April 2023– Performance Cash Unit Supplement Ameriprise Financial, Inc. Performance Cash Unit (“PCU”) Supplement to the Long-Term Incentive Award (“LTIA”) Program Guide [For U.S. and India Employees] April 2023

April 2023– Performance Cash Unit Supplement TABLE OF CONTENTS Introduction 1 Overview 1 Governing Award Documents 1 Award Certificates 1 Definitions 1 PCU Award Program 2 Overview 2 Eligible Participants 2 Award Value (at Target) 2 Payout Determination 2 PCU Payout 3 Payment 3 Illustration 3 Performance Matrix 4 TSR Adjustment Matrix 4 PCU Payout 4 Effect of Certain Events 5 Termination Prior to Payment Date 5 Death or Disability 5 Retirement 5 Change in Control 5 Certain Corporate Transactions 6 Administration 6 Amendment 7 Definitions 7 Miscellaneous Provisions 9 Committee Adjustments 9 No Assignment 9 No Right to Continued Employment 9 No Right to Awards 10 Compliance with Section 409A 10 Tax Implications 10 Contact Information 11

April 2023 – Performance Cash Unit Supplement 1 Introduction Overview This Supplement to the LTIA Program Guide (the “Guide”) provides information about the terms and conditions of Performance Cash Unit awards (“PCU Awards”). A PCU Award is a long-term incentive opportunity that is tied to certain performance goals and awarded under the Ameriprise Financial 2005 Incentive Compensation Plan (As Amended and Restated Effective April 26, 2023) (the “Plan”). PCU Awards are made to eligible employees of Ameriprise Financial, Inc., and any of its affiliates participating in the Plan (collectively, the “Company” or “Ameriprise”), as determined by the Compensation and Benefits Committee of the Board of Directors of the Company (the “Committee”). The features of PCU Awards may be different than those shown in this Supplement in order to meet local regulatory or other requirements. PCU Awards are granted at the discretion of the Company and the Committee or, to the extent permitted by the Plan and the Company’s Long- Term Incentive Award structure and design, its designee, and are subject to local market regulations and legislation, which could change at any time. Also note that while the tax laws that apply to recipients of PCU Awards are based on each employee’s tax jurisdiction, most tax information provided in this Supplement is generally for U.S. purposes only. Any tax information provided in this Supplement is not intended to constitute tax advice. The Company urges all employees to consult their personal tax advisor with any questions or issues regarding their PCU Awards. Governing Award Documents Each PCU Award is subject to the applicable terms and conditions contained in the Plan, the Guide, including the Detrimental Conduct Provisions attached to the Guide, any applicable Award Certificate and this Supplement. These documents, along with Committee decisions, will govern in cases of conflict, ambiguity or miscommunication. In the event of a conflict between the Plan and the Guide or this Supplement, the Plan document shall control. Award Certificates Award Certificates for PCU Awards will generally be distributed to employees either via regular or electronic mail. Participants should retain electronically distributed PCU Award documents for their records. Definitions Capitalized terms have the meanings given to them in the “Definitions” section towards the end of, or elsewhere in, this Supplement. Capitalized terms that are not defined in this Supplement have the meanings given such terms in the Plan, the Guide or the Award Certificate, as applicable.

April 2023 – Performance Cash Unit Supplement 2 PCU Award Program Overview A PCU Award is a long-term incentive opportunity that is designed to reward senior leaders for the Company’s financial performance over a three-year performance period. A PCU Award is evidenced by an Award Certificate, setting forth the applicable Award Date, Performance Period, Performance Matrix and Total Shareholder Return (“TSR”) Adjustment Matrix. The amount payable to a Participant under a PCU Award is dependent upon the performance of the Company as compared to the performance criteria in the Performance Matrix and TSR Adjustment Matrix described in this Supplement and the Participant’s Award Certificate, as well as the Participant’s continued employment with the Company. As a result of these requirements, the payment that a Participant receives may be greater or lesser than the Participant’s Award Value (at Target), or the performance results could result in no payment at all under the PCU Award. For a PCU Award covering the three-year Performance Period commencing on January 1st of the first year and ending on December 31st of the third year, the Performance Matrix uses two criteria: Compound Annual Growth Rate of Earnings Per Share (“EPS”) and Average Annual Return on Equity (“ROE”), and the TSR Adjustment Matrix uses one criterion: Relative Total Shareholder Return. Participants should refer to their Award Certificate for the specific performance criteria, weightings and performance levels under the Performance Matrix and the TSR Adjustment Matrix. PCU Awards generally vest three years after the date of grant. PCU Awards generally become payable no later than March 15th of the year following the end of the applicable three-year performance period, after the PCU Payout for that period has been determined. The PCU Awards that are earned will be paid in the form of cash. Eligible Participants Currently, only employees of the Company in Bands 50 and above are eligible to receive PCU Awards. Participation is generally limited to those employees who participate in the Ameriprise Financial Annual Incentive Award (“AIA”) Plan, unless otherwise specified by the Company. Award Value (at Target) The Award Value (at Target) of a Participant’s PCU Award will be communicated to the Participant shortly after the Award is granted. Payout Determination After the end of the Performance Period, for purposes of determining the PCU Payout, there will be straight-line interpolation used to determine the payout percentage earned on any of the measures for actual performance that falls between the goals stated in the Performance Matrix and TSR Adjustment Matrix. The Committee will review and approve all payout percentages as determined in accordance with this Supplement and the Performance Matrix and TSR Adjustment Matrix grids approved for each Performance Period. Such determinations by the Committee shall be final, binding and conclusive upon each Participant and all persons claiming under or through such Participant.

