UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549 |

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES |

The Dreyfus/Laurel Funds, Inc.

(Exact name of Registrant as specified in charter) |

c/o The Dreyfus Corporation

200 Park Avenue

New York, New York 10166

(Address of principal executive offices) (Zip code) |

Michael A. Rosenberg, Esq.

200 Park Avenue

New York, New York 10166

(Name and address of agent for service) |

| Registrant's telephone number, including area code: | | (212) 922-6000 |

| Date of fiscal year end: | | 10/31 | | |

| Date of reporting period: | | 10/31/2008 | | |

The following N-CSR relates only to the Registrant’s series listed below and does not affect Dreyfus Core Equity Fund, a series of the Registrant with a fiscal year end of August 31. A separate N-CSR will be filed for that series as appropriate.

Dreyfus Bond Market Index Fund

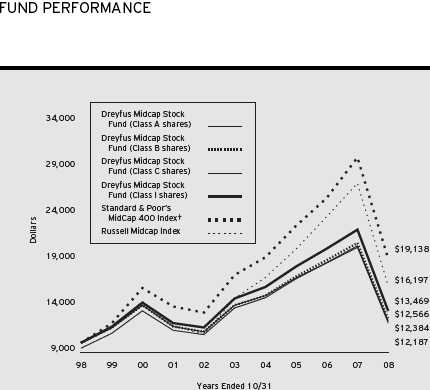

Dreyfus Midcap Stock Fund

Dreyfus Disciplined Stock Fund

Dreyfus Large Company Stock Fund

Dreyfus Money Market Reserves

Dreyfus AMT-Free Municipal Reserves

Dreyfus Tax Managed Growth Fund

Dreyfus BASIC S&P 500 Stock Index Fund

Dreyfus U.S. Treasury Reserves

Dreyfus Balanced Fund

Dreyfus Limited Term Income Fund

Dreyfus Small Cap Value Fund

Dreyfus Strategic Income Fund |

Investment Company Act file number 811-05202

Item 1. Reports to Stockholders.

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

Not FDIC-Insured Not Bank-Guaranteed May Lose Value

| | Contents |

| |

| | THE FUND |

| |

| 2 | A Letter from the CEO |

| |

| 3 | Discussion of Fund Performance |

| |

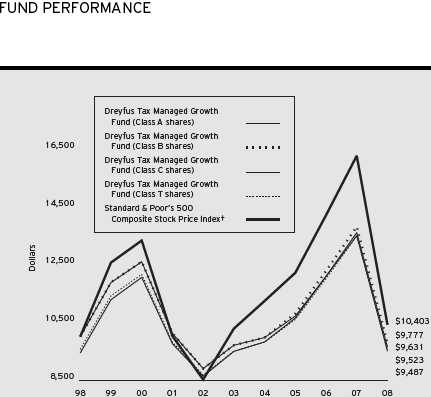

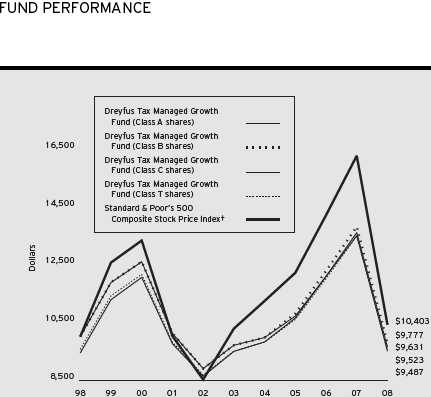

| 6 | Fund Performance |

| |

| 7 | Understanding Your Fund’s Expenses |

| |

| 7 | Comparing Your Fund’s Expenses With Those of Other Funds |

| |

| 8 | Statement of Investments |

| |

| 47 | Statement of Assets and Liabilities |

| |

| 48 | Statement of Operations |

| |

| 49 | Statement of Changes in Net Assets |

| |

| 51 | Financial Highlights |

| |

| 53 | Notes to Financial Statements |

| |

| 61 | Report of Independent Registered Public Accounting Firm |

| |

| 62 | Important Tax Information |

| |

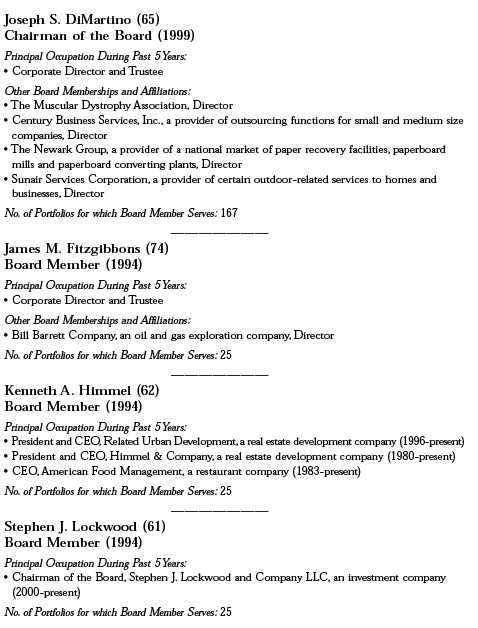

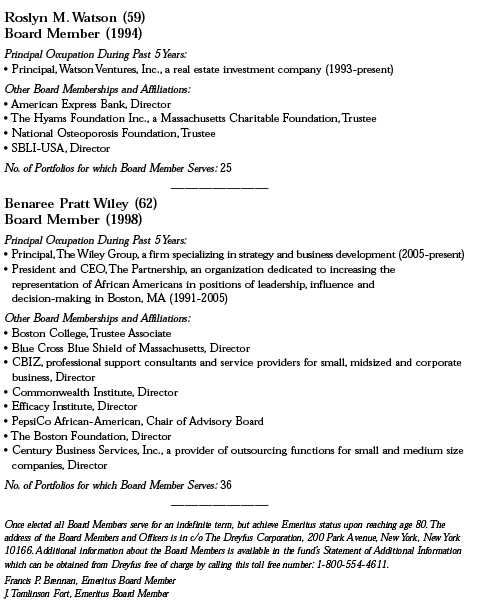

| 63 | Board Members Information |

| |

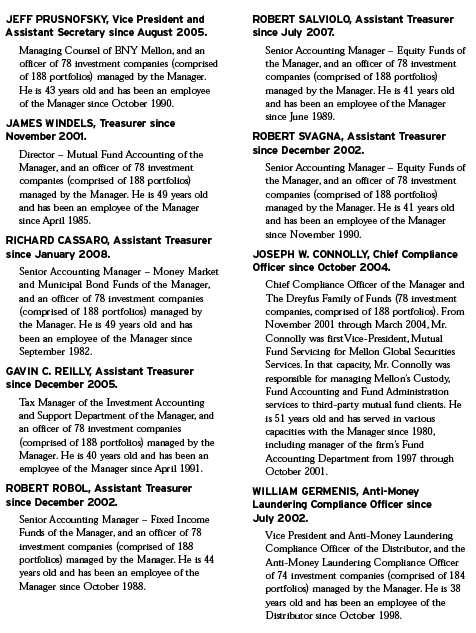

| 65 | Officers of the Fund |

| |

| | FOR MORE INFORMATION |

| |

| | Back Cover |

| |

The Fund

A LETTER FROM THE CEO

Dear Shareholder: |

We present to you this annual report for Dreyfus Bond Market Index Fund, covering the 12-month period from November 1, 2007, through October 31, 2008.

These are difficult times for fixed-income investors.A credit crunch that began in 2007 has developed into a full-blown global financial crisis, recently resulting in the failure of several major financial institutions and prompting a massive government rescue effort.The U.S. economic slowdown also has gathered momentum, depressing investor sentiment and consumer confidence. These factors undermined returns in the bond market’s higher-yielding sectors, including high yield corporate and municipal securities, and even the traditional safe haven of U.S. government securities has encountered heightened yield volatility. The depth and duration of the economic downturn will depend on how quickly the financial system can be stabilized.We believe that the Temporary Guarantee Program for Money Market Funds and the $700 billion rescue package intended to promote greater liquidity in the financial markets meet several critical requirements for addressing today’s financial stresses, and we expect these measures to contribute to a more orderly deleveraging process. However, recuperation from the financial crisis is likely to take time. In the meantime, we encourage you to keep in touch with your financial advisor and maintain a long-term and disciplined perspective to investing. Indeed, we already are seeing some positive signs, including a likely peak in global inflationary pressures, a bottoming of the U.S. dollar and a large pool of worldwide financial liquidity that could be deployed gradually to riskier assets as the economic cycle turns.

For information about how the fund performed during the reporting period, as well as market perspectives, we have provided a Discussion of Fund Performance given by the fund’s Portfolio Manager.

Thank you for your continued confidence and support.

Jonathan R. Baum

Chief Executive Officer

The Dreyfus Corporation

November 17, 2008 |

2

| Dreyfus |

| Bond Market Index Fund |

DISCUSSION OF FUND PERFORMANCE

For the period of November 1, 2007, through October 31, 2008, as provided by Laurie Carroll, Portfolio Manager

Fund and Market Performance Overview

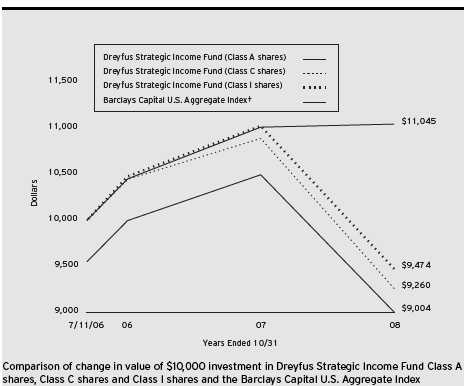

For the 12-month period ended October 31, 2008, Dreyfus Bond Market Index Fund’s Investor shares produced a total return of 0.51%, and BASIC shares produced a total return of 0.67% ..1 In comparison, the Barclays Capital U.S. Aggregate Index (the “Index”) achieved a total return of 0.30% for the same period.2

The U.S. bond market produced modestly positive absolute returns during an especially challenging reporting period. Concerns regarding a slowing economy, turmoil in global credit markets and the near collapse of the global banking system fueled a “flight to quality” among investors, causing U.S.Treasuries securities and U.S. government agency securities to produce some of the bond market’s better results. Conversely, the corporate-backed sector produced less attractive returns.

The Fund’s Investment Approach

The fund seeks to match the total return of the Index.To pursue this goal, the fund normally invests at least 80% of its assets in bonds that are included in the Index. To maintain liquidity, the fund may invest up to 20% of its assets in various short-term, fixed-income securities and money market instruments.

While the fund seeks to mirror the returns of the Index, it does not hold the same number of bonds. Instead, the fund holds approximately 1,300 securities as compared to 9,500 securities in the Index. The fund’s average duration — a measure of sensitivity to changing interest rates — generally remains neutral to the Index. As of October 31, 2008, the average duration of the fund was approximately 4.74 years.

Volatility Increases as Financial Crisis Intensifies

A credit crisis that dominated much of the reporting period later developed into a full-blown global financial crisis, resulting in the failure of

| DISCUSSION OF FUND PERFORMANCE (continued) |

several major financial institutions. As lenders grew increasingly risk-averse, virtually all investment sectors scrambled to obtain funding from a rapidly shrinking supply of available credit. Investors responded by flocking to the relative safety of U.S. government securities, and support for most other sectors of the bond market waned.

While the impact of the credit crisis was particularly severe in higher-yielding bond market sectors, even money market funds were not immune, as interbank lending rates spiked to abnormally high levels and the commercial paper market suffered bouts of challenged liquid-ity.A barrage of negative economic news put further downward pressure on the bond market, including a slowing global economy, and, in the United States, falling home prices, growing unemployment and sluggish consumer spending. As the slowdown intensified, previously high-flying commodity prices retreated sharply from their peaks.

The Federal Reserve Board (the “Fed”) responded aggressively to these developments, reducing short-term interest rates and, in March 2008, participating in the rescue of investment bank Bear Stearns in an effort to limit damage to the capital markets.While the fixed-income markets subsequently rallied, the recovery proved to be short-lived. Over the summer, additional government rescues were announced for insurer American International Group and mortgage agencies Freddie Mac and Fannie Mae. Meanwhile, investment bank Lehman Brothers filed for bankruptcy, Merrill Lynch and Wachovia were acquired by competitors, Washington Mutual was seized by regulators, and Goldman Sachs and Morgan Stanley re-registered as bank holding companies to enable them to tap government funds.With the nation’s major financial institutions realigned or eliminated, fixed-income liquidity became increasingly limited. By September, the financial crisis threatened to spin out of control, and the global banking system came close to collapse.

