UNITED STATES

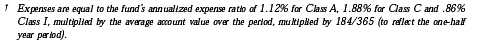

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549 |

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES |

Investment Company Act file number 811-05202

The Dreyfus/Laurel Funds, Inc.

(Exact name of Registrant as specified in charter) |

c/o The Dreyfus Corporation

200 Park Avenue

New York, New York 10166

(Address of principal executive offices) (Zip code) |

Michael A. Rosenberg, Esq.

200 Park Avenue

New York, New York 10166

(Name and address of agent for service) |

| Registrant's telephone number, including area code: | | (212) 922-6000 |

| Date of fiscal year end: | | 10/31 | | |

| Date of reporting period: | | 10/31/2009 | | |

The following N-CSR relates only to the Registrant’s series listed below and does not affect Dreyfus Core Equity Fund, a series of the Registrant with a fiscal year end of August 31. A separate N-CSR will be filed for that series as appropriate.

Dreyfus Bond Market Index Fund

Dreyfus Disciplined Stock Fund

Dreyfus Money Market Reserves

Dreyfus AMT-Free Municipal Reserves

Dreyfus Tax Managed Growth Fund

Dreyfus BASIC S&P 500 Stock Index Fund

Dreyfus U.S. Treasury Reserves

Dreyfus Small Cap Value Fund

Dreyfus Strategic Income Fund |

| Item 1. | | Reports to Stockholders. |

2

Save time. Save paper. View your next shareholder report online as soon as it s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