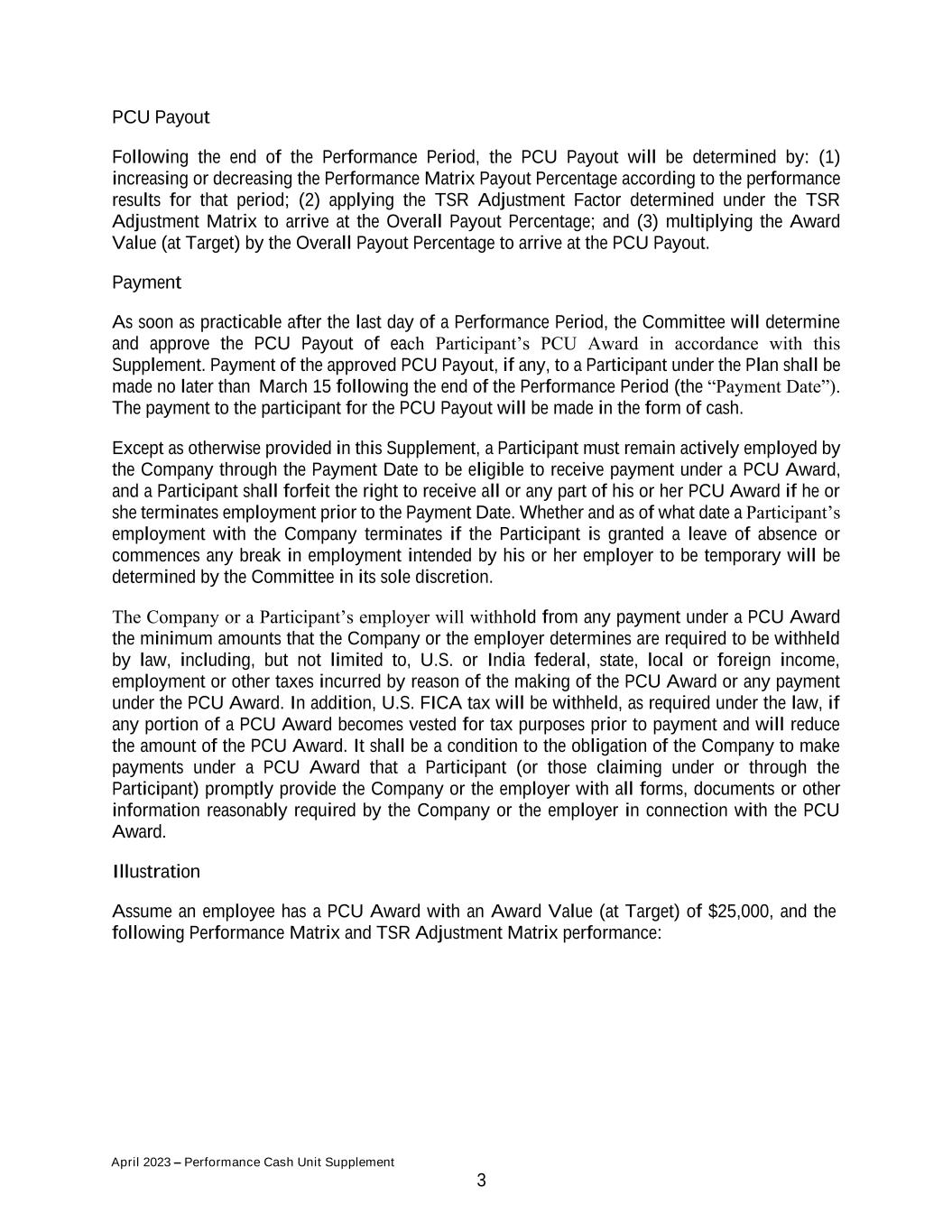

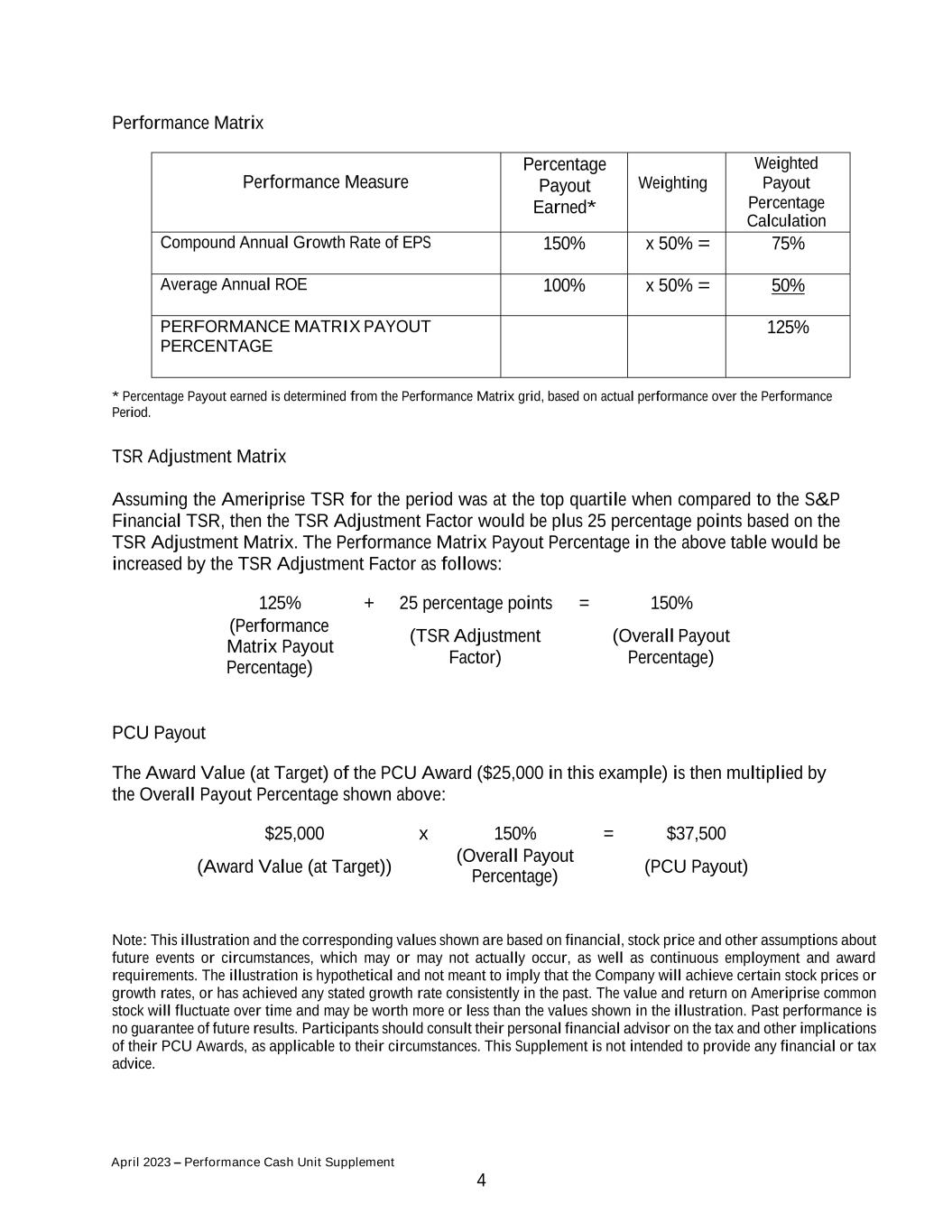

April 2023 – Performance Cash Unit Supplement 3 PCU Payout Following the end of the Performance Period, the PCU Payout will be determined by: (1) increasing or decreasing the Performance Matrix Payout Percentage according to the performance results for that period; (2) applying the TSR Adjustment Factor determined under the TSR Adjustment Matrix to arrive at the Overall Payout Percentage; and (3) multiplying the Award Value (at Target) by the Overall Payout Percentage to arrive at the PCU Payout. Payment As soon as practicable after the last day of a Performance Period, the Committee will determine and approve the PCU Payout of each Participant’s PCU Award in accordance with this Supplement. Payment of the approved PCU Payout, if any, to a Participant under the Plan shall be made no later than March 15 following the end of the Performance Period (the “Payment Date”). The payment to the participant for the PCU Payout will be made in the form of cash. Except as otherwise provided in this Supplement, a Participant must remain actively employed by the Company through the Payment Date to be eligible to receive payment under a PCU Award, and a Participant shall forfeit the right to receive all or any part of his or her PCU Award if he or she terminates employment prior to the Payment Date. Whether and as of what date a Participant’s employment with the Company terminates if the Participant is granted a leave of absence or commences any break in employment intended by his or her employer to be temporary will be determined by the Committee in its sole discretion. The Company or a Participant’s employer will withhold from any payment under a PCU Award the minimum amounts that the Company or the employer determines are required to be withheld by law, including, but not limited to, U.S. or India federal, state, local or foreign income, employment or other taxes incurred by reason of the making of the PCU Award or any payment under the PCU Award. In addition, U.S. FICA tax will be withheld, as required under the law, if any portion of a PCU Award becomes vested for tax purposes prior to payment and will reduce the amount of the PCU Award. It shall be a condition to the obligation of the Company to make payments under a PCU Award that a Participant (or those claiming under or through the Participant) promptly provide the Company or the employer with all forms, documents or other information reasonably required by the Company or the employer in connection with the PCU Award. Illustration Assume an employee has a PCU Award with an Award Value (at Target) of $25,000, and the following Performance Matrix and TSR Adjustment Matrix performance:

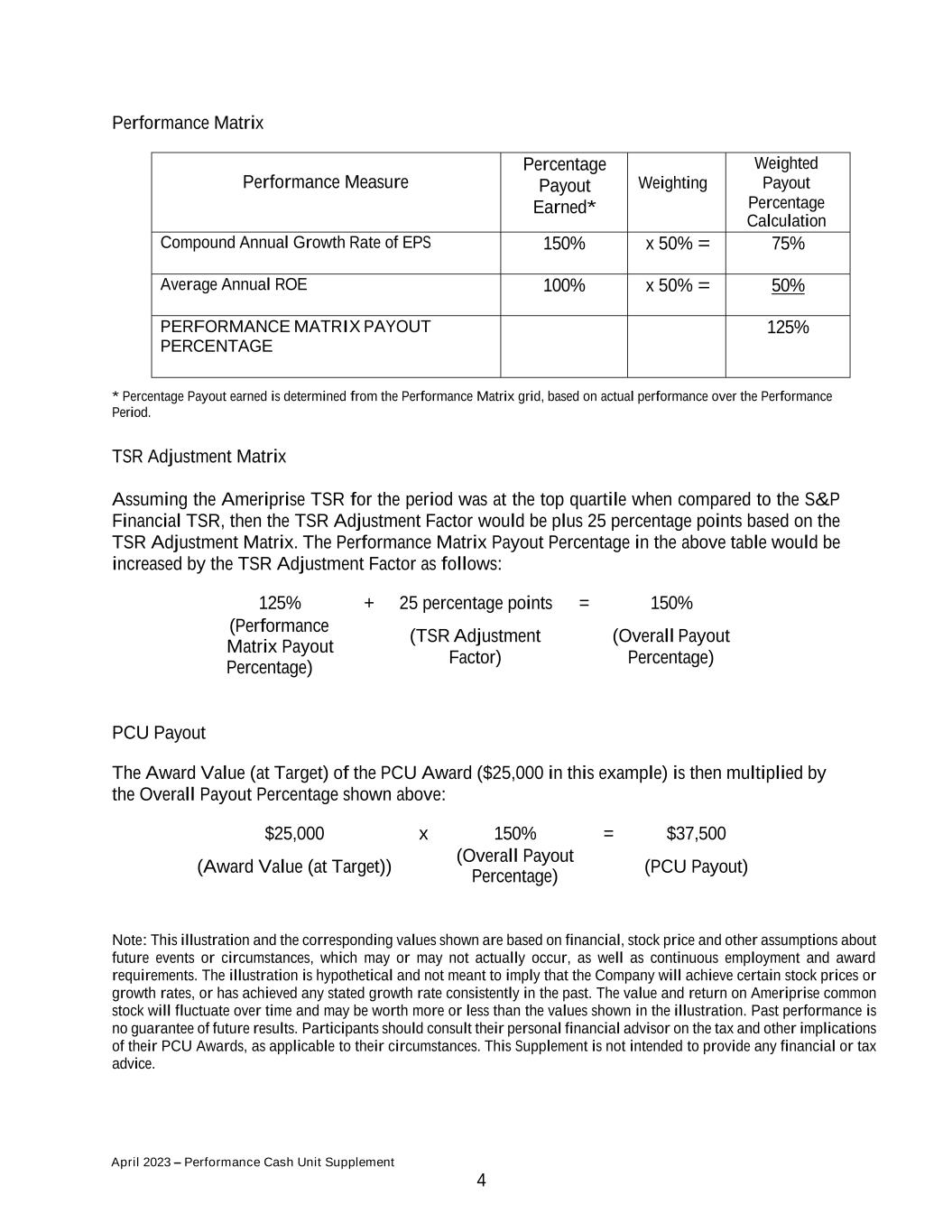

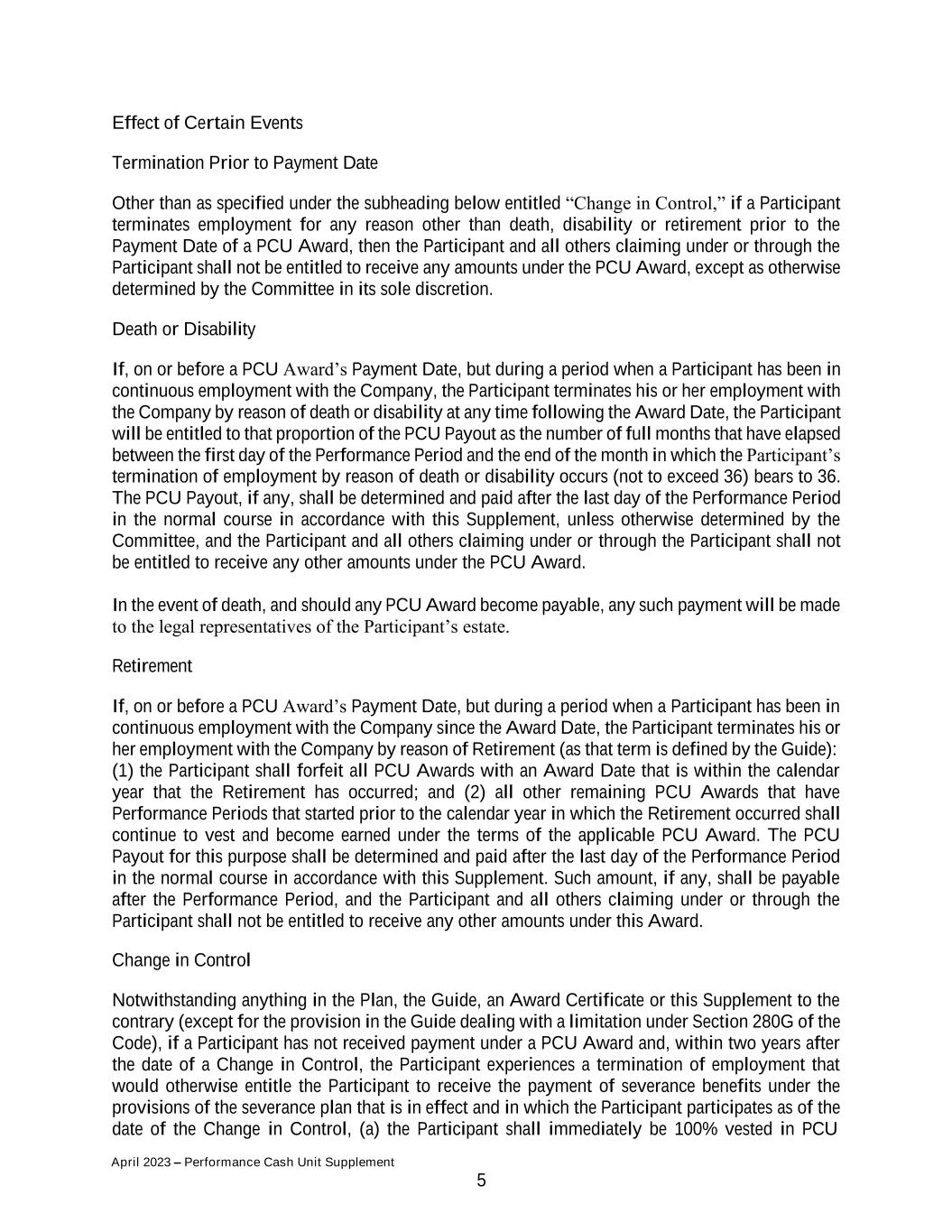

April 2023 – Performance Cash Unit Supplement 4 Percentage) Performance Matrix Performance Measure Percentage Payout Earned* Weighting Weighted Payout Percentage Calculation Compound Annual Growth Rate of EPS 150% x 50% = 75% Average Annual ROE 100% x 50% = 50% PERFORMANCE MATRIX PAYOUT PERCENTAGE 125% * Percentage Payout earned is determined from the Performance Matrix grid, based on actual performance over the Performance Period. TSR Adjustment Matrix Assuming the Ameriprise TSR for the period was at the top quartile when compared to the S&P Financial TSR, then the TSR Adjustment Factor would be plus 25 percentage points based on the TSR Adjustment Matrix. The Performance Matrix Payout Percentage in the above table would be increased by the TSR Adjustment Factor as follows: 125% + 25 percentage points = 150% (Performance Matrix Payout Percentage) (TSR Adjustment Factor) (Overall Payout Percentage) PCU Payout The Award Value (at Target) of the PCU Award ($25,000 in this example) is then multiplied by the Overall Payout Percentage shown above: $25,000 x 150% = $37,500 (Award Value (at Target)) (Overall Payout (PCU Payout) Note: This illustration and the corresponding values shown are based on financial, stock price and other assumptions about future events or circumstances, which may or may not actually occur, as well as continuous employment and award requirements. The illustration is hypothetical and not meant to imply that the Company will achieve certain stock prices or growth rates, or has achieved any stated growth rate consistently in the past. The value and return on Ameriprise common stock will fluctuate over time and may be worth more or less than the values shown in the illustration. Past performance is no guarantee of future results. Participants should consult their personal financial advisor on the tax and other implications of their PCU Awards, as applicable to their circumstances. This Supplement is not intended to provide any financial or tax advice.

April 2023 – Performance Cash Unit Supplement 5 Effect of Certain Events Termination Prior to Payment Date Other than as specified under the subheading below entitled “Change in Control,” if a Participant terminates employment for any reason other than death, disability or retirement prior to the Payment Date of a PCU Award, then the Participant and all others claiming under or through the Participant shall not be entitled to receive any amounts under the PCU Award, except as otherwise determined by the Committee in its sole discretion. Death or Disability If, on or before a PCU Award’s Payment Date, but during a period when a Participant has been in continuous employment with the Company, the Participant terminates his or her employment with the Company by reason of death or disability at any time following the Award Date, the Participant will be entitled to that proportion of the PCU Payout as the number of full months that have elapsed between the first day of the Performance Period and the end of the month in which the Participant’s termination of employment by reason of death or disability occurs (not to exceed 36) bears to 36. The PCU Payout, if any, shall be determined and paid after the last day of the Performance Period in the normal course in accordance with this Supplement, unless otherwise determined by the Committee, and the Participant and all others claiming under or through the Participant shall not be entitled to receive any other amounts under the PCU Award. In the event of death, and should any PCU Award become payable, any such payment will be made to the legal representatives of the Participant’s estate. Retirement If, on or before a PCU Award’s Payment Date, but during a period when a Participant has been in continuous employment with the Company since the Award Date, the Participant terminates his or her employment with the Company by reason of Retirement (as that term is defined by the Guide): (1) the Participant shall forfeit all PCU Awards with an Award Date that is within the calendar year that the Retirement has occurred; and (2) all other remaining PCU Awards that have Performance Periods that started prior to the calendar year in which the Retirement occurred shall continue to vest and become earned under the terms of the applicable