April 2023 – Performance Share Unit Plan Supplement Ameriprise Financial, Inc. Performance Share Unit Plan (“PSU”) Supplement to the Long-Term Incentive Award (“LTIA”) Program Guide April 2023

April 2023 – Performance Share Unit Plan Supplement TABLE OF CONTENTS Introduction 1 Overview 1 Governing Award Documents 1 Award Certificates 1 Definitions 1 PSU Award Program 2 Overview 2 Eligible Participants 2 Award Value (at Award Date) 2 Number of Performance Share Units Awarded (at Target) 2 Payout Determination 3 PSU Payout 3 Payment 3 Illustration 4 Performance Matrix 4 TSR Adjustment Matrix 4 PSU Payout 4 Effect of Certain Events 5 Termination Prior to Payment Date 5 Death or Disability 5 Retirement 5 Change in Control 6 Certain Corporate Transactions 6 Administration 7 Amendment 7 Definitions 7 Miscellaneous Provisions 10 Covered Employees 10 Committee Adjustments 10 No Assignment 10 No Right to Continued Employment 10 No Right to Awards 10 Compliance with Section 409A 11 Tax Implications 11 Contact Information 12

April 2023 – Performance Share Unit Plan Supplement 1 Introduction Overview This Supplement to the LTIA Program Guide (the “Guide”) provides information about the terms and conditions of Performance Share Unit awards (“PSU Awards”). A PSU Award is a long-term incentive opportunity that is tied to certain performance goals and awarded under the Ameriprise Financial 2005 Incentive Compensation Plan, as amended and restated (the “Plan”). PSU Awards are made to eligible employees of Ameriprise Financial, Inc., and any of its affiliates participating in the Plan (collectively, the “Company” or “Ameriprise”), as determined by the Compensation and Benefits Committee of the Board of Directors of the Company (the “Committee”). In some countries, the features of PSU Awards may be different than those shown in this Supplement in order to meet local regulatory or other requirements. PSU Awards are granted at the discretion of the Company and the Committee or, to the extent permitted by the Plan and the Company’s Long-Term Incentive Award structure and design, its designee, and are subject to local market regulations and legislation, which could change at any time. Also note that while the tax laws that apply to recipients of PSU Awards are based on each employee’s tax jurisdiction, most tax information provided in this Supplement is generally for U.S. purposes only. Any tax information provided in this Supplement is not intended to constitute tax advice. The Company urges all employees to consult their personal tax advisor with any questions or issues regarding their PSU Awards. Governing Award Documents Each PSU Award is subject to the applicable terms and conditions contained in the Plan, the Guide, including the Detrimental Conduct Provisions attached to the Guide, any applicable Award Certificate and this Supplement. These documents, along with Committee decisions, will govern in cases of conflict, ambiguity or miscommunication. In the event of a conflict between the Plan and the Guide or this Supplement, the Plan document shall control. Award Certificates Award Certificates for PSU Awards will generally be distributed to employees either via regular or electronic mail. Participants should print out and retain electronically distributed PSU Award documents for their records. Definitions Capitalized terms have the meanings given to them in the “Definitions” section towards the end of, or elsewhere in, this Supplement. Capitalized terms that are not defined in this Supplement have the meanings given such terms in the Plan, the Guide or the Award Certificate, as applicable.