| | Contents |

| |

| | THE FUND |

| |

| 2 | A Letter from the Chairman and CEO |

| |

| 3 | Discussion of Fund Performance |

| |

| 6 | Fund Performance |

| |

| 7 | Understanding Your Fund s Expenses |

| |

| 7 | Comparing Your Fund s Expenses With Those of Other Funds |

| |

| 8 | Statement of Investments |

| |

| 51 | Statement of Assets and Liabilities |

| |

| 52 | Statement of Operations |

| |

| 53 | Statement of Changes in Net Assets |

| |

| 55 | Financial Highlights |

| |

| 57 | Notes to Financial Statements |

| |

| 67 | Report of Independent Registered Public Accounting Firm |

| |

| 68 | Important Tax Information |

| |

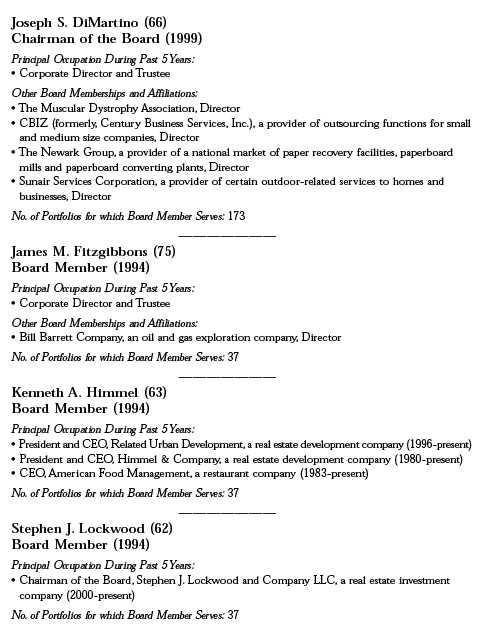

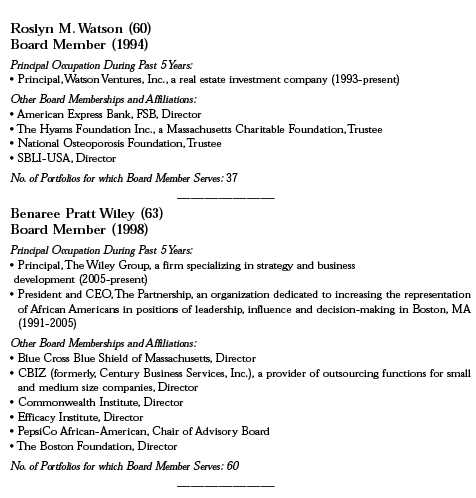

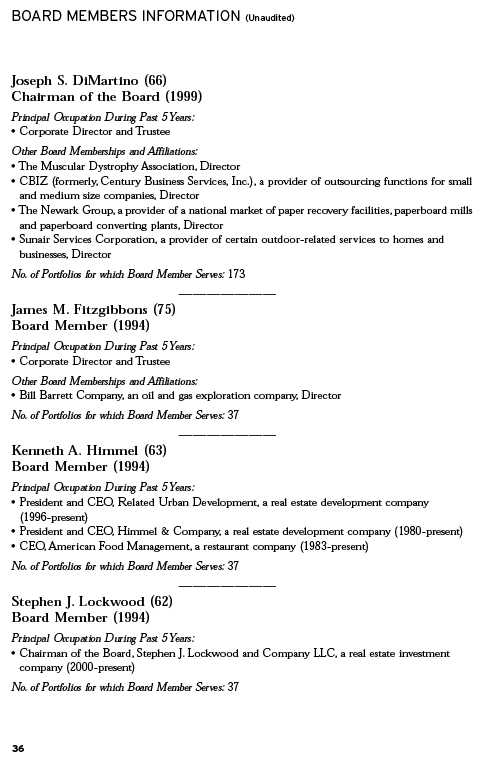

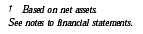

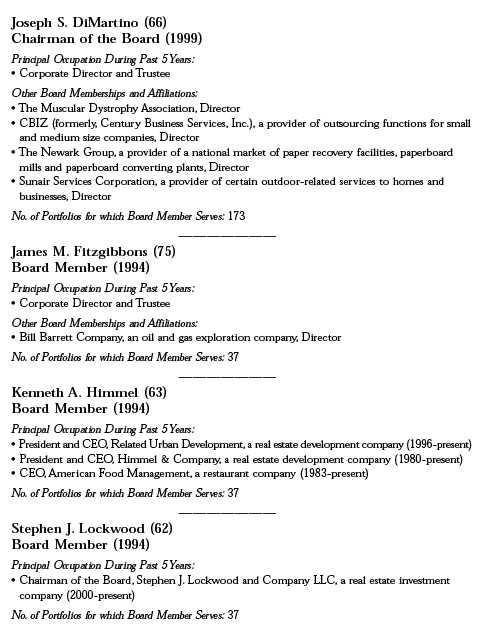

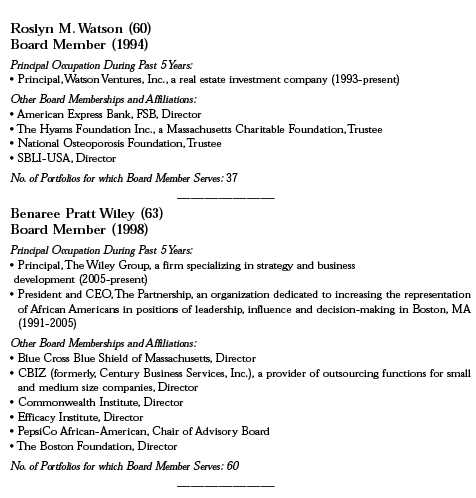

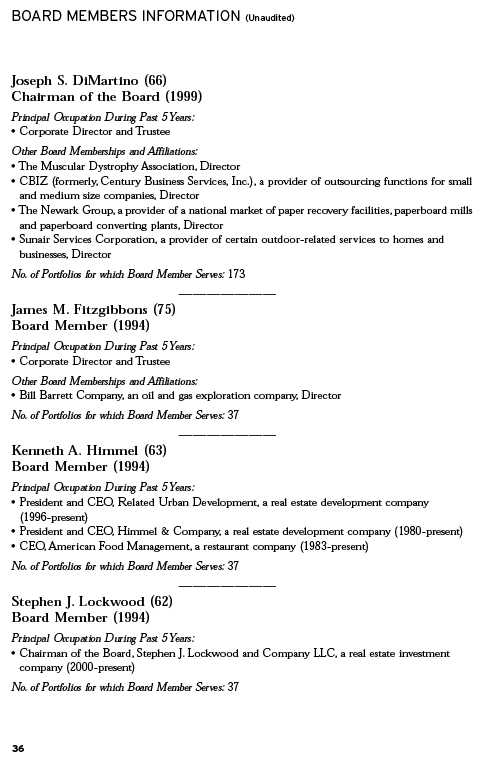

| 69 | Board Members Information |

| |

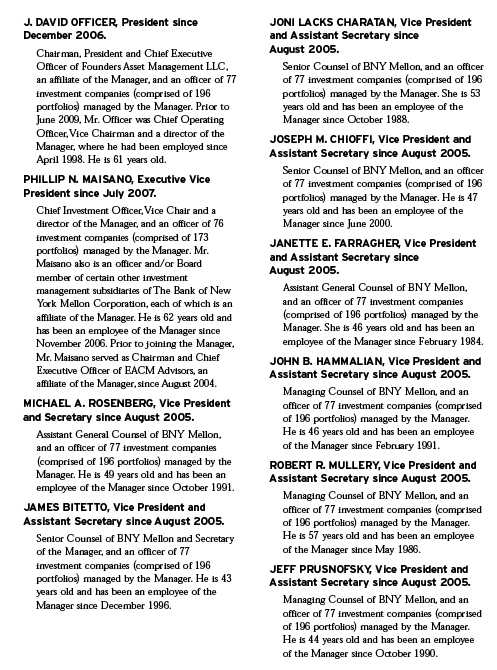

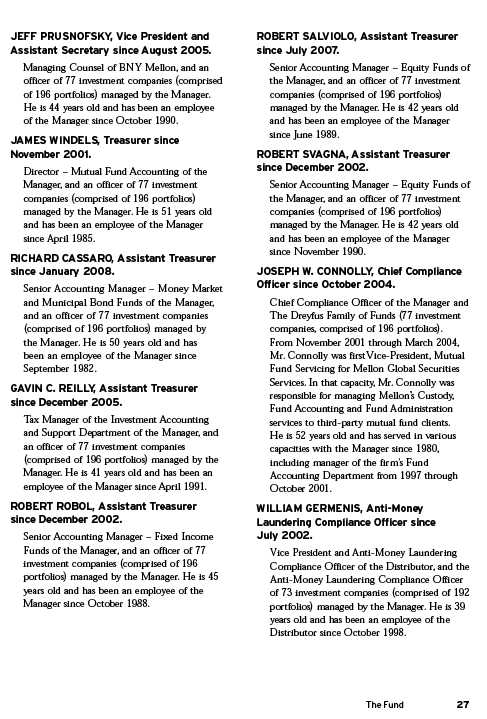

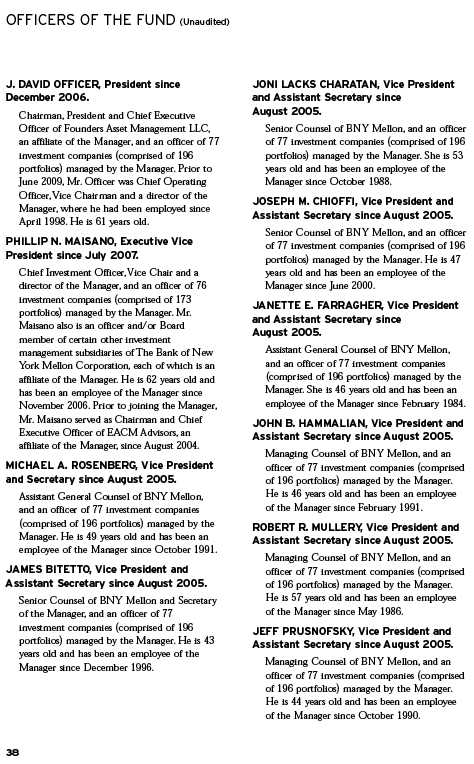

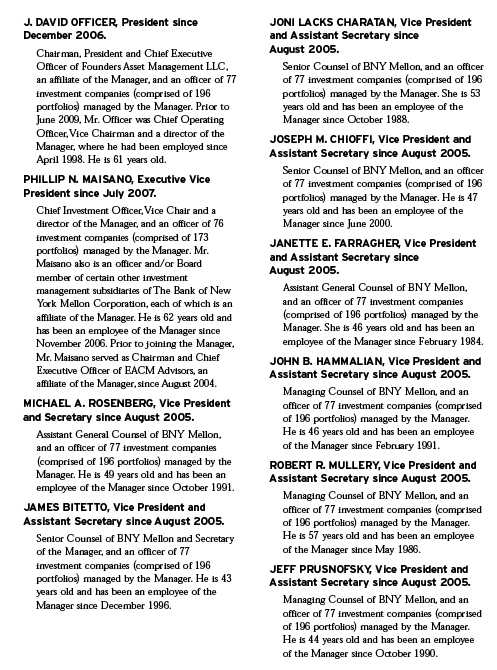

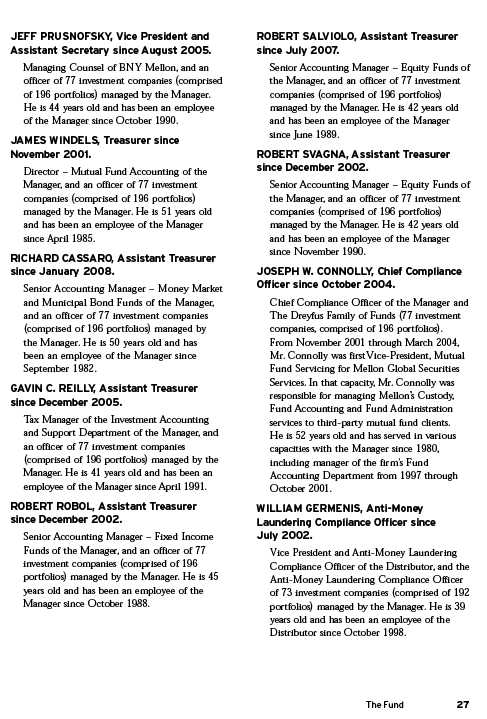

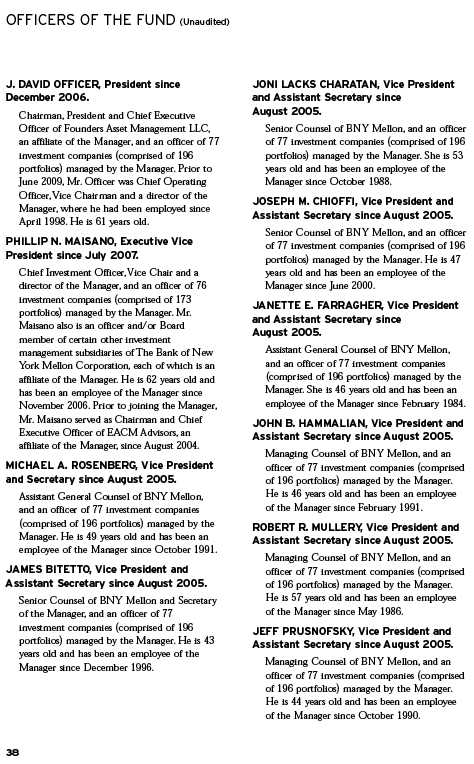

| 71 | Officers of the Fund |

| |

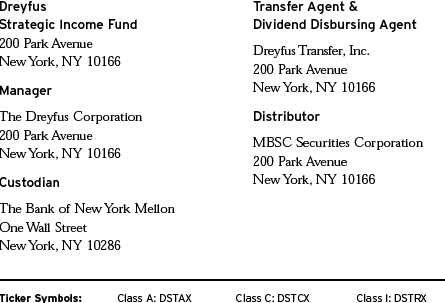

| | FOR MORE INFORMATION |

| |

| | Back Cover |

| |

Dreyfus

Bond Market Index Fund |

The Fund

A LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Bond Market Index Fund, covering the 12-month period from November 1, 2008, through October 31, 2009.

Reports of positive U.S. economic growth over the third quarter of 2009 may have signaled the end of the deep recession that technically began in December 2007. Signs that the economy finally has turned a corner include inventory rebuilding among manufacturers, improvements in home sales and prices, and an increase in consumer spending. These indicators, along with improved investor sentiment, have helped higher-yielding bonds rally during the reporting period, while a weak U.S. dollar has supported currency transactions in other global markets. Short-term securities and higher quality, corporate bond investments have participated in the rally as investors exchanged out of low-yielding cash investments, but they have so far lagged non-investment-grade counterparts. U.S.Treasury securities, still considered to rank among the safest investments in the world, continue to underperform relative to other fixed-income categories.

As the financial markets currently appear poised to enter into a new phase, the best strategy for your portfolio depends not only on your view of the economy s direction, but on your current financial needs, future goals and attitudes toward risk.Your financial advisor can help you decide which investments have the potential to benefit from a recovery while guarding against the risks that may accompany unexpected market developments.

For information about how the fund performed during the reporting period, as well as market perspectives, we have provided a Discussion of Fund Performance.

Thank you for your continued confidence and support.

Jonathan R. Baum

Chairman and Chief Executive Officer

The Dreyfus Corporation

November 16, 2009 |

2

DISCUSSION OF FUND PERFORMANCE

For the period of November 1, 2008, through October 31, 2009, as provided by Laurie Carroll, Portfolio Manager

Market and Fund Performance Overview

For the 12-month period ended October 31, 2009, Dreyfus Bond Market Index Fund s Investor shares produced a total return of 12.70%, and its BASIC shares produced a total return of 12.99%.1 In comparison, the Barclays Capital U.S. Aggregate Index (the Index ) achieved a total return of 13.79% for the same period.2

The U.S. bond market produced positive absolute returns during the reporting period, as improving investor sentiment resulted in a reversal of the flight to quality seen earlier in the calendar year. As their risk appetites increased, investors returned to higher-yielding market sectors, where gains were most prevalent among commercial mortgage-backed securities and corporate bonds, many of which benefited from liquidity programs adopted by government and monetary authorities.

The Fund s Investment Approach

The fund seeks to match the total return of the Index.To pursue this goal, the fund normally invests at least 80% of its assets in bonds that are included in the Index. To maintain liquidity, the fund may invest up to 20% of its assets in various short-term, fixed-income securities and money market instruments.

While the fund seeks to mirror the returns of the Index, it does not hold the same number of bonds. Instead, the fund holds approximately 1,500 securities as compared to 8,800 securities in the Index.The fund s average duration a measure of sensitivity to changing interest rates generally remains neutral to the Index.As of October 31, 2009, the average duration of the fund was approximately 4.42 years.

Fixed-Income Securities Aided by Government Actions

When the reporting period began, the U.S. economic outlook remained relatively bleak as job losses continued to mount and tight credit condi-

The Fund 3

| DISCUSSION OF FUND PERFORMANCE (continued) |

tions weighed on consumer sentiment and spending. Only a few months earlier, the U.S. government had introduced a number of new and, in some cases, unprecedented programs in an attempt to alleviate some of the adverse effects of the ongoing financial crisis and recession. Remedial programs included theTemporary Liquidity Guarantee Program adopted by the Federal Deposit Insurance Corporation (FDIC) to encourage liquidity in the Interbank lending market by allowing banks to issue debt guaranteed by the FDIC. At the same time, the Federal Reserve Board (the Fed ) announced that it would inject additional liquidity into the markets by purchasing up to $750 billion of agency mortgage-backed securities, increasing its purchases of agency debentures by up to $100 billion, and purchasing up to $300 billion of longer-term U.S.Treasury securities.The Fed also made it clear that it would employ all available tools to stimulate the economy, improve mark et liquidity and achieve greater price stability in the bond markets.Therefore, by the end of 2008, the Fed had lowered its overnight federal funds rate to the record-low range of between 0% and 0.25%.

Investors Favored Higher-Yielding Bonds

The bond markets were buoyed by the midway point of the reporting period by signs that these remedial programs were gaining traction. In a reversal of market sentiment, investors began to feel more comfortable taking on risk in higher-yielding market sectors, and the bond market staged an impressive rally. Commercial mortgage-backed securities and corporate bonds, which experienced some of the market s steepest declines in 2008, posted some of the reporting period s stronger returns. For example, the troubled financials sector proved to be one of the corporate bond market s best-performing segments over the reporting period. All industry groups within the financials sector performed well, including brokerage, banking and insurance companies. In the industrials sector, consumer cyclicals (including home construction) and utilities achieved especially strong gains, rebounding from the lows reached during the recession and financial crisis.

4

Mortgage-backed securities, which comprise over one-third of the Index, also rebounded from their lows.These securities tend to perform well when interest rates are stable and fewer homeowners refinance their mortgages, primarily because it reduces the risk of larger-than-expected prepayments of existing mortgages.

On the other hand, U.S. Treasury securities and U.S. government agency securities gave back some of the gains achieved during the fall of 2008, as investors sought opportunities in other, higher-yielding areas of the bond market.

Mirroring the Index s Composition

As an index fund, we attempt to replicate the returns of the Index by closely approximating its composition. As of October 31, 2009, approximately 36% of the fund s assets were invested in mortgage-backed securities, 3% in commercial mortgage-backed securities, 18% in corporate bonds and asset-backed securities, 31% in U.S. Treasury securities and 12% in U.S. government agency bonds. In addition, all of the fund s corporate securities were at least BBB-rated or better at the end of the reporting period, and the fund has maintained an overall credit quality that is closely aligned with that of the Index.

November 16, 2009

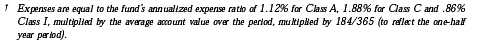

| 1 | | Total return includes reinvestment of dividends and any capital gains paid. Past performance is no |

| | | guarantee of future results. Share price, yield and investment return fluctuate such that upon |

| | | redemption, fund shares may be worth more or less than their original cost. Return figures |

| | | provided reflect the absorption of certain fund expenses by The Dreyfus Corporation pursuant to |

| | | an undertaking in effect that may be extended, terminated or modified at any time. Had these |

| | | expenses not been absorbed, the fund s returns would have been lower.The undertaking is no |

| | | longer in effect. |

| 2 | | SOURCE: LIPPER INC. Reflects reinvestment of dividends and, where applicable, capital |

| | | gain distributions.The Barclays Capital U.S. Aggregate Index is a widely accepted, unmanaged |

| | | total return index of corporate, U.S. government and U.S. government agency debt instruments, |

| | | mortgage-backed securities and asset-backed securities with an average maturity of 1-10 years. |

| | | Index returns do not reflect fees and expenses associated with operating a mutual fund. |

The Fund 5

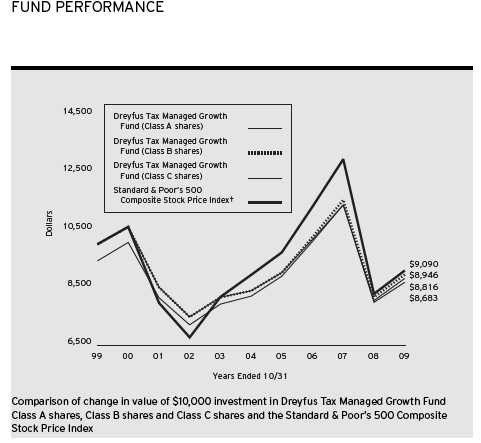

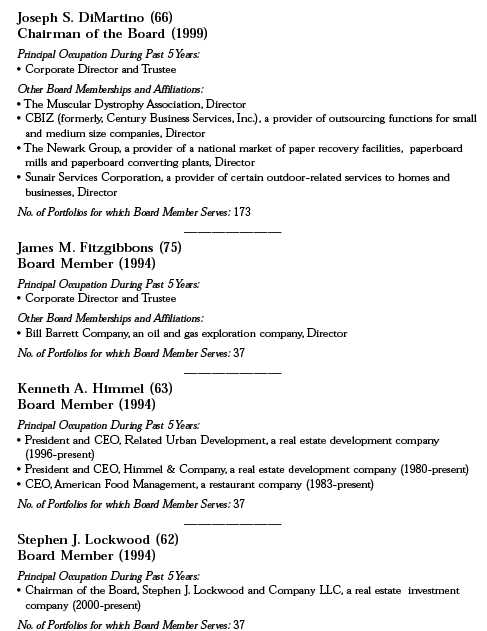

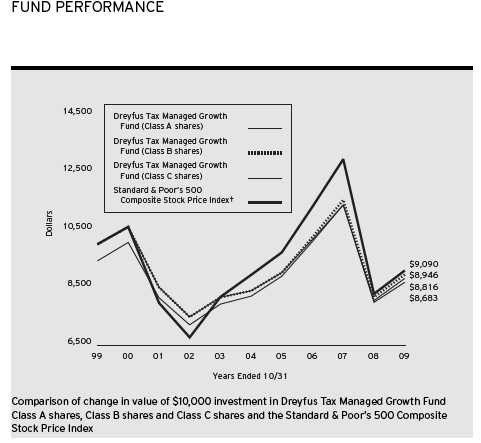

FUND PERFORMANCE

Comparison of change in value of $10,000 investment in Dreyfus Bond Market Index Fund BASIC shares and Investor shares and the Barclays Capital U.S. Aggregate Index

| Average Annual Total Returns as of 10/31/09 | | | | | | |

| | | 1 Year | | 5 Years | | 10 Years |

| |

| |

| |

|

| BASIC shares | | 12.99% | | 4.89% | | 6.06% |

| Investor shares | | 12.70% | | 4.65% | | 5.81% |

| Source: Lipper Inc. |

| Past performance is not predictive of future performance.The fund s performance shown in the graph and table does not |

| reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| The above graph compares a $10,000 investment made in both the BASIC shares and Investor shares of Dreyfus Bond |

| Market Index Fund on 10/31/99 to a $10,000 investment made in the Barclays Capital U.S. Aggregate Index (the |

| Index ) on that date. All dividends and capital gain distributions are reinvested. |

| The fund s performance shown in the line graph takes into account all applicable fees and expenses on both BASIC and |

| Investor shares.The Index is a widely accepted, unmanaged index of corporate, U.S. government and U.S. government |

| agency debt instruments, mortgage-backed securities, and asset-backed securities. Unlike a mutual fund, the Index is not |

| subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to |

| fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the |

| prospectus and elsewhere in this report. |

6

UNDERSTANDING YOUR FUND S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund s prospectus or talk to your financial adviser.

