 |

| Reckitt Benckiser Group PLC | | 40,560 | | | 2,105,057 |

| | | | | |

| | | | | $ | 10,743,907 |

| Electrical Equipment - 3.3% | | | | | |

| Danaher Corp. | | 43,640 | | $ | 3,677,979 |

| Keyence Corp. | | 5,400 | | | 1,287,863 |

| Schneider Electric S.A. | | 24,447 | | | 2,792,632 |

| | | | | |

| | | | | $ | 7,758,474 |

| Electronics - 5.4% | | | | | |

| Hoya Corp. | | 72,800 | | $ | 2,002,454 |

| Microchip Technology, Inc. | | 40,730 | | | 1,189,723 |

| Samsung Electronics Co. Ltd. | | 4,483 | | | 3,390,567 |

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR | | 437,908 | | | 4,637,446 |

| Tokyo Electron Ltd. | | 20,000 | | | 1,322,191 |

| | | | | |

| | | | | $ | 12,542,381 |

| Energy - Independent - 1.6% | | | | | |

| INPEX Corp. | | 508 | | $ | 3,591,070 |

| | |

| Energy - Integrated - 4.1% | | | | | |

| Chevron Corp. | | 21,370 | | $ | 1,740,373 |

| Exxon Mobil Corp. | | 13,730 | | | 931,581 |

| Hess Corp. | | 47,810 | | | 3,038,326 |

| Petroleo Brasileiro S.A., ADR | | 47,600 | | | 2,019,668 |

| TOTAL S.A. | | 34,080 | | | 1,846,692 |

| | | | | |

| | | | | $ | 9,576,640 |

7

Portfolio of Investments (unaudited) – continued

| | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | |

| Common Stocks - continued | | | | | |

| Food & Beverages - 5.1% | | | | | |

| Groupe Danone (l) | | 44,958 | | $ | 2,653,595 |

| Mead Johnson Nutrition Co., “A” | | 35,900 | | | 1,852,799 |

| Nestle S.A. | | 90,737 | | | 4,428,373 |

| PepsiCo, Inc. | | 45,170 | | | 2,945,987 |

| | | | | |

| | | | | $ | 11,880,754 |

| Food & Drug Stores - 1.1% | | | | | |

| Tesco PLC | | 399,689 | | $ | 2,658,774 |

| | |

| Internet - 1.8% | | | | | |

| Google, Inc., “A” (a) | | 7,920 | | $ | 4,161,485 |

| | |

| Major Banks - 7.1% | | | | | |

| Bank of New York Mellon Corp. | | 105,980 | | $ | 3,299,157 |

| Credit Suisse Group AG | | 64,580 | | | 2,954,323 |

| HSBC Holdings PLC | | 264,078 | | | 2,690,267 |

| Julius Baer Group Ltd. | | 96,255 | | | 3,324,274 |

| Standard Chartered PLC | | 90,899 | | | 2,422,972 |

| State Street Corp. | | 40,850 | | | 1,776,975 |

| | | | | |

| | | | | $ | 16,467,968 |

| Medical & Health Technology & Services - 0.5% | | | | | |

| Patterson Cos., Inc. | | 36,350 | | $ | 1,162,837 |

| | |

| Medical Equipment - 7.4% | | | | | |

| Becton, Dickinson & Co. | | 15,550 | | $ | 1,187,554 |

| DENTSPLY International, Inc. | | 70,120 | | | 2,569,197 |

| Essilor International S.A. | | 19,960 | | | 1,219,733 |

| Medtronic, Inc. | | 39,910 | | | 1,743,668 |

| Sonova Holding AG | | 18,840 | | | 2,351,170 |

| St. Jude Medical, Inc. (a) | | 29,890 | | | 1,220,110 |

| Synthes, Inc. | | 25,800 | | | 2,941,653 |

| Thermo Fisher Scientific, Inc. (a) | | 37,130 | | | 2,052,546 |

| Waters Corp. (a) | | 27,520 | | | 1,981,165 |

| | | | | |

| | | | | $ | 17,266,796 |

| Metals & Mining - 1.0% | | | | | |

| BHP Billiton PLC | | 77,830 | | $ | 2,391,127 |

| | |

| Network & Telecom - 2.6% | | | | | |

| Cisco Systems, Inc. (a)(s) | | 220,960 | | $ | 5,948,243 |

8

Portfolio of Investments (unaudited) – continued

| | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | |

| Common Stocks - continued | | | | | |

| Oil Services - 2.0% | | | | | |

| Schlumberger Ltd. | | 63,700 | | $ | 4,549,454 |

| | |

| Other Banks & Diversified Financials - 2.2% | | | | | |

| China Construction Bank | | 1,955,000 | | $ | 1,583,505 |

| Credicorp Ltd. | | 21,850 | | | 1,897,891 |

| HDFC Bank Ltd. | | 38,400 | | | 1,716,342 |

| | | | | |

| | | | | $ | 5,197,738 |

| Pharmaceuticals - 7.1% | | | | | |

| Abbott Laboratories | | 34,230 | | $ | 1,751,207 |

| Allergan, Inc. | | 28,350 | | | 1,805,612 |

| Bayer AG (l) | | 50,003 | | | 3,200,665 |

| Johnson & Johnson | | 60,650 | | | 3,899,795 |

| Roche Holding AG | | 20,400 | | | 3,224,495 |

| Teva Pharmaceutical Industries Ltd., ADR | | 45,750 | | | 2,686,897 |

| | | | | |

| | | | | $ | 16,568,671 |

| Printing & Publishing - 0.5% | | | | | |

| MSCI, Inc., “A” (a) | | 33,640 | | $ | 1,165,626 |

| | |

| Specialty Chemicals - 6.1% | | | | | |

| Akzo Nobel N.V. (l) | | 54,870 | | $ | 3,225,264 |

| L’Air Liquide S.A. | | 9,717 | | | 1,124,445 |

| Linde AG (l) | | 17,450 | | | 2,086,620 |

| Praxair, Inc. | | 35,810 | | | 2,999,804 |

| Shin-Etsu Chemical Co. Ltd. | | 53,900 | | | 3,112,411 |

| Symrise AG | | 62,708 | | | 1,592,680 |

| | | | | |

| | | | | $ | 14,141,224 |

| Specialty Stores - 2.5% | | | | | |

| Esprit Holdings Ltd. | | 366,730 | | $ | 2,624,398 |

| Industria de Diseno Textil S.A. | | 30,100 | | | 1,850,277 |

| Staples, Inc. | | 61,130 | | | 1,438,389 |

| | | | | |

| | | | | $ | 5,913,064 |

| Telecommunications - Wireless - 0.8% | | | | | |

| MTN Group Ltd. | | 128,030 | | $ | 1,884,802 |

| Total Common Stocks (Identified Cost, $213,503,881) | | | | $ | 228,721,464 |

| | |

| Money Market Funds (v) - 1.5% | | | | | |

MFS Institutional Money Market Portfolio, 0.19%,

at Cost and Net Asset Value | | 3,370,449 | | $ | 3,370,449 |

9

Portfolio of Investments (unaudited) – continued

| | | | | | |

| Collateral for Securities Loaned - 4.4% | | | | | | |

| | | | | | |

| Issuer | | Shares/Par | | Value ($) | |

| Goldman Sachs & Co. Repurchase Agreement, 0.19%, dated 04/30/10, due 05/03/10, total to be received $8,138,124 (secured by various U.S. Treasury and Federal Agency obligations valued at $8,300,761 in an individually traded account) | | 8,137,995 | | $ | 8,137,995 | |

| Morgan Stanley Repurchase Agreement, 0.19%, dated 4/30/10, due 5/03/10, total to be received $2,000,032 (secured by U.S. Treasury and Federal Agency obligations valued at $2,040,039 in an individually traded account) | | 2,000,000 | | | 2,000,000 | |

| Total Collateral for Securities Loaned, at Identified Cost and Value | | | | $ | 10,137,995 | |

| Total Investments (Identified Cost, $227,012,325) | | | | $ | 242,229,908 | |

| | |

| Other Assets, Less Liabilities - (4.3)% | | | | | (9,898,568 | ) |

| Net Assets - 100.0% | | | | $ | 232,331,340 | |

| (a) | Non-income producing security. |

| (l) | All or a portion of this security is on loan. |

| (s) | Security or a portion of the security was pledged to cover collateral requirements for securities sold short. At April 30, 2010, the value of securities pledged amounted to $177,672. At April 30, 2010, the fund had no short sales outstanding. |

| (v) | Underlying fund that is available only to investment companies managed by MFS. The rate quoted is the annualized seven-day yield of the fund at period end. |