April 2023 – Performance Share Unit Plan Supplement 2 PSU Award Program Overview A PSU Award is a long-term incentive opportunity that is designed to reward senior leaders for the Company’s financial performance over a three-year performance period. A PSU Award is evidenced by an Award Certificate, setting forth the applicable Award Date, Performance Period, Award Value (at Award Date), Performance Matrix and Total Shareholder Return (“TSR”) Adjustment Matrix. The number of Performance Share Units payable to a Participant under a PSU Award is dependent upon the performance of the Company as compared to the performance criteria in the Performance Matrix and TSR Adjustment Matrix described in this Supplement and the Participant’s Award Certificate, as well as the Participant’s continued employment with the Company. As a result of these requirements, the payment that a Participant receives may be greater or lesser than the Participant’s Number of Performance Share Units Awarded (at Target), or the performance results could result in no payment at all under the PSU Award. For a PSU Award covering the three-year Performance Period commencing on January 1st of the first year and ending on December 31st of the third year, the Performance Matrix uses two criteria: Compound Annual Growth Rate of Earnings Per Share (“EPS”) and Average Annual Return on Equity (“ROE”), and the TSR Adjustment Matrix uses one criterion: Relative Total Shareholder Return. Participants should refer to their Award Certificate for the specific performance criteria, weightings and performance levels under the Performance Matrix and the TSR Adjustment Matrix. PSU Awards generally vest three years after the date of grant. PSU Awards generally become payable no later than March 15th of the year following the end of the applicable three-year performance period, after the PSU Payout for that period has been determined. The PSU Awards that are earned will be paid in the form of shares of Ameriprise common stock. Eligible Participants Currently, only members of the Executive Leadership Team are eligible to receive PSU Awards. Award Value (at Award Date) The Award Value as of the Award Date of a Participant’s PSU Award will be communicated to the Participant shortly after the Award is granted. Number of Performance Share Units Awarded (at Target) The Number of Performance Share Units Awarded (at Target) will be set forth in Shareworks and will be equal to the Award Value (at Award Date) of the PSU Award divided by the Fair Market Value of a share of Ameriprise common stock on the Award Date, as determined under the Company’s Long-Term Incentive Award Policy.

April 2023 – Performance Share Unit Plan Supplement 3 Payout Determination After the end of the Performance Period, for purposes of determining the PSU Payout, there will be straight-line interpolation used to determine the payout percentage earned on any of the measures for actual performance that falls between the goals stated in the Performance Matrix and TSR Adjustment Matrix. The Committee will review and approve all payout percentages as determined in accordance with this Supplement and the Performance Matrix and TSR Adjustment Matrix grids approved for each Performance Period. Such determinations by the Committee shall be final, binding and conclusive upon each Participant and all persons claiming under or through such Participant. PSU Payout Following the end of the Performance Period, the PSU Payout will be determined by: (1) increasing or decreasing the Performance Matrix Payout Percentage according to the performance results for that period; (2) applying the TSR Adjustment Factor determined under the TSR Adjustment Matrix to arrive at the Overall Payout Percentage; and (3) multiplying the Number of Performance Share Units Awarded (at Target) by the Overall Payout Percentage to arrive at the PSU Payout. Payment As soon as practicable after the last day of a Performance Period, the Committee will determine and approve the PSU Payout of each Participant’s PSU Award in accordance with this Supplement. Payment of the approved PSU Payout, if any, to a Participant under the Plan shall be made no later than March 15 following the end of the Performance Period (the “Payment Date”). The payment to the participant for the PSU Payout will be made in the form of shares of Company common stock at a rate of one share of Company common stock for each Performance Share Unit that is earned and is part of the PSU Payout (subject to any adjustments as described below under the caption “Effect of Certain Events”). Each Performance Share Unit that is earned and is part of the PSU Payout will be entitled to a cash payment equal to the amount of any dividends declared and paid on a share of Company common stock during the Performance Period and through the Payment Date (“Dividend Equivalents”). Any Dividend Equivalents vest at the same time as the underlying Performance Share Unit and will be paid in cash on the Payment Date. Except as otherwise provided in this Supplement, a Participant must remain actively employed by the Company through the Payment Date to be eligible to receive payment under a PSU Award, and a Participant shall forfeit the right to receive all or any part of his or her PSU Award if he or she terminates employment prior to the Payment Date. Whether and as of what date a Participant’s employment with the Company terminates, if the Participant is granted a leave of absence, or commences any break in employment intended by his or her employer to be temporary will be determined by the Committee in its sole discretion. The Company or a Participant’s employer will withhold from any payment under a PSU Award, the minimum amounts that the Company or the employer determines are required to be withheld by law, including, but not limited to, U.S. federal, state, local or foreign income, employment or