Review your fund s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Bond Market Index Fund from May 1, 2009 to October 31, 2009. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | Expenses and Value of a $1,000 Investment

assuming actual returns for the six months ended October 31, 2009 |

| | | Investor Shares | | BASIC Shares |

| |

| |

|

| Expenses paid per $1,000 | | $ 2.06 | | $ .77 |

| Ending value (after expenses) | | $1,048.00 | | $1,049.40 |

| | COMPARING YOUR FUND S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited) |

Using the SEC s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | Expenses and Value of a $1,000 Investment

assuming a hypothetical 5% annualized return for the six months ended October 31, 2009 |

| | | Investor Shares | | BASIC Shares |

| |

| |

|

| Expenses paid per $1,000 | | $ 2.04 | | $ .77 |

| Ending value (after expenses) | | $1,023.19 | | $1,024.45 |

The Fund 7

STATEMENT OF INVESTMENTS

October 31, 2009 |

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes 98.7% | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Aerospace & Defense .4% | | | | | | | | |

| Boeing, | | | | | | | | |

| Sr. Unscd. Notes | | 6.00 | | 3/15/19 | | 2,000,000 | | 2,223,018 |

| Boeing, | | | | | | | | |

| Sr. Unscd. Bonds | | 7.25 | | 6/15/25 | | 150,000 | | 174,327 |

| General Dynamics, | | | | | | | | |

| Gtd. Notes | | 4.25 | | 5/15/13 | | 125,000 | | 132,829 |

| Lockheed Martin, | | | | | | | | |

| Sr. Unscd. Notes, Ser. B | | 6.15 | | 9/1/36 | | 455,000 | | 503,365 |

| Northrop Grumman Systems, | | | | | | | | |

| Gtd. Debs. | | 7.75 | | 3/1/16 | | 540,000 | | 651,056 |

| Raytheon, | | | | | | | | |

| Sr. Unscd. Notes | | 4.85 | | 1/15/11 | | 125,000 | | 129,813 |

| Raytheon, | | | | | | | | |

| Sr. Unscd. Debs. | | 7.20 | | 8/15/27 | | 150,000 | | 182,722 |

| United Technologies, | | | | | | | | |

| Sr. Unscd. Notes | | 4.88 | | 5/1/15 | | 2,750,000 | | 3,002,711 |

| United Technologies, | | | | | | | | |

| Sr. Unscd. Notes | | 6.70 | | 8/1/28 | | 50,000 | | 58,050 |

| United Technologies, | | | | | | | | |

| Sr. Unscd. Debs. | | 8.75 | | 3/1/21 | | 50,000 | | 66,651 |

| | | | | | | | | 7,124,542 |

| Agriculture .3% | | | | | | | | |

| Altria Group, | | | | | | | | |

| Gtd. Notes | | 9.25 | | 8/6/19 | | 1,100,000 | | 1,335,892 |

| Altria Group, | | | | | | | | |

| Gtd. Notes | | 9.70 | | 11/10/18 | | 1,850,000 | | 2,281,257 |

| Archer Daniels, | | | | | | | | |

| Sr. Unscd. Notes | | 5.45 | | 3/15/18 | | 130,000 | | 140,260 |

| Philip Morris International, | | | | | | | | |

| Sr. Unscd. Notes | | 5.65 | | 5/16/18 | | 760,000 | | 818,841 |

| Reynolds American, | | | | | | | | |

| Gtd. Notes | | 7.63 | | 6/1/16 | | 170,000 | | 183,354 |

| | | | | | | | | 4,759,604 |

| Asset Backed Certificates .0% | | | | | | | | |

| CPL Transition Funding, | | | | | | | | |

| Ser. 2002-1, Cl. A4 | | 5.96 | | 7/15/15 | | 550,000 | | 603,296 |

| Asset-Backed Ctfs./ | | | | | | | | |

| Auto Receivables .0% | | | | | | | | |

| Honda Auto Receivables Owner | | | | | | | | |

| Trust, Ser. 2007-1, Cl. A4 | | 5.09 | | 7/18/13 | | 700,000 | | 724,557 |

8

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Asset-Backed Ctfs./ | | | | | | | | | | |

| Credit Cards .1% | | | | | | | | | | |

| Bank One Issuance Trust, | | | | | | | | | | |

| Ser. 2003-C3, Cl. C3 | | 4.77 | | 2/16/16 | | 200,000 | | | | 199,923 |

| Capital One Multi-Asset Execution | | | | | | | | | | |

| Trust, Ser. 2007-A7, Cl. A7 | | 5.75 | | 7/15/20 | | 565,000 | | | | 623,822 |

| Citibank Credit Card Issuance | | | | | | | | | | |

| Trust, Ser. 2005-A4, Cl. A4 | | 4.40 | | 6/20/14 | | 500,000 | | | | 531,455 |

| Citibank Credit Card Issuance | | | | | | | | | | |

| Trust, Ser. 2003-A10, Cl. A10 | | 4.75 | | 12/10/15 | | 500,000 | | | | 537,167 |

| | | | | | | | | | | 1,892,367 |

| Asset-Backed Ctfs./ | | | | | | | | | | |

| Home Equity Loans .0% | | | | | | | | | | |

| Centex Home Equity, | | | | | | | | | | |

| Ser. 2005-C, Cl. AF5 | | 5.05 | | 6/25/35 | | 200,000 | | a | | 182,666 |

| Automobile Manufacturers .1% | | | | | | | | | | |

| Daimler Finance North America, | | | | | | | | | | |

| Gtd. Notes | | 6.50 | | 11/15/13 | | 225,000 | | | | 245,176 |

| Daimler Finance North America, | | | | | | | | | | |

| Gtd. Notes | | 7.30 | | 1/15/12 | | 400,000 | | b | | 435,870 |

| Daimler Finance North America, | | | | | | | | | | |

| Gtd. Notes | | 8.50 | | 1/18/31 | | 200,000 | | | | 245,256 |

| | | | | | | | | | | 926,302 |

| Banks 3.2% | | | | | | | | | | |

| Bank of America, | | | | | | | | | | |

| Gtd. Notes | | 3.13 | | 6/15/12 | | 3,000,000 | | b | | 3,125,823 |

| Bank of America, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.13 | | 11/15/14 | | 350,000 | | | | 363,015 |

| Bank of America, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.38 | | 6/15/14 | | 275,000 | | | | 287,974 |

| Bank of America, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.63 | | 10/14/16 | | 575,000 | | | | 589,691 |

| Bank of America, | | | | | | | | | | |

| Sr. Unscd. Notes, | | | | | | | | | | |

| Ser. L | | 5.65 | | 5/1/18 | | 965,000 | | | | 976,987 |

| Bank of America, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.75 | | 12/1/17 | | 2,450,000 | | | | 2,495,176 |

| Bank of America, | | | | | | | | | | |

| Jr. Sub. Notes | | 7.80 | | 2/15/10 | | 500,000 | | | | 508,571 |

| Bank One, | | | | | | | | | | |

| Sub. Notes | | 5.90 | | 11/15/11 | | 500,000 | | | | 537,819 |

The Fund 9

| STATEMENT OF INVESTMENTS (continued) |

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Banks (continued) | | | | | | | | | | |

| Barclays Bank, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.75 | | 5/22/19 | | 1,300,000 | | b | | 1,464,419 |

| BB & T, | | | | | | | | | | |

| Sr. Notes | | 3.38 | | 9/25/13 | | 3,400,000 | | | | 3,429,135 |

| BB & T, | | | | | | | | | | |

| Sub. Notes | | 4.75 | | 10/1/12 | | 325,000 | | b | | 340,175 |

| BB & T, | | | | | | | | | | |

| Sub. Notes | | 4.90 | | 6/30/17 | | 150,000 | | | | 145,081 |

| Citigroup, | | | | | | | | | | |

| Gtd. Bonds | | 2.13 | | 4/30/12 | | 3,500,000 | | | | 3,569,209 |

| Citigroup, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.50 | | 4/11/13 | | 4,400,000 | | | | 4,589,006 |

| Credit Suisse New York, | | | | | | | | | | |

| Sub. Notes | | 6.00 | | 2/15/18 | | 1,400,000 | | | | 1,477,757 |

| Deutsche Bank AG London, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.00 | | 9/1/17 | | 845,000 | | | | 923,473 |

| Dresdner Bank, | | | | | | | | | | |

| Sub. Notes | | 7.25 | | 9/15/15 | | 145,000 | | | | 141,548 |

| Fifth Third Bank, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.20 | | 2/23/10 | | 200,000 | | | | 201,450 |

| Fifth Third Bank, | | | | | | | | | | |

| Sub. Notes | | 8.25 | | 3/1/38 | | 1,000,000 | | | | 965,416 |

| First Tennessee Bank, | | | | | | | | | | |

| Sub. Notes | | 5.65 | | 4/1/16 | | 250,000 | | | | 217,517 |

| Fleet Financial Group, | | | | | | | | | | |

| Sub. Notes | | 7.38 | | 12/1/09 | | 175,000 | | | | 175,785 |

| Golden West Financial, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.75 | | 10/1/12 | | 1,000,000 | | | | 1,050,633 |

| Goldman Sachs Group, | | | | | | | | | | |

| Gtd. Notes | | 3.25 | | 6/15/12 | | 4,350,000 | | b | | 4,549,761 |

| HSBC Holdings, | | | | | | | | | | |

| Sub. Notes | | 6.50 | | 5/2/36 | | 1,350,000 | | | | 1,484,896 |

| HSBC Holdings, | | | | | | | | | | |

| Sub. Notes | | 6.50 | | 9/15/37 | | 555,000 | | | | 610,364 |

| JP Morgan Chase, | | | | | | | | | | |

| Sub. Notes | | 6.00 | | 10/1/17 | | 150,000 | | | | 160,022 |

| KeyBank, | | | | | | | | | | |

| Sub. Notes | | 6.95 | | 2/1/28 | | 100,000 | | | | 88,064 |

| KFW, | | | | | | | | | | |

| Gov t Gtd. Bonds | | 4.00 | | 10/15/13 | | 1,400,000 | | | | 1,488,484 |

10

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Banks (continued) | | | | | | | | | | |

| KFW, | | | | | | | | | | |

| Gov t Gtd. Bonds | | 4.13 | | 10/15/14 | | 1,200,000 | | | | 1,280,711 |

| KFW, | | | | | | | | | | |

| Gov t Gtd. Bonds | | 4.50 | | 7/16/18 | | 1,800,000 | | | | 1,903,862 |

| KFW, | | | | | | | | | | |

| Gov t Gtd. Notes | | 4.88 | | 1/17/17 | | 1,240,000 | | | | 1,354,924 |

| KFW, | | | | | | | | | | |

| Gov t Gtd. Bonds | | 5.13 | | 3/14/16 | | 625,000 | | | | 692,250 |

| KFW, | | | | | | | | | | |

| Gov t Gtd. Notes | | 8.00 | | 2/15/10 | | 35,000 | | | | 35,750 |

| Korea Development Bank, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.50 | | 11/13/12 | | 350,000 | | b | | 370,946 |