The following abbreviations are used in this report and are defined:

| ADR | | American Depository Receipt |

| PLC | | Public Limited Company |

See Notes to Financial Statements

10

Financial Statements

STATEMENT OF ASSETS AND LIABILITIES

At 4/30/10 (unaudited)

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| | | |

| Assets | | | |

Investments- | | | |

Non-affiliated issuers, at value (identified cost, $223,641,876) | | $238,859,459 | |

Underlying funds, at cost and value | | 3,370,449 | |

Total investments, at value, including $9,532,291 of securities on loan (identified cost, $227,012,325) | | $242,229,908 | |

Foreign currency, at value (identified cost, $15,072) | | 15,075 | |

Receivables for | | | |

Investments sold | | 101,315 | |

Fund shares sold | | 310,692 | |

Interest and dividends | | 621,873 | |

Other assets | | 2,259 | |

Total assets | | $243,281,122 | |

| Liabilities | | | |

Payables for | | | |

Investments purchased | | $266,310 | |

Fund shares reacquired | | 313,348 | |

Collateral for securities loaned, at value | | 10,137,995 | |

Payable to affiliates | | | |

Investment adviser | | 11,492 | |

Shareholder servicing costs | | 62,450 | |

Distribution and service fees | | 4,462 | |

Administrative services fee | | 230 | |

Payable for independent Trustees’ compensation | | 42,339 | |

Accrued expenses and other liabilities | | 111,156 | |

Total liabilities | | $10,949,782 | |

Net assets | | $232,331,340 | |

| Net assets consist of | | | |

Paid-in capital | | $246,524,141 | |

Unrealized appreciation (depreciation) on investments and translation of assets and liabilities in foreign currencies (net of $73,038 deferred country tax) | | 15,141,515 | |

Accumulated net realized gain (loss) on investments and foreign currency transactions | | (29,244,591 | ) |

Accumulated distributions in excess of net investment income | | (89,725 | ) |

Net assets | | $232,331,340 | |

Shares of beneficial interest outstanding | | 9,818,219 | |

| | | | | | |

| | | Net assets | | Shares

outstanding | | Net asset value

per share (a) |

Class A | | $186,519,991 | | 7,796,400 | | $23.92 |

Class B | | 15,574,221 | | 700,421 | | 22.24 |

Class C | | 14,693,720 | | 667,437 | | 22.02 |

Class I | | 6,705,957 | | 274,947 | | 24.39 |

Class R1 | | 1,058,224 | | 48,148 | | 21.98 |

Class R2 | | 5,232,422 | | 224,096 | | 23.35 |

Class R3 | | 2,382,528 | | 99,914 | | 23.85 |

Class R4 | | 164,277 | | 6,856 | | 23.96 |

| (a) | Maximum offering price per share was equal to the net asset value per share for all share classes, except for Class A, for which the maximum offering price per share was $25.38 [100 / 94.25 x $23.92]. On sales of $50,000 or more, the maximum offering price of Class A shares is reduced. A contingent deferred sales charge may be imposed on redemptions of Class A, Class B, and Class C shares. Redemption price per share was equal to the net asset value per share for Classes I, R1, R2, R3, and R4. |

See Notes to Financial Statements

11

Financial Statements

STATEMENT OF OPERATIONS

Six months ended 4/30/10 (unaudited)

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| | | |

| Net investment loss | | | |

Income | | | |

Dividends | | $1,967,303 | |

Interest | | 23,636 | |

Dividends from underlying funds | | 2,604 | |

Foreign taxes withheld | | (104,957 | ) |

Total investment income | | $1,888,586 | |

Expenses | | | |

Management fee | | $1,046,069 | |

Distribution and service fees | | 409,887 | |

Shareholder servicing costs | | 270,882 | |

Administrative services fee | | 21,764 | |

Independent Trustees’ compensation | | 7,845 | |

Custodian fee | | 52,111 | |

Shareholder communications | | 17,645 | |

Auditing fees | | 38,207 | |

Legal fees | | 2,944 | |

Miscellaneous | | 63,596 | |

Total expenses | | $1,930,950 | |

Fees paid indirectly | | (2 | ) |

Reduction of expenses by investment adviser | | (508 | ) |

Net expenses | | $1,930,440 | |

Net investment loss | | $(41,854 | ) |

Realized and unrealized gain (loss) on investments

and foreign currency transactions | | | |

Realized gain (loss) (identified cost basis)

Investment transactions | | $1,341,082 | |

Foreign currency transactions | | (16,693 | ) |

Net realized gain (loss) on investments

and foreign currency transactions | | $1,324,389 | |

Change in unrealized appreciation (depreciation)

Investments (net of $73,038 deferred country tax) | | $19,612,305 | |

Translation of assets and liabilities in foreign currencies | | (12,096 | ) |

Net unrealized gain (loss) on investments

and foreign currency translation | | $19,600,209 | |

Net realized and unrealized gain (loss) on investments

and foreign currency | | $20,924,598 | |

Change in net assets from operations | | $20,882,744 | |

See Notes to Financial Statements

12

Financial Statements

STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| | | | | | |

| Change in net assets | | Six months ended

4/30/10

(unaudited) | | | Year ended

10/31/09 | |

| From operations | | | | | | |

Net investment income (loss) | | $(41,854 | ) | | $911,276 | |

Net realized gain (loss) on investments and foreign currency transactions | | 1,324,389 | | | (24,756,718 | ) |

Net unrealized gain (loss) on investments and foreign currency translation | | 19,600,209 | | | 69,445,156 | |

Change in net assets from operations | | $20,882,744 | | | $45,599,714 | |

| Distributions declared to shareholders | | | | | | |

From net investment income | | $(823,078 | ) | | $(24,131 | ) |

Change in net assets from fund share transactions | | $(13,027,537 | ) | | $(14,939,634 | ) |

Total change in net assets | | $7,032,129 | | | $30,635,949 | |

| Net assets | | | | | | |

At beginning of period | | 225,299,211 | | | 194,663,262 | |

At end of period (including accumulated distributions in excess of net investment income of $89,725 and undistributed net investment income of $775,207, respectively) | | $232,331,340 | | | $225,299,211 | |

See Notes to Financial Statements

13

Financial Statements

FINANCIAL HIGHLIGHTS

The financial highlights table is intended to help you understand the fund’s financial performance for the semiannual period and the past 5 fiscal years (or life of a particular share class, if shorter). Certain information reflects financial results for a single fund share. The total returns in the table represent the rate by which an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| | | | | | | | | | | | | | | | |

| | | Six months

ended

4/30/10

(unaudited) | | | Years ended 10/31 |

| Class A | | | 2009 | | | 2008 | | | 2007 | | | 2006 | | 2005 |

| | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $21.93 | | | $17.35 | | | $29.26 | | | $23.97 | | | $20.10 | | $17.76 |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | |

Net investment income (d) | | $0.01 | | | $0.11 | | | $0.08 | | | $0.25 | | | $0.11 | | $0.01 |

Net realized and unrealized gain (loss) on investments and foreign currency | | 2.07 | | | 4.47 | | | (11.82 | ) | | 5.28 | | | 3.76 | | 2.33 |

Total from investment operations | | $2.08 | | | $4.58 | | | $(11.74 | ) | | $5.53 | | | $3.87 | | $2.34 |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | |

From net investment income | | $(0.09 | ) | | $(0.00 | )(w) | | $(0.17 | ) | | $(0.24 | ) | | $— | | $— |

Net asset value, end of period | | $23.92 | | | $21.93 | | | $17.35 | | | $29.26 | | | $23.97 | | $20.10 |

Total return (%) (r)(s)(t) | | 9.52 | (n) | | 26.40 | | | (40.34 | ) | | 23.24 | | | 19.25 | | 13.18 |

| Ratios (%) (to average net assets) and Supplemental data: | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 1.56 | (a) | | 1.70 | | | 1.62 | | | 1.58 | | | 1.61 | | 1.69 |

Expenses after expense reductions (f) | | 1.56 | (a) | | 1.67 | | | 1.52 | | | 1.48 | | | 1.51 | | 1.59 |

Net investment income | | 0.07 | (a) | | 0.59 | | | 0.30 | | | 0.97 | | | 0.49 | | 0.07 |

Portfolio turnover | | 34 | | | 83 | | | 88 | | | 68 | | | 96 | | 92 |

Net assets at end of period (000 omitted) | | $186,520 | | | $180,278 | | | $153,184 | | | $297,956 | | | $290,952 | | $290,256 |

See Notes to Financial Statements

14

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | |

| | | Six months

ended

4/30/10

(unaudited) | | | Years ended 10/31 | |

| Class B | | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $20.37 | | | $16.24 | | | $27.42 | | | $22.46 | | | $18.98 | | | $16.90 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | $(0.08 | ) | | $(0.03 | ) | | $(0.11 | ) | | $0.06 | | | $(0.05 | ) | | $(0.13 | ) |

Net realized and unrealized gain (loss) on investments and foreign currency | | 1.95 | | | 4.16 | | | (11.07 | ) | | 4.95 | | | 3.53 | | | 2.21 | |

Total from investment

operations | | $1.87 | | | $4.13 | | | $(11.18 | ) | | $5.01 | | | $3.48 | | | $2.08 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | | |

From net investment income | | $— | | | $— | | | $— | | | $(0.05 | ) | | $— | | | $— | |

Net asset value, end of period | | $22.24 | | | $20.37 | | | $16.24 | | | $27.42 | | | $22.46 | | | $18.98 | |

Total return (%) (r)(s)(t) | | 9.18 | (n) | | 25.43 | | | (40.77 | ) | | 22.35 | | | 18.34 | | | 12.31 | |

Ratios (%) (to average net assets) and Supplemental

data: | | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 2.31 | (a) | | 2.43 | | | 2.27 | | | 2.23 | | | 2.26 | | | 2.34 | |

Expenses after expense reductions (f) | | 2.31 | (a) | | 2.43 | | | 2.27 | | | 2.23 | | | 2.26 | | | 2.34 | |

Net investment income (loss) | | (0.70 | )(a) | | (0.19 | ) | | (0.47 | ) | | 0.25 | | | (0.26 | ) | | (0.70 | ) |

Portfolio turnover | | 34 | | | 83 | | | 88 | | | 68 | | | 96 | | | 92 | |

Net assets at end of period (000 omitted) | | $15,574 | | | $17,219 | | | $19,582 | | | $64,416 | | | $75,573 | | | $87,769 | |

See Notes to Financial Statements

15

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | |

| | | Six months

ended

4/30/10

(unaudited) | | | Years ended 10/31 | |

| Class C | | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $20.17 | | | $16.08 | | | $27.15 | | | $22.26 | | | $18.80 | | | $16.74 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | $(0.07 | ) | | $(0.03 | ) | | $(0.11 | ) | | $0.05 | | | $(0.06 | ) | | $(0.13 | ) |

Net realized and unrealized gain (loss) on investments and foreign currency | | 1.92 | | | 4.12 | | | (10.96 | ) | | 4.91 | | | 3.52 | | | 2.19 | |

Total from investment

operations | | $1.85 | | | $4.09 | | | $(11.07 | ) | | $4.96 | | | $3.46 | | | $2.06 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | | |

From net investment income | | $— | | | $— | | | $(0.00 | )(w) | | $(0.07 | ) | | $— | | | $— | |

Net asset value, end of period | | $22.02 | | | $20.17 | | | $16.08 | | | $27.15 | | | $22.26 | | | $18.80 | |

Total return (%) (r)(s)(t) | | 9.17 | (n) | | 25.44 | | | (40.77 | ) | | 22.33 | | | 18.40 | | | 12.31 | |

Ratios (%) (to average net assets) and Supplemental

data: | | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 2.31 | (a) | | 2.42 | | | 2.27 | | | 2.23 | | | 2.26 | | | 2.34 | |

Expenses after expense reductions (f) | | 2.31 | (a) | | 2.41 | | | 2.27 | | | 2.23 | | | 2.26 | | | 2.34 | |

Net investment income (loss) | | (0.68 | )(a) | | (0.19 | ) | | (0.45 | ) | | 0.21 | | | (0.27 | ) | | (0.69 | ) |

Portfolio turnover | | 34 | | | 83 | | | 88 | | | 68 | | | 96 | | | 92 | |

Net assets at end of period (000 omitted) | | $14,694 | | | $13,598 | | | $10,326 | | | $20,249 | | | $20,450 | | | $20,924 | |

See Notes to Financial Statements

16

Financial Highlights – continued

| | | | | | | | | | | | | | | | |

| | | Six months

ended

4/30/10

(unaudited) | | | Years ended 10/31 |

| Class I | | | 2009 | | | 2008 | | | 2007 | | | 2006 | | 2005 |

| | | | | | | | | | | | | | | |

Net asset value, beginning of

period | | $22.37 | | | $17.73 | | | $29.87 | | | $24.46 | | | $20.46 | | $18.04 |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | |

Net investment income (d) | | $0.04 | | | $0.16 | | | $0.14 | | | $0.32 | | | $0.17 | | $0.06 |

Net realized and unrealized gain (loss) on investments and foreign currency | | 2.12 | | | 4.55 | | | (12.05 | ) | | 5.39 | | | 3.83 | | 2.36 |

Total from investment

operations | | $2.16 | | | $4.71 | | | $(11.91 | ) | | $5.71 | | | $4.00 | | $2.42 |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | |

From net investment income | | $(0.14 | ) | | $(0.07 | ) | | $(0.23 | ) | | $(0.30 | ) | | $— | | $— |

Net asset value, end of period | | $24.39 | | | $22.37 | | | $17.73 | | | $29.87 | | | $24.46 | | $20.46 |

Total return (%) (r)(s) | | 9.68 | (n) | | 26.68 | | | (40.16 | ) | | 23.57 | | | 19.55 | | 13.41 |

Ratios (%) (to average net assets) and Supplemental

data: | | | | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | 1.31 | (a) | | 1.42 | | | 1.27 | | | 1.23 | | | 1.26 | | 1.34 |