PCU Award. The PCU Payout for this purpose shall be determined and paid after the last day of the Performance Period in the normal course in accordance with this Supplement. Such amount, if any, shall be payable after the Performance Period, and the Participant and all others claiming under or through the Participant shall not be entitled to receive any other amounts under this Award. Change in Control Notwithstanding anything in the Plan, the Guide, an Award Certificate or this Supplement to the contrary (except for the provision in the Guide dealing with a limitation under Section 280G of the Code), if a Participant has not received payment under a PCU Award and, within two years after the date of a Change in Control, the Participant experiences a termination of employment that would otherwise entitle the Participant to receive the payment of severance benefits under the provisions of the severance plan that is in effect and in which the Participant participates as of the date of the Change in Control, (a) the Participant shall immediately be 100% vested in PCU

April 2023 – Performance Cash Unit Supplement 6 Awards, (b) the Committee shall determine the Performance Matrix Payout Percentage and TSR Adjustment Factor of PCU Awards as of the date of such termination of employment as if the Performance Period had just ended, based on results against the performance measures up to the last day of the calendar quarter ending on or immediately prior to such date, but prorated based on (i) the total number of full and partial months of the Performance Period that have elapsed between (1) the first day of the Performance Period and (2) the date of the termination of employment (not to exceed 36) divided by (ii) 36, and (c) such value of the Award shall be paid to the Participant in cash within five days after the date of such termination of employment. The Committee may not amend or delete this section of this Supplement in a manner that is detrimental to a Participant, without the Participant’s written consent. Certain Corporate Transactions In the event of any change in the corporate capitalization of the Company, such as by reason of any stock split, or a material corporate transaction, such as any merger of the Company into another corporation, any consolidation of the Company and one or more corporations into another corporation, any separation of the Company (including a spin-off or other distribution of stock or property by the Company), any reorganization of the Company (whether or not such reorganization comes within the definition of such term in Section 368 of the Code), or any partial or complete liquidation by the Company, other than a normal cash dividend, the Committee shall make an equitable adjustment in the calculation or terms of the Performance Matrix and TSR Adjustment Matrix under a PCU Award. Any such determination by the Committee under this paragraph shall be final, binding and conclusive. In the event of the sale, disposition, restructuring, discontinuance of operations or other extraordinary corporate event in respect of a material business during the Performance Period or any of the events discussed in the preceding paragraph during a Performance Period, the Committee shall make an equitable adjustment in the calculation of the Compound Annual Growth Rate of EPS component or the Average Annual ROE component in accordance with the Committee Adjustments section of this Guide. Any such determination by the Committee under this paragraph shall be final, binding and conclusive. Administration The PCU Award program is administered by the Committee. Any action taken or decision made by the Company, the Board or the Committee or its delegates arising out of or in connection with the construction, administration, interpretation or effect of the Plan or this Supplement shall lie within its sole and absolute discretion, as the case may be and shall be final, conclusive and binding upon all Participants and all persons claiming under or through such Participants. By accepting a PCU Award or other benefit under the Plan, a Participant and each person claiming under or through the Participant shall be conclusively deemed to have indicated acceptance and ratification of, and consent to, any action taken or decision made under the Plan by the Company, the Board or the Committee or its delegates.