April 2023 – Performance Share Unit Plan Supplement 4 other taxes incurred by reason of the making of the PSU Award or any payment under the PSU Award. In addition, FICA tax will be withheld, as required under the law, if any portion of a PSU Award becomes vested for tax purposes prior to payment. It shall be a condition to the obligation of the Company to make payments under a PSU Award that a Participant (or those claiming under or through the Participant) promptly provide the Company or the employer with all forms, documents or other information reasonably required by the Company or the employer in connection with the PSU Award. Illustration Assume an employee has a PSU Award with an Award Value (at Award Date) of $50,000, which, based on a Fair Market Value on Award Date of $50, is equal to 1,000 Performance Share Units, and the following Performance Matrix and TSR Adjustment Matrix performance: Performance Matrix Performance Measure Percentage Payout Earned* Weighting Weighted Payout Percentage Calculation Compound Annual Growth Rate of EPS 150% x 50% = 75% Average Annual ROE 100% x 50% = 50% PERFORMANCE MATRIX PAYOUT PERCENTAGE 125% * Percentage Payout earned is determined from the Performance Matrix grid, based on actual performance over the Performance Period. TSR Adjustment Matrix Assuming the Ameriprise TSR for the period was at the top quartile when compared to the S&P Financial TSR, then the TSR Adjustment Factor would be plus 25 percentage points based on the TSR Adjustment Matrix. The Performance Matrix Payout Percentage in the above table would be increased by the TSR Adjustment Factor as follows: 125% + 25 percentage points = 150% (Performance Matrix Payout Percentage) (TSR Adjustment Factor) (Overall Payout Percentage) PSU Payout The Number of Performance Share Units Awarded (at Target) subject to the PSU Award (1,000 in this example) is then multiplied by the Overall Payout Percentage shown above:

April 2023 – Performance Share Unit Plan Supplement 5 1,000 x 150% = 1,500 (Number of Performance Share Units Awarded (at Target)) (Overall Payout Percentage) (PSU Payout) Note: This illustration and the corresponding values shown are based on financial, stock price and other assumptions about future events or circumstances, which may or may not actually occur, as well as continuous employment and award requirements. The illustration is hypothetical and not meant to imply that the Company will achieve certain stock prices or growth rates, or has achieved any stated growth rate consistently in the past. The value and return on Ameriprise common stock will fluctuate over time and may be worth more or less than the values shown in the illustration. Past performance is no guarantee of future results. Participants should consult their personal financial advisor on the tax and other implications of their PSU Awards, as applicable to their circumstances. This Supplement is not intended to provide any financial or tax advice. Effect of Certain Events Termination Prior to Payment Date Other than as specified under the subheading below entitled “Change in Control,” if a Participant terminates employment for any reason other than death, disability or retirement prior to the Payment Date of a PSU Award, then the Participant and all others claiming under or through the Participant shall not be entitled to receive any amounts under the PSU Award, except as otherwise determined by the Committee in its sole discretion. Death or Disability If, on or before a PSU Award’s Payment Date, but during a period when a Participant has been in continuous employment with the Company, the Participant terminates his or her employment with the Company by reason of death or disability at any time following the Award Date, the Participant will be entitled to that proportion of the PSU Payout as the number of full months that have elapsed between the first day of the Performance Period and the end of the month in which the Participant’s termination of employment by reason of death or disability occurs (not to exceed 36) bears to 36. The PSU Payout, if any, shall be determined and paid after the last day of the Performance Period in the normal course in accordance with this Supplement, unless otherwise determined by the Committee, and the Participant and all others claiming under or through the Participant shall not be entitled to receive any other amounts under the PSU Award. In the event of death, and should any PSU Award become payable, any such payment will be made to the Participant’s designated beneficiary or, in the absence of a beneficiary, to the legal representatives of the Participant’s estate. Retirement If, on or before a PSU Award’s Payment Date, but during a period when a Participant has been in continuous employment with the Company since the Award Date, the Participant terminates his or her employment with the Company by reason of Retirement (as that term is defined by the Guide): (1) the Participant shall forfeit all PSU Awards with an Award Date that is within the calendar year that the Retirement has occurred; and (2) all other remaining PSU Awards that have Performance Periods that started prior to the calendar year in which the Retirement occurred shall continue to vest and become earned under the terms of the applicable PSU Award. The PSU Payout for this