| Mercantile Bankshares, | | | | | | | | | | |

| Sub. Notes, Ser. B | | 4.63 | | 4/15/13 | | 200,000 | | | | 203,524 |

| Morgan Stanley, | | | | | | | | | | |

| Sr. Unscd. Notes | | 7.30 | | 5/13/19 | | 1,300,000 | | | | 1,459,062 |

| National City Bank, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.50 | | 3/15/10 | | 1,275,000 | | | | 1,289,215 |

| National City, | | | | | | | | | | |

| Sub. Notes | | 6.88 | | 5/15/19 | | 1,800,000 | | | | 1,946,579 |

| NationsBank, | | | | | | | | | | |

| Sub. Notes | | 7.80 | | 9/15/16 | | 235,000 | | | | 257,699 |

| Oesterreichische Kontrollbank, | | | | | | | | | | |

| Gov t Gtd. Notes | | 4.88 | | 2/16/16 | | 1,500,000 | | b | | 1,616,934 |

| PNC Funding, | | | | | | | | | | |

| Bank Gtd. Notes | | 5.25 | | 11/15/15 | | 225,000 | | | | 230,901 |

| Rentenbank, | | | | | | | | | | |

| Gov t Gtd. Bonds | | 5.13 | | 2/1/17 | | 950,000 | | | | 1,027,918 |

| Royal Bank of Scotland Group, | | | | | | | | | | |

| Sub. Notes | | 5.00 | | 10/1/14 | | 175,000 | | | | 159,344 |

| Royal Bank of Scotland Group, | | | | | | | | | | |

| Sr. Sub. Notes | | 6.38 | | 2/1/11 | | 410,000 | | | | 410,524 |

| SouthTrust, | | | | | | | | | | |

| Sub. Notes | | 5.80 | | 6/15/14 | | 500,000 | | b | | 525,805 |

| Sovereign Bancorp, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.80 | | 9/1/10 | | 500,000 | | a | | 514,406 |

| State Street Bank & Trust, | | | | | | | | | | |

| Sub. Notes | | 5.25 | | 10/15/18 | | 200,000 | | | | 208,473 |

| Suntrust Capital VIII, | | | | | | | | | | |

| Gtd. Secs. | | 6.10 | | 12/1/66 | | 335,000 | | a | | 237,651 |

The Fund 11

| STATEMENT OF INVESTMENTS (continued) |

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Banks (continued) | | | | | | | | |

| U.S. Bank, | | | | | | | | |

| Sub. Notes | | 4.95 | | 10/30/14 | | 45,000 | | 48,443 |

| U.S. Bank, | | | | | | | | |

| Sub. Notes | | 6.38 | | 8/1/11 | | 100,000 | | 108,001 |

| UBS, | | | | | | | | |

| Sub. Notes | | 5.88 | | 7/15/16 | | 75,000 | | 75,466 |

| UBS, | | | | | | | | |

| Sr. Unscd. Notes | | 5.88 | | 12/20/17 | | 760,000 | | 781,831 |

| Union Planters, | | | | | | | | |

| Sr. Unscd. Notes | | 4.38 | | 12/1/10 | | 400,000 | | 398,004 |

| Wachovia Bank, | | | | | | | | |

| Sub. Notes | | 5.00 | | 8/15/15 | | 250,000 | | 257,785 |

| Wachovia Bank, | | | | | | | | |

| Sub. Notes | | 6.60 | | 1/15/38 | | 415,000 | | 453,468 |

| Wachovia, | | | | | | | | |

| Sub. Notes | | 5.25 | | 8/1/14 | | 200,000 | | 208,116 |

| Wachovia, | | | | | | | | |

| Sr. Unscd. Notes | | 5.75 | | 2/1/18 | | 1,100,000 | | 1,151,453 |

| Wells Fargo & Co., | | | | | | | | |

| Sr. Unscd. Notes | | 5.63 | | 12/11/17 | | 2,140,000 | | 2,229,435 |

| Wells Fargo & Co., | | | | | | | | |

| Sub. Notes | | 6.38 | | 8/1/11 | | 420,000 | | 450,335 |

| Wells Fargo Bank, | | | | | | | | |

| Sub. Notes | | 5.75 | | 5/16/16 | | 875,000 | | 911,286 |

| Westpac Banking, | | | | | | | | |

| Sub. Notes | | 4.63 | | 6/1/18 | | 500,000 | | 481,398 |

| | | | | | | | | 59,238,750 |

| Building & Construction .0% | | | | | | | | |

| CRH America, | | | | | | | | |

| Gtd. Notes | | 5.30 | | 10/15/13 | | 500,000 | | 519,818 |

| Chemicals .4% | | | | | | | | |

| Dow Chemical, | | | | | | | | |

| Sr. Unscd. Notes | | 6.00 | | 10/1/12 | | 2,200,000 | | 2,352,614 |

| Dow Chemical, | | | | | | | | |

| Sr. Unscd. Notes | | 8.55 | | 5/15/19 | | 1,700,000 | | 1,944,008 |

| E.I. Du Pont De Nemours, | | | | | | | | |

| Sr. Unscd. Notes | | 5.25 | | 12/15/16 | | 1,900,000 | | 2,041,670 |

| E.I. Du Pont De Nemours, | | | | | | | | |

| Sr. Unscd. Notes | | 6.00 | | 7/15/18 | | 560,000 | | 629,944 |

| |

| |

| 12 | | | | | | | | |

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Chemicals (continued) | | | | | | | | | | |

| Lubrizol, | | | | | | | | | | |

| Gtd. Notes | | 5.50 | | 10/1/14 | | 150,000 | | | | 161,559 |

| Potash of Saskatchewan, | | | | | | | | | | |

| Sr. Unscd. Notes | | 7.75 | | 5/31/11 | | 200,000 | | | | 219,130 |

| Praxair, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.38 | | 4/1/12 | | 100,000 | | | | 110,616 |

| | | | | | | | | | | 7,459,541 |

| Commercial Mortgage | | | | | | | | | | |

| Pass-Through Ctfs. 3.0% | | | | | | | | | | |

| Asset Securitization, | | | | | | | | | | |

| Ser. 1995-D1, Cl. A2 | | 7.59 | | 7/11/27 | | 6,476 | | | | 6,537 |

| Banc of America Commercial | | | | | | | | | | |

| Mortgage, Ser. 2005-3, Cl. A4 | | 4.67 | | 7/10/43 | | 1,000,000 | | | | 978,370 |

| Banc of America Commercial | | | | | | | | | | |

| Mortgage, Ser. 2005-4, Cl. A5B | | 5.00 | | 7/10/45 | | 1,800,000 | | a | | 1,507,766 |

| Banc of America Commercial | | | | | | | | | | |

| Mortgage, Ser. 2007-1, Cl. A4 | | 5.45 | | 1/15/49 | | 1,000,000 | | | | 928,342 |

| Banc of America Commercial | | | | | | | | | | |

| Mortgage, Ser. 2000-2, Cl. A2 | | 7.20 | | 9/15/32 | | 430,705 | | a | | 434,102 |

| Banc of America Commercial | | | | | | | | | | |

| Mortgage, Ser. 2007-4, Cl. A4 | | 5.94 | | 2/10/51 | | 300,000 | | a | | 279,548 |

| Bear Stearns Commercial Mortgage | | | | | | | | | | |

| Securities, Ser. 2003-T12, | | | | | | | | | | |

| Cl. A4 | | 4.68 | | 8/13/39 | | 350,000 | | a | | 352,347 |

| Bear Stearns Commercial Mortgage | | | | | | | | | | |

| Securities, Ser. 2003-T10, | | | | | | | | | | |

| Cl. A2 | | 4.74 | | 3/13/40 | | 400,000 | | | | 411,015 |

| Bear Stearns Commercial Mortgage | | | | | | | | | | |

| Securities, Ser. 2005-PWR9, | | | | | | | | | | |

| Cl. A4A | | 4.87 | | 9/11/42 | | 900,000 | | | | 875,723 |

| Bear Stearns Commercial Mortgage | | | | | | | | | | |

| Securities, Ser. 2006-PW14, | | | | | | | | | | |

| Cl. A4 | | 5.20 | | 12/11/38 | | 2,630,000 | | | | 2,503,424 |

| Bear Stearns Commercial Mortgage | | | | | | | | | | |

| Securities, Ser. 2006-PW12, | | | | | | | | | | |

| Cl. A4 | | 5.90 | | 9/11/38 | | 850,000 | | a | | 867,628 |

| Bear Stearns Commercial Mortgage | | | | | | | | | | |

| Securities, Ser. 2002-TOP6, | | | | | | | | | | |

| Cl. A2 | | 6.46 | | 10/15/36 | | 175,000 | | | | 185,869 |

The Fund 13

| STATEMENT OF INVESTMENTS (continued) |

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Commercial Mortgage | | | | | | | | | | |

| Pass-Through Ctfs. (continued) | | | | | | | | | | |

| Bear Stearns Commercial Mortgage | | | | | | | | | | |

| Securities, Ser. 2001-TOP2, | | | | | | | | | | |

| Cl. A2 | | 6.48 | | 2/15/35 | | 230,000 | | | | 238,095 |

| Chase Commercial Mortgage | | | | | | | | | | |

| Securities, Ser. 2000-3, Cl. A2 | | 7.32 | | 10/15/32 | | 384,871 | | | | 396,797 |

| Chase Commercial Mortgage | | | | | | | | | | |

| Securities, Ser. 2000-2, Cl. A2 | | 7.63 | | 7/15/32 | | 237,163 | | | | 243,058 |

| Citigroup Commercial Mortgage | | | | | | | | | | |

| Trust, Ser. 2006-C4, Cl. A3 | | 5.73 | | 3/15/49 | | 225,000 | | a | | 219,724 |

| Citigroup Commercial Mortgage | | | | | | | | | | |

| Trust, Ser. 2008-C7, Cl. A4 | | 6.30 | | 12/10/49 | | 1,100,000 | | a | | 1,029,190 |

| Citigroup/Deutsche Bank Commercial | | | | | | | | | | |

| Mortgage Trust, Ser. 2005-CD1, | | | | | | | | | | |

| Cl. A4 | | 5.23 | | 7/15/44 | | 1,900,000 | | a | | 1,931,475 |

| Citigroup/Deutsche Bank Commercial | | | | | | | | | | |

| Mortgage Trust, Ser. 2006-CD2, | | | | | | | | | | |

| Cl. A4 | | 5.36 | | 1/15/46 | | 85,000 | | a | | 82,958 |

| Commercial Mortgage Pass-Through | | | | | | | | | | |

| Certificates, Ser. 2005-LP5, | | | | | | | | | | |

| Cl. A2 | | 4.63 | | 5/10/43 | | 762,516 | | | | 765,582 |

| Credit Suisse Mortgage Capital | | | | | | | | | | |

| Certificates, Ser. 2006-C3, | | | | | | | | | | |

| Cl. A3 | | 5.83 | | 6/15/38 | | 1,500,000 | | a | | 1,325,253 |

| CS First Boston Mortgage | | | | | | | | | | |

| Securities, Ser. 2004-C3, | | | | | | | | | | |

| Cl. A5 | | 5.11 | | 7/15/36 | | 1,245,000 | | a | | 1,246,135 |

| CS First Boston Mortgage | | | | | | | | | | |

| Securities, Ser. 2002-CKP1, | | | | | | | | | | |

| Cl. A3 | | 6.44 | | 12/15/35 | | 675,000 | | | | 720,531 |

| CS First Boston Mortgage | | | | | | | | | | |

| Securities, Ser. 2001-CK3, | | | | | | | | | | |

| Cl. A4 | | 6.53 | | 6/15/34 | | 374,779 | | | | 391,223 |

| CS First Boston Mortgage | | | | | | | | | | |

| Securities, Ser. 2000-C1, | | | | | | | | | | |

| Cl. A2 | | 7.55 | | 4/15/62 | | 134,541 | | | | 136,723 |

| CWCapital Cobalt, | | | | | | | | | | |

| Ser. 2007-C3, Cl. A4 | | 5.82 | | 5/15/46 | | 1,000,000 | | a | | 890,675 |

| DLJ Commercial Mortgage, | | | | | | | | | | |

| Ser. 2000-CKP1, Cl. A1B | | 7.18 | | 11/10/33 | | 351,399 | | | | 360,976 |

14

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Commercial Mortgage | | | | | | | | | | |

| Pass-Through Ctfs. (continued) | | | | | | | | | | |

| GE Capital Commercial Mortgage, | | | | | | | | | | |

| Ser. 2002-1A, Cl. A3 | | 6.27 | | 12/10/35 | | 1,250,000 | | | | 1,331,391 |

| GMAC Commercial Mortgage | | | | | | | | | | |

| Securities, Ser. 2003-C1, Cl. B | | 4.19 | | 5/10/36 | | 4,700,000 | | | | 4,190,413 |