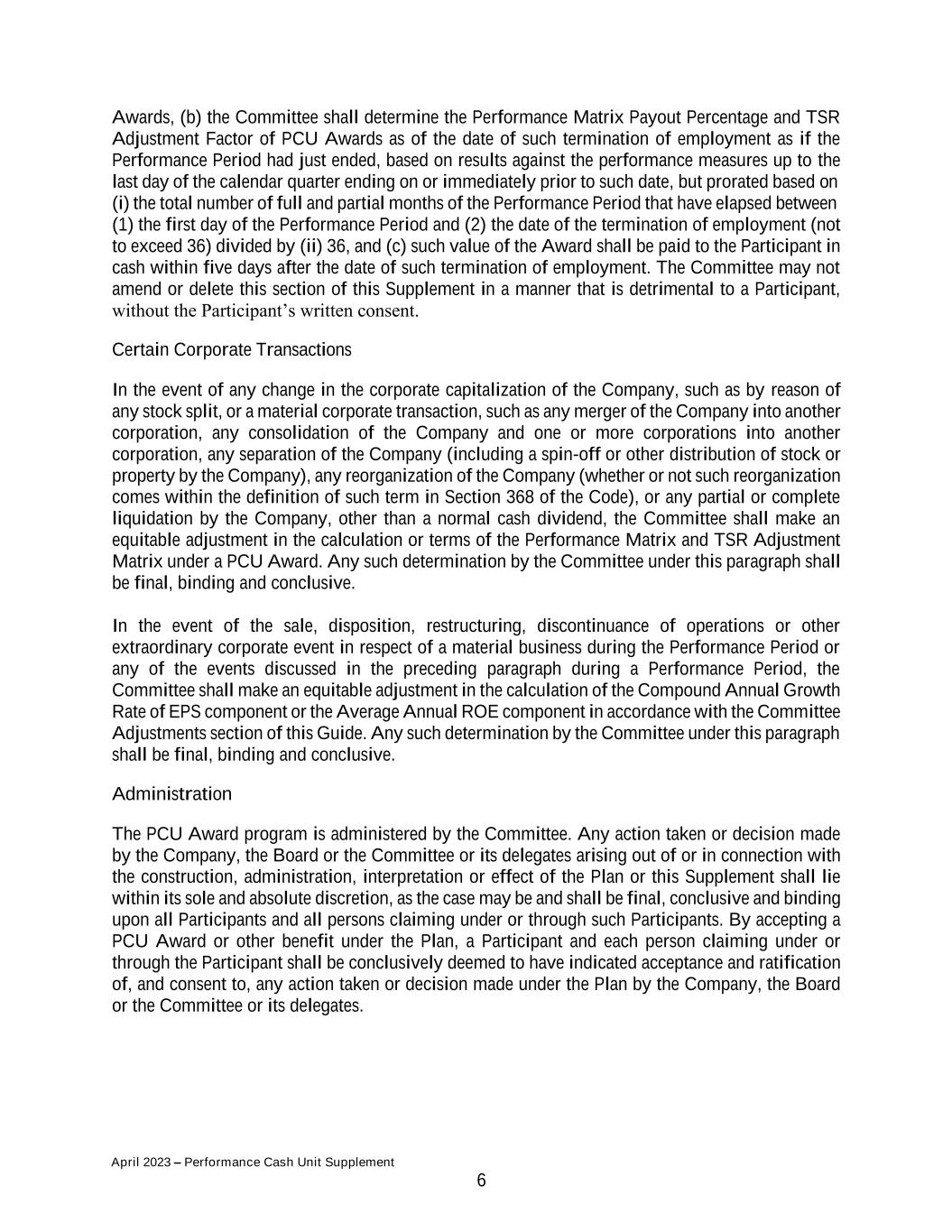

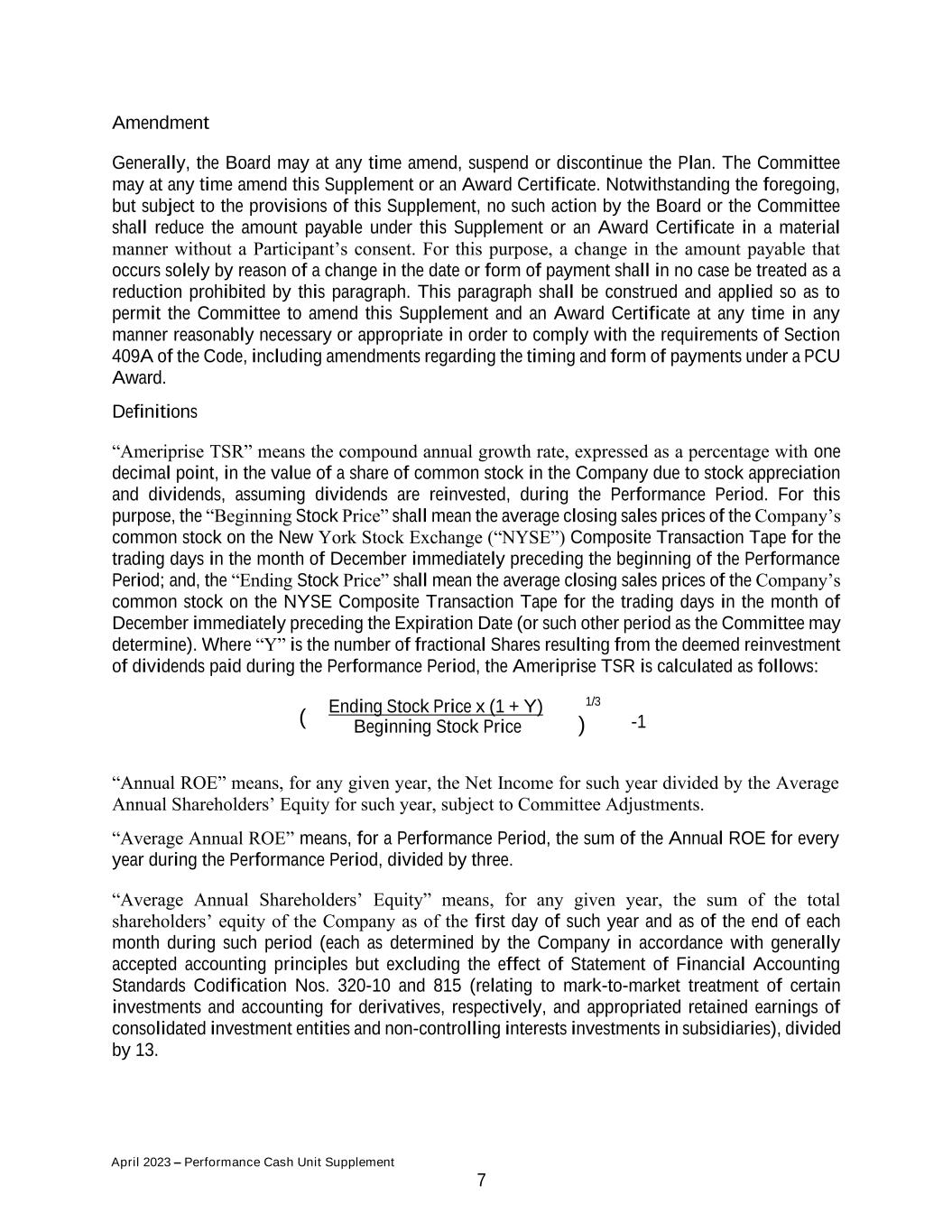

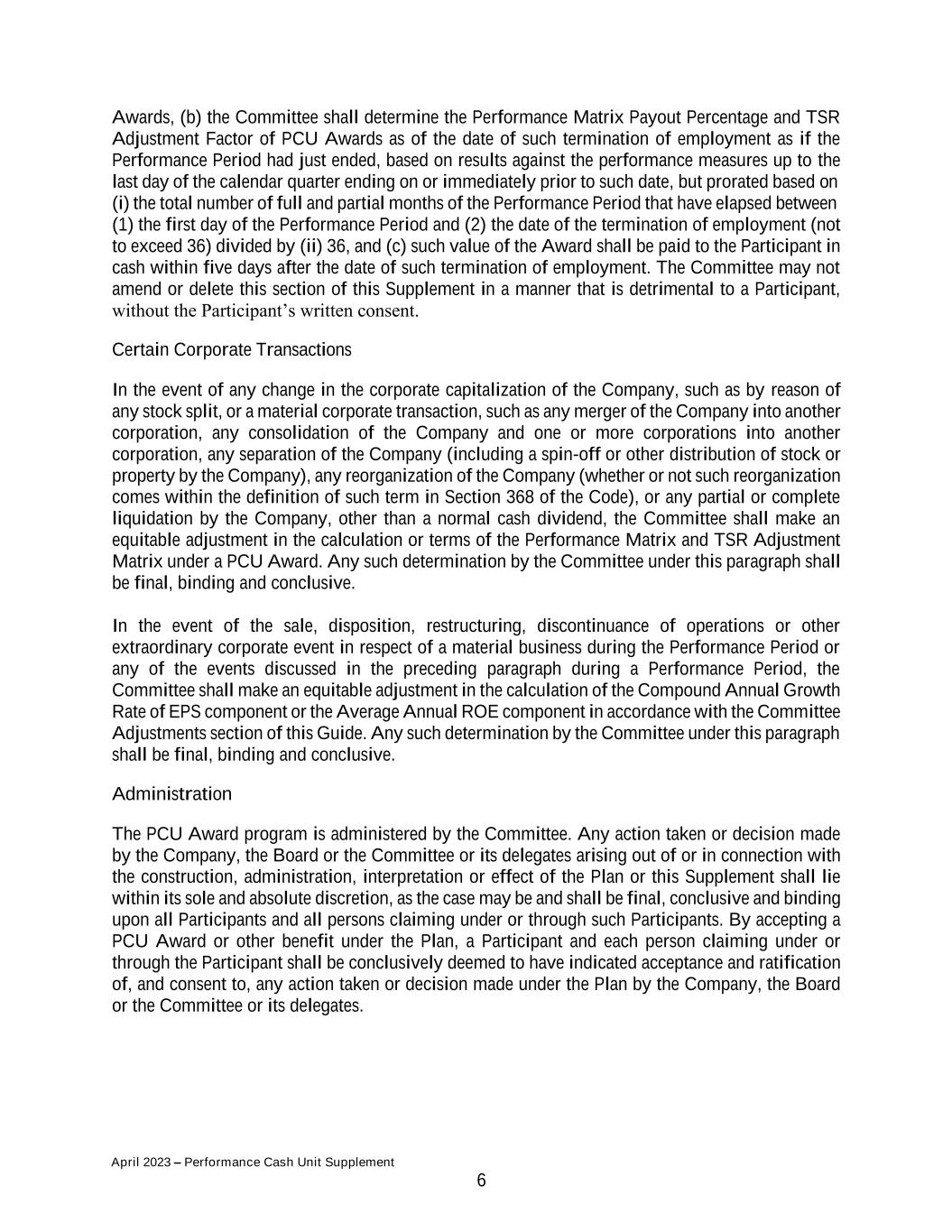

April 2023 – Performance Cash Unit Supplement 7 Amendment Generally, the Board may at any time amend, suspend or discontinue the Plan. The Committee may at any time amend this Supplement or an Award Certificate. Notwithstanding the foregoing, but subject to the provisions of this Supplement, no such action by the Board or the Committee shall reduce the amount payable under this Supplement or an Award Certificate in a material manner without a Participant’s consent. For this purpose, a change in the amount payable that occurs solely by reason of a change in the date or form of payment shall in no case be treated as a reduction prohibited by this paragraph. This paragraph shall be construed and applied so as to permit the Committee to amend this Supplement and an Award Certificate at any time in any manner reasonably necessary or appropriate in order to comply with the requirements of Section 409A of the Code, including amendments regarding the timing and form of payments under a PCU Award. Definitions “Ameriprise TSR” means the compound annual growth rate, expressed as a percentage with one decimal point, in the value of a share of common stock in the Company due to stock appreciation and dividends, assuming dividends are reinvested, during the Performance Period. For this purpose, the “Beginning Stock Price” shall mean the average closing sales prices of the Company’s common stock on the New York Stock Exchange (“NYSE”) Composite Transaction Tape for