Expenses after expense

reductions (f) | | 1.31 | (a) | | 1.41 | | | 1.27 | | | 1.23 | | | 1.26 | | 1.34 |

Net investment income | | 0.33 | (a) | | 0.84 | | | 0.54 | | | 1.22 | | | 0.74 | | 0.31 |

Portfolio turnover | | 34 | | | 83 | | | 88 | | | 68 | | | 96 | | 92 |

Net assets at end of period (000 omitted) | | $6,706 | | | $5,875 | | | $4,306 | | | $7,739 | | | $7,368 | | $7,233 |

See Notes to Financial Statements

17

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | |

| | | Six months

ended

4/30/10

(unaudited) | | | Years ended 10/31 | |

| Class R1 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 (i) | |

| | | | | | | | | | | | | | | | | |

Net asset value, beginning of

period | | $20.14 | | | $16.05 | | | $27.29 | | | $22.42 | | | $18.96 | | | $18.12 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | | |

Net investment loss (d) | | $(0.07 | ) | | $(0.02 | ) | | $(0.12 | ) | | $(0.10 | ) | | $(0.07 | ) | | $(0.08 | ) |

Net realized and unrealized gain (loss) on investments and foreign currency | | 1.91 | | | 4.11 | | | (10.95 | ) | | 5.06 | | | 3.53 | | | 0.92 | (g) |

Total from investment

operations | | $1.84 | | | $4.09 | | | $(11.07 | ) | | $4.96 | | | $3.46 | | | $0.84 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | | |

From net investment income | | $— | | | $— | | | $(0.17 | ) | | $(0.09 | ) | | $— | | | $— | |

Net asset value, end of period | | $21.98 | | | $20.14 | | | $16.05 | | | $27.29 | | | $22.42 | | | $18.96 | |

Total return (%) (r)(s) | | 9.14 | (n) | | 25.48 | | | (40.80 | ) | | 22.17 | | | 18.25 | | | 4.64 | (n) |

Ratios (%) (to average net assets) and Supplemental

data: | | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 2.31 | (a) | | 2.41 | | | 2.31 | | | 2.35 | | | 2.45 | | | 2.54 | (a) |

Expenses after expense

reductions (f) | | 2.31 | (a) | | 2.41 | | | 2.31 | | | 2.33 | | | 2.35 | | | 2.52 | (a) |

Net investment loss | | (0.66 | )(a) | | (0.11 | ) | | (0.53 | ) | | (0.43 | ) | | (0.35 | ) | | (0.77 | )(a) |

Portfolio turnover | | 34 | | | 83 | | | 88 | | | 68 | | | 96 | | | 92 | |

Net assets at end of period (000 omitted) | | $1,058 | | | $886 | | | $632 | | | $1,009 | | | $127 | | | $104 | |

See Notes to Financial Statements

18

Financial Highlights – continued

| | | | | | | | | | | | | | | | |

| | | Six months

ended

4/30/10

(unaudited) | | | Years ended 10/31 | |

| Class R2 | | | 2009 | | 2008 | | | 2007 | | | 2006 | | 2005 | |

| | | | | | | | | | | | | | | |

Net asset value, beginning of

period | | $21.37 | | | $16.95 | | $28.77 | | | $23.58 | | | $19.85 | | $17.63 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | |

Net investment income

(loss) (d) | | $(0.02 | ) | | $0.06 | | $0.02 | | | $0.04 | | | $0.03 | | $(0.06 | ) |

Net realized and unrealized gain (loss) on investments and foreign currency | | 2.04 | | | 4.36 | | (11.66 | ) | | 5.29 | | | 3.70 | | 2.28 | |

Total from investment

operations | | $2.02 | | | $4.42 | | $(11.64 | ) | | $5.33 | | | $3.73 | | $2.22 | |

Less distributions declared

to shareholders | | | | | | | | | | | | | | |

From net investment income | | $(0.04 | ) | | $— | | $(0.18 | ) | | $(0.14 | ) | | $— | | $— | |

Net asset value, end of period | | $23.35 | | | $21.37 | | $16.95 | | | $28.77 | | | $23.58 | | $19.85 | |

Total return (%) (r)(s) | | 9.44 | (n) | | 26.08 | | (40.70 | ) | | 22.73 | | | 18.79 | | 12.59 | |

Ratios (%) (to average net assets) and Supplemental

data: | | | | | | | | | | | | | | | | |

Expenses before expense

reductions (f) | | 1.81 | (a) | | 1.93 | | 1.79 | | | 1.90 | | | 2.00 | | 2.10 | |

Expenses after expense

reductions (f) | | 1.81 | (a) | | 1.93 | | 1.79 | | | 1.88 | | | 1.90 | | 2.09 | |

Net investment income (loss) | | (0.17 | )(a) | | 0.36 | | 0.06 | | | 0.16 | | | 0.15 | | (0.29 | ) |

Portfolio turnover | | 34 | | | 83 | | 88 | | | 68 | | | 96 | | 92 | |

Net assets at end of period (000 omitted) | | $5,232 | | | $5,128 | | $4,808 | | | $4,168 | | | $619 | | $466 | |

See Notes to Financial Statements

19

Financial Highlights – continued

| | | | | | | | | | | | | | | | |

| | | Six months

ended

4/30/10 (unaudited) | | | Years ended 10/31 | |

| Class R3 | | | 2009 | | 2008 | | | 2007 | | | 2006 | | 2005 (i) | |

| | | | | | | | | | | | | | | |

Net asset value, beginning of

period | | $21.86 | | | $17.29 | | $29.16 | | | $23.91 | | | $20.08 | | $19.10 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | |

Net investment income (d) | | $0.01 | | | $0.11 | | $0.07 | | | $0.15 | | | $0.11 | | $0.02 | |

Net realized and unrealized gain (loss) on investments and foreign currency | | 2.08 | | | 4.46 | | (11.78 | ) | | 5.33 | | | 3.72 | | 0.96 | (g) |

Total from investment

operations | | $2.09 | | | $4.57 | | $(11.71 | ) | | $5.48 | | | $3.83 | | $0.98 | |

Less distributions declared

to shareholders | | | | | | | | | | | | | | |

From net investment income | | $(0.10 | ) | | $– | | $(0.16 | ) | | $(0.23 | ) | | $– | | $– | |

Net asset value, end of period | | $23.85 | | | $21.86 | | $17.29 | | | $29.16 | | | $23.91 | | $20.08 | |

Total return (%) (r)(s) | | 9.56 | (n) | | 26.43 | | (40.37 | ) | | 23.10 | | | 19.07 | | 5.13 | (n) |

Ratios (%) (to average net assets) and Supplemental

data: | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 1.56 | (a) | | 1.67 | | 1.55 | | | 1.62 | | | 1.64 | | 1.75 | (a) |

Expenses after expense

reductions (f) | | 1.56 | (a) | | 1.67 | | 1.55 | | | 1.62 | | | 1.64 | | 1.75 | (a) |

Net investment income | | 0.07 | (a) | | 0.60 | | 0.28 | | | 0.58 | | | 0.48 | | 0.20 | (a) |

Portfolio turnover | | 34 | | | 83 | | 88 | | | 68 | | | 96 | | 92 | |

Net assets at end of period (000 omitted) | | $2,383 | | | $2,168 | | $1,779 | | | $3,563 | | | $1,857 | | $53 | |

See Notes to Financial Statements

20

Financial Highlights – continued

| | | | | | | | | | | | | | | | | |

| | | Six months

ended

4/30/10

(unaudited) | | | Years ended 10/31 | |

| Class R4 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | | 2005 (i) | |

| | | | | | | | | | | | | | | | |

Net asset value, beginning of

period | | $21.98 | | | $17.41 | | | $29.33 | | | $24.02 | | | $20.11 | | $19.10 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | |

Net investment income (d) | | $0.04 | | | $0.19 | | | $0.14 | | | $0.28 | | | $0.14 | | $0.06 | |

Net realized and unrealized gain (loss) on investments and foreign currency | | 2.08 | | | 4.44 | | | (11.85 | ) | | 5.31 | | | 3.77 | | 0.95 | (g) |

Total from investment

operations | | $2.12 | | | $4.63 | | | $(11.71 | ) | | $5.59 | | | $3.91 | | $1.01 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | |

From net investment income | | $(0.14 | ) | | $(0.06 | ) | | $(0.21 | ) | | $(0.28 | ) | | $— | | $— | |

Net asset value, end of period | | $23.96 | | | $21.98 | | | $17.41 | | | $29.33 | | | $24.02 | | $20.11 | |

Total return (%) (r)(s) | | 9.67 | (n) | | 26.73 | | | (40.20 | ) | | 23.47 | | | 19.44 | | 5.29 | (n) |

Ratios (%) (to average net assets) and Supplemental

data: | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | 1.31 | (a) | | 1.38 | | | 1.29 | | | 1.33 | | | 1.35 | | 1.45 | (a) |

Expenses after expense

reductions (f) | | 1.31 | (a) | | 1.38 | | | 1.29 | | | 1.33 | | | 1.35 | | 1.45 | (a) |

Net investment income | | 0.33 | (a) | | 1.03 | | | 0.54 | | | 1.07 | | | 0.65 | | 0.50 | (a) |

Portfolio turnover | | 34 | | | 83 | | | 88 | | | 68 | | | 96 | | 92 | |

Net assets at end of period (000 omitted) | | $164 | | | $146 | | | $46 | | | $78 | | | $63 | | $53 | |

Any redemption fees charged by the fund during the 2005 fiscal year resulted in a per share impact of less than $0.01.

| (d) | Per share data is based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly, if applicable. |

| (g) | The per share amount is not in accordance with the net realized and unrealized gain/loss for the period because of the timing of sales of fund shares and the per share amount of realized and unrealized gains and losses at such time. |

| (i) | For the period from the class’ inception, April 1, 2005, through the stated period end. |

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (s) | From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower. |

| (t) | Total returns do not include any applicable sales charges. |

| (w) | Per share amount was less than $0.01. |

See Notes to Financial Statements

21

NOTES TO FINANCIAL STATEMENTS

(unaudited)

| (1) | | Business and Organization |

MFS Global Growth Fund (the fund) is a series of MFS Series Trust VIII (the trust). The trust is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company.

| (2) | | Significant Accounting Policies |

General – The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. In the preparation of these financial statements, management has evaluated subsequent events occurring after the date of the fund’s Statement of Assets and Liabilities through the date that the financial statements were issued. The fund can invest in foreign securities, including securities of emerging market issuers. Investments in foreign securities are vulnerable to the effects of changes in the relative values of the local currency and the U.S. dollar and to the effects of changes in each country’s legal, political, and economic environment. The markets of emerging markets countries are generally more volatile than the markets of developed countries with more mature economies. All of the risks of investing in foreign securities previously described are heightened when investing in emerging markets countries.

Investment Valuations – Equity securities, including restricted equity securities, are generally valued at the last sale or official closing price as provided by a third-party pricing service on the market or exchange on which they are primarily traded. Equity securities, for which there were no sales reported that day, are generally valued at the last quoted daily bid quotation as provided by a third-party pricing service on the market or exchange on which such securities are primarily traded. Equity securities held short, for which there were no sales reported for that day, are generally valued at the last quoted daily ask quotation as provided by a third-party pricing service on the market or exchange on which such securities are primarily traded. Short-term instruments with a maturity at issuance of 60 days or less generally are valued at amortized cost, which approximates market value. Open-end investment companies are generally valued at net asset value per share. Securities and other assets generally valued on the basis of information from a third-party pricing service may also be valued at a broker/dealer bid quotation. Values obtained from third-party pricing services can utilize both transaction data and market information such as yield, quality, coupon rate, maturity, type of issue,

22

Notes to Financial Statements (unaudited) – continued

trading characteristics, and other market data. The values of foreign securities and other assets and liabilities expressed in foreign currencies are converted to U.S. dollars using the mean of bid and asked prices for rates provided by a third-party pricing service.

The Board of Trustees has delegated primary responsibility for determining or causing to be determined the value of the fund’s investments (including any fair valuation) to the adviser pursuant to valuation policies and procedures approved by the Board. If the adviser determines that reliable market quotations are not readily available, investments are valued at fair value as determined in good faith by the adviser in accordance with such procedures under the oversight of the Board of Trustees. Under the fund’s valuation policies and procedures, market quotations are not considered to be readily available for most types of debt instruments and floating rate loans and many types of derivatives. These investments are generally valued at fair value based on information from third-party pricing services. In addition, investments may be valued at fair value if the adviser determines that an investment’s value has been materially affected by events occurring after the close of the exchange or market on which the investment is principally traded (such as foreign exchange or market) and prior to the determination of the fund’s net asset value, or after the halting of trading of a specific security where trading does not resume prior to the close of the exchange or market on which the security is principally traded. Events that occur on a frequent basis after foreign markets close (such as developments in foreign markets and significant movements in the U.S. markets) and prior to the determination of the fund’s net asset value may be deemed to have a material effect on the value of securities traded in foreign markets. Accordingly, the fund’s foreign equity securities may often be valued at fair value. The adviser generally relies on third-party pricing services or other information (such as the correlation with price movements of similar securities in the same or other markets; the type, cost and investment characteristics of the security; the business and financial condition of the issuer; and trading and other market data) to assist in determining whether to fair value and at what value to fair value an investment. The value of an investment for purposes of calculating the fund’s net asset value can differ depending on the source and method used to determine value. When fair valuation is used, the value of an investment used to determine the fund’s net asset value may differ from quoted or published prices for the same investment. There can be no assurance that the fund could obtain the fair value assigned to an investment if it were to sell the investment at the same time at which the fund determines its net asset value per share.

Various inputs are used in determining the value of the fund’s assets or liabilities. These inputs are categorized into three broad levels. In certain cases,

23

Notes to Financial Statements (unaudited) – continued

the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. The fund’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the investment. Level 1 includes unadjusted quoted prices in active markets for identical assets or liabilities. Level 2 includes other significant observable market-based inputs (including quoted prices for similar securities, interest rates, prepayment speed, and credit risk). Level 3 includes unobservable inputs, which may include the adviser’s own assumptions in determining the fair value of investments. Other financial instruments are derivative instruments not reflected in total investments, such as futures, forwards, swap contracts, and written options. The following is a summary of the levels used as of April 30, 2010 in valuing the fund’s assets or liabilities:

| | | | | | | | |

| Investments at Value | | Level 1 | | Level 2 | | Level 3 | | Total |

| Equity Securities: | | | | | | | | |

United States | | $108,731,201 | | $— | | $— | | $108,731,201 |

United Kingdom | | 6,341,335 | | 15,699,769 | | — | | 22,041,104 |

Switzerland | | 8,517,318 | | 12,912,119 | | — | | 21,429,437 |

Japan | | 1,322,191 | | 14,376,358 | | — | | 15,698,549 |

France | | — | | 11,846,890 | | — | | 11,846,890 |

Germany | | 5,928,673 | | 4,737,441 | | — | | 10,666,114 |

Taiwan | | 4,637,446 | | 2,926,073 | | — | | 7,563,519 |

Netherlands | | — | | 5,318,729 | | — | | 5,318,729 |

Hong Kong | | — | | 4,598,226 | | — | | 4,598,226 |

Other Countries | | 10,402,203 | | 10,425,492 | | — | | 20,827,695 |

| Short Term Securities | | — | | 10,137,995 | | — | | 10,137,995 |

| Mutual Funds | | 3,370,449 | | — | | — | | 3,370,449 |

| Total Investments | | $149,250,816 | | $92,979,092 | | $— | | $242,229,908 |

For further information regarding security characteristics, see the Portfolio of Investments.