| Greenwich Capital Commercial | | | | | | | | | | |

| Funding, Ser. 2005-GG5, Cl. A5 | | 5.22 | | 4/10/37 | | 1,000,000 | | a | | 968,248 |

| GS Mortgage Securities II, | | | | | | | | | | |

| Ser. 2005-GG4, Cl. A3 | | 4.61 | | 7/10/39 | | 775,000 | | | | 773,980 |

| GS Mortgage Securities II, | | | | | | | | | | |

| Ser. 2007-GG10, Cl. A4 | | 6.00 | | 8/10/45 | | 1,000,000 | | a | | 842,135 |

| J.P. Morgan Chase Commercial | | | | | | | | | | |

| Mortgage Securities, | | | | | | | | | | |

| Ser. 2004-CB8, Cl. A4 | | 4.40 | | 1/12/39 | | 1,000,000 | | | | 968,405 |

| J.P. Morgan Chase Commercial | | | | | | | | | | |

| Mortgage Securities, | | | | | | | | | | |

| Ser. 2005-LDP3, Cl. A4A | | 4.94 | | 8/15/42 | | 600,000 | | a | | 593,886 |

| J.P. Morgan Chase Commercial | | | | | | | | | | |

| Mortgage Securities, | | | | | | | | | | |

| Ser. 2004-LN2, Cl. A2 | | 5.12 | | 7/15/41 | | 150,000 | | | | 148,606 |

| J.P. Morgan Chase Commercial | | | | | | | | | | |

| Mortgage Securities, | | | | | | | | | | |

| Ser. 2007-LDPX, Cl. A3 | | 5.42 | | 1/15/49 | | 1,200,000 | | | | 1,054,062 |

| J.P. Morgan Chase Commercial | | | | | | | | | | |

| Mortgage Securities, | | | | | | | | | | |

| Ser. 2007-CB18, Cl. A4 | | 5.44 | | 6/12/47 | | 350,000 | | | | 319,218 |

| J.P. Morgan Chase Commercial | | | | | | | | | | |

| Mortgage Securities, | | | | | | | | | | |

| Ser. 2006-LDP8, Cl. A3B | | 5.45 | | 5/15/45 | | 225,000 | | | | 221,710 |

| J.P. Morgan Chase Commercial | | | | | | | | | | |

| Mortgage Securities, | | | | | | | | | | |

| Ser. 2006-CB14, Cl. A4 | | 5.48 | | 12/12/44 | | 500,000 | | a | | 492,143 |

| J.P. Morgan Chase Commercial | | | | | | | | | | |

| Mortgage Securities, | | | | | | | | | | |

| Ser. 2007-CB20, Cl. A4 | | 5.79 | | 2/12/51 | | 1,000,000 | | a | | 908,957 |

| J.P. Morgan Chase Commercial | | | | | | | | | | |

| Mortgage Securities, | | | | | | | | | | |

| Ser. 2007-LD11, Cl. A4 | | 5.82 | | 6/15/49 | | 1,855,000 | | a | | 1,713,187 |

| LB-UBS Commercial Mortgage Trust, | | | | | | | | | | |

| Ser. 2003-C3, Cl. A4 | | 4.17 | | 5/15/32 | | 475,000 | | | | 475,670 |

The Fund 15

| STATEMENT OF INVESTMENTS (continued) |

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Commercial Mortgage | | | | | | | | | | |

| Pass-Through Ctfs. (continued) | | | | | | | | | | |

| LB-UBS Commercial Mortgage Trust, | | | | | | | | | | |

| Ser. 2004-C7, Cl. A6 | | 4.79 | | 10/15/29 | | 4,028,000 | | a | | 3,894,778 |

| LB-UBS Commercial Mortgage Trust, | | | | | | | | | | |

| Ser. 2005-C3, Cl. AJ | | 4.84 | | 7/15/40 | | 500,000 | | | | 392,417 |

| LB-UBS Commercial Mortgage Trust, | | | | | | | | | | |

| Ser. 2004-C6, Cl. A6 | | 5.02 | | 8/15/29 | | 275,000 | | a | | 258,944 |

| LB-UBS Commercial Mortgage Trust, | | | | | | | | | | |

| Ser. 2007-C2, Cl. A3 | | 5.43 | | 2/15/40 | | 1,200,000 | | | | 1,020,698 |

| LB-UBS Commercial Mortgage Trust, | | | | | | | | | | |

| Ser. 2000-C3, Cl. A2 | | 7.95 | | 5/15/25 | | 450,118 | | a | | 452,121 |

| Merrill Lynch Mortgage Trust, | | | | | | | | | | |

| Ser. 2003-KEY1, Cl. A4 | | 5.24 | | 11/12/35 | | 500,000 | | a | | 511,928 |

| Merrill Lynch Mortgage Trust, | | | | | | | | | | |

| Ser. 2005-CKI1, Cl. A6 | | 5.41 | | 11/12/37 | | 375,000 | | a | | 377,059 |

| Merrill Lynch Mortgage Trust, | | | | | | | | | | |

| Ser. 2007-C1, Cl. A4 | | 5.83 | | 6/12/50 | | 1,000,000 | | a | | 859,823 |

| Merrill Lynch/Countrywide | | | | | | | | | | |

| Commercial Mortgage, | | | | | | | | | | |

| Ser. 2007-7, Cl. A4 | | 5.75 | | 6/12/50 | | 1,200,000 | | a | | 1,013,320 |

| Morgan Stanley Capital I, | | | | | | | | | | |

| Ser. 2004-T13, Cl. A4 | | 4.66 | | 9/13/45 | | 1,000,000 | | | | 1,003,694 |

| Morgan Stanley Capital I, | | | | | | | | | | |

| Ser. 2004-T15, Cl. A4 | | 5.27 | | 6/13/41 | | 3,160,000 | | a | | 3,151,956 |

| Morgan Stanley Capital I, | | | | | | | | | | |

| Ser. 2007-IQ14, Cl. A4 | | 5.69 | | 4/15/49 | | 1,300,000 | | a | | 1,105,049 |

| Morgan Stanley Capital I, | | | | | | | | | | |

| Ser. 2006-HQ9, Cl. A4 | | 5.73 | | 7/12/44 | | 500,000 | | a | | 497,362 |

| Morgan Stanley Dean Witter Capital | | | | | | | | | | |

| I, Ser. 2003-HQ2, Cl. A2 | | 4.92 | | 3/12/35 | | 500,000 | | | | 510,066 |

| Morgan Stanley Dean Witter Capital | | | | | | | | | | |

| I, Ser. 2001-TOP1, Cl. A4 | | 6.66 | | 2/15/33 | | 108,031 | | | | 111,558 |

| Wachovia Bank Commercial Mortgage | | | | | | | | | | |

| Trust, Ser. 2005-C20, Cl. A7 | | 5.12 | | 7/15/42 | | 800,000 | | a | | 791,896 |

| Wachovia Bank Commercial Mortgage | | | | | | | | | | |

| Trust, Ser. 2004-C11, Cl. A5 | | 5.22 | | 1/15/41 | | 800,000 | | a | | 783,782 |

| Wachovia Bank Commercial Mortgage | | | | | | | | | | |

| Trust, Ser. 2007-C31, Cl. A4 | | 5.51 | | 4/15/47 | | 2,500,000 | | | | 2,036,031 |

| Wachovia Bank Commercial Mortgage | | | | | | | | | | |

| Trust, Ser. 2006-C28, Cl. A3 | | 5.68 | | 10/15/48 | | 150,000 | | | | 143,287 |

16

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Commercial Mortgage | | | | | | | | | | |

| Pass-Through Ctfs. (continued) | | | | | | | | | | |

| Wachovia Bank Commercial Mortgage | | | | | | | | | | |

| Trust, Ser. 2006-C27, Cl. A3 | | 5.77 | | 7/15/45 | | 1,150,000 | | a | | 1,110,897 |

| | | | | | | | | | | 54,337,743 |

| Consumer Products .2% | | | | | | | | | | |

| Avon Products, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.20 | | 7/15/18 | | 250,000 | | | | 245,254 |

| Procter & Gamble, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.95 | | 8/15/14 | | 2,625,000 | | | | 2,886,114 |

| Procter & Gamble, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.55 | | 3/5/37 | | 300,000 | | | | 317,702 |

| | | | | | | | | | | 3,449,070 |

| Diversified Financial Services 4.6% | | | | | | | | | | |

| AEP Texas Central Transition | | | | | | | | | | |

| Funding, Sr. Scd. Bonds, | | | | | | | | | | |

| Ser. A-4 | | 5.17 | | 1/1/18 | | 250,000 | | | | 275,136 |

| AEP Texas Central Transition | | | | | | | | | | |

| Funding, Sr. Scd. Bonds, | | | | | | | | | | |

| Ser. A-5 | | 5.31 | | 7/1/20 | | 45,000 | | | | 49,222 |

| American Express, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.15 | | 8/28/17 | | 700,000 | | | | 739,311 |

| American Express, | | | | | | | | | | |

| Sr. Unscd. Notes | | 7.00 | | 3/19/18 | | 2,600,000 | | | | 2,878,166 |

| Bear Stearns, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.30 | | 10/30/15 | | 100,000 | | | | 107,002 |

| Bear Stearns, | | | | | | | | | | |

| Sub. Notes | | 5.55 | | 1/22/17 | | 500,000 | | | | 513,227 |

| Bear Stearns, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.40 | | 10/2/17 | | 540,000 | | | | 591,150 |

| Bear Stearns, | | | | | | | | | | |

| Sr. Unscd. Notes | | 7.25 | | 2/1/18 | | 270,000 | | | | 309,319 |

| BP Capital Markets, | | | | | | | | | | |

| Gtd. Notes | | 5.25 | | 11/7/13 | | 2,500,000 | | | | 2,761,643 |

| Capital One Bank, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.13 | | 2/15/14 | | 200,000 | | b | | 211,100 |

| Capital One Capital III, | | | | | | | | | | |

| Gtd. Cap. Secs. | | 7.69 | | 8/15/36 | | 200,000 | | | | 174,500 |

| Caterpillar Financial Services, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.13 | | 2/17/14 | | 2,600,000 | | | | 2,892,492 |

The Fund 17

| STATEMENT OF INVESTMENTS (continued) |

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Diversified Financial | | | | | | | | | | |

| Services (continued) | | | | | | | | | | |

| Citigroup Funding, | | | | | | | | | | |

| Gtd. Notes | | 1.88 | | 10/22/12 | | 4,900,000 | | | | 4,919,884 |

| Citigroup, | | | | | | | | | | |

| Sub. Notes | | 5.00 | | 9/15/14 | | 3,230,000 | | | | 3,188,171 |

| Citigroup, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.00 | | 2/21/12 | | 1,075,000 | | | | 1,143,917 |

| Citigroup, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.13 | | 11/21/17 | | 885,000 | | | | 904,598 |

| Citigroup, | | | | | | | | | | |

| Sub. Notes | | 6.13 | | 8/25/36 | | 575,000 | | | | 513,467 |

| Citigroup, | | | | | | | | | | |

| Sr. Unscd. Debs. | | 6.63 | | 1/15/28 | | 100,000 | | | | 97,958 |

| Citigroup, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.88 | | 3/5/38 | | 700,000 | | | | 730,446 |

| Countrywide Home Loans, | | | | | | | | | | |

| Gtd. Notes, Ser. L | | 4.00 | | 3/22/11 | | 750,000 | | | | 764,774 |

| Credit Suisse USA, | | | | | | | | | | |

| Gtd. Notes | | 5.38 | | 3/2/16 | | 200,000 | | b | | 212,627 |

| Credit Suisse USA, | | | | | | | | | | |

| Gtd. Notes | | 5.50 | | 8/15/13 | | 1,000,000 | | b | | 1,089,938 |

| Credit Suisse USA, | | | | | | | | | | |

| Gtd. Notes | | 6.50 | | 1/15/12 | | 1,300,000 | | | | 1,424,654 |

| General Electric Capital, | | | | | | | | | | |

| Gtd. Notes | | 2.13 | | 12/21/12 | | 4,000,000 | | | | 4,051,308 |

| General Electric Capital, | | | | | | | | | | |

| Gtd. Notes | | 2.20 | | 6/8/12 | | 3,000,000 | | b | | 3,055,341 |

| General Electric Capital, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.00 | | 1/8/16 | | 375,000 | | b | | 382,728 |

| General Electric Capital, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.25 | | 10/19/12 | | 5,700,000 | | b | | 6,130,293 |

| General Electric Capital, | | | | | | | | | | |

| Sr. Unscd. Notes, Ser. A | | 5.45 | | 1/15/13 | | 650,000 | | | | 691,729 |

| General Electric Capital, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.63 | | 9/15/17 | | 1,000,000 | | | | 1,034,779 |

| General Electric Capital, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.63 | | 5/1/18 | | 1,335,000 | | | | 1,376,293 |

| General Electric Capital, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.88 | | 1/14/38 | | 500,000 | | | | 479,386 |