the trading days in the month of December immediately preceding the beginning of the Performance Period; and, the “Ending Stock Price” shall mean the average closing sales prices of the Company’s common stock on the NYSE Composite Transaction Tape for the trading days in the month of December immediately preceding the Expiration Date (or such other period as the Committee may determine). Where “Y” is the number of fractional Shares resulting from the deemed reinvestment of dividends paid during the Performance Period, the Ameriprise TSR is calculated as follows: Ending Stock Price x (1 + Y) Beginning Stock Price 1/3 ) -1 “Annual ROE” means, for any given year, the Net Income for such year divided by the Average Annual Shareholders’ Equity for such year, subject to Committee Adjustments. “Average Annual ROE” means, for a Performance Period, the sum of the Annual ROE for every year during the Performance Period, divided by three. “Average Annual Shareholders’ Equity” means, for any given year, the sum of the total shareholders’ equity of the Company as of the first day of such year and as of the end of each month during such period (each as determined by the Company in accordance with generally accepted accounting principles but excluding the effect of Statement of Financial Accounting Standards Codification Nos. 320-10 and 815 (relating to mark-to-market treatment of certain investments and accounting for derivatives, respectively, and appropriated retained earnings of consolidated investment entities and non-controlling interests investments in subsidiaries), divided by 13. (