The U.S. Congress responded to the crisis by making $700 billion available to banks through the controversial Troubled Asset Relief Program. In addition, the Fed and several of the world’s major central banks announced unprecedented, coordinated reductions in short-term inter-

4

est rates to help strengthen the world’s financial systems. By the reporting period’s end, the overnight federal funds rate had declined to 1.00% .

“Flight to Quality” Benefited U.S. Government Securities

The fund benefited from its relatively heavy exposure to U.S.Treasury securities and U.S. government agency securities, which produced some of the Index’s stronger returns. Mortgage-backed securities also fared well, especially after the U.S. government took conservatorship of Freddie Mac and Fannie Mae.

On the other hand, corporate bonds declined sharply due to credit concerns, a slowing global economy and anemic investor demand. Commercial mortgage-backed securities also declined, but, because this asset class represents only a small portion of the Index’s composition, the overall effect was muted.

Mirroring the Index’s Composition

As an index fund, we attempt to replicate the returns of the Index by closely approximating its composition. As of October 31, 2008, approximately 41% of the fund’s assets were invested in mortgage-backed securities, 4% in commercial mortgage-backed securities, 17% in corporate bonds and asset-backed securities, 25% in U.S. Treasury securities and 13% in U.S. government agency bonds. In addition, all of the fund’s corporate securities were at least BBB-rated or better at the end of the reporting period, and the fund has maintained an overall credit quality that is closely aligned with that of the Index.

November 17, 2008

| 1 | | Total return includes reinvestment of dividends and any capital gains paid. Past performance is no |

| | | guarantee of future results. Share price, yield and investment return fluctuate such that upon |

| | | redemption, fund shares may be worth more or less than their original cost. |

| 2 | | SOURCE: LIPPER INC. — Reflects reinvestment of dividends and, where applicable, capital |

| | | gain distributions.The Barclays Capital U.S. Aggregate Index is a widely accepted, unmanaged |

| | | total return index of corporate, U.S. government and U.S. government agency debt instruments, |

| | | mortgage-backed securities and asset-backed securities with an average maturity of 1-10 years. |

| | | Index returns do not reflect fees and expenses associated with operating a mutual fund. |

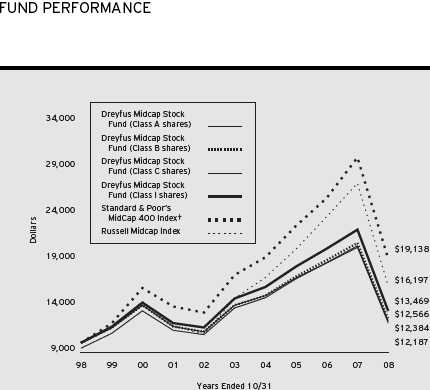

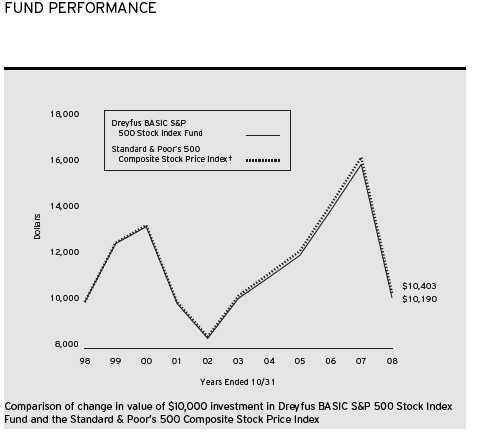

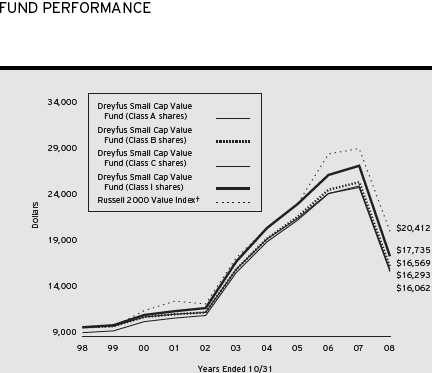

| Average Annual Total Returns as of 10/31/08 | | | | | | |

| | | 1 Year | | 5 Years | | 10 Years |

| |

| |

| |

|

| BASIC shares | | 0.67% | | 3.43% | | 4.80% |

| Investor shares | | 0.51% | | 3.19% | | 4.55% |

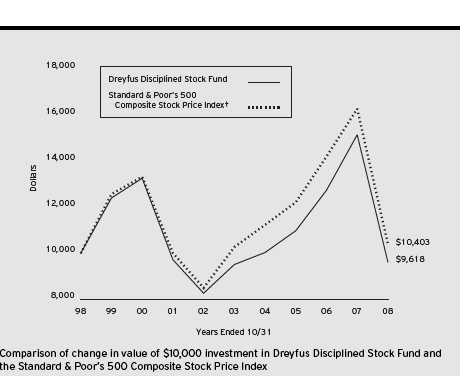

| † Source: Lipper Inc. |

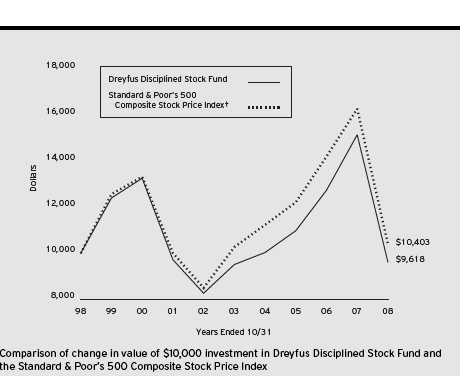

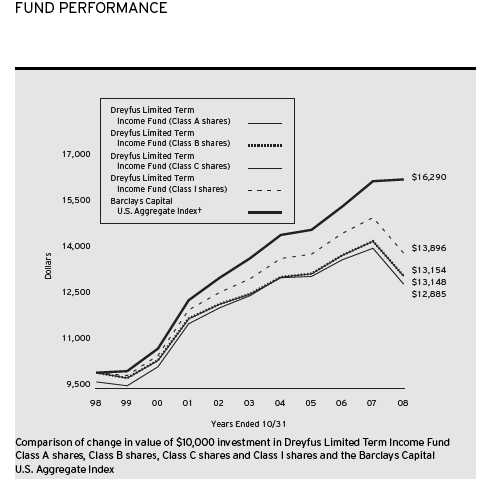

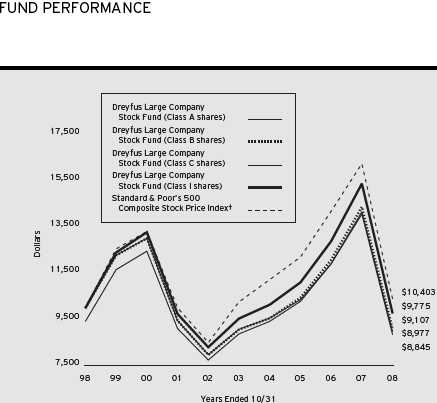

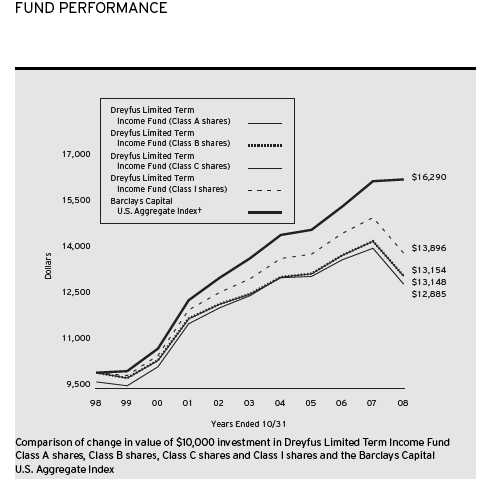

| Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not |

| reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

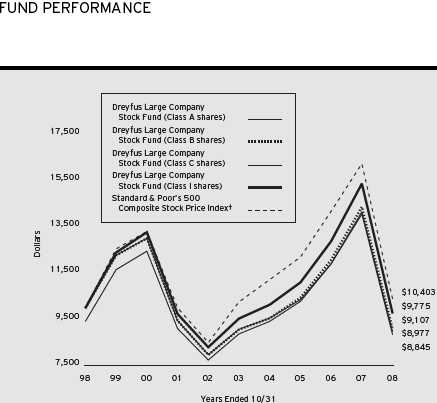

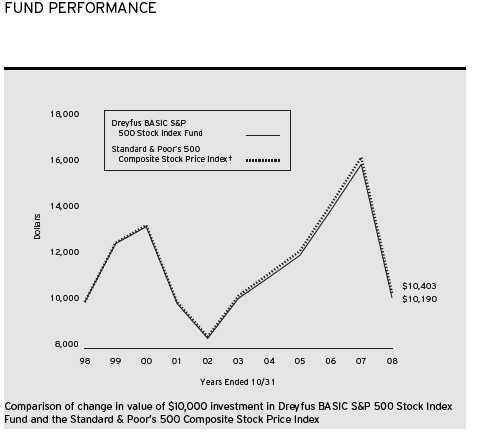

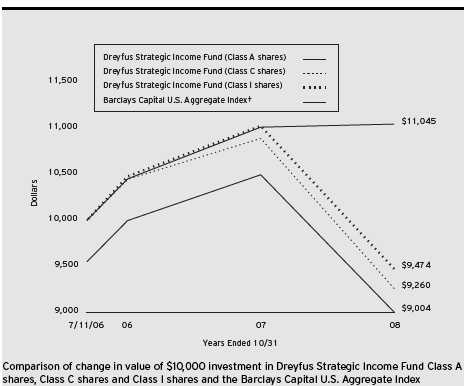

| The above graph compares a $10,000 investment made in both the BASIC shares and Investor shares of Dreyfus Bond |

| Market Index Fund on 10/31/98 to a $10,000 investment made in the Barclays Capital U.S. Aggregate Index (the |

| “Index”) on that date. All dividends and capital gain distributions are reinvested. |

| The fund’s performance shown in the line graph takes into account all applicable fees and expenses on both BASIC and |

| Investor shares.The Index is a widely accepted, unmanaged index of corporate, U.S. government and U.S. government |

| agency debt instruments, mortgage-backed securities, and asset-backed securities. Unlike a mutual fund, the Index is not |

| subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to |

| fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the |

| prospectus and elsewhere in this report. |

6

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Bond Market Index Fund from May 1, 2008 to October 31, 2008. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