18

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Diversified Financial | | | | | | | | | | |

| Services (continued) | | | | | | | | | | |

| General Electric Capital, | | | | | | | | | | |

| Sr. Unscd. Notes, Ser. A | | 6.75 | | 3/15/32 | | 1,445,000 | | | | 1,523,179 |

| Goldman Sachs Capital I, | | | | | | | | | | |

| Gtd. Cap. Secs | | 6.35 | | 2/15/34 | | 350,000 | | | | 332,545 |

| Goldman Sachs Group, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.75 | | 7/15/13 | | 2,800,000 | | | | 2,943,427 |

| Goldman Sachs Group, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.95 | | 1/18/18 | | 15,000 | | | | 15,831 |

| Goldman Sachs Group, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.13 | | 2/15/33 | | 475,000 | | | | 495,465 |

| Goldman Sachs Group, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.15 | | 4/1/18 | | 680,000 | | | | 725,812 |

| Goldman Sachs Group, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.25 | | 9/1/17 | | 190,000 | | | | 203,597 |

| Goldman Sachs Group, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.60 | | 1/15/12 | | 2,725,000 | | | | 2,969,037 |

| Goldman Sachs Group, | | | | | | | | | | |

| Sub. Notes | | 6.75 | | 10/1/37 | | 630,000 | | | | 665,693 |

| Goldman Sachs Group, | | | | | | | | | | |

| Sr. Unscd. Notes | | 7.50 | | 2/15/19 | | 1,000,000 | | | | 1,171,414 |

| Household Finance, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.75 | | 7/15/13 | | 700,000 | | b | | 728,482 |

| Household Finance, | | | | | | | | | | |

| Sr. Unscd. Notes | | 8.00 | | 7/15/10 | | 630,000 | | | | 659,149 |

| HSBC Finance, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.50 | | 1/19/16 | | 2,625,000 | | b | | 2,734,833 |

| International Lease Finance, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.75 | | 1/13/12 | | 250,000 | | | | 204,972 |

| International Lease Finance, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.00 | | 4/15/10 | | 1,200,000 | | b | | 1,184,021 |

| International Lease Finance, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.65 | | 6/1/14 | | 350,000 | | | | 264,571 |

| Jefferies Group, | | | | | | | | | | |

| Sr. Unscd. Debs | | 6.25 | | 1/15/36 | | 200,000 | | | | 157,053 |

| Jefferies Group, | | | | | | | | | | |

| Sr. Unscd. Debs | | 6.45 | | 6/8/27 | | 35,000 | | b | | 29,674 |

| JP Morgan Chase Capital XX, | | | | | | | | | | |

| Gtd. Notes, Ser. T | | 6.55 | | 9/29/36 | | 50,000 | | | | 46,765 |

The Fund 19

| STATEMENT OF INVESTMENTS (continued) |

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Diversified Financial | | | | | | | | | | |

| Services (continued) | | | | | | | | | | |

| JP Morgan Chase XVII, | | | | | | | | | | |

| Gtd. Debs., Ser. Q | | 5.85 | | 8/1/35 | | 310,000 | | | | 275,734 |

| JPMorgan Chase & Co., | | | | | | | | | | |

| Gtd. Notes | | 3.13 | | 12/1/11 | | 2,500,000 | | b | | 2,603,298 |

| JPMorgan Chase & Co., | | | | | | | | | | |

| Sub. Notes | | 5.13 | | 9/15/14 | | 2,525,000 | | | | 2,675,202 |

| JPMorgan Chase & Co., | | | | | | | | | | |

| Sub. Notes | | 5.15 | | 10/1/15 | | 250,000 | | | | 264,324 |

| JPMorgan Chase & Co., | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.00 | | 1/15/18 | | 2,000,000 | | | | 2,144,796 |

| JPMorgan Chase & Co., | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.40 | | 5/15/38 | | 650,000 | | | | 722,137 |

| JPMorgan Chase & Co., | | | | | | | | | | |

| Sub. Notes | | 6.75 | | 2/1/11 | | 1,000,000 | | | | 1,058,479 |

| Merrill Lynch & Co., | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.45 | | 7/15/14 | | 565,000 | | | | 590,892 |

| Merrill Lynch & Co., | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.05 | | 8/15/12 | | 1,235,000 | | | | 1,324,235 |

| Merrill Lynch & Co., | | | | | | | | | | |

| Sub. Notes | | 6.05 | | 5/16/16 | | 575,000 | | | | 576,172 |

| Merrill Lynch & Co., | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.40 | | 8/28/17 | | 65,000 | | | | 67,284 |

| Merrill Lynch & Co., | | | | | | | | | | |

| Notes | | 6.88 | | 4/25/18 | | 1,450,000 | | | | 1,563,737 |

| Merrill Lynch & Co., | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.88 | | 11/15/18 | | 150,000 | | | | 160,524 |

| Morgan Stanley, | | | | | | | | | | |

| Gtd. Notes | | 1.95 | | 6/20/12 | | 2,000,000 | | b | | 2,027,740 |

| Morgan Stanley, | | | | | | | | | | |

| Sub. Notes | | 4.75 | | 4/1/14 | | 1,580,000 | | | | 1,586,304 |

| Morgan Stanley, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.45 | | 1/9/17 | | 1,100,000 | | | | 1,110,688 |

| Morgan Stanley, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.75 | | 10/18/16 | | 175,000 | | | | 181,103 |

| Morgan Stanley, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.63 | | 4/1/18 | | 1,100,000 | | | | 1,180,931 |

| Morgan Stanley, | | | | | | | | | | |

| Sr. Unscd. Notes | | 7.25 | | 4/1/32 | | 300,000 | | | | 343,225 |

20

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Diversified Financial | | | | | | | | | | |

| Services (continued) | | | | | | | | | | |

| National Rural Utilities | | | | | | | | | | |

| Cooperative Finance, Coll. | | | | | | | | | | |

| Trust Bonds | | 4.38 | | 10/1/10 | | 600,000 | | | | 619,109 |

| National Rural Utilities | | | | | | | | | | |

| Cooperative Finance, Coll. | | | | | | | | | | |

| Trust Bonds | | 5.45 | | 2/1/18 | | 1,100,000 | | | | 1,166,007 |

| SLM, | | | | | | | | | | |

| Sr. Unscd. Notes, Ser. A | | 5.00 | | 10/1/13 | | 100,000 | | | | 83,161 |

| SLM, | | | | | | | | | | |

| Sr. Unscd. Notes, Ser. A | | 5.00 | | 4/15/15 | | 450,000 | | | | 355,212 |

| Toyota Motor Credit, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.35 | | 12/15/10 | | 150,000 | | b | | 152,927 |

| | | | | | | | | | | 83,583,300 |

| Diversified Metals & Mining .4% | | | | | | | | | | |

| Alcan, | | | | | | | | | | |

| Sr. Unscd. Debs. | | 7.25 | | 3/15/31 | | 350,000 | | | | 391,591 |

| Alcoa, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.72 | | 2/23/19 | | 612,000 | | | | 588,688 |

| Alcoa, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.00 | | 1/15/12 | | 250,000 | | b | | 263,926 |

| BHP Finance USA, | | | | | | | | | | |

| Gtd. Notes | | 4.80 | | 4/15/13 | | 1,175,000 | | | | 1,253,828 |

| Freeport-McMoRan Cooper & Gold, | | | | | | | | | | |

| Sr. Unscd. Notes | | 8.38 | | 4/1/17 | | 895,000 | | | | 963,459 |

| Inco, | | | | | | | | | | |

| Unsub. Bonds | | 7.20 | | 9/15/32 | | 100,000 | | | | 104,417 |

| Noranda, | | | | | | | | | | |

| Gtd. Notes | | 5.50 | | 6/15/17 | | 165,000 | | | | 158,477 |

| Rio Tinto Finance USA, | | | | | | | | | | |

| Gtd. Notes | | 6.50 | | 7/15/18 | | 1,820,000 | | | | 1,988,066 |

| Vale Overseas, | | | | | | | | | | |

| Gtd. Notes | | 6.25 | | 1/23/17 | | 510,000 | | | | 534,429 |

| Vale Overseas, | | | | | | | | | | |

| Gtd. Notes | | 6.88 | | 11/21/36 | | 900,000 | | | | 907,740 |

| | | | | | | | | | | 7,154,621 |

| Electric Utilities 1.4% | | | | | | | | | | |

| Cincinnati Gas & Electric, | | | | | | | | | | |

| Sr. Unscd. Bonds | | 5.70 | | 9/15/12 | | 185,000 | | | | 202,682 |

The Fund 21

| STATEMENT OF INVESTMENTS (continued) |

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Electric Utilities (continued) | | | | | | | | |

| Cleveland Electric Illuminating, | | | | | | | | |

| Sr. Unscd. Notes | | 5.70 | | 4/1/17 | | 150,000 | | 156,738 |

| Consolidated Edison of New York, | | | | | | | | |

| Sr. Unscd. Debs., Ser. 05-A | | 5.30 | | 3/1/35 | | 175,000 | | 169,976 |

| Consolidated Edison of New York, | | | | | | | | |

| Sr. Unscd. Debs., Ser. 08-A | | 5.85 | | 4/1/18 | | 600,000 | | 651,042 |

| Consolidated Edison of New York, | | | | | | | | |

| Sr. Unscd. Debs., Ser. 06-B | | 6.20 | | 6/15/36 | | 200,000 | | 219,106 |

| Constellation Energy Group, | | | | | | | | |

| Sr. Unscd. Notes | | 7.00 | | 4/1/12 | | 225,000 b | | 242,568 |

| Constellation Energy Group, | | | | | | | | |

| Sr. Unscd. Notes | | 7.60 | | 4/1/32 | | 250,000 | | 267,972 |

| Consumers Energy, | | | | | | | | |

| First Mortgage Bonds, Ser. P | | 5.50 | | 8/15/16 | | 200,000 | | 214,191 |

| Dominion Resources, | | | | | | | | |

| Sr. Unscd. Notes, Ser. C | | 5.15 | | 7/15/15 | | 2,075,000 | | 2,204,717 |

| Dominion Resources, | | | | | | | | |

| Sr. Unscd. Notes, Ser. E | | 6.30 | | 3/15/33 | | 100,000 | | 107,537 |

| Duke Energy Carolinas, | | | | | | | | |

| First Mortgage Bonds | | 6.00 | | 1/15/38 | | 710,000 | | 786,603 |

| Duke Energy Carolinas, | | | | | | | | |

| Sr. Unscd. Notes | | 6.25 | | 1/15/12 | | 75,000 | | 81,587 |

| Exelon, | | | | | | | | |

| Sr. Unscd. Notes | | 4.90 | | 6/15/15 | | 2,500,000 | | 2,597,502 |

| FirstEnergy, | | | | | | | | |

| Sr. Unscd. Notes, Ser. B | | 6.45 | | 11/15/11 | | 7,000 | | 7,569 |

| FirstEnergy, | | | | | | | | |

| Sr. Unscd. Notes, Ser. C | | 7.38 | | 11/15/31 | | 1,210,000 | | 1,346,594 |

| Florida Power & Light, | | | | | | | | |

| First Mortgage Bonds | | 5.63 | | 4/1/34 | | 1,100,000 | | 1,154,621 |

| Florida Power & Light, | | | | | | | | |

| First Mortgage Debs. | | 5.65 | | 2/1/35 | | 25,000 | | 26,456 |

| Florida Power, | | | | | | | | |

| First Mortgage Bonds | | 6.40 | | 6/15/38 | | 1,000,000 | | 1,151,081 |

| Hydro-Quebec, | | | | | | | | |

| Gov t Gtd. Debs., Ser. HH | | 8.50 | | 12/1/29 | | 200,000 | | 270,541 |

| Hydro-Quebec, | | | | | | | | |

| Gov t Gtd. Debs., Ser. HK | | 9.38 | | 4/15/30 | | 20,000 | | 28,463 |

| MidAmerican Energy Holdings, | | | | | | | | |

| Sr. Unscd. Notes | | 5.88 | | 10/1/12 | | 950,000 | | 1,037,000 |

22

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Electric Utilities (continued) | | | | | | | | | | |