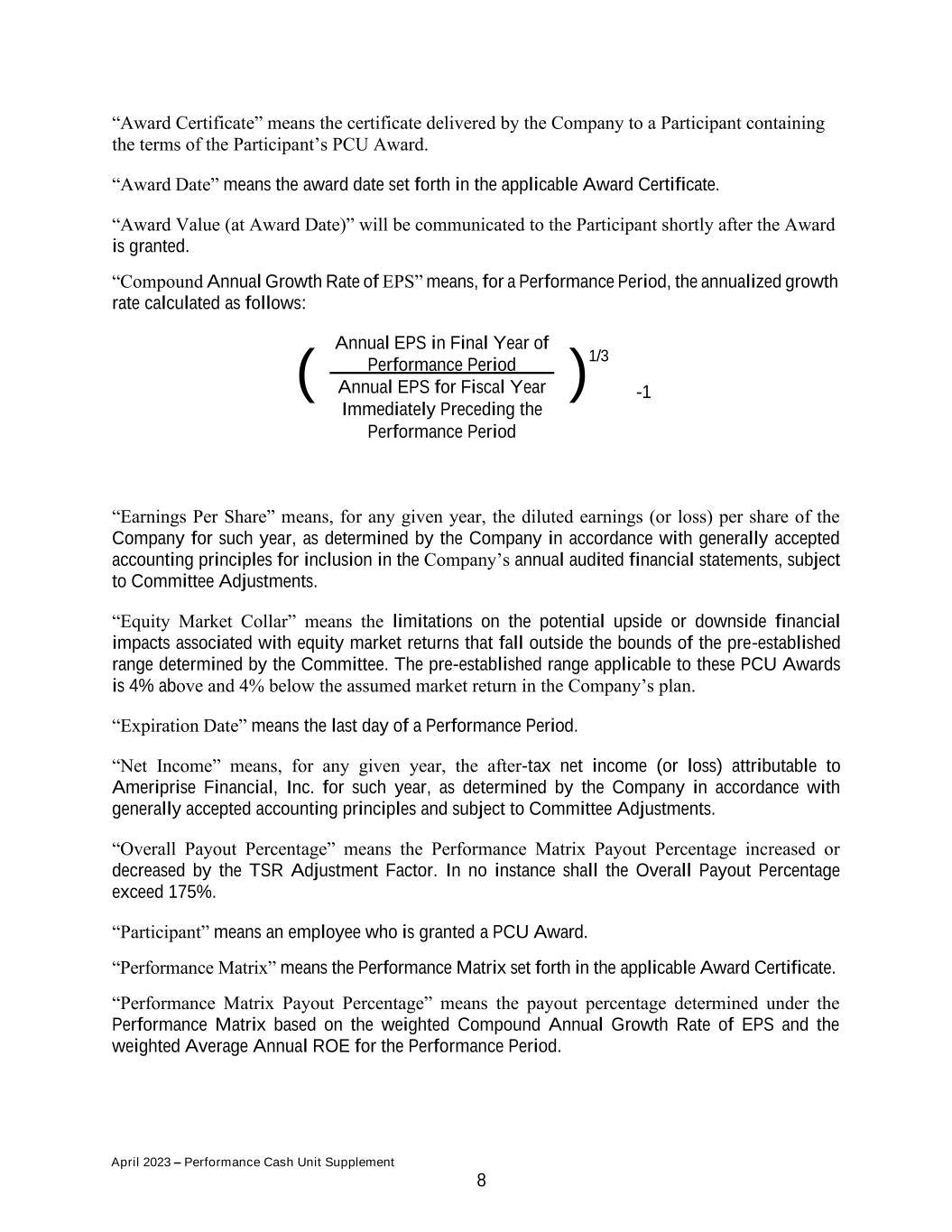

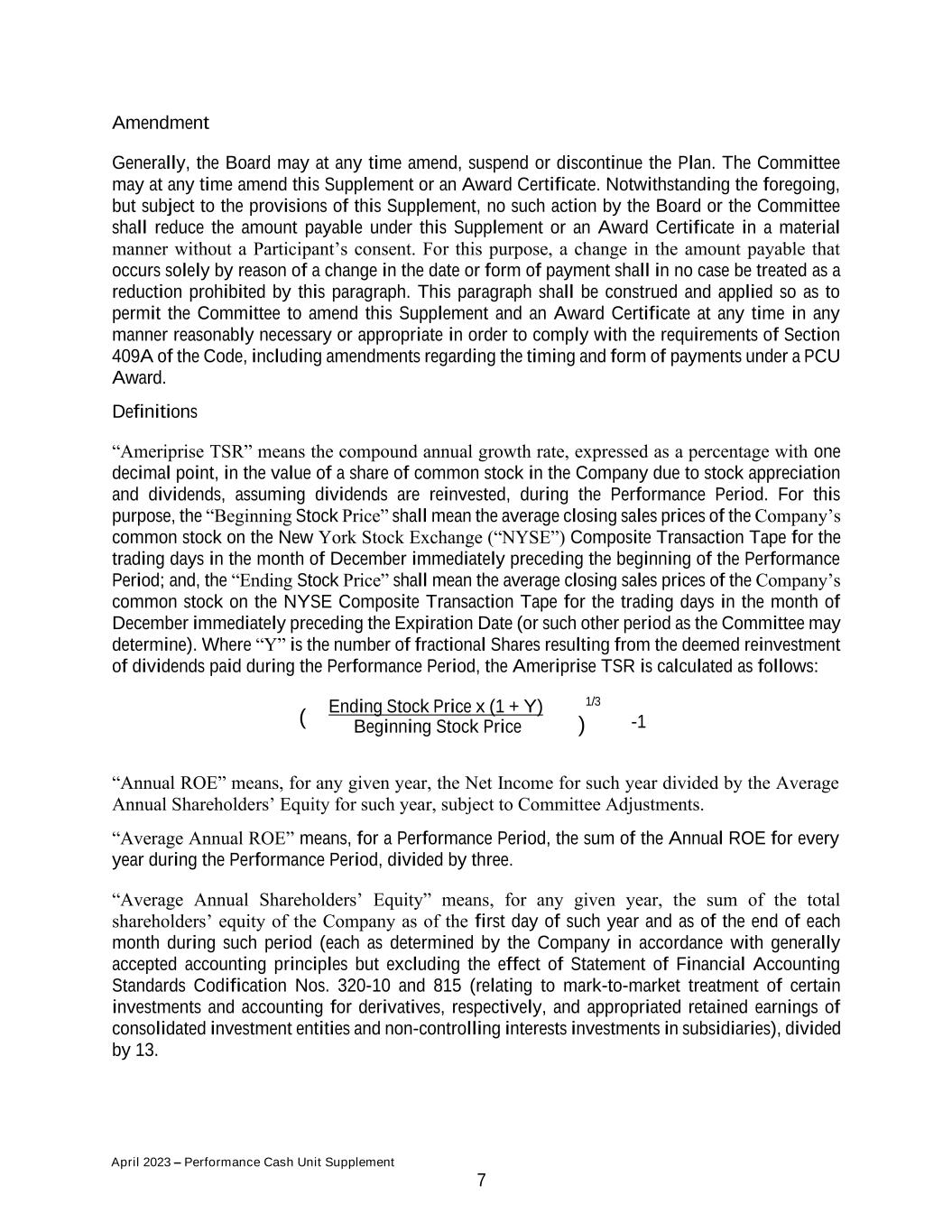

April 2023 – Performance Cash Unit Supplement 8 “Award Certificate” means the certificate delivered by the Company to a Participant containing the terms of the Participant’s PCU Award. “Award Date” means the award date set forth in the applicable Award Certificate. “Award Value (at Award Date)” will be communicated to the Participant shortly after the Award is granted. “Compound Annual Growth Rate of EPS” means, for a Performance Period, the annualized growth rate calculated as follows: Annual EPS in Final Year of Performance Period Annual EPS for Fiscal Year Immediately Preceding the Performance Period 1/3 -1 “Earnings Per Share” means, for any given year, the diluted earnings (or loss) per share of the Company for such year, as determined by the Company in accordance with generally accepted accounting principles for inclusion in the Company’s annual audited financial statements, subject to Committee Adjustments. “Equity Market Collar” means the limitations on the potential upside or downside financial impacts associated with equity market returns that fall outside the bounds of the pre-established range determined by the Committee. The pre-established range applicable to these PCU Awards is 4% above and 4% below the assumed market return in the Company’s plan. “Expiration Date” means the last day of a Performance Period. “Net Income” means, for any given year, the after-tax net income (or loss) attributable to Ameriprise Financial, Inc. for such year, as determined by the Company in accordance with generally accepted accounting principles and subject to Committee Adjustments. “Overall Payout Percentage” means the Performance Matrix Payout Percentage increased or decreased by the TSR Adjustment Factor. In no instance shall the Overall Payout Percentage exceed 175%. “Participant” means an employee who is granted a PCU Award. “Performance Matrix” means the Performance Matrix set forth in the applicable Award Certificate. “Performance Matrix Payout Percentage” means the payout percentage determined under the Performance Matrix based on the weighted Compound Annual Growth Rate of EPS and the weighted Average Annual ROE for the Performance Period. ( )

April 2023 – Performance Cash Unit Supplement 9 “Performance Period” means the period set forth in the applicable Award Certificate, and is normally a three-year period commencing with the start of the fiscal year in which the Award Date occurs. “PCU Payout” means the amount payable pursuant to the terms of a PCU Award. “Relative Total Shareholder Return” means the comparison of the Ameriprise TSR to the S&P Financial TSR. “S&P Financial TSR” means the compound annual growth rate, expressed as a percentage with one decimal point, in the value of the S&P Financial Index during the Performance Period (or such other index as may be selected by the Committee and set forth in the applicable Award Certificate). The S&P Financial TSR is calculated in a manner consistent with the calculation of Ameriprise TSR, from information publicly reported by Standard & Poors Company (or the entity that publishes such other index, as the case may be). “TSR Adjustment Factor” means the adjustment percentage determined under the TSR Adjustment Matrix given the Relative Total Shareholder Return for the Performance Period. “TSR Adjustment Matrix” means the TSR Adjustment Matrix set forth in the applicable Award Certificate. Miscellaneous Provisions Committee Adjustments The Committee reserves the right, in its sole discretion to make performance adjustments for any one-time or unusual events, internal or external factors, or for fundamental changes that have impacted the results over the Performance Period (collectively, the “Committee Adjustments”). Such Committee Adjustments include, but are not limited to, acquisitions and divestitures, accounting changes, restructurings and the consideration of equity market returns that fall outside the Equity Market Collar. Committee Adjustments can have the effect of either increasing or decreasing the payout percentage that is determined according to the Performance Matrix; provided, however, that in no instance shall the Overall Payout Percentage exceed 175%. No Assignment A Participant shall have no right to sell, pledge, hypothecate, assign, margin or otherwise transfer in any manner any interest he or she might have in all or any part of a PCU Award that has been granted to him or her, and any attempt to do so shall be null and void and shall have no force or effect whatsoever. No Right to Continued Employment Nothing contained in the Plan or in this Supplement shall confer upon an employee any right to continue in the employ or other service of the Company or constitute any contract (of employment or otherwise) or limit in any way the right of the Company to change the employee’s compensation or other benefits or to terminate the employee’s employment with or without cause.