Repurchase Agreements – The fund may enter into repurchase agreements with approved counterparties. Each repurchase agreement is recorded at cost. The fund requires that the securities collateral in a repurchase transaction be transferred to a custodian. The fund monitors, on a daily basis, the value of the collateral to ensure that its value, including accrued interest, is greater than amounts owed to the fund under each such repurchase agreement.

Foreign Currency Translation – Purchases and sales of foreign investments, income, and expenses are converted into U.S. dollars based upon currency exchange rates prevailing on the respective dates of such transactions or on the reporting date for foreign denominated receivables and payables. Gains and

24

Notes to Financial Statements (unaudited) – continued

losses attributable to foreign currency exchange rates on sales of securities are recorded for financial statement purposes as net realized gains and losses on investments. Gains and losses attributable to foreign exchange rate movements on receivables, payables, income and expenses are recorded for financial statement purposes as foreign currency transaction gains and losses. That portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed.

Derivatives – The fund may use derivatives for different purposes, including to earn income and enhance returns, to increase or decrease exposure to a particular market, to manage or adjust the risk profile of the fund, or as alternatives to direct investments. Derivatives may be used for hedging or non-hedging purposes. While hedging can reduce or eliminate losses, it can also reduce or eliminate gains. When the fund uses derivatives as an investment to increase market exposure, or for hedging purposes, gains and losses from derivative instruments may be substantially greater than the derivative’s original cost.

Derivative instruments include written options, purchased options, futures contracts, forward foreign currency exchange contracts, and swap agreements. For the six months ended April 30, 2010, the fund did not invest in any derivative instruments.

Short Sales – The fund may enter into short sales whereby it sells a security it does not own in anticipation of a decline in the value of that security. The fund will realize a gain if the security price decreases and a loss if the security price increases between the date of the short sale and the date on which the fund replaces the borrowed security. Losses from short sales can exceed the proceeds of the security sold; and they can also exceed the potential loss from an ordinary buy and sell transaction. The amount of any premium, dividends, or interest the fund may be required to pay in connection with a short sale will be recognized as a fund expense. The fund segregates cash or marketable securities in an amount that, when combined with the amount of proceeds from the short sale deposited with the broker, at least equals the current market value of the security sold short. At April 30, 2010, the fund has yet to enter into such transactions.

Security Loans – JPMorgan Chase and Co. (“Chase”), as lending agent, may loan the securities of the fund to certain qualified institutions (the “Borrowers”) approved by the fund. The loans are collateralized by cash and/or U.S. Treasury and federal agency obligations in an amount typically at least equal to the market value of the securities loaned. The market value of the loaned securities is determined at the close of business of the fund and any additional required collateral is delivered to the fund on the next business day.

25

Notes to Financial Statements (unaudited) – continued

Chase provides the fund with indemnification against Borrower default. The fund bears the risk of loss with respect to the investment of cash collateral. On loans collateralized by cash, the cash collateral is invested in short-term securities. A portion of the income generated upon investment of the collateral is remitted to the Borrowers, and the remainder is allocated between the fund and the lending agent. On loans collateralized by U.S. Treasury and/or federal agency obligations, a fee is received from the Borrower, and is allocated between the fund and the lending agent. Income from securities lending is included in interest income on the Statement of Operations. The dividend and interest income earned on the securities loaned is accounted for in the same manner as other dividend and interest income.

Indemnifications – Under the fund’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the fund. Additionally, in the normal course of business, the fund enters into agreements with service providers that may contain indemnification clauses. The fund’s maximum exposure under these agreements is unknown as this would involve future claims that may be made against the fund that have not yet occurred.

Investment Transactions and Income – Investment transactions are recorded on the trade date. Interest income is recorded on the accrual basis. All premium and discount is amortized or accreted for financial statement purposes in accordance with U.S. generally accepted accounting principles. Dividends received in cash are recorded on the ex-dividend date. Certain dividends from foreign securities will be recorded when the fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date. Dividend and interest payments received in additional securities are recorded on the ex-dividend or ex-interest date in an amount equal to the value of the security on such date. The fund may receive proceeds from litigation settlements. Any proceeds received from litigation involving portfolio holdings are reflected in the Statement of Operations in realized gain/loss if the security has been disposed of by the fund or in unrealized gain/loss if the security is still held by the fund. Any other proceeds from litigation not related to portfolio holdings are reflected as other income in the Statement of Operations.

Fees Paid Indirectly – The fund’s custody fee may be reduced according to an arrangement that measures the value of cash deposited with the custodian by the fund. This amount, for the six months ended April 30, 2010, is shown as a reduction of total expenses on the Statement of Operations.

Tax Matters and Distributions – The fund intends to qualify as a regulated investment company, as defined under Subchapter M of the Internal Revenue Code, and to distribute all of its taxable income, including realized capital

26

Notes to Financial Statements (unaudited) – continued

gains. As a result, no provision for federal income tax is required. The fund’s federal tax returns for the prior three fiscal years remain subject to examination by the Internal Revenue Service. Foreign taxes, if any, have been accrued by the fund in the accompanying financial statements.

Distributions to shareholders are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles. Certain capital accounts in the financial statements are periodically adjusted for permanent differences in order to reflect their tax character. These adjustments have no impact on net assets or net asset value per share. Temporary differences which arise from recognizing certain items of income, expense, gain or loss in different periods for financial statement and tax purposes will reverse at some time in the future. Distributions in excess of net investment income or net realized gains are temporary overdistributions for financial statement purposes resulting from differences in the recognition or classification of income or distributions for financial statement and tax purposes.

Book/tax differences primarily relate to wash sale loss deferrals, foreign currency transactions, and foreign taxes.

The tax character of distributions made during the current period will be determined at fiscal year end. The tax character of distributions declared to shareholders for the last fiscal year is as follows:

| | |

| | | 10/31/09 |

| Ordinary income (including any short-term capital gains) | | $24,131 |

The federal tax cost and the tax basis components of distributable earnings were as follows:

| | | |

| As of 4/30/10 | | | |

| Cost of investments | | $227,546,313 | |

| Gross appreciation | | 25,132,977 | |

| Gross depreciation | | (10,449,382 | ) |

| Net unrealized appreciation (depreciation) | | $14,683,595 | |

| |

| As of 10/31/09 | | | |

| Undistributed ordinary income | | 822,157 | |

| Capital loss carryforwards | | (30,034,992 | ) |

| Other temporary differences | | (37,884 | ) |

| Net unrealized appreciation (depreciation) | | (5,001,748 | ) |

27

Notes to Financial Statements (unaudited) – continued

As of October 31, 2009, the fund had capital loss carryforwards available to offset future realized gains. Such losses expire as follows:

| | | |

| 10/31/11 | | $(4,551,465 | ) |

| 10/31/17 | | (25,483,527 | ) |

| | $(30,034,992 | ) |

Multiple Classes of Shares of Beneficial Interest – The fund offers multiple classes of shares, which differ in their respective distribution and service fees. The fund’s income, realized and unrealized gain (loss), and common expenses are allocated to shareholders based on the daily net assets of each class. Dividends are declared separately for each class. Differences in per share dividend rates are generally due to differences in separate class expenses. Class B shares will convert to Class A shares approximately eight years after purchase. The fund’s distributions declared to shareholders as reported on the Statements of Changes in Net Assets are presented by class as follows:

| | | | |

| | | From net investment income |

| | | Six months ended

4/30/10 | | Year ended

10/31/09 |

| Class A | | $767,064 | | $7,021 |

| Class I | | 37,502 | | 16,937 |

| Class R2 | | 7,879 | | — |

| Class R3 | | 9,694 | | — |

| Class R4 | | 939 | | 173 |

| Total | | $823,078 | | $24,131 |

| (3) | | Transactions with Affiliates |

Investment Adviser – The fund has an investment advisory agreement with MFS to provide overall investment management and related administrative services and facilities to the fund. The management fee is computed daily and paid monthly at the following annual rates:

| | | |

| First $1 billion of average daily net assets | | 0.90 | % |

| Next $1 billion of average daily net assets | | 0.75 | % |

| Average daily net assets in excess of $2 billion | | 0.65 | % |

The management fee incurred for the six months ended April 30, 2010 was equivalent to an annual effective rate of 0.90% of the fund’s average daily net assets.

Distributor – MFS Fund Distributors, Inc. (MFD), a wholly-owned subsidiary of MFS, as distributor, received $8,962 for the six months ended April 30, 2010, as its portion of the initial sales charge on sales of Class A shares of the fund.

The Board of Trustees has adopted a distribution plan for certain class shares pursuant to Rule 12b-1 of the Investment Company Act of 1940.

28

Notes to Financial Statements (unaudited) – continued

The fund’s distribution plan provides that the fund will pay MFD for services provided by MFD and financial intermediaries in connection with the distribution and servicing of certain share classes. One component of the plan is a distribution fee paid to MFD and another component of the plan is a service fee paid to MFD. MFD may subsequently pay all, or a portion, of the distribution and/or service fees to financial intermediaries.

Distribution Plan Fee Table:

| | | | | | | | | | |

| | | Distribution

Fee Rate (d) | | Service

Fee Rate (d) | | Total

Distribution

Plan (d) | | Annual

Effective

Rate (e) | | Distribution

and Service

Fee |

Class A | | — | | 0.25% | | 0.25% | | 0.25% | | $232,719 |

Class B | | 0.75% | | 0.25% | | 1.00% | | 1.00% | | 84,076 |

Class C | | 0.75% | | 0.25% | | 1.00% | | 1.00% | | 72,597 |

Class R1 | | 0.75% | | 0.25% | | 1.00% | | 1.00% | | 4,977 |

Class R2 | | 0.25% | | 0.25% | | 0.50% | | 0.50% | | 12,616 |

Class R3 | | — | | 0.25% | | 0.25% | | 0.25% | | 2,902 |

| Total Distribution and Service Fees | | $409,887 |

| (d) | In accordance with the distribution plan for certain classes, the fund pays distribution and/or service fees equal to these annual percentage rates of each class’ average daily net assets. The distribution and service fee rates disclosed by class represent the current rates in effect at the end of the reporting period. Any rate changes, if applicable, are detailed below. |

| (e) | The annual effective rates represent actual fees incurred under the distribution plan for the six months ended April 30, 2010 based on each class’ average daily net assets. |

Certain Class A shares purchased on or subsequent to September 1, 2008 are subject to a contingent deferred sales charge (CDSC) in the event of a shareholder redemption within 24 months of purchase. Class C shares are subject to a CDSC in the event of a shareholder redemption within 12 months of purchase. Class B shares are subject to a CDSC in the event of a shareholder redemption within six years of purchase. All contingent deferred sales charges are paid to MFD and during the six months ended April 30, 2010, were as follows:

| | |

| | | Amount |

| Class A | | $20 |

| Class B | | 5,747 |

| Class C | | 120 |

Shareholder Servicing Agent – MFS Service Center, Inc. (MFSC), a wholly-owned subsidiary of MFS, receives a fee from the fund for its services as shareholder servicing agent calculated as a percentage of the average daily net assets of the fund as determined periodically under the supervision of the fund’s Board of Trustees. For the six months ended April 30, 2010, the fee was $126,174, which equated to 0.1085% annually of the fund’s average daily net assets. MFSC also receives payment from the fund for out-of-pocket expenses, sub-accounting and other shareholder servicing costs which may be paid to

29

Notes to Financial Statements (unaudited) – continued

affiliated and unaffiliated service providers. For the six months ended April 30, 2010, these out-of-pocket expenses, sub-accounting and other shareholder servicing costs amounted to $144,708.

Administrator – MFS provides certain financial, legal, shareholder communications, compliance, and other administrative services to the fund. Under an administrative services agreement, the fund partially reimburses MFS the costs incurred to provide these services. The fund is charged an annual fixed amount of $17,500 plus a fee based on average daily net assets. The administrative services fee incurred for the six months ended April 30, 2010 was equivalent to an annual effective rate of 0.0187% of the fund’s average daily net assets.

Trustees’ and Officers’ Compensation – The fund pays compensation to independent Trustees in the form of a retainer, attendance fees, and additional compensation to Board and Committee chairpersons. The fund does not pay compensation directly to Trustees or officers of the fund who are also officers of the investment adviser, all of whom receive remuneration for their services to the fund from MFS. Certain officers and Trustees of the fund are officers or directors of MFS, MFD, and MFSC.

Prior to December 31, 2001, the fund had an unfunded defined benefit plan (“DB plan”) for independent Trustees. As of December 31, 2001, the Board took action to terminate the DB plan with respect to then-current and any future independent Trustees, such that the DB Plan covers only certain of those former independent Trustees who retired on or before December 31, 2001. Effective January 1, 2002, accrued benefits under the DB Plan for then-current independent Trustees who continued were credited to an unfunded retirement deferral plan (the “Retirement Deferral plan”), which was established for and exists solely with respect to these credited amounts, and is not available for other deferrals by these or other independent Trustees. Although the Retirement Deferral plan is unfunded, amounts deferred under the plan are periodically adjusted for investment experience as if they had been invested in shares of the fund. The DB Plan resulted in a pension expense of $843 and the Retirement Deferral plan resulted in an expense of $2,340. Both amounts are included in independent Trustees’ compensation for the six months ended April 30, 2010. The liability for deferred retirement benefits payable to certain independent Trustees under both Plans amounted to $41,597 at April 30, 2010, and is included in payable for independent Trustees’ compensation on the Statement of Assets and Liabilities.

Other – This fund and certain other funds managed by MFS (the funds) have entered into services agreements (the Agreements) which provide for payment of fees by the funds to Tarantino LLC and Griffin Compliance LLC in return for the provision of services of an Independent Chief Compliance Officer (ICCO)

30

Notes to Financial Statements (unaudited) – continued

and Assistant ICCO, respectively, for the funds. The ICCO and Assistant ICCO are officers of the funds and the sole members of Tarantino LLC and Griffin Compliance LLC, respectively. The funds can terminate the Agreements with Tarantino LLC and Griffin Compliance LLC at any time under the terms of the Agreements. For the six months ended April 30, 2010, the aggregate fees paid by the fund to Tarantino LLC and Griffin Compliance LLC were $1,407 and are included in miscellaneous expense on the Statement of Operations. MFS has agreed to reimburse the fund for a portion of the payments made by the fund in the amount of $508, which is shown as a reduction of total expenses in the Statement of Operations. Additionally, MFS has agreed to bear all expenses associated with office space, other administrative support, and supplies provided to the ICCO and Assistant ICCO.