| MidAmerican Energy Holdings, | | | | | | | | | | |

| Sr. Unscd. Bonds | | 6.13 | | 4/1/36 | | 1,250,000 | | | | 1,337,871 |

| NiSource Finance, | | | | | | | | | | |

| Gtd. Notes | | 5.40 | | 7/15/14 | | 150,000 | | | | 155,276 |

| NiSource Finance, | | | | | | | | | | |

| Gtd. Notes | | 6.40 | | 3/15/18 | | 1,700,000 | | | | 1,755,340 |

| Northern States Power, | | | | | | | | | | |

| First Mortgage Bonds | | 6.25 | | 6/1/36 | | 750,000 | | | | 849,630 |

| Ohio Power, | | | | | | | | | | |

| Sr. Unscd. Notes, Ser. F | | 5.50 | | 2/15/13 | | 1,500,000 | | | | 1,586,690 |

| Oncor Electric Delivery, | | | | | | | | | | |

| Sr. Scd. Debs. | | 7.00 | | 9/1/22 | | 170,000 | | | | 197,202 |

| Oncor Electric Delivery, | | | | | | | | | | |

| Sr. Scd. Notes | | 7.00 | | 5/1/32 | | 250,000 | | | | 285,332 |

| Pacific Gas & Electric, | | | | | | | | | | |

| Sr. Unscd. Bonds | | 4.80 | | 3/1/14 | | 100,000 | | | | 106,560 |

| Pacific Gas & Electric, | | | | | | | | | | |

| Sr. Unscd. Bonds | | 6.05 | | 3/1/34 | | 465,000 | | | | 508,218 |

| Pacific Gas & Electric, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.25 | | 3/1/39 | | 750,000 | | | | 847,940 |

| Pacificorp, | | | | | | | | | | |

| First Mortgage Bonds | | 5.75 | | 4/1/37 | | 335,000 | | | | 356,088 |

| Progress Energy, | | | | | | | | | | |

| Sr. Unscd. Notes | | 7.10 | | 3/1/11 | | 500,000 | | | | 530,945 |

| Progress Energy, | | | | | | | | | | |

| Sr. Unscd. Notes | | 7.75 | | 3/1/31 | | 480,000 | | | | 596,302 |

| Public Service Company of | | | | | | | | | | |

| Colorado, First Mortgage | | | | | | | | | | |

| Bonds, Ser. 10 | | 7.88 | | 10/1/12 | | 350,000 | | | | 406,349 |

| Public Service Electric & Gas, | | | | | | | | | | |

| Scd. Notes, Ser. D | | 5.25 | | 7/1/35 | | 230,000 | | | | 228,029 |

| South Carolina Electric & Gas, | | | | | | | | | | |

| First Mortgage Bonds | | 6.63 | | 2/1/32 | | 200,000 | | b | | 234,039 |

| Southern California Edison, | | | | | | | | | | |

| First Mortgage Notes, | | | | | | | | | | |

| Ser. 08-A | | 5.95 | | 2/1/38 | | 70,000 | | b | | 77,599 |

| Southern California Edison, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.65 | | 4/1/29 | | 450,000 | | b | | 501,980 |

| Southern California Gas, | | | | | | | | | | |

| First Mortgage Bonds, Ser. HH | | 5.45 | | 4/15/18 | | 100,000 | | | | 108,314 |

The Fund 23

| | STATEMENT OF INVESTMENTS (continued) |

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Electric Utilities (continued) | | | | | | | | | | |

| Southern Power, | | | | | | | | | | |

| Sr. Unscd. Notes, Ser. D | | 4.88 | | 7/15/15 | | 2,000,000 | | | | 2,097,190 |

| SouthWestern Electric Power, | | | | | | | | | | |

| Sr. Unscd. Notes, Ser. F | | 5.88 | | 3/1/18 | | 150,000 | | | | 156,584 |

| Virginia Electric & Power, | | | | | | | | | | |

| Sr. Unscd. Notes, Ser. A | | 5.40 | | 1/15/16 | | 500,000 | | | | 530,531 |

| | | | | | | | | | | 26,378,555 |

| Food & Beverages .8% | | | | | | | | | | |

| Anheuser-Busch Cos., | | | | | | | | | | |

| Sr. Unscd. Bonds | | 5.00 | | 1/15/15 | | 1,000,000 | | | | 1,051,310 |

| Anheuser-Busch Cos., | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.50 | | 1/15/18 | | 145,000 | | b | | 148,688 |

| Bottling Group, | | | | | | | | | | |

| Gtd. Notes | | 4.63 | | 11/15/12 | | 350,000 | | | | 377,664 |

| Coca-Cola Enterprises, | | | | | | | | | | |

| Sr. Unscd. Debs. | | 6.70 | | 10/15/36 | | 250,000 | | b | | 302,157 |

| Coca-Cola Enterprises, | | | | | | | | | | |

| Sr. Unscd. Debs. | | 6.95 | | 11/15/26 | | 175,000 | | | | 208,989 |

| Coca-Cola Enterprises, | | | | | | | | | | |

| Sr. Unscd. Debs. | | 8.50 | | 2/1/22 | | 100,000 | | | | 133,774 |

| ConAgra Foods, | | | | | | | | | | |

| Sr. Unscd. Notes | | 7.00 | | 10/1/28 | | 350,000 | | | | 380,283 |

| Diageo Capital, | | | | | | | | | | |

| Gtd. Notes | | 5.75 | | 10/23/17 | | 720,000 | | | | 785,976 |

| Diageo Finance, | | | | | | | | | | |

| Gtd. Notes | | 5.30 | | 10/28/15 | | 125,000 | | | | 136,539 |

| General Mills, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.70 | | 2/15/17 | | 1,300,000 | | | | 1,420,489 |

| General Mills, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.00 | | 2/15/12 | | 125,000 | | | | 136,101 |

| H.J. Heinz, | | | | | | | | | | |

| Sr. Unscd. Debs. | | 6.38 | | 7/15/28 | | 100,000 | | | | 104,572 |

| Hershey, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.30 | | 9/1/11 | | 750,000 | | | | 802,079 |

| Hershey, | | | | | | | | | | |

| Sr. Unscd. Debs. | | 8.80 | | 2/15/21 | | 30,000 | | | | 39,231 |

| Kellogg, | | | | | | | | | | |

| Sr. Unscd. Debs., Ser. B | | 7.45 | | 4/1/31 | | 340,000 | | | | 431,099 |

| Kraft Foods, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.13 | | 2/1/18 | | 2,975,000 | | | | 3,158,299 |

24

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Food & Beverages (continued) | | | | | | | | | | |

| Kraft Foods, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.25 | | 6/1/12 | | 225,000 | | | | 244,481 |

| Kroger, | | | | | | | | | | |

| Gtd. Notes | | 7.50 | | 4/1/31 | | 800,000 | | b | | 972,762 |

| Nabisco, | | | | | | | | | | |

| Sr. Unscd. Debs. | | 7.55 | | 6/15/15 | | 640,000 | | | | 732,323 |

| Pepsi Bottling Group, | | | | | | | | | | |

| Gtd. Notes, Ser. B | | 7.00 | | 3/1/29 | | 800,000 | | | | 965,880 |

| Pepsico, | | | | | | | | | | |

| Sr. Unscd. Notes | | 7.90 | | 11/1/18 | | 1,000,000 | | | | 1,258,868 |

| Safeway, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.95 | | 8/16/10 | | 125,000 | | | | 128,909 |

| Safeway, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.80 | | 8/15/12 | | 210,000 | | | | 229,808 |

| Sara Lee, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.25 | | 9/15/11 | | 300,000 | | b | | 323,993 |

| SYSCO, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.38 | | 9/21/35 | | 350,000 | | | | 358,889 |

| | | | | | | | | | | 14,833,163 |

| Foreign/Governmental 2.5% | | | | | | | | | | |

| Asian Development Bank, | | | | | | | | | | |

| Sr. Notes | | 2.75 | | 5/21/14 | | 3,500,000 | | | | 3,545,804 |

| Asian Development Bank, | | | | | | | | | | |

| Sr. Unsub. Notes | | 4.50 | | 9/4/12 | | 1,750,000 | | | | 1,883,182 |

| European Investment Bank, | | | | | | | | | | |

| Sr. Unscd. Notes | | 3.25 | | 2/15/11 | | 2,000,000 | | | | 2,068,906 |

| European Investment Bank, | | | | | | | | | | |

| Sr. Unscd. Bonds | | 3.25 | | 5/15/13 | | 2,600,000 | | | | 2,705,277 |

| European Investment Bank, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.63 | | 5/15/14 | | 500,000 | | | | 544,703 |

| European Investment Bank, | | | | | | | | | | |

| Sr. Unscd. Bonds | | 4.63 | | 10/20/15 | | 350,000 | | | | 382,348 |

| European Investment Bank, | | | | | | | | | | |

| Sr. Unscd. Bonds | | 4.88 | | 1/17/17 | | 850,000 | | | | 929,915 |

| European Investment Bank, | | | | | | | | | | |

| Sr. Unscd. Bonds | | 5.13 | | 5/30/17 | | 1,600,000 | | | | 1,779,243 |

| Federal Republic of Brazil, | | | | | | | | | | |

| Sr. Unscd. Bonds | | 6.00 | | 1/17/17 | | 2,270,000 | | | | 2,437,980 |

| Federal Republic of Brazil, | | | | | | | | | | |

| Sr. Unscd. Bonds | | 7.13 | | 1/20/37 | | 575,000 | | | | 665,563 |

The Fund 25

| STATEMENT OF INVESTMENTS (continued) |

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Foreign/Governmental (continued) | | | | | | | | |

| Federal Republic of Brazil, | | | | | | | | |

| Unscd. Bonds | | 8.25 | | 1/20/34 | | 1,000,000 | | 1,290,000 |

| Federal Republic of Brazil, | | | | | | | | |

| Unscd. Bonds | | 10.13 | | 5/15/27 | | 500,000 | | 732,500 |

| Inter-American Development Bank, | | | | | | | | |

| Notes | | 4.25 | | 9/10/18 | | 540,000 b | | 564,168 |

| Inter-American Development Bank, | | | | | | | | |

| Sr. Unscd. Notes | | 4.38 | | 9/20/12 | | 1,530,000 | | 1,639,756 |

| Inter-American Development Bank, | | | | | | | | |

| Sr. Unscd. Notes | | 5.13 | | 9/13/16 | | 150,000 | | 166,282 |

| International Bank for | | | | | | | | |

| Reconstruction & Development, | | | | | | | | |

| Sr. Unscd. Notes | | 5.00 | | 4/1/16 | | 700,000 | | 773,037 |

| International Bank for | | | | | | | | |

| Reconstruction & Development, | | | | | | | | |

| Unsub. Bonds | | 7.63 | | 1/19/23 | | 700,000 | | 930,047 |

| Japan Finance, | | | | | | | | |

| Gov t. Gtd. Bonds | | 2.00 | | 6/24/11 | | 2,500,000 | | 2,540,078 |

| Province of British Columbia | | | | | | | | |

| Canada, Sr. Unscd. Bonds, | | | | | | | | |

| Ser. USD2 | | 6.50 | | 1/15/26 | | 25,000 | | 28,942 |

| Province of Manitoba Canada, | | | | | | | | |

| Debs., Ser. CB | | 8.80 | | 1/15/20 | | 10,000 | | 13,685 |

| Province of Manitoba Canada, | | | | | | | | |

| Debs. | | 8.88 | | 9/15/21 | | 450,000 | | 623,488 |

| Province of Ontario Canada, | | | | | | | | |

| Bonds | | 4.10 | | 6/16/14 | | 3,000,000 | | 3,175,197 |

| Province of Ontario Canada, | | | | | | | | |

| Sr. Unscd. Notes | | 4.95 | | 11/28/16 | | 1,000,000 b | | 1,084,717 |

| Province of Quebec Canada, | | | | | | | | |

| Unscd. Notes | | 4.60 | | 5/26/15 | | 700,000 | | 750,509 |

| Province of Quebec Canada, | | | | | | | | |

| Bonds | | 5.13 | | 11/14/16 | | 125,000 | | 136,645 |

| Province of Quebec Canada, | | | | | | | | |

| Debs., Ser. NJ | | 7.50 | | 7/15/23 | | 200,000 | | 251,029 |

| Province of Quebec Canada, | | | | | | | | |

| Unscd. Debs., Ser. PD | | 7.50 | | 9/15/29 | | 250,000 | | 327,694 |

| Province of Saskatchewan Canada, | | | | | | | | |

| Debs. | | 7.38 | | 7/15/13 | | 500,000 | | 570,636 |

| Republic of Chile, | | | | | | | | |

| Sr. Unscd. Bonds | | 5.50 | | 1/15/13 | | 625,000 | | 704,625 |

26

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Foreign/Governmental (continued) | | | | | | | | | | |