Expenses and Value of a $1,000 Investment assuming actual returns for the six months ended October 31, 2008

| | | Investor Shares | | BASIC Shares |

| |

| |

|

| Expenses paid per $1,000† | | $ 1.98 | | $ .74 |

| Ending value (after expenses) | | $965.50 | | $966.70 |

COMPARING YOUR FUND’S EXPENSES WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment assuming a hypothetical 5% annualized return for the six months ended October 31, 2008

| | | Investor Shares | | BASIC Shares |

| |

| |

|

| Expenses paid per $1,000† | | $ 2.03 | | $ .76 |

| Ending value (after expenses) | | $1,022.13 | | $1,024.38 |

| † Expenses are equal to the fund’s annualized expense ratio of .40% for Investor shares and .15% for Basic shares, |

| multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). |

| STATEMENT OF INVESTMENTS | | | | | | |

| October 31, 2008 | | | | | | | | |

| |

| |

| |

| |

|

| |

| |

| |

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes—96.7% | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Aerospace & Defense—.2% | | | | | | | | |

| Boeing, | | | | | | | | |

| Sr. Unscd. Bonds | | 7.25 | | 6/15/25 | | 150,000 | | 143,647 |

| General Dynamics, | | | | | | | | |

| Gtd. Notes | | 4.25 | | 5/15/13 | | 125,000 | | 117,166 |

| Lockheed Martin, | | | | | | | | |

| Sr. Unscd. Notes, Ser. B | | 6.15 | | 9/1/36 | | 455,000 | | 391,341 |

| Northrop Grumman, | | | | | | | | |

| Gtd. Debs. | | 7.75 | | 3/1/16 | | 540,000 | | 535,530 |

| Raytheon, | | | | | | | | |

| Sr. Unscd. Notes | | 4.85 | | 1/15/11 | | 125,000 | | 121,387 |

| Raytheon, | | | | | | | | |

| Sr. Unscd. Debs. | | 7.20 | | 8/15/27 | | 150,000 | | 140,360 |

| United Technologies, | | | | | | | | |

| Sr. Unscd. Notes | | 4.88 | | 5/1/15 | | 500,000 | | 456,232 |

| United Technologies, | | | | | | | | |

| Sr. Unscd. Notes | | 6.70 | | 8/1/28 | | 50,000 | | 50,609 |

| United Technologies, | | | | | | | | |

| Sr. Unscd. Debs. | | 8.75 | | 3/1/21 | | 50,000 | | 60,327 |

| | | | | | | | | 2,016,599 |

| Agricultural—.1% | | | | | | | | |

| Philip Morris International, | | | | | | | | |

| Sr. Unscd Notes | | 5.65 | | 5/16/18 | | 760,000 | | 651,290 |

| Reynolds American, | | | | | | | | |

| Sr. Scd. Notes | | 7.63 | | 6/1/16 | | 170,000 | | 139,652 |

| | | | | | | | | 790,942 |

| Asset-Backed Ctfs./ | | | | | | | | |

| Auto Receivables—.1% | | | | | | | | |

| Americredit Automobile Receivables | | | | | | | | |

| Trust, Ser. 2006-RM, Cl. A2 | | 5.42 | | 8/8/11 | | 379,974 | | 365,683 |

| Chase Manhattan Auto Owner Trust, | | | | | | | | |

| Ser. 2006-A, Cl. A4 | | 5.36 | | 1/15/13 | | 90,000 | | 89,080 |

| Honda Auto Receivables Owner | | | | | | | | |

| Trust, Ser. 2006-1, Cl. A3 | | 5.07 | | 2/18/10 | | 57,901 | | 57,950 |

| Honda Auto Receivables Owner | | | | | | | | |

| Trust, Ser. 2007-1, Cl. A4 | | 5.09 | | 7/18/13 | | 700,000 | | 675,471 |

| | | | | | | | | 1,188,184 |

| Asset-Backed Ctfs./Credit Cards—.2% | | | | | | | | |

| Bank One Issuance Trust, | | | | | | | | |

| Ser. 2004-A1, Cl. A1 | | 3.45 | | 10/17/11 | | 950,000 | | 940,720 |

8

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Asset-Backed Ctfs./ | | | | | | | | | | |

| Credit Cards (continued) | | | | | | | | | | |

| Bank One Issuance Trust, | | | | | | | | | | |

| Ser. 2003-C3, Cl. C3 | | 4.77 | | 2/16/16 | | 200,000 | | | | 138,208 |

| Citibank Credit Card Issuance | | | | | | | | | | |

| Trust, Ser. 2005-A4, Cl. A4 | | 4.40 | | 6/20/14 | | 500,000 | | | | 433,214 |

| | | | | | | | | | | 1,512,142 |

| Asset-Backed Ctfs./ | | | | | | | | | | |

| Home Equity Loans—.1% | | | | | | | | | | |

| Centex Home Equity, | | | | | | | | | | |

| Ser. 2005-C, Cl. AF5 | | 5.05 | | 6/25/35 | | 200,000 | | a | | 161,208 |

| Countrywide Asset-Backed | | | | | | | | | | |

| Certificates, Ser. 2006-11, | | | | | | | | | | |

| Cl. 1AF4 | | 6.30 | | 9/25/46 | | 1,030,000 | | a | | 426,671 |

| CPL Transition Funding, | | | | | | | | | | |

| Ser. 2002-1, Cl. A4 | | 5.96 | | 7/15/15 | | 550,000 | | | | 547,326 |

| | | | | | | | | | | 1,135,205 |

| Automobile Manufacturers—.1% | | | | | | | | | | |

| Daimler Finance North America, | | | | | | | | | | |

| Gtd. Notes | | 6.50 | | 11/15/13 | | 225,000 | | | | 168,824 |

| Daimler Finance North America, | | | | | | | | | | |

| Gtd. Notes | | 7.30 | | 1/15/12 | | 400,000 | | | | 326,243 |

| Daimler Finance North America, | | | | | | | | | | |

| Gtd. Notes | | 8.50 | | 1/18/31 | | 200,000 | | | | 157,421 |

| | | | | | | | | | | 652,488 |

| Banks—2.9% | | | | | | | | | | |

| Abbey National, | | | | | | | | | | |

| Sub. Debs | | 7.95 | | 10/26/29 | | 350,000 | | | | 271,984 |

| BAC Capital Trust XI, | | | | | | | | | | |

| Bank Gtd. Cap. Secs. | | 6.63 | | 5/23/36 | | 125,000 | | | | 87,995 |

| Bank of America, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.13 | | 11/15/14 | | 350,000 | | | | 308,660 |

| Bank of America, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.38 | | 6/15/14 | | 275,000 | | | | 248,223 |

| Bank of America, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.63 | | 10/14/16 | | 575,000 | | | | 494,216 |

| Bank of America, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.65 | | 5/1/18 | | 965,000 | | | | 830,904 |

| Bank of America, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.75 | | 12/1/17 | | 750,000 | | | | 647,040 |

| STATEMENT OF INVESTMENTS (continued) |

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Banks (continued) | | | | | | | | | | |

| Bank of America, | | | | | | | | | | |

| Sub. Notes | | 7.80 | | 2/15/10 | | 500,000 | | | | 504,788 |

| Bank One, | | | | | | | | | | |

| Sub. Notes | | 5.90 | | 11/15/11 | | 500,000 | | | | 490,236 |

| Bayerische Landesbank, | | | | | | | | | | |

| Sub. Notes | | 5.88 | | 12/1/08 | | 300,000 | | | | 301,071 |

| BB & T, | | | | | | | | | | |

| Sub. Notes | | 4.75 | | 10/1/12 | | 325,000 | | | | 295,100 |

| BB & T, | | | | | | | | | | |

| Sub. Notes | | 4.90 | | 6/30/17 | | 150,000 | | | | 120,150 |

| Capital One Bank, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.13 | | 2/15/14 | | 200,000 | | b | | 170,126 |

| Credit Suisse USA, | | | | | | | | | | |

| Gtd. Notes | | 5.38 | | 3/2/16 | | 200,000 | | | | 159,007 |

| Deutsche Bank London, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.00 | | 9/1/17 | | 845,000 | | | | 751,225 |

| Dresdner Bank, | | | | | | | | | | |

| Sr. Sub. Notes | | 7.25 | | 9/15/15 | | 145,000 | | | | 122,307 |

| Fifth Third Bank, | | | | | | | | | | |

| Notes | | 4.20 | | 2/23/10 | | 200,000 | | | | 186,598 |

| First Tennessee Bank, | | | | | | | | | | |

| Sub. Notes | | 5.65 | | 4/1/16 | | 250,000 | | | | 126,193 |

| Fleet Financial Group, | | | | | | | | | | |

| Sr. Sub. Notes | | 7.38 | | 12/1/09 | | 175,000 | | | | 176,775 |

| Golden West Financial, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.75 | | 10/1/12 | | 1,000,000 | | | | 837,287 |

| HSBC Holdings, | | | | | | | | | | |

| Sub. Notes | | 6.50 | | 5/2/36 | | 250,000 | | | | 198,344 |

| HSBC Holdings, | | | | | | | | | | |

| Sub. Notes | | 6.50 | | 9/15/37 | | 555,000 | | | | 438,846 |

| HSBC Holdings, | | | | | | | | | | |

| Sub. Notes | | 7.50 | | 7/15/09 | | 200,000 | | | | 198,860 |

| JP Morgan Chase, | | | | | | | | | | |

| Sub. Notes | | 6.00 | | 10/1/17 | | 150,000 | | | | 131,526 |

| KeyBank, | | | | | | | | | | |

| Sub. Notes | | 6.95 | | 2/1/28 | | 100,000 | | | | 65,041 |

| KFW, | | | | | | | | | | |

| Gov’t Gtd. Notes | | 3.25 | | 3/30/09 | | 1,250,000 | | | | 1,247,397 |

| KFW, | | | | | | | | | | |

| Govt Gtd. Bonds | | 4.00 | | 10/15/13 | | 1,400,000 | | b | | 1,425,578 |

10

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Banks (continued) | | | | | | | | | | |

| KFW, | | | | | | | | | | |

| Gov’t Gtd. Bonds | | 4.13 | | 10/15/14 | | 1,200,000 | | b | | 1,222,300 |

| KFW, | | | | | | | | | | |

| Gov’t Gtd. Notes | | 4.88 | | 1/17/17 | | 1,240,000 | | | | 1,276,829 |

| KFW, | | | | | | | | | | |

| Gov’t Gtd. Bonds | | 5.13 | | 3/14/16 | | 625,000 | | b | | 618,063 |

| KFW, | | | | | | | | | | |

| Gov’t Gtd. Notes | | 8.00 | | 2/15/10 | | 35,000 | | | | 37,056 |

| Korea Development Bank, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.50 | | 11/13/12 | | 350,000 | | | | 296,621 |

| Mercantile Bankshares, | | | | | | | | | | |

| Sub. Notes, Ser. B | | 4.63 | | 4/15/13 | | 200,000 | | | | 193,994 |

| National City Bank, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.50 | | 3/15/10 | | 1,275,000 | | b | | 1,179,360 |

| NationsBank, | | | | | | | | | | |

| Sub. Notes | | 7.80 | | 9/15/16 | | 235,000 | | | | 220,661 |

| NB Capital Trust IV, | | | | | | | | | | |

| Bank Gtd. Cap. Secs. | | 8.25 | | 4/15/27 | | 55,000 | | | | 45,620 |

| Oesterreichische Kontrollbank, | | | | | | | | | | |

| Govt. Gtd. Notes | | 4.88 | | 2/16/16 | | 1,500,000 | | b | | 1,547,841 |

| Pemex Project Funding Master | | | | | | | | | | |

| Trust, Gtd. Bonds | | 6.63 | | 6/15/35 | | 60,000 | | | | 44,999 |

| PNC Funding, | | | | | | | | | | |

| Bank Gtd. Notes | | 5.25 | | 11/15/15 | | 225,000 | | | | 190,379 |

| Royal Bank of Scotland Group, | | | | | | | | | | |

| Sr. Sub. Notes | | 6.38 | | 2/1/11 | | 410,000 | | | | 394,641 |

| Royal Bank of Scotland Group, | | | | | | | | | | |

| Jr. Sub. Bonds | | 7.65 | | 8/29/49 | | 550,000 | | a | | 303,678 |

| Royal Bank of Scotland, | | | | | | | | | | |

| Sr. Sub. Notes | | 5.00 | | 10/1/14 | | 175,000 | | | | 134,167 |

| Sanwa Finance Aruba, | | | | | | | | | | |

| Bank Gtd. Notes | | 8.35 | | 7/15/09 | | 150,000 | | | | 151,889 |

| SouthTrust, | | | | | | | | | | |

| Sub. Notes | | 5.80 | | 6/15/14 | | 500,000 | | | | 413,537 |

| Sovereign Bancorp, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.80 | | 9/1/10 | | 500,000 | | | | 444,977 |

| State Street Bank & Trust, | | | | | | | | | | |

| Sub. Notes | | 5.25 | | 10/15/18 | | 200,000 | | | | 163,529 |

| Suntrust Capital VIII, | | | | | | | | | | |

| Bank Gtd. Secs. | | 6.10 | | 12/15/36 | | 335,000 | | a | | 172,429 |

| | STATEMENT OF INVESTMENTS (continued) |

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Banks (continued) | | | | | | | | |