April 2023 – Performance Share Unit Plan Supplement 6 purpose shall be determined and paid after the last day of the Performance Period in the normal course in accordance with this Supplement. Such amount, if any, shall be payable after the Performance Period, and the Participant and all others claiming under or through the Participant shall not be entitled to receive any other amounts under this Award. Change in Control Notwithstanding anything in the Plan, the Guide, an Award Certificate or this Supplement to the contrary (except for the provision in the Guide dealing with a limitation under Section 280G of the Code), if a Participant has not received payment under a PSU Award and, within two years after the date of a Change in Control, the Participant experiences a termination of employment that would otherwise entitle the Participant to receive the payment of severance benefits under the provisions of the severance plan that is in effect and in which the Participant participates as of the date of the Change in Control, (a) the Participant shall immediately be 100% vested in PSU Awards, (b) the Committee shall determine the Performance Matrix Payout Percentage and TSR Adjustment Factor of PSU Awards as of the date of such termination of employment as if the Performance Period had just ended, based on results against the performance measures up to the last day of the calendar quarter ending on or immediately prior to such date, but prorated based on (i) the total number of full and partial months of the Performance Period that have elapsed between (1) the first day of the Performance Period and (2) the date of the termination of employment (not to exceed 36) divided by (ii) 36, and (c) such value of the Award shall be paid to the Participant in cash within five days after the date of such termination of employment. The Committee may not amend or delete this section of this Supplement in a manner that is detrimental to a Participant, without the Participant’s written consent. Certain Corporate Transactions In the event of any change in the corporate capitalization of the Company, such as by reason of any stock split, or a material corporate transaction, such as any merger of the Company into another corporation, any consolidation of the Company and one or more corporations into another corporation, any separation of the Company (including a spin-off or other distribution of stock or property by the Company), any reorganization of the Company (whether or not such reorganization comes within the definition of such term in Section 368 of the Code), or any partial or complete liquidation by the Company, other than a normal cash dividend, the Committee shall make an equitable adjustment in the calculation or terms of the Performance Matrix and TSR Adjustment Matrix under a PSU Award. Any such determination by the Committee under this paragraph shall be final, binding and conclusive. In the event of the sale, disposition, restructuring, discontinuance of operations or other extraordinary corporate event in respect of a material business during the Performance Period or any of the events discussed in the preceding paragraph during a Performance Period, the Committee shall make an equitable adjustment in the calculation of the Compound Annual Growth Rate of EPS component or the Average Annual ROE component in accordance with the Committee Adjustments section of this Guide. Any such determination by the Committee under this paragraph shall be final, binding and conclusive.

April 2023 – Performance Share Unit Plan Supplement 7 Administration The PSU Award program is administered by the Committee. Any action taken or decision made by the Company, the Board or the Committee or its delegates arising out of or in connection with the construction, administration, interpretation or effect of the Plan or this Supplement shall lie within its sole and absolute discretion, as the case may be and shall be final, conclusive and binding upon all Participants and all persons claiming under or through such Participants. By accepting a PSU Award or other benefit under the Plan, a Participant and each person claiming under or through the Participant shall be conclusively deemed to have indicated acceptance and ratification of, and consent to, any action taken or decision made under the Plan by the Company, the Board or the Committee or its delegates. Amendment Generally, the Board may at any time amend, suspend or discontinue the Plan. The Committee may at any time amend this Supplement or an Award Certificate. Notwithstanding the foregoing, but subject to the provisions of this Supplement, no such action by the Board or the Committee shall reduce the amount payable under this Supplement or an Award Certificate in a material manner without a Participant’s consent. For this purpose, a change in the amount payable that occurs solely by reason of a change in the date or form of payment shall in no case be treated as a reduction prohibited by this paragraph. This paragraph shall be construed and applied so as to permit the Committee to amend this Supplement and an Award Certificate at any time in any manner reasonably necessary or appropriate in order to comply with the requirements of Section 409A of the Code, including amendments regarding the timing and form of payments under a PSU Award. Definitions “Ameriprise TSR” means the compound annual growth rate, expressed as a percentage with one decimal point, in the value of a share of common stock in the Company due to stock appreciation and dividends, assuming dividends are reinvested, during the Performance Period. For this purpose, the “Beginning Stock Price” shall mean the average closing sales prices of the Company’s common stock on the New York Stock Exchange (“NYSE”) Composite Transaction Tape for the trading days in the month of December immediately preceding the beginning of the Performance Period; and, the “Ending Stock Price” shall mean the average closing sales prices of the Company’s common stock on the NYSE Composite Transaction Tape for the trading days in the month of December immediately preceding the Expiration Date (or such other period as the Committee may determine). Where “Y” is the number of fractional Shares resulting from the deemed reinvestment of dividends paid during the Performance Period, the Ameriprise TSR is calculated as follows: ( Ending Stock Price x (1 + Y) Beginning Stock Price 1/3 ) -1