April 2023 – Performance Cash Unit Supplement 10 No Right to Awards A Participant’s status as an employee shall not be construed as a commitment that any one or more PCU Awards shall be made to the Participant or to employees generally. A Participant’s status as a participant shall not entitle him or her to any additional award. The information in this Supplement does not imply there will be a PCU Award program in the future, nor what the participation, selection and award guidelines would be. The Company reserves the right to amend, change or terminate all or part of the PCU Award program in accordance with applicable plans, agreements and regulations. Compliance with Section 409A Notwithstanding any other provision of this Supplement to the contrary, to the extent that a PCU Award constitutes a nonqualified deferred compensation plan to which Section 409A of the Code applies, payments under such PCU Award shall be made at a time and in a manner that satisfies the requirements of Section 409A of the Code and guidance of general applicability issued thereunder, including the provisions of Section 409A(a)(2)(B) of the Code to the extent distributions to any employee are required to be delayed six months. It is intended that this PCU Award comply with the requirements of Section 409A so as to prevent the inclusion in gross income of any benefits accrued thereunder in a taxable year prior to the taxable year or years in which such amount would otherwise be actually distributed or made available to the Participant. This PCU Award shall be administered and interpreted in a manner that is consistent with such intention and the Company’s Policy Regarding Section 409A Compliance. If any payment that would otherwise be made under a PCU Award is required to be delayed by reason of this section, such payment shall be made at the earliest date permitted by Section 409A of the Code. The amount of any delayed payment shall be the amount that would have been paid prior to the delay and shall be paid without interest. Tax Implications The following is a summary description of the United States and India federal income tax consequences generally arising with respect to grants of PCU Awards. There may also be state and local taxes applicable to these awards. This summary is not intended to be a complete description of all possible tax consequences of PCU Awards, and Participants should be aware that different tax treatments may apply outside of the United States or India depending upon their country of residence or citizenship. Generally, in the U.S. or India, a Participant will not have income at the time the Committee grants a PCU Award. Under current tax laws, a Participant generally will have income (perquisite income in India) at the time that the Company pays cash, Ameriprise Shares, other Company securities or property to the Participant under such PCU Award, which will equal the amount of cash and the fair market value of the Ameriprise Shares, securities, or property received. In addition to U.S. or India federal income tax, a Participant’s PCU Award is also subject to other taxes such as FICA and FUTA taxes.

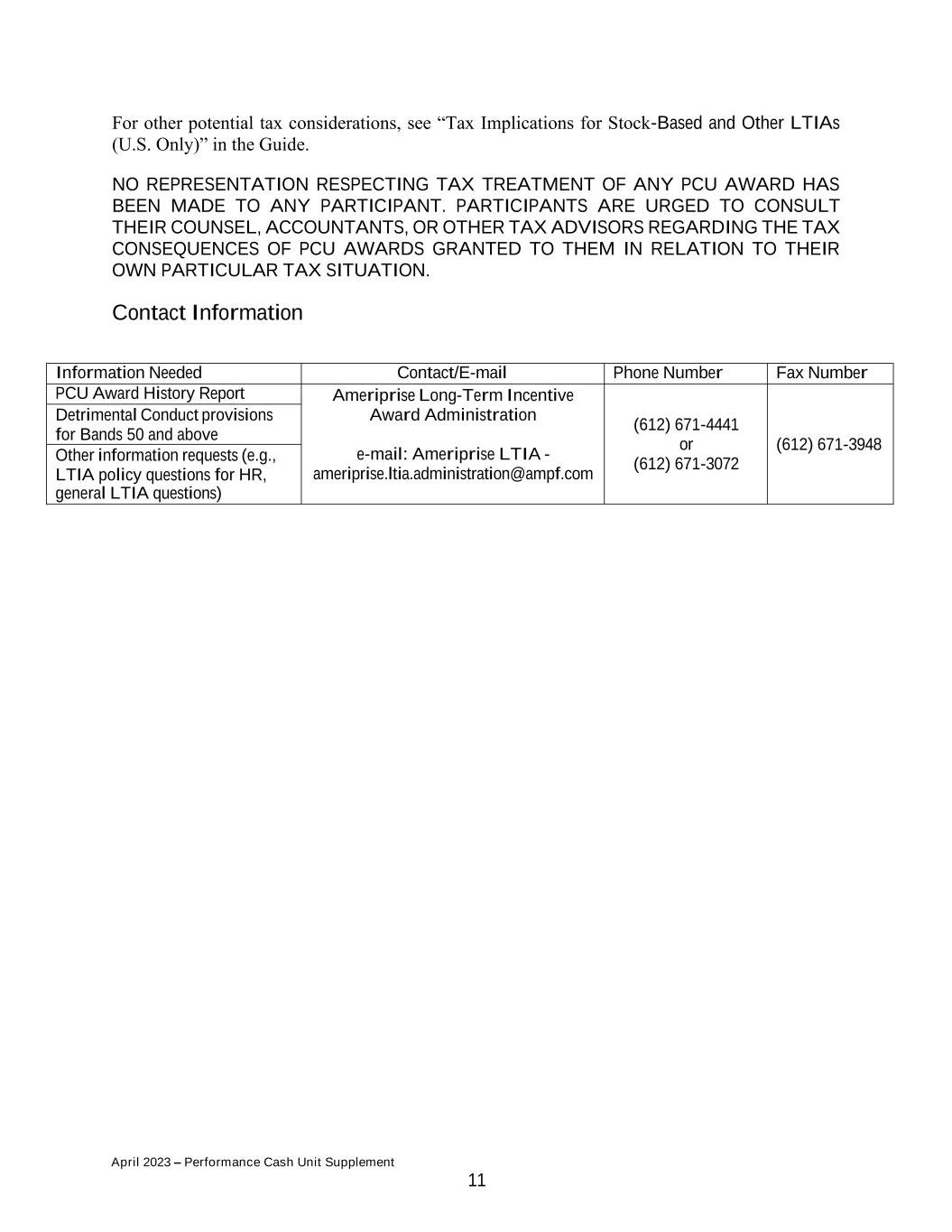

April 2023 – Performance Cash Unit Supplement 11 For other potential tax considerations, see “Tax Implications for Stock-Based and Other LTIAs (U.S. Only)” in the Guide. NO REPRESENTATION RESPECTING TAX TREATMENT OF ANY PCU AWARD HAS BEEN MADE TO ANY PARTICIPANT. PARTICIPANTS ARE URGED TO CONSULT THEIR COUNSEL, ACCOUNTANTS, OR OTHER TAX ADVISORS REGARDING THE TAX CONSEQUENCES OF PCU AWARDS GRANTED TO THEM IN RELATION TO THEIR OWN PARTICULAR TAX SITUATION. Contact Information Information Needed Contact/E-mail Phone Number Fax Number PCU Award History Report Ameriprise Long-Term Incentive Award Administration e-mail: Ameriprise LTIA - ameriprise.ltia.administration@ampf.com (612) 671-4441 or (612) 671-3072 (612) 671-3948 Detrimental Conduct provisions for Bands 50 and above Other information requests (e.g., LTIA policy questions for HR, general LTIA questions)