| U.S. Bank, | | | | | | | | |

| Sub. Notes | | 4.95 | | 10/30/14 | | 45,000 | | 42,623 |

| U.S. Bank, | | | | | | | | |

| Sub. Notes | | 6.38 | | 8/1/11 | | 100,000 | | 99,053 |

| UBS, | | | | | | | | |

| Sr. Sub. Notes | | 5.88 | | 7/15/16 | | 75,000 | | 63,385 |

| UBS, | | | | | | | | |

| Sr. Unscd. Notes | | 5.88 | | 12/20/17 | | 760,000 | | 607,629 |

| Union Planters, | | | | | | | | |

| Sr. Unscd. Notes | | 4.38 | | 12/1/10 | | 400,000 | | 368,207 |

| Wachovia Bank, | | | | | | | | |

| Sub. Notes | | 5.00 | | 8/15/15 | | 250,000 | | 199,171 |

| Wachovia Bank, | | | | | | | | |

| Sub. Notes | | 6.60 | | 1/15/38 | | 415,000 | | 329,046 |

| Wachovia, | | | | | | | | |

| Sub. Notes | | 5.25 | | 8/1/14 | | 200,000 | | 166,900 |

| Wells Fargo & Co., | | | | | | | | |

| Sr. Unscd. Notes | | 5.63 | | 12/11/17 | | 1,140,000 | | 1,007,423 |

| Wells Fargo & Co., | | | | | | | | |

| Sub. Notes | | 6.38 | | 8/1/11 | | 420,000 | | 429,248 |

| Wells Fargo Bank, | | | | | | | | |

| Sub. Notes | | 5.75 | | 5/16/16 | | 875,000 | | 785,152 |

| Westpac Banking, | | | | | | | | |

| Sub. Notes | | 4.63 | | 6/1/18 | | 500,000 | | 428,961 |

| Zions Bancorporation, | | | | | | | | |

| Sub. Notes | | 6.00 | | 9/15/15 | | 250,000 | | 167,415 |

| | | | | | | | | 24,582,260 |

| Building & Construction—.1% | | | | | | | | |

| CRH America, | | | | | | | | |

| Gtd. Notes | | 5.30 | | 10/15/13 | | 500,000 | | 402,550 |

| Masco, | | | | | | | | |

| Sr. Unscd. Bonds | | 4.80 | | 6/15/15 | | 375,000 | | 283,497 |

| | | | | | | | | 686,047 |

| Chemicals—.2% | | | | | | | | |

| Archer Daniels, | | | | | | | | |

| Sr. Unscd. Notes | | 5.45 | | 3/15/18 | | 130,000 | | 110,688 |

| E.I. Du Pont De Nemours, | | | | | | | | |

| Sr. Unscd. Notes | | 5.25 | | 12/15/16 | | 500,000 | | 440,699 |

12

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Building & Construction (continued) | | | | | | | | | | |

| E.I. Du Pont De Nemours, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.00 | | 7/15/18 | | 560,000 | | | | 513,444 |

| Lubrizol, | | | | | | | | | | |

| Gtd. Notes | | 5.50 | | 10/1/14 | | 150,000 | | | | 124,536 |

| Potash of Saskatchewan, | | | | | | | | | | |

| Sr. Unscd. Notes | | 7.75 | | 5/31/11 | | 200,000 | | | | 203,302 |

| Praxair, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.38 | | 4/1/12 | | 100,000 | | | | 102,501 |

| Rohm & Haas, | | | | | | | | | | |

| Sr. Unscd. Notes | | 7.85 | | 7/15/29 | | 430,000 | | | | 368,390 |

| | | | | | | | | | | 1,863,560 |

| Commercial & Professional Services—.1% | | | | | | | | |

| R.R. Donnelley & Sons, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.95 | | 5/15/10 | | 750,000 | | | | 683,043 |

| Commercial Mortgage | | | | | | | | | | |

| Pass-Through Ctfs.—4.0% | | | | | | | | | | |

| Asset Securitization, | | | | | | | | | | |

| Ser. 1995-D1, Cl. A2 | | 7.59 | | 7/11/27 | | 14,264 | | | | 14,255 |

| Banc of America Commercial | | | | | | | | | | |

| Mortgage, Ser. 2005-3, Cl. A4 | | 4.67 | | 7/10/43 | | 1,000,000 | | | | 792,207 |

| Banc of America Commercial | | | | | | | | | | |

| Mortgage, Ser. 2007-1, Cl. A4 | | 5.45 | | 1/15/49 | | 1,000,000 | | | | 742,344 |

| Banc of America Commercial | | | | | | | | | | |

| Mortgage, Ser. 2000-2, Cl. A2 | | 7.20 | | 9/15/32 | | 600,000 | | a | | 597,362 |

| Bank of America, | | | | | | | | | | |

| Ser. 2007-4, Cl. A4 | | 5.94 | | 2/10/51 | | 300,000 | | a | | 226,117 |

| Bear Stearns Commercial Mortgage | | | | | | | | | | |

| Securities, Ser. 2003-T12, | | | | | | | | | | |

| Cl. A4 | | 4.68 | | 8/13/39 | | 350,000 | | a | | 301,280 |

| Bear Stearns Commercial Mortgage | | | | | | | | | | |

| Securities, Ser. 2003-T10, | | | | | | | | | | |

| Cl. A2 | | 4.74 | | 3/13/40 | | 400,000 | | | | 350,095 |

| Bear Stearns Commercial Mortgage | | | | | | | | | | |

| Securities, Ser. 2005-PWR9, | | | | | | | | | | |

| Cl. A4A | | 4.87 | | 9/11/42 | | 900,000 | | | | 716,946 |

| Bear Stearns Commercial Mortgage | | | | | | | | | | |

| Securities, Ser. 2006-PW12, | | | | | | | | | | |

| Cl. A4 | | 5.72 | | 9/11/38 | | 850,000 | | a | | 678,823 |

| STATEMENT OF INVESTMENTS (continued) |

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Commercial Mortgage | | | | | | | | | | |

| Pass-Through Ctfs. (continued) | | | | | | | | | | |

| Bear Stearns Commercial Mortgage | | | | | | | | | | |

| Securities, Ser. 2002-TOP6, | | | | | | | | | | |

| Cl. A2 | | 6.46 | | 10/15/36 | | 175,000 | | | | 166,581 |

| Bear Stearns Commercial Mortgage | | | | | | | | | | |

| Securities, Ser. 2001-TOP2, | | | | | | | | | | |

| Cl. A2 | | 6.48 | | 2/15/35 | | 230,000 | | | | 223,647 |

| Bear Stearns Commercial Mortgage | | | | | | | | | | |

| Securities, Ser. 1999-WF2, | | | | | | | | | | |

| Cl. A2 | | 7.08 | | 7/15/31 | | 154,710 | | | | 154,125 |

| Chase Commercial Mortgage | | | | | | | | | | |

| Securities, Ser. 2000-3, Cl. A2 | | 7.32 | | 10/15/32 | | 400,989 | | | | 398,115 |

| Chase Commercial Mortgage | | | | | | | | | | |

| Securities, Ser. 2000-2, Cl. A2 | | 7.63 | | 7/15/32 | | 250,000 | | | | 249,493 |

| Citigroup Commercial Mortgage | | | | | | | | | | |

| Trust, Ser. 2006-C4, Cl. A3 | | 5.72 | | 3/15/49 | | 225,000 | | a | | 179,425 |

| Citigroup Commercial Mortgage | | | | | | | | | | |

| Trust, Ser. 2008-C7, Cl. A4 | | 6.10 | | 12/10/49 | | 1,100,000 | | a | | 852,142 |

| Citigroup/Deutsche Bank Commercial | | | | | | | | | | |

| Mortgage Trust, Ser. 2005-CD1, | | | | | | | | | | |

| Cl. A4 | | 5.23 | | 7/15/44 | | 1,900,000 | | a | | 1,550,200 |

| Citigroup/Deutsche Bank Commercial | | | | | | | | | | |

| Mortgage Trust, Ser. 2006-CD2, | | | | | | | | | | |

| Cl. A4 | | 5.36 | | 1/15/46 | | 85,000 | | a | | 66,599 |

| Commercial Mortgage Pass-Through | | | | | | | | | | |

| Certificates, Ser. 2005-LP5, | | | | | | | | | | |

| Cl. A2 | | 4.63 | | 5/10/43 | | 1,459,259 | | | | 1,397,035 |

| Credit Suisse Mortgage Capital | | | | | | | | | | |

| Certificates, Ser. 2006-C3, | | | | | | | | | | |

| Cl. A3 | | 5.83 | | 6/15/38 | | 1,500,000 | | a | | 1,200,367 |

| CS First Boston Mortgage | | | | | | | | | | |

| Securities, Ser. 2004-C3, Cl. A5 | | 5.11 | | 7/15/36 | | 1,245,000 | | a | | 1,041,218 |

| CS First Boston Mortgage | | | | | | | | | | |

| Securities, Ser. 2002-CKP1, Cl. A3 | | 6.44 | | 12/15/35 | | 675,000 | | | | 647,580 |

| CS First Boston Mortgage | | | | | | | | | | |

| Securities, Ser. 2001-CK3, Cl. A4 | | 6.53 | | 6/15/34 | | 375,000 | | | | 365,060 |

| CS First Boston Mortgage | | | | | | | | | | |

| Securities, Ser. 1999-C1, Cl. A2 | | 7.29 | | 9/15/41 | | 630,970 | | | | 630,560 |

| CS First Boston Mortgage | | | | | | | | | | |

| Securities, Ser. 2000-C1, Cl. A2 | | 7.55 | | 4/15/62 | | 278,055 | | | | 278,492 |

14

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Commercial Mortgage | | | | | | | | | | |

| Pass-Through Ctfs. (continued) | | | | | | | | | | |

| CWCapital Cobalt, | | | | | | | | | | |

| Ser. 2007-C3, Cl. A4 | | 5.82 | | 5/15/46 | | 1,000,000 | | a | | 751,762 |

| DLJ Commercial Mortgage, | | | | | | | | | | |

| Ser. 2000-CKP1, Cl. A1B | | 7.18 | | 11/10/33 | | 435,288 | | | | 432,632 |

| GE Capital Commercial Mortgage, | | | | | | | | | | |

| Ser. 2002-1A, Cl. A3 | | 6.27 | | 12/10/35 | | 1,250,000 | | | | 1,185,367 |

| Greenwich Capital Commercial | | | | | | | | | | |

| Funding, Ser. 2005-GG5, Cl. A5 | | 5.22 | | 4/10/37 | | 1,000,000 | | a | | 808,308 |

| GS Mortgage Securities II, | | | | | | | | | | |

| Ser. 2005-GG4, Cl. A3 | | 4.61 | | 7/10/39 | | 775,000 | | | | 674,217 |

| GS Mortgage Securities II, | | | | | | | | | | |

| Ser. 2007-GG10, Cl. A4 | | 5.80 | | 8/10/45 | | 1,000,000 | | a | | 754,900 |

| Heller Financial Commercial | | | | | | | | | | |

| Mortgage Asset, Ser. 1999-PH1, | | | | | | | | | | |

| Cl. A2 | | 6.85 | | 5/15/31 | | 155,219 | | a | | 154,719 |

| J. P. Morgan Chase Commercial | | | | | | | | | | |

| Mortgage Securities, | | | | | | | | | | |

| Ser. 2007-CB20, Cl. A4 | | 5.79 | | 2/12/51 | | 1,000,000 | | a | | 745,503 |

| J.P. Morgan Chase Commercial | | | | | | | | | | |

| Mortgage Securities, | | | | | | | | | | |

| Ser. 2004-CB8, Cl. A4 | | 4.40 | | 1/12/39 | | 1,000,000 | | | | 810,374 |

| J.P. Morgan Chase Commercial | | | | | | | | | | |

| Mortgage Securities, | | | | | | | | | | |

| Ser. 2005-LDP3, Cl. A4A | | 4.94 | | 8/15/42 | | 600,000 | | a | | 474,633 |

| J.P. Morgan Chase Commercial | | | | | | | | | | |

| Mortgage Securities, | | | | | | | | | | |

| Ser. 2004-LN2, Cl. A2 | | 5.11 | | 7/15/41 | | 150,000 | | | | 124,778 |

| J.P. Morgan Chase Commercial | | | | | | | | | | |

| Mortgage Securities, | | | | | | | | | | |

| Ser. 2007-LDPX, Cl. A3 | | 5.42 | | 1/15/49 | | 1,200,000 | | | | 887,536 |

| J.P. Morgan Chase Commercial | | | | | | | | | | |

| Mortgage Securities, | | | | | | | | | | |

| Ser. 2007-CB18, Cl. A4 | | 5.44 | | 6/12/47 | | 350,000 | | | | 258,695 |

| J.P. Morgan Chase Commercial | | | | | | | | | | |

| Mortgage Securities, | | | | | | | | | | |

| Ser. 2006-LDP8, Cl. A3B | | 5.45 | | 5/15/45 | | 225,000 | | | | 185,862 |

| J.P. Morgan Chase Commercial | | | | | | | | | | |

| Mortgage Securities, | | | | | | | | | | |

| Ser. 2006-CB14, Cl. A4 | | 5.48 | | 12/12/44 | | 500,000 | | a | | 390,491 |

| STATEMENT OF INVESTMENTS (continued) |

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Commercial Mortgage | | | | | | | | | | |