| Republic of Finland, | | | | | | | | | | |

| Bonds | | 6.95 | | 2/15/26 | | 25,000 | | | | 30,666 |

| Republic of Hungary, | | | | | | | | | | |

| Unsub. Notes | | 4.75 | | 2/3/15 | | 125,000 | | b | | 124,081 |

| Republic of Italy, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.50 | | 1/21/15 | | 50,000 | | | | 53,136 |

| Republic of Italy, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.25 | | 9/20/16 | | 155,000 | | | | 168,660 |

| Republic of Italy, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.38 | | 6/12/17 | | 1,450,000 | | | | 1,593,333 |

| Republic of Italy, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.38 | | 6/15/33 | | 550,000 | | | | 562,139 |

| Republic of Italy, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.00 | | 2/22/11 | | 1,725,000 | | | | 1,835,488 |

| Republic of Italy, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.88 | | 9/27/23 | | 610,000 | | | | 722,399 |

| Republic of Korea, | | | | | | | | | | |

| Sr. Unscd. Notes | | 4.88 | | 9/22/14 | | 200,000 | | | | 210,504 |

| Republic of Korea, | | | | | | | | | | |

| Sr. Unscd. Notes | | 7.13 | | 4/16/19 | | 1,000,000 | | b | | 1,173,115 |

| Republic of Peru, | | | | | | | | | | |

| Sr. Unscd. Bonds | | 6.55 | | 3/14/37 | | 540,000 | | b | | 564,300 |

| Republic of Poland, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.25 | | 1/15/14 | | 250,000 | | | | 265,578 |

| Republic of South Africa, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.50 | | 6/2/14 | | 170,000 | | | | 186,150 |

| United Mexican States, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.63 | | 1/15/17 | | 791,000 | | | | 824,618 |

| United Mexican States, | | | | | | | | | | |

| Notes | | 5.95 | | 3/19/19 | | 1,200,000 | | b | | 1,260,000 |

| United Mexican States, | | | | | | | | | | |

| Sr. Unscd. Notes, Ser. A | | 6.75 | | 9/27/34 | | 1,340,000 | | | | 1,460,600 |

| United Mexican States, | | | | | | | | | | |

| Notes | | 9.88 | | 2/1/10 | | 1,525,000 | | b | | 1,566,175 |

| | | | | | | | | | | 45,846,898 |

| Health Care 1.1% | | | | | | | | | | |

| Abbott Laboratories, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.13 | | 4/1/19 | | 1,500,000 | | | | 1,593,080 |

| Abbott Laboratories, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.88 | | 5/15/16 | | 170,000 | | | | 190,667 |

The Fund 27

| STATEMENT OF INVESTMENTS (continued) |

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Health Care (continued) | | | | | | | | | | |

| Aetna, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.63 | | 6/15/36 | | 300,000 | | | | 310,355 |

| Amgen, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.85 | | 6/1/17 | | 400,000 | | | | 440,851 |

| Amgen, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.40 | | 2/1/39 | | 570,000 | | | | 652,810 |

| Astrazeneca, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.45 | | 9/15/37 | | 520,000 | | | | 605,591 |

| Baxter International, | | | | | | | | | | |

| Sr. Unsub. Notes | | 6.25 | | 12/1/37 | | 700,000 | | | | 794,868 |

| Bristol-Myers Squibb, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.88 | | 11/15/36 | | 425,000 | | | | 460,853 |

| Covidien International Finance, | | | | | | | | | | |

| Gtd. Notes | | 6.00 | | 10/15/17 | | 590,000 | | | | 652,425 |

| Eli Lilly & Co., | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.55 | | 3/15/37 | | 750,000 | | | | 782,567 |

| Eli Lilly & Co., | | | | | | | | | | |

| Sr. Unscd. Notes | | 7.13 | | 6/1/25 | | 200,000 | | | | 239,620 |

| GlaxoSmithKline Capital, | | | | | | | | | | |

| Gtd. Notes | | 4.38 | | 4/15/14 | | 3,200,000 | | | | 3,393,504 |

| GlaxoSmithKline Capital, | | | | | | | | | | |

| Gtd. Notes | | 5.65 | | 5/15/18 | | 740,000 | | | | 815,975 |

| Johnson & Johnson, | | | | | | | | | | |

| Unscd. Debs. | | 4.95 | | 5/15/33 | | 170,000 | | | | 170,821 |

| Johnson & Johnson, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.95 | | 8/15/37 | | 470,000 | | | | 528,576 |

| Merck & Co., | | | | | | | | | | |

| Sr. Unscd. Debs. | | 6.40 | | 3/1/28 | | 150,000 | | | | 172,216 |

| Pfizer, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.20 | | 3/15/19 | | 2,400,000 | | | | 2,737,375 |

| Quest Diagnostic, | | | | | | | | | | |

| Gtd. Notes | | 5.45 | | 11/1/15 | | 500,000 | | | | 529,105 |

| Quest Diagnostic, | | | | | | | | | | |

| Gtd. Notes | | 6.95 | | 7/1/37 | | 50,000 | | | | 57,224 |

| Schering-Plough, | | | | | | | | | | |

| Gtd. Notes | | 5.55 | | 12/1/13 | | 1,000,000 | | a | | 1,100,570 |

| Schering-Plough, | | | | | | | | | | |

| Gtd. Notes | | 6.75 | | 12/1/33 | | 80,000 | | a | | 92,768 |

| Teva Pharmaceutical Finance, | | | | | | | | | | |

| Gtd. Notes | | 6.15 | | 2/1/36 | | 85,000 | | | | 89,437 |

28

| | | Coupon | | Maturity | | Principal | | | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | | | Value ($) |

| |

| |

| |

| |

| |

|

| Health Care (continued) | | | | | | | | | | |

| UnitedHealth Group, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.00 | | 8/15/14 | | 300,000 | | | | 314,049 |

| UnitedHealth Group, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.88 | | 2/15/38 | | 810,000 | | | | 869,344 |

| Wellpoint, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.00 | | 12/15/14 | | 1,000,000 | | | | 1,055,311 |

| Wellpoint, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.88 | | 6/15/17 | | 65,000 | | | | 68,719 |

| WellPoint, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.25 | | 1/15/16 | | 375,000 | | | | 385,707 |

| WellPoint, | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.80 | | 8/1/12 | | 300,000 | | | | 330,018 |

| Wyeth, | | | | | | | | | | |

| Gtd. Notes | | 5.50 | | 2/1/14 | | 150,000 | | | | 164,542 |

| Wyeth, | | | | | | | | | | |

| Gtd. Notes | | 5.95 | | 4/1/37 | | 200,000 | | | | 216,384 |

| Wyeth, | | | | | | | | | | |

| Gtd. Notes | | 6.50 | | 2/1/34 | | 200,000 | | | | 232,067 |

| | | | | | | | | | | 20,047,399 |

| Industrial .1% | | | | | | | | | | |

| Continental Airlines, | | | | | | | | | | |

| Pass-Through Certificates, | | | | | | | | | | |

| Ser. 974A | | 6.90 | | 1/2/18 | | 183,989 | | | | 171,110 |

| USA Waste Services, | | | | | | | | | | |

| Sr. Unscd. Notes | | 7.00 | | 7/15/28 | | 150,000 | | | | 166,614 |

| Waste Management, | | | | | | | | | | |

| Gtd. Notes | | 6.38 | | 3/11/15 | | 1,600,000 | | | | 1,782,906 |

| | | | | | | | | | | 2,120,630 |

| Machinery .1% | | | | | | | | | | |

| Caterpillar, | | | | | | | | | | |

| Sr. Unscd. Debs. | | 6.05 | | 8/15/36 | | 375,000 | | | | 414,094 |

| Caterpillar, | | | | | | | | | | |

| Sr. Unscd. Debs. | | 7.30 | | 5/1/31 | | 125,000 | | | | 154,711 |

| Deere & Co., | | | | | | | | | | |

| Sr. Unscd. Notes | | 6.95 | | 4/25/14 | | 775,000 | | b | | 910,633 |

| | | | | | | | | | | 1,479,438 |

| Manufacturing .2% | | | | | | | | | | |

| 3M, | | | | | | | | | | |

| Sr. Unscd. Notes | | 5.70 | | 3/15/37 | | 750,000 | | b | | 830,312 |

The Fund 29

| STATEMENT OF INVESTMENTS (continued) |

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Manufacturing (continued) | | | | | | | | |

| General Electric, | | | | | | | | |

| Sr. Unscd. Notes | | 5.00 | | 2/1/13 | | 500,000 | | 532,832 |

| General Electric, | | | | | | | | |

| Sr. Unscd. Notes | | 5.25 | | 12/6/17 | | 1,000,000 | | 1,042,055 |

| Honeywell International, | | | | | | | | |

| Sr. Unscd. Notes | | 4.25 | | 3/1/13 | | 1,300,000 | | 1,377,137 |

| Honeywell International, | | | | | | | | |

| Sr. Unscd. Notes | | 6.13 | | 11/1/11 | | 175,000 | | 190,941 |

| Tyco International Finance, | | | | | | | | |

| Gtd. Notes | | 6.88 | | 1/15/21 | | 235,000 | | 269,211 |

| | | | | | | | | 4,242,488 |

| Media .9% | | | | | | | | |

| AOL Time Warner, | | | | | | | | |

| Gtd. Notes | | 7.63 | | 4/15/31 | | 1,100,000 | | 1,233,650 |

| AT & T Broadband, | | | | | | | | |

| Gtd. Notes | | 9.46 | | 11/15/22 | | 304,000 b | | 388,796 |

| CBS, | | | | | | | | |

| Gtd. Debs. | | 7.88 | | 7/30/30 | | 80,000 | | 79,742 |

| Comcast Cable Communications | | | | | | | | |

| Holdings, Gtd. Notes | | 8.38 | | 3/15/13 | | 4,000,000 | | 4,652,996 |

| Comcast Cable Communications, | | | | | | | | |

| Sr. Unscd. Notes | | 6.75 | | 1/30/11 | | 600,000 | | 637,536 |

| Comcast, | | | | | | | | |

| Gtd. Notes | | 6.45 | | 3/15/37 | | 200,000 | | 205,698 |

| Comcast, | | | | | | | | |

| Gtd. Notes | | 6.95 | | 8/15/37 | | 365,000 | | 399,411 |

| COX Communications, | | | | | | | | |

| Sr. Unscd. Bonds | | 5.50 | | 10/1/15 | | 450,000 | | 480,389 |

| COX Communications, | | | | | | | | |

| Unscd. Notes | | 7.13 | | 10/1/12 | | 275,000 | | 308,805 |

| News America Holdings, | | | | | | | | |

| Gtd. Debs. | | 7.75 | | 12/1/45 | | 100,000 | | 114,317 |

| News America Holdings, | | | | | | | | |

| Gtd. Debs. | | 8.25 | | 8/10/18 | | 150,000 | | 176,595 |

| News America, | | | | | | | | |

| Gtd. Notes | | 6.20 | | 12/15/34 | | 250,000 | | 246,111 |

| News America, | | | | | | | | |

| Gtd. Notes | | 6.40 | | 12/15/35 | | 1,000,000 | | 1,003,071 |

| News America, | | | | | | | | |

| Gtd. Notes | | 6.65 | | 11/15/37 | | 360,000 | | 377,207 |

30

| | | Coupon | | Maturity | | Principal | | |

| Bonds and Notes (continued) | | Rate (%) | | Date | | Amount ($) | | Value ($) |

| |

| |

| |

| |

|

| Media (continued) | | | | | | | | |

| Thomson Reuters, | | | | | | | | |

| Gtd. Notes | | 6.50 | | 7/15/18 | | 800,000 | | 910,522 |

| Time Warner Cable, | | | | | | | | |

| Gtd. Debs. | | 6.55 | | 5/1/37 | | 350,000 | | 363,186 |

| Time Warner Cable, | | | | | | | | |

| Gtd. Debs. | | 7.30 | | 7/1/38 | | 495,000 | | 559,438 |