April 2023 – Performance Share Unit Plan Supplement 8 “Annual ROE” means, for any given year, the Net Income for such year divided by the Average Annual Shareholders’ Equity for such year, subject to Committee Adjustments. “Average Annual ROE” means, for a Performance Period, the sum of the Annual ROE for every year during the Performance Period, divided by three. “Average Annual Shareholders’ Equity” means, for any given year, the sum of the total shareholders’ equity of the Company as of the first day of such year and as of the end of each month during such period (each as determined by the Company in accordance with generally accepted accounting principles but excluding the effect of Statement of Financial Accounting Standards Codification Nos. 320-10 and 815 (relating to mark-to-market treatment of certain investments and accounting for derivatives, respectively, and appropriated retained earnings of consolidated investment entities and non-controlling interests investments in subsidiaries), divided by 13. “Award Certificate” means the certificate delivered by the Company to a Participant containing the terms of the Participant’s PSU award. “Award Date” means the award date set forth in the applicable Award Certificate. “Award Value (at Award Date)” will be communicated to the Participant shortly after the Award is granted. “Compound Annual Growth Rate of EPS” means, for a Performance Period, the annualized growth rate calculated as follows: ( Annual EPS in Final Year of Performance Period Annual EPS for Fiscal Year Immediately Preceding the Performance Period )1/3 -1 “Earnings Per Share” means, for any given year, the diluted earnings (or loss) per share of the Company for such year, as determined by the Company in accordance with generally accepted accounting principles for inclusion in the Company’s annual audited financial statements, subject to Committee Adjustments. “Equity Market Collar” means the limitations on the potential upside or downside financial impacts associated with equity market returns that fall outside the bounds of the pre-established range determined by the Committee. The pre-established range applicable to these PSU Awards is 4% above and 4% below the assumed market return in the Company’s plan. “Expiration Date” means the last day of a Performance Period. “Fair Market Value” has the meaning given to such term under the Plan, which, for the avoidance of doubt, with respect to the shares of Company common stock as of any date, means the per-share closing price as reported on the NYSE Composite Transaction Tape on such date, or, if there is no such reported sale price on the NYSE Composite Transaction Tape on such date,

April 2023 – Performance Share Unit Plan Supplement 9 then the per-share closing price as reported on the NYSE Composite Transaction Tape on the last previous day on which sale price was reported on the NYSE Composite Transaction Tape, or such other value as determined by the Committee in accordance with applicable law. “Net Income” means, for any given year, the after-tax net income (or loss) attributable to Ameriprise Financial, Inc. for such year, as determined by the Company in accordance with generally accepted accounting principles and subject to Committee Adjustments. “Number of Performance Share Units Awarded (at Target)” will be communicated to the Participant shortly after the Award is granted. “Overall Payout Percentage” means the Performance Matrix Payout Percentage increased or decreased by the TSR Adjustment Factor. In no instance shall the Overall Payout Percentage exceed 175%. “Participant” means an employee who is granted a PSU Award. “Performance Matrix” means the Performance Matrix set forth in the applicable Award Certificate. “Performance Matrix Payout Percentage” means the payout percentage determined under the Performance Matrix based on the weighted Compound Annual Growth Rate of EPS and the weighted Average Annual ROE for the Performance Period. “Performance Period” means the period set forth in the applicable Award Certificate and is normally a three-year period commencing with the start of the fiscal year in which the Award Date occurs. “PSU Payout” means the number of Performance Share Units payable pursuant to the terms of a PSU Award. “Relative Total Shareholder Return” means the comparison of the Ameriprise TSR to the S&P Financial TSR. “S&P Financial TSR” means the compound annual growth rate, expressed as a percentage with one decimal point, in the value of the S&P Financial Index during the Performance Period (or such other index as may be selected by the Committee and set forth in the applicable Award Certificate). The S&P Financial TSR is calculated in a manner consistent with the calculation of Ameriprise TSR, from information publicly reported by Standard & Poors Company (or the entity that publishes such other index, as the case may be). “TSR Adjustment Factor” means the adjustment percentage determined under the TSR Adjustment Matrix given the Relative Total Shareholder Return for the Performance Period. “TSR Adjustment Matrix” means the TSR Adjustment Matrix set forth in the applicable Award Certificate.