| Pass-Through Ctfs. (continued) | | | | | | | | | | |

| LB Commercial Conduit Mortgage | | | | | | | | | | |

| Trust, Ser. 1999-C2, Cl. A2 | | 7.32 | | 10/15/32 | | 136,695 | | | | 136,290 |

| LB-UBS Commercial Mortgage Trust, | | | | | | | | | | |

| Ser. 2003-C3, Cl. A4 | | 4.17 | | 5/15/32 | | 475,000 | | | | 399,472 |

| LB-UBS Commercial Mortgage Trust, | | | | | | | | | | |

| Ser. 2004-C7, Cl. A6 | | 4.79 | | 10/15/29 | | 700,000 | | a | | 571,765 |

| LB-UBS Commercial Mortgage Trust, | | | | | | | | | | |

| Ser. 2005-C3, Cl. AJ | | 4.84 | | 7/15/40 | | 500,000 | | | | 334,154 |

| LB-UBS Commercial Mortgage Trust, | | | | | | | | | | |

| Ser. 2004-C6, Cl. A6 | | 5.02 | | 8/15/29 | | 275,000 | | a | | 229,307 |

| LB-UBS Commercial Mortgage Trust, | | | | | | | | | | |

| Ser. 2007-C2, Cl. A3 | | 5.43 | | 2/15/40 | | 1,200,000 | | | | 890,175 |

| LB-UBS Commercial Mortgage Trust, | | | | | | | | | | |

| Ser. 2000-C3, Cl. A2 | | 7.95 | | 5/15/25 | | 1,057,384 | | a | | 1,063,012 |

| Merrill Lynch Mortgage Trust, | | | | | | | | | | |

| Ser. 2003-KEY1, Cl. A4 | | 5.24 | | 11/12/35 | | 500,000 | | a | | 433,208 |

| Merrill Lynch Mortgage Trust, | | | | | | | | | | |

| Ser. 2005-CKI1, Cl. A6 | | 5.42 | | 11/12/37 | | 375,000 | | a | | 304,388 |

| Merrill Lynch Mortgage Trust, | | | | | | | | | | |

| Ser. 2007-C1, Cl. A4 | | 5.83 | | 6/12/50 | | 1,000,000 | | a | | 760,137 |

| Merrill Lynch/Countrywide | | | | | | | | | | |

| Commercial Mortgage, | | | | | | | | | | |

| Ser. 2007-7, Cl. A4 | | 5.75 | | 6/12/50 | | 1,200,000 | | a | | 905,220 |

| Morgan Stanley Capital I, | | | | | | | | | | |

| Ser. 2004-T13, Cl. A4 | | 4.66 | | 9/13/45 | | 1,000,000 | | | | 845,277 |

| Morgan Stanley Capital I, | | | | | | | | | | |

| Ser. 2007-IQ14, Cl. A4 | | 5.69 | | 4/15/49 | | 1,300,000 | | a | | 976,687 |

| Morgan Stanley Capital I, | | | | | | | | | | |

| Ser. 2006-HQ9, Cl. A4 | | 5.73 | | 7/12/44 | | 500,000 | | a | | 393,864 |

| Morgan Stanley Dean Witter Capital | | | | | | | | | | |

| I, Ser. 2003-HQ2, Cl. A2 | | 4.92 | | 3/12/35 | | 500,000 | | | | 438,741 |

| Morgan Stanley Dean Witter Capital | | | | | | | | | | |

| I, Ser. 2001-TOP1, Cl. A4 | | 6.66 | | 2/15/33 | | 112,662 | | | | 110,562 |

| Wachovia Bank Commercial Mortgage | | | | | | | | | | |

| Trust, Ser. 2005-C20, Cl. A7 | | 5.12 | | 7/15/42 | | 800,000 | | a | | 639,431 |

| Wachovia Bank Commercial Mortgage | | | | | | | | | | |

| Trust, Ser. 2004-C11, Cl. A5 | | 5.22 | | 1/15/41 | | 800,000 | | a | | 673,225 |

| Wachovia Bank Commercial Mortgage | | | | | | | | | | |

| Trust, Ser. 2006-C28, Cl. A3 | | 5.68 | | 10/15/48 | | 150,000 | | | | 112,745 |

16

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Commercial Mortgage | | | | | | | | | | |

| Pass-Through Ctfs. (continued) | | | | | | | | | | |

| Wachovia Bank Commercial Mortgage | | | | | | | | | | |

| Trust, Ser. 2006-C27, Cl. A3 | | 5.76 | | 7/15/45 | | 1,150,000 | | a | | 868,935 |

| | | | | | | | | | | 33,546,440 |

| Consumer Products—.1% | | | | | | | | | | |

| Avon Products, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.20 | | 7/15/18 | | 250,000 | | | | 176,581 |

| Procter & Gamble, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.95 | | 8/15/14 | | 125,000 | | | | 123,393 |

| Procter & Gamble, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.55 | | 3/5/37 | | 300,000 | | | | 260,339 |

| Procter & Gamble, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.88 | | 9/15/09 | | 750,000 | | b | | 771,217 |

| | | | | | | | | | | 1,331,530 |

| Diversified Financial Services—3.9% | | | | | | | | | | |

| AEP Texas Central Transition | | | | | | | | | | |

| Funding, Sr. Scd. Bonds, | | | | | | | | | | |

| Ser. A-4 | | 5.17 | | 1/1/20 | | 250,000 | | | | 213,420 |

| AEP Texas Central Transition | | | | | | | | | | |

| Funding, Sr. Scd. Bonds, | | | | | | | | | | |

| Ser. A-5 | | 5.31 | | 7/1/21 | | 45,000 | | | | 36,413 |

| American Express, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.15 | | 8/28/17 | | 700,000 | | | | 501,674 |

| American Express, | | | | | | | | | | |

| Sr. Unscd. Notes | | 7.00 | | 3/19/18 | | 1,000,000 | | | | 771,532 |

| American General Finance, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.90 | | 12/15/17 | | 900,000 | | | | 326,091 |

| BA Master Credit Card Trust, | | | | | | | | | | |

| Asset Backed Notes, Ser. 99-J | | 7.00 | | 2/15/12 | | 875,000 | | | | 876,584 |

| Bear Stearns, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.30 | | 10/30/15 | | 100,000 | | | | 85,276 |

| Bear Stearns, | | | | | | | | | | |

| Sub. Notes | | 5.55 | | 1/22/17 | | 500,000 | | b | | 424,384 |

| Bear Stearns, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.40 | | 10/2/17 | | 540,000 | | | | 480,755 |

| Bear Stearns, | | | | | | | | | | |

| Sr. Unscd. Notes | | 7.25 | | 2/1/18 | | 270,000 | | | | 254,596 |

| Capital One Bank, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.25 | | 12/1/08 | | 275,000 | | | | 273,007 |

| STATEMENT OF INVESTMENTS (continued) |

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Diversified Financial | | | | | | | | | | |

| Services (continued) | | | | | | | | | | |

| Capital One Capital III, | | | | | | | | | | |

| Gtd. Cap. Secs. | | 7.69 | | 8/15/36 | | 200,000 | | | | 95,458 |

| CIT Group Funding, | | | | | | | | | | |

| Gtd. Notes | | 4.65 | | 7/1/10 | | 1,375,000 | | a | | 950,359 |

| Citigroup Capital XXI, | | | | | | | | | | |

| Gtd. Bonds | | 8.30 | | 12/21/77 | | 835,000 | | a | | 574,371 |

| Citigroup, | | | | | | | | | | |

| Sub. Notes | | 5.00 | | 9/15/14 | | 730,000 | | | | 577,733 |

| Citigroup, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.00 | | 2/21/12 | | 1,075,000 | | | | 1,019,270 |

| Citigroup, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.13 | | 11/21/17 | | 885,000 | | | | 762,131 |

| Citigroup, | | | | | | | | | | |

| Sub. Notes | | 6.13 | | 8/25/36 | | 575,000 | | | | 388,722 |

| Citigroup, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.63 | | 1/15/28 | | 100,000 | | | | 82,985 |

| Countrywide Home Loans, | | | | | | | | | | |

| Gtd. Notes, Ser. L | | 4.00 | | 3/22/11 | | 750,000 | | | | 692,041 |

| Countrywide Home Loans, | | | | | | | | | | |

| Gtd. Notes | | 4.13 | | 9/15/09 | | 200,000 | | | | 191,838 |

| Credit Suisse USA, | | | | | | | | | | |

| Gtd. Notes | | 5.50 | | 8/15/13 | | 1,000,000 | | b | | 894,704 |

| Credit Suisse USA, | | | | | | | | | | |

| Gtd. Notes | | 6.50 | | 1/15/12 | | 1,300,000 | | | | 1,267,348 |

| General Electric Capital, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.00 | | 1/8/16 | | 375,000 | | | | 301,437 |

| General Electric Capital, | | | | | | | | | | |

| Sr. Unscd. Notes, Ser. A | | 5.45 | | 1/15/13 | | 650,000 | | | | 601,290 |

| General Electric Capital, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.63 | | 9/15/17 | | 1,000,000 | | | | 818,890 |

| General Electric Capital, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.63 | | 5/1/18 | | 135,000 | | | | 111,330 |

| General Electric Capital, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.88 | | 1/14/38 | | 500,000 | | | | 357,683 |

| General Electric Capital, | | | | | | | | | | |

| Sr. Unscd. Notes, Ser. A | | 6.75 | | 3/15/32 | | 1,445,000 | | | | 1,175,583 |

| General Electric Capital, | | | | | | | | | | |

| Sr. Unscd. Debs. | | 8.30 | | 9/20/09 | | 15,000 | | | | 15,217 |

18

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Diversified Financial | | | | | | | | | | |

| Services (continued) | | | | | | | | | | |

| Goldman Sachs Capital I, | | | | | | | | | | |

| Gtd. Cap. Secs. | | 6.35 | | 2/15/34 | | 350,000 | | b | | 216,514 |

| Goldman Sachs Group, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.95 | | 1/18/18 | | 15,000 | | | | 12,253 |

| Goldman Sachs Group, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.13 | | 2/15/33 | | 475,000 | | | | 352,686 |

| Goldman Sachs Group, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.15 | | 4/1/18 | | 680,000 | | | | 564,257 |

| Goldman Sachs Group, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.25 | | 9/1/17 | | 190,000 | | | | 159,041 |

| Goldman Sachs Group, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.60 | | 1/15/12 | | 2,725,000 | | | | 2,577,444 |

| Goldman Sachs Group, | | | | | | | | | | |

| Sub. Notes | | 6.75 | | 10/1/37 | | 630,000 | | | | 411,289 |

| Goldman Sachs Group, | | | | | | | | | | |

| Sr. Unscd. Notes | | 7.35 | | 10/1/09 | | 100,000 | | | | 99,977 |

| Household Finance, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.75 | | 7/15/13 | | 700,000 | | | | 616,930 |

| Household Finance, | | | | | | | | | | |

| Sr. Unscd. Notes | | 8.00 | | 7/15/10 | | 630,000 | | | | 613,261 |

| HSBC Finance, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.50 | | 1/19/16 | | 325,000 | | | | 268,425 |

| International Lease Finance, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.75 | | 1/13/12 | | 250,000 | | | | 164,081 |

| International Lease Finance, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.00 | | 4/15/10 | | 1,200,000 | | | | 890,528 |

| International Lease Finance, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.65 | | 6/1/14 | | 350,000 | | b | | 223,659 |

| J.P. Morgan Chase Capital XX, | | | | | | | | | | |

| Gtd. Notes, Ser. T | | 6.55 | | 9/29/36 | | 50,000 | | | | 35,117 |

| Janus Capital Group, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.25 | | 6/15/12 | | 75,000 | | | | 59,160 |

