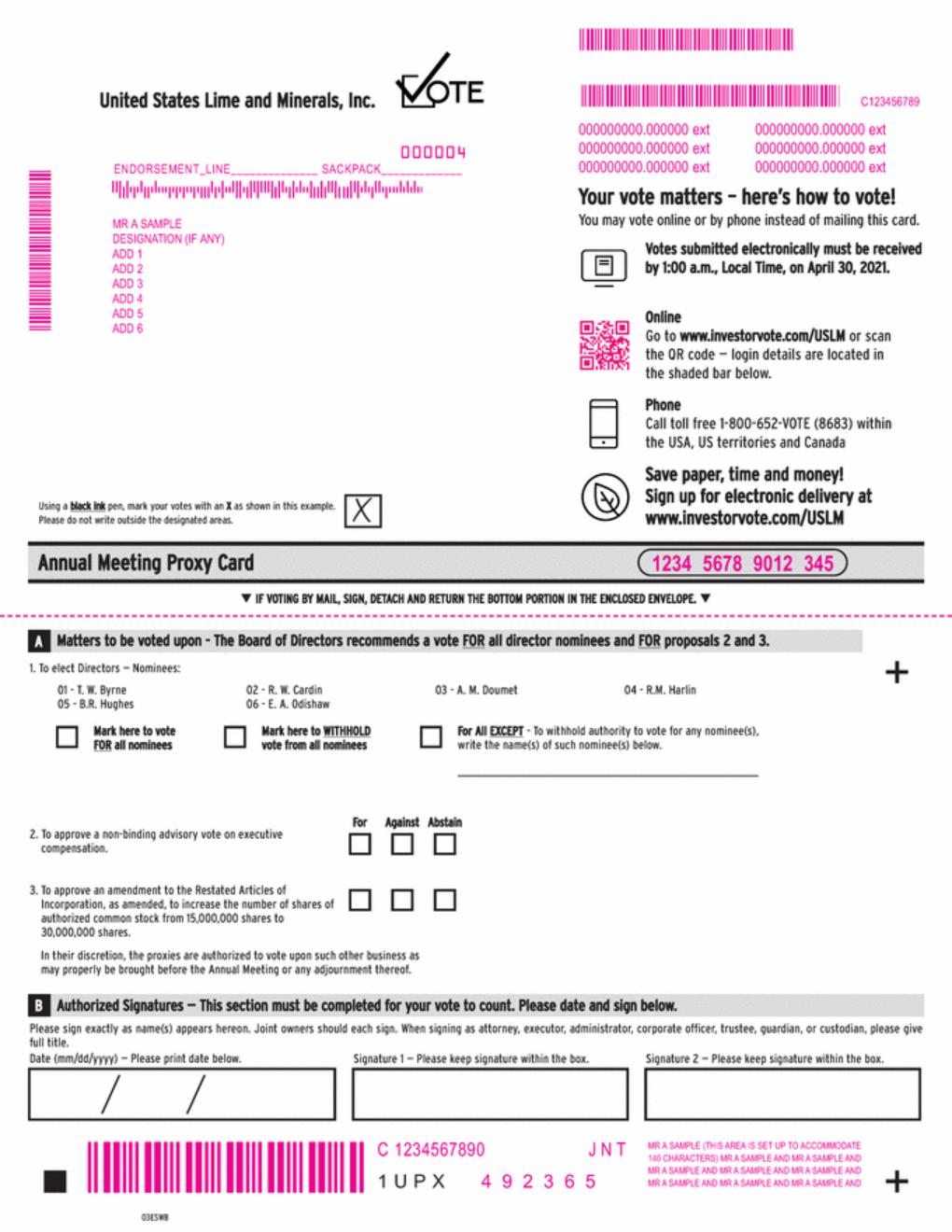

PROPOSAL 3: AMEND THE RESTATED ARTICLES TO INCREASE THE NUMBER OF SHARES OF AUTHORIZED COMMON STOCK FROM 15,000,000 TO 30,000,000

The company’s Restated Articles currently authorize the board to issue a maximum of 15,500,000 shares of the company’s capital stock, consisting of 15,000,000 shares of common stock, par value $0.10 per share, and 500,000 shares of preferred stock, par value $5.00 per share. The company may issue shares of preferred stock from time to time upon the approval of the board in one or more series without further stockholder approval. As of the date hereof, we have no outstanding shares of preferred stock.

Of the 15,000,000 shares of common stock currently authorized, as of our record date, March 12, 2021, 6,663,875 shares were issued. Additionally, we have 156,577 shares reserved for issuance under the 2001 Plan, including 38,600 shares issuable upon exercise of outstanding stock options. The company, therefore, only has approximately 8,179,548 shares of unreserved common stock available for future issuance. If the increase in authorized shares is approved by shareholders, the company would have 23,179,548 shares of common stock available for issuance (after taking into consideration the 156,577 shares reserved for issuance under the 2001 Plan).

The board believes that the increase in authorized shares is advisable in order to maintain our business, financing and capital raising flexibility in connection with our working capital needs and for general corporate purposes. Such possible uses for the additional authorized shares of common stock include, without limitation, future stock splits, stock dividends, rights offerings, acquiring other companies, businesses or products in exchange for shares of common stock, attracting and retaining employees by the issuance of additional securities under our 2001 plan and any future equity compensation plans, issuance of shares underlying shares convertible into common stock, and other transactions and corporate purposes that the board deems to be in the best interests of the company and its shareholders. The additional authorized shares would enable us to act quickly in response to opportunities that may arise for these types of transactions, in most cases without the necessity of obtaining further shareholder approval and incurring expenses associated with holding a special shareholders’ meeting before such issuance(s) could proceed, except as otherwise required under applicable Texas law or Nasdaq rules.

Other than issuances pursuant to our 2001 plan, as of the date of this proxy statement the company has not adopted any plans to issue any additional shares of common stock and has not heretofore entered into any arrangements or understandings with respect thereto. However, the company reviews and evaluates potential capital raising activities, transactions, compensatory plans, and other corporate actions on an ongoing basis to determine if such actions would be in the best interests of the company and its shareholders, and accordingly, it is possible that the company may issue additional shares of common stock, from time to time, in the future.

The increase in authorized shares would be effective following the filing of the Articles of Amendment with the Texas Secretary of State, which will occur as soon as reasonably practicable after shareholder approval at the meeting, and will increase our authorized shares of common stock from 15,000,000 shares to 30,000,000 shares.

Effects of Increase in Authorized Shares

The proposed additional shares of authorized common stock would become part of the existing class of common stock and, if and when issued, would have the same rights and privileges as the shares of common stock presently issued and outstanding. Adoption of this proposal would not have any immediate dilutive effect on the proportionate voting power of existing shareholders. The increase in authorized shares will not itself cause any changes in our capital accounts or have any immediate effect on the rights of existing shareholders. Current shareholders do not have any preemptive or similar rights, and accordingly, current shareholders do not have a prior right to purchase shares of any newly issued common stock in order to maintain their proportionate ownership thereof.

As is true for shares of common stock presently authorized but unissued, the future issuance of common stock authorized by the increase in authorized shares may, among other things, decrease existing shareholders’ percentage equity ownership, result in the issuance of shares of common stock at prices lower than the prices at which existing shareholders purchased their stock and be dilutive to the voting rights of existing shareholders. In addition, depending on the price at which they are issued, the issuance of additional shares of common stock may have a negative effect on the market price of the common stock. It is also possible that shares of common stock may be issued at a time and under circumstances that