April 2023 – Performance Share Unit Plan Supplement 10 Miscellaneous Provisions Covered Employees Additional threshold performance requirements apply to any Participant that the Company determines may be a Covered Employee as of the last day of the year in which the Payment Date occurs. It is possible that such Participants could receive no PSU Payout based on the failure of the Company to achieve such threshold performance requirements, even though a PSU Payout would otherwise be earned under the terms of this Supplement. Committee Adjustments The Committee reserves the right, in its sole discretion to make performance adjustments for any one-time or unusual events, internal or external factors, or for fundamental changes that have impacted the results over the Performance Period (collectively, the “Committee Adjustments”). Such Committee Adjustments include, but are not limited to, acquisitions and divestitures, accounting changes, restructurings and the consideration of equity market returns that fall outside the Equity Market Collar. Committee Adjustments can have the effect of either increasing or decreasing the payout percentage that is determined according to the Performance Matrix; provided, however, that in no instance shall the Overall Payout Percentage exceed 175%. No Assignment A Participant shall have no right to sell, pledge, hypothecate, assign, margin or otherwise transfer in any manner any interest he or she might have in all or any part of a PSU Award which has been granted to him or her, and any attempt to do so shall be null and void and shall have no force or effect whatsoever. No Right to Continued Employment Nothing contained in the Plan or in this Supplement shall confer upon an employee any right to continue in the employ or other service of the Company or constitute any contract (of employment or otherwise) or limit in any way the right of the Company to change the employee’s compensation or other benefits or to terminate the employee’s employment with or without cause. No Right to Awards A Participant’s status as an employee shall not be construed as a commitment that any one or more PSU Awards shall be made to the Participant or to employees generally. A Participant’s status as a participant shall not entitle him or her to any additional award. The information in this Supplement does not imply there will be a PSU Award program in the future, nor what the participation, selection and award guidelines would be. The Company reserves the right to amend, change or terminate all or part of the PSU Award program in accordance with applicable plans, agreements and regulations.

April 2023 – Performance Share Unit Plan Supplement 11 Compliance with Section 409A Notwithstanding any other provision of this Supplement to the contrary, to the extent that a PSU Award constitutes a nonqualified deferred compensation plan to which Section 409A of the Code applies, payments under such PSU Award shall be made at a time and in a manner that satisfies the requirements of Section 409A of the Code and guidance of general applicability issued thereunder, including the provisions of Section 409A(a)(2)(B) of the Code to the extent distributions to any employee are required to be delayed six months. It is intended that this PSU Award comply with the requirements of Section 409A so as to prevent the inclusion in gross income of any benefits accrued thereunder in a taxable year prior to the taxable year or years in which such amount would otherwise be actually distributed or made available to the Participant. This PSU Award shall be administered and interpreted in a manner that is consistent with such intention and the Company’s Policy Regarding Section 409A Compliance. If any payment that would otherwise be made under a PSU Award is required to be delayed by reason of this section, such payment shall be made at the earliest date permitted by Section 409A of the Code. The amount of any delayed payment shall be the amount that would have been paid prior to the delay and shall be paid without interest. Tax Implications The following is a summary description of the United States federal income tax consequences generally arising with respect to grants of PSU Awards. There may also be state and local taxes applicable to these awards. This summary is not intended to be a complete description of all possible tax consequences of PSU Awards and Participants should be aware that different tax treatments may apply outside of the United States depending upon their country of residence or citizenship. Generally, a Participant will not have income at the time the Committee grants a PSU Award. Under current tax laws, a Participant generally will have income at the time that the Company pays cash, Ameriprise Shares, other Company securities or property to the Participant under such PSU Award, which will equal the amount of cash and the fair market value of the Ameriprise Shares, securities, or property received. In addition to federal income tax, a Participant’s PSU Award is also subject to FICA and FUTA taxes. For other potential tax considerations, see “Tax Implications for LTIAs (U.S. citizens and residents only)” in the Guide. NO REPRESENTATION RESPECTING TAX TREATMENT OF ANY PSU AWARD HAS BEEN MADE TO ANY PARTICIPANT. PARTICIPANTS ARE URGED TO CONSULT THEIR COUNSEL, ACCOUNTANTS, OR OTHER TAX ADVISORS REGARDING THE TAX CONSEQUENCES OF PSU AWARDS GRANTED TO THEM IN RELATION TO THEIR OWN PARTICULAR TAX SITUATION.