| Jefferies Group, | | | | | | | | | | |

| Sr. Unscd. Debs. | | 6.25 | | 1/15/36 | | 200,000 | | | | 132,417 |

| Jefferies Group, | | | | | | | | | | |

| Sr. Unscd. Debs. | | 6.45 | | 6/8/27 | | 35,000 | | | �� | 24,971 |

| JP Morgan Chase XVII, | | | | | | | | | | |

| Gtd. Debs., Ser. Q | | 5.85 | | 8/1/35 | | 310,000 | | | | 195,032 |

| STATEMENT OF INVESTMENTS (continued) |

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Diversified Financial | | | | | | | | |

| Services (continued) | | | | | | | | |

| JPMorgan Chase & Co., | | | | | | | | |

| Sub. Notes | | 5.13 | | 9/15/14 | | 2,525,000 | | 2,250,171 |

| JPMorgan Chase & Co., | | | | | | | | |

| Sub. Notes | | 5.15 | | 10/1/15 | | 250,000 | | 217,964 |

| JPMorgan Chase & Co., | | | | | | | | |

| Sr. Sub. Notes | | 6.75 | | 2/1/11 | | 1,000,000 | | 993,551 |

| Merrill Lynch & Co., | | | | | | | | |

| Sr. Unscd. Notes | | 5.45 | | 7/15/14 | | 565,000 | | 492,677 |

| Merrill Lynch & Co., | | | | | | | | |

| Sr. Unscd. Notes | | 6.05 | | 8/15/12 | | 1,235,000 | | 1,125,085 |

| Merrill Lynch & Co., | | | | | | | | |

| Sub. Notes | | 6.05 | | 5/16/16 | | 575,000 | | 466,013 |

| Merrill Lynch & Co., | | | | | | | | |

| Sr. Unscd. Notes | | 6.40 | | 8/28/17 | | 65,000 | | 55,010 |

| Merrill Lynch & Co., | | | | | | | | |

| Notes | | 6.88 | | 4/25/18 | | 150,000 | | 133,451 |

| Merrill Lynch & Co., | | | | | | | | |

| Sr. Unscd. Notes | | 6.88 | | 11/15/18 | | 150,000 | | 132,793 |

| Morgan Stanley, | | | | | | | | |

| Sub. Notes | | 4.75 | | 4/1/14 | | 1,580,000 | | 1,124,998 |

| Morgan Stanley, | | | | | | | | |

| Sr. Unscd. Notes | | 5.45 | | 1/9/17 | | 1,100,000 | | 880,433 |

| Morgan Stanley, | | | | | | | | |

| Sr. Unscd. Notes | | 5.75 | | 10/18/16 | | 175,000 | | 136,699 |

| Morgan Stanley, | | | | | | | | |

| Sr. Unscd. Notes | | 7.25 | | 4/1/32 | | 300,000 | | 229,444 |

| National Rural Utilities | | | | | | | | |

| Cooperative Finance, Coll. | | | | | | | | |

| Trust Notes | | 4.38 | | 10/1/10 | | 600,000 | | 570,503 |

| SLM, | | | | | | | | |

| Sr. Unscd. Notes, Ser. A | | 5.00 | | 10/1/13 | | 100,000 | | 60,808 |

| SLM, | | | | | | | | |

| Sr. Unscd. Notes, Ser. A | | 5.00 | | 4/15/15 | | 450,000 | | 253,615 |

| Toyota Motor Credit, | | | | | | | | |

| Unscd. Notes | | 4.35 | | 12/15/10 | | 150,000 b | | 150,511 |

| Toyota Motor Credit, | | | | | | | | |

| Unscd. Notes | | 5.50 | | 12/15/08 | | 225,000 | | 224,444 |

| | | | | | | | | 32,237,334 |

20

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Diversified Metals & Mining—.4% | | | | | | | | |

| Alcan, | | | | | | | | |

| Sr. Unscd. Debs. | | 7.25 | | 3/15/31 | | 350,000 | | 272,040 |

| Alcoa, | | | | | | | | |

| Sr. Unscd. Notes | | 5.72 | | 2/23/19 | | 612,000 | | 415,481 |

| Alcoa, | | | | | | | | |

| Sr. Unscd. Notes | | 6.00 | | 1/15/12 | | 250,000 | | 229,789 |

| BHP Finance USA, | | | | | | | | |

| Gtd. Notes | | 4.80 | | 4/15/13 | | 1,175,000 | | 1,078,903 |

| Freeport-McMoran C&G, | | | | | | | | |

| Sr. Unscd. Notes | | 8.38 | | 4/1/17 | | 895,000 | | 703,547 |

| Inco, | | | | | | | | |

| Unsub. Bonds | | 7.20 | | 9/15/32 | | 100,000 | | 67,007 |

| Noranda, | | | | | | | | |

| Notes | | 5.50 | | 6/15/17 | | 165,000 | | 125,077 |

| Rio Tinto Finance USA, | | | | | | | | |

| Gtd. Notes | | 6.50 | | 7/15/18 | | 120,000 | | 93,238 |

| Vale Overseas, | | | | | | | | |

| Gtd. Notes | | 6.25 | | 1/23/17 | | 510,000 | | 416,028 |

| Wellpoint, | | | | | | | | |

| Sr. Unscd. Notes | | 5.88 | | 6/15/17 | | 65,000 | | 53,219 |

| | | | | | | | | 3,454,329 |

| Electric Utilities—1.3% | | | | | | | | |

| Cincinnati Gas & Electric, | | | | | | | | |

| Sr. Unscd. Bonds | | 5.70 | | 9/15/12 | | 185,000 | | 180,473 |

| Cleveland Electric Illumination, | | | | | | | | |

| Sr. Unscd. Notes | | 5.70 | | 4/1/17 | | 150,000 | | 119,653 |

| Consolidated Edison of New York, | | | | | | | | |

| Sr. Unscd. Debs., Ser. 05-A | | 5.30 | | 3/1/35 | | 175,000 | | 116,037 |

| Consolidated Edison of New York, | | | | | | | | |

| Sr. Unscd. Debs., Ser. 08-A | | 5.85 | | 4/1/18 | | 600,000 | | 511,976 |

| Consolidated Edison of New York, | | | | | | | | |

| Sr. Unscd. Debs., Ser. 06-B | | 6.20 | | 6/15/36 | | 200,000 | | 150,756 |

| Constellation Energy Group, | | | | | | | | |

| Sr. Unscd. Notes | | 7.00 | | 4/1/12 | | 225,000 | | 207,442 |

| Constellation Energy Group, | | | | | | | | |

| Sr. Unscd. Notes | | 7.60 | | 4/1/32 | | 250,000 | | 197,337 |

| Consumers Energy, | | | | | | | | |

| First Mortgage Bonds, Ser. P | | 5.50 | | 8/15/16 | | 200,000 | | 163,278 |

| STATEMENT OF INVESTMENTS (continued) |

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Electric Utilities (continued) | | | | | | | | |

| Dominion Resources, | | | | | | | | |

| Sr. Unscd. Notes, Ser. C | | 5.15 | | 7/15/15 | | 175,000 | | 144,275 |

| Dominion Resources, | | | | | | | | |

| Sr. Unscd. Notes, Ser. E | | 6.30 | | 3/15/33 | | 100,000 | | 70,655 |

| Duke Energy Carolinas, | | | | | | | | |

| First Mortgage Bonds | | 6.00 | | 1/15/38 | | 710,000 | | 596,683 |

| Duke Energy Carolinas, | | | | | | | | |

| Sr. Unscd. Notes | | 6.25 | | 1/15/12 | | 75,000 | | 74,579 |

| Exelon, | | | | | | | | |

| Sr. Unscd. Notes | | 4.90 | | 6/15/15 | | 600,000 | | 449,490 |

| FirstEnergy, | | | | | | | | |

| Sr. Unscd. Notes, Ser. B | | 6.45 | | 11/15/11 | | 135,000 | | 127,254 |

| FirstEnergy, | | | | | | | | |

| Sr. Unscd. Notes, Ser. C | | 7.38 | | 11/15/31 | | 460,000 | | 357,632 |

| Florida Power & Light, | | | | | | | | |

| First Mortgage Bonds | | 5.63 | | 4/1/34 | | 250,000 | | 207,326 |

| Florida Power & Light, | | | | | | | | |

| First Mortgage Debs | | 5.65 | | 2/1/35 | | 25,000 | | 20,756 |

| Hydro-Quebec, | | | | | | | | |

| Gov’t Gtd. Debs., Ser. HH | | 8.50 | | 12/1/29 | | 200,000 | | 279,930 |

| Hydro-Quebec, | | | | | | | | |

| Gov’t Gtd. Debs., Ser. HK | | 9.38 | | 4/15/30 | | 20,000 | | 30,257 |

| MidAmerican Energy Holdings, | | | | | | | | |

| Sr. Unscd. Notes | | 5.88 | | 10/1/12 | | 950,000 | | 900,230 |

| NiSource Finance, | | | | | | | | |

| Gtd. Notes | | 5.40 | | 7/15/14 | | 150,000 | | 115,689 |

| NiSource Finance, | | | | | | | | |

| Gtd. Notes | | 7.88 | | 11/15/10 | | 100,000 | | 90,331 |

| Ohio Power, | | | | | | | | |

| Sr. Unscd. Notes, Ser. F | | 5.50 | | 2/15/13 | | 1,500,000 | | 1,369,065 |

| Oncor Electric Delivery, | | | | | | | | |

| Sr. Scd. Debs. | | 7.00 | | 9/1/22 | | 170,000 | | 136,171 |

| Oncor Electric Delivery, | | | | | | | | |

| Sr. Unscd. Notes | | 7.00 | | 5/1/32 | | 250,000 | | 187,346 |

| Pacific Gas & Electric, | | | | | | | | |

| Sr. Unscd. Bonds | | 4.80 | | 3/1/14 | | 100,000 | | 88,689 |

| Pacific Gas & Electric, | | | | | | | | |

| Sr. Unscd. Bonds | | 6.05 | | 3/1/34 | | 465,000 | | 355,671 |

| Pacificorp, | | | | | | | | |

| First Mortgage Bonds | | 5.75 | | 4/1/37 | | 335,000 | | 255,046 |

22

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Electric Utilities (continued) | | | | | | | | |

| PPL Electric Utilities, | | | | | | | | |

| Sr. Scd. Bonds | | 6.25 | | 8/15/09 | | 300,000 | | 298,669 |

| Progress Energy, | | | | | | | | |

| Sr. Unscd. Notes | | 7.10 | | 3/1/11 | | 500,000 | | 495,808 |

| Progress Energy, | | | | | | | | |

| Sr. Unscd. Notes | | 7.75 | | 3/1/31 | | 480,000 | | 403,310 |

| Public Service Company of | | | | | | | | |

| Colorado, First Mortgage | | | | | | | | |

| Bonds, Ser. 10 | | 7.88 | | 10/1/12 | | 350,000 | | 351,491 |

| Public Service Electric El & Gas, | | | | | | | | |

| Scd. Notes, Ser. D | | 5.25 | | 7/1/35 | | 230,000 | | 157,275 |

| South Carolina Electric & Gas, | | | | | | | | |

| First Mortgage Bonds | | 6.63 | | 2/1/32 | | 200,000 | | 184,304 |

| Southern California Edison, | | | | | | | | |

| First Mortgage Bonds, Ser. 08-A | | 5.95 | | 2/1/38 | | 70,000 | | 58,042 |

| Southern California Edison, | | | | | | | | |

| Sr. Unscd. Notes | | 6.65 | | 4/1/29 | | 450,000 b | | 378,208 |

| Southern California Gas, | | | | | | | | |

| First Mortgage Bonds, Ser. HH | | 5.45 | | 4/15/18 | | 100,000 | | 89,363 |

| Southern Power, | | | | | | | | |

| Sr. Unscd. Notes, Ser. D | | 4.88 | | 7/15/15 | | 300,000 | | 247,884 |

| SouthWestern Electric Power, | | | | | | | | |

| Sr. Unscd. Notes, Ser. F | | 5.88 | | 3/1/18 | | 150,000 | | 123,224 |

| Virginia Electric & Power, | | | | | | | | |

| Sr. Unscd. Notes, Ser. A | | 5.40 | | 1/15/16 | | 500,000 | | 427,210 |

| | | | | | | | | 10,718,815 |

| Food & Beverages—.8% | | | | | | | | |

| Anheuser-Busch Cos., | | | | | | | | |

| Sr. Unscd. Bonds | | 5.00 | | 1/15/15 | | 1,000,000 | | 822,353 |

| Anheuser-Busch Cos., | | | | | | | | |

| Sr. Unscd. Notes | | 5.50 | | 1/15/18 | | 145,000 | | 112,736 |

| Bottling Group, | | | | | | | | |

| Gtd. Notes | | 4.63 | | 11/15/12 | | 350,000 | | 336,076 |

| Coca-Cola Enterprises, | | | | | | | | |

| Sr. Unscd. Debs. | | 6.70 | | 10/15/36 | | 250,000 | | 205,490 |

| Coca-Cola Enterprises, | | | | | | | | |

| Sr. Unscd. Debs. | | 6.95 | | 11/15/26 | | 175,000 | | 155,256 |

| Coca-Cola Enterprises, | | | | | | | | |

| Sr. Unscd. Debs. | | 8.50 | | 2/1/22 | | 100,000 | | 105,653 |

| | STATEMENT OF INVESTMENTS (continued) |

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Food & Beverages (continued) | | | | | | | | | | |