The fund may invest in the MFS Institutional Money Market Portfolio which is managed by MFS and seeks a high level of current income consistent with preservation of capital and liquidity. Income earned on this investment is included in dividends from underlying funds on the Statement of Operations. This money market fund does not pay a management fee to MFS.

Purchases and sales of investments, other than U.S. Government securities, purchased option transactions, and short-term obligations, aggregated $76,816,480 and $89,841,099, respectively.

| (5) | | Shares of Beneficial Interest |

The fund’s Declaration of Trust permits the Trustees to issue an unlimited number of full and fractional shares of beneficial interest. Transactions in fund shares were as follows:

| | | | | | | | |

| | | Six months ended

4/30/10 | | Year ended

10/31/09 |

| | | Shares | | Amount | | Shares | | Amount |

| Shares sold | | | | | | | | |

Class A | | 413,932 | | $9,679,550 | | 1,140,621 | | $20,468,985 |

Class B | | 48,767 | | 1,062,789 | | 136,125 | | 2,332,213 |

Class C | | 44,081 | | 951,903 | | 164,062 | | 2,919,260 |

Class I | | 25,251 | | 606,491 | | 54,872 | | 1,070,421 |

Class R1 | | 7,633 | | 162,875 | | 13,039 | | 204,677 |

Class R2 | | 22,779 | | 525,270 | | 51,191 | | 896,132 |

Class R3 | | 8,055 | | 187,932 | | 14,357 | | 260,422 |

Class R4 | | 191 | | 4,379 | | 3,992 | | 61,365 |

| | 570,689 | | $13,181,189 | | 1,578,259 | | $28,213,475 |

31

Notes to Financial Statements (unaudited) – continued

| | | | | | | | | | | | |

| | | Six months ended

4/30/10 | | | Year ended

10/31/09 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| Shares issued to shareholders in reinvestment of distributions | | | | | | | | | | | | |

Class A | | 30,668 | | | $703,849 | | | 408 | | | $6,991 | |

Class I | | 1,468 | | | 34,319 | | | 975 | | | 16,937 | |

Class R2 | | 325 | | | 7,281 | | | — | | | — | |

Class R3 | | 424 | | | 9,694 | | | — | | | — | |

Class R4 | | 41 | | | 939 | | | 10 | | | 173 | |

| | 32,926 | | | $756,082 | | | 1,393 | | | $24,101 | |

| Shares reacquired | | | | | | | | | | | | |

Class A | | (870,537 | ) | | $(20,149,974 | ) | | (1,747,948 | ) | | $(30,336,311 | ) |

Class B | | (193,645 | ) | | (4,219,160 | ) | | (496,733 | ) | | (7,982,943 | ) |

Class C | | (50,937 | ) | | (1,106,410 | ) | | (132,048 | ) | | (2,100,034 | ) |

Class I | | (14,425 | ) | | (347,051 | ) | | (36,123 | ) | | (673,974 | ) |

Class R1 | | (3,509 | ) | | (74,241 | ) | | (8,368 | ) | | (146,491 | ) |

Class R2 | | (38,957 | ) | | (887,102 | ) | | (94,866 | ) | | (1,625,381 | ) |

Class R3 | | (7,766 | ) | | (180,008 | ) | | (17,994 | ) | | (311,949 | ) |

Class R4 | | (38 | ) | | (862 | ) | | (7 | ) | | (127 | ) |

| | (1,179,814 | ) | | $(26,964,808 | ) | | (2,534,087 | ) | | $(43,177,210 | ) |

| Net change | | | | | | | | | | | | |

Class A | | (425,937 | ) | | $(9,766,575 | ) | | (606,919 | ) | | $(9,860,335 | ) |

Class B | | (144,878 | ) | | (3,156,371 | ) | | (360,608 | ) | | (5,650,730 | ) |

Class C | | (6,856 | ) | | (154,507 | ) | | 32,014 | | | 819,226 | |

Class I | | 12,294 | | | 293,759 | | | 19,724 | | | 413,384 | |

Class R1 | | 4,124 | | | 88,634 | | | 4,671 | | | 58,186 | |

Class R2 | | (15,853 | ) | | (354,551 | ) | | (43,675 | ) | | (729,249 | ) |

Class R3 | | 713 | | | 17,618 | | | (3,637 | ) | | (51,527 | ) |

Class R4 | | 194 | | | 4,456 | | | 3,995 | | | 61,411 | |

| | (576,199 | ) | | $(13,027,537 | ) | | (954,435 | ) | | $(14,939,634 | ) |

The fund and certain other funds managed by MFS participate in a $1.1 billion unsecured committed line of credit, subject to a $1 billion sublimit, provided by a syndication of banks under a credit agreement. Borrowings may be made for temporary financing needs. Interest is charged to each fund, based on its borrowings, generally at a rate equal to the higher of the Federal Reserve funds rate or one month LIBOR plus an agreed upon spread. A commitment fee, based on the average daily, unused portion of the committed line of credit, is allocated among the participating funds at the end of each calendar quarter. In addition, the fund and other funds managed by MFS have established unsecured uncommitted borrowing arrangements with certain banks for temporary financing needs. Interest is charged to each fund, based on its borrowings, at a rate equal to the Federal Reserve funds rate plus an agreed

32

Notes to Financial Statements (unaudited) – continued

upon spread. For the six months ended April 30, 2010, the fund’s commitment fee and interest expense were $1,830 and $0, respectively, and are included in miscellaneous expense on the Statement of Operations.

| (7) | | Transactions in Underlying Funds-Affiliated Issuers |

An affiliated issuer may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. For the purposes of this report, the fund assumes the following to be affiliated issuers:

| | | | | | | | | |

| Underlying Funds | | Beginning

Shares/Par

Amount | | Acquisitions

Shares/Par

Amount | | Dispositions

Shares/Par

Amount | | | Ending

Shares/Par

Amount |

| MFS Institutional Money Market Portfolio | | 4,379,498 | | 27,109,307 | | (28,118,356 | ) | | 3,370,449 |

| | | | |

| Underlying Funds | | Realized

Gain (Loss) | | Capital Gain

Distributions | | Dividend

Income | | | Ending

Value |

| MFS Institutional Money Market Portfolio | | $— | | $— | | $2,604 | | | $3,370,449 |

33

RESULTS OF SHAREHOLDER MEETING

(unaudited)

At a special meeting of shareholders of the MFS Series Trust VIII, which was held on January 28, 2010, the following actions were taken:

Item 1. To elect the following individuals as Trustees:

| | | | |

| | | Number of Dollars |

Nominee | | For | | Withheld Authority |

| Robert E. Butler | | 285,561,587.438 | | 6,609,092.018 |

| Lawrence H. Cohn, M.D. | | 285,558,768.585 | | 6,611,910.870 |

| Maureen R. Goldfarb | | 285,617,072.153 | | 6,553,607.302 |

| David H. Gunning | | 285,523,761.792 | | 6,646,917.663 |

| William R. Gutow | | 285,524,663.862 | | 6,646,015.593 |

| Michael Hegarty | | 285,560,556.325 | | 6,610,123.130 |

| John P. Kavanaugh | | 285,588,193.331 | | 6,582,486.124 |

| Robert J. Manning | | 285,559,729.009 | | 6,610,950.446 |

| Robert C. Pozen | | 285,596,407.892 | | 6,574,271.563 |

| J. Dale Sherratt | | 285,524,072.106 | | 6,646,607.349 |