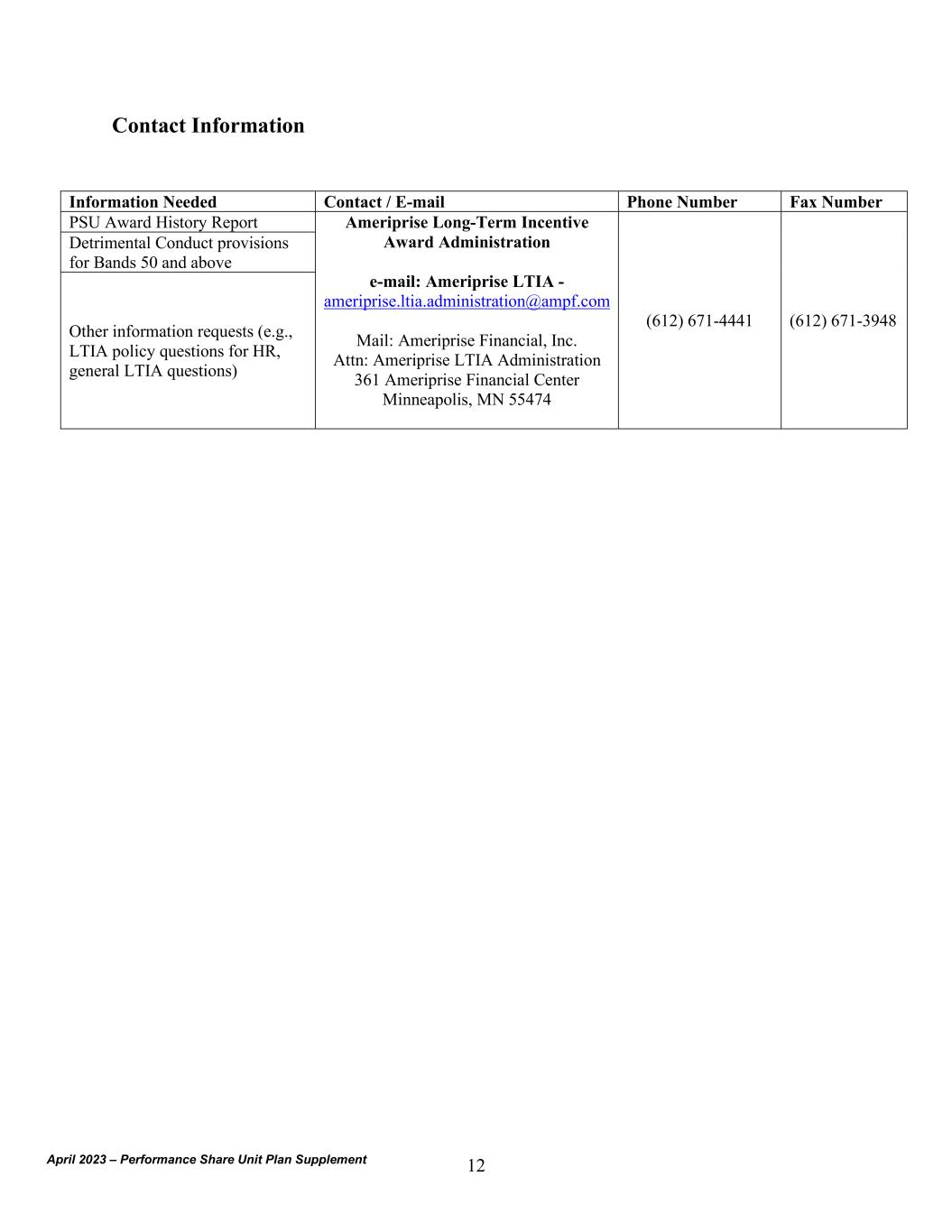

April 2023 – Performance Share Unit Plan Supplement 12 Contact Information Information Needed Contact / E-mail Phone Number Fax Number PSU Award History Report Ameriprise Long-Term Incentive Award Administration e-mail: Ameriprise LTIA - ameriprise.ltia.administration@ampf.com Mail: Ameriprise Financial, Inc. Attn: Ameriprise LTIA Administration 361 Ameriprise Financial Center Minneapolis, MN 55474 (612) 671-4441 (612) 671-3948 Detrimental Conduct provisions for Bands 50 and above Other information requests (e.g., LTIA policy questions for HR, general LTIA questions)