| ConAgra Foods, | | | | | | | | | | |

| Sr. Unscd. Notes | | 7.00 | | 10/1/28 | | 350,000 | | | | 274,562 |

| Diageo Capital, | | | | | | | | | | |

| Gtd. Notes | | 5.75 | | 10/23/17 | | 720,000 | | | | 620,011 |

| Diageo Finance, | | | | | | | | | | |

| Gtd. Notes | | 5.30 | | 10/28/15 | | 125,000 | | | | 108,802 |

| General Mills, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.00 | | 2/15/12 | | 125,000 | | | | 122,706 |

| H.J. Heinz, | | | | | | | | | | |

| Sr. Unscd. Debs. | | 6.38 | | 7/15/28 | | 100,000 | | b | | 77,982 |

| Hershey, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.30 | | 9/1/11 | | 750,000 | | | | 740,073 |

| Hershey, | | | | | | | | | | |

| Sr. Unscd. Debs. | | 8.80 | | 2/15/21 | | 30,000 | | | | 34,786 |

| Kellogg, | | | | | | | | | | |

| Sr. Unscd. Debs., Ser. B | | 7.45 | | 4/1/31 | | 340,000 | | | | 340,517 |

| Kraft Foods, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.13 | | 2/1/18 | | 775,000 | | | | 665,131 |

| Kraft Foods, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.25 | | 6/1/12 | | 225,000 | | | | 215,495 |

| Kroger, | | | | | | | | | | |

| Gtd. Notes | | 7.25 | | 6/1/09 | | 550,000 | | | | 554,036 |

| Kroger, | | | | | | | | | | |

| Gtd. Notes | | 7.50 | | 4/1/31 | | 100,000 | | b | | 85,766 |

| Nabisco, | | | | | | | | | | |

| Sr. Unscd. Debs. | | 7.55 | | 6/15/15 | | 640,000 | | | | 609,400 |

| Safeway, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.95 | | 8/16/10 | | 125,000 | | | | 123,383 |

| Safeway, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.80 | | 8/15/12 | | 210,000 | | | | 196,595 |

| Sara Lee, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.25 | | 9/15/11 | | 300,000 | | | | 288,354 |

| SYSCO, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.38 | | 9/21/35 | | 350,000 | | | | 252,190 |

| | | | | | | | | | | 7,047,353 |

| Foreign/Governmental—2.7% | | | | | | | | | | |

| Asian Development Bank, | | | | | | | | | | |

| Sr. Unsub. Notes | | 4.50 | | 9/4/12 | | 750,000 | | | | 783,674 |

| European Investment Bank, | | | | | | | | | | |

| Sr. Unscd. Notes | | 3.25 | | 2/15/11 | | 2,000,000 | | | | 2,029,496 |

24

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Foreign/Governmental (continued) | | | | | | | | | | |

| European Investment Bank, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.63 | | 5/15/14 | | 500,000 | | | | 518,040 |

| European Investment Bank, | | | | | | | | | | |

| Sr. Unscd. Bonds | | 4.63 | | 10/20/15 | | 350,000 | | | | 361,170 |

| European Investment Bank, | | | | | | | | | | |

| Sr. Unscd. Bonds | | 4.88 | | 1/17/17 | | 850,000 | | | | 877,016 |

| European Investment Bank, | | | | | | | | | | |

| Sr. Unscd. Bonds | | 5.13 | | 5/30/17 | | 250,000 | | | | 261,399 |

| Federal Republic of Brazil, | | | | | | | | | | |

| Sr. Unscd. Bonds | | 6.00 | | 1/17/17 | | 2,270,000 | | | | 2,060,025 |

| Federal Republic of Brazil, | | | | | | | | | | |

| Unscd. Bonds | | 10.13 | | 5/15/27 | | 500,000 | | | | 558,000 |

| Inter-American Development Bank, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.38 | | 9/20/12 | | 1,530,000 | | | | 1,552,782 |

| Inter-American Development Bank, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.13 | | 9/13/16 | | 150,000 | | | | 154,250 |

| International Bank for | | | | | | | | | | |

| Reconstruction & Development, | | | | | | | | | | |

| Notes | | 5.00 | | 4/1/16 | | 700,000 | | | | 726,698 |

| International Bank for | | | | | | | | | | |

| Reconstruction & Development, | | | | | | | | | | |

| Unsub. Bonds | | 7.63 | | 1/19/23 | | 250,000 | | | | 309,853 |

| Malaysia Government, | | | | | | | | | | |

| Sr. Unsub. Notes | | 8.75 | | 6/1/09 | | 330,000 | | | | 333,241 |

| Province of British Columbia | | | | | | | | | | |

| Canada, Bonds, Ser. USD-2 | | 6.50 | | 1/15/26 | | 25,000 | | | | 29,507 |

| Province of Manitoba Canada, | | | | | | | | | | |

| Debs., Ser. CB | | 8.80 | | 1/15/20 | | 10,000 | | | | 13,444 |

| Province of Ontario Canada, | | | | | | | | | | |

| Sr. Unscd. Bonds | | 3.63 | | 10/21/09 | | 1,200,000 | | b | | 1,217,567 |

| Province of Ontario Canada, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.95 | | 11/28/16 | | 1,000,000 | | b | | 1,019,412 |

| Province of Quebec Canada, | | | | | | | | | | |

| Unscd. Notes | | 4.60 | | 5/26/15 | | 700,000 | | | | 716,575 |

| Province of Quebec Canada, | | | | | | | | | | |

| Bonds | | 5.13 | | 11/14/16 | | 125,000 | | | | 127,028 |

| Province of Quebec Canada, | | | | | | | | | | |

| Sr. Unscd. Debs., Ser. PA | | 5.75 | | 2/15/09 | | 175,000 | | | | 176,948 |

| Province of Quebec Canada, | | | | | | | | | | |

| Debs., Ser. NJ | | 7.50 | | 7/15/23 | | 200,000 | | | | 246,085 |

| STATEMENT OF INVESTMENTS (continued) |

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Foreign/Governmental (continued) | | | | | | | | | | |

| Province of Saskatchewan Canada, | | | | | | | | | | |

| Debs. | | 7.38 | | 7/15/13 | | 500,000 | | | | 582,158 |

| Republic of Chile, | | | | | | | | | | |

| Sr. Unsub. Bonds | | 5.50 | | 1/15/13 | | 625,000 | | | | 643,000 |

| Republic of Finland, | | | | | | | | | | |

| Bonds | | 6.95 | | 2/15/26 | | 25,000 | | | | 30,686 |

| Republic of Hungary, | | | | | | | | | | |

| Unsub. Notes | | 4.75 | | 2/3/15 | | 125,000 | | | | 93,825 |

| Republic of Italy, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.50 | | 1/21/15 | | 50,000 | | | | 51,937 |

| Republic of Italy, | | | | | | | | | | |

| Sr. Unsub. Notes | | 5.25 | | 9/20/16 | | 155,000 | | | | 162,022 |

| Republic of Italy, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.38 | | 6/15/33 | | 550,000 | | | | 559,252 |

| Republic of Italy, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.00 | | 2/22/11 | | 1,725,000 | | | | 1,875,004 |

| Republic of Italy, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.88 | | 9/27/23 | | 610,000 | | | | 710,953 |

| Republic of Korea, | | | | | | | | | | |

| Unscd. Notes | | 4.88 | | 9/22/14 | | 200,000 | | b | | 169,290 |

| Republic of Peru, | | | | | | | | | | |

| Sr. Unscd. Bonds | | 6.55 | | 3/14/37 | | 540,000 | | b | | 375,300 |

| Republic of Poland, | | | | | | | | | | |

| Sr. Unsub. Notes | | 5.25 | | 1/15/14 | | 250,000 | | | | 226,479 |

| Republic of South Africa, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.50 | | 6/2/14 | | 170,000 | | | | 141,950 |

| United Mexican States, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.63 | | 1/15/17 | | 791,000 | | b | | 707,945 |

| United Mexican States, | | | | | | | | | | |

| Sr. Unscd. Notes, Ser. A | | 6.75 | | 9/27/34 | | 640,000 | | | | 534,400 |

| United Mexican States, | | | | | | | | | | |

| Notes | | 9.88 | | 2/1/10 | | 1,525,000 | | | | 1,647,000 |

| | | | | | | | | | | 22,583,411 |

| Health Care—.8% | | | | | | | | | | |

| Abbott Laboratories, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.88 | | 5/15/16 | | 170,000 | | | | 162,679 |

| Amgen, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.85 | | 6/1/17 | | 400,000 | | | | 355,653 |

26

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Health Care (continued) | | | | | | | | |

| Astrazeneca, | | | | | | | | |

| Sr. Unscd. Notes | | 6.45 | | 9/15/37 | | 520,000 | | 446,541 |

| Bristol-Myers Squibb, | | | | | | | | |

| Sr. Unscd. Notes | | 5.88 | | 11/15/36 | | 425,000 | | 349,473 |

| Covidien International Finance, | | | | | | | | |

| Gtd. Notes | | 6.00 | | 10/15/17 | | 590,000 | | 515,321 |

| Eli Lilly & Co., | | | | | | | | |

| Sr. Unscd. Notes | | 7.13 | | 6/1/25 | | 200,000 | | 194,163 |

| GlaxoSmithKline Capital, | | | | | | | | |

| Gtd. Notes | | 4.38 | | 4/15/14 | | 500,000 | | 455,523 |

| GlaxoSmithKline Capital, | | | | | | | | |

| Gtd. Notes | | 5.65 | | 5/15/18 | | 740,000 | | 656,958 |

| Johnson & Johnson, | | | | | | | | |

| Unscd. Debs. | | 4.95 | | 5/15/33 | | 170,000 | | 137,635 |

| Johnson & Johnson, | | | | | | | | |

| Unscd. Notes | | 5.95 | | 8/15/37 | | 470,000 | | 435,626 |

| Merck & Co., | | | | | | | | |

| Sr. Unscd. Debs. | | 6.40 | | 3/1/28 | | 150,000 | | 135,710 |

| Quest Diagnostic, | | | | | | | | |

| Gtd. Notes | | 6.95 | | 7/1/37 | | 50,000 | | 35,937 |

| Quest Diagnostics, | | | | | | | | |

| Gtd. Notes | | 5.45 | | 11/1/15 | | 500,000 | | 405,211 |

| Schering-Plough, | | | | | | | | |

| Sr. Unscd. Notes | | 5.55 | | 12/1/13 | | 1,000,000 | | 949,405 |

| Teva Pharmaceutical Finance, | | | | | | | | |

| Gtd. Notes | | 6.15 | | 2/1/36 | | 85,000 | | 61,626 |

| UnitedHealth Group, | | | | | | | | |

| Sr. Unscd. Notes | | 5.00 | | 8/15/14 | | 300,000 | | 235,333 |

| UnitedHealth Group, | | | | | | | | |

| Sr. Unscd. Notes | | 6.88 | | 2/15/38 | | 60,000 | | 42,930 |

| WellPoint, | | | | | | | | |

| Sr. Unscd. Bonds | | 5.25 | | 1/15/16 | | 375,000 | | 299,296 |

| Wellpoint, | | | | | | | | |

| Sr. Unscd. Notes | | 6.80 | | 8/1/12 | | 300,000 | | 319,217 |

| Wyeth, | | | | | | | | |

| Sr. Unscd. Notes | | 5.50 | | 2/1/14 | | 150,000 | | 140,721 |

| Wyeth, | | | | | | | | |

| Sr. Unscd. Notes | | 5.95 | | 4/1/37 | | 200,000 | | 162,862 |

| STATEMENT OF INVESTMENTS (continued) |

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Health Care (continued) | | | | | | | | |

| Wyeth, | | | | | | | | |

| Sr. Unscd. Notes | | 6.50 | | 2/1/34 | | 200,000 | | 163,868 |

| | | | | | | | | 6,661,688 |

| Industrial—.1% | | | | | | | | |

| Continental Airlines, | | | | | | | | |

| Pass-Through Certificates, | | | | | | | | |

| Ser. 974A | | 6.90 | | 1/2/18 | | 193,066 | | 139,007 |

| Mohawk Industries, | | | | | | | | |

| Sr. Unscd. Notes | | 6.13 | | 1/15/16 | | 70,000 | | 61,494 |

| Pemex Project Funding Master | | | | | | | | |

| Trust, Gtd. Notes | | 7.88 | | 2/1/09 | | 244,000 a | | 243,522 |

| US Steel, | | | | | | | | |

| Sr. Unscd. Notes | | 5.65 | | 6/1/13 | | 250,000 | | 197,979 |

| USA Waste Services, | | | | | | | | |

| Sr. Unscd. Notes | | 7.00 | | 7/15/28 | | 150,000 | | 105,640 |

| | | | | | | | | 747,642 |

| Machinery—.1% | | | | | | | | |

| Caterpillar, | | | | | | | | |

| Sr. Unscd. Debs. | | 6.05 | | 8/15/36 | | 375,000 | | 298,911 |

| Caterpillar, | | | | | | | | |

| Sr. Unscd. Debs. | | 7.30 | | 5/1/31 | | 125,000 | | 114,662 |

| Deere & Co., | | | | | | | | |

| Sr. Unscd. Notes | | 6.95 | | 4/25/14 | | 775,000 | | 786,082 |

| | | | | | | | | 1,199,655 |

| Manufacturing—.3% | | | | | | | | |

| General Electric, | | | | | | | | |

| Sr. Unscd. Notes | | 5.00 | | 2/1/13 | | 500,000 | | 472,086 |

| General Electric, | | | | | | | | |

| Sr. Unscd. Notes | | 5.25 | | 12/6/17 | | 1,000,000 | | 838,491 |

| Honeywell International, | | | | | | | | |

| Sr. Unscd. Notes | | 4.25 | | 3/1/13 | | 1,300,000 | | 1,196,032 |

| Honeywell International, | | | | | | | | |

| Sr. Unscd. Notes | | 6.13 | | 11/1/11 | | 175,000 | | 175,753 |

| Tyco International Finance, | | | | | | | | |

| Gtd. Bonds | | 6.88 | | 1/15/21 | | 235,000 | | 176,169 |

| | | | | | | | | 2,858,531 |

| Media—.7% | | | | | | | | |

| AOL Time Warner, | | | | | | | | |

| Gtd. Notes | | 6.88 | | 5/1/12 | | 250,000 | | 224,797 |

28

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Media (continued) | | | | | | | | |

| AOL Time Warner, | | | | | | | | |

| Gtd. Notes | | 7.63 | | 4/15/31 | | 300,000 | | 240,443 |

| AT & T Broadband, | | | | | | | | |

| Gtd. Notes | | 9.46 | | 11/15/22 | | 304,000 | | 292,687 |

| Comcast Cable Communications, | | | | | | | | |

| Gtd. Notes | | 6.75 | | 1/30/11 | | 600,000 | | 589,681 |

| Comcast Cable Communications, | | | | | | | | |

| Gtd. Notes | | 7.13 | | 6/15/13 | | 300,000 | | 285,661 |

| Comcast, | | | | | | | | |

| Gtd. Notes | | 6.45 | | 3/15/37 | | 200,000 | | 154,018 |

| Comcast, | | | | | | | | |

| Gtd. Notes | | 6.95 | | 8/15/37 | | 365,000 | | 298,428 |

| COX Communications, | | | | | | | | |

| Sr. Unscd. Bonds | | 5.50 | | 10/1/15 | | 450,000 | | 370,981 |

| COX Communications, | | | | | | | | |

| Unscd. Notes | | 7.13 | | 10/1/12 | | 275,000 | | 262,868 |

| News America Holdings, | | | | | | | | |

| Gtd. Debs. | | 7.75 | | 12/1/45 | | 100,000 | | 83,696 |

| News America Holdings, | | | | | | | | |

| Gtd. Debs. | | 8.25 | | 8/10/18 | | 150,000 | | 132,607 |

| News America, | | | | | | | | |

| Gtd. Notes | | 6.20 | | 12/15/34 | | 250,000 | | 189,290 |

| News America, | | | | | | | | |

| Gtd. Notes | | 6.65 | | 11/15/37 | | 360,000 | | 285,930 |

| Thomson Reuters, | | | | | | | | |

| Gtd. Notes | | 6.50 | | 7/15/18 | | 800,000 | | 673,760 |

| Time Warner Cable, | | | | | | | | |

| Gtd. Debs. | | 6.55 | | 5/1/37 | | 350,000 | | 267,272 |

| Time Warner Cable, | | | | | | | | |

| Gtd. Debs. | | 7.30 | | 7/1/38 | | 495,000 | | 415,270 |

| Time Warner, | | | | | | | | |

| Gtd. Debs. | | 6.50 | | 11/15/36 | | 200,000 | | 142,517 |

| Time Warner, | | | | | | | | |

| Gtd. Debs. | | 6.95 | | 1/15/28 | | 325,000 | | 251,640 |

| Viacom, | | | | | | | | |

| Gtd. Notes | | 5.50 | | 5/15/33 | | 250,000 | | 151,489 |

| Viacom, | | | | | | | | |

| Sr. Unscd. Notes | | 6.88 | | 4/30/36 | | 235,000 | | 164,446 |

| Viacom, | | | | | | | | |

| Gtd. Debs | | 7.88 | | 7/30/30 | | 80,000 | | 57,683 |

| STATEMENT OF INVESTMENTS (continued) |

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Media (continued) | | | | | | | | |

| Walt Disney, | | | | | | | | |

| Sr. Unscd. Notes, Ser. B | | 6.38 | | 3/1/12 | | 100,000 | | 101,471 |

| Walt Disney, | | | | | | | | |

| Sr. Unscd. Notes, Ser. B | | 7.00 | | 3/1/32 | | 150,000 | | 141,225 |

| Walt Disney, | | | | | | | | |

| Sr. Unscd. Debs. | | 7.55 | | 7/15/93 | | 100,000 | | 97,193 |

| | | | | | | | | 5,875,053 |

| Oil & Gas—1.3% | | | | | | | | |

| Amerada Hess, | | | | | | | | |

| Sr. Unscd. Bonds | | 7.88 | | 10/1/29 | | 175,000 | | 149,551 |

| Anadarko Finance, | | | | | | | | |

| Gtd. Notes, Ser. B | | 6.75 | | 5/1/11 | | 300,000 | | 299,149 |

| Anadarko Petroleum, | | | | | | | | |

| Sr. Unscd. Notes | | 5.95 | | 9/15/16 | | 350,000 | | 292,371 |

| Anadarko Petroleum, | | | | | | | | |

| Sr. Unscd. Notes | | 6.45 | | 9/15/36 | | 150,000 | | 107,269 |

| Apache, | | | | | | | | |

| Sr. Unscd. Notes | | 6.00 | | 1/15/37 | | 380,000 | | 290,747 |

| Canadian National Resources, | | | | | | | | |

| Sr. Unscd. Notes | | 6.25 | | 3/15/38 | | 80,000 | | 55,974 |

| Canadian Natural Resources, | | | | | | | | |

| Sr. Unscd. Notes | | 4.90 | | 12/1/14 | | 350,000 | | 298,541 |

| Conoco, | | | | | | | | |

| Sr. Unscd. Notes | | 6.95 | | 4/15/29 | | 125,000 | | 109,233 |

| ConocoPhillips, | | | | | | | | |

| Gtd. Notes | | 5.90 | | 10/15/32 | | 500,000 | | 389,003 |

| ConocoPhillips, | | | | | | | | |

| Sr. Unscd. Notes | | 8.75 | | 5/25/10 | | 200,000 | | 208,391 |

| Devon Financing, | | | | | | | | |

| Gtd. Debs. | | 7.88 | | 9/30/31 | | 275,000 | | 247,972 |

| EnCana, | | | | | | | | |

| Sr. Unscd. Bonds | | 7.20 | | 11/1/31 | | 625,000 | | 479,756 |

| Energy Transfer Partners, | | | | | | | | |

| Sr. Unscd. Bonds | | 7.50 | | 7/1/38 | | 375,000 | | 285,388 |

| Enterprise Products Operating, | | | | | | | | |

| Gtd. Notes, Ser. B | | 5.60 | | 10/15/14 | | 995,000 | | 834,844 |

| Enterprise Products Operating, | | | | | | | | |

| Gtd. Bonds | | 6.30 | | 9/15/17 | | 75,000 | | 61,391 |

30

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Oil & Gas (continued) | | | | | | | | |

| Exxon Mobil, | | | | | | | | |

| Sr. Unscd. Bonds | | 8.63 | | 8/15/21 | | 15,000 | | 17,821 |

| Kerr-McGee, | | | | | | | | |

| Gtd. Notes | | 6.95 | | 7/1/24 | | 600,000 | | 476,860 |

| Kinder Morgan Energy Partners, | | | | | | | | |

| Sr. Unscd. Notes | | 6.95 | | 1/15/38 | | 75,000 | | 55,145 |

| Kinder Morgan Energy Partners, | | | | | | | | |

| Sr. Unscd. Notes | | 7.40 | | 3/15/31 | | 350,000 | | 266,829 |

| Marathon Oil, | | | | | | | | |

| Sr. Unscd. Notes | | 6.60 | | 10/1/37 | | 350,000 | | 248,240 |

| Nexen, | | | | | | | | |

| Sr. Unscd. Notes | | 5.20 | | 3/10/15 | | 150,000 | | 123,453 |

| Nexen, | | | | | | | | |

| Sr. Unscd. Notes | | 5.88 | | 3/10/35 | | 125,000 | | 82,430 |

| ONEOK Partners, | | | | | | | | |

| Gtd. Notes | | 6.15 | | 10/1/16 | | 545,000 | | 440,900 |

| ONEOK Partners, | | | | | | | | |

| Gtd. Notes | | 6.85 | | 10/15/37 | | 60,000 | | 40,869 |

| Oneok, | | | | | | | | |

| Sr. Unscd. Notes | | 5.20 | | 6/15/15 | | 200,000 | | 156,732 |

| Pemex Project Funding Master | | | | | | | | |

| Trust, Gtd. Notes | | 7.38 | | 12/15/14 | | 400,000 | | 357,564 |

| Petrobras International Finance, | | | | | | | | |

| Gtd. Notes | | 5.88 | | 3/1/18 | | 625,000 | | 493,756 |

| Petro-Canada, | | | | | | | | |

| Sr. Unscd. Notes | | 4.00 | | 7/15/13 | | 450,000 | | 383,121 |

| Plains All America Pipeline, | | | | | | | | |

| Gtd. Notes | | 6.13 | | 1/15/17 | | 525,000 | | 391,176 |

| Schering-Plough, | | | | | | | | |

| Sr. Unscd. Bonds | | 6.75 | | 12/1/33 | | 80,000 a | | 66,405 |

| Sempra Energy, | | | | | | | | |

| Sr. Unscd. Notes | | 7.95 | | 3/1/10 | | 500,000 | | 502,836 |

| Shell International Finance, | | | | | | | | |

| Gtd. Notes | | 5.63 | | 6/27/11 | | 500,000 | | 518,287 |